Exhibit 99.2

1

TABLE OF CONTENTS

Company Information | | 3 |

| | |

Forward-Looking Statements | | 4 |

| | |

Earnings Release Text | | 5 |

| | |

Financial & Operating Highlights | | 11 |

| | |

Balance Sheets | | 12 |

| | |

Statements of Operations, FFO & CORE FFO | | |

Trailing 5 Quarters | | 13 |

Three and Twelve Months Ended December 31, 2018 and 2017 | | 14 |

| | |

Adjusted EBITDA Reconciliations and Coverage Ratio | | |

Trailing 5 Quarters | | 15 |

Three and Twelve Months Ended December 31, 2018 and 2017 | | 15 |

| | |

Same-Store Portfolio Net Operating Income | | |

Trailing 5 Quarters | | 16 |

Three and Twelve Months Ended December 31, 2018 and 2017 | | 17 |

| | |

Net Operating Income Bridge | | 18 |

| | |

Capital Recycling Activity | | 19 |

| | |

Value Add Summary | | 20 |

| | |

Property Summary | | 21 |

| | |

NOI Exposure by Market | | 22 |

| | |

Debt Summary | | 23 |

| | |

Definitions | | 24 |

2

Independence Realty Trust

December 31, 2018

Company Information:

Independence Realty Trust (NYSE: IRT) is a real estate investment trust that currently owns and operates 58 multifamily apartment properties, totaling 15,880 units, across non-gateway U.S. markets, including Atlanta, Louisville, Memphis, and Raleigh. IRT’s investment strategy is focused on gaining scale within key amenity rich submarkets that offer good school districts, high-quality retail and major employment centers. IRT aims to provide stockholders attractive risk-adjusted returns through diligent portfolio management, strong operational performance, and a consistent return of capital through distributions and capital appreciation.

Corporate Headquarters | | Two Liberty Place |

| | 50 S. 16th Street, Suite 3575 |

| | Philadelphia, PA 19102 |

| | 267.270.4800 |

| |

Trading Symbol | | NYSE: “IRT” |

| |

Investor Relations Contact | | Edelman Financial Communications & Capital Markets |

| | Ted McHugh and Lauren Tarola |

| | 212-277-4322 |

| | IRT@edelman.com |

| | |

3

Forward-Looking Statements

This supplemental information contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “seek,” “outlook,” “assumption,” “projected,” “strategy”, “guidance” or other, similar words. Because such forward-looking statements involve significant risks, uncertainties and contingencies, many of which are not within IRT’s control, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such statements. These forward-looking statements are based upon the current judgements and expectations of IRT’s management. Risks and uncertainties that might cause IRT’s actual results to differ materially from those expressed or implied by forward-looking statements include, but are not limited to: adverse changes in national, regional and local economic climates; changes in market demand for rental apartment homes and pricing pressures from competitors that could limit our ability to lease units or increase rents; competition that could adversely affect our ability to acquire additional properties; volatility in capital and credit markets, including changes that reduce availability, and increase costs, of capital; unexpected changes in the assumptions underlying our 2019 EPS, CFFO and same store NOI growth guidance; delays in completing, and cost overruns incurred in connection with, the value add initiatives and failure to achieve projected rent increases and occupancy levels on account of the initiatives; risks associated with pursuit of strategic acquisitions, including risks associated with the need to raise additional capital to fund the acquisitions and failure of acquisitions to produce expected returns; failure to complete planned sales on expected terms or at all; unexpected costs of REIT qualification compliance; costs and disruptions as the result of a cybersecurity incident or other technology disruption; and share price fluctuations. Additional risks and uncertainties that could cause our actual results to differ materially from those expressed or implied by the forward-looking statements in this press release are discussed in IRT’s filings with the Securities and Exchange Commission (“SEC”), including those under the heading “Risk Factors” in IRT’s most recently filed Annual Report on Form 10-K. Dividends are subject to the discretion of IRT’s Board of Directors, and will depend on IRT’s financial condition, results of operations, capital requirements, compliance with applicable laws and agreements and any other factors deemed relevant by IRT’s Board. IRT undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, except as may be required by law.

4

Independence Realty Trust Announces Fourth Quarter and Full Year 2018 Financial Results

Introduces 2019 Full Year Guidance Metrics

PHILADELPHIA – (BUSINESS WIRE) – February 21, 2019 — Independence Realty Trust, Inc. (“IRT”) (NYSE: IRT), a multifamily apartment REIT, today announced its fourth quarter and full year 2018 financial results.

Fourth Quarter Highlights

| • | Net income allocable to common shares of $14.6 million for the quarter ended December 31, 2018 as compared to $6.3 million for the quarter ended December 31, 2017. |

| • | Earnings per diluted share of $0.16 for the quarter ended December 31, 2018 as compared to $0.08 for the quarter ended December 31, 2017. |

| • | Core Funds from Operations (“CFFO”) of $16.6 million for the quarter ended December 31, 2018 as compared to $15.3 million for the quarter ended December 31, 2017. CFFO per share was $0.19 for the fourth quarter of 2018 as compared to $0.18 for the fourth quarter of 2017. |

| • | Adjusted EBITDA of $25.7 million for the quarter ended December 31, 2018 as compared to $21.7 million for the quarter ended December 31, 2017. |

Full Year Highlights:

| • | Since the inception of our value add program, IRT has completed renovations in 1,232 units, achieving a weighted average return on investment of 18.4% on interior renovations. |

| • | Net income allocable to common shares of $26.3 million for the twelve months ended December 31, 2018 as compared to $30.2 million for the twelve months ended December 31, 2017. |

| • | Earnings per diluted share of $0.30 for the twelve months ended December 31, 2018 as compared to $0.41 for the twelve months ended December 31, 2017. |

| • | Core Funds from Operations (“CFFO”) of $65.1 million for the twelve months ended December 31, 2018 as compared to $55.7 million for the twelve months ended December 31, 2017. CFFO per share was $0.74 for the full year 2018 as compared to $0.73 for the full year 2017. |

| • | Adjusted EBITDA of $97.1 million for the twelve months ended December 31, 2018 as compared to $81.0 million for the twelve months ended December 31, 2017. |

Included later in this press release are definitions of CFFO, Adjusted EBITDA and other Non-GAAP financial measures and reconciliations of such measures to their most comparable financial measures as calculated and presented under GAAP.

Management Commentary:

“IRT’s 2018 performance highlights our focus on providing strong, consistent results at the property level while investing in long-term growth through portfolio enhancements.,” said Scott Schaeffer, IRT’s Chairman and CEO. “We are executing on our value add program which is designed to increase rents while lowering operating costs resulting in expanded operating margins, as highlighted by the 3.9% same store NOI growth achieved in the fourth quarter. During 2018 we continued to demonstrate our ability to identify high-quality, middle market communities in core markets like Columbus and Tampa, while exiting markets where we do not see favorable, long-term fundamentals. We also strengthened the balance sheet with a new $200 million term loan, extending our maturities by over 2 years and reducing our interest cost by 15 basis points. As we look to 2019, we are encouraged by the positive macro outlook for multifamily communities, and are dedicated to driving strong NOI growth through our value add program. We are confident that our strategies and execution puts us on the right path to achieve our long-term objectives.”

5

Same Store Property Operating Results

| | |

| Fourth Quarter 2018 Compared to Fourth Quarter 2017(1) | Twelve Months Ended 12/31/18 Compared to Twelve Months Ended 12/31/17(1) |

Rental income | 1.6% increase | 1.7% increase |

Total revenues | 1.7% increase | 2.0% increase |

Property level operating expenses | 1.5% decrease | 1.1% increase |

Net operating income (“NOI”) | 3.9% increase | 2.6% increase |

Portfolio average occupancy | 170 bps decrease to 93.1% | 60 bps decrease to 94.1% |

Portfolio average rental rate | 3.3% increase to $1,049 | 2.4% increase to $1,033 |

NOI Margin | 130 bps increase to 61.7% | 30 bps increase to 60.1% |

| (1) | Same store portfolio for the three and twelve months ended December 31, 2018 includes 37 properties, which represent 10,329 units. |

Same Store Property Operating Results, Excluding Value Add

The same store portfolio results below exclude seven communities that are both part of our same store portfolio and part of our Value Add program for the three and twelve months ended December 31, 2018.

| | |

| Fourth Quarter 2018 Compared to Fourth Quarter 2017(1) | Twelve Months Ended 12/31/18 Compared to Twelve Months Ended 12/31/17(1) |

Rental income | 2.2% increase | 2.1% increase |

Total revenues | 2.5% increase | 2.5% increase |

Property level operating expenses | 0.9% increase | 2.4% increase |

Net operating income (“NOI”) | 3.5% increase | 2.6% increase |

Portfolio average occupancy | 50 bps decrease to 94.3% | 30 bps increase to 95.0% |

Portfolio average rental rate | 2.8% increase to $1,045 | 1.9% increase to $1,032 |

NOI Margin | 50 bps increase to 61.3% | 10 bps increase to 60.0% |

| (1) | Same store portfolio, excluding value add, for the three and twelve months ended December 31, 2018 includes 30 properties, which represent 7,976 units. |

Capital Recycling

As previously announced, IRT commenced a capital recycling initiative in the third quarter of 2018 aimed to dispose of assets in markets that lack desirable long-term fundamentals in order to invest in attractive non-gateway markets to gain scale. As part of this capital recycling initiative, IRT identified four acquisitions in target markets as well as five properties in its portfolio that it identified as held for sale. IRT completed the acquisition of the fourth target community during the quarter, and completed the disposition of two communities held for sale in the quarter.

Acquisitions completed in the fourth quarter:

| • | On October 11, 2018, IRT completed the acquisition of a 260-unit community located in McDonough, GA for a purchase price of $30.5 million. IRT assumed $15.5 million of property level debt in connection with this acquisition. As of December 31, 2018, the community was 96.9% occupied with average rent per unit of $981. IRT closed this acquisition using proceeds from its line of credit in advance of completing sales associated with the capital recycling initiative. |

| • | On November 7, 2018, IRT completed the acquisition of a 276-unit community located in Brandon, FL for a purchase price of $47.0 million. As of December 31, 2018, the community was 96.4% occupied with average rent per unit of $1,145. IRT closed this acquisition using proceeds from its line of credit in advance of completing sales associated with the capital recycling initiative. |

6

Dispositions completed in the fourth quarter:

| • | On December 20, 2018, IRT completed the disposition of a 346-unit community located in Greenville, SC for $52.5 million, which was previously identified as held for sale. |

| • | On December 27, 2018, IRT completed the disposition of a 170-unit community located in Ridgeland, MS for $24.8 million, which was previously identified as held for sale. |

Term Loan Agreement

As previously announced, on October 30, 2018 IRT entered into a five-year, $200 million unsecured term loan that will mature in January 2024. The proceeds were used to paydown borrowings outstanding under the revolving portion of IRT’s $300 million unsecured credit facility. The term loan bears interest at a spread over LIBOR based on IRT’s overall leverage. At closing, the spread to LIBOR was 145 basis points. To continue IRT’s practice of reducing exposure to floating interest rates, IRT purchased an interest rate collar that caps LIBOR at 2.50%, subject to a floor on LIBOR of 2.25%, during the five-year term.

