UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22314

Oppenheimer Corporate Bond Fund

(Exact name of registrant as specified in charter)

6803 South Tucson Way, Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Arthur S. Gabinet

OFI Global Asset Management, Inc.

Two World Financial Center, New York, New York 10281-1008

(Name and address of agent for service)

Registrant’s telephone number, including area code: (303) 768-3200

Date of fiscal year end: July 31

Date of reporting period: 7/31/2013

Item 1. Reports to Stockholders.

Table of Contents

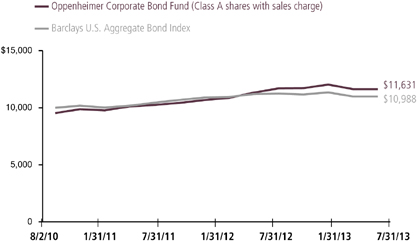

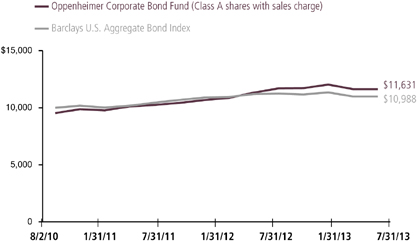

Class A Shares

AVERAGE ANNUAL TOTAL RETURNS AT 7/31/13

| | | | | | |

| | | Class A Shares of the Fund | | |

| | | Without Sales Charge With Sales Charge | | Barclays U.S.

Aggregate Bond Index |

| 1-Year | | 2.70% | | -2.18% | | -1.90% |

|

| Since Inception (8/2/10) | | 6.89 | | 5.17 | | 3.26 |

|

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund returns include changes in share price, reinvested distributions, and a 4.75% maximum applicable sales charge except where “without sales charge” is indicated. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800.CALL OPP (225.5677).

2 OPPENHEIMER CORPORATE BOND FUND

Fund Performance Discussion

The Fund’s Class A shares (without sales charge) returned 2.70% during the period. On a relative basis, the Fund outperformed the Barclays U.S. Aggregate Bond Index (the “Index”), which returned -1.90%. While fixed-income markets and the Fund experienced declines after the Federal Reserve (the “Fed”) indicated it may taper its quantitative easing program, the Fund produced a positive absolute return and outperformed the Index for the reporting period. The Fund’s outperformance relative to the Index was driven by its investments in corporate bonds and notes, as well as its lack of exposure to U.S. Treasuries, which experienced declines this reporting period.

MARKET OVERVIEW

The reporting period began at the start of an economic rebound following disappointing employment data, a sluggish housing market, the ongoing impact of the European debt crisis and slowing growth in the emerging markets. Investor sentiment improved dramatically when the unemployment rate declined sharply in the fall of 2012, housing sales and prices climbed, and the European

Central Bank announced credible measures to address weakness in its banking system. In addition, U.S. investors were encouraged when the Fed launched an open-ended quantitative easing program involving monthly purchases of $85 billion of U.S. government securities. The quantitative easing program was designed to help boost the U.S. economy by keeping mortgage rates

COMPARISON OF CHANGE IN VALUE OF $10,000 HYPOTHETICAL INVESTMENTS IN:

3 OPPENHEIMER CORPORATE BOND FUND

and other long-term interest rates low. In addition, the Bank of Japan’s massive asset purchase program “Abe-nomics” was a major driving force as Japanese investors were pushed out on the risk curve away from Japanese government bonds (JGBs) and into riskier assets.

At the end of May, market volatility picked up measurably as comments from Fed Chairman Ben Bernanke at a Congressional hearing surprised the market when he indicated a possible slowdown of the central bank’s asset purchase program if the economy continued to show improvement. Additionally, fears began to creep into the market about a possible slowdown in the world’s emerging economies. As a result, risk assets sold off across the board, with Japanese stocks and emerging market debt absorbing the brunt of the selling, although investment grade credit was certainly not immune. Simultaneously, the intermediate and long-end of the U.S. Treasury curve steepened quite dramatically as investors began to price in the likelihood of higher interest rates in the future. The volatility continued through June as the Federal Open Market Committee (FOMC) issued a statement indicating again that if the U.S. economy continued to improve the Fed would begin to slow down its quantitative easing program.

Equity and fixed-income markets in the U.S. stabilized over the final weeks of the reporting period when investors came to the realization that an end to the quantitative easing program did not necessarily imply an

imminent increase in short-term interest rates. In addition, an objective view of recent economic data revealed that, in a slow-but-steady economic recovery, inflation, employment, and GDP growth remained well below the Fed’s previously stated targets.

FUND REVIEW

During the period, corporate bonds within the financials and wirelines sectors provided the strongest contribution to the Fund’s performance. Within financials, our allocations to large-cap banks and multiline insurance companies were helpful. These investments performed particularly well over the first half of the period as the financials sector benefited from the stimulative measures enacted by the Fed. Banks also benefited as the housing market continued to improve and mortgage-related headline risk decreased. When the wirelines sector performed weakly in the first quarter of 2013, we saw an opportunity to increase our allocation to the sector. This decision benefited performance, as the wirelines sector rallied in the closing months of the period. Our exposure to the bonds of Verizon Communications, Inc., British Telecommunications plc and Telefonica Emisiones, were among the positive individual performers within the wirelines sector this period. Other top performing areas of the Fund this period included pipelines, lodging and supermarkets.

The most significant detractors from performance this period were corporate bonds in the media and technology sectors.

4 OPPENHEIMER CORPORATE BOND FUND

Leveraged buyout (“LBO”) risk returned to these sectors, which had a detrimental impact on performance. Within the technology sector specifically, we had a position in Dell, which detracted from overall performance due to the much publicized LBO discussions. Our decision and ability to react quickly helped to limit the downside as the bonds continued to sell off as more details of the deal were made public. Also detracting from performance were investments in the food and beverage, pharmaceuticals and wireless sectors.

STRATEGY & OUTLOOK

Although it appears that all eyes remain firmly fixated on the Fed and its eventual asset purchase unwind and the perceived growth slowdown within the emerging markets, we believe there is reason for optimism. By historical standards central banks around the globe are executing exceedingly loose monetary policy, which provides plenty of liquidity to the markets. U.S. growth appears to be a surprising bright spot and we are even beginning to see early signs that growth within Europe may be

turning the corner. And while it may be clear that China’s growth trajectory is slowing, we believe policy makers have the situation in hand and the probability of a hard landing is still quite low.

In such an environment, we believe that the recent widening of credit spreads creates a good buying opportunity as the markets become less concerned about potentially negative global macroeconomic events, and instead focus on the fundamental strength of corporate balance sheets. In a “yield-starved” domestic fixed income market dominated by U.S. Treasuries hovering near historic lows, we believe the case for high grade and high yield corporate debt remains compelling.

| | |

| |

Krishna Memani Portfolio Manager |

5 OPPENHEIMER CORPORATE BOND FUND

Top Holdings and Allocations

| | | | |

| | | | | |

Corporate Bonds and Notes Top Ten Industries | | | | |

|

| |

Oil, Gas & Consumable Fuels | | 10.6% | | |

Commercial Banks | | 7.7 | | |

Capital Markets | | 6.4 | | |

Insurance | | 6.0 | | |

Diversified Financial Services | | 4.8 | | |

Electric Utilities | | 4.8 | | |

Diversified Telecommunications Service | | 4.7 | | |

Media | | 3.6 | | |

Metals & Mining | | 3.1 | | |

Automobiles | | 3.0 | | |

Portfolio holdings and allocations are subject to change. Percentages are as of July 31, 2013, and are based on net assets.

| | | | |

| | NRSRO |

| | Only |

Credit Rating Breakdown | | Total |

|

| |

AAA | | 7.5% | | |

AA | | 2.7 | | |

A | | 25.1 | | |

BBB | | 49.6 | | |

BB | | 13.3 | | |

B | | 0.2 | | |

CCC | | 1.4 | | |

CC | | 0.2 | | |

Total | | 100.0% |

The percentages above are based on the market value of the Fund’s securities as of July 31, 2013, and are subject to change. Except for certain securities issued or guaranteed by a foreign sovereign, all securities have been rated by at least one Nationally Recognized Statistical Rating Organization (“NRSRO”), such as Standard & Poor’s (“S&P”). For securities rated only by an NRSRO other than S&P, OppenheimerFunds, Inc. converts that rating to the equivalent S&P rating. If two or more NRSROs have assigned a rating to a security, the highest S&P equivalent rating is used. Unrated securities issued or guaranteed by a foreign sovereign are assigned a credit rating equal to the highest NRSRO rating assigned to that foreign sovereign. Fund assets invested in Oppenheimer Institutional Money Market Fund are assigned that fund’s S&P rating, which is currently AAA. For the purposes of this table, “investment-grade” securities are securities rated within the NRSROs’ four highest rating categories (AAA, AA, A and BBB). Unrated securities do not necessarily indicate low credit quality, and may or may not be the equivalent of investment-grade. Please consult the Fund’s prospectus and Statement of Additional Information for further information.

