FY 2024 Financial Results 1 FY 2024 FINANCIAL RESULTSFebruary 27, 2025 P ic : I -6 6

FY 2024 Financial Results 2 DISCLAIMER This presentation has been produced by Ferrovial SE (the “Company”, “we” or “us” and, together with its subsidiaries, the “Group”) for the sole purpose expressed herein. By accessing this presentation, you acknowledge that you have read and understood the following statements. Neither this presentation nor any of the information contained herein constitute or form part of, and should not be construed as, an offer to purchase, sale or exchange any security, a solicitation of any offer to purchase, sale or exchange any security, or a recommendation or advice regarding any security of the Company. In this presentation, unless otherwise specified, the terms “Ferrovial,” the “Company,” “we,” “us,” and the “Group” refer to Ferrovial SE, individually or together with its consolidated subsidiaries, as the context may require (or, unless stated otherwise, if referring to the period prior to the completion of the cross-border merger on June 16, 2023, to Ferrovial, S.A., the former parent entity of the Group, individually or together with its consolidated subsidiaries, as the context may require). Neither this presentation nor the historical performance of the Group’s management team or the Group constitutes a guarantee of the future performance of the Company and there can be no assurance that the Group’s management team will be successful in implementing the investment strategy of the Group. Forward-Looking Statements This presentation contains forward-looking statements. Any express or implied statements contained in this presentation that are not statements of historical fact may be deemed to be forward-looking statements, including, without limitation, statements regarding estimates and projections provided by the Company and certain other sources with respect to the Company’s financial position, business strategy, plans, and objectives of management for future operations, as well as statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “forecast,” “estimate,” “may,” “should,” “target,” “anticipate” and similar statements of a future or forward-looking nature, or the negative of these terms or other similar expressions, although not all forward-looking statements contain these words. Such statements may reflect various assumptions by the Company concerning anticipated results and are subject to significant business, economic and competitive uncertainties and contingencies, and known and unknown risks, many of which are beyond the Company’s control and may be impossible to predict. Any forecast made or contained herein, and actual results, will likely vary and those variations may be material. The Company makes no representation or warranty as to the accuracy or completeness of such statements, expectations, estimates and projections contained in this presentation or that any forecast made or contained herein will be achieved. Risks and uncertainties that could cause actual results to differ include, without limitation: risks related to our diverse geographical operations; risks related to our acquisitions, divestments and other strategic transactions that we may undertake; the impact of competitive pressures in our industry and pricing, including the lack of certainty and costs in winning competitive tender processes; general economic and political conditions and events and the impact they may have on us, including, but not limited to, increases in inflation rates and rates of interest, increased costs for materials, and other ongoing impacts resulting from the Russia/Ukraine and the Middle East conflicts; the fact that our business is derived from a small number of major projects; cyber threats or other technology disruptions; our ability to obtain adequate financing in the future as needed; our ability to maintain compliance with the continued listing requirements of Euronext Amsterdam, the Nasdaq Global Select Market and the Spanish Stock Exchanges; lawsuits and other claims by third parties or investigations by various regulatory agencies that we may be subject to; our ability to comply with our ESG commitments or other sustainability demands; the impact of any changes in existing or future tax regimes or regulations; and the other important factors discussed under the caption “Risk Factors” in our Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission (“SEC”) for the fiscal year ended December 31, 2024 which is available on the SEC website at www.sec.gov, as such factors may be updated from time to time in our other filings with the SEC. Any forward-looking statements contained in this presentation speak only as of the date hereof and accordingly undue reliance should not be placed on such statements. We disclaim any obligation or undertaking to update or revise any forward-looking statements contained in this presentation, whether as a result of new information, future events or otherwise, other than to the extent required by applicable law. Forward-looking statements in this press release are made pursuant to the safe harbor provisions contained in the U.S. Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by relevant safe harbor provisions for forward-looking statements (or their equivalent) of any applicable jurisdiction. In addition, certain industry data and information contained in this presentation has been derived from industry sources. The Company has not undertaken any independent investigation to confirm the accuracy or completeness of such data and information, some of which may be based on estimates and subjective judgments. Accordingly, the Company makes no representation or warranty as to the accuracy or completeness of such data and information. Other than as specified, the information contained in this presentation has not been audited, reviewed or verified by the external auditor of the Group. The information contained herein should therefore be considered as a whole and in conjunction with all the other publicly available information regarding the Group. Alternative Performance Measures In addition to the financial information prepared under the International Financial Reporting Standards (“IFRS”), this presentation may include certain alternative performance measures (“APMs” or “non-IFRS measures”) as defined in the Guidelines on Alternative Performance Measures issued by the European Securities and Markets Authority on 5 October 2015, that differ from financial information presented by the Group in its financial statements and reports containing financial information. The aforementioned non-IFRS measures include “Adjusted EBIT,” “Adjusted EBIT Margin,” “Adjusted EBITDA,” “Adjusted EBITDA Margin,” “Comparable or ‘Like-for-Like’ (‘LfL’) Growth,” “Order Book,” “Consolidated Net Debt,” “Cash flows excluding infrastructure projects (Ex-Infrastructure Cash Flows),” Cash flows from infrastructure projects (Infrastructure Cash Flows),” and “Ex-Infrastructure Liquidity.” These non-IFRS measures are designed to complement and should not be considered superior to measures calculated in accordance with IFRS. Although the aforementioned non-IFRS measures are not measures of operating performance, an alternative to cash flows, or a measure of financial position under IFRS, they are used by the Group’s management to review operating performance and profitability, for decision-making purposes, and to allocate resources. Moreover, some of these non-IFRS measures, such as “Consolidated Net Debt” are used by the Group’s management to explain the evolution of our global indebtedness and to assist our management in making decisions related to our financial structure. Furthermore, it is used by analysts and rating agencies to better understand the indebtedness that has recourse to the Group. Non-IFRS measures presented in this presentation are being provided for informative purposes only and shall not be construed as investment, financial, or other advice. The Group believes that there are certain non-IFRS measures, which are used by the Group’s management in making financial, operational and planning decisions, which provide useful financial information that should be considered in addition to the financial statements prepared in accordance with the accounting regulations that applies (IFRS EU), in assessing its performance. These are consistent with the main indicators used by the community of analysts and investors in the capital markets. However, they do not have any standardized meaning and are therefore unlikely to be comparable to similarly titled measures presented by other companies. They have not been audited, reviewed or verified by the external auditor of the Group. For further details on the definition, explanation on the use, and reconciliation of non-IFRS measures, please see the section on “Alternative performance measures” in Ferrovial SE’s Integrated Annual Report (including the Consolidated Financial Statements and Management Report) for the year ended December 31, 2024. Additional Information The Company is subject to the information and reporting requirements of the Securities Exchange Act of 1934, as amended, applicable to foreign private issuers and in accordance therewith is required to file reports and other information with the SEC relating to its business, financial condition, and other matters. The Company's filings can be accessed by visiting EDGAR on the SEC's website at www.sec.gov.

