1 VEON 3Q23 TRADING UPDATE 20 November 2023 RAISING FULL-YEAR REVENUE AND EBITDA GUIDANCE, RETURN TO USD REVENUE GROWTH, EXIT FROM RUSSIA COMPLETED

2 3Q23 Trading Update|2 AGENDA 1. OPENING 2. HIGHLIGHTS & BUSINESS UPDATE Faisal Ghori Kaan Terzioğlu 4. CLOSING REMARKS Kaan Terzioğlu 3. TRADING RESULTS Joop Brakenhoff 5. Q&A Kaan Terzioğlu, Joop Brakenhoff

3 3Q23 Trading Update|3 DISCLAIMER VEON’s results presented in this document are, unless otherwise stated, prepared in accordance with International Financial Reporting Standards ("IFRS") and have not been externally reviewed and audited. The financial information included in this document is preliminary and is based on a number of assumptions that are subject to inherent uncertainties and subject to change. The financial information presented herein is based on internal management accounts, is the responsibility of management and is subject to financial closing procedures which have not yet been completed and has not been audited, reviewed or verified. Certain amounts and percentages that appear in this document have been subject to rounding adjustments. As a result, certain numerical figures shown as totals, including those in the tables, may not be an exact arithmetic aggregation of the figures that precede or follow them. Although we believe the information to be reasonable, actual results may vary from the information contained above and such variations could be material. As such, you should not place undue reliance on this information. This information may not be indicative of the actual results for the current period or any future period. This document contains “forward-looking statements”, as the phrase is defined in Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. These forward-looking statements may be identified by words such as “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “seek,” “believe,” “estimate,” “predict,” “potential,” “continue,” “contemplate,” “possible” and other similar words. Forward-looking statements include statements relating to, among other things, VEON’s plans to implement its strategic priorities, including operating model and development plans; anticipated performance, including VEON’s ability to generate sufficient cash flow; VEON’s assessment of the impact of the conflict surrounding Russia and Ukraine, including related sanctions and counter-sanctions, on its current and future operations and financial condition; future market developments and trends; operational and network development and network investment, including expectations regarding the roll-out and benefits of 3G/4G/LTE networks, as applicable; spectrum acquisitions and renewals; the effect of the acquisition of additional spectrum on customer experience; VEON’s ability to realize the acquisition and disposition of any of its businesses and assets and to execute its strategic transactions in the timeframes anticipated, or at all; VEON’s ability to realize financial improvements, including an expected reduction of net pro-forma leverage ratio following the successful completion of certain dispositions and acquisitions; our dividends; and VEON’s ability to realize its targets and commercial initiatives in its various countries of operation. The forward-looking statements included in this document are based on management’s best assessment of VEON’s strategic and financial position and of future market conditions, trends and other potential developments. These discussions involve risks and uncertainties. The actual outcome may differ materially from these statements as a result of, among other things: further escalation in the conflict surrounding Russia and Ukraine, including further sanctions and counter-sanctions and any related involuntary deconsolidation of our Ukrainian operations; demand for and market acceptance of VEON’s products and services; our plans regarding our dividend payments and policies, as well as our ability to receive dividends, distributions, loans, transfers or other payments or guarantees from our subsidiaries; continued volatility in the economies in VEON’s markets; governmental regulation of the telecommunications industries; general political uncertainties in VEON’s markets; government investigations or other regulatory actions; litigation or disputes with third parties or regulatory authorities or other negative developments regarding such parties; the impact of export controls and laws affecting trade and investment on our and important third-party suppliers' ability to procure goods, software or technology necessary for the services we provide to our customers; risks associated with our material weakness in internal control over financial reporting; risks associated with data protection or cyber security, other risks beyond the parties’ control or a failure to meet expectations regarding various strategic priorities, the effect of foreign currency fluctuations, increased competition in the markets in which VEON operates and the effect of consumer taxes on the purchasing activities of consumers of VEON’s services. Certain other factors that could cause actual results to differ materially from those discussed in any forward-looking statements include the risk factors described in VEON’s Annual Report on Form 20-F for the year ended 31 December 2022 filed with the U.S. Securities and Exchange Commission (the “SEC”) on 24 July 2023 and other public filings made from time to time by VEON with the SEC. Other unknown or unpredictable factors also could harm our future results. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Under no circumstances should the inclusion of such forward-looking statements in this document be regarded as a representation or warranty by us or any other person with respect to the achievement of results set out in such statements or that the underlying assumptions used will in fact be the case. Therefore, you are cautioned not to place undue reliance on these forward-looking statements. The forward-looking statements speak only as of the date hereof. We cannot assure you that any projected results or events will be achieved. Except to the extent required by law, we disclaim any obligation to update or revise any of these forward- looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made, or to reflect the occurrence of unanticipated events. Furthermore, elements of this document contain or may contain, “inside information” as defined under the Market Abuse Regulation (EU) No. 596/2014.

4 3Q23 Trading Update|4 NOTICE TO READERS: FINANCIAL INFORMATION PRESENTED VEON's results and other financial information presented in these financial statements are, unless otherwise stated, prepared in accordance with International Financial Reporting Standards ("IFRS") based on internal management reporting, are the responsibility of management, and have not been externally audited, reviewed, or verified. As such, you should not place undue reliance on this information. This information may not be indicative of the actual results for any future period. On 24 November 2022, VEON Ltd. announced that following a competitive process, it had entered into an agreement to sell its Russian operations. Upon execution of the agreement, the Russian business has been classified as `held for sale' and `discontinued operations', and accounted for as such, in line with the requirements of IFRS 5. The result is that the Russian operations do not contribute to VEON's comparison base or actual reported results in this press release (except as specifically noted and except with respect to net debt excluding leases as of 3Q22), however, this classification has no impact on balance sheet amounts in prior periods. On 9 October 2023, VEON Ltd. announced that it completed its exit from Russia with the closing of the sale of its Russian operations to a group of senior members of the PJSC VimpelCom management team. NOTICE TO READERS: IMPACT OF THE WAR IN UKRAINE The ongoing war between Russia and Ukraine and the sanctions imposed by the United States, member states of the European Union, the European Union itself, the United Kingdom, Ukraine and certain other nations, counter-sanctions by Russia and other legal and regulatory responses, as well as responses by our service providers, partners, suppliers and other counterparties, and the consequences of all of the foregoing have impacted and, if the war, sanctions and such responses continue or escalate, may significantly impact our results and aspects of our operations in Ukraine, and may significantly affect our results and aspects of our operations in the other countries in which we operate. We are closely monitoring events in Russia and Ukraine, as well as the possibility of the imposition of further sanctions in connection with the ongoing war between Russia and Ukraine and any resulting further rise in tensions between Russia and the United States, the United Kingdom and/or the European Union. Although we have completed our exit from Russia, our operations in Ukraine continue to be affected by the war. We are doing everything we can to protect the safety of our employees, while continuing to ensure the uninterrupted operation of our communications, financial and digital services.

5 3Q23 Trading Update|5 AGENDA 1. OPENING 2. HIGHLIGHTS & BUSINESS UPDATE Faisal Ghori Kaan Terzioğlu 4. CLOSING REMARKS Kaan Terzioğlu 3. TRADING RESULTS Joop Brakenhoff 5. Q&A Kaan Terzioğlu, Joop Brakenhoff

6 3Q23 Trading Update|6 VEON 2.0 – BEST IN CLASS DIGITAL OPERATOR Key fundamental trends and themes 1 • Across our geographies, 4G data consumption, B2B growth, digital product monetization and pricing should support double-digit topline growth Double-digit growth 2 • EBITDA margin will expand through operating leverage and cost optimization programs, specifically at HQ Margin expansion 3 • Strong EBITDA growth will be accompanied with declines in capex and interest expense, supporting robust equity FCF growth dynamics High FCF generation 4 • Deleveraging to be a key theme, we will equally prioritize a healthy capital structure and attractive returns over the medium-term Stronger balance sheet 5 • Moving from telecom "market-share" to consumer "wallet-share" focus. Digital portfolio offer tremendous monetisation across all core consumer verticals Digital Operator

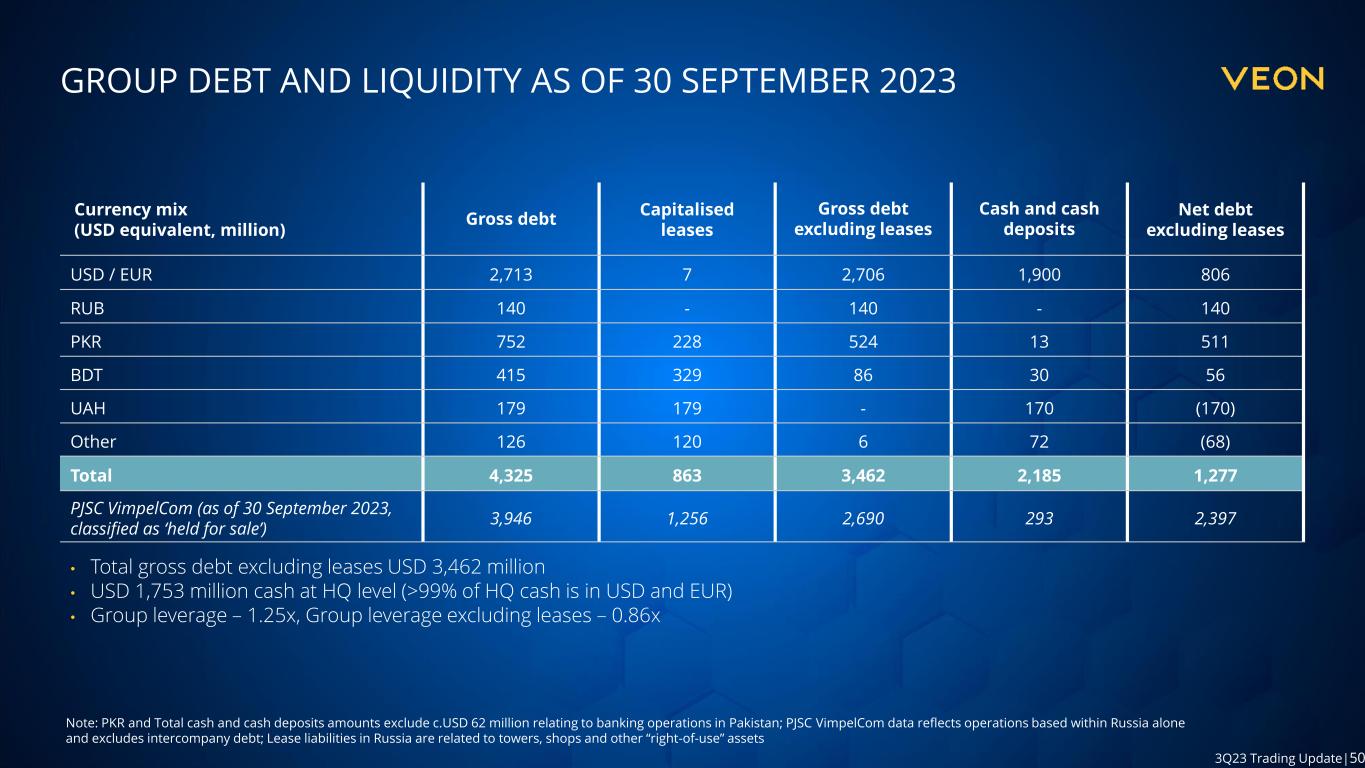

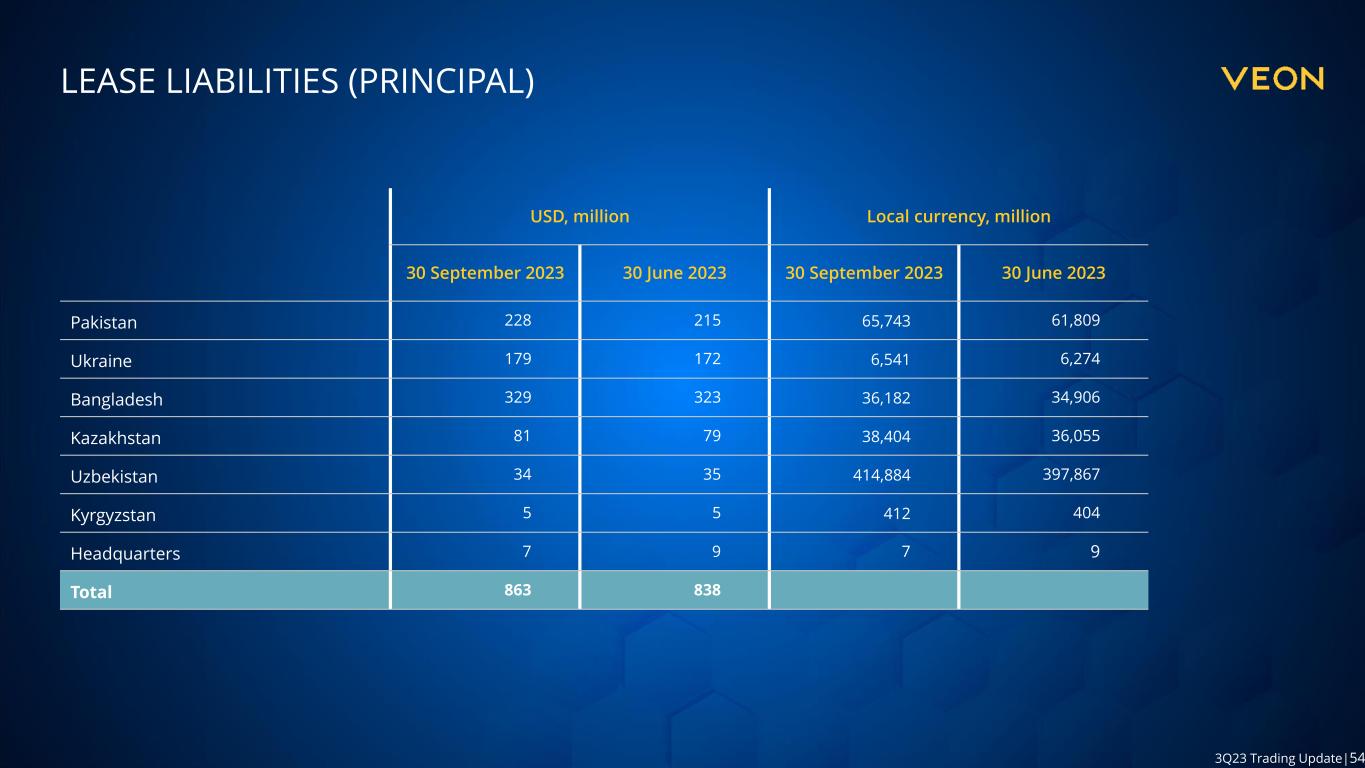

7 3Q23 Trading Update|7 3Q23 HIGHLIGHTS 3Q23 Capex intensity at 13.9% LTM Capex intensity trending lower YoY to 17.8% CAPEX $131mn Inflationary pricing, ARPU expansion, effective cost control $444mn EBITDA +17.0% YoY Balanced growth across markets, disciplined inflationary pricing +19.3% YoY local currency TOTAL REVENUE +6.1% YoY $945mn -29.8% YoY Strong uptake in Multiplay segment, higher ARPU and lower churn +19.8% YoY local currency SERVICE REVENUE +6.9% YoY $913mn +30.6% YoY local currency Marked reduction of Group and HQ net debt $1,277mn NET DEBT EXCL. LEASES $1,057mn at HQ Effective use of Group liquidity $2,187mn CASH $1,751mn at HQ Note: Amounts and YoY performance exclude Russian operations, which were reclassified as ‘held for sale’ and ‘discontinued operations’ in 4Q22. Group cash excludes c.USD 62 million relating to banking operations in Pakistan. As of 30 September 2023, lease liabilities of USD 863 million

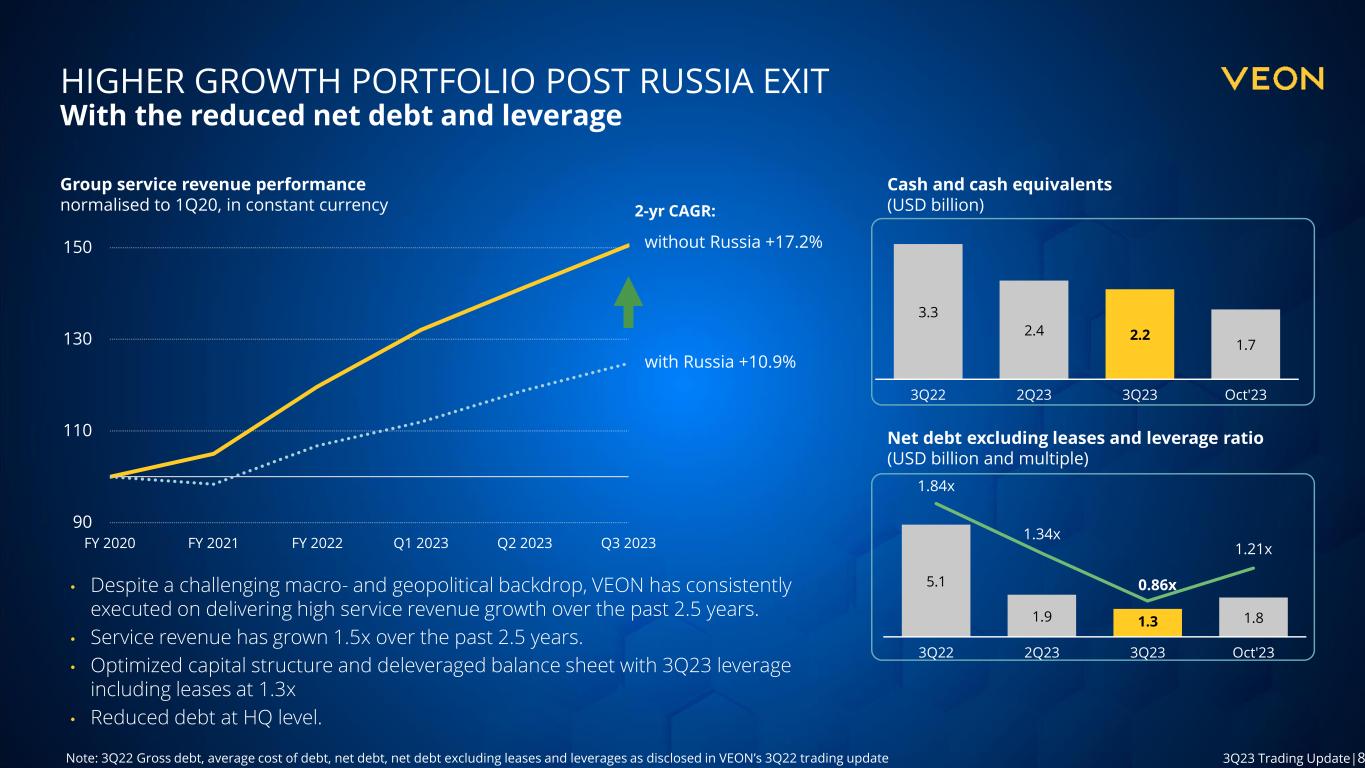

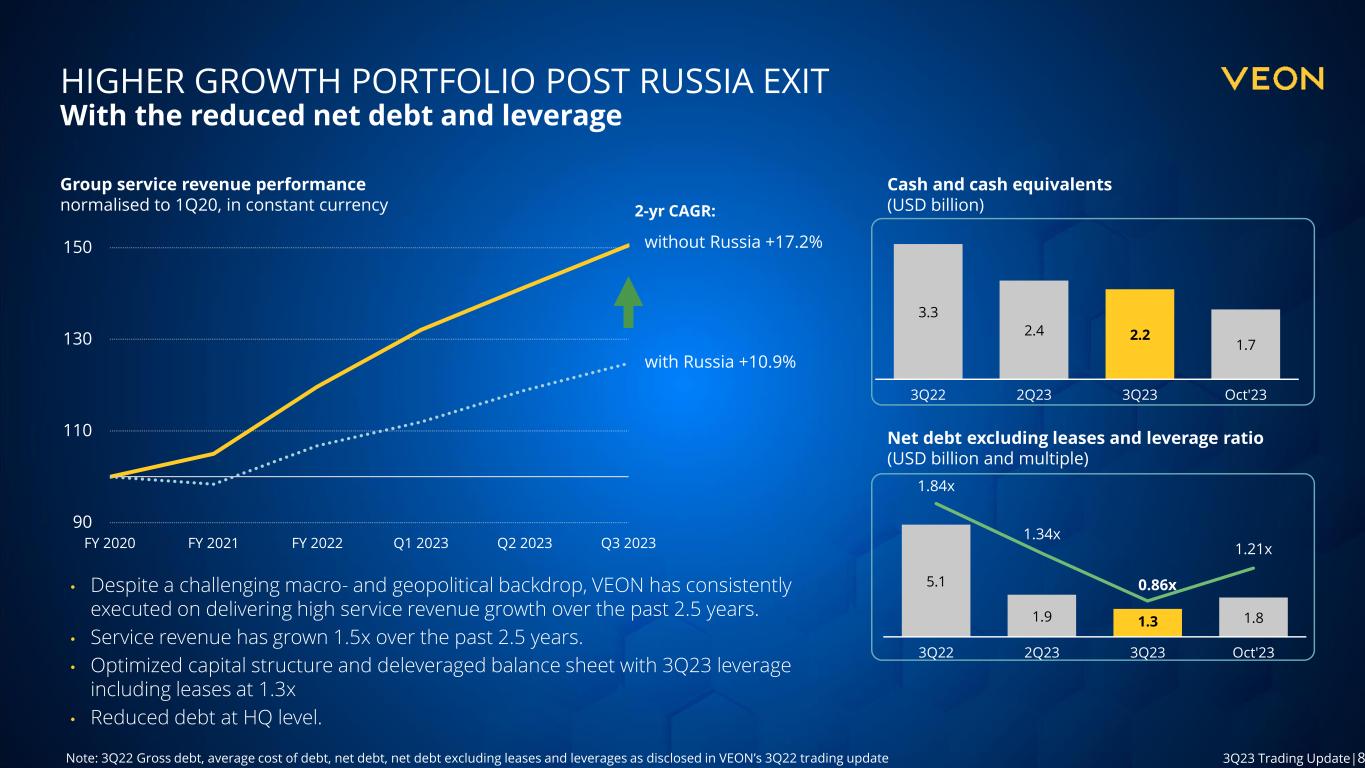

8 3Q23 Trading Update|8 HIGHER GROWTH PORTFOLIO POST RUSSIA EXIT With the reduced net debt and leverage Group service revenue performance normalised to 1Q20, in constant currency • Despite a challenging macro- and geopolitical backdrop, VEON has consistently executed on delivering high service revenue growth over the past 2.5 years. • Service revenue has grown 1.5x over the past 2.5 years. • Optimized capital structure and deleveraged balance sheet with 3Q23 leverage including leases at 1.3x • Reduced debt at HQ level. Cash and cash equivalents (USD billion) Net debt excluding leases and leverage ratio (USD billion and multiple) 5.1 1.9 1.3 1.8 1.84x 1.34x 0.86x 1.21x 3Q22 2Q23 3Q23 Oct'23 Note: 3Q22 Gross debt, average cost of debt, net debt, net debt excluding leases and leverages as disclosed in VEON’s 3Q22 trading update 3.3 2.4 2.2 1.7 3Q22 2Q23 3Q23 Oct'23 without Russia +17.2% with Russia +10.9% 90 110 130 150 FY 2020 FY 2021 FY 2022 Q1 2023 Q2 2023 Q3 2023 2-yr CAGR:

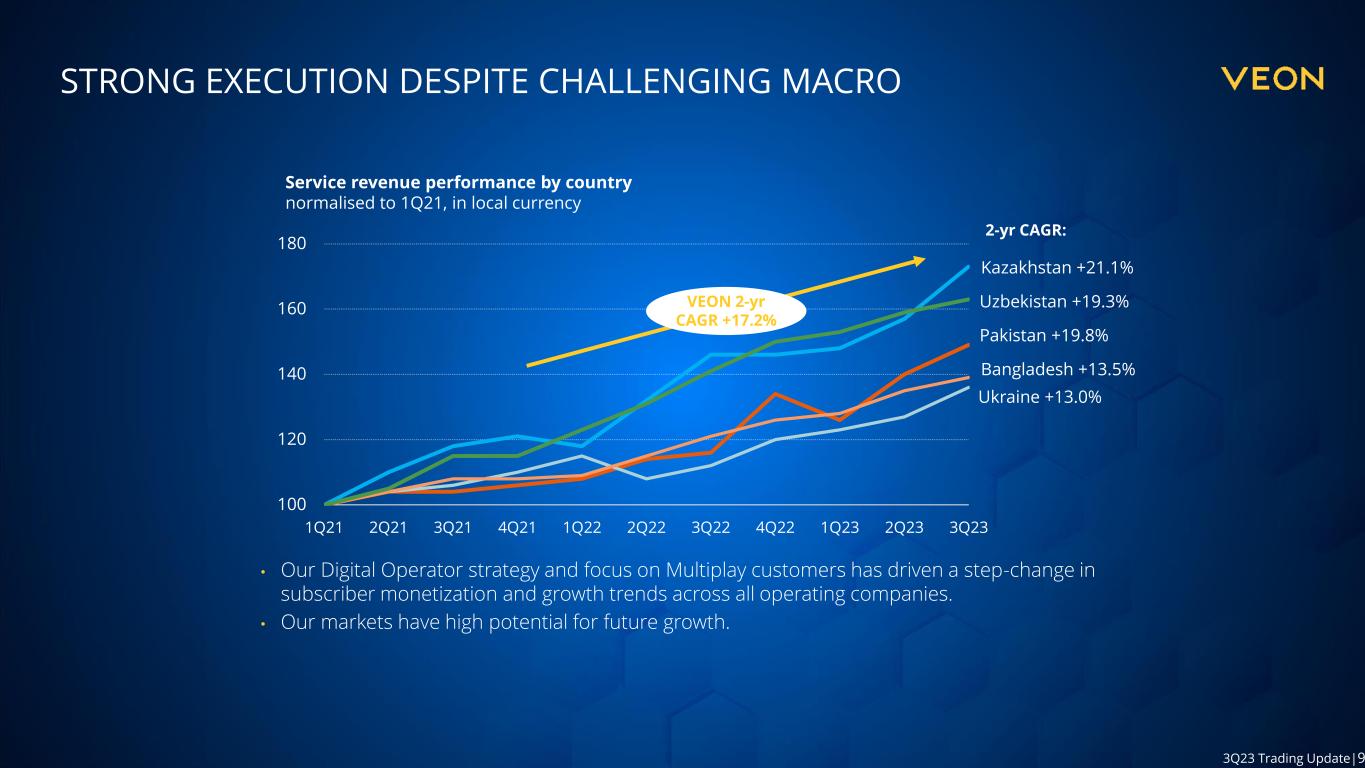

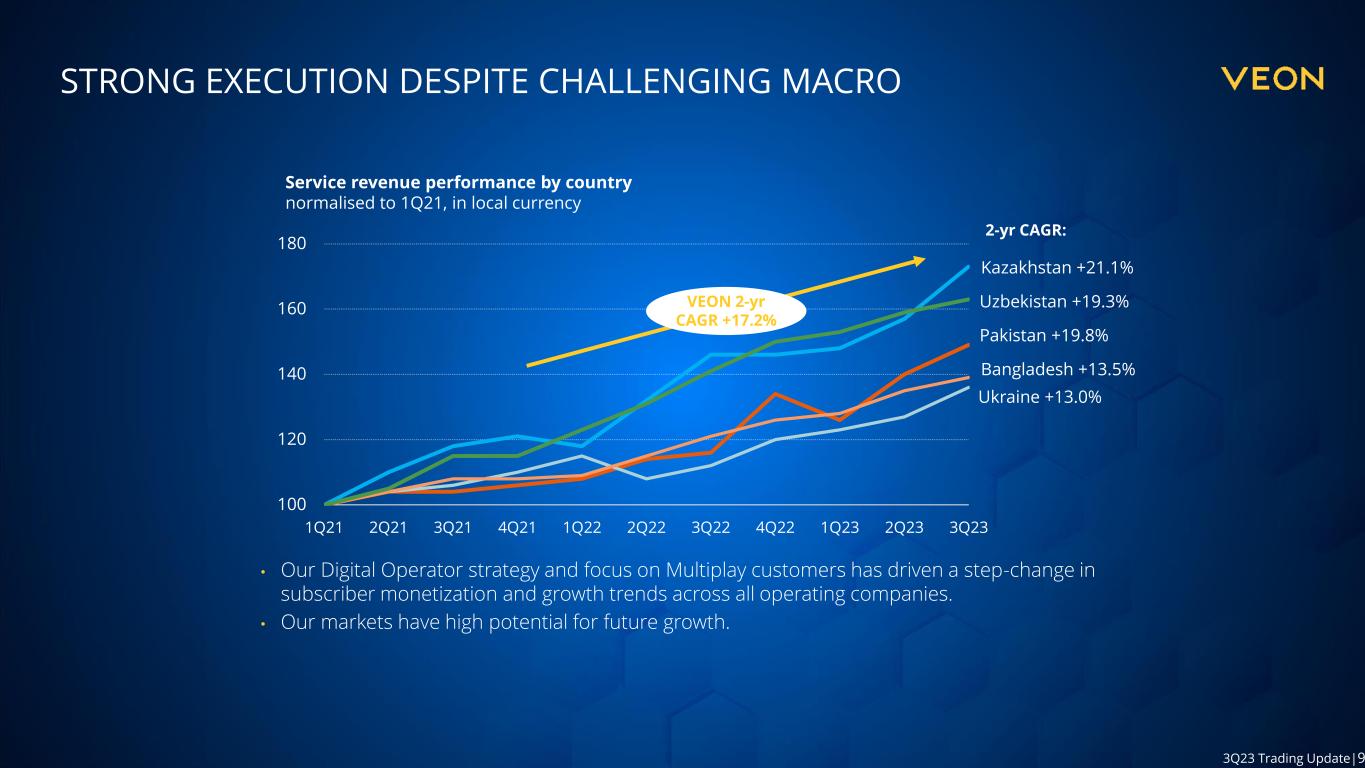

9 3Q23 Trading Update|9 STRONG EXECUTION DESPITE CHALLENGING MACRO Pakistan +19.8% Ukraine +13.0% Bangladesh +13.5% Kazakhstan +21.1% Uzbekistan +19.3% 100 120 140 160 180 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 Service revenue performance by country normalised to 1Q21, in local currency 2-yr CAGR: • Our Digital Operator strategy and focus on Multiplay customers has driven a step-change in subscriber monetization and growth trends across all operating companies. • Our markets have high potential for future growth. VEON 2-yr CAGR +17.2%

10 3Q23 Trading Update|10 19.4% 21.3% 14.1% 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 Group A Group B Weighted annual inflation* ACCELERATING TOP LINE, GROWING ABOVE INFLATION Note: Group revenue YoY performance is normalised for one-offs. Group A is: Bangladesh, Kazakhstan, Kyrgyzstan, Pakistan, Ukraine, and Uzbekistan. Group B is: Bangladesh, Kazakhstan, Kyrgyzstan, Pakistan, and Uzbekistan. * Denotes exclusion of Ukraine. Revenue performance YoY in local currency

