May 25, 2016

VIA EDGAR

Ms. Kristi Marrone

Mr. Jorge L. Bonilla

Division of Corporation Finance

United States Securities and Exchange Commission

100 F Street, NE

Washington, D.C. 20549

|

| |

| Re: | Colony Capital, Inc. |

| | Form 10-K for the Year Ended December 31, 2015 |

Dear Ms. Marrone and Mr. Bonilla:

This letter is submitted in response to comments from the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) in a letter dated April 28, 2016 (the “Comment Letter”) with respect to Colony Capital, Inc.’s (the “Company”) Form 10-K for the fiscal year ended December 31, 2015, which was filed with the Commission on February 29, 2016 (the “Form 10-K”), as amended on March 29, 2016.

For your convenience, the Staff’s numbered comments set forth in the Comment Letter have been reproduced in bold herein with responses immediately following each comment. Unless otherwise indicated, page references in the reproductions of the Staff’s comments refer to the Form 10-K.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

Funds from Operations, page 69

| |

| 1. | Please tell us, and consider disclosing in future filings, the nature and quantification of the adjustments attributable to noncontrolling interests in investment entities. |

The components of adjustments attributable to noncontrolling interests in investment entities for Funds from Operations ("FFO") are as follows:

|

| | | | | | | |

| | Year Ended December 31, |

| (In thousands) | 2015 | | 2014 |

| FFO adjustments attributable to noncontrolling interests in investment entities: | | | |

| Real estate depreciation and amortization | 44,665 |

| | $ | 1,582 |

|

| Impairment of real estate | 4,888 |

| | — |

|

| (Gain) loss on sales of real estate | (5,808 | ) | | — |

|

| | $ | 43,745 |

| | $ | 1,582 |

|

In the Form 10-Q for the three months ended March 31, 2016, we have disclosed the components of FFO adjustments attributable to noncontrolling interests in investment entities in a footnote to the reconciliation table. To the extent the adjustments attributable to noncontrolling interests are significant, we will continue to provide similar disclosure.

Consolidated Statements of Cash Flows, page F-9

| |

| 2. | Please tell us the nature of the line item titled “Accretion in excess of cash receipts on purchased credit impaired loan” included in operating activities and explain how this differs from the “cash receipts in excess of accretion on purchased credit impaired loans” included in investing activities. |

The Company has acquired loans with evidence of credit quality deterioration since origination for which it is probable at acquisition that the Company will collect less than the contractually required payments. The Company follows ASC 310-30, Loans and Debt Securities Acquired with Deteriorated Credit Quality, to recognize interest income on these purchased credit-impaired ("PCI") loans. In accounting for PCI loans, there is no distinction between principal and interest, and interest income recognition is based upon expected cash flows in excess of our cost of investment, or accretable yield. Accretable yield is recognized as interest income using the effective interest method based upon expected cash flows and accretes to the loan carrying value, while cash receipts (whether principal or interest) reduce the loan carrying value. When the Company recognizes more interest than it receives in cash on a PCI loan (or loan pool) in any given reporting period, we present the excess as an adjustment (a reduction) to reconcile net income to cash flows from operating activities, since the excess effectively represents noncash income (i.e., a shortfall in cash receipts compared to interest recognized). Such excess is labeled as "accretion in excess of cash receipts on purchased credit impaired loans" within cash flows from operating activities. When the Company receives more cash on a PCI loan than it recognizes in income, we present the excess as "cash receipts in excess of accretion on purchased credit impaired loans" within cash flows from investing activities.

The Company's policy to present cash receipts in excess of accretion within investing activities is consistent with ASC paragraph 230-10-45-12, which states receipts from collections or sales of loans, other than those acquired specifically for resale, are cash inflows from investing activities. Since there is no distinction between principal and interest in PCI loan accounting, the Company has adopted the foregoing policy to attribute cash receipts in excess of accretion as a return of investment, rather than return on investment.

For the year ended December 31, 2015, the Company presented amounts in both operating and investing activities based upon cash receipts and accretion activity attributable to discrete units of accounting (whether single loans or loan pools). For certain single loans or pools, cash receipts exceeded accretion and such excess was presented as an investing cash inflow; for others, accretion exceeded cash receipts and such excess was presented as an adjustment to operating cash flows.

