General Motors Company CY 2011 Results February 16, 2012 Exhibit 99.2

Forward Looking Statements In this presentation and in related comments by our management, our use of the words “expect,” “anticipate,” “possible,” “potential,” “target,” “believe,” “commit,” “intend,” “continue,” “may,” “would,” “could,” “should,” “project,” “projected,” “positioned,” “outlook” or similar expressions is intended to identify forward looking statements that represent our current judgment about possible future events. We believe these judgments are reasonable, but these statements are not guarantees of any events or financial results, and our actual results may differ materially due to a variety of important factors. Among other items, such factors might include: our ability to realize production efficiencies and to achieve reductions in costs as a result of our restructuring initiatives and labor modifications; our ability to maintain quality control over our vehicles and avoid material vehicle recalls; our suppliers’ ability to deliver parts, systems and components at such times to allow us to meet production schedules; our ability to maintain adequate financing sources, including as required to fund our planned significant investment in new technology; our ability to realize successful vehicle applications of new technology; and our ability to continue to attract new customers, particularly for our new products. GM's most recent annual report on Form 10-K provides information about these and other factors, which we may revise or supplement in future reports to the SEC. 1

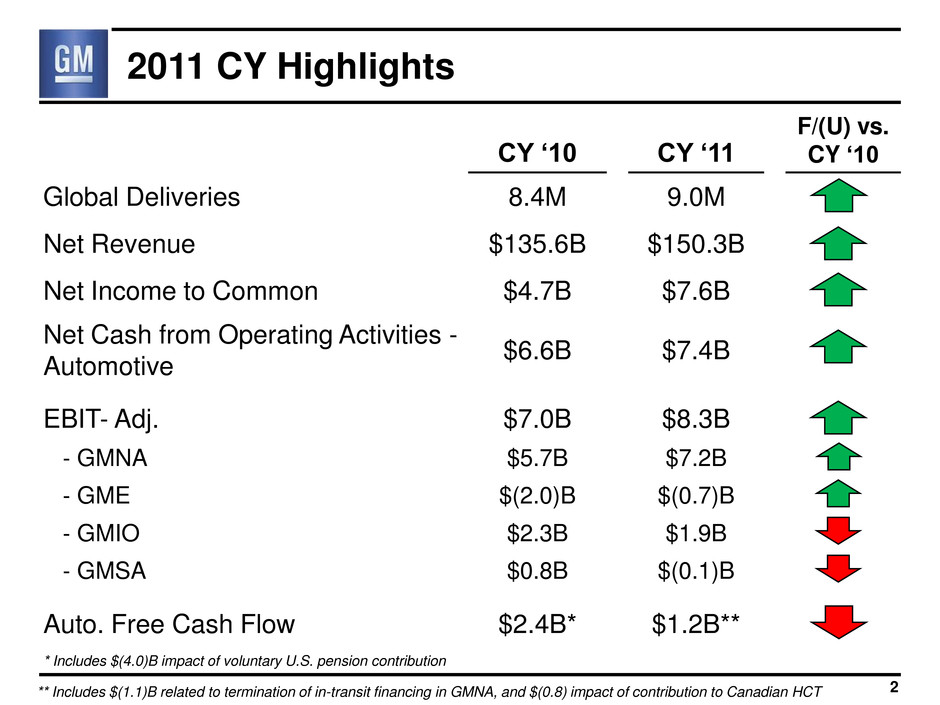

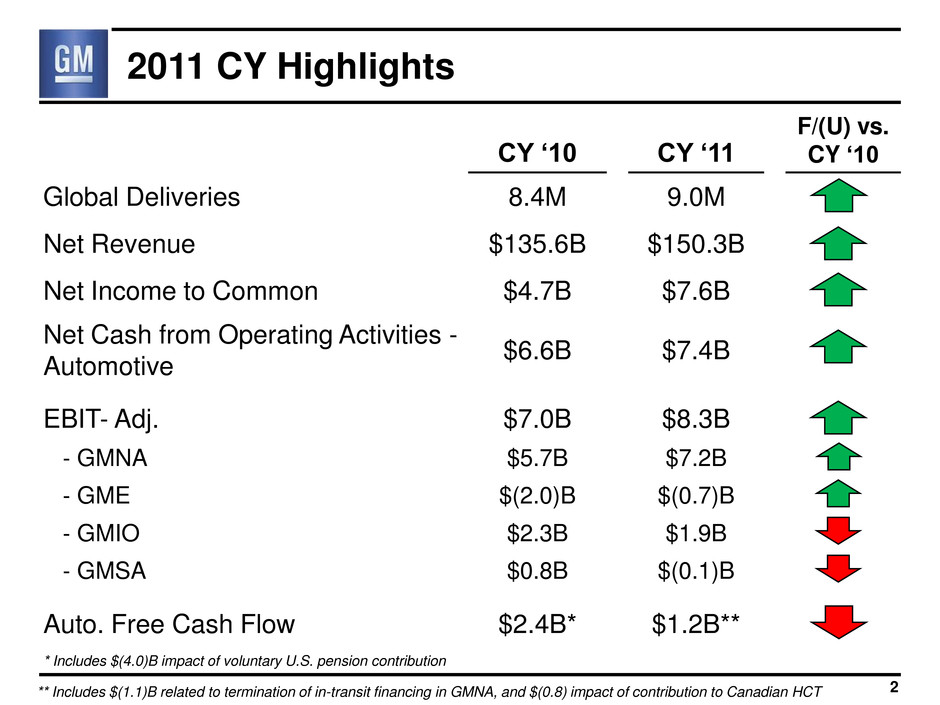

2011 CY Highlights 2 CY ‘10 CY ‘11 F/(U) vs. CY ‘10 Global Deliveries 8.4M 9.0M Net Revenue $135.6B $150.3B Net Income to Common $4.7B $7.6B Net Cash from Operating Activities - Automotive $6.6B $7.4B EBIT- Adj. $7.0B $8.3B - GMNA $5.7B $7.2B - GME $(2.0)B $(0.7)B - GMIO $2.3B $1.9B - GMSA $0.8B $(0.1)B Auto. Free Cash Flow $2.4B* $1.2B** * Includes $(4.0)B impact of voluntary U.S. pension contribution ** Includes $(1.1)B related to termination of in-transit financing in GMNA, and $(0.8) impact of contribution to Canadian HCT

Fourth Quarter Highlights • Chevrolet celebrates 100th birthday with record global annual sales for 2011 • Establishment of Canadian Health Care Trust • Named new GME President – appointed new chairman and 3 other top GM leaders to the Opel Supervisory Board • Important product announcements – – Chevrolet Malibu – Cadillac XTS sedan – CUE (Cadillac User Experience) infotainment system • Other upcoming launches – – Cadillac ATS – Chevrolet Spark – Buick Encore 3

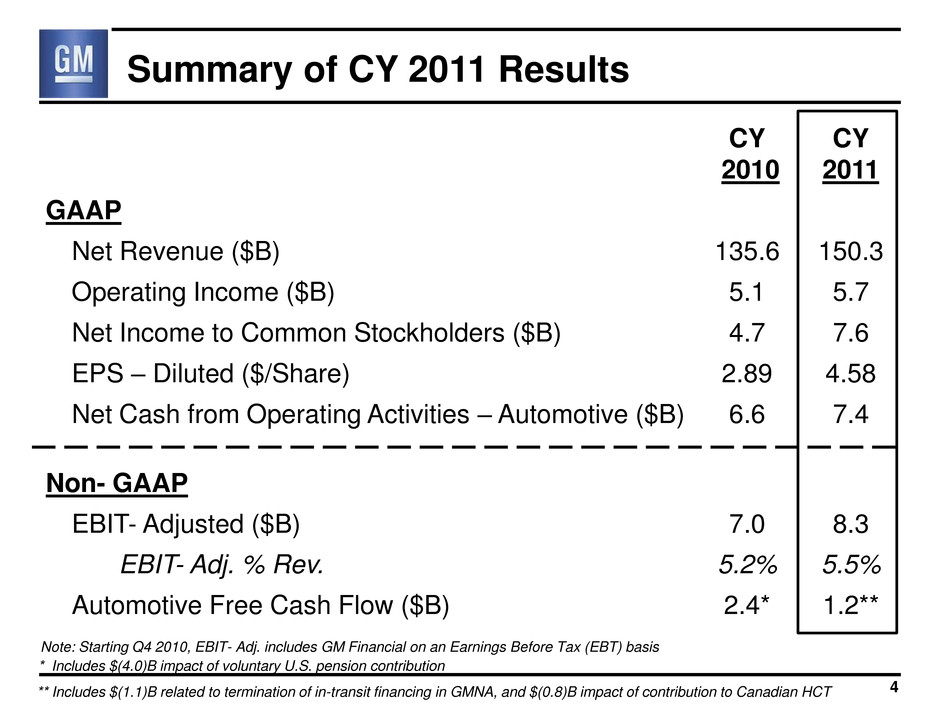

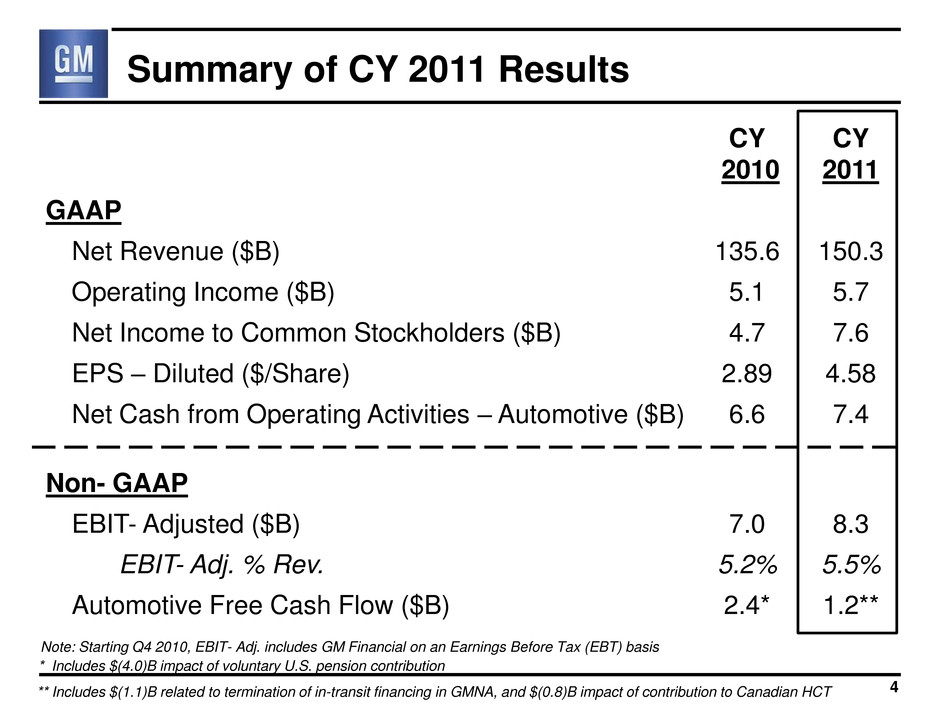

CY 2010 CY 2011 GAAP Net Revenue ($B) 135.6 150.3 Operating Income ($B) 5.1 5.7 Net Income to Common Stockholders ($B) 4.7 7.6 EPS – Diluted ($/Share) 2.89 4.58 Net Cash from Operating Activities – Automotive ($B) 6.6 7.4 Non- GAAP EBIT- Adjusted ($B) 7.0 8.3 EBIT- Adj. % Rev. 5.2% 5.5% Automotive Free Cash Flow ($B) 2.4* 1.2** Summary of CY 2011 Results 4 Note: Starting Q4 2010, EBIT- Adj. includes GM Financial on an Earnings Before Tax (EBT) basis * Includes $(4.0)B impact of voluntary U.S. pension contribution ** Includes $(1.1)B related to termination of in-transit financing in GMNA, and $(0.8)B impact of contribution to Canadian HCT

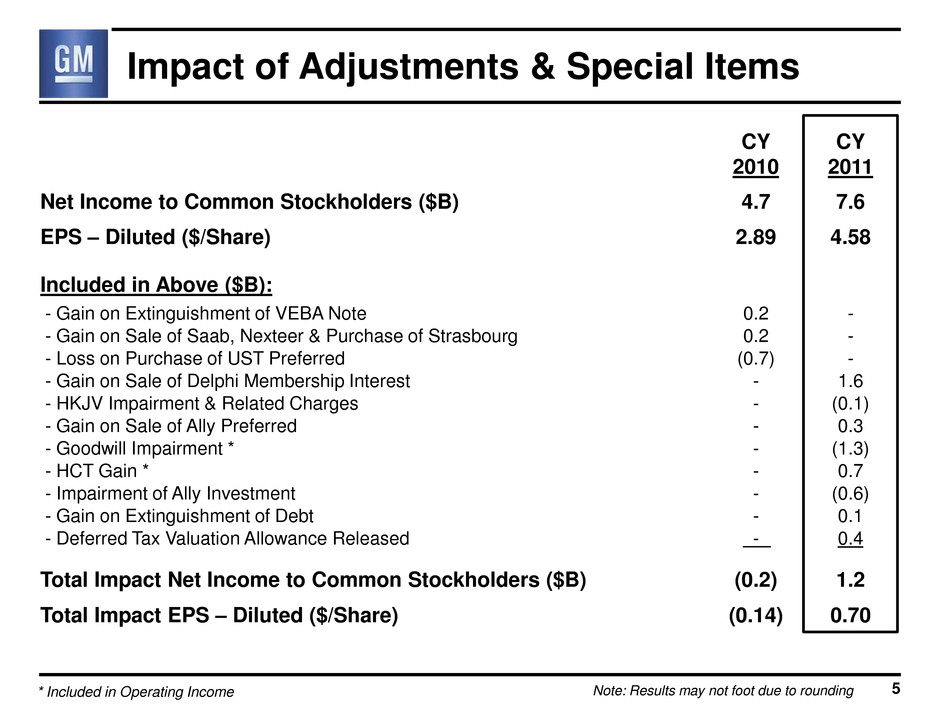

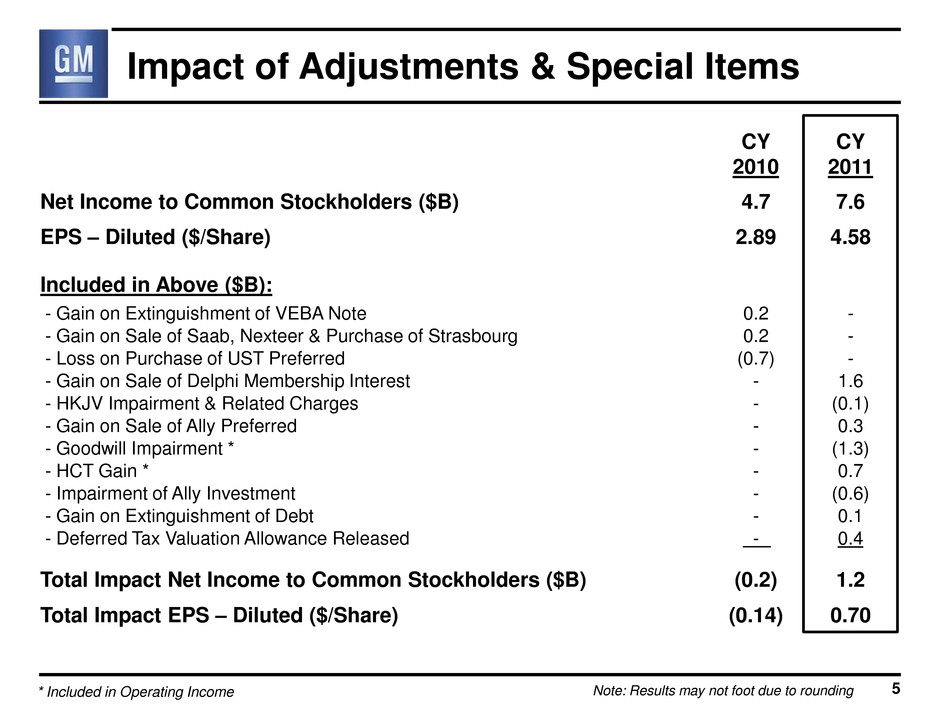

CY 2010 CY 2011 Net Income to Common Stockholders ($B) 4.7 7.6 EPS – Diluted ($/Share) 2.89 4.58 Included in Above ($B): - Gain on Extinguishment of VEBA Note 0.2 - - Gain on Sale of Saab, Nexteer & Purchase of Strasbourg 0.2 - - Loss on Purchase of UST Preferred (0.7) - - Gain on Sale of Delphi Membership Interest - 1.6 - HKJV Impairment & Related Charges - (0.1) - Gain on Sale of Ally Preferred - 0.3 - Goodwill Impairment * - (1.3) - HCT Gain * - 0.7 - Impairment of Ally Investment - (0.6) - Gain on Extinguishment of Debt - 0.1 - Deferred Tax Valuation Allowance Released - 0.4 Total Impact Net Income to Common Stockholders ($B) (0.2) 1.2 Total Impact EPS – Diluted ($/Share) (0.14) 0.70 Note: Results may not foot due to rounding Impact of Adjustments & Special Items * Included in Operating Income 5

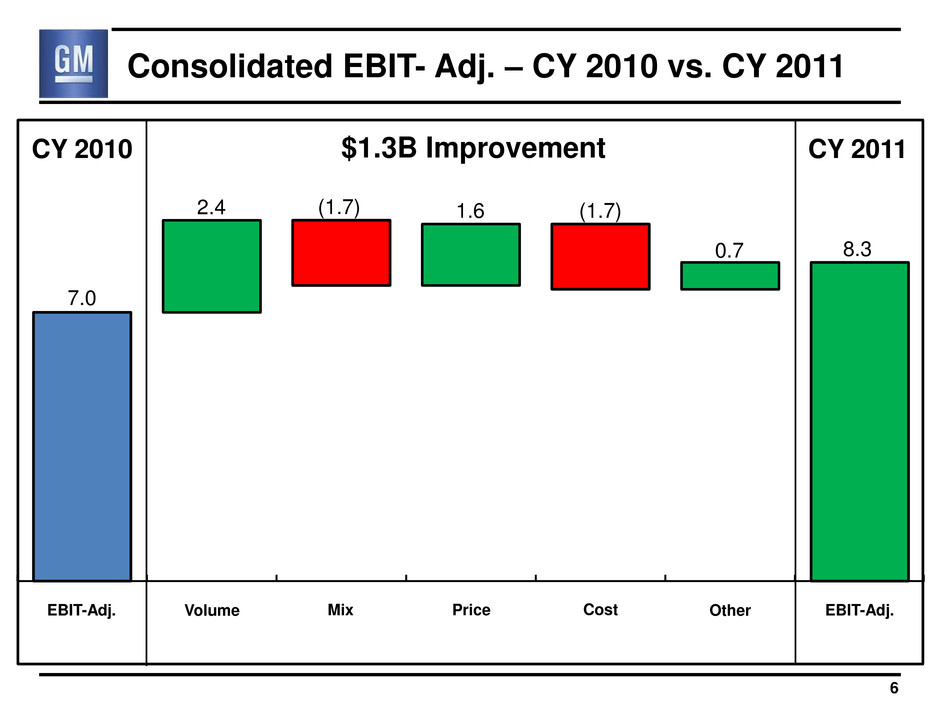

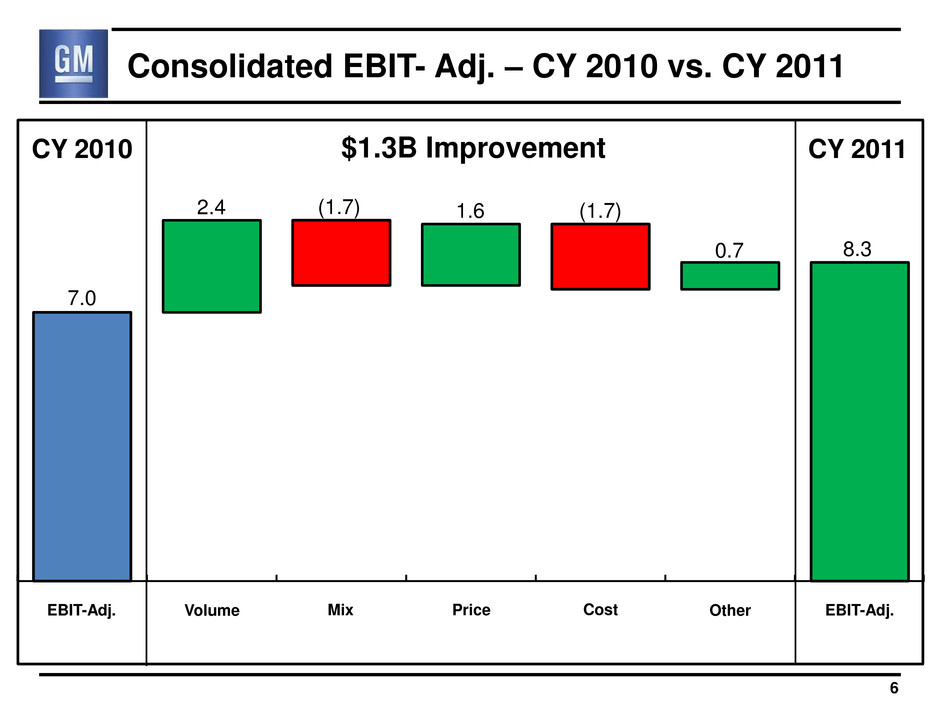

Consolidated EBIT- Adj. – CY 2010 vs. CY 2011 CY 2010 CY 2011 $1.3B Improvement EBIT-Adj. EBIT-Adj. 2.4 1.6 (1.7) 0.7 Volume Price Cost Other 7.0 8.3 6 (1.7) Mix

