- IRT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Independence Realty Trust (IRT) DEF 14ADefinitive proxy

Filed: 25 Mar 20, 8:41am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

☐ | Preliminary Proxy Statement |

|

|

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ | Definitive Proxy Statement |

|

|

☐ | Definitive Additional Materials |

|

|

☐ | Soliciting Material under §240.14a-12 |

INDEPENDENCE REALTY TRUST, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

| |

☒ | No fee required. | |

|

| |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

|

|

|

| 1) | Title of each class of securities to which transaction applies:

|

| 2) | Aggregate number of securities to which transaction applies:

|

| 3)

| Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| 4) | Proposed maximum aggregate value of transaction:

|

| 5) | Total fee paid:

|

|

| |

☐ | Fee paid previously with preliminary materials. | |

|

| |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

|

|

|

| 1) | Amount Previously Paid:

|

| 2) | Form, Schedule or Registration Statement No.:

|

| 3) | Filing Party:

|

| 4) | Date Filed:

|

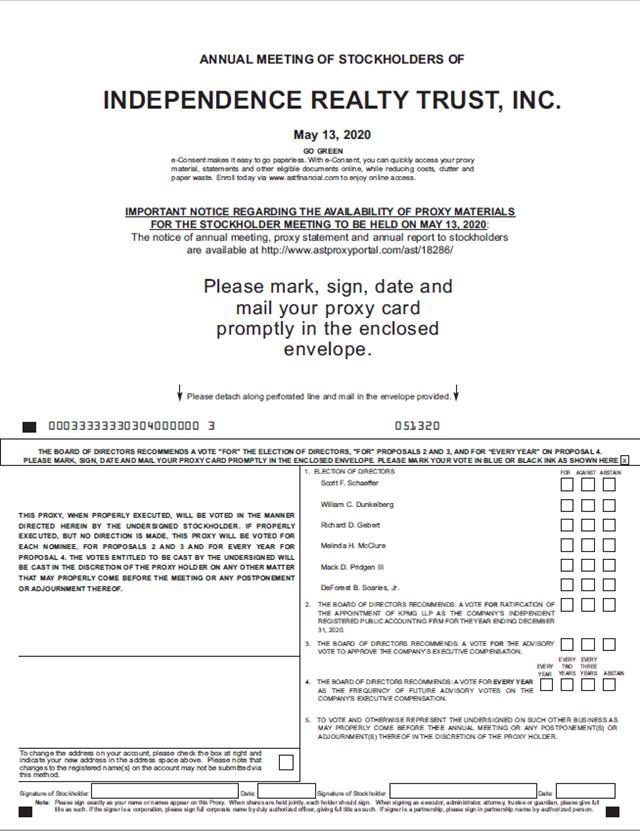

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 13, 2020

To our Stockholders:

We invite you to attend the 2020 annual meeting of stockholders of Independence Realty Trust, Inc., a Maryland corporation, at 9:00 a.m. (local time) on Wednesday, May 13, 2020. The annual meeting will be held at 1835 Market Street, Suite 2601, Philadelphia, Pennsylvania 19103. Because of the uncertainties surrounding the impact of the coronavirus, we are planning for the possibility that the Annual Meeting may be held solely by means of remote communication (i.e., a virtual meeting). If we take this step, we will announce the decision to do so in advance of the Annual Meeting, and details on how to participate in the webcast will be set forth in a press release issued by us and available at www.irtliving.com. We encourage you to check this website prior to the meeting if you plan to participate. If we do hold our meeting by means of remote communication you will be able to access the virtual meeting by using your 16-digit control number, which is provided with these materials.

At the annual meeting, stockholders as of the close of business on the record date will be asked to consider and vote upon the following matters, as more fully described in the Proxy Statement:

1. The election of six persons to our Board of Directors, each to serve for a term expiring at the 2021 annual meeting of stockholders and until his or her successor is duly elected and qualified.

2. The ratification of the appointment of KPMG LLP as our independent registered public accounting firm for calendar year 2020.

3. An advisory, non-binding resolution on our executive compensation.

4. An advisory, non-binding resolution on the frequency of future advisory votes on our executive compensation.

5. Such other business as may properly come before the annual meeting and any adjournment or postponement thereof.

Only stockholders of record at the close of business on March 19, 2020 are entitled to notice of, and to vote at, the annual meeting or any adjournment or postponement thereof.

Your vote is very important. Whether or not you attend the annual meeting in person, we urge you to vote as soon as possible. Instructions on how to vote are contained in the Proxy Statement.

|

By order of the Board of Directors, |

|

Jessica K. Norman, Secretary |

March 25, 2020

PROXY STATEMENT

2020 ANNUAL MEETING OF STOCKHOLDERS

The 2020 annual meeting of stockholders of Independence Realty Trust, Inc. (“IRT,” “we,” “us” or the “Company”) will be held on Wednesday, May 13, 2020, at 9:00 a.m. (local time) at 1835 Market Street, Suite 2601, Philadelphia, Pennsylvania 19103. Because of the uncertainties surrounding the impact of the coronavirus, we are planning for the possibility that the Annual Meeting may be held solely by means of remote communication (i.e., a virtual meeting). If we take this step, we will announce the decision to do so in advance of the Annual Meeting, and details on how to participate in the webcast will be set forth in a press release issued by us and available at www.irtliving.com. We encourage you to check this website prior to the meeting if you plan to participate. If we do hold our meeting by means of remote communication you will be able to access the virtual meeting by using your 16-digit control number, which is provided with these materials.

At the annual meeting, stockholders as of the close of business on the record date will be asked to consider and vote upon the following matters:

1. The election of six persons to our Board of Directors, each to serve for a term expiring at the 2021 annual meeting of stockholders and until his or her successor is duly elected and qualified.

2. The ratification of the appointment of KPMG LLP as our independent registered public accounting firm for calendar year 2020.

3. An advisory, non-binding resolution on our executive compensation.

4. An advisory, non-binding resolution on the frequency of future advisory votes on our executive compensation.

5. Such other business as may properly come before the annual meeting and any adjournment or postponement thereof.

Only holders of record of our common stock at the close of business on March 19, 2020 are entitled to notice of, and to vote at, the annual meeting and any adjournment or postponement thereof.

Our Board of Directors knows of no other business that will be presented for consideration at the annual meeting. If any other matter should be properly presented at the annual meeting or any adjournment or postponement of the annual meeting for action by the stockholders, the persons named in the proxy card will vote the proxy in accordance with their discretion on such matter.

On or about March 25, 2020, we mailed a Notice of Internet Availability of Proxy Materials to stockholders. This proxy statement and the form of proxy are first being furnished to stockholders on or about March 25, 2020.

Instead of receiving paper copies of future annual reports and proxy statements in the mail, you may elect to receive an e-mail that will provide an electronic link to these documents. Choosing to receive your proxy materials online will save us the cost of producing and mailing documents to you. With electronic delivery, we will notify you by e-

mail as soon as the annual report and proxy statement are available on the Internet, and you may easily submit your stockholder votes online. If you are a stockholder of record, you may enroll in the electronic delivery service at the time you vote by selecting electronic delivery if you vote on the Internet, or at any time in the future by going directly to www.voteproxy.com, selecting the “request copy” option, and following the enrollment instructions.

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Stockholders to be Held on May 13, 2020

This notice of annual meeting, proxy statement, form of proxy and our 2019 annual report to

stockholders are available at www.astproxyportal.com/ast/18286.

