KBS Legacy Partners Apartment REIT Revaluation and Portfolio Update December 16, 2016 1

Forward-Looking Statements The information contained herein should be read in conjunction with, and is qualified by, the information in the KBS Legacy Partners Apartment REIT, Inc. (“KBS Legacy Partners REIT”) Annual Report on Form 10-K for the year ended December 31, 2015, filed with the Securities and Commission Exchange (the “SEC”) on March 18, 2016 (the “Annual Report”), and in KBS Legacy Partners REIT’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2016, filed with the SEC on November 14, 2016 (the “Quarterly Report”), including the “Risk Factors” contained in each filing. For a full description of the limitations, methodologies and assumptions used to value KBS Legacy Partners REIT’s assets and liabilities in connection with the calculation of KBS Legacy Partners REIT’s estimated value per share, see KBS Legacy Partners REIT’s Current Report on Form 8-K, filed with the SEC on December 15, 2016, (the “Valuation 8-K”). Forward-Looking Statements Certain statements contained herein may be deemed to be forward-looking statements within the meaning of the Federal Private Securities Litigation Reform Act of 1995. KBS Legacy Partners REIT intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent, belief or current expectations of KBS Legacy Partners REIT and members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should” or similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. KBS Legacy Partners REIT undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law. Such statements are subject to known and unknown risks and uncertainties which could cause actual results to differ materially from those contemplated by such forward-looking statements. KBS Legacy Partners REIT makes no representation or warranty (express or implied) about the accuracy of any such forward-looking statements. These statements are based on a number of assumptions involving the judgment of management. The appraisal methodology for KBS Legacy Partners REIT’s real estate properties assumes the properties realize the projected net operating income and that investors would be willing to invest in such properties at similar capitalization rates. Though the appraisals of the real estate properties, with respect to CBRE, Inc., an independent, third-party real estate valuation firm (“CBRE”), and the valuation estimates used in calculating the estimated value per share, with respect to KBS Capital Advisors LLC, KBS Legacy Partners REIT’s external advisor (the “Advisor”), and KBS Legacy Partners REIT, are the respective party’s best estimates, as of September 30, 2016 or December 9, 2016, as applicable, KBS Legacy Partners REIT can give no assurance in this regard. Even small changes to these assumptions could result in significant differences in the appraised values of KBS Legacy Partners REIT’s real estate properties and the estimated value per share. Actual events may cause the value and returns on KBS Legacy Partners REIT’s investments to be less than that used for purposes of KBS Legacy Partners REIT’s estimated value per share. Although KBS Legacy Partners REIT has updated its strategy in relation to its consideration of strategic alternatives as described herein, it can give no assurances that it will be successful. There are many factors that may affect KBS Legacy Partners REIT’s ability to execute such strategic alternatives including, among other factors, its ability to dispose of some of its real estate properties at the times and the prices it expects and its ability to fund and execute its plan to renovate certain of its real estate properties. Further, although KBS Legacy Partners REIT has updated its strategic alternatives strategy and intends to pursue strategic asset sales for certain of its real estate properties and to renovate certain others, it can give no assurances that the execution of such strategy will create additional stockholder value or that it will be able to continue to pay attractive distributions or pay a special distribution to its stockholders at the time and at the amount it expects. The forward-looking statements also depend on factors such as: future economic, competitive and market conditions; KBS Legacy Partners REIT’s ability to maintain occupancy levels and rental rates at its real estate properties; and other risks identified in Part I, Item IA of the Annual Report and Part II, Item 1A of the Quarterly Report. 2

As of September 30, 2016 Portfolio Overview 3 Total Capital Raised: $214.5 Million (including DRIP proceeds) Total Acquisitions (by Purchase Price)1: $431.0 Million 11 Assets Total Rental Units: 3,039 Submarkets: 11 Total Leverage2: 61% Occupancy: 94.4% 1 Amount includes capital expenditures. 2 Total leverage is calculated based on total mortgage debt outstanding divided by total appraised value of the real estate portfolio, as of September 30, 2016.

