Exhibit 99.1

March 31, 2016

Dear Investor,

On behalf of the Resource Real Estate Opportunity REIT (the “Opportunity REIT”), we wanted to provide you with an update on the performance of the Opportunity REIT, as well as announce its recent valuation.

The goal of the Opportunity REIT is to provide an investment in the U.S. apartment market that focuses on capital protection, current cash income and the potential for capital appreciation utilizing Resource Real Estate’s refined value-add apartment strategies. We believe that our strategies have continued to result in notable investment performance to date, and that the Opportunity REIT continues to meet its financial goals and objectives.

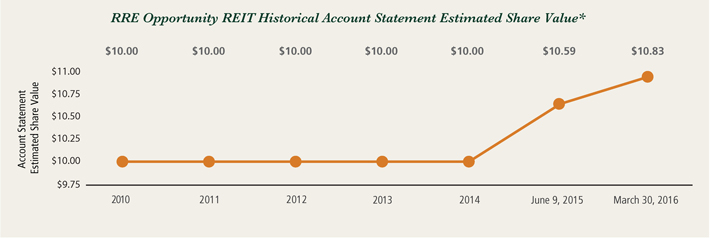

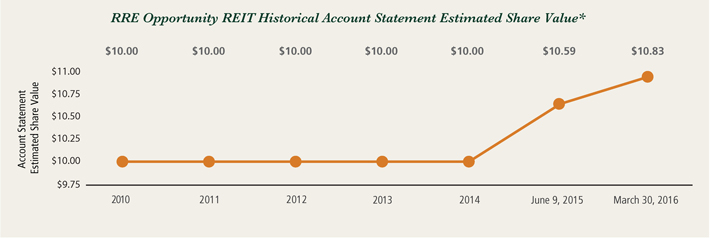

Valuation Increased from $10.59 per Share to $10.83 per Share

In accordance with Investment Program Association (“IPA”) Valuation Guidelines for non-traded REITs, the Opportunity REIT’s Board of Directors (the “Board”) engaged Duff & Phelps, LLC (“Duff & Phelps”), a global independent valuation advisor, to appraise the Opportunity REIT’s portfolio as of December 31, 2015, and to provide the Board with a range of estimated values per share of the Opportunity REIT’s common stock based upon the estimated market value of the REIT’s assets. On March 29, 2016, Duff & Phelps provided the Board with an estimated valuation range from a low of $10.15 per share to a high of $11.57 per share, and the Board approved Duff & Phelps’ mid-point estimate of $10.83 per share as the new estimated share value of the Opportunity REIT’s common stock, which will replace the prior estimated share value of $10.59 on all customer account statements.

| * | The historical account statement estimated share value of $10.00 was based entirely on the maximum price at which shares were offered in our initial public offering. We established the initial offering price of our shares on an arbitrary basis. This price may not have been indicative of the price at which our shares would have traded if they were listed on an exchange or actively traded, and this price bears not relationship to the book or net value of our assets or to our expected operating income. |

1845 Walnut Street, 18th Floor, Philadelphia, PA 19103 • Phone: (866) 469-0129 • Website: www.ResourceREIT.com

Details regarding the methodology of the Opportunity REIT’s valuation can be found in the Form 10-K for the year ended December 31, 2015 as filed with the Securities Exchange Commission on March 30, 2016. Below you will find a chart illustrating the Duff & Phelps proposed range of valuation from which the Board unanimously approved the mid-point of $10.83 per share.

| | | | | | | | | | | | |

| | | Duff & Phelps Estimated Valuation Range | | | Board Approved Valuation | |

| | | Low-end Estimated | | | Mid-point Estimated | | | High-end Estimated | |

| | | Market Value | | | Market Value | | | Market Value | |

Net Asset Value (NAV) | | $ | 727,254,277 | | | $ | 775,874,277 | | | $ | 828,334,277 | |

