KBS Legacy Partners Apartment REIT Revaluation and Portfolio Update December 11, 2014 1 Exhibit 99.3

Forward-Looking Statements The information contained herein should be read in conjunction with, and is qualified by, the information in the KBS Legacy Partners Apartment REIT, Inc. (“KBS Legacy Partners REIT”) Annual Report on Form 10-K for the year ended December 31, 2013, filed with the Securities and Commission Exchange (the “SEC”) on March 10, 2014 (the “Annual Report”), and in KBS Legacy Partners REIT’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2014 (the “Quarterly Report”), filed with the SEC on November 13, 2014, including the “Risk Factors” contained in each filing. For a full description of the limitations, methodologies and assumptions used to value KBS Legacy Partners REIT’s assets and liabilities in connection with the calculation of KBS Legacy Partners REIT’s estimated value per share, see KBS Legacy Partners REIT’s Current Report on Form 8-K, filed with the SEC on December 11, 2014. Forward-Looking Statements Certain statements contained herein may be deemed to be forward-looking statements within the meaning of the Federal Private Securities Litigation Reform Act of 1995. KBS Legacy Partners REIT intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent, belief or current expectations of KBS Legacy Partners REIT and members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should” or similar expressions. Further, forward-looking statements speak only as of the date they are made, and KBS Legacy Partners REIT undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law. Actual results may differ materially from those contemplated by such forward-looking statements. The appraisal methodology for KBS Legacy Partners REIT’s real estate properties assumes the properties realize the projected net operating income and that investors would be willing to invest in such properties at similar capitalization rates. Though the appraisals of the real estate properties are CRBE, Inc.’s best estimates as of September 30, 2014 and the valuation estimates used in calculating the estimated value per share, with respect to CBRE Capital Advisors, Inc, KBS Capital Advisors LLC (the “Advisor”) and/ or KBS Legacy Partners REIT, are the respective party’s best estimates as of December 9, 2014, KBS Legacy Partners REIT can give no assurance in this regard. Even small changes to these assumptions could result in significant differences in the appraised values of KBS Legacy Partners REIT’s real estate properties and the estimated value per share. These statements also depend on factors such as: future economic, competitive and market conditions; KBS Legacy Partners REIT’s ability to maintain occupancy levels and rental rates at its real estate properties; and other risks identified in Part I, Item IA of the Annual Report and Part II, Item 1A of the Quarterly Report, each as filed with the SEC. Actual events may cause the value and returns on KBS Legacy Partners REIT’s investments to be less than that used for purposes of KBS Legacy Partners REIT’s estimated value per share. 2

Primary initial public offering broke escrow December 9, 2010, and terminated on March 12, 2013 Follow-on offering commenced on March 13, 2013, and terminated on March 31, 2014 Raised $203.0 million through September 30, 2014 (including DRIP proceeds) Pricing History Primary offering price: $10.00 through March 4, 2013 Primary offering repriced on March 5, 2013 to $10.68 (estimated value per share of $9.08) Follow-on offering repriced on March 11, 2014 to $10.96 (estimated value per share of $9.48) Offering and Pricing Overview 3

