UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| | | | | | | | | | | |

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| | | | | |

| CHECK THE APPROPRIATE BOX: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

Trane Technologies plc

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | |

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): |

| ☑ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

2024

Notice and

Proxy Statement

A Letter from Our Board of Directors

Dear Fellow Shareholders:

As the Board of Directors, we are pleased to share that Trane Technologies achieved another year of very strong financial performance while advancing our bold sustainability commitments.

Through leading innovation, strong customer focus and a talented team, Trane Technologies delivered organic revenue growth* of 9%, adjusted earnings per share growth* of 23% and powerful free cash flow. This builds on a strong track record of consistent performance over time, with 2023 marking the third year of adjusted earnings per share growth of 20% or more.

Trane Technologies remains committed to addressing some of the world’s most pressing challenges while creating long-term value for shareholders, customers, employees and communities. The company’s strategy is aligned to powerful megatrends: energy efficiency, decarbonization and digital transformation. These trends continue to intensify, increasing demand for our innovative and sustainable products, services, and digital solutions. We are relentlessly investing for growth, and in 2023 launched approximately 100 new products and broadened our global portfolio through several acquisitions.

The company’s efforts in 2023 resulted in meaningful progress toward our 2030 Sustainability Commitments:

•Gigaton Challenge: We continue to innovate with the goal to reduce our customers’ carbon emissions (CO2e) from the use of our products and services by one billion metric tons (one gigaton) by 2030. In addition, we’re reducing the carbon that is embodied in the products we provide. In less than a year, we’ve shipped more than one million HVAC systems built with low-carbon steel.

•Leading by Example: Across our global footprint, we continue to reduce operational emissions by leveraging our own technology and increasing onsite renewable energy. We are on track to achieve carbon neutral operations by 2030 and have pledged to reach net-zero greenhouse gas emissions across our value chain by 2050.

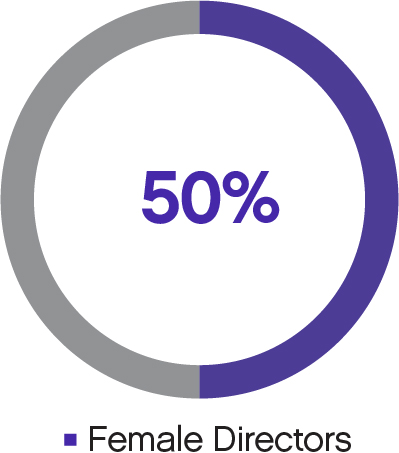

•Opportunity for All: Trane Technologies remains focused on creating opportunity for all, guided by an uplifting, inclusive and engaging culture. This past year, we achieved gender parity among our Board membership and have continued to increase diversity in management and within our global workforce.

As a Board of Directors, we are committed to ensuring the company’s purpose and strategy support the transition to a more sustainable and resilient future and achieve differentiated, long-term financial results for shareholders.

We are proud of Trane Technologies’ strong financial performance and global leadership in sustainability. We encourage you to review our 2023 Annual Report and Proxy for a comprehensive overview of our performance throughout the year.

Sincerely,

The Board of Directors of Trane Technologies plc

(Left to Right) Melissa N. Schaeffer, John P. Surma, Ann C. Berzin, Mark R. George, Gary D. Forsee, Ana P. Assis,

David S. Regnery (Chair), Myles P. Lee, Kirk E. Arnold, April Miller Boise, Linda P. Hudson, and John A. Hayes

* These are non-GAAP financial measures. Reconciliation of non-GAAP financial measures can be found in Appendix A to the Proxy Statement.

Notice of 2024 Annual General Meeting of Shareholders

| | | | | | | | | | | | | | | | | | | | | | | |

| Voting Items | | | | |

| | Date and Time June 6, 2024 (Thursday) 2:30 p.m. local time Location Adare Manor Hotel Adare, County Limerick, Ireland See “Information Concerning Voting and Solicitation” of the Proxy Statement for further information on participating in the Annual General Meeting. Who Can Vote Only shareholders of record as of the close of business on April 11, 2024 are entitled to receive notice of and to vote at the Annual General Meeting. | |

| | | | | |

| Proposals To Be Voted | Board Vote Recommendation | For Further Details | | | |

| 1. | To elect 12 directors for a period of one year | FOR each director nominee | | | | |

| 2. | To give advisory approval of the compensation of the Company’s Named Executive Officers | FOR | | | | |

| 3. | To approve the appointment of PricewaterhouseCoopers LLP as independent auditors of the Company and authorize the Audit Committee of the Board of Directors to set the auditors’ remuneration | FOR | | | | |

| 4. | To renew the existing authority of the directors of the Company to issue shares | FOR | | | | |

| 5. | To renew the existing authority of the directors of the Company to issue shares for cash without first offering shares to existing shareholders (Special Resolution) | FOR | | | | |

| 6. | To determine the price range at which the Company can reallot shares that it holds as treasury shares (Special Resolution) | FOR | | | | |

| | | | | | |

Shareholders will also conduct such other business properly brought before the meeting. By Order of the Board of Directors,

EVAN M. TURTZSENIOR VICE PRESIDENT AND GENERAL COUNSEL | | | |

| | | |

| | How to Vote Whether or not you plan to attend the meeting, please provide your proxy by either using the Internet or telephone as further explained in the accompanying Proxy Statement or filling in, signing, dating, and promptly mailing a proxy card. By Telephone In the U.S. or Canada, you can vote your shares by submitting your proxy toll-free by calling 1-800-690-6903. By Internet You can vote your shares online at www.proxyvote.com. By Mail You can vote by mail by marking, dating, and signing your proxy card or voting instruction form and returning it in the postage-paid envelope. | |

| | | |

| | | |

Attending the Meeting If you are a shareholder who is entitled to attend and vote, then you are entitled to appoint a proxy or proxies to attend and vote on your behalf. A proxy is not required to be a shareholder of the Company. If you wish to appoint as proxy any person other than the individuals specified on the proxy card, please contact the Company Secretary at our registered office. Important Notice regarding the availability of proxy materials for the Annual General Meeting of Shareholders to be held on June 6, 2024. The Annual Report and Proxy Statement are available at www.proxyvote.com. The Notice of Internet Availability of Proxy Materials or this Notice of 2024 Annual General Meeting of Shareholders, the Proxy Statement and the Annual Report are first being mailed to shareholders on or about April 25, 2024. 2025 Annual Meeting Deadline for shareholder proposals for inclusion in the Proxy Statement: December 26, 2024 Deadline for business proposals and nominations for director: March 8, 2025 | | | |

| | |

Table of Contents

Proxy Voting Roadmap

This summary highlights information contained elsewhere in this Proxy Statement. For more complete information about these topics, please review Trane Technologies plc’s Annual Report on Form 10-K and the entire Proxy Statement.

| | | | | | | | | | | |

| | | |

ITEM | Election of Directors •11 out of 12 Director nominees are independent. •The Board of Directors is nominating six female directors, one Black director and two non-U.S. directors out of a total of 12 directors. •The tenure and experience of our directors is varied, which brings varying perspectives to our Board functionality. | | The Board of Directors recommends a vote FOR the directors nominated for election. |

| See page 11 for further information |

| | | |

Director Nominees

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Director since | | | Trane Technologies Committees |

| Name/Occupation | Age | Independent | Other Current Public Boards | A | H | S | F | T | E |

Kirk E. Arnold

Advisor to General Catalyst Former Chief Executive Officer, Data Intensity | 64 | 2018 | YES | •Ingersoll Rand Inc. •Thomson Reuters | | C | M | | M | M |

Ana P. Assis Chair and General Manager of IBM in Europe, the Middle East and Africa (EMEA) | 50 | 2023 | YES | | | M | M | | M | |

Ann C. Berzin Former Chairman and CEO of Financial Guaranty Insurance Company | 72 | 2001 | YES | | M | | | M | | |

April Miller Boise Executive Vice President and Chief Legal Officer of Intel Corporation | 55 | 2020 | YES | | | M | C | | | M |

Gary D. Forsee Former President of University of Missouri System and Former Chairman of the Board and Chief Executive Officer of Sprint Nextel Corporation | 74 | 2007 | YES | •Ingersoll Rand Inc. | | | | | M | M |

Mark R. George Executive Vice President and Chief Financial Officer of Norfolk Southern Corporation | 57 | 2022 | YES | | M | | | M | | |

John A. Hayes Former Chairman and President and CEO of Ball Corporation | 58 | 2023 | YES | | | M | M | | | |

