- PAM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Pampa Energía (PAM) 6-KCurrent report (foreign)

Filed: 5 Apr 21, 4:46pm

|  |

Contents

Pampa Energía ● 2020 Annual Report ●3 |

|  |

2020 Annual Report

To the shareholders of Pampa Energía S.A. (‘Pampa,’ the ‘Company’ or the ‘Group’):

Pursuant to the statutory rules and Bylaws currently in force, we submit to your consideration the Annual Report and Financial Statements for the 77th fiscal year ended December 31, 2020.

Pampa Energía ● 2020 Annual Report ●4 |

|  |

| Term | Definition |

| +GC Panel | ByMA’s Corporate Governance Plus Panel |

| ABOL | Argentine Business Organizations Law No. 19,550 |

| ADR/ADS | American Depositary Receipts |

| AFIP | Administración Federal de Ingresos Públicos (Federal Administration of Public Revenue) |

| AR$ | Argentine Pesos |

| ASPO | Aislamiento social, preventivo y obligatorio (Preventive and mandatory social isolation) |

| Bbl | Barrel |

| BCRA | Banco Central de la República Argentina (Central Bank of the Republic of Argentina) |

| BNA | Banco de la Nación Argentina (Argentine National Bank) |

| BO | Boletín Oficial (Public Gazette) |

| Board of Directors / The Board | Pampa Energía’s Board of Directors |

| Boe | Barrels of oil equivalent |

| BTU | British Thermal Unit |

| Buyback Programs | Share buyback programs approved on April 27, 2018, June 22, 2018, March 27, 2019, August 12, 2019, November 8, 2019, March 9, 2020, April 13, 2020, October 30, 2020, and March 1, 2021 |

| Bylaws | Pampa Energía’s Bylaws |

| ByMA | Bolsas y Mercados Argentinos (Buenos Aires Stock Exchange) |

| CAMMESA | Compañía Administradora del Mercado Mayorista Eléctrico S.A. (Argentine Wholesale Electricity Market Clearing Company) |

| CAU | Cargo de Acceso y Uso (Access and Use Position) |

| CB | Corporate Bonds |

| CC | Combined Cycle |

| CEE | Comité Ejecutivo de Emergencia (Emergency Executive Committee) |

| CEO | Chief Executive Officer |

| CFO | Chief Financial Officer |

| CH | Hydroelectric power plant |

| CIESA | Compañía de Inversiones de Energía S.A. |

| CITELEC | Compañía Inversora en Transmisión Eléctrica Citelec S.A. |

| CMA | Capital Markets Act No. 26,831 |

| CNG | Compressed Natural Gas |

| CNV | Comisión Nacional de Valores (National Securities and Exchange Commission) |

| Code | Pampa’s Code of Corporate Governance |

| COVID-19 | Coronavirus disease |

| CPB | Central Piedra Buena S.A. |

Pampa Energía ● 2020 Annual Report ●5 |

|  |

| CPD | Costo Propio de Distribución (Own Distribution Cost) |

| CPI | Consumer Price Index |

| CT | Thermal Power Plant |

| CTBSA | CT Barragán S.A. |

| CTEB | Central Térmica Ensenada Barragán |

| CTG | Central Térmica Güemes |

| CTGEBA | Central Térmica Genelba |

| CTIW | Central Térmica Ingeniero White |

| CTLL | Central Térmica Loma de la Lata |

| CTP | Central Térmica Piquirenda |

| CTPP | Central Térmica Parque Pilar |

| CVP | Costo Variable de Producción (Variable Production Cost) |

| Dam3 | Cubic decameters |

| DDJJ | Affidavit |

| DIGO | Guaranteed Availability Commitments |

| DISPO | Distanciamiento social, preventivo y obligatorio (Preventive and mandatory social distancing) |

| DisTro | High-Voltage Electric Power Transmission System and/or Main Distribution Electric Power Transmission System |

| DNU | Decreto de Necesidad y Urgencia (Necessity and Urgency Decree) |

| DoP | Deliver or Pay |

| E&P | Exploration and Production |

| EBITDA | Earnings before interest, tax, depreciation and amortization |

| EcoEnergía | EcoEnergía Co-Generation Power Plant |

| Edenor | Empresa Distribuidora y Comercializadora Norte S.A. |

| ENARGAS | Ente Nacional Regulador del Gas (National Gas Regulatory Entity) |

| ENARSA / IEASA | Integración Energética Argentina S.A. (former Energía Argentina S.A.) |

| Energía Plus | Energía Plus Program, SE Res. No. 1,281/06 |

| ENRE | Ente Nacional Regulador de la Electricidad (National Electricity Regulatory Entity) |

| ESG | Environmental, Social and Governance |

| FO | Fuel Oil |

| FOB | Free on Board |

| FOCEDE | Fondo de Obras de Consolidación y Expansión de Distribución Eléctrica (Fund for Electricity Distribution Expansion and Consolidation Works) |

| Foundation | Fundación Pampa Energía |

| FS | Financial statements |

| FV | Face Value |

| FX | Nominal Exchange Rate(s) |

| GB | Great Britain |

Pampa Energía ● 2020 Annual Report ●6 |

|  |

| GDP | Gross Domestic Product |

| GE | General Electric |

| GHG | Greenhouse gases |

| GO | Gas Oil (Diesel Oil) |

| Government / National Administration / Federal Government | Federal Government of the Republic of Argentina |

| GS | Gas stations |

| GT | Gas turbine |

| GU | Large Users |

| GU300 | Large Users with demands over 300 kW |

| GUDI | Large Distribution Company Users |

| GWh | Gigawatt-hour |

| GyP | Gas y Petróleo de Neuquén S.A.P.E.M. |

| HI | Hydroelectric Plants |

| HIDISA | Hidroeléctrica Diamante S.A. |

| HINISA | Hidroeléctrica Los Nihuiles S.A. |

| HMRT | Hours of Maximum Thermal Demand |

| HPPL | Hidroeléctrica Pichi Picún Leufú |

| Hydrocarbon Investments Committee | National Plan for Hydrocarbon Investments’ Strategic Planning and Coordination Committee |

| ICBC | Industrial and Commercial Bank of China Dubai Branch |

| IFRS | International Financial Reporting Standards |

| IGJ | Inspección General de Justicia (Public Registry of Organizations) |

| INDEC | Instituto Nacional de Estadística y Censos de Argentina (National Institute of Statistics and Censuses) |

| IPIM | Índice de Precios Internos al por Mayor (Wholesale Domestic Price Index) |

| Kb/kbbl/kboe | Thousand barrels/thousand barrels of oil equivalent |

| kCal | Kilocalories |

| Km | Kilometer |

| kton | Thousand tons |

| kW | Kilowatt |

| kWh | Kilowatt-hour |

| LNG | Liquefied Natural Gas |

| LPG | Liquefied Petroleum Gas |

| M&A | Mergers and acquisitions |

| M3 | Cubic meters |

| MAT | Term Market |

| MAT ER | Term Market from Renewable Energy Sources |

| MBTU | Million BTU |

Pampa Energía ● 2020 Annual Report ●7 |

|  |

| MDP | Ministry of Productive Development (former SGE) |

| MEGSA | Mercado Electrónico de Gas S.A. |

| Merval | Mercado de Valores de Buenos Aires (Buenos Aires Securities Market) |

| MEyM | Former Ministry of Energy and Mining |

| MinEn | Former Ministry of Energy (former MEyM) |

| MLC | Mercado Libre de Cambios (Free Foreign Exchange Market) |

| MMC | Cost Monitoring Mechanism |

| MW | Mega watt |

| MWh | Mega watt-hour |

| N.a. | Not applicable |

| N/A | Not available |

| NGL | Natural Gas Liquids |

| NYSE | New York Stock Exchange |

| OCP | Oleoducto de Crudos Pesados |

| OldelVal | Oleoductos del Valle S.A. |

| PACOGEN | Pampa Cogeneración S.A. |

| Pampa / the Company / the Group / the Issuer | Pampa Energía S.A. and its subsidiaries |

| PE | Wind Farm |

| PEMC | Parque Eólico Ingeniero Mario Cebreiro |

| PEN | Poder Ejecutivo Nacional (National Executive Branch) |

| PEPE | Parque Eólico Pampa Energía |

| PHA | PHA SAU. |

| PIST | Transportation System Entry Point, or natural gas price at the wellhead |

| Plan Gas.Ar | Argentine Natural Gas Production Promotion Plan – 2020 – 2024 Supply and Demand Scheme (DNU No. 892/20 and supplementary provisions) |

| Polisur | PBB Polisur S.A. |

| PPA | Power Purchase Agreement |

| Priority Demand | Set of residential users, hospitals, schools, healthcare centers and other essential services (as from the launching of Plan Gas.Ar, it does not include CNG) |

| PUREE | Program for the Rational Use of Electric Power |

| PyME | Small and Medium-sized Enterprises |

| QHSE | Quality, Health, Safety and Environment |

| R&D | Refining and Distribution segment |

| RCD | Campo Durán Refinery |

| RECPAM | Results from Net Monetary Position |

| Refinor | Refinería del Norte S.A. |

| RENPER | Registry of Renewable Electric Power Generation Projects |

| Res. | Resolution(s) |

Pampa Energía ● 2020 Annual Report ●8 |

|  |

| RTI | Integral Tariff Review |

| S&P | Standard & Poor’s Global Ratings |

| SADI | Sistema Argentino de Interconexión (Argentine Electricity Grid) |

| SDG | Sustainable Development Goals |

| SE | Former Secretariat of Energy |

| SEC | Security and Exchange Commission |

| Sect. | Section(s) |

| SEE | Subsecretariat of Electric Energy (former Secretariat of Electric Energy) |

| SGE | Former Government Secretariat of Energy (former MinEn) |

| SHC | Subsecretariat of Hydrocarbons and Fuels |

| SME | Subsecretariat of Electricity Market |

| Solidarity Law | Social Solidarity and Productive Reactivation Law No. 27,541 within the framework of Public Emergency |

| SOX | Sarbanes-Oxley Act |

| SRH | Subsecretariat of Hydrocarbon Resources (former Secretariat of Hydrocarbon Resources) |

| SRRYME | Secretariat of Renewable Resources and Electricity Market |

| ST | Steam turbine |

| Telcosur | Telcosur S.A. |

| TGS | Transportadora de Gas del Sur S.A. |

| TJSM | Termoeléctrica José de San Martín |

| TMB | Termoeléctrica Manuel Belgrano |

| Ton | Metric ton |

| ToP | Take or pay |

| Transba | Empresa de Transporte de Energía Eléctrica por Distribución Troncal de la Provincia de Buenos Aires Transba S.A. |

| Transelec | Transelec Argentina S.A. |

| Transener | Compañía de Transporte de Energía Eléctrica en Alta Tensión Transener S.A. |

| TWh | Terawatt-hora |

| Unconventional Plan Gas | Encouragement Program for the Investment in Development of Natural Gas Production from Unconventional Reservoirs Program, MEyM Res. No. 46, 419, 447 /17 and 12/18 |

| UNIREN | Public Utility Contract Renegotiation and Analysis Unit |

| US$ | USS Dollars |

| VAD | Distribution Added Value |

| VAT | Value-added tax |

| VRD | Debt Securities |

| WEM | Wholesale Electricity Market |

| YPF | YPF SA. |

Pampa Energía ● 2020 Annual Report ●9 |

|  |

| 1. | 2020 results and future outlook |

The year 2020 has been unprecedented in history, as it was marked by the global impact of COVID-19. Pampa Energía proudly celebrated the 15th anniversary of its accomplishments in this unusual context, with the same enthusiasm for investing and growth.

