Exhibit 99.1

For Release: June 29, 2010

GM Hosts Global Business Conference for the Financial Community

Senior leaders provide in-depth overview of the new company’s global business

and offer hands-on driving experience in GM’s great new vehicles

DETROIT – The new General Motors today hosted a group of approximately 200 members of the financial community and other stakeholders at its first annual Global Business Conference at GM’s Technical Center in Warren, Michigan. The event was the first of its kind since thelaunch of the new company in July 2009.

The conference featured an in-depth review of GM’s global business, with updates by Chairman and CEO Ed Whitacre, Vice Chairman Steve Girsky, Vice Chairman and CFO, Chris Liddell, and GM’s regional presidents. Vice Chairman of Global Product Operations Tom Stephens provided a review of GM’s global product portfolio, and an early preview of some upcoming products, including the next generations of the popular Opel Insignia, Chevrolet Malibu, and Cadillac CTS.

Whitacre kicked off the conference by sharing his perspective on how he sees the company today, the progress it has made, and the opportunities ahead for GM.

“We’re not reintroducing GM today, we’re introducing a new GM, because we are a new and much different company than we were 12 months ago,” Whitacre said. “We’re creating a new GM – one that truly is different. We have a simplified focus on designing, building, and selling the world’s best vehicles. We’re producing first-rate cars and trucks that customers are buying around the world. We have a new management team that ‘gets it’ and is executing well.”

Tim Lee, president of GM’s International Operations; Jamie Ardila, president of GM South America; Nick Reilly, president of GM Europe and chairman of the management board of Opel/Vauxhall; Vice President and CFO of Opel/Vauxhall Europe, Mark James; and Mark Reuss, president of GM North America, gave a market-by-market assessment of the company’s progress.

By closely managing the business at the regional level, with specific focus on the trends in local markets, and by leveraging GM’s global capability, the company is well positioned to take advantage of anticipated growth in the global auto market.

A highlight of the day was an extensive ride-and-drive for the guests, which featured virtually all of GM’s current U.S. models from its Chevrolet, Buick, GMC, and Cadillac brands, including the all-newChevrolet Cruze and theChevrolet Volt extended-range electric vehicle.

Girsky shared his perspectives on how GM is operating differently today, and what global market challenges still lie ahead, including further market fragmentation and new vehicle market volatility, and outlined how GM is addressing these challenges and aligning the company to take full advantage of opportunities ahead.

Liddell concluded the day by summarizing the importance of GM’s global resources and financial strength in stabilizing and growing the business. He reinforced GM’s commitment to communicating in an open and consistent manner, and to keeping the focus on the key factors that are important to the business and its stakeholders.

“Today’s event gave us a unique opportunity to highlight the fundamental changes we’re making at GM. With global growth potential in both mature and emerging markets, a dramatically lower break-even level in North America, actions underway to restructure Europe, and a much stronger balance sheet, we are making the changes needed for long-term success,” Liddell said.

An audio replay and accompanying presentation charts are available onGM’s Investor Relations website at www.gm.com/corporate/investor_information/cal_events.

# # #

About General Motors:

General Motors, one of the world’s largest automakers, traces its roots back to 1908. With its global headquarters in Detroit, GM employs 205,000 people in every major region of the world and does business in some 157 countries. GM and its strategic partners produce cars and trucks in 31 countries, and sell and service these vehicles through the following brands: Buick, Cadillac, Chevrolet, FAW, GMC, Daewoo, Holden, Jiefang, Opel, Vauxhall and Wuling. GM’s largest national market is the United States, followed by China, Brazil, Germany, the United Kingdom, Canada, and Italy. GM’s OnStar subsidiary is the industry leader in vehicle safety, security and information services. General Motors acquired operations from General Motors Corporation on July 10, 2009, and references to prior periods in this and other press materials refer to operations of the old General Motors Corporation. More information on the new General Motors can be found atwww.gm.com.