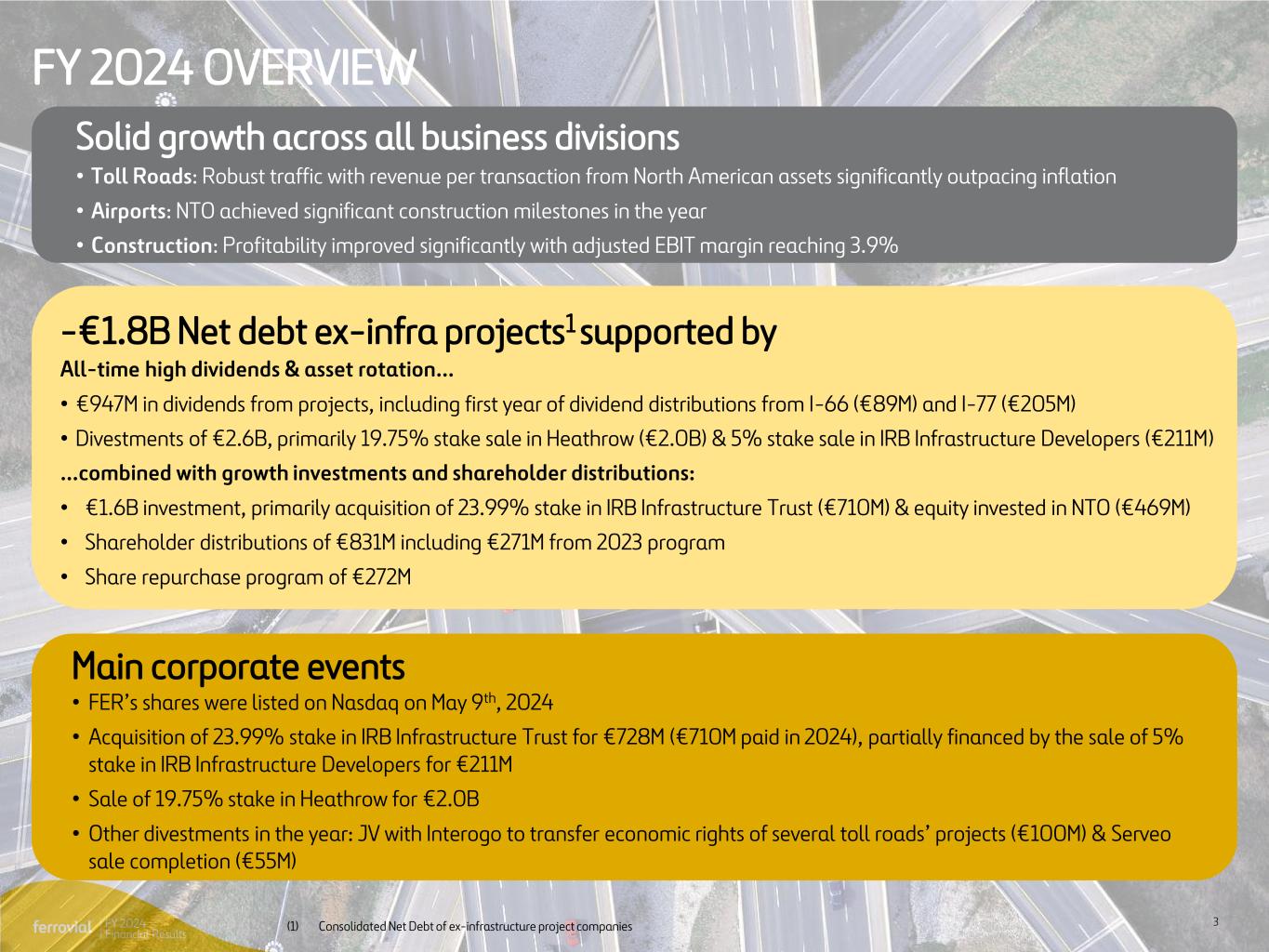

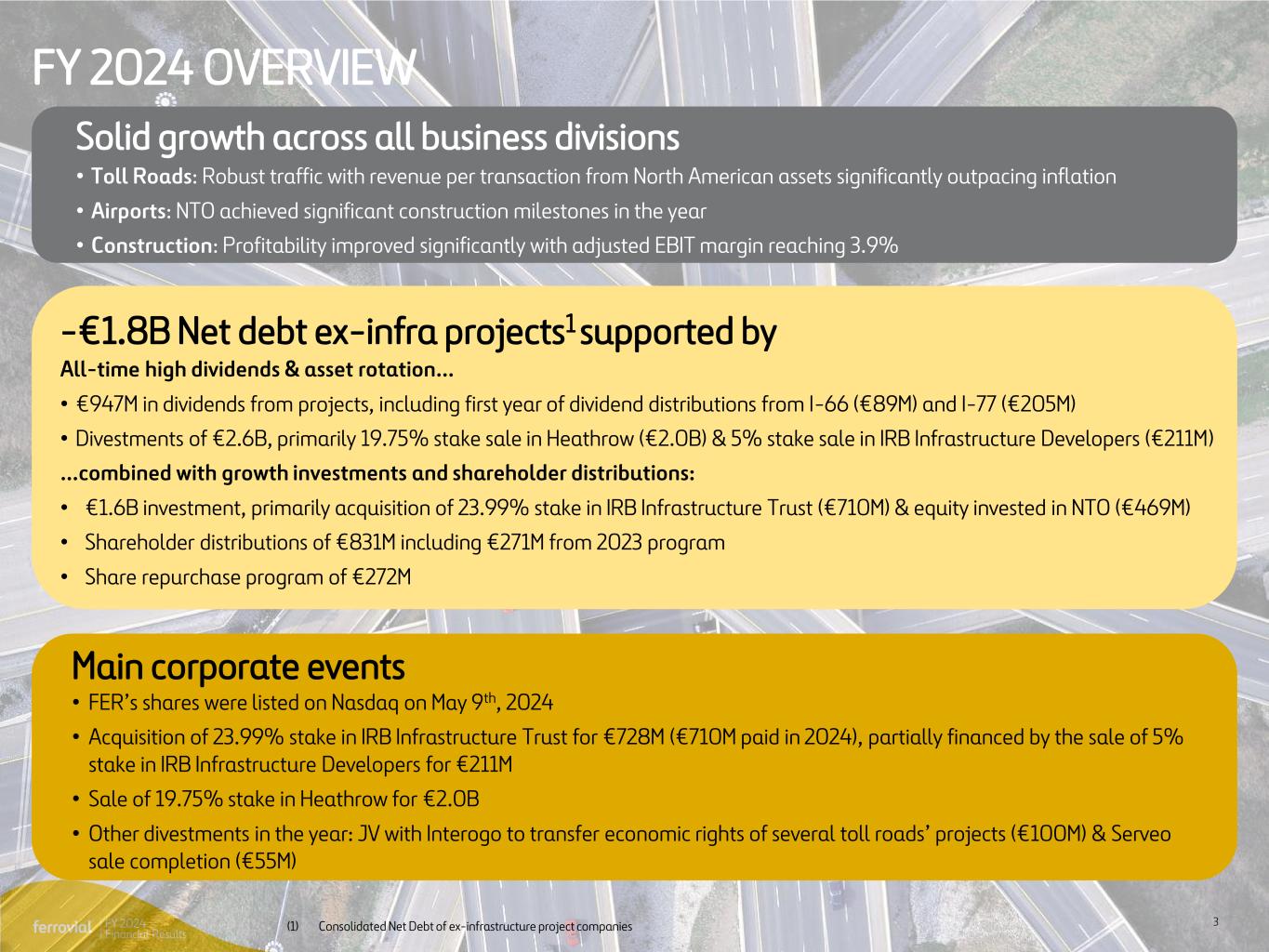

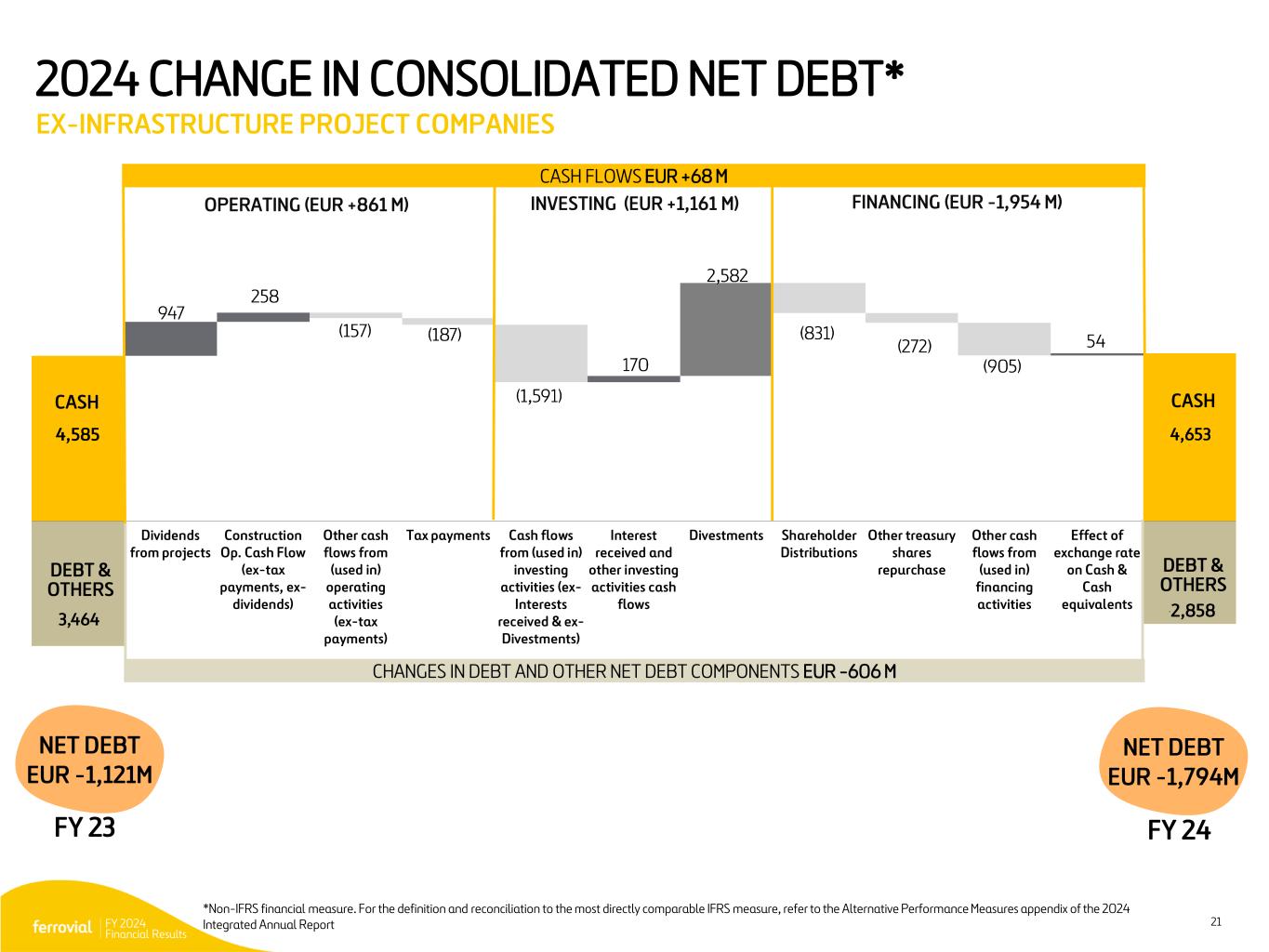

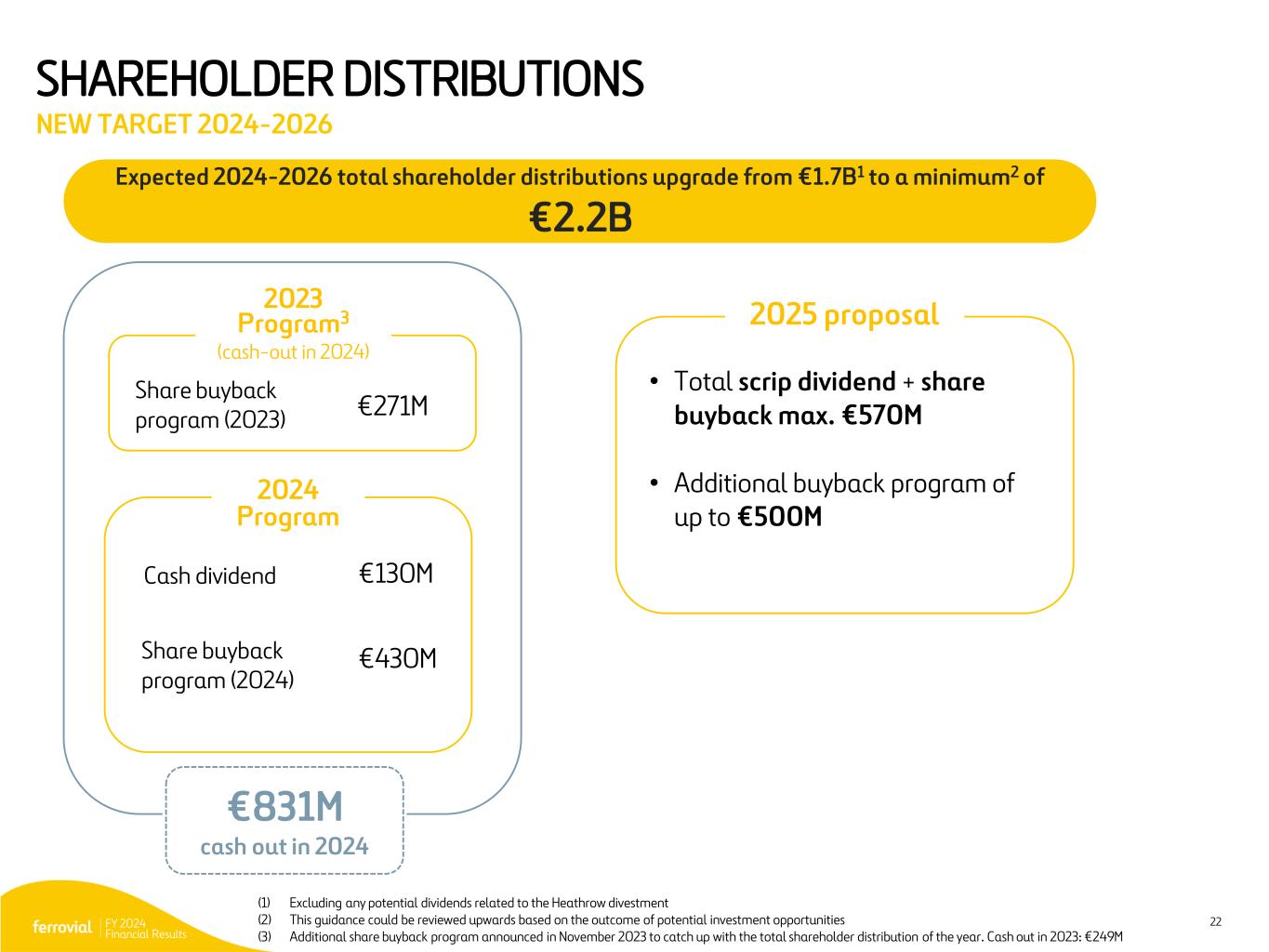

FY 2024 Financial Results 3 FY 2024 OVERVIEW Solid growth across all business divisions • Toll Roads: Robust traffic with revenue per transaction from North American assets significantly outpacing inflation • Airports: NTO achieved significant construction milestones in the year • Construction: Profitability improved significantly with adjusted EBIT margin reaching 3.9% -€1.8B Net debt ex-infra projects1 supported by All-time high dividends & asset rotation… • €947M in dividends from projects, including first year of dividend distributions from I-66 (€89M) and I-77 (€205M) • Divestments of €2.6B, primarily 19.75% stake sale in Heathrow (€2.0B) & 5% stake sale in IRB Infrastructure Developers (€211M) …combined with growth investments and shareholder distributions: • €1.6B investment, primarily acquisition of 23.99% stake in IRB Infrastructure Trust (€710M) & equity invested in NTO (€469M) • Shareholder distributions of €831M including €271M from 2023 program • Share repurchase program of €272M Main corporate events • FER’s shares were listed on Nasdaq on May 9th, 2024 • Acquisition of 23.99% stake in IRB Infrastructure Trust for €728M (€710M paid in 2024), partially financed by the sale of 5% stake in IRB Infrastructure Developers for €211M • Sale of 19.75% stake in Heathrow for €2.0B • Other divestments in the year: JV with Interogo to transfer economic rights of several toll roads’ projects (€100M) & Serveo sale completion (€55M) (1) Consolidated Net Debt of ex-infrastructure project companies

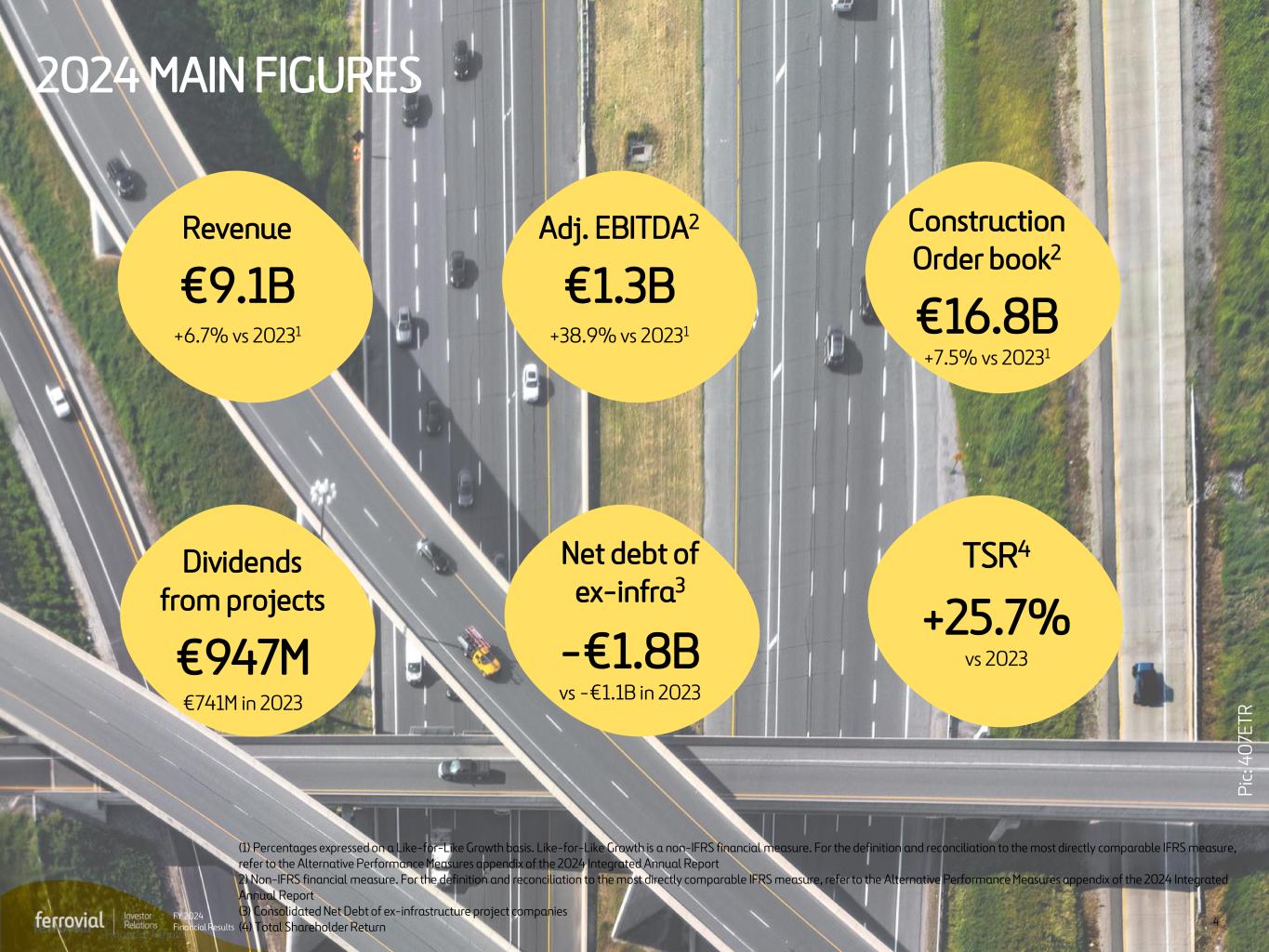

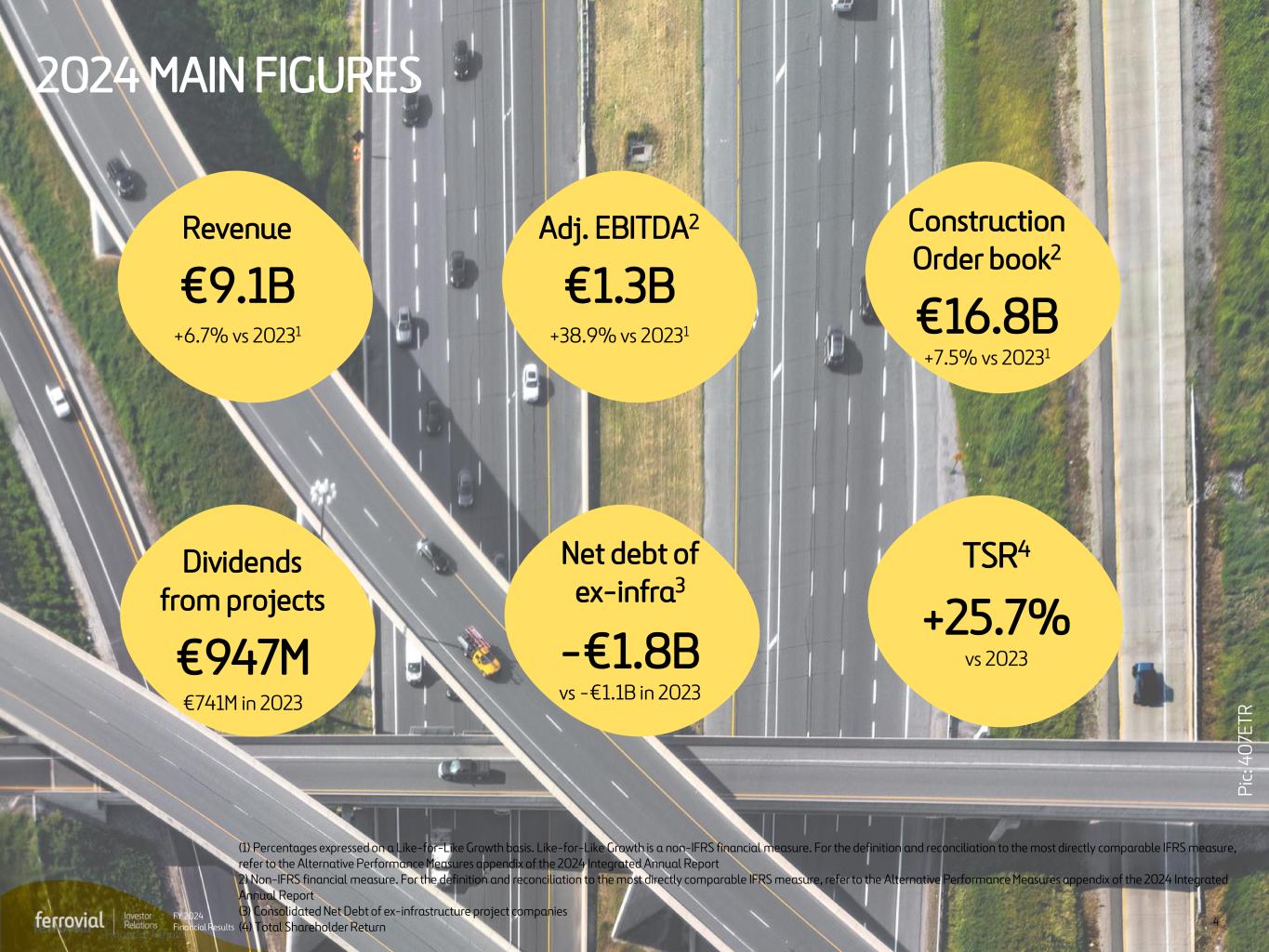

FY 2024 Financial Results 4 2024 MAIN FIGURES Revenue €9.1B +6.7% vs 20231 Adj. EBITDA2 €1.3B +38.9% vs 20231 Construction Order book2 €16.8B +7.5% vs 20231 Dividends from projects €947M €741M in 2023 Net debt of ex-infra3 -€1.8B vs -€1.1B in 2023 TSR4 +25.7% vs 2023 (1) Percentages expressed on a Like-for-Like Growth basis. Like-for-Like Growth is a non-IFRS financial measure. For the definition and reconciliation to the most directly comparable IFRS measure, refer to the Alternative Performance Measures appendix of the 2024 Integrated Annual Report 2) Non-IFRS financial measure. For the definition and reconciliation to the most directly comparable IFRS measure, refer to the Alternative Performance Measures appendix of the 2024 Integrated Annual Report (3) Consolidated Net Debt of ex-infrastructure project companies (4) Total Shareholder Return P ic : 4 0 7E T R FY 2024 Financial Results

FY 2024 Financial Results 5 FOCUSED ON GROWTH Solid cash flow generation and financial discipline Selected investments in other geographies / activities • Other infrastructure projects in the US (Data Centers, Airports & Energy) Asset rotation of mature assets P ic : N T E 35 W Atlanta, GA I-285 E I-285 W Charlotte, NC I-77S Nashville,TN I-24 | I-65 Alexandria, VA I-495 SW Focus on toll road projects in North America • Short listed in I-285 East (Georgia) • RFQ (Request for Qualification) submission for I-24 (Tennessee) • Record pipeline with six near term opportunities • Strong revenue growth in US MLs & 407 ETR • NTO project advancing on budget & on scheduleGrowth in North American assets

FY 2024 Financial Results 6 SUSTAINABILITY P ic : N T E (T ex a s, U SA ) NEW 1.5°C SBTI-VALIDATED TARGETS, SBTI CONFIRMATION EXPECTED IN EARLY 2025 PERFORMANCE IN 2024 Scope 1 & 2 in absolute terms -42% in 2030 (vs 2020) -35.3% in 2030 (vs 2009) -25% in 2030 (vs 2020) -20% in 2030 (vs 2012) Scope 34 in absolute terms HEALTH & SAFETY -26.0% Serious Injuries & Fatal frequency rate3 (vs 2022) WATER WITHDRAWAL -26.7% Water consumption2 (vs 2017) CLIMATE -35.8% -18.0% Scope 1&21 (vs 2020) Scope 31 (vs 2020) ELECTRICITY CONSUMPTION 72.8% from renewable sources (1) Scope 1, 2 and 3 absolute emissions (CO2 emissions). (2) BWI Business Water Index. Targets vs Base year 2017. (3) SIF - Frequency rate = no. (serious accidents + fatalities)*1,000,000/no. hours worked. Includes employees and contractors. (4) SBTi updated targets focus on the following Scope 3 categories: purchased goods & services, upstream transportation, waste generated in operations and fuel and energy. Previous Scope 3 emission categories excluded from SBTi target: capital goods and purchased goods & services. Included in the last 21 editions Index member for 23 years in a row Leading European company in Construction & Engineering A rating Highest posible climate rating for 15th consecutive year Climate: A Water: A for 2nd time Member of the Euronext- Vigeo Europe 120 index HIGHLY RANKED IN SUSTAINABLITY RATINGS 1.5°C trajectory 2°C trajectory (2017) 1.5°C trajectory 2°C trajectory (2017)

