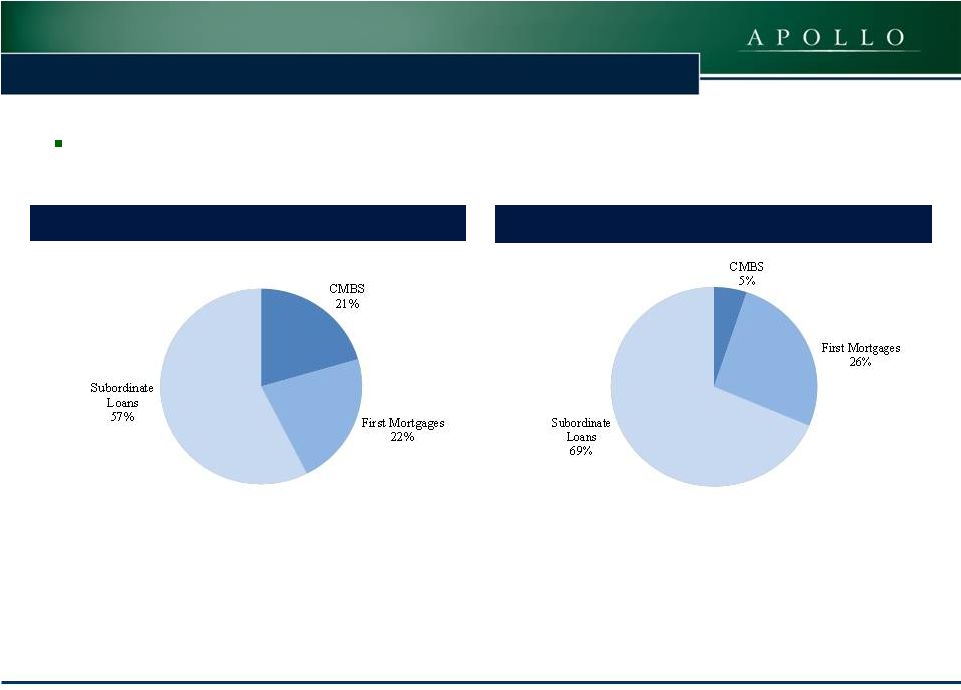

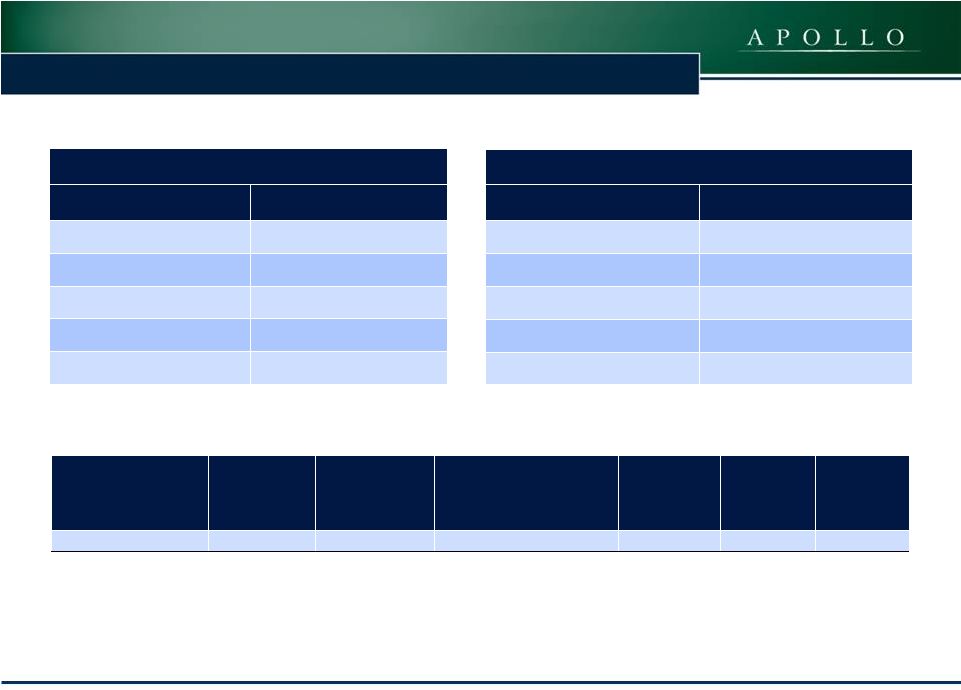

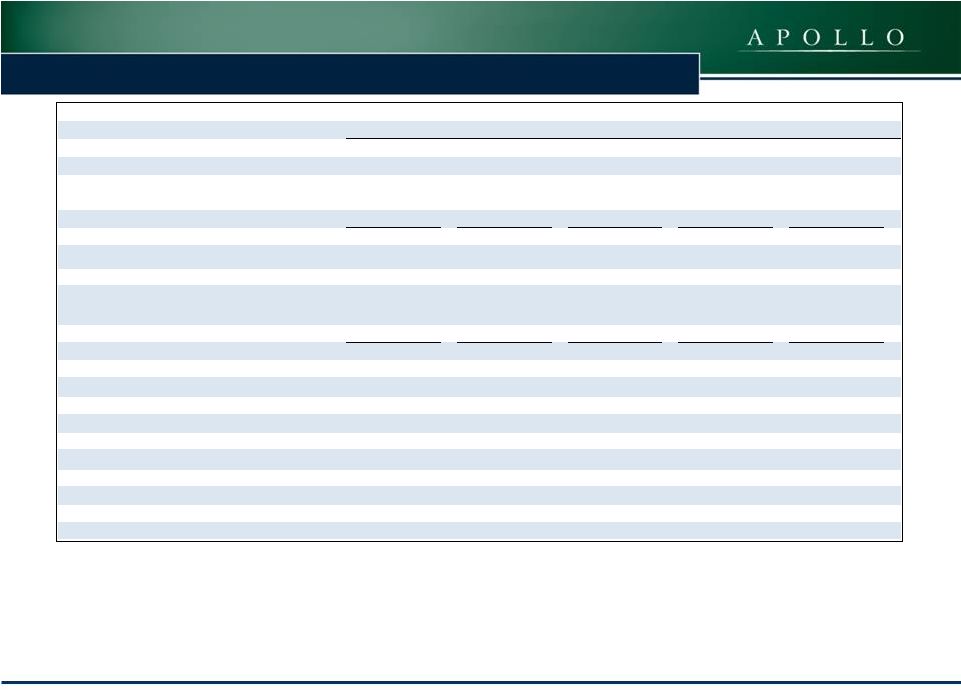

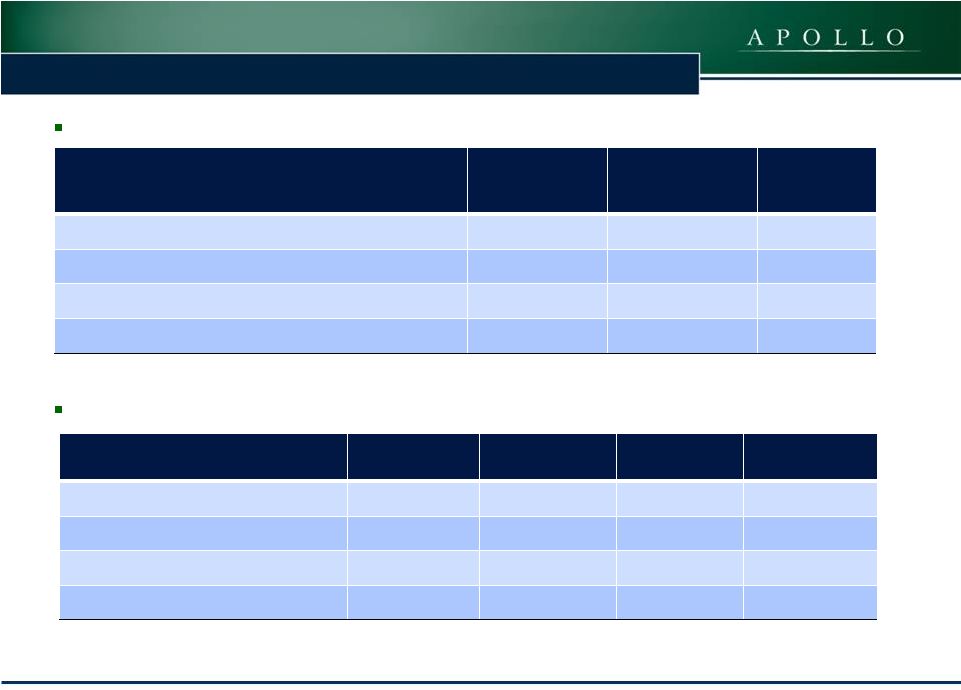

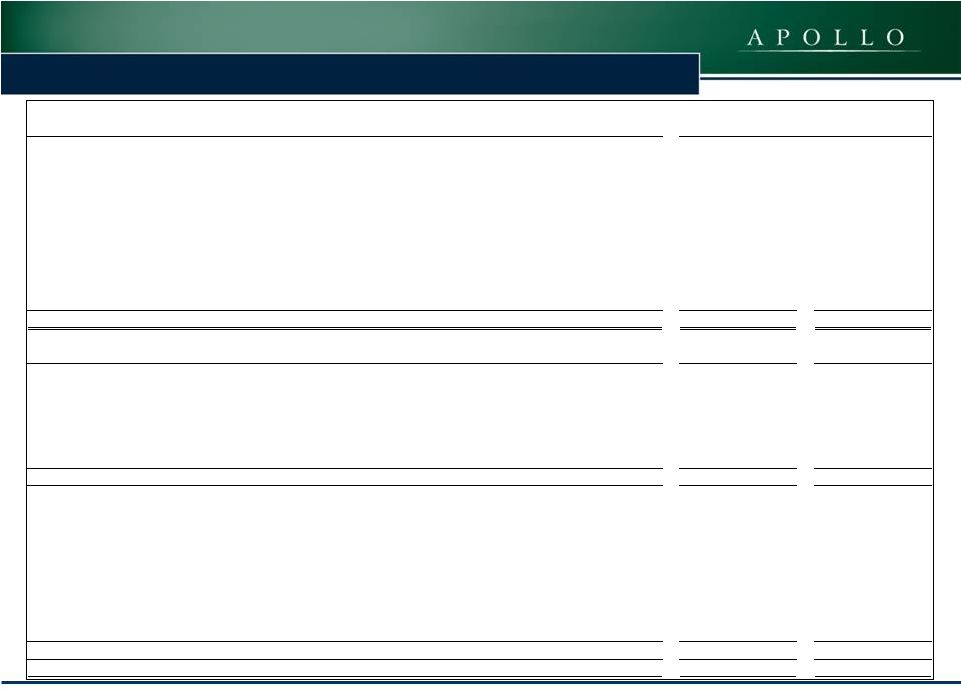

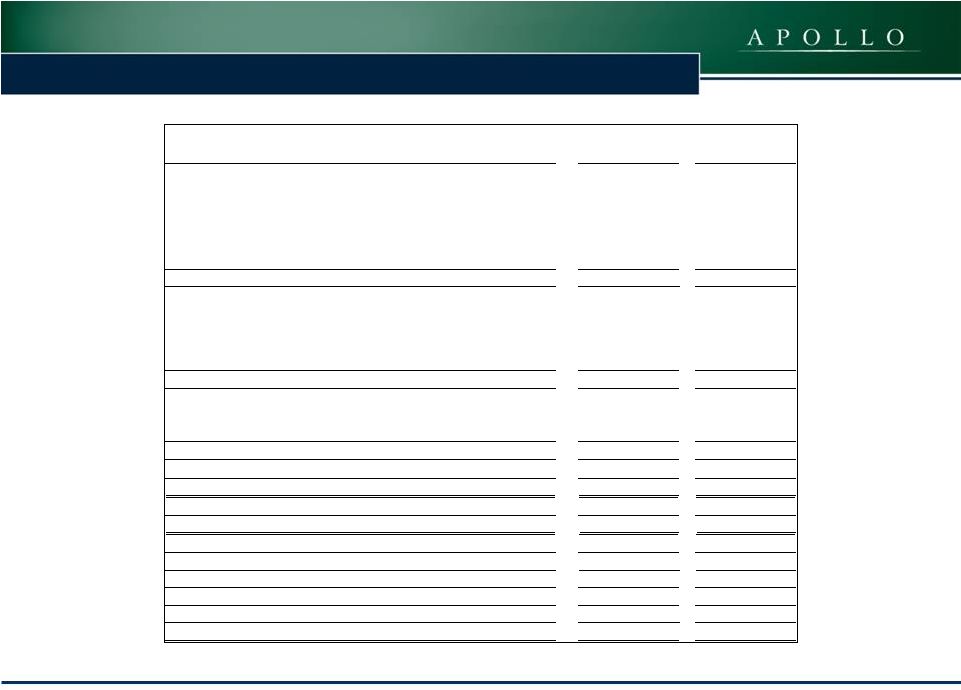

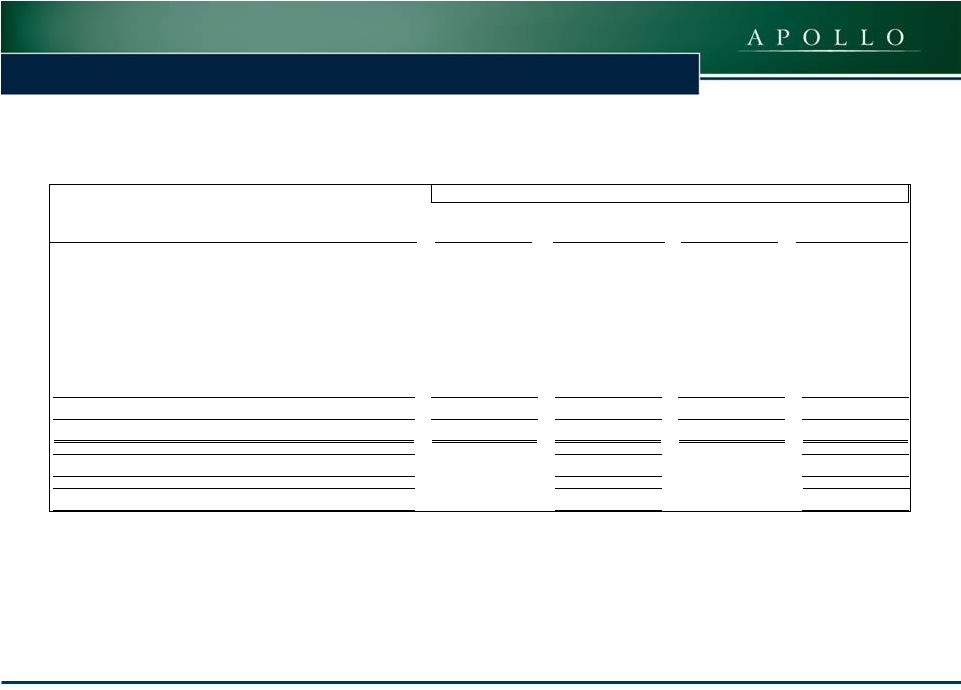

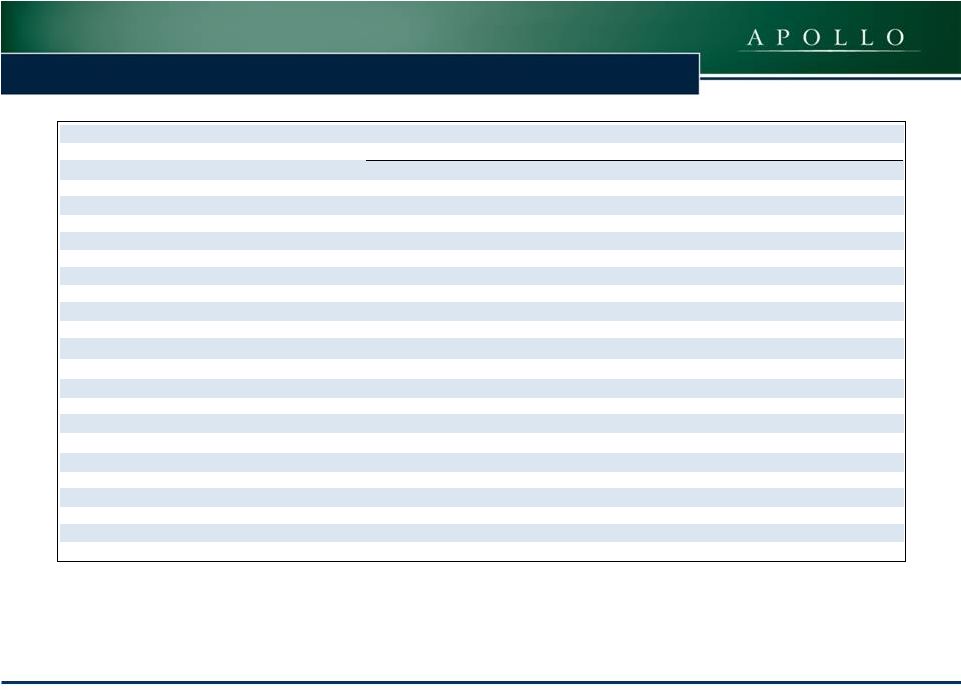

15 COMMERCIAL REAL ESTATE FINANCE, INC. (“ARI”) Portfolio Metrics – Quarterly Migration Summary Portfolio Metrics ($ in thousands) Q1 2014 Q4 2013 Q3 2013 Q2 2013 Q1 2013 (Investment balances represent amortized cost) First Mortgage Loans 185,516 $ 161,099 $ 160,893 $ 143,492 $ 142,833 $ Subordinate Loans 484,979 497,484 394,554 354,865 286,569 CMBS 173,174 190,178 218,019 165,553 188,824 CMBS - Hilton - - 69,587 69,521 69,912 Total Investments 843,669 $ 848,761 $ 843,053 $ 733,431 $ 688,138 $ (Investment balances represent net equity, at cost) First