Exhibit 99.1

LETTER TO THE BOARD OF DIRECTORS

Richard Betz

Chief Executive Officer and Director

Members of the Board of Directors

Resolute Energy Corporation (“Resolute” or the “Company”)

1700 Lincoln Street, Suite 2800

Denver, CO 80203

Dear Rick and Members of the Board of Directors (the “Board”):

Monarch Alternative Capital LP (“Monarch,” “we,” or “our”), anSEC-registered investment advisor, is the beneficial owner of 2,073,400 shares of the Company, representing approximately 9.21% of the shares outstanding. As of the date of writing, we believe, based on publicly available information, that we are the largest beneficial owner of shares of common stock of Resolute.

As you know, we have been long-term passive investors in Resolute. To date, we have supported the Company’s strategy and management, applauding along the way as the team successfully navigated a tumultuous commodity price cycle, unlocked significant value through drilling in the Permian basin, and transformed the Company through a series of divestitures and acquisitions into a more focused growth enterprise with what we believe is some of the world’s most attractive drilling inventory across approximately 21,000 net acres in the heart of the Delaware Basin.

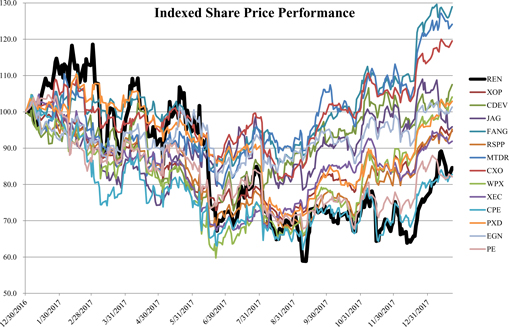

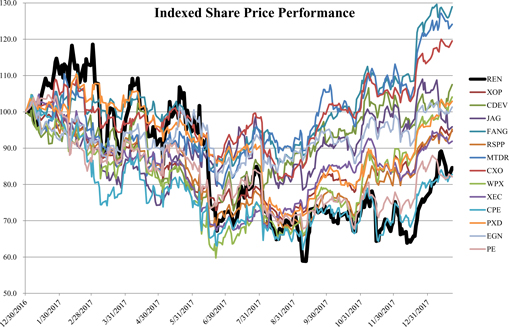

For too long following this transformation, however, Resolute’s share price performance has significantly lagged that of its peers, and its valuation today languishes at a glaring discount to other Permian operators. We highlight these painful realities below in Exhibits 1 and 2. Trading at just 5.5x total enterprise value to 2018 consensus EBITDA, Resolute lags peers by 3.5x on average, a gap which, if closed, would yield a value of over $70 per Resolute share.

Exhibit 1.

Exhibit 2.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Ticker | | | 1/23/18

Closing Price | | | Market Cap.

($ mm) | | | Total Enterprise

Value ($ mm) | | | 3Q17 Prod.

(KBOED) | | | TEV /

BOEPD | | | Permian

Net Acres | | | EBITDA (1) | | | TEV/ EBITDA | |

| | | | | | | | | 2017E | | | 2018E | | | 2019E | | | 2017E | | | 2018E | | | | | | 2019E | |

Pioneer Natural Resources Co | | | PXD | | | $ | 186.04 | | | | 31,658 | | | | 32,402 | | | | 276 | | | $ | 117,520 | | | | 690,000 | | | | 2,191 | | | | 2,965 | | | | 3,648 | | | | 14.8x | | | | 10.9x | | | | | | | | 8.9x | |

Concho Resources Inc | | | CXO | | | $ | 160.53 | | | | 23,870 | | | | 26,676 | | | | 193 | | | $ | 138,102 | | | | 610,000 | | | | 1,777 | | | | 2,154 | | | | 2,627 | | | | 15.0x | | | | 12.4x | | | | | | | | 10.2x | |

Diamondback Energy Inc | | | FANG | | | $ | 132.31 | | | | 12,989 | | | | 14,902 | | | | 85 | | | $ | 175,262 | | | | 191,000 | | | | 906 | | | | 1,354 | | | | 1,842 | | | | 16.5x | | | | 11.0x | | | | | | | | 8.1x | |