Forward-Looking Statements:

In this press release and in related comments by our management, our use of the words “expect,” “anticipate,” “possible,” “potential,” “target,” “believe,” “commit,” “intend,” “continue,” “may,” “would,” “could,” “should,” “project,” “projected,” “positioned” or similar expressions is intended to identify forward-looking statements that represent our current judgment about possible future events. We believe these judgments are reasonable, but these statements are not guarantees of any events or financial results, and our actual results may differ materially due to a variety of important factors. Among other items, such factors might include: our ability to realize production efficiencies and to achieve reductions in costs as a result of our restructuring initiatives and labor modifications; our ability to maintain quality control over our vehicles and avoid material vehicle recalls; our ability to maintain adequate liquidity and financing sources and an appropriate level of debt, including as required to fund our planning significant investment in new technology; our ability to realize successful vehicle applications of new technology; and our ability to comply with the continuing requirements related to U.S. and other government support.

GM’s most recent annual report on Form 10-K and quarterly report on Form 10-Q provides information about these and other factors, which we may revise or supplement in future reports to the SEC.

Contacts:

Reneé Rashid-Merem

Office 313.665.3128

Cell 313.701.8560

renee.rashid-merem@gm.com

Randy Arickx

Office 313.667.0006

Cell 313.268.7070

randy.c.arickx@gm.com

|

FORWARD LOOKING STATEMENTS FORWARD LOOKING STATEMENTS In this presentation and in related comments by our management, our use of the words “expect,” “anticipate,” “possible,” “potential,” “target,” “believe,” “commit,” “intend,” “continue,” “may,” “would,” “could,” “should,” “project,” “projected,” “positioned” or similar expressions is intended to identify forward-looking statements that represent our current judgment about possible future events. We believe these judgments are reasonable, but these statements are not guarantees of any events or financial results, and our actual results may differ materially due to a variety of important factors. Among other items, such factors might include: our ability to realize production efficiencies and to achieve reductions in costs as a result of our restructuring initiatives and labor modifications; our ability to maintain quality control over our vehicles and avoid material vehicle recalls; our ability to maintain adequate liquidity and financing sources and an appropriate level of debt, including as required to fund our planning significant investment in new technology; our ability to realize successful vehicle applications of new technology; and our ability to comply with the continuing requirements related to U.S. and other government support. GM's most recent annual report on Form 10-K and quarterly report on Form 10-Q provides information about these and other factors, which we may revise or supplement in future reports to the SEC. |

|

TOM STEPHENS Vice Chairman, Global Product Operations |

|

STEVE GIRSKY Vice Chairman, Corporate Strategy & Business Development |

|

CHRIS LIDDELL Vice Chairman & CFO |

|

THE NEW GENERAL MOTORS THE NEW GENERAL MOTORS World’s Best Vehicles Global Opportunity New Management Approach Financial Flexibility Breakeven at Bottom |

|

WORLD’S BEST VEHICLES WORLD’S BEST VEHICLES Source: Incentive information based on J.D. Power and Associates Power Information Network Data (Syndicated Report) |

