|

|

| |

| Forward-Looking Statements |

| |

| |

Some of the statements contained in this presentation constitute forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions.

The forward-looking statements contained in this presentation reflect Colony Capital, Inc.’s (or “the Company”) current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances, many of which are beyond the Company’s control, that may cause the Company’s actual results to differ significantly from those expressed in any forward-looking statement. Statements regarding the following subjects, among others, may be forward-looking: the market, economic and environmental conditions in the industrial real estate, single-family rental, and lodging sectors; any decrease in the Company’s net income and funds from operations as a result of the combination transaction with Colony Capital, LLC; the Company’s ability to manage the combination with Colony Capital, LLC effectively; the Company’s exposure to risks to which it has not historically been exposed, including liabilities with respect to the assets acquired from Colony Capital, LLC and ongoing liabilities and business risks inherent to Colony Capital LLC’s business; the Company’s business and investment strategy, including the Company’s investment in and ability to generate revenue from the single-family homes in which the Company indirectly owns an interest; the Company’s ability to dispose of its real estate investments quickly; the performance of the hotels in which the Company owns an interest; market trends in the Company’s industry, interest rates, real estate values, the debt securities markets or the general economy or the demand for commercial real estate loans; the Company’s projected operating results; actions, initiatives and policies of the U.S. government and changes to U.S. government policies and the execution and impact of these actions, initiatives and policies; the state of the U.S. and global economy generally or in specific geographic regions; the Company’s ability to obtain and maintain financing arrangements, including securitizations; the amount and value of commercial mortgage loans requiring refinancing in future periods; the availability of attractive investment opportunities; the availability and cost of debt financing from traditional lenders; the volume of short-term loan extensions; the demand for new capital to replace maturing loans; the Company’s expected leverage; the general volatility of the securities markets in which the Company participates; changes in the value of the Company’s assets; interest rate mismatches between the Company’s target assets and any borrowings used to fund such assets; changes in interest rates and the market value of the Company’s target assets; changes in prepayment rates on the Company’s target assets; effects of hedging instruments on the Company’s target assets; rates of default or decreased recovery rates on the Company’s target assets; the impact of and changes in governmental regulations, tax law and rates, accounting guidance and similar matters; the Company’s ability to maintain its qualification as a real estate investment trust, or REIT, for U.S. federal income tax purposes; the Company’s ability to maintain its exemption from registration as an investment company under the Investment Company Act of 1940, as amended (the “1940 Act”); the availability of opportunities to acquire commercial mortgage-related, real estate-related and other securities; the availability of qualified personnel; estimates relating to the Company’s ability to make distributions to the Company’s stockholders in the future; and the Company’s understanding of its competition.

While forward-looking statements reflect Colony Capital, Inc.’s good faith beliefs, assumptions and expectations, they are not guarantees of future performance. Furthermore, the Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes. For a further discussion of these and other factors that could cause the Company’s future results to differ materially from any forward-looking statements, see the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015 and subsequent filings with the SEC.

This presentation contains statistics and other data that has been obtained from or compiled from information made available by third-party service providers. Colony Capital, Inc. has not independently verified such statistics or data.

This information is provided for informational purposes only and is not intended to be indicative of future results. Actual performance of Colony Capital, Inc. may vary materially.

|

| |

| | |

Colony Capital, Inc. Third Quarter 2016 Supplemental Financial Report | | 1 | |

|

|

| |

| Important Note Regarding Non-GAAP Financial Measures |

| |

| |

This supplemental package includes certain “non-GAAP” supplemental measures that are not defined by generally accepted accounting principles, or GAAP, including funds from operations, or FFO, and core funds from operations, or Core FFO and pro rata financial information.

The Company calculates funds from operations ("FFO") in accordance with standards established by the Board of Governors of the National Association of Real Estate Investment Trusts, which defines FFO as net income or loss calculated in accordance with GAAP, excluding gains and losses from sales of depreciable real estate and impairment write-downs associated with depreciable real estate, plus real estate-related depreciation and amortization, and after similar adjustments for unconsolidated partnerships and joint ventures. Included in FFO are gains and losses from sales of assets which are not depreciable real estate such as loans receivable, investments in unconsolidated joint ventures as well as investments in debt and other equity securities, as applicable.

The Company computes core funds from operations ("Core FFO") by adjusting FFO for the following items, including the Company's share of these items recognized by unconsolidated partnerships and joint ventures: (i) gains and losses from sales of depreciable real estate, net of depreciation, amortization and impairment previously adjusted for FFO; (ii) stock compensation expense; (iii) effects of straight-line rent revenue and straight-line rent expense on ground leases; (iv) amortization of acquired above- and below-market lease values; (v) amortization of deferred financing costs and debt premiums and discounts; (vi) unrealized fair value gains or losses on derivative instruments and on foreign currency remeasurements; (vii) acquisition-related expenses, merger and integration costs; (viii) amortization and impairment of finite-lived intangibles related to investment management contracts and customer relationships; (ix) gain on remeasurement of consolidated investment entities and the effect of amortization thereof; (x) non-real estate depreciation and amortization; (xi) change in fair value of contingent consideration; and (xii) deferred tax effect on the foregoing adjustments. Also, beginning with the first quarter of 2016, the Company's share of Core FFO from its interest in Colony Starwood Homes (NYSE:SFR) will represent its percentage interest multiplied by SFR's reported Core FFO, which may differ from the Company's calculation of Core FFO. Refer to SFR's filings for its definition and calculation of Core FFO.

FFO and Core FFO should not be considered alternatives to GAAP net income as indications of operating performance, or to cash flows from operating activities as measures of liquidity, nor as indications of the availability of funds for the Company's cash needs, including funds available to make distributions. FFO and Core FFO should not be used as supplements to or substitutes for cash flow from operating activities computed in accordance with GAAP. The Company's calculations of FFO and Core FFO may differ from methodologies utilized by other REITs for similar performance measurements, and, accordingly, may not be comparable to those of other REITs.

The Company uses FFO and Core FFO as supplemental performance measures because, in excluding real estate depreciation and amortization and gains and losses from property dispositions, it provides a performance measure that, when compared year over year, captures trends in occupancy rates, rental rates, and operating costs. The Company also believes that, as widely recognized measures of the performance of REITs, FFO and Core FFO will be used by investors as a basis to compare its operating performance with that of other REITs. However, because FFO and Core FFO excludes depreciation and amortization and captures neither the changes in the value of the Company’s properties that results from use or market conditions nor the level of capital expenditures and leasing commissions necessary to maintain the operating performance of its properties, all of which have real economic effect and could materially impact the Company’s results from operations, the utility of FFO and Core FFO as measures of the Company’s performance is limited. Our calculation of FFO and Core FFO may differ from methodologies utilized by other REITs for similar performance measurements, and, accordingly, may not be comparable to those of other REITs. Accordingly, FFO and Core FFO should be considered only as supplements to net income as a measure of the Company’s performance.

The Company presents pro rata financial information, which is not, and is not intended to be, a presentation in accordance with GAAP. The Company computes pro rata financial information by applying its economic interest to each financial statement line item on an investment-by-investment basis. Similarly, noncontrolling interests’ share of assets, liabilities, profits and losses was computed by applying noncontrolling interests’ economic interest to each financial statement line item. The Company provides pro rata financial information because it may assist investors and analysts in estimating the Company’s economic interest in its investments. However, pro rata financial information as an analytical tool has limitations. Other equity REITs may not calculate their pro rata information in the same methodology, and accordingly, the Company’s pro rata information may not be comparable to such other REITs' pro rata information. As such, the pro rata financial information should not be considered in isolation or as a substitute for our financial statements as reported under GAAP, but may be used as a supplement to financial information as reported under GAAP.

|

| |

| | |

Colony Capital, Inc. Third Quarter 2016 Supplemental Financial Report | | 2 | |

|

| | | | | | | | |

| | | | Page | | | | | Page |

| I. | Overview | | | V. | Single Family Residential Rentals | |

| | a. | Summary Metrics | | | | a. | Summary Metrics | |

| | b. | Summary of Segments | | | VI. | Other Real Estate Equity | |

| II. | Financial Results | | | | a. | Summary Metrics | |

| | a. | Consolidated Income Statement | | | | b. | Portfolio Overview | |

| | b. | Consolidated Segment Balance Sheet

| | | | | | |

| | c. | Noncontrolling Interests' Share Segment Balance Sheet

| | | VII. | Real Estate Debt | |

| | d. | Consolidated Segment Operating Results

| | | | a. | Summary Metrics | |

| | e.

| Noncontrolling Interests' Share Segment Operating Results | | | | b. | Portfolio Overview by Loan Type | |

| | f. | Segment Reconciliation of Net Income to FFO & Core FFO | | | | c. | Portfolio Overview by Collateral Type | |

| III. | Capitalization | | | VIII.

| Investment Management

| |

| | a. | Overview | | | | a.

| Summary Metrics

| |

| | b. | Debt Overview | | | IX.

| Definitions

| |

| | c. | Debt Maturity and Amortization Schedules | | | | | | |

| | d. | Investment-Level Debt Overview | | | | | | |

| | e. | Credit Facility, Convertible Debt & Preferred Equity Overview | | | | | | |

| IV. | Colony Light Industrial Platform | | | | | | |

| | a. | Summary Metrics | | | | | | |

| | b. | Portfolio & Lease Overview | | | | | | |

| | | | | | | | | |

|

| |

| | |

Colony Capital, Inc. Third Quarter 2016 Supplemental Financial Report | | 3 | |

|

|

| |

| Ia. Overview—Summary Metrics |

| |

| |

|

| | | | | | |

| ($ and shares in thousands, except per share data) | | Three months ended September 30, 2016 | | Nine months ended September 30, 2016 |

| Financial data | | | | |

| Net income attributable to common stockholders | $ | 22,878 |

| $ | 83,969 |

|

| Net income attributable to common stockholders per basic share | | 0.20 |

| | 0.73 |

|

| Core FFO | | 69,994 |

| | 225,704 |

|

| Core FFO per basic share | | 0.52 |

| | 1.67 |

|

| FFO | | 46,992 |

| | 162,301 |

|

| FFO per basic share | | 0.35 |

| | 1.20 |

|

| Q4 2016 dividend per share | | 0.40 |

| | |

| Annualized dividend per share | | 1.60 |

| | |

|

| | | | | |

| Balance sheet, capitalization and trading statistics | | | | |

| Total consolidated assets | $ | 10,146,641 |

| | |

| CLNY OP share of consolidated assets | | 6,602,384 |

| | |

Total consolidated debt (1) | | 4,111,772 |

| | |

CLNY OP share of consolidated debt (1) | | 3,033,381 |

| | |

| Shares and OP units outstanding as of 11/4/2016 | | 134,699 |

| | |

| Share price as of 11/4/2016 | | 19.32 |

| | |

| Market value of common equity & OP units | | 2,602,366 |

| | |

| Liquidation preference of preferred equity | | 625,750 |

| | |

| Insider ownership of shares and OP units | | 18.1 | % | | |

| AUM | | 18.1 billion |

| | |

| FEEUM | | 7.8 billion |

| | |

________

Note: See appendix for definitions and acronyms.