Note 3. Combination with Colony Capital, page F-22

| |

| 3. | Please tell us your basis for accounting for the Combination under the acquisition method. Also, tell us how you accounted for the non-competition arrangements disclosed on page F-22 and your preexisting relationship with the Manager. |

The Combination involved the internalization of the Company’s manager, Colony Financial Manager, LLC (the “Manager”), which was a wholly-owned subsidiary of Colony Capital, LLC (“CCLLC”), and acquisition of substantially all of the real estate investment management business and operations of CCLLC and its affiliates, including assumption of in-place investment management contracts and obtaining the right to sponsor new investment vehicles under the Colony name. CCLLC is a wholly-owned subsidiary of Colony Capital Holdings, LLC, which in turn is owned by certain senior executives of the Company, with majority ownership and control held by the Executive Chairman, Thomas J. Barrack Jr., as the managing member. Upon consummation of the Combination, CCLLC's personnel became employees of the Company. Consideration for the acquisition included a combination of the Company’s Class A common stock, Class B common stock, membership units in an operating subsidiary of the Company and cash.

Basis of Accounting for the Combination

In considering the basis of accounting for the Combination, the Company concluded that (i) the Combination was not a transaction that combined entities under common control; and (ii) the transaction met the requirements to be accounted for as a business combination under the acquisition method, with the Company as the acquirer.

Common Control Transaction

U.S. GAAP does not define the term “common control.” EITF Issue No. 02-5, Definition of “Common Control” in Relation to FASB Statement No. 141, indicates, based on an SEC speech, that common control exists through ownership of more than 50% of voting interest of each entity held by an individual, another entity, immediate family members (which include married couples and their children, but not grandchildren, with no evidence that those family members will vote their shares in any way other than in concert) or a group of shareholders (with contemporaneous written evidence of an agreement to vote a majority of the entities’ shares in concert). Although a consensus was not reached in the discussion in EITF Issue No. 02-5, in absence of other authoritative guidance, the guidance in this SEC speech is

widely applied in practice. Additionally, in ASC 805, “control” has the same meaning as “controlling financial interest” under ASC 810-10-15-8, which includes a controlling financial interest through other means such as contractual or legal rights, general partnership interests and as primary beneficiary of a variable interest entity ("VIE").

The Company determined that common control did not exist between the combining entities, as follows:

| |

| ▪ | Ownership of a majority (more than 50%) voting interest—No. The Company is controlled by its shareholders with no one shareholder or group of shareholders holding a majority of voting interest. Mr. Barrack (including his immediate family members), as the majority owner of CCLLC, directly or indirectly, held less than 1% of the Company’s outstanding common stock as of the date of closing of the Combination on April 2, 2015. Therefore, CCLLC and the Company were not under common control based on ownership of majority voting interests. |

| |

| ▪ | Primary beneficiary of a VIE—No. The Company evaluated whether CCLLC and its affiliates, including Mr. Barrack, had a variable interest in the Company, whether the Company was a VIE and if so, whether CCLLC and its affiliates, including Mr. Barrack, would be the primary beneficiary. |

The Company determined that CCLLC and its affiliates did not have a variable interest in the Company as they did not hold equity interests in the Company nor had any other interests or arrangements that created a variable interest in the Company. As the manager of the Company prior to the Combination, CCLLC was paid a base management fee and if predetermined performance targets were met, an incentive fee. In the absence of other variable interests held by CCLLC in the Company, such fees were not considered to be a variable interest in accordance with ASC 810-10-55-37 (as amended by ASU 2015-02) as they were determined to be at-market (as discussed below under “Pre-combination management agreement”). The fees represented compensation that was commensurate with the level of services provided by the manager and the management contract included only terms, conditions and amounts that were customarily present in arrangements for similar services negotiated at arms-length.

While Mr. Barrack has a variable interest in the Company through his equity ownership, such interest is insignificant at less than 1% of the Company’s outstanding common stock.

Based on the above consideration, no further analysis under the VIE model was warranted. The Company concluded that the combining entities were not under common control within the VIE framework.

Additionally, the Combination was subject to approval of two-thirds of the Company’s non-affiliated shareholders, and such approval was not perfunctory given the dispersion of ownership interests among the Company’s shareholders. This provided further evidence that the Combination was not a common control transaction.

Business Combination

It was determined that the Combination qualified as an acquisition of a business based on ASC 805-10-55-4. The Company acquired the following:

| |

| • | Investment management business of CCLLC and its affiliates, in which the Company assumed the in-place investment advisory contracts, that generate management fee income; |

| |

| • | Ownership of the Colony trade name; and |

| |

| • | Employees of CCLLC, including senior management and investment professionals, all of whom became full-time employees of the Company post-Combination. |

All of the above serve as inputs, and through the skills applied by the employees, which serves as a process, result in generation of management fees from existing and future investment vehicles in which the Company acts as investment advisor and potentially carried interest from future investment vehicles to be sponsored by the Company, which serve as outputs.