At-the-Market Offering

During the fourth quarter of 2018, IRT issued 273,000 shares of common stock under IRT’s at-the-market sales program at a weighted average per share price of $10.35, yielding net proceeds of approximately $2.8 million.

Capital Expenditures

For the three months ended December 31, 2018, recurring capital expenditures for the total portfolio were $1.9 million, or $120 per unit. For the twelve months ended December 31, 2018, recurring capital expenditures for the total portfolio were $7.3 million, or $463 per unit.

Value Add Update

Value add initiatives, comprised of renovations and upgrades at selected communities to drive increased rental rates, remain a core component of IRT’s growth strategy for the fourth quarter of 2018 and beyond. IRT currently executing on two phases of value add projects covering 4,314 units across 14 communities. Seven of these 14 communities are part of the same store portfolio in 2018. These value-add initiatives have an estimated total investment of approximately $50.0 million and are expected to unlock an additional $8.0 to $9.0 million in NOI once all of the renovations are completed.

During the fourth quarter of 2018, IRT continued to execute on its value add program completing 385 units, which brings the total units completed to 1,232 units, or 29% of the Phase 1 and 2 value add program. The remaining value add projects, covering 3,082 units, are expected to be completed in 2019 and through the beginning of 2020. To-date, 90% of the completed units have been leased with a rental premium of $156 per unit per month, generating an 18.4% return on interior renovations. In addition to interior unit renovations, we are also improving many of the common area amenities at these value add communities as we position them to compete with Class A properties in their markets, but at a much lower price point. See the “Value Add Summary” within our Supplemental Information for additional detail.

Distributions

On December 13, 2018, IRT’s Board of Directors declared a quarterly cash dividend for the fourth quarter of 2018 of $0.18 per share of IRT common stock, payable on January 24, 2019 to stockholders of record on December 27, 2018.

2019 EPS and CFFO Guidance

IRT is announcing 2019 full year guidance. EPS per diluted share is projected to be in a range of $0.76 to $0.80. CFFO per diluted share, a non-GAAP financial measure, is projected to be in the range of $0.74 to $0.78. A reconciliation of IRT's projected net income allocable to common shares to its projected CFFO per share, is included below. Also, included below are the primary assumptions underlying these estimates. See the schedules and definitions at the end of this release for further information regarding how IRT calculates CFFO and for management’s definition and rationale for the usefulness of CFFO.

7

| | |

2019 Full Year EPS and CFFO Guidance (1)(2) | Low | High |

Earnings per share | $0.76 | $0.80 |

Adjustments: | | |

Depreciation and amortization | 0.43 | 0.47 |

Gains on sale of assets | (0.51) | (0.55) |

Share base compensation | 0.04 | 0.04 |

Amortization of deferred financing fees | 0.02 | 0.02 |

CORE FFO per share allocated to common shareholders | $0.74 | $0.78 |

| (1) | This guidance, including the underlying assumptions, constitutes forward-looking information. Actual full year 2019 EPS and CFFO could vary significantly from the projections presented. See “Forward-Looking Statements” below. Our guidance is based on the following key assumptions for our 2019 performance. |

| (2) | Per share guidance is based on weighted average shares and units outstanding of 90.2 million. |

| |

Same Store Communities

| 2019 Outlook |

Number of properties/units | 50 properties / 13,697 units |

Property revenue growth | 4.0% to 6.0% |

Controllable property operating expense growth | 2.5% to 3.5% |

Real estate tax and insurance expense increase (1) | 6.0% to 12.0% |

Total real estate operating expense growth | 4.0% to 6.0% |

Property NOI growth | 3.5% to 5.5% |

| |

Corporate Expenses | |

General and administrative expenses (excluding stock based compensation) | $9.0 to $10.0 million |

| |

Transaction/Investment Volume | |

Acquisition volume (2) | $30.0 to $110.0 million |

Disposition volume (3) | $100.0 to $180.0 million |

| |

Capital Expenditures | |

Recurring | $8.0 to $9.0 million |

Value add & non-recurring | $30.0 to $38.0 million |

| (1) | In 2019, we are expecting increases in real estate tax expense in several of our recently acquired communities that are new to our same store portfolio. Our underwriting contemplates tax increases due to re-assessments, however, the ultimate timing is difficult to predict. |

| (2) | Acquisition volume includes the completion of acquisitions from the 2018 capital recycling program ($30.0 million) and potential capital recycling acquisitions in 2019. |

| (3) | Dispositions include the completion of dispositions from the 2018 capital recycling program ($100.0 million) and potential capital recycling dispositions in 2019. |

Selected Financial Information

See the schedules at the end of this earnings release for selected financial information for IRT.

8

Non-GAAP Financial Measures and Definitions

IRT discloses the following non-GAAP financial measures in this earnings release: FFO, CFFO, Adjusted EBITDA and NOI. Included at the end of this release is a reconciliation of IRT’s reported net income to its FFO and CFFO, a reconciliation of IRT’s same store NOI to its reported net income, a reconciliation of IRT’s Adjusted EBITDA to net income, and management’s respective definitions and rationales for the usefulness of each of these non-GAAP financial measures and other definitions used in this release.

Conference Call

All interested parties can listen to the live conference call webcast at 10:00 AM ET on Thursday, February 21, 2019 from the investor relations section of the IRT website at www.irtliving.com or by dialing 1.844.775.2542, access code 4378632. For those who are not available to listen to the live call, the replay will be available shortly following the live call from the investor relations section of IRT’s website and telephonically until Thursday, February 28, 2019 by dialing 1.855.859.2056, access code 4378632.

Supplemental Information

IRT produces supplemental information that includes details regarding the performance of the portfolio, financial information, non-GAAP financial measures, same store information and other useful information for investors. The supplemental information is available via the Company's website, www.irtliving.com, through the "Investor Relations" section.

About Independence Realty Trust, Inc.

Independence Realty Trust (NYSE: IRT) is a real estate investment trust that currently owns and operates 58 multifamily apartment properties, totaling 15,880 units, across non-gateway U.S. markets, including Atlanta, Louisville, Memphis, and Raleigh. IRT’s investment strategy is focused on gaining scale within key amenity rich submarkets that offer good school districts, high-quality retail and major employment centers. IRT aims to provide stockholders attractive risk-adjusted returns through diligent portfolio management, strong operational performance, and a consistent return of capital through distributions and capital appreciation.

9

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “seek,” “outlook,” “assumption,” “projected,” “strategy”, “guidance” or other, similar words. Because such forward-looking statements involve significant risks, uncertainties and contingencies, many of which are not within IRT’s control, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such statements. These forward-looking statements are based upon the current judgements and expectations of IRT’s management. Risks and uncertainties that might cause IRT’s actual results to differ materially from those expressed or implied by forward-looking statements include, but are not limited to: adverse changes in national, regional and local economic climates; changes in market demand for rental apartment homes and pricing pressures from competitors that could limit our ability to lease units or increase rents; competition that could adversely affect our ability to acquire additional properties; volatility in capital and credit markets, including changes that reduce availability, and increase costs, of capital; unexpected changes in the assumptions underlying our 2019 EPS, CFFO and same store NOI growth guidance; delays in completing, and cost overruns incurred in connection with, the value add initiatives and failure to achieve projected rent increases and occupancy levels on account of the initiatives; risks associated with pursuit of strategic acquisitions, including risks associated with the need to raise additional capital to fund the acquisitions and failure of acquisitions to produce expected returns; failure to complete planned sales on expected terms or at all; unexpected costs of REIT qualification compliance; costs and disruptions as the result of a cybersecurity incident or other technology disruption; and share price fluctuations. Additional risks and uncertainties that could cause our actual results to differ materially from those expressed or implied by the forward-looking statements in this press release are discussed in IRT’s filings with the Securities and Exchange Commission (“SEC”), including those under the heading “Risk Factors” in IRT’s most recently filed Annual Report on Form 10-K. Dividends are subject to the discretion of IRT’s Board of Directors, and will depend on IRT’s financial condition, results of operations, capital requirements, compliance with applicable laws and agreements and any other factors deemed relevant by IRT’s Board. IRT undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, except as may be required by law.

Independence Realty Trust, Inc. Contact

Edelman Financial Communications & Capital Markets

Ted McHugh and Lauren Tarola

212.277.4322

IRT@edelman.com

10

FINANCIAL & OPERATING HIGHLIGHTS

Dollars in thousands, except share and per share data

| | As of or For the Three Months Ended | |

| | December 31, 2018 | | | September 30, 2018 | | | June 30, 2018 | | | March 31, 2018 | | | December 31, 2017 | |

Selected Financial Information: | | | | | | | | | | | | | | | | | | | | |

Operating Statistics: | | | | | | | | | | | | | | | | | | | | |

Net income allocable to common shares | | $ | 14,580 | | | $ | 4,787 | | | $ | 3,509 | | | $ | 3,412 | | | $ | 6,293 | |

Earnings (loss) per share -- diluted | | $ | 0.16 | | | $ | 0.05 | | | $ | 0.04 | | | $ | 0.04 | | | $ | 0.08 | |

Total property revenue | | $ | 49,718 | | | $ | 48,644 | | | $ | 46,734 | | | $ | 45,616 | | | $ | 42,307 | |

Total property operating expenses | | $ | 19,450 | | | $ | 19,792 | | | $ | 18,703 | | | $ | 18,418 | | | $ | 16,610 | |

Net operating income | | $ | 30,268 | | | $ | 28,852 | | | $ | 28,031 | | | $ | 27,198 | | | $ | 25,697 | |

NOI margin | | | 60.9 | % | | | 59.3 | % | | | 60.0 | % | | | 59.6 | % | | | 60.7 | % |

Adjusted EBITDA | | $ | 25,653 | | | $ | 24,748 | | | $ | 23,722 | | | $ | 23,012 | | | $ | 21,743 | |

FFO per share -- diluted | | $ | 0.16 | | | $ | 0.18 | | | $ | 0.17 | | | $ | 0.17 | | | $ | 0.14 | |

CORE FFO per share -- diluted | | $ | 0.19 | | | $ | 0.19 | | | $ | 0.19 | | | $ | 0.18 | | | $ | 0.18 | |

Dividends per share | | $ | 0.18 | | | $ | 0.18 | | | $ | 0.18 | | | $ | 0.18 | | | $ | 0.18 | |

CORE FFO payout ratio | | | 94.7 | % | | | 94.7 | % | | | 94.7 | % | | | 100.0 | % | | | 100.0 | % |

Portfolio Data: | | | | | | | | | | | | | | | | | | | | |

Total gross assets | | $ | 1,798,736 | | | $ | 1,782,186 | | | $ | 1,706,465 | | | $ | 1,689,689 | | | $ | 1,551,238 | |

Total number of properties | | | 58 | | | | 58 | | | | 56 | | | | 56 | | | | 52 | |

Total units | | | 15,880 | | | | 15,860 | | | | 15,280 | | | | 15,280 | | | | 14,017 | |

Period end occupancy | | | 92.5 | % | | | 92.3 | % | | | 93.8 | % | | | 93.5 | % | | | 94.0 | % |

Total portfolio average occupancy | | | 92.3 | % | | | 93.5 | % | | | 94.1 | % | | | 93.7 | % | | | 94.1 | % |

