VIDEO ATS Spot :60 Exhibit 99.2

CADILLAC ATS NORTH AMERICAN CAR OF THE YEAR Exhibit 99.2

FORWARD LOOKING STATEMENTS In this presentation and in related comments by our management, our use of the words “expect,” “anticipate,” “possible,” “potential,” “target,” “believe,” “commit,” “intend,” “continue,” “may,” “would,” “could,” “should,” “project,” “projected,” “positioned,” “outlook” or similar expressions is intended to identify forward looking statements that represent our current judgment about possible future events. We believe these judgments are reasonable, but these statements are not guarantees of any events or financial results, and our actual results may differ materially due to a variety of important factors. Among other items, such factors may include: our ability to realize production efficiencies and to achieve reductions in costs as a result of our restructuring initiatives and labor modifications; our ability to maintain quality control over our vehicles and avoid material vehicle recalls; our suppliers’ ability to deliver parts, systems and components at such times to allow us to meet production schedules; our ability to maintain adequate financing sources, including as required to fund our planned significant investment in new technology; our ability to realize successful vehicle applications of new technology; overall strength and stability of our markets, particularly Europe; and our ability to continue to attract new customers, particularly for our new products. GM's most recent annual report on Form 10-K and quarterly reports on Form 10Q provide information about these and other factors, which we may revise or supplement in future reports to the SEC.

CHUCK STEVENS CFO GM North America

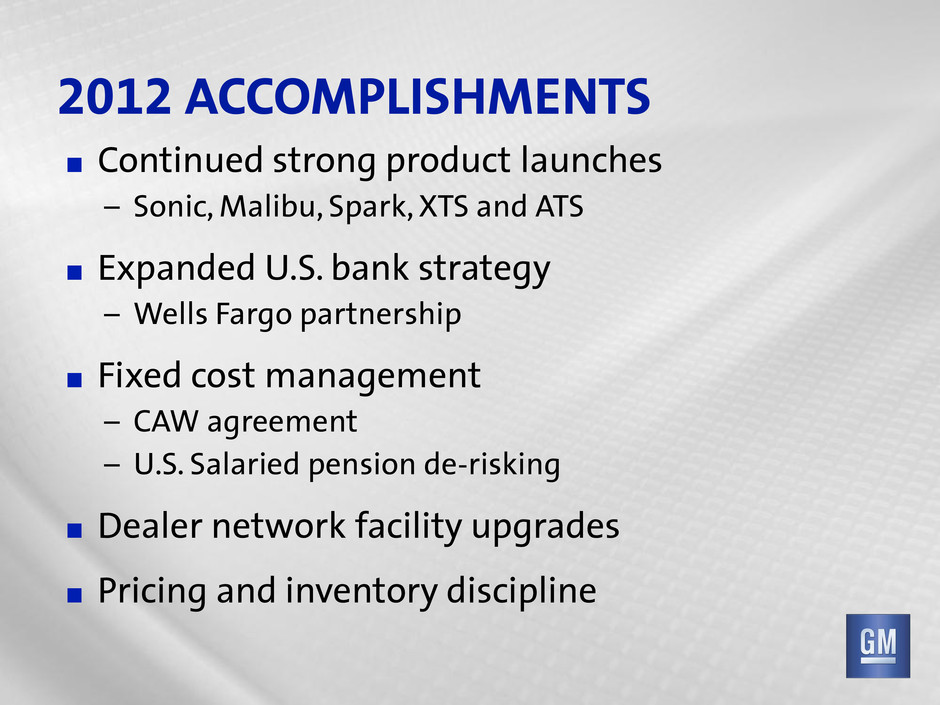

2012 ACCOMPLISHMENTS ¶ Continued strong product launches – Sonic, Malibu, Spark, XTS and ATS ¶ Expanded U.S. bank strategy – Wells Fargo partnership ¶ Fixed cost management – CAW agreement – U.S. Salaried pension de-risking ¶ Dealer network facility upgrades ¶ Pricing and inventory discipline