Additionally, in accordance with ASC 805-10-55-9, a business is presumed to exist when goodwill is present in the acquired group, which was the case in the Combination.

Considering the provisions of ASC 805-10-55-12 and 13, the Company was identified as the acquirer in the Combination on the following basis:

| |

| a) | shareholders of the Company retained control post-Combination; |

| |

| b) | no large minority voting interest was created as a result of the Combination; |

| |

| c) | there was no change in the composition of the Company’s board of directors post-Combination; |

| |

| d) | the Company is liable for the consideration transferred to consummate the Combination, which included a premium over the fair value of assets acquired, liabilities assumed and noncontrolling interests acquired, resulting in goodwill; and |

| |

| e) | the Company was significantly larger relative to CCLLC in terms of total assets, total income and net income. |

As a business combination, the transaction was accounted for under the acquisition method pursuant to ASC 805. In a change in control event, the fair value of consideration transferred for the Combination was used to establish a new accounting basis at the fair value of the assets acquired, liabilities assumed and noncontrolling interests acquired, measured as of the closing date of April 2, 2015.

Non-Competition Arrangements

The employment agreements of Thomas J. Barrack Jr., Executive Chairman, and Richard B. Saltzman, Chief Executive Officer, provide for non-competition terms to not engage in competitive business for a period, generally effective from the closing of the Combination through one year after termination of their employment.

The Company did not allocate any purchase price to the non-competition arrangements as the Company determined that its value was de minimis, given the very low likelihood of Messrs. Barrack and Saltzman leaving and competing against the Company, for the following reasons:

| |

| ▪ | Available opportunities—Subject to certain terms and conditions, the employment agreements of Messrs. Barrack and Saltzman allow them to individually pursue opportunities that may be passed on by the board of directors of the Company, in which case, they could pursue such opportunities without leaving the Company. |

| |

| ▪ | Clawback—The upfront consideration paid to Messrs. Barrack and Saltzman for the Combination, both cash and equity, while not tied to their continued employment, is subject to clawback for up to $250 million if they violate the terms of the non-competition arrangement within 5 years. The Company believed that the size of the clawback is impactful and serves as a significant disincentive for Messrs. Barrack and Saltzman to leave the Company and compete. |

| |

| ▪ | Lock-up—The equity portion of the upfront consideration paid to Messrs. Barrack and Saltzman for the Combination is subject to lock-up arrangements with the Company, which generally restrict them from transferring their respective equity interests in the Company over the next 5 years. The ownership of equity in the Company would align their interests to the interests of the Company, and serves as a disincentive for them to leave and compete against the Company. |

| |

| ▪ | Other—Taking into consideration that Messrs. Barrack and Saltzman will not have the benefit of the Colony name and also, their respective ages at 67 and 58 at the time of closing of the Combination, further supports the very low likelihood of competition. |

Pre-Combination Management Agreement

Pursuant to the Combination, the Company became an internally managed REIT, which effectively resulted in a “settlement” of its pre-Combination management agreement with the Manager. The Company considered the guidance in ASC 805-10-55-21(b) which provides for recognition of a gain or loss upon settlement of a pre-existing contractual relationship in a business combination, measured as the lesser of (1) the amount by which the contract is favorable or unfavorable from perspective of the acquirer when compared to pricing for current market transactions for the same or similar items, and (2) the amount of any stated settlement provisions in the contract available to the counterparty to whom the contract is unfavorable. The Company determined that the terms of its management agreement were at market and therefore, no gain or loss was recognized.

The Company’s management agreement with the Manager provided for the following terms:

| |

| • | Base management fee of 1.5% of stockholders’ equity; |

| |

| • | Incentive fee of 20% of Core Earnings (a non-GAAP measure) in excess of 8% return on capital raised from inception to-date common stock offerings; |

| |

| • | Initial term of 3 years with automatic one year renewal thereafter; and |

| |

| • | Termination by vote of at least two-thirds of independent directors for unsatisfactory performance or unsatisfactory compensation by the Manager; in which case, a termination fee was payable at three times the average annual base management fee and average annual incentive fee in the 24-month period immediately preceding the quarter prior to termination. |

An evaluation of the foregoing key terms in the Company’s management agreement relative to those of other private equity sponsored mortgage REITs (such as Starwood Property Trust, Apollo Commercial Real Estate Finance, Inc. and Ares Commercial Real Estate Corporation) indicated that the provisions in connection with fee rates, term of contract and termination were comparable (if not, almost identical in some instances). Additionally, the management agreement permitted a termination due to unfair compensation to be negated if the Manager reduced its fee to a level that was deemed to be fair by two-thirds of the independent directors. This meant that there was a mechanism embedded within the contract that allowed fee rates to be reset to market terms.