(1) Represents principal balance and excludes debt issuance costs, discounts and premiums.

|

| |

| | |

Colony Capital, Inc. Third Quarter 2016 Supplemental Financial Report | | 4 | |

|

|

| |

| Ib. Overview—Summary of Segments |

| |

| |

|

| | | | | | | |

| ($ in thousands, unless otherwise noted; as of or for the three months ended September 30, 2016) | | Consolidated amount | | | CLNY OP share of consolidated amount |

| Light Industrial | | | | | |

1) Undepreciated cost basis of real estate assets (1)(2) | $ | 2,126,176 |

| | $ | 1,114,886 |

|

Investment-level non-recourse financing (3) | | 1,227,740 |

| | | 643,780 |

|

| 2) Carrying value of CLIP operating platform | | 20,000 |

| | | 20,000 |

|

| Net income attributable to common stockholders | |

| | | 1,169 |

|

| Core FFO | | | | | 15,553 |

|

| Single Family Residential Rentals | |

| | | |

| 1) Equity method investments - Colony Starwood Homes (Represents 14.0% interest in SFR) | $ | 320,963 |

| | $ | 320,963 |

|

| Colony Starwood Homes shares beneficially owned by OP and common stockholders | | 15.1 million |

| | | 15.1 million |

|

| 2) Equity method investments - Colony American Finance (Represents 17.4% interest in CAF) | | 57,883 |

| | | 57,883 |

|

| Net loss attributable to common stockholders | | | | | (385 | ) |

Core FFO

| | | | | 7,758 |

|

| Other Real Estate Equity | | | | | |

1) Undepreciated cost basis of real estate assets, held for investment (1)(2) | $ | 1,570,948 |

| | $ | 943,101 |

|

2) Undepreciated cost basis of real estate assets, held for sale (1) | | 129,516 |

| | | 63,866 |

|

Investment-level non-recourse financing (3) | | 966,837 |

| | | 602,714 |

|

| 3) Equity method investments | | 224,347 |

| | | 173,108 |

|

| 4) Other investments - Albertsons investment | | 99,736 |

| | | 49,862 |

|

| Net income attributable to common stockholders | | | | | 11,229 |

|

Core FFO

| | | | | 21,326 |

|

| Real Estate Debt | | | | | |

| 1) Loans receivable held for investment, net | $ | 3,685,654 |

| | $ | 2,417,557 |

|

| 2) Loans receivable held for sale, net | | 56,357 |

| | | 54,187 |

|

Investment-level financing (3) | | 912,976 |

| | | 782,668 |

|

3) Carrying value of real estate assets (REO within debt portfolio) (1) | | 83,669 |

| | | 28,883 |

|

| 4) Equity method investments | | 270,599 |

| | | 127,544 |

|

| 5) Other investments | | 23,882 |

| | | 4,393 |

|

| Net income attributable to common stockholders | | | | | 44,436 |

|

Core FFO

| | | | | 57,394 |

|

| Investment Management | | | | | |

| AUM | | | | $ | 18.1 billion |

|

| FEEUM | | | | | 7.8 billion |

|

| Credit Funds | | | | | 3.8 billion |

|

| Core Plus / Value-Add Funds | | | | | 1.7 billion |

|

| Opportunity Funds | | | | | 2.3 billion |

|

| Net income attributable to common common stockholders | | | | | 7,128 |

|

Core FFO

| | | | | 11,789 |

|

________

(1) Includes all components related to real estate assets, including tangible real estate and lease-related intangibles.

(2) Excludes accumulated depreciation.

(3) Represents unpaid principal balance.

|

| |

| | |

Colony Capital, Inc. Third Quarter 2016 Supplemental Financial Report | | 5 | |

|

|

| |

| IIa. Financial Results—Consolidated Income Statements |

| |

| |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 2015 | | 2016 |

| ($ in thousands, except per share data) | | | Q1 (1) | | Q2 | | Q3 | | Q4 | | Q1 | | Q2 | | Q3 |

| Income | | | | | | | | | | | | | | | |

| Interest income | | | $ | 46,137 |

| | $ | 101,270 |

| | $ | 142,269 |

| | $ | 127,629 |

| | $ | 89,361 |

| | $ | 103,860 |

| | $ | 98,275 |

|

| Property operating income | | | 43,793 |

| | 83,230 |

| | 86,435 |

| | 86,413 |

| | 91,617 |

| | 95,348 |

| | 92,505 |

|

| Income from equity method investments | | | 26,349 |

| | 10,956 |

| | 6,879 |

| | 3,421 |

| | 2,429 |

| | 53,113 |

| | 16,684 |

|

| Fee income | | | — |

| | 21,928 |

| | 23,070 |

| | 20,745 |

| | 16,609 |

| | 15,505 |

| | 17,233 |

|

| Other income | | | 333 |

| | 3,520 |

| | 4,325 |

| | 3,274 |

| | 3,202 |

| | 2,815 |

| | 4,054 |

|

| Total income | | | 116,612 |

| | 220,904 |

| | 262,978 |

| | 241,482 |

| | 203,218 |

| | 270,641 |

| | 228,751 |

|

| Expenses | | | | | | | | | | | | | | | |

| Management fees | | | 14,961 |

| | 101 |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Transaction, investment and servicing expenses | | | 16,807 |

| | 10,034 |

| | 7,058 |

| | 28,722 |

| | 11,421 |

| | 13,360 |

| | 11,305 |

|

| Interest expense | | | 26,593 |

| | 30,924 |

| | 38,027 |

| | 37,550 |

| | 41,871 |

| | 42,568 |

| | 42,196 |

|

| Property operating expenses | | | 14,011 |

| | 35,905 |

| | 35,615 |

| | 32,182 |

| | 30,786 |

| | 29,780 |

| | 28,903 |

|

| Depreciation and amortization | | | 22,308 |

| | 36,645 |

| | 42,656 |

| | 39,368 |

| | 46,142 |

| | 39,541 |

| | 43,593 |

|

| Provision for loan losses | | | — |

| | 4,078 |

| | 26,495 |

| | 6,538 |

| | 4,630 |

| | 6,213 |

| | 6,569 |

|

| Impairment loss | | | — |

| | — |

| | 317 |

| | 10,425 |

| | 2,079 |

| | 2,441 |

| | 941 |

|

| Compensation expense | | | — |

| | 28,644 |

| | 25,734 |

| | 29,513 |

| | 26,867 |

| | 24,240 |

| | 29,582 |

|

| Administrative expenses | | | 4,781 |

| | 11,411 |

| | 11,154 |

| | 11,507 |

| | 12,771 |

| | 13,098 |

| | 12,891 |

|

| Total expenses | | | 99,461 |

| | 157,742 |

| | 187,056 |

| | 195,805 |

| | 176,567 |

| | 171,241 |

| | 175,980 |

|

| Gain on sale of real estate assets, net | | | — |

| | — |

| | — |

| | — |

| | 51,119 |

| | 5,844 |

| | 11,151 |

|

| Gain on remeasurement of consolidated investment entities, net | | | — |

| | 41,486 |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Other (loss) gain, net | | | (286 | ) | | (1,215 | ) | | (759 | ) | | 5,602 |

| | 14,045 |

| | (348 | ) | | 4,573 |

|

| Income before income taxes | | | 16,865 |

| | 103,433 |

| | 75,163 |

| | 51,279 |

| | 91,815 |

| | 104,896 |

| | 68,495 |

|

| Income tax (provision) benefit | | | (650 | ) | | (349 | ) | | 3,598 |

| | 6,697 |

| | (784 | ) | | (1,760 | ) | | 3,409 |

|

| Net income | | | 16,215 |

| | 103,084 |

| | 78,761 |

| | 57,976 |

| | 91,031 |

| | 103,136 |

| | 71,904 |

|

| Net income attributable to noncontrolling interests—Investment entities | | | 5,686 |

| | 34,630 |

| | 22,264 |

| | 23,543 |

| | 57,595 |

| | 40,169 |

| | 32,744 |

|

| Net income attributable to noncontrolling interests—Operating Company | | | — |

