1 Midland States Bancorp, Inc. NASDAQ: MSBI Third Quarter 2024 Earnings Presentation

22 Forward-Looking Statements. This presentation may contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements expressing management’s current expectations, forecasts of future events or long-term goals may be based upon beliefs, expectations and assumptions of the Company’s management, and are generally identifiable by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “intend,” “estimate,” “may,” “will,” “would,” “could,” “should” or other similar expressions. All statements in this presentation speak only as of the date they are made, and the Company undertakes no obligation to update any statement. A number of factors, many of which are beyond the ability of the Company to control or predict, could cause actual results to differ materially from those in its forward-looking statements including changes in interest rates and other general economic, business and political conditions, the impact of inflation, increased deposit volatility and potential regulatory developments. These risks and uncertainties should be considered in evaluating forward-looking statements, and undue reliance should not be placed on such statements. Additional information concerning the Company and its businesses, including additional factors that could materially affect the Company’s financial results, are included in the Company’s filings with the Securities and Exchange Commission. Use of Non-GAAP Financial Measures. This presentation may contain certain financial information determined by methods other than in accordance with accounting principles generally accepted in the United States (“GAAP”). These non-GAAP financial measures include “Adjusted Earnings,” "Adjusted Earnings Available to Common Shareholders," “Adjusted Diluted Earnings Per Common Share,” “Adjusted Return on Average Assets,” “Adjusted Return on Average Shareholders’ Equity,” “Adjusted Return on Average Tangible Common Equity,” “Adjusted Pre-Tax, Pre-Provision Earnings,” “Adjusted Pre-Tax, Pre-Provision Return on Average Assets,” “Efficiency Ratio,” “Tangible Common Equity to Tangible Assets,” “Tangible Book Value Per Share,” “Tangible Book Value Per Share excluding Accumulated Other Comprehensive Income,”and “Return on Average Tangible Common Equity.” The Company believes that these non-GAAP financial measures provide both management and investors a more complete understanding of the Company’s funding profile and profitability. These non-GAAP financial measures are supplemental and are not a substitute for any analysis based on GAAP financial measures. Not all companies use the same calculation of these measures; therefore this presentation may not be comparable to other similarly titled measures as presented by other companies. Reconciliations of these non-GAAP measures are provided in the Appendix section of this presentation.

33 Company Snapshot Financial Highlights as of September 30, 2024 $7.8 Billion Total Assets $5.7 Billion Total Loans $6.3 Billion Total Deposits $4.3 Billion Assets Under Administration YTD Adjusted ROAA(1): 0.67% YTD Adjusted Return on TCE(1): 8.61% TCE/TA: 7.03% YTD PTPP(1) ROAA: 1.46% Dividend Yield: 5.54% Price/Tangible Book: 0.9x Price/LTM EPS: 9.7x Notes: (1) Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. Founded in 1881, this Illinois state- chartered community bank focuses on in-market relationships while having national diversification through equipment finance. • 53 Branches in Illinois and Missouri • 16 successful acquisitions since 2008

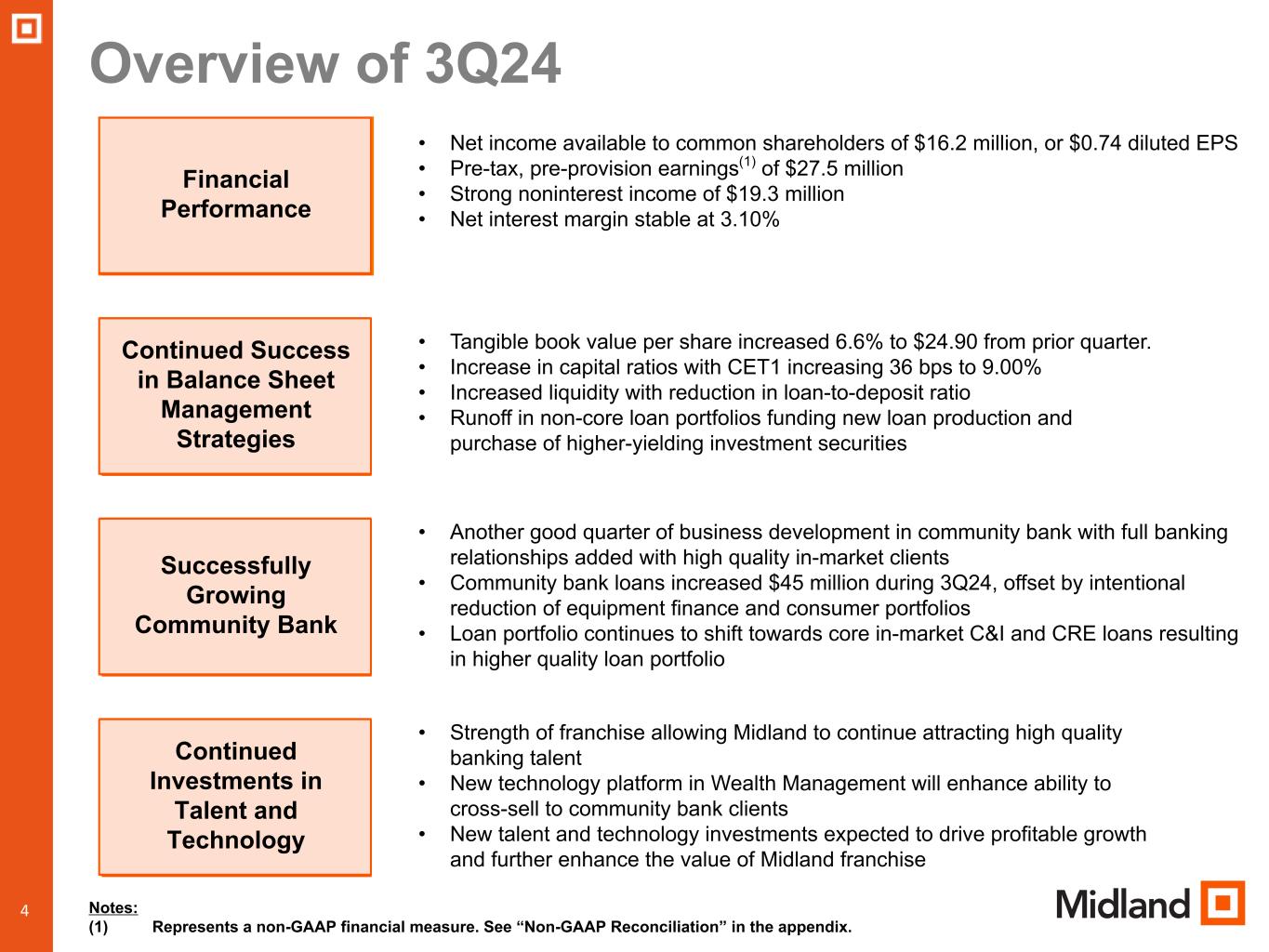

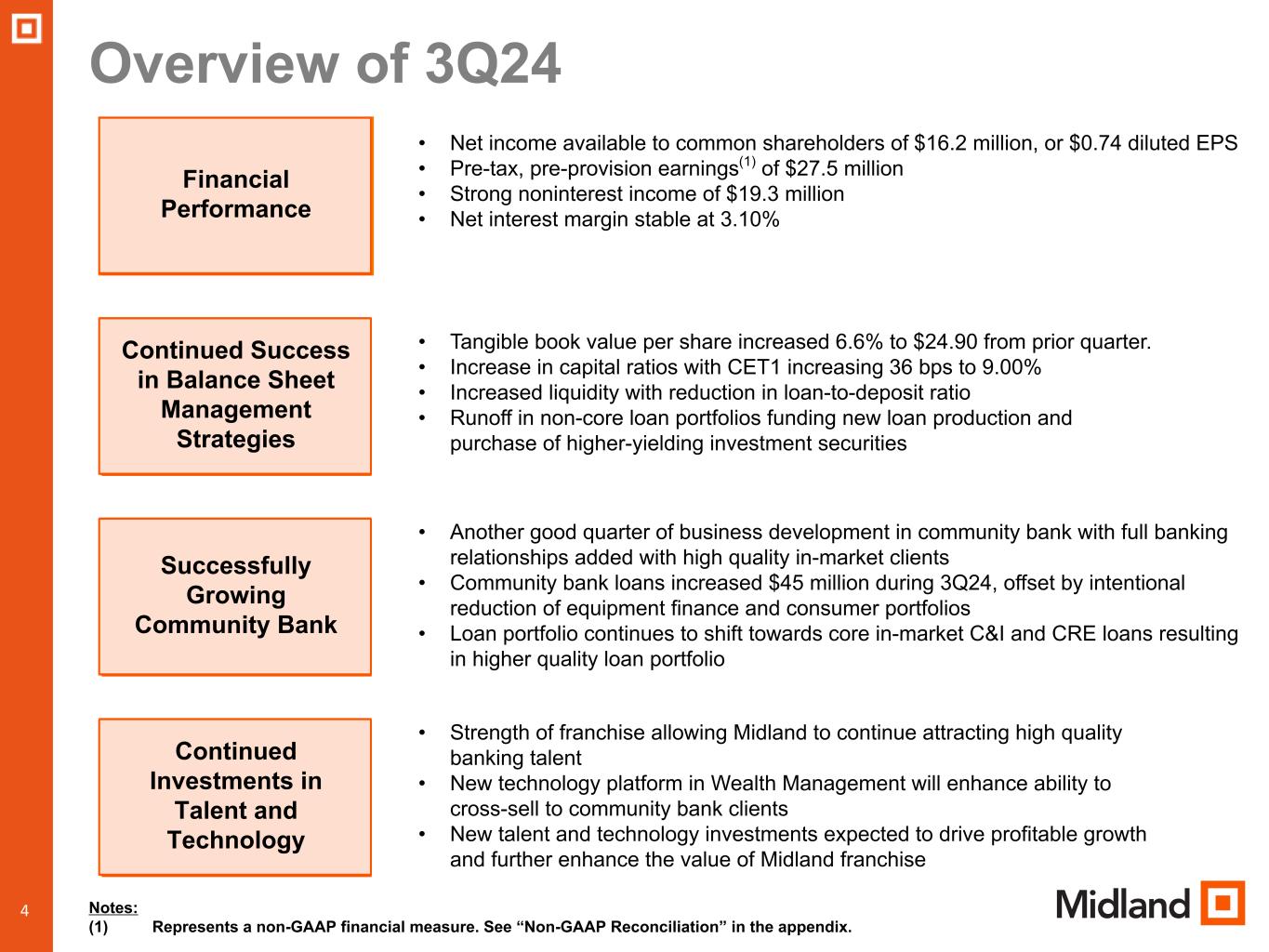

4 Overview of 3Q24 Financial Performance Continued Success in Balance Sheet Management Strategies Successfully Growing Community Bank Continued Investments in Talent and Technology 4 • Net income available to common shareholders of $16.2 million, or $0.74 diluted EPS • Pre-tax, pre-provision earnings(1) of $27.5 million • Strong noninterest income of $19.3 million • Net interest margin stable at 3.10% • Tangible book value per share increased 6.6% to $24.90 from prior quarter. • Increase in capital ratios with CET1 increasing 36 bps to 9.00% • Increased liquidity with reduction in loan-to-deposit ratio • Runoff in non-core loan portfolios funding new loan production and purchase of higher-yielding investment securities • Another good quarter of business development in community bank with full banking relationships added with high quality in-market clients • Community bank loans increased $45 million during 3Q24, offset by intentional reduction of equipment finance and consumer portfolios • Loan portfolio continues to shift towards core in-market C&I and CRE loans resulting in higher quality loan portfolio • Strength of franchise allowing Midland to continue attracting high quality banking talent • New technology platform in Wealth Management will enhance ability to cross-sell to community bank clients • New talent and technology investments expected to drive profitable growth and further enhance the value of Midland franchise Notes: (1) Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix.

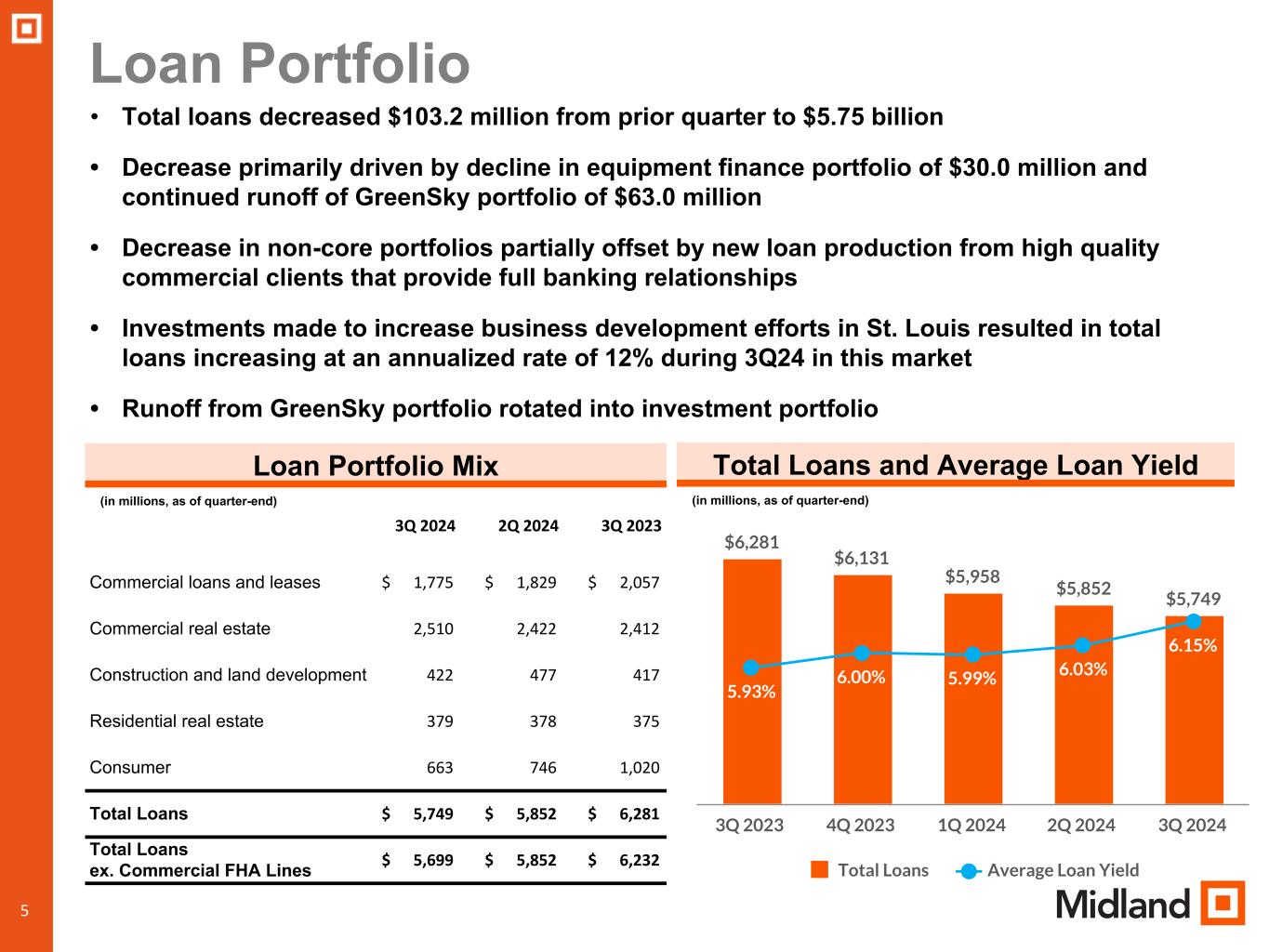

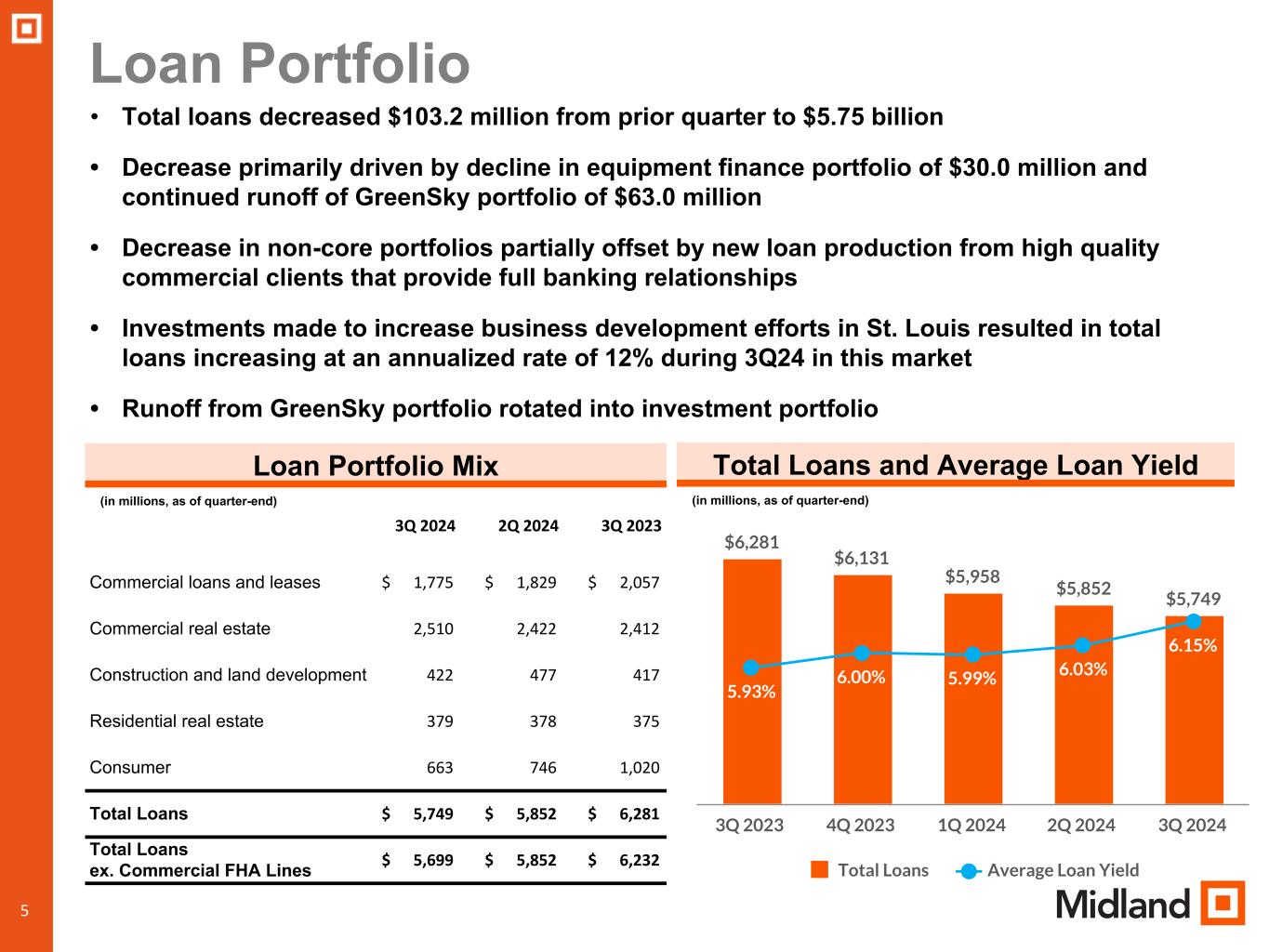

5 Loan Portfolio 5 • Total loans decreased $103.2 million from prior quarter to $5.75 billion • Decrease primarily driven by decline in equipment finance portfolio of $30.0 million and continued runoff of GreenSky portfolio of $63.0 million • Decrease in non-core portfolios partially offset by new loan production from high quality commercial clients that provide full banking relationships • Investments made to increase business development efforts in St. Louis resulted in total loans increasing at an annualized rate of 12% during 3Q24 in this market • Runoff from GreenSky portfolio rotated into investment portfolio Loan Portfolio Mix (in millions, as of quarter-end) 3Q 2024 2Q 2024 3Q 2023 Commercial loans and leases $ 1,775 $ 1,829 $ 2,057 Commercial real estate 2,510 2,422 2,412 Construction and land development 422 477 417 Residential real estate 379 378 375 Consumer 663 746 1,020 Total Loans $ 5,749 $ 5,852 $ 6,281 Total Loans ex. Commercial FHA Lines $ 5,699 $ 5,852 $ 6,232 $6,281 $6,131 $5,958 $5,852 $5,749 5.93% 6.00% 5.99% 6.03% 6.15% Total Loans Average Loan Yield 3Q 2023 4Q 2023 1Q 2024 2Q 2024 3Q 2024 Total Loans and Average Loan Yield (in millions, as of quarter-end)

