Exhibit 99.2

TABLE OF CONTENTS

Company Information | | 3 |

| | |

Forward-Looking Statements | | 4 |

| | |

Earnings Release Text | | 5 |

| | |

Financial Highlights | | 9 |

| | |

Balance Sheets | | 10 |

| | |

Statements of Operations, FFO & CORE FFO | | |

Trailing 5 Quarters | | 11 |

Three and Twelve Months Ended December 31, 2015 | | 12 |

| | |

Adjusted EBITDA Reconciliations | | |

Trailing 5 Quarters | | 13 |

Three and Twelve Months Ended December 31, 2015 | | 13 |

| | |

Same-Store Portfolio Net Operating Income | | |

Trailing 5 Quarters | | 14 |

Three and Twelve Months Ended December 31, 2015 | | 15 |

| | |

Net Operating Income Bridge | | 16 |

| | |

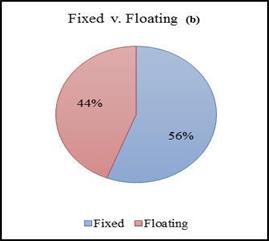

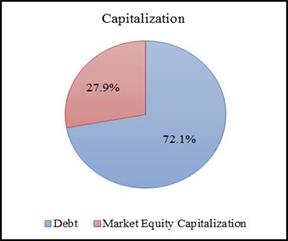

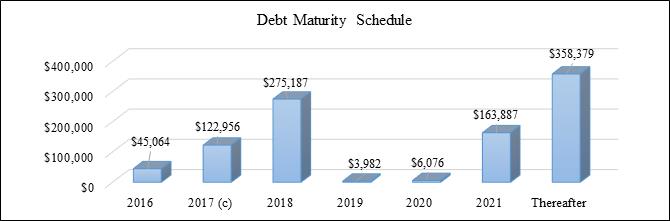

Debt and Capitalization Overview | | 17 |

| | |

Property Summary | | 18 |

| | |

NOI Exposure by Market | | 19 |

| | |

Definitions | | 20 |

2

Independence Realty Trust

December 31, 2015

Company Information:

Independence Realty Trust, Inc. (NYSE MKT: IRT) is a real estate investment trust that seeks to own well-located apartment properties in geographic submarkets that it believes support strong occupancy and the potential for growth in rental rates. IRT seeks to provide stockholders with attractive risk-adjusted returns, with an emphasis on distributions and capital appreciation. IRT is externally advised by a wholly-owned subsidiary of RAIT Financial Trust (NYSE: RAS).

Corporate Headquarters | | 2929 Arch Street |

| | 17th Floor, Cira Centre |

| | Philadelphia, Pa 19104 |

| | 215.243.9000 |

| |

Trading Symbol | | NYSE MKT: “IRT” |

| |

Investor Relations Contact | | Andres Viroslav |

| | 2929 Arch Street |

| | 17th Floor, Cira Centre |

| | Philadelphia, Pa 19104 |

| | 215.243.9000 |

| | For the Three-Months Ended | |

| | December 31, 2015 | | | September 30, 2015 | | | June 30, 2015 | | | March 31, 2015 | | | December 31, 2014 | |

Common Shares & Units: | | | | | | | | | | | | | | | | | | | | |

Share Price, period end | | $ | 7.51 | | | $ | 7.21 | | | $ | 7.53 | | | $ | 9.49 | | | $ | 9.31 | |

Share Price, high | | $ | 8.13 | | | $ | 8.57 | | | $ | 9.65 | | | $ | 9.78 | | | $ | 10.29 | |

Share Price, low | | $ | 6.88 | | | $ | 6.95 | | | $ | 7.45 | | | $ | 9.07 | | | $ | 8.96 | |

Dividends declared | | $ | 0.18 | | | $ | 0.18 | | | $ | 0.18 | | | $ | 0.18 | | | $ | 0.18 | |

Dividend yield, period end | | | 9.6 | % | | | 10.0 | % | | | 9.6 | % | | | 7.6 | % | | | 7.7 | % |

3

Forward-Looking Statements

This supplemental information may contain certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as "may," “trend”, "will," "expect," "intend," "anticipate," "estimate," "believe," "continue," “seek,” “outlook,” “project,” “guidance” or other similar words. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such forward-looking statements. These forward looking statements are based upon the current beliefs and expectations of IRT’s management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally not within IRT’s control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. These risks, uncertainties and contingencies include, but are not limited to, those disclosed in IRT’s filings with the Securities and Exchange Commission. IRT undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, except as may be required by law.

4

Independence Realty Trust Announces Fourth Quarter and Fiscal 2015 Financial Results

PHILADELPHIA, PA — February 18, 2016 — Independence Realty Trust, Inc. (“IRT”) (NYSE MKT: IRT) today announced its fourth quarter and fiscal 2015 financial results. All per share results are reported on a diluted basis.

Results for the Quarter

| · | Core Funds from Operations (“CFFO”) per share increased 29% to $0.22 for the quarter ended December 31, 2015 from $0.17 for the quarter ended December 31, 2014. |

| · | Earnings per share (“EPS”) was $0.09 for the quarter ended December 31, 2015 as compared to $0.01 for the quarter ended December 31, 2014. |

| · | Earnings before interest, taxes, depreciation and amortization and before acquisition expenses (“Adjusted EBITDA”), increased 156% to $19.7 million for the quarter ended December 31, 2015 from $7.7 million for the quarter ended December 31, 2014. |

| · | On December 22, 2015, IRT sold a 320 unit apartment property located in Tucson, Arizona for $33.6 million. IRT received net cash proceeds of approximately $14.2 million, after transaction costs and full repayment of the debt underlying the property. |

Results for the Year

| · | CFFO per share increased 14% to $0.80 for the year ended December 31, 2015 from $0.70 for the year ended December 31, 2014. |

| · | EPS was $0.78 for the year ended December 31, 2015 as compared to $0.14 for the year-ended December 31, 2014. |

| · | Adjusted EBITDA increased 126% to $51.8 million for the year ended December 31, 2015 from $22.9 million for the year ended December 31, 2014. |

| · | On September 17, 2015, IRT completed the acquisition of Trade Street Residential, Inc. (“TSRE”) adding nineteen properties or 4,989 units to its portfolio. |

Scott Schaeffer, IRT’s Chairman and CEO said, “In 2015, we took a dramatic step forward towards our goal of becoming a leading owner of apartment communities in non-gateway markets through the acquisition of Trade Street Residential. During that year, IRT grew its total number of units 56% and its total gross assets increased 100% to $1.4 billion. In 2016, we remain focused on maximizing the operating performance of the portfolio through revenue increases and managing expenses lower while selling non-core assets to reduce leverage.”

Same-Store Property Operating Results

| | |

| Fourth Quarter 2015 Compared to Fourth Quarter 2014(1) | Year Ended 12/31/15 Compared to Year Ended 12/31/14(2) |

Rental income | 4.5% increase | 5.2% increase |

Total revenues | 5.2% increase | 5.9% increase |

Property level operating expenses | 4.2% increase | 4.3% increase |

Net operating income (“NOI”) | 6.1% increase | 7.5% increase |

Portfolio average occupancy | 92.9%, or a 0.4% increase | 94.0%, or a 0.1% decrease |

Portfolio average rental rate | 4.2% increase to $823 | 5.5% increase to $809 |

NOI Margin | 0.4% increase to 52.0% | 0.8% increase to 49.9% |

| (1) | Same store portfolio for the three months ended December 31, 2015 and 2014 includes 21 properties which represents 6,150 apartment units. |

5

| (2) | Same store portfolio for the year ended December 31, 2015 and 2014 includes 9 properties which represents 2,470 apartment units. |

Capital Expenditures

For the three months ended December 31, 2015, our recurring capital expenditures for the total portfolio was $1.6 million, or $118 per unit. For the year ended December 31, 2015, our recurring capital expenditures for the total portfolio was $5.1 million, or $472 per unit.

2016 CFFO Guidance

IRT estimates that its 2016 full year CFFO per diluted share will be in a range of $0.82-$0.88 per common share. A reconciliation of IRT's projected net income (loss) allocable to common shares to its projected CFFO, a non-GAAP financial measure, is included below. Also included below are the primary assumptions underlying this estimate. See Schedule II to this release for further information regarding how IRT calculates CFFO and Schedule V to this release for management’s definition and rationale for the usefulness of CFFO.

| | | | | | | | | | |

| | | | | |

2016 Full Year CFFO Guidance (1) | | Low | | High | |

Net income (loss) available to common shares | | $0.34 | - | $0.39 | |

| | | | | | | | |

Adjustments: | | | | | | | | |

Depreciation and amortization | 0.95 | - | 0.95 | |

Gains on asset sales | (0.56) | - | (0.56) | |

Share base compensation | 0.02 | - | 0.03 | |

Amortization of deferred financing fees | | | | | | 0.07 | - | 0.07 | |

CORE FFO per diluted share allocated to common shareholders | | | | | $0.82 | - | $0.88 | |

| (1) | This guidance, including the underlying assumptions, constitutes forward-looking information. Actual full 2016 CFFO could vary significantly from the projections presented. Our estimate is based on the following key operating assumptions: |

| - | For 2016, a same store pool of 26 properties totaling 7,755 units. |

| - | Same store NOI growth of 4.5% to 5.5%, driven by revenue growth of 4% to 5% and property operating expense growth of 2% to 3%. |

| - | The portfolio of properties acquired from TSRE, which is not included in the same store pool, experiences NOI growth of 6% to 7%, driven by revenue growth of 4% to 5% and an improved operating margin of 56%, up from 54% in 2015. The improved operating margin is driven through reduced operating expenses for property insurance. |

| - | No property acquisitions in 2016. |

| - | Completion of the sale of Cumberland Glen in February 2016 for $18 million, the sale of Belle Creek in March 2016 for $23 million and the sale of Tresa at Arrowhead in April 2016 for $47 million. Assume substantially all net proceeds from the sales of these assets are used to repay the KeyBank interim facility. |

| - | General and administrative expenses of approximately $1.25 million to $1.75 million. |

Selected Financial Information

See Schedule I to this Release for selected financial information for IRT.

