equity or equity-related compensation was continued in 2016. Furthermore, the Compensation Committee and Board determined that each non-employee director would receive a combination of restricted stock and cash-settled stock appreciation rights in satisfaction of the $81,250 amount. On February 18, 2016, awards were made to each of Messrs. Duffy, Hicks, Hultquist and White of 11,287 shares of restricted stock and 20,833 cash settled stock appreciation rights, each with a grant date fair value of $1.95 and a base price of $2.65. Both the restricted stock and the cash-settled stock appreciation rights granted in 2016 vested on the first anniversary of the date of grant. The value of each share of restricted stock awarded to the non-employee directors for purposes of satisfying the target “equity” grant of $81,250 was the average closing stock price of the Company’s Common Stock on the NYSE for the last 60 trading days before the date of grant, which was calculated as $3.60. This yielded a calculated amount granted in the form of restricted stock of $40,633 per non-employee director. In addition, each director is reimbursed for any out-of-pocket expenses incurred by such director in connection with attending meetings of the Board or its committees.”

The share ownership level of each current non-employee director will be set forth in the Company’s proxy statement for the 2018 Annual Meeting (when available).

According to the Company’s public filings, each director of the Company is the beneficiary of a liability insurance policy “paid for by the Company and is indemnified, to the fullest extent permitted under Delaware law, by the Company for his or her actions associated with being a director. The Company has also entered into indemnification agreements with each of its directors.”

None of the Nominees has any position or office with the Company, and no occupation or employment with which the Nominees have been involved, during the past five years, was carried on with the Company or any corporation or organization that is a parent, subsidiary or other affiliate of the Company. None of the Nominees has ever served on the Board.

Monarch engaged Korn Ferry International, a third party search firm that was paid a fee for its services, to assist in identifying and evaluating potential director nominees for the 2018 Annual Meeting.

None of the Nominees, or any of their respective associates, has received any cash compensation, cash bonuses, deferred compensation, compensation pursuant to plans, or other compensation, from, or in respect of, services rendered on behalf of the Company that is required to be disclosed under, or is subject to any arrangement described in Item 402 of Regulation S-K promulgated under the Exchange Act.

Interests of the Nominees

The Nominees may be deemed to have an interest in their nominations for election to the Board by virtue of compensation the Nominees will receive from the Company as a director, if elected to the Board, and as described elsewhere in this proxy statement. Monarch expects that the Nominees, if elected, will be indemnified for service as directors of the Company to the same extent indemnification is provided to the current directors of the Company under the Bylaws and the Charter and be covered by the policy of insurance which insures the Company’s directors and officers. Other than as set forth in this proxy statement, none of the persons listed on Annex A of this proxy statement, including any Nominee, or any associate of the foregoing persons, has any substantial interest, direct or indirect, by security holdings or otherwise, in any matter to be acted upon at the 2018 Annual Meeting.

Messrs. Bartels and Citarrella are eligible to receive discretionary performance-related compensation in connection with their employment relationship with MAC.

The information herein regarding a particular Nominee has been furnished to Monarch by such Nominee.

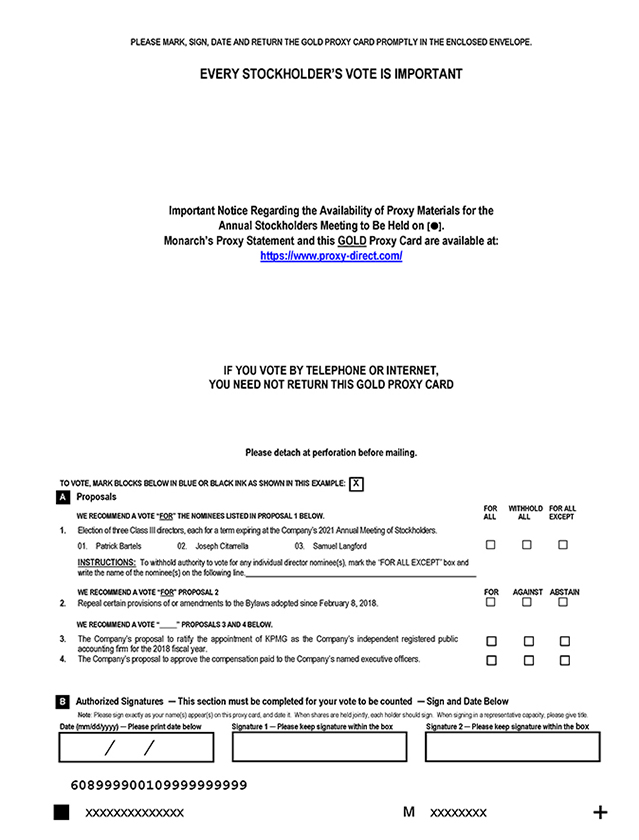

WE STRONGLY URGE YOU TO VOTE “FOR” THE ELECTION OF PATRICK BARTELS, JOSEPH CITARRELLA AND SAMUEL LANGFORD BY MARKING, SIGNING, DATING AND RETURNING

14