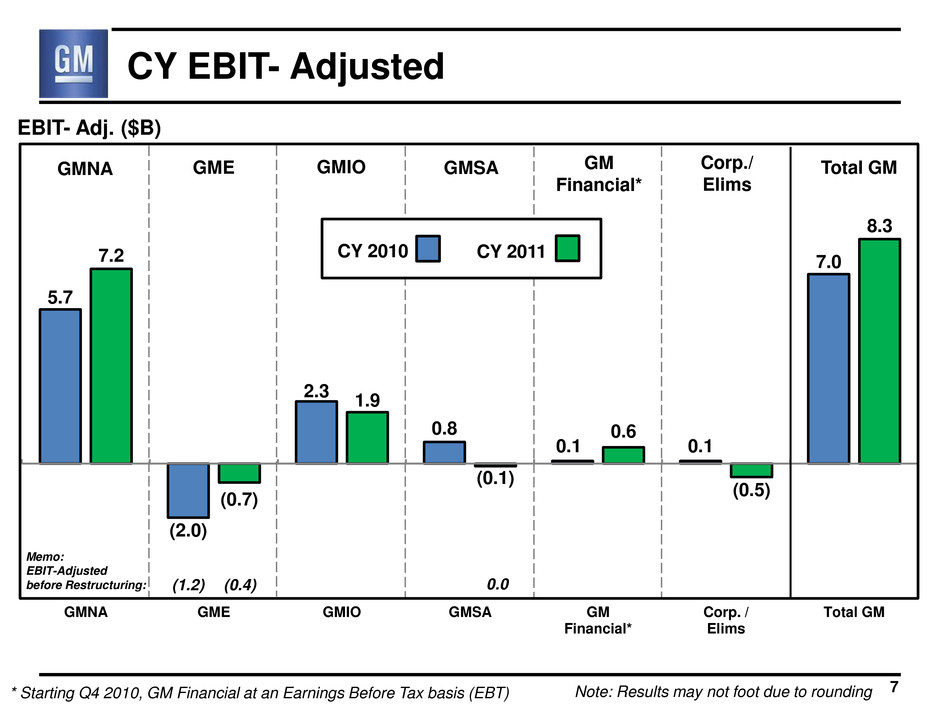

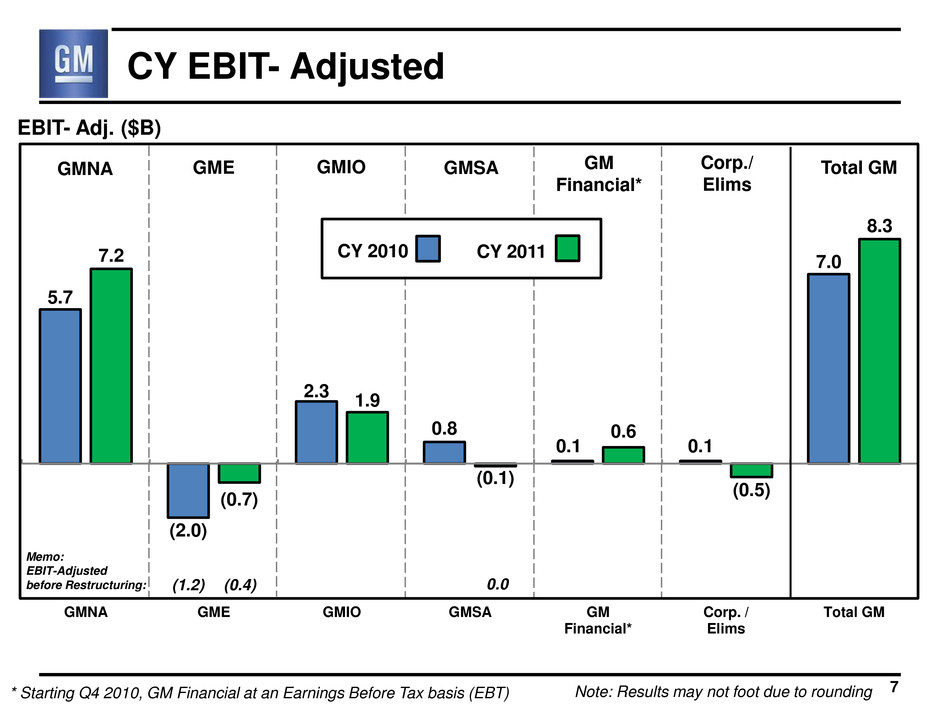

5.7 (2.0) 2.3 0.8 0.1 0.1 7.0 7.2 (0.7) 1.9 (0.1) 0.6 (0.5) 8.3 GMNA GME GMIO GMSA GM Financial* Corp. / Elims Total GM CY EBIT- Adjusted EBIT- Adj. ($B) GMNA GME GMIO GMSA GM Financial* Corp./ Elims Total GM CY 2010 CY 2011 Note: Results may not foot due to rounding 7 * Starting Q4 2010, GM Financial at an Earnings Before Tax basis (EBT) Memo: EBIT-Adjusted before Restructuring: (1.2) (0.4) 0.0

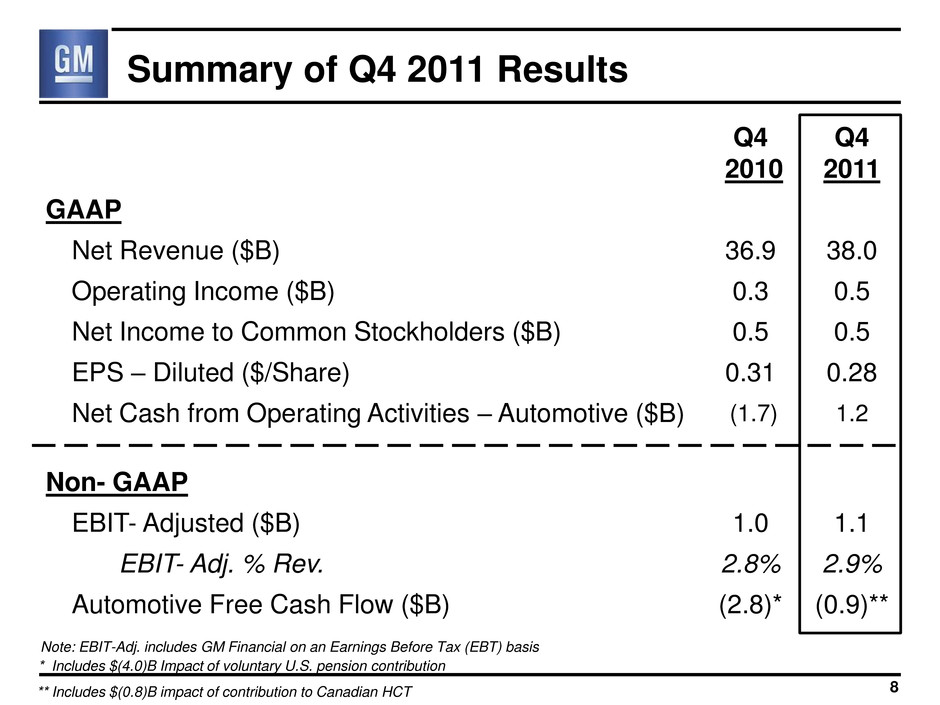

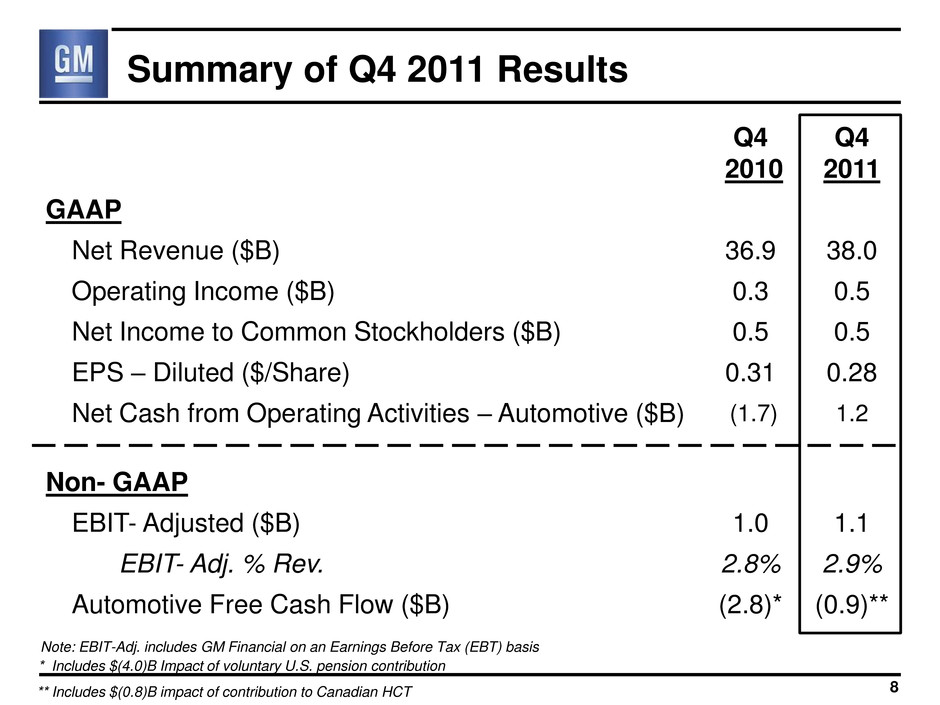

Q4 2010 Q4 2011 GAAP Net Revenue ($B) 36.9 38.0 Operating Income ($B) 0.3 0.5 Net Income to Common Stockholders ($B) 0.5 0.5 EPS – Diluted ($/Share) 0.31 0.28 Net Cash from Operating Activities – Automotive ($B) (1.7) 1.2 Non- GAAP EBIT- Adjusted ($B) 1.0 1.1 EBIT- Adj. % Rev. 2.8% 2.9% Automotive Free Cash Flow ($B) (2.8)* (0.9)** Summary of Q4 2011 Results 8 Note: EBIT-Adj. includes GM Financial on an Earnings Before Tax (EBT) basis * Includes $(4.0)B Impact of voluntary U.S. pension contribution ** Includes $(0.8)B impact of contribution to Canadian HCT

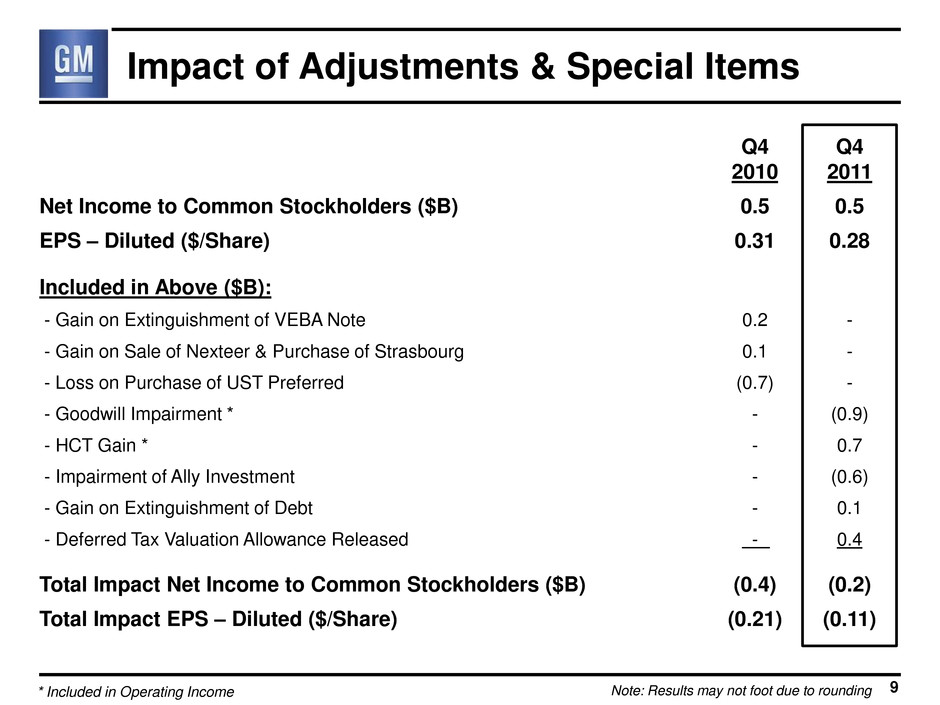

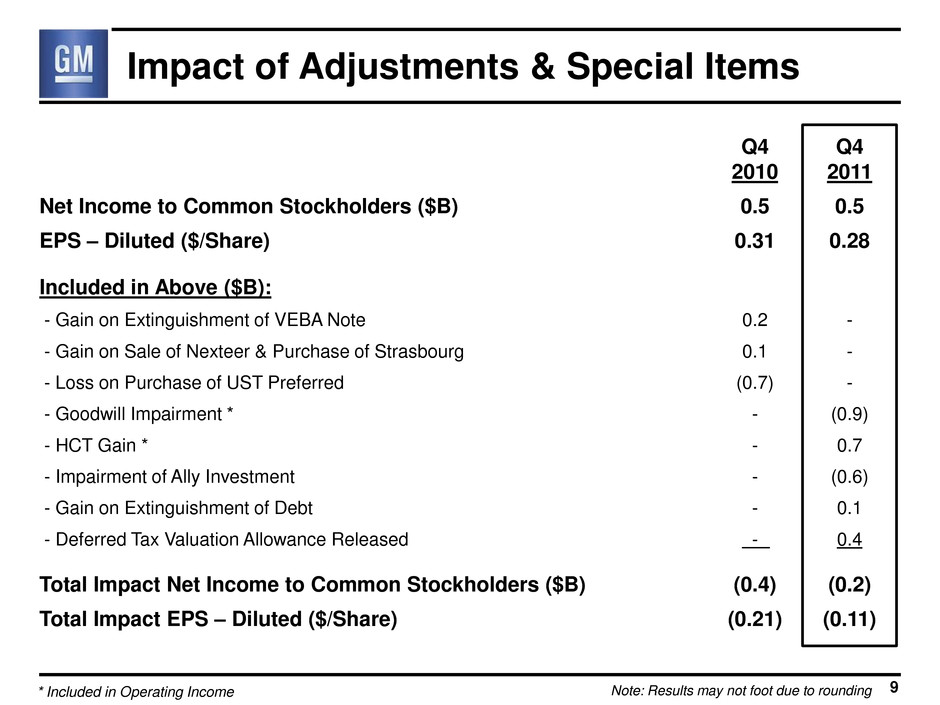

9 Q4 2010 Q4 2011 Net Income to Common Stockholders ($B) 0.5 0.5 EPS – Diluted ($/Share) 0.31 0.28 Included in Above ($B): - Gain on Extinguishment of VEBA Note 0.2 - - Gain on Sale of Nexteer & Purchase of Strasbourg 0.1 - - Loss on Purchase of UST Preferred (0.7) - - Goodwill Impairment * - (0.9) - HCT Gain * - 0.7 - Impairment of Ally Investment - (0.6) - Gain on Extinguishment of Debt - 0.1 - Deferred Tax Valuation Allowance Released - 0.4 Total Impact Net Income to Common Stockholders ($B) (0.4) (0.2) Total Impact EPS – Diluted ($/Share) (0.21) (0.11) Note: Results may not foot due to rounding Impact of Adjustments & Special Items * Included in Operating Income

0.8 (0.6) 0.3 0.2 0.1 0.2 1.0 1.5 (0.6) 0.4 (0.2) 0.2 (0.2) 1.1 GMNA GME GMIO GMSA GM Financial* Corp. / Elims EBIT- Adj. EBIT- Adj. ($B) GMNA GME GMIO GMSA GM Financial* Corp./ Elims Total GM Q4 2010 Q4 2011 Note: Results may not foot due to rounding 10 Q4 EBIT- Adjusted * GM Financial at an Earnings Before Tax basis (EBT) Memo: EBIT-Adjusted before Restructuring: (0.5) (0.4) (0.1)

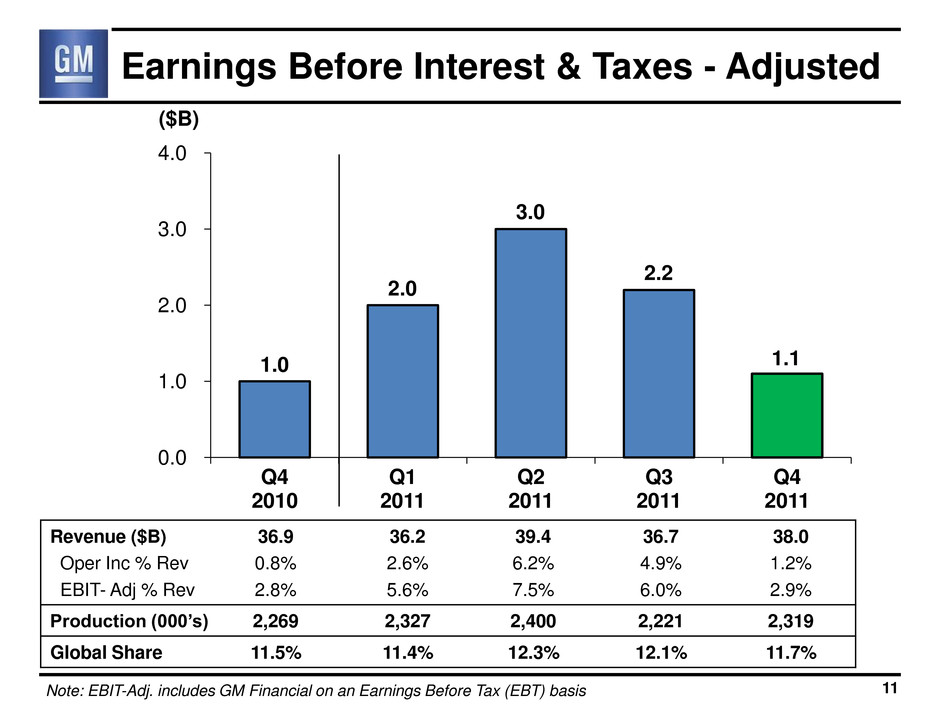

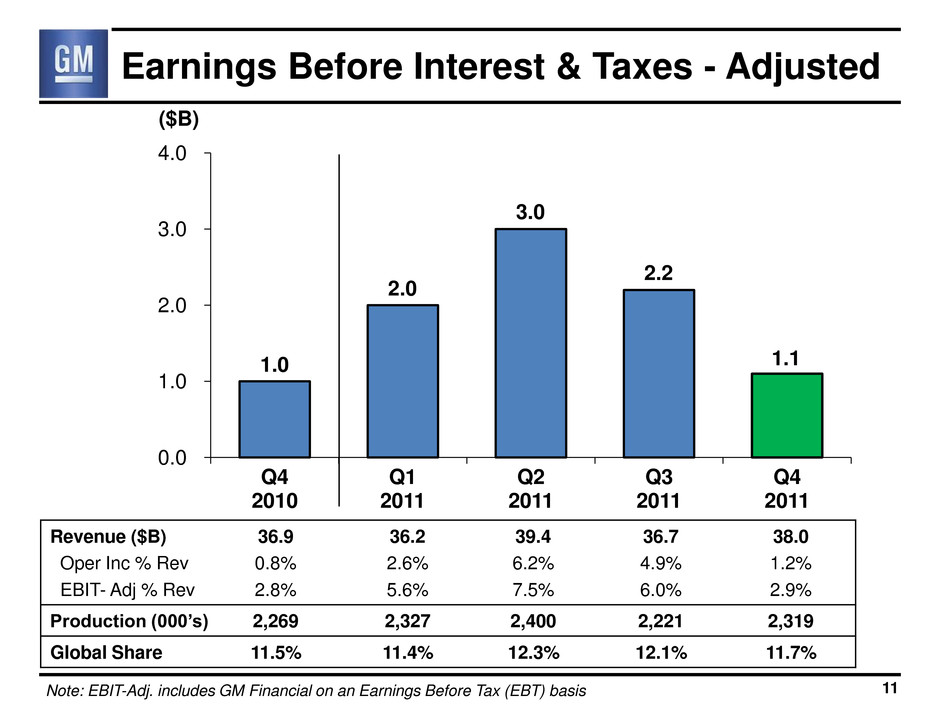

0.0 1.0 2.0 3.0 4.0 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 Earnings Before Interest & Taxes - Adjusted ($B) Revenue ($B) 36.9 36.2 39.4 36.7 38.0 Oper Inc % Rev 0.8% 2.6% 6.2% 4.9% 1.2% EBIT- Adj % Rev 2.8% 5.6% 7.5% 6.0% 2.9% Production (000’s) 2,269 2,327 2,400 2,221 2,319 Global Share 11.5% 11.4% 12.3% 12.1% 11.7% 1.0 2.0 Note: EBIT-Adj. includes GM Financial on an Earnings Before Tax (EBT) basis 11 3.0 2.2 1.1