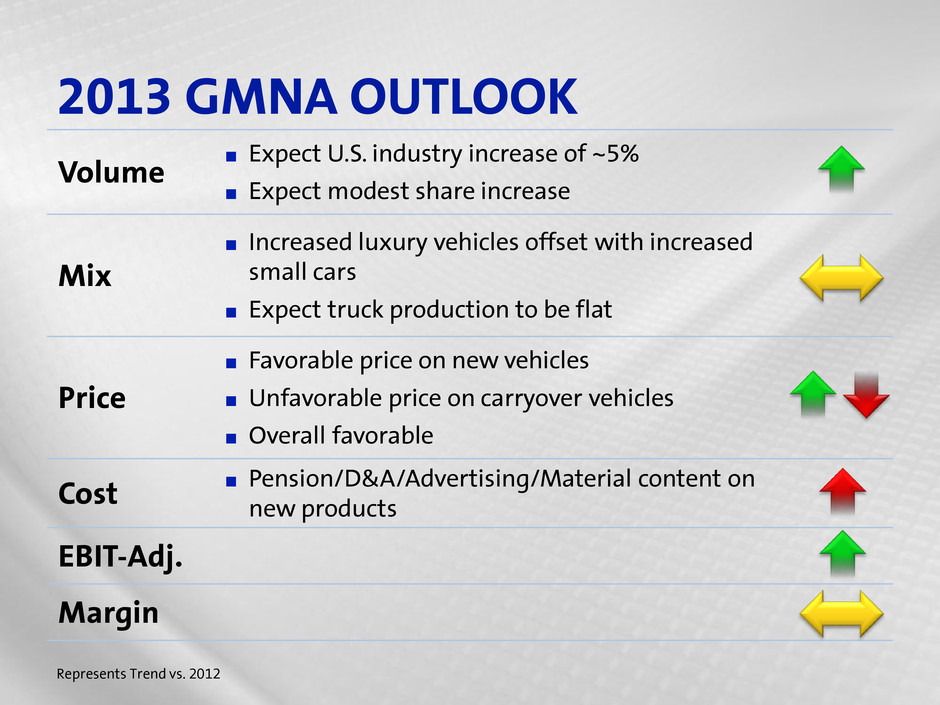

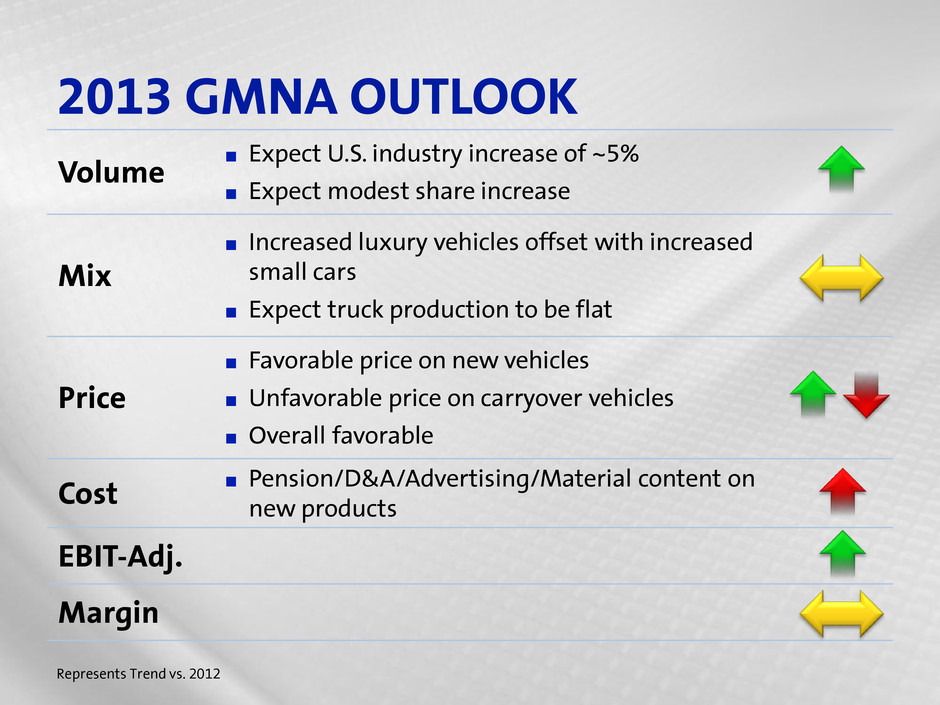

2013 GMNA OUTLOOK Volume ¶ Expect U.S. industry increase of ~5% ¶ Expect modest share increase Mix ¶ Increased luxury vehicles offset with increased small cars ¶ Expect truck production to be flat Price ¶ Favorable price on new vehicles ¶ Unfavorable price on carryover vehicles ¶ Overall favorable Cost ¶ Pension/D&A/Advertising/Material content on new products EBIT-Adj. Margin Represents Trend vs. 2012

CHEVROLET SILVERADO

CHEVROLET IMPALA

CHEVROLET CORVETTE

CADILLAC CTS

2013 OPPORTUNITIES AND CHALLENGES Opportunities ¶ From oldest to among freshest portfolio in next 18 months ¶ Brand image improvements, dealer facility upgrades ¶ GM Financial Challenges ¶ Execute flawless product launches ¶ Economic risk ¶ Market share growth