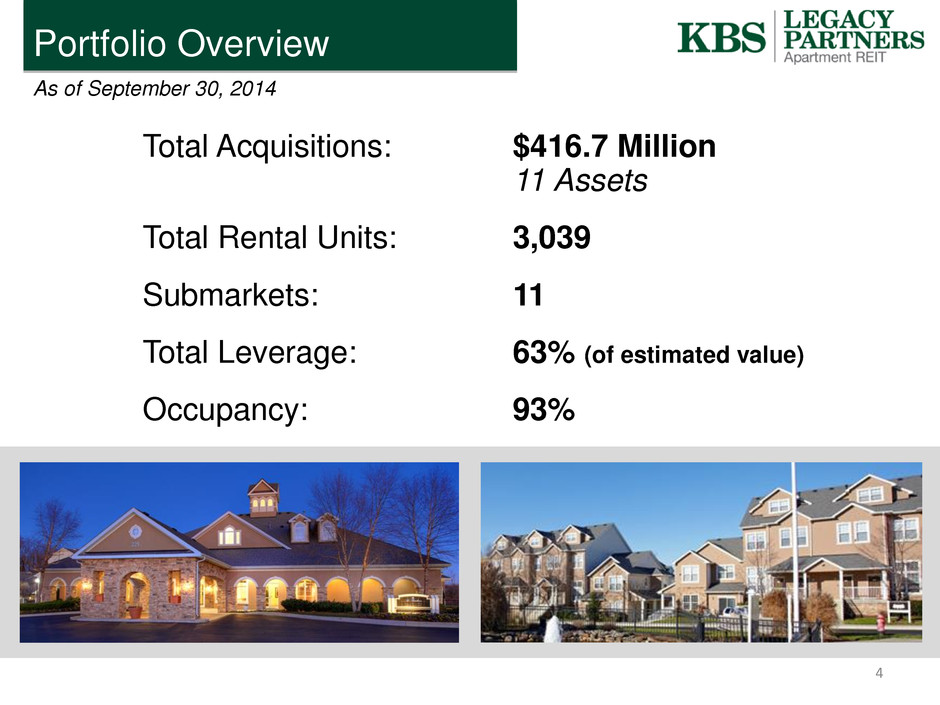

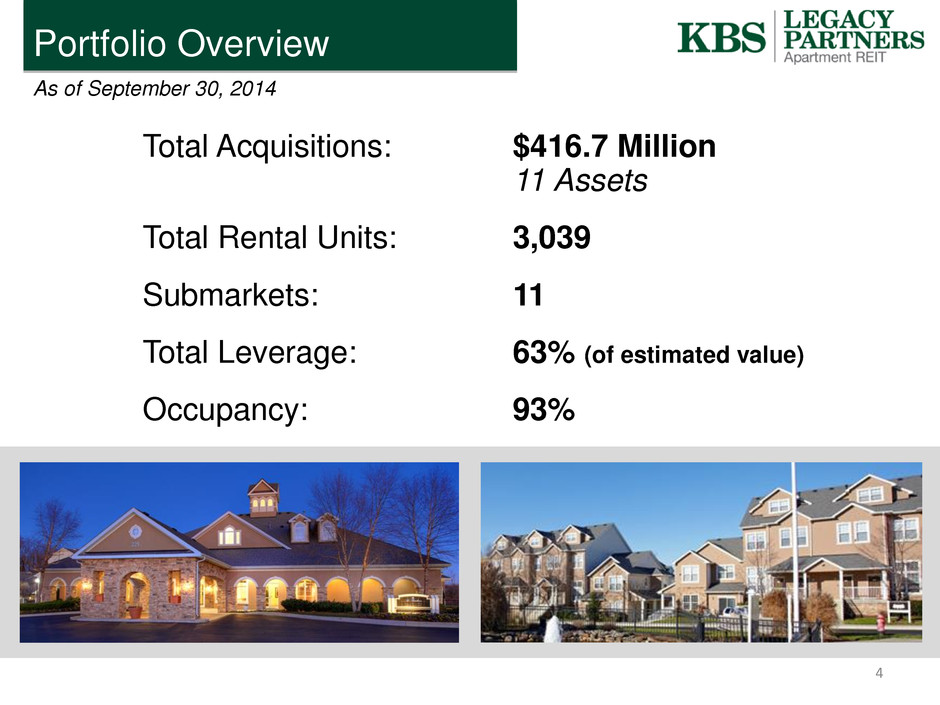

Total Acquisitions: $416.7 Million 11 Assets Total Rental Units: 3,039 Submarkets: 11 Total Leverage: 63% (of estimated value) Occupancy: 93% As of September 30, 2014 Portfolio Overview 4