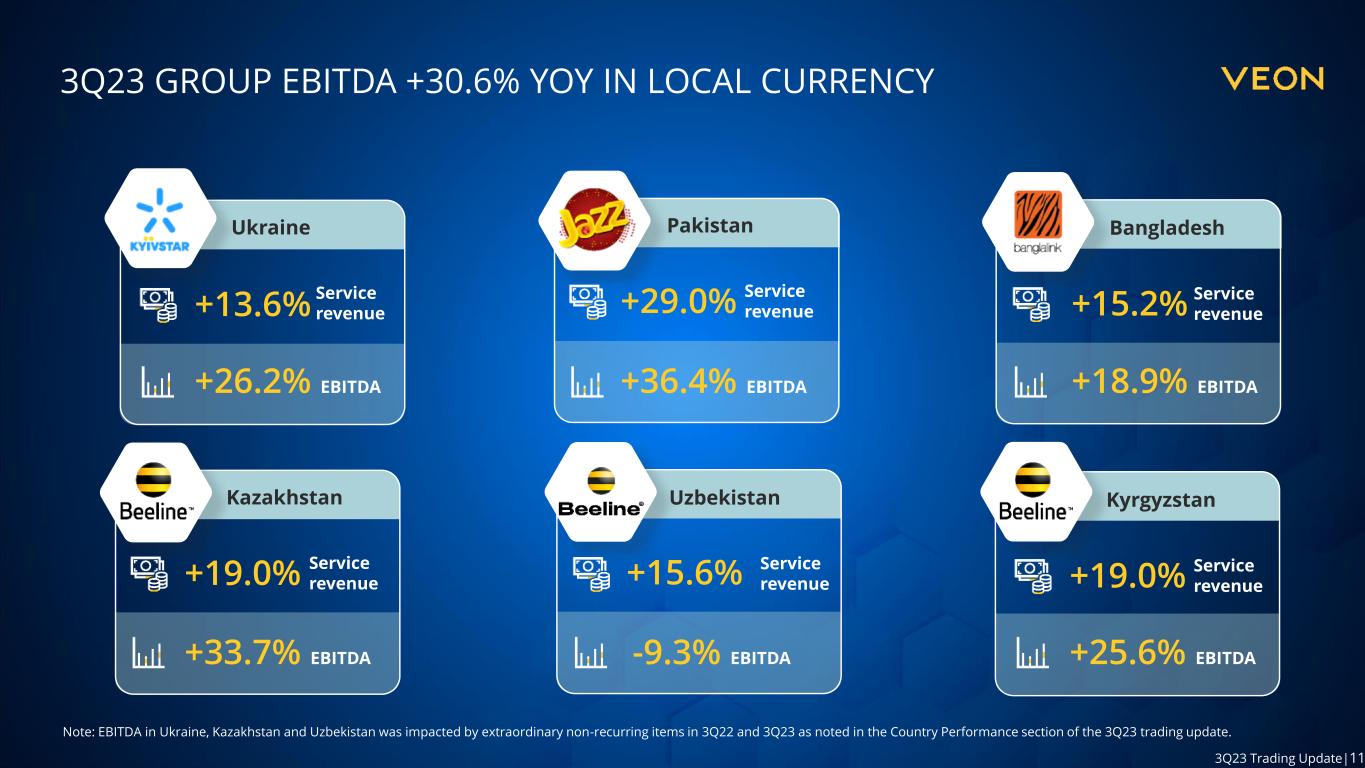

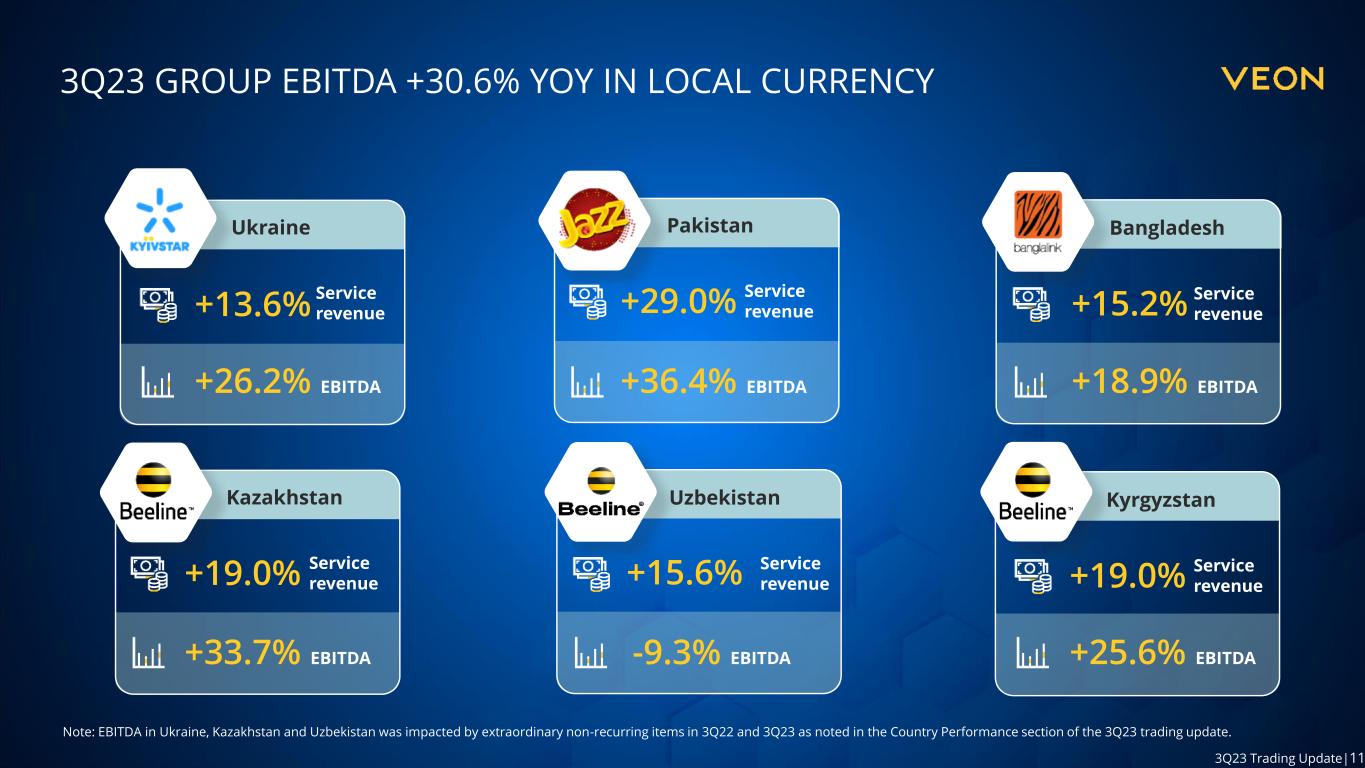

11 3Q23 Trading Update|11 3Q23 GROUP EBITDA +30.6% YOY IN LOCAL CURRENCY Note: EBITDA in Ukraine, Kazakhstan and Uzbekistan was impacted by extraordinary non-recurring items in 3Q22 and 3Q23 as noted in the Country Performance section of the 3Q23 trading update. +29.0% +36.4% EBITDA +19.0% +33.7% EBITDA +15.2% +18.9% EBITDA +15.6% -9.3% EBITDA +19.0% +25.6% EBITDA Pakistan Kazakhstan Bangladesh Uzbekistan Kyrgyzstan +26.2% EBITDA Ukraine +13.6% Service revenue Service revenue Service revenue Service revenue Service revenue Service revenue

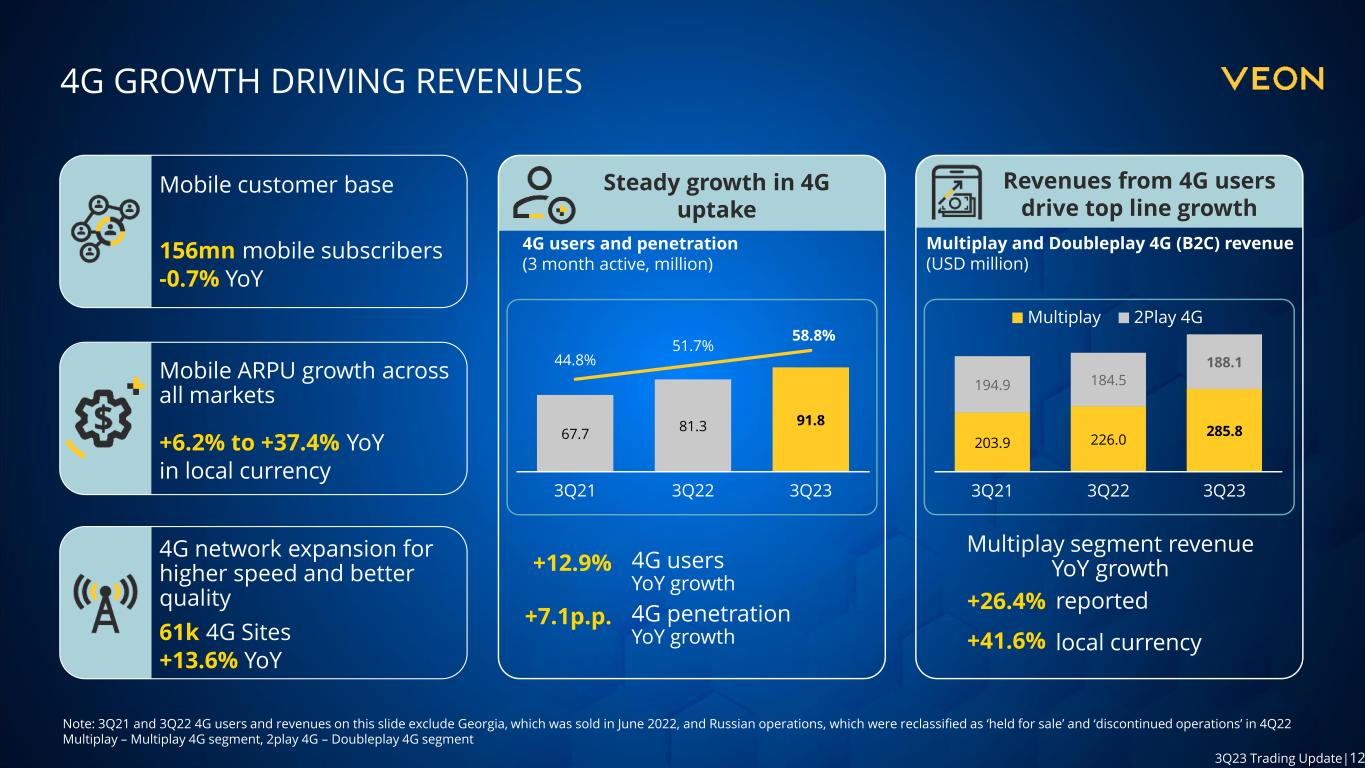

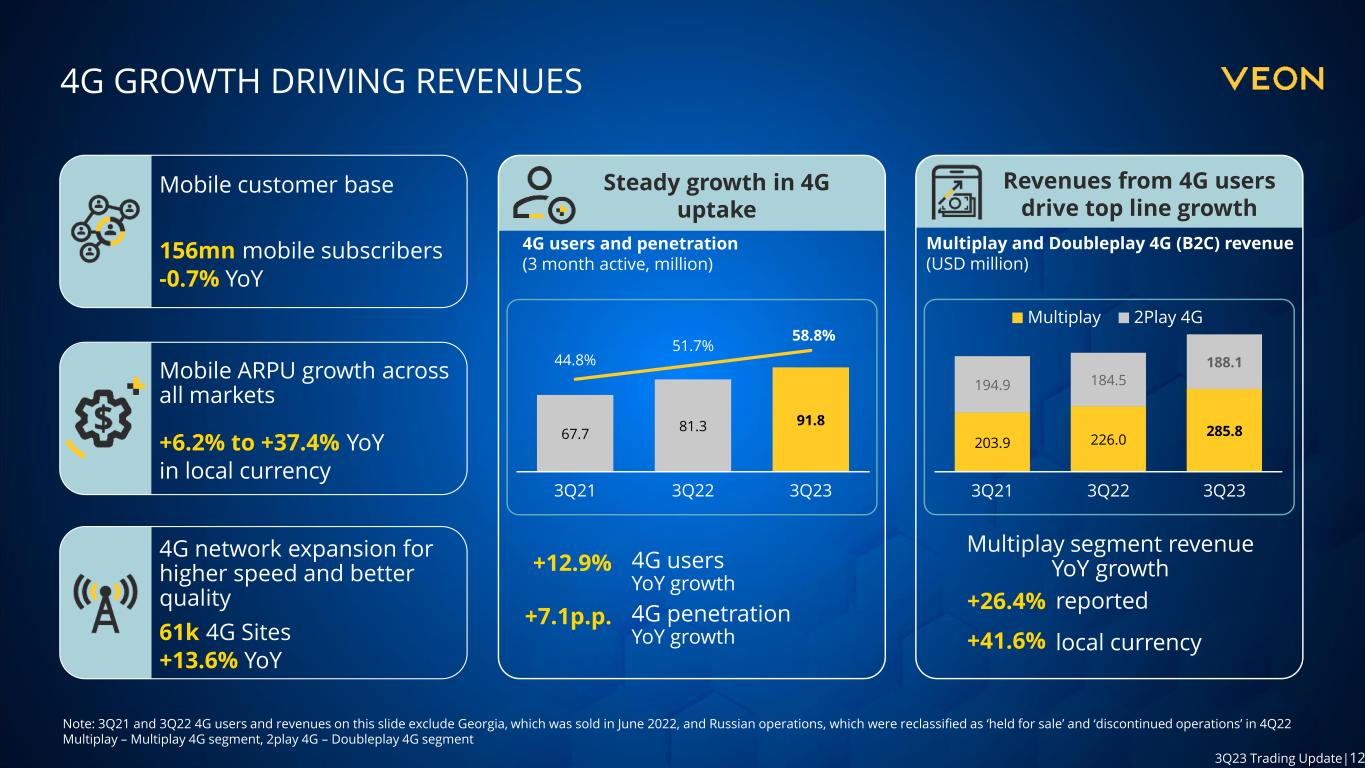

12 3Q23 Trading Update|12 4G GROWTH DRIVING REVENUES Note: 3Q21 and 3Q22 4G users and revenues on this slide exclude Georgia, which was sold in June 2022, and Russian operations, which were reclassified as ‘held for sale’ and ‘discontinued operations’ in 4Q22 Multiplay – Multiplay 4G segment, 2play 4G – Doubleplay 4G segment Steady growth in 4G uptake Revenues from 4G users drive top line growth Multiplay and Doubleplay 4G (B2C) revenue (USD million) 67.7 81.3 91.8 44.8% 51.7% 58.8% 3Q21 3Q22 3Q23 203.9 226.0 285.8 194.9 184.5 188.1 3Q21 3Q22 3Q23 Multiplay 2Play 4G +12.9% 4G users YoY growth +26.4% Multiplay segment revenue YoY growth 4G users and penetration (3 month active, million) +7.1p.p. 4G penetration YoY growth Mobile ARPU growth across all markets +6.2% to +37.4% YoY in local currency Mobile customer base 156mn mobile subscribers -0.7% YoY 4G network expansion for higher speed and better quality 61k 4G Sites +13.6% YoY +41.6% local currency reported

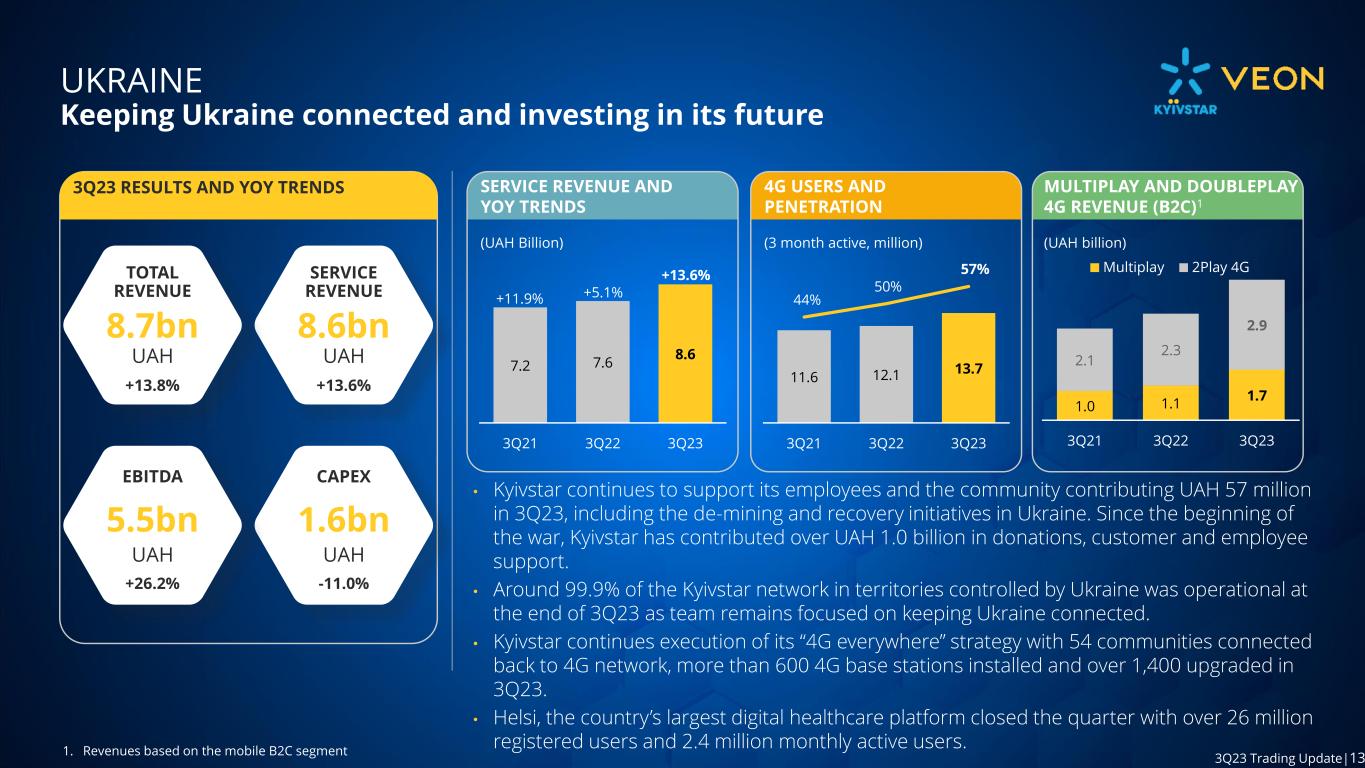

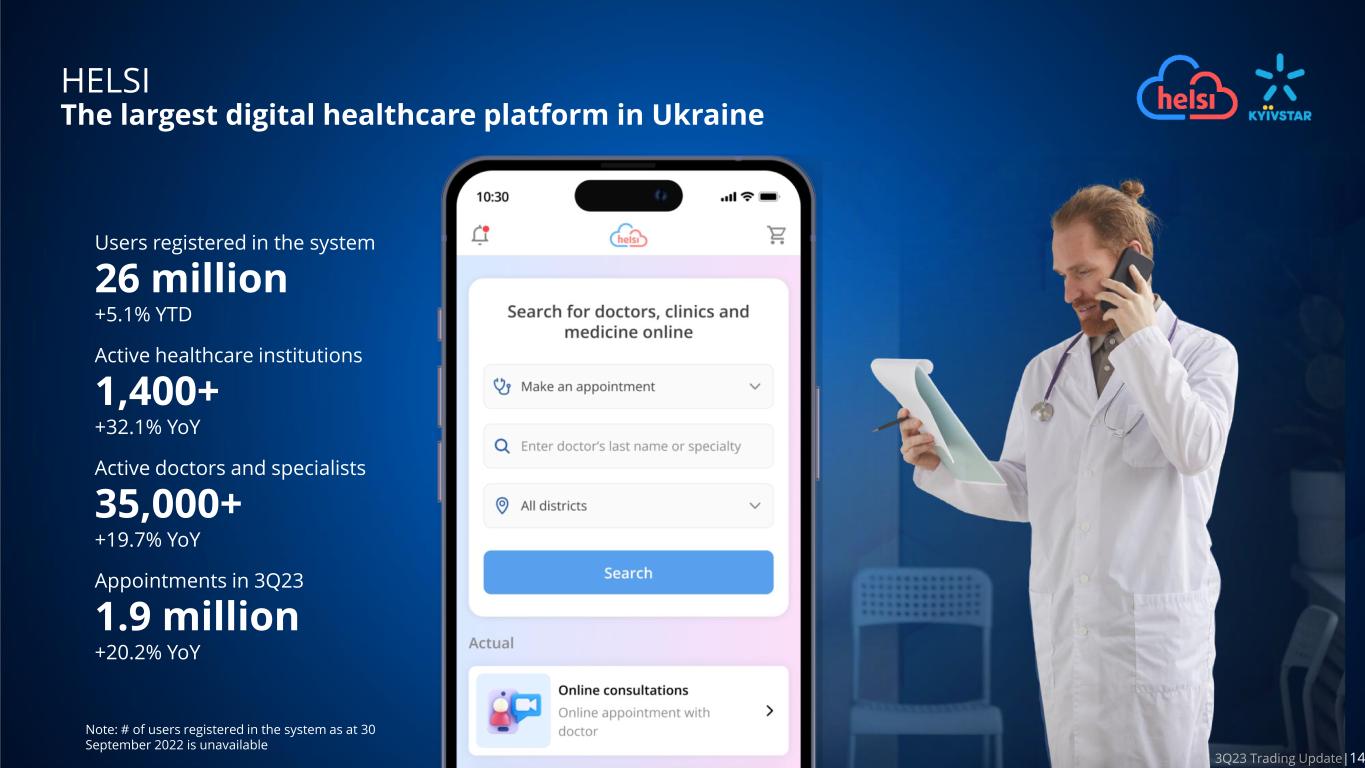

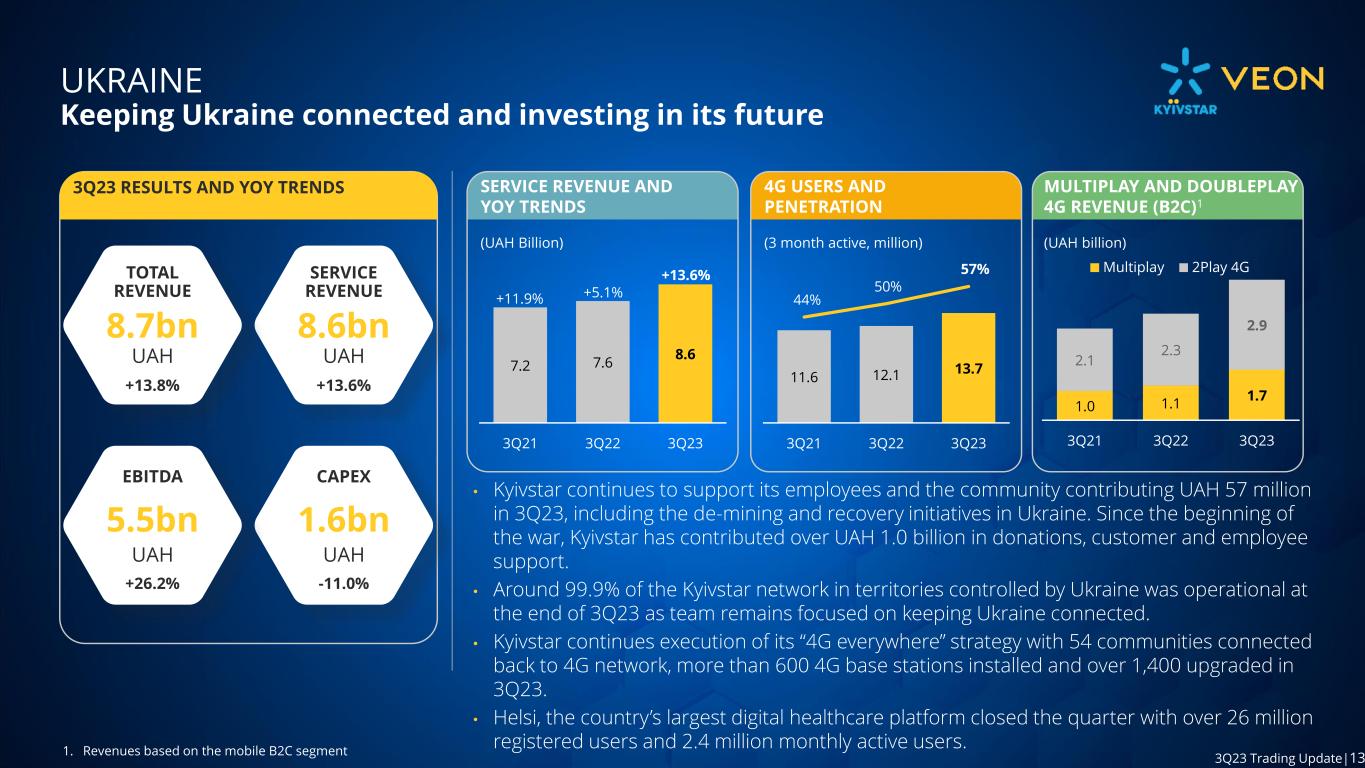

13 3Q23 Trading Update|13 UKRAINE Keeping Ukraine connected and investing in its future • Kyivstar continues to support its employees and the community contributing UAH 57 million in 3Q23, including the de-mining and recovery initiatives in Ukraine. Since the beginning of the war, Kyivstar has contributed over UAH 1.0 billion in donations, customer and employee support. • Around 99.9% of the Kyivstar network in territories controlled by Ukraine was operational at the end of 3Q23 as team remains focused on keeping Ukraine connected. • Kyivstar continues execution of its “4G everywhere” strategy with 54 communities connected back to 4G network, more than 600 4G base stations installed and over 1,400 upgraded in 3Q23. • Helsi, the country’s largest digital healthcare platform closed the quarter with over 26 million registered users and 2.4 million monthly active users. 3Q23 RESULTS AND YOY TRENDS SERVICE REVENUE +13.6% CAPEX UAH 8.6bn 7.2 7.6 8.6 3Q21 3Q22 3Q23 11.6 12.1 13.7 44% 50% 57% 3Q21 3Q22 3Q23 +11.9% +5.1% +13.6% 1.6bn -11.0% UAH TOTAL REVENUE 8.7bn 5.5bn UAH +13.8% EBITDA +26.2% UAH 4G USERS AND PENETRATION (3 month active, million) MULTIPLAY AND DOUBLEPLAY 4G REVENUE (B2C)1 (UAH billion) SERVICE REVENUE AND YOY TRENDS (UAH Billion) 1. Revenues based on the mobile B2C segment 1.0 1.1 1.7 2.1 2.3 2.9 3Q21 3Q22 3Q23 Multiplay 2Play 4G

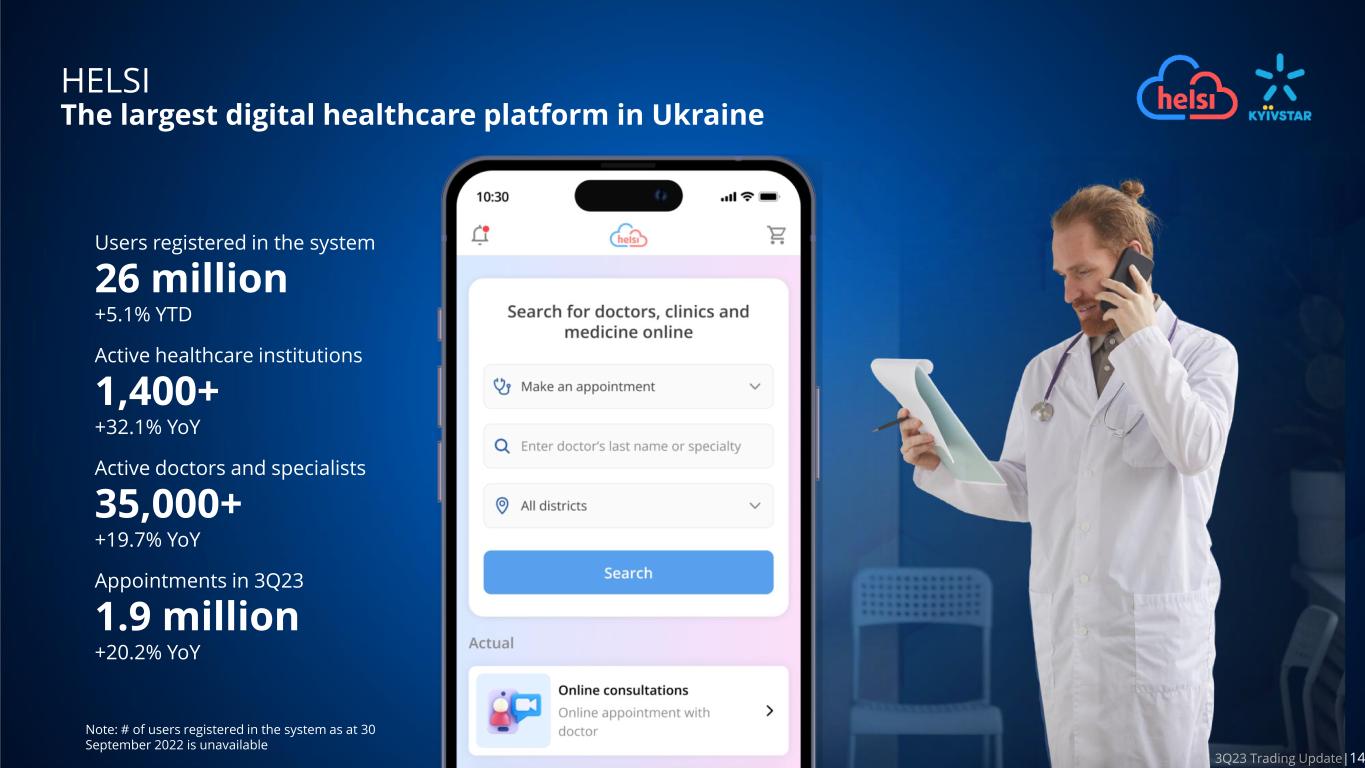

14 3Q23 Trading Update|14 HELSI The largest digital healthcare platform in Ukraine Users registered in the system 26 million +5.1% YTD Active healthcare institutions 1,400+ +32.1% YoY Active doctors and specialists 35,000+ +19.7% YoY Appointments in 3Q23 1.9 million +20.2% YoY Note: # of users registered in the system as at 30 September 2022 is unavailable

15 3Q23 Trading Update|15 UKRAINE Reiterating our commitment to the country’s future 2 Protection of VEON investors Engagement with the Ukrainian government and authorities Commitment to Ukraine • Swift, strong and effective governance response • Changes and new appointment to Kyivstar board • Challenging the freezing of corporate rights with Kyiv Court • We are actively seeking clarifications • VEON Board and Management delegation visited Ukraine • VEON is open for constructive direct dialogue • VEON and Rakuten signed MoU for Open-RAN in Ukraine • Pledged $600 million to recovery and reconstruction • Ongoing donations, staff and customer support 4 3 Ownership • VEON HQ in the Netherlands, Nasdaq- and Euronext-listed • VEON has diverse institutional and retail investors and has no controlling or majority shareholder • VEON is the sole and rightful owner of Kyivstar 1

