As filed with the Securities and Exchange Commission on March 14, 2024

Securities Act File No. [ ]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 ☑

Pre-Effective Amendment No. [ ]

Post-Effective Amendment No. [ ]

MAINSTAY FUNDS TRUST

(Exact Name of Registrant as Specified in Charter)

51 Madison Avenue, New York, New York 10010

(Address of Principal Executive Offices) (Zip Code)

(800) 624-6782

(Registrant’s Area Code and Telephone Number)

J. Kevin Gao, Esq.

MainStay Funds Trust

30 Hudson Street

Jersey City, New Jersey 07302

(Name and Address of Agent for Service)

With copies to:

Thomas C. Bogle, Esq.

Corey F. Rose, Esq.

Dechert LLP

1900 K Street, NW

Washington, DC 20006

Approximate Date of Proposed Public Offering:

As soon as practicable after this Registration Statement becomes effective.

It is proposed that this filing will become effective on April 13, 2024, pursuant to Rule 488 under the Securities Act of 1933, as amended.

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

Title of Securities Being Registered: Class A, Class C, Class I and Class Z shares of MainStay MacKay Strategic Municipal Allocation Fund, a series of the Registrant.

AQUILA MUNICIPAL TRUST

Aquila Churchill Tax-Free Fund of Kentucky

Aquila Narragansett Tax-Free Income Fund

120 West 45th Street, Suite 3600

New York, New York 10036

April [ ], 2024

Dear Shareholder:

On behalf of the Board of Trustees (the “Board”) of Aquila Churchill Tax-Free Fund of Kentucky (the “Aquila Kentucky Fund”) and Aquila Narragansett Tax-Free Income Fund (the “Aquila Narragansett Fund”) (each, an “Acquired Fund” and together, the “Acquired Funds”), each a series of Aquila Municipal Trust (the “Trust”), we are pleased to invite you to a special meeting of shareholders (with any postponements or adjournments, the “Special Meeting”) of the Acquired Funds. The Special Meeting is scheduled to be held on June 17, 2024, at 2:00 p.m., local time, at the offices of Morgan, Lewis & Bockius LLP, 101 Park Avenue, New York, New York 10178.

At the Special Meeting, as a shareholder of the Aquila Kentucky Fund and/or the Aquila Narragansett Fund, you will be asked to consider and vote on one or more of the following proposals:

| | 1) | To approve an Agreement and Plan of Reorganization providing for the transfer of the assets of the Aquila Kentucky Fund to MainStay MacKay Strategic Municipal Allocation Fund (the “Acquiring Fund”), a series of MainStay Funds Trust, in exchange for the assumption of all of the liabilities of the Aquila Kentucky Fund by the Acquiring Fund and shares of the Acquiring Fund, followed by the complete liquidation of the Aquila Kentucky Fund (the “Aquila Kentucky Reorganization”); and |

| | 2) | To approve an Agreement and Plan of Reorganization providing for the transfer of the assets of the Aquila Narragansett Fund to the Acquiring Fund in exchange for the assumption of all of the liabilities of the Aquila Narragansett Fund by the Acquiring Fund and shares of the Acquiring Fund, followed by the complete liquidation of the Aquila Narragansett Fund (the “Aquila Narragansett Reorganization”); and |

| | 3) | To transact such other business as may properly come before the Special Meeting. |

The Aquila Kentucky Fund Reorganization and Aquila Narragansett Fund Reorganization may hereinafter be referred to collectively as the “Reorganizations.”

The Acquiring Fund is managed by New York Life Investment Management LLC and subadvised by MacKay Shields LLC (“MacKay”). The Acquired Funds are managed by Aquila Investment Management LLC and Aquila Narragansett Fund is subadvised by Clarfeld Financial Advisors, LLC (“Clarfeld”), a wholly-owned subsidiary of Citizens Bank, N.A. The Aquila Kentucky Fund does not have a subadvisor.

If the Reorganizations take place, you will become a shareholder of the Acquiring Fund. Only shareholders of the Aquila Kentucky Fund will vote on the Aquila Kentucky Fund Reorganization and only shareholders of Aquila Narragansett Fund will vote on the Aquila Narragansett Fund Reorganization. Each Reorganization is not contingent on the approval of the other Reorganization, although there are certain other preconditions to the closing of the respective Reorganizations.

Formal notice of the Special Meeting appears on the next page, followed by a combined proxy statement and prospectus (the “Proxy Statement/Prospectus”). The Reorganizations are discussed in detail in the enclosed Proxy Statement/Prospectus, which you should read carefully.

The Board recommends that you vote “FOR” the Reorganizations.

Your vote is important, regardless of the number of shares of the Aquila Kentucky Fund and/or the Aquila Narragansett Fund you own. Whether or not you expect to attend the Special Meeting in person, please read the Proxy Statement/Prospectus and cast your vote promptly. You may cast your vote by completing, signing and returning the

2

enclosed proxy card by mail in the postage-paid envelope provided or by following the instructions on the proxy card for voting your proxy on the Internet or by touch-tone telephone. It is important that your vote be received no later than 11:59 p.m. ET on June 16, 2024.

We appreciate your participation and prompt response in this matter and thank you for your continued support.

Sincerely,

/s/ Diana P. Herrmann, President

3

AQUILA MUNICIPAL TRUST

Aquila Churchill Tax-Free Fund of Kentucky

Aquila Narragansett Tax-Free Income Fund

120 West 45th Street, Suite 3600

New York, New York 10036

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 17, 2024

NOTICE IS HEREBY GIVEN THAT a special meeting of shareholders (with any postponements or adjournments, the “Special Meeting”) of Aquila Churchill Tax-Free Fund of Kentucky (the “Aquila Kentucky Fund”) and Aquila Narragansett Tax-Free Income Fund (the “Aquila Narragansett Fund”) (each, an “Acquired Fund” and together, the “Acquired Funds”), each a series of Aquila Municipal Trust, are scheduled to be held on June 17, 2024, at 2:00 p.m., local time, at the offices of Morgan, Lewis & Bockius LLP, 101 Park Avenue, New York, New York 10178 to consider and vote on one or more of the following proposals:

| | 1) | To approve an Agreement and Plan of Reorganization providing for the transfer of the assets of the Aquila Kentucky Fund to MainStay MacKay Strategic Municipal Allocation Fund (the “Acquiring Fund”), a series of MainStay Funds Trust, in exchange for the assumption of all of the liabilities of the Aquila Kentucky Fund by the Acquiring Fund and shares of the Acquiring Fund, followed by the complete liquidation of the Aquila Kentucky Fund (the “Aquila Kentucky Reorganization”); and |

| | 2) | To approve an Agreement and Plan of Reorganization providing for the transfer of the assets of the Aquila Narragansett Fund to the Acquiring Fund in exchange for the assumption of all of the liabilities of the Aquila Narragansett Fund by the Acquiring Fund and shares of the Acquiring Fund, followed by the complete liquidation of the Aquila Narragansett Fund (the “Aquila Narragansett Reorganization”); and |

| | 3) | To transact such other business as may properly come before the Special Meeting. |

The Aquila Kentucky Fund Reorganization and Aquila Narragansett Fund Reorganization may hereinafter be referred to collectively as the “Reorganizations.”

If the Reorganizations take place, you will become a shareholder of the Acquiring Fund. Only shareholders of the Aquila Kentucky Fund will vote on the Aquila Kentucky Fund Reorganization and only shareholders of Aquila Narragansett Fund will vote on the Aquila Narragansett Fund Reorganization. Each Reorganization is not contingent on the approval of the other Reorganization, although there are certain other preconditions to the closing of the respective Reorganizations.

Please read the enclosed combined proxy statement and prospectus (the “Proxy Statement/Prospectus”) carefully for information concerning the Reorganizations.

The Board of Trustees of the Acquired Funds recommends that you vote “FOR” the Reorganizations.

Shareholders of record as of the close of business on March 29, 2024 are entitled to notice of, and to vote at, the Special Meeting. Your attention is called to the Proxy Statement/Prospectus. Regardless of whether you plan to attend the Special Meeting, please complete, sign and return the enclosed proxy card by 11:59 p.m. ET on June 16, 2024, or follow the instructions on the proxy card for voting your proxy on the Internet or by touch-tone telephone to help achieve a quorum and so that a maximum number of shares may be voted. Proxies may be revoked at any time before they are exercised by submitting a revised proxy card, by giving written notice of revocation to the Acquired Fund(s) or by voting in person at the Special Meeting.

By Order of the Board of Trustees of Aquila Municipal Trust,

/s/ Diana P. Herrmann, President

4

QUESTIONS AND ANSWERS RELATING TO THE REORGANIZATION

We recommend that you read the complete Proxy Statement/Prospectus. However, we thought it would be helpful to provide brief answers to some questions concerning the proposal described in this Proxy Statement/Prospectus.

