UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22320

U.S One Trust

(Exact name of registrant as specified in charter)

9190 Double Diamond Parkway, Reno, Nevada 89521

(Address of principal executive offices) (Zip code)

Paul Hrabal

9190 Double Diamond Parkway, Reno, Nevada 89521

(Name and address of agent for service)

Registrant's telephone number, including area code: 775-329-5500

Date of fiscal year end: December 31

Date of reporting period: June 30, 2010

The registrant, an open-end investment company registered pursuant to Section 8(b) of the Investment Company Act of 1940 (the “Act”), has not filed a registration statement that has gone effective under the Securities Act of 1933 (the “1933 Act”) because beneficial interests in the registrant are issued and sold solely in private transactions that do not involve any public offering within the meaning of Section 4(2) of the 1933 Act. Accordingly, this report is not filed under Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934.

Item 1. Reports to Stockholders.

The registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

One Fund® ETF

NYSE Arca Ticker Symbol: ONEF

Semi-Annual Report

June 30, 2010

TABLE OF CONTENTS

| Letter To Shareholders | 3 |

| | |

| Current Holdings | 6 |

| | |

| Fund Expenses | 8 |

| | |

| Historical Premium/Discount Data | 9 |

| | |

| Statement of Assets and Liabilities | 10 |

| | |

| Statement of Operations | 11 |

| | |

| Statement of Changes in Net Assets | 12 |

| | |

| Financial Highlights | 13 |

| | |

| Notes to Financial Statements | 14 |

| | |

| Supplemental Information | 19 |

| | | |

| One Fund® | 2 | Q2 2010 Semi-Annual Report |

LETTER TO SHAREHOLDERS

Dear Fellow Shareholders,

I'm writing to you in this inaugural letter reporting on your investment in One Fund.

As a fund that invests exclusively in stocks and seeks to track the overall performance of the global market, One Fund had a difficult second quarter of 2010. Both the U.S. and international stock markets declined substantially last quarter for reasons ranging from fears of a stalled U.S. economic recovery to worries over a possible European debt crisis.

Below is One Fund’s performance for the partial quarter from the fund’s inception on May 11, 2010 through June 30, 2010:

| | Since Inception | 1 Month | 1 Year | 3 Year | 5 Year |

| NAV | -10.80% | -4.86% | N/A | N/A | N/A |

| Market Price | -10.56% | -4.73% | N/A | N/A | N/A |

| S&P 500 Index | -8.78% | -5.23% | 14.43% | -9.81% | -0.79% |

| | | | | | |

| Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Returns less than one year are not annualized. For the most recent month-end performance, please visit www.onefund.com. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.51%. |

You will notice that One Fund declined more than the S&P 500, the benchmark we strive to beat. This is due to the fact that One Fund owns a much broader range of stocks, including U.S. small company stocks, which performed worse than the U.S. large company stocks that make up the S&P 500.

Despite this short term underperformance vs. the S&P 500, we stand by One Fund’s allocation strategy. Historical data shows that a broader diversity of stocks, including U.S. large and small company stocks as well as international large and small company stocks, has outperformed the S&P 500 over the long haul. 1

The Case For Stocks

Many investors have grown weary of investing in stocks. They see the constant ups and downs of the market and the poor returns stock investors have received in recent years. Many have cut back on the stock portion of their portfolios.

_______________________________

1 Source: Ibbotson, historical data 1926-2009.

| | | |

| One Fund® | 3 | Q2 2010 Semi-Annual Report |

LETTER TO SHAREHOLDERS (Continued)

I think this is a mistake.

The argument for owning stocks remains as strong as ever. Stocks may go up and down in bigger swings over the short to medium term. But, historically, if you hold stocks for long periods of time, returns can be significantly more than other types of investments and have the best record of outpacing inflation.2

But I believe there is a right way and wrong way to invest in stocks.

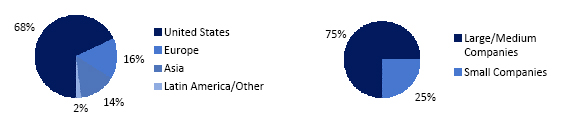

First, a stock portfolio should be properly diversified across industries, geographies and company sizes. This is why One Fund doesn’t just invest in U.S. companies, but invests approximately 30% overseas, including developed markets like Europe and Japan as well as emerging markets like China and Brazil where a significant amount of future economic growth will occur.

