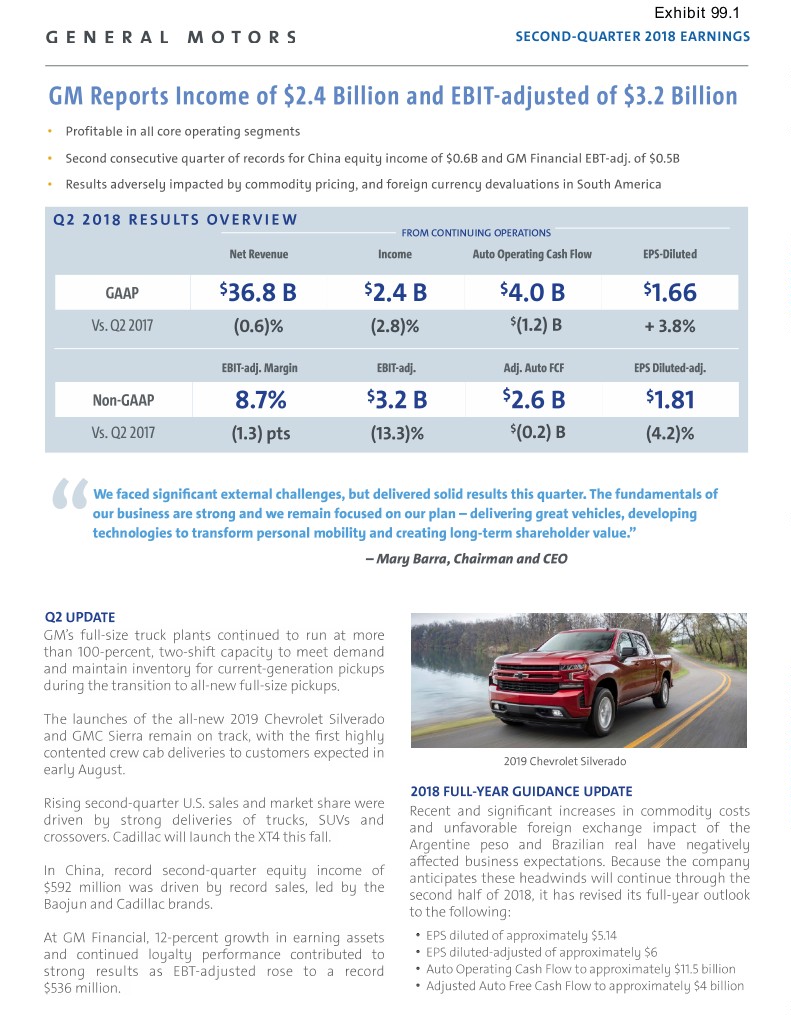

Exhibit 99.1 SECOND-QUARTER 2018 EARNINGS GM Reports Income of $2.4 Billion and EBIT-adjusted of $3.2 Billion • Profitable in all core operating segments • Second consecutive quarter of records for China equity income of $0.6B and GM Financial EBT-adj. of $0.5B • Results adversely impacted by commodity pricing, and foreign currency devaluations in South America Q2 2018 RESULTS OVERVIEW FROM CONTINUING OPERATIONS Net Revenue Income Auto Operating Cash Flow EPS-Diluted GAAP $36.8 B $2.4 B $4.0 B $1.66 Vs. Q2 2017 (0.6)% (2.8)% $(1.2) B + 3.8% EBIT-adj. Margin EBIT-adj. Adj. Auto FCF EPS Diluted-adj. Non-GAAP 8.7% $3.2 B $2.6 B $1.81 Vs. Q2 2017 (1.3) pts (13.3)% $(0.2) B (4.2)% We faced signifcant external challenges, but delivered solid results this quarter. The fundamentals of our business are strong and we remain focused on our plan – delivering great vehicles, developing technologies to transform personal mobility and creating long-term shareholder value.” “ – Mary Barra, Chairman and CEO Q2 UPDATE GM’s full-size truck plants continued to run at more than 100-percent, two-shift capacity to meet demand and maintain inventory for current-generation pickups during the transition to all-new full-size pickups. The launches of the all-new 2019 Chevrolet Silverado and GMC Sierra remain on track, with the frst highly contented crew cab deliveries to customers expected in 2019 Chevrolet Silverado early August. 2018 FULL-YEAR GUIDANCE UPDATE Rising second-quarter U.S. sales and market share were Recent and signifcant increases in commodity costs driven by strong deliveries of trucks, SUVs and and unfavorable foreign exchange impact of the crossovers. Cadillac will launch the XT4 this fall. Argentine peso and Brazilian real have negatively afected business expectations. Because the company In China, record second-quarter equity income of anticipates these headwinds will continue through the $592 million was driven by record sales, led by the second half of 2018, it has revised its full-year outlook Baojun and Cadillac brands. to the following: At GM Financial, 12-percent growth in earning assets EPS diluted of approximately $5.14 and continued loyalty performance contributed to EPS diluted-adjusted of approximately $6 strong results as EBT-adjusted rose to a record Auto Operating Cash Flow to approximately $11.5 billion $536 million. Adjusted Auto Free Cash Flow to approximately $4 billion

