- SCWX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

SecureWorks (SCWX) DEF 14ADefinitive proxy

Filed: 15 May 24, 5:06pm

| Filed by the Registrant ☒ | | | Filed by a party other than the Registrant ☐ |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

| SecureWorks Corp. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| ☒ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

| 1. | To elect to the Board of Directors the two nominees specified in the accompanying proxy statement to serve as Class II directors, each for a three-year term expiring at the 2027 Annual Meeting of Stockholders and until such director’s successor is duly elected and qualified |

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP as Secureworks’s independent registered public accounting firm for the fiscal year ending January 31, 2025 |

| 3. | To approve, on a non-binding, advisory basis, the compensation of the named executive officers of Secureworks as disclosed in the accompanying proxy statement |

| 4. | To approve an amendment to increase the number of shares of Class A common stock issuable under the SecureWorks Corp. 2016 Long-Term Incentive Plan |

| | YOUR VOTE IS IMPORTANT | |

| | Whether or not you plan to attend Secureworks’s annual meeting, please submit your proxy or voting instructions as soon as possible. Under stock exchange rules, if you hold your shares of Class A common stock through a bank, brokerage firm, or other nominee, your nominee holding shares on your behalf will NOT be able to vote your shares on Proposal 1 (election of directors), Proposal 3 (advisory vote to approve named executive officer compensation as disclosed in the accompanying proxy statement) or Proposal 4 (approval of the share increase amendment under the SecureWorks Corp. 2016 Long-Term Incentive Plan) unless it receives specific instructions from you. We strongly encourage you to submit your voting instructions. | |

| | We encourage you to submit your proxy or voting instructions via the Internet. For instructions on how to submit your proxy or voting instructions and how to vote your shares, please refer to the section entitled “Questions and Answers About the Annual Meeting” beginning on page 74 of the accompanying proxy statement. | |

| | |

| • | | | Date: | | | Tuesday, June 25, 2024 |

| • | | | Time: | | | 11:00 a.m., Eastern Time |

| • | | | Record Date: | | | April 29, 2024 |

| • | | | Webcast: | | | The meeting can be accessed by visiting www.virtualshareholdermeeting.com/SCWX2024, where you will be able to listen to the meeting live, submit questions, and vote online. |

| • | | | Voting Methods: | |||

| | |  | | |  | | |  | | |  |

| | | | | | | | | |||||

Submit your proxy or voting instructions by Internet | | | Submit your proxy by mobile device | | | Submit your proxy or voting instructions by telephone | | | Submit your proxy or voting instructions by mail | | | Submit your vote online during the meeting |

| | | | | | | | | |||||

Go to www.proxyvote.com and enter the 16-digit control number provided on your proxy card, voting instruction form, or Notice of Internet Availability of Proxy Materials. | | | Scan this QR code to vote with your mobile device. You will need the 16-digit control number provided on your proxy card, voting instruction form, or Notice of Internet Availability of Proxy Materials. | | | Call the number on your proxy card or voting instruction form. You will need the 16-digit control number provided on your proxy card, voting instruction form, or Notice of Internet Availability of Proxy Materials. | | | Complete, sign, and date the proxy card or voting instruction form and mail it in the accompanying pre-addressed, postage-paid envelope | | | See the instructions in the section captioned “Webcast” above regarding attendance at the virtual annual meeting to vote online. You will need the 16-digit control number provided on your proxy card, voting instruction form, or Notice of Internet Availability of Proxy Materials. |

| Meeting Proposal | | | Board Recommendation | | | Page |

| Election of the Class II director nominees specified in this proxy statement | | | FOR ALL NOMINEES | | | |

| | | | | |||

| Ratification of appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending January 31, 2025 | | | FOR | | | |

| | | | | |||

| Non-binding, advisory vote to approve named executive officer compensation as disclosed in this proxy statement, or Say-on-Pay | | | FOR | | | |

| | | | | |||

| Vote to approve the share increase amendment under the SecureWorks Corp. 2016 Long-Term Incentive Plan | | | FOR | | |

Nominee Name and Principal Occupation | | | Age | | | Director Since | | | Director Class | | | Independent | | | Current Committee Membership |

Pamela Daley Retired | | | 71 | | | 2016 | | | II | | | √ | | | Audit Committee Nominating and Governance Committee (Chair) |

Kyle Paster Managing Director of Silver Lake | | | 37 | | | 2020 | | | II | | | | |

| • | Deadline for stockholder proposals to be included in our 2025 proxy statement: January 15, 2025 |

| • | Deadline for proposed business and nominations for a director that will not be included in our 2025 proxy statement: February 25, 2025 – March 27, 2025 |

| • | Deadline for notice under the SEC’s universal proxy rules for solicitation of proxies in connection with our 2025 annual meeting in support of director nominees other than the Company’s nominees: April 26, 2025 |

| • | Advancing Sustainability – We acknowledge our responsibility to contribute to the health and prosperity of our teammates, our society and local communities, and our customers and partners. We reduced our carbon footprint by migrating our workloads to more efficient and sustainable public cloud environments and evolving our business solutions through Software-as-a-Service, or SaaS, delivery. After completing the migration to our public cloud model, we engaged in optimization activities for the cloud environments we deploy to ensure our usage is both efficient and effective. We also utilize a remote-friendly work environment, which allows us to further reduce our carbon footprint and gives our global teammates more flexibility and a better work-life balance. We have taken, and plan to continue taking, steps to reduce our facility footprint to further minimize our energy usage. |

| • | Upholding Ethics – We believe that ethics and integrity are foundational for us to continue having a positive social impact. We maintain internal company policies that reflect our commitment to acting with high ethics and integrity in our operations and in every business relationship we make. We endeavor to embed ethical practices into all we do and to take responsibility for our actions, while continuing to enhance our governance practices whenever possible. |

| • | Cultivating Inclusion – We strive for our culture to be grounded in honesty and respect, which allows us to learn from one another and permits teammates to be their true selves. We are committed to ensuring a respectful and inclusive work environment for our teammates. We encourage teammates to participate in a variety of employee resource groups, which help foster inclusion by facilitating dialogue and creating opportunities to learn and engage with those who can provide unique insights, experiences, and perspectives. We are an equal opportunity employer fully committed to supporting our culturally diverse workplace at all levels. As we continue to evolve our company and fortify our technology, we remain committed to furthering our inclusive employment policies that support diverse teammates, which we believe will foster creativity, increase collaboration, and enhance innovation. |

| • | Community Involvement – We aim to give back to the communities where we live and work, and we believe that such actions assist us with attracting and retaining teammates. We partner with a variety of universities and inclusion-focused programs in the United States and internationally to promote STEM education for all. When humanitarian crises or other natural disasters have occurred, we have supplemented donations made by our teammates to support affected communities. Beyond financial contributions, we encourage teammates to participate in local events and provide volunteer services. We believe that our contributions make a meaningful difference in our communities throughout the year. |

| • | Governance – In furtherance of our commitment to govern with integrity, equity, and honesty, we have established standards and practices that apply to our Board, executives, and teammates alike. The Board is tasked with overseeing the establishment and maintenance of our governance, compliance, and risk oversight processes and procedures to ensure we conduct our business with the highest standards of responsibility, ethics, and integrity. To promote excellence powered by integrity and ethical and responsible actions, each of the Board’s Audit Committee, Compensation Committee, and Nominating and Governance Committee support the oversight, development, implementation, and performance of our policies and management systems to achieve compliance with applicable laws, promote best practices, and accurately assess the Company’s performance against its objectives. |

| • | The term for each of the Class I directors will expire at the 2026 Annual Meeting of Stockholders. The Class I directors currently serving on the Board consist of Yagyensh (Buno) C. Pati and Wendy K. Thomas. |

| • | The term for each of the Class II directors will expire at this 2024 Annual Meeting of Stockholders. The Class II directors currently serving on the Board are Pamela Daley and Kyle Paster. |

| • | The term for each of the Class III directors will expire at the 2025 Annual Meeting of Stockholders. The Class II directors currently serving on the Board are Michael S. Dell, Mark J. Hawkins, and William (Bill) H. Cary. |

| • | Leadership Experience – We seek directors who demonstrate extraordinary leadership qualities. Strong leadership from directors brings vision, strategic agility, diverse and global perspectives, and broad business insight to our Company. They demonstrate practical management experience, skills for managing change, deep knowledge of industries and geographies, and risk management strategies relevant to the Company. We believe that directors with these capabilities will be able to identify and develop our current and future leaders. |

