2024 Annual Report

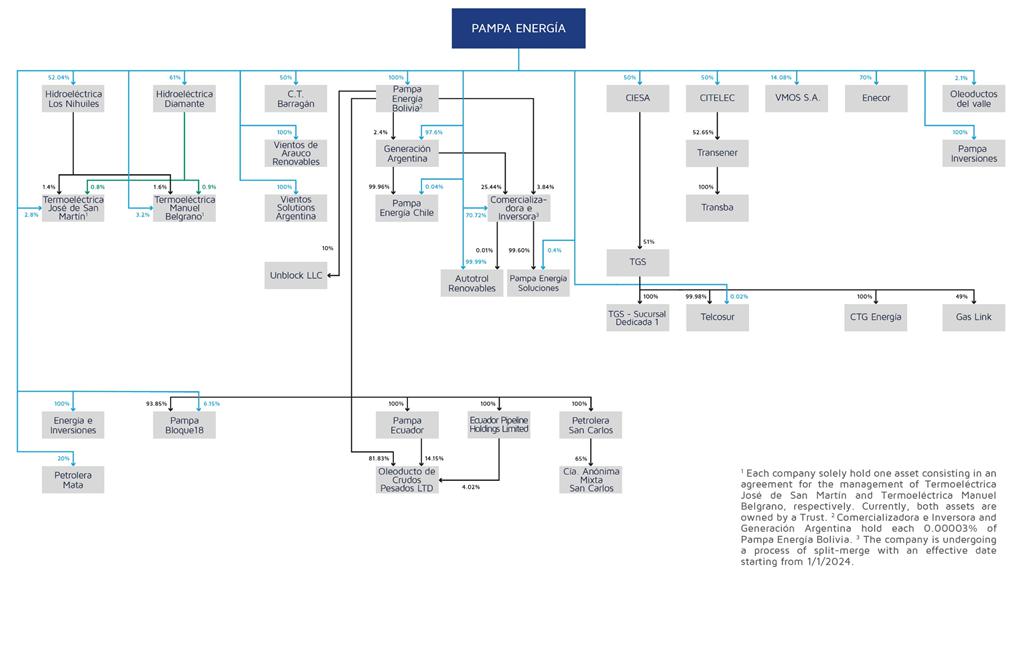

To the shareholders of Pampa Energía S.A. (‘Pampa,’ the ‘Company’ or the ‘Group’):

Pursuant to the statutory rules and Bylaws currently in force, we submit for your consideration the Annual Report and Financial Statements for the 81st fiscal year that ended December 31, 2024.

| |

Pampa Energía ● 2024 Annual Report ● 3 |

Contents

| |

Pampa Energía ● 2024 Annual Report ● 4 |

| 1. | The fiscal year 2024 and the outlook |

The year 2024 was marked by a process towards normalization of macroeconomic variables, with an emphasis on fiscal balance as the basis for balanced growth. In this context, the energy sector was one of the most impacted by the adjustment since tariff normalization raised the coverage of real costs from 22% in January to 90% in December 2024, the highest level in more than 20 years. Said adjustment made it possible to reduce energy subsidies by 0.5% of GDP, from US$9.7 to US$6.3 billion of annual outflows, and to normalize the payment chain, minimizing delays to the lowest level in 7 years. It also laid the foundations for the deregulation of electricity generation, consolidating opportunities for organic growth, economic development and the sector’s stable projection.

Coverage of seasonal price over actual electricity cost (%)

Note: Values between 2001 and 2011 are only available with an annual frequency.

In 2024, we took a strategic step with the development of Rincón de Aranda, a block 100% owned by Pampa located at the heart of Vaca Muerta’s shale oil. With a firm commitment to the country’s energy development and operational efficiency, we are ramping up production in one of the world’s most promising formations. The well, connected in March 2024, has exceeded our expectations, with an initial production of 1.4 kbbl/day and an average of 1.1 kbbl/day in 2024, outperforming the neighboring blocks’ average yield. In August, we started developing the plan with an active drilling campaign in anticipation of Duplicar’s commissioning, with six wells drilled in 2024 and the construction of facilities and treatment plants. By the end of 2024, we increased drilling rigs to four, and in February 2025, we incorporated a fracking fleet. We aim to increase Pampa’s current oil production tenfold, reaching 45 kbbl/day in 2027.

Given the increasing production scale at Rincón de Aranda and the higher need for additional evacuation, we announced our participation in the Vaca Muerta Sur project in December 2024, together with YPF, PAE, Vista and Pluspetrol. This project involves the construction and operation of a 437-km oil pipeline, with an initial 550 kbbl/day capacity, expandable to 700 kbbl/day, and an estimated US$3 billion investment. In addition to our firm capacity in Duplicar, we have secured the evacuation of new shale oil production through VMOS, multiplying Pampa’s firm transportation capacity by nine times.

Also, to continue monetizing our gas reserves in Vaca Muerta and mitigate seasonality effects on production, in November 2024, we confirmed our participation in the FLNG Project, a pioneering initiative in gas liquefaction in Argentina, together with PAE, Harbour Energy, YPF and Golar. This project envisages the assembly of floating liquefaction facilities in the San Matías Gulf, Río Negro, with operations starting in 2027. From Pampa, we will procure gas backed by the solid performance of our Sierra Chata and El Mangrullo blocks, estimating strong production growth. The FLNG project will position Argentina in the global LNG market, boosting the energy sector.

| |

Pampa Energía ● 2024 Annual Report ● 5 |

All these new shale oil and infrastructure initiatives in Vaca Muerta are strategic investments generating employment, foreign currency, operational efficiencies and new markets for growth and economic development, positioning Argentina and Pampa as top-tier energy suppliers.

Moreover, our gas production continues to reach record highs, consolidating our position in the Neuquina Basin. In July 2024, midwinter and the most critical supply period, we reached 16.7 million m3 per day, showing once again our shale gas wells’ outstanding productivity, especially in Sierra Chata. The growing natural gas contribution to the national energy matrix is key to replacing liquid fuels and decreasing foreign-currency dependency and electricity generation costs, which are fundamental for the grid’s sustainability.

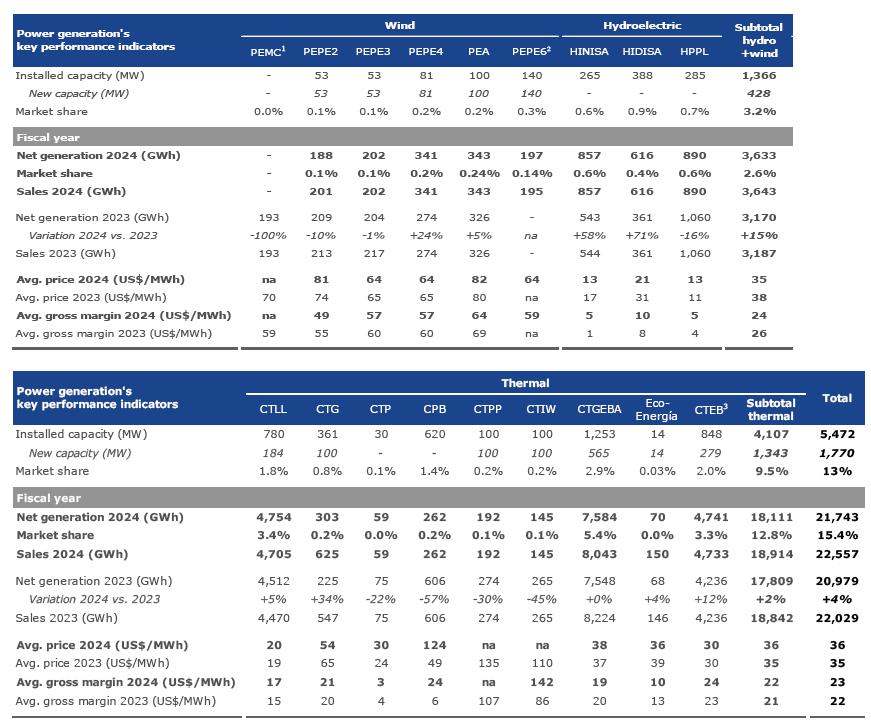

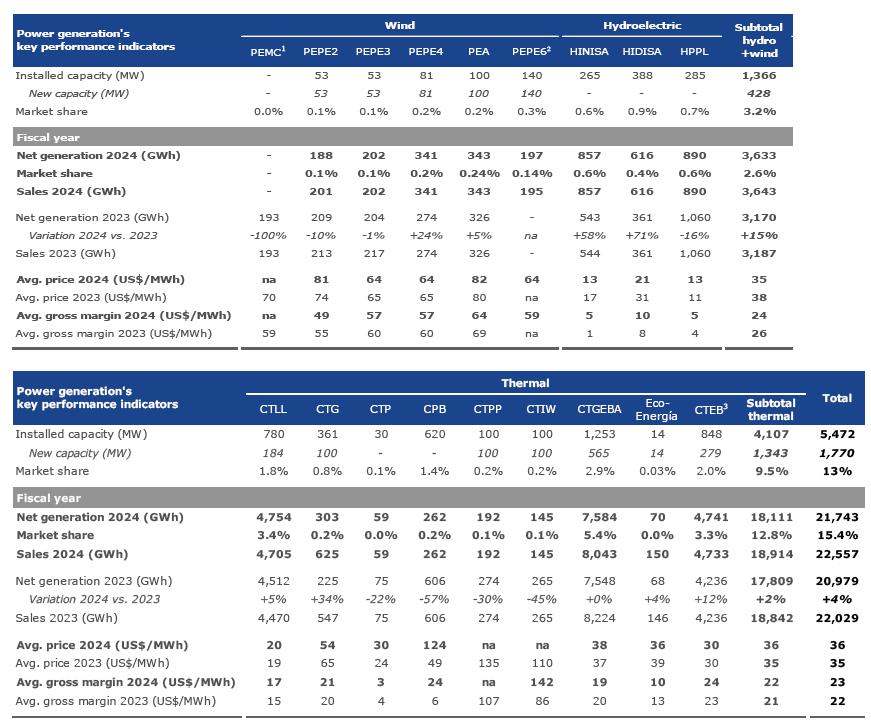

In 2024, and thanks to our asset portfolio’s operational excellence, we were recognized once again as the country’s largest independent power producer. Our asset portfolio includes four CCGTs that, together with our Vaca Muerta gas supply, offer us a key competitive advantage given the imminent sector deregulation. Our thermal units recorded a 95.4% commercial availability, reflecting our assets’ strength and reliability, backed by sustained maintenance and modernization investments toward efficiency.

In terms of expansion projects, in December, we completed the commissioning of PEPE 6, our most recent wind farm, reaching a total 427-MW clean energy capacity and positioning us as one of the country’s leading renewable energy generators.