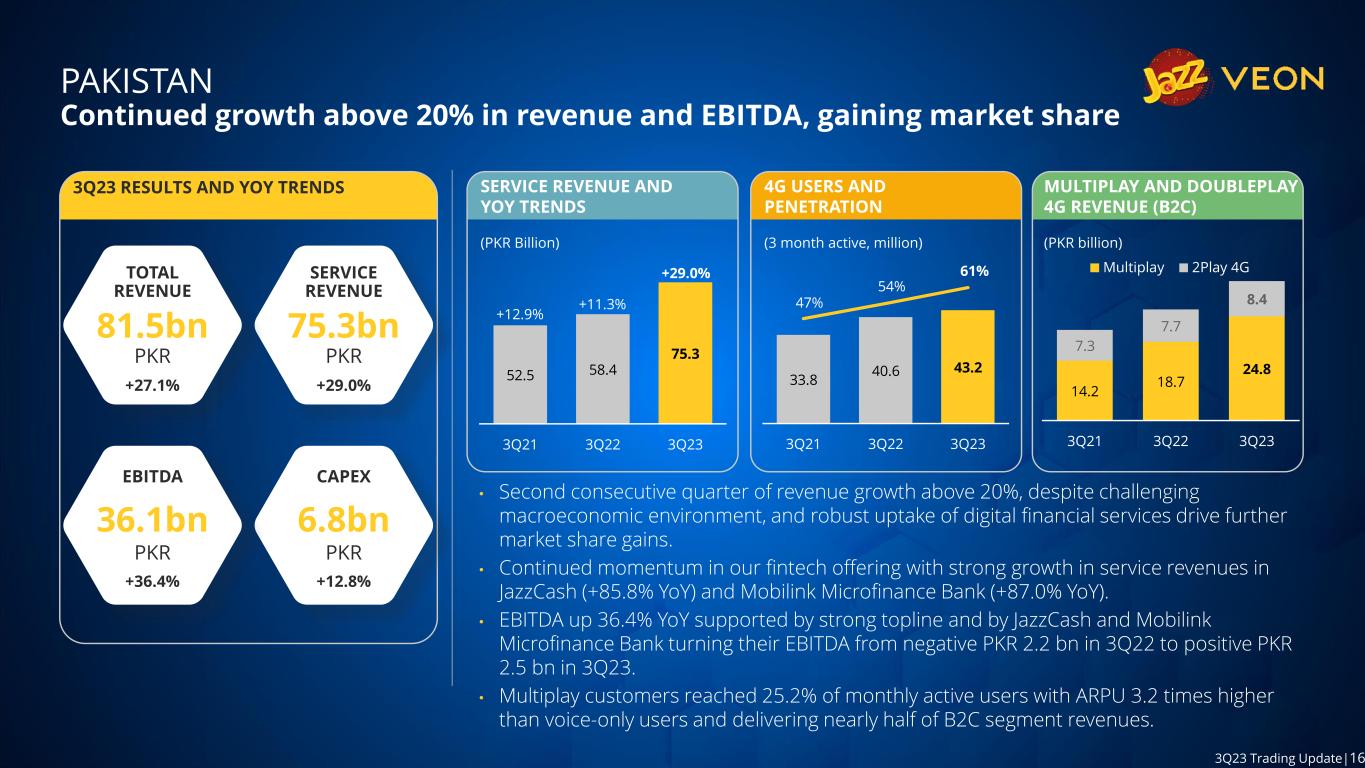

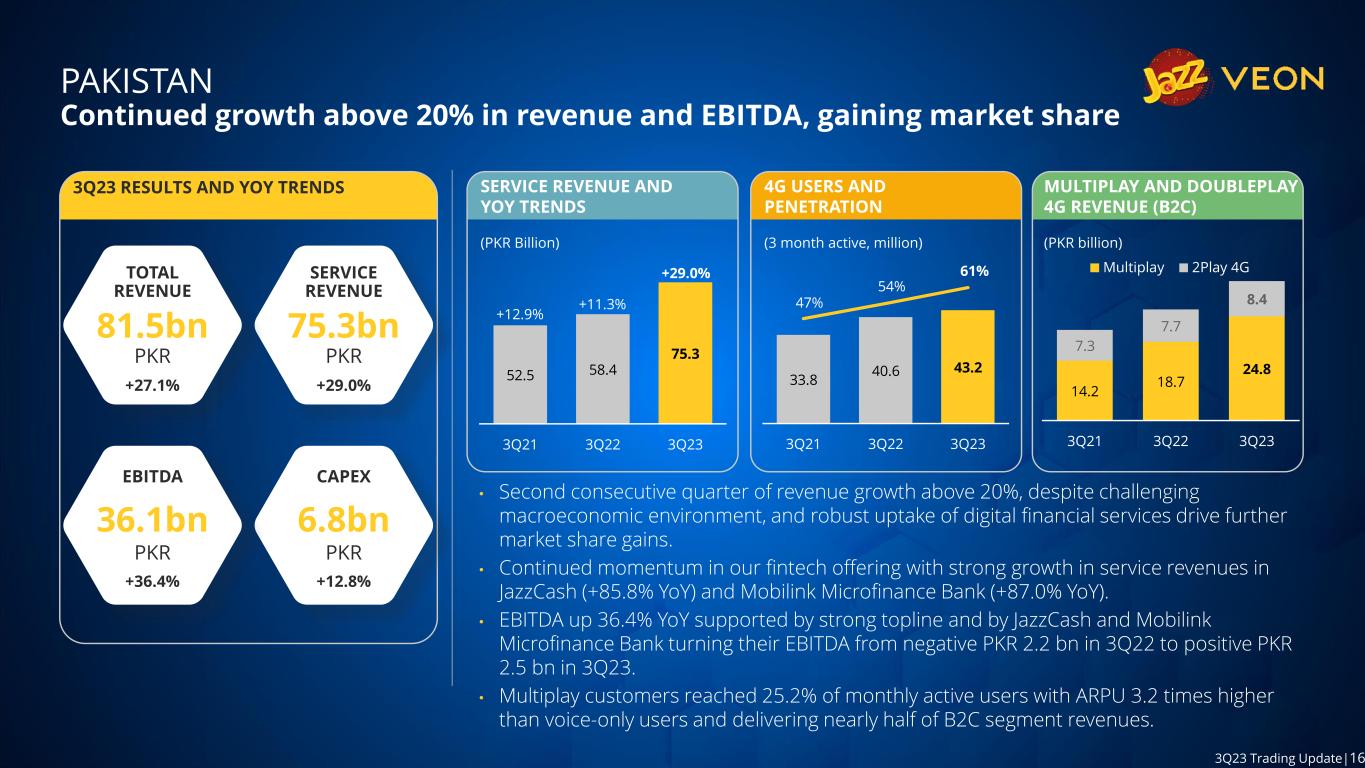

16 3Q23 Trading Update|16 PAKISTAN Continued growth above 20% in revenue and EBITDA, gaining market share • Second consecutive quarter of revenue growth above 20%, despite challenging macroeconomic environment, and robust uptake of digital financial services drive further market share gains. • Continued momentum in our fintech offering with strong growth in service revenues in JazzCash (+85.8% YoY) and Mobilink Microfinance Bank (+87.0% YoY). • EBITDA up 36.4% YoY supported by strong topline and by JazzCash and Mobilink Microfinance Bank turning their EBITDA from negative PKR 2.2 bn in 3Q22 to positive PKR 2.5 bn in 3Q23. • Multiplay customers reached 25.2% of monthly active users with ARPU 3.2 times higher than voice-only users and delivering nearly half of B2C segment revenues. 3Q23 RESULTS AND YOY TRENDS SERVICE REVENUE 75.3bn +29.0% 6.8bn +12.8% PKR PKR 52.5 58.4 75.3 3Q21 3Q22 3Q23 33.8 40.6 43.2 47% 54% 61% 3Q21 3Q22 3Q23 +29.0% CAPEX +12.9% +11.3% TOTAL REVENUE 81.5bn 36.1bn PKR +27.1% EBITDA +36.4% PKR 4G USERS AND PENETRATION (3 month active, million) SERVICE REVENUE AND YOY TRENDS (PKR Billion) 14.2 18.7 24.8 7.3 7.7 8.4 3Q21 3Q22 3Q23 Multiplay 2Play 4G MULTIPLAY AND DOUBLEPLAY 4G REVENUE (B2C) (PKR billion)

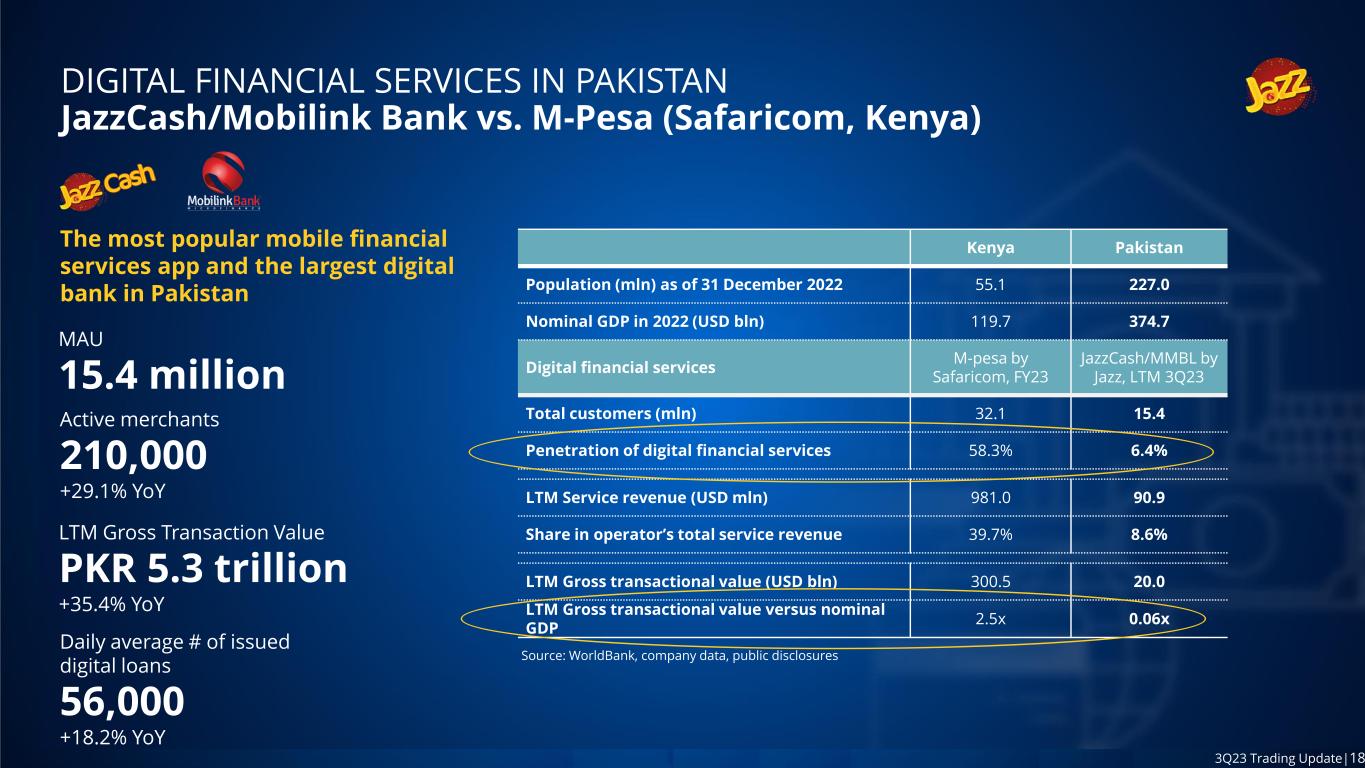

17 3Q23 Trading Update|17 PKR 2.5 bn 3Q23 DFS EBITDA PKR 4.7 bn improvement DIGITAL FINANCIAL SERVICES IN PAKISTAN JazzCash and Mobilink Bank The most popular mobile financial services app in Pakistan Pakistan’s largest digital bank MAU 15.4 million -7.9% YoY; +4.5% QoQ Active merchants 210,000 +29.1% YoY Daily average # of issued digital loans 56,000 +18.2% YoY LTM Gross Transaction Value PKR 5.3 trillion +35.4% YoY Gross Loan Portfolio PKR 54.4 billion +21.5% YoY Average loan size PKR 283,000 +12.2% YoY Bank customers 842,000 +26.6% YoY # of loans issued in 3Q23 35,000 +38.2% YoY

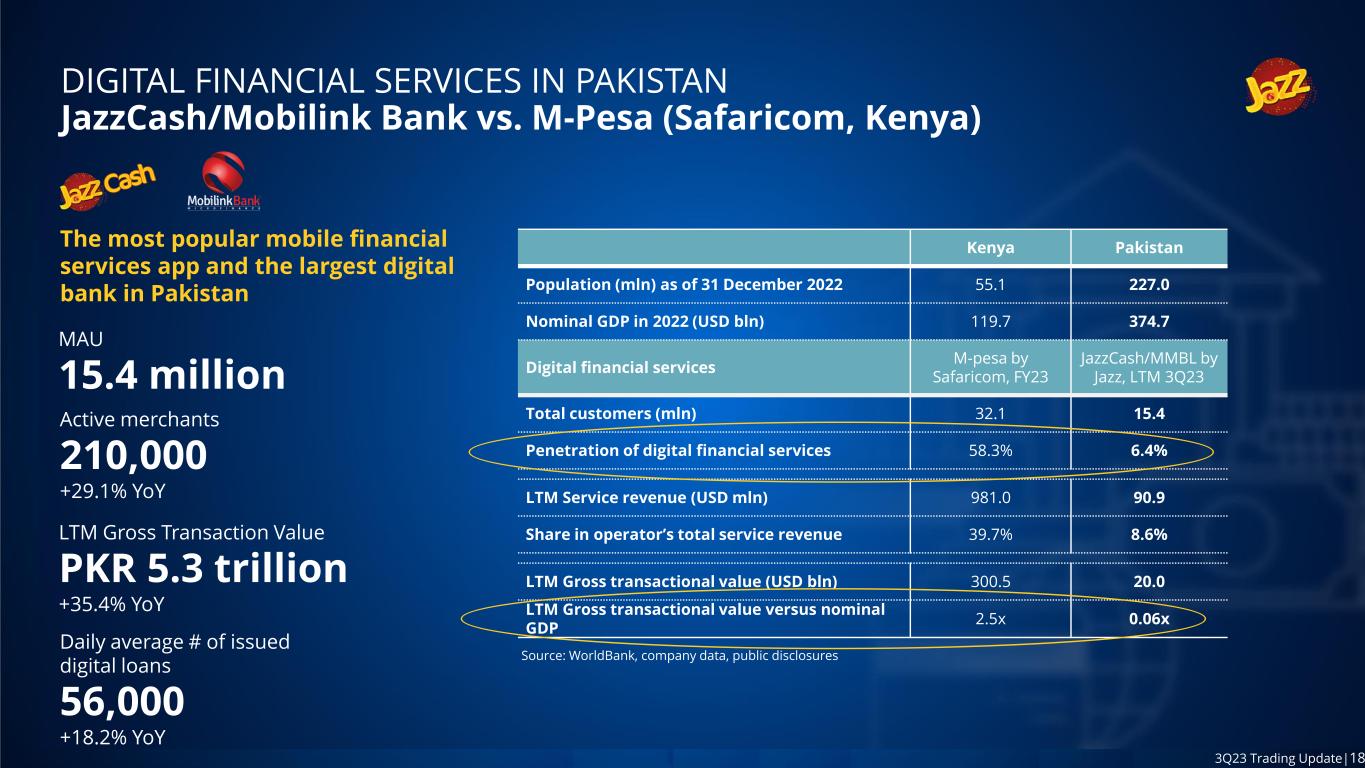

18 3Q23 Trading Update|18 DIGITAL FINANCIAL SERVICES IN PAKISTAN JazzCash/Mobilink Bank vs. M-Pesa (Safaricom, Kenya) The most popular mobile financial services app and the largest digital bank in Pakistan MAU 15.4 million Active merchants 210,000 +29.1% YoY Daily average # of issued digital loans 56,000 +18.2% YoY LTM Gross Transaction Value PKR 5.3 trillion +35.4% YoY Kenya Pakistan Population (mln) as of 31 December 2022 55.1 227.0 Nominal GDP in 2022 (USD bln) 119.7 374.7 Digital financial services M-pesa by Safaricom, FY23 JazzCash/MMBL by Jazz, LTM 3Q23 Total customers (mln) 32.1 15.4 Penetration of digital financial services 58.3% 6.4% LTM Service revenue (USD mln) 981.0 90.9 Share in operator’s total service revenue 39.7% 8.6% LTM Gross transactional value (USD bln) 300.5 20.0 LTM Gross transactional value versus nominal GDP 2.5x 0.06x Source: WorldBank, company data, public disclosures

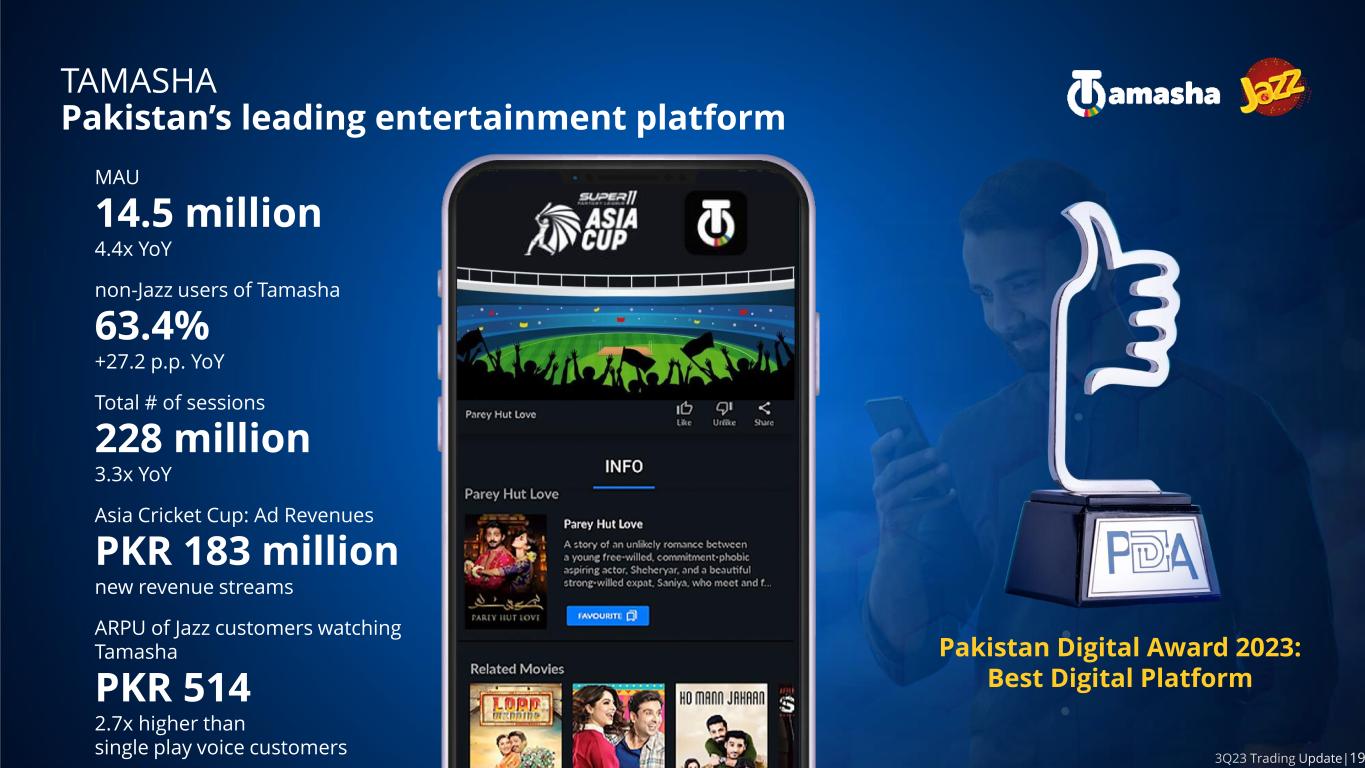

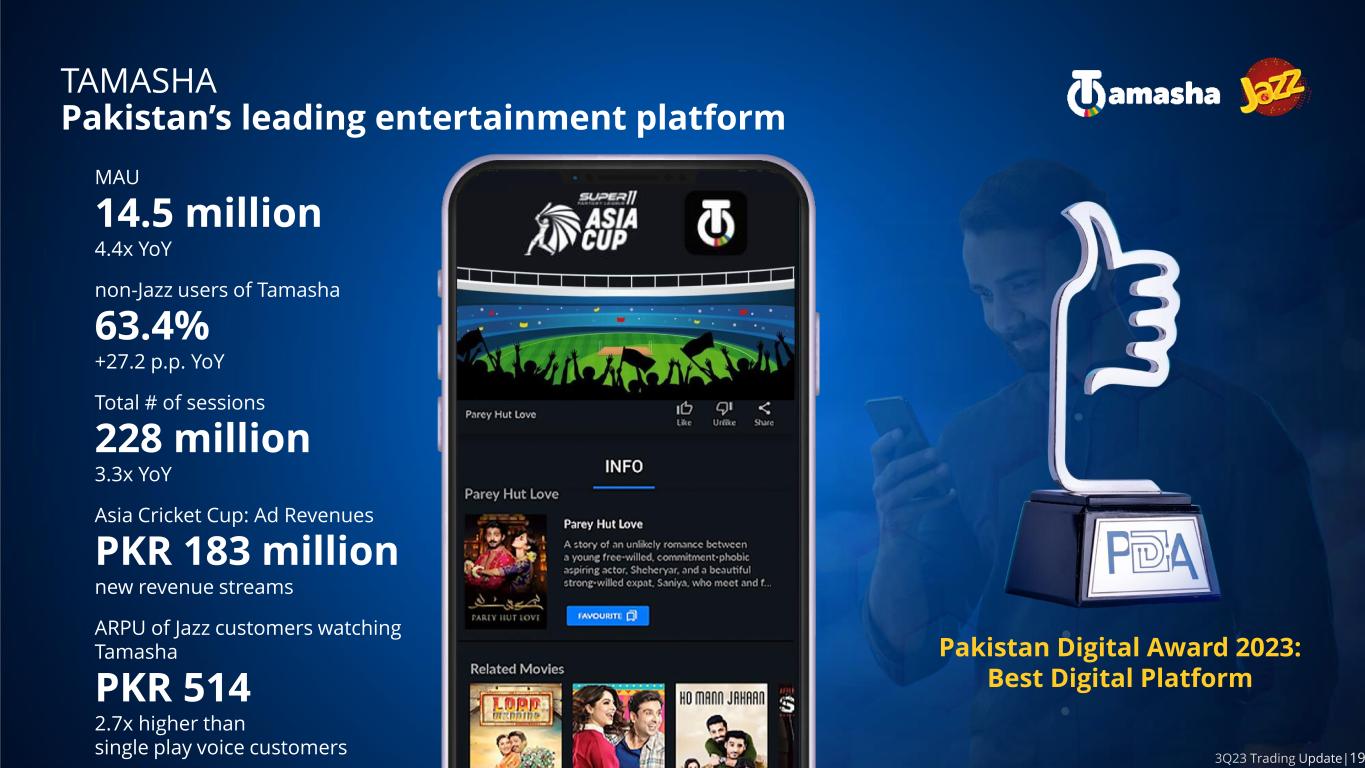

19 3Q23 Trading Update|19 TAMASHA Pakistan’s leading entertainment platform MAU 14.5 million 4.4x YoY non-Jazz users of Tamasha 63.4% +27.2 p.p. YoY Total # of sessions 228 million 3.3x YoY Asia Cricket Cup: Ad Revenues PKR 183 million new revenue streams ARPU of Jazz customers watching Tamasha PKR 514 2.7x higher than single play voice customers Pakistan Digital Award 2023: Best Digital Platform

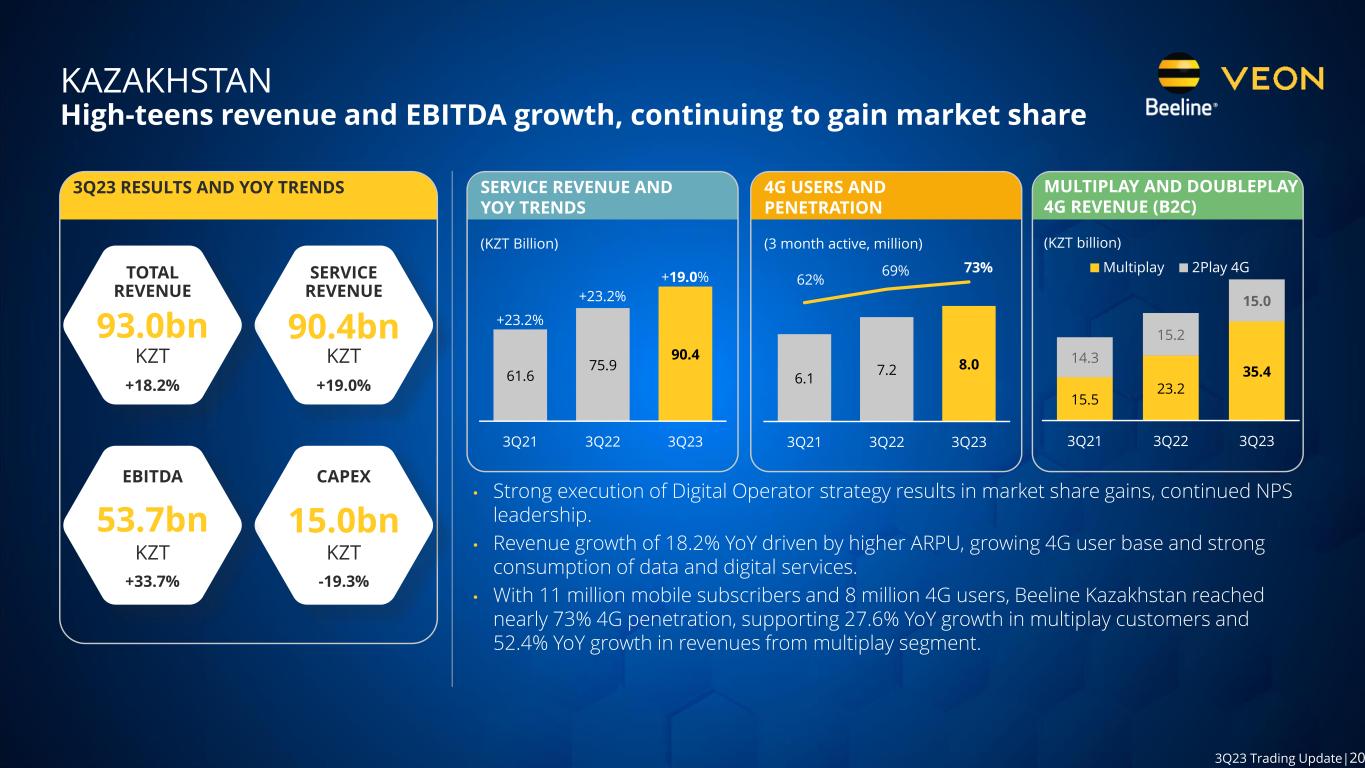

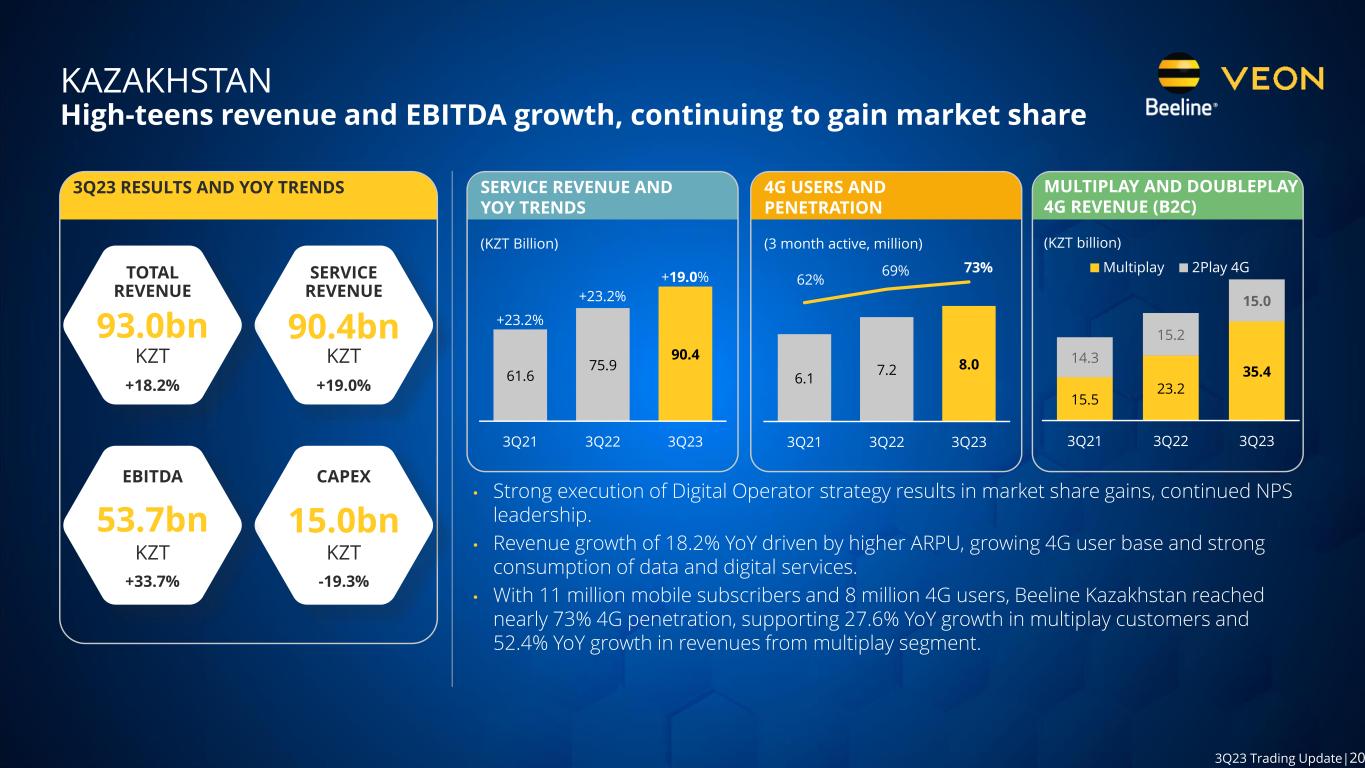

20 3Q23 Trading Update|20 KAZAKHSTAN High-teens revenue and EBITDA growth, continuing to gain market share • Strong execution of Digital Operator strategy results in market share gains, continued NPS leadership. • Revenue growth of 18.2% YoY driven by higher ARPU, growing 4G user base and strong consumption of data and digital services. • With 11 million mobile subscribers and 8 million 4G users, Beeline Kazakhstan reached nearly 73% 4G penetration, supporting 27.6% YoY growth in multiplay customers and 52.4% YoY growth in revenues from multiplay segment. 61.6 75.9 90.4 3Q21 3Q22 3Q23 6.1 7.2 8.0 62% 69% 73% 3Q21 3Q22 3Q23 +23.2% +23.2% +19.0% 4G USERS AND PENETRATION (3 month active, million) SERVICE REVENUE AND YOY TRENDS (KZT Billion) 3Q23 RESULTS AND YOY TRENDS SERVICE REVENUE 90.4bn +19.0% 15.0bn -19.3% KZT KZT CAPEX TOTAL REVENUE 93.0bn 53.7bn KZT +18.2% EBITDA +33.7% KZT MULTIPLAY AND DOUBLEPLAY 4G REVENUE (B2C) (KZT billion) 15.5 23.2 35.4 14.3 15.2 15.0 3Q21 3Q22 3Q23 Multiplay 2Play 4G

21 3Q23 Trading Update|21 IZI First mobile entertainment operator in Kazakhstan MAU 455,000 4.3x YoY non-Beeline Kazakhstan users of IZI app 47.7% Average DAU 50,000 3.1x YoY Monthly active mobile customers 219,000 +59.1% YoY “I Join” NPS 57.4% +3.5 p.p. YoY ARPU of IZI mobile customers with digital experience KZT 1,831 4.4 times higher than non-app IZI customers Entertainment platform The app offers a variety of unique and new content Mobile operator The number 1 platform for number portability in Kazakhstan with the highest NPS score and lower churn