6 OPPENHEIMER CORPORATE BOND FUND

Share Class Performance

AVERAGE ANNUAL TOTAL RETURNS WITHOUT SALES CHARGE AS OF 7/31/13

| | | | | | | | | | | | | | |

| | | Inception

Date | | | | | 1-Year | | | | Since Inception | | |

| Class A (OFIAX) | | | 8/2/10 | | | | | 2.70% | | | | 6.89% | | |

| Class C (OFICX) | | | 8/2/10 | | | | | 1.84% | | | | 5.95% | | |

| Class I (OFIIX) | | | 11/28/12 | | | | | N/A | | | | -0.17% | | |

| Class N (OFINX) | | | 8/2/10 | | | | | 2.35% | | | | 6.52% | | |

| Class Y (OFIYX) | | | 8/2/10 | | | | | 2.79% | | | | 6.99% | | |

AVERAGE ANNUAL TOTAL RETURNS WITH SALES CHARGE AS OF 7/31/13

| | | | | | | | | | | | | | |

| | | Inception

Date | | | | | 1-Year | | | | Since Inception | | |

| Class A (OFIAX) | | | 8/2/10 | | | | | -2.18% | | | | 5.17% | | |

| Class C (OFICX) | | | 8/2/10 | | | | | 0.85% | | | | 5.95% | | |

| Class I (OFIIX) | | | 11/28/12 | | | | | N/A | | | | -0.17% | | |

| Class N (OFINX) | | | 8/2/10 | | | | | 1.37% | | | | 6.52% | | |

| Class Y (OFIYX) | | | 8/2/10 | | | | | 2.79% | | | | 6.99% | | |

Standardized Yields

For the 30 Days Ended 7/31/13

| | | | | | |

| Class A | | | 3.23 | % | | |

| Class C | | | 2.64 | | | |

| Class I | | | 3.83 | | | |

| Class N | | | 3.14 | | | |

| Class Y | | | 3.55 | | | |

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800.CALL OPP (225.5677). Fund returns include changes in share price, reinvested distributions, and the applicable sales charge: for Class A shares, the current maximum initial sales charge of 4.75% and for Class C and N shares, the 1% contingent deferred sales charge for the 1-year period. There is no sales charge for Class I and Class Y shares. Returns for periods of less than one year are cumulative and not annualized.

Standardized yield is based on net investment income for the 30-day period ended 7/31/13 and the maximum offering price at the end of the period (including the maximum sales charge) for Class A shares and the net asset value for Class C, Class I, Class N and Class Y shares. Each result is compounded semiannually and then annualized. Falling share prices will tend to artificially raise yields.

7 OPPENHEIMER CORPORATE BOND FUND

The Fund’s performance is compared to the performance of the Barclays U.S. Aggregate Bond Index, an index of U.S. corporate and government bonds. Indices are unmanaged and cannot be purchased by investors. Index performance includes reinvestment of income, but does not reflect transaction costs, fees, expenses or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund’s performance, and does not predict or depict performance of the Fund. The Fund’s performance reflects the effects of the Fund’s business and operating expenses.

The Fund’s investment strategy and focus can change over time. The mention of specific fund holdings does not constitute a recommendation by OppenheimerFunds, Inc. or its affiliates.

Before investing in any of the Oppenheimer funds, investors should carefully consider a fund’s investment objectives, risks, charges and expenses. Fund prospectuses and summary prospectuses contain this and other information about the funds, and may be obtained by asking your financial advisor, visiting oppenheimerfunds.com, or calling 1.800.CALL OPP (225.5677). Read prospectuses and summary prospectuses carefully before investing.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

8 OPPENHEIMER CORPORATE BOND FUND

Fund Expenses

Fund Expenses. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions; and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire 6-month period ended July 31, 2013.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or contingent deferred sales charges (loads), or a $12.00 fee imposed annually on accounts valued at less than $500.00 (subject to exceptions described in the Statement of Additional Information). Therefore, the “hypothetical” section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

9 OPPENHEIMER CORPORATE BOND FUND

| | | | | | | | | | | | | | |

| Actual | | Beginning Account Value February 1, 2013 | | | Ending Account Value July 31, 2013 | | | Expenses Paid During 6 Months Ended July 31, 2013 | | | |

Class A | | $ | 1,000.00 | | | $ | 992.80 | | | $ | 5.10 | | | |

Class C | | | 1,000.00 | | | | 988.30 | | | | 8.66 | | | |

Class I | | | 1,000.00 | | | | 994.20 | | | | 2.77 | | | |

Class N | | | 1,000.00 | | | | 990.70 | | | | 6.29 | | | |

Class Y | | | 1,000.00 | | | | 992.20 | | | | 3.96 | | | |

| | | | |

| Hypothetical | | | | | | | | | | | | | | |

(5% return before expenses) | | | | | | | | | | | | | | |

Class A | | | 1,000.00 | | | | 1,019.69 | | | | 5.17 | | | |

Class C | | | 1,000.00 | | | | 1,016.12 | | | | 8.79 | | | |

Class I | | | 1,000.00 | | | | 1,022.02 | | | | 2.81 | | | |

Class N | | | 1,000.00 | | | | 1,018.50 | | | | 6.38 | | | |

Class Y | | | 1,000.00 | | | | 1,020.83 | | | | 4.02 | | | |

Expenses are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). Those annualized expense ratios, excluding indirect expenses from affiliated funds, based on the 6-month period ended July 31, 2013 are as follows:

| | | | | | |

| Class | | Expense Ratios | | | |

Class A | | | 1.03% | | | |

Class C | | | 1.75 | | | |

Class I | | | 0.56 | | | |

Class N | | | 1.27 | | | |

Class Y | | | 0.80 | | | |

The expense ratios reflect voluntary waivers and/or reimbursements of expenses by the Fund’s Manager. Some of these undertakings may be modified or terminated at any time, as indicated in the Fund’s prospectus. The “Financial Highlights” tables in the Fund’s financial statements, included in this report, also show the gross expense ratios, without such waivers or reimbursements and reduction to custodian expenses, if applicable.

10 OPPENHEIMER CORPORATE BOND FUND

| | | | |

| | |

| | STATEMENT OF INVESTMENTS July 31, 2013 | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Asset-Backed Securities—2.2% | | | | | | | | |

| American Credit Acceptance Receivables Trust, Series 2012-3, Cl. C, 2.78%, 9/17/181 | | $ | 225,000 | | | $ | 224,012 | |

| AmeriCredit Automobile Receivables Trust: | | | | | | | | |

| Series 2010-4, Cl. E, 6.40%, 4/9/182 | | | 350,000 | | | | 375,412 | |

| Series 2011-4, Cl. D, 4.08%, 9/8/17 | | | 80,000 | | | | 83,177 | |

| Series 2012-1, Cl. D, 4.72%, 3/8/18 | | | 135,000 | | | | 143,252 | |

| Series 2012-2, Cl. D, 3.38%, 4/9/18 | | | 100,000 | | | | 102,323 | |

| |

| CarMax Auto Owner Trust, Series 2011-1, Cl. D, 3.62%, 8/15/17 | | | 300,000 | | | | 311,795 | |

| |

| Santander Drive Auto Receivables Trust: | | | | | | | | |

| Series 2012-1, Cl. C, 3.78%, 11/15/17 | | | 355,000 | | | | 363,363 | |

| Series 2012-3, Cl. C, 3.01%, 4/16/18 | | | 190,000 | | | | 192,107 | |

| Series 2012-3, Cl. D, 3.64%, 5/15/18 | | | 60,000 | | | | 61,224 | |

| |

| United Auto Credit Securitization Trust, Series 2013-1, Cl. D, 2.90%, 12/15/171 | | | 19,000 | | | | 18,898 | |

| | | | | | | | |

| Total Asset-Backed Securities (Cost $1,854,647) | | | | | | | 1,875,563 | |

|

| |

Corporate Bonds and Notes—87.2% | | | | | | | | |

| |

Consumer Discretionary—11.0% | | | | | | | | |

| |

Auto Components—0.5% | | | | | | | | |

| Dana Holding Corp., 6.75% Sr. Unsec. Nts., 2/15/21 | | | 410,000 | | | | 439,725 | |

|

| |

Automobiles—3.0% | | | | | | | | |

| Daimler Finance North America LLC, 8.50% Sr. Unsec. Unsub. Nts., 1/18/31 | | | 542,000 | | | | 788,884 | |

| |

| Ford Motor Credit Co. LLC, 5.875% Sr. Unsec. Unsub. Nts., 8/2/21 | | | 1,227,000 | | | | 1,363,812 | |

| |

| General Motors Financial Co., Inc., 4.25% Sr. Unsec. Nts., 5/15/231 | | | 416,000 | | | | 400,400 | |

| | | | | | | | |

| | | | | | | 2,553,096 | |

|

| |

Hotels, Restaurants & Leisure—1.1% | | | | | | | | |

| Brinker International, Inc., 2.60% Sr. Unsec. Nts., 5/15/18 | | | 240,000 | | | | 237,793 | |

| |

| Hyatt Hotels Corp., 3.875% Sr. Unsec. Unsub. Nts., 8/15/16 | | | 115,000 | | | | 121,414 | |

| |

| Starwood Hotels & Resorts Worldwide, Inc., 7.15% Sr. Unsec. Unsub. Nts., 12/1/19 | | | 517,000 | | | | 631,148 | |

| | | | | | | | |

| | | | | | | 990,355 | |

|

| |

Household Durables—1.1% | | | | | | | | |

| Jarden Corp., 6.125% Sr. Unsec. Nts., 11/15/22 | | | 405,000 | | | | 431,325 | |

| |

| Lennar Corp., 4.125% Sr. Unsec. Nts., 12/1/181 | | | 500,000 | | | | 485,000 | |

| | | | | | | | |

| | | | | | | 916,325 | |

|

| |

Media—3.6% | | | | | | | | |

| CBS Corp., 4.85% Sr. Unsec. Unsub. Nts., 7/1/42 | | | 315,000 | | | | 292,906 | |

| |

| Comcast Corp., 4.65% Sr. Unsec. Unsub. Nts., 7/15/42 | | | 810,000 | | | | 780,287 | |

| |

| DIRECTV Holdings LLC/DIRECTV Financing Co., Inc., 5.15% Sr. Unsec. Nts., 3/15/42 | | | 207,000 | | | | 187,560 | |

