March 1, 2013

VIA EDGAR SUBMISSION

Ms. Suzanne Hayes

Assistant Director

Division of Corporation Finance

U.S. Securities and Exchange Commission

100 F Street, N.E.; mail stop 4561

Washington, D.C. 20549

U.S.A.

Re: Banco Santander (Brasil) S.A.

Form 20-F for Fiscal Year Ended December 31, 2011

Filed March 30, 2012

Form 6-K filed October 25, 2012

File No. 001-34476

Dear Ms. Hayes:

On behalf of Banco Santander (Brasil) S.A.. (“Santander Brasil” or the “Bank”), I hereby submit Santander Brasil’s responses to certain of the comments of the staff of the Division of Corporation Finance (the “Staff”) of the United States Securities and Exchange Commission (the “Commission”) set forth in your letter dated December 28, 2012 in connection with the above referenced Annual Report on Form 20-F (the “20-F”) and Form 6-K (the “6-K”) of Santander Brasil. This letter is furnished in addition to the response letter furnished by the Bank on February 15, 2013 in response to the Staff’s comments numbered 1, 2, 5, 6, 9, 13, 16, 26, 27 and 33 .I respectfully advise the Staff that the Bank continues to analyze certain other comments provided by the Staff and the responses set forth herein constitute a partial response to your letter dated December 28, 2012. The Bank will provide responses for the remaining comments not addressed in this letter and its prior letter as soon as possible.

I set forth below our responses to each of the Staff’s comments numbered 7, 8, 10-12, 14, 18-20, 23-25, 28-32 and 34-38, indicating each comment in boldface text with our response below. All references to page numbers in Santander Brasil’s responses are to pages in the filed version of the 20-F and 6-K. I have also underlined and italicized our proposed changes to our Annual Report on Form 20-F and to our consolidated financial statements that will be included in future filings and I have struck through the text that will be deleted in future filings.

****************************

Asset Management and Insurance, page 31

7. We note that the sale of Santander Seguros S.A. occurred in October 2011 and your disclosure that products issued by Santander Seguros represented almost 91% of your insurance premiums in 2011. We also note your statement on page 23 that you are entitled to receive fees approximately equal to the fees you received prior to the sale of Santander Seguros. However, you disclose on page 132 a decline in results for your asset management and insurance segment during the fourth quarter of 2011 as a result of the sale of Santander Seguros. Please clarify the apparent discrepancy between your disclosure on pages 23 and 132, and revise where appropriate to further explain or quantify the impact of your sale of Santander Seguros on your operations and performance, including, if applicable, how this transaction is expected to cause your historical results to not be indicative of future operating results or performance.

Response

We acknowledge the Staff’s comment and we would like to clarify that where we mention on Page 31 that “products issued by Santander Seguros represented almost 91% of our insurance premiums in 2011,” we mean to indicate that the Bank sells insurance products of insurance companies other than Santander Seguros (now named Zurich Santander Brasil Seguros e Previdência S.A.), though the Bank’s sales of insurance products do tend to be concentrated in products offered by Santander Seguros (hence, the 91% in 2011 mentioned above).

On page 23 when we mention that “we are entitled to receive fees approximately equal to the fees we received prior to the sale of Santander Seguros”, we refer to the commissions that we received on sale of insurance products by our branches (which are part of our Commercial Banking segment) and insurance broker (which are part of our Asset Management and Insurance segment), which are approximately the same prior to the sale of Santander Seguros to ZS Insurance and, we continued to concentrate our sales of insurance products among those offered by Santander Seguros, receiving similar commissions to those we had received prior to such sale.

With respect to the decrease in results for the asset management and insurance segment during the fourth quarter of 2011 as a result of the sale of Santander Seguros (mentioned on page 132) in 2011 in comparison with 2010, we would like to clarify that beginning in the fourth quarter of 2011, we no longer consolidated the results of operations of Santander Seguros due to the sale, and therefore, the overall results in this segment declined. Nevertheless, we continue to receive commissions (which are reflected in our Commercial Banking segment) after the sale of Santander Seguros, similar to the commissions we received prior to such sale, because of the arrangements between our commercial branches and the insurance companies (including Santander Seguros) to continue selling their products.

On a consolidated basis, we do not expect the sale of Santander Seguros to have a material impact on our future operating results or performance.

