UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the RegistrantS

Filed by a Party other than the Registrant£

Check the appropriate box:

£ Preliminary Proxy Statement

£ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

£ Definitive Proxy Statement

S Definitive Additional Materials

£ Soliciting Material Under Rule 14a-12

(Name of Registrant as Specified In Its Charter)

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

S No Fee required

£ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

£ Fee paid previously with preliminary materials.

£ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

1) Amount previously paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

On May 16, 2012, AOL Inc. commenced mailing of the below letter and proxy card to its shareholders.

May 16, 2012

Dear Fellow Stockholder:

We believe that Jeffrey Smith of Starboard Value has no viable plan for AOL other than to break up the company and liquidate it. In our view, this would deprive our stockholders of the opportunity to participate in a Company that is primed for growth and instead result in stockholders receiving far less than what AOL is worth.

THE BOARD’S STRATEGY IS WORKING

· AOL HAS MOMENTUMand posted its third consecutive quarter of better-than-expected earnings results in the first quarter of 2012.

· AOL INCREASEDAdjusted OIBDA guidance from $310 million to approximately $350 million.[1]

· AOL GREWglobal advertising revenue year-over-year for the fourth consecutive quarter in the first quarter of 2012.

· AOL GREWcombined AOL Properties Display & Third Party Network revenue 10% year-over-year in the first quarter of 2012.

· AOL REDUCED Adjusted OIBDA expenses by 7% year-over-year and $6 million sequentially (excluding TAC and a legal settlement)in the first quarter of 2012.

· AOL PRODUCED substantial progress in moderating the decline in subscribers withthe lowest rate of churn in seven years in the first quarter of 2012.

· AOL EXPANDEDits audience in key growth areas of the internet, growing total unique visitors quarter over quarter and video views, mobile users and local unique visitors at double digit rates year-over-year in the first quarter of 2012.

· AOL GAINED significant traction with Patch growing traffic and advertisers over 40% year-over-year and revenue over 100% year-over-year in the first quarter of 2012.

· AOL’sSTOCK PRICE HAS INCREASED approximately 170% since August 2011 and Wall Street analysts’ mean share price target for AOL has increased from $17 to $30 per share.

THE BOARD HAS ACTED

· AOL IS RETURNINGall of the proceeds of the approximately $1 billion patent transaction to our stockholders.

· AOL IS COMMITTINGto bring Patch to run-rate profitability by the end of 2013.

· �� AOL IS ENGAGED in a thorough and exhaustive process to selecttwo new independent Board members.

· AOL IS MOVINGto segment reporting.

STARBOARD DOESN’T GET IT

We do not believe Jeffrey Smith and his Starboard nominees have demonstrated an understanding of AOL’s basic business model. They have put forth a series of what we believe to be misleading claims about our supposed standalone “display” business. We believe they do not appreciate the interrelatedness of our content, advertising and access operations. We believe they have demonstrated no understanding of the local advertising opportunity, ignoring the impressive revenue growth that Patch has experienced over the last two quarters and its potential for future growth as we continue to implement our strategy in this high-growth area.

______________________________

[1]Guidance excludes expenses related to the proxy contest and the patent sale.

We believe the issue in this proxy fight is simple: Do you want to hand your investment to Jeffrey Smith – who we believe only plans to liquidate the Company – or do you want to realize the full value of your investment by supporting the AOL Board and its vision for long-term success? Part of this vision includes the expansion of the Board to include two new independent directors chosen after a thorough and exhaustive process.