Linda P. Hudson Founder and Former Chairman and CEO of The Cardea Group and Former President and CEO of BAE Systems, Inc. | 73 | 2015 | YES | •Bank of America •TPI Composites, Inc. | | M | M | | C | |

Myles P. Lee Former Director and CEO of CRH plc | 70 | 2015 | YES | | M | | | C | | M |

David S. Regnery Chair and Chief Executive Officer | 61 | 2021 | NO | | | | | | | C |

Melissa N. Schaeffer Senior Vice President and Chief Financial Officer of Air Products and Chemicals, Inc. | 44 | 2022 | YES |

| M | | | M | | |

John P. Surma Former Chairman and CEO of United States Steel Corporation | 69 | 2013 | YES | •Marathon Petroleum Corporation •MPLX LP (a publicly traded subsidiary of Marathon Petroleum Corporation) •Public Service Enterprise Group | C | | | M | | M |

| | | | | | | | | | | | | | | | | | | | | | | |

| A | Audit Committee | H | Human Resources and Compensation Committee | S | Sustainability, Corporate Governance and Nominating Committee | C | Chair |

| F | Finance Committee | T | Technology and Innovation Committee | E | Executive Committee | M | Member |

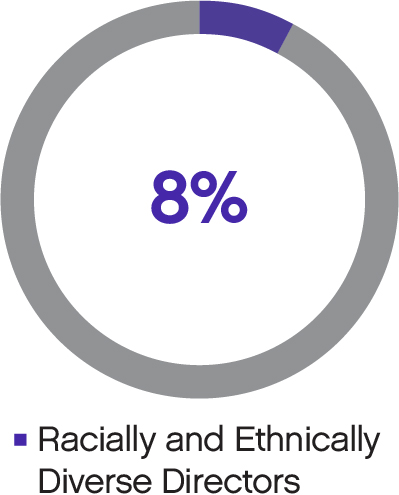

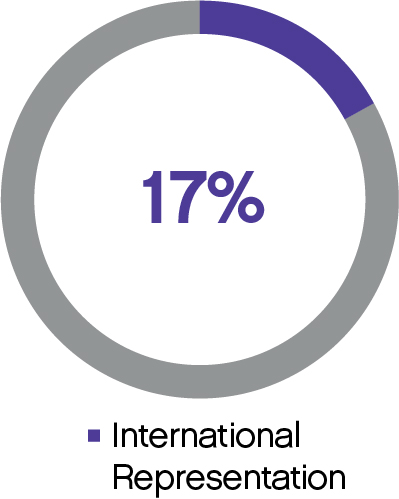

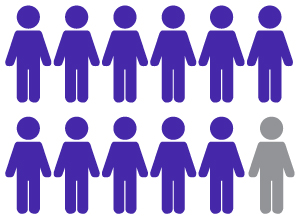

Board Diversity

One of the three pillars of our 2030 Sustainability Commitments is Opportunity for All. We create new possibilities and a better world for our people and our communities. Oversight of our diversity and inclusion strategy begins with our Board of Directors. Our Human Resources and Compensation Committee regularly reviews diversity and inclusion and other human capital management matters. This commitment to diversity and inclusion extends to our Board of Directors. We know that diverse teams are more innovative and collaborative, capable of solving problems and best positioned to realize a better world for future generations. We believe that diversity of our Board contributes to our long-term strategy and business model.

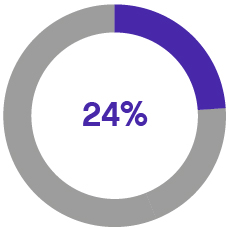

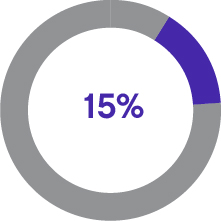

The Company’s policy on Board diversity relates to the selection of nominees for the Board of Directors. In selecting a nominee for the Board, the Sustainability, Corporate Governance and Nominating Committee considers the skills, expertise and background that would complement the existing Board and ensure that its members are of sufficiently diverse and independent backgrounds, recognizing that the Company’s businesses and operations are diverse and global in nature. Currently, 50% of the Board consists of female directors. The Board intends to continue to select diverse candidates and considers gender diversity and racial and ethnic diversity in each board member search that it conducts. The Board of Directors is nominating six female directors (Ms. Arnold, Ms. Assis, Ms. Berzin, Ms. Miller Boise, Ms. Hudson and Ms. Schaeffer), one Black director (Ms. Miller Boise) and two international directors (Ms. Assis and Mr. Lee) out of a total of 12 directors. In addition, the tenure and experience of our directors is diverse, which brings varying perspectives to our Board functionality.

| | | | | | | | | | | |

| GENDER | RACE AND ETHNICITY | NATIONALITY | BOARD SIZE AND

INDEPENDENCE |

| | | |

| | | |

11 out of 12 Director

Nominees are

Independent |

BOARD SKILLS AND EXPERIENCE

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | Financial Expert | | | | | | | | | | | | |

| | Finance/Capital Allocation | | | | | | | | | | | | |

| | Global Experience | | | | | | | | | | | | |

| | Technology/Engineering | | | | | | | | | | | | |

| | Services | | | | | | | | | | | | |

| | Human Resources/Compensation | | | | | | | | | | | | |

| | IT/Cybersecurity/Data Management/Digital | | | | | | | | | | | | |

| | Risk Management/Mitigation | | | | | | | | | | | | |

| | | ESG/Sustainability | | | | | | | | | | | | |

| | Chair/CEO/Business Head | | | | | | | | | | | | |

| | Industrial/Manufacturing | | | | | | | | | | | | |

| | Academia/Education | | | | | | | | | | | | |

| | Government/Public Policy | | | | | | | | | | | | |

| | Financial Services | | | | | | | | | | | | |

For more information regarding our diversity and inclusion strategy, goals and metrics for our Company generally, please see our ESG Report located on our website at www.tranetechnologies.com/ESG and our “Human Capital Management” disclosure in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Director Nomination Process

The Sustainability, Corporate Governance and Nominating Committee identifies individuals qualified to become directors and recommends the candidates for all directorships.

| | | | | |

| |

| 1 | BOARD COMPOSITION ASSESSMENT |

| The Sustainability, Corporate Governance and Nominating Committee reviews the composition of the full Board to identify the qualifications and areas of expertise needed to further enhance the composition of the Board. |

|

| 2 | BOARD RECOMMENDATION |

| The Sustainability, Corporate Governance and Nominating Committee makes recommendations to the Board concerning the appropriate size and needs of the Board including recommendations based on reviews of diversity and the Board’s skill and experience matrix. |

|

| 3 | IDENTIFICATION OF CANDIDATES |

| The Sustainability, Corporate Governance and Nominating Committee, with the assistance of management, identifies candidates with the desired qualifications. The Board has used a third-party search firm for all searches conducted in the past seven years and has included a diverse slate of candidates from a gender, racial and ethnic diversity perspective. The Board intends to continue to consider diverse candidates, including from a gender diversity and racial and ethnic diversity perspective, for each available board seat in each board member search that it conducts. In considering candidates, the Sustainability, Corporate Governance and Nominating Committee will consider all factors it deems appropriate, including breadth of experience, understanding of business and financial issues, ability to exercise sound judgment, diversity, leadership, and achievements and experience in matters affecting business and industry. The Sustainability, Corporate Governance and Nominating Committee considers the entirety of each candidate’s credentials and believes that at a minimum each nominee should satisfy the following criteria: highest character and integrity, experience and understanding of strategy and policy-setting, sufficient time to devote to Board matters, and no conflict of interest that would interfere with performance as a director. Shareholders may recommend candidates for consideration for Board membership by sending recommendations to the Sustainability, Corporate Governance and Nominating Committee, in care of the Secretary of the Company. Candidates recommended by shareholders are evaluated in the same manner as director candidates identified by any other means. |

| |

Corporate Governance Highlights

The Company upholds the highest standards of corporate governance including:

| | | | | |

•Substantial majority of independent director nominees (11 of 12) •Annual election of directors •Majority vote for directors •Lead Independent Director •Board oversight of risk management •Succession planning at all management levels, including for Board Members and Chair and Chief Executive Officer | •Annual Board and committee self-assessments •Executive sessions of non-management directors •Continuing director education •Meaningful executive and director stock ownership guidelines •Board oversight of enterprise-wide sustainability program and strategy |

| | | | | | | | | | | |

| | | |

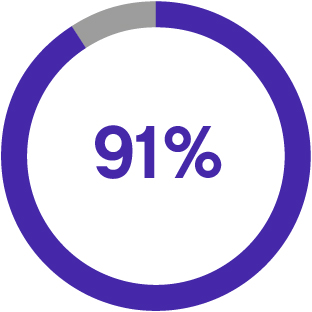

ITEM | Advisory Approval of the Compensation of Our Named Executive Officers •Our Human Resources and Compensation Committee has adopted executive compensation programs with a strong link between pay and achievement of short and long-term Company goals. •Shareholders voted 91% in favor of the Company’s Advisory Approval of the Compensation of our Named Executive Officers (“NEOs”) at our 2023 Annual General Meeting. | | The Board of Directors recommends a vote FOR this item. |

| See page 18 for further information |

| | | |

Executive Compensation Highlights

The Human Resources and Compensation Committee (the “HRCC”) is guided by executive compensation principles that shape the executive compensation programs that the Committee adopts to execute on the Company’s strategies and goals.