The above assessment supported the Company’s conclusion that the terms of its management agreement were at market, therefore neither favorable nor unfavorable at the time the contract was “settled,” resulting in no gain or loss recognized.

Note 4. Variable Interest Entities

Sponsored Funds, page F-24

| |

| 4. | We note that you have an investment in a Sponsored Fund that is accounted for under the equity method. Please provide us with a detailed analysis of how you determined that you are not the primary beneficiary. |

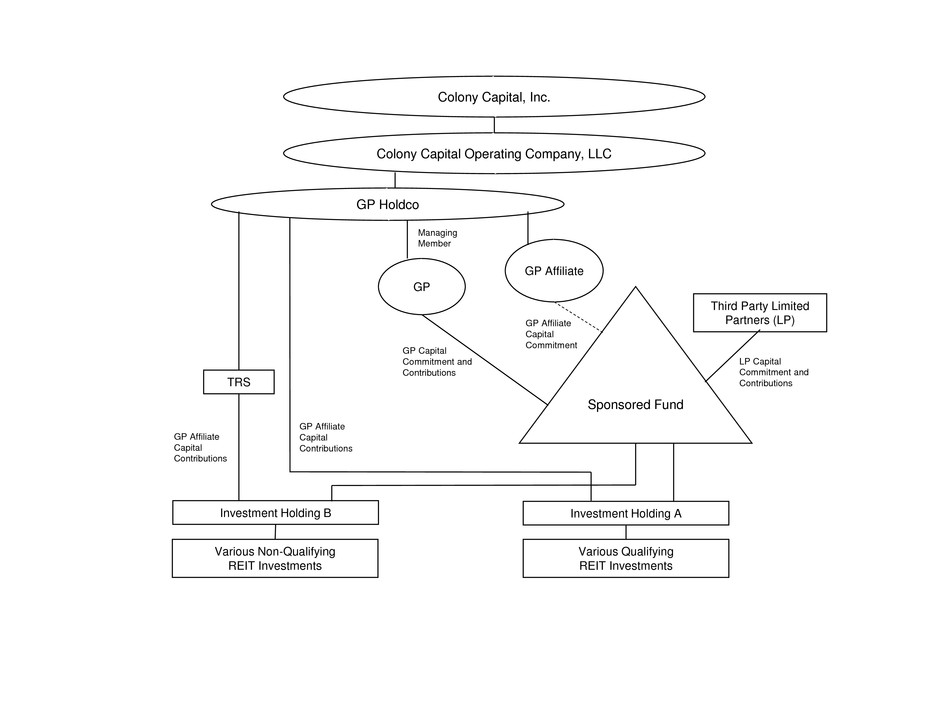

The relevant Sponsored Fund conducts its investing activities through various investment holding entities, each owned approximately 80.15% by the Sponsored Fund and 19.85% directly by the Company. It is through these investment holding entities that the Company structures its investments alongside the Sponsored Fund, which is similar in structure to the Company’s co-investing activities with legacy Colony funds that the Company manages but does not sponsor as general partner. The Company consolidates these investment holding entities, which are established with a governance structure similar to Category B investment entities, as discussed in the Company's response to Comment No. 5.

As general partner ("GP") of the Sponsored Fund, the Company committed $1 million of capital, which currently represents approximately 0.15% of total committed capital of the Sponsored Fund. The Company’s GP commitment is fixed at $1 million, thus is subject to dilution as the Sponsored Fund receives increased capital commitments. As an affiliate of the general partner (“GP Affiliate”), a subsidiary of the Company has additional capital commitments in an amount that, together with the Company’s GP commitment, would limit the Company’s total commitment to the Sponsored Fund at 20%. The GP Affiliate’s current commitment is approximately $136.7 million. The Company’s capital commitments as GP and GP Affiliate are contributed through separate subsidiaries of the Company. The substantial capital commitments as GP Affiliate reflect the Company’s real estate investing activities as a REIT, rather than an as investment contemplated in the Company’s distinct capacity as GP within its investment management business. In accordance with the limited partnership agreement of the Sponsored Fund, the Company may satisfy its capital commitments through direct capital contributions to the investment holding entities. In practice, the Company does satisfy all of its capital commitments as GP Affiliate through contributions to the investment holding entities and not as a direct funding into the Sponsored Fund.