| |

| Historic TW, Inc., 9.15% Debs., 2/1/23 | | | 300,000 | | | | 408,254 | |

| |

| Lamar Media Corp., 5% Sr. Unsec. Sub. Nts., 5/1/23 | | | 479,000 | | | | 461,037 | |

| |

| News America, Inc., 6.15% Sr. Unsec. Nts., 2/15/41 | | | 425,000 | | | | 481,839 | |

| |

| Time Warner Entertainment Co. LP, 8.375% Sr. Unsec. Nts., 7/15/33 | | | 250,000 | | | | 279,175 | |

| |

| Time Warner, Inc., 4.90% Sr. Unsec. Nts., 6/15/42 | | | 130,000 | | | | 127,472 | |

| |

| WPP Finance 2010, 5.125% Sr. Unsec. Unsub. Nts., 9/7/42 | | | 225,000 | | | | 210,098 | |

| | | | | | | | |

| | | | | | | 3,228,628 | |

11 OPPENHEIMER CORPORATE BOND FUND

| | | | |

| | |

| | STATEMENT OF INVESTMENTS Continued | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Multiline Retail—0.4% | | | | | | | | |

| Dollar General Corp., 4.125% Nts., 7/15/17 | | $ | 317,000 | | | $ | 336,152 | |

|

| |

Specialty Retail—0.8% | | | | | | | | |

| Home Depot, Inc. (The), 4.20% Sr. Unsec. Unsub. Nts., 4/1/43 | | | 230,000 | | | | 218,465 | |

| |

| Rent-A-Center, Inc., 4.75% Sr. Unsec. Nts., 5/1/211 | | | 488,000 | | | | 468,480 | |

| | | | | | | | |

| | | | | | | 686,945 | |

|

| |

Textiles, Apparel & Luxury Goods—0.5% | | | | | | | | |

| PVH Corp., 4.50% Sr. Unsec. Unsub. Nts., 12/15/22 | | | 455,000 | | | | 447,038 | |

| |

Consumer Staples—5.5% | | | | | | | | |

| |

Beverages—1.8% | | | | | | | | |

| Anheuser-Busch InBev Worldwide, Inc., 8.20% Sr. Unsec. Unsub. Nts., 1/15/39 | | | 445,000 | | | | 663,457 | |

| |

| Constellation Brands, Inc., 3.75% Sr. Unsec. Nts., 5/1/21 | | | 496,000 | | | | 465,000 | |

| |

| Diageo Capital plc, 3.875% Sr. Unsec. Unsub. Nts., 4/29/43 | | | 290,000 | | | | 260,520 | |

| |

| SABMiller Holdings, Inc., 4.95% Sr. Unsec. Unsub. Nts., 1/15/421 | | | 275,000 | | | | 284,049 | |

| | | | | | | | |

| | | | | | | 1,673,026 | |

|

| |

Food & Staples Retailing—0.7% | | | | | | | | |

| CVS Caremark Corp., 6.125% Sr. Unsec. Unsub. Nts., 9/15/39 | | | 240,000 | | | | 285,105 | |

| |

| Delhaize Group SA, 5.70% Sr. Unsec. Nts., 10/1/40 | | | 329,000 | | | | 317,617 | |

| | | | | | | | |

| | | | | | | 602,722 | |

|

| |

Food Products—1.3% | | | | | | | | |

| Archer-Daniels-Midland Co., 5.765% Sr. Unsec. Nts., 3/1/41 | | | 447,000 | | | | 504,532 | |

| |

| Bunge Ltd. Finance Corp., 8.50% Sr. Unsec. Nts., 6/15/19 | | | 514,000 | | | | 640,547 | |

| | | | | | | | |

| | | | | | | 1,145,079 | |

|

| |

Personal Products—0.5% | | | | | | | | |

| Avon Products, Inc., 4.60% Sr. Unsec. Nts., 3/15/20 | | | 424,000 | | | | 438,449 | |

|

| |

Tobacco—1.2% | | | | | | | | |

| Altria Group, Inc., 10.20% Sr. Unsec. Nts., 2/6/39 | | | 370,000 | | | | 571,784 | |

| |

| Lorillard Tobacco Co., 3.75% Sr. Unsec. Nts., 5/20/23 | | | 489,000 | | | | 447,189 | |

| | | | | | | | |

| | | | | | | 1,018,973 | |

| |

Energy—12.4% | | | | | | | | |

| |

Energy Equipment & Services—1.8% | | | | | | | | |

| Ensco plc, 4.70% Sr. Unsec. Nts., 3/15/21 | | | 599,000 | | | | 643,457 | |

| |

| Rowan Cos., Inc., 4.875% Sr. Unsec. Unsub. Nts., 6/1/22 | | | 610,000 | | | | 639,067 | |

| |

| Weatherford International Ltd. Bermuda, 4.50% Sr. Unsec. Unsub. Nts., 4/15/22 | | | 375,000 | | | | 374,259 | |

| | | | | | | | |

| | | | | | | 1,656,783 | |

|

| |

Oil, Gas & Consumable Fuels—10.6% | | | | | | | | |

| Anadarko Petroleum Corp., 6.20% Sr. Unsec. Nts., 3/15/40 | | | 458,000 | | | | 525,902 | |

| |

| Buckeye Partners LP, 4.15% Sr. Unsec. Nts., 7/1/23 | | | 385,000 | | | | 375,891 | |

| |

| Canadian Oil Sands Ltd., 6% Sr. Unsec. Nts., 4/1/421 | | | 246,000 | | | | 262,951 | |

| |

| CNOOC Finance 2013 Ltd., 4.25% Sr. Unsec. Unsub. Nts., 5/9/43 | | | 86,000 | | | | 73,600 | |

| |

| Concho Resources, Inc., 5.50% Sr. Unsec. Unsub. Nts., 4/1/23 | | | 485,000 | | | | 486,212 | |

| |

| Continental Resources, Inc., 4.50%, 4/15/23 | | | 492,000 | | | | 479,700 | |

| |

| Copano Energy LLC/Copano Energy Finance Corp., 7.125% Sr. Unsec. Unsub. Nts., 4/1/21 | | | 1,185,000 | | | | 1,339,050 | |

12 OPPENHEIMER CORPORATE BOND FUND

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Oil, Gas & Consumable Fuels (Continued) | | | | | | | | |

| DCP Midstream LLC: | | | | | | | | |

| 5.85% Jr. Sub. Nts., 5/21/431,3 | | $ | 505,000 | | | $ | 484,800 | |

| 9.70% Sr. Unsec. Nts., 12/1/131 | | | 170,000 | | | | 174,728 | |

| |

| DCP Midstream Operating LP: | | | | | | | | |

| 2.50% Sr. Unsec. Unsub. Nts., 12/1/17 | | | 655,000 | | | | 649,770 | |

| 3.875% Sr. Unsec. Nts., 3/15/23 | | | 367,000 | | | | 344,411 | |

| |

| El Paso Pipeline Partners Operating Co. LLC, 4.70% Sr. Unsec. Unsub. Nts., 11/1/42 | | | 558,000 | | | | 508,731 | |

| |

| Energy Transfer Partners LP: | | | | | | | | |

| 4.65% Sr. Unsec. Unsub. Nts., 6/1/21 | | | 358,000 | | | | 373,310 | |

| 5.20% Sr. Unsec. Unsub. Nts., 2/1/22 | | | 521,000 | | | | 558,607 | |

| |

| Range Resources Corp., 5.75% Sr. Unsec. Sub. Nts., 6/1/21 | | | 420,000 | | | | 446,250 | |

| |

| Rockies Express Pipeline LLC, 3.90% Sr. Unsec. Unsub. Nts., 4/15/151 | | | 285,000 | | | | 287,138 | |

| |

| Southwestern Energy Co., 4.10% Sr. Unsec. Nts., 3/15/22 | | | 528,000 | | | | 528,478 | |

| |

| Talisman Energy, Inc., 6.25% Sr. Unsec. Unsub. Nts., 2/1/38 | | | 212,000 | | | | 230,004 | |

| |

| Williams Cos., Inc. (The), 3.70% Sr. Unsec. Unsub. Nts., 1/15/23 | | | 520,000 | | | | 480,435 | |

| |

| Woodside Finance Ltd., 4.60% Sr. Unsec. Unsub. Nts., 5/10/211 | | | 556,000 | | | | 589,206 | |

| | | | | | | | |

| | | | | | | 9,199,174 | |

| |

Financials—27.3% | | | | | | | | |

| |

Capital Markets—6.4% | | | | | | | | |

| Blackstone Holdings Finance Co. LLC, 6.625% Sr. Unsec. Nts., 8/15/191 | | | 787,000 | | | | 934,337 | |

| |

| Carlyle Holdings II Finance LLC, 5.625% Sr. Sec. Nts., 3/30/431 | | | 320,000 | | | | 299,123 | |

| |

| Deutsche Bank AG, 4.296% Jr. Sub. Nts., 5/24/283 | | | 506,000 | | | | 460,805 | |

| |

| Goldman Sachs Group, Inc. (The): | | | | | | | | |

| 5.75% Sr. Unsec. Nts., 1/24/22 | | | 410,000 | | | | 457,463 | |

| 6.25% Sr. Unsec. Nts., 2/1/41 | | | 355,000 | | | | 405,326 | |

| |

| Macquarie Bank Ltd., 6.625% Unsec. Sub. Nts., 4/7/211 | | | 495,000 | | | | 540,522 | |

| |

| Morgan Stanley, 5.625% Sr. Unsec. Nts., 9/23/19 | | | 1,010,000 | | | | 1,120,061 | |