Second, a stock investor should not try to pick winners and losers amongst individual stocks, but rather buy the entire stock market worldwide. A recent study showed that only 0.6% of stock picking mutual funds beat the market over the long haul. 3

Instead of stock picking, One Fund follows an approach called "index investing" which invests in the entire stock market (nearly 5,000 companies) at the lowest possible cost as it strives for a return that closely tracks the overall market. (For further details on our investment approach, visit www.OneFund.com/Strategy.)

Following this approach, stock investors should realize solid returns over the long term.

Guidance To Shareholders

My guidance to One Fund shareholders remains the same: Appreciate that stocks are volatile, avoid watching the day to day gyrations up and down (I know it’s hard) and invest for the long run.

In addition, depending on your age, financial goals and other factors, consider how much of your investment dollars you should allocate to stocks. One Fund is intended to be a long term investment and should not be used for money that will be needed in the short term. (See our free investment guide for more on this topic at www.OneFund.com/Guide.)

If you have questions about One Fund or our investment approach, please feel free to call me personally anytime at 866-ONE-FUND (866-663-3863) ext. 472.

If you haven’t already, please let us know you are a shareholder by registering at www.OneFund.com/Register so we can keep in touch with you going forward about your investment in One Fund.

_______________________________

2 Source: Ibbotson, historical data 1926-2009.

3 “False Discoveries in Mutual Fund Performance: Measuring Luck in Estimated Alphas" by Laurent Barras, Olivier Scaillet, and Russ Wermer, April 2009, compared 2,076 U.S. open-end stock mutual funds over 32 years from January 1975 to December 2006

| | | |

| One Fund® | 4 | Q2 2010 Semi-Annual Report |

LETTER TO SHAREHOLDERS (Continued)

Thank you for your trust and confidence.

Sincerely,

Paul Hrabal

Chief Investment Officer

Disclosure

The Fund’s total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted for any income taxes payable by shareholders on these distributions. The Standard & Poor’s 500 Index (S&P 500) is a widely recognized, unmanaged index of U.S. common stock prices. Index returns include dividends and/or interest income and, unlike Fund returns, do not reflect fees or expenses. One cannot invest in an index. Standard & Poor’s and S&P 500® are trademarks of The McGraw-Hill Companies, Inc.

Shares of One Fund are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 PM Eastern time (when NAV is normally determined), and do not represent the returns you would receive if you traded shares at other times.

Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information is in the prospectus, which may be obtained by visiting www.onefund.com. Please read the prospectus carefully before you invest.

An investment in the Fund is subject to risk, including the possible loss of principal amount invested. Other Fund risks include asset allocation risk, foreign securities and currency risk, emerging markets risk, small-cap, mid-cap and large-cap risk, trading risk, and turnover risk that can increase Fund expenses and may decrease Fund performance. The Fund is, also, subject to the risks, which can result in higher volatility, associated with the underlying ETFs that comprise this “fund of funds”. Newly organized, actively managed Funds have no trading history and there can be no assurance that active trading markets will be developed or maintained. Brokerage costs will reduce returns. When the Fund invests in Underlying ETFs, in addition to directly bearing the expenses associated with its own operations, it will bear a pro rata portion of the Underlying ETFs’ expenses (including operating costs and management fees). Consequently, an investment in the Fund entails more direct and indirect expenses than a direct investment in the Underlying ETF.

Foreside Fund Services, LLC, Distributor.

| | | |

| One Fund® | 5 | Q2 2010 Semi-Annual Report |

CURRENT HOLDINGS

June 30, 2010 (unaudited)

One Fund’s holdings represent a broad-based global stock portfolio with nearly 5,000 large, medium and small companies covering over 95% of the world’s stock market value, including most developed and emerging markets.

Holdings are weighted based on their contribution to global stock market capitalization, adjusted for management’s view of the relative long term economic prospects, competitive advantage and potential return of each target market.

| By Investment |

| Ticker | Exchange-Traded Fund (ETF) | Number of Shares | U.S. $ Value | % of Net Assets |

| VV | Vanguard Large Cap ETF | 36,438 | 1,708,578 | 49.75% |

| VB | Vanguard Small Cap ETF | 12,127 | 686,388 | 19.99% |

| VEA | Vanguard Europe Pacific ETF | 24,253 | 709,158 | 20.65% |

| VWO | Vanguard Emerging Markets ETF | 4,811 | 182,770 | 5.32% |

| SCZ | iShares MSCI EAFE Small Cap Index Fund | 5,400 | 175,608 | 5.11% |

TOTAL INVESTMENTS (cost $3,815,767) | | 3,462,502 | 100.82% |

| Liabilities in Excess of Other Assets | | (28,243) | (0.82%) |

| NET ASSETS | | 3,434,259 | 100% |

| By Geography and Company Size |

| | | |

| One Fund® | 6 | Q2 2010 Semi-Annual Report |

CURRENT HOLDINGS (Continued)

