1 4Q23 trading update |1 VEON 4Q23 TRADING UPDATE 21 March 2024 STRONG ORGANIC GROWTH IN REVENUE AND EBITDA SOLID EXECUTION OF VEON 2.0 STRATEGY

2 4Q23 trading update |2 AGENDA 1. OPENING 2. HIGHLIGHTS & BUSINESS UPDATE Faisal Ghori Kaan Terzioğlu 4. CLOSING REMARKS Kaan Terzioğlu 3. TRADING RESULTS – INCLUDING DEBT MATURITY AND LIQUIDITY UPDATE Joop Brakenhoff 5. Q&A Kaan Terzioğlu, Joop Brakenhoff

3 4Q23 trading update |3 DISCLAIMER VEON's results and other financial information presented in this presentation are, unless otherwise stated, prepared in accordance with International Financial Reporting Standards ("IFRS") and have not been externally reviewed and audited. The financial information included in this presentation is preliminary and is based on a number of assumptions that are subject to inherent uncertainties and subject to change. The financial information presented herein is based on internal management accounts, is the responsibility of management and is subject to financial closing procedures which have not yet been completed and has not been audited, reviewed or verified. Certain amounts and percentages that appear in this presentation have been subject to rounding adjustments. As a result, certain numerical figures shown as totals, including those in the tables, may not be an exact arithmetic aggregation of the figures that precede or follow them. Although we believe the information to be reasonable, actual results may vary from the information contained above and such variations could be material. As such, you should not place undue reliance on this information. This information may not be indicative of the actual results for the current period or any future period. this presentation contains “forward-looking statements”, as the phrase is defined in Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. These forward-looking statements may be identified by words such as “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “seek,” “believe,” “estimate,” “predict,” “potential,” “continue,” “contemplate,” “possible” and other similar words. Forward-looking statements include statements relating to, among other things, VEON’s plans to implement its strategic priorities, including operating model and development plans; anticipated performance, including VEON’s ability to generate sufficient cash flow; VEON’s assessment of the impact of the war in Ukraine, including related sanctions and counter- sanctions, on its current and future operations and financial condition; future market developments and trends; operational and network development and network investment, including expectations regarding the roll-out and benefits of 3G/4G/LTE networks, as applicable; spectrum acquisitions and renewals; the effect of the acquisition of additional spectrum on customer experience; VEON’s ability to realize the acquisition and disposition of any of its businesses and assets and to execute its strategic transactions in the timeframes anticipated, or at all; VEON’s ability to realize financial improvements, including an expected reduction of net pro-forma leverage ratio following the successful completion of certain dispositions and acquisitions; our dividends; and VEON’s ability to realize its targets and commercial initiatives in its various countries of operation. The forward-looking statements included in this presentation are based on management’s best assessment of VEON’s strategic and financial position and of future market conditions, trends and other potential developments. These discussions involve risks and uncertainties. The actual outcome may differ materially from these statements as a result of, among other things: further escalation in the conflict surrounding Russia and Ukraine, including further sanctions and counter-sanctions and any related involuntary deconsolidation of our Ukrainian operations; demand for and market acceptance of VEON’s products and services; our plans regarding our dividend payments and policies, as well as our ability to receive dividends, distributions, loans, transfers or other payments or guarantees from our subsidiaries; continued volatility in the economies in VEON’s markets; governmental regulation of the telecommunications industries; general political uncertainties in VEON’s markets; government investigations or other regulatory actions; litigation or disputes with third parties or regulatory authorities or other negative developments regarding such parties; the impact of export controls and laws affecting trade and investment on our and important third-party suppliers' ability to procure goods, software or technology necessary for the services we provide to our customers; risks associated with our material weakness in internal control over financial reporting; risks associated with data protection or cyber security, other risks beyond the parties’ control or a failure to meet expectations regarding various strategic priorities, the effect of foreign currency fluctuations, increased competition in the markets in which VEON operates and the effect of consumer taxes on the purchasing activities of consumers of VEON’s services. Certain other factors that could cause actual results to differ materially from those discussed in any forward-looking statements include the risk factors described in VEON’s Annual Report on Form 20-F for the year ended 31 December 2022 filed with the U.S. Securities and Exchange Commission (the “SEC”) on 24 July 2023 and other public filings made from time to time by VEON with the SEC. Other unknown or unpredictable factors also could harm our future results. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Under no circumstances should the inclusion of such forward-looking statements in this presentation be regarded as a representation or warranty by us or any other person with respect to the achievement of results set out in such statements or that the underlying assumptions used will in fact be the case. Therefore, you are cautioned not to place undue reliance on these forward-looking statements. The forward-looking statements speak only as of the date hereof. We cannot assure you that any projected results or events will be achieved. Except to the extent required by law, we disclaim any obligation to update or revise any of these forward- looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made, or to reflect the occurrence of unanticipated events. This presentation also includes ratings from credit rating agencies. A rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time. Furthermore, elements of this presentation contain or may contain, “inside information” as defined under the Market Abuse Regulation (EU) No. 596/2014.

4 4Q23 trading update |4 NOTICE TO READERS: FINANCIAL INFORMATION PRESENTED VEON's results and other financial information presented in this presentation are, unless otherwise stated, prepared in accordance with International Financial Reporting Standards ("IFRS") based on internal management reporting, are the responsibility of management, and have not been externally audited, reviewed, or verified. As such, you should not place undue reliance on this information. This information may not be indicative of the actual results for any future period. NOTICE TO READERS: IMPACT OF THE WAR IN UKRAINE The ongoing war between Russia and Ukraine and the sanctions imposed by the United States, member states of the European Union, the European Union itself, the United Kingdom, Ukraine and certain other nations, counter-sanctions by Russia and other legal and regulatory responses, as well as responses by our service providers, partners, suppliers and other counterparties, and the other indirect and direct consequences of the war have impacted and, if the war, sanctions and such responses and other consequences continue or escalate, may significantly impact our results and aspects of our operations in Ukraine, and may significantly affect our results and aspects of our operations in the other countries in which we operate. We are closely monitoring events in Russia and Ukraine, as well as the possibility of the imposition of further sanctions in connection with the ongoing war between Russia and Ukraine and any resulting further rise in tensions between Russia and the United States, the United Kingdom and/or the European Union. Although we have completed our exit from Russia, our operations in Ukraine continue to be affected by the war. We are doing everything we can to protect the safety of our employees, while continuing to ensure the uninterrupted operation of our communications, financial and digital services.

5 4Q23 trading update |5 AGENDA 1. OPENING 2. HIGHLIGHTS & BUSINESS UPDATE Faisal Ghori Kaan Terzioğlu 4. CLOSING REMARKS Kaan Terzioğlu 3. TRADING RESULTS – INCLUDING DEBT MATURITY AND LIQUIDITY UPDATE Joop Brakenhoff 5. Q&A Kaan Terzioğlu, Joop Brakenhoff

6 4Q23 trading update |6 VEON 2.0 – BEST IN CLASS DIGITAL OPERATOR Key fundamental trends and themes shaping our equity story 1 • Across our geographies, population growth, 4G data consumption, smart phone penetration, digital product monetization and pricing drives double-digit topline growth Double-digit growth 2 • EBITDA margin will expand organically through operating leverage and effective cost management Margin expansion 4 • Strong EBITDA growth will be accompanied with declines in capex as 4G penetration reaches 70%, and lower interest expense, supporting robust equity FCF growth dynamics High FCF generation 3 • Deleveraging to be a key theme, we will equally prioritize a healthy capital structure and attractive returns over the medium-term Stronger balance sheet 5 • Moving from telecom "market-share" to consumer "wallet-share" focus. Digital portfolio offers tremendous monetisation across all core consumer verticals Digital Operator

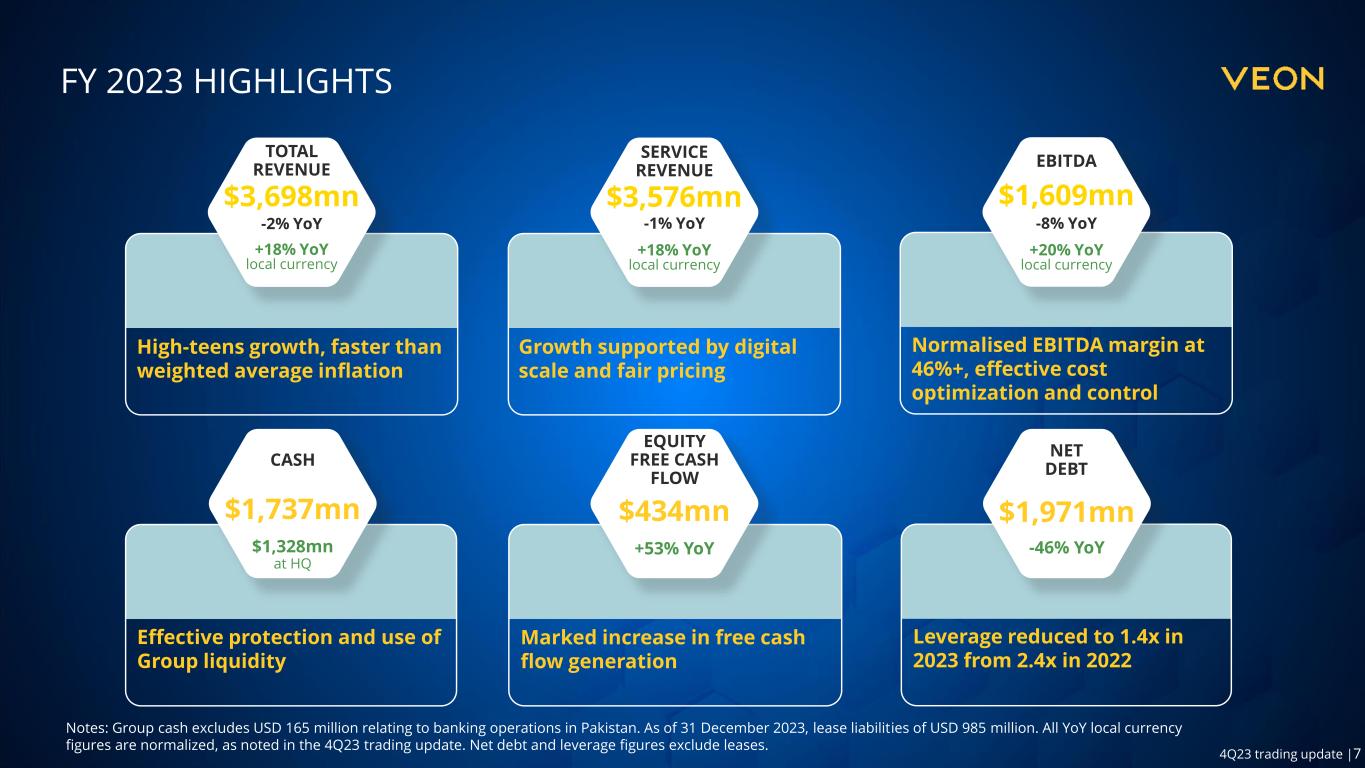

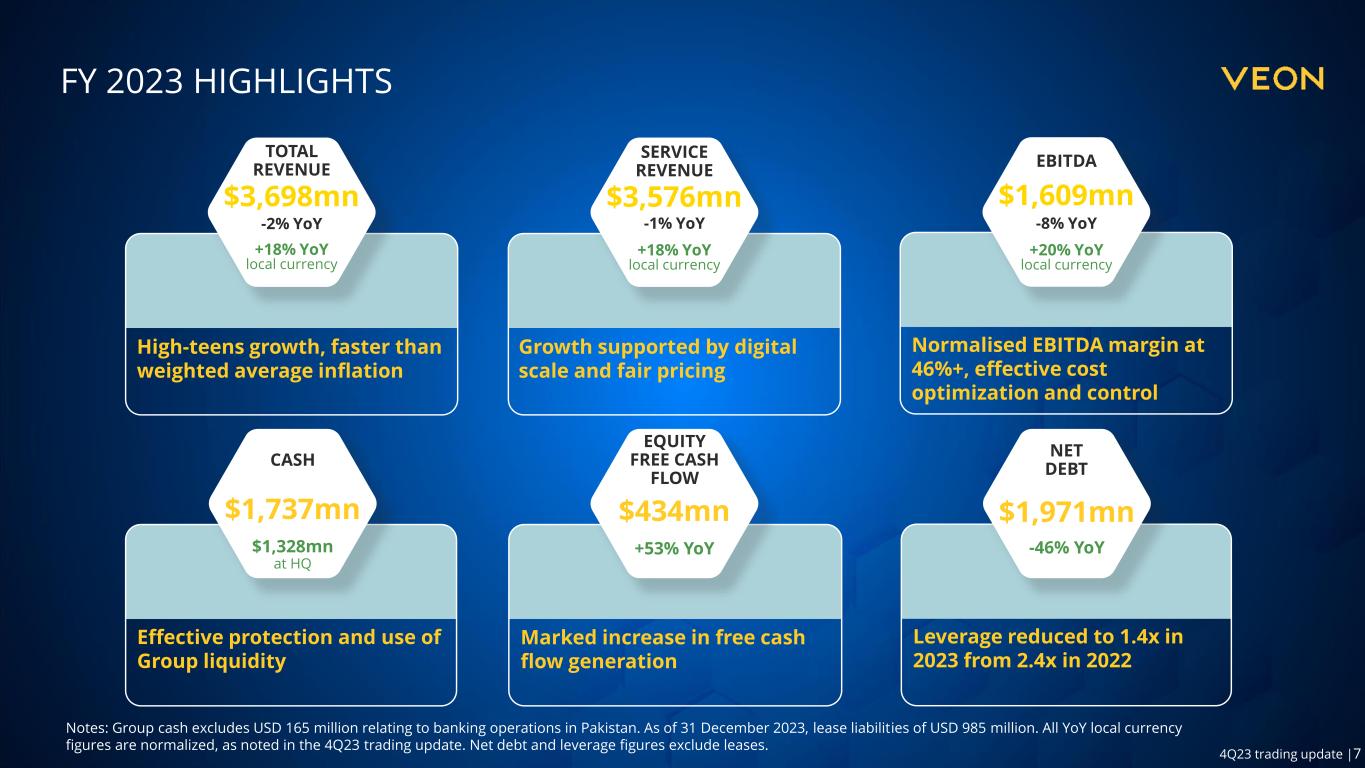

7 4Q23 trading update |7 FY 2023 HIGHLIGHTS Normalised EBITDA margin at 46%+, effective cost optimization and control EBITDA $1,609mn +20% YoY local currency Effective protection and use of Group liquidity $1,737mn CASH $1,328mn at HQ High-teens growth, faster than weighted average inflation +18% YoY local currency TOTAL REVENUE -2% YoY $3,698mn -8% YoY Growth supported by digital scale and fair pricing +18% YoY local currency SERVICE REVENUE -1% YoY $3,576mn Leverage reduced to 1.4x in 2023 from 2.4x in 2022 $1,971mn NET DEBT -46% YoY Marked increase in free cash flow generation $434mn EQUITY FREE CASH FLOW +53% YoY Notes: Group cash excludes USD 165 million relating to banking operations in Pakistan. As of 31 December 2023, lease liabilities of USD 985 million. All YoY local currency figures are normalized, as noted in the 4Q23 trading update. Net debt and leverage figures exclude leases.

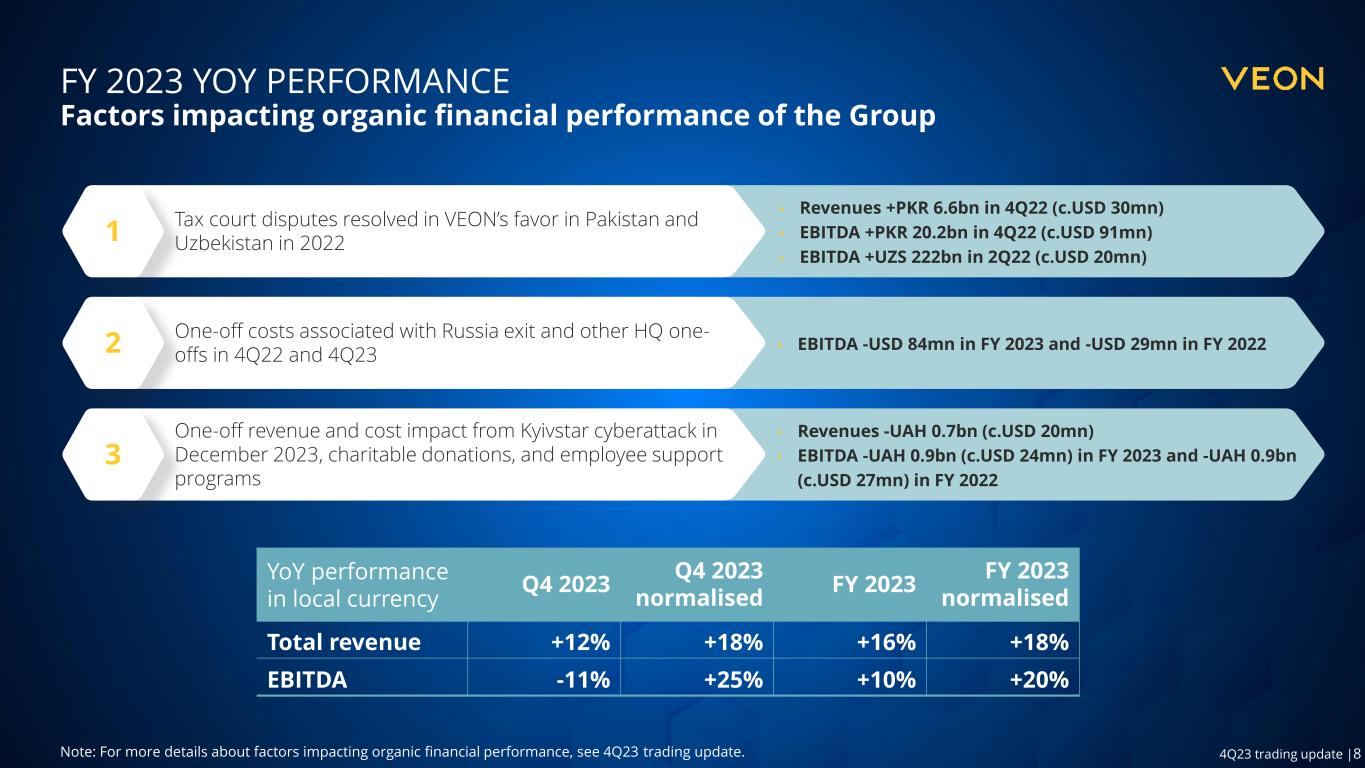

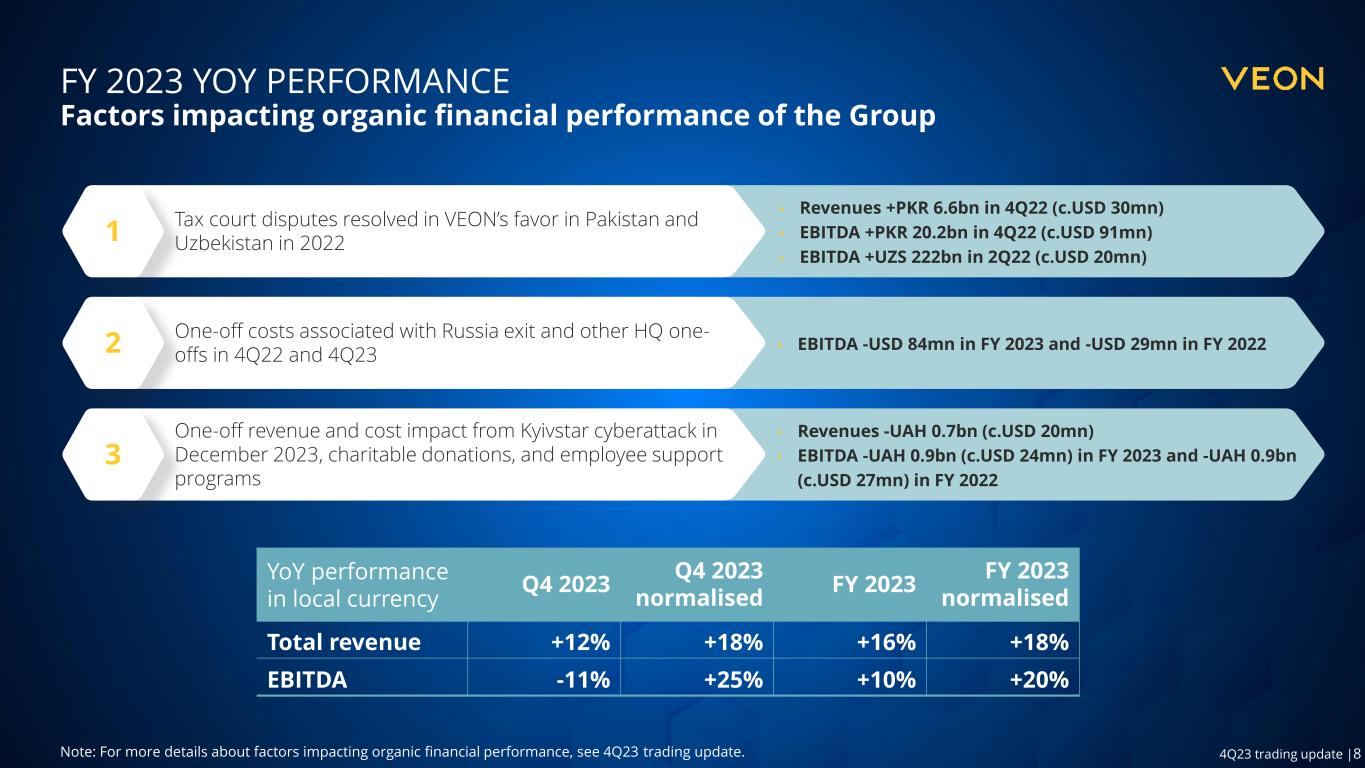

8 4Q23 trading update |8 FY 2023 YOY PERFORMANCE Factors impacting organic financial performance of the Group 1 One-off costs associated with Russia exit and other HQ one- offs in 4Q22 and 4Q23 Tax court disputes resolved in VEON’s favor in Pakistan and Uzbekistan in 2022 • EBITDA -USD 84mn in FY 2023 and -USD 29mn in FY 2022 • Revenues +PKR 6.6bn in 4Q22 (c.USD 30mn) • EBITDA +PKR 20.2bn in 4Q22 (c.USD 91mn) • EBITDA +UZS 222bn in 2Q22 (c.USD 20mn) 2 YoY performance in local currency Q4 2023 Q4 2023 normalised FY 2023 FY 2023 normalised Total revenue +12% +18% +16% +18% EBITDA -11% +25% +10% +20% One-off revenue and cost impact from Kyivstar cyberattack in December 2023, charitable donations, and employee support programs • Revenues -UAH 0.7bn (c.USD 20mn) • EBITDA -UAH 0.9bn (c.USD 24mn) in FY 2023 and -UAH 0.9bn (c.USD 27mn) in FY 2022 3 Note: For more details about factors impacting organic financial performance, see 4Q23 trading update.

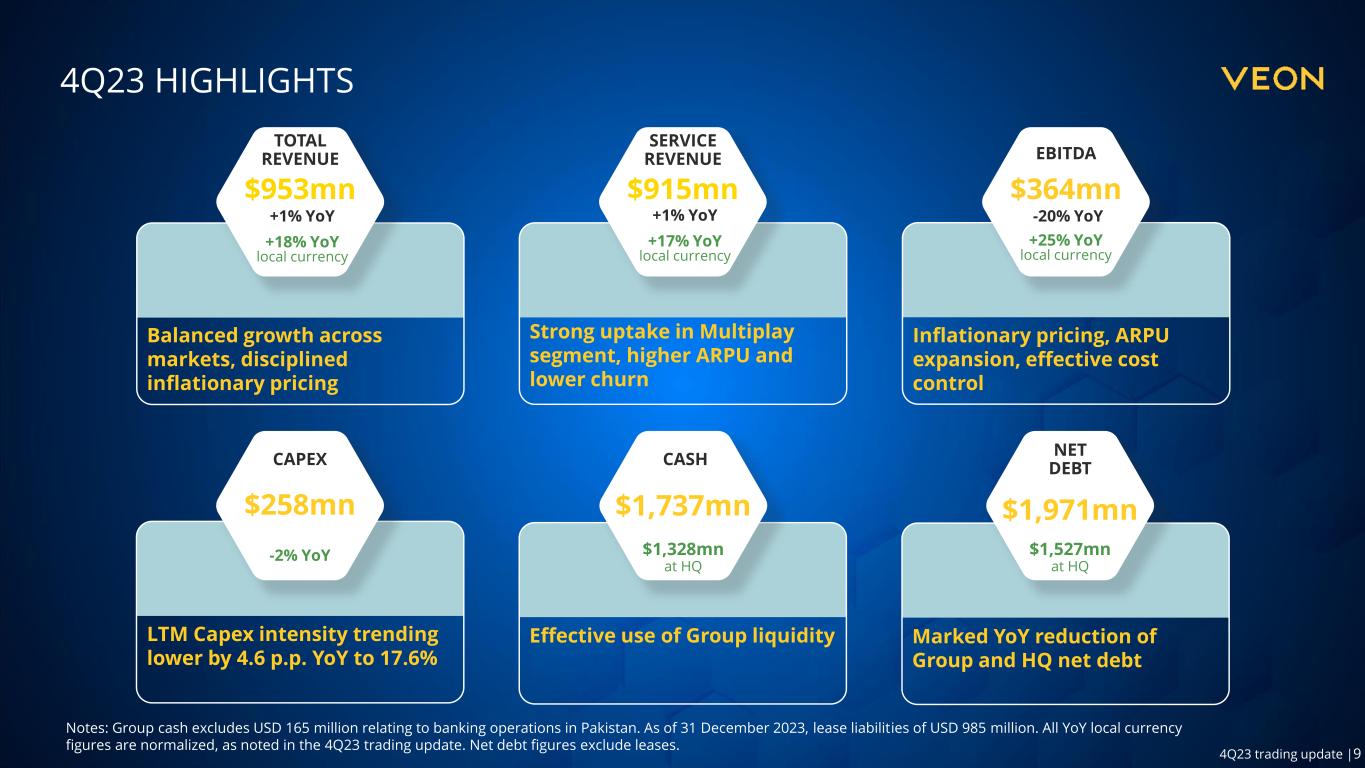

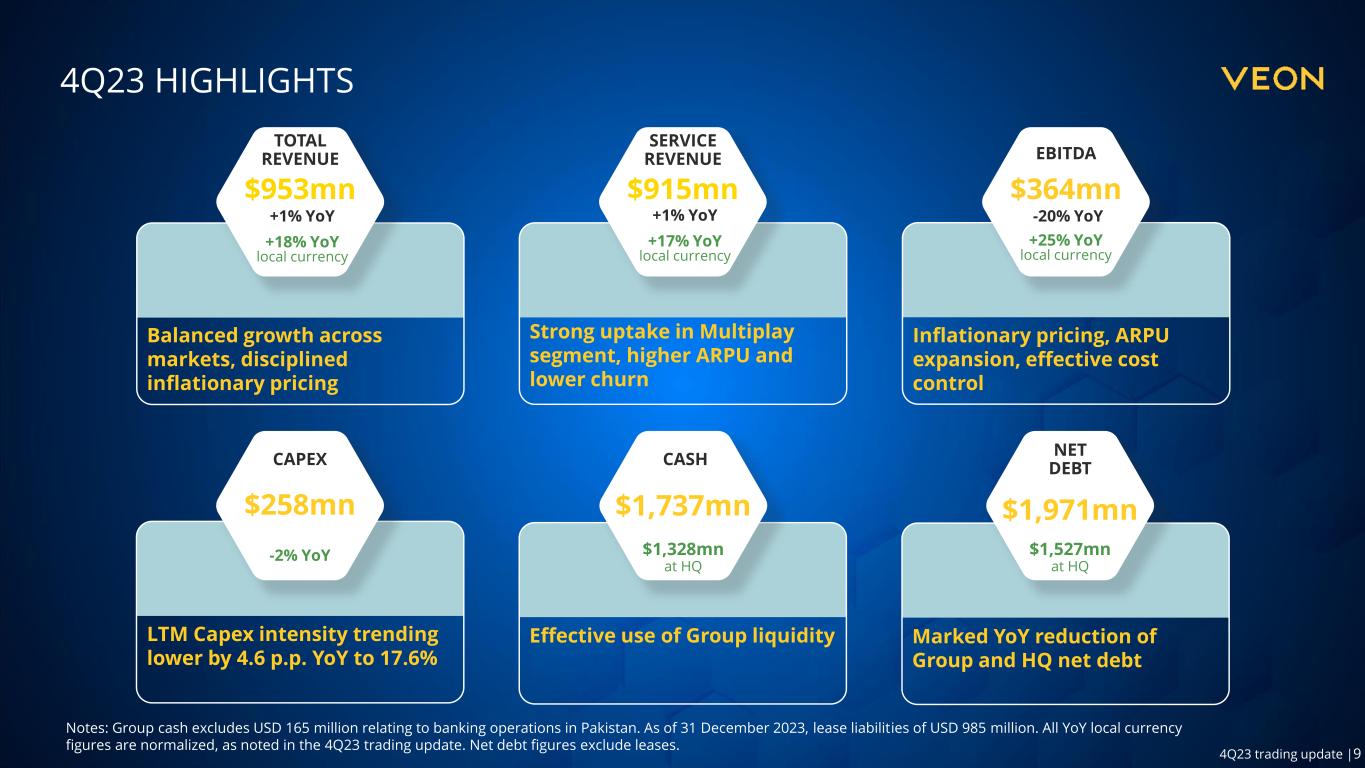

9 4Q23 trading update |9 4Q23 HIGHLIGHTS LTM Capex intensity trending lower by 4.6 p.p. YoY to 17.6% CAPEX $258mn Inflationary pricing, ARPU expansion, effective cost control $364mn EBITDA Balanced growth across markets, disciplined inflationary pricing +18% YoY local currency TOTAL REVENUE +1% YoY $953mn -2% YoY Strong uptake in Multiplay segment, higher ARPU and lower churn +17% YoY local currency SERVICE REVENUE +1% YoY $915mn Marked YoY reduction of Group and HQ net debt $1,971mn NET DEBT $1,527mn at HQ Effective use of Group liquidity $1,737mn CASH $1,328mn at HQ -20% YoY +25% YoY local currency Notes: Group cash excludes USD 165 million relating to banking operations in Pakistan. As of 31 December 2023, lease liabilities of USD 985 million. All YoY local currency figures are normalized, as noted in the 4Q23 trading update. Net debt figures exclude leases.

