Brown Shoe Company, Inc.

Investor Update

September 2007

This document contains certain forward-looking statements and expectations regarding the Company's future performance and the future performance of its brands. Such statements are subject to various risks and uncertainties that could cause actual results to differ materially. These include (i) the preliminary nature of estimates of the costs and benefits of the strategic earnings enhancement plan, which are subject to change as the Company refines these estimates over time; (ii) intense competition within the footwear industry; (iii) rapidly changing consumer demands and fashion trends and purchasing patterns, which may be influenced by consumers' disposable income, which in turn can be influenced by general economic conditions; (iv) customer concentration and increased consolidation in the retail industry; (v) the Company’s ability to successfully implement its strategic earnings enhancement plan; (vi) political and economic conditions or other threats to continued and uninterrupted flow of inventory from China and Brazil, where the Company relies heavily on third-party manufacturing facilities for a significant amount of its inventory; (vii) the Company's ability to attract and retain licensors and protect its intellectual property; (viii) the Company's ability to secure leases on favorable terms; (ix) the Company's ability to maintain relationships with current suppliers; and (x) the uncertainties of pending litigation. The Company's reports to the Securities and Exchange Commission contain detailed information relating to such factors, including, without limitation, the information under the caption “Risk Factors” in Item 1A of the Company’s Annual Report for the year ended February 3, 2007 and as updated in the Company’s 10-Q for the Quarter ended August 4, 2007, which information is incorporated by reference herein. The Company does not undertake any obligation or plan to update these forward-looking statements, even though its situation may change.

- September 10, 2007

NOTE:

On April 2, 2007, The Company effected a 3-for-2 stock split. All per share data detailed in this packet is on a post-split basis. Guidance was issued on August 29, 2007 and has not been updated.

=

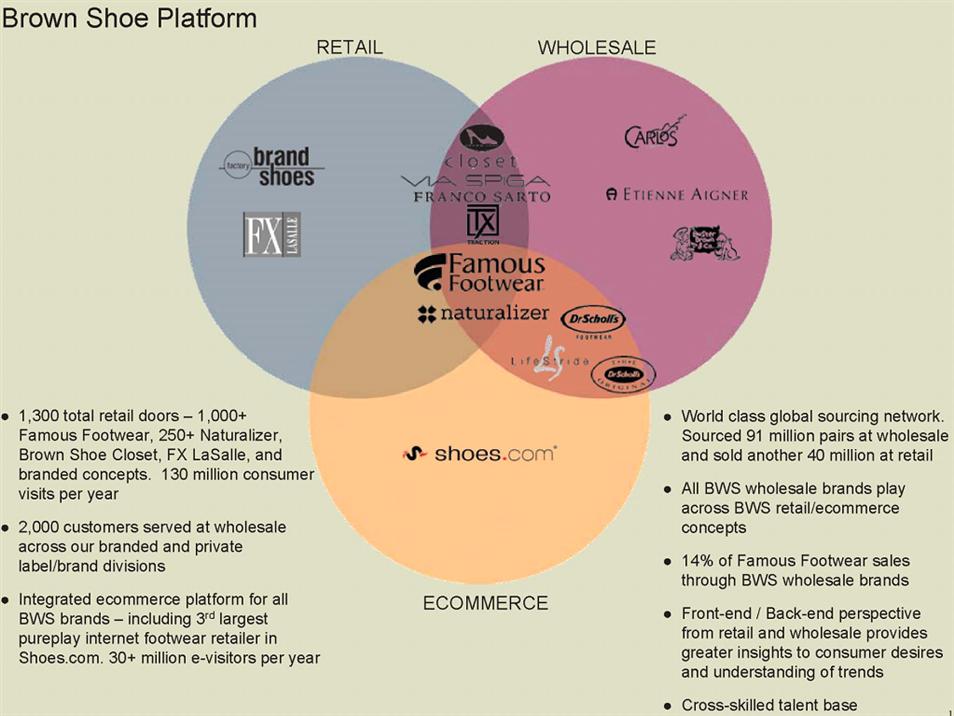

| Brown Shoe is the Leading Fashion Footwear Marketer, |

| Winning Loyal Customers with Compelling Global Brands |

* Source: Public filings, last 4 quarters

**Source: NPD Women’s dollar sales for 12 months ending 4/30/07 all POS channels (Department Stores, National Chains, Shoe Chains. This NPD data is confidential and proprietary and cannot be reproduced or disseminated by third parties without prior written consent.