We succeeded in building a leading company in the Argentine power industry during this period of changing environments, focusing on electricity generation and gas upstream. We have become a regional benchmark, standing out for our operating excellence and financial resilience. Despite the pandemic, in 2020 we’ve managed to ensure our operations’ continuity at an optimal level in line with our commitment to the country and our values, thanks to the enormous effort and support of all our employees, suppliers, financial relationships, investors and customers.

The atypical impact of COVID-19 in the communities where we operate has generated a reaction of the same magnitude in our Corporate Social Responsibility activities, breaking all previous records. Besides, our volunteering programs demonstrate the human quality of our employees.

From the companies controlled and co-controlled by Pampa, we have invested a total of US$528 million1. This plan highlights the timely and proper conclusion of important projects despite the pandemic’s unthinkable impact. Out of the total investment, US$347 million were disbursed for the maintenance of our assets, specifically, the provision of quality service by our regulated subsidiaries, and approximately US$181 million were allocated to expansions and non-recurring investments, mainly distributed between the closings to combined cycle at Genelba and Ensenada Barragán, and midstream projects in TGS.

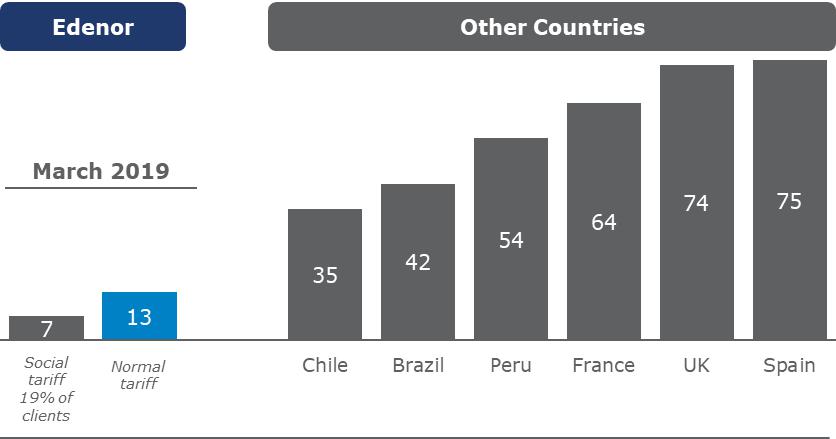

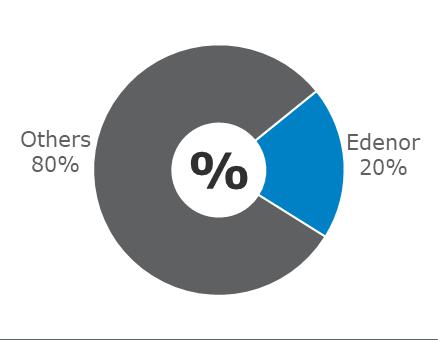

Moreover, we have continued with our plan to strategically reorganize our asset portfolio given a complex and uncertain prospect. After 15 years of controlling the country’s largest electricity distributor, we announced the sale of our controlling stake in Edenor, Pampa’s most relevant strategic divestment decision made over the last few years. Convinced that our Company’s synergy is increasingly limited, we made this divestment decision to continue focusing on developing our core businesses: power generation and natural gas production.

We are very proud of the work carried out as Edenor’s controlling company. In these 15 years, the company has achieved outstanding customer satisfaction levels despite the challenging context under which we had to manage it. We have always prioritized expediting as much as possible service quality recovery, for which we had to relegate the interests of our shareholders. Edenor is a company that reinvests 100% of its financial capacity in its business without distributing dividends since the year 2001. With this decision, a significant chapter in the history of Pampa is closed, one that, although not economically profitable and implying an accounting impairment of US$382 million, has left us profound knowledge of the sector as a whole, and that we will certainly be able to capitalize on in the future. Our deep gratitude to all the excellent professionals who have accompanied us during this stage.

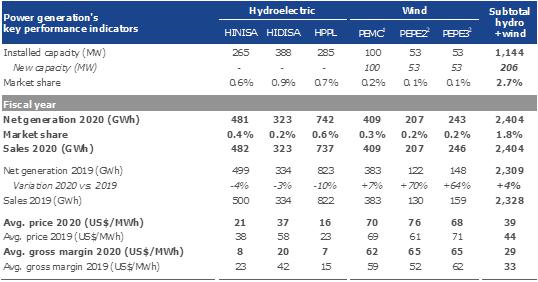

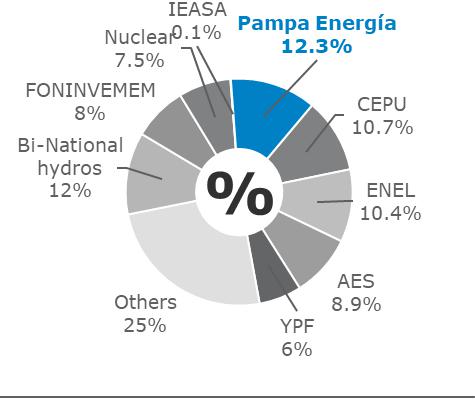

Moving on to Pampa’s core businesses, for the third consecutive year, we have positioned ourselves as the largest independent power producer in Argentina, representing 12% of the country’s total generation. Despite the challenging scenario, on July 2, 2020 we set another milestone by commissioning the second combined cycle at Genelba, investing approximately US$320 million, 9% less than the budgeted amount. We timely and properly finishing the most ambitious expansion project in the history of Pampa, adding 400 MW of efficient energy to the grid, with an exceptional availability level since the beginning of operations. Thanks to the investments made over the last few years, even though the new capacity represents 41% of our 4,955 MW, its contribution to the EBITDA reaches 78% of the segment.

We continued with the development of expansion projects, and we expect that within the next year, we will contribute an additional 295 MW, of which 280 MW will come from the closing to combined cycle at Ensenada Barragán, an affiliate co-controlled and operated by Pampa, with an existing capacity of 567 MW. This expansion project is vital to meet the industrial area’s growing consumption needs neighboring Greater La Plata. The project will require a US$200 million investment and currently provides direct employment to an average of 800 people. The leap in efficiency this work implies, that is, increased generation without additional fuel, contributes to environmental improvement by reducing the carbon footprint. Our goal in the power generation sector has always been growing on a sustainable basis, seeking maximum efficiency through renewable energy and highly productive thermal units.

1 The amount includes Edenor and 100% of the investments in affiliates CTEB, PEMC, TGS, Transener, OldelVal and Refinor, which under IFRS are not consolidated in Pampa’s FS and are denominated in nominal AR$ converted at the year’s average FX.

Pampa Energía ● 2020 Annual Report ●10 |

|  |

We want to stress the high availability level of our power plants again, reaching 97%, well above the average of the national power grid and even above the global standards for each of the technologies we operate. However, the remuneration update for legacy capacity is imperative to continue with the proper maintenance of these plants, which are being remunerated at minimum historical values.

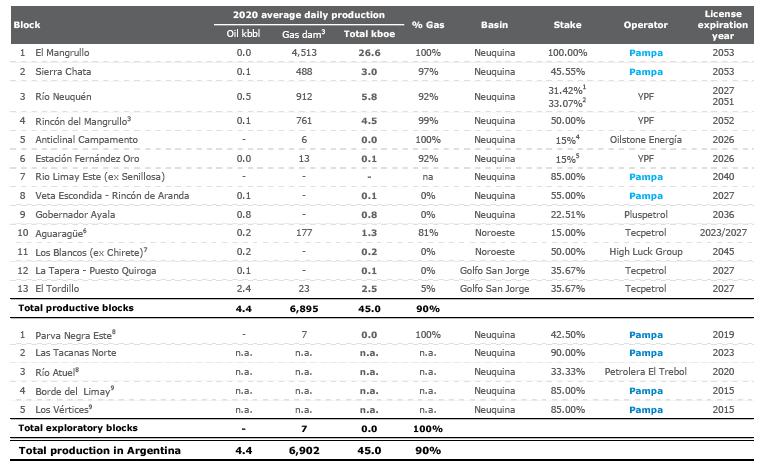

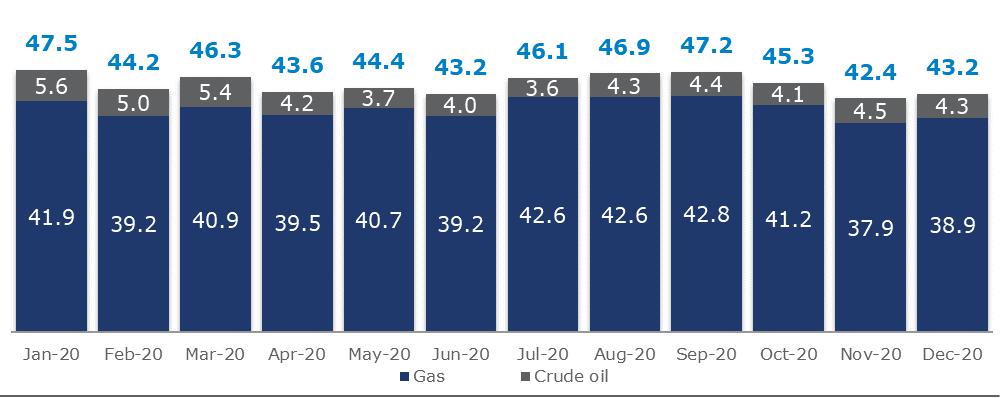

2020 was another challenging year in the E&P business, which was marked again by a steep drop in prices. This situation, which we had already warned about last year, generated a standstill in investment in the industry that started to become evident halfway through 2019, and resulted in an 11% year-on-year drop in domestic gas production. Despite all these vicissitudes, at Pampa, we have kept production essentially stable, positioning ourselves as the country’s sixth largest gas producer. We produced sustainably and pursued new paths for monetizing our products: for the first time, we exported Medanito crude oil, and in the off-peak period, we delivered gas to Chile.