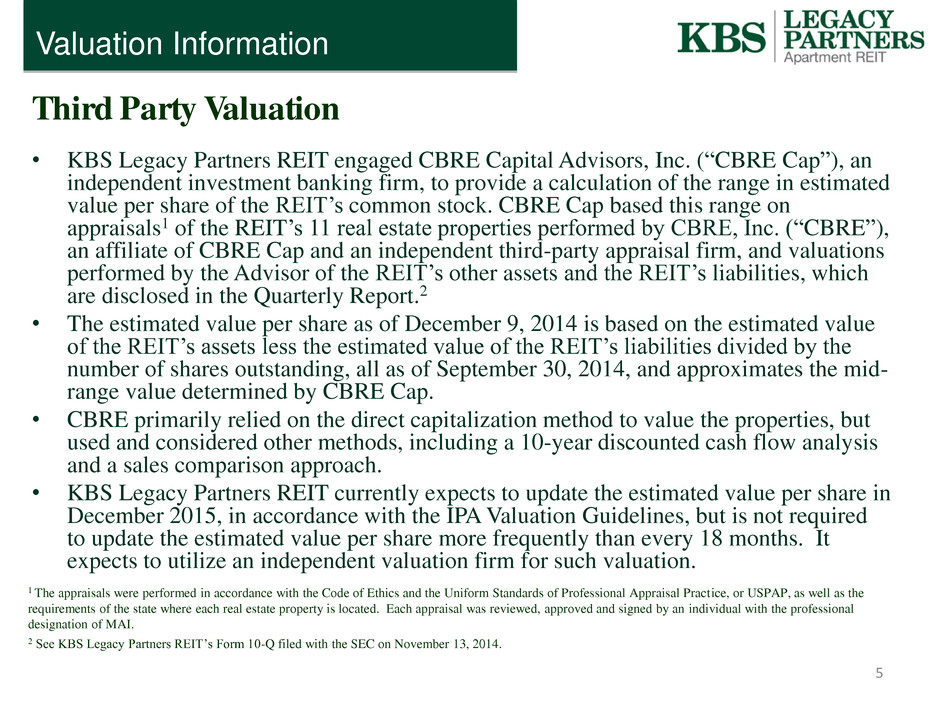

• KBS Legacy Partners REIT engaged CBRE Capital Advisors, Inc. (“CBRE Cap”), an independent investment banking firm, to provide a calculation of the range in estimated value per share of the REIT’s common stock. CBRE Cap based this range on appraisals1 of the REIT’s 11 real estate properties performed by CBRE, Inc. (“CBRE”), an affiliate of CBRE Cap and an independent third-party appraisal firm, and valuations performed by the Advisor of the REIT’s other assets and the REIT’s liabilities, which are disclosed in the Quarterly Report.2 • The estimated value per share as of December 9, 2014 is based on the estimated value of the REIT’s assets less the estimated value of the REIT’s liabilities divided by the number of shares outstanding, all as of September 30, 2014, and approximates the mid- range value determined by CBRE Cap. • CBRE primarily relied on the direct capitalization method to value the properties, but used and considered other methods, including a 10-year discounted cash flow analysis and a sales comparison approach. • KBS Legacy Partners REIT currently expects to update the estimated value per share in December 2015, in accordance with the IPA Valuation Guidelines, but is not required to update the estimated value per share more frequently than every 18 months. It expects to utilize an independent valuation firm for such valuation. 5 Third Party Valuation 1 The appraisals were performed in accordance with the Code of Ethics and the Uniform Standards of Professional Appraisal Practice, or USPAP, as well as the requirements of the state where each real estate property is located. Each appraisal was reviewed, approved and signed by an individual with the professional designation of MAI. 2 See KBS Legacy Partners REIT’s Form 10-Q filed with the SEC on November 13, 2014. Valuation Information

