Filed by MainStay Funds Trust (SEC File Nos.: 333-234098; 811-22321) pursuant to Rule 425 under the Securities Act of 1933, as amended, and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934, as amended.

Subject Company: Voya Equity Trust

Subject Company SEC File Numbers: 333-56881; 811-08817

October 4, 2019

Voya Investment Management

ClientTalking Points

Voya Real Estate Fund

Voya Investment Management has announced the following changes:

Planned

Change(s) | Effective Date

(on or about) | Merging Fund Name | Surviving Fund Name |

| Reorganization | February 21, 2020 | Voya Real Estate Fund | MainStay CBRE Real Estate Fund |

The Board of Trustees (the “Board”) of Voya Real Estate Fund (“RE Fund”) approved an Agreement and Plan of Reorganization (“Merger” or “Reorganization”). The approval of shareholders of Voya Real Estate Fund is required before the Merger may take place. If approved, a second merger of Voya Global Real Estate Fund into MainStay CBRE Real Estate Fund would occur if approved by Voya Global Real Estate Fund’s shareholders.

§ What is happening?

| o | On September 12, 2019, the Board approved a proposal to merge RE Fund into MainStay CBRE Real Estate Fund. |

| o | On October 3, 2019 the MainStay Funds’ Board approved the creation of MainStay CBRE Real Estate Fund. |

| o | Shareholders of RE Fund will be sent a combined proxy statement and prospectus on or about November 29, 2019. |

| o | A shareholder meeting will be held on or about February 6, 2020. |

| o | Pending shareholder approval, the Merger will occur as of the close of business on or about February 21, 2020. |

| o | CBRE Clarion Securities LLC. (“Clarion”) serves as the sub-adviser to RE Fund and will continue to serve as sub-adviser to MainStay CBRE Real Estate Fund. New York Life Investment Management LLC. (“NYLIM”) will serve as the manager of the MainStay CBRE Real Estate Fund. |

October 4, 2019

Client Talking Points

| | | If the Merger is approved, shareholders of the RE Fund will become shareholders of MainStay CBRE Real Estate Fund as of the close of business on or about February 21, 2020. |

| o | A prospectus supplement was filed on or about October 4, 2019 to notify shareholders of the changes. |

| § | Why is the Merger proposed? |

| o | Voya Investments, LLC (“Voya Investments” ) has determined that continuing to support certain real estate mutual funds is not well aligned with its strategy going forward |

| o | Voya Investments believes that shareholders value having Clarion continue to manage RE Fund’s assets as sub-advisor. |

| o | Voya Investments also believes that RE Fund and its shareholders will benefit from the involvement of NYLIM as investment manager and from being part of a strong and stable mutual fund platform like the MainStay Group of Funds. |

| o | Voya Investments believes that NYLIM will provide strong administrative, compliance and marketing and sales support. |

| o | This Merger was determined to be in the best interest of shareholders by the Board after a review of several factors. |

| § | What are the key dates for the transaction? |

| o | October 4, 2019: Shareholder proxies filed |

| o | November 29, 2019: RE Funds’ proxies and supplements mailed to shareholders |

| o | February 6, 2019: Shareholder meeting to approve the reorganizations |

| o | February 21, 2019: Closing date |

| § | How are the Funds’ shareholders expected to benefit from the proposed transaction? |

| o | Continuity of portfolio management as CBRE Clarion would be named the new funds’ sub-advisor as part of the reorganization. |

| o | Continuity of the Real Estate investment strategies in the new MainStay Funds. |

| o | Reduced total expenses due in part to the reduction of management fees and expense limitation agreements between New York Life Investments and the new funds. |

| o | An investment in a mutual fund complex with the reputation, financial strength, resources, and operational oversight of New York Life Investments and the MainStay Funds. |

| § | How do the Investment Objectives compare? |

| | Voya Real Estate Fund | MainStay CBRE Real Estate Fund |

| Investment Objective | The Fund seeks total return consisting of long-term capital appreciation and current income. | The Fund seeks total return. |

October 4, 2019

Client Talking Points

CBRE Clarion is the listed securities investment management arm of CBRE Global Investors, one of the world’s leading real asset investment managers with $107 billion in assets under management as of June 30, 2019. As part of CBRE Group, a premier real estate services platform, CBRE Clarion offers clients a competitive advantage with enriched local market knowledge and access to best-in-class services.

