Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

AOL Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange ActRule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

Notice of 2015 Annual Meeting

of Stockholders and Proxy Statement

May 27, 2015

9:00 a.m., Eastern Time

Hyatt Regency Greenwich

Old Greenwich, Connecticut

Table of Contents

April 16, 2015

Dear Fellow Stockholders:

Please join us for AOL Inc.’s Annual Meeting of Stockholders on May 27, 2015, at 9:00 a.m. (Eastern Time) at the Hyatt Regency Greenwich, 1800 East Putnam Avenue, Old Greenwich, Connecticut 06870. We are pleased to be utilizing the Securities and Exchange Commission rule allowing companies to furnish proxy materials to their stockholders over the internet. We believe that the e-proxy process will expedite our stockholders’ receipt of proxy materials, lower the costs of distribution and reduce the environmental impact of our Annual Meeting.

In accordance with this rule, we are sending stockholders of record at the close of business on April 2, 2015 a Notice of Internet Availability of Proxy Materials. The Notice contains instructions on how to access our Proxy Statement and Annual Report and vote online. If you would like to receive a printed copy of our proxy materials instead of downloading a printable version from the internet, please follow the instructions for requesting such materials included in the Notice as well as in the attached Proxy Statement.

Attached to this letter are a Notice of Annual Meeting of Stockholders and Proxy Statement, which describe the business to be conducted at the Annual Meeting. We also will report on matters of current interest to our stockholders.

Your vote is important. Whether you own a few shares or many, and whether or not you plan to attend the Annual Meeting in person, it is important that your shares be represented and voted at the Annual Meeting.

Thank you for your continued support of AOL Inc.

Sincerely,

Tim Armstrong

Chairman and Chief Executive Officer

Table of Contents

PROXY VOTING METHODS

If at the close of business on April 2, 2015 you were a stockholder of record, you may vote your shares by proxy over the internet, by telephone or by mail. If at the close of business on April 2, 2015 you held shares through a bank, broker or other nominee, you may vote by submitting voting instructions to your bank, broker or nominee. In these cases, you may vote directly over the internet or by telephone or you may vote by mail by submitting a voting instruction form. We encourage you to vote over the internet or by telephone, both of which you may do 24 hours a day, 7 days a week. In addition, if at the close of business on April 2, 2015 you were a stockholder of record or held shares through a bank, broker or other nominee, you may vote in person at our Annual Meeting of Stockholders to be held on May 27, 2015 (the “Annual Meeting”). You may revoke your proxy and change your vote at the time and in the manner described on page 4 of the Proxy Statement.

If you hold your shares directly in your name in our stock records maintained by our transfer agent, Computershare Trust Company N.A., proxies submitted via the internet or by telephone must be received by 11:59 p.m., Eastern Time, on Tuesday, May 26, 2015.

If you hold shares through a bank, broker or other nominee, voting instructions submitted over the internet or by telephone as described above must be received by 11:59 p.m., Eastern Time, on Tuesday, May 26, 2015.

Proxies or voting instructions submitted by mail must be returned in the envelope provided to you with your paper proxy card or voting instruction form, and received not later than 9:00 a.m. Eastern Time, on Wednesday, May 27, 2015.

You may vote by proxy:

BY INTERNET

| • | If you have internet access, by following the instructions included in the Notice of Internet Availability of Proxy Materials or your proxy card. |

BY TELEPHONE

| • | By following the telephone voting instructions included on the proxy card or on the internet voting website specified on the proxy card. |

BY MAIL

| • | If you have not already received a printed copy of the proxy materials by mail, request a proxy card from us by following the instructions on your Notice of Internet Availability of Proxy Materials and follow these additional steps: |

| • | When you receive the proxy card, mark your selections on the proxy card. |

| • | Date and sign your name exactly as it appears on your proxy card. |

| • | Mail the proxy card in the postage-paid envelope that will be provided to you. |

YOUR VOTE IS IMPORTANT. THANK YOU FOR VOTING.

Table of Contents

AOL INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| TIME | 9:00 a.m. (Eastern Time) on Wednesday, May 27, 2015 | |||

| PLACE | Hyatt Regency Greenwich, 1800 East Putnam Avenue, Old Greenwich, CT 06870 | |||

| ITEMS OF BUSINESS | 1. | To elect the nine director nominees listed in the Proxy Statement. | ||

| 2. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2015. | |||

| 3. | To approve the Company’s executive compensation on an advisory basis. | |||

| 4. | To approve the Company’s amended and restated AOL Inc. Annual Incentive Plan For Executive Officers. | |||

| 5. | To consider such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. | |||

| RECORD DATE | You may vote at the Annual Meeting or any adjournment or postponement of the Annual Meeting if you were a stockholder of record at the close of business on April 2, 2015. | |||

| VOTING BY PROXY | To ensure your shares are voted, you may vote your shares via the internet, by telephone or, if you have received a printed copy of the proxy materials from us by mail, by completing, signing, dating and promptly returning the enclosed proxy card by mail. Internet and telephone voting procedures are described on the preceding page, in the General Information section beginning on page 1 of the Proxy Statement and on the proxy card. For shares held through a bank, broker or other nominee, you may vote by submitting voting instructions to your bank, broker or nominee. | |||

By Order of the Board of Directors,

Julie Jacobs

Executive Vice President, General Counsel and Corporate Secretary

This Notice of Annual Meeting and Proxy Statement

are being distributed to stockholders beginning on or about April 16, 2015.

Table of Contents

| 1 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

Code of Ethics for Our Senior Executive and Senior Financial Officers | 17 | |||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

Executive Sessions of Non-Employee and Independent Directors | 21 | |||

| 21 | ||||

| 22 | ||||

| 22 | ||||

Item 2—Ratification of the Appointment of Independent Registered Public Accounting Firm | 23 | |||

| 23 | ||||

| 23 | ||||

Policy Regarding Pre-Approval of Services Provided by the Independent Auditors | 24 | |||

| 25 | ||||

| 27 | ||||

| Item 4— Approval of the amended and restated AOL Inc. Annual Incentive Plan For Executive Officers | 28 | |||

| 28 | ||||

| 29 | ||||

| 31 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| 38 | ||||

| 47 | ||||

| 49 | ||||

| 49 | ||||

| 50 | ||||

| 50 | ||||

| 52 | ||||

Narrative to the 2014 Summary Compensation Table and the Grants of Plan-Based Awards in 2014 Table | 53 | |||

| 59 | ||||

| 61 | ||||

| 61 | ||||

Potential Payments Upon Termination of Employment or Change in Control for 2014 | 62 | |||

| 63 | ||||

| 65 |

Table of Contents

| 72 | ||||

| 72 | ||||

| 73 | ||||

| 75 | ||||

| 78 | ||||

| 78 | ||||

| 79 | ||||

| 79 | ||||

| 79 | ||||

| 79 | ||||

| 80 | ||||

Annex A— Amended and Restated AOL Inc. Annual Incentive Plan For Executive Officers | A-1 | |||

| B-1 |

Table of Contents

AOL INC.