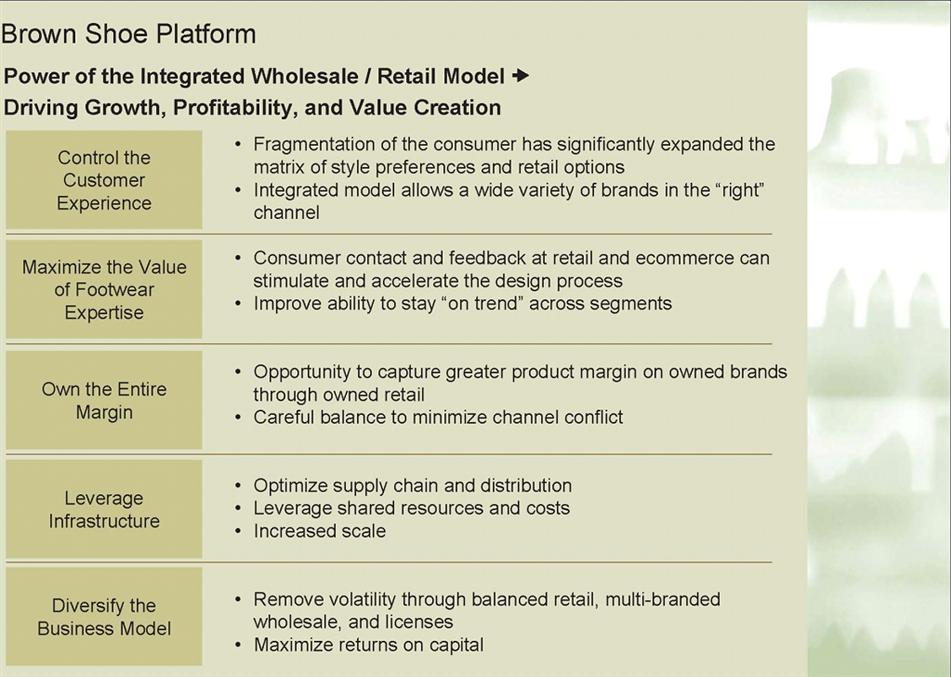

PARTNERSHIP MODEL

Continue path towards being a world-class partner holistically in the industry: Vendor, Supplier, Customer, Consumer, Real Estate, Investor

OPERATIONAL EXCELLENCE

Disciplined approach to profitability enhancement, efficiency and effectiveness

PORTFOLIO OPTIMIZATION

Financial and market orientation

Maximize returns and market space opportunities

BRAND POWER

Leverage our unique branded assets

Delivering consumer-driven brands to the marketplace

Marketing Initiatives – investing in our flagship brands and increasing understanding of our consumers through addition of CMO and updated market research

