INVESTOR PRESENTATION March 2020 Talison Row at Daniel Island, South Carolina Exhibit 99.1

Table of Contents IRT Overview Investment Thesis 2 – 4 Portfolio Composition 5 Value Add Program 6 – 7 Capital Recycling Program 8 – 9 Capital Structure 10 – 11 Guidance 12 Sustainability Commitment 13 Conclusion 14 Appendix Historic Portfolio Growth and Transformation 16 Market Profiles 17 – 26 Value Add Progress-to-date 27 Demographic Profile 28 Definitions and Non-GAAP Financial Measure Reconciliations 29 – 30 Forward-Looking Statement 31

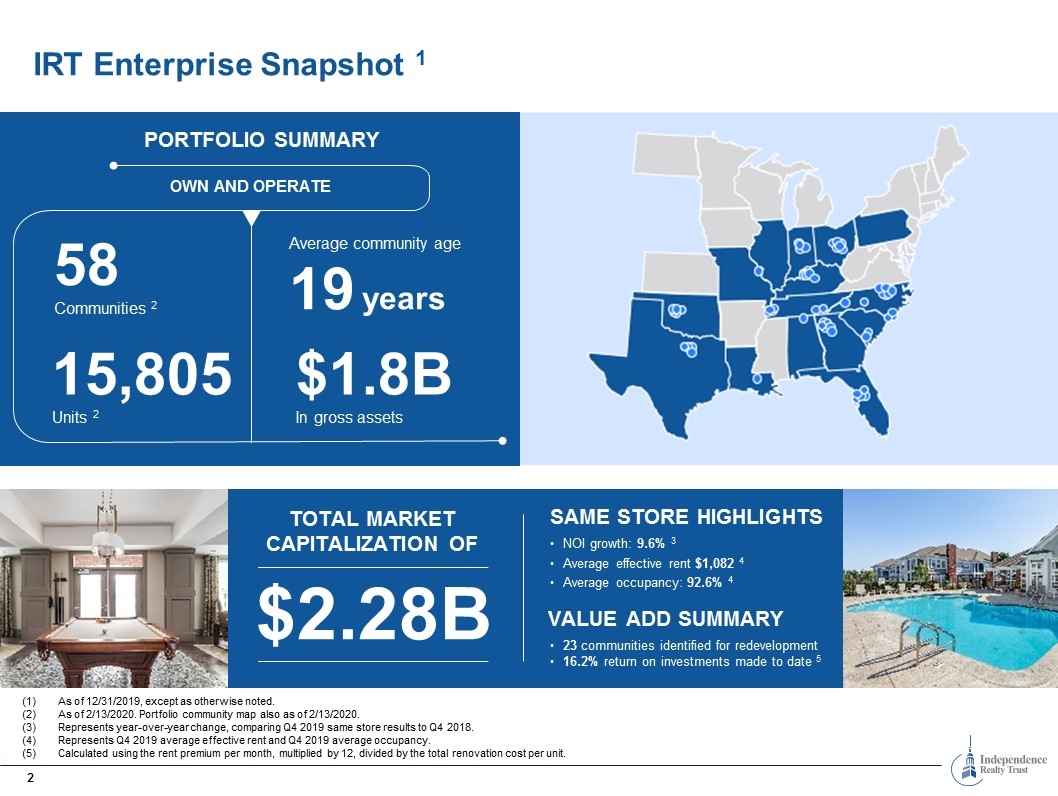

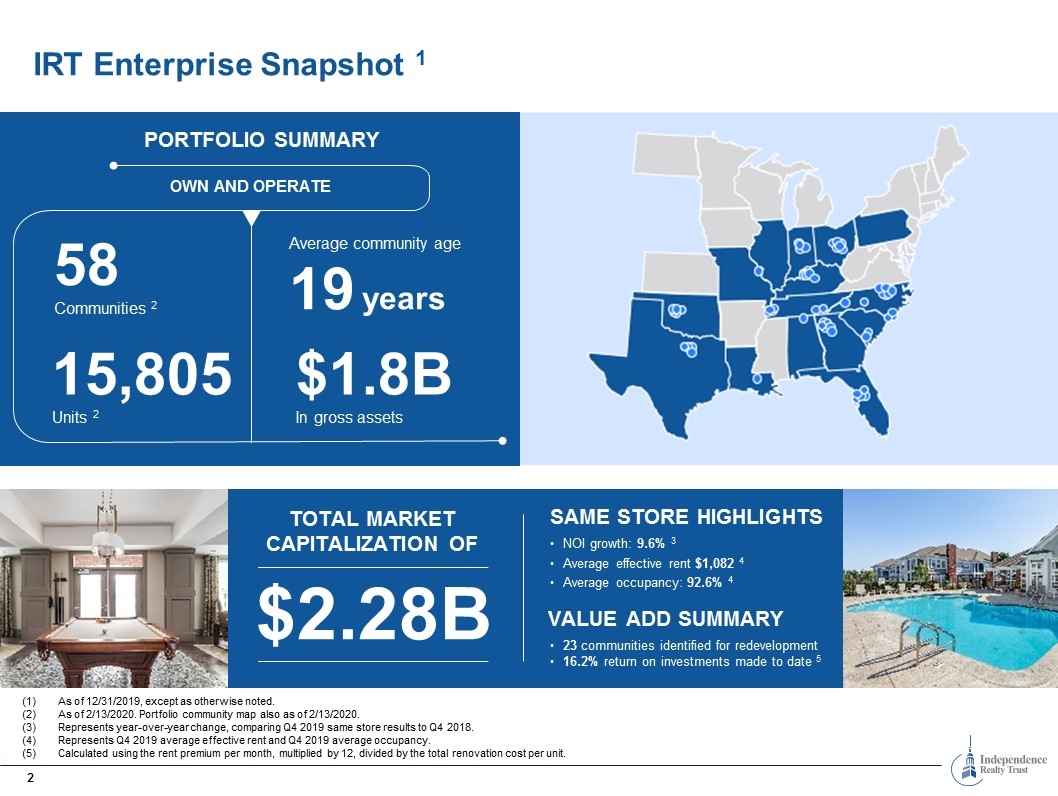

IRT Enterprise Snapshot 1 OWN AND OPERATE Average community age 19 years 58 Communities 2 15,805 Units 2 $1.8B In gross assets PORTFOLIO SUMMARY $2.28B Total market capitalization of SAME STORE HIGHLIGHTS NOI growth: 9.6% 3 Average effective rent $1,082 4 Average occupancy: 92.6% 4 VALUE ADD SUMMARY 23 communities identified for redevelopment 16.2% return on investments made to date 5 As of 12/31/2019, except as otherwise noted. As of 2/13/2020. Portfolio community map also as of 2/13/2020. Represents year-over-year change, comparing Q4 2019 same store results to Q4 2018. Represents Q4 2019 average effective rent and Q4 2019 average occupancy. Calculated using the rent premium per month, multiplied by 12, divided by the total renovation cost per unit.

Positioned to Unlock Long-term Value Clear investment strategy focused on middle-market communities across non-gateway MSAs Accretive, tenant-first approach to owning and operating high-quality multifamily communities Value add community redevelopment initiatives Simple capital structure

Clear Investment and Ownership Strategy Assets Our Focus: Well-located middle-market communities, likely to benefit from: Robust management platform, including revenue management Operational expertise Economies of scale Markets Our Focus: Targeted submarkets within non-gateway markets exhibiting: Strong apartment demand Limited new construction Strong economic indicators We Look For: Strong employment drivers Population growth & positive net migration trends Well-rated schools Attractive rent vs. buy dynamics Mature, infill locations with high barriers to entry We Look For: Mid-rise/garden style (150–500) units with attractive amenities Acquire properties at less than replacement cost Opportunities for repositioning or updating through capital expenditures Ability to apply tailored marketing and management strategies to attract and retain residents and increase rents Creating value by identifying the right assets in the right markets Leading To Increased Property Level NOI – Stable Occupancy Rates, Above Average Rent Growth and Reduced Expenses

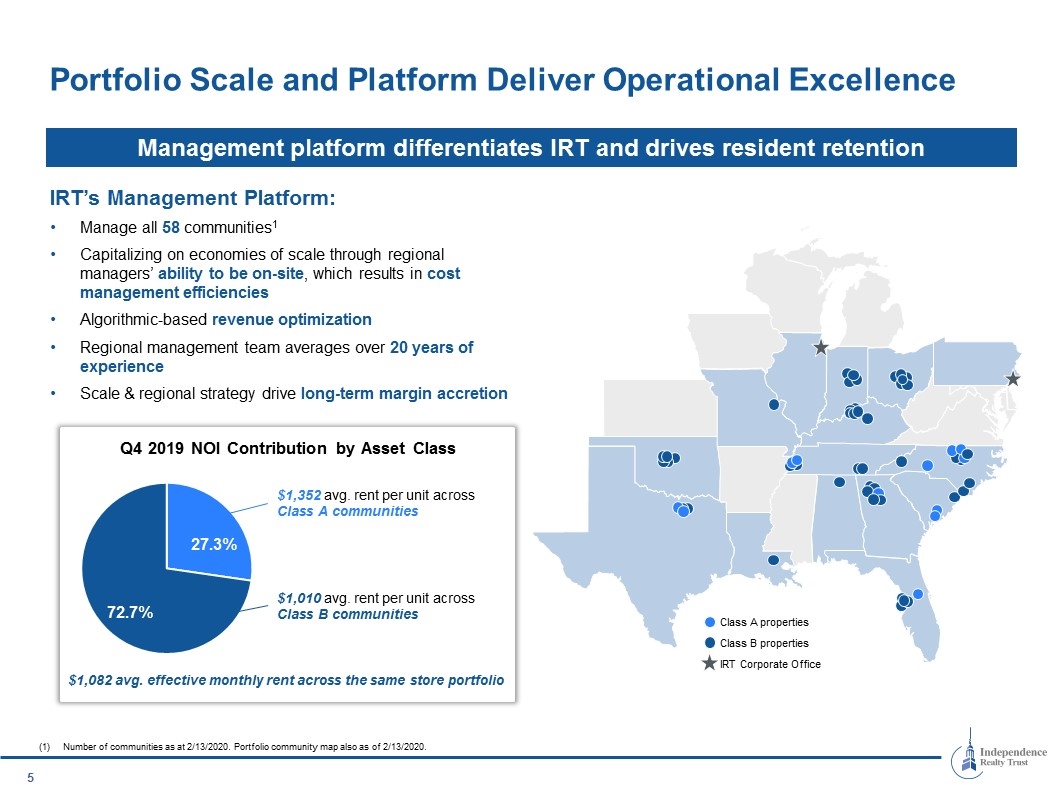

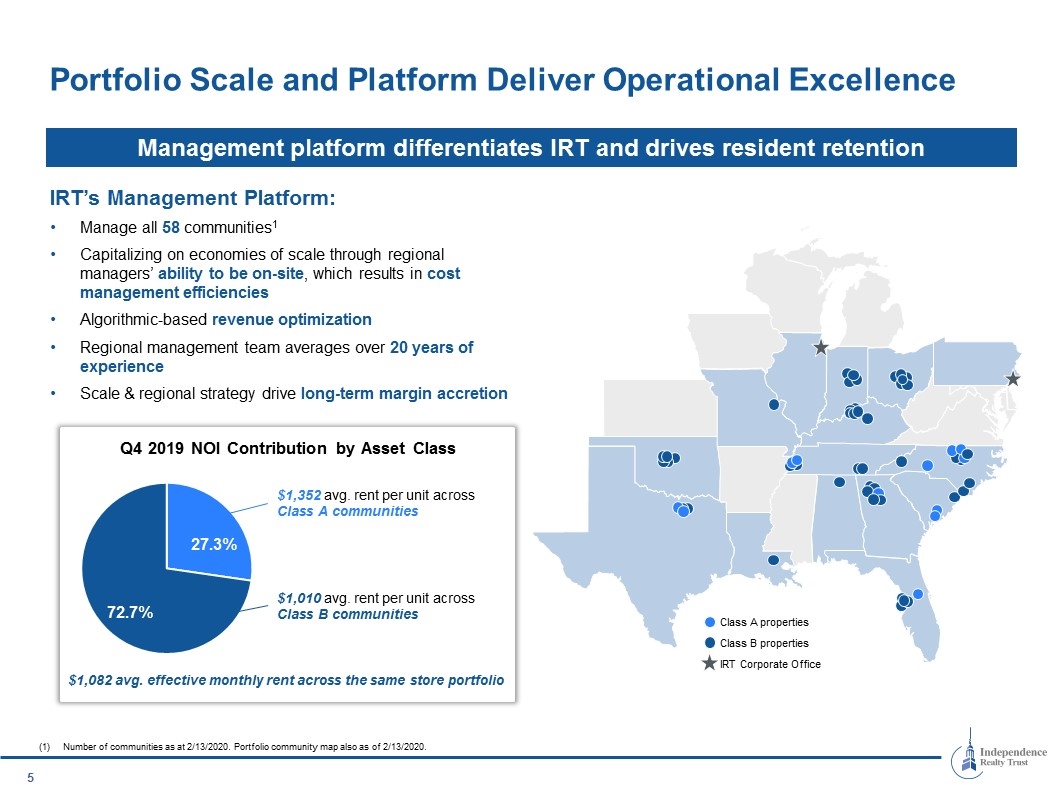

Portfolio Scale and Platform Deliver Operational Excellence IRT’s Management Platform: Manage all 58 communities1 Capitalizing on economies of scale through regional managers’ ability to be on-site, which results in cost management efficiencies Algorithmic-based revenue optimization Regional management team averages over 20 years of experience Scale & regional strategy drive long-term margin accretion Management platform differentiates IRT and drives resident retention $1,082 avg. effective monthly rent across the same store portfolio Class A properties Class B properties IRT Corporate Office $1,352 avg. rent per unit across Class A communities $1,010 avg. rent per unit across Class B communities Q4 2019 NOI Contribution by Asset Class Number of communities as at 2/13/2020. Portfolio community map also as of 2/13/2020.