Trade Street Acquisition

On September 17, 2015, IRT completed the acquisition of TSRE adding nineteen high-quality properties with 4,989 units to its portfolio. As a result of the acquisition, each outstanding share of TSRE common stock was automatically converted into (a) $3.80 in cash and (b) 0.4108 shares of IRT common stock. In connection with the acquisition, IRT paid approximately $139.8 million in cash and issued approximately 15.1 million shares of common stock to former TSRE stockholders. On a fully diluted basis following the closing of the merger, legacy IRT stockholders owned approximately 68% of the combined company, and former TSRE stockholders owned approximately 32% of the combined company. In addition, in connection with the merger, the holder of all TSRE operating

6

partnership common units not held by TSRE contributed those units to IRT’s operating partnership in exchange for approximately 1.9 million IRT operating partnership common units exchangeable for a like number of shares of IRT common stock.

Non-GAAP Financial Measures and Definitions

IRT discloses the following non-GAAP financial measures in this release: funds from operations (“FFO”), CFFO, Adjusted EBITDA and NOI. A reconciliation of IRT’s reported net income (loss) to its FFO and CFFO is included as Schedule II to this release. A reconciliation of IRT’s same store NOI to its reported net income (loss) is included as Schedule III to this release. A reconciliation of IRT’s Adjusted EBITDA, to net income (loss) is included as Schedule IV to this release. See Schedule V to this release for management’s respective definitions and rationales for the usefulness of each of these non-GAAP financial measures and other definitions used in this release.

Distributions

On January 14, 2016, IRT’s Board of Directors declared monthly cash dividends for the first quarter of 2016 on IRT’s shares of common stock in the amount of $0.06 per share per month. The monthly dividends total $0.18 per share for the first quarter. The month for which each dividend was declared is set forth below, with the relevant amount per share, record date and payment date set forth opposite the month:

| | | | | | | | | | | | |

Month | | | | Amount | | | | Record Date | | | | Payment Date |

January 2016 | | | | $0.06 | | | | 01/29/2016 | | | | 02/16/2016 |

February 2016 | | | | $0.06 | | | | 02/29/2016 | | | | 03/15/2016 |

March 2016 | | | | $0.06 | | | | 03/31/2016 | | | | 04/15/2016 |

Conference Call

All interested parties can listen to the live conference call webcast at 9:00 AM ET on

Thursday, February 18, 2016 from the investor relations section of the IRT website at www.irtreit.com or by dialing 1.877.787.3988, access code 38518766. For those who are not available to listen to the live call, the replay will be available shortly following the live call on IRT’s website and telephonically until Thursday, February 25, 2016, by dialing 855.859.2056, access code 38518766.

Supplemental Information

IRT produces supplemental information that includes details regarding the performance of the portfolio, financial information, non-GAAP financial measures, same-store information and other useful information for investors. The supplemental information is available via the Company's website, www.irtreit.com, through the "Investor Relations" section.

About Independence Realty Trust, Inc.

Independence Realty Trust, Inc. (NYSE MKT: IRT) is a real estate investment trust that seeks to own well-located apartment properties in geographic submarkets that it believes support strong occupancy and the potential for growth in rental rates. IRT seeks to provide stockholders with attractive risk-adjusted returns, with an emphasis on distributions and capital appreciation. IRT is externally advised by a wholly-owned subsidiary of RAIT Financial Trust (NYSE: RAS).

Forward-Looking Statements

This press release may contain certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as "may," “trend”, "will," "expect," "intend," "anticipate," "estimate," "believe," "continue," “seek,” “outlook,” “project,” “guidance” or other similar words. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such forward-looking statements. These forward looking statements are based upon the current beliefs and expectations of IRT’s management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally not within IRT’s control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to

7

change. These risks, uncertainties and contingencies include, but are not limited to, whether IRT can maintain its assumed same store pool in 2016; whether it can achieve projected same store NOI growth and revenue growth and limit projected property operating expense growth; whether the TSRE portfolio of properties achieves projected NOI growth, revenue growth, improved operating margins and reduced operating expenses for property insurance; whether IRT will not make any property acquisitions in 2016; whether the sales of Cumberland Glen, Belle Creek and Tresa at Arrowhead can be completed at the expected times on the projected terms generating the expected net proceeds; whether substantially all net proceeds from such sales will be available to be used to repay the KeyBank interim facility; whether general and administrative expenses can be limited to projected levels; and those disclosed in IRT’s filings with the Securities and Exchange Commission. IRT undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, except as may be required by law.

Independence Realty Trust, Inc. Contact

Andres Viroslav

215.243.9000

aviroslav@irtreit.com

8

FINANCIAL HIGHLIGHTS

| | For the Three-Months Ended | |

| | December 31, 2015 | | | September 30, 2015 | | | June 30, 2015 | | | March 31, 2015 | | | December 31, 2014 | |

Selected Financial Information: | | | | | | | | | | | | | | | | | | | | |

Operating Statistics: | | | | | | | | | | | | | | | | | | | | |

Total revenue | | $ | 39,709 | | | $ | 25,492 | | | $ | 22,718 | | | $ | 21,657 | | | $ | 16,349 | |

Total property operating expenses | | $ | 17,398 | | | $ | 11,945 | | | $ | 10,517 | | | $ | 10,095 | | | $ | 7,689 | |

Net operating income | | $ | 22,311 | | | $ | 13,547 | | | $ | 12,201 | | | $ | 11,562 | | | $ | 8,660 | |

NOI margin | | | 56.2 | % | | | 53.1 | % | | | 53.7 | % | | | 53.4 | % | | | 53.0 | % |

Adjusted EBITDA | | $ | 19,720 | | | $ | 11,742 | | | $ | 10,518 | | | $ | 9,851 | | | $ | 7,673 | |

Net income available to common shares | | $ | 4,123 | | | $ | 24,015 | | | $ | 337 | | | $ | (233 | ) | | $ | 189 | |

Earnings (loss) per share -- diluted | | $ | 0.09 | | | $ | 0.71 | | | $ | 0.01 | | | $ | (0.01 | ) | | $ | 0.01 | |

FFO per share -- diluted | | $ | 0.19 | | | $ | 0.86 | | | $ | 0.18 | | | $ | 0.18 | | | $ | 0.14 | |

CORE FFO per share -- diluted | | $ | 0.22 | | | $ | 0.20 | | | $ | 0.19 | | | $ | 0.19 | | | $ | 0.17 | |

Dividends per share | | $ | 0.18 | | | $ | 0.18 | | | $ | 0.18 | | | $ | 0.18 | | | $ | 0.18 | |

CORE FFO payout ratio | | | 81.8 | % | | | 90.0 | % | | | 94.7 | % | | | 94.7 | % | | | 105.9 | % |

Portfolio Data: | | | | | | | | | | | | | | | | | | | | |

Total gross assets (total assets plus accumulated depreciation) | | $ | 1,432,052 | | | $ | 1,448,559 | | | $ | 754,347 | | | $ | 721,293 | | | $ | 717,526 | |

Total number of properties | | | 49 | | | | 50 | | | | 31 | | | | 30 | | | | 30 | |

Total units | | | 13,724 | | | | 14,044 | | | | 9,055 | | | | 8,819 | | | | 8,819 | |

Total portfolio average occupancy | | | 93.6 | % | | | 94.0 | % | | | 93.6 | % | | | 93.5 | % | | | 91.9 | % |

Total portfolio average effective monthly rent, per unit | | $ | 951 | | | $ | 950 | | | $ | 840 | | | $ | 827 | | | $ | 792 | |

Same store portfolio average occupancy (a) | | | 92.9 | % | | | 93.5 | % | | | 93.2 | % | | | 93.0 | % | | | 92.5 | % |

Same store portfolio average effective monthly rent, per unit (a) | | $ | 823 | | | $ | 814 | | | $ | 808 | | | $ | 794 | | | $ | 790 | |

Capitalization: | | | | | | | | | | | | | | | | | | | | |

Total debt | | $ | 975,837 | | | $ | 993,908 | | | $ | 457,202 | | | $ | 422,613 | | | $ | 418,901 | |

