1Q20 RESULTS 7 MAY 2020 ©VEON Ltd 2020

AGENDA 1. OPENING Nik Kershaw: HEAD IR 2. FINANCIAL RESULTS Serkan Okandan: CFO 3. OPERATIONAL REVIEW Kaan Terzioglu: CO-CEO Sergi Herrero: CO-CEO 4. OUTLOOK AND GUIDANCE Serkan Okandan: CFO 2

DISCLAIMER This press release contains “forward-looking statements”, as the phrase is defined in Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. These forward-looking statements may be identified by words such as “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “seek,” “believe,” “estimate,” “predict,” “potential,” “continue,” “contemplate,” “possible” and other similar words. Forward-looking statements include statements relating to, among other things, VEON’s plans to implement its strategic priorities, including operating model and development plans, among others; VEON’s assessment of the impact of the COVID- 19 pandemic on its operations and financial condition; anticipated performance and guidance for 2020, including VEON’s ability to generate sufficient cash flow; future market developments and trends; operational and network development and network investment, including expectations regarding the roll-out and benefits of 3G/4G/LTE networks, as applicable; spectrum acquisitions and renewals; the effect of the acquisition of additional spectrum on customer experience; VEON’s ability to realize the acquisition and disposition of any of its businesses and assets and to execute its strategic transactions in the timeframes anticipated, or at all; VEON’s ability to realize financial improvements, including an expected reduction of net pro-forma leverage ratio following the successful completion of certain dispositions and acquisitions; our dividends; and VEON’s ability to realize its targets and commercial initiatives in its various countries of operation. The forward-looking statements included in this press release are based on management’s best assessment of VEON’s strategic and financial position and of future market conditions, trends and other potential developments. These discussions involve risks and uncertainties. The actual outcome may differ materially from these statements as a result of further unanticipated developments related to the COVID-19 pandemic that negatively affected VEON’s operations and financial condition; demand for and market acceptance of VEON’s products and services; our plans regarding our dividend payments and policies, as well as our ability to receive dividends, distributions, loans, transfers or other payments or guarantees from our subsidiaries; continued volatility in the economies in VEON’s markets; including adverse macroeconomic developments caused by recent volatility in oil prices in the wake of COVID-19 outbreak; unforeseen developments from competition; governmental regulation of the telecommunications industries; general political uncertainties in VEON’s markets; government investigations or other regulatory actions; litigation or disputes with third parties or other negative developments regarding such parties; the impact of export controls and laws affecting trade and investments on our and important third-party suppliers' ability to procure goods, software or technology necessary for the services we provide to our customers; risks associated with data protection or cyber security, other risks beyond the parties’ control or a failure to meet expectations regarding various strategic priorities, the effect of foreign currency fluctuations, increased competition in the markets in which VEON operates and the effect of consumer taxes on the purchasing activities of consumers of VEON’s services. Certain other factors that could cause actual results to differ materially from those discussed in any forward-looking statements include the risk factors described in VEON’s Annual Report on Form 20-F for the year ended December 31, 2019 filed with the U.S. Securities and Exchange Commission (the “SEC”) and other public filings made by VEON with the SEC. Other unknown or unpredictable factors also could harm our future results. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Under no circumstances should the inclusion of such forward- looking statements in this press release be regarded as a representation or warranty by us or any other person with respect to the achievement of results set out in such statements or that the underlying assumptions used will in fact be the case. Therefore, you are cautioned not to place undue reliance on these forward-looking statements. The forward-looking statements speak only as of the date hereof. We cannot assure you that any projected results or events will be achieved. Except to the extent required by law, we disclaim any obligation to update or revise any of these forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made, or to reflect the occurrence of unanticipated events. Furthermore, elements of this press release contain or may contain, “inside information” as defined under the Market Abuse Regulation (EU) No. 596/2014. All non-IFRS measures disclosed further in this press release (including, without limitation, EBITDA, EBITDA margin, EBT, net debt, equity free cash flow after licenses (excluding capitalized leases), local currency growth, capital expenditures excluding licenses and LTM (last twelve months) capex excluding licenses/revenue) are reconciled to comparable IFRS measures in Attachment C to this earnings release. In addition, we present certain information on a forward-looking basis. We are not able to, without unreasonable efforts, provide a full reconciliation to IFRS due to potentially high variability, complexity and low visibility as to the items that would be excluded from the comparable IFRS measure in the relevant future period, including, but not limited to, depreciation and amortization, impairment loss, loss on disposal of non-current assets, financial income and expenses, foreign currency exchange losses and gains, income tax expense and performance transformation costs, cash and cash equivalents, long - term and short-term deposits, interest accrued related to financial liabilities, other unamortized adjustments to financial liabilities, derivatives, and other financial liabilities. 3

AGENDA 1. OPENING Nik Kershaw: HEAD IR 2. FINANCIAL RESULTS Serkan Okandan: CFO 3. OPERATIONAL REVIEW Kaan Terzioglu: CO-CEO Sergi Herrero: CO-CEO 4. OUTLOOK AND GUIDANCE Serkan Okandan: CFO 4

