As filed with the Securities and Exchange Commission on July 14, 2011

Registration No. 333-175348

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

Form F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Union Agriculture Group Corp

(Exact name of Registrant as specified in its charter)

| | | | |

| British Virgin Islands | | 200 | | None |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

Union Agriculture Group Corp

Plaza Independencia 737 – 11000

Montevideo

Uruguay

+598 2900-0000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

CT Corporation System

111 Eighth Avenue

New York, New York 10011

(212) 894-8800

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | |

Adam M. Givertz Paul, Weiss, Rifkind, Wharton & Garrison LLP 1285 Avenue of the Americas New York, New York 10019 United States (212) 373-3000 | | Jorge U. Juantorena Francesca L. Odell Cleary Gottlieb Steen & Hamilton LLP One Liberty Plaza New York, New York 10006 United States (212) 225-2000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

| | | | | | | | | | | | | | | | |

| | |

Title of Each Class of Securities to be Registered | | Amount

to be

Registered | | | Proposed

Maximum

Aggregate

Offering Price

Per Share | | | Proposed

Maximum

Aggregate

Offering Price(1)(2) | | | Amount of

Registration Fee | |

Common Shares, without par value | | | Not Applicable | | | | Not Applicable | | | $ | 246,428,580 | | | $ | 28,610.36 | |

| | |

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended, and based on a bona fide estimate of the public offering price. |

| (2) | Includes offering price of shares which the underwriters have the option to purchase. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 14, 2011

14,285,715 Shares

Union Agriculture Group Corp

Common Shares

$ per share

This is an initial public offering of the common shares of Union Agriculture Group Corp. We are offering 14,285,715 common shares.

Prior to this offering, there has been no public market for our common shares. The initial public offering price of the common shares is expected to be between $13.00 and $15.00 per common share. We have been authorized to list our common shares on the New York Stock Exchange, or the NYSE, under the symbol “UAGR.”

We have granted the underwriters an option to purchase a maximum of 2,142,857 additional common shares to cover over-allotments.

Investing in our common shares involves risks. See “Risk Factors” on page 12.

| | | | | | | | | | | | |

| | | Price to Public | | | Underwriting

Discounts and

Commissions | | | Proceeds

to Issuer | |

Per Share | | $ | | | | $ | | | | $ | | |

Total | | $ | | | | $ | | | | $ | | |

Delivery of the common shares will be made on or about , 2011.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | |

| Credit Suisse | | J.P. Morgan |

| |

| Itau BBA | | Wellington West Capital Markets |

The date of this prospectus is , 2011.

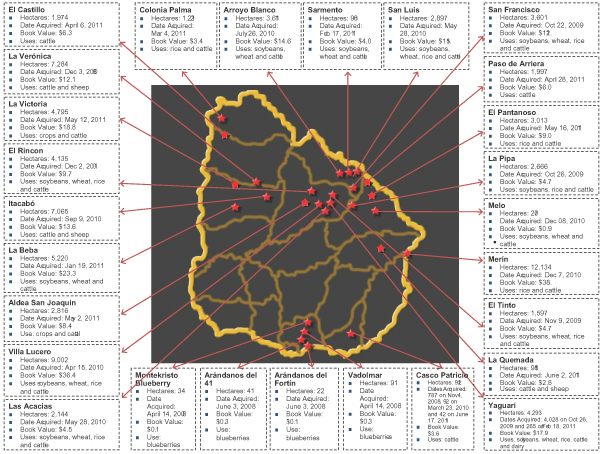

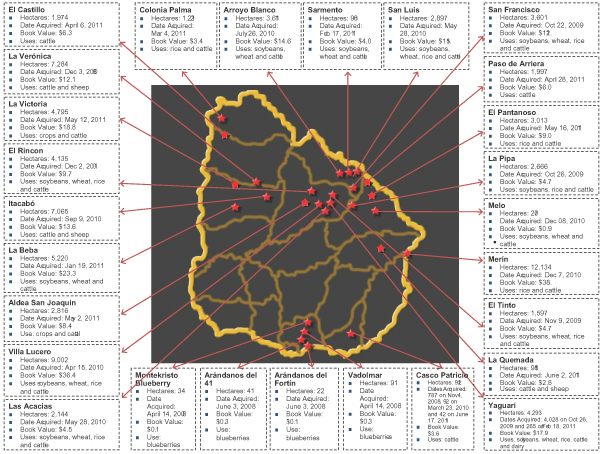

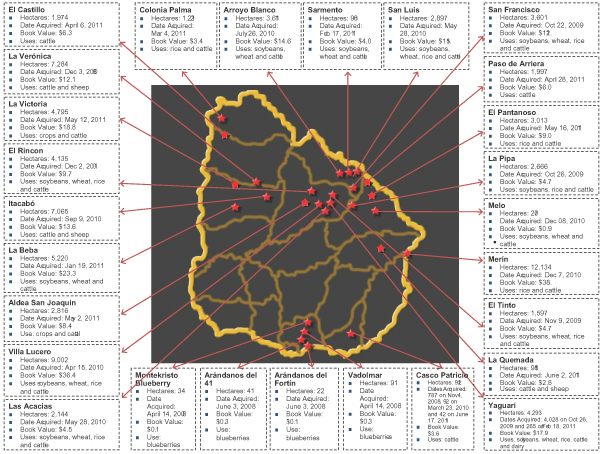

UAG’s acquired farmland as of July 13, 2011

($ in millions)

TABLE OF CONTENTS

We have not authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This document may only be used where it is legal to sell these common shares. The information in this document may only be accurate as of the date of this document. Our business, financial condition, results of operations and prospects may have changed since then.

This prospectus has been prepared on the basis that all offers of common shares will be made pursuant to an exemption under the Prospectus Directive, as implemented in member states of the European Economic Area, or EEA, from the requirement to produce a prospectus for offers of the common shares. Accordingly, any person making or intending to make any offer within the EEA of common shares which are the subject of the offering contemplated in this prospectus should only do so in circumstances in which no obligation arises for us or any of the underwriters to produce a prospectus for such offer. Neither we nor the underwriters have authorized, nor do they authorize, the making of any offer of common shares through any financial intermediary, other than offers made by the underwriters which constitute the final offering of common shares contemplated in this prospectus.

i

The distribution of this prospectus and the offering and sale of the common shares in certain jurisdictions may be restricted by law. Persons who receive this prospectus must inform themselves about and observe any such restrictions. This prospectus does not constitute an offer of, or an invitation to purchase, any of the common shares in any jurisdiction in which such offer or invitation would be unlawful.

ii

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Certain Defined Terms

In this prospectus, unless otherwise specified or if the context so requires:

| | • | | References to the terms “UAG,” “we,” “us,” “our” and “our company” refer to the registrant, Union Agriculture Group Corp, a company incorporated under the laws of the British Virgin Islands, or BVI, and its subsidiaries, unless otherwise indicated or the context otherwise requires. |

| | • | | References to “$,” “US$,” “U.S. dollars,” “dollars” and “USD” are to U.S. dollars. |

| | • | | References to “Uruguayan Pesos,” “Pesos” or “Ps.” are to Uruguayan Pesos, the legal currency of Uruguay. |

| | • | | References to “Canadian dollars” and “Cdn$” are to Canadian dollars, the legal currency of Canada. |

Financial Statements

Our audited consolidated financial statements as of June 30, 2010, 2009 and 2008, and for the years ended June 30, 2010 and 2009 and for the period from our inception on January 2, 2008 through June 30, 2008, or our Audited Consolidated Financial Statements, are prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or the IASB, and the interpretations of the International Financial Reporting Interpretations Committee, or the IFRIC. All IFRS issued by the IASB effective at the time of preparing our Audited Consolidated Financial Statements have been applied. We applied IFRS for the first time for the fiscal year ended June 30, 2010 with a transition date of January 2, 2008. See note 3 to our Audited Consolidated Financial Statements for details regarding our transition to IFRS and application of IFRS 1 “First Time Adoption of IFRS.” Our audited consolidated interim financial statements as of March 31, 2011 and for the nine-month periods ended March 31, 2011 and 2010, or our Audited Interim Consolidated Financial Statements, are prepared in accordance with IFRS as issued by the IASB, and the interpretations of the IFRIC, including IAS 34 “Interim Financial Reporting.” Our Audited Consolidated Financial Statements and our Audited Interim Consolidated Financial Statements, or, collectively, our Consolidated Financial Statements, are prepared under the historical cost convention as modified by financial assets and liabilities at fair value through profit or loss and biological assets and agricultural produce at the point of harvest measured at fair value. Earnings per share data included in our Consolidated Financial Statements was restated for all periods presented to give effect to the reverse stock split (as defined below) in accordance with IAS 33 “Earnings Per Share.” All other share data presented in our Consolidated Financial Statements was not retrospectively adjusted, as the reverse stock split is a non-adjusting event in accordance with IAS 10 “Events After the Reporting Period.”

