VEON Average and closing rates of functional currencies to USD Index sheet Consolidated VEON 4Q21 4Q20 YoY 4Q21 4Q20 YoY Consolidated VEON Russian Ruble RUB 72.61 76.22 4.7% 74.29 73.88 -0.6% Customers Euro EUR 0.87 0.84 -4.3% 0.88 0.82 -7.4% Russia Algerian Dinar DZD 138.16 129.72 -6.5% 138.81 132.08 -5.1% Pakistan Pakistan Rupee PKR 174.52 160.72 -8.6% 176.80 160.19 -10.4% Algeria Bangladeshi Taka BDT 85.73 84.78 -1.1% 86.09 84.69 -1.7% Bangladesh Ukrainian Hryvnia UAH 26.68 28.27 5.6% 27.28 28.27 3.5% Ukraine Kazakh Tenge KZT 430.01 426.18 -0.9% 431.67 420.71 -2.6% Uzbekistan Uzbekistan Som UZS 10,742.07 10,397.82 -3.3% 10,837.66 10,476.92 -3.4% Armenian Dram AMD 480.70 503.51 4.5% 477.97 522.59 8.5% Kyrgyz Som KGS 84.79 82.65 -2.6% 84.76 82.65 -2.6% Georgian Lari GEL 3.13 3.27 4.4% 3.10 3.28 5.5% Average rates Closing rates

VEON index page (in USD millions, unless stated otherwise, unaudited) Consolidated* 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 Pro-forma Warid FY17 FY18 FY19 IFRS 16 FY19** FY20 FY21 Total revenue 1,912 1,731 1,820 1,828 1,830 1,902 2,005 2,052 9,040 9,474 9,086 8,089 8,089 7,291 7,788 Service revenue 1,794 1,636 1,683 1,673 1,694 1,764 1,825 1,864 8,700 9,105 8,526 7,472 7,472 6,786 7,147 EBITDA 839 744 819 748 808 808 889 827 3,268 3,587 3,273 3,861 510 3,351 3,151 3,332 EBITDA margin (%) 43.9% 43.0% 45.0% 40.9% 44.1% 42.5% 44.4% 40.3% 36.1% 37.9% 36.0% 47.7% 41.4% 43.2% 42.8% EBIT 372 306 (402) 235 359 355 413 417 1,063 1,467 554 1,865 71 1,794 511 1,544 Profit/(Loss) before tax 164 226 (565) 94 212 205 238 253 316 328 (248) 1,044 (106) 1,149 (82) 909 Net income/(loss) attributavle to VEON shareholders 108 156 (620) 8 129 101 145 299 2,294 (506) 581 622 (85) 707 (349) 674 CAPEX 353 469 328 644 392 487 381 566 1,623 1,460 1,415 1,715 1,715 1,794 1,826 CAPEX / LTM Total revenue 21.3% 23.1% 24.5% 24.6% 25.4% 25.1% 25.2% 23.4% 18.0% 15.4% 15.6% 21.2% 21.2% 24.6% 23.4% Equity Free Cash Flow (after licenses) 110 (49) 239 (64) (18) 29 308 14 235 334 *Notes: For definitions please see VEON Ltd.’s earnings release published on its website on the date hereof * Prior year comparatives restated for two previous years from the last year reported in this factbook ** Pre-IFRS16 values (values before adjustments related to IFRS16)