FINANCIAL RESULTS 1Q20 Results1 REPORTED REVENUE EBITDA OPERATIONAL CAPEX4 $2.1bn $0.9bn $0.4bn +0.3% local currency2 YoY -1.8% local currency2 YoY -5.4% reported YoY 4 -1.3% reported YoY -29.1% reported3 YoY 19.5% LTM Capital intensity ratio DATA REVENUE EBITDA MARGIN LTM NET DEBT/EBITDA5 $0.7bn 43.9% 1.8X +18.3% local currency2 YoY -1.0 p.p. local currency2 YoY Versus 1.9x in 1Q19 +16.6% reported YoY -17.2 p.p. reported3 YoY 1. All 1Q20 numbers include the impact of the introduction of IFRS 16, unless stated otherwise. 2. Local currency growth for 2020 excludes the effect of foreign currency movements, and one-time cash received in 2019 in connection with a one-off vendor payment of USD 350 million 3. Reported EBITDA and EBITDA margin decline was negatively impacted by one-off vendor payment in 1Q19 of USD 350 million 4. Operational Capex is defined as capex excluding license expenditures and capitalized leases. Operational Capex ratio is defined as capex excluding license expenditures and capitalized leases, divided by total revenue 5 5. Net Debt/EBITDA ratio excludes capitalized leases and in prior year has been adjusted for the one-off vendor payment of USD 350 million

FINANCIAL RESULTS 1Q20 Key Financial highlights Local Reported 1Q20 1Q19 currency USD MILLION YoY YoY ► 2.7% YoY increase in local currency revenue excluding the impact of tax change in Revenue 2,097 2,124 (1.3%) 0.3% Pakistan Other operating income - 350 n.m. n.m. ► Other operating income is related to one-off vendor payment of USD 350 million Service costs (381) (368) 3.5% Cost of equipment and accessories (89) (90) (1.1%) SG&A (706) (718) (1.7%) EBITDA 920 1,298 (29.1%) (28.3%) EBITDA margin 43.9% 61.1% (17.2p.p.) (17.4p.p.) EBITDA Adjusted 920 948 (3.0%) (1.8%) ► EBITDA Adjusted in 1Q19 excludes other operating income of USD 350 million EBITDA Adjusted margin 43.9% 44.6% (0.7p.p.) (1.0p.p.) ► 1.0% YoY increase in local currency EBITDA excluding the impact of tax change Operating Profit 407 788 (48.4%) in Pakistan Net financial cost and Other (211) (180) 17.2% Profit before tax 195 609 (67.9%) Tax (76) (79) (3.7%) Minority payments (12) (35) (65.7%) Net Profit attributable to VEON 108 495 (78.2%) shareholders Op Capex1 368 389 (5.4%) Equity Free Cash Flow2 104 369 (71.8%) ► 1Q19 includes cash receipt related to one-off vendor payment of USD 175 million 1. Operational Capex is defined as capex excluding license expenditures and capitalized leases 2. Equity free cash flow after licenses (excluding capitalized leases) is a non-IFRS measure and is defined as free cash flow from operating activities less repayment of lease liabilities and cash flow used in investing activities, excluding M&A transactions, inflow/outflow of 6 deposits, financial assets, other one-off items

FINANCIAL RESULTS Revenue and EBITDA by country USD MILLION (-1.3%) YoY reported 5 (4) 30 18 (2) (9) (27) (5) (34) 2,124 2,131 2,097 Reported total Ukraine Kazakhstan Bangladesh Uzbekistan Algeria Pakistan Russia Other1 Local currency FOREX Reported total revenue 1Q19 total revenue revenue 1Q20 1Q20 (-3.0%) YoY reported excl. one-off vendor agreement (350) 30 10 (0) (3) (7) (19) (42) 14 (11) 1,298 948 931 920 1 Reported Other EBITDA Ukraine Kazakhstan Bangladesh Uzbekistan Algeria Pakistan Russia Other Local Currency FOREX Reported EBITDA 1Q19 operating Adjusted 1Q19 EBITDA EBITDA Income 1Q20 1Q20 1. Other in Q1 2020 mainly includes the results of Kyrgyzstan, Armenia, Georgia, corporate cost, other global operations and services and intercompany eliminations. 7

FINANCIAL RESULTS Prudent capital structure ► Funding mix (post hedging) that appropriately 1Q20 GROUP DEBT CURRENCY MIX 5%1% reflects the currency mix of our operations (including effect of FX derivatives) USD 52% RUB ► The decline in proportion of ruble funding follows Average maturity: 2.3 years USD 42% PKR the marked depreciation of the ruble in the period Average cost of debt: 6.8% 7.5bn Other ► Continued strong liquidity after repaying debt 4Q19 GROUP DEBT CURRENCY MIX and paying dividends during the quarter (including effect of FX derivatives) 6% 3% USD ► Pro-actively addressing future maturities when 46% RUB prudent and economical Average maturity: 2.4 years USD PKR Average cost of debt: 7.4% 47% 7.5bn Other ► Management focused on improving maturity and lowering cost of debt TOTAL CASH AND UNDRAWN COMMITTED CREDIT LINES: USD 2.7 BILLION For both Q4 2019 and Q1 2020 the amount of USD debt swapped to RUB amounted to USD 1,212 million 8

FINANCIAL RESULTS Stable net debt and leverage trends USD MILLION 113 72 61 246 (393) 449 (796) 6,302 6,054 1 3 1 1 Net debt Cash capex (incl. Financial Taxes Change in working Dividend FOREX EBITDA Net debt 31 December 2019 licenses) charges capital and other 31 March and provisions 2020 1 LTM NET DEBT 1.9x 2 EBITDA 1.8x 1. Net Debt, EBITDA and Net Debt/EBITDA ration exclude capitalized leases 2. LTM Net Debt/EBITDA ratio for December 2019 excludes one-off vendor payment of USD 350 million 3. FOREX and Other mainly consists of FOREX (USD 426 million), partly offset by other investing activities 9