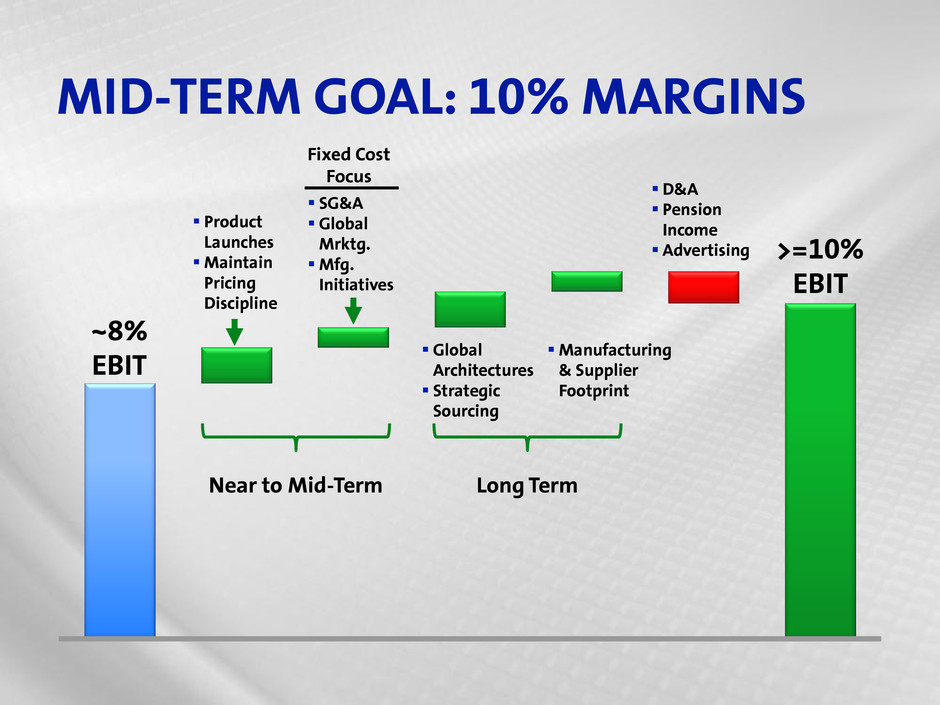

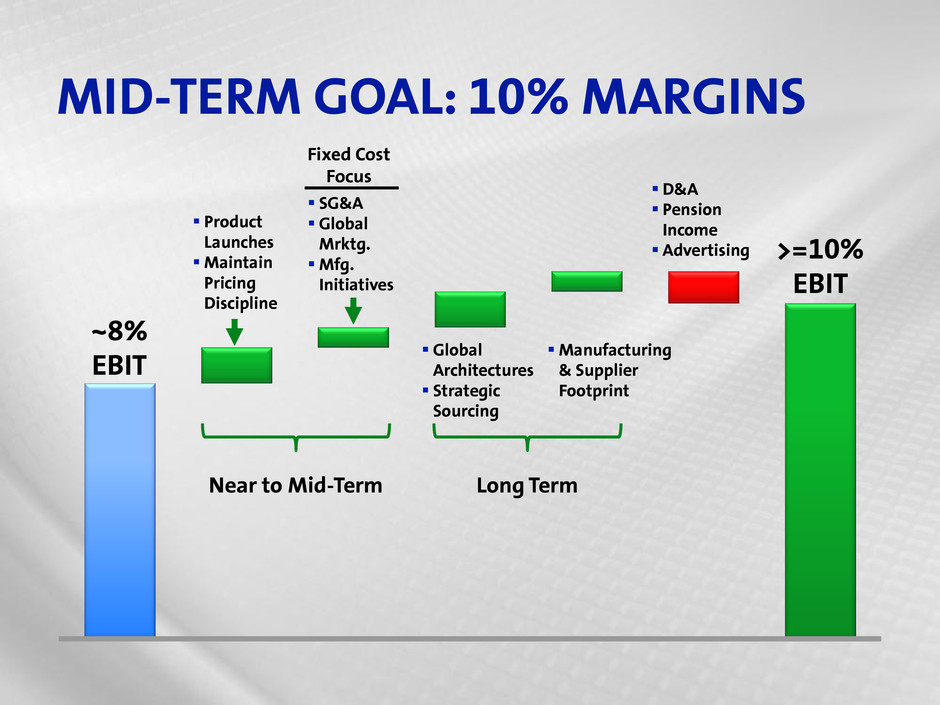

MID-TERM GOAL: 10% MARGINS Product Launches Maintain Pricing Discipline SG&A Global Mrktg. Mfg. Initiatives Near to Mid-Term Fixed Cost Focus Long Term Global Architectures Strategic Sourcing Manufacturing & Supplier Footprint D&A Pension Income Advertising >=10% EBIT ~8% EBIT

SUMMARY ¶ 2013 setting the stage for enhanced profit growth in mid-term ¶ Flawless launch execution is critical ¶ Maintain pricing discipline/inventory management ¶ Continue to execute roadmap to 10% margins

CHUCK STEVENS CFO GM South America

2012 ACCOMPLISHMENTS ¶Return to profitability driven by – Successful product launches around region... especially Brazil – Good progress on cost side of business – Ability to manage volatility/changing environment and still meet commitments

