UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the RegistrantS

Filed by a Party other than the Registrant£

Check the appropriate box:

£ Preliminary Proxy Statement

£ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

£ Definitive Proxy Statement

S Definitive Additional Materials

£ Soliciting Material Under Rule 14a-12

(Name of Registrant as Specified In Its Charter)

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

S No Fee required

£ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

£ Fee paid previously with preliminary materials.

£ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

1) Amount previously paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

AOL Inc. intends to commence mailing of the below letter and proxy card to its shareholders on June 1, 2012.

June 1, 2012

Dear Fellow Stockholder:

I am writing to remind you that AOL’s upcoming Annual Meeting of Stockholders, scheduled for June 14, 2012, is fast approaching. As an investor, we see the choice you face as that of endorsing the long-term strategic plan unanimously endorsed by your Board, which is already enhancing stockholder value, or endorsing what we believe is a potentially destructive short-term agenda driven by a stockholder activist.

Your vote is extremely important and could have a significant impact on the future of your investment in AOL. We are asking you to protect the value of that investment by supporting your Board of Director’s efforts to enhance long-term value and voting “FOR” all of AOL’s experienced and highly qualified director nominees on the enclosedWHITE proxy card today.

WE BELIEVE AOL’S STRATEGY IS WORKING AND

PRODUCING SIGNIFICANT VALUE FOR STOCKHOLDERS

Stockholders look for returns that exceed industry averages, and we have developed a strategic plan that is accomplishing just that. As a result of the actions taken by your Board and management team,AOL’s stock has significantly outperformed the major indices1, as well as our online peers2 over the last 12 months. AOL’s stock is up approximately 166% since its low in August 2011 and reached a new 52-week high on May 25, 2012, illustrating the momentum we have in place.

Furthermore, our Board continues to unlock significant stockholder value and AOL reported three consecutive quarters of better than expected earnings results. While our strategy is showing impressive results, we are neither satisfied nor complacent. AOL has made significant operating and financial progress since spinning off from Time Warner only two and a half years ago. We see tremendous opportunities and potential for this Company and expect to continue to execute our strategy to further enhance stockholder value. Our Board and management team have made the following value-enhancing improvements for which Starboard cannot claim credit and we expect to continue to lead the Company in the right direction:

· Improved operational performance, which has resulted in AOL beating Wall Street analyst expectations in each of the last three quarters;

· Adjusted OIBDA 2012 guidance released on May 9, 2012 that was approximately $40 million or 13% ahead of Wall Street’s previous consensus;

· $250 million share repurchase authorization announced on August 11, 2011 and subsequent repurchase of 14% of the shares outstanding;

· $1.056 billion patent transaction with Microsoft, generated from a process initiated in July 2011, and our commitment to return 100% of the proceeds of the transaction to stockholders;

· Commitment to bring Patch to run-rate profitably by Q4 2013; and

· Commitment to return to Adjusted OIBDA growth in2013.

IT’S TIME TO SET THE RECORD STRAIGHT

In a blatant attempt to force what we believe to be a flawed strategy upon the Company, Starboard has issued a barrage of what we believe to be false and misleading statements targeted at AOL’s stockholders. We believe Starboard does not have a long-term strategy and we believe its nominees are unqualified to lead your company. We believe Starboard’s plan to break up and liquidate the Company lacks credibility and would forfeit the opportunity to fully realize the potential value of your investment and undermine the Board’s vision for long-term success. The addition of Starboard’s nominees would decrease the Board’s level of industry expertise, public company experience and diversity. Furthermore, we believe the addition of Starboard’s nominees could stunt the momentum currently being exhibited by AOL’s highly qualified Board. Why dismantle a strategy that we believe is clearly working?

1NASDAQ Composite and S&P Mid Cap 400

2Online peers are market value weighted and include US companies with market values greater than $500 million in the FactSet defined industries of Internet Software / Services and Internet Retail

WE BELIEVE THAT AOL'S BOARD NOMINEES HAVE SIGNIFICANTLY GREATER

RELEVANT EXPERIENCE THAN STARBOARD'S NOMINEES

Each of the three AOL Board members targeted by Starboard is diverse in culture and experience, which aligns perfectly with AOL’s strategy. AOL’s nominees have significant operational, financial and public Board experience highly relevant to AOL’s areas of strategic focus and bring a fresh, independent perspective to our Board. We have a sound strategy and team, which has produced proven results. On the other hand,we believethat none of Starboard’s nominees brings any additive experience or diversity to the Board.