Q. Why is a shareholder meeting being held?

A. You are being asked to consider and approve an Agreement and Plan of Reorganization for the Aquila Kentucky Reorganization and/or an Agreement and Plan of Reorganization for the Aquila Narragansett Reorganization (each, a “Reorganization Agreement” and together, the “Reorganization Agreements”) providing for the transfer of the assets of your Acquired Fund, a series of Aquila Municipal Trust, to the Acquiring Fund, a series of MainStay Funds Trust, in exchange for the assumption of all of the liabilities of your Acquired Fund by the Acquiring Fund and shares of the Acquiring Fund, followed by the complete liquidation of your Acquired Fund. The Acquiring Fund and the Acquired Funds may be referred to together in this Proxy Statement/Prospectus as the “Funds.”

As described more fully in this Proxy Statement/Prospectus, the Acquiring Fund is a series of MainStay Funds Trust and is managed by New York Life Investment Management LLC (“New York Life Investments”), an indirect wholly-owned subsidiary of New York Life Insurance Company. Also, upon completion of a Reorganization, MacKay Shields LLC (“MacKay”) will continue to provide day-to-day portfolio management responsibilities for the Acquiring Fund, under the supervision of New York Life Investments, pursuant to a subadvisory agreement with New York Life Investments. Aquila Investment Management LLC (“Aquila”) currently serves as the investment adviser for the Acquired Funds and will not serve as the investment adviser for an Acquiring Fund upon completion of the Aquila Kentucky Reorganization and/or Aquila Narragansett Reorganization, as applicable. Clarfeld Financial Advisors, LLC (“Clarfeld”), a wholly-owned subsidiary of Citizens Bank, N.A., currently serves as the investment subadvisor for the Aquila Narragansett Fund, and will not serve as the subadvisor for the Acquiring Fund upon completion of the Aquila Narragansett Reorganization.

New York Life Investments or its affiliates will continue to provide distribution and administrative services to the Acquiring Fund, among other services, in addition to supervising the day-to-day portfolio management activities of MacKay. For more information regarding New York Life Investments, MacKay, Aquila and Clarfeld, please see “Information About Management of the Funds” in the Proxy Statement/Prospectus.

Q. Why are the Reorganizations being proposed?

A. Aquila, the investment adviser for the Acquired Funds, has agreed to sell assets used in its investment advisory business relating to the Acquired Funds to New York Life Investments, subject to shareholder approval of the Reorganizations, among other conditions. New York Life Investments serves as investment adviser of the Acquiring Fund and MacKay serves as investment subadvisor to the Acquiring Fund. As further described in the attached Proxy Statement/Prospectus, there are certain important differences between the investment objectives and principal investment strategies of each Acquired Fund and the Acquiring Fund, and the Acquiring Fund is under different management than the Acquired Funds. The Reorganizations would also result in the Acquired Funds’ existing shareholders becoming part of a larger fund family with access to the wide array of distribution, marketing, administrative and other services offered by New York Life Investments or its affiliates.

Q. What are the potential benefits from the Reorganizations?

A. The management fee payable by the Acquiring Fund is lower than the management fee payable by the Aquila Narragansett Fund and is equal to the management fee payable by the Aquila Kentucky Fund. In addition, the Reorganizations are expected to result in a lower net expense ratio for existing shareholders of Class A, Class C, Class F, Class I and Class Y shares of the Acquired Funds as they would be subject to lower other expenses than the Acquired Funds when they become shareholders of Class Z, Class C, Class I, Class A and Class I shares, respectively, of the Acquiring Fund. New York Life Investments has contractually agreed to waive fees and/or reimburse expenses of the Acquiring Fund so that Total Annual Fund Operating Expenses (excluding taxes, interest, litigation, extraordinary expenses, brokerage and other transaction expenses relating to the purchase or sale of portfolio investments, and acquired (underlying) fund fees and expenses) do not exceed the following percentage of its average daily net assets: Class A, 0.77% and Class Z, 0.79%. New York Life Investments will apply an equivalent waiver or reimbursement, in an equal number of basis points as the Class A shares waiver/reimbursement to Class C shares and Class I shares.

5

This agreement will remain in effect until February 28, 2027, and thereafter shall renew automatically for one-year terms unless New York Life Investments provides written notice of termination prior to the start of the next term or upon approval of the Board of Trustees of the Acquiring Fund.

In addition, shareholders of the Acquired Funds will become shareholders of the Acquiring Fund, which is part of a larger fund family, the MainStay Funds. This larger family benefits from a wider array of distribution, marketing and administrative services than those currently provided to the Aquila Municipal Trust.

Q. How will the Reorganization(s) affect me?

A. Each Reorganization is subject to the approval of the applicable Acquired Fund’s shareholders. If shareholders of an Acquired Fund approve its Reorganization and all other conditions are satisfied or waived, such shareholders will become shareholders of the Acquiring Fund. You will receive shares of a class of the Acquiring Fund equal in value to the shares that you hold of the Aquila Kentucky Fund or Aquila Narragansett Fund, as applicable, as of the close of business of the New York Stock Exchange, usually 4:00 pm Eastern time, on the closing day of the applicable Reorganization.

Shareholders of the Aquila Kentucky Fund and/or the Aquila Narragansett Fund will receive shares of the Acquiring Fund in the corresponding Reorganization as set forth in the table below:

| | |

Aquila Kentucky Fund Shares and Aquila Narragansett Fund Shares | | Acquiring Fund Shares |

Class A | | Class Z |

Class C | | Class C |

Class F | | Class I |

Class I | | Class A |

Class Y | | Class I |

If a Reorganization is approved by shareholders and certain other conditions are satisfied or waived, such Reorganization will take place on or about July 19, 2024 (“Closing Date”).

Q. Are there differences between the Funds?

A. Yes. Aquila is the Acquired Funds’ investment adviser and Clarfeld is the subadvisor to the Aquila Narragansett Fund. New York Life Investments serves as the investment manager to the Acquiring Fund and supervises the services provided by MacKay, which serves as subadvisor to the Acquiring Fund. New York Life Investments will continue to serve as the investment manager to the Acquiring Fund after the Reorganizations and will supervise the services provided by MacKay, which will continue to serve as subadvisor to the Acquiring Fund.

Additionally, as summarized below and set forth more fully in the Proxy Statement/Prospectus, there are several important differences between the investment objectives and principal investment strategies of each of the Acquired Funds and the Acquiring Fund.

The Acquired Funds’ and Acquiring Fund’s investment objectives are similar in that they all seek current income exempt from federal income taxes. However, whereas the Acquiring Fund is a “national” municipal fund that does not focus its investments on municipal obligations related to a particular state, each Acquired Fund is a “single-state” municipal fund. In addition to seeking current income exempt from federal income taxes, the Aquila Kentucky Fund seeks current income exempt from Kentucky state income taxes and the Aquila Narragansett Fund seeks current income exempt from Rhode Island state income taxes. Each Acquired Fund’s investment objective is fundamental, which means it cannot be changed without shareholder approval. The Acquiring Fund’s investment objective is non-fundamental and may be changed without shareholder approval.

6

Each Fund invests primarily in municipal obligations, however, there are certain important differences in the Funds’ principal investment strategies:

| | - | Each Fund has a different 80% investment policy, related to the Fund’s investment objective as a “national” municipal fund or a “single-state” municipal fund. Under normal circumstances, the Aquila Kentucky Fund invests at least 80% of its net assets in municipal obligations that pay interest exempt, in the opinion of bond counsel, from Kentucky income and regular Federal income taxes, the income paid upon which will not be subject to the Federal alternative minimum tax on individuals. Under normal circumstances, the Aquila Narragansett Fund invests at least 80% of its net assets in municipal obligations that pay interest exempt, in the opinion of bond counsel, from Rhode Island income and regular Federal income taxes, the income paid upon which will not be subject to the Federal alternative minimum tax on individuals. The Acquiring Fund, under normal circumstances, invests at least 80% of its net assets plus borrowings for investment purposes in municipal bonds, the income from which is exempt from federal income tax, without regard to whether that income is exempt from Kentucky state income tax or Rhode Island state income tax, as applicable. Each Fund’s 80% investment policy is fundamental, which means it cannot be changed without shareholder approval. |

| | - | The Acquiring Fund invests, under normal circumstances, at least 65% of its net assets in investment grade quality bonds as rated by a nationally recognized statistical rating organization (“NRSRO”) (such as bonds rated BBB- or higher, or Baa3 or higher), or if unrated, judged to be of comparable quality by MacKay, the Acquiring Fund’s Subadvisor. The Acquiring Fund may invest up to 35% of its net assets in municipal bonds rated below investment grade by an NRSRO, commonly referred to as “high yield” or “junk” bonds, including up to 10% of its net assets in municipal bonds that are the subject of bankruptcy proceedings, that are in default as to the payment of principal or interest, or that are rated in the lowest rating category by an NRSRO (such as bonds rated D) (“distressed securities”), or if unrated, judged to be of comparable quality by MacKay. If NRSROs assign different ratings to the same security, the Fund will use the higher rating for purposes of determining the security’s credit quality. Municipal bonds that are rated below investment grade may be more likely to pay interest that is includable in taxable income for purposes of the federal alternative minimum tax than other municipal bonds. The Acquiring Fund’s Portfolio Management Team (the “Team”) dynamically allocates the Fund’s assets across investment grade and high yield municipal bond securities. While the Team focuses primarily on investment grade quality securities, they may opportunistically allocate to high yield bonds based upon changes in relative value within the municipal fixed income markets. The Team believes that high yield is often underutilized in traditional municipal bond portfolios and may offer incremental total return and diversification benefits. |

