Supplemental Financial Information Q1 2018 May 2, 2018 Exhibit 99.2

Forward Looking Statements and Other Disclosures This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and such statements are intended to be covered by the safe harbor provided by the same. Forward-looking statements are subject to substantial risks and uncertainties, many of which are difficult to predict and are generally beyond management’s control. These forward-looking statements may include information about possible or assumed future results of Apollo Commercial Real Estate Finance, Inc.’s (“ARI” or the “Company”) business, financial condition, liquidity, results of operations, plans and objectives. When used in this presentation, the words “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may” or similar expressions, are intended to identify forward-looking statements. Statements regarding the following subjects, among others, may be forward-looking: ARI’s business and investment strategy; ARI’s operating results; ARI’s ability to obtain and maintain financing arrangements; and the return on equity, the yield on investments and risks associated with investing in real estate assets including changes in business conditions and the general economy. The forward-looking statements are based on management’s beliefs, assumptions and expectations of future performance, taking into account all information currently available to ARI. Forward-looking statements are not predictions of future events. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to ARI. Some of these factors are described under “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in ARI’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017 and other filings with the Securities and Exchange Commission (“SEC”), which are accessible on the SEC’s website at www.sec.gov. If a change occurs, ARI’s business, financial condition, liquidity and results of operations may vary materially from those expressed in ARI’s forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible for management to predict those events or how they may affect ARI. Except as required by law, ARI is not obligated to, and does not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. This presentation contains information regarding ARI’s financial results that is calculated and presented on the basis of methodologies other than in accordance with accounting principles generally accepted in the United States (“GAAP”), including Operating Earnings and Operating Earnings per share. Please refer to slide 17 for a definition of “Operating Earnings” and the reconciliation of the applicable GAAP financial measures to non-GAAP financial measures set forth on slide 16. This presentation may contain statistics and other data that in some cases has been obtained from or compiled from information made available by third-party service providers. ARI makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness or completeness of such information. Past performance is not indicative nor a guarantee of future returns. Index performance and yield data are shown for illustrative purposes only and have limitations when used for comparison or for other purposes due to, among other matters, volatility, credit or other factors (such as number and types of securities). Indices are unmanaged, do not charge any fees or expenses, assume reinvestment of income and do not employ special investment techniques such as leveraging or short selling. No such index is indicative of the future results of any investment by ARI.

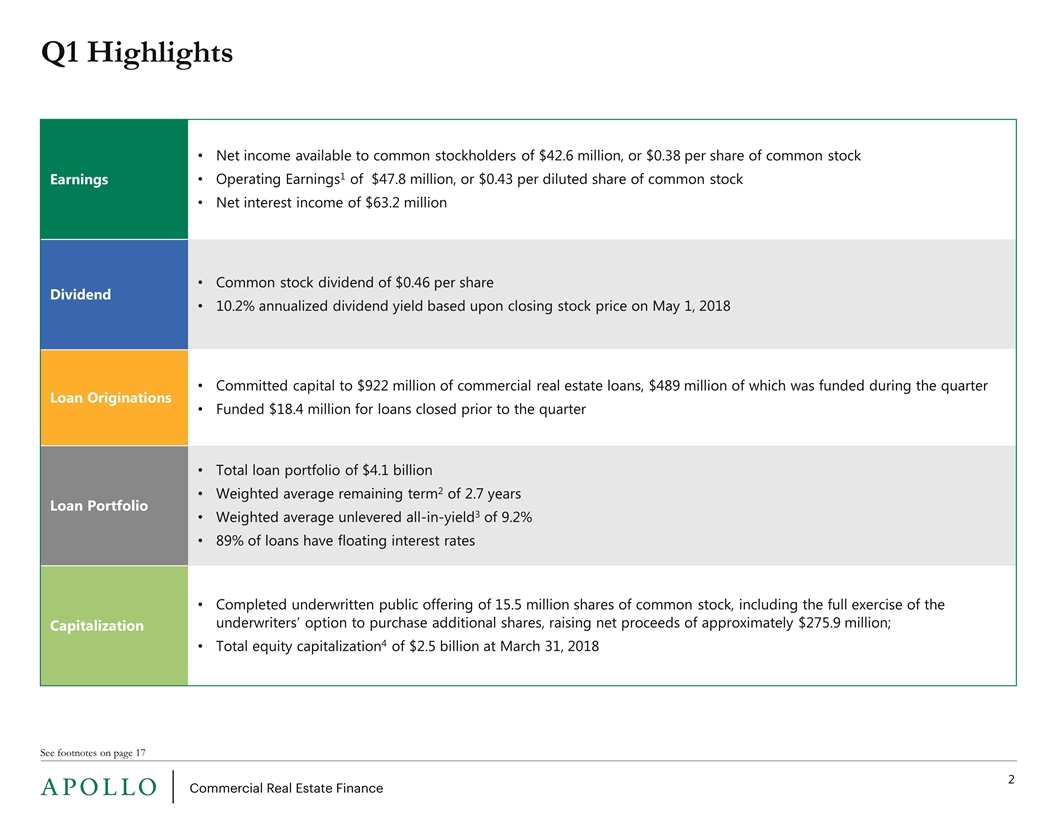

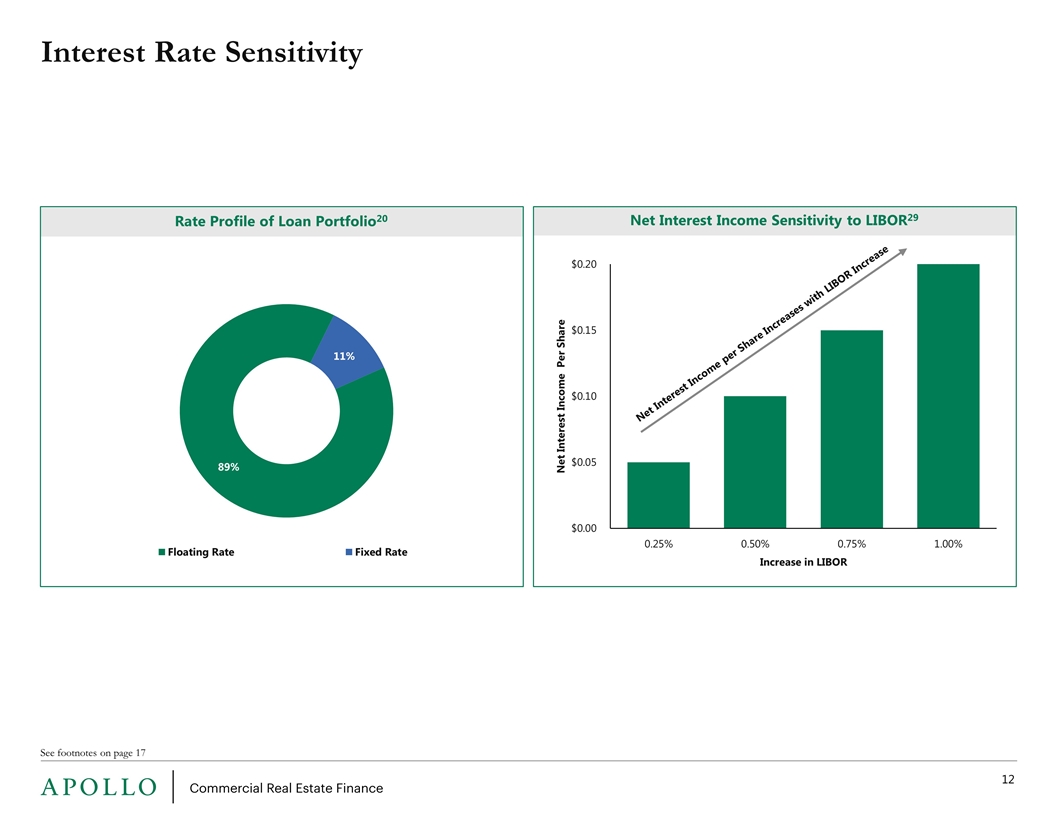

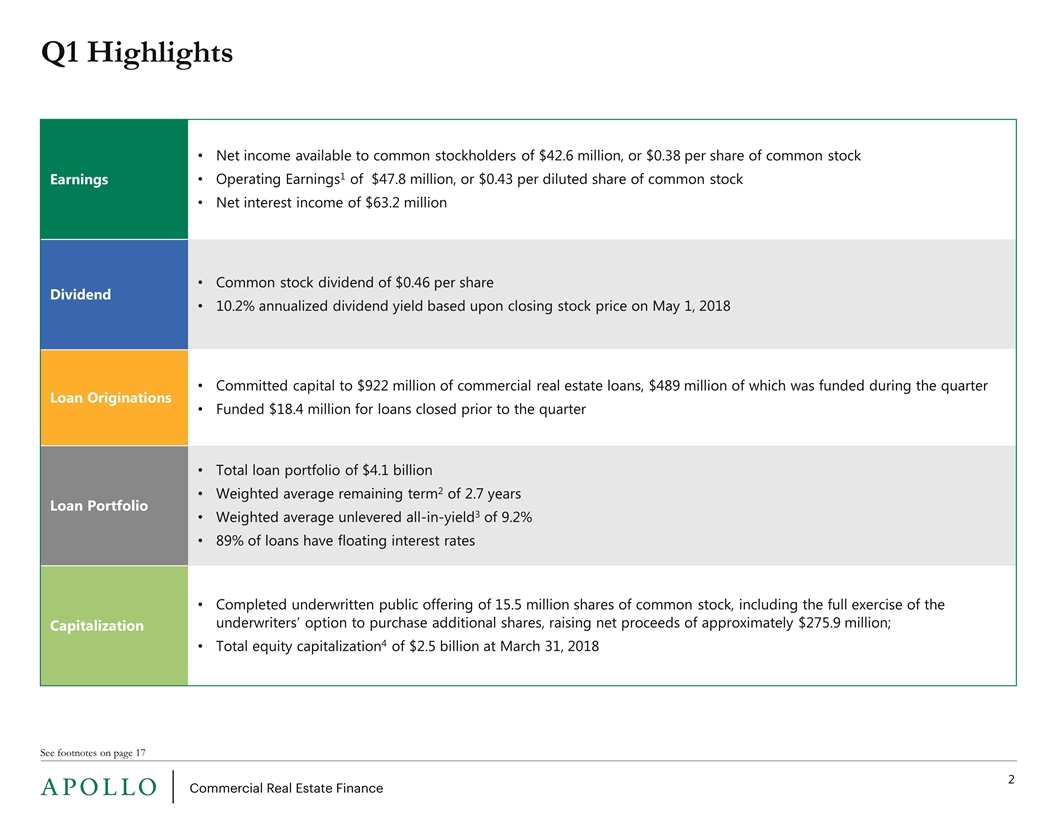

Q1 Highlights See footnotes on page 17 Earnings Net income available to common stockholders of $42.6 million, or $0.38 per share of common stock Operating Earnings1 of $47.8 million, or $0.43 per diluted share of common stock Net interest income of $63.2 million Dividend Common stock dividend of $0.46 per share 10.2% annualized dividend yield based upon closing stock price on May 1, 2018 Loan Originations Committed capital to $922 million of commercial real estate loans, $489 million of which was funded during the quarter Funded $18.4 million for loans closed prior to the quarter Loan Portfolio Total loan portfolio of $4.1 billion Weighted average remaining term2 of 2.7 years Weighted average unlevered all-in-yield3 of 9.2% 89% of loans have floating interest rates Capitalization Completed underwritten public offering of 15.5 million shares of common stock, including the full exercise of the underwriters’ option to purchase additional shares, raising net proceeds of approximately $275.9 million; Total equity capitalization4 of $2.5 billion at March 31, 2018

