- PAM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

CORRESP Filing

Pampa Energía (PAM) CORRESPCorrespondence with SEC

Filed: 25 Jan 19, 12:00am

|

Writer’sDirectDial:(54114344-6000)

E-mail:gcohen@pampaenergia.com

John Hodgin

Petroleum Engineer

JenniferThompson

Division of CorporateFinance

Officeof Consumer Products

U.S. Securitiesand ExchangeCommission

Washington, D.C. 20549

Re: Pampa EnergíaS.A.(“Pampa”)

Form20-FfortheFiscal YearEnded December31,2017

Filed April 30, 2018

FileNo.1-34429

DearMr.Hodgin and Ms. Thompson:

OnbehalfofPampaEnergíaS.A.(“Pampa”orthe“Company”),wearewritingto respondtothecommentssetforthintheletterofthestaff(the“Staff”)oftheSecuritiesandExchangeCommissiondatedDecember13,2018,relatedtotheabove-referencedannual report onForm 20-FfiledbyPampa(the“2017 20-F”).

Forconvenience,wehavereproducedbelowinitalicstheStaff’scommentsand haveprovidedresponsesimmediatelybelowto those comments.

Informationon theCompany

Our Oil and Gas Business

Reserves, page88

1. Totheextentthatthenetquantitiesofprovedreservesdisclosedonpage 89 andelsewhereinyourfiling includematerial amounts of natural gasconsumed inoperations,expandyourdisclosuretoclarifythenetamountsofsuchreserves andexplainhowthesereserveswereaccountedforinthecalculationofthe standardizedmeasureofdiscountedfuturenetcashflowspresentedonpageS-6. Thiscommentalsoappliestothenetquantitiesofprovedreservesdisclosedin Exhibit 13.2. Refer to FASB ASC 932-235-50-10and 50-36, respectively.

|

WerespectfullyadvisetheStaffthat,onpage89ofthe201720-F,weincluded gas tobeconsumedasfuelinouroperationsinourtotalnaturalgasprovedreserves. Conversely,we didnotincludegastobeconsumedasfuelinouroperationsinthecalculationofthestandardizedmeasureofdiscountedfuturenetcashflows presented onpageS-6 ofour2017 20-F.

Inthisrespect,thenetquantitiesofnaturalgasprovedreservestotaled752.7billioncubicfeet,ofwhich:(i)690.6billioncubicfeetwereestimatedtobemarketable, representing92%ofourtotalnaturalgasprovedreserves;and(ii)62.1billioncubic feetwereestimatedtobeconsumedasfuelgasinoperations,representing8%of our total naturalgas proved reserves.

Thisresponsealsoappliestothenetquantitiesofprovedreservesdisclosedin Exhibit13.2tothe201720-F.PleaseseeNoteNo.3toTable1intheamendedand restatedreserves report issuedbyGaffney, Cline&AssociatesInc. onJanuary 4,2019(the“AmendedandRestatedReservesReport”),attachedheretoasAnnexI,whichreferstoestimatedgasusedforconsumption.Also,seeresponseto Question No. 4 belowforfurtherclarification.

InresponsetotheStaff’scomment,wewillincludedisclosureinourfuture20-Fs toclarify ifgastobeconsumedasfuelinoperationsisincludedornotinourtotal naturalgasprovedreservesorinthecalculationofstandardizedmeasure of discounted futurenetcash flows.

ReservesEvolution, page89

2. Expandthediscussionofthechangesthatoccurredduring2017inyour provedundevelopedreservestoincludeanexplanationofthereasonorsourceof thechangerelatingtorevisionsofpreviousestimates,e.g.changescausedbycommoditypricesand/orwellperformance.Totheextentthattwoormore unrelatedfactorarecombinedtoarriveatthelineitemfigure,yourdisclosure shouldseparatelyidentifyandquantifyeachindividualfactorthatcontributedto amaterialchangesothatthechangeinnetreservesbetweenperiodsisfullyexplained. Refer to Item1203(b) of RegulationS-K.

WerespectfullyadvisetheStaffthatthechangesthatoccurredduring2017inour provedundevelopedreservesrelatingtorevisionsofpreviousestimateswereaddressedbyitem(4)onpage92ofthe201720-F.Downwardrevisionswere mainlyattributableto(i)adjustmentstoproductionestimatesbasedon performanceofdrillingactivities,mainlyinRincóndelMangrullo(-1.5MMBoe), ElMangrullo(-0.9MMBoe),Aguaragüe(-0.3MMBoe)andJagüeldelosMachos(-0.3MMBoe);(ii)revisionofimprovedrecoveryinMedanito(-0.1MMBoe);and(iii)thereprogramingofdevelopmentactivitiesinElTordilloarea(-0.9 MMBoe)(exceedingfiveyears from the date of report ofreserves).

|

WetakenoteoftheStaff’scommentandwillincludedisclosureonrevisionsof previousestimates in ourfuture20-Fs.

Exhibits

Exhibit 13.2, page 242

3. Thereservesreportdoesnotappeartoincludeall oftheinformationthat isrequiredbyItem1202(a)(8)ofRegulationS-K.Obtainandfilearevised reservesreport to address thefollowing points:

• Thereservesreportshouldspecifythepercentageoftheregistrant’stotalproved reservesreviewedinconnectionwiththepreparationofthereport.This informationshouldbeincludedinthereportaspartoftherequirementspursuant to Items 1202(a)(8)(iii)and(iv) of RegulationS-K.

• Thereservesreportshouldspecifythevolume-weightedaveragerealized prices after adjustments for location and quality differentials, byproduct typeincluding naturalgasliquids,forthereservesincludedinthereport.Thisinformation shouldbeincludedinthereportaspartoftheprimaryeconomicassumptions pursuant to Item 1202(a)(8)(v) of RegulationS-K.

PleaseseetheAmendedandRestated Reserves Report,attached hereto asAnnexI,whichwasrevisedtospecify(i)thattheindependentauditexaminationcovered 100%ofourtotalprovedreservesbasedonourworkinginterest;and(ii)the volume-weightedaveragerealizedpricesafteradjustmentsforlocationand qualitydifferentials,byproducttypeincludingnatural gas liquids.

InlinewiththeStaff’scomment,thereservesreportstobefiledwithourfuture 20-Fs will includethesespecifications.

4. Thereservesfigurespresentedinthereserves reportfiledasExhibit13.2 donotappeartocorrelatewiththereservefiguresprovidedinthetabular disclosureonpage89ofForm20-FasofDecember31,2017.Inthis regard,we notethestatementonpage88ofForm20-Findicatingthatthethirdparty performedanindependentauditof100%oftheestimatedreservesasofDecember 31,2017.Obtainandfilearevisedreservereporttoresolve theapparent lackofcorrelationwiththedisclosurepresentedinyourfilingortellusthereason(s)for the apparent inconsistencyin such disclosure.

WerespectfullyadvisetheStaffthatpursuanttoASC932-235-50-8,ifanentity issuesconsolidatedfinancialstatements,100percentofthenetreserve quantitiesattributabletotheparent and100percentofthenetreservequantitiesattributable to itsconsolidated subsidiaries(whether ornot whollyowned) shall beincluded.

|

TheCompanyissuesconsolidatedfinancialstatements,therefore,100%ofthenet reservequantitiesattributabletoitsconsolidatedsubsidiaries(whetherornot wholly-owned)wereincludedinthetabulardisclosureonpage89ofthe201720-F,as described in theNote to such tabular disclosure.