Executive Compensation Principles

Our executive compensation programs are based on the following principles:

| | | | | | | | | | | | | | | | | |

| (i) | business strategy alignment | (iii) | shareholder alignment | (v) | internal parity |

| | | | | |

| (ii) | pay for performance | (iv) | mix of short and long-term incentives | (vi) | market competitiveness |

Executive Compensation Program Overview

The Committee has adopted executive compensation programs with a strong link between pay and performance and the achievement of short-term and long-term Company goals. The primary components of the executive compensation programs are base salary, Annual Incentive Matrix (“AIM”) and long-term incentives (“LTI”). The Committee places significant emphasis on variable compensation (AIM and LTI) so that a substantial percentage of the five Named Executive Officers’ (“NEOs”) target total direct compensation (“TDC”) is contingent on the successful achievement of the Company’s short-term and long-term performance goals.

Pay for Performance

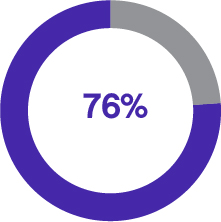

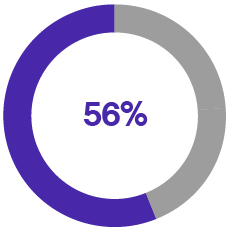

A strong pay for performance culture is paramount to our success and encourages behavior that promotes long-term value creation for our shareholders. Accordingly, each executive’s TDC is strongly tied to Company, business and individual performance against set goals. Within our AIM Program, Company and business performance are measured against pre-established financial, operational and strategic objectives, and modified by an Environmental, Social and Governance (“ESG”) goal, which are all set by the Committee. Individual performance is measured against pre-established individual goals, inclusive of a personal sustainability commitment, as well as demonstrated leadership competencies and behaviors consistent with our leadership principles. Additionally, a portion of the executive’s LTI award is earned based on Company cash flow return on invested capital (“CROIC”) and total shareholder return (“TSR”) relative to companies in the Standard & Poor’s (“S&P”) 500 Industrials Index. In 2023, greater than 91% of our Chair and Chief Executive Officer’s TDC was performance-based and 76% of our other NEOs’ average TDC was performance-based compensation, which is dependent on our Company’s performance.

2023 Executive Compensation

The table below shows the 2023 compensation for our Chief Executive Officer (“CEO”) and other NEOs, as required to be reported in the Summary Compensation Table pursuant to U.S. Securities and Exchange Commission (“SEC”) rules. Please see the notes accompanying the Summary Compensation Table on page 54 for further information. Summary Compensation Table - 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and

Principal Position | Year | Salary

($) | Bonus

($) | Stock

Awards

($) | Option

Awards

($) | Non-Equity

Incentive Plan

Compensation

($) | Change in

Pension

Value and

Nonqualified

Deferred

Compensation

Earnings

($) | All Other

Compensation

($) | Total

($) |

D. S. Regnery

Chair and Chief

Executive Officer | 2023 | 1,362,500 | | — | | 9,487,257 | | 2,875,006 | | 4,059,149 | | 4,487,670 | | 584,762 | | 22,856,344 | |

C. J. Kuehn

Executive Vice President

and Chief Financial Officer | 2023 | 812,500 | | — | | 2,337,454 | | 756,293 | | 1,494,999 | | 401,595 | | 184,861 | | 5,987,702 | |

P. A. Camuti

Executive Vice President

and Chief Technology

and Sustainability Officer | 2023 | 662,500 | | — | | 1,237,754 | | 375,009 | | 903,002 | | 407,574 | | 130,229 | | 3,716,068 | |

E. M. Turtz

Senior Vice President

and General Counsel | 2023 | 622,500 | | — | | 1,155,192 | | 350,005 | | 599,359 | | 425,624 | | 117,906 | | 3,270,586 | |

R. D. Pittard

Executive Vice President and Chief Integrated Supply Chain Officer | 2023 | 609,625 | | — | | 701,452 | | 212,532 | | 733,739 | | 474,065 | | 130,889 | | 2,862,302 | |

See the “Compensation Discussion and Analysis” section for more information about our Committee’s executive compensation principles, the programs the Committee has adopted and the decisions the Committee made regarding 2023 compensation.

| | | | | | | | | | | |

| | | |

ITEM | Approval of Appointment of

Independent Auditors •The Audit Committee engages in an annual evaluation of the qualifications, performance and independence of PricewaterhouseCoopers LLP (“PwC”). •Both by virtue of its familiarity with the Company’s affairs and its professional competencies and resources, PwC is considered best qualified to perform this important function. •The Audit Committee and the Board believe that the continued retention of PwC to serve as our independent auditor is in the best interests of the Company and its investors. | | The Board of Directors recommends a vote FOR this item. |

| See page 18 for further information |

| | | |

| | | | | | | | | | | |

| | | |

ITEM | Renewal of the Directors’ Existing Authority to Issue Shares •The Board of Directors’ authority to issue shares under Irish law is fundamental to our business. •Granting the Board this authority is a routine matter for public companies incorporated in Ireland. | | The Board of Directors recommends a vote FOR this item. |

| See page 20 for further information |

| | | |

| | | | | | | | | | | |

| | | |

ITEM | Renewal of the Directors’ Existing Authority to Issue Shares for Cash without First Offering Shares to Existing Shareholders •The Board of Directors’ authority to issue shares for cash without first offering shares to existing shareholders is fundamental to our business. •Granting the Board this authority is a routine matter for public companies incorporated in Ireland. •As required under Irish law, this proposal requires the affirmative vote of at least 75% of the votes cast. | | The Board of Directors recommends a vote FOR this item. |

| See page 21 for further information |

| | | |

| | | | | | | | | | | |

| | | |

ITEM | Determine the Price at which the Company Can Reallot Shares Held as Treasury Shares •From time to time the Company may acquire ordinary shares and hold them as treasury shares. •The Company may reallot such treasury shares, and under Irish law, our shareholders must authorize the price range at which we may reallot shares held in treasury. •As required under Irish law, this proposal requires the affirmative vote of at least 75% of the votes cast. | | The Board of Directors recommends a vote FOR this item. |

| See page 22 for further information |

| | | |

Proposals Requiring Your Vote

In this Proxy Statement, “Trane Technologies,” the “Company,” “we,” “us” and “our” refer to Trane Technologies plc, an Irish public limited company. This Proxy Statement and the enclosed proxy card, or the Notice of Internet Availability of Proxy Materials, are first being mailed to shareholders of record as of April 11, 2024 (the “Record Date”) on or about April 25, 2024.