Reference is made to a simplified illustration of the relevant Sponsored Fund structure in Appendix I.

Identification of Variable Interests in Sponsored Fund

The Company determined that its fee arrangement is not a variable interest and only its equity interest as GP, not GP Affiliate, represents a variable interest in the Sponsored Fund. The Company’s assessment is as follows.

| |

| (i) | Equity interest—The Company determined that its exposure to variability from the results of operations and performance of the underlying investments, as GP Affiliate, is absorbed through its direct interests in the investment |

holding entities, separate from its interest in the Sponsored Fund. As such, the Company’s capital commitment to the Sponsored Fund as GP Affiliate, which is satisfied through direct capital contributions to the investment holding entities, in substance, represents variable interests in the investment holding entities themselves, rather than a variable interest in the Sponsored Fund.

In making this evaluation, the Company assessed that the separation between the Company’s direct investment in the Sponsored Fund as GP and direct investments in the investment holding entities as GP Affiliate is a substantive economic arrangement, based on the following considerations:

| |

| ▪ | The establishment of the investment holding entities to conduct the investing activities of the Sponsored Fund allows the Company to maintain its REIT qualification status by holding certain assets or conducting certain activities related to its investments that it could not otherwise do so directly as a REIT. Specifically, the Company is able to segregate “good” vs. “bad” REIT assets, the latter to be held through investment holding entities which are in turn held by taxable REIT subsidiaries. Additionally, to the extent the investing capacity of the Sponsored Fund may be limited, whether due to capital availability, legal, regulatory or other factors, the Company may increase its investment in an investee beyond its share of co-investment committed to the Sponsored Fund, directly through the investment holding entities. |

| |

| ▪ | The use of a similar investment holding entity structure for REIT compliance purposes is prevalent across the Company’s co-investing activities with legacy Colony funds that the Company manages but does not sponsor as general partner. |

| |

| ▪ | The investment holding entity structure was not contemplated to circumvent consolidation under the provisions of the variable interest model as the Company consolidates these investment holding entities as the primary beneficiary. |

Accordingly, in terms of equity interests, only the Company’s de minimis equity interest as GP is considered to be a variable interest in the Sponsored Fund. The Company also considered that it does not have any indirect interests in the Sponsored Fund held through related parties.

| |

(ii) | Fee arrangement—As the Sponsored Fund’s investment advisor, the Company is entitled to an investment management fee ranging from 1% to 2% per annum of net funded capital of the Sponsored Fund paid quarterly in arrears, and an asset management fee of 0.5% of net funded capital of each investment upon closing of each investment. In its capacity as GP, the Company is entitled to an allocation of carried interest up to 20% of cumulative profits realized from the Sponsored Fund’s underlying investments in excess of return of capital and 9% preferred returns to limited partners. The management advisory agreement is for a term effective over the life of the Sponsored Fund and is cancellable at any time with 30 days’ notice from the Sponsored Fund. |

In accordance with ASC 810-10-55-37, as modified by ASU 2015-02, the Company’s fee arrangement with the Sponsored Fund is not deemed to be a variable interest, having met all of the following criteria:

| |

| ▪ | The service arrangement includes only terms, conditions, or amounts that are customarily present in arrangements for similar services negotiated at arm’s length. The Company’s fee arrangement with the Sponsored Fund, consisting of a base management fee, complemented by a 20% incentive fee over a 9% preferred return, is representative of a typical fee structure of an alternative investment advisor. As the majority of the investors, being limited partners who hold 80% of the equity interest in the Sponsored Fund, are not related parties of the Company, the fees are considered to be negotiated at arm’s length with independent third parties. There are no unique provisions or terms that are inconsistent with market convention. These fees are also consistent with those of legacy Colony funds in which the Company acts as manager but does not sponsor as GP. |

| |

| ▪ | The fees are compensation for services provided and are commensurate with the level of effort required to provide those services. The fact that the fees are considered to be an arm’s length arrangement implies that they represent compensation that is at fair value for the level of services provided. The fees are not structured in a manner that is inconsistent with the Company acting in a fiduciary role. |

| |

| ▪ | The Company does not have any other direct or indirect interests in the Sponsored Fund that individually, or in the aggregate, absorb more than an insignificant amount of expected losses or receive more than an insignificant amount of expected residual returns from the Sponsored Fund. The Company’s de minimis equity interest as GP is exposed to insignificant variability. |

