Tax Jat • ACCELERATING USD GROWTH • STRONG OPERATIONAL EXECUTION FIRST QUARTER 2024 TRADING UPDATE

Trading update 1Q24 2 LEVERAGE Net debt excl. leases to EBITDA* 1.51x NET DEBT EXCLUDING LEASES USD 2.0 billion Note: Total cash and cash equivalents does not include USD 200 million relating to banking operations in Pakistan; VEON also holds long-term sovereign bonds of USD 215 million as of 31 March 2024. * Denotes last-twelve-months (LTM) EBITDA USD 125 million CAPEX +38.6% YoY LTM capex intensity 18.3% EQUITY FREE CASHFLOW +6.3% YoY USD 112 million USD 942 million REVENUE +6.6% YoY +11.6% YoY in local currency SERVICE REVENUE +5.5% YoY +10.4% YoY in local currency TOTAL CASH AND CASH EQUIVALENTS USD 261 million at HQ USD 632 million 4G USERS +10.6% YoY 61.7% penetration 97 million TOTAL DIGITAL MONTHLY ACTIVE USERS +40.0% YoY Across all VEON digital services and platforms GROSS DEBT USD 2.0 billion lower YoY USD 3.7 billion MULTIPLAY AND DOUBLEPLAY 4G REVENUES +11.9% YoY +17.3% YoY in local currency USD 474 million USD 903 million EBITDA +0.2% YoY +5.1% YoY in local currency USD 386 million 111 million 1Q 2024 HIGHLIGHTS

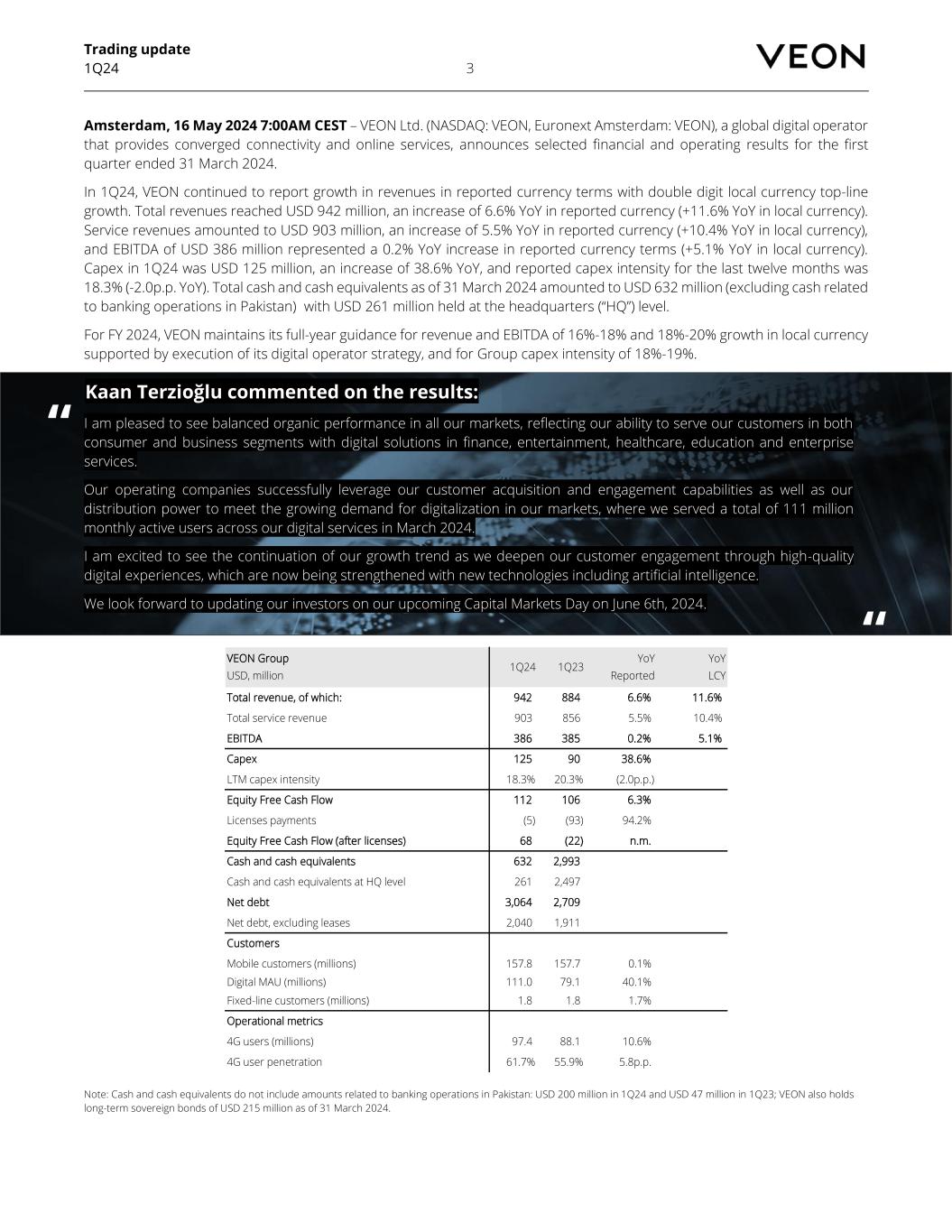

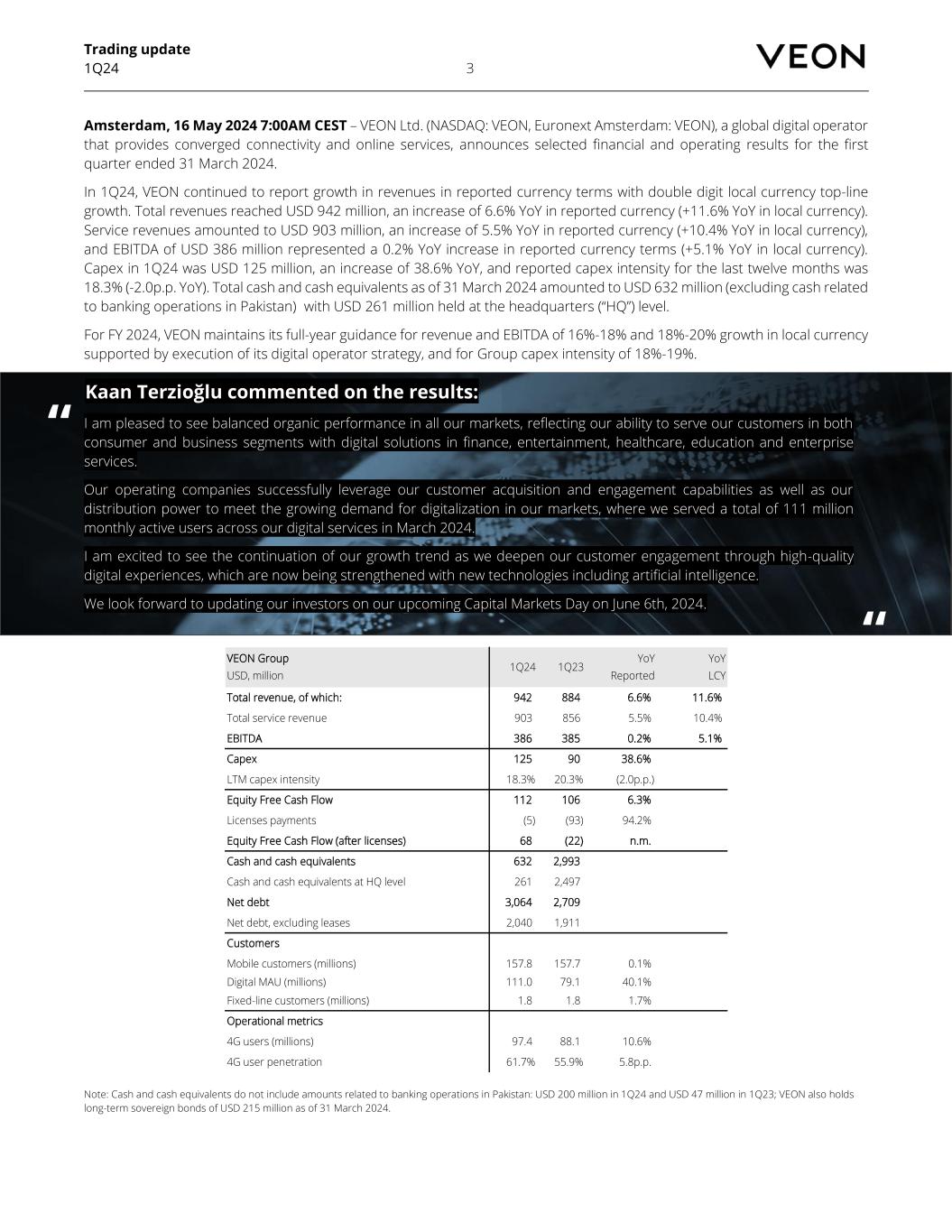

Trading update 1Q24 3 Amsterdam, 16 May 2024 7:00AM CEST – VEON Ltd. (NASDAQ: VEON, Euronext Amsterdam: VEON), a global digital operator that provides converged connectivity and online services, announces selected financial and operating results for the first quarter ended 31 March 2024. In 1Q24, VEON continued to report growth in revenues in reported currency terms with double digit local currency top-line growth. Total revenues reached USD 942 million, an increase of 6.6% YoY in reported currency (+11.6% YoY in local currency). Service revenues amounted to USD 903 million, an increase of 5.5% YoY in reported currency (+10.4% YoY in local currency), and EBITDA of USD 386 million represented a 0.2% YoY increase in reported currency terms (+5.1% YoY in local currency). Capex in 1Q24 was USD 125 million, an increase of 38.6% YoY, and reported capex intensity for the last twelve months was 18.3% (-2.0p.p. YoY). Total cash and cash equivalents as of 31 March 2024 amounted to USD 632 million (excluding cash related to banking operations in Pakistan) with USD 261 million held at the headquarters (“HQ”) level. For FY 2024, VEON maintains its full-year guidance for revenue and EBITDA of 16%-18% and 18%-20% growth in local currency supported by execution of its digital operator strategy, and for Group capex intensity of 18%-19%. VEON Group USD, million 1Q24 1Q23 YoY Reported YoY LCY Total revenue, of which: 942 884 6.6% 11.6% Total service revenue 903 856 5.5% 10.4% EBITDA 386 385 0.2% 5.1% Capex 125 90 38.6% LTM capex intensity 18.3% 20.3% (2.0p.p.) Equity Free Cash Flow 112 106 6.3% Licenses payments (5) (93) 94.2% Equity Free Cash Flow (after licenses) 68 (22) n.m. Cash and cash equivalents 632 2,993 (78.9%) Cash and cash equivalents at HQ level 261 2,497 (89.6%) Net debt 3,064 2,709 13.1% Net debt, excluding leases 2,040 1,911 6.8% Customers Mobile customers (millions) 157.8 157.7 0.1% Digital MAU (millions) 111.0 79.1 40.1% Fixed-line customers (millions) 1.8 1.8 1.7% Operational metrics 4G users (millions) 97.4 88.1 10.6% 4G user penetration 61.7% 55.9% 5.8p.p. Note: Cash and cash equivalents do not include amounts related to banking operations in Pakistan: USD 200 million in 1Q24 and USD 47 million in 1Q23; VEON also holds long-term sovereign bonds of USD 215 million as of 31 March 2024. Kaan Terzioğlu commented on the results: “ I am pleased to see balanced organic performance in all our markets, reflecting our ability to serve our customers in both consumer and business segments with digital solutions in finance, entertainment, healthcare, education and enterprise services. Our operating companies successfully leverage our customer acquisition and engagement capabilities as well as our distribution power to meet the growing demand for digitalization in our markets, where we served a total of 111 million monthly active users across our digital services in March 2024. I am excited to see the continuation of our growth trend as we deepen our customer engagement through high-quality digital experiences, which are now being strengthened with new technologies including artificial intelligence. We look forward to updating our investors on our upcoming Capital Markets Day on June 6th, 2024. “

1Q24 GROUP PERFORMANCE 5 KEY RECENT DEVELOPMENTS 7 LIQUIDITY AND CAPITAL STRUCTURE 9 COUNTRY PERFORMANCE 11 CONFERENCE CALL INFORMATION 17 PRESENTATION OF FINANCIAL RESULTS AND NONRECURRING ITEMS 18 DISCLAIMER AND NOTICE TO READERS 19 ATTACHMENTS 21 CONTENTS