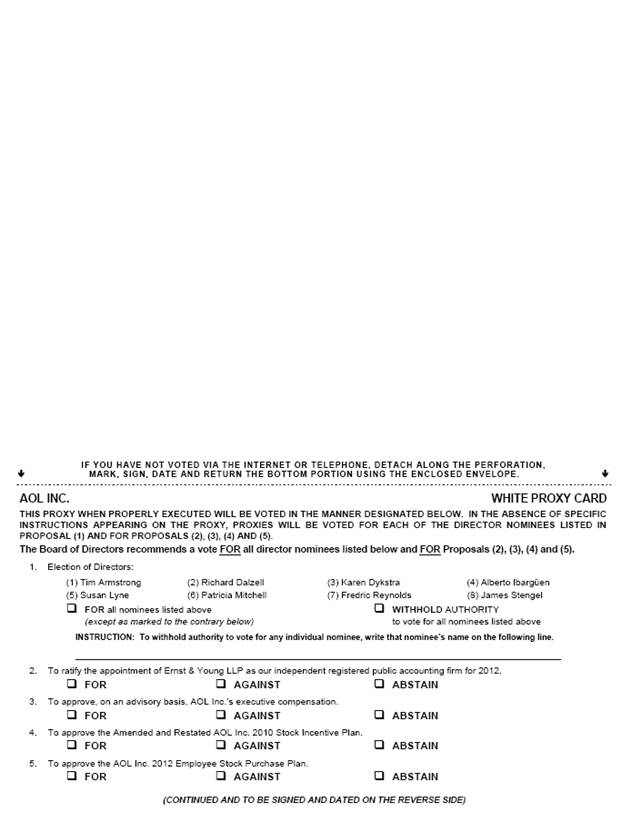

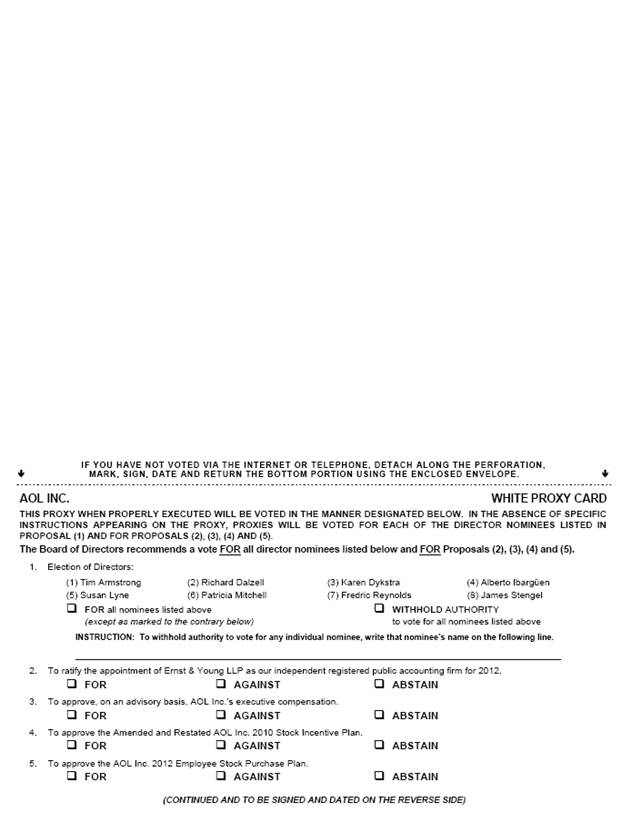

We believe Starboard is determined to wage a damaging proxy fight that could sacrifice the Company’s long-term success. We believe that to maximize the full value of your investment in AOL, you should vote theWHITE proxy card today. Your Board unanimously recommends that stockholders vote“FOR” the Company’s experienced and highly qualified Director nominees: Tim Armstrong, Richard Dalzell, Karen Dykstra, Alberto Ibargüen, Susan Lyne, Patricia Mitchell, Fredric Reynolds and James Stengel.

Your vote is extremely important, no matter how many or how few shares you own. Whether or not you plan to attend the Annual Meeting, you have an opportunity to protect your investment in AOL by voting theWHITE proxy card. We urge you to vote today by telephone, by Internet, or by signing and dating the enclosedWHITE proxy card and returning it in the postage-paid envelope provided. Please do not return or otherwise vote any proxy card sent to you by Starboard. If you have any questions or need assistance voting your shares, please contact MacKenzie Partners, Inc., which is assisting us in connection with this year’s Annual Meeting, at 800-322-2885.

On behalf of your Board, we thank you for your continued support of AOL as we work to create a lasting business that provides stockholders with exceptional value.

Sincerely,

/s/

Tim Armstrong

Chairman and Chief Executive Officer

ABOUT AOL

AOL Inc. (NYSE: AOL) is a brand company, committed to continuously innovating, growing, and investing in brands and experiences that inform, entertain, and connect the world. The home of a world-class collection of premium brands, AOL creates original content that engages audiences on a local and global scale. We help marketers connect with these audiences through effective and engaging digital advertising solutions.