We will revise our disclosure in future filings to clarify this matter as follows:

Summary

Profit before income tax attributed to the Asset Management and Insurance segment for the year ended December 31, 2011 reached R$835 million, a 0.4%, or a R$3 million, increase from R$832 million for the year ended December 31, 2010. The result was affected by a decline of insurance segment results during the fourth quarter of 2011 as a consequence of the sale of Santander Seguros to ZS Insurance. The main variations included:

2

8. We also note your disclosure on page 129 of an increase in the commissions paid by your insurance business to your commercial banking segment. Please revise to explain how your insurance activities affect your commercial banking segment and your asset management and insurance segment.

Response:

We acknowledge the Staff’s comment and we would like to clarify that because a certain portion of sales of insurance and capitalization products is made through our branches (which are part of our Commercial Banking segment), we have entered into agreements with insurance and capitalization companies, whose products we sell whereby our branches receive commissions for sales of such insurance and capitalization products. In 2011, the agreements between the insurance and capitalization companies and our Commercial Banking segment were amended, increasing the rate of commissions to be paid to our Commercial Banking segment. The commissions under these agreements continue to be in force following the sale of Santander Seguros in the fourth quarter of 2011, however, as mentioned above (in question 7), we do not expect the sale of Santander Seguros to have a material impact on our future operating results or performance.

We will revise our disclosure in future fillings to clarify this matter as follows:

As regards 2012 compared to 2011: There was no significant variation in commissions paid by Asset Management and Insurance segment in 2012, and net fee and commission income for 2012 was stable.

“Asset Management and Insurance Segment

Net fee and commission income

Net fee and commission income for the Asset Management and Insurance segment for the year ended December 31, 2012 totaled R$xxx million, a xxx%, or R$xxx million decrease from R$x million for the year ended December 31, 2011.”

As regards 2011 compared to 2010:

“Asset Management and Insurance segment

Net fee and commission income

“Net fee and commission income for the Asset Management and Insurance segment for the year ended December 31, 2011 reached R$351 million, a 15.2%, or R$63 million decrease from R$414 million for the year ended December 31, 2010. This decrease is mainly due to the increase in the rate of sales commissions paid to our commercial branches and resultant increase in net fee and commission income in our Commercial Banking segment, due to a revision in the sales commission contract between our own insurance and capitalization companies that resulted in a corresponding decrease in net fee and commission income that had previously been (recorded in our Asset Management and Insurance segment. This commission paid to our Commercial Banking is in connection with their sales of insurance and capitalization products.”

Changes in Impaired Assets, page 63

Commercial, financial and industrial, page 64

10. We note your disclosure that non-performing assets in commercial, financial, and industrial loans on December 31, 2011 increased R$1,212 million, or 34.0%, compared to December 31, 2010, mainly due to an increase in lending in the commercial, financial, and industrial loan category. You disclose on page 59 that this loan portfolio grew from R$78.1 billion to R$94.9 billion or by 21.5% year over

3

year. As such, it does not seem that the portfolio growth of 21.5% accounts for the whole increase of 34.0% in nonperforming loans in this category. Please tell us and revise your disclosure in future filings to address the following:

| · | Discuss the underlying reasons for the increase in your non-performing assets in commercial, financial, and industrial loans, including the factors contributing to the deterioration in credit quality of this portfolio. |

| · | Describe the extent to which you have revised your underwriting standards for this loan portfolio during the periods presented. |

| · | Discuss the trends experienced in the credit quality for the more recent vintage loans in this portfolio. |

| · | You disclose on page 125 that the increase in non-performing assets in this portfolio was “expected” and “was in line with market trends.” More clearly explain why the significant increase in nonperforming assets was expected for this loan category and why you believe the increase was in line with market trends. Identify the market trends to which you are referring, and discuss your expectations of the impact these trends will have on your credit losses. |

| · | To the extent that newly originated loans in this portfolio are becoming non-performing assets more quickly than you have experienced in comparable historical periods, discuss how you are adjusting your allowance estimation methodology accordingly to capture these trends. As part of your response, specifically address the fact that the coverage ratio for this loan category has declined steadily over the last few years and why you believe the reduction in coverage ratio is appropriate. |

| · | Discuss how you captured the acceleration of nonperforming loans combined with the lengthy charge-off periods when determining your best estimate for the allowance. |

Response:

We acknowledge the Staff’s comment and recognize that the 21.5% growth in the Bank’s commercial, financial and industrial loan portfolio does not fully explain the 34.0% increase in non-performing assets in this category. The following response addresses each point raised in the bulleted list above.

