1 VEON STRONG GROWTH ACROSS THE GROUP 2Q21 RESULTS August 30 2021

2 AGENDA 1. OPENING 2. HIGHLIGHTS & BUSINESS UPDATE Nik Kershaw Kaan Terzioğlu 4. CLOSING REMARKS Kaan Terzioğlu 3. 2Q21 FINANCIAL RESULTS Serkan Okandan

3 DISCLAIMER This presentation contains “forward-looking statements”, as the phrase is defined in Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. These forward-looking statements may be identified by words such as “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “seek,” “believe,” “estimate,” “predict,” “potential,” “continue,” “contemplate,” “possible” and other similar words. Forward-looking statements include statements relating to, among other things, VEON’s plans to implement its strategic priorities, including operating model and development plans, among others; anticipated performance and guidance for 2021, including VEON’s ability to sufficient cash flow; VEON’s assessment of the impact of the COVID-19 pandemic on its current and future operations and financial condition; future market developments and trends; operational and network development and network investment, including expectations regarding the roll-out and benefits of 3G/4G/LTE networks, as applicable; spectrum acquisitions and renewals; the effect of the acquisition of additional spectrum on customer experience; VEON’s ability to realize the acquisition and disposition of any of its businesses and assets and to execute its strategic transactions in the timeframes anticipated, or at all; VEON’s ability to realize financial improvements, including an expected reduction of net pro-forma leverage ratio following the successful completion of certain dispositions and acquisitions; our dividends; and VEON’s ability to realize its targets and commercial initiatives in its various countries of operation. The forward-looking statements included in this presentation are based on management’s best assessment of VEON’s strategic and financial position and of future market conditions, trends and other potential developments. These discussions involve risks and uncertainties. The actual outcome may differ materially from these statements as a result of further unanticipated developments related to the COVID-19 pandemic, such as the effect on consumer spending, that negatively affected VEON’s operations and financial condition; demand for and market acceptance of VEON’s products and services; our plans regarding our dividend payments and policies, as well as our ability to receive dividends, distributions, loans, transfers or other payments or guarantees from our subsidiaries; continued volatility in the economies in VEON’s markets, including adverse macroeconomic developments related to the COVID-19 outbreak; unforeseen developments from competition; governmental regulation of the telecommunications industries; general political uncertainties in VEON’s markets; government investigations or other regulatory actions; litigation or disputes with third parties or regulatory authorities or other negative developments regarding such parties; the impact of export controls and laws affecting trade and investments on our and important third-party suppliers' ability to procure goods, software or technology necessary for the services we provide to our customers; risks associated with data protection or cyber security, other risks beyond the parties’ control or a failure to meet expectations regarding various strategic priorities, the effect of foreign currency fluctuations, increased competition in the markets in which VEON operates and the effect of consumer taxes on the purchasing activities of consumers of VEON’s services. Certain other factors that could cause actual results to differ materially from those discussed in any forward-looking statements include the risk factors described in VEON’s Annual Report on Form 20-F for the year ended December 31, 2020 filed with the U.S. Securities and Exchange Commission (the “SEC”) and other public filings made by VEON with the SEC. Other unknown or unpredictable factors also could harm our future results. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Under no circumstances should the inclusion of such forward-looking statements in this presentation be regarded as a representation or warranty by us or any other person with respect to the achievement of results set out in such statements or that the underlying assumptions used will in fact be the case. Therefore, you are cautioned not to place undue reliance on these forward-looking statements. The forward-looking statements speak only as of the date hereof. We cannot assure you that any projected results or events will be achieved. Except to the extent required by law, we disclaim any obligation to update or revise any of these forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made, or to reflect the occurrence of unanticipated events. PRESENTATION OF THE FINANCIAL RESULTS: All non-IFRS measures disclosed further in this presentation (including, without limitation, EBITDA, EBITDA Margin, Operational Capex, net debt, Equity Free Cash Flow, local currency growth) are being defined and reconciled to comparable IFRS measures in VEON Ltd.’s earnings release published on its website on the date hereof. Reported growth is growth in Group’s reporting currency – USD. In addition, we present certain information on a forward-looking basis. We are not able to, without unreasonable efforts, provide a full reconciliation to IFRS due to potentially high variability, complexity and low visibility as to the items that would be excluded from the comparable IFRS measure in the relevant future period, including, but not limited to, depreciation and amortization, impairment loss, loss on disposal of non-current assets, financial income and expenses, foreign currency exchange losses and gains, income tax expense and performance transformation costs, cash and cash equivalents, long term and short-term deposits, interest accrued related to financial liabilities, other unamortized adjustments to financial liabilities, derivatives, and other financial liabilities.

4 AGENDA 1. OPENING 2. HIGHLIGHTS & BUSINESS UPDATE Nik Kershaw Kaan Terzioğlu 4. CLOSING REMARKS Kaan Terzioğlu 3. 2Q21 FINANCIAL RESULTS Serkan Okandan

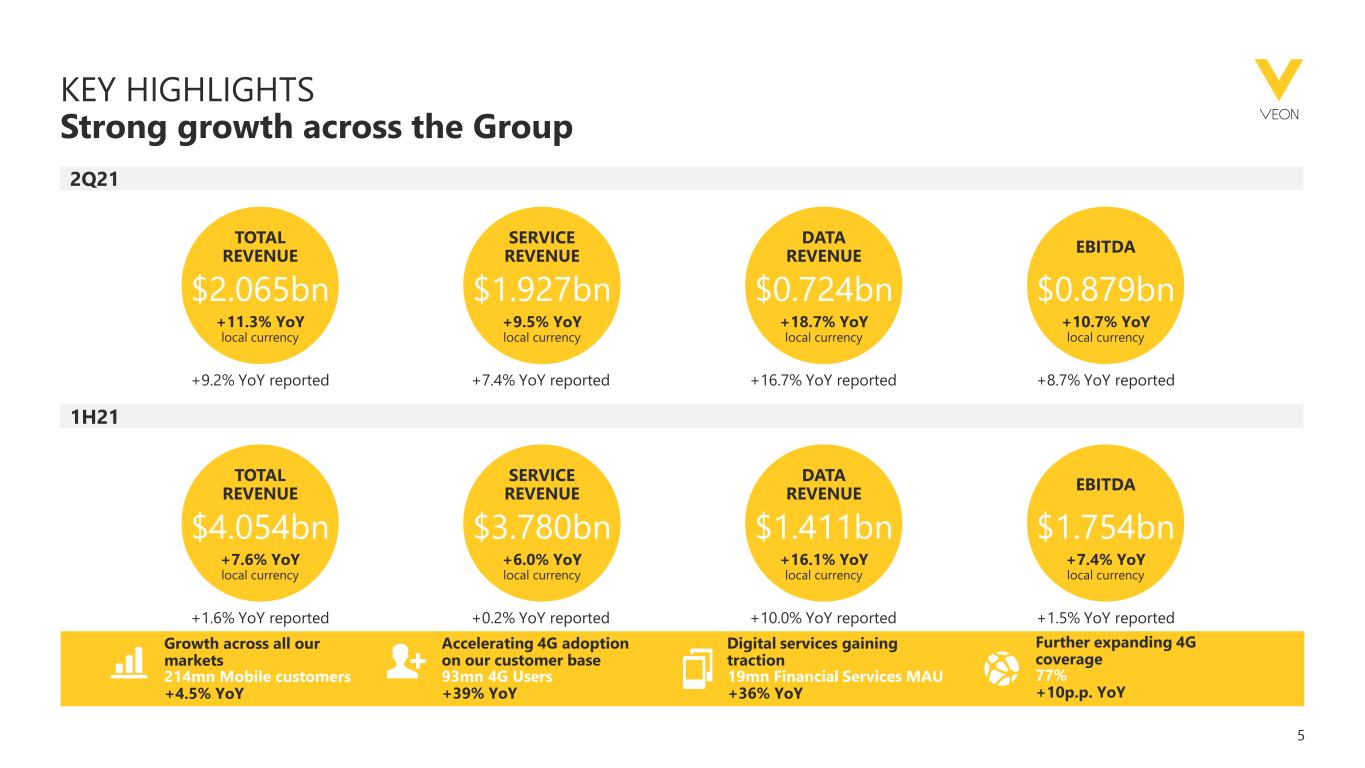

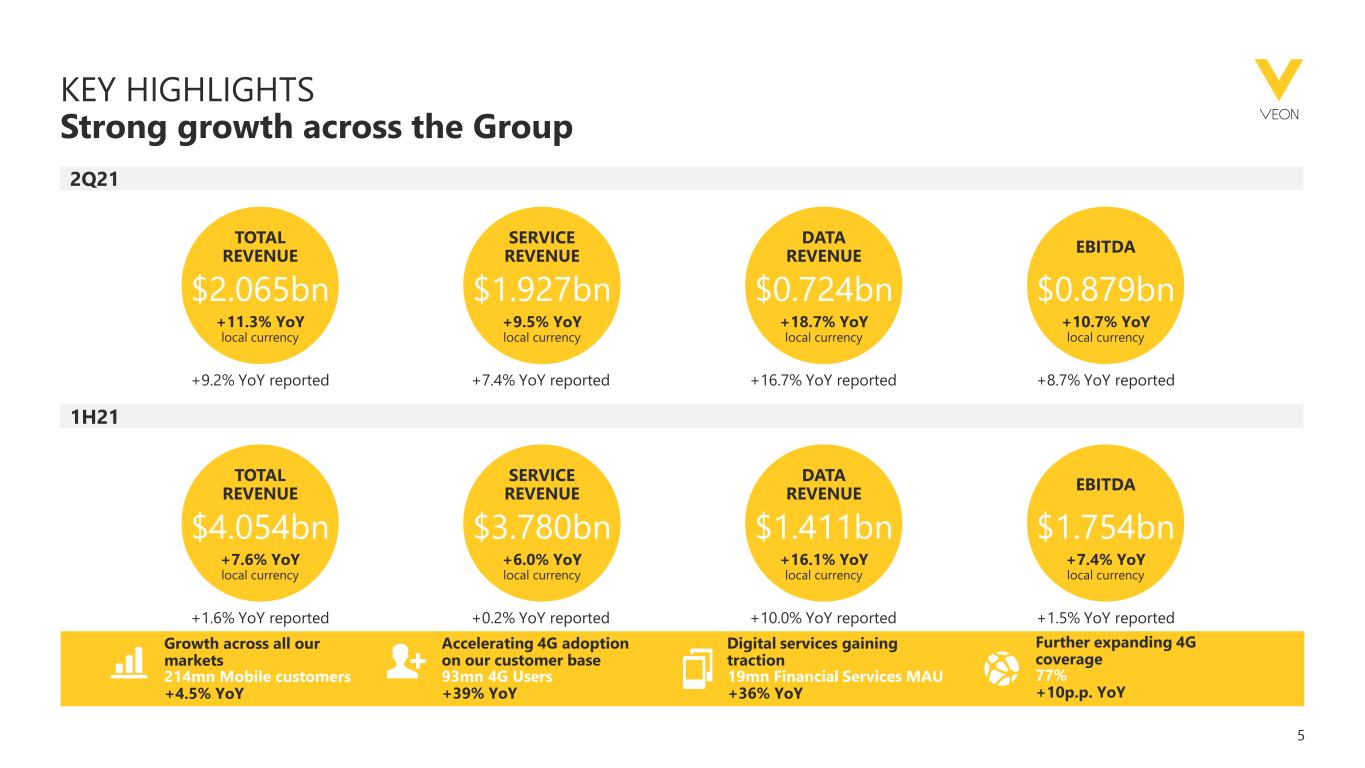

5 KEY HIGHLIGHTS Strong growth across the Group Further expanding 4G coverage Accelerating 4G adoption on our customer base Growth across all our markets Digital services gaining traction TOTAL REVENUE $2.065bn +11.3% YoY local currency EBITDA $0.879bn +10.7% YoY local currency DATA REVENUE $0.724bn +18.7% YoY local currency SERVICE REVENUE $1.927bn +9.5% YoY local currency +16.7% YoY reported+7.4% YoY reported+9.2% YoY reported +8.7% YoY reported 77% +10p.p. YoY 93mn 4G Users +39% YoY 214mn Mobile customers +4.5% YoY 19mn Financial Services MAU +36% YoY 2Q21 1H21 TOTAL REVENUE $4.054bn +7.6% YoY local currency EBITDA $1.754bn +7.4% YoY local currency DATA REVENUE $1.411bn +16.1% YoY local currency SERVICE REVENUE $3.780bn +6.0% YoY local currency +10.0% YoY reported+0.2% YoY reported+1.6% YoY reported +1.5% YoY reported

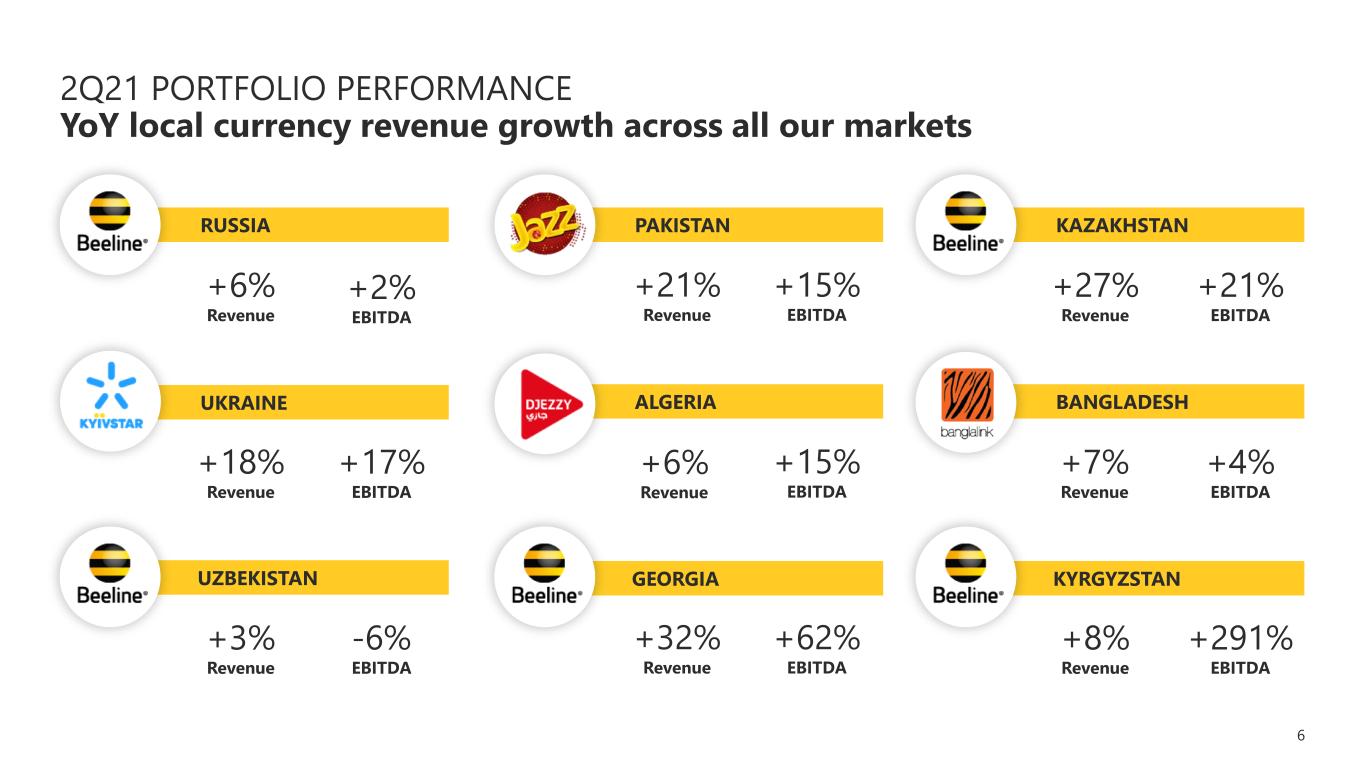

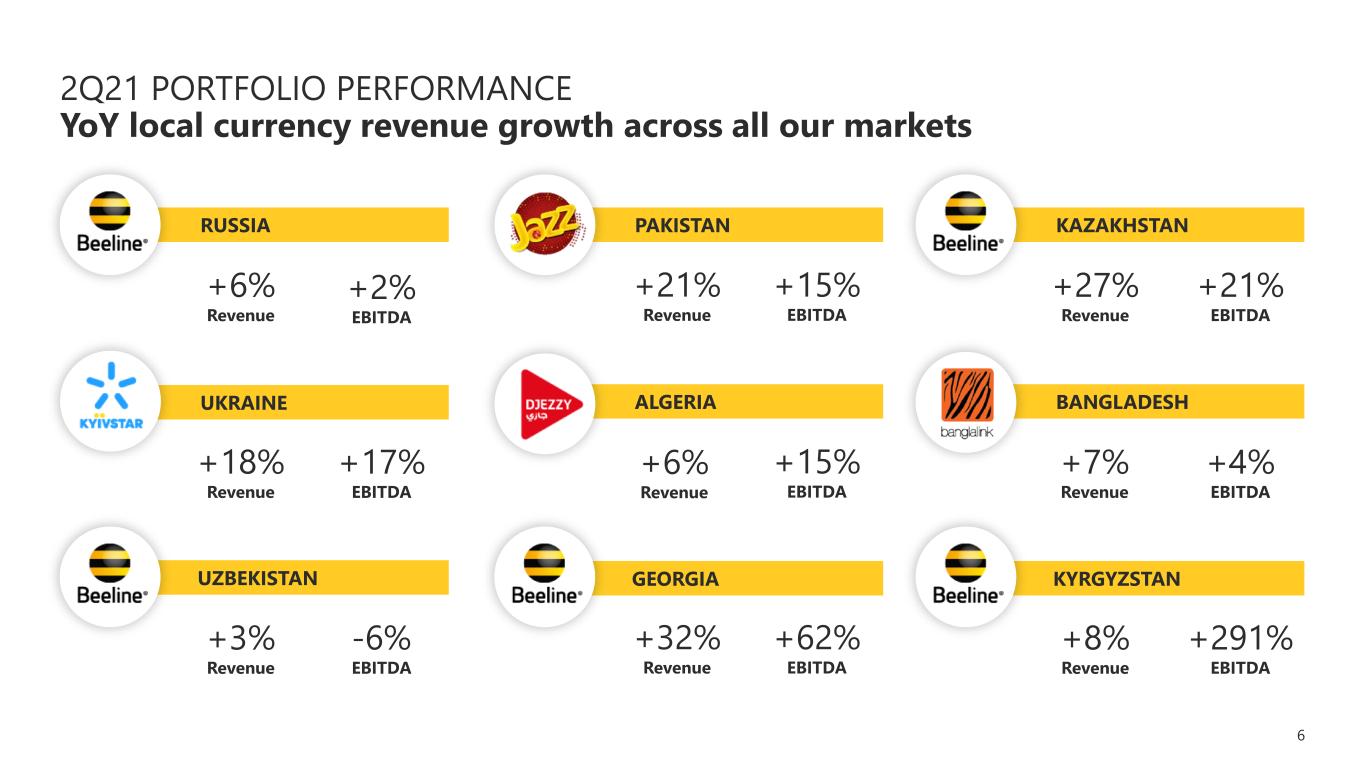

6 PAKISTAN ALGERIA GEORGIA KAZAKHSTAN BANGLADESH KYRGYZSTAN RUSSIA UKRAINE UZBEKISTAN 2Q21 PORTFOLIO PERFORMANCE YoY local currency revenue growth across all our markets +6% Revenue +2% EBITDA +21% Revenue +15% EBITDA +18% Revenue +17% EBITDA +27% Revenue +21% EBITDA +7% Revenue +4% EBITDA +6% Revenue +15% EBITDA +3% Revenue -6% EBITDA +32% Revenue +62% EBITDA +8% Revenue +291% EBITDA