June 30, 2010 (unaudited)

| Top 20 Countries | | | |

| United States | 68.4% | Spain | 0.7% |

| Japan | 6.3% | South Korea | 0.7% |

| United Kingdom | 5.4% | Italy | 0.6% |

| France | 2.3% | Netherlands | 0.6% |

| Australia | 2.0% | Taiwan | 0.6% |

| Germany | 2.0% | Singapore | 0.5% |

| Switzerland | 1.9% | India | 0.5% |

| China/Hong Kong | 1.7% | South Afria | 0.4% |

| Brazil | 0.8% | Russia | 0.3% |

| Sweden | 0.8% | Mexico | 0.2% |

Current holdings by investment is shown as a percentage of net assets. Holdings by geography, company size and country are shown as a percentage of total investments. All are subject to change daily. For more current Fund information, please visit www.onefund.com. The above summaries are provided for informational purposes only, and should not be viewed as recommendations.

| | | |

| One Fund® | 7 | Q2 2010 Semi-Annual Report |

FUND EXPENSES (unaudited)

As a shareholder of the One Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of your Fund shares and (2) ongoing costs, including management fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 11, 2010* to June 30, 2010.

Actual Expenses

The first line of the table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide the account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period 5/11/10* to 6/30/10” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line of the table is useful in comparing ongoing Fund costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning Account | Ending Account | Annualized Expense Ratio Based on the Period | Expenses Paid During the Period† |

| | | Value | Value | 5/11/10* to | 5/11/10* to |

| | | 5/11/10* | 6/30/10 | 6/30/10 | 6/30/10 |

| One Fund | | | | |

| | Actual | $1,000.00 | $892.00 | 1.71% | $2.26 |

| | Hypothetical (5% return before expenses) | $1,000.00 | $1,016.33 | 1.71% | $8.53 |

*Commencement of investment operations.

†Expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 181/365 (to reflect one-half year period) except for actual return information which reflects the 51 day period.

| | | |

| One Fund® | 8 | Q2 2010 Semi-Annual Report |

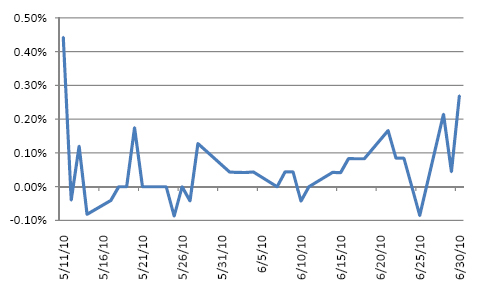

HISTORICAL PREMIUM/DISCOUNT DATA

The chart that follows presents information about the differences between the daily market price on secondary markets for shares of One Fund and One Fund’s net asset value (“NAV”). The “Market Price” of One Fund is determined using the midpoint between the highest bid and the lowest offer on the NYSE Arca as of the time that One Fund’s NAV is calculated. One Fund’s Market Price may be at, above or below its NAV. The NAV of One Fund will fluctuate with changes in the market value of its portfolio holdings. The Market Price of One Fund will fluctuate in accordance with changes in its NAV, as well as market supply and demand.

Premiums or discounts are the differences (expressed as a percentage) between the NAV and Market Price of One Fund on a given day, generally at the time NAV is calculated. A premium is the amount that One Fund is trading above the reported NAV, expressed as a percentage of the NAV. A discount is the amount that One Fund is trading below the reported NAV, expressed as a percentage of the NAV.

The following information shows the premium/discount to NAV for each trading day since One Fund’s inception on May 11, 2010. All data presented here represents past performance, which cannot be used to predict future results.