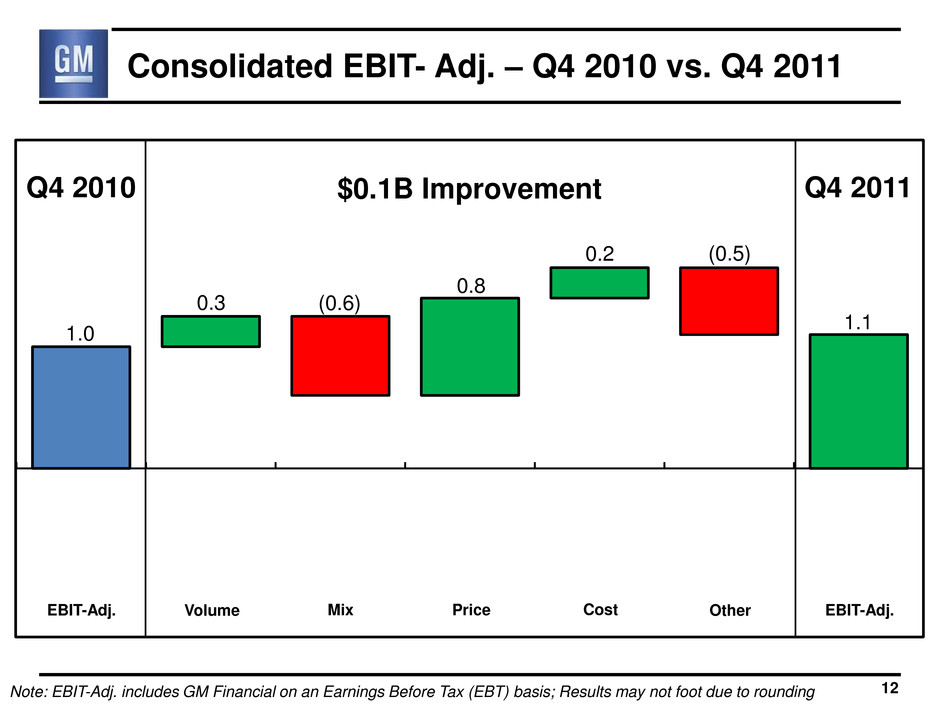

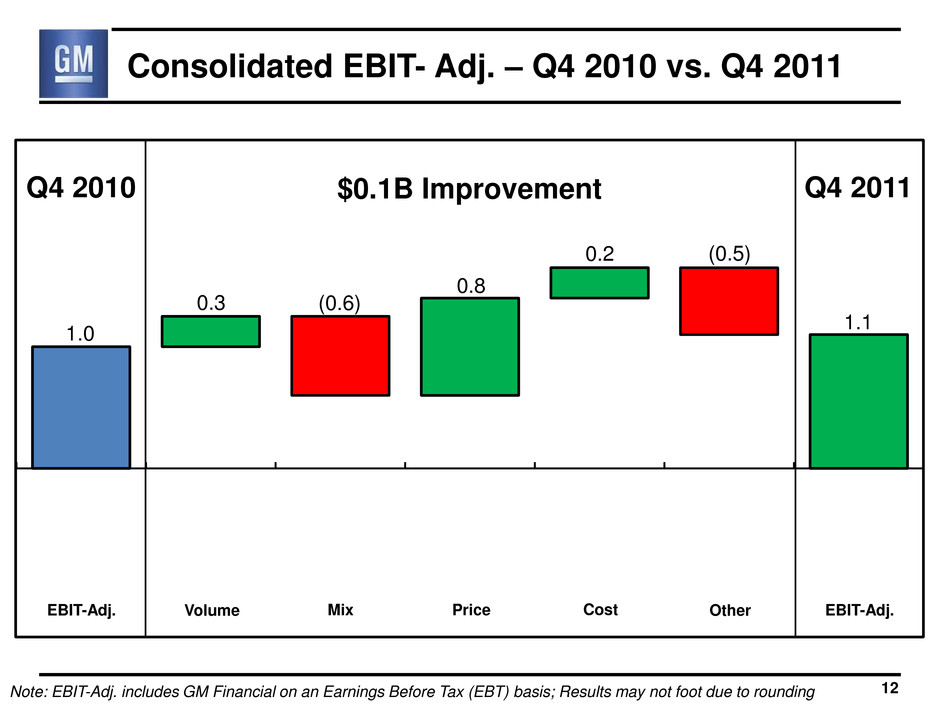

Consolidated EBIT- Adj. – Q4 2010 vs. Q4 2011 Q4 2010 Q4 2011 $0.1B Improvement 12 Note: EBIT-Adj. includes GM Financial on an Earnings Before Tax (EBT) basis; Results may not foot due to rounding EBIT-Adj. EBIT-Adj. Volume Price Cost Other Mix (0.6) 0.8 0.2 (0.5) 1.0 1.1 0.3

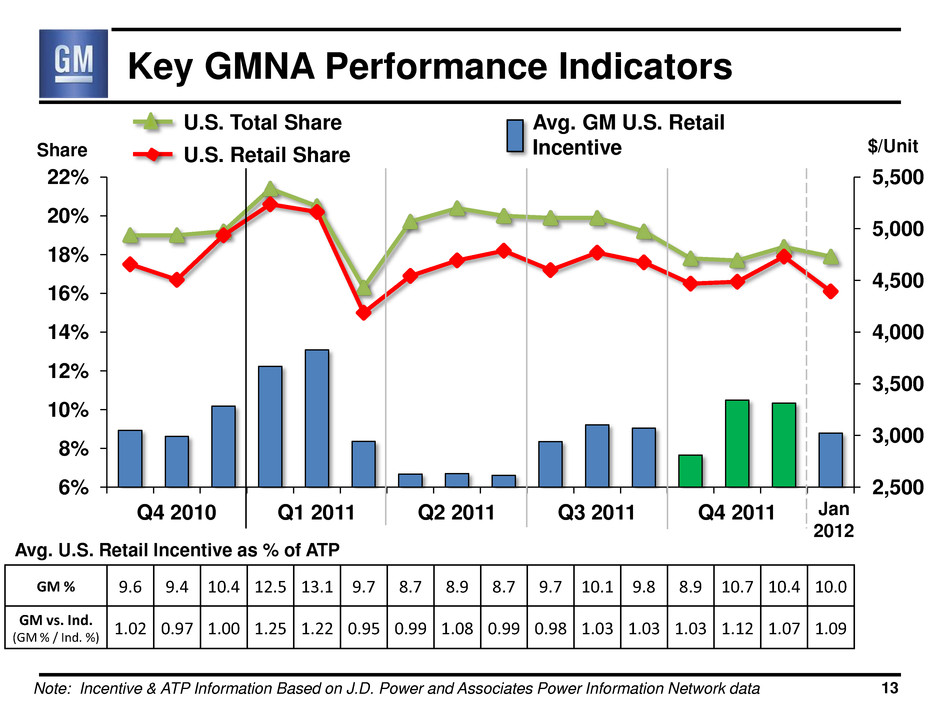

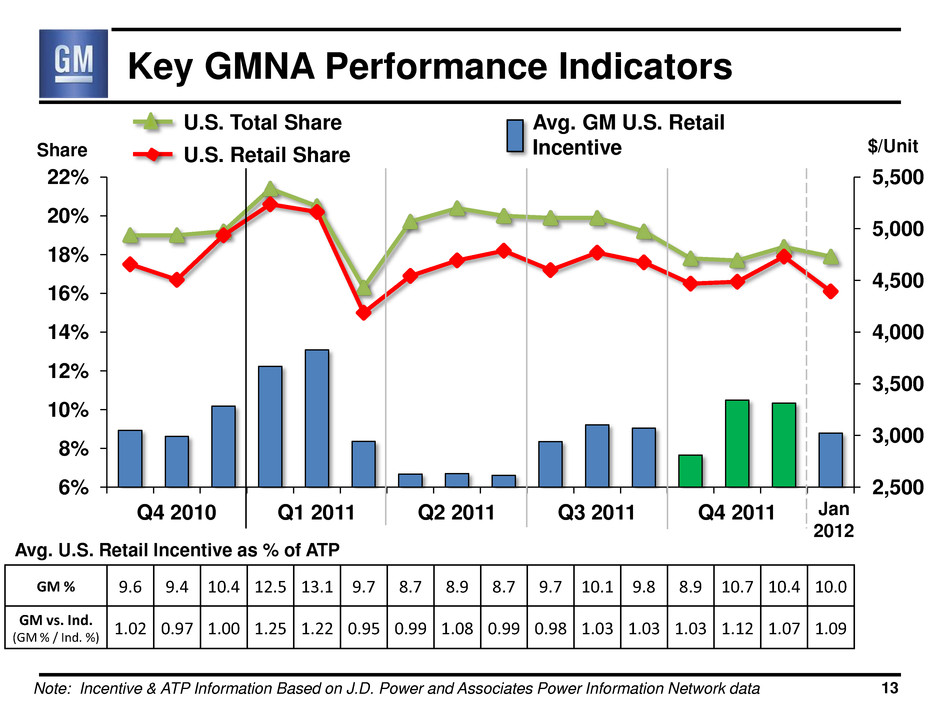

2,500 3,000 3,500 4,000 4,500 5,000 5,500 6% 8% 10% 12% 14% 16% 18% 20% 22% Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 Key GMNA Performance Indicators Avg. U.S. Retail Incentive as % of ATP GM % 9.6 9.4 10.4 12.5 13.1 9.7 8.7 8.9 8.7 9.7 10.1 9.8 8.9 10.7 10.4 10.0 GM vs. Ind. (GM % / Ind. %) 1.02 0.97 1.00 1.25 1.22 0.95 0.99 1.08 0.99 0.98 1.03 1.03 1.03 1.12 1.07 1.09 Share $/Unit U.S. Retail Share U.S. Total Share Avg. GM U.S. Retail Incentive Note: Incentive & ATP Information Based on J.D. Power and Associates Power Information Network data Jan 2012 13

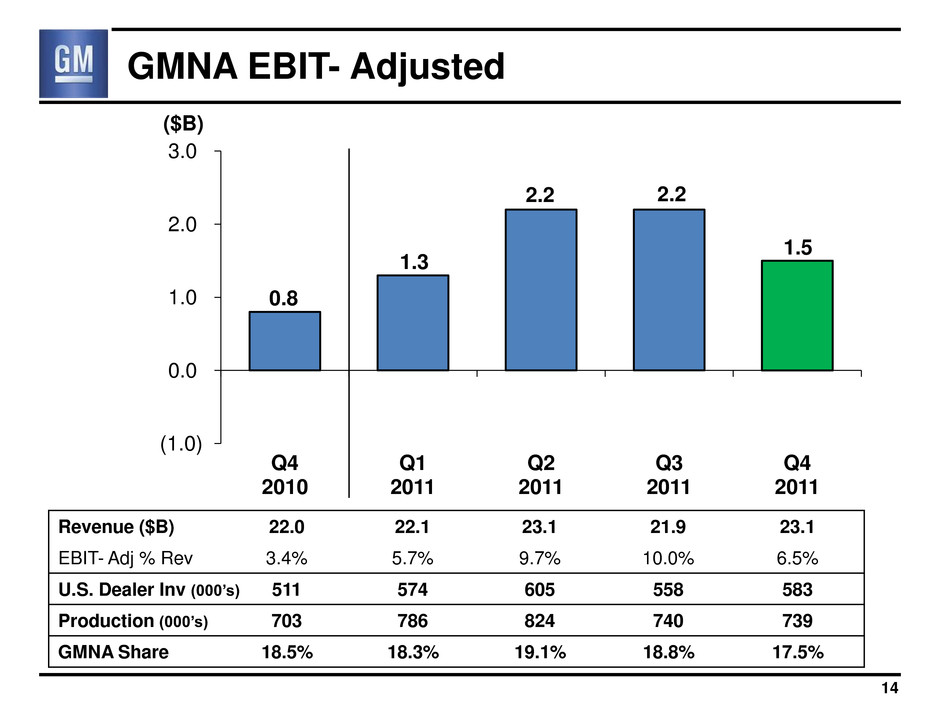

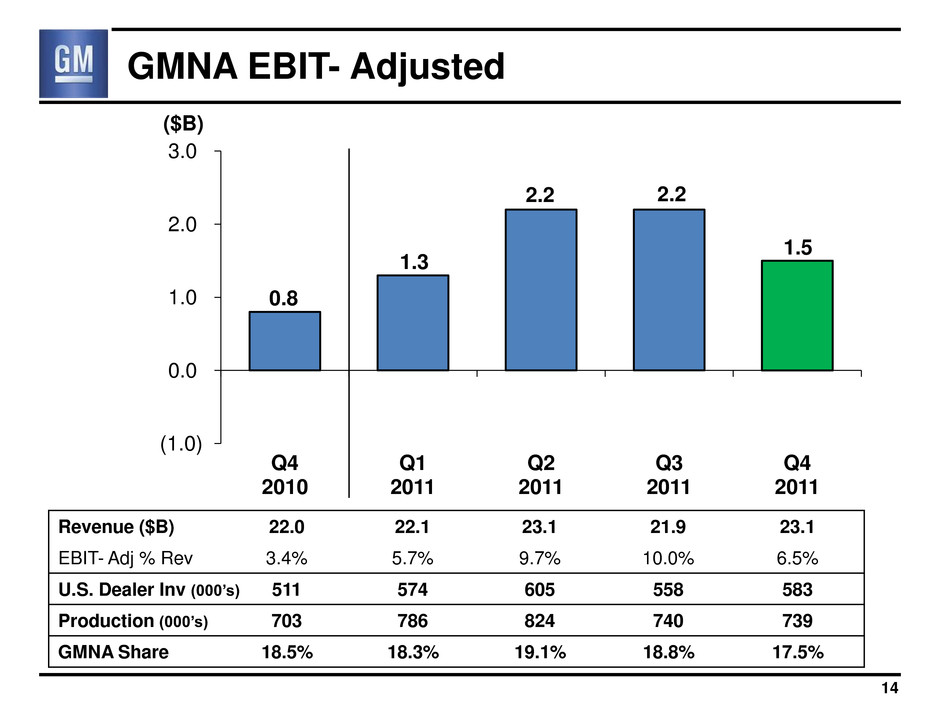

(1.0) 0.0 1.0 2.0 3.0 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 GMNA EBIT- Adjusted ($B) Revenue ($B) 22.0 22.1 23.1 21.9 23.1 EBIT- Adj % Rev 3.4% 5.7% 9.7% 10.0% 6.5% U.S. Dealer Inv (000’s) 511 574 605 558 583 Production (000’s) 703 786 824 740 739 GMNA Share 18.5% 18.3% 19.1% 18.8% 17.5% 0.8 1.3 14 2.2 2.2 1.5

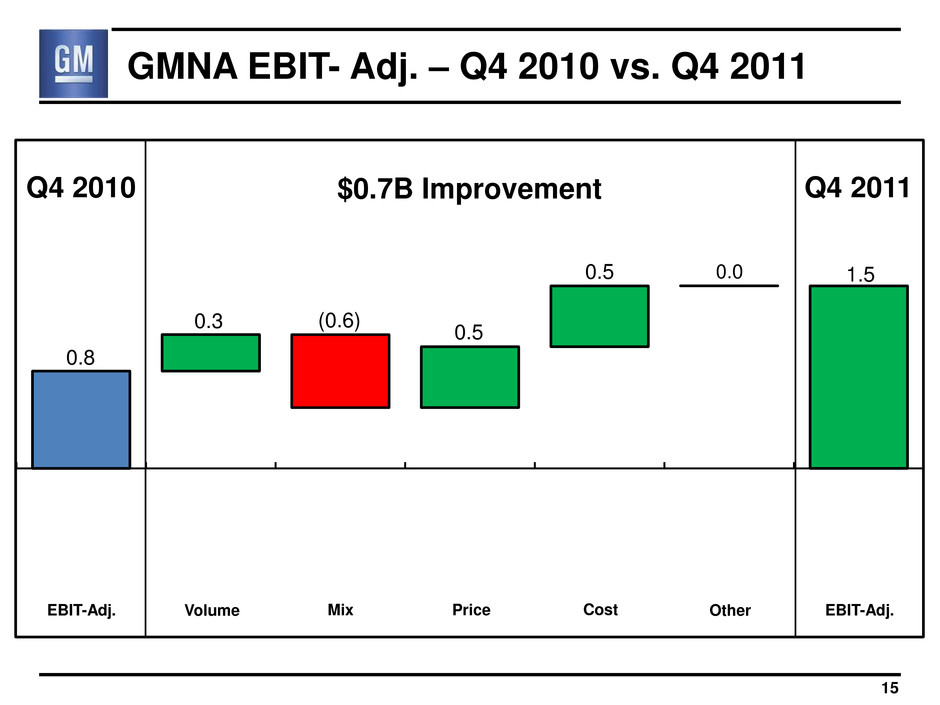

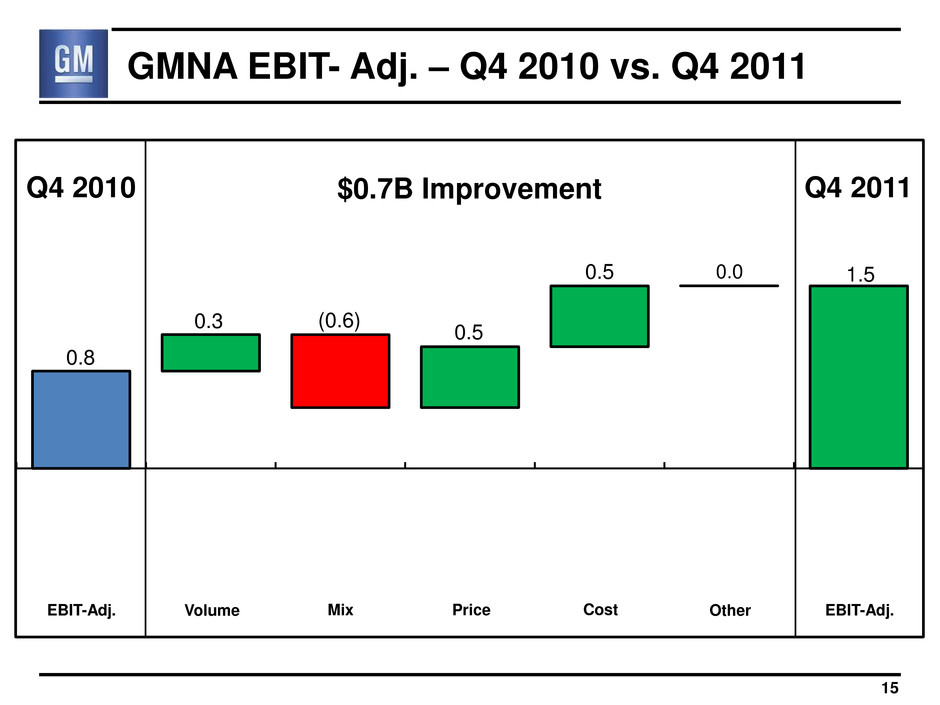

GMNA EBIT- Adj. – Q4 2010 vs. Q4 2011 Q4 2010 Q4 2011 $0.7B Improvement 0.5 0.3 0.5 0.0 0.8 1.5 15 (0.6) EBIT-Adj. EBIT-Adj. Volume Price Cost Other Mix

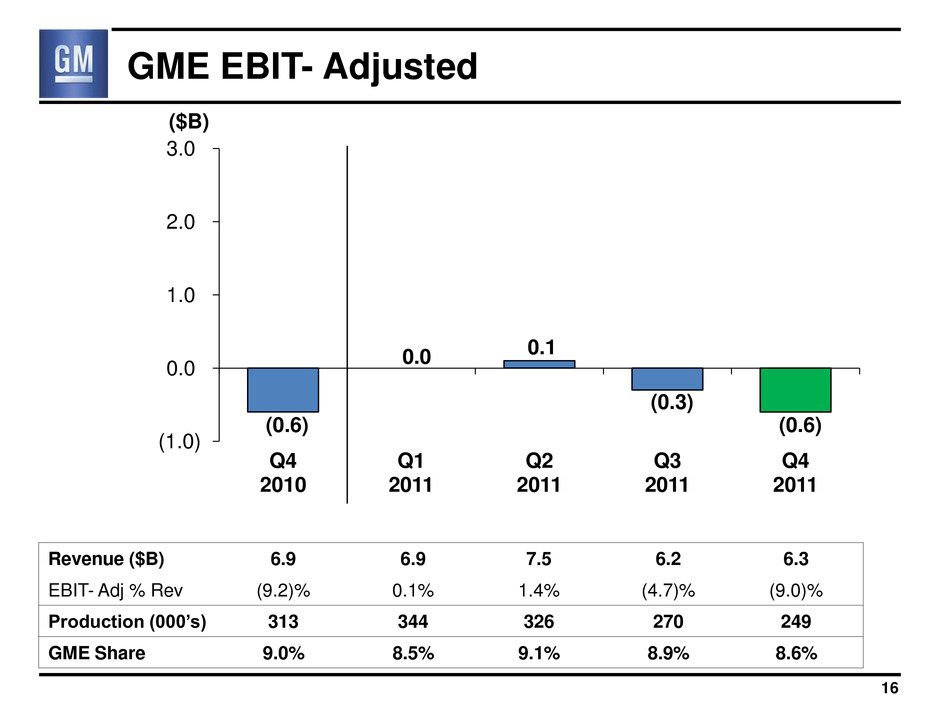

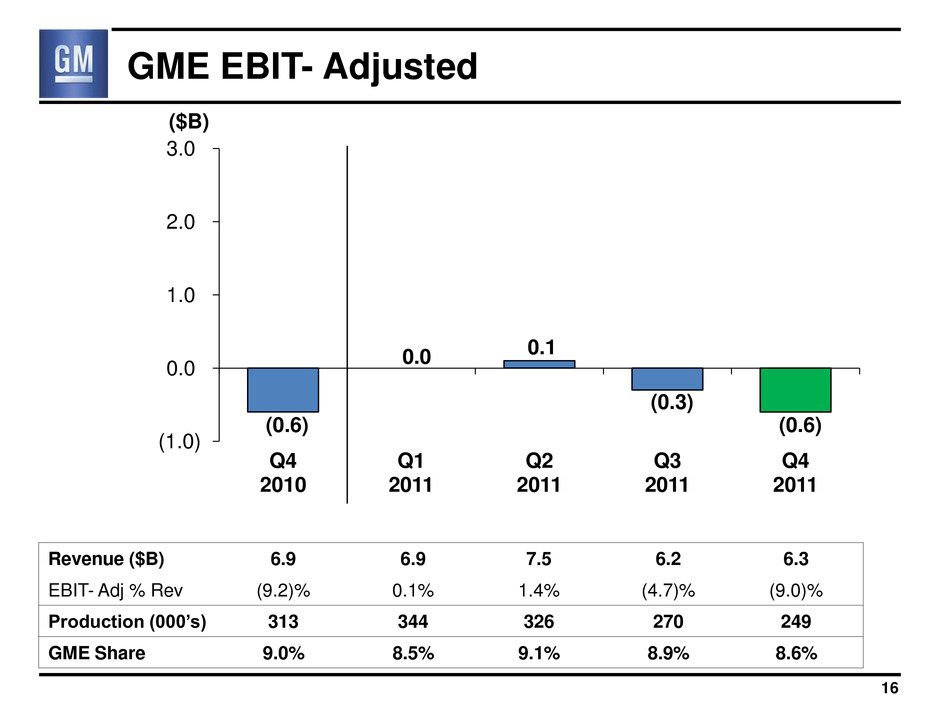

(1.0) 0.0 1.0 2.0 3.0 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 GME EBIT- Adjusted ($B) Revenue ($B) 6.9 6.9 7.5 6.2 6.3 EBIT- Adj % Rev (9.2)% 0.1% 1.4% (4.7)% (9.0)% Production (000’s) 313 344 326 270 249 GME Share 9.0% 8.5% 9.1% 8.9% 8.6% (0.6) 0.0 16 0.1 (0.3) (0.6)