AOL Nominees |

| New MediaExperience3 | Relevant Public CompanyBoardExperience4 | Company CEO / CFO Experience |

Alberto Ibargüen | ü | ü | ü |

Patricia Mitchell | ü | ü | ü |

James Stengel | ü | ü | ü |

Starboard Nominees |

Dennis Miller | ü | NONE | NONE |

Jeffrey Smith | NONE | ü | ü |

James Warner | ü | NONE | NONE |

AOL WILL ADD TWO NEW BOARD MEMBERS, BUT BELIEVES STARBOARD’S SLATE

WILL DAMAGE THE COMPANY

While the AOL Board is comprised of eight highly qualified and experienced directors, the Company is committed to adding two new independent directors to the Board, which we believe will add fresh, relevant perspectives and further enhance stockholder value.

We believe Starboard’s slate, however, would damage the Company and would have a negative impact on advertiser relationships with AOL. A majority of Starboard’s nominees do not have relevant public company Board experience. Why risk electing nominees with no relevant public company Board experience to guide a large company with a world-class collection of premium brandsand which already has a fully functional and effective Board? Our Board has been a driver of significant change and has spent the last two years rebuilding and improving relationships with advertisers who are attracted to and invested in AOL’s strategy. We believe a departure from that course could lead to advertisers spending less with AOL and harm the Company and its outlook.

We also believe that providing a particular investor with handpicked representation on the Board will undermine good governance and the effectiveness of the Board.

3“New media” includes the Internet, websites, computer multimedia, video games, CD-ROMs and DVDs

4 Greater than $500 million in revenue

WE BELIEVE STARBOARD’S CAMPAIGN IS DESIGNED TO FOIST ITS SHORT-TERM

STRATEGY ON AOL AND OUR STOCKHOLDERS

The AOL management team and Board have reached out to Mr. Smith numerous times to engage in a constructive board-level dialogue; however, Starboard has refused AOL’s numerous requests to reach a mutually agreed upon outcome that benefits ALL stockholders. We believe that Starboard’s and Mr. Smith’s campaign to secure Board representation is solely designed to foist what we believe is Starboard’s misguided, short-term strategy on AOL. We believe that Starboard has falsely suggested that they have attempted to constructively engage with AOL and are interested in an “amicable resolution” of the dispute over AOL’s Board composition. Starboard does not detail the numerous efforts made by AOL to resolve the parties’ dispute through discussion of adding mutually acceptable directors. We urge Starboard to present the truth and abandon what we believe to be value-destructive fabrications that it is presenting to stockholders and the media.

Starboard’s proxy campaign furthers our belief that Starboard and Mr. Smith’s interests are not aligned with the interests of all stockholders but is designed, in our view, to establish Mr. Smith’s bona fides as an “activist” investor and to garner him the publicity and prestige of a board seat at AOL. We believe that the long-term prospects for AOL far outweigh the short-sighted interests of Starboard. We have proven we can drive value in the short-term while executing on a strategy that we believe will produce even greater long-term value.

There is no better example of this than our investment in Patch. Starboard’s short-sightedness, in our view, is evidenced by what we perceive to be their intention to shut down Patch immediately, despite AOL’s public commitment to bring Patch to run-rate profitability by the fourth quarter of 2013. We believe this resolution is uninformed and myopic and would drastically reduce potential stockholder returns. We believe Patch is an investment in a very large market opportunity and that over the next 12 to 18 months, the value of Patch will increase significantly and benefit from AOL’s prior investment.

You can vote for the team that has been dedicated to successfully making significant operational and financial improvements at AOL over the last two and a half years and that in our view has positioned AOL for future growth and stockholder value by voting the WHITE proxy today.