Total portfolio average effective monthly rent, per unit | | $ | 1,035 | | | $ | 1,024 | | | $ | 1,009 | | | $ | 1,004 | | | $ | 1,003 | |

Same store period end occupancy (a) | | | 93.2 | % | | | 93.2 | % | | | 94.3 | % | | | 94.2 | % | | | 95.1 | % |

Same store portfolio average occupancy (a) | | | 93.1 | % | | | 94.1 | % | | | 94.8 | % | | | 94.5 | % | | | 94.8 | % |

Same store portfolio average effective monthly rent, per unit (a) | | $ | 1,049 | | | $ | 1,041 | | | $ | 1,025 | | | $ | 1,018 | | | $ | 1,015 | |

Capitalization: | | | | | | | | | | | | | | | | | | | | |

Total debt | | $ | 985,488 | | | $ | 963,238 | | | $ | 911,772 | | | $ | 903,286 | | | $ | 778,442 | |

Common share price, period end | | $ | 9.18 | | | $ | 10.53 | | | $ | 10.31 | | | $ | 9.18 | | | $ | 10.09 | |

Market equity capitalization | | $ | 826,802 | | | $ | 945,615 | | | $ | 906,696 | | | $ | 806,671 | | | $ | 885,094 | |

Total market capitalization | | $ | 1,812,290 | | | $ | 1,908,853 | | | $ | 1,818,468 | | | $ | 1,709,957 | | | $ | 1,663,536 | |

Total debt/total gross assets | | | 54.8 | % | | | 54.0 | % | | | 53.4 | % | | | 53.5 | % | | | 50.2 | % |

Net debt to adjusted EBITDA | | | 9.5 | x | (b) | | 9.7 | x | | | 9.5 | x | | | 9.7 | x | | | 8.8 | x |

Interest coverage | | | 2.6 | x | | | 2.7 | x | | | 2.8 | x | | | 2.8 | x | | | 3.0 | x |

Common shares and OP Units: | | | | | | | | | | | | | | | | | | | | |

Shares outstanding | | | 89,184,443 | | | | 88,920,879 | | | | 87,044,121 | | | | 86,973,397 | | | | 84,708,551 | |

OP units outstanding | | | 881,107 | | | | 881,107 | | | | 899,215 | | | | 899,215 | | | | 3,011,351 | |

Common shares and OP units outstanding | | | 90,065,550 | | | | 89,801,986 | | | | 87,943,336 | | | | 87,872,612 | | | | 87,719,902 | |

Weighted average common shares and units | | | 89,532,373 | | | | 88,585,940 | | | | 87,543,931 | | | | 87,466,518 | | | | 86,646,371 | |

| | | | | | | | | | | | | | | | | | | | |

(a) | Same store portfolio consists of 37 properties, which represent 10,329 units. |

(b) | Net debt to adjusted EBITDA would be 9.2x if adjusted for the timing of acquisitions, the full quarter effect of current value add initiatives, and the completion of the announced 2018 capital recycling activities. |

11

BALANCE SHEETS

Dollars in thousands, except per share data

| | As of | |

| | December 31, 2018 | | | September 30, 2018 | | | June 30, 2018 | | | March 31, 2018 | | | December 31, 2017 | |

Assets | | | | | | | | | | | | | | | | | | | | |

Investments in real estate at cost | | $ | 1,660,423 | | | $ | 1,572,015 | | | $ | 1,496,591 | | | $ | 1,638,544 | | | $ | 1,504,156 | |

Less: accumulated depreciation | | | (112,270 | ) | | | (101,589 | ) | | | (91,426 | ) | | | (94,001 | ) | | | (84,097 | ) |

Investments in real estate, net | | | 1,548,153 | | | | 1,470,426 | | | | 1,405,165 | | | | 1,544,543 | | | | 1,420,059 | |

Real estate held for sale | | | 77,285 | | | | 141,853 | | | | 141,132 | | | | — | | | | — | |

Cash and cash equivalents | | | 9,316 | | | | 7,645 | | | | 10,896 | | | | 10,399 | | | | 9,985 | |

Restricted cash | | | 6,729 | | | | 8,265 | | | | 7,051 | | | | 5,645 | | | | 4,634 | |

Accounts receivable and other assets | | | 8,802 | | | | 6,924 | | | | 6,712 | | | | 5,318 | | | | 7,556 | |

Derivative assets | | | 8,307 | | | | 12,440 | | | | 11,755 | | | | 10,525 | | | | 7,291 | |

Intangible assets, net | | | 744 | | | | 555 | | | | 406 | | | | 1,449 | | | | 1,099 | |

Total assets | | $ | 1,659,336 | | | $ | 1,648,108 | | | $ | 1,583,117 | | | $ | 1,577,879 | | | $ | 1,450,624 | |

Liabilities and Equity | | | | | | | | | | | | | | | | | | | | |

Total indebtedness | | $ | 985,488 | | | $ | 963,238 | | | $ | 911,772 | | | $ | 903,286 | | | $ | 778,442 | |

Accounts payable and accrued expenses | | | 22,815 | | | | 28,477 | | | | 24,173 | | | | 17,896 | | | | 17,216 | |

Accrued interest payable | | | 719 | | | | 540 | | | | 423 | | | | 373 | | | | 249 | |

Dividends payable | | | 16,162 | | | | 16,113 | | | | 15,922 | | | | 15,754 | | | | 5,245 | |

Other liabilities | | | 4,107 | | | | 3,697 | | | | 3,520 | | | | 3,580 | | | | 3,353 | |

Total liabilities | | | 1,029,291 | | | | 1,012,065 | | | | 955,810 | | | | 940,889 | | | | 804,505 | |

Equity | | | | | | | | | | | | | | | | | | | | |

Shareholders' Equity: | | | | | | | | | | | | | | | | | | | | |

Preferred shares, $0.01 par value per share | | | — | | | | — | | | | — | | | | — | | | | — | |

Common shares, $0.01 par value per share | | | 892 | | | | 889 | | | | 870 | | | | 868 | | | | 846 | |

Additional paid in capital | | | 742,429 | | | | 739,152 | | | | 719,656 | | | | 718,260 | | | | 703,849 | |

Accumulated other comprehensive income (loss) | | | 2,016 | | | | 9,788 | | | | 9,103 | | | | 7,890 | | | | 4,626 | |

Retained earnings (deficit) | | | (122,342 | ) | | | (120,924 | ) | | | (109,762 | ) | | | (97,581 | ) | | | (85,221 | ) |

Total shareholders' equity | | | 622,995 | | | | 628,905 | | | | 619,867 | | | | 629,437 | | | | 624,100 | |

Noncontrolling Interests | | | 7,050 | | | | 7,138 | | | | 7,440 | | | | 7,553 | | | | 22,019 | |

Total equity | | | 630,045 | | | | 636,043 | | | | 627,307 | | | | 636,990 | | | | 646,119 | |

Total liabilities and equity | | $ | 1,659,336 | | | $ | 1,648,108 | | | $ | 1,583,117 | | | $ | 1,577,879 | | | $ | 1,450,624 | |

12

STATEMENTS OF OPERATIONS, FFO & CORE FFO

TRAILING 5 QUARTERS

Dollars in thousands, except per share data

| | For the Three Months Ended | |

| | December 31, 2018 | | | September 30, 2018 | | | June 30, 2018 | | | March 31, 2018 | | | December 31, 2017 | |

Revenue: | | | | | | | | | | | | | | | | | | | | |

Rental income | | $ | 44,562 | | | $ | 43,418 | | | $ | 41,675 | | | $ | 40,858 | | | $ | 38,029 | |

Reimbursement and other property income | | | 5,156 | | | | 5,226 | | | | 5,059 | | | | 4,758 | | | | 4,278 | |

Total property revenue | | | 49,718 | | | | 48,644 | | | | 46,734 | | | | 45,616 | | | | 42,307 | |

Property management and other income | | | 91 | | | | 135 | | | | 155 | | | | 139 | | | | 140 | |

Total revenue | | | 49,809 | | | | 48,779 | | | | 46,889 | | | | 45,755 | | | | 42,447 | |

Expenses: | | | | | | | | | | | | | | | | | | | | |

Real estate operating expenses | | | 19,450 | | | | 19,792 | | | | 18,703 | | | | 18,418 | | | | 16,610 | |

Property management expenses | | | 2,027 | | | | 1,661 | | | | 1,592 | | | | 1,683 | | | | 1,696 | |

General and administrative expenses | | | 2,633 | | | | 2,578 | | | | 2,872 | | | | 2,734 | | | | 2,398 | |

Acquisition and integration expenses | | | — | | | | — | | | | — | | | | — | | | | 386 | |

Depreciation and amortization expense | | | 11,631 | | | | 10,783 | | | | 11,583 | | | | 11,224 | | | | 9,912 | |

Casualty related costs | | | 46 | | | | — | | | | — | | | | — | | | | — | |

Total expenses | | | 35,787 | | | | 34,814 | | | | 34,750 | | | | 34,059 | | | | 31,002 | |

Operating Income (loss) | | | 14,022 | | | | 13,965 | | | | 12,139 | | | | 11,696 | | | | 11,445 | |

Interest expense | | | (9,943 | ) | | | (9,129 | ) | | | (8,594 | ) | | | (8,340 | ) | | | (7,129 | ) |

Other income (expense) | | | — | | | | — | | | | — | | | | 144 | | | | 94 | |

Net gains (losses) on sale of assets | | | 10,650 | | | | — | | | | — | | | | — | | | | 2,952 | |

Acquisition related debt extinguishment expenses | | | — | | | | — | | | | — | | | | — | | | | (843 | ) |

Net income (loss) | | | 14,729 | | | | 4,836 | | | | 3,545 | | | | 3,500 | | | | 6,519 | |

(Income) loss allocated to noncontrolling interests | | | (149 | ) | | | (49 | ) | | | (36 | ) | | | (88 | ) | | | (226 | ) |

Net income (loss) allocable to common shares | | $ | 14,580 | | | $ | 4,787 | | | $ | 3,509 | | | $ | 3,412 | | | $ | 6,293 | |

EPS - basic | | $ | 0.16 | | | $ | 0.05 | | | $ | 0.04 | | | $ | 0.04 | | | $ | 0.08 | |

Weighted-average shares outstanding - Basic | | | 88,651,266 | | | | 87,702,078 | | | | 86,644,716 | | | | 85,303,010 | | | | 83,612,566 | |

EPS - diluted | | $ | 0.16 | | | $ | 0.05 | | | $ | 0.04 | | | $ | 0.04 | | | $ | 0.08 | |

Weighted-average shares outstanding - Diluted | | | 89,032,952 | | | | 88,046,311 | | | | 86,908,978 | | | | 85,535,089 | | | | 83,849,367 | |

Funds From Operations (FFO): | | | | | | | | | | | | | | | | | | | | |

Net Income (loss) | | $ | 14,729 | | | $ | 4,836 | | | $ | 3,545 | | | $ | 3,500 | | | $ | 6,519 | |

Add-Back (Deduct): | | | | | | | | | | | | | | | | | | | | |

Depreciation | | | 11,577 | | | | 10,738 | | | | 11,550 | | | | 11,201 | | | | 9,868 | |