| • | Industry Experience – Given the nature of the cybersecurity industry, we desire directors who have relevant industry experience. We value experience in our high-priority areas, including (1) new or expanding cybersecurity solutions and other offerings, customer segments or geographies, organic and inorganic growth strategies, and existing and new technologies; (2) deep or unique understanding of our business environments; and (3) experience with, exposure to, or reputation among, a broad subset of our customer base. |

| • | Financial Experience – We believe that all directors must possess an understanding of finance and related corporate reporting processes. To that end, we seek independent directors who may qualify as an “audit committee financial expert,” as defined by the SEC in Regulation S-K, for service on the Board’s Audit Committee. |

| • | International Experience – As a global provider of cybersecurity solutions with teammates based worldwide, we seek directors who possess a global mindset and have experience in emerging markets to navigate growth opportunities. We seek directors with international operational experience to understand the competitive landscape so we can achieve our strategic objectives and successfully operate our business. |

| • | Diversity of Background – Our Board’s current strength stems from its collegiality and from the diverse perspectives and experiences held by our Board members, which stimulates discussions and nurtures creative and effective strategic decision-making. While the Board has not established any formal diversity policy for identifying director nominees, the Nominating and Governance Committee considers a broad range of factors, including a candidate’s gender, age, race, and ethnicity, when assessing a candidate’s background and experience. In compliance with board diversity rules applicable to companies listed on the Nasdaq Global Select Market of the Nasdaq Stock Market, or Nasdaq, we have obtained self-identifying information from our Board of Directors and have determined that three of our seven directors qualify as “Diverse” under the rule, as discussed below under “—Board Diversity Matrix.” |

| | | Leadership | | | Financial | | | International | ||||||||||

| Name | | | Security Industry Experience | | | Chief Executive Officer Experience | | | Financial Literacy | | | Audit Committee Financial Expert | | | Chief Financial Officer Experience | | | Global Mindset, Emerging Markets, Operational Experience |

| Pamela Daley | | | | | | | ✔ | | | ✔ | | | | | ✔ | |||

| Michael S. Dell | | | ✔ | | | ✔ | | | ✔ | | | | | | | ✔ | ||

| Kyle Paster | | | | | | | ✔ | | | | | | | ✔ | ||||

| Mark J. Hawkins | | | | | | | ✔ | | | ✔ | | | ✔ | | | ✔ | ||

| Yagyensh (Buno) C. Pati | | | | | ✔ | | | ✔ | | | ✔ | | | | | ✔ | ||

| Wendy K. Thomas | | | ✔ | | | ✔ | | | ✔ | | | | | ✔ | | | ✔ | |

| William (Bill) H. Cary | | | | | ✔ | | | ✔ | | | ✔ | | | | | ✔ | ||

| | | Female | | | Male | | | | | Non-Binary | | | Did Not Disclose Gender | ||

| Total Number of Directors | | | 7 | ||||||||||||

| Part 1: Gender Identity | | | | | | | | | | | |||||

| Directors | | | 2 | | | 5 | | | | | — | | | — | |

| Part II: Demographic Background | | | | | | | | | | | |||||

| African American or Black | | | — | | | — | | | | | — | | | — | |

| Alaskan Native or Native American | | | — | | | — | | | | | — | | | — | |

| Asian | | | — | | | 1 | | | | | — | | | — | |

| Hispanic or Latinx | | | — | | | — | | | | | — | | | — | |

| Native Hawaiian or Pacific Islander | | | — | | | — | | | | | — | | | — | |

| White | | | 2 | | | 4 | | | | | — | | | — | |

| Two or More Races or Ethnicities | | | — | | | — | | | | | — | | | — | |

| LGBTQ+ | | | | | | | — | | | — | | | — | ||

| Did Not Disclose Demographic Background | | | | | | | — | | | — | | | — | ||

Pamela Daley Class II Director Term Expires: 2024 Annual Meeting Age: 71 Director since April 2016 Committee Service: • Audit • Nominating and Governance (Chair) | | | Before her retirement on January 1, 2014 from General Electric Company, or GE, one of the world’s largest infrastructure and financial services companies, Ms. Daley served with GE in a number of roles, including Senior Vice President and Senior Advisor to the Chairman from April 2013 to January 2014, Senior Vice President of Corporate Business Development from August 2004 to March 2013, and Vice President and Senior Counsel for Transactions from 1991 to July 2004. As Senior Vice President for Corporate Business Development, Ms. Daley was responsible for GE’s merger, acquisition, and divestiture activities worldwide. Before she joined GE in 1989 as Tax Counsel, Ms. Daley was a partner at Morgan, Lewis & Bockius, an international law firm, where she specialized in domestic and cross-border tax-oriented financings and commercial transactions. Ms. Daley also serves as a director of BlackRock, Inc., a global asset management company, and BP plc, one of the five integrated supermajors in oil and gas and energy. She was a director of BG Group plc, an international gas and oil company traded on the London Stock Exchange, until BG Group plc was acquired by Royal Dutch Shell plc in February 2016. Ms. Daley was also a director of Patheon N.V., a global pharmaceutical contract development and manufacturing organization, until August 2017, when Patheon was acquired by Thermo Fisher Scientific Inc. Director Qualifications Leadership Experience – Over 20 years of service as an executive with GE Strategic and Transactional Experience – Over 35 years of experience in leadership development, international operations, transactions, business development, and global strategy In selecting Ms. Daley for service on the Board of Directors, the Board also considered Ms. Daley’s gender in the context of the Board’s diversity considerations for Board membership. |

Kyle Paster Class II Director Term Expires: 2024 Annual Meeting Age: 37 Director since May 2020 | | | Mr. Paster is a Managing Director of Silver Lake, a global technology investment firm, where he has worked since July 2011. Previously, he worked in the Technology Investment Banking Group at Credit Suisse in San Francisco from July 2009 to June 2011. Mr. Paster currently serves on the board of directors of Entrata, Inc., a provider of comprehensive property management software, and Qualtrics, LLC, a provider of experience management software. He served on the board of directors of ServiceMax, Inc., a cloud-based field service management software company, until January 2023. Director Qualifications Industry and Finance Experience – Experience in technology and finance |

Michael S. Dell Class III Director Term Expires: 2025 Annual Meeting Age: 60 Director since December 2015 | | | Mr. Dell has served as a director and our non-executive Chairman of the Board since December 11, 2015. Mr. Dell serves as Chairman of the Board and Chief Executive Officer of Dell Technologies Inc., or Dell Technologies. Mr. Dell also served as Chief Executive Officer of Dell Inc., a wholly-owned subsidiary of Dell Technologies, from 1984 until July 2004 and resumed that role in January 2007. In 1998, Mr. Dell formed MSD Capital, L.P., now DFO Management, LLC, a private investment firm, for the purpose of managing his and his family’s investments, and, in 1999, he and his wife established the Michael & Susan Dell Foundation to provide philanthropic support to a variety of global causes. Mr. Dell is an honorary member of the Foundation Board of the World Economic Forum and is an executive committee member of the International Business Council. He is a member of the Technology CEO Council and is a member of the Business Roundtable. He also serves on the advisory board of Tsinghua University’s School of Economics and Management in Beijing, China, on the governing board of the Indian School of Business in Hyderabad, India, and as a board member of Catalyst, a non-profit organization that promotes inclusive workplaces for women. In June 2014, Mr. Dell was named the United Nations Foundation’s first Global Advocate for Entrepreneurship. Mr. Dell was Chairman of the board of directors of VMware, Inc., a cloud infrastructure and digital workspace technology company that formerly was a public majority-owned subsidiary of Dell Technologies, from September 2016 until it was acquired by Broadcom Inc. in November 2023 and was a director of Pivotal Software, Inc., formerly a public majority-owned subsidiary of Dell Technologies that provided a cloud-native platform, from September 2016 until it was acquired by VMware, Inc. in December 2019. Director Qualifications Leadership Experience – Founder of Dell Inc. and Chairman of the Board and CEO of Dell Technologies Industry Experience – Deep knowledge of new and existing technologies and the information technology industry |