AGENDA 1. OPENING Nik Kershaw: HEAD IR 2. FINANCIAL RESULTS Serkan Okandan: CFO 3. OPERATIONAL REVIEW Kaan Terzioglu: CO-CEO Sergi Herrero: CO-CEO 4. OUTLOOK AND GUIDANCE Serkan Okandan: CFO 10

COVID-19 IMPACT ON OPERATIONAL PERFORMANCE ► In the quarter we were impacted by material forex movements, COVID-19 as well as lockdown ► COVID-19 is redefining the role of our industry and accelerating digital transformation ► Divergent impact on our operational performance so far: ► Increase in voice and data volumes ► Lower roaming, device and top-up revenues ► Retail network and supply chain disruption ► Disruption to income of daily wage earners especially in cash-based economies ► Low migrant workforce, low remittances to home countries ► Migration of customer base away from urban centers ► Migration of data traffic from mobile to fixed line ► Financial impact is negative at Group level, with clear pressure on 2Q20 operational performance 11

COVID-19 IMPACT ON OPERATIONAL PERFORMANCE ► As we look to mitigate the impact on COVID-19 on our business: ► We are extending payment terms with our key vendors ► Optimizing costs and capex as appropriate across our operations ► Continue to focus on optimizing our balance sheet structure in the coming quarters ► Focus on our planned operational improvements ► This pandemic is not without opportunities as we see accelerating acceptance of relevant digital services across the countries in which we operate and bridging the financial divide providing us with additional opportunities to serve our customers. We will continue to explore select M&A opportunities in this environment 12

RUSSIA Organizational alignment in place, continued focus on quality of service ► Appointment of Alexander Torbakhov as Chief Executive Officer of Beeline Russia ► Significant progress on network rollout, 33% YoY increase in base stations ► Retail optimization on track ► Growing customer engagement via new digital and financial product initiatives ► Increased pace of investments to improve customer experience IMPROVING CUSTOMER SATISFACTION REMAINS OUR KEY PRIORITY 13

RUSSIA Organizational alignment in place, continued focus on quality of service REVENUE DATA REVENUE KEY OPERATIONAL METRICS (RUB Billion) (RUB Billion) -2.6% +8.5% 54 million -1.4% 72.6 74.7 73.4 69.2 67.5 Total mobile subscribers 16.2 16.2 16.3 YoY 15.4 15.0 31% +4 p.p. Data rev % of mobile YoY service rev 1Q19 2Q19 3Q19 4Q19 1Q20 1Q19 2Q19 3Q19 4Q19 1Q20 40% +8 p.p. 4G subscriber YoY EBITDA 4G USERS AND PENETRATION base penetration1 (RUB Billion) (Million and %) -8.9% 49.0% 35 55% +10 p.p. 40% 44.0% 33.9 37% 38% 30 32.2 32% 34% 39.0% 4G Smartphone YoY 34.0% 25 penetration 30.9 29.7 29.0% 20 28.2 24.0% 15 19.0% 14.0% 86% 10 19.9 20.2 +9 p.p. 16.5 17.5 19.2 9.0% 4G Population 5 4.0% Coverage YoY 0 -1.0% 1Q19 2Q19 3Q19 4Q19 1Q20 1Q19 2Q19 3Q19 4Q19 1Q20 4G users 4G penetration 1. % of Active 4G data users in total 3 months active customer base 14

KAZAKHSTAN Strong operational performance driven by 4G customer penetration ► Infrastructure modernization and 4G network coverage expansion ► Strong value proposition, good progress with Izi ‘digital operator’ ► 4G customer penetration reached 44% and 4G customer base increased YoY by 41% in 1Q20 ► Beeline signed a spectrum sharing agreement with Kcell relating to the use of 5MHz CUSTOMER BASE VALUE MANAGEMENT AND DIGITAL SERVICES DEVELOPMENT 15

KAZAKHSTAN Strong operational performance driven by 4G customer penetration REVENUE DATA REVENUE KEY OPERATIONAL METRICS (KZT Billion) 40.0 (KZT Billion) +17.7% +46.5% 35.0 57.0 60.0 30.0 10 million -1.1% 45.5 50.0 44.5 46.0 25.0 39.0 Total mobile subscribers 40.0 18.6 YoY 20.0 17.4 14.3 15.5 30.0 15.0 12.7 20.0 10.0 49% +10 p.p. Data rev % of mobile 10.0 5.0 YoY service rev 0.0 0.0 1Q19 2Q19 3Q19 4Q19 1Q20 1Q19 2Q19 3Q19 4Q19 1Q20 44% +13 p.p. 4G subscriber YoY EBITDA 4G USERS AND PENETRATION base penetration1 (KZT Billion) 7 (Million and %) 44% 50.0% +17.8% 41% 45.0% 6 39% 34% 40.0% 59% +12 p.p. 5 31% 35.0% 36.8 4G Smartphone YoY 30.0% 4 penetration 23.0 22.7 24.6 25.0% 3 20.9 20.0% 15.0% 2 4.0 4.2 4.2 69% 3.0 3.4 10.0% +9 p.p. 1 4G Population 5.0% Coverage YoY 0 0.0% 1Q19 2Q19 3Q19 4Q19 1Q20 1Q19 2Q19 3Q19 4Q19 1Q20 4G users 4G penetration 1. % of Active 4G data users in total 3 months active customer base 16