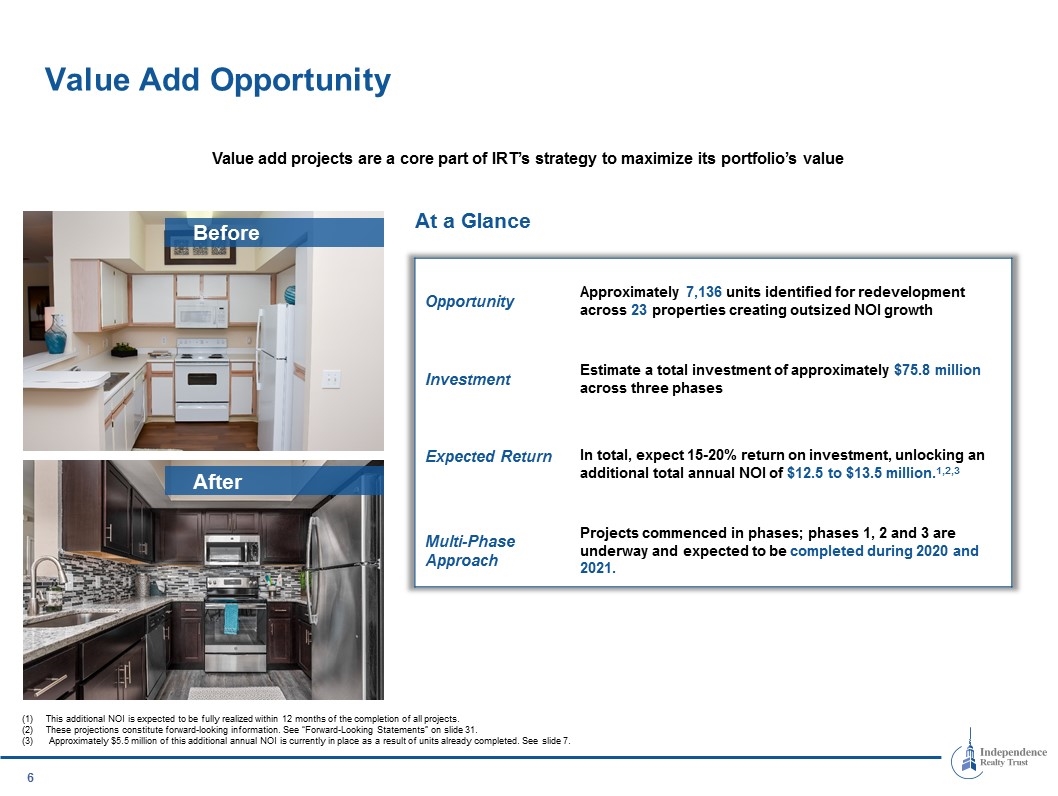

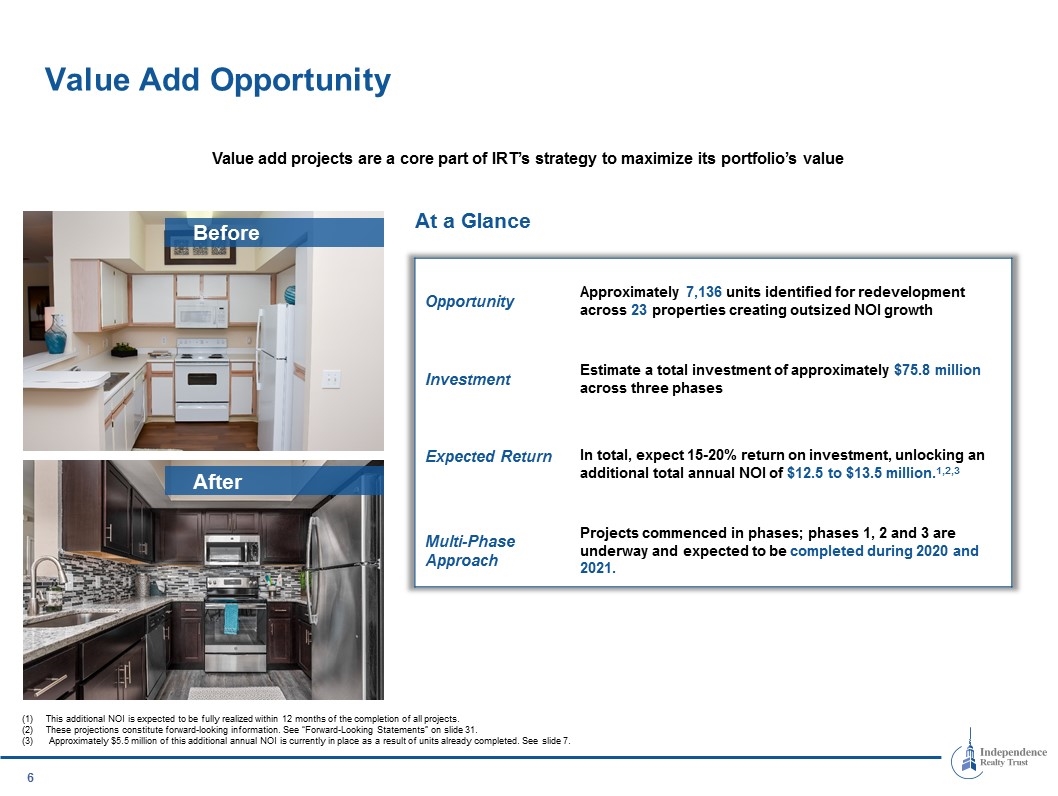

Value Add Opportunity After Before At a Glance Value add projects are a core part of IRT’s strategy to maximize its portfolio’s value Opportunity Approximately 7,136 units identified for redevelopment across 23 properties creating outsized NOI growth Investment Estimate a total investment of approximately $75.8 million across three phases Expected Return In total, expect 15-20% return on investment, unlocking an additional total annual NOI of $12.5 to $13.5 million.1,2,3 Multi-Phase Approach Projects commenced in phases; phases 1, 2 and 3 are underway and expected to be completed during 2020 and 2021. This additional NOI is expected to be fully realized within 12 months of the completion of all projects. These projections constitute forward-looking information. See “Forward-Looking Statements” on slide 31. Approximately $5.5 million of this additional annual NOI is currently in place as a result of units already completed. See slide 7.

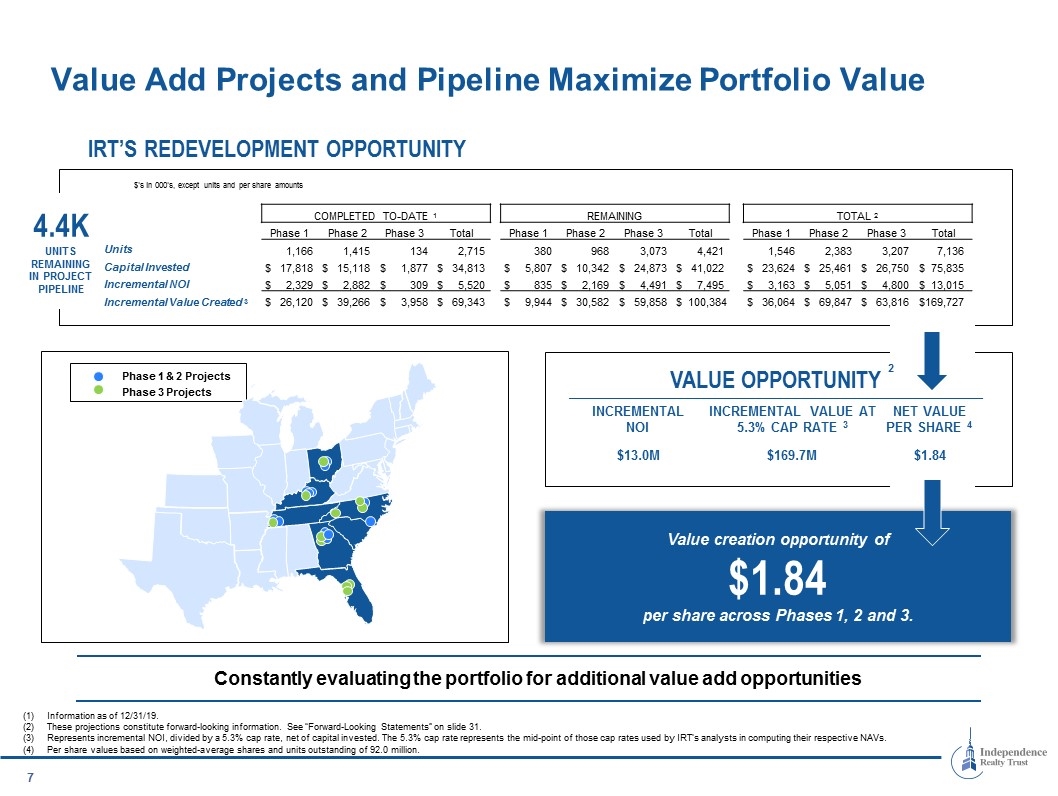

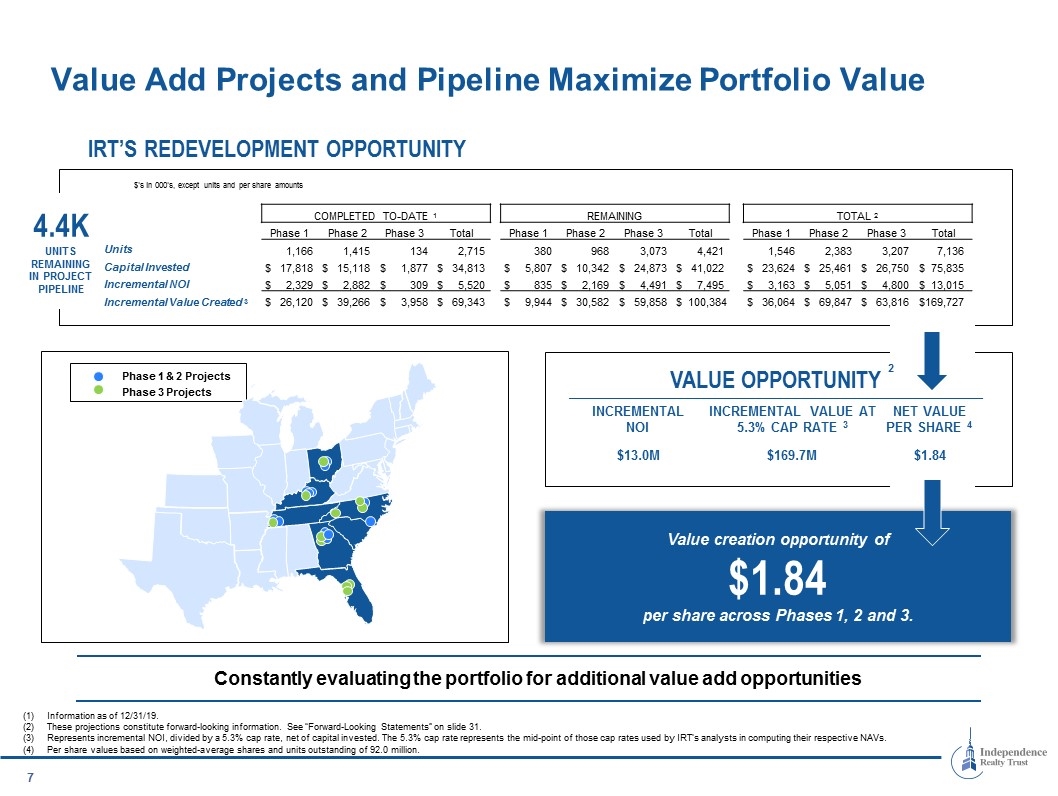

Phase 1 Value Add Projects and Pipeline Maximize Portfolio Value Value creation opportunity of $1.84 per share across Phases 1, 2 and 3. $'s in 000's, except units and per share amounts 4.4K UNITS REMAINING IN PROJECT PIPELINE IRT’s Redevelopment Opportunity VALUE OPPORTUNITY 2 Incremental NOI Incremental Value At 5.3% Cap Rate 3 Net Value Per Share 4 $13.0M $169.7M $1.84 Information as of 12/31/19. These projections constitute forward-looking information. See “Forward-Looking Statements” on slide 31. Represents incremental NOI, divided by a 5.3% cap rate, net of capital invested. The 5.3% cap rate represents the mid-point of those cap rates used by IRT’s analysts in computing their respective NAVs. Per share values based on weighted-average shares and units outstanding of 92.0 million. Phase 1 & 2 Projects Constantly evaluating the portfolio for additional value add opportunities Units Capital Invested Incremental NOI Incremental Value Created 3 Phase 3 Projects COMPLETED TO-DATE 1 REMAINING TOTAL 2 Phase 1 Phase 2 Phase 3 Total Phase 1 Phase 2 Phase 3 Total Phase 1 Phase 2 Phase 3 Total 1,166 1,415 134 2,715 380 968 3,073 4,421 1,546 2,383 3,207 7,136 $ 17,818 $ 15,118 $ 1,877 $ 34,813 $ 5,807 $ 10,342 $ 24,873 $ 41,022 $ 23,624 $ 25,461 $ 26,750 $ 75,835 $ 2,329 $ 2,882 $ 309 $ 5,520 $ 835 $ 2,169 $ 4,491 $ 7,495 $ 3,163 $ 5,051 $ 4,800 $ 13,015 $ 26,120 $ 39,266 $ 3,958 $ 69,343 $ 9,944 $ 30,582 $ 59,858 $ 100,384 $ 36,064 $ 69,847 $ 63,816 $169,727

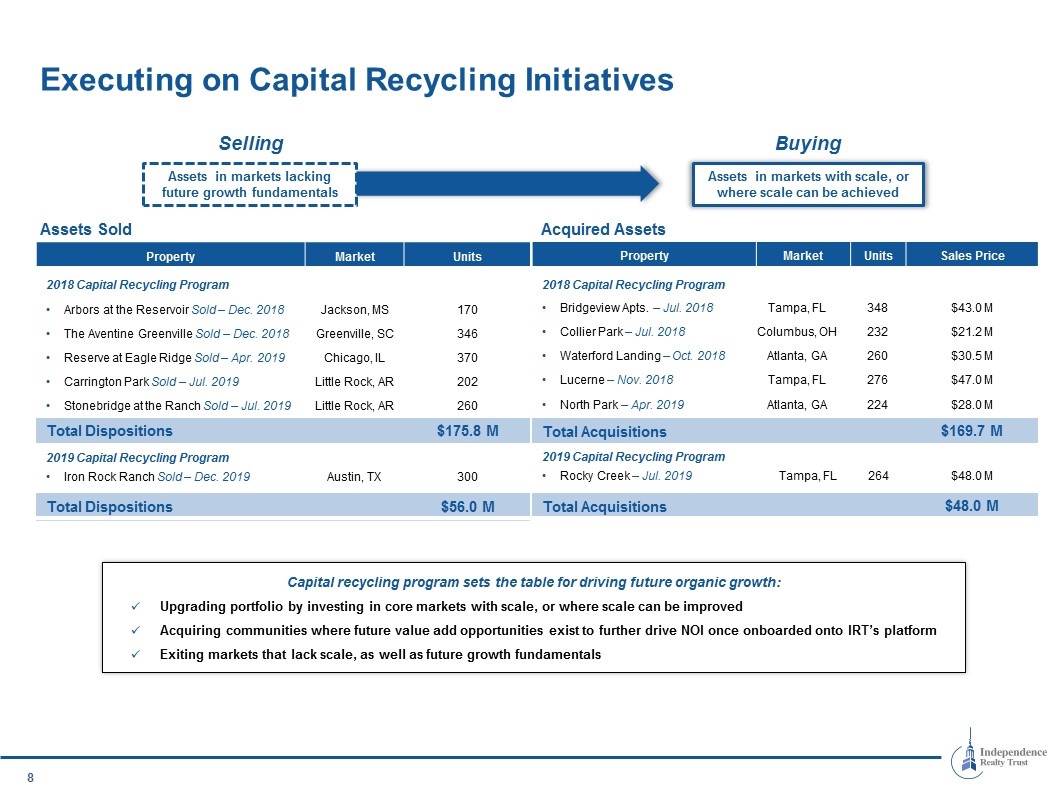

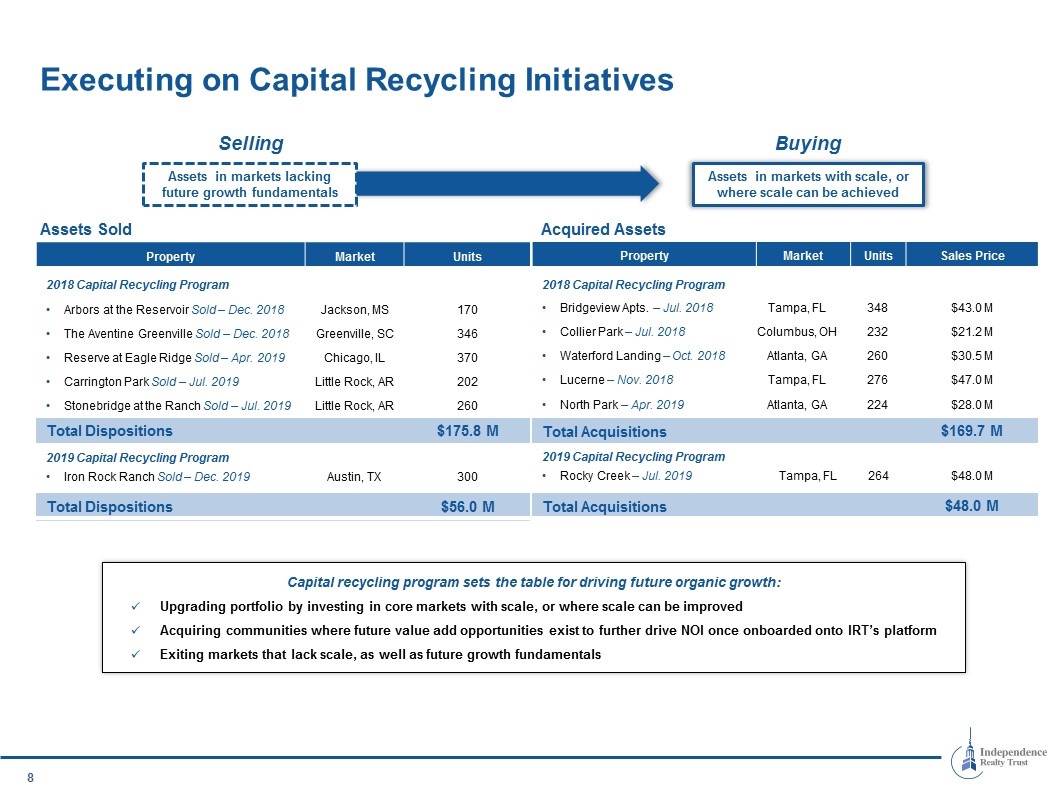

Capital recycling program sets the table for driving future organic growth: Upgrading portfolio by investing in core markets with scale, or where scale can be improved Acquiring communities where future value add opportunities exist to further drive NOI once onboarded onto IRT’s platform Exiting markets that lack scale, as well as future growth fundamentals Executing on Capital Recycling Initiatives Assets Sold Property Market Units 2018 Capital Recycling Program Arbors at the Reservoir Sold – Dec. 2018 Jackson, MS 170 The Aventine Greenville Sold – Dec. 2018 Greenville, SC 346 Reserve at Eagle Ridge Sold – Apr. 2019 Chicago, IL 370 Carrington Park Sold – Jul. 2019 Little Rock, AR 202 Stonebridge at the Ranch Sold – Jul. 2019 Little Rock, AR 260 Total Dispositions $175.8 M 2019 Capital Recycling Program Iron Rock Ranch Sold – Dec. 2019 Austin, TX 300 Total Dispositions $56.0 M Property Market Market Units Sales Price 2018 Capital Recycling Program Bridgeview Apts. – Jul. 2018 Tampa, FL 348 $43.0 M Collier Park – Jul. 2018 Columbus, OH 232 $21.2 M Waterford Landing – Oct. 2018 Atlanta, GA 260 $30.5 M Lucerne – Nov. 2018 Tampa, FL 276 $47.0 M North Park – Apr. 2019 Atlanta, GA 224 $28.0 M Total Acquisitions $169.7 M 2019 Capital Recycling Program Rocky Creek – Jul. 2019 Tampa, FL 264 $48.0 M Total Acquisitions $48.0 M Acquired Assets Assets in markets lacking future growth fundamentals Assets in markets with scale, or where scale can be achieved Selling Buying