Evolution of thermal generation availability

In % of rated capacity

Another important milestone in 2024 was the significant improvement in our debt profile. Thanks to our proactivity and leveraging market opportunities, we placed two 7- and 10-year international bonds with the most competitive market rates. Furthermore, backed by solid cash generation in our power generation and gas production businesses, we closed the year with a net debt of US$410 million, the lowest level since 2016. These achievements reaffirm the market’s trust in our management, contributing more robustly to our growth plan.

In addition to our operational excellence, in 2024, we reinforced our commitment to ESG principles, promoting our teammates and contractors’ well-being, close dialog with our stakeholders and the development of the communities where we operate. This progress is the result of our team’s effort and dedication, along with the support of our families, suppliers, financial institutions and investors. We thank our shareholders for the trust placed in us and renew our commitment to continuing to invest and grow to consolidate our position as a key player in the Argentine energy sector.

| |

Pampa Energía ● 2024 Annual Report ● 6 |

In 2024, the new administration launched an economic stabilization plan based on a fiscal and an exchange rate pillar.

In the fiscal sphere, the Government achieved a primary and financial surplus of 2.4% and 0.8% of GDP, respectively, a milestone that had not been reached for 14 years. This result was possible thanks to a 27% adjustment in public spending in real terms, despite political and social challenges. A key component of this reduction was the decrease in energy subsidies: at the beginning of the year, electricity tariffs only covered 22% of the real cost, whereas by the end of 2024, the coverage reached 90%. The reduction in economic subsidies accounted for 12% of the total adjustment.

In line with the economic plan, in July 2024, the ‘May Pact’ was signed, which included fiscal balance and a public spending level below 25% of GDP among its goals. The Treasury has been rigorous in this respect, considering it a central axis of its economic policy. In this way, the achieved surplus has allowed it to meet its obligations, paying both amortizations and interest on its foreign-currency international obligations, significantly reducing the country risk from 1,938 in December 2023 to 635 basis points in December 2024. This improvement has reopened the international capital markets for Argentine companies, with 16 corporate bond issues, including two by Pampa and one by TGS, enabling the refinancing of the companies’ US$-denominated debts. However, the fiscal adjustment has impacted economic activity, which accumulated a 3% year-on-year decline as of the third quarter of 2024.

On the monetary front, the Government applied a policy that included two main measures: limiting the expansion of the broad monetary base and establishing a foreign exchange crawling peg regime, with a monthly 2% devaluation, to anchor devaluation expectations. This policy was feasible, in part, due to the continuity of capital controls. The wholesale US$ exchange rate closed at AR$1,032/US$ as of December 31, 2024, accumulating a 28% increase vs. the end of 2023 and an average 210% year-on-year increase. A controlled exchange rate, combined with the lack of need to issue money to finance the Treasury given the above-mentioned surplus, resulted in a sharp decrease in the monthly inflation rate, from 25.5% in December 2023 to 2.7% in December 2024.

Regarding the balance of payments, an estimated US$18.9 billion surplus was achieved, with a US$5.7 billion energy surplus, the highest in 18 years. This was made possible by oil export growth and lower imports of gas and liquids used for electricity generation, which was driven by the gas production increase at Vaca Muerta. Furthermore, progress was made in regularizing importers’ commercial debt through the issuance of US$-denominated securities by the BCRA and the elimination of most of the entity’s remunerated liabilities, helping to clean up its balance sheet.

It is worth highlighting that in October, the Government launched a tax amnesty. Under it, more than US$32 billion was declared, of which US$22 billion entered the system in cash. This result contributed to strengthening fiscal accounts and allowed the Government to rebuild BCRA’s reserves, which closed at approximately US$30 billion, US$7 billion more than at the end of 2023, strengthening the local market and providing new financing sources.

Finally, towards the end of 2024, the Government started reducing some taxes, including the elimination of the PAÍS tax, with a positive impact on Pampa.

| |

Pampa Energía ● 2024 Annual Report ● 7 |

At Pampa, we consider that the best way to preserve and protect our investors is by adopting and implementing the best corporate governance practices. This approach has consolidated us as one of the most reliable and transparent companies in the market. We work continuously to incorporate the above-mentioned practices, aligning them with international trends and current local and foreign regulations.

In this sense, Pampa is a member of the +GC Panel, sponsored by ByMA, which brings together BYMA-listed companies with single-vote shares that are committed to good governance and corporate transparency best practices, going beyond regulatory requirements. Pampa fulfills all these practices, which are aligned with the Corporate Governance principles of the Organization for Economic Co-operation and Development (OECD) adopted by the G20 and periodically reviewed to ensure compliance.

Further details on Pampa’s corporate governance practices are available in Appendix I of this Annual Report, which includes the corporate governance report required under the Code as per Sect. 1, Title I, Chapter I, Part IV of the CNV Rules, restated in 2013 and amended by CNV General Res. No. 797/19.

As of December 31, 2024, Pampa’s capital stock consisted of 1,363,520,380 common shares, each with a par value of AR$1 and granting the right to one vote. The following table shows information on Pampa’s common shareholdings:

Holders

as of December 31, 2024 | In million | % of outstanding capital stock |

| Shares | ADR |

| Management1 | 302.2 | 12.1 | 22.2% |

| Free float on NYSE and ByMA | 1,057.4 | 42.3 | 77.6% |

| Employee stock-based compensation plan | 3.9 | 0.2 | 0.3% |

| Outstanding capital | 1,363.5 | 54.5 | 100.0% |

Note: Figures are rounded, so the total may not equal the sum of the figures. 1 Direct and indirect stakes of Messrs. Marcos Marcelo Mindlin, Damián Miguel Mindlin, Gustavo Mariani and Ricardo Alejandro Torres.

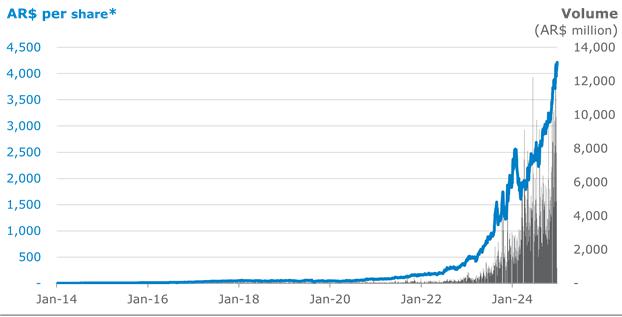

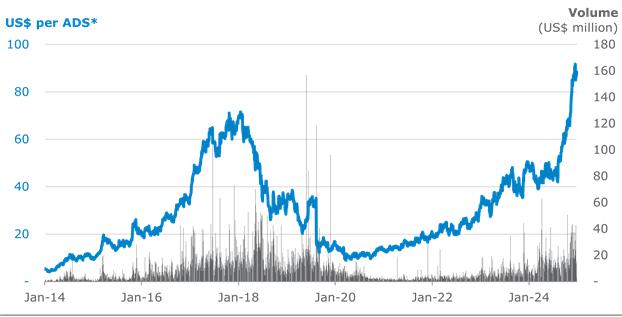

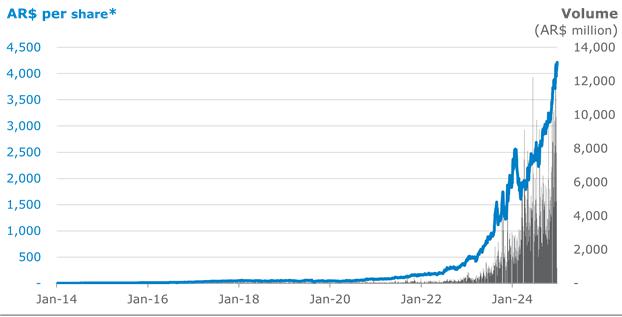

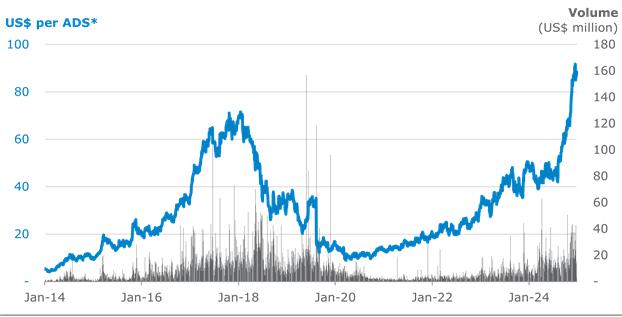

Pampa is listed on the ByMA, participates in the S&P Merval and the Sustainability (non-traded) indexes, and is a member of the +GC Panel. Moreover, Pampa has a Level II ADS program listed on the NYSE, where each ADS represents 25 common shares.

| 3.2 | Pampa’s corporate bodies |

Board of Directors

Under the ABOL, the CMA, and Pampa’s Bylaws, decision-making within the Company is vested in the Board of Directors. The Board consists of ten regular directors and an equal or smaller number of alternate directors, as determined by the Shareholders’ Meeting, a percentage of whom will be independent according to the independence criteria set out in the CNV rules. All our directors are elected for a term of three years and may be re-elected indefinitely, except for the restrictions arising from CNV’s independence standards. The expiration and further renewal of terms of office are made on a partial and staggered basis every year, with the election of three directors for two consecutive years and four directors the following year. Currently, Pampa’s Board is composed by:

| |

Pampa Energía ● 2024 Annual Report ● 8 |

| Name | Position | Independence | Term-expiration* |

| Marcos Marcelo Mindlin | Chairman | Non-Independent | 12/31/2026 |

| Gustavo Mariani | Vice-chairman | Non-Independent | 12/31/2025 |

| Ricardo Alejandro Torres | Director | Non-Independent | 12/31/2025 |

| Damián Miguel Mindlin | Director | Non-Independent | 12/31/2026 |

| María Carolina Sigwald | Director | Non-Independent | 12/31/2026 |

| Silvana Wasersztrom | Director | Independent | 12/31/2025 |

| Carolina Zang | Director | Independent | 12/31/2024 |

| Carlos Correa Urquiza | Director | Independent | 12/31/2024 |

| Julia Sofía Pomares | Director | Independent | 12/31/2024 |

| Lucas Sebastián Amado | Director | Independent | 12/31/2024 |

| Horacio Jorge Tomás Turri | Alternate Director | Non-Independent | 12/31/2025 |

| María Agustina Montes | Alternate Director | Non-Independent | 12/31/2025 |

| Mariana De la Fuente | Alternate Director | Non-Independent | 12/31/2024 |

| Mauricio Penta | Alternate Director | Non-Independent | 12/31/2026 |

| Diego Martín Salaverri | Alternate Director | Non-Independent | 12/31/2024 |

| Clarisa Diana Lifsic | Alternate Director | Independent | 12/31/2024 |

| Clarisa Vittone | Alternate Director | Independent | 12/31/2026 |

| María de Lourdes Vázquez | Alternate Director | Independent | 12/31/2026 |

| Verónica Cheja | Alternate Director | Independent | 12/31/2024 |

| Lorena Rappaport | Alternate Director | Independent | 12/31/2024 |

Note: *They will be in office until their reelection or the election of their substitutes.

