NASDAQ: ICBK investors.icbk.com Subordinated Notes Offering June 2020 Exhibit 99.2

Forward Looking Statements THE INFORMATION INCLUDED IN THIS PRESENTATION IS CONFIDENTIAL AND MAY NOT BE REPRODUCED OR REDISTRIBUTED, PASSED ON OR DIVULGED, DIRECTLY OR INDIRECTLY, TO ANY OTHER PERSON. COUNTY BANCORP, INC. (THE “COMPANY”) RESERVES THE RIGHT TO REQUEST THE RETURN OF THIS PRESENTATION AT ANY TIME. FORWARD-LOOKING STATEMENTS THIS PRESENTATION CONTAINS FORWARD-LOOKING STATEMENTS. IN SOME CASES, FORWARD-LOOKING STATEMENTS CAN BE IDENTIFIED BY THE USE OF WORDS SUCH AS “ESTIMATE,” “PROJECT,” “BELIEVE,” “INTEND,” “ANTICIPATE,” “ASSUME,” “PLAN,” “SEEK,” “EXPECT,” “MAY,” “SHOULD,” “INDICATE,” “WOULD,” “CONTEMPLATE,” “CONTINUE,” “INTEND,” “TARGET” AND WORDS OF SIMILAR MEANING. THESE FORWARD-LOOKING STATEMENTS ARE NOT HISTORICAL FACTS, AND ARE BASED ON CURRENT EXPECTATIONS, ESTIMATES AND PROJECTIONS ABOUT THE COMPANY, ITS INDUSTRY, MANAGEMENT’S BELIEFS AND CERTAIN ASSUMPTIONS MADE BY MANAGEMENT, MANY OF WHICH, BY THEIR NATURE, ARE INHERENTLY UNCERTAIN AND BEYOND THE COMPANY’S CONTROL. ACCORDINGLY, YOU ARE CAUTIONED THAT ANY SUCH FORWARD-LOOKING STATEMENTS ARE NOT GUARANTEES OF FUTURE PERFORMANCE AND ARE SUBJECT TO CERTAIN RISKS, UNCERTAINTIES AND ASSUMPTIONS THAT ARE DIFFICULT TO PREDICT, INCLUDING THE RISK FACTORS SET FORTH IN THE COMPANY’S FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”), INCLUDING THE RISKS RELATING TO THE EFFECTS OF THE COVID-19 PANDEMIC, INCLUDING ITS POTENTIAL EFFECTS ON THE ECONOMIC ENVIRONMENT, OUR CUSTOMERS AND OUR OPERATIONS, AS WELL AS ANY CHANGES TO FEDERAL, STATE OR LOCAL GOVERNMENT LAWS, REGULATIONS OR ORDERS IN CONNECTION WITH THE PANDEMIC. ALTHOUGH THE COMPANY BELIEVES THAT THE EXPECTATIONS REFLECTED IN SUCH FORWARD-LOOKING STATEMENTS ARE REASONABLE AS OF THE DATE MADE, EXPECTATIONS MAY PROVE TO BE MATERIALLY DIFFERENT FROM THE RESULTS EXPRESSED OR IMPLIED BY SUCH FORWARD-LOOKING STATEMENTS. UNLESS REQUIRED BY LAW, THE COMPANY ALSO DISCLAIMS ANY OBLIGATION TO UPDATE ANY FORWARD-LOOKING STATEMENTS. INTERESTED PARTIES SHOULD NOT PLACE UNDUE RELIANCE ON ANY FORWARD-LOOKING STATEMENT AND SHOULD CAREFULLY CONSIDER THE RISKS AND OTHER FACTORS THAT THE COMPANY FACES. OTHER IMPORTANT NOTICES THIS PRESENTATION HAS BEEN PREPARED BY THE COMPANY SOLELY FOR INFORMATIONAL PURPOSES BASED ON INFORMATION REGARDING ITS BUSINESS, OPERATIONS AND FINANCIAL CONDITION, AS WELL AS INFORMATION FROM PUBLIC SOURCES. THIS PRESENTATION HAS BEEN PREPARED TO ASSIST INTERESTED PARTIES IN MAKING THEIR OWN EVALUATION AND DOES NOT PURPORT TO CONTAIN ALL OF THE INFORMATION THAT MAY BE RELEVANT OR MATERIAL TO AN INTERESTED PARTY’S INVESTMENT DECISION. IN ALL CASES, INTERESTED PARTIES SHOULD CONDUCT THEIR OWN INVESTIGATION AND ANALYSIS OF THE COMPANY, THE INFORMATION SET FORTH IN THIS PRESENTATION AND OTHER INFORMATION PROVIDED BY OR ON BEHALF OF THE COMPANY. THIS PRESENTATION DOES NOT CONSTITUTE AN OFFER TO SELL, OR A SOLICITATION OF AN OFFER TO BUY, ANY SECURITIES OF THE COMPANY BY ANY PERSON IN ANY JURISDICTION IN WHICH IT IS UNLAWFUL FOR SUCH PERSON TO MAKE SUCH AN OFFERING OR SOLICITATION. NEITHER THE SEC NOR ANY OTHER REGULATORY BODY HAS APPROVED OR DISAPPROVED OF THE SECURITIES OF THE COMPANY OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PRESENTATION. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. SECURITIES OF THE COMPANY ARE NOT DEPOSITS OR INSURED BY THE FDIC OR ANY OTHER AGENCY. EXCEPT WHERE INFORMATION IS PROVIDED AS OF A SPECIFIED DATE, THIS PRESENTATION SPEAKS AS OF THE DATE HEREOF. THE DELIVERY OF THIS PRESENTATION SHALL NOT, UNDER ANY CIRCUMSTANCES, CREATE ANY IMPLICATION THAT THERE HAS BEEN NO CHANGE IN THE AFFAIRS OF THE COMPANY AFTER THE DATE HEREOF. MARKET DATA AND OTHER STATISTICAL DATA USED IN THIS PRESENTATION HAS BEEN OBTAINED FROM INDEPENDENT INDUSTRY SOURCES AND PUBLICATIONS AS WELL AS FROM RESEARCH REPORTS PREPARED FOR OTHER PURPOSES. INDUSTRY PUBLICATIONS AND SURVEYS AND FORECASTS GENERALLY STATE THAT THE INFORMATION CONTAINED THEREIN HAS BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE. THE COMPANY HAS NOT INDEPENDENTLY VERIFIED THE DATA OBTAINED FROM THESE SOURCES. FORWARD-LOOKING INFORMATION OBTAINED FROM THESE SOURCES IS SUBJECT TO THE SAME QUALIFICATIONS AND THE ADDITIONAL UNCERTAINTIES REGARDING THE OTHER FORWARD-LOOKING STATEMENTS IN THIS PRESENTATION. THIS PRESENTATION INCLUDES CERTAIN MEASURES THAT ARE NOT CALCULATED UNDER GENERALLY ACCEPTED ACCOUNTING PRINCIPLES OF THE UNITED STATES (“GAAP”). THESE NON-GAAP FINANCIAL MEASURES SHOULD BE CONSIDERED ONLY AS SUPPLEMENTAL TO, AND NOT SUPERIOR TO, FINANCIAL MEASURES PREPARED IN ACCORDANCE WITH GAAP. PLEASE REFER TO THE APPENDIX OF THIS PRESENTATION FOR A RECONCILIATION OF THE NON-GAAP FINANCIAL MEASURES INCLUDED IN THIS PRESENTATION TO THE MOST DIRECTLY COMPARABLE FINANCIAL MEASURES PREPARED IN ACCORDANCE WITH GAAP.

Company Overview

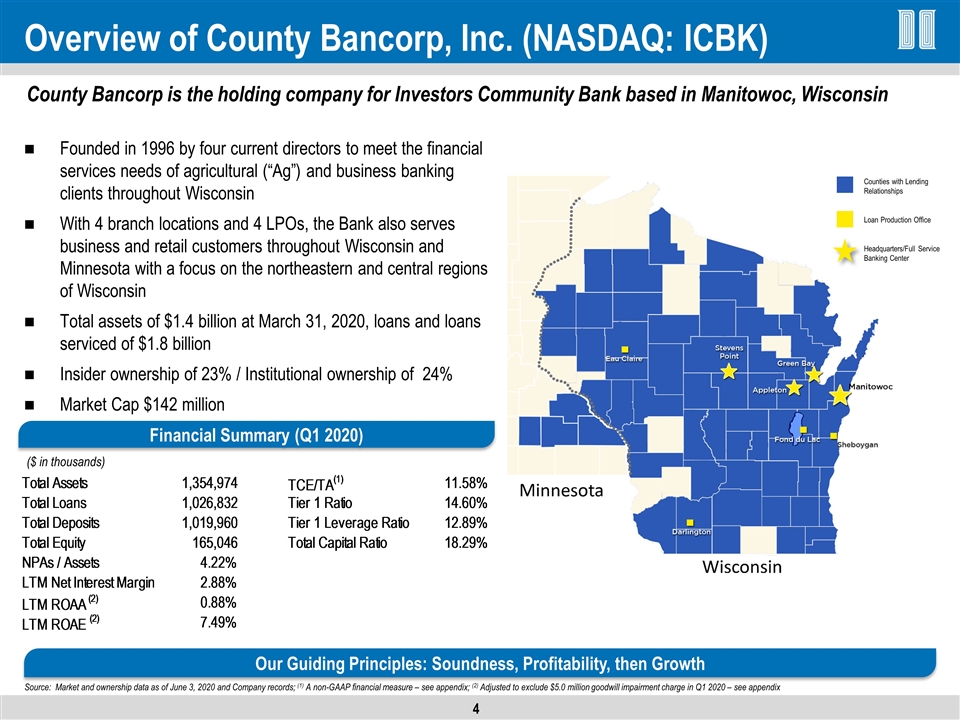

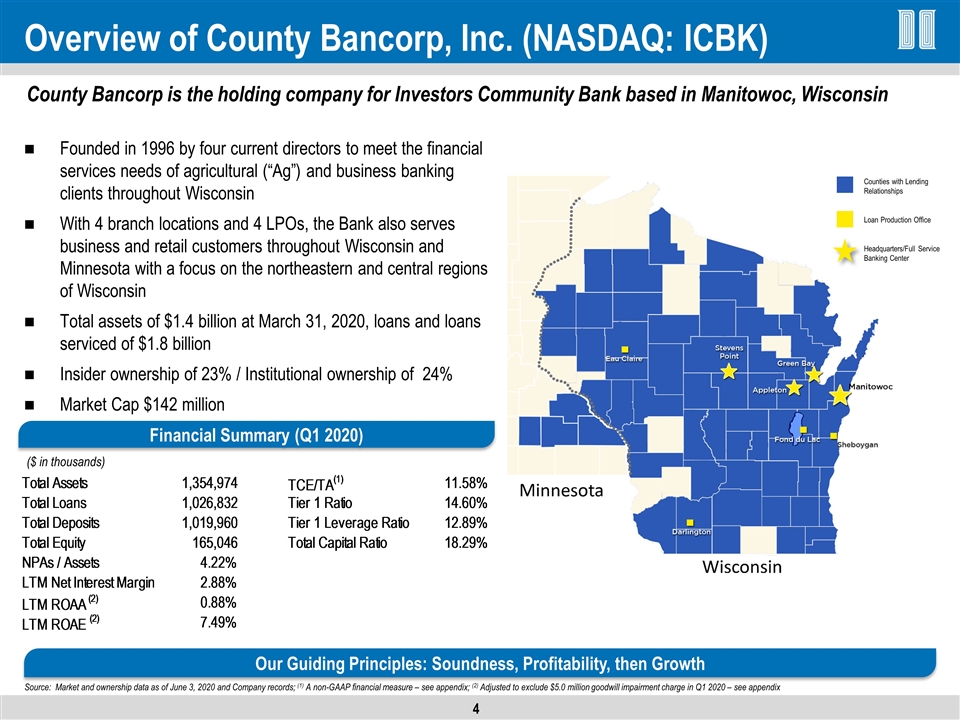

Overview of County Bancorp, Inc. (NASDAQ: ICBK) Founded in 1996 by four current directors to meet the financial services needs of agricultural (“Ag”) and business banking clients throughout Wisconsin With 4 branch locations and 4 LPOs, the Bank also serves business and retail customers throughout Wisconsin and Minnesota with a focus on the northeastern and central regions of Wisconsin Total assets of $1.4 billion at March 31, 2020, loans and loans serviced of $1.8 billion Insider ownership of 23% / Institutional ownership of 24% Market Cap $142 million County Bancorp is the holding company for Investors Community Bank based in Manitowoc, Wisconsin Our Guiding Principles: Soundness, Profitability, then Growth Source: Market and ownership data as of June 3, 2020 and Company records; (1) A non-GAAP financial measure – see appendix; (2) Adjusted to exclude $5.0 million goodwill impairment charge in Q1 2020 – see appendix Financial Summary (Q1 2020) ($ in thousands) Counties with Lending Relationships Loan Production Office Headquarters/Full Service Banking Center

Investment Highlights M&A Focused on Commercial and/or Deposit-Rich Targets Strong Capital Position Unique Focus On and Understanding of Ag Industry High Touch Customer Relationship Emphasis Significant Insider Ownership Efficient Operating Model Proven Management Team Track Record of Growth & Profitability Our Guiding Principles: Soundness, Profitability, then Growth

Proven Senior Management Team Senior Vice President – Marketing 6 Years at County President & Director of the Company, Chief Executive Officer of the Bank 24 Years at County President of the Bank, Director of the Company & Bank 24 Years at County Timothy J. Schneider Mark R. Binversie Executive Vice President, Chief Banking Officer of the Bank 11 Years at County Executive Vice President, Chief Credit Officer of the Bank 2 Years at County Secretary of the Company, Executive Vice President, Chief Risk Officer and Counsel of the Bank 10 Years at County Senior Vice President – Ag Banking 3 Years at County Senior Vice President – Operations 9 Years at County David A. Coggins John R. Fillingim Mark A. Miller Tim McTigue Laura Wiegert Cyrene Wilke Chief Financial Officer and Treasurer of the Company, Executive Vice President, Chief Financial Officer of the Bank 3 Years at County Senior Vice President – Banking Services 4 Years at County Senior Vice President – Business Banking 9 Years at County Glen L. Stiteley Matt Lemke Bill Hodgkiss

Strategic Summary Ag lending Primarily focused on the dairy industry Ag lending team comprised of experienced bankers with deep backgrounds in agriculture, all of whom grew up on farms Commercial lending Deposits: diversified & low “all-in” funding costs Dairy farmers throughout the state of Wisconsin Small and mid-sized businesses Revenue up to $50 million Commercial real estate owners and investors Direct, personal relationships with our customers (“boots in the driveway” approach) Unique understanding of Wisconsin ag community and niche lending business Highly personalized customer service coupled with an efficient operating model Branch-lite model minimizes brick and mortar costs – ultimately leading to lower operating costs Strategic use of Farm Service Agency (“FSA”) government-guaranteed loan programs to provide credit risk mitigation Robust loan sales and loan servicing business activity drives non-interest income generation Lines of Business Target Customers Our strategy and growth are not dependent upon significant investment in traditional branch infrastructure Differentiation Through Unique Banking Model

Financial Summary

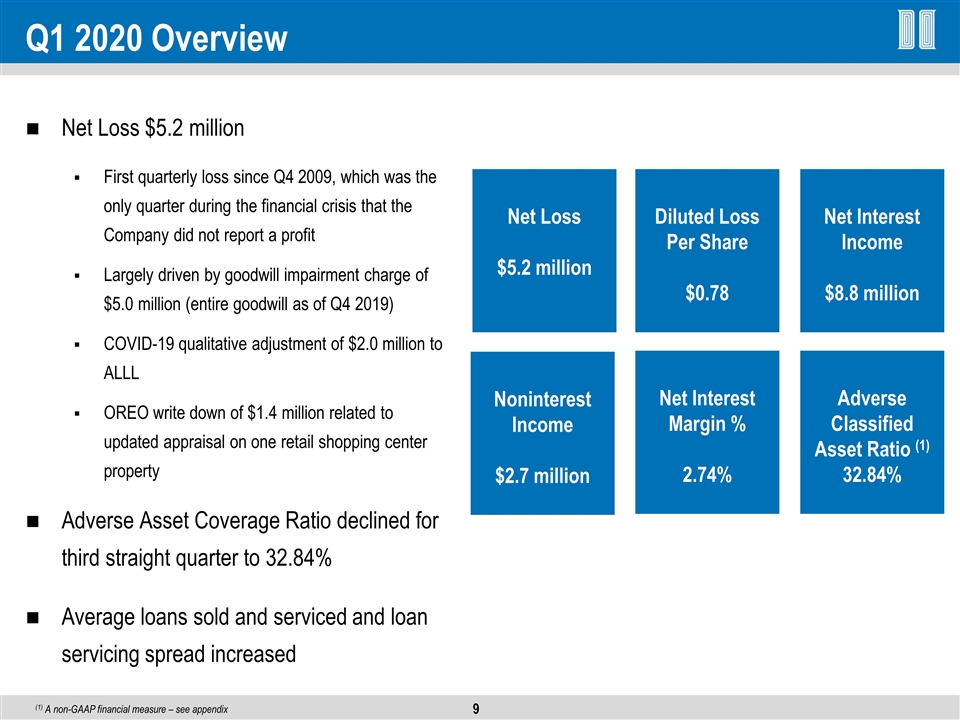

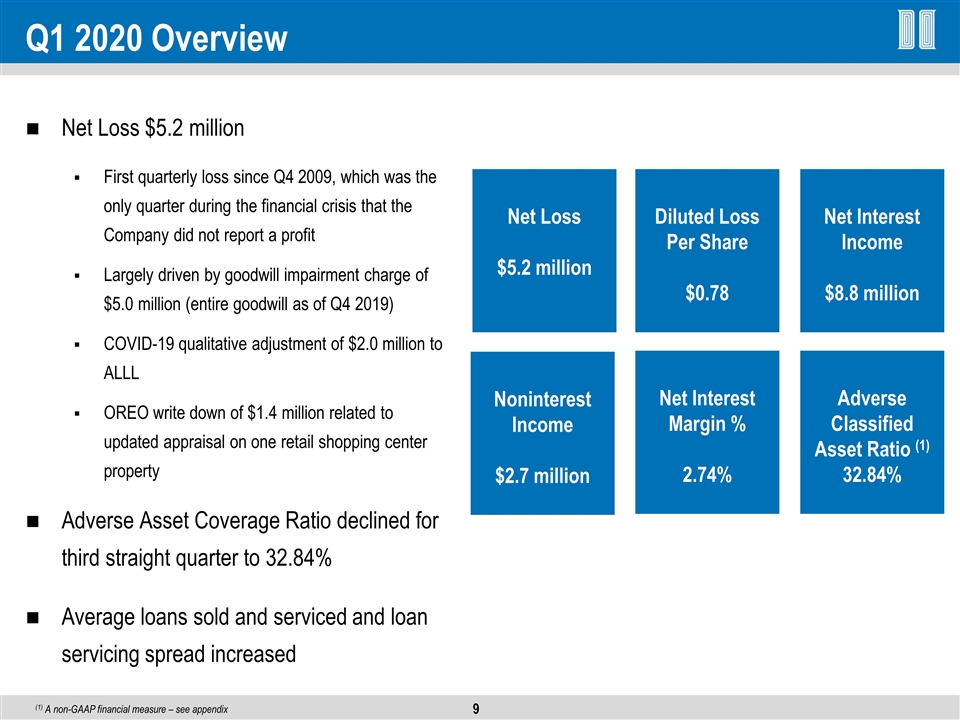

Q1 2020 Overview Net Loss $5.2 million First quarterly loss since Q4 2009, which was the only quarter during the financial crisis that the Company did not report a profit Largely driven by goodwill impairment charge of $5.0 million (entire goodwill as of Q4 2019) COVID-19 qualitative adjustment of $2.0 million to ALLL OREO write down of $1.4 million related to updated appraisal on one retail shopping center property Adverse Asset Coverage Ratio declined for third straight quarter to 32.84% Average loans sold and serviced and loan servicing spread increased Net Loss $5.2 million Net Interest Income $8.8 million Diluted Loss Per Share $0.78 Net Interest Margin % 2.74% Adverse Classified Asset Ratio (1) 32.84% (1) A non-GAAP financial measure – see appendix Noninterest Income $2.7 million