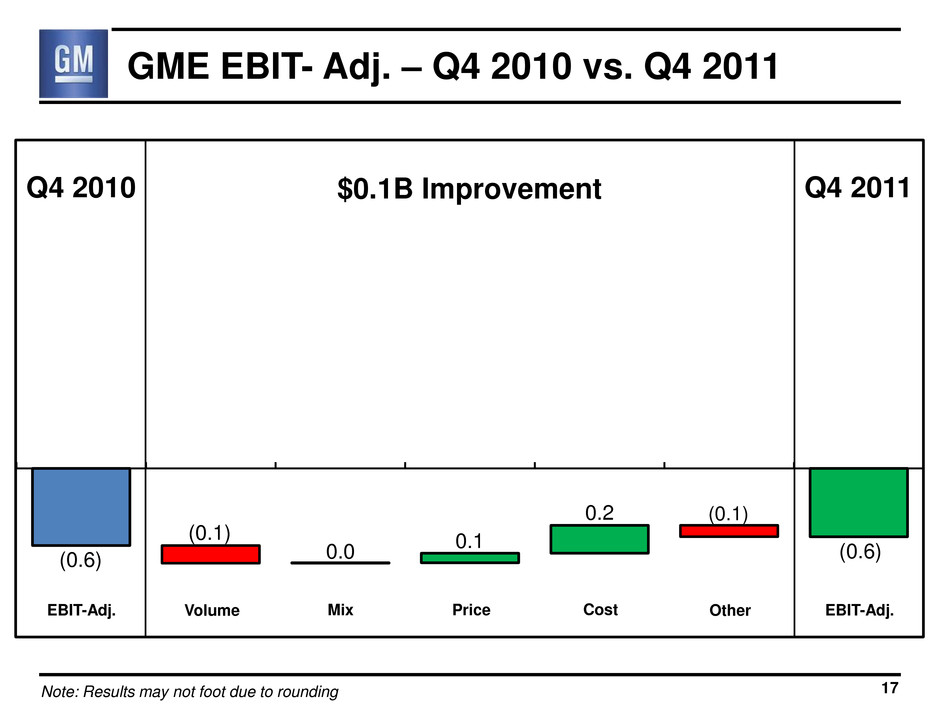

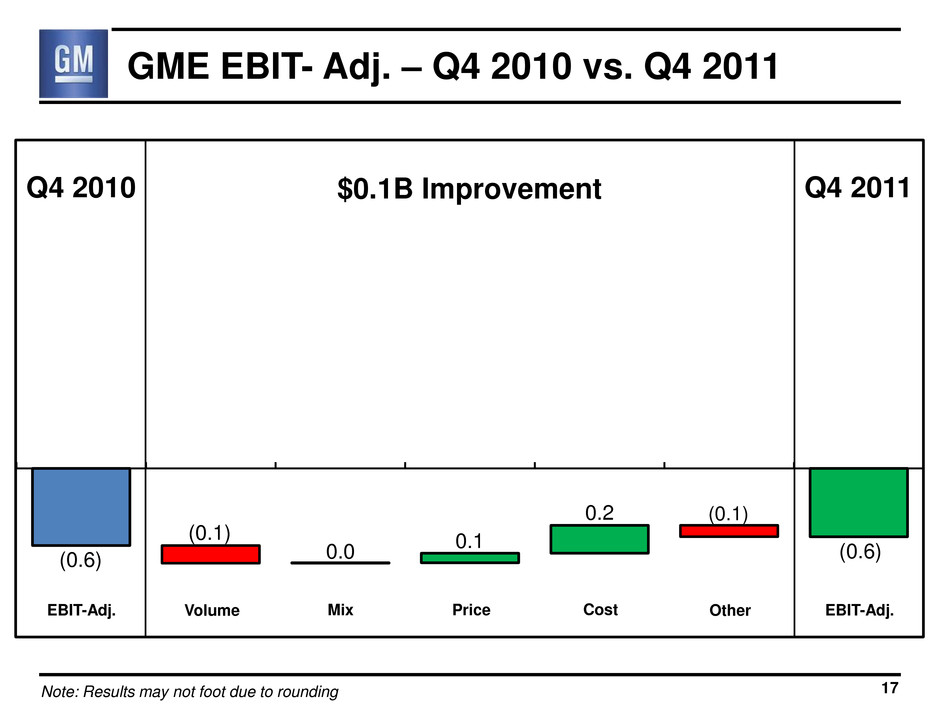

GME EBIT- Adj. – Q4 2010 vs. Q4 2011 Q4 2010 Q4 2011 $0.1B Improvement 0.1 (0.1) 0.2 (0.1) (0.6) (0.6) 17 Note: Results may not foot due to rounding 0.0 EBIT-Adj. EBIT-Adj. Volume Price Cost Other Mix

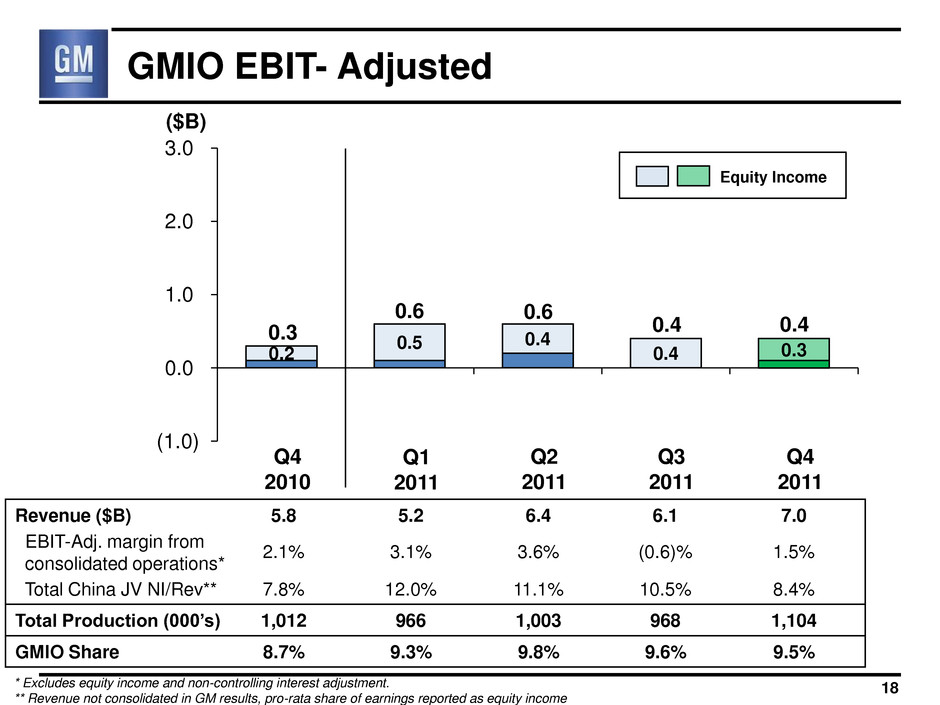

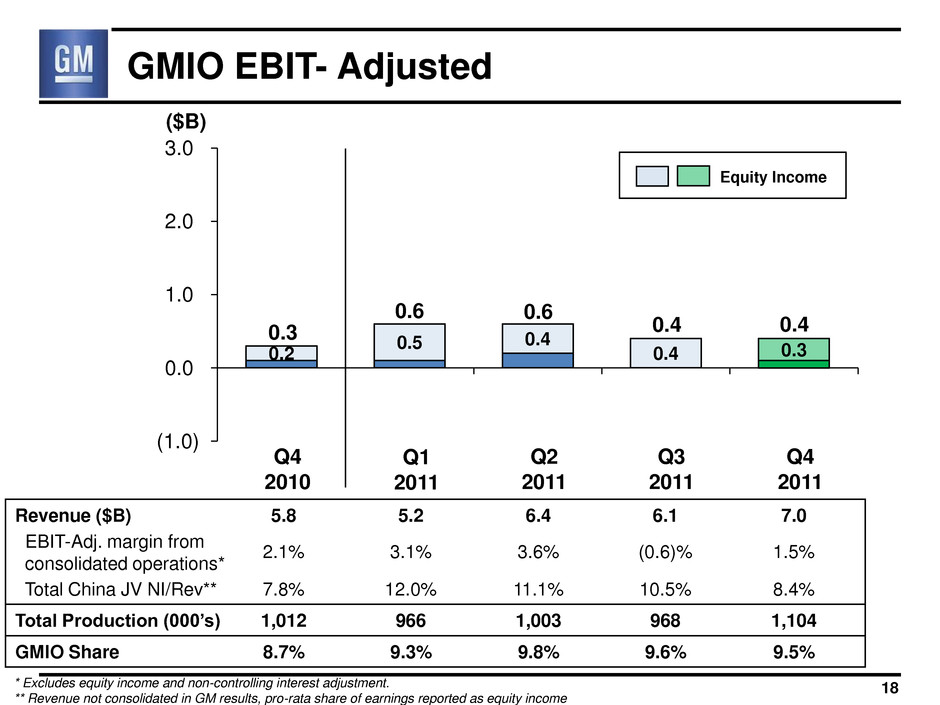

0.2 0.5 0.4 0.4 0.3 (1.0) 0.0 1.0 2.0 3.0 GMIO EBIT- Adjusted ($B) Revenue ($B) EBIT-Adj. margin from consolidated operations* Total China JV NI/Rev** 5.8 2.1% 7.8% 5.2 3.1% 12.0% 6.4 3.6% 11.1% 6.1 (0.6)% 10.5% 7.0 1.5% 8.4% Total Production (000’s) 1,012 966 1,003 968 1,104 GMIO Share 8.7% 9.3% 9.8% 9.6% 9.5% 0.3 0.6 18 0.6 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 * Excludes equity income and non-controlling interest adjustment. ** Revenue not consolidated in GM results, pro-rata share of earnings reported as equity income 0.4 Equity Income 0.4

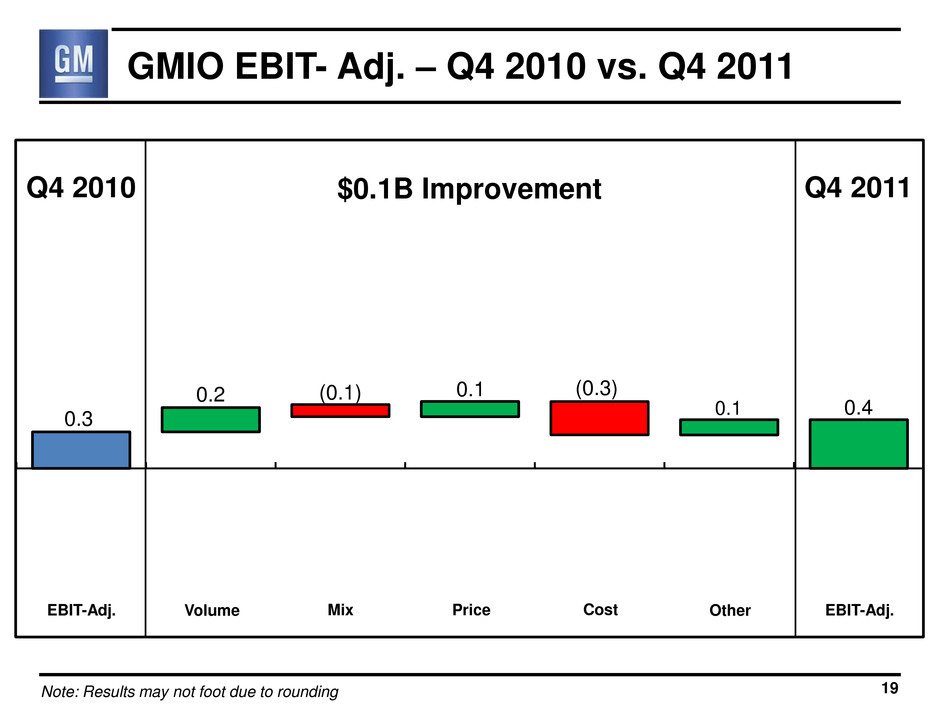

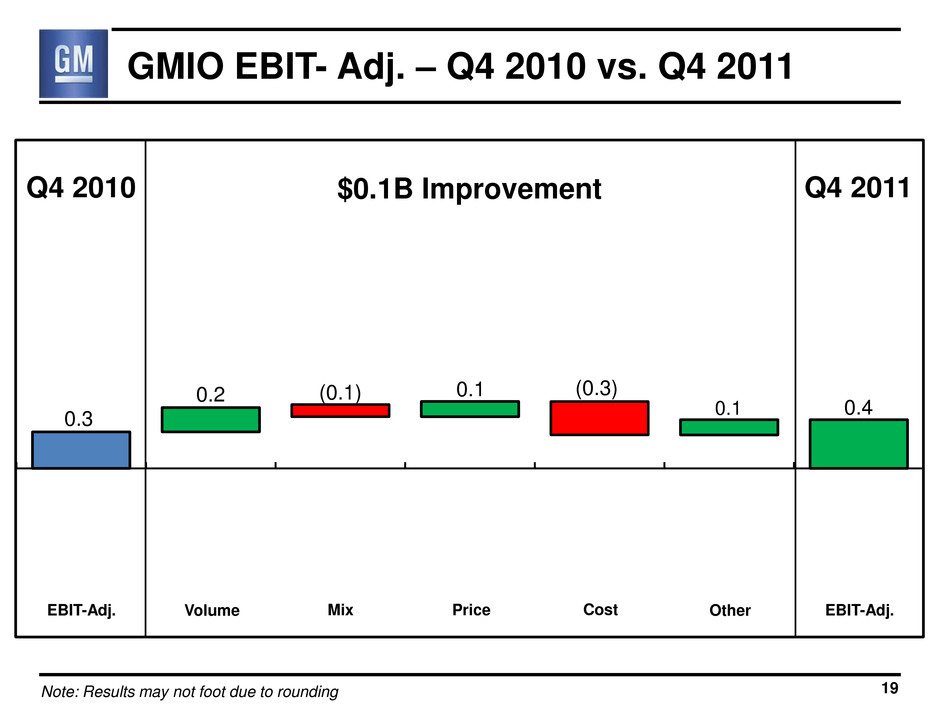

GMIO EBIT- Adj. – Q4 2010 vs. Q4 2011 Q4 2010 Q4 2011 $0.1B Improvement 0.1 0.2 (0.3) 0.1 0.3 0.4 19 Note: Results may not foot due to rounding (0.1) EBIT-Adj. EBIT-Adj. Volume Price Cost Other Mix

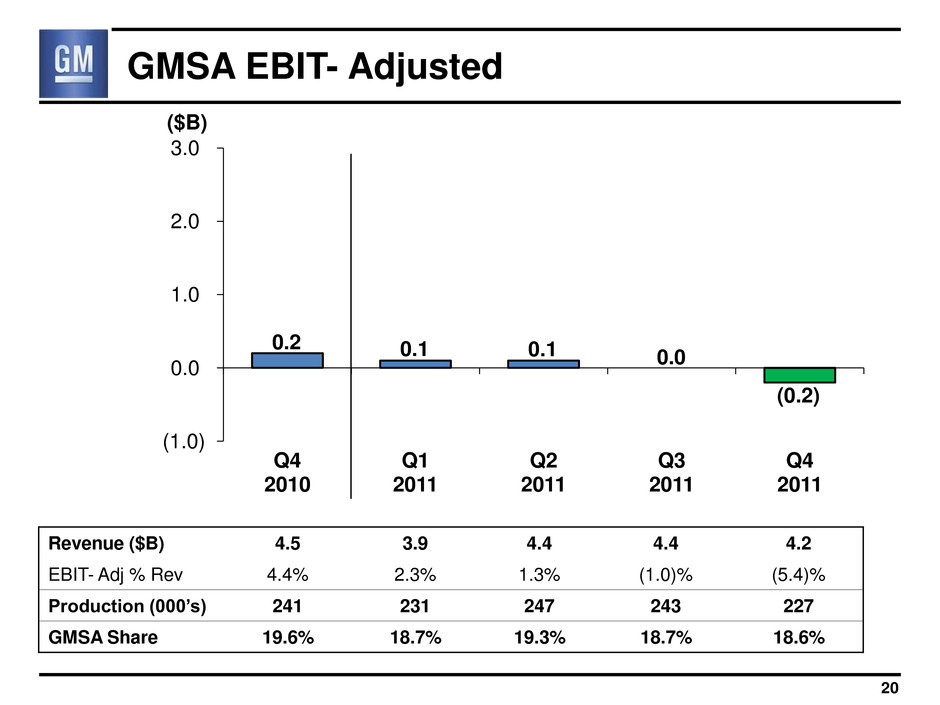

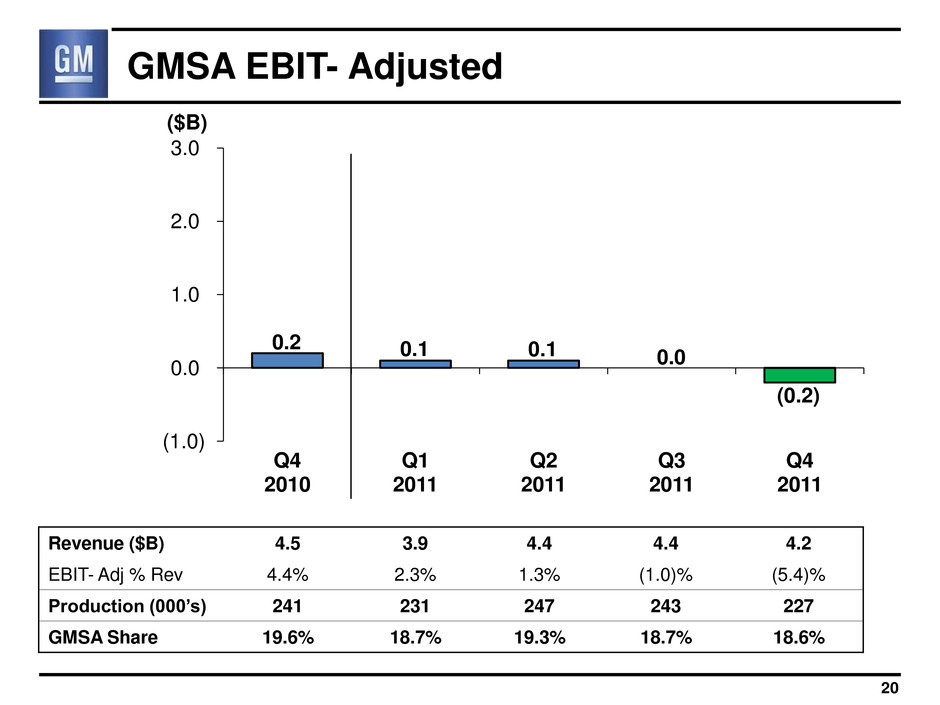

(1.0) 0.0 1.0 2.0 3.0 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 GMSA EBIT- Adjusted ($B) Revenue ($B) 4.5 3.9 4.4 4.4 4.2 EBIT- Adj % Rev 4.4% 2.3% 1.3% (1.0)% (5.4)% Production (000’s) 241 231 247 243 227 GMSA Share 19.6% 18.7% 19.3% 18.7% 18.6% 0.2 0.1 0.1 0.0 20 (0.2)