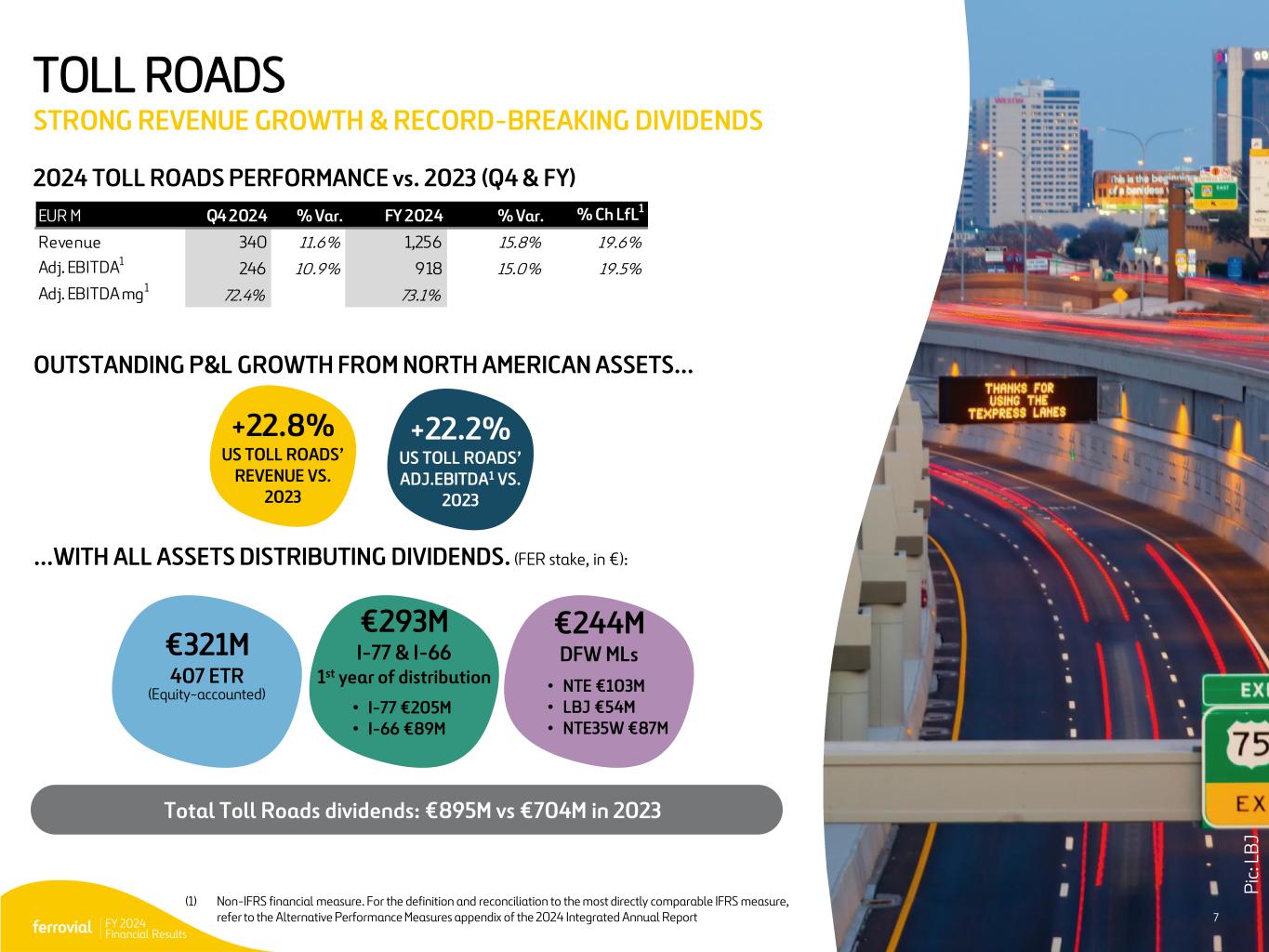

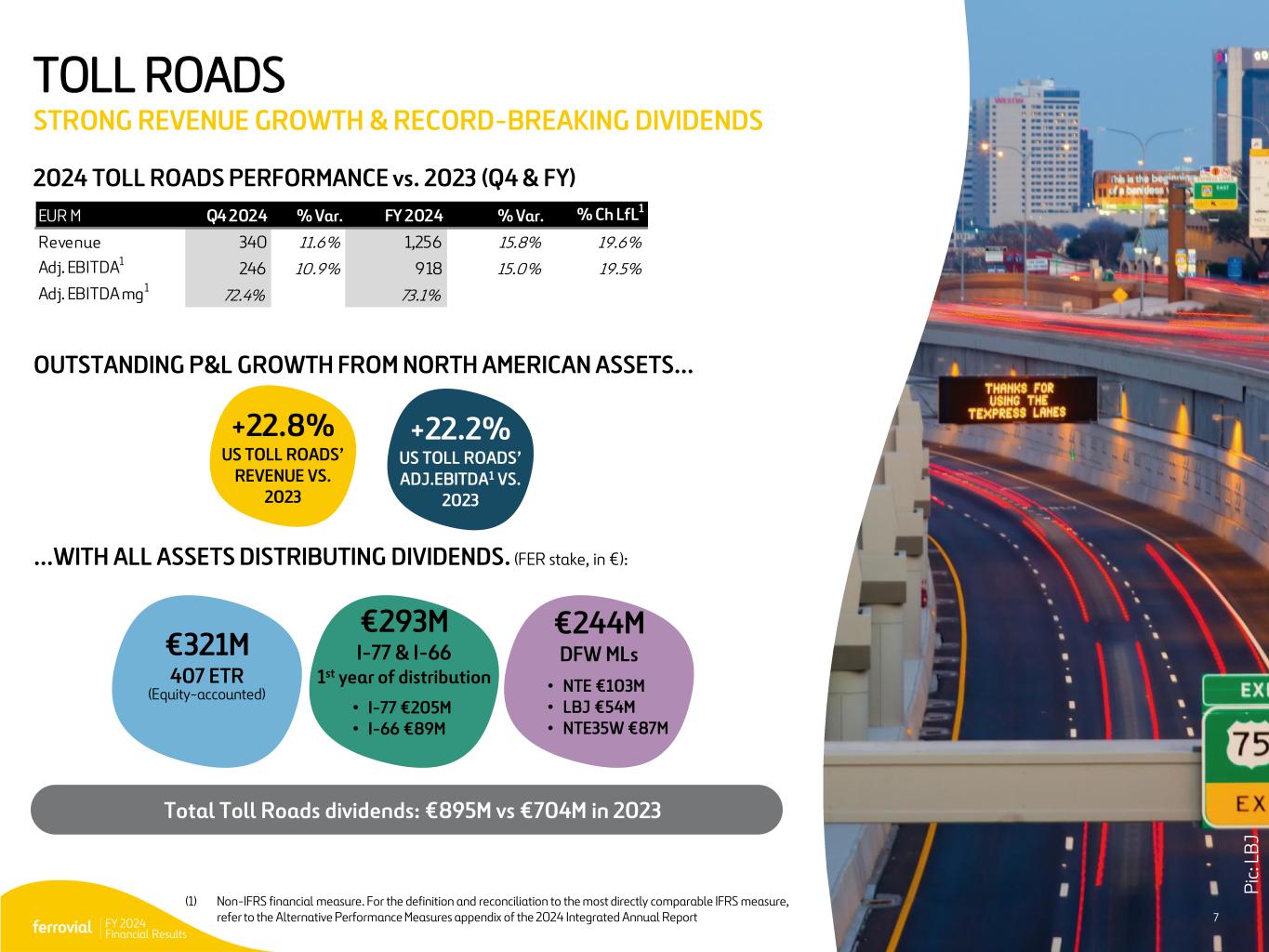

FY 2024 Financial Results 7 TOLL ROADS STRONG REVENUE GROWTH & RECORD-BREAKING DIVIDENDS 2024 TOLL ROADS PERFORMANCE vs. 2023 (Q4 & FY) P ic : L B J €244M DFW MLs • NTE €103M • LBJ €54M • NTE35W €87M 7 OUTSTANDING P&L GROWTH FROM NORTH AMERICAN ASSETS… €321M 407 ETR (Equity-accounted) (1) Non-IFRS financial measure. For the definition and reconciliation to the most directly comparable IFRS measure, refer to the Alternative Performance Measures appendix of the 2024 Integrated Annual Report EUR M Q4 2024 % Var. FY 2024 % Var. % Ch LfL1 Revenue 340 11.6% 1,256 15.8% 19.6% Adj. EBITDA1 246 10.9% 918 15.0% 19.5% Adj. EBITDA mg1 72.4% 73.1% €293M I-77 & I-66 1st year of distribution • I-77 €205M • I-66 €89M …WITH ALL ASSETS DISTRIBUTING DIVIDENDS. (FER stake, in €): +22.8% US TOLL ROADS’ REVENUE VS. 2023 +22.2% US TOLL ROADS’ ADJ.EBITDA1 VS. 2023 Total Toll Roads dividends: €895M vs €704M in 2023

FY 2024 Financial Results 8 2024 PERFORMANCE vs. 2023 (Q4 & FY) 407 ETR ROBUST TRAFFIC & REVENUE GROWTH 2024 TRAFFIC PERFORMANCE vs. 2023 (VKT) Traffic increase in all time periods • Traffic growth supported by an increase in mobility, impact from construction activities on Highway 401, fewer winter weather events and more promotional offers in Q4 to reduce congestion in the corridor during peak hours CAD M Q4 2024 VAR. FY 2024 VAR. Traffic (VKT M) 678 5.5% 2,658 4.8% Revenue 438 16.5% 1,705 14.0% EBITDA 370 17.3% 1,478 15.1% EBITDA mg 84.5% 86.7% Avg revenue per trip 14.7 12.3% 14.7 11.4% CAD M Q4 2024 Q4 2023 VAR. FY 2024 FY 2023 VAR. Toll Revenue 413 353 17.2% 1,610 1,379 16.8% Total Revenue 438 376 16.5% 1,705 1,495 14.0% Q1 Q2 Q3 Q4 FY 24 Note: The 407ETR financial information presented here has been based on, and is consistent with, the financial statements of 407 ETR • Toll revenue positively impacted by higher traffic volumes and new toll rate schedule (2024). Other charges linked to tolling (camera charge, trip toll charge) remained flat • Fee revenue: impacted by lower late payment charges resulting from a higher reserve provision rate and lower enforcement fees • Contract revenue: No contribution in 2024 due to the removal of tolls for Highways 412 and 418, that ended in June 2023 NEW RATE SCHEDULE IN 2025 • Effective Jan. 1, 2025 • More demand segmentation: • Number of toll zones from 4 to 12 • New Vehicle Classifications: Introduced new rate classes for Motorcycles and medium-sized vehicles • Fee Increases for camera charge, account fee, and transponder lease RECORD DIVIDEND DISTRIBUTION: CAD1,100M dividend paid in 2024 (CAD950M in 2023, +15.8%)

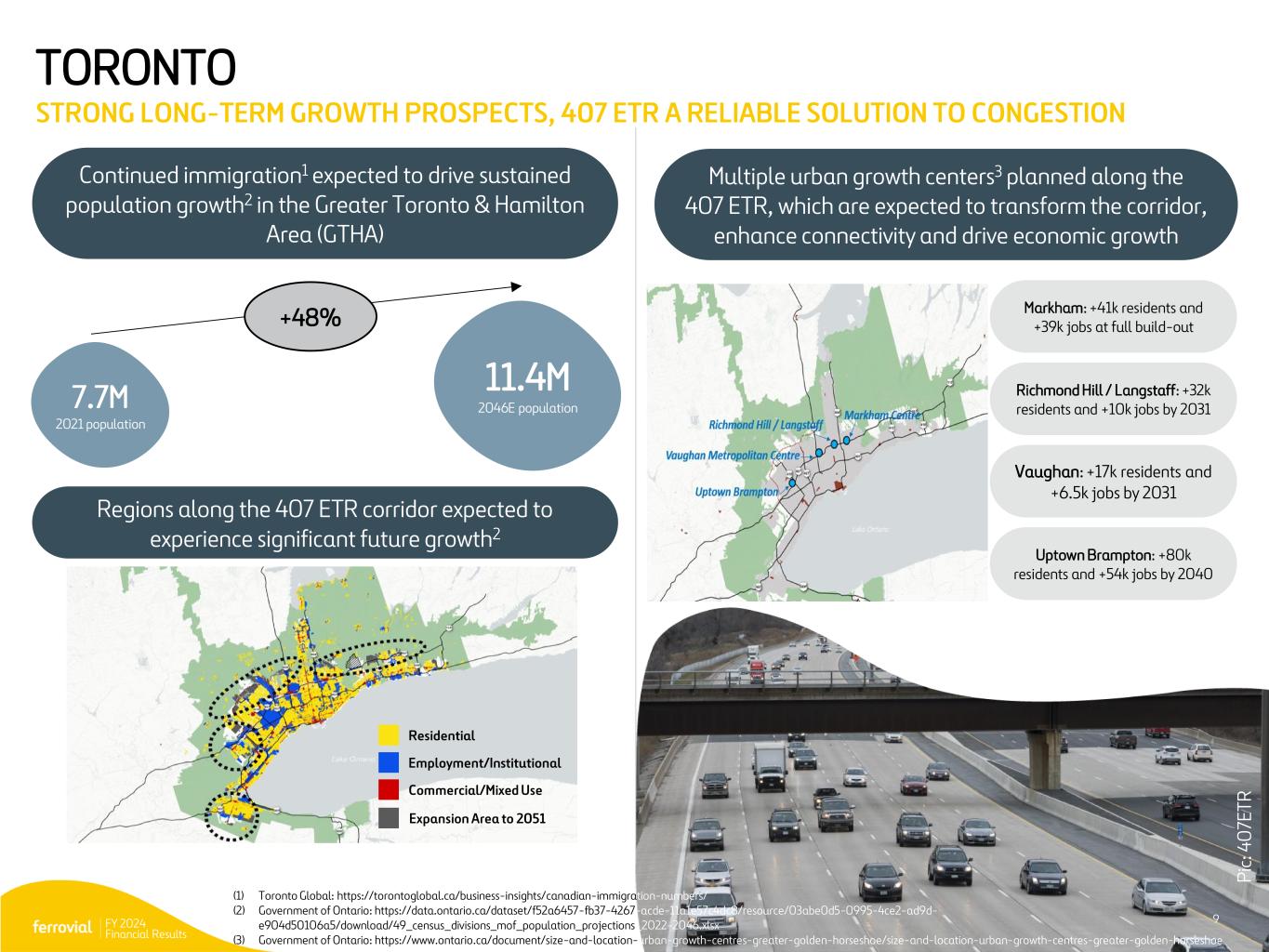

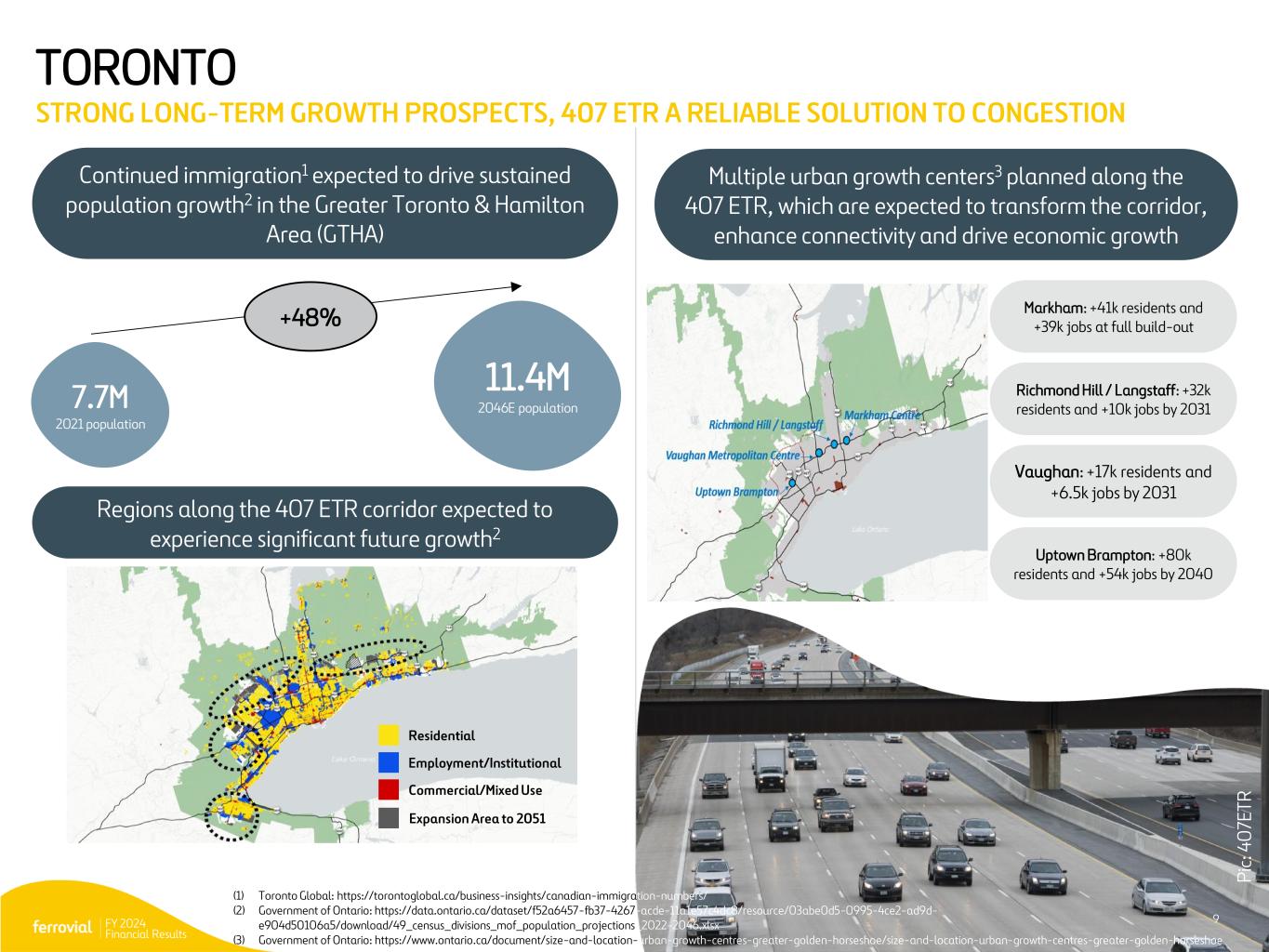

FY 2024 Financial Results 9 P ic : 4 0 7E T R 9 +48% 16Mn 2050E population 7.7M 2021 population 11.4M 2046E population Continued immigration1 expected to drive sustained population growth2 in the Greater Toronto & Hamilton Area (GTHA) Regions along the 407 ETR corridor expected to experience significant future growth2 Multiple urban growth centers3 planned along the 407 ETR, which are expected to transform the corridor, enhance connectivity and drive economic growth Vaughan: + 7k residents and +6.5k jobs by 2031 Richmond Hill / Langstaff: +32k residents and +10k jobs by 2031 Markham: +41k residents and +39k jobs at full build-out P ic : 4 0 7E T R Uptown Brampton: +80k residents and +54k jobs by 2040 (1) Toronto Global: https://torontoglobal.ca/business-insights/canadian-immigration-numbers/ (2) Government of Ontario: https://data.ontario.ca/dataset/f52a6457-fb37-4267-acde-11a1e57c4dc8/resource/03abe0d5-0995-4ce2-ad9d- e904d50106a5/download/49_census_divisions_mof_population_projections_2022-2046.xlsx (3) Government of Ontario: https://www.ontario.ca/document/size-and-location-urban-growth-centres-greater-golden-horseshoe/size-and-location-urban-growth-centres-greater-golden-horseshoe Employment/Institutional Commercial/Mixed Use Residential Expansion Area to 2051 TORONTO STRONG LONG-TERM GROWTH PROSPECTS, 407 ETR A RELIABLE SOLUTION TO CONGESTION