Inthisregard,wehadadirectinterestof58.88%inoursubsidiaryPetroleraEntreLomasS.A.(“PELSA”),whichweconsolidated.PELSAhad73.15%interestin thejointoperationagreementsoftheAguaAmarga,BajadadelPaloandEntreLomasareas(“PELSA’sareas”).Additionally,wehada3.85%directinterestin thejointoperationagreementsofthePELSA’sareas.Asaconsequence,our workinginterest (“WI”)in PELSA’sareaswas 46.92%obtainedas aresultof:

(i) 58.88%ofourdirectinterestinPELSAmultipliedbyPELSA’s73.15%WIinthejointoperationagreementsofthePELSA’sareas(58.88x73.15= 43.07%); plus

(ii) 3.85%ofourdirectinterestinthejointoperationagreementsofthe PELSA´sareas.

Asmentionedabove,wedisclosed100%ofthenetreservequantitiesattributable tooursubsidiaryPELSAfollowingASC932-235-50-8,suchthatthetabular disclosureonpage89ofthe201720-Fincludedour3.85%directinterestinthe jointoperationagreementsofthePELSA’sareasandour73.15%indirectinterest through PELSA, totaling77%.

However,asmentionedintheresponsetoQuestionNo.3above,theindependentauditofGaffney,Cline&AssociatesInc.covered100%ofourtotalproved reservesbased onWI, i.e., 46.92% (pleaseseeAppendixIIto Exhibit 13.2of our 2017 20-F).

Toclarify,belowweincludeatablewithgrossreserves,netreservesbasedonWI (includingthe46.92%inPELSA)andnetconsolidatedreserves(includingthe 77%inPELSA)asofDecember31, 2017:

| Gross (100%) | Pampa Net Reserves | Pampa Net Reserves | |||||||||

| Reserves | Field Volumes | Working Interest | Consolidated | ||||||||

| Liquids | Gas | Liquids | Gas | Liquids | Gas | ||||||

| (MMbl) | (Bcf) | (MMbl) | (Bcf) | (MMbl) | (Bcf) | ||||||

| Proved | |||||||||||

| Developed | 56.1 | 975 | 28.0 | 426 | 32.9 | 446.6 | |||||

| Undeveloped | 20.6 | 681 | 7.7 | 299 | 8.7 | 306.1 | |||||

| Total Proved | 76.6 | 1,656 | 35.7 | 724 | 41.6 | 752.7 | |||||

|

We respectfully advise the Staff that Pampa sold PELSA to Vista Oil & Gas S.A.B. de C.V., as disclosed in “—Recent Developments—Sale of Certain Oil and Gas Assets to Vista” in our 2017 20-F.

If you have any questions or require any additional information with respect to the above, please do not hesitate to contact Horacio Turri, our Executive Director of Oil and Gas, at (5411) 4344 6000.

[Signaturepagefollows]

|

Sincerely, |

/s/ Gabriel Cohen |

Gabriel Cohen |

Chief Financial Officer |

cc: Juan G.Giráldez, Esq.

ClearyGottlieb Steen & HamiltonLLP

|

ANNEXI

ThirdPartyReportAmendment,January4,2019 Gaffney,Cline & Associates

| |

PampaEnergíaS.A.Maipú 1-Piso22C1084ABACiudadAutónomadeBuenosAires | January4,2019 |

Ladies andGentlemen:

WeherebyconsenttothereferencestoGaffney,Cline&Associatesandtotheinclusionofour third-partyletterreportissuedonJanuary4,2019,assetforthunderthesections“Item4 InformationontheCompany–OurOilandGasBusiness–Reserves,”“Item19Exhibits,”andasExhibit13.2inPampaEnergíaSociedadAnónima’s(PAMPA)reportonForm20-Ffortheyear endedDecember31,2017,tobefiledwiththeUnitedStatesSecuritiesandExchangeCommission(SEC).

Ourthird-party letterreportdatedJanuary 4,2019 is anamendmentofthereportissuedonApril 19,2018andcontainsourindependentauditoftheprovedcrudeoil,condensate,naturalgasliquids,gasolineandmarketablegasreservesasofDecember31,2017ofallpropertiesinArgentinainwhichPAMPAholds interests.

Yourssincerely, | ||

| ||

SergioParedes PrincipalAdvisor |

SOP/sop/AB-17-2023.00

PampaEnergía S.A.

| |

Mr.HoracioTurri Director Ejecutivo Exploración yProducción PampaEnergíaS.A. Maipú 1-Piso22 C1084ABACiudadAutónomadeBuenosAires República Argentina | January4,2019 |

DearMr.Turri,

ProvedHydrocarbon ReservesStatement

for Pampa EnergíaS.A.for CertainArgentineProperties

as of December31,2017

ThisProved reservesstatementisanamendmentofthereportissuedonApril19,2018 andhas beenpreparedbyGaffney,Cline&Associates(GCA)andissuedonJanuary4,2019atthe requestofPampaEnergíaS.A.(PAMPAor“theClient”),forcertainassetsinArgentina.PAMPA’s participatinginterestineach assetisshown inAppendixII.

GCAhasconductedanindependentauditexaminationofthehydrocarbon liquidandnaturalgas provedreservesof16unitsthatincludes100%ofPAMPA’sassetsasofDecember31,2017. OnthebasisoftechnicalandotherinformationmadeavailabletoGCAconcerningtheseproperty units,GCA herebyprovidesthereservesstatementinthefollowingtable:

Table1

StatementofRemainingHydrocarbonVolumes

PampaEnergíaS.A.CertainPropertiesinArgentina

asofDecember31,2017

| Gross(100%)Contract Volumes | NetReserves | ||||

|

Liquids | Marketable Gas | Sales Gas |

Liquids | Marketable Gas | Sales Gas |

| MMBbl | Bcf | Bcf | MMBbl | Bcf | Bcf |

Proved | 56.1 | 975 | 888 | 28.0 | 426 | 391 |

Developed | ||||||

Undeveloped | 20.6 | 681 | 632 | 7.7 | 299 | 280 |

Total Proved | 76.6 | 1656 | 1520 | 35.7 | 724 | 671 |

Notes:

SOP/sop/AB-17-2023.00

PampaEnergía S.A.

1. PAMPA Net Reserves represent PAMPA’s working interest volumes and therefore include volumes related to royalties payable to the relevant Argentine provinces, which according to domestic treatment in Argentina and reporting in PAMPA’s 20-F filings with the SEC are treated as financial obligations.

2. Hydrocarbon liquid volumes represent crude oil, condensate, gasoline and NGL estimated to be recovered during field separation and plant processing and are reported in millions of stock tank barrels (MMBbl).

3. Marketable gas results from field separation and processing, being reduced by injection, flare and shrinkage. Marketable gas volumes include the volume of gas consumed at the field for production operations and are reported in billion (109) standard cubic foot (Bcf) at standard condition of 15 degrees Celsius and 1 atmosphere. Of the total proved gas reserves of 724 Bcf, 671 Bcf represents sales gas and 53 Bcf is fuel.

4. Totals may not exactly equal the sum of the individual entries because of rounding.

Gasreservessalesvolumesarebasedonfirmandexistinggascontracts,oronthereasonable expectationofacontractoronthereasonableexpectationthatanysuchexistinggassales contractswill be renewedon similartermsinthefuture.

Ourstudywascompleted onFebruary 16,2018.

ReservesAssessment

GCA’sauditofthePAMPAreservesestimateswasbasedondeclinecurveanalysistoextrapolate theproductionofexistingwellsorelaboratetypecurvestoestimatefutureproductionfromthelocationsproposedbyPAMPA.Geologicalinformation,materialbalance,fluidlaboratorytests andotherpertinentinformationwasusedtoassessthereservesestimatesandthe classification/categorizationoftheproposeddevelopmentplan.