“ SEGMENT RESULTS (EBIT-ADJUSTED - $B) North America International GM Cruise GM Financial (EBT) Q2 18 Q2 17 Q2 18 Q2 17 Q2 18 Q2 17 Q2 18 Q2 17 2.7 3.5 0.1 0.3 (0.2) (0.2) 0.5 0.4 EBIT-adj. and margin of Results include record GM Cruise results were on Record EBT-adjusted, as 9.4% refect the unfavorable China equity income of plan, refecting continued earning assets grew 12% to impact of rising commodity $0.6 billion, partially ofset spending on autonomous $90.4 billion, supporting costs. by unfavorable FX in South as the company moves to expected long-term earnings America. commercialization. growth. Our operating performance was impacted by signifcant headwinds from commodity costs and currency devaluations in South America. For the rest of the year we will focus on fawlessly executing our full-size truck launches and continue managing the business with discipline in a more challenging environment.” “ – Chuck Stevens, Executive Vice President and CFO Q2 VEHICLE SALES PRODUCT LAUNCHES In the United States, GM delivered more than 758,000 In June, Chevrolet revealed the all-new 2019 Blazer as vehicles in the second quarter, up 4.6 percent, ahead of the newest member of the industry’s broadest, an industry increase of 2.2 percent. Market share rose freshest crossover and SUV lineup. Positioned between 0.4 percentage points driven by very strong truck, SUV the Equinox and Traverse, the 2019 Blazer will ofer and all-new crossover sales. GM reduced inventory unique design elements that appeal to customers levels by 193,000 year over year – an 83 days supply seeking distinctive styling and outstanding utility. compared to 105 days supply a year ago. Chevrolet and GMC pickup sales were up 21 percent and the brands’ large SUVs were up 22 percent versus a year ago in the U.S. Average transaction prices of the 2018 Chevrolet Traverse climbed nearly $7,000, or more than 20 percent, while the segment average was up just 1 percent in the frst half of the year. GM China delivered more than 858,000 vehicles in the second quarter. Deliveries in the frst half of 2018 grew 4.4 percent, an all-time high for the period. Baojun and 2019 Chevrolet Blazer Cadillac achieved record sales in the second quarter, up 6 percent and 19 percent respectively. Chevrolet GM China introduced the Baojun 530 SUV, Baojun 360 continued to post double-digit growth of 22 percent. MPV, all-new Buick Excelle, and Wuling Rong Guang For more details on GM’s global sales, click here. Mini Pickup. In the second half of the year, GM China will introduce 10 new models, including the Cadillac XT4. In addition, GM China is on track to deliver 20 new ZERO CRASHES, ZERO EMISSIONS, ZERO CONGESTION energy vehicle models by 2023. The SoftBank Vision Fund announced it will invest $2.25 billion in GM Cruise, valuing the company at $11.5 billion. GM also invested $1.1 billion in GM Cruise. The investments are expected to provide the capital LIQUIDITY ($B) (excludes GM Financial) necessary to reach commercialization at scale Q2 18 Q4 17 beginning in 2019. Cash and Current Marketable Securities GM continued its path toward an all-electric future, (includes GM Cruise) 18.0 19.6 announcing an agreement with Honda to develop Total Liquidity advanced battery components. Honda will source the 32.1 33.6 modules from GM.