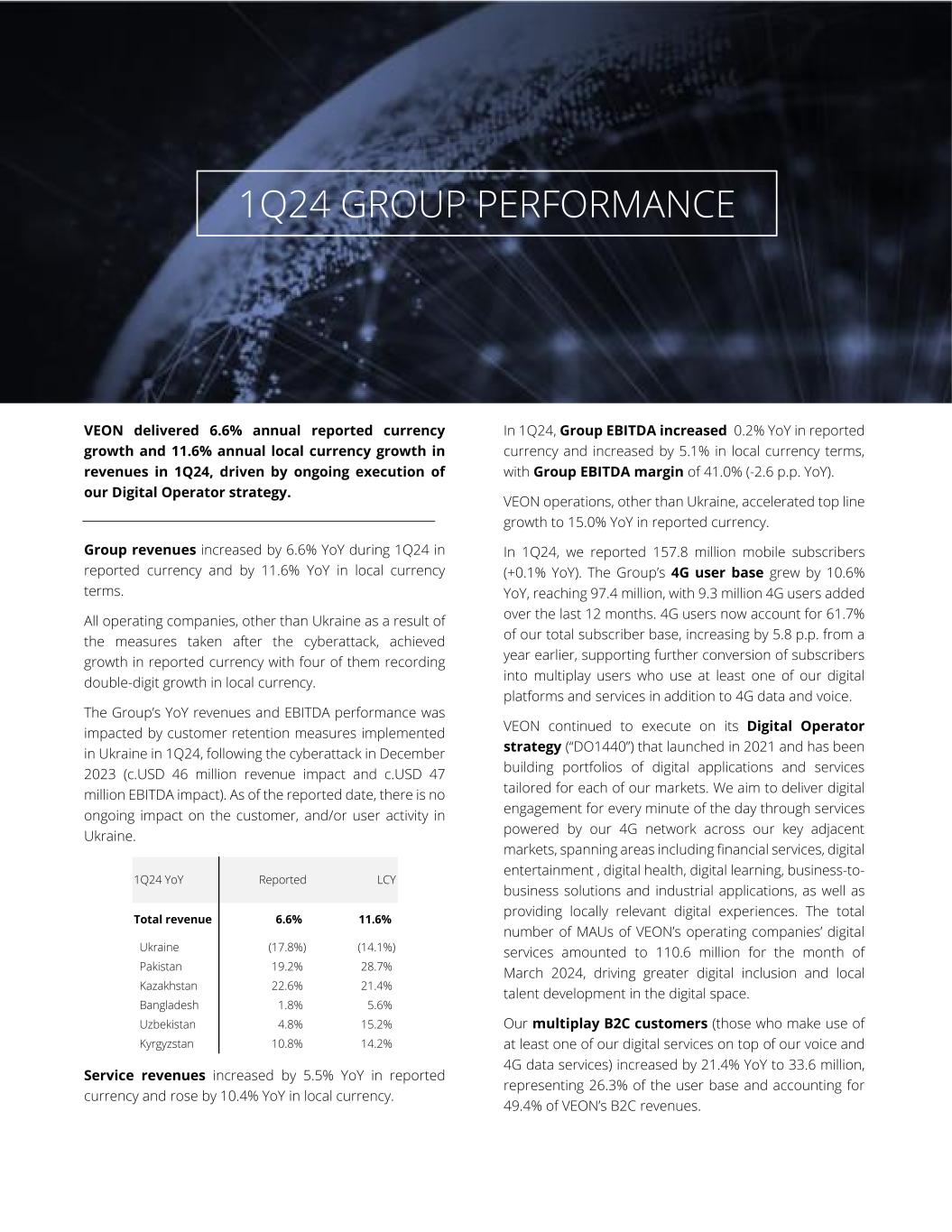

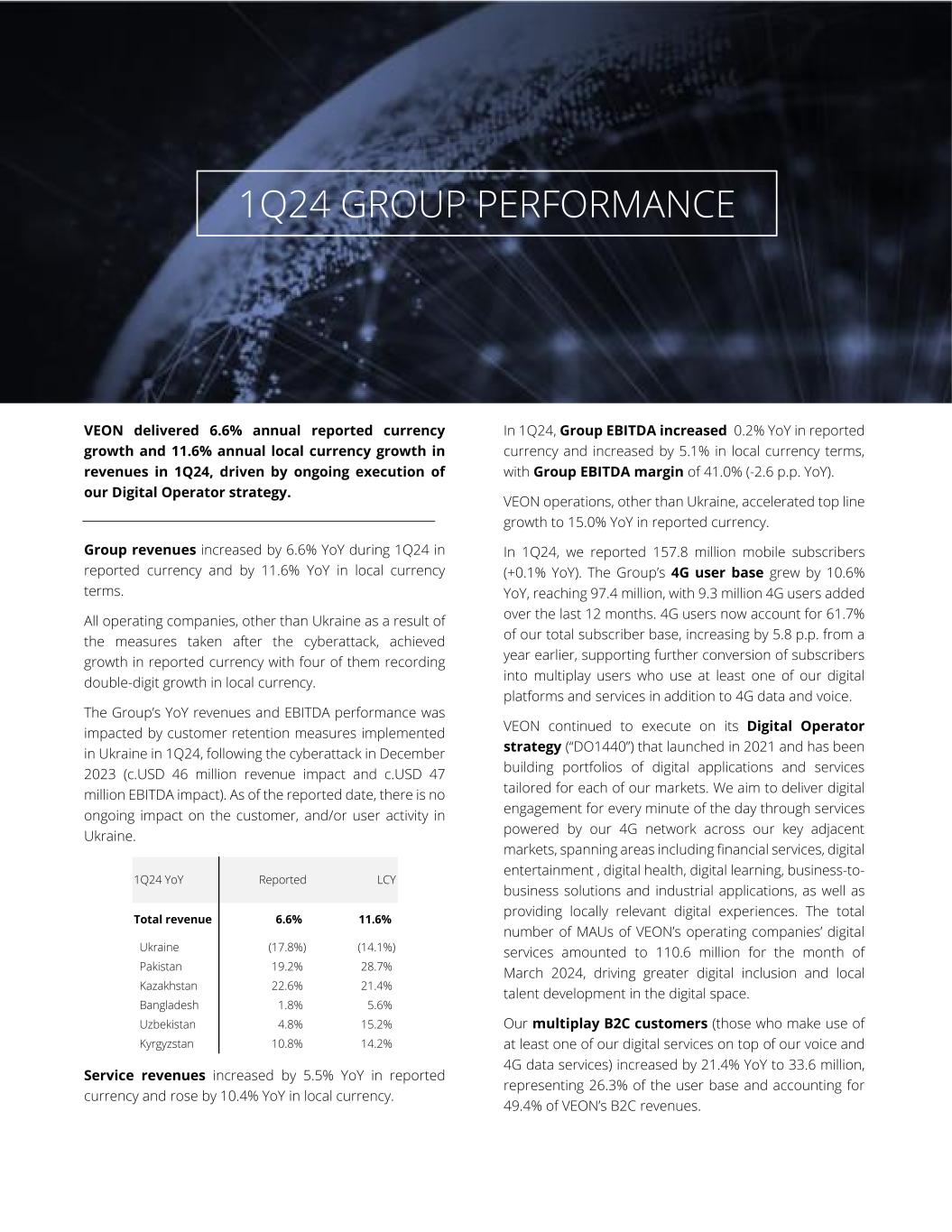

Trading update 1Q24 5 VEON delivered 6.6% annual reported currency growth and 11.6% annual local currency growth in revenues in 1Q24, driven by ongoing execution of our Digital Operator strategy. Group revenues increased by 6.6% YoY during 1Q24 in reported currency and by 11.6% YoY in local currency terms. All operating companies, other than Ukraine as a result of the measures taken after the cyberattack, achieved growth in reported currency with four of them recording double-digit growth in local currency. The Group’s YoY revenues and EBITDA performance was impacted by customer retention measures implemented in Ukraine in 1Q24, following the cyberattack in December 2023 (c.USD 46 million revenue impact and c.USD 47 million EBITDA impact). As of the reported date, there is no ongoing impact on the customer, and/or user activity in Ukraine. 1Q24 YoY Reported LCY Total revenue 6.6% 11.6% Ukraine (17.8%) (14.1%) Pakistan 19.2% 28.7% Kazakhstan 22.6% 21.4% Bangladesh 1.8% 5.6% Uzbekistan 4.8% 15.2% Kyrgyzstan 10.8% 14.2% Service revenues increased by 5.5% YoY in reported currency and rose by 10.4% YoY in local currency. In 1Q24, Group EBITDA increased 0.2% YoY in reported currency and increased by 5.1% in local currency terms, with Group EBITDA margin of 41.0% (-2.6 p.p. YoY). VEON operations, other than Ukraine, accelerated top line growth to 15.0% YoY in reported currency. In 1Q24, we reported 157.8 million mobile subscribers (+0.1% YoY). The Group’s 4G user base grew by 10.6% YoY, reaching 97.4 million, with 9.3 million 4G users added over the last 12 months. 4G users now account for 61.7% of our total subscriber base, increasing by 5.8 p.p. from a year earlier, supporting further conversion of subscribers into multiplay users who use at least one of our digital platforms and services in addition to 4G data and voice. VEON continued to execute on its Digital Operator strategy (“DO1440”) that launched in 2021 and has been building portfolios of digital applications and services tailored for each of our markets. We aim to deliver digital engagement for every minute of the day through services powered by our 4G network across our key adjacent markets, spanning areas including financial services, digital entertainment , digital health, digital learning, business-to- business solutions and industrial applications, as well as providing locally relevant digital experiences. The total number of MAUs of VEON’s operating companies’ digital services amounted to 110.6 million for the month of March 2024, driving greater digital inclusion and local talent development in the digital space. Our multiplay B2C customers (those who make use of at least one of our digital services on top of our voice and 4G data services) increased by 21.4% YoY to 33.6 million, representing 26.3% of the user base and accounting for 49.4% of VEON’s B2C revenues. 1Q24 GROUP PERFORMANCE IGHLIGHTS:

Trading update 1Q24 6 Multiplay B2C customer ARPU is 3.9x higher, and churn is 2.2x lower, than for voice-only B2C customers. Multiplay ARPU levels in each of our operating companies, excluding Ukraine, increased at rates ranging from 4% to 47% YoY in 1Q24 in local currency terms. Through digital entertainment applications, VEON Group’s digital operators aim to meet the rising demand in their respective markets for locally relevant content, delivered with a superior digital experience. These applications support not only local content creators but also increasingly provide viable avenues for advertisers who want to reach the young and digitally savvy audiences of the Group’s digital applications. Our media streaming services, including Toffee in Bangladesh and Tamasha in Pakistan, remain important drivers for growth in our multiplay customer base. Toffee had 9.2 million MAUs (-21.2% YoY), while Tamasha in Pakistan reached 12.0 million MAUs, representing a 2.1- fold YoY increase. For Toffee, YoY comparison in MAU is distorted is distorted by the introduction of a paywall for sports which was not in place in 1Q23. Our digital financial services business in Pakistan, JazzCash, reported 17.2 million MAUs (+17.7% YoY) and increased its 12-month total transaction volume by 47.1% YoY. In 1Q24, Group capex was USD 125.1 million (+38.6% YoY) with capex intensity for the last twelve months of 18.3% (-2.0 p.p. YoY). We closed the first quarter of 2024 with total cash and cash equivalents of USD 632 million (a decrease from USD1,738 million at December 2023 following the USD 1,055 million RCF repayment in the quarter), excluding banking operations in Pakistan, with USD 261 million at the HQ level. Our local operations remain self-funded. In Ukraine, the team continued to focus on keeping the country connected despite the cyberattack in December 2023. Nearly 100% of our radio network is operational at the end of the quarter. Kyivstar’s revenues decreased 14.1% YoY in local currency (-17.8% YoY in reported currency). Kyivstar’s 4G customer base grew 8.9% YoY, with data usage rising 3.8% YoY per user. EBITDA decreased by 26.3% YoY in local currency terms (-29.6% YoY in reported currency) despite ongoing operational cost pressures in 1Q24, including electricity and fuel costs, and continued charitable donations, as well as staff and customer support programs. Pakistan revenues rose 28.7% YoY in local currency (+19.2% YoY in reported currency), a strong result with an improving macroeconomic environment. Jazz grew its 4G users (+6.7% YoY), ARPU (+30.3% YoY) and data usage (+24.5% YoY) in 1Q24. EBITDA increased by 27.1% YoY in local currency terms (+17.8% YoY in reported currency). In Kazakhstan, revenues increased 21.4% YoY in local currency terms (+22.6% YoY in reported currency). This was driven by the further expansion of our mobile customer base (+5.7% YoY) , 4G user growth (+16.2% YoY), increased data usage (+7.2% YoY) that supported ARPU expansion (+18.4% YoY). EBITDA rose by 27.8% YoY in local currency terms (+29.1% YoY in reported currency). In Bangladesh, Banglalink’s revenues increased 5.6% YoY in local currency (+1.8% YoY in reported currency) supported by the growth of its customer base. The operator’s nationwide network expansion supported 23.1% YoY growth in 4G users. Banglalink continued to deliver joint growth in its subscriber base, which increased +6.0% YoY, as well as a stable ARPU (-0.6% YoY). In 1Q24, EBITDA for Banglalink decreased by 9.4% YoY in local currency (-12.6% YoY in reported currency) primarily due to higher electricity tariffs, costs related to the network expansion, and a one-off charge related to the sale of towers. In Uzbekistan, revenues increased by 15.2% YoY in local currency (+4.8% YoY in reported currency), for the eleventh consecutive quarter of double-digit YoY revenue growth. This was driven by a 6.2% YoY expansion of the 4G subscriber base, which now represents 74% of total customers, and robust growth in ARPU and data usage. EBITDA decreased by 4.8% YoY in local currency (-13.4% YoY in reported currency) in 1Q24 due to investment in AdTech. As we deliver on our Digital Operator strategy targets across the Group, we maintain our guidance for 2024 local currency revenue growth of 16%-18%, and for 2024 local currency EBITDA growth of 18%- 20%, on a normalized basis. VEON’s 2024 outlook for the Group’s capex intensity is in the range of 18%- 19%.

VEON and Beeline Kazakhstan partner with GSMA and Barcelona Supercomputing Centre to support use of AI in local languages On 15 May 2024, VEON announced that it has signed a Memorandum of Understanding (“MoU”) with Beeline Kazakhstan, the GSMA and the Barcelona Supercomputing Centre - Centro Nacional de Supercomputacion (“BSC- CNS”) to explore collaboration on the development of artificial intelligence and language technologies for languages with low digital resources. The parties will explore collaboration opportunities focusing on the development of mechanisms and documentation on language models and AI systems for under-resourced languages, including the local languages of the countries where VEON operates. Streaming ICC cricket tournaments in 2024 and 2025 in Pakistan and Bangladesh On 14 May 2024, VEON announced that Tamasha, its leading digital entertainment platform in Pakistan, has secured digital streaming rights for all major International Cricket Council’s (“ICC”) tournaments throughout 2024 and 2025. Tamasha, Pakistan’s largest homegrown OTT platform with more than 60 million unique viewers over the past year, will digitally broadcast the ICC Men's T20 World Cup 2024, ICC Champions Trophy 2025, ICC Men’s Test Championship, and all Women ICC events. On 26 April 2024, VEON announced that Banglalink, its digital operator in Bangladesh, secured the exclusive rights to the nation-wide streaming of ICC world events until the end of 2025. The ICC matches will be available on Toffee streaming platform, commencing with the ICC Men’s T20 World Cup on 1 June 2024. VEON’s Banglalink leads 3G phase-out, deepening its focus on 4G On 9 May 2024, VEON announced that its digital operator Banglalink has become the first in Bangladesh to phase out 3G services, as part of its strategy to enhance 4G performance throughout the country through reallocation of network resources. The 3G phase out follows extensive investment by Banglalink in next generation 4G networks to provide high- quality nationwide connectivity and accelerate the use of digital services. Banglalink’s 4G subscriber base have grown from 8.0 million at the end of 2020 to 21.5 million at the end of the first quarter of 2024, while its population coverage in 4G increased from 60% to 88% in the same period. VEON launches consent solicitation process On 7 May 2024, VEON Holdings B.V. announced that its April 2025 USD noteholders and its November 2027 USD noteholders have consented to certain proposals in respect of its notes, most notable being to extend the deadline for provision of audited financial statements for the years 2023 and 2024 and that no further payments of principal or interest (including any Accrued Interest) will be made on the notes of the relevant series which remain outstanding (further details of the consents are set out in VEON Holdings B.V.’s Notice of Meetings dated 18 April 2024). VEON Holdings B.V. will issue new notes to the April 2025 and November 2027 noteholders who participated in the consent process. VEON Holdings B.V. further announced the adjourned meeting for the June 2025 and September 2026 RUB notes as it did not achieve quorum in the first noteholder meetings; lastly VEON Holdings B.V. announced and that in respect of the September 2025 RUB notes the consent has not passed. Sukuk in Pakistan On 30 April 2024, VEON’s subsidiary Jazz announced that it completed its PKR 15 billion (c.USD 50 million) Sukuk issuance of Islamic financial certificates, similar to bonds, KEY RECENT DEVELOPMENTS IGHLIGHTS:

Trading update 1Q24 8 that comply with Shariah principles. This transaction marks the first ever and largest short term unsecured Sukuk by a telecom operator in Pakistan. This will pave way to an entirely new funding avenue for Jazz to fund its 4G for all digital ambitions. This Sukuk issue will also contribute to the increased utilization of Shariah-compliant financial instruments in Pakistan’s capital markets. VEON announces 2024 AGM and Board nominees On 24 April 2024, VEON announced that its Board of Directors (“Board”) has set the date for the Company’s 2024 Annual General Meeting of Shareholders (the “AGM”) for 31 May 2024. The record date for the AGM has been set for 25 April 2024. VEON management increases share ownership On 12 April 2024, VEON announced an increase in management’s ownership of VEON shares through awards under its existing equity incentive-based compensation plans. VEON is utilising certain of the 92,459,532 common shares issued to VEON Holdings B.V., announced on 1 March 2024, to satisfy the awards made. Figures represent the ADS equivalents of VEON common shares awarded: STI 20231 Project Award2 Special Award3 LTI 2024 Award4 Kaan Terzioglu 57,248 240,169 Joop Brakenhoff 10,515 8,778 2,102 95,913 Omiyinka Doris 5,832 7,524 82,211 In connection with the above-mentioned share awards, VEON’s Group Executive Committee (“GEC”) received a total of 2,299,995 VEON common shares (equal to 91,999 VEON American Depositary Shares (“ADSs”)) within the scope of the VEON’s Deferred Share plans, and the GEC were granted a total of 10,457,359 VEON common shares (equal to 418,294 ADSs) as a part of the LTI plans. The grant amounts set out in the table above reflect the net award amounts transferred to each of the GEC members after deducting shares to cover withholding taxes (as applicable), save for the LTI 2024 awards which are unvested and reflect the gross award amounts. 1 The Short-Term Incentives (“STI”) 2023 share awards were granted as part of VEON’s Deferred Share Plan. The Deferred Share grant, which represents 50% of the STI scheme, relates to the period from 1 January 2023 to 31 December 2023 and is deferred into shares under the Deferred Share grant rules. The shares vested immediately and are required to be held for period of two years from 16 February 2024. 2 A ‘Project Award’ was granted as part of VEON’s Deferred Share Plan to Joop Brakenhoff and Omiyinka Doris for their contributions to successfully As previously announced, GEC members are required to accrue and maintain a minimum level of VEON shares. This will be equivalent to 6.0x the annual base salary for the Group CEO and 2.0x the annual base salary for the other GEC members. VEON pays back outstanding balance and cancels its Revolving Credit Facility On 28 March 2024, VEON announced that it repaid in full the outstanding balance of USD 805 million (principal, excluding accrued interest), preceded by an earlier payment of USD 250 million, under its revolving credit facility (“RCF”) and cancelled the RCF. The repayment of the outstanding amount and the cancellation of the RCF will reduce VEON’s interest expenses, in line with our effective cash and balance sheet management practices. VEON announces sale of its stake in Beeline Kyrgyzstan On 26 March 2024, VEON announced that it signed an agreement for the sale of its 50.1% indirect stake in Beeline Kyrgyzstan to CG Cell Technologies, which is wholly owned by CG Corp Global. The sale is a part of VEON’s strategy to simplify the Group’s structure and focus on its markets where it can create scale with its DO1440 digital operator model by providing digital services in finance, entertainment, healthcare and education. The transaction values Beeline Kyrgyzstan’s business at 3.4x 2023 EBITDA (pre-IFRS16). Completion of the sale of VEON’s stake in Beeline Kyrgyzstan, which is held by VIP Kyrgyzstan Holding AG, to CG Cell Technologies Designated Activity Company is subject to relevant regulatory approvals. As of 31 March 2024 the net assets of the Kyrgyzstan operations have been classified as assets held for sale. completing a key project. The shares vested immediately and are required to be held for one year from 5 March 2024. 3 A ‘Special Award’ was granted to GEC member, Joop Brakenhoff, as part of VEON’s Deferred Share Plan granted in December 2021 and is now fully vested. 4 The Long-Term Incentive (“LTI”) 2024 share grant is awarded in relation to the three-year period from 1 January 2024 to 31 December 2026. The vesting of these shares is linked to the relative TSR performance to VEON’s peer group which will be assessed at the end of the plan period.