Net (gains) losses on sale of assets | | | (11,561 | ) | | | — | | | | — | | | | — | | | | (4,455 | ) |

FFO | | $ | 14,745 | | | $ | 15,574 | | | $ | 15,095 | | | $ | 14,701 | | | $ | 11,932 | |

FFO per share | | $ | 0.16 | | | | 0.18 | | | $ | 0.17 | | | $ | 0.17 | | | $ | 0.14 | |

CORE Funds From Operations (CFFO): | | | | | | | | | | | | | | | | | | | | |

FFO | | $ | 14,745 | | | $ | 15,574 | | | $ | 15,095 | | | $ | 14,701 | | | $ | 11,932 | |

Add-Back (Deduct): | | | | | | | | | | | | | | | | | | | | |

Stock compensation expense | | | 558 | | | | 563 | | | | 933 | | | | 470 | | | | 420 | |

Amortization of deferred financing costs | | | 352 | | | | 309 | | | | 325 | | | | 444 | | | | 309 | |

Acquisition and integration expenses | | | — | | | | — | | | | — | | | | — | | | | 386 | |

Other depreciation and amortization | | | 54 | | | | 45 | | | | 33 | | | | 23 | | | | 44 | |

Other expense (income) | | | — | | | | — | | | | — | | | | (52 | ) | | | (94 | ) |

Debt extinguishment costs included in net gains (losses) on sale of assets | | | 911 | | | | — | | | | — | | | | — | | | | 1,503 | |

Acquisition related debt extinguishment expenses | | | — | | | | — | | | | — | | | | — | | | | 843 | |

| | | | | | | | | | | | | | | | | | | | |

CFFO | | $ | 16,620 | | | $ | 16,491 | | | $ | 16,386 | | | $ | 15,586 | | | $ | 15,343 | |

CFFO per share | | $ | 0.19 | | | $ | 0.19 | | | $ | 0.19 | | | $ | 0.18 | | | $ | 0.18 | |

Weighted-average shares and units outstanding | | | 89,532,373 | | | | 88,585,940 | | | | 87,543,931 | | | | 87,466,518 | | | | 86,646,371 | |

13

STATEMENTS OF OPERATIONS, FFO & CORE FFO

THREE AND TWELVE MONTHS ENDED DECEMBER 31, 2018 and 2017

| | Three Months Ended December 31, | | | Twelve Months Ended December 31, | |

| | 2018 | | | 2017 | | | 2018 | | | 2017 | |

Revenue: | | | | | | | | | | | | | | | | |

Rental income | | $ | 44,562 | | | | 38,029 | | | $ | 170,513 | | | | 143,473 | |

Reimbursement and other property income | | | 5,156 | | | | 4,278 | | | | 20,199 | | | | 17,024 | |

Total property revenue | | | 49,718 | | | | 42,307 | | | | 190,712 | | | | 160,497 | |

Property management and other income | | | 91 | | | | 140 | | | | 520 | | | | 719 | |

Total revenue | | | 49,809 | | | | 42,447 | | | | 191,232 | | | | 161,216 | |

Expenses: | | | | | | | | | | | | | | | | |

Real estate operating expenses | | | 19,450 | | | | 16,610 | | | | 76,363 | | | | 64,716 | |

Property management expenses | | | 2,027 | | | | 1,696 | | | | 6,963 | | | | 6,006 | |

General and administrative expenses | | | 2,633 | | | | 2,398 | | | | 10,817 | | | | 9,526 | |

Acquisition and integration expenses | | | — | | | | 386 | | | | — | | | | 1,342 | |

Depreciation and amortization expense | | | 11,631 | | | | 9,912 | | | | 45,221 | | | | 34,201 | |

Casualty related costs | | | 46 | | | | — | | | | 46 | | | | — | |

Total expenses | | | 35,787 | | | | 31,002 | | | | 139,410 | | | | 115,791 | |

Operating Income (loss) | | | 14,022 | | | | 11,445 | | | | 51,822 | | | | 45,425 | |

Interest expense | | | (9,943 | ) | | | (7,129 | ) | | | (36,006 | ) | | | (28,702 | ) |

Other income (expense) | | | — | | | | 94 | | | | 144 | | | | 89 | |

Net gains (losses) on sale of assets | | | 10,650 | | | | 2,952 | | | | 10,650 | | | | 18,825 | |

Gains(losses) on extinguishment of debt | | | — | | | | — | | | | — | | | | (572 | ) |

Acquisition related debt extinguishment expenses | | | — | | | | (843 | ) | | | — | | | | (3,624 | ) |

Net income (loss) | | | 14,729 | | | | 6,519 | | | | 26,610 | | | | 31,441 | |

(Income) loss allocated to noncontrolling interests | | | (149 | ) | | | (226 | ) | | | (322 | ) | | | (1,235 | ) |

Net income (loss) available to common shares | | $ | 14,580 | | | $ | 6,293 | | | $ | 26,288 | | | $ | 30,206 | |

EPS - basic | | $ | 0.16 | | | $ | 0.08 | | | $ | 0.30 | | | $ | 0.41 | |

Weighted-average shares outstanding - Basic | | | 88,651,266 | | | | 83,612,566 | | | | 87,086,585 | | | | 73,338,219 | |

EPS - diluted | | $ | 0.16 | | | $ | 0.08 | | | $ | 0.30 | | | $ | 0.41 | |

Weighted-average shares outstanding - Diluted | | | 89,032,952 | | | | 83,849,367 | | | | 87,376,991 | | | | 73,599,869 | |

Funds From Operations (FFO): | | | | | | | | | | | | | | | | |

Net Income (loss) | | $ | 14,729 | | | $ | 6,519 | | | $ | 26,610 | | | $ | 31,441 | |

Adjustments: | | | | | | | | | | | | | | | | |

Real estate depreciation and amortization | | | 11,577 | | | | 9,868 | | | | 45,067 | | | | 34,097 | |

Net (gains) losses on sale of assets | | | (11,561 | ) | | | (4,455 | ) | | | (11,561 | ) | | | (23,076 | ) |

Funds From Operations | | $ | 14,745 | | | $ | 11,932 | | | $ | 60,116 | | | $ | 42,462 | |

FFO per share | | $ | 0.16 | | | $ | 0.14 | | | $ | 0.68 | | | $ | 0.56 | |

Core Funds From Operations (CFFO): | | | | | | | | | | | | | | | | |

Funds From Operations | | $ | 14,745 | | | $ | 11,932 | | | $ | 60,116 | | | $ | 42,462 | |

Adjustments: | | | | | | | | | | | | | | | | |

Stock compensation expense | | | 558 | | | | 420 | | | | 2,524 | | | | 1,967 | |

Amortization of deferred financing costs | | | 352 | | | | 309 | | | | 1,430 | | | | 1,469 | |

Acquisition and integration expenses | | | — | | | | 386 | | | | — | | | | 1,342 | |

Other depreciation and amortization | | | 54 | | | | 44 | | | | 154 | | | | 104 | |

Other expense (income) | | | — | | | | (94 | ) | | | (52 | ) | | | (94 | ) |

(Gains) losses on extinguishment of debt | | | — | | | | — | | | | — | | | | 572 | |

Debt extinguishment costs included in net gains (losses) on sale of assets | | | 911 | | | | 1,503 | | | | 911 | | | | 4,251 | |

Acquisition related debt extinguishment expenses | | | — | | | | 843 | | | | — | | | | 3,624 | |

| | | | | | | | | | | | | | | | |

CFFO | | $ | 16,620 | | | $ | 15,343 | | | $ | 65,083 | | | $ | 55,697 | |

CFFO per share | | $ | 0.19 | | | $ | 0.18 | | | $ | 0.74 | | | $ | 0.73 | |

Weighted-average shares and units outstanding | | | 89,532,373 | | | | 86,646,371 | | | | 88,289,110 | | | | 76,291,465 | |

14

ADJUSTED EBITDA RECONCILIATION AND COVERAGE RATIO

Dollars in thousands

| | Three Months Ended | |

ADJUSTED EBITDA: | | December 31, 2018 | | | September 30, 2018 | | | June 30, 2018 | | | March 31, 2018 | | | December 31, 2017 | |

Net income (loss) | | $ | 14,729 | | | $ | 4,836 | | | $ | 3,545 | | | $ | 3,500 | | | $ | 6,519 | |

Add-Back (Deduct): | | | | | | | | | | | | | | | | | | | | |

Depreciation and amortization | | | 11,631 | | | | 10,783 | | | | 11,583 | | | | 11,224 | | | | 9,912 | |

Interest expense | | | 9,943 | | | | 9,129 | | | | 8,594 | | | | 8,340 | | | | 7,129 | |

Other (income) expense | | | — | | | | — | | | | — | | | | (52 | ) | | | (94 | ) |

Acquisition and integration expenses | | | — | | | | — | | | | — | | | | — | | | | 386 | |

Net (gains) losses on sale of assets | | | (10,650 | ) | | | — | | | | — | | | | — | | | | (2,952 | ) |

(Gains) losses on extinguishment of debt | | | — | | | | — | | | | — | | | | — | | | | — | |

Acquisition related debt extinguishment expenses | | | — | | | | — | | | | — | | | | — | | | | 843 | |

Adjusted EBITDA | | $ | 25,653 | | | $ | 24,748 | | | $ | 23,722 | | | $ | 23,012 | | | $ | 21,743 | |

| | | | | | | | | | | | | | | | | | | | |

INTEREST COST: | | | | | | | | | | | | | | | | | | | | |

Interest expense | | $ | 9,943 | | | $ | 9,129 | | | $ | 8,594 | | | $ | 8,340 | | | $ | 7,129 | |

| | | | | | | | | | | | | | | | | | | | |

INTEREST COVERAGE: | | | 2.6 | x | | | 2.7 | x | | | 2.8 | x | | | 2.8 | x | | | 3.0 | x |

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Twelve Months Ended | |

ADJUSTED EBITDA: | | December 31, 2018 | | | December 31, 2017 | | | December 31, 2018 | | | December 31, 2017 | |

Net income (loss) | | $ | 14,729 | | | $ | 6,519 | | | $ | 26,610 | | | $ | 31,441 | |

Add-Back (Deduct): | | | | | | | | | | | | | | | | |

Depreciation and amortization | | | 11,631 | | | | 9,912 | | | | 45,221 | | | | 34,201 | |

Interest expense | | | 9,943 | | | | 7,129 | | | | 36,006 | | | | 28,702 | |

Other (income) expense | | | — | | | | (94 | ) | | | (52 | ) | | | (89 | ) |

Acquisition and integration expenses | | | — | | | | 386 | | | | — | | | | 1,342 | |

Net (gains) losses on sale of assets | | | (10,650 | ) | | | (2,952 | ) | | | (10,650 | ) | | | (18,825 | ) |

(Gains) losses on extinguishment of debt | | | — | | | | — | | | | — | | | | 572 | |

Acquisition related debt extinguishment expenses | | | — | | | | 843 | | | | — | | | | 3,624 | |