CONTACTS Tom Henderson Michael Heifler GM Finance Communications GM Investor Relations Media Investors 313-410-2704 313-418-0220 tom.e.henderson@gm.com michael.heifler@gm.com General Motors (NYSE:GM) is committed to delivering safer, better and more sustainable ways for people to get around. General Motors, its subsidiaries and its joint venture entities sell vehicles under the Cadillac, Chevrolet, Baojun, Buick, GMC, Holden, Jiefang and Wuling brands. More information on the company and its subsidiaries, including OnStar, a global leader in vehicle safety and security services, Maven, its personal mobility brand, and Cruise, its autonomous vehicle ride-sharing company, can be found at http:// www.gm.com. Cautionary Note on Forward-Looking Statements. This presentation and related comments by management may include forward-looking statements. These statements are based on current expectations about possible future events and thus are inherently uncertain. Our actual results may difer materially from forward-looking statements due to a variety of factors, including: (1) our ability to deliver new products, services and experiences that attract new, and are desired by existing, customers and to efectively compete in autonomous, ride-sharing and transportation as a service; (2) sales of crossovers, SUVs and full-size pickup trucks; (3) our ability to reduce the costs associated with the manufacture and sale of electric vehicles; (4) the volatility of global sales and operations; (5) our signifcant business in China which subjects us to unique operational, competitive and regulatory risks; (6) our joint ventures, which we cannot operate solely for our beneft and over which we may have limited control; (7) changes in government leadership and laws (including tax laws and regulations), economic tensions between governments and changes in international trade policies, new barriers to entry and changes to or withdrawals from free trade agreements, changes in foreign exchange rates, economic downturns in foreign countries, difering local product preferences and product requirements, compliance with U.S. and foreign countries' export controls and economic sanctions, difering labor laws and regulations and difculties in obtaining fnancing in foreign countries; (8) our dependence on our manufacturing facilities; (9) the ability of suppliers to deliver parts, systems and components without disruption and on schedule; (10) prices of raw materials; (11) our highly competitive industry; (12) the possibility that competitors may independently develop products and services similar to ours despite our intellectual property rights; (13) security breaches and other disruptions to our vehicles, information technology networks and systems; (14) compliance with laws and regulations applicable to our industry, including those regarding fuel economy and emissions; (15) costs and risks associated with litigation and government investigations; (16) compliance with the terms of the Deferred Prosecution Agreement; (17) the cost and efect on our reputation of product safety recalls and alleged defects in products and services; (18) our ability to successfully and cost-efciently restructure operations in various countries, including Korea, with minimal disruption to our supply chain and operations, globally; (19) our ability to realize production efciencies and to achieve reductions in costs; (20) our ability to develop captive fnancing capability through GM Financial; and (21) signifcant increases in pension expense or projected pension contributions. A further list and description of these risks, uncertainties and other factors can be found in our Annual Report on Form 10-K for the fscal year ended December 31, 2017, and our subsequent flings with the U.S. Securities and Exchange Commission. GM cautions readers not to place undue reliance on forward-looking statements. GM undertakes no obligation to update publicly or otherwise revise any forward- looking statements.