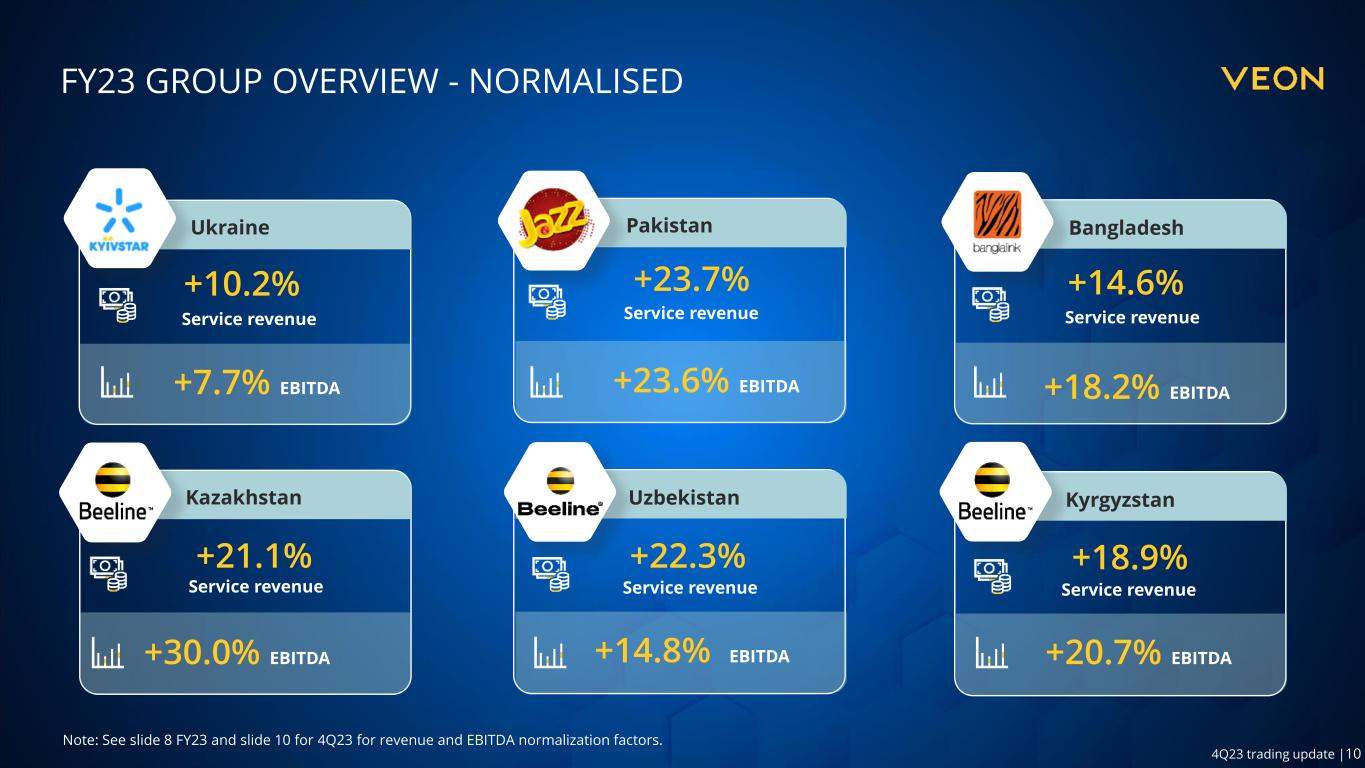

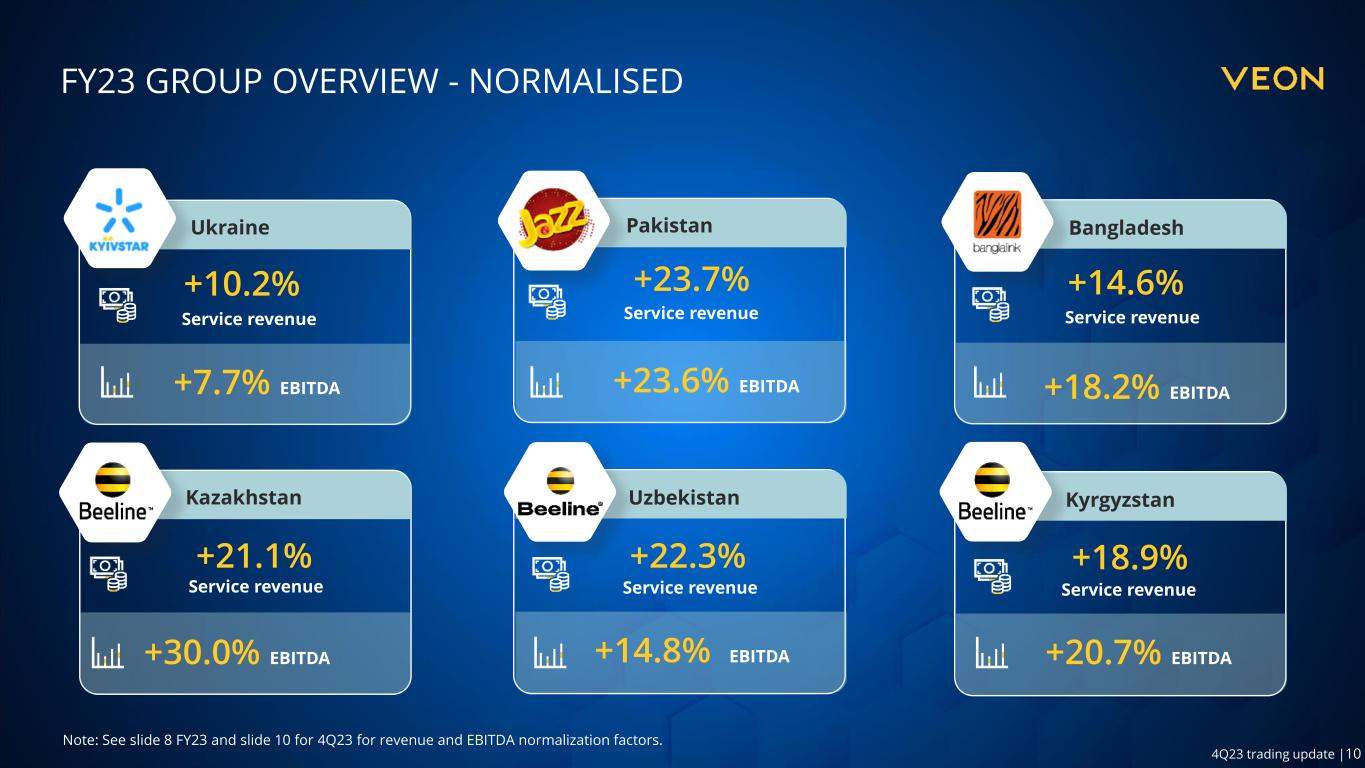

10 4Q23 trading update |10 FY23 GROUP OVERVIEW - NORMALISED Note: See slide 8 FY23 and slide 10 for 4Q23 for revenue and EBITDA normalization factors. +23.7% +23.6% EBITDA +21.1% +30.0% EBITDA +14.6% +18.2% EBITDA +22.3% +14.8% EBITDA +18.9% +20.7% EBITDA Pakistan Kazakhstan Bangladesh Uzbekistan Kyrgyzstan +7.7% EBITDA Ukraine +10.2% Service revenue Service revenue Service revenue Service revenue Service revenue Service revenue

11 4Q23 trading update |11 4Q23 GROUP OVERVIEW - NORMALISED +25.6% +23.3% EBITDA +21.9% +30.1% EBITDA +8.6% +24.2% EBITDA +28.5% +50.1% EBITDA +15.9% +30.4% EBITDA Pakistan Kazakhstan Bangladesh Uzbekistan Kyrgyzstan +12.4% EBITDA Ukraine +5.5% Service revenue Service revenue Service revenue Service revenue Service revenue Service revenue

12 4Q23 trading update |12 ACCELERATED GROWTH DESPITE CHALLENGING MACRO -2% 10% 13% 18% -30.0% -20.0% -10.0% 0.0% 10.0% 20.0% 30.0% FY 2020 FY 2021 FY 2022 FY 2023 VEON +18% Pakistan +23% Uzbekistan +22% Kazakhstan +21% Kyrgyzstan +19% Bangladesh +14% Ukraine +10% Inflation YoY* +14% Total revenue, YoY performance by country in local currency • Our Digital Operator strategy and focus on Multiplay customers has driven a step-change in subscriber monetisation and growth trends across all operating companies. • Our markets have high potential for future growth. VEON 3-yr CAGR +15% FY 2023 YoY Growth Rates

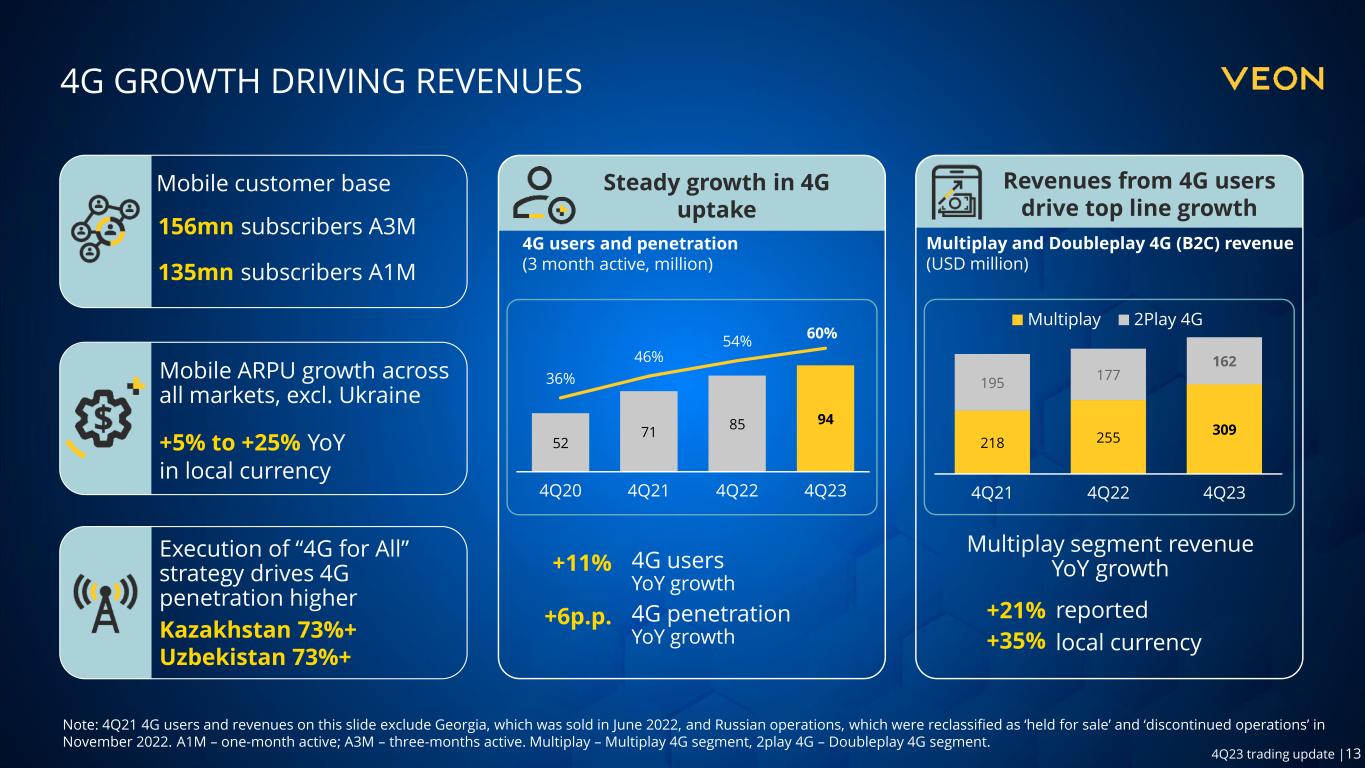

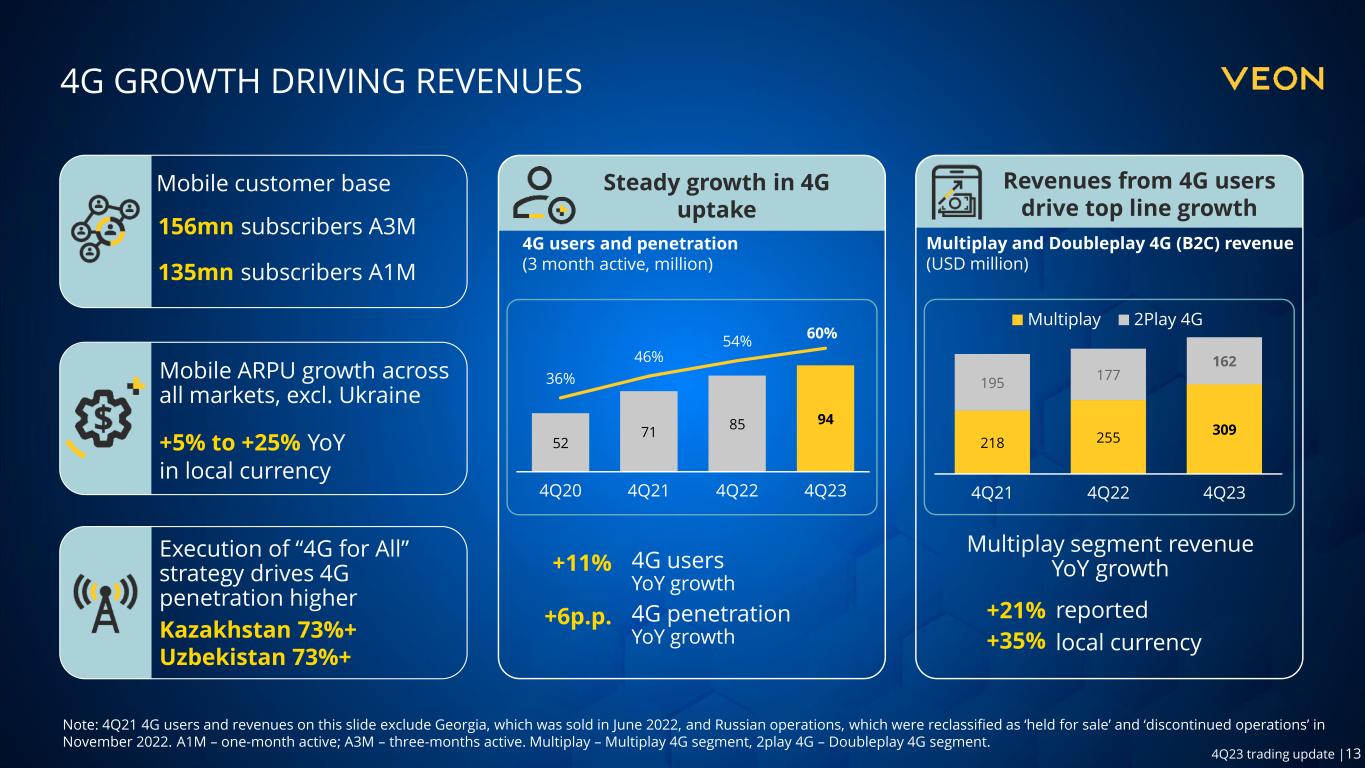

13 4Q23 trading update |13 4G GROWTH DRIVING REVENUES Note: 4Q21 4G users and revenues on this slide exclude Georgia, which was sold in June 2022, and Russian operations, which were reclassified as ‘held for sale’ and ‘discontinued operations’ in November 2022. A1M – one-month active; A3M – three-months active. Multiplay – Multiplay 4G segment, 2play 4G – Doubleplay 4G segment. Steady growth in 4G uptake Revenues from 4G users drive top line growth Multiplay and Doubleplay 4G (B2C) revenue (USD million) 52 71 85 94 36% 46% 54% 60% 4Q20 4Q21 4Q22 4Q23 218 255 309 195 177 162 4Q21 4Q22 4Q23 Multiplay 2Play 4G +11% 4G users YoY growth +21% Multiplay segment revenue YoY growth 4G users and penetration (3 month active, million) +6p.p. 4G penetration YoY growth Mobile ARPU growth across all markets, excl. Ukraine +5% to +25% YoY in local currency Mobile customer base 156mn subscribers A3M Execution of “4G for All” strategy drives 4G penetration higher Kazakhstan 73%+ Uzbekistan 73%+ +35% local currency reported 135mn subscribers A1M

14 4Q23 trading update |14 UKRAINE FY 2023 Keeping Ukraine connected and investing in its future • Kyivstar restored its network and services in multiple stages within just days of the cyberattack in December 2023. The team remains fully committed to the reconstruction and recovery of Ukraine. • Kyivstar’s FY23 revenues (UAH 0.7 billion) and EBITDA (UAH 0.8 billion) impacted by cyberattack and a dedicated customer retention program. • Nearly 100% of the Kyivstar network in territories controlled by Ukraine was operational at the end of 2023 as team remains focused on keeping Ukraine connected. • In line with its “4G everywhere” strategy, Kyivstar modernized around 4,000 4G base stations and installed nearly 1,000 new 4G sites in 2023. FY23 RESULTS AND YOY TRENDS SERVICE REVENUE +7.9% CAPEX UAH 33.3bn 28.6 30.9 33.3 FY21 FY22 FY23 +14.2% +8.1% +7.9% 6.4bn +6.8% UAH TOTAL REVENUE 33.6bn 19.8bn UAH +8.0% EBITDA +8.1% UAH MULTIPLAY AND DOUBLEPLAY 4G REVENUE (B2C)1 (UAH billion) EBITDA AND EBITDA MARGIN (UAH billion) SERVICE REVENUE AND YOY TRENDS (UAH Billion) 1. Revenues based on the mobile B2C segment 3.6 4.8 6.3 7.8 9.1 10.9 FY21 FY22 FY23 Multiplay 2Play 4G +10.2% (norm.)+10.4% (norm.) +7.7% (norm.) 19.2 18.3 19.8 66.8% 58.9% 58.9% FY21 FY22 FY23

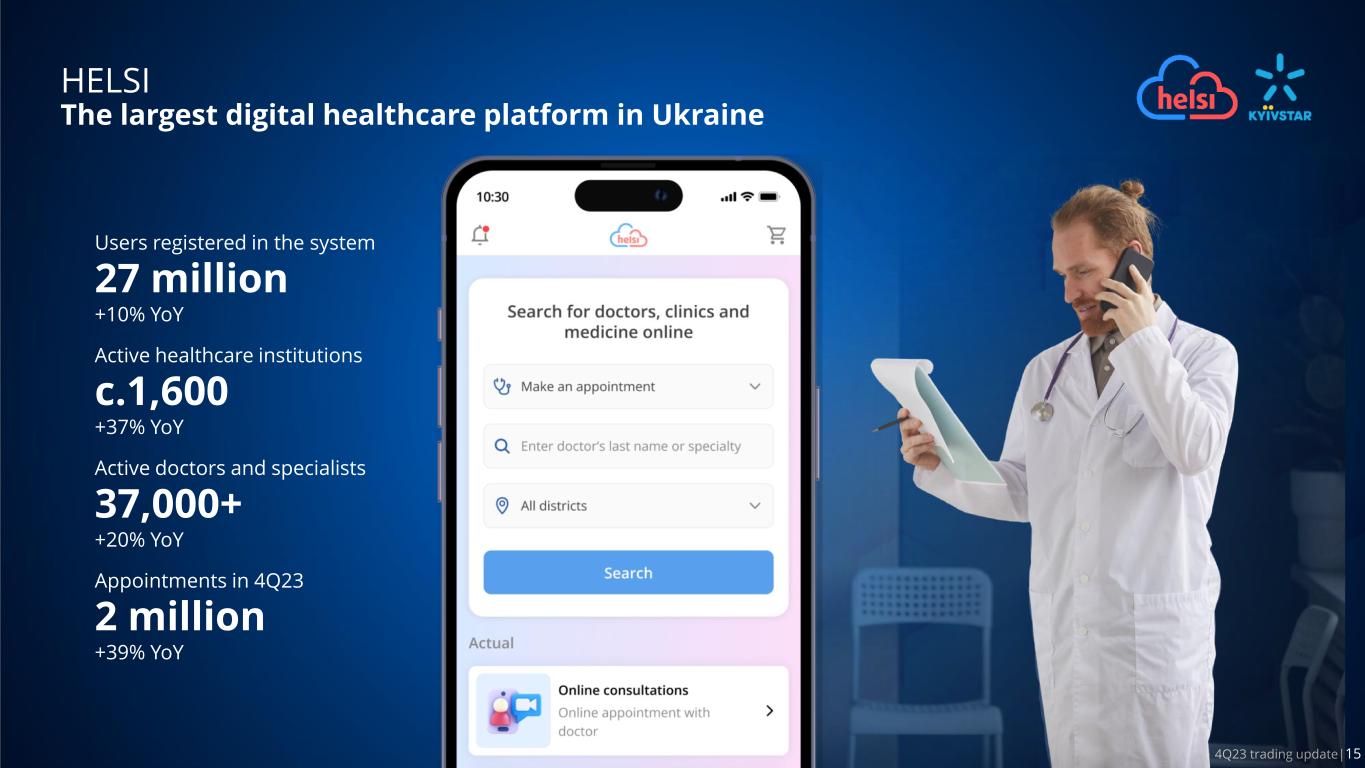

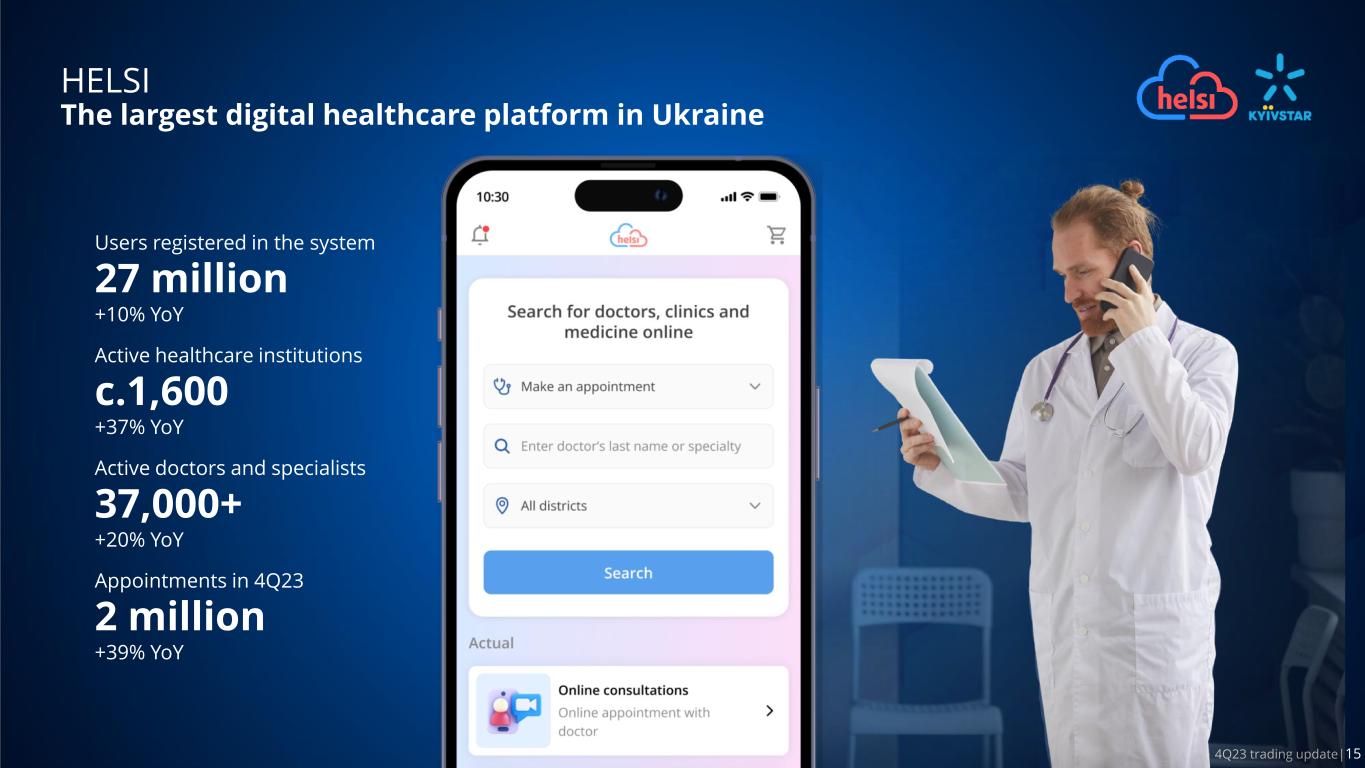

15 4Q23 trading update|15 HELSI The largest digital healthcare platform in Ukraine Users registered in the system 27 million +10% YoY Active healthcare institutions c.1,600 +37% YoY Active doctors and specialists 37,000+ +20% YoY Appointments in 4Q23 2 million +39% YoY

16 4Q23 trading update |16 UKRAINE Reiterating our commitment to the country’s future Engagement with the Ukrainian government and authorities Commitment to Ukraine • VEON Board and Management delegation visited Ukraine in February’24 • Continued engagement with Ukrainian authorities and lawmakers • Started rolling out USD 600 million to recovery and reconstruction • Rebuilding Ukraine: signed LOI with Rakuten • Increasing cyber-resilience: working with leading international partners to address the learnings • Worked with partners to raise UAH 180 million (c.USD 4.8 million) for Ukraine’s demining • Ongoing donations, employee and customer support

17 4Q23 trading update |17 PAKISTAN FY 2023 ~20% revenue YoY growth, gaining market share • Revenue growth nearly 20% YoY, and robust uptake of digital financial services. • Revenues and EBITDA YoY growth impacted by extraordinary one-off recorded in 4Q22. Normalised for this non-recurring item, FY23 total revenue and EBITDA grew 23.0% YoY and 23.6% YoY, respectively. • Continued momentum in our fintech offering with strong growth in service revenues in JazzCash (+85.7% YoY) and Mobilink Microfinance Bank (+88.2% YoY). • JazzCash turned their EBITDA from negative PKR 7.8 billion in 2022 to positive PKR 3.0 billion in 2023, MMBL accounted PKR 7.9 billion in EBITDA, 2.2 times higher YoY. • Multiplay customers reached 29.2% of monthly active users with ARPU 2.9 times higher than voice-only users and delivering 48.5% of B2C segment revenues. FY23 RESULTS AND YOY TRENDS SERVICE REVENUE 291.6bn +20.3% 36.9bn -29.5% PKR PKR 208.9 242.4 291.6 FY21 FY22 FY23 +20.3% CAPEX +16.0% +13.9% TOTAL REVENUE 313.6bn 140.7bn PKR +19.9% EBITDA +4.9% PKR SERVICE REVENUE AND YOY TRENDS (PKR Billion) EBITDA AND EBITDA MARGIN (PKR billion) Note: Restated service revenue and YoY trend for FY21 and FY22 without impact on total revenue in these periods. +23.7% (norm.)+23.0% (norm.) +23.6% (norm.) MULTIPLAY AND DOUBLEPLAY 4G REVENUE (B2C)1 (PKR billion) 54.2 70.6 97.3 29.0 31.4 31.5 FY21 FY22 FY23 Multiplay 2Play 4G 104.6 134.0 140.7 45.7% 51.2% 44.9% FY21 FY22 FY23

18 4Q23 trading update|18 PKR 3.7bn 4Q23 DFS EBITDA 12.3x YoY DIGITAL FINANCIAL SERVICES IN PAKISTAN JazzCash and Mobilink Bank The most popular domestic mobile financial services app in Pakistan Pakistan’s largest domestic digital bank with 42+ million customers Gross Loan Portfolio PKR 59.1 billion +28% YoY Average loan size in 4Q23 PKR 286,000 +31% YoY Gross Deposits PKR 59.1 billion 2.9x YoY MAU 16.2 million Active merchants 240,500 +29% YoY Daily average # of issued digital loans in 4Q23 65,200+ +14% YoY LTM Gross Transaction Value PKR 5.8 trillion +39% YoY

19 4Q23 trading update|19 TAMASHA Pakistan’s leading domestic entertainment platform MAU 11 million 2.5x YoY non-Jazz users of Tamasha 46% +24 p.p. YoY Total # of sessions 555 million 4x YoY Asia/World Cricket Cup: Ad Revenues PKR 186 million new revenue streams keep momentum ARPU PKR 514 3x higher than single play voice customers Pakistan Digital Award 2023: Best Digital Platform

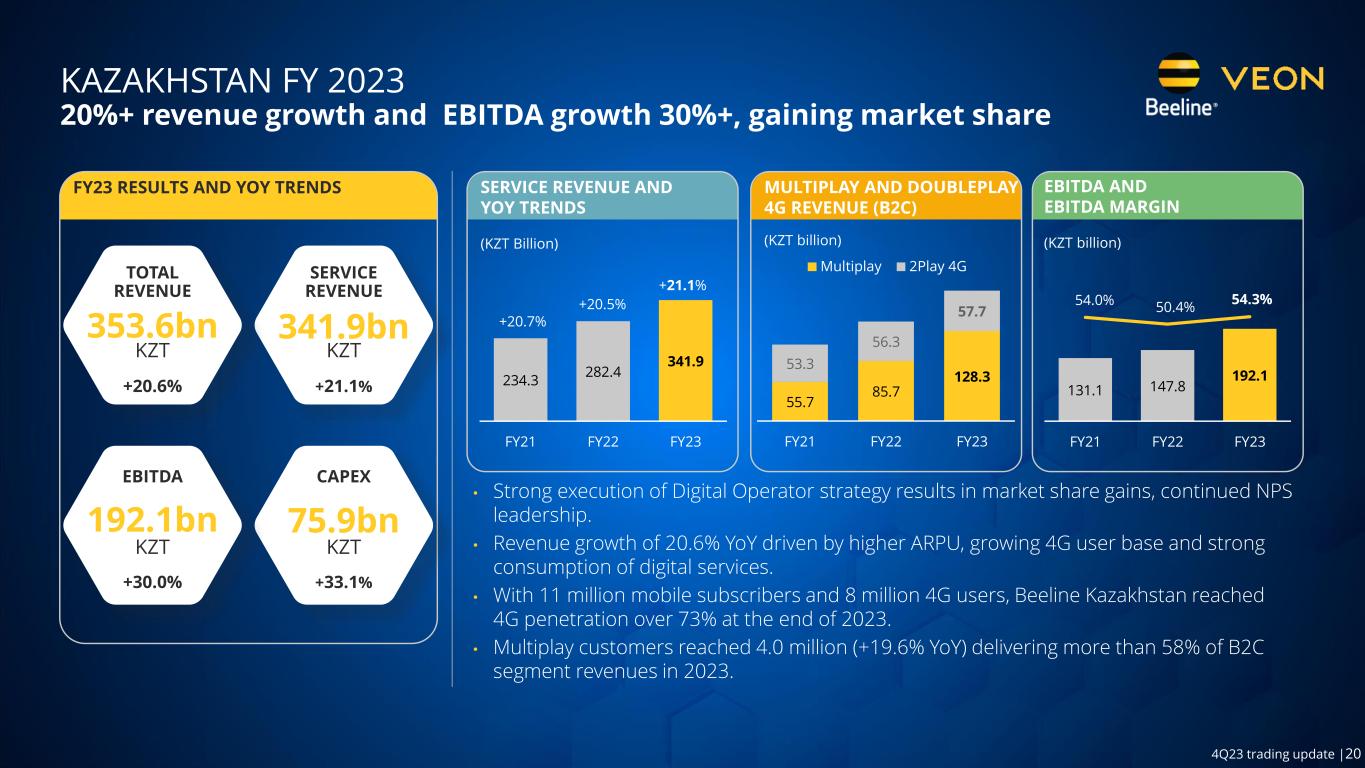

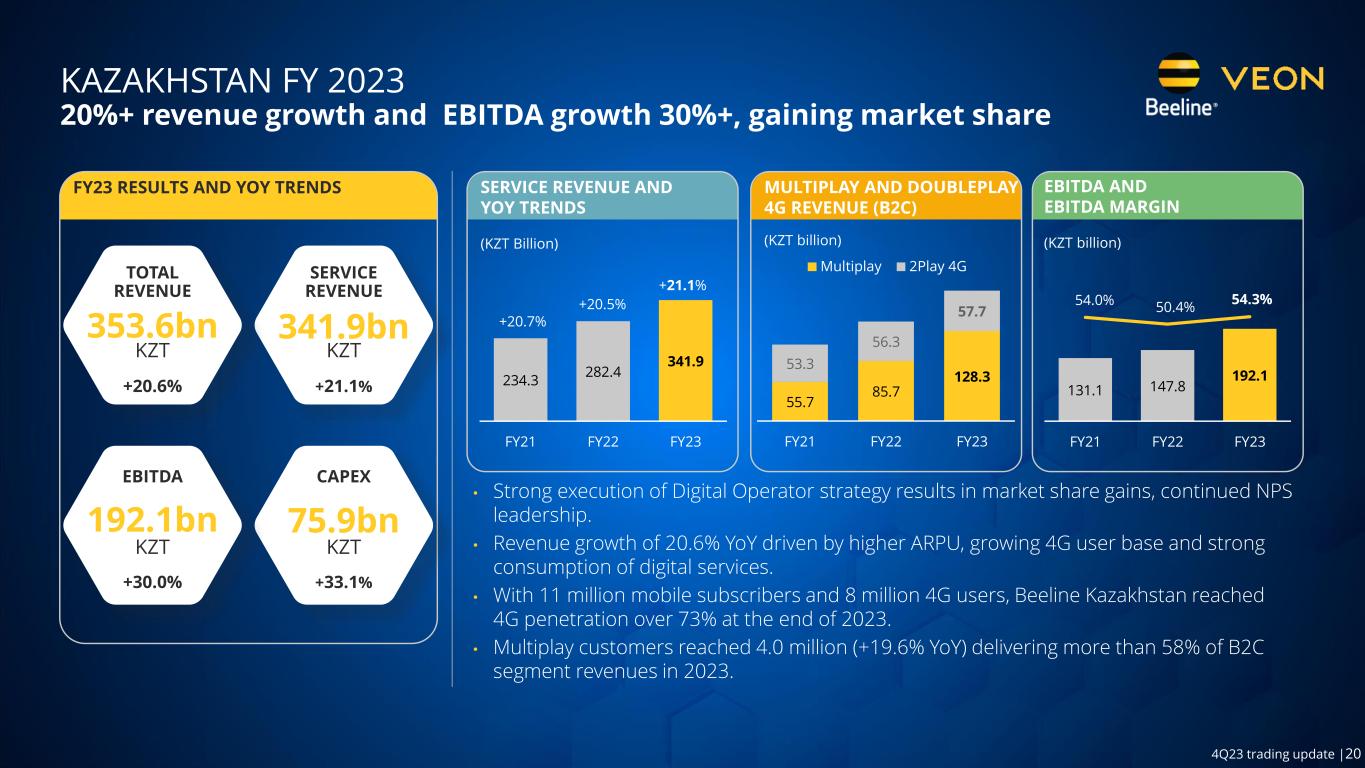

20 4Q23 trading update |20 KAZAKHSTAN FY 2023 20%+ revenue growth and EBITDA growth 30%+, gaining market share • Strong execution of Digital Operator strategy results in market share gains, continued NPS leadership. • Revenue growth of 20.6% YoY driven by higher ARPU, growing 4G user base and strong consumption of digital services. • With 11 million mobile subscribers and 8 million 4G users, Beeline Kazakhstan reached 4G penetration over 73% at the end of 2023. • Multiplay customers reached 4.0 million (+19.6% YoY) delivering more than 58% of B2C segment revenues in 2023. 234.3 282.4 341.9 FY21 FY22 FY23 +20.7% +20.5% +21.1% MULTIPLAY AND DOUBLEPLAY 4G REVENUE (B2C) (KZT billion) SERVICE REVENUE AND YOY TRENDS (KZT Billion) FY23 RESULTS AND YOY TRENDS SERVICE REVENUE 341.9bn +21.1% 75.9bn +33.1% KZT KZT CAPEX TOTAL REVENUE 353.6bn 192.1bn KZT +20.6% EBITDA +30.0% KZT EBITDA AND EBITDA MARGIN (KZT billion) 55.7 85.7 128.3 53.3 56.3 57.7 FY21 FY22 FY23 Multiplay 2Play 4G 131.1 147.8 192.1 54.0% 50.4% 54.3% FY21 FY22 FY23