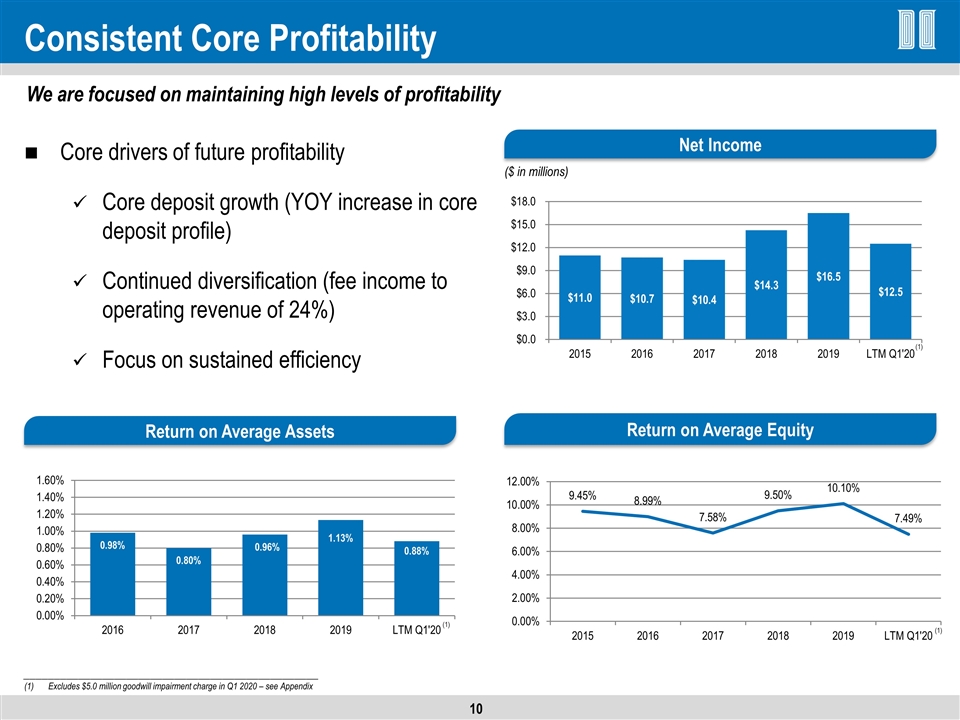

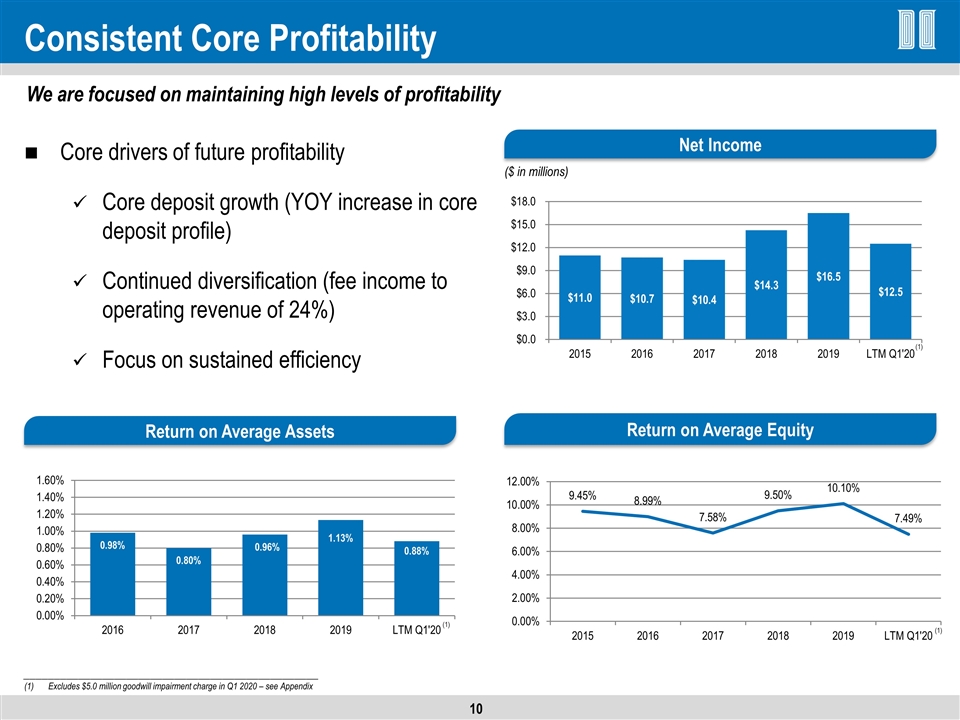

Consistent Core Profitability Return on Average Assets Return on Average Equity ($ in millions) Net Income We are focused on maintaining high levels of profitability Core drivers of future profitability Core deposit growth (YOY increase in core deposit profile) Continued diversification (fee income to operating revenue of 24%) Focus on sustained efficiency _________________________________________________ Excludes $5.0 million goodwill impairment charge in Q1 2020 – see Appendix (1) (1) (1)

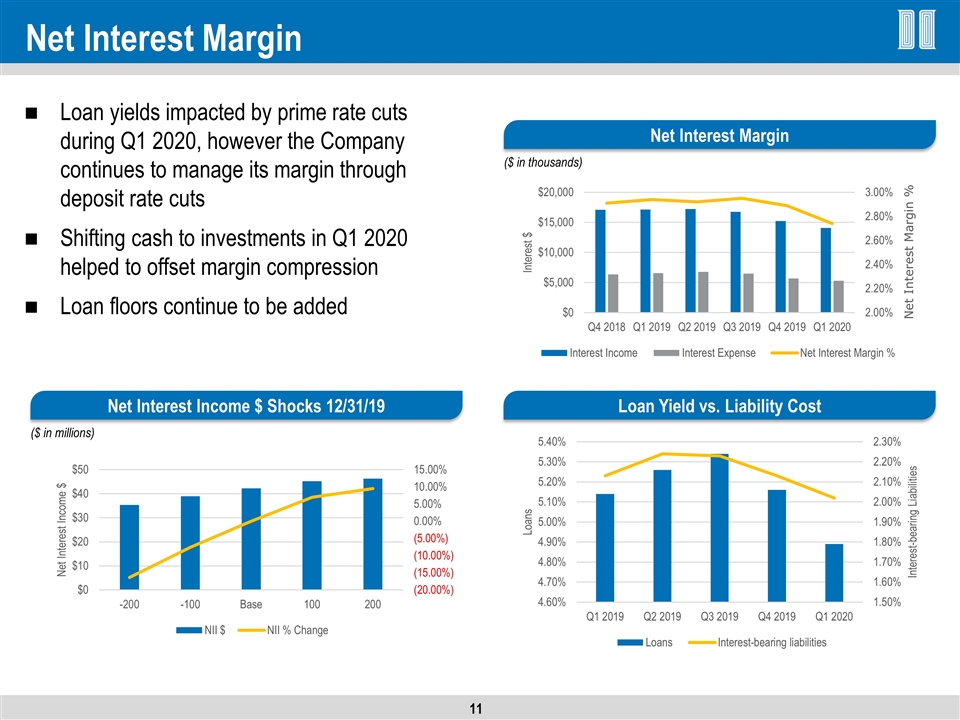

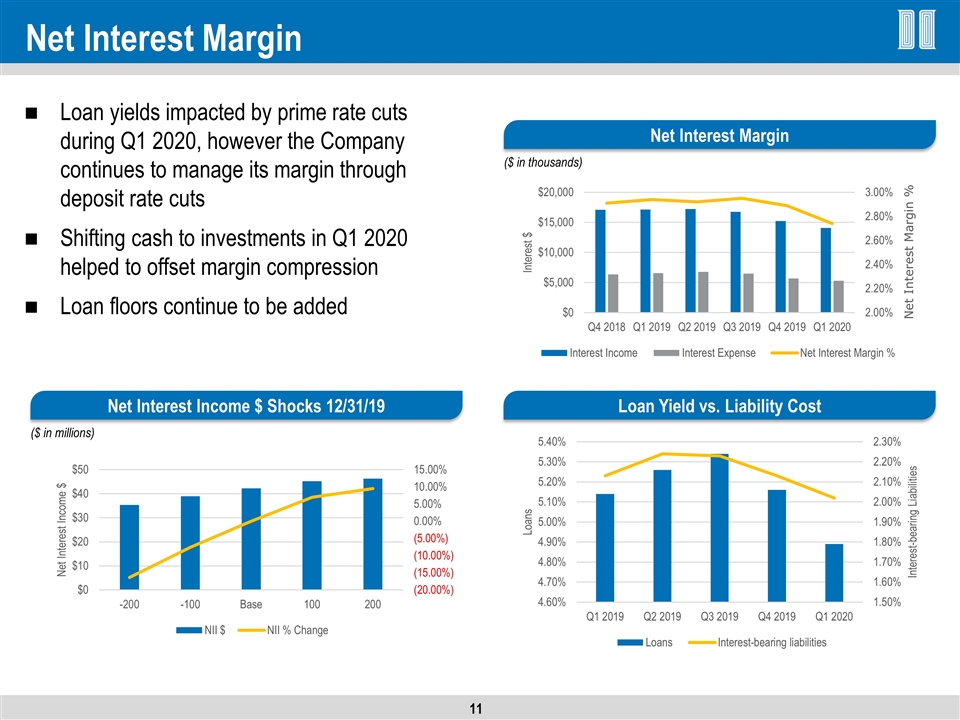

Net Interest Margin Loan yields impacted by prime rate cuts during Q1 2020, however the Company continues to manage its margin through deposit rate cuts Shifting cash to investments in Q1 2020 helped to offset margin compression Loan floors continue to be added ($ in thousands) Net Interest Margin Loan Yield vs. Liability Cost ($ in millions) Net Interest Income $ Shocks 12/31/19

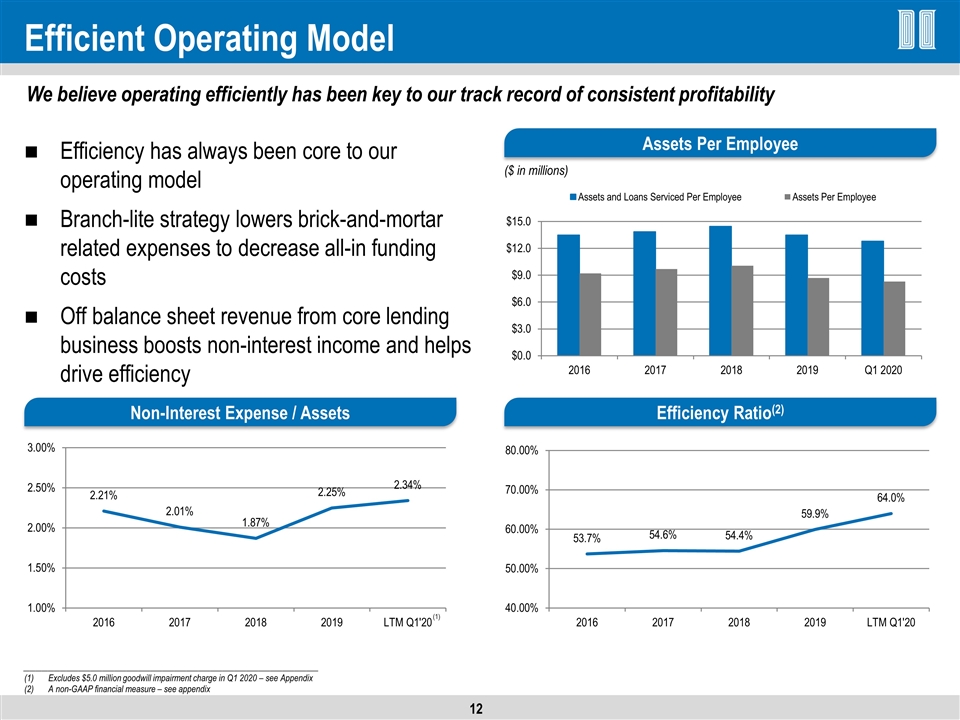

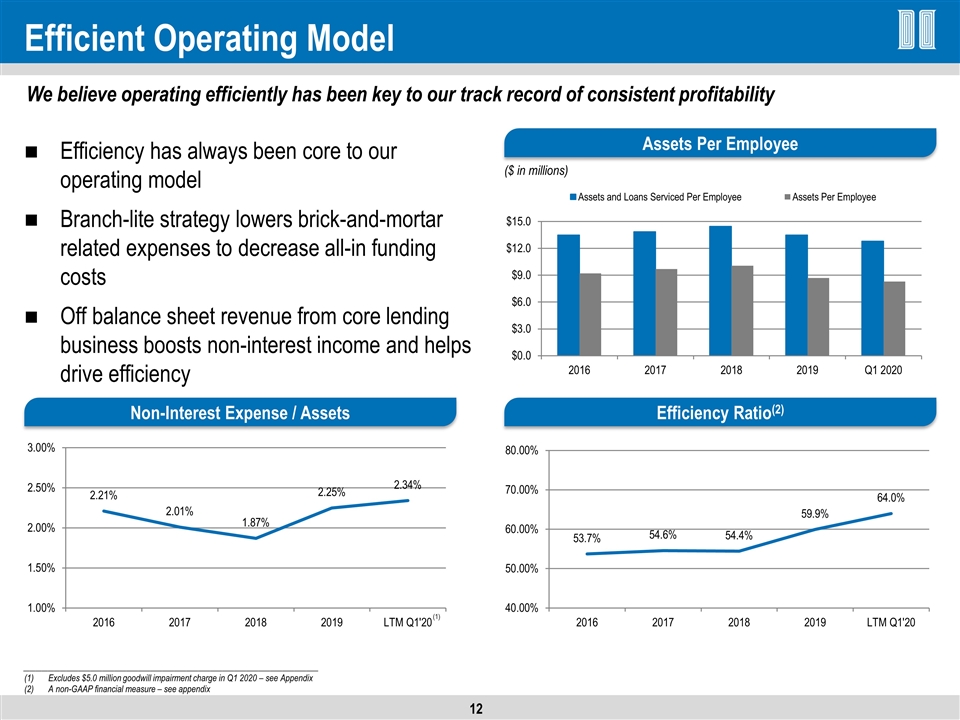

Efficient Operating Model Efficiency has always been core to our operating model Branch-lite strategy lowers brick-and-mortar related expenses to decrease all-in funding costs Off balance sheet revenue from core lending business boosts non-interest income and helps drive efficiency _________________________________________________ Excludes $5.0 million goodwill impairment charge in Q1 2020 – see Appendix A non-GAAP financial measure – see appendix Efficiency Ratio(2) Assets Per Employee We believe operating efficiently has been key to our track record of consistent profitability Non-Interest Expense / Assets ($ in millions) (1)

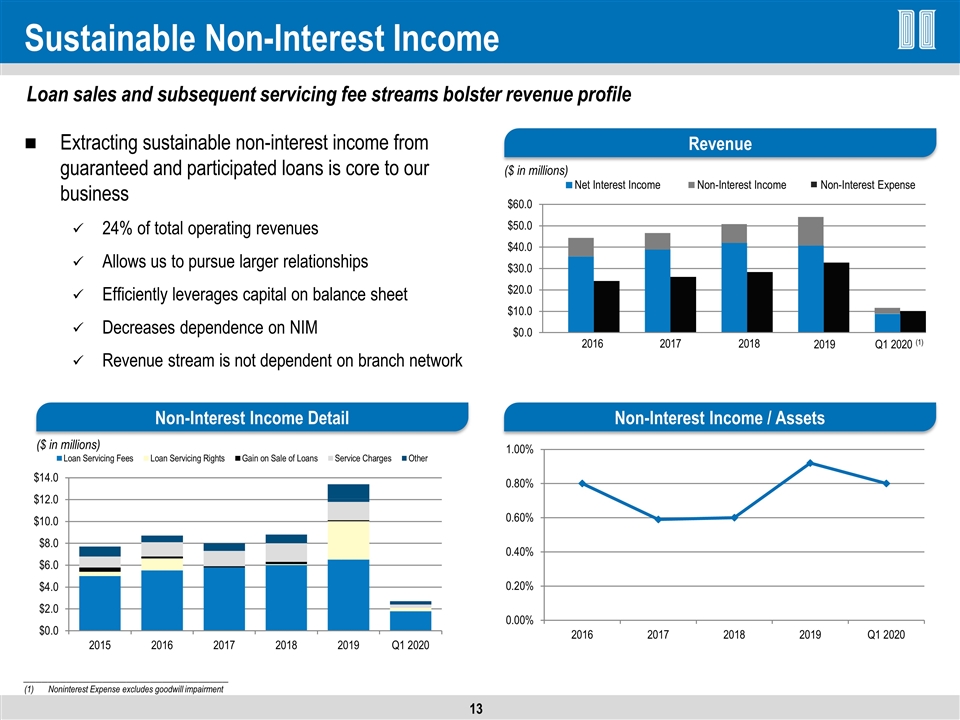

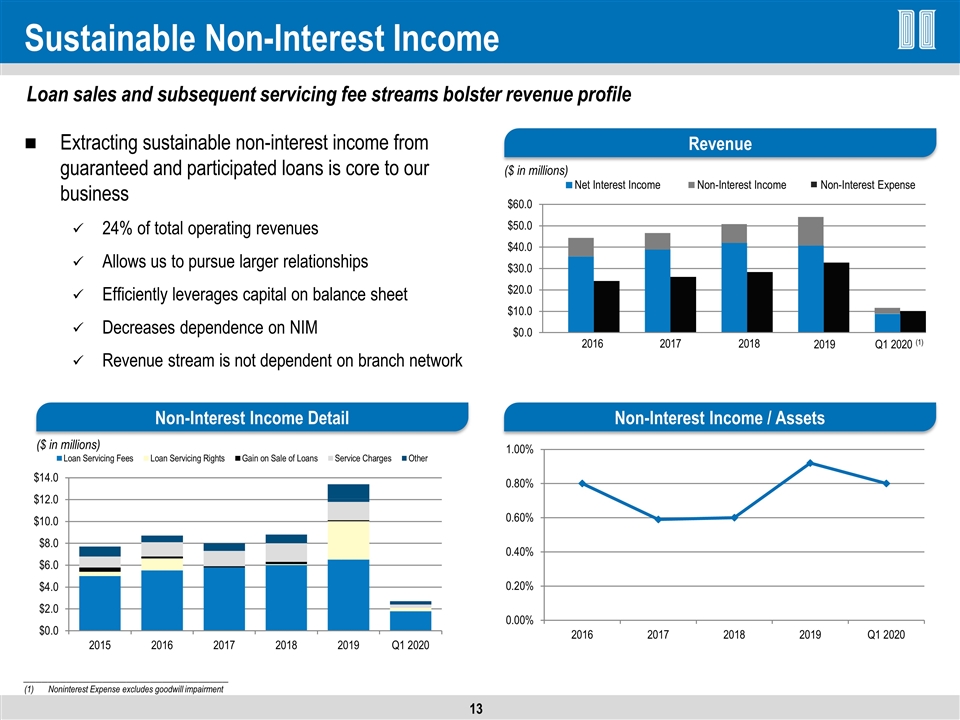

Non-Interest Income / Assets Sustainable Non-Interest Income Extracting sustainable non-interest income from guaranteed and participated loans is core to our business 24% of total operating revenues Allows us to pursue larger relationships Efficiently leverages capital on balance sheet Decreases dependence on NIM Revenue stream is not dependent on branch network ($ in millions) Non-Interest Income Detail Loan sales and subsequent servicing fee streams bolster revenue profile Revenue ($ in millions) __________________________________ Noninterest Expense excludes goodwill impairment

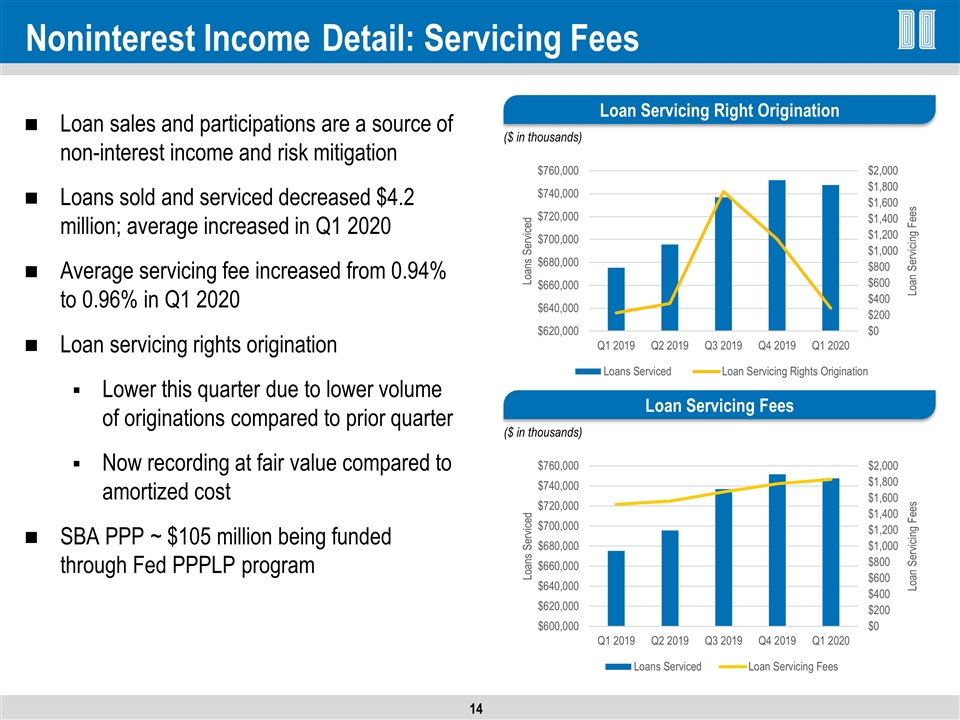

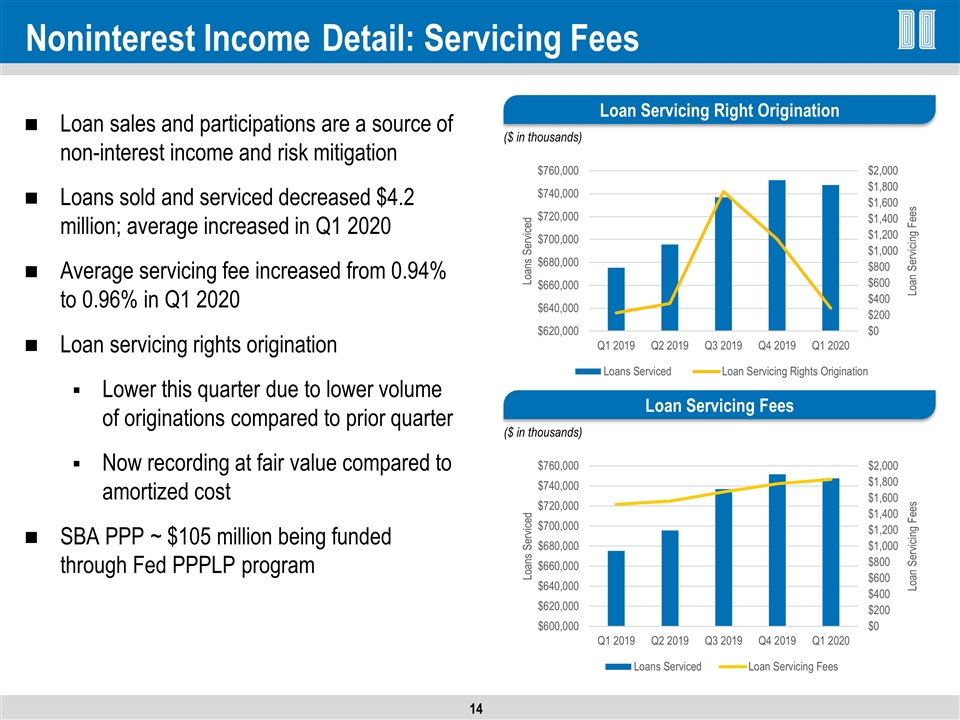

Noninterest Income Detail: Servicing Fees Loan sales and participations are a source of non-interest income and risk mitigation Loans sold and serviced decreased $4.2 million; average increased in Q1 2020 Average servicing fee increased from 0.94% to 0.96% in Q1 2020 Loan servicing rights origination Lower this quarter due to lower volume of originations compared to prior quarter Now recording at fair value compared to amortized cost SBA PPP ~ $105 million being funded through Fed PPPLP program ($ in thousands) Loan Servicing Fees ($ in thousands) Loan Servicing Right Origination