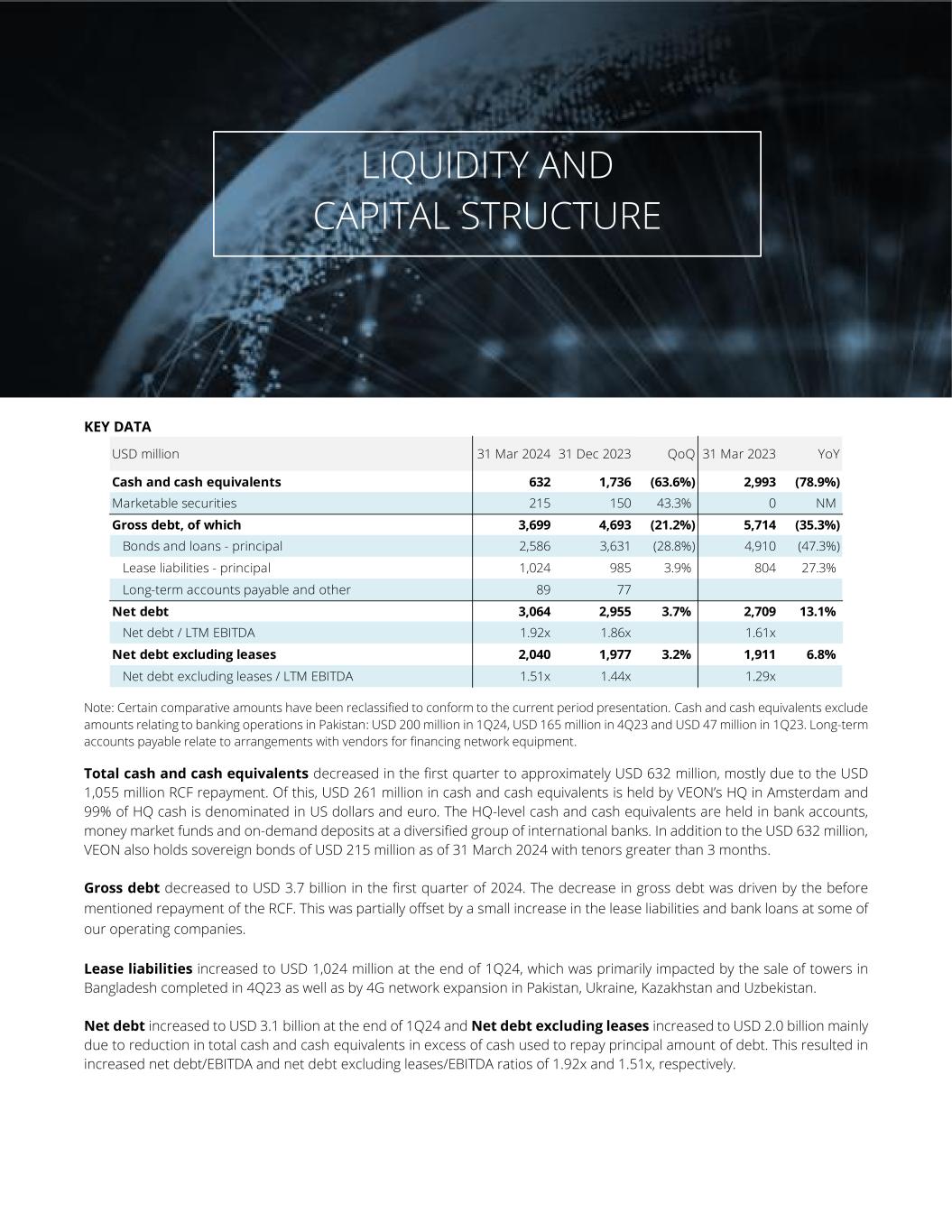

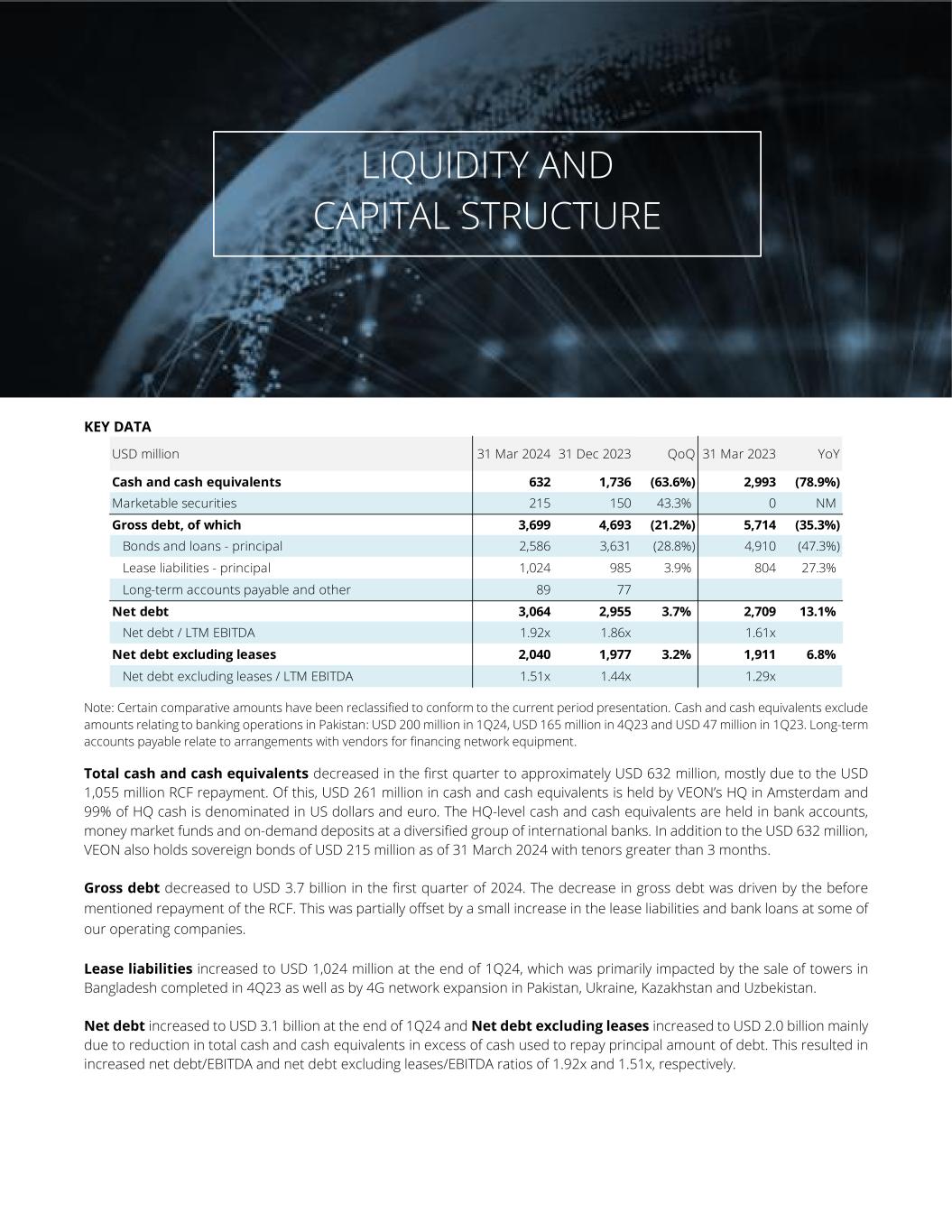

Trading update 1Q24 9 KEY DATA USD million 31 Mar 2024 31 Dec 2023 QoQ 31 Mar 2023 YoY Cash and cash equivalents 632 1,736 (63.6%) 2,993 (78.9%) Marketable securities 215 150 43.3% 0 NM Gross debt, of which 3,699 4,693 (21.2%) 5,714 (35.3%) Bonds and loans - principal 2,586 3,631 (28.8%) 4,910 (47.3%) Lease liabilities - principal 1,024 985 3.9% 804 27.3% Long-term accounts payable and other 89 77 Net debt 3,064 2,955 3.7% 2,709 13.1% Net debt / LTM EBITDA 1.92x 1.86x 1.61x Net debt excluding leases 2,040 1,977 3.2% 1,911 6.8% Net debt excluding leases / LTM EBITDA 1.51x 1.44x 1.29x Note: Certain comparative amounts have been reclassified to conform to the current period presentation. Cash and cash equivalents exclude amounts relating to banking operations in Pakistan: USD 200 million in 1Q24, USD 165 million in 4Q23 and USD 47 million in 1Q23. Long-term accounts payable relate to arrangements with vendors for financing network equipment. Total cash and cash equivalents decreased in the first quarter to approximately USD 632 million, mostly due to the USD 1,055 million RCF repayment. Of this, USD 261 million in cash and cash equivalents is held by VEON’s HQ in Amsterdam and 99% of HQ cash is denominated in US dollars and euro. The HQ-level cash and cash equivalents are held in bank accounts, money market funds and on-demand deposits at a diversified group of international banks. In addition to the USD 632 million, VEON also holds sovereign bonds of USD 215 million as of 31 March 2024 with tenors greater than 3 months. Gross debt decreased to USD 3.7 billion in the first quarter of 2024. The decrease in gross debt was driven by the before mentioned repayment of the RCF. This was partially offset by a small increase in the lease liabilities and bank loans at some of our operating companies. Lease liabilities increased to USD 1,024 million at the end of 1Q24, which was primarily impacted by the sale of towers in Bangladesh completed in 4Q23 as well as by 4G network expansion in Pakistan, Ukraine, Kazakhstan and Uzbekistan. Net debt increased to USD 3.1 billion at the end of 1Q24 and Net debt excluding leases increased to USD 2.0 billion mainly due to reduction in total cash and cash equivalents in excess of cash used to repay principal amount of debt. This resulted in increased net debt/EBITDA and net debt excluding leases/EBITDA ratios of 1.92x and 1.51x, respectively. LIQUIDITY AND CAPITAL STRUCTURE

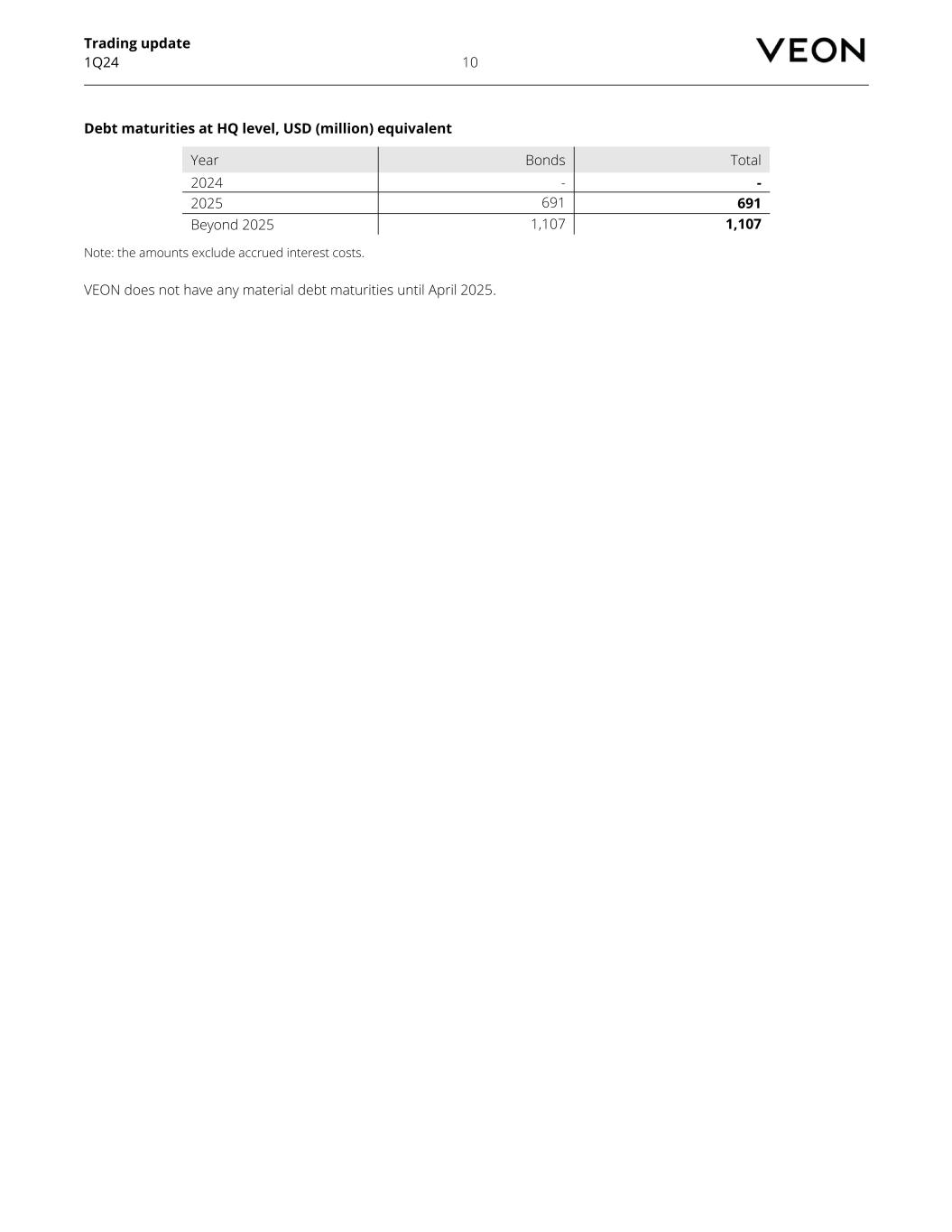

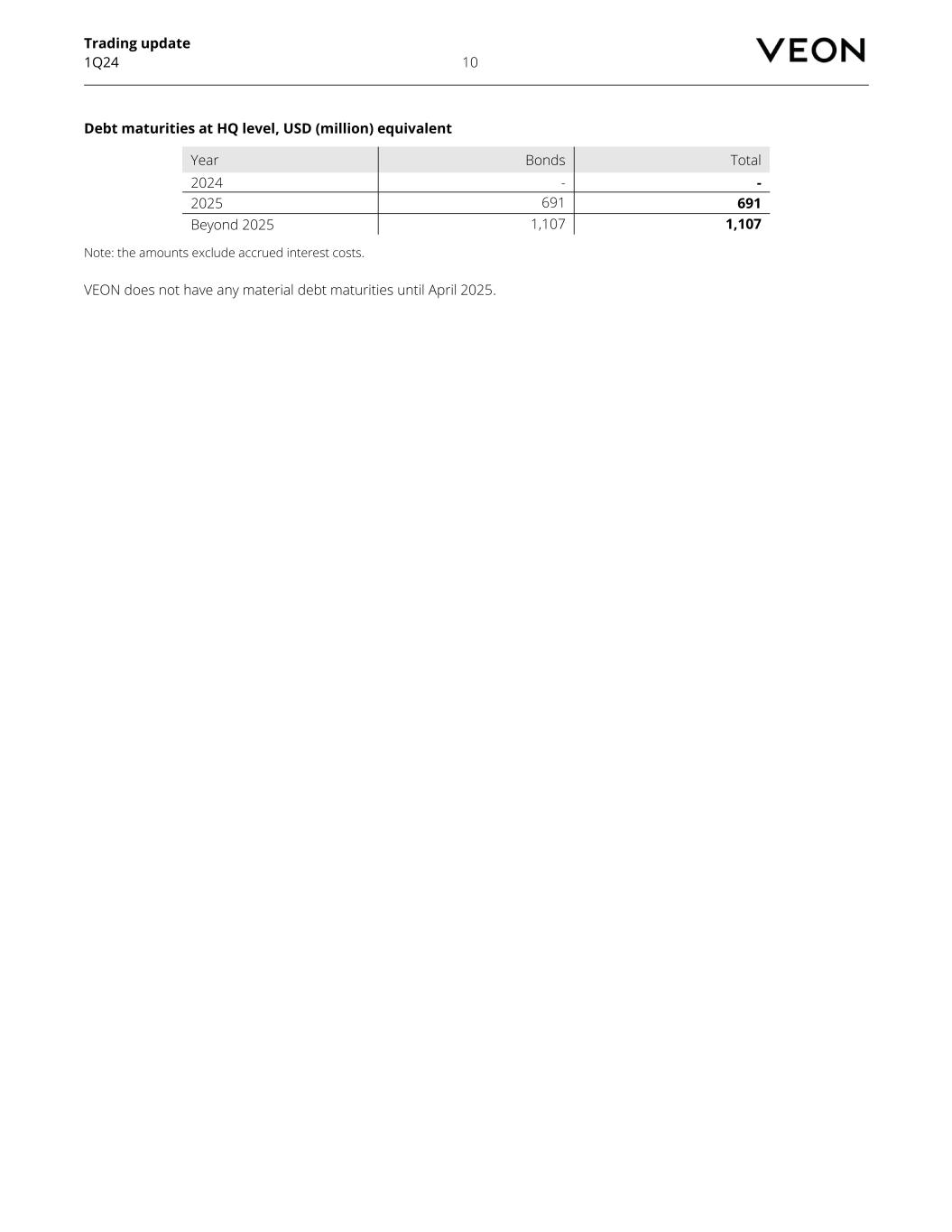

Trading update 1Q24 10 Debt maturities at HQ level, USD (million) equivalent Year Bonds Total 2024 - - 2025 691 691 Beyond 2025 1,107 1,107 Note: the amounts exclude accrued interest costs. VEON does not have any material debt maturities until April 2025.