| | 9,138 |

| | 7,200 |

| | 3,595 |

| | 3,421 |

| | 7,918 |

| | 4,189 |

|

| Net income attributable to Colony Capital, Inc. | | | 10,529 |

| | 59,316 |

| | 49,297 |

| | 30,838 |

| | 30,015 |

| | 55,049 |

| | 34,971 |

|

| Preferred dividends | | | 6,972 |

| | 11,410 |

| | 12,094 |

| | 12,093 |

| | 11,880 |

| | 12,093 |

| | 12,093 |

|

| Net income attributable to common stockholders | | | $ | 3,557 |

| | $ | 47,906 |

| | $ | 37,203 |

| | $ | 18,745 |

| | $ | 18,135 |

| | $ | 42,956 |

| | $ | 22,878 |

|

| Net income per common share—Basic | | | $ | 0.03 |

| | $ | 0.43 |

| | $ | 0.33 |

| | $ | 0.17 |

| | $ | 0.16 |

| | $ | 0.38 |

| | $ | 0.20 |

|

| Net income per common share—Diluted | | | $ | 0.03 |

| | $ | 0.40 |

| | $ | 0.32 |

| | $ | 0.17 |

| | $ | 0.16 |

| | $ | 0.36 |

| | $ | 0.20 |

|

| Weighted average number of common shares outstanding—Basic | | | 109,415 |

| | 111,394 |

| | 111,443 |

| | 111,444 |

| | 111,660 |

| | 112,306 |

| | 112,423 |

|

| Weighted average number of common shares outstanding—Diluted | | | 109,415 |

| | 136,434 |

| | 136,138 |

| | 111,444 |

| | 111,660 |

| | 137,255 |

| | 112,423 |

|

| FFO | | | $ | 29,663 |

| | $ | 83,159 |

| | $ | 72,162 |

| | $ | 54,272 |

| | $ | 36,729 |

| | $ | 78,580 |

| | $ | 46,992 |

|

| FFO per basic share | | | $ | 0.27 |

| | $ | 0.62 |

| | $ | 0.54 |

| | $ | 0.41 |

| | $ | 0.27 |

| | $ | 0.58 |

| | $ | 0.35 |

|

| Core FFO | | | $ | 53,561 |

| | $ | 58,692 |

| (2) | $ | 70,064 |

| (2)

| $ | 75,562 |

| (2)

| $ | 55,316 |

| (2)

| $ | 100,394 |

| | $ | 69,994 |

|

| Core FFO per basic share | | | $ | 0.49 |

| | $ | 0.44 |

| (2)

| $ | 0.52 |

| (2)

| $ | 0.56 |

| (2)

| $ | 0.41 |

| (2)

| $ | 0.75 |

| | $ | 0.52 |

|

__________

| |

| (1) | Prior to the Combination transaction on April 2, 2015, the Company was externally managed and many of the Company's investments were held through unconsolidated joint ventures. Therefore, results of operations for Q1 2015 are not directly comparable to subsequent quarters. |

| |

| (2) | In Q2 2016, the Company added the deferred tax effect related to Core FFO adjustments to the definition of Core FFO. As such, the Company has presented revised Core FFO and Core FFO per basic common share / common OP Unit for prior periods to exclude such deferred tax effects to conform to the current quarter calculation of Core FFO. |

|

| |

| | |

Colony Capital, Inc. Third Quarter 2016 Supplemental Financial Report | | 6 | |

|

|

| |

| IIb. Financial Results—Consolidated Segment Balance Sheet |

| |

| |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | Total |

| ($ in thousands; as of September 30, 2016) | Light Industrial Platform | | Single-Family Residential Rentals | | Other Real Estate Equity | | Real Estate Debt | | Investment Management | | Amounts not allocated to segments | |

| ASSETS | | | | | | | | | | | | | |

| Cash | $ | 233,003 |

| | $ | — |

| | $ | 91,479 |

| | $ | 60,387 |

| | $ | 10,416 |

| | $ | 44,888 |

| | $ | 440,173 |

|

| Loans receivable, net | | | | | | | | | | | | | |

| Held for investment | — |

| | — |

| | — |

| | 3,685,654 |

| | — |

| | — |

| | 3,685,654 |

|

| Held for sale | — |

| | — |

| | — |

| | 56,357 |

| | — |

| | — |

| | 56,357 |

|

| Real estate assets, net | | | | | | | | | | | | |

|

| Held for investment | 1,896,537 |

| | — |

| | 1,383,973 |

| | 13,612 |

| | — |

| | — |

| | 3,294,122 |

|

| Held for sale | 4,518 |

| | — |

| | 120,970 |

| | 69,903 |

| | — |

| | — |

| | 195,391 |

|

| Equity method investments | — |

| | 378,846 |

| | 224,347 |

| | 270,599 |

| | 14,676 |

| | 17,691 |

| | 906,159 |

|

| Other investments | — |

| | — |

| | 99,736 |

| | 23,882 |

| | — |

| | — |

| | 123,618 |

|

| Goodwill | 20,000 |

| | — |

| | — |

| | — |

| | 660,127 |

| | — |

| | 680,127 |

|

| Deferred leasing costs and intangible assets, net | 82,821 |

| | — |

| | 156,090 |

| | 154 |

| | 74,380 |

| | — |

| | 313,445 |

|

| Due from affiliates and other assets | 120,606 |

| | — |

| | 47,832 |

| | 180,539 |

| | 25,445 |

| | 77,173 |

| | 451,595 |

|

| Total assets | $ | 2,357,485 |

| | $ | 378,846 |

| | $ | 2,124,427 |

| | $ | 4,361,087 |

| | $ | 785,044 |

| | $ | 139,752 |

| | $ | 10,146,641 |

|

| LIABILITIES & EQUITY | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | |

| Accrued and other liabilities | $ | 49,160 |

| | $ | — |

| | $ | 80,685 |

| | $ | 101,965 |

| | $ | 61,537 |

| | $ | 17,616 |

| | $ | 310,963 |

|

| Intangible liabilities, net | 12,519 |

| | — |

| | 10,272 |

| | — |

| | — |

| | — |

| | 22,791 |

|

| Due to affiliates—contingent consideration | — |

| | — |

| | — |

| | — |

| | — |

| | 39,350 |

| | 39,350 |

|

| Dividends and distributions payable | — |

| | — |

| | — |

| | — |

| | — |

| | 65,924 |

| | 65,924 |

|

| Debt, net | 1,214,081 |

| | — |

| | 948,549 |

| | 908,013 |

| | — |

| | 401,719 |

| | 3,472,362 |

|

| Convertible senior notes, net | — |

| | — |

| | — |

| | — |

| | — |

| | 592,382 |

| | 592,382 |

|

| Total liabilities | 1,275,760 |

| | — |

| | 1,039,506 |

| | 1,009,978 |

| | 61,537 |

| | 1,116,991 |

| | 4,503,772 |

|

| Equity: | | | | | | | | | | | | | |

| Stockholders' equity | 504,943 |

| | 331,692 |

| | 549,671 |

| | 1,669,166 |

| | 633,454 |

| | (855,603 | ) | | 2,833,323 |

|

| Noncontrolling interests in investment entities | 504,997 |

| | — |

| | 457,107 |

| | 1,444,649 |

| | — |

| | — |

| | 2,406,753 |

|

| Noncontrolling interests in Operating Company | 71,785 |

| | 47,154 |

| | 78,143 |

| | 237,294 |

| | 90,053 |

| | (121,636 | ) | | 402,793 |

|

| Total equity | 1,081,725 |

| | 378,846 |

| | 1,084,921 |

| | 3,351,109 |

| | 723,507 |

| | (977,239 | ) | | 5,642,869 |

|

| Total liabilities and equity | $ | 2,357,485 |

| | $ | 378,846 |

| | $ | 2,124,427 |

| | $ | 4,361,087 |

| | $ | 785,044 |

| | $ | 139,752 |

| | $ | 10,146,641 |

|

|

| |

| | |

Colony Capital, Inc. Third Quarter 2016 Supplemental Financial Report | | 7 | |

|

|

| |

| IIc. Financial Results—Noncontrolling Interests' Share Segment Balance Sheet |

| |

| |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | Total noncontrolling interest share |

| ($ in thousands; as of September 30, 2016) | Light Industrial Platform | | Single-Family Residential Rentals | | Other Real Estate Equity | | Real Estate Debt | | Investment Management | | Amounts not allocated to segments | |

| ASSETS | | | | | | | | | | | | | |

| Cash | $ | 110,825 |

| | $ | — |

| | $ | 46,158 |

| | $ | 31,480 |

| | $ | — |

| | $ | — |

| | $ | 188,463 |

|

| Loans receivable held for investment, net | | | | | | | | | | | | |

|

| Held for investment | — |

| | — |

| | — |

| | 1,268,097 |

| | — |

| | — |

| | 1,268,097 |

|

| Held for sale | — |

| | — |

| | — |

| | 2,170 |

| | — |

| | — |

| | 2,170 |

|

| Real estate assets, net | | | | | | | | | | | | |

|

| Held for investment | 902,065 |

| | — |

| | 541,022 |

| | 4,344 |

| | — |

| | — |

| | 1,447,431 |

|

| Held for sale | 2,149 |

| | — |

| | 64,791 |

| | 50,359 |

| | — |

| | — |

| | 117,299 |

|

| Equity method investments | — |

| | — |

| | 51,239 |

| | 143,055 |

| | — |

| | — |

| | 194,294 |

|

| Other investments | — |

| | — |

| | 49,874 |

| | 19,489 |

| | — |

| | — |

| | 69,363 |

|

| Goodwill | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Deferred leasing costs and intangible assets, net | 39,393 |