What am I Voting on?1

What are the Board’s Recommendations?1

Who is Entitled to Vote?1

What Constitutes a Quorum?1

What is a Broker Non-Vote?2

How are Abstentions Treated?2

What Vote is Required to Approve Each Proposal?2

How Do I Vote?2

How May I Revoke or Change my Vote?3

What Does it Mean if I Receive More Than One Proxy Card?3

What if I Receive Only One Set of Proxy Materials Although There are Multiple Stockholders at My Address?4

How Can I Access the Proxy Materials Electronically?4

Will I Receive a Copy of the Annual Report and Form 10-K?4

Who is Soliciting My Vote and Who Bears the Expenses of the Proxy Solicitation?4

How Do I Submit a Stockholder Proposal for Next Year’s Annual Meeting?5

PROPOSAL 1. ELECTION OF DIRECTORS8

Directors9

Corporate Governance Documents13

Director Independence and Independence Determinations13

Board Leadership Structure13

Executive Sessions of Non-Management Directors14

Lead Independent Director14

Communications with our Independent Directors and Board14

Limits on Service on Other Boards14

Director Tenure15

Risk Oversight15

Code of Ethics15

Hotline Submissions15

Board and Committee Meetings; Attendance16

Audit Committee16

Compensation Committee17

Nominating Committee17

Board, Committee and Director Evaluations18

Stockholder Engagement19

Corporate and Social Responsibility19

Environmental and Sustainability Commitments19

Stock Ownership Requirements19

Anti-Hedging Policy19

Clawback Policy20

Additional Governance Matters20

PROPOSAL 2. RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM21

Ratification of the Selection of Independent Registered Public Accounting Firm21

Audit Fees21

Audit Committee Report22

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT23

NON-DIRECTOR EXECUTIVE OFFICERS25

EXECUTIVE OFFICER AND DIRECTOR COMPENSATION26

Compensation Discussion and Analysis27

i

2019 Compensation Decisions29

Base Salary29

2019 Cash Bonus Awards29

2019 Equity Awards32

2020 Compensation Decisions35

Implementing the Objectives of Our Compensation Policies35

Impact of 2017 Stockholder Advisory Votes35

Role of Chief Executive Officer in Setting Compensation36

Role of Compensation Consultant36

Peer Groups36

Other Compensation Matters37

Compensation Committee Report40

Compensation Committee Interlocks and Insider Participation40

named executive officer compensation40

Summary Compensation Table41

Grants of Plan-Based Awards in 201942

CEO Pay Ratio43

Outstanding Equity Awards at 2019 Fiscal Year-End44

Option Exercises and Stock Vested in 201945

Potential Payments on Termination or Change-In-Control45

Director Compensation48

EQUITY COMPENSATION PLAN INFORMATION50

Proposal 3: Advisory Vote on Executive Compensation51

Proposal 4: Advisory Vote on the Frequency of Future Advisory Votes on Executive Compensation52

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS53

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE54

STOCKHOLDER PROPOSALS AND DIRECTOR NOMINATIONS55

Stockholder Proposals Submitted Pursuant to Rule 14a-855

Director Nominations and Stockholder Proposals Not Submitted Pursuant to Rule 14a-855

General Requirements55

Discretionary Authority Pursuant to Rule 14a-4(c) of the Exchange Act55

Director Recommendations56

ANNUAL REPORT AND REPORT ON FORM 10-K57

APPENDIX A RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO GAAP MEASURESA

ii

INFORMATION ABOUT THE MEETING AND VOTING

Our Board of Directors is soliciting your vote for:

| • | The election of six persons to our Board of Directors, each to serve for a term expiring at the 2021 annual meeting of stockholders and until his or her successor is duly elected and qualified. Each of the six individuals nominated for election is currently serving on our Board. |

| • | The ratification of the appointment of KPMG LLP as our independent registered public accounting firm for calendar year 2020. |

Our Board of Directors is also requesting you to cast an advisory, non-binding vote on:

| • | Our executive compensation. |

| • | The frequency of future advisory votes on our executive compensation. |

If any other matter should be properly presented at the annual meeting or any adjournment or postponement of the annual meeting for action by the stockholders, the persons named in the proxy card will vote the proxy in accordance with their discretion on such matter.

What are the Board’s Recommendations?

Our Board recommends that you vote FOR the election of the six nominees identified in this proxy statement, with each to serve as a director for a term expiring at the 2021 annual meeting of stockholders and until his or her successor is duly elected and qualified.

Our Board recommends that you vote FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for calendar year 2020.

Our Board recommends that you vote FOR the advisory, non-binding resolution on our executive compensation.

Our Board recommends that you vote FOR an annual vote as the frequency for future advisory votes on our executive compensation.

Holders of shares of our common stock, par value $0.01 per share, or common shares, of record as of the close of business on March 19, 2020 are entitled to notice of, and to vote at, the annual meeting. Common shares may be voted only if the stockholder is present in person or is represented by proxy at the annual meeting. As of the record date, 91,303,615 common shares were issued and outstanding and entitled to vote. Each common share is entitled to one vote on each matter to be voted on at the annual meeting. Stockholders do not have cumulative voting rights.

The holders of a majority of the outstanding common shares entitled to vote at the annual meeting must be present in person or by proxy to constitute a quorum. Unless a quorum is present at the meeting, no action may be taken at the meeting except the adjournment thereof to a later time. All valid proxies returned will be included in the determination of whether a quorum is present at the meeting. The shares of a stockholder whose ballot on any or all proposals is marked as “abstain” will be treated as present for quorum purposes. “Broker non-votes,” as discussed below, will also be treated as present for quorum purposes.

| 1 | 2020 Proxy Statement |

A “broker non-vote” occurs when a broker or other nominee holding shares for a beneficial owner returns a properly executed proxy but does not cast a vote on a particular proposal because the broker or nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner. Brokers that are member firms of the New York Stock Exchange, or NYSE, and who hold common shares in street name for customers generally may vote their customers’ shares on proposals considered to be “routine” matters under the NYSE rules and may not vote their customers’ shares on proposals that are not considered to be “routine” matters under the NYSE rules if the customers have not furnished voting instructions within a specified period of time prior to the annual meeting. Proposal One, the election of directors, is not considered to be a “routine” matter under the NYSE rules. Proposal Two, ratification of the appointment of our independent registered public accounting firm, is considered a “routine” matter under the NYSE rules. Proposal Three, an advisory non-binding resolution on our executive compensation, is not considered to be a “routine” matter under the NYSE rules. Proposal Four, an advisory, non-binding resolution on the frequency of an advisory vote on our executive compensation, is not considered to be a “routine” matter under the NYSE rules.

Abstentions are treated as present for quorum purposes, but are not considered to be votes cast on a proposal.

What Vote is Required to Approve Each Proposal?

| • | Election of Directors. Directors are elected by a plurality of the votes cast at the annual meeting. Any shares not voted (whether by abstention, broker non-vote, or otherwise) will have no impact on the vote. Shares represented by proxies marked “For” will be counted in favor of all nominees, except to the extent the proxy withholds authority to vote for a specified nominee. Shares represented by proxies marked “Abstain” or withholding authority to vote for a specified nominee will not be counted in favor of any such nominee. In the absence of specific direction, shares represented by a proxy will be voted “For” the election of all nominees. |

| • | Ratification of Appointment of Independent Registered Public Accounting Firm. Ratification of the Audit Committee’s appointment of KPMG LLP as our independent registered public accounting firm for calendar year 2020 requires the affirmative vote of a majority of all votes cast on this proposal. Abstentions and broker non-votes, which are not treated as votes cast, will therefore have no effect on the results of such vote. In the absence of specific direction, shares represented by a proxy will be voted “For” the ratification. |

| • | Advisory Vote on Executive Compensation. Approval of the advisory, non-binding resolution on our executive compensation requires the affirmative vote of a majority of all of the votes cast on this Proposal. Abstentions and broker non-votes, which are not treated as votes cast, will therefore have no effect on the result of such vote. |

| • | Advisory Vote on Frequency of Future Advisory Votes on Executive Compensation. The frequency of the advisory vote on our executive compensation receiving the greatest number of votes cast (every one, two or three years) will be considered the frequency recommended by stockholders. Abstentions and broker non-votes, which are not treated as votes cast, will therefore have no effect on the result of such vote. |