From time to time, we post information about AOL on our investor relations website (http://ir.aol.com) and our official corporate blog (http://blog.aol.com).

FORWARD-LOOKING STATEMENTS

This letter may contain “forward-looking statements” within the meaning of the federal securities laws, including statements concerning anticipated future events and expectations that are not historical facts. Words such as “anticipates,” “estimates,” “expects,” “projects,” “forecasts,” “intends,” “plans,” “will,” “believes” and words and terms of similar substance used in connection with any discussion of future operating or financial performance identify forward-looking statements. These forward-looking statements are based on management’s current expectations and beliefs about future events. As with any projection or forecast, they are inherently susceptible to uncertainty and changes in circumstances. Except as required by law, we are under no obligation to, and expressly disclaim any obligation to, update or alter any forward-looking statements whether as a result of such changes, new information, subsequent events or otherwise. Various factors could adversely affect our operations, business or financial results in the future and cause our actual results to differ materially from those contained in the forward-looking statements, including those factors discussed in detail in the “Risk Factors” section contained in our Annual Report on Form 10-K for the year ended December 31, 2011 (the “Annual Report”), filed with the Securities and Exchange Commission. In addition, we operate a web servicescompany in a highly competitive, rapidly changing and consumer- and technology-driven industry. This industry is affected by government regulation, economic, strategic, political and social conditions, consumer response to new and existing products and services, technological developments and, particularly in view of new technologies, the continued ability to protect intellectual property rights. Our actual results could differ materially from management’s expectations because of changes in such factors. Achieving our business and financial objectives, including growth in operations and maintenance of a strong balance sheet and liquidity position, could be adversely affected by the factors discussed or referenced under the “Risk Factors” section contained in the Annual Report as well as, among other things: 1) changes in our plans, strategies and intentions; 2) continual decline in market valuations associated with our cash flows and revenues; 3) the impact of significant acquisitions, dispositions and other similar transactions; 4) our ability to attract and retain key employees; 5) any negative unintended consequences of cost reductions, restructuring actions or similar efforts, including with respect to any associated savings, charges or other amounts; 6) market adoption of new products and services; 7) the failure to meet earnings expectations; 8) asset impairments; 9) decreased liquidity in the capital markets; 10) our ability to access the capital markets for debt securities or bank financings; 11) the impact of “cyber-warfare” or terrorist acts and hostilities and 12) the approval of the patent transaction with Microsoft Corporation by antitrust authorities and the satisfaction of the other closing conditions to that transaction as well as factors that could affect the manner, timing and amount of the return of any of the sale proceeds to AOL shareholders including the need for AOL to retain cash for its business or to satisfy liabilities.

ADDITIONAL INFORMATION

In connection with the solicitation of proxies, AOL has filed with the Securities and Exchange Commission, a definitive proxy statement and other relevant documents concerning the proposals to be presented at AOL’s 2012 Annual Meeting of Stockholders. The proxy statement contains important information about AOL and the 2012 Annual Meeting. In connection with the 2012 Annual Meeting, AOL has mailed the definitive proxy statement to stockholders. In addition, AOL files annual, quarterly and special reports, proxy statements and other information with the SEC. You are urged to read the proxy statement and other information because they contain important information about AOL and the proposals to be presented at the 2012 Annual Meeting. These documents are available free of charge at the SEC’s website (www.sec.gov) or from AOL at our investor relations website (http://ir.aol.com). The contents of the websites referenced herein are not deemed to be incorporated by reference into the proxy statement.

AOL and its directors, executive officers and certain employees may be deemed to be participants in the solicitation of proxies from AOL’s stockholders in connection with the election of directors and other matters to be proposed at the 2012 Annual Meeting. Information regarding the interests, if any, of these directors, executive officers and specified employees is included in the definitive proxy statement and other materials filed by AOL with the SEC.

If you have any questions, require assistance in voting your shares, or need

additional copies of AOL’s proxy materials, please call MacKenzie Partners

at the phone numbers listed below.

105 Madison Avenue

New York, NY 10016

(212) 929-5500 (call collect)

Or

TOLL-FREE (800) 322-2885