| | — |

| | 67,352 |

| | 83 |

| | — |

| | — |

| | 106,828 |

|

| Due from affiliates and other assets | 57,365 |

| | — |

| | 22,946 |

| | 70,001 |

| | — |

| | — |

| | 150,312 |

|

| Total assets | $ | 1,111,797 |

| | $ | — |

| | $ | 843,382 |

| | $ | 1,589,078 |

| | $ | — |

| | $ | — |

| | $ | 3,544,257 |

|

| LIABILITIES & EQUITY | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | |

| Accrued and other liabilities | $ | 23,382 |

| | $ | — |

| | $ | 25,368 |

| | $ | 14,199 |

| | $ | — |

| | $ | — |

| | $ | 62,949 |

|

| Intangible liabilities, net | 5,955 |

| | — |

| | 6,184 |

| | — |

| | — |

| | — |

| | 12,139 |

|

| Due to affiliates—contingent consideration | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Dividends and distributions payable | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Debt, net | 577,463 |

| | — |

| | 354,723 |

| | 130,230 |

| | — |

| | — |

| | 1,062,416 |

|

| Convertible senior notes, net | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Total liabilities | 606,800 |

| | — |

| | 386,275 |

| | 144,429 |

| | — |

| | — |

| | 1,137,504 |

|

| Equity: | | | | | | | | | | | | | |

| Stockholders' equity | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Noncontrolling interests in investment entities | 504,997 |

| | — |

| | 457,107 |

| | 1,444,649 |

| | — |

| | — |

| | 2,406,753 |

|

| Noncontrolling interests in Operating Company | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Total equity | 504,997 |

| | — |

| | 457,107 |

| | 1,444,649 |

| | — |

| | — |

| | 2,406,753 |

|

| Total liabilities and equity | $ | 1,111,797 |

|

| $ | — |

| | $ | 843,382 |

| | $ | 1,589,078 |

| | $ | — |

| | $ | — |

| | $ | 3,544,257 |

|

|

| |

| | |

Colony Capital, Inc. Third Quarter 2016 Supplemental Financial Report | | 8 | |

|

|

| |

| IId. Financial Results—Consolidated Segment Operating Results |

| |

| |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| ($ in thousands; for the three months ended September 30, 2016) | Light Industrial Platform | | Single-Family Residential Rentals | | Other Real Estate Equity | | Real Estate Debt | | Investment Management | | Amounts not allocated to segments | | Total |

| Income | | | | | | | | | | | | | |

| Interest income | $ | — |

| | $ | — |

| | $ | — |

| | $ | 98,249 |

| | $ | — |

| | $ | 26 |

| | $ | 98,275 |

|

| Property operating income | 49,256 |

| | — |

| | 41,850 |

| | 1,399 |

| | — |

| | — |

| | 92,505 |

|

| (Loss) income from equity method investments | — |

| | (455 | ) | | 5,644 |

| | 6,385 |

| | 3,879 |

| | 1,231 |

| | 16,684 |

|

| Fee income | — |

| | — |

| | — |

| | — |

| | 17,233 |

| | — |

| | 17,233 |

|

| Other income | 238 |

| | — |

| | 295 |

| | 2,081 |

| | — |

| | 1,440 |

| | 4,054 |

|

| Total income | 49,494 |

| | (455 | ) | | 47,789 |

| | 108,114 |

| | 21,112 |

| | 2,697 |

|

| 228,751 |

|

| Expenses | | | | | | | | | | | | | |

| Transaction, investment and servicing expenses | 612 |

| | — |

| | 9 |

| | 2,843 |

| | 1,511 |

| | 6,330 |

| | 11,305 |

|

| Interest expense | 11,532 |

| | — |

| | 10,651 |

| | 8,824 |

| | — |

| | 11,189 |

| | 42,196 |

|

| Property operating expenses | 13,921 |

| | — |

| | 13,495 |

| | 1,487 |

| | — |

| | — |

| | 28,903 |

|

| Depreciation and amortization | 22,295 |

| | — |

| | 16,238 |

| | 94 |

| | 3,779 |

| | 1,187 |

| | 43,593 |

|

| Provision for loan losses | — |

| | — |

| | — |

| | 6,569 |

| | — |

| | — |

| | 6,569 |

|

| Impairment loss | — |

| | — |

| | 334 |

| | 607 |

| | — |

| | — |

| | 941 |

|

| Compensation expense | 1,507 |

| | — |

| | 819 |

| | 2,435 |

| | 8,111 |

| | 16,710 |

| | 29,582 |

|

| Administrative expenses | 1,220 |

| | — |

| | 1,320 |

| | 1,235 |

| | 1,005 |

| | 8,111 |

| | 12,891 |

|

| Total expenses | 51,087 |

| | — |

| | 42,866 |

| | 24,094 |

| | 14,406 |

| | 43,527 |

|

| 175,980 |

|

| Gain on sale of real estate assets, net | 1,949 |

| | — |

| | 8,216 |

| | 986 |

| | — |

| | — |

| | 11,151 |

|

| Other gain (loss), net | 114 |

| | — |

| | (168 | ) | | 61 |

| | 16 |

| | 4,550 |

| | 4,573 |

|

| Income before income taxes | 470 |

| | (455 | ) | | 12,971 |

| | 85,067 |

| | 6,722 |

| | (36,280 | ) | | 68,495 |

|

| Income tax (expense) benefit | (31 | ) | | — |

| | 1,516 |

| | (9 | ) | | 1,711 |

| | 222 |

| | 3,409 |

|

| Net income (loss) | 439 |

| | (455 | ) | | 14,487 |

| | 85,058 |

| | 8,433 |

| | (36,058 | ) | | 71,904 |

|

| Net income attributable to noncontrolling interests: | | | | | | | | | | | | | |

| Investment entities | (944 | ) | | — |

| | 1,202 |

| | 32,486 |

| | — |

| | — |

| | 32,744 |

|

| Operating Company | 214 |

| | (70 | ) | | 2,056 |

| | 8,136 |

| | 1,305 |

| | (7,452 | ) | | 4,189 |

|

| Net income (loss) attributable to Colony Capital, Inc. | 1,169 |

| | (385 | ) | | 11,229 |

| | 44,436 |

| | 7,128 |

| | (28,606 | ) | | 34,971 |

|

| Preferred dividends | — |

| | — |

| | — |

| | — |

| | — |

| | 12,093 |

| | 12,093 |

|

| Net income (loss) attributable to common stockholders | $ | 1,169 |

| | $ | (385 | ) | | $ | 11,229 |

| | $ | 44,436 |

| | $ | 7,128 |

| | $ | (40,699 | ) | | $ | 22,878 |

|

|

| |

| | |

Colony Capital, Inc. Third Quarter 2016 Supplemental Financial Report | | 9 | |

|

|

| |

| IIe. Financial Results—Noncontrolling Interests' Share Segment Operating Results |

| |

| |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| ($ in thousands; for the three months ended September 30, 2016) | Light Industrial Platform | | Single-Family Residential Rentals | | Other Real Estate Equity | | Real Estate Debt | | Investment Management | | Amounts not allocated to segments | | Total noncontrolling interest share |

| Income | | | | | | | | | | | | | |

| Interest income | $ | — |

| | $ | — |

| | $ | — |

| | $ | 37,210 |

| | $ | — |

| | $ | — |

| | $ | 37,210 |

|

| Property operating income | 18,536 |

| | — |

| | 18,466 |

| | 676 |

| | — |

| | — |

| | 37,678 |

|

| Income from equity method investments | — |

| | — |

| | 753 |

| | 3,167 |

| | — |

| | — |

| | 3,920 |

|

| Fee income | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Other income | (1,160 | ) | | — |

| | 207 |

| | 1,220 |

| | — |

| | — |

| | 267 |

|

| Total income | 17,376 |

| | — |

| | 19,426 |

| | 42,273 |

| | — |

| | — |

|

| 79,075 |

|

| Expenses | | | | | | | | | | | | | |

| Transaction, investment and servicing expenses | 230 |

| | — |

| | 6 |

| | 1,829 |

| | — |

| | — |

| | 2,065 |

|

| Interest expense | 4,340 |

| | — |

| | 5,014 |

| | 638 |

| | — |

| | — |

| | 9,992 |

|

| Property operating expenses | 5,239 |

| | — |

| | 8,027 |

| | 904 |

| | — |

| | — |

| | 14,170 |

|

| Depreciation and amortization | 8,377 |

| | — |

| | 7,215 |

| | 37 |

| | — |

| | — |

| | 15,629 |

|

| Provision for loan losses | — |

| | — |

| | — |

| | 5,401 |

| | — |

| | — |

| | 5,401 |

|

| Impairment loss | — |

| | — |

| | 240 |

| | 527 |

| | — |

| | — |

| | 767 |

|

| Compensation expense | 439 |

| | — |

| | 137 |

| | 457 |

| | — |

| | — |

| | 1,033 |

|

| Administrative expenses | 459 |

| | — |

| | 737 |

| | 712 |

| | — |

| | — |

| | 1,908 |

|

| Total expenses | 19,084 |

| | — |

| | 21,376 |

| | 10,505 |

| | — |

| | — |

|

| 50,965 |

|

| Gain on sale of real estate assets, net | 733 |

| | — |

| | 2,970 |

| | 717 |

| | — |

| | — |

| | 4,420 |

|

| Other gain, net | 43 |

| | — |

| | 32 |

| | 12 |

| | — |

| | — |

| | 87 |

|

| Income before income taxes | (932 | ) | | — |

| | 1,052 |

| | 32,497 |

| | — |

| | — |

| | 32,617 |

|

| Income tax (expense) benefit | (12 | ) | | — |

| | 150 |

| | (11 | ) | | — |

| | — |

| | 127 |

|

| Net income (loss) attributable to noncontrolling interests in investment entities | $ | (944 | ) | | $ | — |

| | $ | 1,202 |

| | $ | 32,486 |

| | $ | — |

| | $ | — |

| | $ | 32,744 |

|

|

| |

| | |

Colony Capital, Inc. Third Quarter 2016 Supplemental Financial Report | | 10 | |

|

|

| |

| IIf. Financial Results—Segment Reconciliation of Net Income to FFO & Core FFO |