CBRE Clarion manages global and regionally focused portfolios of real estate securities, listed infrastructure, and midstream energy and MLPs. CBRE Clarion has a deep and experienced investment team, where the senior investment team averages 25 years of experience and investment professionals are located across offices in Philadelphia, London, Tokyo, Sydney and Hong Kong

| § | What is the experience of the CBRE Clarion Securities LLC Team? |

MainStay CBRE Real Estate Fund will be managed by the CBRE Clarion Securities LLC team of T. Ritson Ferguson, Joseph P. Smith, Jonathan miniman and Kenneth Weinberg

T. Ritson Ferguson, CFA

Portfolio Manager

Mr. Ferguson joined CBRE Clarion Securities predecessor firm in 1992. Prior to joining CBRE Clarion, Mr. Ferguson was on the global management committee of ING Real Estate Investment Management. He was also one of the founding principals who formed the predecessor entity to CBRE Clarion Securities. Earlier in his real estate career, Mr. Ferguson worked at K.S. Sweet Associates and Trammell Crow Company. He was also a consultant at Bain & Company and a Captain in the U.S. Air Force. Mr. Ferguson began his real estate career in 1986. He has an M.B.A. from the University of Pennsylvania’s Wharton School of Business and a B.S. from Duke University. He is also a Chartered Financial Analyst® (“CFA®”) charterholder.

Joseph P. Smith, CFA

Portfolio Manager

Mr. Smith joined CBRE Clarion Securities’ predecessor firm in 1997. Prior to that, Mr. Smith worked in various management and analyst positions in the real estate industry including positions at Alex Brown & Sons, PaineWebber and Radnor Advisors. He has over 29 years of real estate investment management experience. Mr. Smith has an M.B.A. from the Wharton School, University of Pennsylvania and a B.S. from Villanova University. He is also a CFA® charterholder.

Jonathan Miniman, CFA

Portfolio Manager

Mr. Miniman joined CBRE Clarion Securities’ in 2002. Prior to that, Mr. Miniman worked at Group One Trading as a trader. Mr. Miniman has over 18 years of financial industry experience. He has a B.S. from Villanova University and he is also a CFA® charterholder.

Kenneth Weinberg, CFA

Portfolio Manager

October 4, 2019

Client Talking Points

Mr. Weinberg joined CBRE Clarion Securities in 2004. Prior to that, Mr. Weinberg has worked in various management and analyst positions in the real estate industry including positions with Legg Mason Wood Walker, Inc. and Prudential Real Estate Investors. Mr. Weinberg has over 28 years of real estate investment management experience. Mr. Weinberg has an M.B.A. from the Fuqua School, Duke University and a B.S. from Duke University. He is also a CFA® charterholder.

| § | How do the Annual Portfolio Operating Expenses compare? |

Below is a comparison of the fees and expenses of the Funds before and after the Reorganization. Onlypro-forma information is provided for the MainStay CBRE Real Estate Fund because it will not commence operations until the Reorganization is completed.

It is important to note that following the Reorganization, shareholders of the RE Fund will be subject to the actual fee and expense structures of the MainStay CBRE Real Estate Fund, which may not be the same as thepro-forma combined fees and expenses. Future fees and expenses may be greater or lesser than those indicated below. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the MainStay Funds.

RE Fund offers Class A, Class C, Class I, Class O, Class R, Class R6 and Class W shares. Class O shares will be converted to Class A shares in advance of the closing of the Reorganization.