| | - | In contrast to the Acquiring Fund, the Aquila Kentucky Fund’s investments in municipal bonds issued by the Commonwealth of Kentucky, its counties and various other local authorities must be of investment grade quality at the time of purchase and the Aquila Narragansett Fund’s investments in municipal bonds issued by the State of Rhode Island, its counties and various other local authorities must be of investment grade quality at the time of purchase. |

| | - | The Acquiring Fund expects generally to invest in municipal bonds that have a maturity of 3 to 10 years, although the Acquiring Fund may invest in instruments of any duration or maturity. In contrast, the weighted average maturity of the Acquired Funds have traditionally been between 5 and 15 years. |

| | - | The Acquiring Fund may invest in derivatives, such as futures, options and swap agreements to seek enhanced returns or to reduce the risk of loss by hedging certain of its holdings. In contrast, the Acquired Funds do not invest in derivatives. |

| | - | Each of the Aquilla Kentucky Fund and the Aquila Narragansett Fund is classified as a “non-diversified” investment company under the 1940 Act, which means it may invest a greater percentage of its assets in a smaller number of issuers than the Acquiring Fund, which is classified as a “diversified fund.” |

| | - | In selecting investments for the Acquiring Fund, the subadvisor to the Acquiring Fund may take into account environmental, social, and governance risks that the subadvisor believes may have a material impact on the performance of a security. |

7

In addition, the Acquired Funds are each a series of a Massachusetts business trust, whereas the Acquiring Fund is a series of a Delaware statutory trust. There are differences between Massachusetts state law and Delaware state law. There are also differences in the Declarations of Trust and By-Laws of the Acquiring Funds and the Acquired Fund. See “Material Differences in the Rights of Fund Shareholders” for more information. Also, the Acquired Funds and Acquiring Fund have different service providers including: (i) investment manager; (ii) subadvisor; (iii) administrator/sub-administrator; (iv) distributor; (v) transfer agent; and (vi) custodian.

See “Comparison of the Aquila Kentucky Fund and the Acquiring Fund”, “Comparison of the Aquila Narragansett Fund and the Acquiring Fund” and “Additional Information About the Funds” in the Proxy Statement/Prospectus for more information.

Additionally, unlike the Acquired Funds, the Acquiring Fund (and New York Life Investments) has obtained an exemptive order from the Securities and Exchange Commission (“SEC”) permitting the investment manager, on behalf of the Acquiring Fund and subject to the approval of the Board of Trustees of MainStay Funds Trust, to hire and to modify any existing or future subadvisory agreements with subadvisors, subject to certain conditions. See “Do the Funds operate in accordance with exemptive relief regarding “manager of managers” arrangements?” for more information.

Q. How will the Reorganizations affect shareholder fees and expenses?

A. The Reorganizations are expected to result in:

| | - | Management Fee: The management fee payable by the Acquiring Fund (0.40% of average daily net assets) is lower than the management fee payable by the Aquila Narragansett Fund (0.50% of average daily net assets) and equal to the management fee payable by the Aquila Kentucky Fund (0.40% of average daily net assets). |

| | - | Rule 12b-1 distribution and service fees: The Acquiring Fund will have lower Rule 12b-1 distribution and service fees for Class C shares (0.50% of average daily net assets attributable to Class C shares) as compared to the Rule 12b-1 distribution and service fees for Class C shares of the Acquired Funds (1.00% of average daily net assets attributable to Class C shares). The Acquiring Fund will also have lower Rule 12b-1 distribution and services fees for Class A shares (0.25% of average daily net assets attributable to Class A shares) as compared to the Rule 12b-1 distribution and service fees for Class I shares of the Acquired Funds (0.40% of average daily net assets attributable to Class I shares). Rule 12b-1 distribution and service fees for Class Z shares of the Acquiring Fund will be the same as the Rule 12b-1 distribution and service fees for Class A shares of the Acquired Funds (0.15% of average daily net assets). Class F and Class Y shares of the Acquired Funds and Class I shares of the Acquiring Fund are not subject to any Rule 12b-1 distribution and/or service fees. |

| | - | Total annual fund operating expenses: Each Reorganization is expected to result in a reduction in total annual fund operating expenses immediately after the consummation of the Reorganization as compared to the applicable Acquired Fund’s current total annual fund operating expenses. New York Life Investments has contractually agreed to waive fees and/or reimburse expenses of the Acquiring Fund so that total annual fund operating expenses (excluding taxes, interest, litigation, extraordinary expenses, brokerage and other transaction expenses relating to the purchase or sale of portfolio investments, and acquired (underlying) fund fees and expenses) for a class do not exceed the following percentage of its average daily net assets: Class A, 0.77% and Class Z, 0.79%. New York Life Investments will apply an equivalent waiver or reimbursement, in an equal number of basis points as the Class A shares waiver/reimbursement to Class C and Class I shares. This agreement will remain in effect until February 28, 2027, and thereafter shall renew automatically for one-year terms unless New York Life Investments provides written notice of termination prior to the start of the next term or upon approval of the Board of Trustees of the Acquiring Fund. Following the expiration of the expense limitation agreement, it is possible that the Total Annual Fund Operating Expenses of one or more share classes of the Acquiring Fund would be higher than the Total Annual Fund Operating Expenses of the corresponding share class of one or both of the Acquired Funds, based in part on the asset size of the Acquiring Fund at that time. |

No sales charges will be assessed to shares received in connection with each Reorganization.

8

See “Comparison of Fees and Expenses” in the Proxy Statement/Prospectus for more information.

Q. Do the Acquired Funds operate in accordance with exemptive relief regarding “manager of managers” arrangements like the Acquiring Fund?

A. No. The Acquiring Fund (and New York Life Investments) has obtained an exemptive order from the SEC permitting the investment manager, on behalf of the Acquiring Fund and subject to the approval of the Board of Trustees of MainStay Funds Trust, to hire and to modify any existing or future subadvisory agreements with certain subadvisors, subject to certain conditions. The Acquiring Fund’s order applies to both unaffiliated subadvisors and subadvisors that are wholly-owned or otherwise affiliated with the Acquiring Fund. The Acquired Funds have not received a comparable SEC exemptive order.

Q. Who will bear the expenses of the Reorganizations and related costs?

A. The expenses of the Reorganizations will be borne by New York Life Investments. The expenses of the Reorganizations include, but are not limited to, the costs associated with the preparation of necessary filings with the SEC, printing and distribution of the Proxy Statement/Prospectus and other proxy materials, proxy solicitation costs, legal fees, accounting fees, securities registration fees, and expenses of holding the Special Meeting. The expenses of the Reorganizations are estimated to be approximately $165,000-180,000 for Aquila Kentucky Reorganization and $165,000-180,000 for Aquila Narragansett Reorganization. Neither the Acquiring Fund nor the Acquired Funds will bear any of the direct costs of the Reorganizations.

Additionally, following the Reorganizations, the Acquiring Fund may sell a portion of the assets obtained from the Acquired Funds in a manner consistent with its investment strategies and policies. If the Reorganizations are approved by shareholders and certain other conditions are met, it is anticipated that approximately 78% and 82% of the investments held by the Aquila Kentucky Fund and the Aquila Narragansett Fund, respectively, will be sold by the Acquiring Fund following consummation of the Reorganizations. Although the transaction costs associated with these transactions would be borne by the Acquiring Fund, it is not possible to precisely quantify transaction costs in transitioning a fixed income portfolio because bonds, unlike equities, do not trade continuously on an exchange with a published bid / ask spread. The secondary market for fixed income securities is a dealer-driven market in which transactions occur over-the-counter at a negotiated price between the Acquiring Fund and a dealer. The Team does not expect meaningful mark-ups given the Acquiring Fund’s current holdings predominantly consist of liquid, U.S. municipal securities. The actual amounts of brokerage and other transaction expenses may change at the time of the Reorganizations based on market conditions and other factors. See “Portfolio Transitioning” in the Proxy Statement/Prospectus for more information.