| |

| |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | OP pro rata share by segment | | Amounts attributable to noncontrolling interests | | CLNY consolidated as reported |

| ($ in thousands; for the three months ended September 30, 2016) | Light Industrial Platform | | Single-Family Residential Rentals | | Other Real Estate Equity | | Real Estate Debt | | Investment Management | | Amounts not allocated to segments | | Total OP pro rata share | | |

| Net income (loss) attributable to common stockholders | $ | 1,169 |

| | $ | (385 | ) | | $ | 11,229 |

| | $ | 44,436 |

| | $ | 7,128 |

| | $ | (40,699 | ) | | $ | 22,878 |

| | $ | — |

| | $ | 22,878 |

|

| Net income (loss) attributable to noncontrolling common interests in Operating Company | 214 |

| | (70 | ) | | 2,056 |

| | 8,136 |

| | 1,305 |

| | (7,452 | ) | | 4,189 |

| | — |

| | 4,189 |

|

| Net income (loss) attributable to common interests in Operating Company and common stockholders | 1,383 |

|

| (455 | ) |

| 13,285 |

|

| 52,572 |

|

| 8,433 |

|

| (48,151 | ) |

| 27,067 |

|

| — |

| | 27,067 |

|

| Adjustments for FFO: | | | | | | | | | | | | |

|

| |

|

| |

|

|

| Real estate depreciation and amortization | 13,884 |

| | 6,564 |

| | 9,744 |

| | 57 |

| | — |

| | — |

| | 30,249 |

| | 15,990 |

| | 46,239 |

|

| Impairment of real estate | — |

| | 50 |

| | 93 |

| | 80 |

| | — |

| | — |

| | 223 |

| | 768 |

| | 991 |

|

| Gain on sales of real estate | (1,216 | ) | | (204 | ) | | (5,244 | ) | | (299 | ) | | (3,584 | ) | | — |

| | (10,547 | ) | | (4,423 | ) | | (14,970 | ) |

| Less: Adjustments attributable to noncontrolling interests in investment entities | — |

|

| — |

|

| — |

|

| — |

|

| — |

|

| — |

| | — |

| | (12,335 | ) | | (12,335 | ) |

| FFO | $ | 14,051 |

| | $ | 5,955 |

| | $ | 17,878 |

| | $ | 52,410 |

| | $ | 4,849 |

| | $ | (48,151 | ) | | $ | 46,992 |

| | $ | — |

| | $ | 46,992 |

|

| | | | | | | | | | | | | |

|

| | | | |

| Additional adjustments for Core FFO: | | | | | | | | | | | | |

|

| | | | |

| Gain on sale of real estate, net of depreciation, amortization and impairment previously adjusted for FFO | 829 |

| | — |

| | 4,168 |

| | 299 |

| | 3,584 |

| | — |

| | 8,880 |

| | 2,551 |

| | 11,431 |

|

| Noncash equity compensation expense | 104 |

| | 115 |

| | 85 |

| | 216 |

| | 1,013 |

| | 2,065 |

| | 3,598 |

| | — |

| | 3,598 |

|

| Straight-line rent revenue | (699 | ) | | — |

| | (1,088 | ) | | — |

| | — |

| | — |

| | (1,787 | ) | | (778 | ) | | (2,565 | ) |

| Gain on change in fair value of contingent consideration | — |

| | — |

| | — |

| | — |

| | — |

| | (4,550 | ) | | (4,550 | ) | | — |

| | (4,550 | ) |

| Amortization of acquired above- and below-market lease intangibles, net | 305 |

| | — |

| | (389 | ) | | — |

| | — |

| | — |

| | (84 | ) | | 167 |

| | 83 |

|

| Amortization of deferred financing costs and debt premium and discounts | 674 |

| | 1,648 |

| | 797 |

| | 1,646 |

| | — |

| | 927 |

| | 5,692 |

| | 1,607 |

| | 7,299 |

|

| Unrealized (gain) loss on derivatives | (71 | ) | | (149 | ) | | 69 |

| | 26 |

| | — |

| | — |

| | (125 | ) | | (47 | ) | | (172 | ) |

| Acquisition-related expenses, merger and integration costs | 347 |

| | 252 |

| | 127 |

| | 144 |

| | — |

| | 4,908 |

| | 5,778 |

| | 1,305 |

| | 7,083 |

|

| Amortization and impairment of investment management intangibles | — |

| | — |

| | — |

| | — |

| | 3,779 |

| | — |

| | 3,779 |

| | — |

| | 3,779 |

|

| Non-real estate depreciation and amortization | 13 |

| | — |

| | — |

| | — |

| | — |

| | 1,187 |

| | 1,200 |

| | — |

| | 1,200 |

|

| Amortization of gain on remeasurement of consolidated investment entities, net | — |

| | — |

| | (296 | ) | | 2,939 |

| | — |

| | — |

| | 2,643 |

| | 10,066 |

| | 12,709 |

|

| Deferred tax benefit, net | — |

| | — |

| | (25 | ) | | (286 | ) | | (1,436 | ) | | (212 | ) | | (1,959 | ) | | — |

| | (1,959 | ) |

| Net gain on SFR's non-performing loans business | — |

| | (63 | ) | | — |

| | — |

| | — |

| | — |

| | (63 | ) | | — |

| | (63 | ) |

| Less: Adjustments attributable to noncontrolling interests in investment entities | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (14,871 | ) | | (14,871 | ) |

| Core FFO | $ | 15,553 |

| | $ | 7,758 |

| | $ | 21,326 |

| | $ | 57,394 |

| | $ | 11,789 |

| | $ | (43,826 | ) | | $ | 69,994 |

| | $ | — |

| | $ | 69,994 |

|

|

| |

| | |

Colony Capital, Inc. Third Quarter 2016 Supplemental Financial Report | | 11 | |

|

|

| |

| IIIa. Capitalization—Overview |

| |

| |

|

| | | | | | | | | | | | | | |

| ($ in thousands, except share and per share data; as of September 30, 2016, unless otherwise noted) | | | | | | | |

| Debt (UPB) | | | | | Consolidated amount | | CLNY OP share of consolidated amount |

| $850,000 Revolving credit facility | | | | | $ | 360,100 |

| | $ | 360,100 |

|

| 5.0% Convertible senior notes due 2023 | | | | | 200,000 |

| | 200,000 |

|

| 3.875% Convertible senior notes due 2021 | | | | | 402,500 |

| | 402,500 |

|

| Corporate aircraft promissory note | | | | | 41,619 |

| | 41,619 |

|

| Investment-level debt | | | | | 3,107,553 |

| | 2,029,162 |

|

| Total CLNY OP share of debt | | | | | 4,111,772 |

| | 3,033,381 |

|

| Preferred equity | | | | | | | |

| Series A 8.5% cumulative redeemable perpetual preferred stock, redemption value | | | | | 252,000 |

| | 252,000 |

|

| Series B 7.5% cumulative redeemable perpetual preferred stock, redemption value | | | | | 86,250 |

| | 86,250 |

|

| Series C 7.125% cumulative redeemable perpetual preferred stock, redemption value | | | | | 287,500 |

| | 287,500 |

|

| Total redemption value of preferred equity | | | | | 625,750 |

| | 625,750 |

|

| Common equity (as of November 4, 2016) | Price per share |

| | Shares / Units |

| | | | |

| Class A common stock | $ | 19.32 |

| | 113,384 |

| | 2,190,579 |

| | 2,190,579 |

|

| Class B common stock | 19.32 |

| | 527 |

| | 10,182 |

| | 10,182 |

|

| OP units | 19.32 |

| | 20,787 |

| | 401,605 |

| | 401,605 |

|

| Total market value of common equity | | |

| | 2,602,366 |

| | 2,602,366 |

|

| | | | | | | | |

| Total capitalization | | | | | $ | 7,339,888 |

| | $ | 6,261,497 |

|

|

| |

| | |

Colony Capital, Inc. Third Quarter 2016 Supplemental Financial Report | | 12 | |

|

|

| |

| IIIb. Capitalization—Debt Overview |

| |

| |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

($ in thousands; as of or for the three months ended September 30, 2016)

| | | | | | | | | | | | |

| Debt overview | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Consolidated | | CLNY OP share of consolidated amount |

| | | Type | | | Unpaid principal balance | | Deferred financing costs and discount / premium | | Carrying value | | Unpaid Principal balance | | Deferred financing costs and discount / premium | | Carrying value | | Weighted-average years remaining to maturity | | Weighted-average interest rate |

| Investment-level debt by segment | | | | | | | | | | | | | | | | | | | | | |

| Light Industrial Platform | | Non-recourse | | | $ | 1,227,740 |

| | $ | (13,659 | ) | | $ | 1,214,081 |

| | $ | 643,780 |

| | $ | (7,162 | ) | | $ | 636,618 |

| | 5.7 |

| | 3.17 | % |

| Other Real Estate Equity | | Non-recourse | | | 966,837 |

| | (18,288 | ) | | 948,549 |

| | 602,714 |

| | (8,888 | ) | | 593,826 |

| | 7.6 |

| | 3.57 | % |

| Real Estate Debt | | Partial recourse (1) | | | 912,976 |

| | (4,963 | ) | | 908,013 |

| | 782,668 |

| | (4,885 | ) | | 777,783 |

| | 15.1 |

| | 2.77 | % |

| Total investment-level debt | | | | | | | 3,107,553 |

| | (36,910 | ) | | 3,070,643 |

| | 2,029,162 |

| | (20,935 | ) | | 2,008,227 |

| | 9.9 |

| | 3.14 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| Corporate debt | | | | | | | | | | | | | | | | | | | | | |