If shareholders approve the Reorganization, shareholders of the RE Fund would receive shares of the MainStay CBRE Real Estate Fund as set forth in the table below:

| Acquired Fund Shares | Acquiring Fund Shares |

| Class A | Class A |

| Class O | Class A |

| Class C | Class C |

| Class I | Class I |

| Class W | Class I |

| Class R | Class R3 |

| Class R6 | Class R6 |

| | | Voya Real

Estate Fund

Class A | | | Voya Real

Estate Fund

Class O | | | MainStay CBRE

Real Estate

FundPro Forma

Combined

Class A | |

| Shareholder Fees(fees paid directly from shareholder’s investment) | | | | | | | | | |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | | 5.75 | % | | None | | | 5.50 | % |

| Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of the original offering price or redemption proceeds)1 | | None | | | None | | | None | |

| Annual Fund Operating Expenses(expenses that are deducted from Fund assets) | | | | | | | | | |

| Management Fees | | 0.80 | % | | 0.80 | % | | 0.75 | % |

| Distribution and/or Service (12b-1) Fees | | 0.25 | % | | 0.25 | % | | 0.25 | % |

| Other Expenses2 | | 0.26 | % | | 0.26 | % | | 0.30 | % |

| Total Annual Fund Operating Expenses | | 1.31 | % | | 1.31 | % | | 1.30 | % |

| Waivers / Expenses3,4 | | (0.11) | % | | (0.11) | % | | (0.12) | % |

| Total Annual Fund Operating Expenses After Waivers / Reimbursements3,4 | | 1.20 | % | | 1.20 | % | | 1.18 | % |

October 4, 2019

Client Talking Points

| | | Voya Real Estate

Fund

Class C | | | MainStay CBRE

Real Estate Fund

Pro Forma

Combined

Class C | |

| Shareholder Fees(fees paid directly from shareholder’s investment) | | | | | | |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | | None | | | None | |

| Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of the original offering price or redemption proceeds)1 | | | 1.00 | % | | 1.00 | % |

| Annual Fund Operating Expenses(expenses that are deducted from Fund assets) | | | | | | | |

| Management Fees | | | 0.80 | % | | 0.75 | % |

| Distribution and/or Service (12b-1) Fees | | | 1.00 | % | | 1.00 | % |

| Other Expenses2 | | | 0.26 | % | | 0.24 | % |

| Total Annual Fund Operating Expenses | | | 2.06 | % | | 1.99 | % |

| Waivers / Expenses3,4 | | | (0.11) | % | | (0.06) | % |

| Total Annual Fund Operating Expenses After Waivers / Reimbursements3,4 | | | 1.95 | % | | 1.93 | % |

| | | Voya Real

Estate Fund

Class I | | | Voya Real

Estate Fund

Class W | | | MainStay CBRE

Real Estate Fund

Pro Forma

Combined

Class I | |

| Shareholder Fees(fees paid directly from shareholder’s investment) | | | | | | | | | |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | | None | | | None | | | None | |

| Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of the original offering price or redemption proceeds)1 | | None | | | None | | | None | |

| Annual Fund Operating Expenses(expenses that are deducted from Fund assets) | | | | | | | | | |

| Management Fees | | 0.80 | % | | 0.80 | % | | 0.75 | % |

| Distribution and/or Service (12b-1) Fees | | None | | | None | | | None | |

| Other Expenses2 | | 0.17 | % | | 0.26 | % | | 0.30 | % |

| Total Annual Fund Operating Expenses | | 0.97 | % | | 1.06 | % | | 1.05 | % |

| Waivers / Expenses3,4 | | (0.12) | % | | (0.11) | % | | (0.22) | % |

| Total Annual Fund Operating Expenses After Waivers / Reimbursements3,4 | | 0.85 | % | | 0.95 | % | | 0.83 | % |