Faced with an even more complex outlook for the winter of 2021, at the end of 2020 the federal authorities, fortunately, reacted with the Plan Gas.Ar’s implementation and tender, a turning point for the business. This 4-year program seeks to promote and contractualize Argentine natural gas production and limit imports’ foreign exchange expenditures. Pampa was the third largest awardee in the Neuquina Basin, which involves an average 15% growth commitment in annual production and a 28% increase in the winter, the year’s peak period. Under this new scheme, we will continue focusing on the development of tight gas, with an aggregate investment of more than US$250 million over the four years of the program, which allows us to expect an increase in profitability and cash flow generation.

Pampa Energía ● 2020 Annual Report ●11 |

|  |

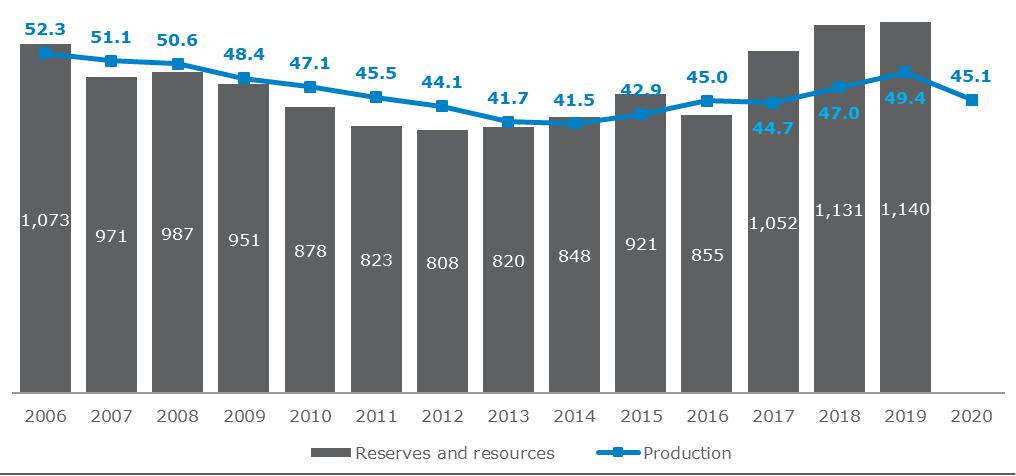

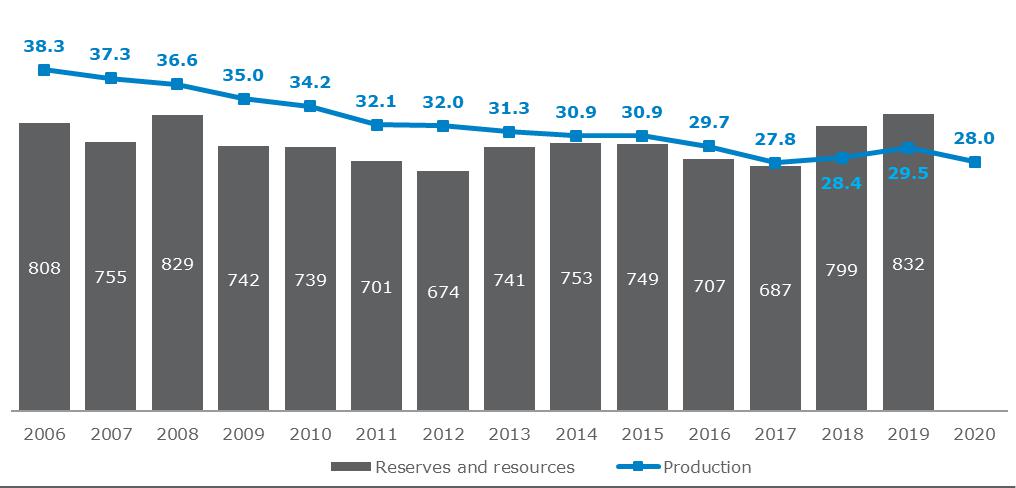

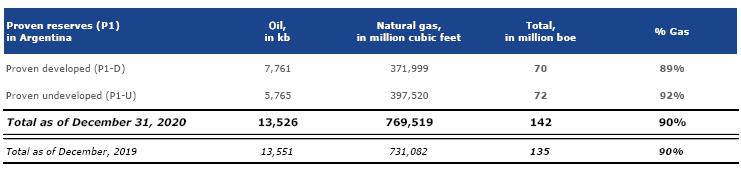

Moreover, we succeeded in certifying shale reserves from the Vaca Muerta formation for the second consecutive year, 2.5 times larger than the certified volume recorded in 2019. Despite the conditions prevailing in the sector, we have registered for the third straight year a positive reserve replacement ratio of 1.4, with proven reserves reaching 142 million boe and an average life of approximately 8.6 years.

As regards the petrochemicals segment, despite the country’s recessive context, 2020 was an excellent year for this segment, with record volumes of rubber exported to Brazil and growing demand for styrene and octane bases linked with the industry recovery and the easing of the lockdown.

In 2020 we continued our public securities buyback activity at depressed prices, with the conviction that it represents a proper use of our liquidity generation. During the year, we have repurchased 11% of the original capital stock and 10% of the international corporate bonds maturing in 2023, 2027 and 2029.

The pandemic reinforced the importance of sustainability, hence our continuous dedication and effort towards improving ESG variables and accountability, leading this area in Argentina. Our report has incorporated more management information and further developed material issues related to our industry, such as environmental performance and gender diversity. In 2020 we joined CDP, and we were the only Argentine power company to obtain a positive score. Additionally, we continue participating in ByMA’s corporate governance panel and sustainability index and Bloomberg’s gender equality index.

The year 2020 was exceptional from every single point of view. Confronted with a historic downturn in economic activity, Pampa has shown strength and robustness in all its business segments, with a healthy cash flow generation even in this difficult context. We were prepared to handle adversity, and we remain enthusiastic about facing a challenging future. All this would not have been possible without the effort and dedication of the Company’s employees and advisors, our families, suppliers, financial institutions and investors, who have shown the continuous trust they place in us.

Pampa Energía ● 2020 Annual Report ●12 |

|  |

| 2. | Corporate governance |

At Pampa, we believe that the best way of preserving and protecting our investors is to adopt and implement the best corporate governance practices, which consolidate us as one of the most trustworthy and transparent companies in the market. For such purpose, we constantly strive to incorporate those practices by considering international market trends and domestic and foreign applicable corporate governance standards and rules.

In this line, in December 2018, Pampa joined the special stock quote panel called +GC Panel, sponsored by ByMA. The +GC Panel has no precedents in Argentina. It includes companies already listed at ByMA with single-vote shares that comply with the best corporate governance and transparency practices even beyond the required regulatory level, which Pampa entirely fulfills. These practices, which are subject to periodic review for compliance, are aligned with the Corporate Governance principles of the Organization for Economic Co-operation and Development (OECD) and adopted by the G20.

Beyond the information contained in this section, further information on Pampa’s corporate governance practices can be found in Appendix I to this Annual Report, which includes the corporate governance report required under the Code pursuant to Section 1, Title I, Chapter I, Part IV of the CNV Rules, following the text restated in 2013 as amended by CNV General Res. No. 797/19.

2.1 Pampa’s corporate structure

Board of Directors

According to the ABOL, amended from time to time, the CMA and Pampa’s Bylaws, decision-making within the Company is vested in the Board. The Board consists of ten regular directors and an equal or smaller number of alternate directors as determined by the Shareholders’ Meeting, a percentage of whom will be independent according to the independence criteria set out in the CNV rules. All our directors are elected for a term of three years. They may be re-elected indefinitely, except for the restrictions arising from the independence standards set out in the CNV rules. The expiration and further renewal of terms of office are made on a partial and staggered basis every year, with the election of three directors for two years and four directors on the third year. Currently, Pampa’s Board is composed as follows:

Pampa Energía ● 2020 Annual Report ●13 |

|  |

| Name | Position | Independence | Term expiration* |

| Marcos Marcelo Mindlin | Chairman | Non-Independent | 12/31/2020 |

| Gustavo Mariani | Vice-chairman | Non-Independent | 12/31/2022 |

| Ricardo Alejandro Torres | Director | Non-Independent | 12/31/2022 |

| Damián Miguel Mindlin | Director | Non-Independent | 12/31/2020 |

| Miguel Ricardo Bein | Director | Independent | 12/31/2022 |

| María Carolina Sigwald | Director | Non-Independent | 12/31/2020 |

| Gabriel Cohen | Director | Non-Independent | 12/31/2021 |

| Carlos Correa Urquiza | Director | Independent | 12/31/2021 |

| Juan Santiago Fraschina | Director | Independent | 12/31/2021 |

| Darío Epstein | Director | Independent | 12/31/2021 |

| Horacio Jorge Tomás Turri | Alternate Director | Non-Independent | 12/31/2022 |

| Victoria Hitce | Alternate Director | Non-Independent | 12/31/2022 |

| Gerardo Carlos Paz | Alternate Director | Non-Independent | 12/31/2020 |

| Mauricio Penta | Alternate Director | Non-Independent | 12/31/2020 |

| Brian Henderson | Alternate Director | Non-Independent | 12/31/2020 |

| Diego Martín Salaverri | Alternate Director | Non-Independent | 12/31/2021 |

| Pablo Díaz | Alternate Director | Non-Independent | 12/31/2021 |

| Silvana Wasersztrom | Alternate Director | Independent | 12/31/2021 |

| Nicolás Mindlin | Alternate Director | Non-Independent | 12/31/2021 |

| Haroldo Adrián Montagu | Alternate Director | Independent | 12/31/2021 |

Note: *They will be in office until their reelection or the election of their substitutes.

Senior management

The following table includes information on our senior management:

| Name | Position |

| Marcos Marcelo Mindlin | Chairman |

| Gustavo Mariani | Executive vice president and CEO |

| Ricardo Alejandro Torres | Executive vice president |

| Damián Miguel Mindlin | Executive vice president |

| Gabriel Cohen | CFO |

| Horacio Jorge Tomás Turri | Executive director of oil and gas |

| María Carolina Sigwald | Executive director of legal affairs |

| Nicolás Mindlin | Director of M&A, petrochemicals and affiliates |

Pampa Energía ● 2020 Annual Report ●14 |

|  |

Supervisory committee

Our Bylaws provide that the oversight of Pampa will be in charge of a Supervisory Committee consisting of three regular members and three alternate members appointed by our shareholders under the legal provisions in force. The Supervisory Committee will be composed of duly registered lawyers and/or accountants admitted to practice in Argentina, who will serve for a term of three fiscal years.

The Supervisory Committee’s primary function is to exercise statutory control over the Board, complying with the provisions outlined in the ABOL, the Bylaws, their regulations, if any, and the Shareholders’ Meeting decisions. In accomplishing these duties, the Supervisory Committee neither monitors our operations nor assesses the merits of the Board’s members’ decisions.