770 Broadway

New York, New York 10003

Telephone: (212) 652-6400

PROXY STATEMENT

Annual Meeting of Stockholders

May 27, 2015

9:00 a.m. (Eastern Time)

| Q: | Why am I being provided with these materials? |

| A: | We have made these proxy materials available to you via the internet or, upon your request, have delivered printed versions of these materials to you by mail in connection with the solicitation by the Board of Directors (the “Board”) of AOL Inc. (the “Company” or “AOL”) of proxies to be voted at our Annual Meeting of Stockholders to be held on May 27, 2015 (the “Annual Meeting”), and at any postponements or adjournments of the Annual Meeting. If at the close of business on April 2, 2015 you were a stockholder of record or held shares through a bank, broker or other nominee, you are invited to vote your shares and attend the meeting. |

There are four proposals scheduled to be voted on at the Annual Meeting:

| • | Election of nine director nominees. |

| • | Ratification of the appointment of Ernst & Young LLP (“Ernst & Young”) as our independent registered public accounting firm for 2015. |

| • | Approval of the Company’s executive compensation on an advisory basis. |

| • | Approval of the amended and restated AOL Inc. Annual Incentive Plan For Executive Officers. |

| Q: | Why did I receive a one-page notice in the mail regarding the internet availability of proxy materials instead of a full set of proxy materials? |

| A: | Pursuant to the rules adopted by the United States Securities and Exchange Commission (the “SEC”), we have elected to provide stockholders access to our proxy materials via the internet. We believe that the e-proxy process will expedite our stockholders’ receipt of proxy materials, lower the costs of distribution and reduce the environmental impact of our Annual Meeting. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) on or about April 16, 2015 to stockholders of record entitled to vote at the Annual Meeting. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or your proxy card and to download printable versions of the proxy materials or to request and receive a printed set of the proxy materials from us. Instructions on how to access the proxy materials over the internet or to request a printed copy from us may be found in the Notice. |

| Q: | Who is entitled to vote? |

| A: | Stockholders as of the close of business on April 2, 2015 (the “Record Date”) may vote at the Annual Meeting. As of that date, there were 78,328,821 shares of our common stock |

1

Table of Contents

| outstanding and entitled to vote. You have one vote for each director nominee and for each other proposal to be voted on at the Annual Meeting with respect to each share of common stock held by you as of the Record Date, including shares: |

| • | Held directly in your name as “stockholder of record” (also referred to as “registered stockholder”); and |

| • | Held for you in an account with a broker, bank or other nominee (shares held in “street name”)—street name holders generally cannot vote their shares directly and instead must instruct the broker, bank or nominee how to vote their shares. |

| Q: | What constitutes a quorum? |

| A: | A majority of the voting power of the outstanding shares of common stock entitled to vote generally on the business properly brought before the Annual Meeting must be represented in person or by proxy to constitute a quorum for the Annual Meeting. Abstentions are counted as present and entitled to vote for purposes of determining a quorum. If you hold your shares in street name and do not provide voting instructions to your broker, New York Stock Exchange (“NYSE”) rules grant your broker discretionary authority to vote your shares on “routine matters” at the Annual Meeting, including the ratification of the appointment of the independent auditors in Proposal 2. However, the proposals regarding the election of directors, the advisory vote to approve executive compensation and the approval of the Company’s amended and restated AOL Inc. Annual Incentive Plan For Executive Officers, are not considered “routine matters.” As a result, if you do not provide instructions, your shares will not be voted on Proposals 1, 3 and 4 (resulting in a “broker non-vote”). Although “broker non-votes” will be counted as present and entitled to vote for purposes of determining a quorum, we urge you to promptly provide voting instructions to your broker so that your shares are voted on all proposals. |

| Q: | How many votes are required to approve each proposal? |

| A: | Each director nominee shall be elected at the Annual Meeting by the vote of a majority of the votes cast with respect to the nominee. A majority of the votes cast with respect to election of a director nominee means that the number of votes cast “FOR” a nominee must exceed the votes cast “AGAINST” that nominee (with “abstentions” and “broker non-votes” not counted as votes cast with respect to that nominee). |

Under our by-laws, any other proposal requires the affirmative vote of a majority of the voting power of the shares of common stock of the Company present in person or represented by proxy at the Annual Meeting and voting thereon.

| Q: | How are votes counted? |

| A: | You may vote “FOR” or “AGAINST” each of the director nominees, or you may “ABSTAIN” from voting for one or more nominees. You may vote “FOR” or “AGAINST” or you may “ABSTAIN” from voting on each of the other proposals. |

With respect to the election of directors, neither an abstention nor a broker non-vote will count as a vote cast “for” or “against” a director nominee. Therefore, abstentions and broker non-votes will have no direct effect on the outcome of the election of directors.

With respect to each of the other proposals to be voted on at the Annual Meeting, neither an abstention nor a broker non-vote will count as voting with respect to the proposal. Therefore, abstentions and broker non-votes will have no direct effect on the outcome of the proposal.

2

Table of Contents

If you sign and submit your proxy card without specifying how you would like your shares voted, your shares will be voted in accordance with the Board’s recommendations specified below under “How does the Board recommend that I vote?” and in accordance with the discretion of the persons named on the proxy card (the “proxyholders”) with respect to any other matters that may be voted upon at the Annual Meeting or at any adjournments or postponements of the Annual Meeting.

| Q: | Who will count the vote? |

| A: | Representatives of Computershare Trust Company N.A., our transfer agent, will tabulate the votes and act as inspectors of election. |

| Q: | How does the Board recommend that I vote? |

| A: | Our Board recommends that you vote your shares: |

| • | “FOR” the election of each of the director nominees set forth in this Proxy Statement. |

| • | “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2015. |

| • | “FOR” the approval of the Company’s executive compensation on an advisory basis. |

| • | “FOR” the approval of the Company’s amended and restated AOL Inc. Annual Incentive Plan For Executive Officers. |

| Q: | How do I vote my shares without attending the Annual Meeting? |

| A: | If you are a registered stockholder you may vote by granting a proxy using any of the following methods: |

| • | By Internet—If you have internet access, by submitting your proxy by following the instructions included in the Notice or your proxy card. |

| • | By Telephone—By submitting your proxy by following the telephone voting instructions included on the proxy card or on the internet voting website specified on the proxy card. |

| • | By Mail—If you have received or requested a printed copy of the proxy materials from us by mail, you may vote by mail by completing, signing and dating the enclosed proxy card where indicated and by mailing the proxy card in the envelope provided to you. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as guardian, executor, trustee, custodian, attorney or officer of a corporation), indicate your name and title or capacity. |

If your shares are held in street name, your bank, broker or other nominee should give you instructions for voting your shares. In these cases, you may vote via the internet, by telephone or by mail by submitting a voting instruction form. Internet and telephone voting facilities will close at 11:59 p.m. (Eastern Time) on May 26, 2015 for the voting of shares held by stockholders of record and for the voting of shares held in street name. Mailed proxy cards or voting instruction forms must be returned in the envelope provided to you with your proxy card or voting instruction form, and received by 9:00 a.m. (Eastern Time) on May 27, 2015.

| Q: | How do I vote my shares in person at the Annual Meeting? |

| A: | First, you must satisfy the requirements for admission to the Annual Meeting as detailed below. Then, if you are a stockholder of record and prefer to vote your shares at the Annual Meeting, |

3

Table of Contents

| you must bring either your Notice or proof of stock ownership. You may vote shares held in street name at the Annual Meeting only if you obtain a signed proxy from the record holder (bank, broker or other nominee) giving you the right to vote the shares. |

You may obtain directions to the Annual Meeting by contacting our Corporate Secretary via email at corporatesecretary@teamaol.com, via phone at (212) 652-6450, via fax at (703) 466-9813 or via mail to AOL Inc., 770 Broadway, New York, New York 10003.