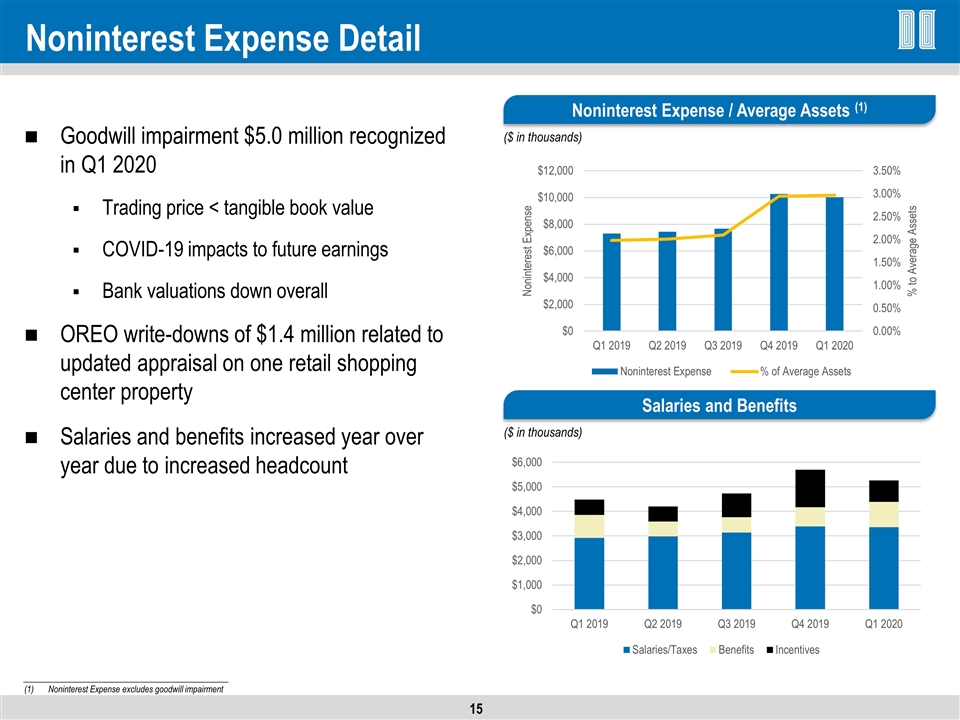

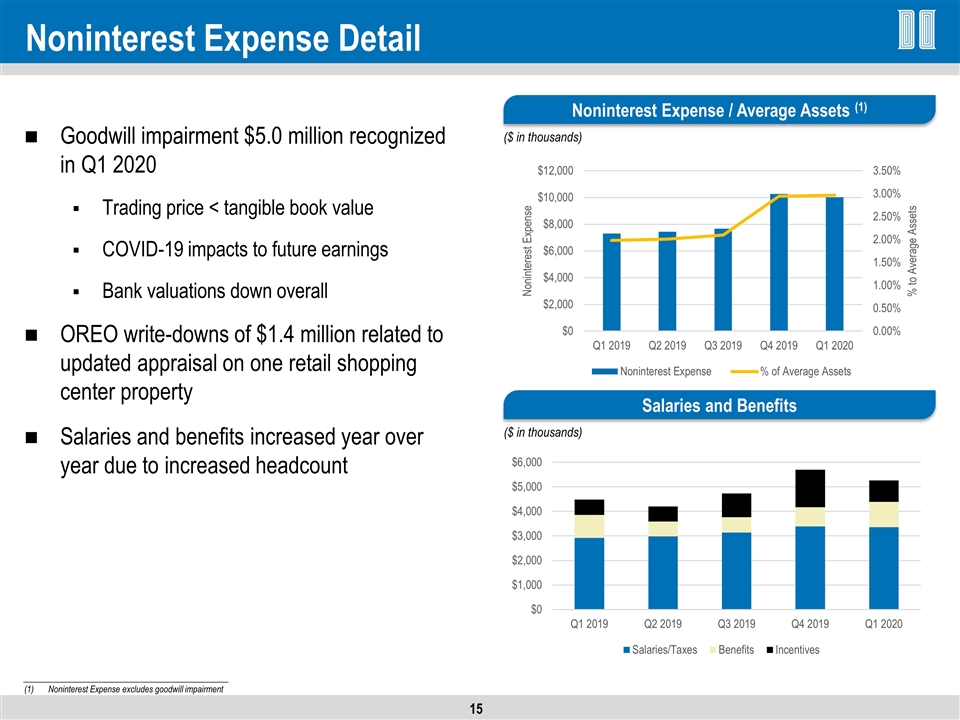

Noninterest Expense Detail Goodwill impairment $5.0 million recognized in Q1 2020 Trading price < tangible book value COVID-19 impacts to future earnings Bank valuations down overall OREO write-downs of $1.4 million related to updated appraisal on one retail shopping center property Salaries and benefits increased year over year due to increased headcount ($ in thousands) Salaries and Benefits ($ in thousands) Noninterest Expense / Average Assets (1) __________________________________ Noninterest Expense excludes goodwill impairment

Loan Portfolio & COVID-19 Credit Update

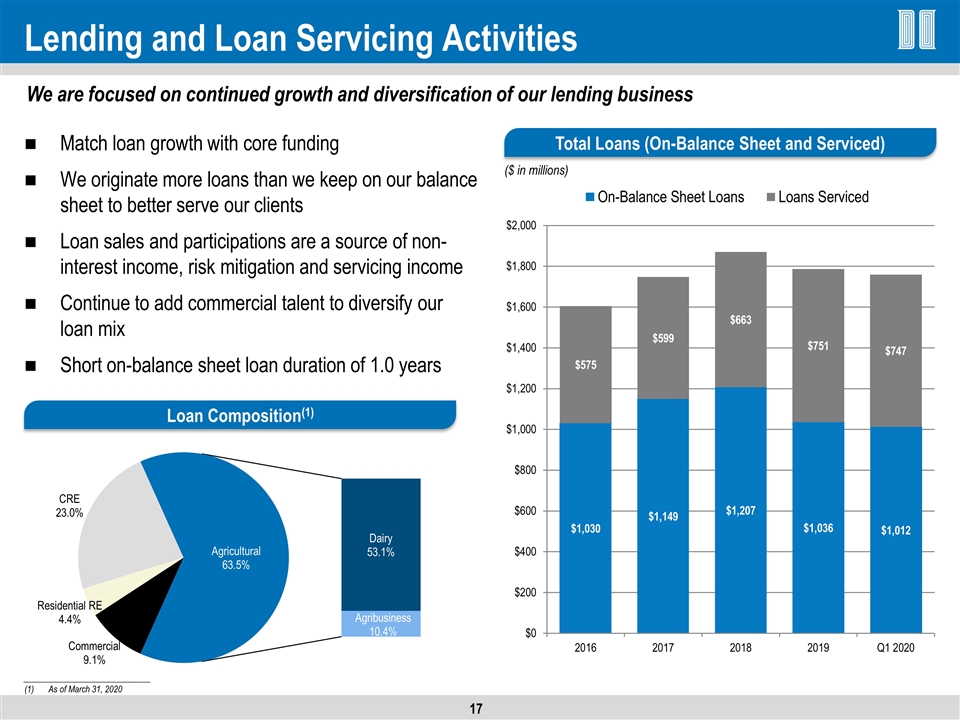

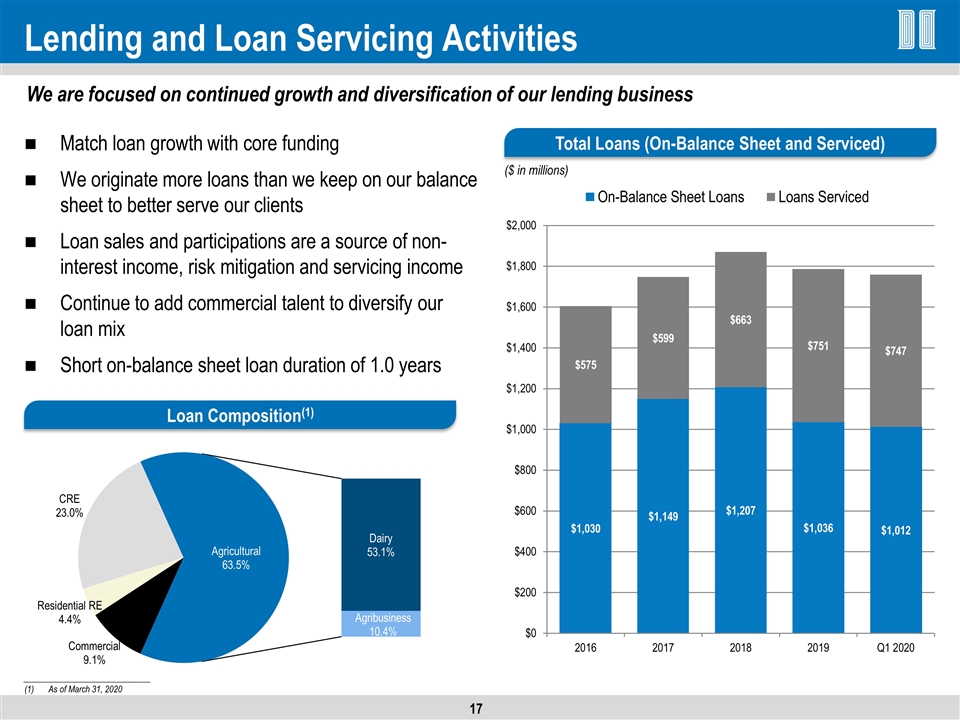

($ in millions) Total Loans (On-Balance Sheet and Serviced) Lending and Loan Servicing Activities Match loan growth with core funding We originate more loans than we keep on our balance sheet to better serve our clients Loan sales and participations are a source of non-interest income, risk mitigation and servicing income Continue to add commercial talent to diversify our loan mix Short on-balance sheet loan duration of 1.0 years _____________________ As of March 31, 2020 Loan Composition(1) We are focused on continued growth and diversification of our lending business

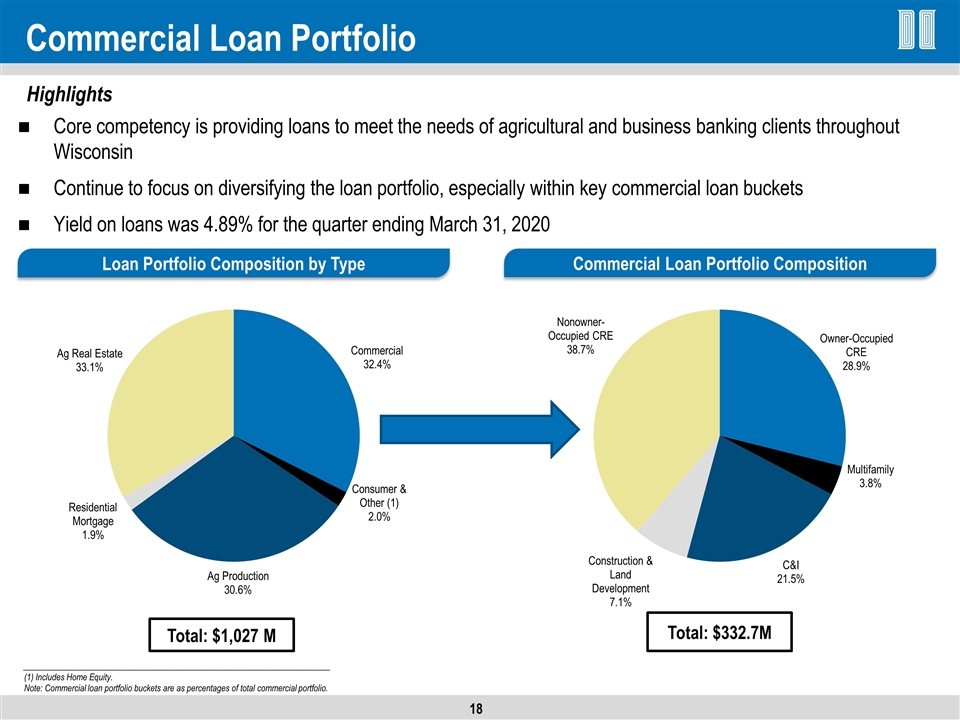

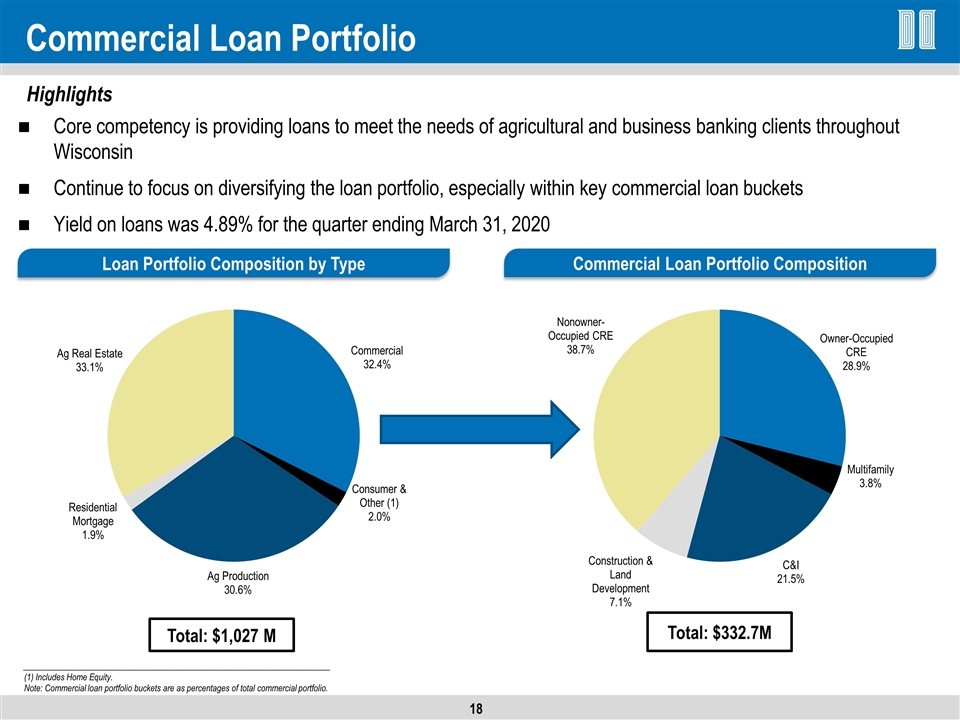

Commercial Loan Portfolio Core competency is providing loans to meet the needs of agricultural and business banking clients throughout Wisconsin Continue to focus on diversifying the loan portfolio, especially within key commercial loan buckets Yield on loans was 4.89% for the quarter ending March 31, 2020 Highlights Loan Portfolio Composition by Type ___________________________________________________ (1) Includes Home Equity. Note: Commercial loan portfolio buckets are as percentages of total commercial portfolio. Commercial Loan Portfolio Composition Total: $1,027 M Total: $332.7M

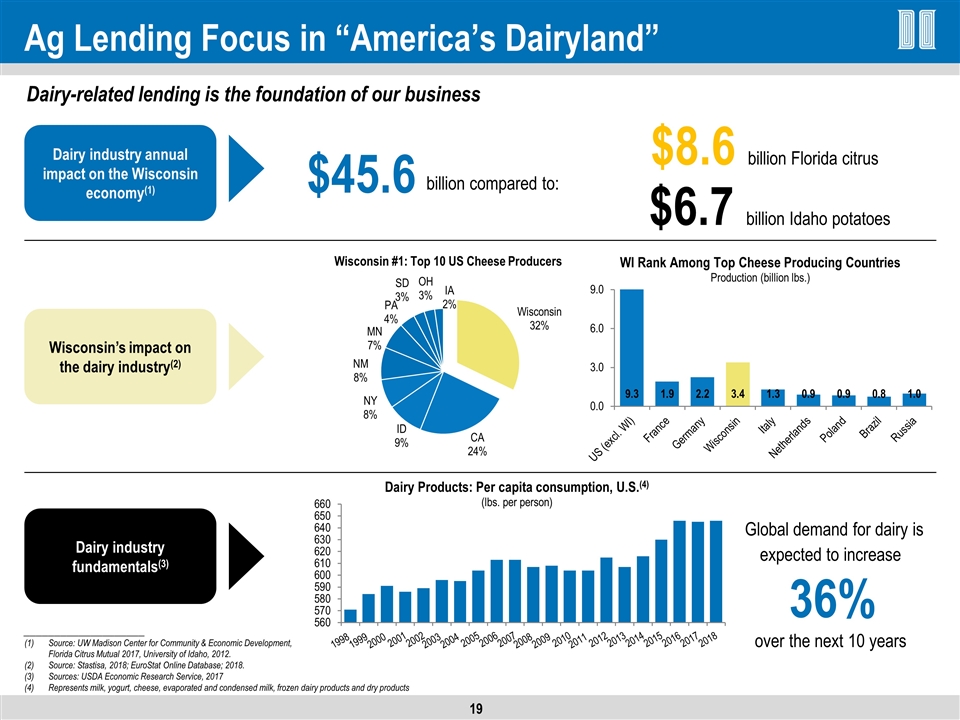

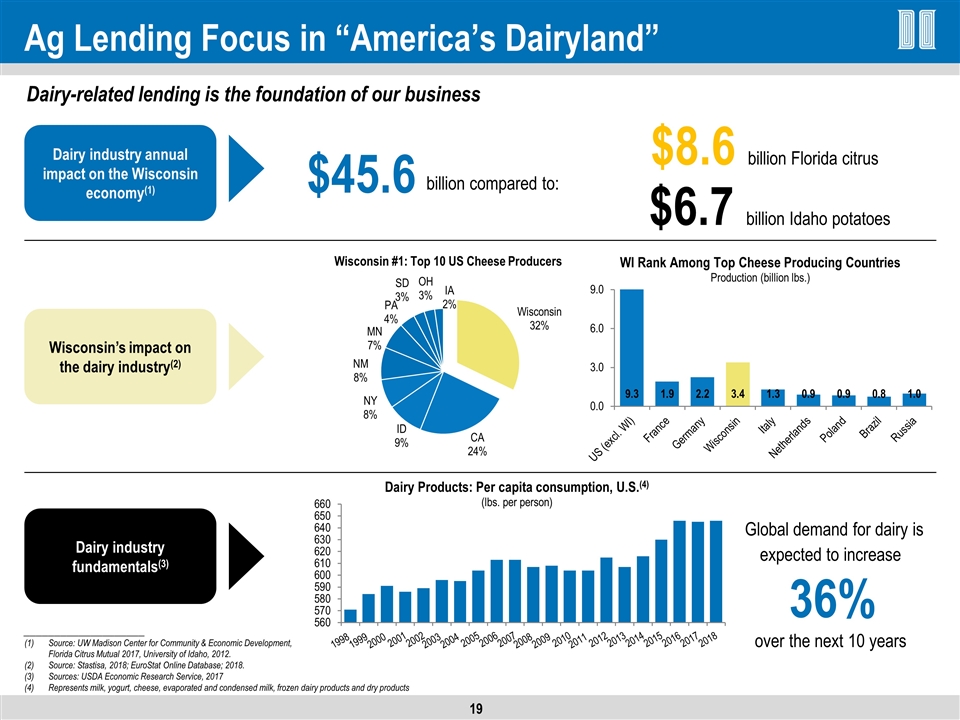

Ag Lending Focus in “America’s Dairyland” ____________________ Source: UW Madison Center for Community & Economic Development, Florida Citrus Mutual 2017, University of Idaho, 2012. Source: Stastisa, 2018; EuroStat Online Database; 2018. Sources: USDA Economic Research Service, 2017 Represents milk, yogurt, cheese, evaporated and condensed milk, frozen dairy products and dry products Dairy-related lending is the foundation of our business billion compared to: $45.6 Wisconsin’s impact on the dairy industry(2) $8.6 billion Florida citrus $6.7 billion Idaho potatoes Dairy industry fundamentals(3) Dairy industry annual impact on the Wisconsin economy(1) Global demand for dairy is expected to increase 36% over the next 10 years Wisconsin #1: Top 10 US Cheese Producers