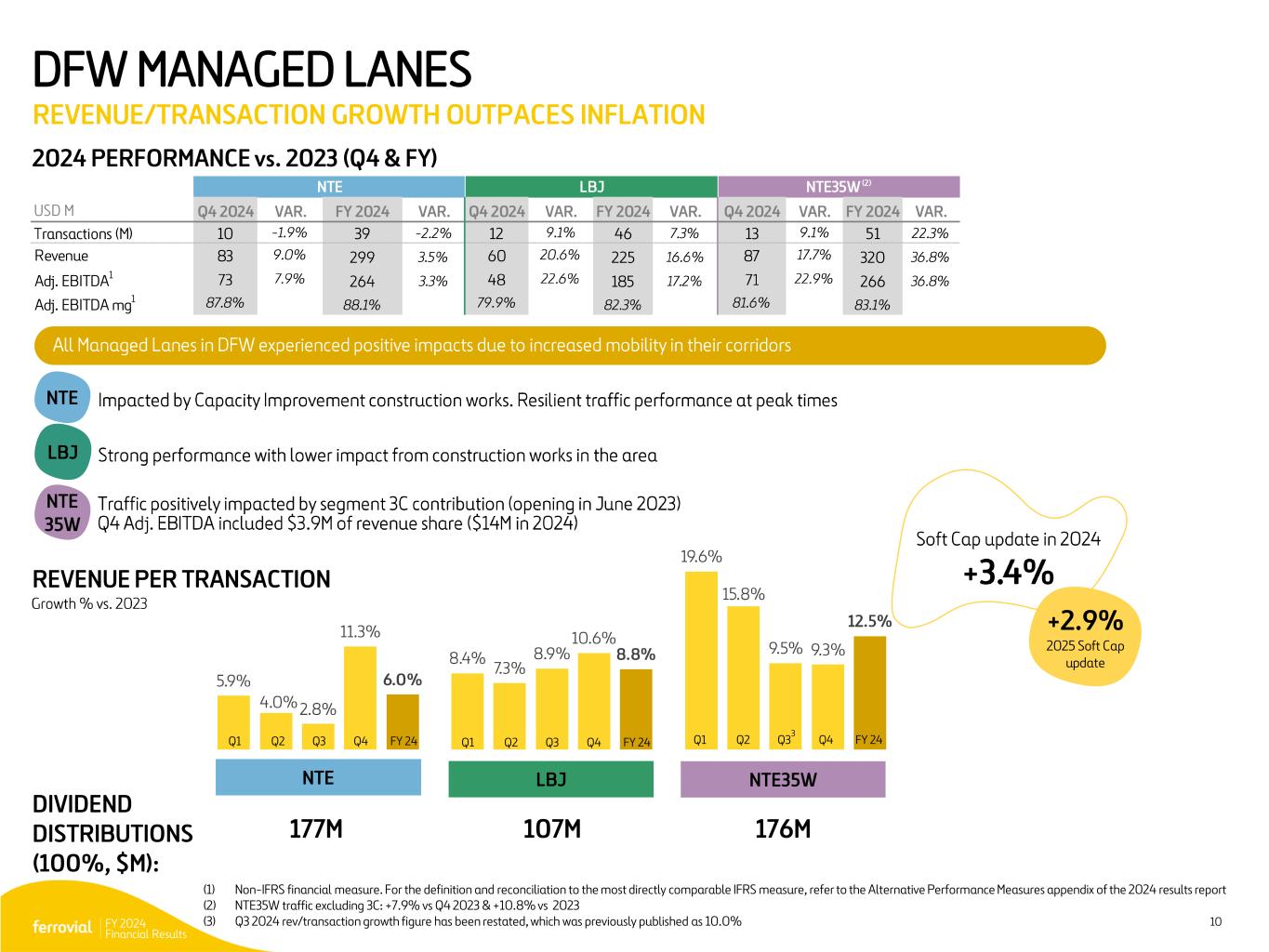

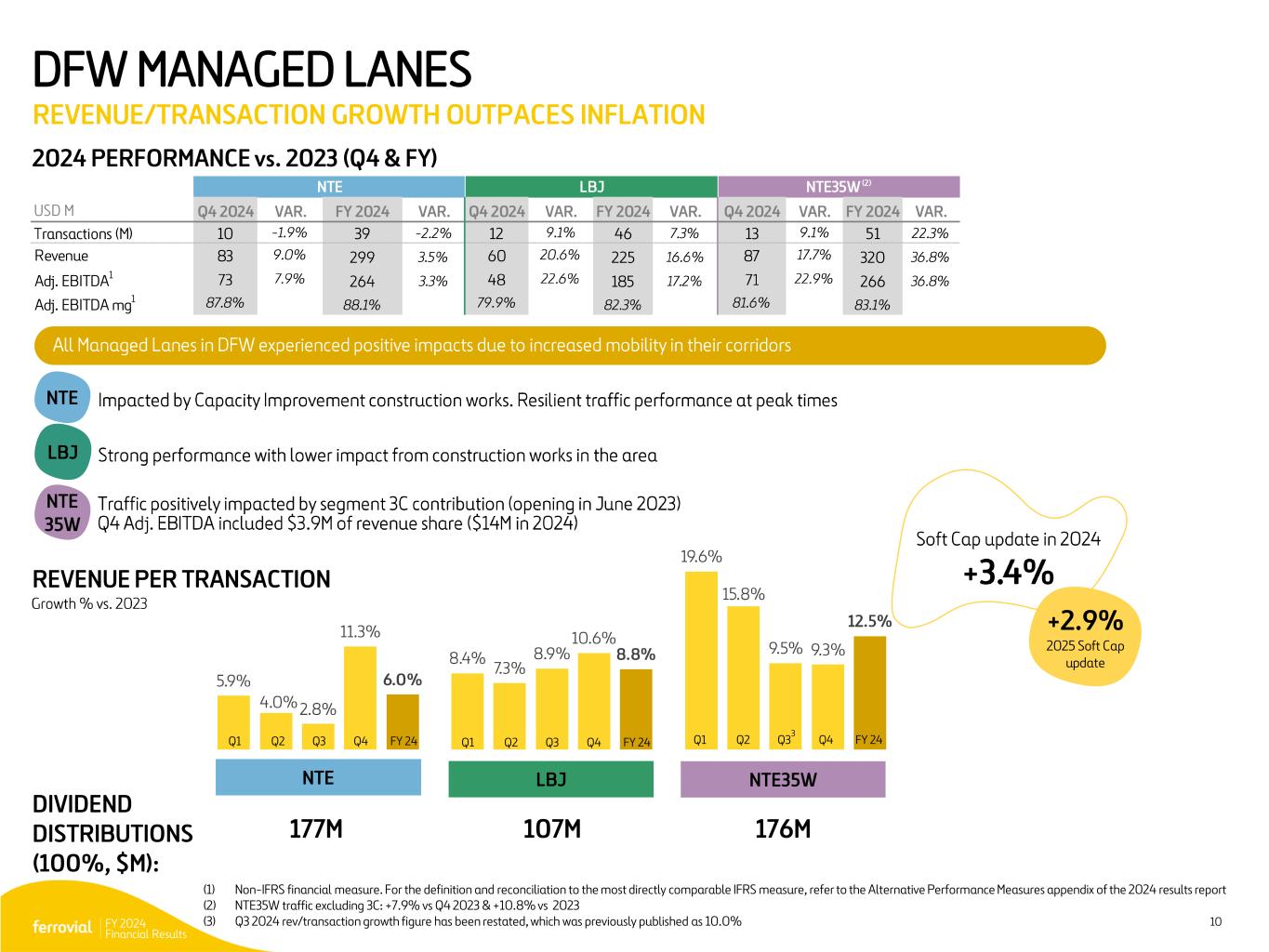

FY 2024 Financial Results 10 2024 PERFORMANCE vs. 2023 (Q4 & FY) REVENUE PER TRANSACTION DFW MANAGED LANES REVENUE/TRANSACTION GROWTH OUTPACES INFLATION NTE NTE 35W LBJ +2.9% 2025 Soft Cap update Q2 Q3 Q4 FY 24Q1 NTE LBJ NTE35W (1) Non-IFRS financial measure. For the definition and reconciliation to the most directly comparable IFRS measure, refer to the Alternative Performance Measures appendix of the 2024 results report (2) NTE35W traffic excluding 3C: +7.9% vs Q4 2023 & +10.8% vs 2023 (3) Q3 2024 rev/transaction growth figure has been restated, which was previously published as 10.0% NTE LBJ NTE35W (2) Q4 2024 VAR. FY 2024 VAR. Q4 2024 VAR. FY 2024 VAR. Q4 2024 VAR. FY 2024 VAR. Revenue Adj. EBITDA 1 Adj. EBITDA mg 1 DIVIDEND DISTRIBUTIONS (100%, $M): 177M 107M 176M Q2 Q3 Q4 FY 24Q1 Q2 Q3 Q4 FY 24Q1 3