Currently, Pampa’s Supervisory Committee is composed as follows:

| Name | Position | Term expiration** |

| Germán Wetzler Malbrán | Statutory Auditor* | 12/31/2020 |

| José Daniel Abelovich | Statutory Auditor | 12/31/2020 |

| Martín Fernández Dussaut | Statutory Auditor | 12/31/2020 |

| Tomás Arnaude | Alternate Statutory Auditor | 12/31/2020 |

| Marcelo Héctor Fuxman | Alternate Statutory Auditor | 12/31/2021 |

| Damián Burgio | Alternate Statutory Auditor | 12/31/2021 |

Note: *Chairman of the Supervisory Committee. **They will be in office until their reelection or the election of their substitutes.

Audit committee

According to Section 109 of the CMA, Pampa has an Audit Committee integrated by three regular members and one alternate member, whom all hold independent status according to the independence standards set out in the CNV Rules. The Audit Committee members have professional expertise in financial, accounting, legal, and/or business matters.

Under the applicable legislation and its own Internal Regulations, the Audit Committee is responsible for compliance with the following duties, among others:

| i. | Supervising the operation of internal control and administrative/reporting systems, as well as the latter’s reliability and of all financial information or any other significant events that may be disclosed to the CNV and the markets, in compliance with the applicable reporting system; |

| ii. | Rendering opinion on any Board’s proposal appointing external auditors to be hired by the Company, and ensuring their independence; |

| iii. | Reviewing the plans submitted by external and internal auditors, assessing their performance, and issuing an opinion on the presentation and disclosure of annual FS, all under the CNV rules. For the supervision of external auditor’s performance, the Committee may determine a series of objective indicators to assess their commitment, efficiency and independence; |

| iv. | Supervising the implementation of risk management information policies within the Company; |

| v. | Providing the market with complete information on transactions where there may be a conflict of interest with members of corporate bodies or controlling shareholders; |

| vi. | Rendering its opinion on remunerations and stock options plans’ proposals for the Company’s directors and managers submitted by the Company’s Board; |

Pampa Energía ● 2020 Annual Report ●15 |

|  |

| vii. | Rendering its opinion on the compliance with legal requirements and the reasonableness of the conditions for the issuance of shares or convertible securities in capital increases with the exclusion or limitation of preemptive rights; |

| viii. | Issuing a well-founded opinion on related-party transactions in the cases provided by law and disclosing it in compliance with law whenever there is or may be an alleged conflict of interest within Pampa; |

| ix. | Supervising the operation of a channel whereby the Company’s executives and staff may report accounting, internal control and audit issues under the applicable provisions to such effect; |

| x. | Providing any report, opinion or statement required by the current regulations in force, with the scope and frequency required by such regulations, as amended, etc.; |

| xi. | Fulfilling all obligations provided for in the Bylaws, as well as laws and regulations binding the Company; |

| xii. | Checking compliance with applicable standards of ethical conduct; and |

| xiii. | Drawing up an annual action plan, for which it will be held accountable to the Board and the Audit Committee. The Audit Committee will submit such action plan within a term of 60 calendar days from the beginning of the fiscal year. |

Currently, Pampa’s Audit Committee is composed as follows:

| Name | Position |

| Miguel Ricardo Bein | Chair |

| Darío Epstein | Regular Member |

| Carlos Correa Urquiza | Regular Member |

| Silvana Wasersztrom | Alternate Member |

2.2 Minority shareholder protection

Pampa’s Bylaws include safeguards aimed at the protection of minority shareholders, such as: (i) only one class of shares granting equal economic and political rights; (ii) special majorities of up to 66.6% of the votes to amend specific clauses of the Bylaws; and (iii) possibility to call a shareholders’ meeting upon request of shareholders representing at least 5% of the capital stock.

2.3 Corporate governance policies

Integrity program – Law No. 27,401

Upon enacting and entering into force of the Legal Entities’ Criminal Liability Law, Pampa’s Board assessed the Integrity Program’s compliance level, outlined in Sections 22 and 23 of such law. Said law seeks to implement internal proceedings, mechanisms and actions for integrity, supervision and control, geared at preventing, detecting and correcting the irregularities and illegal acts covered by such law.

The Program set forth by law has mandatory and optional requirements, and Pampa has defined the need to comply with all of them. It is worth highlighting that all mandatory requirements had already been implemented at Pampa before said law’s effective date.

Pampa Energía ● 2020 Annual Report ●16 |

|  |

Furthermore, the Integrity Program is periodically reviewed by the Board, including identifying potential improvement opportunities. The Board has defined that Pampa’s Internal Audit Department will be the body internally responsible for the program, including its development, coordination and supervision.

Code of business conduct – ethics hotline

Pampa has a Code of Business Conduct in place, which lays down the ethical principles for the relationships’ foundation between Pampa and all stakeholders (employees, customers, suppliers, government, shareholders, community, etc.) by providing guidelines and instruments that guarantee transparency of affairs and proper Company management.

Moreover, Pampa has a Procedure for handling complaints. This document describes the process to be followed from the reception of the complaint, the investigation’s conclusion and the application of any appropriate corrective action. One of the available instruments is the Ethics Hotline, an exclusive channel to report any suspected misconduct or breach of the Code of Business Conduct on a strictly confidential basis. This line can be accessed through different channels (website, toll-free telephone number or e-mail) and is managed by a third-party provider to ensure higher transparency. The Audit Committee is responsible for supervising the channel’s operation and resolving complaints in issues within its authority.

Policy against fraud, corruption and other irregularities

In 2020, Pampa’s Board of Directors approved an update to the policy against fraud, corruption and other irregularities, reaffirming transparency and ethics as necessary behaviors to lead the Company’s business and achieve its sustainable growth.

In this sense, this policy prohibits fraud, corruption in any form, or acts of misconduct within Pampa. Moreover, it sets Pampa’s stance on preventing corruption and other acts of misconduct, complementing the principles and values defined in our Code of Conduct; therefore, both documents should be read in conjunction. Finally, this policy also stipulates the obligation to report any actual or suspected violation of laws and/or regulations, as well as the prohibition of retaliation against any employee or third party for filing a report legitimately and in good faith or for refusing to participate in acts of corruption.

Policy on best security market practices

This policy sets certain restrictions and rules regarding marketable securities trading in a stock exchange, whether Pampa’s and/or any related companies. Therefore, it ensures higher transparency and guarantees that no Pampa employee may be rewarded of any economic advantage or benefit from using material non-public information about Pampa and/or any of its affiliates.

This policy applies to Pampa and its subsidiaries’ employees deemed ‘covered individuals,’ including, but not limited to, directors, members of the Supervisory Committee, and Senior Management lines.

Policy on related-party transactions

Since 2008, the Company has a Policy on Related-Party Transactions where, under the CMA, all high-value transactions made between Pampa and individuals and/or legal entities that could be deemed as ‘related parties’ according to the applicable regulations in force, shall be subject to a specific prior authorization and control procedure under the supervision of Pampa’s Legal Affairs Executive Department and involves both Pampa’s Board and its Audit Committee (if applicable).

Pampa Energía ● 2020 Annual Report ●17 |

|  |

Money laundering and terrorist financing prevention policy

In its capacity as trustee under the CIESA Trust, Pampa qualifies as an ‘Obliged Subject’ according to Subsection 22, Section 20 of Law No. 25,246 on Concealment and Laundering of Proceeds of Crime, as amended. This policy was approved to meet the obligations resulting from its condition as ‘Obliged Subject,’ even though Pampa neither acts as a trustee in companies nor any other activity set out in Section 20 of Law No. 25,246 are among the Company’s main activities as of this date. Said law is based on and geared at possible risks for the Company resulting from its role as trustee under a single trust.

Board of Directors’ self-assessment questionnaire

Since 2008, Pampa’s Board has implemented a self-assessment questionnaire that allows for annually examining and assessing its performance and management.

The Company’s Legal Affairs Executive Department oversees the examining and filing of each individual questionnaire; afterward, based on the results, it will submit to Pampa’s Board all measures deemed valid to improve the performance of the Board’s duties.

Policy on material information disclosure

Since 2009, the Company has a Relevant Information Disclosure Policy approved by Pampa’s Board, which sets the basic principles guiding the process when information relevant to Pampa is published, as per regulatory requirements imposed by the stock exchanges where Pampa’s securities are traded or those in which Pampa is a registered issuer.

QHSE policy

This policy, approved by Pampa’s Board in 2017, seeks to consolidate the QHSE standards into the operating processes of E&P, power generation, electricity distribution, R&D and petrochemicals with the highest safety possible within the ordinary course of each activity.

Dividend policy

Approved by Pampa’s Board in 2018, this policy outlines the guidelines to reach a proper balance between distributed amounts and Pampa’s investment plans. Aiming at a clear, transparent and consistent practice allowing shareholders informed decision-making, all of this consistent with the Company’s Bylaws and the applicable legal and regulatory framework in force.

Compensation policy

Pampa’s Board approved the Compensation Policy in 2018, which aims to establish general rules to determine the composition, update and handling of directors’ remunerations and the rules for the reimbursement of their expenses.

Under the Compensation Policy, the Board created the Compensation Committee, which reports to Pampa’s Board and comprises three regular members and an equal or smaller number of alternate members, who may not exercise executive functions in the Company. Currently, Pampa’s Compensation Committee is composed as follows:

Pampa Energía ● 2020 Annual Report ●18 |

|  |

| Name | Position | Independence | Term expiration |

| Miguel Ricardo Bein | Chairman | Independent | 12/31/2022 |

| Carlos Correa Urquiza | Regular Member | Independent | 12/31/2021 |

| Darío Epstein | Regular Member | Independent | 12/31/2021 |

| Silvana Wasersztrom | Alternate Member | Independent | 12/31/2021 |

Nomination policy

Pampa’s Board approved the Nomination Policy in 2018, which sets the general guidelines regarding independence, incompatibilities and diversity in the Board, and describes the process to be followed by both the Board and shareholders for the identification and evaluation of Board’s nominees to be presented for consideration by the Shareholders’ Meeting.

Under the Nomination Policy, the Board created the Nomination Committee, which assists Pampa’s Board and Shareholders’ Meeting in the nomination and appointment process for Board members. The Nomination Committee reports to Pampa’s Board. It comprises three regular members and an equal or smaller number of alternate members, the Chairman having to be independent according to the criteria stipulated by the CNV rules. Currently, Pampa’s Nomination Committee is composed as follows:

| Name | Position | Independence | Term expiration |

| Miguel Ricardo Bein | Chairman | Independent | 31/12/2022 |

| Gustavo Mariani | Regular Member | Non-Independent | 31/12/2022 |

| Ricardo Alejandro Torres | Regular Member | Non-Independent | 31/12/2022 |

| Silvana Wasersztrom | Alternate Member | Independent | 31/12/2021 |

| Victoria Hitce | Alternate Member | Non-Independent | 31/12/2022 |

| María Carolina Sigwald | Alternate Member | Non-Independent | 31/12/2020 |

Pampa Energía ● 2020 Annual Report ●19 |

|  |

| 3. | Our shareholders/stock performance |

On December 31, 2020, Pampa held 1,747,873,239 issued common shares with a par value of AR$1 each, each granting the right to one vote. However, Pampa’s Shareholders Meetings held on April 7 and December 10, 2020, approved capital stock reductions of 151,585,025 and 140,786,959 common treasury shares, respectively, which Pampa and its subsidiaries have acquired. These reductions are in the process of registration with the IGJ, and once approved, Pampa Energía’s issued capital stock would amount to 1,455,501,255 common shares2.