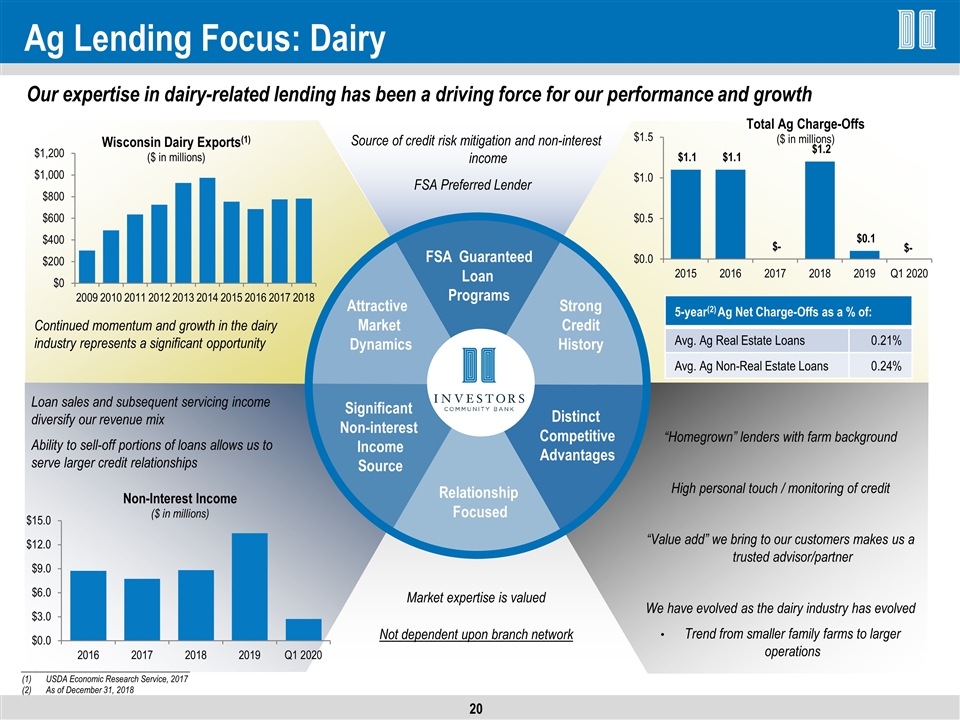

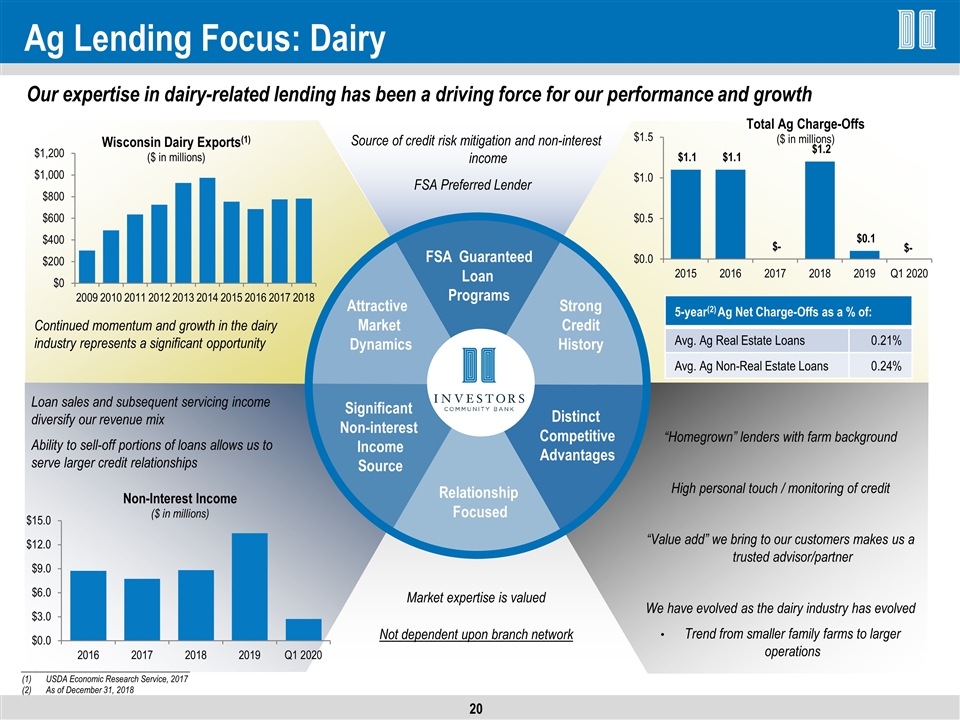

Ag Lending Focus: Dairy Source of credit risk mitigation and non-interest income Not dependent upon branch network “Homegrown” lenders with farm background High personal touch / monitoring of credit “Value add” we bring to our customers makes us a trusted advisor/partner We have evolved as the dairy industry has evolved Trend from smaller family farms to larger operations FSA Preferred Lender Market expertise is valued Our expertise in dairy-related lending has been a driving force for our performance and growth Loan sales and subsequent servicing income diversify our revenue mix Ability to sell-off portions of loans allows us to serve larger credit relationships Continued momentum and growth in the dairy industry represents a significant opportunity ____________________________ USDA Economic Research Service, 2017 As of December 31, 2018 5-year(2) Ag Net Charge-Offs as a % of: Avg. Ag Real Estate Loans 0.21% Avg. Ag Non-Real Estate Loans 0.24% Significant Non-interest Income Source Strong Credit History Distinct Competitive Advantages Attractive Market Dynamics Relationship Focused FSA Guaranteed Loan Programs

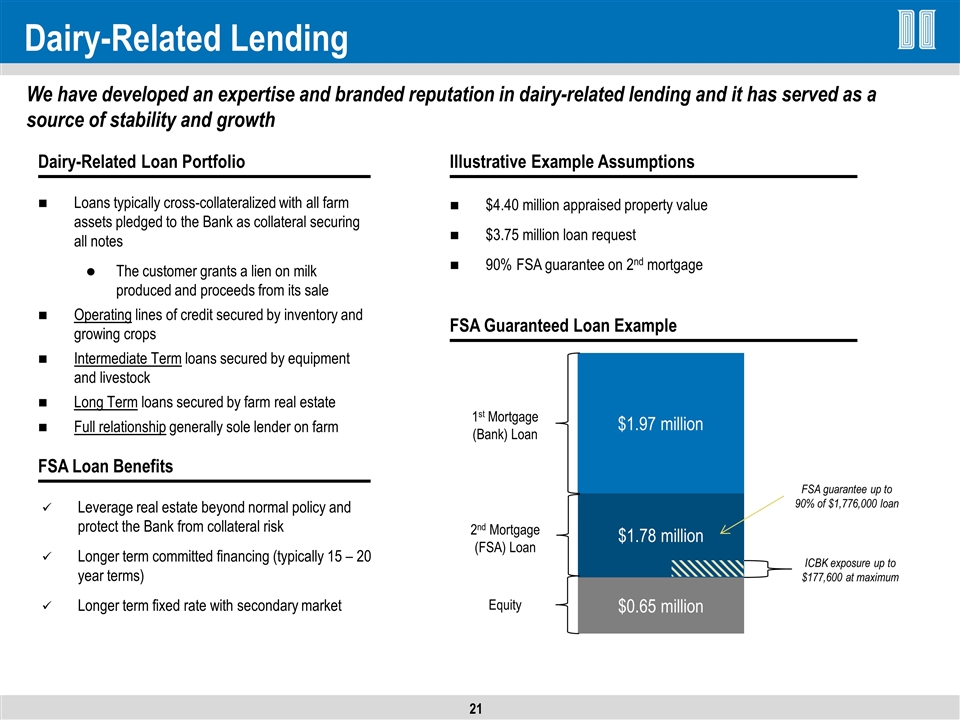

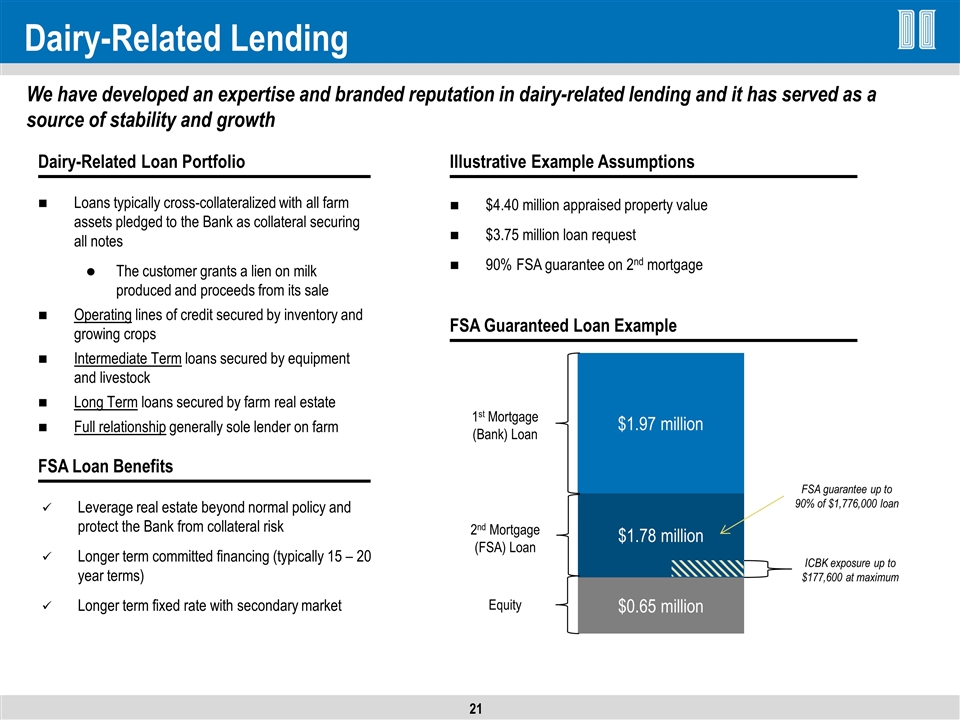

$1.97 million $0.65 million FSA guarantee up to 90% of $1,776,000 loan Dairy-Related Lending We have developed an expertise and branded reputation in dairy-related lending and it has served as a source of stability and growth FSA Guaranteed Loan Example Illustrative Example Assumptions $4.40 million appraised property value $3.75 million loan request 90% FSA guarantee on 2nd mortgage 1st Mortgage (Bank) Loan 2nd Mortgage (FSA) Loan FSA Loan Benefits Leverage real estate beyond normal policy and protect the Bank from collateral risk Longer term committed financing (typically 15 – 20 year terms) Longer term fixed rate with secondary market Total Credit Exposure: $139,200 Loans typically cross-collateralized with all farm assets pledged to the Bank as collateral securing all notes The customer grants a lien on milk produced and proceeds from its sale Operating lines of credit secured by inventory and growing crops Intermediate Term loans secured by equipment and livestock Long Term loans secured by farm real estate Full relationship generally sole lender on farm $1.78 million Dairy-Related Loan Portfolio Equity ICBK exposure up to $177,600 at maximum

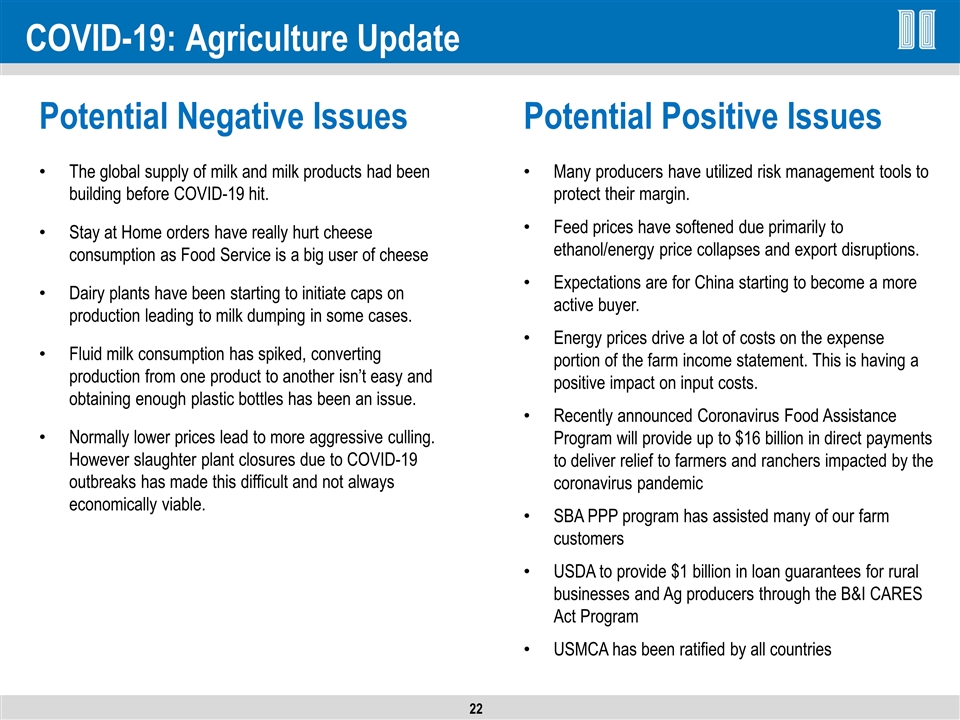

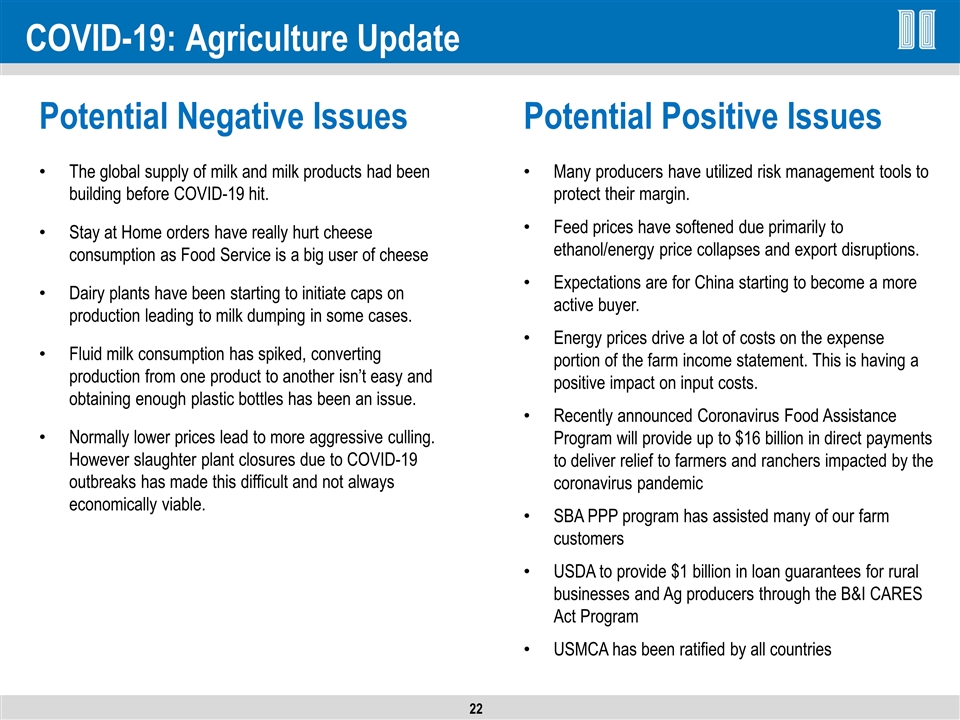

COVID-19: Agriculture Update Potential Negative Issues The global supply of milk and milk products had been building before COVID-19 hit. Stay at Home orders have really hurt cheese consumption as Food Service is a big user of cheese Dairy plants have been starting to initiate caps on production leading to milk dumping in some cases. Fluid milk consumption has spiked, converting production from one product to another isn’t easy and obtaining enough plastic bottles has been an issue. Normally lower prices lead to more aggressive culling. However slaughter plant closures due to COVID-19 outbreaks has made this difficult and not always economically viable. Potential Positive Issues Many producers have utilized risk management tools to protect their margin. Feed prices have softened due primarily to ethanol/energy price collapses and export disruptions. Expectations are for China starting to become a more active buyer. Energy prices drive a lot of costs on the expense portion of the farm income statement. This is having a positive impact on input costs. Recently announced Coronavirus Food Assistance Program will provide up to $16 billion in direct payments to deliver relief to farmers and ranchers impacted by the coronavirus pandemic SBA PPP program has assisted many of our farm customers USDA to provide $1 billion in loan guarantees for rural businesses and Ag producers through the B&I CARES Act Program USMCA has been ratified by all countries

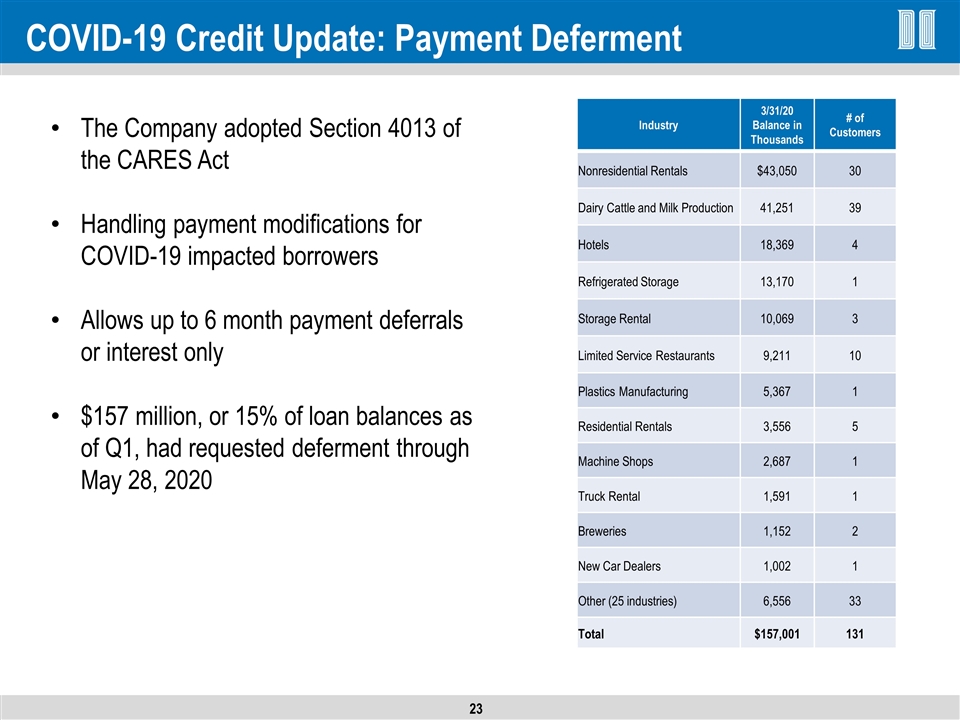

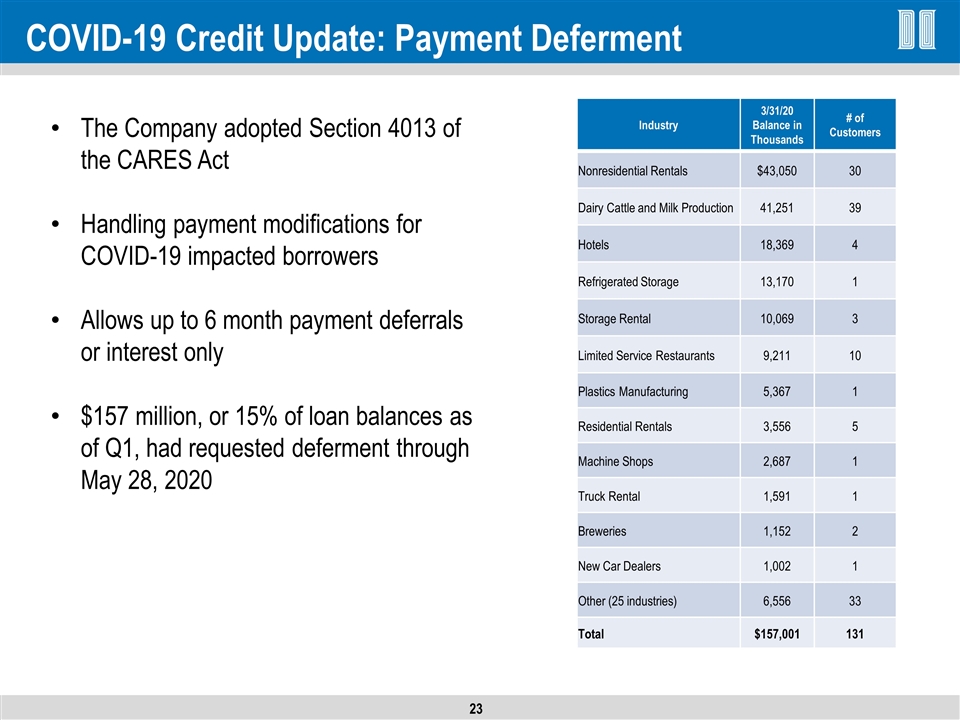

COVID-19 Credit Update: Payment Deferment The Company adopted Section 4013 of the CARES Act Handling payment modifications for COVID-19 impacted borrowers Allows up to 6 month payment deferrals or interest only $157 million, or 15% of loan balances as of Q1, had requested deferment through May 28, 2020 Industry 3/31/20 Balance in Thousands # of Customers Nonresidential Rentals $43,050 30 Dairy Cattle and Milk Production 41,251 39 Hotels 18,369 4 Refrigerated Storage 13,170 1 Storage Rental 10,069 3 Limited Service Restaurants 9,211 10 Plastics Manufacturing 5,367 1 Residential Rentals 3,556 5 Machine Shops 2,687 1 Truck Rental 1,591 1 Breweries 1,152 2 New Car Dealers 1,002 1 Other (25 industries) 6,556 33 Total $157,001 131