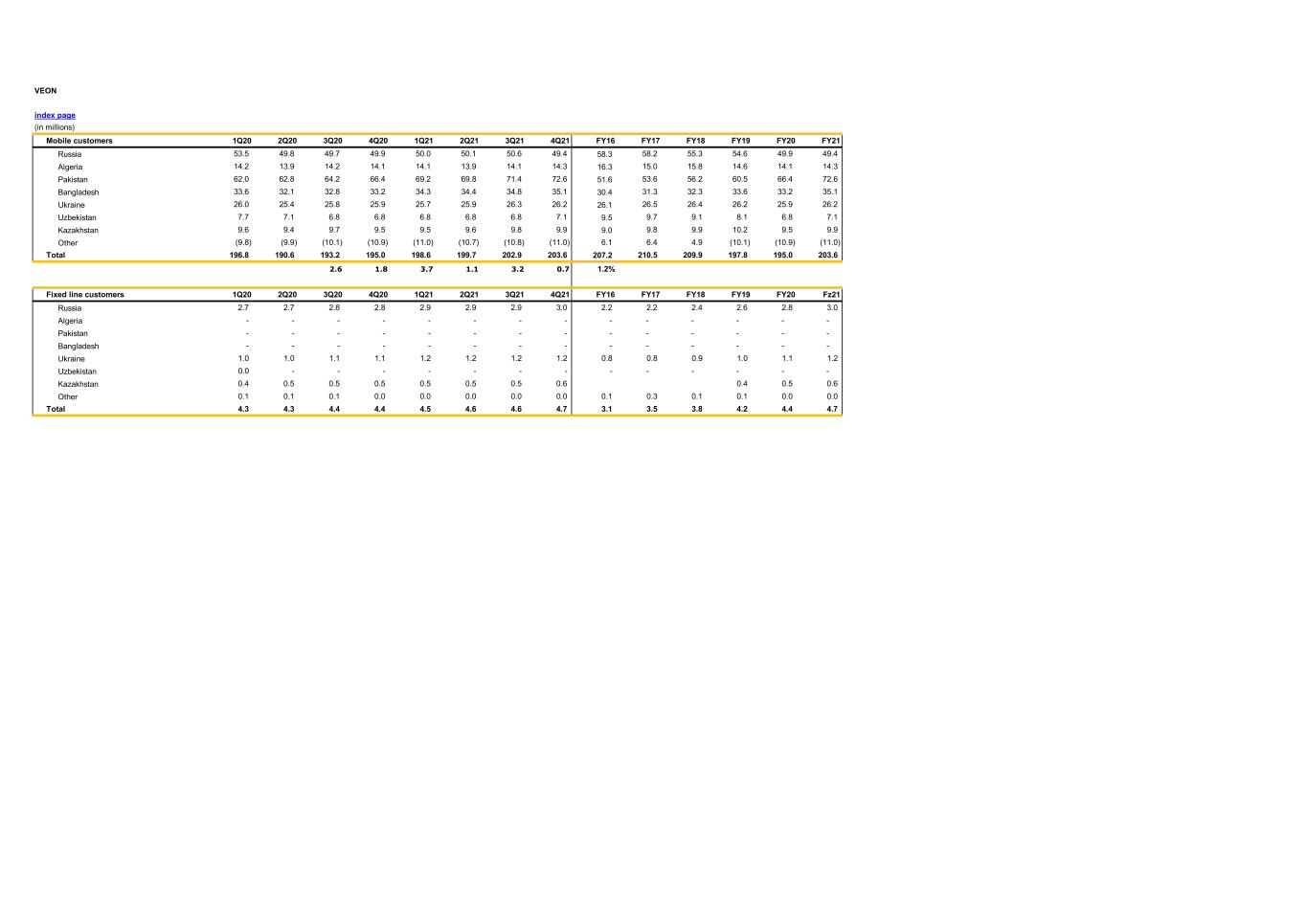

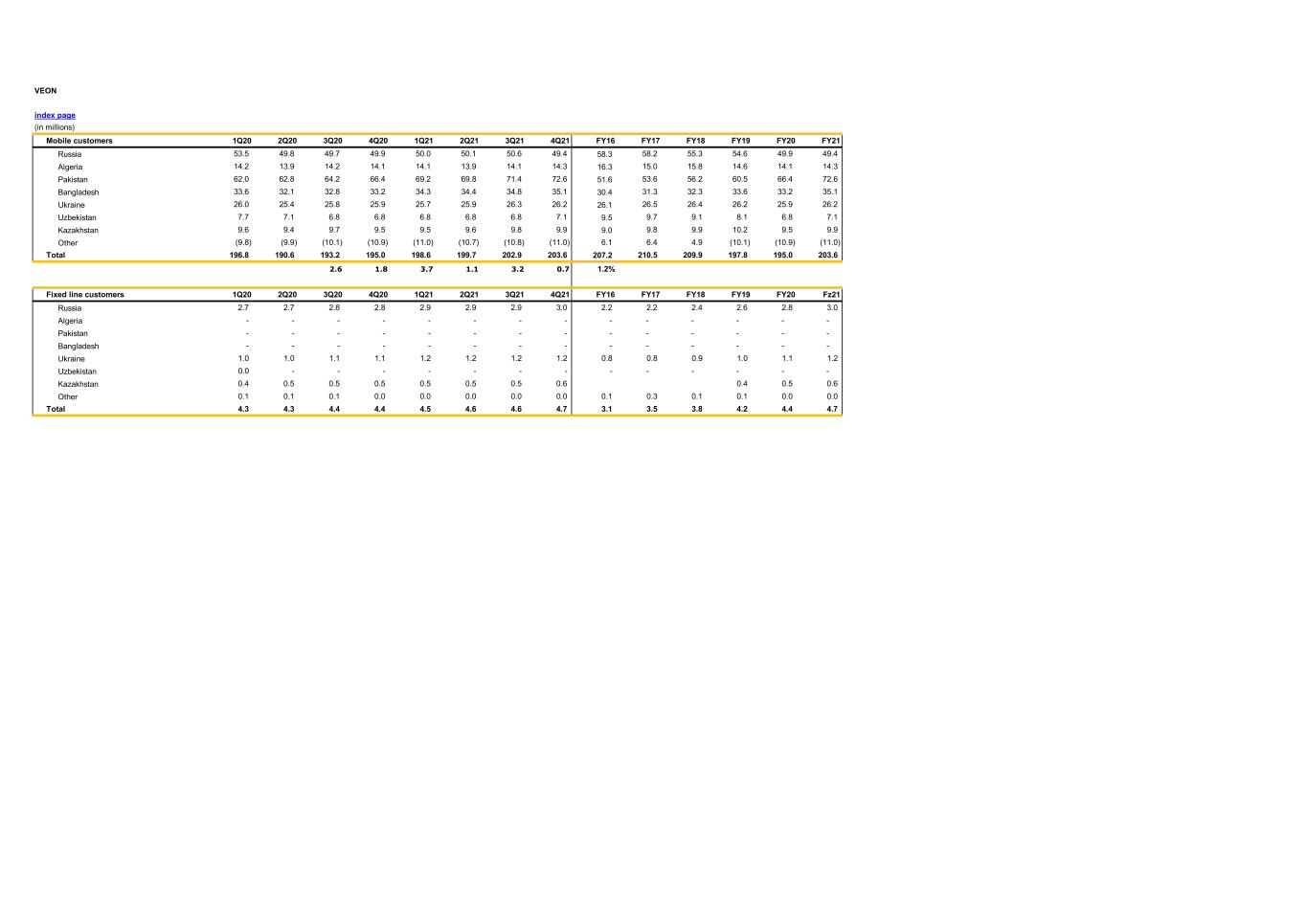

VEON index page (in millions) Mobile customers 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 FY20 FY21 Russia 53.5 49.8 49.7 49.9 50.0 50.1 50.6 49.4 58.3 58.2 55.3 54.6 49.9 49.4 Algeria 14.2 13.9 14.2 14.1 14.1 13.9 14.1 14.3 16.3 15.0 15.8 14.6 14.1 14.3 Pakistan 62.0 62.8 64.2 66.4 69.2 69.8 71.4 72.6 51.6 53.6 56.2 60.5 66.4 72.6 Bangladesh 33.6 32.1 32.8 33.2 34.3 34.4 34.8 35.1 30.4 31.3 32.3 33.6 33.2 35.1 Ukraine 26.0 25.4 25.8 25.9 25.7 25.9 26.3 26.2 26.1 26.5 26.4 26.2 25.9 26.2 Uzbekistan 7.7 7.1 6.8 6.8 6.8 6.8 6.8 7.1 9.5 9.7 9.1 8.1 6.8 7.1 Kazakhstan 9.6 9.4 9.7 9.5 9.5 9.6 9.8 9.9 9.0 9.8 9.9 10.2 9.5 9.9 Other (9.8) (9.9) (10.1) (10.9) (11.0) (10.7) (10.8) (11.0) 6.1 6.4 4.9 (10.1) (10.9) (11.0) Total 196.8 190.6 193.2 195.0 198.6 199.7 202.9 203.6 207.2 210.5 209.9 197.8 195.0 203.6 2.6 1.8 3.7 1.1 3.2 0.7 1.2% Fixed line customers 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 FY20 Fz21 Russia 2.7 2.7 2.8 2.8 2.9 2.9 2.9 3.0 2.2 2.2 2.4 2.6 2.8 3.0 Algeria - - - - - - - - - - - - - - Pakistan - - - - - - - - - - - - - - Bangladesh - - - - - - - - - - - - - - Ukraine 1.0 1.0 1.1 1.1 1.2 1.2 1.2 1.2 0.8 0.8 0.9 1.0 1.1 1.2 Uzbekistan 0.0 - - - - - - - - - - - - - Kazakhstan 0.4 0.5 0.5 0.5 0.5 0.5 0.5 0.6 0.4 0.5 0.6 Other 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.1 0.3 0.1 0.1 0.0 0.0 Total 4.3 4.3 4.4 4.4 4.5 4.6 4.6 4.7 3.1 3.5 3.8 4.2 4.4 4.7