In addition to the growth in our commercial, financial and industrial loan portfolio, unfavorable economic conditions also contributed to the increase in non-performing assets in this portfolio. Many of our borrowers, specifically industrial borrowers focused on production for retail sales, exhibited an increased appetite for borrowings in 2010 and 2011 primarily to fund expansion of their manufacturing capabilities with the expectation of favorable economic conditions.

However, the retail sector was adversely affected in 2011 due to a number of economic measures adopted by the Brazilian government, as described in the 20-F under “Risk Factors—Risks Relating to Brazil— Government efforts to control inflation may hinder the growth of the Brazilian economy and could harm our business.” As a result of these measures, production costs for these industrial borrowers (and others) increased, which costs were not fully reflected in their product pricing, which reduced these borrowers’ profitability and their capacity to service their loans.

To avoid increases in non-performing assets, the Bank took a number of actions, such as readapting the limits of new loans and requiring higher level of collateral on new loans. The Bank also revisited its collection practices to evaluate borrowers’ cash flows to more closely align such cash flows with installment plans for outstanding loans, especially offering to our borrowers the chance to restructure their debts through renegotiation.

4

In spite of the measures taken by the Bank in its loan underwriting standards, the 2011 vintage of commercial, financial and industrial loan portfolio demonstrated have higher default rate when compared with the 2010 vintage in large measure due to the economic factors and measures adopted by the Brazilian government described above.

The increase in the Bank’s non-performing assets was indicative (if slightly more pronounced) of increases observed across the Brazilian financial system. According to Brazilian Central Bank the default rate in commercial, financial and industrial loan portfolio increased from 3.5% in 2010 to 3.9% in 2011 (an increase of 37 basis points), a trend similar to the default rate increase experienced by the Bank from 4.6% in 2010 to 5.0% in 2011 (an increase of 47 basis points). As a result of the increase in the default rate, the Bank recognized additional provisions for loan losses on this category.

However, despite the scenario mentioned above, the Bank understands that its methodology for loan losses efficiently captured the acceleration in delinquencies due to internal rating models based on client behavior data and available external credit bureau rating information, which updates the Probability of default, or “PD” (the probability of the borrower failing to meet its principal and/or interest payment obligations) used by the Bank to estimate the provision for loan losses.

PD is measured using a time horizon of one year; that is, it quantifies the probability of the borrower defaulting in the coming year. A loan is in default if either the principal or interest is past due by ninety days or more or the loan is current but there are doubts as to the solvency of the borrower (subjective doubtful assets).

The Bank’s loan loss allowance methodology is developed to fit its risk metrics and capture loans that could potentially become impaired. Though the Bank’s coverage ratio for this loan portfolio decreased from 91.9% in 2010 to 78.5% in 2011, the Bank believes such lower coverage ratio remains adequate within its risk profile because a higher proportion of the loans originated in 2011 have higher level of collateral as required in the Bank’s revised its underwriting standards as described above, which therefore requires a lower level of coverage ratio.

In addition, prior to charging off past due loans (which is only done after we have completed all recovery efforts), we fully provision the remaining balance of the loan so our allowance for loan losses fully cover our losses. Thus, the Bank understands that its loan loss allowance methodology has been developed to fit its risk metrics and capture loans that could potentially become impaired.

Finally, the loans originated in 2011 have a higher proportion of loans with higher level of collateral as required in the Bank’s revised underwriting standards as described, which therefore requires a lower level of provisioning.

We will revise our future disclosure to more clearly describe the trends underlying the increase in the Bank’s non-performing assets in commercial, financial and industrial loan portfolio on December 31, 2011 as compared to December 31, 2010 and we will use the same approach in our future disclosure for Bank’s non-performing assets in commercial, financial and industrial loan portfolio on December 31, 2012 as compared to December 31, 2011, as well as any increases or decreases in subsequent periods, as shown below:

“Commercial, financial and industrial

Non-performing assets in commercial, financial and industrial loans portfolio on December 31, 2011 increased R$1,212 million, or 34.0%, compared to December 31, 2010, mainly due to unfavorable economic conditions that contributed to the increase of non-performing in this category.