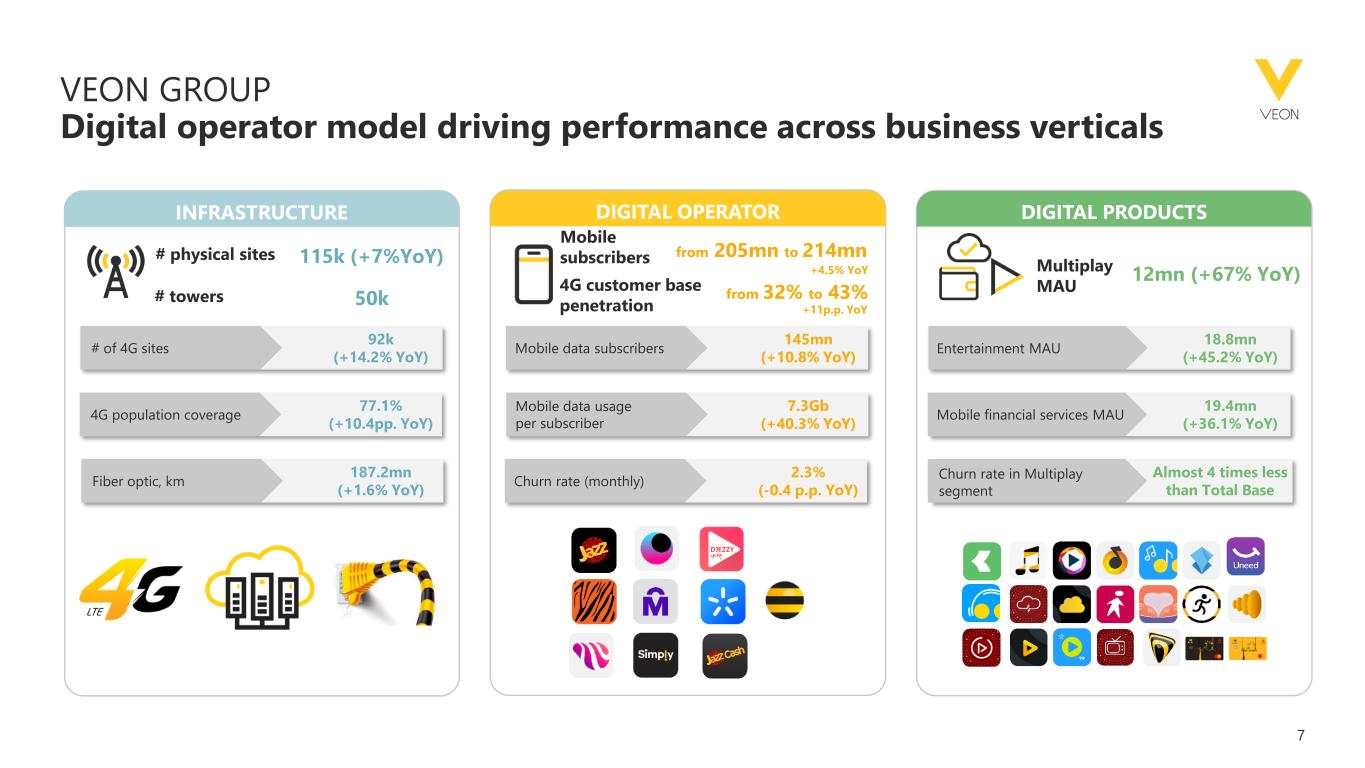

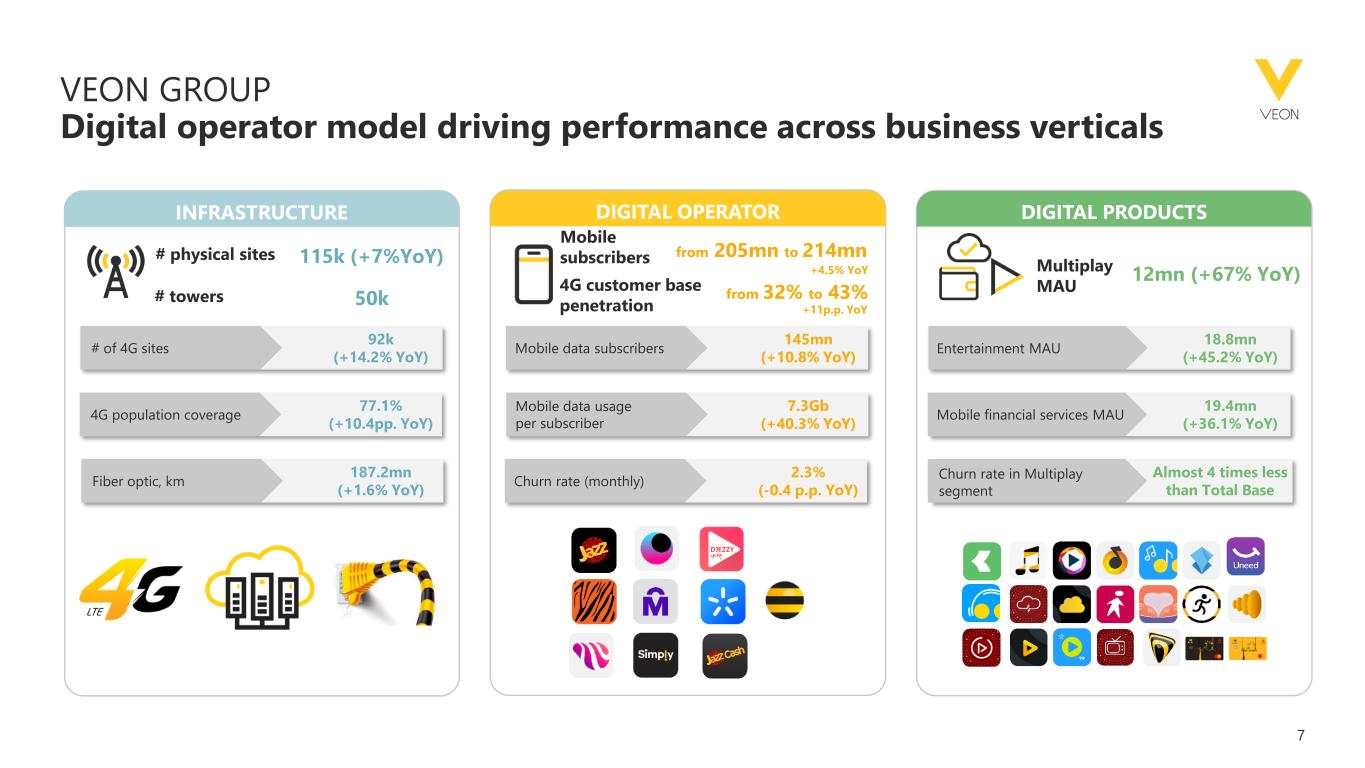

7 INFRASTRUCTURE DIGITAL OPERATOR VEON GROUP Digital operator model driving performance across business verticals Multiplay MAU 12mn (+67% YoY) # of 4G sites 92k (+14.2% YoY) 4G population coverage 77.1% (+10.4pp. YoY) Fiber optic, km 187.2mn (+1.6% YoY) Mobile data subscribers 145mn (+10.8% YoY) Mobile data usage per subscriber 7.3Gb (+40.3% YoY) Churn rate (monthly) 2.3% (-0.4 p.p. YoY) Entertainment MAU 18.8mn (+45.2% YoY) Mobile financial services MAU 19.4mn (+36.1% YoY) Churn rate in Multiplay segment Almost 4 times less than Total Base # physical sites 115k (+7%YoY) # towers 50k Mobile subscribers 4G customer base penetration DIGITAL PRODUCTS from 205mn to 214mn +4.5% YoY +11p.p. YoY from 32% to 43%

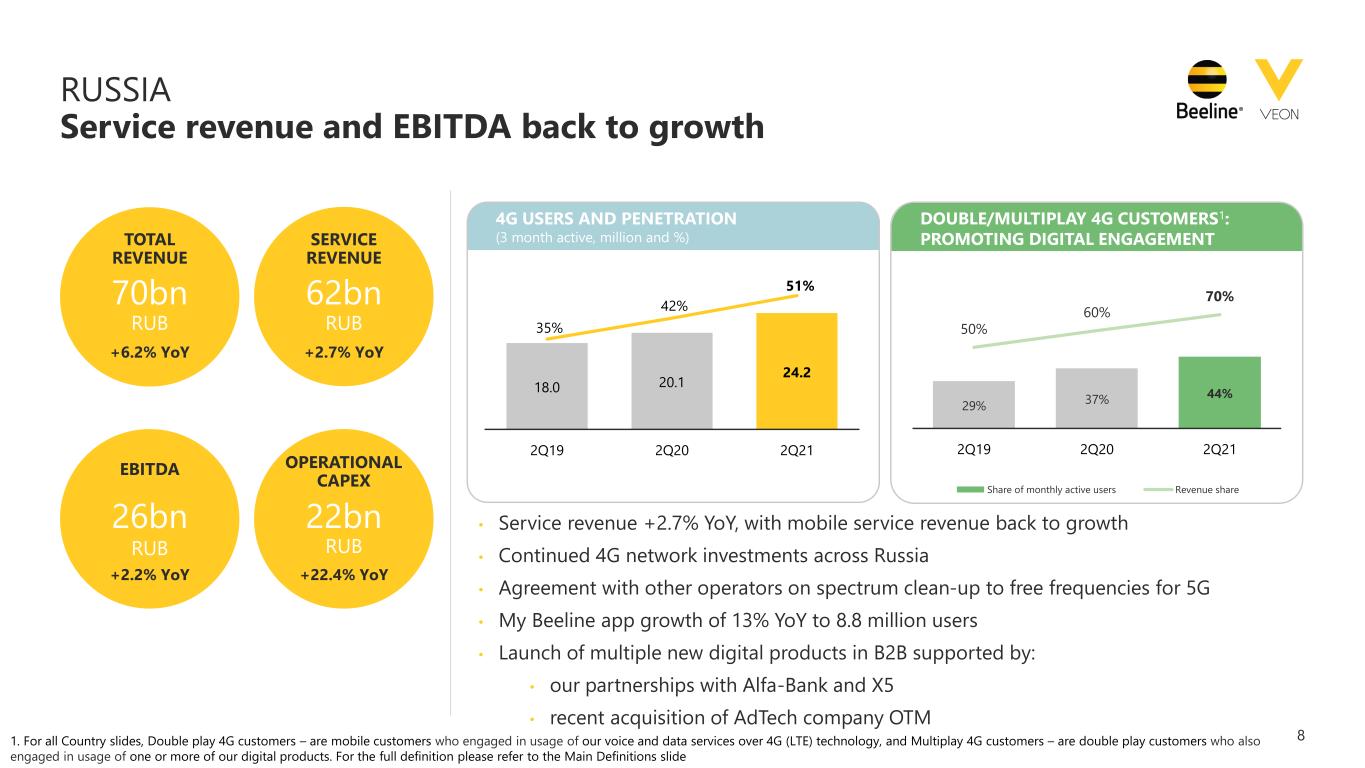

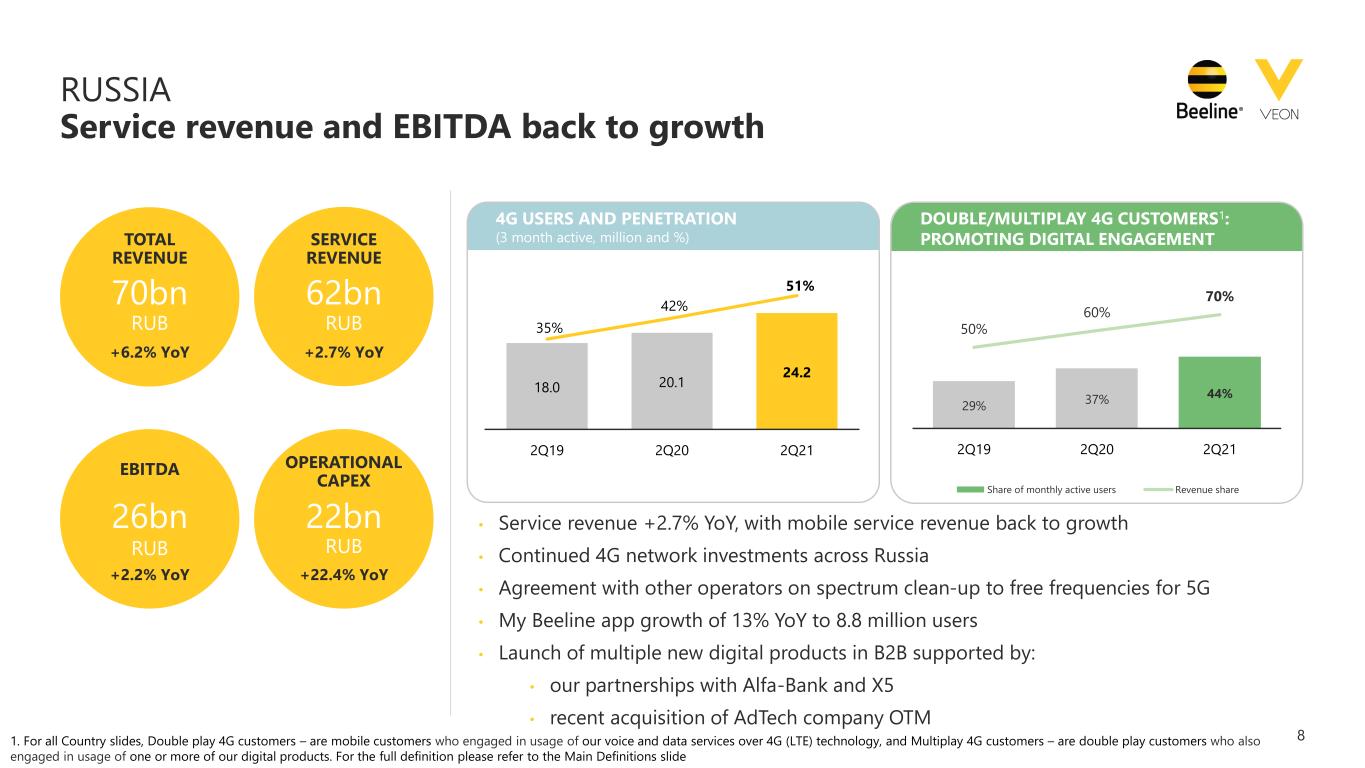

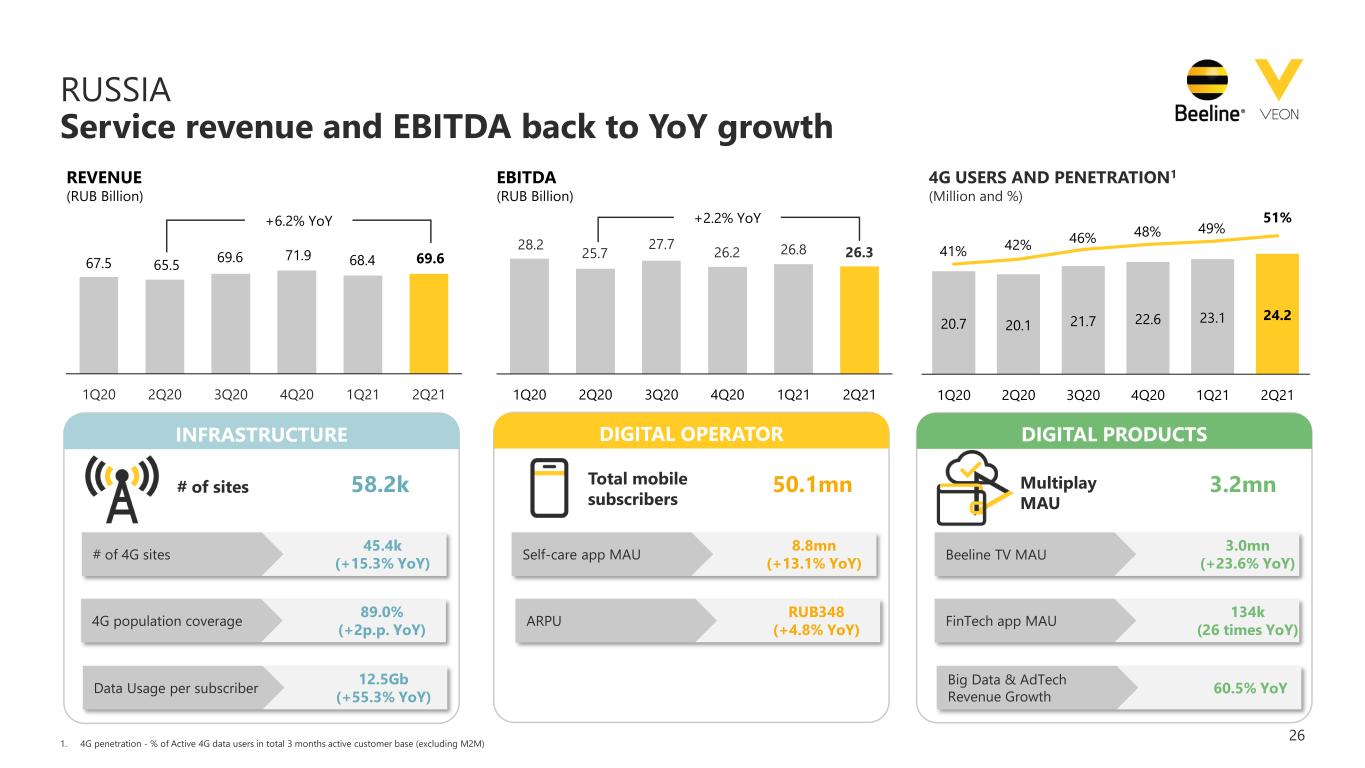

8 RUSSIA Service revenue and EBITDA back to growth 18.0 20.1 24.2 35% 42% 51% 2Q19 2Q20 2Q21 4G USERS AND PENETRATION (3 month active, million and %) 29% 37% 44% 50% 60% 70% 2Q19 2Q20 2Q21 Share of monthly active users Revenue share TOTAL REVENUE 70bn +6.2% YoY SERVICE REVENUE 62bn +2.7% YoY • Service revenue +2.7% YoY, with mobile service revenue back to growth • Continued 4G network investments across Russia • Agreement with other operators on spectrum clean-up to free frequencies for 5G • My Beeline app growth of 13% YoY to 8.8 million users • Launch of multiple new digital products in B2B supported by: • our partnerships with Alfa-Bank and X5 • recent acquisition of AdTech company OTM EBITDA 26bn +2.2% YoY OPERATIONAL CAPEX 22bn +22.4% YoY DOUBLE/MULTIPLAY 4G CUSTOMERS1: PROMOTING DIGITAL ENGAGEMENT RUB RUB RUB RUB 1. For all Country slides, Double play 4G customers – are mobile customers who engaged in usage of our voice and data services over 4G (LTE) technology, and Multiplay 4G customers – are double play customers who also engaged in usage of one or more of our digital products. For the full definition please refer to the Main Definitions slide