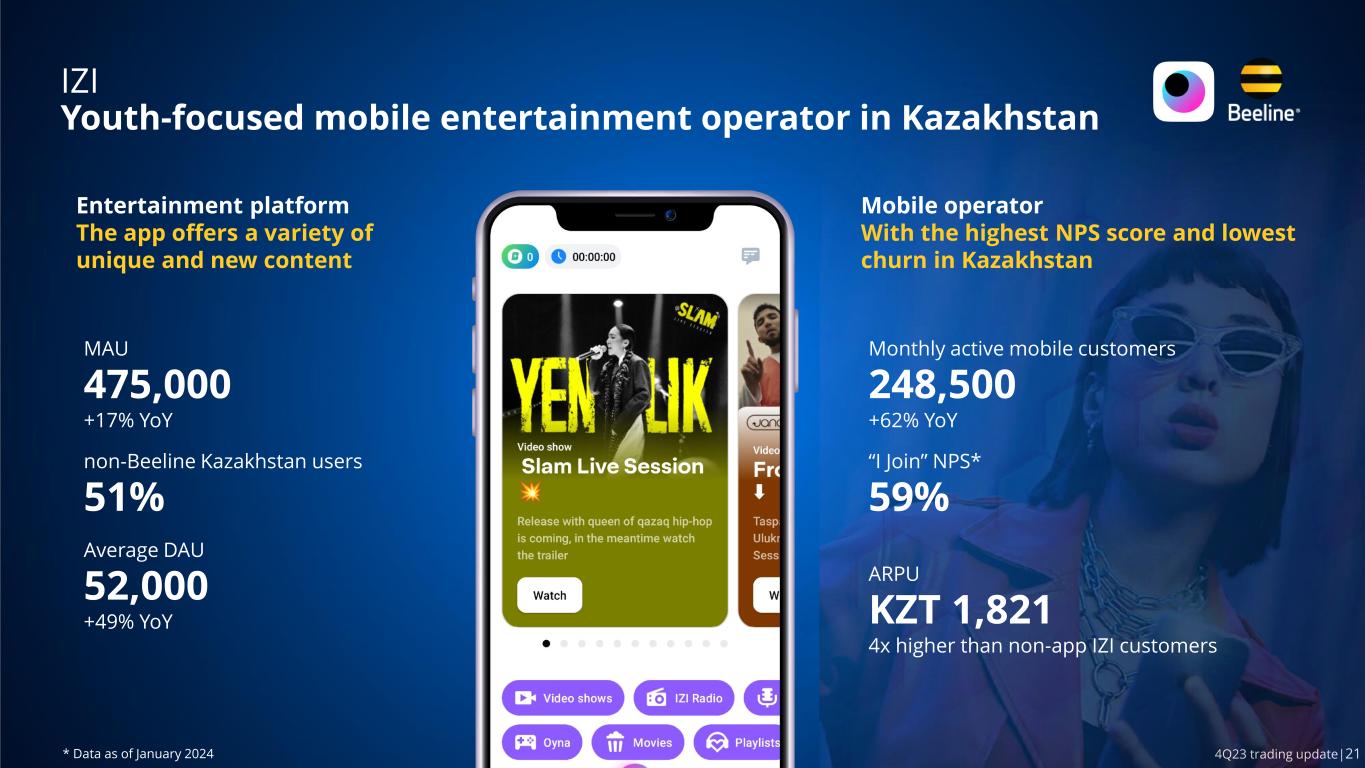

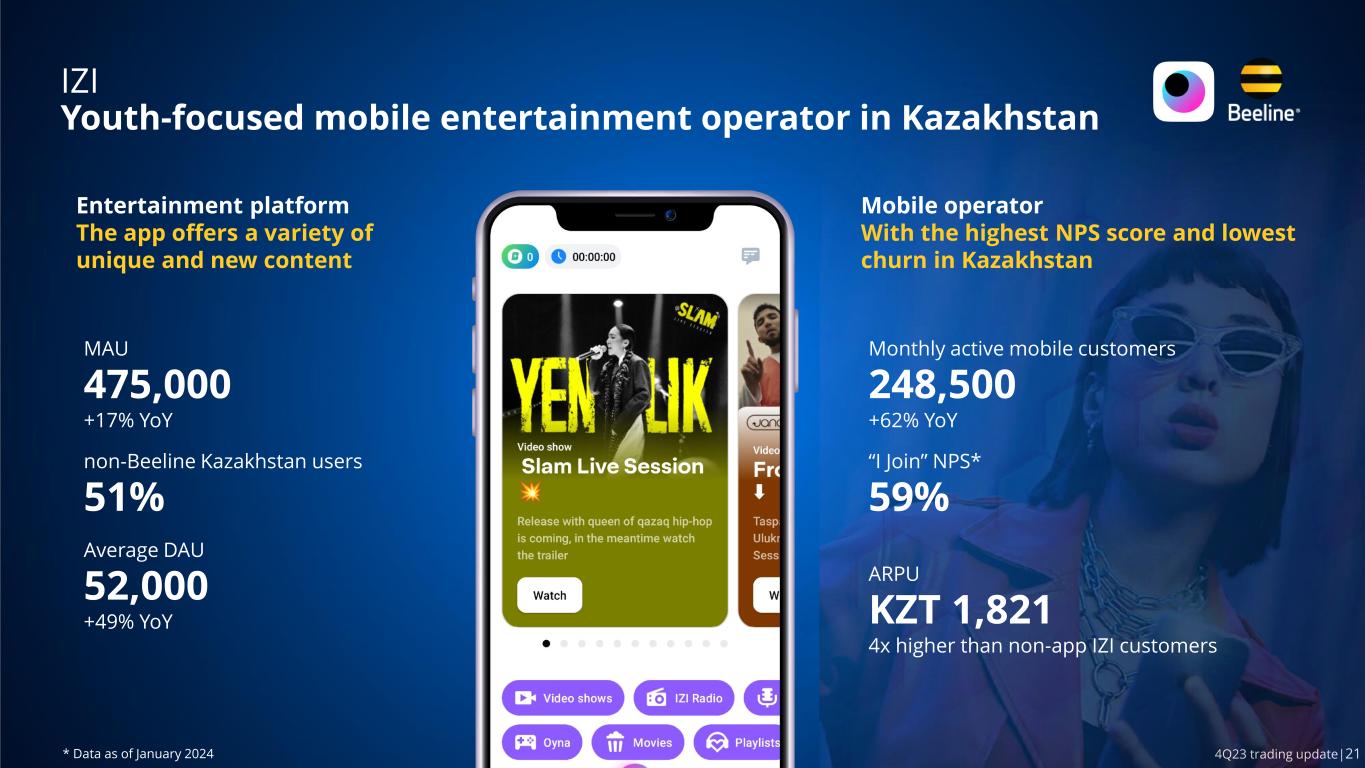

21 4Q23 trading update|21 IZI Youth-focused mobile entertainment operator in Kazakhstan MAU 475,000 +17% YoY non-Beeline Kazakhstan users 51% Average DAU 52,000 +49% YoY Monthly active mobile customers 248,500 +62% YoY “I Join” NPS* 59% ARPU KZT 1,821 4x higher than non-app IZI customers Entertainment platform The app offers a variety of unique and new content Mobile operator With the highest NPS score and lowest churn in Kazakhstan * Data as of January 2024

22 4Q23 trading update |22 BANGLADESH FY 2023 Mid teens revenue growth and high-teens EBITDA growth • Banglalink continued its balanced growth and gained revenue market share driven by expansion in both the customer base (+7.5% YoY) and ARPU (+8.0% YoY). • A full year of double-digit EBITDA growth as the network investment and market expansion deliver results. EBITDA increased by 18.2% YoY supported by healthy topline growth and strong focus on cost control. • Successful 4G network rollout and execution of Digital Operator strategy in 2023 with 4.8 million Multiplay customers (+9.4% YoY) at the end of 2023 supporting 60% YoY growth in revenues in multiplay segment. • Banglalink has been recognized by Ookla as the Fastest Mobile Network in Bangladesh for the eighth time in a row. FY23 RESULTS AND YOY TRENDS TOTAL REVENUE 61.5bn SERVICE REVENUE 23.1bn 60.5bn 11.3bn 47.1 52.8 60.5 FY21 FY22 FY23 +5.2% +12.3% +14.6% EBITDA CAPEX -38.1% BDT +18.2% BDT MULTIPLAY AND DOUBLEPLAY 4G REVENUE (B2C) (BDT billion) SERVICE REVENUE AND YOY TRENDS (BDT Billion) +14.6% BDTBDT +14.4% EBITDA AND EBITDA MARGIN (BDT billion) 5.7 10.3 16.5 8.7 10.3 10.2 FY21 FY22 FY23 Multiplay 2Play 4G 20.0 19.6 23.1 41.6% 36.4% 37.6% FY21 FY22 FY23

23 4Q23 trading update|23 TOFFEE The largest domestic mobile entertainment platform in Bangladesh MAU 8 million non-Banglalink users of Toffee 65% Total # of sessions 152 million Asia/World Cricket Cup: Ad Revenues BDT 72 million ARPU BDT 331 3x higher than single play voice customers Note: YoY comparison in MAU, non-Banglalink users of Toffee and Total # of sessions is distorted by uniquely high viewership during FIFA World Cup in 4Q22.

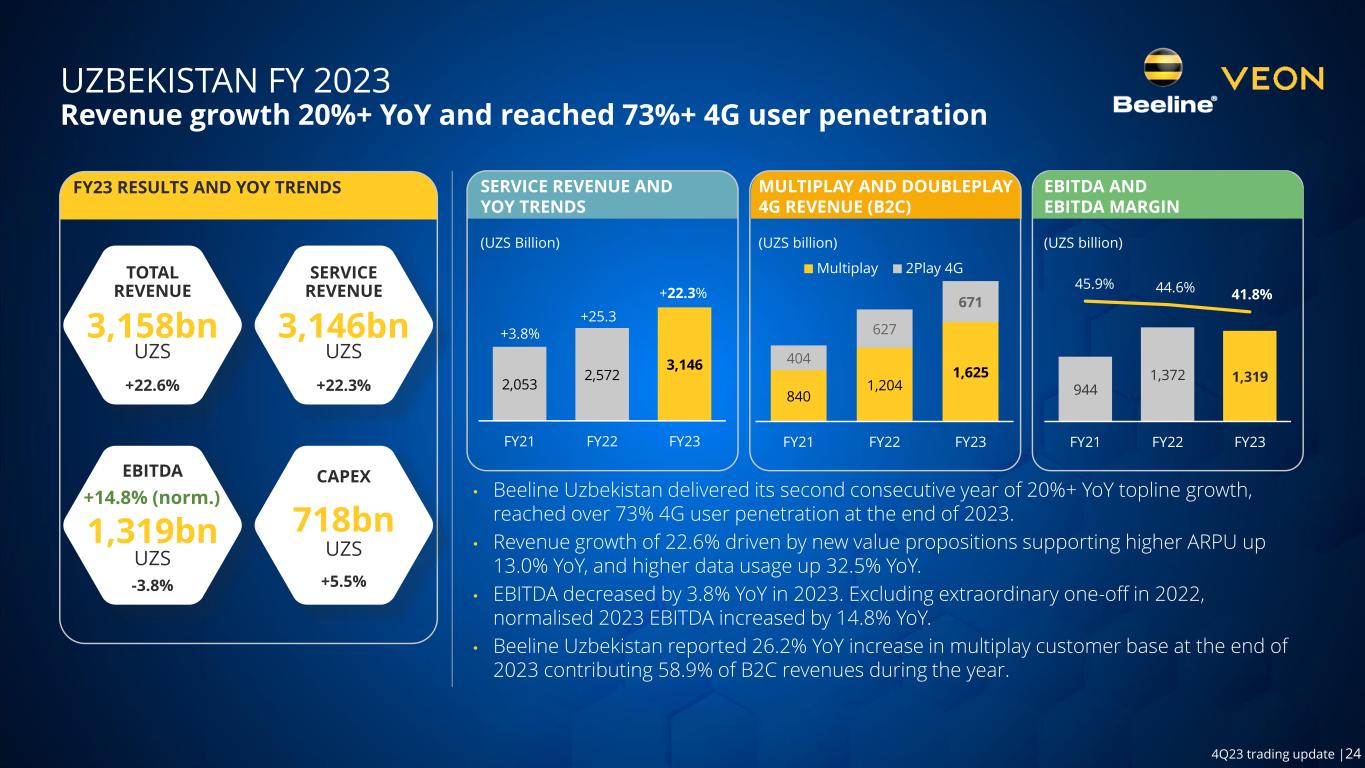

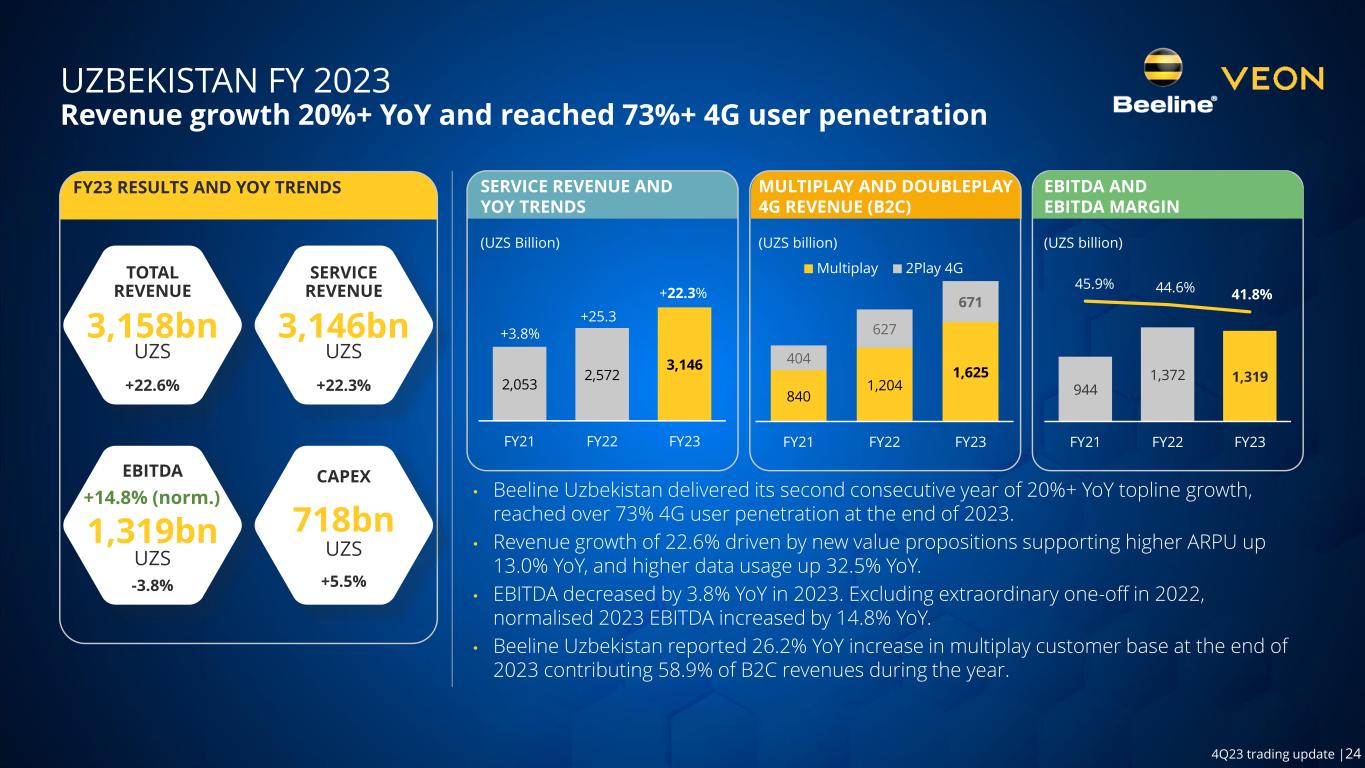

24 4Q23 trading update |24 UZBEKISTAN FY 2023 Revenue growth 20%+ YoY and reached 73%+ 4G user penetration • Beeline Uzbekistan delivered its second consecutive year of 20%+ YoY topline growth, reached over 73% 4G user penetration at the end of 2023. • Revenue growth of 22.6% driven by new value propositions supporting higher ARPU up 13.0% YoY, and higher data usage up 32.5% YoY. • EBITDA decreased by 3.8% YoY in 2023. Excluding extraordinary one-off in 2022, normalised 2023 EBITDA increased by 14.8% YoY. • Beeline Uzbekistan reported 26.2% YoY increase in multiplay customer base at the end of 2023 contributing 58.9% of B2C revenues during the year. 2,053 2,572 3,146 FY21 FY22 FY23 +3.8% +25.3 +22.3% MULTIPLAY AND DOUBLEPLAY 4G REVENUE (B2C) (UZS billion) SERVICE REVENUE AND YOY TRENDS (UZS Billion) FY23 RESULTS AND YOY TRENDS SERVICE REVENUE 3,146bn +22.3% 718bn +5.5% UZS UZS CAPEX TOTAL REVENUE 3,158bn 1,319bn UZS +22.6% EBITDA -3.8% UZS EBITDA AND EBITDA MARGIN (UZS billion) 840 1,204 1,625 404 627 671 FY21 FY22 FY23 Multiplay 2Play 4G +14.8% (norm.) 944 1,372 1,319 45.9% 44.6% 41.8% FY21 FY22 FY23

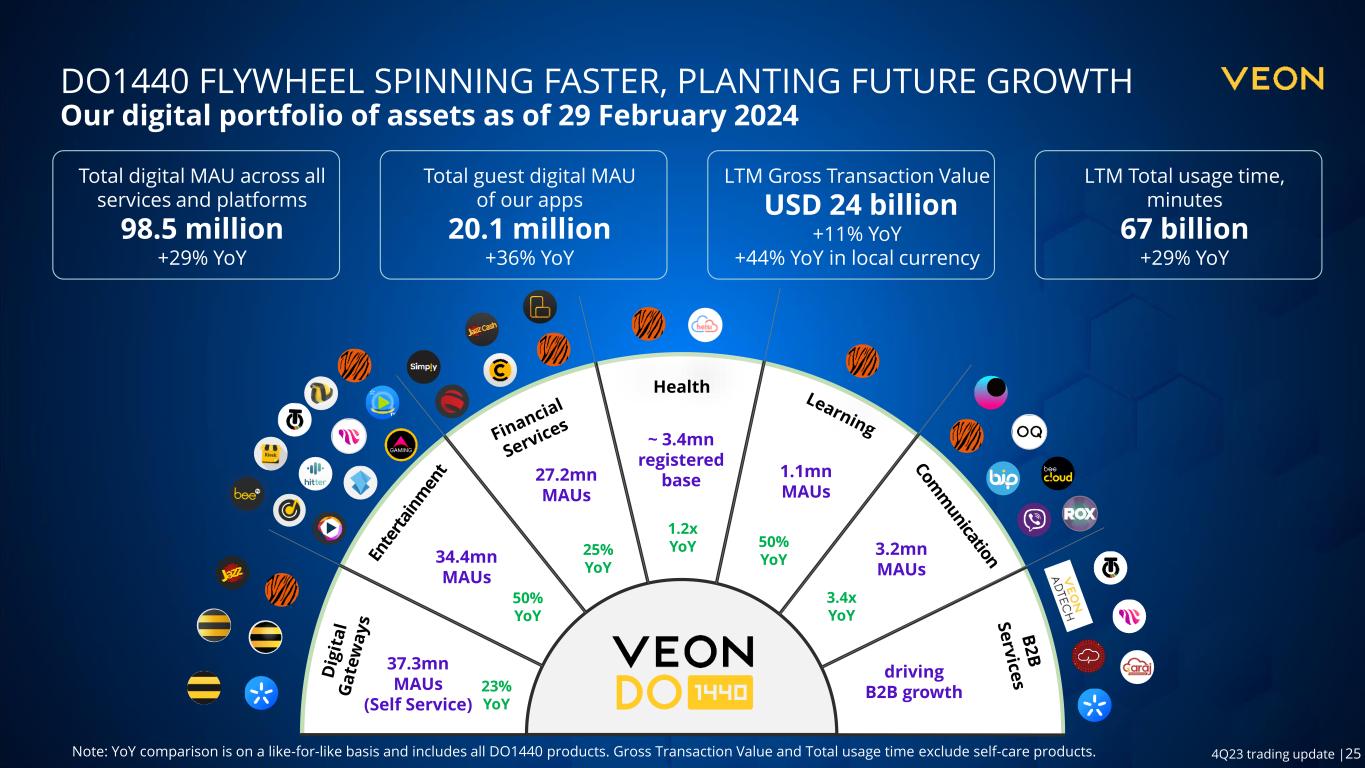

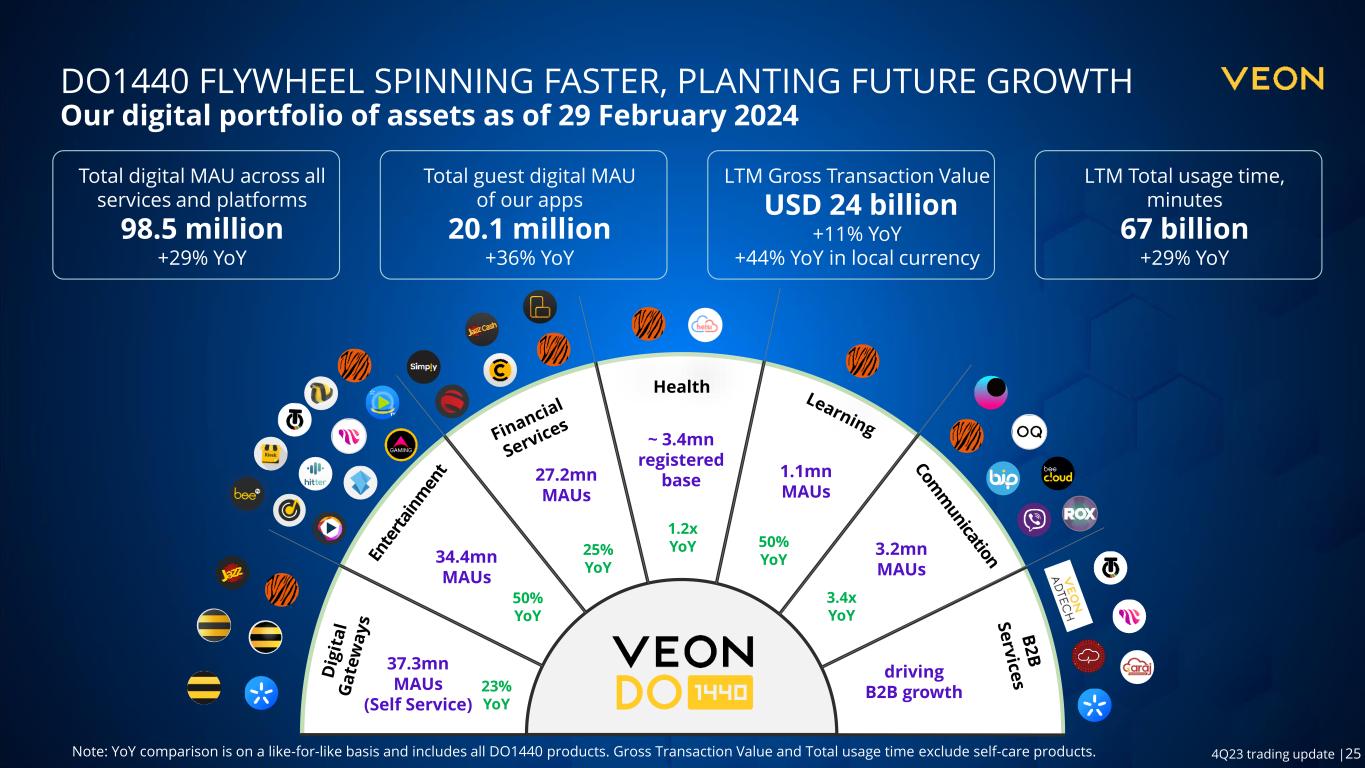

25 4Q23 trading update |25 driving B2B growth 3.2mn MAUs 1.1mn MAUs Health ~ 3.4mn registered base27.2mn MAUs 34.4mn MAUs 37.3mn MAUs (Self Service) DO1440 FLYWHEEL SPINNING FASTER, PLANTING FUTURE GROWTH Our digital portfolio of assets as of 29 February 2024 LTM Gross Transaction Value USD 24 billion +11% YoY +44% YoY in local currency Total digital MAU across all services and platforms 98.5 million +29% YoY Note: YoY comparison is on a like-for-like basis and includes all DO1440 products. Gross Transaction Value and Total usage time exclude self-care products. 23% YoY 50% YoY 25% YoY 1.2x YoY 3.4x YoY Total guest digital MAU of our apps 20.1 million +36% YoY LTM Total usage time, minutes 67 billion +29% YoY 50% YoY

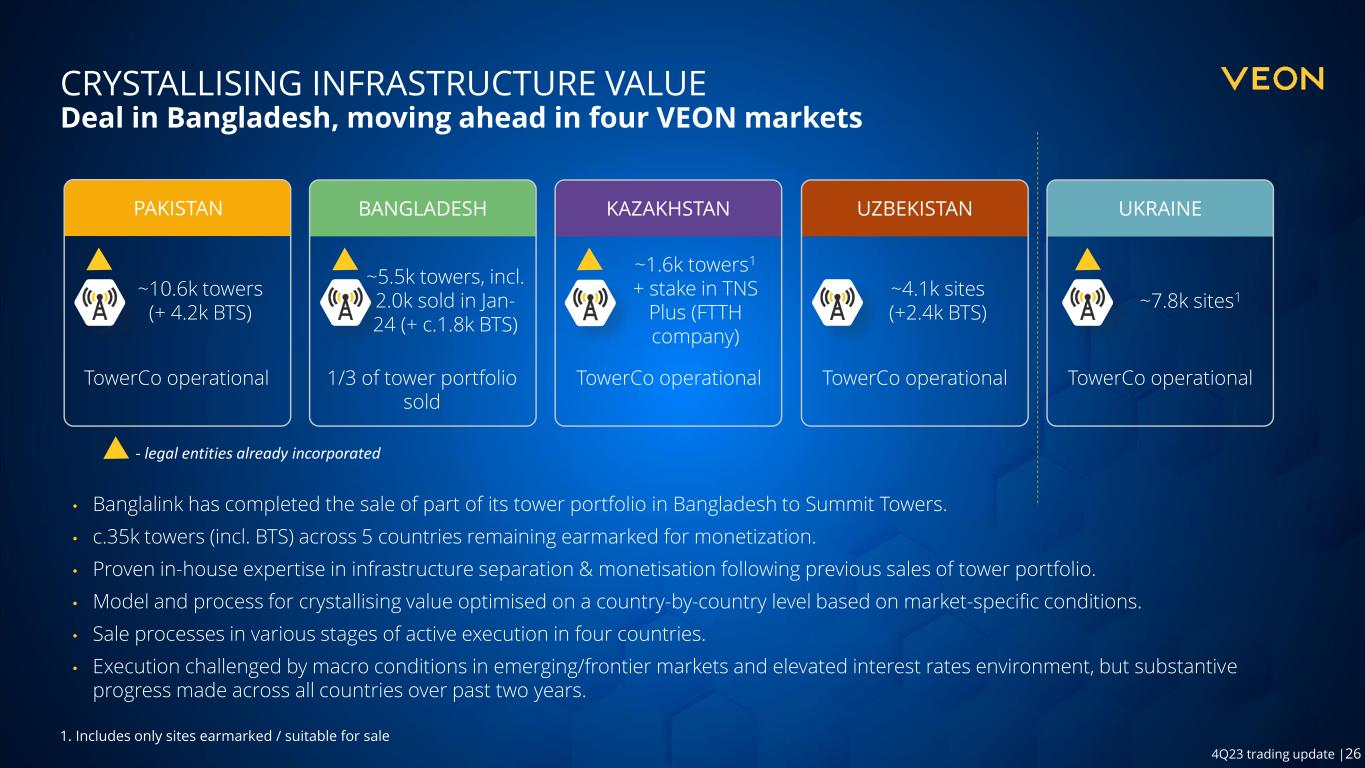

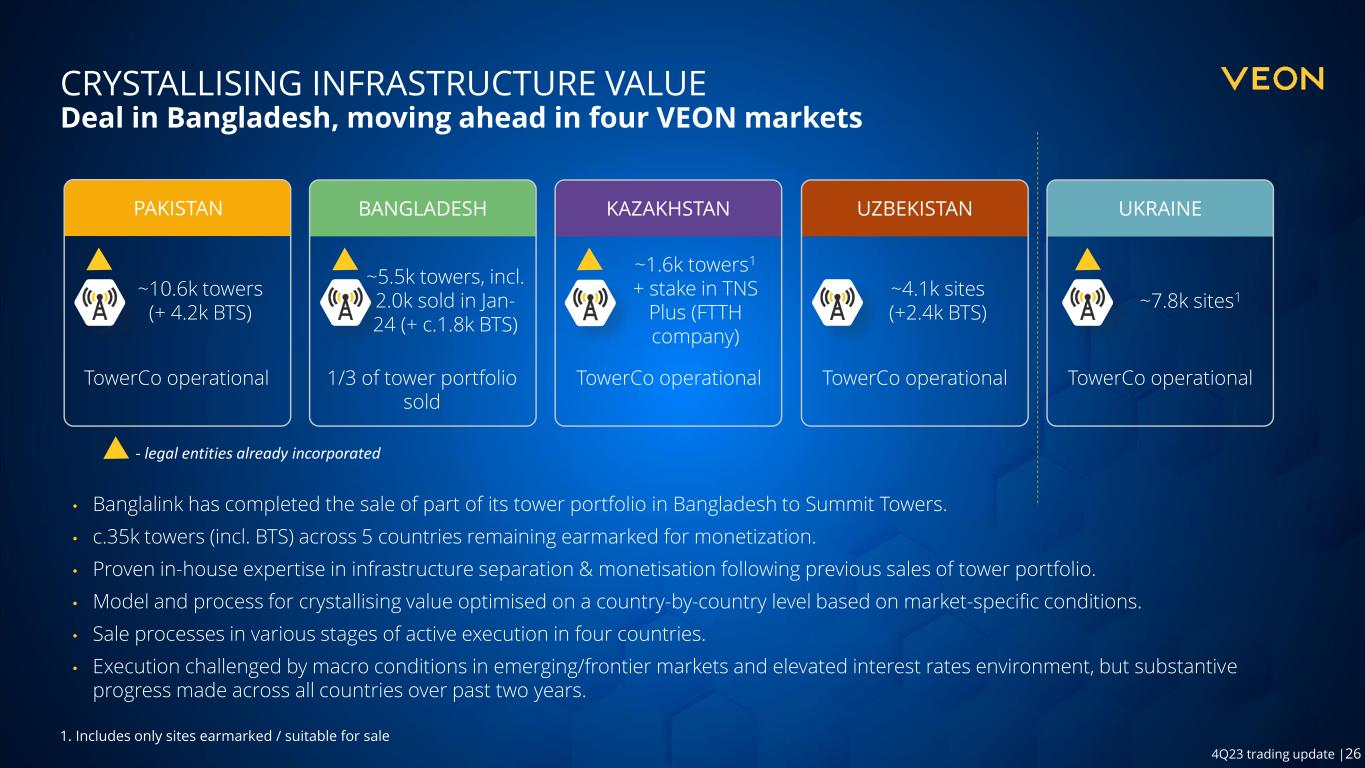

26 4Q23 trading update |26 CRYSTALLISING INFRASTRUCTURE VALUE Deal in Bangladesh, moving ahead in four VEON markets • Banglalink has completed the sale of part of its tower portfolio in Bangladesh to Summit Towers. • c.35k towers (incl. BTS) across 5 countries remaining earmarked for monetization. • Proven in-house expertise in infrastructure separation & monetisation following previous sales of tower portfolio. • Model and process for crystallising value optimised on a country-by-country level based on market-specific conditions. • Sale processes in various stages of active execution in four countries. • Execution challenged by macro conditions in emerging/frontier markets and elevated interest rates environment, but substantive progress made across all countries over past two years. KAZAKHSTAN ~1.6k towers1 + stake in TNS Plus (FTTH company) PAKISTAN BANGLADESH ~5.5k towers, incl. 2.0k sold in Jan- 24 (+ c.1.8k BTS) UZBEKISTAN ~4.1k sites (+2.4k BTS) UKRAINE ~7.8k sites1~10.6k towers (+ 4.2k BTS) 1. Includes only sites earmarked / suitable for sale - legal entities already incorporated TowerCo operational 1/3 of tower portfolio sold TowerCo operational TowerCo operational TowerCo operational

