- GM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

General Motors (GM) 8-KNew Labor Agreement Enables GM’s Continued Progress

Filed: 30 Sep 11, 12:00am

General Motors Company 2011 GM-UAW Labor Agreement September 28, 2011 Exhibit 99.2 |

Forward Looking Statements In this presentation and in related comments by our management, our use of the words “expect,” “anticipate,” “possible,” “potential,” “target,” “believe,” “commit,” “intend,” “continue,” “may,” “would,” “could,” “should,” “project,” “projected,” “positioned” or similar expressions is intended to identify forward looking statements that represent our current judgment about possible future events. We believe these judgments are reasonable, but these statements are not guarantees of any events or financial results, and our actual results may differ materially due to a variety of important factors. Among other items, such factors might include: our ability to realize production efficiencies and to achieve reductions in costs as a result of our restructuring initiatives and labor modifications; our ability to maintain quality control over our vehicles and avoid material vehicle recalls; our suppliers’ ability to deliver parts, systems and components at such times to allow us to meet production schedules; our ability to maintain adequate liquidity and financing sources and an appropriate level of debt, including as required to fund our planned significant investment in new technology; our ability to realize successful vehicle applications of new technology; and our ability to continue to attract new customers, particularly for our new products. GM's most recent annual report on Form 10-K and quarterly report on Form 10-Q provides information about these and other factors, which we may revise or supplement in future reports to the SEC. 1 |

Key Takeaways 2 • Maintained GMNA break-even point • Minimal P & L impact • Protected our balance sheet • Increased flexibility to add U.S. jobs |

2011 GM-UAW Agreement Overview • Key non-compensation items – Entry Level transitioned to Defined Contribution pension plan – No pension increases – Permanent elimination of “JOBs Bank” – Special Attrition Program (SAP) for skilled trades – Elimination of Legal Services Plan for active / retiree • Key compensation items – Entry Level maximum wage rates increased – No base wage increase for Tier I employees – Cost of living (COLA) still suspended – Lump sums and larger ratification bonus in lieu of base wage increases – Gain sharing plan linked to quality – Simplified and transparent profit sharing formula, which is capped • Strategic investment in U.S manufacturing 3 |

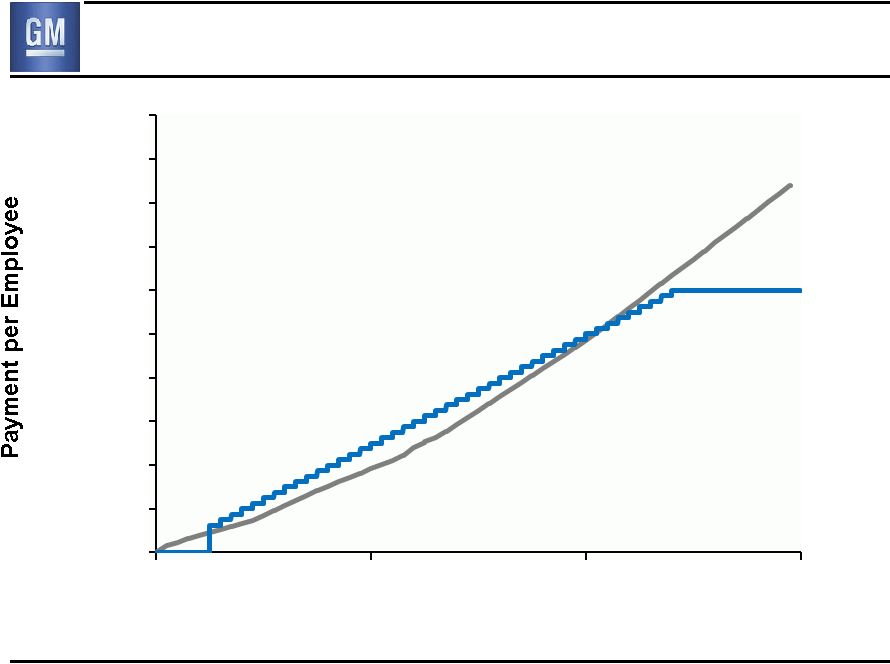

Profit Sharing Comparison New (Capped) Old* (Not Capped) 4 * Estimate based on U.S. eligible profits as defined by old plan $- $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 $18,000 $20,000 0 5 10 15 GMNA EBIT Adjusted ($B) |

U.S. Hourly Workforce Demographics 5 % of U.S. Hourly Workforce Production Skilled Total Retirement Eligible – All Types Memo: - Detroit Competitors 34% 58% 39% 17% Data as of 12/31/2010, Hourly Workforce Demographics Study • $10K retirement incentive for all eligible employees who retire between October 1, 2011 and September 1, 2013 • Special Attrition Program for skilled trades – Incremental $65K retirement incentive if retired by March 31, 2012 |