PAKISTAN Continued focus on development of new services ► Continued focus in Jazz Cash with appointment of Erwan Gelebart as Jazz Cash CEO1 ► Partnership commenced with Mastercard ► 4G penetration reached 29% in the quarter, with the 4G customer base doubling YoY ► Self-care app Jazz World has grown ten-fold in past 12 months to over 5 million users ► Demographics support medium-term growth DATA AND DIGITAL SERVICES TO DRIVE GROWTH 1. Effective as of 18 May 2020 17

PAKISTAN Continued focus on development of new services REVENUE DATA REVENUE KEY OPERATIONAL METRICS (PKR Billion) (PKR Billion) -2.6% +17.1% 60.0 50.6 51.1 50.5 55.0 15.9 62 million +6.3% 49.3 14.3 15.1 50.0 13.6 45.4 12.5 Total mobile subscribers YoY 45.0 40.0 35% +6 p.p. 35.0 Data rev % of mobile 30.0 YoY service rev 25.0 1Q19 2Q19 3Q19 4Q19 1Q20 1Q19 2Q19 3Q19 4Q19 1Q20 29% +14 p.p. 4G subscriber YoY EBITDA 4G USERS AND PENETRATION base penetration1 (PKR Billion) (Million and %) -10.7% 20 26% 29% 30.00% 29% +7 p.p. 22% 25.00% 27.3 4G Smartphone 25.6 24.9 15 19% YoY 22.3 22.9 20.00% penetration 15% 10 15.00% 17.7 15.5 10.00% 13.0 54% 5 11.1 +15 p.p. 8.8 5.00% 4G Population Coverage YoY 0 0.00% 1Q19 2Q19 3Q19 4Q19 1Q20 1Q19 2Q19 3Q19 4Q19 1Q20 4G users 4G penetration 1. % of Active 4G data users in total 3 months active customer base 18

PAKISTAN Continued focus on development of new services REVENUE DATA REVENUE JAZZ CASH KEY OPERATIONAL METRICS (PKR Billion) (PKR Billion) -2.6% +17.1% 60.0 55.0 +42% 50.6 51.1 50.5 15.9 49.3 14.3 15.1 50.0 13.6 YoY Mobile wallets 45.4 12.5 45.0 40.0 35.0 PKR 450 billion 230 million 30.0 Value processed Transactions 25.0 1Q19 2Q19 3Q19 4Q19 1Q20 1Q19 2Q19 3Q19 4Q19 1Q20 EBITDA 4G USERS AND PENETRATION MOBILE WALLETS2 (PKR Billion) (Million and %) 14 (Million) -10.7% 20 26% 29% 30.00% 12 22% 25.00% 27.3 10 25.6 24.9 15 19% 22.3 22.9 20.00% 15% 8 10 15.00% 6 17.7 7.3 7.8 15.5 10.00% 13.0 4 5.8 6.2 5 11.1 5.5 8.8 5.00% 2 0 0.00% 0 1Q19 2Q19 3Q19 4Q19 1Q20 1Q19 2Q19 3Q19 4Q19 1Q20 1Q19 2Q19 3Q19 4Q19 1Q20 4G users 4G penetration 1. % of Active 4G data users in total 3 months active customer base 2. Mobile wallets are based on 30 day active mobile wallet 19