| |

| Raymond James Financial, Inc., 5.625% Sr. Unsec. Unsub. Nts., 4/1/24 | | | 669,000 | | | | 699,962 | |

| |

| UBS AG (Stamford, CT), 2.25% Sr. Unsec. Nts., 8/12/13 | | | 25,000 | | | | 25,016 | |

| |

| UBS Preferred Funding Trust V, 6.243% Jr. Sub. Perpetual Bonds, Series 13,4 | | | 613,000 | | | | 650,546 | |

| | | | | | | | |

| | | | | | | 5,593,161 | |

|

| |

Commercial Banks—7.7% | | | | | | | | |

| Barclays Bank plc, 6.05% Unsec. Sub. Nts., 12/4/171 | | | 1,000,000 | | | | 1,106,607 | |

| |

| CIT Group, Inc., 5% Sr. Unsec. Nts., 8/1/235 | | | 460,000 | | | | 452,266 | |

| |

| Fifth Third Capital Trust IV, 6.50% Jr. Sub. Nts., 4/15/373 | | | 728,000 | | | | 730,730 | |

| |

| HSBC Finance Capital Trust IX, 5.911% Unsec. Sub. Nts., 11/30/353 | | | 660,000 | | | | 676,500 | |

| |

| LBG Capital No. 1 plc, 7.875% Unsec. Sub. Nts., 11/1/201 | | | 430,000 | | | | 459,240 | |

| |

| Lloyds TSB Bank plc, 6.50% Unsec. Sub. Nts., 9/14/201 | | | 466,000 | | | | 506,360 | |

| |

| PNC Financial Services Group, Inc. (The), 4.85% Jr. Sub. Perpetual Bonds3,4 | | | 522,000 | | | | 476,325 | |

| |

| Rabobank Capital Funding Trust III, 5.254% Jr. Sub. Perpetual Bonds1,3,4 | | | 780,000 | | | | 789,750 | |

| |

| Regions Bank, 7.50% Sub. Nts., 5/15/18 | | | 400,000 | | | | 473,468 | |

| |

| Royal Bank of Scotland Group plc, 7.64% Jr. Sub. Perpetual Bonds, Series U3,4 | | | 600,000 | | | | 547,500 | |

| |

| Wells Fargo & Co., 7.98% Jr. Sub. Perpetual Bonds, Series K3,4 | | | 533,000 | | | | 600,958 | |

| | | | | | | | |

| | | | | | | 6,819,704 | |

|

| |

Consumer Finance—1.3% | | | | | | | | |

| Ally Financial, Inc., 3.50%, 7/18/16 | | | 461,000 | | | | 464,816 | |

| |

| Discover Financial Services, 3.85% Sr. Unsec. Unsub. Nts., 11/21/22 | | | 699,000 | | | | 669,538 | |

| | | | | | | | |

| | | | | | | 1,134,354 | |

13 OPPENHEIMER CORPORATE BOND FUND

| | | | |

| | |

| | STATEMENT OF INVESTMENTS Continued | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Diversified Financial Services—4.8% | | | | | | | | |

| Bank of America Corp., 5.20% Jr. Sub. Perpetual Bonds3,4 | | $ | 506,000 | | | $ | 457,930 | |

| |

| Citigroup, Inc.: | | | | | | | | |

| 3.375% Sr. Unsec. Unsub. Nts., 3/1/23 | | | 745,000 | | | | 713,013 | |

| Series D, 5.95% Jr. Sub. Perpetual Bonds3,4 | | | 515,000 | | | | 500,194 | |

| |

| ING US, Inc., 5.65% Unsec. Sub. Nts., 5/15/531,3 | | | 413,000 | | | | 389,252 | |

| |

| Jefferies Group LLC, 5.125% Sr. Unsec. Nts., 1/20/23 | | | 275,000 | | | | 279,072 | |

| |

| JPMorgan Chase & Co.: | | | | | | | | |

| Series 1, 7.90% Jr. Sub. Perpetual Bonds3,4 | | | 728,000 | | | | 810,707 | |

| Series Q, 5.15% Jr. Sub. Perpetual Bonds3,4 | | | 506,000 | | | | 471,845 | |

| |

| Merrill Lynch & Co., Inc., 7.75% Jr. Sub. Nts., 5/14/38 | | | 581,000 | | | | 696,010 | |

| | | | | | | | |

| | | | | | | 4,318,023 | |

|

| |

Insurance—6.0% | | | | | | | | |

| CNA Financial Corp.: | | | | | | | | |

| 5.75% Sr. Unsec. Unsub. Nts., 8/15/21 | | | 338,000 | | | | 384,812 | |

| 5.875% Sr. Unsec. Unsub. Nts., 8/15/20 | | | 490,000 | | | | 561,388 | |

| |

| Liberty Mutual Group, Inc., 4.25% Sr. Unsec. Nts., 6/15/231 | | | 392,000 | | | | 385,568 | |

| |

| Lincoln National Corp., 6.05% Jr. Unsec. Sub. Nts., 4/20/673 | | | 1,360,000 | | | | 1,366,800 | |

| |

| PacifiCorp, 4.10% Sr. Sec. Nts., 2/1/42 | | | 170,000 | | | | 158,934 | |

| |

| Prudential Financial, Inc.: | | | | | | | | |

| 5.20% Jr. Sub. Nts., 3/15/443 | | | 309,000 | | | | 287,756 | |

| 5.625% Jr. Sub. Nts., 6/15/433 | | | 260,000 | | | | 252,850 | |

| |

| QBE Insurance Group Ltd., 2.40% Sr. Unsec. Nts., 5/1/181 | | | 595,000 | | | | 578,644 | |

| |

| Swiss Re Capital I LP, 6.854% Jr. Sub. Perpetual Bonds1,3,4 | | | 1,240,000 | | | | 1,305,100 | |

| | | | | | | | |

| | | | | | | 5,281,852 | |

|

| |

Real Estate Investment Trusts (REITs)—1.1% | | | | | | | | |

| American Tower Corp.: | | | | | | | | |

| 5.05% Sr. Unsec. Unsub. Nts., 9/1/20 | | | 280,000 | | | | 290,830 | |

| 7.00% Sr. Unsec. Nts., 10/15/17 | | | 337,000 | | | | 387,921 | |

| |

| Host Hotels & Resorts LP, 3.75% Sr. Unsec. Nts., 10/15/23 | | | 337,000 | | | | 313,694 | |

| | | | | | | | |

| | | | | | | 992,445 | |

| |

Health Care—3.1% | | | | | | | | |

| |

Biotechnology—1.0% | | | | | | | | |

| Celgene Corp., 3.25% Sr. Unsec. Nts., 8/15/22 | | | 580,000 | | | | 556,800 | |

| |

| Gilead Sciences, Inc., 5.65% Sr. Unsec. Unsub. Nts., 12/1/41 | | | 270,000 | | | | 304,656 | |

| | | | | | | | |

| | | | | | | 861,456 | |

|

| |

Health Care Providers & Services—0.6% | | | | | | | | |

| Cardinal Health, Inc., 3.20% Sr. Unsec. Nts., 3/15/23 | | | 322,000 | | | | 304,142 | |

| |

| McKesson Corp., 6% Sr. Unsec. Unsub. Nts., 3/1/41 | | | 158,000 | | | | 186,595 | |

| | | | | | | | |

| | | | | | | 490,737 | |

|

| |

Pharmaceuticals—1.5% | | | | | | | | |

| Eli Lilly & Co., 5.95% Sr. Unsec. Unsub. Nts., 11/15/37 | | | 320,000 | | | | 380,757 | |

| |

| GlaxoSmithKline Capital, Inc., 6.375% Sr. Unsec. Unsub. Nts., 5/15/38 | | | 190,000 | | | | 238,294 | |

| |

| Mallinckrodt International Finance SA, 3.50% Sr. Unsec. Unsub. Nts., 4/15/181 | | | 168,000 | | | | 166,344 | |

| |

| Teva Pharmaceutical Finance Co. LLC, 6.15% Sr. Unsec. Nts., 2/1/36 | | | 181,000 | | | | 215,497 | |

| |

| Zoetis, Inc., 4.70% Sr. Unsec. Nts., 2/1/431 | | | 250,000 | | | | 238,941 | |

| | | | | | | | |

| | | | | | | 1,239,833 | |

14 OPPENHEIMER CORPORATE BOND FUND

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Industrials—6.1% | | | | | | | | |

| |

Aerospace & Defense—0.8% | | | | | | | | |

| Huntington Ingalls Industries, Inc., 7.125% Sr. Unsec. Unsub. Nts., 3/15/21 | | $ | 355,000 | | | $ | 392,275 | |

| |

| Lockheed Martin Corp., 4.07% Sr. Unsec. Nts., 12/15/42 | | | 287,000 | | | | 255,920 | |

| | | | | | | | |

| | | | | | | 648,195 | |

|

| |

Building Products—0.4% | | | | | | | | |

| Owens Corning, 4.20% Sr. Unsec. Nts., 12/15/22 | | | 394,000 | | | | 386,303 | |

|

| |

Commercial Services & Supplies—0.5% | | | | | | | | |

| Clean Harbors, Inc., 5.25% Sr. Unsec. Unsub. Nts., 8/1/20 | | | 456,000 | | | | 469,680 | |

|

| |

Industrial Conglomerates—1.1% | | | | | | | | |

| General Electric Capital Corp.: | | | | | | | | |

| 6.375% Unsec. Sub. Nts., 11/15/673 | | | 537,000 | | | | 573,919 | |

| Series B, 6.25% Jr. Sub. Perpetual Bonds3,4 | | | 300,000 | | | | 313,294 | |

| | | | | | | | |

| | | | | | | 887,213 | |

|

| |

Machinery—1.3% | | | | | | | | |

| CNH Capital LLC, 6.25% Sr. Unsec. Nts., 11/1/16 | | | 252,000 | | | | 276,570 | |