Mark J. Hawkins Class III Director Term Expires: 2025 Annual Meeting Age: 65 Director since April 2016 Committee Service: • Audit • Compensation (Chair) | | | Mr. Hawkins served as President and CFO Emeritus for Salesforce.com, Inc., a provider of enterprise cloud computing solutions, from February 2021 to November 2021. Prior to that, Mr. Hawkins served as President and Chief Financial Officer of Salesforce.com, from August 2017 to January 2021, and as the Chief Financial Officer and Executive Vice President from August 2014 to August 2017. Prior to his time at Salesforce, Mr. Hawkins served as Chief Financial Officer and Executive Vice President at Autodesk, Inc., a provider of three-dimensional design, engineering, and entertainment software, from April 2009 to July 2014. He served as Chief Financial Officer and Senior Vice President of Finance and Information Technology at Logitech International SA, a global provider of personal computer and tablet accessories, from April 2006 to April 2009 and served as Vice President of Finance at Dell Inc. from January 2000 to March 2006. Before joining Dell Inc., he spent over 18 years at Hewlett-Packard Company, a global IT company, where he held a variety of finance and business management roles. Mr. Hawkins currently serves as a member of the board of directors of Workday, Inc., an enterprise cloud applications company, Toast Inc., a cloud-based restaurant software company, and Cloudflare, Inc., a global cloud services provider. In addition, Mr. Hawkins served during 2021 as a director for Fidelity National Information Services, Inc., a provider of technology solutions for merchants, banks, and capital markets firms, before stepping down from the role. Mr. Hawkins also serves as an Operating Partner for BDT & MSD Partners, LLC, a merchant bank with an advisory and investment platform built to serve the distinct needs of business owners and strategic, long-term investors, and as a Venture Partner of New Enterprise Associates, Inc., a global venture capital firm. Mr. Hawkins is a founding member of the USA Chapter of His Majesty King Charles III's sponsored Accounting for Sustainability CFO Leadership Network and serves as Chair of the A4S Global Advisory Council. Director Qualifications Finance Experience – Over 35 years of experience with leading finance organizations at public global software and technology companies Leadership Experience – Decades of executive management experience and expertise providing leadership and insight in finance, information technology, global operations, and global capital markets Industry Experience – Extensive experience serving in top positions with leading global software and technology companies |

William (Bill) H. Cary Class III Director Term Expires: 2025 Annual Meeting Age: 65 Director since March 2024 Committee Service: • Audit Committee (Chair) | | | Mr. Cary served as an executive of General Electric Company, or GE, one of the world’s largest infrastructure and financial services companies. Before his retirement in January 2015, Mr. Cary spent 29 years at GE, holding several leadership positions in consumer and wholesale finance, as well as in areas of finance, risk, and capital markets. His roles included the President and Chief Operating Officer for GE Capital Corp., the financial services unit of GE, from November 2008 until December 2014, and the President and Chief Executive Officer of GE Money (Global), a subsidiary of GE Capital in London, from February 2008 to November 2008. Mr. Cary began his career at Clorox Company. Mr. Cary currently serves on the board of directors of Ally Financial Inc., the largest all-digital bank in the United States and an industry-leading automative financing and insurance business, and Rush Enterprises, Inc., an international, full-service retailer of commercial vehicles and related services. He is also a member of the board of directors of Lendmark Financial Services, LLC, a privately-held, U.S.-based personal lending company that serves customers who are underserved by traditional banks. Mr. Cary previously served as a director of BRP, Inc. from September 2015 through May 2019. Director Qualifications Financial Leadership Experience – Nearly 30 years of experience leading financial and operations organizations at multi-national financial companies, including as President, Chief Operating Officer, and Chief Executive Officer The Secureworks Board of Directors selected Mr. Cary to serve as a director and as the Audit Committee Chair because of his extensive experience leading financial organizations, as well as his expertise in the areas of leadership development, global operations, risk, and capital markets. |

Yagyensh (Buno) C. Pati Class I Director Term Expires: 2026 Annual Meeting Age: 60 Director since September 2016 Committee Service: • Audit • Compensation • Nominating and Governance | | | Mr. Pati is currently the Chief Executive Officer of Infoworks.io, an enterprise software company, and has served as its Chairman from its inception in 2014, and as its Executive Chairman from September 2017 through January 2019. Mr. Pati also has been a Partner of Centerview Capital Technology, or Centerview, a private investment firm, since May 2016. At Centerview, Mr. Pati’s investment focus is on cybersecurity and data and analytics. Previously, Mr. Pati served as an Advisor to Centerview from June 2014 to May 2016. Before his association with Centerview, Mr. Pati founded Numerical Technologies, Inc., a company that redefined how integrated circuits are designed and manufactured, and served as the company’s Chief Executive Officer from October 1995 to August 2002 and as Chairman from August 2002 to March 2003, when the company was acquired by Synopsys, Inc. He helped launch Nexus Venture Partners, a pioneer in Indian venture capital, and has served as Advisor to that firm since January 2012. Mr. Pati also founded Sezmi Corporation, a company that developed and marketed video services offerings for telecommunications service providers, serving as its Chief Executive Officer and as a director of the company from June 2006 to December 2011. Director Qualifications Leadership Experience – Founder and CEO of two technology companies; experience as chairman or advisor to several other companies Industry Experience – Extensive knowledge of hardware and software technologies; specialization in technology investment in cybersecurity and in the data and analytics sectors In selecting Mr. Pati for service on the Board of Directors, the Board also considered Mr. Pati’s ethnic background in the context of the Board’s diversity considerations for Board membership. |

Wendy K. Thomas Class I Director Term expires: 2026 Annual Meeting Age: 52 Director since July 2021 | | | Ms. Thomas has served as our Chief Executive Officer since September 2021. Prior to this appointment, Ms. Thomas served in a number of critical positions at Secureworks, including as President and Chief Executive Officer from September 2021 to February 2023, as President, Customer Success from April 2020 to September 2021, as Chief Product Officer from June 2019 to April 2020, as Senior Vice President, Business and Product Strategy, from March 2018 to June 2019, as Vice President, Strategic and Financial Planning, from March 2017 to March 2018, and as Vice President, Financial Planning and Analysis from July 2015 to March 2017 and from June 2008 to June 2011. In addition, Ms. Thomas served as Chief Financial Officer of Bridgevine, Inc. (currently known as Updater Inc.), a marketing software company, from November 2013 to July 2015, and as Vice President, Financial Planning and Analysis, at First Data Corporation (currently known as Fiserv, Inc.), a payment processing and financial services technology company, from July 2011 to October 2013. Earlier in her career, Ms. Thomas held other positions, including multiple finance roles at BellSouth Corporation, a telecommunications company, culminating in the position of Director, Finance. Ms. Thomas currently serves as a member of the board of directors of IonQ, Inc., a quantum computing company. Director Qualifications Leadership Experience – Principal executive officer of Secureworks since 2021 Finance Experience – Experience as former chief financial officer and with strategic acquisitions within the software and technology industries Industry Experience – Over 25 years of experience in strategic and functional leadership roles across multiple technology-driven companies |

| • | executive sessions without management and non-independent directors present are a standing Board agenda item at no fewer than two regular meetings of the Board each year; |

| • | executive sessions of the independent directors are held at any time requested by a majority of the independent directors; |

| • | the agenda for each executive session principally focuses on whether management is performing its responsibilities in a manner consistent with the Board’s direction; |

| • | all committee members on the Board’s standing committees are independent directors; and |

| • | each Chair for the Board’s standing committees has authority to hold executive sessions without management and non-independent directors present. |

| Name | | | Independent | | | Audit Committee | | | Compensation Committee | | | Nominating and Governance Committee |

| William (Bill) H. Cary | | | ✔ | | | Chair | | | | | ||

| Pamela Daley | | | ✔ | | | ✔ | | | | | Chair | |

| Michael S. Dell | | | | | | | | | ||||

| Kyle Paster | | | | | | | | | ||||

Mark J. Hawkins(1) | | | ✔ | | | | | Chair | | | ✔ | |

| Yagyensh (Buno) C. Pati | | | ✔ | | | ✔ | | | ✔ | | | ✔ |

| Wendy K. Thomas | | | | | | | | |

| (1) | Effective September 27, 2023, Mark J. Hawkins became an Adviser to the Board's Audit Committee for a period of one year from the effective date of the Committee Adviser Agreement signed by and between SecureWorks Corp. and Mr. Hawkins (the “Agreement”). The Agreement sets forth the terms of the advisory contract with Mr. Hawkins and expressly states that Mr. Hawkins cannot vote as an Audit Committee member and is not entitled to consent or withhold consent on Audit Committee actions by unanimous written consent. The Agreement shall auto renew in successive one-year terms unless either party provides written notice of non-renewal. |

| • | reviewing with our independent registered public accounting firm the scope and results of the firm’s annual audit of our financial statements; |

| • | overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual financial statements that we file with the SEC; |

| • | overseeing and discussing with management the policies and guidelines that govern the processes through which risk assessment and risk management are taken, which include, but is not limited to, the following risk types: legal, regulatory, enterprise, and vendor; |

| • | overseeing our compliance with legal and regulatory requirements, including, among others, compliance with federal banking laws and regulations applicable to us in connection with the solutions we provide to financial institutions regulated by the member agencies of the Federal Financial Institutions Examination Council, including that agency’s examination of the Company; |