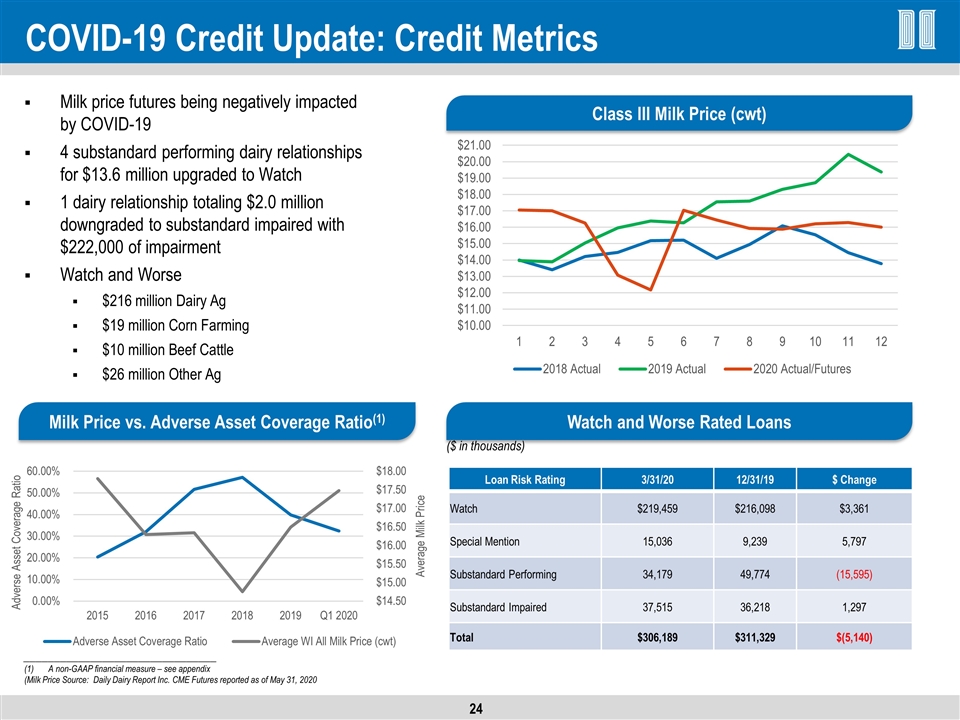

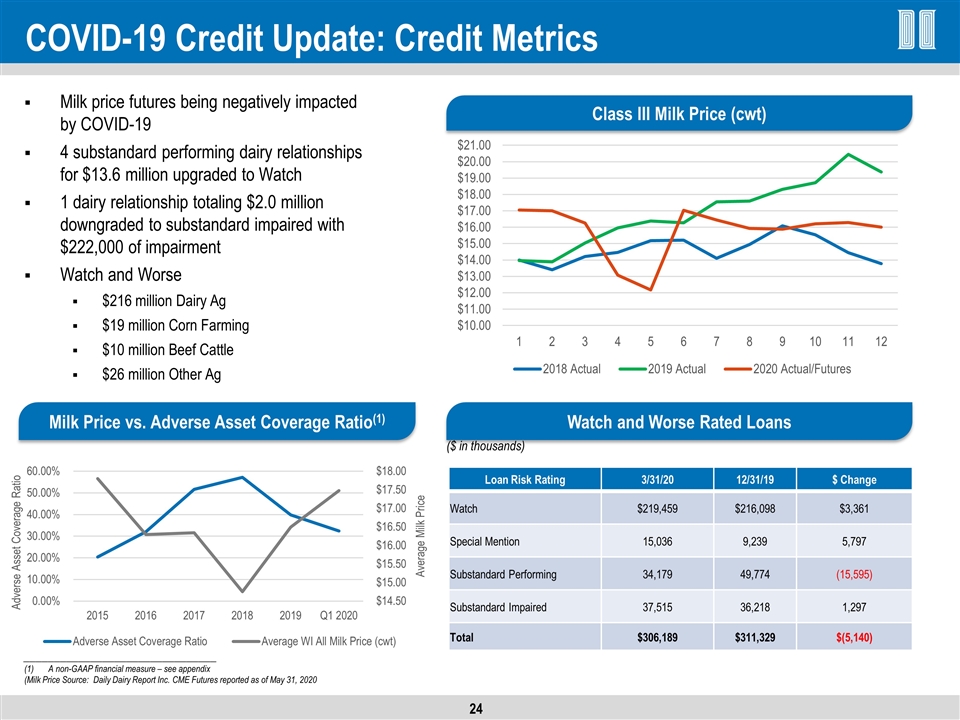

COVID-19 Credit Update: Credit Metrics Milk price futures being negatively impacted by COVID-19 4 substandard performing dairy relationships for $13.6 million upgraded to Watch 1 dairy relationship totaling $2.0 million downgraded to substandard impaired with $222,000 of impairment Watch and Worse $216 million Dairy Ag $19 million Corn Farming $10 million Beef Cattle $26 million Other Ag Class III Milk Price (cwt) Milk Price vs. Adverse Asset Coverage Ratio(1) Loan Risk Rating 3/31/20 12/31/19 $ Change Watch $219,459 $216,098 $3,361 Special Mention 15,036 9,239 5,797 Substandard Performing 34,179 49,774 (15,595) Substandard Impaired 37,515 36,218 1,297 Total $306,189 $311,329 $(5,140) ($ in thousands) Watch and Worse Rated Loans ________________________________ A non-GAAP financial measure – see appendix (Milk Price Source: Daily Dairy Report Inc. CME Futures reported as of May 31, 2020

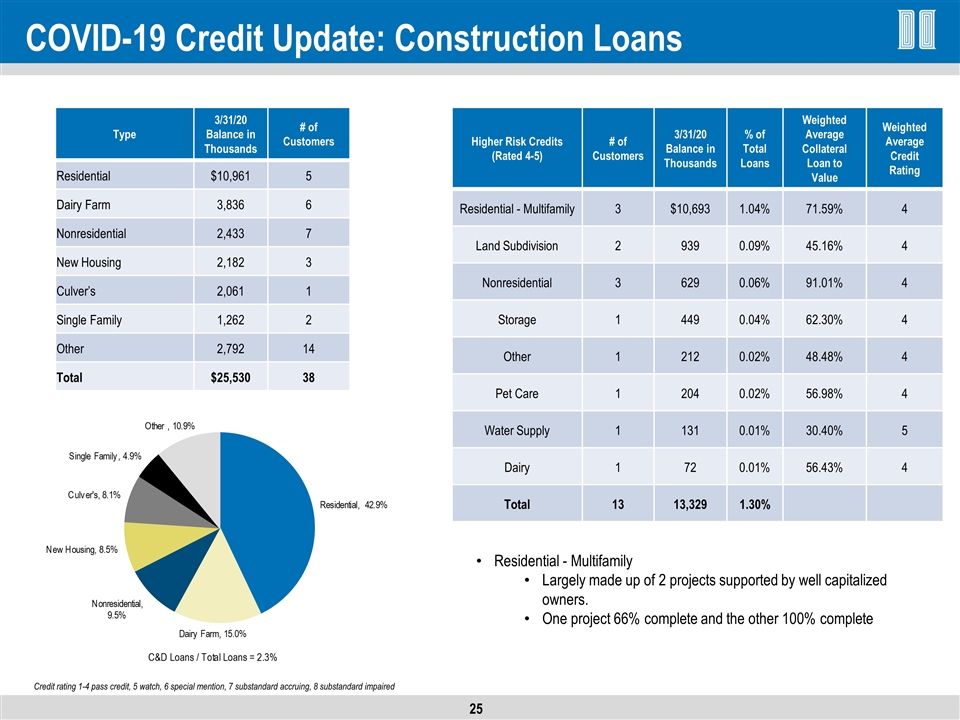

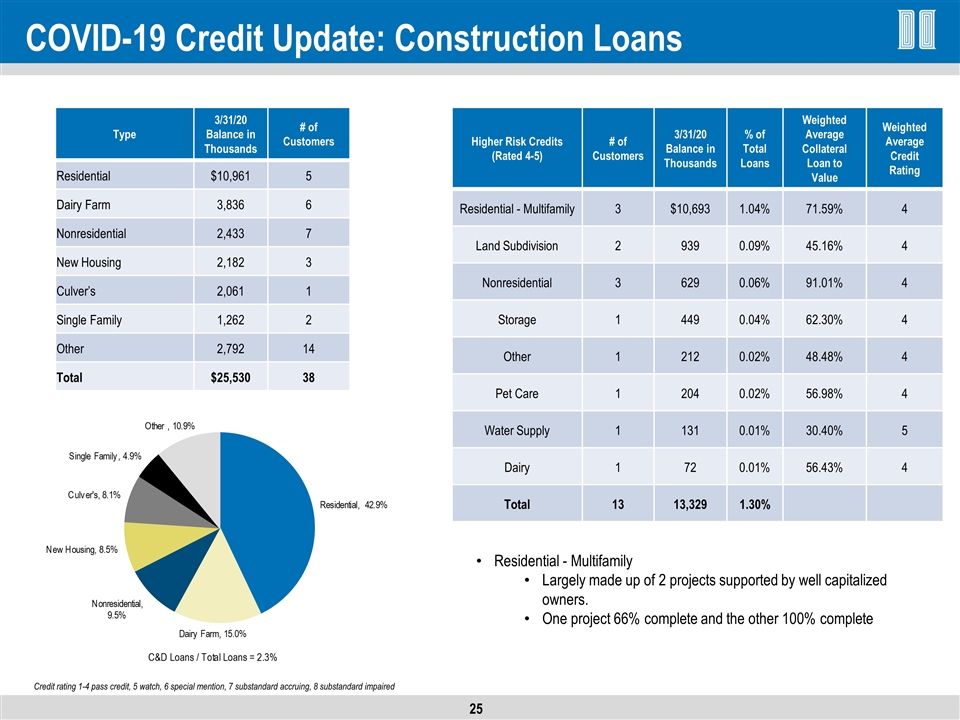

COVID-19 Credit Update: Construction Loans Type 3/31/20 Balance in Thousands # of Customers Residential $10,961 5 Dairy Farm 3,836 6 Nonresidential 2,433 7 New Housing 2,182 3 Culver’s 2,061 1 Single Family 1,262 2 Other 2,792 14 Total $25,530 38 Credit rating 1-4 pass credit, 5 watch, 6 special mention, 7 substandard accruing, 8 substandard impaired Higher Risk Credits (Rated 4-5) # of Customers 3/31/20 Balance in Thousands % of Total Loans Weighted Average Collateral Loan to Value Weighted Average Credit Rating Residential - Multifamily 3 $10,693 1.04% 71.59% 4 Land Subdivision 2 939 0.09% 45.16% 4 Nonresidential 3 629 0.06% 91.01% 4 Storage 1 449 0.04% 62.30% 4 Other 1 212 0.02% 48.48% 4 Pet Care 1 204 0.02% 56.98% 4 Water Supply 1 131 0.01% 30.40% 5 Dairy 1 72 0.01% 56.43% 4 Total 13 13,329 1.30% Residential - Multifamily Largely made up of 2 projects supported by well capitalized owners. One project 66% complete and the other 100% complete

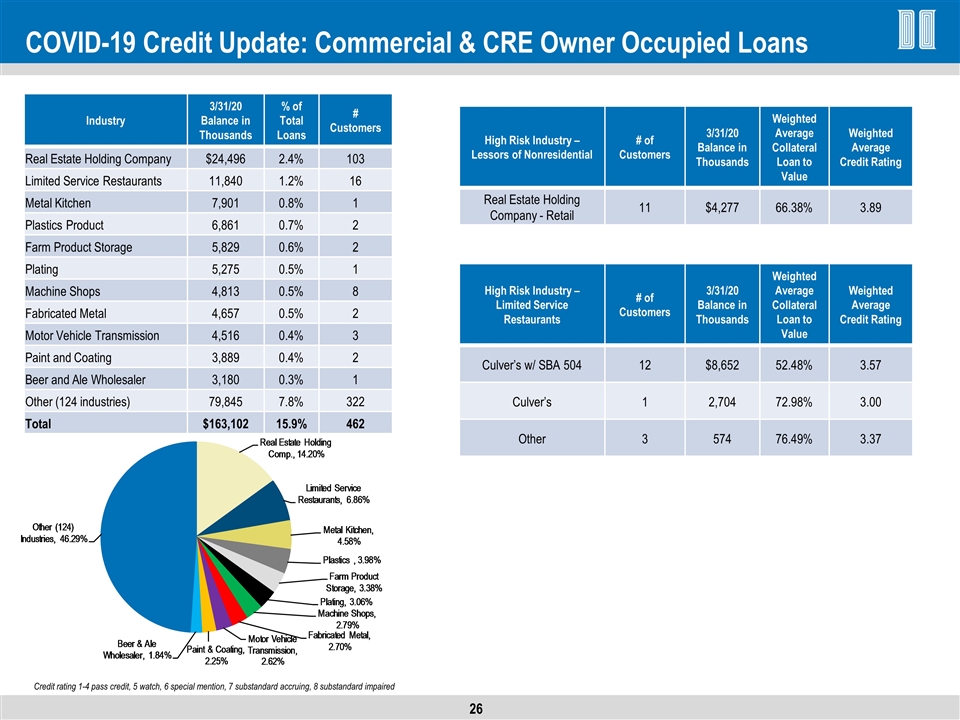

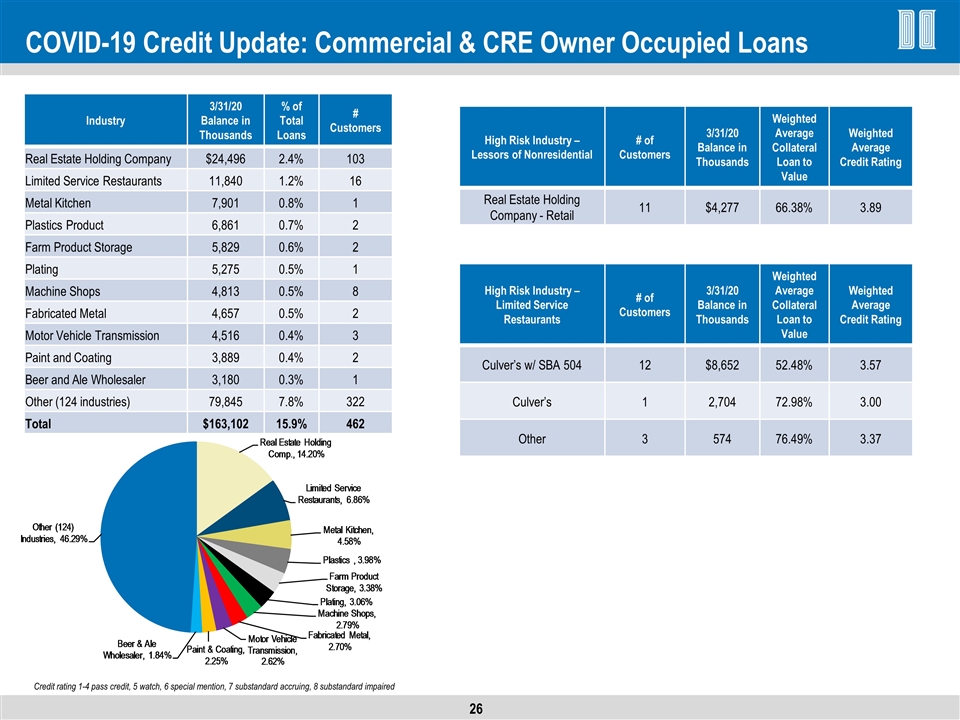

COVID-19 Credit Update: Commercial & CRE Owner Occupied Loans Industry 3/31/20 Balance in Thousands % of Total Loans # Customers Real Estate Holding Company $24,496 2.4% 103 Limited Service Restaurants 11,840 1.2% 16 Metal Kitchen 7,901 0.8% 1 Plastics Product 6,861 0.7% 2 Farm Product Storage 5,829 0.6% 2 Plating 5,275 0.5% 1 Machine Shops 4,813 0.5% 8 Fabricated Metal 4,657 0.5% 2 Motor Vehicle Transmission 4,516 0.4% 3 Paint and Coating 3,889 0.4% 2 Beer and Ale Wholesaler 3,180 0.3% 1 Other (124 industries) 79,845 7.8% 322 Total $163,102 15.9% 462 High Risk Industry – Limited Service Restaurants # of Customers 3/31/20 Balance in Thousands Weighted Average Collateral Loan to Value Weighted Average Credit Rating Culver’s w/ SBA 504 12 $8,652 52.48% 3.57 Culver’s 1 2,704 72.98% 3.00 Other 3 574 76.49% 3.37 High Risk Industry – Lessors of Nonresidential # of Customers 3/31/20 Balance in Thousands Weighted Average Collateral Loan to Value Weighted Average Credit Rating Real Estate Holding Company - Retail 11 $4,277 66.38% 3.89 Credit rating 1-4 pass credit, 5 watch, 6 special mention, 7 substandard accruing, 8 substandard impaired

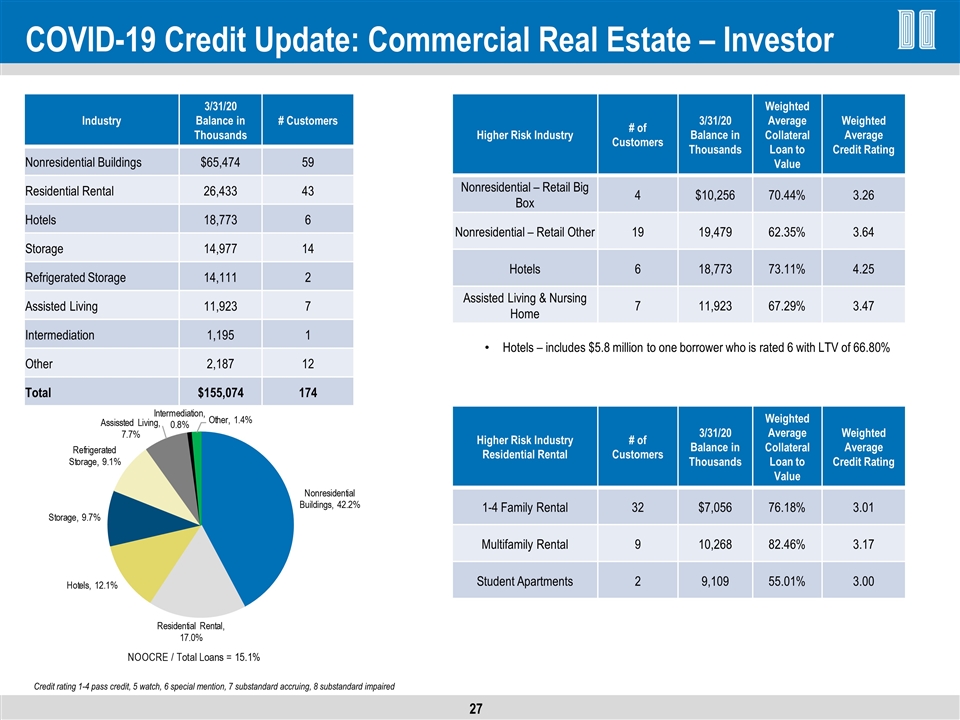

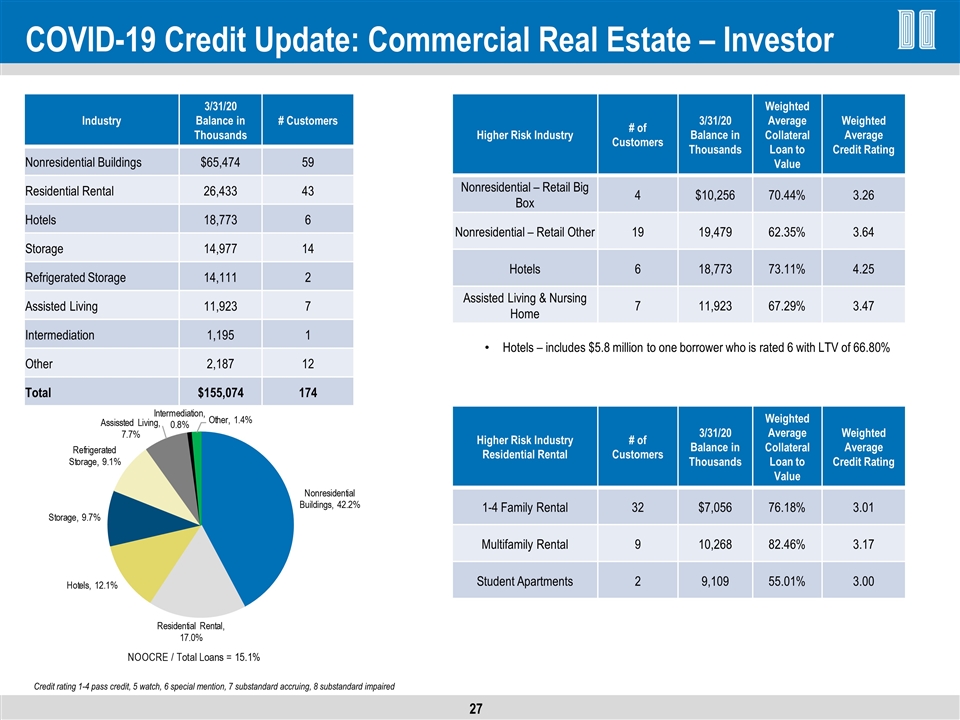

COVID-19 Credit Update: Commercial Real Estate – Investor Industry 3/31/20 Balance in Thousands # Customers Nonresidential Buildings $65,474 59 Residential Rental 26,433 43 Hotels 18,773 6 Storage 14,977 14 Refrigerated Storage 14,111 2 Assisted Living 11,923 7 Intermediation 1,195 1 Other 2,187 12 Total $155,074 174 Higher Risk Industry # of Customers 3/31/20 Balance in Thousands Weighted Average Collateral Loan to Value Weighted Average Credit Rating Nonresidential – Retail Big Box 4 $10,256 70.44% 3.26 Nonresidential – Retail Other 19 19,479 62.35% 3.64 Hotels 6 18,773 73.11% 4.25 Assisted Living & Nursing Home 7 11,923 67.29% 3.47 Hotels – includes $5.8 million to one borrower who is rated 6 with LTV of 66.80% Higher Risk Industry Residential Rental # of Customers 3/31/20 Balance in Thousands Weighted Average Collateral Loan to Value Weighted Average Credit Rating 1-4 Family Rental 32 $7,056 76.18% 3.01 Multifamily Rental 9 10,268 82.46% 3.17 Student Apartments 2 9,109 55.01% 3.00 Credit rating 1-4 pass credit, 5 watch, 6 special mention, 7 substandard accruing, 8 substandard impaired