Cimarex Energy Co | | | XEC | | | $ | 125.05 | | | | 11,912 | | | | 12,976 | | | | 191 | | | $ | 68,109 | | | | 216,000 | | | | 1,180 | | | | 1,494 | | | | 1,836 | | | | 11.0x | | | | 8.7x | | | | | | | | 7.1x | |

Parsley Energy Inc | | | PE | | | $ | 29.26 | | | | 9,199 | | | | 10,452 | | | | 72 | | | $ | 146,109 | | | | 229,000 | | | | 670 | | | | 1,174 | | | | 1,705 | | | | 15.6x | | | | 8.9x | | | | | | | | 6.1x | |

RSP Permian Inc | | | RSPP | | | $ | 41.97 | | | | 6,656 | | | | 8,088 | | | | 59 | | | $ | 137,250 | | | | 92,300 | | | | 580 | | | | 885 | | | | 1,216 | | | | 14.0x | | | | 9.1x | | | | | | | | 6.7x | |

WPX Energy Inc (3) | | | WPX | | | $ | 15.51 | | | | 6,175 | | | | 9,264 | | | | 77 | | | $ | 119,954 | | | | 135,000 | | | | 675 | | | | 1,191 | | | | 1,585 | | | | 13.7x | | | | 7.8x | | | | | | | | 5.8x | |

Centennial Resource Development | | | CDEV | | | $ | 21.73 | | | | 5,995 | | | | 6,363 | | | | 35 | | | $ | 183,373 | | | | 87,917 | | | | 277 | | | | 606 | | | | 898 | | | | 23.0x | | | | 10.5x | | | | | | | | 7.1x | |

Energen Corp | | | EGN | | | $ | 58.20 | | | | 5,657 | | | | 6,423 | | | | 81 | | | $ | 79,000 | | | | 147,428 | | | | 613 | | | | 952 | | | | 1,160 | | | | 10.5x | | | | 6.7x | | | | | | | | 5.5x | |

Matador Resources Co | | | MTDR | | | $ | 33.30 | | | | 3,611 | | | | 4,252 | | | | 42 | | | $ | 101,343 | | | | 115,700 | | | | 316 | | | | 421 | | | | 511 | | | | 13.5x | | | | 10.1x | | | | | | | | 8.3x | |

Jagged Peak Energy Inc | | | JAG | | | $ | 14.40 | | | | 3,066 | | | | 3,097 | | | | 19 | | | $ | 161,486 | | | | 75,200 | | | | 201 | | | | 436 | | | | 626 | | | | 15.4x | | | | 7.1x | | | | | | | | 4.9x | |

Callon Petroleum Co | | | CPE | | | $ | 12.54 | | | | 2,531 | | | | 3,137 | | | | 23 | | | $ | 139,178 | | | | 60,000 | | | | 247 | | | | 408 | | | | 588 | | | | 12.7x | | | | 7.7x | | | | | | | | 5.3x | |

Resolute Energy Corp (3) | | | REN | | | $ | 35.75 | | | | 805 | | | | 1,449 | | | | 23 | | | $ | 64,025 | | | | 21,100 | | | | 152 | | | | 263 | | | | 405 | | | | 9.6x | | | | 5.5x | | | | | | | | 3.6x | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Median | | | | | | | | | | | 6,175 | | | | 8,088 | | | | 72 | | | $ | 137,250 | | | | 135,000 | | | | 613 | | | | 952 | | | | 1,216 | | | | 14.0x | | | | 8.9x | | | | | | | | 6.7x | |

Average | | | | | | | | | | | 9,548 | | | | 10,729 | | | | 90 | | | $ | 125,439 | | | | 205,434 | | | | 753 | | | | 1,100 | | | | 1,435 | | | | 14.2x | | | | 9.0x | | | | | | | | 6.7x | |

Maximum | | | | | | | | | | | 31,658 | | | | 32,402 | | | | 276 | | | $ | 183,373 | | | | 690,000 | | | | 2,191 | | | | 2,965 | | | | 3,648 | | | | 23.0x | | | | 12.4x | | | | | | | | 10.2x | |