We present our Consolidated Financial Statements in U.S. dollars, which is our functional and presentation currency.

Exchange Rates

Our financial statements are prepared and presented in U.S. dollars, and a portion of our expenses are transacted in Uruguayan Pesos. As a result, we are exposed to fluctuations in the exchange rates among the U.S. dollar and the Uruguayan Peso. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Quantitative and Qualitative Disclosures About Market Risks.”

iii

The following table sets forth the annual high, low, average and period-end daily interbank end-of-day bid rates for the periods indicated, expressed in Pesos per U.S. dollar, as reported by the Central Bank of Uruguay.

| | | | | | | | | | | | |

| | | Exchange Rate(1) | |

| | | High | | | Low | | | Average | |

| | | (Peso per Dollar) | |

Year Ended June 30, | | | | |

2008 | | | 24.550 | | | | 19.100 | | | | 20.950 | (2) |

2009 | | | 24.350 | | | | 19.534 | | | | 22.414 | (2) |

2010 | | | 21.329 | | | | 19.042 | | | | 20.027 | (2) |

Month Ended | | | | | | | | | | | | |

January 31, 2011 | | | 20.000 | | | | 19.650 | | | | 19.862 | (3) |

February 28, 2011 | | | 19.650 | | | | 19.468 | | | | 19.584 | (3) |

March 31, 2011 | | | 19.450 | | | | 19.193 | | | | 19.334 | (3) |

April 30, 2011 | | | 19.150 | | | | 18.885 | | | | 18.996 | (3) |

May 31, 2011 | | | 18.984 | | | | 18.600 | | | | 18.846 | (3) |

June 30, 2011 | | | 18.600 | | | | 18.400 | | | | 18.521 | (3) |

July 1 – 12 | | | 18.583 | | | | 18.300 | | | | 18.444 | (3) |

| (1) | Daily interbank end-of-day bid rates (Dolar USA Fondo BCU). |

| (2) | Calculated using the average of the exchange rates on the last day of each month during the period. |

| (3) | Calculated using the average of the exchange rates on each day during the period. |

The exchange rate on July 12, 2011 was Ps. 18.550 to $1.00.

Fiscal Year

Our fiscal year begins on July 1 of each year and ends on June 30 of the following year.

Reverse Stock Split

Unless otherwise indicated, all information in this prospectus reflects, for all of our fiscal periods, the 6:1 reverse split of our outstanding common shares, or the reverse stock split, which became effective on June 23, 2011.

Market Data and Forecasts

We have obtained information and statistical data relating to the markets in which we operate from independent consultant reports, reports and publications published by governmental agencies and other publications, including, but not limited to, the Food and Agriculture Organization of the United Nations, or FAO, the Economist Intelligence Unit, or EIU, the Organisation for Economic Co-operation and Development, or OECD, the World Bank, the World Trade Organization, or WTO, the United States Department of Agriculture, or USDA, the Central Bank of Uruguay (Banco Central del Uruguay), or BCU, and the Agriculture Statistics Bureau’s 2010 Agricultural Statistics Yearbook, or DIEA, of the Uruguayan Ministry of Fishing, Agriculture and Livestock (Ministerio de Ganadería, Agricultura y Pesca), or MFAL, Transparency International, the Heritage Freedom Index’s “Economic Freedom Index”, the Mercer Eco-City Ranking, the Central Intelligence Agency’s World Factbook, or CIA World Factbook, the World Organization for Animal Health, the World Economic Forum’s Global Competitiveness Report 2008-2009, Uruguay XXI Investment and Export Promotion Agency, or Uruguay XXI, the World Soil Resources Report of the FAO, or the World Soil Resources Report, the Uruguayan Fruit Growers and Exporters Union (Unión de Productores y Exportadores de Frutas del Uruguay), or UPEFRUY, the Uruguayan Rice Growers Association (Asociasción de Cultivadores de Arroz del Uruguay), or ACA, the National Agricultural Research Institute (Instituto Nacional de Investigación Agropecuaria), or INIA, the GeoNova Group, or GeoNova, and the IBISWorld Industry Report 11111 (February 2011) and the

iv

IBISWorld Industry Report 11115 (March 2011), or the IBISWorld Industry Reports. Although we have no reason to believe that any of this information is inaccurate in any material respect, we have not independently verified such information. The economic conditions in the markets in which we sell our products may deteriorate, and those economies may not grow at the rates projected by market data, or at all. The deterioration of the economic conditions in the markets in which we sell our products may have a material adverse effect on our business, financial condition and results of operations and the market price of our common shares.

Rounding

Some percentages and other amounts included in this prospectus were rounded up or down for ease of presentation. Accordingly, some of the figures shown as totals may not represent the exact sum of the amounts that precede them.

v

ENFORCEMENT OF LEGAL RIGHTS

We are a company incorporated under the laws of BVI. All of our assets are located outside the United States and Canada. Furthermore, all of our directors and officers and the experts named in this prospectus reside outside the United States and Canada and a substantial portion of their assets are located outside the United States and Canada. As a result, investors may not be able to effect service of process within the United States or Canada upon us or our directors or officers or experts or to enforce against us or them in United States courts judgments predicated upon the civil liability provisions of U.S. federal securities law or in Canadian courts predicated on Canadian securities laws. Likewise, it may also be difficult for an investor to enforce judgments obtained against us, or these persons in courts located in jurisdictions outside the U.S. or Canada, in U.S. or Canadian courts. It may also be difficult for an investor to bring an original action in a BVI or other foreign court predicated upon the civil liability provisions of the U.S. federal securities laws against us or these persons.

We have appointed CT Corporation System as our agent to receive service of process with respect to any action brought against us in the United States District Court for the Southern District of New York under the federal securities laws of the United States or of any states in the United States or any action brought against us in the Supreme Court of the State of New York under the securities laws of the State of New York. We will also appoint Cassels Brock & Blackwell LLP, Suite 2100, 40 King Street West, Toronto, Ontario M5H 3C2 as our agent for service of process in Canada.

It is possible for civil liabilities predicated upon U.S. federal securities law to be enforced through proceedings commenced in the courts of BVI, assuming such liabilities constitute a cause of action that is recognizable under the laws of BVI. Enforceability in BVI of judgments of U.S. courts based upon the civil liability provisions of U.S. federal securities law is, however, predicated upon such judgments fulfilling certain requirements under BVI law, including the conditions that:

| | • | | the proceedings pursuant to which such judgements were obtained were not contrary to natural justice, nor would they violate BVI’s public policy; and |

| | • | | these judgments were not in respect of penalties, taxes, fines or similar fiscal or revenue obligations of the party against whom or in respect of which such judgments were obtained. |

vi

PROSPECTUS SUMMARY

This summary highlights selected information about us and our common shares. Before investing in the common shares, you should read this entire prospectus carefully for a more complete understanding of our business and this offering, including our Consolidated Financial Statements and the related notes, and the sections entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Regulatory and Environmental Overview” included elsewhere in this prospectus.