| |

| Ingersoll-Rand Global Holding Co. Ltd., 4.25% Sr. Unsec. Nts., 6/15/231 | | | 497,000 | | | | 497,104 | |

| |

| National Rural Utilities Cooperative Finance Corp., 4.75% Sr. Unsec. Sub. Nts., 4/30/433 | | | 392,000 | | | | 379,260 | |

| | | | | | | | |

| | | | | | | 1,152,934 | |

|

| |

Professional Services—0.6% | | | | | | | | |

| Nielsen Finance LLC/Nielsen Finance Co., 4.50% Sr. Unsec. Nts., 10/1/201 | | | 480,000 | | | | 474,000 | |

|

| |

Road & Rail—0.8% | | | | | | | | |

| Kansas City Southern Railway, 4.30% Sr. Unsec. Nts., 5/15/431 | | | 266,000 | | | | 242,740 | |

| |

| Penske Truck Leasing Co. LP/PTL Finance Corp., 4.25% Sr. Unsec. Nts., 1/17/231 | | | 443,000 | | | | 430,986 | |

| | | | | | | | |

| | | | | | | 673,726 | |

|

| |

Trading Companies & Distributors—0.6% | | | | | | | | |

| International Lease Finance Corp., 5.875% Sr. Unsec. Unsub. Nts., 4/1/19 | | | 500,000 | | | | 525,000 | |

| |

Information Technology—3.3% | | | | | | | | |

| |

Computers & Peripherals—1.0% | | | | | | | | |

| Hewlett-Packard Co., 2.65% Sr. Unsec. Unsub. Nts., 6/1/16 | | | 825,000 | | | | 846,085 | |

|

| |

Electronic Equipment, Instruments, & Components—1.2% | | | | | | | | |

| Arrow Electronics, Inc., 5.125% Sr. Unsec. Unsub. Nts., 3/1/21 | | | 575,000 | | | | 586,473 | |

| |

| Avnet, Inc., 4.875% Sr. Unsec. Unsub. Nts., 12/1/22 | | | 435,000 | | | | 430,737 | |

| | | | | | | | |

| | | | | | | 1,017,210 | |

|

| |

IT Services—0.4% | | | | | | | | |

| Fidelity National Information Services, Inc., 3.50% Sr. Unsec. Nts., 4/15/23 | | | 365,000 | | | | 337,459 | |

|

| |

Semiconductors & Semiconductor Equipment—0.3% | | | | | | | | |

| Intel Corp., 4.25% Sr. Unsec. Unsub. Nts., 12/15/42 | | | 300,000 | | | | 275,121 | |

|

| |

Software—0.4% | | | | | | | | |

| Oracle Corp., 5.375% Sr. Unsec. Unsub. Nts., 7/15/40 | | | 320,000 | | | | 357,647 | |

15 OPPENHEIMER CORPORATE BOND FUND

| | | | |

| | |

| | STATEMENT OF INVESTMENTS Continued | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Materials—6.7% | | | | | | | | |

| |

Chemicals—2.0% | | | | | | | | |

| CF Industries, Inc., 4.95% Sr. Unsec. Nts., 6/1/43 | | $ | 311,000 | | | $ | 292,183 | |

| |

| Dow Chemical Co., 8.55% Sr. Unsec. Nts., 5/15/19 | | | 455,000 | | | | 586,432 | |

| |

| LYB International Finance BV, 5.25% Sr. Unsec. Nts., 7/15/43 | | | 188,000 | | | | 189,471 | |

| |

| RPM International, Inc., 3.45% Sr. Unsec. Unsub. Nts., 11/15/22 | | | 325,000 | | | | 307,448 | |

| |

| Sherwin-Williams Co. (The), 4% Sr. Unsec. Unsub. Nts., 12/15/42 | | | 367,000 | | | | 334,018 | |

| | | | | | | | |

| | | | | | | 1,709,552 | |

|

| |

Containers & Packaging—0.6% | | | | | | | | |

| Rock Tenn Co., 3.50% Sr. Unsec. Unsub. Nts., 3/1/20 | | | 510,000 | | | | 503,591 | |

|

| |

Metals & Mining—3.1% | | | | | | | | |

| Allegheny Technologies, Inc., 5.95% Sr. Unsec. Unsub. Nts., 1/15/21 | | | 517,000 | | | | 546,973 | |

| |

| Barrick Gold Corp., 3.85% Sr. Unsec. Nts., 4/1/22 | | | 375,000 | | | | 320,740 | |

| |

| Carpenter Technology Corp., 4.45% Sr. Unsec. Unsub. Nts., 3/1/23 | | | 250,000 | | | | 244,899 | |

| |

| Cliffs Natural Resources, Inc., 3.95% Sr. Unsec. Unsub. Nts., 1/15/18 | | | 665,000 | | | | 642,434 | |

| |

| Freeport-McMoRan Copper & Gold, Inc., 3.875% Sr. Unsec. Nts., 3/15/231 | | | 695,000 | | | | 630,572 | |

| |

| Xstrata Canada Corp.: | | | | | | | | |

| 5.375% Sr. Unsec. Unsub. Nts., 6/1/15 | | | 215,000 | | | | 227,178 | |

| 6.00% Sr. Unsec. Unsub. Nts., 10/15/15 | | | 197,000 | | | | 213,022 | |

| | | | | | | | |

| | | | | | | 2,825,818 | |

|

| |

Paper & Forest Products—1.0% | | | | | | | | |

| Georgia-Pacific LLC, 3.734% Sr. Unsec. Nts., 7/15/231 | | | 428,000 | | | | 421,577 | |

| |

| International Paper Co., 6% Sr. Unsec. Unsub. Nts., 11/15/41 | | | 430,000 | | | | 472,936 | |

| | | | | | �� | | |

| | | | | | | 894,513 | |

| |

Telecommunication Services—6.0% | | | | | | | | |

| |

Diversified Telecommunication Services—4.7% | | | | | | | | |

| AT&T, Inc., 6.30% Sr. Unsec. Unsub. Nts., 1/15/38 | | | 1,148,000 | | | | 1,297,765 | |

| |

| British Telecommunications plc, 9.625% Sr. Unsec. Nts., 12/15/30 | | | 336,000 | | | | 511,885 | |

| |

| CenturyLink, Inc., 5.625% Sr. Unsec. Unsub. Nts., 4/1/20 | | | 420,000 | | | | 430,500 | |

| |

| Frontier Communications Corp., 8.50% Sr. Unsec. Nts., 4/15/20 | | | 405,000 | | | | 451,575 | |

| |

| MetroPCS Wireless, Inc., 6.25% Sr. Unsec. Unsub. Nts., 4/1/211 | | | 450,000 | | | | 460,687 | |

| |

| Telecom Italia Capital SA, 7.721% Sr. Unsec. Unsub. Nts., 6/4/38 | | | 295,000 | | | | 296,039 | |

| |

| Telefonica Emisiones SAU, 7.045% Sr. Unsec. Unsub. Nts., 6/20/36 | | | 250,000 | | | | 277,423 | |

| |

| Verizon Communications, Inc., 6.40% Sr. Unsec. Nts., 2/15/38 | | | 404,000 | | | | 466,556 | |

| | | | | | | | |

| | | | | | | 4,192,430 | |

|

| |

Wireless Telecommunication Services—1.3% | | | | | | | | |

| America Movil SAB de CV, 4.375% Sr. Unsec. Unsub. Nts., 7/16/42 | | | 582,000 | | | | 491,855 | |

| |

| CC Holdings GS V LLC/Crown Castle GS III Corp., 3.849% Sr. Sec. Nts., 4/15/23 | | | 424,000 | | | | 400,667 | |

| |

| Vodafone Group plc, 4.375% Sr. Unsec. Unsub. Nts., 2/19/43 | | | 194,000 | | | | 174,338 | |

| | | | | | | | |

| | | | | | | 1,066,860 | |

| |

Utilities—5.8% | | | | | | | | |

| |

Electric Utilities—4.8% | | | | | | | | |

| Duke Energy Florida, Inc., 3.85% Sec. Nts., 11/15/42 | | | 500,000 | | | | 448,277 | |

| |

| Electricite de France SA, 5.25% Jr. Sub. Perpetual Bonds1,3,4 | | | 657,000 | | | | 629,408 | |

| |

| Exelon Generation Co. LLC, 4.25% Sr. Unsec. Unsub. Nts., 6/15/22 | | | 405,000 | | | | 408,052 | |

| |

| FirstEnergy Corp., 2.75% Sr. Unsec. Nts., 3/15/18 | | | 350,000 | | | | 339,390 | |

| |

| Florida Power & Light Co., 5.40% Sr. Sec. Nts., 9/1/35 | | | 280,000 | | | | 317,650 | |