| Line of credit | | Recourse | | | 360,100 |

| | — |

| | 360,100 |

| | 360,100 |

| | — |

| | 360,100 |

| | 4.5 |

| | 2.78 | % |

| 5.0% Convertible senior notes | | Recourse | | | 200,000 |

| | (4,508 | ) | | 195,492 |

| | 200,000 |

| | (4,508 | ) | | 195,492 |

| | 6.5 |

| | 5.00 | % |

| 3.875% Convertible senior notes | | Recourse | | | 402,500 |

| | (5,610 | ) | | 396,890 |

| | 402,500 |

| | (5,610 | ) | | 396,890 |

| | 4.3 |

| | 3.88 | % |

| Corporate aircraft promissory note | | Recourse | | | 41,619 |

| | — |

| | 41,619 |

| | 41,619 |

| | — |

| | 41,619 |

| | 9.2 |

| | 5.02 | % |

| Total corporate debt | | | | | | | 1,004,219 |

| | (10,118 | ) | | 994,101 |

| | 1,004,219 |

| | (10,118 | ) | | 994,101 |

| | 5.0 |

| | 3.75 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| Total debt outstanding | | | | | | | $ | 4,111,772 |

| | $ | (47,028 | ) | | $ | 4,064,744 |

| | $ | 3,033,381 |

| | $ | (31,053 | ) | | $ | 3,002,328 |

| | 8.3 |

| | 3.34 | % |

__________

(1) $31 million is recourse debt.

|

| |

| | |

Colony Capital, Inc. Third Quarter 2016 Supplemental Financial Report | | 13 | |

|

|

| |

| IIIc. Capitalization—Debt Maturity and Amortization Schedules |

| |

| |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

($ in thousands; as of or for the three months ended September 30, 2016)

| | | | | | | | | | | |

| Consolidated debt maturity and amortization schedule | | | �� | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | Payments due by period(1) |

| | 2016 | | 2017 | | 2018 | | 2019 | | 2020 | | 2021 and after | | Total |

| Line of credit | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 360,100 |

| | $ | 360,100 |

|

| Convertible senior notes | — |

| | — |

| | — |

| | — |

| | — |

| | 602,500 |

| | 602,500 |

|

| Warehouse facilities | — |

| | 17,598 |

| | 58,760 |

| | — |

| | — |

| | — |

| | 76,358 |

|

| Corporate aircraft promissory note | 470 |

| | 1,930 |

| | 2,029 |

| | 2,134 |

| | 2,244 |

| | 32,812 |

| | 41,619 |

|

| CMBS securitization debt | — |

| | — |

| | — |

| | — |

| | — |

| | 637,641 |

| | 637,641 |

|

| Scheduled amortization payments on investment-level debt | 1,720 |

| | 8,301 |

| | 8,526 |

| | 7,133 |

| | 7,230 |

| | 85,455 |

| | 118,365 |

|

| Balloon payments on investment-level debt | 126,153 |

| | 123,965 |

| | 1,109,967 |

| | 34,440 |

| | 38,712 |

| | 841,952 |

| | 2,275,189 |

|

| Total | $ | 128,343 |

| | $ | 151,794 |

| | $ | 1,179,282 |

| | $ | 43,707 |

| | $ | 48,186 |

| | $ | 2,560,460 |

| | $ | 4,111,772 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Pro rata debt maturity and amortization schedule | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | Payments due by period(1) |

| | 2016 | | 2017 | | 2018 | | 2019 | | 2020 | | 2021 and after | | Total |

| Line of credit | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 360,100 |

| | $ | 360,100 |

|

| Convertible senior notes | — |

| | — |

| | — |

| | — |

| | — |

| | 602,500 |

| | 602,500 |

|

| Warehouse facilities | — |

| | 16,894 |

| | 58,760 |

| | — |

| | — |

| | — |

| | 75,654 |

|

| Corporate aircraft promissory note | 470 |

| | 1,930 |

| | 2,029 |

| | 2,134 |

| | 2,244 |

| | 32,812 |

| | 41,619 |

|

| CMBS securitization debt | — |

| | — |

| | — |

| | — |

| | — |

| | 628,225 |

| | 628,225 |

|

| Scheduled amortization payments on investment-level debt | 1,485 |

| | 6,411 |

| | 6,534 |

| | 6,150 |

| | 6,230 |

| | 63,335 |

| | 90,145 |

|

| Balloon payments on investment-level debt | 26,482 |

| | 65,240 |

| | 504,121 |

| | 10,849 |

| | 19,356 |

| | 609,090 |

| | 1,235,138 |

|

| Total | $ | 28,437 |

| | $ | 90,475 |

| | $ | 571,444 |

| | $ | 19,133 |

| | $ | 27,830 |

| | $ | 2,296,062 |

| | $ | 3,033,381 |

|

__________

(1) Based on initial maturity dates or extended maturity dates to the extent criteria are met and the extension option is at the borrower's discretion.

|

| |

| | |

Colony Capital, Inc. Third Quarter 2016 Supplemental Financial Report | | 14 | |

|

|

| |

| IIId. Capitalization—Investment Level Debt Overview |

| |

| |

|

| | | | | | | | | | | | | | | | | | | | | |

($ and € in thousands; as of September 30, 2016) | | | | | | | | |

| Light Industrial Platform | | | | | | | | | | | | | | | | |

| | | | | | | Initial / current maturity date | | Fully extended maturity date | | Interest rate | | Maximum principal amount | | Consolidated amount | | CLNY OP share of consolidated amount |

| CLIP acquisition financing | | | | | | Dec-2016 | | Dec-2019 | | L + 2.25% |

| (1) | N/A | | $ | 772,665 |

| | $ | 405,156 |

|

| CLIP fixed rate mortgage | | | | | | Aug-2025 | | Aug-2025 | | 3.80% |

| | N/A | | 165,750 |

| | 86,913 |

|

| CLIP credit facility | | | | | | Jan-2017 | | Jan-2017 | | L + 2.25% |

| | 100,000 | | — |

| | — |

|

| CLIP fixed rate mortgage | | | | | | Apr-2028 | | Apr-2028 | | 4.04% |

| | N/A | | 93,450 |

| | 49,002 |

|

| CLIP fixed rate mortgage | | | | | | Aug-2029

| | Aug-2029 | | 4.11% |

| | N/A | | 43,875 |

| | 23,007 |

|

CLIP fixed rate mortgage

| | | | | | Oct-2031

| | Oct-2031 | | 3.65% |

| | N/A | | 59,000 |

| | 30,937 |

|

CLIP fixed rate mortgage

| | | | | | Oct-2031

| | Oct-2031 | | 3.60% |

| | N/A | | 93,000 |

| | 48,765 |

|

| Total UPB of debt related to Light Industrial Platform | | | | | | | 1,227,740 |

| | 643,780 |

|

| Debt issuance costs | | | | | | | | | | | | | | (13,659 | ) | | (7,162 | ) |

| Total carrying value of debt related to Light Industrial Platform segment | | | | | | $ | 1,214,081 |

| | $ | 636,618 |

|

| | | | | | | | | | | | | | |

|

| | |

| Other Real Estate Equity | | | | | | | | | | | | | |

| | |

| | | | | | | Initial / current maturity date | | Fully extended maturity date | | Interest rate | | Maximum principal amount | | Consolidated

amount | | CLNY OP share of consolidated amount

|

| NNN investments | | | | | | | | | | | | | |

| | |

| Office - Minnesota | | | | | | Jan-2024 | | Jan-2024 | | 4.84 | % | | N/A | | $ | 87,163 |

| | $ | 86,509 |

|

| Office - France | | | | | | Nov-2022 | | Nov-2022 | | 1.89 | % | | N/A | | 17,619 |

| | 17,619 |

|

| Office - Norway | | | | | | Jun-2025 | | Jun-2025 | | 3.91 | % | | N/A | | 199,009 |

| | 199,009 |

|

| Education - Switzerland | | | | Dec-2029 | | Dec-2029 | | 2.72 | % | | N/A | | 122,199 |

| | 122,199 |

|

| Total UPB of debt related to NNN investments, held for investment | | | | | | 425,990 |

| | 425,336 |

|

| | | | | | | | | | | | |

| | |

| Other real estate assets | | | | | | | | | | | | | | |

| Office - Arizona | | Jul-2018 | | Jul-2020 | | L + 2.65% |

| | N/A | | 14,061 |

| | 7,032 |

|

| Mixed use - Italy | | | | | | Nov-2018 | | Nov-2018 | | 4.02% |

| | N/A | | 88,376 |

| (2) | 24,745 |

|

| Industrial - Spain | | | | | Jan-2021 | | Jan-2021 | | 3M EUR + 3.00% |

| | N/A | | 50,395 |

| | 22,678 |

|

| Industrial - Spain | | | | | Jun-2022 | | Jun-2022 | | 3M EUR + 2.80% |

| | N/A | | 25,987 |

| | 11,694 |

|

| Office portfolio - UK | | | | | | Aug-2018 | | Aug-2020 | | 3M GBP L + 2.50% |

| | N/A | | 71,682 |

| | 35,841 |

|

| Office - UK | | | | | | Feb-2020 | | Feb-2020 | | 3M GBP L + 2.35% |

| | N/A | | 12,357 |

| | 6,178 |

|

| Office, Industrial and Retail Portfolio - UK | | | | | | Jul-2020 | | Jul-2020 | | 3M GBP L + 2.50% |

| | N/A | | 26,356 |

| | 13,178 |

|

Office, Industrial and Retail Portfolio - UK

| | | | | | Nov-2018 | | Nov-2020 | | 3M GBP L + 3.28% |

| | N/A | | 208,592 |

| | 41,415 |

|

| Total UPB of debt related to other real estate assets, held for investment | | | | | | 497,806 |

| | 162,761 |

|

| | | | | | |

|

| | |

| Total UPB of debt related to other real estate assets, held for sale | | | | | | 43,041 |

| | 14,617 |

|

| Total UPB of debt related to Other Real Estate Equity segment | | | | | | 966,837 |

| | 602,714 |

|

| Total debt issuance costs and discount | | | | | | (18,288 | ) | | (8,888 | ) |

| Total carrying value of debt related to Other Real Estate Equity segment | | | | | | $ | 948,549 |

| | $ | 593,826 |

|

__________

(1) Interest rate increases to 1-month LIBOR plus 2.5% after December 2018.