Recent Developments Properties Under LOI Executed non-binding LOI to acquire three Class A assets in Atlanta, Georgia Purchase price: ~$300.0 million / 1,202 units Assets are approximately 95% occupied The Adley Craig Ranch: Dallas, Texas Equity Offering to Fuel Robust Acquisition Pipeline 2020 Acquisition Pipeline February 2020 Equity Offering On February 24, 2020 IRT closed an equity offering of 10,350,000 shares of common stock (including an over-allotment of 1,350,000 shares) at a price of $15.30 per share. Net proceeds from the equity offering will be used to fund: Potential acquisitions and other investment opportunities The reduction of outstanding borrowings and for other corporate purposes Purchasing high quality properties Executing accretive transactions Expanding presence in top target markets Building a defensive portfolio with embedded upside potential The Adley Craig Ranch Location: Dallas, TX Purchase Price: $51.2 million Units: 251 2020 Acquisitions to Date

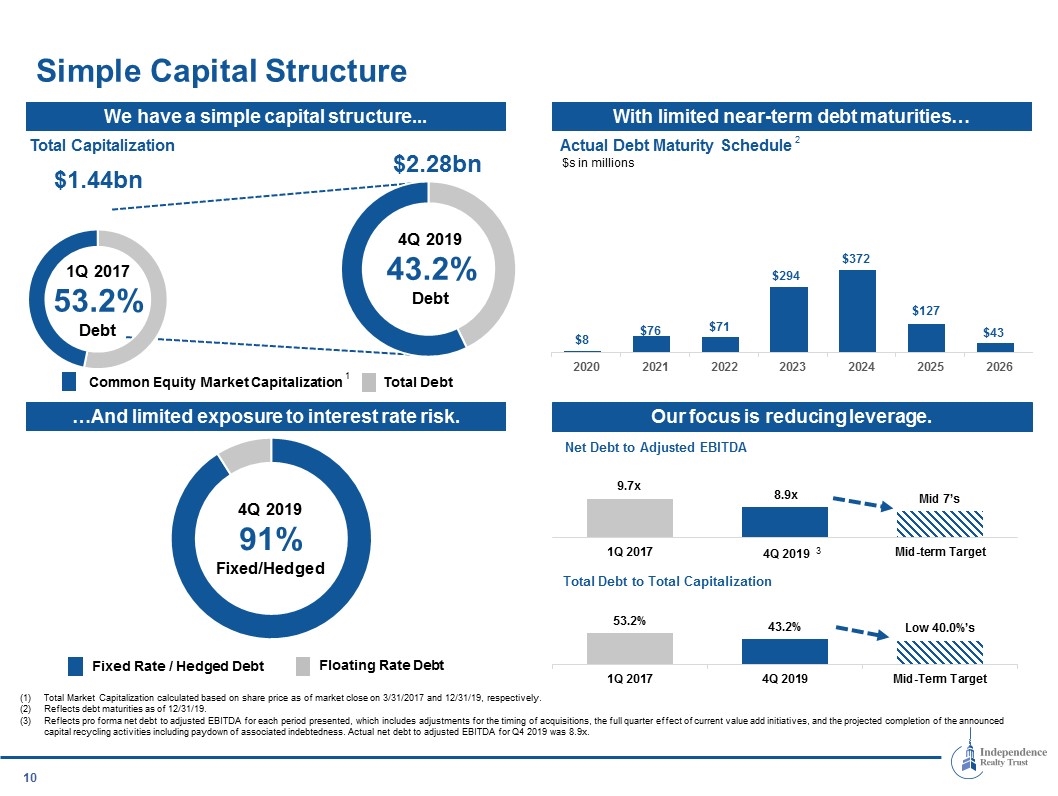

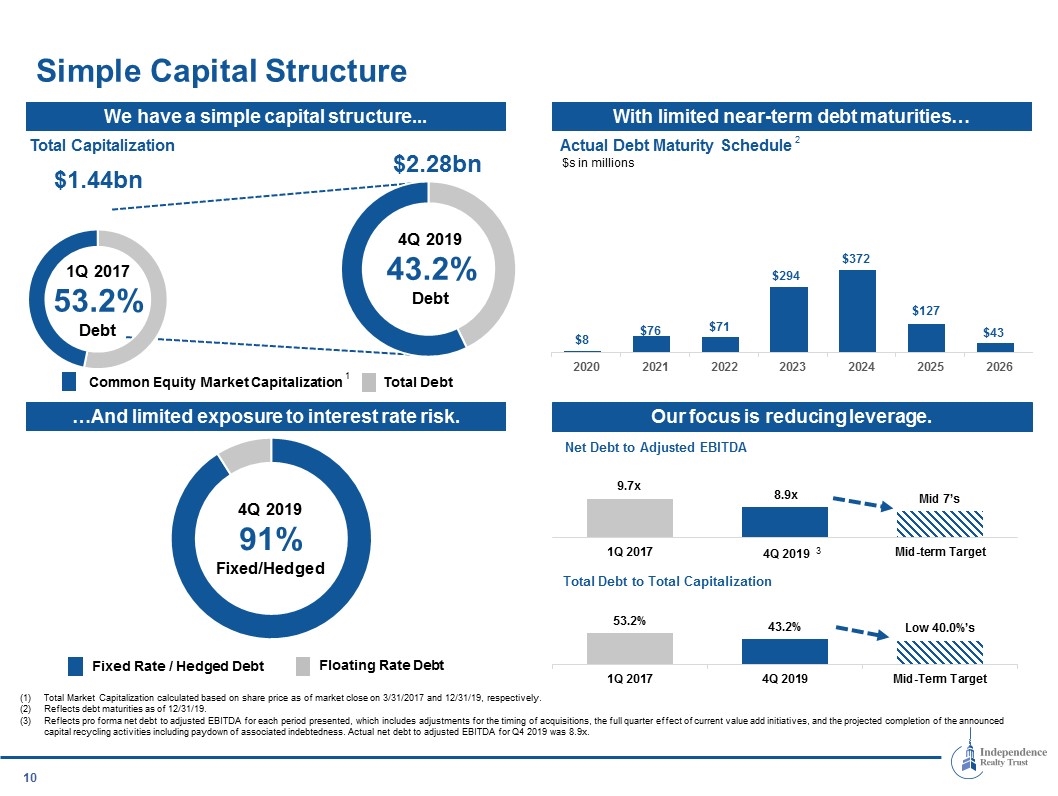

Total Market Capitalization calculated based on share price as of market close on 3/31/2017 and 12/31/19, respectively. Reflects debt maturities as of 12/31/19. Reflects pro forma net debt to adjusted EBITDA for each period presented, which includes adjustments for the timing of acquisitions, the full quarter effect of current value add initiatives, and the projected completion of the announced capital recycling activities including paydown of associated indebtedness. Actual net debt to adjusted EBITDA for Q4 2019 was 8.9x. 1Q 2017 53.2% Debt Simple Capital Structure We have a simple capital structure... With limited near-term debt maturities… …And limited exposure to interest rate risk. Our focus is reducing leverage. 4Q 2019 43.2% Debt Total Debt Common Equity Market Capitalization Net Debt to Adjusted EBITDA Total Capitalization Floating Rate Debt Fixed Rate / Hedged Debt 4Q 2019 91% Fixed/Hedged $s in millions $1.44bn $2.28bn Actual Debt Maturity Schedule Total Debt to Total Capitalization 1 2 4Q 2019 3

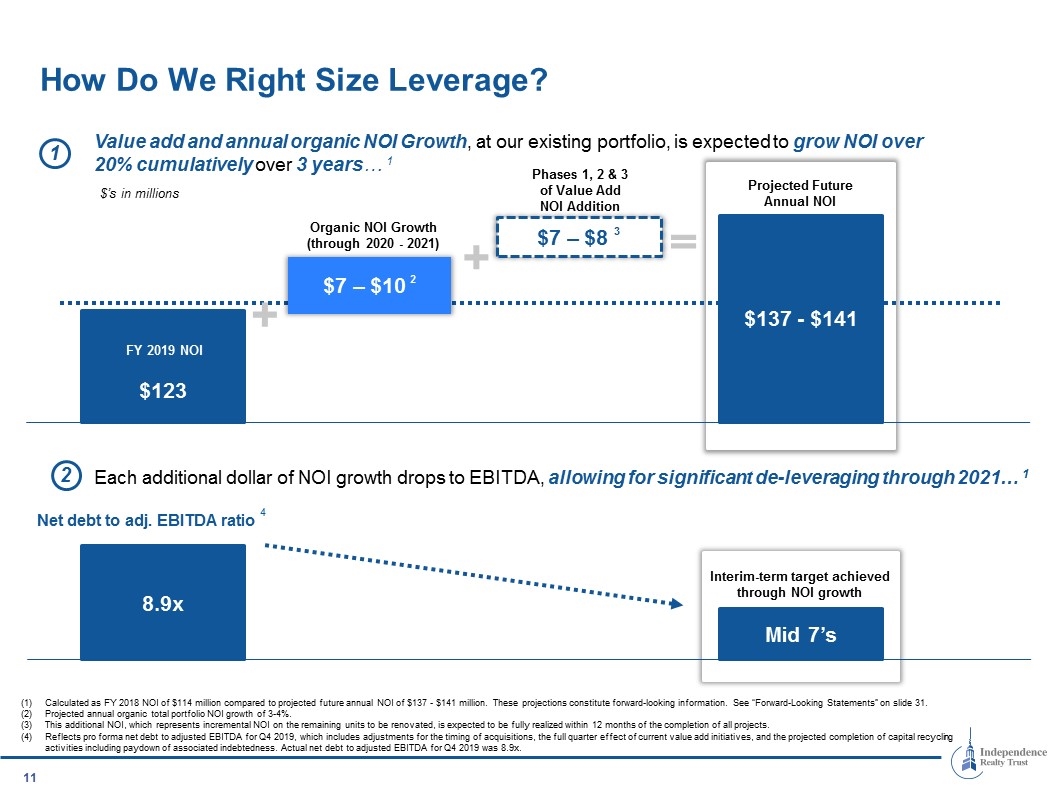

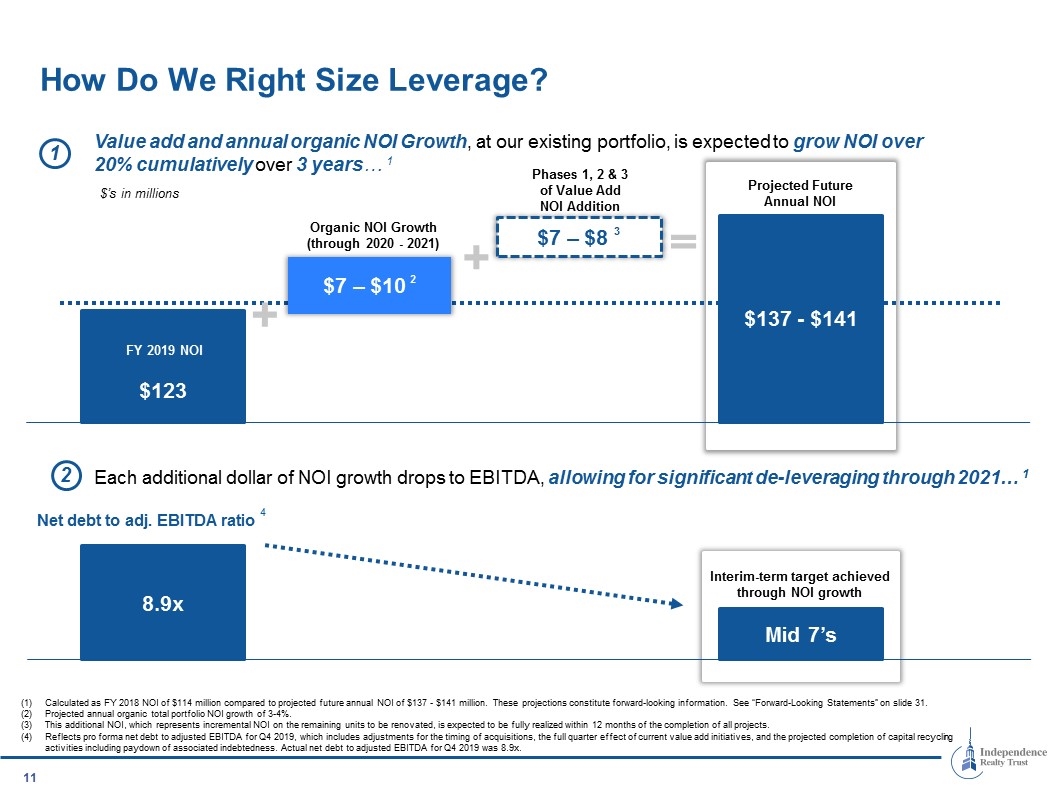

How Do We Right Size Leverage? Calculated as FY 2018 NOI of $114 million compared to projected future annual NOI of $137 - $141 million. These projections constitute forward-looking information. See “Forward-Looking Statements” on slide 31. Projected annual organic total portfolio NOI growth of 3-4%. This additional NOI, which represents incremental NOI on the remaining units to be renovated, is expected to be fully realized within 12 months of the completion of all projects. Reflects pro forma net debt to adjusted EBITDA for Q4 2019, which includes adjustments for the timing of acquisitions, the full quarter effect of current value add initiatives, and the projected completion of capital recycling activities including paydown of associated indebtedness. Actual net debt to adjusted EBITDA for Q4 2019 was 8.9x. 1 Value add and annual organic NOI Growth, at our existing portfolio, is expected to grow NOI over 20% cumulatively over 3 years… 1 2 Each additional dollar of NOI growth drops to EBITDA, allowing for significant de-leveraging through 2021… 1 Phases 1, 2 & 3 of Value Add NOI Addition $123 $7 – $8 3 $7 – $10 2 $137 - $141 Organic NOI Growth (through 2020 - 2021) Projected Future Annual NOI 8.9x Mid 7’s + + FY 2019 NOI Net debt to adj. EBITDA ratio 4 Interim-term target achieved through NOI growth $’s in millions