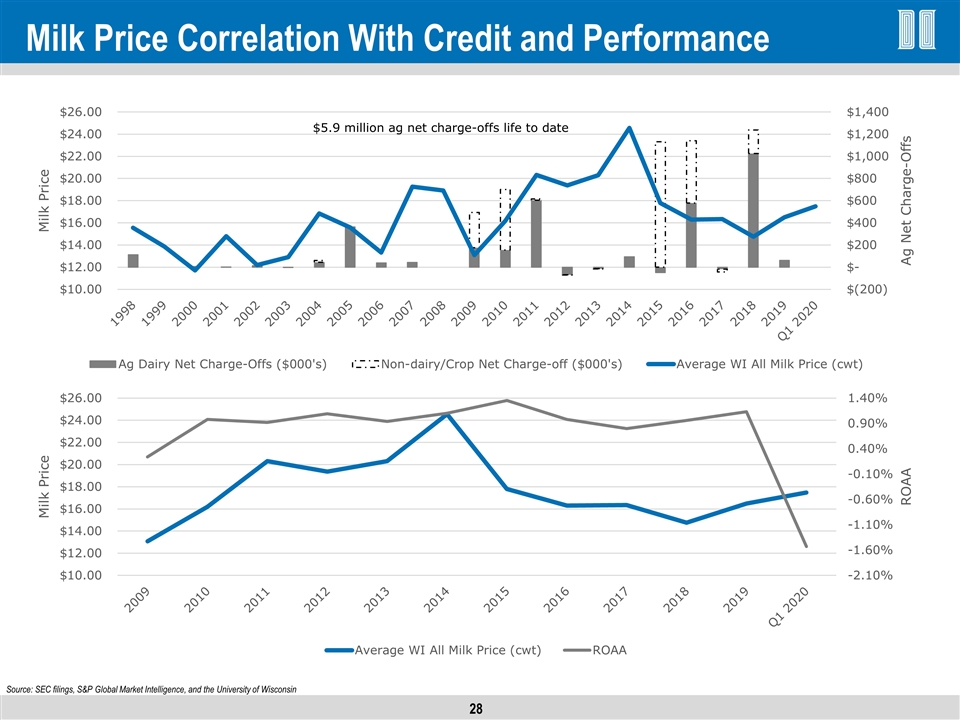

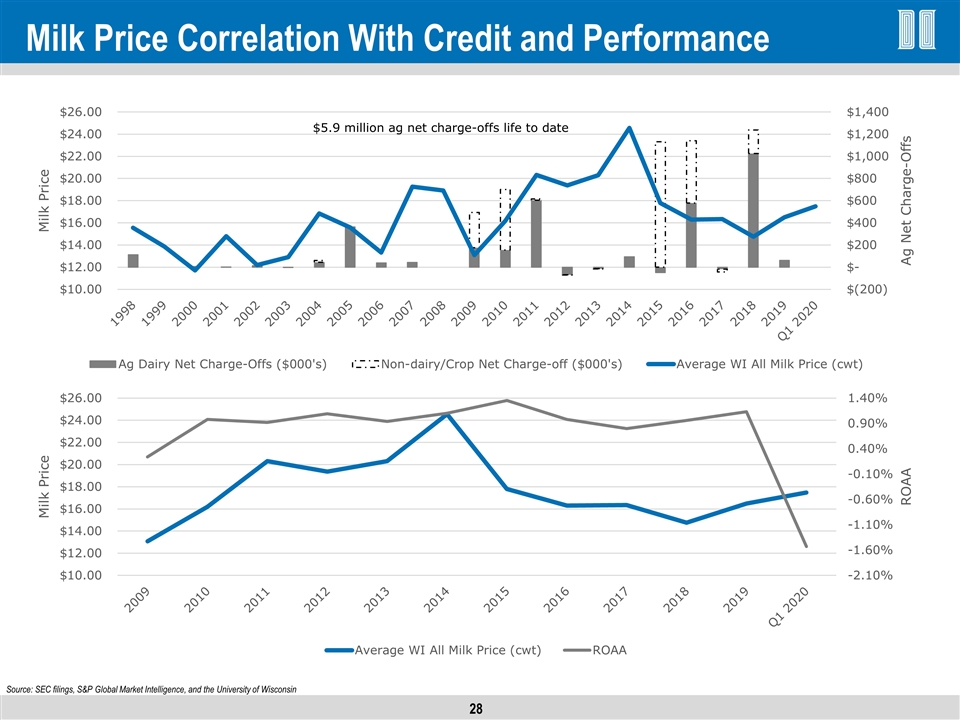

Milk Price Correlation With Credit and Performance Source: SEC filings, S&P Global Market Intelligence, and the University of Wisconsin $5.9 million ag net charge-offs life to date

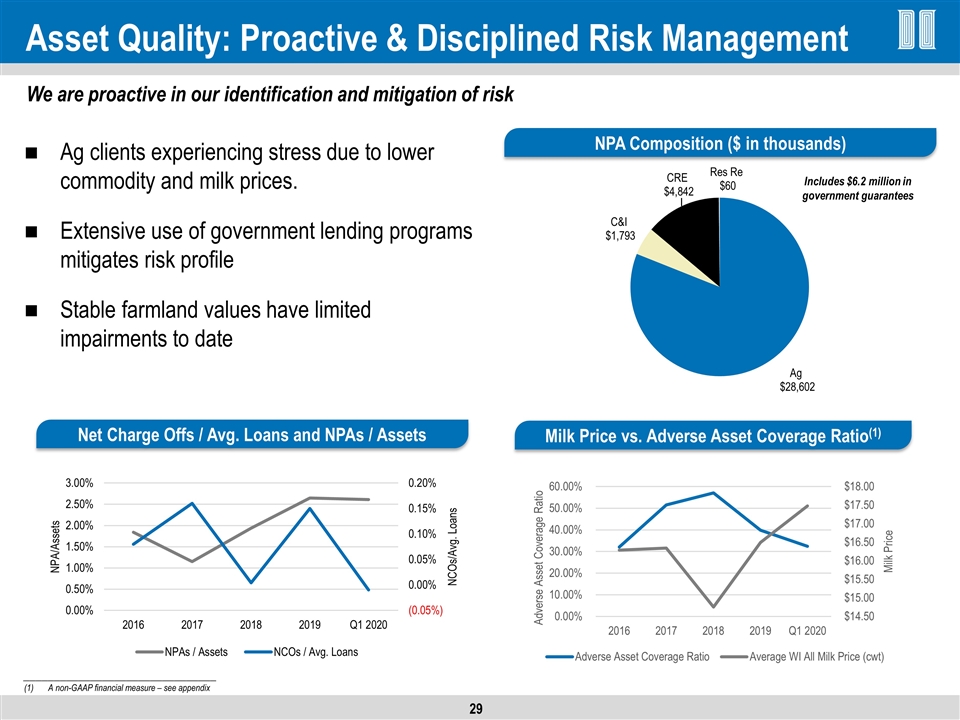

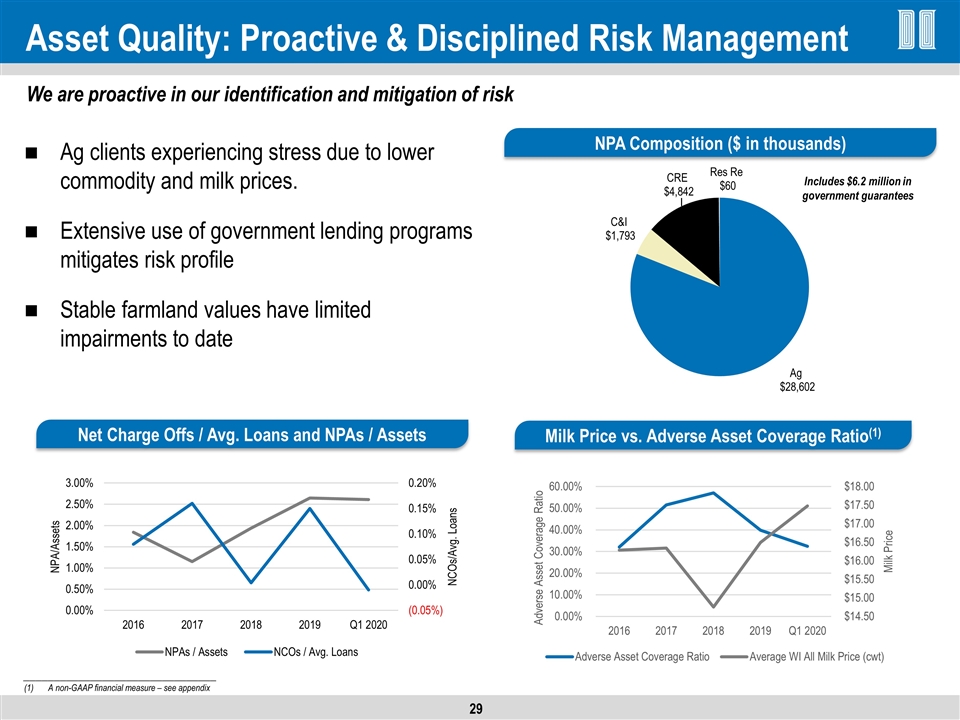

Asset Quality: Proactive & Disciplined Risk Management Ag clients experiencing stress due to lower commodity and milk prices. Extensive use of government lending programs mitigates risk profile Stable farmland values have limited impairments to date Net Charge Offs / Avg. Loans and NPAs / Assets We are proactive in our identification and mitigation of risk NPA Composition ($ in thousands) ________________________________ A non-GAAP financial measure – see appendix Includes $6.2 million in government guarantees Milk Price vs. Adverse Asset Coverage Ratio(1)

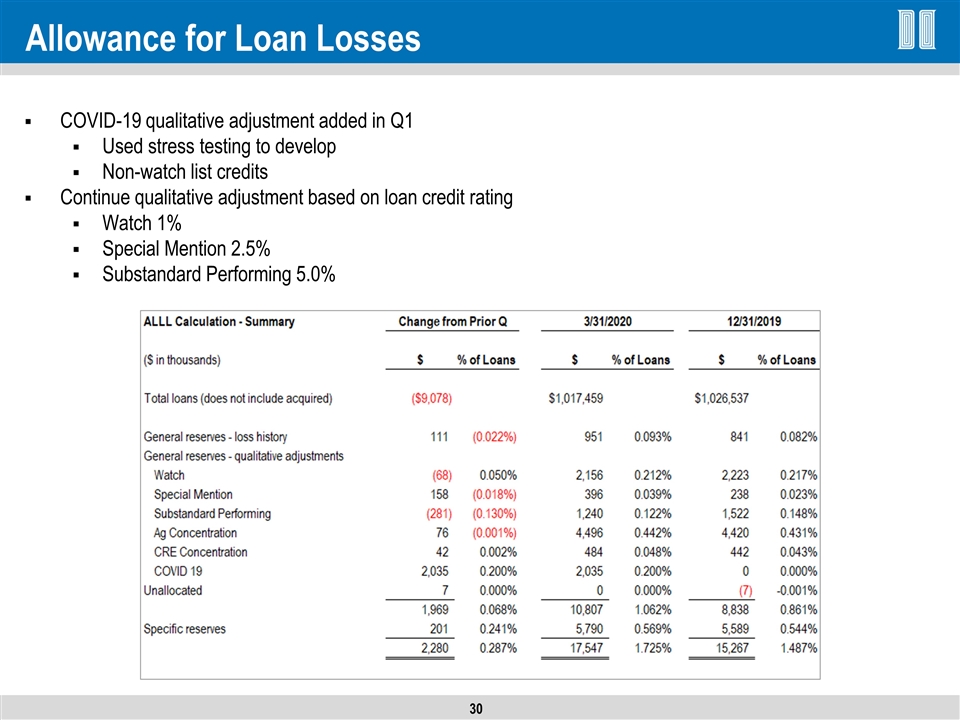

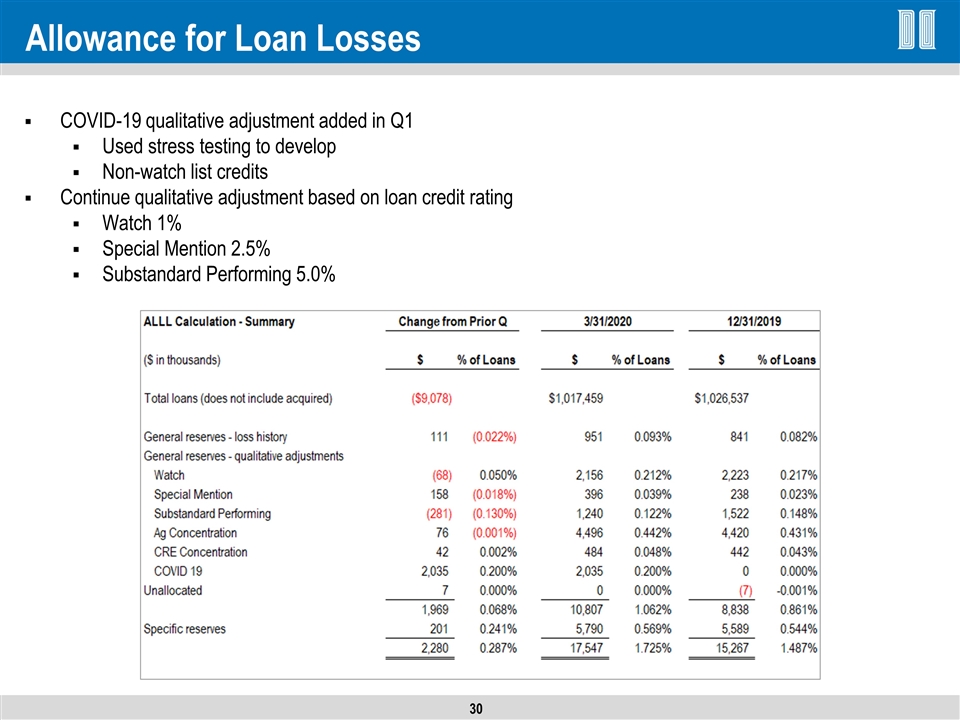

Allowance for Loan Losses COVID-19 qualitative adjustment added in Q1 Used stress testing to develop Non-watch list credits Continue qualitative adjustment based on loan credit rating Watch 1% Special Mention 2.5% Substandard Performing 5.0%

Capital, Investments, Funding & Liquidity

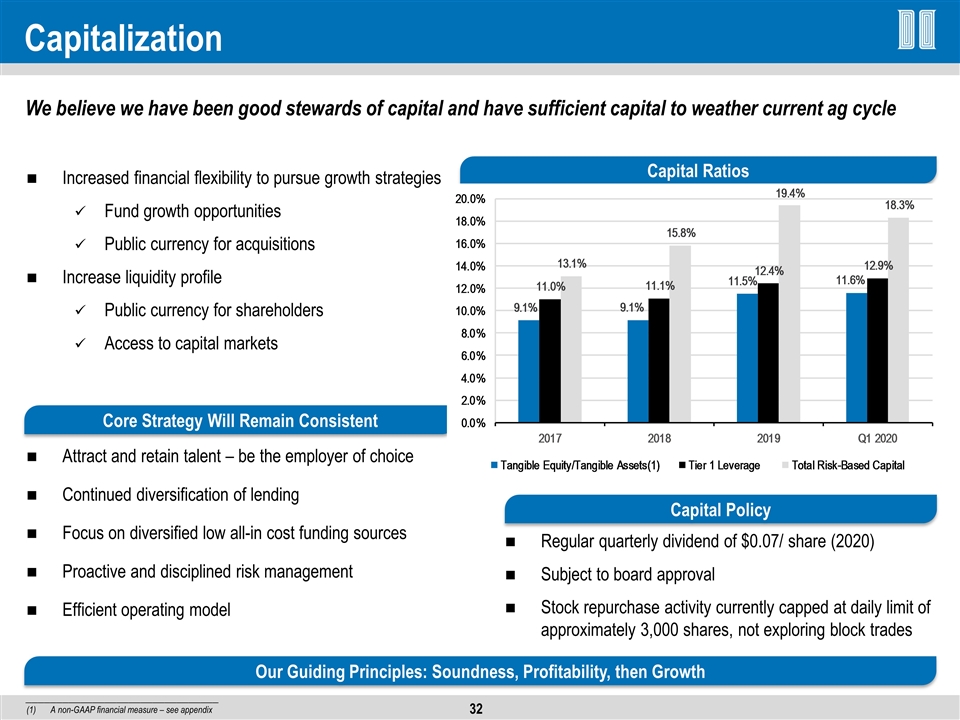

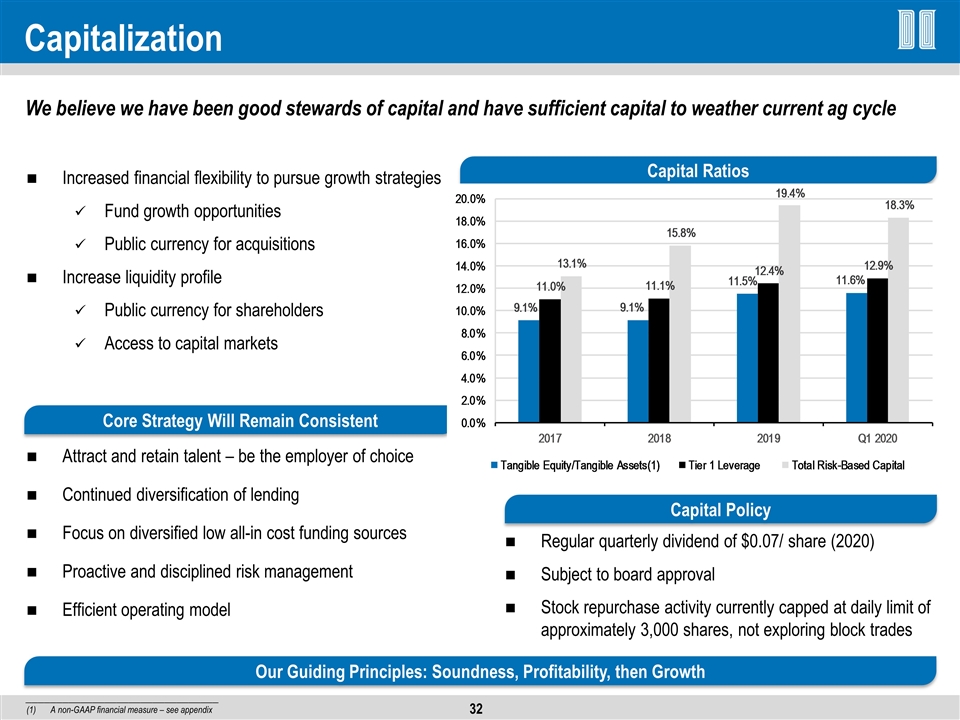

Capitalization We believe we have been good stewards of capital and have sufficient capital to weather current ag cycle Increased financial flexibility to pursue growth strategies Fund growth opportunities Public currency for acquisitions Increase liquidity profile Public currency for shareholders Access to capital markets Attract and retain talent – be the employer of choice Continued diversification of lending Focus on diversified low all-in cost funding sources Proactive and disciplined risk management Efficient operating model Regular quarterly dividend of $0.07/ share (2020) Subject to board approval Stock repurchase activity currently capped at daily limit of approximately 3,000 shares, not exploring block trades Core Strategy Will Remain Consistent Capital Policy Capital Ratios Our Guiding Principles: Soundness, Profitability, then Growth ________________________________ A non-GAAP financial measure – see appendix