On March 5, 2025, María Carolina Sigwald resigned as a Director, and her replacement will be appointed at Pampa’s next shareholders’ meeting.

Our senior management

The following table includes information on our senior management:

| Name | Position |

| Marcos Marcelo Mindlin | Chairman |

| Gustavo Mariani | Executive vice-president and CEO |

| Ricardo Alejandro Torres | Executive vice-president |

| Damián Miguel Mindlin | Executive vice-president |

| Nicolás Mindlin | Executive vice-president |

| Horacio Jorge Tomás Turri | Executive vice-president and executive director

of exploration and production |

| Adolfo Zuberbühler | Executive director of finances (CFO) |

| María Carolina Sigwald | Executive director of legal affairs |

| Mauricio Penta | Executive director of administration, IT and supply |

| |

Pampa Energía ● 2024 Annual Report ● 9 |

On December 23, 2024, the Board of Directors approved Nicolás Mindlin and Horacio Turri’s promotion to executive vice-presidents, effective January 1, 2025. Horacio Turri maintains his position as executive director of exploration and production. Also, Adolfo Zuberbühler, who previously held the position of director of finance, was promoted to CFO.

Supervisory Committee

The Supervisory Committee’s primary responsibility is exercising statutory control over the Board’s compliance with the provisions of the ABOL, the Bylaws, their regulations, if any, and the decisions adopted at Shareholders’ Meetings, without intervening in operational management or the merits of decisions adopted by the directors.

Our Bylaws establish that the Supervisory Committee should be composed of three regular members and three alternate members appointed by our shareholders, who should be lawyers or certified accountants. Members serve for a term of three fiscal years. The current composition is as follows:

| Name | Position | Term expiration* |

| José Daniel Abelovich | Statutory Auditor | 12/31/2026 |

| Roberto Antonio Lizondo | Statutory Auditor | 12/31/2026 |

| Tomás Arnaude | Statutory Auditor | 12/31/2026 |

| Martín Fernández Dussaut | Alternate Statutory Auditor | 12/31/2026 |

| Noemí Ivonne Cohn | Alternate Statutory Auditor | 12/31/2024 |

| Germán Wetzler Malbrán | Alternate Statutory Auditor | 12/31/2026 |

Note: * They will be in office until their reelection or the election of their substitutes.

Audit Committee

Under Sect. 109 of the CMA, Pampa has an Audit Committee composed of three regular members and one alternate member, all of whom are independent, as per CNV rules, and have professional experience in financial, accounting, legal and/or business matters.

In accordance with the applicable legislation and its own internal regulations, the Audit Committee has, among others, the following duties:

| i. | Supervising the operation of internal control and administrative/accounting systems and the reliability of the latter and of all financial information or any other noteworthy events that may be disclosed to the CNV and the markets. |

| ii. | Rendering an opinion on any Board proposal appointing external auditors to be hired by the Company and ensuring their independence. |

| iii. | Reviewing the plans sent by external and internal auditors, assessing their performance, and issuing an opinion on the presentation and disclosure of annual FS. The Committee may determine objective indicators to assess the external auditor’s performance, commitment, efficiency and independence. |

| iv. | Supervising the implementation of risk management reporting policies. |

| v. | Providing the market with complete information on transactions involving potential conflicts of interest with members of corporate bodies or controlling shareholders. |

| vi. | Rendering its opinion on remunerations and stock options plans’ proposals for the Company’s directors and managers drawn up by the Company’s Board. |

| vii. | Rendering its opinion on compliance with legal requirements and the reasonableness of conditions for the issuance of shares or convertible securities in case of capital increases with the exclusion or limitation of preemptive rights. |

| |

Pampa Energía ● 2024 Annual Report ● 10 |

| viii. | Issuing a well-founded opinion on related-party transactions in the cases established by legislation and disclosing it in compliance with the law in case there is an actual or alleged conflict of interest within Pampa. |

| ix. | Supervising the operation of a channel whereby the Company’s executives and staff may report accounting, internal control and audit issues. |

| x. | Providing any report, opinion or statement required by the current regulations in force, with the scope and frequency required by such regulations, as amended, etc. |

| xi. | Fulfilling all obligations imposed in the Bylaws, as well as laws and regulations binding the Company. |

| xii. | Ensuring compliance with applicable standards of conduct. |

| xiii. | Drawing up an annual action plan, for which it will be held accountable to the Board and the Audit Committee. The Audit Committee will submit this action plan within 60 calendar days from the beginning of the fiscal year. |

Pampa’s Audit Committee is composed as follows:

| Name | Position | Independence |

| Carlos Correa Urquiza | Chair | Independent |

| Carolina Zang | Vice president | Independent |

| Silvana Wasersztrom | Regular Member | Independent |

| Clarisa Diana Lifsic | Alternate Member | Independent |

| 3.3 | Minority shareholder protection |

Pampa’s Bylaws include specific measures to protect minority shareholders:

| · | A single class of shares granting equal economic and political rights. |

| · | Special majorities of up to 66.6% of the votes to amend specific clauses of the Bylaws. |

| · | The possibility of convening a shareholders’ meeting upon the request of shareholders representing at least 5% of the capital stock. |

| 3.4 | Corporate governance policies |

Integrity Program – Law No. 27,401

Pampa fully complies with the Legal Entities’ Criminal Liability Law. To this effect, it implements internal actions, mechanisms and procedures making up our Integrity Program, which aims to prevent, detect and correct irregularities and illicit acts typified in said law. The Program is periodically reviewed by the Board, including the identification of possible improvements. The internal audit department is internally responsible for the program and is in charge of its development, coordination, and supervision.

Code of Conduct

Pampa has a Code of Conduct approved by the Board that guides honest decision-making in day-to-day activities and how challenges are addressed. The Code promotes relationships based on principles of excellence with our customers, suppliers, teammates, shareholders, authorities, intermediate organizations and the community.

| |

Pampa Energía ● 2024 Annual Report ● 11 |

Ethics Committee

We have a consultation body on the Integrity Program. Its main responsibilities include providing guidance on the Code of Conduct, supervising cases received through the Ethics Hotline and rendering its opinion on disciplinary actions and conflicts of interest. This committee is composed of the Human Resources, Legal and Audit Departments, under the supervision of the CEO, and is accessible by direct contact or e-mail: etica@pampa.com.

Ethics Hotline

Pampa offers the Ethics Hotline, an exclusive channel to report any suspected irregularities or breaches of the Code of Conduct on a strictly confidential basis. The line is operated by an external provider offering different reporting channels (website, chat, toll-free telephone line or e-mail), thus ensuring transparency. It also has a procedure for handling complaints, which describes the process from the reception of an objection to the investigation’s conclusion and the potential application of corrective actions. The Audit Committee supervises the channels’ operation and resolution of complaints in issues within its authority.

Policy against fraud, corruption and other irregularities

This policy reinforces ethics and transparency as essential behaviors to carry out Pampa’s business, prohibiting any form of fraud, corruption or other misconduct. It also sets Pampa’s stance on preventing corruption and other irregular conduct, complementing the principles and values defined in our Code of Conduct. Therefore, both documents should be read in conjunction. This policy also contemplates the obligation to report any actual or suspected violation of laws and/or regulations, and the prohibition of retaliation against anyone filing a report in good faith or refusing to participate in acts of corruption.

Policy on best security market practices

This policy regulates the purchase and sale of Pampa and/or its affiliates’ marketable securities to ensure transparency and prevent the improper use of material non-public information. It applies to all Pampa’s and its subsidiaries’ staff, including Board and Supervisory Committee members and Senior management lines.

Policy on related-party transactions

In line with the CMA, the policy establishes that all relevant transactions carried out by Pampa with individuals and/or legal entities deemed ‘related parties’ must be authorized and controlled by the Board and the Audit Committee, as appropriate, in coordination with Pampa’s executive legal affairs department.

Board of directors’ self-assessment questionnaire

The Board conducts an annual management self-assessment, answered individually by each Board member, to identify performance improvement areas. The executive legal affairs department is responsible for analyzing and filing the questionnaires.

Policy on relevant information disclosure

This policy regulates processes for publishing relevant information in compliance with the regulatory requirements of the stock exchanges where Pampa’s securities are traded or in which Pampa is a registered issuer.

| |

Pampa Energía ● 2024 Annual Report ● 12 |

Integrated management policy

This policy promotes our businesses’ sustainable development, incorporating the efficient use of energy and natural resources, the reliability and integrity of our facilities and operations, and asset management optimization. It includes ten management principles that guide its simple and agile implementation and strengthen Pampa’s culture.

Dividend Policy

This policy sets out the guidelines for balancing dividend distribution with investment plans, offering clarity, transparency and consistency so that shareholders can make informed decisions, following the Company’s Bylaws and current regulations.

Compensation Policy

This policy establishes general rules to determine the composition, updating and handling of directors’ compensation and expense reimbursement. The Compensation Committee reports to Pampa’s Board and is exclusively made up of three regular members and an equal or smaller number of alternate independent members. Its composition is as follows:

| Name | Position | Independence |

| Silvana Wasersztrom | Chair | Independent |

| Carlos Correa Urquiza | Regular Member | Independent |

| Carolina Zang | Regular Member | Independent |

| Clarisa Lifsic | Alternate Member | Independent |

Nomination Policy

This policy establishes independence, diversity and competence criteria applicable to Board nominees, whether proposed by the Board itself or by the shareholders, to be presented at the shareholders’ meeting. The Nomination Committee, which assists the Board and the shareholders’ meeting in the Board members’ nomination and appointment process, is composed of three regular members and an equal or lower number of alternate members, and its Chair must be independent. Its composition is as follows:

| Name | Position | Independence |

| Silvana Wasersztrom | Chair | Independent |

| Gustavo Mariani | Regular Member | Non-independent |

| Carlos Correa Urquiza | Regular Member | Independent |

| Mariana de la Fuente | Alternate Member | Non-independent |

| Clarisa Lifsic | Alternate Member | Non-independent |

| |

Pampa Energía ● 2024 Annual Report ● 13 |

| 4. | The Argentine oil and gas market |

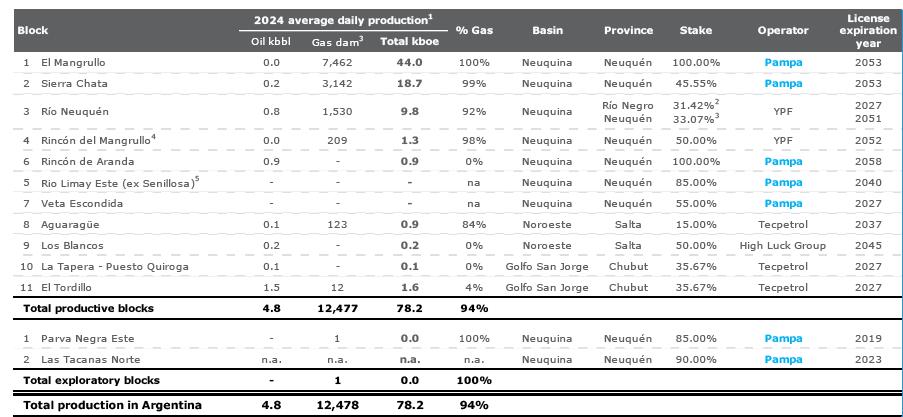

| 4.1 | Hydrocarbon exploration and exploitation1 |

The Argentine energy matrix

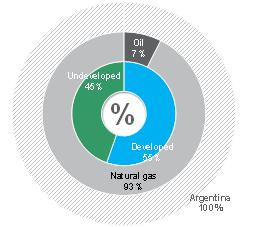

Natural gas and oil constitute the main resources in the national primary energy matrix. The following chart illustrates the matrix as of December 31, 2023 (last available information):

2023 Argentine energy matrix

100% = 79.4 million tons of oil equivalent

Note: It excludes other primary sources for 4.7%. Source: SE.