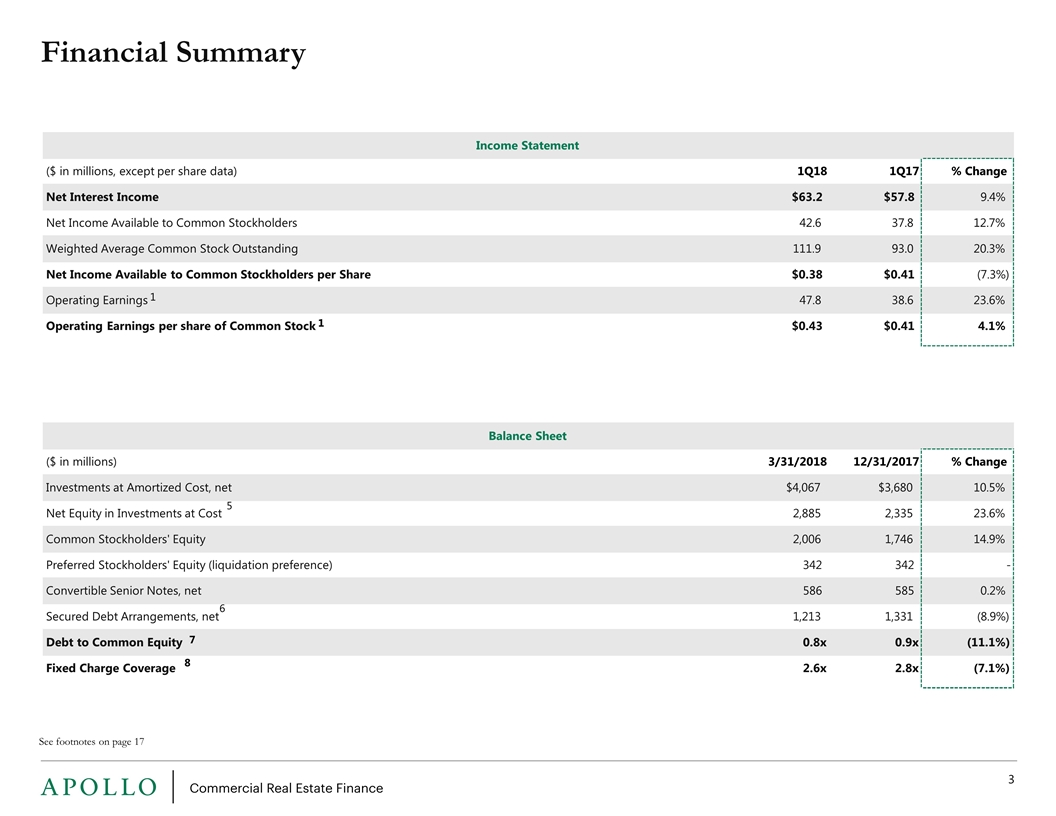

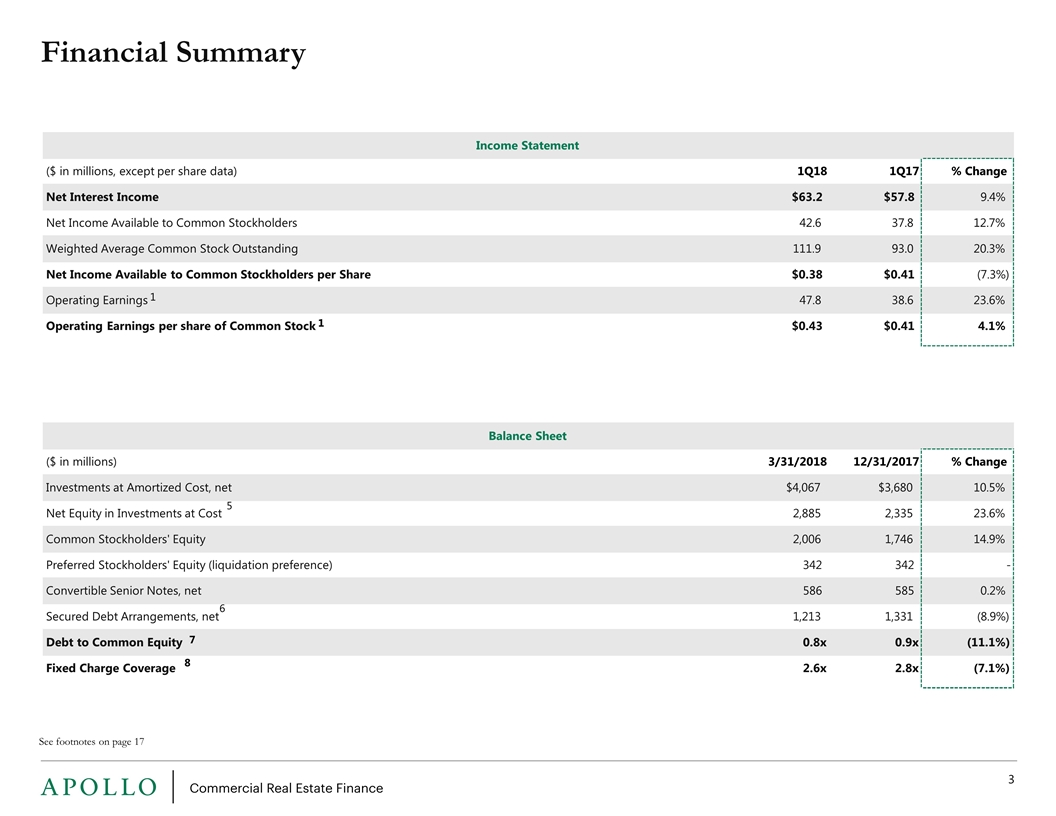

Income Statement ($ in millions, except per share data) 1Q18 1Q17 % Change Net Interest Income $63.2 $57.8 9.4% Net Income Available to Common Stockholders 42.6 37.8 12.7% Weighted Average Common Stock Outstanding 111.9 93.0 20.3% Net Income Available to Common Stockholders per Share $0.38 $0.41 (7.3%) Operating Earnings 47.8 38.6 23.6% Operating Earnings per share of Common Stock $0.43 $0.41 4.1% Balance Sheet Balance Sheet ($ in millions) 3/31/2018 12/31/2017 % Change Investments at Amortized Cost, net $4,067 $3,680 10.5% Net Equity in Investments at Cost 2,885 2,335 23.6% Common Stockholders' Equity 2,006 1,746 14.9% Preferred Stockholders' Equity (liquidation preference) 342 342 - Convertible Senior Notes, net 586 585 0.2% Secured Debt Arrangements, net 1,213 1,331 (8.9%) Debt to Common Equity 0.8x 0.9x (11.1%) Fixed Charge Coverage 2.6x 2.8x (7.1%) Financial Summary See footnotes on page 17 1 1 6 7 8 5

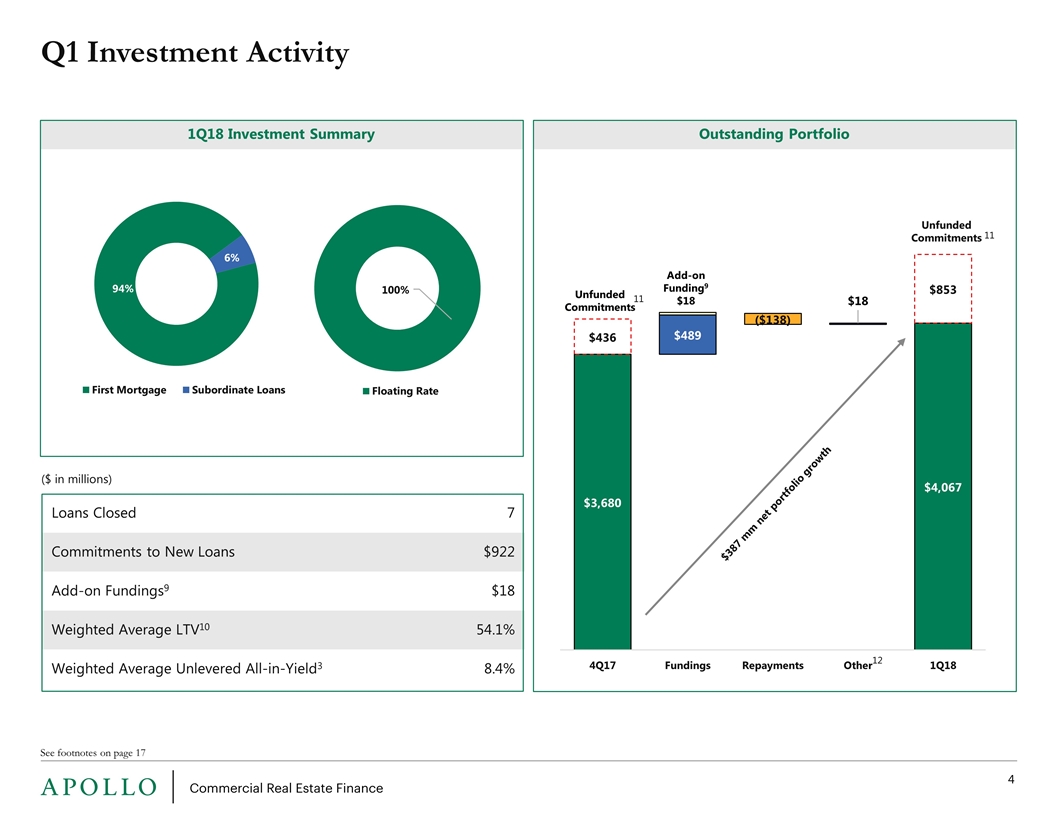

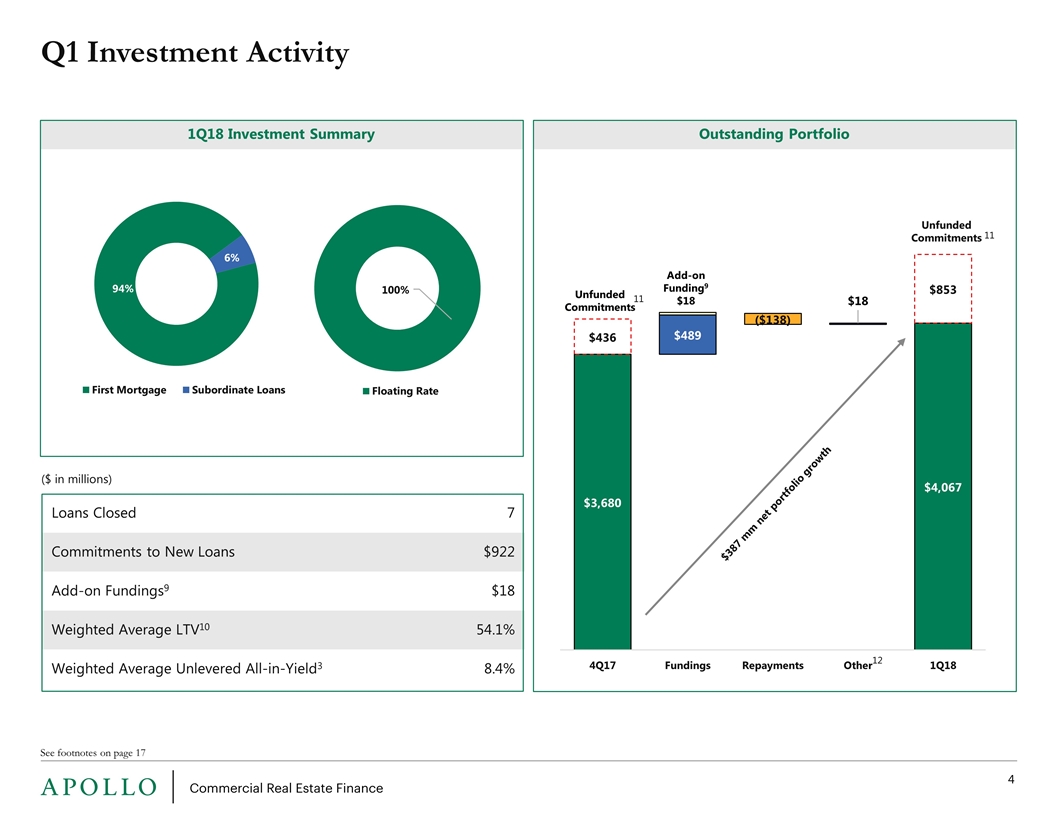

Q1 Investment Activity See footnotes on page 17 1Q18 Investment Summary Outstanding Portfolio Loans Closed 7 Commitments to New Loans $922 Add-on Fundings9 $18 Weighted Average LTV10 54.1% Weighted Average Unlevered All-in-Yield3 8.4% $387 mm net portfolio growth ($ in millions) 12 11 11