| | | |

| One Fund® | 9 | Q2 2010 Semi-Annual Report |

| STATEMENT OF ASSETS AND LIABILITIES | | | |

June 30, 2010 (unaudited) | | | |

| | | | |

| ASSETS | | | |

| Investments, at value (cost $3,815,767) | | $ | 3,462,502 | |

| | | | | |

| Total Assets | | | 3,462,502 | |

| | | | | |

| LIABILITIES | | | | |

| Due to custodian | | | 21,994 | |

| Management fee payable | | | 1,281 | |

| Accrued expenses | | | 4,968 | |

| | | | | |

| Total Liabilities | | | 28,243 | |

| | | | | |

| NET ASSETS | | $ | 3,434,259 | |

| | | | | |

| | | | | |

| COMPOSITION OF NET ASSETS | | | | |

| Paid-in capital | | $ | 3,783,707 | |

| | | | | |

| Undistributed net investment income | | | 3,817 | |

| | | | | |

| Net unrealized depreciation on investments | | | (353,265 | ) |

| NET ASSETS | | $ | 3,434,259 | |

| | | | | |

| | | | | |

| NET ASSET VALUE PER SHARE | | | | |

| 154,000 Shares Outstanding | | | | |

| (no par value, unlimited shares authorized) | | $ | 22.30 | |

| | | |

| One Fund® | 10 | Q2 2010 Semi-Annual Report |

| STATEMENT OF OPERATIONS | | | |

For the Period May 11, 2010* through June 30, 2010 (unaudited) | | | |

| | | | |

| INVESTMENT INCOME | | | |

| Dividends | | $ | 10,066 | |

| | | | | |

| EXPENSES | | | | |

| | | | | |

| Management fee (Note B) | | | 1,281 | |

| | | | | |

| Trustees' fees | | | 2,288 | |

| | | | | |

| Insurance | | | 1,590 | |

| | | | | |

| Miscellaneous | | | 1,090 | |

| | | | | |

| Total Expenses | | | 6,249 | |

| | | | | |

| | | | | |

| Net Investment Income | | | 3,817 | |

| | | | | |

| UNREALIZED LOSS ON INVESTMENTS | | | | |

| | | | | |

| Net change in unrealized depreciation on investments | | | (353,265 | ) |

| | | | | |

| NET DECREASE IN NET ASSETS FROM OPERATIONS | | $ | (349,448 | ) |

| | * Commencement of investment operations | | | | |

| | | |

| One Fund® | 11 | Q2 2010 Semi-Annual Report |

| STATEMENT OF CHANGES IN NET ASSETS | | | |

For the Period May 11, 2010* through June 30, 2010 (unaudited) | | | |

| | | | |

| DECREASE IN NET ASSETS FROM OPERATIONS | | | |

| Net investment income | | $ | 3,817 | |

| | | | | |

| Net unrealized depreciation on investments | | | (353,265 | ) |

| | | | | |

| Net decrease in net assets from operations | | | (349,448 | ) |

| | | | | |

| | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | |

| | | | | |

| Proceeds from sale of shares | | | 3,683,707 | |

| | | | | |

| | | | | |

| Net increase from capital share transactions | | | 3,683,707 | |

| | | | | |

| | | | | |

| Total Increase in Net Assets | | | 3,334,259 | |

| | | | | |

| NET ASSETS | | | | |

| | | | | |

| Beginning of period | | | 100,000 | |

| End of period (including undistributed net investment income of $3,817) | | $ | 3,434,259 | |

| | | | | |

| | | | | |

| Shares outstanding, beginning of period | | | 4,000 | |

| | | | | |

| Shares created | | | 150,000 | |

| | | | | |

| Shares redeemed | | | - | |

| | | | | |

| Shares outstanding, end of period | | | 154,000 | |

| | | | |

| | * Commencement of investment operations | | |

| | | |

| One Fund® | 12 | Q2 2010 Semi-Annual Report |

| FINANCIAL HIGHLIGHTS | | |

For the Period May 11, 2010* through June 30, 2010 (unaudited) | | |

| | | | |

| Selected data for a share outstanding throughout the period: | | |

| | | | |

| Net asset value, beginning of period | | $25.00 |

| | | | |

| From Investment Operations | | |

Net investment income(b) | | 0.03 |

| | | | |

| Net unrealized loss | | (2.73) |

| | | | |

| Total from investment operations | | (2.70) |

| | | | |

| Net asset value, end of period | | $22.30 |

| | | | |

| | | | |

Total Return(c) | | (10.80)% |

| | | | |

| Ratios/Supplemental Data | | |

| Net assets, end of period (000's omitted) | | $3,434 |

| Ratio of expenses to average net assets | | 1.71%* |

| Ratio of net investment income to average net assets | | 1.04%* |

| Portfolio turnover rate | | 0% |

| (a) | Commencement of investment operations. |

| (b) | Calculated based upon average shares outstanding during the period. |

| (c) | Total investment return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions, if any, at net asset value during the period, and redemption on the last day of the period. Total return calculated for a period of less than one year is not annualized. |

| | | |

| One Fund® | 13 | Q2 2010 Semi-Annual Report |

NOTES TO FINANCIAL STATEMENTS

June 30, 2010 (unaudited)

1. ORGANIZATION

U.S. One Trust (the “Trust”) is an open-end management investment company, currently offering one series, the One Fund (the “Fund”). The Trust was organized as a Delaware statutory trust on July 27, 2009. The Trust is registered with the United States Securities and Exchange Commission (the “SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”) as an open-end management investment company and the offering of the Fund’s shares (“Shares”) is registered under the Securities Act of 1933, as amended (the “Securities Act”). The investment objective of the Fund is long-term capital appreciation. U.S. One, Inc. (the “Adviser”) manages the Fund. The Fund is classified as a “diversified” investment company under the 1940 Act, as amended. The Fund commenced operations May 11, 2010.