Common share price, period end | | $ | 7.51 | | | $ | 7.21 | | | $ | 7.53 | | | $ | 9.49 | | | $ | 9.31 | |

Market equity capitalization | | $ | 377,194 | | | $ | 362,127 | | | $ | 249,915 | | | $ | 314,852 | | | $ | 307,998 | |

Total market capitalization | | $ | 1,353,031 | | | $ | 1,356,035 | | | $ | 707,117 | | | $ | 737,465 | | | $ | 726,899 | |

Total debt/total gross assets | | | 68.1 | % | | | 68.6 | % | | | 60.6 | % | | | 58.6 | % | | | 58.4 | % |

Net debt (b) / total market capitalization | | | 69.3 | % | | | 72.0 | % | | | 61.6 | % | | | 54.7 | % | | | 55.6 | % |

Net debt (b) to adjusted EBITDA | | | 11.9 | x | | | 12.4 | x | (c) | | 10.4 | x | | | 10.2 | x | | | 13.2 | x |

Interest coverage | | | 1.9 | x | | | 2.1 | x | (c) | | 2.5 | x | | | 2.4 | x | | | 2.6 | x |

Common shares and OP Units: | | | | | | | | | | | | | | | | | | | | |

Shares outstanding | | | 47,070,678 | | | | 47,070,678 | | | | 31,933,218 | | | | 31,894,751 | | | | 31,800,076 | |

OP units outstanding | | | 3,154,936 | | | | 3,154,936 | | | | 1,255,983 | | | | 1,282,450 | | | | 1,282,450 | |

Common shares and OP units outstanding | | | 50,225,614 | | | | 50,225,614 | | | | 33,189,201 | | | | 33,177,201 | | | | 33,082,526 | |

Weighted average common shares and units | | | 50,101,609 | | | | 35,472,807 | | | | 33,066,770 | | | | 31,768,468 | | | | 28,578,949 | |

(a) | Same store portfolio includes 21 properties which represents 6,150 units. |

(b) | Net debt equals total debt less cash and cash equivalents. |

(c) | Annualized assuming the TSRE merger occurred at the beginning of the period. |

9

BALANCE SHEETS

Dollars in thousands, except per share data

| | As of | |

| | December 31, 2015 | | | September 30, 2015 | | | June 30, 2015 | | | March 31, 2015 | | | December 31, 2014 | |

Assets | | | | | | | | | | | | | | | | | | | | |

Investments in real estate at cost (a) | | $ | 1,372,015 | | | $ | 1,400,892 | | | $ | 716,581 | | | $ | 689,867 | | | $ | 689,112 | |

Less: accumulated depreciation | | | (39,638 | ) | | | (35,304 | ) | | | (31,188 | ) | | | (27,261 | ) | | | (23,376 | ) |

Investments in real estate, net | | | 1,332,377 | | | | 1,365,588 | | | | 685,393 | | | | 662,606 | | | | 665,736 | |

Cash and cash equivalents | | | 38,301 | | | | 16,939 | | | | 21,568 | | | | 19,084 | | | | 14,763 | |

Restricted cash | | | 5,413 | | | | 7,330 | | | | 6,335 | | | | 6,228 | | | | 5,206 | |

Accounts receivable and other assets | | | 3,362 | | | | 5,153 | | | | 6,689 | | | | 1,818 | | | | 2,270 | |

Intangible assets, net | | | 3,735 | | | | 7,544 | | | | 182 | | | | 1,342 | | | | 3,251 | |

Deferred costs, net | | | 9,226 | | | | 10,701 | | | | 2,992 | | | | 2,954 | | | | 2,924 | |

Total assets | | $ | 1,392,414 | | | $ | 1,413,255 | | | $ | 723,159 | | | $ | 694,032 | | | $ | 694,150 | |

Liabilities and Equity | | | | | | | | | | | | | | | | | | | | |

Total indebtedness | | $ | 975,837 | | | $ | 993,908 | | | $ | 457,202 | | | $ | 422,613 | | | $ | 418,901 | |

Accounts payable and accrued expenses | | | 19,304 | | | | 18,724 | | | | 10,922 | | | | 10,691 | | | | 8,353 | |

Accrued interest payable | | | 1,239 | | | | 558 | | | | 30 | | | | 31 | | | | 49 | |

Dividends payable | | | 3,006 | | | | 2,427 | | | | 1,982 | | | | 1,982 | | | | 1,982 | |

Other liabilities | | | 2,998 | | | | 3,183 | | | | 1,893 | | | | 1,860 | | | | 1,831 | |

Total liabilities | | | 1,002,384 | | | | 1,018,800 | | | | 472,029 | | | | 437,177 | | | | 431,116 | |

Equity | | | | | | | | | | | | | | | | | | | | |

Shareholders' Equity: | | | | | | | | | | | | | | | | | | | | |

Preferred shares, $0.01 par value per share | | | — | | | | — | | | | — | | | | — | | | | — | |

Common shares, $0.01 par value per share | | | 471 | | | | 471 | | | | 318 | | | | 318 | | | | 318 | |

Additional paid in capital | | | 378,187 | | | | 377,989 | | | | 267,566 | | | | 267,695 | | | | 267,683 | |

Accumulated other comprehensive income (loss) | | | (8 | ) | | | 5 | | | | — | | | | — | | | | — | |

Retained earnings (deficit) | | | (14,500 | ) | | | (10,174 | ) | | | (28,065 | ) | | | (22,680 | ) | | | (16,728 | ) |

Total shareholders' equity | | | 364,150 | | | | 368,291 | | | | 239,819 | | | | 245,333 | | | | 251,273 | |

Noncontrolling Interests | | | 25,880 | | | | 26,164 | | | | 11,311 | | | | 11,522 | | | | 11,761 | |

Total equity | | | 390,030 | | | | 394,455 | | | | 251,130 | | | | 256,855 | | | | 263,034 | |

Total liabilities and equity | | $ | 1,392,414 | | | $ | 1,413,255 | | | $ | 723,159 | | | $ | 694,032 | | | $ | 694,150 | |

(a) | Includes $3,283 of a parcel of land acquired with the TSRE merger, as of September30, 2015. This parcel was sold in October 2015. |

10

STATEMENTS OF OPERATIONS, FFO & CORE FFO

TRAILING 5 QUARTERS

Dollars in thousands, except per share data

| | For the Three-Months Ended | |

| | December 31, 2015 | | | September 30, 2015 | | | June 30, 2015 | | | March 31, 2015 | | | December 31, 2014 | |

Revenue: | | | | | | | | | | | | | | | | | | | | |

Rental income | | $ | 35,747 | | | $ | 22,758 | | | $ | 20,268 | | | $ | 19,443 | | | $ | 14,996 | |

Reimbursement and other income | | | 3,962 | | | | 2,734 | | | | 2,450 | | | | 2,214 | | | | 1,353 | |

Total revenue | | | 39,709 | | | | 25,492 | | | | 22,718 | | | | 21,657 | | | | 16,349 | |

Expenses: | | | | | | | | | | | | | | | | | | | | |

Real estate operating expenses | | | 17,398 | | | | 11,945 | | | | 10,517 | | | | 10,095 | | | | 7,689 | |

General and administrative expenses | | | 709 | | | | 546 | | | | 423 | | | | 499 | | | | 343 | |

Asset management fees - Base | | | 1,690 | | | | 1,259 | | | | 1,046 | | | | 1,001 | | | | 644 | |

Asset management fees - Incentive | | | 192 | | | | - | | | | 214 | | | | 211 | | | | - | |

Acquisition and integration expenses | | | 524 | | | | 12,830 | | | | 168 | | | | 33 | | | | 641 | |

Depreciation and amortization expense | | | 11,632 | | | | 4,704 | | | | 5,720 | | | | 6,038 | | | | 3,856 | |

Total expenses | | | 32,145 | | | | 31,284 | | | | 18,088 | | | | 17,877 | | | | 13,173 | |

Operating Income (loss) | | | 7,564 | | | | (5,792 | ) | | | 4,630 | | | | 3,780 | | | | 3,176 | |

Interest expense | | | (10,160 | ) | | | (5,094 | ) | | | (4,277 | ) | | | (4,022 | ) | | | (2,986 | ) |

Interest income | | | — | | | | 18 | | | | — | | | | 1 | | | | 5 | |

Net gains (losses) on sale of assets | | | 6,412 | | | | | | | | | | | | | | | | | |

TSRE financing extinguishment and employee separation expenses | | | — | | | | (27,508 | ) | | | — | | | | — | | | | — | |

Gains (losses) on TSRE merger and property acquisitions | | | 592 | | | | 64,012 | | | | — | | | | — | | | | — | |

Net income (loss) | | | 4,408 | | | | 25,636 | | | | 353 | | | | (241 | ) | | | 195 | |

(Income) loss allocated to noncontrolling interests | | | (285 | ) | | | (1,621 | ) | | | (16 | ) | | | 8 | | | | (6 | ) |