October 4, 2019

Client Talking Points

| | | Voya Real Estate

Fund

Class R | | | MainStay CBRE

Real Estate Fund

Pro Forma

Combined

Class R3 | |

| Shareholder Fees (fees paid directly from shareholder’s investment) | | | | | | |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | | None | | | None | |

| Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of the original offering price or redemption proceeds)1 | | None | | | None | |

| Annual Fund Operating Expenses (expenses that are deducted from Fund assets) | | | | | | | | |

| Management Fees | | | 0.80 | % | | | 0.75 | % |

| Distribution and/or Service (12b-1) Fees | | | 0.50 | % | | | 0.50 | % |

| Other Expenses2 | | | 0.26 | % | | | 0.40 | % |

| Total Annual Fund Operating Expenses | | | 1.56 | % | | | 1.65 | % |

| Waivers / Expenses3,4 | | | (0.11) | % | | | (0.22) | % |

| Total Annual Fund Operating Expenses After Waivers / Reimbursements3,4 | | | 1.45 | % | | | 1.43 | % |

| | | Voya Real Estate

Fund

Class R6 | | | MainStay CBRE

Real Estate Fund

Pro Forma

Combined

Class R6 | |

| Shareholder Fees (fees paid directly from shareholder’s investment) | | | | | | |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | | None | | | None | |

| Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of the original offering price or redemption proceeds)1 | | None | | | None | |

| Annual Fund Operating Expenses (expenses that are deducted from Fund assets) | | | | | | | | |

| Management Fees | | | 0.80 | % | | | 0.75 | % |

| Distribution and/or Service (12b-1) Fees | | | None | | | | None | |

| Other Expenses2 | | | 0.09 | % | | | 0.08 | % |

| Total Annual Fund Operating Expenses | | | 0.89 | % | | | 0.83 | % |

| Waivers / Expenses3,4 | | | (0.13) | % | | | (0.09) | % |

| Total Annual Fund Operating Expenses After Waivers / Reimbursements3,4 | | | 0.76 | % | | | 0.74 | % |

| 1. | No initial sales charge applies on investments of $1 million or more (and certain other qualified purchases). However, a contingent deferred sales charge of 1.00% may be imposed on certain redemptions made within 18 months of the date of purchase on shares that were purchased without an initial sales charge. |

| 2. | Based on estimated amounts for the current fiscal year. |

| 3 | Voya Investments and CBRE Clarion are contractually obligated to limit expenses to 1.30%, 2.05%, 0.95%, 1.30%, 1.55%, 0.86%, 1.30%, and 1.05% for Class A, Class C, Class I, Class O, Class R, Class R6, Class T, and Class W shares, respectively, through October 1, 2019. This limitation is subject to possible recoupment by Voya Investments within 36 months of the waiver or reimbursement. In addition, Voya Investments is contractually obligated to further limit expenses to 1.20%, 1.95%, 0.85%, 1.20%, 1.45%, 0.76%, 1.20%, and 0.95% for Class A, Class C, Class I, Class O, Class R, Class R6, Class T, and Class W shares, respectively, through October 1, 2020. The limitations do not extend to interest, taxes, investment-related costs, leverage expenses, extraordinary expenses, and Acquired Fund Fees and Expenses. Termination or modification of these obligations requires approval by the Acquired Fund’s board. |

| 4. | New York Life Investments has contractually agreed to waive fees and/or reimburse expenses so that Total Annual Fund Operating Expenses (excluding taxes, interest, litigation, extraordinary expenses, brokerage and other transaction expenses relating to the purchase or sale of portfolio investments, and acquired (underlying) fund fees and expenses) for a class do not exceed the following percentage of its average |

October 4, 2019

Client Talking Points

| | | daily net assets: Class A, 1.18%; Class C, 1.93%; Class I, 0.83%; Class R3, 1.43%; and Class R6, 0.74%. This agreement will remain in effect until February 28, 2022, and shall renew automatically for one-year terms unless New York Life Investments provides written notice of termination prior to the start of the next term or upon approval of the Board of Trustees of the Fund. |