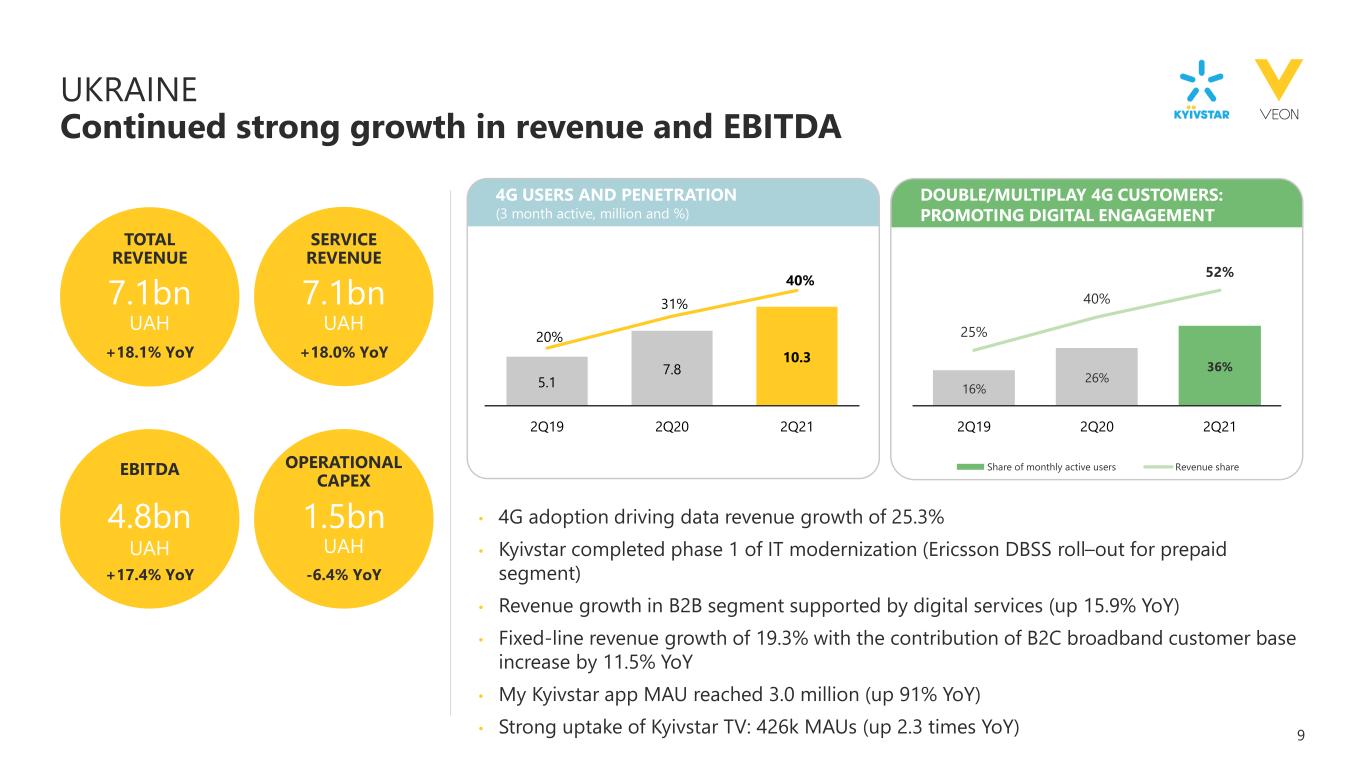

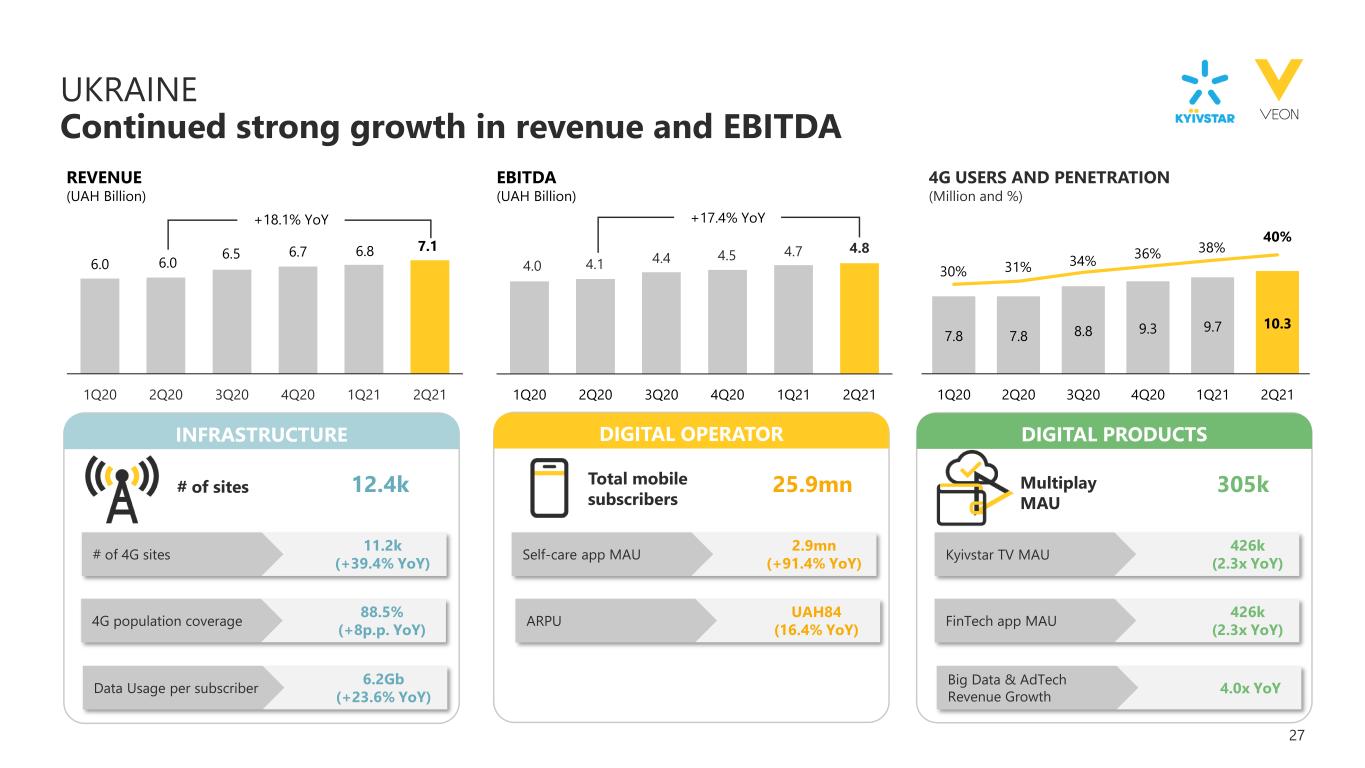

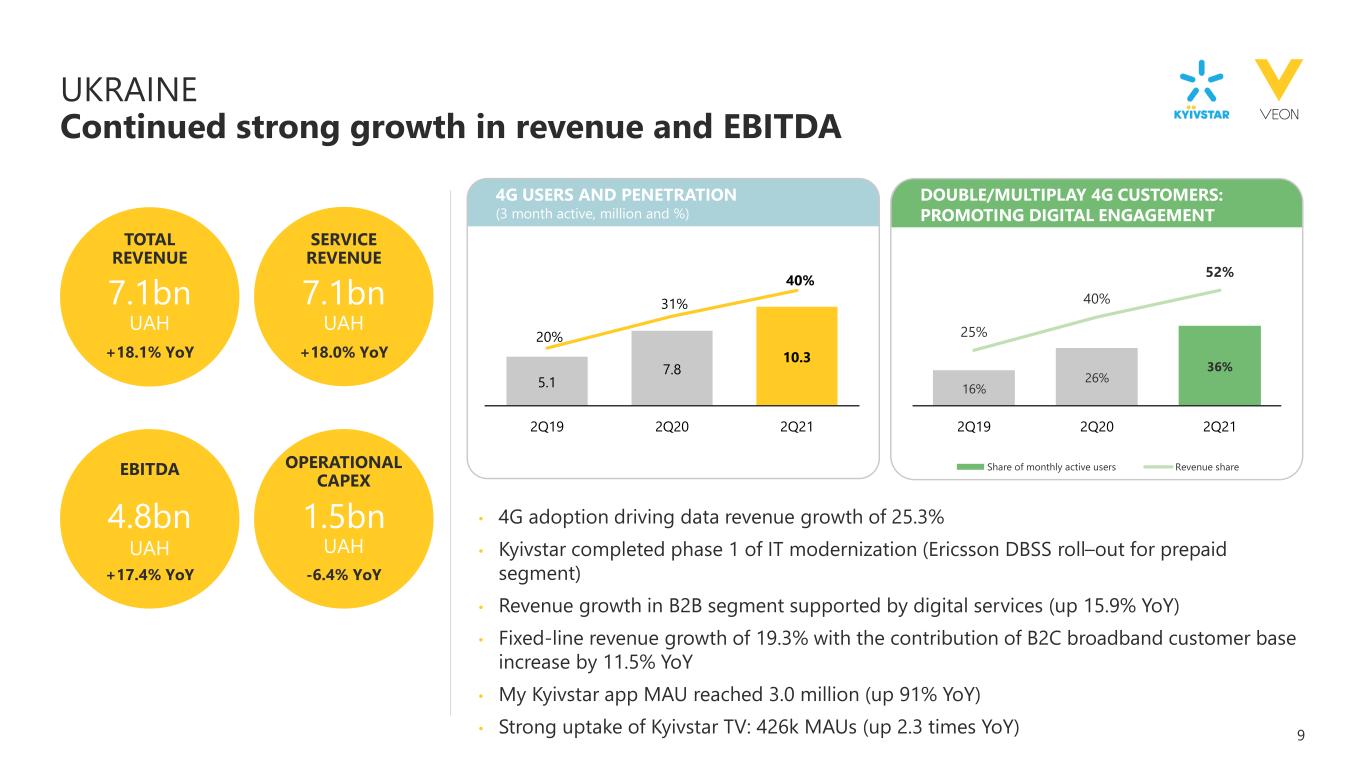

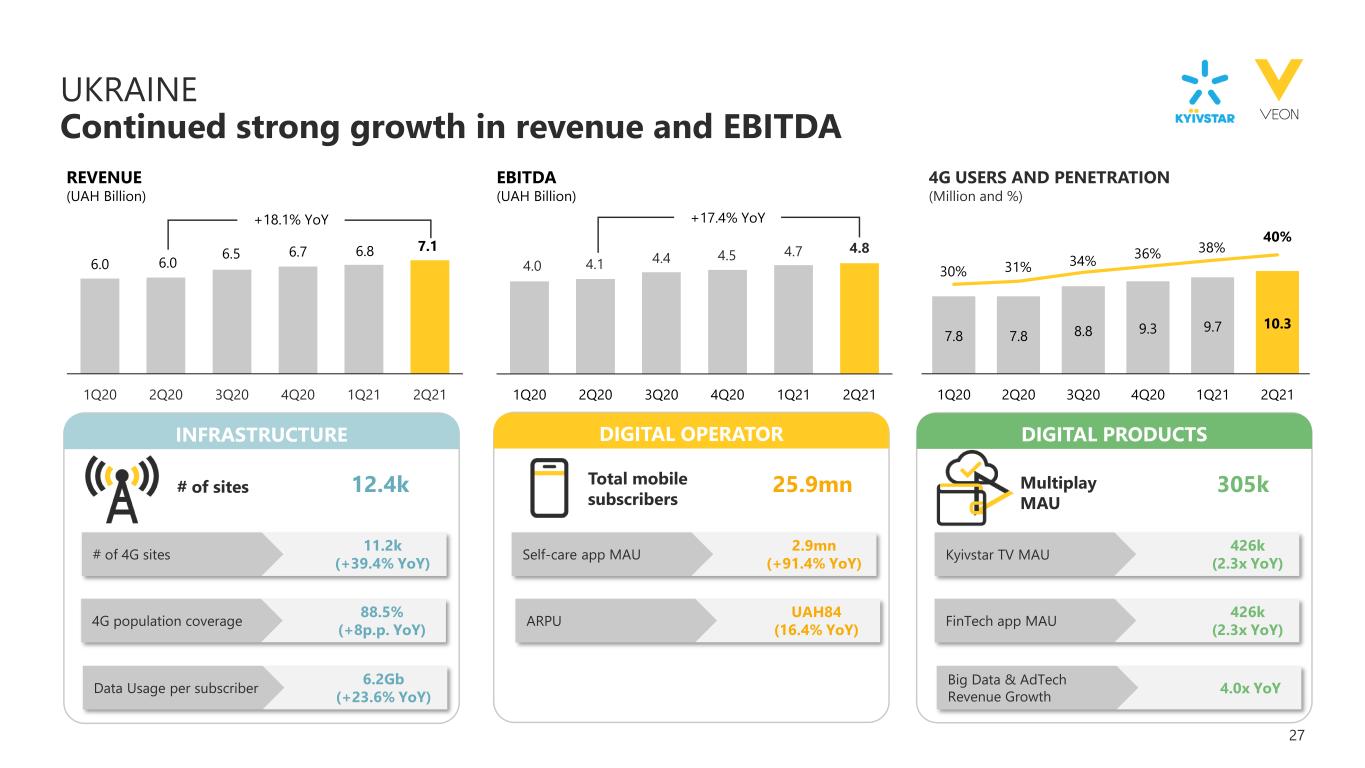

9 UKRAINE Continued strong growth in revenue and EBITDA 5.1 7.8 10.3 20% 31% 40% 2Q19 2Q20 2Q21 4G USERS AND PENETRATION (3 month active, million and %) 16% 26% 36% 25% 40% 52% 2Q19 2Q20 2Q21 Share of monthly active users Revenue share TOTAL REVENUE 7.1bn +18.1% YoY SERVICE REVENUE 7.1bn +18.0% YoY • 4G adoption driving data revenue growth of 25.3% • Kyivstar completed phase 1 of IT modernization (Ericsson DBSS roll–out for prepaid segment) • Revenue growth in B2B segment supported by digital services (up 15.9% YoY) • Fixed-line revenue growth of 19.3% with the contribution of B2C broadband customer base increase by 11.5% YoY • My Kyivstar app MAU reached 3.0 million (up 91% YoY) • Strong uptake of Kyivstar TV: 426k MAUs (up 2.3 times YoY) EBITDA 4.8bn +17.4% YoY OPERATIONAL CAPEX 1.5bn -6.4% YoY DOUBLE/MULTIPLAY 4G CUSTOMERS: PROMOTING DIGITAL ENGAGEMENT UAH UAH UAH UAH

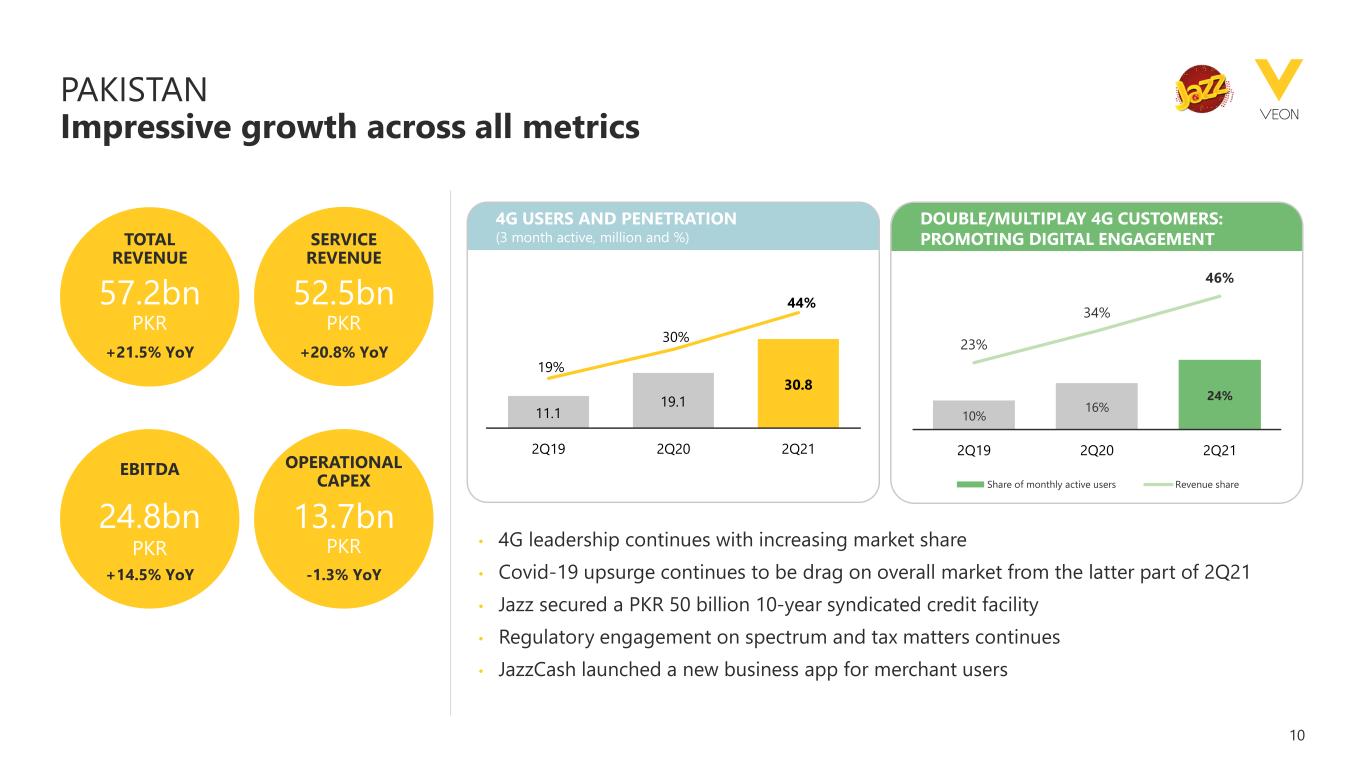

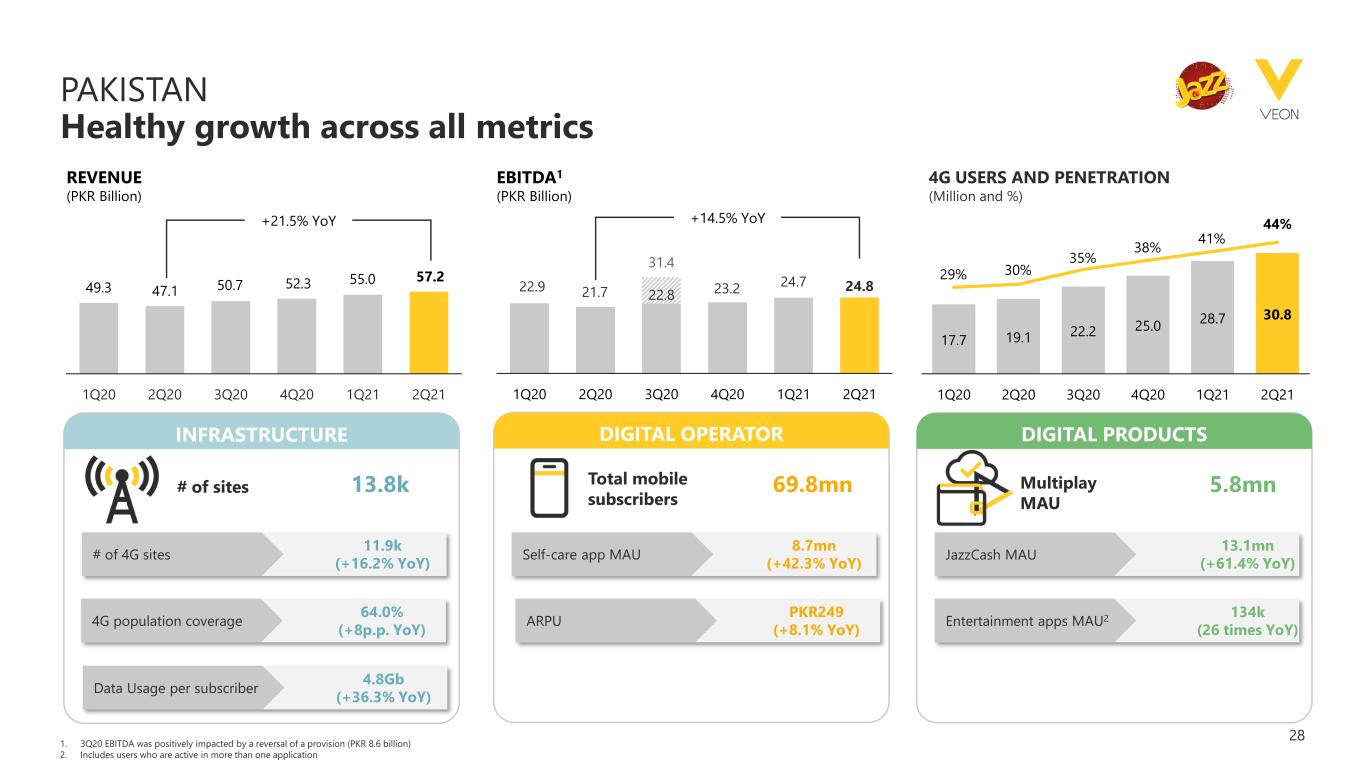

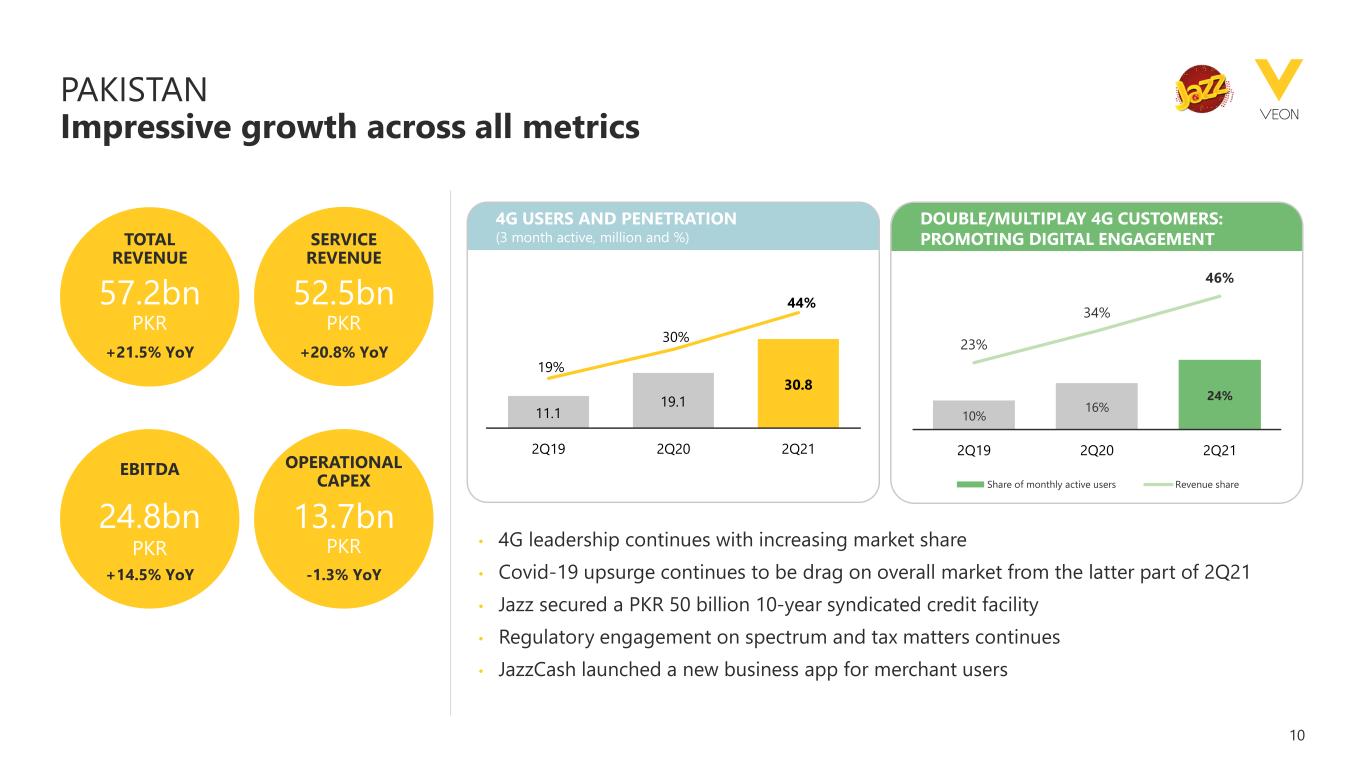

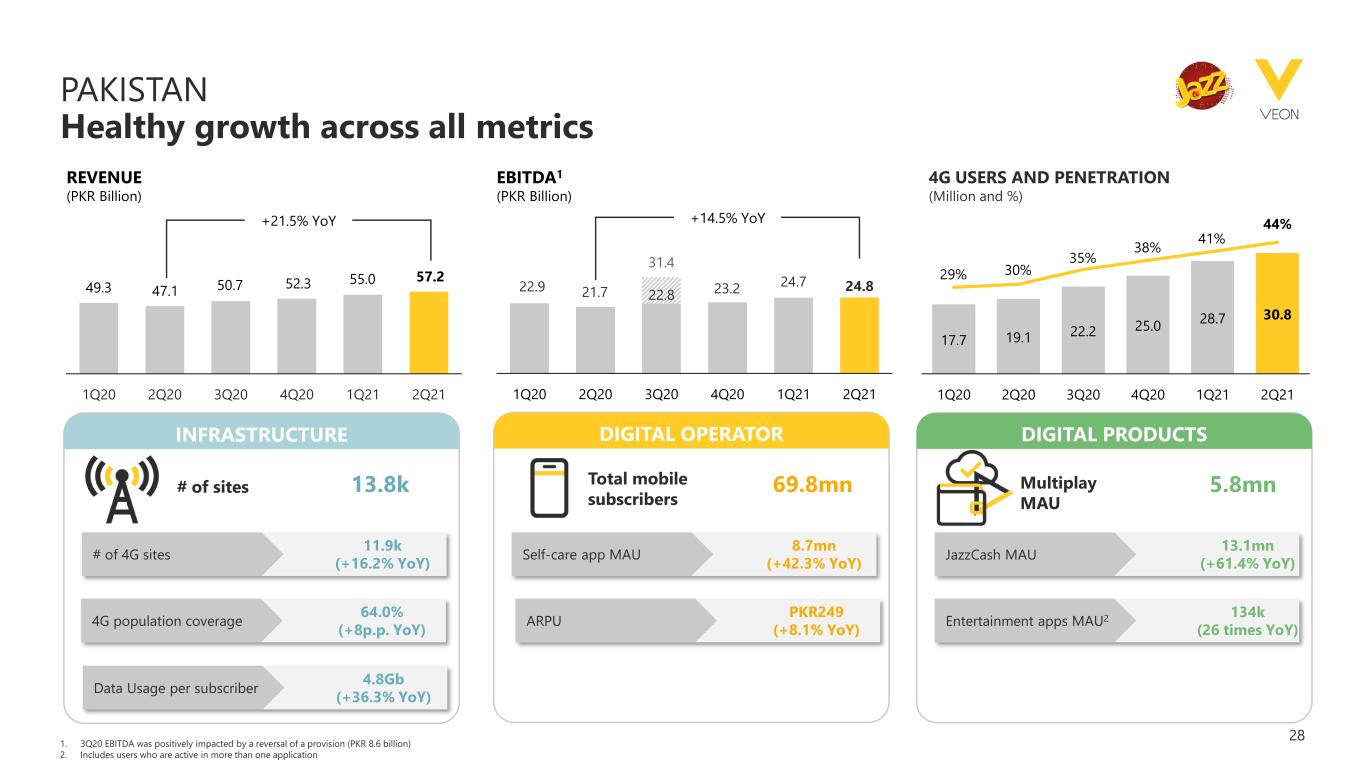

10 PAKISTAN Impressive growth across all metrics 11.1 19.1 30.8 19% 30% 44% 2Q19 2Q20 2Q21 4G USERS AND PENETRATION (3 month active, million and %) 10% 16% 24% 23% 34% 46% 2Q19 2Q20 2Q21 Share of monthly active users Revenue share TOTAL REVENUE 57.2bn +21.5% YoY SERVICE REVENUE 52.5bn +20.8% YoY • 4G leadership continues with increasing market share • Covid-19 upsurge continues to be drag on overall market from the latter part of 2Q21 • Jazz secured a PKR 50 billion 10-year syndicated credit facility • Regulatory engagement on spectrum and tax matters continues • JazzCash launched a new business app for merchant users EBITDA 24.8bn +14.5% YoY OPERATIONAL CAPEX 13.7bn -1.3% YoY DOUBLE/MULTIPLAY 4G CUSTOMERS: PROMOTING DIGITAL ENGAGEMENT PKR PKR PKR PKR