Adjusted EBITDA | | $ | 25,653 | | | $ | 21,743 | | | $ | 97,135 | | | $ | 80,968 | |

| | | | | | | | | | | | | | | | |

INTEREST COST: | | | | | | | | | | | | | | | | |

Interest expense | | $ | 9,943 | | | $ | 7,129 | | | $ | 36,006 | | | $ | 28,702 | |

| | | | | | | | | | | | | | | | |

INTEREST COVERAGE: | | | 2.6 | x | | | 3.0 | x | | | 2.7 | x | | | 2.8 | x |

15

SAME STORE PORTFOLIO NET OPERATING INCOME

TRAILING 5 QUARTERS

Dollars in thousands, except per unit data

| | For the Three-Months Ended (a) | |

| | December 31, 2018 | | | September 30, 2018 | | | June 30, 2018 | | | March 31, 2018 | | | December 31, 2017 | |

Revenue: | | | | | | | | | | | | | | | | | | | | |

Rental income | | $ | 29,069 | | | $ | 29,136 | | | $ | 28,860 | | | $ | 28,527 | | | $ | 28,612 | |

Reimbursement and other property income | | | 3,423 | | | | 3,628 | | | | 3,621 | | | | 3,503 | | | | 3,326 | |

Total revenue | | | 32,492 | | | | 32,764 | | | | 32,481 | | | | 32,030 | | | | 31,938 | |

Operating Expenses: | | | | | | | | | | | | | | | | | | | | |

Real estate taxes | | | 4,145 | | | | 3,922 | | | | 3,990 | | | | 4,039 | | | | 3,864 | |

Property insurance | | | 624 | | | | 638 | | | | 646 | | | | 713 | | | | 678 | |

Personnel expenses | | | 3,035 | | | | 3,249 | | | | 3,198 | | | | 3,064 | | | | 3,008 | |

Utilities | | | 2,041 | | | | 2,083 | | | | 1,964 | | | | 2,107 | | | | 1,995 | |

Repairs and maintenance | | | 818 | | | | 1,345 | | | | 1,274 | | | | 889 | | | | 936 | |

Contract services | | | 955 | | | | 1,004 | | | | 1,068 | | | | 997 | | | | 964 | |

Advertising expenses | | | 290 | | | | 376 | | | | 370 | | | | 381 | | | | 413 | |

Other expenses | | | 540 | | | | 748 | | | | 506 | | | | 717 | | | | 784 | |

Total operating expenses | | | 12,448 | | | | 13,365 | | | | 13,016 | | | | 12,907 | | | | 12,642 | |

Same-store net operating income (a) | | $ | 20,044 | | | $ | 19,399 | | | $ | 19,465 | | | $ | 19,123 | | | $ | 19,296 | |

Same-store NOI margin | | | 61.7 | % | | | 59.2 | % | | | 59.9 | % | | | 59.7 | % | | | 60.4 | % |

Average occupancy | | | 93.1 | % | | | 94.1 | % | | | 94.8 | % | | | 94.5 | % | | | 94.8 | % |

Average effective monthly rent, per unit | | $ | 1,049 | | | $ | 1,041 | | | $ | 1,025 | | | $ | 1,018 | | | $ | 1,015 | |

Reconciliation of same-store net operating income to net income (loss) | | | | | | | | | | | | | | | | | | | | |

Same-store net operating income | | $ | 20,044 | | | $ | 19,399 | | | $ | 19,465 | | | $ | 19,123 | | | $ | 19,296 | |

Non same-store net operating income | | | 10,224 | | | | 9,453 | | | | 8,566 | | | | 8,075 | | | | 6,401 | |

Property management income | | | 91 | | | | 135 | | | | 155 | | | | 139 | | | | 140 | |

Property management expenses | | | (2,027 | ) | | | (1,661 | ) | | | (1,592 | ) | | | (1,683 | ) | | | (1,696 | ) |

General and administrative expenses | | | (2,633 | ) | | | (2,578 | ) | | | (2,872 | ) | | | (2,734 | ) | | | (2,398 | ) |

Acquisition and integration expenses | | | — | | | | — | | | | — | | | | — | | | | (386 | ) |

Depreciation and amortization expense | | | (11,631 | ) | | | (10,783 | ) | | | (11,583 | ) | | | (11,224 | ) | | | (9,912 | ) |

Casualty related costs | | | (46 | ) | | | — | | | | — | | | | — | | | | — | |

Interest expense | | | (9,943 | ) | | | (9,129 | ) | | | (8,594 | ) | | | (8,340 | ) | | | (7,129 | ) |

Other income (expense) | | | — | | | | — | | | | — | | | | 144 | | | | 94 | |

Net gains (losses) on sale of assets | | | 10,650 | | | | — | | | | — | | | | — | | | | 2,952 | |

Acquisition related debt extinguishment expenses | | | — | | | | — | | | | — | | | | — | | | | (843 | ) |

Net income (loss) | | $ | 14,729 | | | $ | 4,836 | | | $ | 3,545 | | | $ | 3,500 | | | $ | 6,519 | |

(a) | Same store portfolio consists of 37 properties, which represent 10,329 units. |

16

SAME STORE PORTFOLIO NET OPERATING INCOME

THREE AND TWELVE MONTHS ENDED DECEMBER 31, 2018 and 2017

Dollars in thousands, except per unit data

| | Three-Months Ended December 31 | | | Twelve-Months Ended December 31 | |

| | 2018 | | | 2017 | | | % change | | | 2018 | | | 2017 | | | % change | |

Revenue: | | | | | | | | | | | | | | | | | | | | | | | |

Rental income | | $ | 29,069 | | | $ | 28,612 | | | | 1.6 | % | | $ | 115,592 | | | $ | 113,705 | | | | 1.7 | % |

Reimbursement and other property income | | | 3,423 | | | | 3,326 | | | | 2.9 | % | | | 14,175 | | | | 13,554 | | | | 4.6 | % |

Total revenue | | | 32,492 | | | | 31,938 | | | | 1.7 | % | | | 129,767 | | | | 127,259 | | | | 2.0 | % |

Operating Expenses: | | | | | | | | | | | | | | | | | | | | | | | |

Real estate taxes | | | 4,145 | | | | 3,864 | | | | 7.3 | % | | | 16,096 | | | | 15,456 | | | | 4.1 | % |

Property insurance | | | 624 | | | | 678 | | | | -8.0 | % | | | 2,621 | | | | 2,752 | | | | -4.8 | % |

Personnel expenses | | | 3,035 | | | | 3,008 | | | | 0.9 | % | | | 12,546 | | | | 12,282 | | | | 2.1 | % |

Utilities | | | 2,041 | | | | 1,995 | | | | 2.3 | % | | | 8,195 | | | | 8,015 | | | | 2.2 | % |

Repairs and maintenance | | | 818 | | | | 936 | | | | -12.6 | % | | | 4,326 | | | | 4,606 | | | | -6.1 | % |

Contract services | | | 955 | | | | 964 | | | | -0.9 | % | | | 4,024 | | | | 3,890 | | | | 3.4 | % |

Advertising expenses | | | 290 | | | | 413 | | | | -29.8 | % | | | 1,417 | | | | 1,458 | | | | -2.8 | % |

Other expenses | | | 540 | | | | 784 | | | | -31.1 | % | | | 2,511 | | | | 2,739 | | | | -8.3 | % |

Total operating expenses | | | 12,448 | | | | 12,642 | | | | -1.5 | % | | | 51,736 | | | | 51,198 | | | | 1.1 | % |

Same-store net operating income (a) | | $ | 20,044 | | | $ | 19,296 | | | | 3.9 | % | | $ | 78,031 | | | $ | 76,061 | | | | 2.6 | % |

Same-store NOI margin | | | 61.7 | % | | | 60.4 | % | | | 1.3 | % | | | 60.1 | % | | | 59.8 | % | | | 0.3 | % |

Average occupancy | | | 93.1 | % | | | 94.8 | % | | | -1.7 | % | | | 94.1 | % | | | 94.7 | % | | | -0.6 | % |

Average effective monthly rent, per unit | | $ | 1,049 | | | $ | 1,015 | | | | 3.3 | % | | $ | 1,033 | | | $ | 1,009 | | | | 2.4 | % |

Reconciliation of same-store net operating income to net income (loss) | | | | | | | | | | | | | | | | | | | | | | | | |

Same-store portfolio net operating income | | $ | 20,044 | | | $ | 19,296 | | | | | | | $ | 78,031 | | | $ | 76,061 | | | | | |

Non same-store net operating income | | | 10,224 | | | | 6,401 | | | | | | | | 36,318 | | | | 19,720 | | | | | |

Property management income | | | 91 | | | | 140 | | | | | | | | 520 | | | | 719 | | | | | |

Property management expenses | | | (2,027 | ) | | | (1,696 | ) | | | | | | | (6,963 | ) | | | (6,006 | ) | | | | |

General and administrative expenses | | | (2,633 | ) | | | (2,398 | ) | | | | | | | (10,817 | ) | | | (9,526 | ) | | | | |

Acquisition and integration expenses | | | — | | | | (386 | ) | | | | | | | — | | | | (1,342 | ) | | | | |

Depreciation and amortization expense | | | (11,631 | ) | | | (9,912 | ) | | | | | | | (45,221 | ) | | | (34,201 | ) | | | | |

Casualty related costs | | | (46 | ) | | | — | | | | | | | | (46 | ) | | | — | | | | | |

Interest expense | | | (9,943 | ) | | | (7,129 | ) | | | | | | | (36,006 | ) | | | (28,702 | ) | | | | |

Other income (expense) | | | — | | | | 94 | | | | | | | | 144 | | | | 89 | | | | | |

Net gains (losses) on sale of assets | | | 10,650 | | | | 2,952 | | | | | | | | 10,650 | | | | 18,825 | | | | | |

Acquisition related debt extinguishment expenses | | | — | | | | (843 | ) | | | | | | | — | | | | (3,624 | ) | | | | |

Gains (losses) on extinguishment of debt | | | — | | | | — | | | | | | | | — | | | | (572 | ) | | | | |

Net income (loss) | | $ | 14,729 | | | $ | 6,519 | | | | | | | $ | 26,610 | | | $ | 31,441 | | | | | |

(a) | Same store portfolio consists of 37 properties, which represent 10,329 units. |

17

NET OPERATING INCOME (NOI) BRIDGE

TRAILING 5 QUARTERS

| | For the Three-Months Ended | |

| | December 31, 2018 | | | September 30, 2018 | | | June 30, 2018 | | | March 31, 2018 | | | December 31, 2017 | |

Property revenue | | | | | | | | | | | | | | | | | | | | |

Same store (a) | | $ | 32,492 | | | $ | 32,764 | | | $ | 32,481 | | | $ | 32,030 | | | $ | 31,938 | |

Non same store | | | 17,226 | | | | 15,880 | | | | 14,253 | | | | 13,586 | | | | 10,369 | |

Total property revenue | | | 49,718 | | | | 48,644 | | | | 46,734 | | | | 45,616 | | | | 42,307 | |

Property expenses | | | | | | | | | | | | | | | | | | | | |

Same store (a) | | | 12,448 | | | | 13,365 | | | | 13,016 | | | | 12,907 | | | | 12,642 | |

Non same store | | | 7,002 | | | | 6,427 | | | | 5,687 | | | | 5,511 | | | | 3,968 | |

Total property expenses | | | 19,450 | | | | 19,792 | | | | 18,703 | | | | 18,418 | | | | 16,610 | |