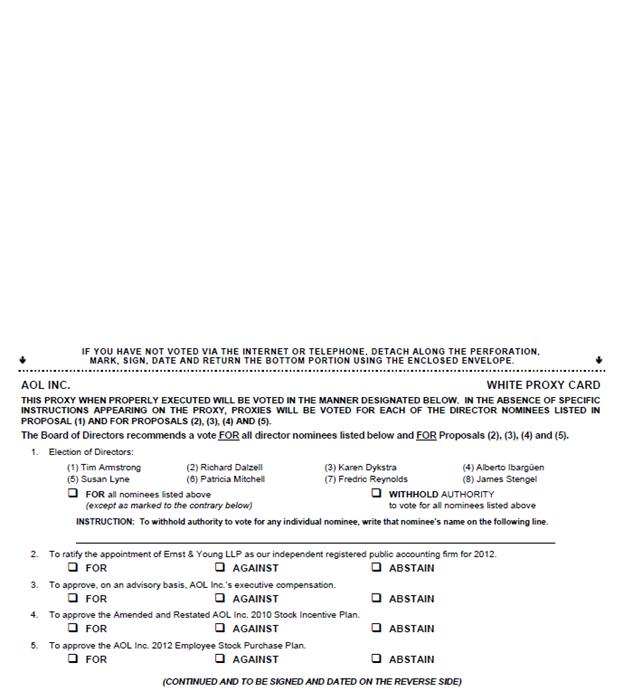

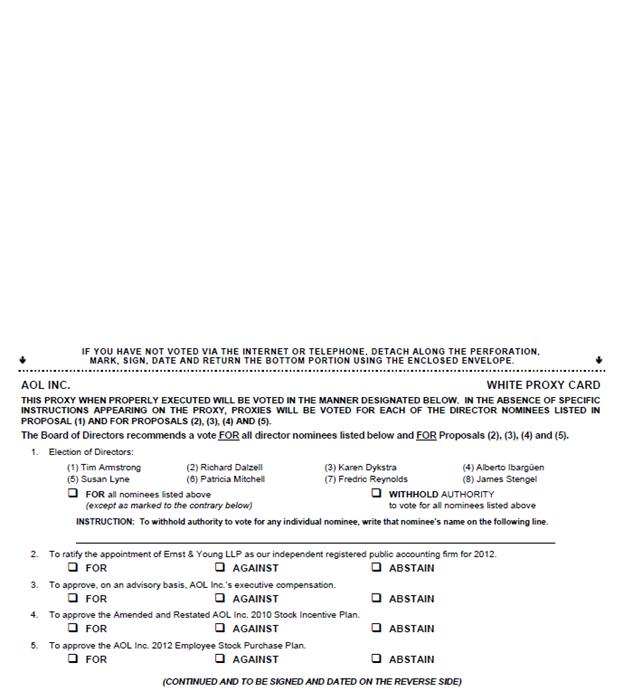

The AOL Board unanimously recommends that all stockholders voteFOR all of AOL’s experienced and highly qualified director nominees: Tim Armstrong, Richard Dalzell, Karen Dykstra, Alberto Ibargüen, Susan Lyne, Patricia Mitchell, Fredric Reynolds and James Stengel.

Your vote is extremely important, no matter how many or how few shares you own. Whether or not you plan to attend the Annual Meeting, you have an opportunity to protect your investment in AOL by voting by telephone, by Internet or by signing, dating and returning theWHITE proxy card as soon as possible.If you have already voted on Starboard’s gold proxy card, you may still revoke that prior vote by simply voting your WHITE proxy card. Only your latest dated proxy will be counted.

If you have any questions or need assistance voting your shares, please contact MacKenzie Partners, Inc., which is assisting us in connection with this year’s Annual Meeting, at 800-322-2885.

On behalf of your Board, we thank you for your continued support of AOL as we work to create a lasting business that provides stockholders with exceptional value.

Sincerely,

/s/

Tim Armstrong

Chairman and Chief Executive Officer

If you have any questions, require assistance in voting your shares, or need

additional copies of AOL’s proxy materials, please call MacKenzie Partners

at the phone numbers listed below.