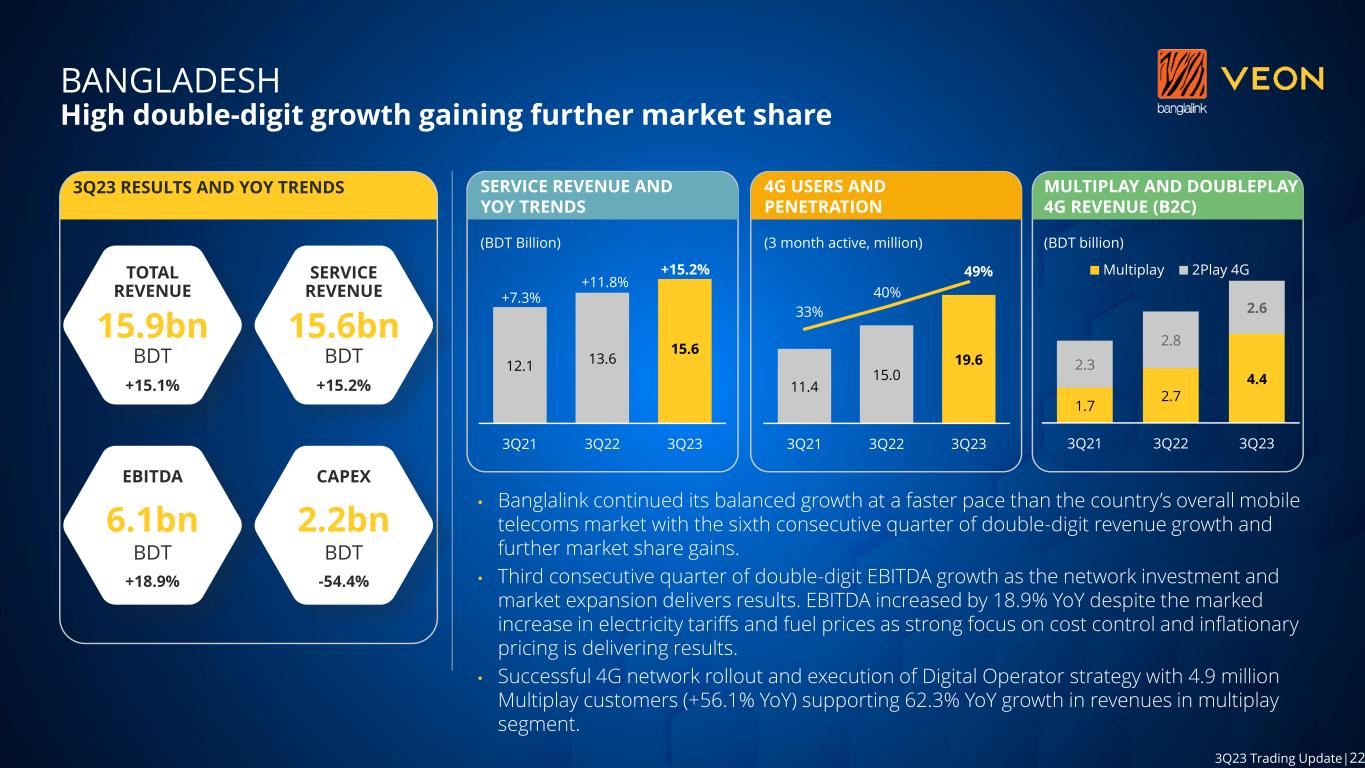

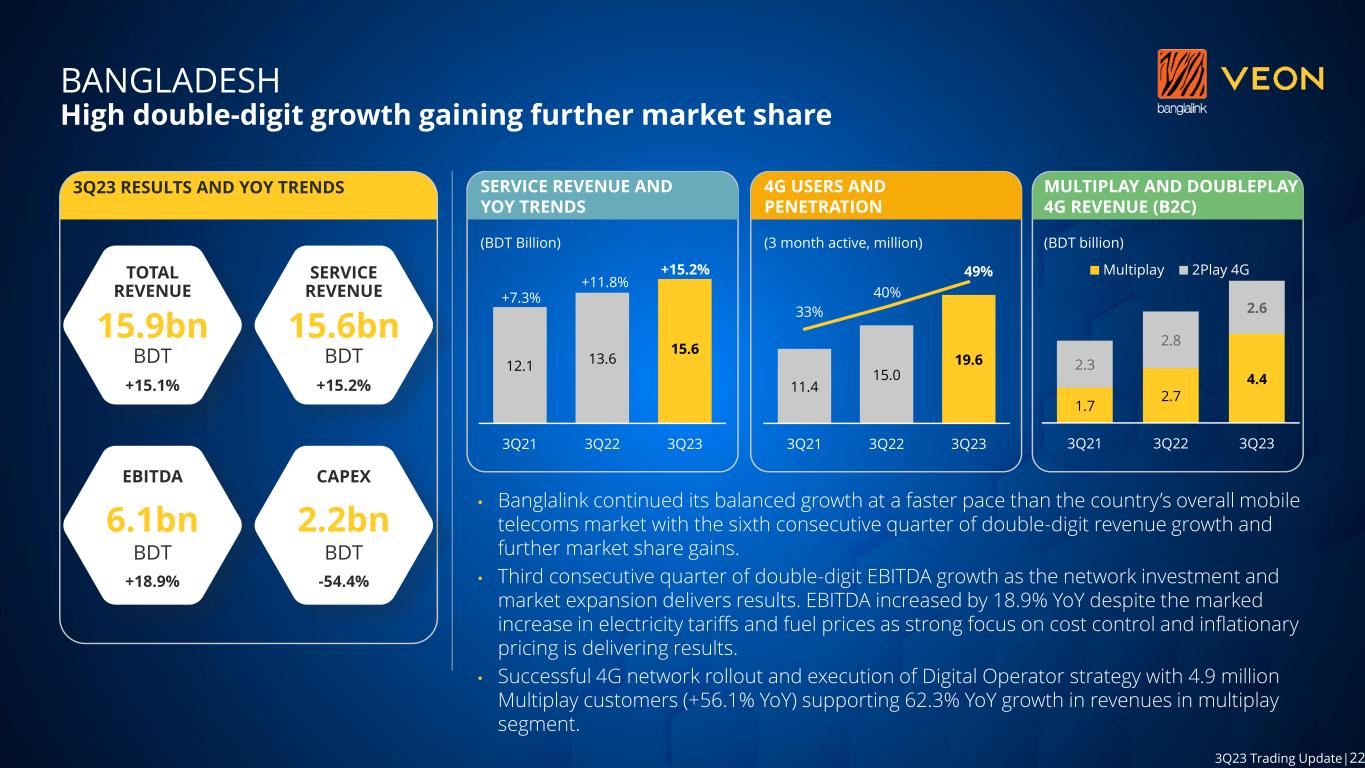

22 3Q23 Trading Update|22 BANGLADESH High double-digit growth gaining further market share • Banglalink continued its balanced growth at a faster pace than the country’s overall mobile telecoms market with the sixth consecutive quarter of double-digit revenue growth and further market share gains. • Third consecutive quarter of double-digit EBITDA growth as the network investment and market expansion delivers results. EBITDA increased by 18.9% YoY despite the marked increase in electricity tariffs and fuel prices as strong focus on cost control and inflationary pricing is delivering results. • Successful 4G network rollout and execution of Digital Operator strategy with 4.9 million Multiplay customers (+56.1% YoY) supporting 62.3% YoY growth in revenues in multiplay segment. 3Q23 RESULTS AND YOY TRENDS TOTAL REVENUE 15.9bn SERVICE REVENUE 6.1bn 15.6bn 2.2bn 12.1 13.6 15.6 3Q21 3Q22 3Q23 11.4 15.0 19.6 33% 40% 49% 3Q21 3Q22 3Q23 +7.3% +11.8% +15.2% EBITDA CAPEX -54.4% BDT +18.9% BDT 4G USERS AND PENETRATION (3 month active, million) SERVICE REVENUE AND YOY TRENDS (BDT Billion) +15.2% BDTBDT +15.1% MULTIPLAY AND DOUBLEPLAY 4G REVENUE (B2C) (BDT billion) 1.7 2.7 4.4 2.3 2.8 2.6 3Q21 3Q22 3Q23 Multiplay 2Play 4G

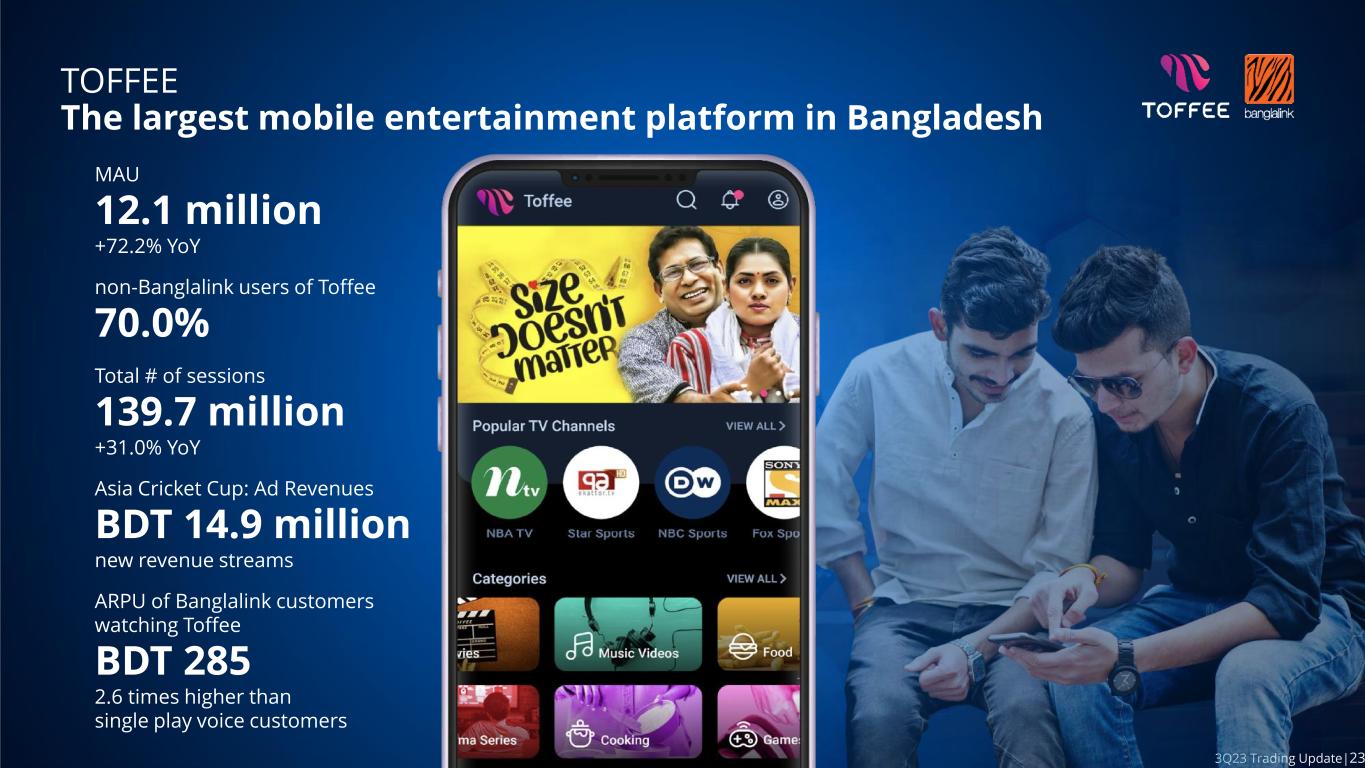

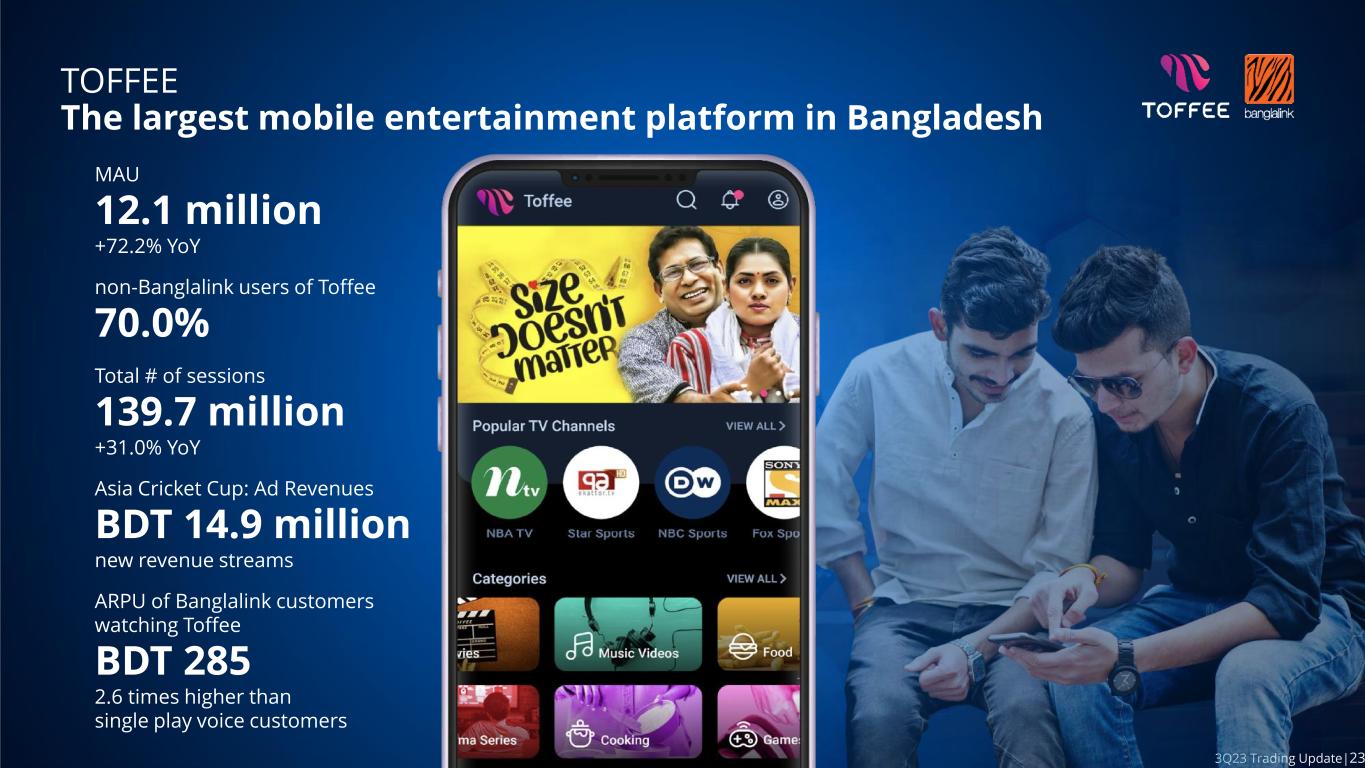

23 3Q23 Trading Update|23 TOFFEE The largest mobile entertainment platform in Bangladesh MAU 12.1 million +72.2% YoY non-Banglalink users of Toffee 70.0% Total # of sessions 139.7 million +31.0% YoY Asia Cricket Cup: Ad Revenues BDT 14.9 million new revenue streams ARPU of Banglalink customers watching Toffee BDT 285 2.6 times higher than single play voice customers

24 3Q23 Trading Update|24 UZBEKISTAN Rising 4G coverage and 4G users drive data and digital services use • Beeline Uzbekistan delivered its ninth consecutive quarter of double-digit topline growth, reaching VEON’s target of 70% 4G user penetration. • Revenue growth of 15.6% driven by balanced growth in customer base and ARPU, 17.8% YoY increase in 4G users and higher data usage up 29.7% YoY. • EBITDA was down by 9.3% YoY, impacted by higher regulatory costs in 3Q23, extraordinary one-offs and projects in 3Q22 and 3Q23. Adjusted for these one-offs, EBITDA increased by 10.0% YoY. • Beeline Uzbekistan reported 21.2% YoY increase in multiplay customer base contributing 55.5% of B2C revenues during 3Q23. • Beeline Uzbekistan launched its digital-first operator OQ to provide integrated experiences in entertainment and communication. 542.2 664.4 768.1 3Q21 3Q22 3Q23 3.9 5.2 6.1 57% 64% 71% 3Q21 3Q22 3Q23 +10.5% +22.5% +15.6% 4G USERS AND PENETRATION (3 month active, million) SERVICE REVENUE AND YOY TRENDS (UZS Billion) 3Q23 RESULTS AND YOY TRENDS SERVICE REVENUE 768bn +15.6% 96bn -46.4% UZS UZS CAPEX TOTAL REVENUE 768bn 275bn UZS +15.6% EBITDA -9.3% UZS MULTIPLAY AND DOUBLEPLAY 4G REVENUE (B2C) (UZS billion) 211.5 309.1 384.5 110.3 170.1 191.9 3Q21 3Q22 3Q23 Multiplay 2Play 4G

25 3Q23 Trading Update|25 OUR DIGITAL PORTFOLIO A backbone of DO 1440 Strategy Total usage time YTD, minutes 49.6 billion # of sessions YTD 7.0 billion Total MAU across all services and platforms 101.3 million +39.5% YoY Non-VEON cumulative MAU of our apps 30.0 million As of 30 October 2023 R e a d P a y

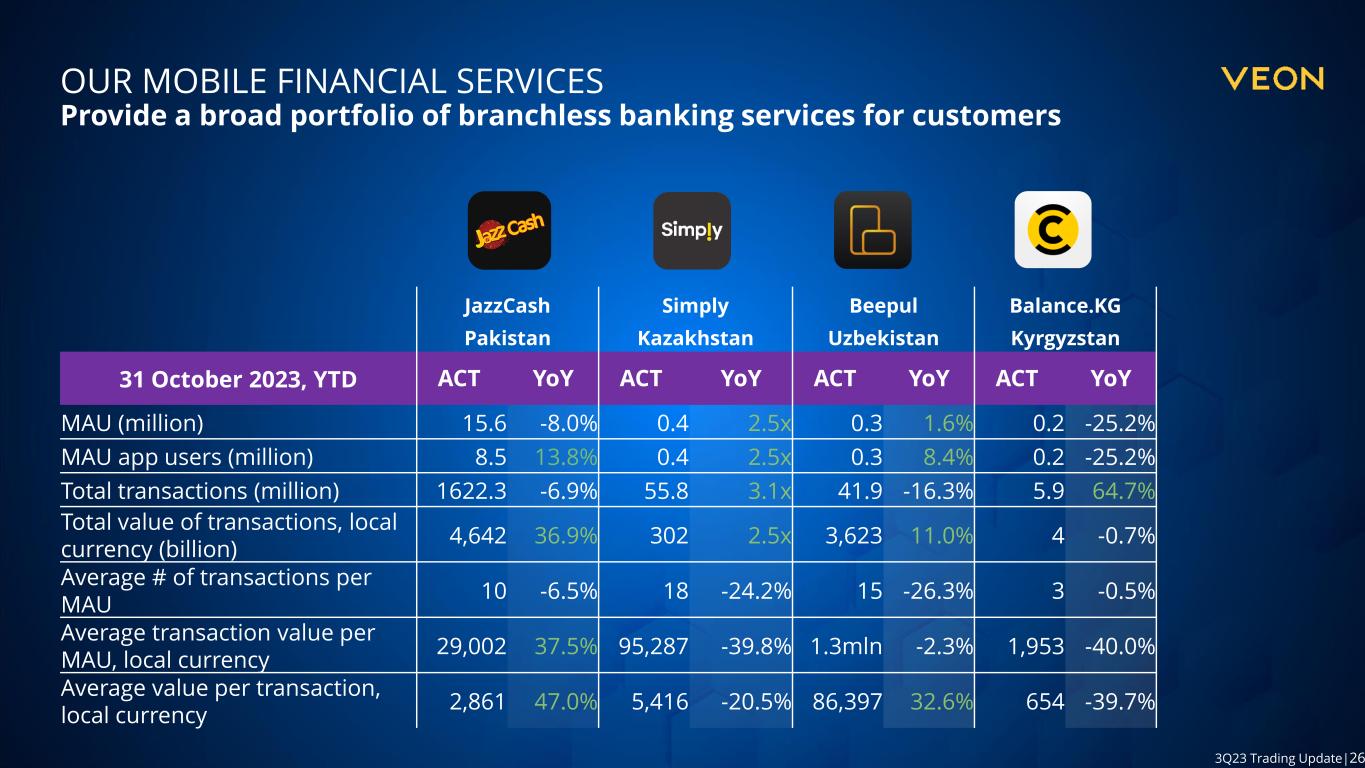

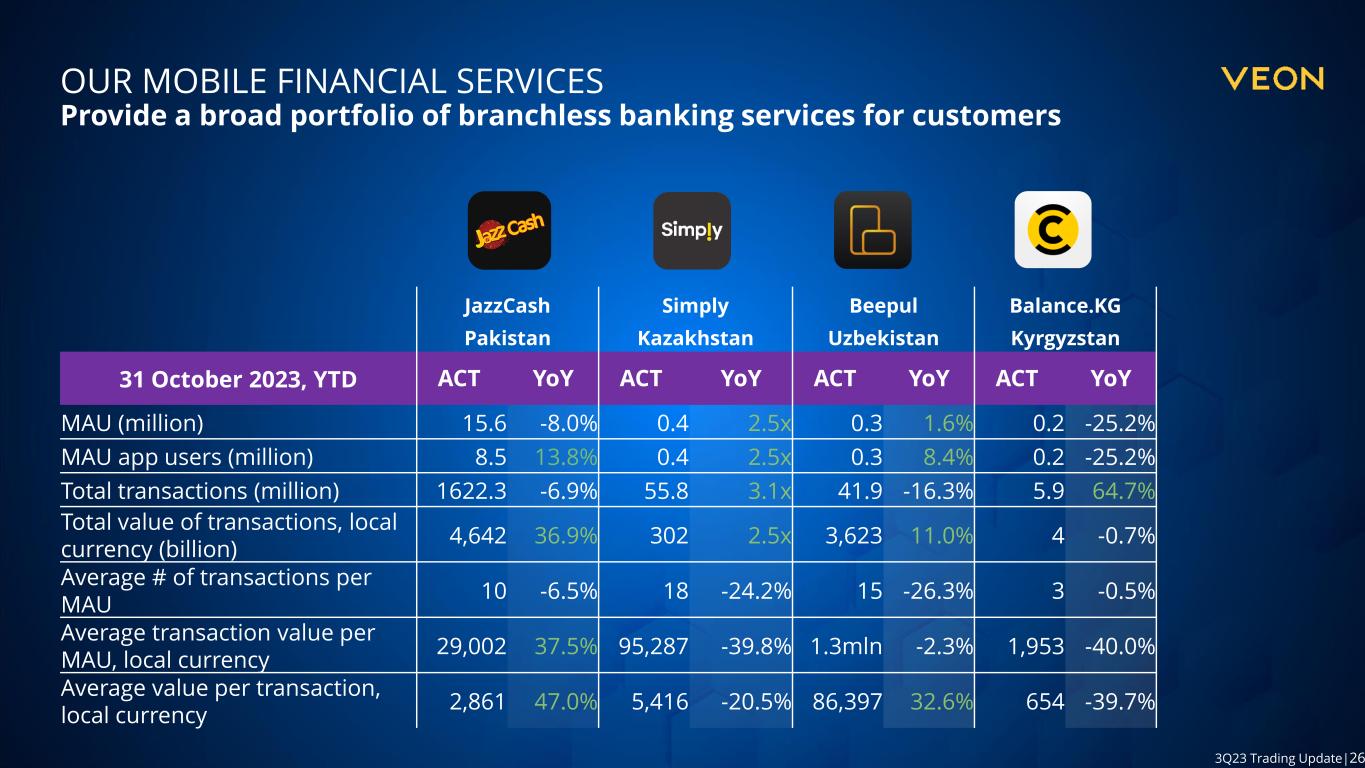

26 3Q23 Trading Update|26 OUR MOBILE FINANCIAL SERVICES Provide a broad portfolio of branchless banking services for customers JazzCash Simply Beepul Balance.KG Pakistan Kazakhstan Uzbekistan Kyrgyzstan 31 October 2023, YTD ACT YoY ACT YoY ACT YoY ACT YoY MAU (million) 15.6 -8.0% 0.4 2.5x 0.3 1.6% 0.2 -25.2% MAU app users (million) 8.5 13.8% 0.4 2.5x 0.3 8.4% 0.2 -25.2% Total transactions (million) 1622.3 -6.9% 55.8 3.1x 41.9 -16.3% 5.9 64.7% Total value of transactions, local currency (billion) 4,642 36.9% 302 2.5x 3,623 11.0% 4 -0.7% Average # of transactions per MAU 10 -6.5% 18 -24.2% 15 -26.3% 3 -0.5% Average transaction value per MAU, local currency 29,002 37.5% 95,287 -39.8% 1.3mln -2.3% 1,953 -40.0% Average value per transaction, local currency 2,861 47.0% 5,416 -20.5% 86,397 32.6% 654 -39.7%

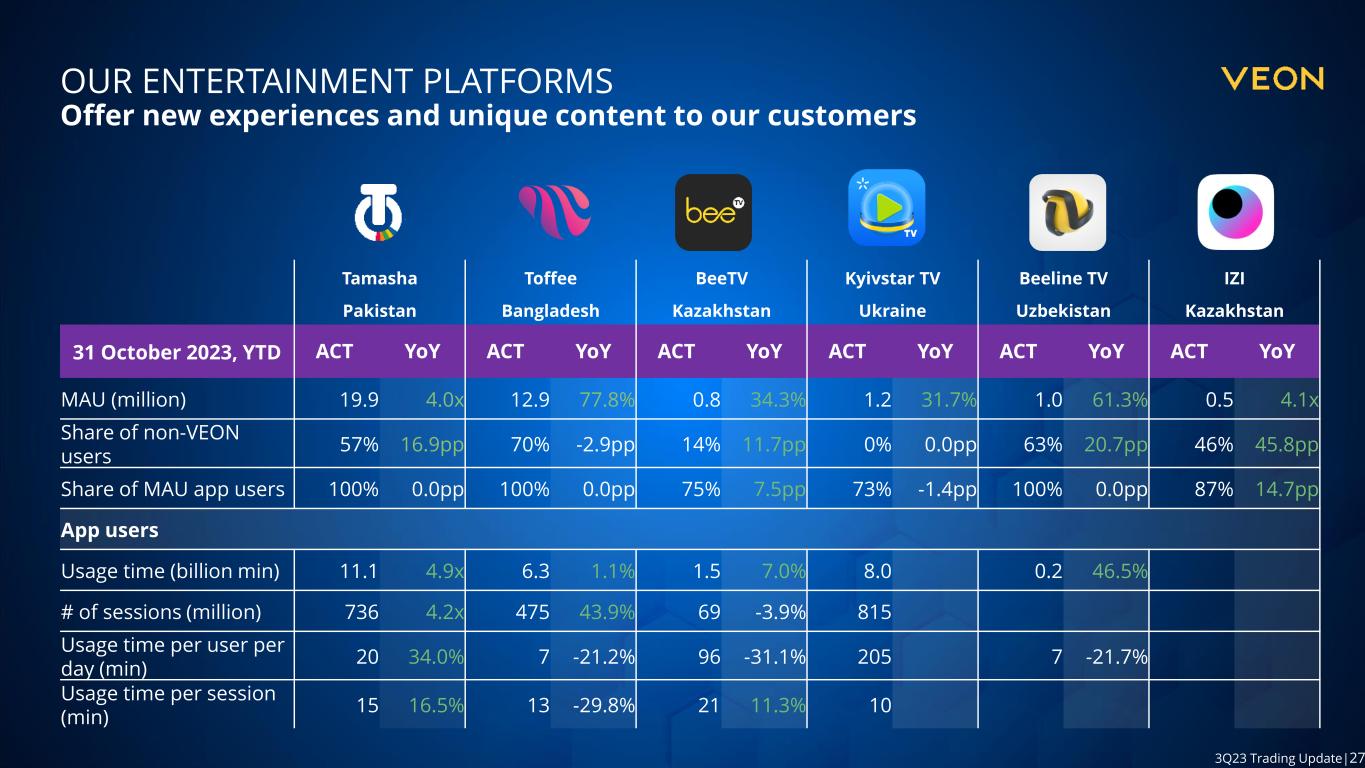

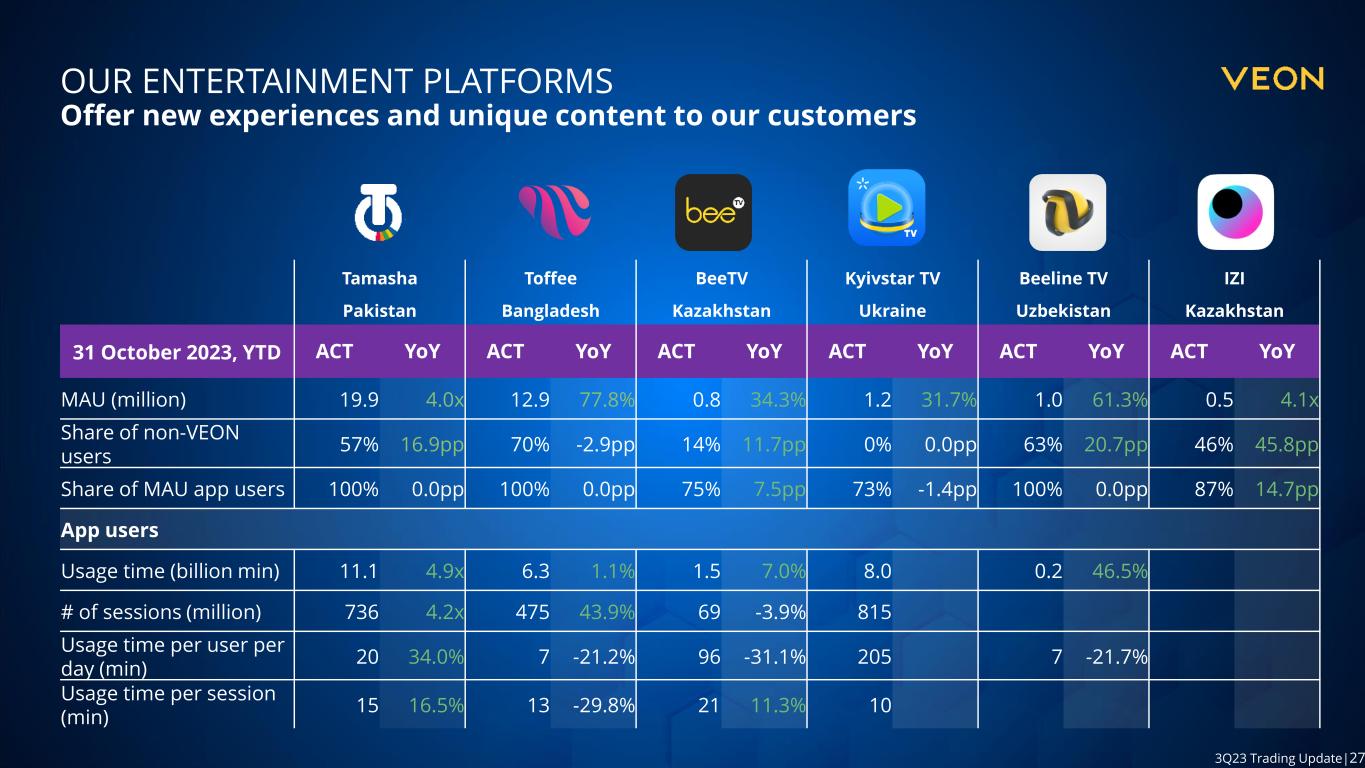

27 3Q23 Trading Update|27 OUR ENTERTAINMENT PLATFORMS Offer new experiences and unique content to our customers Tamasha Toffee BeeTV Kyivstar TV Beeline TV IZI Pakistan Bangladesh Kazakhstan Ukraine Uzbekistan Kazakhstan 31 October 2023, YTD ACT YoY ACT YoY ACT YoY ACT YoY ACT YoY ACT YoY MAU (million) 19.9 4.0x 12.9 77.8% 0.8 34.3% 1.2 31.7% 1.0 61.3% 0.5 4.1x Share of non-VEON users 57% 16.9pp 70% -2.9pp 14% 11.7pp 0% 0.0pp 63% 20.7pp 46% 45.8pp Share of MAU app users 100% 0.0pp 100% 0.0pp 75% 7.5pp 73% -1.4pp 100% 0.0pp 87% 14.7pp App users Usage time (billion min) 11.1 4.9x 6.3 1.1% 1.5 7.0% 8.0 0.2 46.5% # of sessions (million) 736 4.2x 475 43.9% 69 -3.9% 815 Usage time per user per day (min) 20 34.0% 7 -21.2% 96 -31.1% 205 7 -21.7% Usage time per session (min) 15 16.5% 13 -29.8% 21 11.3% 10