Q. Will the Reorganizations create a taxable event?

A. It is anticipated that the Reorganizations will each qualify for U.S. federal income tax purposes as a “reorganization” under Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, the Acquired Funds, the Acquiring Fund and their respective shareholders are not expected to recognize any gain or loss for U.S. federal income tax purposes as a direct result of the transactions contemplated by the Reorganization Agreements. Specifically, it is expected that neither Acquired Fund will recognize any gain or loss upon the acquisition by the Acquiring Fund of the assets and the assumption of the liabilities of such Acquired Fund. In addition, when shares held by shareholders of the Acquired Funds are exchanged for Acquiring Fund shares pursuant to the Reorganizations, it is expected that the shareholders of the Acquired Funds will recognize no gain or loss on the exchange, and that each shareholder of each Acquired Fund will have the same aggregate tax basis and holding period with respect to the Acquiring Fund shares received as the shareholder’s tax basis and holding period in its Acquired Fund shares immediately before the exchange.

As discussed above, there are certain important differences between the principal investment strategies of the Acquiring Fund and the Acquired Funds. However, Aquila does not anticipate that it will need to sell the Acquired Funds’ holdings if the Reorganizations are approved by shareholders. If any of the Acquired Funds’ holdings are sold prior to the Closing Date, any such portfolio transitioning may generate capital gains, which may result in taxable distributions to shareholders of the Funds after the date of the Reorganizations. It is not possible at this time to provide an estimate of the gain or loss to be recognized by the Acquired Funds that would be carried over to the Acquiring Fund for U.S. federal income tax purposes in connection with the transition of the Acquired Funds’ portfolio.

9

Following the Reorganizations, the Acquiring Fund’s ability to carry forward and use the Acquired Funds’ or its own pre-Reorganizations capital losses, if any, may be limited.

Tax-exempt dividends from the Acquiring Fund may not qualify for a state or local income tax exemption in certain states or localities. Shareholders of the Acquired Funds should consult their tax advisers regarding the income tax consequences of holding shares in the Acquiring Fund, including differences in the state and local tax treatment of dividends received from the Acquired Funds and the Acquiring Fund.

For more detailed information about the tax consequences of the Reorganizations please refer to the “Information About the Reorganizations – U.S. Federal Income Tax Consequences” section below.

Shareholders should consult their tax advisors about possible state and local tax consequences of the Reorganizations, if any, because the information about tax consequences in this document relates to the U.S. federal income tax consequences of the Reorganizations only.

Q. Has the Board of Trustees of Aquila Municipal Trust approved the Reorganization Agreements?

A. Yes. After careful consideration, the Board of Trustees of Aquila Municipal Trust unanimously approved each Reorganization Agreement and recommends that you vote “FOR” the proposal or proposals applicable to you (i.e., the applicable Reorganization Agreement(s)).

The Board of Trustees of MainStay Funds Trust also approved each Reorganization Agreement.

Q. What happens if shareholders do not approve a Reorganization?

A. If shareholders do not approve the Aquila Kentucky Reorganization and/or the Aquila Narragansett Reorganization, such Acquired Fund will continue to be advised by Aquila, as described in the Acquired Fund’s prospectus, and the Board of Trustees of Aquila Municipal Trust will determine what additional action, if any, should be taken. The Reorganizations are two of several reorganizations of Aquila Municipal Trust into different MainStay Funds, and each of those reorganizations is contingent upon the approval by the shareholders of the respective fund(s) in Aquila Municipal Trust. Even if shareholders approve the respective reorganizations of the funds in Aquila Municipal Trust, including the Reorganizations, consummation of each Reorganization is subject to certain conditions, including that the combined assets of such fund(s) in Aquila Municipal Trust for which the conditions precedent for the reorganizations of such funds have been satisfied amount to a certain agreed-upon threshold. Therefore, if such condition and other conditions are not satisfied or waived, then the Reorganizations may not be consummated. If the Reorganizations do not take place, the Board of Trustees of Aquila Municipal Trust may opt to continue one or both of the Acquired Funds as a series of Aquila Municipal Trust or it may, depending on its assessment of each Acquired Fund’s viability as part of the Aquila Municipal Trust, opt to liquidate and terminate one or both of the Acquired Funds.

Q. How do I vote?

A. You may submit your proxy card in one of four ways:

| | ● | | By Internet. The web address and instructions for voting can be found on the enclosed proxy card. You will be required to provide your control number located on the proxy card. |

| | ● | | By Telephone. The toll-free number for telephone voting can be found on the enclosed proxy card. You will be required to provide your control number located on the proxy card. |

| | ● | | By Mail. Mark the enclosed proxy card, sign and date it, and return it in the postage-paid envelope we provided. Both joint owners must sign the proxy card. |

| | ● | | In Person at the Special Meeting. You can vote your shares in person at the Special Meeting. If you expect to attend the Special Meeting in person, please call 800-437-1020 (toll-free) or 212-697-6666. |

10

To be certain your vote will be counted, a properly executed proxy card must be received no later than 11:59 p.m. ET, on June 16, 2024.

Should shareholders require additional information regarding the Special Meeting, they may contact the Proxy Solicitor toll-free at 833-876-2476. (See “Voting Information” for more information on the Proxy Solicitor.)

Q. When and where will the Special Meeting be held?

A. The Special Meeting is scheduled to be held at the offices of Morgan, Lewis & Bockius LLP, 101 Park Avenue, New York, New York 10178, on June 17, 2024, at 2:00 p.m., local time, and if the Special Meeting is adjourned or postponed, any adjournments or postponements of the Special Meeting will also be held at the above location. If you expect to attend the Special Meeting in person, please call 800-437-1020 (toll-free) or 212-697-6666.

11

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general rules for signing proxy cards may be of assistance to you and may help avoid the time and expense involved in validating your vote if you fail to sign your proxy card properly.

| | 1. | INDIVIDUAL ACCOUNTS: Sign your name exactly as it appears in the registration on the proxy card. |

| | 2. | JOINT ACCOUNTS: Both parties must sign: the names of the parties signing should conform exactly to the names shown in the registration on the proxy card. |

| | 3. | ALL OTHER ACCOUNTS: The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. |

For example:

REGISTRATION VALID

| | | | |

CORPORATE ACCOUNTS |

| | |

(1) | | ABC Corp. | | ABC Corp. John Doe, Treasurer |

| | |

(2) | | ABC Corp. | | John Doe |

| | |

(3) | | ABC Corp. c/o John Doe | | John Doe |

| | |

(4) | | ABC Corp. Profit Sharing Plan | | John Doe |

|

PARTNERSHIP ACCOUNTS |

| | |

(1) | | The XYZ Partnership | | Jane B. Smith, Partner |

| | |

(2) | | Smith and Jones, Limited Partnership | | Jane B. Smith, General Partner |

|

TRUST ACCOUNTS |

| | |

(1) | | ABC Trust | | Jane B. Doe, Trustee |

| | |

(2) | | Jane B. Doe, Trustee u/t/d 01/01/01 | | Jane B. Doe, Trustee u/t/d/ 01/01/01 |

|

CUSTODIAL OR ESTATE ACCOUNTS |

| | |

(1) | | John B. Smith, Cust f/b/o | | John B. Smith, Custodian f/b/o |

| | |

| | John B. Smith, Jr. UGMA/UTMA | | John B. Smith, Jr. UGMA/UTMA |

| | |

(2) | | Estate of John B. Smith | | John B. Smith, Jr., Executor Estate of John B. Smith |

PLEASE CHOOSE ONE OF THE FOLLOWING OPTIONS TO VOTE YOUR SHARES:

| | 1. | AUTHORIZE YOUR PROXY THROUGH THE INTERNET. You may authorize your proxy by logging into the Internet site indicated on your proxy card and following the instructions on the website. In order to log on, you will need the control number found on your proxy card. |

| | 2. | AUTHORIZE YOUR PROXY BY TELEPHONE. You may authorize your proxy by telephone by calling the toll-free number located on your proxy card. Please make sure to have your proxy card available at the time of the call. |

| | 3. | VOTE BY MAIL. You may cast your vote by signing, dating and mailing the enclosed proxy card in the postage-paid envelope provided. |

| | 4. | VOTE IN PERSON AT THE SPECIAL MEETING. |

12

PROXY STATEMENT/PROSPECTUS

PROXY STATEMENT FOR

AQUILA CHURCHILL TAX-FREE FUND OF KENTUCKY

AQUILA NARRAGANSETT TAX-FREE INCOME FUND

(each, a series of Aquila Municipal Trust)

120 West 45th Street, Suite 3600

New York, New York 10036

(212) 697-6666

PROSPECTUS FOR

MAINSTAY MACKAY STRATEGIC MUNICIPAL ALLOCATION FUND

(a series of MainStay Funds Trust)

51 Madison Avenue

New York, New York 10010

(212) 576-7000

This Proxy Statement/Prospectus is being furnished in connection with a solicitation of proxies made by, and on behalf of, the Board of Trustees of Aquila Municipal Trust, in connection with the special meetings of shareholders (with any postponements or adjournments, “Special Meeting”) of Aquila Churchill Tax-Free Fund of Kentucky (“Aquila Kentucky Fund”) and Aquila Narragansett Tax-Free Income Fund (“Aquila Narragansett Fund”) (each, an “Acquired Fund” and together, the “Acquired Funds”).