Mortgage Loans 185,513 $ 140,716 $ 160,890 $ 143,489 $ 142,830 $ Subordinate Loans 484,979 497,484 394,554 354,865 286,569 CMBS 36,310 (2) 38,655 (2) 36,760 (2) 21,353 24,620 CMBS - Hilton - - 23,049 22,412 22,175 Net Equity in Investments at Cost 706,802 $ 676,855 $ 615,253 $ 542,119 $ 476,194 $ Levered Weighted Average Underwritten IRR (1) 14.1% (3) 14.1% (3) 13.9% (3) 14.2% (3) 14.2% (3) Weighted Average Duration 3.2 Years 3.3 Years 3.0 Years 3.0 Years 3.0 Years Loan Portfolio Weighted Average Ending LTV (4) 58.0% 58.0% 55.0% 56.0% 53.6% Borrowings under repurchase agreements 166,994 $ 202,033 $ 227,167 $ 191,312 $ 211,944 $ Convertible senior notes 139,163 $ - $ - $ - $ - $ (1) The underwritten IRR for the investments shown in this presentation reflect the returns underwritten by the Manager, calculated on a weighted average basis assuming no dispositions, early prepayments or defaults but assuming that extension options are exercised and that the cost of borrowings under the Wells Facility remains constant over the remaining terms and extension terms under this facility. With respect to certain loans, the underwritten IRR calculation assumes certain estimates with respect to the timing and magnitude of future fundings for the remaining commitments and associated loan repayments, and assumes no defaults. IRR is the annualized effective compounded return rate that accounts for the time-value of money and represents the rate of return on an investment over a holding period expressed as a percentage of the investment. It is the discount rate that makes the net present value of all cash outflows (the costs of investment) equal to the net present value of cash inflows (returns on investment). It is derived from the negative and positive cash flows