During the year, many of our borrower clients, specifically industrial clients focused on production for retail sales, exhibited an increased appetite for borrowing with the expectation of favorable economic conditions. However, the retail sector was adversely affected in 2011 due to a number of economic measures adopted by the Brazilian government during this period, (as described in the 20-F under “Risk Factors—Risks Relating to Brazil— Government efforts to control inflation may hinder the

5

growth of the Brazilian economy and could harm our business.”) As a result of these measure, production costs for these industrial clients (and others) increased, which costs were not fully reflected in their product pricing, which reduced these clients’ profitability and their capacity to service their debt obligations.

In spite of the measures taken by the Bank such as enhancing its loan underwriting standards, the 2011 vintage commercial, financial and industrial loans demonstrated worse performance when compared with the 2010 vintage in large measure due to the economic factors and measures adopted by the Brazilian government described above.

However, despite the scenario mentioned above, the Bank understands that its methodology for loan losses efficiently captured the acceleration in delinquencies due to internal rating models based on client behavior data and available external credit bureau rating information, which updates the Probability of default, or “PD”(the probability of the borrower failing to meet its principal and/or interest payment obligations) used by the Bank to estimate the provision for loan losses.

PD is measured using a time horizon of one year; that is, it quantifies the probability of the borrower defaulting in the coming year. A loan is in default if either the principal or interest is past due by ninety days or more or the loan is current but there are doubts as to the solvency of the borrower (subjective doubtful assets).

In addition, prior to charging off past due loans (which is only done after we have completed all recovery efforts), we fully provision the remaining balance of the loan so our allowance for loan losses fully cover our losses. Thus, the Bank understands that its loan loss allowance methodology has been developed to fit its risk metrics and capture loans that could potentially become impaired.

Finally, the loans originated in 2011 have a higher proportion of loans with higher level of collateral as required in the Bank’s revised underwriting standards as described, which therefore requires a lower level of provisioning.”

Installment loans to individuals, page 64

11. We note your disclosure that non-performing assets in installment loans to individuals increased R$2,856 million, or 58.7%, at December 31, 2011 compared to December 31, 2010. You also disclose that this figure was adversely influenced by an increase in Brazilian interest rates, inflation, and certain measures implemented by the Brazilian Central Bank to control consumer credit, which directly affected the individuals segment of the banking system, mainly the consumer lending portfolio. Given the significant increase in your non-performing assets in this loan portfolio, please tell us and revise your disclosure in future filings to address the following:

| · | Discuss how interest rates, inflation, and measures implemented by the Brazilian Central Bank have impacted your non-performing assets in this portfolio. More clearly identify the impact you expect these measures will have on your credit quality and credit losses, and discuss any measures you have taken to mitigate the unfavorable impact of these measures. |

| · | In addition, based on your disclosures on page 59, this loan portfolio grew by 26.9% year over year. As such, revise this section to discuss the appearance that the nonperforming assets in this loan category are accelerating faster than the portfolio itself. |

| · | Identify the extent to which you have revised your underwriting standards for this loan category. |

| · | To the extent that newly originated loans in this portfolio are becoming non-performing assets more quickly than you have experienced in comparable historical periods, discuss how you are adjusting your allowance estimation methodology accordingly to capture these trends. As part of your response, specifically address the fact that the coverage ratio for this |

6

| loan category has declined steadily over the last few years and why you believe the reduction in coverage ratio is appropriate. |

| · | Discuss how you captured the acceleration of nonperforming loans combined with the lengthy charge-off periods when determining your best estimate for the allowance. |

Response:

We acknowledge the Staff's comment and we would like to clarify that, prior to 2010, consumer credit had not been accessible to many Brazilian families. Beginning in 2010, consumer credit (especially personal loans, credit cards and payroll loans) was much more widely accessible to Brazilian families, due to a significant reduction in social and regional inequalities (in the last 10 years , nearly 42 million of Brazilian had access to banking system), and increased purchasing power for Brazilian families; which led many Brazilian families to assume a high level of household debt, in large part due to lack of experience in managing credit. Combined with high interest rates and inflation, the increased availability of consumer credit resulted in higher rate of customer defaults.