Even if you plan to attend the Annual Meeting, we encourage you to vote in advance via internet, telephone or mail so that your vote will be counted even if you later decide not to attend the Annual Meeting.

| Q: | What does it mean if I receive more than one Notice or proxy card on or about the same time? |

| A: | It generally means you hold shares registered in more than one account. To ensure that all your shares are voted, please sign and return each proxy card or, if you vote via internet or telephone, vote once for each Notice you receive. For more information, see “Householding of Proxy Materials” on page 79 of this Proxy Statement. |

| Q: | May I change my vote or revoke my proxy? |

| A: | Yes. Whether you have voted via internet, telephone or mail, if you are a stockholder of record, you may change your vote and revoke your proxy by: |

| • | Sending a written statement to that effect to our Corporate Secretary, provided such statement is received at or prior to the Annual Meeting; |

| • | Submitting a vote at a later time via internet or telephone before the closing of those voting facilities at 11:59 p.m. (Eastern Time) on May 26, 2015; |

| • | Submitting a properly signed proxy card with a later date that is received at or prior to the Annual Meeting; or |

| • | Attending the Annual Meeting and voting in person. |

If you hold shares in street name, you may submit new voting instructions by contacting your bank, broker or other nominee. You may also change your vote or revoke your voting instructions in person at the Annual Meeting if you obtain a signed proxy from the record holder (bank, broker or other nominee) giving you the right to vote the shares.Only the latest validly executed proxy that you submit will be counted.

| Q: | Do I need a ticket to be admitted to the Annual Meeting? |

| A: | No, although only stockholders and one guest, and other individuals invited by the Company are entitled to attend the Annual Meeting. To obtain admission to the Annual Meeting, you must register in advance by emailingcorporatesecretary@teamaol.com, by calling (212) 652-6450 or by faxing (703) 466-9813. You may bring one immediate family member as a guest. Please register by May 23, 2015. Please include the following information in your email, voicemail or fax: |

| • | your name and mailing address; |

| • | whether you need special assistance at the Annual Meeting; |

4

Table of Contents

| • | the name of your immediate family member guest, if one will accompany you; and |

| • | if your shares are held for you in the name of your bank, broker or other nominee, evidence of your stock ownership (such as a letter from your bank or broker or a photocopy of a current brokerage or other account statement) as of April 2, 2015. |

In addition, we may establish additional or different rules and regulations for admission into and the conduct of the Annual Meeting.

| Q: | Do I also need to present identification to be admitted to the Annual Meeting? |

| A: | Yes, all stockholders and guests must present a valid, government-issued form of identification in order to be admitted to the Annual Meeting. |

| Q: | Could other matters be decided at the Annual Meeting? |

| A: | We are currently unaware of any matters to be raised at the Annual Meeting other than those referred to in this Proxy Statement. If other matters are properly presented at the Annual Meeting for consideration, the proxyholders will have the discretion to vote on those matters for you. |

| Q: | Who will pay for the cost of this proxy solicitation? |

| A: | We will pay for the cost of soliciting proxies. Proxies may be solicited on our behalf by directors, officers or employees (for no additional compensation) in person or by telephone, electronic transmission and facsimile transmission. We have hired Georgeson Inc. to solicit proxies. We will pay Georgeson Inc. a fee of $9,000, plus reasonable expenses, for these services. Brokers and other nominees will be requested to solicit proxies or authorizations from beneficial owners and will be reimbursed for their reasonable and documented expenses. |

5

Table of Contents

DEVELOPMENTS SINCE THE 2014 ANNUAL MEETING

Since the 2014 Annual Meeting, at which each of the Company’s directors standing for election was reelected, we have followed through on the commitments we made to stockholders. Specifically, we have achieved the following:

| • | Grew total revenue and profit year-over-year each quarter of 2014 |

| • | Completed 2014 with trend improvements across all segments and reduced corporate expenses |

| • | Grew pricing double-digits across AOL and third party properties for the full year 2014 |

| • | Brought AOL Platforms business to profitability in full year 2014 |

| • | Grew programmatic revenue 250% in 2014 surging to 39% of non-search advertising and other revenue during the fourth quarter compared to 6% in the fourth quarter of 2013 |

| • | Delivered the fastest multi-platform user growth among top 5 internet properties |

| • | Repurchased approximately $98.6 million of our common stock and issued $379.5 million of convertible debt as part of our disciplined capital allocation strategy |

NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on May 27, 2015.

The Proxy Statement and Annual Report are available at http://corp.aol.com/proxymaterials.

6

Table of Contents

The Board, upon recommendation of the Nominating and Governance Committee of the Board (the “Nominating and Governance Committee”), unanimously nominated the nine director nominees listed below for election to the Board at the Annual Meeting. Each of the nine nominees currently serves as a member of the Board and was last elected by the stockholders at the 2014 Annual Meeting of Stockholders.

Directors elected at the Annual Meeting will be elected to hold office until the 2016 Annual Meeting of Stockholders and until their successors are duly elected and qualified. Unless otherwise instructed, the proxyholders intend to vote the proxies held by them for the election of the nine director nominees named below. The proxies cannot be voted for more than nine candidates for director. If any of the nine director nominees is unable or unwilling to be a candidate for election by the time of the Annual Meeting (a contingency which the Board does not expect to occur), the proxyholders may vote for a substitute nominee chosen by the present Board to fill the vacancy. In the alternative, the proxyholders may vote just for the remaining nominees, leaving a vacancy that may be filled at a later date by the Board. Alternatively, the Board may reduce the size of the Board. Set forth below are the principal occupations, business experience, qualifications, directorships and certain other information for each of the nine director nominees.

Nominees for Election as Directors

Name, Title, Age and Tenure as a Director | Principal Occupation, Business Experience, Qualifications and Directorships | |

TIM ARMSTRONG

Chairman and AOL Inc. Director since 2009 Age 44 | Mr. Tim Armstrong has served as Chairman and Chief Executive Officer of AOL since April 2009. Prior to that, Mr. Armstrong served as President, Americas Operations and Senior Vice President of Google Inc., a global technology company, and served on its operating committee. Mr. Armstrong joined Google Inc. in 2000 as Vice President, Advertising Sales. In 2004, Mr. Armstrong was promoted to Vice President, Advertising and Commerce and then in 2007 was named President, Americas Operations and Senior Vice President. Before joining Google Inc., Mr. Armstrong served as Vice President of Sales and Strategic Partnerships for Snowball.com Inc. from 1998 to 2000. Prior to that, he served as Director of Integrated Sales and Marketing at Starwave’s and Disney’s ABC/ESPN Internet Ventures. Mr. Armstrong started his career by co-founding and running a newspaper based in Boston, Massachusetts. Mr. Armstrong currently serves on the board of directors of The Priceline Group Inc. Mr. Armstrong is a trustee of Lawrence Academy, on the board of trustees of The Paley Center for Media, on the New York regional board of Teach for America and on the board of the Waterside Charter School. Mr. Armstrong is a Chair Emeritus of the Ad Council and Chairman of the IAB Education Foundation, both of which are non-profit organizations.

Skills and Qualifications Mr. Armstrong brings to the Board extensive experience, expertise and background in internet marketing, sales and the interactive media industry gained from his former positions at Google Inc. He also possesses executive leadership experience and extensive knowledge of our business gained from his positions as Chairman and Chief Executive Officer with responsibility for the day-to-day oversight of the Company’s business operations. |

7

Table of Contents

Name, Title, Age and Tenure as a Director | Principal Occupation, Business Experience, Qualifications and Directorships | |

EVE BURTON

Senior Vice President and General Counsel The Hearst Corporation Director since 2013 Age 56 | Ms. Eve Burton has served as Senior Vice President and General Counsel of The Hearst Corporation, a diversified media company, since March 2012. She joined The Hearst Corporation in 2002 as Vice President and General Counsel and served in that role until March 2012. She also serves as an Adjunct Professor of Constitutional Law and Journalism at the Columbia University Graduate School of Journalism. Prior to that Ms. Burton was Vice President and Chief Legal Officer of CNN from 2000 to 2001 and Vice President of the New York Daily News from 1995 to 2000. Ms. Burton practiced law at Weil, Gotshal & Manges from 1992 to 1995 and was a law clerk for the Honorable Leonard B. Sand in the U.S. District Court for the Southern District of New York. Ms. Burton serves on the boards of directors of The Hearst Corporation and Gryphon Technologies LC.