| |

| (2) | Seller provided zero-interest financing on acquired portfolio of properties, requiring principal payments of €15,750, €35,438 and €27,562 in Nov 2016, Nov 2017 and Nov 2018, respectively, of which CLNY and OP share is 28%. A discount was established at inception and is being accreted to debt principal as interest expense. |

|

| |

| | |

Colony Capital, Inc. Third Quarter 2016 Supplemental Financial Report | | 15 | |

|

|

| |

| IIId. Capitalization—Investment Level Debt Overview (cont'd) |

| |

| |

|

| | | | | | | | | | | | | | | | | | | | |

| ($ in thousands; as of September 30, 2016) | | | | | | | | |

| Real Estate Debt | | | | | | | | | | | | | | |

| | | | | Initial / current maturity date | | Fully-extended maturity date | | Interest rate | | Maximum principal amount | | Consolidated amount | | CLNY OP share of consolidated amount |

| Non-PCI | | | | | | | | | | | | | | |

| CMBS 2015-FL3 | | | | Sept-2032 | | Sept-2032 | | L + 2.36% | | N/A |

| | $ | 284,150 |

| | $ | 284,150 |

|

| CMBS 2014-FL2 | | | | Nov-2031 | | Nov-2031 | | L + 2.01% | | N/A |

| | 156,921 |

| | 150,880 |

|

| CMBS MF2014-1 | | | | Apr-2050 | | Apr-2050 | | 2.54% | | N/A |

| | 108,894 |

| | 108,894 |

|

| CMBS 2014-FL1 | | | | Apr-2031 | | Apr-2031 | | L + 1.78% | | N/A |

| | 87,676 |

| | 84,301 |

|

| April 2015 warehouse facility | | | | Apr-2018 | | Apr-2019 | | L + 2.50% - L+2.75% | | $ | 250,000 |

| | 58,760 |

| | 58,760 |

|

| Freddie Mac portfolio | | | | Dec-2017 | | Dec-2019 | | L + 2.85% | | N/A |

| | 52,043 |

| | 38,028 |

|

| February 2014 warehouse facility | | | | Feb-2017 | | Feb-2017 | | L + 2.50% | | 150,000 |

| | 17,598 |

| | 16,894 |

|

| Total UPB of debt related to Non-PCI loans | | | | | | | | | | | | $ | 766,042 |

| | $ | 741,907 |

|

| | | | | | | | | | | | | | | |

| PCI | | | | | | | | | | | | | | |

| Project London loan portfolio | | | | Apr-2017 | | Apr-2019 | | L + 3.75% | | N/A |

| | $ | 21,552 |

| | $ | 10,776 |

|

| Metro loan portfolio | | | | Apr-2017 | | Apr-2018 | | L + 3.75% | | N/A |

| | 7,334 |

| | 3,667 |

|

| California first mortgage portfolio I | | | | Aug-2017 | | Aug-2018 | | L + 3.75% | | N/A |

| | 3,314 |

| | 1,657 |

|

| Midwest loan portfolio | | | | Jun-2017 | | Jun-2017 | | L + 4.00% | | N/A |

| | 3,268 |

| | 1,634 |

|

| California first mortgage portfolio II | | | | Sept-2017 | | Sept-2018 | | L + 3.25% | | N/A |

| | 2,988 |

| | 1,494 |

|

| Total UPB of debt related to PCI loans | | | | | | | | | | | | $ | 38,456 |

| | $ | 19,228 |

|

| | | | | | | | | | | | | | | |

| Subscription line | | | | Dec-2016 | | Dec-2016 | | L + 1.60% | | N/A |

| | 108,478 |

| | 21,533 |

|

| Total UPB of debt related to Real Estate Debt segment | | | | | | | | $ | 912,976 |

| | $ | 782,668 |

|

| Total debt issuance costs | | | | | | | | | | | | (4,963 | ) | | (4,885 | ) |

| Total carrying value of debt related to Real Estate Debt segment | | | | | | $ | 908,013 |

| | $ | 777,783 |

|

|

| |

| | |

Colony Capital, Inc. Third Quarter 2016 Supplemental Financial Report | | 16 | |

|

|

| |

| IIIe. Capitalization—Credit Facility, Convertible Debt & Preferred Stock Overview |

| |

| |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ and shares in thousands; as of or for the three months ended September 30, 2016) | | | | | | | | | | |

| Credit facility | | | | | | | | | | | | | | | | |

| Revolving credit facility | | | | | | | | | | | | | | | | |

| Maximum principal amount | | | | | | | | | | | | | | | | $ | 850,000 |

|

| Amount outstanding | | | | | | | | | | | | | | | | 360,100 |

|

| Initial maturity | | | | | | | | | | | | | | March 31, 2020 | |

| Fully-extended maturity | | | | | | | | | | | | | | March 31, 2021 | |

| Interest rate | | | | | | | | | | | | | | LIBOR + 2.25% | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Covenant level | | Actual level at September 30, 2016 |

| Financial covenants as defined in the Credit Agreement: | | | | | | | | | | | | |

| Consolidated Tangible Net Worth | | | | | | | | | Minimum $1,915 million | | $2,574 million |

|

| Consolidated Fixed Charge Coverage Ratio | | | | | | | | | Minimum 1.50 to 1.00 | | 2.45 to 1.00 |

|

| Consolidated Interest Coverage Ratio | | | | | | | | | Minimum 3.00 to 1.00 | | 15.03 to 1.00 |

|

| Consolidated Leverage Ratio | | | | | | | | | | | | Maximum 0.65 to 1.00 | | 0.40 to 1.00 |

|

| | | | | | | | | | | | | | | | | |

| Convertible debt | | | | | | | | | | | | | | | | |

| Description | | Outstanding principal | | Issuance date | | Due date | | Interest rate | | Conversion price (per share of common stock) | | Conversion ratio | | Conversion shares | | Redemption date |

| 5.0% Convertible senior notes | | $ | 200,000 |

| | April 2013 | | April 15, 2023 | | 5.00% fixed | | $ | 23.35 |

| | 42.8183 | | 8,564 |

| | On or after April 22, 2020 |

| 3.875% Convertible senior notes | | 402,500 |

| | January and June 2014 | | January 15, 2021 | | 3.875% fixed | | $ | 24.56 |

| | 40.7089 | | 16,385 |

| | On or after January 22, 2019 |

| | | $ | 602,500 |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Preferred stock | | | | | | | | | | | | | | | | |

| Description | | | | | | | | Liquidation preference | | Issuance date | | Dividend rate | | Shares outstanding | | Redemption period |

| Series A 8.5% cumulative redeemable perpetual | | | | $ | 252,000 |

| | March 2012 | | 8.50% | | 10,080 |

| | On or after March 27, 2017 |

| Series B 7.5% cumulative redeemable perpetual | | | | 86,250 |

| | June 2014 | | 7.50% | | 3,450 |

| | On or after June 19, 2019 |

| Series C 7.125% cumulative redeemable perpetual | | | | 287,500 |

| | April 2015 | | 7.125% | | 11,500 |

| | On or after April 13, 2020 |

| | | | | | | | | $ | 625,750 |

| | | | | | 25,030 |

| | |

|

| |

| | |

Colony Capital, Inc. Third Quarter 2016 Supplemental Financial Report | | 17 | |

|

|

| |

| IVa. CLIP—Summary Metrics |

| |

| |

|

| | | | | | | | | | | | | | | | | | | | |

| ($ in thousands, except per share; as of or for the three months ended September 30, 2016) | | | | | | | |

| Financial results related to the segment | | | | | | | | | | | | | | |

| Net Income attributable to common stockholders | | | | | | | | | | $ | 1,169 |

|

| Net Income attributable to common stockholders per basic share | | | | 0.01 |

|

| Core FFO | | | | | | | | | | 15,553 |

|

| Core FFO per basic common share | | | | 0.12 |

|

| FFO | | | | | | 14,051 |

|

| FFO per basic common share | | | | 0.10 |

|

| | | | | | | |

| Portfolio overview | | | | | | | | | | | | | | |

| Number of buildings | | | | | | | | | | | | | | 336 |

|

| Rentable square feet | | | | | | | | | | | | | | 36,430 |

|

| % leased at end of period | | | | | | | | | |

| | | | 95 | % |

| | | | | | | | | | | | | Consolidated amount | | CLNY OP share of consolidated amount |