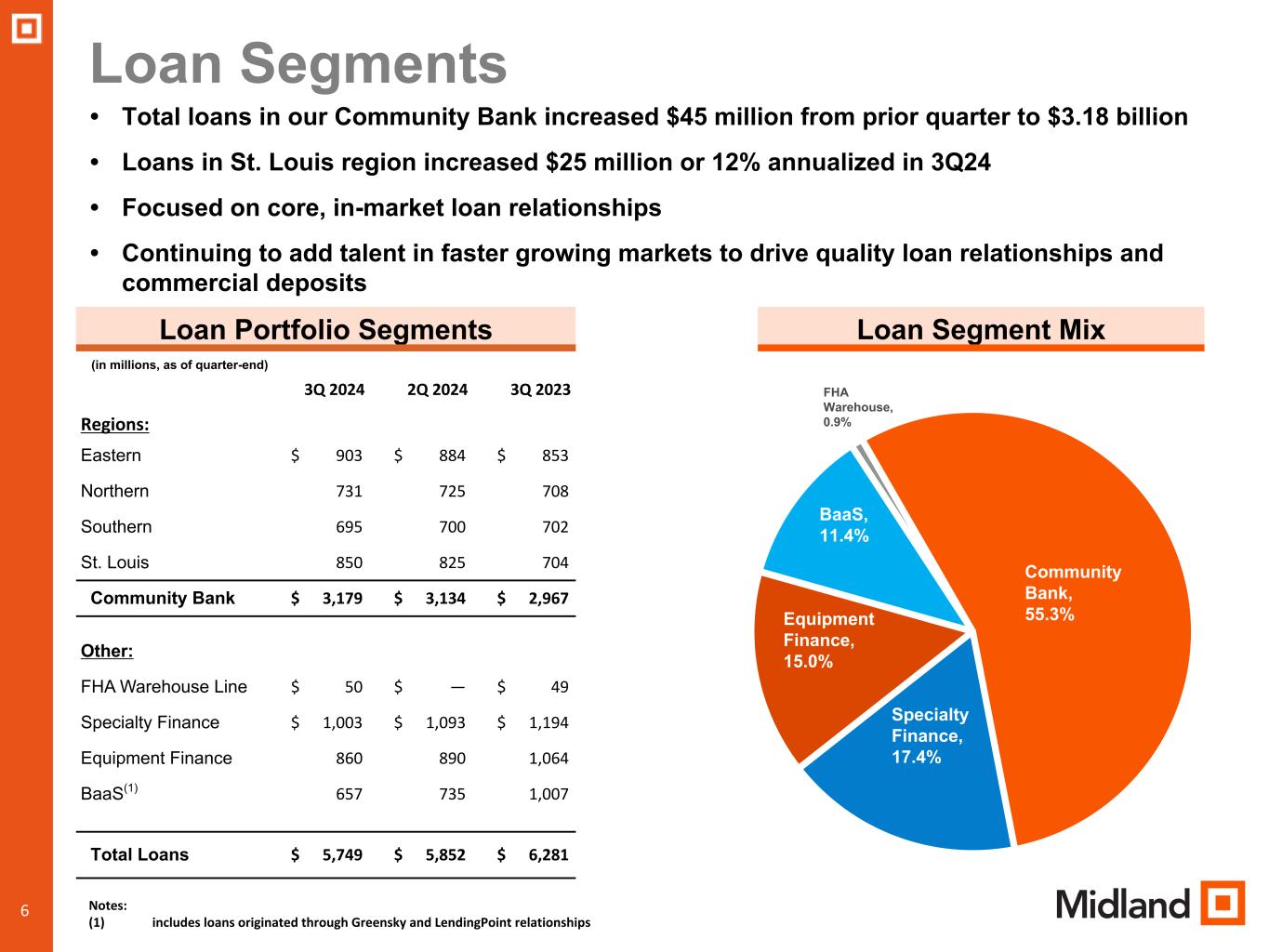

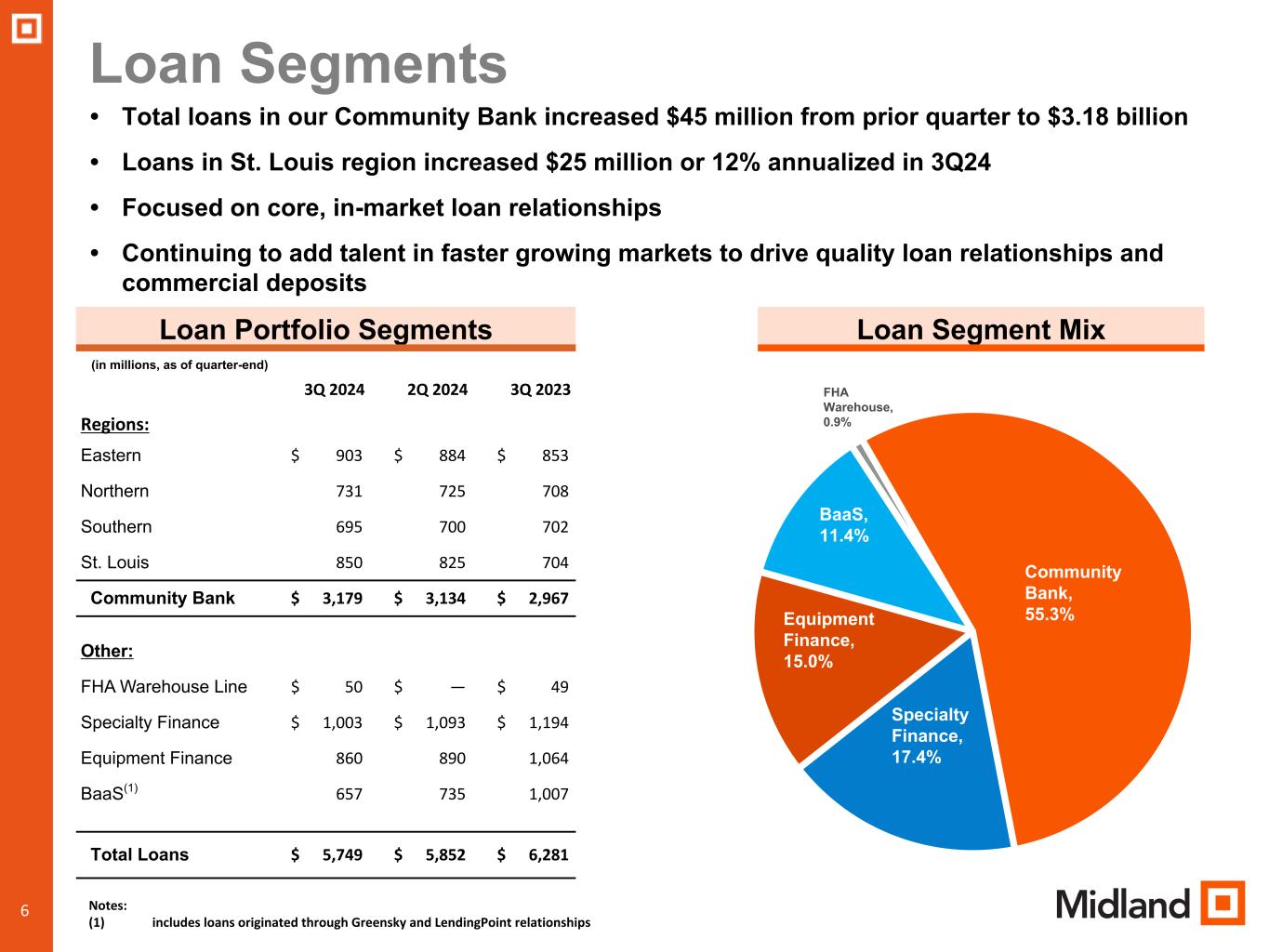

6 Loan Segments 6 • Total loans in our Community Bank increased $45 million from prior quarter to $3.18 billion • Loans in St. Louis region increased $25 million or 12% annualized in 3Q24 • Focused on core, in-market loan relationships • Continuing to add talent in faster growing markets to drive quality loan relationships and commercial deposits Loan Portfolio Segments (in millions, as of quarter-end) 3Q 2024 2Q 2024 3Q 2023 Regions: Eastern $ 903 $ 884 $ 853 Northern 731 725 708 Southern 695 700 702 St. Louis 850 825 704 Community Bank $ 3,179 $ 3,134 $ 2,967 Other: FHA Warehouse Line $ 50 $ — $ 49 Specialty Finance $ 1,003 $ 1,093 $ 1,194 Equipment Finance 860 890 1,064 BaaS(1) 657 735 1,007 Total Loans $ 5,749 $ 5,852 $ 6,281 Loan Segment Mix Community Bank, 55.3% Specialty Finance, 17.4% Equipment Finance, 15.0% BaaS, 11.4% FHA Warehouse, 0.9% Notes: (1) includes loans originated through Greensky and LendingPoint relationships

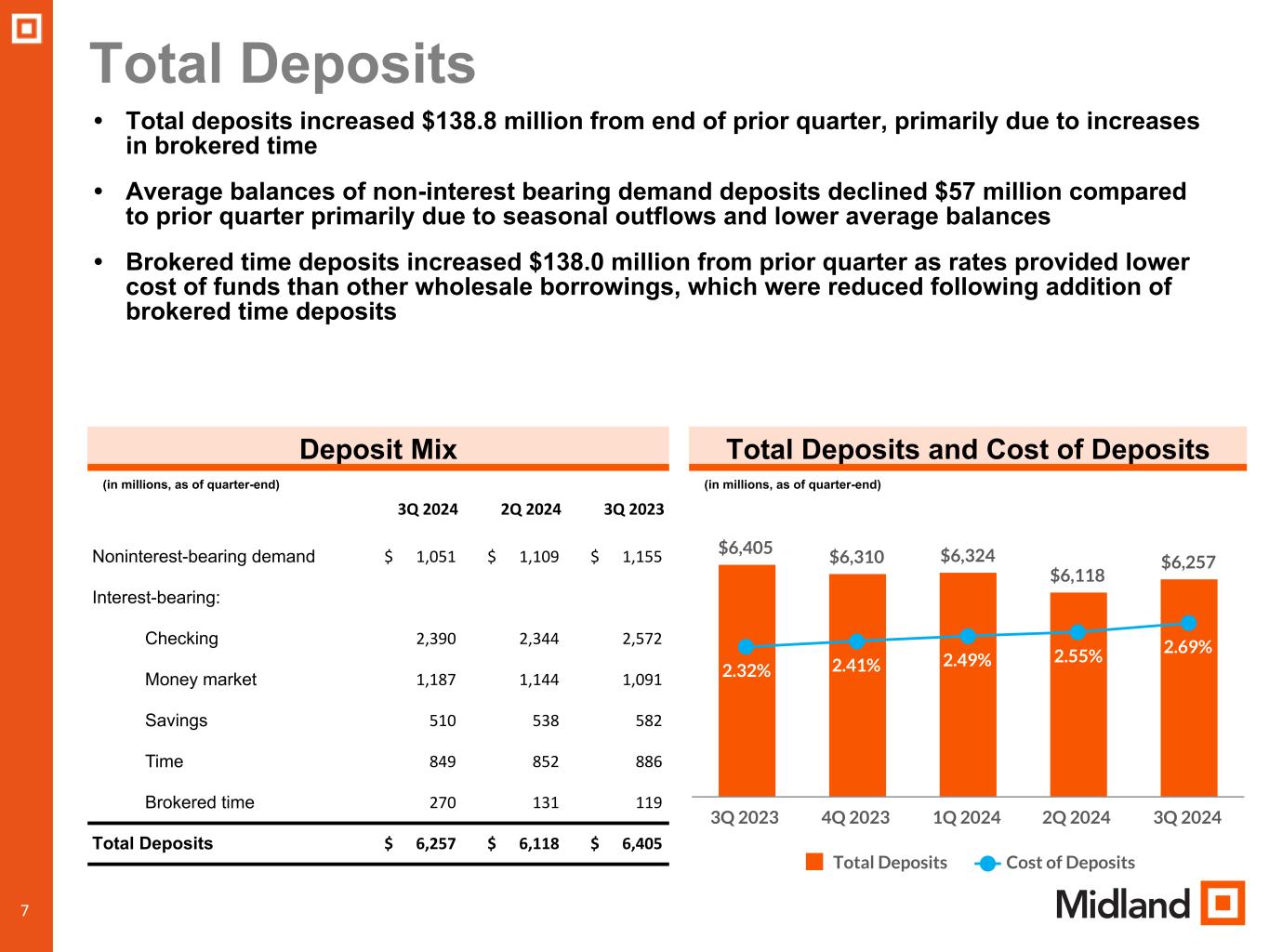

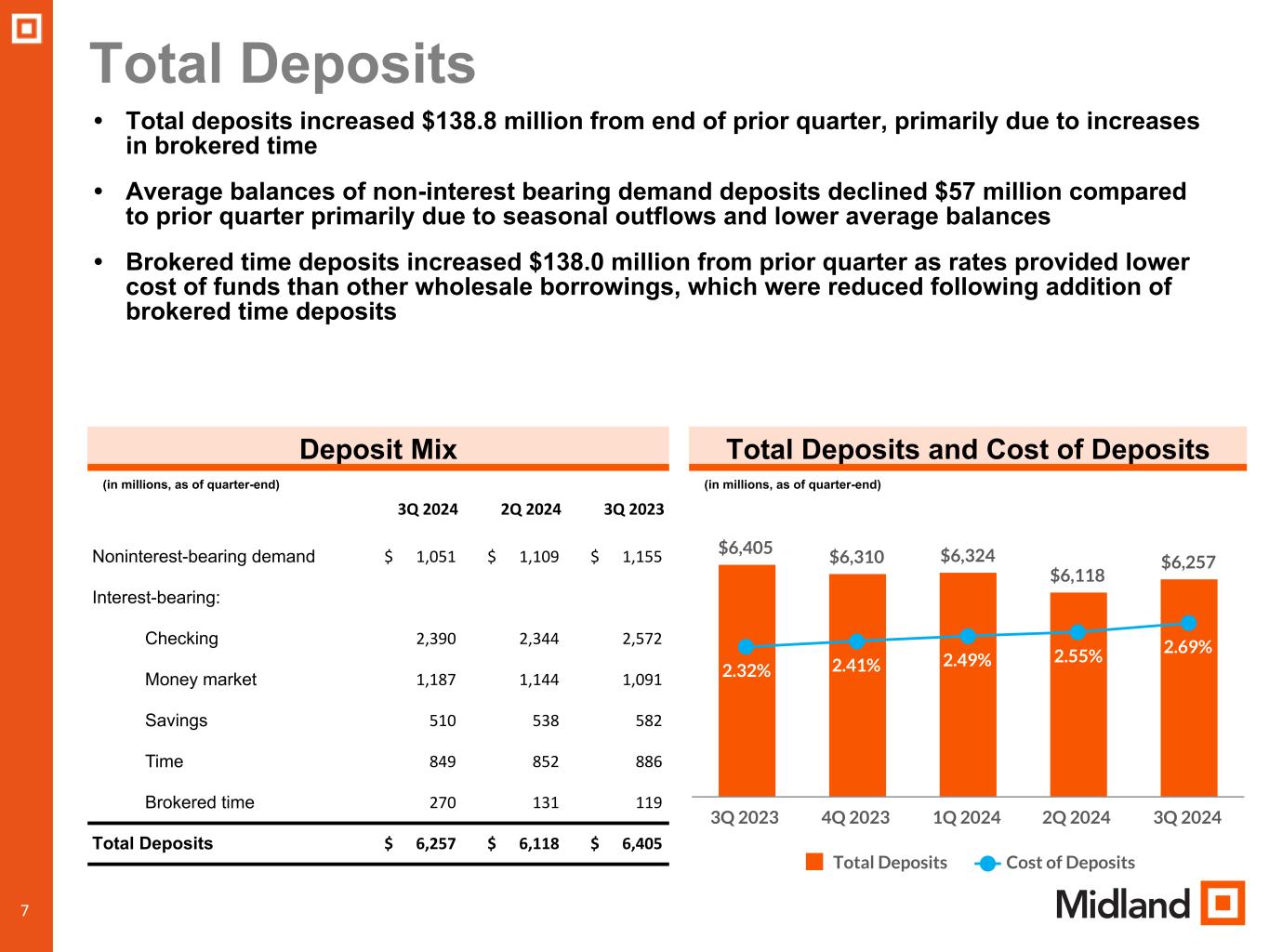

7 Total Deposits 7 • Total deposits increased $138.8 million from end of prior quarter, primarily due to increases in brokered time • Average balances of non-interest bearing demand deposits declined $57 million compared to prior quarter primarily due to seasonal outflows and lower average balances • Brokered time deposits increased $138.0 million from prior quarter as rates provided lower cost of funds than other wholesale borrowings, which were reduced following addition of brokered time deposits Deposit Mix (in millions, as of quarter-end) 3Q 2024 2Q 2024 3Q 2023 Noninterest-bearing demand $ 1,051 $ 1,109 $ 1,155 Interest-bearing: Checking 2,390 2,344 2,572 Money market 1,187 1,144 1,091 Savings 510 538 582 Time 849 852 886 Brokered time 270 131 119 Total Deposits $ 6,257 $ 6,118 $ 6,405 $6,405 $6,310 $6,324 $6,118 $6,257 2.32% 2.41% 2.49% 2.55% 2.69% Total Deposits Cost of Deposits 3Q 2023 4Q 2023 1Q 2024 2Q 2024 3Q 2024 Total Deposits and Cost of Deposits (in millions, as of quarter-end)