27 4Q23 trading update |27 AGENDA 1. OPENING 2. HIGHLIGHTS & BUSINESS UPDATE Faisal Ghori Kaan Terzioğlu 4. CLOSING REMARKS Kaan Terzioğlu 3. TRADING RESULTS – INCLUDING DEBT MATURITY AND LIQUIDITY UPDATE Joop Brakenhoff 5. Q&A Kaan Terzioğlu, Joop Brakenhoff

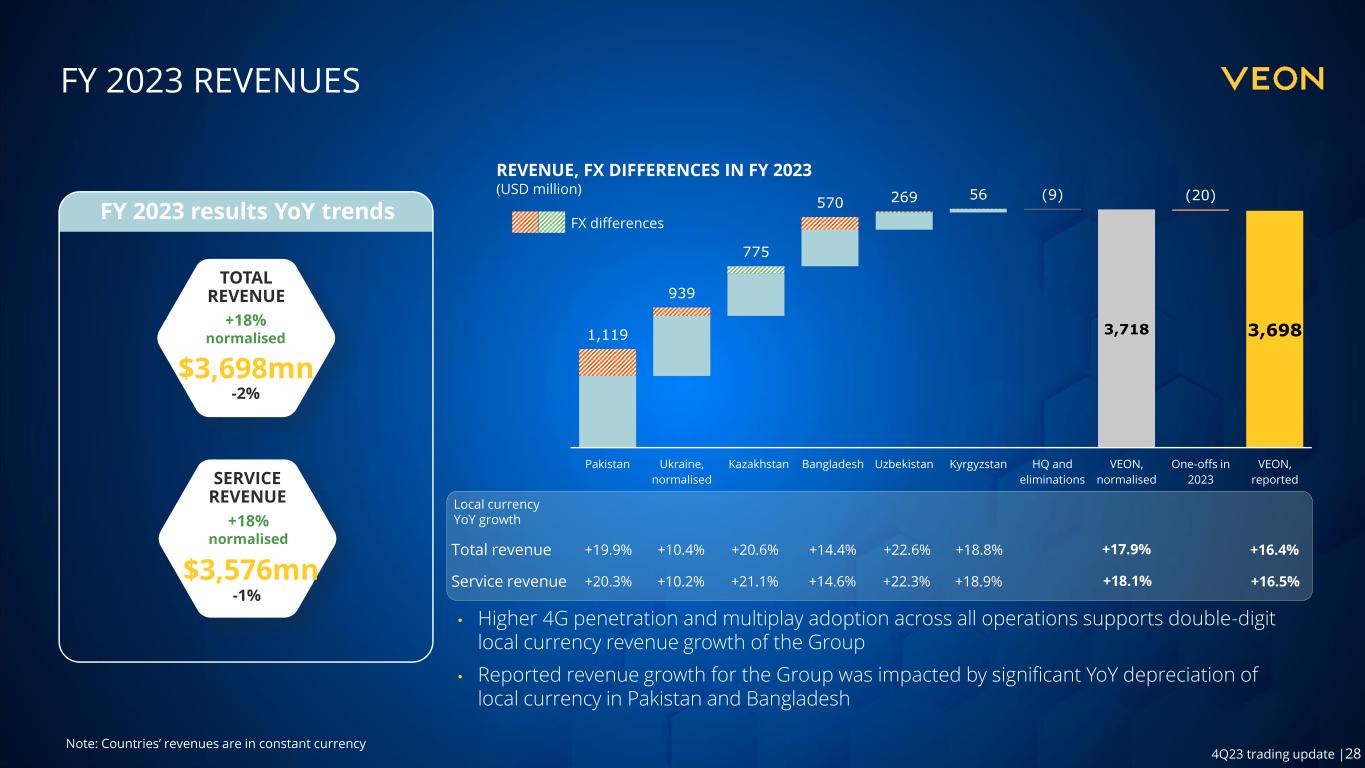

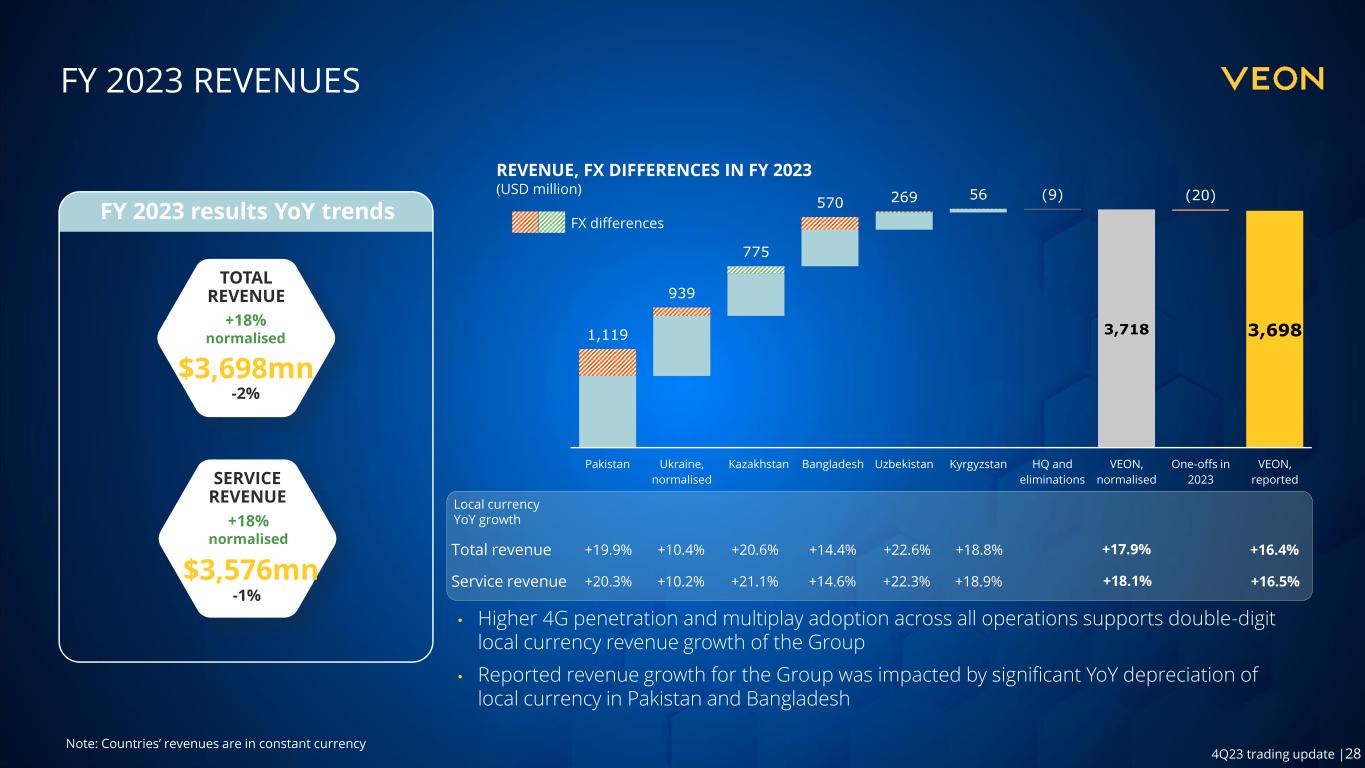

28 4Q23 trading update |28 FY 2023 REVENUES • Higher 4G penetration and multiplay adoption across all operations supports double-digit local currency revenue growth of the Group • Reported revenue growth for the Group was impacted by significant YoY depreciation of local currency in Pakistan and Bangladesh Total revenue FY 2023 results YoY trends TOTAL REVENUE $3,698mn +18% normalised -2% SERVICE REVENUE $3,576mn Service revenue Local currency YoY growth +10.4%+19.9% +14.4% +22.6%+20.6% +16.4% +16.5%+10.2%+20.3% +14.6% +22.3%+21.1% +18.8% +18.9% +18% normalised -1% Note: Countries’ revenues are in constant currency 3,6983,7181,119 939 775 570 269 56 (9) (20) Pakistan Ukraine, normalised Kazakhstan Bangladesh Uzbekistan Kyrgyzstan HQ and eliminations VEON, normalised One-offs in 2023 VEON, reported +17.9% +18.1% REVENUE, FX DIFFERENCES IN FY 2023 (USD million) FX differences

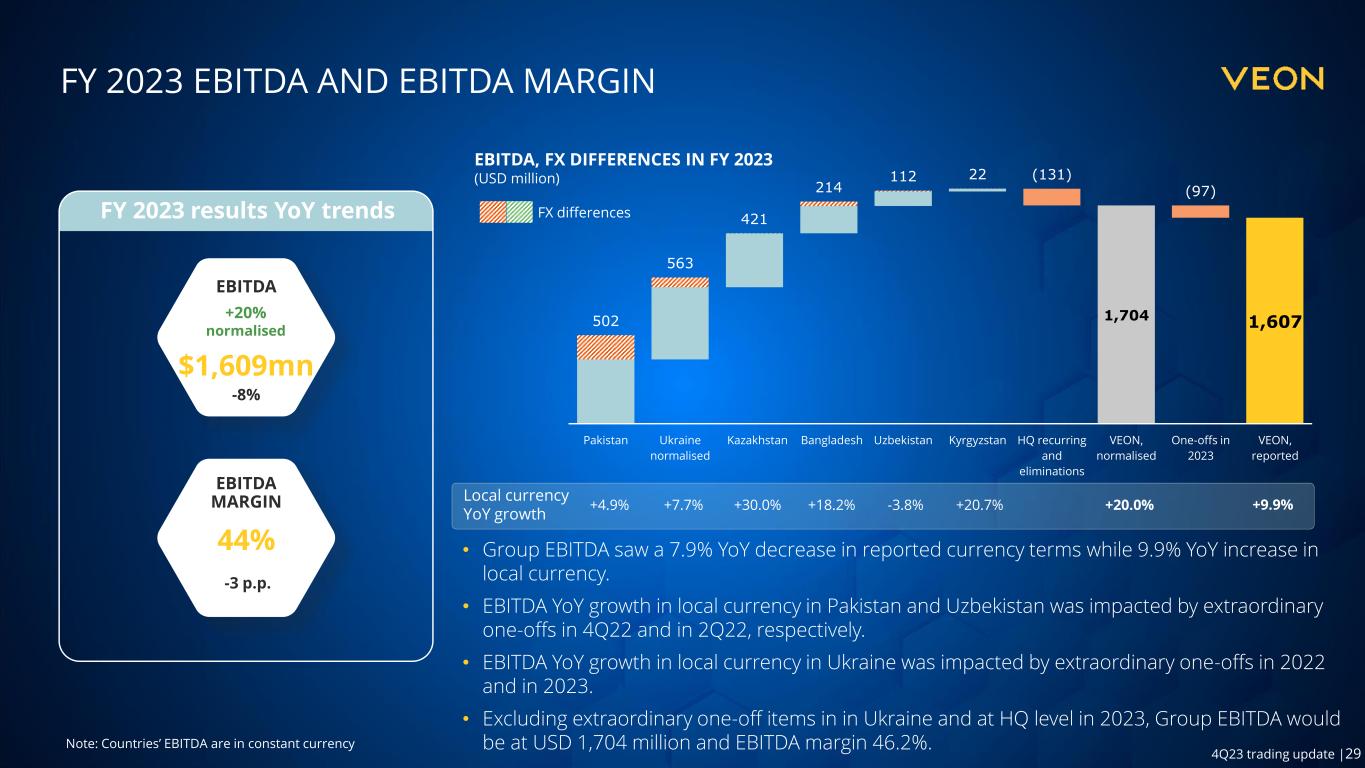

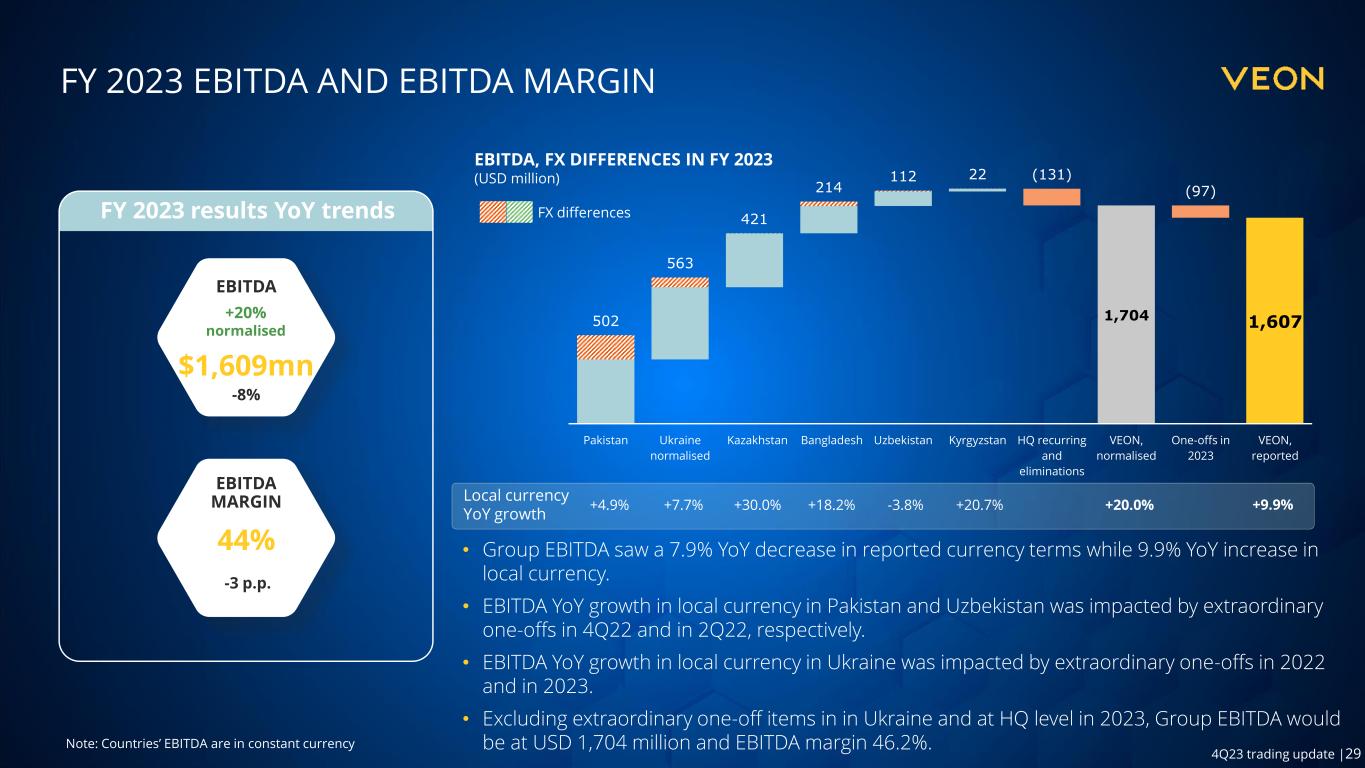

29 4Q23 trading update |29 EBITDA, FX DIFFERENCES IN FY 2023 (USD million) FX differences FY 2023 EBITDA AND EBITDA MARGIN FY 2023 results YoY trends EBITDA $1,609mn +20% normalised -8% EBITDA MARGIN 44% +7.7%+4.9% -3.8%+30.0% Local currency YoY growth +18.2% +20.0% • Group EBITDA saw a 7.9% YoY decrease in reported currency terms while 9.9% YoY increase in local currency. • EBITDA YoY growth in local currency in Pakistan and Uzbekistan was impacted by extraordinary one-offs in 4Q22 and in 2Q22, respectively. • EBITDA YoY growth in local currency in Ukraine was impacted by extraordinary one-offs in 2022 and in 2023. • Excluding extraordinary one-off items in in Ukraine and at HQ level in 2023, Group EBITDA would be at USD 1,704 million and EBITDA margin 46.2%. -3 p.p. +20.7% 1,6071,704502 563 421 214 112 22 (131) (97) Pakistan Ukraine normalised Kazakhstan Bangladesh Uzbekistan Kyrgyzstan HQ recurring and eliminations VEON, normalised One-offs in 2023 VEON, reported +9.9% Note: Countries’ EBITDA are in constant currency

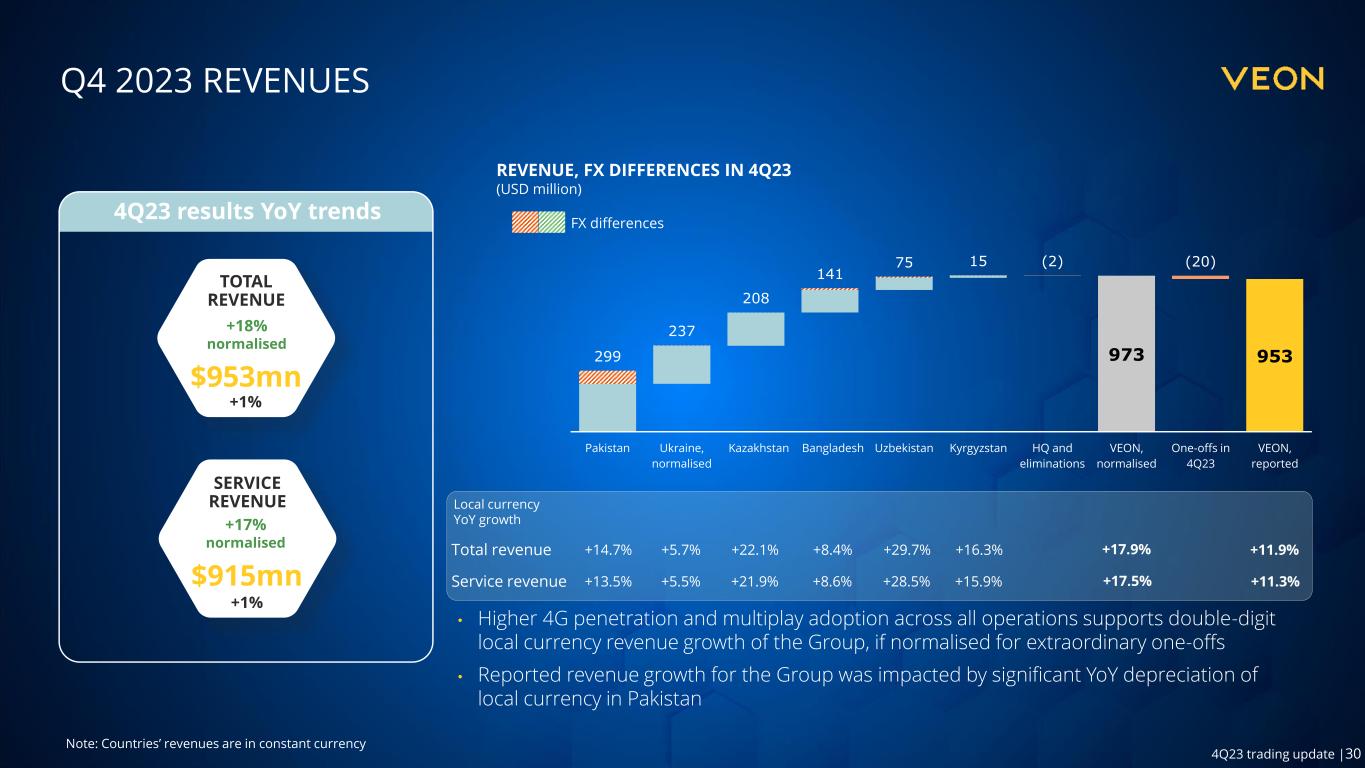

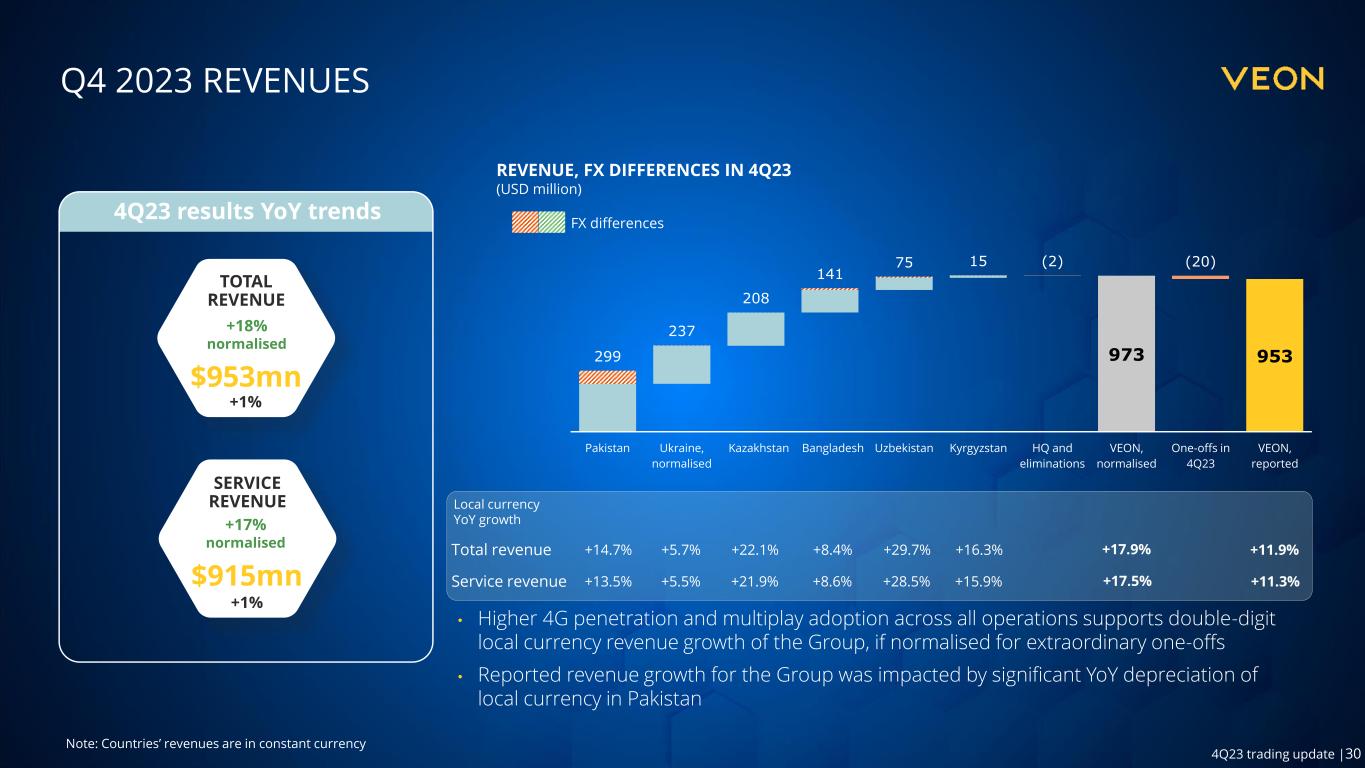

30 4Q23 trading update |30 Q4 2023 REVENUES • Higher 4G penetration and multiplay adoption across all operations supports double-digit local currency revenue growth of the Group, if normalised for extraordinary one-offs • Reported revenue growth for the Group was impacted by significant YoY depreciation of local currency in Pakistan Total revenue 4Q23 results YoY trends TOTAL REVENUE $953mn +18% normalised +1% SERVICE REVENUE $915mn Service revenue Local currency YoY growth +5.7%+14.7% +8.4% +29.7%+22.1% +11.9% +11.3%+5.5%+13.5% +8.6% +28.5%+21.9% +16.3% +15.9% +17% normalised +1% Note: Countries’ revenues are in constant currency REVENUE, FX DIFFERENCES IN 4Q23 (USD million) FX differences 953973299 237 208 141 75 15 (2) (20) Pakistan Ukraine, normalised Kazakhstan Bangladesh Uzbekistan Kyrgyzstan HQ and eliminations VEON, normalised One-offs in 4Q23 VEON, reported +17.9% +17.5%

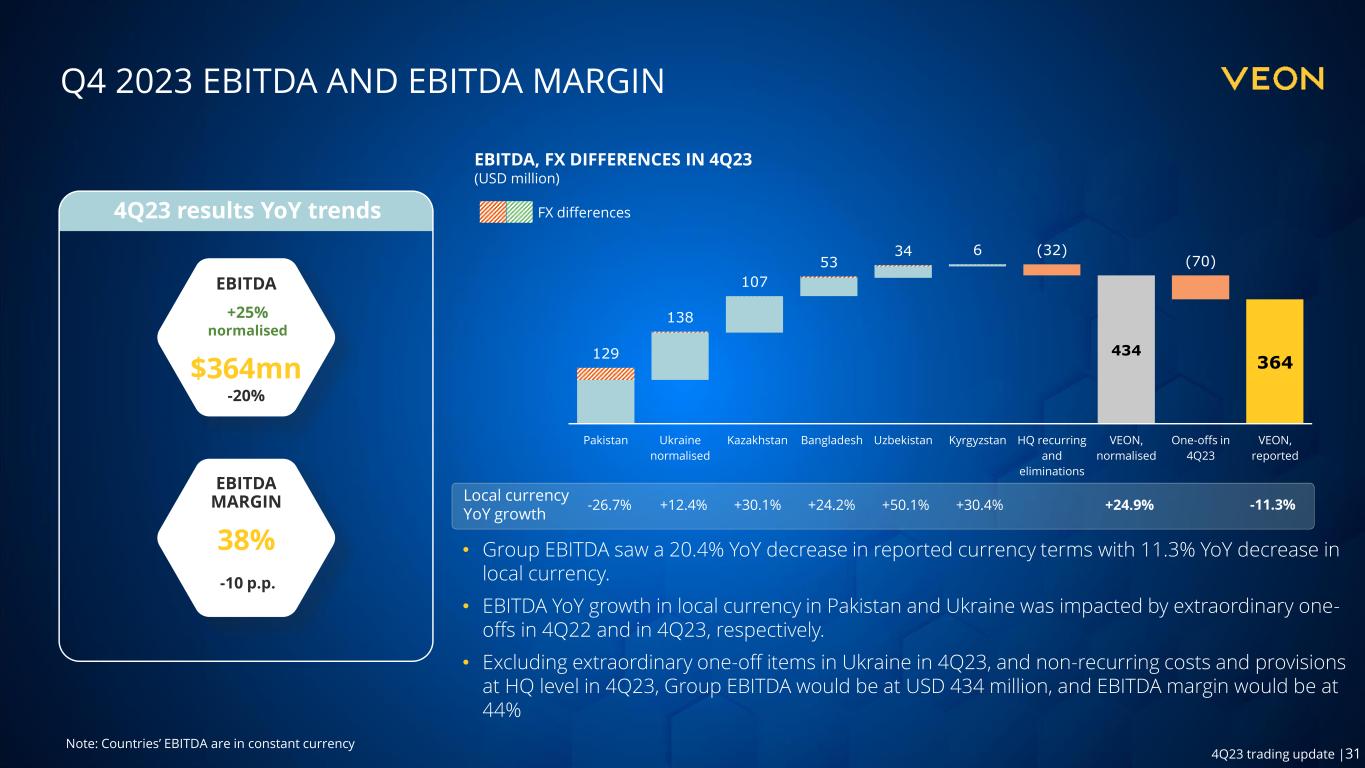

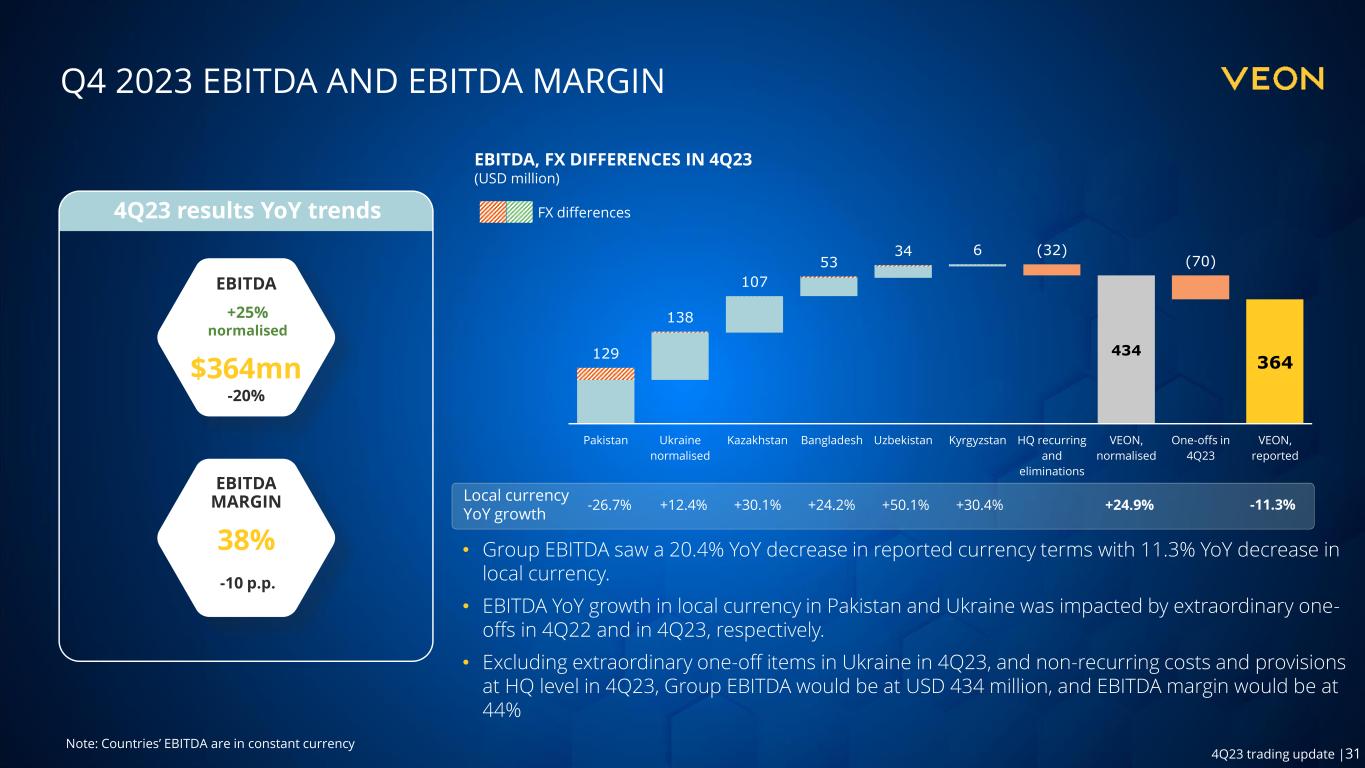

31 4Q23 trading update |31 EBITDA, FX DIFFERENCES IN 4Q23 (USD million) FX differences Q4 2023 EBITDA AND EBITDA MARGIN 4Q23 results YoY trends EBITDA $364mn +25% normalised -20% EBITDA MARGIN 38% +12.4%-26.7% +50.1%+30.1% Local currency YoY growth +24.2% +24.9% • Group EBITDA saw a 20.4% YoY decrease in reported currency terms with 11.3% YoY decrease in local currency. • EBITDA YoY growth in local currency in Pakistan and Ukraine was impacted by extraordinary one- offs in 4Q22 and in 4Q23, respectively. • Excluding extraordinary one-off items in Ukraine in 4Q23, and non-recurring costs and provisions at HQ level in 4Q23, Group EBITDA would be at USD 434 million, and EBITDA margin would be at 44% -10 p.p. +30.4% 364 434129 138 107 53 34 6 (32) (70) Pakistan Ukraine normalised Kazakhstan Bangladesh Uzbekistan Kyrgyzstan HQ recurring and eliminations VEON, normalised One-offs in 4Q23 VEON, reported -11.3% Note: Countries’ EBITDA are in constant currency