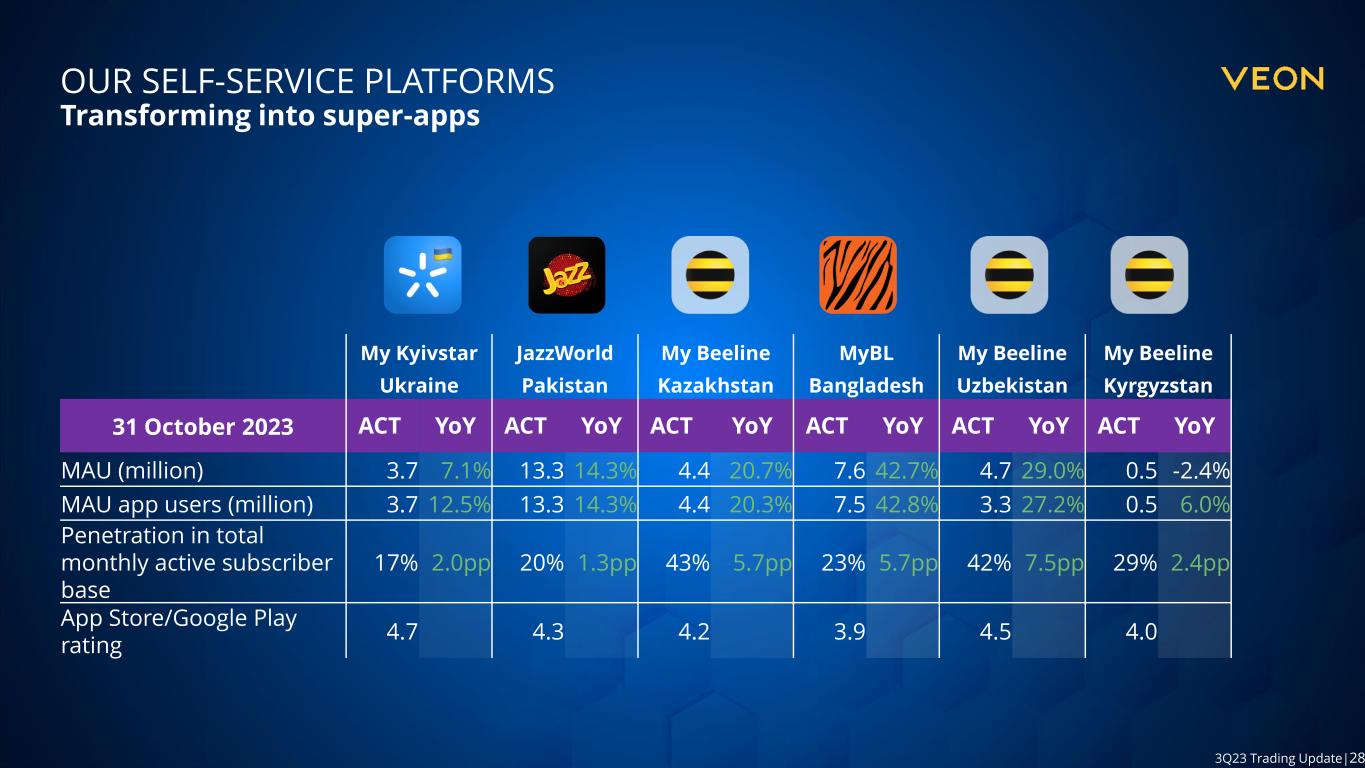

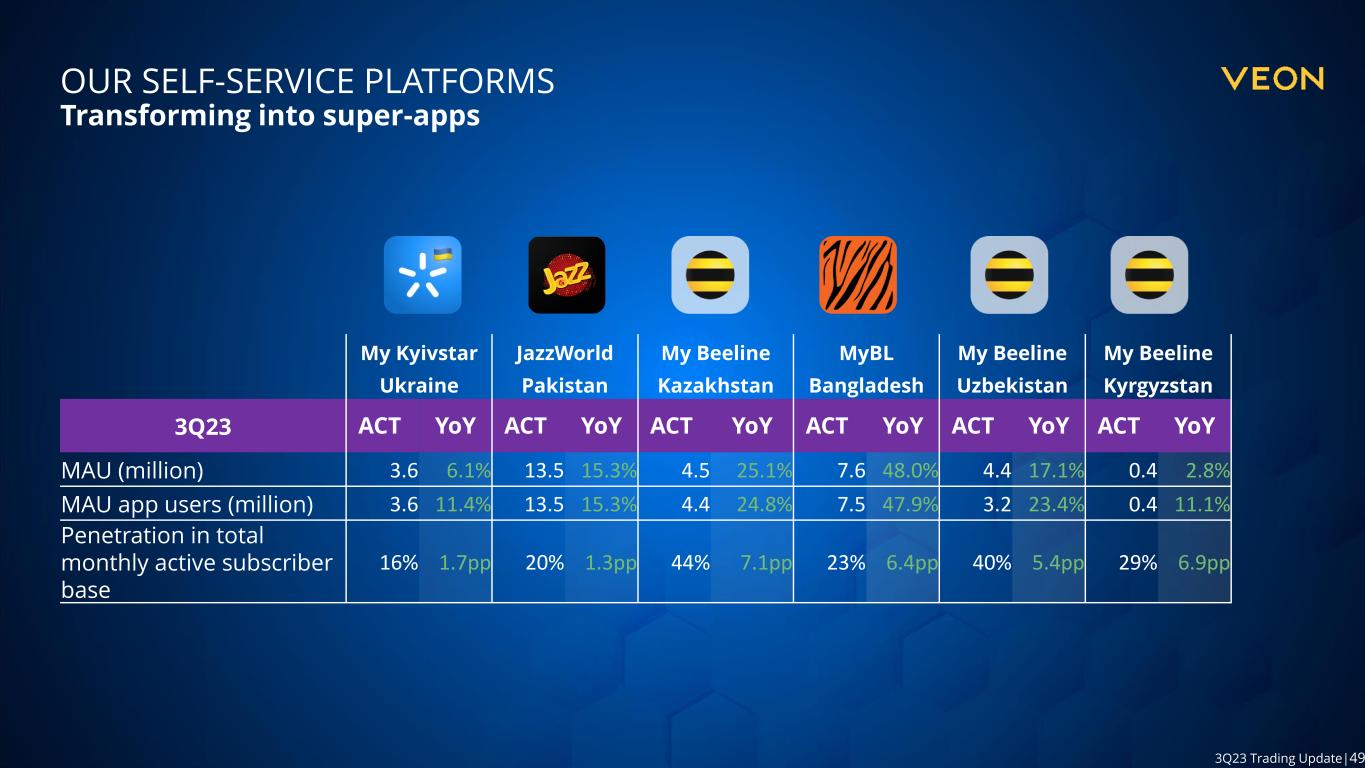

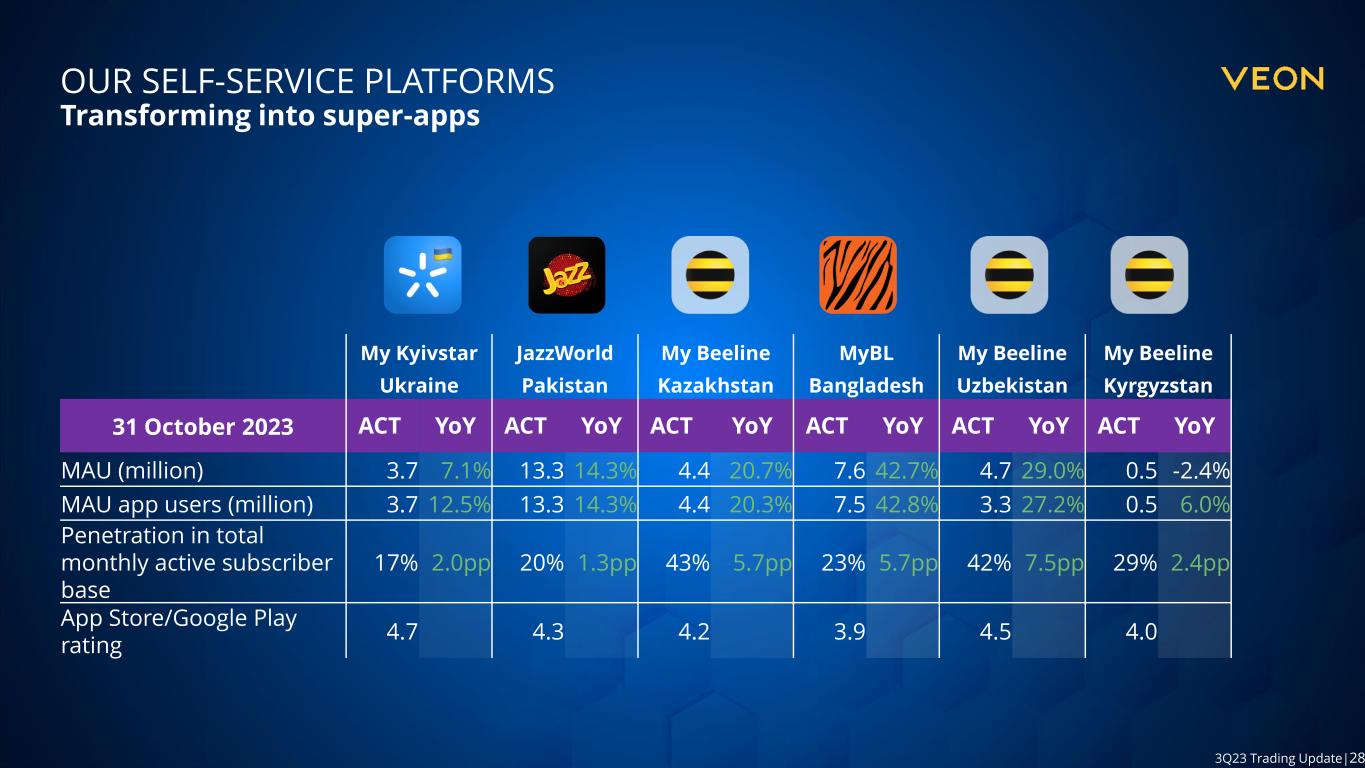

28 3Q23 Trading Update|28 OUR SELF-SERVICE PLATFORMS Transforming into super-apps My Kyivstar JazzWorld My Beeline MyBL My Beeline My Beeline Ukraine Pakistan Kazakhstan Bangladesh Uzbekistan Kyrgyzstan 31 October 2023 ACT YoY ACT YoY ACT YoY ACT YoY ACT YoY ACT YoY MAU (million) 3.7 7.1% 13.3 14.3% 4.4 20.7% 7.6 42.7% 4.7 29.0% 0.5 -2.4% MAU app users (million) 3.7 12.5% 13.3 14.3% 4.4 20.3% 7.5 42.8% 3.3 27.2% 0.5 6.0% Penetration in total monthly active subscriber base 17% 2.0pp 20% 1.3pp 43% 5.7pp 23% 5.7pp 42% 7.5pp 29% 2.4pp App Store/Google Play rating 4.7 4.3 4.2 3.9 4.5 4.0

29 3Q23 Trading Update|29 AGENDA 1. OPENING 2. HIGHLIGHTS & BUSINESS UPDATE Faisal Ghori Kaan Terzioğlu 4. CLOSING REMARKS Kaan Terzioğlu 3. TRADING RESULTS Joop Brakenhoff 5. Q&A Kaan Terzioğlu, Joop Brakenhoff

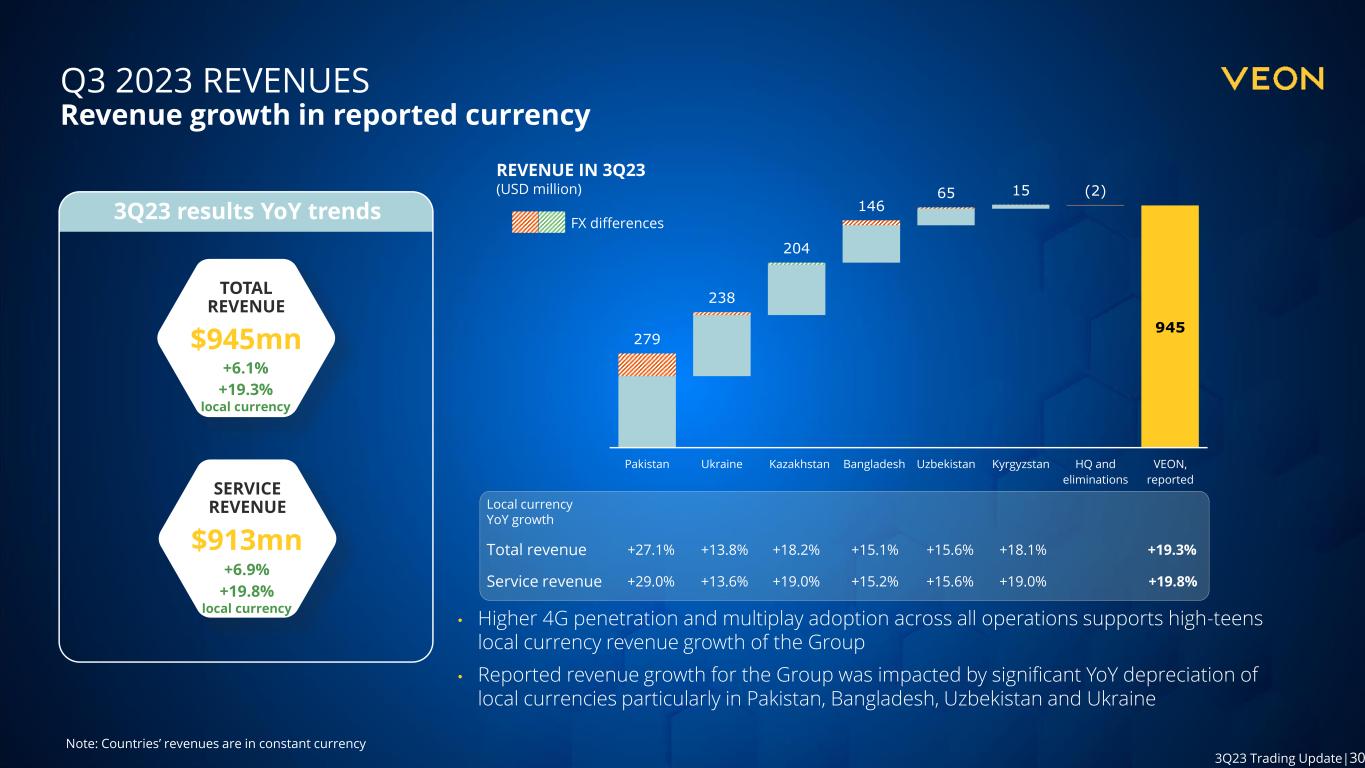

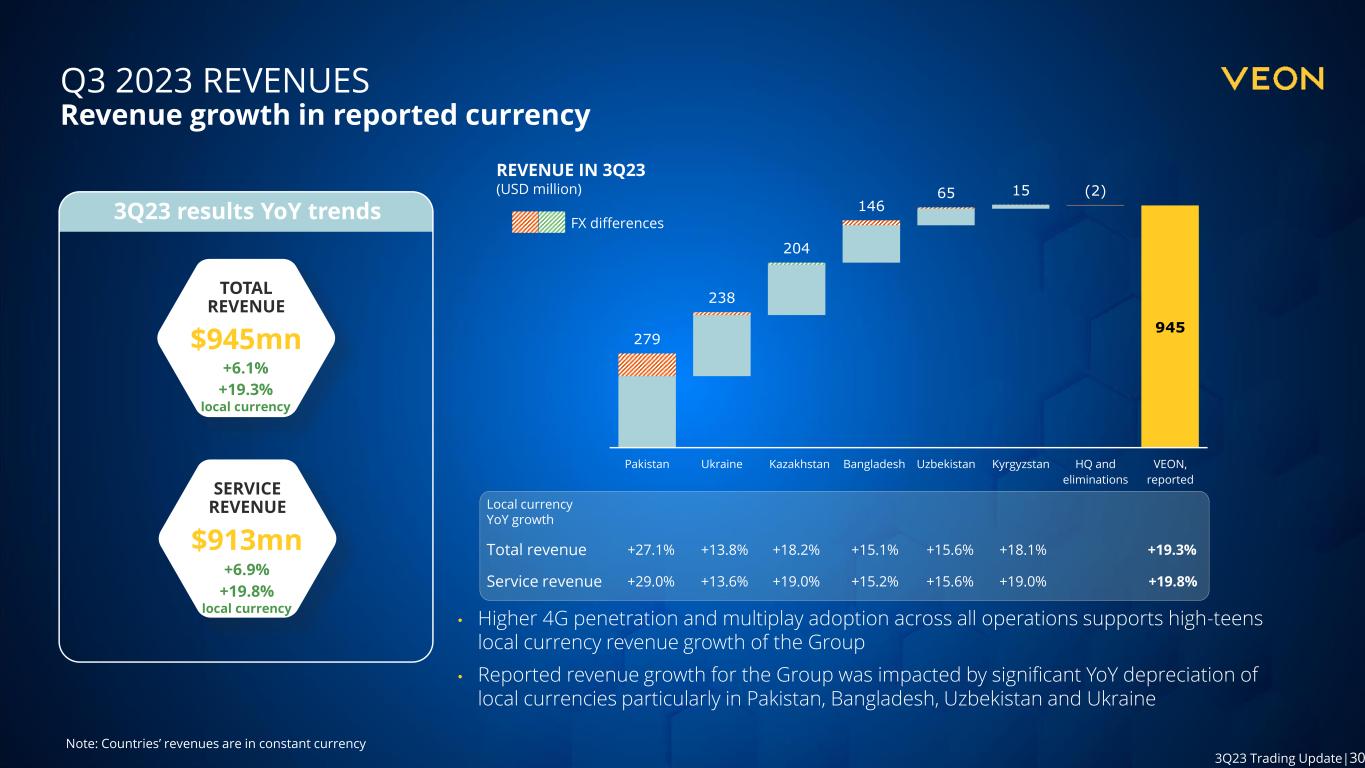

30 3Q23 Trading Update|30 Q3 2023 REVENUES Revenue growth in reported currency • Higher 4G penetration and multiplay adoption across all operations supports high-teens local currency revenue growth of the Group • Reported revenue growth for the Group was impacted by significant YoY depreciation of local currencies particularly in Pakistan, Bangladesh, Uzbekistan and Ukraine Total revenue 3Q23 results YoY trends TOTAL REVENUE $945mn +19.3% local currency +6.1% SERVICE REVENUE $913mn Service revenue Local currency YoY growth +13.8%+27.1% +15.1% +15.6%+18.2% +19.3% +19.8%+13.6%+29.0% +15.2% +15.6%+19.0% +18.1% +19.0% +19.8% local currency +6.9% Note: Countries’ revenues are in constant currency REVENUE IN 3Q23 (USD million) FX differences 945 279 238 204 146 65 15 (2) Pakistan Ukraine Kazakhstan Bangladesh Uzbekistan Kyrgyzstan HQ and eliminations VEON, reported

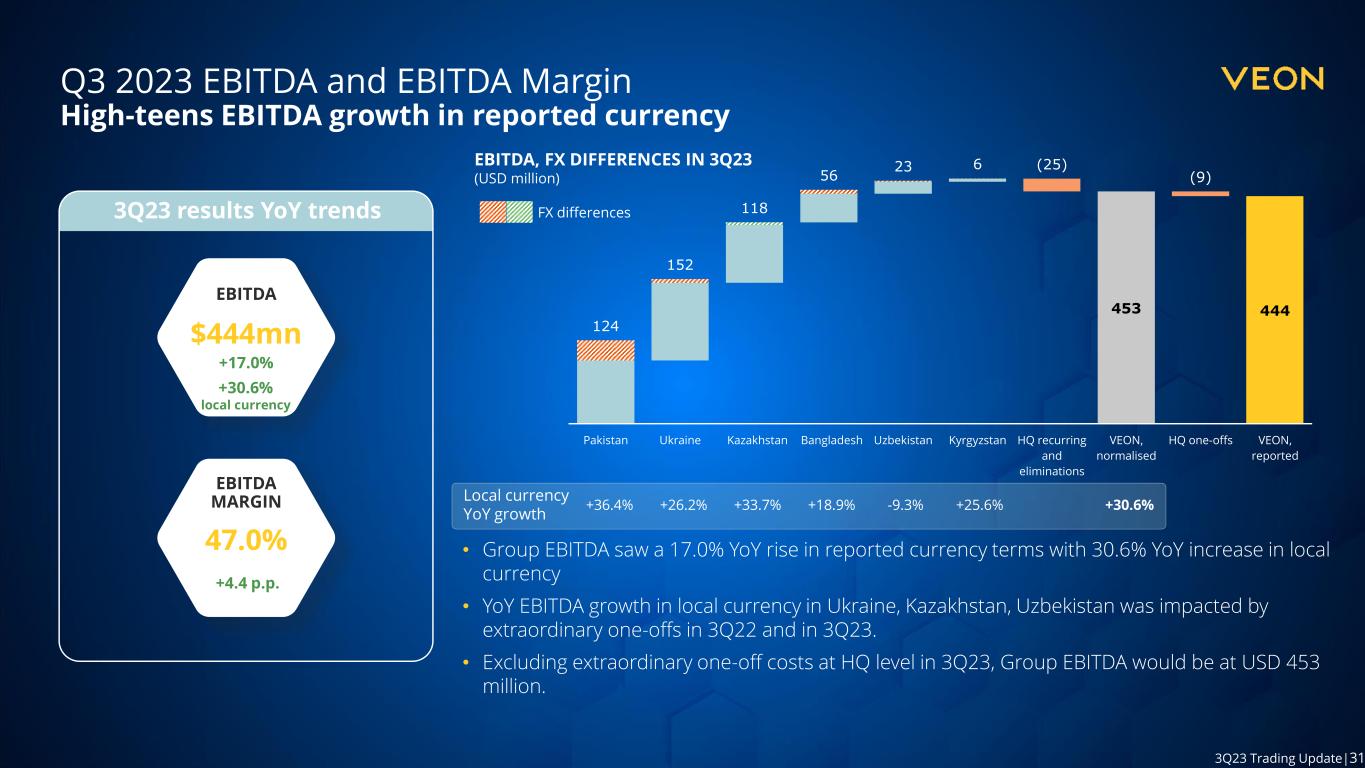

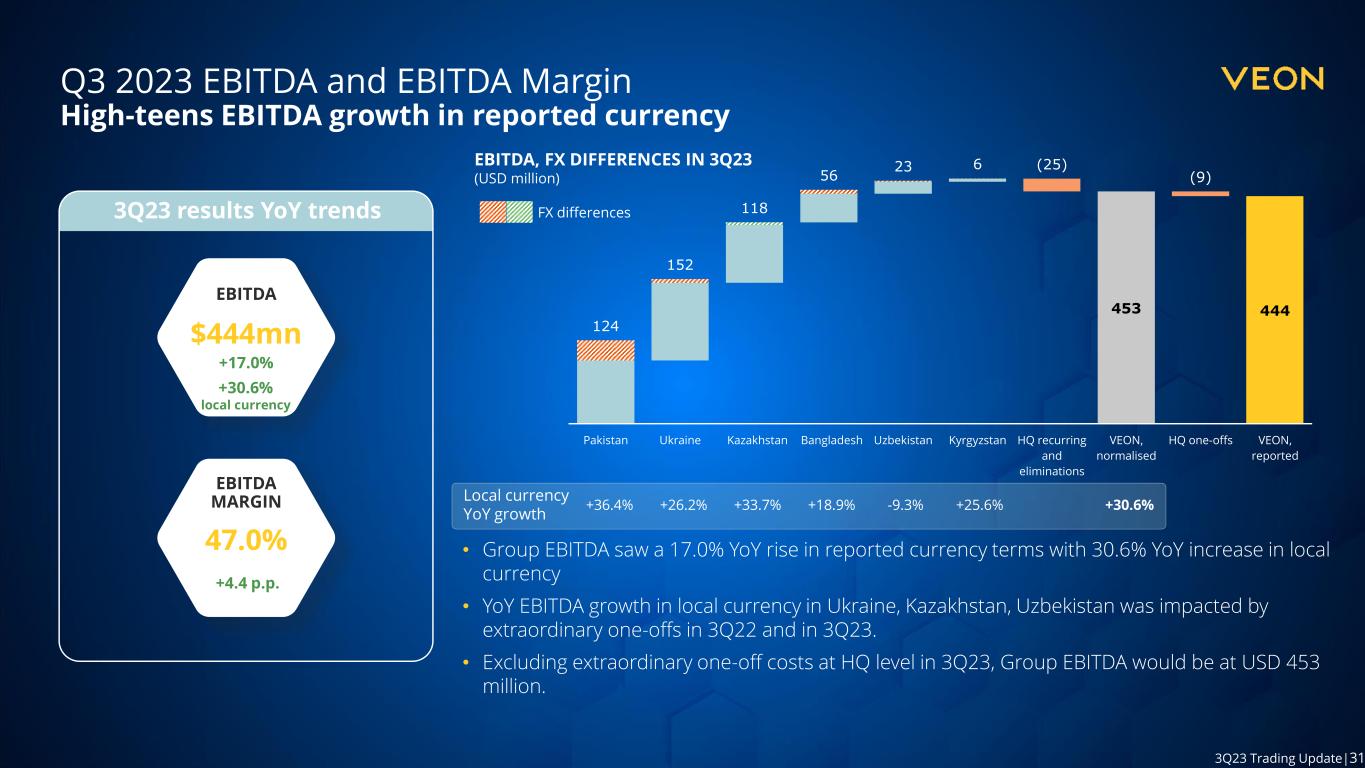

31 3Q23 Trading Update|31 EBITDA, FX DIFFERENCES IN 3Q23 (USD million) FX differences 444453 124 152 118 56 23 6 (25) (9) Pakistan Ukraine Kazakhstan Bangladesh Uzbekistan Kyrgyzstan HQ recurring and eliminations VEON, normalised HQ one-offs VEON, reported Q3 2023 EBITDA and EBITDA Margin High-teens EBITDA growth in reported currency 3Q23 results YoY trends EBITDA $444mn +30.6% local currency +17.0% EBITDA MARGIN 47.0% +26.2%+36.4% -9.3%+33.7% Local currency YoY growth +18.9% +30.6% • Group EBITDA saw a 17.0% YoY rise in reported currency terms with 30.6% YoY increase in local currency • YoY EBITDA growth in local currency in Ukraine, Kazakhstan, Uzbekistan was impacted by extraordinary one-offs in 3Q22 and in 3Q23. • Excluding extraordinary one-off costs at HQ level in 3Q23, Group EBITDA would be at USD 453 million. +4.4 p.p. +25.6%

32 3Q23 Trading Update|32 Q3 2023 CAPEX AND CAPEX INTENSITY Capex is a function of balanced 4G network expansion and asset light strategy 186.7 131.1 22.2% 17.8% 3Q22 3Q23 Capex and LTM Capex intensity (USD million and %) • LTM capex intensity of 17.8% is within our FY 2023 guidance, and is trending lower with 13.9% capex intensity in the quarter • 4G network rollout and other projects driving capex in operating companies continue as planned • As we drive our top line ahead of initial expectations, the LTM capex intensity is trending lower

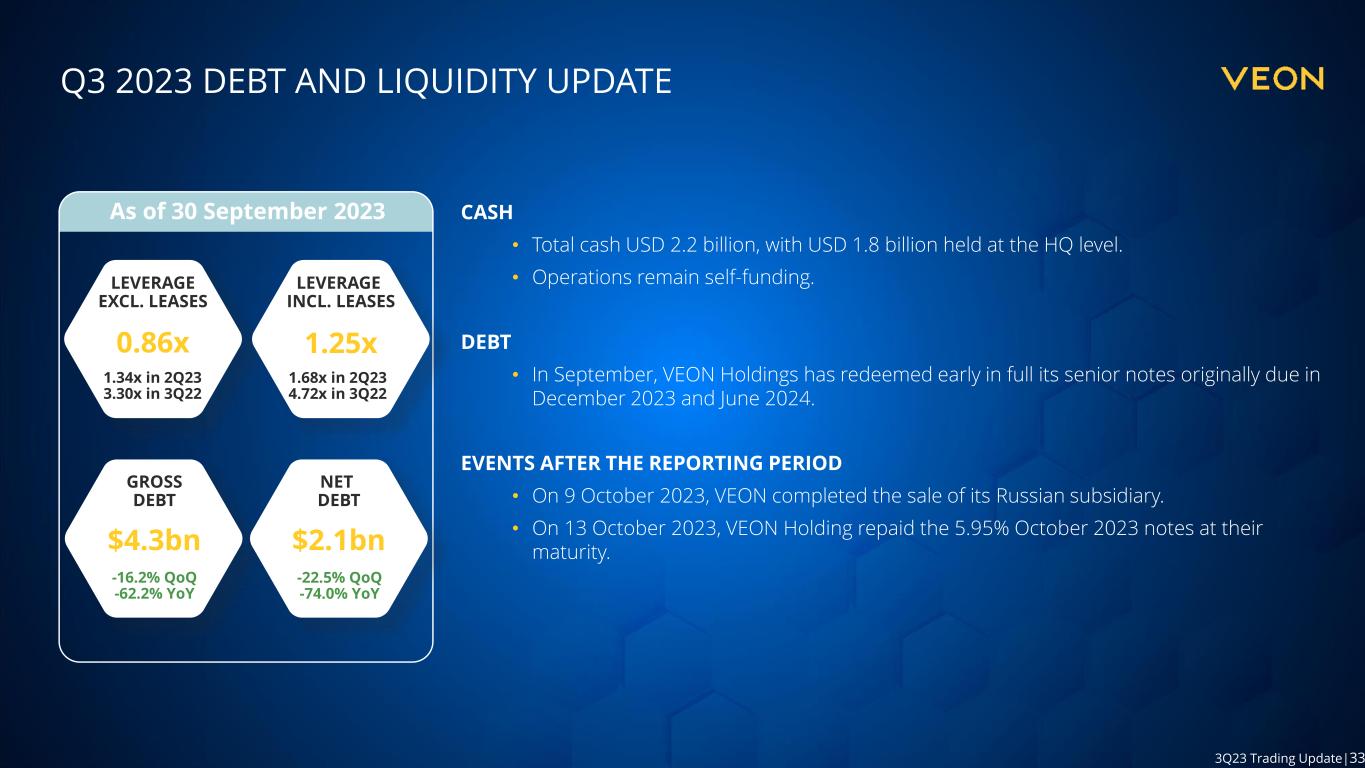

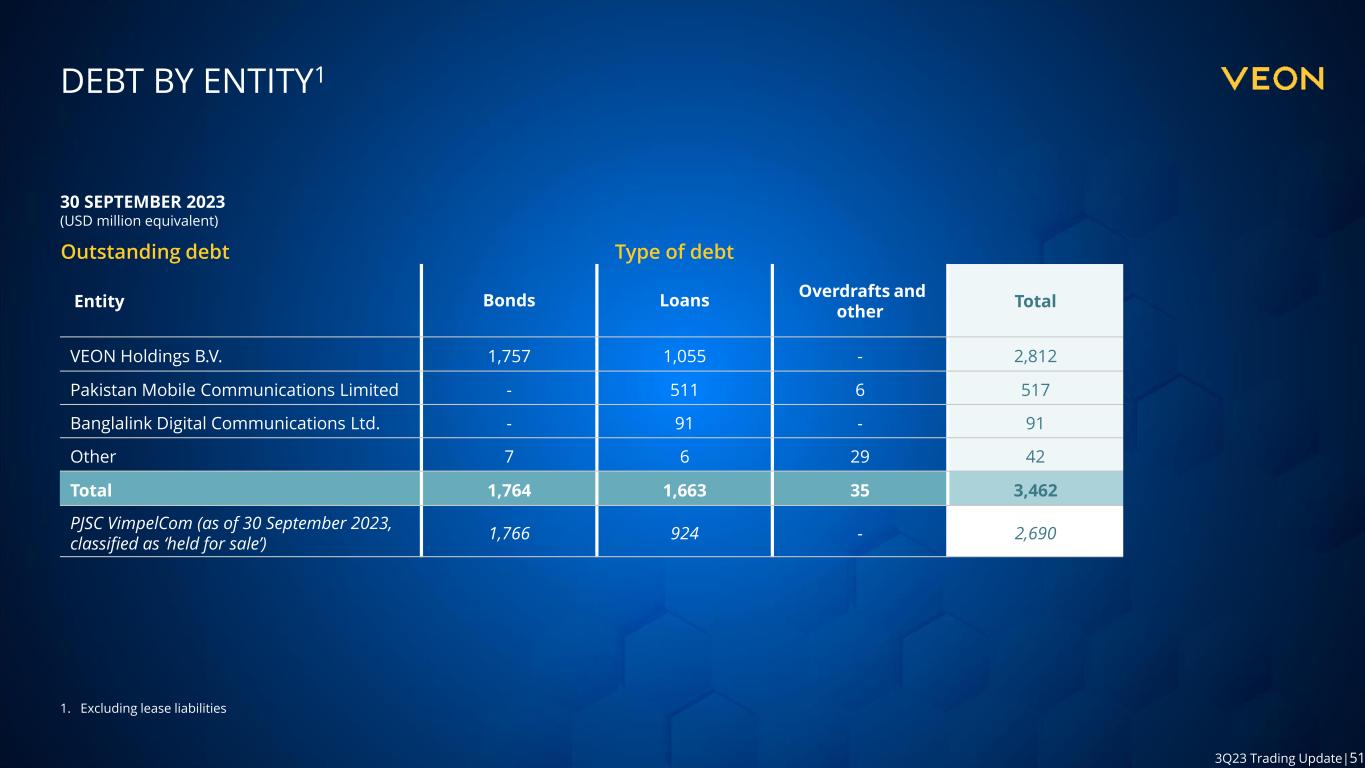

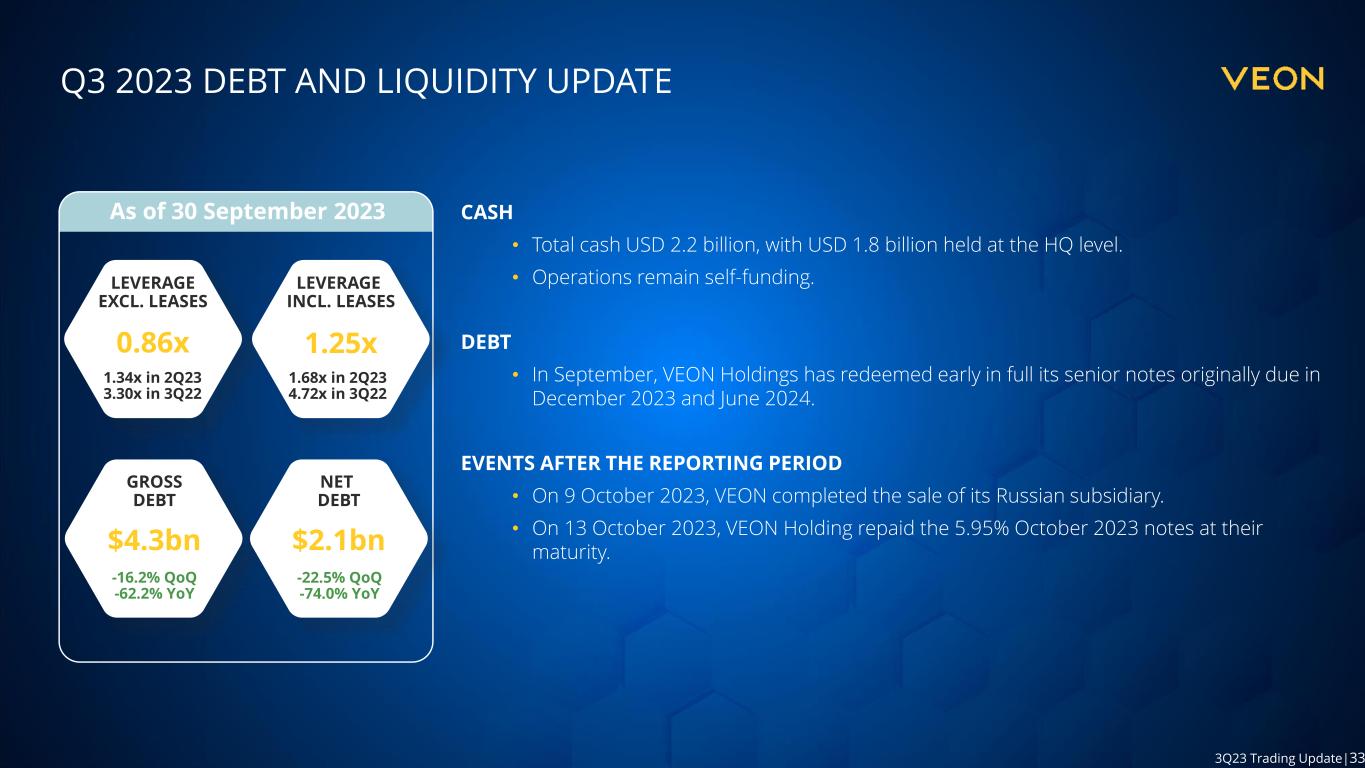

33 3Q23 Trading Update|33 Q3 2023 DEBT AND LIQUIDITY UPDATE As of 30 September 2023 GROSS DEBT -16.2% QoQ -62.2% YoY $4.3bn NET DEBT $2.1bn LEVERAGE EXCL. LEASES 0.86x LEVERAGE INCL. LEASES 1.25x -22.5% QoQ -74.0% YoY 1.34x in 2Q23 3.30x in 3Q22 1.68x in 2Q23 4.72x in 3Q22 CASH • Total cash USD 2.2 billion, with USD 1.8 billion held at the HQ level. • Operations remain self-funding. DEBT • In September, VEON Holdings has redeemed early in full its senior notes originally due in December 2023 and June 2024. EVENTS AFTER THE REPORTING PERIOD • On 9 October 2023, VEON completed the sale of its Russian subsidiary. • On 13 October 2023, VEON Holding repaid the 5.95% October 2023 notes at their maturity.