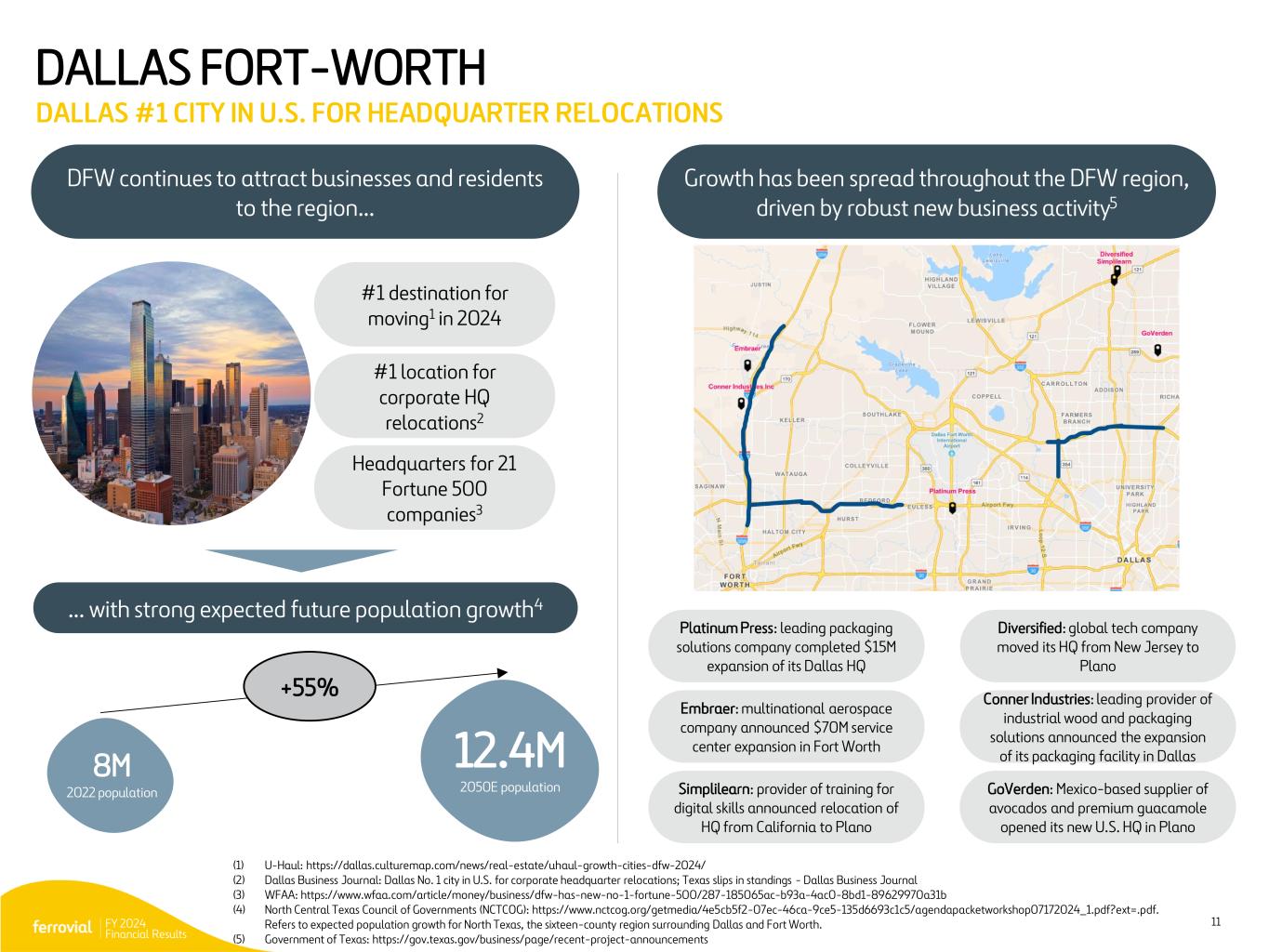

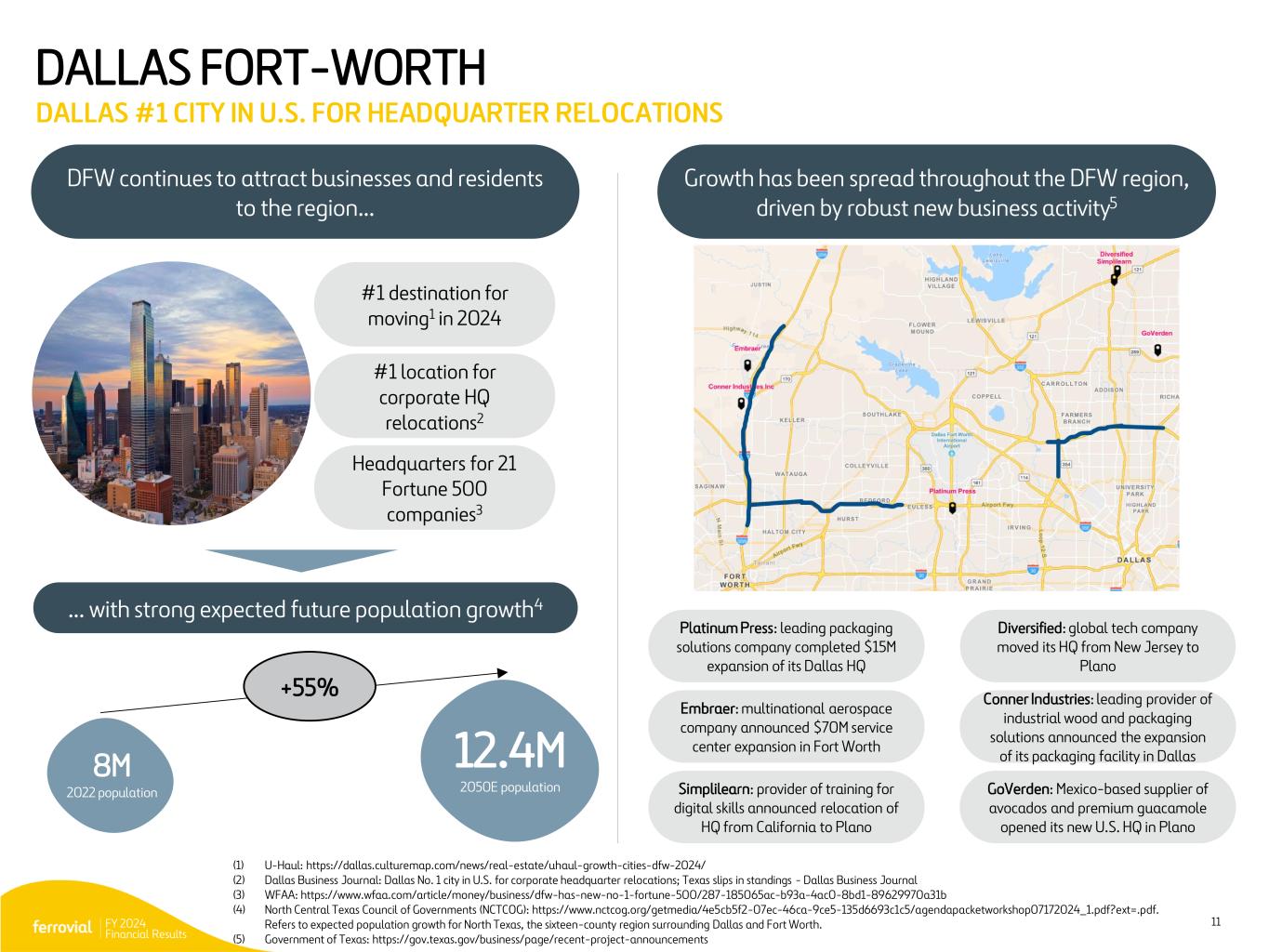

FY 2024 Financial Results 11 Headquarters for 21 Fortune 500 companies3 #1 destination for moving1 in 2024 #1 location for corporate HQ relocations2 16M Population +55% DFW continues to attract businesses and residents to the region… … with strong expected future population growth4 8M 2022 population 12.4M 2050E population Growth has been spread throughout the DFW region, driven by robust new business activity5 (1) U-Haul: https://dallas.culturemap.com/news/real-estate/uhaul-growth-cities-dfw-2024/ (2) Dallas Business Journal: Dallas No. 1 city in U.S. for corporate headquarter relocations; Texas slips in standings - Dallas Business Journal (3) WFAA: https://www.wfaa.com/article/money/business/dfw-has-new-no-1-fortune-500/287-185065ac-b93a-4ac0-8bd1-89629970a31b (4) North Central Texas Council of Governments (NCTCOG): https://www.nctcog.org/getmedia/4e5cb5f2-07ec-46ca-9ce5-135d6693c1c5/agendapacketworkshop07172024_1.pdf?ext=.pdf. Refers to expected population growth for North Texas, the sixteen-county region surrounding Dallas and Fort Worth. (5) Government of Texas: https://gov.texas.gov/business/page/recent-project-announcements Platinum Press: leading packaging solutions company completed $15M expansion of its Dallas HQ Diversified: global tech company moved its HQ from New Jersey to Plano Embraer: multinational aerospace company announced $70M service center expansion in Fort Worth Conner Industries: leading provider of industrial wood and packaging solutions announced the expansion of its packaging facility in Dallas Simplilearn: provider of training for digital skills announced relocation of HQ from California to Plano GoVerden: Mexico-based supplier of avocados and premium guacamole opened its new U.S. HQ in Plano DALLAS FORT-WORTH DALLAS #1 CITY IN U.S. FOR HEADQUARTER RELOCATIONS

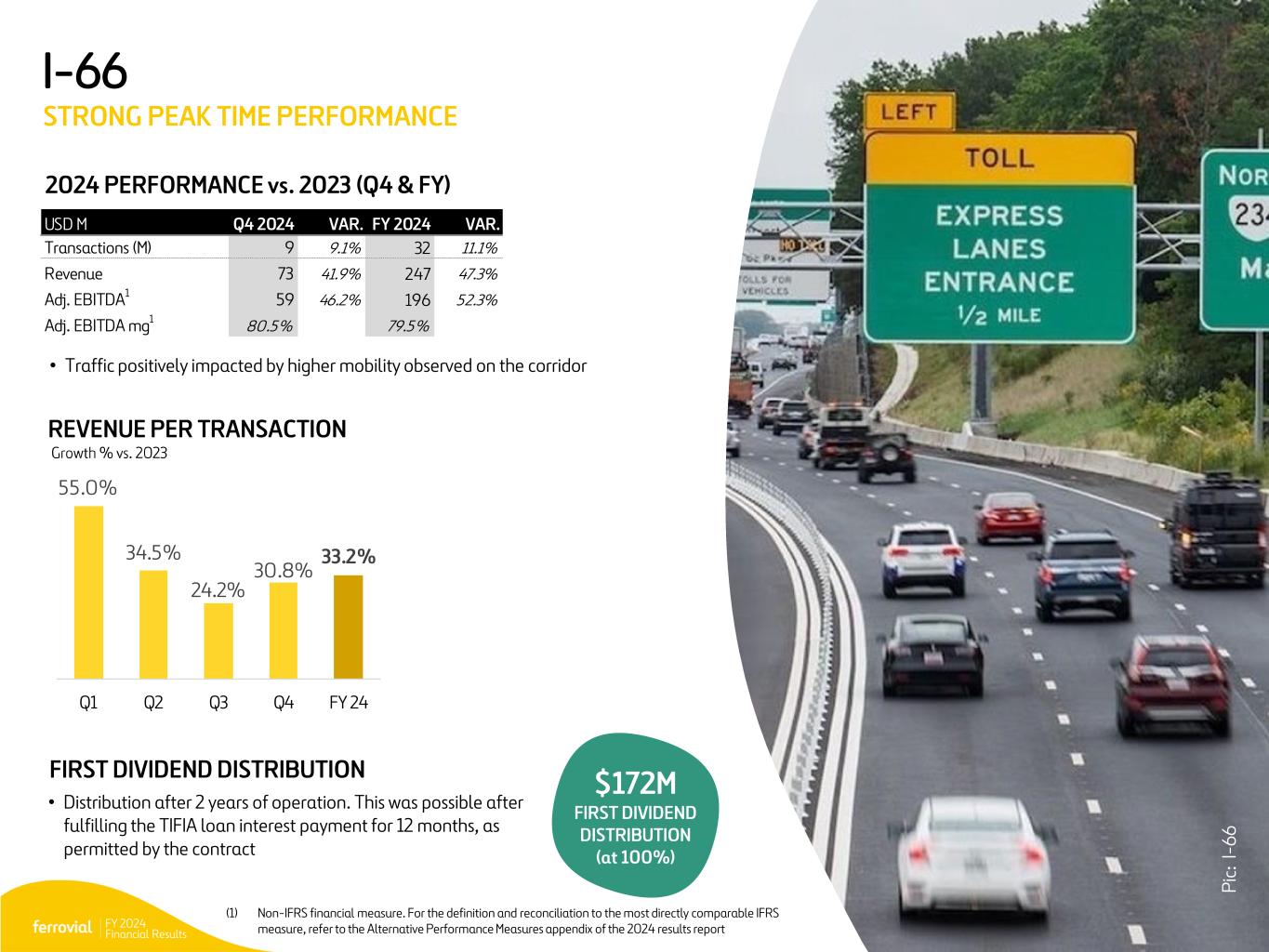

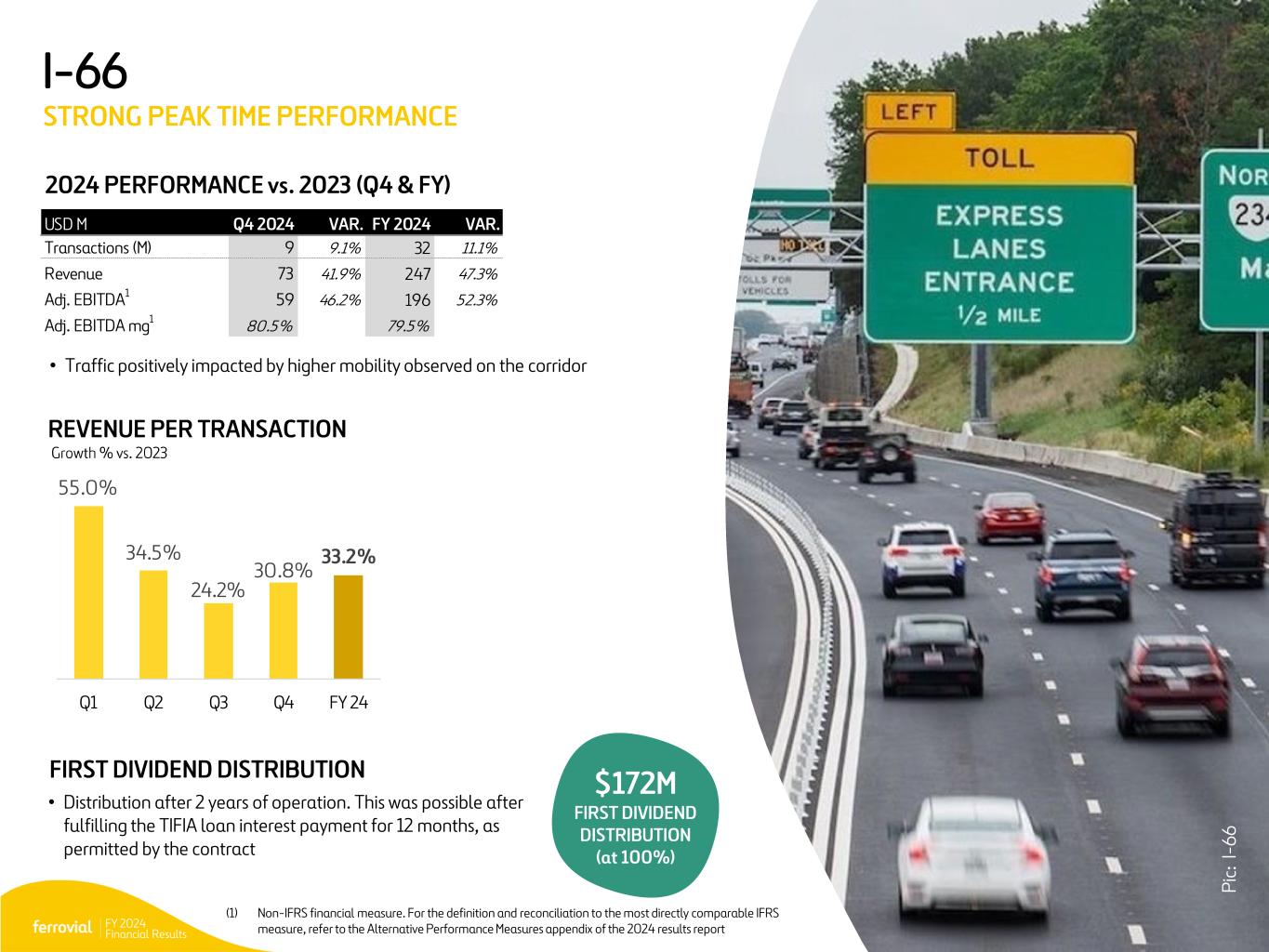

FY 2024 Financial Results 12 I-66 STRONG PEAK TIME PERFORMANCE 2024 PERFORMANCE vs. 2023 (Q4 & FY) USD M Q4 2024 VAR. FY 2024 VAR. Transactions (M) 9 9.1% 11.1% Revenue 73 41.9% 47.3% Adj. EBITDA1 59 46.2% 52.3% Adj. EBITDA mg1 80.5% 79.5% • Traffic positively impacted by higher mobility observed on the corridor REVENUE PER TRANSACTION $172M FIRST DIVIDEND DISTRIBUTION (at 100%) 55.0% 34.5% 24.2% 30.8% 33.2% Q1 Q2 Q3 Q4 FY 24 FIRST DIVIDEND DISTRIBUTION • Distribution after 2 years of operation. This was possible after fulfilling the TIFIA loan interest payment for 12 months, as permitted by the contract (1) Non-IFRS financial measure. For the definition and reconciliation to the most directly comparable IFRS measure, refer to the Alternative Performance Measures appendix of the 2024 results report P ic : I- 6 6