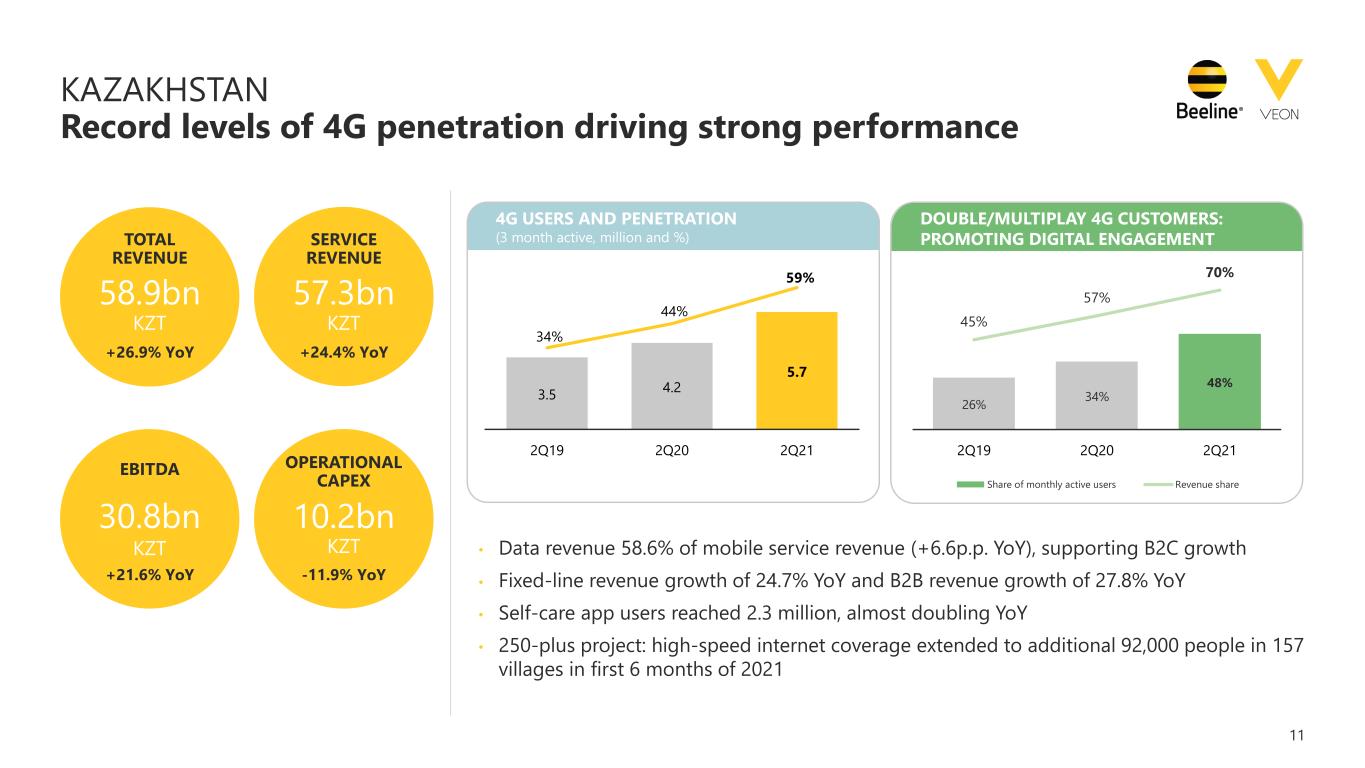

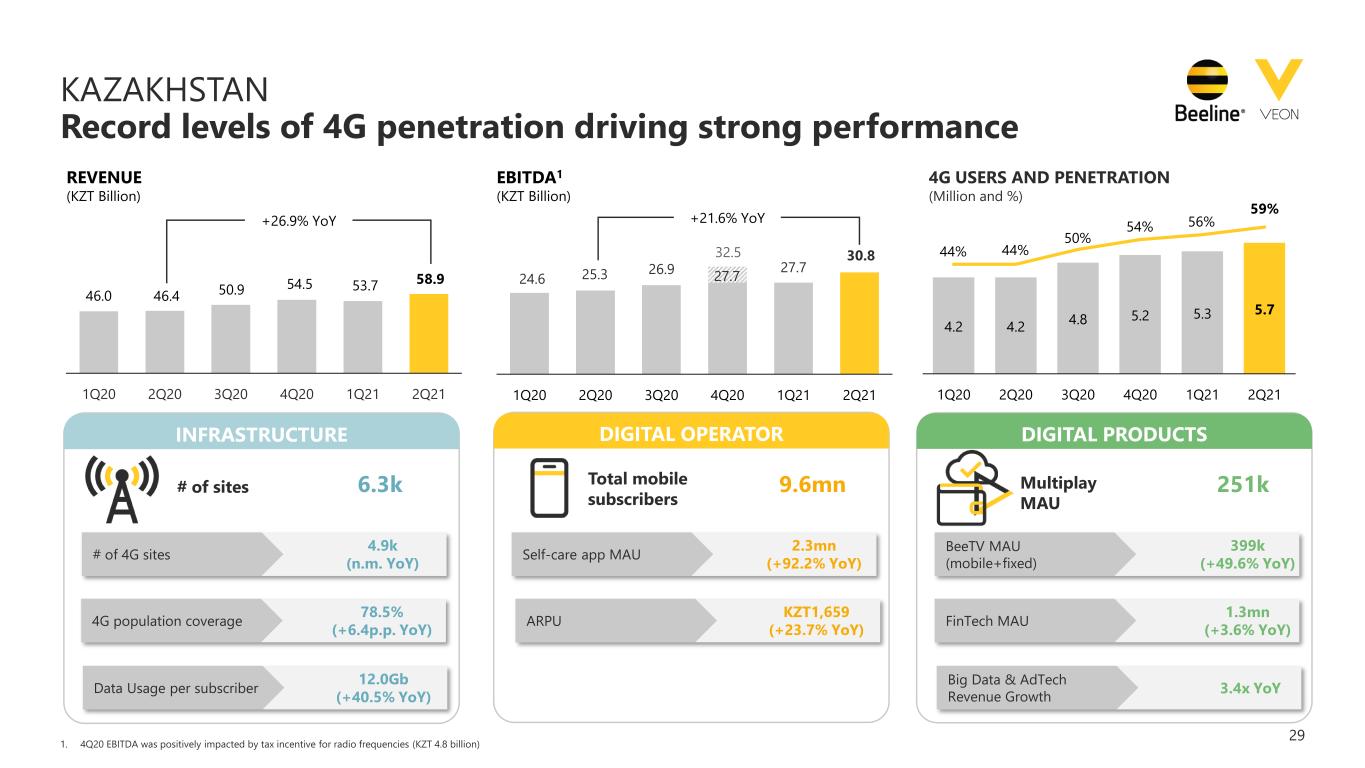

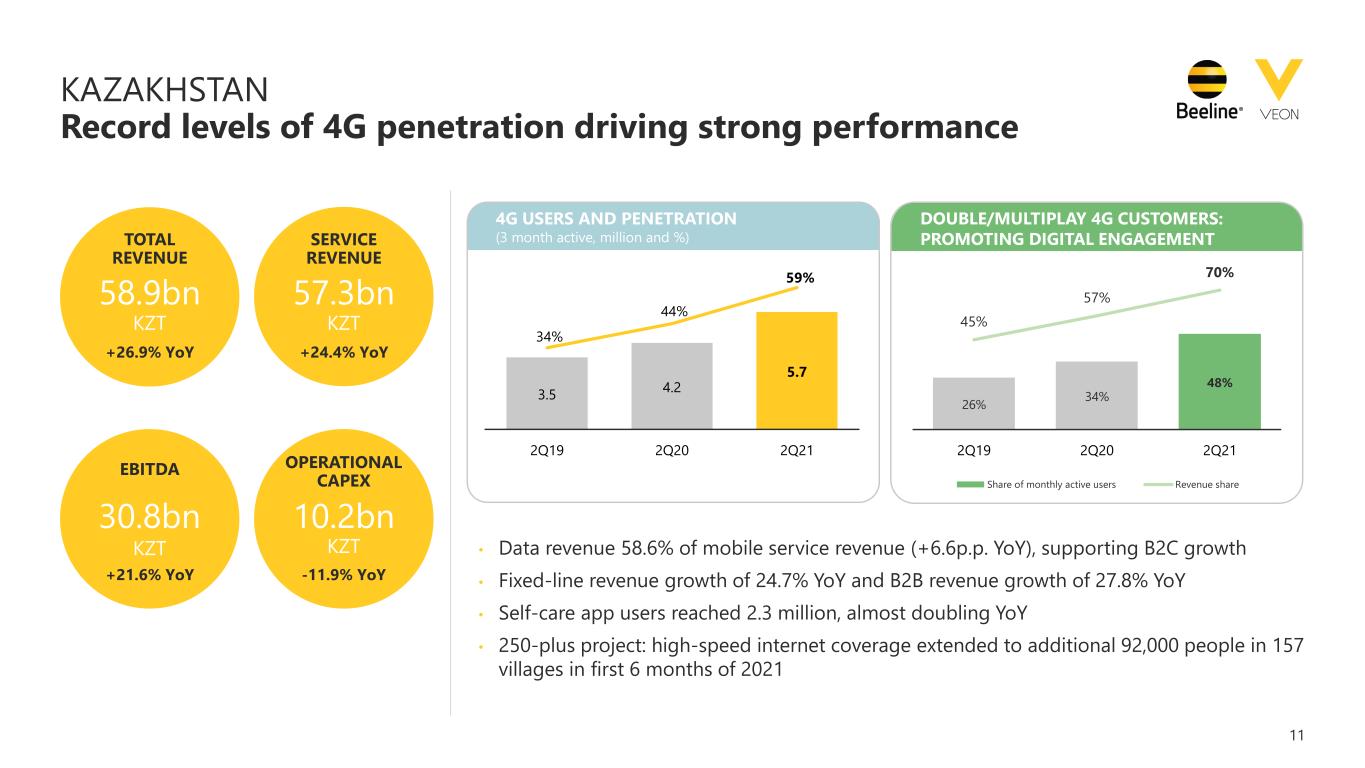

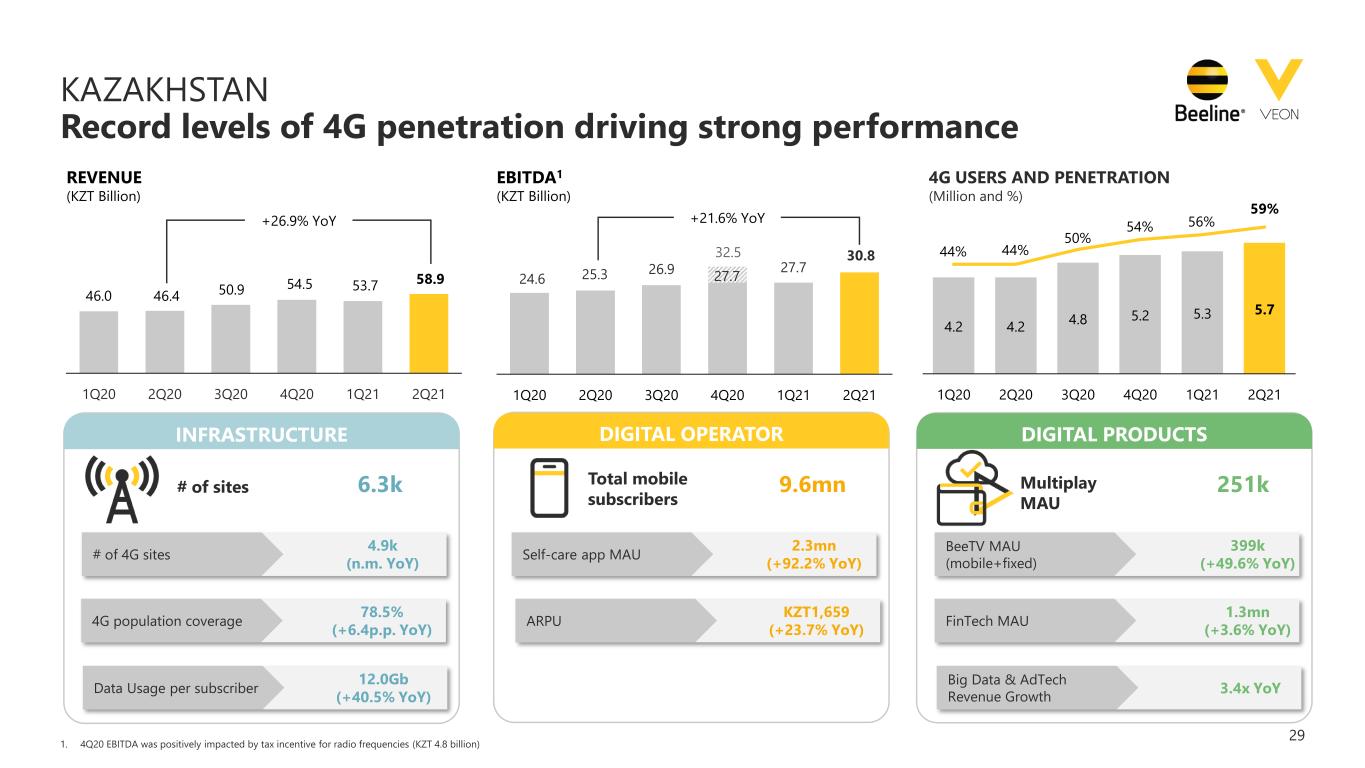

11 KAZAKHSTAN Record levels of 4G penetration driving strong performance 3.5 4.2 5.7 34% 44% 59% 2Q19 2Q20 2Q21 4G USERS AND PENETRATION (3 month active, million and %) 26% 34% 48% 45% 57% 70% 2Q19 2Q20 2Q21 Share of monthly active users Revenue share TOTAL REVENUE 58.9bn +26.9% YoY SERVICE REVENUE 57.3bn +24.4% YoY • Data revenue 58.6% of mobile service revenue (+6.6p.p. YoY), supporting B2C growth • Fixed-line revenue growth of 24.7% YoY and B2B revenue growth of 27.8% YoY • Self-care app users reached 2.3 million, almost doubling YoY • 250-plus project: high-speed internet coverage extended to additional 92,000 people in 157 villages in first 6 months of 2021 EBITDA 30.8bn +21.6% YoY OPERATIONAL CAPEX 10.2bn -11.9% YoY DOUBLE/MULTIPLAY 4G CUSTOMERS: PROMOTING DIGITAL ENGAGEMENT KZT KZT KZT KZT

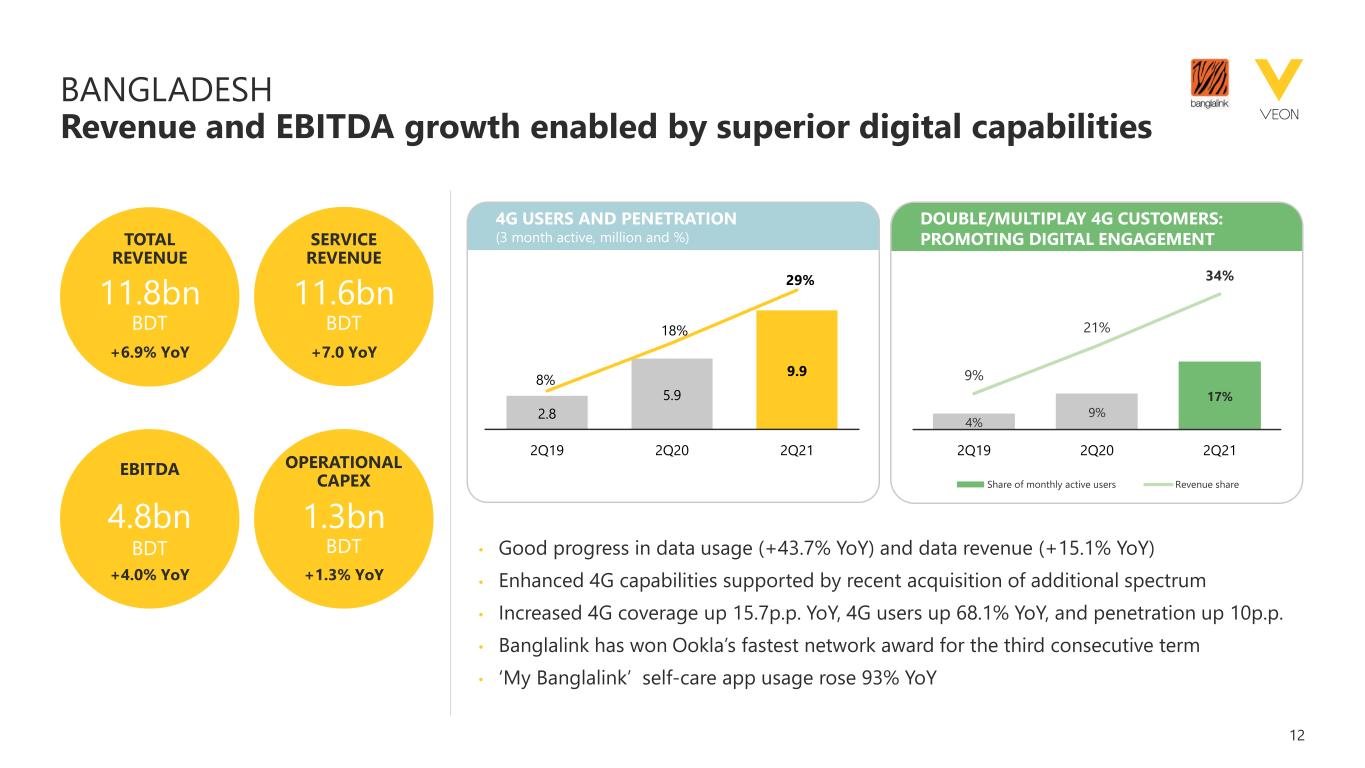

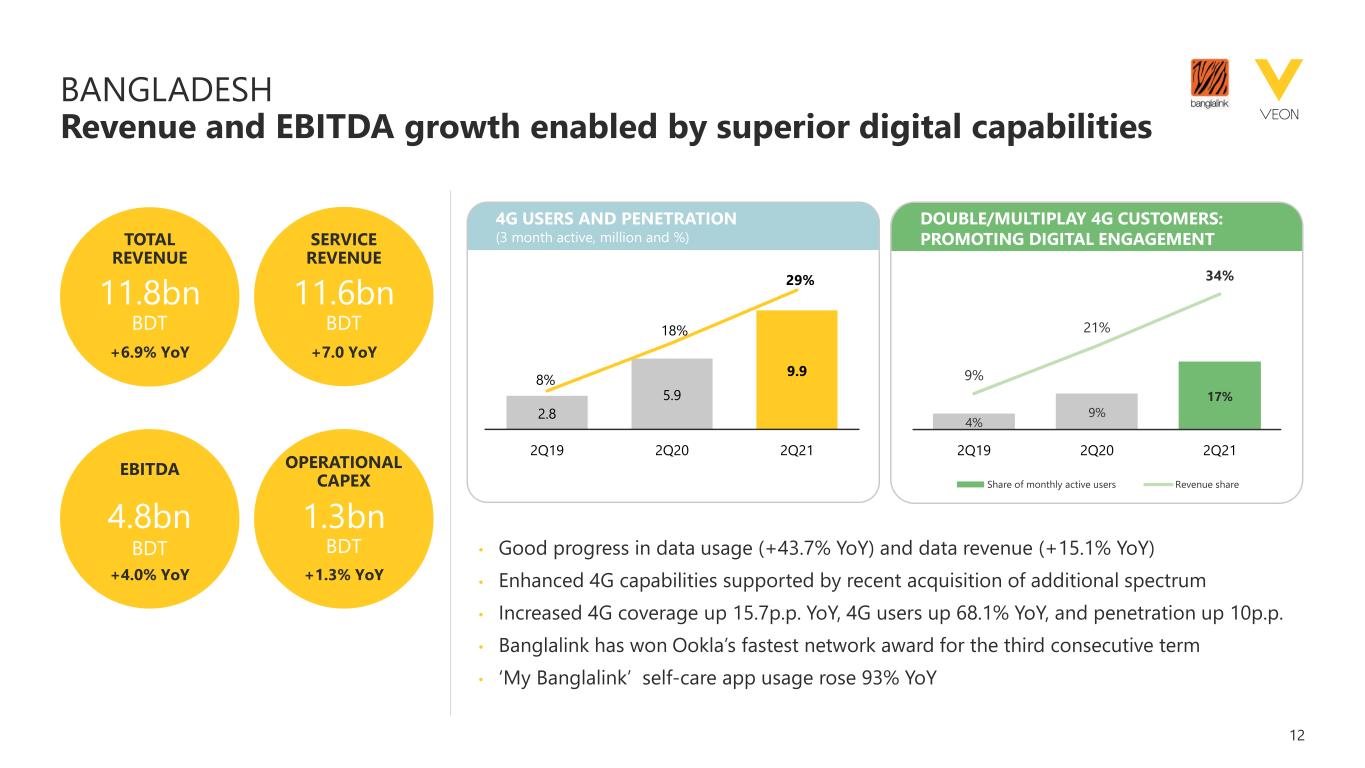

12 BANGLADESH Revenue and EBITDA growth enabled by superior digital capabilities 2.8 5.9 9.9 8% 18% 29% 2Q19 2Q20 2Q21 4G USERS AND PENETRATION (3 month active, million and %) 4% 9% 17% 9% 21% 34% 2Q19 2Q20 2Q21 Share of monthly active users Revenue share TOTAL REVENUE 11.8bn +6.9% YoY SERVICE REVENUE 11.6bn +7.0 YoY • Good progress in data usage (+43.7% YoY) and data revenue (+15.1% YoY) • Enhanced 4G capabilities supported by recent acquisition of additional spectrum • Increased 4G coverage up 15.7p.p. YoY, 4G users up 68.1% YoY, and penetration up 10p.p. • Banglalink has won Ookla’s fastest network award for the third consecutive term • ‘My Banglalink’ self-care app usage rose 93% YoY EBITDA 4.8bn +4.0% YoY OPERATIONAL CAPEX 1.3bn +1.3% YoY DOUBLE/MULTIPLAY 4G CUSTOMERS: PROMOTING DIGITAL ENGAGEMENT BDT BDT BDT BDT

13 OTHER MARKETS Customer 4G adoption remains the driving force UZBEKISTAN ALGERIA GEORGIA KYRGYZSTAN • 61% 4G population coverage • 32% YoY increase in 4G users • 53% YoY increase in data usage • 6.5 p.p. YoY decrease in churn rate • 27% YoY increase in data revenue1 • 62% 4G population coverage • 21% YoY increase in 4G users • 24% YoY increase in data usage • 1.1 p.p. YoY decrease in churn rate • 14% YoY increase in data revenue1 • 92% 4G population coverage • 27% YoY increase in 4G users • 25% YoY increase in data usage • 11.6 p.p. YoY decrease in churn rate • 9% YoY increase in data revenue1 • 91% 4G population coverage • 25% YoY increase in 4G users • 30% YoY increase in data usage • 4.6 p.p. YoY decrease in churn rate • 34% YoY increase in data revenue1 1. Data revenue YoY growth refers to local currency growth