Number of outstanding shares | | | 71,617,117 | | | | 71,617,117 | | | | 71,617,117 | |

| | | | | | | | | | | | |

NAV Per Share | | $ | 10.15 | | | $ | 10.83 | | | $ | 11.57 | |

Opportunity REIT Performance Versus S&P and Traded REITs

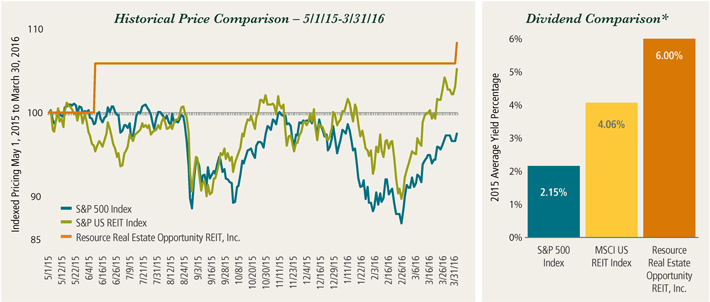

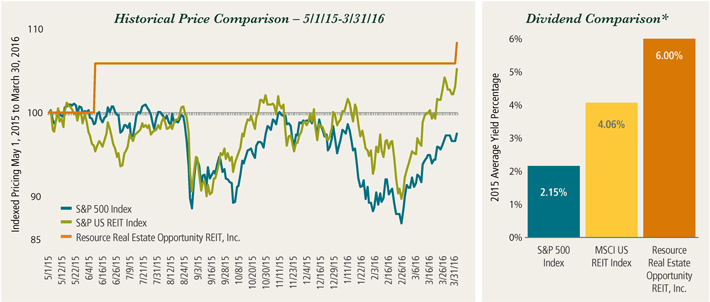

The estimated value for the Opportunity REIT has now increased twice from the original offering price of $10.00 per share, first in June, 2015, and now again in March, 2016. Since the Opportunity REIT’s inception in 2010, there has been significant volatility in the U.S. economy, with valuations of publicly traded stocks fluctuating daily as world events continue to impact markets. Non-traded REITs like the Opportunity REIT, are designed to provide protection from this type of volatility as well as cash flow, and to date, the Opportunity REIT has performed favorably against the broader markets. Below you will find illustrations comparing the recent historical pricing and cash dividends of the S&P index, the traded US REIT indexes, and the Opportunity REIT.

While there are many ways to compare investments in addition to simply looking at price fluctuation and dividends, these charts illustrate that to date, the Opportunity REIT has protected investors from market volatility while methodically increasing its overall value to investor and providing competitive cash dividends. It is important to note that, despite the lack of volatility in the estimated share value of the Opportunity REIT’s common stock, shares of the Opportunity REIT’s common stock are significantly less liquid than the publicly-traded securities included in both the S&P Index and the S&P US REIT Index. The Opportunity REIT’s ability to redeem shares under its share redemption program is very limited and the share redemption program may be amended, suspended or terminated by the Board upon 30 days’ notice to stockholders. Additionally, the Board and management of the Opportunity REIT is not required to provide an ultimate liquidity event to stockholders and there is no guarantee that any such liquidity event will occur.

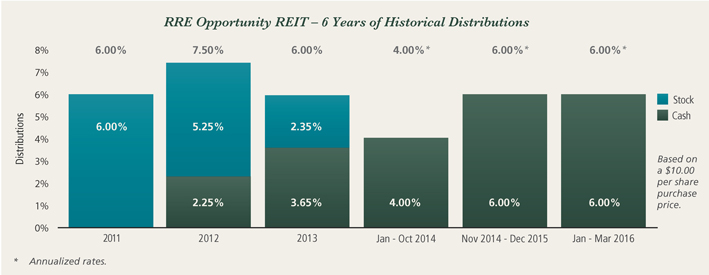

| * | The Opportunity REIT has historically funded distributions, which includes net cash distributions and distributions reinvested by stockholders, with cash flow from operating activities, proceeds from disposals of real estate assets and proceeds from debt financing. To the extent that the Opportunity REIT pays distributions from sources other than its cash flow from operating activities or gains from asset sales, the Opportunity REIT will have fewer funds available for investment and the overall return to stockholders will be reduced. |