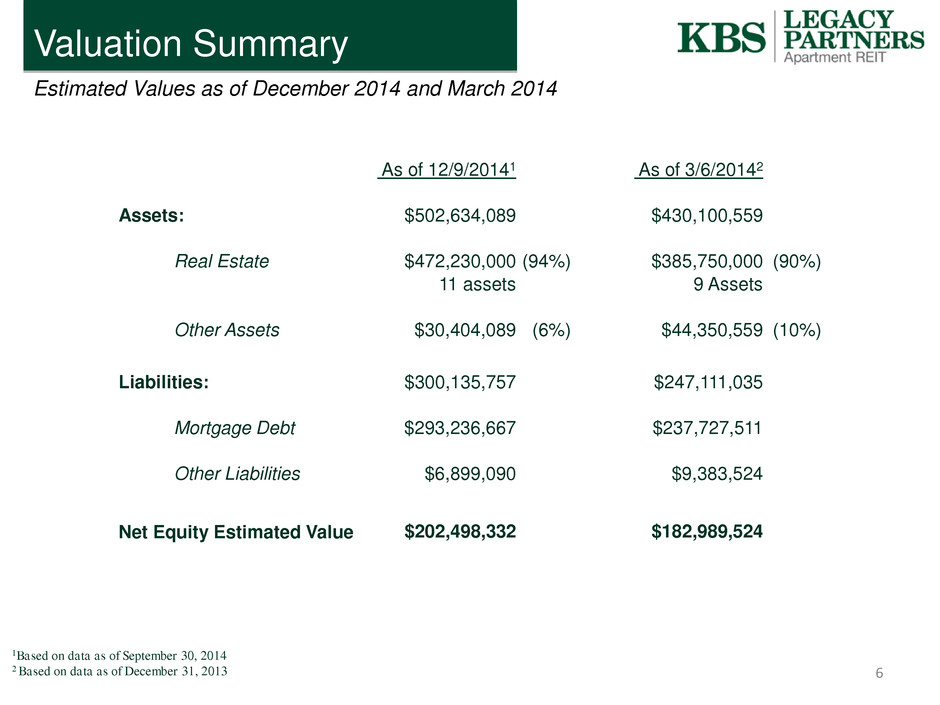

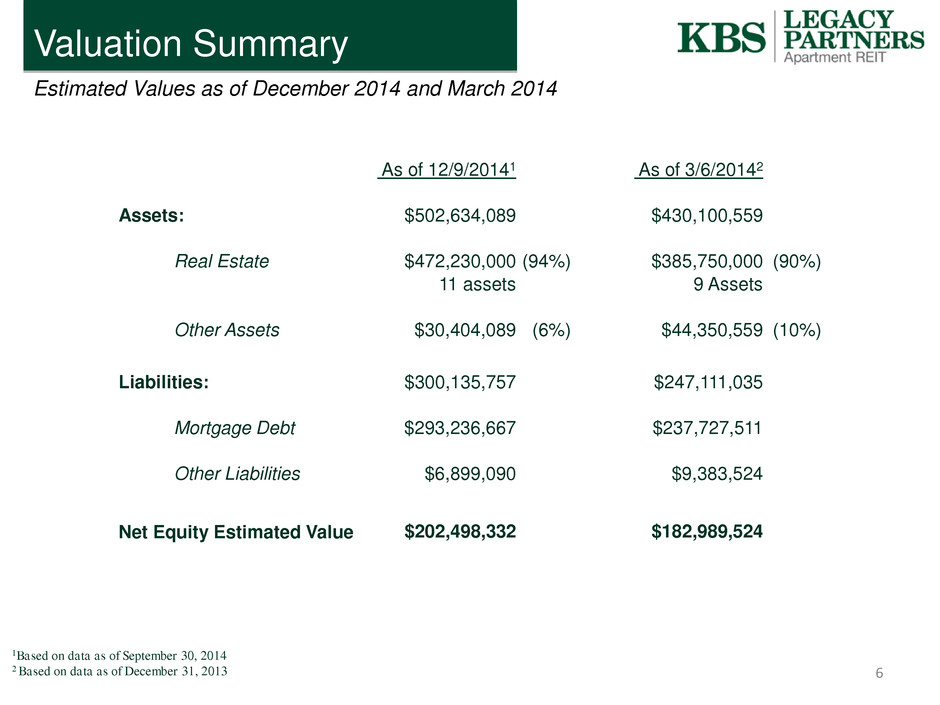

6 1Based on data as of September 30, 2014 2 Based on data as of December 31, 2013 Valuation Summary Estimated Values as of December 2014 and March 2014 As of 12/9/20141 As of 3/6/20142 Assets: $502,634,089 $430,100,559 Real Estate $472,230,000 (94%) $385,750,000 (90%) 11 assets 9 Assets Other Assets $30,404,089 (6%) $44,350,559 (10%) Liabilities: $300,135,757 $247,111,035 Mortgage Debt $293,236,667 $237,727,511 Other Liabilities $6,899,090 $9,383,524 Net Equity Estimated Value $202,498,332 $182,989,524

