- GM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

General Motors (GM) 8-KOther Events

Filed: 9 Sep 11, 12:00am

Exhibit 99.1

Exhibit 99.1

Steve Girsky

Vice Chairman, General Motors

FORWARD LOOKING STATEMENTS

In this presentation and in related comments by our management, our use of the words “expect,” “anticipate,” “possible,” “potential,” “target,” “believe,” “commit,” “intend,” “continue,” “may,” “would,” “could,” “should,” “project,” “projected,” “positioned” or similar expressions is intended to identify forward looking statements that represent our current judgment about possible future events. We believe these judgments are reasonable, but these statements are not guarantees of any events or financial results, and our actual results may differ materially due to a variety of important factors. Among other items, such factors might include: our ability to realize production efficiencies and to achieve reductions in costs as a result of our restructuring initiatives and labor modifications; our ability to maintain quality control over our vehicles and avoid material vehicle recalls; our suppliers’ ability to deliver parts, systems and components at such times to allow us to meet production schedules; our ability to maintain adequate liquidity and financing sources and an appropriate level of debt, including as required to fund our planned significant investment in new technology; our ability to realize successful vehicle applications of new technology; and our ability to continue to attract new customers, particularly for our new products.

GM’s most recent annual report on Form 10-K and quarterly reports on Form 10-Q provides information about these and other factors, which we may revise or supplement in future reports to the SEC.

New GM

Corporate Strategy

Update on GM Ventures

NEW GM

New Business Model

Leverage to Global Growth

Significantly Lower Risk Profile

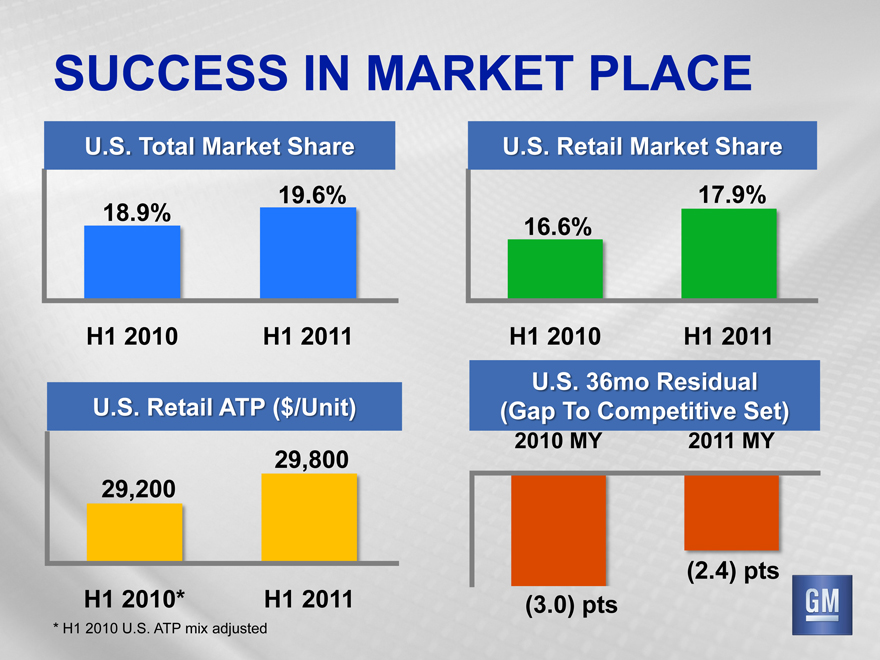

SUCCESS IN MARKET PLACE

U.S. Total Market Share

18.9%

19.6%

H1 2010

H1 2011

U.S. Retail ATP ($/Unit)

29,200

29,800

H1 2010*

H1 2011

U.S. Retail Market Share

16.6%

17.9%

H1 2010

H1 2011

U.S. 36mo Residual (Gap To Competitive Set)