Natural gas

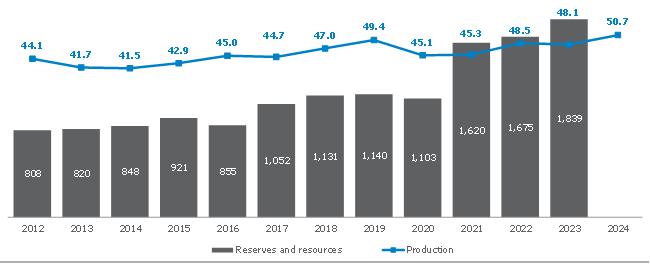

In 2024, total gross natural gas production amounted to 139 million m3 per day, a 5% increase vs. 2023. This increase is explained by growth in the Neuquina Basin (+9.1 million m3 per day) driven by the commissioning of the GPM in August 2023, partially offset by falls in production in the remaining basins: Austral (-1.2 million m3/day), Golfo San Jorge (-0.6 million m3/day) and Noroeste (-0.2 million m3/day). Net production grew by 7%, totaling 129 million m3 per day.

Total demand grew by 2% year-on-year, mainly due to higher power plants’ gas consumption, residential demand and exports. Likewise, there was a significant reduction in natural gas imports, with year-on-year decreases of 48% from Bolivia (3.2 million m3/day) and 34% in LNG (4.5 million m3/day), explained by the new evacuation capacity from Neuquén and the reversal of the Northern gas pipeline. In contrast, exports to Chile increased by 10%, reaching 6.5 million m3/day and representing 5% of total production in 2024.

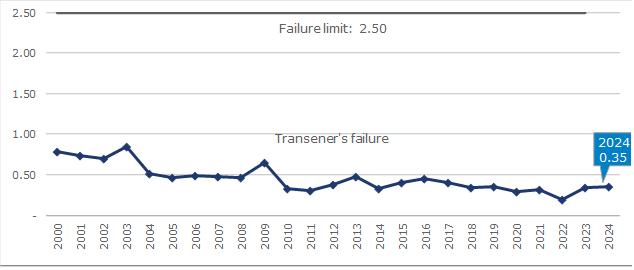

As of December 31, 2023, the country’s natural gas reserves and resources totaled 1,839 million m3, a 10% increase vs. 2022. Of the total, 27% were proven reserves, and 78% came from unconventional formations.

1 For further information on the assets under this segment, see section 6.1 of this Annual Report.

| |

Pampa Energía ● 2024 Annual Report ● 14 |

Evolution of natural gas production, and reserves and resources*

In billion m3, 2012-2024

Note: * There is no information on reserves and resources for 2024. Source: SE.

Oil

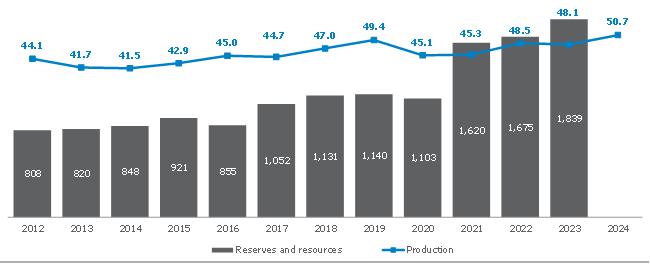

In 2024, total oil production reached 700.7 kbbl per day, a 10% increase vs. 2023. This growth was led by the Neuquina Basin, where production increased by 20%. Oldelval and OTASA’s systems have improved the evacuation capacity from Vaca Muerta, which has also contributed to the increase. Out of total production, 69% came from the Neuquina Basin (481 kbbl per day) and 27% from the Golfo San Jorge Basin (190 kbbl per day, -5% vs. 2023).

Evolution of oil production, and reserves and resources*

In million boe, 2012-2024

Note: * There is no information on reserves and resources for 2024. Source: SE.

Local refining remained at 2023 levels, with a total volume of 520.7 kbbl per day, mainly supplied by the Neuquina (341.3 kbbl per day, +6% year-on-year) and the Golfo San Jorge Basins (160.6 kbbl per day, -9% vs. 2023). Other basins contributed 18.8 kbbl per day (-7.5% year-on-year). In 2024, no oil imports were made, and exports increased by 41%, reaching 185.5 kbbl per day (26% of total production), thanks to improvements in transportation infrastructure.

| |

Pampa Energía ● 2024 Annual Report ● 15 |

As of December 31, 2023, the country’s total oil reserves and resources remained stable at 10,513 million bbl, of which 29% were proven and 68% were unconventional reserves.

The Argentine Hydrocarbons Law

Hydrocarbons Law No. 17,319, amended in October 2014 (Law No. 27,007) and updated on July 8, 2024 (Law No. 27,742 or Bases Law), establishes a regulatory framework to promote the exploration, exploitation and commercialization of conventional and unconventional hydrocarbon resources. Its pillars include the flexibilization of permit terms, onshore and offshore unconventional hydrocarbon exploration and exploitation concepts, investment incentives and exports not subject to internal supply considerations, among others.

Unconventional hydrocarbons exploitation

The Law conferred legal status to the ‘Hydrocarbons Unconventional Exploitation Concession’ concept created by DNU No. 929/13 for the extraction of liquid and/or gaseous hydrocarbons by unconventional stimulation techniques applied in reservoirs situated in geological formations of schist rock or slate (shale gas or shale oil), tight sandstone (tight sands, tight gas, tight oil), coal bed methane and/or characterized by the presence of low permeability rocks.

Holders of hydrocarbon exploration permits and/or exploitation concessions may request an unconventional exploitation concession to the enforcement authority until December 31, 2028. This application must include the development of a pilot plan for the field’s commercial exploitation, and adjacent unconventional blocks may be unified, provided geological continuity is demonstrated.

Unconventional hydrocarbons exploitation concession (CENCH) in the Province of Neuquén

The Ministry of Energy and Natural Resources of the Province of Neuquén set certain parameters to grant a CENCH (Res. No. 53/20 and 142/21, ratified by Provincial Executive Order No. 2183/21).

Companies are required to submit annual development plans for up to five years, demonstrating their technical and economic feasibility, along with additional parameters related to operation, actual productivity assessments, costs and investment commitment. Once the request is filed, a block extension bond payment is incorporated. Its value will be associated with the resources expected to be recovered in the block, considering the average price over the last 2 years.

Terms for concessions and permits

The terms for the exploration permits will be established in each call for tenders issued by the enforcement authority according to the exploration’s target: (i) conventional exploration, divided into two 3-year periods, plus an optional extension of up to 5 years (maximum 11 years); (ii) unconventional exploration, divided into two 4-year periods, plus an optional extension of up to 5 years (maximum 13 years); and (iii) onshore and offshore exploration, divided into two 3-year periods, plus an optional extension of one year each.

Upon expiration of the basic term’s first period, the permit holder will decide whether to continue exploring the block or entirely relinquish it to the Government. The originally granted block may be kept provided permit obligations are met. If the exploration permit holder exercises the right of extension upon the basic term’s expiration, the relinquishment will be limited to 50% of the remaining block. In exploitation concessions, terms run as from the date of the granting Res.: (i) conventional exploitation, 25 years; (ii) unconventional exploitation, 35 years; and (iii) onshore and offshore exploitation, 30 years.

Exploitation concessions granted before the Bases Law’s enactment will continue being governed by the established terms until expiration. After that, they may not be awarded without a new tender process. In new concessions, the above-mentioned terms are maintained, and the authority may justifiably extend them for up to 10 more years.

| |

Pampa Energía ● 2024 Annual Report ● 16 |

Awarding of blocks

Law No. 17,319, amended by Laws No. 27,007 and 27,742, proposes model tender specifications drawn up by the SE and the provincial authorities establishing conditions, guarantees and minimum investments to which tenders must conform. It also establishes adjustment mechanisms for royalties, which may consider investments made, income obtained and operating expenses, among other variables. The evaluation of tenders will consider the project’s total value, and tenderers will compete for royalties, with a base 15% value plus a percentage of their choice, which may even be negative.

Levy and royalties

Levy values per km2 or fraction will be paid annually in AR$ and in advance by the permit holder, adjusted as per the average Brent crude oil barrel price. The amount equals 0.50 bbl of oil per km2 in the first and 2 oil barrels per km2 in the second period. In extensions, the levy is the equivalent in AR$ to 15 bbl of oil per km2.

Royalties are the only production-based income mechanism the granting jurisdictions will receive on a monthly basis and are set as a percentage in the awarding process. Contracts prior to the Bases Law range from 12% to 15%, as agreed with the PEN or Province, and may be reduced to 5% depending on the wells’ productivity, conditions and location.

Transport and processing

The Bases Law replaces concessions with transportation concessions, granted and extended for the same term as the originating exploitation concession. After these terms’ expiration, the facilities will be transferred to the Federal or Provincial Government, as applicable, without any charges or encumbrances. Previous concessions will be governed by the terms and conditions under which they were awarded.

Moreover, the Bases Law enables the grantor to issue authorizations to process hydrocarbons and derivatives and construct and operate natural gas conditioning, separation and liquefaction plants and the necessary facilities without being linked to an exploitation concession. Holders of processing projects and/or facilities may request an indefinite-term transportation authorization to and from their facilities. Holders authorized before the Bases Law will not be required to apply for the reconversion of the granted authorizations (DNU No. 1,057/24).