| | | | | | | | | | | |

| | | |

ITEM | Election of Directors The Company uses a majority of votes cast standard for the election of directors. A majority of the votes cast means that the number of votes cast “for” a director nominee must exceed the number of votes cast “against” that director nominee. Each director of the Company is being nominated for election for a one-year term beginning at the end of the 2024 Annual General Meeting of Shareholders to be held on June 6, 2024 (the “Annual General Meeting”) and expiring at the end of the 2025 Annual General Meeting of Shareholders. Under our Articles of Association, if a director is not re-elected in a director election, the director shall retire at the close or adjournment of the Annual General Meeting. Our Corporate Governance Guidelines provide for the retirement of directors after reaching the retirement age of 75. | | The Board of Directors recommends a vote FOR the directors nominated for election listed below. |

| | | |

Nominees for Director

| | | | | | | | |

Kirk E. Arnold Independent Director Age 64 Director since 2018 Committees Human Resources and Compensation (Chair) Sustainability, Corporate Governance and Nominating Technology and Innovation Executive | Principal Occupation •Advisor to General Catalyst, a venture capital firm backing entrepreneurs, from September 2018 to Present. •Chief Executive Officer of Data Intensity from 2013 to 2017. |

|

Current Public Directorships •Ingersoll Rand Inc. (IR) •Thomson Reuters (TRI) | Public Directorships Held in the Past Five Years •Epiphany Technology Acquisition Corp. |

| |

Other Activities •Director of The Predictive Index •Director of UP Education Network •Director of HousecallPro | |

| |

| Skills and Experience |

|

|

| |

| |

Nominee Highlights Ms. Arnold’s vast experience in technology and service leadership brings critical insight into the Company’s operations, digital analytics and technologies. Ms. Arnold has served in executive positions throughout the technology industry including as COO at Avid, a technology provider to the media industry, and CEO and President of Keane, Inc., then a publicly traded billion-dollar global services provider. Ms. Arnold has also held senior leadership roles at Computer Sciences Corporation, Fidelity Investments and IBM. Ms. Arnold’s active participation in the technology and business community provides the Company ongoing insight into digital marketing and technology related issues. |

| | |

PROPOSALS REQUIRING YOUR VOTE

| | | | | | | | |

Ana P. Assis Independent Director Age 50 Director since 2023 Committees Human Resources and Compensation Sustainability, Corporate Governance and Nominating Technology and Innovation

| Principal Occupation •Chair (from January 2023 to Present) and General Manager (from 2022 to Present) of IBM in Europe, the Middle East and Africa (EMEA) •General Manager, Client Transition Leader, IBM (from October 2020 to December 2021) •General Manager, Latin America, IBM (July 2017 to November 2020) |

|

Current Public Directorships •None | Public Directorships Held in the Past Five Years •None |

| |

Other Activities •Director, Junior Achievement Americas | |

| |

| Skills and Experience |

|

|

| |

| |

Nominee Highlights Ms. Assis brings more than 25 years of global leadership experience in the information technology and solutions industry. She is a recognized thought leader in areas including artificial intelligence and data responsibility. Since 2022, Ms. Assis has served as the General Manager of IBM EMEA, responsible for IBM’s business operations, client satisfaction and employee engagement in a region with more than 100 countries. In January 2023, she was named Chair of IBM EMEA, overseeing IBM’s relationship with the European Union and other institutions across the region. |

| | |

| | | | | | | | |

Ann C. Berzin Independent Director Age 72 Director since 2001 Committees Audit Finance | Principal Occupation •Chairman and Chief Executive Officer of Financial Guaranty Insurance Company (insurer of municipal bonds and structured finance obligations), a subsidiary of General Electric Capital Corporation, from 1992 to 2001. |

|

Current Public Directorships •None | Public Directorships Held in the Past Five Years •Exelon Corporation |

| |

Other Activities •Member of University of Chicago College Advisory Council | |

| |

| Skills and Experience |

|

|

| |

| |

Nominee Highlights Ms. Berzin’s extensive experience in finance at a global diversified industrial firm and her expertise in complex investment and financial products and services bring critical insight to the Company’s financial affairs, including its borrowings, capitalization and liquidity. In addition, Ms. Berzin’s relationships across the global financial community strengthen the Company’s access to capital markets. Her board memberships have provided deep understanding of trends in the energy sector, which presents ongoing opportunities and challenges for the Company. |

| | |

PROPOSALS REQUIRING YOUR VOTE

| | | | | | | | |

April Miller Boise Independent Director Age 55 Director since 2020 Committees Executive Human Resources and Compensation Sustainability, Corporate Governance and Nominating (Chair) | Principal Occupation •Executive Vice President and Chief Legal Officer of Intel Corporation from July 2022 to Present. •Executive Vice President and Chief Legal Officer of Eaton Corporation plc from

January 2020 to June 2022. •Senior Vice President, General Counsel / Chief Legal Officer of Meritor, Inc. from

August 2016 to December 2019. |

|

Current Public Directorships •None | Public Directorships Held in the Past Five Years •None |

| |

Other Activities •Trustee, Cleveland Clinic •Director, City Club of Cleveland •Trustee, George W. Codrington Charitable Foundation •Trustee, Assembly for the Arts •Trustee, College Now Greater Cleveland •Director, Rock N Roll Hall of Fame | |

| |

| Skills and Experience |

|

|

| |

| |

Nominee Highlights Ms. Miller Boise adds valuable perspective as we execute our climate-focused strategy and expand our global leadership in sustainability. She brings extensive experience in business strategy, strategic transactions and international growth, in addition to her deep background in corporate governance and inclusive talent management. In particular, Ms. Miller Boise’s experience working with companies in relevant industries across the global manufacturing arena including semiconductors, automotive, electrical products and services and commercial transportation brings relevant insight regarding the manufacturing industry and dynamic end markets around the world. |

| | |

| | | | | | | | |

Gary D. Forsee Lead Independent Director Age 74 Director since 2007 Committees Executive Technology and Innovation | Principal Occupation •President, University of Missouri System from 2007 to 2011. •Chairman of the Board (from 2006 to 2007) and Chief Executive Officer (from 2005 to 2007) of Sprint Nextel Corporation (a telecommunications company). |

|

Current Public Directorships •Ingersoll Rand Inc. (IR) | Public Directorships Held in the Past Five Years •Evergy, Inc. |

| |

Other Activities •Director, Kansas City Police Foundation | |

| |

| Skills and Experience |

|

|

| |

| |

Nominee Highlights In addition to his broad operational and financial expertise, Mr. Forsee’s experience as chairman and chief executive officer with one of the largest U.S. firms in the global telecommunications industry offers a deep understanding of the challenges and opportunities within markets experiencing significant technology-driven change. His role as president of a major university system provides insight into the Company’s talent development initiatives, which remain a critical enabler of the Company’s long-term success. Mr. Forsee’s experience serving on the board of an energy services utility also benefits the Company as it seeks to achieve more energy-efficient operations and customer solutions. |

| | |

PROPOSALS REQUIRING YOUR VOTE

| | | | | | | | |

Mark R. George Independent Director Age 57 Director since 2022 Committees Audit Finance | Principal Occupation •Executive Vice President and Chief Financial Officer of Norfolk Southern Corporation from 2019 to Present. •Vice President and Chief Financial Officer of Carrier Global Corporation (a United Technologies Corporation business) from 2008 through 2015 and again in 2019. •Vice President and Chief Financial Officer of Otis Worldwide Corporation (a United Technologies Corporation business) from 2015 to 2019. |

|

Current Public Directorships •None | Public Directorships Held in the Past Five Years •None |

| |

Other Activities •Director, Junior Achievement of Georgia | |

| |

| Skills and Experience |

|

|

| |

| |

Nominee Highlights Mr. George brings more than 30 years of diverse and international financial management and leadership experience to our Company. He has deep experience in corporate strategy, business development including M&A and joint venture partnerships, board of director interactions, as well as investor relations. During his tenure with Raytheon Technologies Corporation, formerly United Technologies Corporation (“UTC”), Mr. George held positions of increasing responsibility in finance, treasury, planning and analysis, and information technology for several of UTC’s former businesses in the United States and Asia, including as vice president finance and chief financial officer at Otis Worldwide Corporation and Carrier Global Corporation. The Company will benefit from Mr. George’s industry and global insights, which contribute to the Company's achieving continued financial success, meeting our business goals, and furthering our sustainable climate initiatives. |

| | |

| | | | | | | | |

John A. Hayes Independent Director Age 58 Director since 2023 Committees Human Resources and Compensation Sustainability, Corporate Governance and Nominating | Principal Occupation •Former Chairman, Ball Corporation (from 2013 to April 2023) and Chief Executive Officer (from 2011 to 2022). |

|

Current Public Directorships •None | Public Directorships Held in the Past Five Years •Ball Corporation |

| |

Other Activities •Director, Kohler Co. •Director, Veritiv Corporation •Operating Advisor, Clayton, Dubilier & Rice •Chair, WilsonArt | |

| |

| Skills and Experience |

|

|

| |

| |

Nominee Highlights Mr. Hayes brings more than 30 years of leadership experience in global, industrial markets. During his tenure as Chief Executive Officer of Ball Corporation, Mr. Hayes led multiple acquisitions and strategic transactions as the corporation’s revenues doubled and its market capitalization increased sixfold. The Company will benefit from Mr. Hayes’s significant experience leading a global corporation. |