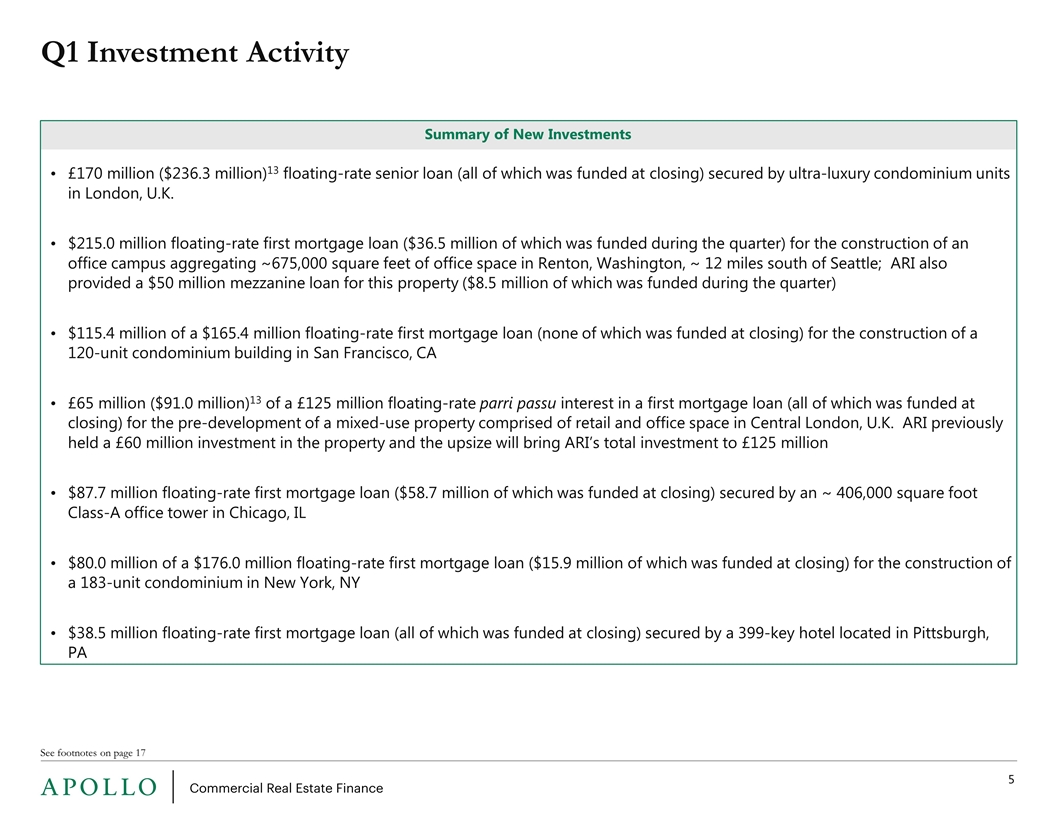

Q1 Investment Activity See footnotes on page 17 Summary of New Investments £170 million ($236.3 million)13 floating-rate senior loan (all of which was funded at closing) secured by ultra-luxury condominium units in London, U.K. $215.0 million floating-rate first mortgage loan ($36.5 million of which was funded during the quarter) for the construction of an office campus aggregating ~675,000 square feet of office space in Renton, Washington, ~ 12 miles south of Seattle; ARI also provided a $50 million mezzanine loan for this property ($8.5 million of which was funded during the quarter) $115.4 million of a $165.4 million floating-rate first mortgage loan (none of which was funded at closing) for the construction of a 120-unit condominium building in San Francisco, CA £65 million ($91.0 million)13 of a £125 million floating-rate parri passu interest in a first mortgage loan (all of which was funded at closing) for the pre-development of a mixed-use property comprised of retail and office space in Central London, U.K. ARI previously held a £60 million investment in the property and the upsize will bring ARI’s total investment to £125 million $87.7 million floating-rate first mortgage loan ($58.7 million of which was funded at closing) secured by an ~ 406,000 square foot Class-A office tower in Chicago, IL $80.0 million of a $176.0 million floating-rate first mortgage loan ($15.9 million of which was funded at closing) for the construction of a 183-unit condominium in New York, NY $38.5 million floating-rate first mortgage loan (all of which was funded at closing) secured by a 399-key hotel located in Pittsburgh, PA

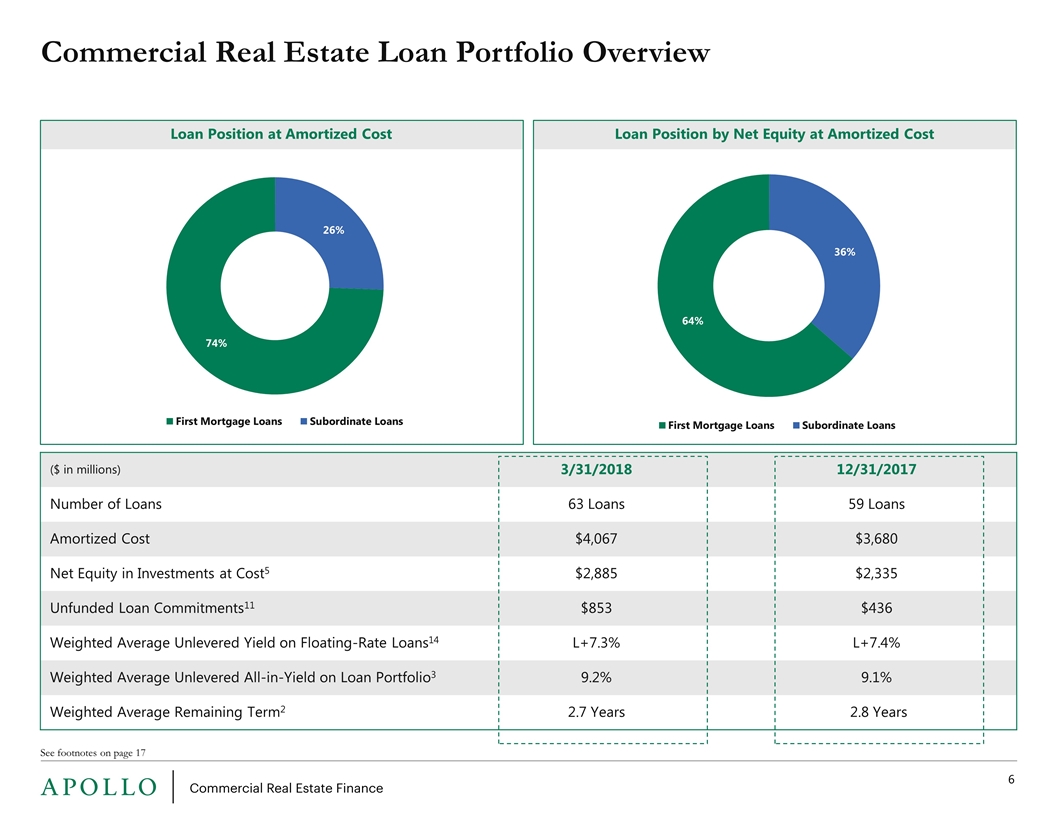

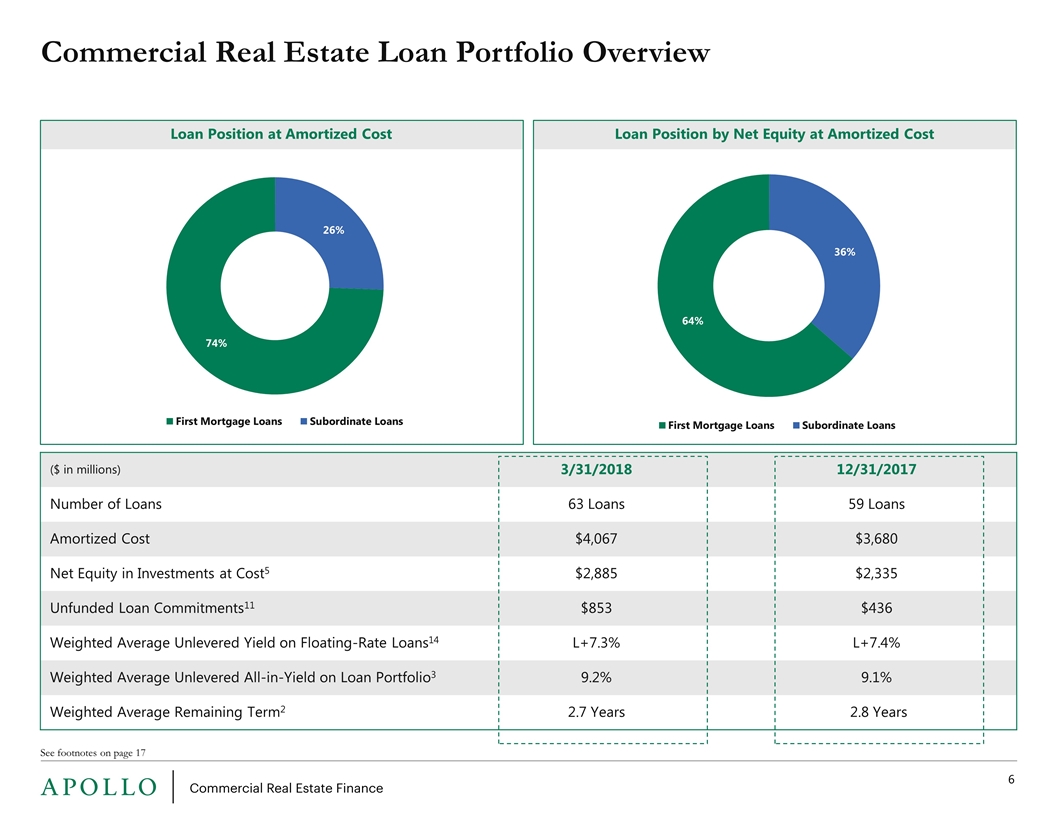

Loan Position by Net Equity at Amortized Cost Commercial Real Estate Loan Portfolio Overview See footnotes on page 17 Loan Position at Amortized Cost ($ in millions) 3/31/2018 12/31/2017 Number of Loans 63 Loans 59 Loans Amortized Cost $4,067 $3,680 Net Equity in Investments at Cost5 $2,885 $2,335 Unfunded Loan Commitments11 $853 $436 Weighted Average Unlevered Yield on Floating-Rate Loans14 L+7.3% L+7.4% Weighted Average Unlevered All-in-Yield on Loan Portfolio3 9.2% 9.1% Weighted Average Remaining Term2 2.7 Years 2.8 Years