105 Madison Avenue

New York, NY 10016

(212) 929-5500 (call collect)

Or

TOLL-FREE (800) 322-2885

About AOL

AOL Inc. (NYSE: AOL) is a brand company, committed to continuously innovating, growing, and investing in brands and experiences that inform, entertain, and connect the world. The home of a world-class collection of premium brands, AOL creates original content that engages audiences on a local and global scale. We help marketers connect with these audiences through effective and engaging digital advertising solutions.

From time to time, we post information about AOL on our investor relations website (http://ir.aol.com) and our official corporate blog (http://blog.aol.com).

Forward-Looking Statements

This letter may contain “forward-looking statements” within the meaning of the federal securities laws, including statements concerning anticipated future events and expectations that are not historical facts. Words such as “anticipates,” “estimates,” “expects,” “projects,” “forecasts,” “intends,” “plans,” “will,” “believes” and words and terms of similar substance used in connection with any discussion of future operating or financial performance identify forward-looking statements. These forward-looking statements are based on management’s current expectations and beliefs about future events. As with any projection or forecast, they are inherently susceptible to uncertainty and changes in circumstances. Except as required by law, we are under no obligation to, and expressly disclaim any obligation to, update or alter any forward-looking statements whether as a result of such changes, new information, subsequent events or otherwise. Various factors could adversely affect our operations, business or financial results in the future and cause our actual results to differ materially from those contained in the forward-looking statements, including those factors discussed in detail in the “Risk Factors” section contained in our Annual Report on Form 10-K for the year ended December 31, 2011 (the “Annual Report”), filed with the Securities and Exchange Commission. In addition, we operate a web services company in a highly competitive, rapidly changing and consumer- and technology-driven industry. This industry is affected by government regulation, economic, strategic, political and social conditions, consumer response to new and existing products and services, technological developments and, particularly in view of new technologies, the continued ability to protect intellectual property rights. Our actual results could differ materially from management’s expectations because of changes in such factors. Achieving our business and financial objectives, including growth in operations and maintenance of a strong balance sheet and liquidity position, could be adversely affected by the factors discussed or referenced under the “Risk Factors” section contained in the Annual Report as well as, among other things: 1) changes in our plans, strategies and intentions; 2) continual decline in market valuations associated with our cash flows and revenues; 3) the impact of significant acquisitions, dispositions and other similar transactions; 4) our ability to attract and retain key employees; 5) any negative unintended consequences of cost reductions, restructuring actions or similar efforts, including with respect to any associated savings, charges or other amounts; 6) market adoption of new products and services; 7) the failure to meet earnings expectations; 8) asset impairments; 9) decreased liquidity in the capital markets; 10) our ability to access the capital markets for debt securities or bank financings; 11) the impact of “cyber-warfare” or terrorist acts and hostilities and 12) the approval of the patent transaction with Microsoft Corporation by antitrust authorities and the satisfaction of the other closing conditions to that transaction as well as factors that could affect the manner, timing and amount of the return of any of the sale proceeds to AOL shareholders including the need for AOL to retain cash for its business or to satisfy liabilities.

Additional Information

In connection with the solicitation of proxies, AOL has filed with the Securities and Exchange Commission, a definitive proxy statement and other relevant documents concerning the proposals to be presented at AOL’s 2012 Annual Meeting of Stockholders. The proxy statement contains important information about AOL and the 2012 Annual Meeting. In connection with the 2012 Annual Meeting, AOL has mailed the definitive proxy statement to stockholders. In addition, AOL files annual, quarterly and special reports, proxy statements and other information with the SEC. You are urged to read the proxy statement and other information because they contain important information about AOL and the proposals to be presented at the 2012 Annual Meeting. These documents are available free of charge at the SEC’s website (www.sec.gov) or from AOL at our investor relations website (http://ir.aol.com). The contents of the websites referenced herein are not deemed to be incorporated by reference into the proxy statement.

AOL and its directors, executive officers and certain employees may be deemed to be participants in the solicitation of proxies from AOL’s stockholders in connection with the election of directors and other matters to be proposed at the 2012 Annual Meeting. Information regarding the interests, if any, of these directors, executive officers and specified employees is included in the definitive proxy statement and other materials filed by AOL with the SEC.