| | |

PROPOSALS REQUIRING YOUR VOTE

| | | | | | | | |

Linda P. Hudson Independent Director Age 73 Director since 2015 Committees Human Resources and Compensation Sustainability, Corporate Governance and Nominating Technology and Innovation (Chair) | Principal Occupation •Founder and Former Chairman and Chief Executive Officer of The Cardea Group, a business management consulting firm she founded in 2014 and sold in 2020. •Former President and Chief Executive Officer of BAE Systems, Inc. from 2009 to 2014. |

|

Current Directorships •Bank of America Corporation (BAC) •TPI Composites, Inc. (TPIC) | Public Directorships Held in the Past Five Years •None |

| |

Other Activities •Director, University of Florida Foundation Inc. •Director, University of Florida Engineering Leadership Institute | |

| |

| Skills and Experience |

|

|

| |

| |

Nominee Highlights Ms. Hudson’s prior role as President and Chief Executive Officer of BAE Systems and her extensive experience in the defense and engineering sectors provides the Company with strong operational insight and understanding of matters crucial to the Company’s business. Prior to becoming Chief Executive Officer of BAE Systems, Ms. Hudson was president of BAE Systems’ Land & Armaments operating group, the world’s largest military vehicle and equipment business. A member of the National Academy of Engineering, Ms. Hudson is a recognized authority on industrial, manufacturing and operational systems. In addition, Ms. Hudson has broad experience in strategic planning and risk management in complex business environments. |

| | |

| | | | | | | | |

Myles P. Lee Independent Director Age 70 Director since 2015 Committees Audit Finance (Chair) Executive | Principal Occupation •Director (from 2003 to 2013) and Chief Executive Officer (from 2009 to 2013) of CRH plc. |

|

Current Public Directorships •None | Public Directorships Held in the Past Five Years •Babcock International Group plc •UDG Healthcare plc •Saint Vincent’s Healthcare Group |

Other Activities •None |

| |

| Skills and Experience |

|

|

| |

| |

Nominee Highlights Mr. Lee’s experience as the former head of the largest public or private company in Ireland provides strategic and practical judgment to critical elements of the Company’s growth and productivity strategies, expertise in Irish governance matters and significant insight into the building and construction sector. In addition, Mr. Lee’s previous service as Finance Director and General Manager of Finance of CRH plc and in a professional accountancy practice provides valuable financial expertise to the Company. |

| | |

PROPOSALS REQUIRING YOUR VOTE

| | | | | | | | |

David S. Regnery Chair and Chief Executive Officer Age 61 Director since 2021 Committees Executive (Chair) | Principal Occupation •Chair of the Board of Directors since January 1, 2022. •Chief Executive Officer of the Company since July 1, 2021. |

|

Current Public Directorships •None | Public Directorships Held in the Past Five Years •None |

| |

Other Activities •Member, Alliance of CEO Climate Leaders for the World Economic Forum | |

| |

| Skills and Experience |

|

|

| |

| |

Nominee Highlights Mr. Regnery has been with the Company for his entire career. He was appointed Chief Executive Officer in July 2021 and named chair of the Company’s Board of Directors in January 2022. Previously, Mr. Regnery served as the Company’s President and Chief Operating Officer, with direct responsibility for its three regional reportable segments and full portfolio of businesses, as well as mission-critical company operations including supply chain, engineering and information technology. Throughout his tenure, Mr. Regnery has led the majority of the Company’s businesses around the world, including Commercial HVAC and Transport Refrigeration. As president of the Commercial HVAC business, Mr. Regnery led the launch of the Company’s successful EcoWise™ portfolio of products, designed to lower environmental impact through high efficiency operation and low-GWP refrigerants. Under Mr. Regnery’s leadership, Trane Technologies has sharpened its strategy as an industry leader in climate solutions with a singular purpose – to boldly challenge what’s possible for a sustainable world. |

| | |

| | | | | | | | |

Melissa N. Schaeffer Independent Director Age 44 Director since 2022 Committees Audit Finance | Principal Occupation •Senior Vice President and Chief Financial Officer of Air Products and Chemicals, Inc. (2021 to present), Senior Vice President, Finance and Global Engineering, Americas, Middle East & India (2020 to 2021) and Vice President and Chief Audit Executive (2016 to 2020) of Air Products and Chemicals, Inc. |

|

Current Public Directorships •None | Public Directorships Held in the Past Five Years •None |

| |

Other Activities •None | |

| |

| Skills and Experience |

|

|

| |

| |

Nominee Highlights Ms. Schaeffer has been a finance leader in the industrial sector for more than 20 years. She has deep international, M&A, investor relations, project financing, and audit/risk management experience. Over her career, she has held positions in global finance, investor relations, project finance, compliance, accounting and risk management. In her current role, she is responsible for controller, accounting, treasury, tax, audit, investor relations and shared business functions. Ms. Schaeffer’s leadership skills and international business experience are of great value for the Company’s global financial, risk management and sustainability strategies. |

| | |

PROPOSALS REQUIRING YOUR VOTE

| | | | | | | | |

John P. Surma Independent Director Age 69 Director since 2013 Committees Audit (Chair) Finance Executive | Principal Occupation •Former Chairman (from 2006 to 2013) and Chief Executive Officer (from 2004 to 2013) of United States Steel Corporation (a steel manufacturing company). |

|

Current Public Directorships •Marathon Petroleum Corporation (MPC) •MPLX LP (a publicly traded subsidiary of Marathon Petroleum Corporation)* (MPLX) •Public Service Enterprise Group (PEG) | Public Directorships Held in the Past Five Years •Concho Resources Inc. |

| |

* MPLX GP LLC is a Master Limited Partnership and is a consolidated subsidiary of Marathon Petroleum Corporation, which holds >50% of its voting units. We view Mr. Surma’s service on the MPLX board as an extension of his service on the Marathon Petroleum Corporation board for purposes of assessing the level of outside public board commitments. |

| |

Other Activities •Chair and Director, University of Pittsburgh Medical Center •Trustee, University of Pittsburgh Board of Trustees •Former Director and Chair, Federal Reserve Bank of Cleveland •Former Director and Former Chair, National Safety Council •Member Emeritus and Former Chair, Allegheny Conference on Community Development | |

| |

| Skills and Experience |

|

|

| |

| |

Nominee Highlights Mr. Surma’s experience as the former chairman and chief executive officer of a large industrial company provides significant and direct expertise across all aspects of the Company’s operational and financial affairs. In particular, Mr. Surma’s financial experience, having previously served as the chief financial officer of United States Steel Corporation and as a partner of the audit firm PricewaterhouseCoopers LLP, provides the Board with valuable insight into financial reporting and accounting oversight of a public company. Mr. Surma’s board memberships and other activities provide the Board an understanding of developments in the energy sector as the Company seeks to develop more energy-efficient operations and insight into national and international business and trade policy that could impact the Company. |

| | |

PROPOSALS REQUIRING YOUR VOTE

| | | | | | | | | | | |

| | | |

ITEM | Advisory Approval of the

Compensation of Our Named

Executive Officers | | The Board of Directors recommends a vote FOR advisory approval of the compensation of our NEOs as disclosed in the “Compensation Discussion and Analysis,” the compensation tables, and the related disclosure contained in this Proxy Statement. |

| | | |

The Company is presenting the following proposal, commonly known as a “Say-on-Pay” proposal, which gives you as a shareholder the opportunity to endorse or not endorse our compensation program for NEOs by voting for or against the following resolution:

“RESOLVED, that the shareholders approve the compensation of the Company’s NEOs, as disclosed in the “Compensation Discussion and Analysis”, the compensation tables, and the related disclosure contained in the Company’s Proxy Statement.”

While our Board of Directors intends to carefully consider the shareholder vote resulting from this proposal, the final vote will not be binding on us and is advisory in nature. At our 2023 Annual General Meeting, shareholders voted 91% in favor of the Company’s Advisory Approval of the Compensation of the Company’s NEOs.