The Special Meeting is scheduled to be held on June 17, 2024, at 2:00 p.m., local time, at the offices of Morgan, Lewis & Bockius LLP, 101 Park Avenue, New York, New York 10178.

Shareholders of record of the Acquired Funds at the close of business on March 29, 2024 (the “Record Date”) are entitled to notice of, and to vote at, the Special Meeting. This Proxy Statement/Prospectus, proxy card and accompanying Notice of Special Meeting of Shareholders will be first sent or given to shareholders of the Acquired Fund on or about April [19], 2024.

At the Special Meeting, as a shareholder of the Aquila Kentucky Fund and/or the Aquila Narragansett Fund, you will be asked to consider and vote on one or more of the following proposals:

| | 1) | To approve an Agreement and Plan of Reorganization providing for the transfer of the assets of the Aquila Kentucky Fund to MainStay MacKay Strategic Municipal Allocation Fund (the “Acquiring Fund”), a series of MainStay Funds Trust, in exchange for the assumption of all of the liabilities of the Aquila Kentucky Fund by the Acquiring Fund and shares of the Acquiring Fund, followed by the complete liquidation of the Aquila Kentucky Fund (the “Aquila Kentucky Reorganization”); and |

| | 2) | To approve an Agreement and Plan of Reorganization providing for the transfer of the assets of the Aquila Narragansett Fund to the Acquiring Fund in exchange for the assumption of all of the liabilities of the Aquila Narragansett Fund by the Acquiring Fund and shares of the Acquiring Fund, followed by the complete liquidation of the Aquila Narragansett Fund (the “Aquila Narragansett Reorganization”); and |

| | 3) | To transact such other business as may properly come before the Special Meeting. |

The Aquila Kentucky Fund Reorganization and Aquila Narragansett Fund Reorganization may hereinafter be referred to each as a “Reorganization” and collectively as the “Reorganizations.”

13

Only shareholders of the Aquila Kentucky Fund will vote on the Aquila Kentucky Fund Reorganization and only shareholders of Aquila Narragansett Fund will vote on the Aquila Narragansett Fund Reorganization. Each Reorganization is not contingent on the approval of the other Reorganization.

There are important differences between the investment objectives and principal investment strategies of the Acquiring Fund and the Acquired Funds. In particular, the Acquiring Fund is a “national” municipal fund that does not focus its investments on municipal obligations related to a particular state, whereas each Acquired Fund is a “single-state” municipal fund; the Aquila Kentucky Fund invests primarily in Kentucky municipal obligations and the Aquila Narragansett Fund invests primarily in Rhode Island municipal obligations. Also, each Acquired Fund’s investments in municipal bonds must be of investment grade quality at the time of purchase, whereas the Acquiring Fund may invest up to 35% of its net assets in municipal bonds rated below investment grade. The Acquired Funds are series of Aquila Municipal Trust, which is organized as a Massachusetts business trust. The Acquiring Fund is a series of MainStay Funds Trust, which is organized as a statutory trust under the State of Delaware. For more information, see “Comparison of the Aquila Kentucky Fund and the Acquiring Fund”, “Comparison of the Aquila Narragansett Fund and the Acquiring Fund” below.

In connection with the Reorganizations, each shareholder of the Aquila Kentucky Fund or the Aquila Narragansett Fund would receive shares of the Acquiring Fund equal in value to the shares of the Aquila Kentucky Fund or the Aquila Narragansett Fund held by that shareholder as of the close of business of the New York Stock Exchange, usually 4:00 p.m. Eastern time, on the closing day of the Reorganizations.

You are being asked to consider and vote on an Agreement and Plan of Reorganization for the Aquila Kentucky Reorganization and/or an Agreement and Plan of Reorganization for the Aquila Narragansett Reorganization (each, a “Reorganization Agreement” and together, the “Reorganization Agreements”) pursuant to which the Reorganization transaction(s) would be accomplished. This Proxy Statement/Prospectus sets forth concisely the information shareholders of the Acquired Funds should know before voting on the Reorganization(s) and constitutes an offering of the shares of the Acquiring Fund that would be issued in the Reorganization(s). Please read it carefully and retain it for future reference.

The following documents containing additional information about the Acquired Funds and the Acquiring Fund, each having been filed with the SEC, are incorporated by reference into (legally considered to be part of) this Proxy Statement/Prospectus:

| | ● | | Statement of Additional Information dated April [ ], 2024 relating to this Proxy Statement/Prospectus (Securities Act File No. [ ]); |

14

The policies and procedures set forth in the “Shareholder Guide” in Appendix C to this Proxy Statement/Prospectus will apply to the shares issued by the Acquiring Fund in connection with the Reorganizations. The Funds are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “1940 Act”), and in accordance therewith, file reports and other information, including proxy materials, with the SEC.

Additional copies of the foregoing (other than the Statement of Additional Information relating to this Proxy Statement/Prospectus, which is not available on www.nylinvestments.com/mainstay) and any more recent reports filed after the date hereof may be obtained without charge:

for the Acquiring Fund:

| | |

By Phone: | | 800-MAINSTAY (624-6782) |

By Mail: | | NYLIFE Distributors LLC: |

| | Attn: MainStay Marketing Department, |

| | 30 Hudson Street, Jersey City, New Jersey 07302 |

By Internet: | | www.nylinvestments.com/mainstay |

for the Acquired Funds:

| | |

By Phone: | | 800-437-1000 |

By Mail: | | Aquila Churchill Tax-Free Fund of Kentucky |

| | Aquila Narragansett Tax-Free Income Fund c/o Aquila Distributors LLC |

| | 120 West 45th Street, Suite 3600, New York, New York 10036 |

By Internet: | | https://www.aquilafunds.com |

15

You also may view or obtain these documents from the SEC:

By e-mail: publicinfo@sec.gov (duplicating fee required)

By Internet: www.sec.gov

The Board of Trustees of Aquila Municipal Trust knows of no business other than that discussed above that will be presented for consideration at the Special Meeting. If any other matter is properly presented, the persons named in the enclosed proxy card intend to vote in accordance with their best judgment.

No person has been authorized to give any information or make any representation not contained in this Proxy Statement/Prospectus and, if so given or made, such information or representation must not be relied upon as having been authorized. This Proxy Statement/Prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which, or to any person to whom, it is unlawful to make such offer or solicitation.

THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR DETERMINED THAT THIS PROXY STATEMENT/PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

16

TABLE OF CONTENTS

17

SUMMARY

The following is a summary of certain information contained elsewhere in this Proxy Statement/Prospectus. Shareholders should read the entire Proxy Statement/Prospectus carefully.

The Board of Trustees of Aquila Municipal Trust (the “Board”), including a majority of the trustees who are not “interested persons” (as defined in the 1940 Act) (the “Independent Trustees”), has approved each Reorganization Agreement.

Subject to shareholder approval and certain other conditions, the Reorganization Agreement for the Aquila Kentucky Fund provides for:

| | ● | | the transfer of all of the assets of the Aquila Kentucky Fund to the Acquiring Fund, in exchange for shares of the Acquiring Fund; |

| | ● | | the assumption by the Acquiring Fund of all of the liabilities of the Aquila Kentucky Fund; |

| | ● | | the distribution of shares of the Acquiring Fund to the shareholders of the Aquila Kentucky Fund; and |

| | ● | | the complete liquidation of the Aquila Kentucky Fund. |

Subject to shareholder approval and certain other conditions, the Reorganization Agreement for the Aquila Narragansett Fund provides for:

| | ● | | the transfer of all of the assets of the Aquila Narragansett Fund to the Acquiring Fund, in exchange for shares of the Acquiring Fund; |

| | ● | | the assumption by the Acquiring Fund of all of the liabilities of the Aquila Narragansett Fund; |

| | ● | | the distribution of shares of the Acquiring Fund to the shareholders of the Aquila Narragansett Fund; and |

| | ● | | the complete liquidation of the Aquila Narragansett Fund. |

If shareholders of an Acquired Fund approve the Reorganization of their Acquired Fund and certain other conditions are satisfied or waived, each owner of Class A, Class C, Class F, Class I and Class Y shares would become a shareholder of Class Z, Class C, Class I, Class A and Class I shares, respectively, of the Acquiring Fund. Each Reorganization is expected to be effective on the Closing Date. Each shareholder of an Acquired Fund will hold, immediately after the close of the Reorganization of their Acquired Fund, shares of the Acquiring Fund having an aggregate net asset value equal to the aggregate net asset value of shares of the Acquired Fund held by such shareholder as of the close of business on the Closing Date.