In response to the increasing level of household debt and in an attempt to compensate for consumers’ lack of experience in managing personal credit, the Brazilian Central Bank implemented a number of measures in 2011 intended to limit or control the level of household debt, mainly related to the requirement of a minimum of 20% payment of the outstanding monthly balance on credit cards incurred after December 1, 2011, while maintaining the minimum payment requirement at 15% of the outstanding monthly balance incurred prior to such date. However, this and other measures had the opposite effect from what was intended by the Brazilian Central Bank, contributing to a rise in borrower default. See “Risk Factors—Risks Relating to Brazil—Government efforts to control inflation may hinder the growth of the Brazilian economy and could harm our business” in our Form 20-F.

As a result, the Bank has implemented the following measures to manage this situation:

| · | Readapted the limits for concessions to new customers, in order to improve the credit quality of Bank’s loan portfolio; Developed new lending models with better predictive scoring, in order to avoid future rise in borrower delinquency; and |

| · | Initiated recovery campaigns targeted toward delinquent customers to offer adjusted lending terms, such as favorable condition of renegotiation, to meet their payment obligations on terms appropriate for their economic circumstances. In addition, new training programs were offered for our recovery teams, in order to increase our capacity and effectiveness with the recovery process. |

The Bank's loan loss allowance methodology is developed to fit its risk metrics and account for loans that could potentially become impaired. Though the Bank's coverage ratio decreased from 115.3% in 2010 to 92.0% in 2011, the Bank believes such lower coverage ratio remains adequate within its risk profile because the Bank has focused on receivables generally secured by guarantees and has revised its underwriting standards as described above to focus on receipt of additional credit enhancements for outstanding loans, which therefore requires a lower level of coverage ratio

Finally, prior to charging off past due loans (which is only done after we have completed all recovery efforts), we fully provision the remaining balance of the loan so our allowance for loan losses fully cover our losses. Thus, the Bank understands that its loan loss allowance methodology has been developed to fit its risk metrics and capture loans that could potentially become impaired.

As requested, we will revise our disclosure of non-performing assets in installment loans to individuals to more fully discuss the underlying economic and business trends that led to any increases or decreases in this item in 2011 and in subsequent periods, as follow:

7

“Installment loans to individuals

Non-performing assets in installment loans to individuals increased R$2,856 million, or 58.7%, at December 31, 2011 compared to December 31, 2010. This figure was adversely influenced by a high level of household debt of Brazilian families, in large part due to lack of experience in managing credit, an increase in Brazilian interest rates, inflation, and certain measures implemented by the Brazilian Central Bank to control consumer credit, which directly affected the individuals segment of the banking system, mainly the consumer lending portfolio.

However, despite the scenario mentioned above, the Bank understands that its methodology for loan losses efficiently captured the acceleration in delinquencies due to internal rating models based on client behavior data and available external credit bureau rating information, which updates the Probability of default, or “PD”(the probability of the borrower failing to meet its principal and/or interest payment obligations) used by the Bank to estimate the provision for loan losses.

PD is measured using a time horizon of one year; that is, it quantifies the probability of the borrower defaulting in the coming year. A loan is in default if ether the principal or interest is past due by ninety days or more or the loan is current but there are doubts as to the solvency of the borrower (subjective doubtful assets).

In addition, prior to charging off past due loans (which is only done after we have completed all recovery efforts), we fully provision the remaining balance of the loan so our allowance for loan losses fully cover our losses. Thus, the Bank understands that its loan loss allowance methodology has been developed to fit its risk metrics and capture loans that could potentially become impaired.

Finally, the loans originated in 2011 have a higher proportion of loans with higher level of collateral as required in the Bank’s revised underwriting standards as described, which therefore requires a lower level of provisioning.”

12. In this regard, we note that you have not disclosed any potential problem loans. To the extent that you have loans in your portfolio that are not otherwise disclosed but where known information about possible credit problems of borrowers cause you to have serious doubts as to the ability of such borrowers to comply with the present loan repayment terms, please disclose the nature and extent of those loans. Refer to Item III.C.2 of Industry Guide 3. Otherwise, please confirm that you have none.