Our Company

We are one of the largest corporate agricultural landholders and operators in Uruguay and a leading producer of agricultural products for export to the global market. We have grown rapidly since our formation in 2008 and have fully paid for and acquired approximately 84,670 hectares of agricultural land in Uruguay for our operations. Substantially all of our land is held underpromesas, pursuant to which we expect to receive title at a later date. See “Business—Farmland Overview.” Our diversified agricultural operations include crops (soybeans and wheat), rice, dairy, cattle, sheep and other products (blueberries and honey). By combining our management’s experience and operational knowledge with state-of-the-art agricultural techniques, we have created a hard-to-replicate agricultural production platform in Uruguay.

We are focused on acquiring high-quality agricultural land that we believe is underutilized, developing such land for increased productivity and exploiting it in an efficient and sustainable manner. We have demonstrated our ability to identify attractive land acquisition opportunities by acquiring approximately 84,670 hectares since our formation in 2008, and signed contracts to purchase an additional 7,718 hectares of land, for a total average cost of approximately $3,213 per hectare. As of April 30, 2011, 70,901 hectares of our land, or 83.7% of our total land holdings, was valued at approximately $270.0 million by Deloitte S.C. We purchased this land for a total purchase price of $220.3 million. Based on Deloitte S.C.’s appraisal, as of April 30, 2011 the value of the properties appraised by Deloitte S.C. exceeded the purchase price by more than 20%. The price of agricultural land in Uruguay increased approximately 540% from 2001 to 2010. See “Business—Land—Price Development.” These land acquisitions have enabled us to rapidly expand our production scale, diversify our product and revenue mix and achieve significant negotiation power in the sale of our products.

After acquisition of new land, our focus is on rapidly optimizing its use, for example, by planting soybeans or rice on land previously only used for cattle grazing. We have an in-house group of agronomists and over 300 farmland employees to plan and execute our optimization process to increase productivity and returns on our acquired land. To further enhance our efficiency, we organize our operations by productive regions, with a dedicated manager and technical staff supervising nearby farmlands. Each regional manager is guided by a plan developed by management based on analyses of product performance metrics. This allows us to reduce our personnel and machinery expenses. By consolidating land in proximity, we reduce potential economies of scale for new entrants and increase barriers to entry for competitors. Finally, we impose tight controls on our costs of operations by managing all planning, hiring and purchasing activities centrally from our headquarters in Montevideo. To support these centralized operations, we rely on our ISO 9001-certified processes and our custom-built information management system. We believe our processes and system allow us to control our input costs and negotiate lower purchasing prices and higher selling prices.

We have financed our land acquisitions solely with funds from private placements of our common shares. Since our initial private placement in 2008 through March 31, 2011, we have raised aggregate net proceeds of $353.3 million. We believe that listing our shares in the public capital markets should allow us to access a larger pool of capital and enable us to accelerate our growth plan. We recorded net losses of $1.6 million and $0.4 million in the nine months ended March 31, 2011 and in our fiscal year ended June 30, 2010, respectively, and have recorded cumulative net losses of $4.6 million since our formation in 2008.

1

Our strategy is to continue to expand our operations by acquiring more high-quality land that we believe is underutilized in Uruguay at attractive prices, and to be a large low-cost producer of food for global export. We intend to continue integrating new land acquisitions into our operations in order to increase our operational efficiency, continue to gain economies of scale, and to enhance profitability. Finally, we plan to achieve higher returns by leveraging our existing investments in employees, equipment and infrastructure for use on leased farmland close to our lands, with minimum additional investment.

Under the laws of Uruguay, we are not permitted to obtain legal title to rural land without first obtaining governmental authorization. As a result, we acquire land in Uruguay under purchase promise agreements, orpromesas. Under apromesa, the seller agrees to transfer legal title to us once the requisite governmental authorization has been obtained. We pay the full purchase price of the land at the time of execution of apromesa and have full rights to use such land, as well as the right to sell, transfer or assign thepromesa and the rights to the underlying land to a third-party purchaser. Approximately 99.8% of our land is held underpromesas. We recently obtained governmental authorization to obtain title to 17,846 hectares of land we hold underpromesas, or 21% of our total land holdings. We have applied for governmental authorization to obtain title with respect to 66,645 hectares of land we hold underpromesas, or 78.7% of our total land holdings, and we currently expect to obtain such governmental authorization by June 2012. In addition, as of July 1, 2011, under the laws of Uruguay, we are not entitled to use rural land without first obtaining governmental authorization. Until June 30, 2011, we were permitted to use 64,505 hectares of our land we hold underpromesas, or 76.2% of our total land holdings, pursuant to an exemption under the law. On June 22, 2011, we applied for governmental authorization to continue using such land. On June 23, 2011, the executive branch of the Uruguayan government issued a decree confirming that companies that had properly applied to obtain authorization could continue to use the land pending government determination of their applications. We expect to obtain this authorization 30 business days after the date we made the application, although there can be no assurance that the government will not deny the application. A proper application to obtain governmental authorization under the expedited process is an application submitted to the Uruguayan Ministry of Fishing, Agriculture and Livestock, or the MFAL, by an entity that has obtained prior authorization to own or use land and has timely requested that such authorization be extended to own or use additional land. We have concluded that we properly applied for governmental authorization and therefore are permitted to continue using the 64,505 hectares of land because the application was submitted by our wholly-owned subsidiary, Boisy S.A., which had previously obtained governmental authorization to use land, and that such application was submitted on June 22, 2011, and therefore it was timely filed. The Uruguayan government will review the application based on three factors: whether the applicant had previously received governmental authorization to use land; whether the land that is the subject of the application can be used for the requested purposes; and whether the application was timely filed. We fully expect that we will be granted the authorization under the expedited process based on (1) a certificate issued to us by the MFAL on June 24, 2011, certifying that the Uruguayan government does not have any comments with respect to the application as of the date of such certificate and (2) direct discussions with officials of the MFAL, who have indicated that such authorization is expected to be granted upon the expiration of the 30 business day waiting period. There can be no assurance that the government will not deny the expedited process application. If our application for authorization to use the land is denied under the expedited process, processing of our application will continue under the standard process, which process generally takes 12 to 16 months from the date of application to complete. However, during such time, we would continue to be able to use the land that is the subject of the standard authorization process. We are currently authorized to use all of our land held underpromesas, as the use of all of our land held underpromesas has either been authorized by the Uruguayan government or is subject to applications for authorization.Upon the completion of this offering, we intend to submit an application for governmental authorization to obtain title to, and use of, our lands held underpromesas under a different provision of the applicable law, namely the public company exception, which we would be permitted to apply for once this offering is completed and our common shares are traded on the NYSE, which we refer to as the Public Company Exception. We fully expect that we will receive such authorizations under the Public CompanyException in due course following completion of this offering. If, however, the Uruguayan government denies our requests for authorization under the exemptions available to us,or it is determined that

2

the required authorization has not been adequately obtained, we could lose our rights to the use of such land, andany of our subsidiaries that has not obtained such authorization would be required to dissolve and liquidate its assets to our parent company. Although we do not intend to do so, we also have the right at any time to, and could, sell thepromesasto a third-party purchaser at market value. See “Business—Farmland Overview.”