Minimum | | | | | | | | | | | 805 | | | | 1,449 | | | | 19 | | | $ | 64,025 | | | | 21,100 | | | | 152 | | | | 263 | | | | 405 | | | | 9.6x | | | | 5.5x | | | | | | | | 3.6x | |

Source: Bloomberg and company filings

| (1) | Bloomberg consensus estimates. |

| (2) | Production, hedge value andnon-Permian asset value backed out of TEV to isolate Permian acreage value. Denominator consists only of Permian acreage. |

| (3) | Production adjusted for asset divestitures. |

Resolute’s acreage quality is almost certainly not the culprit for this disparity. Indeed, we and many reputable third party analysts and experts believe Resolute possesses some of the most prolific acreage in the basin, with breakeven oil prices at or below approximately $30/bbl, arguably among the best in the Lower 48.1 Management itself has said “we think it’s some of the best [acreage] in the basin.”2 Similarly, lack of confidence in the Company’s ability to execute seems an equally implausible explanation, as consensus production and capital spending estimates for 2018 arein-line with the midpoint of Resolute’s most recent guidance range.3

Instead, other elements appear to be at play. We believe two in particular weigh heavily on valuation: Resolute’s relative lack of operating scale and comparatively small market capitalization, both of which are apparent from Exhibit 2. Management appears to appreciate the importance of these factors, remarking as recently as August 2017 that “the transition to being a pure-play Delaware [operator] was never meant to suggest that we’re going to sort of sit tight with 21,000 acres and drill within our little patch of the basin… we’ll look for accretive [acquisition] opportunities.”4 But we note an important circularity: achieving the former as an independent entity almost certainly depends on growing the latter. Hence, we believe Resolute is left with essentially three options: (1) wait and hope that the Company’s valuation improves, (2) raise capital, including potentially issuing stock at today’s highly dilutive levels, to acquire scale, or (3) explore a sale to, or combination with, another company.

Option 1, we think, is not a true strategy or viable path toward closing the value gap. With current consensus expectations calibrated to the Company’s guidance, an effective remedy will evidently require more than managerial prowess. Option 2 is fraught with obvious complications, and it risks exacerbating the problem at hand. Price tags for comparable acreage in the public and private markets in many cases exceed the implied value per acre at which Resolute trades. Moreover, Resolute’s small size and dramatic undervaluation disadvantages the Company in pursuing a dwindling supply oftop-tier Delaware acreage acquisitions. Management itself has openly acknowledged these inherent challenges, noting on its 2Q2017 earnings conference call that “it’s certainly quieted down a little bit on the A&D front… [and] more meaningful opportunities… get more expensive, more challenging, [and a] little bit more competitive.” Option 3, we think, is the surest and quickest path toward addressing the undervaluation of the Company’s shares. We are concerned, however, that a misalignment of interests between stockholders and incumbent management could emerge as merger or sale options present themselves.

| | | | |

535 Madison Avenue New York, NY 10022 T. 212.554.1700 F. 212.554.1701 www.monarchlp.com | | - 2 - | | |

The direction Resolute takes at this crossroads will no doubt have profound implications for stockholders. We see a clear, compelling path forward. To that end, we outline a series of steps to maximize value for all stockholders and immediately drive toward a successful denouement of the Resolute story:

| | • | | Increase stockholder representation on the Board through the immediate appointment of two Monarch-designated directors. We believe this is the most effective and credible way to ensure that the interests of stockholders are voiced and heard in the boardroom, and maintained as the first and foremost consideration when evaluating strategic alternatives; |

| | • | | Form a committee of the Board consisting of the two Monarch-designees and one other independent director to explore strategic transactions, including a potential sale of the Company or combination with another company in order to maximize value; and |

| | • | | Engage a reputable financial advisor with deep industry expertise and relationships to assist the newly formed committee and Board in evaluating and executing on potential transactions. |

Of course, if subsequent developments, facts or market conditions warrant a different course of action to appropriately address the valuation problems outlined above, we would be open to considering other approaches.