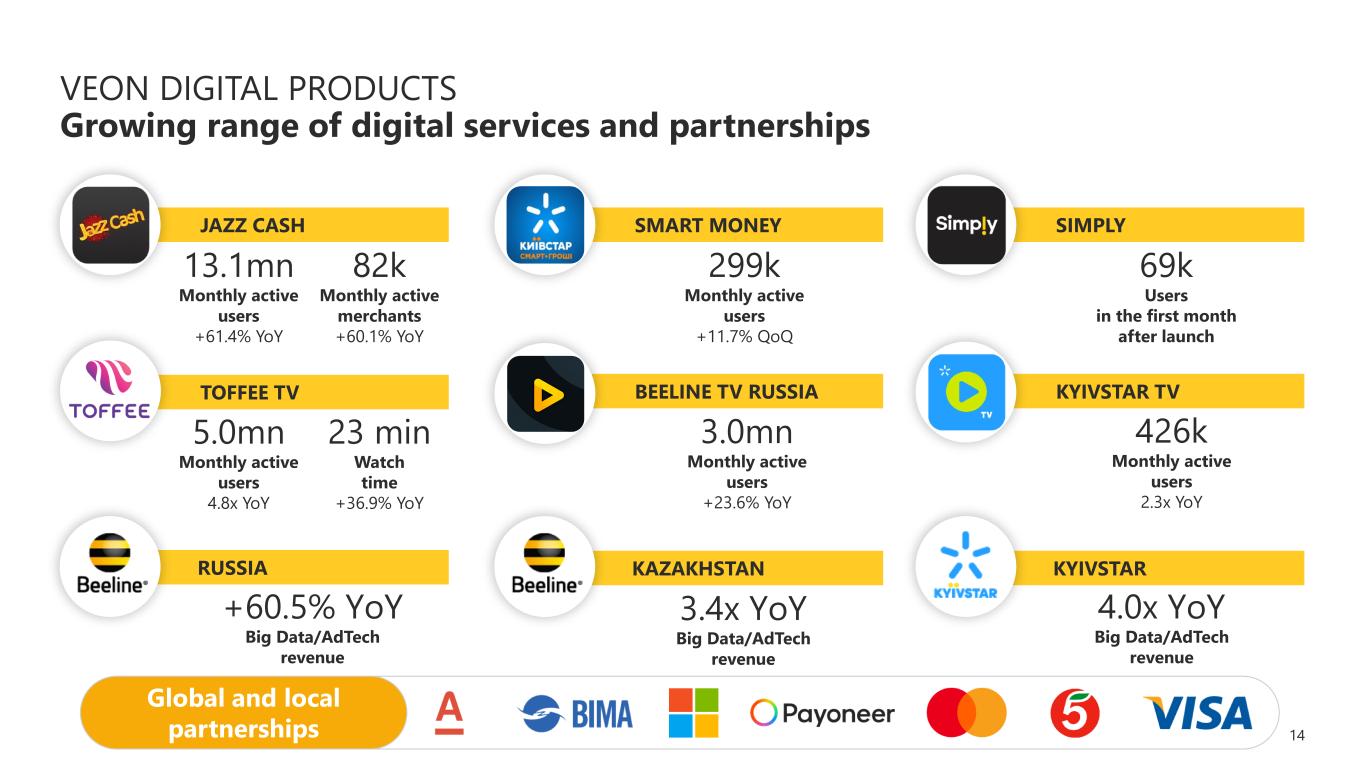

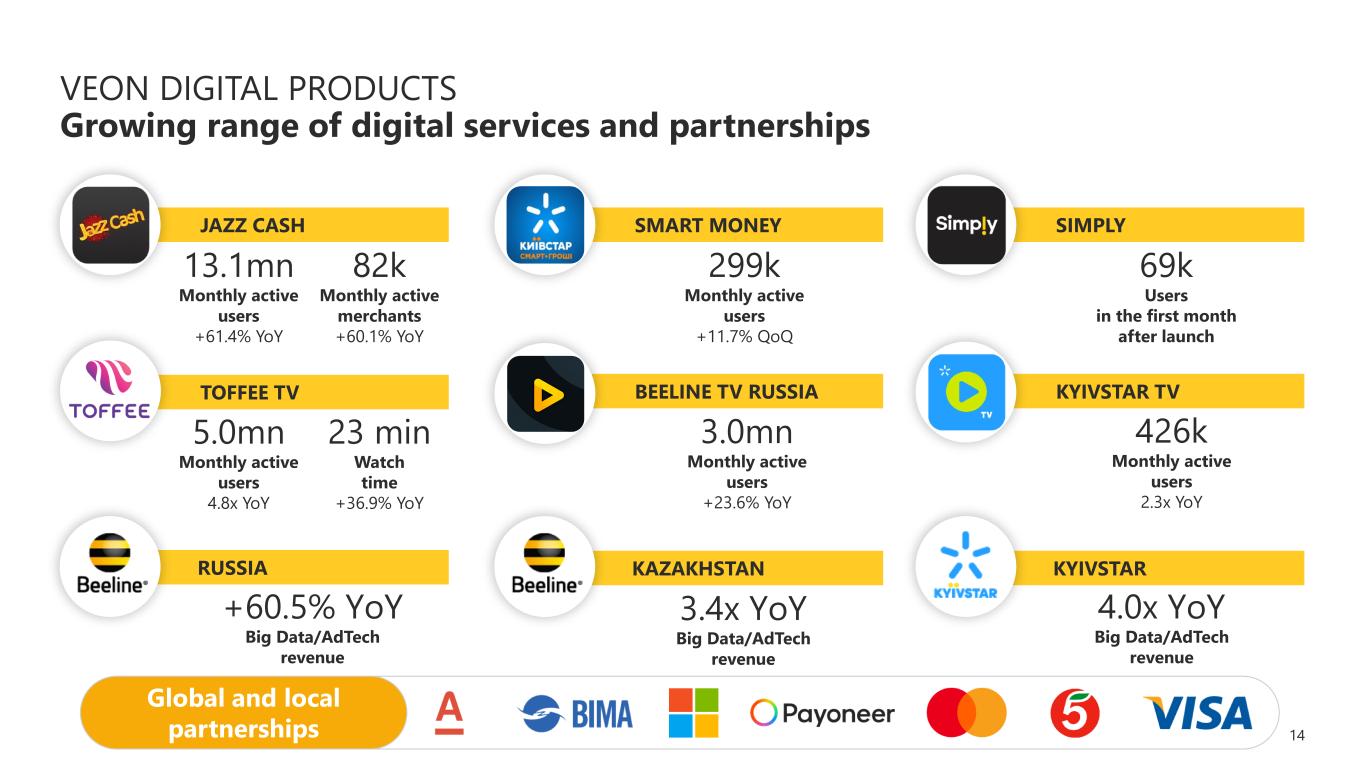

14 SMART MONEY BEELINE TV RUSSIA KAZAKHSTAN SIMPLY KYIVSTAR TV KYIVSTAR JAZZ CASH TOFFEE TV RUSSIA VEON DIGITAL PRODUCTS Growing range of digital services and partnerships 13.1mn Monthly active users +61.4% YoY 82k Monthly active merchants +60.1% YoY 299k Monthly active users +11.7% QoQ 5.0mn Monthly active users 4.8x YoY 23 min Watch time +36.9% YoY 69k Users in the first month after launch +60.5% YoY Big Data/AdTech revenue 3.0mn Monthly active users +23.6% YoY 426k Monthly active users 2.3x YoY 3.4x YoY Big Data/AdTech revenue 4.0x YoY Big Data/AdTech revenue Global and local partnerships

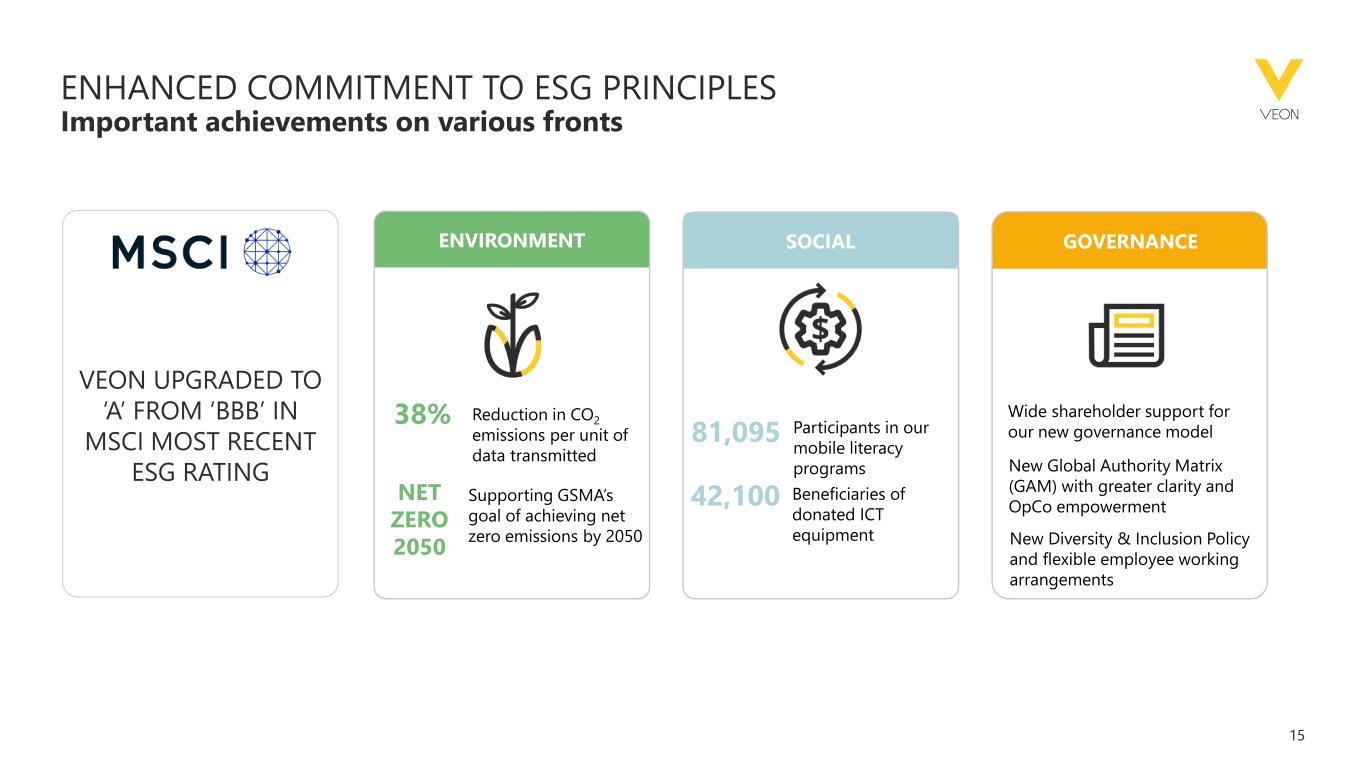

15 ENHANCED COMMITMENT TO ESG PRINCIPLES Important achievements on various fronts 60 SOCIAL 81,095 Participants in our mobile literacy programs 42,100 Beneficiaries of donated ICT equipment 60 ENVIRONMENT 38% Reduction in CO2 emissions per unit of data transmitted NET ZERO 2050 Supporting GSMA’s goal of achieving net zero emissions by 2050 60 GOVERNANCE Wide shareholder support for our new governance model New Global Authority Matrix (GAM) with greater clarity and OpCo empowerment New Diversity & Inclusion Policy and flexible employee working arrangements VEON UPGRADED TO ‘A’ FROM ‘BBB’ IN MSCI MOST RECENT ESG RATING

16 AGENDA 1. OPENING 2. HIGHLIGHTS & BUSINESS UPDATE Nik Kershaw Kaan Terzioğlu 4. CLOSING REMARKS Kaan Terzioğlu 3. 2Q21 FINANCIAL RESULTS Serkan Okandan

17 2Q21 HIGHLIGHTS Strong growth across the Group TOTAL REVENUE $2,065mn +11.3% YoY local currency EBITDA $879mn +10.7% YoY local currency DATA REVENUE $724mn +18.7% YoY local currency SERVICE REVENUE $1,927mn +9.5% YoY local currency +16.7% YoY reported+7.4% YoY reported+9.2% YoY reported +8.7% YoY reported EBITDA MARGIN 42.6% -0.2p.p. YoY reported EQUITY FREE CASH FLOW $63mn OPERATIONAL CAPEX $505mn +4.6% YoY local currency NET INCOME $127mn -27.1% YoY reported +2.5% YoY reported

18 2Q21 REVENUE Continued growth in local currency +9.2% YoY reported TOTAL REVENUE $2,065mn +7.4% YoY reported SERVICE REVENUE $1,927mn +16.7% YoY reported DATA REVENUE $724mn +11.3% YoY local currency +9.5% YoY local currency +18.7% YoY local currency 939 2,065 370 257 163 140 137 47 20 -8 Russia Pakistan Ukraine Algeria Bangladesh Kazakhstan Uzbekistan Other Eliminations Group 6.2% 18.1%21.5% 6.9% 26.9% 3.2% Local currency growth 5.9% • In 2Q21 VEON recorded YoY growth both on a reported basis and on a local currency basis • YoY growth recorded by all operations, a strong performance across the board • Russia back to growth in service revenue • Growth driven by strong 4G adoption, customer growth and ARPU expansion REVENUE IN 2Q21 (USD million)

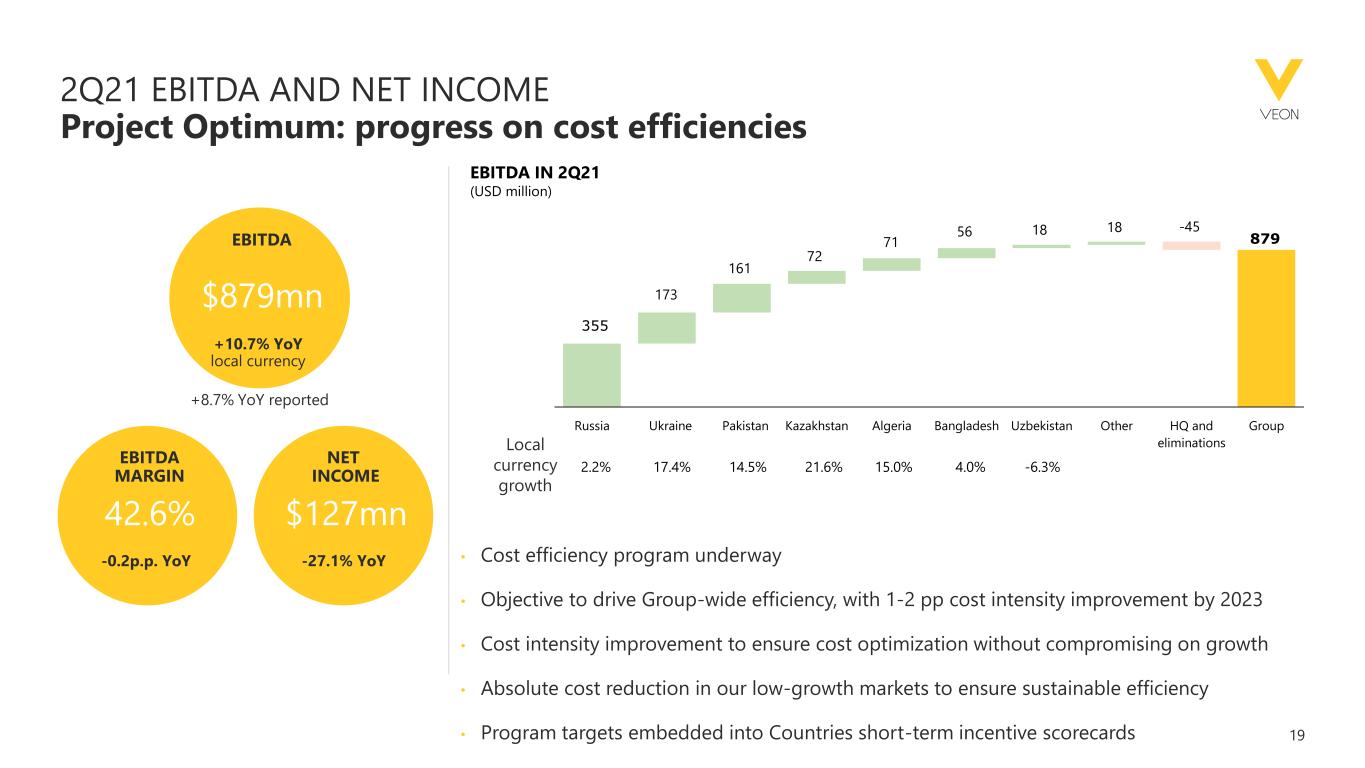

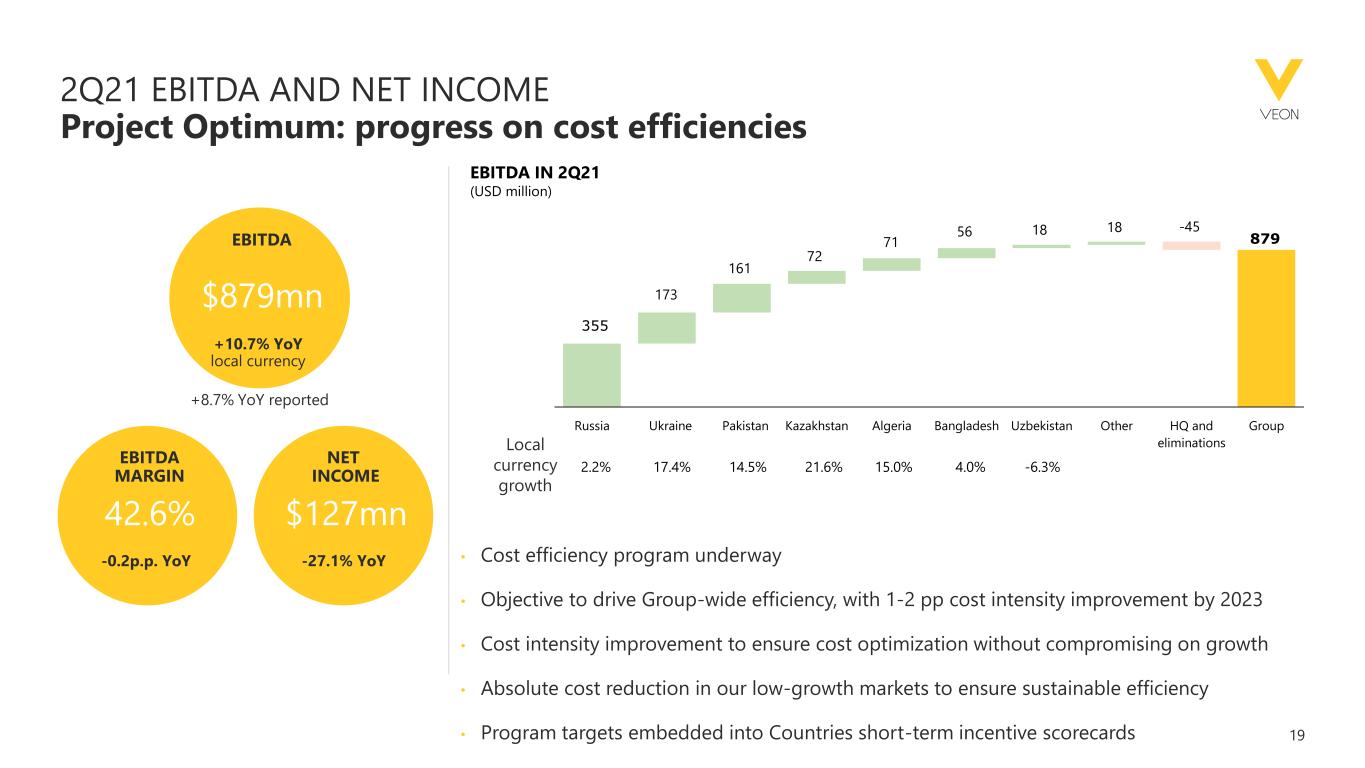

19 2Q21 EBITDA AND NET INCOME Project Optimum: progress on cost efficiencies 355 879 173 161 72 71 56 18 18 -45 Russia Ukraine Pakistan Kazakhstan Algeria Bangladesh Uzbekistan Other HQ and eliminations Group 2.2% 14.5%17.4% 15.0% 4.0% -6.3%21.6% • Cost efficiency program underway • Objective to drive Group-wide efficiency, with 1-2 pp cost intensity improvement by 2023 • Cost intensity improvement to ensure cost optimization without compromising on growth • Absolute cost reduction in our low-growth markets to ensure sustainable efficiency • Program targets embedded into Countries short-term incentive scorecards +8.7% YoY reported EBITDA $879mn EBITDA MARGIN 42.6% NET INCOME $127mn +10.7% YoY local currency -0.2p.p. YoY -27.1% YoY EBITDA IN 2Q21 (USD million) Local currency growth