The remaining treasury shares are out of free float, and their cancellation will be timely submitted for shareholder’s approval.

The following table shows the information on Pampa’s common shareholdings:

Holders as of December 31, 2020 | In million | % of issued capital stock | % of outstanding capital stock | |

| Shares | ADR | |||

| Management1 | 381.4 | 15.3 | 21.8% | 26.2% |

| Free float on NYSE and ByMA | 1,068.2 | 42.7 | 61.1% | 73.5% |

| Treasury shares | 294.0 | 11.8 | 16.8% | - |

| Pending cancellation | 292.4 | 11.7 | 16.7% | - |

| In treasury2 | 1.6 | 0.1 | 0.1% | - |

| Employee stock-based compensation plan | 4.3 | 0.2 | 0.2% | 0.3% |

| Issued capital | 1,747.9 | 69.9 | 100.0% | 100.0% |

| Outstanding capital | 1,453.9 | 58.2 | ||

Note: All figures are rounded, so the total may not equal the sum of the figures. 1 It includes direct and indirect stakes of Messrs. Marcos Marcelo Mindlin, Damián Miguel Mindlin, Gustavo Mariani and Ricardo Alejandro Torres. 2 Shares repurchased as of December 31, 2020.

Pampa is listed on the ByMA, takes part in the S&P Merval and the sustainability (non-traded) indexes, and is a member of the special stock quote panel, known as +GC Panel, which selects listed companies having the best corporate governance practices.

Moreover, Pampa has a Level II ADS program listed on the NYSE, and each ADS represents 25 common shares. Our ADR participates in the MSCI Argentina index and the Bloomberg’s gender-equality stock index (non-traded), in which Pampa is the only Argentine company jointly with other 14 Latin American companies.

2 For further information, see section 7.7 of this Annual Report.

Pampa Energía ● 2020 Annual Report ●20 |

|  |

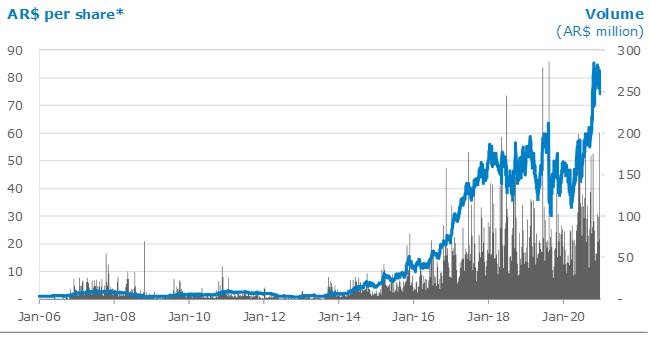

The following chart shows the price evolution per share and Pampa’s traded volume on the ByMA from January 2006 to December 31, 2020:

Note: *Price adjusted to preemptive subscription rights and issuances. Source: ByMA/Bloomberg.

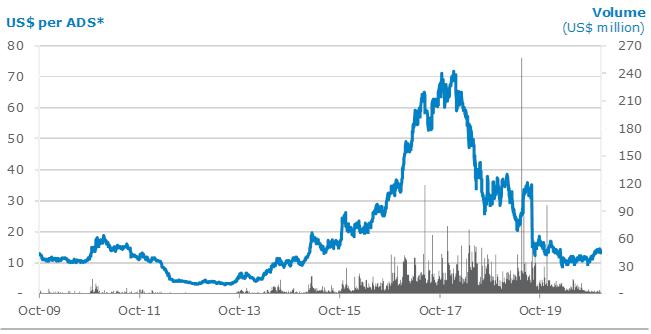

The following chart shows the price evolution per ADS and Pampa’s traded volume on the NYSE from October 9, 2009, to December 31, 2020:

Note: *Price adjusted as per issuances. Source: Bloomberg.

Pampa Energía ● 2020 Annual Report ●21 |

|  |

| 4. | Macroeconomic context |

As of the third quarter of 2020, the economic activity recorded an accumulated 11.8% decrease compared to the same period of the previous year, mainly due to the impact of COVID-19, with 14.6%, 5.4% and 22.3% decreases in private and public consumption, and investment, respectively. The activity contraction reached 15 out of 16 identified sectors of the economy, the most affected ones being hotels and restaurants (-47.6%), construction (-32.1%), transportation and communications (-16.5%), manufacturing industry (-11.0%) and wholesale and retail business and repairs (-8.5%). These drops were partially offset by net exports, against net imports in 2019, mainly because of the sharp decline in imports from the beginning of the lockdown.

Regarding the evolution of prices, the National Cost of Living Index published by the INDEC showed a 36.1% variation in 2020. The most important variations were recorded in clothing and footwear (+60.0%), leisure and culture (+48.0%), and food and non-alcoholic beverages (+42.1%). The sectors affected to a lower extent were communications (+7.6%), housing, water, electricity utilities and other fuels (+17.6%) and education (+20.1%). Furthermore, salaries, as measured by the registry of the Stable Workers’ Average Taxable Remuneration (Remuneración Imponible Promedio de los Trabajadores Estables, RIPTE), experienced a 34.9% year-on-year increase between December 2020 and the same month of 2019.

Moreover, as of December 2020 Non-Financial Public Sector’s fiscal accounts accumulated a 7.0% and 9.1% primary and total deficit to GDP, respectively. The annual variation in aggregated tax revenues, measured in AR$ based on figures published by the AFIP, ended with a 32.2% year-on-year increase. Besides, in 2020 recorded primary expenditures by the National Treasury showed a 63.5% year-on-year variation.

As regards the financial situation, the BCRA’s US$ currency wholesale FX rate (Res. A3500) closed at AR$84.15/US$ on December 31, 2020, showing a cumulative 40.5% increase compared to the end of 2019 and a 46.3% average year-on-year variation. The BCRA’s international reserves amounted to US$39.4 billion at year-end, which represents a US$5.5 billion decrease compared to the previous year. Moreover, the monetary base reached AR$2,470 billion at the end of 2020, showing a 30.3% increase compared with last year. Furthermore, the BCRA’s debt stock in issued bonds totaled an equivalent amount expressed in dollars of US$35.0 billion as of the closing of 2020, which represents a 97% year-on-year increase.

Finally, at the external front, according to INDEC’s data, the cumulative current account surplus amounted to US$4.3 billion as of the third quarter of 2020, which represents 1.2% of the GDP. This phenomenon is mainly accounted for by the trade balance surplus, where the Free on Board value of exports totaled US$41.9 billion. In contrast, the Cost, Insurance and Freight value of imports amounted to US$30.4 billion. Primary exports increased by 5.4% during this period, whereas agricultural and industrial manufactured exports recorded an 8.3% and 31.1% contraction, respectively. Fuel and energy exports reversed their trend, showing a 28.5% year-on-year decline. Imports recorded a contraction compared to the same period of 2019, explained by decreases in the automotive (-45.4%), fuels and lubricants (-40.3%), parts and accessories (-34.2%), capital goods (-21.8%), intermediate goods (-9.6%) and consumables goods (-7.7%).

Pampa Energía ● 2020 Annual Report ●22 |

|  |

5. The Argentine electricity market

5.1 Power generation

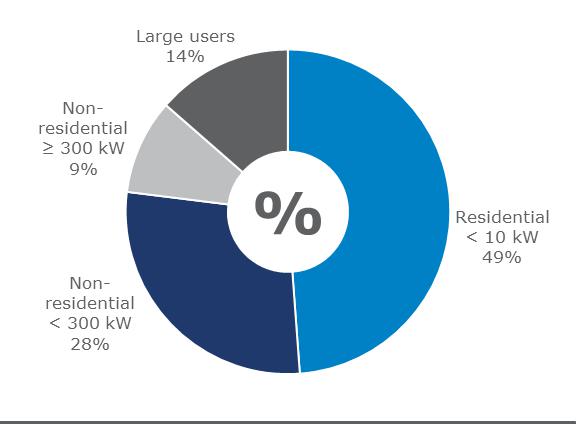

During 2020, electricity consumption experienced a slight decrease due to the lockdown, with a 1.3% variation compared to 2019, and a total electricity demand volume of 127,306 GWh and 128,946 GWh for 2020 and 2019, respectively.

The following chart shows the breakdown of electricity consumption in 2020 by type of customer:

Electricity demand by type of customer

Source: ADEERA

Peak power capacity records

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

| Capacity (MW) | 21,564 | 21,949 | 23,794 | 24,034 | 23,949 | 25,380 | 25,628 | 26,320 | 26,113 | 25,791 |

| Date | 1-Aug | 16-Feb | 23-Dec | 20-Jan | 27-Jan | 12-Feb | 24-feb | 8-Feb | 29-Jan | 4-Feb |

| Temperature (ºC) | 3.5 | 34.2 | 35.4 | 29.6 | 35.6 | 35.1 | 27.7 | 30.2 | 34.0 | 29.5 |

| Hour | 20:18 | 15:10 | 14:20 | 15:05 | 14:13 | 14:35 | 14:25 | 15:35 | 14:25 | 14:57 |

Source: CAMMESA.

On January 25, 2021, at 14:41, there was a 26,450 MW record-breaking demand for electricity in the SADI.

Evolution of the electricity supply

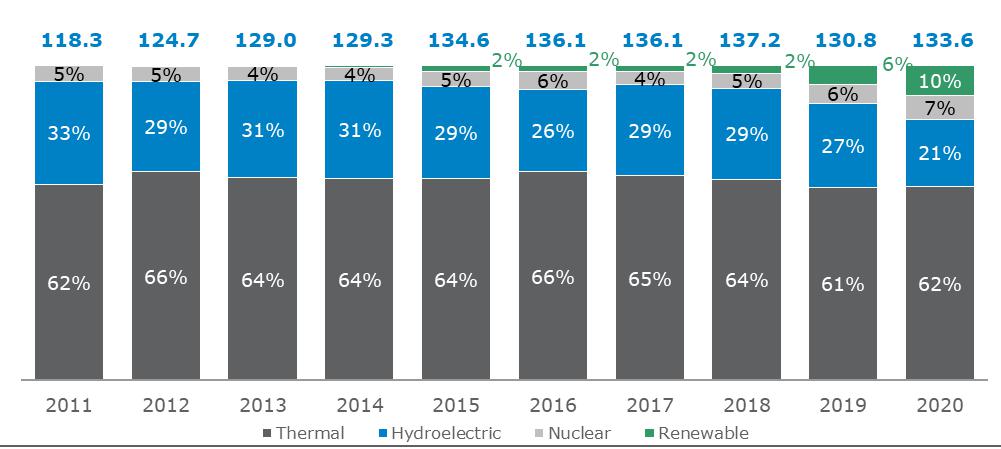

2020 recorded a 2% increase in power generation, with 133,584 GWh and 130,804 GWh volumes for 2020 and 2019, respectively, mainly due to the rise in exports, partially offset by the lockdown.