In considering whether to approve the Reorganization(s), you should note that:

| | ● | | The Acquired Funds and the Acquiring Fund are each open-end, management investment companies registered with the SEC. The Acquiring Fund is a series of MainStay Funds Trust, which is organized as a statutory trust under the laws of the State of Delaware. The Acquired Funds are series of Aquila Municipal Trust, which is organized as a business trust under the laws of the Commonwealth of Massachusetts. |

| | ● | | New York Life Investment Management LLC (“New York Life Investments”) serves as the investment manager of the Acquiring Fund. MacKay Shields LLC (“MacKay”) serves as the subadvisor of the Acquiring Fund. |

| | ● | | Aquila Investment Management LLC (“Aquila”) serves as the investment adviser of the Acquired Funds. Clarfeld Financial Advisors, LLC (“Clarfeld”) serves as the subadvisor of Aquila Narragansett Fund. |

18

| | ● | | The Acquiring Fund and Acquired Funds have similar investment objectives in that they each seek current income exempt from federal income taxes. However, in addition to seeking current income exempt from federal income taxes, the Aquila Kentucky Fund seeks current income exempt from Kentucky state income taxes and the Aquila Narragansett Fund seeks current income exempt from Rhode Island state income taxes. |

| | ● | | There are certain important differences between the principal investment strategies of the Acquiring Fund and the Acquired Funds, including: |

| | - | Each Fund has a different 80% investment policy, related to the Fund’s investment objective as a “national” municipal fund or a “single-state” municipal fund. Under normal circumstances, the Aquila Kentucky Fund invests at least 80% of its net assets in municipal obligations that pay interest exempt, in the opinion of bond counsel, from Kentucky income and regular Federal income taxes, the income paid upon which will not be subject to the Federal alternative minimum tax on individuals. Under normal circumstances, the Aquila Narragansett Fund invests at least 80% of its net assets in municipal obligations that pay interest exempt, in the opinion of bond counsel, from Rhode Island income and regular Federal income taxes, the income paid upon which will not be subject to the Federal alternative minimum tax on individuals. The Acquiring Fund, under normal circumstances, invests at least 80% of its net assets plus borrowings for investment purposes in municipal bonds, the income from which is exempt from federal income tax, without regard to whether it is exempt from Kentucky state income tax or Rhode Island state income tax, as applicable. |

| | - | Each Acquired Fund’s investments in municipal bonds must be of investment grade quality at the time of purchase, whereas the Acquiring Fund may invest up to 35% of its net assets in municipal bonds rated below investment grade. Municipal bonds that are rated below investment grade may be more likely to pay interest that is includable in taxable income for purposes of the federal alternative minimum tax than other municipal bonds. |

| | - | The Acquiring Fund expects generally to invest in municipal bonds that have a maturity of 3 to 10 years, although the Acquiring Fund may invest in instruments of any duration or maturity. In contrast, the weighted average maturity of each Acquired Fund has traditionally been between 5 and 15 years. |

| | - | The Acquiring Fund may invest in derivatives, such as futures, options and swap agreements, to seek enhanced returns or to reduce the risk of loss by hedging certain of its holdings. In contrast, the Acquired Funds do not invest in derivatives. |

| | - | Each of the Aquilla Kentucky Fund and the Aquila Narragansett Fund is classified as a “non-diversified” investment company under the 1940 Act, which means it may invest a greater percentage of its assets in a smaller number of issuers than the Acquiring Fund, which is classified as a “diversified” fund. |

| | - | In selecting investments for the Acquiring Fund, the Acquiring Fund’s subadvisor may take into account environmental, social and governance risks that it believes may have a material impact on the performance of a security. |

| | ● | | The management fee payable by the Acquiring Fund is lower than the management fee payable by the Aquila Narragansett Fund and is equal to the management fee payable by the Aquila Kentucky Fund. The Acquiring Fund will have lower Rule 12b-1 distribution and service fees for Class C shares (0.50% of average daily net assets attributable to Class C shares) as compared to the Rule 12b-1 distribution and service fees for Class C shares of the Acquired Funds (1.00% of average daily net assets attributable to Class C shares). The Acquiring Fund will also have lower Rule 12b-1 distribution and services fees for Class A shares (0.25% of average daily net assets attributable to Class A shares) as compared to the Rule 12b-1 distribution and service fees for Class I shares of the Acquired Funds (0.40% of average daily net assets attributable to Class I shares). Rule 12b-1 distribution and service fees for Class Z shares of the Acquiring Fund will be the same as the Rule 12b-1 distribution and service fees for Class A shares of the Acquired Funds (0.15% of average daily net assets). Class F and Class Y shares of the Acquired Funds and Class I shares of the Acquiring Fund are not subject to any Rule 12b-1 distribution and/or service fees. |

19

| | ● | | The Reorganizations are expected to result in a lower net expense ratio for existing shareholders of Class A, Class C, Class F, Class I and Class Y of the Acquired Funds. The Acquiring Fund’s expense limitation agreement is expected to result in the Acquiring Fund’s net expense ratio for each class of its shares to be equal to or below the total net expense ratio of the Acquired Funds’ corresponding share class. This agreement will remain in effect until February 28, 2027. |

| | ● | | Class C shares or Class I shares of the Acquiring Fund may not be available at all financial intermediaries, investment platforms and investment accounts, as disclosed in the “Shareholder Guide” in Appendix D to this Proxy Statement/Prospectus. If a shareholder moves to a different financial intermediary, or the policies of their current financial intermediary change, the shareholder may not be able to hold and/or purchase Class C shares or Class I shares of the Acquiring Fund or may be subject to certain investment minimums or restrictions. |

| | ● | | No sales charges will be assessed to shares received in connection with the Reorganization(s). However, additional purchases of a class of shares of the Acquiring Fund after the Reorganization(s) will be subject to the initial sales charge or contingent deferred sales charge applicable to that class of shares, as disclosed in the “Shareholder Guide” in Appendix D to this Proxy Statement/Prospectus. |

| | ● | | The sales charge structures of Class Z, Class C, Class I and Class I shares of the Acquiring Fund are similar to the sales charge structures of the corresponding Class A, Class C, Class F and Class Y shares of each Acquired Fund. |

| | ● | | The sales charge structure of Class A shares of the Acquiring Fund is different from the sales charge structure of the corresponding Class I shares of each Acquired Fund: purchases of Class A shares of the Acquiring Fund are subject to a 3.00% initial sales charge, whereas purchases of Class I shares of each Acquired Fund are not subject to an initial sales charge. However, as noted above, the Rule 12b-1 distribution and services fees for Class A shares of the Acquiring Fund are lower than the Rule 12b-1 distribution and service fees for Class I shares of the Acquired Funds. |

| | ● | | Each Reorganization is intended to qualify for U.S. federal income tax purposes as a “reorganization” pursuant to Section 368(a) of the Code; accordingly, neither the Acquired Funds or their shareholders, nor the Acquiring Fund or its shareholders are expected to recognize any gain or loss for federal income tax purposes from the Reorganization(s). |

| | ● | | Shareholders of the Aquila Kentucky Fund and/or of the Aquila Narragansett Fund who determine that they do not wish to become shareholders of the Acquiring Fund may redeem their shares of their Acquired Fund prior to the Closing Date. Please note that a redemption of shares of an Acquired Fund prior to the Closing Date will be a taxable event and a shareholder may recognize a gain or loss for federal income tax purposes in connection with that transaction. Any applicable sales charge would also be assessed. |

20

BACKGROUND AND REASONS FOR THE REORGANIZATIONS

Aquila, the investment adviser for the Acquired Funds, has agreed to sell assets used in its investment advisory business relating to the Acquired Funds to New York Life Investments, subject to shareholder approval of the Reorganizations and other conditions. The Reorganizations are two of several reorganizations of Aquila Municipal Trust into different MainStay Funds, and each of those reorganizations is contingent upon the approval by the shareholders of the respective fund(s) in Aquila Municipal Trust. Even if shareholders approve the respective reorganizations of the funds in Aquila Municipal Trust, including the Reorganizations, consummation of each Reorganization is subject to certain conditions, including that the combined assets of such fund(s) in Aquila Municipal Trust for which the conditions precedent for the reorganizations of such funds have been satisfied amount to a certain agreed-upon threshold. Therefore, if such condition and other conditions are not satisfied or waived, then the Reorganizations may not be consummated. If the Reorganizations do not take place, the Board of Trustees of Aquila Municipal Trust may opt to continue one or both of the Acquired Funds as series of Aquila Municipal Trust or it may, depending on its assessment of each Acquired Fund’s viability as part of the Aquila Municipal Trust, opt to liquidate and terminate one or both of the Acquired Funds.

As further described herein, New York Life Investments believes that the reorganization of each Acquired Fund with and into the Acquiring Fund will further benefit shareholders of the Acquired Funds through, among other things, opportunities to deliver potentially improved long-term risk-adjusted returns. Although the Acquiring Fund is a “national” municipal fund rather than a “state-specific” municipal fund that invests primarily in Kentucky municipal obligations or Rhode Island municipal obligations, New York Life Investments believes that the shareholders of each Acquired Fund will continue to obtain exposure through the Acquiring Fund to municipal bonds, the income from which is exempt from federal income tax, management fees that are no higher than either Acquired Fund’s management fees, and lower net operating expenses.