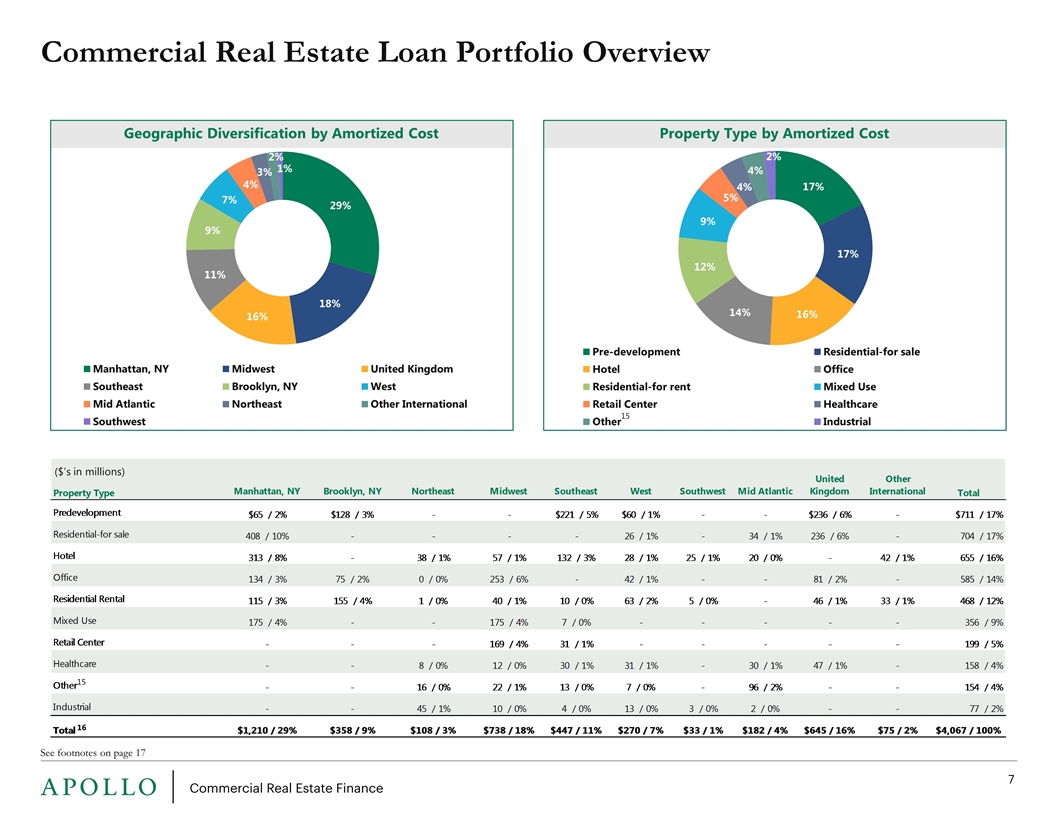

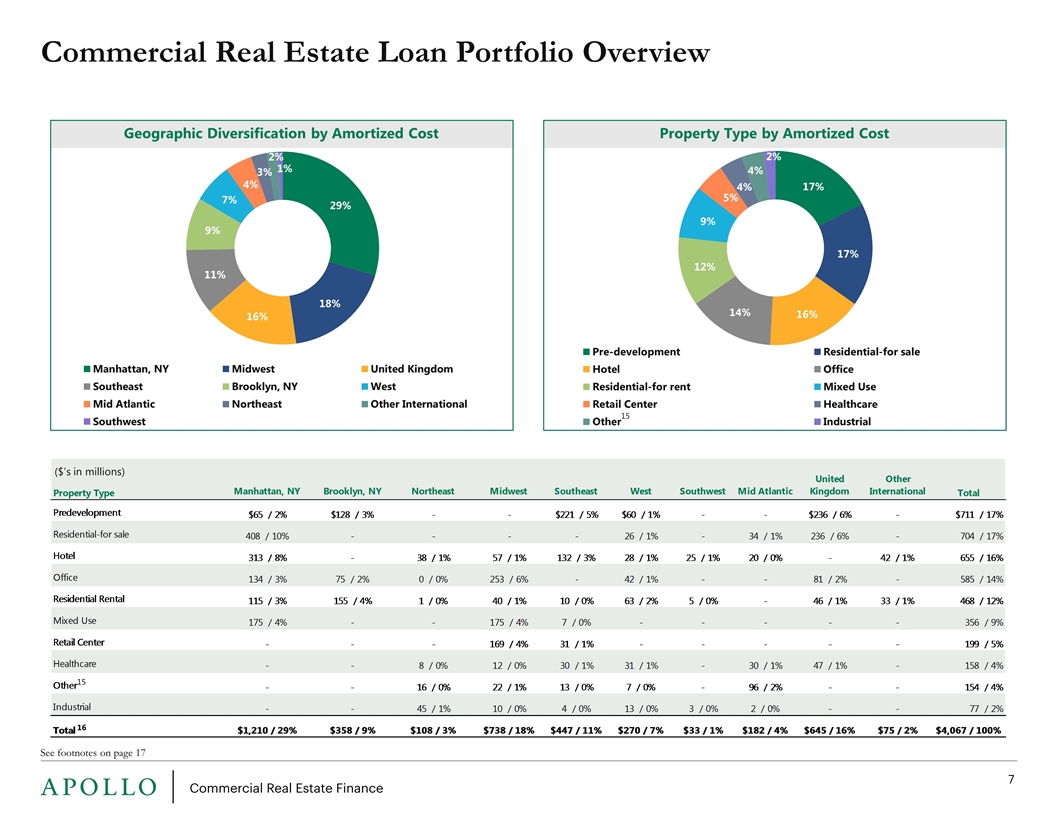

Commercial Real Estate Loan Portfolio Overview See footnotes on page 17 Geographic Diversification by Amortized Cost Property Type by Amortized Cost ($’s in millions) 15 16 Pre-development

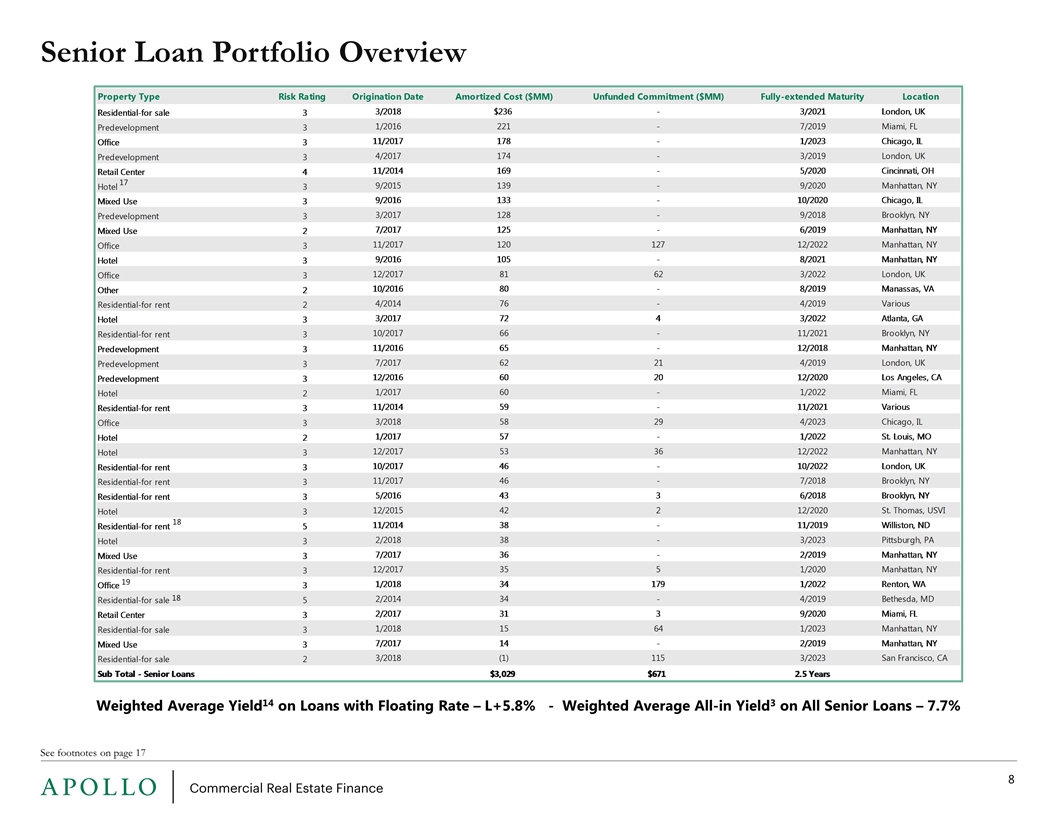

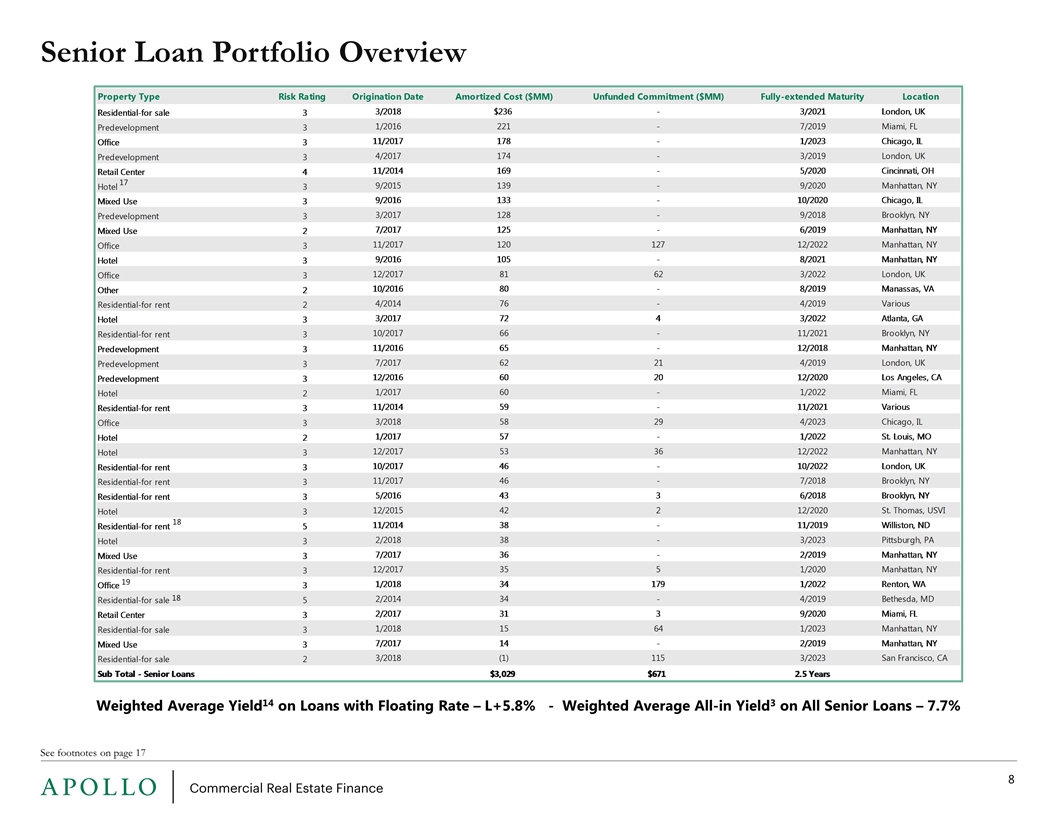

Senior Loan Portfolio Overview See footnotes on page 17 Weighted Average Yield14 on Loans with Floating Rate – L+5.8% - Weighted Average All-in Yield3 on All Senior Loans – 7.7% 17 18 18 19