Pampa Energía ● 2020 Annual Report ●23 |

|  |

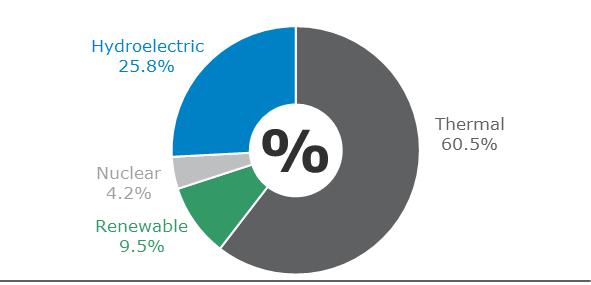

Thermal power generation remained as the primary resource to meet the electricity demand, fired with natural gas or liquid fuels (GO and GO) and mineral coal, supplying an electricity volume of 82,333 GWh (62%), followed by hydroelectric power generation, which contributed 28,505 GWh net of pumping (21%), renewable power generation with 12,734 GWh (10%), and nuclear power generation with 10,011 GWh (7%) Additionally, there were imports for 1,204 GWh (56% lower than in 2019), exports for 3,089 GWh (higher than the 261 GWh recorded in 2019), and losses for 4,392 GWh (1% higher than in 2019).

Hydroelectric power generation net of pumping decreased its contribution volume by 18% compared to 2019, mainly due to the droughts that affected the Yacyretá and Salto Grande dams. This decrease was partially offset by the increase in renewable (64%), thermal (3%) and nuclear (26%) generation compared to 2019, mainly on account of the commissioning of the PPA under RenovAr, MAT ER and MEyM Res. No. 287/17, added to the higher nuclear generation as from the start-up of Central Nuclear Embalse’s reconditioning at the end of the first quarter of 2019.

The following chart shows the evolution of electric power generation by source:

Generation by type of power plant

In % and TWh, 2011 - 2020

Note: It includes WEM and Patagonian WEM systems. Hydroelectric power generation net of pumping. Source: CAMMESA.

During 2020, power generation facilities recorded an increase in their installed capacity compared to the previous year, totaling 41,951 MW (+2,247 MW compared to 2019). This increase was mainly due to the commissioning of renewable units under the RenovAr and MAT ER programs for 1,408 MW. In the thermal area, 817 MW were commissioned, mostly under MEyM Res. No. 287/17, including the completion of Genelba Plus’ closing to CC project (199 MW).

Pampa Energía ● 2020 Annual Report ●24 |

|  |

The following table describes the incorporation of new power units in 2020:

| Region | Technology | Capacity (MW) | |

| Buenos Aires Metro Area - Northwest Litoral | Biogas | 4.1 | 1,146.7 |

| CC | 395.9 | ||

| Wind | 477.2 | ||

| GT | 269.5 | ||

| Center | Biogas y biomass | 4.6 | 91.1 |

| CC | 55.6 | ||

| Wind | 22.8 | ||

| Diesel y ST | 8.1 | ||

| Midwest - Comahue | Wind | 100.5 | 100.5 |

| Cuyo | Renewable hydro | 11.6 | 23.3 |

| Solar | 11.7 | ||

| Northeast | Biomass | 51.0 | 51.0 |

| Northwest | CC | 199.0 | 598.8 |

| Wind | 99.8 | ||

| Solar | 300.0 | ||

| South - Patagonia | Wind | 101.6 | 134.1 |

| Diesel | 32.5 | ||

| Total | 2,145.5 | ||

| Thermal | 44.6% | ||

| Renewable | 55.4% | ||

Source: CAMMESA and Pampa Energía’s analysis.

Additionally, the power capacities of CH were adjusted based on their reservoirs for +22 MW, CT for +30 MW, wind power for +213 MW and solar generation for +8 MW. Additionally, GT agreements for -171 MW were terminated.

Pampa Energía ● 2020 Annual Report ●25 |

|  |

The following chart shows the composition of the Argentine installed power capacity as of December 31, 2020:

2020 Argentine installed power capacity

100% = 42.0 GW

Source: CAMMESA.

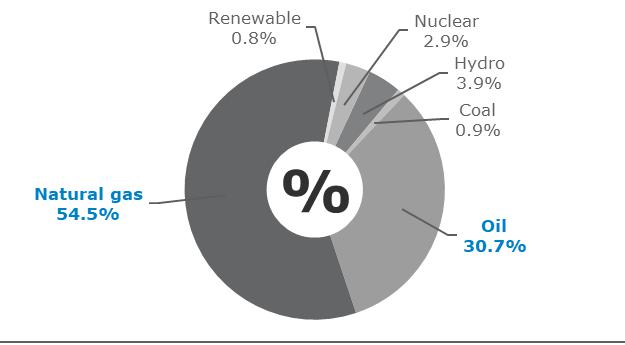

Fuel supply and consumption3

According to MDP Res. No. 12/19, the fuel supply for power generation and fuel commercial management and procurement was centralized again in CAMMESA as of December 30, 2019, except for generators with Energía Plus and SEE Res. No. 287/17 contracts. Additionally, following the implementation of Plan Gas.Ar, on December 2, 2020 SE Res. No. 354/20 was published, which, among other measures, established an optional scheme for the operating assignment of natural gas and its transportation to CAMMESA, effective as of January 2021 for such exempted generators. Pampa adhered to this scheme. This new scheme set a new thermal dispatch order centralized in CAMMESA, prioritizing units supplied with gas imported from Bolivia under a ToP condition, followed by those provided under Plan Gas.Ar and, lastly, those with gas assigned to CAMMESA.

Regarding fuel consumption, the natural gas used for power plants amounted to 16.3 million dam3 in 2020, representing a 5% decrease compared to the previous year, mainly accounted for by the 7% year-on-year decrease in domestic supply. Consequently, the shortage of fuel to meet electric power generation worsened. Therefore, the purchase of LNG and its re-gasification in Escobar continued, as well as natural gas imports from Bolivia, which experienced an 8% year-on-year increase. Moreover, alternative fuels (FO, GO and mineral coal) were used to meet the demand, in volumes significantly higher than in 2019. The use of FO tripled to 0.6 million ton, whereas the demand for GO and mineral coal doubled.

Price of electricity

The energy authority has continued with the policy launched in the year 2003 whereby the WEM spot price is determined according to the available power generating units’ CVP with natural gas, even if these units are not generating electricity with such fuel (SE Res. No. 240/03). The additional cost for consuming liquid fuels is recognized outside the specified market price as a temporary dispatch surcharge. Moreover, the WEM bears the costs of natural gas and its regulated transportation, in addition to the associated costs in the case of import (SGE Res. No. 25/18 and SE Res. No. 354/20).

3 For further information, see sections 6.1, 7.3 and 7.4 of this Annual Report.

Pampa Energía ● 2020 Annual Report ●26 |

|  |

Evolution of WEM prices

As of November 2019, according to SEE Res. No. 38/19, the approved average monthly spot price for energy is AR$720/MWh. However, the following chart shows the average monthly price that all electricity system users should pay so that the power grid would not run into a deficit. This cost includes the energy price and the power capacity fee, the generation cost, fuels such as natural gas, FO, GO and mineral coal, and other minor items.

Average monthly monomic price

In US$ / MWh

Source: CAMMESA, converted to US dollars at the official FX rate.

Remuneration scheme for generation not covered by contracts

SRRYME Res. No. 1/19: March 2019 - February 2020

SRRYME Res. No. 1/19, which was in effect until January 31, 2020, reduced CT’s remuneration, both for power capacity and operation and maintenance. It also introduced an adjustment factor correlated to the average load factor per thermal unit over the last 12 months.

Thermal power generators

The following chart shows base prices for power capacity applicable to generators not offering DIGO:

| Technology / scale | Capacity’s base price (US$ / MW-month) |

| Large CC capacity > 150 MW | 3,050 |

| Small CC capacity ≤ 150 MW | 3,400 |

| Large ST capacity > 100 MW | 4,350 |

| Small ST capacity ≤ 100 MW, internal combustion engines | 5,200 |

| Large GT capacity > 50 MW | 3,550 |

| Small GT capacity ≤ 50 MW | 4,600 |

Pampa Energía ● 2020 Annual Report ●27 |

|  |

For agents with a DIGO declaration, a remuneration scheme for seasonal power capacity was established: a) summer (December through February); b) winter (June through August), and c) ‘other,’ which comprises two quarters (March through May, and September through November). The power capacity price was set at US$7,000/MW-month in the summer and winter quarters and at US$5,500/MW-month in the ‘other’ quarters.

Additionally, whether or not the agent had a DIGO declaration, the power capacity weighed a load factor equivalent to the average dispatch factor for the generating unit during the rolling year before the calculation month and applied a coefficient to the power capacity remuneration if the load factor was: i) higher than 70%, 100% was paid; ii) lower than 30%, 70% was paid; and iii) between 30% and 70%, the power capacity remuneration was linearly associated with between 70% and 100%.

Generated energy remuneration values were reduced by US$1/MWh for all technologies except for internal combustion engines, where the reduction was US$3/MWh. The remuneration value for operated energy was reduced from US$2/MWh to US$1.4/MWh.

Finally, the additional remuneration schemes were abrogated: capacity remuneration to encourage DIGO during peak demand periods, variable remuneration for efficiency, and power capacity remuneration for low-dispatch CT.

Hydropower generators

SRRYME Res. No. 1/19 maintained the base prices for power capacity established by SEE Res. No. 19/17, as well as remuneration values for generated and operated energy. However, regarding the power capacity payment, the hours during which a hydroelectric generator was not available due to programmed and agreed maintenance were no longer computed to calculate the power capacity remuneration. However, to mitigate this impact, in May 2019, SME Note No. 46631495 provided a 1.05 factor on the capacity payment.

Other considerations

For generation from unconventional sources, a single remuneration value for generated energy was established at US$28/MWh, or 50% of this value if it is generated before commercial commissioning.