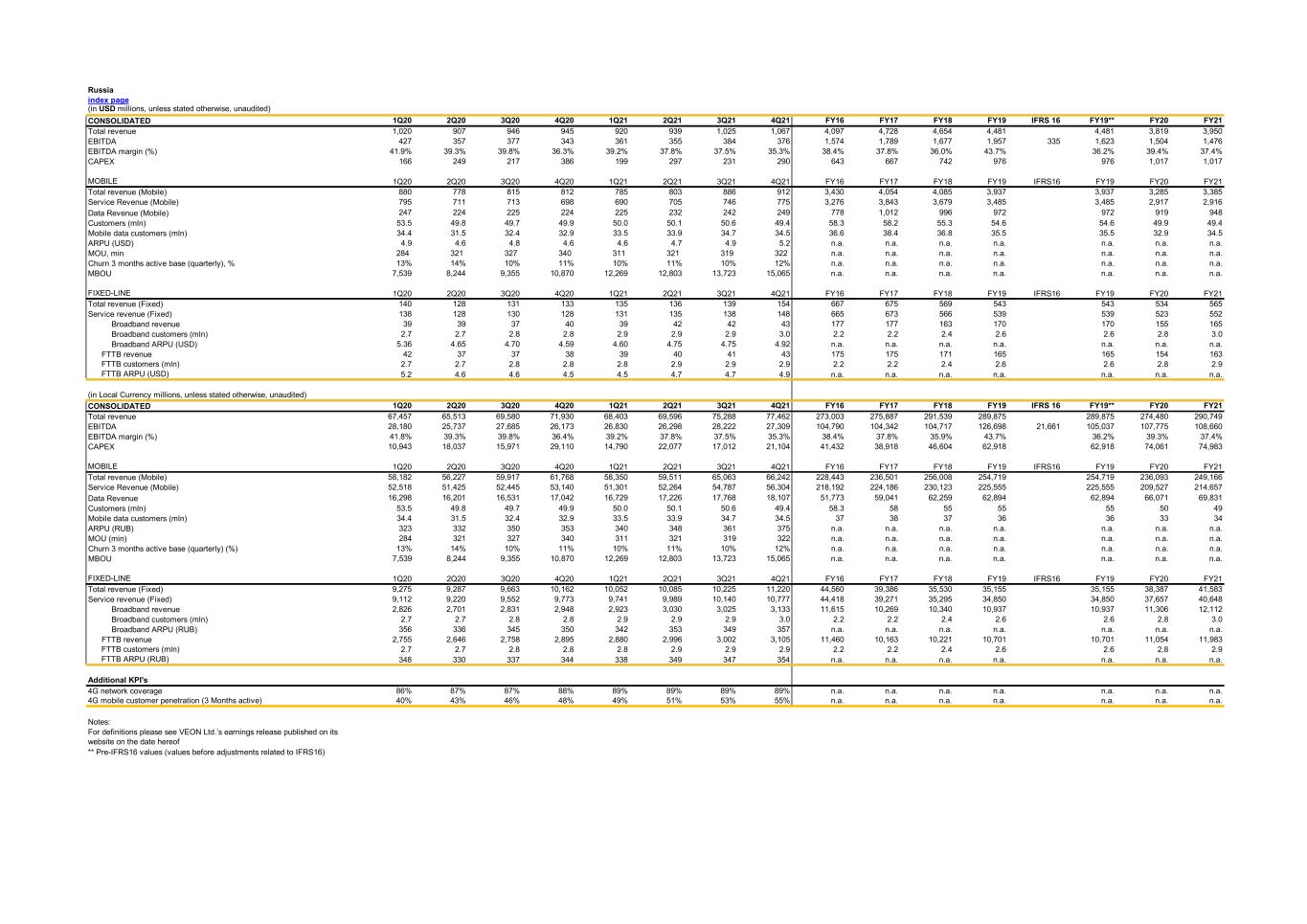

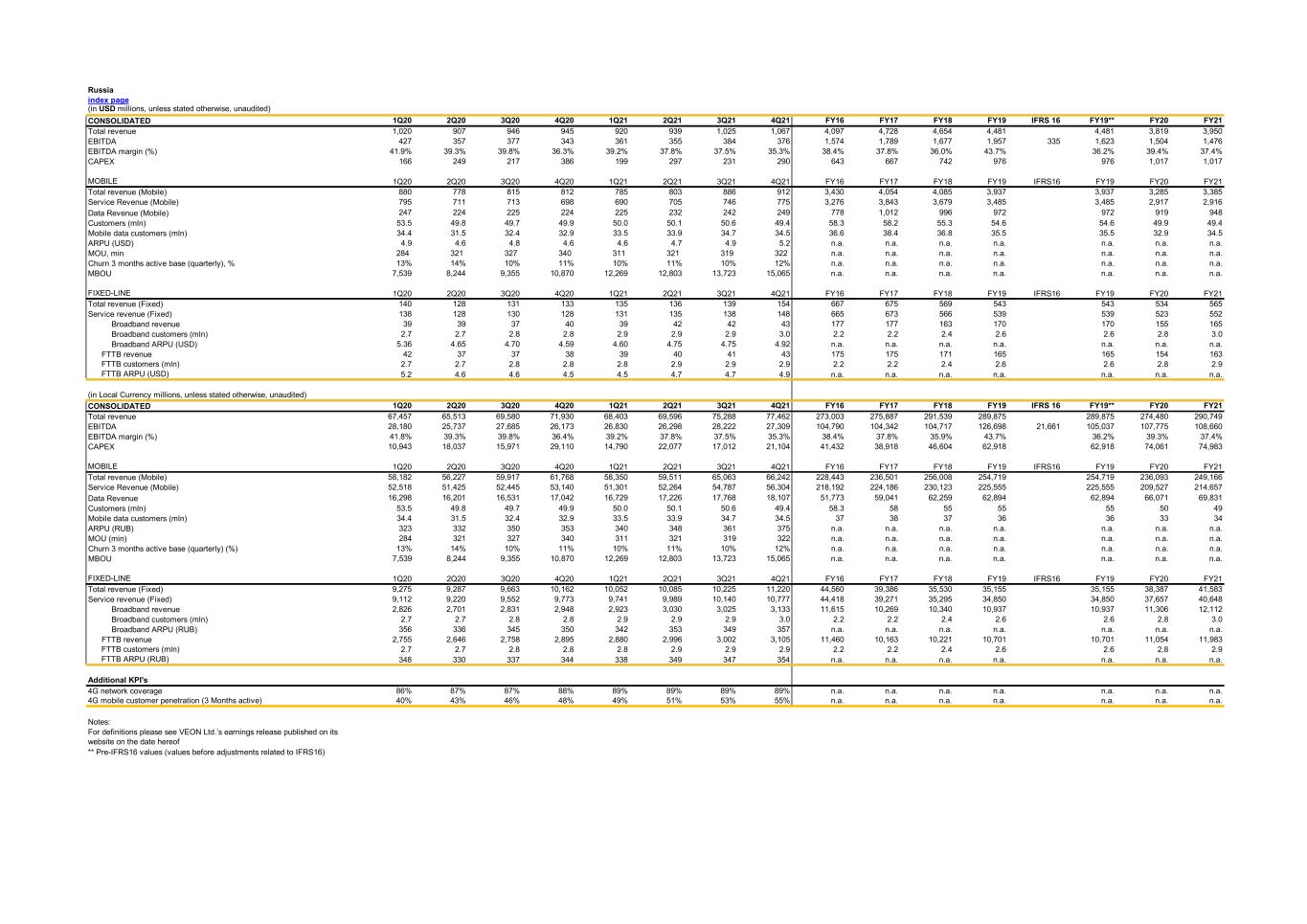

Russia index page (in USD millions, unless stated otherwise, unaudited) CONSOLIDATED 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS 16 FY19** FY20 FY21 Total revenue 1,020 907 946 945 920 939 1,025 1,067 4,097 4,728 4,654 4,481 4,481 3,819 3,950 EBITDA 427 357 377 343 361 355 384 376 1,574 1,789 1,677 1,957 335 1,623 1,504 1,476 EBITDA margin (%) 41.9% 39.3% 39.8% 36.3% 39.2% 37.8% 37.5% 35.3% 38.4% 37.8% 36.0% 43.7% 36.2% 39.4% 37.4% CAPEX 166 249 217 386 199 297 231 290 643 667 742 976 976 1,017 1,017 MOBILE 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS16 FY19 FY20 FY21 Total revenue (Mobile) 880 778 815 812 785 803 886 912 3,430 4,054 4,085 3,937 3,937 3,285 3,385 Service Revenue (Mobile) 795 711 713 698 690 705 746 775 3,276 3,843 3,679 3,485 3,485 2,917 2,916 Data Revenue (Mobile) 247 224 225 224 225 232 242 249 778 1,012 996 972 972 919 948 Customers (mln) 53.5 49.8 49.7 49.9 50.0 50.1 50.6 49.4 58.3 58.2 55.3 54.6 54.6 49.9 49.4 Mobile data customers (mln) 34.4 31.5 32.4 32.9 33.5 33.9 34.7 34.5 36.6 38.4 36.8 35.5 35.5 32.9 34.5 ARPU (USD) 4.9 4.6 4.8 4.6 4.6 4.7 4.9 5.2 n.a. n.a. n.a. n.a. n.a. n.a. n.a. MOU, min 284 321 327 340 311 321 319 322 n.a. n.a. n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly), % 13% 14% 10% 11% 10% 11% 10% 12% n.a. n.a. n.a. n.a. n.a. n.a. n.a. MBOU 7,539 8,244 9,355 10,870 12,269 12,803 13,723 15,065 n.a. n.a. n.a. n.a. n.a. n.a. n.a. FIXED-LINE 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS16 FY19 FY20 FY21 Total revenue (Fixed) 140 128 131 133 135 136 139 154 667 675 569 543 543 534 565 Service revenue (Fixed) 138 128 130 128 131 135 138 148 665 673 566 539 539 523 552 Broadband revenue 39 39 37 40 39 42 42 43 177 177 163 170 170 155 165 Broadband customers (mln) 2.7 2.7 2.8 2.8 2.9 2.9 2.9 3.0 2.2 2.2 2.4 2.6 2.6 2.8 3.0 Broadband ARPU (USD) 5.36 4.65 4.70 4.59 4.60 4.75 4.75 4.92 n.a. n.a. n.a. n.a. n.a. n.a. n.a. FTTB revenue 42 37 37 38 39 40 41 43 175 175 171 165 165 154 163 FTTB customers (mln) 2.7 2.7 2.8 2.8 2.8 2.9 2.9 2.9 2.2 2.2 2.4 2.6 2.6 2.8 2.9 FTTB ARPU (USD) 5.2 4.6 4.6 4.5 4.5 4.7 4.7 4.9 n.a. n.a. n.a. n.a. n.a. n.a. n.a. (in Local Currency millions, unless stated otherwise, unaudited) CONSOLIDATED 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS 16 FY19** FY20 FY21 Total revenue 67,457 65,513 69,580 71,930 68,403 69,596 75,288 77,462 273,003 275,887 291,539 289,875 289,875 274,480 290,749 EBITDA 28,180 25,737 27,685 26,173 26,830 26,298 28,222 27,309 104,790 104,342 104,717 126,698 21,661 105,037 107,775 108,660 EBITDA margin (%) 41.8% 39.3% 39.8% 36.4% 39.2% 37.8% 37.5% 35.3% 38.4% 37.8% 35.9% 43.7% 36.2% 39.3% 37.4% CAPEX 10,943 18,037 15,971 29,110 14,790 22,077 17,012 21,104 41,432 38,918 46,604 62,918 62,918 74,061 74,983 MOBILE 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS16 FY19 FY20 FY21 Total revenue (Mobile) 58,182 56,227 59,917 61,768 58,350 59,511 65,063 66,242 228,443 236,501 256,008 254,719 254,719 236,093 249,166 Service Revenue (Mobile) 52,518 51,425 52,445 53,140 51,301 52,264 54,787 56,304 218,192 224,186 230,123 225,555 225,555 209,527 214,657 Data Revenue 16,298 16,201 16,531 17,042 16,729 17,226 17,768 18,107 51,773 59,041 62,259 62,894 62,894 66,071 69,831 Customers (mln) 53.5 49.8 49.7 49.9 50.0 50.1 50.6 49.4 58.3 58 55 55 55 50 49 Mobile data customers (mln) 34.4 31.5 32.4 32.9 33.5 33.9 34.7 34.5 37 38 37 36 36 33 34 ARPU (RUB) 323 332 350 353 340 348 361 375 n.a. n.a. n.a. n.a. n.a. n.a. n.a. MOU (min) 284 321 327 340 311 321 319 322 n.a. n.a. n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 13% 14% 10% 11% 10% 11% 10% 12% n.a. n.a. n.a. n.a. n.a. n.a. n.a. MBOU 7,539 8,244 9,355 10,870 12,269 12,803 13,723 15,065 n.a. n.a. n.a. n.a. n.a. n.a. n.a. FIXED-LINE 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS16 FY19 FY20 FY21 Total revenue (Fixed) 9,275 9,287 9,663 10,162 10,052 10,085 10,225 11,220 44,560 39,386 35,530 35,155 35,155 38,387 41,583 Service revenue (Fixed) 9,112 9,220 9,552 9,773 9,741 9,989 10,140 10,777 44,418 39,271 35,295 34,850 34,850 37,657 40,648 Broadband revenue 2,826 2,701 2,831 2,948 2,923 3,030 3,025 3,133 11,615 10,269 10,340 10,937 10,937 11,306 12,112 Broadband customers (mln) 2.7 2.7 2.8 2.8 2.9 2.9 2.9 3.0 2.2 2.2 2.4 2.6 2.6 2.8 3.0 Broadband ARPU (RUB) 356 336 345 350 342 353 349 357 n.a. n.a. n.a. n.a. n.a. n.a. n.a. FTTB revenue 2,755 2,646 2,758 2,895 2,880 2,996 3,002 3,105 11,460 10,163 10,221 10,701 10,701 11,054 11,983 FTTB customers (mln) 2.7 2.7 2.8 2.8 2.8 2.9 2.9 2.9 2.2 2.2 2.4 2.6 2.6 2.8 2.9 FTTB ARPU (RUB) 348 330 337 344 338 349 347 354 n.a. n.a. n.a. n.a. n.a. n.a. n.a. Additional KPI's 4G network coverage 86% 87% 87% 88% 89% 89% 89% 89% n.a. n.a. n.a. n.a. n.a. n.a. n.a. 4G mobile customer penetration (3 Months active) 40% 43% 46% 48% 49% 51% 53% 55% n.a. n.a. n.a. n.a. n.a. n.a. n.a. Notes: For definitions please see VEON Ltd.’s earnings release published on its website on the date hereof ** Pre-IFRS16 values (values before adjustments related to IFRS16)