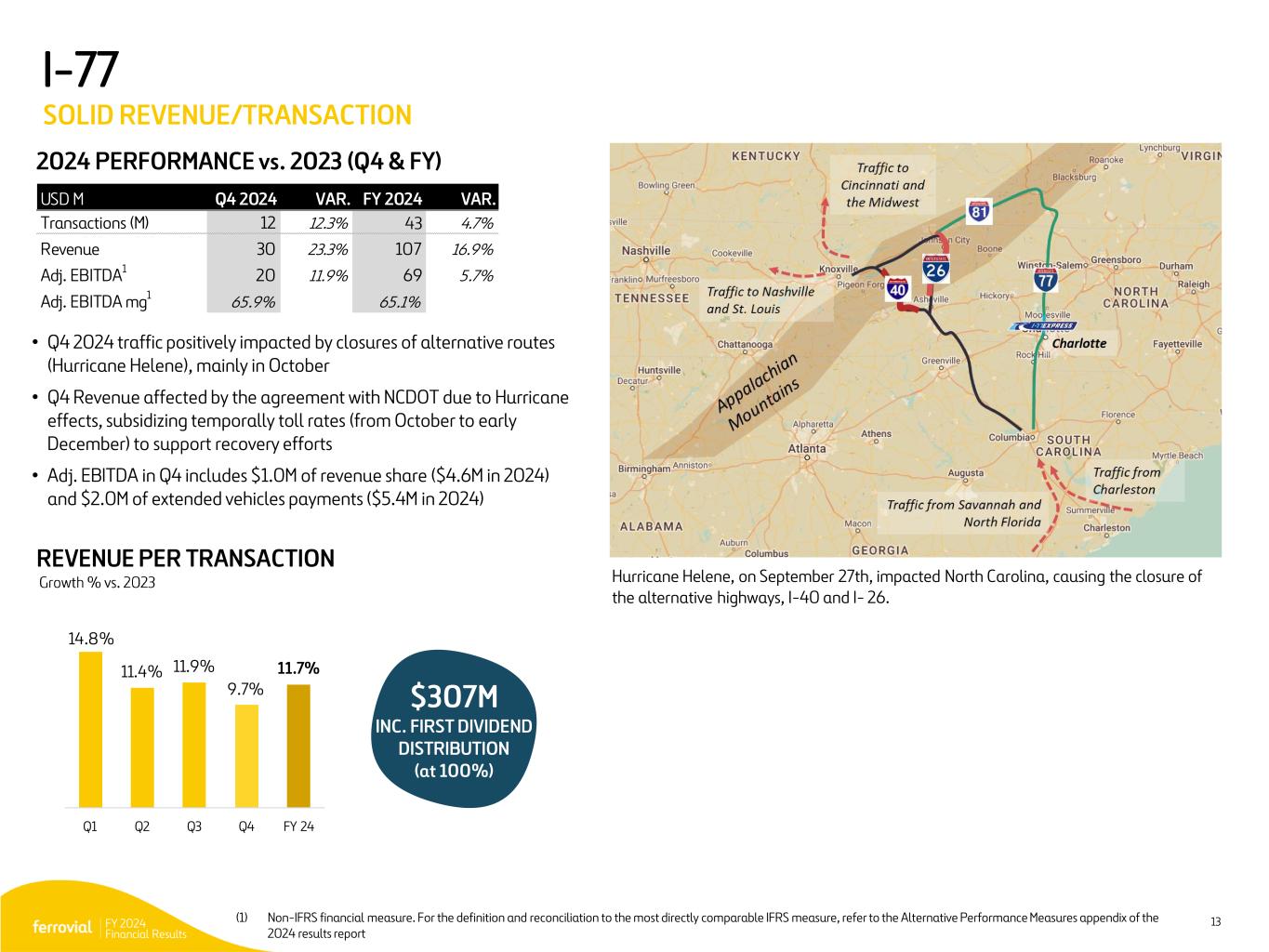

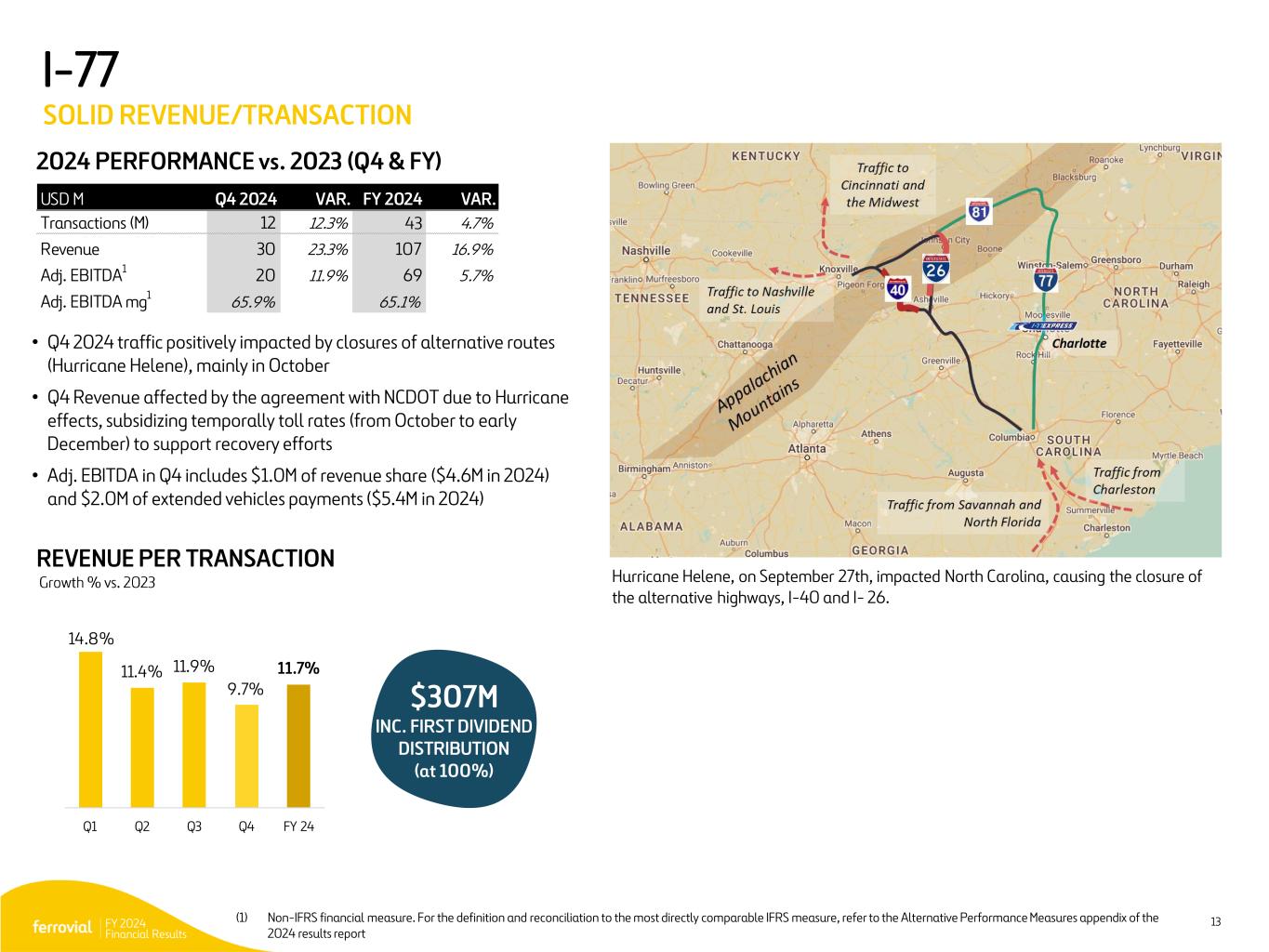

FY 2024 Financial Results 13 I-77 SOLID REVENUE/TRANSACTION 2024 PERFORMANCE vs. 2023 (Q4 & FY) USD M Q4 2024 VAR. FY 2024 VAR. Transactions (M) 12 12.3% 4.7% Revenue 30 23.3% 107 16.9% Adj. EBITDA1 20 11.9% 69 5.7% Adj. EBITDA mg1 65.9% 65.1% • Q4 2024 traffic positively impacted by closures of alternative routes (Hurricane Helene), mainly in October • Q4 Revenue affected by the agreement with NCDOT due to Hurricane effects, subsidizing temporally toll rates (from October to early December) to support recovery efforts • Adj. EBITDA in Q4 includes $1.0M of revenue share ($4.6M in 2024) and $2.0M of extended vehicles payments ($5.4M in 2024) REVENUE PER TRANSACTION $307M INC. FIRST DIVIDEND DISTRIBUTION (at 100%) 14.8% 11.4% 11.9% 9.7% 11.7% Q1 Q2 Q3 Q4 FY 24 Hurricane Helene, on September 27th, impacted North Carolina, causing the closure of the alternative highways, I-40 and I- 26. (1) Non-IFRS financial measure. For the definition and reconciliation to the most directly comparable IFRS measure, refer to the Alternative Performance Measures appendix of the 2024 results report

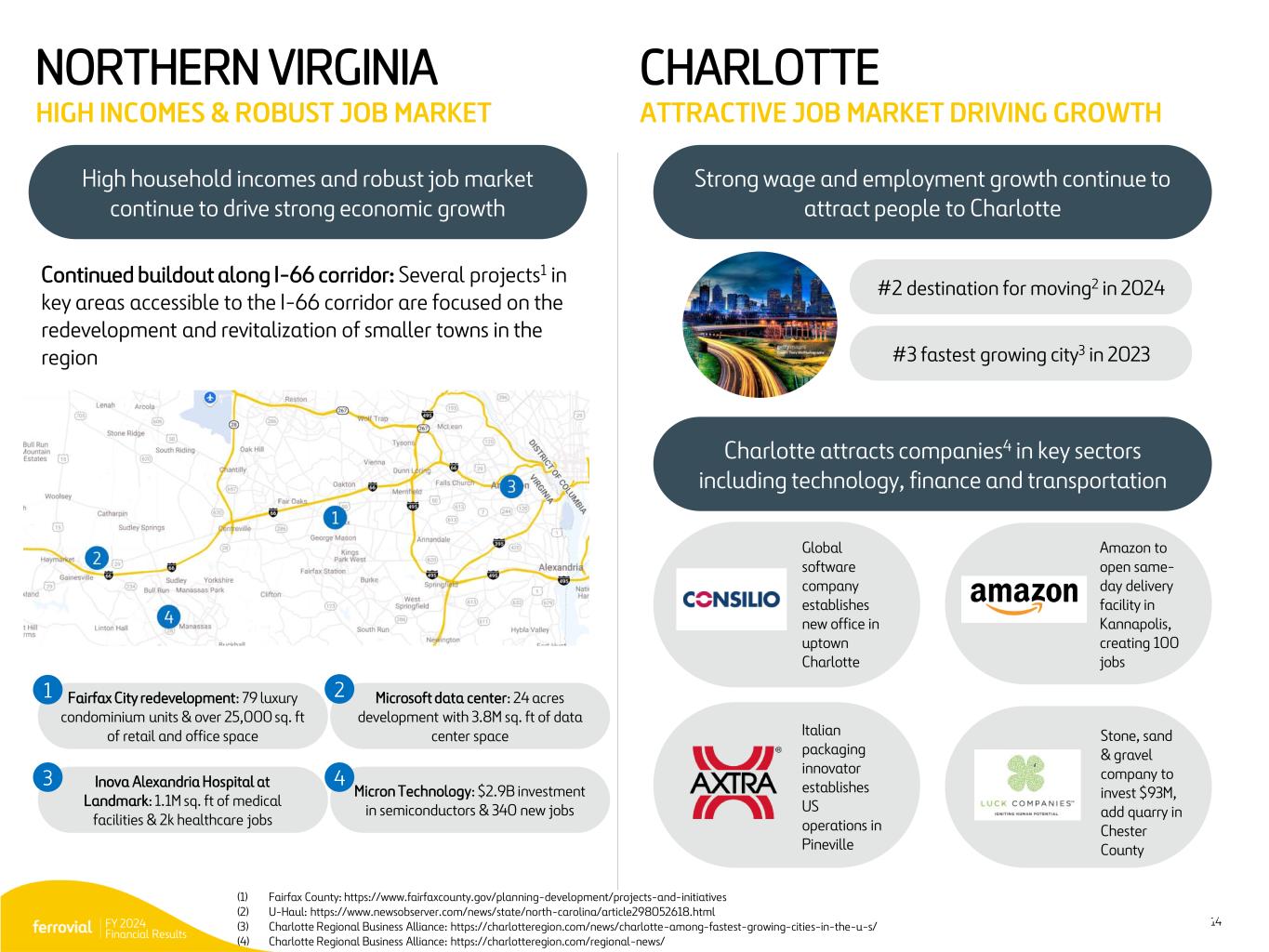

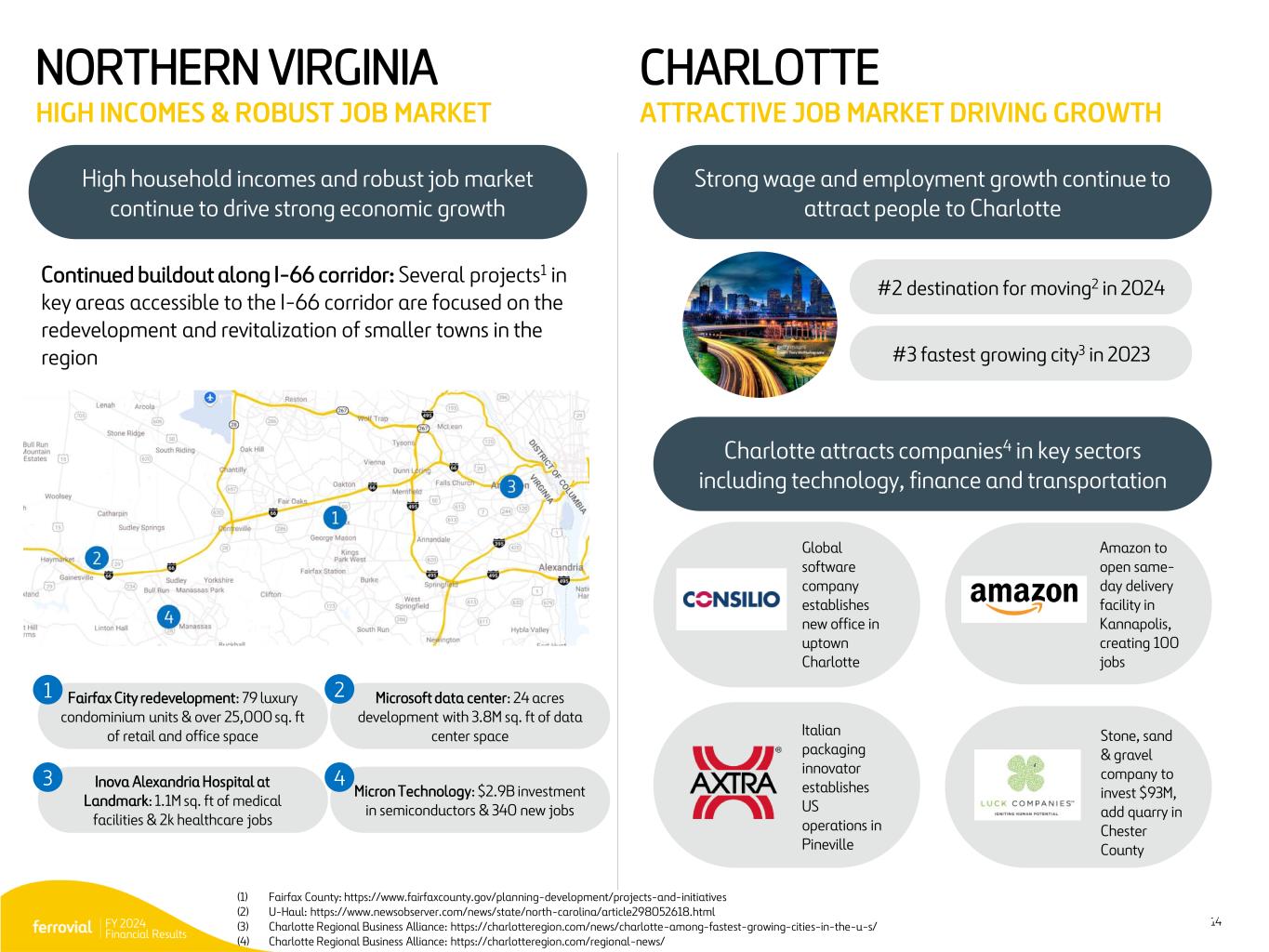

FY 2024 Financial Results 14 P ic : 4 0 7E T R 14 High household incomes and robust job market continue to drive strong economic growth Strong wage and employment growth continue to attract people to Charlotte Continued buildout along I-66 corridor: Several projects1 in key areas accessible to the I-66 corridor are focused on the redevelopment and revitalization of smaller towns in the region NORTHERN VIRGINIA HIGH INCOMES & ROBUST JOB MARKET CHARLOTTE ATTRACTIVE JOB MARKET DRIVING GROWTH #2 destination for moving2 in 2024 (1) Fairfax County: https://www.fairfaxcounty.gov/planning-development/projects-and-initiatives (2) U-Haul: https://www.newsobserver.com/news/state/north-carolina/article298052618.html (3) Charlotte Regional Business Alliance: https://charlotteregion.com/news/charlotte-among-fastest-growing-cities-in-the-u-s/ (4) Charlotte Regional Business Alliance: https://charlotteregion.com/regional-news/ #3 fastest growing city3 in 2023 Fairfax City redevelopment: 79 luxury condominium units & over 25,000 sq. ft of retail and office space Microsoft data center: 24 acres development with 3.8M sq. ft of data center space Inova Alexandria Hospital at Landmark: 1.1M sq. ft of medical facilities & 2k healthcare jobs Micron Technology: $2.9B investment in semiconductors & 340 new jobs Charlotte attracts companies4 in key sectors including technology, finance and transportation Global software company establishes new office in uptown Charlotte Italian packaging innovator establishes US operations in Pineville Stone, sand & gravel company to invest $93M, add quarry in Chester County Amazon to open same- day delivery facility in Kannapolis, creating 100 jobs