|

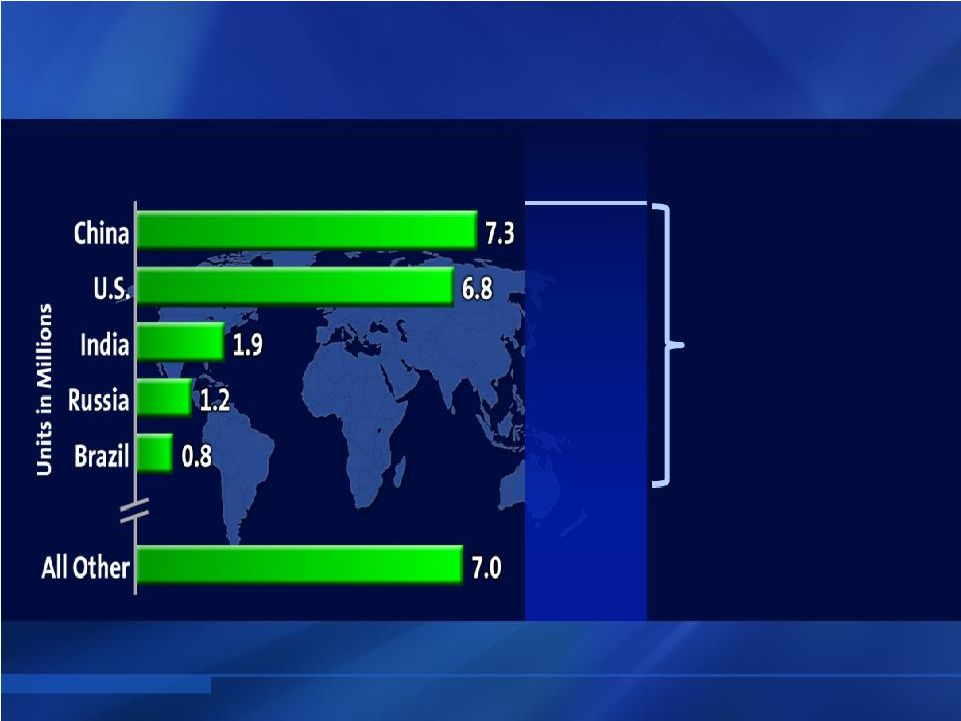

GLOBAL OPPORTUNITY GLOBAL OPPORTUNITY Top 5 Projected Growth Markets 2009-2014E 2009 GM Market Share 13% 20% 3% 10% 19% 8% GM Growth Opportunity 2.6 Million Units Source: Growth Markets per Global Insight 2009 GM Market Share per GM 2009 10-K |