Undepreciated cost basis of real estate assets (1) | | | | | $ | 2,126,176 |

| | $ | 1,114,886 |

|

| Debt (UPB) | | | | | | 1,227,740 |

| | 643,780 |

|

| Debt / undepreciated cost basis | | | | | | 58 | % | | 58 | % |

| Carrying value of CLIP operating platform | | | | | | $ | 20,000 |

| | $ | 20,000 |

|

| | | | | | | | | | | | | | | |

| Recent acquisitions | | | | | | | | | | | | | | |

| Property / portfolio name | | | | | | Acquisition date | | Number of buildings | | Rentable square feet | | % leased | | Purchase price |

| Q3 2016 acquisitions | | | | | | | | | | | | | | |

| Phoenix light industrial building | | | | | | July-2016 | | 1 |

| | 60,000 |

| | 100 | % | | $ | 4,250 |

|

| Minneapolis light industrial portfolio | | | | | | Aug-2016 | | 4 |

| | 899,061 |

| | 100 | % | | 62,585 |

|

| Dallas light industrial portfolio | | | | | | Sep-2016 | | 7 |

| | 567,696 |

| | 97 | % | | 61,525 |

|

| Total | | | | | | | | 12 |

| | 1,526,757 |

| | 99 | % | | $ | 128,360 |

|

| | | | | | | | | | | | | | | |

| Q4 2016 acquisitions | | | | | | | | | | | | | | |

| Dallas light industrial portfolio | | | | | | Oct-2016 | | 3 |

| | 230,018 |

| | 88 | % | | 20,950 |

|

| Orlando light industrial portfolio | | | | | | Oct-2016 | | 3 |

| | 497,100 |

| | 84 | % | | 47,900 |

|

| Total | | | | | | | | 6 |

| | 727,118 |

| | 84 | % | | $ | 68,850 |

|

__________

(1) Includes all components related to the real estate assets, including tangible real estate and lease-related intangibles. Excludes accumulated depreciation.

|

| |

| | |

Colony Capital, Inc. Third Quarter 2016 Supplemental Financial Report | | 18 | |

|

|

| |

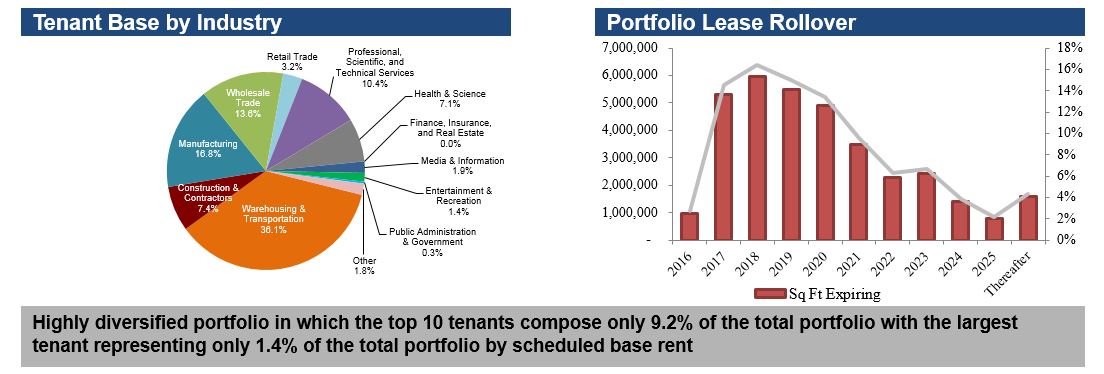

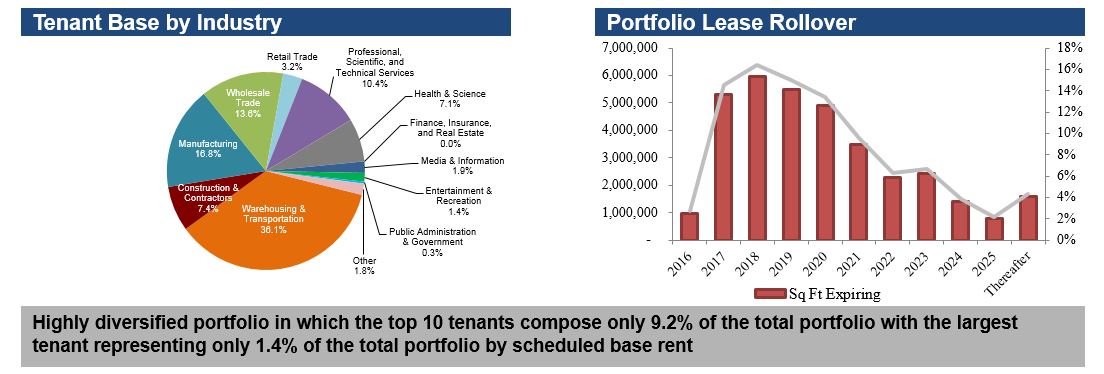

| IVb. CLIP—Portfolio and Lease Overview |

| |

| |

|

| | | | | | | | | | | | | | | | | | | | | | |

| (As of or for the three months ended September 30, 2016) | | | | | | | |

| Location Markets | | Property type | | Number of buildings | | Rentable square feet (in thousands) | | Annualized base rent (in thousands) | | Percentage leased | | Number of leases | | Lease expiration | | Year acquired |

| United States | | | | | | | | | | | | | | | | |

| Atlanta | | Industrial | | 83 |

| | 8,185 |

| | $ | 34,285 |

| | 96 | % | | 238 |

| | 10/2016 to 4/2030 | | 2014-2015 |

| Austin | | Industrial | | 4 |

| | 236 |

| | 1,512 |

| | 94 | % | | 14 |

| | 2/2017 to 8/2025 | | 2014 |

| Chicago | | Industrial | | 34 |

| | 3,972 |

| | 16,923 |

| | 93 | % | | 51 |

| | 10/2016 to 12/2026 | | 2014 |

| Dallas | | Industrial | | 65 |

| | 6,710 |

| | 28,239 |

| | 96 | % | | 163 |

| | 11/2016 to 1/2027 | | 2014-2016 |

| Denver | | Industrial | | 8 |

| | 1,128 |

| | 5,003 |

| | 98 | % | | 24 |

| | 10/2016 to 3/2026 | | 2014 |

| Houston | | Industrial | | 21 |

| | 1,713 |

| | 9,629 |

| | 96 | % | | 53 |

| | 10/2016 to 8/2026 | | 2014 |

| Kansas City | | Industrial | | 9 |

| | 1,664 |

| | 5,983 |

| | 98 | % | | 24 |

| | 1/2017 to 11/2024 | | 2014 |

| Maryland | | Industrial | | 5 |

| | 431 |

| | 2,030 |

| | 94 | % | | 10 |

| | 5/2017 to 12/2023 | | 2015-2016 |

| Minneapolis | | Industrial | | 19 |

| | 2,893 |

| | 13,848 |

| | 95 | % | | 64 |

| | 1/2017 to 10/2025 | | 2014-2016 |

| New Jersey South / Philadelphia | | Industrial | | 30 |

| | 3,328 |

| | 14,470 |

| | 93 | % | | 68 |

| | 10/2016 to 4/2027 | | 2014-2015 |

| Orlando | | Industrial | | 7 |

| | 1,224 |

| | 5,786 |

| | 97 | % | | 21 |

| | 10/2016 to 6/2021 | | 2014 / 2016 |

| Phoenix | | Industrial | | 18 |

| | 1,705 |

| | 8,979 |

| | 93 | % | | 52 |

| | 10/2016 to 8/2024 | | 2014-2016 |

| Salt Lake City | | Industrial | | 16 |

| | 1,269 |

| | 5,400 |

| | 93 | % | | 33 |

| | 12/2016 to 11/2023 | | 2014 |

| St. Louis | | Industrial | | 8 |

| | 1,355 |

| | 4,785 |

| | 91 | % | | 17 |

| | 11/2016 to 7/2024 | | 2014 |

| Tampa | | Industrial | | 9 |

| | 617 |

| | 3,123 |

| | 95 | % | | 34 |

| | 10/2016 to 1/2024 | | 2014 |

| Total / Weighted average | | | | 336 |

| | 36,430 |

| | $ | 159,995 |

| | 95 | % | | 866 |

| | | | |

|

| |

| | |

Colony Capital, Inc. Third Quarter 2016 Supplemental Financial Report | | 19 | |

|

|

| |

| Va. Single Family Residential Rentals—Summary Metrics |

| |

| |

|

| | | | | | | | | | | | | | | | |

| ($ in thousands, except per share and unless otherwise noted; as of or for the three months ended September 30, 2016) | | | | | | |

| Financial results related to the segment | | | | | | | | | | |

| Net income attributable to common stockholders | | $ | (385 | ) |

| Net income attributable to common stockholders per basic share | | 0.00 |

|

| Core FFO | | 7,758 |

|

| Core FFO per basic common share | | 0.06 |

|

| FFO | | 5,955 |

|

| FFO per basic common share | | 0.04 |

|

| Balance sheet | | | | | | | | | | | | | | |

| Equity method investments - Colony Starwood Homes | | $ | 320,963 |

|

| Equity method investments - Colony American Finance | | 57,883 |

|

| Ownership in SFR and CAF | | | | | | | | | |

| Colony Starwood Homes shares beneficially owned by OP and common stockholders | | 15.1 million |

|

| CLNY OP interest in SFR as of September 30, 2016 | | | | | | | | | | 14.0% |

|

| CLNY OP interest in CAF as of September 30, 2016 | | | | | | | | | | 17.4% |

|

_____________

Note: Refer to SFR filing for additional information.

|

| |

| | |

Colony Capital, Inc. Third Quarter 2016 Supplemental Financial Report | | 20 | |

|

|

|

| VIa. Other Real Estate Equity—Summary Metrics |

| |

| |

|

| | | | | | | | | | | | | | | | | | | | |

| ($ in thousands, except per share data; as of or for the three months ended September 30, 2016) | | | | | | |

| Financial results related to the segment | | | | | | | | | | | | |

| Net Income attributable to common stockholders | | | | | | | | | | $ | 11,229 |

|

| Net Income attributable to common stockholders per basic share | | | | | | 0.10 |

|

| Core FFO | | | | | | | | | | 21,326 |

|

| Core FFO per basic share | | | | | | 0.16 |

|

| FFO | | | | | | | | | | 17,878 |

|

| FFO per basic share | | | | | | 0.13 |

|