Net income (loss) available to common shares | | $ | 4,123 | | | $ | 24,015 | | | $ | 337 | | | $ | (233 | ) | | $ | 189 | |

EPS - basic | | $ | 0.09 | | | $ | 0.71 | | | $ | 0.01 | | | $ | (0.01 | ) | | $ | 0.01 | |

Weighted-average shares outstanding - Basic | | | 46,946,678 | | | | 33,962,015 | | | | 31,794,822 | | | | 31,768,468 | | | | 28,174,568 | |

EPS - diluted | | $ | 0.09 | | | $ | 0.71 | | | $ | 0.01 | | | $ | (0.01 | ) | | $ | 0.01 | |

Weighted-average shares outstanding - Diluted | | | 46,966,605 | | | | 33,962,015 | | | | 33,066,770 | | | | 31,768,468 | | | | 28,578,949 | |

Funds From Operations (FFO): | | | | | | | | | | | | | | | | | | | | |

Net Income (loss) | | $ | 4,408 | | | $ | 25,636 | | | $ | 353 | | | $ | (241 | ) | | $ | 195 | |

Add-Back (Deduct): | | | | | | | | | | | | | | | | | | | | |

Income allocated to preferred units | | | — | | | | — | | | | — | | | | — | | | | (6 | ) |

Depreciation | | | 11,632 | | | | 4,704 | | | | 5,720 | | | | 6,038 | | | | 3,856 | |

Net (gains) losses on sale of assets | | | (6,412 | ) | | | | | | | | | | | | | | | | |

FFO | | $ | 9,628 | | | $ | 30,340 | | | $ | 6,073 | | | $ | 5,797 | | | $ | 4,045 | |

FFO per share--diluted | | $ | 0.19 | | | $ | 0.86 | | | $ | 0.18 | | | $ | 0.18 | | | $ | 0.14 | |

CORE Funds From Operations (CFFO): | | | | | | | | | | | | | | | | | | | | |

FFO | | $ | 9,628 | | | $ | 30,340 | | | $ | 6,073 | | | $ | 5,797 | | | $ | 4,045 | |

Add-Back (Deduct): | | | | | | | | | | | | | | | | | | | | |

Equity based compensation | | | 198 | | | | 217 | | | | 10 | | | | 70 | | | | 32 | |

Amortization of deferred financing costs | | | 1,034 | | | | 151 | | | | 150 | | | | 147 | | | | 126 | |

Acquisition and integration expenses | | | 524 | | | | 12,830 | | | | 168 | | | | 33 | | | | 641 | |

TSRE financing extinguishment and employee separation expenses | | | — | | | | 27,508 | | | | — | | | | — | | | | — | |

(Gains) losses on TSRE merger and property acquisitions | | | (592 | ) | | | (64,012 | ) | | | — | | | | — | | | | — | |

CFFO | | $ | 10,792 | | | $ | 7,034 | | | $ | 6,401 | | | $ | 6,047 | | | $ | 4,844 | |

CFFO per share--diluted | | $ | 0.22 | | | $ | 0.20 | | | $ | 0.19 | | | $ | 0.19 | | | $ | 0.17 | |

Weighted-average shares and units outstanding | | | 50,101,609 | | | | 35,472,807 | | | | 33,066,770 | | | | 31,768,468 | | | | 28,578,949 | |

11

STATEMENTS OF OPERATIONS, FFO & CORE FFO

THREE AND TWELVE MONTHS ENDED DECEMBER 31, 2015

Dollars in thousands, except per share data

| | Three-Months Ended December 31 | | | Twelve-Months Ended December 31 | |

| | 2015 | | | 2014 | | | 2015 | | | 2014 | |

Revenue: | | | | | | | | | | | | | | | | |

Rental income | | $ | 35,747 | | | | 14,996 | | | $ | 98,216 | | | | 44,834 | |

Reimbursement and other income | | | 3,962 | | | | 1,353 | | | | 11,360 | | | | 4,337 | |

Total revenue | | | 39,709 | | | | 16,349 | | | | 109,576 | | | | 49,171 | |

Expenses: | | | | | | | | | | | | | | | | |

Real estate operating expenses | | | 17,398 | | | | 7,689 | | | | 49,955 | | | | 23,395 | |

General and administrative expenses | | | 709 | | | | 343 | | | | 2,177 | | | | 1,137 | |

Asset management fees - Base | | | 1,690 | | | | 644 | | | | 4,996 | | | | 1,582 | |

Asset management fees - Incentive | | | 192 | | | | — | | | | 617 | | | | 154 | |

Acquisition and integration expenses | | | 524 | | | | 641 | | | | 13,555 | | | | 1,842 | |

Depreciation and amortization expense | | | 11,632 | | | | 3,856 | | | | 28,094 | | | | 12,520 | |

Total expenses | | | 32,145 | | | | 13,173 | | | | 99,394 | | | | 40,630 | |

Operating Income (loss) | | | 7,564 | | | | 3,176 | | | | 10,182 | | | | 8,541 | |

Interest expense | | | (10,160 | ) | | | (2,986 | ) | | | (23,553 | ) | | | (8,496 | ) |

Interest income | | | — | | | | 5 | | | | 19 | | | | 17 | |

Net gains (losses) on sale of assets | | | 6,412 | | | | - | | | | 6,412 | | | | - | |

TSRE financing extinguishment and employee separation expenses | | | — | | | | — | | | | (27,508 | ) | | | — | |

Gains (losses) on TSRE merger and property acquisitions | | | 592 | | | | — | | | | 64,604 | | | | 2,882 | |

Net income (loss) | | | 4,408 | | | | 195 | | | | 30,156 | | | | 2,944 | |

(Income) loss allocated to noncontrolling interests | | | (285 | ) | | | (6 | ) | | | (1,914 | ) | | | (4 | ) |

Net income (loss) available to common shares | | $ | 4,123 | | | $ | 189 | | | $ | 28,242 | | | $ | 2,940 | |

EPS - basic | | $ | 0.09 | | | $ | 0.01 | | | $ | 0.78 | | | $ | 0.14 | |

Weighted-average shares outstanding - Basic | | | 46,946,678 | | | | 28,174,568 | | | | 36,153,673 | | | | 21,315,928 | |

EPS - diluted | | $ | 0.09 | | | $ | 0.01 | | | $ | 0.78 | | | $ | 0.14 | |

Weighted-average shares outstanding - Diluted | | | 46,966,605 | | | | 28,578,949 | | | | 36,160,274 | | | | 21,532,671 | |

| | | | | | | | | | | | | | | | |

Funds From Operations: | | | | | | | | | | | | | | | | |

Net Income (loss) | | $ | 4,408 | | | $ | 195 | | | $ | 30,156 | | | $ | 2,944 | |

Adjustments: | | | | | | | | | | | | | | | | |

Income allocated to preferred units | | | — | | | | (6 | ) | | | — | | | | (4 | ) |

Real estate depreciation and amortization | | | 11,632 | | | | 3,856 | | | | 28,094 | | | | 12,520 | |

Net (gains) losses on sale of assets | | | (6,412 | ) | | — | | | | (6,412 | ) | | | — | |

Funds From Operations | | $ | 9,628 | | | $ | 4,045 | | | $ | 51,838 | | | $ | 15,460 | |

FFO per share--diluted | | $ | 0.19 | | | $ | 0.14 | | | $ | 1.37 | | | $ | 0.72 | |

Core Funds From Operations: | | | | | | | | | | | | | | | | |

Funds From Operations | | $ | 9,628 | | | $ | 4,045 | | | $ | 51,838 | | | $ | 15,460 | |

Adjustments: | | | | | | | | | | | | | | | | |

Equity based compensation | | | 198 | | | | 32 | | | | 495 | | | | 206 | |

Amortization of deferred financing costs | | | 1,034 | | | | 126 | | | | 1,483 | | | | 358 | |

Acquisition and integration expenses | | | 524 | | | | 641 | | | | 13,555 | | | | 1,842 | |

TSRE financing extinguishment and employee separation expenses | | | — | | | | — | | | | 27,508 | | | | — | |

(Gains) losses on TSRE merger and property acquisitions | | | (592 | ) | | | — | | | | (64,604 | ) | | | (2,882 | ) |

Core Funds From Operations | | $ | 10,792 | | | $ | 4,844 | | | $ | 30,275 | | | $ | 14,984 | |

CFFO per share--diluted | | $ | 0.22 | | | $ | 0.17 | | | $ | 0.80 | | | $ | 0.70 | |

Weighted-average shares and units outstanding | | | 50,101,609 | | | | 28,578,949 | | | | 37,968,183 | | | | 21,532,671 | |

12

ADJUSTED EBITDA RECONCILIATIONS

Dollars in thousands, except per share data

| | Three-Months Ended | | | Twelve-Months Ended | |

| | December 31 | | | December 31 | |

| | 2015 | | | 2014 | | | 2015 | | | 2014 | |

Net income (loss) | | $ | 4,408 | | | $ | 195 | | | $ | 30,156 | | | $ | 2,944 | |

Add-Back (Deduct): | | | | | | | | | | | | | | | | |

Depreciation and amortization | | | 11,632 | | | | 3,856 | | | | 28,094 | | | | 12,520 | |