16 OPPENHEIMER CORPORATE BOND FUND

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Electric Utilities (Continued) | | | | | | | | |

| Georgia Power Co., 4.30% Sr. Unsec. Unsub. Nts., 3/15/42 | | $ | 465,000 | | | $ | 435,326 | |

| |

| ITC Holdings Corp., 5.30% Sr. Unsec. Nts., 7/1/43 | | | 338,000 | | | | 347,879 | |

| |

| PPL Capital Funding, Inc., 3.50% Sr. Unsec. Unsub. Nts., 12/1/22 | | | 425,000 | | | | 411,579 | |

| |

| PPL WEM Holdings plc, 5.375% Sr. Unsec. Unsub. Nts., 5/1/211 | | | 708,000 | | | | 769,405 | |

| | | | | | | | |

| | | | | | | 4,106,966 | |

|

| |

Multi-Utilities—1.0% | | | | | | | | |

| Boston Gas Co., 4.487% Sr. Unsec. Nts., 2/15/421 | | | 165,000 | | | | 158,555 | |

| |

| CMS Energy Corp., 5.05% Sr. Unsec. Unsub. Nts., 3/15/22 | | | 161,000 | | | | 175,818 | |

| |

| Niagara Mohawk Power Corp., 2.721% Sr. Unsec. Nts., 11/28/221 | | | 370,000 | | | | 344,532 | |

| |

| Pacific Gas & Electric Co., 4.50% Sr. Unsec. Unsub. Nts., 12/15/41 | | | 168,000 | | | | 165,136 | |

| | | | | | | | |

| | | | | | | 844,041 | |

| | | | | | | | |

| Total Corporate Bonds and Notes (Cost $77,324,226) | | | | | | | 76,258,379 | |

|

| |

Mortgage-Backed Obligations—1.9% | | | | | | | | |

| Banc of America Commercial Mortgage Trust, Series 2007-5, Cl. AM, 5.772%, 2/10/513 | | | 120,000 | | | | 130,605 | |

| |

| Banc of America Mortgage Securities Trust, Collateralized Mtg. Obligations, Series 2007-1, Cl. 1A24, 6%, 3/25/37 | | �� | 133,890 | | | | 124,755 | |

| |

| Citigroup Mortgage Loan Trust, Series 2006-AR2, Cl. 1A2, 2.935%, 3/25/363 | | | 92,482 | | | | 80,510 | |

| |

| Countrywide Alternative Loan Trust: | | | | | | | | |

| Series 2005-86CB, Cl. A8, 5.50%, 2/25/36 | | | 50,874 | | | | 47,176 | |

| Series 2006-24CB, Cl. A12, 5.75%, 6/25/36 | | | 199,801 | | | | 162,938 | |

| |

| Countrywide Home Loans: | | | | | | | | |

| Series 2006-17, Cl. A2, 6.00%, 12/25/36 | | | 249,708 | | | | 224,628 | |

| Series 2006-20, Cl. 1A17, 5.75%, 2/25/37 | | | 157,396 | | | | 138,001 | |

| |

| WaMu Mortgage Pass-Through Certificates Trust: | | | | | | | | |

| Series 2005-AR12, Cl. 1A8, 2.426%, 10/25/353 | | | 51,885 | | | | 48,810 | |

| Series 2005-AR14, Cl. 1A4, 2.509%, 12/25/353 | | | 152,037 | | | | 137,899 | |

| |

| Wells Fargo Alternative Loan Trust, Collateralized Mtg. Obligations, Series 2007- PA5, Cl. 1A1, 6.25%, 11/25/37 | | | 202,058 | | | | 186,588 | |

| |

| Wells Fargo Mortgage-Backed Securities Trust: | | | | | | | | |

| Series 2006-AR2, Cl. 2A3, 2.64%, 3/25/363 | | | 157,639 | | | | 155,079 | |

| Series 2006-AR6, Cl. 3A1, 2.77%, 3/25/363 | | | 155,868 | | | | 148,028 | |

| Series 2007-AR8, Cl. A1, 5.967%, 11/25/373 | | | 130,745 | | | | 114,820 | |

| | | | | | | | |

| Total Mortgage-Backed Obligations (Cost $1,602,690) | | | | | | | 1,699,837 | |

| | |

| | | Shares | | | | |

| |

Investment Company—7.4% | | | | | | | | |

Oppenheimer Institutional Money Market Fund, Cl. E, 0.10%6,7

(Cost $6,481,870) | | | 6,481,870 | | | | 6,481,870 | |

| |

Total Investments, at Value | | | | | | | | |

| (Cost $87,263,433) | | | 98.7 | % | | | 86,315,649 | |

| |

| Assets in Excess of Other Liabilities | | | 1.3 | | | | 1,181,119 | |

| | | | |

Net Assets | | | 100.0 | % | | $ | 87,496,768 | |

| | | | |

Footnotes to Statement of Investments

1. Represents securities sold under Rule 144A, which are exempt from registration under the Securities Act of 1933, as amended. These securities have been determined to be liquid under guidelines established by the Board of Trustees. These securities amount to $16,439,016 or 18.79% of the Fund’s net assets as of July 31, 2013.

17 OPPENHEIMER CORPORATE BOND FUND

| | | | |

| | |

| | STATEMENT OF INVESTMENTS Continued | | |

| | | | |

| | Footnotes to Statement of Investments (Continued) | | |

2. Restricted security. The aggregate value of restricted securities as of July 31, 2013 was $375,412, which represents 0.43% of the Fund’s net assets. See Note 7 of the accompanying Notes. Information concerning restricted securities is as follows:

| | | | | | | | | | | | | | | | |

| | | Acquisition | | | | | | | | | Unrealized | |

| Security | | Date | | | Cost | | | Value | | | Appreciation | |

| |

AmeriCredit Automobile Receivables Trust, Series 2010-4, Cl. E, 6.40%, 4/9/18 | | | 7/2712 | | | $ | 369,469 | | | $ | 375,412 | | | $ | 5,943 | |

3. Represents the current interest rate for a variable or increasing rate security.

4. This bond has no contractual maturity date, is not redeemable and contractually pays an indefinite stream of interest. Rate reported represents the current interest rate for this variable rate security.

5. All or a portion of the security position is when-issued or delayed delivery to be delivered and settled after July 31, 2013. See Note 1 of the accompanying Notes.

6. Is or was an affiliate, as defined in the Investment Company Act of 1940, at or during the period ended July 31, 2013, by virtue of the Fund owning at least 5% of the voting securities of the issuer or as a result of the Fund and the issuer having the same investment adviser. Transactions during the period in which the issuer was an affiliate are as follows:

| | | | | | | | | | | | | | | | |

| | | Shares | | | Gross | | | Gross | | | Shares | |

| | | July 31, 2012 | | | Additions | | | Reductions | | | July 31, 2013 | |

| |

Oppenheimer Institutional

Money Market Fund, Cl. E | | | 5,015,124 | | | | 65,914,232 | | | | 64,447,486 | | | | 6,481,870 | |

| | | | |

| | | | | | | | | Value | | | Income | |

| |

Oppenheimer Institutional

Money Market Fund, Cl. E | | | | | | | | | | | $ 6,481,870 | | | | $ 9,346 | |

7. Rate shown is the 7-day yield as of July 31, 2013.

| | |

|

Futures Contracts as of July 31, 2013 are as follows: | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Unrealized | |

| | | | | | Number of | | | Expiration | | | | | | Appreciation | |

| Contract Description | | Buy/Sell | | | Contracts | | | Date | | | Value | | | (Depreciation) | |

| |

| U.S. Treasury Long Bonds | | | Sell | | | | 91 | | | | 9/19/13 | | | $ | 12,199,688 | | | $ | 835,254 | |

| U.S. Treasury Nts., 2 yr. | | | Buy | | | | 61 | | | | 9/30/13 | | | | 13,439,063 | | | | (725) | |

| U.S. Treasury Nts., 5 yr. | | | Sell | | | | 113 | | | | 9/30/13 | | | | 13,714,492 | | | | 233,285 | |

| U.S. Treasury Nts., 10 yr. | | | Buy | | | | 5 | | | | 9/19/13 | | | | 632,187 | | | | 6,306 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | $ | 1,074,120 | |

| | | | | | | | | | | | | | | | | | | | |

See accompanying Notes to Financial Statements.

18 OPPENHEIMER CORPORATE BOND FUND

| | | | |

| | |

| | STATEMENT OF ASSETS AND LIABILITIES July 31, 2013 | | |

| | | | |

| |

Assets | | | | |

| Investments, at value—see accompanying statement of investments: | | | | |

| Unaffiliated companies (cost $80,781,563) | | $ | 79,833,779 | |

| Affiliated companies (cost $6,481,870) | | | 6,481,870 | |

| | | | |

| | | 86,315,649 | |

| |

| Cash | | | 47,717 | |

| |

| Cash used for collateral on futures | | | 349,500 | |

| |

| Receivables and other assets: | | | | |

| Interest, dividends and principal paydowns | | | 1,021,563 | |

| Investments sold | | | 768,358 | |

| Shares of beneficial interest sold | | | 24,998 | |

| Variation margin receivable | | | 1,984 | |

| Other | | | 9,775 | |

| | | | |

| Total assets | | | 88,539,544 | |

| |

Liabilities | | | | |

| Payables and other liabilities: | | | | |

| Investments purchased (including $455,543 purchased on a when-issued or delayed delivery basis) | | | 629,748 | |

| Shares of beneficial interest redeemed | | | 303,310 | |

| Distribution and service plan fees | | | 19,184 | |

| Transfer and shareholder servicing agent fees | | | 17,574 | |

| Variation margin payable | | | 15,984 | |

| Dividends payable | | | 12,705 | |

| Shareholder communications | | | 10,760 | |

| Trustees’ compensation | | | 3,704 | |

| Other | | | 29,807 | |

| | | | |

| Total liabilities | | | 1,042,776 | |

| |

| Net Assets | | $ | 87,496,768 | |

| | | | |

| | | | |

| |

Composition of Net Assets | | | | |

| Par value of shares of beneficial interest | | $ | 8,150 | |

| |

| Additional paid-in capital | | | 86,164,241 | |

| |

| Accumulated net investment income | | | 19,109 | |

| |

| Accumulated net realized gain on investments | | | 1,178,896 | |

| |

| Net unrealized appreciation on investments | | | 126,372 | |

| | | | |

| Net Assets | | $ | 87,496,768 | |

| | | | |

19 OPPENHEIMER CORPORATE BOND FUND

| | | | |

| | |

| | STATEMENT OF INVESTMENTS Continued | | |

| | | | |

| |

Net Asset Value Per Share | | | | |

Class A Shares: | | | | |

| Net asset value and redemption price per share (based on net assets of $65,006,312 and 6,054,320 shares of beneficial interest outstanding) | | $ | 10.74 | |

| Maximum offering price per share (net asset value plus sales charge of 4.75% of offering price) | | $ | 11.28 | |

| |

| |

| Class C Shares: | | | | |

| Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $18,060,228 and 1,683,009 shares of beneficial interest outstanding) | | $ | 10.73 | |

| |

| |

| Class I Shares: | | | | |

| Net asset value, redemption price and offering price per share (based on net assets of $9,871 and 920 shares of beneficial interest outstanding) | | $ | 10.73 | |

| |

| |

| Class N Shares: | | | | |

| Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $3,733,419 and 347,576 shares of beneficial interest outstanding) | | $ | 10.74 | |

| |

| |

| Class Y Shares: | | | | |

| Net asset value, redemption price and offering price per share (based on net assets of $686,938 and 64,060 shares of beneficial interest outstanding) | | $ | 10.72 | |

See accompanying Notes to Financial Statements.