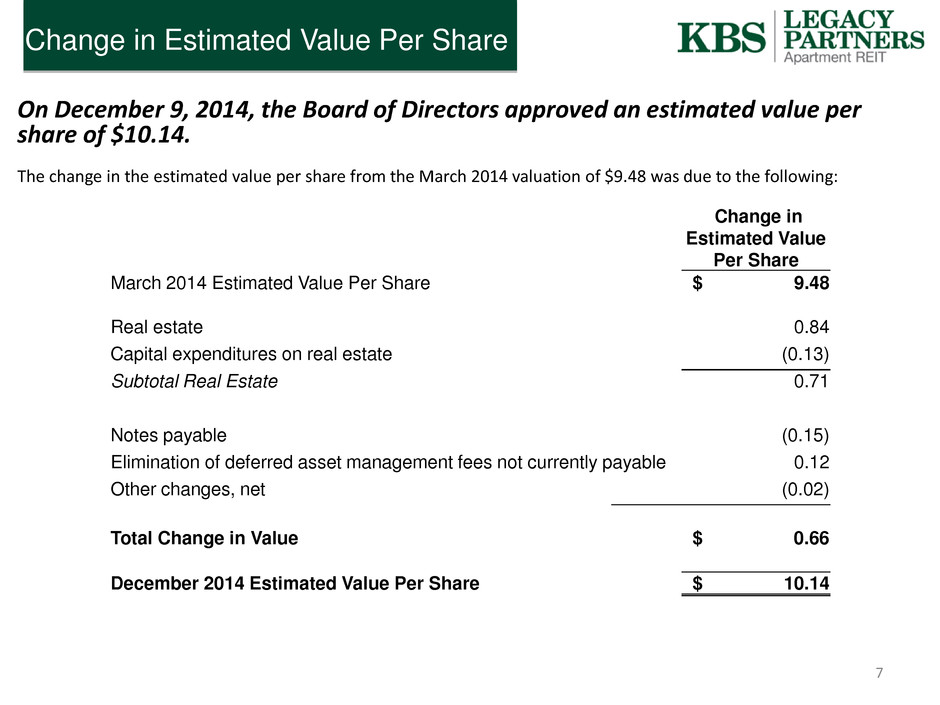

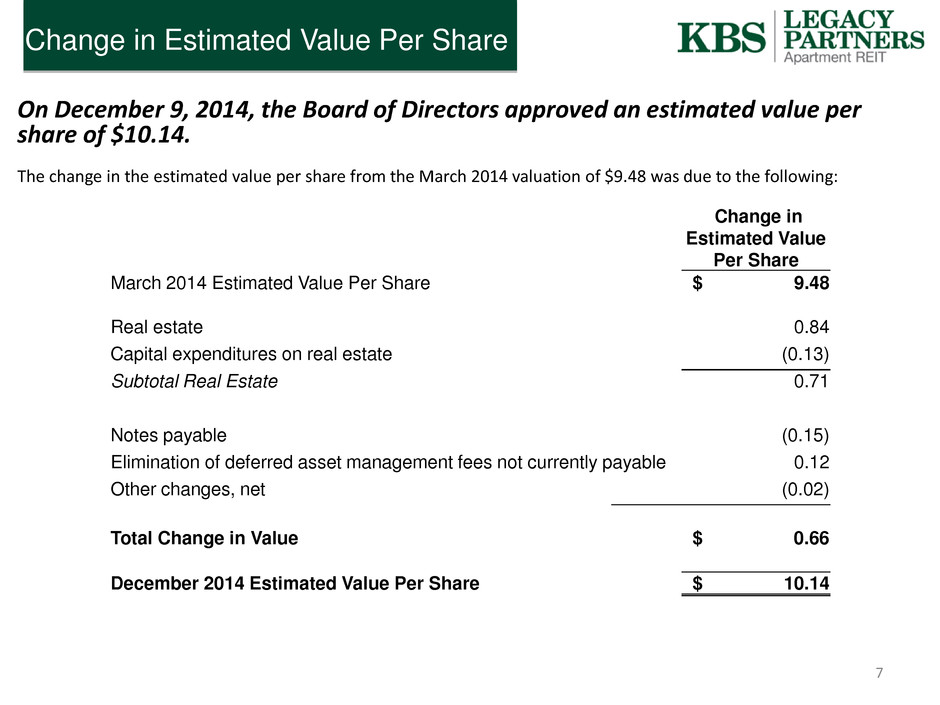

On December 9, 2014, the Board of Directors approved an estimated value per share of $10.14. The change in the estimated value per share from the March 2014 valuation of $9.48 was due to the following: 7 Change in Estimated Value Per Share Change in Estimated Value Per Share March 2014 Estimated Value Per Share $ 9.48 Real estate 0.84 Capital expenditures on real estate (0.13) Subtotal Real Estate 0.71 Notes payable (0.15) Elimination of deferred asset management fees not currently payable 0.12 Other changes, net (0.02) Total Change in Value $ 0.66 December 2014 Estimated Value Per Share $ 10.14

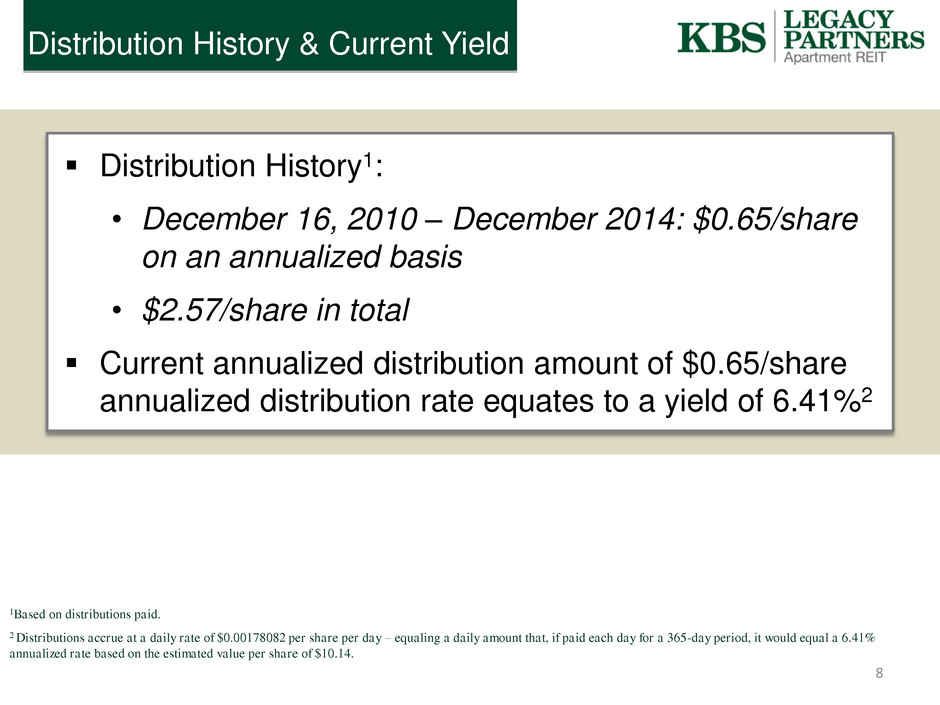

Distribution History & Current Yield 1Based on distributions paid. 2 Distributions accrue at a daily rate of $0.00178082 per share per day – equaling a daily amount that, if paid each day for a 365-day period, it would equal a 6.41% annualized rate based on the estimated value per share of $10.14. Distribution History1: • December 16, 2010 – December 2014: $0.65/share on an annualized basis • $2.57/share in total Current annualized distribution amount of $0.65/share annualized distribution rate equates to a yield of 6.41%2 8

Account statements will reflect new estimated value per share of $10.14 beginning with December 2014 statements. Statements previously reflected an offering price equal to the March 2014 estimated value per share plus estimated offering costs. Stockholder letter will be included with December statements explaining new estimated value per share. Estimated value per share visible through DST will be updated to show new estimated value. While KBS Legacy Partners REIT cannot control reporting of custodians, the REIT believes (based on inquiries) they will report the new estimated value per share. – It’s possible that some custodians will take longer to report the estimated value per share than others and also that some may first require reporting of the estimated value per share from a third-party data provider. Stockholder Communication 9

Thank you! If you have any questions, please contact your financial advisor or contact us at: KBS Capital Markets Group Member FINRA & SIPC 660 Newport Center Dr., Suite 1200 Newport Beach, CA 92660 (866) 527-4264 10