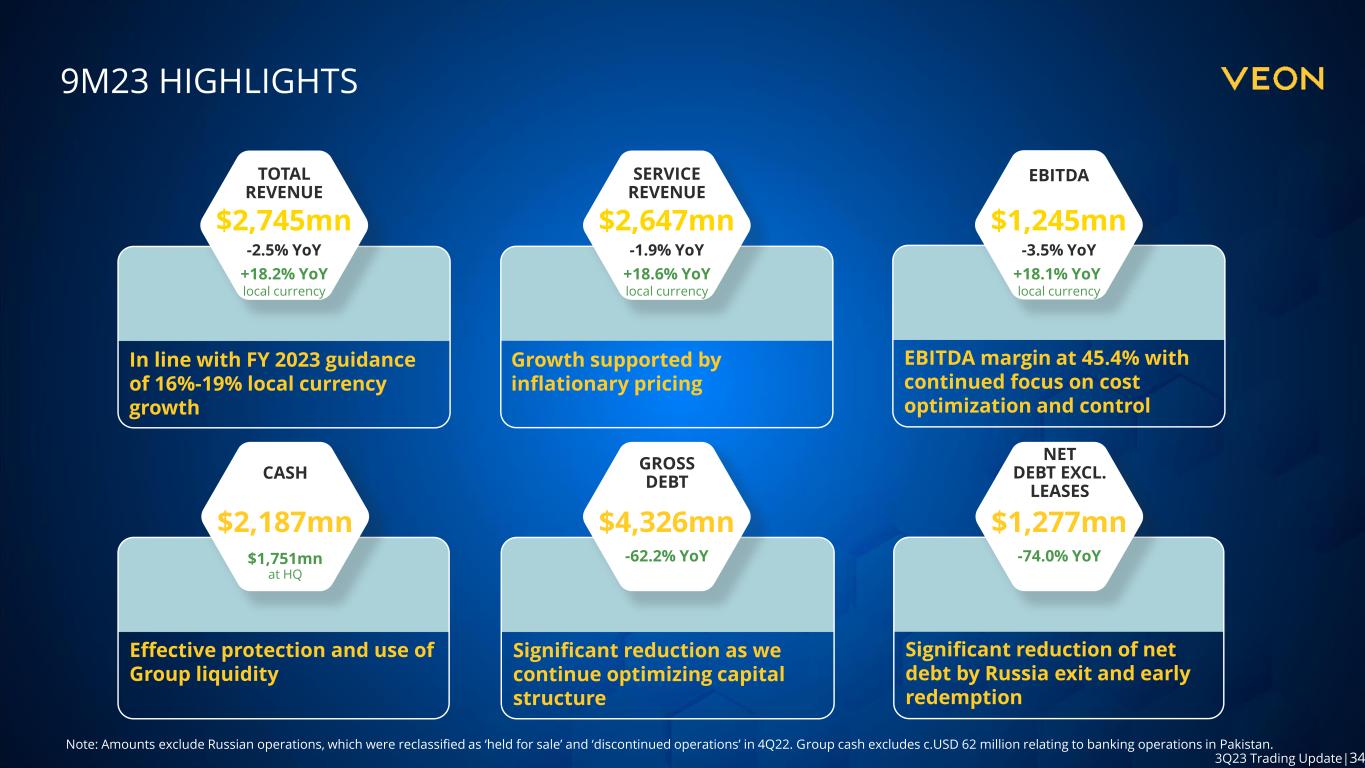

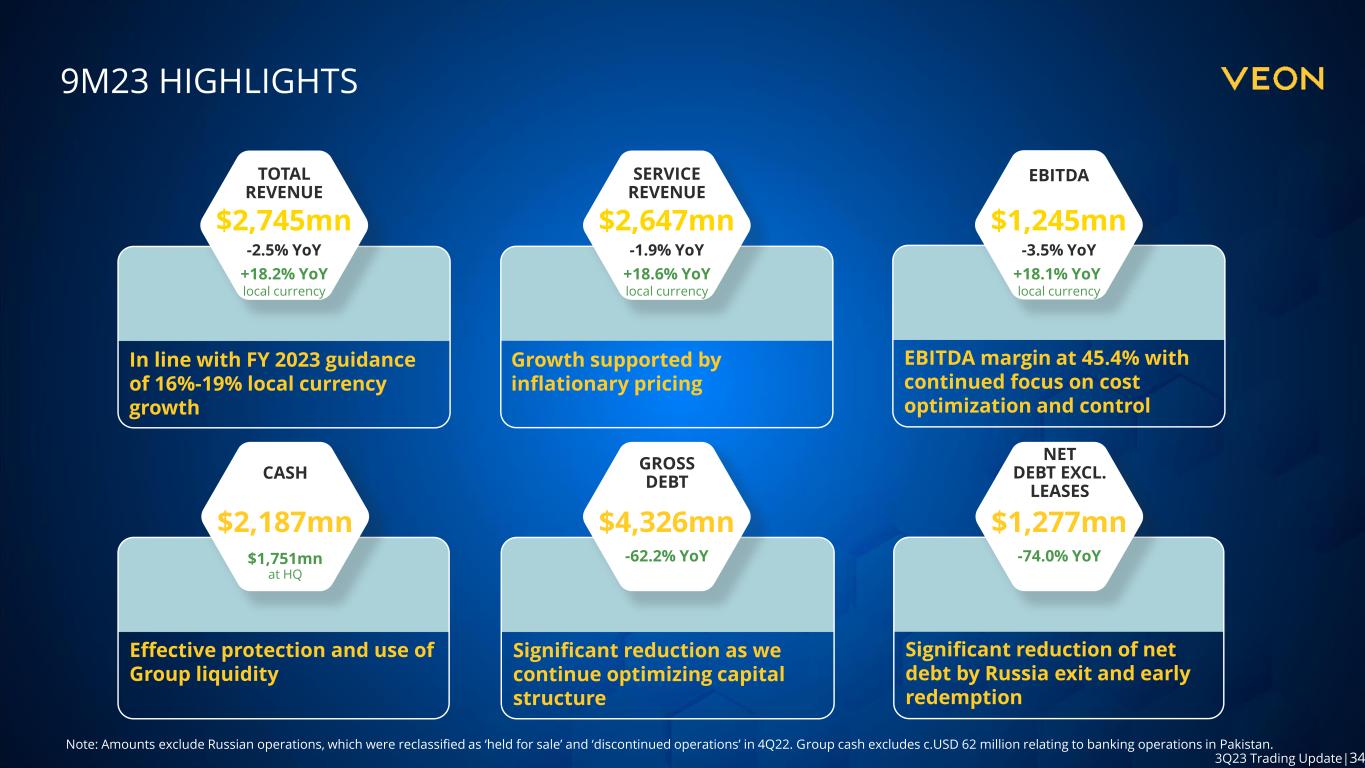

34 3Q23 Trading Update|34 9M23 HIGHLIGHTS EBITDA margin at 45.4% with continued focus on cost optimization and control EBITDA $1,245mn +18.1% YoY local currency Effective protection and use of Group liquidity $2,187mn CASH $1,751mn at HQ In line with FY 2023 guidance of 16%-19% local currency growth +18.2% YoY local currency TOTAL REVENUE -2.5% YoY $2,745mn -3.5% YoY Growth supported by inflationary pricing +18.6% YoY local currency SERVICE REVENUE -1.9% YoY $2,647mn Significant reduction of net debt by Russia exit and early redemption $1,277mn NET DEBT EXCL. LEASES -74.0% YoY Significant reduction as we continue optimizing capital structure $4,326mn GROSS DEBT -62.2% YoY Note: Amounts exclude Russian operations, which were reclassified as ‘held for sale’ and ‘discontinued operations’ in 4Q22. Group cash excludes c.USD 62 million relating to banking operations in Pakistan.

35 3Q23 Trading Update|35 LIQUIDITY AND CAPITAL STRUCTURE AFTER THE REPORTING PERIOD Optimized capital structure and de-levered balance sheet • On 9 October 2023, VEON completed the sale of its Russian subsidiary. • On 13 October 2023, VEON Holding repaid the 5.95% October 2023 notes at their maturity. • As of 31 October 2023, VEON net debt was USD 2.7 billion, of which USD 1.6 billion at the HQ level – a significant reduction versus the USD 8.2 billion as per 30 September 2022, while VEON cash balance is USD 1.7 billion, of which USD 1.3 billion at HQ. Liquidity and capital structure (USD, billions) As of 30 September 2023 As of 31 October 2023 Cash and cash equivalents, of which 2.2 1.7 At HQ level 1.8 1.3 Gross debt, of which 4.3 4.4 Bonds 1.8 1.8 Loans and other outstanding debt 1.7 1.7 Lease liabilities 0.9 0.9 Net debt, of which 2.1 2.7 At HQ level 1.1 1.6 Note: As of 31 October 2023, gross debt and net debt includes USD 72 million of VEON Holding notes held by PJSC VimpelCom

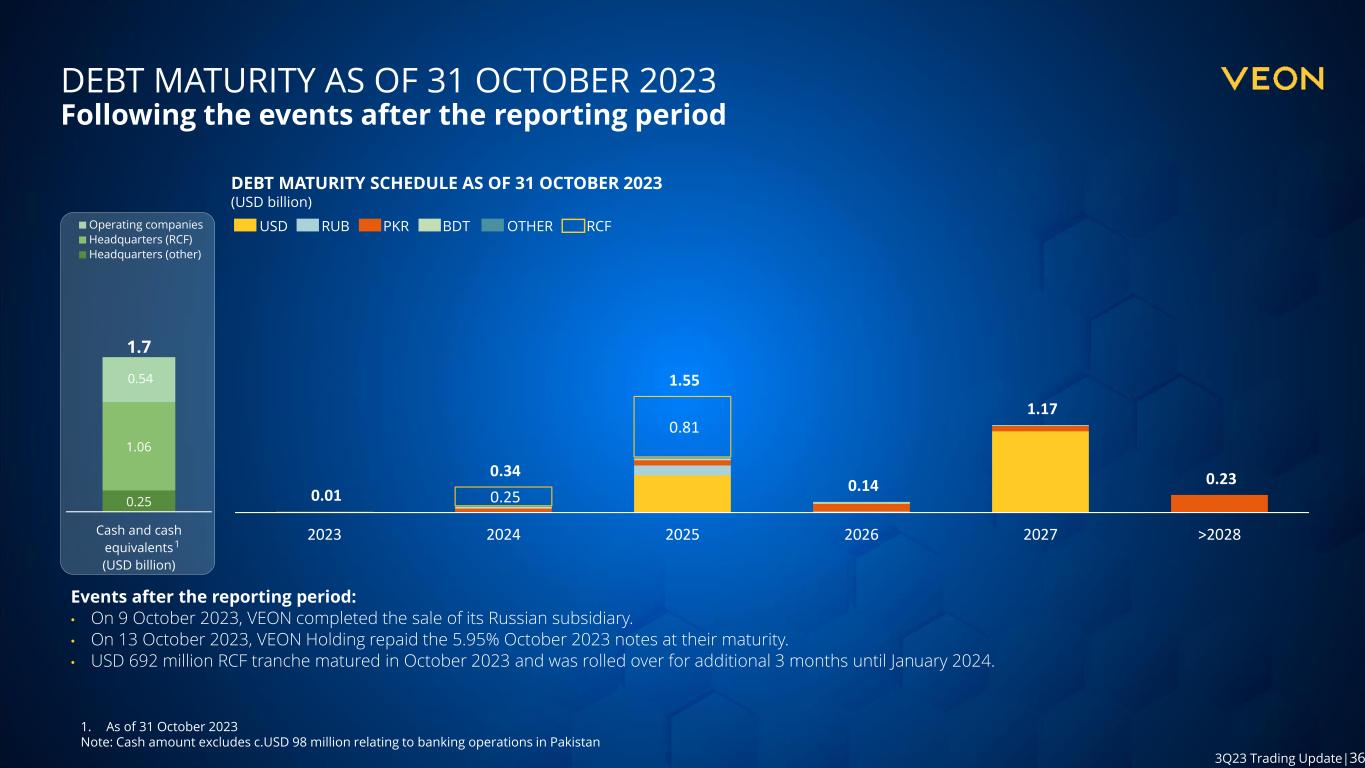

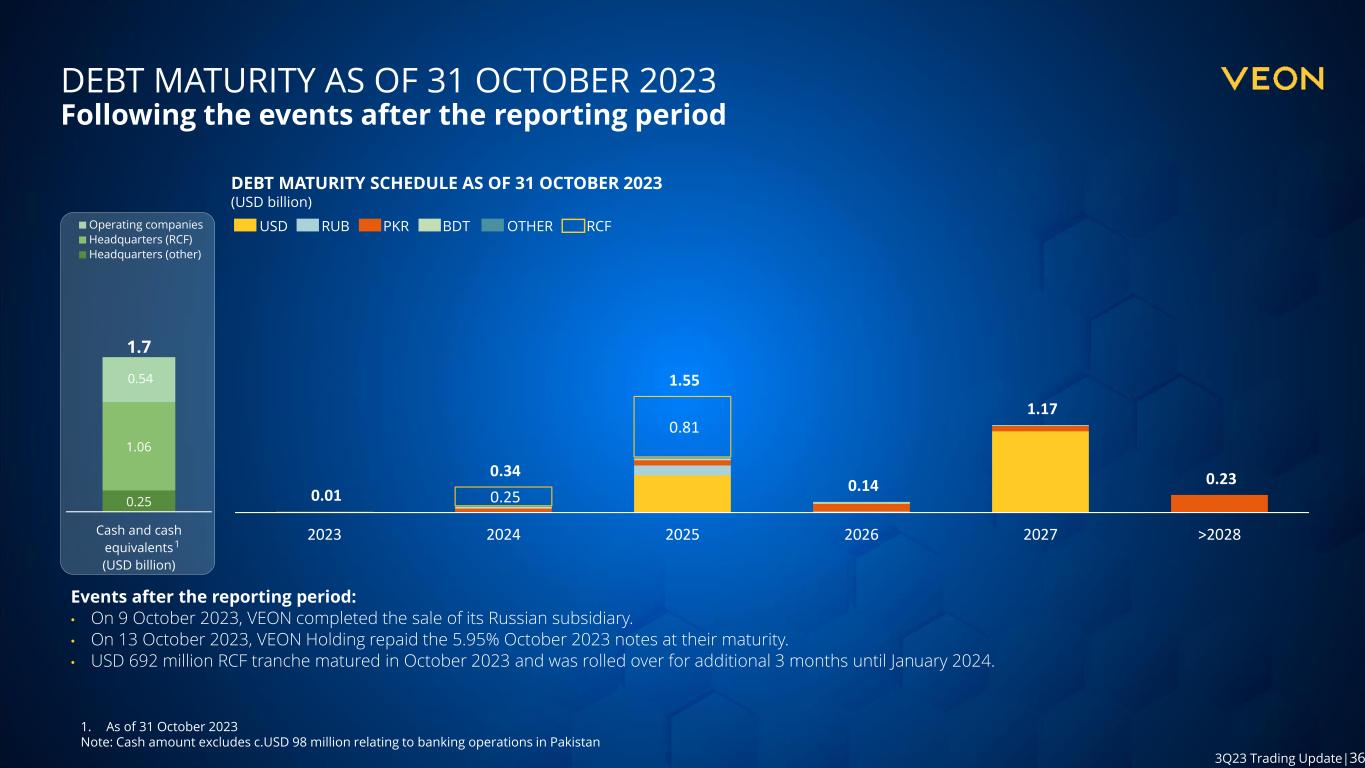

36 3Q23 Trading Update|36 DEBT MATURITY AS OF 31 OCTOBER 2023 Following the events after the reporting period 1. As of 31 October 2023 Note: Cash amount excludes c.USD 98 million relating to banking operations in Pakistan DEBT MATURITY SCHEDULE AS OF 31 OCTOBER 2023 (USD billion) Events after the reporting period: • On 9 October 2023, VEON completed the sale of its Russian subsidiary. • On 13 October 2023, VEON Holding repaid the 5.95% October 2023 notes at their maturity. • USD 692 million RCF tranche matured in October 2023 and was rolled over for additional 3 months until January 2024. 1 0.25 1.06 0.54 Cash and cash equivalents (USD billion) Operating companies Headquarters (RCF) Headquarters (other) 1.7 0.25 0.81 0.01 0.34 1.55 0.14 1.17 0.23 2023 2024 2025 2026 2027 >2028 USD RUB PKR BDT OTHER RCF

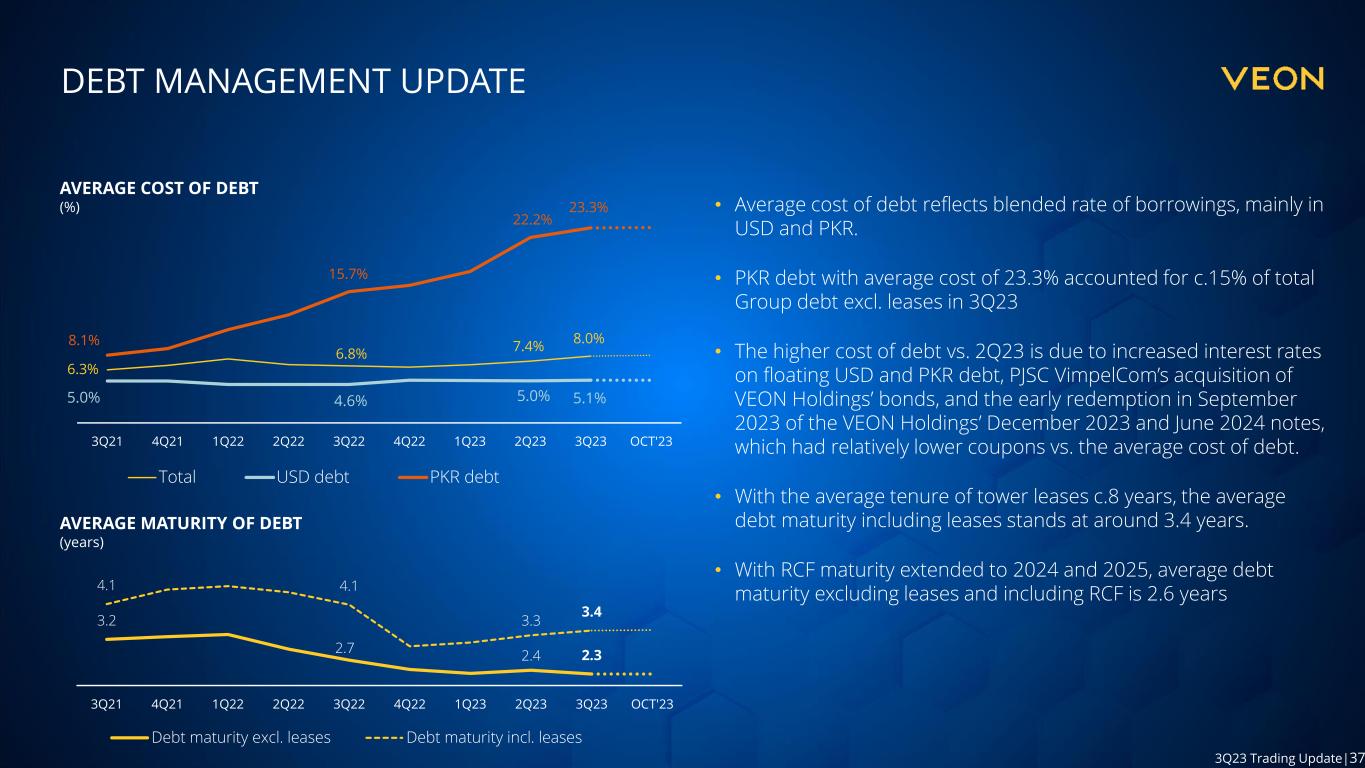

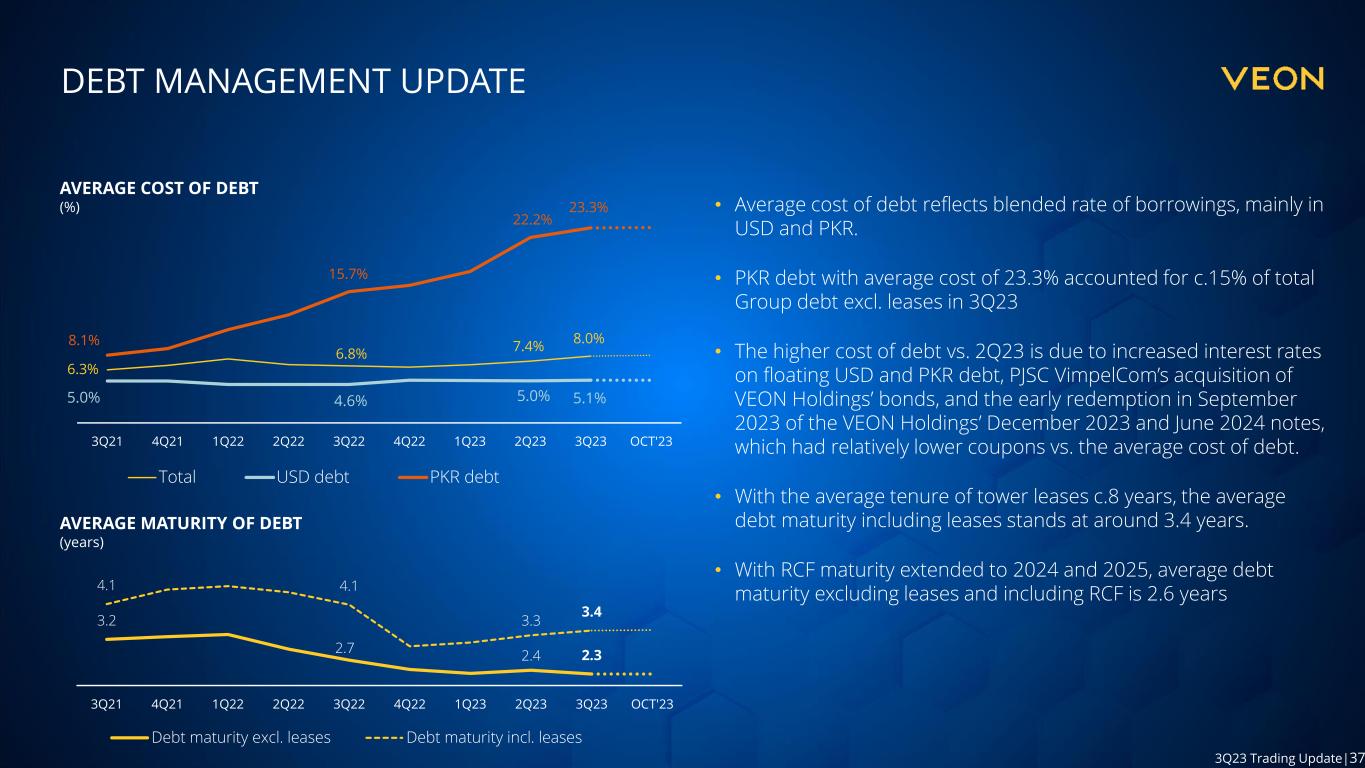

37 3Q23 Trading Update|37 DEBT MANAGEMENT UPDATE • Average cost of debt reflects blended rate of borrowings, mainly in USD and PKR. • PKR debt with average cost of 23.3% accounted for c.15% of total Group debt excl. leases in 3Q23 • The higher cost of debt vs. 2Q23 is due to increased interest rates on floating USD and PKR debt, PJSC VimpelCom’s acquisition of VEON Holdings’ bonds, and the early redemption in September 2023 of the VEON Holdings’ December 2023 and June 2024 notes, which had relatively lower coupons vs. the average cost of debt. • With the average tenure of tower leases c.8 years, the average debt maturity including leases stands at around 3.4 years. • With RCF maturity extended to 2024 and 2025, average debt maturity excluding leases and including RCF is 2.6 years AVERAGE COST OF DEBT (%) AVERAGE MATURITY OF DEBT (years) 6.3% 6.8% 7.4% 8.0% 5.0% 4.6% 5.0% 5.1% 8.1% 15.7% 22.2% 23.3% 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 OCT'23 Total USD debt PKR debt 3.2 2.7 2.4 2.3 4.1 4.1 3.3 3.4 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 OCT'23 Debt maturity excl. leases Debt maturity incl. leases

38 3Q23 Trading Update|38 AGENDA 1. OPENING 2. HIGHLIGHTS & BUSINESS UPDATE Faisal Ghori Kaan Terzioğlu 4. CLOSING REMARKS Kaan Terzioğlu 3. TRADING RESULTS Joop Brakenhoff 5. Q&A Kaan Terzioğlu, Joop Brakenhoff

39 3Q23 Trading Update|39 2023 OUTLOOK AND EARNINGS Factors impacting financial performance, and near-term outlook 1 Extraordinary costs associated with the exit from Russia and restructuring of HQ in 2023 Positive impact of the reversal of a tax provision in Pakistan in October 2022 • c.USD 43 million YTD • The recorded revenues by PKR 6.6 billion (c.USD 30 million) • EBITDA by PKR 20.2 billion (c.USD 91 million) 2 YoY performance in local currency October 2023 October 2023, pro forma Total revenue, year to date +17.0% +18.1% EBITDA, year to date +11.5% +20.3%

40 3Q23 Trading Update|40 2023 AMBITIONS We are progressing towards our full-year ambitions, yet addressing new challenges 1 Driving growth and expanding margin Ukraine Exit from Russia • Execution on “4G for all” and “Digital Operator” strategy • Disciplined inflationary pricing and cost control • Leaner HQ Management Team, smaller Board of Directors • Reiterating our commitment to the future of Ukraine • Engagement with Ukrainian authorities and lawmakers • Support from US, UK and EU investors • Done 2 3 Executing on asset-light portfolio • Continued work on monetizing towers assets4 Creating shareholder value • Monetizing towers assets, optimizing capital structure, effective balance sheet management, progressing on local listings, crystalizing value of our digital assets 5