8 Deposit Summary 8 Deposits by Channel (in millions, as of quarter-end) 3Q 2024 2Q 2024 3Q 2023 Retail $ 2,695 $ 2,742 $ 2,756 Commercial 1,219 1,217 1,231 Public Funds 574 569 615 Wealth & Trust 332 299 318 Servicing 959 932 1,020 Brokered Deposits 391 239 228 Other 87 120 237 Total Deposits $ 6,257 $ 6,118 $ 6,405 $6,405 $6,310 $6,324 $6,118 $6,257 Retail Commercial Public Funds Wealth & Trust Servicing Brokered Deposits Other 3Q 2023 4Q 2023 1Q 2024 2Q 2024 3Q 2024 • Deposits excluding brokered remained relatively stable from prior quarter • Total brokered deposits increased $152 million in 3Q24 • Interest rates will decrease for servicing and brokered deposits reducing pressure on cost of funds Trend of Deposit Channel Mix (in millions, as of quarter-end)

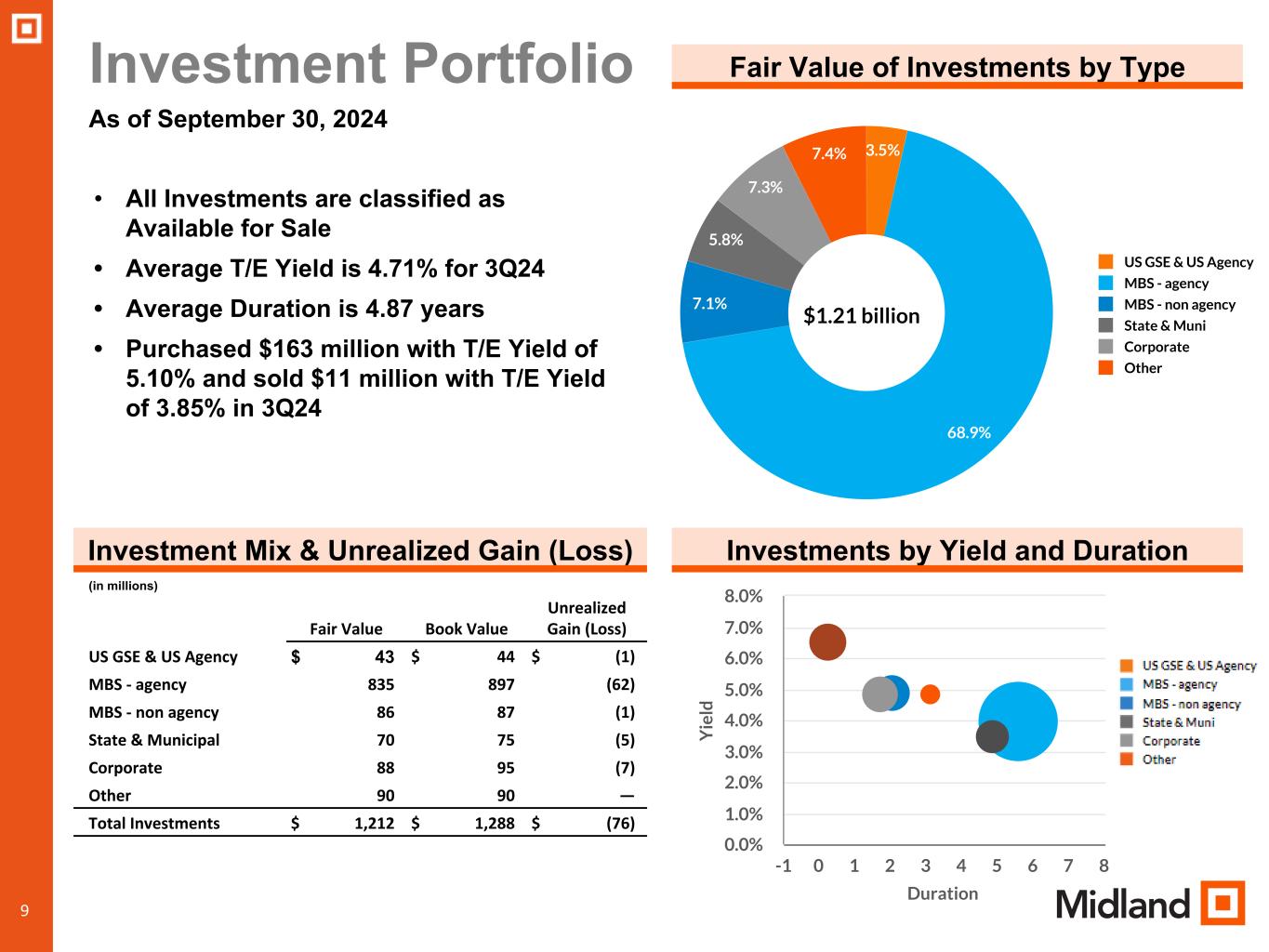

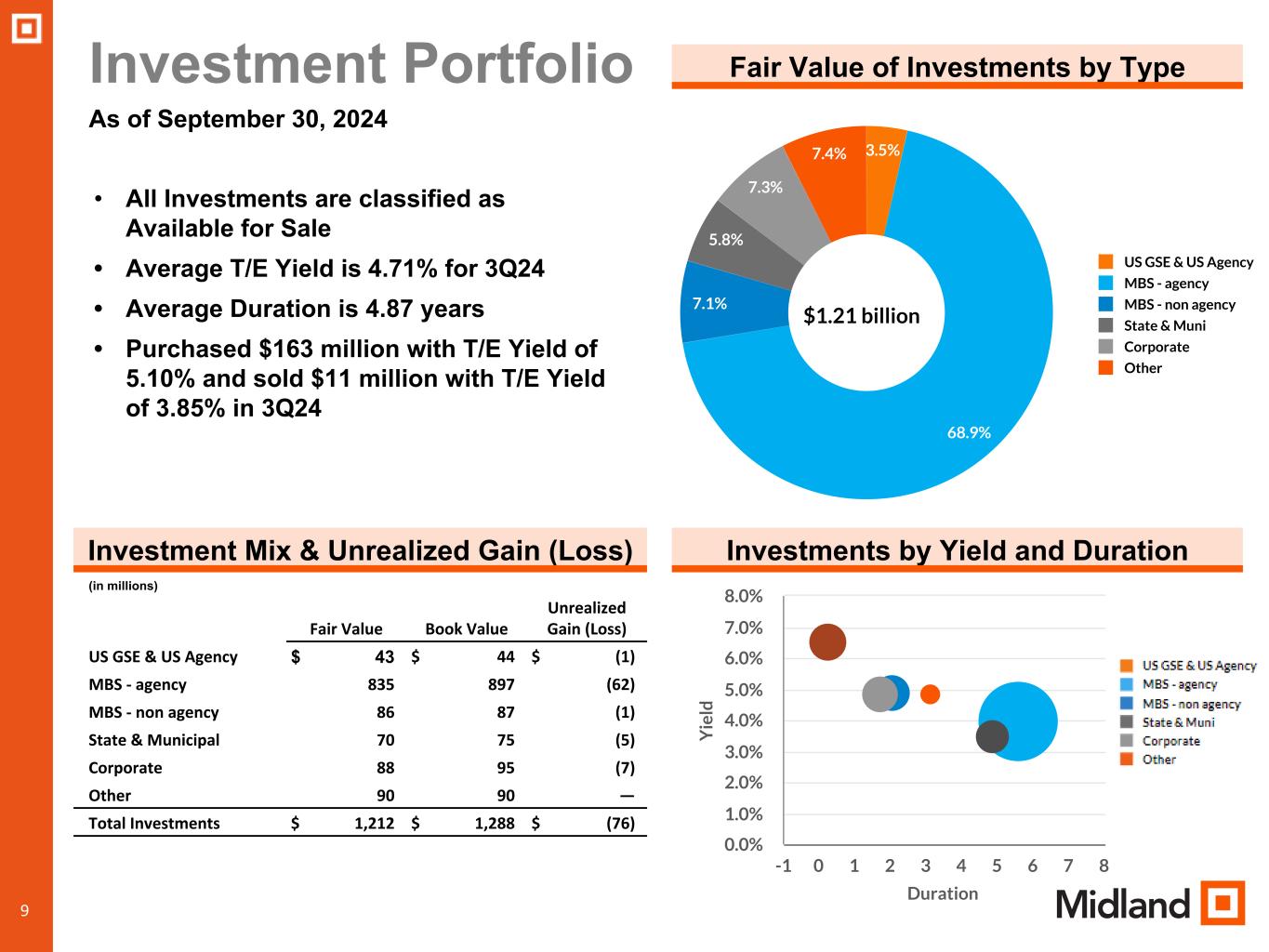

9 3.5% 68.9% 7.1% 5.8% 7.3% 7.4% US GSE & US Agency MBS - agency MBS - non agency State & Muni Corporate Other Investment Portfolio As of September 30, 2024 9 Fair Value of Investments by Type • All Investments are classified as Available for Sale • Average T/E Yield is 4.71% for 3Q24 • Average Duration is 4.87 years • Purchased $163 million with T/E Yield of 5.10% and sold $11 million with T/E Yield of 3.85% in 3Q24 Investments by Yield and DurationInvestment Mix & Unrealized Gain (Loss) (in millions) Fair Value Book Value Unrealized Gain (Loss) US GSE & US Agency $ 43 $ 44 $ (1) MBS - agency 835 897 (62) MBS - non agency 86 87 (1) State & Municipal 70 75 (5) Corporate 88 95 (7) Other 90 90 — Total Investments $ 1,212 $ 1,288 $ (76) Duration Y ie ld -1 0 1 2 3 4 5 6 7 8 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% $1.21 billion

10 3.20% 3.21% 3.18% 3.12% 3.10% 3Q 2023 4Q 2023 1Q 2024 2Q 2024 3Q 2024 $58.6 $58.1 $55.9 $55.1 $55.0 3Q 2023 4Q 2023 1Q 2024 2Q 2024 3Q 2024 Net Interest Income/Margin 10 • Net interest income down slightly from prior quarter due to higher interest-bearing deposit rates and average short-term borrowings • Net interest margin decreased 2 bp to 3.10% as the increase in the cost of deposits exceeded the increase in the average yield on earning assets • Average rate on new and renewed loan originations was 7.82% in 3Q24 and higher than average rates on loan payoffs making them accretive to net interest margin • Deposit rates starting to decline following Fed rate cuts and expected to positively impact net interest margin in 2025 Net Interest Income (in millions) Net Interest Margin