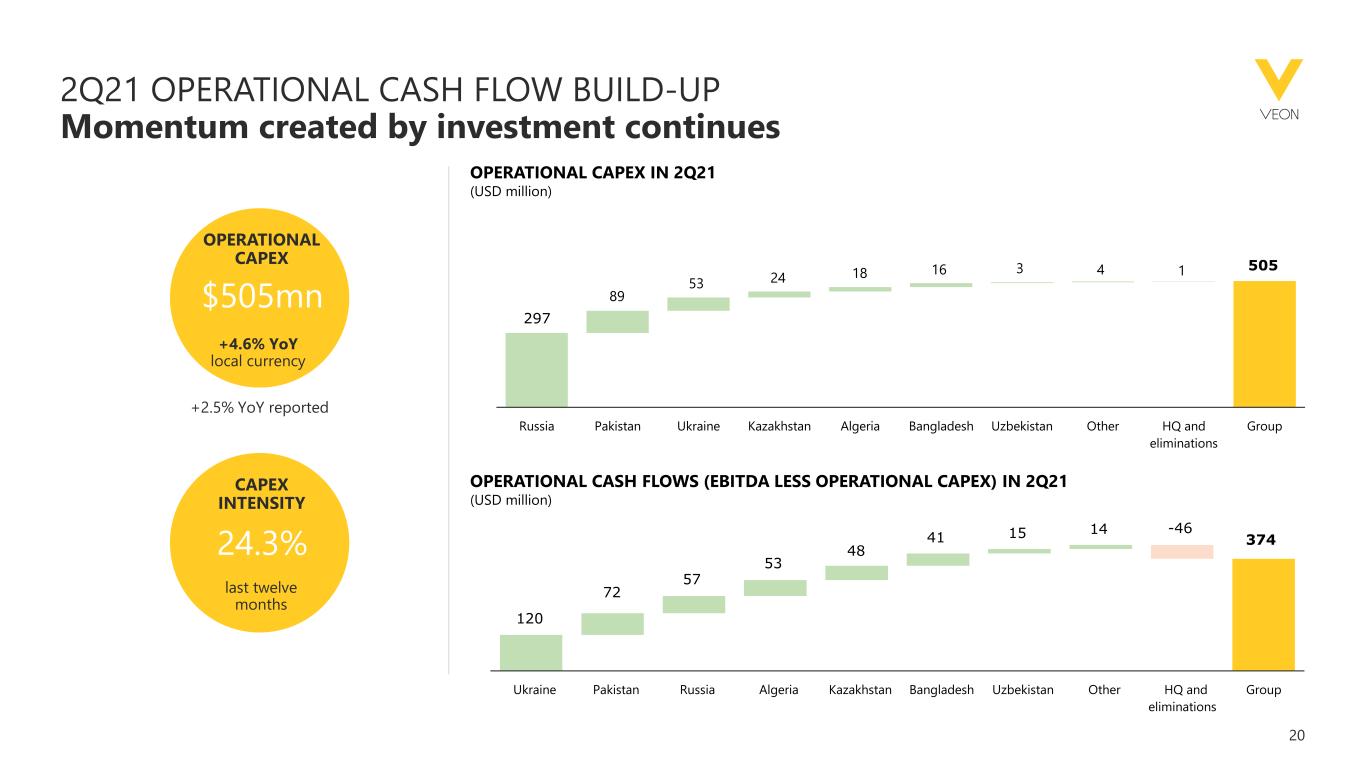

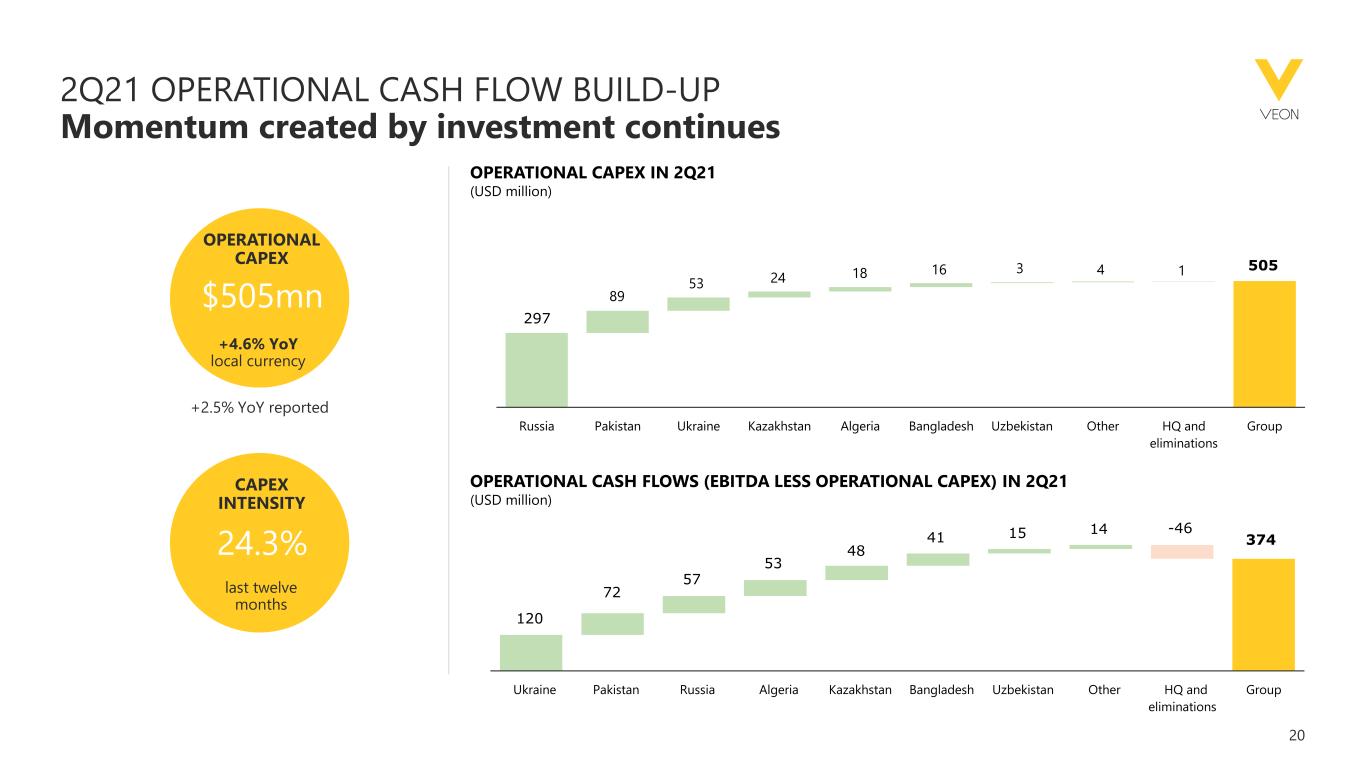

20 2Q21 OPERATIONAL CASH FLOW BUILD-UP Momentum created by investment continues +2.5% YoY reported OPERATIONAL CAPEX $505mn CAPEX INTENSITY 24.3% 297 505 89 53 24 18 16 3 4 1 Russia Pakistan Ukraine Kazakhstan Algeria Bangladesh Uzbekistan Other HQ and eliminations Group +4.6% YoY local currency OPERATIONAL CASH FLOWS (EBITDA LESS OPERATIONAL CAPEX) IN 2Q21 (USD million) 120 374 72 57 53 48 41 15 14 -46 Ukraine Pakistan Russia Algeria Kazakhstan Bangladesh Uzbekistan Other HQ and eliminations Group last twelve months OPERATIONAL CAPEX IN 2Q21 (USD million)

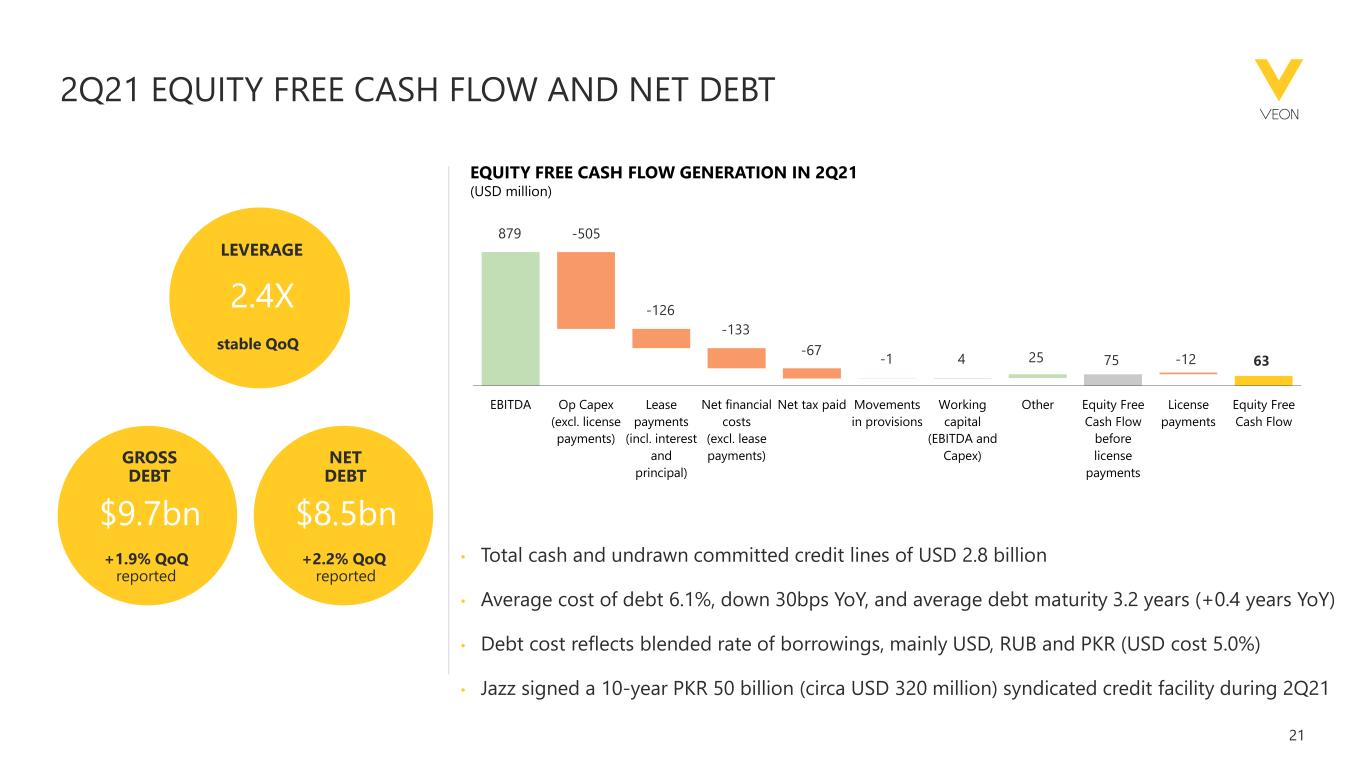

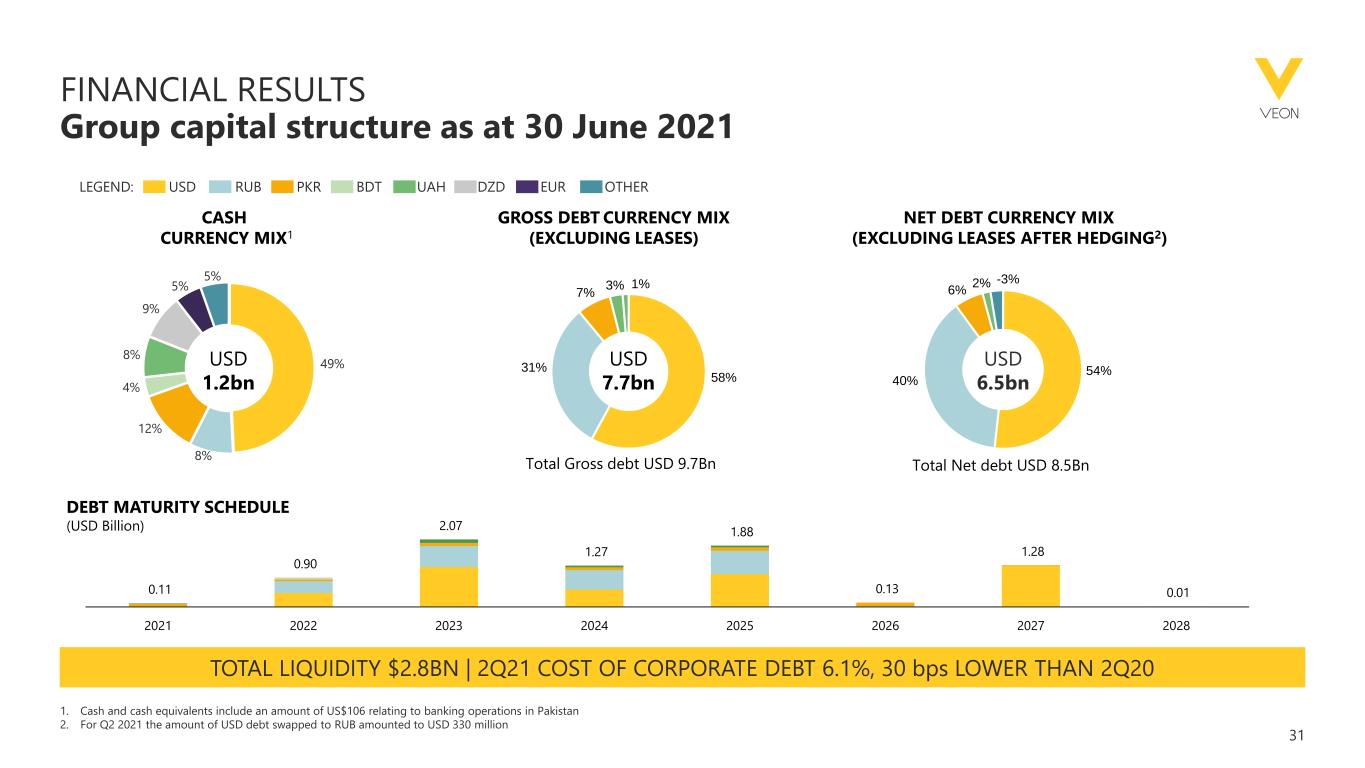

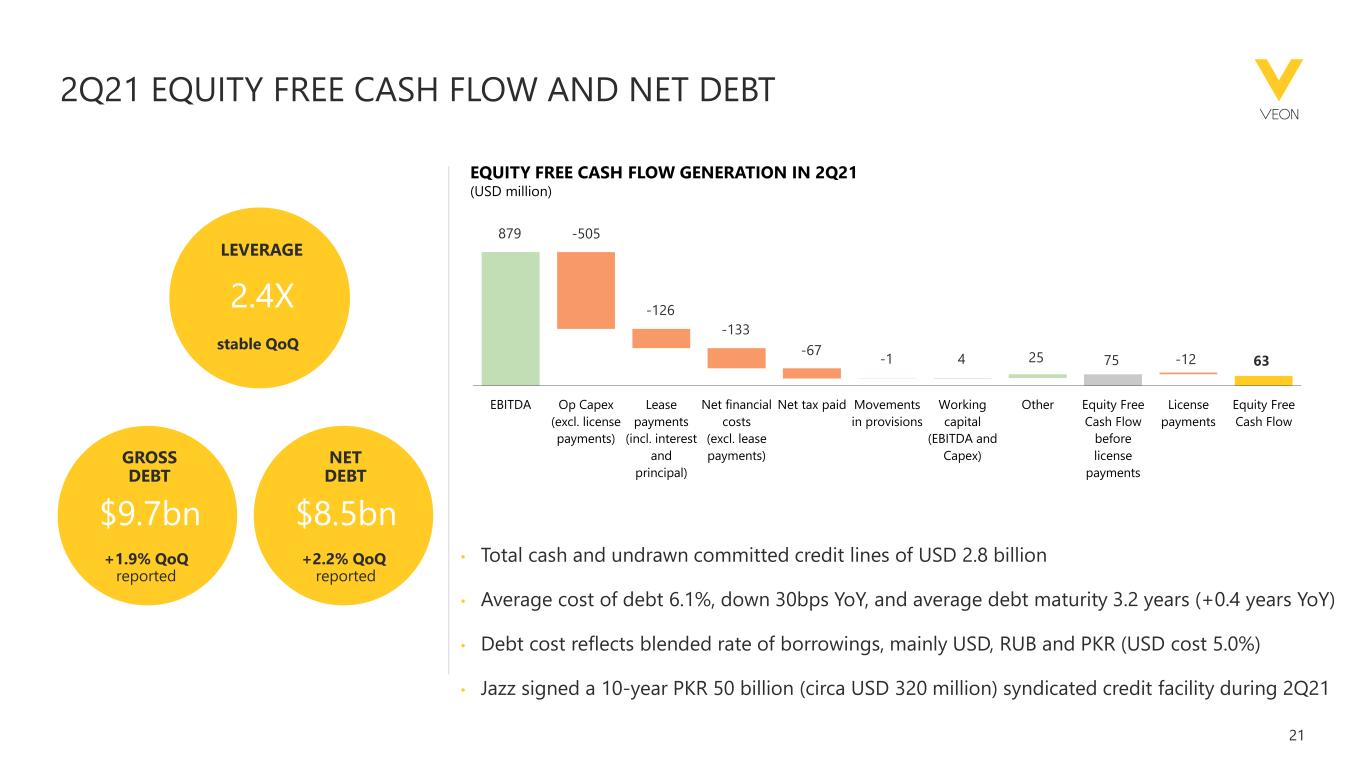

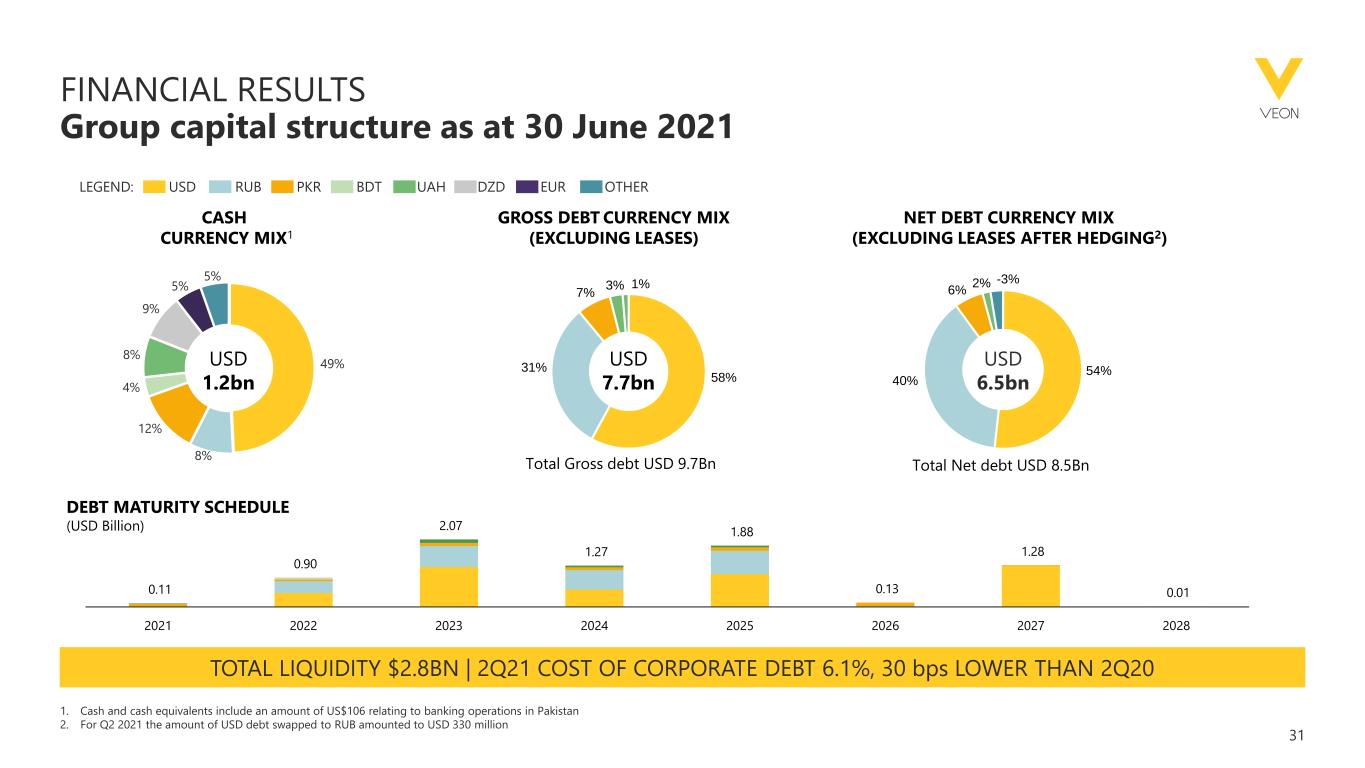

21 EBITDA Op Capex (excl. license payments) Lease payments (incl. interest and principal) Net financial costs (excl. lease payments) Net tax paid Movements in provisions Working capital (EBITDA and Capex) Other Equity Free Cash Flow before license payments License payments Equity Free Cash Flow 2Q21 EQUITY FREE CASH FLOW AND NET DEBT EQUITY FREE CASH FLOW GENERATION IN 2Q21 (USD million) -126 879 -67 -1 4 25 75 -12 63 -133 -505 LEVERAGE 2.4X GROSS DEBT $9.7bn NET DEBT $8.5bn stable QoQ +1.9% QoQ reported +2.2% QoQ reported • Total cash and undrawn committed credit lines of USD 2.8 billion • Average cost of debt 6.1%, down 30bps YoY, and average debt maturity 3.2 years (+0.4 years YoY) • Debt cost reflects blended rate of borrowings, mainly USD, RUB and PKR (USD cost 5.0%) • Jazz signed a 10-year PKR 50 billion (circa USD 320 million) syndicated credit facility during 2Q21