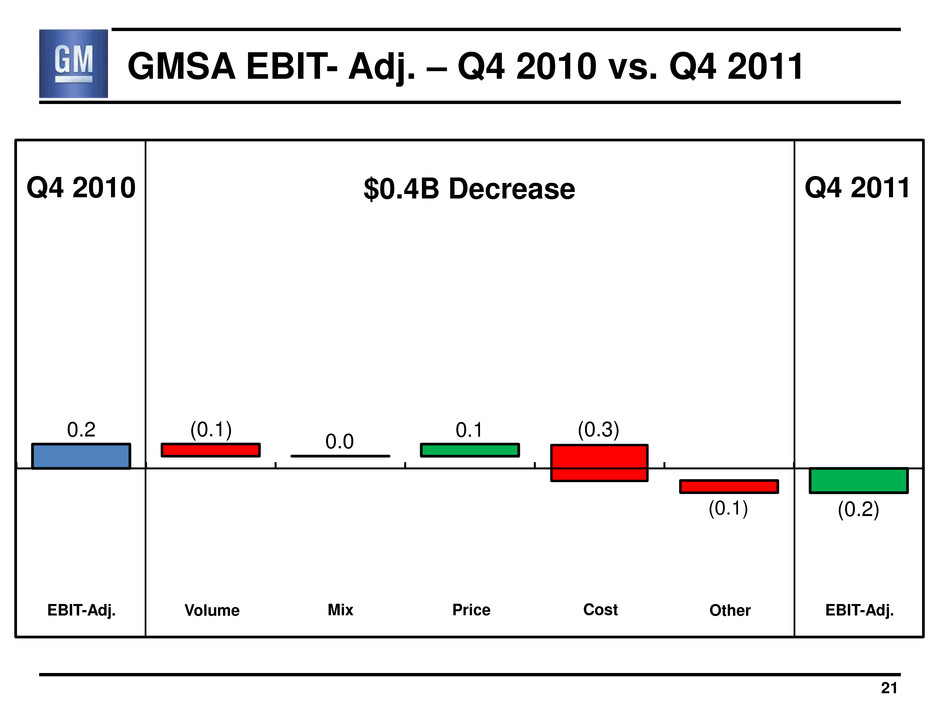

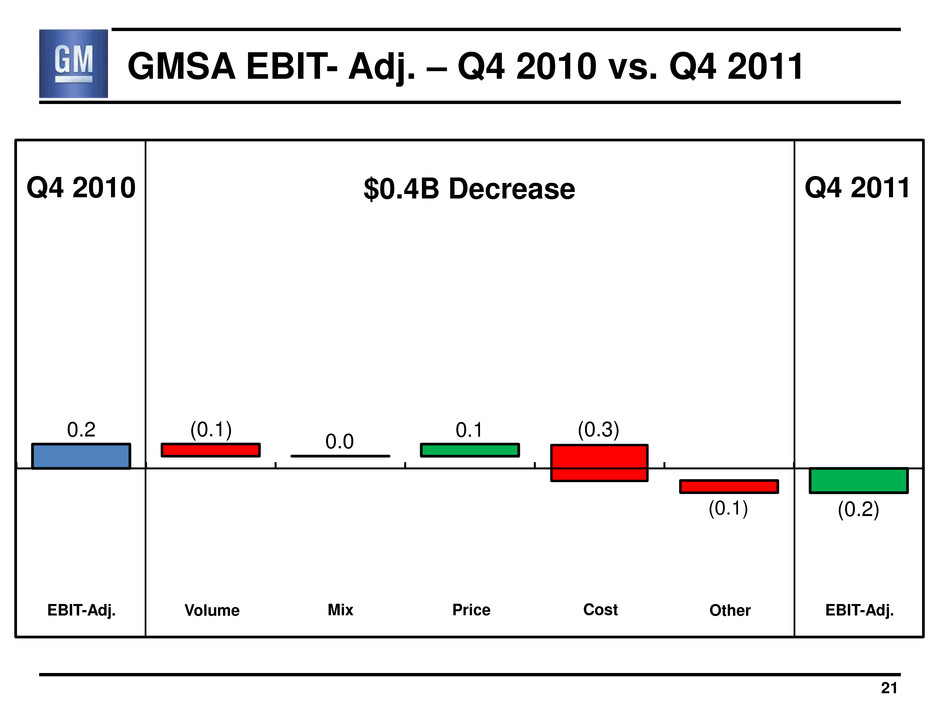

GMSA EBIT- Adj. – Q4 2010 vs. Q4 2011 Q4 2010 Q4 2011 $0.4B Decrease 0.1 (0.1) (0.3) (0.1) 0.2 (0.2) 21 0.0 EBIT-Adj. EBIT-Adj. Volume Price Cost Other Mix

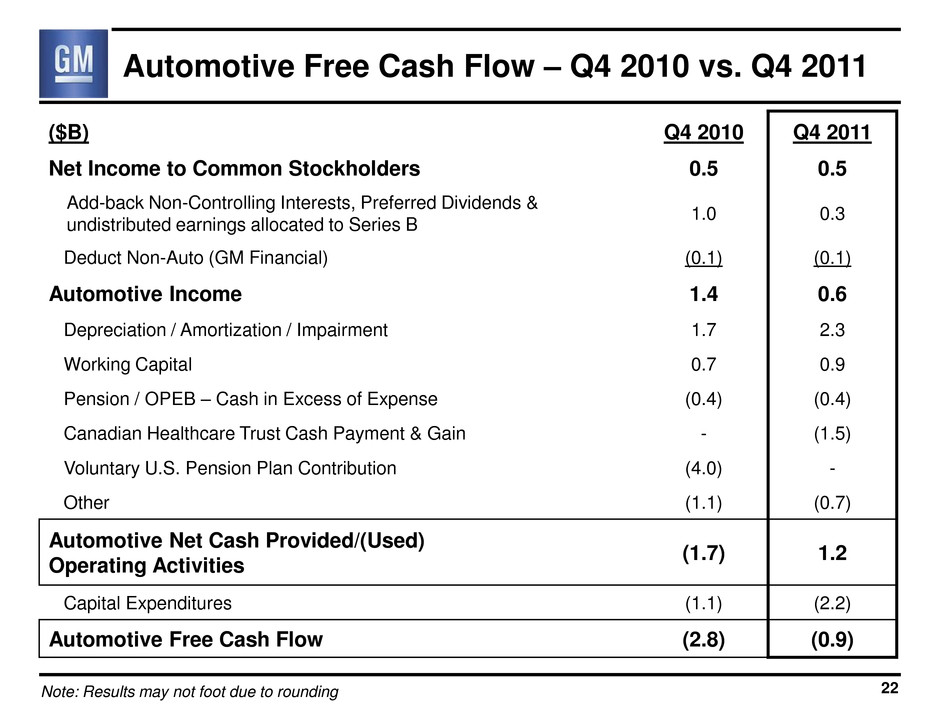

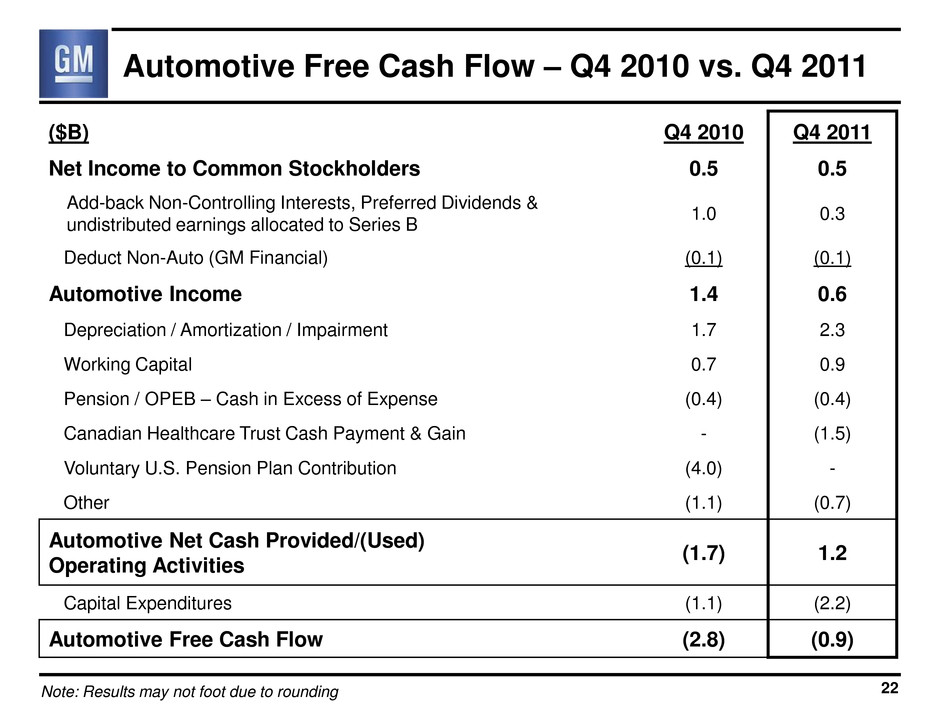

Automotive Free Cash Flow – Q4 2010 vs. Q4 2011 ($B) Q4 2010 Q4 2011 Net Income to Common Stockholders 0.5 0.5 Add-back Non-Controlling Interests, Preferred Dividends & undistributed earnings allocated to Series B 1.0 0.3 Deduct Non-Auto (GM Financial) (0.1) (0.1) Automotive Income 1.4 0.6 Depreciation / Amortization / Impairment 1.7 2.3 Working Capital 0.7 0.9 Pension / OPEB – Cash in Excess of Expense (0.4) (0.4) Canadian Healthcare Trust Cash Payment & Gain - (1.5) Voluntary U.S. Pension Plan Contribution (4.0) - Other (1.1) (0.7) Automotive Net Cash Provided/(Used) Operating Activities (1.7) 1.2 Capital Expenditures (1.1) (2.2) Automotive Free Cash Flow (2.8) (0.9) 22 Note: Results may not foot due to rounding

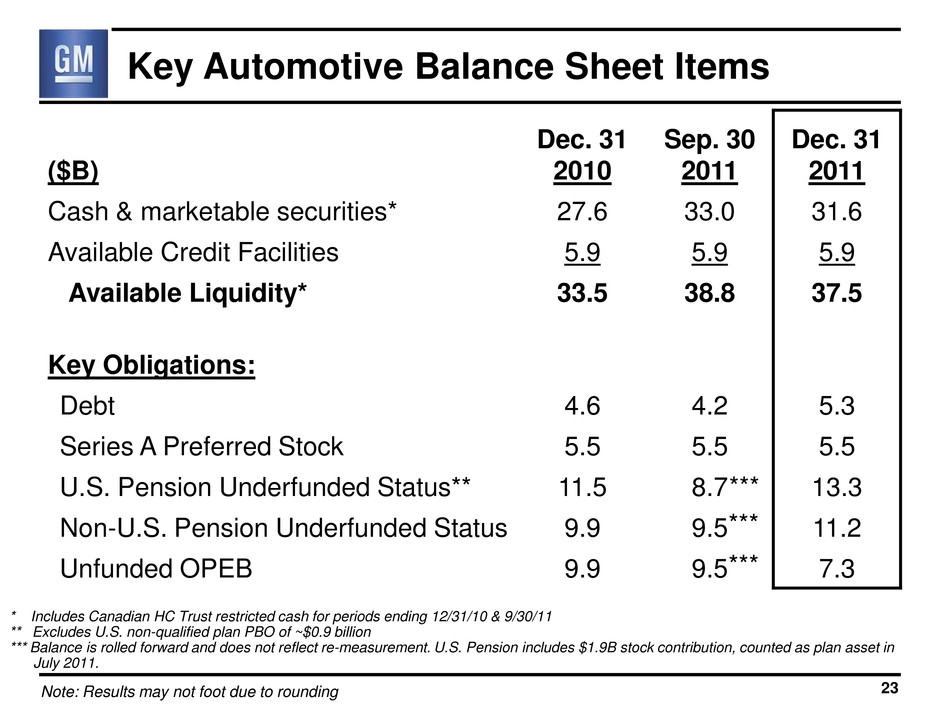

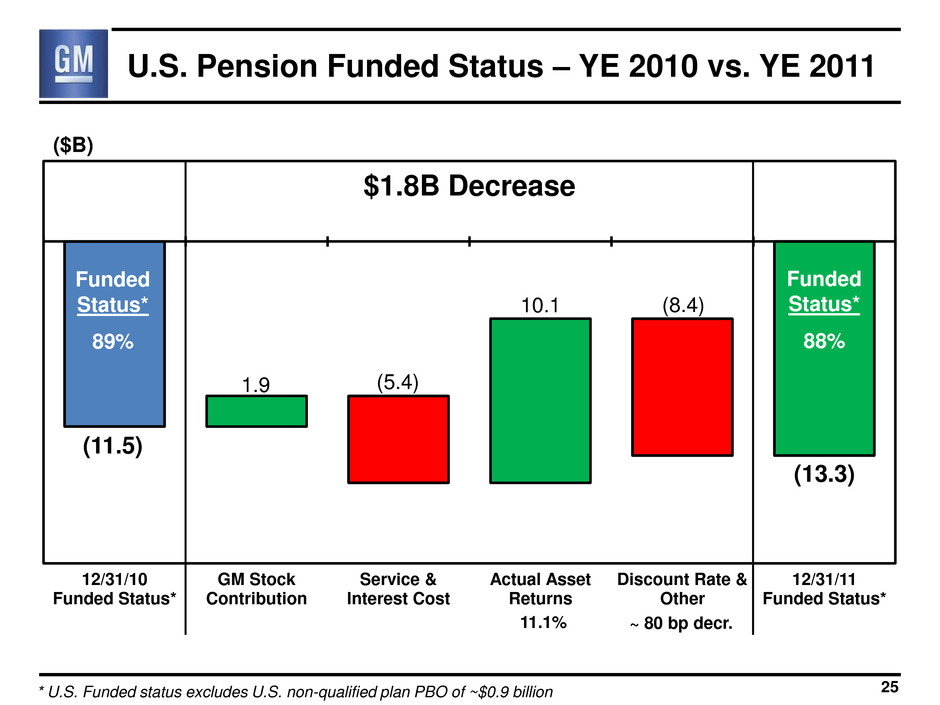

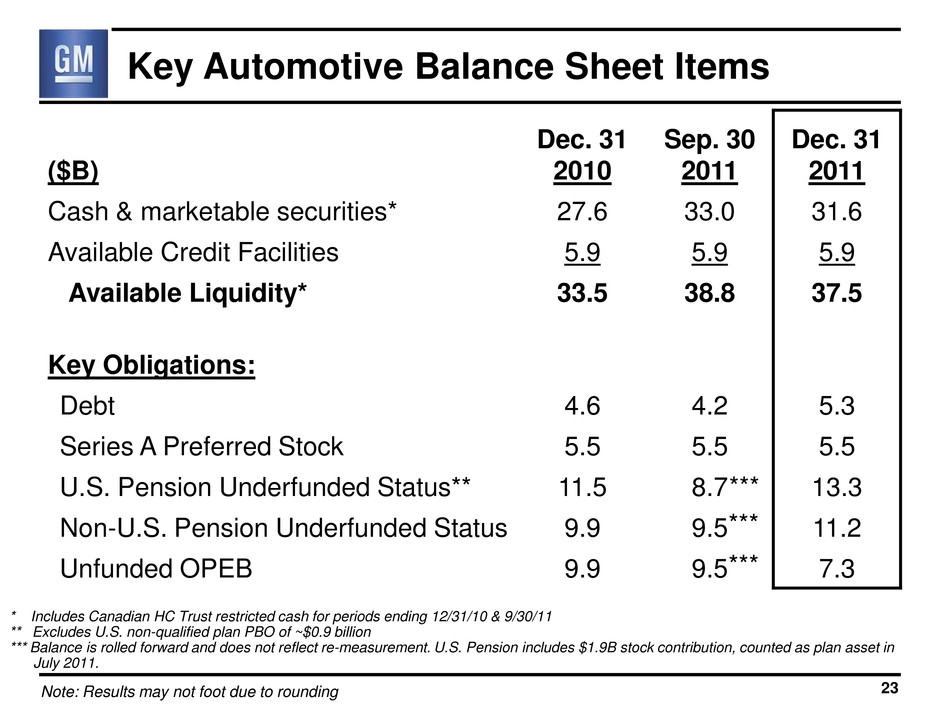

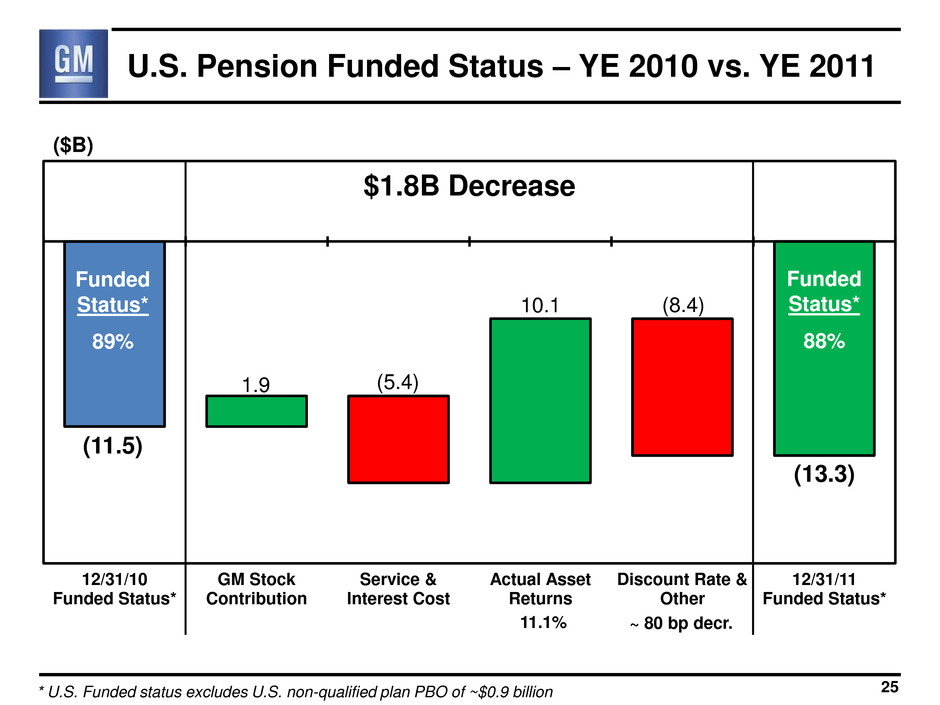

Key Automotive Balance Sheet Items ($B) Dec. 31 2010 Sep. 30 2011 Dec. 31 2011 Cash & marketable securities* 27.6 33.0 31.6 Available Credit Facilities 5.9 5.9 5.9 Available Liquidity* 33.5 38.8 37.5 Key Obligations: Debt 4.6 4.2 5.3 Series A Preferred Stock 5.5 5.5 5.5 U.S. Pension Underfunded Status** 11.5 8.7 13.3 Non-U.S. Pension Underfunded Status 9.9 9.5 11.2 Unfunded OPEB 9.9 9.5 7.3 * Includes Canadian HC Trust restricted cash for periods ending 12/31/10 & 9/30/11 ** Excludes U.S. non-qualified plan PBO of ~$0.9 billion *** Balance is rolled forward and does not reflect re-measurement. U.S. Pension includes $1.9B stock contribution, counted as plan asset in July 2011. 23 Note: Results may not foot due to rounding *** *** ***