Trading update 1Q24 11 KEY FIGURES BY COUNTRIES USD million 1Q24 1Q23 YoY reported YoY LCY Total revenue 942 884 6.6% 11.6% Ukraine 188 228 (17.8%) (14.1%) Pakistan 321 269 19.2% 28.7% Kazakhstan 214 175 22.6% 21.4% Bangladesh 141 138 1.8% 5.6% Uzbekistan 67 63 4.8% 15.2% Kyrgyzstan 14 13 10.8% 14.2% HQ and eliminations (2) (2) 31.4% Service revenue 903 856 5.5% 10.4% Ukraine 185 227 (18.3%) (14.6%) Pakistan 291 250 16.5% 25.7% Kazakhstan 209 169 23.4% 22.2% Bangladesh 139 136 2.4% 6.2% Uzbekistan 66 63 4.6% 15.1% Kyrgyzstan 14 13 10.5% 13.9% HQ and eliminations (2) (2) 24.0% EBITDA 386 385 0.2% 5.1% Ukraine 95 135 (29.6%) (26.3%) Pakistan 143 122 17.8% 27.1% Kazakhstan 118 92 29.1% 27.8% Bangladesh 44 50 (12.6%) (9.4%) Uzbekistan 24 28 (13.4%) (4.8%) Kyrgyzstan 5 5 5.1% 8.4% HQ and eliminations (44) (46) 4.9% EBITDA margin 41.0% 43.6% (2.6p.p.) COUNTRY PERFORMANCE

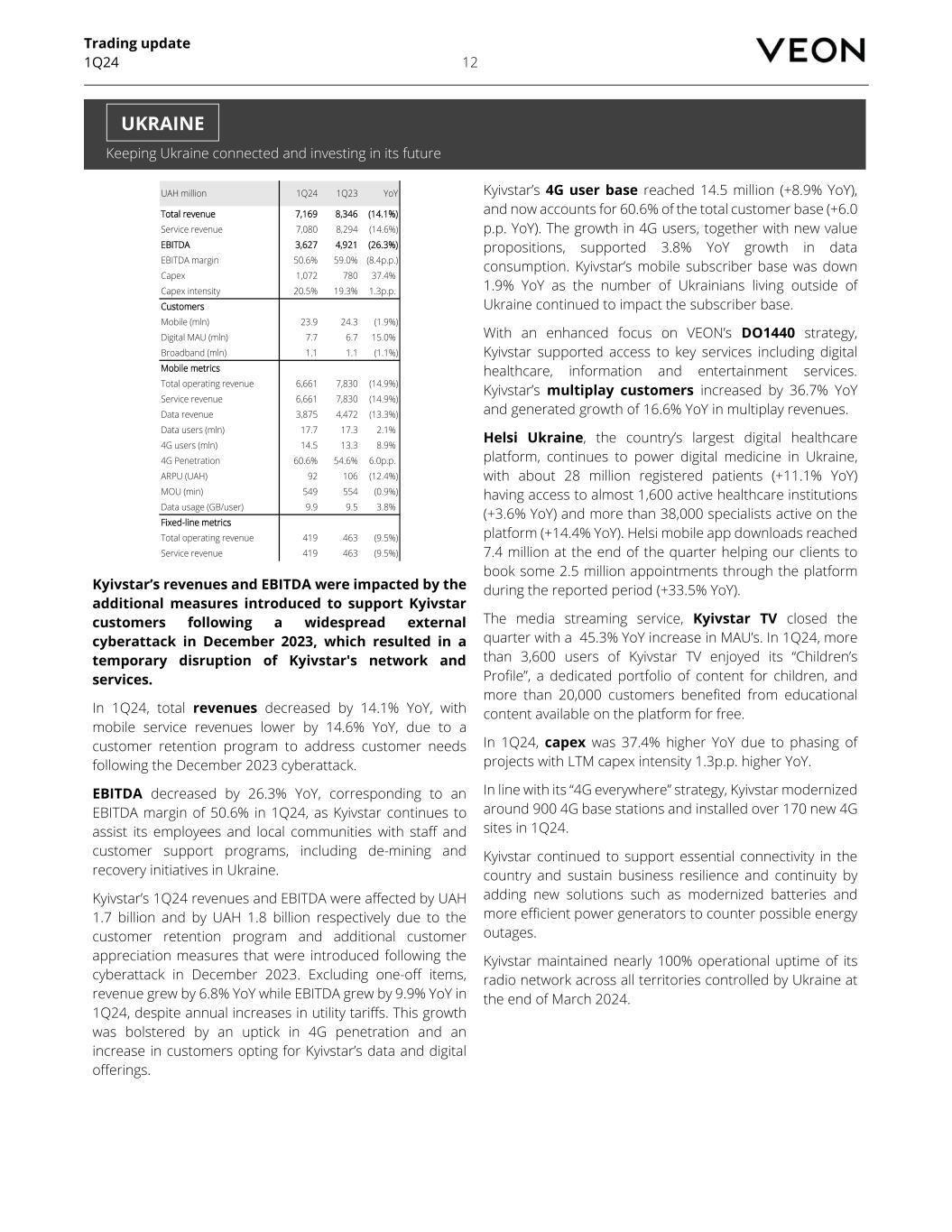

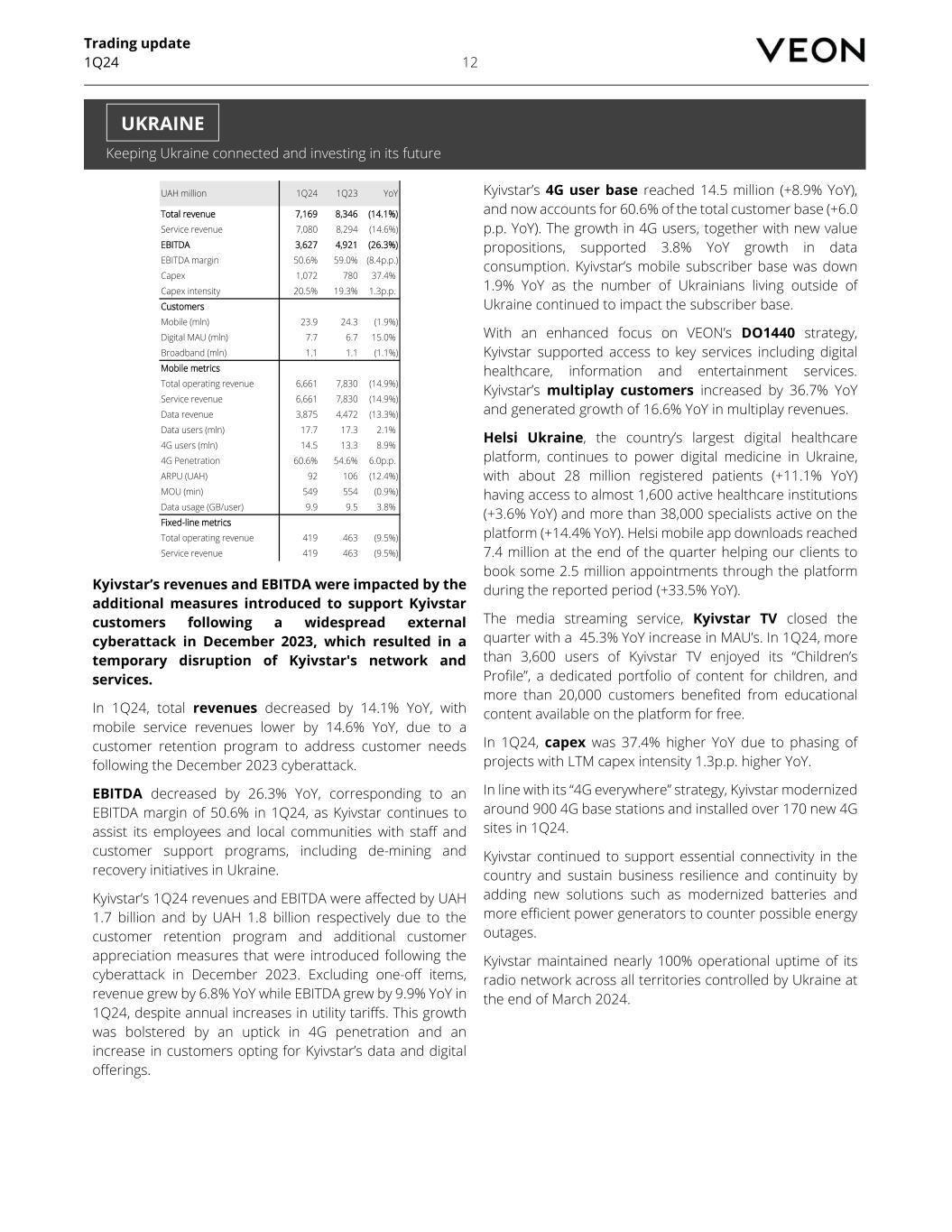

Trading update 1Q24 12 Keeping Ukraine connected and investing in its future UAH million 1Q24 1Q23 YoY Total revenue 7,169 8,346 (14.1%) Service revenue 7,080 8,294 (14.6%) EBITDA 3,627 4,921 (26.3%) EBITDA margin 50.6% 59.0% (8.4p.p.) Capex 1,072 780 37.4% Capex intensity 20.5% 19.3% 1.3p.p. Customers Mobile (mln) 23.9 24.3 (1.9%) Digital MAU (mln) 7.7 6.7 15.0% Broadband (mln) 1.1 1.1 (1.1%) Mobile metrics Total operating revenue 6,661 7,830 (14.9%) Service revenue 6,661 7,830 (14.9%) Data revenue 3,875 4,472 (13.3%) Data users (mln) 17.7 17.3 2.1% 4G users (mln) 14.5 13.3 8.9% 4G Penetration 60.6% 54.6% 6.0p.p. ARPU (UAH) 92 106 (12.4%) MOU (min) 549 554 (0.9%) Data usage (GB/user) 9.9 9.5 3.8% Fixed-line metrics Total operating revenue 419 463 (9.5%) Service revenue 419 463 (9.5%) Kyivstar’s revenues and EBITDA were impacted by the additional measures introduced to support Kyivstar customers following a widespread external cyberattack in December 2023, which resulted in a temporary disruption of Kyivstar's network and services. In 1Q24, total revenues decreased by 14.1% YoY, with mobile service revenues lower by 14.6% YoY, due to a customer retention program to address customer needs following the December 2023 cyberattack. EBITDA decreased by 26.3% YoY, corresponding to an EBITDA margin of 50.6% in 1Q24, as Kyivstar continues to assist its employees and local communities with staff and customer support programs, including de-mining and recovery initiatives in Ukraine. Kyivstar’s 1Q24 revenues and EBITDA were affected by UAH 1.7 billion and by UAH 1.8 billion respectively due to the customer retention program and additional customer appreciation measures that were introduced following the cyberattack in December 2023. Excluding one-off items, revenue grew by 6.8% YoY while EBITDA grew by 9.9% YoY in 1Q24, despite annual increases in utility tariffs. This growth was bolstered by an uptick in 4G penetration and an increase in customers opting for Kyivstar’s data and digital offerings. Kyivstar’s 4G user base reached 14.5 million (+8.9% YoY), and now accounts for 60.6% of the total customer base (+6.0 p.p. YoY). The growth in 4G users, together with new value propositions, supported 3.8% YoY growth in data consumption. Kyivstar’s mobile subscriber base was down 1.9% YoY as the number of Ukrainians living outside of Ukraine continued to impact the subscriber base. With an enhanced focus on VEON’s DO1440 strategy, Kyivstar supported access to key services including digital healthcare, information and entertainment services. Kyivstar’s multiplay customers increased by 36.7% YoY and generated growth of 16.6% YoY in multiplay revenues. Helsi Ukraine, the country’s largest digital healthcare platform, continues to power digital medicine in Ukraine, with about 28 million registered patients (+11.1% YoY) having access to almost 1,600 active healthcare institutions (+3.6% YoY) and more than 38,000 specialists active on the platform (+14.4% YoY). Helsi mobile app downloads reached 7.4 million at the end of the quarter helping our clients to book some 2.5 million appointments through the platform during the reported period (+33.5% YoY). The media streaming service, Kyivstar TV closed the quarter with a 45.3% YoY increase in MAU’s. In 1Q24, more than 3,600 users of Kyivstar TV enjoyed its “Children’s Profile”, a dedicated portfolio of content for children, and more than 20,000 customers benefited from educational content available on the platform for free. In 1Q24, capex was 37.4% higher YoY due to phasing of projects with LTM capex intensity 1.3p.p. higher YoY. In line with its “4G everywhere” strategy, Kyivstar modernized around 900 4G base stations and installed over 170 new 4G sites in 1Q24. Kyivstar continued to support essential connectivity in the country and sustain business resilience and continuity by adding new solutions such as modernized batteries and more efficient power generators to counter possible energy outages. Kyivstar maintained nearly 100% operational uptime of its radio network across all territories controlled by Ukraine at the end of March 2024. UKRAINE

Trading update 1Q24 13 Revenue and EBITDA YoY growth in high twenties PKR million 1Q24 1Q23 YoY Total revenue 89,670 69,662 28.7% Service revenue 81,395 64,749 25.7% EBITDA 40,021 31,479 27.1% EBITDA margin 44.6% 45.2% (0.6p.p.) Capex 5,317 3,669 44.9% Capex intensity 11.5% 15.2% (3.6p.p.) Customers Mobile (mln) 71.7 73.7 (2.6%) Digital MAU (mln) 67.1 40.0 67.7% Mobile metrics Total operating revenue 87,951 68,548 28.3% Service revenue 79,675 63,635 25.2% Data revenue 37,072 28,602 29.6% Data users (mln) 54.6 54.2 0.7% 4G users (mln) 45.9 43.1 6.7% 4G penetration 64.0% 58.5% 5.6p.p. ARPU (PKR) 371 285 30.3% MOU (min) 444 427 4.0% Data usage (GB/user) 7.2 5.8 24.5% With a robust portfolio of digital offerings and double- digit growth in multiplay customers, Jazz delivered another quarter of strong local currency revenue growth. In 1Q24, total revenues rose by 28.7% YoY reflecting strong growth in 4G users and disciplined inflationary pricing as ARPU grew 30.3% YoY. Jazz’s fintech offerings stood out in this quarter, with robust growth in service revenues for both JazzCash (+98.0% YoY) and Mobilink Microfinance Bank (+95.6% YoY). EBITDA increased by 27.1% YoY, marking a fifth consecutive quarter of growth above 20% in revenues and EBITDA. JazzCash and Mobilink Microfinance Bank saw further EBITDA margin expansion. JazzCash grew EBITDA from PKR 688 million in 1Q23 to PKR 1.99 billion in 1Q24, Mobilink Microfinance Bank generated PKR 4.35 billion in EBITDA, representing 149% growth YoY. In 1Q24, the 4G user base reached 45.9 million, a YoY increase of 6.7%, with 4G penetration of 64.0% (+5.6 p.p.). Jazz reported 71.7 million mobile subscribers (-2.6% YoY) as the team continues focusing on driving top-line growth, expanding ARPU and retaining more valuable customers. With the continued execution of its DO1440 strategy Jazz’s strong portfolio of digital services continues to scale. Jazz recorded 25.5% YoY growth in multiplay customers who benefit from digital services such as JazzCash, the self-care app JazzWorld and the entertainment platform Tamasha. In 1Q24, multiplay customers accounted for 28.9% of the monthly active consumer base. With 3.2x the ARPU of voice- only users, Jazz’s multiplay customers generated 56.6% of the operator’s revenues in the B2C segment (+11.5 p.p. YoY). In 1Q24, JazzCash was the largest domestic fintech platform and the most popular mobile fintech application in Pakistan. In addition to having a significant representation of female customers, JazzCash’s extensive network of agents and merchants has facilitated considerable digitalization of society and payment/loan services, effectively transforming Pakistan’s financial landscape. As the leader in NPS scores, JazzCash is honoured to be the people’s choice for fintech services. JazzCash had 17.2 million MAUs and issued 7.9 million digital loans to its customers (+47.2% YoY) during 1Q24. Total revenue grew 89.1% YoY driven by LTM Gross Transaction Value of PKR 6.6 trillion in 1Q24, a 47.1% YoY increase as well as 93.2% YoY increase in revenue from digital lending. This was supported by continued expansion of its retail distribution network, reaching almost 246,000 active merchants (+37.1% YoY) and optimizing its agent base with more than 119,000 active agents by the end of 1Q24 (-2.5% YoY). The self-care app Simosa (formerly JazzWorld) saw MAUs increase by 22.3% YoY, reaching 14.9 million at the end of 1Q24. Simosa continues to enrich the daily lives of its customers, fulfilling their needs from telecom to lifestyle services. On a monthly basis, more than 10.0 million users access lifestyle features, podcasts, horoscopes, games, financial updates and more - all in one app. In 1Q24, Tamasha reached 12.0 million MAUs (2.1x more YoY), and average daily active users rose 2.3x YoY to 2.1 million at the end of the quarter. This success was mainly driven by Pakistan Super League 2024 in February-March. Tamasha revenue doubled YoY driven by AdTech revenues during the PSL and ICC cricket matches. Tamasha will digitally broadcast the ICC Men's T20 World Cup 2024, ICC Champions Trophy 2025, ICC Men’s Test Championship, and all Women ICC events throughout 2024 and 2025. Capex was PKR 5.3 billion in 1Q24 (+44.9% YoY) as Jazz continues to expand and upgrade its 4G network, with LTM capex intensity of 11.5% (-3.6 p.p. YoY) being impacted by the Pakistan authorities management of their current account. Recently, Jazz issued a PKR 15 billion Sukuk (Islamic bonds), marking the first ever and largest short term unsecured Sukuk by a telecom operator in Pakistan. PAKISTAN