Interest expense | | | 10,160 | | | | 2,986 | | | | 23,553 | | | | 8,496 | |

Interest Income | | | — | | | | (5 | ) | | | (19 | ) | | | (17 | ) |

Acquisition and integration expenses | | | 524 | | | | 641 | | | | 13,555 | | | | 1,842 | |

Net (gains) losses on sale of assets | | | (6,412 | ) | | | | | | | (6,412 | ) | | | | |

TSRE financing extinguishment and employee separation expenses | | | — | | | | — | | | | 27,508 | | | | — | |

(Gains) losses on TSRE merger and property acquisitions | | | (592 | ) | | | — | | | | (64,604 | ) | | | (2,882 | ) |

Adjusted EBITDA | | $ | 19,720 | | | $ | 7,673 | | | $ | 51,831 | | | $ | 22,903 | |

| | For the Three-Months Ended | |

| | December 31, 2015 | | | September 30, 2015 | | | June 30, 2015 | | | March 31, 2015 | | | December 31, 2014 | |

Net income (loss) | | $ | 4,408 | | | $ | 25,636 | | | $ | 353 | | | $ | (241 | ) | | $ | 195 | |

Add-Back (Deduct): | | | | | | | | | | | | | | | | | | | | |

Depreciation and amortization | | | 11,632 | | | | 4,704 | | | | 5,720 | | | | 6,038 | | | | 3,856 | |

Interest expense | | | 10,160 | | | | 5,094 | | | | 4,277 | | | | 4,022 | | | | 2,986 | |

Interest Income | | | — | | | | (18 | ) | | | — | | | | (1 | ) | | | (5 | ) |

Acquisition and integration expenses | | | 524 | | | | 12,830 | | | | 168 | | | | 33 | | | | 641 | |

Net (gains) losses on sale of assets | | | (6,412 | ) | | | | | | | | | | | | | | | | |

TSRE financing extinguishment and employee separation expenses | | | — | | | | 27,508 | | | | — | | | | — | | | | — | |

(Gains) losses on TSRE merger and property acquisitions | | | (592 | ) | | | (64,012 | ) | | | — | | | | — | | | | — | |

Adjusted EBITDA | | $ | 19,720 | | | $ | 11,742 | | | $ | 10,518 | | | $ | 9,851 | | | $ | 7,673 | |

13

SAME STORE PORTFOLIO NET OPERATING INCOME

TRAILING 5 QUARTERS

Dollars in thousands, except per share data

| | For the Three-Months Ended (a) | |

| | December 31, 2015 | | | September 30, 2015 | | | June 30, 2015 | | | March 31, 2015 | | | December 31, 2014 | |

Revenue: | | | | | | | | | | | | | | | | | | | | |

Rental income | | $ | 13,446 | | | $ | 13,389 | | | $ | 13,263 | | | $ | 13,029 | | | $ | 12,868 | |

Reimbursement and other income | | | 1,440 | | | | 1,470 | | | | 1,418 | | | | 1,322 | | | | 1,282 | |

Total revenue | | | 14,886 | | | | 14,859 | | | | 14,681 | | | | 14,351 | | | | 14,150 | |

Operating Expenses: | | | | | | | | | | | | | | | | | | | | |

Real estate taxes | | | 1,597 | | | | 1,532 | | | | 1,382 | | | | 1,484 | | | | 1,478 | |

Property insurance | | | 459 | | | | 439 | | | | 453 | | | | 434 | | | | 434 | |

Personnel expenses | | | 1,733 | | | | 1,757 | | | | 1,646 | | | | 1,577 | | | | 1,605 | |

Utilities | | | 1,105 | | | | 1,217 | | | | 1,091 | | | | 1,193 | | | | 1,168 | |

Repairs and maintenance | | | 612 | | | | 740 | | | | 744 | | | | 498 | | | | 596 | |

Management fees | | | 539 | | | | 539 | | | | 517 | | | | 522 | | | | 504 | |

Contract services | | | 378 | | | | 391 | | | | 386 | | | | 372 | | | | 381 | |

Advertising expenses | | | 206 | | | | 213 | | | | 220 | | | | 222 | | | | 202 | |

Other expenses | | | 514 | | | | 541 | | | | 611 | | | | 506 | | | | 487 | |

Total operating expenses | | | 7,143 | | | | 7,369 | | | | 7,050 | | | | 6,808 | | | | 6,855 | |

Net operating income | | $ | 7,743 | | | $ | 7,490 | | | $ | 7,631 | | | $ | 7,543 | | | $ | 7,295 | |

NOI Margin | | | 52.0 | % | | | 50.4 | % | | | 52.0 | % | | | 52.6 | % | | | 51.6 | % |

Average Occupancy | | | 92.9 | % | | | 93.5 | % | | | 93.2 | % | | | 93.0 | % | | | 92.5 | % |

Average effective monthly rent, per unit | | $ | 823 | | | $ | 814 | | | $ | 808 | | | $ | 794 | | | $ | 790 | |

Reconciliation of Same-Store Net Operating Income to Net Income (loss) | | | | | | | | | | | | | | | | | | | | |

Same-store net operating income (a) | | $ | 7,743 | | | $ | 7,490 | | | $ | 7,631 | | | $ | 7,543 | | | $ | 7,295 | |

Non same-store net operating income | | | 14,568 | | | | 6,057 | | | | 4,570 | | | | 4,019 | | | | 1,365 | |

Asset management fees | | | (1,882 | ) | | | (1,259 | ) | | | (1,260 | ) | | | (1,212 | ) | | | (644 | ) |

General and administrative expenses | | | (709 | ) | | | (546 | ) | | | (423 | ) | | | (499 | ) | | | (343 | ) |

Acquisition and integration expenses | | | (524 | ) | | | (12,830 | ) | | | (168 | ) | | | (33 | ) | | | (641 | ) |

Depreciation and amortization | | | (11,632 | ) | | | (4,704 | ) | | | (5,720 | ) | | | (6,038 | ) | | | (3,856 | ) |

Interest expense | | | (10,160 | ) | | | (5,094 | ) | | | (4,277 | ) | | | (4,022 | ) | | | (2,986 | ) |

Interest income | | | — | | | | 18 | | | | — | | | | 1 | | | | 5 | |

Net gains (losses) on sale of assets | | | 6,412 | | | | — | | | | — | | | | — | | | | — | |

TSRE financing extinguishment and employee separation expenses | | | — | | | | (27,508 | ) | | | — | | | | — | | | | — | |

Gains (losses) on TSRE merger and property acquisitions | | | 592 | | | | 64,012 | | | | — | | | | — | | | | — | |

Net income (loss) | | $ | 4,408 | | | $ | 25,636 | | | $ | 353 | | | $ | (241 | ) | | $ | 195 | |

(a) | Same store portfolio includes 21 properties which represents 6,150 units. |

14

SAME STORE PORTFOLIO NET OPERATING INCOME

THREE AND TWELVE MONTHS ENDED DECEMBER 31, 2015

Dollars in thousands, except per share data

| | Three-Months Ended December 31 (a) | | | Twelve-Months Ended December 31 (b) | |

| | 2015 | | | 2014 | | | % change | | | 2015 | | | 2014 | | | % change | |

Revenue: | | | | | | | | | | | | | | | | | | | | | | | |

Rental income | | $ | 13,446 | | | $ | 12,868 | | | | 4.5 | % | | $ | 21,171 | | | $ | 20,121 | | | | 5.2 | % |

Reimbursement and other income | | | 1,440 | | | | 1,282 | | | | 12.3 | % | | | 2,709 | | | | 2,439 | | | | 11.1 | % |

Total revenue | | | 14,886 | | | | 14,150 | | | | 5.2 | % | | | 23,880 | | | | 22,560 | | | | 5.9 | % |

Operating Expenses: | | | | | | | | | | | | | | | | | | | | | | | |

Real estate taxes | | | 1,597 | | | | 1,478 | | | | 8.1 | % | | | 2,024 | | | | 2,056 | | | | -1.6 | % |

Property insurance | | | 459 | | | | 434 | | | | 5.8 | % | | | 664 | | | | 691 | | | | -3.9 | % |

Personnel expenses | | | 1,733 | | | | 1,605 | | | | 8.0 | % | | | 2,723 | | | | 2,549 | | | | 6.8 | % |

Utilities | | | 1,105 | | | | 1,168 | | | | -5.4 | % | | | 2,456 | | | | 2,402 | | | | 2.2 | % |

Repairs and maintenance | | | 612 | | | | 596 | | | | 2.7 | % | | | 1,157 | | | | 1,134 | | | | 2.0 | % |

Management fees | | | 539 | | | | 504 | | | | 6.9 | % | | | 945 | | | | 886 | | | | 6.7 | % |

Contract services | | | 378 | | | | 381 | | | | -0.7 | % | | | 589 | | | | 604 | | | | -2.5 | % |

Advertising expenses | | | 206 | | | | 202 | | | | 2.2 | % | | | 341 | | | | 323 | | | | 5.6 | % |