2013 GMSA OUTLOOK Volume ¶ Moderate industry growth ¶ Slight market share increase Price ¶ Price increase to recover economics Mix ¶ Richer launch mix ¶ Portfolio renewal Cost ¶ Performance to partially offset economics and FX impact EBIT-Adj. Margin Represents Trend vs. 2012

CHEVROLET ONIX Represents 26% of Brazil sales for both NB and HB

CHEVROLET SPIN Segment leader after 4-6 months introduction

2013 OPPORTUNITIES AND CHALLENGES Opportunities ¶ Lower than expected VEB/USD devaluation ¶ Further cost reduction initiatives ¶ Infrastructure investments in Brazil Challenges ¶ Venezuela – Chavez health/succession ¶ Argentina – Government protests, intervention ¶ Brazil – Onix launch, elimination of IPI tax benefit

MID-TERM GOAL: MID-SINGLE DIGIT MARGINS ¶ Mid and long term plans set the path to sustained profit in the region ¶ Product refresh ¶ Rationalize portfolio ¶ Fixed cost discipline ¶ Low cost manufacturing footprint ¶ Supplier footprint ¶ Protect market leadership in high risk countries 2013 Important step on glidepath after 2012 “recovery” …

SUMMARY ¶ Profit improving, but headwinds persist ¶ Key launch cadence completed with Onix in Q1 2013 ¶ YOY Revenue, EBIT, and EBIT margin improvement ¶ Defined mid-term path toward mid-single digit margins ¶ Challenging economic, political, and regulatory environment

MICHAEL LOHSCHELLER Vice President & CFO Opel/Vauxhall

2012 ACCOMPLISHMENTS ¶ Launch of six new products in 2012 ¶ Opel/Vauxhall: ranks #3 passenger car brand in Europe ¶ Opel/Vauxhall: sales of +1 million units ¶ Inventory reduction from more than 180,000 units to less than 100,000 units ¶ Manufacturing footprint reduction: next gen Astra production in two plants (from three), announcement to close Bochum plant for car production in 2016 ¶ Opel Ampera: European Car of the Year in 2012, also Zafira, Mokka and ADAM Award winning products ¶ Significant management changes