Trading update 1Q24 14 20%+ revenue and EBITDA growth, gaining market share KZT million 1Q24 1Q23 YoY Total revenue 96,397 79,417 21.4% Service revenue 93,996 76,947 22.2% EBITDA 53,294 41,702 27.8% EBITDA margin 55.3% 52.5% 2.8p.p. Capex 8,644 7,143 21.0% Capex intensity 20.9% 18.7% 2.2p.p. Customers Mobile (mln) 11.2 10.6 5.7% Digital MAU (mln) 10.7 7.6 39.7% Broadband (mln) 0.7 0.7 6.5% Mobile metrics Total operating revenue 77,795 63,226 23.0% Service revenue 75,409 60,768 24.1% Data revenue 49,957 37,016 35.0% Data users (mln) 9.6 8.5 12.5% 4G users (mln) 8.4 7.3 16.2% 4G penetration 75.6% 68.7% 6.8p.p. ARPU (KZT) 2,251 1,902 18.4% MOU (min) 211 237 (10.9%) Data usage (GB/user) 18.7 17.5 7.2% Fixed-line metrics Total operating revenue 18,603 16,191 14.9% Service revenue 18,587 16,179 14.9% Beeline Kazakhstan continued to gain market share in 1Q24, with over 20% YoY growth in revenues and 28% YoY growth in EBITDA. Beeline Kazakhstan has 76% 4G penetration in 1Q24 and Multiplay customers rose 10.2% YoY. In 1Q24, total revenues rose by 21.4% YoY, while service revenues increased by 22.2% YoY, driven by growth in the mobile business as well as from digital offerings. EBITDA increased by 27.8% YoY in 1Q24, as higher ARPU, a growing customer base and rising consumption of data and digital services supported solid topline YoY growth. Beeline Kazakhstan expanded its 4G user base to 8.4 million, up 16.2% YoY at the end of 1Q24, and reached 75.6% 4G penetration of the total customer base. Beeline Kazakhstan continued to expand its digital portfolio in line with the DO1440 strategy. Multiplay customers who used services such as izi, Simply, My Beeline and BeeTV reached nearly 3.8 million, up 10.2% YoY. With higher ARPU and lower churn, these customers contributed 63.5% of the revenues in the B2C segment. The MyBeeline self-care platform increased its MAUs by 9.2% YoY, reaching 4.4 million MAUs. The BeeTV multiplatform entertainment service reached almost 0.9 million MAUs (+22.0% YoY), with 75.4% of customers using the mobile version of the service. In 2023, BeeTV acquired broadcasting rights for 125 games of UEFA Champions League 2023/24. Moreover, 24 of them are aired exclusively on BeeTV. The 2023/24 UEFA Champions League group stage began on 19 September 2023 and will end on 1 June 2024. Beeline Kazakhstan’s sub-brand izi continued to deliver strong growth with MAUs of the izi app increasing 61.6% YoY to some 535,000. At the end of 1Q24, izi recorded 275,000 monthly active subscribers using izi SIM card, a 55.1% increase YoY. Total ARPU of izi platform users increased by 15.1% YoY on the back of its expanded value proposition as the platform offers a variety of unique/new content and actively promotes Kazakh celebrities. Simply, Kazakhstan’s first domestic mobile online-only neobank, saw a 5.9x YoY increase in MAUs, which reached more than 1.4 million at the end of 1Q24. This growth was driven by the ecosystem cashback program initiated by Beeline Kazakhstan, with “Simply bonuses” serving as the key integrated pillar of ecosystem development. Capex was KZT 8.6 billion during the quarter, representing a LTM capex intensity of 20.9%. Capex budgets continue to be allocated to the 250+ project, which focuses on expanding the 4G network and connecting remote and rural areas. KAZAKHSTAN

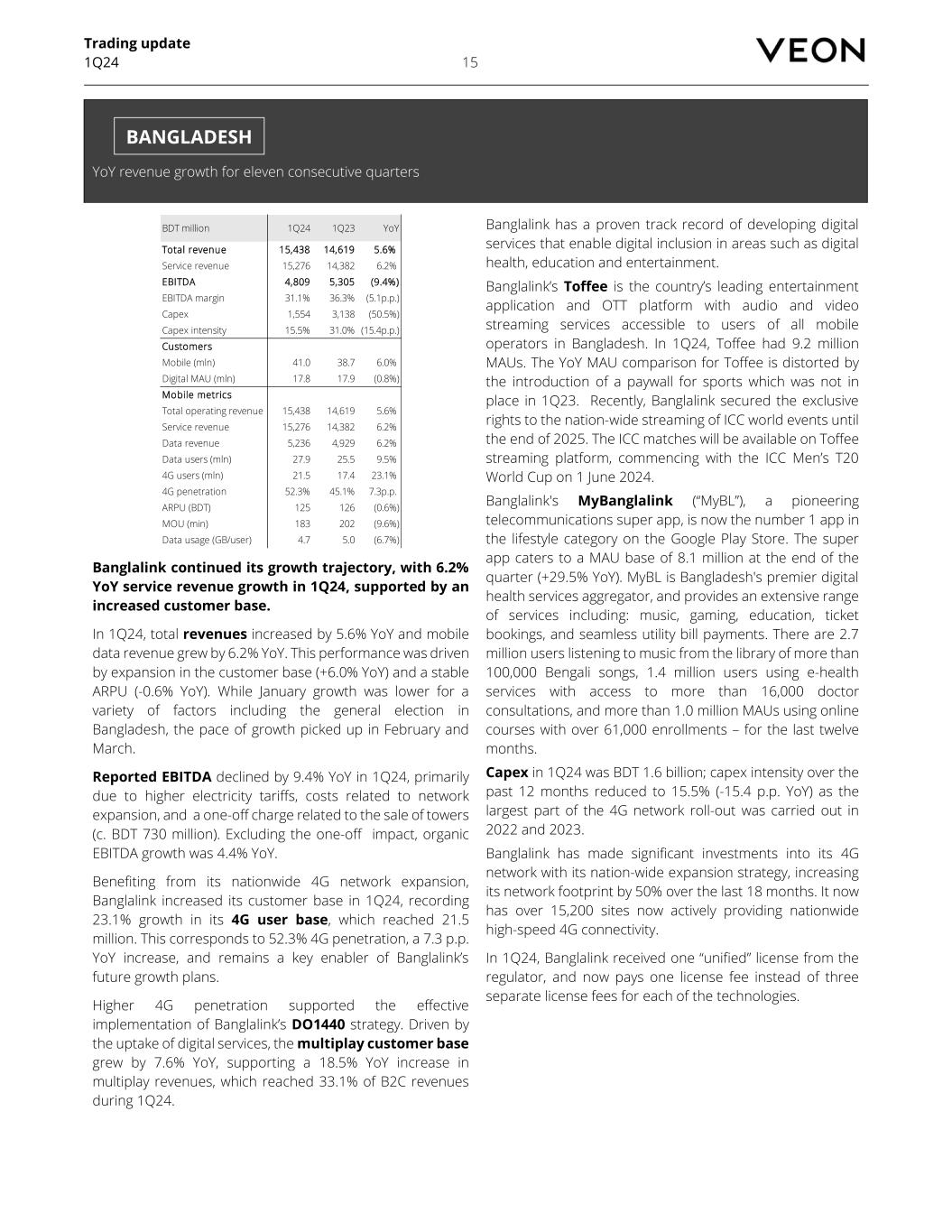

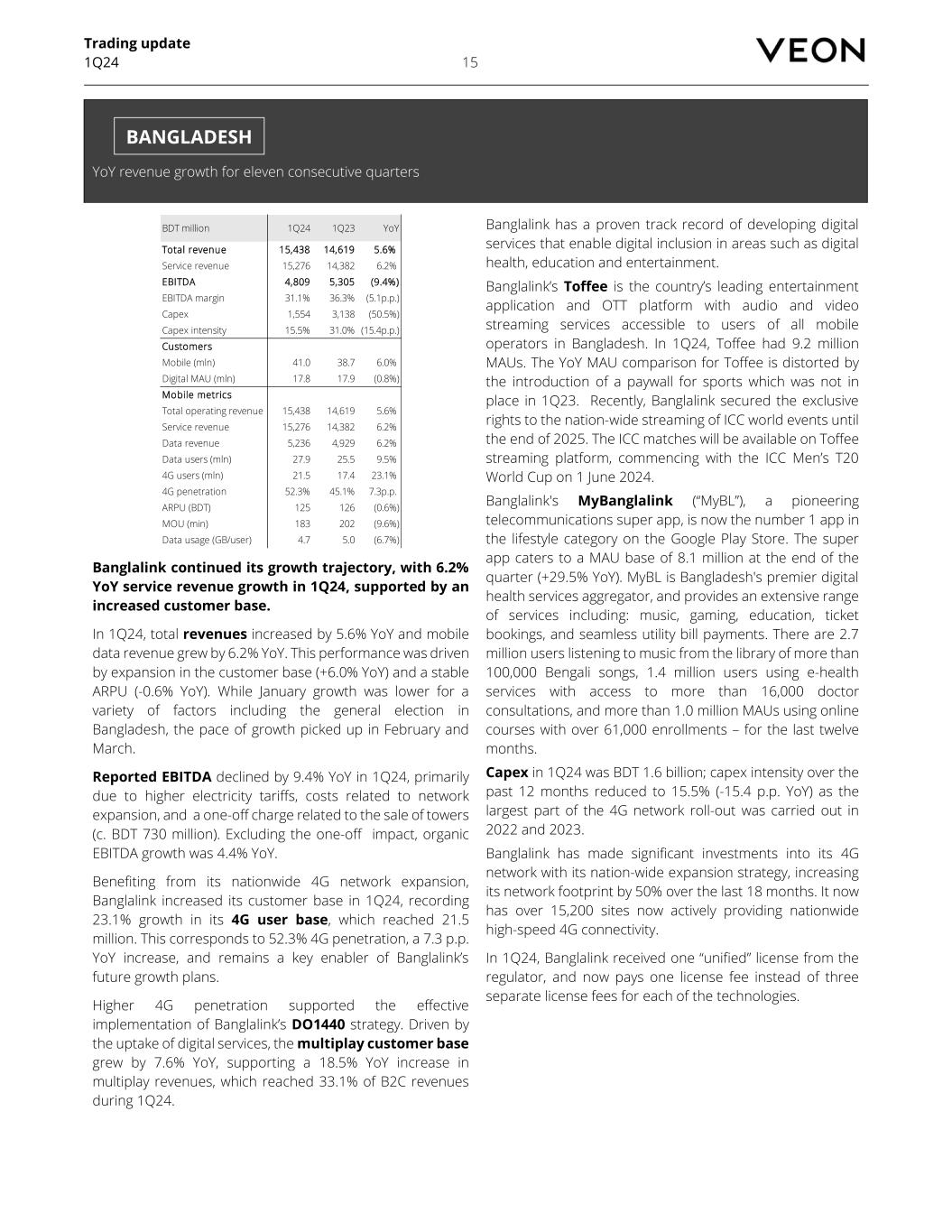

Trading update 1Q24 15 YoY revenue growth for eleven consecutive quarters BDT million 1Q24 1Q23 YoY Total revenue 15,438 14,619 5.6% Service revenue 15,276 14,382 6.2% EBITDA 4,809 5,305 (9.4%) EBITDA margin 31.1% 36.3% (5.1p.p.) Capex 1,554 3,138 (50.5%) Capex intensity 15.5% 31.0% (15.4p.p.) Customers Mobile (mln) 41.0 38.7 6.0% Digital MAU (mln) 17.8 17.9 (0.8%) Mobile metrics Total operating revenue 15,438 14,619 5.6% Service revenue 15,276 14,382 6.2% Data revenue 5,236 4,929 6.2% Data users (mln) 27.9 25.5 9.5% 4G users (mln) 21.5 17.4 23.1% 4G penetration 52.3% 45.1% 7.3p.p. ARPU (BDT) 125 126 (0.6%) MOU (min) 183 202 (9.6%) Data usage (GB/user) 4.7 5.0 (6.7%) Banglalink continued its growth trajectory, with 6.2% YoY service revenue growth in 1Q24, supported by an increased customer base. In 1Q24, total revenues increased by 5.6% YoY and mobile data revenue grew by 6.2% YoY. This performance was driven by expansion in the customer base (+6.0% YoY) and a stable ARPU (-0.6% YoY). While January growth was lower for a variety of factors including the general election in Bangladesh, the pace of growth picked up in February and March. Reported EBITDA declined by 9.4% YoY in 1Q24, primarily due to higher electricity tariffs, costs related to network expansion, and a one-off charge related to the sale of towers (c. BDT 730 million). Excluding the one-off impact, organic EBITDA growth was 4.4% YoY. Benefiting from its nationwide 4G network expansion, Banglalink increased its customer base in 1Q24, recording 23.1% growth in its 4G user base, which reached 21.5 million. This corresponds to 52.3% 4G penetration, a 7.3 p.p. YoY increase, and remains a key enabler of Banglalink’s future growth plans. Higher 4G penetration supported the effective implementation of Banglalink’s DO1440 strategy. Driven by the uptake of digital services, the multiplay customer base grew by 7.6% YoY, supporting a 18.5% YoY increase in multiplay revenues, which reached 33.1% of B2C revenues during 1Q24. Banglalink has a proven track record of developing digital services that enable digital inclusion in areas such as digital health, education and entertainment. Banglalink’s Toffee is the country’s leading entertainment application and OTT platform with audio and video streaming services accessible to users of all mobile operators in Bangladesh. In 1Q24, Toffee had 9.2 million MAUs. The YoY MAU comparison for Toffee is distorted by the introduction of a paywall for sports which was not in place in 1Q23. Recently, Banglalink secured the exclusive rights to the nation-wide streaming of ICC world events until the end of 2025. The ICC matches will be available on Toffee streaming platform, commencing with the ICC Men’s T20 World Cup on 1 June 2024. Banglalink's MyBanglalink (“MyBL”), a pioneering telecommunications super app, is now the number 1 app in the lifestyle category on the Google Play Store. The super app caters to a MAU base of 8.1 million at the end of the quarter (+29.5% YoY). MyBL is Bangladesh's premier digital health services aggregator, and provides an extensive range of services including: music, gaming, education, ticket bookings, and seamless utility bill payments. There are 2.7 million users listening to music from the library of more than 100,000 Bengali songs, 1.4 million users using e-health services with access to more than 16,000 doctor consultations, and more than 1.0 million MAUs using online courses with over 61,000 enrollments – for the last twelve months. Capex in 1Q24 was BDT 1.6 billion; capex intensity over the past 12 months reduced to 15.5% (-15.4 p.p. YoY) as the largest part of the 4G network roll-out was carried out in 2022 and 2023. Banglalink has made significant investments into its 4G network with its nation-wide expansion strategy, increasing its network footprint by 50% over the last 18 months. It now has over 15,200 sites now actively providing nationwide high-speed 4G connectivity. In 1Q24, Banglalink received one “unified” license from the regulator, and now pays one license fee instead of three separate license fees for each of the technologies. BANGLADESH