ThisauditexaminationwasbasedonreservesestimatesandotherinformationprovidedbyPAMPAtoGCAfromSeptembertoDecember2017andincludedsuchtests,proceduresand adjustmentsaswereconsiderednecessaryunderthecircumstancestopreparethereport.Allquestionsthataroseduring thecourseofthe auditprocesswereresolvedto oursatisfaction.

TheeconomictestsfortheDecember31,2017ProvedReservevolumeswerebasedonexpectedgassalesvolumes(excludinggasconsumption)andrealizedcrudeoil,condensate,NGLand averagegassalesprices,asadvisedbyPAMPA(Table2).PAMPAissubjecttoextensive regulationsrelatingtotheoilandgasindustryinArgentina,whichincludespecificnaturalgas marketregulations.

Table2

LiquidPricesbyProperty

| Oil,C5+, | |||

Marker | Property | MarkerOilPrice | QualityAdjustment | Condensate |

|

| US$/Bbl | US$/Bbl | US$/Bbl |

Medanito | Medanito-25deMayo(RioNegro) | 56.9 | -3.2 | 53.7 |

Medanito | JagueldelosMachos | 56.9 | -3.2 | 53.7 |

Medanito | RincondeAranda | 56.9 | 1.1 | 58.0 |

Medanito | SierraChata | 56.9 | 1.9 | 58.8 |

Medanito | ElMangrullo | 56.9 | 2.0 | 58.9 |

Medanito | RioNeuquen | 56.9 | 2.0 | 58.9 |

Medanito | EntreLomas | 56.9 | -2.4 | 54.5 |

Medanito | BajadadelPalo | 56.9 | -2.4 | 54.5 |

Medanito | AguaAmarga | 56.9 | -2.4 | 54.6 |

Medanito | GobernadorAyala | 56.9 | -8.2 | 48.7 |

Medanito | RincondelMangrullo | 56.9 | 1.8 | 58.7 |

Medanito | EstaciónFernandezOro | 56.9 | 1.8 | 58.7 |

Medanito | AnticlinalCampamento | 56.9 | 1.8 | 58.7 |

Medanito | ElMangrulloPEPASA | 56.9 | 2.0 | 58.9 |

Noroeste | Aguaragüe | 49.9 | 0.0 | 49.9 |

Escalante | ElTordillo-LaTapera-Pto.Quiroga | 49.6 | -0.1 | 49.6 |

TheaveragegassalepricewasUS$4.58/MMBTUforPELSAblocks(refertointeresttableinAppendixII)andUS$4.72/MMBTUforallotherproperties.TheNGLpricewasUS$308.08/Tnfor all properties.

Informationon netprovedreservesasofDecember31,2017wascalculatedinaccordancewith theSECrulesandFinancialAccountingStandardsBoard(“FASB”) AccountingStandardsCodification(“ASC”)932,asamended.Accordingly,oilpricesusedtodeterminevolumesand reserveswerecalculatedeachmonth,forcrude oilsofdifferentqualityproduced byPAMPA.

Consequently,forcalculationofvolumesandreservesasofDecember31,2017,PAMPA consideredtherealizedpricesforcrudeoilinthedomesticmarket(whicharehigherthanthose thathadprevailedintheinternationalmarket),takingintoaccounttheunweightedaverageprice foreachmonthwithinthetwelve-month periodendedDecember31,2017.

Thereareno benchmarkcrude oilpricesinArgentinathatrelatetoPAMPA’soilproductionfromwhichfirst-day-of-monthpricescouldbeobtained.Additionally,sincetherearenobenchmark marketnaturalgaspricesavailableinArgentina,PAMPAusedaveragerealizedgaspricesduring theyeartodetermine itsreserves.GCAauditedandacceptedthemethodologyandpricesused byPAMPAin estimating thereserves inArgentina.

FuturecapitalcostswerederivedfromdevelopmentprogramforecastspreparedbyPAMPAfor thefields.Recenthistoricaloperatingexpensedatawereutilizedasthebasisforoperatingcost projections.GCAhasfoundthatPAMPAhasprojectedsufficientcapitalinvestmentsand operatingexpensestoproduce economicallythe projectedvolumes.

ItisGCA’sopinionthattheestimatesoftotalremainingrecoverablehydrocarbonliquidandgasvolumesatDecember31,2017,are,intheaggregate,reasonableandthereservescategorizationisappropriate and consistentwiththe definitions forreserves setoutin17-CFR Part210Rule 4-10(a)ofRegulationS-Xofthe UnitedStatesSecuritiesandExchange Commission(assetoutinAppendixIII).GCAconcludesthatthemethodologiesemployedbyPAMPAinthederivationof thevolumeestimatesareappropriateandthatthequalityofthedatareliedupon,andthedepth andthoroughnessoftheestimation processareadequate.

ThisreportwaspreparedinaccordancewithguidelinesspecifiedinItem1202(a)(8)ofRegulationS-K and istobe usedforinclusionin certain SECfilingsbyPampaEnergíaS.A.

GCAisnotawareofanypotentialchangesinregulationsapplicabletotheseareasthatcouldaffectthe abilityofPAMPAtoproducetheestimatedreserves.

Basisof Opinion

ThisdocumentreflectsGCA’sinformedprofessionaljudgmentbasedonacceptedstandardsof professionalinvestigationand,asapplicable,thedataandinformationprovidedbyPAMPA,thelimited scopeofengagement,andthetime permittedtoconductthe evaluation.

Inlinewiththoseacceptedstandards,thisdocumentdoesnotinanywayconstituteormakeaguaranteeorpredictionofresults,andnowarrantyisimpliedorexpressedthattheactualoutcomewillconformtotheoutcomes presentedherein. GCAhasnot independentlyverifiedanyinformationprovidedby,oratthedirectionofPAMPA,andhasacceptedtheaccuracyand completenessofthisdata.GCAhasnoreasontobelievethatanymaterialfactshavebeenwithheld,butdoesnotwarrantthatitsinquirieshaverevealedallofthemattersthatamore extensiveexaminationmightotherwise disclose.

Theopinionsexpressedhereinaresubjecttoandfullyqualifiedbythegenerallyaccepted uncertaintiesassociatedwiththeinterpretationofgeoscienceandengineeringdataanddonot reflectthetotalityofcircumstances, scenariosandinformationthat couldpotentiallyaffect decisionsmadebythereport’srecipientsand/oractualresults.Theopinionsandstatements containedinthisreportaremadeingoodfaithandinthebeliefthatsuchopinionsandstatements arerepresentativeofprevailingphysicaland economic circumstances.

|

Therearenumerousuncertaintiesinherentinestimatingreserves,andinprojectingfuture production,developmentexpenditures,operatingexpensesandcashflows.Oilandgasreserves assessmentsmustberecognizedasasubjectiveprocessofestimatingsubsurfaceaccumulationsofoilandgasthatcannotbemeasuredinanexactway.Estimatesofoilandgasreserves preparedbyotherpartiesmaydiffer,perhapsmaterially,fromthosecontainedwithinthisreport.

Theaccuracyofanyreservesestimateisafunctionofthequalityoftheavailabledataandof engineeringandgeologicalinterpretation.Resultsofdrilling,testingandproductionthatpost- datethepreparationofthe estimatesmayjustifyrevisions,someorallofwhichmaybematerial.

Accordingly,reservesestimatesareoftendifferentfromthequantitiesofoilandgasthatareultimatelyrecovered,andthetiming andcost ofthosevolumesthatarerecoveredmayvaryfrom thatassumed.