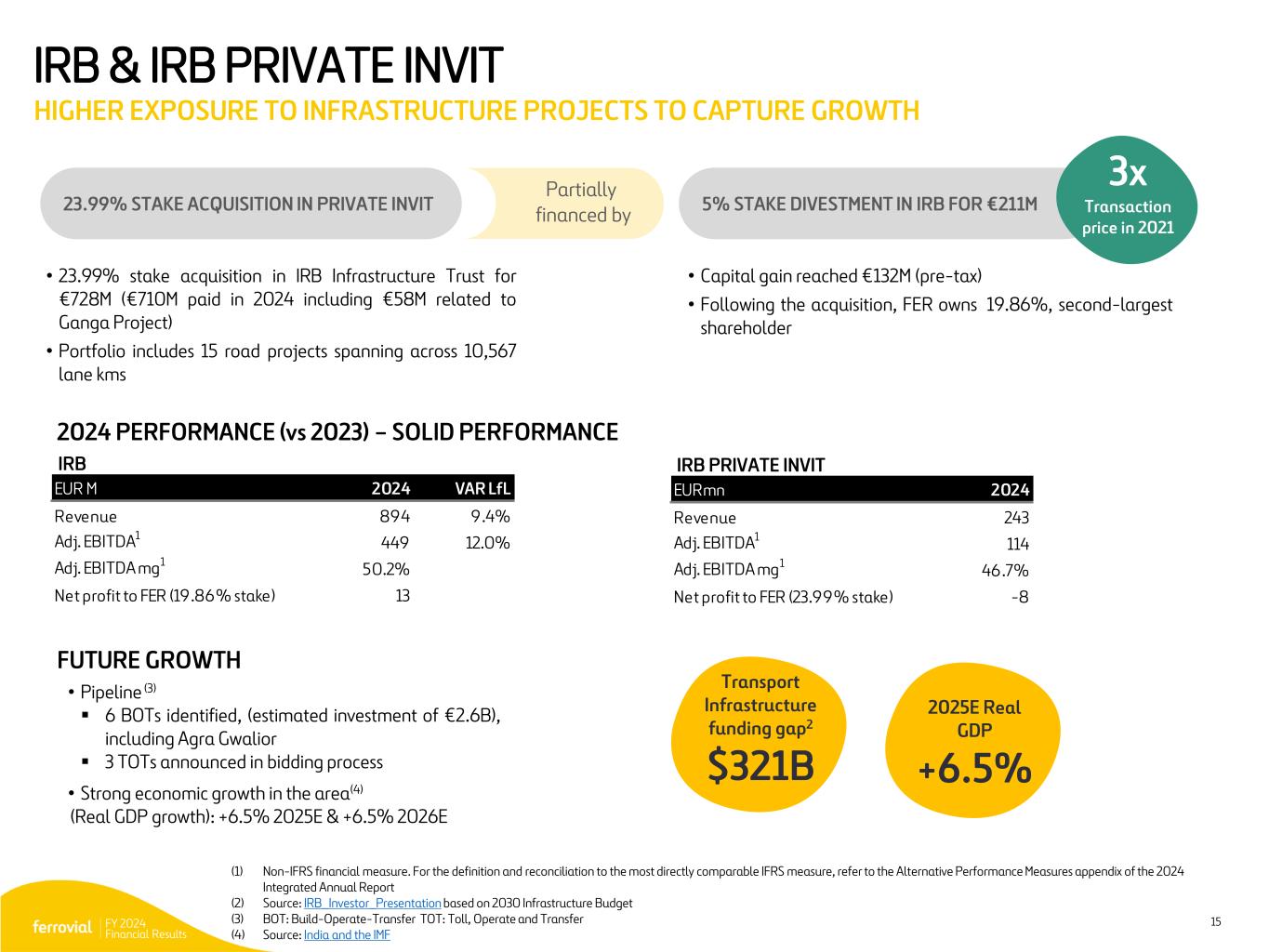

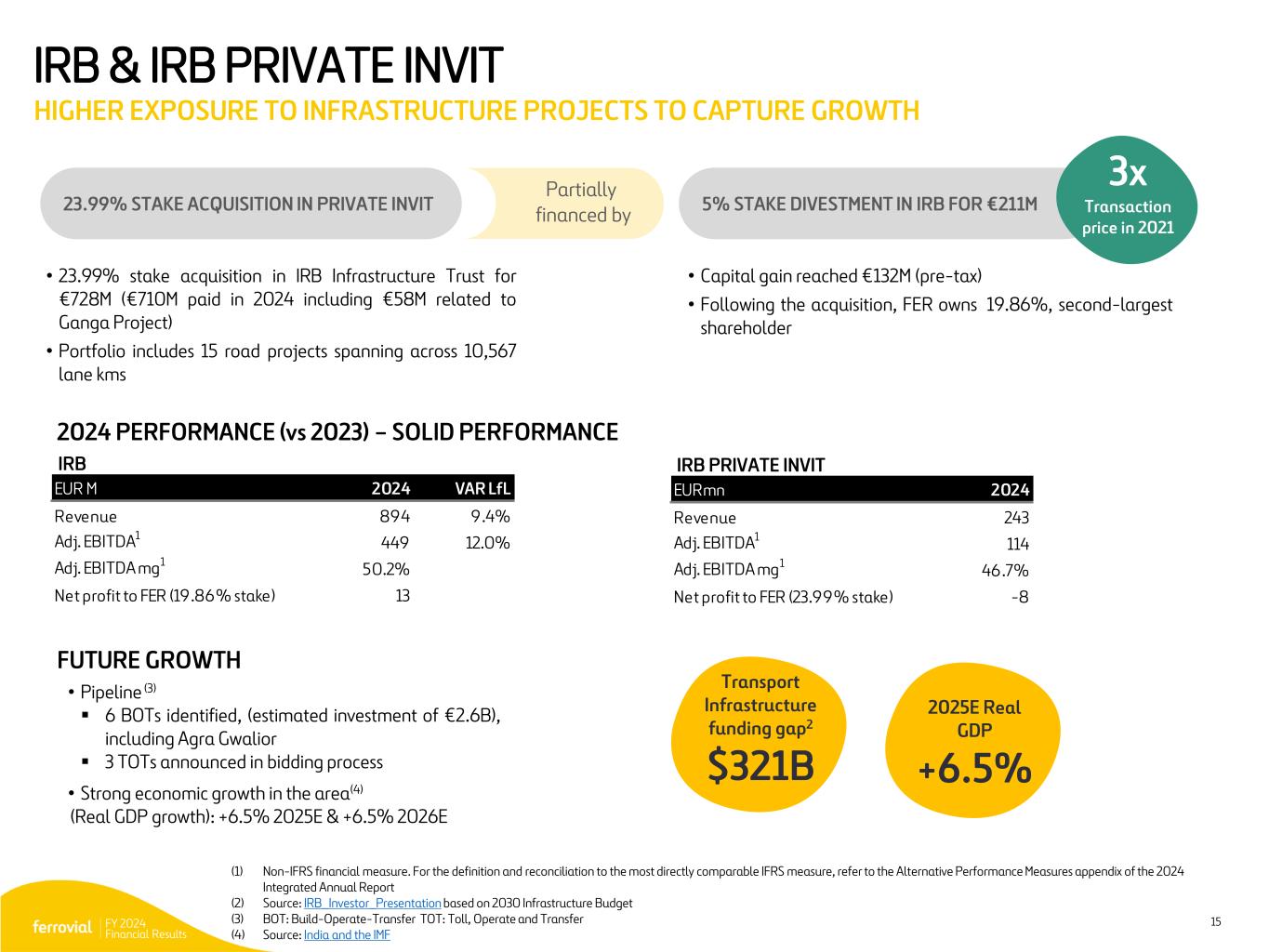

FY 2024 Financial Results 15 IRB & IRB PRIVATE INVIT HIGHER EXPOSURE TO INFRASTRUCTURE PROJECTS TO CAPTURE GROWTH 2024 PERFORMANCE (vs 2023) – SOLID PERFORMANCE FUTURE GROWTH • Pipeline (3) ▪ 6 BOTs identified, (estimated investment of €2.6B), including Agra Gwalior ▪ 3 TOTs announced in bidding process Transport Infrastructure funding gap2 $321B (1) Non-IFRS financial measure. For the definition and reconciliation to the most directly comparable IFRS measure, refer to the Alternative Performance Measures appendix of the 2024 Integrated Annual Report (2) Source: IRB_Investor_Presentation based on 2030 Infrastructure Budget (3) BOT: Build-Operate-Transfer TOT: Toll, Operate and Transfer (4) Source: India and the IMF 2024 TRANSACTIONS • 23.99% stake acquisition in IRB Infrastructure Trust for €728M (€710M paid in 2024 including €58M related to Ganga Project) • Portfolio includes 15 road projects spanning across 10,567 lane kms • Capital gain reached €132M (pre-tax) • Following the acquisition, FER owns 19.86%, second-largest shareholder 23.99% STAKE ACQUISITION IN PRIVATE INVIT 5% STAKE DIVESTMENT IN IRB FOR €211M 3x Transaction price in 2021 IRB IRB PRIVATE INVIT Partially financed by EUR M 2024 VAR LfL Revenue 894 9.4% Adj. EBITDA1 449 12.0% Adj. EBITDA mg1 50.2% Net profit to FER (19.86% stake) 13 EURmn 2024 Revenue 243 Adj. EBITDA1 114 Adj. EBITDA mg1 46.7% Net profit to FER (23.99% stake) -8 • Strong economic growth in the area(4) (Real GDP growth): +6.5% 2025E & +6.5% 2026E 2025E Real GDP +6.5%

FY 2024 Financial Results 16 P ic : H A H 16 HEATHROW HEATHROW DIVESTMENT 19.75% STAKE DIVESTMENT COMPLETION - TRANSACTION DETAILS • In December 2024, Ferrovial closed the sale of 19.75% stake in Heathrow for £1.7B (€2.0B) to Ardian and PIF • Ferrovial now holds shares representing 5.25% of FGP Topco • Ferrovial recognized at 2024 year-end a profit of €2,570M, of which: • €2,023M will correspond to the shares sold (capital gains) • €547M to the 5.25% stake retained, which from that moment will be recorded as a financial investment valued at fair value with changes recognized through P&L (financial results) 5.25%€2.0B €2.6B Heathrow divestment aligned with our value creation strategy through mature asset rotation AGREEMENT REACHED TO SELL 5.25% STAKE IN Q1 2025 • On February 26, 2025, Ferrovial announced that a binding agreement has been reached with Ardian for the sale of its entire stake (5.25%) in FGP Topco Ltd. (Topco), parent company of Heathrow Airport Holdings Ltd., for c. GBP 455 million, which will be adjusted with an interest rate to be applied until closing. • The transaction is subject to complying with the right of first offer (ROFO) and the satisfaction of applicable regulatory conditions.

FY 2024 Financial Results 17 NEW TERMINAL ONE (NTO) AT JFK • NTO remains on budget & on schedule. Physical progress up to 60% as of the end of 2024. 2025 a crucial year for the construction with integration process starting • Agreements with 16 airlines of which 10 executed contracts and 6 under Letter of Intention • NTO closed USD2.55B green bond refinancing (all-in interest cost of 4.65%) A GATEWAY TO FUTURE GROWTH P ic : N ew T er m in a l O n e, N Y, U SA €469M €742M €329M

FY 2024 Financial Results 18 OTHER AIRPORT ASSETS DALAMAN – TRAFFIC AT ALL-TIME HIGH AGS – DIVESTMENT COMPLETE IN Q1 2025 • 5.6M pax. (+7.7% vs 2023) driven by several airlines’ increased capacity and new routes, as well as higher domestic traffic • Sarigerme region declared tourism development area (1) Non-IFRS financial measure. For the definition and reconciliation to the most directly comparable IFRS measure, refer to the Alternative Performance Measures appendix of the 2024 Integrated Annual Report • On January 28, 2025, Ferrovial announced the completion of the sale of its 50% stake in AGS to Avialliance UK Limited for GBP 450M EUR M Q4 2024 VAR. FY 2024 VAR. Passengers (M) 0.9 9.1% 5.6 7.7% Revenue 15 79.0% 82 16.2% Adj. EBITDA1 (pre-concession fee) 10 28.0% 64 16.6% Adj. EBITDA mg1 68.1% 78.4% £450M c.€300M P ic : D a la m a n A ir po rt

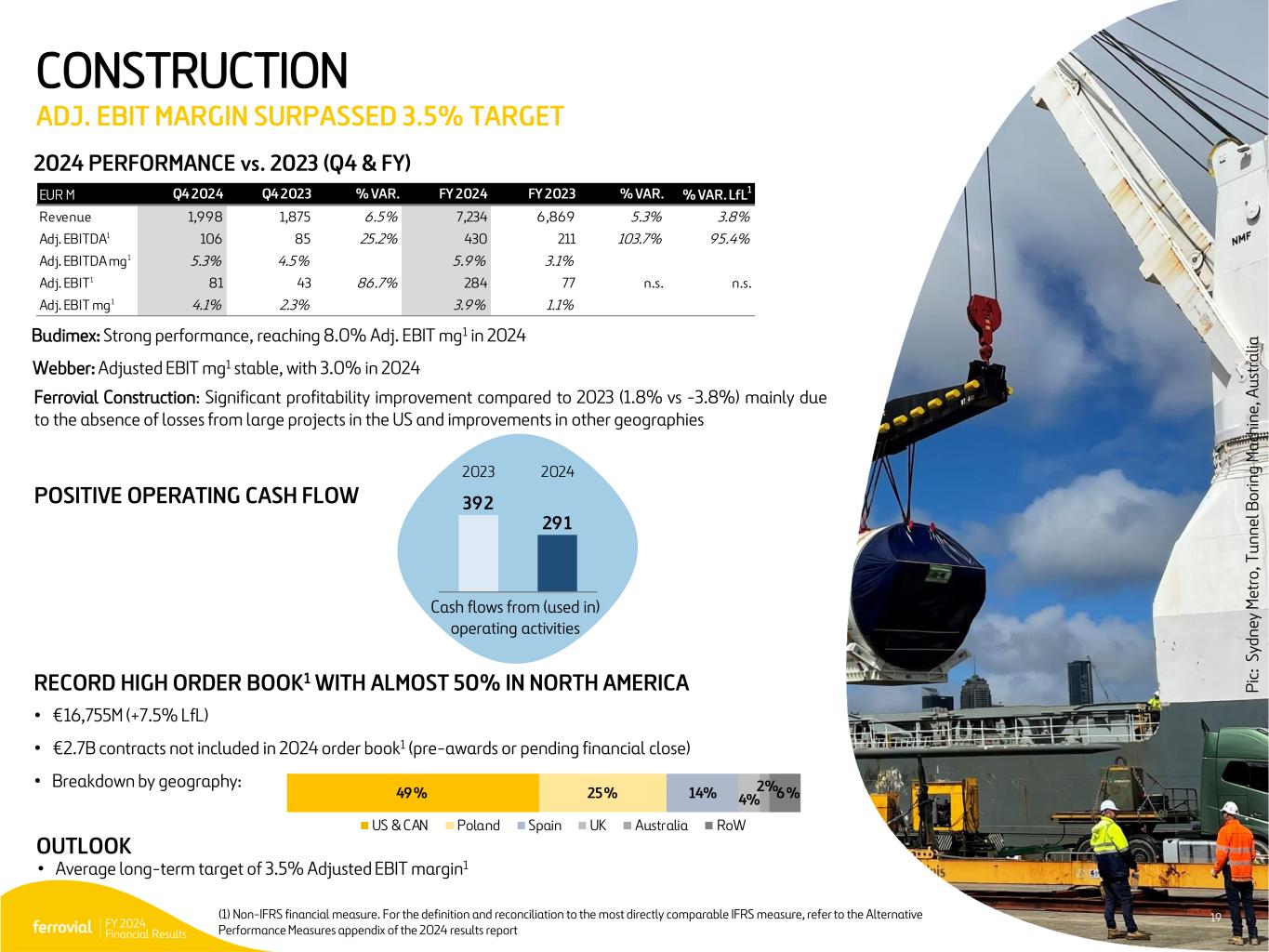

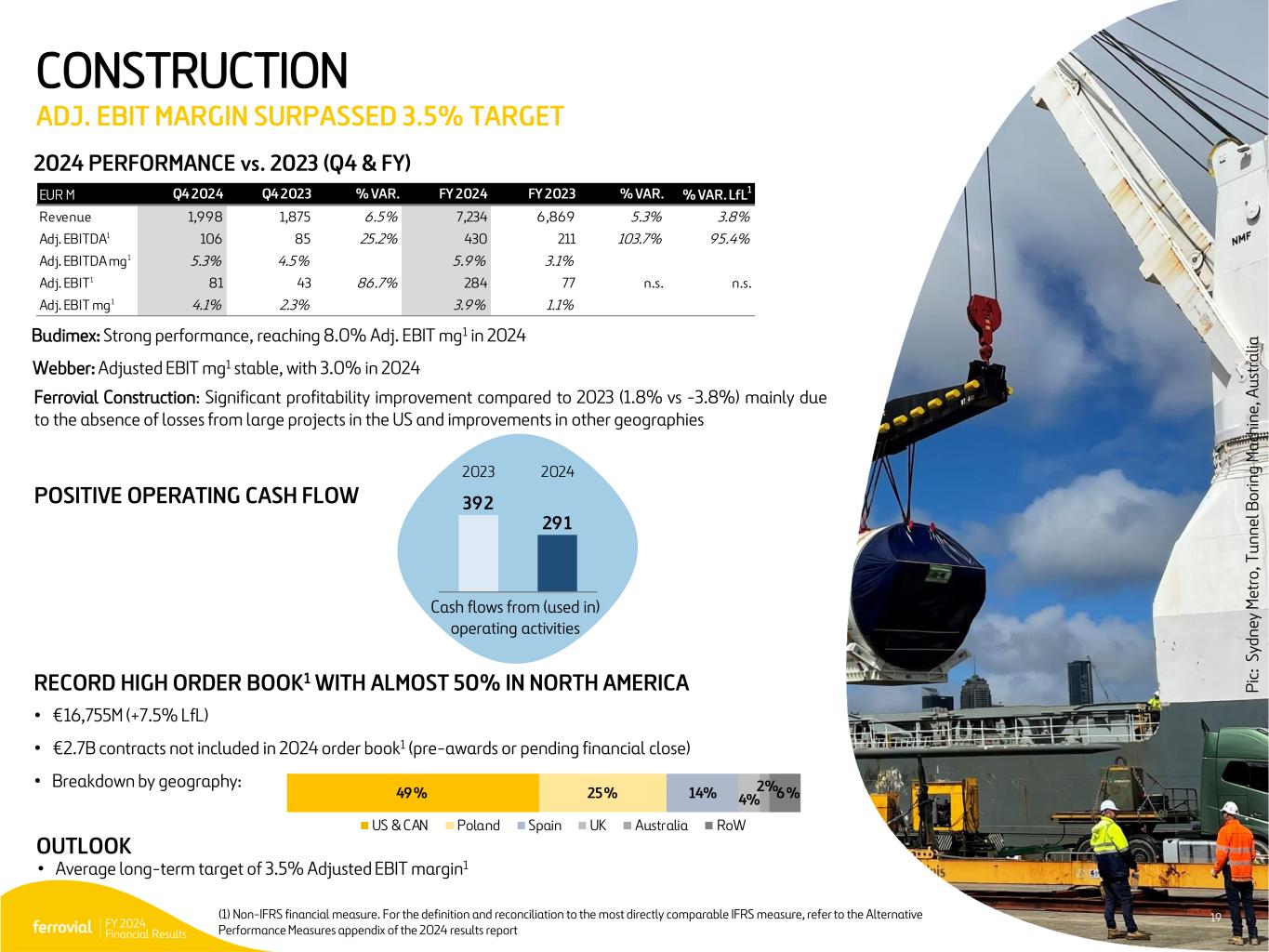

FY 2024 Financial Results 19 CONSTRUCTION ADJ. EBIT MARGIN SURPASSED 3.5% TARGET RECORD HIGH ORDER BOOK1 WITH ALMOST 50% IN NORTH AMERICA • €16,755M (+7.5% LfL) • €2.7B contracts not included in 2024 order book1 (pre-awards or pending financial close) • Breakdown by geography: OUTLOOK • Average long-term target of 3.5% Adjusted EBIT margin1 Budimex: Strong performance, reaching 8.0% Adj. EBIT mg1 in 2024 Ferrovial Construction: Significant profitability improvement compared to 2023 (1.8% vs -3.8%) mainly due to the absence of losses from large projects in the US and improvements in other geographies Webber: Adjusted EBIT mg1 stable, with 3.0% in 2024 P ic : Sy dn ey M et ro , T u n n el B o ri n g M a ch in e, A u st ra lia 19 POSITIVE OPERATING CASH FLOW Cash flows from (used in) operating activities (1) Non-IFRS financial measure. For the definition and reconciliation to the most directly comparable IFRS measure, refer to the Alternative Performance Measures appendix of the 2024 results report EUR M Q4 2024 Q4 2023 % VAR. FY 2024 FY 2023 % VAR. % VAR. LfL1 Revenue 1,998 1,875 6.5% 7,234 6,869 5.3% 3.8% Adj. EBITDA1 106 85 25.2% 430 211 103.7% 95.4% Adj. EBITDA mg1 5.3% 4.5% 5.9% 3.1% Adj. EBIT1 81 43 86.7% 284 77 n.s. n.s. Adj. EBIT mg1 4.1% 2.3% 3.9% 1.1% 2024 PERFORMANCE vs. 2023 (Q4 & FY) 392 291 49% 25% 14% 4% 2%6% US & CAN Poland Spain UK Australia RoW