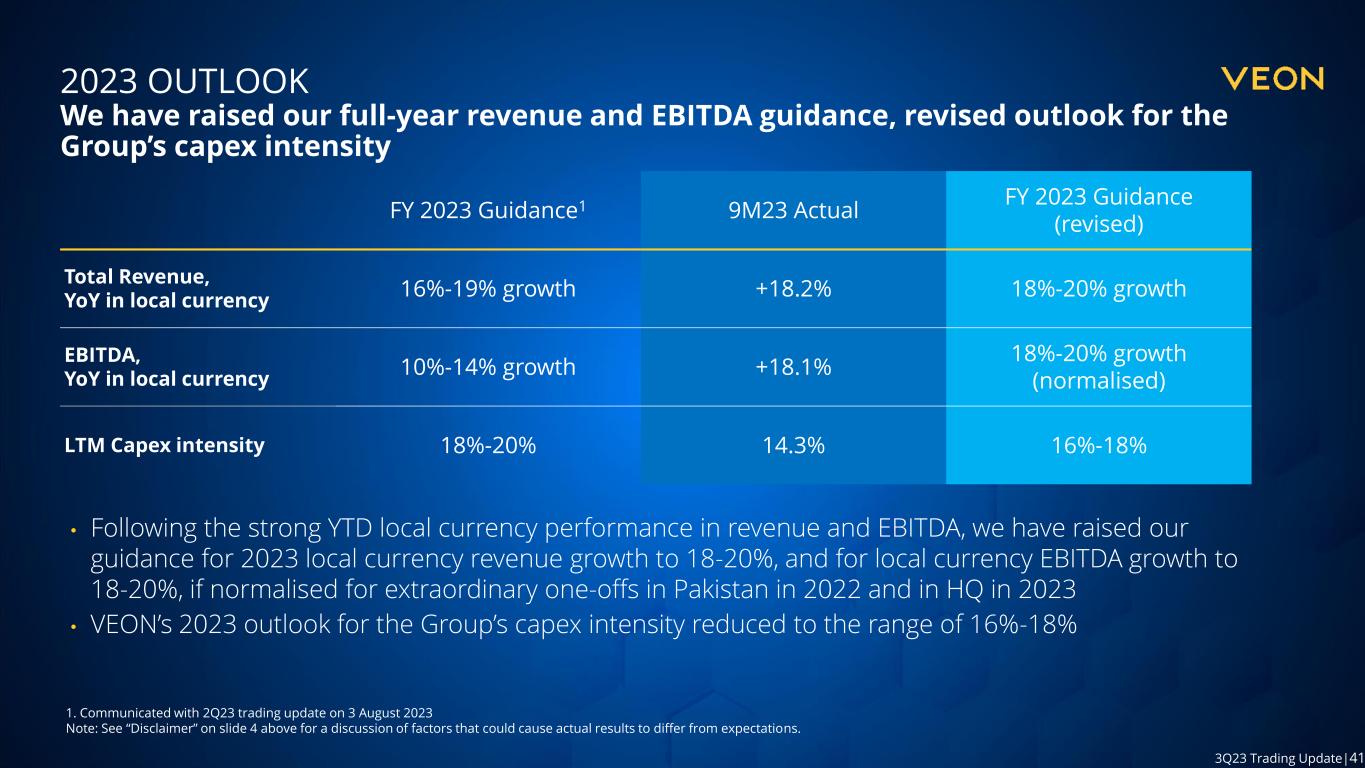

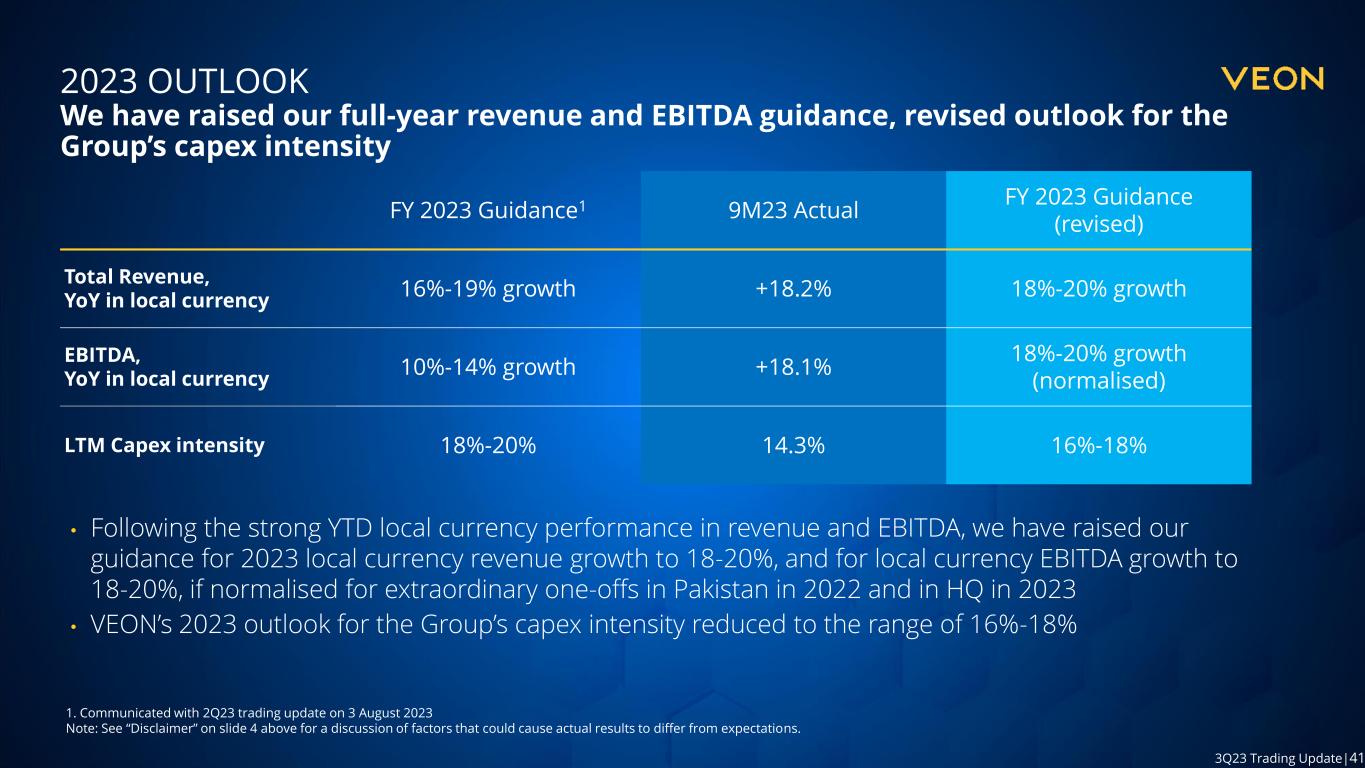

41 3Q23 Trading Update|41 2023 OUTLOOK We have raised our full-year revenue and EBITDA guidance, revised outlook for the Group’s capex intensity • Following the strong YTD local currency performance in revenue and EBITDA, we have raised our guidance for 2023 local currency revenue growth to 18-20%, and for local currency EBITDA growth to 18-20%, if normalised for extraordinary one-offs in Pakistan in 2022 and in HQ in 2023 • VEON’s 2023 outlook for the Group’s capex intensity reduced to the range of 16%-18% 1. Communicated with 2Q23 trading update on 3 August 2023 Note: See “Disclaimer” on slide 4 above for a discussion of factors that could cause actual results to differ from expectations. FY 2023 Guidance1 9M23 Actual FY 2023 Guidance (revised) Total Revenue, YoY in local currency 16%-19% growth +18.2% 18%-20% growth EBITDA, YoY in local currency 10%-14% growth +18.1% 18%-20% growth (normalised) LTM Capex intensity 18%-20% 14.3% 16%-18%

42 Q&A VEON 3Q23 TRADING UPDATE

43 THANK YOU! ir@veon.com Tel: +31 (0)20 79 77 200 VEON 3Q23 TRADING UPDATE

44 APPENDIX VEON 3Q23 TRADING UPDATE

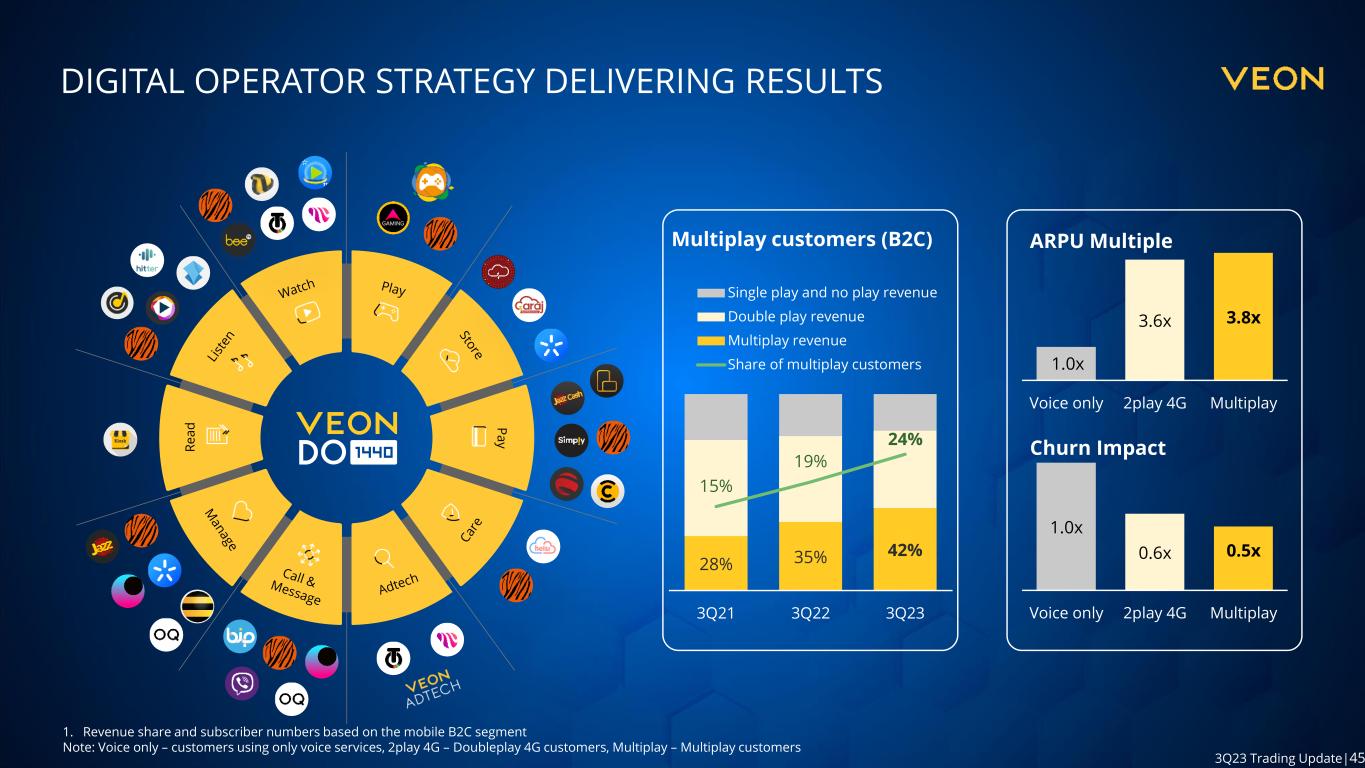

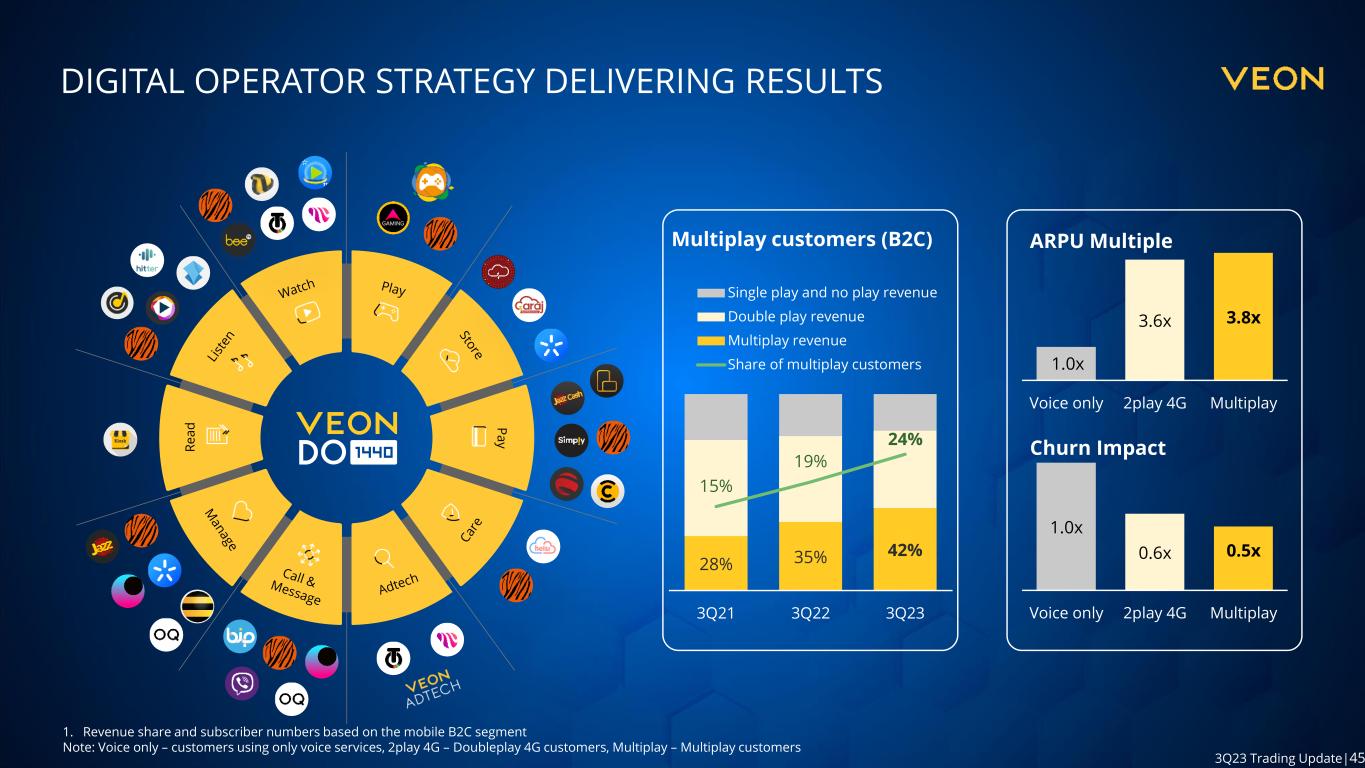

45 3Q23 Trading Update|45 DIGITAL OPERATOR STRATEGY DELIVERING RESULTS ARPU Multiple Churn Impact 1. Revenue share and subscriber numbers based on the mobile B2C segment Note: Voice only – customers using only voice services, 2play 4G – Doubleplay 4G customers, Multiplay – Multiplay customers Multiplay customers (B2C) 28% 35% 42% 15% 19% 24% 3Q21 3Q22 3Q23 Single play and no play revenue Double play revenue Multiplay revenue Share of multiplay customers 1.0x 3.6x 3.8x Voice only 2play 4G Multiplay 1.0x 0.6x 0.5x Voice only 2play 4G Multiplay R e a d P a y

46 3Q23 Trading Update|46 OUR DIGITAL PORTFOLIO AS OF 30 SEPTEMBER 2023 A backbone of DO 1440 Strategy Total usage time in 3Q23, minutes 14.2 billion # of sessions in 3Q23 2.1 billion Total MAU across all services and platforms 93.4 million +32.3% YoY non-VEON users of our apps 23.4 million R e a d P a y

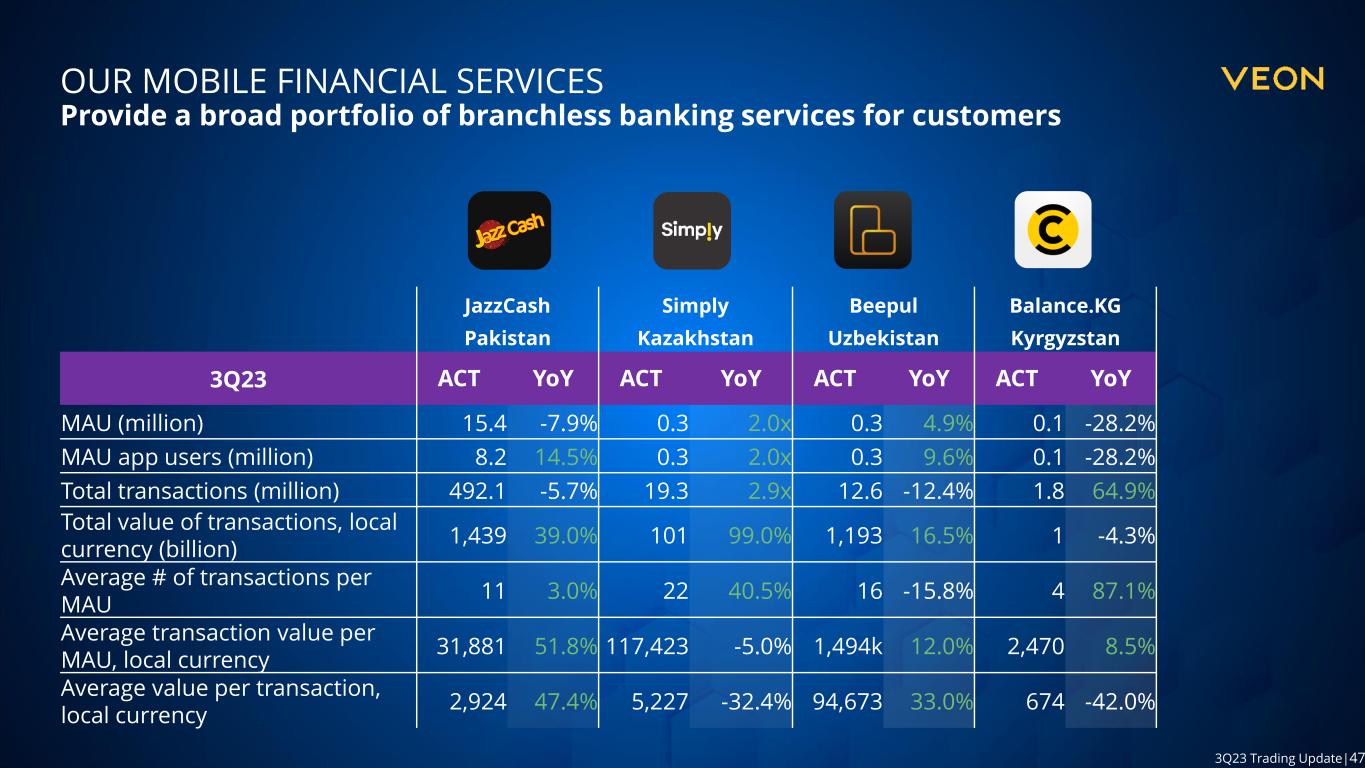

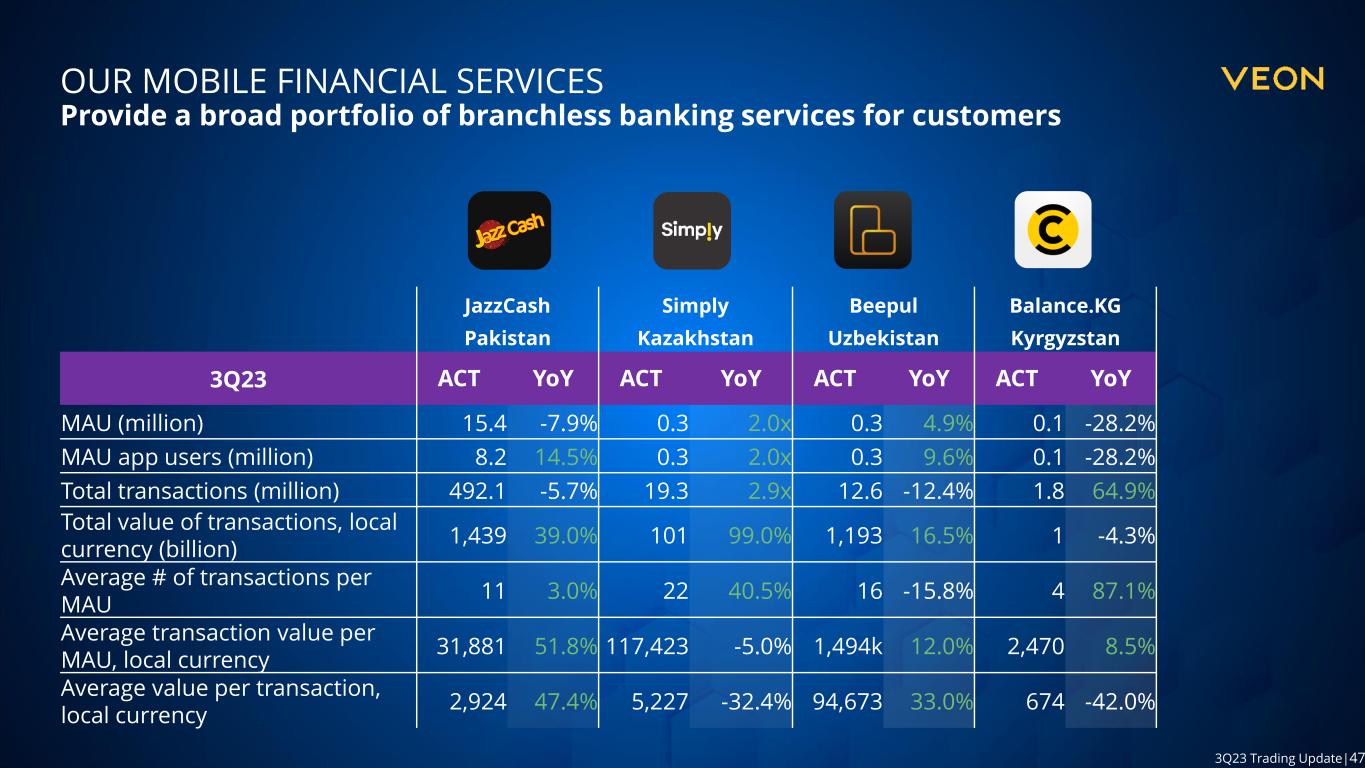

47 3Q23 Trading Update|47 OUR MOBILE FINANCIAL SERVICES Provide a broad portfolio of branchless banking services for customers JazzCash Simply Beepul Balance.KG Pakistan Kazakhstan Uzbekistan Kyrgyzstan 3Q23 ACT YoY ACT YoY ACT YoY ACT YoY MAU (million) 15.4 -7.9% 0.3 2.0x 0.3 4.9% 0.1 -28.2% MAU app users (million) 8.2 14.5% 0.3 2.0x 0.3 9.6% 0.1 -28.2% Total transactions (million) 492.1 -5.7% 19.3 2.9x 12.6 -12.4% 1.8 64.9% Total value of transactions, local currency (billion) 1,439 39.0% 101 99.0% 1,193 16.5% 1 -4.3% Average # of transactions per MAU 11 3.0% 22 40.5% 16 -15.8% 4 87.1% Average transaction value per MAU, local currency 31,881 51.8% 117,423 -5.0% 1,494k 12.0% 2,470 8.5% Average value per transaction, local currency 2,924 47.4% 5,227 -32.4% 94,673 33.0% 674 -42.0%

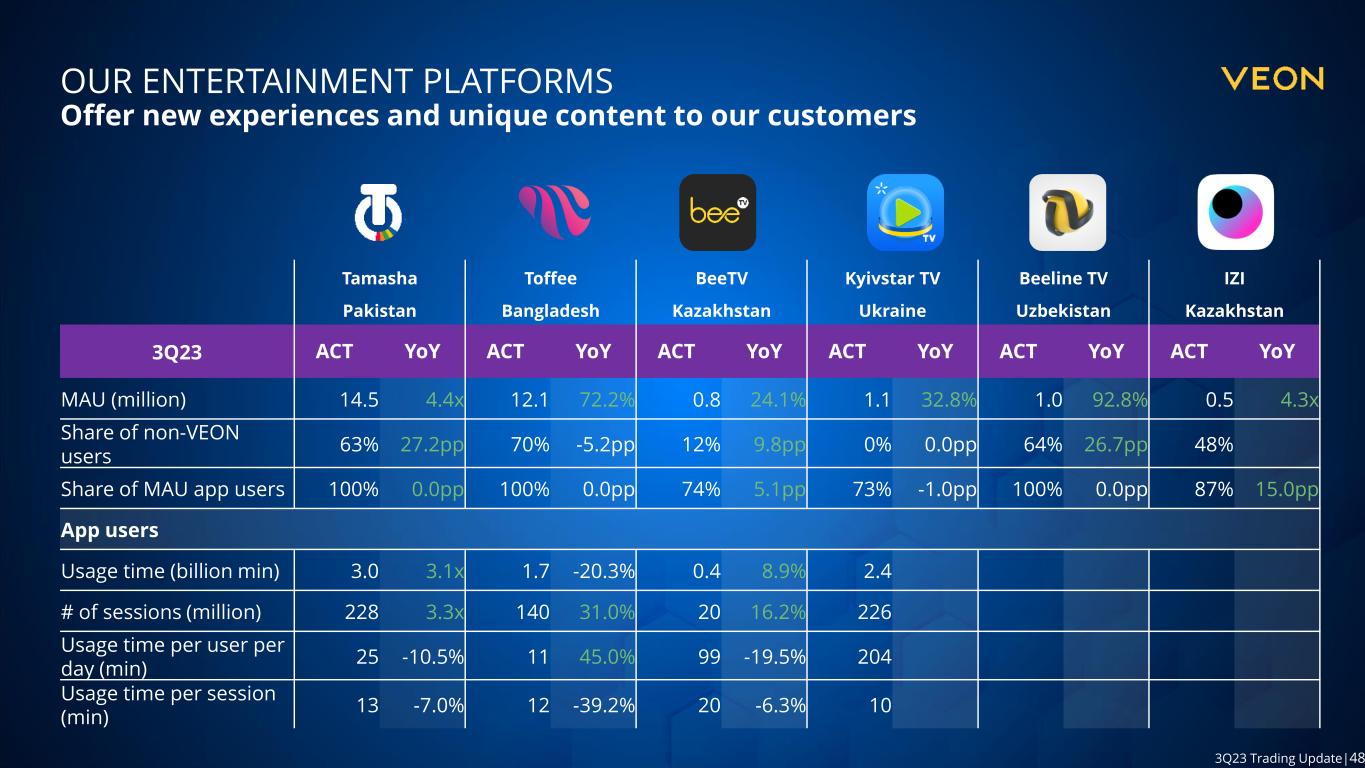

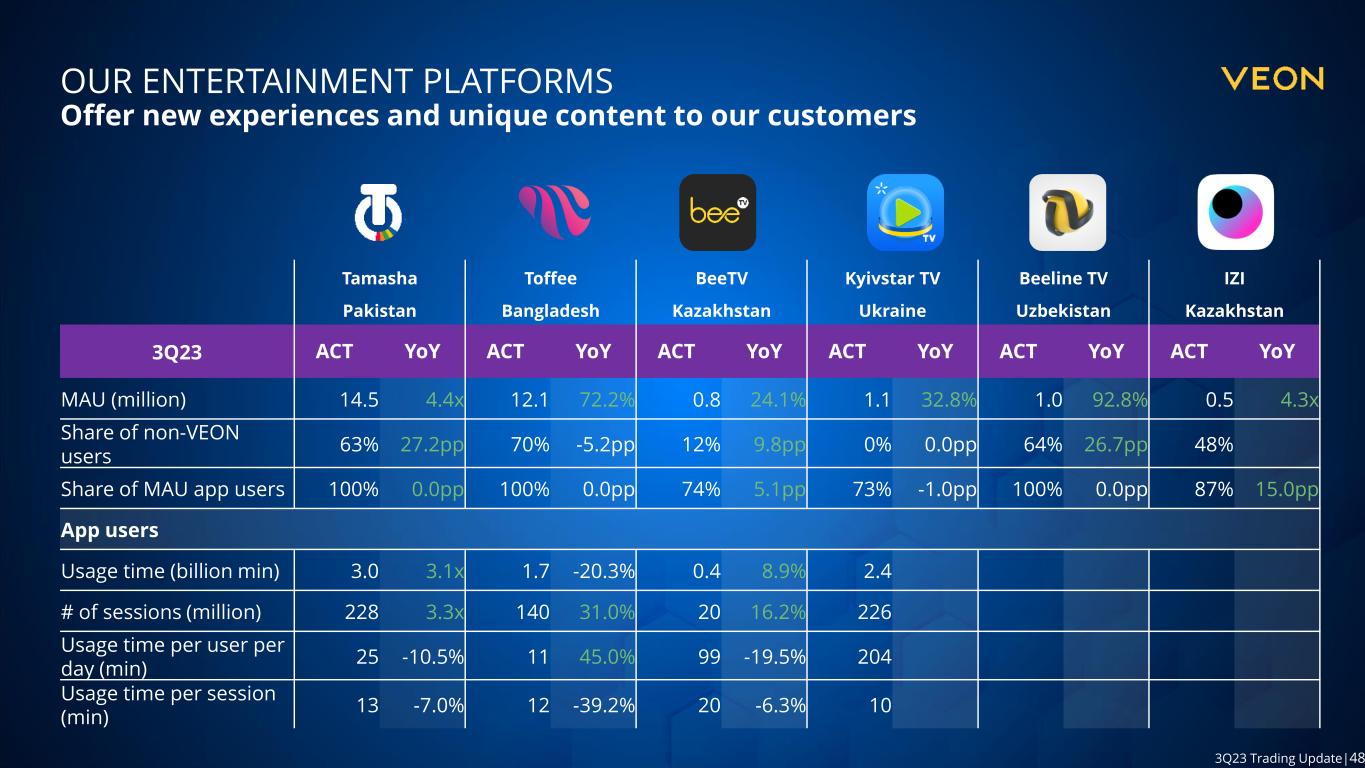

48 3Q23 Trading Update|48 OUR ENTERTAINMENT PLATFORMS Offer new experiences and unique content to our customers Tamasha Toffee BeeTV Kyivstar TV Beeline TV IZI Pakistan Bangladesh Kazakhstan Ukraine Uzbekistan Kazakhstan 3Q23 ACT YoY ACT YoY ACT YoY ACT YoY ACT YoY ACT YoY MAU (million) 14.5 4.4x 12.1 72.2% 0.8 24.1% 1.1 32.8% 1.0 92.8% 0.5 4.3x Share of non-VEON users 63% 27.2pp 70% -5.2pp 12% 9.8pp 0% 0.0pp 64% 26.7pp 48% Share of MAU app users 100% 0.0pp 100% 0.0pp 74% 5.1pp 73% -1.0pp 100% 0.0pp 87% 15.0pp App users Usage time (billion min) 3.0 3.1x 1.7 -20.3% 0.4 8.9% 2.4 # of sessions (million) 228 3.3x 140 31.0% 20 16.2% 226 Usage time per user per day (min) 25 -10.5% 11 45.0% 99 -19.5% 204 Usage time per session (min) 13 -7.0% 12 -39.2% 20 -6.3% 10

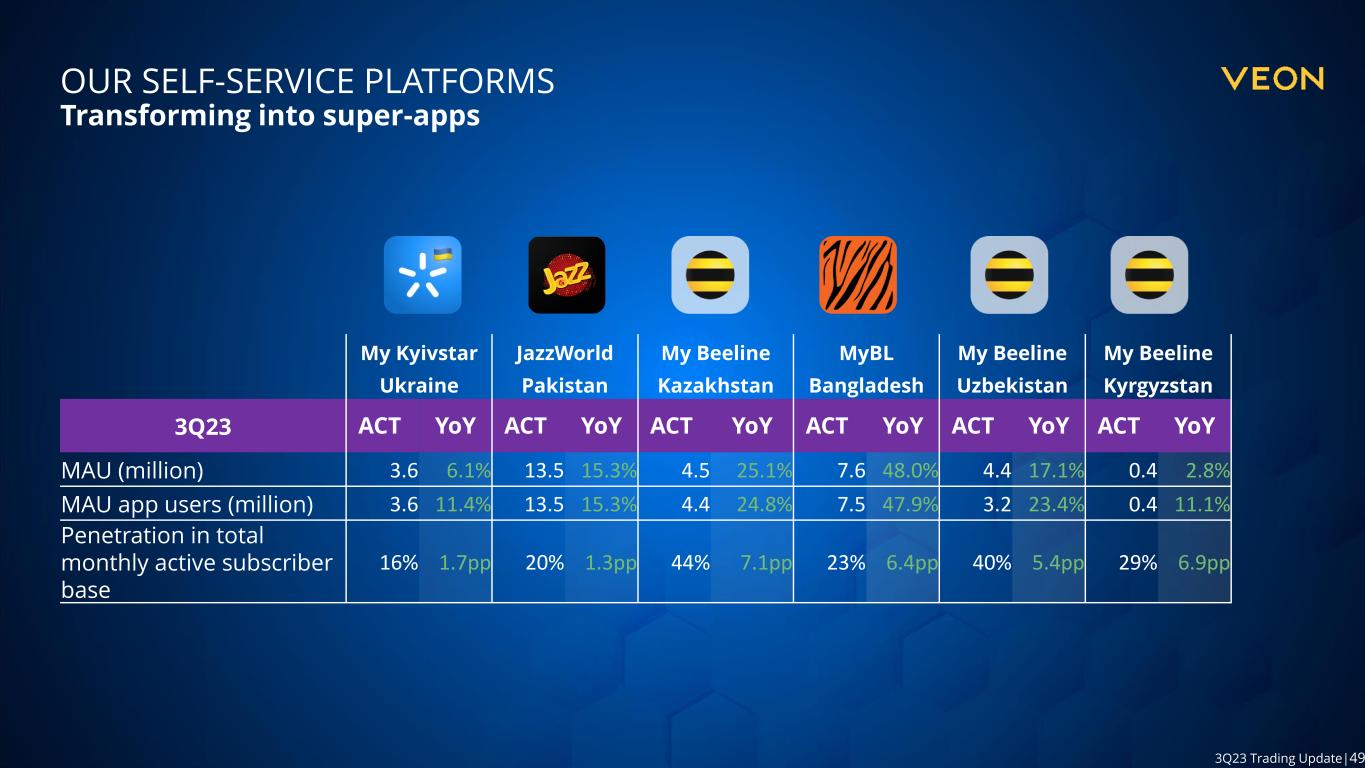

49 3Q23 Trading Update|49 OUR SELF-SERVICE PLATFORMS Transforming into super-apps My Kyivstar JazzWorld My Beeline MyBL My Beeline My Beeline Ukraine Pakistan Kazakhstan Bangladesh Uzbekistan Kyrgyzstan 3Q23 ACT YoY ACT YoY ACT YoY ACT YoY ACT YoY ACT YoY MAU (million) 3.6 6.1% 13.5 15.3% 4.5 25.1% 7.6 48.0% 4.4 17.1% 0.4 2.8% MAU app users (million) 3.6 11.4% 13.5 15.3% 4.4 24.8% 7.5 47.9% 3.2 23.4% 0.4 11.1% Penetration in total monthly active subscriber base 16% 1.7pp 20% 1.3pp 44% 7.1pp 23% 6.4pp 40% 5.4pp 29% 6.9pp