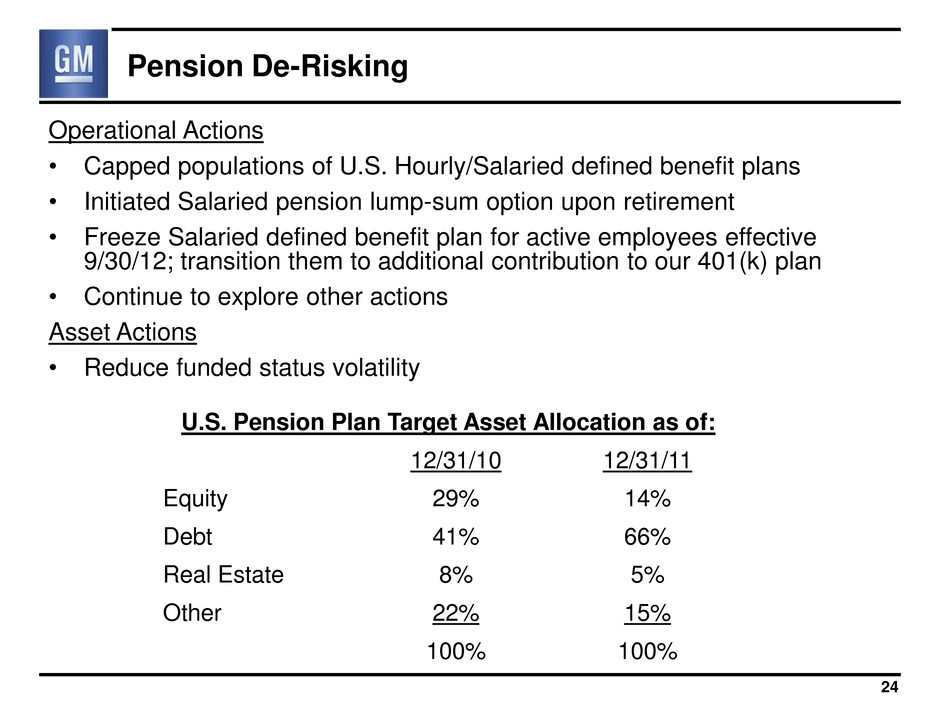

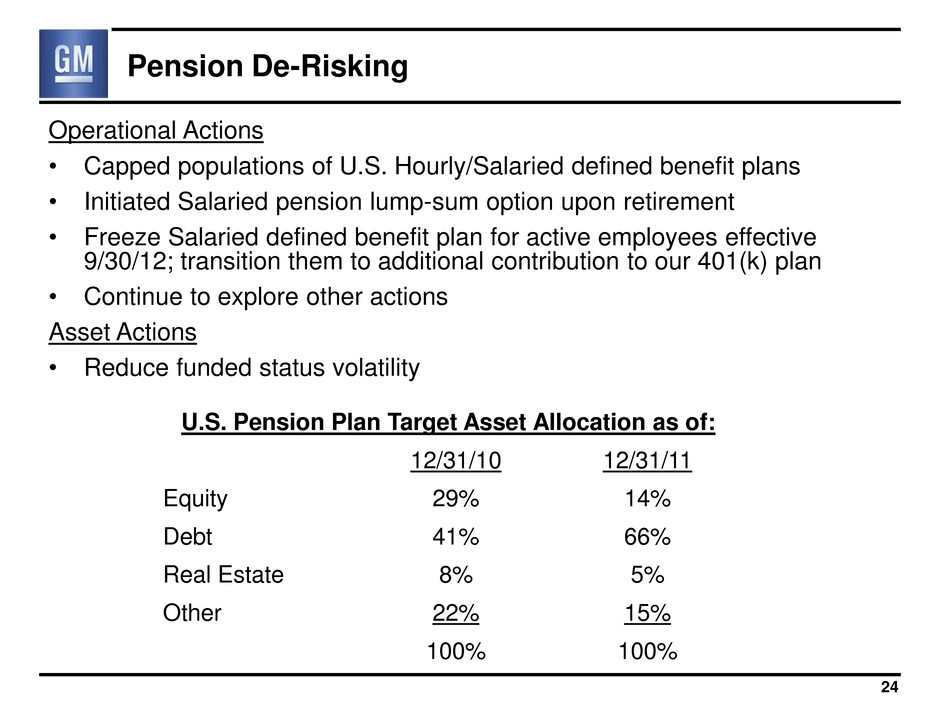

Pension De-Risking Operational Actions • Capped populations of U.S. Hourly/Salaried defined benefit plans • Initiated Salaried pension lump-sum option upon retirement • Freeze Salaried defined benefit plan for active employees effective 9/30/12; transition them to additional contribution to our 401(k) plan • Continue to explore other actions Asset Actions • Reduce funded status volatility 24 U.S. Pension Plan Target Asset Allocation as of: 12/31/10 12/31/11 Equity 29% 14% Debt 41% 66% Real Estate 8% 5% Other 22% 15% 100% 100%

12/31/10 Funded Status* GM Stock Contribution Service & Interest Cost Actual Asset Returns Discount Rate & Other 12/31/11 Funded Status* (8.4) 10.1 U.S. Pension Funded Status – YE 2010 vs. YE 2011 * U.S. Funded status excludes U.S. non-qualified plan PBO of ~$0.9 billion 25 (13.3) (5.4) (11.5) Funded Status* 89% Funded Status* 88% ($B) 1.9 11.1% ~ 80 bp decr. $1.8B Decrease

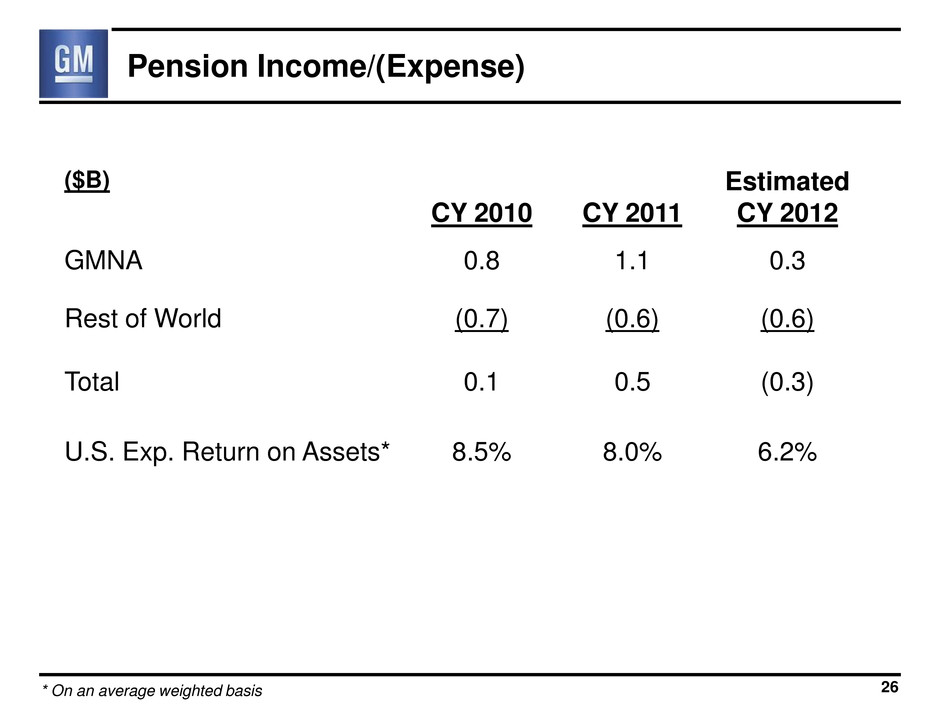

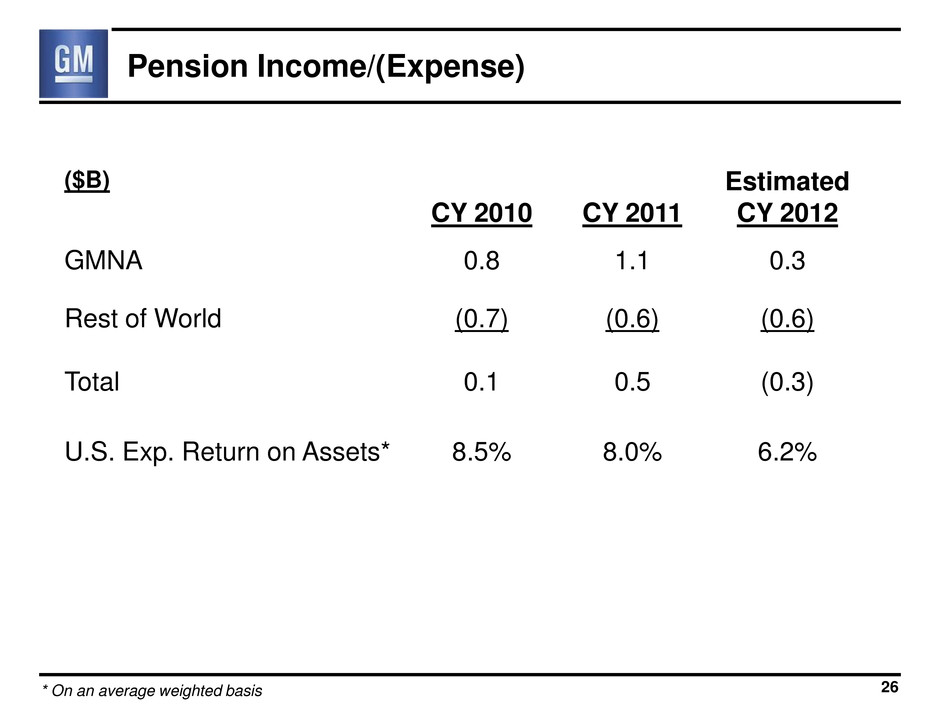

Pension Income/(Expense) 26 ($B) CY 2010 CY 2011 Estimated CY 2012 GMNA 0.8 1.1 0.3 Rest of World (0.7) (0.6) (0.6) Total 0.1 0.5 (0.3) U.S. Exp. Return on Assets* 8.5% 8.0% 6.2% * On an average weighted basis

GM Financial Q4 2010 Q4 2011 Industry Avg. (Excl. GM) Q4 2010 Q4 2011 GM Sales Penetrations U.S. Subprime (<=620) 4.8% 6.8% 4.7% 4.9% U.S. Lease 12.9% 11.1% 21.7% 21.3% Canada Lease 3.4% 8.5% 16.7% 19.1% GM / GM Financial Linkage GM as % of GM Financial Originations (GM New / GMF Loan & Lease) 19.0% 44.3% GM Fin. as % of GM U.S. S/P & Lease 9.3% 27.1% GM Financial Performance GM Financial Credit Losses (annualized net credit losses as % avg. receivables) 5.5% 3.3% EBT ($M) 129 170 27 Note: GM Sales Penetrations based on JD Power PIN

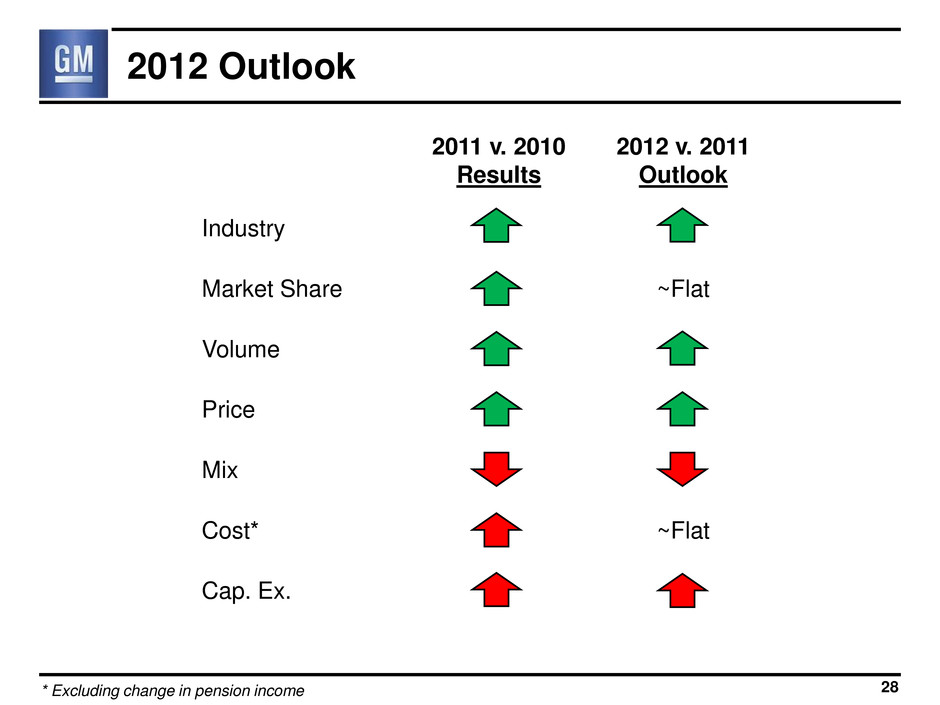

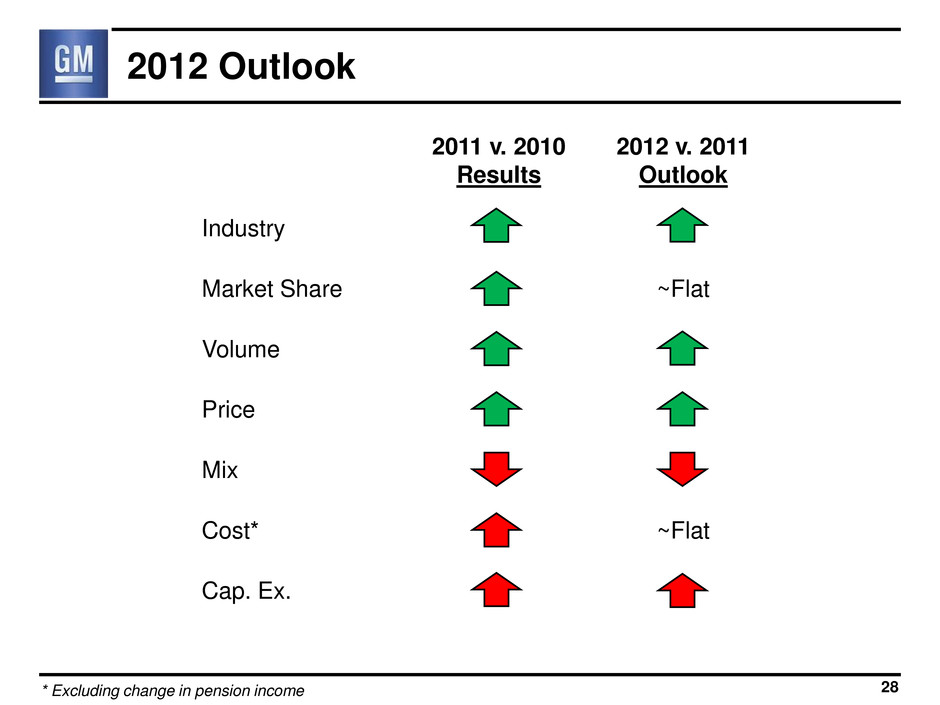

2012 Outlook 2011 v. 2010 Results 2012 v. 2011 Outlook Industry Market Share ~Flat Volume Price Mix Cost* ~Flat Cap. Ex. * Excluding change in pension income 28

Fourth Quarter Summary 29 • Improved Sales volumes Market share EBIT-Adjusted EBIT-Adjusted margins • Fourth quarter showed solid results for GMNA and GMIO, with challenges in GME and GMSA • We anticipate continued industry volume and top-line revenue growth in 2012 with pension expense, restructuring costs, and mix impacting margins

New GM 30 New Business Model Significantly Lower Risk Profile Leverage to Global Growth

General Motors Company Select Supplemental Financial Information

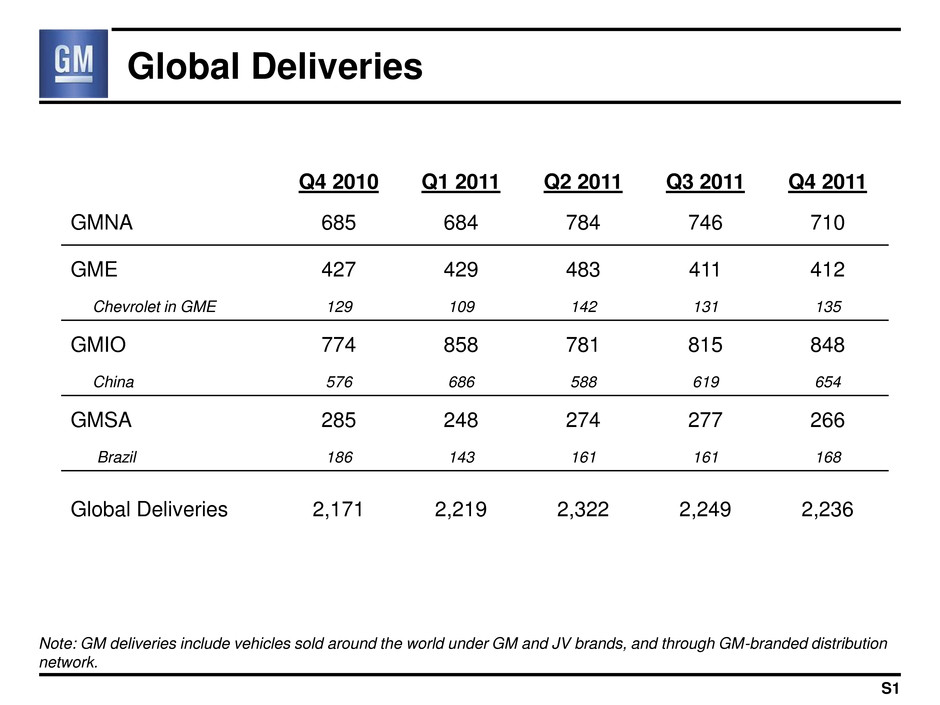

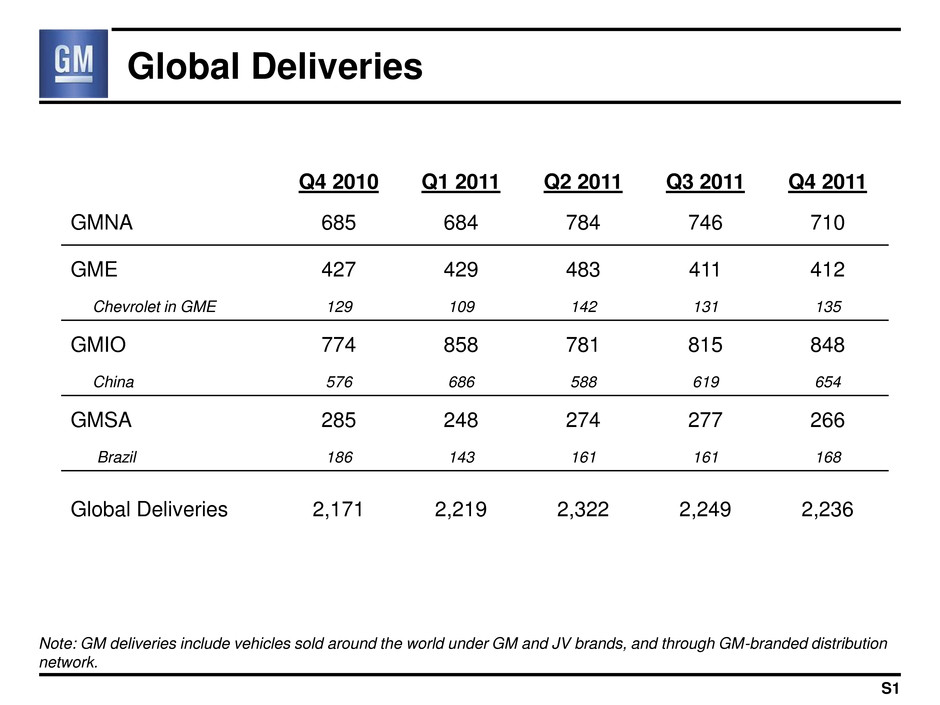

Global Deliveries Note: GM deliveries include vehicles sold around the world under GM and JV brands, and through GM-branded distribution network. S1 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 GMNA 685 684 784 746 710 GME 427 429 483 411 412 Chevrolet in GME 129 109 142 131 135 GMIO 774 858 781 815 848 China 576 686 588 619 654 GMSA 285 248 274 277 266 Brazil 186 143 161 161 168 Global Deliveries 2,171 2,219 2,322 2,249 2,236

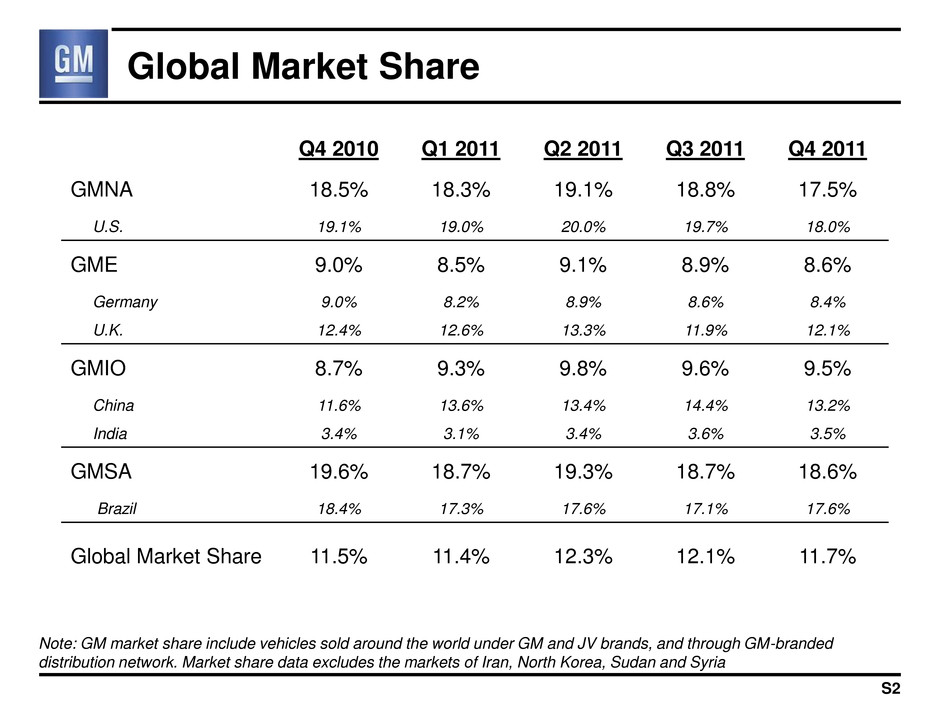

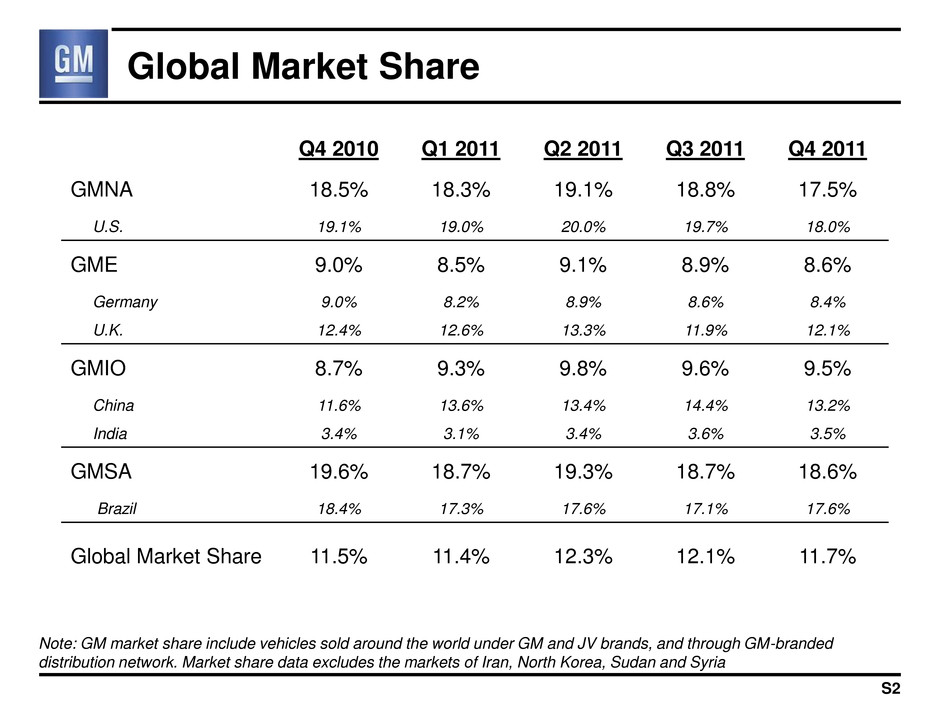

Global Market Share Note: GM market share include vehicles sold around the world under GM and JV brands, and through GM-branded distribution network. Market share data excludes the markets of Iran, North Korea, Sudan and Syria S2 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 GMNA 18.5% 18.3% 19.1% 18.8% 17.5% U.S. 19.1% 19.0% 20.0% 19.7% 18.0% GME 9.0% 8.5% 9.1% 8.9% 8.6% Germany 9.0% 8.2% 8.9% 8.6% 8.4% U.K. 12.4% 12.6% 13.3% 11.9% 12.1% GMIO 8.7% 9.3% 9.8% 9.6% 9.5% China 11.6% 13.6% 13.4% 14.4% 13.2% India 3.4% 3.1% 3.4% 3.6% 3.5% GMSA 19.6% 18.7% 19.3% 18.7% 18.6% Brazil 18.4% 17.3% 17.6% 17.1% 17.6% Global Market Share 11.5% 11.4% 12.3% 12.1% 11.7%