Response:

We respectfully inform the Staff that we do not believe the Bank has any loans where credit problems by borrowers cause us to have serious doubts about the ability of borrowers to comply with repayment terms because the Banks has already classified any potential problem loans as impaired.

Impairment Losses on Financial Assets (Net), page 123

14. We note your disclosure of the increase in non-performing loans, in dollar value and as compared to computable credit risk. Please provide additional explanation regarding this increase. For example, tell us how increases in non-performing loans in commercial, financial, and industrial loans were “in line with market trends” or why non-performing loans grew by a greater percentage than your loan portfolio. Also, discuss the reason for the decrease in your coverage ratio.

Response:

As described in our response to comment 10 above, in addition to the growth in commercial, financial and industrial loan portfolio, unfavorable economic conditions also contributed to the increase in non-performing loans in this category. Many of our borrowers, specifically industrial borrowers focused

8

on production for retail sales, exhibited an increased appetite for borrowing in 2010 and 2011 with the expectation of favorable economic conditions. However, the retail sector was adversely affected in 2011 due to a number of economic measures adopted by the Brazilian government during this period, as described in the 20-F under “Risk Factors—Risks Relating to Brazil— Government efforts to control inflation may hinder the growth of the Brazilian economy and could harm our business.” As a result of these measure, production costs for these industrial clients (and others) increased, which costs were not fully transferred in their product pricing, which reduced these clients’ profitability and their capacity to meet their debt obligations.

To avoid increases in borrower default rates, the Bank took a number of actions, including setting credit limits and requiring additional credit enhancements for new concessions of credit. The Bank also revisited its collection practices to evaluate clients’ cash flows to more closely align such cash flows with installment plans for outstanding financings.

In spite of the measures taken by the Bank in its credit underwriting standards, the vintage of 2011 demonstrated worse performance when compared with the vintage of 2010.

The Bank’s increase in non-performing assets was indicative (if slightly more pronounced) of increases observed across the Brazilian financial system. According to Brazilian Central Bank the default rate in commercial, financial and industrial lending increased from 3.5% in 2010 to 3.9% in 2011 (an increase of 37 basis points), a trend similar to the default rate increase experienced by the bank from 4.6% in 2010 to 5.0% in 2011 (an increase of 47 basis points). As a result of the increase in the default rate, the Bank has made an increase in provisions for loans related to this category, which will be shown in the Bank’s 2012 20-F.

However, despite the scenario mentioned above, the Bank understands that its methodology for loan losses efficiently captured the acceleration in delinquencies due to internal rating models based on client behavior data and available external credit bureau rating information, which updates the Probability of default, or “PD”( the probability of the borrower failing to meet its principal and/or interest payment obligations) used by the Bank to estimate the provision for loan losses.

PD is measured using a time horizon of one year; that is, it quantifies the probability of the borrower defaulting in the coming year. A loan is in default if ether the principal or interest is past due by ninety days or more or the loan is current but there are doubts as to the solvency of the borrower (subjective doubtful assets).

The Bank’s loan loss allowance methodology is developed to fit its risk metrics and capture loans that could potentially become impaired. Though the Bank’s coverage ratio decreased from 91.9% in 2010 to 78.5% in 2011, the Bank believes such lower coverage ratio remains adequate within its risk profile as the Bank has focused on receivables generally secured by guarantees and has revised its underwriting standards as described above to focus on receipt of additional credit enhancements for outstanding loans, which therefore requires a lower level of provisioning.

In addition, prior to charging off past due loans (which is only done after we have completed all recovery efforts), we fully provision the remaining balance of the loan so our allowance for loan losses fully cover our losses. Thus, the Bank understands that its loan loss allowance methodology has been developed to fit its risk metrics and capture loans that could potentially become impaired.

Finally, the loans originated in 2011 have a higher proportion of loans with higher level of collateral as required in the Bank’s revised underwriting standards as described, which therefore requires a lower level of provisioning.

We will revise our future disclosure to more clearly describe the trends underlying the increase in the Bank’s non-performing assets in commercial, financial and industrial loans on December 31, 2011 as compared to December 31, 2010 as well as any increases or decreases in subsequent periods, as shown below:

9

“Commercial, financial and industrial

Non-performing assets in commercial, financial and industrial loans portfolio on December 31, 2011 increased R$1,212 million, or 34.0%, compared to December 31, 2010. Commercial, financial and industrial credit portfolio increased by 21%, mainly due to an unfavorable economic conditions that contributed to the increase of non-performing in this category.