KBS Legacy Partners REIT engaged CBRE to perform appraisals of the REIT’s real estate properties and, through an affiliate, to provide a range of the estimated value per share of the REIT’s common stock (the “EVPS Range”).1 CBRE utilized its appraisals of KBS Legacy Partners REIT’s real estate properties and valuations performed by the Advisor of the REIT’s cash, other assets, mortgage debt and other liabilities, which are disclosed in the Quarterly Report, to determine the EVPS Range. The estimated value per share as of December 9, 2016 is based on the estimated value of the REIT’s assets less the estimated value of the REIT’s liabilities divided by the number of shares outstanding, all as of September 30, 2016. The estimated value per share approximates the mid-range value of the EVPS range as indicated in CBRE’s valuation report, was recommended by the Advisor and is based on CBRE’s appraisals and the Advisor’s valuations.2 CBRE primarily relied on the direct capitalization method to appraise the real estate properties, but used and considered other methods, including a discounted cash flow analysis and a sales comparison approach. KBS Legacy Partners REIT currently expects to update the estimated value per share in December 2017. It expects to utilize an independent valuation firm for such valuation. 4 Third-Party Valuation 1The appraisals were performed in accordance with the Code of Ethics and the Uniform Standards of Professional Appraisal Practice, or USPAP, as well as the requirements of the state where each real estate property is located. Each appraisal was reviewed, approved and signed by an individual with the professional designation of MAI. 2 See the Quarterly Report. Valuation Information

5 1Based on data as of September 30, 2016 2 Based on data as of September 30, 2015 3The decrease in real estate is primarily due to decreases in values of two properties: (i) The Residence at Waterstone and (ii) Crystal Park at Waterford. See Slide 7 for a further discussion. Valuation Summary Estimated Values as of December 2016 and December 2015 As of 12/9/20161 As of 12/8/20152 Assets: $491,692,027 $507,143,726 Real Estate3 $468,430,000 (95%) $480,180,000 (95%) 11 assets 11 assets Other Assets $23,262,027 (5%) $26,963,726 (5%) Liabilities: $297,755,282 $297,436,084 Mortgage Debt $290,035,932 $290,329,326 Other Liabilities $7,719,350 $7,106,758 Net Equity Estimated Value $193,936,745 $209,707,642

On December 9, 2016, the Board of Directors approved an estimated value per share of $9.35. The change in the estimated value per share from the December 2015 valuation of $10.29 was due to the following: 6 Change in Estimated Value Per Share December 2015 Estimated Value Per Share $ 10.29 Real estate1 (0.57) Capital expenditures on real estate (0.09) Subtotal Real Estate (0.66) Mortgage debt Other changes, net (0.26) (0.02) Total Change in Value $ (0.94) December 2016 Estimated Value Per Share $ 9.35 1The decrease in real estate is primarily due to decreases in values of two properties: (i) The Residence at Waterstone and (ii) Crystal Park at Waterford. See Slide 7 for a further discussion.

The Residence at Waterstone and Crystal Park at Waterford properties (both located in Maryland) caused a significant reduction in the REIT’s appraised real estate value in the current year net asset value. The September 30, 2016 appraised values of the properties decreased by $7.5 million and $7.2 million, respectively, from the September 30, 2015 appraised values for a total of $0.71 per share. The most significant reason for both of these decreases is increased cap rates used in the appraisals and to a lesser extent, slightly decreased net operating income (NOI). • Waterstone - At the Waterstone property, the cap rate increased from prior year. Additionally the projected NOI used in the appraisal also decreased by approximately 2%, which is reflective of the decrease in the rental rates at the property over the last year. In addition, there’s been an increase in supply in the market due to development. • Crystal Park - At Crystal Park, the cap rate increased from prior year and projected NOI fell by approximately 8.5%. There has been a decline in revenues at the property year over year, and the appraiser significantly reduced their view on market rents consistent with what the REIT has seen at the property. In addition, there’s been an increase in supply in the market due to development. 7 Significant Real Estate Value Changes