Authorizations for underground natural gas storage

Under the Bases Law, the PEN may authorize the underground storage of gas in depleted natural hydrocarbon reservoirs to any subject who (i) meets technical experience and financial capacity requirements, (ii) has the consent of the holder of the exploration permit and/or exploitation concession where the reservoir is located, and (iii) builds the necessary facilities.

These authorizations will be granted for an indefinite term, and holders of storage authorization may apply for the transportation to and from their facilities to the transportation system. Exploitation bonds and similar payments will be made. Likewise, stored natural gas will only pay royalties when first marketed.

Hydrocarbon export and import

The Bases Law establishes that international hydrocarbon trade will be free and unobjectionable by the SE, except during the 30 administrative working days following the exercise of the export right, founded on domestic supply security. For LNG, the Undersecretariat of Liquid Fuels informed producers that until regulations are readjusted, the current authorization procedure would remain in effect (Note No. 135497092).

| |

Pampa Energía ● 2024 Annual Report ● 17 |

Uniform legislation

The Bases Law empowers the PEN to draw up, with the provinces’ agreement, harmonized environmental legislation primarily aimed at applying the best international environmental management practices in hydrocarbon exploration, exploitation and/or transportation tasks and achieving the activity’s development with proper environmental care.

Regulations in the gas market

Plan Gas

Created in 2020, Plan Gas promotes Argentine natural gas production and manages the gas cost impact on the Priority Demand’s tariff through tendering long-term supply agreements (DNU No. 892/20). Initially, the term for onshore production was 4 years, with an additional 4 years for offshore production from January 2021. Later, the term was extended until December 31, 2028, for the 70 million m3/day base volume awarded under rounds 1 and 3 (DNU No. 730/22).

Agreements are executed between producers (as sellers) and CAMMESA, gas distributors and ENARSA (as purchasers), with a 100% daily DoP and a 75% monthly ToP for CAMMESA and quarterly ToP for gas distributors and ENARSA. The following seasonal adjustment factors are applied to the awarded price: 0.82 in the summer period (October – April), 1.25 (May -September) for the base volume and 1.30 for the additional volume in the winter period. CAMMESA and ENARSA pay the price awarded in the call for tenders. Distributors pay the amount according to the current tariff scheme, with the difference being compensated by the Federal Government, guaranteed by tax credit certificates, without prejudice to other applicable mechanisms.

In December 2020, round 1 was awarded for an annual base volume of 67.4 million m3/day at US$3.5/MBTU as of January 2021 and a winter additional volume of 3.6 million m3/day at US$4.7/MBTU as of May 2021 (SE Res. No. 391/20 and 447/20). In December 2022, rounds 4.1 and 5.1 extended, until December 2028, 48.0 million m3/day in the Neuquina Basin at US$3.592/MBTU and 2.4 million m3/day in the Austral Basin at US$3.479/MBTU (SE Res. No. 860/22).

Round 2 was awarded in March 2021, with an increasing daily DoP and a 75% quarterly ToP for a base volume of 3.3 million m3/day during winter at US$4.7/MBTU from June 2021 (SE Res. No. 169/21).

Round 3 was awarded in November 2021 for an annual base volume of 3 million m3/day at US$3.43/MBTU from May 2022 (SE Res. No. 1091/21). In December 2022, it was extended at US$3.435/MBTU in the Neuquina Basin until December 2028 (SE Res. No. 860/22).

Round 4.2 awarded new volumes until December 2028. Awardees may limit up to 30% of the volume committed with ENARSA for industrial customers and/or CNG, subject to SE’s approval. The tender calls were:

| · | Annual flat commitment from July 2023: 11 million m3/day at US$3.41/MBTU; |

| · | Annual flat commitment from January 2024: 3 million m3/day at US$2.989/MBTU; |

| · | Peak (winter) commitment from May 2024: 7 million m3/day at US$4.249/MBTU; and |

| · | Peak (winter) commitment from May 2025: 7 million m3/day at US$3.597/MBTU. |

Finally, round 5.2 awarded the incremental volumes set monthly in the Austral, Golfo San Jorge and Noroeste Basins for 3.3 million m3/day at US$7.319/MBTU from October 2023 to December 2028. The customers are ENARSA and CAMMESA, with an 80% daily DoP and a 0% monthly ToP (SE Res. No. 799/23).

| |

Pampa Energía ● 2024 Annual Report ● 18 |

Pampa awards under Plan Gas

Pampa’s awards under each round are detailed below:

| Round | Type of delivery | Volume in

million m3 per day | Price in US$/MBTU | Expiration |

| 1 & 4.1 | Annual flat | 4.901 | 3,602 | December 2028 |

| 1 | Winter3 | 1.00 | 4,68 | September 2024 |

| 2 | Winter3 | 0.86 | 4,68 | September 2024 |

| 3 & 4.1 | Annual flat | 2.00 | 3,3472 | December 2028 |

| 4.2 | Annual flat | 4.80 | 3,4852 | December 2028 |

| 5.2 Northwest | Monthly variable | 13.5 – 70.5 thousand m3/day | 6 - 9,84 | December 2028 |

Note: 1 The total commitment from May 2021 is 7 million m3/day. Out of this, 4.9 are deliveries under Plan Gas, and the balance is sold on the market. 2 A 1.25 adjustment factor in the winter and 0.82 for the rest of the year. 3 It covers May through September. 4 Prices start at US$9.8/MBTU and drop to US$6/MBTU in 2028.

Natural gas for the residential and CNG segment

Priority Demand and CEE

In June 2016, CEE criteria were established to guarantee the Priority Demand’s supply in case of operational emergencies (MEyM Res. No. 89/16, as amended). In June 2017, the procedure for dispatch administration in the CEE was approved (ENARGAS Res. No. 4502/17). If the CEE does not reach an agreement, ENARGAS defines the required supply considering each producer’s available quantities and deducts the amounts previously contracted to meet the Priority Demand, with a progressive allocation until matching each producer/importer’s proportional quota in the Priority Demand.

Natural gas prices within the PIST

As of January 2021, gas volumes for the Priority Demand are contracted under Plan Gas. Gas distributors pay the price stated in the effective tariff scheme, and the Federal Government offsets the difference with Plan Gas’ awarded price. ENARSA pays 100% of the Plan Gas’ awarded price.

Natural gas for power plants

Since the end of 2019, power plants’ fuel supply has been centralized in CAMMESA, except for generators with PPA under Energía Plus and SEE Res. No. 287/17 (MDP Res. No. 12/19). CAMMESA launches calls on an interruptible basis to cover its monthly consumption, and most gas has been supplied under Plan Gas since 2021. Generators under Energía Plus and SEE Res. No. 287/17 PPA can assign natural gas operation and transportation to CAMMESA. Pampa opted into this scheme.

As of 2021, reference PIST prices were set for production out of Plan Gas at US$2.3/MBTU in the summer (October – April) and US$3.5/MBTU in the winter period (May – September) for the Neuquina Basin (SE Res. No. 354/20). In addition to Plan Gas, CAMMESA launches calls with a maximum price equal to Plan Gas and 30% DoP, although the volume is marginal.

On January 28, 2025, the SE repealed the dispatch scheme established in SE Res. No. 354/20 as of February 1, 2025. The scheme prioritized dispatch per the obligations under ENARSA’s contracts with Bolivia and Plan Gas. As from March 1, 2025, it authorizes the recognition of fuel costs based on reference prices and declared and accepted CVP, including freight, natural gas transportation and distribution costs, and taxes and fees. CAMMESA will continue centralizing the fuel management of PPA under SE Res. No. 220/07, 21/17 and 287/17. Generators remunerated under spot energy will be able to manage their fuel, with CAMMESA as a last resort supplier (SE Res. No. 21/25). However, note NO-2025-16900682-APN-SE#MEC, sent by the SE to CAMMESA on February 19, 2025, establishes the new dispatch criteria as from March 1, 2025. The note allows generators to choose to manage their fuel to compete based on their declared CVP once CAMMESA has ensured the placement of the ToP volumes set under Plan Gas. This change could affect volumes between ToP and DoP committed under Plan Gas.

| |

Pampa Energía ● 2024 Annual Report ● 19 |

Natural gas export

In April 2021, a procedure was regulated to authorize natural gas exports on a firm and preferential basis for Plan Gas awardees during the summer period, extendable to the winter period in case of oversupply at a specific basin, with the applicable authority’s prior approval (SE Res. No. 360/21). In November 2022, exports were authorized on a firm basis in winter, prioritizing producers with competitive prices and/or a higher contribution under Plan Gas (DNU No. 730/22). In addition, the SE established amendments, such as (i) export limitations per producer to a maximum of 30% of the authorized volume per basin or 50% of the commitment under Plan Gas, (ii) quotas per basin for firm exports, (iii) the exported volume will be deductible from the Plan Gas summer commitment, and (iv) the minimum price will be the higher between a Brent percentage and the Plan Gas price with the adjustment factor (SE Res. No. 774/22).

On July 8, 2024, the Bases Law provided for free sale unobjectionable by the SE, requiring SE Res. No. 360/21’s readjustment. This regulation is still pending.

LNG exports

The Bases Law establishes a special LNG export regime for entities producing, processing, refining, marketing, storing and/or fractionating hydrocarbons and/or their derivatives without objection from the SE within 120 administrative working days from the presentation of the export notification.

LNG export authorizations will be firm sales for up to 30 years from the commissioning of the liquefaction plant or its expansions. The SE will evaluate the long-term gas resource availability to supply domestic demand at least every five years or when a new LNG export request warrants it based on its scale, terms or investment amounts (DNU No. 1057/24).

Liquid hydrocarbon export duty

As from May 2020, export duties are exempted provided the international Brent price is equal to or lower than US$45/bbl, with progressive increases until the reference price reaches 8%, the cap to be recognized when the Brent price equals or exceeds US$60/bbl (DNU No. 488/20). In 2024, the rate remained at 8%. Moreover, the Bases Law provided that the PEN may not intervene in domestic market sales for any segment in the hydrocarbon production chain.

FX access regime

DNU No. 277/22 facilitates access to FX in the MULC for companies with incremental production vs. 2021 to pay principal and interest on commercial and financial liabilities abroad and with non-resident affiliates, dividends from closed and audited balance sheets, and to repatriate direct investments by non-resident companies, transferable to direct suppliers.

For natural gas, the benefit equals 30% of the incremental injection valued at the country’s weighted average export price over the last 12 months, net of export duties. For oil, the benefit equals 20% of the quarterly incremental production at the average Brent quote over the previous 12 months, net of export duties and adjusted based on the crude oil quality.