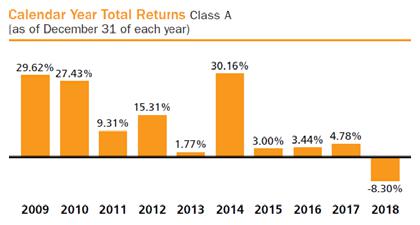

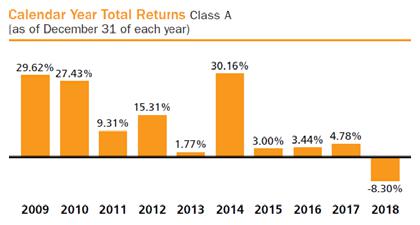

| § | How does Voya Real Estate Fund’s performance compare to MainStay CBRE Real Estate Fund? |

The following information is intended to help you understand the risks of investing in RE Fund. The following bar chart shows the changes in RE Fund’s performance from year to year, and the table compares RE Fund’s performance to the performance of a broad-based securities market index/indices for the same period. RE Fund’s performance information reflects applicable fee waivers and/or expense limitations in effect during the period presented. Absent such fee waivers/expense limitations, if any, performance would have been lower. The bar chart shows the performance of RE Fund’s Class A shares. Sales charges are not reflected in the bar chart. If they were, returns would be less than those shown. However, the table includes all applicable fees and sales charges. Performance for other share classes would differ to the extent they have differences in their fees and expenses. The Class R6 shares performance shown for the period prior to their inception date is the performance of Class I shares without adjustment for any differences in the expenses between the two classes. If adjusted for such differences, returns would be different.

Because Class T shares of RE Fund had not commenced operations as of the calendar year ended December 31, 2018, no performance information for Class T shares is provided below.

As of October 4, 2019, the MainStay CBRE Real Estate Fund has not commenced operations. Therefore, MainStay CBRE Real Estate Fund has no calendar year performance information. MainStay CBRE Real Estate Fund is anticipated to assume the performance history of the Voya Real Estate Fund at the closing of the Reorganization

Voya Real Estate Fund – Net Calendar Year Returns

October 4, 2019

Client Talking Points

Voya Real Estate Fund – Net Total Returns

Average Annual Total Returns%

(for the periods ended December 31, 2018)

| | | | | l Yr | | 5 Yrs | | l0 Yrs | | Since

Inception | | Inception

Date |

| Class Abefore taxes | | % | | -13.57 | | 4.67 | | 10.28 | | N/A | | 12/20/02 |

| After tax on distributions | | % | | -18.84 | | 0.90 | | 7.80 | | N/A | | |

| After tax on distributions with sale | | % | | -3.97 | | 3.17 | | 7.97 | | N/A | | |