The Fund is a “fund of funds,” which means that the Fund seeks to achieve its investment objective by investing primarily in the retail shares of other exchange-traded funds (“Underlying ETFs”). In pursuing its investment objective, U.S. One, Inc. (the “Adviser”) will normally invest at least 80% of the Fund’s total assets in Underlying ETFs. The Fund invests in Underlying ETFs that track various securities indices comprised of large, mid and small capitalization companies in the United States, Europe and Asia, as well as other developed and emerging markets. There is no limit on the percentage of Fund assets that may be invested in securities of foreign issuers, including in securities of emerging market issuers, through Underlying ETFs.

2. SIGNIFICANT ACCOUNTING POLICIES

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification has become the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The Codification has superseded all existing non-SEC accounting and reporting standards.

Indemnifications

In the normal course of business, the Trust enters into contracts that contain a variety of representations which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown. However, the Trust has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates.

Security Valuation

The Net Asset Value (“NAV”) per Share for the Fund is computed by dividing the value of the net assets of a Fund (i.e., the value of its total assets less total liabilities) by the total number of Shares outstanding, rounded to the nearest cent. Expenses and fees, including the management fees, are accrued daily and taken into account for purposes of determining NAV. The Fund’s NAV is calculated by the Custodian and determined at the close of the regular trading session on the NYSE (ordinarily 4:00 p.m. Eastern time) on each day that such exchange is open, provided that fixed-income assets may be valued as of the announced closing time for trading in fixed-income instruments on any day that the Securities Industry and Financial Markets Association (“SIFMA”) announces an early closing time.

| | | |

| One Fund® | 14 | Q2 2010 Semi-Annual Report |

In calculating a Fund’s NAV, a Fund’s investments are generally valued using market valuations. A market valuation generally means a valuation (i) obtained from an exchange, a pricing service, or a major market maker (or dealer) or (ii) based on a price quotation or other equivalent indication of value supplied by an exchange, a pricing service, or a major market maker (or dealer). In the case of shares of other funds that are not traded on an exchange, a market valuation means such fund’s published NAV per share. The Adviser may use various pricing services, or discontinue the use of any pricing service, as approved by the Board from time to time. A price obtained from a pricing service based on such pricing service’s valuation matrix may be considered a market valuation. Any assets or liabilities denominated in currencies other than the U.S. dollar are converted into U.S. dollars at the current market rates on the date of valuation as quoted by one or more sources.

Fair Value Measurement

GAAP provides guidance on fair value measurements. This standard defines fair value, establishes a framework for measuring fair value in accordance with GAAP and expands disclosure about fair value measurements.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

Level 1 – quoted prices in active markets for identical securities

Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

Level 3 – significant unobservable inputs (including each Fund’s assumption in determining the fair value of investments)

Investments that use Level 2 or Level 3 inputs may include, but are not limited to: (i) an unlisted security related to corporate actions; (ii) a restricted security (e.g., one that may not be publicly sold without registration under the Securities Act of 1933, as amended); (iii) a security whose trading has been suspended or which has been de-listed from its primary trading exchange; (iv) a security that is thinly traded; (v) a security in default or bankruptcy proceedings for which there is no current market quotation; (vi) a security affected by currency controls or restrictions; and (vii) a security affected by a significant event (e.g., an event that occurs after the close of the markets on which the security is traded but before the time as of which a Fund’s net asset value is computed and that may materially affect the value of the Fund’s investments). Examples of events that may be “significant events” are government actions, natural disasters, armed conflict and acts of terrorism.

The inputs or methodology used for valuation are not necessarily an indication of the risk associated with investing in those investments.