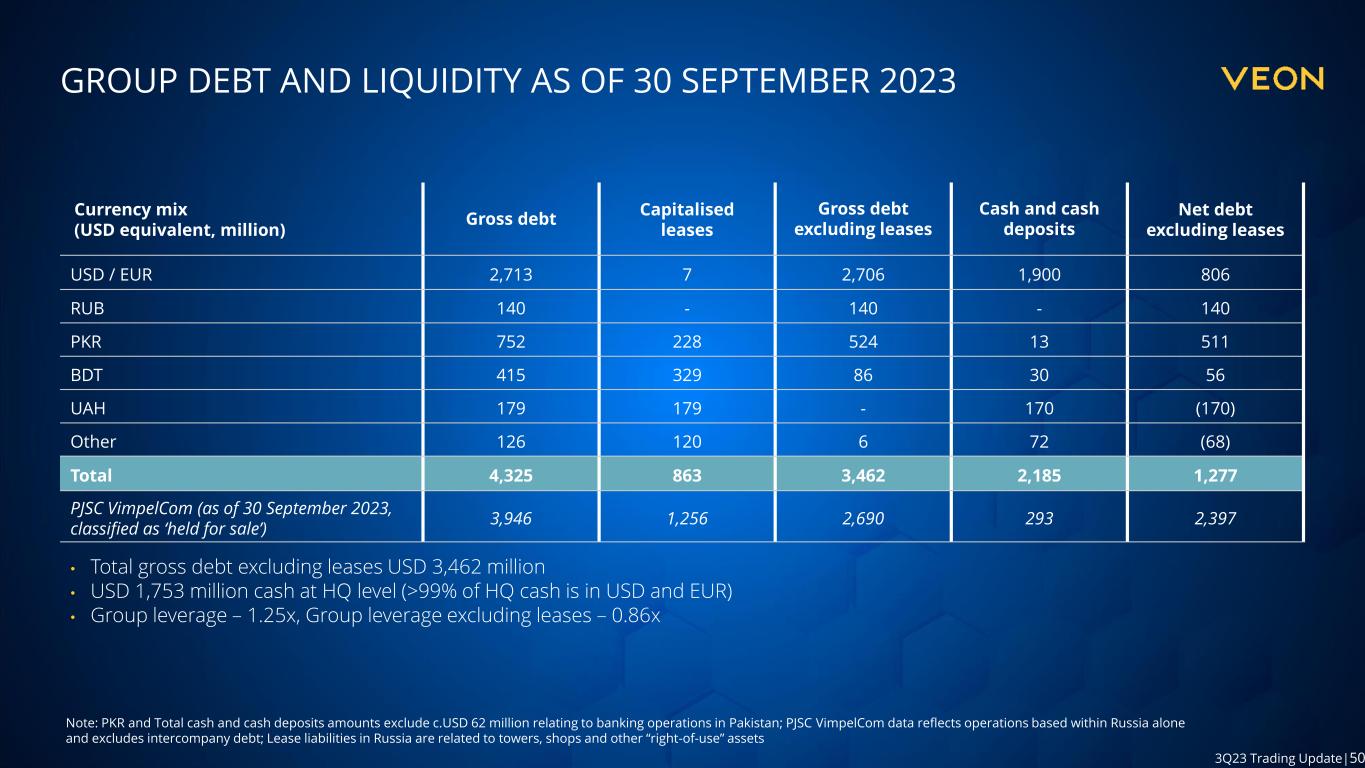

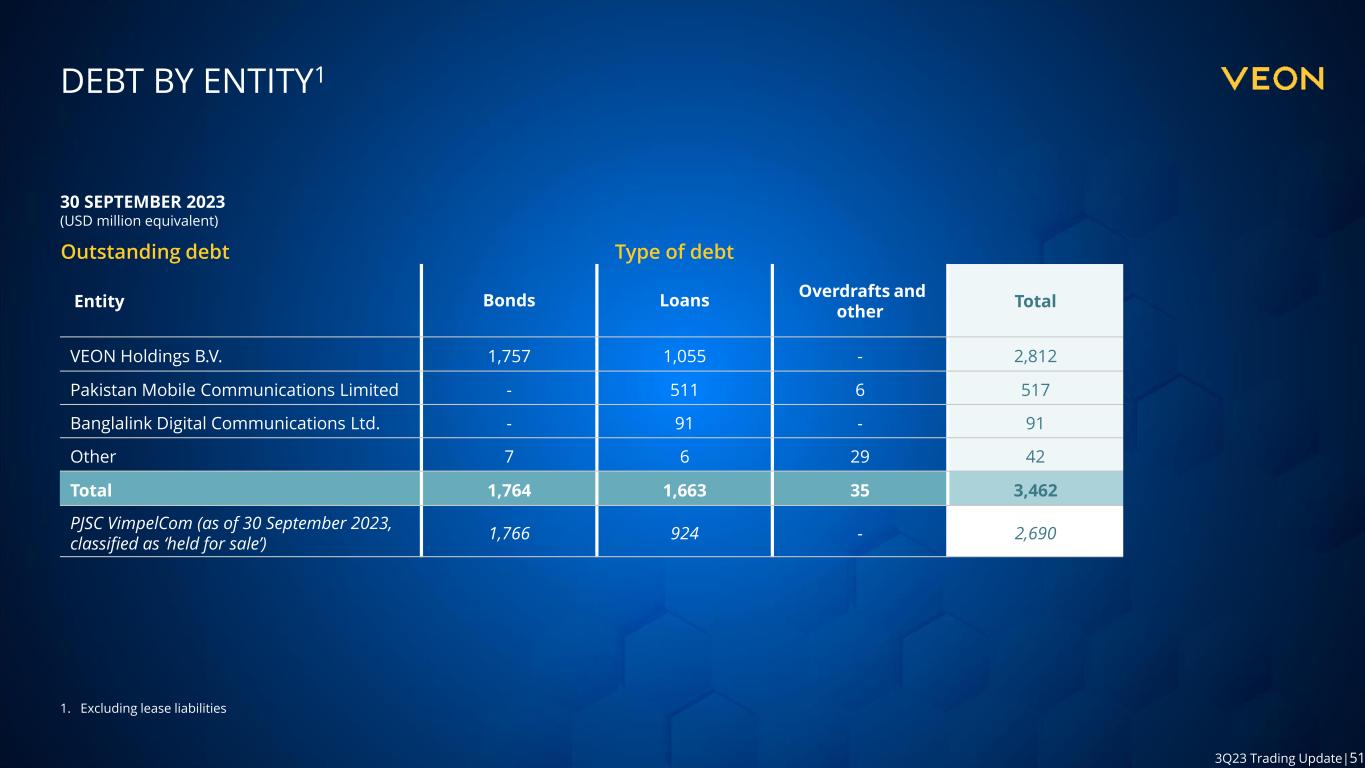

50 3Q23 Trading Update|50 Note: PKR and Total cash and cash deposits amounts exclude c.USD 62 million relating to banking operations in Pakistan; PJSC VimpelCom data reflects operations based within Russia alone and excludes intercompany debt; Lease liabilities in Russia are related to towers, shops and other “right-of-use” assets • Total gross debt excluding leases USD 3,462 million • USD 1,753 million cash at HQ level (>99% of HQ cash is in USD and EUR) • Group leverage – 1.25x, Group leverage excluding leases – 0.86x GROUP DEBT AND LIQUIDITY AS OF 30 SEPTEMBER 2023 Currency mix (USD equivalent, million) Gross debt Capitalised leases Gross debt excluding leases Cash and cash deposits Net debt excluding leases USD / EUR 2,713 7 2,706 1,900 806 RUB 140 - 140 - 140 PKR 752 228 524 13 511 BDT 415 329 86 30 56 UAH 179 179 - 170 (170) Other 126 120 6 72 (68) Total 4,325 863 3,462 2,185 1,277 PJSC VimpelCom (as of 30 September 2023, classified as ‘held for sale’) 3,946 1,256 2,690 293 2,397

51 3Q23 Trading Update|51 DEBT BY ENTITY1 1. Excluding lease liabilities 30 SEPTEMBER 2023 (USD million equivalent) Outstanding debt Type of debt Entity Bonds Loans Overdrafts and other Total VEON Holdings B.V. 1,757 1,055 - 2,812 Pakistan Mobile Communications Limited - 511 6 517 Banglalink Digital Communications Ltd. - 91 - 91 Other 7 6 29 42 Total 1,764 1,663 35 3,462 PJSC VimpelCom (as of 30 September 2023, classified as ‘held for sale’) 1,766 924 - 2,690

52 3Q23 Trading Update|52 DEBT MATURITY AS OF 30 SEPTEMBER 2023 1. As of 30 September 2023 Note: Cash amount excludes c.USD 62 million relating to banking operations in Pakistan DEBT MATURITY SCHEDULE AS OF 30 SEPTEMBER 2023 (USD billion) • USD 124 million of debt maturing in next 12 months, excluding RCF • USD 1,055 million outstanding under the RCF, can be rolled over until the final maturity of the RCF: USD 250 million and USD 805 million of the total commitments under RCF mature in 2024 and 2025 respectively 1 0.70 1.06 0.43 Cash and cash equivalents (USD billion) Operating companies Headquarters (RCF) Headquarters (other) 2.2 0.25 0.81 0.05 0.34 1.54 0.14 1.16 0.23 2023 2024 2025 2026 2027 2028 USD RUB PKR BDT OTHER RCF

53 3Q23 Trading Update|53 DEBT MATURITY Debt maturity schedule 2023-2024 as of 30 September 2023 1. Assuming RCF rollover till maturity in March 2024 DEBT MATURITY SCHEDULE 2023-2024 (Millions) • USD 1,055 million outstanding under the RCF, can be rolled over until the final maturity of the RCF in 2024 (USD 250 million) and in 2025 (USD 805 million) Maturity period Oct 2023 2023 other Mar 2024 Mar 20241 Sep 2024 2024 other Outstanding debt, USD equivalent 39 14 21 250 21 45 Outstanding debt, debt currency USD 39 MIX PKR 6,027 USD 250 PKR 6,027 MIX Entity VEON Holdings B.V. Other Pakistan Mobile Communications Limited VEON Holdings B.V. Pakistan Mobile Communications Limited Other

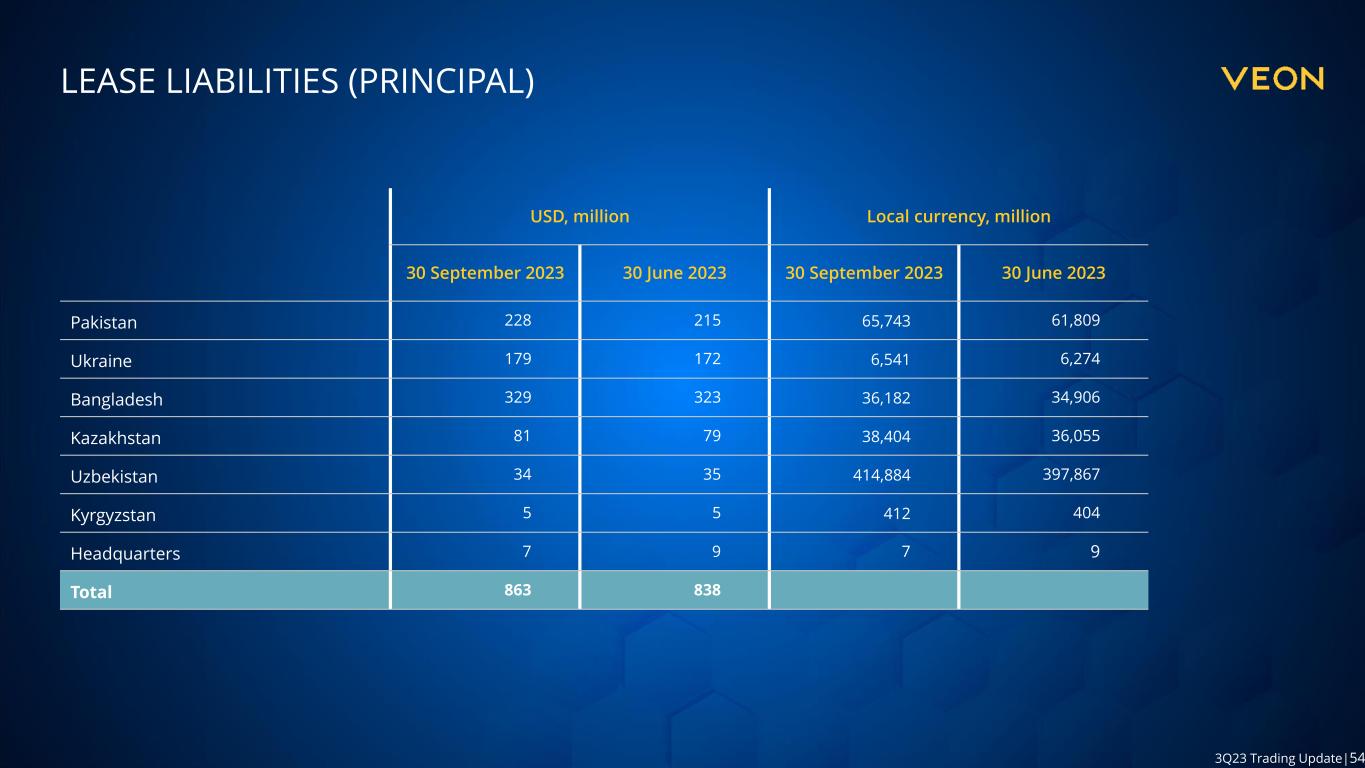

54 3Q23 Trading Update|54 LEASE LIABILITIES (PRINCIPAL) USD, million Local currency, million 30 September 2023 30 June 2023 30 September 2023 30 June 2023 Pakistan 228 215 65,743 61,809 Ukraine 179 172 6,541 6,274 Bangladesh 329 323 36,182 34,906 Kazakhstan 81 79 38,404 36,055 Uzbekistan 34 35 414,884 397,867 Kyrgyzstan 5 5 412 404 Headquarters 7 9 7 9 Total 863 838

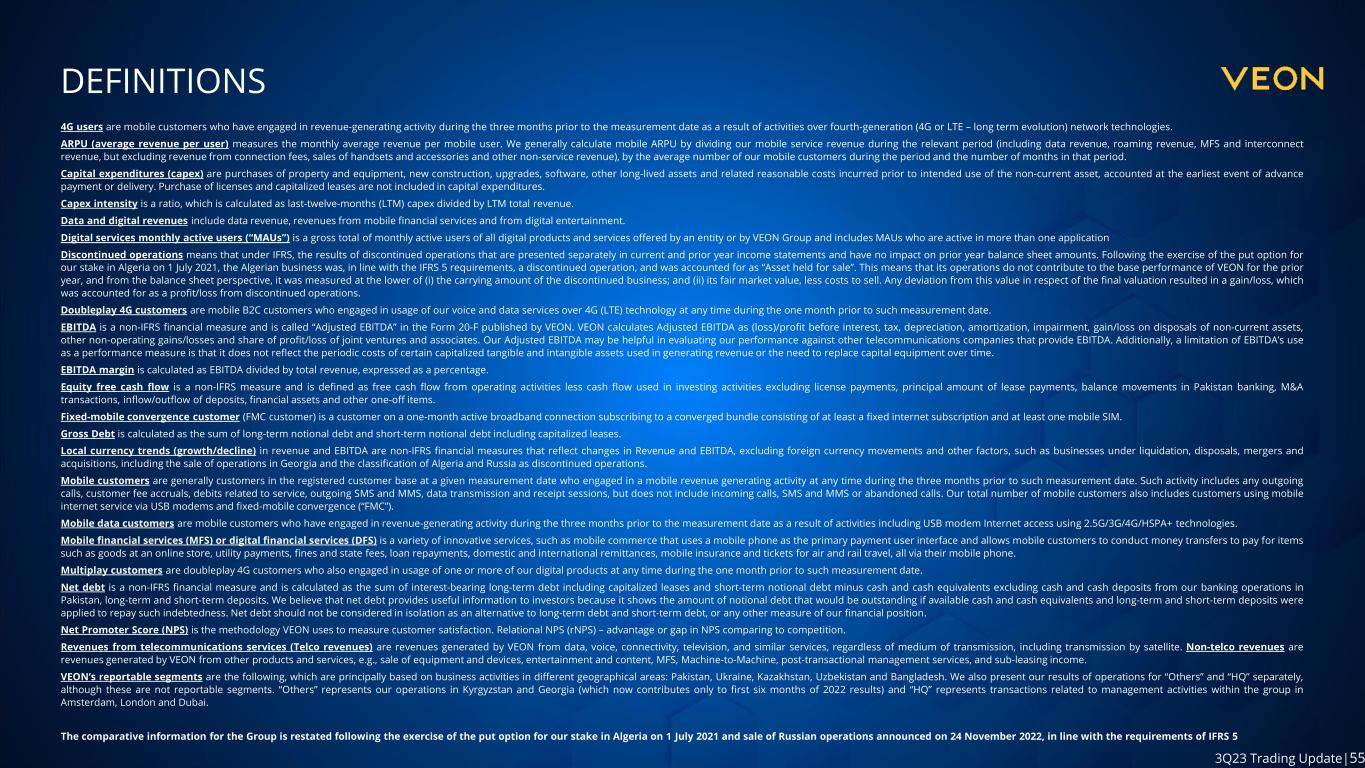

55 3Q23 Trading Update|55 DEFINITIONS 4G users are mobile customers who have engaged in revenue-generating activity during the three months prior to the measurement date as a result of activities over fourth-generation (4G or LTE – long term evolution) network technologies. ARPU (average revenue per user) measures the monthly average revenue per mobile user. We generally calculate mobile ARPU by dividing our mobile service revenue during the relevant period (including data revenue, roaming revenue, MFS and interconnect revenue, but excluding revenue from connection fees, sales of handsets and accessories and other non-service revenue), by the average number of our mobile customers during the period and the number of months in that period. Capital expenditures (capex) are purchases of property and equipment, new construction, upgrades, software, other long-lived assets and related reasonable costs incurred prior to intended use of the non-current asset, accounted at the earliest event of advance payment or delivery. Purchase of licenses and capitalized leases are not included in capital expenditures. Capex intensity is a ratio, which is calculated as last-twelve-months (LTM) capex divided by LTM total revenue. Data and digital revenues include data revenue, revenues from mobile financial services and from digital entertainment. Digital services monthly active users (“MAUs”) is a gross total of monthly active users of all digital products and services offered by an entity or by VEON Group and includes MAUs who are active in more than one application Discontinued operations means that under IFRS, the results of discontinued operations that are presented separately in current and prior year income statements and have no impact on prior year balance sheet amounts. Following the exercise of the put option for our stake in Algeria on 1 July 2021, the Algerian business was, in line with the IFRS 5 requirements, a discontinued operation, and was accounted for as “Asset held for sale”. This means that its operations do not contribute to the base performance of VEON for the prior year, and from the balance sheet perspective, it was measured at the lower of (i) the carrying amount of the discontinued business; and (ii) its fair market value, less costs to sell. Any deviation from this value in respect of the final valuation resulted in a gain/loss, which was accounted for as a profit/loss from discontinued operations. Doubleplay 4G customers are mobile B2C customers who engaged in usage of our voice and data services over 4G (LTE) technology at any time during the one month prior to such measurement date. EBITDA is a non-IFRS financial measure and is called “Adjusted EBITDA” in the Form 20-F published by VEON. VEON calculates Adjusted EBITDA as (loss)/profit before interest, tax, depreciation, amortization, impairment, gain/loss on disposals of non-current assets, other non-operating gains/losses and share of profit/loss of joint ventures and associates. Our Adjusted EBITDA may be helpful in evaluating our performance against other telecommunications companies that provide EBITDA. Additionally, a limitation of EBITDA’s use as a performance measure is that it does not reflect the periodic costs of certain capitalized tangible and intangible assets used in generating revenue or the need to replace capital equipment over time. EBITDA margin is calculated as EBITDA divided by total revenue, expressed as a percentage. Equity free cash flow is a non-IFRS measure and is defined as free cash flow from operating activities less cash flow used in investing activities excluding license payments, principal amount of lease payments, balance movements in Pakistan banking, M&A transactions, inflow/outflow of deposits, financial assets and other one-off items. Fixed-mobile convergence customer (FMC customer) is a customer on a one-month active broadband connection subscribing to a converged bundle consisting of at least a fixed internet subscription and at least one mobile SIM. Gross Debt is calculated as the sum of long-term notional debt and short-term notional debt including capitalized leases. Local currency trends (growth/decline) in revenue and EBITDA are non-IFRS financial measures that reflect changes in Revenue and EBITDA, excluding foreign currency movements and other factors, such as businesses under liquidation, disposals, mergers and acquisitions, including the sale of operations in Georgia and the classification of Algeria and Russia as discontinued operations. Mobile customers are generally customers in the registered customer base at a given measurement date who engaged in a mobile revenue generating activity at any time during the three months prior to such measurement date. Such activity includes any outgoing calls, customer fee accruals, debits related to service, outgoing SMS and MMS, data transmission and receipt sessions, but does not include incoming calls, SMS and MMS or abandoned calls. Our total number of mobile customers also includes customers using mobile internet service via USB modems and fixed-mobile convergence (“FMC”). Mobile data customers are mobile customers who have engaged in revenue-generating activity during the three months prior to the measurement date as a result of activities including USB modem Internet access using 2.5G/3G/4G/HSPA+ technologies. Mobile financial services (MFS) or digital financial services (DFS) is a variety of innovative services, such as mobile commerce that uses a mobile phone as the primary payment user interface and allows mobile customers to conduct money transfers to pay for items such as goods at an online store, utility payments, fines and state fees, loan repayments, domestic and international remittances, mobile insurance and tickets for air and rail travel, all via their mobile phone. Multiplay customers are doubleplay 4G customers who also engaged in usage of one or more of our digital products at any time during the one month prior to such measurement date. Net debt is a non-IFRS financial measure and is calculated as the sum of interest-bearing long-term debt including capitalized leases and short-term notional debt minus cash and cash equivalents excluding cash and cash deposits from our banking operations in Pakistan, long-term and short-term deposits. We believe that net debt provides useful information to investors because it shows the amount of notional debt that would be outstanding if available cash and cash equivalents and long-term and short-term deposits were applied to repay such indebtedness. Net debt should not be considered in isolation as an alternative to long-term debt and short-term debt, or any other measure of our financial position. Net Promoter Score (NPS) is the methodology VEON uses to measure customer satisfaction. Relational NPS (rNPS) – advantage or gap in NPS comparing to competition. Revenues from telecommunications services (Telco revenues) are revenues generated by VEON from data, voice, connectivity, television, and similar services, regardless of medium of transmission, including transmission by satellite. Non-telco revenues are revenues generated by VEON from other products and services, e.g., sale of equipment and devices, entertainment and content, MFS, Machine-to-Machine, post-transactional management services, and sub-leasing income. VEON’s reportable segments are the following, which are principally based on business activities in different geographical areas: Pakistan, Ukraine, Kazakhstan, Uzbekistan and Bangladesh. We also present our results of operations for “Others” and “HQ” separately, although these are not reportable segments. “Others” represents our operations in Kyrgyzstan and Georgia (which now contributes only to first six months of 2022 results) and “HQ” represents transactions related to management activities within the group in Amsterdam, London and Dubai. The comparative information for the Group is restated following the exercise of the put option for our stake in Algeria on 1 July 2021 and sale of Russian operations announced on 24 November 2022, in line with the requirements of IFRS 5

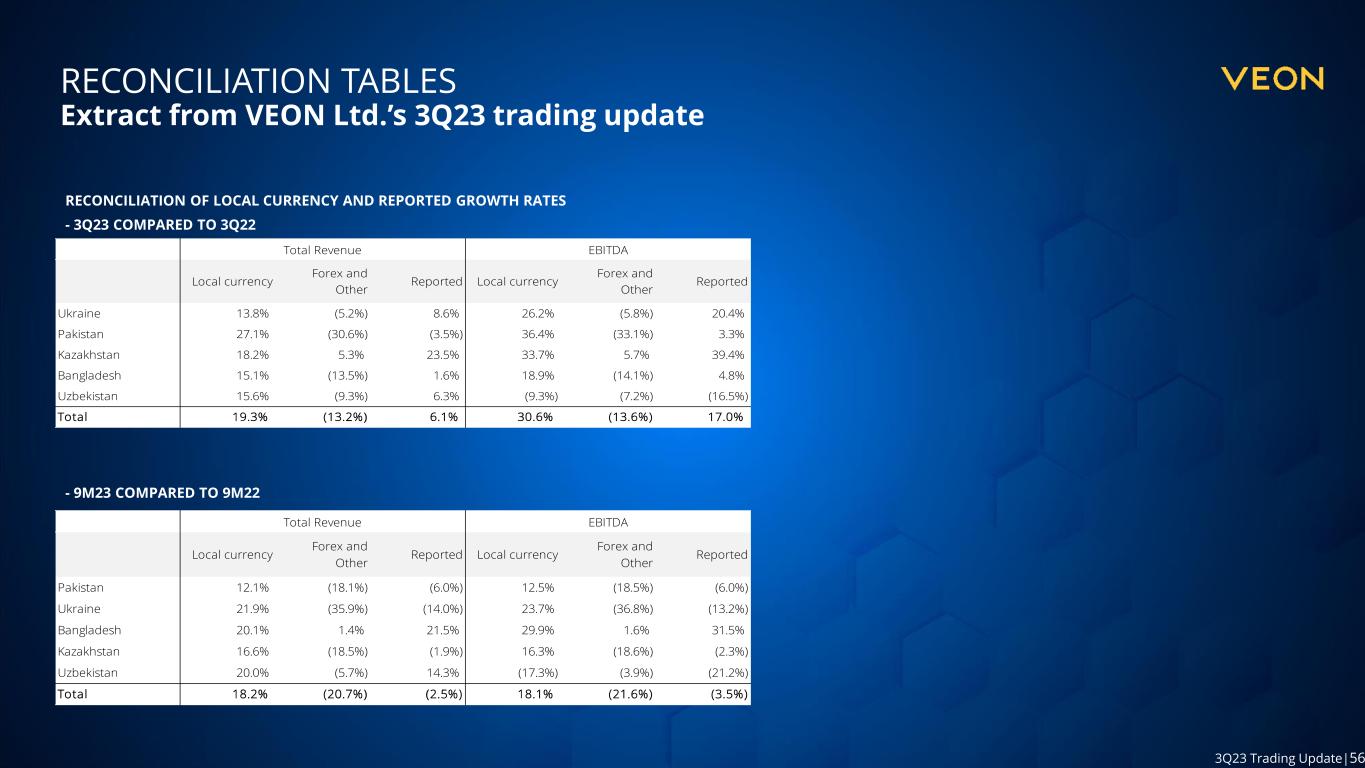

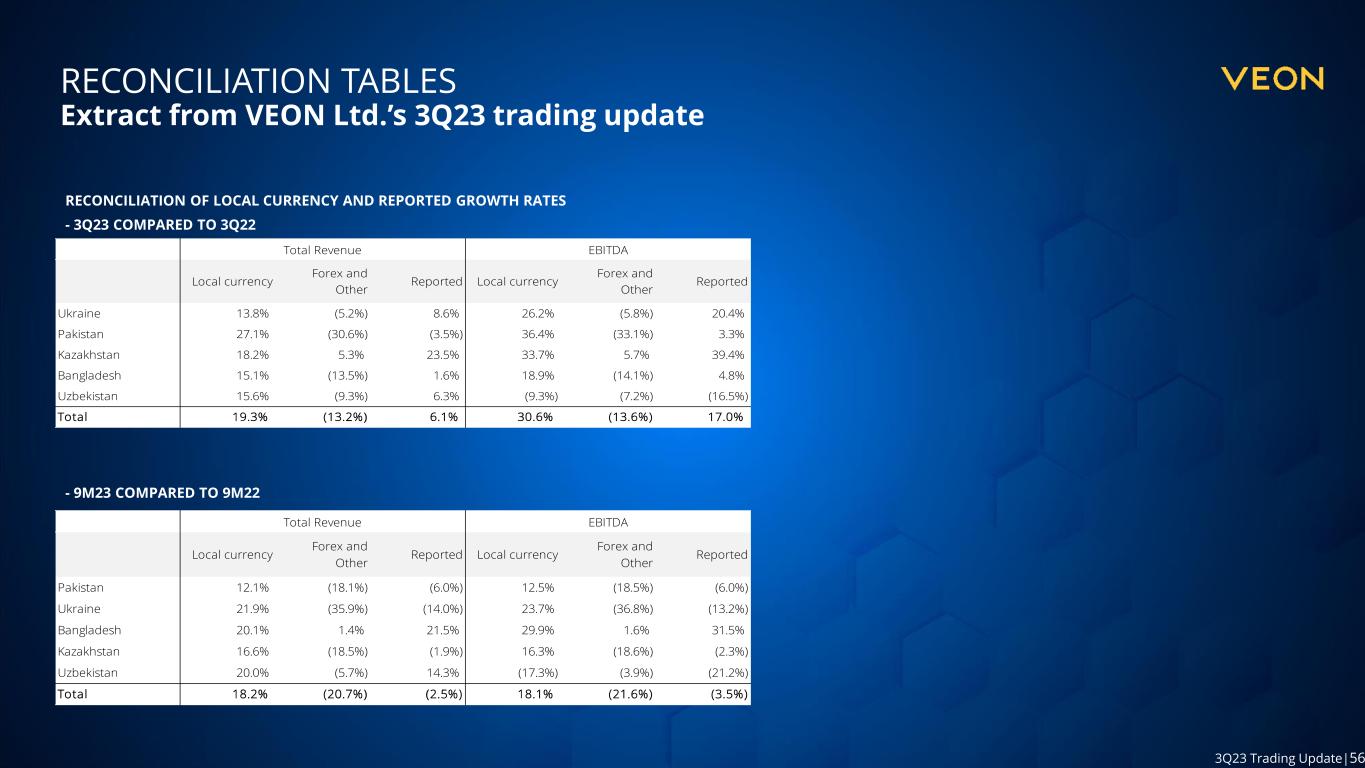

56 3Q23 Trading Update|56 RECONCILIATION TABLES Extract from VEON Ltd.’s 3Q23 trading update RECONCILIATION OF LOCAL CURRENCY AND REPORTED GROWTH RATES - 3Q23 COMPARED TO 3Q22 - 9M23 COMPARED TO 9M22 Local currency Forex and Other Reported Local currency Forex and Other Reported Ukraine 13.8% (5.2%) 8.6% 26.2% (5.8%) 20.4% Pakistan 27.1% (30.6%) (3.5%) 36.4% (33.1%) 3.3% Kazakhstan 18.2% 5.3% 23.5% 33.7% 5.7% 39.4% Bangladesh 15.1% (13.5%) 1.6% 18.9% (14.1%) 4.8% Uzbekistan 15.6% (9.3%) 6.3% (9.3%) (7.2%) (16.5%) Total 19.3% (13.2%) 6.1% 30.6% (13.6%) 17.0% Total Revenue EBITDA Local currency Forex and Other Reported Local currency Forex and Other Reported Pakistan 12.1% (18.1%) (6.0%) 12.5% (18.5%) (6.0%) Ukraine 21.9% (35.9%) (14.0%) 23.7% (36.8%) (13.2%) Bangladesh 20.1% 1.4% 21.5% 29.9% 1.6% 31.5% Kazakhstan 16.6% (18.5%) (1.9%) 16.3% (18.6%) (2.3%) Uzbekistan 20.0% (5.7%) 14.3% (17.3%) (3.9%) (21.2%) Total 18.2% (20.7%) (2.5%) 18.1% (21.6%) (3.5%) Total Revenue EBITDA