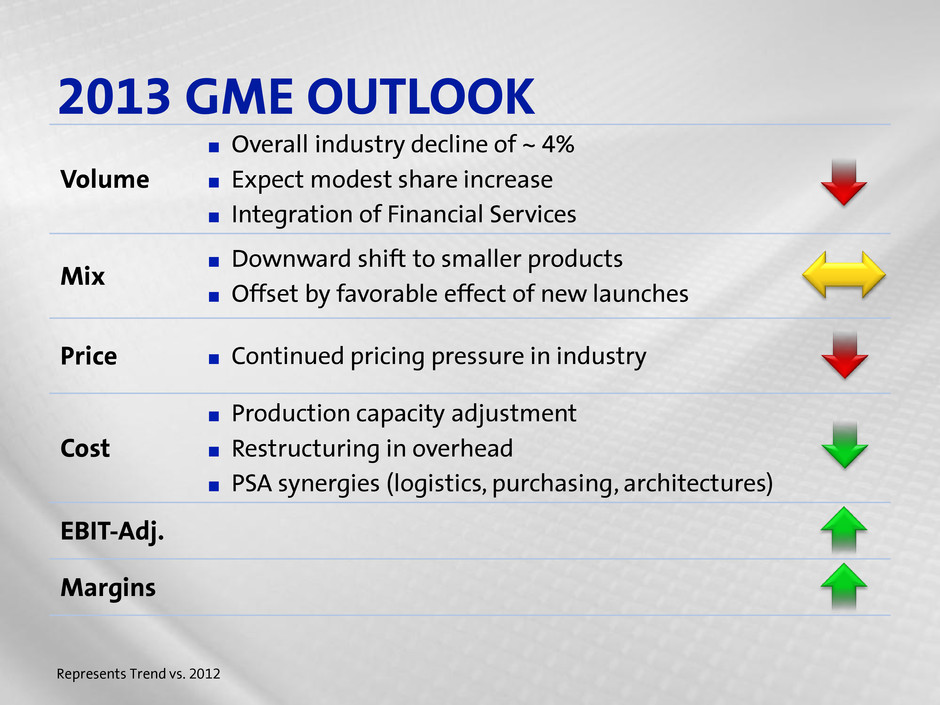

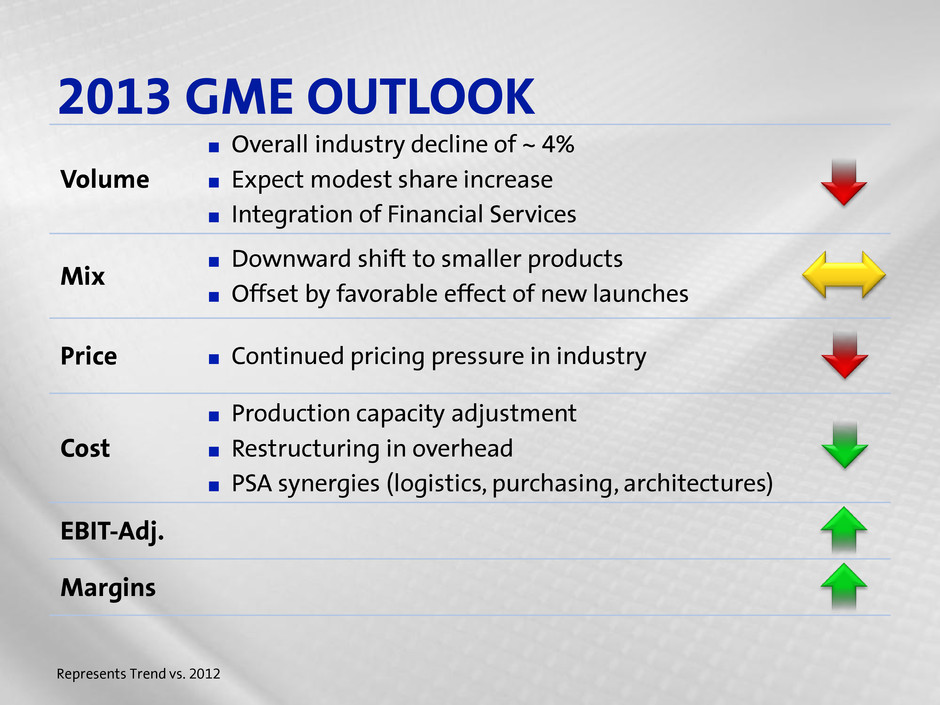

2013 GME OUTLOOK Represents Trend vs. 2012 Volume ¶ Overall industry decline of ~ 4% ¶ Expect modest share increase ¶ Integration of Financial Services Mix ¶ Downward shift to smaller products ¶ Offset by favorable effect of new launches Price ¶ Continued pricing pressure in industry Cost ¶ Production capacity adjustment ¶ Restructuring in overhead ¶ PSA synergies (logistics, purchasing, architectures) EBIT-Adj. Margins

OPEL MOKKA

OPEL ASTRA NB

OPEL ADAM

OPEL CASCADA

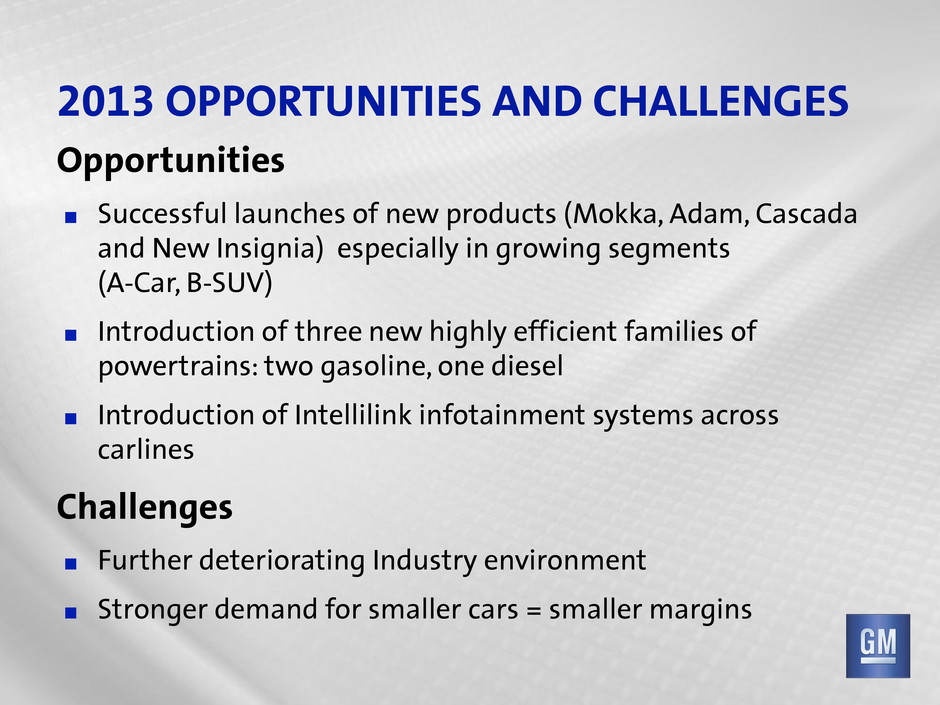

2013 OPPORTUNITIES AND CHALLENGES Opportunities ¶ Successful launches of new products (Mokka, Adam, Cascada and New Insignia) especially in growing segments (A-Car, B-SUV) ¶ Introduction of three new highly efficient families of powertrains: two gasoline, one diesel ¶ Introduction of Intellilink infotainment systems across carlines Challenges ¶ Further deteriorating Industry environment ¶ Stronger demand for smaller cars = smaller margins