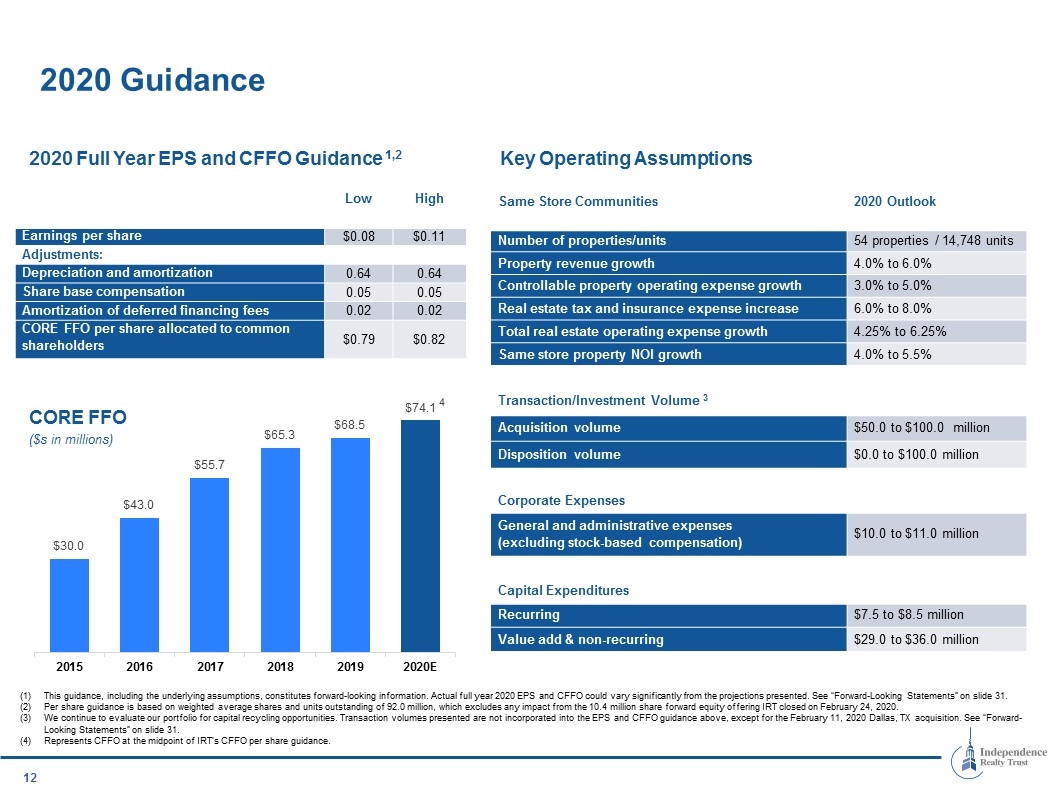

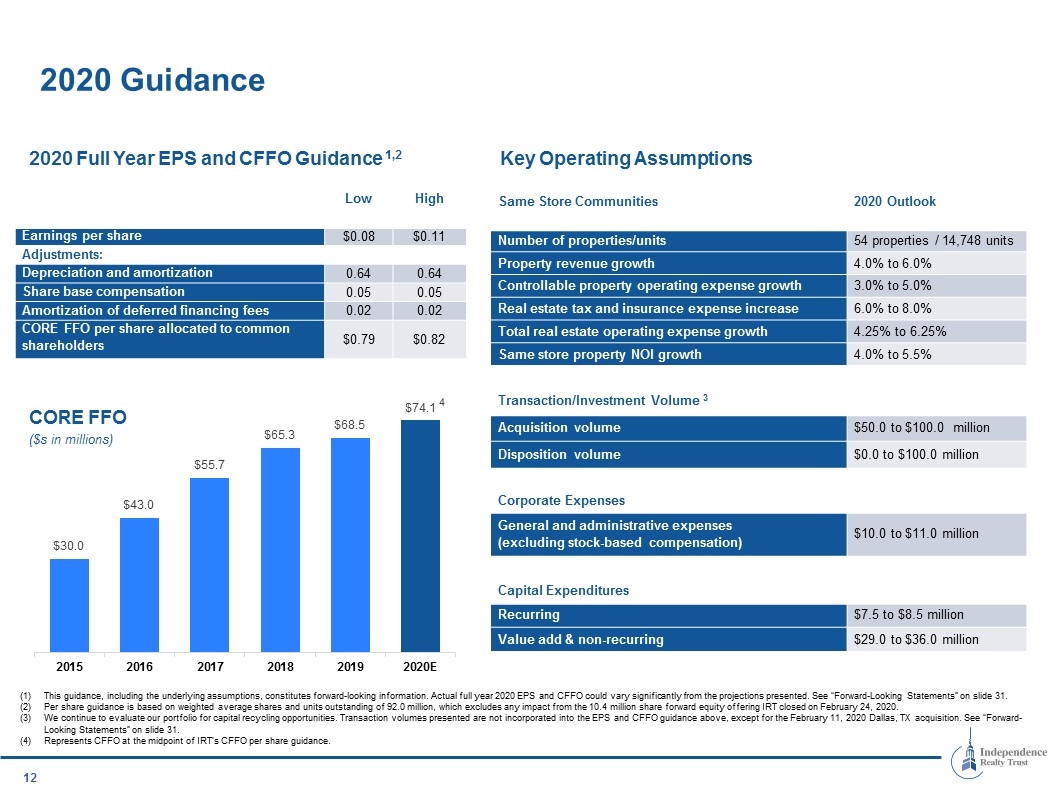

2020 Guidance This guidance, including the underlying assumptions, constitutes forward-looking information. Actual full year 2020 EPS and CFFO could vary significantly from the projections presented. See “Forward-Looking Statements” on slide 31. Per share guidance is based on weighted average shares and units outstanding of 92.0 million, which excludes any impact from the 10.4 million share forward equity offering IRT closed on February 24, 2020. We continue to evaluate our portfolio for capital recycling opportunities. Transaction volumes presented are not incorporated into the EPS and CFFO guidance above, except for the February 11, 2020 Dallas, TX acquisition. See “Forward-Looking Statements” on slide 31. Represents CFFO at the midpoint of IRT’s CFFO per share guidance. Key Operating Assumptions 2020 Full Year EPS and CFFO Guidance 1,2 CORE FFO ($s in millions) Same Store Communities 2020 Outlook Number of properties/units 54 properties / 14,748 units Property revenue growth 4.0% to 6.0% Controllable property operating expense growth 3.0% to 5.0% Real estate tax and insurance expense increase 6.0% to 8.0% Total real estate operating expense growth 4.25% to 6.25% Same store property NOI growth 4.0% to 5.5% Corporate Expenses General and administrative expenses (excluding stock-based compensation) $10.0 to $11.0 million Transaction/Investment Volume 3 Acquisition volume $50.0 to $100.0 million Disposition volume $0.0 to $100.0 million Capital Expenditures Recurring $7.5 to $8.5 million Value add & non-recurring $29.0 to $36.0 million Low High Earnings per share $0.08 $0.11 Adjustments: Depreciation and amortization 0.64 0.64 Share base compensation 0.05 0.05 Amortization of deferred financing fees 0.02 0.02 CORE FFO per share allocated to common shareholders $0.79 $0.82 4

Sustainability Commitment We believe that operating multi-family real estate can be conducted with a conscious regard for the environment and wider society. Find out more on the Sustainability page of IRT’s Investor Relations website at http://investors.irtliving.com.

Path to Continued Growth Operational efficiencies and enhanced resident experience through: Smart home technology pilot High-speed internet rollout Innovative technology strategy Value add community redevelopment initiatives: Approximately 7,136 units identified for redevelopment across 23 properties creating outsized NOI growth In total, expect 15-20% return on investment, unlocking an additional total annual NOI of $12.5 to $13.5 million1,2,3 This additional NOI is expected to be fully realized within 12 months of the completion of all projects. These projections constitute forward-looking information. See “Forward-Looking Statements” on slide 31. Approximately $5.5 million of this additional annual NOI is currently in place as a result of units already completed. See slide 7. Clear investment strategy focused on middle-market communities across non-gateway MSAs. Targeted submarkets within non-gateway markets exhibiting: Strong apartment demand Limited new construction Strong economic indicators Creating value by identifying the right assets in the right markets Technology Value-add Program Non-Gateway Markets

Appendix & Definitions

IRT’s Historical Growth and Key Milestones Portfolio Transformation Driving Gross Asset Growth August 2013 IPO -- $34 million One off acquisitions totaling $300m TradeStreet Merger -- $750 million Internalize & raise $250 million in equity to de-lever Announce $228 million portfolio acquisition Launch Phase 1 and 2 of Value Add Renovation Program Launch Phase 3 of Value Add Renovation Program

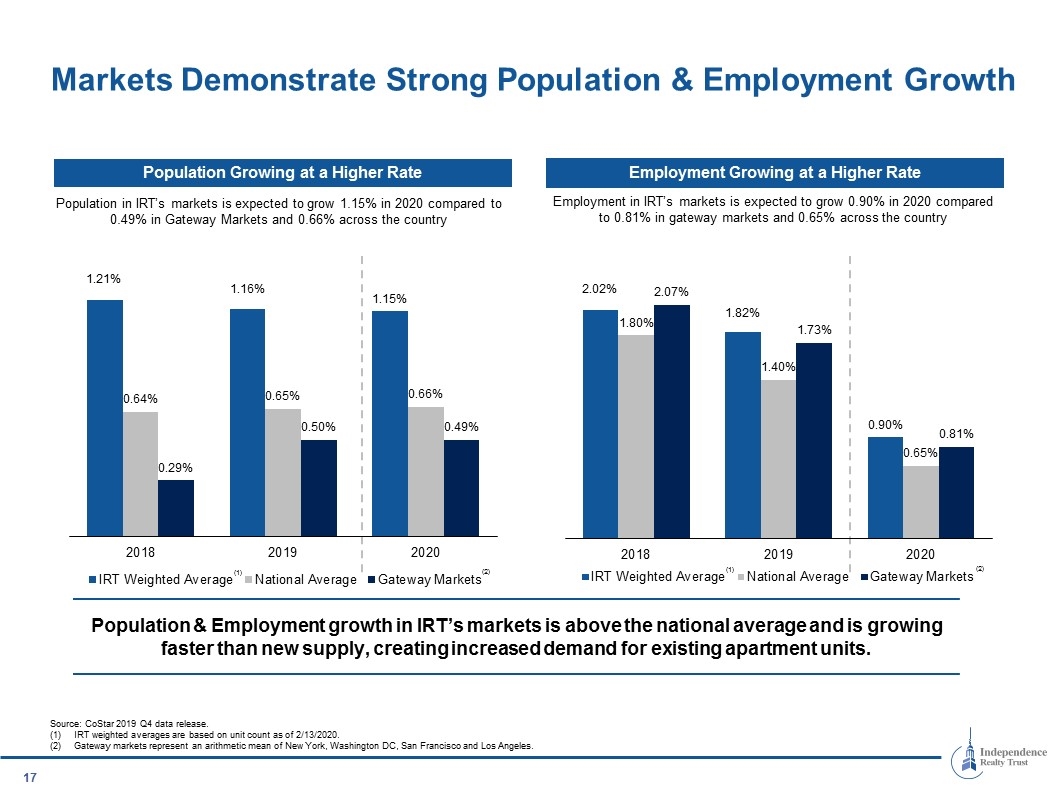

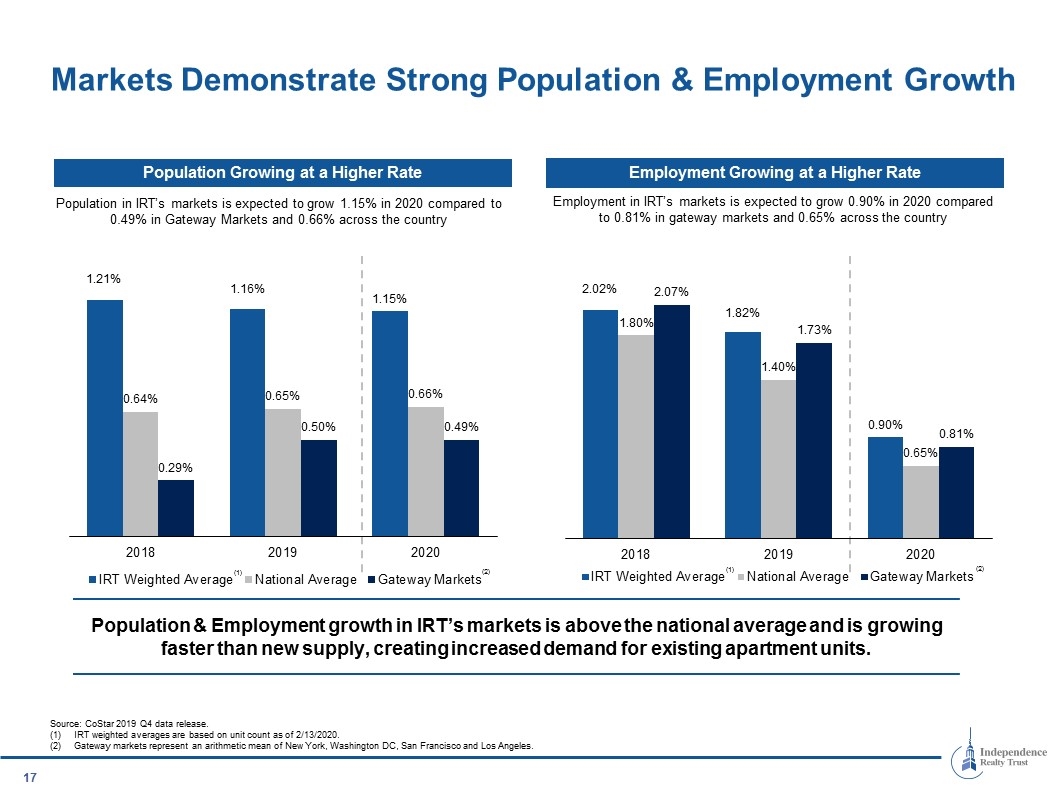

Source: CoStar 2019 Q4 data release. IRT weighted averages are based on unit count as of 2/13/2020. Gateway markets represent an arithmetic mean of New York, Washington DC, San Francisco and Los Angeles. Markets Demonstrate Strong Population & Employment Growth 0 34 84 18 86 154 108 134 195 82 89 95 191 191 191 241 229 24 33 75 35 255 175 25 Population & Employment growth in IRT’s markets is above the national average and is growing faster than new supply, creating increased demand for existing apartment units. Population Growing at a Higher Rate Population in IRT’s markets is expected to grow 1.15% in 2020 compared to 0.49% in Gateway Markets and 0.66% across the country (1) (2) Employment Growing at a Higher Rate Employment in IRT’s markets is expected to grow 0.90% in 2020 compared to 0.81% in gateway markets and 0.65% across the country (1) (2)