20 OPPENHEIMER CORPORATE BOND FUND

| | | | |

| | |

| | STATEMENT OF OPERATIONS For the Year Ended July 31, 2013 | | |

| | | | |

| |

Investment Income | | | | |

| Interest | | $ | 4,000,205 | |

| |

| Dividends from affiliated companies | | | 9,346 | |

| |

| Other income | | | 17,104 | |

| | | | |

| Total investment income | | | 4,026,655 | |

|

| |

Expenses | | | | |

| Management fees | | | 433,792 | |

| |

| Distribution and service plan fees: | | | | |

| Class A | | | 171,765 | |

| Class C | | | 205,036 | |

| Class N | | | 19,266 | |

| |

| Transfer and shareholder servicing agent fees: | | | | |

| Class A | | | 131,323 | |

| Class C | | | 43,763 | |

| Class I | | | 2 | |

| Class N | | | 7,357 | |

| Class Y | | | 1,665 | |

| |

| Shareholder communications: | | | | |

| Class A | | | 43,949 | |

| Class C | | | 14,721 | |

| Class N | | | 2,311 | |

| Class Y | | | 418 | |

| |

| Legal, auditing and other professional fees | | | 44,454 | |

| |

| Custodian fees and expenses | | | 19,622 | |

| |

| Trustees’ compensation | | | 15,202 | |

| |

| Other | | | 16,388 | |

| | | | |

| Total expenses | | | 1,171,034 | |

| Less waivers and reimbursements of expenses | | | (45,024) | |

| | | | |

| Net expenses | | | 1,126,010 | |

|

| |

| Net Investment Income | | | 2,900,645 | |

|

| |

Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investments from unaffiliated companies | | | 2,250,215 | |

| Closing and expiration of futures contracts | | | 368,252 | |

| Swap contracts | | | (128,388) | |

| | | | |

| Net realized gain | | | 2,490,079 | |

| |

| Net change in unrealized appreciation/depreciation on: | | | | |

| Investments | | | (4,540,436) | |

| Futures contracts | | | 1,160,428 | |

| | | | |

| Net change in unrealized appreciation/depreciation | | | (3,380,008) | |

|

| |

| Net Increase in Net Assets Resulting from Operations | | $ | 2,010,716 | |

| | | | |

See accompanying Notes to Financial Statements.

21 OPPENHEIMER CORPORATE BOND FUND

| | | | |

| | |

| | STATEMENT OF CHANGES IN NET ASSETS | | |

| | | | | | | | |

| | | Year Ended July 31, 2013 | | | Year Ended July 31, 2012 | |

| |

Operations | | | | | | | | |

| Net investment income | | $ | 2,900,645 | | | $ | 1,793,407 | |

| |

| Net realized gain | | | 2,490,079 | | | | 1,080,698 | |

| |

| Net change in unrealized appreciation/depreciation | | | (3,380,008) | | | | 2,972,717 | |

| | | | | | | | |

| Net increase in net assets resulting from operations | | | 2,010,716 | | | | 5,846,822 | |

|

| |

Dividends and/or Distributions to Shareholders | | | | | | | | |

| Dividends from net investment income: | | | | | | | | |

| Class A | | | (2,247,957) | | | | (1,496,544) | |

| Class C | | | (497,114) | | | | (251,600) | |

| Class I | | | (241) | | | | — | |

| Class N | | | (113,439) | | | | (42,025) | |

| Class Y | | | (41,147) | | | | (3,229) | |

| | | | |

| | | (2,899,898) | | | | (1,793,398) | |

|

| |

| Distributions from net realized gain: | | | | | | | | |

| Class A | | | (836,866) | | | | (241,548) | |

| Class C | | | (237,090) | | | | (45,753) | |

| Class I | | | (106) | | | | — | |

| Class N | | | (41,582) | | | | (5,288) | |

| Class Y | | | (17,672) | | | | (277) | |

| | | | |

| | | (1,133,316) | | | | (292,866) | |

|

| |

Beneficial Interest Transactions | | | | | | | | |

| Net increase (decrease) in net assets resulting from beneficial interest transactions: | | | | | | | | |

| Class A | | | 9,825,398 | | | | 23,774,878 | |

| Class C | | | 2,022,361 | | | | 13,578,684 | |

| Class I | | | 10,231 | | | | — | |

| Class N | | | 1,180,207 | | | | 1,921,586 | |

| Class Y | | | (282,215) | | | | 949,778 | |

| | | | | | | | |

| | | 12,755,982 | | | | 40,224,926 | |

|

| |

Net Assets | | | | | | | | |

| Total increase | | | 10,733,484 | | | | 43,985,484 | |

| |

| Beginning of period | | | 76,763,284 | | | | 32,777,800 | |

| | | | | | | | |

| | |

| End of period (including accumulated net investment income of $19,109 and $641, respectively) | | $ | 87,496,768 | | | $ | 76,763,284 | |

| | | | |

See accompanying Notes to Financial Statements.

22 OPPENHEIMER CORPORATE BOND FUND

| | | | | | | | | | | | | | |

| | | Year Ended | | | Year Ended | | | Period Ended | | | |

| Class A | | July 31,

2013 | | | July 31,

2012 | | | July 29,

20111 | | | |

| | | |

Per Share Operating Data | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 10.91 | | | $ | 10.28 | | | $ | 10.00 | | | |

| | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | |

| Net investment income2 | | | 0.35 | | | | 0.37 | | | | 0.41 | | | |

| Net realized and unrealized gain (loss) | | | (0.05) | | | | 0.69 | | | | 0.33 | | | |

| | | | | | |

| Total from investment operations | | | 0.30 | | | | 1.06 | | | | 0.74 | | | |

| | | |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.35) | | | | (0.37) | | | | (0.41) | | | |

| Distributions from net realized gain | | | (0.12) | | | | (0.06) | | | | (0.05) | | | |

| | | | | | |

| Total dividends and/or distributions to shareholders | | | (0.47) | | | | (0.43) | | | | (0.46) | | | |

| | | |

| Net asset value, end of period | | $ | 10.74 | | | $ | 10.91 | | | $ | 10.28 | | | |

| | | | | | |

| | | |

Total Return, at Net Asset Value3 | | | 2.70% | | | | 10.53% | | | | 7.58% | | | |

| |

| | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 65,006 | | | $ | 56,674 | | | $ | 30,080 | | | |

| | | |

| Average net assets (in thousands) | | $ | 70,909 | | | $ | 42,490 | | | $ | 23,784 | | | |

| | | |

| Ratios to average net assets:4 | | | | | | | | | | | | | | |

| Net investment income | | | 3.17% | | | | 3.52% | | | | 4.02% | | | |

| Total expenses5 | | | 1.04% | | | | 0.90% | | | | 0.86% | | | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.00% | | | | 0.89% | | | | 0.80% | | | |

| | | |

| Portfolio turnover rate | | | 135% | | | | 123% | | | | 112% | | | |

1. For the period from August 2, 2010 (commencement of operations) to July 29, 2011, which represents the last business day of the Fund’s respective reporting period.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund were as follows:

| | | | | | |

| Year Ended July 31, 2013 | | | 1.05 | % | | |

| Year Ended July 31, 2012 | | | 0.91 | % | | |

| Period Ended July 29, 2011 | | | 0.86 | % | | |

See accompanying Notes to Financial Statements.