| • | reviewing our accounting and financial reporting policies and practices and accounting controls, including any analysis prepared by management and/or the independent audit firm to address any significant issues; |

| • | reviewing with our management the scope and results of management’s evaluation of our disclosure controls and procedures in addition to management’s assessment of our internal control over financial reporting, including the related certifications to be included in the periodic reports we file with the SEC; |

| • | reviewing and assessing the Company’s major information technology, security and related risk exposures, the manner in which those risks are being controlled, and management’s processes and procedures to ensure compliance with the SEC’s cybersecurity disclosure rules; |

| • | establishing adequate procedures for the confidential or anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters, or other ethics or compliance issues; and |

| • | monitoring the compliance by our directors and executive officers with our Code of Conduct. |

| • | annually reviewing and approving our executive compensation plans, programs, and policies; |

| • | annually reviewing and recommending all forms of compensation to our Chief Executive Officer for approval by the Board of Directors; |

| • | annually reviewing and approving all forms of compensation for our other executive officers; |

| • | evaluating the need for, and provisions of, employment contracts or severance arrangements for our executive officers; |

| • | acting as administrator of our equity-based and other incentive plans; |

| • | reviewing the compensation of our non-employee directors for service on the Board of Directors and its committees at least once each year and recommending any changes to such compensation to the Board; |

| • | reviewing and (except in the case of our Chief Executive Officer) approving our management succession plan, and discussing with the full Board the succession plan and the Company’s leadership development strategies and executive retention and diversity strategies, in each case at least annually; |

| • | administering the Company’s recoupment policy applicable to certain performance-based incentive awards, or any successor recoupment or “clawback” policy adopted by the Company in accordance with applicable laws, rules, or regulations; and |

| • | monitoring summary data concerning teammates of the Company and its subsidiaries and overseeing the Company’s policies and practices with respect to human capital management and diversity, equity, and inclusion. |

| • | identifying and evaluating potential candidates to be considered by the Board for appointment or election, including consideration and inclusion of diverse candidates; |

| • | making recommendations to the Board regarding the selection and approval of nominees to be submitted for election by a stockholder vote; |

| • | monitoring and reviewing any issues regarding the independence of our non-employee directors or potential conflicts of interest that may affect these directors; |

| • | reviewing the Board’s committee structure and composition and annually recommending such structure and composition of the Board’s standing committees for Board approval; |

| • | reviewing our Corporate Governance Principles at least annually and recommending any changes to the Board; |

| • | reviewing, overseeing, approving, ratifying, or disapproving any related person transactions in accordance with the Company’s applicable policy; |

| • | periodically reviewing and approving changes to our Code of Conduct and other corporate policies, including, but not limited to, legal and regulatory compliance, conflicts of interest, and ethical conduct; and |

| • | overseeing management’s development and implementation of policies and systems relating to environmental, social and governance issues to ensure compliance with applicable law and best practices. |

| • | The Audit Committee is responsible for the oversight of the Company’s risk policies and risk assessment monitoring and mitigation measures relating to our financial statements and financial reporting, major information technology risk exposures (including, without limitation, cybersecurity risks), financial risk, and risks relating to ethics and compliance. The Audit Committee reviews and discusses significant risks to the Company with our senior management and independent registered public accounting firm. The Audit Committee also will discuss the steps management has taken or plans to take to minimize or manage such risks. Quarterly, the Audit Committee receives from, or participates in updates by: |

| • | the Chief Audit Executive regarding audit status, industry insights and key audit findings, as well as other issues or concerns; |

| • | the Chief Information Security Officer or other members of the Company’s security team regarding cybersecurity and other data and physical security risks; |

| • | members of the Company’s risk, ethics and compliance team who report to the Chief Legal and Administrative Officer relating to ethics investigations, compliance programs, enterprise, and vendor risk management, and other related matters; and |

| • | the Chief Legal and Administrative Officer or other members of the Company’s legal team regarding legal or regulatory matters. |

| • | The Compensation Committee oversees the assessment and management of risks associated with succession planning and leadership development in addition to the Company’s incentive compensation programs, plans, and arrangements. The Compensation Committee evaluates how the Company’s incentive compensation arrangements may affect risk decisions, and it reviews the relationship between risk management practices and compensation. |

| • | The Nominating and Governance Committee oversees the assessment and management of risks related to the Company’s governance structure and process. |

| • | maintains plans for any unexpected short-term absence of the CEO and identifies candidates who could act as interim CEO in case of any such event; and |

| • | identifies potential CEO successors and, for internal candidates, reviews such candidate’s performance and development plans against the criteria and profile for the CEO role. |

| • | an annual cash retainer of $50,000; |

| • | an additional annual cash retainer for service as a member (but not Chair) of the Audit Committee, Compensation Committee or Nominating and Governance Committee of $15,000, $10,000 or $8,000, respectively; |

| • | an additional annual cash retainer for service as Chair of the Audit Committee, Compensation Committee or Nominating and Governance Committee of $30,000, $20,000 or $15,000, respectively; |

| • | an initial equity retainer upon the director’s appointment to the Board of Directors, in the form of a restricted stock unit, or RSU award, with a value of $400,000 that will settle in shares of our Class A common stock and that will vest as described below; and |

| • | an annual equity retainer with a value of $200,000 in each year of service, in the form of an RSU award that will vest as described below. |

| Name | | | Fees Earned or Paid in Cash(1) ($) | | | Cash Fees Elected to be Paid in Stock(2) ($) | | | Stock Awards(3)(4) ($) | | | Total ($) |

| Pamela Daley | | | 80,000 | | | — | | | 199,995 | | | 279,995 |

Mark J. Hawkins(5) | | | 85,000 | | | — | | | 199,995 | | | 284,995 |

| Yagyensh (Buno) C. Pati | | | — | | | 97,999 | | | 199,995 | | | 297,994 |

| (1) | Amounts reported in this column include compensation for committee membership and committee Chair service during Fiscal 2024. |

| (2) | Directors were entitled to elect to receive up to 100% of the annual cash retainer and, if applicable, cash committee Chair retainer fees and cash committee membership fees in the form of vested shares of Class A common stock or deferred stock units that settle in shares of Class A common stock, in each case determined by dividing the applicable portion of the aggregate retainer amount by the closing price of the Class A common stock as reported on Nasdaq on June 27, 2023. For service in Fiscal 2024, Mr. Pati received 14,244 vested shares of Class A common stock. |

| (3) | Stock awards were made in the form of restricted stock units that settle in shares of Class A common stock, subject to each director’s right to elect to receive a specified portion in deferred stock units that settle in shares of Class A common stock. Restricted stock units and deferred stock units, if elected, will vest on June 27, 2024. For service in Fiscal 2024, each of Ms. Daley, Mr. Hawkins and Mr. Pati received 29,069 restricted stock units. The aggregate grant date fair value, computed in accordance with U.S. generally accepted accounting principles, of the restricted stock units awarded to each of Ms. Daley, Mr. Hawkins and Mr. Pati was $199,995, in each case determined by dividing the applicable portion of the aggregate retainer amount by the closing price of Class A common stock as reported on Nasdaq on June 27, 2023. As of February 2, 2024, each of Ms. Daley, Mr. Hawkins and Mr. Pati held an aggregate of 29,069 outstanding restricted stock units. |

| (4) | As of February 2, 2024, each of Ms. Daley and Mr. Hawkins held an aggregate of 48,143 outstanding options, and Mr. Pati held an aggregate of 49,916 outstanding options. |

| (5) | Effective September 6, 2023, Mr. Hawkins resigned as a member of the Audit Committee of the Board. However, on September 27, 2023, the Board retained Mr. Hawkins to serve as an Adviser to the Audit Committee for a period of one year from the effective date of the Committee Adviser Agreement entered into by and between SecureWorks Corp. and Mr. Hawkins. Considering his service as an Adviser to the Audit Committee, beginning on September 27, 2023, the Board elected not to recover any portion of the fees paid to Mr. Hawkins in connection with his prior service as a member of the Audit Committee during Fiscal 2024. Such fees previously paid to Mr. Hawkins for the period on or after the effective date of his resignation from the Audit Committee are deemed to be fees paid for services rendered as an Adviser to the Audit Committee. |

| Fee Type | | | Fiscal 2024 ($) | | | Fiscal 2023 ($) |

Audit Fees(a) | | | 2,041,330 | | | 2,354,500 |

Audit-Related Fees(b) | | | — | | | 50,000 |

| Tax Fees | | | — | | | — |

All Other Fees(c) | | | 4,150 | | | 4,150 |

| Total | | | 2,045,480 | | | 2,408,650 |

| (a) | This category includes fees incurred for professional services rendered in connection with the audit of the annual financial statements, review of the quarterly financial statements and services that are normally provided in connection with statutory audits of international subsidiaries. This category also includes fee estimates obtained from PwC in relation to statutory audits conducted for Fiscal 2024 that will be conducted in Fiscal 2025. |