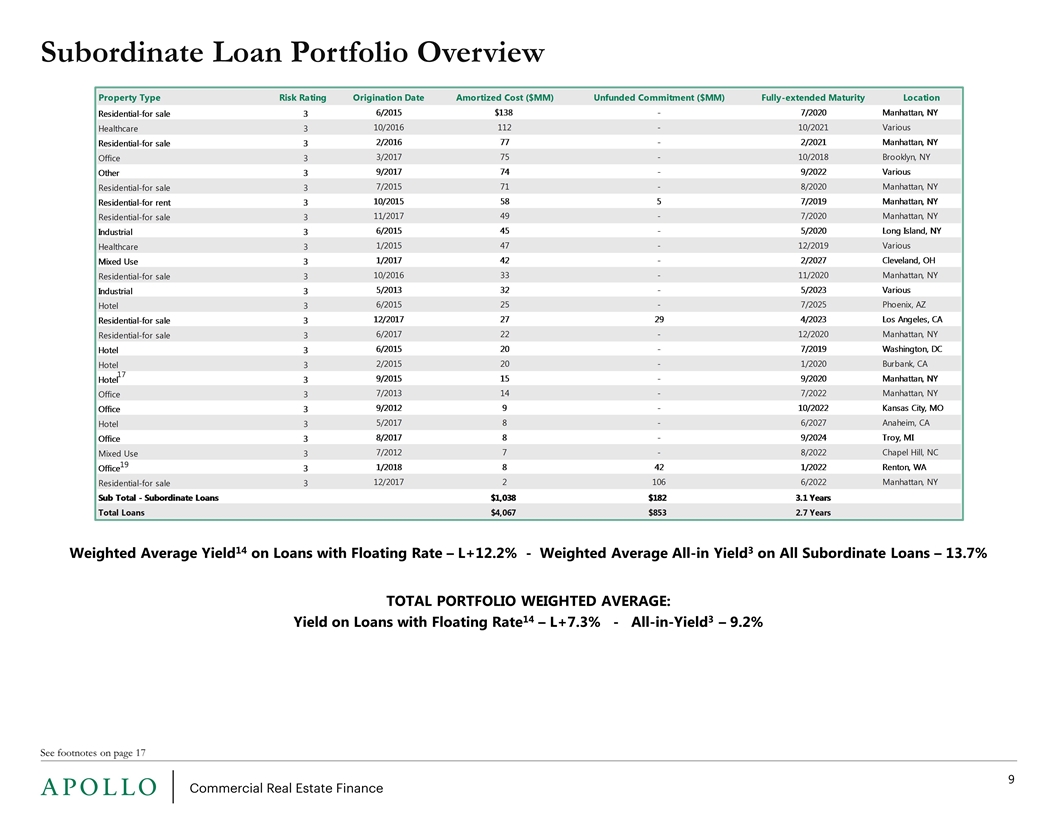

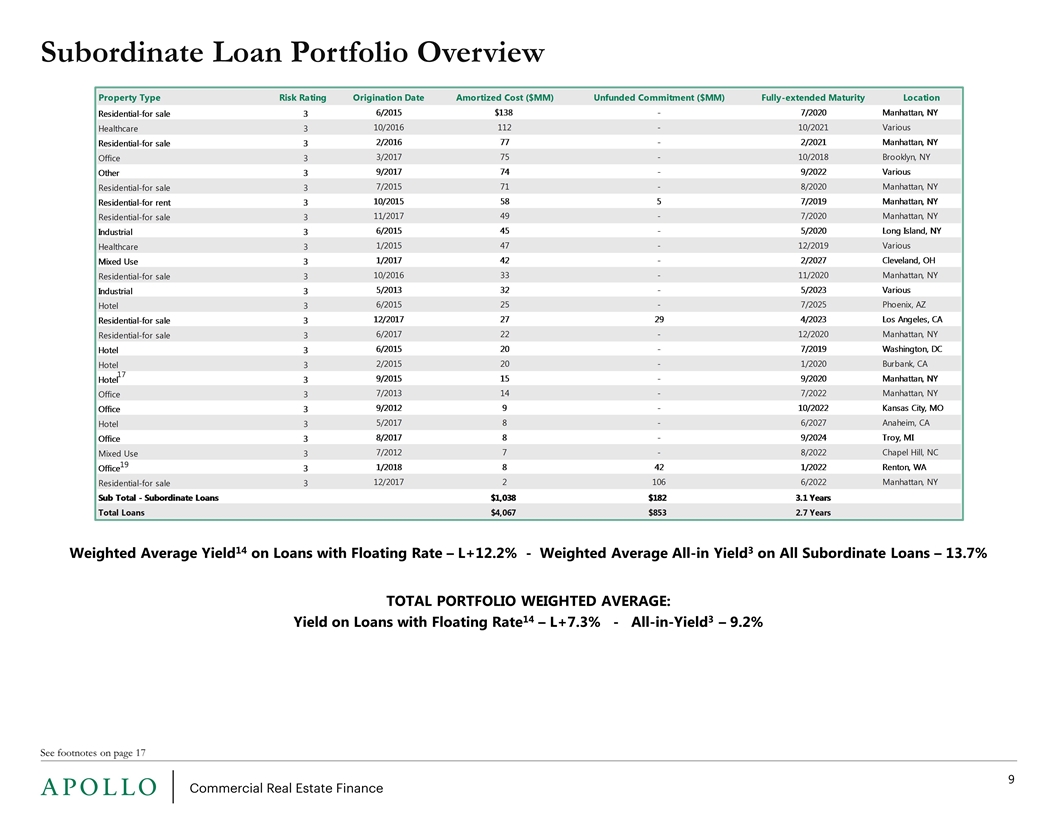

Subordinate Loan Portfolio Overview See footnotes on page 17 Weighted Average Yield14 on Loans with Floating Rate – L+12.2% - Weighted Average All-in Yield3 on All Subordinate Loans – 13.7% TOTAL PORTFOLIO WEIGHTED AVERAGE: Yield on Loans with Floating Rate14 – L+7.3% - All-in-Yield3 – 9.2% 17 19

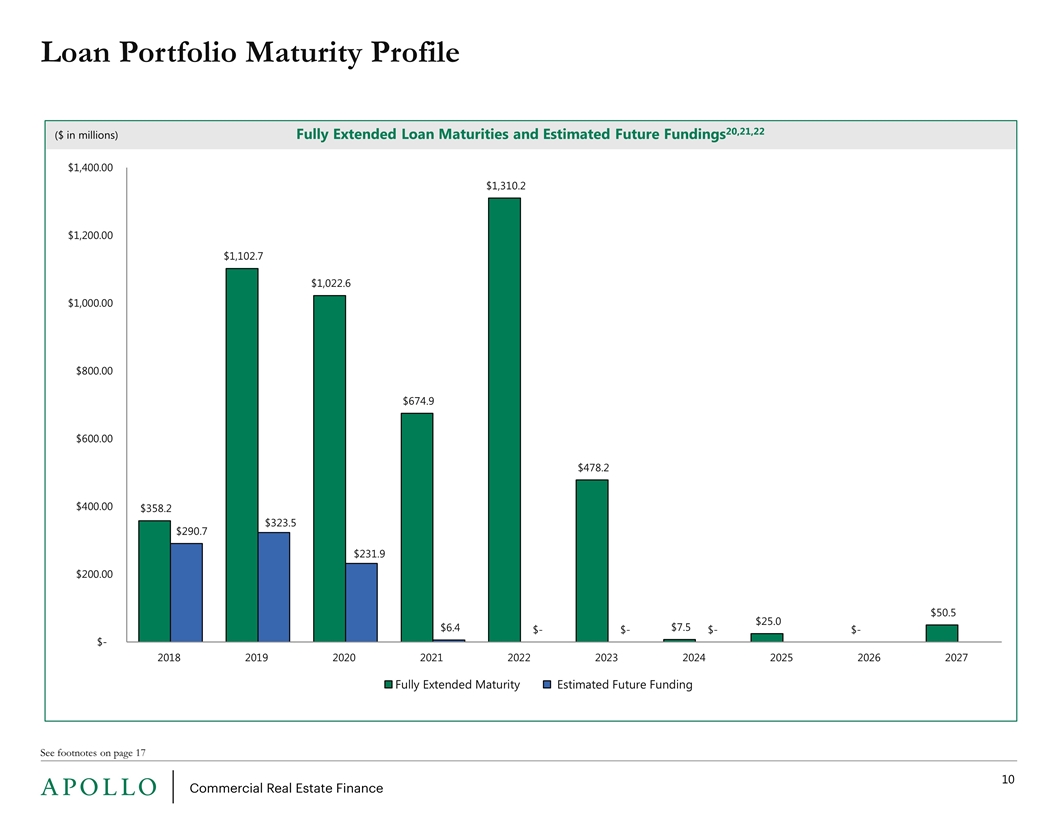

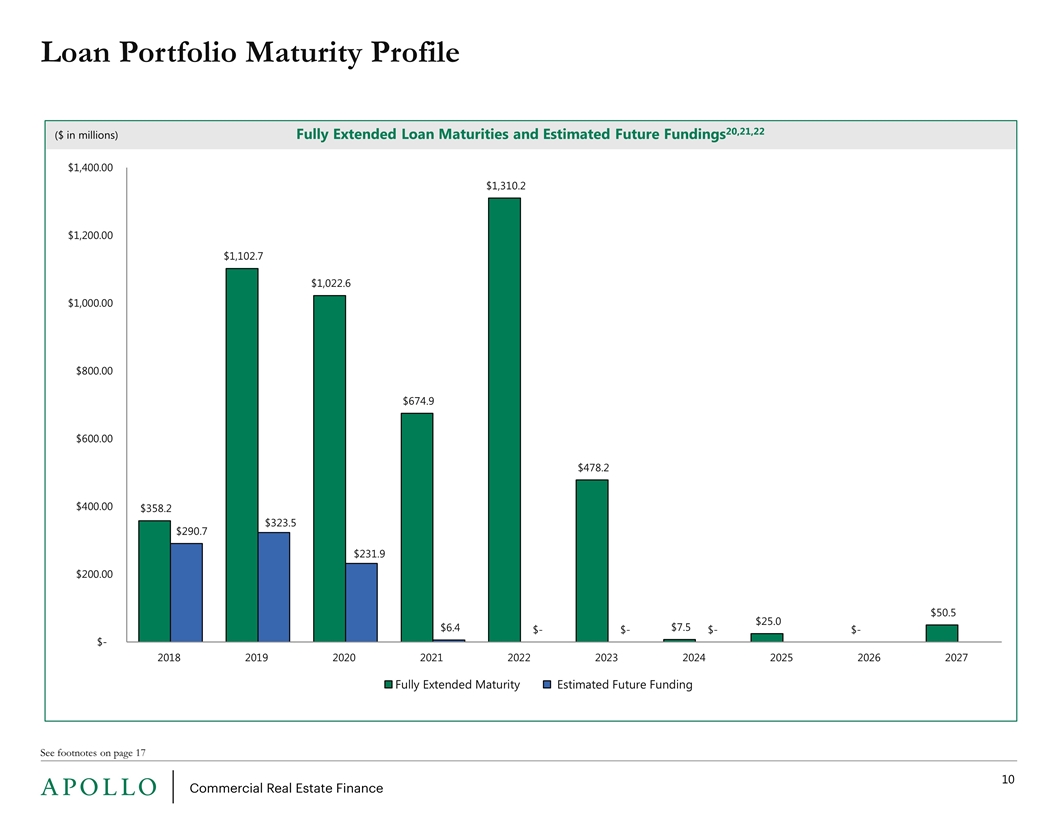

Loan Portfolio Maturity Profile See footnotes on page 17 Fully Extended Loan Maturities and Estimated Future Fundings20,21,22 ($ in millions)