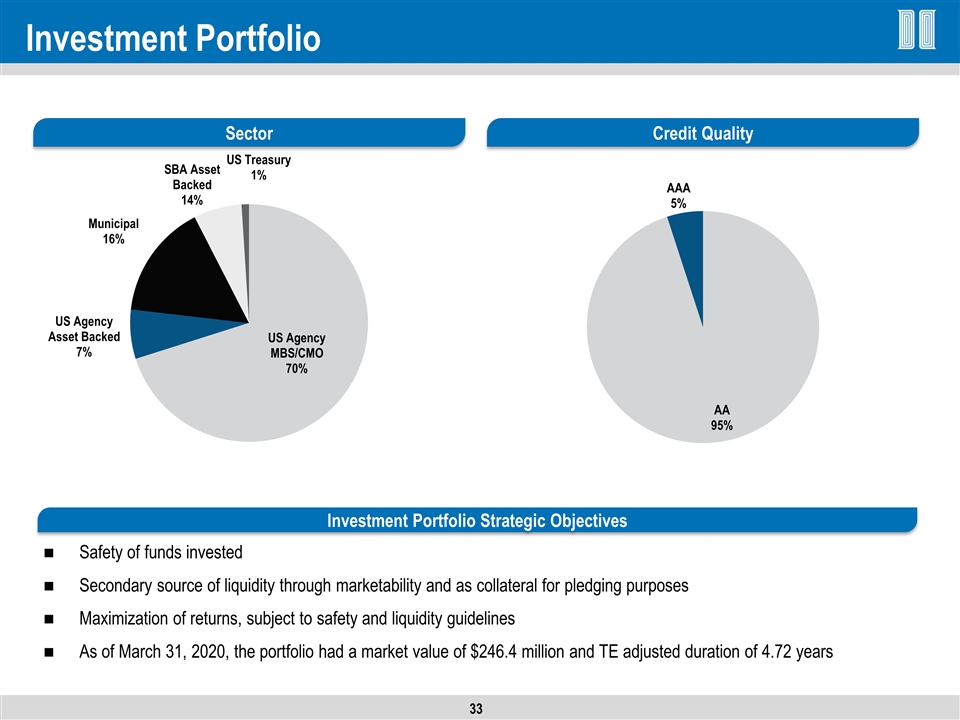

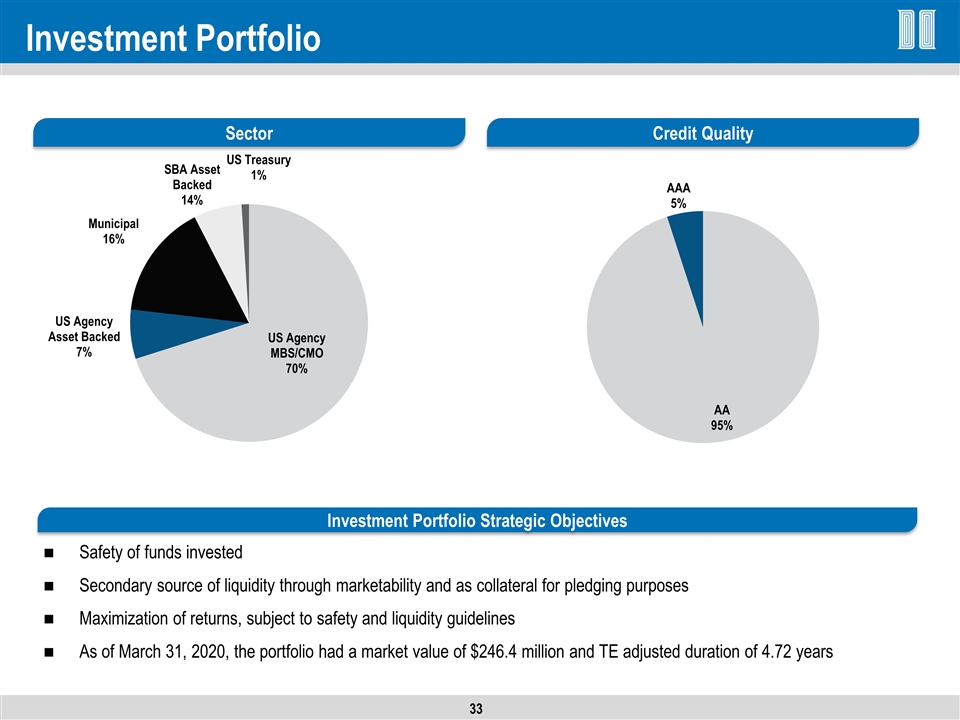

Investment Portfolio Sector Credit Quality Investment Portfolio Strategic Objectives Safety of funds invested Secondary source of liquidity through marketability and as collateral for pledging purposes Maximization of returns, subject to safety and liquidity guidelines As of March 31, 2020, the portfolio had a market value of $246.4 million and TE adjusted duration of 4.72 years

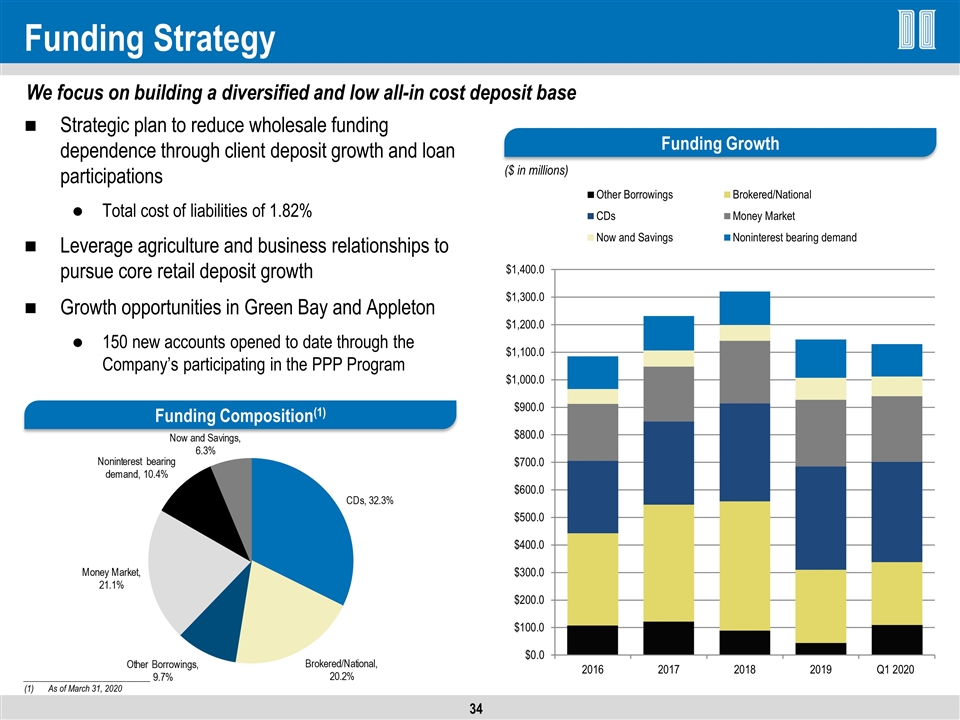

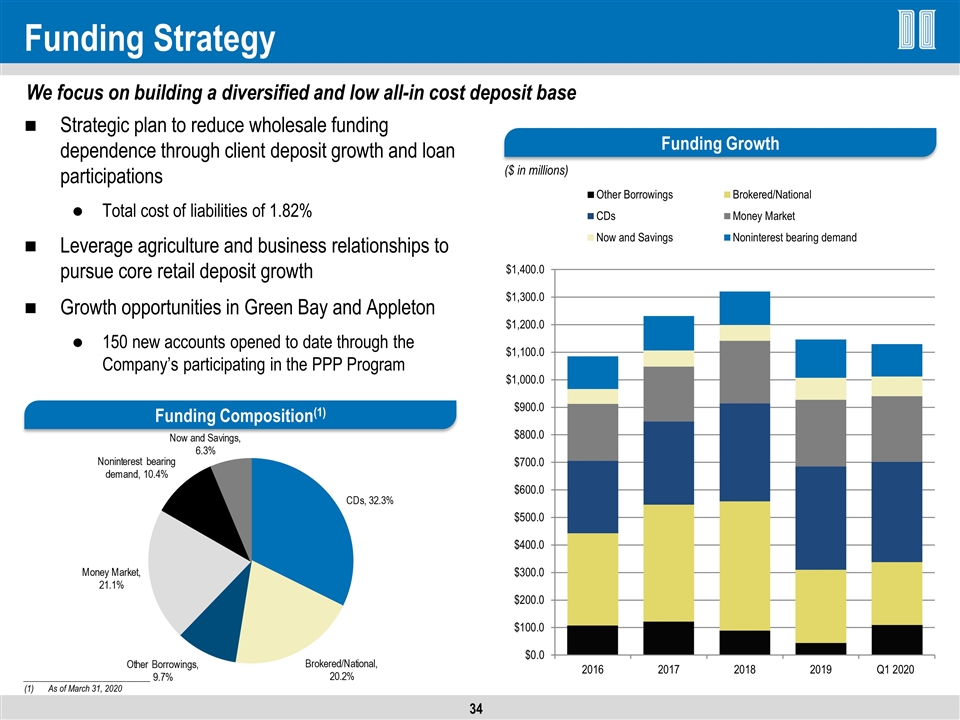

Funding Strategy Strategic plan to reduce wholesale funding dependence through client deposit growth and loan participations Total cost of liabilities of 1.82% Leverage agriculture and business relationships to pursue core retail deposit growth Growth opportunities in Green Bay and Appleton 150 new accounts opened to date through the Company’s participating in the PPP Program Funding Composition(1) ($ in millions) Funding Growth We focus on building a diversified and low all-in cost deposit base _____________________ As of March 31, 2020

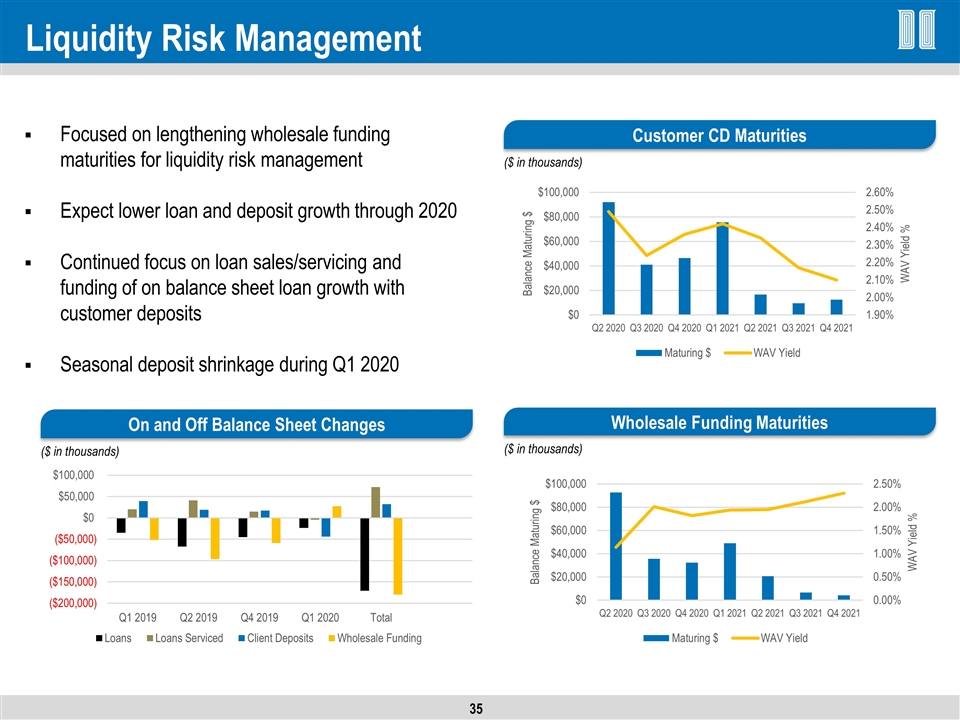

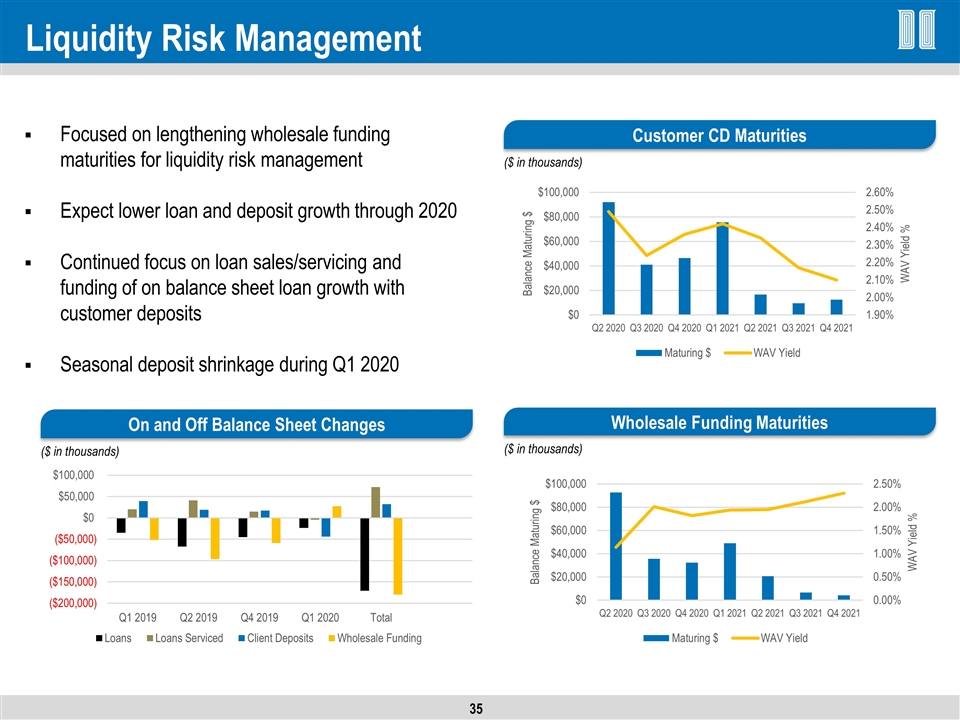

Liquidity Risk Management Focused on lengthening wholesale funding maturities for liquidity risk management Expect lower loan and deposit growth through 2020 Continued focus on loan sales/servicing and funding of on balance sheet loan growth with customer deposits Seasonal deposit shrinkage during Q1 2020 ($ in thousands) Customer CD Maturities ($ in thousands) Wholesale Funding Maturities ($ in thousands) On and Off Balance Sheet Changes

COVID-19 Pandemic Response Overview

COVID-19: Organization Preparedness / Response Organizational response Successfully implemented pandemic disaster recovery plan ~ 90% of staff working remotely, with no drop in productivity or customer service Videoconferencing investments made in 2019 allows us to stay connected and communicate remotely with customers Multiple task forces meet regularly: Pandemic, PPP, Back to Work team, Execs Customer delivery Temporarily closed all 4 lobbies, serving customers through our digital delivery channels, drive-thrus, night depository and phone Accommodate customers with specials needs by appointment, in branch Increased physical cash inventory at select strategic locations and monitored regularly Extra cleaning and protective measures

COVID-19: Employee Protection & Assistance Keeping Staff Safe Extra precautions for branch staff: rotating shifts, additional safety precautions Created COVID-19 paid time off bank for employees affected in any way and to minimize loss of regular work hours/compensation Enhanced employee benefits: Paid Time Off Rollover Change, Fitness Equipment Reimbursement, increased virtual wellness offerings Exemplary IT support and internal customer service Keeping Staff Connected Continual employee communication: Daily Email and weekly all bank virtual meeting Keeping socially connected: ICB Private Employee Facebook Group, organized fun virtual activities Virtual volunteering program to help parents homeschool children

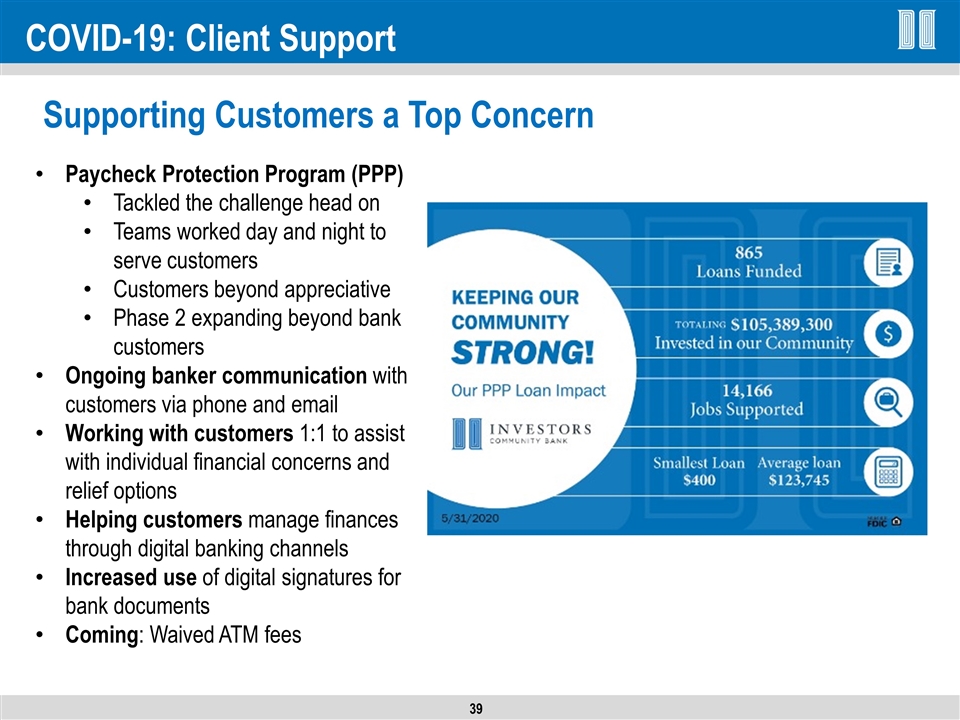

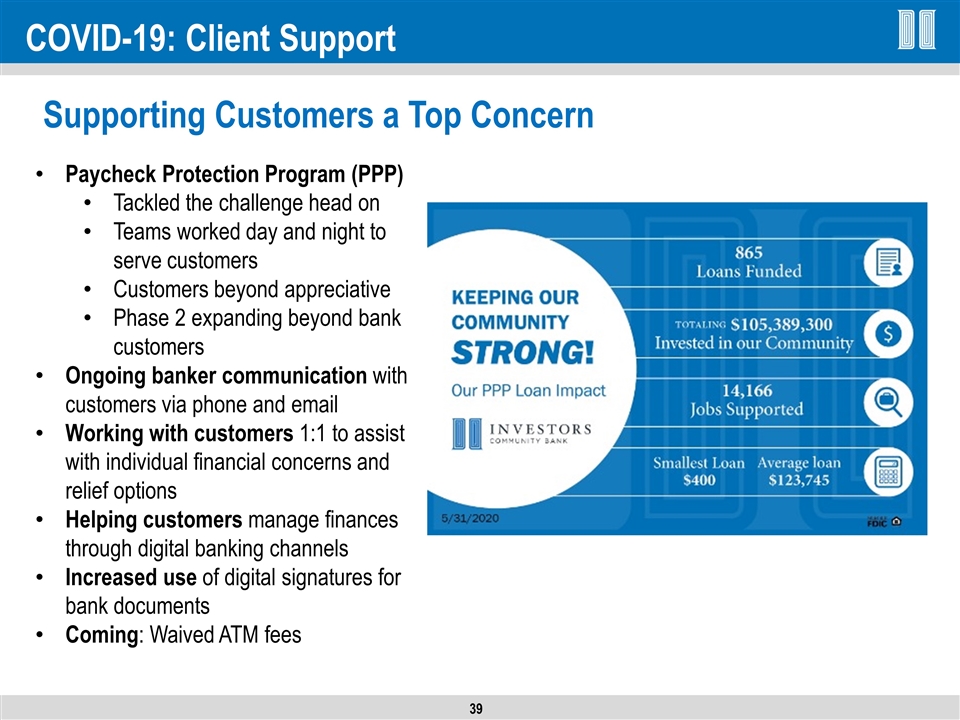

COVID-19: Client Support Paycheck Protection Program (PPP) Tackled the challenge head on Teams worked day and night to serve customers Customers beyond appreciative Phase 2 expanding beyond bank customers Ongoing banker communication with customers via phone and email Working with customers 1:1 to assist with individual financial concerns and relief options Helping customers manage finances through digital banking channels Increased use of digital signatures for bank documents Coming: Waived ATM fees Supporting Customers a Top Concern