Our Strengths

We believe the following are our competitive strengths:

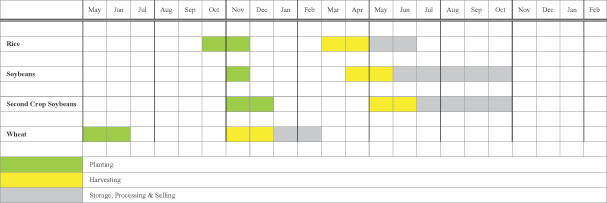

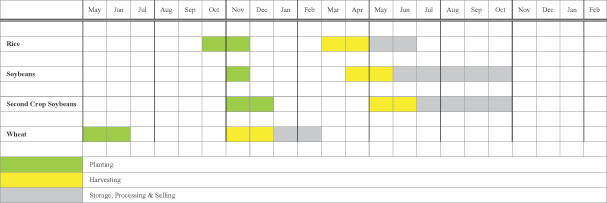

| | • | | Unique farmland portfolio benefiting from the strategic advantages of Uruguay. We have acquired approximately 84,670 hectares of agricultural land in Uruguay on which we produce a diversified range of agricultural products for export to the global market. Our farmland portfolio makes us one of the largest corporate agricultural landholders in Uruguay and we believe this places us in a favorable competitive position that is very difficult to replicate by potential competitors. We believe Uruguay offers unique competitive advantages for agricultural exploitation and business development and has significant amounts of high-quality arable land that is currently underutilized. According to a 2007 FAO study, Uruguay has the world’s top rated soil quality. In addition, according to GeoNova, the country’s abundant rainfall, freshwater resources and moderate temperatures offer an ideal climate for agricultural production, allowing for two annual harvests by mixing certain crops such as planting soybeans and wheat in separate harvests in the same year. Furthermore, Uruguay’s trade relationships, infrastructure and close proximity to maritime transportation make it ideally suited for exporting agriculture production to the global market. Finally, we believe that Uruguay benefits from a stable political environment with limited land use regulation and low taxation compared to other countries in South America. |

| | • | | Proven track record of acquiring high-quality farmland. Our in-house farmland acquisition team has been able to quickly deploy our capital to acquire approximately 84,670 hectares of agricultural land in Uruguay since our formation in 2008. For example, we have already acquired approximately 36,000 hectares of land using approximately $130.0 million of the $155.0 million of net proceeds we received from our last private placement in December 2010 and January 2011. We believe that the farmland we have acquired is high-quality based on Uruguay’s top-rated soil quality, abundant rainfall, freshwater resources and moderate climate allowing for two annual harvests. |

| | • | | Identified pipeline provides substantial growth opportunities. According to the FAO, Uruguay has 14.2 million hectares of arable land, of which only 1.7 million hectares were cultivated in 2008. Our management team has identified approximately 145,000 hectares of underutilized land for potential acquisitions in the short term. We believe that this pipeline will provide us with the ability to acquire additional land at attractive prices, as we have done in the past. For example, between January and March 2011, we acquired an additional 7,677 hectares of land at an aggregate cost of $31.7 million. |

| | • | | Ability to develop underutilized land with a diversified business model and operating efficiency.We have acquired land that we believe was underutilized, either because it was used for a single and less efficient purpose than our intended use or because of the previous owners’ investment restrictions. We seek to optimize our operations and cost structure through the deployment of state-of-the-art agricultural techniques, including crop rotation systems and double cropping, which we believe allow us to achieve increased efficiency, enhanced returns and higher margins relative to other local competitors. To further our operating expertise and mitigate risks, we have developed a diversified portfolio of agricultural products, including wheat, soybeans, rice, dairy, cattle, sheep, blueberries and honey. This business model allows us to reduce the risks associated with climatic conditions that may adversely affect a particular product and lessens our exposure to the volatility of prices for a specific |

3

| | commodity. Moreover, our crops are harvested at different points throughout the year, which enables us to better leverage capital allocated to harvesting machinery and reduces working capital needs. |

| | • | | Economies of scale provide us with negotiation power and lower our production costs. As a landholder of approximately 84,670 hectares of productive agricultural land, we have attained the size to achieve significant economies of scale in our agricultural operations. Currently, we have active operations on 75,414 hectares of land, or approximately 89.1% of our 84,670 hectares of land. With our size of operations, we are able to obtain higher selling prices for our products and better terms in the purchase of our primary supplies. We are also able to lower our costs of production by consolidating our personnel and machinery expenses. Our operations benefit from our ability to purchase state-of-the-art machinery and equipment that would not be economically viable for smaller enterprises. |

| | • | | Experienced local management with ownership stake.Our senior management team has an average of approximately 25 years of experience. Members of our management team have been active in the Latin American agricultural sector since the 1980s. Our founders, directors and management own approximately 5.8% of our company before giving effect to this offering, which we believe creates a strong alignment of incentives. |

Our Business Strategy

The key elements of our business strategy are:

| | • | | Acquire and develop underutilized farmland at attractive prices. Our objective is to increase our landholdings in Uruguay to 160,000 hectares, through acquisitions at attractive prices. To achieve our objective, we have identified more than 33 properties, for a total of approximately 145,000 hectares of underutilized agricultural land that could complement our existing landholdings. After acquisition of new land, we develop the land and optimize its use, for example, by planting soybeans or rice on land previously only used for cattle grazing. We have an in-house group of agronomists and over 300 farmland employees to plan and execute our optimization process to increase productivity and returns on our acquired land. |

| | • | | Continue to increase efficiency and achieve profitability of our farmland operations. We intend to operate our properties with high standards of efficiency, which we believe will make us a profitable and low-cost producer and enhance our position in the agricultural sector in South America. In addition, we believe that our strong financial position, with total assets of $364.8 million and liabilities of only $12.9 million as of March 31, 2011, will allow us to continue to invest in state-of-the-art machinery and equipment to maximize yields. |

| | • | | Produce premium products with sustainable methods. To ensure that our products meet a high standard that distinguishes us in the international market, we intend to continue using sustainable farming practices that comply with applicable environmental regulations, ensure crop rotation throughout the year, maximize efficient water use and minimize soil degradation. We are guided by the belief that premium agricultural products can only be grown through sustainable farming practices. |

| | • | | Generate additional returns by operating leased farmland located near our properties. In addition to managing the farmland we acquired, we plan to augment our existing operations by opportunistically leasing farmland located in close proximity to our existing operations. We believe that selectively adding leased lands to our operations will allow us to achieve higher returns by leveraging our existing investments in our employees, equipment and infrastructure for use on leased farmland, with minimum additional investment. |

4

Global Agricultural Sector

We believe that the global agricultural sector can be expected to continue growing over the coming years, based on attractive supply and demand dynamics, including:

| | • | | rising demand due to economic growth, expanding populations, urbanization and changing diets; |

| | • | | increasing protein consumption driving an exponential increase in grain demand; |

| | • | | the emergence of grain-based biofuels as a substitute for non-renewable fuels, driving demand for grains for non-food uses; and |

| | • | | the expected continued increase in commodity prices over the medium term as a result of global arable land growth lagging increase in demand. |

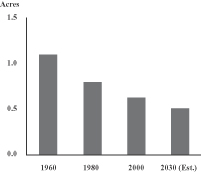

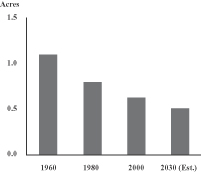

According to the United Nations, the world population is expected to increase from 6.9 billion in 2010 to approximately 8.3 billion in 2030. Accordingly, we believe that agriculture will assume an even greater role in supplying products to satisfy the demand of a growing population.

Uruguay’s Competitive Advantages

Latin America, as a net exporter of agricultural products, is expected to benefit from the growth in agricultural demand and we believe that Uruguay is particularly well-positioned to capitalize on this growth. Specifically, we believe that Uruguay’s competitive advantages and low cost of production provide us with favorable dynamics to grow our agriculture, livestock and dairy businesses.

Soil

Agricultural activities in Uruguay enjoy the advantage of high quality soil. A 2007 FAO study ranks Uruguay first for soil quality out of 160 countries in the study. Ranking is based on a weighted overall score of seven different factors: (i) equivalent arable land, (ii) deserts and drylands, (iii) steeplands, (iv) land degradation severity, (v) actual arable land, (vi) land balance and (vii) population increase.

Uruguay’s soil resources are well preserved and according to the FAO, 87% of Uruguay’s land area has light or no human-induced degradation, compared with 37% for Argentina, 48% for Brazil and 40% for the U.S. According to the FAO, 70% of Uruguay’s total area is arable, compared with 26% for Argentina, 46% for Brazil and 28% for the U.S. However, only 9% of Uruguay’s arable land was used in 2008 according to the World Soil Resources Report. Consequently, there is substantial potential in Uruguay for increased usage of land and agriculture production.