MID TERM GOAL: BREAKEVEN BY MID-DECADE Volume/Revenue ¶Moderate industry recovery ¶23 new models/ strengthened brands ¶Expansion of auto financing ¶New Go-To-Market strategy Variable Cost ¶Material Cost reduction ¶Logistics savings (GEFCO) Fixed Cost ¶Improved capacity utilization ¶Headcount reductions ¶Labor agreements ¶Short work GME EBIT-Adjusted Breakeven by Mid-Decade

SUMMARY ¶ Restructuring of European manufacturing, sales and administration footprint ¶ Price stabilization and mix optimization ¶ Growth in profitable new segments for Opel/Vauxhall ¶ GME Opel/Vauxhall breakeven by mid-decade ¶ Strategic initiatives in Europe

TIM STONESIFER CFO GM International Operations

2012 ACCOMPLISHMENTS Yet Another Record Year… ¶ Leveraged growth with great vehicles – All time record 4 million units* – 18 launches, 9.7% share ¶ $1.8B EBIT-adjusted through Q3 2012 ¶ Built pricing power and operating leverage ¶ Improved customer satisfaction and quality – 28 “Voice of Customer” awards * Including Russia and CIS countries

2013 GMIO OUTLOOK Volume ¶ Industry increase ~5% ¶ Expand portfolio in China, ASEAN, India Mix ¶ Improvement in Korea and Australia Price ¶ Moderate improvement Cost ¶ Favorable material cost performance ¶ Invest in growth EBIT-Adj. Margin ¶ FX headwinds for consolidated operations ¶ Competitive pressure in China

CADILLAC XTS “Most technologically advanced production car in the Cadillac brand’s history, targeting a new generation of luxury customers” Key Markets: China, Middle East

CHEVROLET SPIN Key Markets: ASEAN (Indonesia, Thailand, Philippines) “Low-cost, affordable seven-passenger MPV, aimed at the lower end of the growing small wagon, utility and minivan segments”

CHEVROLET SAIL “Leveraging success in China to broaden India portfolio into small segment with both petroleum and diesel variants” Key Markets: China, India

CHEVROLET TRAX/TRACKER “Urban crossover that offers a perfect combination of SUV design, functionality, performance and value” Key Markets: Western/Central Europe, Korea, Russia

2013 OPPORTUNITIES AND CHALLENGES Opportunities ¶Leveraging growth markets ¶Continuing introduction of fresh products ¶Driving cost productivity…material and SG&A Challenges ¶Executing flawless launches…grow share ¶Delivering price improvements ¶Monitoring economic/political risk

MID-TERM GOAL: IMPROVE MARGINS, CONTINUED PROFITABLE GROWTH IN CHINA ¶ Leverage strong foundation to improve profit and margin across the board – Pricing confidence with winning products – Leveraging “LEAN” to drive cost focus – Increase margins to mid single digit ¶ Maintain leading position and grow in China ¶Execute “turnaround” strategies ¶ Continue to develop local talent

SUMMARY ¶Deliver volume growth ¶Maximize pricing opportunities ¶Drive cost productivity ¶Improve customer satisfaction and quality ¶Increase margins

DAN AMMANN Senior Vice President & Chief Financial Officer

GM FINANCIAL

GM FINANCIAL – ALLY IO ¶Provides financing availability in GM’s key international markets ¶ Positions GMF to leverage success in North America on global platform – Expect to close financing gap vs. competition – Expands financing coverage to 80% of GM global sales ¶ Cumulative $5.5B capital deployment (including 2010 $3.5B GMF acquisition), driving: – ~$1 billion annual pre-tax GMF earnings – Significant incremental vehicle sales