Determination of Primary Beneficiary of Sponsored Fund

As the Company’s fee arrangement is not deemed to be a variable interest, this points to the Company acting in the capacity of an agent, rather than a principal. An agent is presumed to lack the power to direct the activities of a VIE that most significantly impact its economic performance. This means that the Company’s role as an agent of the Sponsored Fund does not meet the power criterion as primary beneficiary. Accordingly, the Company does not consolidate the Sponsored Fund. As GP, the Company exerts significant influence and accounts for its GP interest in the Sponsored Fund under the equity method.

Note 7. Investments in Unconsolidated Joint Ventures, page F-30

| |

| 5. | We note your disclosure that because the combination of the Company’s interests with those held by the Co-Investment Funds in the investment entities, and the Company now acts as investment manager of the Co-Investment Funds, the Company is considered to have a controlling financial interest in these investment entities post-Combination and accordingly, the Company consolidated 52 investment entities. Please tell us how you came to this conclusion and the accounting guidance upon you which you relied. |

Prior to the Combination, a majority of the Company’s investments in real estate debt and equity were structured as joint ventures with one or more private investment funds or other investment vehicles managed by CCLLC (“Co-Investment Funds”). These joint ventures or investment entities were accounted for under the equity method. The Company does not hold any equity interests in Co-Investment Funds.

Upon consummation of the Combination, the Company became the investment manager of Co-Investment Funds and employees of CCLLC, including those who are directors or officers of these investment entities, became employees of the Company. However, the Company did not acquire additional economic interests in the investment entities, nor any economic interests in Co-Investment Funds, including general partner interests in Co-Investment Funds which are held by senior executives and employees through entities residing outside of CCLLC.

The Company assessed that the Combination represented a reconsideration event which resulted in the Company indirectly obtaining a controlling financial interest in the investment entities and therefore, consolidated these investment entities. The Company’s conclusion is based on an analysis of the two broad categories of its investment structures, as follows.

Category A—Voting Interest Entities

These are investment entities in which the Company and Co-Investment Funds share equal equity ownership, equal economic interests in terms of allocation of profits and losses, and equal voting interests through a Board of Directors (i.e., 50:50). Members of the Board of Directors are represented equally by both the Company and Co-Investment Funds. The Board of Directors governs the management of the entity through appointment of officers who act on its behalf. Election of such officers requires consent of both the Company and Co-Investment Funds. All of the officers were senior executives and employees of CCLLC prior to the Combination and are now senior executives and employees of the Company subsequent to the Combination.

Pre-Combination: While the Company and Co-Investment Funds had variable interests in the investment entities through their equity interests, these investment entities did not qualify as VIEs based on the criteria in ASC 810-10-15-14, as follows:

| |

| a) | Insufficient equity investment at risk—No. The investment entities were established with sufficient equity at risk. Their investment assets were funded through capital contributions of their members and non-recourse financing. |

| |

| b) | Holders of equity investment at risk lack the characteristics of a controlling financial interest—No. Equity holders exhibited the characteristics of a controlling financial interest through their voting rights and economic rights to distributions of profits and losses from the investment entities. |

| |

| c) | Entity is established with non-substantive voting interests—No. The investment entities were not established with non-substantive voting rights as the equity holders had voting interests that were proportional to their economic interests, notwithstanding that equity holders were part of a related party group, with both the Company and Co-Investment Funds managed by CCLLC. |

As these investment entities were not the functional equivalent of limited partnerships, they were evaluated for consolidation as corporations under the voting interest model. ASC 810-10-15-8 states that “the usual condition for a controlling financial interest is ownership of a majority voting interest, and, therefore, as a general rule ownership by one reporting entity, directly or indirectly, of more than 50 percent of the outstanding voting shares of another entity is a condition pointing toward consolidation. The power to control may also exist with a lesser percentage of ownership, for example, by contract, lease, agreement with other stockholders, or by court decree.” In this regard, neither equity holders held a majority of voting interests, rather they shared voting interests equally through equal representation on the Board of Directors, with the election of officers acting on behalf of the Board of Directors requiring consent of both members. Additionally, no other legal or contractual arrangements existed among the Company, Co-Investment Funds and the investment entities that directly or indirectly affected the voting interests of either equity holders. Therefore, the Company concluded that it did not have a controlling financial interest over these investment entities and applied the equity method of accounting in light of having significant influence.