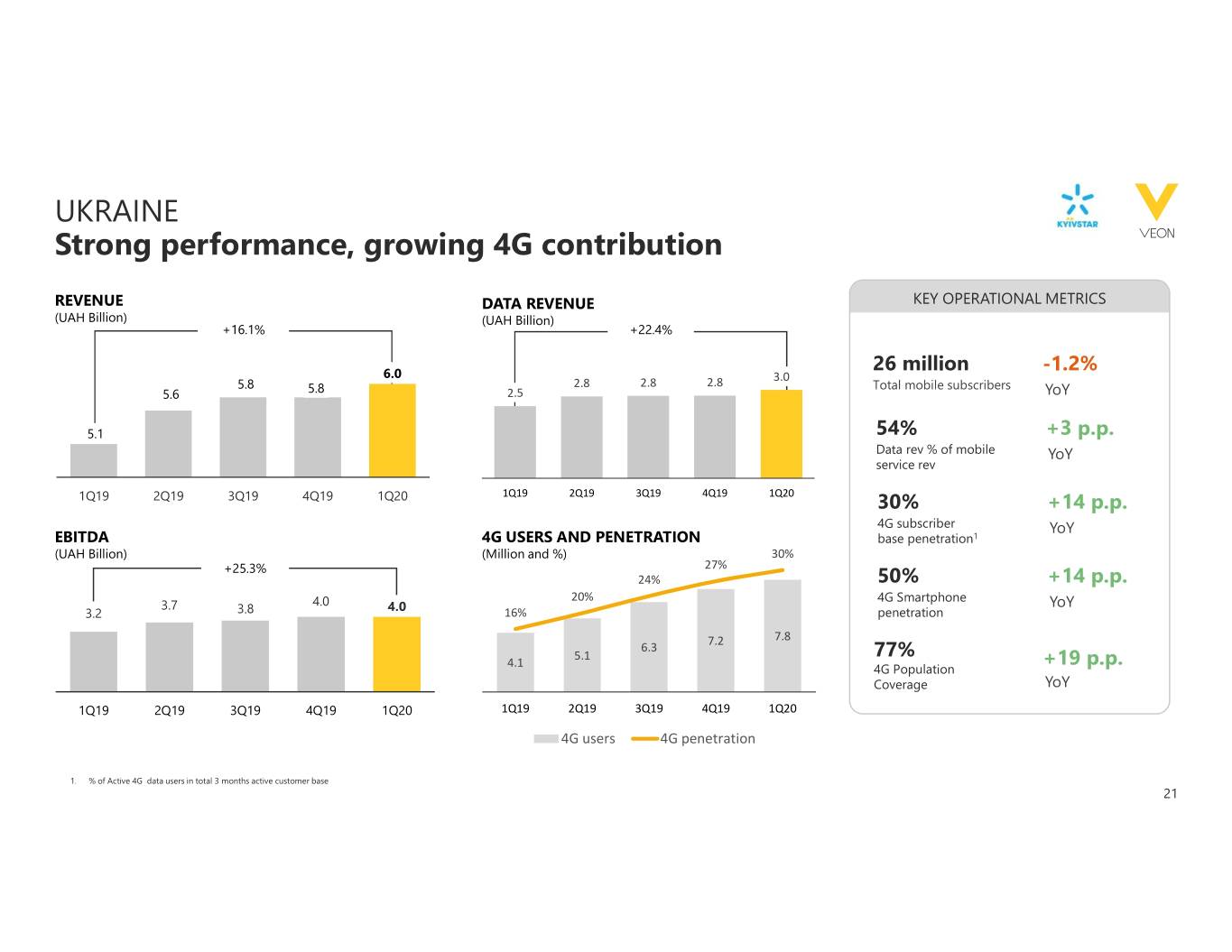

UKRAINE Strong performance, growing 4G contribution ► Enhancing 4G potential through new digital offers ► Expanding revenue streams and deploying new services ► 4G penetration reached 30% as our 4G customer base continued to grow in 1Q20 up 89% YoY ► Kyivstar well positioned for continued strong growth POSITIVE REVENUE TREND CONTINUES 20

UKRAINE Strong performance, growing 4G contribution REVENUE DATA REVENUE KEY OPERATIONAL METRICS (UAH Billion) (UAH Billion) +16.1% +22.4% 6.2 26 million -1.2% 6.0 3.0 5.8 5.8 6.0 2.8 2.8 2.8 Total mobile subscribers 5.6 5.8 2.5 YoY 5.6 5.4 5.1 5.2 54% +3 p.p. 5.0 Data rev % of mobile YoY 4.8 service rev 4.6 1Q19 2Q19 3Q19 4Q19 1Q20 1Q19 2Q19 3Q19 4Q19 1Q20 30% +14 p.p. 4G subscriber YoY EBITDA 4G USERS AND PENETRATION base penetration1 (UAH Billion) 10 (Million and %) 30% 35.0% +25.3% 27% 30.0% 8 24% 50% +14 p.p. 25.0% 4.0 20% 4G Smartphone YoY 3.7 4.0 6 20.0% 3.2 3.8 16% penetration 15.0% 4 7.2 7.8 6.3 10.0% 5.1 77% 2 4.1 +19 p.p. 5.0% 4G Population Coverage YoY 0 0.0% 1Q19 2Q19 3Q19 4Q19 1Q20 1Q19 2Q19 3Q19 4Q19 1Q20 4G users 4G penetration 1. % of Active 4G data users in total 3 months active customer base 21