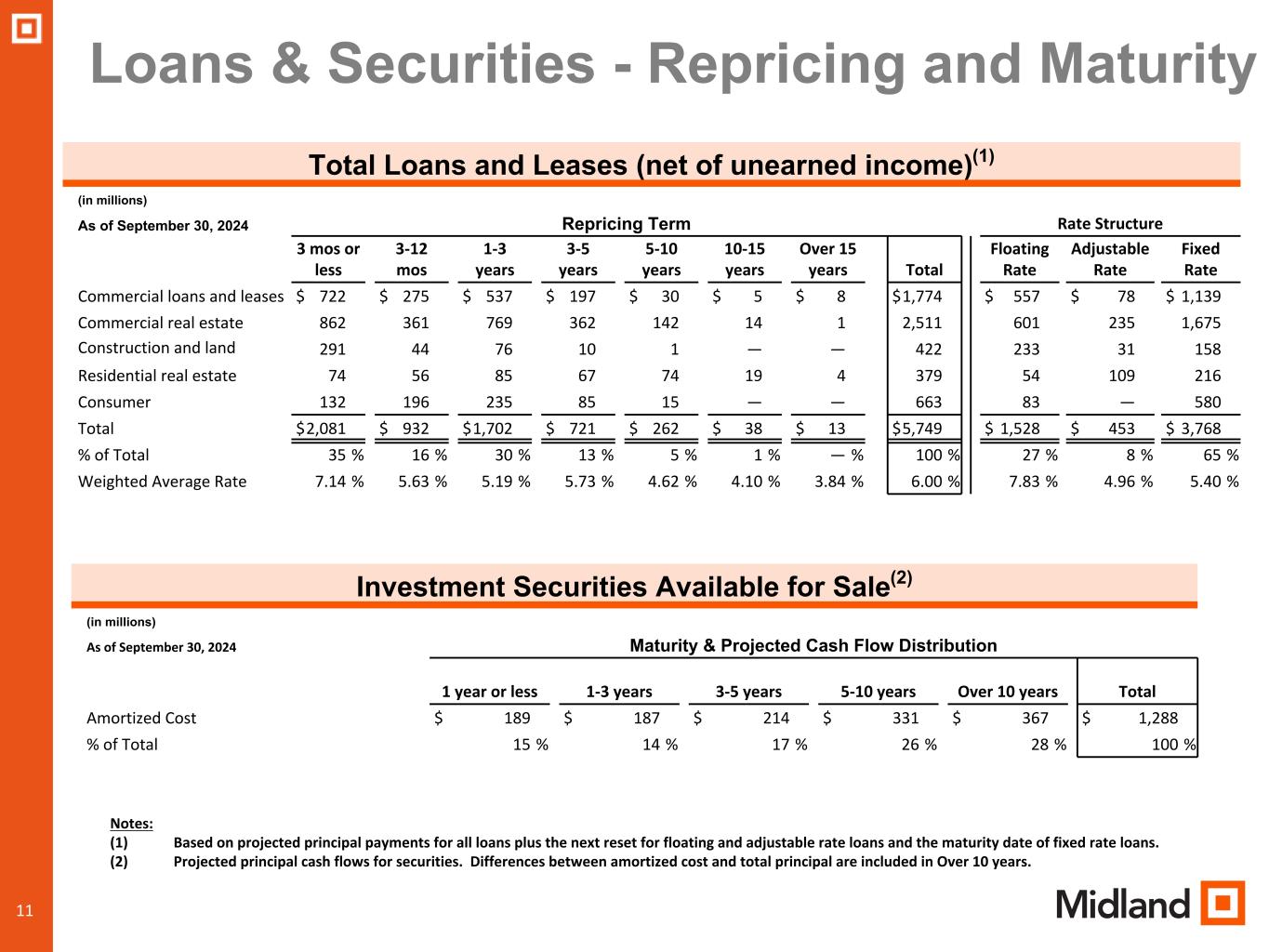

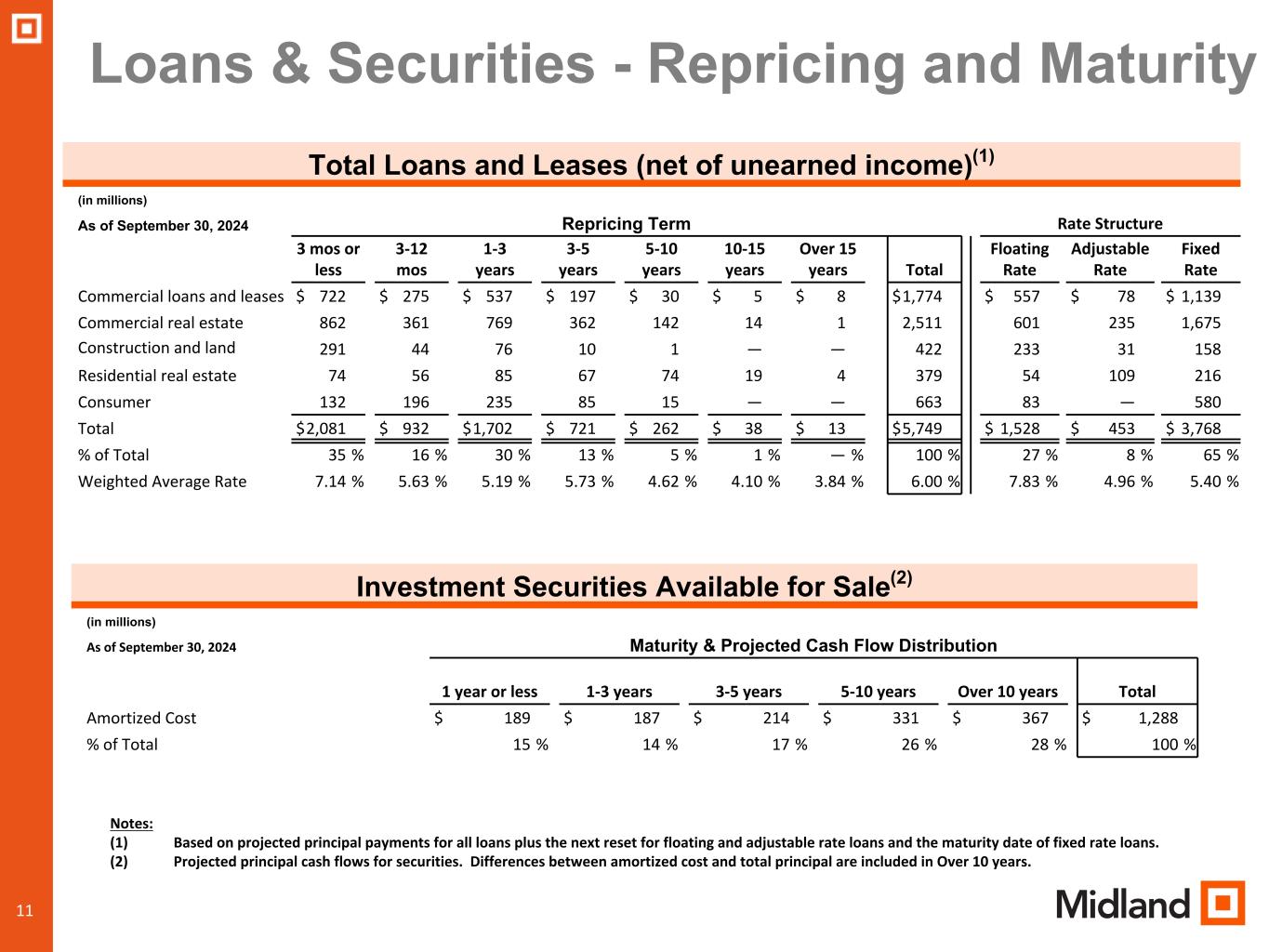

11 Loans & Securities - Repricing and Maturity 11 Total Loans and Leases (net of unearned income)(1) (in millions) As of September 30, 2024 Repricing Term Rate Structure 3 mos or less 3-12 mos 1-3 years 3-5 years 5-10 years 10-15 years Over 15 years Total Floating Rate Adjustable Rate Fixed Rate Commercial loans and leases $ 722 $ 275 $ 537 $ 197 $ 30 $ 5 $ 8 $ 1,774 $ 557 $ 78 $ 1,139 Commercial real estate 862 361 769 362 142 14 1 2,511 601 235 1,675 Construction and land development 291 44 76 10 1 — — 422 233 31 158 Residential real estate 74 56 85 67 74 19 4 379 54 109 216 Consumer 132 196 235 85 15 — — 663 83 — 580 Total $ 2,081 $ 932 $ 1,702 $ 721 $ 262 $ 38 $ 13 $ 5,749 $ 1,528 $ 453 $ 3,768 % of Total 35 % 16 % 30 % 13 % 5 % 1 % — % 100 % 27 % 8 % 65 % Weighted Average Rate 7.14 % 5.63 % 5.19 % 5.73 % 4.62 % 4.10 % 3.84 % 6.00 % 7.83 % 4.96 % 5.40 % Investment Securities Available for Sale(2) (in millions) As of September 30, 2024 Maturity & Projected Cash Flow Distribution 1 year or less 1-3 years 3-5 years 5-10 years Over 10 years Total Amortized Cost $ 189 $ 187 $ 214 $ 331 $ 367 $ 1,288 % of Total 15 % 14 % 17 % 26 % 28 % 100 % Notes: (1) Based on projected principal payments for all loans plus the next reset for floating and adjustable rate loans and the maturity date of fixed rate loans. (2) Projected principal cash flows for securities. Differences between amortized cost and total principal are included in Over 10 years.

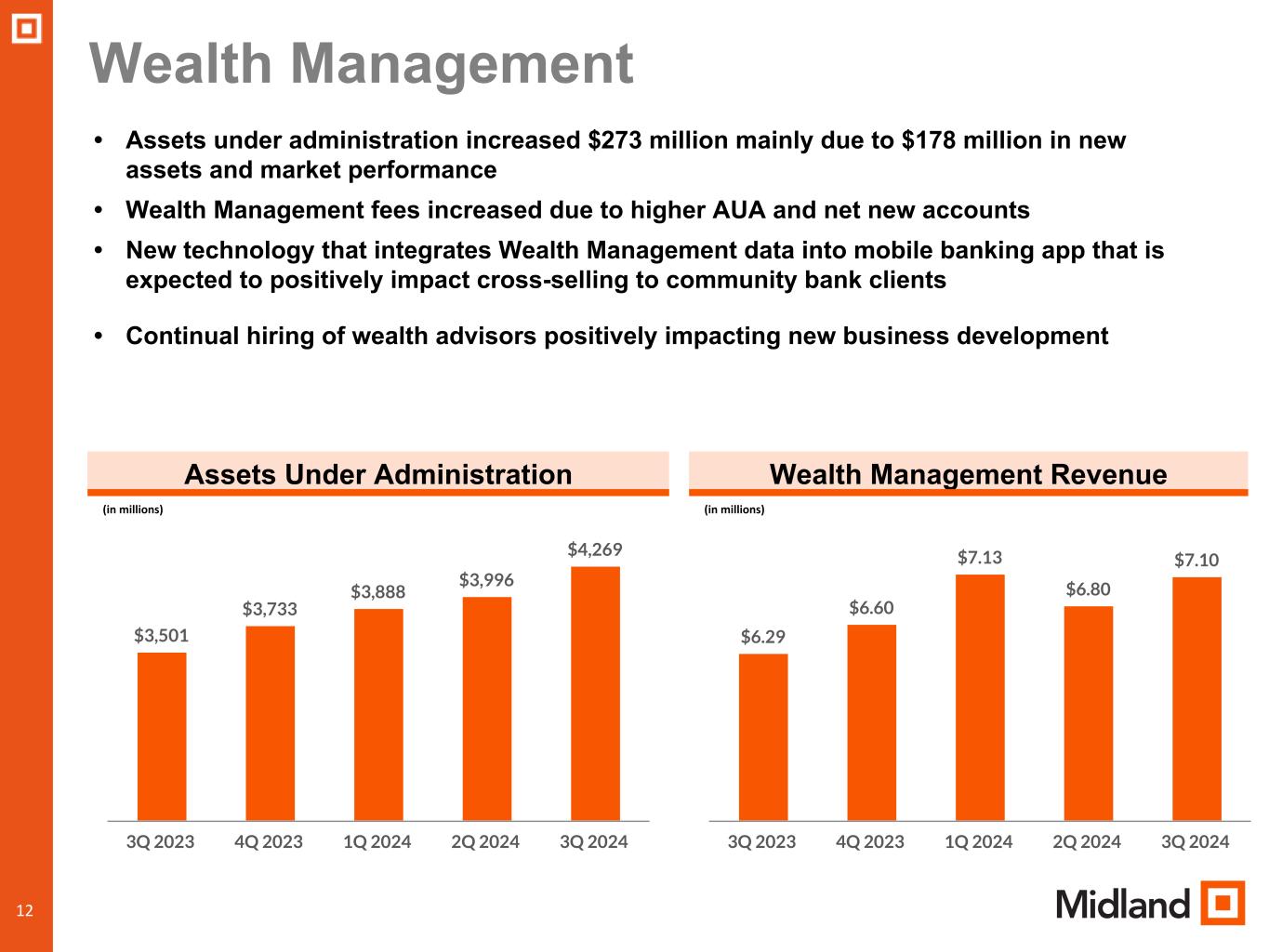

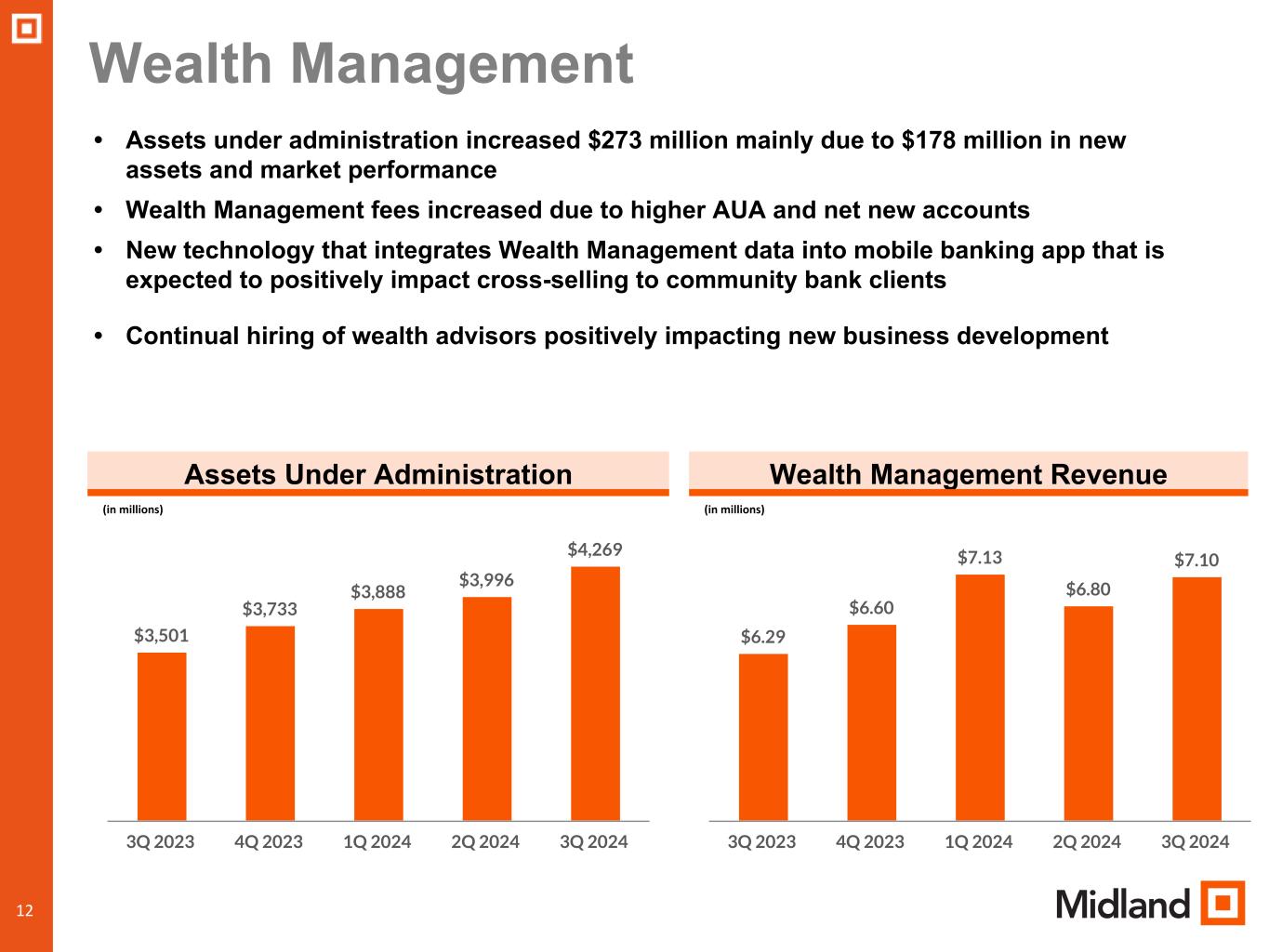

12 Wealth Management 12 • Assets under administration increased $273 million mainly due to $178 million in new assets and market performance • Wealth Management fees increased due to higher AUA and net new accounts • New technology that integrates Wealth Management data into mobile banking app that is expected to positively impact cross-selling to community bank clients • Continual hiring of wealth advisors positively impacting new business development Assets Under Administration (in millions) $3,501 $3,733 $3,888 $3,996 $4,269 3Q 2023 4Q 2023 1Q 2024 2Q 2024 3Q 2024 $6.29 $6.60 $7.13 $6.80 $7.10 3Q 2023 4Q 2023 1Q 2024 2Q 2024 3Q 2024 Wealth Management Revenue (in millions)

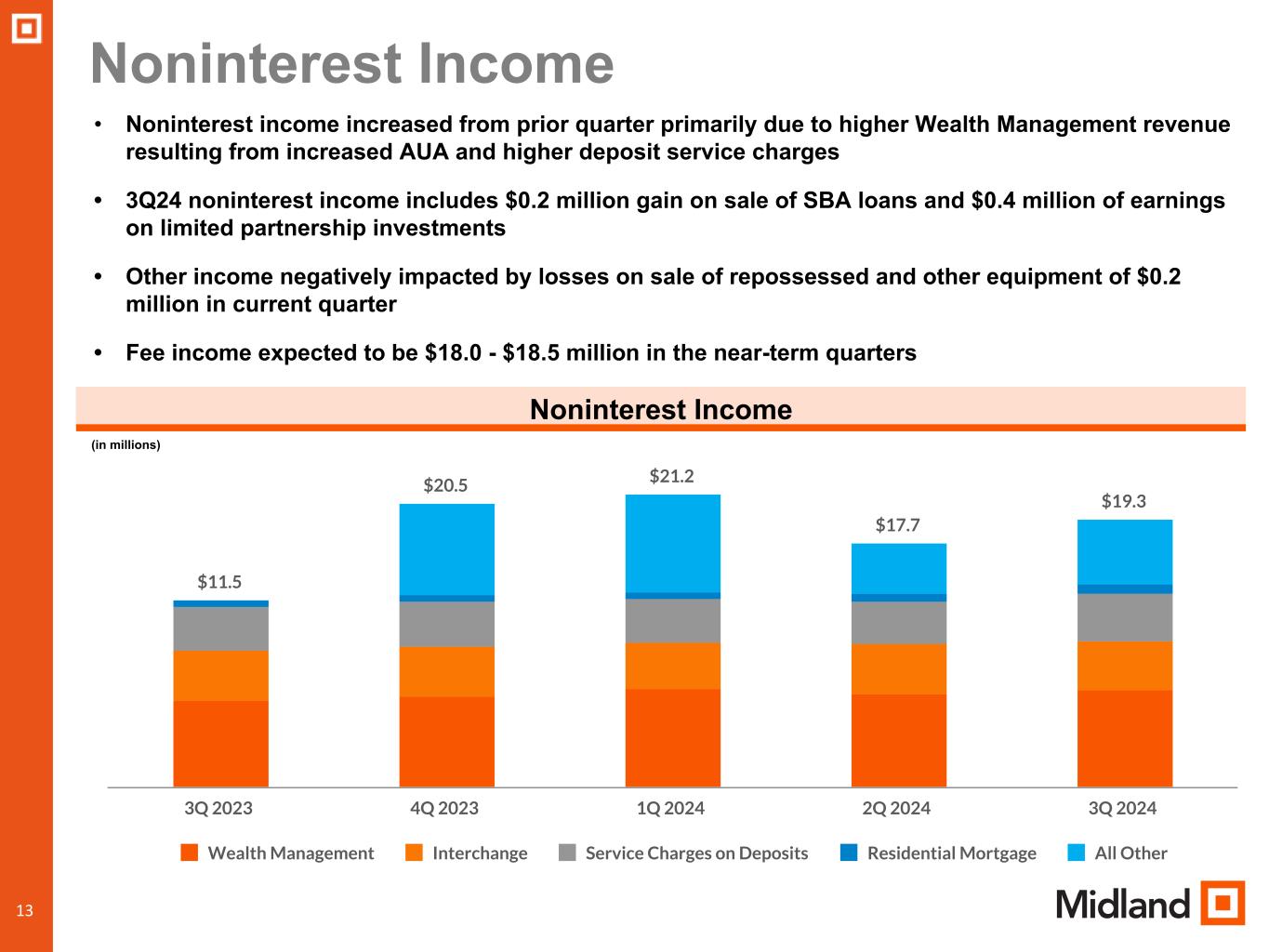

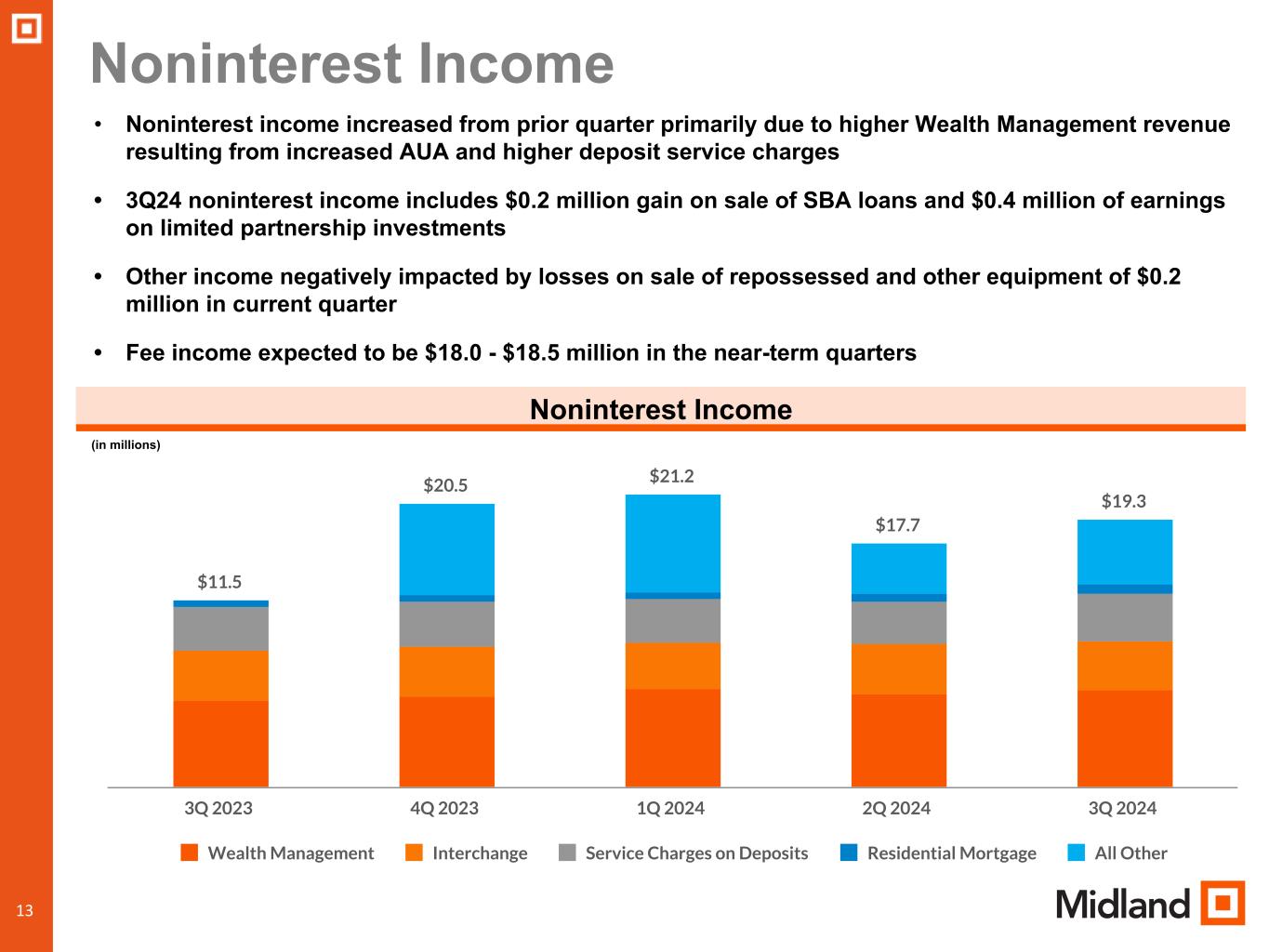

13 $11.5 $20.5 $21.2 $17.7 $19.3 Wealth Management Interchange Service Charges on Deposits Residential Mortgage All Other 3Q 2023 4Q 2023 1Q 2024 2Q 2024 3Q 2024 Noninterest Income 13 • Noninterest income increased from prior quarter primarily due to higher Wealth Management revenue resulting from increased AUA and higher deposit service charges • 3Q24 noninterest income includes $0.2 million gain on sale of SBA loans and $0.4 million of earnings on limited partnership investments • Other income negatively impacted by losses on sale of repossessed and other equipment of $0.2 million in current quarter • Fee income expected to be $18.0 - $18.5 million in the near-term quarters Noninterest Income (in millions)