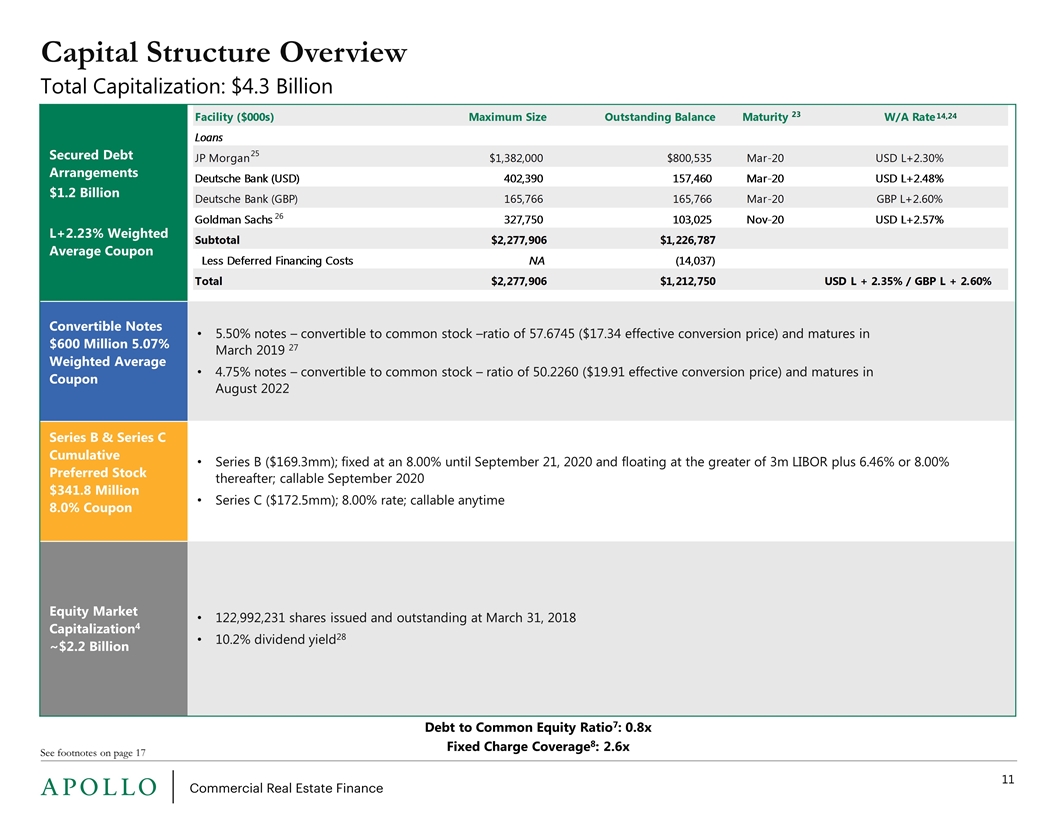

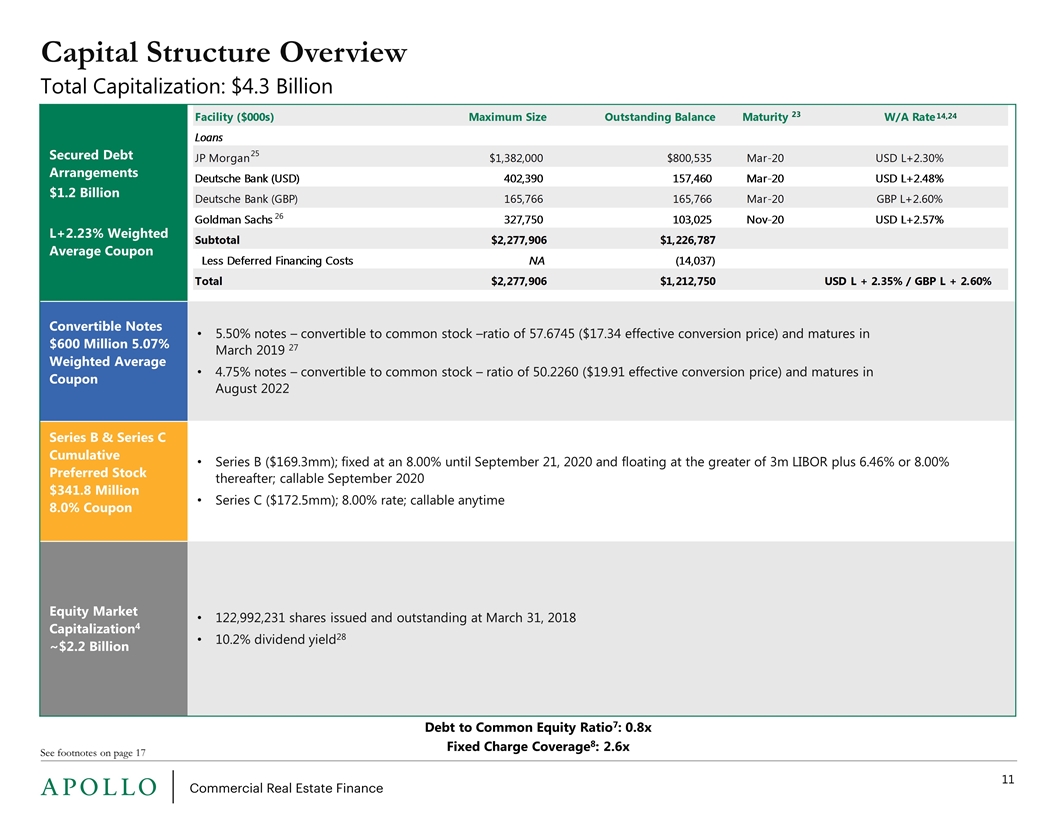

Secured Debt Arrangements $1.2 Billion L+2.23% Weighted Average Coupon Convertible Notes $600 Million 5.07% Weighted Average Coupon 5.50% notes – convertible to common stock –ratio of 57.6745 ($17.34 effective conversion price) and matures in March 2019 27 4.75% notes – convertible to common stock – ratio of 50.2260 ($19.91 effective conversion price) and matures in August 2022 Series B & Series C Cumulative Preferred Stock $341.8 Million 8.0% Coupon Series B ($169.3mm); fixed at an 8.00% until September 21, 2020 and floating at the greater of 3m LIBOR plus 6.46% or 8.00% thereafter; callable September 2020 Series C ($172.5mm); 8.00% rate; callable anytime Equity Market Capitalization4 ~$2.2 Billion 122,992,231 shares issued and outstanding at March 31, 2018 10.2% dividend yield28 Capital Structure Overview See footnotes on page 17 Debt to Common Equity Ratio7: 0.8x Fixed Charge Coverage8: 2.6x 25 26 23 14,24 Total Capitalization: $4.3 Billion

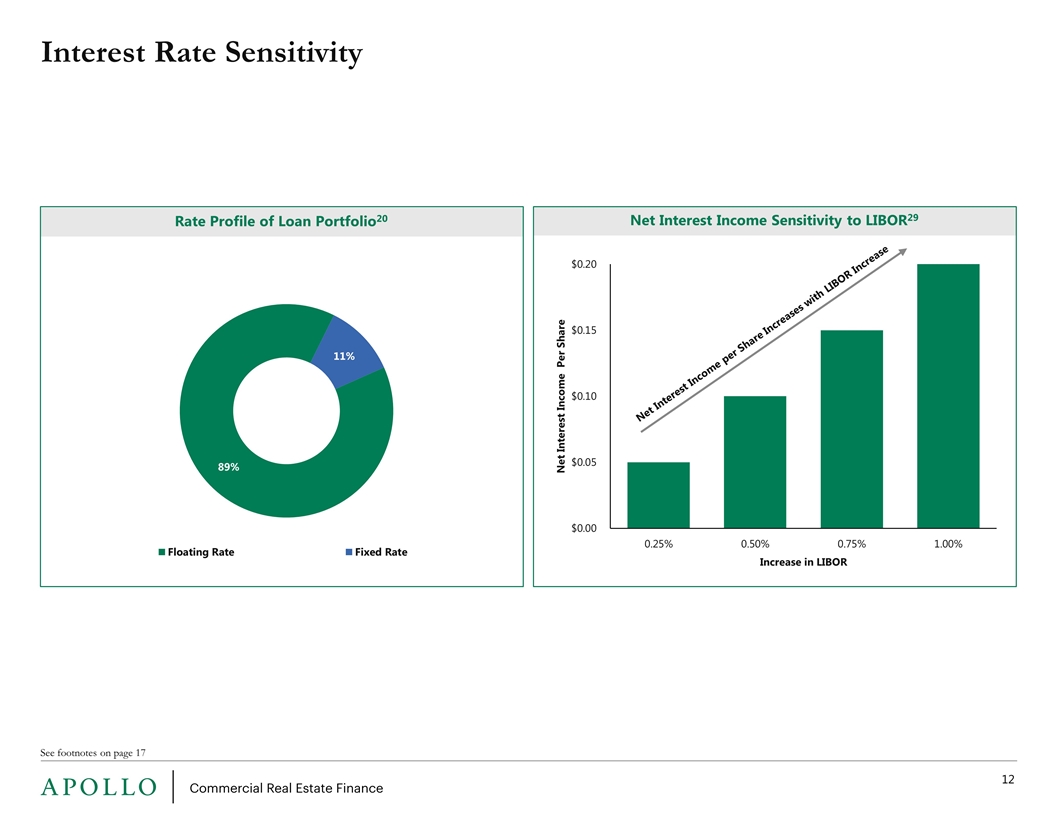

Interest Rate Sensitivity See footnotes on page 17 Rate Profile of Loan Portfolio20 Net Interest Income Sensitivity to LIBOR29 Net Interest Income per Share Increases with LIBOR Increase