|

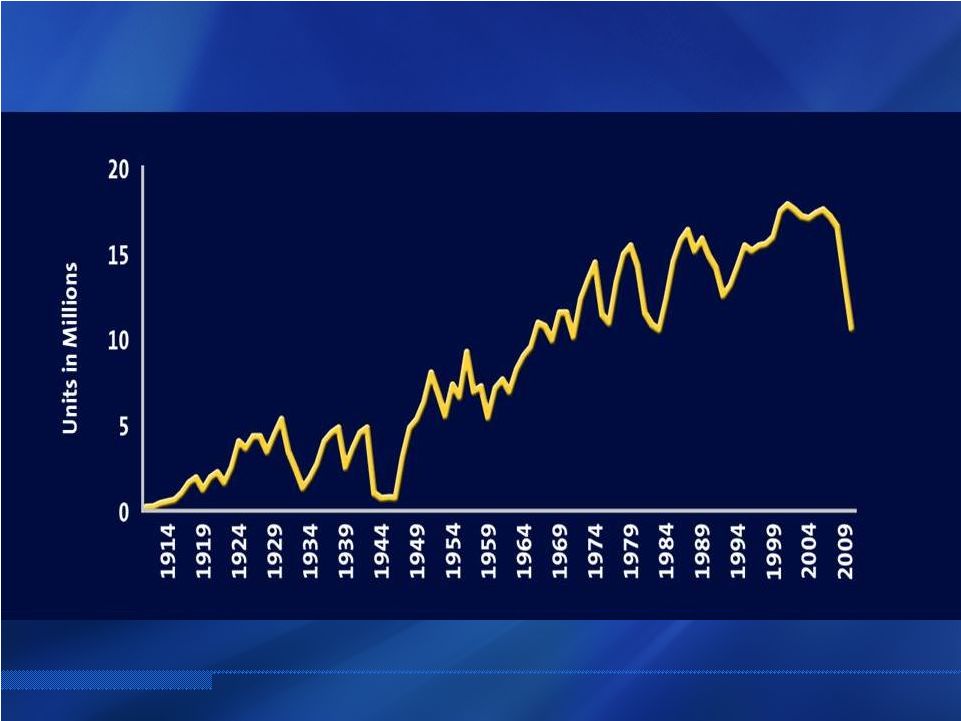

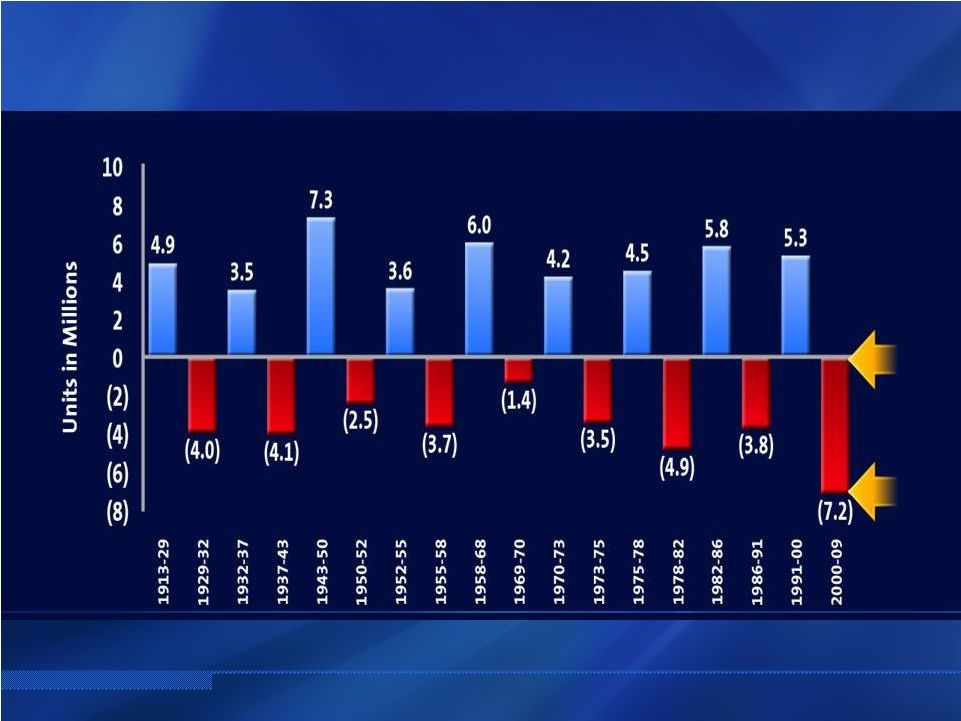

BREAKEVEN AT BOTTOM OF CYCLE BREAKEVEN AT BOTTOM OF CYCLE U.S. Industry |

|

BREAKEVEN AT BOTTOM OF CYCLE BREAKEVEN AT BOTTOM OF CYCLE U.S. Total Auto Sales Peak – Through Swings |

|

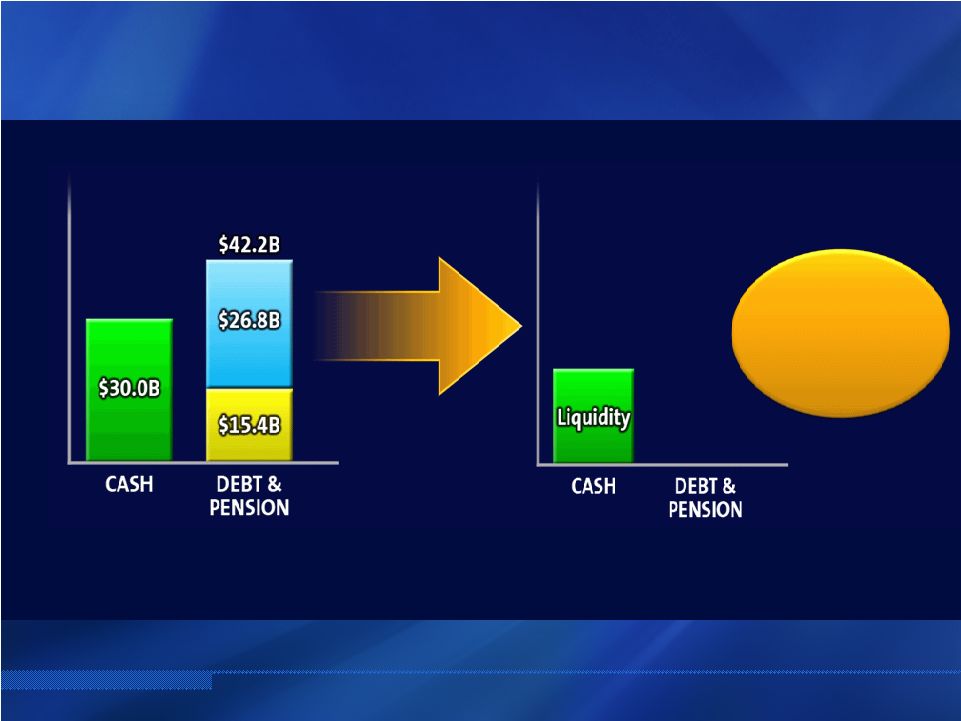

FINANCIAL FLEXIBILITY FINANCIAL FLEXIBILITY 1 Current state reflects GM cash, debt (incl. preferred equity), and pension balances as of 3/31/10 pro forma for pay-down of UST and EDC debt CURRENT STATE 1 FUTURE GOAL Strong Strong Investment Investment Grade Grade |