| (b) | This category includes fees incurred for professional services rendered by PwC to Secureworks in connection with preimplementation insights provided. |

| (c) | This category consists of fees for all services other than the services reported in notes (a) through (b) above, and it primarily includes fees incurred for licenses to information and research services. These services were evaluated by the Audit Committee to be permissible services and determined not to impact the independence and objectivity of the independent registered public accounting firm. |

| • | No “evergreen” provision: The plan does not permit an automatic increase in the number of shares available for issuance without stockholder approval. |

| • | No “reload” stock options: The plan terms, upon an exercise of a stock option, do not create an automatic trigger granting a new stock option with respect to the number of shares used to pay for the exercise of the initial stock option. |

| • | Maximum term of stock options and Stock Appreciate Rights: The maximum term of nonqualified stock options and stock appreciation rights, or SARs, that may be granted under the plan is ten years. |

| • | No stock option or SAR repricing: The plan prohibits repricing of stock options and stock appreciation rights without stockholder approval, whether by reducing the exercise price or by exchanging the stock option or stock appreciation right for cash or a new award with a lower (or no) exercise price. |

| • | No discounting: Stock options and stock appreciation rights granted under the plan generally must have an exercise price no lower than the fair market value of the underlying shares of Class A common stock on the grant date. |

| • | Performance-based vesting of dividends and dividend equivalent rights: Dividends and dividend equivalent rights granted as a component of awards that vest or are earned based on the achievement of performance goals may not vest unless the performance goals for the underlying awards are achieved. |

| • | Clawback requirement: The plan provides for the mandatory repayment of any award to the extent necessary to comply with the Company’s recoupment policy, which was adopted by the Board, effective October 2, 2023, or to comply with applicable law. |

| • | Forfeiture provisions: The Compensation Committee has authority to cancel any plan participant’s outstanding award if that participant is terminated for “cause.” |

| | | Total shares available | | | Equity dilution: Percentage of shares of common stock outstanding(2) | |

Shares of Class A common stock available for future awards if proposal is approved(1) | | | 11.6 | | | 13.1% |

| (1) | Reflects shares of Class A common stock that remain available for issuance for future awards under the plan as of April 29, 2024 and additional shares that will be available for future awards if stockholders approve this proposal (but it does not reflect the impact of awards of RSUs and PSUs to certain executive officers and teammates of the Company granted subject to stockholder approval of the share increase amendment as discussed under “—Plan Benefits” below). For more information about our outstanding awards and the number of shares of Class A common stock available for future awards as of the end of Fiscal 2024, see “—Equity Compensation Plan Information” below. |

| (2) | As of April 29, 2024, Secureworks had issued and outstanding 88,362,846 shares of common stock, consisting of 18,362,846 shares of Class A common stock and 70,000,000 shares of Class B common stock. |

| • | 7,500,000 shares of Class A common stock authorized by the share increase amendment, plus |

| • | any shares of Class A common stock remaining available for issuance for future awards under the plan as of the date of stockholder approval of the share increase amendment. |

| • | tendered, withheld or subject to an award granted under the plan which are surrendered in connection with the purchase of shares of Class A common stock upon the exercise of an option; |

| • | not issued upon the net settlement or net exercise of a stock appreciation right granted under the plan that settled in shares; |

| • | deducted or delivered from payment of an award granted under the plan in connection with our tax withholding obligations; or |

| • | purchased by us with the proceeds from option exercises. |

| • | if there is a reported closing price on that date, the closing price for a share of Class A common stock as reported on that exchange or market (if there is more than one stock exchange or securities market on which our Class A common stock is listed or traded, the Compensation Committee will designate the appropriate stock exchange or securities market for purposes of the fair market value determination); and |

| • | if there is no reported closing price on that date, the closing price for a share of Class A common stock on the next preceding date on which any sale of our Class A common stock was reported. |

| • | asset write-downs; |

| • | litigation or claims, judgments or settlements; |

| • | the effect of changes in tax laws, accounting principles or other laws or provisions affecting reported results; |

| • | any reorganization or restructuring events or programs; |

| • | extraordinary, unusual, non-core, non-operating or non-recurring items and items that are either of an unusual nature or of a type that indicates infrequency of occurrence as a separate component of income from continuing operations; |

| • | acquisitions or divestitures; |

| • | foreign exchange gains and losses; |

| • | impact of repurchase of shares of Class A common stock acquired through share repurchase programs; |

| • | tax valuation allowance reversals; |

| • | impairment expense; and |

| • | environmental expense. |

| • | net earnings or net income; |

| • | operating earnings; |

| • | pretax earnings; |

| • | earnings per share; |

| • | share price, including growth measures and total stockholder return; |

| • | earnings before interest and taxes; |

| • | earnings before interest, taxes, depreciation, and/or amortization; |

| • | earnings before interest, taxes, depreciation and/or amortization as adjusted to exclude any one or more of the following: stock-based compensation expense; income from discontinued operations; gain on cancellation of debt; debt extinguishment and related costs; restructuring, separation and/or integration charges and costs; reorganization and/or recapitalization charges and costs; and impairment charges; |

| • | merger-related events; impact of purchase accounting; gain or loss related to investments; amortization of intangible assets; sales and use tax settlements; legal proceeding settlements; gain on non-monetary transactions; and adjustments for the income tax effect of any of the preceding adjustments; |

| • | sales or revenue growth or targets whether in general or by type of product, service, or customer; |

| • | gross or operating margins; |

| • | return measures, including return on assets, capital, investment, equity, sales, or revenue; |

| • | cash flow, including: operating cash flow; free cash flow, defined as operating cash flow less capital expenditures or as earnings before interest, taxes, depreciation and/or amortization (as adjusted to exclude any one or more of the items that may be excluded pursuant to the performance measure specified in the eighth bullet point above) less capital expenditures; leveraged free cash flow, defined as free cash flow less interest expense; cash flow return on equity; and cash flow return on investment; |

| • | productivity ratios; |

| • | costs, reductions in cost and cost control measures; |

| • | expense targets; |

| • | market or market segment share or penetration; |

| • | financial ratios as provided in any credit agreements of Secureworks and its subsidiaries; |

| • | working capital targets; |

| • | completion of acquisitions of businesses, companies or assets or completion of integration activities following an acquisition of businesses, companies, or assets; |

| • | completion of divestitures and asset sales; |

| • | regulatory achievements or compliance; |

| • | customer satisfaction measurements; |

| • | execution of contractual arrangements or satisfaction of contractual requirements or milestones; |

| • | product development achievements; |

| • | monthly recurring revenue; |

| • | revenue retention rates; and |

| • | any combination of the foregoing business criteria. |

| • | except for performance awards and annual incentive awards, immediately before the change in control, all outstanding shares of restricted stock and all restricted stock units, deferred stock units, and dividend equivalent rights will vest, and the shares of Class A common stock underlying, or cash payment promised under, such awards will be delivered; and |

| • | at the discretion of the Compensation Committee, either or both of the following will occur: (1) all options and stock appreciation rights will become exercisable at least 15 days before the change in control and terminate, if unexercised, upon the completion of the change in control; or (2) all options, stock appreciation rights, restricted stock, restricted stock units, deferred stock units and dividend equivalent rights will be canceled in exchange for cash and/or shares of our stock; and, in the case of performance awards and annual incentive awards, if less than half of the performance period has lapsed, the awards will be treated as though target performance thereunder has been achieved, if at least half of the performance period has lapsed, actual performance to date (if determinable) will be determined and treated as achieved, and if actual performance is not determinable, the awards will be treated as though target performance thereunder has been achieved. |

| • | a transaction or series of related transactions pursuant to which any person or group within the meaning of Sections 13(d) and 14(d)(2) of the Exchange Act (other than one or more of Dell Technologies Inc. and its affiliates, Michael S. Dell, his affiliates and other related persons, the Company, or any affiliate of the Company) becomes the beneficial owner of more than 50% of the total voting power of the voting stock of the Company, on a fully diluted basis; |

| • | individuals who, as of April 28, 2016, constitute the Board, referred to as the Incumbent Board (together with any new directors whose election by such Incumbent Board or whose nomination by such Incumbent Board for election by the stockholders of the Company was approved by a vote of at least a majority of the members of such Incumbent Board then in office who either were members of such Incumbent Board or whose election or nomination for election was previously so approved) cease for any reason to constitute a majority of the members of such Board then in office; |