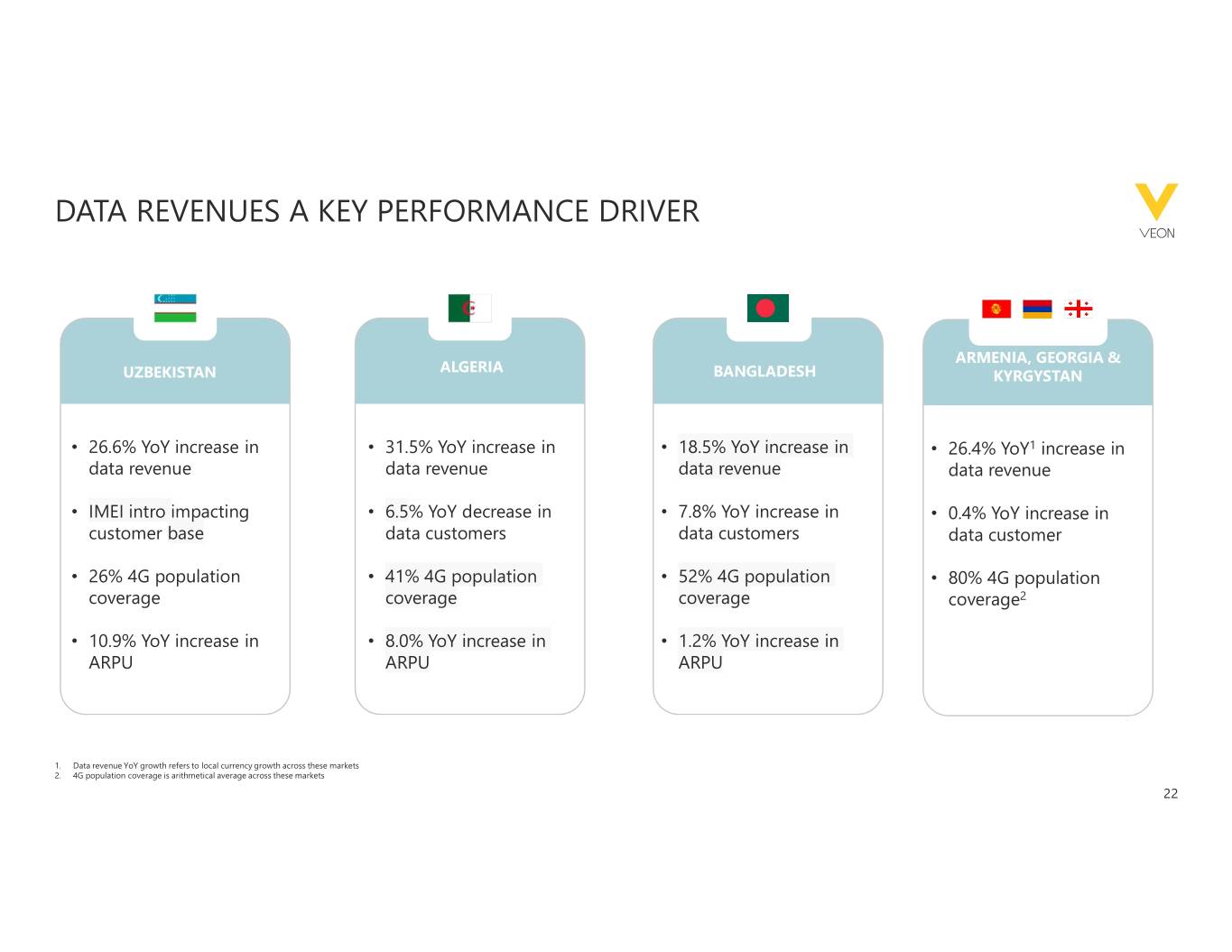

DATA REVENUES A KEY PERFORMANCE DRIVER ARMENIA, GEORGIA & ALGERIA UZBEKISTAN BANGLADESH KYRGYSTAN • 26.6% YoY increase in • 31.5% YoY increase in • 18.5% YoY increase in • 26.4% YoY1 increase in data revenue data revenue data revenue data revenue • IMEI intro impacting • 6.5% YoY decrease in • 7.8% YoY increase in • 0.4% YoY increase in customer base data customers data customers data customer • 26% 4G population • 41% 4G population • 52% 4G population • 80% 4G population coverage coverage coverage coverage2 • 10.9% YoY increase in • 8.0% YoY increase in • 1.2% YoY increase in ARPU ARPU ARPU 1. Data revenue YoY growth refers to local currency growth across these markets 2. 4G population coverage is arithmetical average across these markets 22

AGENDA 1. OPENING Nik Kershaw: HEAD IR 2. FINANCIAL RESULTS Serkan Okandan: CFO 3. OPERATIONAL REVIEW Kaan Terzioglu: CO-CEO Sergi Herrero: CO-CEO 4. OUTLOOK AND GUIDANCE Serkan Okandan: CFO 23