|

Speed Speed + + Simplicity Simplicity + + Accountability Accountability NEW MANAGEMENT APPROACH NEW MANAGEMENT APPROACH |

|

FORWARD LOOKING STATEMENTS FORWARD LOOKING STATEMENTS In this presentation and in related comments by our management, our use of the words “expect,” “anticipate,” “possible,” “potential,” “target,” “believe,” “commit,” “intend,” “continue,” “may,” “would,” “could,” “should,” “project,” “projected,” “positioned” or similar expressions is intended to identify forward-looking statements that represent our current judgment about possible future events. We believe these judgments are reasonable, but these statements are not guarantees of any events or financial results, and our actual results may differ materially due to a variety of important factors. Among other items, such factors might include: our ability to realize production efficiencies and to achieve reductions in costs as a result of our restructuring initiatives and labor modifications; our ability to maintain quality control over our vehicles and avoid material vehicle recalls; our ability to maintain adequate liquidity and financing sources and an appropriate level of debt, including as required to fund our planning significant investment in new technology; our ability to realize successful vehicle applications of new technology; and our ability to comply with the continuing requirements related to U.S. and other government support. GM's most recent annual report on Form 10-K and quarterly report on Form 10-Q provides information about these and other factors, which we may revise or supplement in future reports to the SEC. |

|

ED WHITACRE Chairman & CEO |

|

TIM LEE President, GM International Operations JAIME ARDILA President, GM South America |

|

GM’s fastest growing regions GM’s fastest growing regions |

|

of global automotive industry growth through of global automotive industry growth through 2014 to come from BRIC countries 2014 to come from BRIC countries 45% 45% Source: Global Insight 2009-2014 |

|

GROWTH OPPORTUNITIES WITHIN EMERGING GROWTH OPPORTUNITIES WITHIN EMERGING MARKETS MARKETS China 51% India 2% Other Asia 4% Brazil 17% Other South America 8% Russia 4% Africa 4% Middle East 4% Australia & New Zealand 3% CIS 3% BRIC 74% South America 25% CIS includes: Uzbekistan, Ukraine & Kazakhstan 2009 GM SALES VOLUME |

|

THREE-PRONG PRODUCT STRATEGY THREE-PRONG PRODUCT STRATEGY PARTNER COLLABORATION 3 Chevrolet New Sail Wuling Rong Guang GLOBAL ARCHITECTURES 1 Buick LaCrosse Chevrolet Cruze Chevrolet Aveo RS Chevrolet Spark REGIONAL SOLUTIONS 2 Chevrolet Classic Chevrolet Agile Chevrolet Montana |

|

Key to GM’s Sustainable Growth Emerging Markets |

|

NICK REILLY President, GM Europe and Chairman, Management Board of Opel/Vauxhall |