Pakistan index page (in USD millions, unless stated otherwise, unaudited) MOBILE 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS 16 FY19** FY20 FY21 Total revenue 316 288 303 325 347 370 349 341 1,450 1,525 1,494 1,320 1,320 1,233 1,408 Service revenue 293 266 278 297 318 340 320 307 1,364 1,418 1,391 1,228 1,228 1,134 1,285 EBITDA 147 133 188 144 156 161 173 153 542 703 713 669 47 622 612 643 EBITDA margin (%) 46.4% 46.1% 62.1% 44.4% 44.9% 43.5% 49.5% 44.8% 37.4% 46.1% 47.7% 50.7% 47.2% 49.7% 45.7% CAPEX 68 85 20 76 92 89 58 79 246 240 199 213 213 249 318 Data Revenue 102.2 97.8 107.3 119.0 129.0 135.7 137.2 132.4 167.9 225 311 370 370 426 534 Customers (mln) 62.0 62.8 64.2 66.4 69.2 69.8 71.4 72.6 51.6 53.6 56.2 60.5 60.5 66.4 72.6 ARPU (USD) 1.6 1.4 1.4 1.5 1.6 1.6 1.5 1.4 n.a. n.a. n.a. n.a. n.a. n.a. n.a. MOU (min) 500 475 469 472 464 450 431 437 n.a. n.a. n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 4.1% 3.6% 4.3% 5.0% 3.8% 5.4% 4.6% 5.1% n.a. n.a. n.a. n.a. n.a. n.a. n.a. MBOU 3,027 3,624 3,941 4,268 4,539 4,940 5,064 4,815 n.a. n.a. n.a. n.a. n.a. n.a. n.a. (in Local Currency billions, unless stated otherwise, unaudited) MOBILE 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS 16 FY19** FY20 FY21 Total revenue 49.3 47.1 50.7 52.3 55.0 57.2 57.3 59.4 151.8 161 182 197 197 199 229 Service revenue 45.7 43.4 46.5 47.8 50.4 52.5 52.5 53.6 142.8 149 169 184 184 183 209 EBITDA 22.9 21.7 31.4 23.2 24.7 24.8 28.4 26.6 56.8 74 87 100 7 93 99 105 EBITDA margin (%) 46.4% 46.1% 62.0% 44.4% 44.9% 43.4% 49.6% 44.8% 37.4% 46.1% 47.8% 50.7% 47.1% 49.8% 45.7% CAPEX 10.7 13.9 3.3 12.3 14.6 13.7 9.5 13.9 25.7 25 24 32 32 40 52 Data Revenue 15.9 16.0 17.9 19.1 20.5 20.9 22.5 23.1 17.6 24 38 56 56 69 87 Customers (mln) 62.0 62.8 64.2 66.4 69.2 69.8 71.4 72.6 51.6 53.6 56.2 60.5 60.5 66.4 72.6 ARPU (PKR) 247.3 230.6 241.8 241.4 246.0 249.4 245.5 246.0 n.a. n.a. n.a. n.a. n.a. n.a. n.a. MOU (min) 500 475 469 472 464 450 431 437 n.a. n.a. n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 4.1% 3.6% 4.3% 5.0% 3.8% 5.4% 4.6% 5.1% n.a. n.a. n.a. n.a. n.a. n.a. n.a. MBOU 3,027 3,624 3,941 4,268 4,539 4,940 5,064 4,815 n.a. n.a. n.a. n.a. n.a. n.a. n.a. Additional KPI's 4G network coverage 54% 56% 56% 59% 61% 64% 65% 65% n.a. n.a. n.a. n.a. n.a. n.a. n.a. 4G mobile customer penetration (3 Months active) 29% 30% 35% 38% 41% 44% 47% 48% n.a. n.a. n.a. n.a. n.a. n.a. n.a. Notes: For definitions please see VEON Ltd.’s earnings release published on its website on the date hereof ** Pre-IFRS16 values (values before adjustments related to IFRS16)

Algeria index page (in USD millions, unless stated otherwise, unaudited) MOBILE 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS 16 FY19** FY20 FY21 Total revenue 185 160 173 170 159 163 170 165 1,040 915 813 775 775 689 658 Service revenue 184 159 172 169 159 163 170 164 1,031 898 801 769 769 685 656 EBITDA 81 64 79 78 68 71 80 71 547 426 363 354 34 320 302 290 EBITDA margin (%) 43.6% 40.0% 45.6% 46.1% 42.7% 43.4% 46.9% 42.9% 52.6% 46.5% 44.7% 45.7% 41.3% 43.9% 44.0% CAPEX 15 24 26 30 33 18 22 31 165 132 107 108 108 95 104 Data Revenue 68.3 62.1 64.9 64.5 64.4 67.8 72.6 76.9 73.1 113 188 232 232 260 282 Customers (mln) 14.2 13.9 14.2 14.1 14.1 13.9 14.1 14.3 16.3 15.0 15.8 14.6 14.6 14.1 14.3 ARPU (USD) 4.2 3.8 4.1 4.0 3.7 3.9 4.0 3.8 n.a. n.a. n.a. n.a. n.a. n.a. n.a. MOU (min) 448 464 488 482 468 470 498 486 n.a. n.a. n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 12.8% 9.0% 5.7% 8.2% 7.2% 7.9% 7.0% 6.9% n.a. n.a. n.a. n.a. n.a. n.a. n.a. MBOU 4,574 5,059 4,961 5,104 5,394 6,287 7,071 7,091 n.a. n.a. n.a. n.a. n.a. n.a. n.a. (in Local Currency billions, unless stated otherwise, unaudited) MOBILE 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS 16 FY19** FY20 FY21 Total revenue 22.3 20.6 22.3 22.0 21.2 21.8 23.1 22.8 114 101 95 93 93 87 89 Service revenue 22.2 20.4 22.1 21.9 21.1 21.7 23.0 22.7 113 100 93 92 92 87 89 EBITDA 9.7 8.2 10.2 10.2 9.0 9.5 10.8 9.8 60 47 42 42 4 38 38 39 EBITDA margin (%) 43.6% 40.0% 45.6% 46.1% 42.7% 43.5% 46.9% 42.9% 52.6% 46.5% 44.7% 45.7% 41.3% 43.9% 44.0% CAPEX 1.8 3.0 3.3 4.0 4.4 2.4 3.0 4.3 18 15 13 13 13 12 14 Data Revenue 8.2 8.0 8.3 8.4 8.6 9.0 9.8 10.6 8.0 13 22 28 28 33 38 Customers (mln) 14.2 13.9 14.2 14.1 14.1 13.9 14.1 14.3 16.3 15.0 15.8 14.6 14.6 14.1 14.3 ARPU (DZD) 512.2 484.2 524.0 513.8 497.3 514.8 545.5 530.0 n.a. n.a. n.a. n.a. n.a. n.a. n.a. MOU (min) 448 464 488 482 468 470 498 486 n.a. n.a. n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 12.8% 9.0% 5.7% 8.2% 7.2% 7.9% 7.0% 6.9% n.a. n.a. n.a. n.a. n.a. n.a. n.a. MBOU 4,574 5,059 4,961 5,104 5,394 6,287 7,071 7,091 n.a. n.a. n.a. n.a. n.a. n.a. n.a. Additional KPI's 4G network coverage 41% 44% 47% 52% 61% 62% 67% 72% n.a. n.a. n.a. n.a. n.a. n.a. n.a. 4G mobile customer penetration (3 Months active) 36% 37% 38% 40% 43% 45% 50% 52% n.a. n.a. n.a. n.a. n.a. n.a. n.a. Notes: For definitions please see VEON Ltd.’s earnings release published on its website on the date hereof ** Pre-IFRS16 values (values before adjustments related to IFRS16)