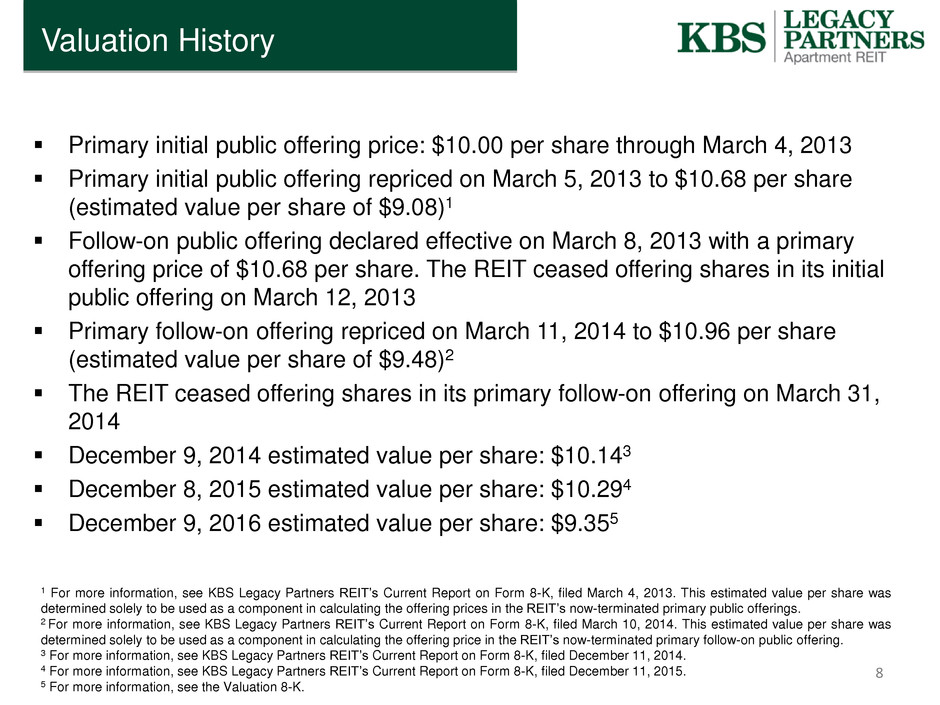

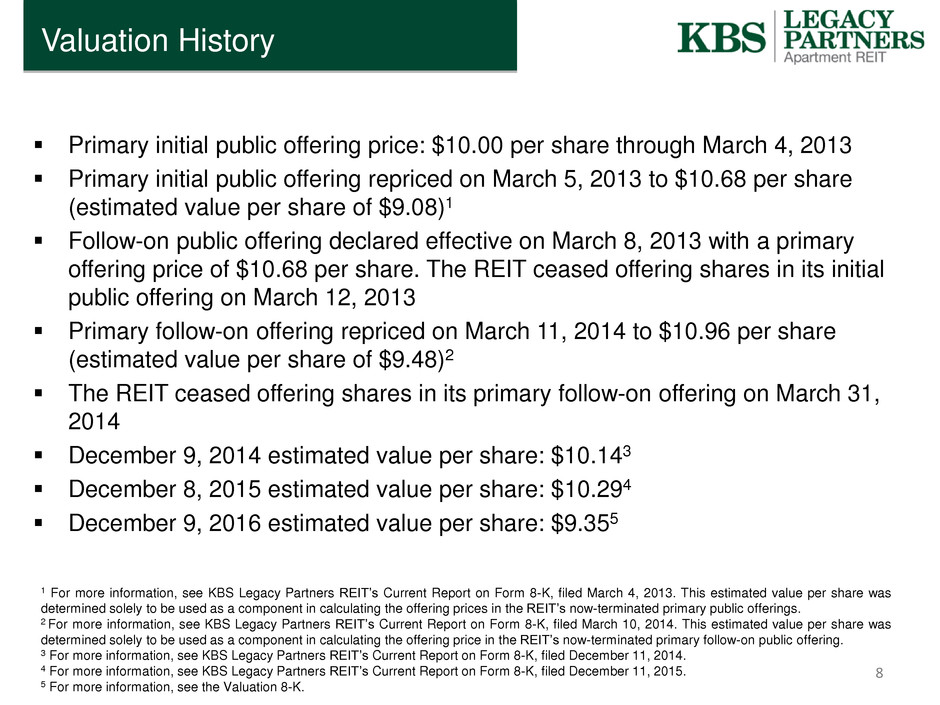

1 For more information, see KBS Legacy Partners REIT’s Current Report on Form 8-K, filed March 4, 2013. This estimated value per share was determined solely to be used as a component in calculating the offering prices in the REIT’s now-terminated primary public offerings. 2 For more information, see KBS Legacy Partners REIT’s Current Report on Form 8-K, filed March 10, 2014. This estimated value per share was determined solely to be used as a component in calculating the offering price in the REIT’s now-terminated primary follow-on public offering. 3 For more information, see KBS Legacy Partners REIT’s Current Report on Form 8-K, filed December 11, 2014. 4 For more information, see KBS Legacy Partners REIT’s Current Report on Form 8-K, filed December 11, 2015. 5 For more information, see the Valuation 8-K. Valuation History Primary initial public offering price: $10.00 per share through March 4, 2013 Primary initial public offering repriced on March 5, 2013 to $10.68 per share (estimated value per share of $9.08)1 Follow-on public offering declared effective on March 8, 2013 with a primary offering price of $10.68 per share. The REIT ceased offering shares in its initial public offering on March 12, 2013 Primary follow-on offering repriced on March 11, 2014 to $10.96 per share (estimated value per share of $9.48)2 The REIT ceased offering shares in its primary follow-on offering on March 31, 2014 December 9, 2014 estimated value per share: $10.143 December 8, 2015 estimated value per share: $10.294 December 9, 2016 estimated value per share: $9.355 8

Distribution History & Current Yield 1 Based on distributions paid. 2 Distributions accrue at a daily rate of $0.00178082 per share per day – equaling a daily amount that, if paid each day for a 365-day period, it would equal a 6.95% annualized rate based on the estimated value per share of $9.35. Distribution History1: • December 16, 2010 – December 2016: $0.65/share on an annualized basis • $3.88/share in total Current annualized distribution amount of $0.65/share or a yield of 6.95%2 9

Stockholder Performance 10 KBS Legacy Partners REIT is providing this estimated value per share to assist broker-dealers that participated in its public offerings in meeting their customer account statement reporting obligations. This valuation was performed in accordance with the provisions of and also to comply with the IPA Valuation Guidelines. As with any valuation methodology, the methodologies used are based upon a number of estimates and assumptions that may not be accurate or complete. Different parties with different assumptions and estimates