GCA’sauditinvolvedreviewingpertinentfacts,interpretationsandassumptionsmadebyPAMPAinpreparingestimatesofreserves. GCAperformedproceduresnecessary to enableitto render anopinionontheappropriatenessofthemethodologiesemployed,adequacyandqualityofthe datareliedon,depthandthoroughnessofthereservesandresourcesestimationprocess, classificationandcategorizationofreservesandresourcesappropriatetotherelevantdefinitions used,andreasonablenessoftheestimates.

DefinitionofReserves

Reservesareestimatedremainingquantitiesofoilandgasandrelatedsubstancesanticipatedto beeconomically producible,asofagivendate,by applicationofdevelopmentprojectsto known accumulations.Inaddition,theremustexist,ortheremustbeareasonableexpectationthattherewillexist,thelegalrighttoproduce,orarevenueinterestin,theproduction,installedmeansof deliveringoilandgasorrelatedsubstancestomarket,andallpermitsandfinancingrequiredtoimplementtheproject.

Reservesarefurthercategorizedinaccordancewiththelevelofcertaintyassociatedwiththe estimatesandmaybesub-classifiedbasedonprojectmaturityand/orcharacterizedby developmentandproductionstatus.Thereservesvolumesquotedhereinhavebeenderivedwithinthecontextofaneconomiclimittest(ELT)assessment(pre-taxandexclusiveof accumulateddepreciation amounts).

GCA hasnotundertakena sitevisitand inspection becauseitwas notpartofthescopeofwork.Assuch,GCAisnotinapositiontocommentontheoperationsorfacilitiesinplace,their appropriatenessand condition,orwhethertheyare in compliancewiththeregulations pertaining tosuchoperations.Further,GCAisnotinapositiontocommentonanyaspect ofhealth,safety, orenvironmentofsuchoperations.

ThisreporthasbeenpreparedbasedonGCA’sunderstandingoftheeffectsofpetroleumlegislation andotherregulationsthatcurrentlyapplytotheseproperties.However, GCAisnotin apositiontoattesttopropertytitleorrights,conditionsoftheserights(includingenvironmental andabandonmentobligations),oranynecessarylicensesandconsents(includingplanning permission,financialinterestrelationships,orencumbrancesthereonforanypartoftheappraised properties).

|

Qualifications

Inperformingthisstudy,GCAisnotawarethatanyconflictofinteresthasexisted.Asanindependentconsultancy,GCAisprovidingimpartialtechnical,commercial,andstrategicadvicewithintheenergy sector.GCA’sremunerationwasnotinanyway contingentonthe contentsof thisreport.

Inthepreparationofthisdocument,GCAhasmaintained,andcontinuestomaintain,astrictindependentconsultant-clientrelationshipwithPAMPA.Furthermore,themanagementand employeesofGCAhavenointerestinanyoftheassetsevaluatedorrelatedwiththeanalysis performed,aspartofthisreport.

Staffmemberswhopreparedthisreportholdappropriateprofessionalandeducationalqualificationsandhavethenecessarylevelsofexperienceandexpertisetoperformthework.Thetechnicalqualificationsofthepersonprimarilyresponsibleforthepreparationofthereserves estimatespresented in thisreportaregivenin AppendixI.

|

Notice

ThisreportisintendedforinclusioninitsentiretyinPAMPA’sfilings(20-F,F-3)withtheUnitedStatesSecuritiesandExchangeCommission(SEC)inaccordancewiththedisclosure requirementssetforthintheSECregulations.PampaEnergíaS.A.willobtainGCA'spriorwritten approvalforanyotheruseofanyresults,statementsoropinionsexpressedtoPampaEnergíaS.A.inthisreport,which areattributedtoGCA.

Yourssincerely, Gaffney,Cline &Associates | ||

| ||

| ProjectManager SergioO.Paredes,TechnicalDirector |

| ||

Reviewedby |

AppendixII: PAMPA’s Participating Interestin each Area

AppendixIII: SECReserves Definitions

AppendixIV:Glossary

|

|

S.O. Paredes

|

AppendixII

PAMPA’sParticipatingInterestinEachArea

|

PAMPA’sParticipatingInterestin eachUnit

Concession/Contract | PAMPAWI | Operator |

25deMayo-Medanito | 100.00% | PAMPA |

AguaAmarga* | 46.92% | PELSA |

BajadadelPalo* | 46.92% | PELSA |

ElMangrullo | 100.00% | PAMPA |

RincóndelMangrullo | 50.00% | YPF |

EntreLomas(Neuquén)* | 46.92% | PELSA |

EntreLomas(RioNegro)* | 46.92% | PELSA |

JagüeldelosMachos | 100.00% | PAMPA |

RioNeuquén(Neuquén) | 33.07% | YPF |

RioNeuquén(RioNegro) | 31.42% | YPF |

SierraChata | 45.55% | PAMPA |

AnticlinalCampamento** | 15.00% | YPF |

EstaciónFernandezOro** | 15.00% | YPF |

GobernadorAyala | 22.51% | Pluspetrol |

ElTordillo | 35.67% | Tecpetrol |

Aguaragüe | 15.00% | Tecpetrol |

*TotalnetWIresultsfrom58.88%equityinterestinPetroleraEntreLomas(PELSA),whichhasa 73.15%WIintheconcessions(totalWIof43.07%),plusa3.85%ofdirectWIparticipationintheAguaAmarga,BajadadelPaloandEntreLomasconcessions.

**WIof15%on9wellsinAnticlinalElCampamentofieldand13wellsinEstaciónFernandezOrofield, drilledunderdevelopmentcontracts.

|

SECReservesDefinitions

|

U.S. SECURITIES AND EXCHANGE COMMISSION (SEC)

MODERNIZATION OF OIL AND GAS REPORTING1

Oil and Gas Reserves Definitions and Reporting

(a) Definitions

(1) Acquisitionof properties.Costsincurred to purchase,leaseor otherwiseacquirea property,includingcostsofleasebonusesandoptionstopurchaseorleaseproperties,theportionofcostsapplicabletomineralswhenlandincludingmineralrightsispurchasedinfee,brokers'fees,recordingfees,legalcosts,andothercostsincurredinacquiringproperties.

(2) Analogousreservoir.Analogousreservoirs,asusedinresourcesassessments,havesimilarrockandfluidproperties,reservoirconditions(depth,temperature,andpressure)anddrivemechanisms,butaretypicallyatamoreadvancedstageofdevelopmentthanthereservoirofinterestandthusmayprovideconceptstoassistintheinterpretationofmorelimiteddataandestimationofrecovery.Whenusedtosupportprovedreserves,an“analogousreservoir”referstoareservoirthatsharesthefollowingcharacteristics withthereservoirofinterest:

(i) Samegeologicalformation(butnotnecessarilyinpressurecommunicationwiththe reservoirofinterest);

(ii) Sameenvironmentofdeposition;

(iii) Similargeologicalstructure;and

(iv) Samedrivemechanism.

Instructionto paragraph(a)(2):Reservoirpropertiesmust, in theaggregate,be nomorefavorableintheanalogthaninthereservoirofinterest.

(3) Bitumen.Bitumen,sometimesreferredtoasnaturalbitumen,ispetroleum inasolidorsemi-solidstateinnaturaldepositswitha viscositygreaterthan10,000centipoisemeasuredatoriginaltemperatureinthedepositandatmosphericpressure,onagasfreebasis.Initsnaturalstateitusuallycontainssulfur,metals,andothernon-hydrocarbons.