Approximately 10 years ago, agricultural activity in Uruguay expanded to land that was previously considered not usable for agriculture. The expansion of agricultural activity on new land is still taking place in Uruguay and is related to the introduction of new farming technology, such as no-till farming, which does not disturb the soil through tillage. No-till farming practices allow Uruguay to increase its grain production by farming in new areas while maintaining high yields and preserving the soil.

Water

Uruguay has favorable water usage statistics and uses on average only 2.3% of its renewable water resources annually, according to the CIA World Factbook. The CIA World Factbook places Uruguay’s total annual water withdrawal at 3.15 cubic kilometers, or km3, per year, versus annual renewable water resources of 139 km3.

5

The southern part of Uruguay lies on top of the Raigón aquifer, which is an important source of water for irrigation. As well, the dense network of rivers and creeks in Uruguay provides water for cattle and irrigation. With the proper permits, farmers in Uruguay can build dams on their land to store water for irrigation, or can pump water from rivers and lakes. The permit system ensures that a farmer will have access to water for farming.

Uruguay also sits atop the Guarani Aquifer, one of the largest reservoirs of groundwater in the world, which covers 1,190,000 square kilometers, or km², (45,000 km² in Uruguay), with a total volume of about 37,000 km³ and a natural recharge of 166 km³ per year, which may be accessed in the future as an alternative source of water.

Double Crop Growing Season

The ability to harvest multiple crops dramatically increases the yield of farmland given that fixed and capital costs typically remain the same regardless of the number of harvests. The suitability of a particular tract of farmland for double-cropping typically depends on favorable average temperature and precipitation conditions. Uruguay is well suited for a double-crop environment due to favorable average temperatures of between 52°F and 74°F (11°C to 23°C). In comparison, double-cropping would be difficult to achieve in the U.S. Midwest due to greatly varying temperatures of between 23°F and 76°F (-5°C to 23°C). Uruguay’s rainfall is both abundant, at approximately 49.7 inches (1,263 millimeters) per year, and roughly evenly distributed across the entire year. Combined, these two factors allow Uruguayan farmers to harvest two annual crops, whereas farmers can only have one harvest in most parts of North America and Europe.

Trade

Uruguay participates in several regional and international arrangements designed to promote cooperation in trade and investment. Uruguay has a flow of exports to a diversified list of countries, including China, the European Union, the U.S. and Canada, with no single country accounting for a majority of Uruguay’s exports. According to Uruguay XXI, from 2009 to 2010, exports from Uruguay increased 23% and in 2009, agro-industrial exports accounted for 77% of the Uruguay’s total exports.

As an agricultural export-driven economy, Uruguay actively promotes tax-free exports. Exporters in Uruguay also enjoy several other key benefits, including their ability to keep foreign currency proceeds from export sales. Goods and certain services exported from Uruguay are eligible for certain tax rebates.

Infrastructure and Location

Uruguay offers competitive advantages to investors, including a strategic geographical location, a network for the transportation of passengers and goods by sea, air and land, and a developed support infrastructure. The Global Competitiveness Report 2008-2009 (World Economic Forum) ranked Uruguay second in South America in terms of infrastructure development.

The road network in Uruguay is the most concentrated in Latin America, with 45 kilometers, or km, of paved roads per 1,000 km2 according to Uruguay XXI. Cargo is transported through Uruguay from the rest of the continent and the flow of international cargo is not restricted at Uruguayan border points according to Uruguay XXI.

According to Uruguay XXI, there are two important ports in Uruguay. The port of Montevideo is on the South American Atlantic coast. The port of Nueva Palmira is on the shore of the Uruguay River, and heads the most important inland waterway transport system in South America. In Uruguay, rice is primarily exported through the port of Montevideo and wheat and soybeans are primarily exported through the port of Nueva Palmira. According to Uruguay XXI, these two ports provide an important logistical advantage to the export of goods from Uruguay as a result of their proximity to most production areas in the country.

6

Uruguay also has a developed telecommunications network, with 100% digital telecommunications and 98 cellular phone lines per 100 inhabitants as reported by Uruguay XXI.

Foreign Direct Investment

Uruguay has a legislative framework that ensures equal treatment of foreign and local investors and foreign access to all economic sectors. The legislative framework promotes and protects investments made by national and foreign investors as to be in the nation’s interest. As a result, Uruguay allows 100% foreign land ownership with no restrictions.

Uruguay is one of the most socially and politically stable countries in South America. Uruguay was recently ranked first in South America in the “Democracy Index (Economist Intelligence Unit)” study, second in South America in the “Low Corruption (Transparency International)” study, and second in South America in the “Economic Freedom Index (Heritage Foundation)” and the “Quality of Living (Mercer Eco-City Ranking)” studies.

Risks Related to Our Business and Industries

Investing in our securities involves substantial risk, and our business is subject to numerous risks and uncertainties. You should carefully consider all of the information set forth in this prospectus and, in particular, the information under the heading “Risk Factors” and “Forward-looking Statements,” prior to making an investment in our securities.

Our Corporate Information

We were incorporated as a company limited by shares under the laws of BVI on January 2, 2008. Our registered office is located at Vanterpool Plaza, 2nd floor, Wickhams Cay I, Road Town, Tortola, British Virgin Islands. Our principal executive office is at Plaza Independencia 737 – 11000, Montevideo, Uruguay, and our phone number is +598 2900-0000. We have appointed CT Corporation System as our agent for service of process in the United States, located at 111 Eighth Avenue, New York, NY 10011 and Cassels Brock & Blackwell LLP, located at Suite 2100, 40 King Street West, Toronto, Ontario M5H 3C2 as our agent for service of process in Canada.

7

THE OFFERING

The following is a brief summary of the terms of this offering and should be read together with the more detailed information and financial data and statements contained elsewhere in this prospectus. For a more complete description of our common shares, see “Description of Share Capital” in this prospectus.

Issuer | Union Agriculture Group Corp |

Offering | We are offering 14,285,715 common shares. |

Offering Price | Between $13.00 and $15.00 per share. |

Over-Allotment Option | We have granted the underwriters the right to purchase up to an additional 2,142,857 common shares within 30 days from the date of this prospectus to cover over-allotments, if any. |

Use of Proceeds | We estimate that the net proceeds to us in this offering (based on the midpoint of the range set forth on the cover page of this prospectus), after deducting the underwriters’ discounts and commissions and estimated expenses incurred in connection with this offering, will be approximately $185.5 million. If the underwriters exercise their over-allotment option in full, we estimate that our net proceeds will be approximately $214.0 million, after deducting the underwriters’ discounts and commissions and estimated expenses incurred in connection with this offering. |

| | We intend to use the proceeds of this offering to acquire additional farmland and the remainder, if any, for working capital and general corporate purposes. See “Use of Proceeds.” |

Share Capital Before and After Offering | Our issued and outstanding share capital consists of 36,881,684 common shares as of the date of this prospectus. Assuming an offering price of $14.00 per share (the midpoint of the range set forth on the cover page of this prospectus), immediately after the offering, we will have 51,167,399 common shares issued and outstanding, assuming no exercise of the underwriters’ over-allotment option. If the underwriters exercise their over-allotment option in full, we will have 53,310,256 common shares issued and outstanding. |

Voting Rights | Holders of our common shares are entitled to one vote per common share at any meeting of shareholders or on any resolution of shareholders. See “Description of Share Capital.” |

Dividends | We currently have no plans to pay dividends following the completion of this offering because we expect to retain our earnings for use in the development and expansion of our business. See “Dividend Policy.” |

Lock-up Agreements | We have generally agreed with the underwriters that, we will not, subject to certain exceptions, during the period commencing on the date of the underwriting agreement and ending 180 days after the date of the underwriting agreement, offer or sell any common shares or securities convertible into or exchangeable or exercisable for common |

8

| | shares. We expect that our officers, directors and certain of our significant shareholders will each enter into similar lock-up restrictions. See “Underwriting.” |

Transfer Agents | American Stock Transfer & Trust Company, LLC and Equity Financial Trust Company |

Market for Shares | Prior to this offering, there has been no public market for our common shares. There can be no assurance that an active public market in the United States for the common shares will develop or that it will continue if one does develop. |

Listing | We have been authorized to list our common shares on the New York Stock Exchange under the symbol “UAGR.” |

Risk Factors | See “Risk Factors” beginning on page 12 and the other information included in this prospectus for a discussion of factors you should consider before deciding to invest in our common shares. |

Unless otherwise indicated, all information contained in this prospectus assumes no exercise of the over-allotment option granted to the underwriters.