could derive a different estimated value per share of KBS Legacy Partners REIT’s common stock, and this difference could be significant. The estimated value per share is not audited and does not represent the fair value of the REIT’s assets less the fair value of the REIT’s liabilities according to GAAP. Accordingly, with respect to the estimated value per share, KBS Legacy Partners REIT can give no assurance that: • a stockholder would be able to resell his or her shares at the estimated value per share; • a stockholder would ultimately realize distributions per share equal to the REIT’s estimated value per share upon liquidation of the REIT’s assets and settlement of its liabilities or a sale of the REIT; • the REIT’s shares of common stock would trade at the estimated value per share on a national securities exchange; • another independent third-party appraiser or third-party valuation firm would agree with the REIT’s estimated value per share; or • the methodology used to determine the REIT’s estimated value per share would be acceptable to FINRA or for compliance with ERISA reporting requirements. Further, the estimated value per share as of December 9, 2016 is based on the estimated value of KBS Legacy Partners REIT’s assets less the estimated value of the REIT’s liabilities divided by the number of shares outstanding, all as of September 30, 2016. The value of KBS Legacy Partners REIT’s shares will fluctuate over time in response to developments related to individual assets in its portfolio and the management of those assets, in response to the real estate and finance markets and due to other factors. Because of, among other factors, KBS Legacy Partners REIT’s relatively small asset base, the high concentration of the REIT’s total assets in real estate, and the number of shares of the REIT’s common stock outstanding, any change in the value of individual assets in the portfolio, particularly changes affecting the REIT’s real estate properties, could have a significant impact on the value of the REIT’s shares. The estimated value per share does not reflect a discount for the fact that KBS Legacy Partners REIT is externally managed, nor does it reflect a real estate portfolio premium/discount versus the sum of the individual property values. The estimated value per share also does not take into account estimated disposition costs and fees for real estate properties, debt prepayment penalties that could apply upon the prepayment of certain of the REIT’s debt obligations or the impact of restrictions on the assumption of debt. KBS Legacy Partners REIT currently expects to utilize an independent valuation firm to update the estimated value per share in December 2017.