Trading update 1Q24 16 Revenue growth over 15% YoY and reached nearly 74% 4G user penetration UZS million 1Q24 1Q23 YoY Total revenue 829,705 719,929 15.2% Service revenue 828,041 719,584 15.1% EBITDA 305,018 320,339 (4.8%) EBITDA margin 36.8% 44.5% (7.7p.p.) Capex 526,978 87,358 503.2% Capex intensity 35.4% 26.2% 9.2p.p. Customers Mobile (mln) 8.2 8.4 (2.4%) Digital MAU (mln) 6.9 5.9 16.5% Mobile Total operating revenue 829,161 718,615 15.4% Service revenue 828,041 718,397 15.3% Data revenue 610,376 497,628 22.7% Data users (mln) 7.4 7.4 1.2% 4G users (mln) 6.1 5.7 6.2% 4G penetration 73.9% 67.9% 6.0p.p. ARPU (UZS) 32,873 28,098 17.0% MOU (min) 608 632 (3.7%) Data usage (GB/user) 11.5 8.9 29.3% Beeline Uzbekistan delivered healthy topline growth of 15%+ YoY, recording its eleventh consecutive quarter of double-digit YoY topline growth, and has reached 74% 4G user penetration. In 1Q24, total revenues increased by 15.2% YoY. This strong operational performance was driven by rising number of 4G users, higher demand for Beeline’s data and digital services, which led to growth in ARPU. EBITDA decreased 4.8% YoY, as Beeline Uzbekistan continued operational investments into AdTech. Excluding AdTech investments, organic growth would have been 2.9% YoY. Additional pressure on EBITDA YoY performance was due to a doubling of electricity tariffs YoY. In 1Q24, Beeline Uzbekistan had 8.2 million subscribers, while the 4G user base reached 6.1 million users during the quarter, 6.2% YoY increase. 4G users now account for 73.9% of total customers (+6.0 p.p. YoY). With a strong focus on the execution of its DO1440 strategy, Beeline Uzbekistan continued offering new digital bundles and tariff plans in 1Q24, building on its portfolio of digital products and services. Supported by higher 4G user penetration and uptake of digital products, Beeline Uzbekistan increased its multiplay customer base by 30.0% YoY. Multiplay users now account for 48.6% of the monthly active B2C customer base, contributing 68.9% of B2C revenues during 1Q24. The Beepul mobile financial services platform serving 279,000 MAUs, saw growing engagement with customers, increasing the average transaction value per user by 16.0% YoY and average value per transaction by 36.1% YoY. Beeline Uzbekistan is progressively transitioning to a new optimized portfolio of digital products and services. The self- service app My Beeline, rated 4.6 on Google Play, recorded 3.3 million MAUs (+9.7%), with a total of 5.1 million MAUs on the platform at the end of the quarter (+14.4% YoY). Entertainment platforms, including Beeline TV and Riitm (formerly Beeline Music), accounted for almost 1.4 million MAUs in 1Q24 (+13.5% YoY). Beeline Uzbekistan’s digital-first operator, OQ, launched in October 2023, reached nearly 183,000 MAUs at the end of the quarter. OQ provides integrated digital experiences in entertainment and communication, serving digital natives who use mobile internet extensively to engage with lifestyle services. Capex was UZS 527.0 billion in 1Q24, with capex intensity of 35.4%. Beeline Uzbekistan accelerated its 4G network rollout to meet growing demand in 4G coverage and quality across the country, and reported a 8.8% YoY increase in 4G base stations. UZBEKISTAN

Trading update 1Q24 17 On 16 May 2024, VEON will host a conference call with senior management at or around 14:00 CEST (13:00 BST, 8:00 EST), which will be accessible through the webcast and over the phone. Webcast and dial-in To register and access the event, please click here or copy and paste this link to the address bar of your browser: https://veon-global.zoom.us/webinar/register/WN_W7f2WQO9RG-2uY-sNmt1jQ Once registered, you will receive registration confirmation on the email address mentioned during registration with the link to access the webcast and dial-in details to listen to the webcast over the phone. We strongly encourage you to join the event through the webcast, but if you prefer to dial in, then please use the dial-in details. Q&A Kindly note, that Q&A session will be facilitated via “Q&A” function in the webcast. You can also submit your questions prior the event to VEON Investor Relations at ir@veon.com. The conference call replay, the slide presentation and a transcript of the conference call will also be available for download from VEON’s website. CONTACT INFORMATION Investor Relations Faisal Ghori ir@veon.com CONFERENCE CALL INFORMATION

Trading update 1Q24 18 VEON’s results presented in this document are, unless otherwise stated, based on International Financial Reporting Standards (“IFRS”) and have not been externally audited or reviewed. Certain amounts and percentages that appear in this document have been subject to rounding adjustments. As a result, certain numerical figures shown as totals, including those in the tables, may not be an exact arithmetic aggregation of the figures that precede or follow them. The non-IFRS information disclosed in the document, including, among other things, EBITDA, EBITDA margin, net debt, capex, capex intensity, local currency ("LCY") trends, and ARPU, is defined in Attachment A. PRESENTATION OF FINANCIAL RESULTS

Trading update 1Q24 19 DISCLAIMER VEON's results and other financial information presented in this document are, unless otherwise stated, prepared in accordance with International Financial Reporting Standards ("IFRS") and have not been externally reviewed and/or audited. The financial information included in this document is preliminary and is based on a number of assumptions that are subject to inherent uncertainties and subject to change. The financial information presented herein is based on internal management accounts, is the responsibility of management and is subject to financial closing procedures which have not yet been completed and has not been audited, reviewed or verified. Certain amounts and percentages that appear in this document have been subject to rounding adjustments. As a result, certain numerical figures shown as totals, including those in the tables, may not be an exact arithmetic aggregation of the figures that precede or follow them. Although we believe the information to be reasonable, actual results may vary from the information contained above and such variations could be material. As such, you should not place undue reliance on this information. This information may not be indicative of the actual results for the current period or any future period. This document contains “forward-looking statements”, as the phrase is defined in Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. These forward-looking statements may be identified by words such as “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “seek,” “believe,” “estimate,” “predict,” “potential,” “continue,” “contemplate,” “possible” and other similar words. Forward-looking statements include statements relating to, among other things, VEON’s plans to implement its strategic priorities, including operating model and development plans; anticipated performance, including VEON’s ability to generate sufficient cash flow; VEON’s assessment of the impact of the war in Ukraine, including related sanctions and counter-sanctions, on its current and future operations and financial condition; future market developments and trends; operational and network development and network investment, including expectations regarding the roll-out and benefits of 3G/4G/LTE networks, as applicable; spectrum acquisitions and renewals; the effect of the acquisition of additional spectrum on customer experience; VEON’s ability to realize the acquisition and disposition of any of its businesses and assets and to execute its strategic transactions in the timeframes anticipated, or at all; VEON’s ability to realize financial improvements, including an expected reduction of net pro-forma leverage ratio following the successful completion of certain dispositions and acquisitions; our dividends; and VEON’s ability to realize its targets and commercial initiatives in its various countries of operation. The forward-looking statements included in this document are based on management’s best assessment of VEON’s strategic and financial position and of future market conditions, trends and other potential developments. These discussions involve risks and uncertainties. The actual outcome may differ materially from these statements as a result of, among other things: further escalation in the war in Ukraine, including further sanctions and counter-sanctions and any related involuntary deconsolidation of our Ukrainian operations; demand for and market acceptance of VEON’s products and services; our plans regarding our dividend payments and policies, as well as our ability to receive dividends, distributions, loans, transfers or other payments or guarantees from our subsidiaries; continued volatility in the economies in VEON’s markets; governmental regulation of the telecommunications industries; general political uncertainties in VEON’s markets; government investigations or other regulatory actions; litigation or disputes with third parties or regulatory authorities or other negative developments DISCLAIMER AND NOTICE TO READERS

Trading update 1Q24 20 regarding such parties; the impact of export controls and laws affecting trade and investment on our and important third-party suppliers' ability to procure goods, software or technology necessary for the services we provide to our customers; risks associated with our material weakness in internal control over financial reporting; risks associated with data protection or cyber security, other risks beyond the parties’ control or a failure to meet expectations regarding various strategic priorities, the effect of foreign currency fluctuations, increased competition in the markets in which VEON operates and the effect of consumer taxes on the purchasing activities of consumers of VEON’s services. Certain other factors that could cause actual results to differ materially from those discussed in any forward-looking statements include the risk factors described in VEON’s Annual Report on Form 20-F for the year ended 31 December 2022 filed with the U.S. Securities and Exchange Commission (the “SEC”) on 24 July 2023 and other public filings made from time to time by VEON with the SEC. Other unknown or unpredictable factors also could harm our future results. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Under no circumstances should the inclusion of such forward-looking statements in this document be regarded as a representation or warranty by us or any other person with respect to the achievement of results set out in such statements or that the underlying assumptions used will in fact be the case. Therefore, you are cautioned not to place undue reliance on these forward-looking statements. The forward- looking statements speak only as of the date hereof. We cannot assure you that any projected results or events will be achieved. Except to the extent required by law, we disclaim any obligation to update or revise any of these forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made, or to reflect the occurrence of unanticipated events. Furthermore, elements of this document contain or may contain, “inside information” as defined under the Market Abuse Regulation (EU) No. 596/2014. NOTICE TO READERS: FINANCIAL INFORMATION PRESENTED VEON's results and other financial information presented in this document are, unless otherwise stated, prepared in accordance with International Financial Reporting Standards ("IFRS") based on internal management reporting, are the responsibility of management, and have not been externally audited, reviewed, or verified. As such, you should not place undue reliance on this information. This information may not be indicative of the actual results for any future period. NOTICE TO READERS: IMPACT OF THE WAR IN UKRAINE The ongoing war between Russia and Ukraine and the sanctions imposed by the United States, member states of the European Union, the European Union itself, the United Kingdom, Ukraine and certain other nations, counter-sanctions by Russia and other legal and regulatory responses, as well as responses by our service providers, partners, suppliers and other counterparties, and the other indirect and direct consequences of the war have impacted and, if the war, sanctions and such responses and other consequences continue or escalate, may significantly impact our results and aspects of our operations in Ukraine, and may significantly affect our results and aspects of our operations in the other countries in which we operate. We are closely monitoring events in Russia and Ukraine, as well as the possibility of the imposition of further sanctions in connection with the ongoing war between Russia and Ukraine and any resulting further rise in tensions between Russia and the United States, the United Kingdom and/or the European Union. Although we have completed our exit from Russia, our operations in Ukraine continue to be affected by the war. We are doing everything we can to protect the safety of our employees, while continuing to ensure the uninterrupted operation of our communications, financial and digital services.

Trading update 1Q24 21 CONTENT OF THE ATTACHMENTS Attachment A Definitions 22 Attachment B Customers 24 Attachment C Reconciliation tables 24 Attachment D Rates of functional currencies to USD 27 For more information on financial and operating data for specific countries, please refer to the supplementary file Factbook1Q2024.xlsx on VEON’s website at https://www.veon.com/investors/reports-results/ ATTACHMENTS

Trading update 1Q24 22 ATTACHMENT A: DEFINITIONS 4G users are mobile customers who have engaged in revenue-generating activity during the three months prior to the measurement date as a result of activities over fourth-generation (4G or LTE – long term evolution) network technologies. ARPU (average revenue per user) measures the monthly average revenue per mobile user. We generally calculate mobile ARPU by dividing our mobile service revenue during the relevant period (including data revenue, roaming revenue, MFS and interconnect revenue, but excluding revenue from connection fees, sales of handsets and accessories and other non-service revenue), by the average number of our mobile customers during the period and the number of months in that period. Capital expenditures (capex) are purchases of property and equipment, new construction, upgrades, software, other long- lived assets and related reasonable costs incurred prior to intended use of the non-current asset, accounted at the earliest event of advance payment or delivery. Purchase of licenses and capitalized leases are not included in capital expenditures. Capex intensity is a ratio, which is calculated as last-twelve-months (LTM) capex divided by LTM total revenue. Data and digital revenues include data revenue, revenues from mobile financial services and from digital entertainment. Discontinued operations under IFRS refers to a component of an entity, representing a major line of business or a geographic area of operations, that has either been disposed of or is classified as held for sale. As presented in the document, the results of discontinued operations that are presented separately either in the current and/or prior year income statements, have no impact on balance sheet amounts of the prior periods. This means that neither the Algerian nor Russian operations contribute to the base performance of VEON for both the current and prior year shown. Doubleplay 4G customers are mobile customers who engaged in usage of our voice and data services over 4G (LTE) technology at any time during the one month prior to such measurement date. EBITDA is a non-IFRS financial measure and is called Adjusted EBITDA in the Form 20-F published by VEON. VEON calculates Adjusted EBITDA as (loss)/profit before interest, tax, depreciation, amortization, impairment, gain/loss on disposals of non- current assets, other non-operating gains/losses and share of profit/loss of joint ventures and associates. Our Adjusted EBITDA may be helpful in evaluating our performance against other telecommunications companies that provide EBITDA. Additionally, a limitation of EBITDA’s use as a performance measure is that it does not reflect the periodic costs of certain capitalized tangible and intangible assets used in generating revenue or the need to replace capital equipment over time. EBITDA margin is calculated as EBITDA divided by total revenue, expressed as a percentage. Equity free cash flow is a non-IFRS measure and is defined as free cash flow from operating activities less cash flow used in investing activities excluding license payments, principal amount of lease payments, balance movements in Pakistan banking, M&A transactions, inflow/outflow of deposits, financial assets and other one-off items. Gross Debt is calculated as the sum of long-term notional debt and short-term notional debt including capitalized leases. Local currency (or “LCY”) trends (growth/decline) in revenue and EBITDA are non-IFRS financial measures that reflect changes in Revenue and EBITDA, excluding foreign currency movements and other factors, such as businesses under liquidation, disposals, mergers and acquisitions, including the sale of operations in Georgia and the classification of Algeria and Russia as ‘discontinued operations’. LCY trends normalised (growth/decline) is an alternative performance measure which is calculated as local currency trends if excluding extraordinary non-recurring items (“one-offs”) with the absolute amount of USD 5 million or more, such as an impact of the customer retention program following the cyberattack in December 2023 in Ukraine in 1Q24. Mobile customers are generally customers in the registered customer base at a given measurement date who engaged in a mobile revenue generating activity at any time during the three months prior to such measurement date. Such activity includes any outgoing calls, customer fee accruals, debits related to service, outgoing SMS and MMS, data transmission and receipt sessions, but does not include incoming calls, SMS and MMS or abandoned calls. Our total number of mobile customers also includes customers using mobile internet service via USB modems and fixed-mobile convergence (“FMC”).

Trading update 1Q24 23 Mobile data customers are mobile customers who have engaged in revenue-generating activity during the three months prior to the measurement date as a result of activities including USB modem Internet access using 2.5G/3G/4G/HSPA+ technologies. Mobile financial services (“MFS”) or digital financial services (“DFS”) is a variety of innovative services, such as mobile commerce that uses a mobile phone as the primary payment user interface and allows mobile customers to conduct money transfers to pay for items such as goods at an online store, utility payments, fines and state fees, loan repayments, domestic and international remittances, mobile insurance and tickets for air and rail travel, all via their mobile phone. Multiplay customers are doubleplay 4G customers who also engaged in usage of one or more of our digital products at any time during the one month prior to such measurement date. Net debt is a non-IFRS financial measure and is calculated as the sum of interest-bearing long-term debt including capitalized leases (unless specifically excluded) and short-term notional debt minus cash and cash equivalents excluding cash and cash deposits from our banking operations in Pakistan, long-term and short-term deposits. We believe that net debt provides useful information to investors because it shows the amount of notional debt that would be outstanding if available cash and cash equivalents and long-term and short-term deposits were applied to repay such indebtedness. Net debt should not be considered in isolation as an alternative to long-term debt and short-term debt, or any other measure of our financial position. Net Promoter Score (“NPS”) is the methodology VEON uses to measure customer satisfaction. Relative NPS (rNPS) – advantage or gap in NPS when comparing to competition. Total digital monthly active users (“MAU”) is a gross total cumulative MAU of all digital platforms, services and applications offered by an entity or by VEON Group and includes MAU who are active in more than one application. VEON’s reportable segments are the following, which are principally based on business activities in different geographical areas: Pakistan, Ukraine, Kazakhstan, Bangladesh and Uzbekistan. We also present our results of operations for “Others” and “HQ” separately, although these are not reportable segments. “Others” represents our operations in Kyrgyzstan and “HQ” represents transactions related to management activities within the group in Amsterdam, London and Dubai.