In considering your vote, please be advised that our compensation program for NEOs is guided by our design principles, as described in the “Compensation Discussion and Analysis” section of this Proxy Statement:

| | | | | | | | | | | | | | | | | |

| (i) | business strategy alignment | (iii) | shareholder alignment | (v) | internal parity |

| | | | | |

| (ii) | pay for performance | (iv) | mix of short and long-term incentives | (vi) | market competitiveness |

By following these design principles, we believe that our compensation program for NEOs is strongly aligned with the long-term interests of our shareholders.

| | | | | | | | | | | |

| | | |

ITEM | Approval of Appointment of

Independent Auditors | | The Board of Directors recommends a vote FOR the proposal to approve the appointment of PwC as independent auditors of the Company and to authorize the Audit Committee of the Board of Directors to set the auditors’ remuneration. |

| | | |

The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the independent external audit firm retained to audit the Company’s financial statements and internal controls over financial reporting. In executing its responsibilities, the Audit Committee engages in an annual evaluation of the qualifications, performance and independence of PricewaterhouseCoopers LLP (“PwC”). In assessing independence, the Committee reviews the fees paid, including those related to non-audit services. The Audit Committee has sole authority to approve all engagement fees to be paid to PwC. The Audit Committee regularly meets with the lead audit partner without members of management present, and in executive session with only the Audit Committee members present, which provides the opportunity for continuous assessment of the firm’s effectiveness and independence and for consideration of rotating audit firms.

In addition, as part of its normal cadence, the Audit Committee considers whether there should be a regular rotation of the independent auditors. The Audit Committee ensures that the mandated rotation of PwC’s lead engagement partner occurs routinely, and the Audit Committee and its Chairman are directly involved in the selection of PwC’s lead engagement partner.

The Audit Committee has recommended that shareholders approve the appointment of PwC as our independent auditors for the fiscal year ending December 31, 2024 and authorize the Audit Committee of our Board of Directors to set the independent auditors’ remuneration.

PwC has been acting continuously as our independent auditors for over one hundred years and, both by virtue of its familiarity with the Company’s affairs and its professional competencies and resources, is considered best qualified to perform this important function. The Audit Committee and the Board believe that the continued retention of PwC to serve as our independent auditors is in the best interests of the Company and its investors.

Representatives of PwC will be present at the Annual General Meeting and will be available to respond to appropriate questions. They will have an opportunity to make a statement if they so desire.

PROPOSALS REQUIRING YOUR VOTE

Audit Committee Report

While management has the primary responsibility for the financial statements and the financial reporting process, including the system of internal controls, the Audit Committee reviews the Company’s audited financial statements and financial reporting process on behalf of the Board of Directors. The independent auditors are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States) (the “PCAOB”) and to issue a report thereon. The Audit Committee monitors those processes. In this context, the Audit Committee has met and held discussions with management and the independent auditors regarding the fair and complete presentation of the Company’s results. The Audit Committee has discussed significant accounting policies applied by the Company in its financial statements, as well as alternative treatments. Management has represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with United States generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent auditors. The Audit Committee also discussed with the independent auditors the matters required to be discussed by Auditing Standard No. 1301, “Communications with Audit Committees” issued by the PCAOB.

In addition, the Audit Committee has received and reviewed the written disclosures and the letter from PwC required by the PCAOB regarding PwC’s communications with the Audit Committee concerning independence and discussed with PwC the auditors’ independence from the Company and its management in connection with the matters stated therein. The Audit Committee also considered whether the independent auditors’ provision of non-audit services to the Company is compatible with the auditors’ independence. The Audit Committee has concluded that the independent auditors are independent from the Company and its management.

The Audit Committee discussed with the Company’s internal and independent auditors the overall scope and plans for their respective audits. The Audit Committee meets separately with the internal and independent auditors, with and without management present, to discuss the results of their examinations, the evaluations of the Company’s internal controls and the overall quality of the Company’s financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board has approved, that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (“2023 Form 10-K”), for filing with the Securities and Exchange Commission (the “SEC”). The Audit Committee has selected PwC, subject to shareholder approval, as the Company’s independent auditors for the fiscal year ending December 31, 2024.

AUDIT COMMITTEE

| | | | | |

John P. Surma (Chair) Ann C. Berzin Mark R. George | Myles P. Lee Melissa N. Schaeffer |

PROPOSALS REQUIRING YOUR VOTE

Fees of the Independent Auditors

The following table shows the fees paid or accrued by the Company for audit and other services provided by PwC for the fiscal years ended December 31, 2023 and 2022:

| | | | | | | | |

| 2023

($) | 2022

($) |

Audit Fees(a) | 10,790,000 | | 9,930,000 | |

Audit-Related Fees(b) | 377,000 | | 332,000 | |

Tax Fees(c) | 2,070,000 | | 1,707,000 | |

All Other Fees(d) | 18,000 | | 16,000 | |

| Total | 13,255,000 | | 11,985,000 | |

(a)Audit Fees for the fiscal years ended December 31, 2023 and 2022, respectively, were for professional services rendered for the audits of the Company’s annual consolidated financial statements and its internal controls over financial reporting, including quarterly reviews, statutory audits, issuance of consents and review of documents filed with the SEC.

(b)Audit-Related Fees for the fiscal year ended December 31, 2023 consist of assurance services that are related to performing the audit and review of certain financial statements including employee benefit plan audits and Service Organization Control 2 (“SOC 2”) readiness pre-assessment and attestation reporting. Audit-Related Fees for the fiscal year ended December 31, 2022 consist of assurance services that are related to performing the audit and review of certain financial statements including employee benefit plan audits.

(c)Tax Fees for the fiscal years ended December 31, 2023 and 2022, respectively, include consulting and compliance services in the U.S. and non-U.S. locations.

(d)All Other Fees for the fiscal years ended December 31, 2023 and 2022 include license fees for accounting and tax research tools and other software licenses.

The Audit Committee has adopted policies and procedures which require that the Audit Committee pre-approve all non-audit services that may be provided to the Company by its independent auditors. The policy: (i) provides for pre-approval of an annual budget for each type of service; (ii) requires Audit Committee approval of specific projects if not included in the approved budget; and (iii) requires Audit Committee approval if the forecast of expenditures exceeds the approved budget on any type of service. The Audit Committee pre-approved all of the services described under Audit-Related Fees, Tax Fees and All Other Fees. The Audit Committee has determined that the provision of all such non-audit services is compatible with maintaining the independence of PwC.

| | | | | | | | | | | |

| | | |

ITEM | Renewal of the Directors’

Existing Authority to

Issue Shares | | The Board of Directors recommends that you vote FOR renewing the Directors’ authority to issue shares. |

| | | |

Under Irish law, directors of an Irish public limited company must have authority from its shareholders to issue any shares, including shares which are part of the Company’s authorized but unissued share capital. Our shareholders provided the Directors with this authorization at our 2023 Annual General Meeting on June 1, 2023 for a period of 18 months. Because this share authorization period will expire in December 2024, we are presenting this proposal to renew the Directors’ authority to issue our authorized shares on the terms set forth below.

We are seeking approval to authorize our Board of Directors to issue up to 20% of our issued ordinary share capital as of April 11, 2024 (the latest practicable date before this Proxy Statement), for a period expiring 18 months from the passing of this resolution, unless renewed, varied or revoked.

Granting the Board of Directors this authority is a routine matter for public companies incorporated in Ireland and is consistent with Irish market practice. This authority is fundamental to our business and enables us to issue shares, including in connection with our equity compensation plans (where required) and, if applicable, funding acquisitions and raising capital. We are not asking you to approve an increase in our authorized share capital or to approve a specific issuance of shares. Instead, approval of this proposal will only grant the Board of Directors the authority to issue shares that are already authorized under our Articles of Association upon the terms below. In addition, we note that, because we are a NYSE-listed company, our shareholders continue to benefit from the protections afforded to them under the rules and regulations of the NYSE and the SEC, including those rules that limit our ability to issue shares in specified circumstances. Furthermore, we note that this authorization is required as a matter of Irish law and is not otherwise required for other non-Irish companies listed on the NYSE with whom we compete. Renewal of the Directors’ existing authority to issue shares is fully consistent with NYSE rules and listing standards and with U.S. capital markets practice and governance standards.

PROPOSALS REQUIRING YOUR VOTE

As required under Irish law, the resolution in respect of this proposal is an ordinary resolution that requires the affirmative vote of a simple majority of the votes cast.