Financials

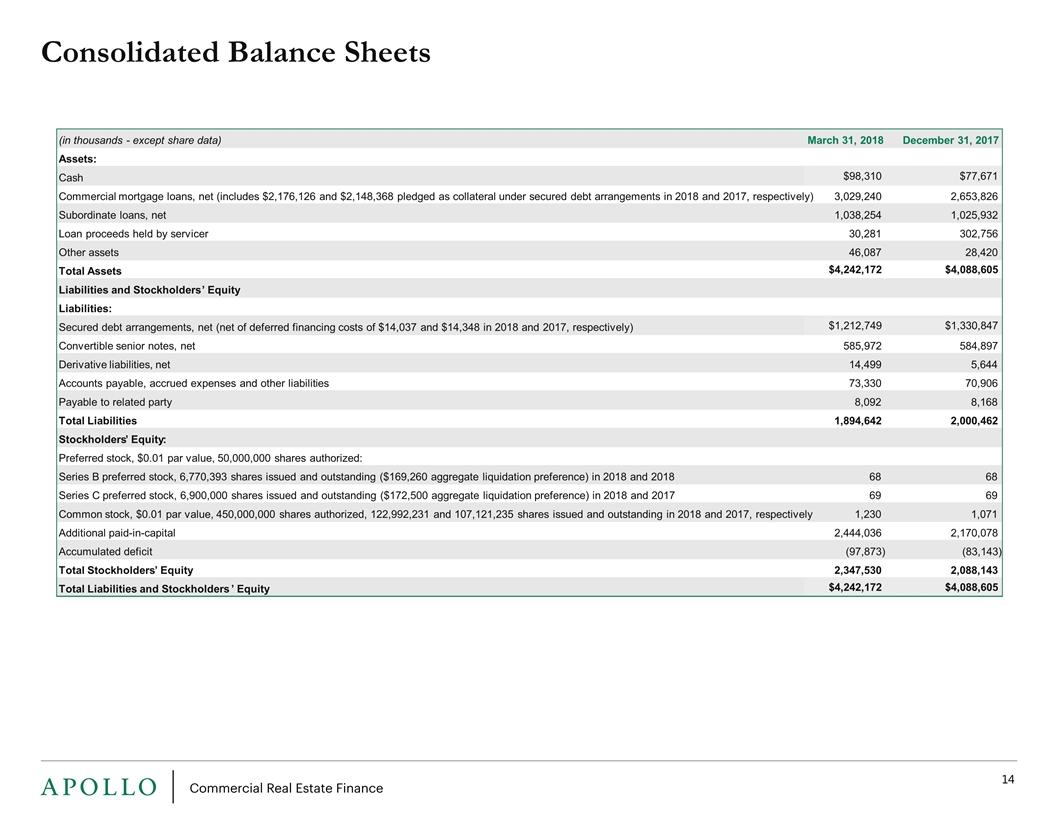

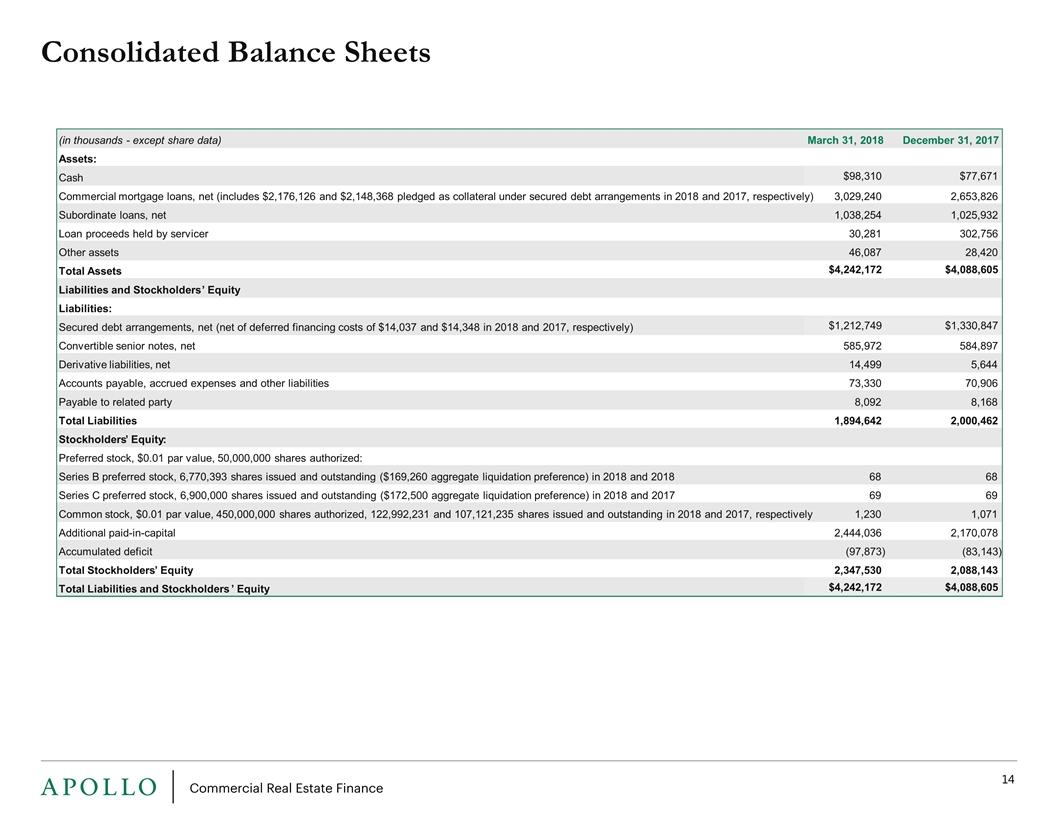

Consolidated Balance Sheets (in thousands - except share data) March 31, 2018 December 31, 2017 Assets: Cash $98,310 $77,671 Commercial mortgage loans, net (includes $2,176,126 and $2,148,368 pledged as collateral under secured debt arrangements in 2018 and 2017, respectively) 3,029,240 2,653,826 Subordinate loans, net 1,038,254 1,025,932 Loan proceeds held by servicer 30,281 302,756 Other assets 46,087 28,420 Total Assets $4,242,172 $4,088,605 Liabilities and Stockholders ’ Equity Liabilities: Secured debt arrangements, net (net of deferred financing costs of $14,037 and $14,348 in 2018 and 2017, respectively) $1,212,749 $1,330,847 Convertible senior notes, net 585,972 584,897 Derivative liabilities, net 14,499 5,644 Accounts payable, accrued expenses and other liabilities 73,330 70,906 Payable to related party 8,092 8,168 Total Liabilities 1,894,642 2,000,462 Stockholders ’ Equity : Preferred stock, $0.01 par value, 50,000,000 shares authorized: Series B preferred stock, 6,770,393 shares issued and outstanding ($169,260 aggregate liquidation preference) in 2018 and 2018 68 68 Series C preferred stock, 6,900,000 shares issued and outstanding ($172,500 aggregate liquidation preference) in 2018 and 2017 69 69 Common stock, $0.01 par value, 450,000,000 shares authorized, 122,992,231 and 107,121,235 shares issued and outstanding in 2018 and 2017, respectively 1,230 1,071 Additional paid-in-capital 2,444,036 2,170,078 Accumulated deficit (97,873) (83,143) Total Stockholders ’ Equity 2,347,530 2,088,143 Total Liabilities and Stockholders ’ Equity $4,242,172 $4,088,605

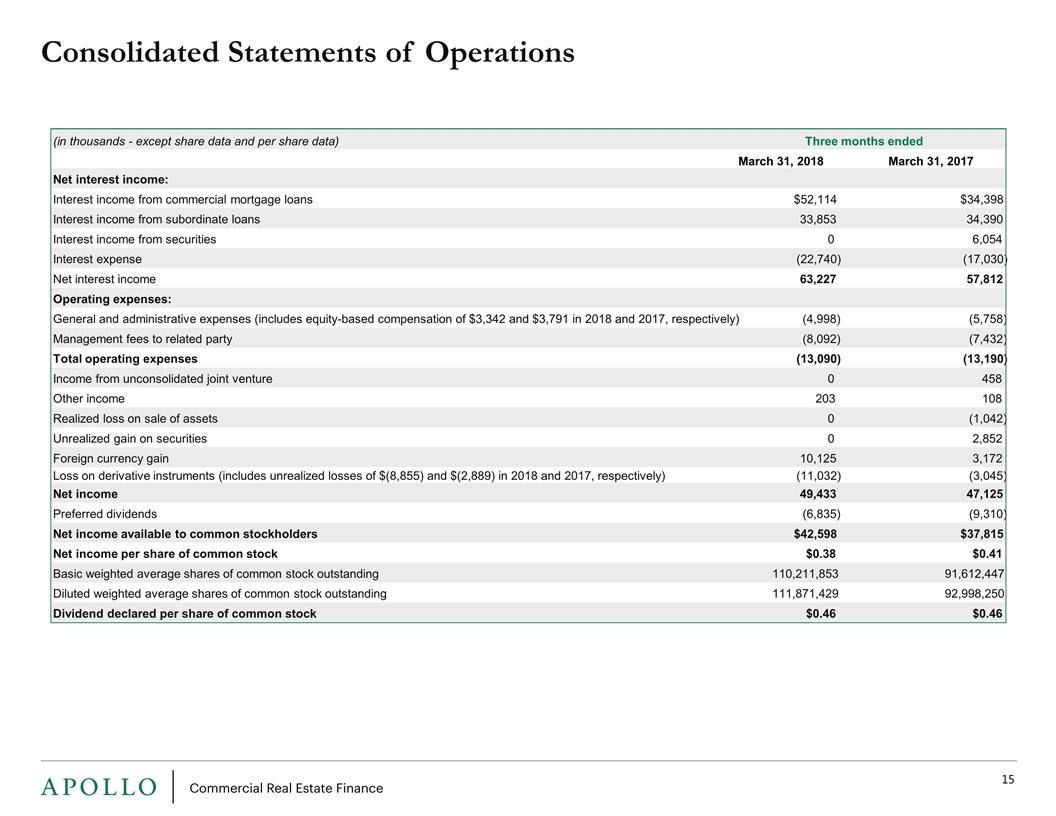

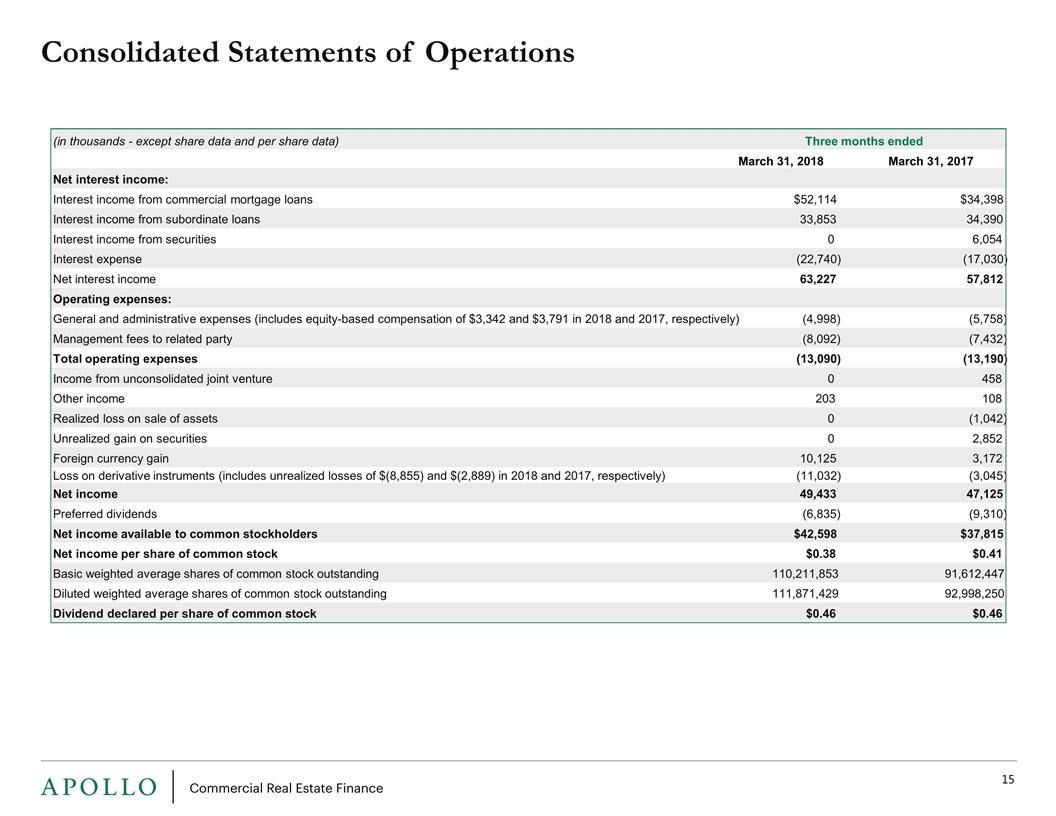

Consolidated Statements of Operations (in thousands - except share data and per share data) March 31, 2018 March 31, 2017 Net interest income: Interest income from commercial mortgage loans $52,114 $34,398 Interest income from subordinate loans 33,853 34,390 Interest income from securities 0 6,054 Interest expense (22,740) (17,030) Net interest income 63,227 57,812 Operating expenses: General and administrative expenses (includes equity-based compensation of $3,342 and $3,791 in 2018 and 2017, respectively) (4,998) (5,758) Management fees to related party (8,092) (7,432) Total operating expenses (13,090) (13,190) Income from unconsolidated joint venture 0 458 Other income 203 108 Realized loss on sale of assets 0 (1,042) Unrealized gain on securities 0 2,852 Foreign currency gain 10,125 3,172 Loss on derivative instruments (includes unrealized losses of $(8,855) and $(2,889) in 2018 and 2017, respectively) (11,032) (3,045) Net income 49,433 47,125 Preferred dividends (6,835) (9,310) Net income available to common stockholders $42,598 $37,815 Net income per share of common stock $0.38 $0.41 Basic weighted average shares of common stock outstanding 110,211,853 91,612,447 Diluted weighted average shares of common stock outstanding 111,871,429 92,998,250 Dividend declared per share of common stock $0.46 $0.46 Three months ended