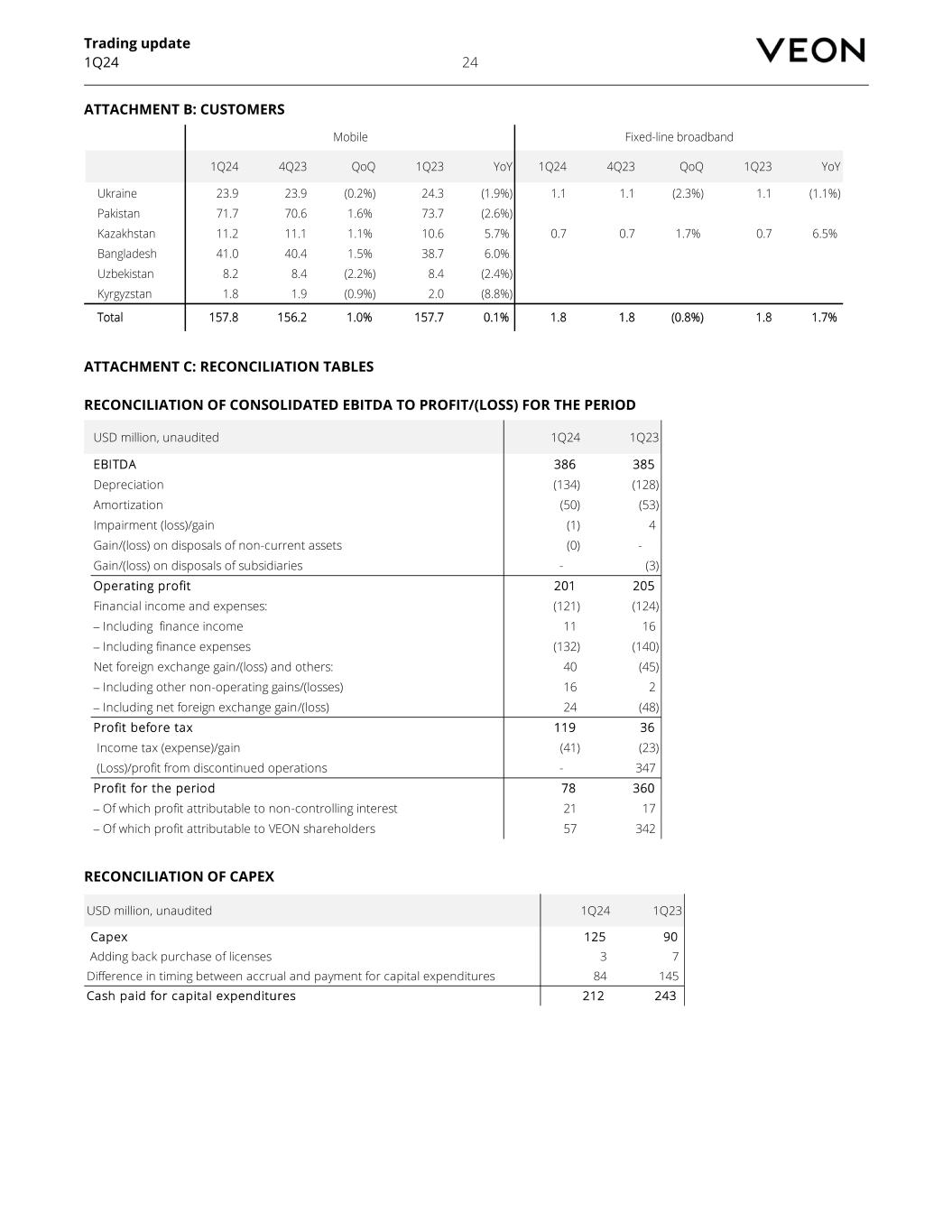

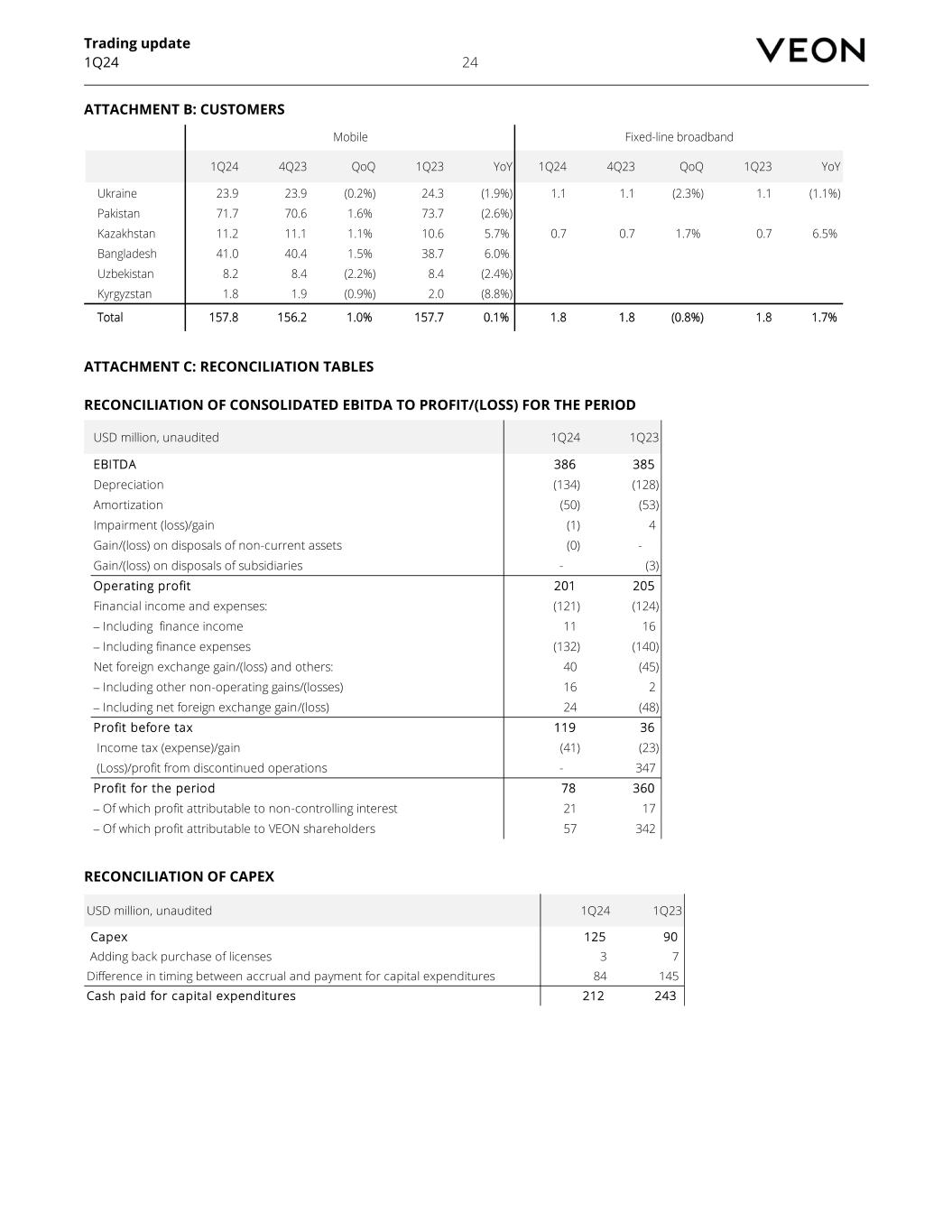

Trading update 1Q24 24 ATTACHMENT B: CUSTOMERS 1Q24 4Q23 QoQ 1Q23 YoY 1Q24 4Q23 QoQ 1Q23 YoY Ukraine 23.9 23.9 (0.2%) 24.3 (1.9%) 1.1 1.1 (2.3%) 1.1 (1.1%) Pakistan 71.7 70.6 1.6% 73.7 (2.6%) Kazakhstan 11.2 11.1 1.1% 10.6 5.7% 0.7 0.7 1.7% 0.7 6.5% Bangladesh 41.0 40.4 1.5% 38.7 6.0% Uzbekistan 8.2 8.4 (2.2%) 8.4 (2.4%) Kyrgyzstan 1.8 1.9 (0.9%) 2.0 (8.8%) Total 157.8 156.2 1.0% 157.7 0.1% 1.8 1.8 (0.8%) 1.8 1.7% Mobile Fixed-line broadband ATTACHMENT C: RECONCILIATION TABLES RECONCILIATION OF CONSOLIDATED EBITDA TO PROFIT/(LOSS) FOR THE PERIOD USD million, unaudited 1Q24 1Q23 EBITDA 386 385 Depreciation (134) (128) Amortization (50) (53) Impairment (loss)/gain (1) 4 Gain/(loss) on disposals of non-current assets (0) - Gain/(loss) on disposals of subsidiaries - (3) Operating profit 201 205 Financial income and expenses: (121) (124) ⎼ Including finance income 11 16 ⎼ Including finance expenses (132) (140) Net foreign exchange gain/(loss) and others: 40 (45) ⎼ Including other non-operating gains/(losses) 16 2 ⎼ Including net foreign exchange gain/(loss) 24 (48) Profit before tax 119 36 Income tax (expense)/gain (41) (23) (Loss)/profit from discontinued operations - 347 Profit for the period 78 360 ⎼ Of which profit attributable to non-controlling interest 21 17 ⎼ Of which profit attributable to VEON shareholders 57 342 RECONCILIATION OF CAPEX USD million, unaudited 1Q24 1Q23 Capex 125 90 Adding back purchase of licenses 3 7 Difference in timing between accrual and payment for capital expenditures 84 145 Cash paid for capital expenditures 212 243

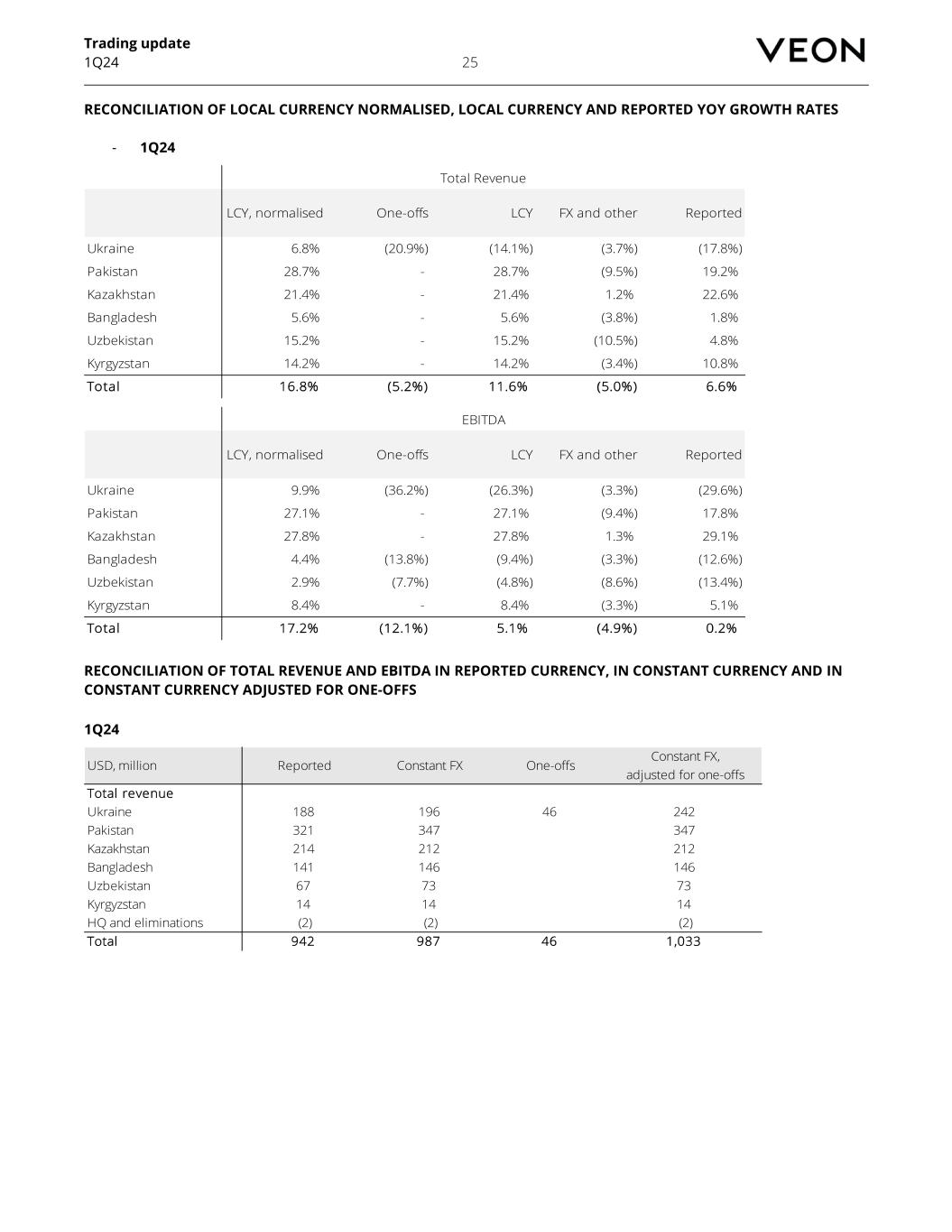

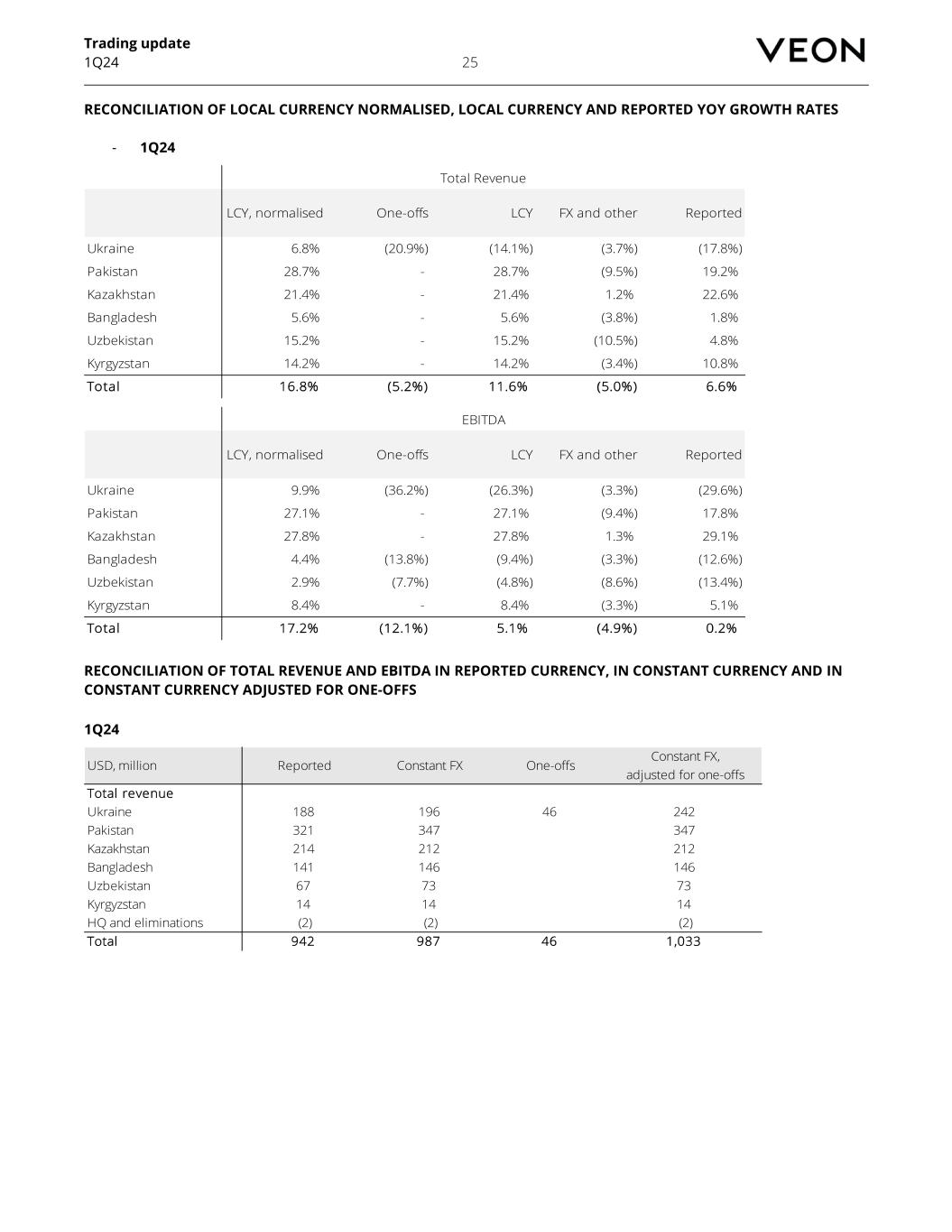

Trading update 1Q24 25 RECONCILIATION OF LOCAL CURRENCY NORMALISED, LOCAL CURRENCY AND REPORTED YOY GROWTH RATES - 1Q24 LCY, normalised One-offs LCY FX and other Reported Ukraine 6.8% (20.9%) (14.1%) (3.7%) (17.8%) Pakistan 28.7% - 28.7% (9.5%) 19.2% Kazakhstan 21.4% - 21.4% 1.2% 22.6% Bangladesh 5.6% - 5.6% (3.8%) 1.8% Uzbekistan 15.2% - 15.2% (10.5%) 4.8% Kyrgyzstan 14.2% - 14.2% (3.4%) 10.8% Total 16.8% (5.2%) 11.6% (5.0%) 6.6% Total Revenue LCY, normalised One-offs LCY FX and other Reported Ukraine 9.9% (36.2%) (26.3%) (3.3%) (29.6%) Pakistan 27.1% - 27.1% (9.4%) 17.8% Kazakhstan 27.8% - 27.8% 1.3% 29.1% Bangladesh 4.4% (13.8%) (9.4%) (3.3%) (12.6%) Uzbekistan 2.9% (7.7%) (4.8%) (8.6%) (13.4%) Kyrgyzstan 8.4% - 8.4% (3.3%) 5.1% Total 17.2% (12.1%) 5.1% (4.9%) 0.2% EBITDA RECONCILIATION OF TOTAL REVENUE AND EBITDA IN REPORTED CURRENCY, IN CONSTANT CURRENCY AND IN CONSTANT CURRENCY ADJUSTED FOR ONE-OFFS 1Q24 USD, million Reported Constant FX One-offs Constant FX, adjusted for one-offs Total revenue Ukraine 188 196 46 242 Pakistan 321 347 347 Kazakhstan 214 212 212 Bangladesh 141 146 146 Uzbekistan 67 73 73 Kyrgyzstan 14 14 14 HQ and eliminations (2) (2) (2) Total 942 987 46 1,033