| • | the Company consolidates with, or merges with or into, any person, or any person consolidates with, or merges with or into, the Company (regardless of whether the Company is the surviving person), other than any such transaction in which the holders of 100% of the voting power of the Company immediately prior to such transaction own directly or indirectly at least a majority of the voting power of the voting stock of the surviving person in such merger or consolidation immediately after such transaction; |

| • | the consummation of any direct or indirect sale, lease, transfer, conveyance, or other disposition (other than by way of reorganization, merger, or consolidation), in one transaction or a series of related transactions, of all or substantially all of the assets of the Company and its subsidiaries, taken as a whole, to any person or group within the meaning of Section 13(d) and 14(d)(2) of the Exchange Act (other than the Company or any affiliate thereof), except any such transaction or series of transactions |

| • | the stockholders of the Company adopt a plan or proposal for the liquidation, winding up, or dissolution of the Company. |

| • | in cash or cash equivalents acceptable to us; |

| • | if the applicable award agreement so provides, by surrendering shares of our Class A common stock (or attestation of ownership of shares of our Class A common stock) with an aggregate fair market value of the exercise price or purchase price on the date of the surrender; |

| • | if permissible by applicable law and if the award agreement so provides, by payment through a broker in accordance with the procedures set by us; or |

| • | if the applicable award agreement so provides and/or unless otherwise specified in an award agreement, any other form permissible by applicable law, including net exercise or net settlement and service rendered to us or our affiliates. |

| Name and Position | | | Dollar Value(1) ($) | | | Number of Units |

Wendy Thomas Chief Executive Officer | | | 6,369,114 | | | 1,044,117(2) |

Alpana Wegner Chief Financial Officer | | | 3,363,967 | | | 551,470(3) |

Steve Fulton President | | | 3,363,967 | | | 551,470(4) |

George Hanna Chief Legal and Administrative Officer | | | 2,915,440 | | | 477,941(5) |

| All current executive officers, as a group | | | 16,012,488 | | | 2,624,998 |

| All current directors who are not executive officers, as a group | | | — | | | — |

| All employees, including all current officers who are not executive officers, as a group | | | 28,551,404 | | | 4,680,558 |

| (1) | Based on the closing price per share of Class A common stock of $6.10 on March 18, 2024, as reported on Nasdaq. |

| (2) | Amount reflects (a) 522,059 time-based RSUs and (b) 522,058 PSUs (the foregoing assumes that the awarded PSUs are earned at 100% of target; assuming maximum payout, a total of 1,044,116 PSUs may be earned in connection with this award). |

| (3) | Amount reflects (a) 275,735 time-based RSUs and (b) 275,735 PSUs (the foregoing assumes that the awarded PSUs are earned at 100% of target; assuming maximum payout, a total of 551,470 PSUs may be earned in connection with this award). |

| (4) | Amount reflects (a) 275,735 time-based RSUs and (b) 275,735 PSUs (the foregoing assumes that the awarded PSUs are earned at 100% of target; assuming maximum payout, a total of 551,470 PSUs may be earned in connection with this award). |

| (5) | Amount reflects (a) 238,971 time-based RSUs and (b) 238,970 PSUs (the foregoing assumes that the awarded PSUs are earned at 100% of target; assuming maximum payout, a total of 477,940 PSUs may be earned in connection with this award). |

| Plan Category | | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | | Weighted-average exercise price of outstanding options, warrants and rights | | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in the first column) |

| Equity compensation plans approved by security holders | | | 9,041,700(1) | | | $14.00(2) | | | 3,887,644(3) |

| Equity compensation plans not approved by security holders | | | — | | | — | | | — |

| Total | | | 9,041,700 | | | $14.00 | | | 3,887,644 |

| (1) | Represents, as of the end of Fiscal 2024, the aggregate number of shares of Class A common stock that were issuable upon the exercise or settlement of 146,202 outstanding options and 8,895,498 outstanding RSUs granted under the plan. |

| (2) | Weighted-average exercise prices do not reflect shares issuable in connection with the settlement of RSUs, as RSUs have no exercise price. |

| (3) | Represents, as of the end of Fiscal 2024, the aggregate number of shares of Class A common stock that were available for future issuance in connection with grants of options, stock appreciation rights, restricted stock, RSUs, deferred stock units, unrestricted stock, dividend equivalent rights and other equity-based awards under the plan. |

| | | COMPENSATION COMMITTEE | |

| | | ||

| | | Mark J. Hawkins, Chair | |

| | | Yagyensh (Buno) C. Pati |

| Name | | | Title |

| Wendy K. Thomas | | | Chief Executive Officer |

Stephen Fulton(1) | | | President |

Alpana Wegner(2) | | | Chief Financial Officer |

| George B. Hanna | | | Chief Legal & Administrative Officer |

Paul M. Parrish(3) | | | Former Chief Financial Officer |

Christian Grant(4) | | | Former Interim Chief Financial Officer |

| (1) | On March 18, 2024, Mr. Fulton’s title was changed by the SecureWorks Corp. Board of Directors from “President, Customer Success” to “President.” |

| (2) | Effective June 9, 2023, the Board appointed Ms. Wegner as the Company’s Chief Financial Officer. |

| (3) | Mr. Parrish retired as the Company’s Chief Financial Officer, effective May 5, 2023. |

| (4) | From May 5, 2023 until June 9, 2023, Mr. Grant served as the Company’s Interim Chief Financial Officer in addition to his role as Chief Accounting Officer. |

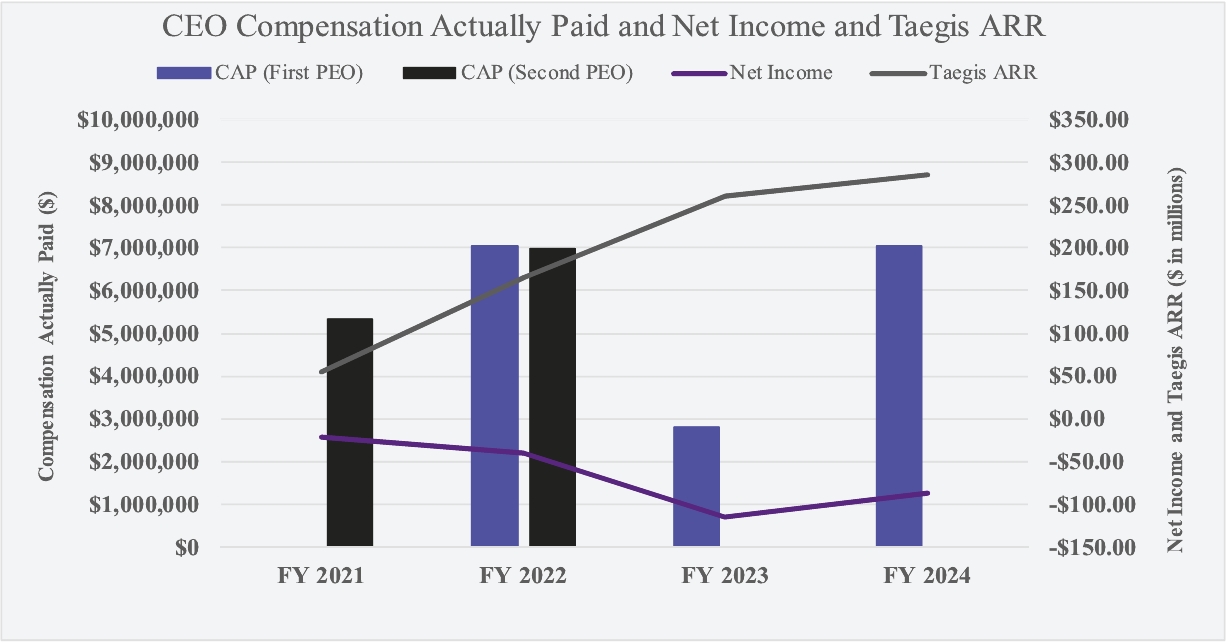

| • | We made substantial progress in completing the strategic business transition to the higher value, higher margin Taegis security solutions resulting in Taegis revenue growth of 41% year-over-year and Taegis annual recurring revenue, or Taegis ARR growth of 9% year-over-year to $285 million. |

| • | We increased the scale and efficiency in our business through automation, use of AI and optimization of our cloud architecture resulting in Taegis GAAP gross margin and non-GAAP gross margin continued expansion in Fiscal 2024, reaching 69.6% and 71.7%, respectively, compared with 65.9% and 67.9%, respectively, in Fiscal 2023, underscoring the scalability of our Taegis security platform. |