Stockholder Performance 11 $9.35 $3.88 $13.23 Hypothetical Performance of Early and Late Investors All Distributions Received in Cash Estimated Value Per Share As of December 9, 2016 Cumulative Cash Distributions Received through December 9, 2016 Sum of Estimated Value Per Share as of December 9, 2016 and Cumulative Cash Distributions Received through December 9, 2016 Late Investor: Invested at Close of Follow-On Primary Public Offering (March 31, 2014) Early Investor: Invested at Escrow Break of Initial Public Offering (December 9, 2010) $9.35 $1.69 $11.04

Stockholder Performance 12 Hypothetical Performance of Early and Late Investors All Distributions Received in Cash 1 Determined solely to be used as a component in calculating the offering prices in one of KBS Legacy Partners REIT’s now-terminated primary public offerings. For information about the estimated value per share for 3/13, 12/14, 12/15 and 12/16, see slide 8. “Cumulative distributions” for an early cash investor assumes all distributions received in cash and no share redemptions and reflect the cash payment amounts (all distributions paid since inception) per share for a hypothetical investor who invested on or before escrow break and consequently has received all distributions paid by the REIT. “Cumulative distributions” for a late cash investor assumes all distributions received in cash and no share redemptions, and reflect the cash payment amounts (all distributions paid since investment) per share for a hypothetical investor who invested on March 31, 2014, the day offers in primary follow-on offering ended. $1.92 $2.57 $3.22 $3.88 $9.08 $10.14 $10.29 $9.35 $11.00 $12.71 $13.51 $13.23 2013 2014 2015 2016 Breakdown of Early Cash Investor Value Cumulative Distributions Estimated Value Per Share $0.39 $1.04 $1.69 $10.14 $10.29 $9.35 $10.53 $11.33 $11.04 2014 2015 2016 Breakdown of Late Cash Investor Value Estimated Value Per Share Cumulative Distributions 1

Strategic Alternatives Update 13 As previously disclosed, the REIT engaged a financial advisor to explore the availability of strategic alternatives with the goal of providing liquidity options for its stockholders while preserving and maximizing overall returns on its investment portfolio. Although the REIT engaged Holliday Fenoglio Fowler, L.P. (“HFF”) to market its real estate properties for sale, it is not obligated to enter into any particular transaction or any transaction at all. HFF has completed the marketing of the REIT’s real estate properties and received offers for both the REIT’s entire portfolio and individual properties. Based on feedback received during the marketing process, the REIT anticipates that it will pursue certain strategic asset sales and hold the majority of its real estate properties in an effort to create additional stockholder value, while still paying attractive distributions. The REIT believes that holding the majority of its real estate properties will allow certain debt prepayment obligations to decrease as the loans secured by those properties move closer to maturity, which should create additional stockholder value. Depending on the number of properties sold, the REIT may adjust the ongoing distribution rate subsequent to such sales in order to maintain the current distribution coverage. The REIT intends to use some of the proceeds from any strategic asset sales it closes to: • Make renovations at certain remaining real estate properties. The REIT believes it can increase property-level NOI and create additional stockholder value by making these updates. • Pay a special distribution to its stockholders. During its appraisals of the REIT’s real estate properties, CBRE collected all reasonably available material information that it deemed relevant in appraising such properties. Among other property-level information CBRE received from the Advisor and reviewed in connection with such appraisals were offers received by HFF as a result of HFF’s efforts to market the REIT’s real estate properties for sale.

2017 Goals & Objectives 14 Make strategic asset sales and use a portion of the proceeds to pay a special distribution to stockholders Undertake renovations at certain assets to create additional stockholder value Maintain portfolio occupancy Increase portfolio net cash flow and MFFO Hold majority of the portfolio to reduce debt prepayment penalties on mortgage loans Grow portfolio NAV

Account statements will reflect new estimated value per share of $9.35 beginning with December 2016 statements mailed in January 2017. Stockholder letter will be included with December statements explaining new estimated value per share. Estimated value per share visible through DST will be updated to show new estimated value. While KBS Legacy Partners REIT cannot control reporting of custodians, the REIT believes (based on inquiries) they will report the new estimated value per share. – It’s possible that some custodians will take longer to report the estimated value per share than others and also that some may first require reporting of the estimated value per share from a third-party data provider. Stockholder Communication 15

Thank you! If you have any questions, please contact your financial advisor or contact us at: KBS Capital Markets Group Member FINRA & SIPC 800 Newport Center Dr., Suite 700 Newport Beach, CA 92660 (866) 527-4264 16