COVID-19: What our clients are saying “You were really on it and we are very thankful you're our banker. We can tell you care about your customers and it means a great deal to us.” “Great job to all of you, we are so appreciative and happy we have the privilege of working with you!” “Just wanted to say thank you for being on the cutting edge as an ag lender and encouraging and supporting the Paycheck Protection Program.” “I am so thankful both the organizations I oversee bank with ICB. Your customer service has been above and beyond anything I have experienced elsewhere.” “It felt great to gather our entire staff yesterday and tell them that despite being surrounded by uncertainty, that we were able to bring them the certainty of knowing that they will receive a regular paycheck for the next 8 weeks guaranteed! Thanks again for bringing quick relief.” “Thank you for the speed in getting this loan approved and funded. You and the bank are to be commended for having a great staff and a great system in place to be able to take advantage of this opportunity.” “I just wanted to say thank you for the work you and your team put in to getting our applications submitted in such a short turnaround time, it really means A LOT to us!! We commend you all for a job well done!” “We received our distribution last week. Your patience with us, your generosity, time and knowledge in dealing with our questions and helping us to maneuver through this unprecedented piece of legislation was truly appreciated.” PPP: Appreciative Ag and Business Customers

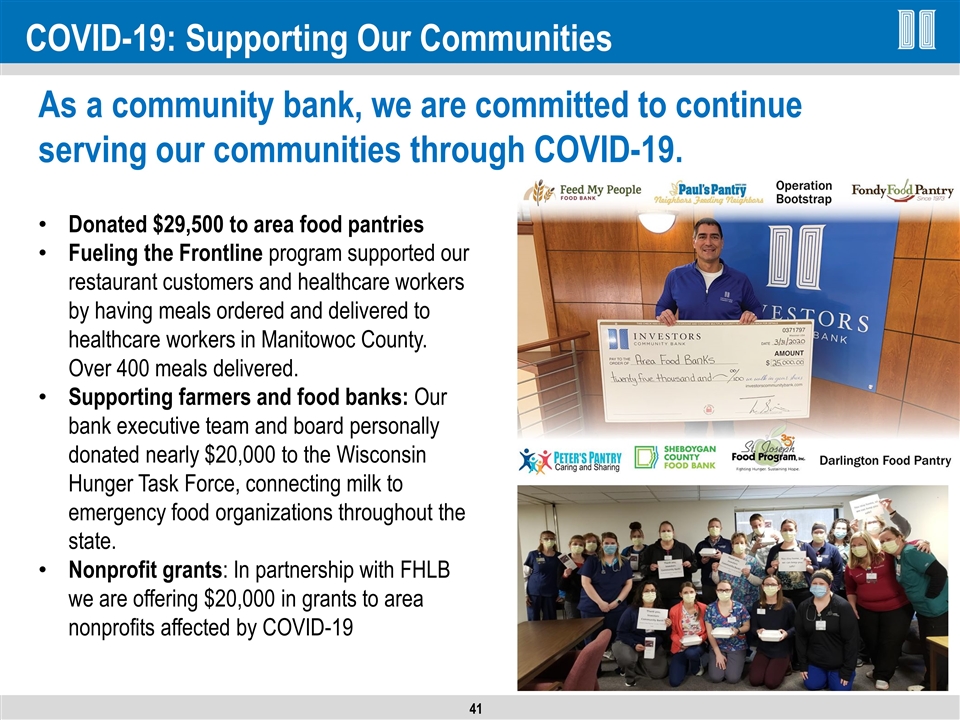

COVID-19: Supporting Our Communities Donated $29,500 to area food pantries Fueling the Frontline program supported our restaurant customers and healthcare workers by having meals ordered and delivered to healthcare workers in Manitowoc County. Over 400 meals delivered. Supporting farmers and food banks: Our bank executive team and board personally donated nearly $20,000 to the Wisconsin Hunger Task Force, connecting milk to emergency food organizations throughout the state. Nonprofit grants: In partnership with FHLB we are offering $20,000 in grants to area nonprofits affected by COVID-19 As a community bank, we are committed to continue serving our communities through COVID-19.

Appendix

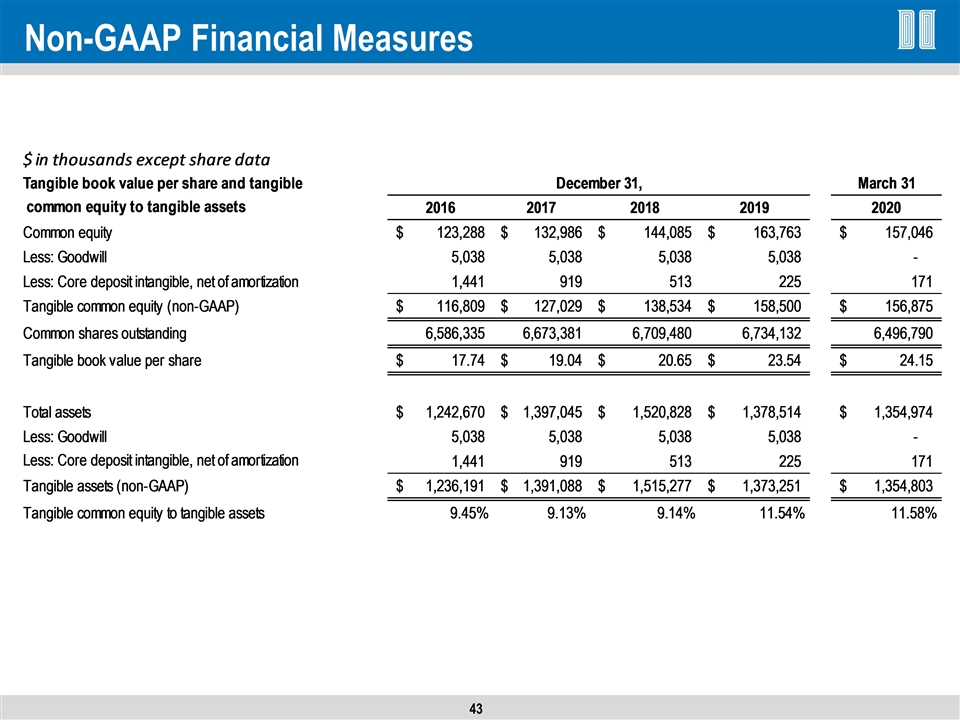

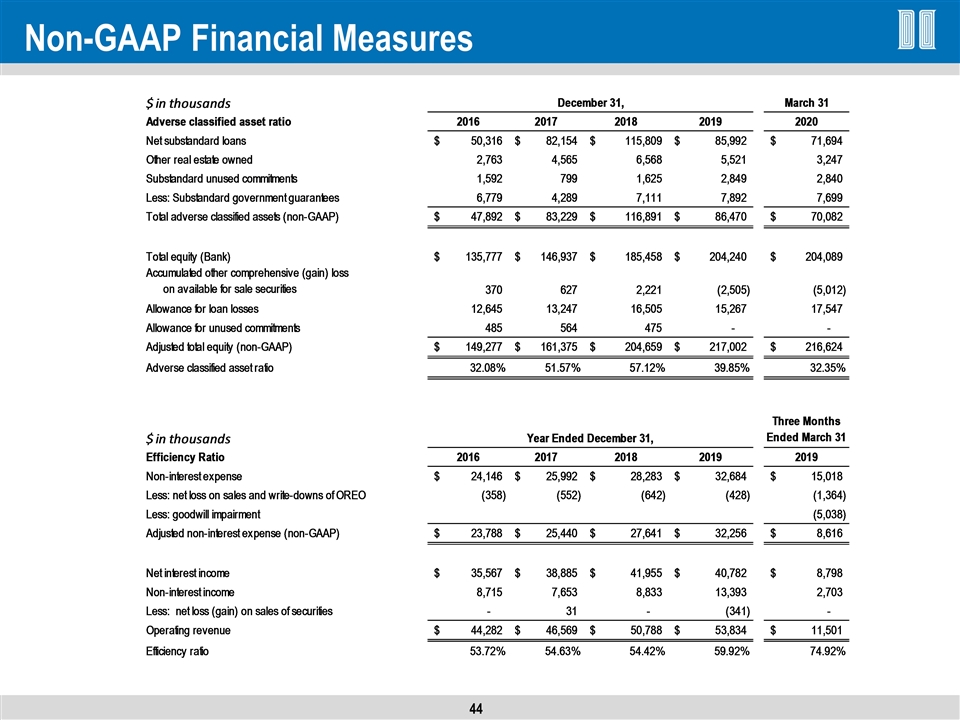

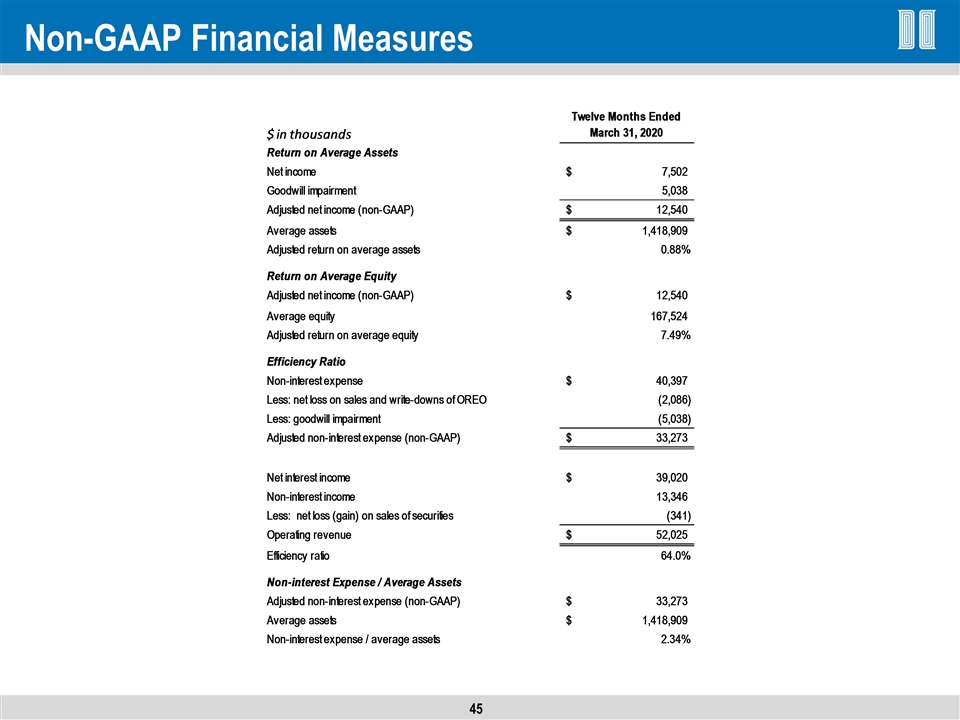

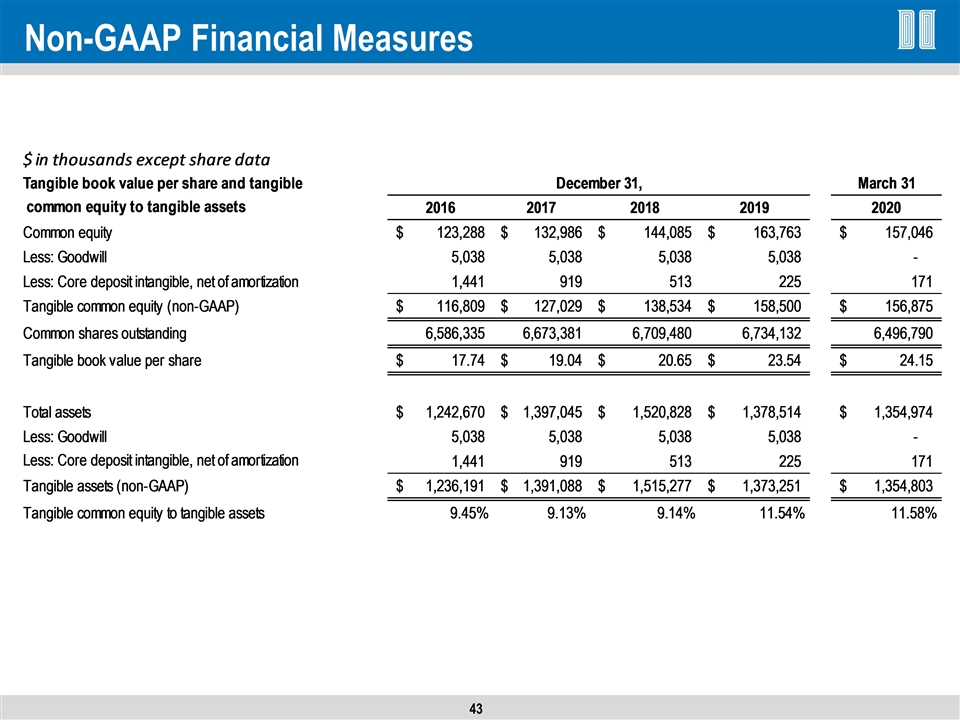

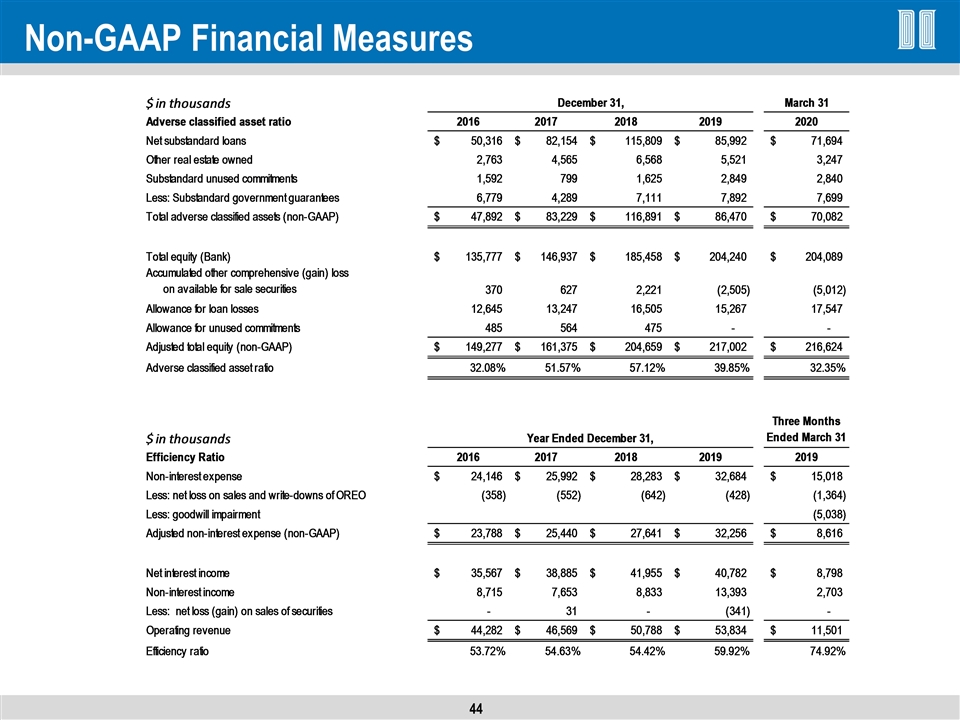

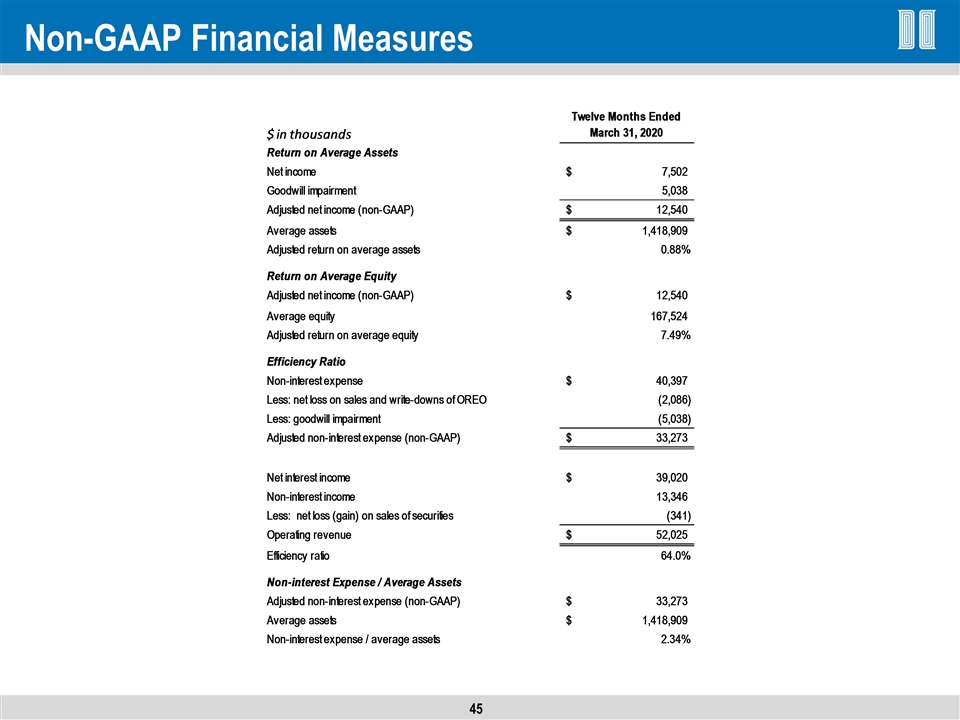

Non-GAAP Financial Measures $ in thousands except share data Tangible book value per share and tangible December 31, March 31 common equity to tangible assets 2015 2016 2017 2018 2019 2020 Common equity $99,024 $,123,288 $,132,986 $,144,085 $,163,763 $,157,046 Less: Goodwill 0 5,038 5,038 5,038 5,038 0 Less: Core deposit intangible, net of amortization 0 1,441 919 513 225 171 Tangible common equity (non-GAAP) $99,024 $,116,809 $,127,029 $,138,534 $,158,500 $,156,875 Common shares outstanding 5,771,001 6,586,335 6,673,381 6,709,480 6,734,132 6,496,790 Tangible book value per share $17.158894964669042 $17.735052954336517 $19.035178719752402 $20.647501743801307 $23.536812168220045 $24.146540060552979 Total assets $,884,889 $1,242,670 $1,397,045 $1,520,828 $1,378,514 $1,354,974 Less: Goodwill 0 5,038 5,038 5,038 5,038 0 Less: Core deposit intangible, net of amortization 0 1,441 919 513 225 171 Tangible assets (non-GAAP) $,884,889 $1,236,191 $1,391,088 $1,515,277 $1,373,251 $1,354,803 Tangible common equity to tangible assets 0.11190556103646898 9.4491061656329811E-2 9.1316293433628931E-2 9.1424868192416298E-2 0.11541954092878869 0.115791742415687 $ in thousands December 31, March 31, March 31, Adverse classified asset ratio 2015 2016 2017 2018 2019 2019 Substandard loans $30,401 $50,316 $83,226 $,120,887 $,107,492 $,107,492 Less: Non-impaired restructured loans 0 0 1,072 5,078 6,382 6,382 Net substandard loans $30,401 $50,316 $82,154 $,115,809 $,101,110 $,101,110 Other real estate owned 2,872 2,763 4,565 6,568 5,019 5,019 Substandard unused commitments 530 1,592 799 1,625 976 976 Less: Substandard government guarantees 8,186 6,779 4,289 7,111 5,864 5,864 Total adverse classified assets (non-GAAP) $25,617 $47,892 $83,229 $,116,891 $,101,241 $,101,241 Total equity (Bank) $,115,277 $,135,777 $,146,937 $,185,458 $,191,287 $,191,287 Accumulated other comprehensive (gain) loss on available for sale securities -,221 370 627 2,221 436 436 Allowance for loan losses 10,405 12,645 13,247 16,505 17,493 17,493 Allowance for unused commitments 422 485 564 475 0 0 Adjusted total equity (non-GAAP) $,125,883 $,149,277 $,161,375 $,204,659 $,209,216 $,209,216 Adverse classified asset ratio 0.20349848669002168 0.32082638316686429 0.51574903175832687 0.57115005936704466 0.48390658458244112 0.48390658458244112 $ in thousands Year Ended December 31, Three Months EndedMarch 31, Three Months EndedMarch 31, Efficiency Ratio 2015 2016 2017 2018 2019 2019 Non-interest expense $17,458 $24,146 $25,992 $28,283 $7,305 $7,305 Less: net loss on sales and write-downs of OREO -,510 -,358 -,552 -,642 136 136 Adjusted non-interest expense (non-GAAP) $16,948 $23,788 $25,440 $27,641 $7,441 $7,441 Net interest income $26,247 $35,567 $38,885 $41,955 $10,560 $10,560 Non-interest income 7,685 8,715 7,653 8,833 2,750 2,750 Less: net loss (gain) on sales of securities 0 0 31 0 0 0 Operating revenue $33,932 $44,282 $46,569 $50,788 $13,310 $13,310 Efficiency ratio 0.49946952728987387 0.53719344203062191 0.54628615602654129 0.54424273450421357 0.55905334335086398 0.55905334335086398

Non-GAAP Financial Measures

Non-GAAP Financial Measures