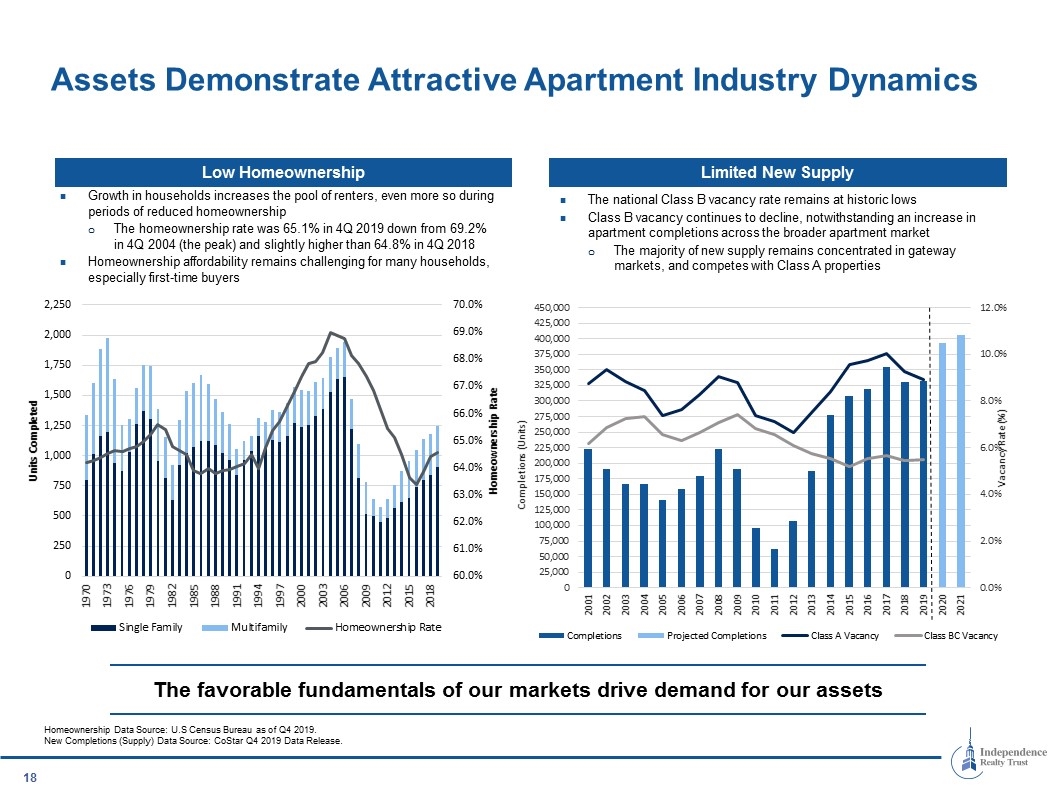

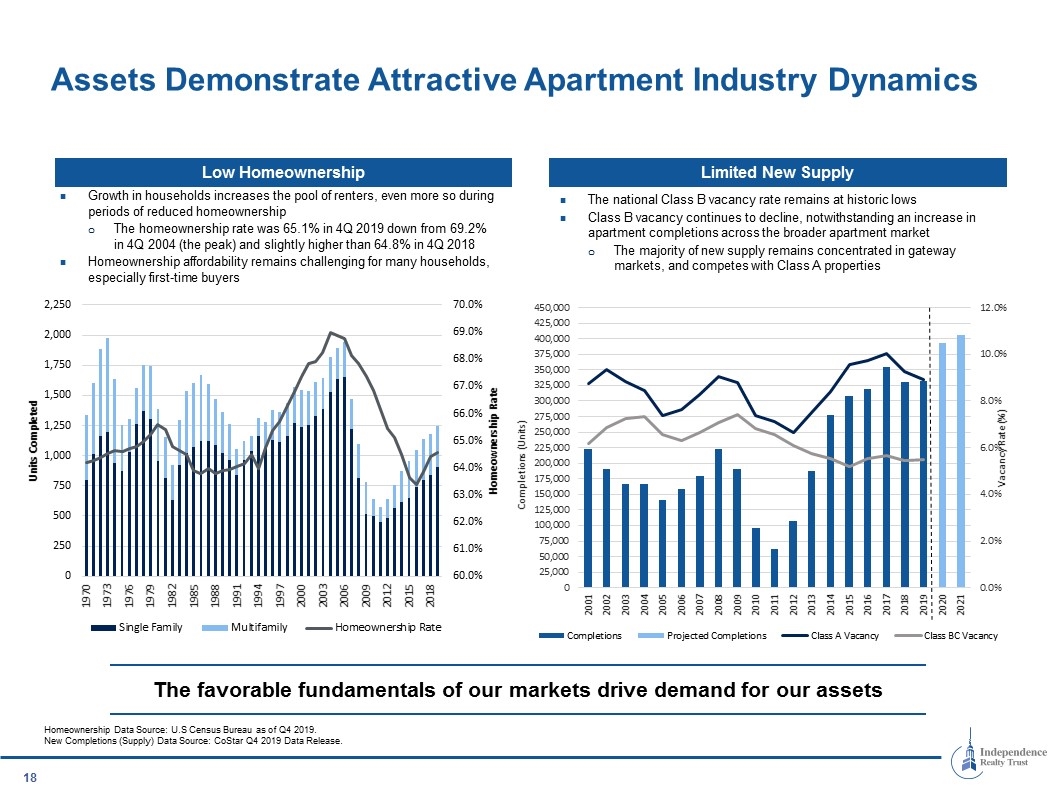

Assets Demonstrate Attractive Apartment Industry Dynamics Low Homeownership Limited New Supply The national Class B vacancy rate remains at historic lows Class B vacancy continues to decline, notwithstanding an increase in apartment completions across the broader apartment market The majority of new supply remains concentrated in gateway markets, and competes with Class A properties Homeownership Data Source: U.S Census Bureau as of Q4 2019. New Completions (Supply) Data Source: CoStar Q4 2019 Data Release. The favorable fundamentals of our markets drive demand for our assets Growth in households increases the pool of renters, even more so during periods of reduced homeownership The homeownership rate was 65.1% in 4Q 2019 down from 69.2% in 4Q 2004 (the peak) and slightly higher than 64.8% in 4Q 2018 Homeownership affordability remains challenging for many households, especially first-time buyers

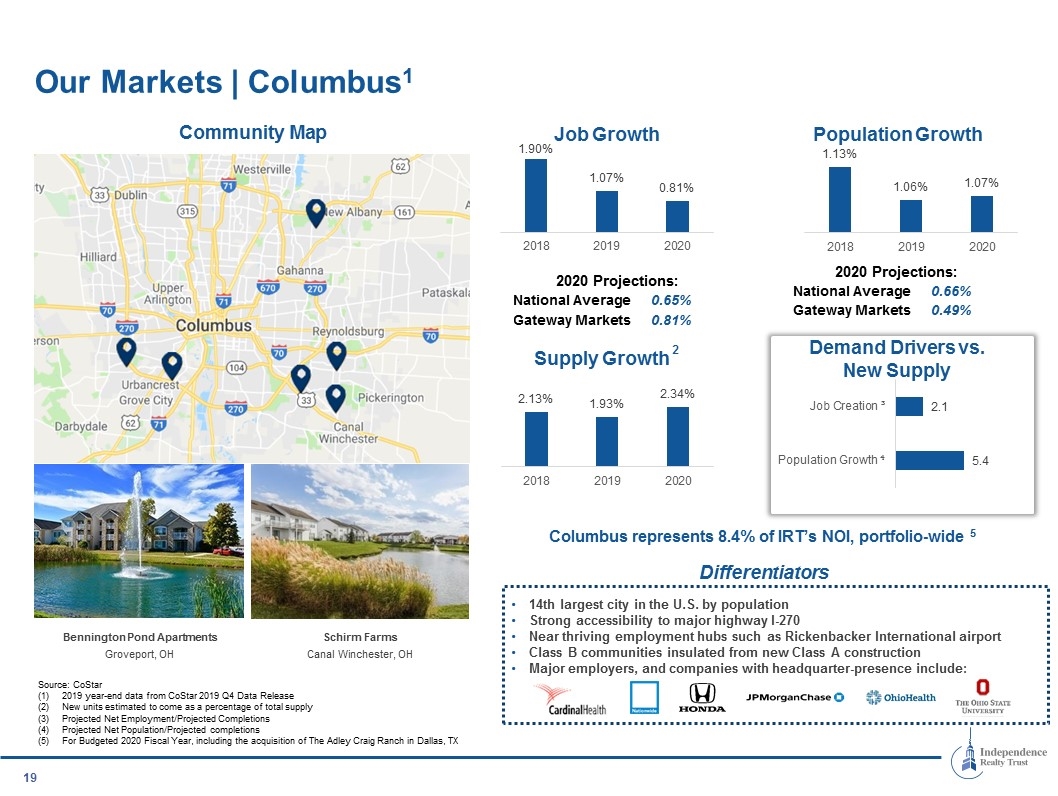

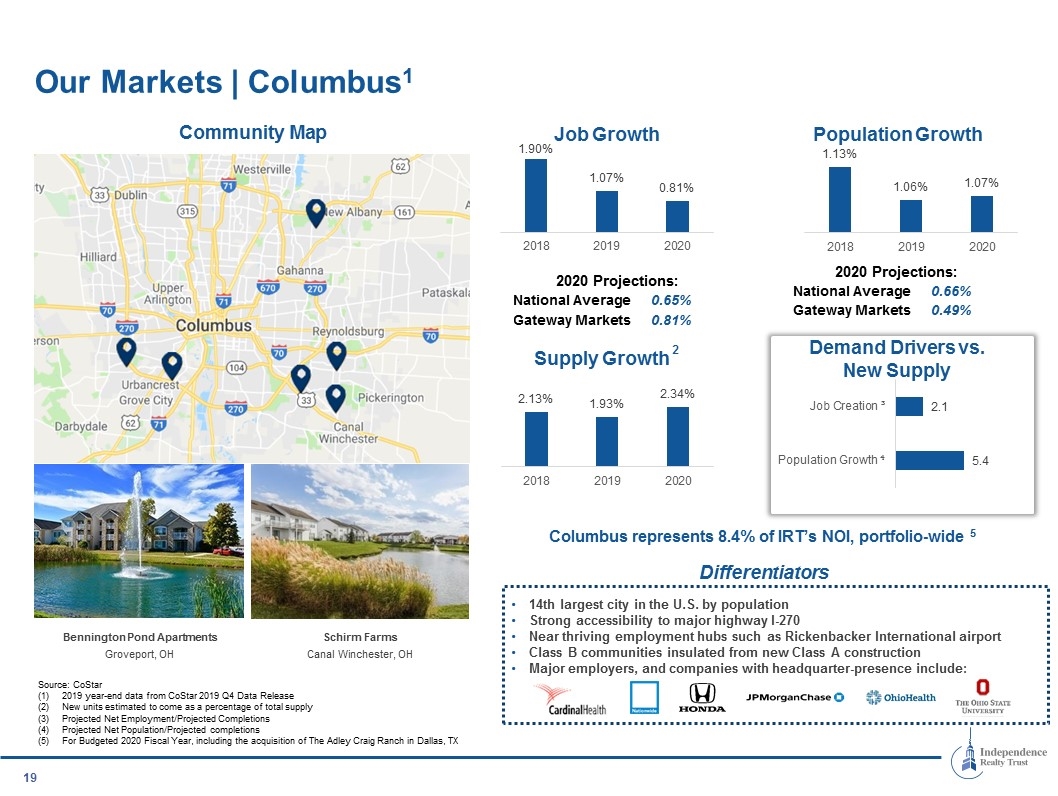

14th largest city in the U.S. by population Strong accessibility to major highway I-270 Near thriving employment hubs such as Rickenbacker International airport Class B communities insulated from new Class A construction Major employers, and companies with headquarter-presence include: Our Markets | Columbus1 Source: CoStar 2019 year-end data from CoStar 2019 Q4 Data Release New units estimated to come as a percentage of total supply Projected Net Employment/Projected Completions Projected Net Population/Projected completions For Budgeted 2020 Fiscal Year, including the acquisition of The Adley Craig Ranch in Dallas, TX Columbus represents 8.4% of IRT’s NOI, portfolio-wide 5 Bennington Pond Apartments Groveport, OH Schirm Farms Canal Winchester, OH

Communities located within 5 min. of major highways Communities located in top school districts Benefitting from suburban sprawl, well-positioned in MSA with growing ancillary job markets Major company presence in Atlanta include: Our Markets | Atlanta 1 Source: CoStar 2019 year-end data from CoStar 2019 Q4 Data Release New units estimated to come as a percentage of total supply Projected Net Employment/Projected Completions Projected Net Population/Projected completions For Budgeted 2020 Fiscal Year, including the acquisition of The Adley Craig Ranch in Dallas, TX Atlanta represents 14.3% of IRT’s NOI, portfolio-wide 5 Pointe at Canyon Ridge Sandy Springs, GA Crestmont Marietta, GA

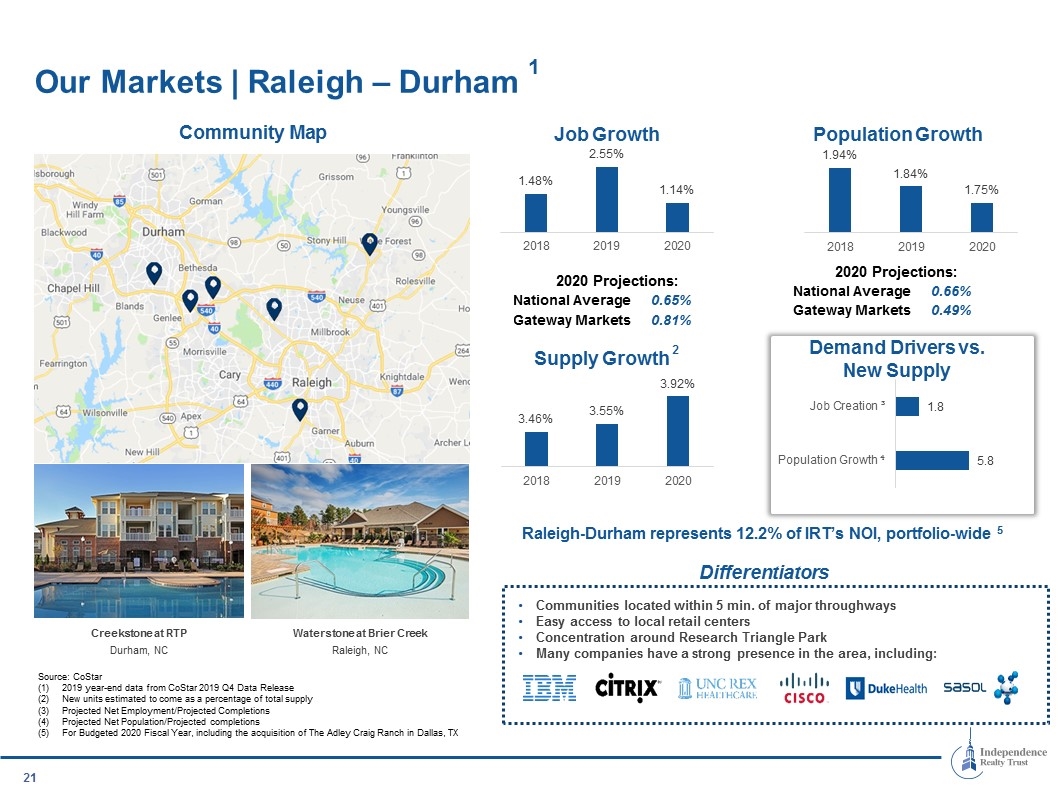

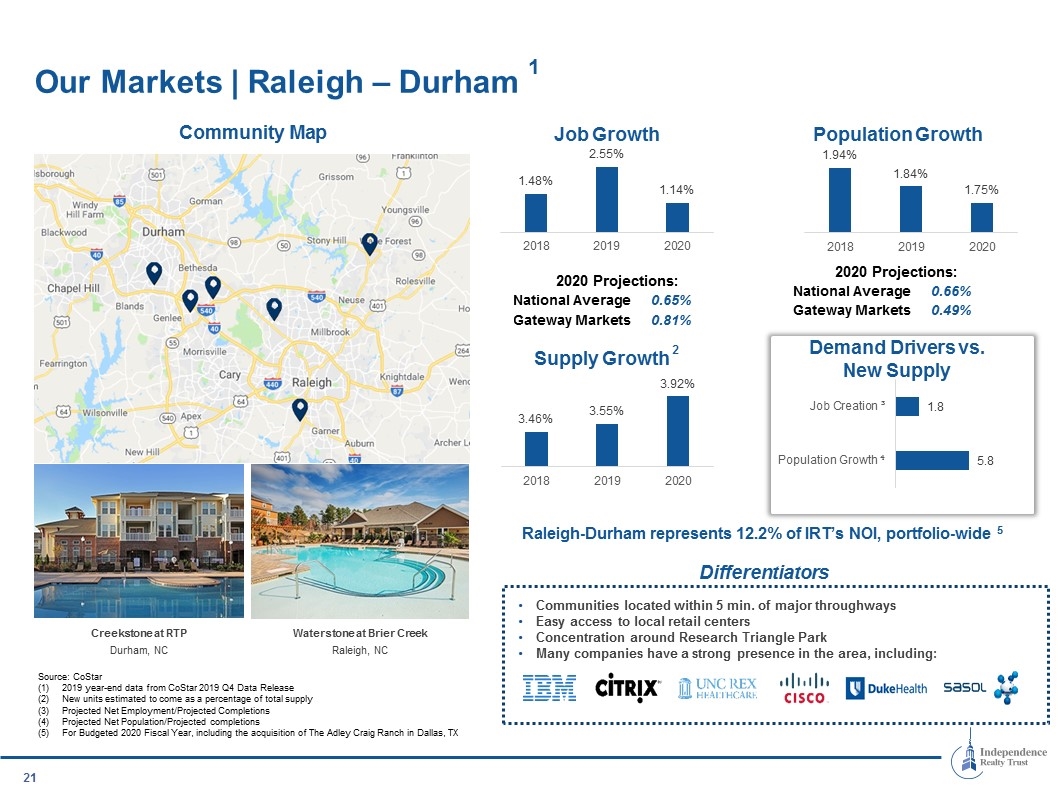

Communities located within 5 min. of major throughways Easy access to local retail centers Concentration around Research Triangle Park Many companies have a strong presence in the area, including: Our Markets | Raleigh – Durham 1 Source: CoStar 2019 year-end data from CoStar 2019 Q4 Data Release New units estimated to come as a percentage of total supply Projected Net Employment/Projected Completions Projected Net Population/Projected completions For Budgeted 2020 Fiscal Year, including the acquisition of The Adley Craig Ranch in Dallas, TX Raleigh-Durham represents 12.2% of IRT’s NOI, portfolio-wide 5 Creekstone at RTP Durham, NC Waterstone at Brier Creek Raleigh, NC