The following is a summary of the inputs used as of June 30, 2010 in valuing each Fund’s assets carried at fair value:

| | | |

| One Fund® | 15 | Q2 2010 Semi-Annual Report |

| | | Level 1 | | | Level 2 | | | Level 3 | |

| Investments | | | | | | | | | |

| Exchange-Traded Fund | | $ | 3,462,502 | | | $ | - | | | $ | - | |

| Total | | $ | 3,462,502 | | | $ | - | | | $ | - | |

| | | | | | | | | | | | | |

Investment Transactions and Investment Income

Investment transactions are recorded as of the date that the securities are purchased or sold (trade date). Realized gains and losses on sales of portfolio securities are calculated using the identified-cost method. Interest income is accrued daily.

Expenses

The Adviser pays all of the expenses of the Fund other than the management fee, brokerage expenses, taxes, interest, fees and expenses of the Independent Trustees (including any Trustee’s counsel fees), litigation expenses, acquired fund fees and expenses and other extraordinary expenses.

Repurchase Agreements

The Fund or its Underlying ETFs may invest in repurchase agreements with commercial banks, brokers or dealers to generate income from its excess cash balances and to invest securities lending cash collateral. A repurchase agreement is an agreement under which the Fund or an Underlying ETF acquires a financial instrument (e.g., a security issued by the U.S. government or an agency thereof, a banker’s acceptance or a certificate of deposit) from the seller, subject to resale to the seller at an agreed upon price and date (normally, the next Business Day). A repurchase agreement may be considered a loan collateralized by securities. The resale price reflects an agreed upon interest rate effective for the period the instrument is held by the Fund or an Underlying ETF and is unrelated to the interest rate on the underlying instrument.

In these repurchase agreement transactions, the securities acquired by the Fund or an Underlying ETF (including accrued interest earned thereon) must have a total value in excess of the value of the repurchase agreement and are held by the Custodian until repurchased. No more than an aggregate of 15% of the Fund’s or an Underlying ETF’s net assets will be invested in illiquid securities, including repurchase agreements having maturities longer than seven days and securities subject to legal or contractual restrictions on resale, or for which there are no readily available market quotations. There is no limit on the Fund’s investment in liquid repurchase agreements.

Short-Term Investments

Each Fund may invest a portion of its assets in high-quality money market instruments on an ongoing basis to provide liquidity or for other reasons. The instruments in which a Fund may invest include short-term obligations issued by the U.S. Government, negotiable certificates of deposit (“CDs”), fixed time deposits and bankers’ acceptances of U.S. and foreign banks and similar institutions, commercial papers, repurchase agreements and money market funds. CDs are short-term negotiable obligations of commercial banks. Time deposits are non-negotiable deposits maintained in banking institutions for specified periods of time at stated interest rates. Banker’s acceptances are time drafts drawn on commercial banks by borrowers, usually in connection with international transactions.

| | | |

| One Fund® | 16 | Q2 2010 Semi-Annual Report |

Security Lending

The Fund or its Underlying ETFs may lend portfolio securities to certain creditworthy borrowers. The borrowers provide collateral that is maintained in an amount at least equal to the current market value of the securities loaned. The Fund or an Underlying ETF may terminate a loan at any time and obtain the return of the securities loaned. The Fund or an Underlying ETF receives the value of any interest or cash or non-cash distributions paid on the loaned securities. Distributions received on loaned securities in lieu of dividend payments (i.e., substitute payments) would not be considered qualified dividend income.

Dividends and Distributions to Shareholders

It is the Fund’s policy to comply with all requirements of the Internal Revenue Code of 1986, as amended (the “Code”). The Fund intends to qualify for and to elect treatment as a separate Regulated Investment Company (“RIC”) under Subchapter M of the Code. It is the policy of the Fund to pay out dividends, if any, to investors at least annually. Taxable net realized gains from investment transactions, reduced by capital loss carryforwards, if any, are declared and distributed to shareholders at least annually. The capital loss carryforward amount, if any, is available to offset future net capital gains. The Fund may occasionally be required to make supplemental distributions at some other time during the year. The Trust reserves the right to declare special distributions if, in its reasonable discretion, such action is necessary or advisable to preserve the status of each Fund as a RIC or to avoid imposition of income or excise taxes on undistributed income. Dividends and distributions to shareholders are recorded on the ex-dividend date. The amount of dividends and distributions from net investment income and net realized capital gains are determined in accordance with the requirements of the Code and the U.S. Treasury regulations which may differ from U.S. GAAP. These book/tax differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the components of net assets based on their Federal tax basis treatment; temporary differences do not require reclassification. Dividends and distributions, that exceed earnings and profit for tax purposes, are reported for tax purposes as a return of capital to the extent of a shareholder’s tax basis, and thereafter as capital gain.