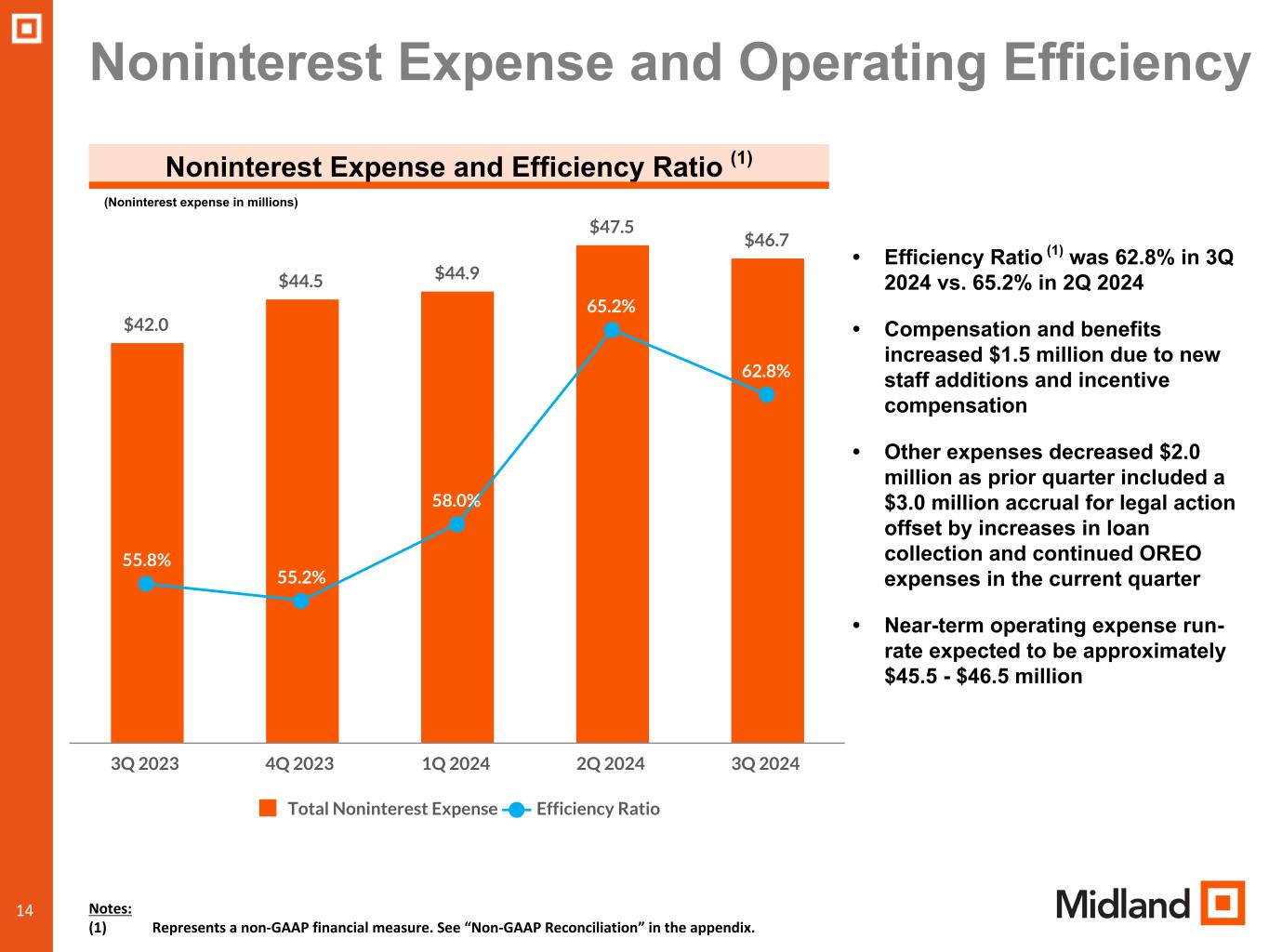

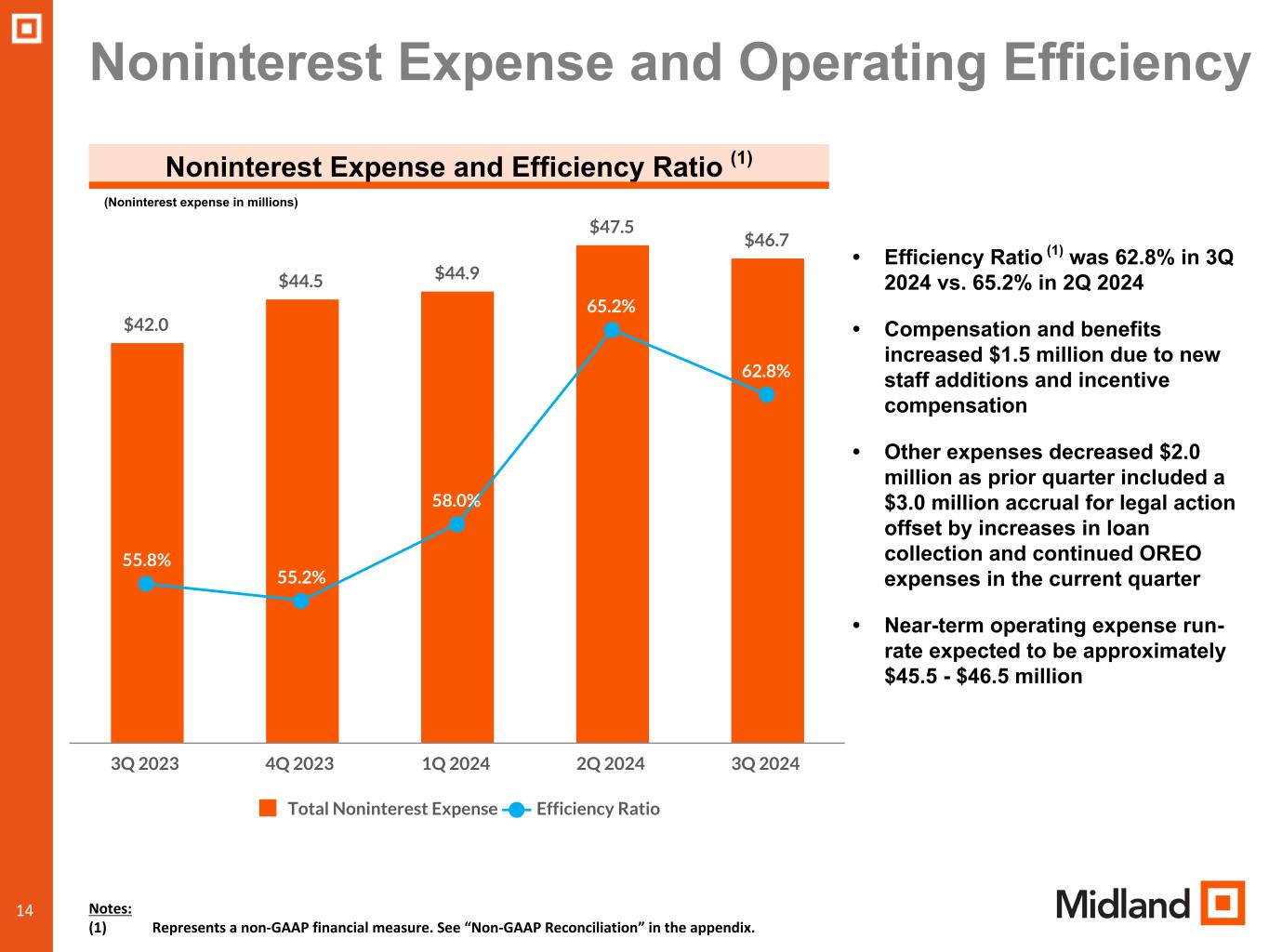

14 $42.0 $44.5 $44.9 $47.5 $46.7 55.8% 55.2% 58.0% 65.2% 62.8% Total Noninterest Expense Efficiency Ratio 3Q 2023 4Q 2023 1Q 2024 2Q 2024 3Q 2024 Noninterest Expense and Operating Efficiency 14 Noninterest Expense and Efficiency Ratio (1) (Noninterest expense in millions) • Efficiency Ratio (1) was 62.8% in 3Q 2024 vs. 65.2% in 2Q 2024 • Compensation and benefits increased $1.5 million due to new staff additions and incentive compensation • Other expenses decreased $2.0 million as prior quarter included a $3.0 million accrual for legal action offset by increases in loan collection and continued OREO expenses in the current quarter • Near-term operating expense run- rate expected to be approximately $45.5 - $46.5 million Notes: (1) Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix.

15 Asset Quality 15 • Nonperforming loans increased from prior quarter • Net charge-offs to average loans was 0.78% driven by equipment finance and $6.2 million of charge offs in the Lending Point portfolio • General stability in asset quality resulted in lower provision for credit losses than prior quarter with ACL/Total Loans of 1.49% • Taking steps to improve asset quality through focus on relationship lending and tighter credit standards Nonperforming Loans / Total Loans (Total Loans as of quarter-end) NCO / Average Loans 0.69% 0.68% 1.49% 1.58% 1.55%0.20% 0.24% 0.27% 0.34% 0.37% 0.07% 0.89% 0.92% 1.76% 1.92% 1.99% Lending Point Equipment Finance All other 3Q 2023 4Q 2023 1Q 2024 2Q 2024 3Q 2024 0.08% 0.07% 0.05% (0.06)% 0.02% 0.14% 0.26% 0.25% 0.26% 0.33% 0.43% 0.22% 0.33% 0.30% 0.20% 0.78% Lending Point Equipment Finance All other 3Q 2023 4Q 2023 1Q 2024 2Q 2024 3Q 2024

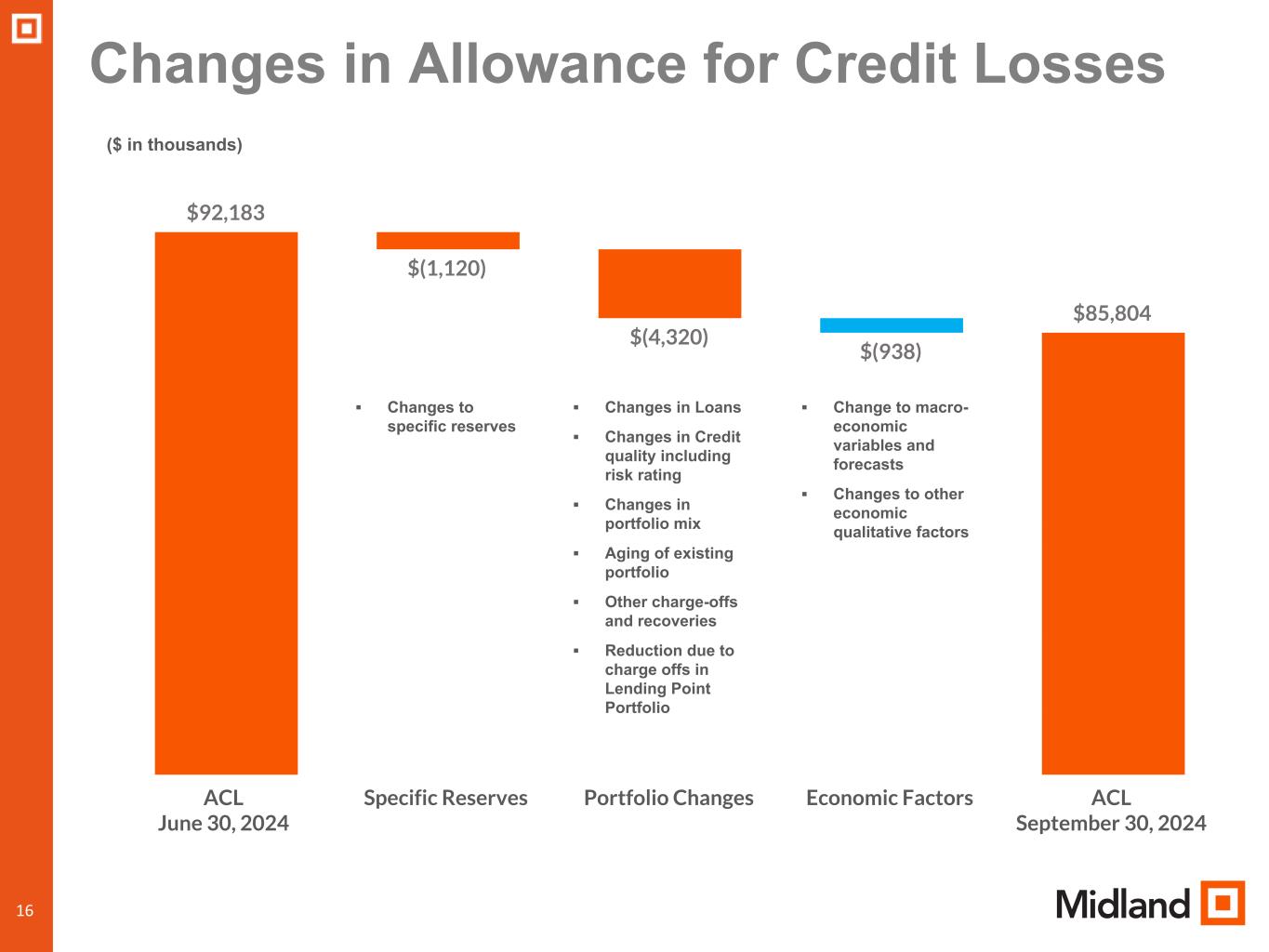

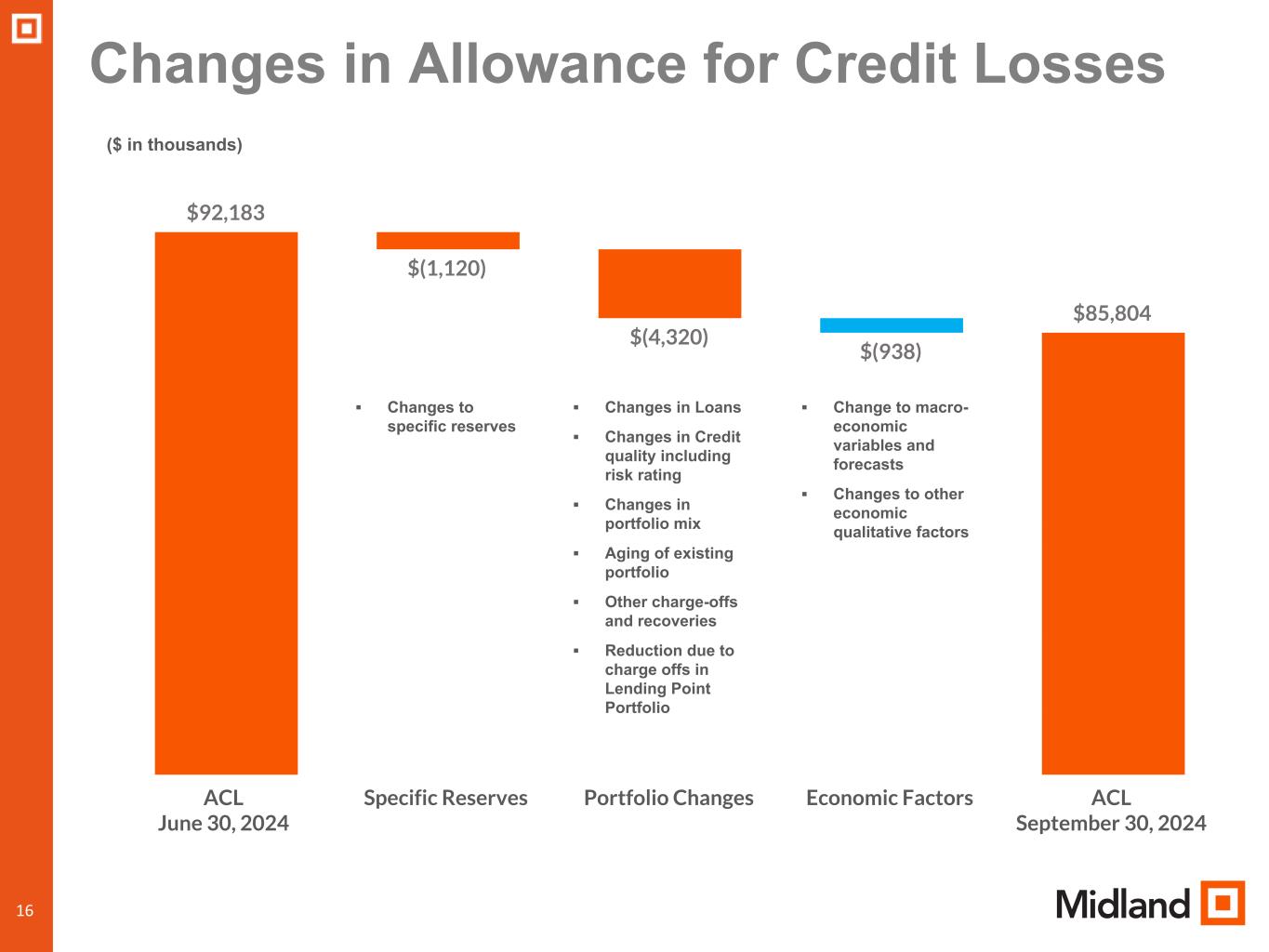

16 $92,183 $(1,120) $(4,320) $(938) $85,804 ACL June 30, 2024 Specific Reserves Portfolio Changes Economic Factors ACL September 30, 2024 Changes in Allowance for Credit Losses 16 ($ in thousands) ▪ Changes to specific reserves ▪ Changes in Loans ▪ Changes in Credit quality including risk rating ▪ Changes in portfolio mix ▪ Aging of existing portfolio ▪ Other charge-offs and recoveries ▪ Reduction due to charge offs in Lending Point Portfolio ▪ Change to macro- economic variables and forecasts ▪ Changes to other economic qualitative factors