| • | Through the acceleration of the sunset of our legacy managed services business and managing our cost structure to increase operating leverage, we achieved significantly improved adjusted EBITDA from a loss of $27.8 million, compared with adjusted EBITDA loss of $59.0 million in Fiscal 2023, resulting in adjusted EBITDA margin expansion of 500 basis points year-over-year, and inclusive of our business’s inflection to positive adjusted EBITDA in fourth quarter of Fiscal 2024. |

| • | We accelerated the expansion of our Partner ecosystem over the last year. We now work with more than 400 partners across Tech Alliances, Solution Providers, Managed Services Providers and Cyber-insurers, including leading providers in each category. Our “better together” go-to-market motion led to an increase in Partner-led opportunities and win rates, and improved sales productivity, driving growth in our Taegis business. |

| • | We delivered on the expansion of our platform capabilities to better support partners and customers, including expanding attack surface coverage with new out-of-the-box integrations, reducing mean time to response leveraging AI-based threat prioritization, orchestration, and Large Language Model-enabled analyst assistance, delivering comprehensive IT and OT security coverage with Taegis for OT, and enabling MSSPs to deliver differentiated services on top of the platform by adding their own integrations, detectors, and playbooks. Additionally, new experiences allow them to efficiently triage and hunt for security attacks across their customer base. |

| • | We were recognized by Forrester as a leader in their Managed Detection and Response Wave Report and by Frost & Sullivan with the Competitive Strategy Leadership Award in the Global XDR Industry, a testament to our strategy effectiveness and execution, competitive differentiation, and exception SecOps experience for our customers and partners. |

| • | We strengthened our leadership team with the additions of Alpana Wegner as our Chief Financial Officer and Allan Peters as our Chief Revenue Officer, each bringing more than 20 years of business experience in their respective fields at public companies and cybersecurity industries. |

| • | Effective June 9, 2023, Ms. Wegner was appointed as the Company’s Chief Financial Officer. In connection with this appointment, Ms. Wegner received an award of time-based restricted stock units that settle in the Company’s Class A common stock under the terms of the Company’s 2016 Long-Term Incentive Plan with an aggregate grant date value equal to $4,000,000. These restricted stock units vest in three equal annual installments beginning on the first anniversary of the date of approval by the Compensation Committee. In addition, Ms. Wegner received an annual base salary of $450,000 and a target cash bonus opportunity under the Company’s Amended and Restated Incentive Bonus Plan for Fiscal 2024 equal to 60% of her annualized base salary, subject to performance conditions established by the Compensation Committee of the Board of Directors. |

| • | Mr. Parrish retired from his position as the Company’s Chief Financial Officer, effective May 5, 2023. In connection with his retirement, we entered into a separation agreement and release with Mr. Parrish whereby he received benefits substantially equivalent to those that would be payable under the Company’s Amended and Restated Severance Pay Plan for Executive Employees as if his departure were a qualifying termination under that plan. |

| • | From May 5, 2023 until June 9, 2023, Mr. Grant served as the Company’s Interim Chief Financial Officer in addition to his role as Chief Accounting Officer. He did not receive a compensation adjustment in connection with this interim appointment. |

| • | structure our executive compensation to drive the Company’s strategic revenue growth and long-term value; |

| • | balance short-term and long-term strategic objectives through a mix of cash- and equity-based incentives that are competitive with those offered by companies with whom Secureworks competes for executive talent; |

| • | link Company and individual performance through compensation based on achievement of our financial goals and strategic objectives; |

| • | cap cash- and equity-based incentive awards at 150% of target for the individual performance of each of our executive officers; |

| • | cap the grant of performance-based equity awards to executive officers based on the Company’s performance relating to the Corporate Performance Goals set by the Board and the Committee at 200% of the initial aggregate grant date value; |

| • | annually review and assess compensation risks to ensure that our executive compensation strategy aligns individual performance with the Company’s long-term business strategy, while discouraging excessive risk-taking that may impact long-term results; |

| • | work with the independent compensation consultant engaged by the Committee as it makes its executive compensation determinations; |

| • | adopt compensation recoupment policies for our former and current executive officers in compliance with Rule 10b-1 of the Securities Exchange Act of 1934, or the Exchange Act, and the applicable listing standards enacted by the Nasdaq Stock Market, or Nasdaq; and |

| • | maintain a Compensation Committee solely composed of independent directors with industry knowledge and experience, even though we are not required to do so under Nasdaq rules given our status as a controlled company. |

| • | guarantee annual base salary increases or annual bonuses; |

| • | provide for single-trigger vesting of equity or other payments in connection with a change-in-control event; |

| • | permit hedging or pledging of our stock by any directors, officers, or teammates of the Company; |

| • | permit short-selling of our stock; or |

| • | provide dividends or dividend equivalents on unvested equity awards. |

| • | the annual performance of Secureworks; |

| • | the performance of each of the executive officer’s functional area(s); |

| • | each executive officer’s performance, experience, and ability to continue contributing to the Company’s long-term strategic goals; |

| • | the historical compensation for each executive officer; |

| • | internal pay equity; |

| • | retention considerations; and |

| • | market-competitive compensation practices and amounts. |

| A10 Networks, Inc. | | | Mandiant, Inc. | | | Rapid7, Inc. |

| ACI Worldwide, Inc. | | | New Relic, Inc. | | | SailPoint Technologies Holdings, Inc. |

| Blackbaud, Inc. | | | OneSpan, Inc. | | | Tenable Holdings, Inc. |

| Commvault Systems, Inc. | | | Progress Software Corporation | | | Varonis Systems, Inc. |

| Guidewire Software, Inc. | | | Qualys, Inc. | | | Verint Systems, Inc. |

| Name | | | Fiscal 2024 Salary ($) |

| Wendy K. Thomas | | | 500,000 |

| Stephen Fulton | | | 450,000 |

| Alpana Wegner | | | 450,000 |

| George B. Hanna | | | 425,000 |

| Paul M. Parrish | | | 463,500 |

| Christian Grant | | | 300,000 |

| Name | | | Target Annual Incentive Opportunity as % of Eligible Earnings |

| Wendy K. Thomas | | | 100% |

| Stephen Fulton | | | 60% |

| Alpana Wegner | | | 60%(1) |

| George B. Hanna | | | 60% |

| Paul M. Parrish | | | 60%(2) |

| Christian Grant | | | 40% |

| (1) | Ms. Wegner was eligible for the full year of annual IBP opportunity. She joined the Company in June 2023. |

| (2) | Mr. Parrish’s incentive bonus opportunity for Fiscal 2024 was not realized due to his retirement, effective May 5, 2023; however, Mr. Parrish’s severance arrangements included cash compensation commensurate with a portion of this opportunity. Please see “—Other Compensation Matters—Severance and Change-in-Control Arrangements Applicable to Named Executive Officers—Severance Agreement with Paul M. Parrish” below for a discussion of Mr. Parrish’s severance arrangements. |

| Name | | | Target IBP ($) | | | Corporate Modifier (%) | | | Individual Modifier (%) | | | Bonus Payment ($) |

| Wendy K. Thomas | | | 500,000 | | | 75 | | | 115 | | | 431,250 |

Stephen Fulton(1) | | | 268,307 | | | 75 | | | 110 | | | 221,353 |

Alpana Wegner(2) | | | 270,000 | | | 75 | | | 120 | | | 243,000 |

| George B. Hanna | | | 255,000 | | | 75 | | | 115 | | | 219,937 |

Paul M. Parrish(3) | | | — | | | — | | | — | | | — |

Christian Grant(4) | | | 115,805 | | | 83 | | | 100 | | | 96,118 |

| (1) | Mr. Fulton’s base salary was increased to $450,000, effective April 29, 2023. As a result, Mr. Fulton’s eligible earnings represent a combination of his salary in Fiscal 2024 from the date of Mr. Fulton’s service as the Company’s President, Customer Success on February 6, 2023 until April 29, 2023, when his title changed to President. |

| (2) | Ms. Wegner was eligible for the full year of annual IBP opportunity. She joined the Company in June 2023. |

| (3) | Mr. Parrish’s incentive bonus opportunity for Fiscal 2024 was not realized due to his retirement, effective May 5, 2023; however, Mr. Parrish’s severance arrangements included cash compensation commensurate with a portion of this opportunity. Please see “—Other Compensation Matters—Severance and Change-in-Control Arrangements Applicable to Named Executive Officers—Severance Agreement with Paul M. Parrish” below for a discussion of Mr. Parrish’s severance arrangements. |