Post-Combination: There were no changes to the fundamental structure of these investment entities, including governance, the Company’s ownership interest, economic interest and voting interest as a result of the Combination. These investment entities remain voting interest entities subsequent to the Combination and adoption of ASU 2015-02. The only changes resulting from the Combination were the relationships between the Company and Co-Investment Funds, as well as officers of the investment entities.

Regulation S-X 1-02(g) defines “control” as “possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a person, whether through the ownership of voting shares, by contract, or otherwise.” Consistent with ASC 810-10-15-8, the SEC’s definition of control suggests that control may be achieved with less than a majority ownership of voting interests.

While the Company does not hold the majority of voting shares in these investment entities, the Company indirectly controls the voting rights held by the Board of Directors, taking into account the following factors:

| |

| ▪ | The Company acts as the investment manager of Co-Investment Funds and is responsible for operations of the funds, including strategic management of their underlying investments held by these investment entities; and |

| |

| ▪ | The member appointed by Co-Investment Funds to the Board of Directors, as well as the officers elected by Co-Investment Funds to act on behalf of the Board of Directors, comprise the same senior executives and employees of the Company. |

As a result, the Company determined that it has the ability to direct the significant financial and operating decisions made by the Board of Directors and carried out by their appointed officers. On this basis, the Company concluded that it holds a controlling financial interest in these investment entities subsequent to the Combination and accordingly, consolidated these investment entities.

Category B—Variable Interest Entities

These investment entities are similar in all respects to Category A, including their governance structure, except that the Company holds less than 50% equity ownership and therefore, is entitled to less than 50% economic interest in terms of allocation of profits and losses, which is proportional to its equity ownership. The Company continues to share with Co-Investment Funds equal voting interests (i.e., 50:50) through a Board of Directors with appointed officers acting on behalf of the Board of Directors.

Pre-Combination: Similar to Category A, Category B investment entities had sufficient equity at risk and equity holders exhibited the characteristics of a controlling financial interest. However, they were considered to be VIEs simply by virtue of disproportionality between voting interests and economic interests among the equity holders, the Company and Co-Investment Funds, who were part of a related party group. Specifically, voting interests were shared equally, while economic interests were proportional to equity ownership, ranging from 15% to 44% to the Company and the remainder to Co-Investment Funds. As a result, these investment entities were deemed to have non-substantive voting rights, thus met the criteria of a VIE under ASC 810-10-15-14.

While both the Company and Co-Investment Funds, individually, had economic interests in the investment entities, power resided with the Board of Directors, with decision-making requiring consent of both members. As neither member had the ability to unilaterally direct the actions of the Board of Directors, power over the investment entities was considered to be shared between the Company and Co-Investment Funds as a related party group. The Company applied the related party

tie-breaker test and concluded that Co-Investment Funds were more closely associated with the investment entities. The Company’s assessment in accordance with ASC 810-10-25-44 was as follows:

| |

| a) | Principal-agency relationship between members of related party group—There was no fiduciary relationship between the Company and Co-Investment Funds, neither party acted as principal or agent of the other party, with both managed by CCLLC. |

| |

| b) | Relationship between VIE and members of related party group—No other relationships existed between the Company or Co-Investment Funds with the investment entities other than an investor-investee relationship. |

| |

| c) | Variability of economic exposure to VIE—The Co-Investment Funds had greater exposure to variability from the performance and results of the investment entities by virtue of their higher economic interest in the investment entities, which was proportional to their equity ownership (greater than 50%). Additionally, the interests of the Co-Investment Funds in the investment entities represented a larger portion of their total assets, relative to the Company, which had a significantly larger asset base. |

| |

| d) | Design of VIE—Both the Company and Co-Investment Funds participated in the design of the investment entities, with the Company having greater input in terms of the legal structure of the investment entities solely to ensure compliance with REIT requirements. Additionally, the investment entities were not structured in a manner such that a substantial portion of their activities benefited one investor over the other by design. |

In evaluating all of the factors as a whole, the Company considered that it did not have any direct relationships with Co-Investment Funds other than as co-investors nor have any other relationships with the investment entities other than as investor-investee. The activities of the investment entities were not more closely aligned to any one investor over the other. Therefore, the Company determined that the Co-Investment Funds’ greater economic exposure carried sufficient weight to point to the Co-Investment Funds as primary beneficiary. Accordingly, the Company did not have a controlling financial interest in the investment entities and applied the equity method to account for its significant influence over the investment entities.