Shareholders of the Acquired Funds will become shareholders of the Acquiring Fund, which is part of a larger fund family, the MainStay Funds. This larger family benefits from a wider array of distribution, marketing and administrative services than those currently provided to the Aquila Municipal Trust.

BOARD CONSIDERATIONS

The Board believes that the Reorganization of each Acquired Fund is in the best interests of that Acquired Fund and its shareholders. The Board considered the following matters, among others, in approving each Reorganization:

First, the Board considered that Aquila, each Acquired Fund’s investment adviser, has agreed to sell assets used in its investment advisory business relating to the Acquired Funds to New York Life Investments, and that, in connection with that transaction, Aquila recommended that each Acquired Fund be reorganized into the Acquiring Fund, which is managed by New York Life Investments and sub-advised by MacKay. The Board considered the experience of New York Life Investments and MacKay in advising other mutual funds, including the Acquiring Fund and other funds that invest primarily in municipal securities.

Second, the Board considered the similarities and differences between the investment objectives and principal investment strategies of each Acquired Fund and the Acquiring Fund, including, in particular, that the Acquiring Fund is a “national” municipal fund that does not focus its investments on municipal obligations related to a particular state, whereas each Acquired Fund is a “single-state” municipal fund. The Board considered that, under normal circumstances, the Aquila Kentucky Fund invests at least 80% of its net assets in municipal obligations that pay interest exempt, in the opinion of bond counsel, from Kentucky income and regular Federal income taxes, the income paid upon which will not be subject to the Federal alternative minimum tax on individuals. The Board considered that, under normal circumstances, the Aquila Narragansett Fund invests at least 80% of its net assets in municipal obligations that pay interest exempt, in the opinion of bond counsel, from Rhode Island income and regular Federal income taxes, the income paid upon which will not be subject to the Federal alternative minimum tax on individuals. The Board considered that, in contrast to the Acquired Funds, the Acquiring Fund, under normal circumstances, invests at least 80% of its net assets plus borrowings for investment purposes in municipal bonds, the income from which is exempt from federal income tax, without regard to whether it is exempt from Kentucky state income tax or Rhode Island state income tax, as applicable.

21

The Board also considered, among other similarities and differences, that each Acquired Fund’s investments in municipal bonds must be of investment grade quality at the time of purchase, whereas the Acquiring Fund may invest up to 35% of its net assets in municipal bonds rated below investment grade; differences in the maturity of the investments of the Acquiring Fund and the Acquired Funds; the Acquiring Fund’s ability to invest in derivatives; that the Acquiring Fund is classified as a “diversified” fund, whereas each Acquired Funds is classified as a “non-diversified” fund; and that, in selecting investments for the Acquiring Fund, the subadvisor to the Acquiring Fund may take into account environmental, social and governance risks that the subadvisor believes may have a material impact on the performance of a security.

The Board considered that, on balance, the opportunity for Acquired Fund shareholders to invest in an investment product managed by New York Life Investments and sub-advised by MacKay that seeks current income exempt from federal income taxes, and that is part of a larger fund family with access to the wide array of distribution, marketing, administrative and other services offered by New York Life Investments or its affiliates, supported approval of each Reorganization.

Third, the Board considered the fees and expenses of the Acquiring Fund as compared to the fees and expenses of each Acquired Fund. The Board considered that the sales charge structures of the Acquiring Fund’s shares are generally similar to the sales charge structures of the corresponding shares of the Acquired Funds, except that Class A shares of the Acquiring Fund are subject to an initial sales charge whereas Class I shares of the Acquired Funds are not subject to an initial sales charge. The Board considered that the management fee payable by the Acquiring Fund is lower than the management fee payable by the Aquila Narragansett Fund and equal to the management fee payable by the Aquila Kentucky Fund. The Board considered that Class C shares and Class A shares of the Acquiring Fund will have lower Rule 12b-1 distribution and service fees as compared to Class C shares and Class I of each Acquired Fund, respectively, that the Rule 12b-1 distribution and service fees for Class Z shares of the Acquiring Fund will be the same as the Rule 12b-1 distribution and service fees for Class A shares of each Acquired Fund, and that neither Class F shares or Class Y shares of the Acquired Fund, nor Class I shares of the Acquiring Fund, are subject to any Rule 12b-1 distribution and/or service fees. The Board considered that each Reorganization is expected to result in a reduction in total annual fund operating expenses immediately after the consummation of the respective Reorganization as compared to the applicable Acquired Fund’s current total annual fund operating expenses. The Board considered that New York Life Investments has contractually agreed to waive fees and/or reimburse expenses for each class of shares of the Acquiring Fund.

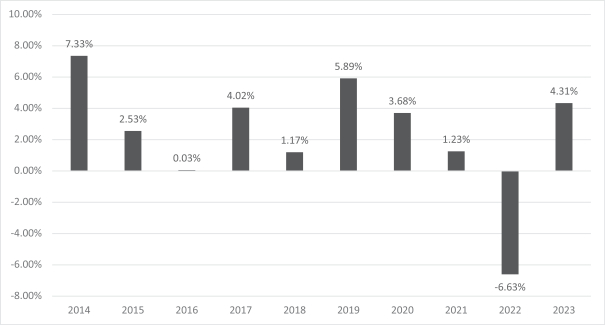

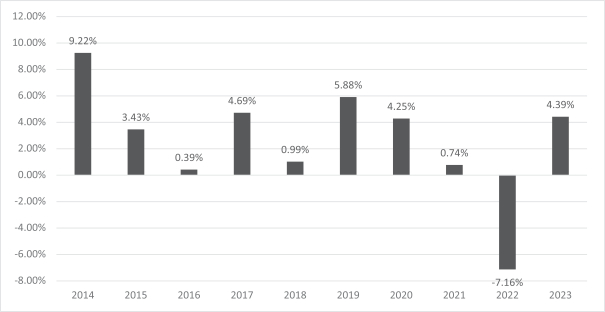

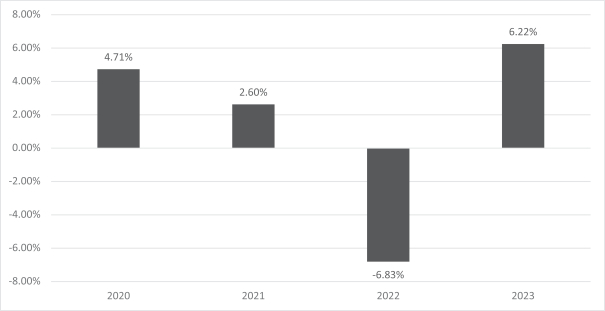

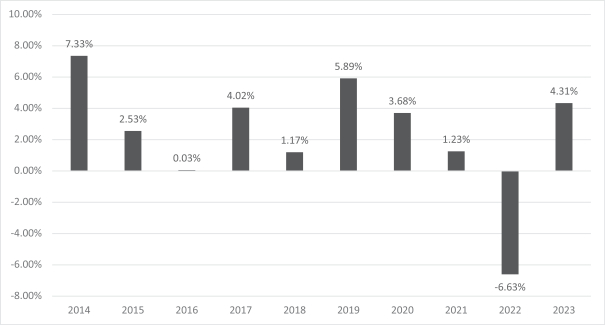

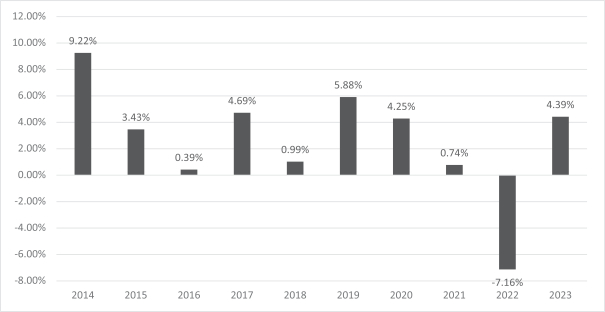

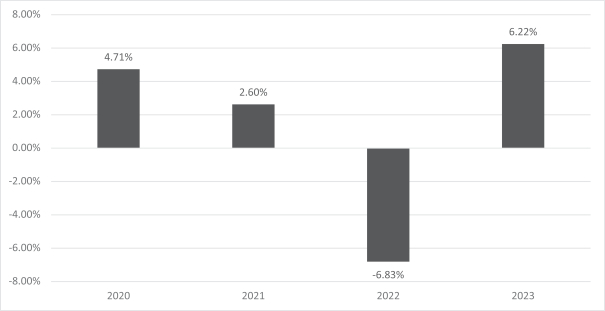

Fourth, the Board considered the historical investment performance records of each Acquired Fund and the Acquiring Fund, including that the historical investment performance record of the Acquiring Fund was generally better than the historical investment performance record of the Acquired Funds.