Other expenses | | | 514 | | | | 487 | | | | 5.5 | % | | | 1,073 | | | | 833 | | | | 28.8 | % |

Total operating expenses | | | 7,143 | | | | 6,855 | | | | 4.2 | % | | | 11,972 | | | | 11,478 | | | | 4.3 | % |

Net operating income | | $ | 7,743 | | | $ | 7,295 | | | | 6.1 | % | | $ | 11,908 | | | $ | 11,082 | | | | 7.5 | % |

NOI Margin | | | 52.0 | % | | | 51.6 | % | | | 0.4 | % | | | 49.9 | % | | | 49.1 | % | | | 0.8 | % |

Average Occupancy | | | 92.9 | % | | | 92.5 | % | | | 0.4 | % | | | 94.0 | % | | | 94.1 | % | | | -0.1 | % |

Average effective monthly rent, per unit | | $ | 823 | | | $ | 790 | | | | 4.2 | % | | $ | 809 | | | $ | 767 | | | | 5.5 | % |

Reconciliation of Same-Store Net Operating Income to Net Income (loss) | | | | | | | | | | | | | | | | | | | | | | | | |

Same-store portfolio net operating income (a) (b) | | $ | 7,743 | | | $ | 7,295 | | | | | | | $ | 11,908 | | | $ | 11,082 | | | | | |

Non same-store net operating income | | | 14,568 | | | | 1,365 | | | | | | | | 47,713 | | | | 14,694 | | | | | |

Asset management fees | | | (1,882 | ) | | | (644 | ) | | | | | | | (5,613 | ) | | | (1,736 | ) | | | | |

General and administrative expenses | | | (709 | ) | | | (343 | ) | | | | | | | (2,177 | ) | | | (1,137 | ) | | | | |

Acquisition and integration expenses | | | (524 | ) | | | (641 | ) | | | | | | | (13,555 | ) | | | (1,842 | ) | | | | |

Depreciation and amortization | | | (11,632 | ) | | | (3,856 | ) | | | | | | | (28,094 | ) | | | (12,520 | ) | | | | |

Interest expense | | | (10,160 | ) | | | (2,986 | ) | | | | | | | (23,553 | ) | | | (8,496 | ) | | | | |

Interest income | | | — | | | | 5 | | | | | | | | 19 | | | | 17 | | | | | |

Net gains (losses) on sale of assets | | | 6,412 | | | | — | | | | | | | | 6,412 | | | | - | | | | | |

TSRE financing extinguishment and employee separation expenses | | | — | | | | — | | | | | | | | (27,508 | ) | | | — | | | | | |

Gains (losses) on TSRE merger and property acquisitions | | | 592 | | | | — | | | | | | | | 64,604 | | | | 2,882 | | | | | |

Net income (loss) | | $ | 4,408 | | | $ | 195 | | | | | | | $ | 30,156 | | | $ | 2,944 | | | | | |

(a) | Same store portfolio for the three months ended December 31, 2015 and 2014 includes 21 properties which represents 6,150 units. |

(b) | Same store portfolio for the twelve months ended December 31, 2015 and 2014 includes 9 properties which represents 2,470 units. |

15

NET OPERATING INCOME (NOI) BRIDGE

Dollars in thousands, except per share data

| | For the Three-Months Ended | |

| | December 31, 2015 | | | September 30, 2015 | | | June 30, 2015 | | | March 31, 2015 | | | December 31, 2014 | |

Property revenue | | | | | | | | | | | | | | | | | | | | |

Same store (a) | | $ | 14,886 | | | $ | 14,859 | | | $ | 14,681 | | | $ | 14,351 | | | $ | 14,150 | |

Non same store | | | 24,823 | | | | 10,633 | | | | 8,037 | | | | 7,306 | | | | 2,199 | |

Total property revenue | | | 39,709 | | | | 25,492 | | | | 22,718 | | | | 21,657 | | | | 16,349 | |

Property expenses | | | | | | | | | | | | | | | | | | | | |

Same store (a) | | | 7,143 | | | | 7,369 | | | | 7,050 | | | | 6,808 | | | | 6,855 | |

Non same store | | | 10,255 | | | | 4,576 | | | | 3,467 | | | | 3,287 | | | | 834 | |

Total property expenses | | | 17,398 | | | | 11,945 | | | | 10,517 | | | | 10,095 | | | | 7,689 | |

Net operating income | | | | | | | | | | | | | | | | | | | | |

Same store (a) | | | 7,743 | | | | 7,490 | | | | 7,631 | | | | 7,543 | | | | 7,295 | |

Non same store | | | 14,568 | | | | 6,057 | | | | 4,570 | | | | 4,019 | | | | 1,365 | |

Total property net operating income | | $ | 22,311 | | | $ | 13,547 | | | $ | 12,201 | | | $ | 11,562 | | | $ | 8,660 | |

Reconciliation of NOI to GAAP net income (loss) | | | | | | | | | | | | | | | | | | | | |

Total property net operating income | | $ | 22,311 | | | $ | 13,547 | | | $ | 12,201 | | | $ | 11,562 | | | $ | 8,660 | |

General and administrative expense | | | (709 | ) | | | (546 | ) | | | (423 | ) | | | (499 | ) | | | (343 | ) |

Asset management fees - base | | | (1,690 | ) | | | (1,259 | ) | | | (1,046 | ) | | | (1,001 | ) | | | (490 | ) |

Asset management fees - incentive | | | (192 | ) | | | — | | | | (214 | ) | | | (211 | ) | | | (154 | ) |

Acquisition and integration expenses | | | (524 | ) | | | (12,830 | ) | | | (168 | ) | | | (33 | ) | | | (641 | ) |

Depreciation and amortization expense | | | (11,632 | ) | | | (4,704 | ) | | | (5,720 | ) | | | (6,038 | ) | | | (3,856 | ) |

Interest expense | | | (10,160 | ) | | | (5,094 | ) | | | (4,277 | ) | | | (4,022 | ) | | | (2,986 | ) |

Interest income | | | — | | | | 18 | | | | — | | | | 1 | | | | 5 | |

Net gains (losses) on sale of assets | | | 6,412 | | | | | | | | | | | | | | | | | |

TSRE financing extinguishment and employee separation expenses | | | — | | | | (27,508 | ) | | | — | | | | — | | | | — | |

Gains (losses) on TSRE merger and property acquisitions | | | 592 | | | | 64,012 | | | | — | | | | — | | | | — | |

Net income (loss) | | $ | 4,408 | | | $ | 25,636 | | | $ | 353 | | | $ | (241 | ) | | $ | 195 | |

(a) | Same store portfolio includes 21 properties which represents 6,150 units. |

16

Debt Summary

(Unaudited, in thousands except shares and per share data)

| | Amount | | | Rate | | | Type | | Weighted Average Maturity (in years) | | |

Debt: | | | | | | | | | | | | | | | |

Credit facility (a) | | $ | 271,500 | | | | 2.9 | % | | Floating | (b) | | 2.8 | | |

Bridge term loan | | | 120,000 | | | | 5.4 | % | | Floating | (b) | | 1.2 | | (c) |

Mortgages-Fixed rate | | | 545,956 | | | | 3.8 | % | | Fixed | | | 7.0 | | |

Mortgages-Floating rate | | | 38,075 | | | | 2.8 | % | | Floating | | | 5.4 | | |

Unamortized debt premiums | | | 306 | | | | | | | | | | | | |

Total Debt | | | 975,837 | | | | 3.7 | % | | | | | 5.0 | | |

Market Equity Capitalization, at period end | | | 377,194 | | | | | | | | | | | | |

Total Capitalization | | $ | 1,353,031 | | | | | | | | | | | | |

(a) | Credit facility total capacity is $325.0 million, of which $271.5 million was drawn as of December 31, 2015. |

(b) | As of December 31, 2015, IRT maintained an interest rate cap, which caps 1-month LIBOR at 3.0% on $200 million in notional. This agreement has a maturity date of October 17, 2017. |

(c) | Includes the initial 6 month extension included in the bridge term loan. |

17

Property Summary

(Unaudited, in thousands except shares and per share data)

Property Name | | Location | | Acquisition Date | | Year Built / Renovated (a) | | | Units (b) | | | Period End Occupancy (c) | | | Average Occupancy (d) | | | Average Effective Rent per Occupied Unit (e) | |

Belle Creek | | Henderson, CO | | 4/29/2011 | | | 2011 | | | 162 | | | | 97.5 | % | | | 98.0 | % | | $ | 1,178 | |

Copper Mill | | Austin, TX | | 4/29/2011 | | | 2010 | | | 320 | | | | 96.3 | % | | | 95.9 | % | | | 912 | |

Crestmont | | Marietta, GA | | 4/29/2011 | | | 2010 | | | 228 | | | | 81.1 | % | | | 84.2 | % | | | 852 | |

Cumberland Glen | | Smyrna, GA | | 4/29/2011 | | | 2010 | | | 222 | | | | 95.0 | % | | | 95.2 | % | | | 786 | |

Heritage Trace | | Newport News, VA | | 4/29/2011 | | | 2010 | | | 200 | | | | 98.5 | % | | | 97.7 | % | | | 702 | |