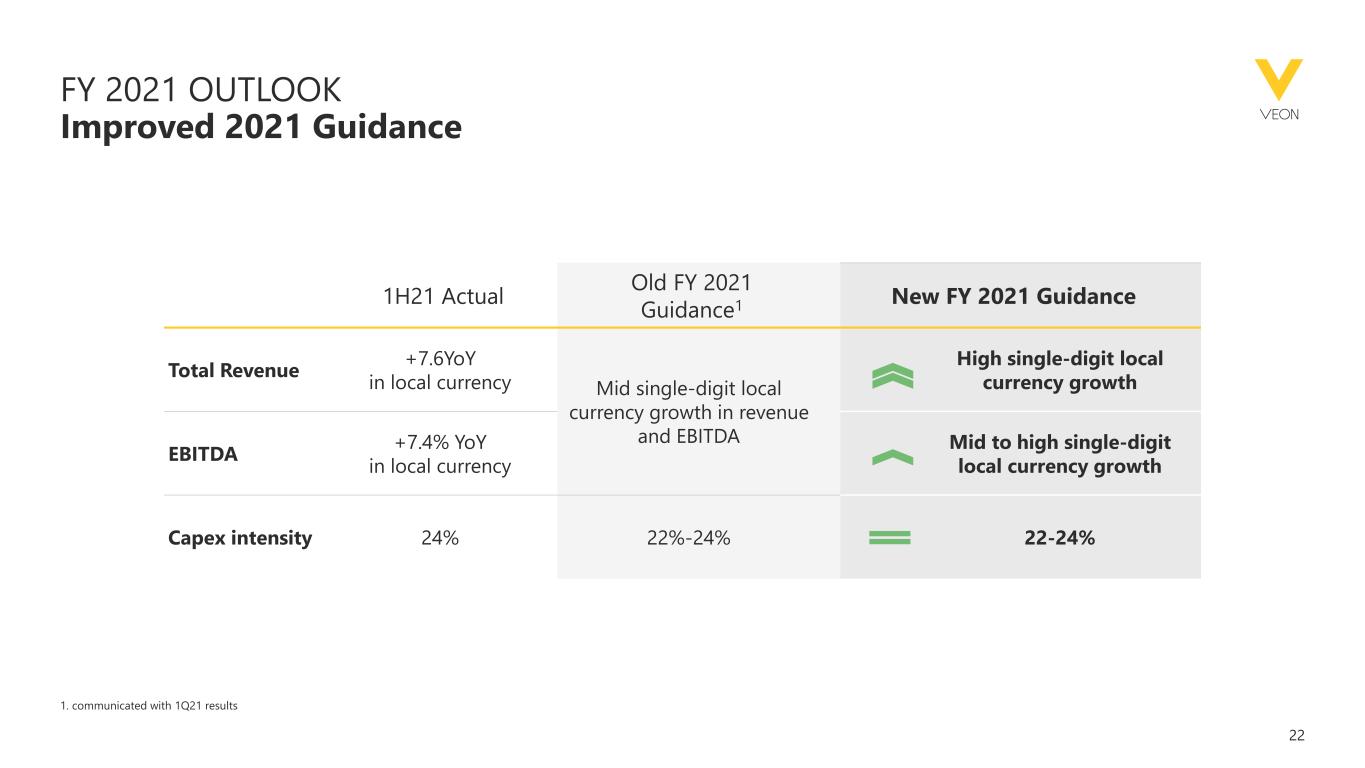

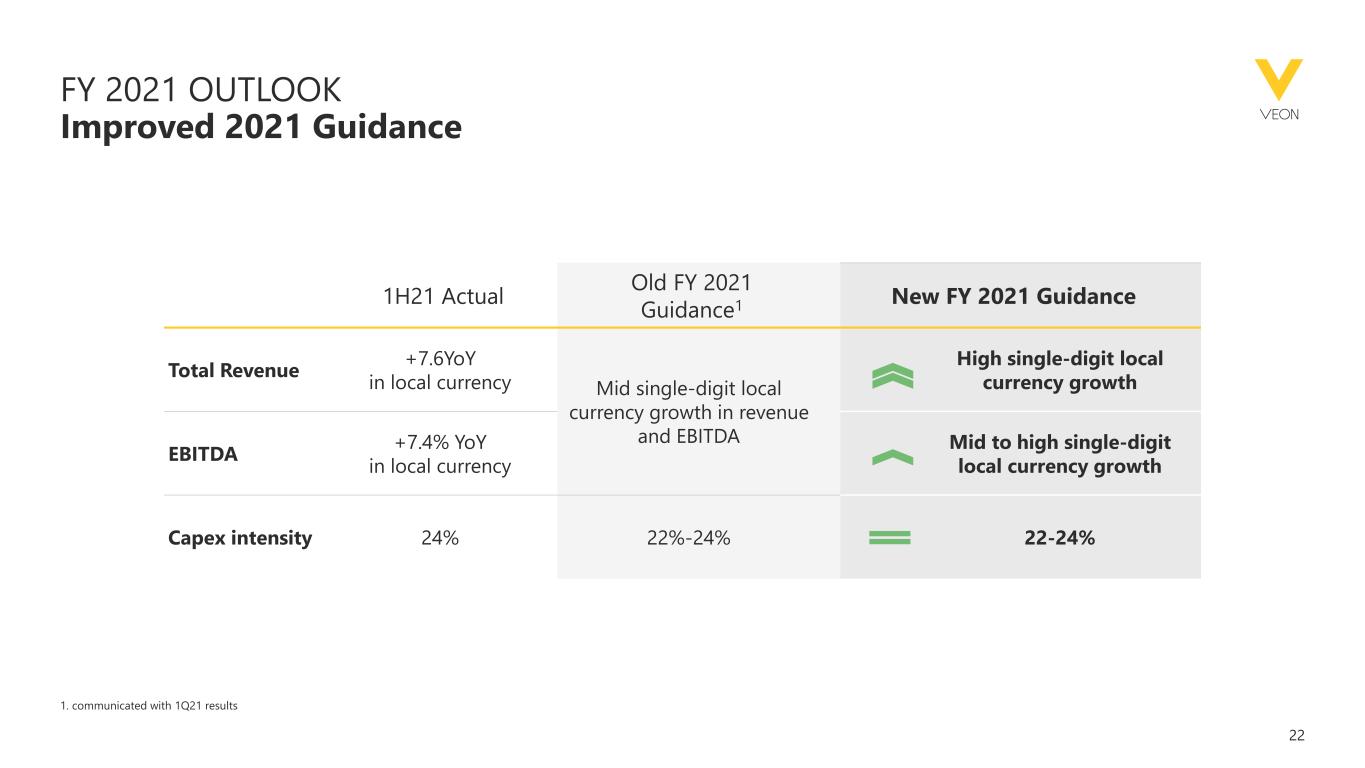

22 FY 2021 OUTLOOK Improved 2021 Guidance 1H21 Actual Old FY 2021 Guidance1 New FY 2021 Guidance Total Revenue +7.6YoY in local currency Mid single-digit local currency growth in revenue and EBITDA High single-digit local currency growth EBITDA +7.4% YoY in local currency Mid to high single-digit local currency growth Capex intensity 24% 22%-24% 22-24% 1. communicated with 1Q21 results

23 AGENDA 1. OPENING 2. HIGHLIGHTS & BUSINESS UPDATE Nik Kershaw Kaan Terzioğlu 4. CLOSING REMARKS Kaan Terzioğlu 3. 2Q21 FINANCIAL RESULTS Serkan Okandan

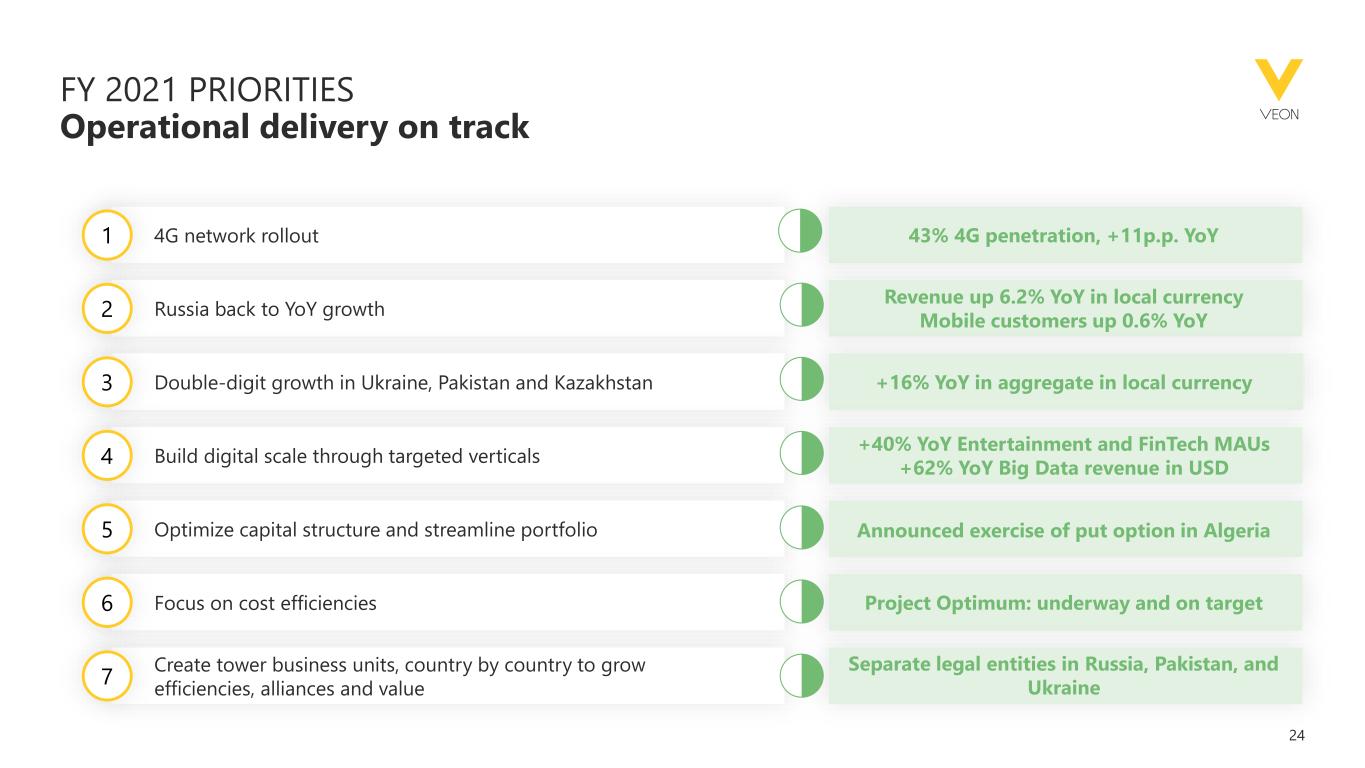

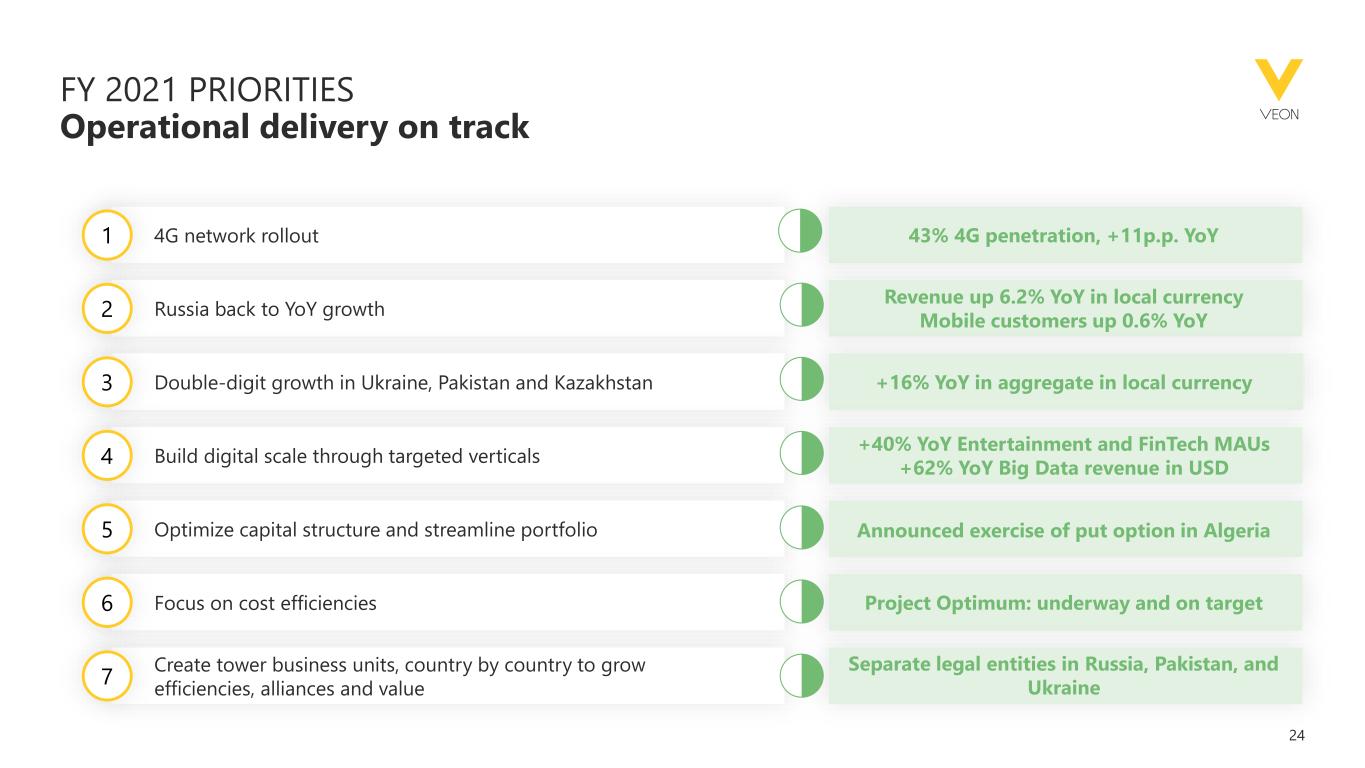

24 FY 2021 PRIORITIES Operational delivery on track 43% 4G penetration, +11p.p. YoY4G network rollout1 Revenue up 6.2% YoY in local currency Mobile customers up 0.6% YoY Russia back to YoY growth2 +16% YoY in aggregate in local currencyDouble-digit growth in Ukraine, Pakistan and Kazakhstan3 +40% YoY Entertainment and FinTech MAUs +62% YoY Big Data revenue in USD Build digital scale through targeted verticals4 Announced exercise of put option in AlgeriaOptimize capital structure and streamline portfolio5 Project Optimum: underway and on targetFocus on cost efficiencies6 Separate legal entities in Russia, Pakistan, and Ukraine Create tower business units, country by country to grow efficiencies, alliances and value 7

25 APPENDIX

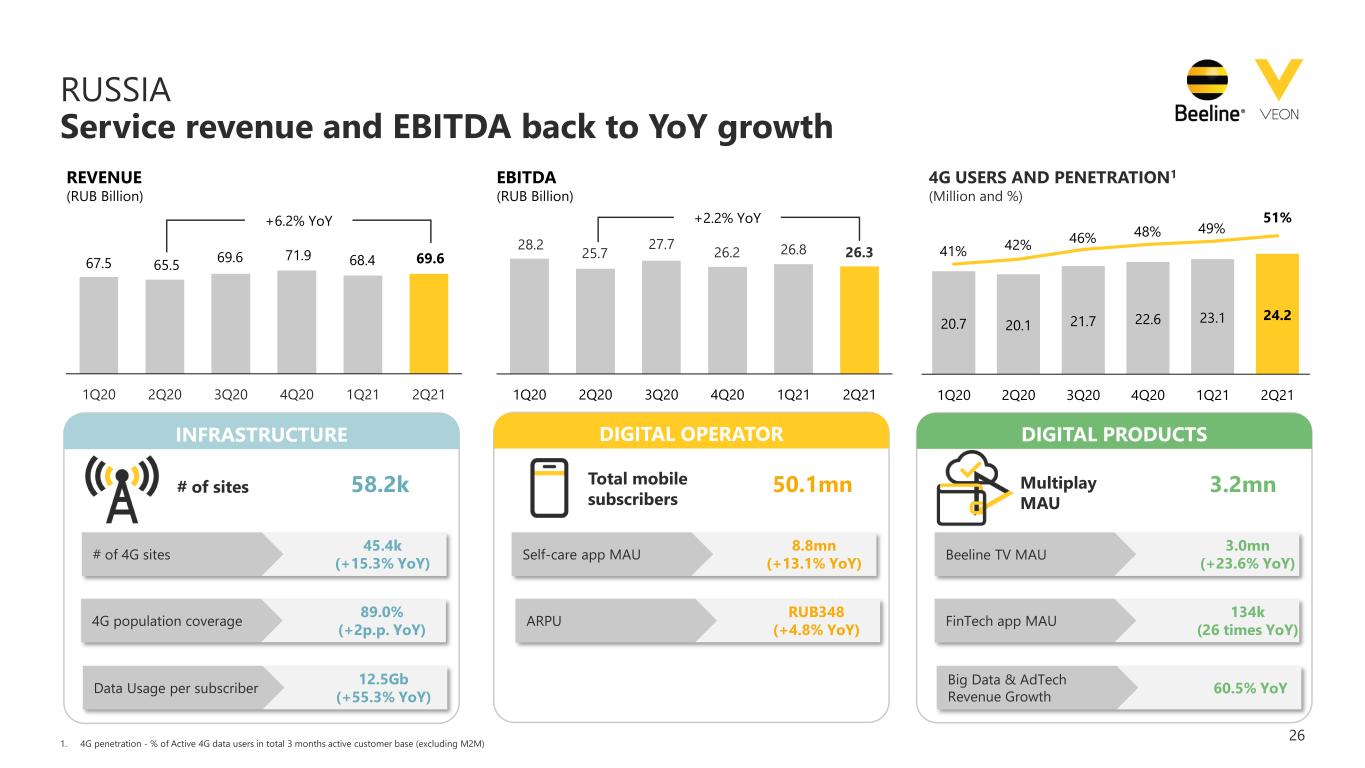

26 RUSSIA Service revenue and EBITDA back to YoY growth 1. 4G penetration - % of Active 4G data users in total 3 months active customer base (excluding M2M) 67.5 65.5 69.6 71.9 68.4 69.6 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 +6.2% YoY 28.2 25.7 27.7 26.2 26.8 26.3 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 +2.2% YoY REVENUE (RUB Billion) EBITDA (RUB Billion) 4G USERS AND PENETRATION1 (Million and %) 20.7 20.1 21.7 22.6 23.1 24.2 41% 42% 46% 48% 49% 51% 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 DIGITAL PRODUCTS Beeline TV MAU FinTech app MAU DIGITAL OPERATOR Self-care app MAU 8.8mn (+13.1% YoY) INFRASTRUCTURE # of 4G sites 45.4k (+15.3% YoY) 3.0mn (+23.6% YoY) 134k (26 times YoY) 4G population coverage ARPU 89.0% (+2p.p. YoY) RUB348 (+4.8% YoY) Data Usage per subscriber 12.5Gb (+55.3% YoY) Total mobile subscribers # of sites 58.2k 50.1mn Multiplay MAU 3.2mn Big Data & AdTech Revenue Growth 60.5% YoY

27 UKRAINE Continued strong growth in revenue and EBITDA REVENUE (UAH Billion) EBITDA (UAH Billion) 4G USERS AND PENETRATION (Million and %) DIGITAL PRODUCTS Kyivstar TV MAU FinTech app MAU DIGITAL OPERATOR Self-care app MAU 2.9mn (+91.4% YoY) INFRASTRUCTURE # of 4G sites 11.2k (+39.4% YoY) 426k (2.3x YoY) 426k (2.3x YoY) 4G population coverage ARPU 88.5% (+8p.p. YoY) UAH84 (16.4% YoY) Data Usage per subscriber 6.2Gb (+23.6% YoY) Total mobile subscribers # of sites 12.4k 25.9mn Multiplay MAU 305k Big Data & AdTech Revenue Growth 4.0x YoY +18.1% YoY +17.4% YoY 6.0 6.0 6.5 6.7 6.8 7.1 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 4.0 4.1 4.4 4.5 4.7 4.8 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 7.8 7.8 8.8 9.3 9.7 10.3 30% 31% 34% 36% 38% 40% 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21

28 PAKISTAN Healthy growth across all metrics 1. 3Q20 EBITDA was positively impacted by a reversal of a provision (PKR 8.6 billion) 2. Includes users who are active in more than one application +21.5% YoY +14.5% YoY REVENUE (PKR Billion) EBITDA1 (PKR Billion) 4G USERS AND PENETRATION (Million and %) DIGITAL PRODUCTS JazzCash MAU Entertainment apps MAU2 DIGITAL OPERATOR Self-care app MAU 8.7mn (+42.3% YoY) INFRASTRUCTURE # of 4G sites 11.9k (+16.2% YoY) 13.1mn (+61.4% YoY) 134k (26 times YoY) 4G population coverage ARPU 64.0% (+8p.p. YoY) PKR249 (+8.1% YoY) Data Usage per subscriber 4.8Gb (+36.3% YoY) Total mobile subscribers # of sites 13.8k 69.8mn Multiplay MAU 5.8mn 22.9 21.7 22.8 23.2 24.7 24.8 31.4 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 49.3 47.1 50.7 52.3 55.0 57.2 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 17.7 19.1 22.2 25.0 28.7 30.8 29% 30% 35% 38% 41% 44% 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21

29 KAZAKHSTAN Record levels of 4G penetration driving strong performance 1. 4Q20 EBITDA was positively impacted by tax incentive for radio frequencies (KZT 4.8 billion) +26.9% YoY +21.6% YoY REVENUE (KZT Billion) EBITDA1 (KZT Billion) 4G USERS AND PENETRATION (Million and %) DIGITAL PRODUCTS BeeTV MAU (mobile+fixed) FinTech MAU DIGITAL OPERATOR Self-care app MAU 2.3mn (+92.2% YoY) INFRASTRUCTURE # of 4G sites 4.9k (n.m. YoY) 399k (+49.6% YoY) 1.3mn (+3.6% YoY) 4G population coverage ARPU 78.5% (+6.4p.p. YoY) KZT1,659 (+23.7% YoY) Data Usage per subscriber 12.0Gb (+40.5% YoY) Total mobile subscribers # of sites 6.3k 9.6mn Multiplay MAU 251k Big Data & AdTech Revenue Growth 3.4x YoY 4.2 4.2 4.8 5.2 5.3 5.7 44% 44% 50% 54% 56% 59% 0% 10% 20% 30% 40% 50% 60% 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 24.6 25.3 26.9 27.7 27.7 30.832.5 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 46.0 46.4 50.9 54.5 53.7 58.9 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21

30 BANGLADESH Revenue and EBITDA growth enabled by superior digital capabilities +6.9% YoY +4.0% YoY REVENUE (BDT Billion) EBITDA (BDT Billion) 4G USERS AND PENETRATION (Million and %) DIGITAL PRODUCTS ShopUp B2B Gross Merchandise Value Toffee TV MAU DIGITAL OPERATOR Self-care app MAU 2.1mn (x2.1 YoY) INFRASTRUCTURE # of 4G sites 9.4k (+24.8% YoY) x10 YoY 5.0mn (5.8x YoY) 4G population coverage ARPU 68.1% (+15.7pp. YoY) BDT113 (+2.4% YoY) Data Usage per subscriber 3.5Gb (+43.7% YoY) Total mobile subscribers # of sites 10.0k 34.4mn Multiplay MAU 336k 11.6 11.1 11.5 11.4 11.4 11.8 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 5.0 4.6 5.1 4.6 4.7 4.8 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 5.4 5.9 7.0 8.0 9.0 9.9 16% 18% 21% 24% 26% 29% 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21

31 0.11 0.90 2.07 1.27 1.88 0.13 1.28 0.01 2021 2022 2023 2024 2025 2026 2027 2028 USD RUB PKR BDT EUR KZT UAH 54% 40% 6% 2% -3% 58% 31% 7% 3% 1% 49% 8% 12% 4% 8% 9% 5% 5% CASH CURRENCY MIX1 FINANCIAL RESULTS Group capital structure as at 30 June 2021 NET DEBT CURRENCY MIX (EXCLUDING LEASES AFTER HEDGING2) GROSS DEBT CURRENCY MIX (EXCLUDING LEASES) 1. Cash and cash equivalents include an amount of US$106 relating to banking operations in Pakistan 2. For Q2 2021 the amount of USD debt swapped to RUB amounted to USD 330 million USD 6.5bn USD 7.7bn USD 1.2bn TOTAL LIQUIDITY $2.8BN | 2Q21 COST OF CORPORATE DEBT 6.1%, 30 bps LOWER THAN 2Q20 LEGEND: USD RUB PKR BDT UAH DZD EUR OTHER Total Gross debt USD 9.7Bn Total Net debt USD 8.5Bn DEBT MATURITY SCHEDULE (USD Billion)