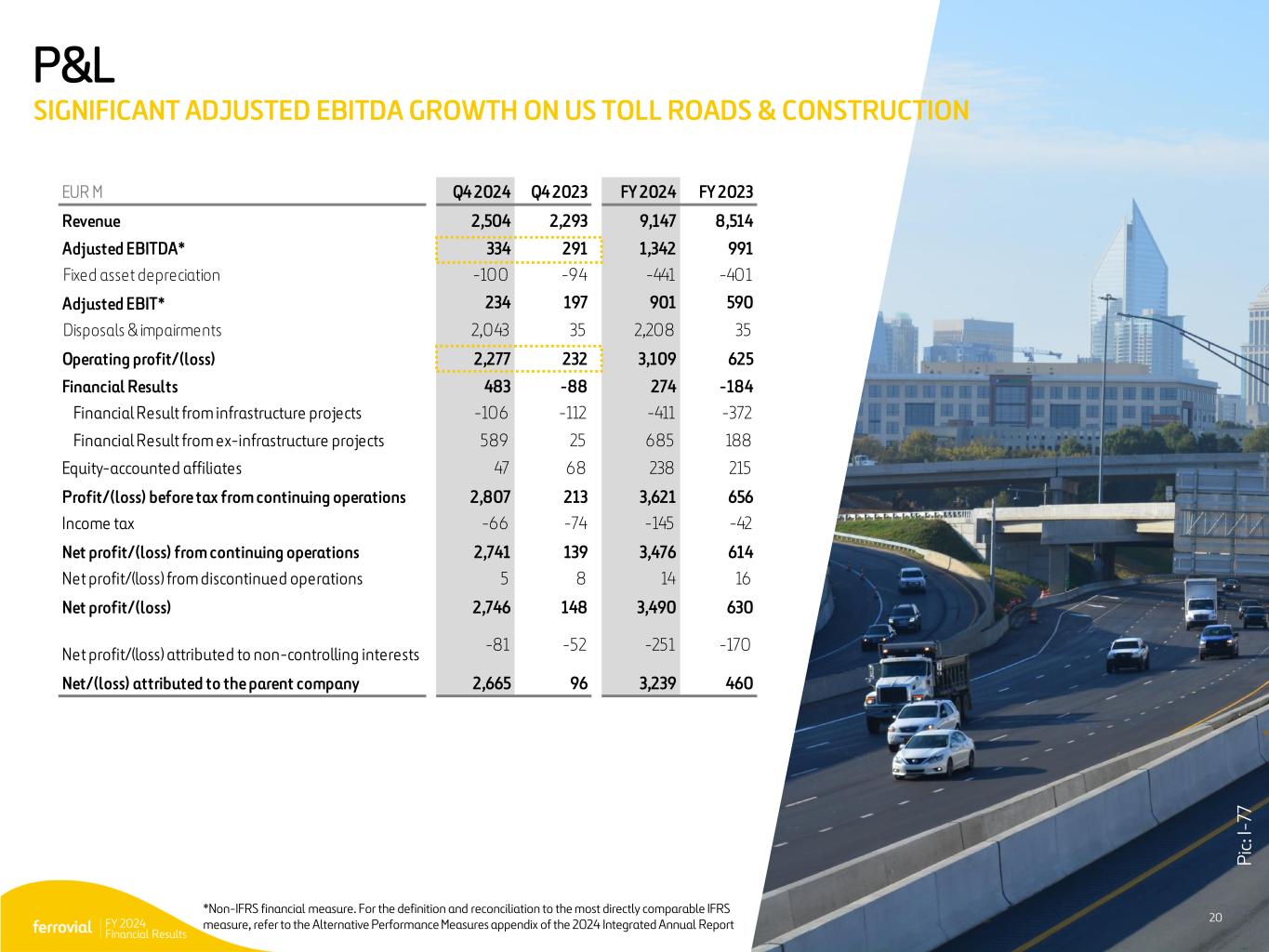

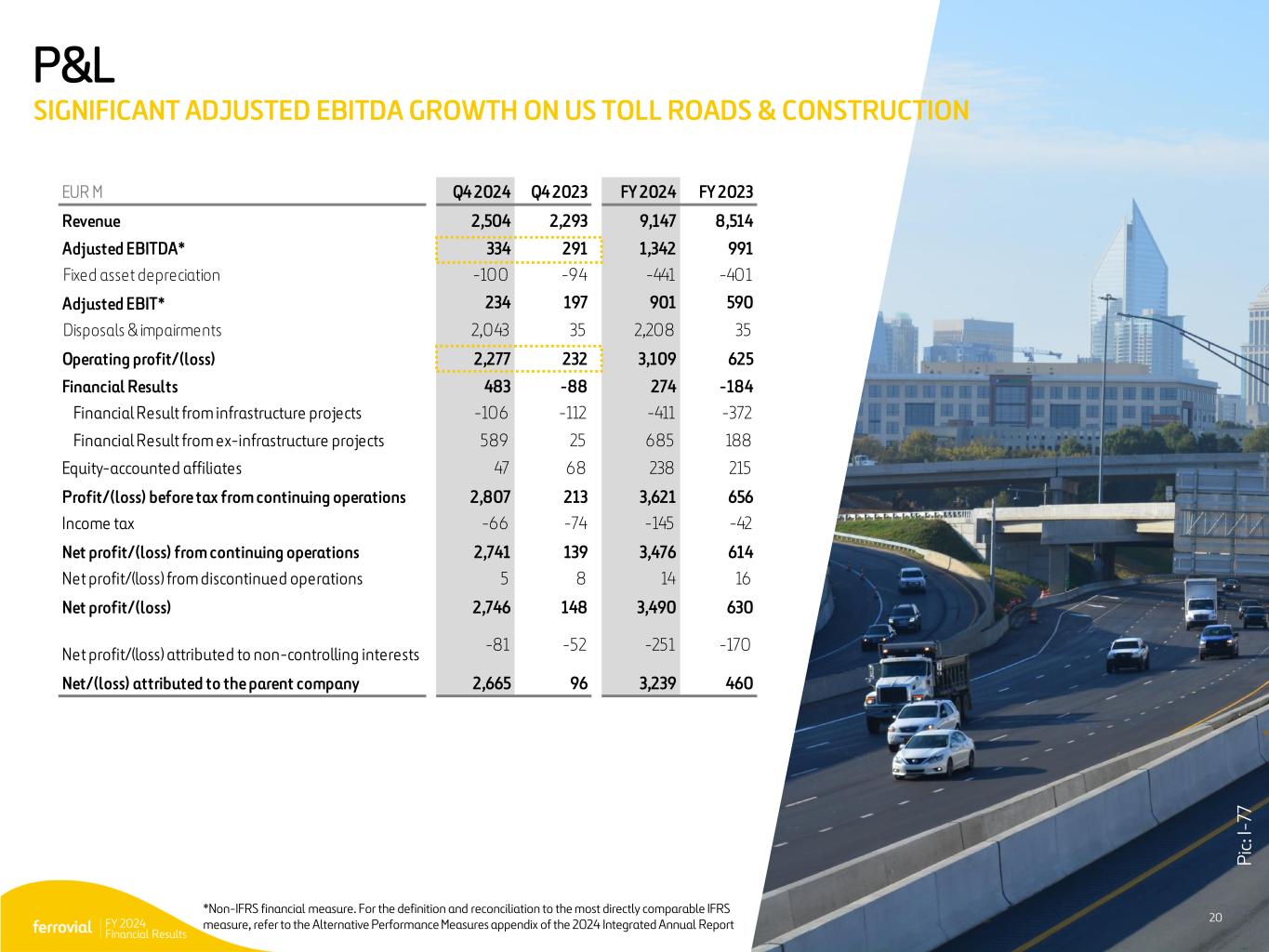

FY 2024 Financial Results 20 EUR M Q4 2024 Q4 2023 FY 2024 FY 2023 Revenue 2,504 2,293 9,147 8,514 Adjusted EBITDA* 334 291 1,342 991 Fixed asset depreciation -100 -9 4 -441 -401 Adjusted EBIT* 234 197 901 590 Disposals & impairments 2,043 35 2,208 35 Operating profit/(loss) 2,277 232 3,109 625 Financial Results 483 -88 274 -184 Financial Result from infrastructure projects -106 -112 -411 -372 Financial Result from ex-infrastructure projects 589 25 685 188 Equity-accounted affiliates 47 68 238 215 Profit/(loss) before tax from continuing operations 2,807 213 3,621 656 Income tax -66 -74 -145 -42 Net profit/(loss) from continuing operations 2,741 139 3,476 614 Net profit/(loss) from discontinued operations 5 8 14 16 Net profit/(loss) 2,746 148 3,490 630 Net profit/(loss) attributed to non-controlling interests -81 -52 -251 -170 Net/(loss) attributed to the parent company 2,665 96 3,239 460 20 P ic : I -7 7 *Non-IFRS financial measure. For the definition and reconciliation to the most directly comparable IFRS measure, refer to the Alternative Performance Measures appendix of the 2024 Integrated Annual Report P&L SIGNIFICANT ADJUSTED EBITDA GROWTH ON US TOLL ROADS & CONSTRUCTION

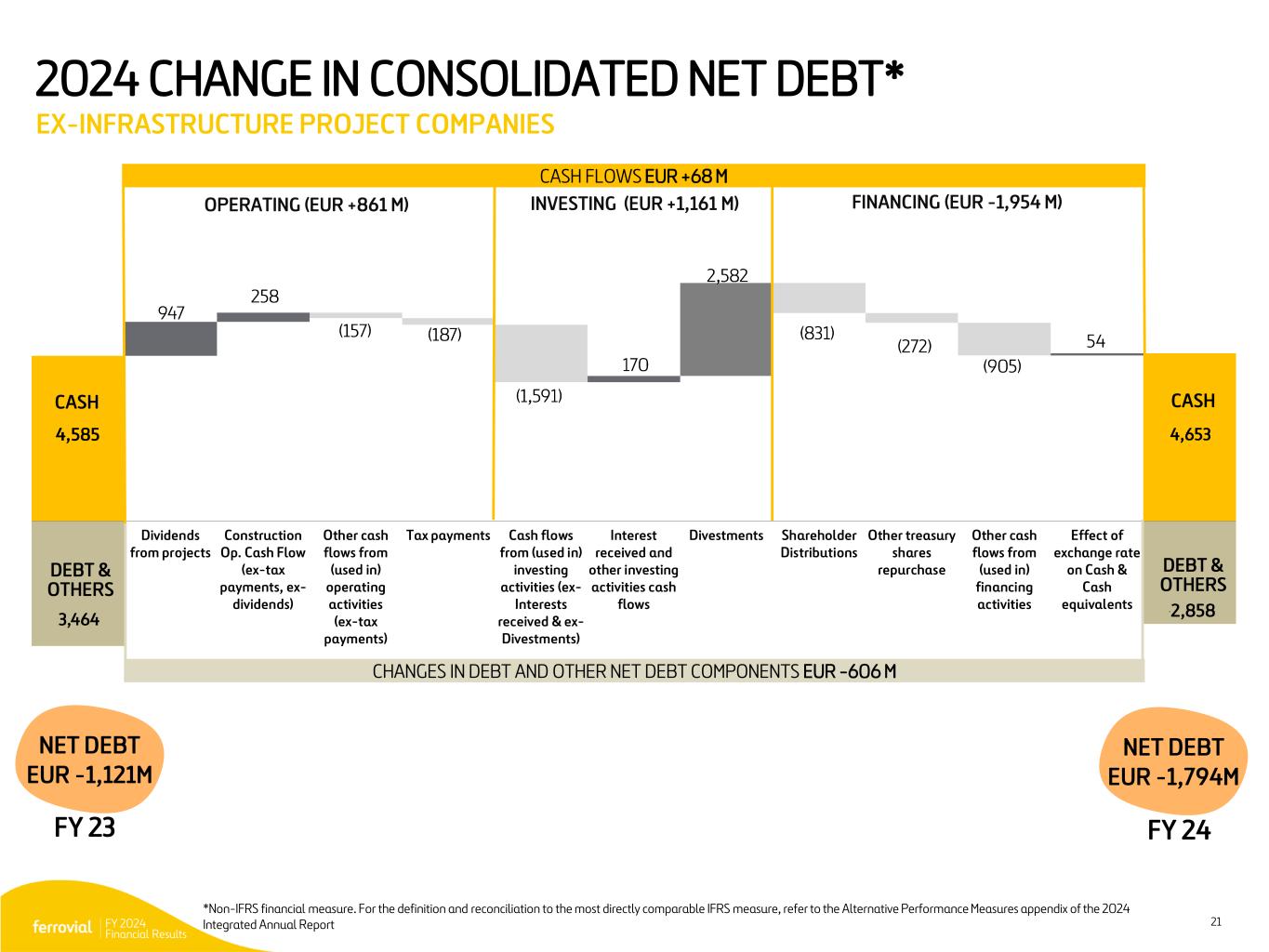

FY 2024 Financial Results 21 2024 CHANGE IN CONSOLIDATED NET DEBT* EX-INFRASTRUCTURE PROJECT COMPANIES Dividends from projects Construction Op. Cash Flow (ex-tax payments, ex- dividends) Other cash flows from (used in) operating activities (ex-tax payments) Tax payments Cash flows from (used in) investing activities (ex- Interests received & ex- Divestments) Interest received and other investing activities cash flows Divestments Shareholder Distributions Other treasury shares repurchase Other cash flows from (used in) financing activities Effect of exchange rate on Cash & Cash equivalents NET DEBT EUR -1,121M OPERATING (EUR +861 M) INVESTING (EUR +1,161 M) FINANCING (EUR -1,954 M) CASH CASH DEBT & OTHERS DEBT & OTHERS CASH FLOWS EUR +68 M CHANGES IN DEBT AND OTHER NET DEBT COMPONENTS EUR -606 M FY 23 FY 24 NET DEBT EUR -1,794M *Non-IFRS financial measure. For the definition and reconciliation to the most directly comparable IFRS measure, refer to the Alternative Performance Measures appendix of the 2024 Integrated Annual Report

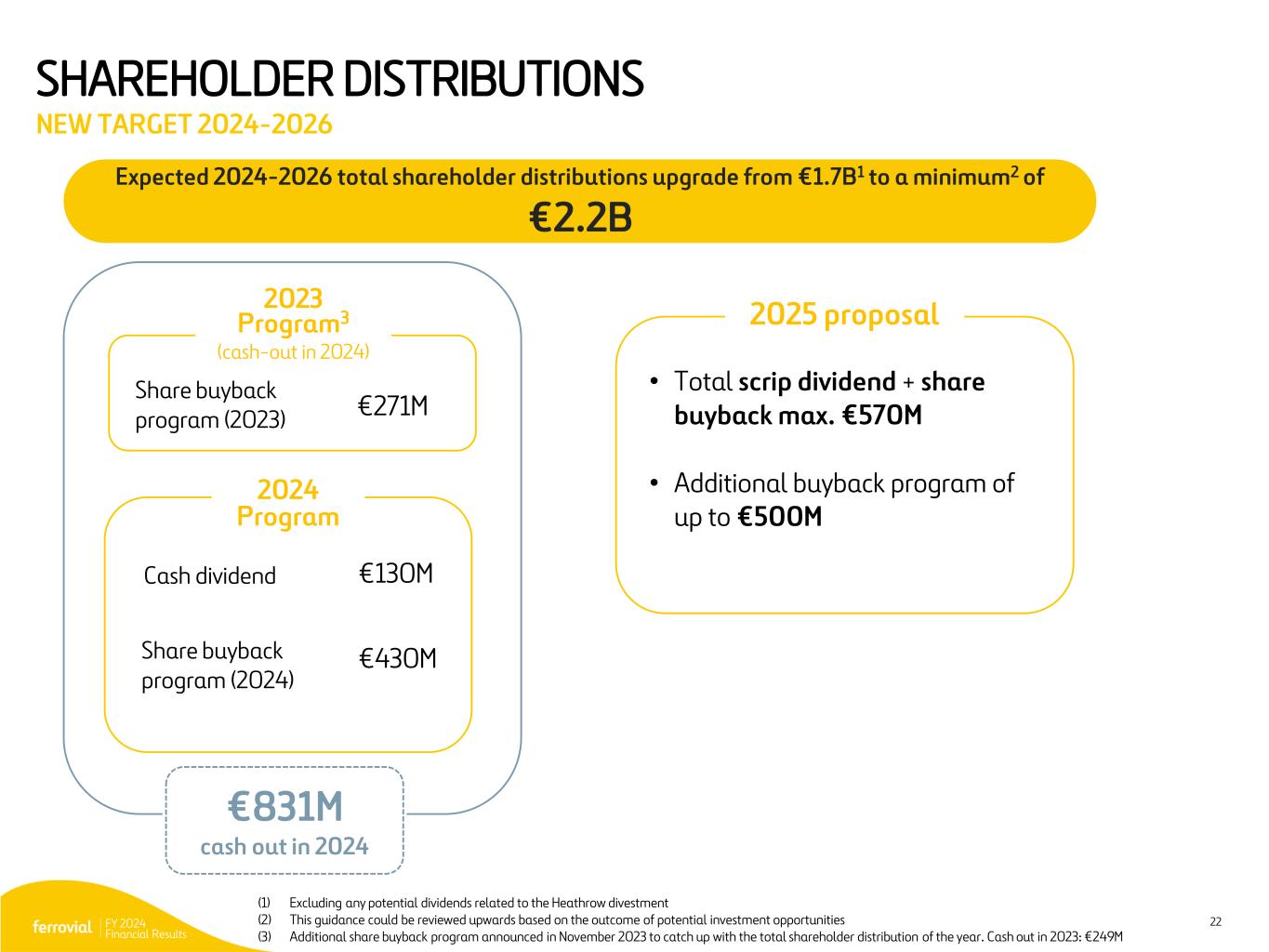

FY 2024 Financial Results 22 SHAREHOLDER DISTRIBUTIONS NEW TARGET 2024-2026 2024 Program 2025 proposal Share buyback program (2023) Share buyback program (2024) Cash dividend €271M €130M €430M Expected 2024-2026 total shareholder distributions upgrade from €1.7B1 to a minimum2 of €2.2B 2023 Program3 (cash-out in 2024) (1) Excluding any potential dividends related to the Heathrow divestment (2) This guidance could be reviewed upwards based on the outcome of potential investment opportunities (3) Additional share buyback program announced in November 2023 to catch up with the total shareholder distribution of the year. Cash out in 2023: €249M €831M cash out in 2024 • Total scrip dividend + share buyback max. €570M • Additional buyback program of up to €500M

FY 2024 Financial Results 23 CLOSING REMARKS • • • 23FY 2024 Financial Results P ic : I -7 7

FY 2024 Financial Results 24 Q&A 24FY 2024 Financial Results

FY 2024 Financial Results INVESTOR RELATIONS DEPARTMENT +34 91 586 25 65 +31 207 983 724 ir@ferrovial.com www.ferrovial.com