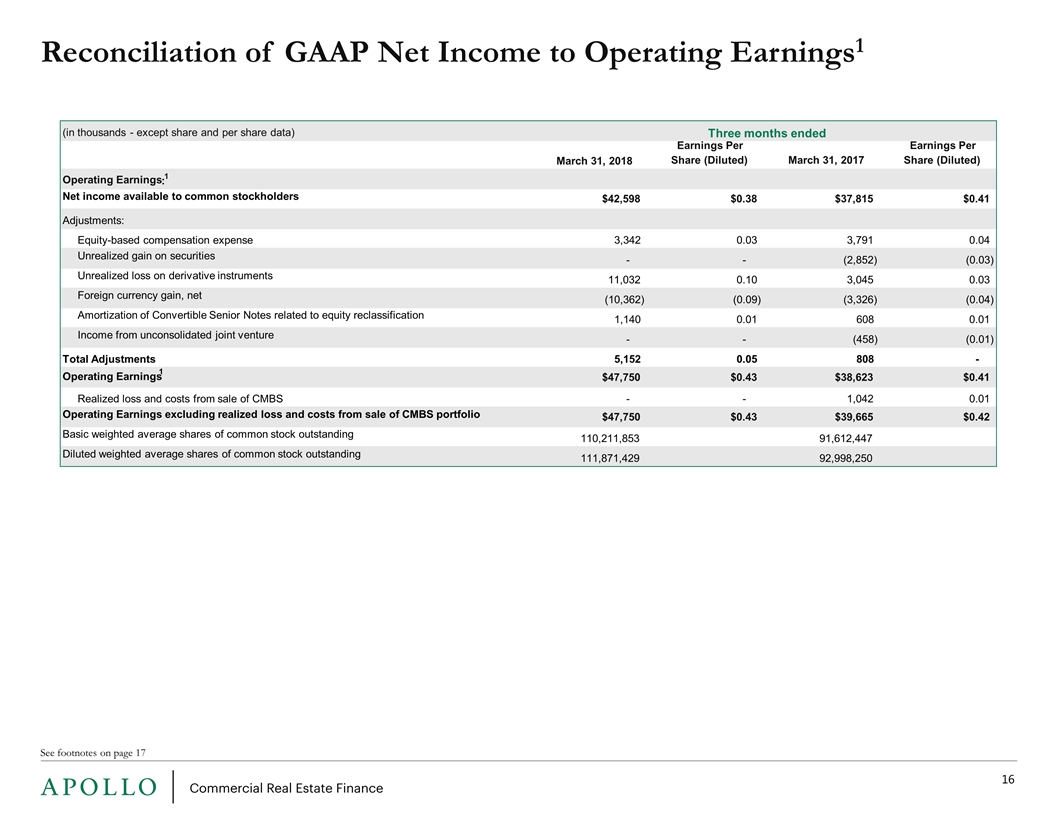

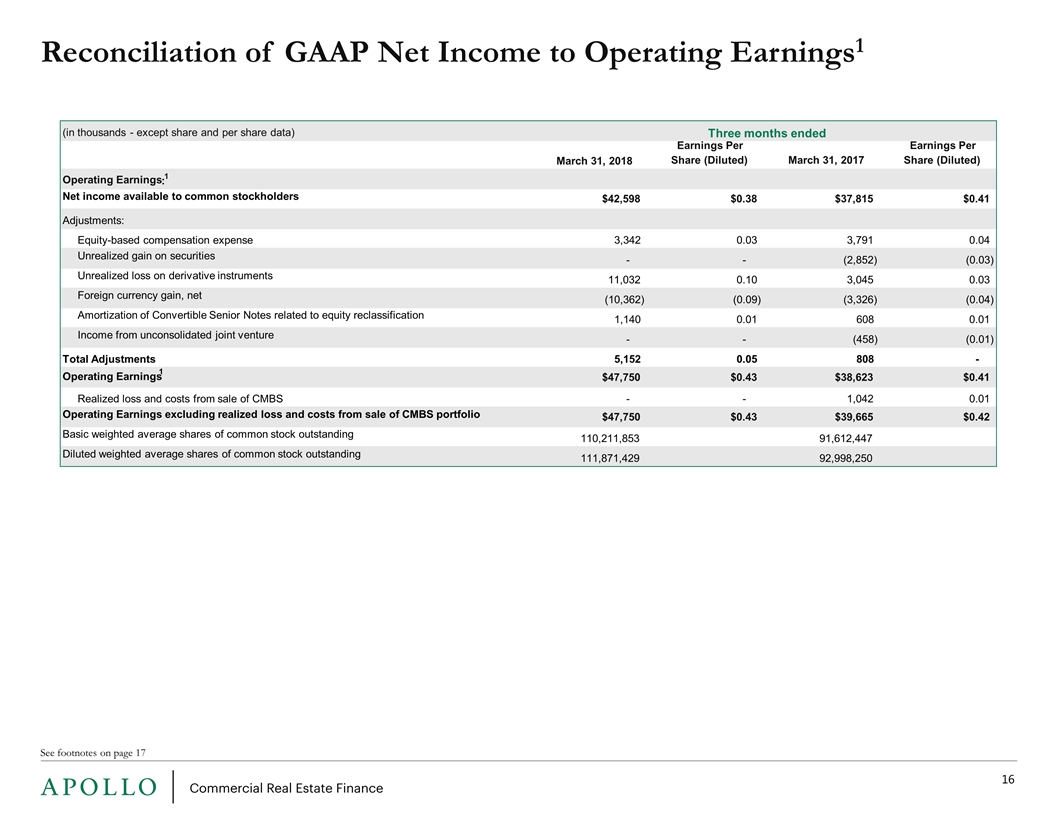

Reconciliation of GAAP Net Income to Operating Earnings1 See footnotes on page 17 (in thousands - except share and per share data) Three months ended March 31, 2018 Earnings Per Share (Diluted) March 31, 2017 Earnings Per Share (Diluted) Operating Earnings 1 : Net income available to common stockholders $42,598 $0.38 $37,815 $0.41 Adjustments: Equity-based compensation expense 3,342 0.03 3,791 0.04 Unrealized gain on securities - - (2,852) (0.03) Unrealized loss on derivative instruments 11,032 0.10 3,045 0.03 Foreign currency gain, net (10,362) (0.09) (3,326) (0.04) Amortization of Convertible Senior Notes related to equity reclassification 1,140 0.01 608 0.01 Income from unconsolidated joint venture - - (458) (0.01) Total Adjustments 5,152 0.05 808 - Operating Earnings 1 $47,750 $0.43 $38,623 $0.41 Realized loss and costs from sale of CMBS - - 1,042 0.01 Operating Earnings excluding realized loss and costs from sale of CMBS portfolio $47,750 $0.43 $39,665 $0.42 Basic weighted average shares of common stock outstanding 110,211,853 91,612,447 Diluted weighted average shares of common stock outstanding 111,871,429 92,998,250

Footnotes Operating Earnings is a non-GAAP financial measure that is used by the Company to approximate cash available for distribution and is defined by the Company as net income available to common stockholders, computed in accordance with GAAP, adjusted for (i) equity-based compensation expense (a portion of which may become cash-based upon final vesting and settlement of awards should the holder elect net share settlement to satisfy income tax withholding); (ii) any unrealized gains or losses or other non-cash items included in net income available to common stockholders, (iii) unrealized income from unconsolidated joint ventures, (iv) foreign currency gains/losses, other than realized gains/(losses) related to interest income; (v) the non-cash amortization expense related to the reclassification of a portion of the convertible senior notes to stockholders’ equity in accordance with GAAP; and (vi) provision for loan losses and impairments. Please see slide 16 for a reconciliation of GAAP net income and GAAP net income per share to Operating Earnings and Operating Earnings per Share. Operating Earnings may also be adjusted to exclude certain other non-cash items, as determined by ACREFI Management, LLC, the Company’s external manager (the “Manager”) and approved by a majority of the Company's independent directors. Weighted Average Remaining Term assumes all extension options are exercised. Weighted Average Unlevered All-in-Yield on the loan portfolio is based upon the applicable benchmark rates as of March 31, 2018 on the floating rate loans. Weighted Average All-in-Yield includes the amortization of deferred origination fees, loan origination costs and accrual of both extension and exit fees. Equity market capitalization based upon shares of common stock outstanding on March 31, 2108 and the closing stock price on May 1, 2018 and the liquidation preference of the preferred stock outstanding on March 31, 2018. Net Equity in investments at cost includes amortized cost of loans and proceeds net secured debt arrangements; does not include debt secured by proceeds held by servicer Total debt balance less $14,037 and $14,348 at March 31, 2018 and December 31, 2017, respectively, in deferred financing costs. Represents total secured debt arrangements and convertible senior notes, less cash and loan proceeds held by servicer to common equity. Fixed charge coverage is EBITDA divided by interest expense and preferred stock dividends. Add-on Fundings are for loans closed prior to 2018. Reflects LTV as of date loans were originated or acquired. Unfunded loan commitments are for loans that have yet to be funded. Includes foreign currency appreciation/depreciation, PIK interest, and the accretion of loan costs and fees. Conversion to USD on the date of investment. Average floating rate spread is calculated as the weighted average yield with applicable floating benchmark rates minus USD one month LIBOR as of March 31, 2018. Other includes a data center and water park resorts. Amounts and percentages may not foot due to rounding. Both loans are secured by the same property. Amortized cost for these loans is net of the recorded provisions for loan losses and impairments. Both loans are secured by the same property. Based upon face amount of loans. Maturities reflect the fully funded amounts of the loans. Future funding dates are based upon the Manager’s estimates based upon the best information available to the Manager at the time. There is no assurance that the payments will occur in accordance with these estimates or at all, which could affect the Company’s operating results. Assumes extension options are exercised. LIBOR is applicable USD or GBP LIBOR as of March 31, 2018. The debt balance as of March 31, 2018, includes asset specific borrowing: currently $80 million drawn out of $132 million max capacity. As of March 31, 2018 the Company’s secured debt arrangements with Goldman Sachs Bank USA provided for maximum total borrowings comprised of a $300,000 repurchase facility and $27,750 of a asset specific financing. The asset specific financing has a maturity of April 2019. Effective rate includes the effect of the adjustment for the conversion option relating to cash dividend payments made by the Company to stockholders that have been deferred and carried-forward in accordance with, and are not yet required to be made pursuant to, the terms of the applicable supplemental indenture. Based upon the $1.84 annualized dividend per share of common stock and the closing stock price on May 1, 2018. Any such hypothetical impact on interest rates on the Company’s variable rate borrowings does not consider the effect of any change in overall economic activity that could occur in a rising interest rate environment. Further, in the event of a change in interest rates of that magnitude, the Company may take actions to further mitigate the Company’s exposure to such a change. However, due to the uncertainty of the specific actions that would be taken and their possible effects, this analysis assumes no changes in the Company’s financial structure. The analysis incorporates movements in both USD LIBOR and GBP LIBOR.