23 OPPENHEIMER CORPORATE BOND FUND

| | | | |

| | |

| | FINANCIAL HIGHLIGHTS Continued | | |

| | | | | | | | | | | | | | |

| | | Year Ended | | | Year Ended | | | Period Ended | | | |

| Class C | | July 31,

2013 | | | July 31,

2012 | | | July 29,

20111 | | | |

| | | |

Per Share Operating Data | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 10.91 | | | $ | 10.28 | | | $ | 10.00 | | | |

| | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | |

| Net investment income2 | | | 0.27 | | | | 0.28 | | | | 0.30 | | | |

| Net realized and unrealized gain (loss) | | | (0.06) | | | | 0.69 | | | | 0.34 | | | |

| | | | | | |

| Total from investment operations | | | 0.21 | | | | 0.97 | | | | 0.64 | | | |

| | | |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.27) | | | | (0.28) | | | | (0.31) | | | |

| Distributions from net realized gain | | | (0.12) | | | | (0.06) | | | | (0.05) | | | |

| | | | | | |

| Total dividends and/or distributions to shareholders | | | (0.39) | | | | (0.34) | | | | (0.36) | | | |

| | | |

| Net asset value, end of period | | $ | 10.73 | | | $ | 10.91 | | | $ | 10.28 | | | |

| | | | | | |

| | | |

Total Return, at Net Asset Value3 | | | 1.84% | | | | 9.58% | | | | 6.57% | | | |

| |

| | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 18,060 | | | $ | 16,454 | | | $ | 2,061 | | | |

| | | |

| Average net assets (in thousands) | | $ | 20,527 | | | $ | 9,231 | | | $ | 491 | | | |

| | | |

| Ratios to average net assets:4 | | | | | | | | | | | | | | |

| Net investment income | | | 2.42% | | | | 2.73% | | | | 3.00% | | | |

| Total expenses5 | | | 1.83% | | | | 1.84% | | | | 2.48% | | | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.75% | | | | 1.75% | | | | 1.75% | | | |

| | | |

| Portfolio turnover rate | | | 135% | | | | 123% | | | | 112% | | | |

1. For the period from August 2, 2010 (commencement of operations) to July 29, 2011, which represents the last business day of the Fund’s respective reporting period.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund were as follows:

| | | | | | |

| Year Ended July 31, 2013 | | | 1.84 | % | | |

| Year Ended July 31, 2012 | | | 1.85 | % | | |

| Period Ended July 29, 2011 | | | 2.48 | % | | |

See accompanying Notes to Financial Statements.

24 OPPENHEIMER CORPORATE BOND FUND

| | | | | | |

| Class I | | Period Ended

July 31,

20131 | | | |

| | | |

Per Share Operating Data | | | | | | |

| Net asset value, beginning of period | | $ | 11.13 | | | |

| | | |

| Income (loss) from investment operations: | | | | | | |

| Net investment income2 | | | 0.27 | | | |

| Net realized and unrealized loss | | | (0.28) | | | |

| | | | | | |

| Total from investment operations | | | (0.01) | | | |

| | | |

| Dividends and/or distributions to shareholders: | | | | | | |

| Dividends from net investment income | | | (0.27) | | | |

| Distributions from net realized gain | | | (0.12) | | | |

| | | | | | |

| Total dividends and/or distributions to shareholders | | | (0.39) | | | |

| | | |

| Net asset value, end of period | | $ | 10.73 | | | |

| | | | | | |

| | | |

Total Return, at Net Asset Value3 | | | (0.17)% | | | |

| |

| | | |

Ratios/Supplemental Data | | | | | | |

| Net assets, end of period (in thousands) | | $ | 10 | | | |

| | | |

| Average net assets (in thousands) | | $ | 10 | | | |

| | | |

| Ratios to average net assets:4 | | | | | | |

| Net investment income | | | 3.61% | | | |

| Total expenses5 | | | 0.56% | | | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.55% | | | |

| | | |

| Portfolio turnover rate | | | 135% | | | |

1. For the period from November 28, 2012 (inception of offering) to July 31, 2013. See Note 1 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund were as follows:

| | | | | | |

| Period Ended July 31, 2013 | | | 0 .57 | % | | |

See accompanying Notes to Financial Statements.

25 OPPENHEIMER CORPORATE BOND FUND

| | | | |

| | |

| | FINANCIAL HIGHLIGHTS Continued | | |

| | | | | | | | | | | | | | |

| | | Year Ended | | | Year Ended | | | Period Ended | | | |

| Class N | | July 31,

2013 | | | July 31,

2012 | | | July 29,

20111 | | | |

| | | |

Per Share Operating Data | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 10.92 | | | $ | 10.29 | | | $ | 10.00 | | | |

| | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | |

| Net investment income2 | | | 0.32 | | | | 0.34 | | | | 0.36 | | | |

| Net realized and unrealized gain (loss) | | | (0.06) | | | | 0.68 | | | | 0.34 | | | |

| | | | | | |

| Total from investment operations | | | 0.26 | | | | 1.02 | | | | 0.70 | | | |

| | | |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.32) | | | | (0.33) | | | | (0.36) | | | |

| Distributions from net realized gain | | | (0.12) | | | | (0.06) | | | | (0.05) | | | |

| | | | | | |

| Total dividends and/or distributions to shareholders | | | (0.44) | | | | (0.39) | | | | (0.41) | | | |

| | | |

| Net asset value, end of period | | $ | 10.74 | | | $ | 10.92 | | | $ | 10.29 | | | |

| | | | | | |

| | | |

Total Return, at Net Asset Value3 | | | 2.35% | | | | 10.12% | | | | 7.21% | | | |

| |

| | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 3,734 | | | $ | 2,648 | | | $ | 611 | | | |

| | | |

| Average net assets (in thousands) | | $ | 3,880 | | | $ | 1,305 | | | $ | 203 | | | |

| | | |

| Ratios to average net assets:4 | | | | | | | | | | | | | | |

| Net investment income | | | 2.92% | | | | 3.22% | | | | 3.53% | | | |

| Total expenses5 | | | 1.30% | | | | 1.31% | | | | 1.81% | | | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses5 | | | 1.25% | | | | 1.24% | | | | 1.24% | | | |

| | | |

| Portfolio turnover rate | | | 135% | | | | 123% | | | | 112% | | | |

1. For the period from August 2, 2010 (commencement of operations) to July 29, 2011, which represents the last business day of the Fund’s respective reporting period.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund were as follows:

| | | | | | |

| Year Ended July 31, 2013 | | | 1.31 | % | | |

| Year Ended July 31, 2012 | | | 1.32 | % | | |

| Period Ended July 29, 2011 | | | 1.81 | % | | |

See accompanying Notes to Financial Statements.

26 OPPENHEIMER CORPORATE BOND FUND

| | | | | | | | | | | | | | |

| | | Year Ended | | | Year Ended | | | Period Ended | | | |

| Class Y | | July 31,

2013 | | | July 31,

2012 | | | July 29,

20111 | | | |

| | | |

Per Share Operating Data | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 10.91 | | | $ | 10.28 | | | $ | 10.00 | | | |

| | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | |

| Net investment income2 | | | 0.38 | | | | 0.36 | | | | 0.41 | | | |

| Net realized and unrealized gain (loss) | | | (0.07) | | | | 0.71 | | | | 0.33 | | | |

| | | | | | |

| Total from investment operations | | | 0.31 | | | | 1.07 | | | | 0.74 | | | |

| | | |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.38) | | | | (0.38) | | | | (0.41) | | | |

| Distributions from net realized gain | | | (0.12) | | | | (0.06) | | | | (0.05) | | | |

| | | | | | |

| Total dividends and/or distributions to shareholders | | | (0.50) | | | | (0.44) | | | | (0.46) | | | |

| | | |

| Net asset value, end of period | | $ | 10.72 | | | $ | 10.91 | | | $ | 10.28 | | | |

| | | | | | |

| | | |

Total Return, at Net Asset Value3 | | | 2.79% | | | | 10.67% | | | | 7.63% | | | |

| |

| | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 687 | | | $ | 987 | | | $ | 26 | | | |

| | | |

| Average net assets (in thousands) | | $ | 1,195 | | | $ | 91 | | | $ | 22 | | | |

| | | |

| Ratios to average net assets:4 | | | | | | | | | | | | | | |

| Net investment income | | | 3.45% | | | | 3.53% | | | | 4.06% | | | |

| Total expenses5 | | | 0.72% | | | | 0.97% | | | | 2.24% | | | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.71% | | | | 0.72% | | | | 0.75% | | | |

| | | |

| Portfolio turnover rate | | | 135% | | | | 123% | | | | 112% | | | |

1. For the period from August 2, 2010 (commencement of operations) to July 29, 2011, which represents the last business day of the Fund’s respective reporting period.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund were as follows:

| | | | | | |

| Year Ended July 31, 2013 | | | 0.73 | % | | |

| Year Ended July 31, 2012 | | | 0.98 | % | | |

| Period Ended July 29, 2011 | | | 2.24 | % | | |

See accompanying Notes to Financial Statements.

27 OPPENHEIMER CORPORATE BOND FUND

| | | | |

| | |

| | NOTES TO FINANCIAL STATEMENTS | | |

|

| 1. Significant Accounting Policies |

Oppenheimer Corporate Bond Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended, as an open-end diversified management investment company. The Fund’s investment objective is to seek total return. The Fund’s investment adviser was OppenheimerFunds, Inc. (“OFI” or the “Sub-Adviser”) through December 31, 2012. Effective January 1, 2013, the Fund’s investment adviser is OFI Global Asset Management, Inc. (“OFI Global” or the “Manager”), a wholly-owned subsidiary of OFI. The Manager has entered into a sub-advisory agreement with OFI, as of the same effective date.

The Fund offers Class A, Class C, Class I, Class N and Class Y shares. Class A shares are sold at their offering price, which is normally net asset value plus a front-end sales charge. Class C and Class N shares are sold without a front-end sales charge but may be subject to a contingent deferred sales charge (“CDSC”). Class N shares are sold only through retirement plans. Retirement plans that offer Class N shares may impose charges on those accounts. Class I and Class Y shares are sold to certain institutional investors or intermediaries without either a front-end sales charge or a CDSC, however, the intermediaries may impose charges on their accountholders who beneficially own Class I and Class Y shares. All classes of shares have identical rights and voting privileges with respect to the Fund in general and exclusive voting rights on matters that affect that class alone. Earnings, net assets and net asset value per share may differ due to each class having its own expenses, such as transfer and shareholder servicing agent fees and shareholder communications, directly attributable to that class. Class A, C and N shares have separate distribution and/or service plans under which they pay fees. Class I and Class Y shares do not pay such fees. Class I shares were first publicly offered on November 28, 2012.

The following is a summary of significant accounting policies consistently followed by the Fund.