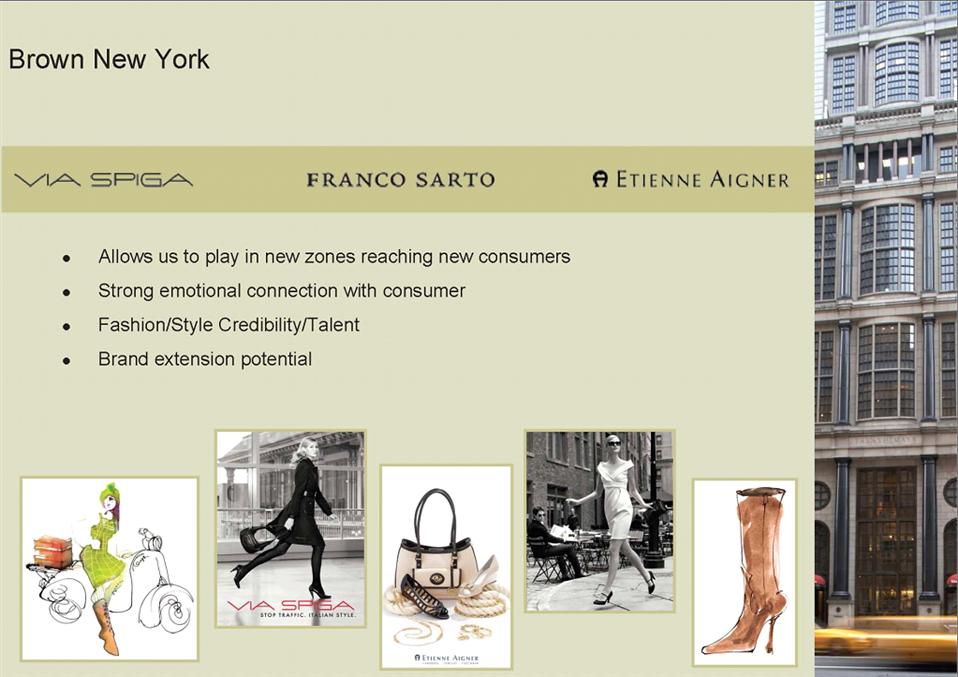

| ● | Partnering with Ogilvy to refine brand positioning |

| ● | Broadcast media and CRM focus |

| ● | Using consumer database to drive Rewards program |

| ● | Brand strategy and consumer research |

| ● | Partnering with Vogue Magazine. Arthur Elgort photos for national magazine ads and out-of-home in Manhattan – taxi tops, king buses, telephone kiosks |

| ● | Trade marketing for FFANY with cover wrap of Footwear News |

| ● | Partnership with Self Magazine – premium position for key Spring months and product opportunities that provide unique consumer touchpoints |

| ● | Ongoing partnership with “Ladies Who Launch” – a national organization for women entrepreneurs – a genuine brand for genuine women |

| ● | Partnering with Ogilvy to refine brand positioning |

| ● | Brand strategy, product segmentation, and positioning study |

| ● | Investing in retail relationships – partnering with Nordstrom on second half ’07 direct mail initiative |

| ● | Leveraging Franco himself, consumers have a strong connection to the individual, by increasing the number of personal appearances in support of the brand |