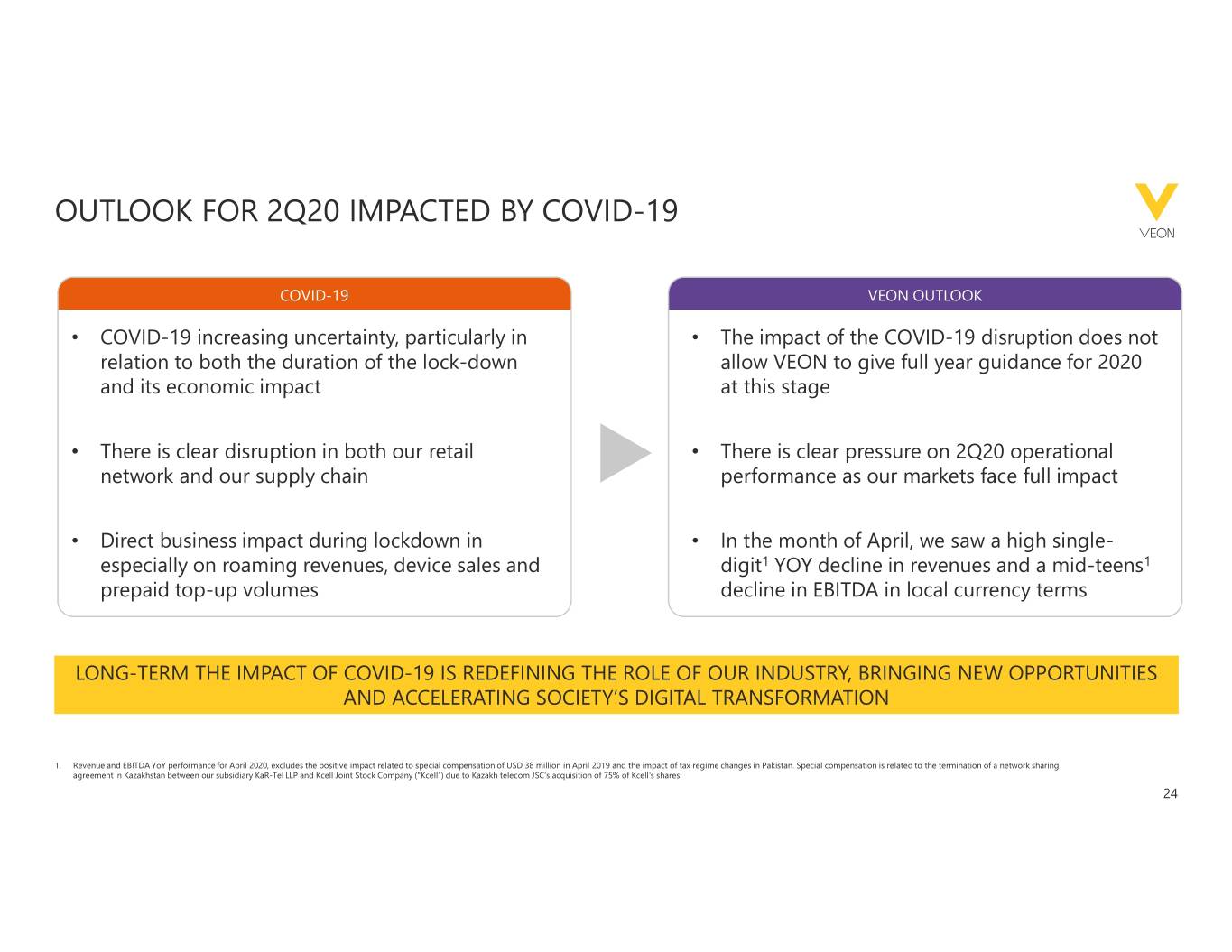

OUTLOOK FOR 2Q20 IMPACTED BY COVID-19 COVID-19 VEON OUTLOOK • COVID-19 increasing uncertainty, particularly in • The impact of the COVID-19 disruption does not relation to both the duration of the lock-down allow VEON to give full year guidance for 2020 and its economic impact at this stage • There is clear disruption in both our retail • There is clear pressure on 2Q20 operational network and our supply chain performance as our markets face full impact • Direct business impact during lockdown in • In the month of April, we saw a high single- especially on roaming revenues, device sales and digit1 YOY decline in revenues and a mid-teens1 prepaid top-up volumes decline in EBITDA in local currency terms LONG-TERM THE IMPACT OF COVID-19 IS REDEFINING THE ROLE OF OUR INDUSTRY, BRINGING NEW OPPORTUNITIES AND ACCELERATING SOCIETY’S DIGITAL TRANSFORMATION 1. Revenue and EBITDA YoY performance for April 2020, excludes the positive impact related to special compensation of USD 38 million in April 2019 and the impact of tax regime changes in Pakistan. Special compensation is related to the termination of a network sharing agreement in Kazakhstan between our subsidiary KaR-Tel LLP and Kcell Joint Stock Company ("Kcell”) due to Kazakh telecom JSC’s acquisition of 75% of Kcell's shares. 24

APPENDIX 7 MAY 2020 ©VEON Ltd 2020

GROUP DEBT MATURITY SCHEDULE1 GROUP DEBT MATURITY SCHEDULE BY CURRENCY – EXCLUDING LEASE LIABILITIES1 Currency breakdown 2020 2021 2022 2023 2024 2025 Currency breakdown incl. fx derivatives2 USD 1.13 0.8 0.4 1.2 0.6 1.0 68% 52% RUB 0.3 0.8 0.4 0.1 0.2 0.1 25% 42% PKR 0.1 0.1 0.1 0.1 0.0 0.0 5% 5% OTHER 0.1 0.0 0.0 0.0 0.0 0.0 1% 1% GROUP DEBT MATURITY SCHEDULE1 31 MARCH 2020 USD BILLION 1.7 1.63 HQ Pakistan Other GTH Russia Bangladesh 1.4 1.1 0.9 0.8 2020 2021 2022 2023 2024 2025 1. Effects of USD/RUB FX forwards and lease liabilities are not included unless stated otherwise. 2. The amount of USD debt swapped to RUB amounted to USD 1,212 million. 3. The amount contains USD 0.6 billion of Revolving Credit Facility drawdowns that may be rolled over until the final maturity of the facility in 2022 as well as USD 0.1 billion related to the overdrawn cash-pool accounts. 26

LIQUIDITY OVERVIEW GROUP CASH BREAKDOWN BY CURRENCY1 UNUSED RCF HEADROOM 31 March 2020 31 March 2020 12% Syndicated RCF facility USD 0.99 billion 7% USD 53% PKR UNUSED CF HEADROOM 31 March 2020 RUB 13% EUR Pakistan – credit facilities PKR 40.5 billion (USD 0.24 billion) Other 15% Total cash and unused committed Group cash (incl. deposits)1: USD 1.49 billion credit lines: USD 2.72 billion 1. Security deposit placed with the Pakistan Telecommunication Authority by Pakistan Mobile Telecommunications Ltd (USD 225 million) is not included within Group cash balance. 27