1845 Walnut Street, 18th Floor, Philadelphia, PA 19103 • Phone: (866) 469-0129 • Website: www.ResourceREIT.com

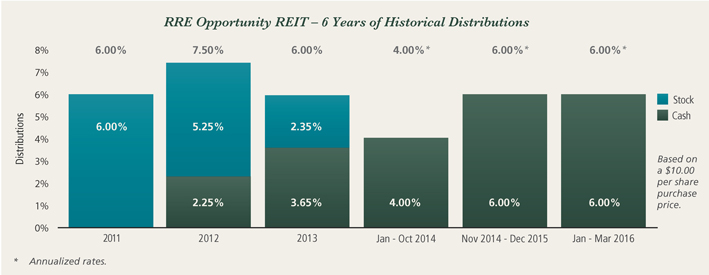

Six Percent Annual Distributions Today

Your current annualized distribution rate is six percent based on a share purchase price of $10.00 and approximately 5.5 percent of the $10.83 estimated value per share. As you are aware, the Opportunity REIT’s strategy is to acquire underperforming multifamily properties and to optimize them through the infusion of additional capital and the insertion of professional management to significantly improve their overall financial performance. As a result of this strategy, the Opportunity REIT’s early investors received stock distributions rather than cash distributions while the Opportunity REIT’s initial acquisitions were being optimized to allow them to produce higher levels of cash flow. Over time, as the Opportunity REIT grew and more properties became optimized, Opportunity REIT distributions were converted from all stock, to a mix of stock and cash, and eventually to an all cash distribution as the properties became more cash flow positive. Below is a brief summary of the Opportunity REIT’s distributions to date:

We are pleased that the Opportunity REIT has continued to provide its investors with cash distributions, and that our strategy of growing cash distributions along with property performance has continued to protect and enhance the overall value of the Opportunity REIT.

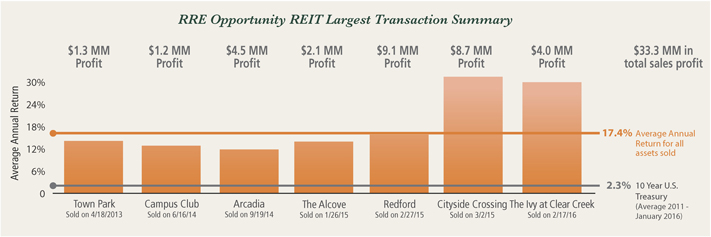

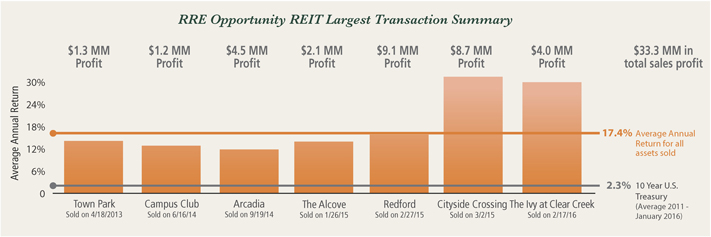

17 Property Sales Result in $33 Million in Profits with an Average Return of 17 Percent*

To date, the Opportunity REIT has selectively sold 17 assets resulting in an average annual return of over 17 percent and a total profit of approximately $33 million. We believe that the results of these transactions are a very positive indicator that not only our strategy, but also our execution of that strategy, has been largely successful in achieving the Opportunity REIT’s goals. Below is a brief summary of the seven largest transactions to date:

| * | Average annual return is calculated by dividing total cash flow from a property by its total capitalization (purchase price of property plus capital expenditures) – and then further divided by number of years from purchase to sale to provide an annualized return on investment. Average annual return is used to calculate a specific investment’s return profile and is not equivalent to actual returns to individual shareholders. |

1845 Walnut Street, 18th Floor, Philadelphia, PA 19103 • Phone: (866) 469-0129 • Website: www.ResourceREIT.com

In many cases, the assets selected for sale have represented either those assets that we believe have reached their maximum value or, those assets we believe would not be strong long-term performers in the Opportunity REIT’s portfolio. Furthermore, we are quite pleased that these initial asset sales earned such high returns in a historically low interest rate environment where the 10-year treasury rate averaged about 2.3 percent. We continue to be pleased with the transactional success that the Opportunity REIT has achieved to date.