Appendix

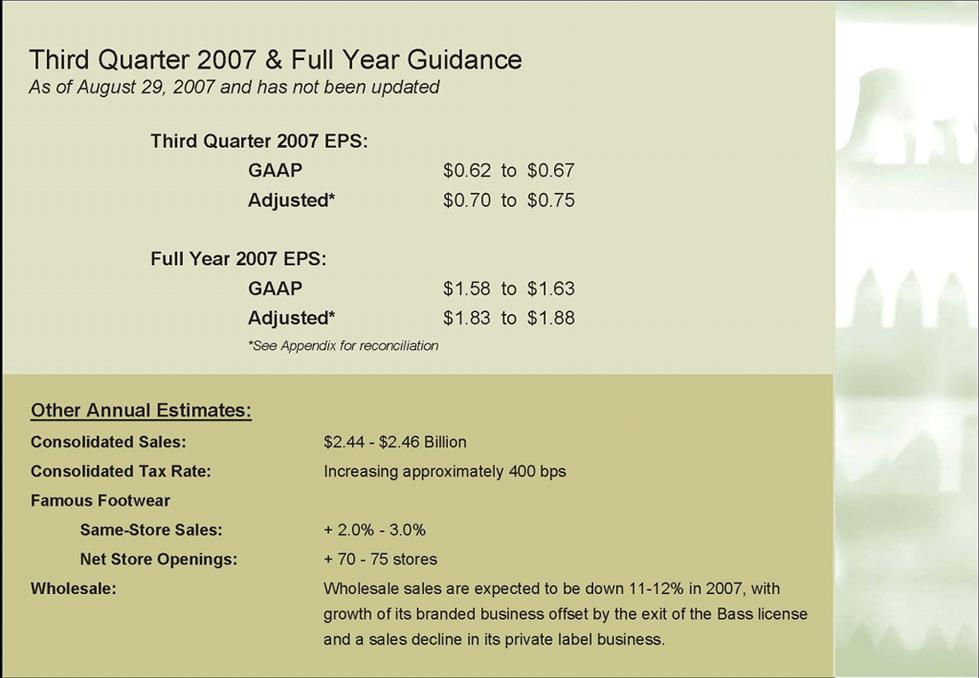

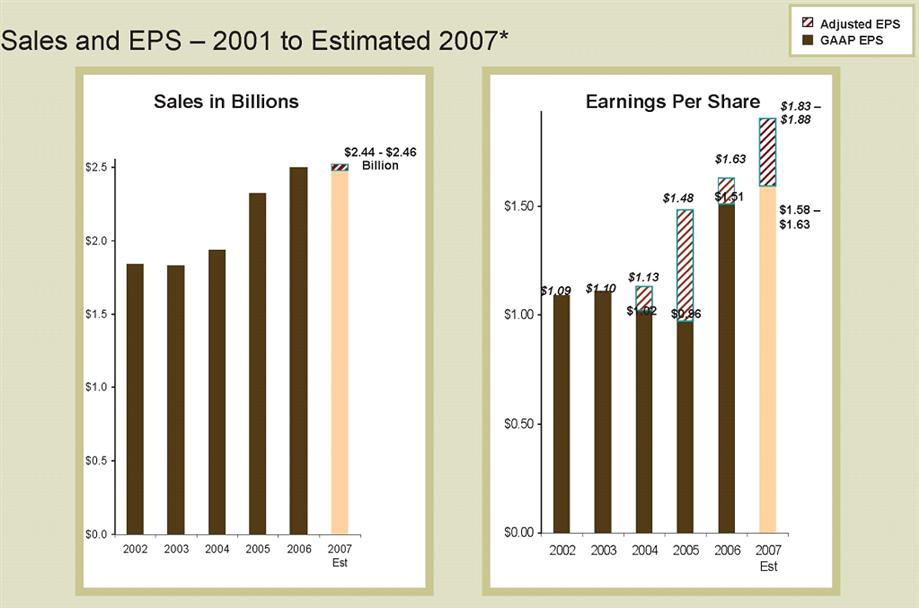

* Note: Guidance was issued on August 29, 2007 and has not been updated.

Charges and recoveries included in net earnings and EPS for 2005, 2006 and 2007 are listed in the Reconciliation of Net Earnings to Adjusted Net Earnings in this Appendix.