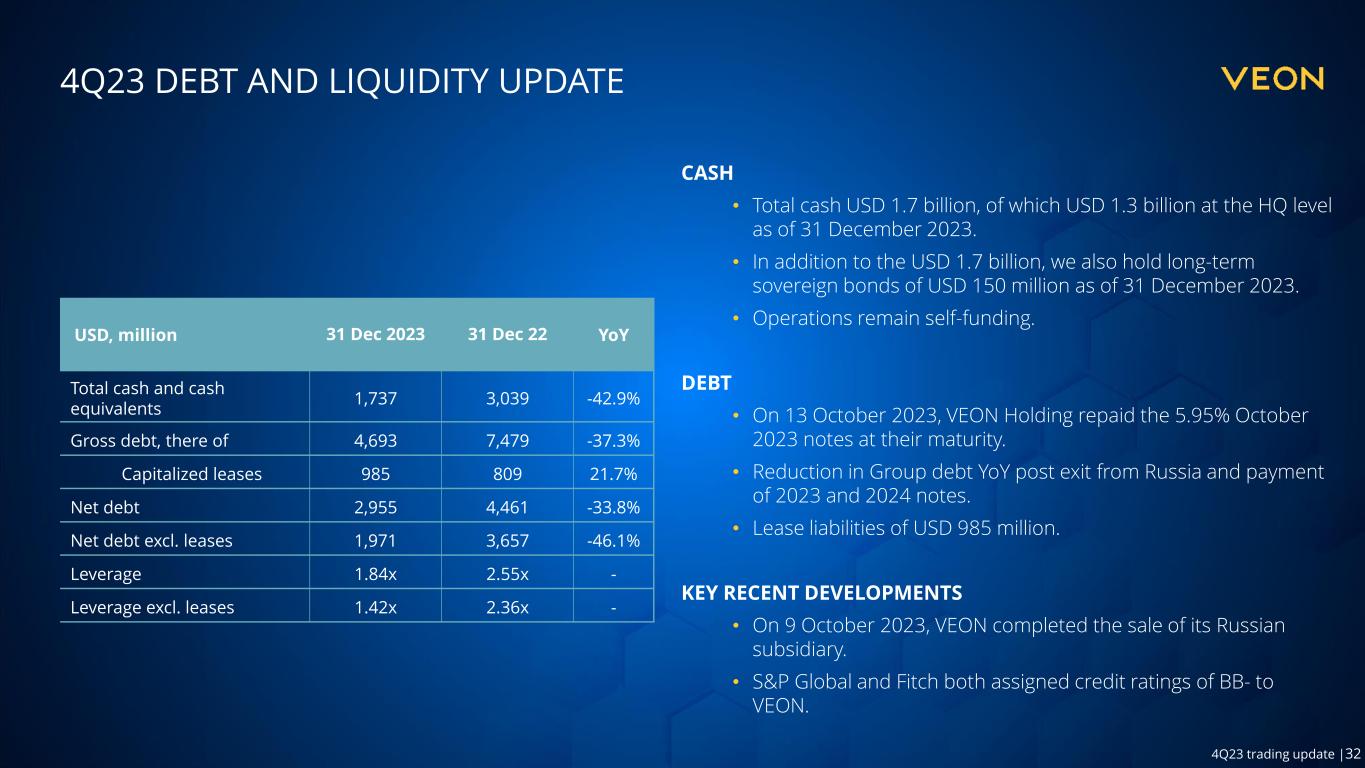

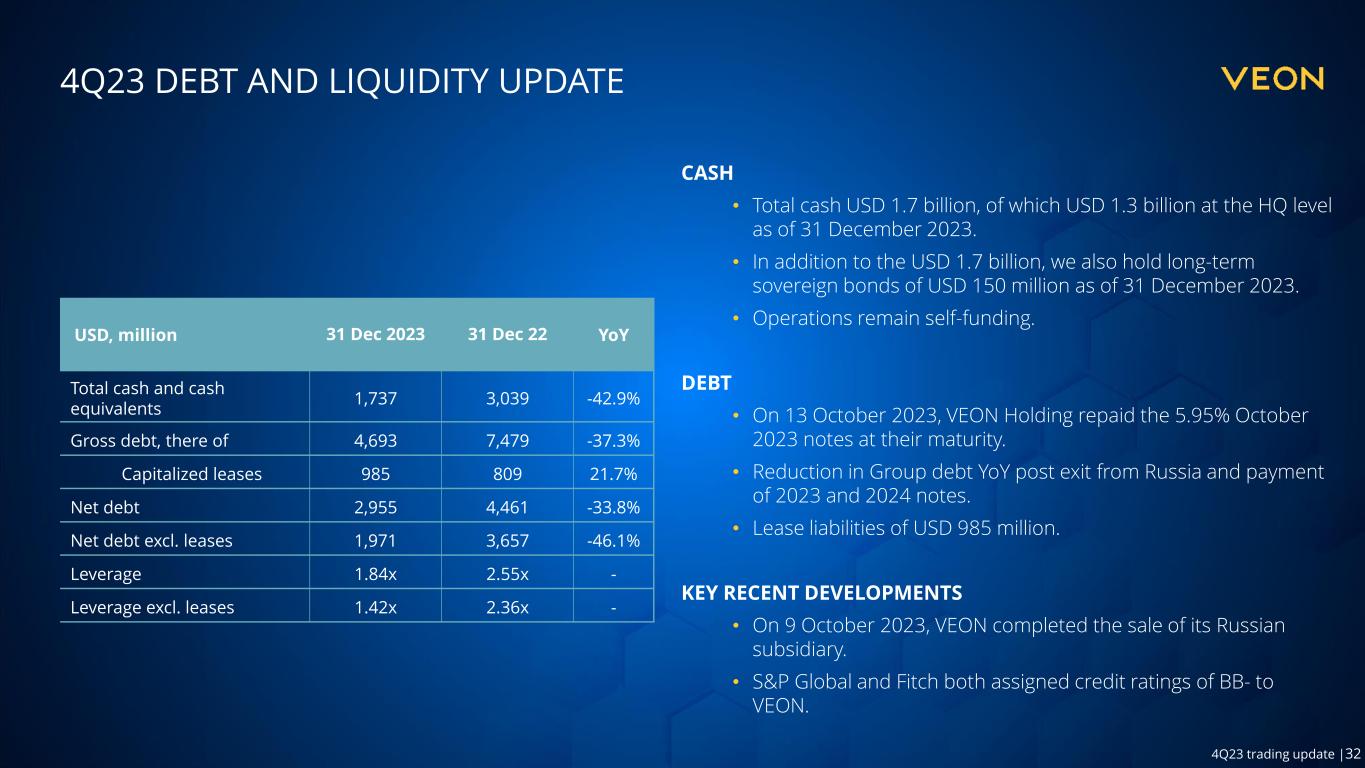

32 4Q23 trading update |32 4Q23 DEBT AND LIQUIDITY UPDATE CASH • Total cash USD 1.7 billion, of which USD 1.3 billion at the HQ level as of 31 December 2023. • In addition to the USD 1.7 billion, we also hold long-term sovereign bonds of USD 150 million as of 31 December 2023. • Operations remain self-funding. DEBT • On 13 October 2023, VEON Holding repaid the 5.95% October 2023 notes at their maturity. • Reduction in Group debt YoY post exit from Russia and payment of 2023 and 2024 notes. • Lease liabilities of USD 985 million. KEY RECENT DEVELOPMENTS • On 9 October 2023, VEON completed the sale of its Russian subsidiary. • S&P Global and Fitch both assigned credit ratings of BB- to VEON. USD, million 31 Dec 2023 31 Dec 22 YoY Total cash and cash equivalents 1,737 3,039 -42.9% Gross debt, there of 4,693 7,479 -37.3% Capitalized leases 985 809 21.7% Net debt 2,955 4,461 -33.8% Net debt excl. leases 1,971 3,657 -46.1% Leverage 1.84x 2.55x - Leverage excl. leases 1.42x 2.36x -

33 4Q23 trading update |33 RUSSIA EXIT Impact on financials • In 4Q23, VEON completed its exit from Russia. • Optimized capital structure and deleveraged balance sheet with 4Q23 leverage including leases at 1.84x. • Reduced debt at HQ level. • In aggregate, our continued operations are profitable. Gross debt* (USD billion) 8.4 6.7 3.7 3Q22 4Q22 4Q23 Lease liabilities (USD billion) 3.1 0.8 1.0 3Q22 4Q22 4Q23 Net debt and leverage ratio* (USD billion and multiple) 5.1 3.7 2.0 3.30x 2.36x 1.42x 3Q22 4Q22 4Q23 Note: Debt figures and leverage ratio exclude lease liabilities. Impact to profit and loss FY 2023 Profit / (loss) from continuing operations 0.4 (Loss) / profit from discontinued operations (from sale of Russia) (2.8) Income Statement (loss) / profit (2.4) Impact to equity Net change in equity in FY 2023 0.3 (USD billion)

34 4Q23 trading update |34 DEBT MATURITY AS OF 31 DECEMBER 2023 1. As of 31 December 2023. Note: Cash amount excludes USD 165 million relating to banking operations in Pakistan. DEBT MATURITY SCHEDULE AS OF 31 DECEMBER 2023 (USD billion) • In addition to total cash and cash equivalents of USD 1.7 billion, we also hold long-term sovereign bonds of USD 150 million as of 31 December 2023. • On 9 October 2023, VEON completed the sale of its Russian subsidiary. • On 13 October 2023, VEON Holding repaid the 5.95% October 2023 notes at their maturity. • USD 692 million RCF tranche matured in October 2023 and was rolled over for additional 3 months until January 2024. USD 363 million RCF tranche matured in November 2023 and was rolled over for additional 3 months until February 2024. • For the USD 1.1 billion RCF, USD 250 million can be rolled over until the final maturity in March 2024 and USD 805 million can be rolled over until the final maturity in March 2025. 0.27 1.06 0.41 Cash and cash equivalents (USD billion) Sovereign bonds Operating companies Headquarters (RCF) Headquarters (other) USD RUB PKR BDT OTHER RCF 0.25 0.81 0.40 1.64 0.16 1.19 0.24 2024 2025 2026 2027 >2028 1 1.74 0.15

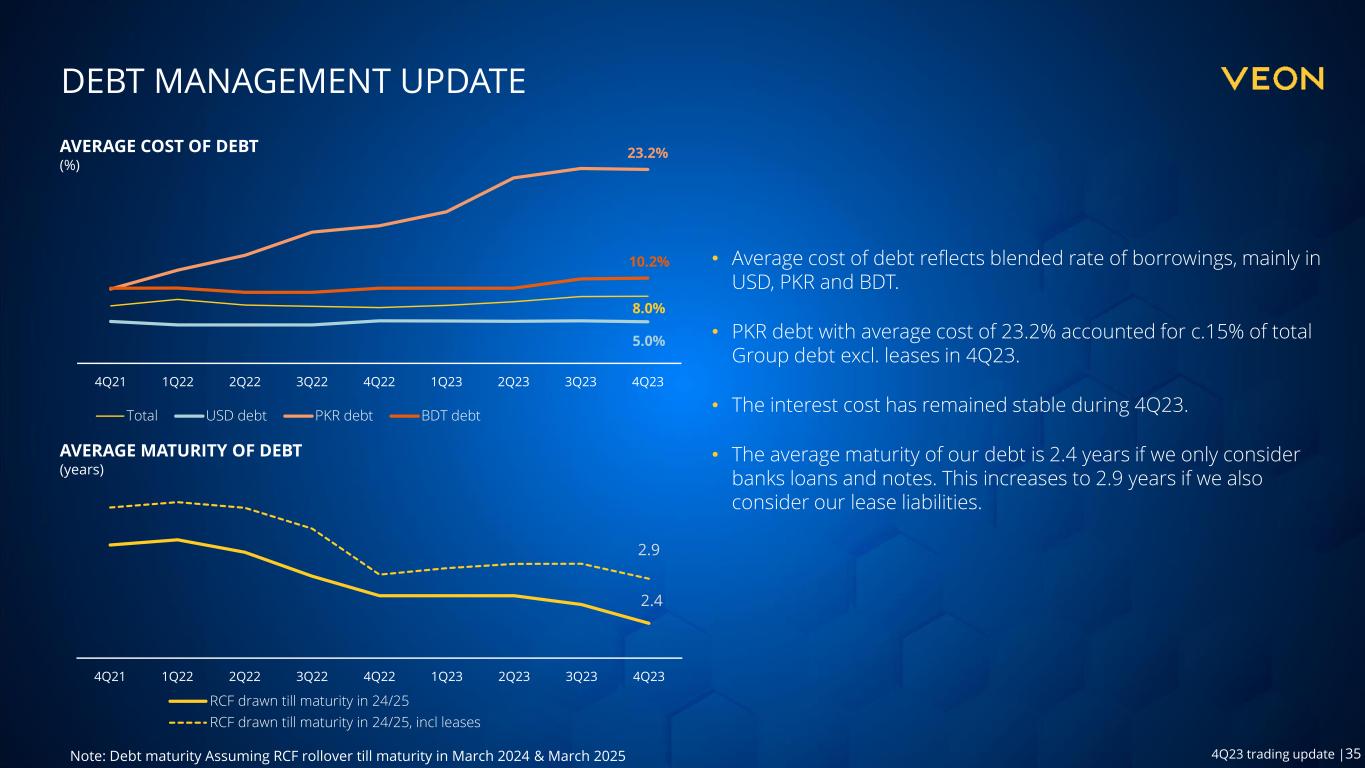

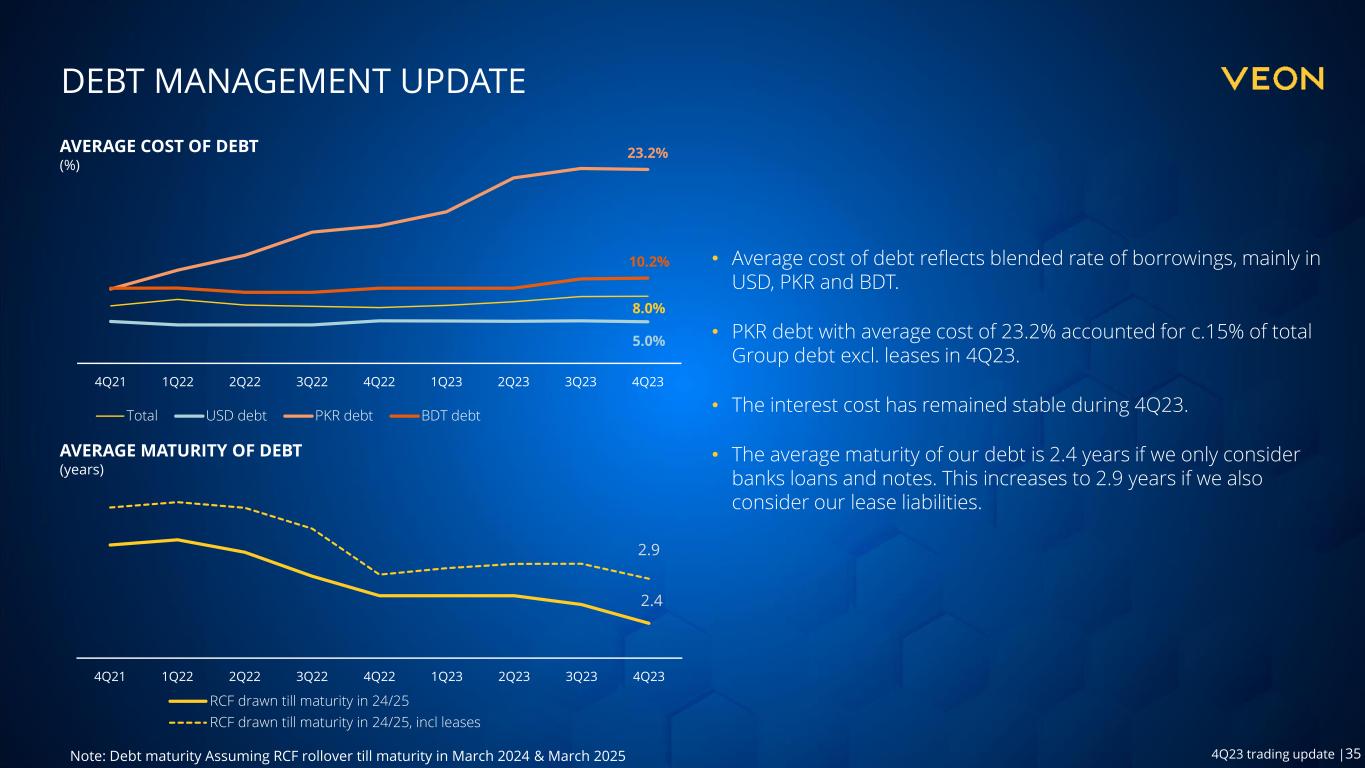

35 4Q23 trading update |35 DEBT MANAGEMENT UPDATE • Average cost of debt reflects blended rate of borrowings, mainly in USD, PKR and BDT. • PKR debt with average cost of 23.2% accounted for c.15% of total Group debt excl. leases in 4Q23. • The interest cost has remained stable during 4Q23. • The average maturity of our debt is 2.4 years if we only consider banks loans and notes. This increases to 2.9 years if we also consider our lease liabilities. AVERAGE COST OF DEBT (%) 8.0% 5.0% 23.2% 10.2% 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 Total USD debt PKR debt BDT debt 2.4 2.9 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 RCF drawn till maturity in 24/25 RCF drawn till maturity in 24/25, incl leases Note: Debt maturity Assuming RCF rollover till maturity in March 2024 & March 2025 AVERAGE MATURITY OF DEBT (years)

36 4Q23 trading update |36 AGENDA 1. OPENING 2. HIGHLIGHTS & BUSINESS UPDATE Faisal Ghori Kaan Terzioğlu 4. CLOSING REMARKS Kaan Terzioğlu 3. TRADING RESULTS – INCLUDING DEBT MATURITY AND LIQUIDITY UPDATE Joop Brakenhoff 5. Q&A Kaan Terzioğlu, Joop Brakenhoff

37 4Q23 trading update |37 2023 AMBITIONS Our full-year ambitions achieved, while addressing new challenges 1 Driving growth and expanding margin Ukraine Exit from Russia • Execution on “4G for all” and “Digital Operator” strategy • Disciplined inflationary pricing and cost control • Leaner HQ Management Team, smaller Board of Directors • Reiterating our commitment to the future of Ukraine • Continued engagement with Ukrainian authorities and lawmakers • Support from US, UK and EU investors • Completed 2 3 Executing on asset-light portfolio • Continued work on monetizing towers assets4 Creating shareholder value • Monetizing towers assets, optimizing capital structure, effective balance sheet management, progressing on local listings, crystalizing value of our digital assets 5

38 4Q23 trading update |38 2023 RESULTS AND 2024 OUTLOOK Continuing our growth trajectory 1. Communicated with 3Q23 trading update on 20 November 2023. FY 2023 Guidance1 FY 2023 Actual FY 2024 Guidance Total Revenue, YoY in local currency 18%-20% growth 18% growth 16%-18% growth EBITDA, YoY in local currency 18%-20% growth 20% growth 18%-20% growth LTM Capex intensity 16%-18% 18% 18%-19% Note: All YoY local currency figures are normalized, as noted in the 4Q23 trading update. See “Disclaimer” on slide 4 above for a discussion of factors that could cause actual results to differ from expectations.

39 4Q23 trading update |39 Q&A VEON 4Q23 TRADING UPDATE

40 4Q23 trading update |40 THANK YOU! ir@veon.com Tel: +31 (0)20 79 77 200 VEON 4Q23 TRADING UPDATE

41 4Q23 trading update |41 APPENDIX VEON 4Q23 TRADING UPDATE

42 4Q23 trading update |42 DIGITAL OPERATOR STRATEGY DELIVERING RESULTS ARPU Multiple Churn Impact 1. Revenue share and subscriber numbers based on the mobile B2C segment Note: Voice only – customers using only voice services, 2play 4G – Doubleplay 4G customers, Multiplay – Multiplay customers Multiplay customers (B2C) 30% 38% 47% 16% 22% 27% 4Q21 4Q22 4Q23 Single play and no play revenue Double play revenue Multiplay revenue Share of multiplay customers 1.0x 3.2x 3.8x Voice only 2play 4G Multiplay 1.0x 0.7x 0.5x Voice only 2play 4G Multiplay

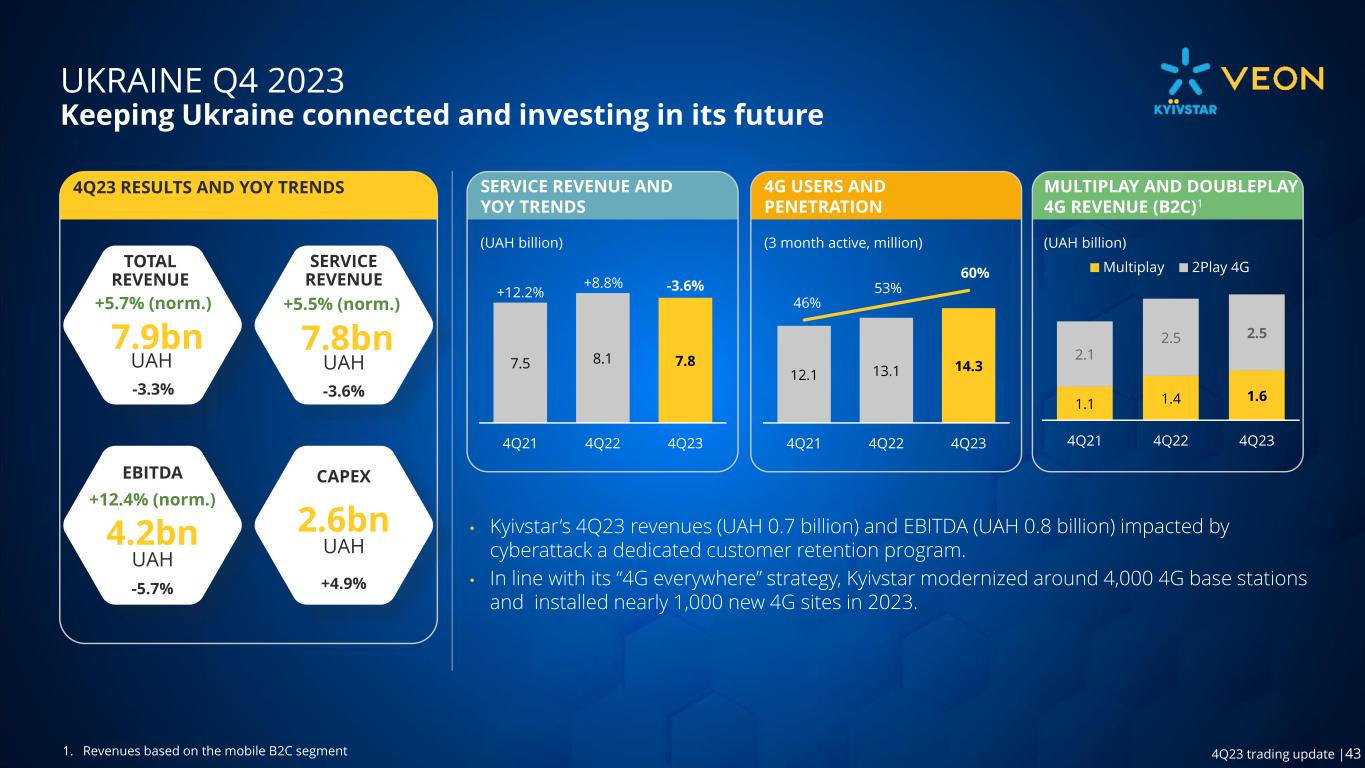

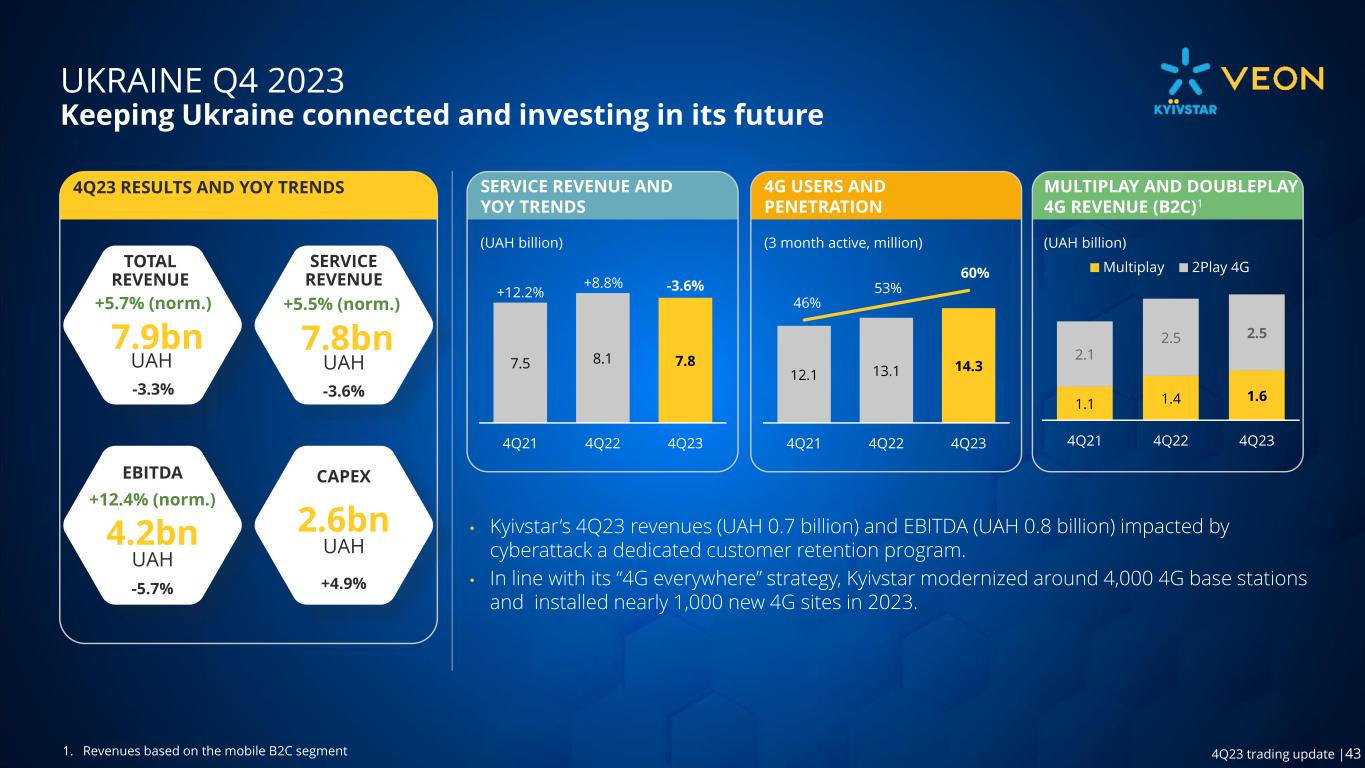

43 4Q23 trading update |43 UKRAINE Q4 2023 Keeping Ukraine connected and investing in its future • Kyivstar’s 4Q23 revenues (UAH 0.7 billion) and EBITDA (UAH 0.8 billion) impacted by cyberattack a dedicated customer retention program. • In line with its “4G everywhere” strategy, Kyivstar modernized around 4,000 4G base stations and installed nearly 1,000 new 4G sites in 2023. 4Q23 RESULTS AND YOY TRENDS SERVICE REVENUE -3.6% CAPEX UAH 7.8bn 7.5 8.1 7.8 4Q21 4Q22 4Q23 12.1 13.1 14.3 46% 53% 60% 4Q21 4Q22 4Q23 +12.2% +8.8% -3.6% 2.6bn +4.9% UAH TOTAL REVENUE 7.9bn 4.2bn UAH -3.3% EBITDA -5.7% UAH 4G USERS AND PENETRATION (3 month active, million) MULTIPLAY AND DOUBLEPLAY 4G REVENUE (B2C)1 (UAH billion) SERVICE REVENUE AND YOY TRENDS (UAH billion) 1. Revenues based on the mobile B2C segment 1.1 1.4 1.6 2.1 2.5 2.5 4Q21 4Q22 4Q23 Multiplay 2Play 4G +5.5% (norm.)+5.7% (norm.) +12.4% (norm.)