The Funds adopted the provisions of Financial Accounting Standards Board (“FASB”) Interpretation No. 48, Accounting for Uncertainty in Income Taxes (“FIN 48”). This interpretation prescribes a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. Foreign taxes are provided for based on each Fund’s understanding of the tax rules and rates that exist in the foreign markets in which it invests. Taxes are accrued and applied to net investment income, net realized capital gains and net unrealized appreciation, as applicable, as the income is earned or capital gains are recorded. If applicable, the Funds will recognize interest accrued related to unrecognized tax benefits in interest expense and penalties in “Other” expenses on the Statement of Operations. Management has evaluated the application of FIN 48 to the Funds, and has determined that there is no impact resulting from the adoption of this interpretation on the Funds’ financial statements.

3. INVESTMENT ADVISORY AGREEMENT AND OTHER AGREEMENTS

Investment Advisory Agreement

U.S One, Inc. serves as the investment adviser to the Fund. Pursuant to the Advisory Agreement, for the services it provides to the Fund, the Adviser receives a fee, which is calculated daily and paid monthly, at an annual rate of 0.35% of the Fund’s average daily net assets. The Adviser pays all of the expenses of the Fund other than the management fee, distribution fees pursuant to the Fund’s Distribution and Service Plan, if any, brokerage expenses, taxes, interest, fees and expenses of the independent Trustees (including any Trustee’s counsel fees), litigation expenses, acquired fund fees and expenses and other extraordinary expenses.

| | | |

| One Fund® | 17 | Q2 2010 Semi-Annual Report |

Administrator, Custodian, Fund Accountant and Transfer Agent

The Bank of New York Mellon serves as the Fund’s Administrator, Custodian, Fund Accountant and Transfer Agent.

Service Providers

Foreside Compliance Services, LLC (“FCS”), an affiliate of the Distributor, provides a Chief Compliance Officer and an Anti-Money Laundering Officer as well as certain additional compliance support functions under a Compliance Services Agreement. As compensation for the foregoing services, FCS receives certain out of pocket costs and a fixed monthly fee, which are accrued daily and paid monthly by the Adviser.

4. DISTRIBUTION AGREEMENT

Foreside Fund Services, LLC (the “Distributor”) serves as the Fund’s distributor of Creation Units for the Fund pursuant to the distribution agreement. The Distributor does not maintain any secondary market shares.

5. ORGANIZATIONAL COSTS

Expenses incurred in the organization of the Trust and the Fund is approximately $100,000. The Adviser has agreed to bear the Trust’s organization costs.

6. CAPITAL SHARE TRANSACTIONS

As of June 30, 2010, there were an unlimited number of no par value shares of beneficial interest authorized by the Trust. Shares are created and redeemed by the Fund at their NAV only in Creation Units or multiples thereof. Except when aggregated in Creation Units, shares of each Fund are not redeemable. Transactions in shares for the Fund are disclosed in detail in the Statement of Changes in Net Assets. The Shares will be listed on the NYSE Arca (“NYSE Arca” or the “Exchange”), subject to notice of issuance. The Shares will trade on the Exchange at market prices. These prices may differ from the Shares’ NAV. The Shares are also redeemable only in Creation Unit aggregations, and generally in exchange for portfolio securities and a specified cash payment. A Creation Unit of the Fund consists of 50,000 Shares.

7. FEDERAL INCOME TAXES

At June 30, 2010, the cost of investments and net unrealized appreciation (depreciation) for federal income tax purposes was as follows:

| | Gross | Gross | Net |

| Cost of | Unrealized | Unrealized | Unrealized |

| Investments | Appreciation | Depreciation | Depreciation |

| $ 3,815,767 | $ - | $ (353,265) | $ (353,265) |

8. SUBSEQUENT EVENT

In accordance with GAAP provisions, management of the Funds has evaluated the possibility of subsequent events existing in the Fund’s financial statements through the date the financial statements were issued. Management has determined that there are no material events that would require disclosure in the Fund’s financial statements.

| | | |

| One Fund® | 18 | Q2 2010 Semi-Annual Report |

SUPPLEMENTAL INFORMATION (unaudited)

TRUSTEES AND OFFICERS OF THE TRUST

The Board has responsibility for the overall management and operations and business affairs of the Trust, including general supervision and review of its investment activities. The Trustees elect the officers of the Trust who are responsible for administering the day-to-day operations of the Trust and the Fund. The Trustees and executive officers of the Trust, along with their principal occupations over the past five years and their affiliations, if any with the Adviser, are listed below:

Name, Address, and Age | Position(s) Held with the Fund | Term of Office and Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of Portfolios in Fund Complex Overseen By Trustee | Other Directorships held by Trustee |

| Interested Trustees | | | | |

Paul Hrabal P.O. Box 17073 Reno, NV 89511 43 | Trustee, President and Treasurer | Since 2009 | U.S. Data Trust Corporation (2002 to 2009), President; U.S. One, Inc. (2008 to Present), President | 1 | None |

| Independent Trustees | | | | |

Samuel W. Humphreys P.O. Box 17073 Reno, NV 89511 50 | Trustee | Since 2010 | London Bay Capital (2007 to Present), CEO; Syntek Capital (1999 to 2007), CEO | 1 | VaultLogix LLC, Selling Source LLC, ContentFilm PLC |

Stephen Matthew Lopez-Bowlan P.O. Box 17073 Reno, NV 89511 51 | Trustee | Since 2010 | H20, LLC (2009 to Present), Vice President and CFO; Sutton Place Ltd (2006 to 2008), COO; Sutton Place Ltd (1994 to 2006), CFO | 1 | None |

David Sean McEwen P.O. Box 17073 Reno, NV 89511 48 | Trustee | Since 2010 | Retired (since 2005); TriTech Software Systems, Inc. (1983 to 2005), Vice President, President, CEO and Chairman | 1 | None |

| | | |

| One Fund® | 19 | Q2 2010 Semi-Annual Report |

The Statement of Additional Information includes additional information regarding the Trustees. This information is available upon request, without charge, by visiting the web site www.onefund.com or by calling the following telephone number: 1-866-ONE-FUND.

The Trust has delegated the voting of the Trust’s voting securities to the Trust’s Adviser pursuant to the proxy voting policies and procedures of the Adviser. You may obtain a copy of these policies and procedures by calling 1-866-ONE-FUND. The policies may also be found on the website of the Securities and Exchange Commission (http://www.sec.gov).

Information regarding how the Trust voted proxies for portfolio securities, if applicable, during the most recent 12-month period ended June 30, is also available, without charge and upon request by calling the Trust at 1-866-ONE-FUND or by accessing the Trust’s Form N-PX on the Commission’s website at http://www.sec.gov.

The Trust will file its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The Trust’s Form N-Qs will be available on the SEC website at http://www.sec.gov. The Trust’s Form N-Qs may also be viewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

FOR MORE INFORMATION

To request a free copy of the prospectus, SAI or to request additional information about the Fund or to make other inquiries, please contact us as follows:

| Call: | 1-866-ONE-FUND |

| | Monday through Friday |

| | 8:00 a.m. to 5:00 p.m. PST |

| | |

| Write: | U.S. One, Inc. |

| | P.O. Box 17073 |

| | Reno, NV 89511 |

| | |

| Visit: | www.onefund.com |

| | | |

| One Fund® | 20 | Q2 2010 Semi-Annual Report |

Item 2. Code of Ethics.

Not applicable for a semi-annual reporting period.

Item 3. Audit Committee Financial Expert.

Not applicable for a semi-annual reporting period.

Item 4. Principal Accountant Fees and Services.

Not applicable for a semi-annual reporting period.

Item 5. Audit Committee of Listed Registrants.

Not applicable for a semi-annual reporting period.

Item 6. Schedule of Investments.

(a) The schedule is included as part of the report to shareholders filed under Item 1 of this form.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The President and Treasurer of the registrant have concluded, based on their evaluation of the effectiveness of the registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Act) as of a date within 90 days of the filing date of this report on Form N-CSR, that to the best of their knowledge the design and operation of such procedures provide reasonable assurance that information required to be disclosed by the registrant in this report on Form N-CSR is recorded, processed, summarized, and reported timely.

(b) There has been no change in the registrant's internal controls over financial reporting (as defined in Rule 30a-3(d) under the Investment company Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits

(a)(1) Not applicable.

(a)(2) Certification of the principal executive officer and principal financial officer of the registrant as required by Rule 30a-2 under the Act.

(a)(3) Not applicable.

(b) Certification of the principal executive officer and principal financial officer of the registrant as required by Section 906 of the Sarbanes-Oxley Act of 2002.

SIGNATURES

Pursuant to the requirements of the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) U.S. One Trust

By /s/ Paul Hrabal

Paul Hrabal, President

Date September 1, 2010

Pursuant to the requirements of the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By /s/ Paul Hrabal

Paul Hrabal, President

Date September 1, 2010

By /s/ Paul Hrabal

Paul Hrabal, Treasurer

Date September 1, 2010