| • | Stockholders of Record. If you are a stockholder of record, there are several ways for you to vote your common shares at the meeting: |

| o | Voting by Internet. You may vote your shares through the Internet by signing on to the website identified on the proxy card and following the procedures described on the |

| 2 | 2020 Proxy Statement |

| website. Internet voting is available 24 hours a day, and the procedures are designed to authenticate votes cast by using a personal identification number located on the proxy card. The procedures allow you to authorize a proxy to vote your shares and to confirm that your instructions have been properly recorded. If you vote through the Internet, you should not return your proxy card. |

| o | Voting by Mail. If you choose to vote by mail, simply complete the enclosed proxy card, date and sign it, and return it in the postage-paid envelope provided. If you sign your proxy card and return it without marking any voting instructions, your shares will be voted: (1) FOR the election of each of the six nominees identified in this proxy statement, with each to serve as a director for a term expiring at the 2021 annual meeting of stockholders and until his or her successor is duly elected and qualified; (2) FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for calendar year 2020; (3) FOR the advisory, non-binding resolution on our executive compensation; and (4) FOR an annual vote as the frequency of future advisory votes on our executive compensation. |

| o | In Person Attendance. You may vote your shares in person at the annual meeting. Even if you plan to attend the meeting in person, we recommend that you submit your proxy card or voting instructions or vote by telephone or via the Internet by the applicable deadline so that your vote will be counted if you later decide not to attend the meeting. If you wish to attend the meeting and vote in person, you may contact Investor Relations at (267) 270-4800 for directions. |

| • | Beneficial Owners. If you are a stockholder whose shares are held in “street name” (i.e., in the name of a broker or other custodian), you may vote the shares in person at the annual meeting only if you obtain a legal proxy from the broker or other custodian giving you the right to vote the shares. Alternatively, you may have your shares voted at the meeting by following the voting instructions provided to you by your broker or custodian. Although most brokers offer voting by mail, telephone and via the Internet, availability and specific procedures will depend on their voting arrangements. If you do not provide voting instructions to your broker or other custodian, your shares are referred to as “uninstructed shares.” Under NYSE rules, your broker or other custodian does not have discretion to vote uninstructed shares on any of the Proposals other than Proposal 2, ratification of the appointment of our independent registered public accounting firm, because this is a routine matter. See “What is a Broker Non-Vote?” |

How May I Revoke or Change my Vote?

You may revoke your proxy at any time before it is voted at the annual meeting by any of the following methods:

| • | Submitting a later-dated proxy by mail, over the telephone or through the Internet. Any later-dated proxy must be delivered to our Secretary at the address shown on the cover page of this proxy statement before the closing of the vote at the meeting. |

| • | Attending the meeting and voting in person. Your attendance at the meeting will not in and of itself revoke any previously delivered proxy. You must also vote your shares at the meeting. |

What Does it Mean if I Receive More Than One Proxy Card?

Some of your shares may be registered differently or in more than one account. You should vote each of your accounts by telephone or the Internet or mail. If you mail proxy cards, please sign, date and return each proxy card to assure that all of your shares are voted. If you hold your shares in registered form and wish to combine your accounts in the future, you should contact our transfer agent, AST Financial, at help@astfiancial.com, phone (800)

| 3 | 2020 Proxy Statement |

937-5449; outside the U.S., phone (718) 921-8300. Combining accounts reduces excess printing and mailing costs, resulting in savings for us that benefit you as a stockholder.

What if I Receive Only One Set of Proxy Materials Although There are Multiple Stockholders at My Address?

If you and other residents at your mailing address own common shares you may have received a notice that your household will receive only one annual report, proxy statement and Notice of Internet Availability of Proxy Materials. If you hold common shares in street name, you may have received this notice from your broker or other custodian and the notice may apply to each company in which you hold shares through that broker or custodian. This practice of sending only one copy of proxy materials is known as “householding.” The reason we do this is to attempt to conserve resources. If you did not respond to a timely notice that you do not want to participate in householding, you were deemed to have consented to the process. If the foregoing procedures apply to you, one copy of our annual report, proxy statement and Notice of Internet Availability of Proxy Materials has been sent to your address. You may revoke your consent to householding at any time by sending your name, the name of your brokerage firm, and your account number to AST, Householding Department, 6201 15th Avenue, Brooklyn, NY 11219, or by calling telephone number (800) 937-5449. The revocation of your consent to householding will be effective 30 days following its receipt. In any event, if you did not receive an individual copy of this proxy statement, our annual report and Notice of Internet Availability of Proxy Materials, we will send a copy to you, free of charge, if you address your request to Independence Realty Trust, Inc., 1835 Market Street, Suite 2601, Philadelphia, Pennsylvania 19103, Attention: Jessica K. Norman, Secretary, or by calling Ms. Norman at (267) 270-4800. If you are receiving multiple copies of our annual report, proxy statement and Notice of Internet Availability of Proxy Materials, you may request householding by contacting Ms. Norman in the same manner.

How Can I Access the Proxy Materials Electronically?

This proxy statement and our 2019 annual report are available on our website at www.voteproxy.com. Instead of receiving copies of future annual reports, proxy statements, proxy cards and, when applicable, Notices of Internet Availability of Proxy Materials, by mail, stockholders may elect to receive an email that will provide electronic links to our proxy materials and also will give you an electronic link to the proxy voting site. Choosing to receive your future proxy materials or Notices of Internet Availability of Proxy Materials online will save us the cost of producing and mailing documents to you and help conserve resources. You may sign up for electronic delivery by visiting www.voteproxy.com.

Will I Receive a Copy of the Annual Report and Form 10-K?

We have furnished our 2019 annual report with this proxy statement. The 2019 annual report includes our audited financial statements, along with other financial information about us. Our 2019 annual report is not part of the proxy solicitation materials. You may obtain, free of charge, a copy of our Annual Report on Form 10-K for our fiscal year ended December 31, 2019 by: (1) accessing our Internet site at www.irtliving.com and clicking on the “Investor Relations” link; (2) writing to our Secretary, Jessica K. Norman, at 1835 Market Street, Suite 2601, Philadelphia, Pennsylvania 19103; or (3) calling Ms. Norman at (267) 270-4800. You may also obtain a copy of our Annual Report on Form 10-K and other periodic and current reports that we file with, or furnish to, the Securities and Exchange Commission (“SEC”) from the SEC’s EDGAR database at www.sec.gov.

Who is Soliciting My Vote and Who Bears the Expenses of the Proxy Solicitation?

We are soliciting proxies and will bear the cost of the solicitations. Our directors, officers and regular employees may solicit proxies either personally, by letter or by telephone. We will not specifically compensate our directors, officers or employees for soliciting proxies. We expect to reimburse banks, brokers and other persons for their reasonable out-of-pocket expenses in handling proxy materials for beneficial owners of our common shares. We have retained D.F. King for a fee of $8,500, plus reasonable out of pocket expenses, to aid in the solicitation of proxies from our stockholders.

| 4 | 2020 Proxy Statement |

How Do I Submit a Stockholder Proposal for Next Year’s Annual Meeting?