(4) Condensate.Condensateisamixtureofhydrocarbonsthatexistsinthegaseousphaseat originalreservoirtemperatureandpressure,butthat,whenproduced,isintheliquidphaseatsurfacepressureandtemperature.

(5) Deterministicestimate.Themethodof estimatingreservesorresourcesiscalleddeterministic whenasingle valueforeachparameter(fromthegeoscience,engineering,oreconomicdata) inthereservescalculationisusedinthereservesestimationprocedure.

(6) Developedoilandgasreserves.Developedoilandgasreservesarereservesof anycategory thatcanbeexpectedtoberecovered:

(i) Throughexistingwellswithexistingequipmentandoperatingmethodsorinwhichthecostof therequiredequipmentisrelativelyminorcomparedtothecostofanewwell;and

(ii) Throughinstalledextractionequipmentandinfrastructureoperationalatthetimeofthe reservesestimateiftheextractionisbymeansnotinvolvingawell.

(7) Developmentcosts. Costsincurredtoobtainaccesstoprovedreservesandtoprovidefacilitiesfor extracting,treating,gatheringandstoringtheoilandgas.Morespecifically,developmentcosts,including depreciation and applicable operating costsofsupport equipment andfacilities andothercostsofdevelopmentactivities,arecostsincurredto:

|

1Extractedfrom17CFRParts210,211,229,and249[ReleaseNos.33-8995;34-59192;FR-78;FileNo.S7-15-08]RIN3235-AK00].

(i) Gainaccesstoandpreparewelllocations fordrilling,includingsurveyingwelllocationsfor thepurposeofdeterminingspecificdevelopmentdrillingsites,clearingground,draining,roadbuilding,andrelocatingpublicroads,gaslines,andpowerlines,totheextent necessaryindevelopingtheprovedreserves.

(ii) Drillandequipdevelopmentwells,development-typestratigraphictestwells,andservice wells,includingthecostsofplatformsandofwellequipmentsuchascasing,tubing, pumpingequipment,andthewellheadassembly.

(iii) Acquire,construct,andinstallproductionfacilitiessuchasleaseflowlines,separators,treaters,heaters,manifolds,measuringdevices,andproductionstoragetanks,naturalgascyclingandprocessingplants,andcentralutilityandwastedisposalsystems.

(iv) Provideimprovedrecoverysystems.

(8) Developmentproject.A developmentproject isthemeansbywhichpetroleumresourcesare broughttothestatusofeconomicallyproducible.Asexamples,thedevelopmentofasinglereservoirorfield,anincrementaldevelopmentinaproducingfield,ortheintegrateddevelopmentofagroupofseveralfieldsandassociatedfacilitieswithacommonownershipmayconstituteadevelopmentproject.

(9) Developmentwell.Awelldrilledwithintheprovedareaofanoilorgasreservoirtothedepthof astratigraphichorizonknowntobeproductive.

(10) Economicallyproducible.Thetermeconomicallyproducible,asitrelatestoaresource,meansa resourcewhichgeneratesrevenuethatexceeds,orisreasonablyexpectedtoexceed,thecostsoftheoperation.Thevalueoftheproductsthatgeneraterevenueshallbedeterminedattheterminalpointofoilandgasproducingactivitiesasdefinedinparagraph(a)(16)ofthissection.

(11) Estimated ultimate recovery (EUR).Estimatedultimaterecoveryisthesumofreserves remainingasofagivendateandcumulativeproductionasofthatdate.

(12) Explorationcosts.Costsincurredinidentifyingareasthatmaywarrantexaminationand inexaminingspecificareasthatareconsideredtohaveprospectsofcontainingoilandgasreserves,includingcostsofdrillingexploratorywellsandexploratory-typestratigraphictestwells.Explorationcostsmaybeincurredbothbeforeacquiringtherelatedproperty(sometimesreferredtoinpailasprospectingcosts)andafteracquiringtheproperty.Principaltypesofexplorationcosts,whichincludedepreciationandapplicableoperatingcostsofsupportequipmentandfacilitiesandothercostsofexploration activities,are:

(i) Costsoftopographical,geographicalandgeophysicalstudies,rightsofaccesstopropertiestoconductthosestudies,andsalariesandotherexpensesofgeologists,geophysicalcrews,andothersconductingthosestudies.Collectively,thesearesometimes referredtoasgeologicalandgeophysicalor"G&G"costs.

(ii) Costsofcarryingandretainingundevelopedproperties,suchasdelayrentals,advaloremtaxesonproperties,legalcostsfortitledefense,andthemaintenanceoflandandleaserecords.

(iii) Dryholecontributionsandbottomholecontributions.

(iv) Costsofdrillingandequippingexploratorywells.

|

(v) Costsofdrillingexploratory-typestratigraphictestwells.

(13) Exploratorywell.Anexploratorywellisawelldrilledtofindanewfieldortofindanewreservoirinafieldpreviouslyfoundtobeproductiveofoilorgasinanotherreservoir.Generally,anexploratorywellis anywellthat isnotadevelopmentwell,anextension well,aservicewell,or astratigraphictestwell asthoseitemsaredefinedinthissection.

(14) Extensionwell.Anextensionwellisawelldrilledtoextendthelimitsofaknownreservoir.

(15) Field.Anareaconsistingofasingle reservoirormultiplereservoirsallgroupedonorrelatedtothe sameindividualgeologicalstructuralfeatureand/orstratigraphiccondition.Theremaybetwoormorereservoirsinafieldwhichareseparatedverticallybyinterveningimpervious strata,orlaterallybylocalgeologicbarriers,or byboth.Reservoirsthatareassociated bybeinginoverlappingoradjacentfieldsmaybetreatedasasingleorcommonoperationalfield.Thegeologicalterms"structuralfeature"and"stratigraphiccondition"areintendedtoidentifylocalizedgeologicalfeaturesasopposedtothebroadertermsofbasins,trends, provinces,plays,areas-of-interest,etc.

(16) Oilandgasproducingactivities.

(i) Oilandgasproducingactivitiesinclude:

(A) Thesearchforcrudeoil,includingcondensateandnaturalgasliquids,ornaturalgas(“oilandgas”)intheirnaturalstatesandoriginallocations;

(B) Theacquisitionofpropertyrightsor propertiesfor thepurposeoffurtherexplorationorforthepurposeofremovingtheoilorgasfromsuchproperties;

(C) Theconstruction,drilling,andproductionactivitiesnecessarytoretrieveoilandgasfromtheirnaturalreservoirs,includingtheacquisition,construction, installation, andmaintenanceoffieldgatheringandstoragesystems,suchas:

(1) Liftingtheoilandgastothesurface;and

(2) Gathering,treating,andfieldprocessing(asinthecaseofprocessinggasto extractliquidhydrocarbons);and

(D) Extractionofsaleablehydrocarbons,inthesolid,liquid,orgaseousstate,fromoilsands,shale,coalbeds,orothernonrenewablenatural resourceswhichareintendedtobeupgradedintosyntheticoilorgas,andactivitiesundertakenwithaviewtosuch extraction.

Instruction1toparagraph(a)(16)(i):Theoilandgasproductionfunctionshallberegardedasendingata“terminalpoint”,whichistheoutletvalveontheleaseorfieldstoragetank.Ifunusual physicaloroperationalcircumstancesexist,itmaybeappropriatetoregardtheterminalpointfor theproductionfunctionas:

a. Thefirstpointatwhichoil,gas,orgasliquids,naturalorsynthetic,aredeliveredtoamain pipeline,acommoncarrier,arefinery,oramarineterminal;and

b. Inthecaseofnaturalresourcesthatareintendedtobeupgradedintosyntheticoilorgas,if thosenaturalresourcesaredeliveredtoapurchaserpriortoupgrading,thefirstpointat whichthenaturalresourcesaredeliveredtoamainpipeline,acommoncarrier,arefinery,amarineterminal,orafacilitywhichupgradessuchnaturalresourcesintosyntheticoilorgas.