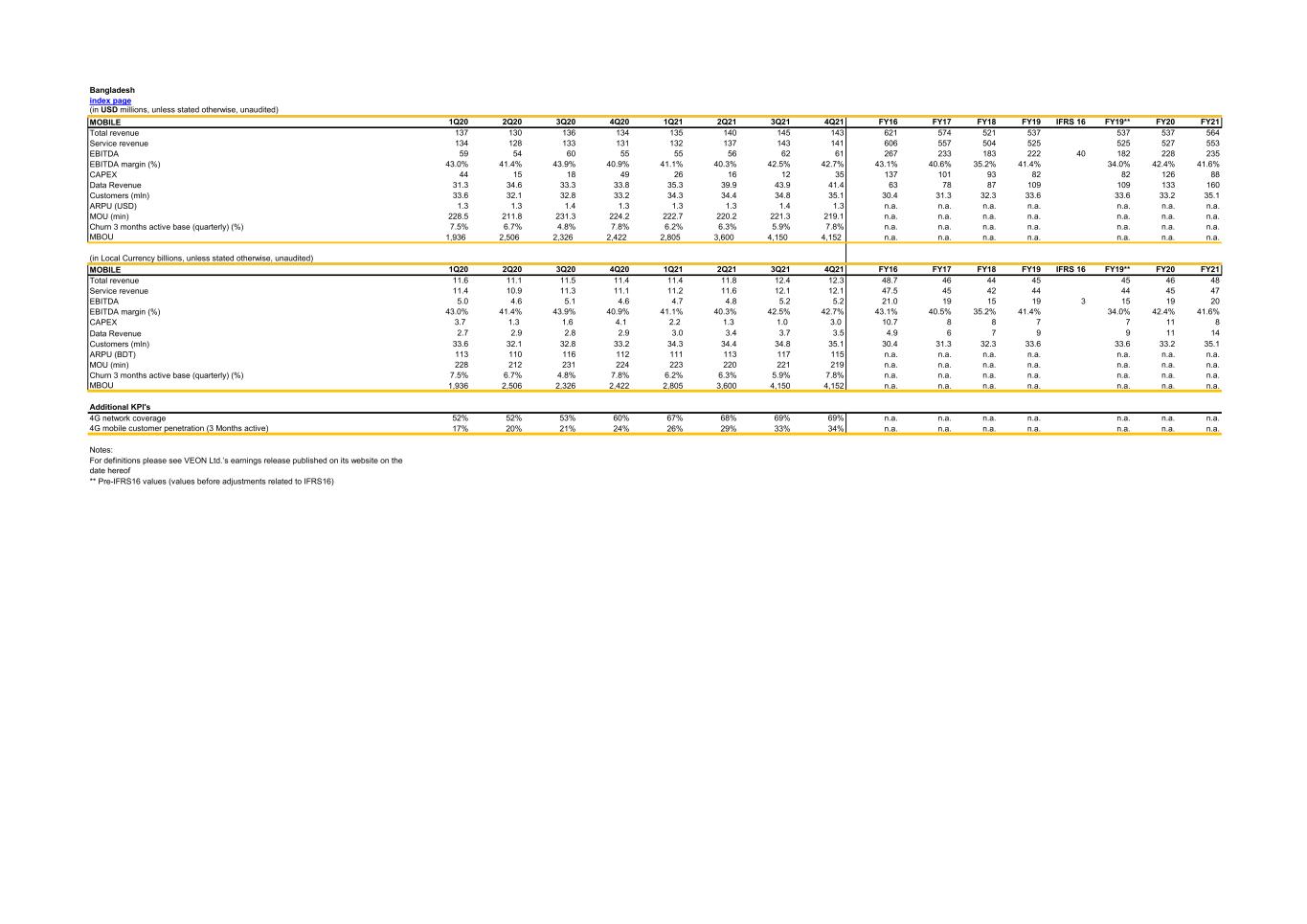

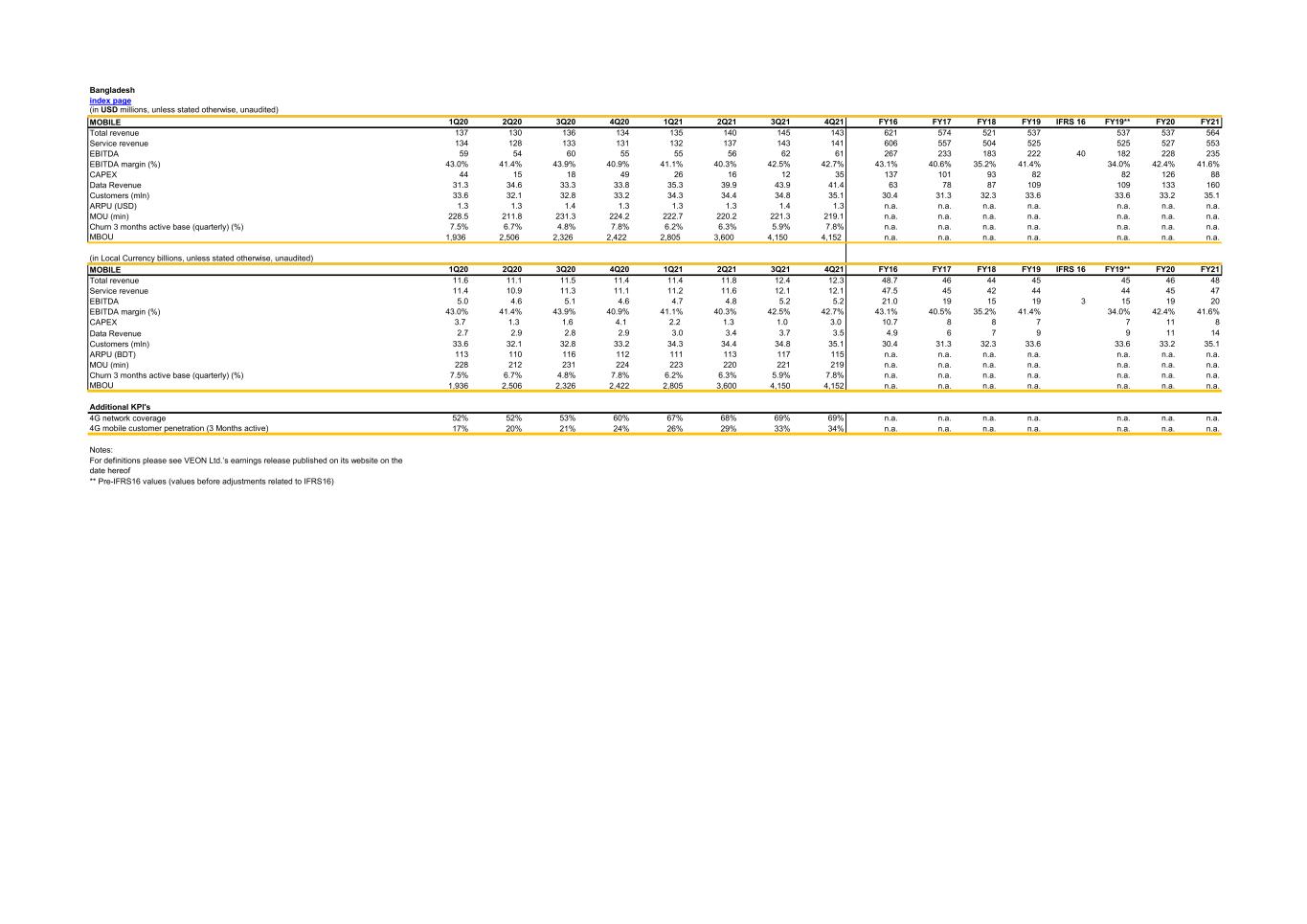

Bangladesh index page (in USD millions, unless stated otherwise, unaudited) MOBILE 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS 16 FY19** FY20 FY21 Total revenue 137 130 136 134 135 140 145 143 621 574 521 537 537 537 564 Service revenue 134 128 133 131 132 137 143 141 606 557 504 525 525 527 553 EBITDA 59 54 60 55 55 56 62 61 267 233 183 222 40 182 228 235 EBITDA margin (%) 43.0% 41.4% 43.9% 40.9% 41.1% 40.3% 42.5% 42.7% 43.1% 40.6% 35.2% 41.4% 34.0% 42.4% 41.6% CAPEX 44 15 18 49 26 16 12 35 137 101 93 82 82 126 88 Data Revenue 31.3 34.6 33.3 33.8 35.3 39.9 43.9 41.4 63 78 87 109 109 133 160 Customers (mln) 33.6 32.1 32.8 33.2 34.3 34.4 34.8 35.1 30.4 31.3 32.3 33.6 33.6 33.2 35.1 ARPU (USD) 1.3 1.3 1.4 1.3 1.3 1.3 1.4 1.3 n.a. n.a. n.a. n.a. n.a. n.a. n.a. MOU (min) 228.5 211.8 231.3 224.2 222.7 220.2 221.3 219.1 n.a. n.a. n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 7.5% 6.7% 4.8% 7.8% 6.2% 6.3% 5.9% 7.8% n.a. n.a. n.a. n.a. n.a. n.a. n.a. MBOU 1,936 2,506 2,326 2,422 2,805 3,600 4,150 4,152 n.a. n.a. n.a. n.a. n.a. n.a. n.a. (in Local Currency billions, unless stated otherwise, unaudited) MOBILE 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS 16 FY19** FY20 FY21 Total revenue 11.6 11.1 11.5 11.4 11.4 11.8 12.4 12.3 48.7 46 44 45 45 46 48 Service revenue 11.4 10.9 11.3 11.1 11.2 11.6 12.1 12.1 47.5 45 42 44 44 45 47 EBITDA 5.0 4.6 5.1 4.6 4.7 4.8 5.2 5.2 21.0 19 15 19 3 15 19 20 EBITDA margin (%) 43.0% 41.4% 43.9% 40.9% 41.1% 40.3% 42.5% 42.7% 43.1% 40.5% 35.2% 41.4% 34.0% 42.4% 41.6% CAPEX 3.7 1.3 1.6 4.1 2.2 1.3 1.0 3.0 10.7 8 8 7 7 11 8 Data Revenue 2.7 2.9 2.8 2.9 3.0 3.4 3.7 3.5 4.9 6 7 9 9 11 14 Customers (mln) 33.6 32.1 32.8 33.2 34.3 34.4 34.8 35.1 30.4 31.3 32.3 33.6 33.6 33.2 35.1 ARPU (BDT) 113 110 116 112 111 113 117 115 n.a. n.a. n.a. n.a. n.a. n.a. n.a. MOU (min) 228 212 231 224 223 220 221 219 n.a. n.a. n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 7.5% 6.7% 4.8% 7.8% 6.2% 6.3% 5.9% 7.8% n.a. n.a. n.a. n.a. n.a. n.a. n.a. MBOU 1,936 2,506 2,326 2,422 2,805 3,600 4,150 4,152 n.a. n.a. n.a. n.a. n.a. n.a. n.a. Additional KPI's 4G network coverage 52% 52% 53% 60% 67% 68% 69% 69% n.a. n.a. n.a. n.a. n.a. n.a. n.a. 4G mobile customer penetration (3 Months active) 17% 20% 21% 24% 26% 29% 33% 34% n.a. n.a. n.a. n.a. n.a. n.a. n.a. Notes: For definitions please see VEON Ltd.’s earnings release published on its website on the date hereof ** Pre-IFRS16 values (values before adjustments related to IFRS16)