Skills and Qualifications Ms. Burton brings to the Board legal and business experience as a general counsel engaged in a broad range of publishing, broadcasting, cable networking and diversified communications activities. She brings insights into operational issues facing content companies in transition as well as an expertise in the area of media law, the First Amendment and government relations.

| |

|

| |

RICHARD DALZELL

Former Senior Vice President and Chief Information Officer Amazon.com, Inc. Director since 2009 Age 58 | Mr. Richard Dalzell was Senior Vice President and Chief Information Officer of Amazon.com, Inc., an online retailer, until his retirement in 2007. Previously, Mr. Dalzell served in numerous other positions at Amazon.com, Inc., including Senior Vice President of Worldwide Architecture and Platform Software and Chief Information Officer from 2001 to 2007, Senior Vice President and Chief Information Officer from 2000 to 2001 and Vice President and Chief Information Officer from 1997 to 2000. Prior to his employment with Amazon.com, Inc., Mr. Dalzell was Vice President of the Information Systems Division at Wal-Mart Stores, Inc. from 1994 to 1997. Mr. Dalzell serves on the board of directors of Intuit Inc.

Skills and Qualifications Mr. Dalzell brings to the Board extensive experience, expertise and background in internet information technology gained from his service as the Chief Information Officer of Amazon.com, Inc. He also brings corporate leadership experience gained from his service in various senior executive roles at Amazon.com, Inc.

| |

|

| |

8

Table of Contents

Name, Title, Age and Tenure as a Director | Principal Occupation, Business Experience, Qualifications and Directorships | |

ALBERTO IBARGÜEN

President and Chief Executive Officer John S. and James L. Knight Foundation Director since 2011 Age 71 | Mr. Alberto Ibargüen is the President and Chief Executive Officer of the John S. and James L. Knight Foundation, a private, independent foundation dedicated to the promotion of informed and engaged communities by funding quality journalism and media innovation, community engagement and the arts. Before joining the Foundation in 2005, Mr. Ibargüen served in various positions at Knight-Ridder, Inc. from 1995 to 2005, as Chairman & Publisher of The Miami Herald and as Vice President of International Operations, The Miami Herald and Publisher of El Nuevo Herald. Mr. Ibargüen serves on the boards of directors of American Airlines Group, Inc. (previously AMR Corporation) and PepsiCo, Inc.

Skills and Qualifications Mr. Ibargüen brings to the Board extensive experience, expertise and background with regard to media, journalism, and financial matters gained from his current position as the President and Chief Executive Officer of the John S. and James L. Knight Foundation and from his service in various positions at Knight-Ridder, Inc. He also brings public company board experience gained from his service on the boards of directors of American Airlines Group, Inc. (previously AMR Corporation) and PepsiCo, Inc. and has served on the Audit Committees of both companies.

| |

|

| |

HUGH F. JOHNSTON

Executive Vice President and Chief Financial Officer PepsiCo, Inc. Director since 2012 Age 53

| Mr. Hugh Johnston has served since 2010 as Executive Vice President and Chief Financial Officer of PepsiCo, Inc., a global food and beverage company. Mr. Johnston joined PepsiCo in 1987 and has held a number of increasing leadership roles, including Executive Vice President, Global Operations from 2009 to 2010 and President, Pepsi-Cola North America Beverages from 2007 to 2009. Mr. Johnston left PepsiCo, Inc. from August 1999 through March 2002 to pursue a general management role as VP, Retail, at Merck Medco, leading the company’s retail pharmacy card business.

Skills and Qualifications Mr. Johnston brings to the Board extensive experience, expertise and background in accounting, financial, strategy and general management matters gained from his current position as Executive Vice President and Chief Financial Officer of PepsiCo, Inc. and various senior executive roles at PepsiCo and Merck Medco.

| |

|

| |

9

Table of Contents

Name, Title, Age and Tenure as a Director | Principal Occupation, Business Experience, Qualifications and Directorships | |

DAWN G. LEPORE

Former CEO and drugstore.com, inc. Director since 2012 Age 61 | Ms. Dawn Lepore was CEO and Chairman of the Board of drugstore.com, inc., a leading online retailer of health, beauty, and wellness products, which she led from 2004 until its sale to Walgreens in 2011. She also served as the former Interim Chief Executive Officer at Prosper Marketplace, Inc., a peer-to-peer lending marketplace, from March 2012 to January 2013. Prior to joining drugstore.com, Ms. Lepore held leadership positions at The Charles Schwab Company, an investment services firm that provides brokerage, banking and investment-related services to consumers and businesses. In Ms. Lepore’s 21 years with Schwab, she held a variety of roles. Ms. Lepore served as Vice Chairman of technology, operations, administration, strategy and active trader, was Chief Information Officer, a member of Schwab’s executive committee and a trustee of SchwabFunds. Ms. Lepore serves on the boards of directors of Real Networks, Inc. and Coupons.com Incorporated. Ms. Lepore previously served on the boards of directors of TJX Companies, Inc. from 2013 to 2014, eBay Inc. from 1999 to January 2013, The New York Times Company from 2008 to 2011 and drugstore.com, inc. from 2004 to 2011.

Skills and Qualifications Ms. Lepore brings to the Board extensive experience, expertise and background in internet commerce and information technology gained from her roles at Schwab and background in building and operating online businesses gained from her service as Chief Executive Officer and Chairman of the Board of drugstore.com, inc. She also brings public company board experience gained from her service as a board member of Real Networks, Inc., Coupons.com Incorporated, TJX Companies, Inc., eBay Inc., The New York Times Company and drugstore.com, inc.

| |

|

| |

PATRICIA MITCHELL

Former President and Chief Executive Officer The Paley Center for Media Director since 2009 Age 72 | Ms. Patricia Mitchell served as President and Chief Executive Officer of The Paley Center for Media, a global non-profit cultural institution, from 2006 to May 2014 and then as Executive Vice Chair until December 2014. Ms. Mitchell is currently a consultant to The Paley Center for Media and other non-profit organizations. Before joining The Paley Center for Media, Ms. Mitchell was President and Chief Executive Officer of the Public Broadcasting Service, a non-profit public broadcasting television service, from 2000 to 2006. Ms. Mitchell also served as President of Turner Original Productions and CNN Productions and for more than two decades, Ms. Mitchell was a journalist and producer, serving as reporter, anchor, talk show host and executive for three broadcast networks and several cable channels. Ms. Mitchell previously served on the boards of directors of Sun Microsystems, Inc. from 2005 to 2010, Bank of America Corporation from 2001 to 2009 and Knight-Ridder, Inc. from 2002 to 2006.