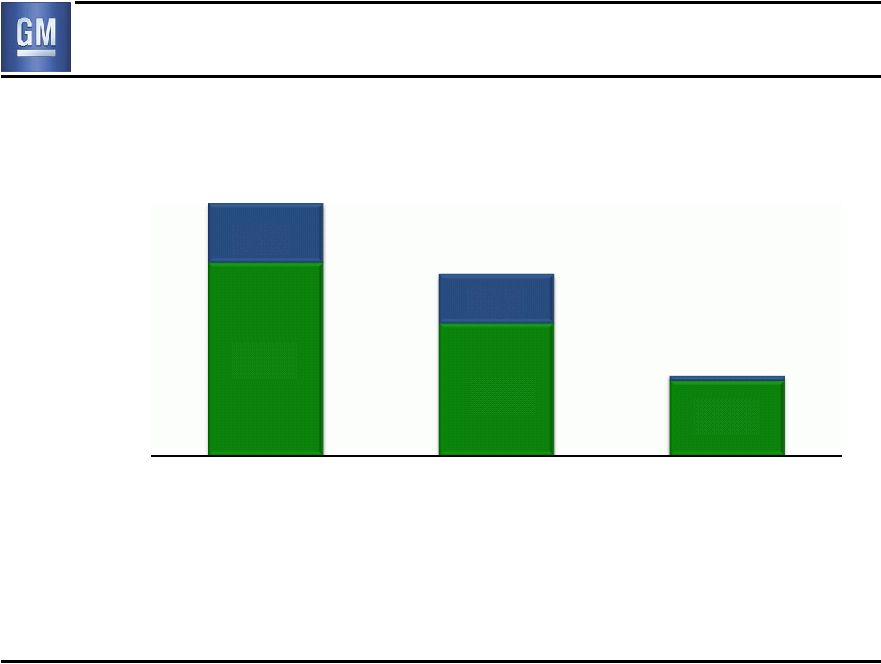

U.S. Hourly Labor Cost Historical Perspective $16B $5B $11B Retiree Healthcare Active Year-End U.S. Hourly Employees (000’s) 111 49 78 6 For periods prior to July 10, 2009 information is related to General Motors Corporation (Old GM), our predecessor entity $4B $12B $8B $5B $3B 2005 2007 2010 |

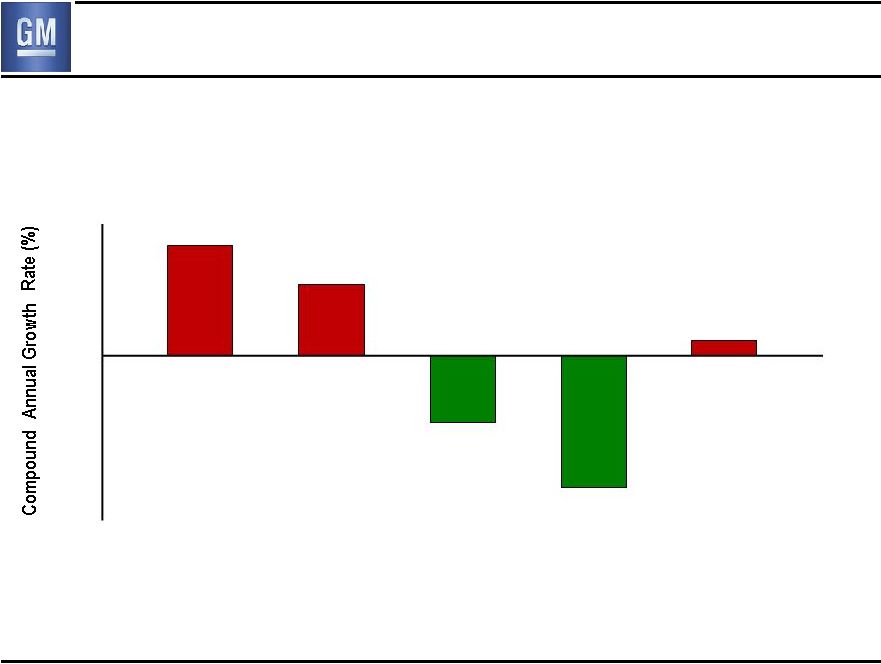

Historic GM-UAW Contract Settlement Economics ‘99 ‘03 Fully Loaded Active Hourly Rate CAGR 7 For periods prior to July 10, 2009 information is related to General Motors Corporation (Old GM), our predecessor entity 6% 8% -10% -8% -6% -4% -2% 0% 2% 4% 7% 4% (4)% (8)% 1% ‘07 ‘09 ‘11 |

Estimated Expense Impact 8 $ Millions F / (U) 2011 CY 2012 CY 2013 CY Compensation Related Impact * (135) (220) (230) Special Attrition Program (Skilled Trades) (90) 55 65 Elimination of Legal Service ** 50 145 145 Estimated Expense Impact (175) (20) (20) * Includes ratification bonus, lump sum payments, tier II wage increase, profit sharing, and layoff provisions ** Impact from elimination ends in 2013 |

Key Takeaways 9 • Maintained GMNA break-even point • Minimal P & L impact • Protected our balance sheet • Increased flexibility to add U.S. jobs |