Instruction2toparagraph(a)(16)(i):Forpurposesofthisparagraph(a)(16),thetermsaleablehydrocarbonsmeanshydrocarbonsthataresaleableinthestateinwhichthehydrocarbonsare delivered.

( i ) Oilandgasproducingactivitiesdonotinclude:

(A) Transporting,refining,ormarketingoilandgas;

|

(B) Processingofproducedoil,gasornaturalresourcesthatcanbeupgradedintosyntheticoilorgasbyaregistrantthatdoesnothavethelegalrighttoproduceora revenueinterestinsuchproduction;

(C) Activitiesrelatingtotheproductionofnaturalresourcesotherthanoil,gas,ornatural resourcesfrom whichsyntheticoilandgascanbeextracted;or

(D) Productionof geothermalsteam.

(17) Possiblereserves.Possiblereservesare thoseadditionalreservesthatarelesscertain tobe recoveredthanprobablereserves.

(i) Whendeterministicmethodsareused,thetotalquantitiesultimatelyrecoveredfroma projecthavealowprobabilityofexceedingprovedplusprobablepluspossiblereserves.Whenprobabilisticmethodsareused,thereshouldbeatleasta10%probabilitythatthe totalquantitiesultimatelyrecoveredwillequalorexceedtheprovedplusprobableplus possiblereservesestimates.

(ii) Possiblereservesmaybeassignedtoareasofareservoiradjacenttoprobablereserveswheredatacontrolandinterpretationsofavailabledataareprogressivelylesscertain. Frequently,thiswillbeinareaswheregeoscienceandengineeringdataareunabletodefineclearlytheareaandverticallimitsofcommercialproductionfromthereservoirbya definedproject.

(iii) Possiblereservesalsoincludeincrementalquantitiesassociatedwithagreaterpercentagerecoveryofthehydrocarbonsinplacethantherecoveryquantitiesassumedforprobable reserves.

(iv) Theprovedplusprobableandprovedplusprobablepluspossiblereservesestimatesmust bebasedonreasonablealternativetechnicalandcommercialinterpretationswithinthereservoirorsubjectprojectthatareclearlydocumented,includingcomparisonstoresultsinsuccessfulsimilarprojects.

(v) Possiblereservesmaybeassignedwheregeoscienceandengineeringdataidentifydirectlyadjacentportionsofareservoirwithinthesameaccumulationthatmaybeseparatedfromprovedareasbyfaultswithdisplacementlessthanformationthicknessorothergeologicaldiscontinuitiesandthathavenotbeenpenetratedbyawellbore,andtheregistrantbelievesthatsuchadjacentportionsareincommunicationwiththeknown (proved)reservoir.Possiblereservesmaybeassigned toareasthatarestructurally higherorlowerthantheprovedareaiftheseareasareincommunicationwiththeproved reservoir.

(vi) Pursuanttoparagraph(a)(22)(iii)ofthissection,wheredirectobservationhasdefinedahighestknownoil(HKO)elevationandthepotentialexistsforanassociatedgascap, provedoilreservesshouldbeassignedinthestructurallyhigherportionsofthereservoirabovetheHKOonlyifthehighercontactcanbeestablishedwithreasonablecertaintythroughreliabletechnology.Portionsofthereservoirthatdonotmeetthisreasonablecertaintycriterionmaybeassignedasprobableandpossibleoilorgasbasedonreservoirfluid propertiesandpressuregradientinterpretations.

(18) Probablereserves.Probablereservesare thoseadditionalreservesthatarelesscertain tobe recoveredthanprovedreservesbutwhich,togetherwithprovedreserves,areaslikelyasnottoberecovered.

(i) Whendeterministicmethodsareused,itisaslikelyasnotthatactualremainingquantitiesrecoveredwillexceedthesumofestimatedprovedplusprobablereserves.Whenprobabilisticmethodsareused,thereshouldbeatleasta50%probabilitythattheactual quantitiesrecoveredwillequalorexceedtheprovedplusprobablereservesestimates.

|

(ii) Probablereservesmaybeassignedtoareasofareservoiradjacenttoprovedreserveswheredatacontrolorinterpretationsofavailabledataarelesscertain,eveniftheinterpretedreservoircontinuityofstructureorproductivitydoesnotmeetthereasonablecertaintycriterion.Probablereservesmaybeassignedtoareasthatarestructurallyhigher thantheprovedareaiftheseareasareincommunicationwiththeprovedreservoir.

(iii) Probablereservesestimatesalsoincludepotentialincrementalquantitiesassociatedwithagreaterpercentagerecoveryofthehydrocarbonsinplacethanassumedforproved reserves.

(iv) Seealsoguidelinesinparagraphs(a)(17)(iv)and(a)(17)(vi)ofthissection.

(19) Probabilisticestimate.Themethodofestimationofreservesorresources iscalledprobabilisticwhenthefullrangeofvaluesthatcouldreasonablyoccurforeachunknownparameter(fromthegeoscienceandengineeringdata)isusedtogenerateafullrangeofpossibleoutcomesandtheir associatedprobabilitiesofoccurrence.

(20) Productioncosts.

(i) Costsincurredtooperateandmaintainwellsandrelatedequipmentandfacilities,includingdepreciationandapplicableoperatingcostsofsupportequipmentandfacilitiesandothercostsofoperatingandmaintainingthosewellsandrelatedequipmentandfacilities,they becomepartofthecostofoilandgasproduced.Examplesofproductioncosts(sometimescalledliftingcosts)are:

(A) Costsoflabor tooperatethewellsandrelatedequipmentandfacilities.

(B) Repairs and maintenance.

(C) Materials,supplies,aridfuelconsumedandsuppliesutilizedinoperatingthewells andrelatedequipmentandfacilities.

(D) Propertytaxesandinsuranceapplicabletoprovedpropertiesandwellsandrelated equipmentandfacilities.

(E) Severancetaxes.

(i) Some supportequipmentor facilities mayservetwoor moreoilandgasproducing activitiesandmayalsoservetransportation,refining,andmarketingactivities.Totheextentthatthesupportequipmentandfacilitiesareusedinoilandgasproducingactivities,theirdepreciationandapplicableoperatingcostsbecomeexploration,developmentor productioncosts,asappropriate.Depreciation,depletion,andamortizationofcapitalized acquisition,exploration,anddevelopmentcostsarenotproductioncostsbutalsobecomepartofthecostofoilandgasproducedalongwithproduction(lifting)costsidentified above.

(21) Provedarea.Thepartofapropertytowhichprovedreserveshavebeenspecifically attributed.

(22) Provedoilandgas reserves.Provedoiland gasreservesarethose quantitiesofoilandgas,which,byanalysisofgeoscienceandengineeringdata,canbeestimatedwithreasonablecertaintytobeeconomicallyproducible—fromagivendateforward,fromknownreservoirs,andunderexistingeconomicconditions,operatingmethods,andgovernmentregulations—priortothetimeatwhichcontractsprovidingtherighttooperateexpire,unlessevidenceindicatesthatrenewalisreasonablycertain, regardlessofwhetherdeterministicorprobabilisticmethodsareusedfortheestimation.Theprojecttoextractthehydrocarbonsmusthavecommencedortheoperatormustbereasonablycertainthatitwillcommencetheprojectwithinareasonabletime.

|

(i) Theareaofthereservoirconsideredasprovedincludes:

(A) Thearea identifiedbydrillingandlimitedbyfluidcontacts,ifany,and

(B) Adjacentundrilledportionsofthereservoirthatcan,withreasonablecertainty,bejudgedtobecontinuouswithitandtocontaineconomicallyproducibleoilorgason thebasisofavailablegeoscienceandengineeringdata.