Skills and Qualifications Ms. Mitchell brings to the Board extensive experience, expertise and background in media, telecommunications and broadcasting gained from her service as the President and Chief Executive Officer and as Executive Vice Chair of The Paley Center for Media, as well as her former role as President and Chief Executive Officer of the Public Broadcasting Service. In addition, Ms. Mitchell brings public company board experience gained from her service on the boards of Sun Microsystems, Inc., Bank of America Corporation and Knight-Ridder.

| |

|

|

10

Table of Contents

Name, Title, Age and Tenure as a Director | Principal Occupation, Business Experience, Qualifications and Directorships | |

FREDRIC REYNOLDS

Former Executive Vice President and Chief Financial Officer CBS Corporation Director since 2009 Age 64 | Mr. Fredric Reynolds was with CBS Corporation, a media company, and its predecessor companies from 1994 until he retired in August 2009. Mr. Reynolds was Executive Vice President and Chief Financial Officer of CBS Corporation from 2005 to 2009. He also served as President and Chief Executive Officer of the Viacom Television Stations Group of Viacom Inc., and President of the CBS Television Stations Division of CBS, Inc. Before that, Mr. Reynolds served as Executive Vice President and Chief Financial Officer of Viacom Inc. and its predecessor CBS Corporation, which was formerly Westinghouse Electric Corporation. Mr. Reynolds joined Westinghouse from PepsiCo, Inc. Mr. Reynolds serves on the boards of directors of Mondelez International, Inc. (formerly Kraft Foods Inc.) and the Hess Corporation.

Skills and Qualifications Mr. Reynolds brings to the Board extensive experience, expertise and background in media, telecommunications, accounting and financial matters gained from his service as the Chief Financial Officer of CBS Corporation, as well as his service on the Audit Committees of Mondelez International, Inc. (formerly Kraft Foods Inc.) and the Hess Corporation. He also brings corporate leadership experience gained from his service in various senior executive positions at CBS Corporation and Viacom Inc.

| |

|

| |

JAMES STENGEL

President and Chief Executive Officer The Jim Stengel Company, LLC Director since 2009 Age 59 | Mr. James Stengel has been President and Chief Executive Officer of The Jim Stengel Company, LLC, a marketing think tank and consulting firm, since 2008. Mr. Stengel is also currently an adjunct marketing professor at UCLA’s Anderson School of Management. Mr. Stengel worked at The Procter & Gamble Company, a global consumer products company, from 1983 to 2008, holding a variety of positions including Global Marketing Officer from 2001 to 2008. Mr. Stengel served on the boards of directors of Motorola, Inc. prior to the spin-off of Motorola Mobility, Inc. in January 2011 and Motorola Mobility Inc. prior to its sale to Google Inc. in 2012.

Skills and Qualifications Mr. Stengel brings to the Board extensive experience, expertise and background in branding and marketing, having served as the Global Marketing Officer of Procter & Gamble Company. He also brings public company board experience and leadership development experience gained from his service as a board member and as the Chairman of the Compensation and Leadership Committee of Motorola Mobility, Inc. prior to its sale to Google Inc. in 2012, and of Motorola, Inc. prior to the spin-off of Motorola Mobility, Inc. in January 2011.

| |

|

| |

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR”

THE ELECTION OF EACH OF THE NINE DIRECTOR NOMINEES NAMED ABOVE.

11

Table of Contents

BOARD OF DIRECTORS INFORMATION

Committees of the Board and Meetings

There are currently four standing committees of the Board: the Audit and Finance Committee, the Compensation and Leadership Committee, the Nominating and Governance Committee and the Executive Committee (each, a “Committee”). Currently, as discussed in more detail below, each Committee is comprised entirely of independent directors, consistent with the definition of “independent” under the NYSE listing standards applicable to boards of directors generally and board committees in particular. Each Committee is authorized to retain its own outside counsel and other advisors as it deems necessary or advisable.

The Board has adopted written charters for each of its standing Committees, copies of which are posted on our website at www.corp.aol.com/corpgov. A stockholder also may request a copy of these materials in print, without charge, by contacting our Corporate Secretary at AOL Inc., 770 Broadway, New York, New York 10003. Each of the Audit and Finance Committee, the Compensation and Leadership Committee, the Nominating and Governance Committee and the Executive Committee reviews its charter on an annual basis. Each Committee makes recommendations, as appropriate, to management or the full Board as a result of its charter review.

The following table summarizes the current membership of the Board and each of its standing Committees, as well as the number of times the Board and each Committee met during 2014.

| Name | Board |

Audit and

|

Compensation and

|

Nominating and

|

Executive | |||||

| Tim Armstrong | Chairperson | |||||||||

| Eve Burton* | Member | Member | ||||||||

| Richard Dalzell* | Member | Member | ||||||||

| Alberto Ibargüen* | Member | Member | Member | |||||||

| Hugh Johnston* | Member | Chairperson | Member | |||||||

| Dawn Lepore* | Member | Member | ||||||||

| Patricia Mitchell* | Member | Chairperson | Member | |||||||

| Fredric Reynolds* | Member | Chairperson | ||||||||

| James Stengel* | Member | Chairperson | Member | |||||||

| Number of 2014 Meetings | 13 | 7 | 8 | 7 | 3 | |||||

| * | Independent Director |

Each current director attended 75% or more of the total number of meetings of the Board and of the Committees on which each such director served during 2014. In addition to the four standing Committees, the Board may approve, and has from time to time approved, the creation of special committees to act on behalf of the Board.

12

Table of Contents

The Audit and Finance Committee of the Board (the “Audit and Finance Committee”), among other things:

| • | assists in the Board’s oversight of the quality and integrity of our financial statements and accounting practices; |

| • | selects an independent registered public accounting firm, taking into account the vote on ratification by stockholders at our annual meeting; |

| • | pre-approves all services to be provided to us by our independent registered public accounting firm; |

| • | confers with our independent auditors on the matters required to be discussed under Auditing Standard No. 16 as well as such other matters relating to the annual financial audit as appropriate; |

| • | oversees our internal audit function; |

| • | reviews the Company’s capital allocation, tax and financial planning strategies with management; and |

| • | meets with our independent auditor, our financial personnel and internal financial controllers regarding our internal controls and other matters; and assists in overseeing our compliance, internal controls and risk management policies. |

All members of the Audit and Finance Committee are “independent,” consistent with the NYSE listing standards applicable to boards of directors in general and audit committees in particular and SEC rules regarding audit committees. In addition, the Board has determined that each of the members of the Audit and Finance Committee is financially literate and that Mr. Johnston has sufficient accounting and related financial management expertise to satisfy the criteria to be an “audit committee financial expert” under the rules and regulations of the SEC.

In accordance with the Audit and Finance Committee charter, no Audit and Finance Committee member may simultaneously serve on more than two other public company audit committees unless the Board specifically determines that it would not impair the ability of an existing or prospective member to serve effectively on the Audit and Finance Committee. None of the current members currently serves on more than two other public company audit committees.

Compensation and Leadership Committee

The Compensation and Leadership Committee of the Board (the “Compensation Committee”), among other things:

| • | sets our general policy regarding executive compensation and reviews, no less than annually, the compensation provided to our Chief Executive Officer (“CEO”) and such other senior executives of the Company as the Compensation Committee may, from time to time, determine should be subject to the Compensation Committee’s direct purview, currently including (i) the Company’s employees with the title of Executive Vice President or higher, (ii) any other officer within the scope of Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (each, a “Section 16 officer”) and (iii) each of the Company’s other employees, if any, whose annual total target compensation has a value of $3 million or greater; |

| • | reviews and approves the compensation (including salary, bonus, equity, equity-based incentives and any other incentive compensation and other benefits, direct and indirect) of our CEO and other senior executives as are subject to the Compensation Committee’s direct purview; |