resulting from or produced by each transaction (or for a transaction involving more than one investment, cash flows resulting from or produced by each of the investments), whether positive, such as investment returns, or negative, such as transaction expenses or other costs of investment, taking into account the dates on which such cash flows occurred or are expected to occur, and compounding interest accordingly. There can be no assurance that the actual IRRs will equal the underwritten IRRs shown in the table. See “Item 1A—Risk Factors—The Company may not achieve its underwritten internal rate of return on its investments which may lead to future returns that may be significantly lower than anticipated” included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013 for a discussion of some of the factors that could adversely impact the returns received by the Company from the investments shown in the table over time (2) Includes $15.8 million of restricted cash related to the UBS Facility and $16.4 million of future borrowings related to unsettled trades at September 30, 2013 and $30.1 million of restricted cash related to the UBS Facility at December 31, 2013 and March 31, 2014, respectively. (3) Represents an underwritten levered weighted average IRR. The Company's ability to achieve the underwritten levered weighted average IRR additionally depends upon the Company re-borrowing approximately $88,000 under the JPMorgan Facility or any replacement facility with similar terms with regard to its portfolio of first mortgage loans. Without such re-borrowing, the levered weighted average underwritten IRR will be lower than the amount shown above, as indicated in the current weighted average underwritten IRR column on page 9. (4) Does not include CMBS. |