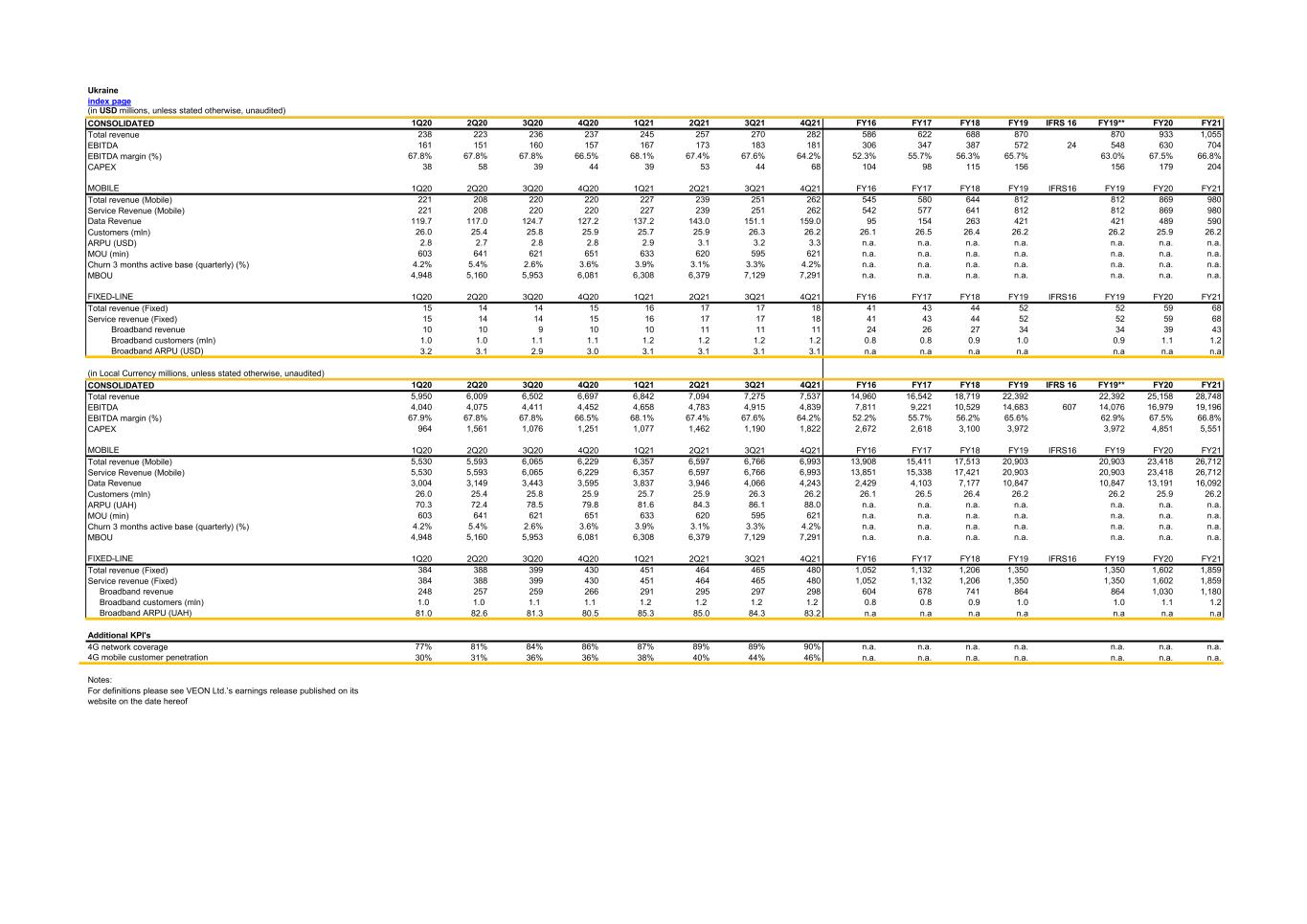

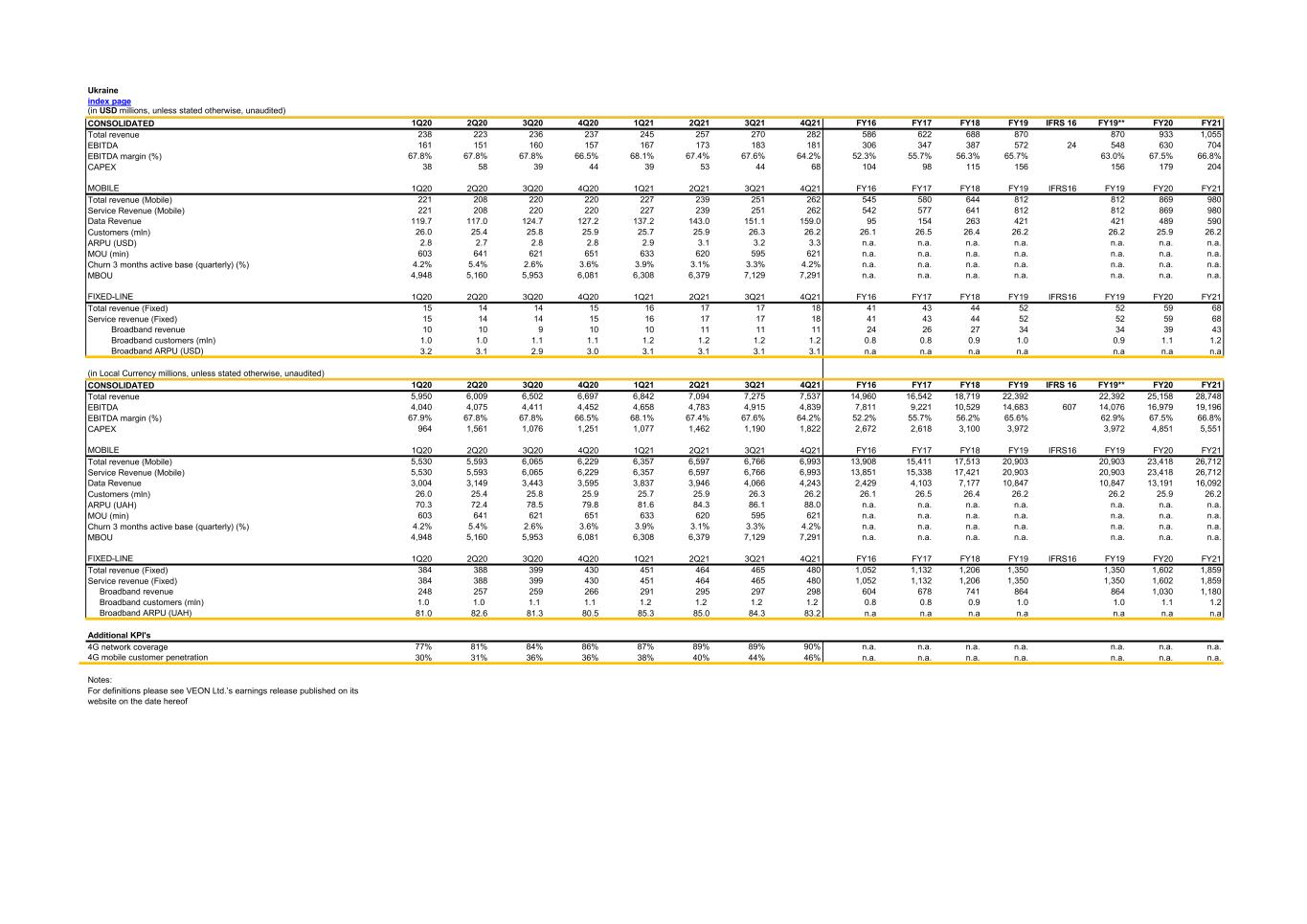

Ukraine index page (in USD millions, unless stated otherwise, unaudited) CONSOLIDATED 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS 16 FY19** FY20 FY21 Total revenue 238 223 236 237 245 257 270 282 586 622 688 870 870 933 1,055 EBITDA 161 151 160 157 167 173 183 181 306 347 387 572 24 548 630 704 EBITDA margin (%) 67.8% 67.8% 67.8% 66.5% 68.1% 67.4% 67.6% 64.2% 52.3% 55.7% 56.3% 65.7% 63.0% 67.5% 66.8% CAPEX 38 58 39 44 39 53 44 68 104 98 115 156 156 179 204 MOBILE 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS16 FY19 FY20 FY21 Total revenue (Mobile) 221 208 220 220 227 239 251 262 545 580 644 812 812 869 980 Service Revenue (Mobile) 221 208 220 220 227 239 251 262 542 577 641 812 812 869 980 Data Revenue 119.7 117.0 124.7 127.2 137.2 143.0 151.1 159.0 95 154 263 421 421 489 590 Customers (mln) 26.0 25.4 25.8 25.9 25.7 25.9 26.3 26.2 26.1 26.5 26.4 26.2 26.2 25.9 26.2 ARPU (USD) 2.8 2.7 2.8 2.8 2.9 3.1 3.2 3.3 n.a. n.a. n.a. n.a. n.a. n.a. n.a. MOU (min) 603 641 621 651 633 620 595 621 n.a. n.a. n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 4.2% 5.4% 2.6% 3.6% 3.9% 3.1% 3.3% 4.2% n.a. n.a. n.a. n.a. n.a. n.a. n.a. MBOU 4,948 5,160 5,953 6,081 6,308 6,379 7,129 7,291 n.a. n.a. n.a. n.a. n.a. n.a. n.a. FIXED-LINE 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS16 FY19 FY20 FY21 Total revenue (Fixed) 15 14 14 15 16 17 17 18 41 43 44 52 52 59 68 Service revenue (Fixed) 15 14 14 15 16 17 17 18 41 43 44 52 52 59 68 Broadband revenue 10 10 9 10 10 11 11 11 24 26 27 34 34 39 43 Broadband customers (mln) 1.0 1.0 1.1 1.1 1.2 1.2 1.2 1.2 0.8 0.8 0.9 1.0 0.9 1.1 1.2 Broadband ARPU (USD) 3.2 3.1 2.9 3.0 3.1 3.1 3.1 3.1 n.a n.a n.a n.a n.a n.a n.a (in Local Currency millions, unless stated otherwise, unaudited) CONSOLIDATED 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS 16 FY19** FY20 FY21 Total revenue 5,950 6,009 6,502 6,697 6,842 7,094 7,275 7,537 14,960 16,542 18,719 22,392 22,392 25,158 28,748 EBITDA 4,040 4,075 4,411 4,452 4,658 4,783 4,915 4,839 7,811 9,221 10,529 14,683 607 14,076 16,979 19,196 EBITDA margin (%) 67.9% 67.8% 67.8% 66.5% 68.1% 67.4% 67.6% 64.2% 52.2% 55.7% 56.2% 65.6% 62.9% 67.5% 66.8% CAPEX 964 1,561 1,076 1,251 1,077 1,462 1,190 1,822 2,672 2,618 3,100 3,972 3,972 4,851 5,551 MOBILE 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS16 FY19 FY20 FY21 Total revenue (Mobile) 5,530 5,593 6,065 6,229 6,357 6,597 6,766 6,993 13,908 15,411 17,513 20,903 20,903 23,418 26,712 Service Revenue (Mobile) 5,530 5,593 6,065 6,229 6,357 6,597 6,766 6,993 13,851 15,338 17,421 20,903 20,903 23,418 26,712 Data Revenue 3,004 3,149 3,443 3,595 3,837 3,946 4,066 4,243 2,429 4,103 7,177 10,847 10,847 13,191 16,092 Customers (mln) 26.0 25.4 25.8 25.9 25.7 25.9 26.3 26.2 26.1 26.5 26.4 26.2 26.2 25.9 26.2 ARPU (UAH) 70.3 72.4 78.5 79.8 81.6 84.3 86.1 88.0 n.a. n.a. n.a. n.a. n.a. n.a. n.a. MOU (min) 603 641 621 651 633 620 595 621 n.a. n.a. n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 4.2% 5.4% 2.6% 3.6% 3.9% 3.1% 3.3% 4.2% n.a. n.a. n.a. n.a. n.a. n.a. n.a. MBOU 4,948 5,160 5,953 6,081 6,308 6,379 7,129 7,291 n.a. n.a. n.a. n.a. n.a. n.a. n.a. FIXED-LINE 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS16 FY19 FY20 FY21 Total revenue (Fixed) 384 388 399 430 451 464 465 480 1,052 1,132 1,206 1,350 1,350 1,602 1,859 Service revenue (Fixed) 384 388 399 430 451 464 465 480 1,052 1,132 1,206 1,350 1,350 1,602 1,859 Broadband revenue 248 257 259 266 291 295 297 298 604 678 741 864 864 1,030 1,180 Broadband customers (mln) 1.0 1.0 1.1 1.1 1.2 1.2 1.2 1.2 0.8 0.8 0.9 1.0 1.0 1.1 1.2 Broadband ARPU (UAH) 81.0 82.6 81.3 80.5 85.3 85.0 84.3 83.2 n.a n.a n.a n.a n.a n.a n.a Additional KPI's 4G network coverage 77% 81% 84% 86% 87% 89% 89% 90% n.a. n.a. n.a. n.a. n.a. n.a. n.a. 4G mobile customer penetration 30% 31% 36% 36% 38% 40% 44% 46% n.a. n.a. n.a. n.a. n.a. n.a. n.a. Notes: For definitions please see VEON Ltd.’s earnings release published on its website on the date hereof