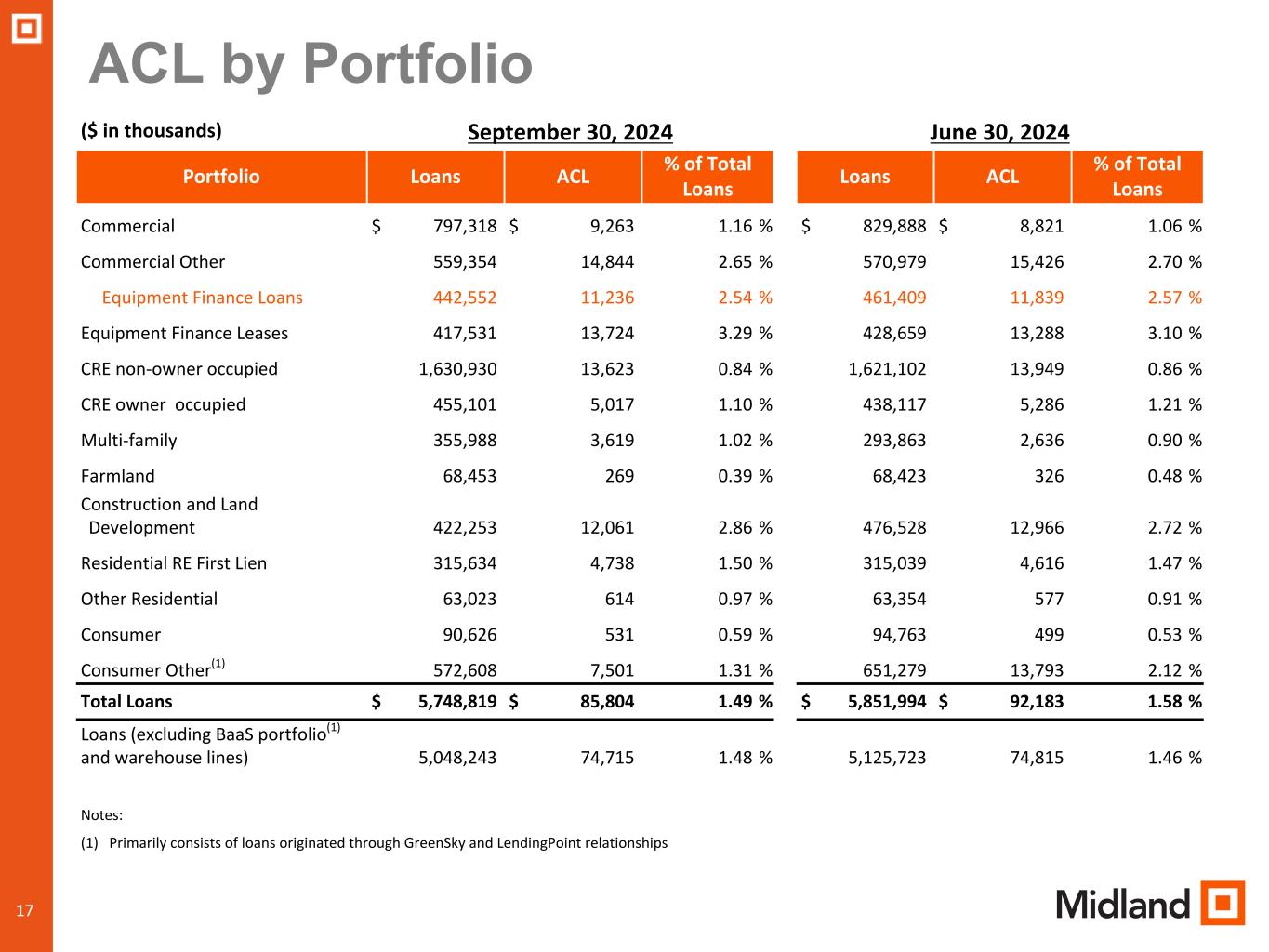

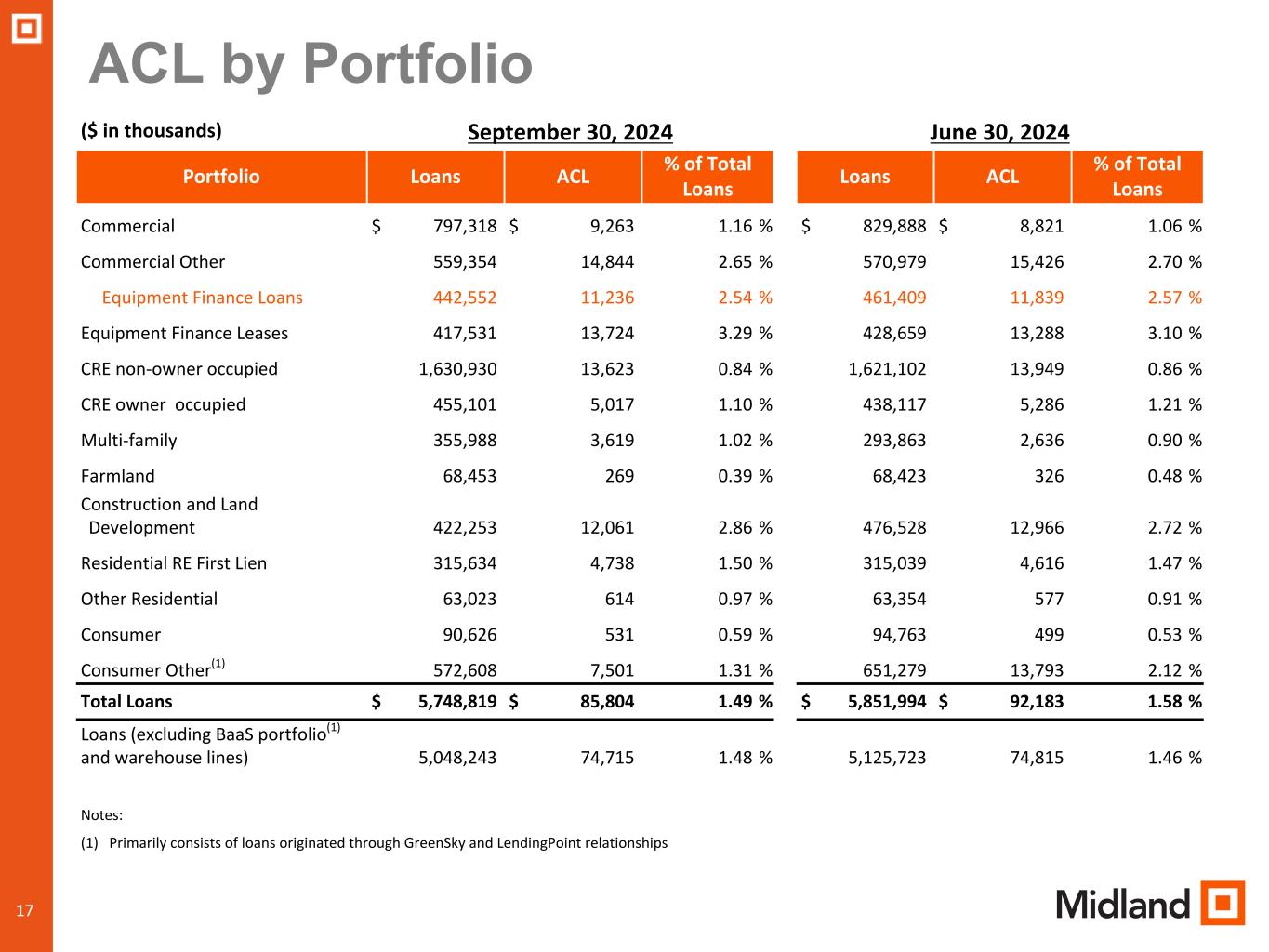

17 ACL by Portfolio 17 ($ in thousands) September 30, 2024 June 30, 2024 Portfolio Loans ACL % of Total Loans Loans ACL % of Total Loans Commercial $ 797,318 $ 9,263 1.16 % $ 829,888 $ 8,821 1.06 % Commercial Other 559,354 14,844 2.65 % 570,979 15,426 2.70 % Equipment Finance Loans 442,552 11,236 2.54 % 461,409 11,839 2.57 % Equipment Finance Leases 417,531 13,724 3.29 % 428,659 13,288 3.10 % CRE non-owner occupied 1,630,930 13,623 0.84 % 1,621,102 13,949 0.86 % CRE owner occupied 455,101 5,017 1.10 % 438,117 5,286 1.21 % Multi-family 355,988 3,619 1.02 % 293,863 2,636 0.90 % Farmland 68,453 269 0.39 % 68,423 326 0.48 % Construction and Land Development 422,253 12,061 2.86 % 476,528 12,966 2.72 % Residential RE First Lien 315,634 4,738 1.50 % 315,039 4,616 1.47 % Other Residential 63,023 614 0.97 % 63,354 577 0.91 % Consumer 90,626 531 0.59 % 94,763 499 0.53 % Consumer Other(1) 572,608 7,501 1.31 % 651,279 13,793 2.12 % Total Loans $ 5,748,819 $ 85,804 1.49 % $ 5,851,994 $ 92,183 1.58 % Loans (excluding BaaS portfolio(1) and warehouse lines) 5,048,243 74,715 1.48 % 5,125,723 74,815 1.46 % Notes: (1) Primarily consists of loans originated through GreenSky and LendingPoint relationships

18 2024 Outlook and Priorities 18 • Well positioned with increased levels of capital, liquidity, and reserves • Continuing to focus on improving credit quality through core relationship lending and tightened credit • Prudent risk management will remain top priority while economic uncertainty remains with business development efforts focused on adding new commercial and retail deposit relationships throughout our markets • Capitalizing on market disruption resulting from M&A to add new clients and banking talent • Prudent balance sheet management and earnings should lead to further increases in capital ratios • Loan pipeline remains steady and new loan production within the community bank will continue to partially offset the runoff from the GreenSky portfolio and continued intentional reduction of the equipment finance portfolio • Well positioned to benefit from lower interest rates with lower funding costs expected to lead to expanded net interest margin • Positive trends in key areas should lead to consistent level of profitability * Continued disciplined expense management while making investments in the business to increase market share, add clients, and generate profitable growth in the future * Wealth Management revenue trending higher due to contributions of new advisors * BaaS initiative continuing to seek high quality FinTech partners

19 APPENDIX 19

2020 Industries as a percentage of Commercial, CRE and Equipment Finance Loans and Leases with outstanding balances of $4.71 billion as of September 30, 2024 ($s in millions) RE/Rental & Leasing $1,708.9 36.3% All Others $569.1 12.1% Skilled Nursing $394.2 8.4% Construction - General $293.2 6.2% Manufacturing $214.8 4.6% Finance and Insurance $218.9 4.7% Accommodation & Food Svcs $305.5 6.5% Trans./Ground Passenger $171.2 3.6% Assisted Living $102.5 2.2% Ag., Forestry, & Fishing $149.6 3.2% General Freight Trucking $171.0 3.6% Retail Trade $174.1 3.7% Wholesale Trade $63.7 1.4% Other Services $102.2 2.2% Commercial Loans and Leases by Industry Health Care $68.0 1.4%