Located within 5 min. of major highways Benefitting from the proximity to growing industrial footprint Each community is in a top school district in the market Burgeoning tourism hub Major employers include: Our Markets | Louisville 1 Source: CoStar 2019 year-end data from CoStar 2019 Q4 Data Release New units estimated to come as a percentage of total supply Projected Net Employment/Projected Completions Projected Net Population/Projected completions For Budgeted 2020 Fiscal Year, including the acquisition of The Adley Craig Ranch in Dallas, TX Louisville represents 9.2% of IRT’s NOI, portfolio-wide 5 Prospect Park Apartment Homes Louisville, KY Meadows Apartment Homes Louisville, KY

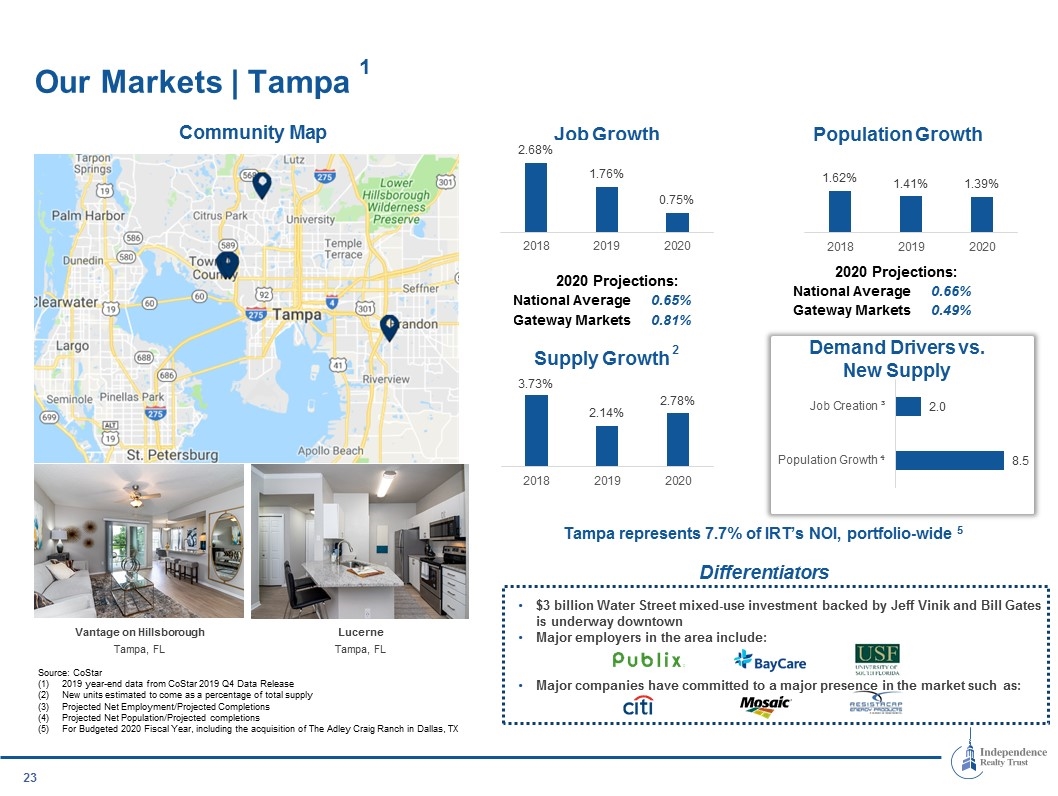

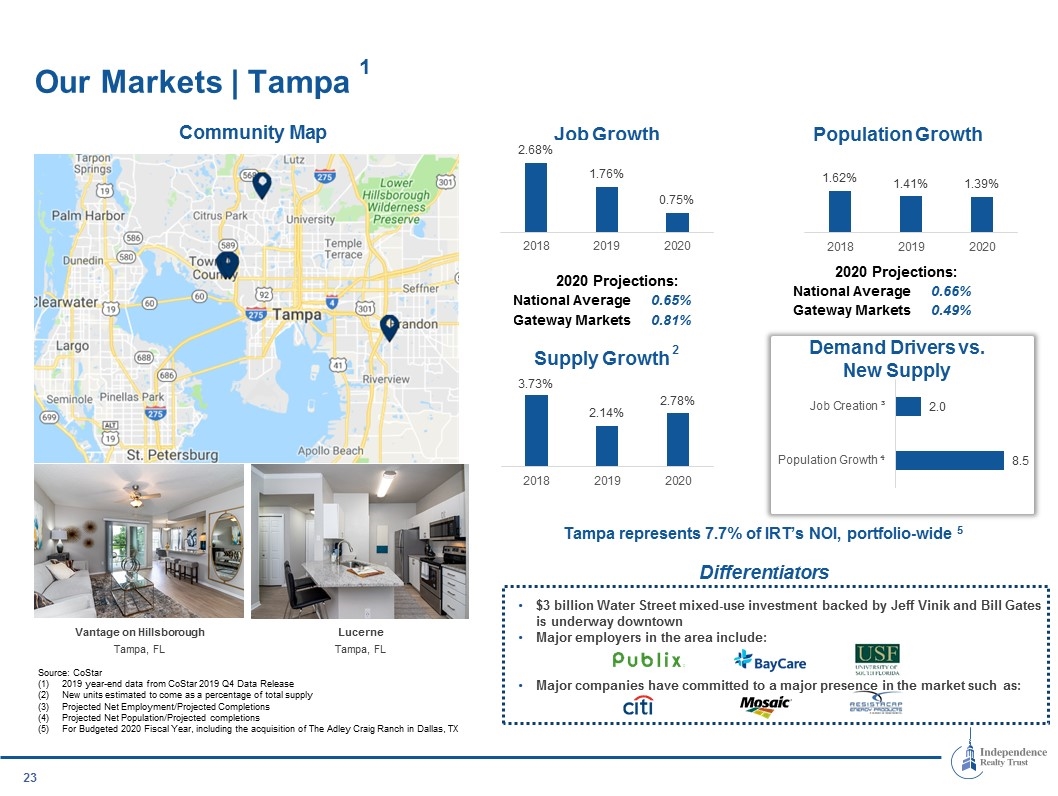

$3 billion Water Street mixed-use investment backed by Jeff Vinik and Bill Gates is underway downtown Major employers in the area include: Major companies have committed to a major presence in the market such as: Our Markets | Tampa 1 Source: CoStar 2019 year-end data from CoStar 2019 Q4 Data Release New units estimated to come as a percentage of total supply Projected Net Employment/Projected Completions Projected Net Population/Projected completions For Budgeted 2020 Fiscal Year, including the acquisition of The Adley Craig Ranch in Dallas, TX Tampa represents 7.7% of IRT’s NOI, portfolio-wide 5 Lucerne Tampa, FL Vantage on Hillsborough Tampa, FL

15th largest city in the U.S. by population Located within 5 min. of major highways Communities located in top school districts Experienced outsized job growth in health care and retail trade industries Major employers include: Our Markets | Indianapolis 1 Source: CoStar 2019 year-end data from CoStar 2019 Q4 Data Release New units estimated to come as a percentage of total supply Projected Net Employment/Projected Completions Projected Net Population/Projected completions For Budgeted 2020 Fiscal Year, including the acquisition of The Adley Craig Ranch in Dallas, TX Indianapolis represents 5.2% of IRT’s NOI, portfolio-wide 5 Bayview Club Apartments Indianapolis, IN Riverchase Apartments Indianapolis, IN

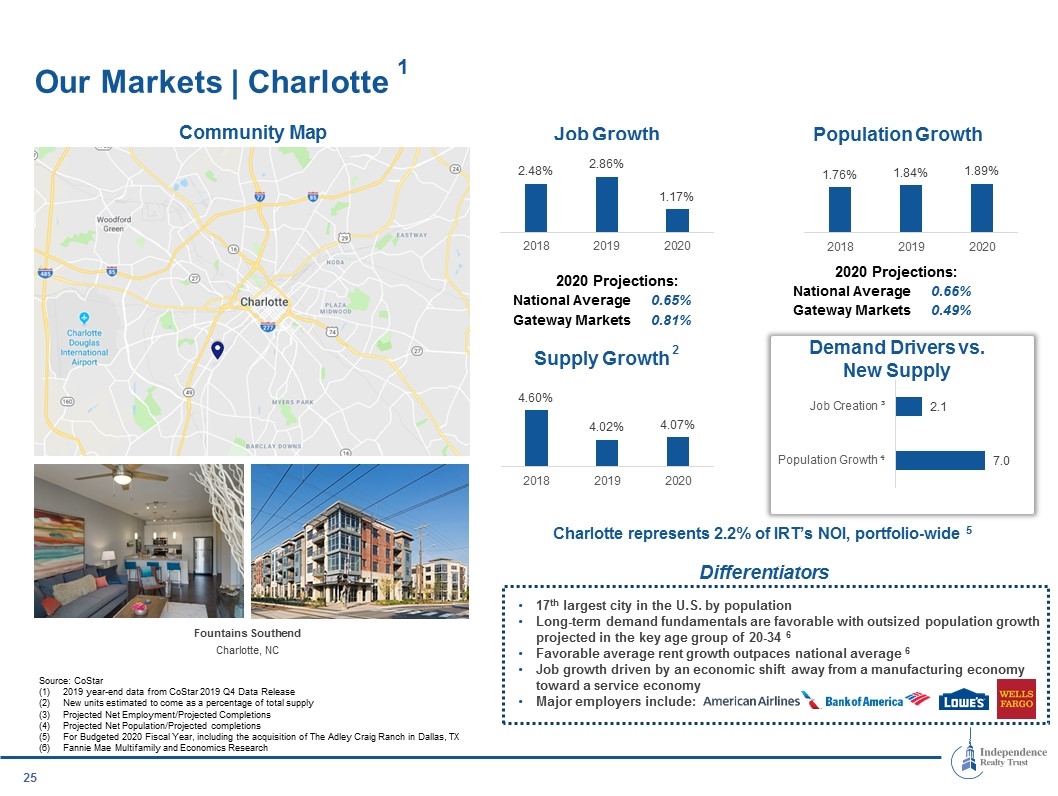

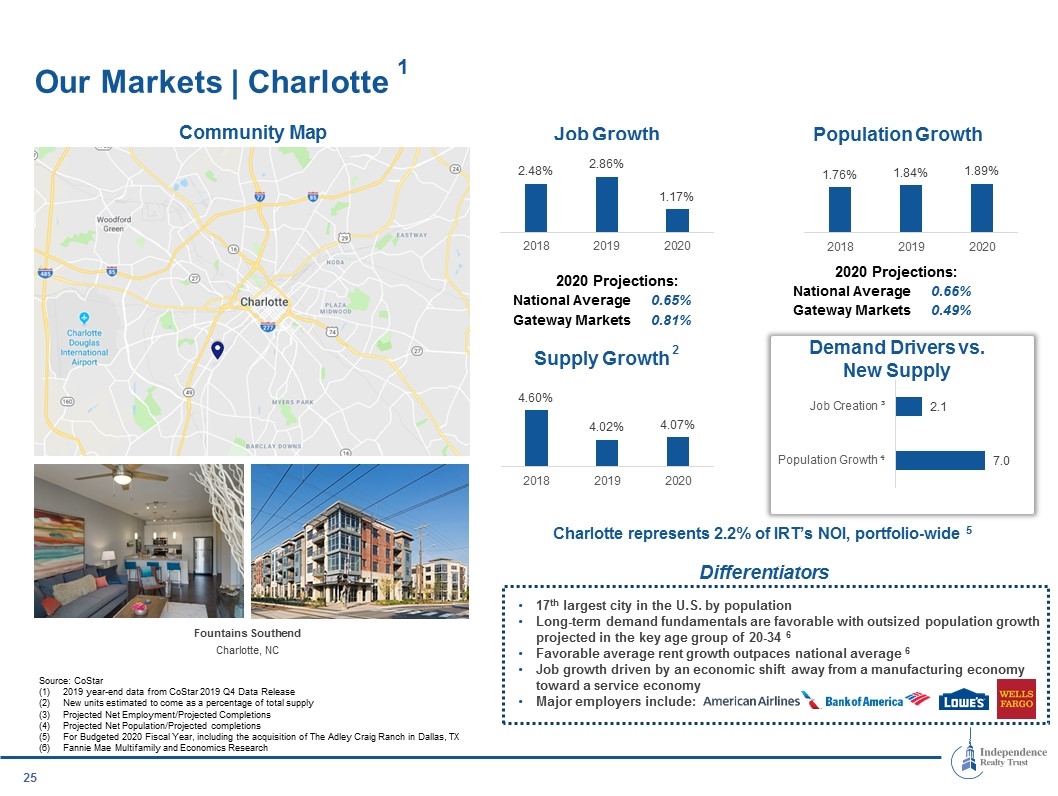

17th largest city in the U.S. by population Long-term demand fundamentals are favorable with outsized population growth projected in the key age group of 20-34 6 Favorable average rent growth outpaces national average 6 Job growth driven by an economic shift away from a manufacturing economy toward a service economy Major employers include: Our Markets | Charlotte 1 Source: CoStar 2019 year-end data from CoStar 2019 Q4 Data Release New units estimated to come as a percentage of total supply Projected Net Employment/Projected Completions Projected Net Population/Projected completions For Budgeted 2020 Fiscal Year, including the acquisition of The Adley Craig Ranch in Dallas, TX Fannie Mae Multifamily and Economics Research Charlotte represents 2.2% of IRT’s NOI, portfolio-wide 5 Fountains Southend Charlotte, NC