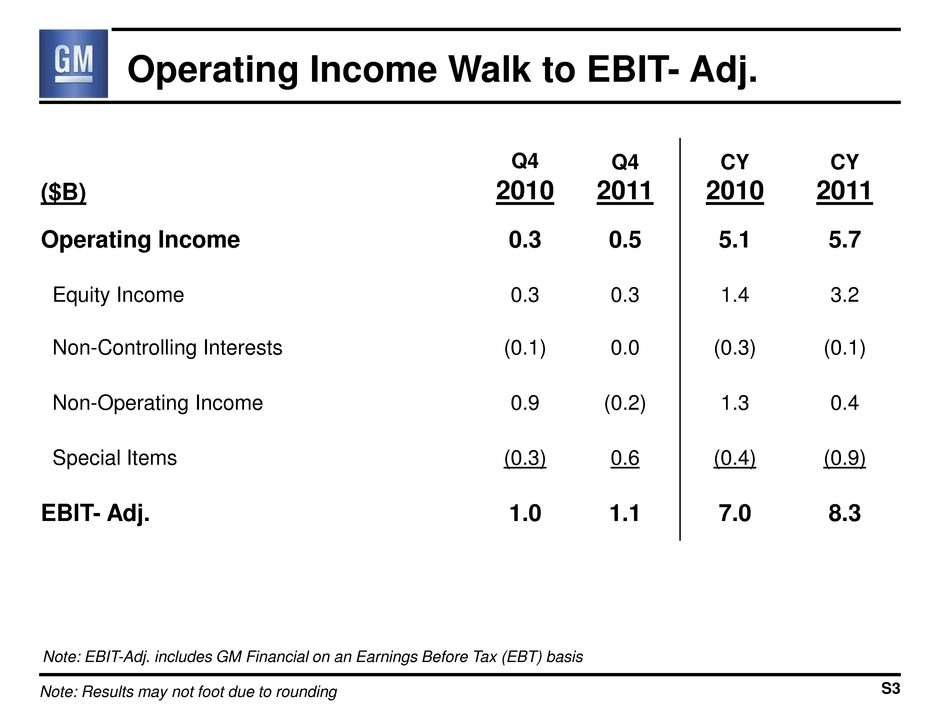

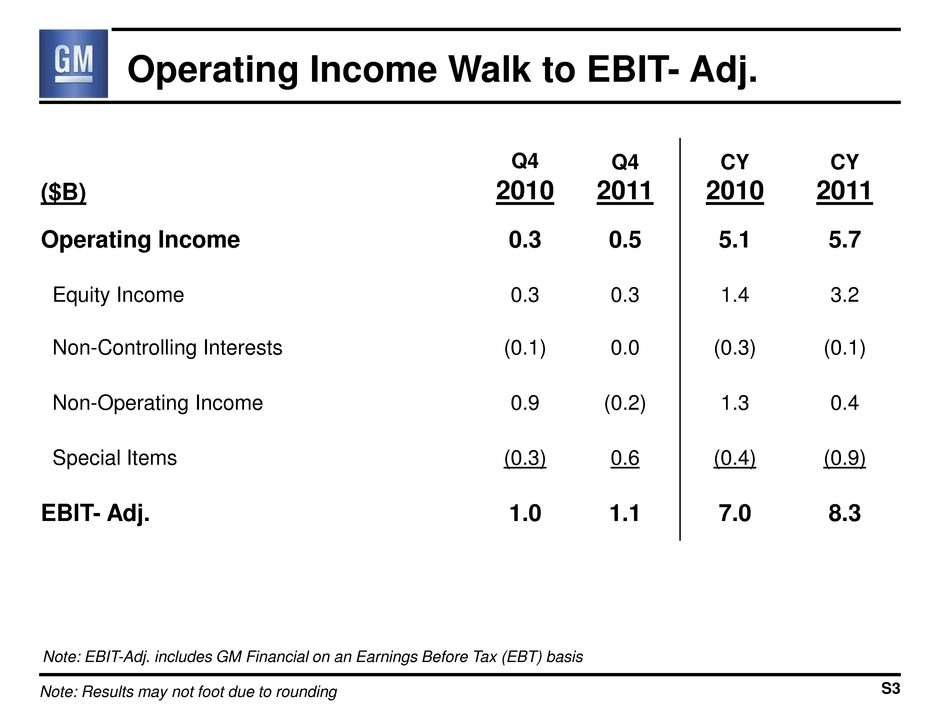

Operating Income Walk to EBIT- Adj. ($B) Q4 2010 Q4 2011 CY 2010 CY 2011 Operating Income 0.3 0.5 5.1 5.7 Equity Income 0.3 0.3 1.4 3.2 Non-Controlling Interests (0.1) 0.0 (0.3) (0.1) Non-Operating Income 0.9 (0.2) 1.3 0.4 Special Items (0.3) 0.6 (0.4) (0.9) EBIT- Adj. 1.0 1.1 7.0 8.3 Note: EBIT-Adj. includes GM Financial on an Earnings Before Tax (EBT) basis S3 Note: Results may not foot due to rounding

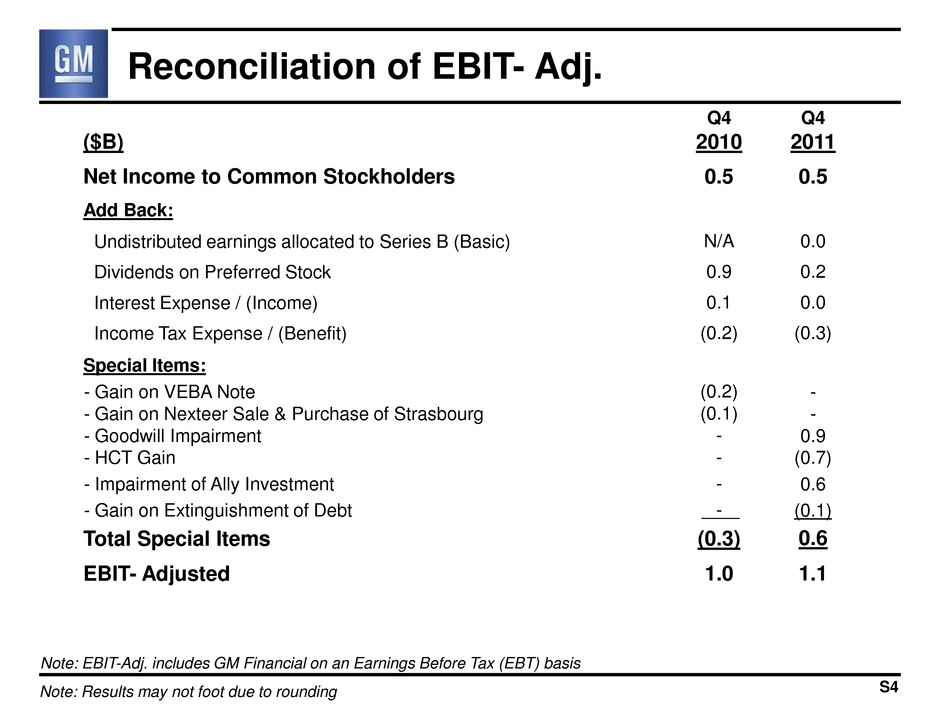

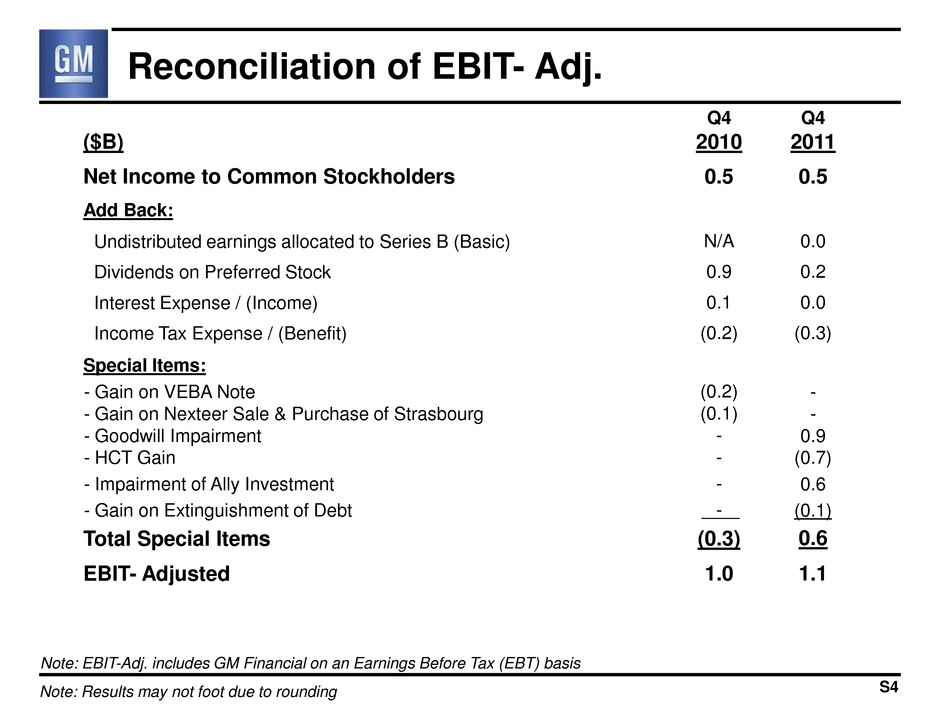

Reconciliation of EBIT- Adj. ($B) Q4 2010 Q4 2011 Net Income to Common Stockholders 0.5 0.5 Add Back: Undistributed earnings allocated to Series B (Basic) N/A 0.0 Dividends on Preferred Stock 0.9 0.2 Interest Expense / (Income) 0.1 0.0 Income Tax Expense / (Benefit) (0.2) (0.3) Special Items: - Gain on VEBA Note (0.2) - - Gain on Nexteer Sale & Purchase of Strasbourg (0.1) - - Goodwill Impairment - 0.9 - HCT Gain - (0.7) - Impairment of Ally Investment - 0.6 - Gain on Extinguishment of Debt - (0.1) Total Special Items (0.3) 0.6 EBIT- Adjusted 1.0 1.1 Note: Results may not foot due to rounding S4 Note: EBIT-Adj. includes GM Financial on an Earnings Before Tax (EBT) basis

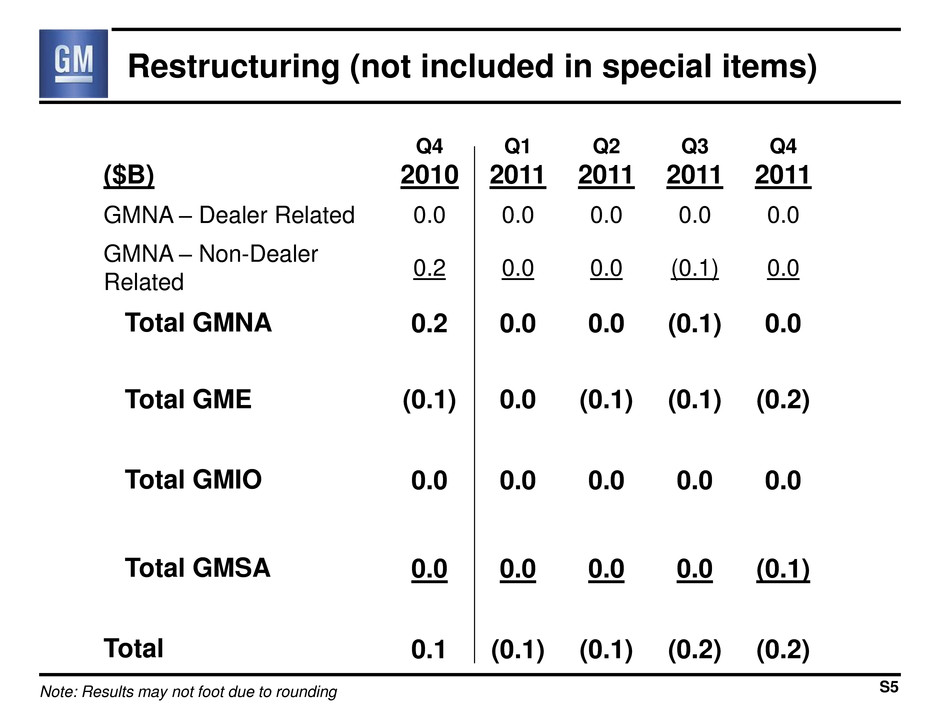

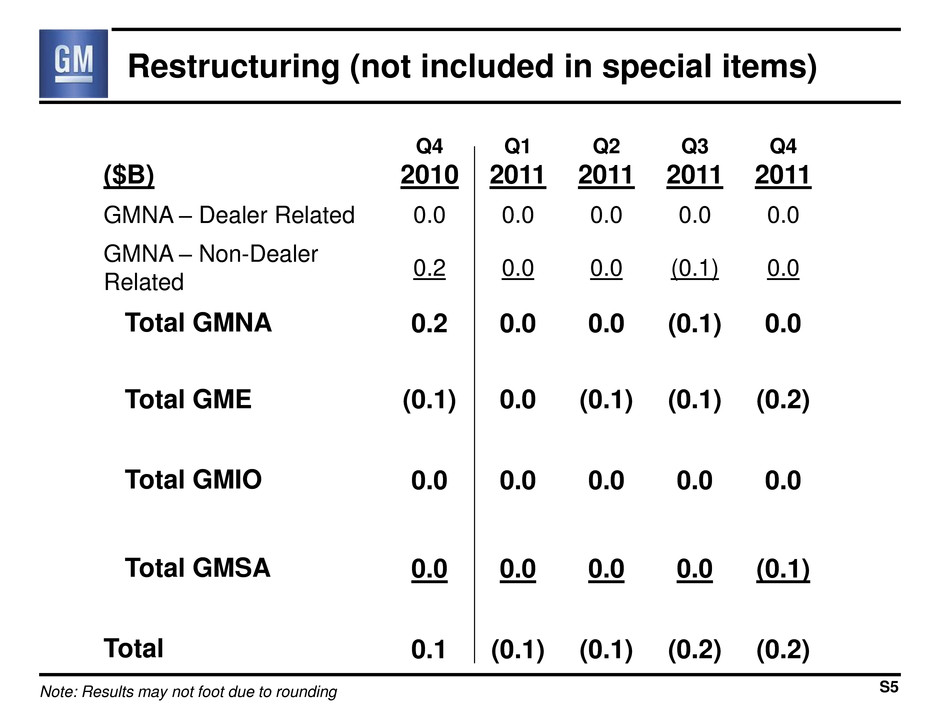

Restructuring (not included in special items) ($B) Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 GMNA – Dealer Related 0.0 0.0 0.0 0.0 0.0 GMNA – Non-Dealer Related 0.2 0.0 0.0 (0.1) 0.0 Total GMNA 0.2 0.0 0.0 (0.1) 0.0 Total GME (0.1) 0.0 (0.1) (0.1) (0.2) Total GMIO 0.0 0.0 0.0 0.0 0.0 Total GMSA 0.0 0.0 0.0 0.0 (0.1) Total 0.1 (0.1) (0.1) (0.2) (0.2) S5 Note: Results may not foot due to rounding

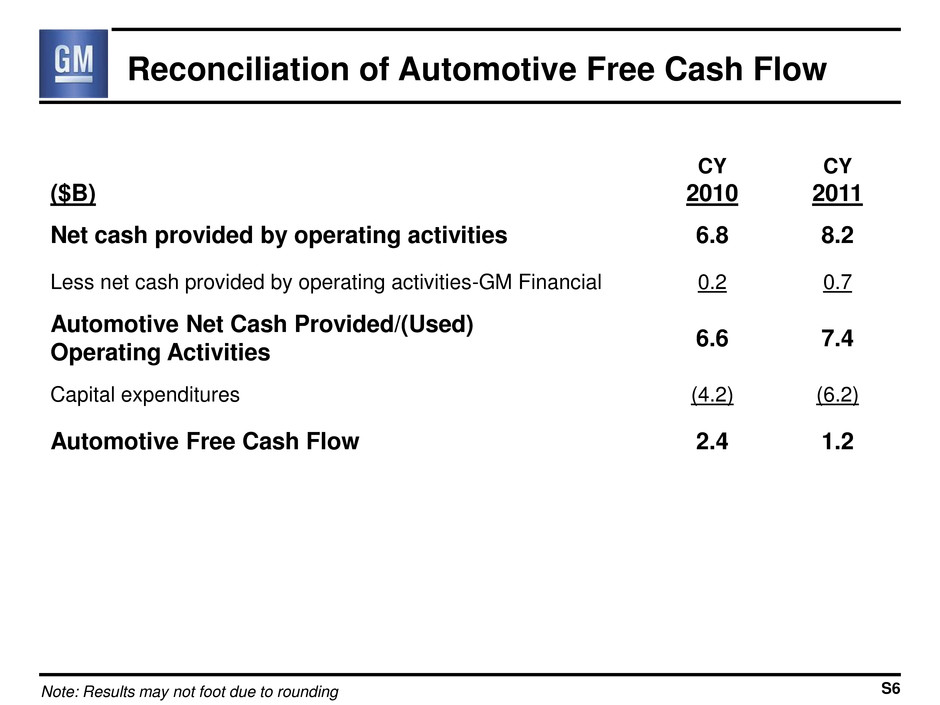

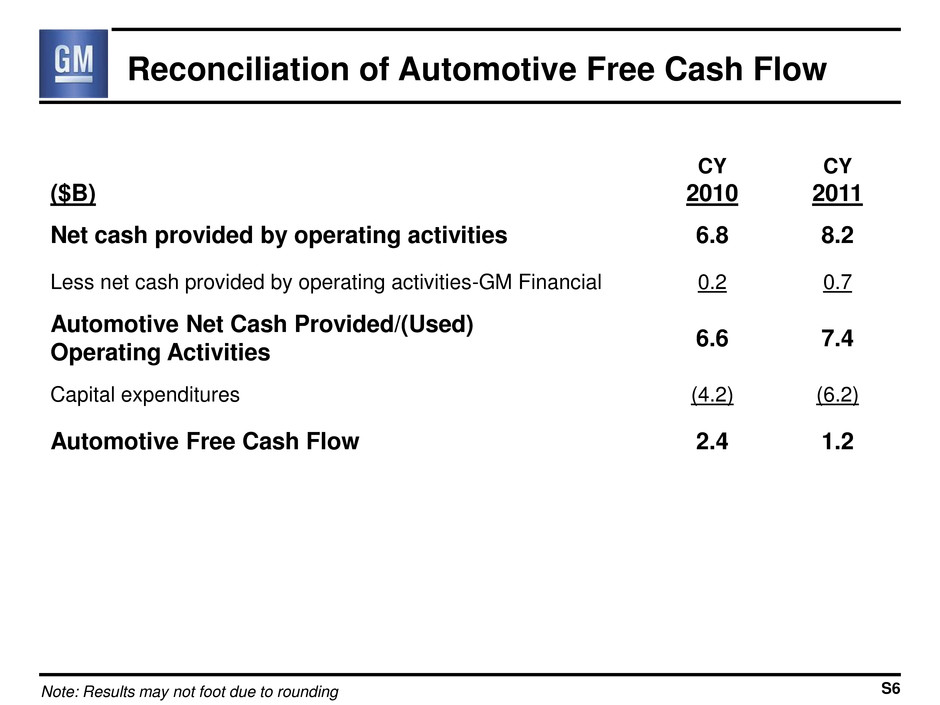

Reconciliation of Automotive Free Cash Flow ($B) CY 2010 CY 2011 Net cash provided by operating activities 6.8 8.2 Less net cash provided by operating activities-GM Financial 0.2 0.7 Automotive Net Cash Provided/(Used) Operating Activities 6.6 7.4 Capital expenditures (4.2) (6.2) Automotive Free Cash Flow 2.4 1.2 S6 Note: Results may not foot due to rounding