During the year, many of our borrower clients, specifically industrial clients focused on production for retail sales, exhibited an increased appetite for borrowing with the expectation of favorable economic conditions. However, the retail sector was adversely affected in 2011 due to a number of economic measures adopted by the Brazilian government during this period, (as described in the 20-F under “Risk Factors—Risks Relating to Brazil— Government efforts to control inflation may hinder the growth of the Brazilian economy and could harm our business.”) As a result of these measure, production costs for these industrial clients (and others) increased, which costs were not fully reflected in their product pricing, which reduced these clients’ profitability and their capacity to meet their debt obligations.

In spite of the measures taken by the Bank such as enhancing its loan underwriting standards, the 2011 vintage commercial, financial and industrial loans demonstrated worse performance when compared with the 2010 vintage in large measure due to the economic factors and policies adopted by the Brazilian government described above.

However, despite the scenario mentioned above, the Bank understands that its methodology for loan losses efficiently captured the acceleration in delinquencies due to internal rating models based on client behavior data and available external credit bureau rating information, which updates the Probability of default, or “PD”( the probability of the counterparty failing to meet its principal and/or interest payment obligations) used by the Bank to estimate the provision for loan losses. Prior to charging off past due loans (which is only done after we have completed all recovery efforts), we fully provision the remaining balance of the loan so our provisions fully cover or losses.

PD is measured using a time horizon of one year; that is, it quantifies the probability of the borrower defaulting in the coming year. A default means loans becoming past due by ninety days or more and cases in which the loan is current but there are doubts as to the solvency of the borrower (subjective doubtful assets).

In addition, prior to charging off past due loans (which is only done after we have completed all recovery efforts), we fully provision the remaining balance of the loan so our allowance for loan losses fully cover our losses. Thus, the Bank understands that its loan loss allowance methodology has been developed to fit its risk metrics and capture loans that could potentially become impaired.

Finally, the loans originated in 2011 have a higher proportion of loans with higher level of collateral as required in the Bank’s revised underwriting standards as described, which therefore requires a lower level of provisioning.”

18. We note your disclosure on page 36 that you issue inflation-index linked installment mortgages. In addition, on page 122, you disclose that administrative expenses increased by R$1,142 million mainly due to labor cost increases tied to inflation, and the expansion of your branch network. These labor costs appear to be related to your collective bargaining agreement that requires certain adjustments in fixed and variable income linked to the official consumer price inflation index (IPCA). Elsewhere, you cite the unfavorable impact of inflation and interest rates on your credit quality and credit losses. Please revise your disclosure in future filings to discuss the types of contracts that include inflation-linked adjustments and how you manage inflation risk. In addition, disclose the impact of inflation risk on your financial position, results of operations and liquidity, including the impact of any contracts that you enter into that specifically contemplate or are linked to inflation risk. Provide a quantitative and qualitative discussion of the impact that inflation and interest rates have on your credit quality and credit losses.

10

Response:

We acknowledge the Staff’s comment and we would like to clarify that we did not describe our mortgage product offering accurately. We currently offer fixed rate mortgage products but not mortgages linked to inflation. In addition, our inflation-linked assets represents less than 0.5% of our total assets, so we believe the direct effect of inflation on our results of operations or liquidity is not significant. With respect to the Bank’s operating expenses, inflation has a direct impact on personnel and administrative expenses, so, as suggested, we will include a quantitative analysis in our next 20F.

The effect of inflation on credit quality is indirect. Inflation affects Brazilian consumers’ purchasing power and, together with other factors such as government macro-economic policies measures, a high level of consumer debt and other factors that were observed in 2011, can indirectly affect our credit losses. Because the correlation between inflation and credit quality is indirect, we do not believe a quantitative analysis of inflation as it relates to credit risk would be relevant or meaningful.

We will revise our future filings to more fully describe the qualitative and quantitative and effects of inflation and interest rates on our operating expenses, as follows:

“Administrative Expenses

Administrative Expenses for the year ended December 31, 2012 were R$xxxx million, a R$xxx million increase compared to expenses of R$xxxx million for the year ended December 31, 2011, mainly due to labor cost increases tied to inflation, and the expansion of our branch network, with the addition of xxx new branches in 2012.