Net operating income | | | | | | | | | | | | | | | | | | | | |

Same store (a) | | | 20,044 | | | | 19,399 | | | | 19,465 | | | | 19,123 | | | | 19,296 | |

Non same store | | | 10,224 | | | | 9,453 | | | | 8,566 | | | | 8,075 | | | | 6,401 | |

Total property net operating income | | $ | 30,268 | | | $ | 28,852 | | | $ | 28,031 | | | $ | 27,198 | | | $ | 25,697 | |

Reconciliation of NOI to net income (loss) | | | | | | | | | | | | | | | | | | | | |

Total property net operating income | | $ | 30,268 | | | $ | 28,852 | | | $ | 28,031 | | | $ | 27,198 | | | $ | 25,697 | |

Property management and other income | | | 91 | | | | 135 | | | | 155 | | | | 139 | | | | 140 | |

Property management expenses | | | (2,027 | ) | | | (1,661 | ) | | | (1,592 | ) | | | (1,683 | ) | | | (1,696 | ) |

General and administrative expenses | | | (2,633 | ) | | | (2,578 | ) | | | (2,872 | ) | | | (2,734 | ) | | | (2,398 | ) |

Acquisition and integration expenses | | | — | | | | — | | | | — | | | | — | | | | (386 | ) |

Depreciation and amortization expense | | | (11,631 | ) | | | (10,783 | ) | | | (11,583 | ) | | | (11,224 | ) | | | (9,912 | ) |

Casualty related costs | | | (46 | ) | | | — | | | | — | | | | — | | | | — | |

Interest expense | | | (9,943 | ) | | | (9,129 | ) | | | (8,594 | ) | | | (8,340 | ) | | | (7,129 | ) |

Other income (expense) | | | — | | | | — | | | | — | | | | 144 | | | | 94 | |

Net gains (losses) on sale of assets | | | 10,650 | | | | — | | | | — | | | | — | | | | 2,952 | |

Acquisition related debt extinguishment expenses | | | — | | | | — | | | | — | | | | — | | | | (843 | ) |

Net income (loss) | | $ | 14,729 | | | $ | 4,836 | | | $ | 3,545 | | | $ | 3,500 | | | $ | 6,519 | |

(a) | Same store portfolio consists of 37 properties, which represent 10,329 units. |

18

CAPITAL RECYCLING ACTIVITY

Dollars in thousands with respect to Contract Price and Price per Unit

Acquisitions | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

2018 Acquisitions | Market | | Units | | | Acquisition Date | | Contract Price | | | Price per Unit | | | Average Rent Per Unit | |

Creekside Corners (a) | Atlanta, GA | | 444 | | | January 3, 2018 | | $ | 43,901 | | | $ | 99 | | | $ | 933 | |

Hartshire Lakes (a) | Indianapolis, IN | | 272 | | | January 3, 2018 | | | 27,597 | | | | 101 | | | | 917 | |

The Chelsea (a) | Columbus, OH | | 312 | | | January 4, 2018 | | | 36,750 | | | | 118 | | | | 1,079 | |

Avalon Oaks (a) | Columbus, OH | | 235 | | | February 27, 2018 | | | 23,000 | | | | 98 | | | | 881 | |

Bridgeview Apartments | Tampa-St. Petersburg, FL | | | 348 | | | July 11, 2018 | | | 43,000 | | | | 124 | | | | 1,029 | |

Collier Park | Columbus, OH | | | 232 | | | July 26, 2018 | | | 21,200 | | | | 91 | | | | 850 | |

Waterford Landing | Atlanta, GA | | | 260 | | | October 11, 2018 | | | 30,500 | | | | 117 | | | | 993 | |

Lucerne Apartments | Tampa-St. Petersburg, FL | | | 276 | | | November 7, 2018 | | | 47,000 | | | | 170 | | | | 1,220 | |

Total - 2018 Acquisitions | | | | 2,379 | | | | | $ | 272,948 | | | $ | 115 | | | $ | 991 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Dispositions | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

2018 Dispositions | Market | | Units | | | Disposition Date | | Contract Price | | | Price per Unit | | | Average Rent Per Unit | |

The Aventine Greenville | Greenville, SC | | 346 | | | December 20, 2018 | | $ | 52,500 | | | $ | 152 | | | $ | 1,083 | |

Arbors at the Reservoir | Jackson, MS | | 170 | | | December 27, 2018 | | | 24,800 | | | | 146 | | | | 1,154 | |

Total - 2018 Dispositions | | | 516 | | | | | $ | 77,300 | | | $ | 150 | | | $ | 1,106 | |

| | | | | | | | | | | | | | | | | | | |

| (a) | Property was acquired with the proceeds from our September 2017 public stock offering. |

19

VALUE ADD SUMMARY

YEAR TO DATE AS OF DECEMBER 31, 2018

| | | | | | | | | | | | | | | | | Renovation Costs per Unit (a) | | | | | | | |

Property | Market | Total Units | | Units Complete | | Units Leased | | Rent Premium (b) | | % Rent Increase | | Interior | | Exterior | | Total | | ROI - Interior Costs(c) | | ROI - Total Costs (d) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Phase 1 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Jamestown (f) | Louisville, KY | | 356 | | | 146 | | | 125 | | $ | 242 | | | 21.9 | % | $ | 17,453 | | $ | 3,187 | | $ | 20,639 | | | 16.6 | % | | 14.1 | % |

The Village at Auburn | Raleigh-Durham, NC | | 328 | | | 196 | | | 155 | | | 187 | | | 15.7 | % | | 13,345 | | | 1,192 | | | 14,537 | | | 16.8 | % | | 15.4 | % |

Pointe at Canyon Ridge (f) | Atlanta, GA | | 494 | | | 227 | | | 217 | | | 176 | | | 19.4 | % | | 8,115 | | | 1,633 | | | 9,748 | | | 26.1 | % | | 21.7 | % |

Haverford | Lexington, KY | | 160 | | | 88 | | | 82 | | | 73 | | | 8.7 | % | | 5,241 | | | 557 | | | 5,798 | | | 16.7 | % | | 15.1 | % |

Crestmont (f) | Atlanta, GA | | 228 | | | 122 | | | 102 | | | 138 | | | 15.6 | % | | 12,028 | | | 9,413 | | | 21,441 | | | 13.8 | % | | 7.7 | % |

Total/Weighted Average | | | 1,566 | | | 779 | | | 681 | | $ | 173 | | | 17.1 | % | $ | 11,259 | | $ | 2,853 | | $ | 14,113 | | | 17.4 | % | | 14.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Phase 2 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Oxmoor (f) | Louisville, KY | | 432 | | | 125 | | | 86 | | $ | 191 | | | 20.2 | % | $ | 11,574 | | $ | 79 | | $ | 11,653 | | | 19.8 | % | | 19.7 | % |

Brunswick Point | Myrtle Beach, SC - Wilmington, NC | | 288 | | | 85 | | | 79 | | | 97 | | | 11.0 | % | | 6,200 | | | 39 | | | 6,239 | | | 18.8 | % | | 18.6 | % |

Schirm Farms | Columbus, OH | | 264 | | | 57 | | | 65 | | | 73 | | | 7.8 | % | | 6,521 | | | 310 | | | 6,831 | | | 13.4 | % | | 12.8 | % |

Kensington Commons | Columbus, OH | | 264 | | | 20 | | | 18 | | | 143 | | | 14.3 | % | | 8,656 | | | 75 | | | 8,731 | | | 19.8 | % | | 19.6 | % |

Creekside Corners | Atlanta, GA | | 441 | | | 67 | | | 88 | | | 125 | | | 12.5 | % | | 9,152 | | | 1,371 | | | 10,523 | | | 16.4 | % | | 14.3 | % |

Stonebridge Crossing (f) | Memphis, TN | | 500 | | | 71 | | | 66 | | | 102 | | | 11.5 | % | | 8,065 | | | 489 | | | 8,553 | | | 15.2 | % | | 14.3 | % |

Arbors River Oaks (f) | Memphis, TN | | 191 | | | 28 | | | 27 | | | 240 | | | 23.7 | % | | 7,343 | | | 163 | | | 7,507 | | | 39.3 | % | | 38.4 | % |

King's Landing (e) (f) | St. Louis, MO | | 152 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | | | | — | |

Riverchase (e) | Indianapolis, IN | | 216 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | | | | — | |

Total/Weighted Average | | | 2,748 | | | 453 | | | 429 | | $ | 130 | | | 13.7 | % | $ | 8,393 | | $ | 440 | | $ | 8,833 | | | 20.4 | % | | 17.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Grand Total/Weighted Average | | 4,314 | | | 1,232 | | | 1,110 | | $ | 156 | | | 15.8 | % | $ | 10,152 | | $ | 1,377 | | $ | 11,529 | | | 18.4 | % | | 16.2 | % |

| (a) | Includes all costs to renovate the interior units and make certain exterior renovations, including clubhouses and amenities. Interior costs per unit are based on units leased. Exterior costs per unit are based on total units at the community. Excludes internal costs to support and manage the value add program as those costs relate to the entire program and cannot be allocated to individual projects. |

| (b) | The rent change per unit per month reflects the difference between the rental rate on the renovated unit and the market rent for an unrenovated unit as of the date presented, as determined by management consistent with its customary rent-setting and evaluation procedures. |

| (c) | Calculated using the rent change per unit per month, multiplied by 12, divided by the interior renovation costs per unit. |

| (d) | Calculated using the rent change per unit per month, multiplied by 12, divided by the total renovation costs per unit. |

| (e) | Renovations are scheduled to commence in Q2 2019. |

| (f) | Property is included in our same store portfolio. |

20

Property Summary

| | | | | | Investments in Real Estate | | | | | | | | | | | | | | | |

Property Name | Market | Acquisition Date | Year Built / Renovated (a) | | Gross Cost | | Accumulated Depreciation | | Net Book Value | | Units (b) | | Period End Occupancy (c) | | | Average Occupancy (d) | | | Effective Rent (e) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Same Store Properties: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Crestmont | Atlanta, GA | 4/29/2011 | 2010 (f) | | | 20,984 | | | (4,361 | ) | | 16,623 | | | 228 | | 93.9% | | (f) | 87.5% | | (f) | | 1,018 | |

Runaway Bay | Indianapolis, IN | 10/11/2012 | | 2002 | | | 16,406 | | | (2,293 | ) | | 14,113 | | | 192 | | 92.2% | | | 93.1% | | | | 1,049 | |

Windrush | Oklahoma City, OK | 2/28/2014 | | 2011 | | | 9,789 | | | (1,135 | ) | | 8,654 | | | 160 | | 93.1% | | | 94.5% | | | | 769 | |

Heritage Park | Oklahoma City, OK | 2/28/2014 | | 2011 | | | 18,576 | | | (2,204 | ) | | 16,372 | | | 453 | | 96.3% | | | 94.0% | | | | 657 | |

Raindance | Oklahoma City, OK | 2/28/2014 | | 2011 | | | 15,299 | | | (1,826 | ) | | 13,473 | | | 504 | | 94.1% | | | 95.3% | | | | 570 | |

Augusta | Oklahoma City, OK | 2/28/2014 | | 2011 | | | 12,179 | | | (1,526 | ) | | 10,653 | | | 197 | | 95.4% | | | 96.0% | | | | 737 | |