32 DEBT BY ENTITY1 1. Excluding lease liabilities 2. As of June 2021, some bank accounts forming part of a cash pooling program and being an integral part of VEON’s cash management remained overdrawn by USD 13 million. Even though the total balance of the cash pool remained positive, VEON has no legally enforceable right to set-off and therefore the overdrawn accounts are presented as financial liabilities and form part of our debt in our financial statements. 30 JUNE 2021 USD MILLION EQUIVALENT Outstanding debt Type of debt Entity Bonds Loans Cash-pool overdrafts2 and other Total VEON Holdings B.V. 4,843 1,935 - 6,778 Pakistan Mobile Communications Limited - 526 22 548 Private Joint Stock Company Kyivstar - 205 - 205 Banglalink Digital Communications Ltd. - 81 - 81 Other 10 23 13 46 Total 4,853 2,770 35 7,658 Total excl. HQ cash pool overdrafts 7,645

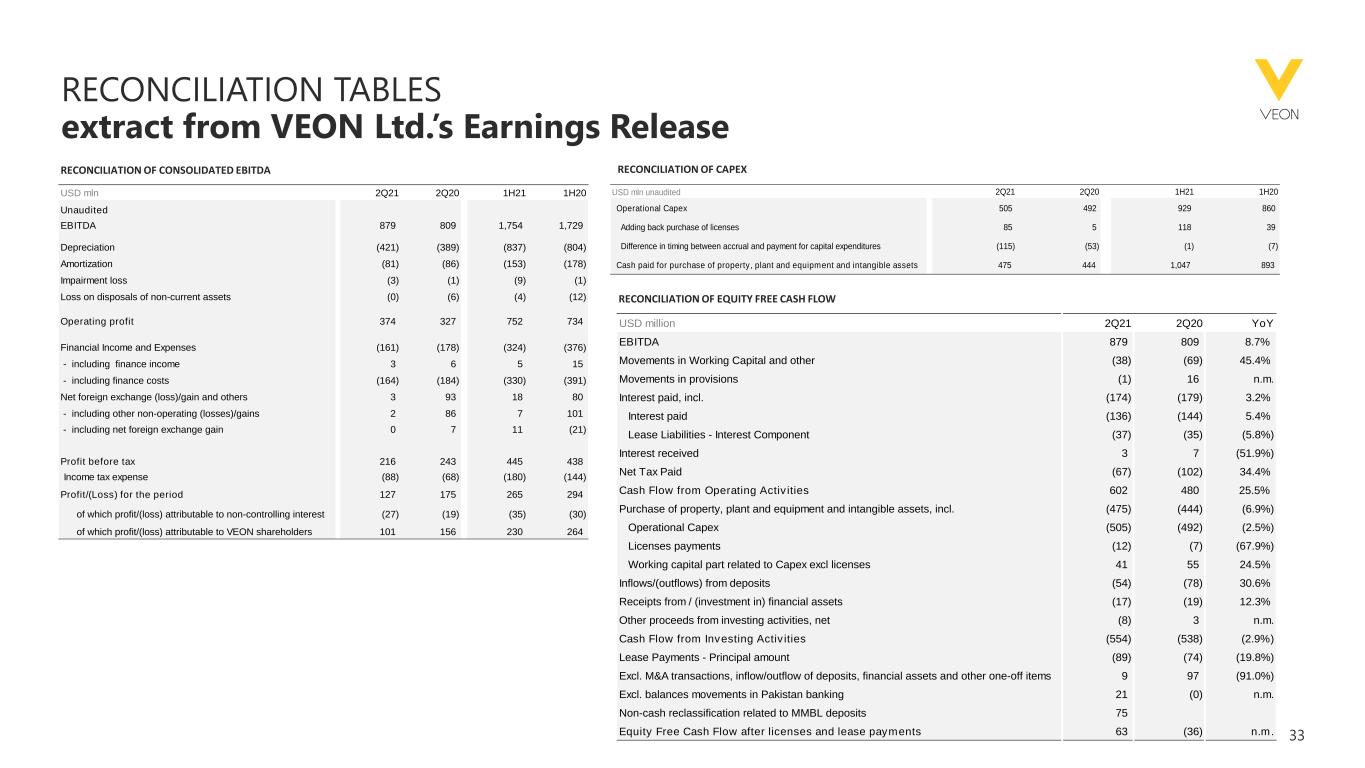

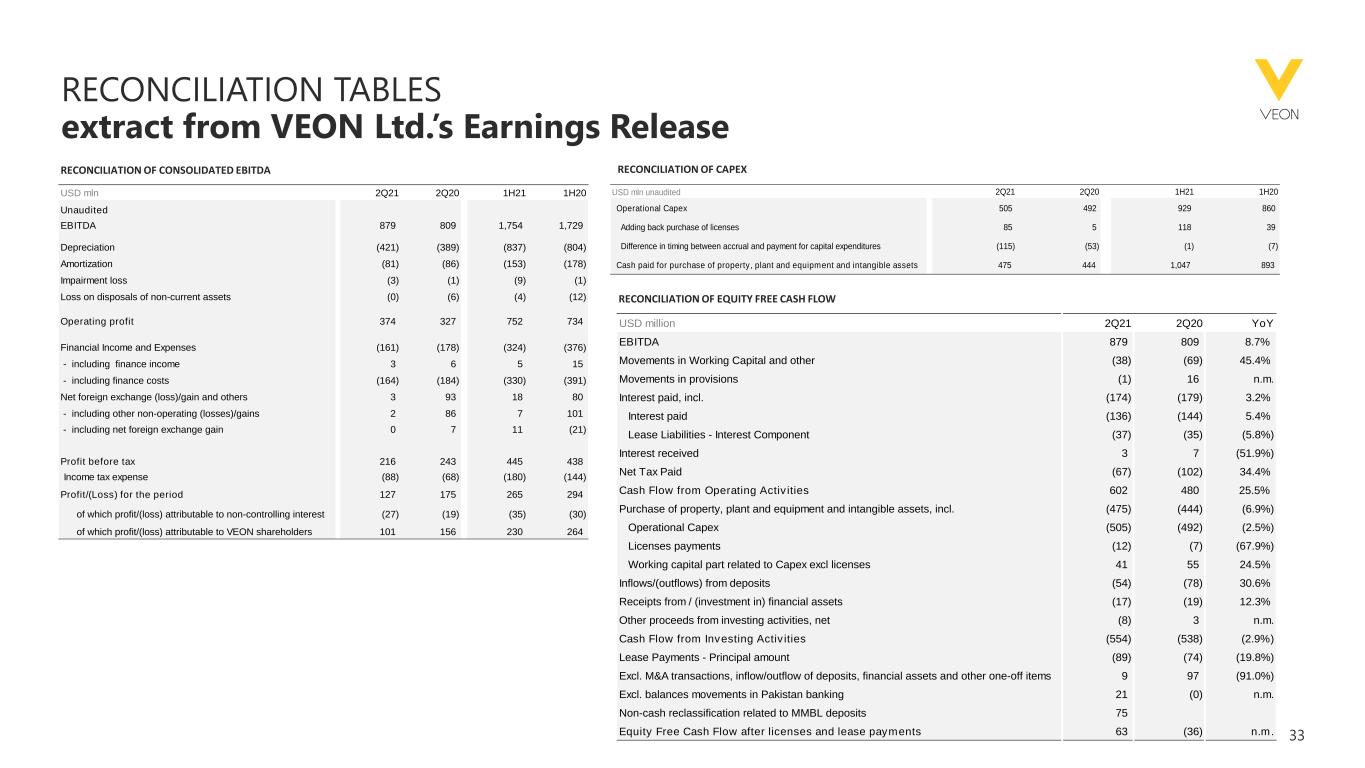

33 RECONCILIATION TABLES extract from VEON Ltd.’s Earnings Release RECONCILIATION OF CAPEX RECONCILIATION OF EQUITY FREE CASH FLOW RECONCILIATION OF CONSOLIDATED EBITDA USD mln unaudited 2Q21 2Q20 1H21 1H20 Operational Capex 505 492 929 860 Adding back purchase of licenses 85 5 118 39 Difference in timing between accrual and payment for capital expenditures (115) (53) (1) (7) Cash paid for purchase of property, plant and equipment and intangible assets 475 444 1,047 893 USD mln 2Q21 2Q20 1H21 1H20 Unaudited EBITDA 879 809 1,754 1,729 Depreciation (421) (389) (837) (804) Amortization (81) (86) (153) (178) Impairment loss (3) (1) (9) (1) Loss on disposals of non-current assets (0) (6) (4) (12) Operating profit 374 327 752 734 Financial Income and Expenses (161) (178) (324) (376) - including finance income 3 6 5 15 - including finance costs (164) (184) (330) (391) Net foreign exchange (loss)/gain and others 3 93 18 80 - including other non-operating (losses)/gains 2 86 7 101 - including net foreign exchange gain 0 7 11 (21) Profit before tax 216 243 445 438 Income tax expense (88) (68) (180) (144) Profit/(Loss) for the period 127 175 265 294 of which profit/(loss) attributable to non-controlling interest (27) (19) (35) (30) of which profit/(loss) attributable to VEON shareholders 101 156 230 264 USD million 2Q21 2Q20 YoY EBITDA 879 809 8.7% Movements in Working Capital and other (38) (69) 45.4% Movements in provisions (1) 16 n.m. Interest paid, incl. (174) (179) 3.2% Interest paid (136) (144) 5.4% Lease Liabilities - Interest Component (37) (35) (5.8%) Interest received 3 7 (51.9%) Net Tax Paid (67) (102) 34.4% Cash Flow from Operating Activities 602 480 25.5% Purchase of property, plant and equipment and intangible assets, incl. (475) (444) (6.9%) Operational Capex (505) (492) (2.5%) Licenses payments (12) (7) (67.9%) Working capital part related to Capex excl licenses 41 55 24.5% Inflows/(outflows) from deposits (54) (78) 30.6% Receipts from / (investment in) financial assets (17) (19) 12.3% Other proceeds from investing activities, net (8) 3 n.m. Cash Flow from Investing Activities (554) (538) (2.9%) Lease Payments - Principal amount (89) (74) (19.8%) Excl. M&A transactions, inflow/outflow of deposits, financial assets and other one-off items 9 97 (91.0%) Excl. balances movements in Pakistan banking 21 (0) n.m. Non-cash reclassification related to MMBL deposits 75 Equity Free Cash Flow after licenses and lease payments 63 (36) n.m.

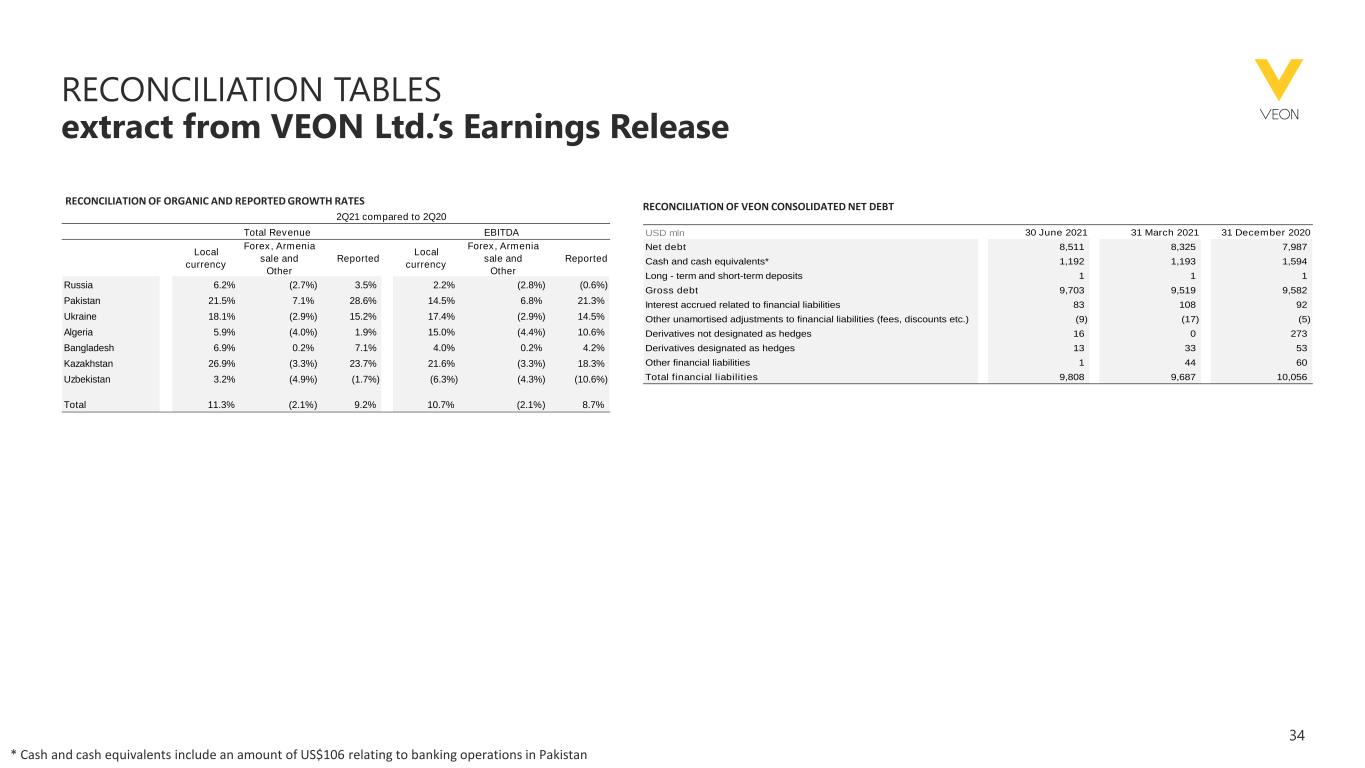

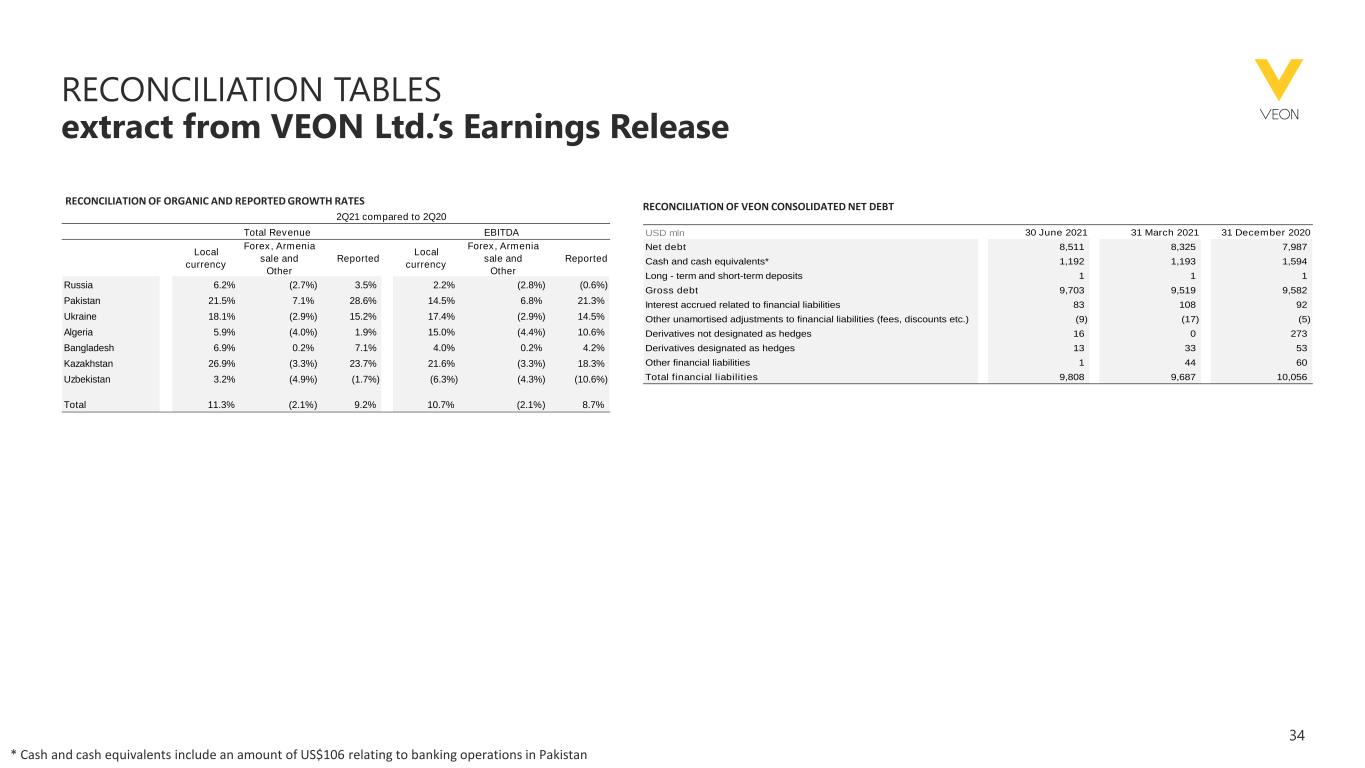

34 USD mln 30 June 2021 31 March 2021 31 December 2020 Net debt 8,511 8,325 7,987 Cash and cash equivalents* 1,192 1,193 1,594 Long - term and short-term deposits 1 1 1 Gross debt 9,703 9,519 9,582 Interest accrued related to financial liabilities 83 108 92 Other unamortised adjustments to financial liabilities (fees, discounts etc.) (9) (17) (5) Derivatives not designated as hedges 16 0 273 Derivatives designated as hedges 13 33 53 Other financial liabilities 1 44 60 Total financial liabilities 9,808 9,687 10,056 RECONCILIATION TABLES extract from VEON Ltd.’s Earnings Release RECONCILIATION OF VEON CONSOLIDATED NET DEBTRECONCILIATION OF ORGANIC AND REPORTED GROWTH RATES Local currency Forex, Armenia sale and Other Reported Local currency Forex, Armenia sale and Other Reported Russia 6.2% (2.7%) 3.5% 2.2% (2.8%) (0.6%) Pakistan 21.5% 7.1% 28.6% 14.5% 6.8% 21.3% Ukraine 18.1% (2.9%) 15.2% 17.4% (2.9%) 14.5% Algeria 5.9% (4.0%) 1.9% 15.0% (4.4%) 10.6% Bangladesh 6.9% 0.2% 7.1% 4.0% 0.2% 4.2% Kazakhstan 26.9% (3.3%) 23.7% 21.6% (3.3%) 18.3% Uzbekistan 3.2% (4.9%) (1.7%) (6.3%) (4.3%) (10.6%) Total 11.3% (2.1%) 9.2% 10.7% (2.1%) 8.7% Total Revenue EBITDA 2Q21 compared to 2Q20 * Cash and cash equivalents include an amount of US$106 relating to banking operations in Pakistan

35 MAIN DEFINITIONS Capital expenditures (capex) are purchases of new equipment, new construction, upgrades, licenses, software, other long-lived assets and related reasonable costs incurred prior to intended use of the non-current asset, accounted at the earliest event of advance payment or delivery. Long-lived assets acquired in business combinations, are not included in capital expenditures. Operational capital expenditures (operational capex) calculated as capex, excluding purchases of new spectrum licenses and capitalised leases. Capex intensity is a ratio, which is calculated as LTM operational capex divided by LTM revenue. EBITDA (called Adjusted EBITDA in the Form 20-F published by VEON) is a non-IFRS financial measure. VEON calculates Adjusted EBITDA as (loss)/profit before interest, tax, depreciation, amortization, impairment, gain / loss on disposals of non-current assets, other non-operating gains / losses and share of profit / loss of joint ventures and associates Our Adjusted EBITDA may be used to evaluate our performance against other telecommunications companies that provide EBITDA. Additionally, a limitation of EBITDA’s use as a performance measure is that it does not reflect the periodic costs of certain capitalized tangible and intangible assets used in generating revenue or the need to replace capital equipment over time. Reconciliation of EBITDA to net income attributable to VEON Ltd., the most directly comparable IFRS financial measure, is presented in the reconciliation tables section in Attachment C below. EBITDA margin is calculated as EBITDA divided by total revenue, expressed as a percentage. Gross Debt is calculated as the sum of long-term notional debt and short-term notional debt including capitalised leases. Net debt is a non-IFRS financial measure and is calculated as the sum of interest bearing long-term debt including capitalised leases and short-term notional debt minus cash and cash equivalents, long-term and short-term deposits. The Company believes that net debt provides useful information to investors because it shows the amount of notional debt outstanding to be paid after using available cash and cash equivalents and long-term and short-term deposits. Net debt should not be considered in isolation as an alternative to long-term debt and short-term debt, or any other measure of the Company financial position. Net debt excluding lease obligations is a net debt less capitalised leases. Equity free cash flow - is a non-IFRS measure and is defined as free cash flow from operating activities less cash flow used in investing activities, after license payments and lease payments (principal amount); excluding balance movements in Pakistan banking, excluding M&A transactions, inflow/outflow of deposits, financial assets and other one-off items. Reconciliation to the most directly comparable IFRS financial measure, is presented in the reconciliation tables section in Attachment C below. Mobile customers are generally customers in the registered customer base as at a given measurement date who engaged in a mobile revenue generating activity at any time during the three months prior to such measurement date. Such activity includes any outgoing calls, customer fee accruals, debits related to service, outgoing SMS and MMS, data transmission and receipt sessions, but does not include incoming calls, SMS and MMS or abandoned calls. Our total number of mobile customers also includes customers using mobile internet service via USB modems and fixed-mobile convergence (“FMC”). Double play customers – are mobile customers who engaged in usage of our voice and data services over 4G (LTE) technology at any time during the one month prior to such measurement date; Multiplay customers – are double play customers who also engaged in usage of one or more of our digital products at any time during the one month prior to such measurement date. Local currency trends (growth/decline) in revenue and EBITDA are non-IFRS financial measures that reflect changes in Revenue and EBITDA, excluding foreign currency movements and other factors, such as businesses under liquidation, disposals, mergers and acquisitions. For other factors please refer to section “non-recurring items that affect year-on-year comparisons”. All non-IFRS measures disclosed in this presentation (including, without limitation, EBITDA, Operational Capex, net debt, equity free cash flow, local currency growth) are being defined and reconciled to comparable IFRS measures in VEON Ltd.’s earnings release published on its website on the date hereof.