(ii) Intheabsenceofdataonfluidcontacts,provedquantitiesinareservoir arelimitedbythelowestknownhydrocarbons(LKH)asseeninawellpenetrationunlessgeoscience,engineering,orperformancedataandreliabletechnologyestablishesalowercontactwithreasonablecertainty.

(iii) Wheredirectobservationfromwellpenetrationshasdefinedahighestknownoil(HKO) elevationandthepotentialexistsforanassociatedgascap,provedoilreservesmaybe assigned inthe structurallyhigherportionsofthereservoironlyifgeoscience,engineering,or performancedataandreliabletechnologyestablishthehighercontactwithreasonablecertainty.

(iv) Reserveswhichcanbeproducedeconomicallythroughapplicationofimprovedrecoverytechniques(including,butnotlimitedto,fluidinjection)areincludedintheprovedclassificationwhen:

(A) Successfultestingbyapilotprojectinanareaofthereservoirwithpropertiesnomorefavorablethaninthereservoirasawhole,theoperationofaninstalledprograminthereservoirorananalogousreservoir,orotherevidenceusingreliabletechnology establishesthereasonablecertaintyoftheengineeringanalysisonwhichtheproject orprogram wasbased;and

(B) Theprojecthas beenapprovedfordevelopmentbyallnecessaryparties andentities,includinggovernmentalentities.

(v) Existingeconomicconditionsincludepricesandcostsatwhicheconomicproducibilityfrom areservoiristobedetermined.Thepriceshallbetheaveragepriceduringthe12-monthperiodpriortotheendingdateoftheperiodcoveredbythereport,determinedasanunweightedarithmeticaverageofthefirst-day-of-the-monthpriceforeachmonthwithinsuchperiod,unlesspricesaredefinedbycontractualarrangements,excludingescalations baseduponfutureconditions.

(23) Provedproperties.Propertieswithprovedreserves.

(24) Reasonablecertainty.Ifdeterministicmethodsareused,reasonablecertaintymeansahighdegreeofconfidencethatthequantitieswillberecovered.Ifprobabilisticmethodsareused,thereshouldbeatleast a90%probabilitythatthequantitiesactuallyrecoveredwillequalorexceedtheestimate.Ahighdegreeofconfidence existsifthequantityismuchmore likelyto be achievedthan not,and,aschangesdue toincreasedavailabilityofgeoscience(geological,geophysical,andgeochemical),engineering,and economicdataaremadetoestimatedultimaterecovery(EUR)withtime,reasonablycertainEURismuchmorelikelytoincreaseorremainconstantthantodecrease.

(25) Reliabletechnology.Reliabletechnologyisagroupingofoneormoretechnologies(includingcomputationalmethods)thathasbeenfieldtestedandhasbeendemonstratedtoprovidereasonablycertainresultswithconsistencyandrepeatabilityintheformationbeingevaluatedorinananalogousformation.

(26) Reserves.Reservesareestimatedremainingquantitiesofoilandgasandrelatedsubstancesanticipatedto beeconomicallyproducible, asofagiven date,byapplication of developmentprojectstoknown accumulations.Inaddition,theremustexist,ortheremustbeareasonableexpectationthattherewillexist,thelegalrighttoproduceorarevenueinterestintheproduction,installedmeansofdeliveringoilandgasorrelatedsubstancestomarket,andallpermitsandfinancingrequiredtoimplementtheproject.

|

Notetoparagraph(a)(26):Reservesshouldnotbeassignedtoadjacentreservoirsisolatedbymajor,potentiallysealing,faultsuntilthosereservoirsarepenetratedandevaluatedaseconomicallyproducible.Reservesshouldnotbeassignedtoareasthatareclearlyseparatedfromaknownaccumulationbyanon-productivereservoir(i.e.,absenceofreservoir,structurallylowreservoir,ornegativetestresults).Suchareasmaycontainprospectiveresources(i.e., potentiallyrecoverableresourcesfromundiscoveredaccumulations).

(27) Reservoir.Aporousandpermeableundergroundformationcontaininganaturalaccumulationof producibleoiland/orgasthatisconfinedbyimpermeablerockorwaterbarriersandisindividualandseparatefromotherreservoirs.

(28) Resources.Resourcesarequantitiesofoilandgas estimatedtoexistinnaturallyoccurringaccumulations. Aportionoftheresourcesmaybe estimatedtoberecoverable,and another portionmaybeconsideredtobeunrecoverable.Resourcesincludebothdiscoveredandundiscovered accumulations.

(29) Servicewell.Awelldrilledorcompletedforthepurposeofsupportingproductioninanexistingfield.Specificpurposesofservicewellsincludegasinjection,waterinjection,steaminjection,airinjection,salt-waterdisposal,watersupplyforinjection,observation,orinjectionforin-situcombustion.

(30) Stratigraphictestwell.Astratigraphictestwellis adrillingeffort,geologicallydirected,toobtaininformationpertainingtoaspecificgeologiccondition.Suchwellscustomarilyaredrilledwithouttheintent

ofbeingcompletedforhydrocarbonproduction.Theclassificationalsoincludestestsidentifiedascoretestsandalltypesofexpendableholesrelatedtohydrocarbonexploration.Stratigraphictestsareclassifiedas“exploratorytype”ifnotdrilledinaknownareaor“developmenttype”ifdrilledinaknown area.

(31) Undevelopedoilandgasreserves.Undevelopedoilandgasreservesarereservesofanycategorythatareexpectedtoberecoveredfromnewwells onundrilledacreage,orfromexistingwellswherearelativelymajorexpenditureisrequiredforrecompletion.

(i) Reservesonundrilledacreageshallbelimitedtothosedirectlyoffsettingdevelopmentspacingareasthatarereasonablycertainofproductionwhendrilled,unlessevidenceusingreliabletechnologyexiststhatestablishesreasonablecertaintyofeconomicproducibilityat greaterdistances.

(ii) Undrilledlocationscanbeclassifiedashavingundevelopedreservesonlyifadevelopment planhasbeenadoptedindicatingthattheyarescheduledtobedrilledwithinfiveyears, unlessthespecificcircumstances,justifyalongertime.

(iii) Undernocircumstancesshallestimatesforundevelopedreservesbeattributabletoanyacreageforwhichanapplicationoffluidinjectionorotherimprovedrecoverytechniqueiscontemplated,unlesssuchtechniqueshavebeenprovedeffectivebyactualprojectsinthesamereservoirorananalogousreservoir,asdefinedinparagraph(a)(2)ofthissection,orbyotherevidenceusingreliabletechnologyestablishingreasonablecertainty.