Tresa | | Phoenix, AZ | | 4/29/2011 | | | 2006 | | | 360 | | | | 98.6 | % | | | 98.1 | % | | | 876 | |

Runaway Bay | | Indianapolis, IN | | 10/11/2012 | | | 2002 | | | 192 | | | | 95.8 | % | | | 97.0 | % | | | 953 | |

Berkshire Square | | Indianapolis, IN | | 9/19/2013 | | | 2012 | | | 354 | | | | 92.7 | % | | | 91.5 | % | | | 624 | |

The Crossings | | Jackson, MS | | 11/22/2013 | | | 2012 | | | 432 | | | | 89.1 | % | | | 91.6 | % | | | 781 | |

Reserve at Eagle Ridge | | Waukegan, IL | | 1/31/2014 | | | 2008 | | | 370 | | | | 95.4 | % | | | 96.2 | % | | | 968 | |

Windrush | | Edmond, OK | | 2/28/2014 | | | 2011 | | | 160 | | | | 91.9 | % | | | 94.4 | % | | | 796 | |

Heritage Park | | Oklahoma City, OK | | 2/28/2014 | | 2011 (f) | | | 453 | | | | 86.3 | % | | | 87.1 | % | | | 669 | |

Raindance | | Oklahoma City, OK | | 2/28/2014 | | | 2011 | | | 504 | | | | 94.1 | % | | | 93.5 | % | | | 563 | |

Augusta | | Oklahoma City, OK | | 2/28/2014 | | | 2011 | | | 197 | | | | 93.9 | % | | | 95.2 | % | | | 729 | |

Invitational | | Oklahoma City, OK | | 2/28/2014 | | | 2011 | | | 344 | | | | 90.7 | % | | | 92.2 | % | | | 667 | |

King's Landing | | Creve Coeur, MO | | 3/31/2014 | | | 2005 | | | 152 | | | | 91.6 | % | | | 95.7 | % | | | 1,480 | |

Carrington Park | | Little Rock, AR | | 5/7/2014 | | | 1999 | | | 202 | | | | 93.6 | % | | | 92.1 | % | | | 992 | |

Arbors at the Reservoir | | Ridgeland, MS | | 6/4/2014 | | | 2000 | | | 170 | | | | 90.6 | % | | | 95.3 | % | | | 1,112 | |

Walnut Hill | | Cordova, TN | | 8/28/2014 | | | 2001 | | | 360 | | | | 92.5 | % | | | 91.3 | % | | | 924 | |

Lenoxplace | | Raleigh, NC | | 9/5/2014 | | | 2012 | | | 268 | | | | 94.4 | % | | | 93.8 | % | | | 870 | |

Stonebridge Crossing | | Cordova, TN | | 9/15/2014 | | | 1994 | | | 500 | | | | 88.0 | % | | | 88.1 | % | | | 770 | |

Bennington Pond | | Groveport, OH | | 11/24/2014 | | | 2000 | | | 240 | | | | 94.2 | % | | | 93.9 | % | | | 828 | |

Prospect Park | | Louisville, KY | | 12/8/2014 | | | 1990 | | | 138 | | | | 94.2 | % | | | 90.7 | % | | | 896 | |

Brookside | | Louisville, KY | | 12/8/2014 | | | 1987 | | | 224 | | | | 97.8 | % | | | 97.3 | % | | | 795 | |

Jamestown | | Louisville, KY | | 12/8/2014 | | 1970 (f) | | | 355 | | | | 88.7 | % | | | 90.1 | % | | | 983 | |

Meadows | | Louisville, KY | | 12/8/2014 | | | 1988 | | | 400 | | | | 93.3 | % | | | 95.3 | % | | | 793 | |

Oxmoor | | Louisville, KY | | 12/8/2014 | | 1999-2000 (f) | | | 432 | | | | 88.7 | % | | | 88.0 | % | | | 1,021 | |

Stonebridge at the Ranch | | Little Rock, AR | | 12/16/2014 | | | 2005 | | | 260 | | | | 93.9 | % | | | 91.6 | % | | | 910 | |

Iron Rock Ranch | | Austin, TX | | 12/30/2014 | | 2001-2002 | | | 300 | | | | 94.0 | % | | | 95.1 | % | | | 1,192 | |

Bayview Club | | Indianapolis, IN | | 5/1/2015 | | | 2004 | | | 236 | | | | 92.0 | % | | | 91.5 | % | | | 862 | |

Arbors River Oaks | | Memphis, TN | | 9/17/2015 | | 1990 (f) | | | 191 | | | | 93.7 | % | | | 91.1 | % | | | 1,146 | |

Aston | | Wake Forest, NC | | 9/17/2015 | | | 2013 | | | 288 | | | | 94.1 | % | | | 94.5 | % | | | 1,032 | |

Avenues at Craig Ranch | | McKinneuy, TX | | 9/17/2015 | | | 2013 | | | 334 | | | | 92.2 | % | | | 94.7 | % | | | 1,216 | |

Bridge Pointe | | Huntsville, AL | | 9/17/2015 | | | 2002 | | | 178 | | | | 97.8 | % | | | 96.1 | % | | | 816 | |

Creekstone at RTP | | Durham, NC | | 9/17/2015 | | | 2012 | | | 256 | | | | 93.4 | % | | | 94.5 | % | | | 1,104 | |

Fountains Southend | | Charlotte, NC | | 9/17/2015 | | | 2013 | | | 208 | | | | 97.6 | % | | | 96.2 | % | | | 1,353 | |

Fox Trails | | Plano, TX | | 9/17/2015 | | | 1981 | | | 286 | | | | 97.6 | % | | | 96.8 | % | | | 965 | |

Lakeshore on the Hill | | Chattanooga, TN | | 9/17/2015 | | | 2015 | | | 123 | | | | 96.8 | % | | | 96.9 | % | | | 925 | |

Millenia 700 | | Orlando, FL | | 9/17/2015 | | | 2012 | | | 297 | | | | 96.3 | % | | | 96.0 | % | | | 1,290 | |

Miller Creek at German Town | | Memphis, TN | | 9/17/2015 | | | 2013 | | | 330 | | | | 93.3 | % | | | 94.9 | % | | | 1,217 | |

Pointe at Canyon Ridge | | Atlanta, GA | | 9/17/2015 | | 1986 (f) | | | 494 | | | | 92.3 | % | | | 91.9 | % | | | 910 | |

St James at Goose Creek | | Goose Creek, SC | | 9/17/2015 | | | 2009 | | | 244 | | | | 91.0 | % | | | 93.1 | % | | | 1,051 | |

Talison Row at Daniel Island | | Daniel Island, SC | | 9/17/2015 | | | 2013 | | | 274 | | | | 87.2 | % | | | 93.4 | % | | | 1,519 | |

The Aventine Greenville | | Greenville, SC | | 9/17/2015 | | | 2013 | | | 346 | | | | 92.8 | % | | | 93.8 | % | | | 1,125 | |

Trails at Signal Mountain | | Chattanooga, TN | | 9/17/2015 | | | 2015 | | | 172 | | | | 97.1 | % | | | 98.6 | % | | | 882 | |

Vue at Knoll Trail | | Dallas, TX | | 9/17/2015 | | | 2015 | | | 114 | | | | 94.7 | % | | | 96.3 | % | | | 846 | |

Waterstone at Brier Creek | | Raleigh, NC | | 9/17/2015 | | | 2014 | | | 232 | | | | 94.4 | % | | | 94.9 | % | | | 1,201 | |

Waterstone Big Creek | | Alpharetta, GA | | 9/17/2015 | | | 2014 | | | 370 | | | | 96.2 | % | | | 97.2 | % | | | 1,322 | |

Westmont Commons | | Asheville, NC | | 9/17/2015 | | | 2003 | | | 252 | | | | 96.8 | % | | | 97.1 | % | | | 979 | |

TOTAL | | | | | | | | | | | 13,724 | | | | 93.0 | % | | | 93.6 | % | | $ | 951 | |

(a) | All dates are for the year in which a significant renovation program was completed, except for Runaway Bay, Arbors at the Reservoir, King’s Landing, Walnut Hill, Stonebridge, Bennington Pond, Prospect Park, Brookside, Jamestown, Meadows, Oxmoor, Stonebridge at the Ranch and Iron Rock Ranch which is the year construction was completed. |

(b) | Units represent the total number of apartment units available for rent at December 31, 2015. |

(c) | Physical occupancy for each of our properties is calculated as (i) total units rented as of December 31, 2015 divided by (ii) total units available as of December 31, 2015, expressed as a percentage. |

(d) | Average occupancy represents the daily average occupied units for the three-month period ended December 31, 2015. |

(e) | Average monthly effective monthly rent, per unit, represents the average monthly rent for all occupied units for the three-month period ended December 31, 2015. |

(f) | Properties are undergoing renovation. |

18

NOI Exposure by Market

Dollars in thousands, except per share data

| | | | | | | | | | | | | | For the Three Months Ended December 31, 2015 | |

Market | | Units | | | Gross Real Estate Assets | | | Period End Occupancy | | | Average Effective Monthly Rent per Unit | | | Net Operating Income (a) | | | % of NOI | |