Stockholder proposals may be submitted for inclusion in the proxy statement for our 2021 annual meeting of stockholders in accordance with rules of the SEC. See “Stockholder Proposals and Director Nominations — Stockholder Proposals Submitted Pursuant to Rule 14a-8” later in this proxy statement. Any stockholder who wishes to propose any business at the 2021 annual meeting, other than for inclusion in our proxy statement pursuant to Rule 14a-8, must provide timely notice and satisfy the other requirements in our Bylaws. Proposals should be delivered or mailed to our Secretary, Jessica K. Norman, at 1835 Market Street, Suite 2601, Philadelphia, Pennsylvania 19103. See “Stockholder Proposals and Director Nominations — Director Nominations and Stockholder Proposals not Submitted pursuant to Rule 14a-8” later in this proxy statement.

| 5 | 2020 Proxy Statement |

2019 BUSINESS HIGHLIGHTS | |

At December 31, 2019, we owned and operated 57 multifamily apartment communities that contain 15,554 units in 15 states. Under the direction of executive management, in 2019 we continued to execute on our long-term strategic plan and deliver strong organic growth to our stockholders.* Our 2019 achievements include: | |

2019 Financial Highlights: | ➢Produced earnings per diluted share of $0.51. ➢Produced core funds from operations (“CFFO”) per share of $0.76. ➢Declared dividends of $0.72 per common share. ➢Generated same-store NOI growth of 7.7%. |

Portfolio Updates: | We recycled $154.5 million of capital in 2019 through the disposition of four of our assets in smaller markets where we lacked scale and/or markets where we believe that growth is slowing. These proceeds were used to acquire three communities, totaling 806 units, which align closely with our investment strategy by expanding our reach in our existing markets of Raleigh, NC, Tampa, FL, and Atlanta, GA. These communities were acquired for a gross purchase price of $128.9 million. |

Capital Markets: | We raised $21.3 million in net proceeds from the sale of 1,717,291 common shares under our at-the-market offering program at an average price per share of $12.82. The proceeds from this program were used to fund value add initiatives during 2019 and to reduce outstanding borrowings on our line of credit. |

Capital Structure: | We strengthened our balance sheet while maintaining our simple capital structure by refinancing our line of credit with a new, $350 million unsecured revolving line of credit which matures in May of 2024, inclusive of two, 6-month extension options. This refinancing extended the maturity of the refinanced portion of our line of credit by two years. In addition, we amended our $100 million term loan thereby reducing our interest cost by 40 basis points based on our consolidated leverage ratio at the time of the amendment. We continue to hedge our exposure to floating rates and, as of year-end, our debt was 91% fixed after factoring in our outstanding interest rate derivatives. |

Value-add Initiative: | As part of our initiative to upgrade units at selected communities, during 2019 we completed renovations and upgrades at 2,715 units. Our renovations provide our residents with a better place to live by improving the unit interiors and upgrading common areas with new and desirable amenities. Our renovations benefit our stockholders by growing NOI, reducing capital expenses in the long-term, and increasing our net asset value per share. |

* Please see “Compensation Discussion and Analysis” later in this proxy statement and Appendix A to this proxy statement for a discussion of non-GAAP financial measures and reconciliations to the most directly comparable GAAP financial measures.

| 6 | 2020 Proxy Statement |

We are dedicated to establishing and maintaining good corporate governance standards in order to serve the interests of our stockholders and better align the interests of directors and management with those of our shareholder. The following are key attributes of our governance framework: | |

➢5 of 6 Director Nominees are Independent ➢Annual Election of Directors ➢Lead Independent Director ➢Independent Audit, Compensation, and Nominating and Governance Committees ➢Regular Executive Sessions of Independent Directors ➢Risk Oversight by Board and Committees ➢Authority for Board to retain outside advisors ➢Annual Board Self-Assessment Process ➢Ongoing Board Refreshment Process

| ➢Regular Succession Planning ➢Executive Compensation Driven by Objective Pay for Performance Philosophy ➢Active Shareholder Engagement ➢No Shareholder Rights Plan ➢Internal Disclosure Committee for Financial Reporting ➢Share Ownership Guidelines for Directors and Certain Executive Officers ➢Prohibition against Hedging of Company shares ➢Shareholders maintain ability to amend Bylaws

|

ENVIRONMENTAL & SOCIAL HIGHLIGHTS | |

We seek to adopt policies and enact practices which are sustainable and socially responsible. The following are key initiatives undertaken by the Company which serve to reduce our impact on the environment and increase our contribution to society: WHAT WE DO TO… | |

PROTECT OUR EARTH: ☑Reduce Consumption by optimizing lighting, electronic usage and thermal settings at every leasing office in the portfolio as well as our corporate offices, opting to go paperless whenever possible. ☑Conserve Water by upgrading plumbing fixtures, and planting native landscape. ☑Reduce Greenhouse Gas Emissions by implementing LED lighting retrofits and replacing outdated appliances with more energy efficient models.

| SUPPORT OUR EMPLOYEES: ☑Ensure Pay Equity by following fair, equal and non-discriminatory compensation practices. ☑Educate Associates by providing robust training and financial assistance for certifications and continued education. ☑Survey Associates to identify employee needs and implement changes to ensure a positive work environment. ☑Support Employees through comprehensive benefits packages including medical, vision, dental, 401(k) and paid time off.

|

SERVE OUR RESIDENTS: ☑Survey Our Residents regularly and tie feedback to compensation for our property management teams. ☑Upgrade Properties with new, desirable amenities to enhance the resident living experience. ☑Engage With Our Residents through regularly hosted community events.

| BENEFIT OUR COMMUNITIES: ☑Fight Homelessness by supporting charities which seek to end poverty and homeless including Project HOME, Shelters to Shutters and dfree®. ☑Encourage Ethical Conduct by maintaining a Code of Ethics, a Vendor Code of Conduct, a Whistleblower Policy and a third-party hosted whistleblower hotline. |

| 7 | 2020 Proxy Statement |

PROPOSAL 1. ELECTION OF DIRECTORS

Our business and affairs are managed under the direction of the Board of Directors. Our Board currently consists of seven directors, six of whom have been nominated for election at the annual meeting, with each to serve for a term expiring at the next annual meeting of stockholders and until his or her successor is duly elected and qualified. Richard H. Ross will be retiring from the Board at the annual meeting.

In selecting nominees, our Board and its Nominating and Governance Committee, which we refer to as our Nominating Committee, assess the independence, character and acumen of candidates and endeavor to establish areas of core competency of the Board, including industry knowledge and experience; management, accounting and finance expertise; and demonstrated business judgment, leadership and strategic vision. Our Board values diversity of backgrounds, experience, perspectives and leadership in different fields when identifying nominees.

The Board, upon the recommendation of the Nominating Committee, has nominated each of Scott F. Schaeffer, William C. Dunkelberg, Ph.D., Richard D. Gebert, Melinda H. McClure, Mack D. Pridgen III, and DeForest B. Soaries, Jr., D.Min. for election at the annual meeting to serve for a term expiring at the 2021 annual meeting of stockholders and until his or her successor is duly elected and qualified. We believe that each of our director nominees has the specific qualifications, attributes, skills and experience necessary to serve as an effective director on our Board, as indicated directly below the biographical summaries of each of them.

We have no reason to believe that any of the nominees will be unable or unwilling to serve if elected. However, if any nominee should become unable for any reason or unwilling for good cause to serve, then proxies may be voted for another person nominated as a substitute by the Board, or the Board may reduce the number of directors.

The Board of Directors unanimously recommends that stockholders vote “FOR” the election of each of the nominees named in this Proposal 1 to serve as a director for a term expiring at the 2021 annual meeting of stockholders and until his or her successor is duly elected and qualified.

Board Composition

Set forth below is a snapshot of the composition of our Board of Directors immediately following the Annual Meeting if the six individuals nominated for election at the annual meeting are re-elected.

| 8 | 2020 Proxy Statement |

Set forth below are biographical summaries of the individuals nominated for election at the annual meeting.