Invitational | Oklahoma City, OK | 2/28/2014 | | 2011 | | | 19,938 | | | (2,511 | ) | | 17,427 | | | 344 | | 93.9% | | | 93.3% | | | | 679 | |

King's Landing | St. Louis, MO | 3/31/2014 | | 2005 | | | 33,347 | | | (3,797 | ) | | 29,550 | | | 152 | | 96.1% | | | 95.9% | | | | 1,411 | |

Walnut Hill | Memphis, TN | 8/28/2014 | | 2001 | | | 28,765 | | | (3,234 | ) | | 25,531 | | | 362 | | 93.4% | | | 94.5% | | | | 1,032 | |

Lenoxplace | Raleigh - Durham, NC | 9/5/2014 | | 2012 | | | 24,862 | | | (2,544 | ) | | 22,318 | | | 268 | | 95.5% | | | 95.1% | | | | 961 | |

Stonebridge Crossing | Memphis, TN | 9/15/2014 | 1994 (f) | | | 32,102 | | | (3,454 | ) | | 28,648 | | | 500 | | 92.6% | | (f) | 91.2% | | (f) | | 884 | |

Bennington Pond | Columbus, OH | 11/24/2014 | | 2000 | | | 18,272 | | | (1,926 | ) | | 16,346 | | | 240 | | 93.8% | | | 94.6% | | | | 942 | |

Prospect Park | Louisville, KY | 12/8/2014 | | 1990 | | | 14,570 | | | (1,262 | ) | | 13,308 | | | 138 | | 91.3% | | | 90.0% | | | | 969 | |

Brookside | Louisville, KY | 12/8/2014 | | 1987 | | | 21,336 | | | (1,907 | ) | | 19,429 | | | 224 | | 95.5% | | | 94.9% | | | | 888 | |

Jamestown | Louisville, KY | 12/8/2014 | 1970 (f) | | | 42,314 | | | (3,960 | ) | | 38,354 | | | 356 | | 89.3% | | (f) | 86.9% | | (f) | | 1,091 | |

Oxmoor | Louisville, KY | 12/8/2014 | 1999-2000 (f) | | | 58,304 | | | (5,370 | ) | | 52,934 | | | 432 | | 78.9% | | (f) | 81.2% | | (f) | | 1,012 | |

Meadows | Louisville, KY | 12/8/2014 | | 1988 | | | 38,670 | | | (3,513 | ) | | 35,157 | | | 400 | | 91.0% | | | 90.0% | | | | 845 | |

Iron Rock Ranch | Austin, TX | 12/30/2014 | 2001-2002 | | | 35,935 | | | (3,295 | ) | | 32,640 | | | 300 | | 92.7% | | | 92.8% | | | | 1,270 | |

Bayview Club | Indianapolis, IN | 5/1/2015 | | 2004 | | | 26,403 | | | (2,388 | ) | | 24,015 | | | 236 | | 92.8% | | | 92.9% | | | | 1,017 | |

Arbors River Oaks | Memphis, TN | 9/17/2015 | 2010 (f) | | | 22,625 | | | (1,896 | ) | | 20,729 | | | 191 | | 94.8% | | (f) | 94.2% | | (f) | | 1,300 | |

Aston | Raleigh - Durham, NC | 9/17/2015 | | 2013 | | | 38,207 | | | (2,887 | ) | | 35,320 | | | 288 | | 93.1% | | | 95.5% | | | | 1,148 | |

Avenues at Craig Ranch | Dallas, TX | 9/17/2015 | | 2013 | | | 48,120 | | | (3,536 | ) | | 44,584 | | | 334 | | 96.1% | | | 95.9% | | | | 1,308 | |

Bridge Pointe | Huntsville, AL | 9/17/2015 | | 2002 | | | 16,318 | | | (1,293 | ) | | 15,025 | | | 178 | | 96.1% | | | 98.0% | | | | 928 | |

Creekstone at RTP | Raleigh - Durham, NC | 9/17/2015 | | 2013 | | | 38,489 | | | (2,766 | ) | | 35,723 | | | 256 | | 95.7% | | | 96.0% | | | | 1,220 | |

Fountains Southend | Charlotte, NC | 9/17/2015 | | 2013 | | | 42,040 | | | (3,089 | ) | | 38,951 | | | 208 | | 94.2% | | | 92.7% | | | | 1,506 | |

Fox Trails | Dallas, TX | 9/17/2015 | | 1981 | | | 29,096 | | | (2,082 | ) | | 27,014 | | | 286 | | 95.5% | | | 95.7% | | | | 1,105 | |

Lakeshore on the Hill | Chattanooga, TN | 9/17/2015 | | 2015 | | | 11,860 | | | (968 | ) | | 10,892 | | | 123 | | 94.3% | | | 96.0% | | | | 1,010 | |

Millenia 700 | Orlando, FL | 9/17/2015 | | 2012 | | | 48,173 | | | (3,552 | ) | | 44,621 | | | 297 | | 98.0% | | | 96.8% | | | | 1,439 | |

Miller Creek at German Town | Memphis, TN | 9/17/2015 | | 2013 | | | 57,168 | | | (4,442 | ) | | 52,726 | | | 330 | | 91.2% | | | 92.2% | | | | 1,290 | |

Pointe at Canyon Ridge | Atlanta, GA | 9/17/2015 | 2007 (f) | | | 53,409 | | | (3,883 | ) | | 49,526 | | | 494 | | 92.1% | | (f) | 92.1% | | (f) | | 1,087 | |

St James at Goose Creek | Charleston, SC | 9/17/2015 | | 2009 | | | 32,084 | | | (2,450 | ) | | 29,634 | | | 244 | | 92.6% | | | 93.2% | | | | 1,159 | |

Talison Row at Daniel Island | Charleston, SC | 9/17/2015 | | 2013 | | | 47,330 | | | (3,500 | ) | | 43,830 | | | 274 | | 90.5% | | | 91.7% | | | | 1,401 | |

Trails at Signal Mountain | Chattanooga, TN | 9/17/2015 | | 2015 | | | 14,810 | | | (1,215 | ) | | 13,595 | | | 172 | | 92.4% | | | 92.3% | | | | 943 | |

Vue at Knoll Trail | Dallas, TX | 9/17/2015 | | 2015 | | | 9,436 | | | (570 | ) | | 8,866 | | | 114 | | 97.4% | | | 98.4% | | | | 949 | |

Waterstone at Brier Creek | Raleigh - Durham, NC | 9/17/2015 | | 2014 | | | 39,171 | | | (2,899 | ) | | 36,272 | | | 232 | | 95.7% | | | 96.1% | | | | 1,287 | |

Waterstone Big Creek | Atlanta, GA | 9/17/2015 | | 2014 | | | 69,896 | | | (5,114 | ) | | 64,782 | | | 370 | | 93.8% | | | 94.7% | | | | 1,447 | |

Westmont Commons | Asheville, NC | 9/17/2015 | 2003, 2008 | | | 28,506 | | | (2,207 | ) | | 26,299 | | | 252 | | 96.4% | | | 97.3% | | | | 1,106 | |

TOTAL Same Store | | | | | $ | 1,134,789 | | $ | (100,855 | ) | $ | 1,033,934 | | | 10,329 | | 93.2% | | | 93.1% | | | $ | 1,049 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Non-Same Store Properties: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reserve at Eagle Ridge (h) | Chicago, IL | 1/31/2014 | | 2008 | | | 29,889 | | | (2,862 | ) | | 27,027 | | | 370 | | 93.2% | | | 91.9% | | | | 1,065 | |

Carrington Park (h) | Little Rock, AR | 5/7/2014 | | 1999 | | | 23,064 | | | (2,445 | ) | | 20,619 | | | 202 | | 98.0% | | | 95.1% | | | | 1,039 | |

Stonebridge at the Ranch (h) | Little Rock, AR | 12/16/2014 | | 2005 | | | 32,264 | | | (2,625 | ) | | 29,639 | | | 260 | | 94.6% | | | 93.6% | | | | 921 | |

Lakes of Northdale | Tampa-St. Petersburg, FL | 2/27/2017 | | 2016 | | | 30,149 | | | (1,270 | ) | | 28,879 | | | 216 | | 94.4% | | | 95.3% | | | | 1,238 | |

Haverford Place | Louisville, KY | 5/24/2017 | 2001 (f) | | | 15,037 | | | (539 | ) | | 14,498 | | | 160 | | 88.8% | | (f) | 89.9% | | (f) | | 946 | |

The Village at Auburn | Raleigh - Durham, NC | 6/30/2017 | 2002 (f) | | | 47,158 | | | (1,759 | ) | | 45,399 | | | 328 | | 76.5% | | (f) | 74.1% | | (f) | | 1,152 | |

Cherry Grove | Myrtle Beach, SC - Wilmington, NC | 9/26/2017 | | 2001 | | | 16,630 | | | (553 | ) | | 16,077 | | | 172 | | 87.8% | | | 92.3% | | | | 1,075 | |

Kensington Commons | Columbus, OH | 9/26/2017 | 2004 (f) | | | 24,836 | | | (700 | ) | | 24,136 | | | 264 | | 93.6% | | (f) | 93.1% | | (f) | | 954 | |

Schirm Farms | Columbus, OH | 9/26/2017 | 2002 (f) | | | 24,421 | | | (660 | ) | | 23,761 | | | 264 | | 80.7% | | (f) | 79.7% | | (f) | | 907 | |

Riverchase | Indianapolis, IN | 9/26/2017 | | 2000 | | | 19,103 | | | (563 | ) | | 18,540 | | | 216 | | 93.5% | | | 92.8% | | | | 858 | |

Live Oak Trace | Baton Rouge, LA | 10/25/2017 | | 2002 | | | 28,610 | | | (813 | ) | | 27,797 | | | 264 | | 74.6% | | (g) | 75.4% | | (g) | | 952 | |

Tides at Calabash | Myrtle Beach, SC - Wilmington, NC | 11/14/2017 | | 2010 | | | 14,359 | | | (352 | ) | | 14,007 | | | 168 | | 91.7% | | | 94.5% | | | | 913 | |

Brunswick Point | Myrtle Beach, SC - Wilmington, NC | 12/12/2017 | 2005 (f) | | | 31,159 | | | (749 | ) | | 30,410 | | | 288 | | 96.5% | | (f) | 96.4% | | (f) | | 930 | |

Creekside Corners | Atlanta, GA | 1/3/2018 | 2001 (f) | | | 45,727 | | | (965 | ) | | 44,762 | | | 444 | | 92.3% | | (f) | 90.2% | | (f) | | 1,015 | |

Hartshire Lakes | Indianapolis, IN | 1/3/2018 | | 2008 | | | 27,584 | | | (575 | ) | | 27,009 | | | 272 | | 91.2% | | | 94.5% | | | | 985 | |

The Chelsea | Columbus, OH | 1/4/2018 | | 2013 | | | 36,603 | | | (779 | ) | | 35,824 | | | 312 | | 92.3% | | | 91.2% | | | | 1,116 | |

Avalon Oaks | Columbus, OH | 2/27/2018 | | 1999 | | | 23,343 | | | (397 | ) | | 22,946 | | | 235 | | 93.2% | | | 92.7% | | | | 946 | |