On January 13, 2023, through Res. No. 13/23, the SE established the conditions for companies to access the regime. Through notes issued in August and September 2023, the Undersecretariat of Hydrocarbons granted Pampa the certificates to access the benefit for Q3 22, Q4 22 and Q1 23. Pampa submitted the applications from Q2 23 to date, which have not been granted.

| |

Pampa Energía ● 2024 Annual Report ● 20 |

Export Growth Program

To encourage oil and gas exports, in October 2023, SE Res. No. 808/23 allowed hydrocarbon exporters to settle transactions under the Export Growth Program (Programa de Incremento Exportador —PIE—, DNU No. 576/22). PIE partially recognizes exports under a differential blue-chip swap (CCL) rate and the remaining balance under the official FX. Pampa opted into this regime. In 2024, 20% of exports were settled under this regime (DNU No. 28/23).

Regulations in the oil market

No domestic reference price has been established for crude oil sales as of this date. Refining companies validated prices below export parity until July 2024, when both prices aligned.

Regulations in gas main pipeline transportation - TGS’s tariff situation

TGS makes significant investments in the operation of gas pipelines to guarantee the service’s quality, safety and reliability. These investments require natural gas transportation tariffs determined based on prudent and efficient economic operation. In this sense, TGS maintains negotiations with ENARGAS for the transitionary tariff update and the RQT.

On December 14, 2023, ENARGAS called for a public hearing, held on January 8, 2024, to define the transitionary tariff update (Res. No. 704/23). As a result, transitionary tariff schemes were published on February 15, 2024 (ENARGAS Res. No. 112/24).

In parallel, DNU No. 55/23, issued on December 16, 2023, declared the national energy sector’s emergency until December 31, 2024, later extended until July 9, 2025, the resulting tariff schemes’ last effective date (DNU No. 1,023/24). Among other issues, this executive order launched the RQT process, intervened in the ENARGAS as of January 1, 2024, and instructed the SE to issue the rules and procedures to set market prices for the natural gas transportation utility.

On March 26, 2024, TGS entered into the 2024 Transitionary Agreement with ENARGAS, which established a transitory 675% update as from April 2024 (ENARGAS Res. No. 112/24). From May 2024 to the RQT’s completion, tariffs would be adjusted monthly according to an index composed of salaries, the PPI and the construction cost in Greater Buenos Aires, as published by INDEC. However, ENARGAS has postponed this monthly update and notified the companies that it would replace the formula with one based on the monthly inflation projected by the MECON. TGS received the following tariff updates:

| Effective as of: | Natural gas transportation |

| Tariff increase | Resolution |

| Apr-24 | 675% | ENARGAS No. 112/24 |

| Aug-24 | 4% | ENARGAS No. 411/24 |

| Sep-24 | 1% | ENARGAS No. 491/24 |

| Oct-24 | 2.7% | ENARGAS No. 601/24 |

| Nov-24 | 3.5% | ENARGAS No. 735/24 |

| Dec-24 | 3% | ENARGAS No. 815/24 |

| Cumulative 2024 | 791.3% | |

| Jan-25 | 2.5% | ENARGAS No. 915/24 |

| Feb-25 | 1.5% | ENARGAS No. 51/25 |

2 For further information, see sections 6.2 about Oldelval and 6.4 about TGS of this Annual Report.

| |

Pampa Energía ● 2024 Annual Report ● 21 |

On January 14, 2025, ENARGAS called for a public hearing for February 6, 2025, to consider the RQT and tariff adjustment methodology, among other issues. TGS presented its 2025-2029 expenditure and investment plan, capital base and its proposed rate of return (WACC). In addition, it proposed two periodic tariff update methodologies: one based on the PPI and another on a formula composed of 30% PPI, 40% wage index and 30% construction cost index. To date, ENARGAS has not concluded the RQT process. However, at that hearing, it proposed a real rate of 7.18% after tax and a periodic tariff update of 50% CPI and 50% PPI.

TGS license renewal

TGS’s license to operate the natural gas transportation system will expire in December 2027. On September 8, 2023, TGS requested ENARGAS to initiate the renewal process. The original contract allowed for a 10-year extension, but the Bases Law approved in July 2024 allows for a 20-year extension, extending the license until December 2047. On June 13, 2024, ENARGAS issued a favorable technical and legal report, highlighting TGS’s compliance with its obligations and authorizing ENARGAS’ comptroller, after the non-binding public hearing held on October 21, 2024, to submit his recommendation report to the PEN, which could finally issue the license extension executive order within 120 business days. This is expected to occur during the first half of 2025 once the affirmative recommendations by the various involved entities have been issued.

Perito Francisco Pascasio Moreno gas pipeline

The GPM, declared of national public interest in February 2022, is a strategic project for Argentina’s gas development (SE Res. No. 67/22). ENARSA was appointed as concession holder for 35 years and is the trustor and beneficiary under the FONDESGAS trust (Fondo de Desarrollo Gasífero Argentino, Argentine Gas Development Fund) with Banco de Inversión y Comercio Exterior S.A. (BICE) acting as trustee (DNU No. 76/22).

On June 5, 2023, ENARSA awarded TGS the technical operation of GPM’s first section for 5 years, extendable for up to 12 months, including the two compression plants at Tratayén and Salliqueló, which increased transportation capacity from 11 to 21 million m3 per day in 2024. TGS has also been the technical operator of the Mercedes Cardales Gas Pipeline for a 5-year term.

Private initiative

Aiming to substitute gas oil and LNG imports with gas from Vaca Muerta, guaranteeing domestic supply and FX savings for the country, in June 2024, TGS submitted to the Federal Government a private initiative proposal on the GPM and an investment commitment in the regulated system, totaling an estimated US$700 million investment. The private initiative proposal, declared of public interest in December 2024 (DNU No. 1,060/24), envisages the expansion of GPM’s transportation capacity by 14 million m3 per day under the RIGI and as provided in the Hydrocarbons Law, with an estimated US$500 million investment and a US$200 million investment commitment in the regulated gas transportation system through the construction of 20 km of pipeline loops and the installation of 15,000 HP of compression in the Neuba II gas pipeline, expanding transportation capacity in the final sections by 12 million m3 per day. On February 25, 2025, the MECON delegated to the SE and ENARSA the responsibility to conduct the Private Initiative call for tenders, establishing the guidelines for drawing up the tender specifications (Res. No. 169/25). To date, the call for tenders has not been launched.

Regulations in the LPG business

Household Gas Bottles’ Program and Propane for Grids Agreement

The Household Gas Bottles’ Program, effective since 2015, subsidizes the price of LPG gas bottles for low-income users (DNU No. 470/15 and amendments). TGS participates in this program, producing and selling a defined LPG quota at below-market reference prices:

| |

Pampa Energía ● 2024 Annual Report ● 22 |

| Period | AR$/ton | Res. SE No. |

| From Sep-23 to Jan-24 | 50,938 | 762/23 |

| Feb-24 | 137,838 | 11/24 |

| Sep-24 | 240,000 | 216/24 |

| Dec-24 | 420,000 | 394/24 |

On January 22, 2025, the SE abrogated the contributions and reference prices defined in the Household Gas Bottles’ Program, setting export parity as the sales price limit (Res. No. 15/25).

On November 6, 2024, TGS signed a new Agreement for the Supply of Propane Gas for Undiluted Propane Gas Distribution Grids. The agreement establishes the participants’ compensation, calculated based on the difference between the sale price and the export parity published monthly by the SE. The Federal Government will pay the compensation through tax credit certificates, which are only applicable to the cancellation of hydrocarbon export duties. To date, the certificates for the year 2024 have not been issued.

Export duty

As with hydrocarbon exports, as from May 2020, export duties are exempted as long as the international Brent price is equal to or lower than US$45/bbl, with progressive increases until the reference price reaches 8%, the cap to be recognized when Brent price equals or exceeds US$60/bbl (DNU No. 488/20). In 2024, the rate remained at 8%.

Regulations in oil transportation3

In November 2022, the SE launched the tariff update process. In 2023 and 2024, Oldelval submitted the requested information, and in July 2024, SE’s audit was conducted. On October 22, 2024, the SE reported the new tariff schemes (Note No. 115035654). However, approval by the enforcement authority is still underway. On September 14, 2022, the SE granted the concession extension and expansion, called Medanito-Puesto Hernández, until November 14, 2037. Therefore, in 2022, Oldelval tendered firm transportation capacity in Duplicar Project’s Allen-Puerto Rosales oil pipeline for more than 314 kbbl/day through contracts valid until the concession’s termination. The Duplicar Project is 89% complete.

3 For further information on the assets under this segment, see section 6.1 on Oldelval of this Annual Report.

| |

Pampa Energía ● 2024 Annual Report ● 23 |

| 5. | The Argentine electricity market |

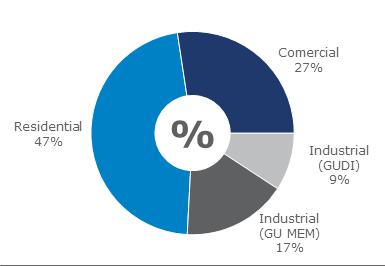

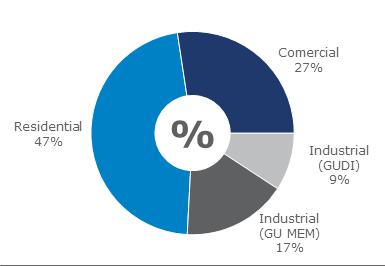

Electricity consumption experienced a slight 0.5% contraction in 2024, reaching 140,227 GWh, explained by decreases of 1.2% in the commercial segment and 1.3% in the industrial demand, partially offset by a 0.4% increase in the residential sector. The following chart shows the breakdown of electricity consumption in 2024 by type of customer:

Electricity demand by type of customer

Source: CAMMESA.

Peak power capacity records

| | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

| Capacity (MW) | 25,628 | 26,320 | 26,113 | 25,791 | 27,088 | 28,283 | 29,105 | 29,653 | 30,257 |

| Date | Feb-24 | Feb-8 | Jan-29 | Feb-4 | Dec-29 | Dec-6 | Mar-13 | Feb-1 | Feb-10 |

| Temperature (°C) | 27.7 | 30.2 | 34.0 | 29.5 | 31.7 | 29.0 | 31.0 | 31.5 | 31.1 |

| Time | 14:25 | 15:35 | 14:25 | 14:57 | 14:28 | 14:43 | 15:28 | 14:48 | 14:47 |

Source: CAMMESA.

On February 1, 2024, the SADI registered a 29,653 MW record-breaking demand for power capacity. However, on February 10, 2025, there was a new record-breaking demand of 30,257 MW.