2010 MY 2011 MY

(3.0) pts

(2.4) pts

* H1 2010 U.S. ATP mix adjusted

Everything Starts & Ends with Great Products

Everything Starts & Ends with Great Products

Everything Starts & Ends with Great Products

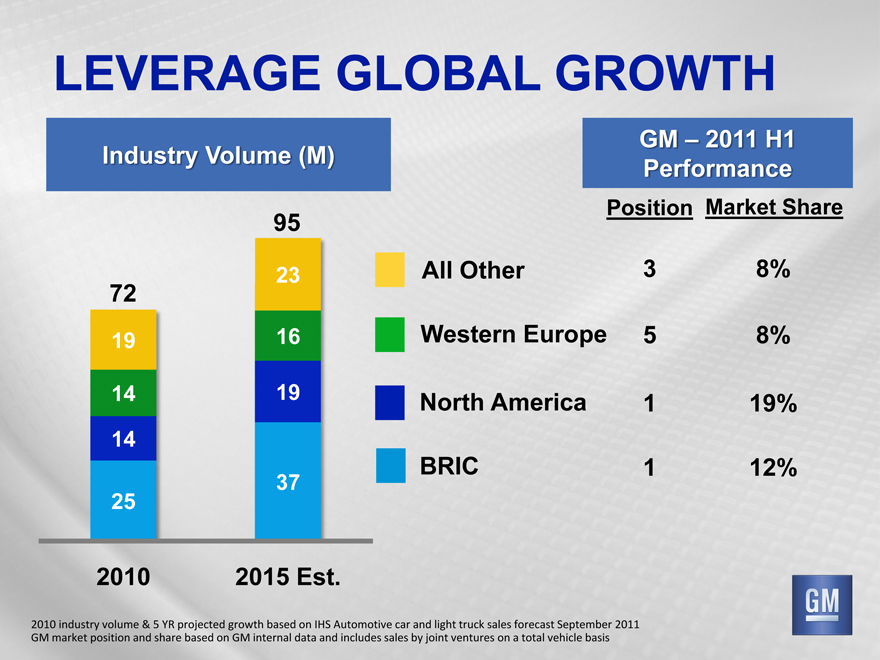

LEVERAGE GLOBAL GROWTH

Industry Volume (M)

72

19

14

14

25

2010

95

23

16

19

37

2015 Est.

GM – 2011 H1 Performance

Position Market Share

All Other 3 8%

Western Europe 5 8%

North America 1 19%

BRIC 1 12%

2010 industry volume & 5 YR projected growth based on IHS Automotive car and light truck sales forecast September 2011

GM market position and share based on GM internal data and includes sales by joint ventures on a total vehicle basis

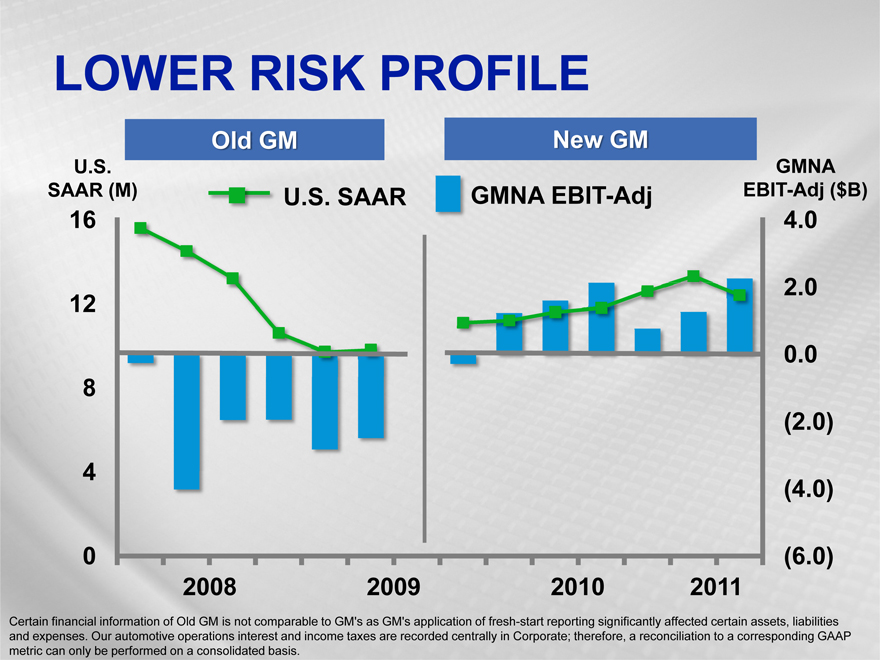

LOWER RISK PROFILE

Old GM

New GM

U.S.