44 4Q23 trading update |44 PAKISTAN Q4 2023 Double-digit revenue YoY growth, gaining market share • Revenue growth above 14% YoY, and robust uptake of digital financial services. • Revenues and EBITDA YoY growth impacted by extraordinary one-off recorded in 4Q22. Normalised for this non-recurring item, 4Q23 total revenue and EBITDA grew 26.0% YoY and 23.3% YoY, respectively. • Continued momentum in our fintech offering with strong growth in service revenues in JazzCash (+90.1% YoY) and Mobilink Microfinance Bank (+89.4% YoY). • JazzCash turned their EBITDA from negative PKR 1.6 billion in 4Q22 to positive PKR 1.3 billion in 4Q23, MMBL accounted PKR 2.4 billion in EBITDA, a 23.4% growth YoY. 4Q23 RESULTS AND YOY TRENDS SERVICE REVENUE 77.9bn +13.5% 16.3bn -19.7% PKR PKR 54.6 68.7 77.9 4Q21 4Q22 4Q23 35.0 41.3 43.9 48% 56% 62% 4Q21 4Q22 4Q23 +13.5% CAPEX +12.2% +25.8% TOTAL REVENUE 84.7bn 36.5bn PKR +14.7% EBITDA -26.7% PKR 4G USERS AND PENETRATION (3 month active, million) SERVICE REVENUE AND YOY TRENDS (PKR Billion) 15.1 20.0 28.4 7.9 7.5 6.9 4Q21 4Q22 4Q23 Multiplay 2Play 4G MULTIPLAY AND DOUBLEPLAY 4G REVENUE (B2C) (PKR billion) +25.6% (norm.)+26.0% (norm.) +23.3% (norm.) Note: Restated service revenue and YoY trend for 4Q21 and 4Q22 without impact on total revenue in these periods.

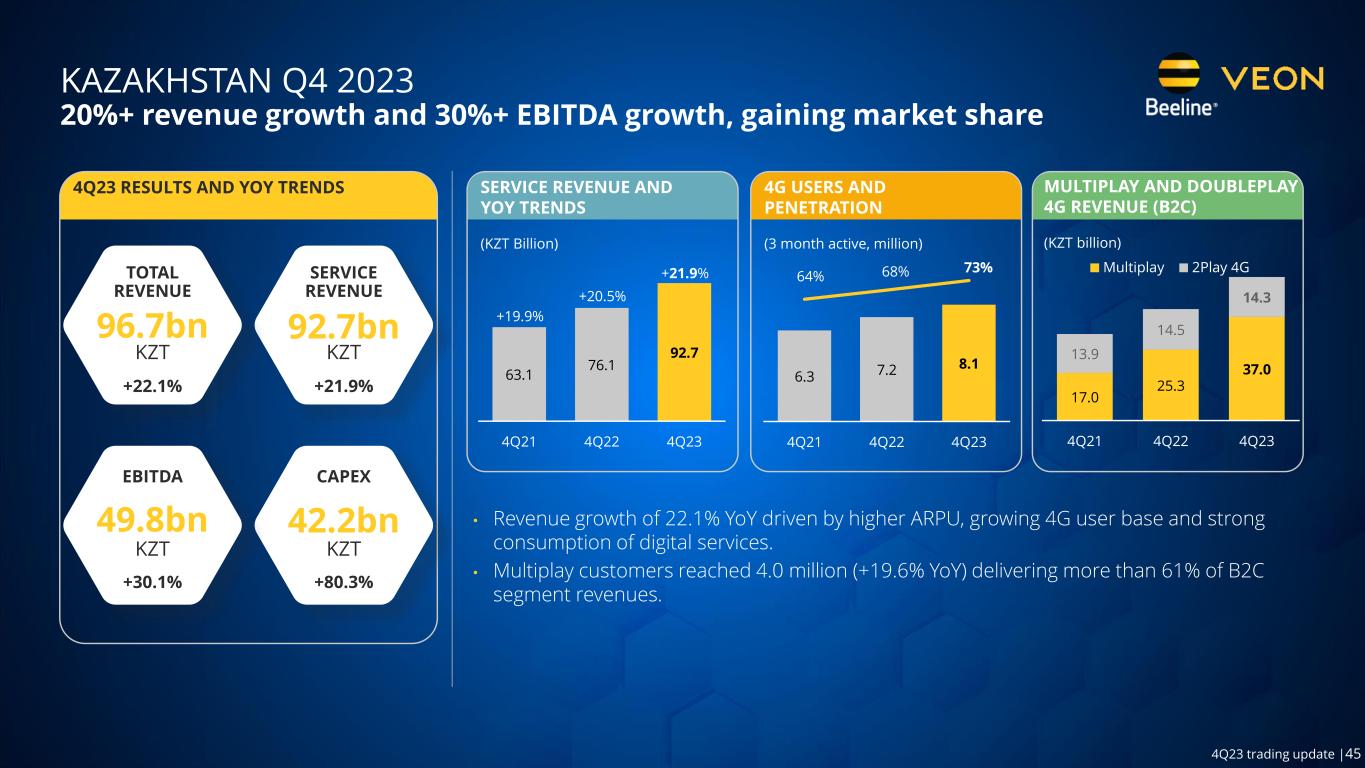

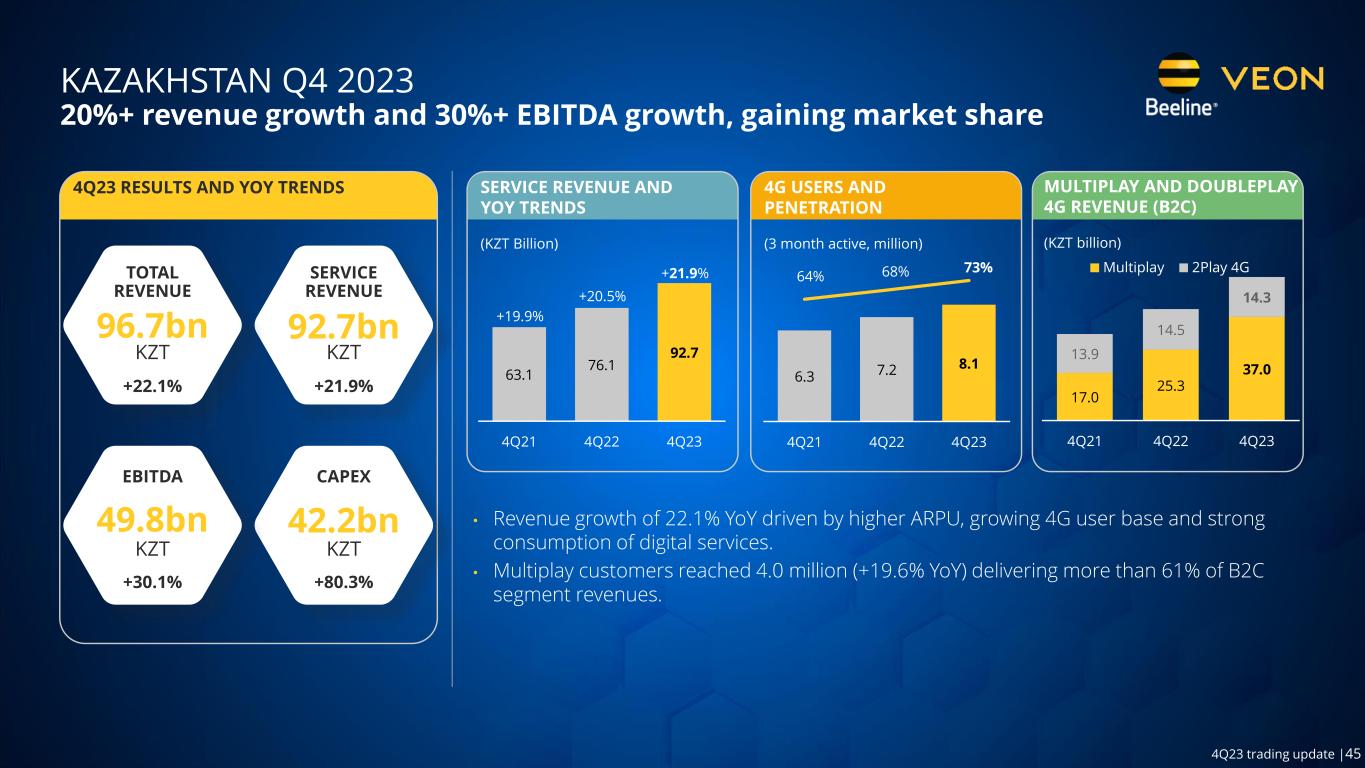

45 4Q23 trading update |45 KAZAKHSTAN Q4 2023 20%+ revenue growth and 30%+ EBITDA growth, gaining market share • Revenue growth of 22.1% YoY driven by higher ARPU, growing 4G user base and strong consumption of digital services. • Multiplay customers reached 4.0 million (+19.6% YoY) delivering more than 61% of B2C segment revenues. 63.1 76.1 92.7 4Q21 4Q22 4Q23 6.3 7.2 8.1 64% 68% 73% 4Q21 4Q22 4Q23 +19.9% +20.5% +21.9% 4G USERS AND PENETRATION (3 month active, million) SERVICE REVENUE AND YOY TRENDS (KZT Billion) 4Q23 RESULTS AND YOY TRENDS SERVICE REVENUE 92.7bn +21.9% 42.2bn +80.3% KZT KZT CAPEX TOTAL REVENUE 96.7bn 49.8bn KZT +22.1% EBITDA +30.1% KZT MULTIPLAY AND DOUBLEPLAY 4G REVENUE (B2C) (KZT billion) 17.0 25.3 37.0 13.9 14.5 14.3 4Q21 4Q22 4Q23 Multiplay 2Play 4G

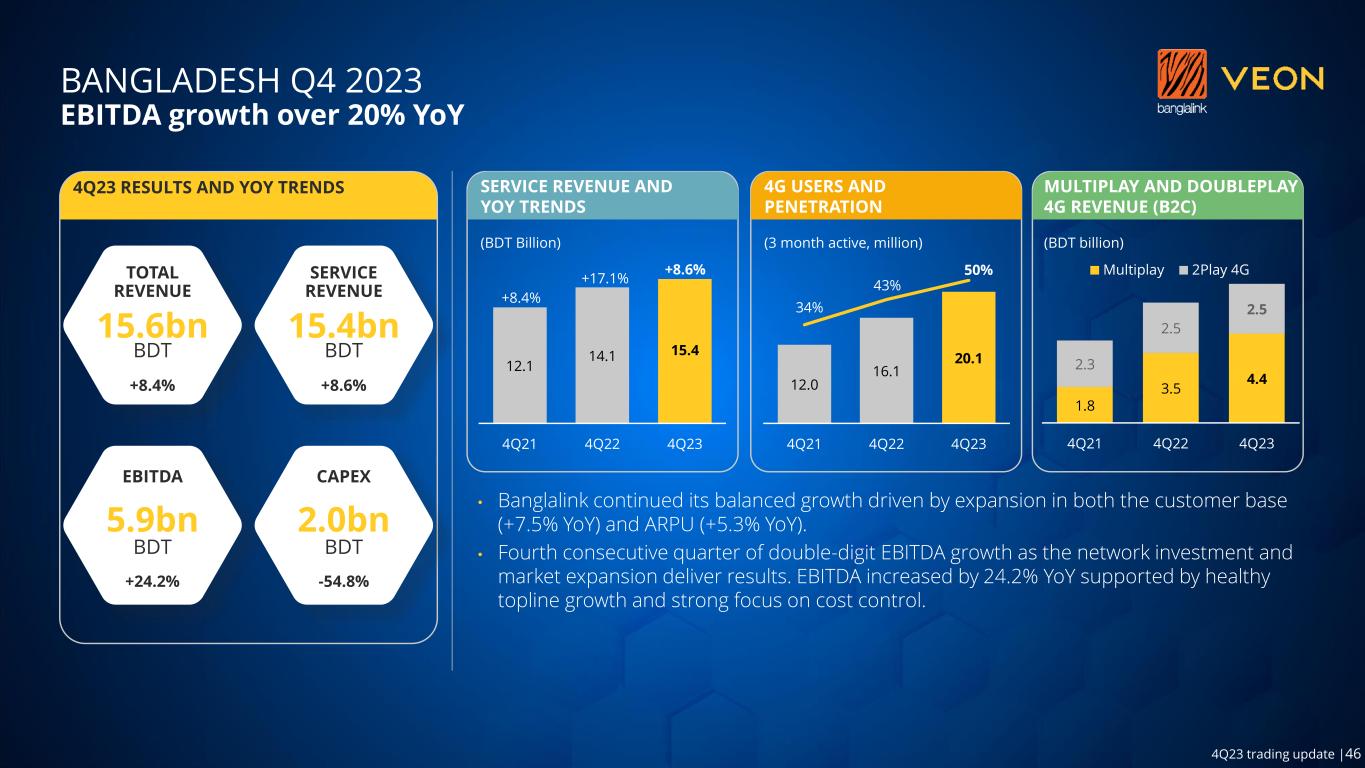

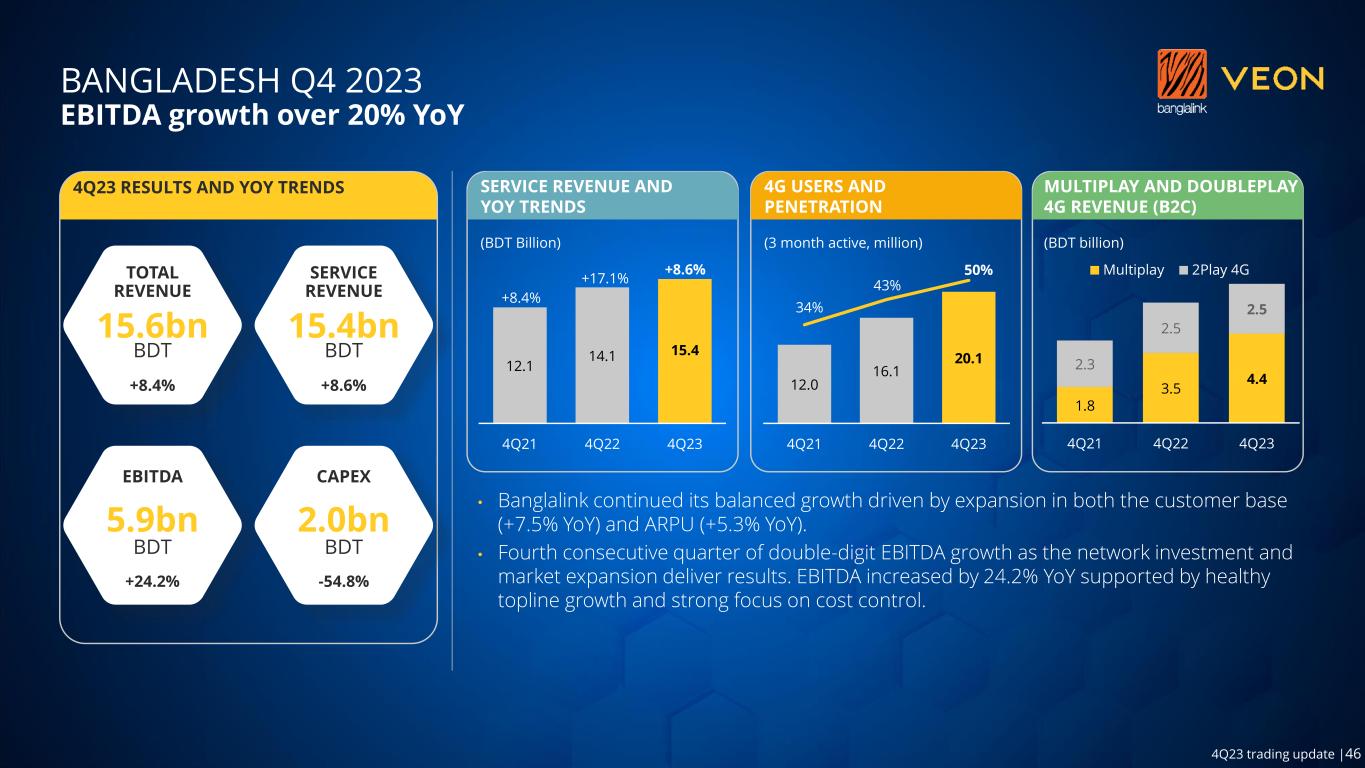

46 4Q23 trading update |46 BANGLADESH Q4 2023 EBITDA growth over 20% YoY • Banglalink continued its balanced growth driven by expansion in both the customer base (+7.5% YoY) and ARPU (+5.3% YoY). • Fourth consecutive quarter of double-digit EBITDA growth as the network investment and market expansion deliver results. EBITDA increased by 24.2% YoY supported by healthy topline growth and strong focus on cost control. 4Q23 RESULTS AND YOY TRENDS TOTAL REVENUE 15.6bn SERVICE REVENUE 5.9bn 15.4bn 2.0bn 12.1 14.1 15.4 4Q21 4Q22 4Q23 12.0 16.1 20.1 34% 43% 50% 4Q21 4Q22 4Q23 +8.4% +17.1% +8.6% EBITDA CAPEX -54.8% BDT +24.2% BDT 4G USERS AND PENETRATION (3 month active, million) SERVICE REVENUE AND YOY TRENDS (BDT Billion) +8.6% BDTBDT +8.4% MULTIPLAY AND DOUBLEPLAY 4G REVENUE (B2C) (BDT billion) 1.8 3.5 4.4 2.3 2.5 2.5 4Q21 4Q22 4Q23 Multiplay 2Play 4G

47 4Q23 trading update |47 UZBEKISTAN Q4 2023 Accelerating rev growth, with multiplay revenues 53% of service rev • Beeline Uzbekistan delivered its tenth consecutive quarter of double-digit topline growth, reached over 73% 4G user penetration. • Revenue growth of 29.7% driven by new value propositions supporting higher ARPU up 25.1% YoY, and higher data usage up 26.5% YoY. • EBITDA grew by 50.1% YoY, supported by strong topline growth and continued focus on cost control. • Beeline Uzbekistan reported 26.2% YoY increase in multiplay customer base contributing 65.8% of B2C revenues during 4Q23. 543.5 707.3 909.0 4Q21 4Q22 4Q23 4.3 5.5 6.2 61% 66% 73% 4Q21 4Q22 4Q23 +10.9% +30.2% +28.5% 4G USERS AND PENETRATION (3 month active, million) SERVICE REVENUE AND YOY TRENDS (UZS Billion) 4Q23 RESULTS AND YOY TRENDS SERVICE REVENUE 909.0bn +28.5% 208.5bn +288.0% UZS UZS CAPEX TOTAL REVENUE 920.5bn 412.3bn UZS +29.7% EBITDA +50.1% UZS MULTIPLAY AND DOUBLEPLAY 4G REVENUE (B2C) (UZS billion) 236.6 369.3 485.1 121.6 151.0 138.1 4Q21 4Q22 4Q23 Multiplay 2Play 4G

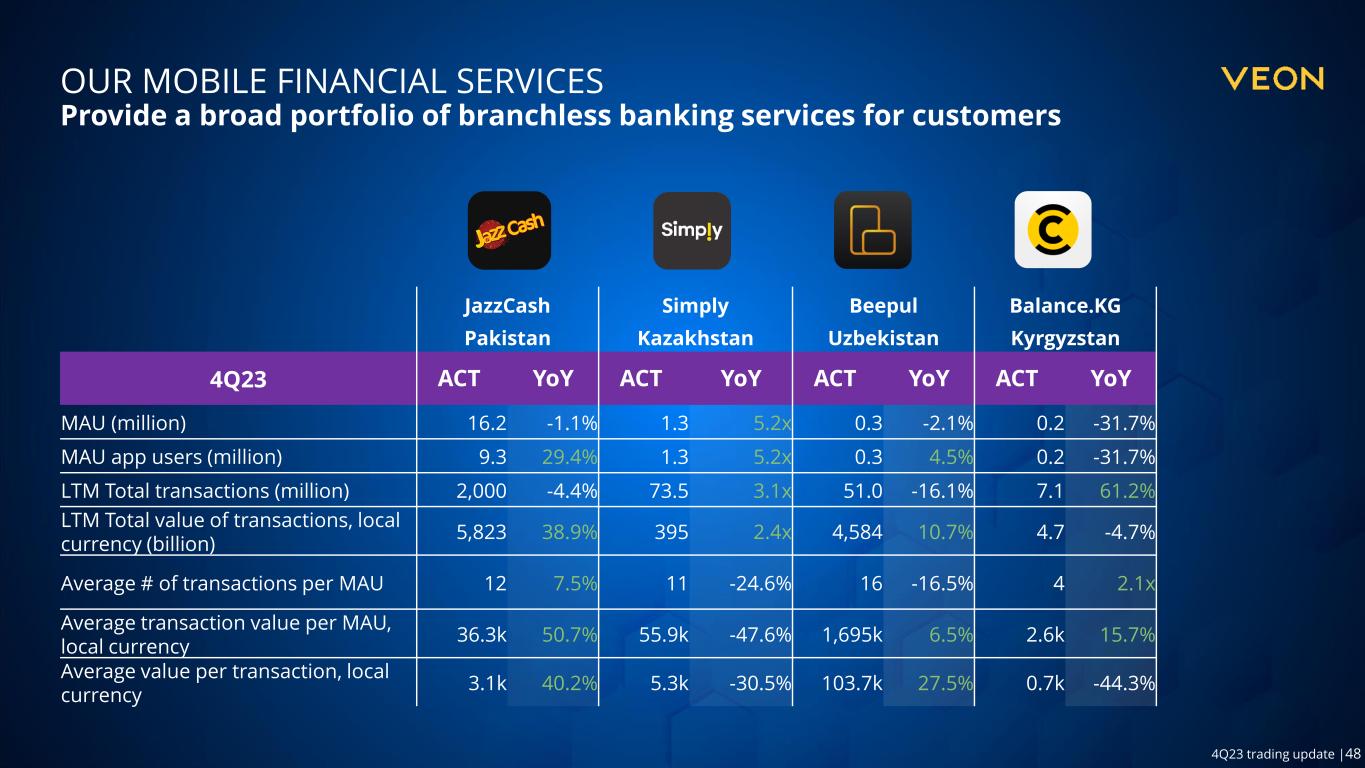

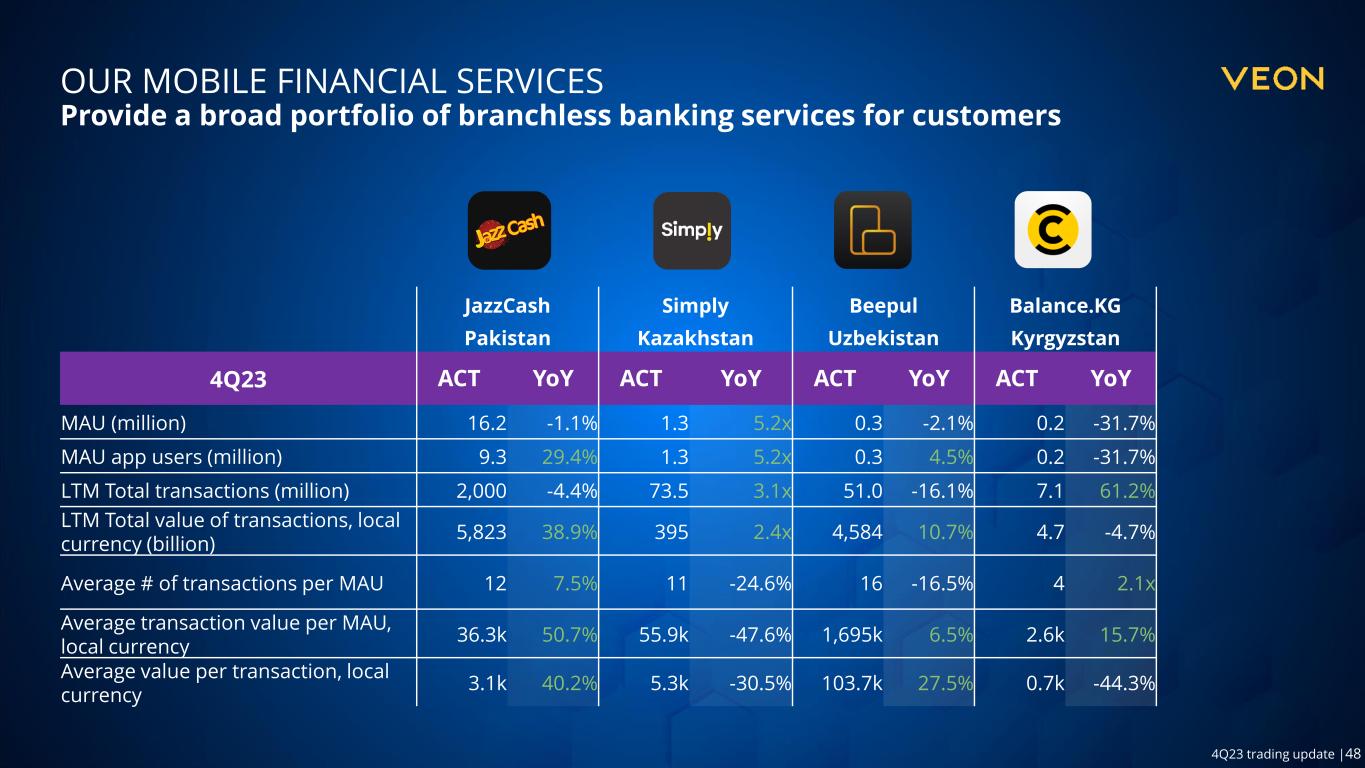

48 4Q23 trading update |48 OUR MOBILE FINANCIAL SERVICES Provide a broad portfolio of branchless banking services for customers JazzCash Simply Beepul Balance.KG Pakistan Kazakhstan Uzbekistan Kyrgyzstan 4Q23 ACT YoY ACT YoY ACT YoY ACT YoY MAU (million) 16.2 -1.1% 1.3 5.2x 0.3 -2.1% 0.2 -31.7% MAU app users (million) 9.3 29.4% 1.3 5.2x 0.3 4.5% 0.2 -31.7% LTM Total transactions (million) 2,000 -4.4% 73.5 3.1x 51.0 -16.1% 7.1 61.2% LTM Total value of transactions, local currency (billion) 5,823 38.9% 395 2.4x 4,584 10.7% 4.7 -4.7% Average # of transactions per MAU 12 7.5% 11 -24.6% 16 -16.5% 4 2.1x Average transaction value per MAU, local currency 36.3k 50.7% 55.9k -47.6% 1,695k 6.5% 2.6k 15.7% Average value per transaction, local currency 3.1k 40.2% 5.3k -30.5% 103.7k 27.5% 0.7k -44.3%

49 4Q23 trading update |49 OUR ENTERTAINMENT PLATFORMS Offer new experiences and unique content to our customers Tamasha Toffee BeeTV Kyivstar TV Beeline TV IZI Pakistan Bangladesh Kazakhstan Ukraine Uzbekistan Kazakhstan 4Q23 ACT YoY ACT YoY ACT YoY ACT YoY ACT YoY ACT YoY MAU (million) 10.6 2.5x 8.4 -60.3% 0.9 4.1% 1.3 18.5% 1.2 38.9% 0.5 16.9% Share of non-VEON app users 45% 23.9pp 65% -13.5pp 18% -11.1pp 0% 0.0pp 61% 10.3pp 51% -15.9pp Share of MAU app users 100% 0.0pp 100% 0.0pp 76% 0.4pp 76% -1.7pp 100% 0.0pp 86% -3.0pp User activity on mobile platform Usage time (billion min) 8.1 4.0x 2.9 -56.4% 0.5 0.4% 3.3 2.1x 0.1 26.8% # of sessions (million) 555 4.1x 152 -60.2% 25 9.9% 313 33% Usage time per user per day (min) 43 11.3% 19 46.2% 110 -21.5% 245 10 -1.1% Usage time per session (min) 15 -2.7% 19 9.5% 22 -8.6% 11 55% Note: for Toffee YoY comparison in MAU, Usage time and Total # of sessions is distorted by uniquely high viewership during FIFA World Cup in 4Q22.