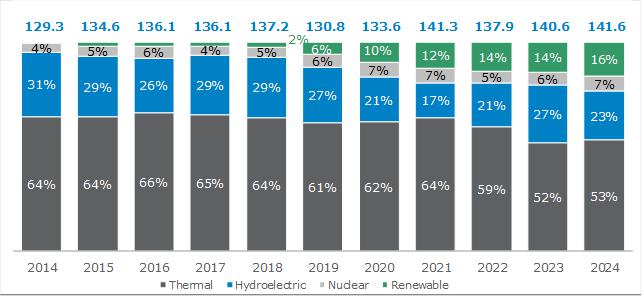

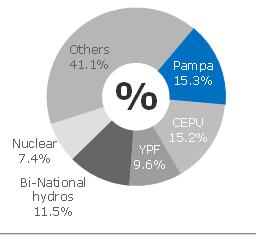

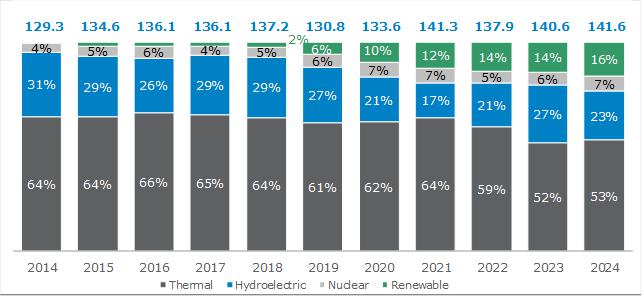

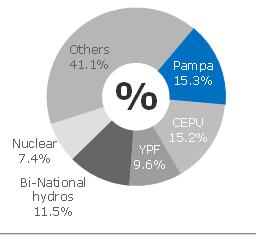

Evolution of the electricity supply

Power generation grew by 1% in 2024, reaching 141,592 GWh, driven by renewable sources (+2,791 GWh), thermal sources (+2,370 GWh) and nuclear power availability (+1,486 GWh), partially offset by a 15% reduction in hydropower generation, net of pumping (-5,635 GWh). The grid maintained its dependence on thermal generation, using both natural gas and liquid fuels (GO and FO) and mineral coal, contributing 53% of the total energy volume (75,388 GWh), followed by hydropower generation net of pumping (32,880 GWh, 23%), renewable energies (22,875 GWh, 16%) and nuclear power (10,449 GWh, 7%). Although the SADI has been a net power importer for the third consecutive year, in 2024, imports decreased by 25% to 4,654 GWh, exports increased tenfold to 970 GWh, and losses were reduced by 14% to 5,049 GWh. The following chart shows the evolution of electric power generation by type of technology:

4 For further information on the assets under this segment, see section 6.2 of this Annual Report.

| |

Pampa Energía ● 2024 Annual Report ● 24 |

Generation by type of power plant

In % and TWh, 2014 - 2024

Note: It includes WEM and Patagonian WEM System. Hydroelectric power generation net of pumping. Source: CAMMESA.

Argentina’s generation capacity fell by 423 MW, reaching a total of 43,351 MW as of December 2024, mainly due to Yacyretá Power Plant’s lower firm availability (-1,195 MW) and the decommissioning of obsolete units (-583 MW). However, 925.2 MW from renewable units and 365.5 MW from thermal units were incorporated, including the 60 MW repowering of the Docksud CCGT. The following table summarizes the incorporation of new power units in 2024:

| Region | Technology | Capacity (MW) |

| Buenos Aires | CCGT | 60 | 438 |

| Wind | 378 |

| Center | Biogas | 4.2 | 273.9 |

| CCGT | 114.7 |

| Wind | 155 |

| Comahue | Solar | | 10.3 |

| Cuyo | Solar | | 52.7 |

| Greater Buenos Aires | CCGT | | 85.4 |

| Litoral | CCGT | | 105.4 |

| Northeast | Solar | | 130 |

| Northwest | Solar | | 114 |

| Patagonia | Wind | | 81 |

| Total | | | 1,290.7 |

| Thermal | | | 28% |

| Renewable | | | 72% |

| | | | | | |

Source: CAMMESA and Pampa Energía’s analysis.

| |

Pampa Energía ● 2024 Annual Report ● 25 |

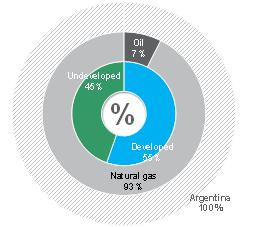

The composition of Argentine installed power capacity as of December 31, 2024, is shown below:

2024 Argentine installed power capacity

100% = 43.4 GW

Source: CAMMESA.

Fuel supply and consumption5

Since December 30, 2019, the commercial management and supply of power plants’ fuel have been centralized in CAMMESA, except for generators with PPA under Energía Plus and SEE Res. No. 287/17 (MDP Res. No. 12/19). Since January 2021, with the implementation of Plan Gas (SE Res. No. 354/20) and the transfer of gas and its transportation by exempted generators to CAMMESA, thermal dispatch has prioritized units supplied with gas imported from Bolivia under a ToP condition, followed by those provided by Plan Gas according to their efficiency and, finally, units assigning gas to CAMMESA.

However, on January 28, 2025, the SE abrogated SE Res. No. 354/20, effective February 1, 2025, and established that, as of March 1, 2025, it would authorize generators to manage their fuel for spot energy units (SE Res. No. SE 21/25).

Fuel consumption for power plants increased by 1% year-on-year in 2024, totaling 45.4 million m3/day of gas equivalent. Natural gas accounted for 92% of total consumption, with a 9% increase, to 41.6 million m3/day, 93% of which was local and 7% imported. The use of alternative fuels (FO, GO and mineral coal) decreased by 65%, 27% and 51%, respectively.

Fuel consumption by type

In % and million m3/day of gas equivalent, 2014 – 2024

Source: CAMMESA.

5 For further information, see Regulations in the gas market – Natural gas for power plants, in section 4.1 of this Annual Report.

| |

Pampa Energía ● 2024 Annual Report ● 26 |

Price of electricity

Since 2003, the energy authority has determined the WEM spot price based on the CVP with natural gas in the available units, even if they are not firing that fuel (SE Res. No. 240/03). Any additional liquid fuel consumption cost is recognized outside the specified market price and considered a temporary dispatch surcharge. The WEM bears the costs of gas and its regulated transportation, as well as import costs (SGE Res. No. 25/18 and SE Res. No. 354/20).

Evolution of WEM prices

The maximum spot energy prices passed since 2024 are summarized below:

| Effective as of: | Spot price in WEM |

| Maximum | Resolution |

| February 2024 | AR$ 7,534 | SE No. 9/24 |

| June 2024 | AR$ 9,418 | SE No. 99/24 |

| August 2024 | AR$ 9,606 | SE No. 193/24 |

| September 2024 | AR$ 10,086 | SE No. 233/24 |

| October 2024 | AR$ 10,358 | SE No. 285/24 |

| November 2024 | AR$ 10,979 | SCEyM No. 20/24 |

| December 2024 | AR$ 11,528 | SE No. 387/24 |

| January 2025 | AR$ 11,989 | SE No. 603/24 |

| February 2025 | AR$12,469 | SE No. 27/25 |

| March 2025 | AR$12,656 | SE No. 113/25 |

However, the following chart shows the monthly wholesale price that all electricity system users should pay so that the power grid would not run into a deficit, as well as the seasonal energy price. The wholesale cost includes, besides the energy price, the power capacity payment, the generation cost, fuels such as natural gas, FO, GO and mineral coal, and other minor items. As of December 2024, the coverage amounted to 92%.

Wholesale monthly cost and seasonal price

In US$/MWh

Source: CAMMESA, converted into US$ at the official FX rate.

| |

Pampa Energía ● 2024 Annual Report ● 27 |

Remuneration scheme for generation without PPA - legacy energy

Increases in legacy energy remuneration granted since 2024 are set out below:

| Effective as of: | Legacy/spot energy |

| Remuneration increase | Resolution |

| February 2024 | 74% | SE No. 9/24 |

| June 2024 | 25% | SE No. 99/24 |

| August 2024 | 3% | SE No. 193/24 |

| September 2024 | 5% | SE No. 233/24 |

| October 2024 | 2.7% | SE No. 285/24 |

| November 2024 | 6% | SCEyM No. 20/24 |

| December 2024 | 5% | SE No. 387/24 |

| Cumulative 2024 | 169% | |

| January 2025 | 4% | SE No. 603/24 |

| February 2025 | 4% | SE No. 27/25 |

| March 2025 | 1.5% | SE No. 113/25 |

Thermal power generators

The remuneration comprises a fixed payment for the monthly available power capacity, with or without offering DIGO, and a variable payment for the energy generated, operated and generated during each month’s hours of maximum thermal demand.

The prices for power capacity, in AR$/MW-month, for generators not offering DIGO are as follows:

| Technology/scale | Until

Jan-24 | Feb-24 | … | Jan-25 | Feb-25 | As of

Mar-25 |

| Large CCGT > 150 MW | 617,377 | 1,073,619 | | 1,725,384 | 1,794,399 | 1,821,315 |

| Small CCGT ≤ 150 MW | 688,220 | 1,196,815 | | 1,923,370 | 2,000,305 | 2,030,310 |

| Large ST > 100 MW | 880,520 | 1,531,224 | | 2,460,790 | 2,559,222 | 2,597,610 |

| Small ST ≤ 100 MW & ICE | 1,052,573 | 1,830,424 | | 2,941,625 | 3,059,290 | 3,105,179 |

| Large GT > 50 MW | 718,586 | 1,249,621 | | 2,008,232 | 2,088,561 | 2,119,889 |

| Small GT ≤ 50 MW | 931,122 | 1,619,221 | | 2,602,206 | 2,706,294 | 2,746,888 |

The prices for power capacity, in AR$/MW-month, for generators offering DIGO are as follows:

| Period | Until

Jan-24 | Feb-24 | … | Jan-25 | Feb-25 | As of

Mar-25 |

Summer (Dec-Feb)

and winter (Jun-Aug) | 2,208,195 | 3,840,051 | | 6,171,236 | 6,418,085 | 6,514,356 |

Others (Mar-May

& Sep-Nov) | 1,656,146 | 2,880,038 | | 4,628,428 | 4,813,565 | 4,885,768 |

| |

Pampa Energía ● 2024 Annual Report ● 28 |

Prices for generated energy according to fuel, in AR$/MWh, are as follows:

| Fuel | Until

Jan-24 | Feb-24 | … | Jan-25 | Feb-25 | As of

Mar-25 |

| Natural gas | 1,473 | 2,562 | | 4,118 | 4,283 | 4,347 |

| FO or GO | 2,578 | 4,483 | | 7,206 | 7,494 | 7,606 |

| Biofuels | 3,681 | 6,401 | | 10,287 | 10,698 | 10,858 |

| Coal | 4,417 | 7,681 | | 12,343 | 12,837 | 13,030 |

The price for operated energy, regardless of the type of fuel, was set at AR$513/MWh (Jan-24), rose to AR$892/MWh (Feb-24), and after the above-detailed increases, reached AR$1,433 (Jan-25), AR$1,490 (Feb-25) and AR$1,512 (Mar-25).