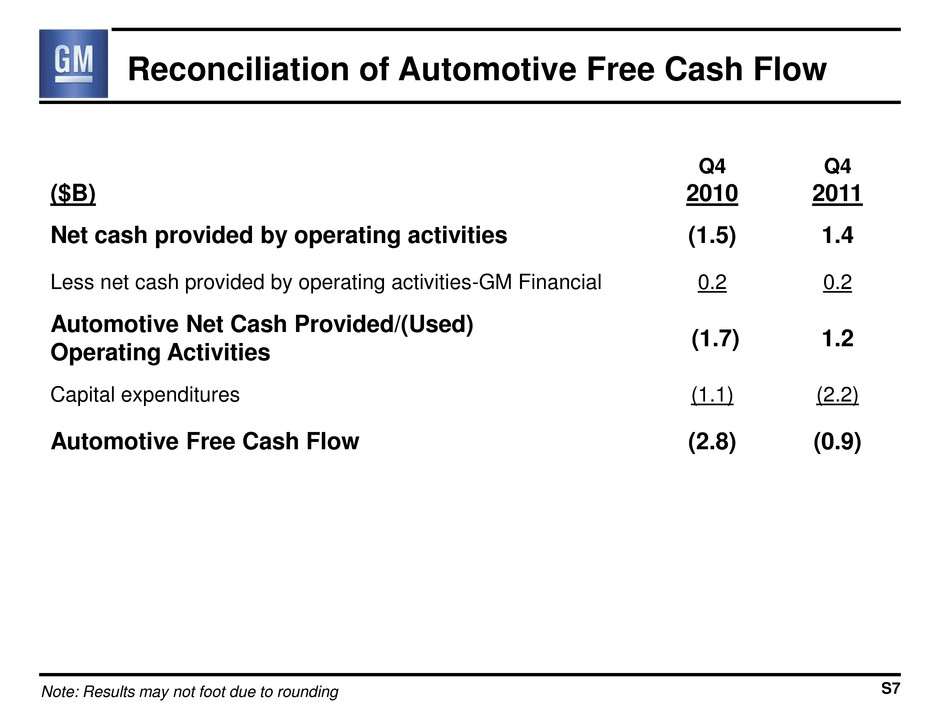

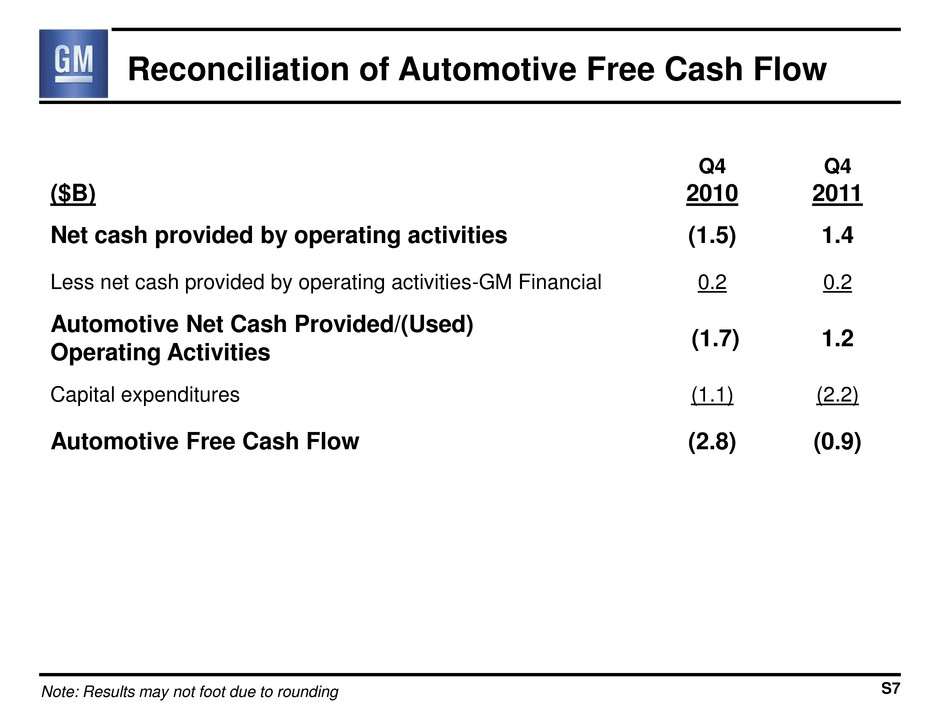

Reconciliation of Automotive Free Cash Flow ($B) Q4 2010 Q4 2011 Net cash provided by operating activities (1.5) 1.4 Less net cash provided by operating activities-GM Financial 0.2 0.2 Automotive Net Cash Provided/(Used) Operating Activities (1.7) 1.2 Capital expenditures (1.1) (2.2) Automotive Free Cash Flow (2.8) (0.9) S7 Note: Results may not foot due to rounding

Automotive Free Cash Flow – 2010 vs. 2011 ($B) CY 2010 CY 2011 Net Income to Common Stockholders 4.7 7.6 Add-back Non-Controlling Interests, Preferred Dividends & undistributed earnings allocated to Series B 1.8 1.7 Deduct Non-Auto (GM Financial) (0.1) (0.4) Automotive Income 6.4 8.9 Depreciation / Amortization / Impairment 6.9 7.3 Working Capital (0.6) (1.1) Termination of In-Transit Financing - (1.1) Pension / OPEB – Cash in Excess of Expense (1.3) (1.5) Canadian Healthcare Trust Cash Payment & Gain - (1.5) Voluntary U.S. Pension Plan Contribution (4.0) - Gain on Sale of Delphi Membership Interest - (1.6) Other (0.8) (1.9) Automotive Net Cash Provided/(Used) Operating Activities 6.6 7.4 Capital Expenditures (4.2) (6.2) Automotive Free Cash Flow 2.4 1.2 Note: Results may not foot due to rounding S8

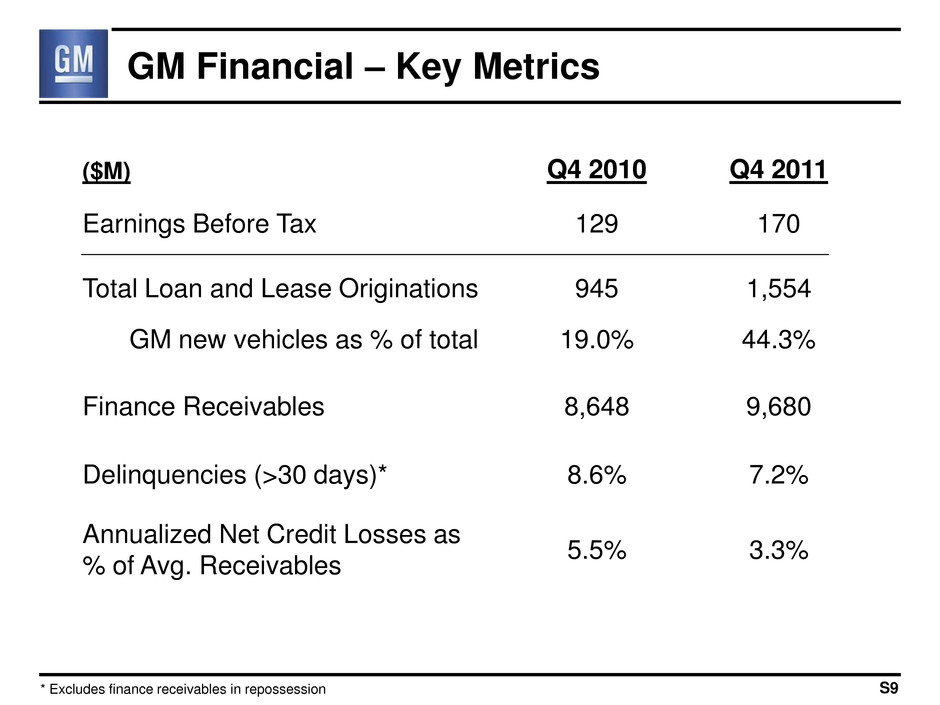

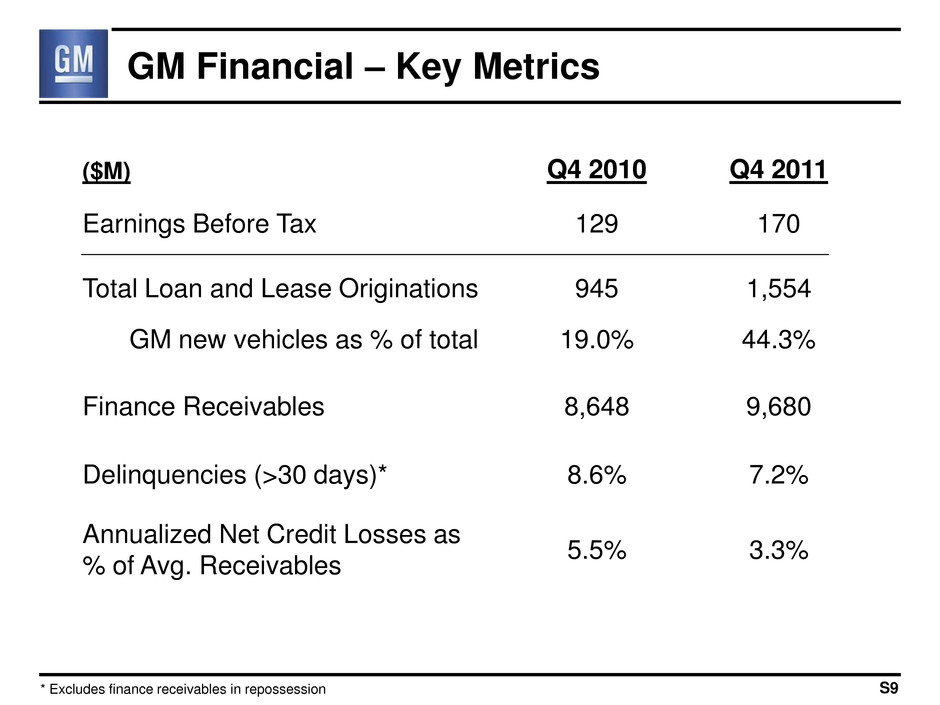

GM Financial – Key Metrics ($M) Q4 2010 Q4 2011 Earnings Before Tax 129 170 Total Loan and Lease Originations 945 1,554 GM new vehicles as % of total 19.0% 44.3% Finance Receivables 8,648 9,680 Delinquencies (>30 days)* 8.6% 7.2% Annualized Net Credit Losses as % of Avg. Receivables 5.5% 3.3% S9 * Excludes finance receivables in repossession

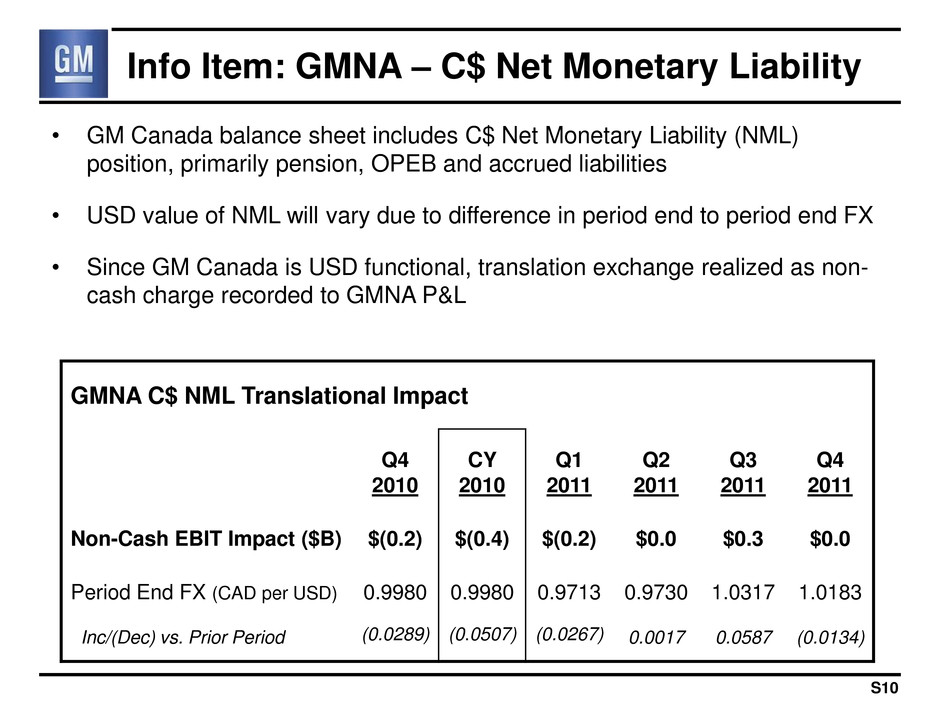

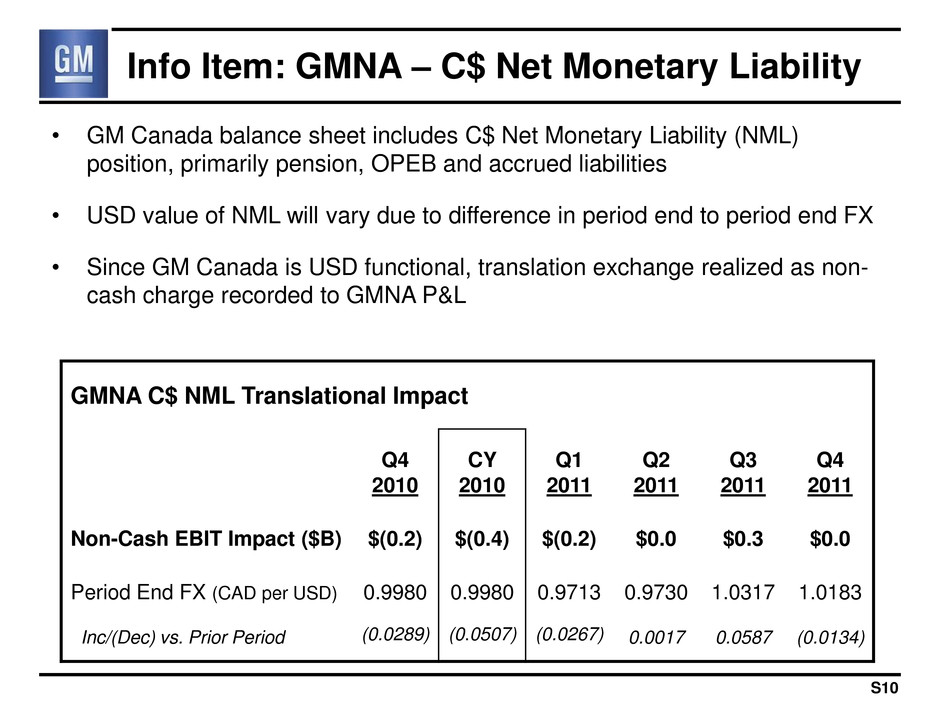

Info Item: GMNA – C$ Net Monetary Liability GMNA C$ NML Translational Impact Q4 2010 CY 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 Non-Cash EBIT Impact ($B) $(0.2) $(0.4) $(0.2) $0.0 $0.3 $0.0 Period End FX (CAD per USD) Inc/(Dec) vs. Prior Period 0.9980 (0.0289) 0.9980 (0.0507) 0.9713 (0.0267) 0.9730 0.0017 1.0317 0.0587 1.0183 (0.0134) • GM Canada balance sheet includes C$ Net Monetary Liability (NML) position, primarily pension, OPEB and accrued liabilities • USD value of NML will vary due to difference in period end to period end FX • Since GM Canada is USD functional, translation exchange realized as non- cash charge recorded to GMNA P&L S10

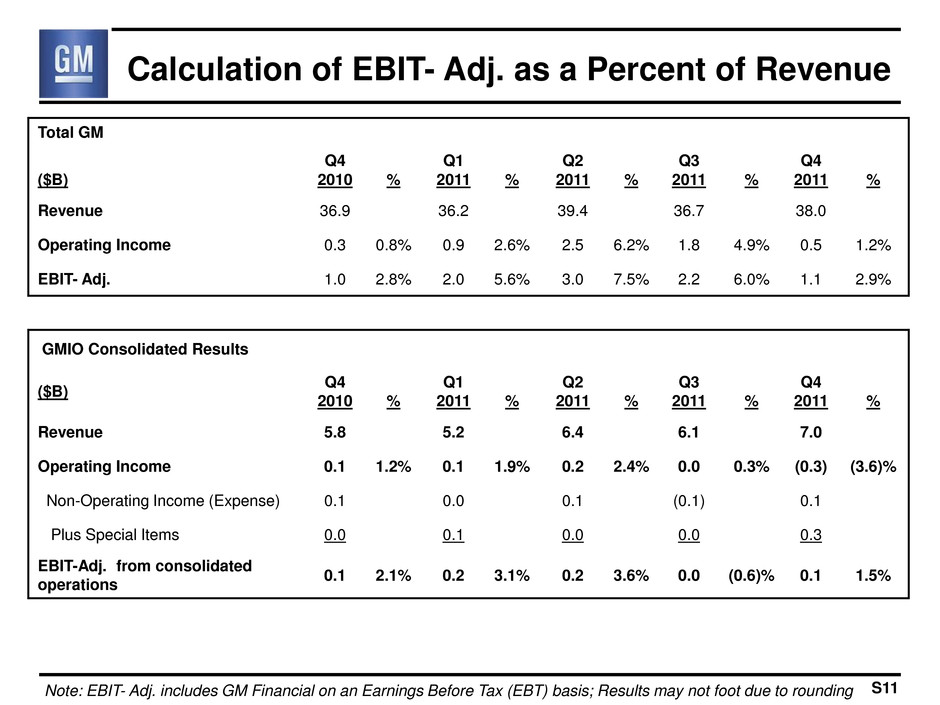

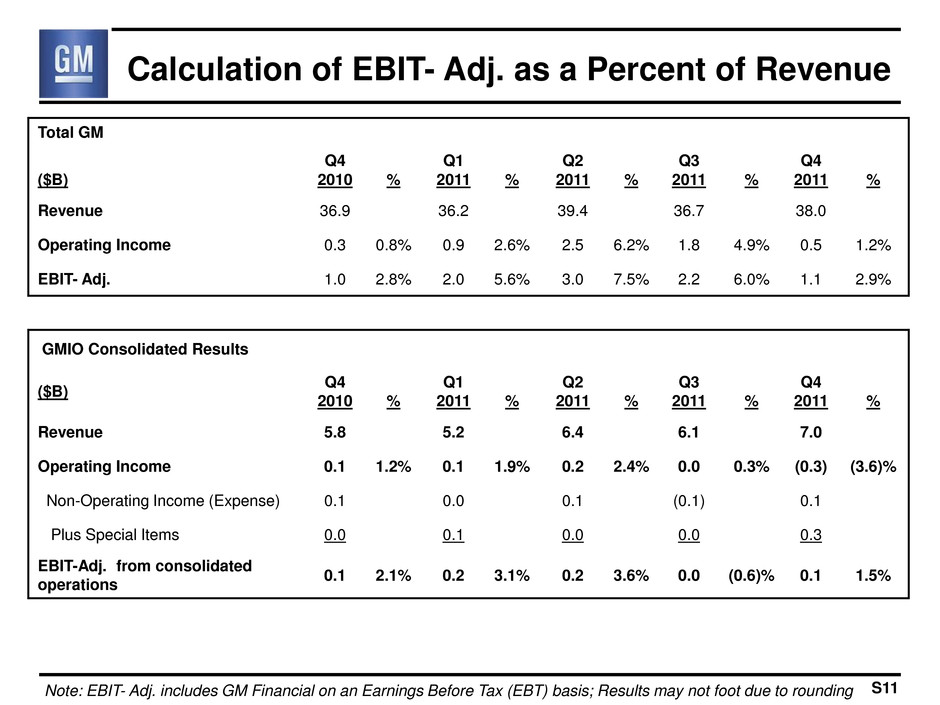

Calculation of EBIT- Adj. as a Percent of Revenue Total GM ($B) Q4 2010 % Q1 2011 % Q2 2011 % Q3 2011 % Q4 2011 % Revenue 36.9 36.2 39.4 36.7 38.0 Operating Income 0.3 0.8% 0.9 2.6% 2.5 6.2% 1.8 4.9% 0.5 1.2% EBIT- Adj. 1.0 2.8% 2.0 5.6% 3.0 7.5% 2.2 6.0% 1.1 2.9% GMIO Consolidated Results ($B) Q4 2010 % Q1 2011 % Q2 2011 % Q3 2011 % Q4 2011 % Revenue 5.8 5.2 6.4 6.1 7.0 Operating Income 0.1 1.2% 0.1 1.9% 0.2 2.4% 0.0 0.3% (0.3) (3.6)% Non-Operating Income (Expense) 0.1 0.0 0.1 (0.1) 0.1 Plus Special Items 0.0 0.1 0.0 0.0 0.3 EBIT-Adj. from consolidated operations 0.1 2.1% 0.2 3.1% 0.2 3.6% 0.0 (0.6)% 0.1 1.5% Note: EBIT- Adj. includes GM Financial on an Earnings Before Tax (EBT) basis; Results may not foot due to rounding S11