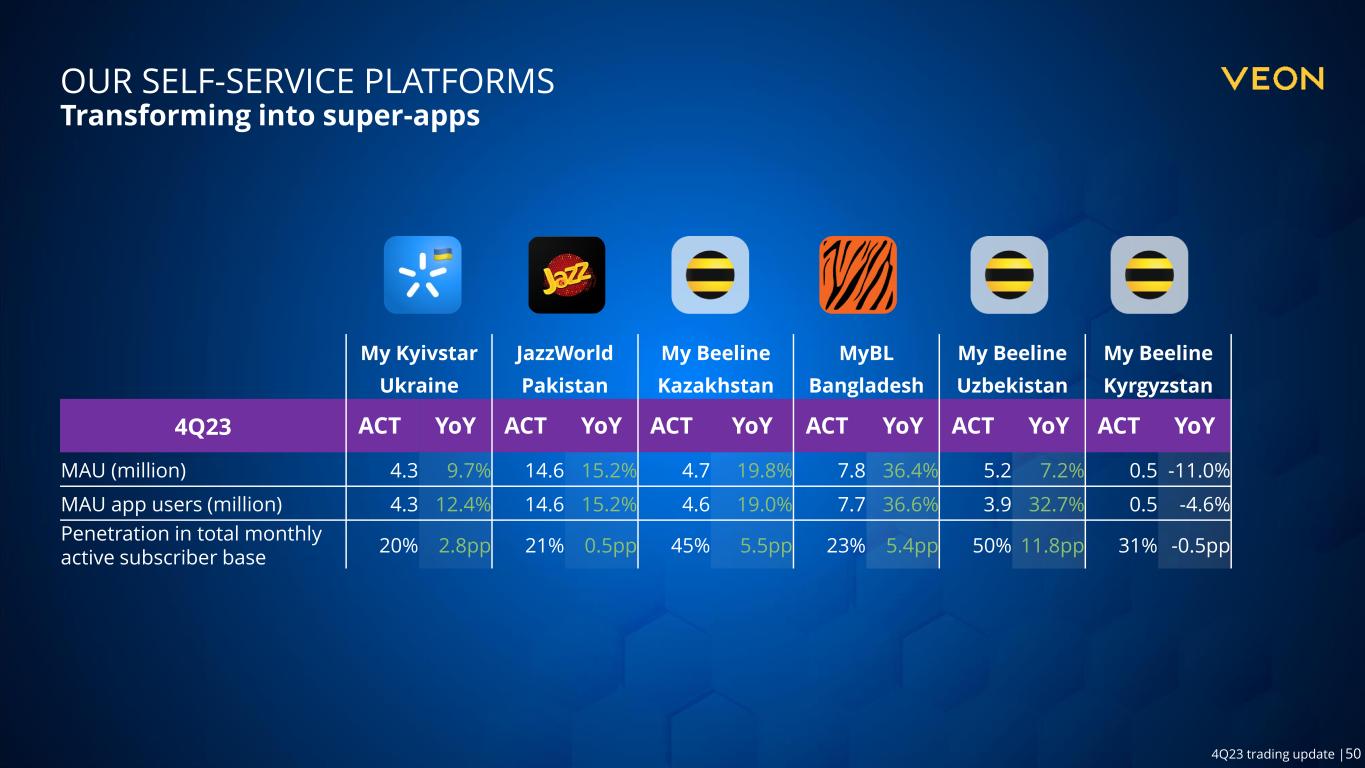

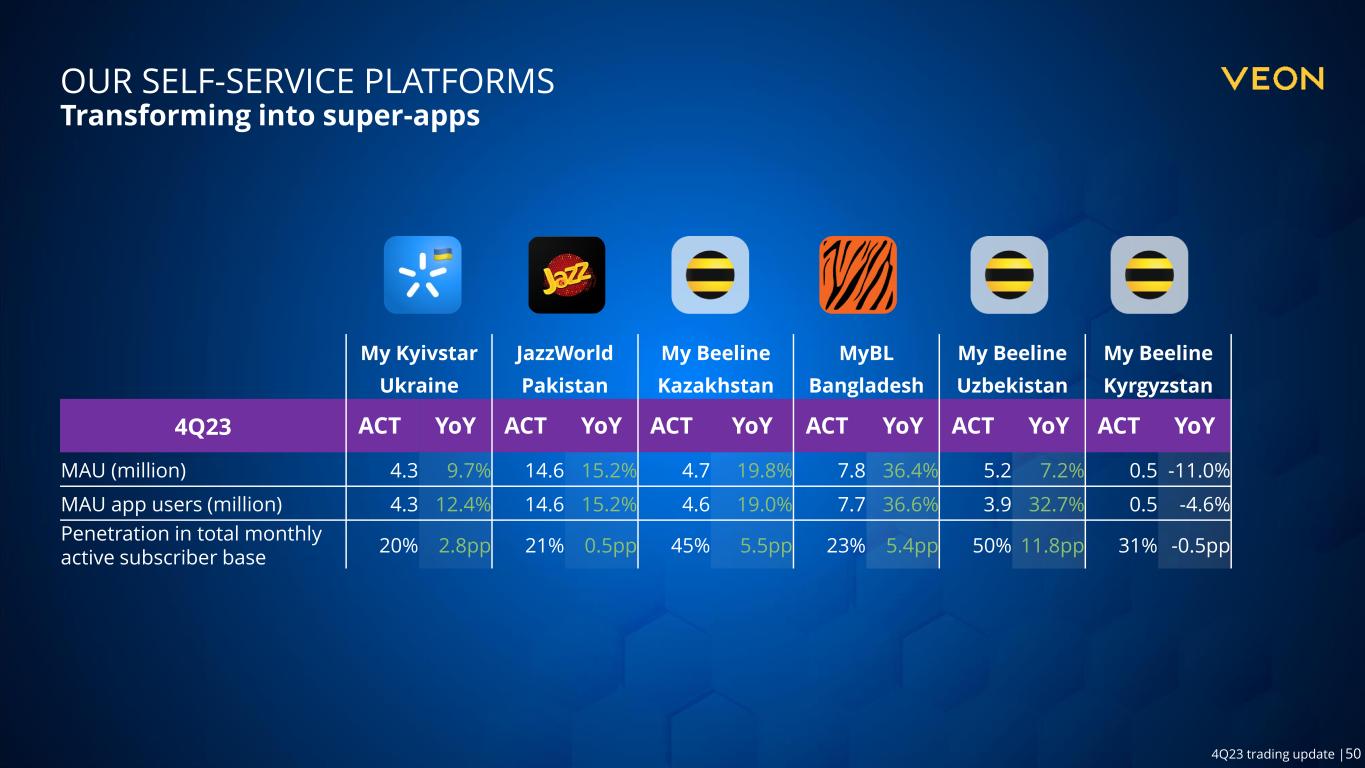

50 4Q23 trading update |50 OUR SELF-SERVICE PLATFORMS Transforming into super-apps My Kyivstar JazzWorld My Beeline MyBL My Beeline My Beeline Ukraine Pakistan Kazakhstan Bangladesh Uzbekistan Kyrgyzstan 4Q23 ACT YoY ACT YoY ACT YoY ACT YoY ACT YoY ACT YoY MAU (million) 4.3 9.7% 14.6 15.2% 4.7 19.8% 7.8 36.4% 5.2 7.2% 0.5 -11.0% MAU app users (million) 4.3 12.4% 14.6 15.2% 4.6 19.0% 7.7 36.6% 3.9 32.7% 0.5 -4.6% Penetration in total monthly active subscriber base 20% 2.8pp 21% 0.5pp 45% 5.5pp 23% 5.4pp 50% 11.8pp 31% -0.5pp

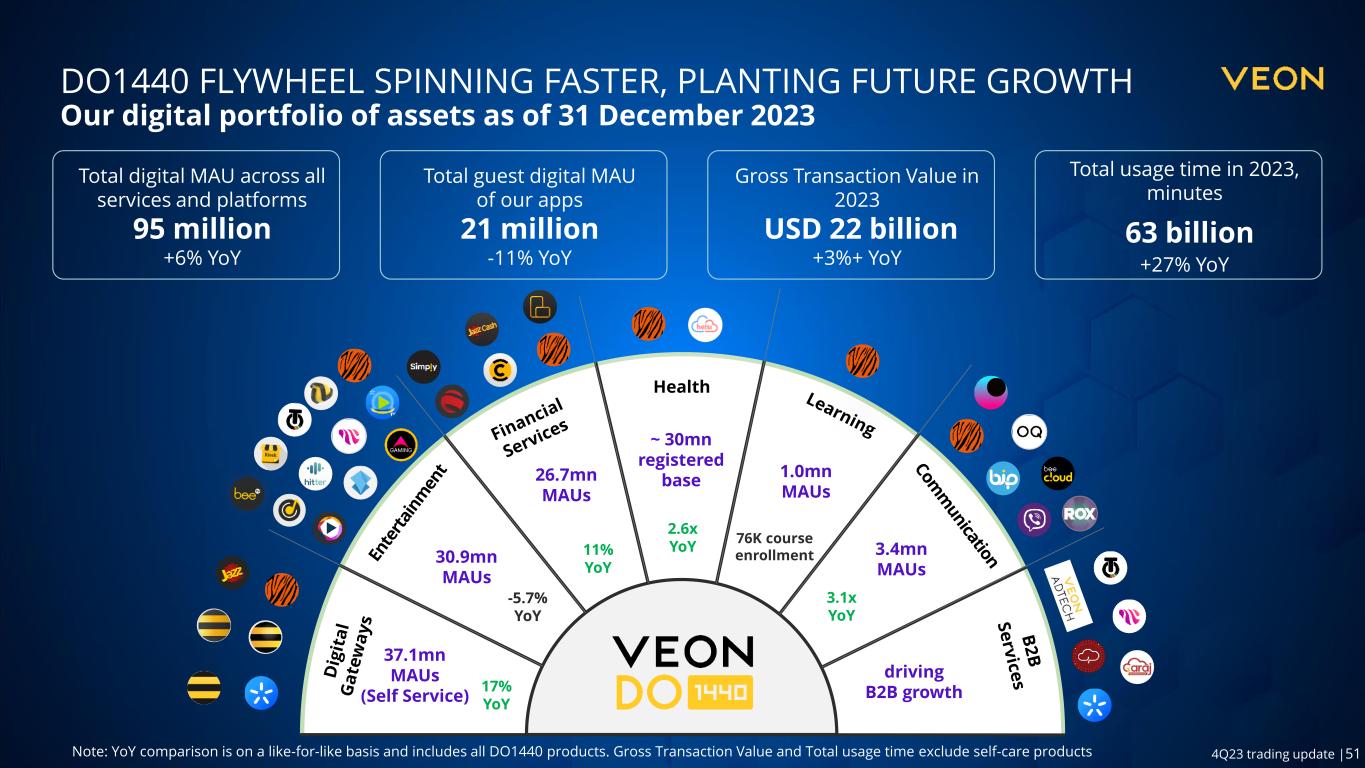

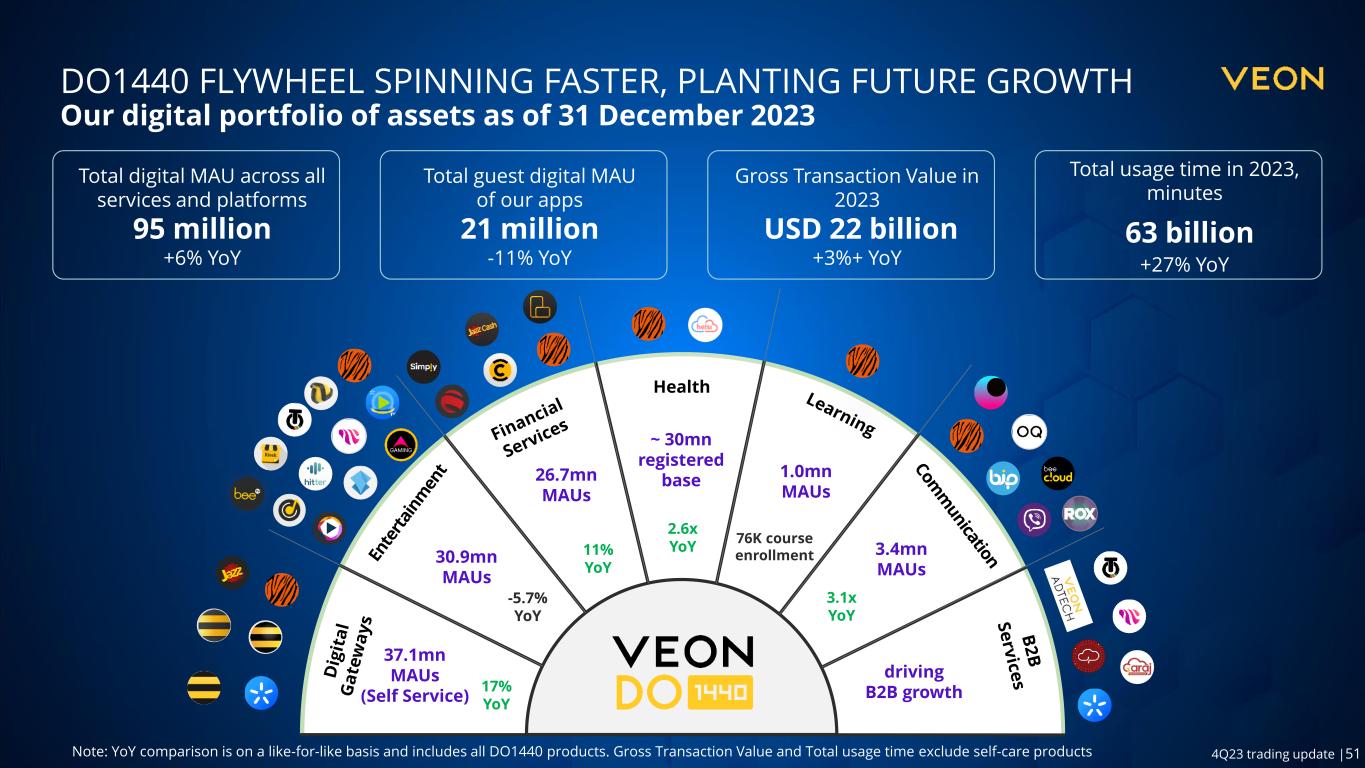

51 4Q23 trading update |51 DO1440 FLYWHEEL SPINNING FASTER, PLANTING FUTURE GROWTH Our digital portfolio of assets as of 31 December 2023 Gross Transaction Value in 2023 USD 22 billion +3%+ YoY Total digital MAU across all services and platforms 95 million +6% YoY Note: YoY comparison is on a like-for-like basis and includes all DO1440 products. Gross Transaction Value and Total usage time exclude self-care products driving B2B growth 3.4mn MAUs 1.0mn MAUs Health ~ 30mn registered base26.7mn MAUs 30.9mn MAUs 37.1mn MAUs (Self Service) 17% YoY -5.7% YoY 11% YoY 2.6x YoY 76K course enrollment 3.1x YoY Total guest digital MAU of our apps 21 million -11% YoY Total usage time in 2023, minutes 63 billion +27% YoY

52 4Q23 trading update |52 OUR MOBILE FINANCIAL SERVICES Provide a broad portfolio of branchless banking services for customers JazzCash Simply Beepul Balance.KG Pakistan Kazakhstan Uzbekistan Kyrgyzstan FEB’2024 ACT YoY ACT YoY ACT YoY ACT YoY MAU (million) 16.8 16.8% 1.4 6.4x 0.3 -6.5% 0.1 -62.0% MAU app users (million) 9.9 63.4% 1.4 6.4x 0.3 -1.0% 0.1 -62.0% LTM Total transactions (million) 2,093 1.4% 82.5 2.8x 49.0 -20.1% 6.8 31.3% LTM Total value of transactions, local currency (billion) 6,307 44.1% 444 2.2x 4,722 10.4% 4.2 -20.4% Average # of transactions per MAU 11 -2.8% 9 - 15 -24.8% 3 1.6x Average transaction value per MAU, local currency 33.7k 38.1% 47.2k - 1,414k 4.0% 2.0k -2.8% Average value per transaction, local currency 3.0k 42.1% 5.4k -22.3% 96.3k 38.2% 0.6k -39.4%

53 4Q23 trading update |53 OUR ENTERTAINMENT PLATFORMS Offer new experiences and unique content to our customers Tamasha Toffee BeeTV Kyivstar TV Beeline TV IZI Pakistan Bangladesh Kazakhstan Ukraine Uzbekistan Kazakhstan FEB’2024 ACT YoY ACT YoY ACT YoY ACT YoY ACT YoY ACT YoY MAU (million) 13.2 2.5x 7.9 -23.4% 0.8 15.6% 1.4 36.8% 1.1 90.1% 0.5 53.9% Share of non-VEON app users 43% 13.3pp 63% -8.6pp 18% -7.1pp 0% 0.0pp 66% 32.2pp 45% 3.2pp Share of MAU app users 100% 0.0pp 100% 0.0pp 75% 3.6pp 75% 0.9pp 100% 0.0pp 79% -6.2pp User activity on mobile platform LTM Usage time (billion min) 16.0 3.5x 8.1 -35.5% 2.0 9.6% 11.7 80.7% 0.3 42% LTM # of sessions (million) 1.123 3.5x 541 -23.1% 90 4.5% 1.154 28.8% Usage time per user per day (min) 32 1.2x 14 9.7% 113 -21.3% 219 9 -6.1% Usage time per session (min) 14 -12.5% 15 -16.1% 22 4.8% 10 40.3%

54 4Q23 trading update |54 OUR SELF-SERVICE PLATFORMS Transforming into super-apps My Kyivstar JazzWorld My Beeline MyBL My Beeline My Beeline Ukraine Pakistan Kazakhstan Bangladesh Uzbekistan Kyrgyzstan FEB’2024 ACT YoY ACT YoY ACT YoY ACT YoY ACT YoY ACT YoY MAU (million) 4.1 10.3% 15.1 23.4% 4.5 17.4% 8.1 32.3% 5.0 31.1% 0.5 -17% MAU app users (million) 4.1 10.3% 15.1 23.4% 4.5 17.6% 8.1 32.3% 3.6 23.0% 0.5 -17% Penetration in total monthly active subscriber base 19.2% 2.6pp 21.4% 3.1pp 43.7% 4.4pp 23.5% 4.9pp 45.4% 8.5pp 30.5% -4.6pp App Store/Google Play rating 4.7 4.3 4.2 4.0 4.6 3.4

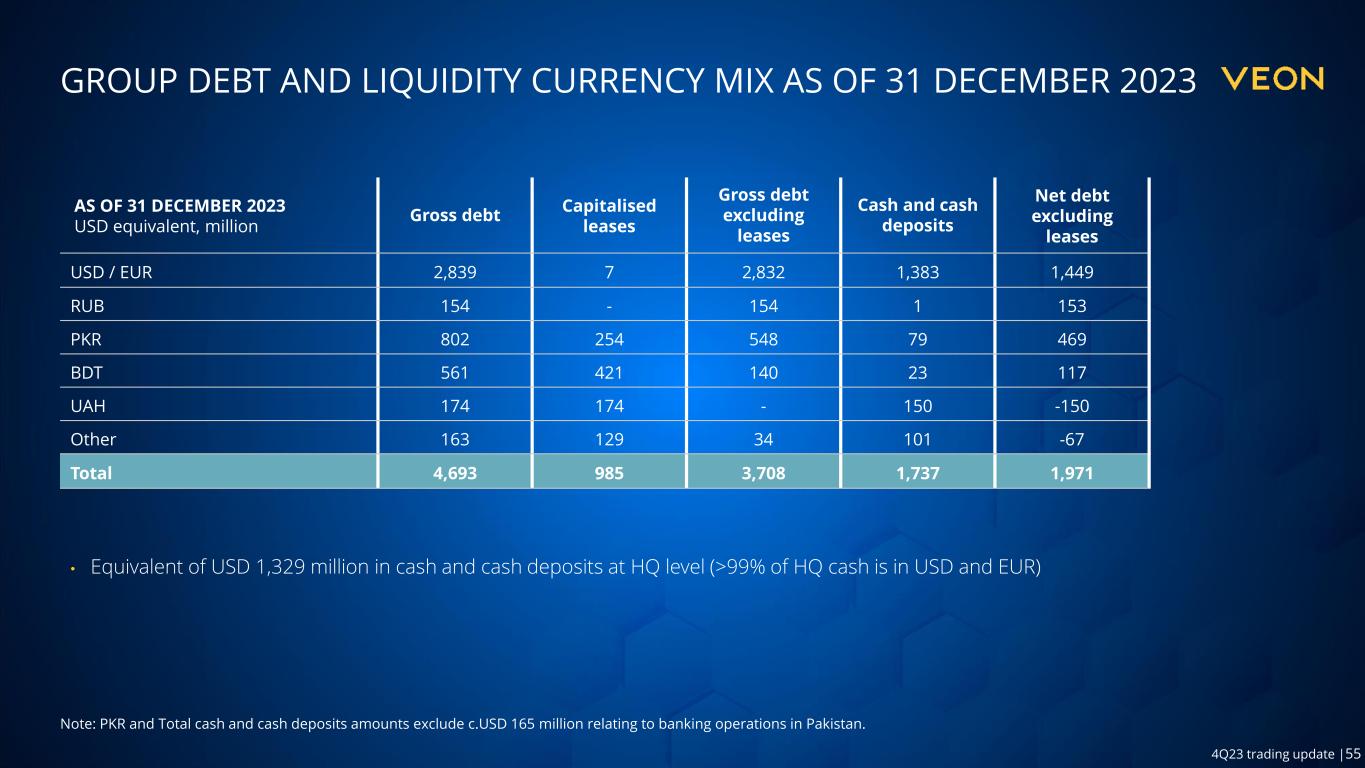

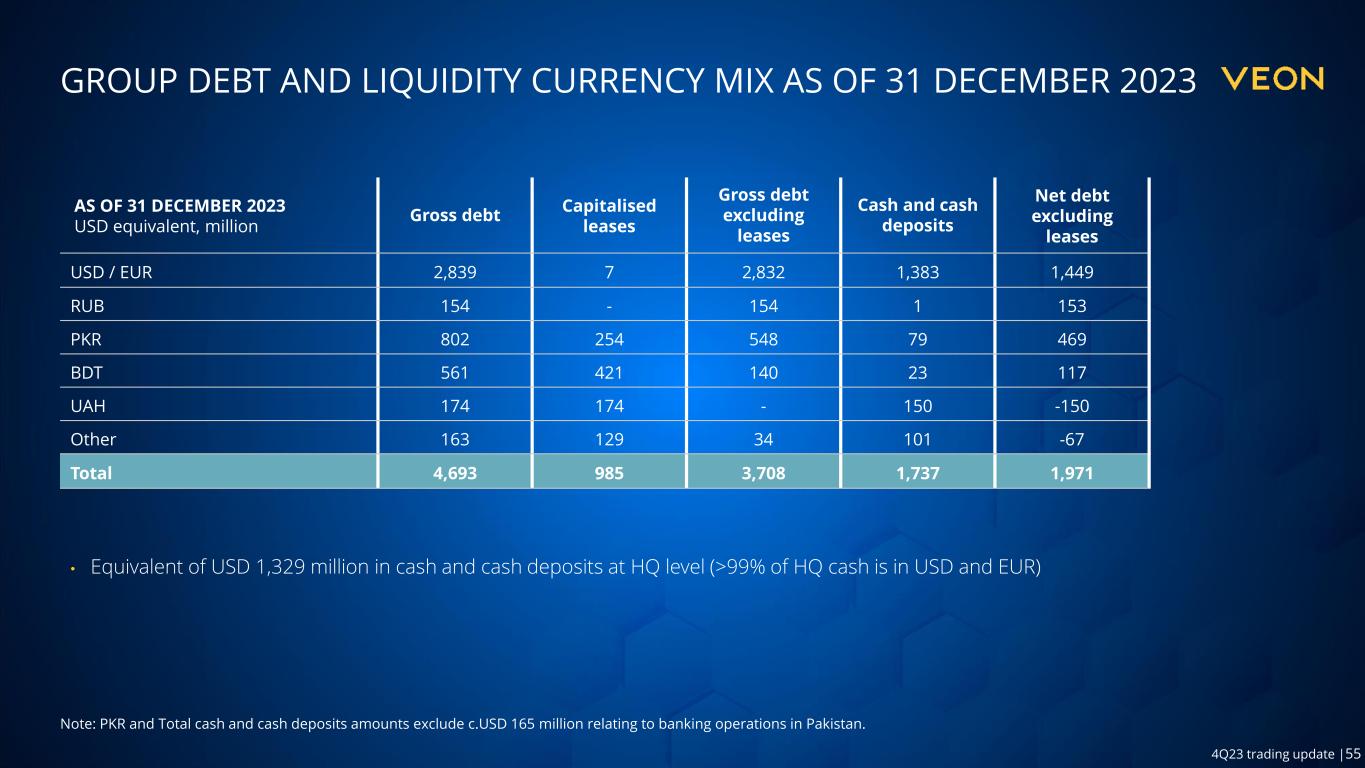

55 4Q23 trading update |55 • Equivalent of USD 1,329 million in cash and cash deposits at HQ level (>99% of HQ cash is in USD and EUR) GROUP DEBT AND LIQUIDITY CURRENCY MIX AS OF 31 DECEMBER 2023 Note: PKR and Total cash and cash deposits amounts exclude c.USD 165 million relating to banking operations in Pakistan. AS OF 31 DECEMBER 2023 USD equivalent, million Gross debt Capitalised leases Gross debt excluding leases Cash and cash deposits Net debt excluding leases USD / EUR 2,839 7 2,832 1,383 1,449 RUB 154 - 154 1 153 PKR 802 254 548 79 469 BDT 561 421 140 23 117 UAH 174 174 - 150 -150 Other 163 129 34 101 -67 Total 4,693 985 3,708 1,737 1,971

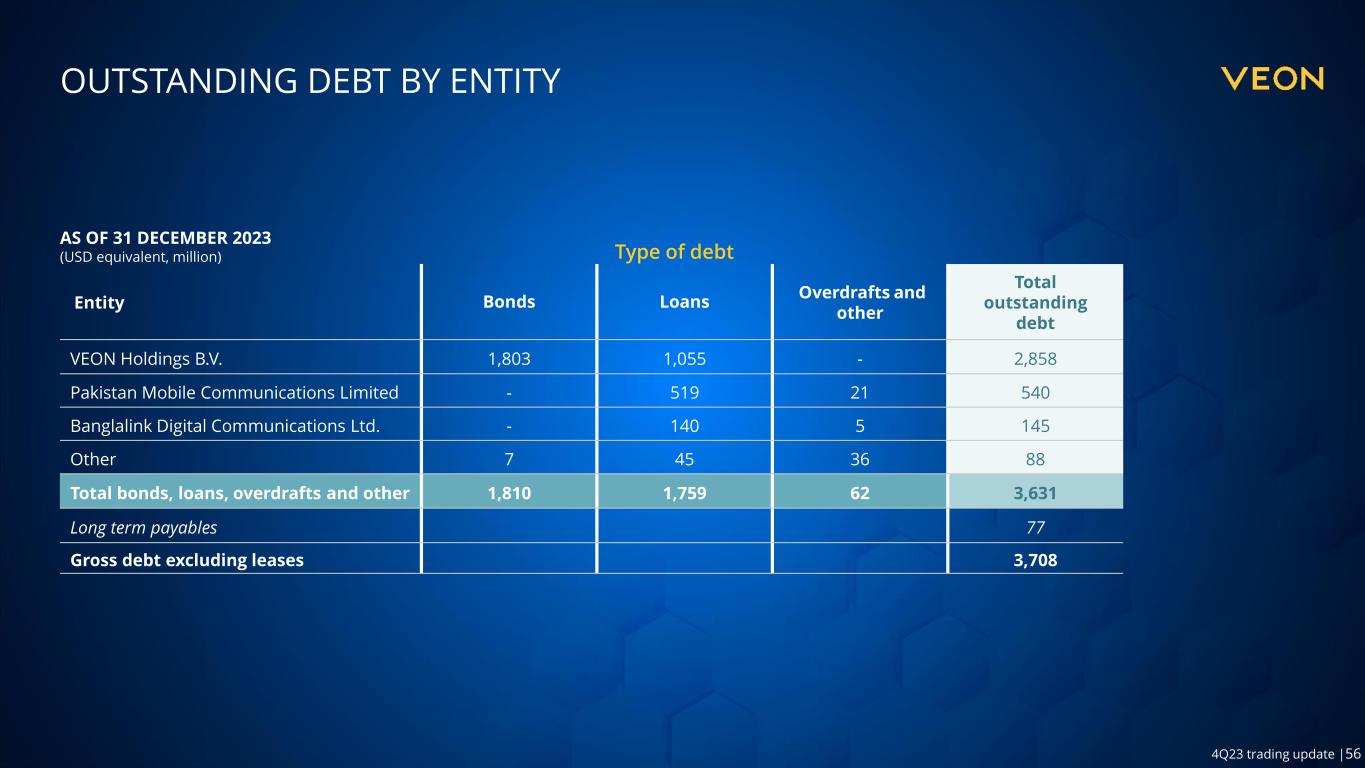

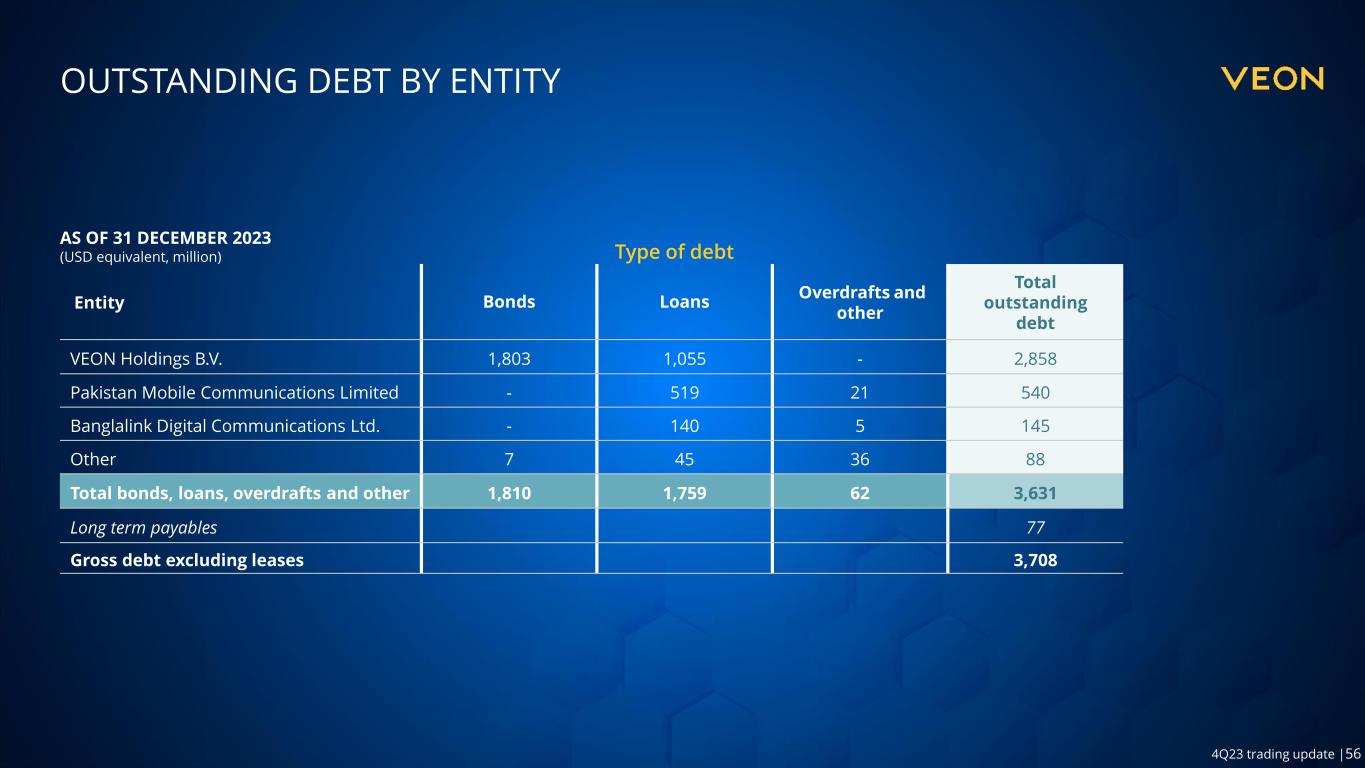

56 4Q23 trading update |56 OUTSTANDING DEBT BY ENTITY AS OF 31 DECEMBER 2023 (USD equivalent, million) Type of debt Entity Bonds Loans Overdrafts and other Total outstanding debt VEON Holdings B.V. 1,803 1,055 - 2,858 Pakistan Mobile Communications Limited - 519 21 540 Banglalink Digital Communications Ltd. - 140 5 145 Other 7 45 36 88 Total bonds, loans, overdrafts and other 1,810 1,759 62 3,631 Long term payables 77 Gross debt excluding leases 3,708

57 4Q23 trading update |57 Maturity period Mar 2024 Mar 20241 Sep 2024 2024 other Mar 2025 Mar 20251 Sep 2025 Sep 2025 2025 other Outstanding debt, USD equivalent 21 250 21 107 22 805 21 556 240 Outstanding debt, debt currency PKR 6,027 USD 250 PKR 6,027 MIX PKR 6,340 USD 805 PKR 6,027 USD 556 MIX Entity Pakistan Mobile Communications Limited VEON Holdings B.V. Pakistan Mobile Communications Limited Other Pakistan Mobile Communications Limited VEON Holdings B.V. Pakistan Mobile Communications Limited VEON Holdings B.V. Other DEBT MATURITY Debt maturity schedule 2024-2025 as of 31 December 2023 1. Assuming RCF rollover till maturity in March 2024 & March 2025 DEBT MATURITY SCHEDULE 2024-2025 (Millions) • USD 1,055 million outstanding under the RCF, can be rolled over until the final maturity of the RCF in 2024 (USD 250 million) and in 2025 (USD 805 million)