Information in this prospectus does not reflect $5.0 million of common shares and $1.0 million of restricted shares that we have agreed to issue to certain of our executive officers as soon as practicable following completion of this offering at the initial public offering price. Based on the midpoint of the range on the cover page of this prospectus, we expect to issue 357,143 common shares and 71,429 restricted shares. The common shares will not be subject to vesting or forfeiture. The restricted shares are common shares that will be issued under our Equity Incentive Plan, which will vest at a rate of one-third per year and until vested will be subject to forfeiture in certain circumstances. See “Management—Compensation of Directors and Executive Officers—Union Agriculture Group Corp Equity Incentive Plan.”

9

SUMMARY HISTORICAL FINANCIAL DATA

The following tables present our summary historical financial data as of and for the periods indicated below. We have derived the summary historical statement of comprehensive income, statement of cash flows and statement of financial position data as of and for the years ended June 30, 2010 and 2009, and as of June 30, 2008 and for the period from our inception on January 2, 2008 through June 30, 2008 from our Audited Consolidated Financial Statements included elsewhere in this prospectus. We have derived the summary historical statement of comprehensive income, statement of cash flows for the nine-month periods ended March 31, 2011 and 2010, and our summary statement of financial position data as of March 31, 2011, from our Audited Interim Consolidated Financial Statements included elsewhere in this prospectus. The historical results for any prior period presented are not necessarily indicative of our results to be expected for any future period.

Our Audited Consolidated Financial Statements are prepared in accordance with IFRS as issued by the IASB, and the interpretations of the IFRIC. All IFRS issued by the IASB effective at the time of preparing our Audited Consolidated Financial Statements have been applied. We applied IFRS for the first time for the fiscal year ended June 30, 2010 with a transition date of January 2, 2008. See note 3 to our Audited Consolidated Financial Statements for details regarding our transition to IFRS and application of IFRS 1 “First Time Adoption of IFRS”. Our Audited Interim Consolidated Financial Statements are prepared in accordance with IFRS as issued by the IASB, and the interpretations of the IFRIC, including IAS 34 “Interim Financial Reporting”.

You should read the information contained in these tables in conjunction with “Selected Consolidated Financial Data,” “Capitalization,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Presentation of Financial and Other Information” and our Consolidated Financial Statements and the accompanying notes included elsewhere in this prospectus.

| | | | | | | | | | | | | | | | | | | | |

| | | Fiscal Year Ended June 30, | | | Nine Months Ended

March 31, | |

| | | 2010 | | | 2009 | | | 2008 | | | 2011 | | | 2010 | |

Statement of Comprehensive Income Data: | | | | | | | | | | | | | | | | | | | | |

Sales of agricultural produce and biological assets and services rendered | | $ | 1,580,880 | | | $ | 199,394 | | | $ | — | | | $ | 6,212,163 | | | $ | 147,016 | |

Rental income | | | 54,133 | | | | — | | | | — | | | | 529,312 | | | | 30,933 | |

Cost of agricultural produce and biological assets sold and services rendered | | | (1,573,883 | ) | | | (157,772 | ) | | | — | | | | (5,926,605 | ) | | | (128,902 | ) |

Initial recognition and changes in fair value of biological assets and agricultural produce | | | 5,335,808 | | | | 232,324 | | | | 5,864 | | | | 11,575,441 | | | | 2,541,921 | |

Cost of production | | | (3,437,732 | ) | | | (943,392 | ) | | | (5,864 | ) | | | (7,595,472 | ) | | | (2,708,184 | ) |

| | | | | | | | | | | | | | | | | | | | |

Margin Before Operating Expenses | | | 1,959,206 | | | | (669,446 | ) | | | — | | | | 4,794,839 | | | | (117,216 | ) |

| | | | | | | | | | | | | | | | | | | | |

General and administrative expenses | | | (3,582,205 | ) | | | (1,636,123 | ) | | | (104,408 | ) | | | (7,668,310 | ) | | | (2,158,190 | ) |

Selling expenses | | | (24,613 | ) | | | (3,911 | ) | | | — | | | | (124,243 | ) | | | (2,762 | ) |

Other operating income, net | | | — | | | | 1,618 | | | | — | | | | 36,544 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Loss from Operations Before Financing and Taxation | | | (1,647,612 | ) | | | (2,307,862 | ) | | | (104,408 | ) | | | (2,961,170 | ) | | | (2,278,168 | ) |

| | | | | | | | | | | | | | | | | | | | |

Financial results, net | | | 1,370,817 | | | | (212,127 | ) | | | (6,615 | ) | | | 1,110,148 | | | | 1,401,127 | |

| | | | | | | | | | | | | | | | | | | | |

Loss Before Income Tax | | | (276,795 | ) | | | (2,519,989 | ) | | | (111,023 | ) | | | (1,851,022 | ) | | | (877,041 | ) |

| | | | | | | | | | | | | | | | | | | | |

10

| | | | | | | | | | | | | | | | | | | | |

| | | Fiscal Year Ended June 30, | | | Nine Months Ended

March 31, | |

| | | 2010 | | | 2009 | | | 2008 | | | 2011 | | | 2010 | |

Income tax expense | | | (81,643 | ) | | | (157,614 | ) | | | (5,249 | ) | | | 249,951 | | | | 131,173 | |

| | | | | | | | | | | | | | | | | | | | |

Loss for the Year/ Period | | | (358,438 | ) | | | (2,677,603 | ) | | | (116,272 | ) | | | (1,601,071 | ) | | | (745,868 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total Comprehensive Loss for the Year/ Period | | $ | (358,438 | ) | | $ | (2,677,603 | ) | | $ | (116,272 | ) | | $ | (1,601,071 | ) | | $ | (745,868 | ) |

| | | | | | | | | | | | | | | | | | | | |

Loss / Total Comprehensive Loss Attributable to: | | | | | | | | | | | | | | | | | | | | |

Equity holders of the parent | | $ | (336,833 | ) | | $ | (2,586,911 | ) | | $ | (107,549 | ) | | $ | (1,601,071 | ) | | $ | (724,263 | ) |

Non-controlling interest | | | (21,605 | ) | | | (90,692 | ) | | | (8,723 | ) | | | — | | | | (21,605 | ) |

Losses per share for loss attributable to equity holders of the parent during the year/ period: | | | | | | | | | | | | | | | | | | | | |

Basic and Diluted | | $ | (0.021 | ) | | $ | (0.305 | ) | | $ | (0.374 | ) | | $ | (0.055 | ) | | $ | (0.055 | ) |

Cash Flow Data: | | | | | | | | | | | | | | | | | | | | |

Net cash used in operating activities | | $ | (13,680,833 | ) | | $ | (2,153,973 | ) | | $ | (290,891 | ) | | $ | (12,037,844 | ) | | $ | (6,501,240 | ) |

Net cash used in investing activities | | | (96,117,100 | ) | | | (14,488,838 | ) | | | (1,064,532 | ) | | | (108,171,514 | ) | | | (42,729,322 | ) |

Net cash generated from financing activities | | | 109,872,680 | | | | 83,735,281 | | | | 1,319,515 | | | | 158,016,627 | | | | 101,842,190 | |

| | | | | | | | | | | | | | | | |

| | | As of June 30, | | | As of

March 31,

2011 | |

| | | 2010 | | | 2009 | | | 2008 | | |

Statement of Financial Position Data: | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 67,125,638 | | | $ | 67,014,579 | | | $ | 43,148 | | | $ | 104,942,161 | |

Biological assets | | | 7,744,547 | | | | 1,922,742 | | | | 730,936 | | | | 23,463,716 | |