13

Table of Contents

| • | reviews and approves corporate goals and objectives relevant to the CEO’s and other senior executives’ compensation, including annual performance objectives; |

| • | oversees our disclosure regarding executive compensation, including the Compensation Committee report on executive officer compensation as required by the SEC to be included in our annual Proxy Statement and included or incorporated by reference in our annual report on Form 10-K; |

| • | approves any employment agreements for our CEO and other senior executives; |

| • | oversees the Company’s overall compensation structure, practices, benefit plans and human development policies, including, as appropriate, reviewing and recommending compensation and benefit plans for Board approval; |

| • | annually considers whether there are any risks arising from the Company’s compensation policies and overall actual compensation practices for employees, including non-executive officers, that are reasonably likely to have a material adverse effect on the Company; |

| • | administers the Company’s executive bonus and equity-based incentive plans; |

| • | assesses the results of the Company’s most recent advisory vote to approve executive compensation, and considers and recommends to the Board the frequency of the Company’s advisory vote to approve executive compensation; |

| • | oversees the Company’s response to any regulatory developments affecting compensation; |

| • | reviews and oversees executive leadership and organizational development and practices; |

| • | periodically reviews compliance by senior executives with the Company’s equity ownership guidelines; |

| • | annually assesses whether the work of compensation consultants involved in determining or recommending executive or director compensation has raised any conflict of interest that is required to be disclosed in the Company’s Proxy Statement and Annual Report onForm 10-K; and |

| • | reviews and makes recommendations to the Board (together with the Nominating and Governance Committee) regarding the Company’s response to stockholder proposals related to compensation matters for inclusion in our annual Proxy Statement. |

All members of the Compensation Committee are “independent,” consistent with the NYSE listing standards applicable to boards of directors in general and compensation committees in particular. In addition, all members of the Compensation Committee qualify as “non-employee directors” (within the meaning of Rule 16b-3 of the Exchange Act and as “outside directors” (within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”)).

Delegation of Authority with Respect to Equity Grants

Pursuant to its charter, unless otherwise prohibited by law, our certificate of incorporation or our by-laws, the Compensation Committee may delegate its responsibilities to subcommittees or individuals. The Compensation Committee has delegated limited authority to individuals serving as our chief executive officer, chief financial officer, chief legal officer and chief human resources officer to make certain equity grants outside of the annual equity grant process to non-executive management employees who are newly hired or who are otherwise selected by the CEO to receive a grant other than employees with the title of Executive Vice President or higher, any other Section 16 officer or any employee whose annual total target compensation has a value of $3 million or greater.

14

Table of Contents

Compensation Consultant

The Compensation Committee has the authority under its charter to retain outside consultants or advisors, as it deems necessary or advisable. In accordance with this authority, the Compensation Committee has engaged Compensation Advisory Partners LLC (“CAP”) as its independent compensation consultant to provide it with objective and expert analyses, advice and information with respect to executive compensation. All executive compensation services provided by CAP were conducted under the direction or authority of the Compensation Committee. After considering the following six factors with respect to CAP, our Compensation Committee has concluded that CAP is independent and that no conflict of interest exists with CAP: (i) the provision of other services to us by CAP; (ii) the amount of fees received from us by CAP, as a percentage of the total revenue of CAP; (iii) the policies and procedures of CAP that are designed to prevent conflicts of interest; (iv) any business or personal relationship of the CAP consultant with a member of the Compensation Committee; (v) any of our stock owned by the CAP consultants; and (vi) any business or personal relationship of the CAP consultant or CAP with any of our executive officers.

In addition to CAP, members of our Human Resources, Legal and Finance Departments support the Compensation Committee in its work.

For additional information on the Compensation Committee’s activities, its use of outside advisors and its consideration and determination of executive compensation, see “Executive Compensation—Compensation Discussion and Analysis” beginning on page 32 of this Proxy Statement.

Compensation Programs and Risk Management

Management engaged the executive compensation firm Exequity LLP (“Exequity”) to assist us in conducting a detailed review and analysis of risk associated with the employee compensation plans administered by the Company in 2014, including (i) base pay, (ii) cash-based incentive plans, (iii) sales incentive plans and (iv) equity plans.

Key characteristics of our compensation plans and programs, such as the structure of annual and long-term incentives, the combination and number of metrics used in such programs, the positions eligible to participate, the use and availability of discretion (including the ability of program administrators to limit award payouts), individual target and maximum awards and the timing of payouts were analyzed based on the level of risk associated with the plans and programs.

The assessment also identified and evaluated characteristics of the plans and programs that mitigate risk associated with compensation, including the processes for calculating payouts under incentive compensation programs (such as third-party verification or determination of performance achieved), approval processes (including the ability of program administrators to limit award payouts), maximum payouts, use of a combination of long-term and short-term incentive programs with different time horizons for measuring performance, share ownership and equity retention policies for senior executives, the mix of cash bonuses and long-term equity incentive compensation, the existence of claw-back and anti-pledging policies, and multi-year vesting schedules for equity awards.

Based on this detailed review and analysis, management and the Compensation Committee determined that there are no risks arising from the Company’s compensation policies and practices that are reasonably likely to have a material adverse effect on the Company.

Nominating and Governance Committee

The Nominating and Governance Committee, among other things:

| • | develops and recommends to the Board our corporate governance principles and otherwise takes a leadership role in corporate governance matters; |

15

Table of Contents

| • | reviews, evaluates the adequacy of, and recommends to the Board, amendments to our by-laws, certificate of incorporation and other governance policies; |

| • | reviews and makes recommendations to the Board regarding the purpose, structure, composition and operations of our various Committees; |

| • | identifies, reviews and recommends directors for election to the Board and establishes procedures for stockholders to recommend director candidates for the Nominating and Governance Committee to consider; |

| • | reviews compliance by non-employee directors with the Company’s stock ownership guidelines for non-employee directors; |

| • | reviews the compensation for non-employee directors and makes recommendations to the Board; |

| • | reviews the leadership structure of the Board and recommends changes to the Board as appropriate and makes a recommendation to the independent directors regarding the appointment of the lead independent director (the “Lead Independent Director”); |

| • | evaluates annually the performance of the Chairman of the Board and the Lead Independent Director; |

| • | oversees the Board’s annual self-evaluation process; |

| • | reviews and approves related-person transactions; |

| • | reviews and makes recommendations to the Board regarding our response to stockholder proposals for inclusion in our annual Proxy Statement; and |

| • | oversees and monitors general governance matters including regulatory developments relating to corporate governance and our corporate social responsibility activities. |

All of the members of the Nominating and Governance Committee are “independent” as defined by the NYSE listing standards.

The Executive Committee of the Board (the “Executive Committee”), consisting of the Lead Independent Director (as described below) and the Chairs of the Audit and Finance Committee, the Nominating and Governance Committee and the Compensation Committee, provides flexibility to act promptly between regularly scheduled meetings of the Board. During these intervals, the Board has granted to the Executive Committee all the powers of the Board in the management of the business and affairs of the Company, including the ability to review and approve all of the Company’s proposed transactions in which the dollar amount for any such proposed transaction equals or exceeds $10 million and is no greater than $100 million, except (i) as limited by the Company’s Amended and Restated Certificate of Incorporation or Amended and Restated By-laws, the rules of the NYSE or applicable law or regulation and (ii) with respect to matters that are specifically reserved for another committee of the Board. The Executive Committee also oversees the CEO succession planning process, including an emergency succession plan.

16

Table of Contents

Our Standards of Business Conduct, our Code of Ethics for Our Senior Executive and Senior Financial Officers, our Corporate Governance Policy, our Committee charters and other corporate governance information are available on our website at www.corp.aol.com/corpgov. Any stockholder also may request them in print, without charge, by contacting our Corporate Secretary at AOL Inc., 770 Broadway, New York, New York 10003.