Uzbekistan index page (in USD millions, unless stated otherwise, unaudited) CONSOLIDATED 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS 16 FY19** FY20 FY21 Total revenue 55 48 48 47 45 47 51 51 663 513 315 258 258 198 194 EBITDA 25.4 20.1 5.7 17.0 22.3 18.0 26.4 22.4 395 261 136 136 4 132 68 89 EBITDA margin (%) 46.4% 42.0% 11.9% 36.0% 49.5% 38.2% 51.7% 44.1% 59.6% 50.9% 43.3% 52.8% 51.1% 34.5% 45.9% CAPEX 5 21 12 14 12 3 6 14 174 63 39 53 53 52 36 MOBILE 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS16 FY19 FY20 FY21 Total revenue (Mobile) 54 47 48 47 45 47 51 50 659 510 313 256 256 196 193 Service Revenue (Mobile) 54 47 48 47 45 47 51 50 659 509 312 255 255 196 193 Data Revenue 31.3 25.3 26.0 28.5 28.7 30.7 30.9 32.1 152 127.9 108.1 119.8 119.8 111.0 122.4 Customers (mln) 7.7 7.1 6.8 6.8 6.8 6.8 6.8 7.1 9.5 9.7 9.1 8.1 8.1 6.8 7.1 ARPU (USD) 2.3 2.1 2.3 2.3 2.2 2.3 2.5 2.4 n.a. n.a. n.a. n.a. n.a. n.a. n.a. MOU (min) 598 642 692 674 681 733 737 730 n.a. n.a. n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 17% 20% 16% 14% 13% 13% 14% 12% n.a. n.a. n.a. n.a. n.a. n.a. n.a. MBOU 2,816 3,292 4,192 4,684 4,703 5,034 5,559 6,231 n.a. n.a. n.a. n.a. n.a. n.a. n.a. FIXED-LINE 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS16 FY19 FY20 FY21 Total revenue (Fixed) 0.3 0.3 0.3 0.3 0.2 0.2 0.2 0.2 4.5 3.3 2.2 1.5 1.5 1.1 0.9 Service revenue (Fixed) 0.3 0.3 0.3 0.3 0.2 0.2 0.2 0.2 4.5 3.3 2.2 1.5 1.5 1.1 0.9 (in Local Currency billions, unless stated otherwise, unaudited) CONSOLIDATED 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS 16 FY19** FY20 FY21 Total revenue 522 480 492 492 474 495 543 545 1,967 2,342 2,538 2,275 2,275 1,985 2,057 EBITDA 242 202 59 177 235 189 281 240 1,173 1,160 1,098 1,204 39 1,165 680 944 EBITDA margin (%) 46.4% 42.0% 12.0% 36.0% 49.5% 38.2% 51.7% 44.1% 59.6% 49.5% 43.3% 52.9% 51.2% 34.2% 45.9% CAPEX 49 212 122 146 128 34 65 151 533 304 315 455 455 529 379 MOBILE 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS16 FY19 FY20 FY21 Total revenue (Mobile) 518 477 488 488 470 492 540 541 1,954 2,327 2,520 2,258 2,258 1,970 2,044 Service Revenue (Mobile) 515 476 488 487 470 492 540 541 1,953 2,323 2,517 2,252 2,252 1,967 2,043 Data Revenue 298.1 253.9 266.0 296.1 301.5 323.1 329.1 345.3 452 585.1 872 1,060 1,060 1,114 1,299 Customers (mln) 7.7 7.1 6.8 6.8 6.8 6.8 6.8 7.1 9.5 9.7 9.1 8.1 8.1 6.8 7.1 ARPU (UZS) 21,573 21,282 23,087 23,531 22,850 23,932 26,256 25,742 n.a. n.a. n.a. n.a. n.a. n.a. n.a. MOU (min) 598 642 692 674 681 733 737 730 n.a. n.a. n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 17% 20% 16% 14% 13% 13% 14% 12% n.a. n.a. n.a. n.a. n.a. n.a. n.a. MBOU 2,816 3,292 4,192 4,684 4,703 5,034 5,559 6,231 n.a. n.a. n.a. n.a. 0 n.a. n.a. n.a. FIXED-LINE 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS16 FY19 FY20 FY21 Total revenue (Fixed) 3.1 2.9 2.7 2.7 2.5 2.2 2.2 2.6 13.3 15.1 17.6 13.5 13 11 9 Service revenue (Fixed) 3.1 2.9 2.7 2.7 2.5 2.2 2.2 2.6 13.2 15.0 17.4 13.2 13 11 9 Additional KPI's 4G network coverage 26% 34% 47% 52% 60% 61% 61% 62% n.a. n.a. n.a. n.a. n.a. n.a. n.a. 4G mobile customer penetration (3 Months active) 37% 39% 43% 46% 50% 54% 57% 61% n.a. n.a. n.a. n.a. n.a. n.a. n.a. Notes: For definitions please see VEON Ltd.’s earnings release published on its website on the date hereof ** Pre-IFRS16 values (values before adjustments related to IFRS16)