Fifth, the Board considered that the Reorganization would result in each Acquired Fund’s existing shareholders becoming part of a larger fund family with access to the wide array of distribution, marketing, administrative and other services offered by New York Life Investments or its affiliates. The Board considered that the reputation, financial strength, resources and capabilities of New York Life Investments could benefit Acquired Fund shareholders. As of December 31, 2023, New York Life Investments, including its investment advisory affiliates, had assets under management of $716 billion. Shareholders of each Acquired Fund would become part of a significantly larger family of funds that offers a more diverse array of investment options. In addition, the Board considered that New York Life Investments has greater potential for increasing the size of the Acquiring Fund due to New York Life Investments’ experience in distributing mutual funds through a generally broader range of distribution channels than currently is available to each Acquired Fund. The Board considered distribution arrangements for the Acquiring Fund, including the availability of each class of shares of the Acquiring Fund at financial intermediaries, as compared to the distribution arrangements for each Acquired Fund. The Board also considered that the level of operational expenses for administrative, compliance and portfolio management services borne by the Acquiring Fund may be less than those borne by each Acquired Fund as the Acquiring Fund is part of a larger mutual fund complex.

Sixth, the Board considered that no sales charges will be assessed to shares received in connection with a Reorganization.

Seventh, the Board considered that each Reorganization is expected to qualify for U.S. federal income tax purposes as a “reorganization” pursuant to Section 368(a) of the Code and therefore shareholders will not recognize gain or loss for U.S. federal income tax purposes from the Reorganization.

22

Eighth, the Board considered that New York Life Investments has agreed to pay all proxy and solicitation costs associated with each Fund’s participation in the Reorganization.

Ninth, the Board also considered that New York Life Investments and Aquila will benefit from each Reorganization. In that regard, the Board considered that New York Life Investments and Aquila have agreed to conduct, and use reasonable best efforts to cause their affiliates to conduct, their respective businesses in compliance with Section 15(f) of the 1940 Act so as not to impose an “unfair burden” on the Acquiring Fund.

BOARD RECOMMENDATION

The Board recommends that you vote “FOR” the proposal(s).

23

PROPOSAL ONE

To approve an Agreement and Plan of Reorganization providing for the transfer of the assets of the Aquila Kentucky Fund to the Acquiring Fund in exchange for the assumption of all of the liabilities of the Aquila Kentucky Fund by the Acquiring Fund and shares of the Acquiring Fund, followed by the complete liquidation of the Aquila Kentucky Fund.

Only shareholders of the Aquila Kentucky Fund will vote on Proposal One.

COMPARISON OF THE AQUILA KENTUCKY FUND AND THE ACQUIRING FUND

Comparison of Investment Objectives and Principal Investment Strategies

The investment objective of the Aquila Kentucky Fund is fundamental and may not be changed without shareholder approval. The Acquiring Fund’s investment objective is non-fundamental and may be changed without shareholder approval.

The following table shows the investment objectives of each Fund:

| | |

| |

| Aquila Kentucky Fund | | Acquiring Fund |

The Fund’s objective is to provide you as high a level of current income exempt from Kentucky state and regular Federal income taxes as is consistent with preservation of capital. | | The Fund seeks current income exempt from regular federal income tax. |

Principal Investment Strategies

Each Fund invests primarily in municipal obligations, however, there are certain important differences in the Funds’ principal investment strategies, including:

| | - | Under normal circumstances, the Aquila Kentucky Fund invests at least 80% of its net assets in municipal obligations that pay interest exempt, in the opinion of bond counsel, from Kentucky income and regular Federal income taxes, the income paid upon which will not be subject to the Federal alternative minimum tax on individuals. The Acquiring Fund, under normal circumstances, invests at least 80% of its net assets plus borrowings for investment purposes in municipal bonds, the income from which is exempt from federal income tax, without regard to whether it is exempt from Kentucky state income tax. |

| | - | The Acquiring Fund invests, under normal circumstances, at least 65% of its net assets in investment grade quality bonds as rated by a nationally recognized statistical rating organization (“NRSRO”) (such as bonds rated BBB- or higher, or Baa3 or higher), or if unrated, judged to be of comparable quality by MacKay, the Acquiring Fund’s Subadvisor. The Acquiring Fund may invest up to 35% of its net assets in municipal bonds rated below investment grade by an NRSRO, commonly referred to as “high yield” or “junk” bonds, including up to 10% of its net assets in municipal bonds that are the subject of bankruptcy proceedings, that are in default as to the payment of principal or interest, or that are rated in the lowest rating category by an NRSRO (such as bonds rated D) (“distressed securities”), or if unrated, judged to be of comparable quality by MacKay. If NRSROs assign different ratings to the same security, the Fund will use the higher rating for purposes of determining the security’s credit quality. Municipal bonds that are rated below investment grade may be more likely to pay interest that is includable in taxable income for purposes of the federal alternative minimum tax than other municipal bonds. The Acquiring Fund’s Portfolio Management Team (the “Team”) dynamically allocates the Fund’s assets across investment grade and high yield municipal bond securities. While the Team focuses primarily on investment grade quality securities, they may opportunistically allocate to high yield bonds based upon changes in relative value within the municipal fixed income markets. The Team believes that high yield |

24

| | is often underutilized in traditional municipal bond portfolios and may offer incremental total return and diversification benefits. |

| | - | In contrast to the Acquiring Fund, the Acquired Fund’s investments in municipal bonds issued by the Commonwealth of Kentucky, its counties and various other local authorities must be of investment grade quality at the time of purchase. |

| | - | The Acquiring Fund expects generally to invest in municipal bonds that have a maturity of 3 to 10 years, although the Acquiring Fund may invest in instruments of any duration or maturity. In contrast, the weighted average maturity of the Acquired Fund has traditionally been between 5 and 15 years. |

| | - | The Acquiring Fund may invest in derivatives, such as futures, options and swap agreements to seek enhanced returns or to reduce the risk of loss by hedging certain of its holdings. In contrast, the Acquired Fund does not invest in derivatives. |

| | - | The Aquilla Kentucky Fund is classified as a “non-diversified” investment company under the 1940 Act, which means it may invest a greater percentage of its assets in a smaller number of issuers than the Acquiring Fund, which is classified as a “diversified fund.” |

| | - | In selecting investments for the Acquiring Fund, the subadvisor to the Acquiring Fund may take into account environmental, social, and governance risks that the subadvisor believes may have a material impact on the performance of a security. |

The principal investment strategies of each Fund are as follows:

| | |

| | |

| Aquila Kentucky Fund | | Acquiring Fund |

Under normal circumstances, at least 80% of the Fund’s net assets will be invested in municipal obligations that pay interest exempt, in the opinion of bond counsel, from Kentucky income and regular Federal income taxes, the income paid upon which will not be subject to the Federal alternative minimum tax on individuals. In general, almost all of these obligations are issued by the Commonwealth of Kentucky, its counties and various other local authorities; these obligations may also include certain other governmental issuers. We call these “Kentucky Obligations.” These securities may include participation or other interests in municipal securities and variable rate demand notes. A significant portion of the Kentucky Obligations in which the Fund invests consist of revenue bonds, which are backed only by revenues from certain facilities or other sources and not by the issuer itself. These obligations can be of any maturity, but the Fund’s weighted average maturity has traditionally been between 5 and 15 years. The Fund is classified as a “non-diversified” investment company under the Investment Company Act of 1940 (the “1940 Act”), which means it may invest a greater percentage of its assets in a smaller number of issuers than a diversified fund. At the time of purchase, the Fund’s Kentucky Obligations must be of investment grade quality. This means that they must either | | The Fund, under normal circumstances, invests at least 80% of its assets (net assets plus borrowings for investment purposes) in municipal bonds, the income from which is exempt from federal income tax. The Fund will seek to maintain a portfolio dollar-weighted average duration of 3 to 10 years, although the Fund may invest in instruments of any duration or maturity. Duration is a measure used to determine the sensitivity of a security’s price to changes in interest rates. The longer a security’s duration, the more sensitive it will be to changes in interest rates. The Fund will invest, under normal circumstances, at least 65% of its net assets in investment grade quality bonds as rated by a nationally recognized statistical rating organization (“NRSRO”) (such as bonds rated BBB- or higher, or Baa3 or higher), or if unrated, judged to be of comparable quality by MacKay Shields LLC, the Fund’s Subadvisor. The Fund may invest up to 35% of its net assets in municipal bonds rated below investment grade by an NRSRO, commonly referred to as “high yield” or “junk” bonds, including up to 10% of its net assets in municipal bonds that are the subject of bankruptcy proceedings, that are in default as to the payment of principal or interest, or that are rated in the lowest rating category by an NRSRO (such as bonds rated D) (“distressed securities”), or if unrated, judged to be of comparable quality by the Subadvisor. If NRSROs assign different ratings to the same security, |

25

| | |

| | |

| Aquila Kentucky Fund | | Acquiring Fund |