Regarding the refund of the amounts disbursed to generators under the loan agreements for the overhaul in their units, it was established the application of all accrued receivables in favor of agents, as well as a discount scheme in the generator’s revenues equivalent to the maximum between US$1/generated MWh or US$700/MW-month for the unit’s actual availability.

SE Res. No. 31/20: current remuneration scheme

On February 27, 2020, SE Res. No. 31/20 was published in the BO, which modified certain aspects of the remuneration scheme set forth by SRRYME Res. No. 1/19, effective as of February 1, 2020. The new Res. converts the entire remuneration scheme to the local currency at an FX of AR$60/US$ and establishes an update factor from the second month of its application, which follows a formula consisting of 60% CPI and 40% IPIM. Later on, through SE Note NO-2020-24910606-APN-SE#MDP dated April 8, 2020, the SE instructed CAMMESA to postpone applying this factor until further decision. As of the issuance of this Annual Report, the Company has not been notified of any update.

Pampa Energía ● 2020 Annual Report ●28 |

|  |

Thermal power generators

Regarding the values of the previous remuneration scheme, SE Res. No. 31/20 reduces the power capacity remuneration, whether base or guaranteed, depending on its technology. However, for CT with a total installed power capacity lower than or equal to 42 MW, the base power capacity values are set out by SRRYME Res. No. 1/19 remain in effect.

| Technology / scale | Capacity base price (AR$/MW-month) | Variation vs. SRRYME Res. No. 1/19* |

| Large CC capacity > 150 MW | 100,650 | -45% |

| Small CC capacity ≤ 150 MW | 112,200 | -45% |

| Large ST capacity > 100 MW | 143,550 | -45% |

| Small ST capacity ≤ 100 MW, Internal combustion engines capacity > 42 MW | 171,600 | -45% |

| Large GT capacity > 50 MW | 117,150 | -45% |

| Small GT capacity ≤ 50 MW | 151,800 | -45% |

| Small CC capacity ≤ 15MW | 204,000 | - |

| Small ST capacity ≤ 15MW | 312,000 | - |

| Small GT capacity ≤ 15MW | 276,000 | - |

| Internal combustion engines capacity ≤ 42 MW | 312,000 | - |

Note: * It assumes an FX of AR$60/US$.

As regards the remuneration for the offered guaranteed power capacity, the following scheme is in effect:

| Period | Capacity base price (AR$/MW-month) | Variation vs. SRRYME Res. No. 1/19* |

| Summer (December - February) and winter (June - August) | 360,000 | -14% |

| Other (March - May and September - November) | 270,000 | -18% |

| Internal combust engines ≤ 42 MW, summer/winter | 420,000 | - |

| Internal combust engines ≤ 42 MW, other | 330,000 | - |

Note: * It assumes an FX of AR$60/US$.

Moreover, SE Res. No. 31/20 maintains the dispatch factor formula. Still, if the usage factor is lower than 30%, 60% of the power capacity payment is collected (except for internal combustion engines ≤ 42 MW, which maintain the scheme provided for by SRRyME Res. No. 1/29).

The new scheme introduces an additional remuneration in the HMRT of the month, which consists of the 50 recorded hours with the highest thermal generation dispatch each month, grouped in two blocks of 25 hours each. The following will be applied to the average generated capacity:

| Period, in AR$/MW-HMRT | First 25 HMRT hours | Second 25 HMRT hours |

| Summer (December - February) and winter (June - August) | 45,000 | 22,500 |

| Other (March - May and September - November) | 7,500 | - |

Pampa Energía ● 2020 Annual Report ●29 |

|  |

As regards the variable remuneration, it remained unchanged in US$ at an FX of AR$60/US$, and was set at AR$240/MWh for generated units with natural gas, AR$420/MWh with FO, AR$600 with biofuels (except for internal combustion engines, AR$720/MWh) and AR$720/MWh with mineral coal. The remuneration for operated energy was set at AR$84/MWh.

Hydropower generators

SE Res. No. 31/20 adjusted the capacity remuneration and added a new item for HMRT. The 1.05 factor over the power capacity to compensate for programmed maintenance’s impact remained unchanged, and the 1.20 factor for units maintaining control structures on river courses and not having an associated power plant.

| Scale | Capacity base price (AR$/MW-month) | Variation vs. SRRYME Res. No. 1/19* |

| Large HI capacity > 300 MW | 99,000 | -45% |

| Medium HI capacity > 120 ≤ 300 MW | 132,000 | -45% |

| Small HI capacity > 50 ≤ 120 MW | 181,500 | -45% |

| Renewable HI capacity ≤ 50 MW | 297,000 | -45% |

| Large pumped HI capacity > 300 MW | 99,000 | +10% |

| Medium pumped HI capacity > 120 ≤ 300 MW | 132,000 | -12% |

Note: * It assumes an FX of AR$60/US$.

As regards the HMRT additional remuneration, the following will be applied to the average operated power capacity:

| Scale | Capacity HMRT price AR$/MW-HMRT |

| Large HI capacity > 300 MW | 27,500 |

| Medium HI capacity > 120 ≤ 300 MW | 32,500 |

| Small HI capacity >50 ≤ 120 MW | 32,500 |

| Renewable HI capacity ≤ 50 MW | 32,500 |

| Large pumped HI capacity > 300 MW | 27,500 |

| Medium pumped HI capacity > 120 ≤ 300 | 32,500 |

Weighted by the following coefficients:

| HMRT | December - February, June - August | Other |

| First 25 HMRT hours | 1.2 | 0.2 |

| Second 25 HMRT hours | 0.6 | - |

The prices for generated and operated energy remained unchanged in US$ at an FX of AR$60/US$, being set at AR$210/MWh and AR$84/MWh, respectively. The remuneration for operated energy should correspond with the grid’s optimal dispatch. The provision does not indicate, as it does for thermal generators, which would be the consequence otherwise.

Pampa Energía ● 2020 Annual Report ●30 |

|  |

Implementation criteria

| Power plant | Generating unit | Technology | Size | Capacity |

| CPB | BBLATV29 | ST | Large | >100 MW |

| BBLATV30 | ST | Large | >100 MW | |

| CTG | GUEMTV11 | ST | Small | ≤100 MW |

| GUEMTV12 | ST | Small | ≤100 MW | |

| GUEMTV13 | ST | Large | >100 MW | |

| CTGEBA | GEBATG01 | CC | Large | >150MW |

| GEBATG02 | CC | Large | >150MW | |

| GEBATG041 | GT | Large | >50 MW | |

| GEBATV01 | CC | Large | >150MW | |

| CTLL | LDLATG01 | GT | Large | >50 MW |

| LDLATG02 | GT | Large | >50 MW | |

| LDLATG03 | GT | Large | >50 MW | |

| LDLATG042 | GT | Large | >50 MW | |

| HIDISA | ADTOHI | HI | Medium | between 120 MW and 300 MW |

| LREYHB | Pumped HI | Medium | between 120 MW and 300 MW | |

| ETIGHI | Renewable HI | - | ≤ 50 MW | |

| HINISA | NIH1HI | HI | Small | between 50 MW and 120 MW |

| NIH2HI | HI | Small | between 50 MW and 120 MW | |

| NIH3HI3 | HI | Small | between 50 MW and 120 MW | |

| HPPL | PPLEHI01 | HI | Medium | between 120 MW and 300 MW |

| PPLEHI02 | HI | Medium | between 120 MW and 300 MW | |

| PPLEHI03 | HI | Medium | between 120 MW and 300 MW |

Note: 1 It applied until the commercial commissioning of Genelba Plus’ CC (July 2, 2020). 2 Only applies the unit’s 26 MW. 3 A 1.20 coefficient applies to remuneration.

With the agreement of ‘Energía Plus’ power generators, CTG’s GUEMTG01 and CTGEBA’s GEBATG03 units’ both energy and available power capacity delivered to the spot market and not committed under the Energía Plus contracts will be remunerated based on the items set out for legacy capacity, the cost of the fuel provided by CAMMESA being excluded from the transaction (SE Res. No. 482/15).

Other considerations

SE Res. No. 31/20 provides a single remuneration value of AR$1,680/MWh for energy generated from an unconventional source, which equals the previous remuneration converted at an FX of AR$60/US$, or 50% of this value if it is generated before commercial commissioning.

Pampa Energía ● 2020 Annual Report ●31 |

|  |

As regards the repayment of the loans for the execution of overhauls, the application of all receivables accrued in favor of generators is established, as well as a discount scheme in the generator’s revenues equivalent to the maximum between AR$60/MWh, or AR$42,000/MW-month for the unit’s actual availability. It is worth highlighting that all overhauls financing owed by Pampa were settled under the Agreement for the Regularization and Settlement of Receivables with the WEM, executed with CAMMESA in August 2019.

Non-spot remuneration for conventional energy

Energía Plus

In September 2006, the SE approved Res. No. 1281/06 implementing Energía Plus scheme to encourage the development of new power generation supply. Power generators, co-generators and self-generators, which as of the date of such Res. are neither WEM agents nor have facilities or interconnection with the WEM, may sell to GU300 the energy used over the Base Demand (the electrical consumption for the year 2005), at a price negotiated between the parties. These power plants should procure fuel and transportation. New GU300 entering the grid consider their Base Demand equal zero.

Under this framework, CTG, EcoEnergía and CTGEBA provide the Energía Plus service to different WEM clients, representing 283 MW gross capacity. It is worth highlighting that, effective as of May 2019, CTG transferred its contracts to CTGEBA, selling its electricity in the spot market. However, as of August 2020, CTG gradually began to sell energy under Energía Plus contracts.

If an agent cannot meet its Energía Plus demand, they should purchase that power in the spot market at the operated marginal cost. Moreover, SE Note No. 567/07, as amended, provided that those GU300 not purchasing their Surplus Demand in Energía Plus should pay the Surplus Demand Incremental Average Charge (Cargo Medio Incremental de la Demanda Excedente, CMIEE). The difference between the actual cost and the CMIEE would be accumulated in an individual account monthly for each GU300 within CAMMESA’s scope. From June 2018, under SE Note No. 28663845/18, the CMIEE became the greater between AR$1,200/MWh or the temporary dispatch surcharge. Additionally, it was provided that movements in each GU300’s account would temporarily not be recorded until further instruction.

Energía Plus contract values are denominated in US$. In certain contracts, prices are adjusted by CAMMESA’s price variation. During the lockdown’s first months, a substantial drop in demand was evidenced, which recovered towards the end of 2020 until reaching 2019 levels. Additionally, Energía Plus continues to be affected by the migration to the MAT ER.

Finally, with the implementation of Plan Gas.Ar, as of January 2021, generators have the option of assigning the operation of gas supply and transportation to CAMMESA, and a centralized dispatch order was set, taking into consideration the fuel designated for generation. Pampa adhered to this scheme.