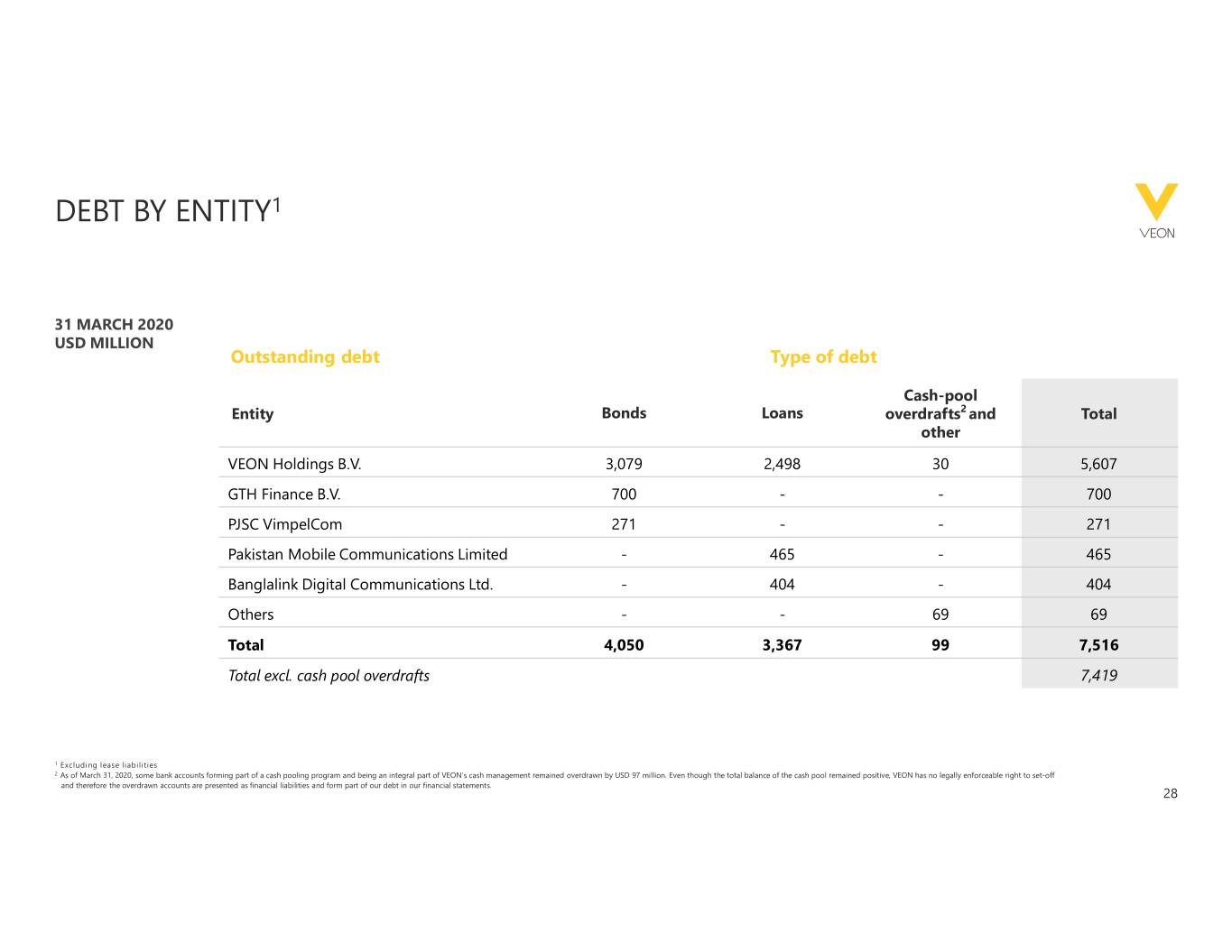

DEBT BY ENTITY1 31 MARCH 2020 USD MILLION Outstanding debt Type of debt Cash-pool Entity Bonds Loans overdrafts2 and Total other VEON Holdings B.V. 3,079 2,498 30 5,607 GTH Finance B.V. 700 - - 700 PJSC VimpelCom 271 - - 271 Pakistan Mobile Communications Limited - 465 - 465 Banglalink Digital Communications Ltd. - 404 - 404 Others - - 69 69 Total 4,050 3,367 99 7,516 Total excl. cash pool overdrafts 7,419 1 Excluding lease liabilities 2 As of March 31, 2020, some bank accounts forming part of a cash pooling program and being an integral part of VEON’s cash management remained overdrawn by USD 97 million. Even though the total balance of the cash pool remained positive, VEON has no legally enforceable right to set-off and therefore the overdrawn accounts are presented as financial liabilities and form part of our debt in our financial statements. 28

COVID-19: OUR RESPONSE 360-degree approach OUR OPERATIONS OUR CUSTOMERS • Network responding well to increased demand • Customer awareness via apps, SMS, • Supply chain delays social media etc. • Store closing partially mitigated by digital • Zero-rating of emergency hotlines channels, self care apps, customer delivery • Continuity of content services, zero-rating of educational websites FINANCIAL FOUNDATIONS ECONOMY & SOCIETY • Group leverage beneath our stated • Taking thought leadership beyond tolerance level COVID-19 customers on remote working: BeeFree • Proactively addressed some of our shorter- 360-DEGREE website term maturities APPROACH • Charitable donations: Ventilators, protective • No liquidity issues gear for health workers, test kits etc. OUR PEOPLE NEW OPPORTUNITIES • Working from home measures in place • Extending our focus on digital ventures • HR and IT support businesses 29

COVID-19: INITIAL RESPONSE LIVES, LIVELIHOODS, LIFESTYLES Protecting Lives Connecting our customers with vital resources around health education, advice and access to essential services Safeguarding Livelihoods Enhancing Lifestyles Through our connectivity services, Providing digital services that can overcome providing job and income continuity for financial obstacles, entertain and provide many millions of new home workers. welcome distraction at a time of social lock- down. 30