SCOTT F. SCHAEFFER Chair of the Board and Chief Executive Officer Director since: Age:57

| Mr. Schaeffer has served as the Chair of our Board since January 2011, as our Chief Executive Officer since February 2013 and as our president from February 2013 to August 2014. He served as the chief executive officer of RAIT Financial Trust, or RAIT, a real estate investment trust, from February 2009 to December 2016 and as its chair from December 2010 to October 2016. Prior to his position as the chief executive officer of RAIT, Mr. Schaeffer held various other executive positions at RAIT from September 2000. Mr. Schaeffer resigned from RAIT when we completed transactions to internalize our management and separate from RAIT in December 2016, which we refer to as our management internalization. Mr. Schaeffer served as the vice chair of the board of directors of Resource America, Inc. (NASDAQ: REXI), a specialty finance company, from 1998 to 2000, and as a director until October 2002. In addition to his roles on the board of directors, Mr. Schaeffer served in several senior management positions at Resource America from 1995 to 1998. Mr. Schaeffer also served as president of Resource Properties, Inc., a wholly owned real estate subsidiary of Resource America, from 1992 to 2000. Mr. Schaeffer currently serves as a National Trustee of the Boys and Girls Club of America, a position he has held since 2018. Mr. Schaeffer holds a Bachelor of Science in Commerce from Rider University in Lawrenceville, New Jersey. |

Key Attributes, Experiences and Skills: Mr. Schaeffer was selected to serve on our Board primarily because of his extensive experience as a chief executive officer of a public REIT and his lengthy career in real estate. Mr. Schaeffer’s position as our Chief Executive Officer, with his detailed knowledge of our business, and his ability to drive and oversee our business strategy, coupled with his communications skills and ability to foster diverse perspectives, make him a highly effective executive Chair of our Board. | |

WILLIAM C. DUNKELBERG, Ph.D. Independent Director

Committees:

Director since: Age:77

| Dr. Dunkelberg has served as one of our independent directors since February 2011. Dr. Dunkelberg served as the chair of the board of directors of Liberty Bell Bank, a publicly-traded commercial bank chartered in New Jersey, from July 2005 until 2018, and as member of the audit committee from 2003. Dr. Dunkelberg serves as a Professor Emeritus in the College of Liberal Arts at Temple University in Philadelphia, Pennsylvania after having served as Professor of Economics from 1987 to his retirement in 2012 and as Dean of the School of Business and Management from 1987 to 1994. He has served as chief economist for the National Federation of Independent Business, a nonprofit industry association representing small and independent businesses, since 1973. Dr. Dunkelberg was a consultant to the National Federation of Independent Business from 1970 until he accepted the position as chief economist. He served as Economic Strategist for Boenning & Scattergood, an independent investment banking firm, from April 2009 to June 2016. He co-founded Wireless Energy Solutions, a private company, in July 2009, and continues to serve on its board of directors. He previously served as a member of the board of directors of NCO Group, Inc., a public provider of business process outsourcing solutions, from 2000 until the company was sold in November 2006. Dr. Dunkelberg holds a Bachelor of Arts, a Master of Economics and a Doctor of Philosophy in Economics, each from the University of Michigan in Ann Arbor. |

Key Attributes, Experiences and Skills: Dr. Dunkelberg was selected to serve on our Board primarily because of his expertise in economics, banking and capital markets, and his experience as a director of both public and private companies. | |

| 9 | 2020 Proxy Statement |

RICHARD D. GEBERT Independent Director

Committees:

Director since: Age:62

| Mr. Gebert has served as one of our independent directors since October 2017. He has served as a board and audit committee member of The Association of Corporate Growth (ACG Global), a membership organization focused on middle market growth from September 2016 to October 2019. Prior to that from 1995 to July 2016, he was an audit partner of Grant Thornton LLP, a national accounting firm. In addition to serving as an audit partner with Grant Thornton LLP, Mr. Gebert held the following additional roles at Grant Thornton LLP: (i) member of the Senior Leadership Team from August 2013 to July 2016, (ii) East Region Managing Partner from 2011 to July 2016, (iii) Managing Partner of Philadelphia Office from 1999 to 2011, and (iv) member of the Partnership Board from 2003 to 2011. Before joining Grant Thornton LLP, he was employed at AG Epstein Co from 1979 to 1995, a local accounting firm that eventually merged into Grant Thornton LLP. Mr. Gebert became a partner at AG Epstein Co in 1987. While in practice, Mr. Gebert was a member of the American Institute of Certified Public Accountants (AICPA), the Pennsylvania Institute of Certified Public Accountants (PICPA), and the Georgia Society of Certified Public Accountants. Mr. Gebert was a certified public accountant, and he holds a Bachelor of Business Administration from Temple University. |

Key Attributes, Experiences and Skills: Mr. Gebert was selected to serve on our Board because of his extensive experience and expertise in financial reporting, accounting and controls; his deep understanding of risk management and finance; and his involvement in executive leadership. | |

MELINDA H. McCLURE Lead Independent Director

Committees:

Director since: Age:52 Other Public Company Boards: | Ms. McClure has served as one of our independent directors since June 2017. She is Executive Vice President and head of Strategic Planning for Old Dominion National Bank, a community bank headquartered in the Greater Washington region. She was the CEO of VisionBank (in Organization) from February 2018 until August of 2019. She served from 2006 to 2018 as the principal shareholder of Democracy Funding LLC, a registered broker-dealer and its affiliates focused on providing capital markets and advisory services to government agencies including the United States Department of Treasury and the Federal Deposit Insurance Corporation as well as to private sector financial services and real estate companies. Ms. McClure served on the board of directors of the Bank of Georgetown, a privately held community bank headquartered in Washington, D.C. from its inception in 2005 to its sale to UnitedBank in 2016. While a director of the Bank of Georgetown she served as the chairman of the strategic planning committee, and as a member of the compensation committee. Ms. McClure served in numerous positions at FBR & Co, an investment bank, from 1991 to 2006 including, as senior managing director of investment banking where she focused on providing capital markets and advisory services to middle market financial services and real estate companies. She earned her Bachelor of Arts Degree from the University of Richmond. Ms. McClure was selected to serve on our board because of her extensive leadership experience in the asset management, financial services, and real estate industries. |

Key Attributes, Experiences and Skills: Ms. McClure was selected to serve on our Board because of her extensive leadership experience in the asset management, financial services, and real estate industries. | |

| 10 | 2020 Proxy Statement |

Independent Director Committees: Director since: Age:70

| Mr. Pridgen has served as one of our independent directors since September 2015 when he joined the Board upon the consummation of our acquisition of Trade Street Residential, Inc. (“TSRE”) in accordance with the merger agreement relating to the TSRE acquisition. From June 2012 to September 2015, Mr. Pridgen served as a director of TSRE, including service as chair of the board and the audit committee and as a member of the nominating and corporate governance committee. From October 2007 until February 2015, Mr. Pridgen served on the board of directors of AmREIT, a shopping center REIT, serving as audit committee chair and a member of the executive committee and the pricing committee. From 1997 until March 2007, Mr. Pridgen served as General Counsel, Vice President and Secretary of Highwoods Properties, Inc. (NYSE:HIW), a commercial REIT that owns and operates primarily suburban office properties, as well as industrial, retail and residential properties. Prior to joining Highwoods Properties, Inc., Mr. Pridgen was a partner with the law firm of Smith, Helms, Mulliss and Moore, LLP, with a specialized focus on the tax, corporate and REIT practices. Mr. Pridgen also served as a tax consultant for Arthur Andersen & Co. for 15 years. Mr. Pridgen received his Bachelor of Business Administration and Accounting degree from the University of North Carolina at Chapel Hill and his law degree from the University of California at Los Angeles School of Law. |