Distributions Have Been Tax Free To Date

It is important to point out that as of December 31, 2015, the Opportunity REIT has provided investors with a tax efficient investment. Primarily as a result of the accelerated property depreciation schedules for multifamily properties, investors have had zero tax liability related to either property sales or their cash distributions since the Opportunity REIT’s inception. While we expect that this may not always be the case in the future, we are pleased to provide our investors with an investment that has, to date, shielded them from tax liabilities.

Strong Demand and Limited Supply Produce Increased Rental Rates

Our well-honed value-add process serves as a main driver of the Opportunity REIT’s strong performance to date; however, the continued growth of the U.S. apartment market has naturally contributed to its success as well. Apartments are generally among the least volatile real estate investments and are a need-based product as compared to other real estate investment types. Historically low homeownership rates continue to drive more Americans into rental housing, while the supply of quality rental options continues to lag behind demand. This trend of imbalance between apartment supply and demand has consistently driven rental rates up and is expected to continue to do so.

Summary

The Opportunity REIT continues to meet our expectations in terms of its performance. We are pleased that our second valuation has resulted in an increase to the estimated share value of the Opportunity REIT. Our distributions to investors have remained a stable source of income and we have sold 17 assets resulting in a 17 percent average annual return, all without creating any tax liabilities to date for our investors. Although past performance is not a guarantee of future performance, we believe that strong long-term apartment fundamentals will continue to provide an environment favorable to our value-add apartment strategy and execution capabilities, and we look forward to continuing to operate the Opportunity REIT to greater financial performance heights.

If you have any questions regarding this correspondence or the REIT, please feel free to contact Investor Relations at 866-469-0129 or via email at InvestorRelations@ResourceREIT.com.

We look forward to speaking with you soon.

| | |

Sincerely, | | |

| |  |

| |

| Alan Feldman | | Kevin Finkel |

| Chief Executive Officer | | President and Chief Operating Officer |

| Resource Real Estate Opportunity REIT, Inc. | | Resource Real Estate Opportunity REIT, Inc. |

1845 Walnut Street, 18th Floor, Philadelphia, PA 19103 • Phone: (866) 469-0129 • Website: www.ResourceREIT.com

Forward-Looking Statements

The foregoing includes forward-looking statements within the meaning of the Federal Private Securities Litigation Reform Act of 1995. The Opportunity REIT intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent, belief or current expectations of the Opportunity REIT and members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should” or similar expressions. Further, forward-looking statements speak only as of the date they are made, and the Opportunity REIT undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law. Actual results may differ materially from those contemplated by such forward-looking statements. The appraisal methodology for the Opportunity REIT’s real estate properties assumes the properties realize the projected net operating income and that investors would be willing to invest in such properties at similar capitalization rates. Though the estimates of the fair market value of the real estate properties and the estimated value per share are Duff & Phelps’s best estimates, the Opportunity REIT can give no assurance in this regard. Even small changes to these assumptions could result in significant differences in the appraised values of the Opportunity REIT’s real estate properties and the estimated value per share. These statements also depend on factors such as: future economic, competitive and market conditions; the Opportunity REIT’s ability to maintain occupancy levels and rental rates at its real estate properties; and other risks identified in Part I, Item IA of the Opportunity REIT’s Annual Report on Form 10-K for the year ended December 31, 2015, as filed with the SEC. Actual events may cause the value and returns on the Opportunity REIT’s investments to be less than that used for purposes of the Opportunity REIT’s estimated value per share.

1845 Walnut Street, 18th Floor, Philadelphia, PA 19103 • Phone: (866) 469-0129 • Website: www.ResourceREIT.com