Bridgeview | Tampa-St. Petersburg, FL | 7/11/2018 | | 1986 | | | 42,754 | | | (335 | ) | | 42,419 | | | 348 | | 94.0% | | | 91.9% | | | | 1,020 | |

Collier Park | Columbus, OH | 7/26/2018 | | 2000 | | | 21,110 | | | (197 | ) | | 20,913 | | | 232 | | 97.0% | | | 96.9% | | | | 876 | |

Waterford Landing | Atlanta, GA | 10/11/2018 | | 1999 | | | 30,392 | | | (114 | ) | | 30,278 | | | 260 | | 96.9% | | | 97.8% | | | | 981 | |

Lucerne | Tampa-St. Petersburg, FL | 11/7/2018 | | 2002 | | | 46,659 | | | (95 | ) | | 46,564 | | | 276 | | 96.4% | | | 94.6% | | | | 1,145 | |

TOTAL Non-Same Store | | | | | $ | 610,851 | | $ | (19,347 | ) | $ | 591,504 | | | 5,551 | | 91.2% | | | 90.8% | | | $ | 1,007 | |

TOTAL | | | | | | $ | 1,745,640 | | $ | (120,202 | ) | $ | 1,625,438 | | | 15,880 | | 92.5% | | | 92.3% | | | $ | 1,035 | |

(a) | All dates for the later of (i) the year in which construction was completed or (ii) the year in which a significant renovation program was completed. |

(b) | Units represent the total number of apartment units available for rent at December 31, 2018. |

(c) | Physical occupancy for each of our properties is calculated as (i) total units rented as of December 31, 2018 divided by (ii) total units available as of December 31, 2018, expressed as a percentage. |

(d) | Average occupancy represents the daily average occupied units for the three-month period ended December 31, 2018. |

(e) | Average monthly effective rent, per unit, represents the average monthly rent for all occupied units for the three-month period ended December 31, 2018. |

(f) | Properties are undergoing renovation. |

(g) | Property was recently renovated and impacted units are in the process of being leased up. |

(h) | Properties are classified as held for sale. |

21

NOI EXPOSURE BY MARKET

Dollars in thousands, except rent per unit

| | | | | | | | | | | | | | | | | | For the Three Months Ended December 31, 2018 | |

Market | | Number of Properties | | | Units | | | Gross Real Estate Assets | | | Period End Occupancy | | | Average Effective Monthly Rent per Unit | | | Net Operating Income (c) | | | % of NOI | |

Atlanta, GA | | 5 | | | | 1,796 | | | $ | 220,408 | | | | 93.4 | % | | $ | 1,119 | | | $ | 3,799 | | | | 13.0 | % |

Raleigh - Durham, NC | | 5 | | | | 1,372 | | | | 187,887 | | | | 90.5 | % | | | 1,149 | | | | 2,899 | | | | 9.9 | % |

Memphis, TN | | 4 | | | | 1,383 | | | | 140,660 | | | | 92.8 | % | | | 1,077 | | | | 2,742 | | | | 9.4 | % |

Louisville, KY | | 6 | | | | 1,710 | | | | 190,231 | | | | 88.0 | % | | | 963 | | | | 2,725 | | | | 9.3 | % |

Columbus, OH | | 6 | | | | 1,547 | | | | 148,585 | | | | 91.6 | % | | | 964 | | | | 2,511 | | | | 8.6 | % |

Oklahoma City, OK | | 5 | | | | 1,658 | | | | 75,781 | | | | 94.7 | % | | | 655 | | | | 1,970 | | | | 6.7 | % |

Indianapolis, IN | | 4 | | | | 916 | | | | 89,496 | | | | 92.4 | % | | | 977 | | | | 1,552 | | | | 5.3 | % |

Dallas, TX | | 3 | | | | 734 | | | | 86,652 | | | | 95.8 | % | | | 1,173 | | | | 1,501 | | | | 5.1 | % |

Tampa-St. Petersburg, FL | | 3 | | | | 840 | | | | 119,562 | | | | 94.9 | % | | | 1,117 | | | | 1,412 | | | | 4.8 | % |

Myrtle Beach, SC - Wilmington, NC | | 3 | | | | 628 | | | | 62,148 | | | | 92.8 | % | | | 965 | | | | 1,176 | | | | 4.0 | % |

Charleston, SC | | 2 | | | | 518 | | | | 79,414 | | | | 91.5 | % | | | 1,287 | | | | 1,144 | | | | 3.9 | % |

Orlando, FL | | 1 | | | | 297 | | | | 48,173 | | | | 98.0 | % | | | 1,439 | | | | 847 | | | | 2.9 | % |

Little Rock, AR (a) | | 2 | | | | 462 | | | | 55,328 | | | | 96.1 | % | | | 972 | | | | 814 | | | | 2.8 | % |

Chicago, IL (b) | | 1 | | | | 370 | | | | 29,889 | | | | 93.2 | % | | | 1,065 | | | | 667 | | | | 2.3 | % |

Charlotte, NC | | 1 | | | | 208 | | | | 42,040 | | | | 94.2 | % | | | 1,506 | | | | 648 | | | | 2.2 | % |

Asheville, NC | | 1 | | | | 252 | | | | 28,506 | | | | 96.4 | % | | | 1,106 | | | | 610 | | | | 2.1 | % |

Austin, TX | | 1 | | | | 300 | | | | 35,935 | | | | 92.7 | % | | | 1,270 | | | | 605 | | | | 2.1 | % |

Chattanooga, TN | | 2 | | | | 295 | | | | 26,670 | | | | 93.2 | % | | | 971 | | | | 487 | | | | 1.7 | % |

St. Louis, MO | | 1 | | | | 152 | | | | 33,347 | | | | 96.1 | % | | | 1,411 | | | | 469 | | | | 1.6 | % |

Baton Rouge, LA | | 1 | | | | 264 | | | | 28,610 | | | | 74.6 | % | | | 952 | | | | 364 | | | | 1.2 | % |

Huntsville, AL | | 1 | | | | 178 | | | | 16,318 | | | | 96.1 | % | | | 928 | | | | 357 | | | | 1.2 | % |

Total/Weighted Average | | | 58 | | | | 15,880 | | | $ | 1,745,640 | | | | 92.5 | % | | $ | 1,035 | | | $ | 29,299 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Market includes two properties which have been classified as held for sale as of December 31, 2018. |

| (b) | Market includes one property which has been classified as held for sale as of December 31, 2018. |

| (c) | Excludes $969 of net operating income from properties sold in the three months ended December 31, 2018. |

22

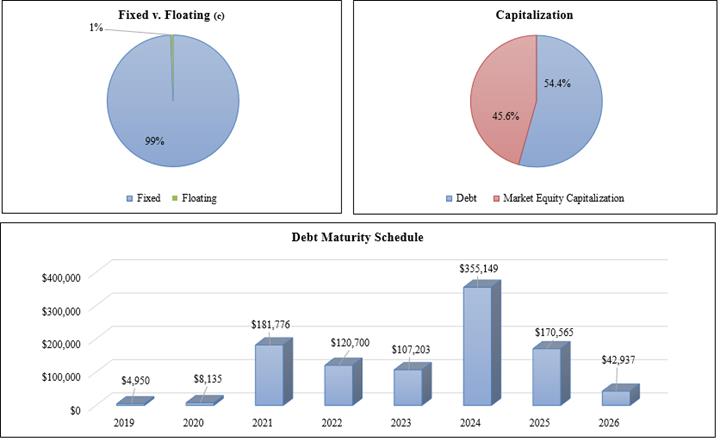

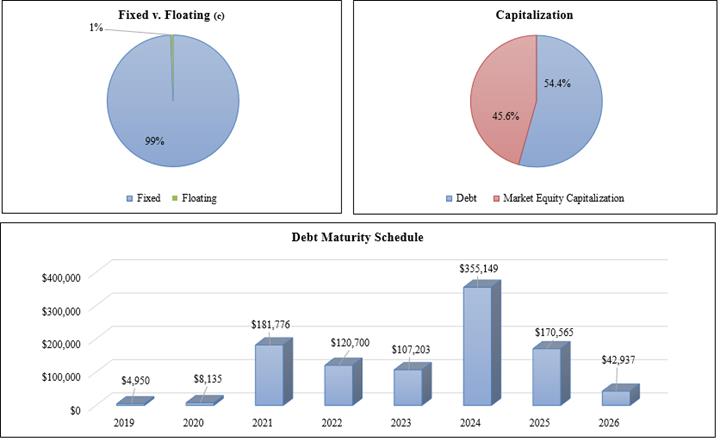

DEBT SUMMARY AS OF DECEMBER 31, 2018

Dollars in thousands

| | Amount | | | Rate | | | Type | | Weighted Average Maturity (in years) | | |

Debt: | | | | | | | | | | | | | | | |

Credit facility (a) | | $ | 155,743 | | | | 3.9 | % | | Floating | | | 2.7 | | |

Term loans (b) | | | 250,000 | | | | 4.0 | % | | Floating | | | 5.4 | | |

Mortgages | | | 585,672 | | | | 3.8 | % | | Fixed | | | 5.1 | | |

Unamortized debt premiums | | | (5,927 | ) | | | | | | | | | | | |

Total Debt | | | 985,488 | | | | 3.9 | % | | | | | 4.8 | | |

Market Equity Capitalization, at period end | | | 826,802 | | | | | | | | | | | | |

Total Capitalization | | $ | 1,812,289 | | | | | | | | | | | | |

| (a) | Credit facility total capacity is $300,000, of which $155,743 was drawn as of December 31, 2018, comprised of a $50,000 term loan and a revolving commitment of up to $250,000. The maturity date on the term loan is May 1, 2022, and the maturity date on borrowings outstanding under the revolving commitment is May 1, 2021. |

| (b) | Comprised of a $150,000 term loan with a maturity date of January 17, 2024 and a $100,000 term loan with a maturity date of November 20, 2024. |

| (a) | As of December 31, 2018, IRT maintained a float-to-fixed interest swap with a $150,000 notional amount. This swap, which expires on June 17, 2021 and has a fixed rate of 1.1325%, has converted $150,000 of our floating rate debt to fixed rate debt. We also maintain: (1) An interest rate collar with a $100,000 notional amount., which expires on November 20, 2024 has a floor of 1.25% and a cap of 2.00%. and (2) An interest rate collar with a $150,000 notional amount, which expires on January 17, 2024, has a floor of 2.25% and a cap of 2.50%. These collars have converted $250,000 of our floating rate debt to fixed rate debt when LIBOR is above the cap rate or below the floor rate. |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Encumbered & Unencumbered Statistics | | | Total Units | | | % of Total | | | Gross Assets | | | % of Total | | | Q4 2018 NOI | | | % of Total | |

Unencumbered assets | | | | 7,733 | | | | 48.7 | % | | $ | 799,415 | | | | 44.4 | % | | $ | 12,970 | | | 42.9% | |

Encumbered assets | | | | 8,147 | | | | 51.3 | % | | | 999,321 | | | | 55.6 | % | | | 17,298 | | | 57.1% | |

| | | | 15,880 | | | | 100.0 | % | | $ | 1,798,736 | | | | 100.0 | % | | $ | 30,268 | | | 100.0% | |

23

Definitions

Average Effective Monthly Rent per Unit