Key Attributes, Experiences and Skills: Mr. Pridgen was selected to serve on our Board because of his knowledge and experience in the area of accounting and tax, with a focus on REITs and his experience as a former executive with a publicly-traded REIT, as well as his familiarity with TSRE’s portfolio and the multi-family business more generally, all of which contribute to the mix of qualifications and experience the Board seeks to maintain. | |

| 11 | 2020 Proxy Statement |

DEFOREST B. SOARIES, JR., D.MIN. Independent Director Committees: Director since: Age:68 Other Public Company Boards: | Dr. Soaries has served as one of our independent directors since February 2011. Dr. Soaries has served as a director for the Federal Home Loan Bank of New York since January 2009, a position which he previously held from February to December 2003. In this capacity, he served on the affordable housing committee that reviews and approves housing development projects for government funding. Since 1990, he has served as the Senior Pastor of the First Baptist Church of Lincoln Gardens in Somerset, New Jersey, where he currently leads a congregation of 7,000 members. Since January 2015, he has served as a director on the board of directors, or the Ocwen board, of Ocwen Financial Corporation (NYSE: OCN), a publicly traded financial services holding company, and serves as a member of the audit committee of the Ocwen board. From 2004 to 2005, he served as the first chair of the U.S. Election Assistance Commission (EAC), appointed by former President George W. Bush and confirmed by the U.S. Senate. From 1999 to 2002, Dr. Soaries served as Secretary of State of New Jersey. In this capacity, he served for three years on the Governor’s Urban Coordinating Council that guided state policy on real estate development, most of which was apartment real estate development. Dr. Soaries was a professor at the Drew University Theological School in Madison, New Jersey from 1997 to 1999, Kean University in Union, New Jersey from 1993 to 1994 and Princeton Theological Seminary in Princeton, New Jersey from 1992 to 1993 and an assistant professor at Mercer County Community College in Trenton, New Jersey from 1989 to 1991. He has led the development, ownership, conversion and management of several apartment projects as a community development executive. Dr. Soaries holds a Bachelor of Arts in Urban and Religious Studies from Fordham University in Bronx, New York, a Master of Divinity from Princeton and a Doctor of Ministry from United Theological Seminary in Dayton, Ohio. |

Key Attributes, Experiences and Skills: Dr. Soaries was selected to serve on our Board primarily because of his diverse background in banking, community development, apartment properties, government and as a director of the Federal Home Loan Bank of New York. | |

| 12 | 2020 Proxy Statement |

Corporate Governance Documents

KEY CORPORATE GOVERNANCE DOCUMENTS | |

Our shares of common stock are listed on the NYSE under the symbol “IRT” and we are subject to the NYSE’s listing standards. We have adopted corporate governance guidelines and charters for our Audit, Compensation and Nominating Committees in compliance with NYSE listing standards. The following key governance documents are available on our website at www.irtliving.com: | |

•Corporate Governance Guidelines •Audit Committee Charter •Compensation Committee Charter •Nominating and Governance Committee Charter •Clawback Policy | •Stock Ownership Guidelines •Section 16 Reporting Compliance Procedures •Code of Ethics •Whistleblower Policy •Insider Trading Policy |

These documents are also available free of charge by writing to Independence Realty Trust, to our Secretary, Jessica K. Norman, at 1835 Market Street, Suite 2601, Philadelphia, Pennsylvania 19103 or by calling Ms. Norman at (267) 270-4800. No information contained on the Company’s website is part of or incorporated into this Proxy Statement. | |

Director Independence and Independence Determinations

None of our directors qualifies as independent unless our Board affirmatively determines that the director has no direct or indirect material relationship with us. Our Corporate Governance Guidelines define independence in accordance with the independence standards established by the NYSE and require our Board to review the independence of all directors at least annually. Our Board has affirmatively determined that five of our six directors are independent under NYSE standards, specifically: Dr. Dunkelberg, Mr. Gebert, Ms. McClure, Mr. Pridgen and Dr. Soaries. In making its independence determinations, our Board considered and reviewed all information known to it (including information identified through annual directors’ questionnaires).

Our Board’s leadership structure is designed to promote Board effectiveness and to appropriately allocate authority and responsibility between Board and management. Our Board has no policy in principle with respect to the separation of the offices of Chair and Chief Executive Officer. From January 2011 to February 2013, these offices were separated with Mr. Schaeffer serving as Chair. Since February 2013, Mr. Schaeffer has served as both Chair and Chief Executive Officer. Our Board considered Mr. Schaeffer’s significant experience in all aspects of our business as part of its rationale for deciding to combine the roles of Chair and Chief Executive Officer. Our Board believes that our current leadership structure is appropriate at this time because the structure enhances Mr. Schaeffer’s ability to provide strong and consistent leadership and a unified voice for us and because our Board believes its governance processes, as reflected in our Corporate Governance Guidelines and Board committee charters, preserve Board independence by ensuring independent discussion among directors and independent evaluation of, and communication with, members of senior management. To further preserve Board independence, our Corporate Governance Guidelines require the independent directors to appoint a Lead Independent Director if the role of the Chair is combined with that of the Chief Executive Officer. Our Lead Independent Director further enhances the Board’s leadership structure and effectiveness by focusing on the Board’s processes and priorities, and facilitating independent oversight of management. The Lead Independent Director promotes open dialogue among

| 13 | 2020 Proxy Statement |

the independent and non-management directors during Board meetings, at executive sessions without the presence of the Chief Executive Officer, and between Board meetings.

Executive Sessions of Non-Management Directors

Our Board holds regular executive sessions of non-management directors. In addition, our corporate governance guidelines provide that the independent directors will meet in executive session on a regularly scheduled basis, but not less frequently than quarterly. Our Corporate Governance Guidelines provide that the Lead Independent Director shall preside at these meetings.

Our Corporate Governance Guidelines provide that when the positions of Chair and Chief Executive Officer are combined, the independent directors shall annually appoint an independent director to serve as Lead Independent Director for a one-year term and until his or her successor is appointed. The Lead Independent Director will preside at any meeting of the Board at which the Chair is not present, including at executive sessions for independent and non-management directors, at meetings or portions of meetings on topics where the Chair or the Board raises a possible conflict, and when requested by the Chair. The Lead Independent Director may call meetings of the independent and non-management directors or of the Board, at such time and place as he or she determines.

The Lead Independent Director will approve Board meeting agendas and schedules for each Board meeting, and may add agenda items in his or her discretion. The Lead Independent Director will have the opportunity to review, approve and/or revise Board meeting materials for distribution to and consideration by the Board; will facilitate communication between the Chair and Chief Executive Officer and the independent and non-management directors, as appropriate; will be available for consultation and communication with stockholders where appropriate; and will perform such other functions as the Board may direct.

Agendas, schedules, and information distributed for meetings of Board committees are the responsibility of the respective Committee Chairs. All directors may request agenda items, additional information, and/or modifications to schedules as they deem appropriate, both for the Board and the committees on which they serve, and they are encouraged to do so.

Communications with our Independent Directors and Board

Our Corporate Governance Guidelines provide that any interested parties desiring to communicate with our independent directors may directly contact such directors by delivering correspondence in care of our Secretary at our principal executive offices at 1835 Market Street, Suite 2601, Philadelphia, Pennsylvania 19103. In addition, stockholders may send communications to our Board by sending them to in care of our Secretary. The Secretary will forward these communications to the Chair of the Audit Committee, who will distribute them to the directors to whom the communications are addressed or as the subject matter warrants. If a stockholder prefers to raise concerns in a confidential or anonymous manner, the concern may be sent in care of our Compliance Officer at our principal executive offices.

Limits on Service on Other Boards

In our Corporate Governance Guidelines, our Board recognizes its members benefit from service on the boards of other companies. The Board encourages this service but also believes it is critical that our directors have the opportunity to dedicate sufficient time to their service on IRT’s Board. To this end, our Corporate Governance Guidelines provide that our directors may not serve on more than two other public company boards (excluding the Board) without the Board’s consent. None of our directors currently serve on more than one other public company board.

| 14 | 2020 Proxy Statement |

Our directors are elected annually. Our Board does not believe it should establish term limits for directors, as it believes term limits have the disadvantage of losing the contribution of directors who have been able to develop, over a period of time, increasing insight into the Company and its operations and, therefore, provide an increasing contribution to the Board as a whole. Instead the Board prefers to rely upon the evaluation procedures described below as the primary method of ensuring each director continues to act in a manner consistent with the best interests of the Company, its stockholders, and the Board.