| (4) | Mr. Grant’s base salary was increased to $300,000 in early Fiscal 2024 and his annual compensation was $289,513 for Fiscal 2024. The Compensation Committee considered the Company’s achievement against its adjusted EBITDA goals and advice obtained from FW Cook and exercised its discretion to approve a corporate modifier of 83% for all eligible employees who were not serving as an executive officer or as a Senior Vice President of the Company at the end of Fiscal 2024. |

| • | Annual Physical – Secureworks pays for a comprehensive annual physical for each executive officer and each such executive officer’s spouse or domestic partner, and it reimburses the executive officer’s related travel and lodging costs, each subject to an annual maximum payment of $5,000 per person. |

| • | Other – The executive officers participate in Secureworks’s other benefit plans on the same terms as other teammates. These plans include medical, dental and life insurance benefits, and the Secureworks 401(k) Plan. For additional information, please see “Compensation of Executive Officers—Other Benefit Plans.” |

| • | a violation of obligations regarding confidentiality or protection of sensitive, confidential, or proprietary information, or trade secrets; |

| • | an act or omission resulting in the named executive officer being charged with a criminal offense which constitutes a felony or involves moral turpitude or dishonesty; |

| • | conduct which constitutes poor performance, gross neglect, insubordination, willful misconduct, or a breach of the Company’s Code of Conduct or a fiduciary duty to the Company or its shareholders; or |

| • | the Company determined that the named executive officer violated state or federal law relating to the workplace environment, including, without limitation, laws relating to sexual harassment or age, sex, race, or other prohibited discrimination. |

| • | a material reduction in compensation (base salary, target annual compensation or long-term incentive compensation) or health or welfare benefits (unless such reduction is for all teammates of the same pay grade); |

| • | a demotion of more than one pay grade; and |

| • | a relocation of the named executive officer’s work location by more than 50 miles. |

| • | Wendy K. Thomas, who served as our Chief Executive Officer |

| • | Stephen Fulton, who served as our President |

| • | Alpana Wegner, who was appointed by the Board as our Chief Financial Officer, effective June 9, 2023 |

| • | George B. Hanna, who served as our Chief Legal & Administrative Officer |

| • | Paul M. Parrish, who served as our Chief Financial Officer until his retirement on May 5, 2023 |

| • | Christian Grant, who served as our Interim Chief Financial Officer from Mr. Parrish’s retirement on May 5, 2023, until Ms. Wegner’s appointment on June 9, 2023, as the Company’s Chief Financial Officer |

| Name and Principal Position | | | Year | | | Salary ($) | | | Bonus(1) ($) | | | Stock Awards(2) ($) | | | Non-Equity Incentive Plan Compensation(3) ($) | | | All Other Compensation ($) | | | Total ($) |

Wendy K. Thomas(4) Chief Executive Officer | | | 2024 | | | 500,000 | | | 71,875 | | | 7,243,375 | | | 359,375 | | | 13,171 | | | 8,187,796 |

| | 2023 | | | 519,230 | | | — | | | 5,521,546 | | | 542,596 | | | 14,538 | | | 6,597,910 | ||

| | 2022 | | | 473,173(4) | | | — | | | 9,538,959 | | | 337,345 | | | 9,963 | | | 10,359,440 | ||

Stephen Fulton(5) President | | | 2024 | | | 447,178 | | | 36,892 | | | 3,833,421 | | | 184,461 | | | 3,528 | | | 4,505,480 |

| | 2023 | | | — | | | — | | | — | | | — | | | — | | | — | ||

| | 2022 | | | — | | | — | | | — | | | — | | | — | | | — | ||

Alpana Wegner(6) Chief Financial Officer | | | 2024 | | | 296,461 | | | 110,039 | | | 3,241,457 | | | 132,960 | | | 2,033 | | | 3,782,950 |

| | 2023 | | | — | | | — | | | — | | | — | | | — | | | — | ||

| | 2022 | | | — | | | — | | | — | | | — | | | — | | | — | ||

George B. Hanna Chief Legal & Administrative Officer | | | 2024 | | | 425,000 | | | 36,656 | | | 2,555,609 | | | 183,281 | | | 6,952 | | | 3,207,498 |

| | 2023 | | | 434,615 | | | — | | | 2,178,734 | | | 272,504 | | | 15,352 | | | 2,901,205 | ||

| | 2022 | | | — | | | — | | | — | | | — | | | — | | | — | ||

Paul M. Parrish(7) Former Chief Financial Officer | | | 2024 | | | 124,788 | | | — | | | — | | | — | | | 378,799 | | | 503,587 |

| | 2023 | | | 477,692 | | | — | | | 2,614,492 | | | 272,285 | | | 18,759 | | | 3,383,228 | ||

| | 2022 | | | 450,000 | | | — | | | 3,442,492 | | | 219,834 | | | 14,632 | | | 4,126,958 | ||

Christian Grant(8) Interim Chief Financial Officer and Chief Accounting Officer | | | 2024 | | | 289,513 | | | 23,740 | | | 489,705 | | | 72,378 | | | 9,046 | | | 884,382 |

| | 2023 | | | — | | | — | | | — | | | — | | | — | | | — | ||

| | 2022 | | | — | | | — | | | — | | | — | | | — | | | — |

| (1) | Consistent with our philosophy of rewarding performance while accounting for current business conditions, and consistent with the Company exceeding its Adjusted EBITDA Target after the Committee’s shift in strategic focus to Adjusted EBITDA improvement, the Committee exercised discretion to set the final Fiscal 2024 corporate performance modifier under the SecureWorks Corp. Amended and Restated Incentive Bonus Program, or IBP, and for PSU grants under the SecureWorks Corp. 2016 Long-Term Incentive Plan at 75% of target. Mr. Grant’s Corporate Modifier was set at 83%, consistent with other teammates since he was no longer a named executive officer at the end of Fiscal 2024. Ms. Wegner was eligible for the full-year IBP payout. |

| (2) | The fair value for restricted stock awards and restricted stock unit awards under the Company’s plan are generally based on the closing price of the Company’s Class A common stock as reported on the Nasdaq Global Select Market, or Nasdaq, on the grant date. Amounts reported for Fiscal 2024 represent the value of restricted stock units granted on March 13, 2023, to Ms. Thomas, Mr. Fulton, Mr. Hanna, and Mr. Grant and on June 14, 2023, to Ms. Wegner. Amounts for Ms. Thomas, Mr. Fulton, Ms. Wegner, Mr. Hanna, and Mr. Grant were contingent upon shareholder approval of a new share amendment. Fair value was determined after the shareholder approval contingency was lifted by obtaining shareholder approval on June 27, 2023, and in accordance with FASB ASC Topic 718. Additionally, amounts reported represent adjustments to the PSU awards for relative performance under the Plan, with additional adjustments for modifications to the awards based on Board action to increase the relative attainment level. The modifications represent share prices ranging from $6.87 per share to $7.15 per share, depending on the date of the modification. Amounts reported for Fiscal 2023 represent restricted stock units granted on March 13, 2022, to Mr. Parrish and Mr. Hanna and on March 15, 2022, to Ms. Thomas. Amounts reported for Fiscal 2022 represent restricted stock units granted on March 9, 2021, and June 3, 2021, to Ms. Thomas, and restricted stock units granted on March 9, 2021, and July 26, 2021, to Mr. Parrish and Mr. Hanna. In accordance with |

| (3) | Amounts reported represent awards earned under the SecureWorks Corp. Amended and Restated Incentive Bonus Plan. |

| (4) | Ms. Thomas was appointed as President and Chief Executive Officer, effective September 3, 2021. On February 6, 2023, Ms. Thomas relinquished her title as President to Mr. Fulton, who became President, Customer Success as of the same date. |

| (5) | Mr. Fulton was appointed by the Board of Directors as the President of Customer Success, effective February 6, 2023, and his title was changed to President in March 2024. |

| (6) | Ms. Wegner was appointed as Chief Financial Officer, effective June 9, 2023. |

| (7) | Mr. Parrish’s employment with Secureworks ended upon his retirement on May 5, 2023. |

| (8) | Mr. Grant was appointed as the Company’s Interim Chief Financial Officer from May 5, 2023, upon Mr. Parrish’s retirement from the Company, until June 9, 2023, the effective date for Ms. Wegner’s appointment as the Chief Financial Officer. |

| Name | | | 401(k) Plan Matching Contribution ($) | | | Benefit Plans(1) ($) | | | Severance Benefits(2) ($) | | | Consulting Fees ($) | | | Total ($) |

| Wendy K. Thomas | | | 7,500 | | | 5,671 | | | — | | | — | | | 13,171 |

| Stephen Fulton | | | 7,500 | | | 3,528 | | | — | | | — | | | 11,028 |

| Alpana Wegner | | | 7,500 | | | 2,033 | | | — | | | — | | | 18,759 |