| MSCI U.S. REIT® Index1 | | % | | -4.57 | | 7.80 | | 12.17 | | N/A | | |

| Class Cbefore taxes | | % | | -9.65 | | 5.03 | | 10.07 | | N/A | | 01/17/03 |

| MSCI U.S. REIT® Index1 | | % | | -4.57 | | 7.80 | | 12.17 | | N/A | | |

| Class Ibefore taxes | | % | | -7.94 | | 6.19 | | 11.26 | | N/A | | 12/31/96 |

| MSCI U.S. REIT® Index1 | | % | | -4.57 | | 7.80 | | 12.17 | | N/A | | |

| Class Obefore taxes | | % | | -8.21 | | 5.92 | | 10.97 | | N/A | | 09/15/04 |

| MSCI U.S. REIT® Index1 | | % | | -4.57 | | 7.80 | | 12.17 | | N/A | | |

| Class Rbefore taxes | | % | | -8.58 | | 5.63 | | N/A | | 7.43 | | 08/05/11 |

| MSCI U.S. REIT® Index1 | | % | | -4.57 | | 7.80 | | N/A | | 9.39 | | |

| Class R6before taxes | | % | | -7.93 | | 6.24 | | 11.29 | | N/A | | 07/03/14 |

| MSCI U.S. REIT® Index1 | | % | | -4.57 | | 7.80 | | 12.17 | | N/A | | |

| Class Wbefore taxes | | % | | -8.03 | | 5.84 | | 11.06 | | N/A | | 12/17/07 |

| MSCI U.S. REIT® Index1 | | % | | -4.57 | | 7.80 | | 12.17 | | N/A | | |

1 The index returns do not reflect deductions for fees, expenses, or taxes.

The performance quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. The investment return and principal value of an investment in the Funds will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. You may obtain performance information current to the most recent month end by visiting www.voyainvestments.com.

As a condition to the closing of the Reorganization, RE Fund and MainStay CBRE Real Estate Fund will have received from Dechert LLP, legal counsel to MainStay Funds Trust, an opinion to the effect that the Reorganization will qualify as a tax-free reorganization for federal income tax purposes. Accordingly, no gain or loss will be recognized by RE Fund or the shareholders of RE Fund as a result of the Reorganization, and the aggregate tax basis of the MainStay CBRE Real Estate Fund shares received by each RE Fund shareholder will be the same as the aggregate tax basis of the shares of the RE Fund exchanged therefor.

For financial professional use only. Not for inspection by or distribution to the general public.

October 4, 2019

Client Talking Points

The foregoing is not an offer to sell, nor a solicitation of an offer to buy, shares of any fund, nor is it a solicitation of any proxy. For information regarding the Fund, please call Voya Investment Management toll free at 1-800-366-0066.

For information regarding any of the Funds discussed in this Client Talking Points, please call Voya Investment Management toll free at 1-800-366-0066. To receive a free copy of a Proxy Statement/Prospectus relating to the proposed merger of Voya Real Estate Fund with and into MainStay CBRE Real Estate Fund, please call Voya Investment Management toll free at 1-800-366-0066. This “Client Talking Points” is qualified in its entirety by reference to the Proxy Statement/ Prospectus, and supersedes any prior Client Talking Points. The Proxy Statement/Prospectus contains important information about fund objectives, strategies, fees, expenses and risk considerations, and therefore you are advised to read it. The Proxy Statement/Prospectus and shareholder reports and other information are or will also be available for free on the SEC’s website (www.sec.gov). Please read any Proxy Statement/Prospectus carefully before making any decision to invest or to approve the merger.

This information is proprietary and cannot be reproduced or distributed. Certain information may be received from sources Voya Investment Management considers reliable; Voya Investment Management does not represent that such information is accurate or complete. Certain statements contained herein may constitute "projections," "forecasts" and other "forward-looking statements" which do not reflect actual results and are based primarily upon applying retroactively a hypothetical set of assumptions to certain historical financial data. Actual results, performance or events may differ materially from those in such statements. Any opinions, projections, forecasts and forward looking statements presented herein are valid only as of the date of this document and are subject to change. Nothing contained herein should be construed as: (i) an offer to buy any security; or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security. Voya Investment Management assumes no obligation to update any forward-looking information. Past performance is no guarantee of future results.

Your clients should consider the investment objectives, risks, charges and expenses of MainStay CBRE Real Estate Fund carefully before investing. Please instruct your clients to read the prospectus carefully before investing.

Filed by MainStay Funds Trust (SEC File Nos.: 333-234098; 811-22321) pursuant to Rule 425 under the Securities Act of 1933, as amended, and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934, as amended.

Subject Company: Voya Mutual Funds and Voya Equity Trust

Subject Company SEC File Numbers: 033-56094; 811-07428 and 333-56881; 811-08817

Reactive Media Statement, Speaking Points and Q&A

These speaking points reinforce messages that were prepared for conversations with clients, consultants, employees and other stakeholders regarding the mergers of certain Voya real estate and infrastructure funds that are sub-advised by CBRE Clarion with and into a series of New York Life Investments funds.