SAAR (M)

16

12

8

4

0

U.S. SAAR

GMNA EBIT-Adj

2008 2009 2010 2011

GMNA EBIT-Adj ($B)

4.0

2.0

0.0

(2.0)

(4.0)

(6.0)

Certain financial information of Old GM is not comparable to GM’s as GM’s application of fresh-start reporting significantly affected certain assets, liabilities and expenses. Our automotive operations interest and income taxes are recorded centrally in Corporate; therefore, a reconciliation to a corresponding GAAP metric can only be performed on a consolidated basis.

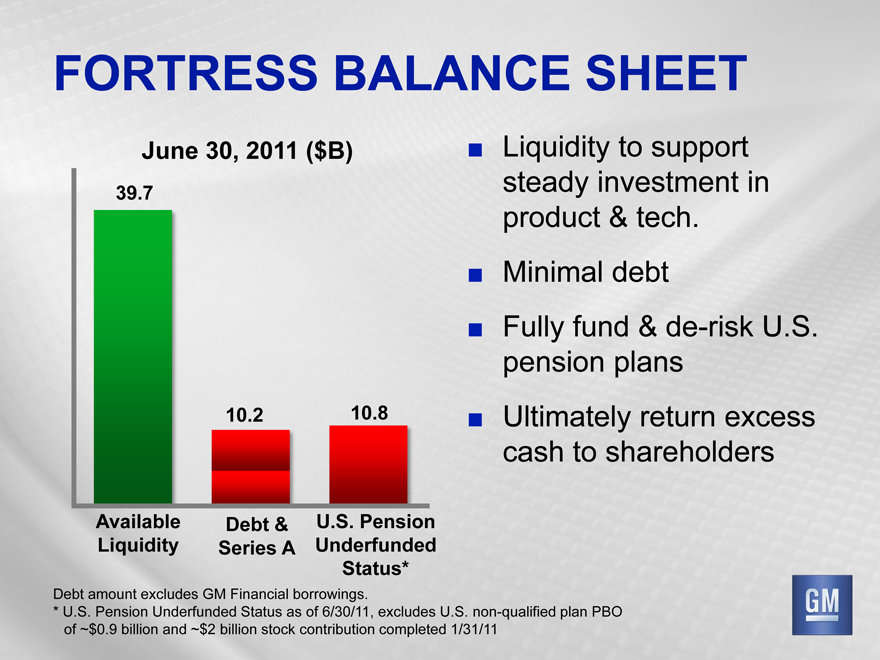

FORTRESS BALANCE SHEET

June 30, 2011 ($B)

39.7

10.2

10.8

Available

Liquidity

Debt &

Series A

U.S. Pension

Underfunded

Status*

• Liquidity to support steady investment in product & tech.

• Minimal debt

• Fully fund & de-risk U.S. pension plans

• Ultimately return excess cash to shareholders

Debt amount excludes GM Financial borrowings.

* U.S. Pension Underfunded Status as of 6/30/11, excludes U.S. non-qualified plan PBO of ~$0.9 billion and ~$2 billion stock contribution completed 1/31/11

THE FUTURE OF PERSONAL

TRANSPORTATION

• Consumers will still need mobility products & services

• World is getting increasingly crowded, dirty and resource constrained

• Competition is intensifying from a number of different places

CORPORATE STRATEGY

• Leverage strengths to provide wide range of automotive solutions to meet different global customer needs

• Build profitability into existing business to fund growth opportunities

• Reallocate capital to drive growth, innovative technology, products, services and business models that will differentiate GM in future

• Utilize collaborative partnerships to access markets and expedite technology development

GM VENTURES INVESTMENT SECTORS

Automotive Cleantech

e.g., EV and fuel cell technology, smart grid…

Infotainment

e.g., vehicle HMI, in-vehicle advertising…

Smart Materials

e.g., lightweight materials, eco-friendly materials…

Value Chain/Business Model

e.g., secondary battery use…

Other Game-Changing Technologies

e.g., inductive charging…

Coskata • Mascoma • Bright Automotive • Satkti3

Powermat • Envia Systems • Proterra • Sunlogics