Post-Combination: The Combination did not result in changes to the Company’s equity interest in the investment entities nor to the governance structure of the investment entities, which are not the functional equivalent of limited partnerships. As disproportionality between voting interests and economic interests continues to exist, these investment entities remain VIEs. Power over the investment entities continues to be held by the Board of Directors and shared between the Company and Co-Investment Funds as a related party group.

Subsequent to the Combination and adoption of ASU 2015-02, however, an assessment of the related party tie-breaker points to the Company as being more closely associated with the investment entities. This resulted from new related party relationships created between the Company with Co-Investment Funds and officers of the investment entities. In the variable interest model, related parties are defined as those identified in ASC 850-10-20 as well as certain other parties acting as de facto agents or de facto principals, which include management, officers, employees and members of the governing board. The Company’s assessment of the guidance in ASC 810-10-25-44 subsequent to the Combination is as follows:

| |

| a) | Principal-agency relationship between members of related party group—Upon consummation of the Combination, a de facto principal-agency relationship exists through the Company’s role as the investment manager of Co-Investment Funds. In its capacity as investment manager, the Company is responsible for operations of the funds, including strategic management of their underlying investments, appointment of members of the Board of Directors of the investment entities as well as election of officers acting on behalf of the Board of Directors. Therefore, within the related party group, the Company acts as principal, which typically would be identified as the primary beneficiary. |

| |

| b) | Relationship between VIE and members of related party group—Officers of the investment entities, who are appointed through consent by both the Company and Co-Investment Funds, comprise senior executives and employees of the Company. The Co-Investment Funds have no employees as the Company acts on behalf of the funds as investment manager. |

| |

| c) | Variability of economic exposure to VIE—As equity ownership, thus economic interests, remain constant, this criterion continues to point to Co-Investment Funds as having greater exposure to variability from the investment entities. |

| |

| d) | Design of VIE—There was no change to the Company’s assessment of this criterion prior and subsequent to the Combination. |

While Co-Investment Funds continue to have greater economic exposure to the investment entities, this factor, by itself, is no longer determinative. In evaluating all of the above factors as a whole, the Company’s role as principal within the related party group, and having senior executives and employees of the Company acting as officers of the investment entities, were stronger indicators that the Company acts as primary beneficiary. Accordingly, the Company consolidated these investment entities subsequent to the Combination.

Note 22. Subsequent Events, page F-56

| |

| 6. | Please tell us how you intend to account for your investments in SFR and CAF following the merger of CAH and SWAY, citing the relevant accounting guidance upon which you relied. |

The Company accounts for its investment in Colony Starwood Homes ("SFR") under the equity method as it exercises significant influence over operating and financial policies of SFR through its voting interest and board representation. As of March 31, 2016, the Company directly and indirectly owned approximately 14% of SFR's operating partnership, or approximately 14.9% of outstanding common stock of SFR. ASC paragraph 323-10-15-8 states that a less than 20% voting interest shall lead to a presumption that an investor does not have the ability to exercise significant influence, unless such ability can be demonstrated. The Company is able to exercise significant influence over SFR through four of twelve seats on SFR's board of trustees represented by the Company—the Company's Executive Chairman, Chief Executive Officer, an Executive Director and one of its independent board members currently serve on SFR's board of trustees.

The Company also continues to account for its investment in CAF under the equity method as the structure described in our correspondence with the Staff dated July 23, 2014 remains in place for the lending business that was excluded from the SWAY merger.

Note 21. Segment Information, page F-53

| |

| 7. | Please disclose the geographic information required by ASC 280-10-50-41 in future filings. |

We will provide the information required by ASC 280-10-50-41 in our future periodic filings.

* * * * *

The Company acknowledges that:

| |

| • | The Company is responsible for the adequacy and accuracy of the disclosure in the filings; |

| |

| • | Staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filings; and |

| |

| • | The Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

If you have any questions concerning this letter or if you would like any additional information, please do not hesitate to call me at (310) 552-7230.

|

|

| Sincerely, |

| |

| /s/ Darren J. Tangen |

| Darren J. Tangen |

| Chief Financial Officer and Treasurer |

| |

| cc: | Ronald M. Sanders, Colony Capital, Inc. |

David W. Bonser, Hogan Lovells US LLP

James E. Showen, Hogan Lovells US LLP

Appendix I

Sponsored Fund Structure

(Simplified Illustration)