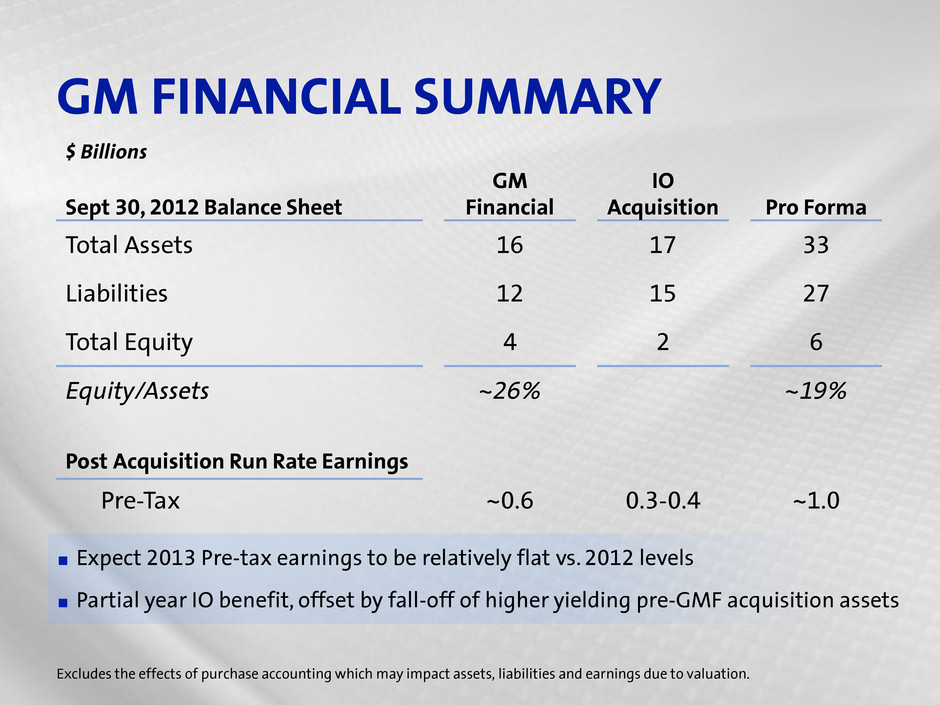

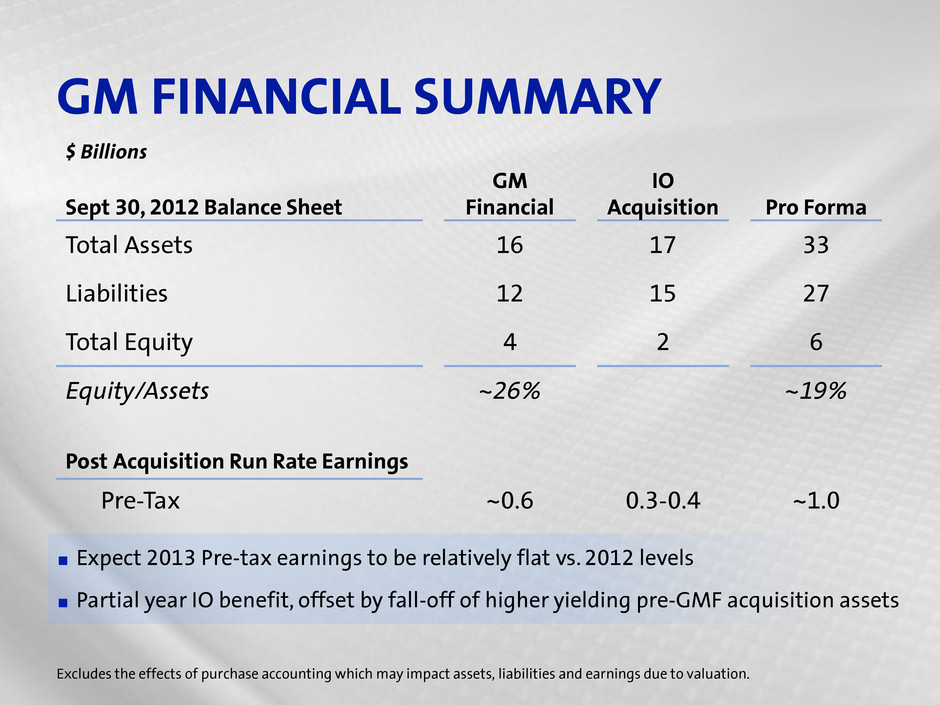

GM FINANCIAL SUMMARY $ Billions Sept 30, 2012 Balance Sheet GM Financial IO Acquisition Pro Forma Total Assets 16 17 33 Liabilities 12 15 27 Total Equity 4 2 6 Equity/Assets ~26% ~19% Post Acquisition Run Rate Earnings Pre-Tax ~0.6 0.3-0.4 ~1.0 Excludes the effects of purchase accounting which may impact assets, liabilities and earnings due to valuation. ¶Expect 2013 Pre-tax earnings to be relatively flat vs. 2012 levels ¶Partial year IO benefit, offset by fall-off of higher yielding pre-GMF acquisition assets

TOTAL COMPANY Summary

2012 ACCOMPLISHMENTS ¶ Delivered solid earnings and cash generation ¶ Proactively addressed multiple strategic issues: – GM South America returned to profitability – European turnaround actions and mid-decade plan – Pension de-risking – reduced obligation $29B – Financial flexibility increased via $11B credit revolver – Capital expenditures increased to $8B – UST overhang addressed and capital returned to shareholders – GM Financial expanded via Ally International acquisition