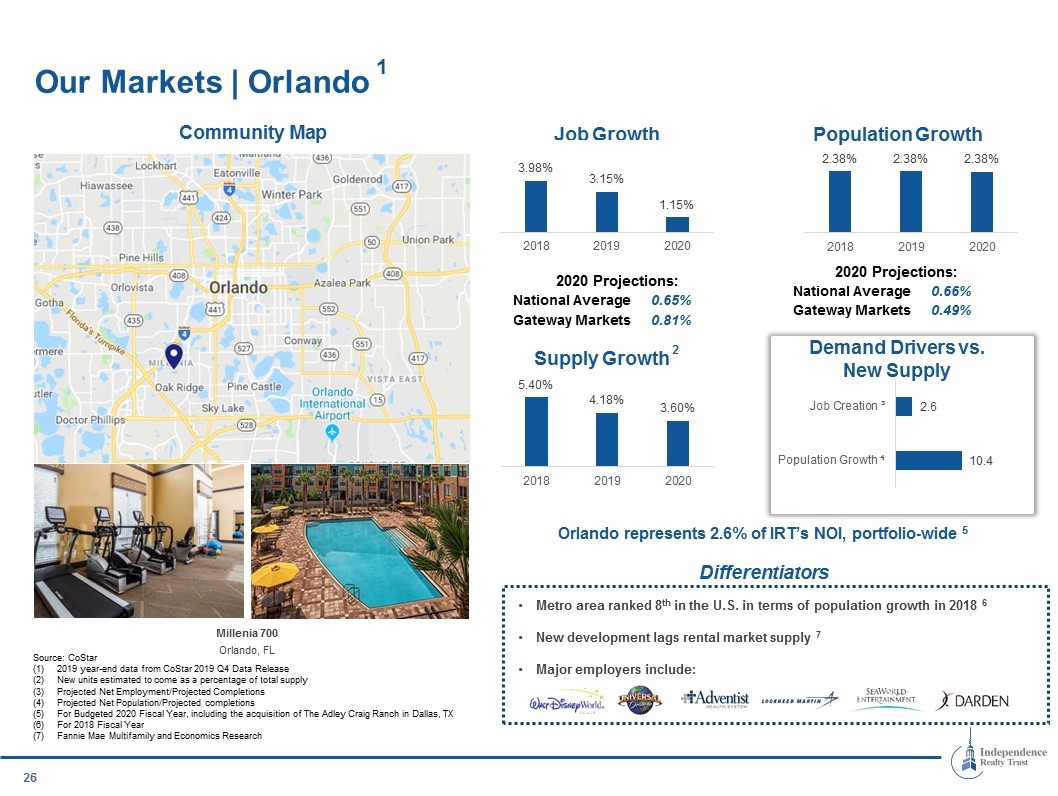

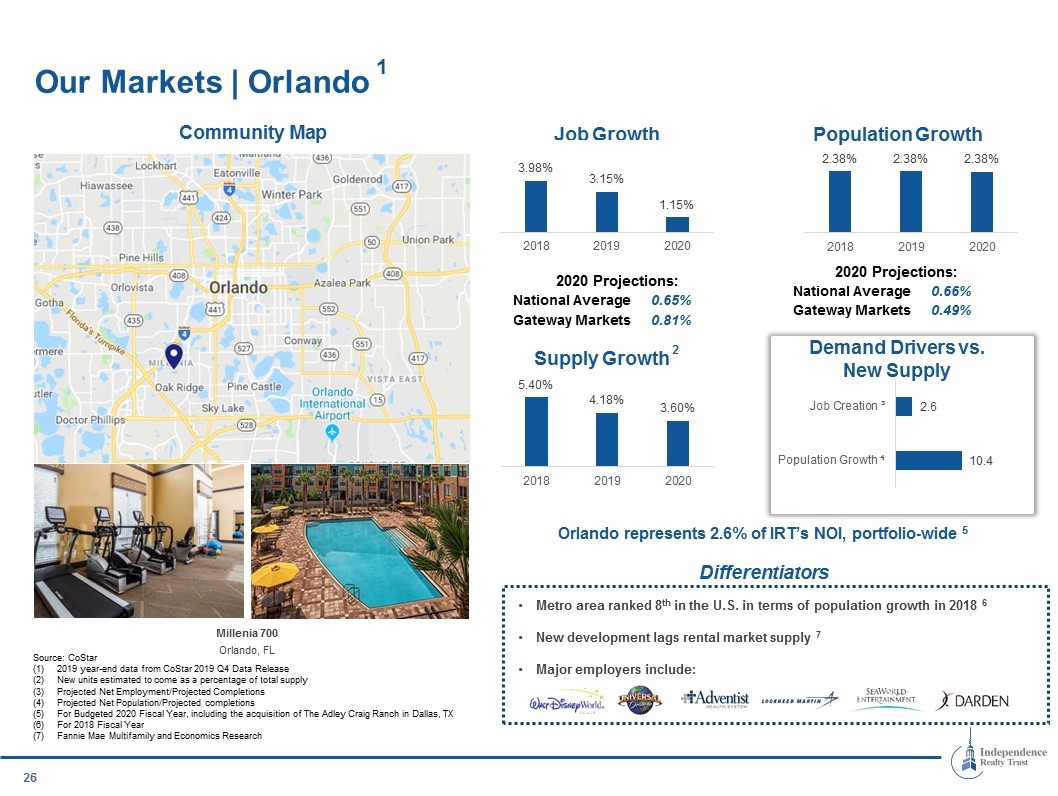

Metro area ranked 8th in the U.S. in terms of population growth in 2018 6 New development lags rental market supply 7 Major employers include: Our Markets | Orlando 1 Source: CoStar 2019 year-end data from CoStar 2019 Q4 Data Release New units estimated to come as a percentage of total supply Projected Net Employment/Projected Completions Projected Net Population/Projected completions For Budgeted 2020 Fiscal Year, including the acquisition of The Adley Craig Ranch in Dallas, TX For 2018 Fiscal Year Fannie Mae Multifamily and Economics Research Orlando represents 2.6% of IRT’s NOI, portfolio-wide 5 Millenia 700 Orlando, FL

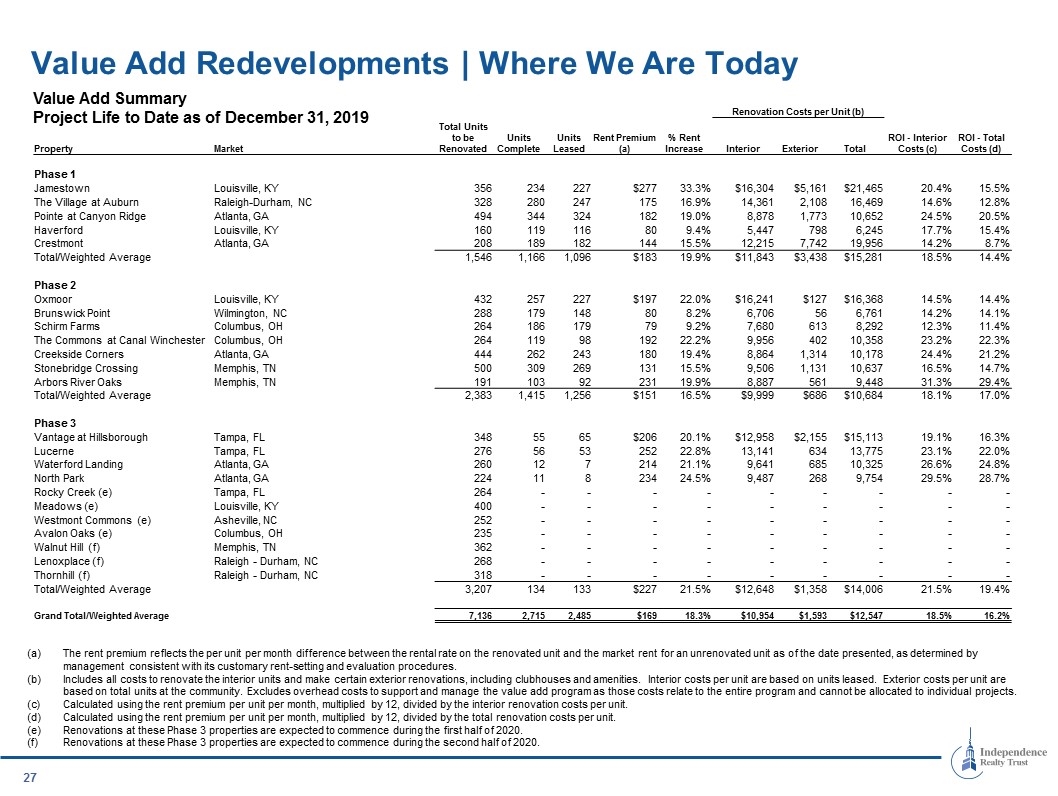

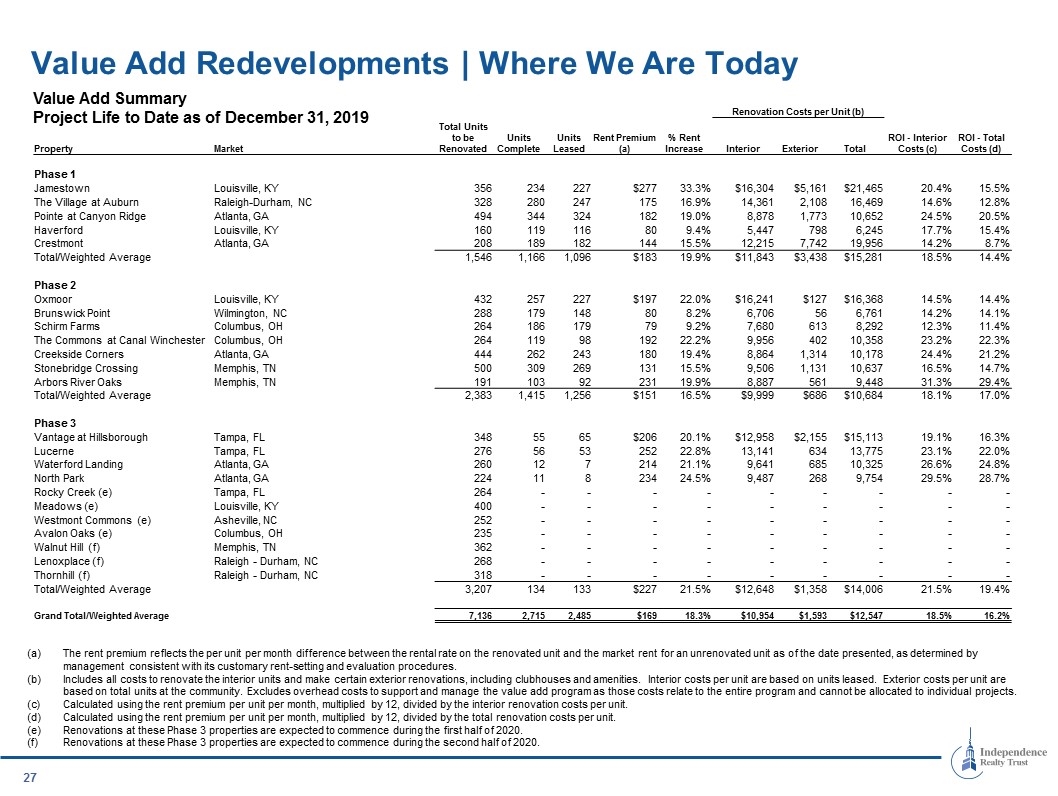

Renovation Costs per Unit (b) Property Market Total Units to be Renovated Units Complete Units Leased Rent Premium (a) % Rent Increase Interior Exterior Total ROI - Interior Costs (c) ROI - Total Costs (d) Phase 1 Jamestown Louisville, KY 356 234 227 $277 33.3% $16,304 $5,161 $21,465 20.4% 15.5% The Village at Auburn Raleigh-Durham, NC 328 280 247 175 16.9% 14,361 2,108 16,469 14.6% 12.8% Pointe at Canyon Ridge Atlanta, GA 494 344 324 182 19.0% 8,878 1,773 10,652 24.5% 20.5% Haverford Louisville, KY 160 119 116 80 9.4% 5,447 798 6,245 17.7% 15.4% Crestmont Atlanta, GA 208 189 182 144 15.5% 12,215 7,742 19,956 14.2% 8.7% Total/Weighted Average 1,546 1,166 1,096 $183 19.9% $11,843 $3,438 $15,281 18.5% 14.4% Phase 2 Oxmoor Louisville, KY 432 257 227 $197 22.0% $16,241 $127 $16,368 14.5% 14.4% Brunswick Point Wilmington, NC 288 179 148 80 8.2% 6,706 56 6,761 14.2% 14.1% Schirm Farms Columbus, OH 264 186 179 79 9.2% 7,680 613 8,292 12.3% 11.4% The Commons at Canal Winchester Columbus, OH 264 119 98 192 22.2% 9,956 402 10,358 23.2% 22.3% Creekside Corners Atlanta, GA 444 262 243 180 19.4% 8,864 1,314 10,178 24.4% 21.2% Stonebridge Crossing Memphis, TN 500 309 269 131 15.5% 9,506 1,131 10,637 16.5% 14.7% Arbors River Oaks Memphis, TN 191 103 92 231 19.9% 8,887 561 9,448 31.3% 29.4% Total/Weighted Average 2,383 1,415 1,256 $151 16.5% $9,999 $686 $10,684 18.1% 17.0% Phase 3 Vantage at Hillsborough Tampa, FL 348 55 65 $206 20.1% $12,958 $2,155 $15,113 19.1% 16.3% Lucerne Tampa, FL 276 56 53 252 22.8% 13,141 634 13,775 23.1% 22.0% Waterford Landing Atlanta, GA 260 12 7 214 21.1% 9,641 685 10,325 26.6% 24.8% North Park Atlanta, GA 224 11 8 234 24.5% 9,487 268 9,754 29.5% 28.7% Rocky Creek (e) Tampa, FL 264 - - - - - - - - - Meadows (e) Louisville, KY 400 - - - - - - - - - Westmont Commons (e) Asheville, NC 252 - - - - - - - - - Avalon Oaks (e) Columbus, OH 235 - - - - - - - - - Walnut Hill (f) Memphis, TN 362 - - - - - - - - - Lenoxplace (f) Raleigh - Durham, NC 268 - - - - - - - - - Thornhill (f) Raleigh - Durham, NC 318 - - - - - - - - - Total/Weighted Average 3,207 134 133 $227 21.5% $12,648 $1,358 $14,006 21.5% 19.4% Grand Total/Weighted Average 7,136 2,715 2,485 $169 18.3% $10,954 $1,593 $12,547 18.5% 16.2% Value Add Summary Project Life to Date as of December 31, 2019 Value Add Redevelopments | Where We Are Today The rent premium reflects the per unit per month difference between the rental rate on the renovated unit and the market rent for an unrenovated unit as of the date presented, as determined by management consistent with its customary rent-setting and evaluation procedures. Includes all costs to renovate the interior units and make certain exterior renovations, including clubhouses and amenities. Interior costs per unit are based on units leased. Exterior costs per unit are based on total units at the community. Excludes overhead costs to support and manage the value add program as those costs relate to the entire program and cannot be allocated to individual projects. Calculated using the rent premium per unit per month, multiplied by 12, divided by the interior renovation costs per unit. Calculated using the rent premium per unit per month, multiplied by 12, divided by the total renovation costs per unit. Renovations at these Phase 3 properties are expected to commence during the first half of 2020. Renovations at these Phase 3 properties are expected to commence during the second half of 2020.