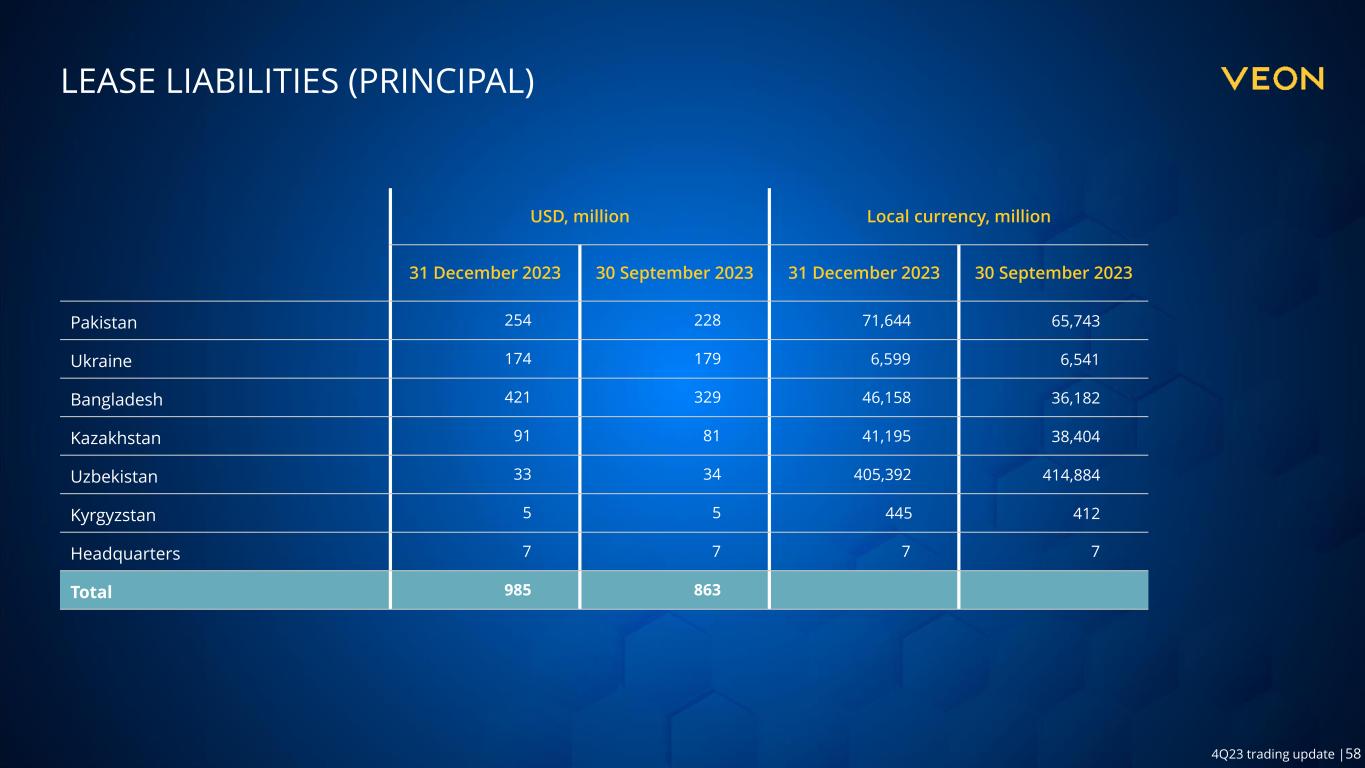

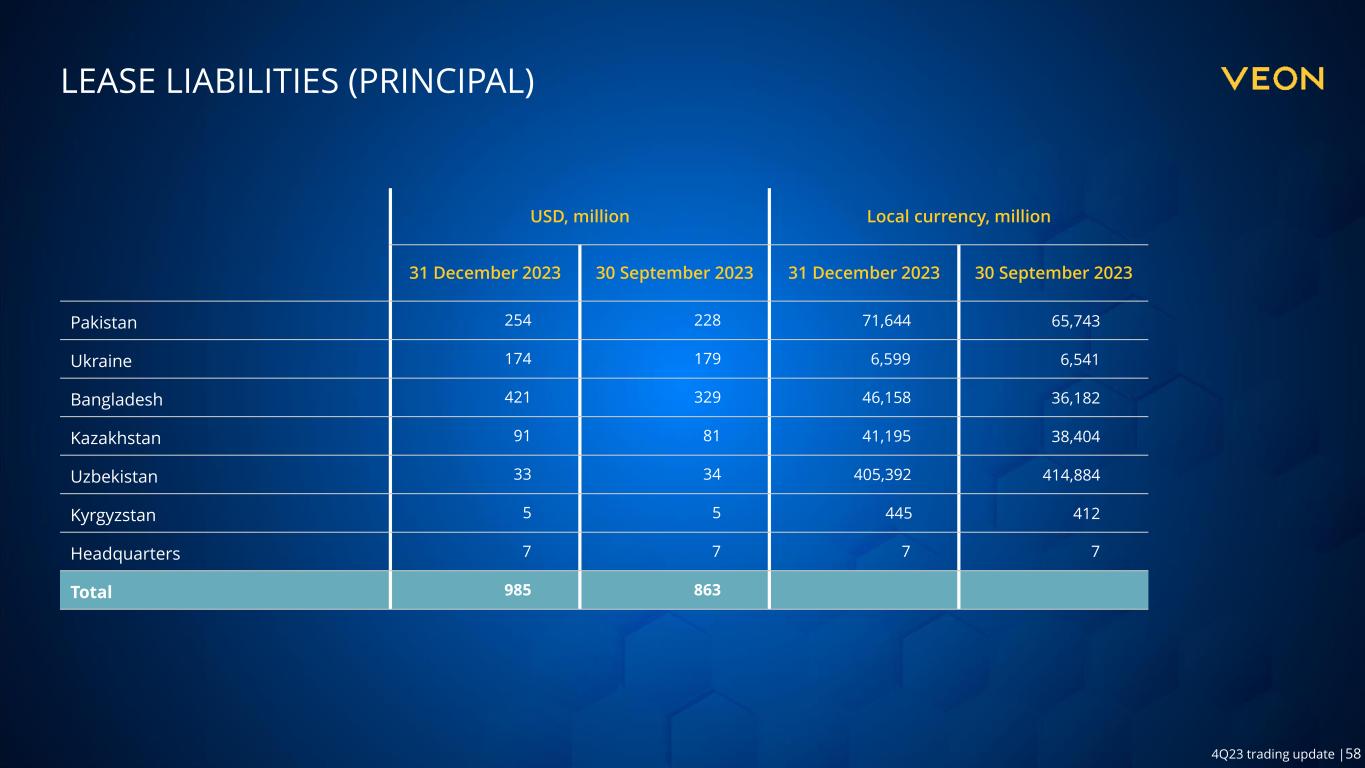

58 4Q23 trading update |58 LEASE LIABILITIES (PRINCIPAL) USD, million Local currency, million 31 December 2023 30 September 2023 31 December 2023 30 September 2023 Pakistan 254 228 71,644 65,743 Ukraine 174 179 6,599 6,541 Bangladesh 421 329 46,158 36,182 Kazakhstan 91 81 41,195 38,404 Uzbekistan 33 34 405,392 414,884 Kyrgyzstan 5 5 445 412 Headquarters 7 7 7 7 Total 985 863

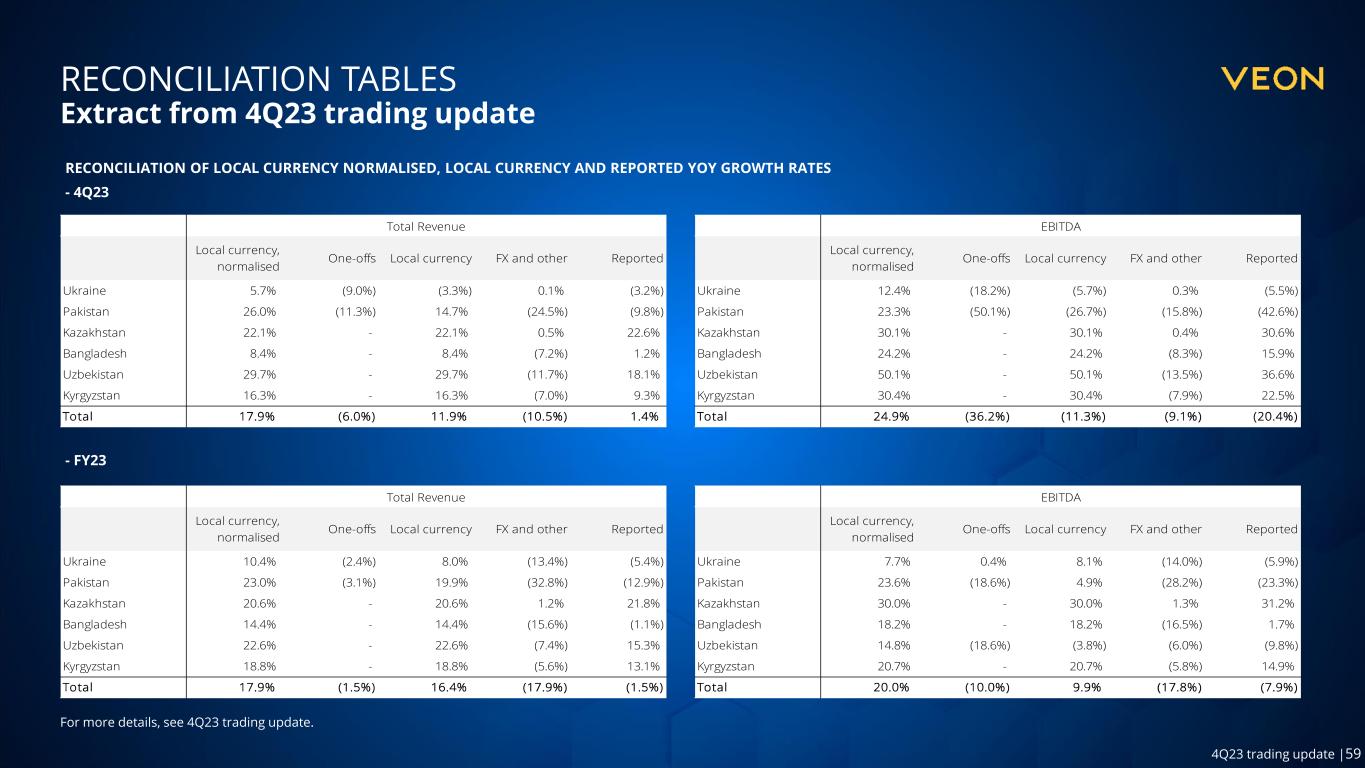

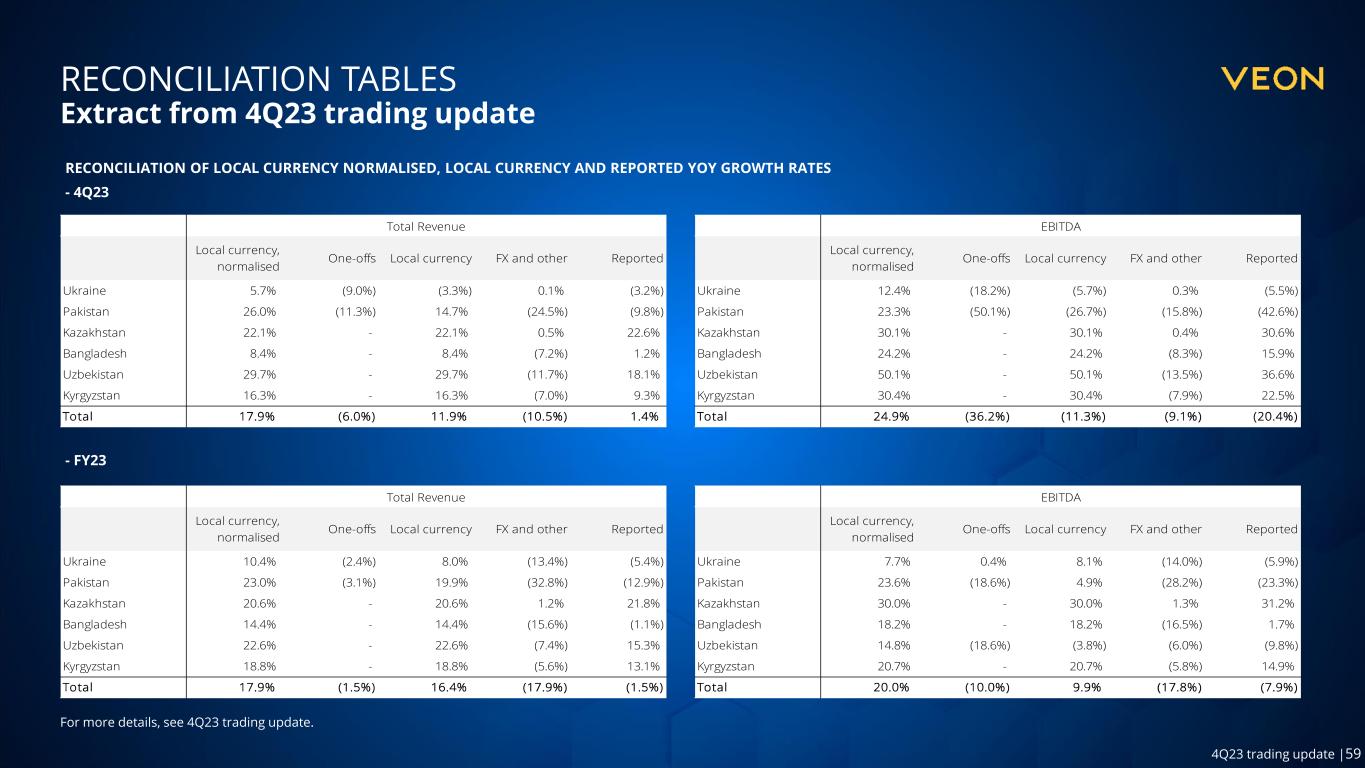

59 4Q23 trading update |59 RECONCILIATION TABLES Extract from 4Q23 trading update RECONCILIATION OF LOCAL CURRENCY NORMALISED, LOCAL CURRENCY AND REPORTED YOY GROWTH RATES - 4Q23 - FY23 Local currency, normalised One-offs Local currency FX and other Reported Ukraine 5.7% (9.0%) (3.3%) 0.1% (3.2%) Pakistan 26.0% (11.3%) 14.7% (24.5%) (9.8%) Kazakhstan 22.1% - 22.1% 0.5% 22.6% Bangladesh 8.4% - 8.4% (7.2%) 1.2% Uzbekistan 29.7% - 29.7% (11.7%) 18.1% Kyrgyzstan 16.3% - 16.3% (7.0%) 9.3% Total 17.9% (6.0%) 11.9% (10.5%) 1.4% Total Revenue Local currency, normalised One-offs Local currency FX and other Reported Ukraine 12.4% (18.2%) (5.7%) 0.3% (5.5%) Pakistan 23.3% (50.1%) (26.7%) (15.8%) (42.6%) Kazakhstan 30.1% - 30.1% 0.4% 30.6% Bangladesh 24.2% - 24.2% (8.3%) 15.9% Uzbekistan 50.1% - 50.1% (13.5%) 36.6% Kyrgyzstan 30.4% - 30.4% (7.9%) 22.5% Total 24.9% (36.2%) (11.3%) (9.1%) (20.4%) EBITDA Local currency, normalised One-offs Local currency FX and other Reported Ukraine 10.4% (2.4%) 8.0% (13.4%) (5.4%) Pakistan 23.0% (3.1%) 19.9% (32.8%) (12.9%) Kazakhstan 20.6% - 20.6% 1.2% 21.8% Bangladesh 14.4% - 14.4% (15.6%) (1.1%) Uzbekistan 22.6% - 22.6% (7.4%) 15.3% Kyrgyzstan 18.8% - 18.8% (5.6%) 13.1% Total 17.9% (1.5%) 16.4% (17.9%) (1.5%) Total Revenue Local currency, normalised One-offs Local currency FX and other Reported Ukraine 7.7% 0.4% 8.1% (14.0%) (5.9%) Pakistan 23.6% (18.6%) 4.9% (28.2%) (23.3%) Kazakhstan 30.0% - 30.0% 1.3% 31.2% Bangladesh 18.2% - 18.2% (16.5%) 1.7% Uzbekistan 14.8% (18.6%) (3.8%) (6.0%) (9.8%) Kyrgyzstan 20.7% - 20.7% (5.8%) 14.9% Total 20.0% (10.0%) 9.9% (17.8%) (7.9%) EBITDA For more details, see 4Q23 trading update.

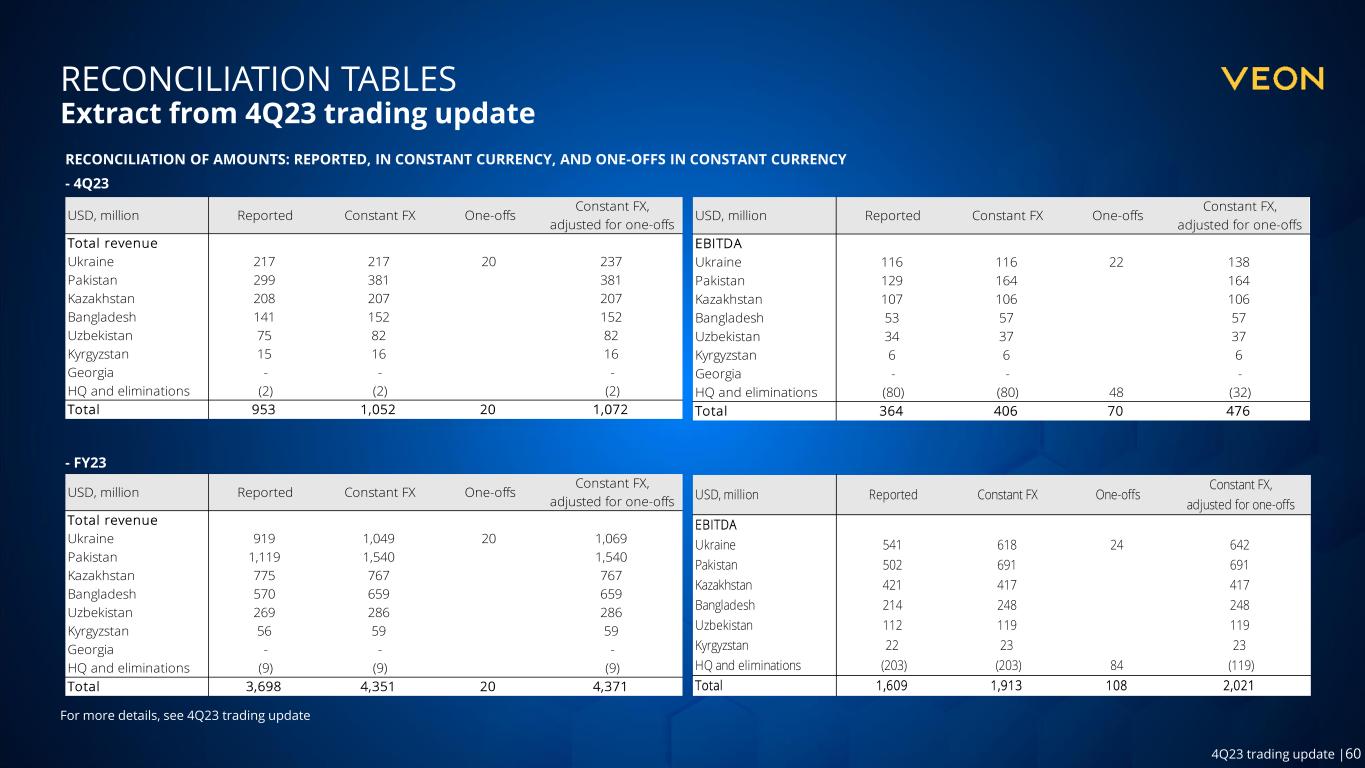

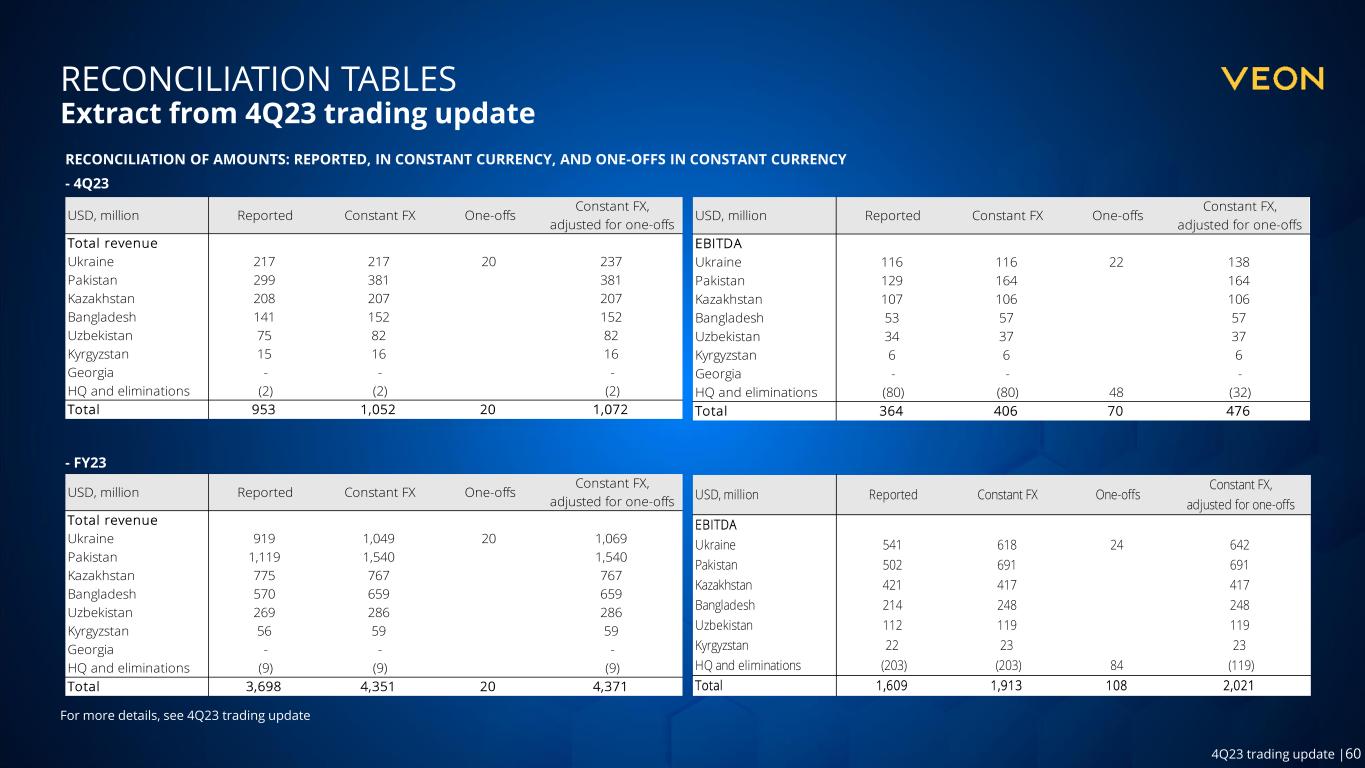

60 4Q23 trading update |60 For more details, see 4Q23 trading update RECONCILIATION OF AMOUNTS: REPORTED, IN CONSTANT CURRENCY, AND ONE-OFFS IN CONSTANT CURRENCY - 4Q23 - FY23 RECONCILIATION TABLES Extract from 4Q23 trading update USD, million Reported Constant FX One-offs Constant FX, adjusted for one-offs Total revenue Ukraine 217 217 20 237 Pakistan 299 381 381 Kazakhstan 208 207 207 Bangladesh 141 152 152 Uzbekistan 75 82 82 Kyrgyzstan 15 16 16 Georgia - - - HQ and eliminations (2) (2) (2) Total 953 1,052 20 1,072 USD, million Reported Constant FX One-offs Constant FX, adjusted for one-offs EBITDA Ukraine 116 116 22 138 Pakistan 129 164 164 Kazakhstan 107 106 106 Bangladesh 53 57 57 Uzbekistan 34 37 37 Kyrgyzstan 6 6 6 Georgia - - - HQ and eliminations (80) (80) 48 (32) Total 364 406 70 476 USD, million Reported Constant FX One-offs Constant FX, adjusted for one-offs Total revenue Ukraine 919 1,049 20 1,069 Pakistan 1,119 1,540 1,540 Kazakhstan 775 767 767 Bangladesh 570 659 659 Uzbekistan 269 286 286 Kyrgyzstan 56 59 59 Georgia - - - HQ and eliminations (9) (9) (9) Total 3,698 4,351 20 4,371 USD, million Reported Constant FX One-offs Constant FX, adjusted for one-offs EBITDA Ukraine 541 618 24 642 Pakistan 502 691 691 Kazakhstan 421 417 417 Bangladesh 214 248 248 Uzbekistan 112 119 119 Kyrgyzstan 22 23 23 HQ and eliminations (203) (203) 84 (119) Total 1,609 1,913 108 2,021

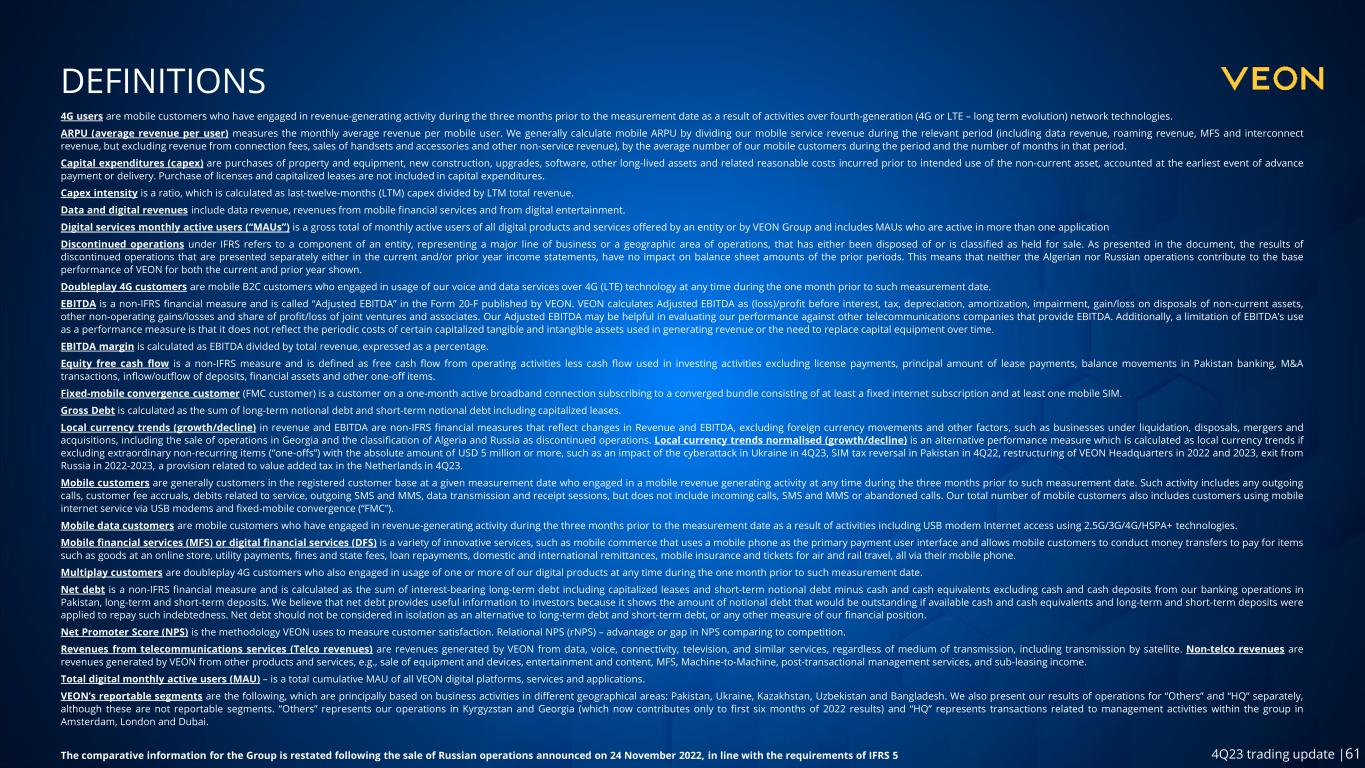

61 4Q23 trading update |61 DEFINITIONS 4G users are mobile customers who have engaged in revenue-generating activity during the three months prior to the measurement date as a result of activities over fourth-generation (4G or LTE – long term evolution) network technologies. ARPU (average revenue per user) measures the monthly average revenue per mobile user. We generally calculate mobile ARPU by dividing our mobile service revenue during the relevant period (including data revenue, roaming revenue, MFS and interconnect revenue, but excluding revenue from connection fees, sales of handsets and accessories and other non-service revenue), by the average number of our mobile customers during the period and the number of months in that period. Capital expenditures (capex) are purchases of property and equipment, new construction, upgrades, software, other long-lived assets and related reasonable costs incurred prior to intended use of the non-current asset, accounted at the earliest event of advance payment or delivery. Purchase of licenses and capitalized leases are not included in capital expenditures. Capex intensity is a ratio, which is calculated as last-twelve-months (LTM) capex divided by LTM total revenue. Data and digital revenues include data revenue, revenues from mobile financial services and from digital entertainment. Digital services monthly active users (“MAUs”) is a gross total of monthly active users of all digital products and services offered by an entity or by VEON Group and includes MAUs who are active in more than one application Discontinued operations under IFRS refers to a component of an entity, representing a major line of business or a geographic area of operations, that has either been disposed of or is classified as held for sale. As presented in the document, the results of discontinued operations that are presented separately either in the current and/or prior year income statements, have no impact on balance sheet amounts of the prior periods. This means that neither the Algerian nor Russian operations contribute to the base performance of VEON for both the current and prior year shown. Doubleplay 4G customers are mobile B2C customers who engaged in usage of our voice and data services over 4G (LTE) technology at any time during the one month prior to such measurement date. EBITDA is a non-IFRS financial measure and is called “Adjusted EBITDA” in the Form 20-F published by VEON. VEON calculates Adjusted EBITDA as (loss)/profit before interest, tax, depreciation, amortization, impairment, gain/loss on disposals of non-current assets, other non-operating gains/losses and share of profit/loss of joint ventures and associates. Our Adjusted EBITDA may be helpful in evaluating our performance against other telecommunications companies that provide EBITDA. Additionally, a limitation of EBITDA’s use as a performance measure is that it does not reflect the periodic costs of certain capitalized tangible and intangible assets used in generating revenue or the need to replace capital equipment over time. EBITDA margin is calculated as EBITDA divided by total revenue, expressed as a percentage. Equity free cash flow is a non-IFRS measure and is defined as free cash flow from operating activities less cash flow used in investing activities excluding license payments, principal amount of lease payments, balance movements in Pakistan banking, M&A transactions, inflow/outflow of deposits, financial assets and other one-off items. Fixed-mobile convergence customer (FMC customer) is a customer on a one-month active broadband connection subscribing to a converged bundle consisting of at least a fixed internet subscription and at least one mobile SIM. Gross Debt is calculated as the sum of long-term notional debt and short-term notional debt including capitalized leases. Local currency trends (growth/decline) in revenue and EBITDA are non-IFRS financial measures that reflect changes in Revenue and EBITDA, excluding foreign currency movements and other factors, such as businesses under liquidation, disposals, mergers and acquisitions, including the sale of operations in Georgia and the classification of Algeria and Russia as discontinued operations. Local currency trends normalised (growth/decline) is an alternative performance measure which is calculated as local currency trends if excluding extraordinary non-recurring items (“one-offs”) with the absolute amount of USD 5 million or more, such as an impact of the cyberattack in Ukraine in 4Q23, SIM tax reversal in Pakistan in 4Q22, restructuring of VEON Headquarters in 2022 and 2023, exit from Russia in 2022-2023, a provision related to value added tax in the Netherlands in 4Q23. Mobile customers are generally customers in the registered customer base at a given measurement date who engaged in a mobile revenue generating activity at any time during the three months prior to such measurement date. Such activity includes any outgoing calls, customer fee accruals, debits related to service, outgoing SMS and MMS, data transmission and receipt sessions, but does not include incoming calls, SMS and MMS or abandoned calls. Our total number of mobile customers also includes customers using mobile internet service via USB modems and fixed-mobile convergence (“FMC”). Mobile data customers are mobile customers who have engaged in revenue-generating activity during the three months prior to the measurement date as a result of activities including USB modem Internet access using 2.5G/3G/4G/HSPA+ technologies. Mobile financial services (MFS) or digital financial services (DFS) is a variety of innovative services, such as mobile commerce that uses a mobile phone as the primary payment user interface and allows mobile customers to conduct money transfers to pay for items such as goods at an online store, utility payments, fines and state fees, loan repayments, domestic and international remittances, mobile insurance and tickets for air and rail travel, all via their mobile phone. Multiplay customers are doubleplay 4G customers who also engaged in usage of one or more of our digital products at any time during the one month prior to such measurement date. Net debt is a non-IFRS financial measure and is calculated as the sum of interest-bearing long-term debt including capitalized leases and short-term notional debt minus cash and cash equivalents excluding cash and cash deposits from our banking operations in Pakistan, long-term and short-term deposits. We believe that net debt provides useful information to investors because it shows the amount of notional debt that would be outstanding if available cash and cash equivalents and long-term and short-term deposits were applied to repay such indebtedness. Net debt should not be considered in isolation as an alternative to long-term debt and short-term debt, or any other measure of our financial position. Net Promoter Score (NPS) is the methodology VEON uses to measure customer satisfaction. Relational NPS (rNPS) – advantage or gap in NPS comparing to competition. Revenues from telecommunications services (Telco revenues) are revenues generated by VEON from data, voice, connectivity, television, and similar services, regardless of medium of transmission, including transmission by satellite. Non-telco revenues are revenues generated by VEON from other products and services, e.g., sale of equipment and devices, entertainment and content, MFS, Machine-to-Machine, post-transactional management services, and sub-leasing income. Total digital monthly active users (MAU) – is a total cumulative MAU of all VEON digital platforms, services and applications. VEON’s reportable segments are the following, which are principally based on business activities in different geographical areas: Pakistan, Ukraine, Kazakhstan, Uzbekistan and Bangladesh. We also present our results of operations for “Others” and “HQ” separately, although these are not reportable segments. “Others” represents our operations in Kyrgyzstan and Georgia (which now contributes only to first six months of 2022 results) and “HQ” represents transactions related to management activities within the group in Amsterdam, London and Dubai. The comparative information for the Group is restated following the sale of Russian operations announced on 24 November 2022, in line with the requirements of IFRS 5