(32) Unprovedproperties.Propertieswithnoprovedreserves.

|

|

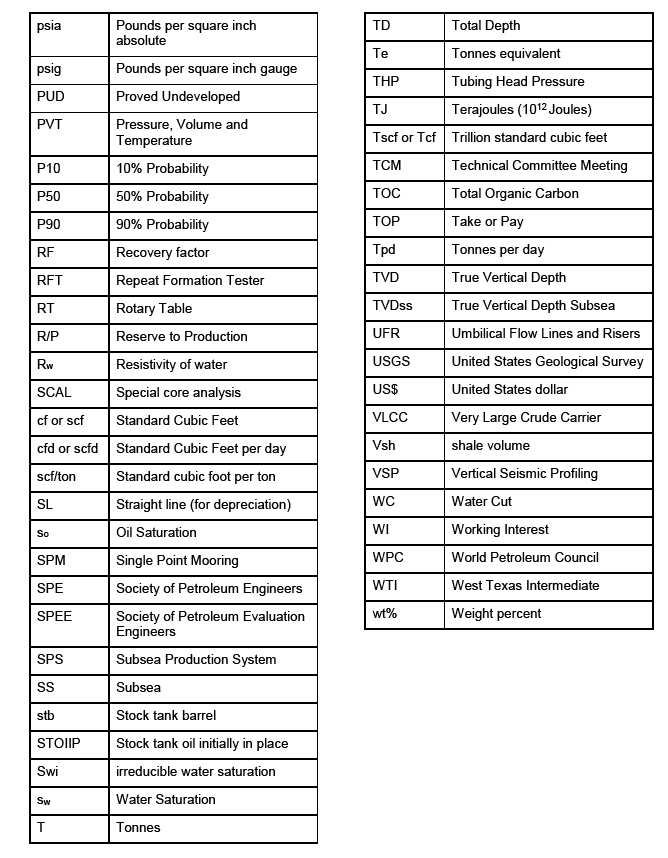

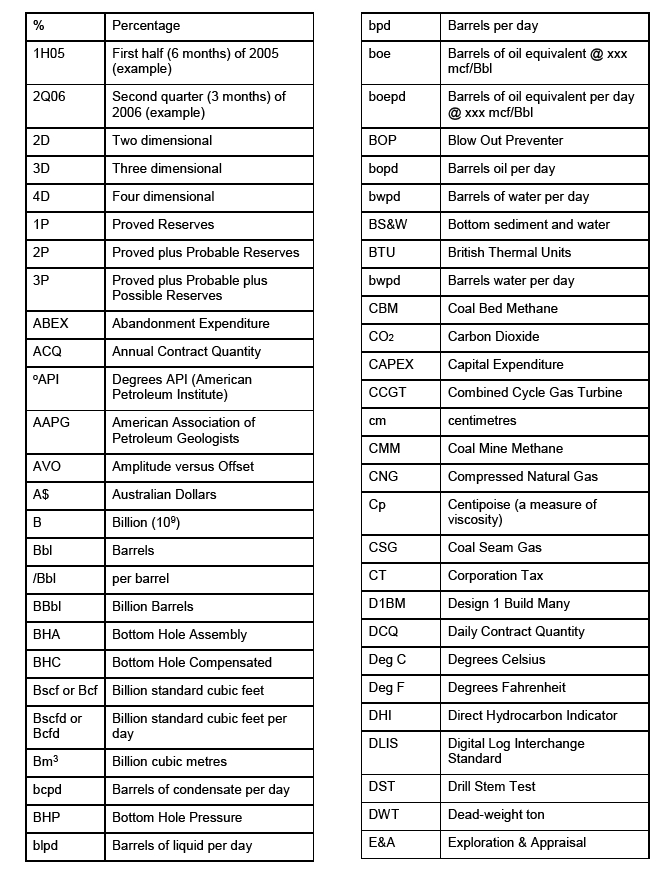

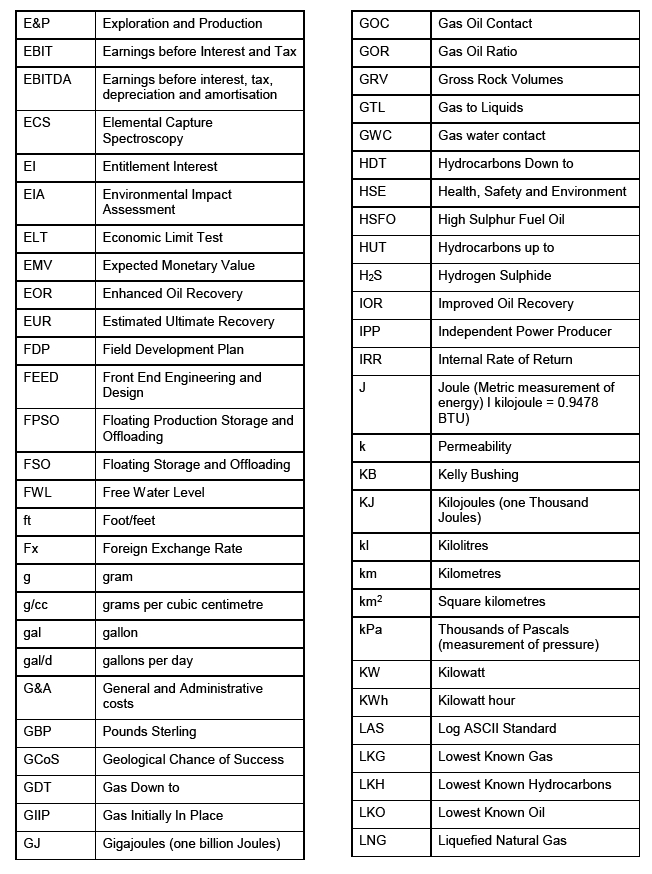

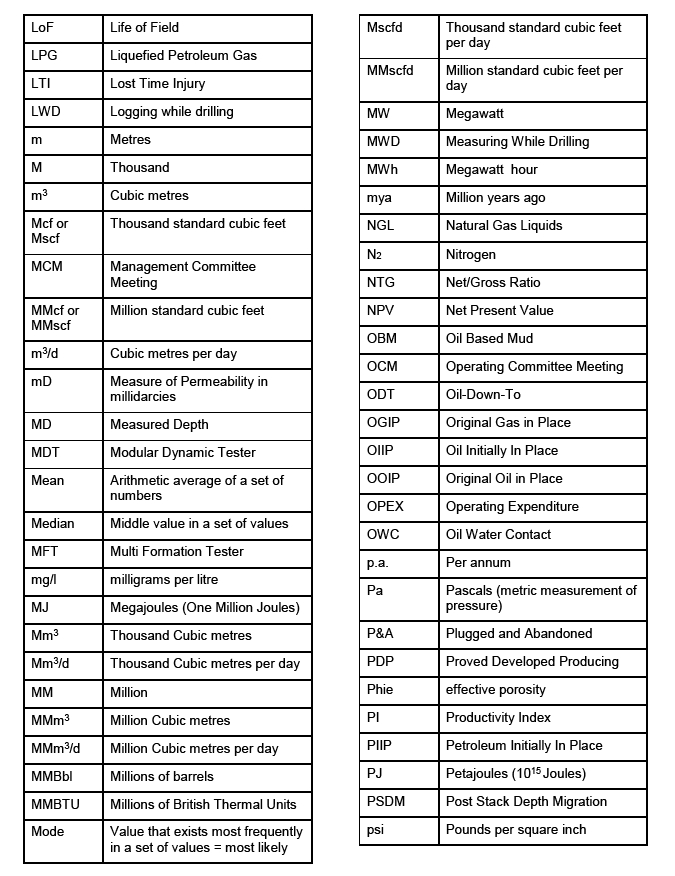

Glossary–StandardOilIndustryTermsandAbbreviations

|

Glossary–StandardOilIndustryTermsandAbbreviations

|

Glossary–StandardOilIndustryTermsandAbbreviations

|

Glossary–StandardOilIndustryTermsandAbbreviations