Inventories | | | 1,824,832 | | | | 33,389 | | | | — | | | | 1,684,450 | |

Property, plant and equipment, net | | | 4,488,147 | | | | 958,580 | | | | 525,299 | | | | 9,227,249 | |

Land underpromesas(1) | | | 100,714,669 | | | | 12,230,211 | | | | 712,909 | | | | 190,864,497 | |

Investment property underpromesas, net | | | 4,633,968 | | | | — | | | | — | | | | 23,293,946 | |

Total assets | | | 196,827,646 | | | | 85,948,053 | | | | 2,736,125 | | | | 364,809,769 | |

Total liabilities | | | 3,355,292 | | | | 2,007,969 | | | | 141,938 | | | | 12,943,785 | |

Share capital | | | 193,373,922 | | | | 84,266,985 | | | | 2,513,059 | | | | 348,881,666 | |

Equity attributable to equity holders of the parent | | | 193,472,354 | | | | 83,897,850 | | | | 2,461,261 | | | | 351,865,984 | |

Non controlling interest | | | — | | | | 42,234 | | | | 132,926 | | | | — | |

| (1) | See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and Estimates—Land Under Promesas” for more details. |

11

RISK FACTORS

Investing in our common shares involves a high degree of risk. Before making an investment decision, you should carefully consider the information contained in this prospectus, particularly the risks described below, as well as in our Consolidated Financial Statements and accompanying notes included in this prospectus. Our business activities, cash flow, financial condition and results of operations could be materially and adversely affected by any of these risks. In addition, the market price of our common shares may decrease due to any of these risks, and you may lose all or part of your investment. The risks described below are all known material risks that we currently believe may materially affect us.

Risks Related to Our Business and Industries

Unpredictable weather conditions, pest infestations and diseases may have an adverse impact on agricultural, livestock, dairy and apiculture production.

The occurrence of severe adverse weather conditions, especially droughts, hail, floods or frost, is unpredictable and may have a potentially devastating impact on agricultural, livestock, dairy and apiculture production, and may otherwise adversely affect the supply and price of the agricultural commodities that we sell and use in our business. Adverse weather conditions may be exacerbated by the effects of climate change. The effects of severe adverse weather conditions may reduce yields of our products or require us to increase our level of investment to maintain yields. Additionally, higher than average temperatures and rainfall can contribute to an increased presence of insects, which could negatively affect crop, rice and livestock yields. In 2008 and 2009, Uruguay suffered one of its worst droughts of the last 70 years. Future droughts could reduce the yield and quality of our agricultural, livestock and dairy production, which could materially and adversely affect our results of operations of our business.

Global climate changes have caused Uruguay’s climate to begin to shift from sub-tropical to tropical. As a result, average honey production per hive in Uruguay has stopped increasing in recent years. In addition, in the past few years, prolonged droughts followed by flooding, an increase in farmland planted in transgenic soybeans, and the growing use of pesticides and herbicides have posed a threat to beehives in Uruguay. Continuation of these factors could adversely affect our apiculture operations, which could adversely affect our business, financial condition and results of operations.

The occurrence and effects of disease and plagues can be unpredictable and devastating to agricultural, livestock, dairy and apiculture products, potentially rendering all or a substantial portion of the affected harvests unsuitable for sale. Our crops, rice and blueberries are also susceptible to fungus and bacteria that are associated with excessively moist conditions. Even when only a portion of the production is damaged, our results of operations could be adversely affected because all or a substantial portion of the production costs may have been incurred. Although some diseases are treatable, the cost of treatment is high, and such events could adversely affect our operating results and financial condition. Furthermore, if we fail to control a given plague or disease and our production is threatened, we may be unable to supply our customers, which could adversely affect our business, financial condition and results of operations.

Diseases among our cattle and sheep herds, such as brucellosis and foot-and-mouth disease, can have an adverse effect on dairy production and fattening, rendering cows and sheep unable to produce dairy or meat for human consumption. Outbreaks of cattle and sheep diseases may also result in the closure of certain important markets, such as the United States, to our cattle and sheep products. In May 2001, an outbreak of foot-and-mouth disease spread throughout Uruguay, affecting almost one million heads of cattle. The outbreak brought rural areas and the meat industry to a standstill and curtailed Uruguayan beef exports to North America. A future outbreak of diseases among our cattle and sheep herds could adversely affect our cattle, sheep and dairy sales, which could adversely affect our business, financial condition and results of operations.

12

Fluctuation in market prices for our products could adversely affect our business, financial condition and results of operations.

Prices for agricultural products, like those of other commodities, have historically been cyclical and sensitive to domestic and international changes in supply and demand and can be expected to fluctuate significantly. In addition, some of the agricultural products we produce, such as soybeans and wheat, are traded on commodities and futures exchanges and thus are subject to speculative trading, which could adversely affect us. The prices that we are able to obtain for our agricultural products depend on many factors beyond our control including:

| | • | | prevailing world commodity prices, which historically have been subject to significant fluctuations over relatively short periods of time, depending on worldwide demand and supply; |

| | • | | changes in the agricultural subsidy levels of certain important producers (mainly the U.S. and the European Union, or EU), and the adoption of other government policies affecting industry market conditions and prices; |

| | • | | changes to trade barriers of certain important consumer markets (including China, India, the U.S. and the EU); |

| | • | | changes in government policies for biofuels; |

| | • | | world inventory levels (i.e., the supply of commodities carried over from year to year); |

| | • | | climatic conditions and natural disasters in areas where agricultural products are cultivated; |

| | • | | the production capacity of our competitors; and |

| | • | | demand for and supply of competing commodities and substitutes. |

We seek to optimize the use of our properties and make decisions regarding increasing or decreasing production of one agricultural product or another based, in part, on our expectations regarding market conditions and land use optimization. Such decisions could prove incorrect, which could adversely affect our results of operations. Further, there is a strong relationship between the value of our land holdings and market prices of the commodities we produce, which are affected by global economic conditions. A decline in the prices of rice, soybeans, wheat, cattle, sheep or blueberries below their current levels for a sustained period of time could significantly reduce the value of our land holdings and materially and adversely affect our financial condition.

Prices for agricultural land in Uruguay have rapidly escalated over the past decade and we have purchased our land at prices far in excess of historical averages. Any significant deterioration in the Uruguayan agricultural real estate market may materially adversely affect our business, financial condition and results of operations.

The real estate market in Uruguay is strong and over the past decade prices for agricultural land in Uruguay have increased dramatically. For example, according to the DIEA, the average price per hectare of agricultural land in Uruguay increased approximately 260% from 2005 to 2010 and approximately 540% from 2001 to 2010. Substantially all of our assets are Uruguayan farmlands that we have acquired since 2008 at prices far in excess of historical averages. While the price increases of the past decade may be driven in part by a strengthening Uruguayan economy combined with increased global demand for agricultural products, the rapid escalation of prices may exceed the economic factors underlying such growth. To the extent that such price increases exceed intrinsic value, the Uruguayan agricultural real estate market may be experiencing a bubble similar to that recently experienced in the residential real estate market in the United States and other parts of the world. In their late stages, real estate bubbles are typically characterized by rapid increases in the valuations of real property until unsustainable levels are reached relative to other economic indicators. This is typically followed by rapid decreases in prices set off by deterioration in the economic factors underlying growth. If the Uruguayan market for agricultural land is experiencing a bubble, any deterioration in the underlying economic factors, such as a

13

decline in global demand for agricultural products, could burst such bubble, causing a rapid decline in the value of our land. Under IFRS, recoverable amount is defined as the higher of an asset’s fair value less costs to sell and its value in use. Accordingly, if the carrying value of our land, and our land underpromesas, could not be supported by either the resale value of the land or the cash flows from its value in use as an agricultural property, this may cause us to recognize significant impairment losses, which may have a material adverse effect on our business, financial condition and results of operations.

We have a limited operating history with a history of losses and we may not achieve or maintain profitability or generate sufficient cash flow.