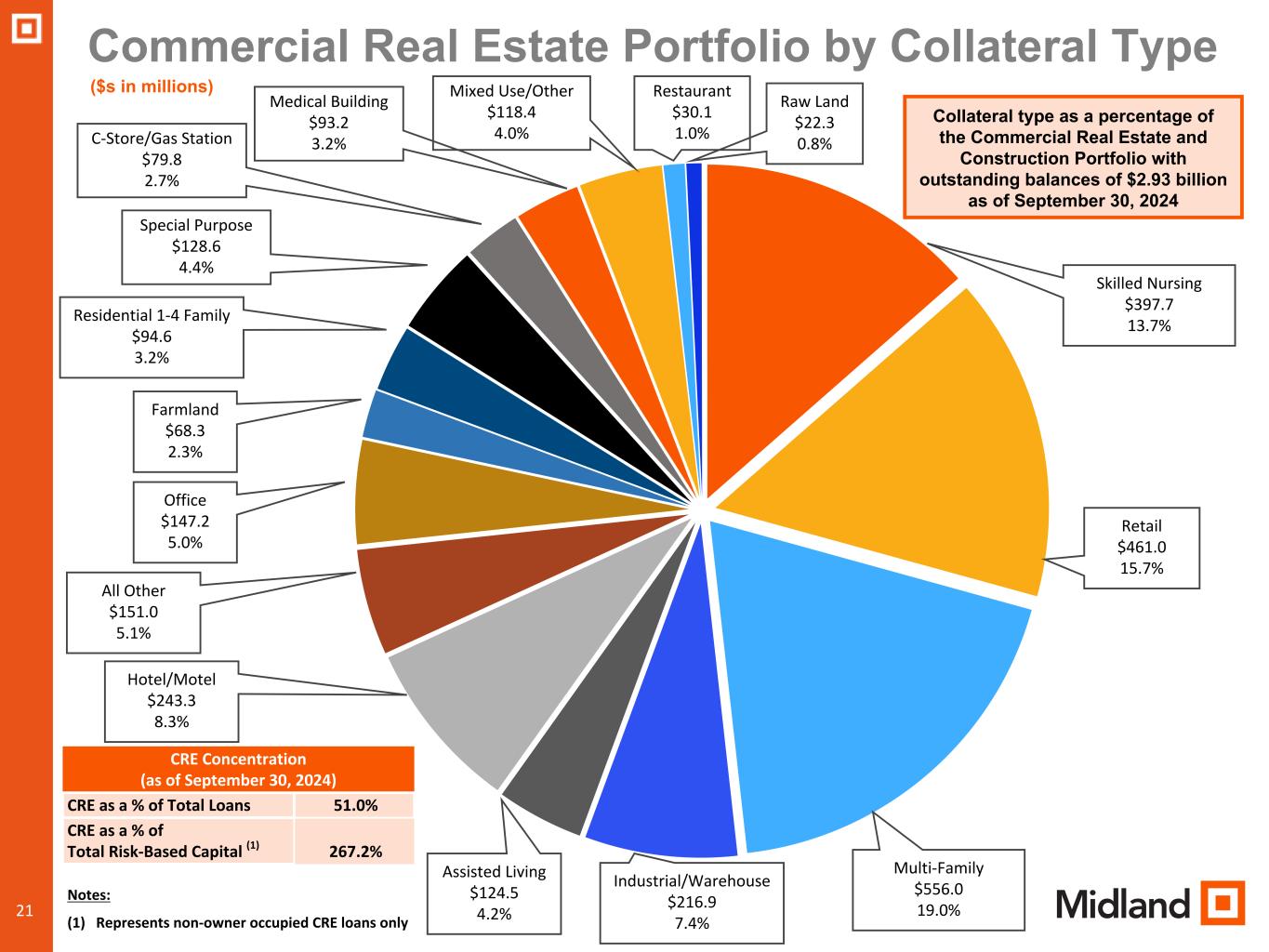

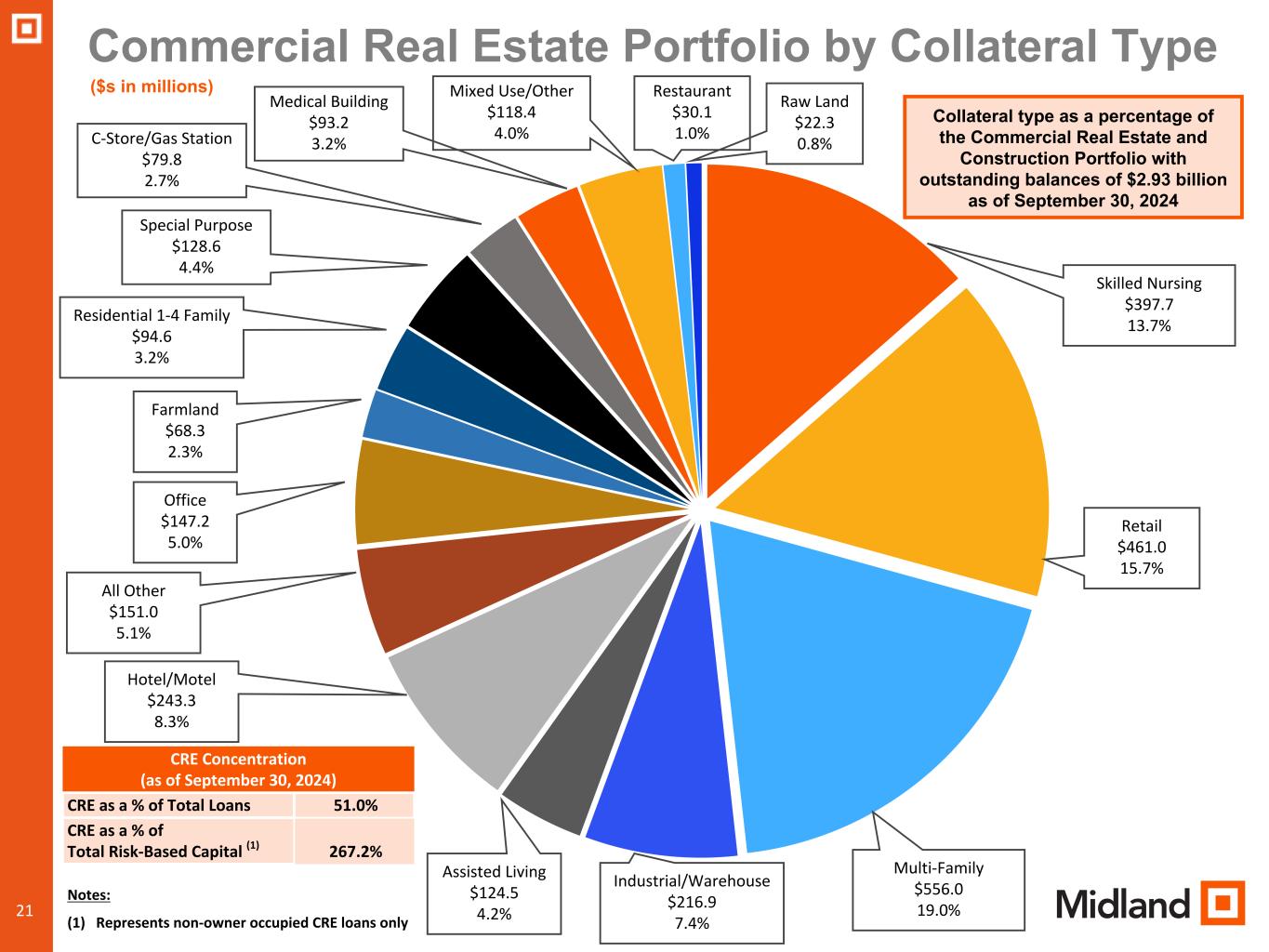

21 Commercial Real Estate Portfolio by Collateral Type 21 CRE Concentration (as of September 30, 2024) CRE as a % of Total Loans 51.0% CRE as a % of Total Risk-Based Capital (1) 267.2% Notes: (1) Represents non-owner occupied CRE loans only Collateral type as a percentage of the Commercial Real Estate and Construction Portfolio with outstanding balances of $2.93 billion as of September 30, 2024 ($s in millions) Skilled Nursing $397.7 13.7% Retail $461.0 15.7% Multi-Family $556.0 19.0% Industrial/Warehouse $216.9 7.4% Assisted Living $124.5 4.2% Hotel/Motel $243.3 8.3% All Other $151.0 5.1% Office $147.2 5.0% Farmland $68.3 2.3% Residential 1-4 Family $94.6 3.2% Raw Land $22.3 0.8% Restaurant $30.1 1.0% Mixed Use/Other $118.4 4.0% Medical Building $93.2 3.2% Special Purpose $128.6 4.4% C-Store/Gas Station $79.8 2.7%

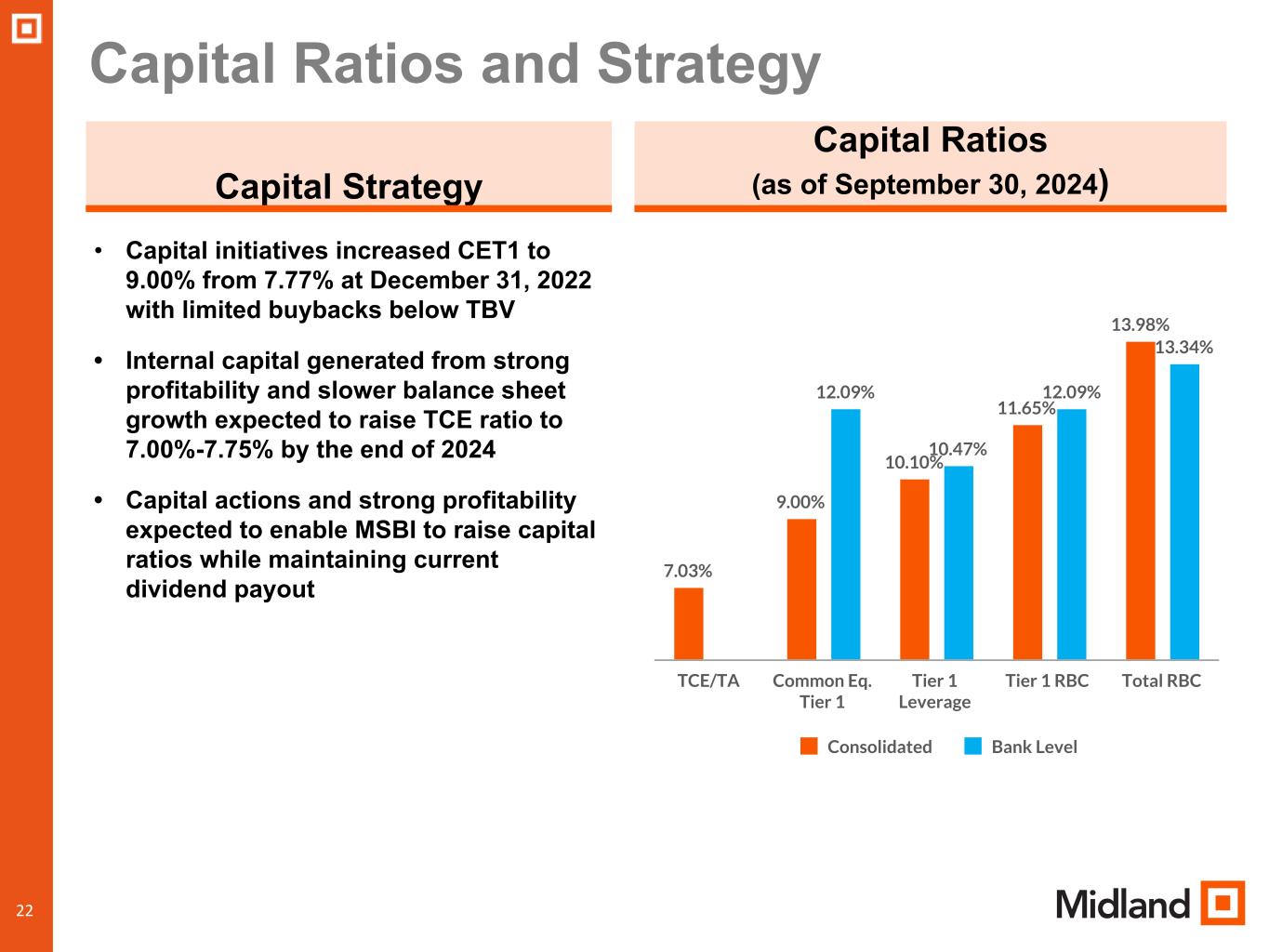

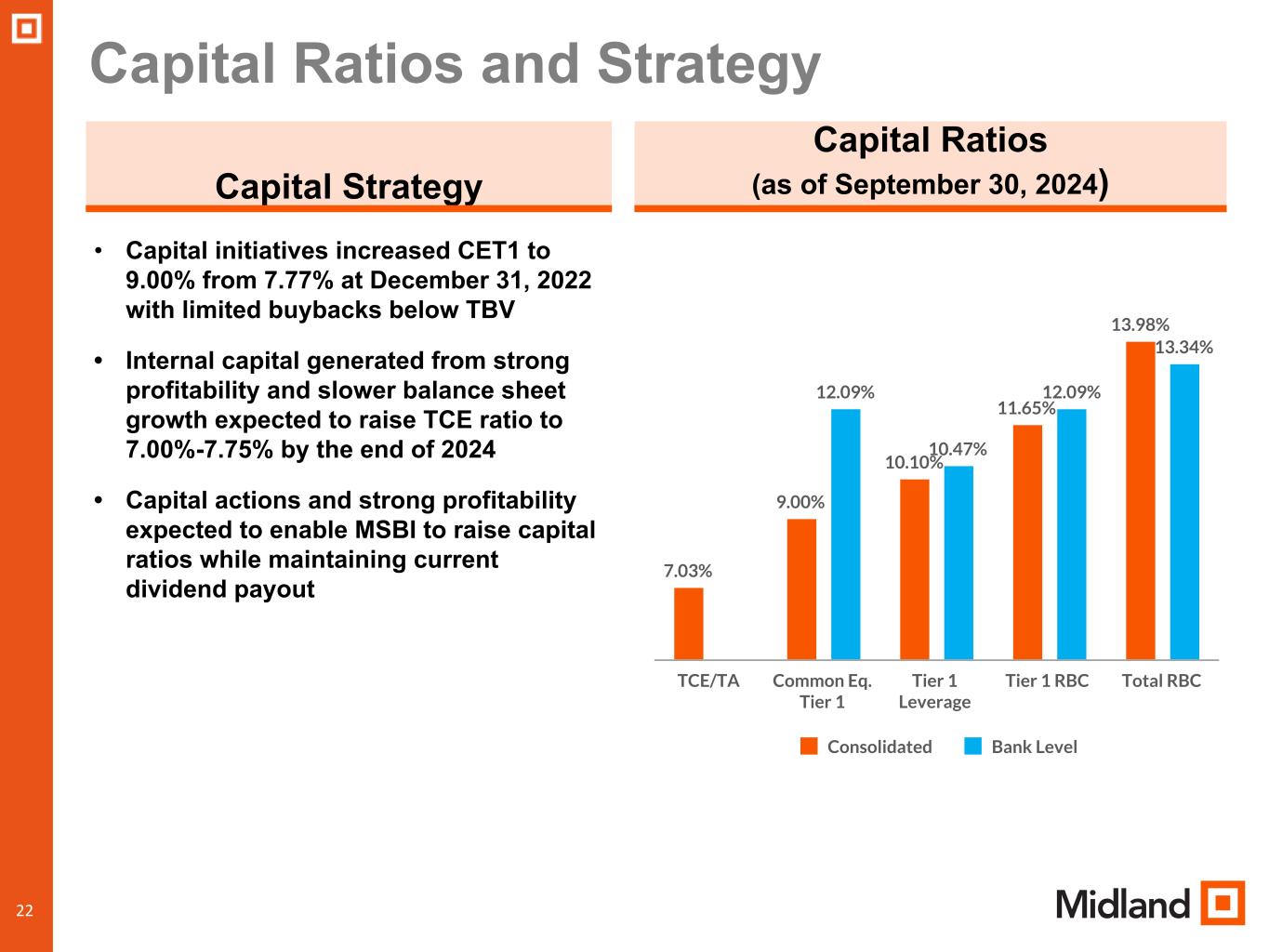

22 Capital Ratios and Strategy 22 • Capital initiatives increased CET1 to 9.00% from 7.77% at December 31, 2022 with limited buybacks below TBV • Internal capital generated from strong profitability and slower balance sheet growth expected to raise TCE ratio to 7.00%-7.75% by the end of 2024 • Capital actions and strong profitability expected to enable MSBI to raise capital ratios while maintaining current dividend payout Capital Strategy Capital Ratios (as of September 30, 2024) 7.03% 9.00% 10.10% 11.65% 13.98% 12.09% 10.47% 12.09% 13.34% Consolidated Bank Level TCE/TA Common Eq. Tier 1 Tier 1 Leverage Tier 1 RBC Total RBC

2323 MIDLAND STATES BANCORP, INC. RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES (unaudited) Tangible Book Value Per Share For the Year Ended (dollars in thousands, except per share data) 2018 2019 2020 2021 2022 2023 Shareholders' Equity to Tangible Common Equity Total shareholders' equity—GAAP $ 608,525 $ 661,911 $ 621,391 $ 663,837 $ 758,574 $ 791,853 Adjustments: Preferred Stock (2,781) — — — (110,548) (110,548) Goodwill (164,673) (171,758) (161,904) (161,904) (161,904) (161,904) Other intangible assets, net (37,376) (34,886) (28,382) (24,374) (20,866) (16,108) Tangible common equity 403,695 455,267 431,105 477,559 465,256 503,293 Less: Accumulated other comprehensive income (AOCI) (2,108) 7,442 11,431 5,237 (83,797) (76,753) Tangible common equity excluding AOCI $ 405,803 $ 447,825 $ 419,674 $ 472,322 $ 549,053 $ 580,046 Common Shares Outstanding 23,751,798 24,420,345 22,325,471 22,050,537 22,214,913 21,551,402 Tangible Book Value Per Share $ 17.00 $ 18.64 $ 19.31 $ 21.66 $ 20.94 $ 23.35 Tangible Book Value Per Share excluding AOCI $ 17.09 $ 18.34 $ 18.80 $ 21.42 $ 24.72 $ 26.91