SE Res. No. 220/07

Aiming to encourage new investments to increase the generation supply, the SE passed Res. No. 220/07, which empowers CAMMESA to enter into ‘WEM Supply Commitment Agreements’ with WEM generating agents for the energy produced with new generation equipment. These are long-term PPA denominated in US$, and the price payable by CAMMESA should compensate the investment made by the plant at a rate of return to be accepted by the SE. CTLL, CTP and CTEB have entered into PPAs with CAMMESA under this Res. for a gross power capacity of 856 MW4.

4 It includes CTLL’s TG04 built under the Agreement to increase thermal generation availability executed in 2014, and which power capacity is partially remunerated under this agreement as from July 2016.

Pampa Energía ● 2020 Annual Report ●32 |

|  |

It is worth highlighting that the 10-year term of the PPA for CTP (30 MW) and CTLL’s TV01 (180 MW) expires in July and November 2021, respectively. On the other hand, CTEB has an expansion project underway to add 280 MW under this scheme, which commissioning is estimated for the first quarter of 2022.

SEE Res. No. 21/16

As a result of the state of emergency in the national electricity sector declared under PEN Executive Order No. 134/15, on March 22, 2016, the SEE issued Res. No. 21/16 launching a call for bids for new thermal power generation capacity with the commitment to making it available through the WEM for 2016/2017 summer, 2017 winter, and 2017/2018 summer periods. Successful bidders entered into a PPA for a fixed price (in US$/MW-month) and a variable price excluding fuels (in US$/MWh) with CAMMESA, which acted as counterparty on behalf of distributors and WEM’s GU.

305 MW are remunerated under this scheme: CTLL’s GT05 for 105 MW and CTPP for 100MW as of August 2017, and CTIW for 100 MW of December 2017.

SEE Res. No. 287/17

On May 10, 2017, the SEE issued Res. No. 287/17 launching a call for tenders for co-generation projects and the closing to CC over existing equipment. The projects should have low specific consumption (lower than 1,680 kcal/kWh with natural gas and 1,820 kcal/kWh with alternative liquid fuels). Moreover, the new capacity should not increase electricity transmission needs beyond the existing capacity; otherwise, the bidder would bear the cost of the necessary extensions.

Awarded projects will be remunerated under a PPA for a term of 15 years, for an available power capacity price plus the non-fuel CVP for the delivered energy and the fuel cost (if tendered), less penalties and fuel surpluses. Power capacity surpluses would be remunerated as legacy capacity.

In September 2017, Pampa was awarded the closing to CC in the Plus unit at CTGEBA for 400 MW within this framework. Commercial operations at open cycle (201 MW) started in June 2019 with the incorporation of GT02, and at closed-cycle mode on July 2, 2020, with the installation of ST02 (199 MW), meeting the originally committed term despite the impacts of COVID-19.

Moreover, and as previously indicated, with the implementation of Plan Gas.Ar, as of January 2021, a scheme for the operating assignment of natural gas supply and transportation to CAMMESA was established under the new centralized dispatch scheme. Pampa acceded to this scheme and agreed to execute an addendum to the PPA with CAMMESA to set the applicable modifications. This addendum has not been executed as of this date.

Non-spot remuneration for renewable energy

In October 2015, Law No. 27,191 (regulated by DNU No. 531/16) was passed, which amends Law No. 26,190 on promoting renewable energy sources. Among other measures, it provided that by December 31, 2025, 20% of the total demand for energy in Argentina should be covered with renewable energy sources5. To meet such objective, WEM’s GU and CAMMESA should cover 8% of their demand with such sources by December 31, 2017, the percentage rising every two years until meeting this objective. The agreements entered with GU and GUDI may not have an average price exceeding US$113/MWh.

Additionally, said law stipulates several incentives, including tax benefits (advance VAT return, accelerated depreciation on the income tax return, import duty exemptions, etc.) and the creation of the Fund for the Development of Renewable Energy (Fondo para el Desarrollo de Energía Renovables, FODER), which is destined, among other objectives, to the granting of loans, capital contributions, etc. for the financing of these projects.

5 As from December 2016, CH with a power capacity lower than 50 MW are classified as renewable sources of energy.

Pampa Energía ● 2020 Annual Report ●33 |

|  |

RenovAr

In 2016, rounds 1 and 1.5 under the RenovAr Program were launched under MEyM Res. No. 71/16 and 252/16, respectively. In round 1, 29 projects were awarded for a total of 1,142 MW (97% of which were wind and solar energy projects), including our 100 MW PEMC project in the Province of Buenos Aires commissioned in June 2018. In round 1.5, 30 projects were awarded for 1,281.5 MW (100% wind and solar energy projects). In 2017, round 2 was launched according to MEyM Res. No. 275/17, under which 88 projects were awarded for a total of 2,043 MW (89% of which were wind and solar energy projects). Finally, in 2018 round 3 (MiniRen) was launched for smaller-scale renewable projects (up to 10 MW), and 246 MW projects were awarded.

It is worth highlighting that the GHG reductions resulting from the power capacity installed throughout the national territory under RenovAr —including any other project to meet the WEM’s renewable goal set by Law No. 27,191— should be considered as the Federal Government’s contribution to the United Nations Framework Convention on Climate Change and the Paris Agreement.

MAT ER

MEyM Res. No. 281/17 issued on August 18, 2017, regulated the MAT ER regime, which sets the procurement conditions for WEM GU and GUDI’s demand obligation from renewable sources through the individual purchase within the MAT ER or self-generation from renewable sources. Furthermore, it regulates the conditions applicable to generation projects. Specifically, it created the RENPER, where such projects should be registered.

Projects destined to the MAT ER should not be committed under other remuneration mechanisms (e.g., the RenovAr Program). Surplus power generation exceeding commitments with MAT ER is remunerated for up to 10% of the power generation at the minimum price for the applicable technology under the RenovAr Program. The balance will be sold in the spot market.

Furthermore, agreements executed under the MAT ER regime should be administered and managed following the WEM Procedures. The contractual terms —life, allocation priorities, prices and others, except for the maximum price set forth by Law No. 27,191— may be freely agreed upon between the parties. However, the committed volumes should be limited by the generator’s renewable energy or supplied by other generators or suppliers with MAT ER agreements in place.

Pampa registered the PEPE II and III projects with the RENPER and requested the corresponding dispatch priority, which was granted for both projects’ total capacity. On May 10, 2019, CAMMESA gave the commissioning of PEPE II and III. The generated energy is sold under PPA in US$ with private parties; therefore, when expressed in AR$, they are exposed to nominal exchange rate variations. The average term amounts to approximately five years.

In terms of volume, the drop in energy demand by GU as a result of COVID-19 and the macroeconomic context has not significantly affected the MAT ER segment, as these contracts were mainly destined to meet the base demand. In this sense, on top of our own generation from PEPE II and III, the Company began commercializing third-party generators’ renewable energy for an approximate volume of 2 MW, contributing to increasing the MAT ER margin segment.

Pampa Energía ● 2020 Annual Report ●34 |

|  |

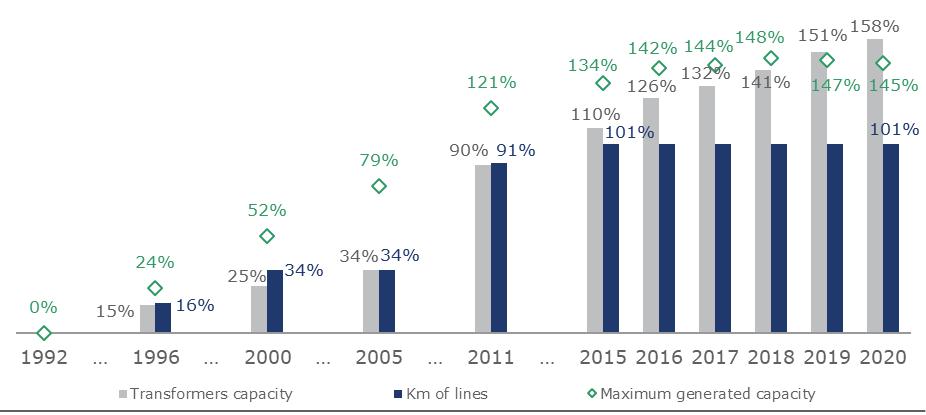

5.2 Transmission6

Evolution of the high-voltage transmission system

The following chart shows the evolution of the transformation capacity’s cumulative growth and the number of km of high-voltage transmission system lines, compared to the cumulative percentage growth of peak demand since 1992.

Evolution of the transmission system

Cumulative growth (in %)

Source: Transener and CAMMESA.

As illustrated in the graphic above, the High-Voltage Transmission System has grown significantly since 2005, mainly due to the implementation of the 500 kV Transmission Federal Plan. Implementing this Federal Plan has provided the SADI with more stability and better conditions to meet the rising demand.

Transener’s tariff situation

2005 Memorandum of Understanding

The Public Emergency and Exchange Rate Regime Reform Law (Law No. 25,561) imposed public utilities, such as Transener and its subsidiary Transba, to renegotiate their agreements in force with the Government while continuing to supply electricity services. This scenario has significantly affected Transener and Transba’s economic and financial situation.

In May 2005, Transener and Transba signed with the UNIREN the Memorandums of Understanding stipulating the terms and conditions for updating the Concession Agreements. The parties agreed to perform an RTI before the ENRE, to establish a new tariff regime for Transener and Transba, which should have come into force in 2006, and to stipulate a recognition of variations in operating costs incurred until the entry into effect of the new tariff regime resulting from the RTI.

Since 2006, Transener and Transba have repeatedly requested the ENRE to regularize compliance with the commitments stipulated in the Memorandum of Understanding, expressing the demand to launch the RTI process. Moreover, Transener and Transba filed their respective tariff claims for their assessment, holding a public hearing and the definition of the new tariff scheme.

6 For further information, see sections 7.2 and 8.5 of this Annual Report.

Pampa Energía ● 2020 Annual Report ●35 |

|  |

Instrumental Agreement

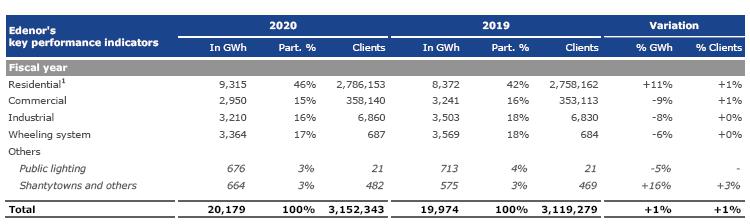

In December 2010, Transener and Transba entered into an Instrumental Agreement to UNIREN’s Memorandum of Understanding with the SE and the ENRE, which mainly recognized a credit claim in favor of Transener and Transba for cost fluctuations incurred between June 2005 – November 2010, calculated as per the Cost Variation Index established in the Memorandum of Understanding. These receivables were assigned in consideration of disbursements by CAMMESA, which were executed through loan agreements.