Our Board as a whole has responsibility for risk oversight, with reviews of certain areas being conducted by the relevant Board committees that report on their deliberations to the Board. The oversight responsibility of the Board and its committees is enabled by management reporting processes that are designed to provide visibility to the Board about the anticipation, identification, assessment and management of critical risks and management’s risk mitigation strategies. These areas of focus include, among other things, competitive, economic, operational, financial (accounting, credit, liquidity and tax), legal, regulatory, compliance and reputational risks. Our Board and its committees oversee risks associated with their respective principal areas of focus, as summarized below. Our Audit Committee oversees risks and exposures associated with financial matters, particularly financial reporting, tax (including compliance with REIT rules), accounting, disclosure, internal control over financial reporting, cybersecurity, financial policies, investment guidelines, development and leasing, and credit and liquidity matters. In addition, the Audit Committee oversees the Company’s enterprise risk management practices to ensure that the Company is equipped to anticipate, identify, prioritize, and manage material risks to the Company Our Compensation Committee oversees risks associated with our executive compensation programs and arrangements, including incentive plans. Our Nominating Committee oversees risks associated with leadership, succession planning and talent development; and corporate governance.

We maintain a code of ethics for our directors, officers and employees in compliance with NYSE listing standards and the definition of a “code of ethics” set forth in applicable rules of the Securities and Exchange Commission, or SEC. The code of ethics reflects and reinforces our commitment to integrity in the conduct of our business. Any waiver of the code of ethics for executive officers or directors may only be made by a majority vote of the disinterested directors or by the Audit Committee, acting as the Board’s “conflicts of interest” committee; and any waiver will be disclosed promptly as required by law or stock exchange regulation, and, in addition, amendments to or waivers of our code of ethics that apply to our principal executive officer, principal financial officer, principal accounting officer, controller and persons performing similar functions and that relate to any matter enumerated in Item 406(b) of Regulation S-K promulgated by the SEC will be disclosed on our website at www.irtliving.com.

Our Audit Committee has established procedures, set forth in our code of ethics, for the submission of complaints about our accounting or auditing matters. These procedures include a hotline for the anonymous and confidential submission of concerns regarding questionable accounting or auditing matters. Any matters reported through the hotline that involve accounting, internal controls over financial reporting or auditing matters will be reported to the Chair of our Audit Committee. Our current hotline number is (844) 348-1579.

| 15 | 2020 Proxy Statement |

Board and Committee Meetings; Attendance

Our Board held 9 meetings during 2019. Our Board currently has a standing Audit Committee, Compensation Committee and Nominating Committee. The table below provides 2019 membership and meeting information for each of these committees:

Board Member | Audit | Compensation | Nominating |

Scott F. Schaeffer* |

|

|

|

William C. Dunkelberg, Ph.D | X |

|

|

Melinda H. McClure** |

| X | Chair |

Mack D. Pridgen III | X | X |

|

Richard H. Ross |

|

|

|

DeForest Soaries, Jr., D.Min |

| Chair | X |

Richard D. Gebert | Chair |

| X |

Meetings held in 2019 | 9 | 7 | 5 |

*Chair of the Board

**Lead Independent Director

In 2019, all directors attended at least 75% of the aggregate of the total number of meetings of the Board and meetings held by committees of the Board on which he or she served. Our Corporate Governance Guidelines provide that our directors are expected to attend our annual meeting of stockholders. All of our directors attended our 2019 annual meeting of stockholders.

Each member of our Audit Committee is independent under NYSE standards and SEC regulations and each member of our Audit Committee is financially literate, knowledgeable and qualified to review financial statements. The charter of our Audit Committee requires such independence and financial literacy as a condition to continued membership on the Audit Committee. ��Mr. Gebert is the Audit Committee Chair is qualified as an “audit committee financial expert” within the meaning of SEC regulations. Our Board reached its conclusion as to the qualifications of Mr. Gebert based on his education and experience in analyzing financial statements of a variety of companies. Our Audit Committee operates pursuant to a written charter adopted by our Board and reviewed for adequacy annually by the committee.

The principal functions of the Audit Committee relate to oversight of: •our accounting and the integrity of our consolidated financial statements and financial reporting process; •our systems of disclosure controls and procedures and internal control over financial reporting; •our compliance with financial, legal and regulatory requirements; •the qualifications, independence and performance of our independent registered public accounting firm; •the performance of our internal audit function; •our compliance with our code of ethics, including the review and assessment of related party transactions and the granting of any waivers to the code of ethics; and •risks and exposures as described above under “Risk Oversight.” |

Our Audit Committee is also responsible for engaging an independent registered public accounting firm, reviewing with the independent registered public accounting firm the plans and results of the audit engagement, approving professional services provided by the independent registered public accounting firm, including all audit and non-audit services, reviewing the independence of the independent registered public accounting firm, considering the range of audit and non-audit fees and reviewing the adequacy of our internal accounting controls.

| 16 | 2020 Proxy Statement |

The Audit Committee also prepares the audit committee report required by SEC regulations to be included in our annual proxy statement. The Audit Committee has adopted audit and non-audit services pre-approval guidelines.

Our Board has delegated oversight of compliance with our code of ethics to the Audit Committee, including the review of related party transactions and the granting of waivers to the code of ethics. If the Audit Committee grants any waivers to the code of ethics for any of our executive officers and directors, we will promptly disclose such waivers as required by law or NYSE regulations.

Each member of our Compensation Committee is independent under NYSE standards. The charter of our Compensation Committee requires such independence as a condition to continued membership on the Compensation Committee. Dr. Soaries is the Compensation Committee Chair. Our Compensation Committee operates pursuant to a written charter adopted by our Board and reviewed for adequacy annually by the committee.

The principal functions of the Compensation Committee include: •reviewing and approving on an annual basis the corporate goals and objectives relevant to our Chief Executive Officer’s compensation, evaluating our Chief Executive Officer’s performance in light of such goals and objectives and determining and approving the compensation of our Chief Executive Officer based on such evaluation; •reviewing and approving the compensation of the Named Executive Officers; •reviewing and approving our executive compensation policies and plans; •administering our incentive compensation equity-based plans, including our Long Term Incentive Plan, or the LTIP; •producing a report on executive compensation to be included in our annual proxy statement; and •reviewing and approving compensation for non-employee directors. |

Our Compensation Committee retained Semler Brossy Consulting Group as its consultant for 2019. We describe the role of the Compensation Committee’s consultant in the “Compensation Discussion and Analysis – Role of Compensation Consultant” later in this proxy statement.

Each member of our Nominating Committee is independent under NYSE standards. The charter of our Nominating Committee requires such independence as a condition to continued membership on the Nominating Committee. Ms. McClure is the Nominating Committee Chair. Our Nominating Committee operates pursuant to a written charter adopted by our Board and reviewed for adequacy annually by the committee.

| 17 | 2020 Proxy Statement |

The Nominating Committee uses a variety of methods for identifying and evaluating nominees for director. In recommending director nominees to the Board, the Nominating Committee solicits candidate recommendations from its own members, other directors and management. It also may engage the services and pay the fees of a professional search firm to assist it in identifying potential director nominees. The Nominating Committee assesses the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. If vacancies are anticipated, or otherwise arise, the Nominating Committee considers whether to fill those vacancies and, if applicable, considers various potential director candidates. These candidates are evaluated at regular or special meetings of the Nominating Committee, and may be considered at any point during the year. The Nominating Committee seeks to make its recommendations for director nominees for each annual meeting to the Board by the end of the first quarter each year.

The Nominating Committee has not adopted specific, minimum qualifications or specific qualities or skills that must be met by a Nominating Committee-recommended nominee. The Nominating Committee seeks to ensure that the membership of the Board and each committee of the Board satisfies all relevant listing standard requirements of the NYSE and applicable laws and regulations and all requirements of our governance documents, as well as to provide directors who have a mixture of skills relevant to our business. The nature of the specific qualifications, qualities, experience or skills (including international versus domestic background, diversity, age, and legal and regulatory requirements) that the Nominating Committee may look for in any particular director nominee depends on the qualifications, qualities, experience and skills of the rest of the directors at the time of any vacancy on the Board. The Nominating Committee does not have a formal policy regarding the consideration of diversity in identifying director nominees beyond being committed to ensuring that no person would be excluded from consideration for service as a director as a result of their sex, race, religion, creed, sexual orientation or disability.