|

MARK JAMES Vice President and CFO, Opel/Vauxhall Europe |

|

TURNAROUND STARTS WITH EXCELLENT TURNAROUND STARTS WITH EXCELLENT PRODUCTS PRODUCTS |

|

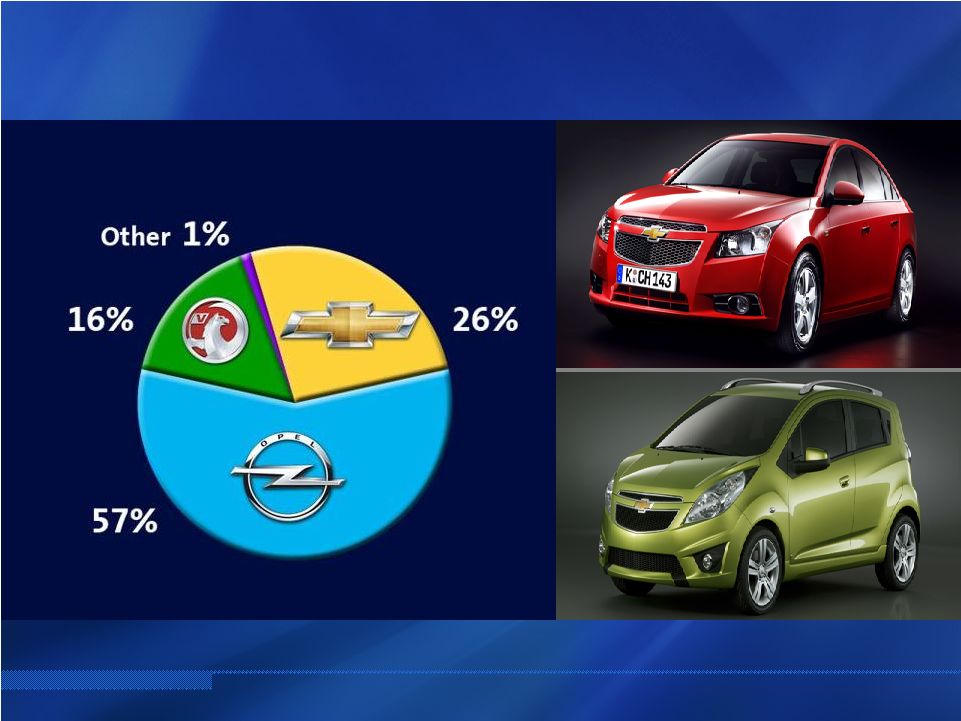

CHEVROLET IS A GROWING PART OF CHEVROLET IS A GROWING PART OF EUROPEAN SALES EUROPEAN SALES GME 2009 SALES VOLUME |

|

GM EUROPE RESTRUCTURING GM EUROPE RESTRUCTURING RESTRUCTURING ELEMENTS RESTRUCTURING ELEMENTS Antwerp facility closure Antwerp facility closure Other separation savings Other separation savings Employee concessions Employee concessions Other restructuring savings Other restructuring savings Lower Breakeven |

|

INDUSTRY GROWTH INDUSTRY GROWTH Source: Global Insight WESTERN & CENTRAL EUROPE EASTERN EUROPE CY 2010 Outlook: 15.6M CY 2014 Outlook: 18.9M CY 2010 Outlook: 1.9M CY 2014 Outlook: 3.3M 20% 70% |

|

CONTINUED PRODUCT OFFENSIVE CONTINUED PRODUCT OFFENSIVE 14 Launches through 2014 13 Launches through 2014 |

|

Product Product Offensive Offensive + + Restructuring Restructuring Measures Measures = Breakeven in 2011… Significant profits as markets recover |

|

MARK REUSS President, GM North America |

|

BREAKEVEN REDUCED BREAKEVEN REDUCED TRANSACTION PRICES LABOR COST CAPACITY UTILIZATION 85% |

|

LAUNCH PRODUCT PERFORMANCE LAUNCH PRODUCT PERFORMANCE Share of Segment Transaction Price Residuals Incentives Consideration Q1 2010 vs Q1 2009 CADILLAC SRX CADILLAC SRX CHEVROLET CHEVROLET EQUINOX EQUINOX GMC TERRAIN GMC TERRAIN BUICK LACROSSE BUICK LACROSSE |

|

U.S. INDUSTRY OUTLOOK U.S. INDUSTRY OUTLOOK 2010 – 2014 CY 2010 Outlook: 12.0M CY 2014 Outlook: 17.5M PROJECTED GROWTH 45% Source: Global Insight |

|

CONTINUED PRODUCT OFFENSIVE CONTINUED PRODUCT OFFENSIVE |

|

¶ Retain strong performers ¶ Strategically align franchise points ¶ Support facility improvements ¶ Improved sales, share and profitability U.S. DEALER STRATEGY U.S. DEALER STRATEGY |