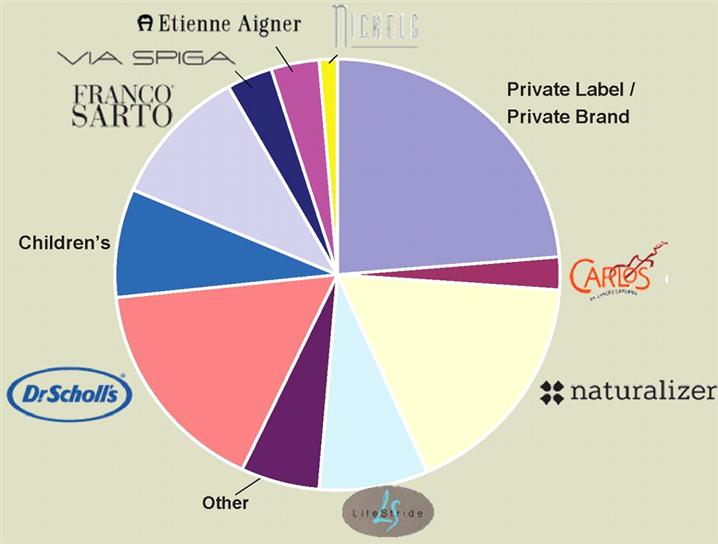

| Distinct Wholesale Portfolio -2006 |

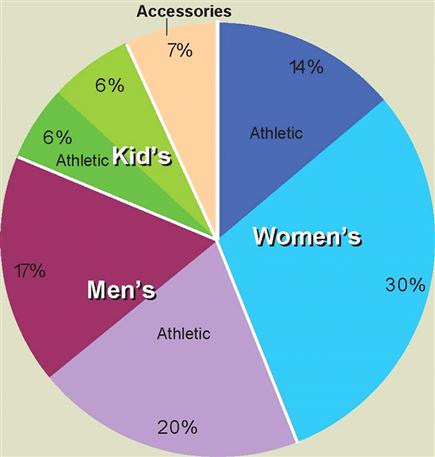

| Famous Footwear --Sales by category 2006 |

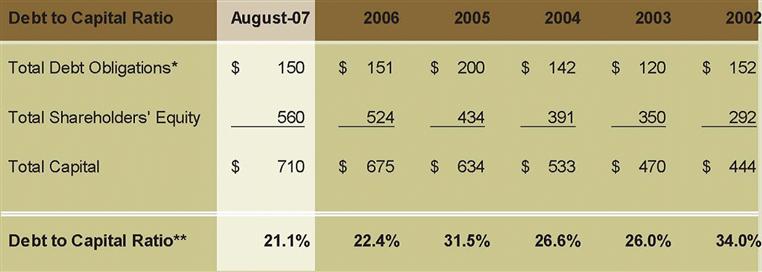

Debt to Capital Ratio

(Millions of dollars, except for Debt to Capital Ratio)

| *Total Debt Obligations include long term debt, borrowings under revolving credit agreement and capital lease obligations. |

| **Total Debt Obligations divided by Total Capital |

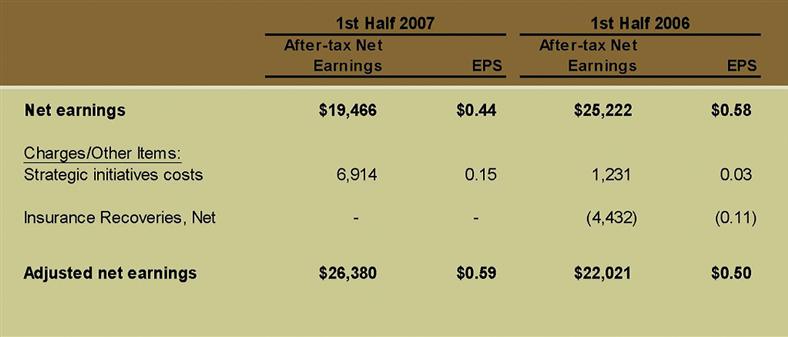

Reconciliation of GAAP Net Earnings to Adjusted Net Earnings:

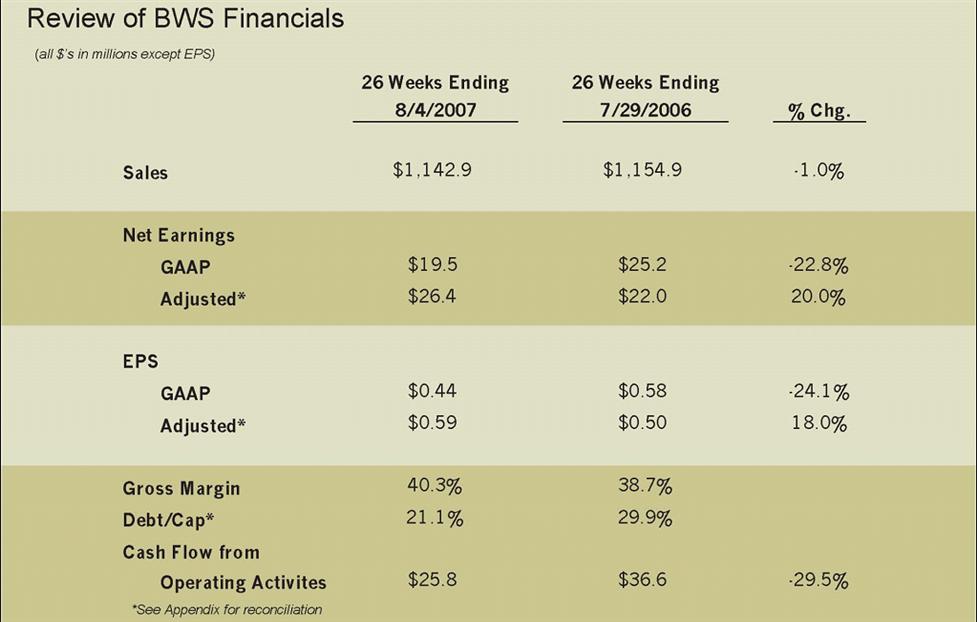

1st Half 2007 v. 1st Half 2006

Non-GAAP Financial Measures

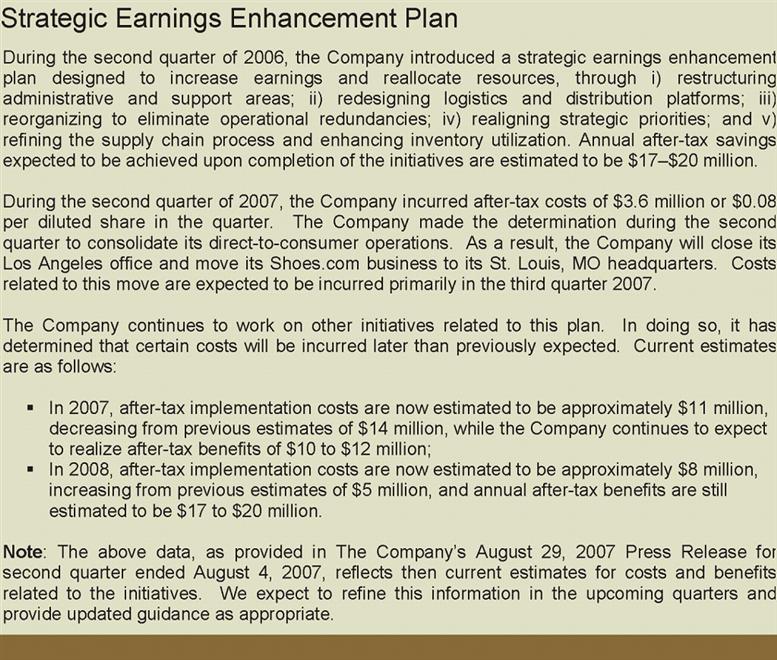

In this document, the Company’s financial results are provided both in accordance with generally accepted accounting principles (GAAP), and using certain non-GAAP financial measures. In particular, the Company provides historic and estimated future net earnings per diluted share excluding certain charges and recoveries, which are non-GAAP financial measures. These results are included as a complement to results provided in accordance with GAAP because management believes these non-GAAP financial measures help indicate underlying trends in the Company’s business and provide useful information to both management and investors by excluding certain items that are not indicative of the Company’s core operating results. These measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results.

Reconciliation of GAAP Net Earnings to Adjusted Net Earnings:

*Full-year fiscal 2006 and 2007 includes stock option expense with no related expense in 2005.

**Note: Estimated Earnings Guidance was issued on August 29, 2007 and has not been updated.

Non-GAAP Financial Measures

In this document, the Company’s financial results are provided both in accordance with generally accepted accounting principles (GAAP), and using certain non-GAAP financial measures. In particular, the Company provides historic and estimated future net earnings per diluted share excluding certain charges and recoveries, which are non-GAAP financial measures. These results are included as a complement to results provided in accordance with GAAP because management believes these non-GAAP financial measures help indicate underlying trends in the Company’s business and provide useful information to both management and investors by excluding certain items that are not indicative of the Company’s core operating results. These measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results.