Atlanta, GA | | | 1,314 | | | $ | 144,941 | | | | 91.9 | % | | $ | 995 | | | $ | 2,361 | | | | 10.8 | % |

Louisville. KY | | | 1,549 | | | | 159,220 | | | | 91.7 | % | | | 910 | | | | 2,343 | | | | 10.7 | % |

Raleigh, NC | | | 1,044 | | | | 137,683 | | | | 94.1 | % | | | 1,046 | | | | 2,099 | | | | 9.6 | % |

Memphis, TN | | | 1,381 | | | | 133,473 | | | | 91.2 | % | | | 969 | | | | 2,082 | | | | 9.5 | % |

Oklahoma City, OK | | | 1,658 | | | | 67,922 | | | | 91.0 | % | | | 656 | | | | 1,496 | | | | 6.8 | % |

Dallas, TX | | | 734 | | | | 83,980 | | | | 94.7 | % | | | 1,061 | | | | 1,292 | | | | 5.9 | % |

Charleston, SC | | | 518 | | | | 78,064 | | | | 89.0 | % | | | 1,298 | | | | 1,175 | | | | 5.4 | % |

Austin, TX | | | 620 | | | | 49,220 | | | | 95.2 | % | | | 1,048 | | | | 927 | | | | 4.2 | % |

Jackson, MS | | | 602 | | | | 41,940 | | | | 90.6 | % | | | 875 | | | | 878 | | | | 4.0 | % |

Indianapolis, IN | | | 782 | | | | 52,568 | | | | 93.2 | % | | | 775 | | | | 831 | | | | 3.8 | % |

Greenville, SC | | | 346 | | | | 47,781 | | | | 92.8 | % | | | 1,125 | | | | 746 | | | | 3.4 | % |

Little Rock, AR | | | 462 | | | | 51,402 | | | | 93.7 | % | | | 946 | | | | 725 | | | | 3.3 | % |

Orlando, FL | | | 297 | | | | 47,011 | | | | 96.3 | % | | | 1,290 | | | | 707 | | | | 3.2 | % |

Phoenix, AZ | | | 360 | | | | 31,206 | | | | 98.6 | % | | | 876 | | | | 638 | | | | 2.9 | % |

Charlotte, NC | | | 208 | | | | 41,393 | | | | 97.6 | % | | | 1,353 | | | | 631 | | | | 2.9 | % |

Chicago, IL | | | 370 | | | | 27,686 | | | | 95.4 | % | | | 968 | | | | 596 | | | | 2.7 | % |

Asheville, NC | | | 252 | | | | 27,837 | | | | 96.8 | % | | | 979 | | | | 489 | | | | 2.2 | % |

St. Louis, MO | | | 152 | | | | 31,175 | | | | 91.6 | % | | | 1,480 | | | | 447 | | | | 2.0 | % |

Chattanooga, TN | | | 295 | | | | 25,128 | | | | 97.0 | % | | | 900 | | | | 409 | | | | 1.9 | % |

Denver, CO | | | 162 | | | | 8,369 | | | | 97.5 | % | | | 1,178 | | | | 364 | | | | 1.7 | % |

Columbus, OH | | | 240 | | | | 17,053 | | | | 94.2 | % | | | 828 | | | | 282 | | | | 1.3 | % |

Huntsville, AL | | | 178 | | | | 15,731 | | | | 97.8 | % | | | 816 | | | | 269 | | | | 1.2 | % |

Norfolk, VA | | | 200 | | | | 11,594 | | | | 98.5 | % | | | 702 | | | | 142 | | | | 0.6 | % |

Total/Weighted Average | | | 13,724 | | | $ | 1,332,377 | | | | 93.0 | % | | $ | 951 | | | $ | 21,929 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

(a) | Net operating income for the three months ended December 31, 2015 excludes $382 for a property sold on December 22, 2015. |

19

Definitions

Average Effective Monthly Rent per Unit

Average effective rent per unit represents the average of gross rent amounts, divided by the average occupancy (in units) for the period presented. We believe average effective rent is a helpful measurement in evaluating average pricing. This metric, when presented, reflects the average effective rent per month.

Average Occupancy

Average occupancy represents the average of the daily physical occupancy for the period presented.

Adjusted EBITDA

EBITDA is defined as net income before gains or losses on asset sales, gains or losses on debt extinguishments, depreciation and amortization expenses, interest expense, income taxes, and amortization of deferred financing costs. Adjusted EBITDA is EBITDA before acquisition expenses and gains. EBITDA and Adjusted EBITDA are each non-GAAP measures. We consider EBITDA and Adjusted EBITDA to be an appropriate supplemental measure of our performance because it eliminates depreciation, income taxes, interest and acquisition expenses and gains relating to IRT’s acquisition of TSRE, which permits investors to view income from operations without non-cash items such as depreciation, amortization, the cost of debt or items specific to the TSRE acquisition. The table is a reconciliation of net income applicable to common stockholders to Adjusted EBITDA. IRT’s calculation of Adjusted EBITDA differs from the methodology used for calculating Adjusted EBITDA by certain other REITs and, accordingly, IRT’s Adjusted EBITDA may not be comparable to Adjusted EBITDA reported by other REITs.

Funds From Operations (“FFO”) and Core Funds From Operations (“CFFO”)

IRT believes that FFO and CFFO, each of which is a non-GAAP measure, are additional appropriate measures of the operating performance of a REIT and IRT in particular. IRT computes FFO in accordance with the standards established by the National Association of Real Estate Investment Trusts, or NAREIT, as net income or loss allocated to common stock (computed in accordance with GAAP), excluding real estate-related depreciation and amortization expense, gains or losses on sales of real estate and the cumulative effect of changes in accounting principles.

CFFO is a computation made by analysts and investors to measure a real estate company’s operating performance by removing the effect of items that do not reflect ongoing property operations, including acquisition and integration expenses, expensed costs related to the issuance of shares of our common stock, gains or losses on real estate transactions and equity-based compensation expenses, from the determination of FFO. IRT incurs acquisition expenses in connection with acquisitions of real estate properties and expenses those costs when incurred in accordance with U.S. GAAP. As these expenses are one-time and reflective of investing activities rather than operating performance, IRT adds back these costs to FFO in determining CFFO. In connection with the TSRE transaction, IRT modified the calculation of CFFO to adjust for amortization of deferred financing costs and TSRE financing extinguishment and employee separation expenses because these are non-cash items or reflective of investing activities rather than operating performance similar to the other CFFO adjustments. The effect of these modifications on prior periods is reflected in the reconciliation of IRT’s reported net income (loss) allocable to common shares to its FFO and CFFO included herein.

IRT’s calculation of CFFO differs from the methodology used for calculating CFFO by certain other REITs and, accordingly, IRT’s CFFO may not be comparable to CFFO reported by other REITs. IRT’s management utilizes FFO and CFFO as measures of IRT’s operating performance, and believes they are also useful to investors, because they facilitate an understanding of IRT’s operating performance after adjustment for certain non-cash items, such as depreciation and amortization expenses, equity based compensation, amortization of deferred financing fees, TSRE financing extinguishment and employee separation costs, gains (loss) on TSRE transaction and property acquisitions and acquisition expenses and pursuit costs that are required by GAAP to be expensed but may not necessarily be indicative of current operating performance and that may not accurately compare IRT’s operating performance between periods. Furthermore, although FFO, CFFO and other supplemental performance measures are defined in various ways throughout the REIT industry, IRT also believes that FFO and CFFO may provide IRT and our investors with an additional useful measure to compare IRT’s financial performance to certain other REITs. IRT also uses CFFO for purposes of determining the quarterly incentive fee, if any, payable to our advisor. Neither FFO nor CFFO is equivalent to net income or cash generated from operating activities determined in accordance with GAAP. Furthermore, FFO and CFFO do not represent amounts available for management’s discretionary use because of needed capital replacement or expansion, debt service obligations or other commitments

20

or uncertainties. Neither FFO nor CFFO should be considered as an alternative to net income as an indicator of IRT’s operating performance or as an alternative to cash flow from operating activities as a measure of IRT’s liquidity.

Net Operating Income

IRT believes that Net Operating Income (“NOI”), a non-GAAP measure, is a useful measure of its operating performance. IRT defines NOI as total property revenues less total property operating expenses, excluding depreciation and amortization, asset management fees, acquisition expenses and general administrative expenses. Other REITs may use different methodologies for calculating NOI, and accordingly, our NOI may not be comparable to other REITs. We believe that this measure provides an operating perspective not immediately apparent from GAAP operating income or net income. We use NOI to evaluate our performance on a same store and non-same store basis because NOI measures the core operations of property performance by excluding corporate level expenses and other items not related to property operating performance and captures trends in rental housing and property operating expenses. However, NOI should only be used as an alternative measure of our financial performance.

Same Store Properties and Same Store Portfolio

IRT defines same store properties or portfolio as conventional multifamily residential apartments which were owned and operational for the entire periods presented, including each comparative period.

21