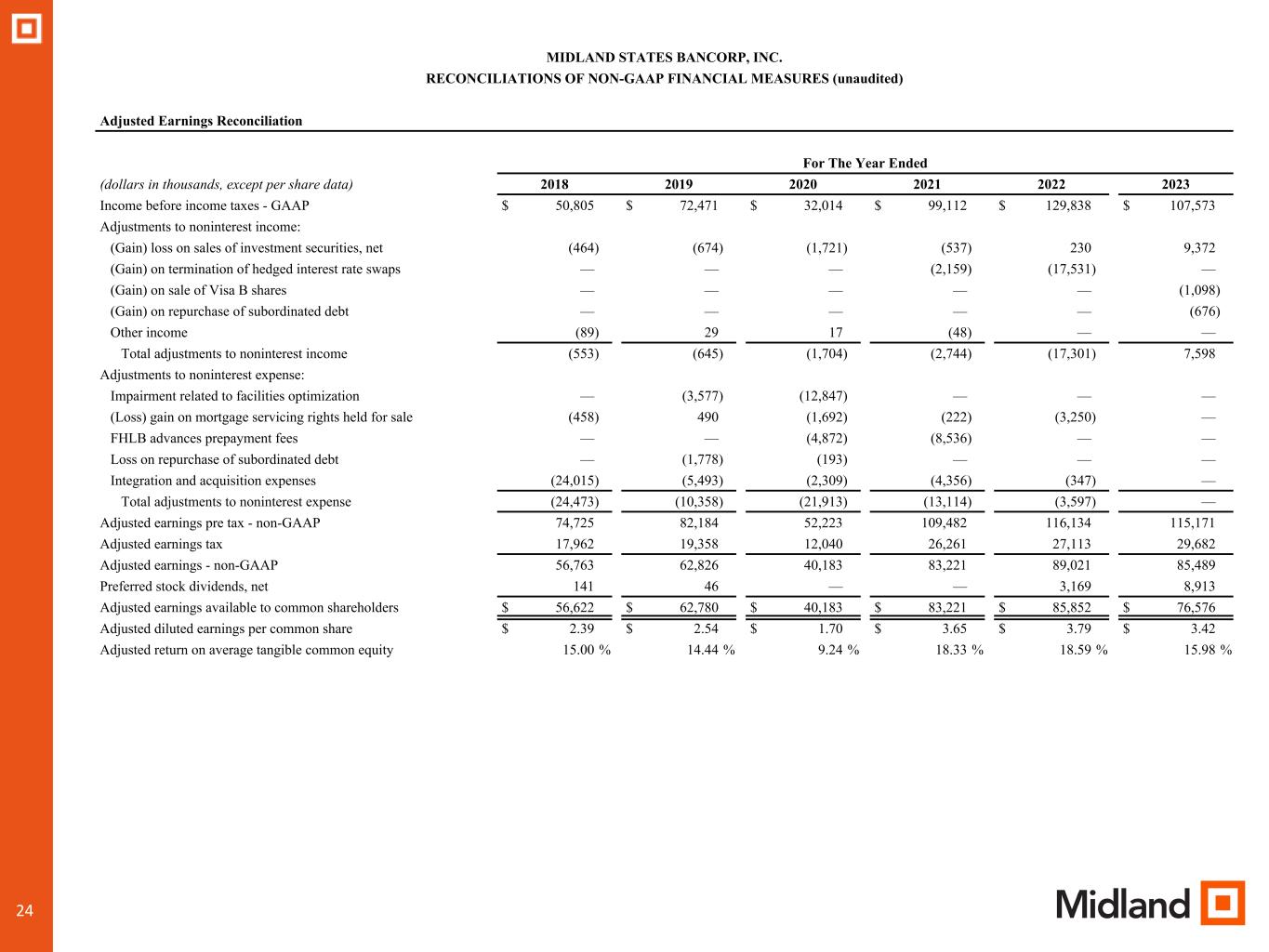

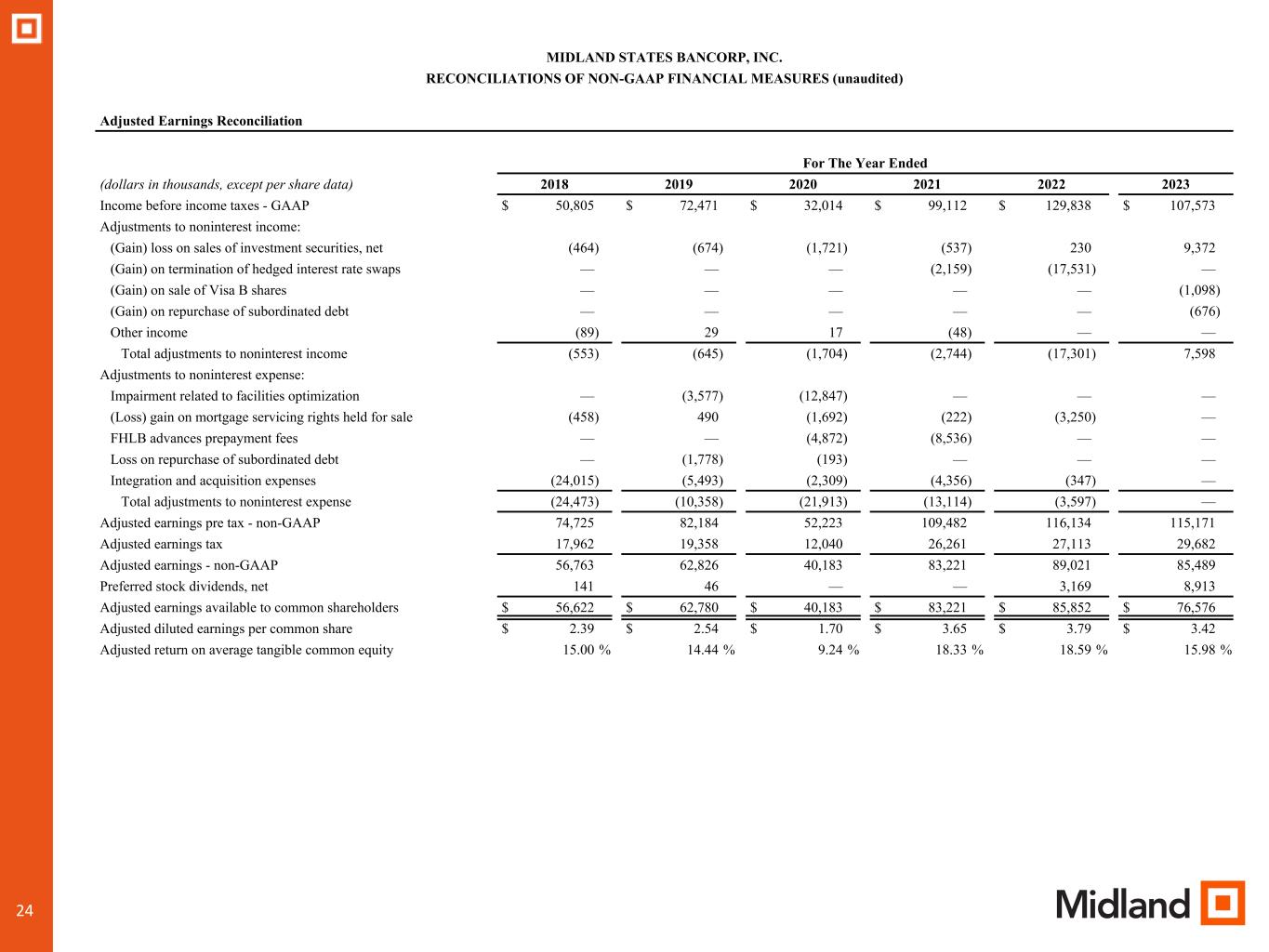

2424 MIDLAND STATES BANCORP, INC. RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES (unaudited) Adjusted Earnings Reconciliation For The Year Ended (dollars in thousands, except per share data) 2018 2019 2020 2021 2022 2023 Income before income taxes - GAAP $ 50,805 $ 72,471 $ 32,014 $ 99,112 $ 129,838 $ 107,573 Adjustments to noninterest income: (Gain) loss on sales of investment securities, net (464) (674) (1,721) (537) 230 9,372 (Gain) on termination of hedged interest rate swaps — — — (2,159) (17,531) — (Gain) on sale of Visa B shares — — — — — (1,098) (Gain) on repurchase of subordinated debt — — — — — (676) Other income (89) 29 17 (48) — — Total adjustments to noninterest income (553) (645) (1,704) (2,744) (17,301) 7,598 Adjustments to noninterest expense: Impairment related to facilities optimization — (3,577) (12,847) — — — (Loss) gain on mortgage servicing rights held for sale (458) 490 (1,692) (222) (3,250) — FHLB advances prepayment fees — — (4,872) (8,536) — — Loss on repurchase of subordinated debt — (1,778) (193) — — — Integration and acquisition expenses (24,015) (5,493) (2,309) (4,356) (347) — Total adjustments to noninterest expense (24,473) (10,358) (21,913) (13,114) (3,597) — Adjusted earnings pre tax - non-GAAP 74,725 82,184 52,223 109,482 116,134 115,171 Adjusted earnings tax 17,962 19,358 12,040 26,261 27,113 29,682 Adjusted earnings - non-GAAP 56,763 62,826 40,183 83,221 89,021 85,489 Preferred stock dividends, net 141 46 — — 3,169 8,913 Adjusted earnings available to common shareholders $ 56,622 $ 62,780 $ 40,183 $ 83,221 $ 85,852 $ 76,576 Adjusted diluted earnings per common share $ 2.39 $ 2.54 $ 1.70 $ 3.65 $ 3.79 $ 3.42 Adjusted return on average tangible common equity 15.00 % 14.44 % 9.24 % 18.33 % 18.59 % 15.98 %

2525 MIDLAND STATES BANCORP, INC. RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES (unaudited) Adjusted Earnings Reconciliation For The Quarter Ended September 30, June 30, March 31, December 31, September 30, (dollars in thousands, except per share data) 2024 2024 2024 2023 2023 Income before income taxes - GAAP $ 22,556 $ 8,429 $ 18,240 $ 27,152 $ 22,935 Adjustments to noninterest income: Loss on sales of investment securities, net 44 152 — 2,894 4,961 (Gain) on sale of Visa B shares — — — (1,098) — (Gain) on repurchase of subordinated debt (77) (167) — — — Total adjustments to noninterest income (33) (15) — 1,796 4,961 Adjusted earnings pre tax - non-GAAP 22,523 8,414 18,240 28,948 27,896 Adjusted earnings tax 4,071 1,675 4,355 6,927 8,389 Adjusted earnings - non-GAAP 18,452 6,739 13,885 22,021 19,507 Preferred stock dividends 2,229 2,228 2,228 2,228 2,229 Adjusted earnings available to common shareholders $ 16,223 $ 4,511 $ 11,657 $ 19,793 $ 17,278 Adjusted diluted earnings per common share $ 0.74 $ 0.20 $ 0.53 $ 0.89 $ 0.78 Adjusted return on average assets 0.95 % 0.35 % 0.72 % 1.11 % 0.98 % Adjusted return on average shareholders' equity 9.23 % 3.46 % 7.07 % 11.42 % 10.03 % Adjusted return on average tangible common equity 12.67 % 3.65 % 9.34 % 16.51 % 14.24 % Adjusted Pre-Tax, Pre-Provision Earnings Reconciliation For the Quarter Ended September 30, June 30, March 31, December 31, September 30, (dollars in thousands) 2024 2024 2024 2023 2023 Adjusted earnings pre tax - non-GAAP $ 22,523 $ 8,414 $ 18,240 $ 28,948 $ 27,896 Provision for credit losses 5,000 16,800 14,000 6,950 5,168 Adjusted pre-tax, pre-provision earnings - non-GAAP $ 27,523 $ 25,214 $ 32,240 $ 35,898 $ 33,064 Adjusted pre-tax, pre-provision return on average assets 1.42 % 1.30 % 1.67 % 1.80 % 1.66 %

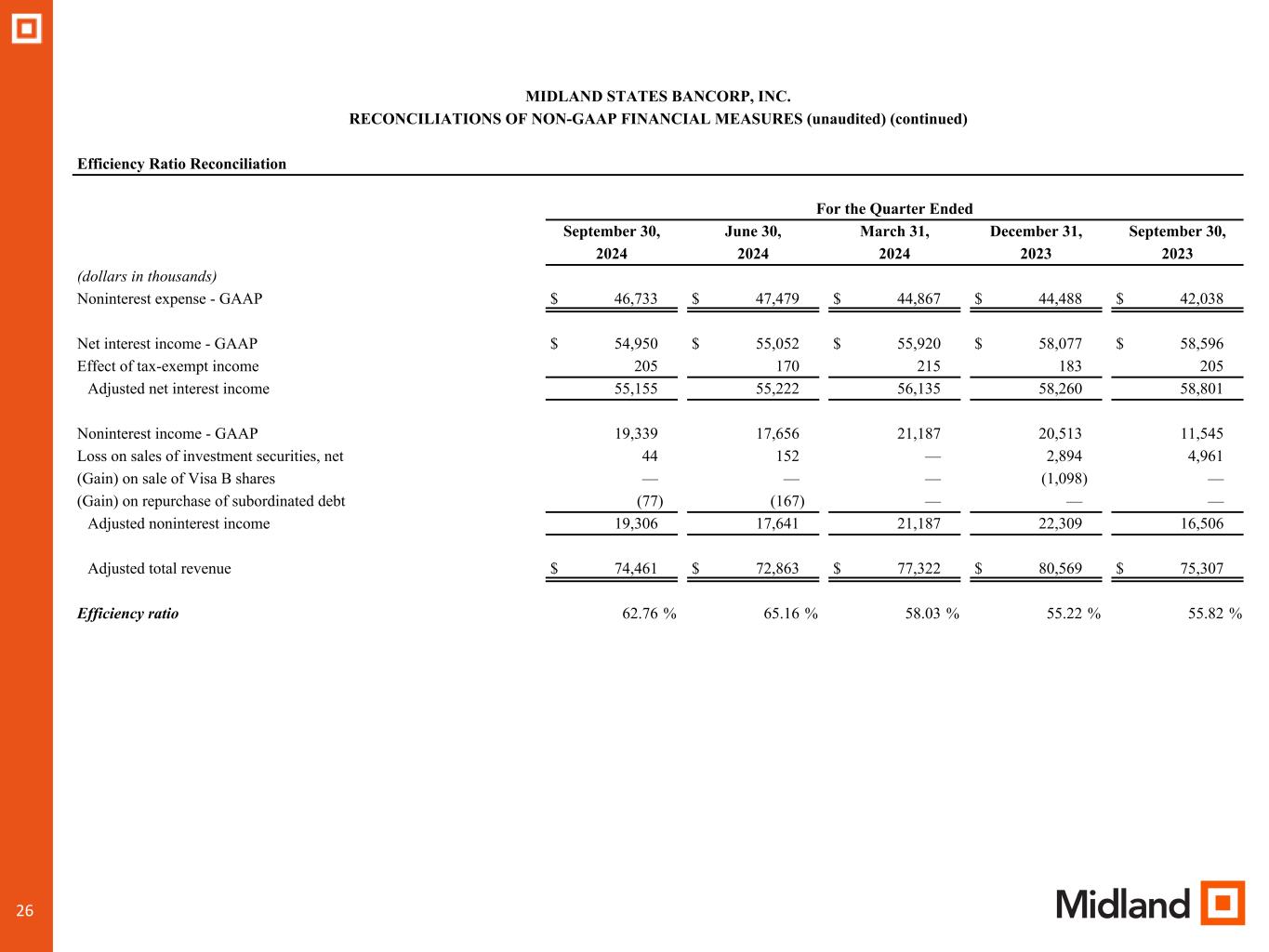

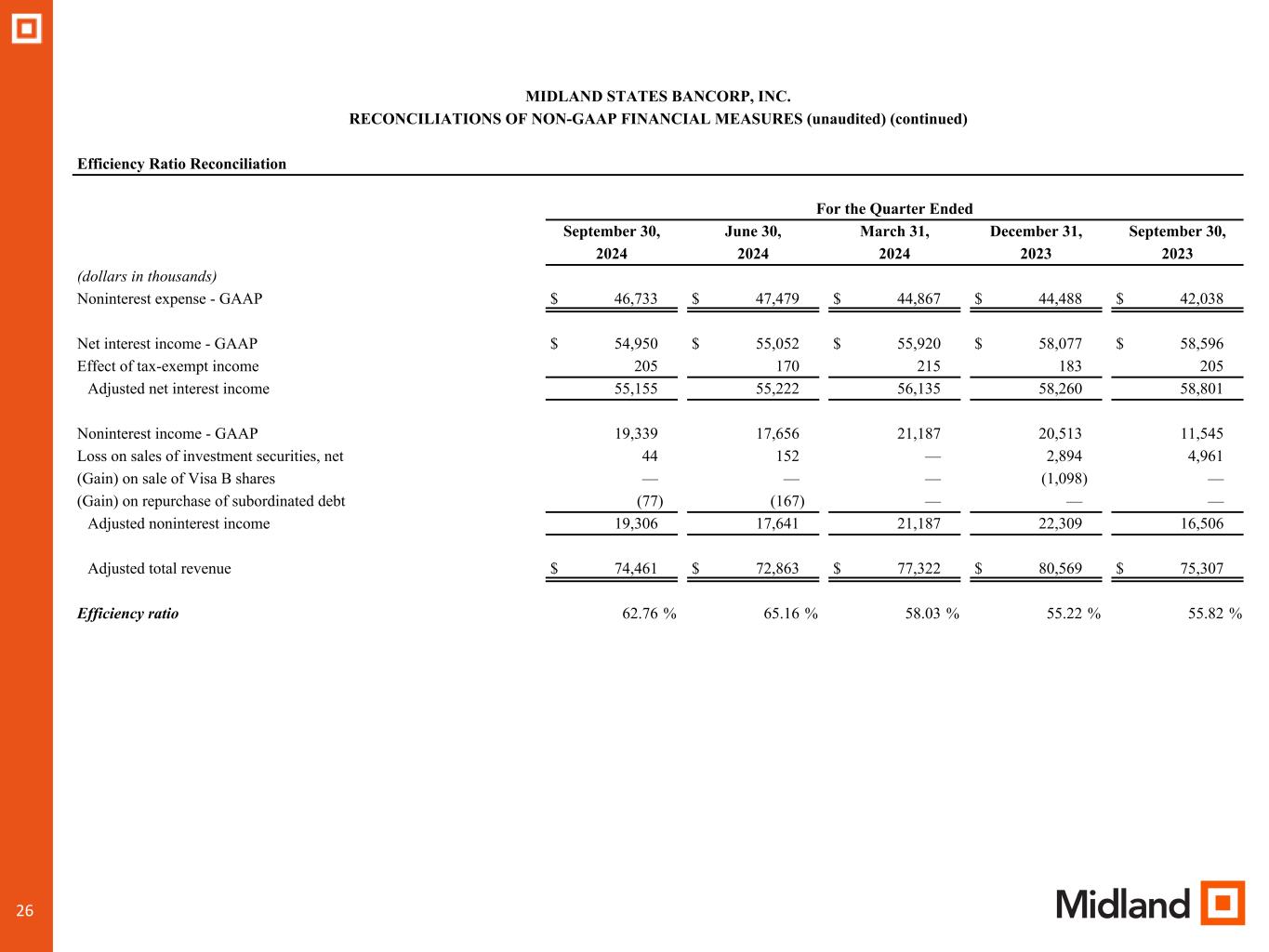

2626 MIDLAND STATES BANCORP, INC. RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES (unaudited) (continued) Efficiency Ratio Reconciliation For the Quarter Ended September 30, June 30, March 31, December 31, September 30, 2024 2024 2024 2023 2023 (dollars in thousands) Noninterest expense - GAAP $ 46,733 $ 47,479 $ 44,867 $ 44,488 $ 42,038 Net interest income - GAAP $ 54,950 $ 55,052 $ 55,920 $ 58,077 $ 58,596 Effect of tax-exempt income 205 170 215 183 205 Adjusted net interest income 55,155 55,222 56,135 58,260 58,801 Noninterest income - GAAP 19,339 17,656 21,187 20,513 11,545 Loss on sales of investment securities, net 44 152 — 2,894 4,961 (Gain) on sale of Visa B shares — — — (1,098) — (Gain) on repurchase of subordinated debt (77) (167) — — — Adjusted noninterest income 19,306 17,641 21,187 22,309 16,506 Adjusted total revenue $ 74,461 $ 72,863 $ 77,322 $ 80,569 $ 75,307 Efficiency ratio 62.76 % 65.16 % 58.03 % 55.22 % 55.82 %

2727 MIDLAND STATES BANCORP, INC. RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES (unaudited) (continued) Tangible Common Equity to Tangible Assets Ratio and Tangible Book Value Per Share As of September 30, June 30, March 31, December 31, September 30, (dollars in thousands, except per share data) 2024 2024 2024 2023 2023 Shareholders' Equity to Tangible Common Equity Total shareholders' equity—GAAP $ 818,259 $ 785,772 $ 791,006 $ 791,853 $ 757,610 Adjustments: Preferred Stock (110,548) (110,548) (110,548) (110,548) (110,548) Goodwill (161,904) (161,904) (161,904) (161,904) (161,904) Other intangible assets, net (13,052) (14,003) (15,019) (16,108) (17,238) Tangible common equity $ 532,755 $ 499,317 $ 503,535 $ 503,293 $ 467,920 Less: Accumulated other comprehensive income (AOCI) (60,640) (82,581) (81,419) (76,753) (101,181) Tangible common equity excluding AOCI $ 593,395 $ 581,898 $ 584,954 $ 580,046 $ 569,101 Total Assets to Tangible Assets: Total assets—GAAP $ 7,751,483 $ 7,757,274 $ 7,831,809 $ 7,866,868 $ 7,969,285 Adjustments: Goodwill (161,904) (161,904) (161,904) (161,904) (161,904) Other intangible assets, net (13,052) (14,003) (15,019) (16,108) (17,238) Tangible assets $ 7,576,527 $ 7,581,367 $ 7,654,886 $ 7,688,856 $ 7,790,143 Common Shares Outstanding 21,393,905 21,377,215 21,485,231 21,551,402 21,594,546 Tangible Common Equity to Tangible Assets 7.03 % 6.59 % 6.58 % 6.55 % 6.01 % Tangible Book Value Per Share $ 24.90 $ 23.36 $ 23.44 $ 23.35 $ 21.67 Tangible Book Value Per Share, excluding AOCI $ 27.74 $ 27.22 $ 27.23 $ 26.91 $ 26.35 Return on Average Tangible Common Equity (ROATCE) For the Quarter Ended September 30, June 30, March 31, December 31, September 30, (dollars in thousands) 2024 2024 2024 2023 2023 Net income available to common shareholders $ 16,247 $ 4,522 $ 11,657 $ 18,483 $ 9,173 Average total shareholders' equity—GAAP $ 795,322 $ 783,846 $ 789,906 $ 764,790 $ 771,625 Adjustments: Preferred Stock (110,548) (110,548) (110,548) (110,548) (110,548) Goodwill (161,904) (161,904) (161,904) (161,904) (161,904) Other intangible assets, net (13,506) (14,483) (15,525) (16,644) (17,782) Average tangible common equity $ 509,364 $ 496,911 $ 501,929 $ 475,694 $ 481,391 ROATCE 12.69 % 3.66 % 9.34 % 15.41 % 7.56 %