The Nominating Committee will consider candidates for nomination as a director recommended by stockholders, directors, officers, third party search firms and other sources. In evaluating candidates, the Nominating Committee considers the attributes of the candidate and the needs of the Board, and will review all candidates in the same manner, regardless of the source of the recommendation. The Nominating Committee will consider individuals recommended by stockholders for nomination as a director in accordance with the procedures described under “Stockholder Proposals and Director Nominations.”

Board, Committee and Director Evaluations

Recognizing the importance of a rigorous self-evaluation process to allow boards to assess their performance and identify and address any potential gaps in the boardroom, our Board conducts an annual self-assessment of the performance of the Board, its committees and individual directors. The Chair of the Nominating Committee is responsible for leading the evaluation process, which takes place in advance of the annual consideration of director nominees. In the fourth quarter of 2019, the Chair of the Nominating Committee reviewed with the Board results of the most recent self-assessments. This annual evaluation process provides a way to monitor progress in certain areas targeted for improvement from year to year and to identify opportunities to enhance Board and committee effectiveness. The assessments confirm whether the current Board leadership and structure continue to be optimal for us and are an important factor taken into account by the Nominating Committee in making its recommendations to the Board regarding director nominees. As part of the evaluation process, each committee reviews its charter annually.

| 18 | 2020 Proxy Statement |

We believe that strong corporate governance should include regular engagement with our stockholders to enable us to understand and respond to stockholder concerns. Our senior management team, including our Chair and Chief Executive Officer and Chief Financial Officer and members of our Investor Relations team, maintain regular contact with a broad base of investors, including through quarterly earnings calls, individual meetings and other channels for communication, to understand their concerns. In 2019, senior management held 119 meetings with institutional investors and research analysts, including two property tours, one non-deal roadshow and five investor conferences.

Corporate and Social Responsibility

We strive to create better places for our residents, neighbors and employees to work and live. We support our employees by investing in training, mentoring and continuing education opportunities, and we promote their health and productivity by providing them and their families with a robust benefits package. We enhance our resident living experience by improving their living environment through robust property management and on-site upgrades, and engaging with our residents through frequent satisfaction surveys and community events. We seek at all times to conduct our business and affairs in accordance with the highest standards of ethical conduct and in compliance with applicable laws, rules and regulations and we expect our partners and vendors to uphold the same standards. We support charities which aim to fight poverty and reduce homelessness.

Environmental and Sustainability Commitments

We are committed to establishing sustainable practices within our office and clubhouse environments and throughout our communities to reduce our impact on the environment and lower operating costs. In order to achieve our commitment, we seek out cost-effective opportunities to reduce our consumption, conserve water and use energy efficiently.

We have adopted stock ownership requirements for our non-employee Directors and certain executive officers. The ownership requirements are to be satisfied six years after the later of (i) their election or appointment as a director or executive officer, as applicable, or (ii) April 1, 2018, the date we adopted the requirements. The requirements provide for a minimum beneficial ownership target of the Company’s common shares, as a multiple of the annual cash retainer, in the case of non-employee Directors, and base salary, in the case of executive officers, as follows:

Position | Minimum Share Ownership |

Non-Employee Directors | 5 times cash retainer |

Chief Executive Officer | 5 times annual salary |

Chief Financial Officer and | 3 times annual salary |

All non-employee Directors and those executive officers who are subject to the stock-ownership requirements are in compliance therewith as they have either met the minimum share ownership requirements or they have not yet reached the date by which such requirements must be satisfied.

We do not consider it appropriate for any of our officers, directors or employees to enter into speculative transactions in our securities that are designed to hedge or offset any decrease in market value of our securities. As the result, we prohibit officers, directors or employees from purchasing puts, calls, options or other derivative securities based on our securities. The policy also prohibits hedging or monetization transactions, such as zero-cost

| 19 | 2020 Proxy Statement |

collars and forward sale contracts. Officers, directors and employees may also not purchase our securities on margin, borrow against any account in which our securities are held or otherwise pledge our securities.

Effective September 12, 2019, our Compensation Committee adopted a Clawback Policy which applies to our executive officers. Under this policy, if the Company is required to prepare an accounting restatement due to material non-compliance with any financial reporting requirement under applicable securities laws, the Compensation Committee will seek to recover incentive compensation erroneously awarded during the three-year period preceding the publication of the restated financial statement, except to the extent the Committee determines that it would be impracticable, inequitable or otherwise inappropriate under the circumstances to do so. The method of recovery of erroneously awarded compensation will be determined by the Compensation Committee.

Additional Governance Matters

We do not have a shareholder rights plan, sometimes referred to as a poison pill. In addition, our Board has by revocable resolution exempted business combinations between us and any other person from the super-majority voting and other restrictions of the Maryland Business Combination Act.

| 20 | 2020 Proxy Statement |

PROPOSAL 2. RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Ratification of the Selection of Independent Registered Public Accounting Firm

Our Audit Committee has appointed KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020. KPMG LLP was first engaged as our independent registered public accounting firm in 2014 and has audited our financial statements for calendar year 2014 through and including calendar year 2019.

In selecting KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020, our Audit Committee considered a number of factors, including: (i) the professional qualifications of KPMG LLP, the lead audit partner and other key engagement team members; (ii) the performance and independence of KPMG LLP; (iii) the quality of the Audit Committee’s ongoing discussions with KPMG LLP, including the professional resolution of accounting and financial reporting matters with the national office; and (iv) the appropriateness of KPMG LLP’s fees in light of our size and complexity.

Although stockholder ratification of the appointment of KPMG LLP as our independent registered public accounting firm is not required by our bylaws or otherwise, our Board has decided to afford our stockholders the opportunity to express their opinions on the matter of our independent registered public accounting firm. Even if the selection is ratified, our Audit Committee in its discretion may select a different independent registered public accounting firm at any time if it determines that such a change would be in our best interests and those of our stockholders. If our stockholders do not ratify the appointment, our Audit Committee will take that fact into consideration, together with such other information as it deems relevant, in determining its next selection of an independent registered public accounting firm.

Representatives of KPMG LLP will be present at the annual meeting and will have the opportunity to make a statement if they desire to do so and will be available to respond to questions from stockholders.

Ratification of the appointment of KPMG LLP as our independent registered public accounting firm requires the affirmative vote of a majority of all votes cast on the matter.

The Board unanimously recommends a vote FOR Proposal 2 to ratify the appointment of KPMG LLP as our independent registered public accounting firm for calendar year 2020.

The following table presents the aggregate fees billed by KPMG for each of the services listed below for each of our last two fiscal years.

| 2019 |

|

| 2018 |

| ||

Audit Fees(1) | $ | 555,000 |

|

| $ | 589,680 |

|

Audit-Related Fees(2) |

| 270,000 |

|

|

| 245,000 |

|

Tax Fees(3) |

| 163,500 |

|

|

| 158,000 |

|

Total | $ | 988,500 |

|

| $ | 992,680 |

|

(1) | Audit fees consisted of the aggregate fees billed for professional services rendered by KPMG in connection with its audit of our consolidated financial statements, audit of internal controls relating to Section 404 of the Sarbanes-Oxley Act, and its reviews of the unaudited consolidated interim financial statements that are normally provided in connection with statutory and regulatory filings or engagements for these fiscal years. |

(2) | Audit-related fees consist of fees to review registration statements and for the issuance of comfort letters associated with the issuance of our common shares. |

| 21 | 2020 Proxy Statement |

(3) | Tax fees consist of the aggregate fees billed for professional services rendered by KPMG for tax compliance, tax advice and tax planning. |