Our Standards of Business Conduct apply to our employees and members of the Board. The Standards of Business Conduct establish policies pertaining to, among other things, employee conduct in the workplace, electronic communications and information security, accuracy of books, records and financial statements, securities trading, confidentiality, conflicts of interest, fairness in business practices, the Foreign Corrupt Practices Act, the UK Bribery Act, antitrust laws and political activities and solicitations.

Our Chief Compliance Officer oversees adherence to the Standards of Business Conduct in addition to overseeing our compliance function throughout our business. Our Chief Compliance Officer also assists in the communication of the Standards of Business Conduct and oversees employee education regarding its requirements, including compliance training. All employees worldwide participate in annual business conduct training.

We maintain an employee help line, called the SBC Help Line. The SBC Help Line and the Whistleblower Procedures discussed below are the Company’s primary mechanisms for receiving and acting on business conduct and ethical complaints. Through the SBC Help Line, employees can report integrity concerns or seek guidance on business conduct matters. In some countries, local and regional differences in culture and law limit the scope and types of reports we may accept through our SBC Help Line. We provide alternative reporting direction for employees in these countries. The SBC Help Line has a toll-free number for U.S.-based employees, and provides toll-free international numbers for employees based in some countries outside the United States. Employees may also report integrity concerns via an online form, mail, or email. If an employee alleges a complaint, our Chief Compliance Officer receives the report and then coordinates with internal and outside resources, as appropriate, to investigate reported concerns. The Chief Compliance Officer regularly reports to the Audit and Finance Committee inquiries and complaints we receive through the SBC Help Line and any resulting investigations and corrective actions.

Code of Ethics for Our Senior Executive and Senior Financial Officers

Our Code of Ethics for Our Senior Executive and Senior Financial Officers (the “Code of Ethics”) applies to certain senior management of the Company, including individuals in the role of CEO, Chief Financial Officer (“CFO”), Controller and the senior-most tax executive (and others performing similar senior executive functions at the Company from time to time in the future). Among other things, the Code of Ethics mandates that the designated officers engage in and promote honest and ethical conduct, avoid conflicts of interest and disclose any material transaction or relationship that reasonably could be expected to give rise to a conflict, protect the confidentiality of non-public information about the Company, take all reasonable measures to achieve responsible use of the Company’s assets and resources, comply with all applicable governmental rules and regulations and promptly report any possible violation of the Code of Ethics. Additionally, the Code of Ethics requires that these individuals promote full, fair, accurate, timely and understandable disclosure in the Company’s publicly filed reports and other public communications and sets forth standards for accounting practices and

17

Table of Contents

records. We hold individuals to whom the Code of Ethics applies accountable for adherence to the Code of Ethics. Our Chief Compliance Officer oversees and assists in the communication of the Code of Ethics.

We intend to disclose any amendments to or waivers of provisions of the Standards of Business Conduct or Code of Ethics granted to directors or executive officers by posting such information on our website.

With respect to complaints and concerns regarding accounting, internal accounting controls and auditing, and in response to Section 301 of the Sarbanes-Oxley Act of 2002, the Audit and Finance Committee has established additional procedures, referred to as Whistleblower Procedures. Under these procedures, as under our standard SBC Help Line procedures, persons, including employees of the Company, may submit, without fear of retaliation, and, where the law permits, anonymously, an allegation of questionable accounting, internal accounting controls or auditing matters to the Company through the SBC Help Line options described above. Employees may also report these types of complaints and concerns to the Company’s Controller. The Chief Compliance Officer’s regular reports to the Audit and Finance Committee include these complaints and concerns, and if the Chief Compliance Officer and/or Company management determine that an allegation is both credible and material to the Company’s financial reporting, financial condition or internal controls, they will inform the Audit and Finance Committee promptly and they will assist in determining the manner in which such material allegation is to be investigated.

Our commitment to good corporate governance is reflected in our Corporate Governance Policy, which describes the Board’s views on a wide range of governance topics. The Corporate Governance Policy is reviewed no less than annually by the Nominating and Governance Committee and, to the extent deemed appropriate in light of emerging practices, revised accordingly, upon recommendation to and approval by the Board.

Significant Governance Practices

Board Composition and Director Nomination Process

Our director recruitment process involves, among other steps: developing criteria for selecting members of the Board; identifying potential candidates; reviewing the potential candidates against the relevant criteria; interviewing the potential candidates; and exchanging relevant information between us and the potential candidates. We have retained an outside executive search firm to assist in the process of identifying and recruiting individuals to serve on our Board.

The Nominating and Governance Committee evaluates director candidates in accordance with the director membership criteria described in our Corporate Governance Policy. The Nominating and Governance Committee evaluates a candidate’s qualifications to serve as a member of our Board based on the skills and characteristics of individual directors as well as the composition of our Board as a whole. With regard to the criteria for our Board members, we believe that each director should possess integrity, judgment, acumen, familiarity with our business, independence of thought and the ability to work collegially, as well as the time and ability to make a constructive contribution to the Board. In addition, we endeavor to provide that the Board has the appropriate overall mix of professional skills and background, industry experience, financial expertise (including expertise that would qualify a director as a “financial expert” as that term is defined under the rules and regulations of

18

Table of Contents

the SEC), age, diversity and geographic background to fulfill the roles of the Board and its committees. In particular, we seek skilled persons in the areas of finance, accounting, technology, marketing and general executive management, as well as those who are experienced in the areas of advertising, media and government. Finally, we seek to have a substantial majority of the Board members who are independent under the NYSE listing standards, and have a majority of the Board members possess prior experience working closely with, or serving on, the board of a public company.

At least annually, in connection with the board self-evaluation and director nomination processes, the Board evaluates its composition to assess the skills and experience that are currently represented on the Board, as well as those that the Board will find valuable in the future, given the Company’s current position and strategic plans. This evaluation enables the Board to update the Board membership criteria as the Company’s needs evolve over time and to assess the effectiveness of efforts at pursuing diversity. In connection with the nominations of each of the current Board members for election as directors at the Annual Meeting, the Board considered the biographical information and director qualifications set forth with respect to each Board member under “Item 1—Election of Directors—Nominees for Election as Directors.”

The Nominating and Governance Committee considers and reviews all candidates in the same manner regardless of the source of the recommendation. The Nominating and Governance Committee has established procedures for stockholders of the Company to recommend director candidates. Stockholders who wish to recommend director candidates for the Nominating and Governance Committee’s consideration should send their recommendation to our Corporate Secretary at AOL Inc., 770 Broadway, New York, New York 10003 and should include:

| • | the full name, address and telephone number of the stockholder making the recommendation and of the candidate being recommended; |

| • | the number of shares of the Company’s stock that are beneficially owned by the stockholder making the recommendation and the amount of time such shares have been held; |

| • | a description of all arrangements or understandings between the stockholder and the candidate; |

| • | a brief explanation of the value or benefit that the stockholder making the recommendation believes that the candidate would provide to the Company as a director along with a copy of the candidate’s résumé, references and an executed written consent of the candidate to be interviewed by the Nominating and Governance Committee, if the Nominating and Governance Committee chooses to do so in its discretion, and to serve as a director of the Company if elected; and |

| • | an analysis of the candidate’s qualifications to serve on the Board and on each of the Board’s committees in light of the criteria set forth in the Company’s by-laws and Corporate Governance Policy (including all regulatory requirements incorporated by reference therein). |

In addition, our amended and restated by-laws provide that any stockholder of record entitled to vote for the election of directors at the applicable meeting of stockholders may nominate persons for election to our Board, if such stockholder complies with the applicable advance notice procedures in the Company’s by-laws, which are discussed on page 79 of this Proxy Statement.