The text of this resolution is as follows:

“That the Directors be and are hereby generally and unconditionally authorized with effect from the passing of this resolution to exercise all powers of the Company to allot relevant securities (within the meaning of Section 1021 of the Companies Act 2014) up to an aggregate nominal amount of $50,213,084 (50,213,084 shares) (being equivalent to approximately 20% of the aggregate nominal value of the issued ordinary share capital of the Company as of April 11, 2024 (the latest practicable date before this Proxy Statement)), and the authority conferred by this resolution shall expire 18 months from the passing of this resolution, unless previously renewed, varied or revoked; provided that the Company may make an offer or agreement before the expiry of this authority, which would or might require any such securities to be allotted after this authority has expired, and in that case, the Directors may allot relevant securities in pursuance of any such offer or agreement as if the authority conferred hereby had not expired.”

| | | | | | | | | | | |

| | | |

ITEM | Renewal of the Directors’ Existing

Authority to Issue Shares for Cash

Without First Offering Shares to

Existing Shareholders | | The Board of Directors recommends that you vote FOR renewing the Directors’ authority to issue shares for cash without first offering shares to existing shareholders. |

| | | |

Under Irish law, unless otherwise authorized, when an Irish public limited company issues shares for cash, it is required first to offer those shares on the same or more favorable terms to existing shareholders of the Company on a pro-rata basis (commonly referred to as the statutory pre-emption right). Our shareholders provided the Directors with this authorization at our 2023 Annual General Meeting on June 1, 2023 for a period of 18 months. Because this share authorization period will expire in December 2024, we are presenting this proposal to renew the Directors’ authority to opt-out of the pre-emption right on the terms set forth below.

We are seeking approval to authorize our Board of Directors to opt out of the statutory pre-emption rights provision in the event of (1) the issuance of shares for cash in connection with any rights issue and (2) any other issuance of shares for cash, if the issuance is limited to up to 20% of our issued ordinary share capital as of April 11, 2024 (the latest practicable date before this Proxy Statement), for a period expiring 18 months from the passing of this resolution, unless renewed, varied or revoked.

Granting the Board of Directors this authority is a routine matter for public companies incorporated in Ireland and is consistent with Irish market practice. Similar to the authorization sought for Item 5, this authority is fundamental to our business and enables us to issue shares under our equity compensation plans (where required) and, if applicable, will facilitate our ability to fund acquisitions and otherwise raise capital. We are not asking you to approve an increase in our authorized share capital. Instead, approval of this proposal will only grant the Board of Directors the authority to issue shares in the manner already permitted under our Articles of Association upon the terms below. Without this authorization, in each case where we issue shares for cash, we would first have to offer those shares on the same or more favorable terms to all of our existing shareholders. This requirement could undermine the operation of our compensation plans and cause delays in the completion of acquisitions and capital raising for our business. Furthermore, we note that this authorization is required as a matter of Irish law and is not otherwise required for other non-Irish companies listed on the NYSE with whom we compete. Renewal of the Directors’ existing authorization to opt out of the statutory pre-emption rights as described above is fully consistent with NYSE rules and listing standards and with U.S. capital markets practice and governance standards.

As required under Irish law, the resolution in respect of this proposal is a special resolution that requires the affirmative vote of at least 75% of the votes cast.

The text of the resolution in respect of this proposal is as follows:

“As a special resolution, that, subject to the passing of the resolution in respect of Item 5 as set out above and with effect from the passing of this resolution, the Directors be and are hereby empowered pursuant to Section 1023 of the Companies Act 2014 to allot equity securities (as defined in Section 1023 of that Act) for cash, pursuant to the authority conferred by Item 6 as if subsection (1) of Section 1022 did not apply to any such allotment, provided that this power shall be limited to:

a.the allotment of equity securities in connection with a rights issue in favor of the holders of ordinary shares (including rights to subscribe for, or convert into, ordinary shares) where the equity securities respectively attributable to the interests of such holders are proportional (as nearly as may be) to the respective numbers of ordinary shares held by them (but subject to such exclusions or other arrangements as the Directors may deem necessary or expedient to deal with fractional entitlements that would otherwise arise, or with legal or practical problems under the laws of, or the requirements of any recognized regulatory body or any stock exchange in, any territory, or otherwise); and

PROPOSALS REQUIRING YOUR VOTE

b.the allotment (otherwise than pursuant to sub-paragraph (a) above) of equity securities up to an aggregate nominal value of $50,213,084 (50,213,084 shares) (being equivalent to approximately 20% of the aggregate nominal value of the issued ordinary share capital of the Company as of April 11, 2024 (the latest practicable date before this Proxy Statement)) and the authority conferred by this resolution shall expire 18 months from the passing of this resolution, unless previously renewed, varied or revoked; provided that the Company may make an offer or agreement before the expiry of this authority, which would or might require any such securities to be allotted after this authority has expired, and in that case, the Directors may allot equity securities in pursuance of any such offer or agreement as if the authority conferred hereby had not expired.”

| | | | | | | | | | | |

| | | |

ITEM | Determine the Price at which the Company Can Reallot Shares Held as Treasury Shares | | The Board of Directors recommends that shareholders vote FOR the proposal to determine the price at which the Company can reallot shares held as treasury shares. |

| | | |

Our open-market share repurchases (redemptions) and other share buyback activities may result in ordinary shares being acquired and held by the Company as treasury shares. We may reissue treasury shares that we acquire through our various share buyback activities including in connection with our executive compensation program and our director programs.

Under Irish law, our shareholders must authorize the price range at which we may reallot any shares held in treasury. In this proposal, that price range is expressed as a minimum and maximum percentage of the closing market price of our ordinary shares on the NYSE the day preceding the day on which the relevant share is reallotted. Under Irish law, this authorization expires 18 months after its passing unless renewed.

The authority being sought from shareholders provides that the minimum and maximum prices at which an ordinary share held in treasury may be reallotted are 95% and 120%, respectively, of the closing market price of the ordinary shares on the NYSE the day preceding the day on which the relevant share is re-issued, except as described below with respect to obligations under employee share schemes, which may be at a minimum price of nominal value. Any reallotment of treasury shares will be at price levels that the Board considers in the best interests of our shareholders.

As required under Irish law, the resolution in respect of this proposal is a special resolution that requires the affirmative vote of at least 75% of the votes cast.

The text of the resolution in respect of this proposal is as follows:

“As a special resolution, that the reallotment price range at which any treasury shares held by the Company may be reallotted shall be as follows:

a.the maximum price at which such treasury share may be reallotted shall be an amount equal to 120% of the “market price”; and

b.the minimum price at which a treasury share may be reallotted shall be the nominal value of the share where such a share is required to satisfy an obligation under an employee share scheme or any option schemes operated by the Company or, in all other cases, an amount equal to 95% of the “market price”; and

c.for the purposes of this resolution, the “market price” shall mean the closing market price of the ordinary shares on the NYSE the day preceding the day on which the relevant share is reallotted.

FURTHER, that this authority to reallot treasury shares shall expire at 18 months from the date of the passing of this resolution unless previously varied or renewed in accordance with the provisions of Sections 109 and 1078 of the Companies Act 2014.”

Corporate Governance

Corporate Governance Guidelines

Our Corporate Governance Guidelines, together with the charters of the various Board committees, provide a framework for the corporate governance of the Company. The following is a summary of our Corporate Governance Guidelines and practices. A copy of our Corporate Governance Guidelines, as well as the charters of each of our Board committees, are available on our website at www.tranetechnologies.com under the heading “About Us – Corporate Governance.”

Role of the Board of Directors

The Company’s business is managed under the direction of the Board of Directors. The Board delegates to the Chief Executive Officer, and through that individual to other senior management, the authority and responsibility for managing the Company’s business. The role of the Board of Directors is to oversee the management and governance of the Company and monitor senior management’s performance.

Board Responsibilities

Among the Board of Directors’ core responsibilities are:

•Select individuals for Board membership and evaluate the performance of the Board, Board committees and individual directors;

•Select, monitor, evaluate and compensate senior management;

•Assure that management succession planning is adequate;

•Review and approve significant corporate actions;

•Review and monitor implementation of management’s strategic plans;

•Review and approve the Company’s annual operating plans and budgets;

•Monitor corporate performance and evaluate results compared to the strategic plans and other long-range goals;

•Review the Company’s financial controls and reporting systems;

•Review and approve the Company’s financial statements and financial reporting;

•Review the Company’s ethical standards and legal compliance programs and procedures;

•Oversee the Company’s management of enterprise risk; and

•Monitor relations with shareholders, employees and the communities in which the Company operates.

Board Leadership Structure

The positions of Chair of the Board and CEO at the Company have been held by the same person, except in unusual circumstances, such as during a CEO transition. This policy has worked well for the Company. It is the Board of Directors’ view that the Company’s corporate governance principles, the quality, stature and substantive business knowledge of the members of the Board, as well as the Board’s culture of open communication with the CEO and senior management are conducive to Board effectiveness with a combined Chair and CEO position.