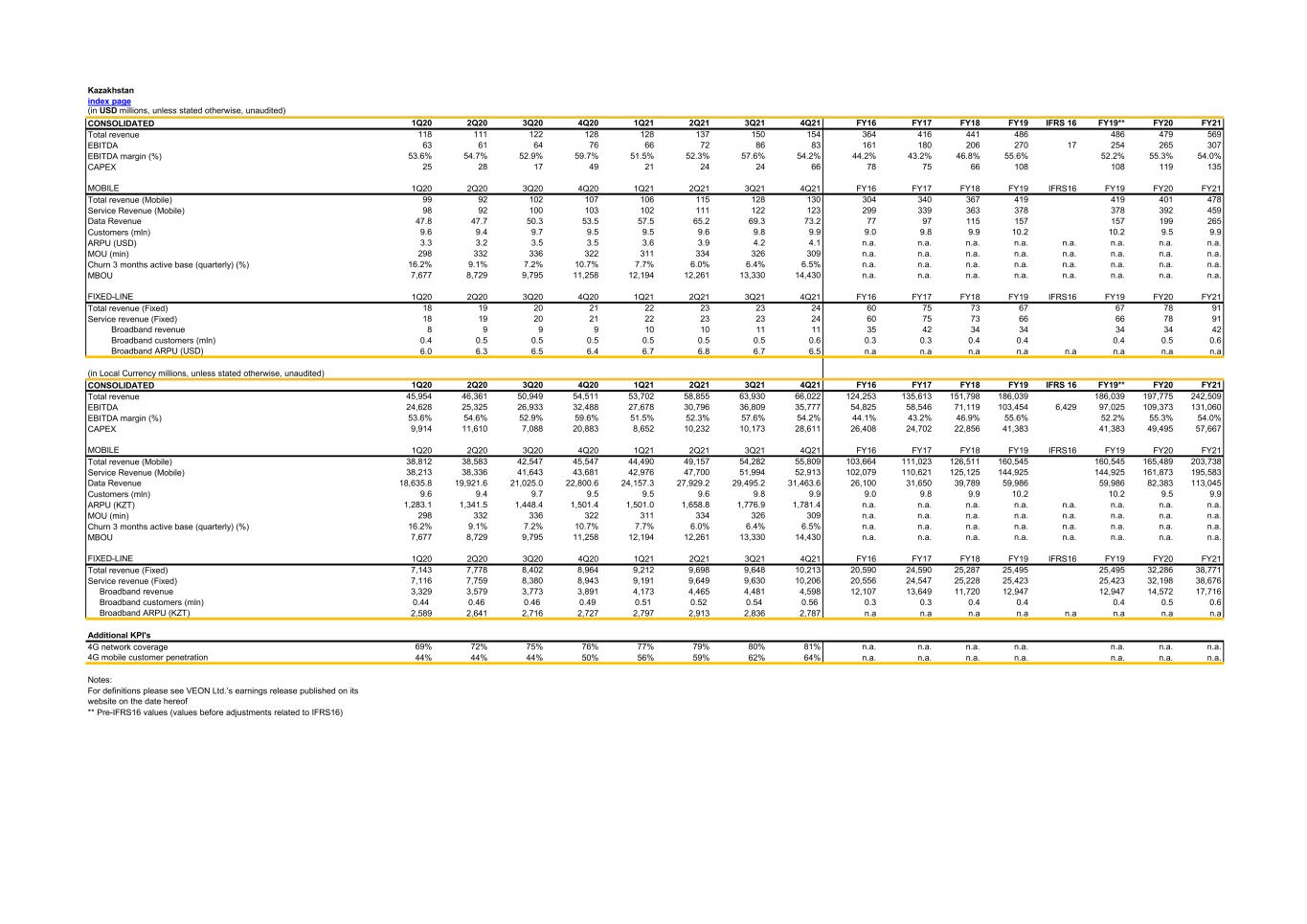

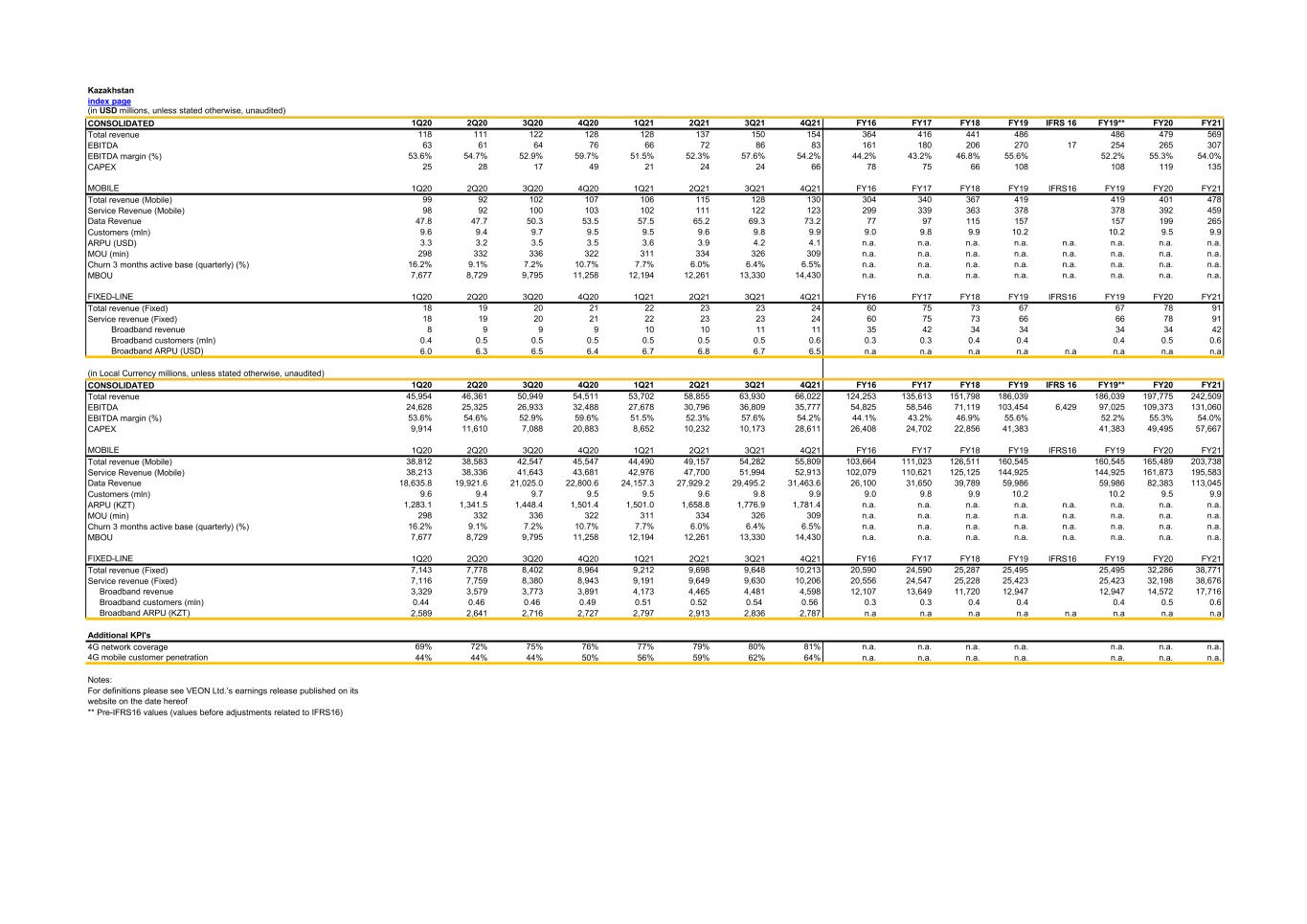

Kazakhstan index page (in USD millions, unless stated otherwise, unaudited) CONSOLIDATED 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS 16 FY19** FY20 FY21 Total revenue 118 111 122 128 128 137 150 154 364 416 441 486 486 479 569 EBITDA 63 61 64 76 66 72 86 83 161 180 206 270 17 254 265 307 EBITDA margin (%) 53.6% 54.7% 52.9% 59.7% 51.5% 52.3% 57.6% 54.2% 44.2% 43.2% 46.8% 55.6% 52.2% 55.3% 54.0% CAPEX 25 28 17 49 21 24 24 66 78 75 66 108 108 119 135 MOBILE 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS16 FY19 FY20 FY21 Total revenue (Mobile) 99 92 102 107 106 115 128 130 304 340 367 419 419 401 478 Service Revenue (Mobile) 98 92 100 103 102 111 122 123 299 339 363 378 378 392 459 Data Revenue 47.8 47.7 50.3 53.5 57.5 65.2 69.3 73.2 77 97 115 157 157 199 265 Customers (mln) 9.6 9.4 9.7 9.5 9.5 9.6 9.8 9.9 9.0 9.8 9.9 10.2 10.2 9.5 9.9 ARPU (USD) 3.3 3.2 3.5 3.5 3.6 3.9 4.2 4.1 n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. MOU (min) 298 332 336 322 311 334 326 309 n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 16.2% 9.1% 7.2% 10.7% 7.7% 6.0% 6.4% 6.5% n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. MBOU 7,677 8,729 9,795 11,258 12,194 12,261 13,330 14,430 n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. FIXED-LINE 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS16 FY19 FY20 FY21 Total revenue (Fixed) 18 19 20 21 22 23 23 24 60 75 73 67 67 78 91 Service revenue (Fixed) 18 19 20 21 22 23 23 24 60 75 73 66 66 78 91 Broadband revenue 8 9 9 9 10 10 11 11 35 42 34 34 34 34 42 Broadband customers (mln) 0.4 0.5 0.5 0.5 0.5 0.5 0.5 0.6 0.3 0.3 0.4 0.4 0.4 0.5 0.6 Broadband ARPU (USD) 6.0 6.3 6.5 6.4 6.7 6.8 6.7 6.5 n.a n.a n.a n.a n.a n.a n.a n.a (in Local Currency millions, unless stated otherwise, unaudited) CONSOLIDATED 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS 16 FY19** FY20 FY21 Total revenue 45,954 46,361 50,949 54,511 53,702 58,855 63,930 66,022 124,253 135,613 151,798 186,039 186,039 197,775 242,509 EBITDA 24,628 25,325 26,933 32,488 27,678 30,796 36,809 35,777 54,825 58,546 71,119 103,454 6,429 97,025 109,373 131,060 EBITDA margin (%) 53.6% 54.6% 52.9% 59.6% 51.5% 52.3% 57.6% 54.2% 44.1% 43.2% 46.9% 55.6% 52.2% 55.3% 54.0% CAPEX 9,914 11,610 7,088 20,883 8,652 10,232 10,173 28,611 26,408 24,702 22,856 41,383 41,383 49,495 57,667 MOBILE 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS16 FY19 FY20 FY21 Total revenue (Mobile) 38,812 38,583 42,547 45,547 44,490 49,157 54,282 55,809 103,664 111,023 126,511 160,545 160,545 165,489 203,738 Service Revenue (Mobile) 38,213 38,336 41,643 43,681 42,976 47,700 51,994 52,913 102,079 110,621 125,125 144,925 144,925 161,873 195,583 Data Revenue 18,635.8 19,921.6 21,025.0 22,800.6 24,157.3 27,929.2 29,495.2 31,463.6 26,100 31,650 39,789 59,986 59,986 82,383 113,045 Customers (mln) 9.6 9.4 9.7 9.5 9.5 9.6 9.8 9.9 9.0 9.8 9.9 10.2 10.2 9.5 9.9 ARPU (KZT) 1,283.1 1,341.5 1,448.4 1,501.4 1,501.0 1,658.8 1,776.9 1,781.4 n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. MOU (min) 298 332 336 322 311 334 326 309 n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 16.2% 9.1% 7.2% 10.7% 7.7% 6.0% 6.4% 6.5% n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. MBOU 7,677 8,729 9,795 11,258 12,194 12,261 13,330 14,430 n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. FIXED-LINE 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 FY16 FY17 FY18 FY19 IFRS16 FY19 FY20 FY21 Total revenue (Fixed) 7,143 7,778 8,402 8,964 9,212 9,698 9,648 10,213 20,590 24,590 25,287 25,495 25,495 32,286 38,771 Service revenue (Fixed) 7,116 7,759 8,380 8,943 9,191 9,649 9,630 10,206 20,556 24,547 25,228 25,423 25,423 32,198 38,676 Broadband revenue 3,329 3,579 3,773 3,891 4,173 4,465 4,481 4,598 12,107 13,649 11,720 12,947 12,947 14,572 17,716 Broadband customers (mln) 0.44 0.46 0.46 0.49 0.51 0.52 0.54 0.56 0.3 0.3 0.4 0.4 0.4 0.5 0.6 Broadband ARPU (KZT) 2,589 2,641 2,716 2,727 2,797 2,913 2,836 2,787 n.a n.a n.a n.a n.a n.a n.a n.a Additional KPI's 4G network coverage 69% 72% 75% 76% 77% 79% 80% 81% n.a. n.a. n.a. n.a. n.a. n.a. n.a. 4G mobile customer penetration 44% 44% 44% 50% 56% 59% 62% 64% n.a. n.a. n.a. n.a. n.a. n.a. n.a. Notes: For definitions please see VEON Ltd.’s earnings release published on its website on the date hereof ** Pre-IFRS16 values (values before adjustments related to IFRS16)