The price for generated energy at peak hours each month equals the prices for generated energy for the fuel type dispatched between 6 and 11 pm, applying a 2.0 factor in the summer (Dec-Feb) and winter (Jun-Aug) periods and a 1.0 factor the rest of the year.

PPA - SE Res. No. 59/23

To promote the maintenance and efficient use of CCGT under legacy energy, on February 7, 2023, the SE published Res. No. 59/23 calling on generators to execute a Power Capacity Availability and Efficiency Improvement Agreement with CAMMESA for a maximum term of 5 years. Adhering units undertake to maintain an 85% net power capacity availability. The PPA offers a US$2,000/MW-month power capacity price, adjusted based on availability, as well as a partial payment of the power capacity price in AR$ under the legacy energy scheme.

| Availability | Adjustment to power capacity price in US$ | |

| ≥85% | Price x 100% | |

| >50% & <85% | Price x [30% + 2 x (Availability – 50%)] | |

| ≤50% | Price x 30% | |

| Period | Adjustment to power capacity price in AR$ |

| Dec-Feb and Jun-Aug | Price x 65% |

| Rest of the year | Price x 85% |

The generated energy price was set at US$3.5/MWh for natural gas, US$6.1/MWh for FO or GO, and US$8.7/MWh for biofuel. The price for energy operated and generated at peak hours is set in AR$ according to the legacy energy price scheme.

On March 15, 2023, the SE established the implementation criteria, including: (i) CCGTs partially committed under other PPA could opt in, excluding self-generators with associated industrial or commercial demand; (ii) the term could not extend beyond May 31, 2028; and (iii) power generators could request termination by proving that the supplementary remuneration resulting from the legacy energy does not reflect cost variations.

Under this scheme, Pampa signed the two CCGTs at CTLL and CTGEBA (1,243 MW) and the two GTs at CTEB, making up the CCGT (569 MW). This differential remuneration came into effect in March 1, 2023, and will continue until February 29, 2028.

| |

Pampa Energía ● 2024 Annual Report ● 29 |

2024-2026 Contingency Plan

On October 1, 2024, the SE established a plan through Res. No. 294/24 to address the energy grid’s critical condition in the months of greatest demand. The plan incorporates an opt-in scheme recognizing an additional, complementary and exceptional remuneration to promote thermal generation plants’ availability in critical months and hours, effective from December 2024 to March 2026:

| · | Additional fixed remuneration of US$2,000/MW-month for power, adjusted according to the criticality of the node where the unit is located and availability during peak demand hours, and 50% of this remuneration for power exceeding the committed power6. |

| · | Additional variable remuneration in US$/MWh for energy generated during peak-demand periods, according to fuel, technology and criticality: |

| Technology | Natural gas | Fuel Oil | Gas Oil | Biofuels | Coal |

| GT | 6.4 | - | 8.6 | 8.7 | - |

| ST | 3.4 | 6.0 | - | 8.7 | 10.4 |

| ICE | 8.1 | 15.4 | 10.5 | 8.7 | - |

The SEE may extend this additional remuneration for 12 further months, subject to the presentation of a maintenance program for each generating unit.

In addition, CAMMESA must implement a strategic dispatch procedure to reduce supply restriction risks during increased consumption periods. The procedure may include dispatch reserve from units nearing the end of their useful life to leverage them during the SADI’s peak demand.

On November 20, 2024, Pampa signed CPB, CTG, CTP, CTLL, CTGEBA and Ecoenergía into the scheme, effective from December 1, 2024, to March 31, 2026.

Unconventional source power generators

The remuneration for energy generated from any unconventional source was set at AR$10,304/MWh (Jan-24) and AR$17,919/MWh (Feb-24); after the above-detailed increases, it reached AR$28,799 (Jan-25), AR$29,951 (Feb-25) and AR$30,400 (Mar-25). The remuneration is reduced by 50% for energy generated before commissioning.

Hydropower generators

The remuneration includes fixed pay for the monthly available power capacity and variable pay for generated and operated energy, as well as generated at peak hours. In addition, a 1.05 factor is maintained on the power capacity to compensate for programmed maintenance’s impacts, and a 1.20 factor for units in charge of maintenance of control structures on river courses and not having an associated power plant.

The following chart shows power capacity prices in AR$/MW-month:

| Scale | Until

Jan-24 | Feb-24 | … | Jan-25 | Feb-25 | As of

Mar-25 |

| Pumped, MW > 300 | 607,254 | 1,056,015 | | 1,697,094 | 1,764,978 | 1,791,453 |

| Pumped, 120 < MW ≤ 300 | 809,672 | 1,408,020 | | 2,262,791 | 2,353,303 | 2,388,603 |

| 50< MW ≤ 120 | 1,113,298 | 1,936,025 | | 3,111,333 | 3,235,786 | 3,284,323 |

| MW ≤ 50 | 1,821,760 | 3,168,041 | | 5,091,272 | 5,294,923 | 5,374,347 |

6 A distinction is made between nodes with high (1.25), medium (1.00) and low (0.75) criticality, and summer and winter.

| |

Pampa Energía ● 2024 Annual Report ● 30 |

The price for generated and operated energy was set in AR$/MWh:

| Price | Until

Jan-24 | Feb-24 | … | Jan-25 | Feb-25 | As of

Mar-25 |

| Generated energy | 1,288 | 2,240 | | 3,600 | 3,744 | 3,800 |

| Operated energy | 513 | 892 | | 1,433 | 1,490 | 1,512 |

The price for generated energy at peak hours each month equals the prices for energy generated between 6 and 11 pm, applying a 2.0 factor in the summer (Dec-Feb) and winter (Jun-Aug) periods and a 1.0 factor the rest of the year.

Classification of Pampa’s legacy energy units

| Power plant | Generating unit | Technology | Size | Capacity |

| CPB | BBLATV29 | ST | Large | >100 MW |

| BBLATV30 | ST | Large | >100 MW |

| CTEB | EBARTG01 | GT | Large | >50 MW |

| EBARTG02 | GT | Large | >50 MW |

| CTG | GUEMTV11 | ST | Small | ≤100 MW |

| GUEMTV12 | ST | Small | ≤100 MW |

| GUEMTV13 | ST | Large | >100 MW |

| CTGEBA | GEBATG01 | CCGT | Large | >150MW |

| GEBATG02 | CCGT | Large | >150MW |

| GEBATV01 | CCGT | Large | >150MW |

| CTLL | LDLACC01 | CCGT | Large | > 150 MW |

| LDLACC02 | CCGT | Large | > 150 MW |

| LDLACC03 | CCGT | Large | > 150 MW |

| LDLATG041 | GT | Large | >50 MW |

| LDLMDI01 | ICE | - | - |

| CTP | PIQIDI01 | ICE | - | - |

| HIDISA | ADTOHI | HI | Medium | > 120 ≤ 300 MW |

| LREYHB | Pumped HI | Medium | > 120 ≤ 300 MW |

| ETIGHI | Renewable HI | - | ≤ 50 MW |

| HINISA | NIH1HI | HI | Small | > 50 ≤ 120 MW |

| NIH2HI | HI | Small | > 50 ≤ 120 MW |

| NIH3HI2 | HI | Small | > 50 ≤ 120 MW |

| HPPL | PPLEHI | HI | Medium | > 120 ≤ 300 MW |

Note: 1 Only applicable to the unit’s 26 MW. 2 A 1.20 multiplier to the remuneration.

In the case of CTG’s GUEMTG01, EcoEnergía and CTGEBA’s GEBATG03 units, energy and available power capacity under no contractual commitments will be remunerated as legacy energy, excluding from the transaction the cost of fuel provided by CAMMESA.

| |

Pampa Energía ● 2024 Annual Report ● 31 |

Non-spot remuneration for conventional energy

Energía Plus - Res. No. 1,281/06

In September 2006, to encourage the development of new generation supply, the SE implemented the Energía Plus program, which allows generators to sell energy to GU300 above their 2005 electricity consumption under freely negotiated US$ prices, provided they have fuel supply and transportation. If they cannot meet the demand, the generator must buy the energy on the spot market.

GU300 not contracting in the MAT must pay the Surplus Demand Incremental Average Charge (Cargo Medio Incremental de la Demanda Excedente, CMIEE) set as the maximum between AR$1,200/MWh and the temporary dispatch surcharge since June 2018 (SE Note No. 28663845/18).

Some Energía Plus contracts are adjusted according to CAMMESA price variations. From January 2021, with the implementation of Plan Gas, Pampa assigns gas supply and transportation to CAMMESA. Currently, CTG, EcoEnergía and CTGEBA provide Energía Plus to different WEM customers with a 283 MW total gross capacity.

However, on January 28, 2025, the SE introduced changes in dispatch regulation and WEM operation, which impacted Energía Plus, limiting new contracts’ renewal and execution. Although the provision does not specify a termination date, they may be extended until October 31, 2025. Upon the contracts’ expiration, Energía Plus would cease to exist and the power plants under this scheme would have to sell their capacity and energy according to market schemes yet to be defined by the SE during the WEM’s regularization process.

PPA - SE Res. No. 220/07

To increase generation supply, the SE passed Res. No. 220/07 empowering CAMMESA to enter into ‘WEM Supply Commitment Agreements’ with WEM generators for the energy produced with new generation equipment. These are long-term PPAs denominated in US$, and the price payable by CAMMESA remunerates the investment made by the plant at a rate of return accepted by the SE. CTLL’s TG04 (79 MW) and CTEB’s expansion (279 MW) are remunerated under this scheme until July 2026 and February 2033, respectively.

PPA - SEE Res. No. 21/16

The power generators awarded under the SEE’s March 2016 tenders entered into a PPA for a fixed price (US$/MW-month) and a variable price excluding fuel (US$/MWh), with CAMMESA as offtake on behalf of distributors and WEM GU. The units remunerated under this regulation are CTLL’s GT05 (105 MW) and CTPP (100 MW) until August 2027 and CTIW (100 MW) until December 2027.

PPA - SEE Res. No. 287/17

In May 2017, the SEE launched a call for tenders for co-generation and existing equipment’s CCGT closing projects. Awarded projects executed a 15-year PPA for an available power capacity price plus the non-fuel CVP for the delivered energy and the fuel cost (if tendered), minus the penalties and fuel surpluses.

CTGEBA has a 400 MW gross capacity PPA until July 2035. Besides, as from January 2021, CTGEBA assigns gas supply and transportation operations to CAMMESA, and a centralized dispatch order was established considering the fuel designated for generation.

Non-spot remuneration for renewable energy

In October 2015, Law No. 27,191 was enacted, providing that by December 31, 2025, 20% of Argentina’s total demand for energy should be covered with renewable energy sources. To meet this objective, WEM GU and CAMMESA should cover 20% of their demand from such sources by December 31, 2025. The average price under agreements entered with GU and GUDI may not exceed US$113/MWh.

| |

Pampa Energía ● 2024 Annual Report ● 32 |