In addition, the Board of Directors has a strong Lead Independent Director and it believes this role adequately addresses the need for independent leadership and an organizational structure for the independent directors. The Board of Directors appoints a Lead Independent Director from among the Board’s independent directors. The Lead Independent Director coordinates the activities of all of the Board’s independent directors working with the Chair and CEO. The Lead Independent Director is the principal liaison with the CEO and ensures that the Board of Directors has an open, trustful relationship with the Company’s senior management team. In addition to the duties of all directors, as set forth in the Company’s Governance Guidelines, the specific responsibilities of the Lead Independent Director are as follows:

•Chair meetings of the independent directors;

•Ensure full participation and engagement of all Board members in deliberations;

•Lead the Board of Directors in all deliberations involving the CEO’s employment, including hiring, contract negotiations, performance evaluations and separation;

•Engage and counsel the Chair and CEO on issues of interest/concern to directors, including majority and minority viewpoints, and encourage all directors to engage the Chair and CEO with their interests and concerns;

•Work with the Chair and CEO to develop an appropriate schedule of Board meetings and approve such schedule, to ensure that the directors have sufficient time for discussion of all agenda items, while not interfering with the flow of Company operations;

•Set the agendas for Board meetings in collaboration with the Chair and CEO;

•Plan the agendas and chair executive sessions of the Board’s independent directors;

•Act as the primary liaison between the directors and the Chair and CEO;

•Provide advice and counsel to the Chair and CEO;

•Keep abreast of key Company activities and advise the Chair and CEO as to the quality, quantity and timeliness of the flow of information from Company management that is necessary for the directors to effectively and responsibly perform their duties; although Company management is responsible for the preparation of materials for the Board, the Lead Independent Director will approve information provided to the Board and may specifically request the inclusion of certain material;

•Engage consultants who report directly to the Board and assist in recommending consultants that work directly for Board Committees;

•Work in conjunction with the Sustainability, Corporate Governance and Nominating Committee in compliance with Committee processes to interview director candidates and make recommendations to the Board;

•Provide oversight and act as a liaison between management and the Board with respect to succession of the CEO and lead the Board in an annual review of Board and CEO succession plans;

•Assist the Board and Company officers in assuring compliance with and implementation of the Company’s Governance Guidelines;

•Work in conjunction with the Sustainability, Corporate Governance and Nominating Committee to identify for appointment the members of the various Board committees, as well as selection of the committee chairs;

•Be available for consultation and direct communication with major shareholders coordinating with the Chair and CEO;

•Make a commitment to serve in the role of Lead Independent Director for a minimum of three years; and

•Help set the tone and uphold the highest standards of ethics and integrity and encourage that throughout the Company.

Mr. Forsee has been the Company’s Lead Independent Director since the 2021 Annual General Meeting.

Board Risk Oversight

The Board of Directors has oversight responsibility of the processes established to report and monitor systems for material risks applicable to the Company. The Board of Directors has delegated to its various committees the oversight of risk management practices for categories of risk relevant to their functions.

| | | | | |

| |

| BOARD OF DIRECTORS |

|

•The Board of Directors focuses on the Company’s general risk management strategy and the most significant risks facing the Company and ensures that appropriate risk mitigation strategies are implemented by management. •The full Board has oversight of strategic Human Capital Management risks and opportunities including succession planning, diversity and inclusion, employee engagement, employee health and safety and development. •The full Board has ultimate oversight for risks relating to our cybersecurity program, risks, and practices and receives regular updates from our internal cybersecurity team on cybersecurity risks and threats. •The Board regularly receives reports from each Committee as to risk oversight within its areas of responsibility. |

| |

| |

|

| |

| |

| BOARD COMMITTEES |

|

Audit Committee •Oversees risks associated with the Company’s systems of disclosure controls and internal controls over financial reporting, as well as the Company’s compliance with legal and regulatory requirements. •Oversees the Company’s internal audit function. •Oversees the Company’s cybersecurity programs and risks, including Board level oversight for management’s actions with respect to: (1)the practices, procedures and controls to identify, assess and manage its key cybersecurity programs and risks; (2)the protection, confidentiality, integrity and availability of the Company’s digital information, intellectual property and compliance-protected data through the associated networks as it relates to connected networks, suppliers, employees and channel partners; and (3)the protection and privacy of data related to our customers. •Discusses with management and the independent auditors the Company’s policies with respect to risk assessment and risk management, including the review and approval of a risk-based audit plan. | Human Resources and Compensation Committee •Considers risks related to the attraction and retention of talent and risks related to the design of compensation programs and arrangements. Sustainability, Corporate Governance and Nominating Committee •Oversees risks associated with Board succession, conflicts of interest, corporate governance and sustainability. •Oversees risks associated with the Company’s performance against its sustainability and ESG objectives, including the impacts of climate change. Finance Committee •Oversees risks associated with foreign exchange, insurance, liquidity, credit and debt. Technology and Innovation Committee •Considers risks associated with technologies that can have a material impact on the Company, including product and process development technologies, manufacturing technologies and practices, and the utilization of quality assurance programs |

| |

| | |

|

| |

| | |

| MANAGEMENT |

|

•Identification, assessment and management of risks through the Company’s Enterprise Risk Intelligence program and Committee. •The Enterprise Risk Intelligence program and Committee are responsible for identifying and managing strategic risks within the Company’s risk appetite and providing reasonable assurance regarding the achievement of these objectives. •Risks are prioritized based upon potential impact, likelihood and vulnerability; an owner is assigned to each risk area to develop a risk mitigation strategy; and key risk indicators are utilized to track progress against these objectives. The risk universe is reviewed regularly to ensure the Company is addressing any potential changes in the risk landscape. •The Company has appointed the Chief Financial Officer (“CFO”) as its Chief Risk Officer, and in that role, the Chief Risk Officer periodically reports on risk management policies and practices to the relevant Board Committee or to the full Board so that any decisions can be made as to any required changes in the Company’s risk management and mitigation strategies or in the Board’s oversight of these. The Chief Risk Officer also reports on specific risks and risk mitigation action plans, including risk indicators to track progress. |

| | |

| | | | | | | | | | | |

| SPOTLIGHT: RISK OVERSIGHT | | |

| | |

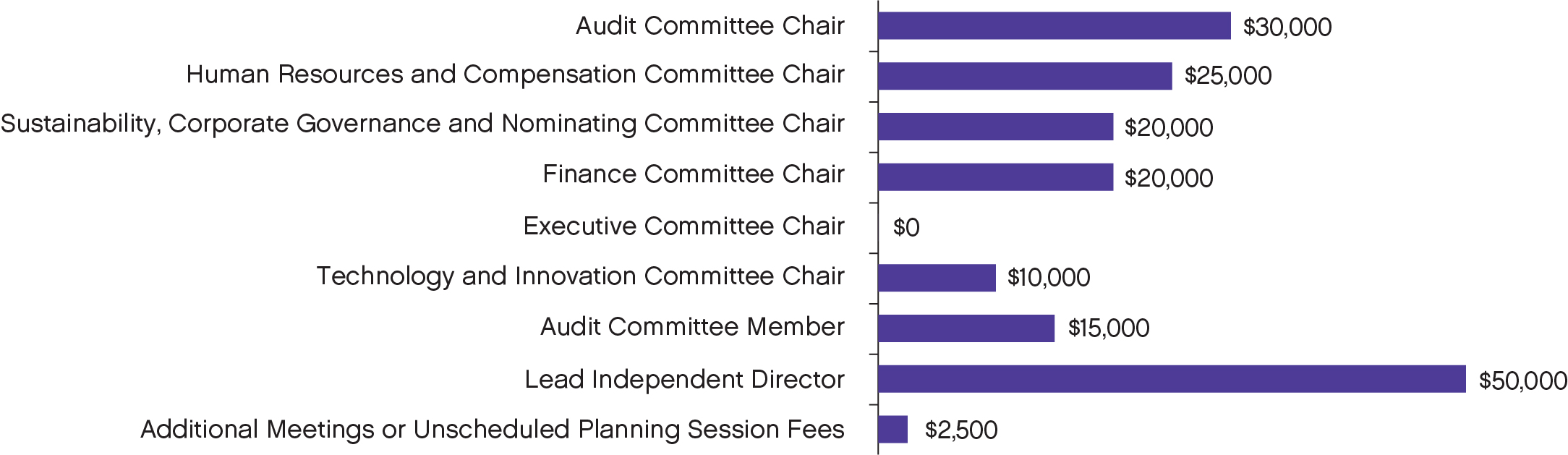

| | | |