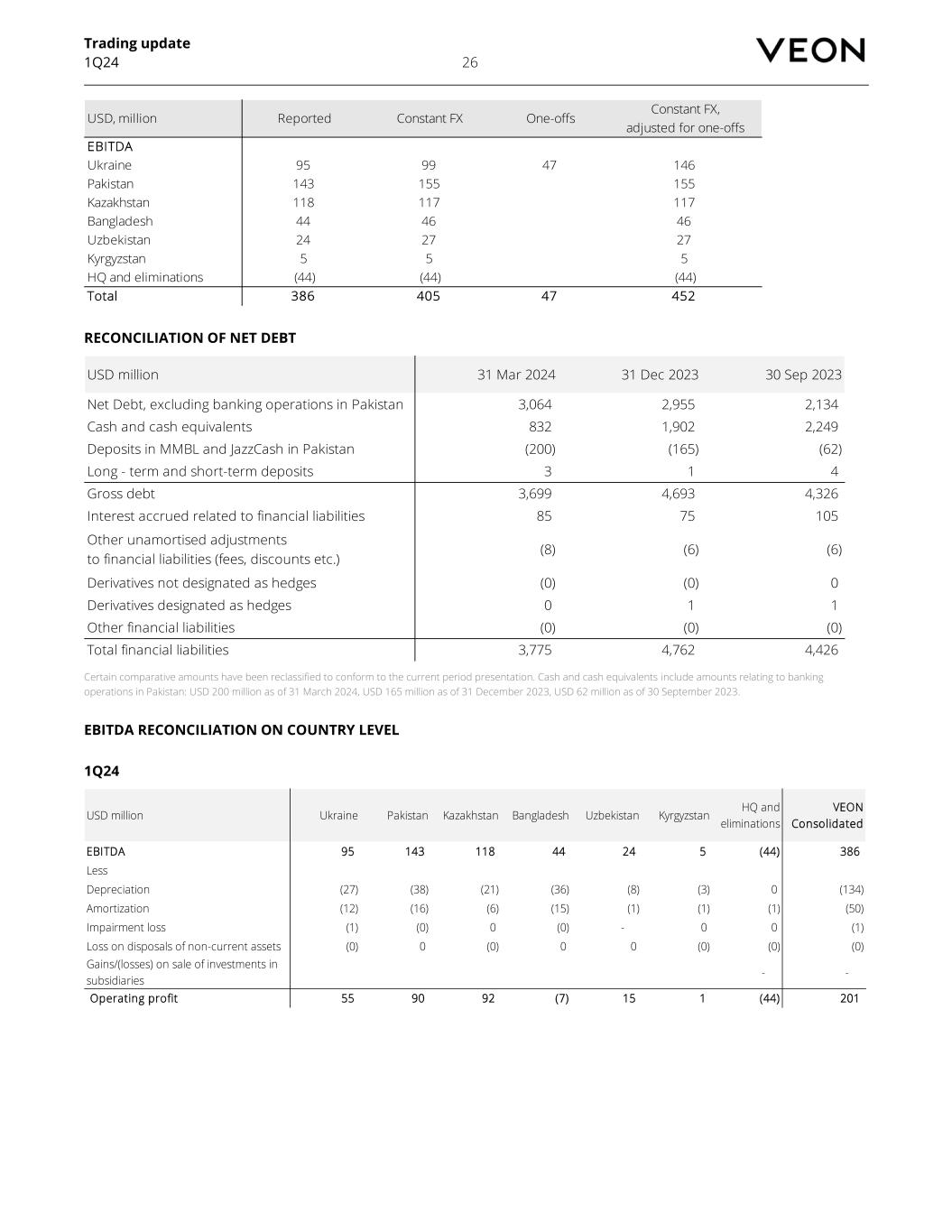

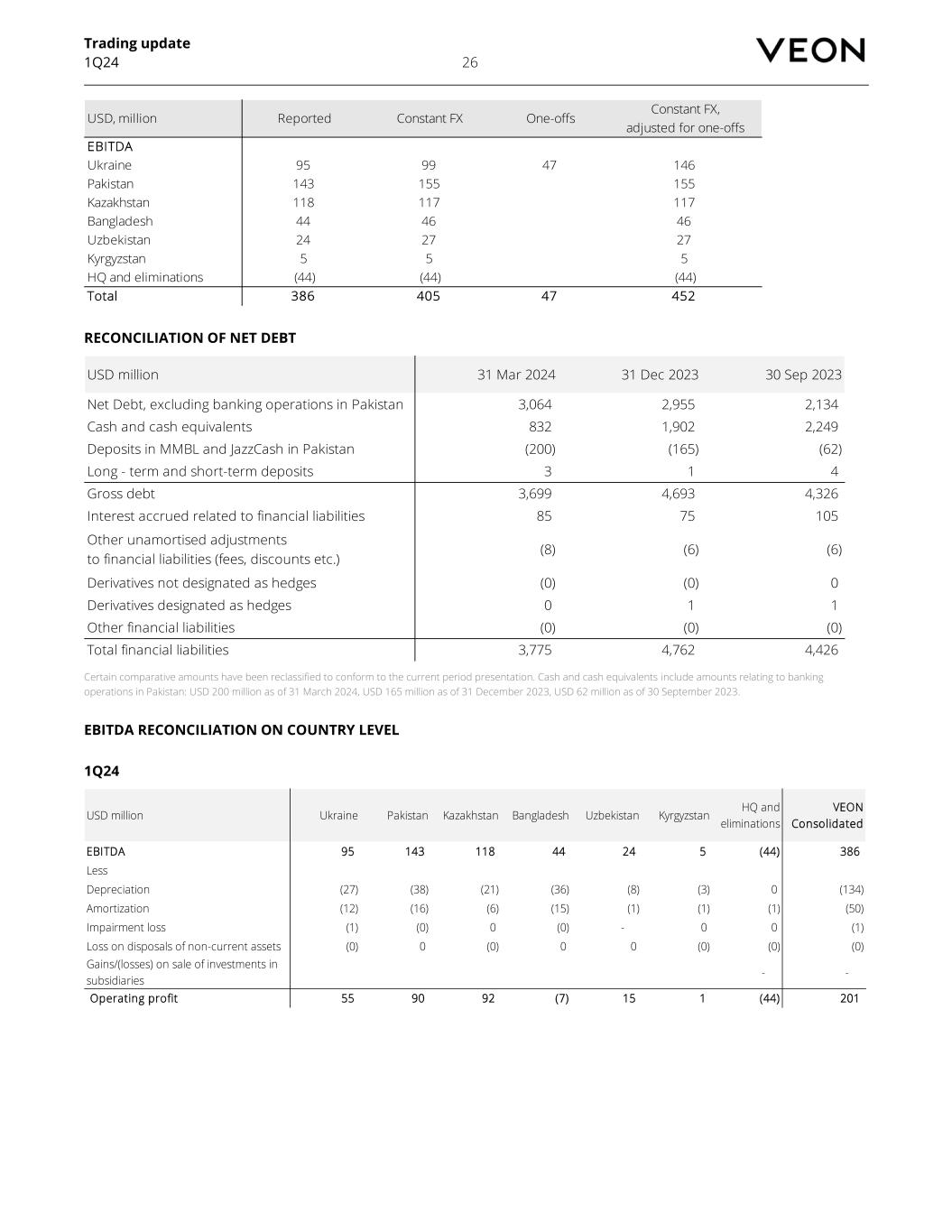

Trading update 1Q24 26 USD, million Reported Constant FX One-offs Constant FX, adjusted for one-offs EBITDA Ukraine 95 99 47 146 Pakistan 143 155 155 Kazakhstan 118 117 117 Bangladesh 44 46 46 Uzbekistan 24 27 27 Kyrgyzstan 5 5 5 HQ and eliminations (44) (44) (44) Total 386 405 47 452 RECONCILIATION OF NET DEBT USD million 31 Mar 2024 31 Dec 2023 30 Sep 2023 Net Debt, excluding banking operations in Pakistan 3,064 2,955 2,134 Cash and cash equivalents 832 1,902 2,249 Deposits in MMBL and JazzCash in Pakistan (200) (165) (62) Long - term and short-term deposits 3 1 4 Gross debt 3,699 4,693 4,326 Interest accrued related to financial liabilities 85 75 105 Other unamortised adjustments to financial liabilities (fees, discounts etc.) (8) (6) (6) Derivatives not designated as hedges (0) (0) 0 Derivatives designated as hedges 0 1 1 Other financial liabilities (0) (0) (0) Total financial liabilities 3,775 4,762 4,426 Certain comparative amounts have been reclassified to conform to the current period presentation. Cash and cash equivalents include amounts relating to banking operations in Pakistan: USD 200 million as of 31 March 2024, USD 165 million as of 31 December 2023, USD 62 million as of 30 September 2023. EBITDA RECONCILIATION ON COUNTRY LEVEL 1Q24 USD million Ukraine Pakistan Kazakhstan Bangladesh Uzbekistan Kyrgyzstan HQ and eliminations VEON Consolidated EBITDA 95 143 118 44 24 5 (44) 386 Less Depreciation (27) (38) (21) (36) (8) (3) 0 (134) Amortization (12) (16) (6) (15) (1) (1) (1) (50) Impairment loss (1) (0) 0 (0) - 0 0 (1) Loss on disposals of non-current assets (0) 0 (0) 0 0 (0) (0) (0) Gains/(losses) on sale of investments in subsidiaries - - Operating profit 55 90 92 (7) 15 1 (44) 201

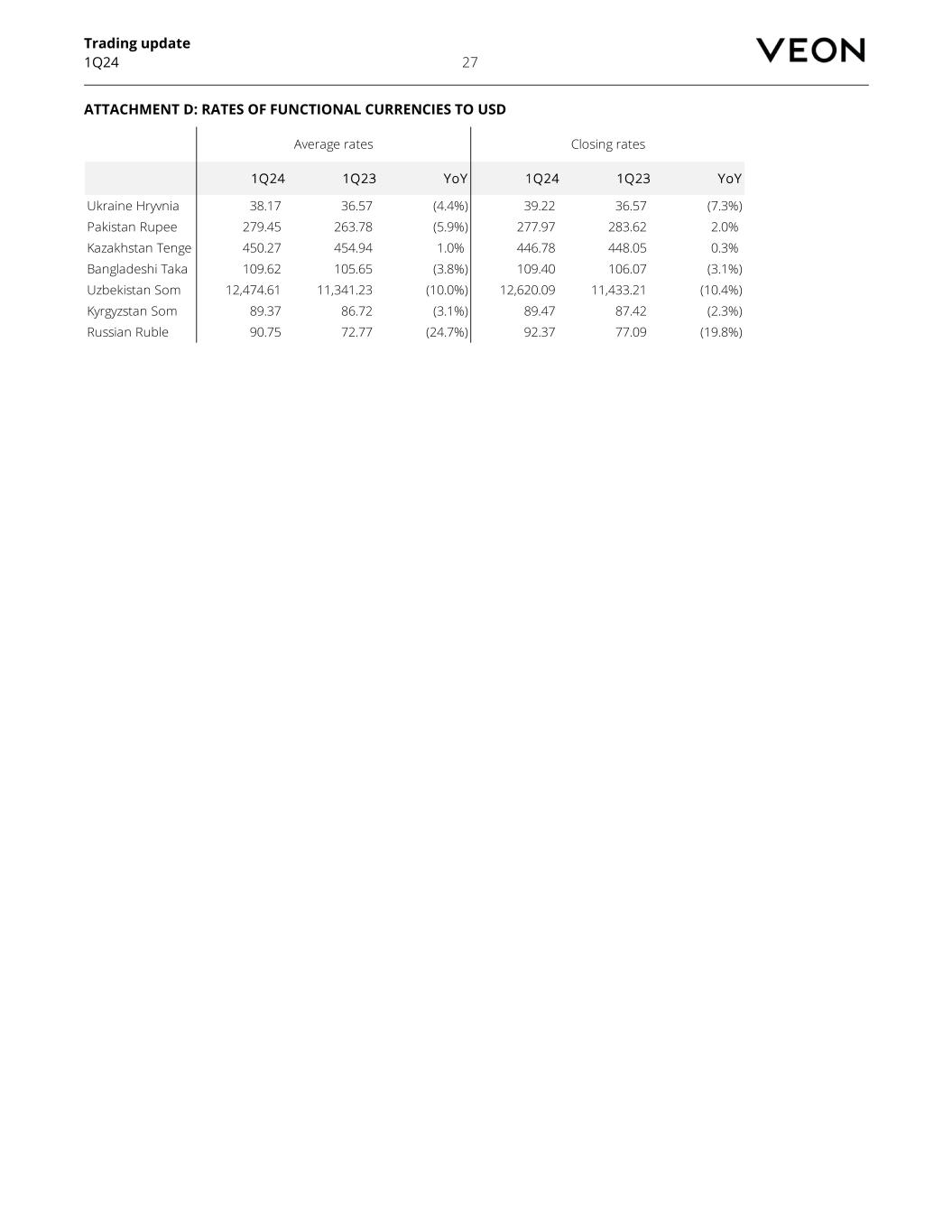

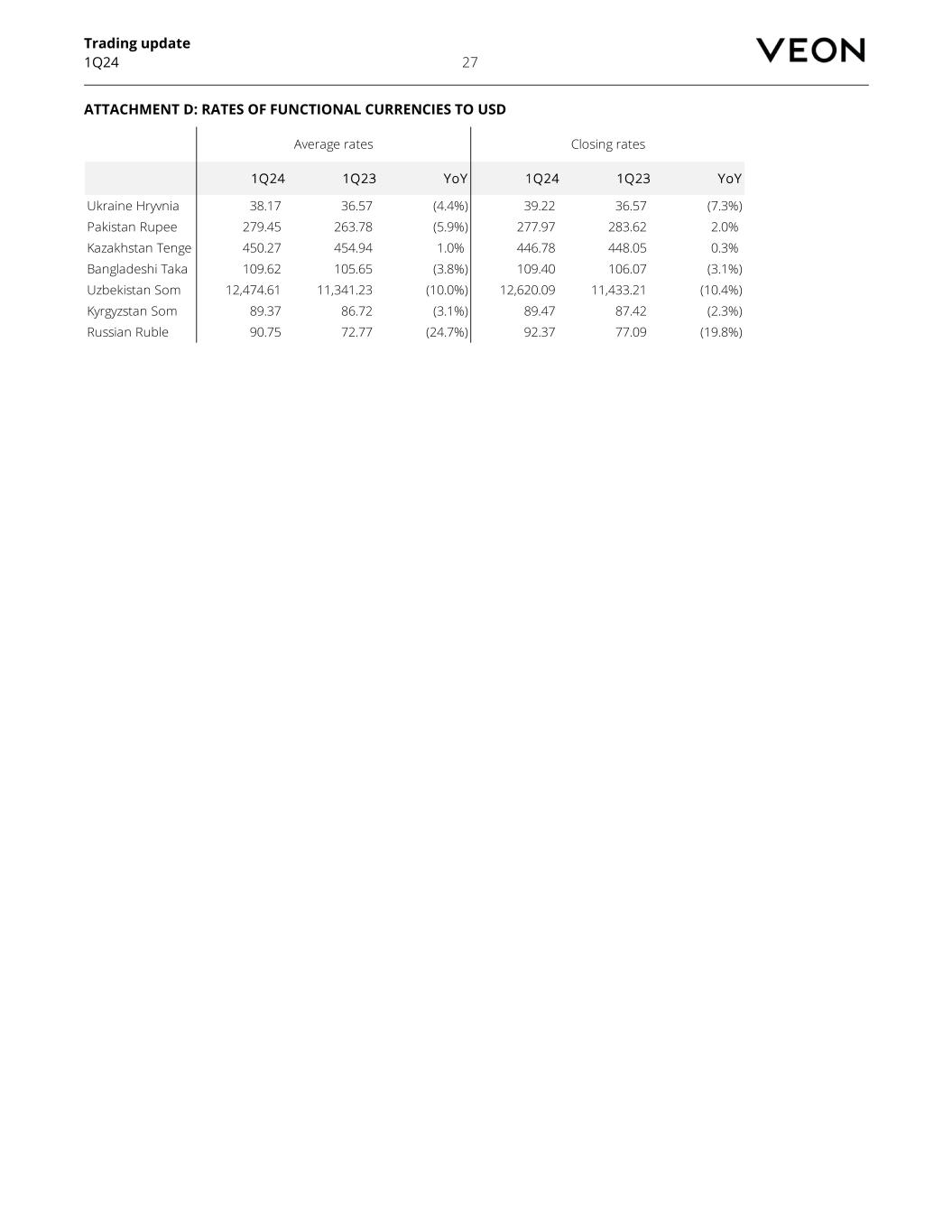

Trading update 1Q24 27 ATTACHMENT D: RATES OF FUNCTIONAL CURRENCIES TO USD 1Q24 1Q23 YoY 1Q24 1Q23 YoY Ukraine Hryvnia 38.17 36.57 (4.4%) 39.22 36.57 (7.3%) Pakistan Rupee 279.45 263.78 (5.9%) 277.97 283.62 2.0% Kazakhstan Tenge 450.27 454.94 1.0% 446.78 448.05 0.3% Bangladeshi Taka 109.62 105.65 (3.8%) 109.40 106.07 (3.1%) Uzbekistan Som 12,474.61 11,341.23 (10.0%) 12,620.09 11,433.21 (10.4%) Kyrgyzstan Som 89.37 86.72 (3.1%) 89.47 87.42 (2.3%) Russian Ruble 90.75 72.77 (24.7%) 92.37 77.09 (19.8%) Closing ratesAverage rates