This document should not be circulated to any external parties. All media inquiries should be directed to Kris Kagel / 212-309-6568/ Kristopher.Kagel@voya.com.

Reactive Media Statement

Voya Investment Management and New York Life Investments are pleased to enter into this agreement whereby New York Life Investments will adopt three funds subadvised by CBRE Clarion — subject to approval by the fund’s shareholders.

After a rigorous and thoughtful analysis, as part of our focus on investing in our public and private market capabilities, we determined that listed real estate and infrastructure mutual funds did not best align with our strategic product focus.

We believe that these funds will benefit from New York Life Investment’s strong mutual fund platform and the continuity of having CBRE Clarion as subadvisors and that shareholders will continue to receive strong administrative, compliance and marketing and sales support.

Speaking Points

| · | Voya Investment Management, after a rigorous and thoughtful process, determined that continuing to support these retail real estate and infrastructure mutual funds did not align with the firm’s strategy going forward. |

| · | Voya Investment Management further believes that the retail CBRE Funds and their shareholders will benefit from the involvement of New York Life Investments and its strong mutual fund platform. |

| · | New York Life Investments’ involvement ensures the funds will continue to receive strong administrative, compliance and marketing and sales support. |

| · | The portfolios will continue to be managed by CBRE. |

| · | We anticipate that this transaction, pending approval by the fund’s shareholders, will be completed on or about February 21, 2020. |

| · | Proxy material will be mailed to shareholders of the funds on or about November 29th, 2019. |

Q&A

What is the rationale behind this transaction?

After a rigorous and thoughtful analysis, and as part of our focus on making further investments in our expertise in specialty asset classes, Voya Investment Management determined that these funds did not best align with our strategy going forward.

Can you explain this transaction in further detail?

Upon approval of shareholders of these funds, the CBRE Global Infrastructure Fund will be merged into MainStay CBRE Global Infrastructure Fund; and Real Estate and Global Real Estate Funds will be merged into MainStay CBRE Real Estate Fund. If approved by shareholders, the adoptions will take place on or about February 21, 2020.

Throughout this process, and following the transfer of these funds to New York Life Investments, they will continue to be managed by CBRE Clarion.

How will this impact Voya Investment Management’s AUM?

The transaction will have a minimal effect on Voya IM’s AUM. Combined, the funds account for approximately $1 billion in AUM, which represents less than 0.5% of Voya IM’s AUM as of 6/30/2019.

Will this transaction result in any changes in Voya Investment Management staff?

No.

How will this transaction benefit investors in these funds?

We believe that these funds and their shareholders will benefit from New York Life Investments’ strong mutual fund platform and that shareholders will continue to receive strong administrative, compliance and marketing and sales support.”

Can you provide the financial terms of this transaction

Financial terms of this transaction are not being disclosed.

When do you expect this transaction to be complete?

We anticipate that this transaction, pending approval by the fund’s shareholders, to be completed on or about February 21, 2020.

Proxy material will be mailed to shareholders of the funds on or about November 29th, 2019.

Contents of this communication may contain information regarding past performance, market opinions, competitor data, projections, forecasts and other forward-looking statements that cannot be shared with clients, prospective clients or current investors of Voya investment products. The information presented has been obtained from sources Voya Investment Management (“Voya IM”) deems to be reliable, however, this data is subject to unintentional errors, omissions and changes prior to distribution without notice. This information is provided to Voya IM employees for internal or educational use only and cannot be used as sales or marketing material, nor can it be distributed outside of the firm. Please only use compliance-approved marketing materials with clients and prospects. These materials contain compliant sales language, appropriate risk disclosures and other relevant disclaimers that provides a sound basis for evaluating our investment products and services. This information cannot be reproduced in whole or in part in any manner without the prior permission of a Voya IM Compliance Officer.