Annual Meeting of Stockholders

We encourage all of our directors to attend each annual meeting of stockholders. All nine of the directors who were members of our Board at the time of our 2014 Annual Meeting of Stockholders attended that meeting.

19

Table of Contents

Director Independence and Independence Determinations

Under NYSE rules, a director is not independent unless the Board makes an affirmative determination to such effect. In order to determine that a director is independent, the Board must affirmatively determine that the director has no material relationship with the Company, and the director must satisfy the standards and objective tests set forth under NYSE rules.

In making this determination, the Board considers all relevant facts and circumstances, including commercial, charitable and familial relationships that exist between the director and the Company, or between entities with which the director is affiliated and the Company. In the event a director has a relationship with the Company that is relevant to his or her independence, the Board determines in its judgment whether such relationship is material. During its independence review, the Board considered that Mr. Armstrong, our Chairman and CEO, serves on the Board of Trustees of The Paley Center for Media, a non-profit institution, where Ms. Mitchell served as President and CEO until May 2014 and then as Executive Vice Chair until December 2014. The Board determined that this relationship does not impair Ms. Mitchell’s independence because Mr. Armstrong does not serve on the Executive Compensation Committee of The Paley Center for Media’s Board of Trustees or otherwise determine or influence Ms. Mitchell’s compensation. The Board also considered that the Company made charitable contributions to The Paley Center for Media in each of 2012, 2013 and 2014, but in each year the amounts involved did not exceed the greater of $1 million or 2% of The Paley Center for Media’s consolidated gross revenues. The Board determined that the Company’s charitable contributions to The Paley Center for Media do not impair Ms. Mitchell’s independence. Ms. Mitchell is no longer an officer or employee of The Paley Center for Media.

Our Corporate Governance Policy requires that a substantial majority of the members of the Board and that all the members of the Audit and Finance Committee, the Compensation Committee and the Nominating and Governance Committee be independent under the NYSE regulations. The Board has determined that each of the following director nominees is independent: Ms. Burton, Ms. Lepore and Ms. Mitchell, and Messrs. Dalzell, Ibargüen, Johnston, Reynolds and Stengel. Mr. Armstrong, our CEO, is not independent.

The Board has determined that combining the CEO and Chairman positions is currently the appropriate leadership structure for the Company. The Board believes that combining the CEO and Chairman roles fosters clear accountability, effective decision-making and alignment on corporate strategy between the Board and the senior management of the Company. Nevertheless, the Board believes that “one-size” does not fit all, and that the decision of whether to combine or separate the positions of CEO and Chairman depends upon each company’s particular circumstances at a given point in time. Accordingly, the Board intends to carefully consider from time to time, including during its annual self-evaluation, whether the CEO and Chairman positions should be combined or separated based on what the Board believes is best for the Company and its stockholders at that time.

The Board has a Lead Independent Director who is elected by the independent members of the Board. Currently, the Lead Independent Director is Mr. Reynolds. As set forth in the Company’s Corporate Governance Policy, the responsibilities of the Lead Independent Director include:

| • | presiding at executive sessions of the non-employee and independent directors and at meetings of the Board at which the Chairperson is not present; |

| • | serving as the liaison between the Chairperson of the Board and the independent directors; |

| • | approving the schedule, agenda and information for Board meetings (including seeking input from the independent board members on agenda items for specific Board meetings and having the ability to include specific items on those agendas); |

20

Table of Contents

| • | providing leadership and serving as temporary Chairperson of the Board and CEO in the event of the inability of the Chairperson or CEO to fulfill his or her role due to crisis or any other event or circumstance; |

| • | advising the Chairperson of the Board with respect to consultants who may report directly to the Board; |

| • | working with the Nominating and Governance Committee on the annual Board self-assessment; |

| • | convening executive sessions of the non-employee and independent directors when necessary and appropriate; and |

| • | being available, as appropriate, for communication with the Company’s stockholders. |

As part of its evaluation of the Board’s leadership structure, the Board considered the fact that it has appointed a Lead Independent Director with responsibilities that are substantially similar to many of the functions typically fulfilled by a board chairman, including presiding at executive sessions of independent directors and convening such sessions when necessary and appropriate, serving as the liaison between the CEO and the independent directors, approving the agenda for Board meetings and being available for communication with the Company’s stockholders. The Board believes that the Lead Independent Director position balances the need for effective and independent oversight of management with the significant benefits of strong, unified leadership. In addition, the Board has noted that all of the members of the Board other than Mr. Armstrong are independent, and that all of the members of each of the committees of the Board are independent, within the meaning of “independent” under NYSE listing standards.

The Board has also considered that the combined role of CEO and Chairman promotes unified leadership and direction for the Company as it continues to execute its strategy to improve the Company’s growth trajectory and create meaningful stockholder value. Additionally, the Board believes that the current structure promotes effective decision-making by seeing that the Board’s agenda responds to the Company’s strategic opportunities and challenges and that the Board receives the information it needs to fulfill its responsibilities. The Board also considered that the combined role of CEO and Chairman allows one person to speak on behalf of the Company to its customers, employees and stockholders, and minimizes inefficiencies that might arise under a different structure as the Board and management respond to developments affecting the Company. The Board believes that its existing structure is in the best interest of the Company and our stockholders, as it allows for a balance of authority between the CEO and Chairman and the independent directors and provides an environment in which the independent directors, under the leadership of the Lead Independent Director, are fully informed, have significant input into the content of Board meeting agendas and are able to provide objective and thoughtful oversight of management.

Executive Sessions of Non-Employee and Independent Directors

In 2014, the independent directors on the Board met in executive sessions six times, without any employee directors or management present. Executive sessions of the non-employee directors and independent directors are led by the Lead Independent Director and facilitate candid discussion of the independent directors’ viewpoints regarding the performance of management and the strategic direction of the Company.

Board and Committee Evaluations

Annually the Board and each of the Audit and Finance, Compensation and Leadership and Nominating and Governance Committees evaluate and discuss their respective performances and effectiveness, as required by our Corporate Governance Policy and their respective charters. These

21

Table of Contents

evaluations cover a wide range of topics, including, but not limited to, the fulfillment of the Board and Committee responsibilities identified in the Corporate Governance Policy and Committee charters, which are posted on our website at www.corp.aol.com/corpgov.

Communications with the Board of Directors

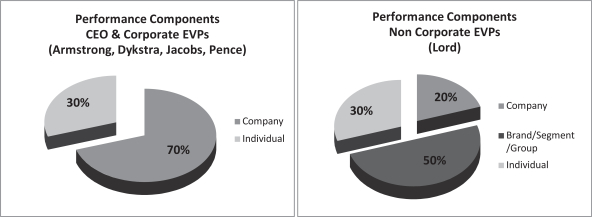

Stockholders and other interested parties who wish to communicate with our Board or a particular member of our Board (including the Lead Independent Director) or with the non-management or independent directors as a group, may do so by addressing such communications to our Corporate Secretary, AOL Inc., 770 Broadway, New York, New York 10003 or corporatesecretary@teamaol.com, who will forward such communications to the appropriate party. Such communications may be made confidentially or anonymously. All communications that relate to matters that are within the scope of the responsibilities of the Board and its Committees will be forwarded to the Chairman (or Lead Independent Director, as the case may be). Communications that relate to matters that are within the responsibility of one of the Committees will also be forwarded to the Chair of the appropriate Committee. Communications that relate to ordinary business matters that are not within the scope of the Board’s responsibilities, such as customer complaints, will be sent to the appropriate contact person within the Company. Solicitations, junk mail and obviously frivolous or inappropriate communications will not be forwarded, but will be made available to any director who wishes to review them.