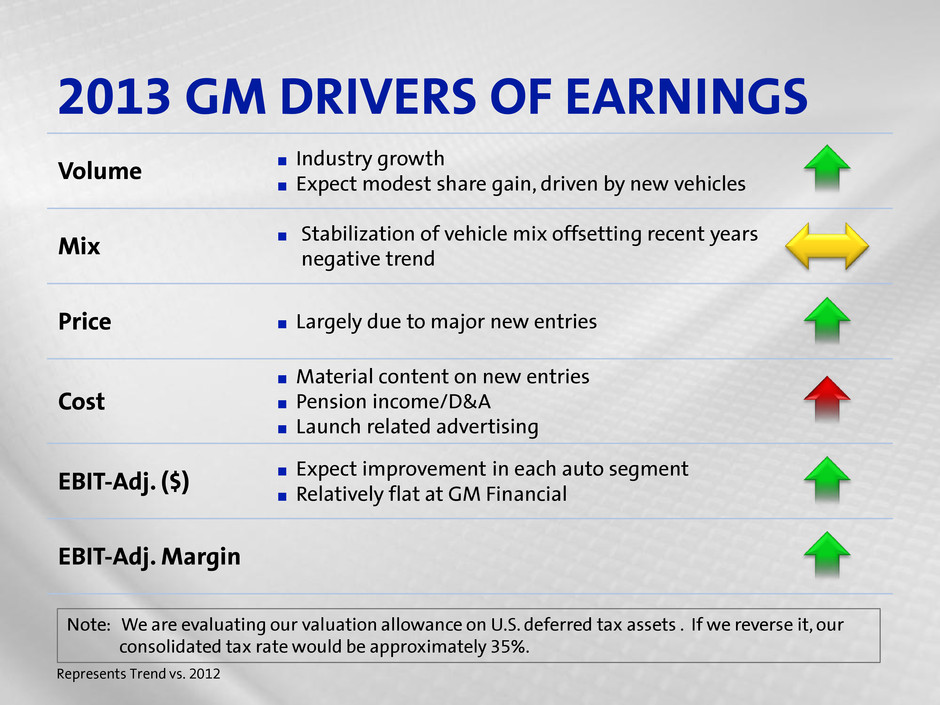

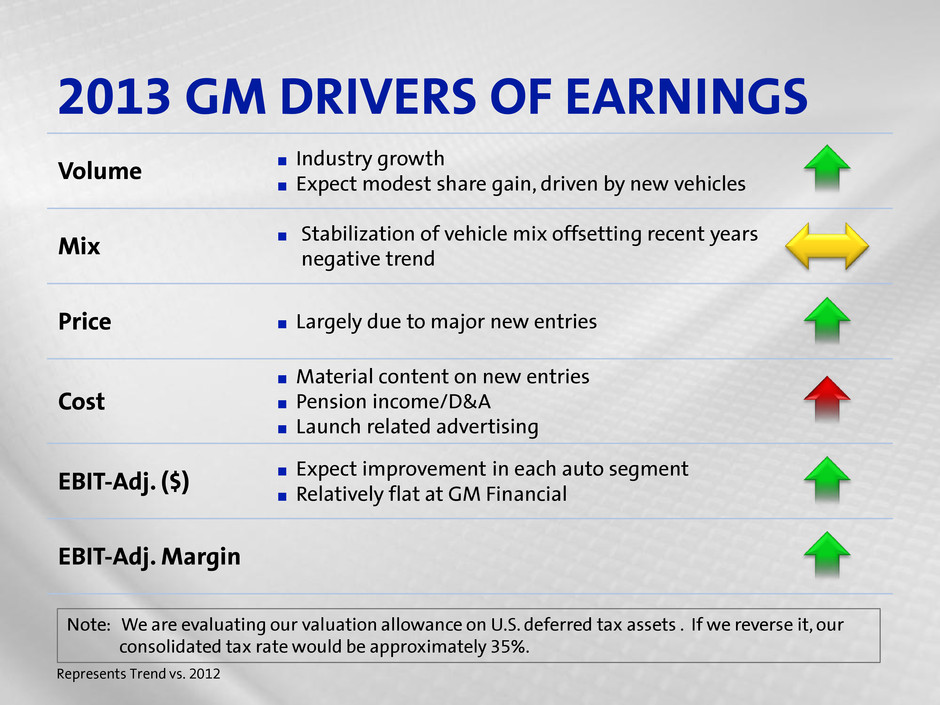

2013 GM DRIVERS OF EARNINGS Volume ¶ Industry growth ¶ Expect modest share gain, driven by new vehicles Mix ¶ Stabilization of vehicle mix offsetting recent years negative trend Price ¶ Largely due to major new entries Cost ¶ Material content on new entries ¶ Pension income/D&A ¶ Launch related advertising EBIT-Adj. ($) ¶ Expect improvement in each auto segment ¶ Relatively flat at GM Financial EBIT-Adj. Margin Represents Trend vs. 2012 Note: We are evaluating our valuation allowance on U.S. deferred tax assets . If we reverse it, our consolidated tax rate would be approximately 35%.

PROGRESS IN 2012… MORE TO DO IN 2013 ¶ Addressed many strategic issues in 2012 to further solidify the foundation ¶ 2013 focus is on execution – Flawless product launches – Maintain discipline in marketplace – Ongoing cost/efficiency actions – Progress in Europe – Working capital improvements