We have a limited operating history and we have recorded negative cash flows and incurred operating losses in every fiscal year since our formation. From our formation to March 31, 2011, we have incurred cumulative losses of $4.6 million and we recorded negative operating cash flows of $12.0 million in the nine months ended March 31, 2011, $13.7 million in fiscal year 2010, $2.2 million in fiscal year 2009 and $0.3 million in fiscal year 2008, resulting primarily from the establishment of our business. The continued development of our business and the acquisition of additional farmland will require us to make significant capital expenditures. These expenditures, together with associated operating expenses, may result in continued negative cash flow and net losses in the foreseeable future. In addition, with our relatively limited operating history, the risk profile of our business may be higher than for those companies with more established records of operation. We may continue to record losses and negative cash flows in future periods, our losses may increase in the future, and in the event that we do have profits, we may be unable to sustain our operating cash flow.

Our limited operating history may not serve as an adequate basis on which to evaluate our current business and future prospects and results of operations.

We have a limited operating history upon which to evaluate the viability and sustainability of our current business and future prospects. Accordingly, you should consider our future prospects in light of the risks and uncertainties experienced by other early stage agricultural companies. If we are unsuccessful in addressing any of these risks and uncertainties, our business, financial condition, results of operations and future growth could be adversely affected.

We may depend on new capital to fund the development of our business. Our inability to obtain new capital could adversely affect our business, financial condition and results of operations.

We have financed our business with new equity because our cash flow from operations was insufficient to provide the necessary capital to fund our operations and expansion. We may need additional capital to fund our operations and acquisitions of farmland. If we are unable to raise equity or debt financing on favorable terms, we may not be able to fund our capital expenditures and we will be required to change our current business plan, which could have a material adverse effect on our business, financial condition and results of operations.

The expansion of our business through land acquisitions poses risks that may reduce the benefits we anticipate from these transactions.

We have grown primarily through land acquisitions and plan to continue growing by acquiring other farmland throughout Uruguay. However, our management is unable to predict whether or when any prospective land acquisitions will occur, or the likelihood of certain transactions being completed on favorable terms and conditions. Our ability to continue to expand our business successfully through land acquisitions depends on many factors, including our ability to identify land for acquisition or to access capital markets at a favorable cost and negotiate favorable transaction terms. Even if we are able to identify acquisition targets and obtain the necessary financing to carry out these acquisitions, we could financially overextend ourselves, especially if a land acquisition is followed by a period of lower than projected prices for our products.

14

Acquiring land also exposes us to risks associated with activities on such land by prior owners. The due diligence we typically conduct in connection with an acquisition, and any contractual guarantees or indemnities that we may receive from the sellers of that land, may not be sufficient to protect us from, or compensate us for, actual liabilities. Any material liability associated with an acquisition could adversely affect our reputation and results of operations and reduce the benefits of the acquisition.

If we do not obtain governmental authorizations with respect to all of our lands, we could lose the rights to the use of such lands.

We execute purchase promise agreements, orpromesas de compraventa, instead of definitive purchases, orcompraventas definitivas,to acquire our rural land in Uruguay. In order for our subsidiaries to obtain legal title to and use the rural land acquired under apromesa, Uruguayan law requires that each such subsidiary obtain prior governmental authorization. We have received governmental authorization to obtain legal title to and use certain of our lands in the past, and we expect to obtain such authorizations in the future. If, however, the Uruguayan government denies our requests for authorization under the exemptions available to us, or it is determined that the required authorization has not been adequately obtained, we could lose our rights to the use of such land, and any of our subsidiaries that has not obtained such authorization would be required to dissolve and liquidate its assets to our parent company. Any such liquidation could be on unfavorable terms, and could deprive us of the benefits of the rights to the use of such lands underpromesas. Any liquidation of a substantial portion of our assets, or any loss of our rights to the use of such lands, could have a material adverse effect on our business, financial condition and results of operations. See “Business–Farmland Overview,” “Regulatory and Environmental Overview–Sale and Ownership of Real Estate” and “Regulatory and Environmental Overview–Rural Real Estate” for more details.

Our title to our farmland may have defects or may not be valid.

We have not conducted surveys of all our farmland and, consequently, the precise area and location of our titles may be in doubt. Title to our farmlands may be subject to clerical errors in the official certificates or plans or other undetected title defects. Any such clerical errors or defects in the chain of ownership could subject us to third party title claims as the last acquiror of the farmland. A claim contesting our title to a farmland may cause us to lose our right to farm the land and we may incur significant costs related to the defense of our title, which would adversely affect our business and financial condition.

Our leases with respect to some of our farmlands may not be renewed on terms and conditions favorable to us.

We currently lease farmland as a lessee and intend to increase the amount of farmland that we lease in the future. We began leasing farmland in September 2009, and our current leases are for short term periods of one to three years, and we expect future leases to be of a similar duration. We may be unable to secure new leases to expand our operations on terms that are favorable to us, which would limit our ability to optimize our operations as currently planned. We also may not be able to renew leases after their respective terms conclude. Even if we are able to renew these leases, such renewals may not be on terms and conditions that are favorable to us. Any failure to renew the leases or lease other lands that are suitable for our business needs in sufficient quantity and at reasonable prices to develop our activities could adversely affect our results of operations, increase our costs or force us to seek alternative properties, which may not be available or be available only at higher prices.

We face competition in the markets in which we operate and for the acquisition of farmland.

We operate in a market where there are other competitors. Competition within the agricultural, livestock, dairy and apiculture industry is based primarily on quality and price. If we are unable to compete effectively in these areas, we may lose existing customers or fail to acquire new customers, which would have a material adverse effect on our business, financial condition and results of operations. We rely on advanced technological and scientific methodologies to improve our operations. If we fail to adopt new technology or to continually upgrade our facilities and processes to reflect technological advances, such failure could negatively impact our competitive position, which could have a material adverse effect on our business, financial condition and results of operations.

15

We also experience competition for farmland purchases. Certain of our competitors have greater financial and capital resources than us. We could face increased competition from newly formed or emerging entities, as well as from established entities that choose to focus (or increase their existing focus) on farmland in Uruguay. As a result, farmland properties may not be available to us on commercially favorable terms or at all.

A significant increase in the price of raw materials that we use in our operations, or the shortage of such raw materials, could adversely affect our business, financial condition and results of operations.

Our production process requires various raw materials, including fertilizer, feed, herbicide, agrochemicals and seeds, which we acquire from local and international suppliers. We do not have long-term supply contracts for most of these raw materials. For our fiscal year 2010 and the nine months ended March 31, 2011, consumable supplies, including but not limited to fertilizers, agrochemicals, herbicides, feed and seeds, represented 29.0% and 39.2% of our cost of production, respectively. Worldwide production of agricultural products has increased significantly in recent years, increasing the demand for agrochemicals and fertilizers. This has resulted, among other things, in increased prices for fertilizers and agrochemicals. Our agricultural business is seasonal, and our revenues may fluctuate significantly depending on the growing cycle of our crops. A significant increase in the cost of these raw materials, especially fertilizer, feed and agrochemicals, a shortage of raw materials or the unavailability of these raw materials entirely could reduce our profit margin, reduce our production and/or interrupt the production of some of our products, in all cases adversely affecting our business, financial condition and results of operations.

Our agricultural business is seasonal, and our revenues may fluctuate significantly depending on the growing cycle of our crops.

Our agricultural business is seasonal, based upon the planting, growing and harvesting cycles. The inherent seasonality of the industry could have a material adverse effect on our business. In addition, quarterly results can vary significantly from one year to the next due primarily to weather-related shifts in planting schedules, production yields, purchase patterns and costs. We incur substantial expenditures for fixed costs throughout the year and substantial expenditures for inventory in advance of the planting season.

Seasonality also relates to the limited windows of opportunity that we have to complete required tasks at each stage of crop cultivation. Should events such as adverse weather or transportation interruptions occur during these seasonal windows, we would face reduced revenue without the opportunity to recover until the following season. In addition, because of the seasonality of agriculture, we face the risk of significant inventory carrying costs should our customers’ activities be curtailed during their normal seasons.

Increased energy prices and frequent interruptions of energy supply could adversely affect our business.