For a multitude of reasons, we believe Monarch is ideally situated to represent the interests of stockholders as the Board undertakes these steps. To name a few:

| | • | | As the Company’s largest stockholder, our single greatest motivation is to maximize the value of Resolute’s common stock; |

| | • | | Our investment in Resolute securities dates back to November 2014 as substantial unsecured bondholders. As a result, we have deep familiarity with the Company and its history, asset base, operations, and senior leadership team; |

| | • | | We have a long-term institutional track record of adding value through directorships and constructive active involvement in many of the businesses in which we invest, including within the oil and gas sector; |

| | • | | Joseph Citarrella, a Managing Principal with Monarch and a proposed nominee to the Board, would bring extensive relevant sector and financial expertise in this role. In addition to his investment responsibilities at Monarch, Mr. Citarrella has served since August 2017 asnon-executive Chairman of the Board of Vanguard Natural Resources, Inc. (“Vanguard”), a Houston-based independent oil and gas company with operations across Wyoming, Colorado, Texas, Louisiana, and Oklahoma. Mr. Citarrella also serves as a member of Vanguard’s Strategic Opportunities Committee, which is responsible for overseeing an ongoing strategic review of Vanguard’s asset base and development plans. In this capacity, Mr. Citarrella has worked closely with management, the Board, and financial advisor Jefferies LLC to evaluate potential strategic transactions and pursue targeted objectives to maximize stockholder value. Prior to joining Monarch in May 2012, Mr. Citarrella was an Associate at Goldman Sachs in the Global Investment Research group, covering the integrated oil, exploration and production, and refining sectors. Mr. Citarrella received a B.A. in Economics from Yale University. |

| | | | |

535 Madison Avenue New York, NY 10022 T. 212.554.1700 F. 212.554.1701 www.monarchlp.com | | - 3 - | | |

| | • | | Patrick Bartels, a Managing Principal with Monarch and our second proposed nominee to the Board, has served on numerous public and private boards and has over 20 years of investment experience, including across complex situations in North America and Europe. Mr. Bartels currently serves as a Director of Arch Coal, Inc. and LifeCare Health Partners. Previously, Mr. Bartels served on the board of directors of WCI Communities Inc. and JL French Automotive Castings, Inc. As a fiduciary for stockholders, Mr. Bartels has a demonstrated record of value-added returns through capital markets transactions and M&A processes. Mr. Bartels holds the Chartered Financial Analyst designation and a bachelor’s degree in accounting, with a concentration in finance, from Bucknell University. |

We feel strongly about the Company implementing the recommendations outlined above and are prepared to take whatever steps may be necessary to accomplish this goal. We would prefer to do so cooperatively, as we believe that would be in the best interests of Resolute. To that end, we note that your bylaws provide that a stockholder must submit to the Company any Board nominee not later than 90 days prior to the anniversary of Resolute’s 2017 annual meeting, a deadline which will be upon us quickly. We urge you to act on our suggestions with that in mind. To that end, we would welcome the opportunity to meet with you and members of your Board to discuss these matters.

We further note that, effective as of the delivery of this letter, we have ceased to be passive holders of Resolute stock, and as a result, we will be filing a Schedule 13D with the Securities and Exchange Commission in a matter of days. This filing may well generate inquiry both to the Company and us. We therefore implore you to respond to us as soon as possible.

|

Sincerely, |

|

/s/ Michael A. Weinstock |

Michael A. Weinstock |

Chief Executive Officer |

Monarch Alternative Capital LP |

|

/s/ Joseph Citarrella |

Joseph Citarrella |

Managing Principal |

Monarch Alternative Capital LP |

| | | | |

535 Madison Avenue New York, NY 10022 T. 212.554.1700 F. 212.554.1701 www.monarchlp.com | | - 4 - | | |

| 1. | Sources: RS Energy’s “Permian Basin Activity Map” and presentation entitled “Permian Basin: The Spectrum of Change” (November 2017); Goldman Sachs initiation report (July 17, 2017); Imperial Capital initiation report (July 18, 2017). |

| 2. | Source: IPAA Oil & Gas Investment Symposium transcript (April 4, 2017). |

| 3. | Source: Bloomberg consensus estimates and Resolute’s December 5, 2017 investor presentation. |

| 4. | Source: Resolute’s 2Q2017 earnings conference call (August 8, 2017). |

| | | | |

535 Madison Avenue New York, NY 10022 T. 212.554.1700 F. 212.554.1701 www.monarchlp.com | | - 5 - | | |