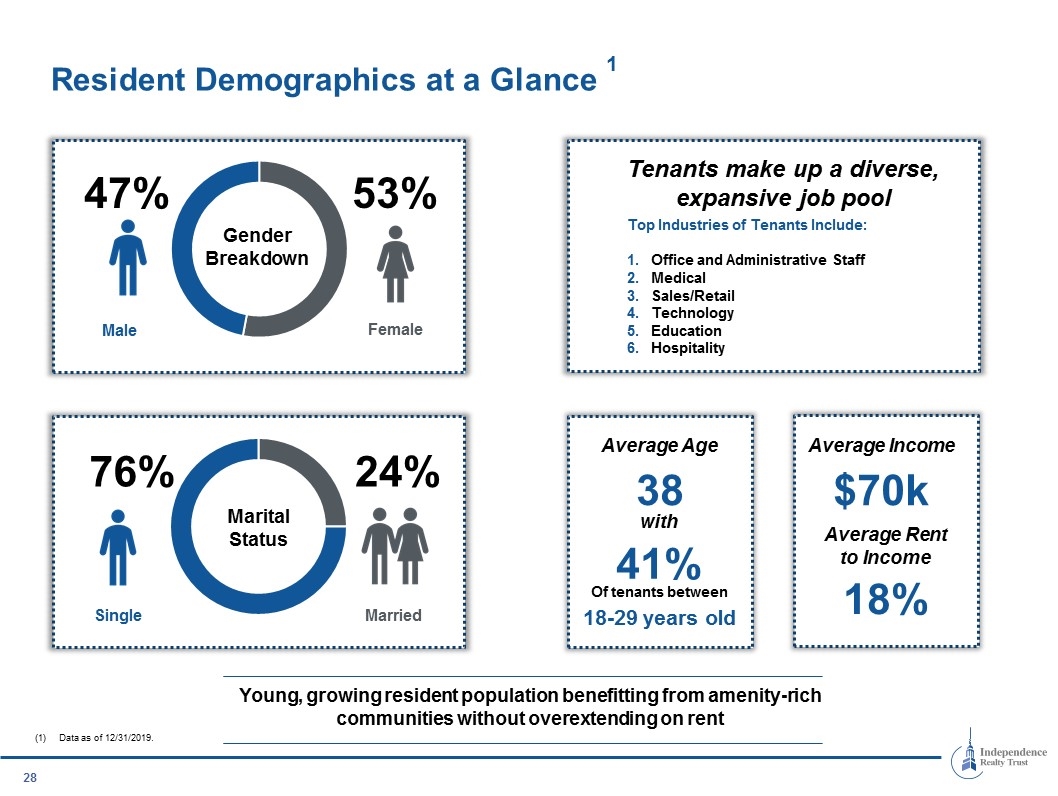

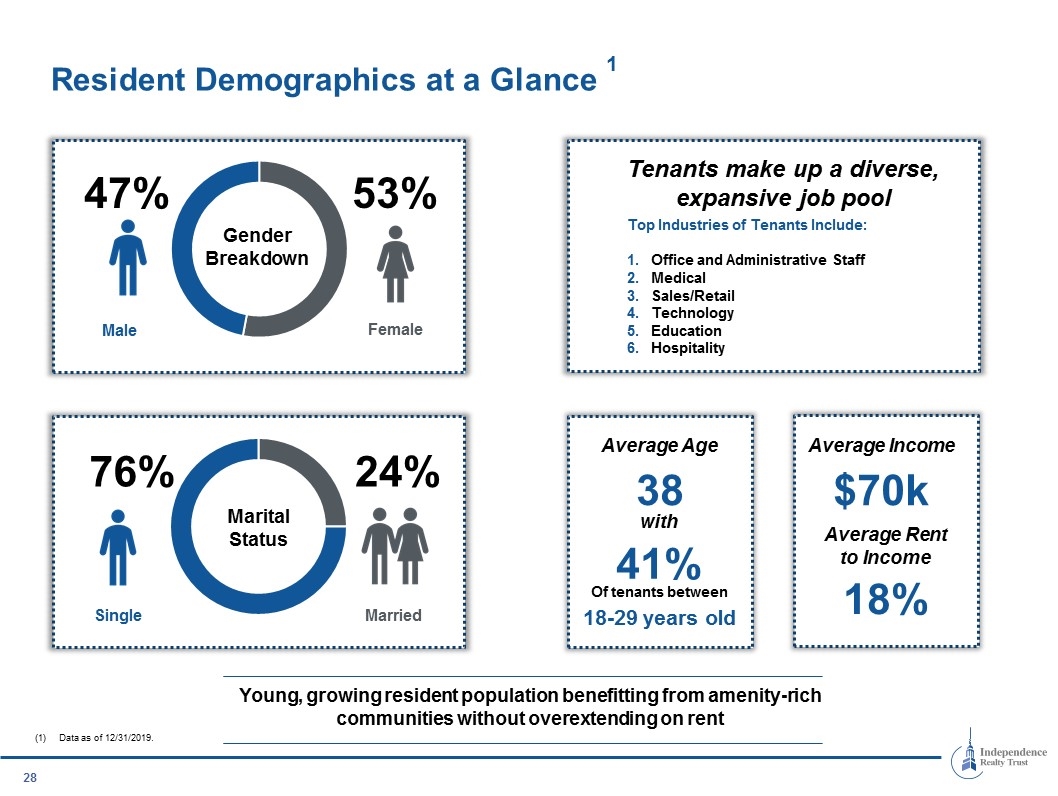

Resident Demographics at a Glance 1 Data as of 12/31/2019. 47% 53% Gender Breakdown 76% 24% Marital Status 38 Average Income Of tenants between 41% $70k Average Rent to Income 18-29 years old Average Age with Young, growing resident population benefitting from amenity-rich communities without overextending on rent 18% Tenants make up a diverse, expansive job pool Top Industries of Tenants Include: Office and Administrative Staff Medical Sales/Retail Technology Education Hospitality Male Female Single Married

Definitions and Non-GAAP Financial Measure Reconciliations This presentation may contain non-U.S. generally accepted accounting principals (“GAAP”) financial measures. A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures is included in this document and/or IRT’s reports filed or furnished with the SEC available at IRT’s website www.IRTLIVING.com under Investor Relations. IRT’s other SEC filings are also available through this website. Average Effective Monthly Rent per Unit Average effective rent per unit represents the average of gross rent amounts, divided by the average occupancy (in units) for the period presented. IRT believes average effective rent is a helpful measurement in evaluating average pricing. This metric, when presented, reflects the average effective rent per month. Average Occupancy Average occupancy represents the average occupied units for the reporting period divided by the average of total units available for rent for the reporting period. EBITDA and Adjusted EBITDA EBITDA is defined as net income before interest expense including amortization of deferred financing costs, income tax expense, and depreciation and amortization expenses. Adjusted EBITDA is EBITDA before certain other non-cash or non-operating gains or losses related to items such as asset sales, debt extinguishments and acquisition related debt extinguishment expenses. EBITDA and Adjusted EBITDA are each non-GAAP measures. IRT considers each of EBITDA and Adjusted EBITDA to be an appropriate supplemental measure of performance because it eliminates interest, income taxes, depreciation and amortization, and other non-cash or non-operating gains and losses, which permits investors to view income from operations without these non-cash or non-operating items. IRT’s calculation of Adjusted EBITDA differs from the methodology used for calculating Adjusted EBITDA by certain other REITs and, accordingly, IRT’s Adjusted EBITDA may not be comparable to Adjusted EBITDA reported by other REITs. Funds From Operations (“FFO”) and Core Funds From Operations (“CFFO”) IRT believes that FFO and CFFO, each of which is a non-GAAP financial measure, are additional appropriate measures of the operating performance of a REIT and IRT in particular. IRT computes FFO in accordance with the standards established by the National Association of Real Estate Investment Trusts, or NAREIT, as net income or loss (computed in accordance with GAAP), excluding real estate-related depreciation and amortization expense, gains or losses on sales of real estate and the cumulative effect of changes in accounting principles. CFFO is a computation made by analysts and investors to measure a real estate company’s operating performance by removing the effect of items that do not reflect ongoing property operations, including stock compensation expense, depreciation and amortization of other items not included in FFO, amortization of deferred financing costs, and other non-cash or non-operating gains or losses related to items such as debt extinguishment costs from the determination of FFO. IRT’s calculation of CFFO differs from the methodology used for calculating CFFO by certain other REITs and, accordingly, IRT’s CFFO may not be comparable to CFFO reported by other REITs. IRT’s management utilizes FFO and CFFO as measures of IRT’s operating performance, and believes they are also useful to investors, because they facilitate an understanding of IRT’s operating performance after adjustment for certain non-cash or non-operating items that are required by GAAP to be expensed but may not necessarily be indicative of current operating performance and that may not accurately compare IRT’s operating performance between periods. Furthermore, although FFO, CFFO and other supplemental performance measures are defined in various ways throughout the REIT industry, IRT believes that FFO and CFFO provide investors with additional useful measures to compare IRT’s financial performance to certain other REITs. Neither FFO nor CFFO is equivalent to net income or cash generated from operating activities determined in accordance with GAAP. Furthermore, FFO and CFFO do not represent amounts available for management’s discretionary use because of needed capital replacement or expansion, debt service obligations or other commitments or uncertainties. Neither FFO nor CFFO should be considered as an alternative to net income as an indicator of IRT’s operating performance or as an alternative to cash flow from operating activities as a measure of IRT’s liquidity.

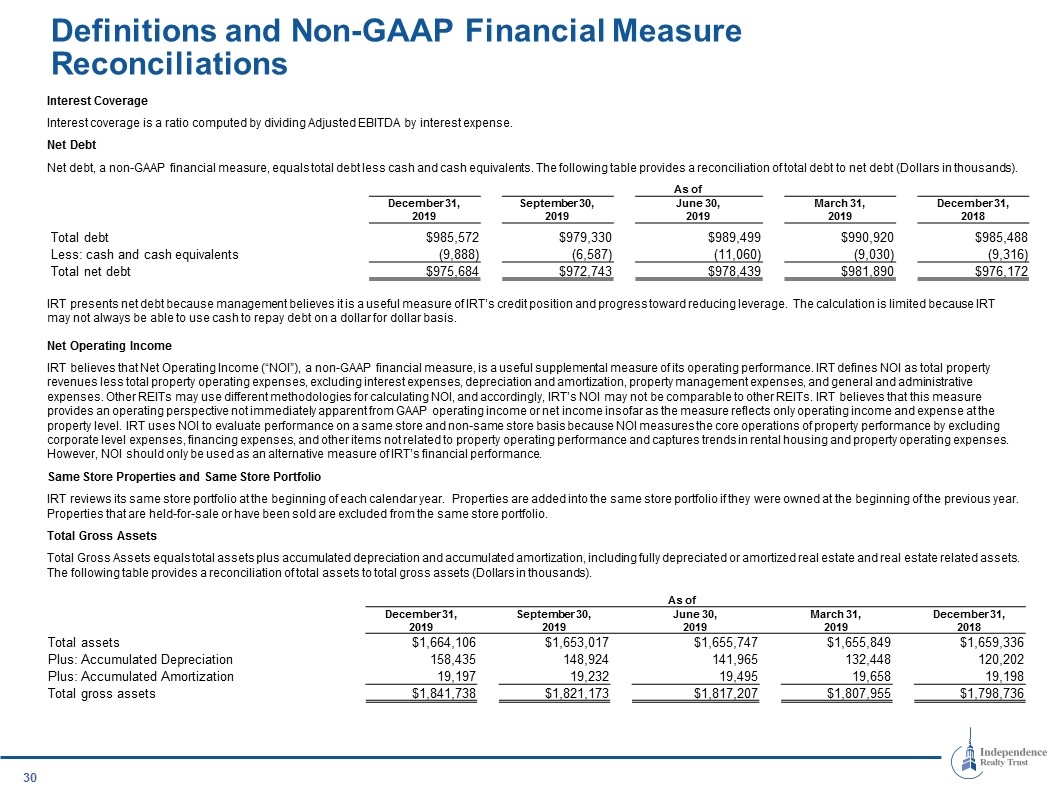

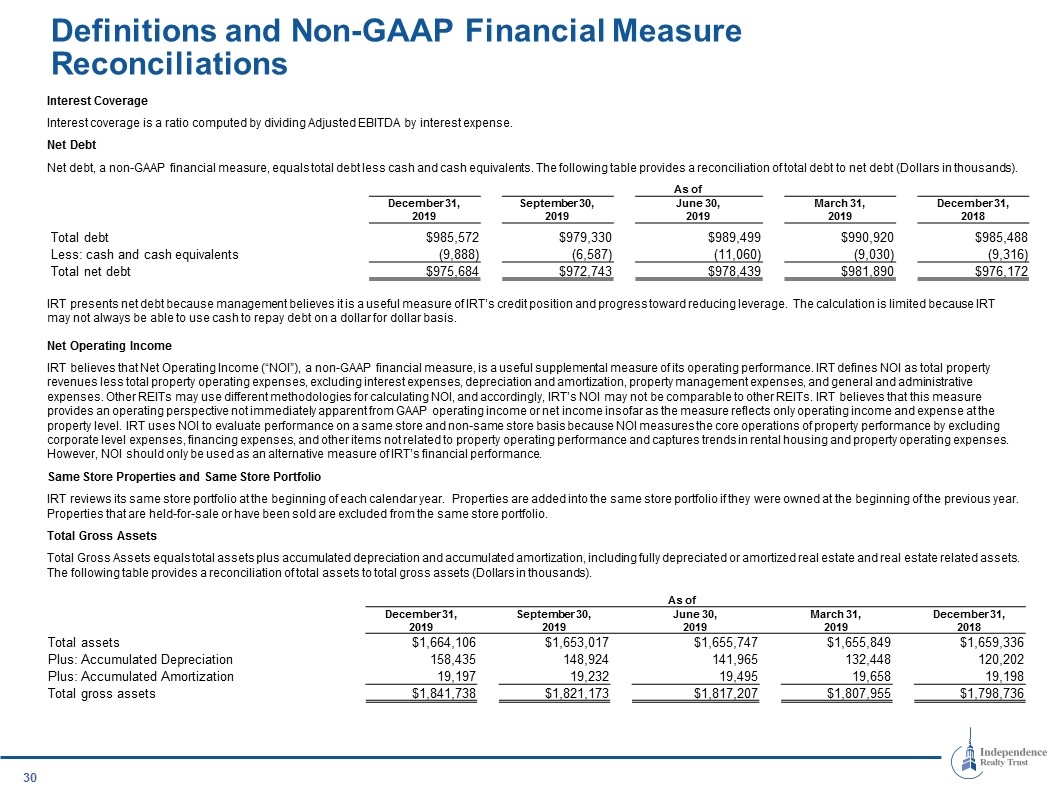

Interest Coverage Interest coverage is a ratio computed by dividing Adjusted EBITDA by interest expense. Net Debt Net debt, a non-GAAP financial measure, equals total debt less cash and cash equivalents. The following table provides a reconciliation of total debt to net debt (Dollars in thousands). IRT presents net debt because management believes it is a useful measure of IRT’s credit position and progress toward reducing leverage. The calculation is limited because IRT may not always be able to use cash to repay debt on a dollar for dollar basis. Definitions and Non-GAAP Financial Measure Reconciliations Net Operating Income IRT believes that Net Operating Income (“NOI”), a non-GAAP financial measure, is a useful supplemental measure of its operating performance. IRT defines NOI as total property revenues less total property operating expenses, excluding interest expenses, depreciation and amortization, property management expenses, and general and administrative expenses. Other REITs may use different methodologies for calculating NOI, and accordingly, IRT’s NOI may not be comparable to other REITs. IRT believes that this measure provides an operating perspective not immediately apparent from GAAP operating income or net income insofar as the measure reflects only operating income and expense at the property level. IRT uses NOI to evaluate performance on a same store and non-same store basis because NOI measures the core operations of property performance by excluding corporate level expenses, financing expenses, and other items not related to property operating performance and captures trends in rental housing and property operating expenses. However, NOI should only be used as an alternative measure of IRT’s financial performance. Same Store Properties and Same Store Portfolio IRT reviews its same store portfolio at the beginning of each calendar year. Properties are added into the same store portfolio if they were owned at the beginning of the previous year. Properties that are held-for-sale or have been sold are excluded from the same store portfolio. Total Gross Assets Total Gross Assets equals total assets plus accumulated depreciation and accumulated amortization, including fully depreciated or amortized real estate and real estate related assets. The following table provides a reconciliation of total assets to total gross assets (Dollars in thousands). As of December 31, 2019 September 30, 2019 June 30, 2019 March 31, 2019 December 31, 2018 Total debt $985,572 $979,330 $989,499 $990,920 $985,488 Less: cash and cash equivalents (9,888) (6,587) (11,060) (9,030) (9,316) Total net debt $975,684 $972,743 $978,439 $981,890 $976,172 As of December 31, 2019 September 30, 2019 June 30, 2019 March 31, 2019 December 31, 2018 Total assets $1,664,106 $1,653,017 $1,655,747 $1,655,849 $1,659,336 Plus: Accumulated Depreciation 158,435 148,924 141,965 132,448 120,202 Plus: Accumulated Amortization 19,197 19,232 19,495 19,658 19,198 Total gross assets $1,841,738 $1,821,173 $1,817,207 $1,807,955 $1,798,736

Forward-Looking Statements This presentation contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “seek,” “outlook,” “assumption,” “projected,” “strategy”, “guidance” or other, similar words. Because such forward-looking statements involve significant risks, uncertainties and contingencies, many of which are not within IRT’s control, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such statements. These forward-looking statements are based upon the current judgements and expectations of IRT’s management. Risks and uncertainties that might cause IRT’s actual results to differ materially from those expressed or implied by forward-looking statements include, but are not limited to: adverse changes in national, regional and local economic climates; changes in market demand for rental apartment homes and pricing pressures from competitors that could limit our ability to lease units or increase rents; competition that could adversely affect our ability to acquire additional properties; volatility in capital and credit markets, including changes that reduce availability, and increase costs, of capital; unexpected changes in the assumptions underlying our 2020 EPS, CFFO and same store NOI growth guidance; delays in completing, and cost overruns incurred in connection with, our value add initiatives and failure to achieve projected rent increases and occupancy levels on account of the initiatives; risks associated with pursuit of strategic acquisitions, including risks associated with the need to raise additional capital to fund the acquisitions and failure of acquisitions to produce expected returns; unexpected costs of REIT qualification compliance; costs and disruptions as the result of a cybersecurity incident or other technology disruption; and share price fluctuations. Additional risks and uncertainties that could cause our actual results to differ materially from those expressed or implied by the forward-looking statements in this press release are discussed in IRT’s filings with the Securities and Exchange Commission (“SEC”), including those under the heading “Risk Factors” in IRT’s most recently filed Annual Report on Form 10-K. Dividends are subject to the discretion of IRT’s Board of Directors, and will depend on IRT’s financial condition, results of operations, capital requirements, compliance with applicable laws and agreements and any other factors deemed relevant by IRT’s Board. IRT undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, except as may be required by law.