Salaries, benefits and social security expenses increased R$xxx million in 2012 due principally to the impact of salary increases tied to inflation under our collective bargaining agreement. This agreement requires certain adjustments in fixed and variable income, linked to the official consumer price inflation index (IPCA).

The following table sets forth personnel expenses for each of the periods indicated:

For the year ended December 31

| 2012 | 2011 | % Change | Change |

(in millions of R$, except percentages)

Salaries ............................................................................

Social security .................................................................

Benefits............................................................................

Training ...........................................................................

Others ..............................................................................

Total................................................................................

Other administrative expenses increased R$xxx million from R$xxx million for the year ended December 31,2011 to R$xxx million for the year ended December 31, 2012. The increase was primarily due to third-party technical services, data processing, new points of sale, a growth in our customer base, which generally leads to increased spending on infrastructure and services.

The efficiency ratio, which we calculate as total administrative expenses divided by total income, reached xxx% in the year ended December 31, 2012, as compared to xxx% for the year ended December 31, 2011.”

In addition, the analysis of the effects of inflation on the Bank’s operating expenses will be included in the Bank’s 2012 20F (Item 3. D. Risk Factors – “Government efforts to control inflation may hinder the growth of the Brazilian economy and could harm business”), as follows:

Inflation adversely affects our personnel and other administrative expenses that are directly or indirectly tied to inflation rates, generally IPCA (the consumer price inflation) and IGP-M (the producer price inflation index). For example, considering the amounts in 2012, each additional percentage point

11

change in inflation would impact our personnel and other administrative expenses by approximately R$xxx million and R$xxx million, respectively.”

Market Risk: VaR Consolidated Analysis, page 234

19. We note that your non-trading VaR estimate of interest rate risk declined from R$351.86 million as of December 31, 2010 to R$251.8 million as of December 31, 2011. Please revise your disclosure in future filings to explain the reason for this significant decline in accordance with Item 11(a)(3) of Form 20-F. Also, discuss why the interest rate risk of your balance sheet increased in 2011 as measured by the market value of equity (MVE), as disclosed on page 232, while the interest rate risk as measured by VaR declined by 27% as of period end. Please correlate these discussions with your disclosure elsewhere about the interest rate, inflation, and other measures implemented by the Brazilian Central Bank.

Response:

We acknowledge the Staff’s comment and we would like to clarify that the VaR is calculated based on a historical scenario of 520 returns. In 2010, the subprime credit crisis had a significant effect on historical returns and consequently caused the non-trading VaR to appear significantly worse in 2010 than the non-trading VaR for 2011. In 2011, the effects of the subprime credit crisis were no longer considered in the calculation of VaR, which resulted in significant improvement of the measure for interest rate risk as of December 31, 2011.

In contrast, MVE measures the market value of all assets and liabilities on the Bank’s balance sheet based not on historical scenarios (as is the case with VaR) but rather on market forecasts. While the asset base being considered in both analyses is the same, VaR is a backward-looking measure based on a specified historical time horizon while MVE incorporates changes in our asset position based on a forward-looking approach. This difference in methodology for measuring interest rate risk, that is, the historical approach of VaR versus the forward-looking approach of MVE, explains the difference between a decline in interest rate risk as measured by VaR and an increase as measured by MVE (particularly considering the significantly higher measure of interest rate risk in 2010 using VaR due to inclusion of the effects of the subprime credit crisis as compared to 2011 when these effects were no longer considered). We will revise our future filings to distinguish more clearly how the VaR and MVE differ and how the results of VaR and MVE affect the Bank’s risk analysis vis-a-vis market disruptions and Central Bank policies regarding interest rates, inflation and other measures.

MVE and VaR are periodically calculated and observing the exposure given, are utilized as a monitoring measure for business and investment decisions, always. We note that a limit is given for MVE, and market risk has to control periodically the actual exposure of the banking book and the limit established.

We advise the Staff that the response below includes material nonpublic information that will only be made available to investors after the Bank files its annual report on form 20-F for the year ended December 31, 2012. In case this letter will become public before the Bank files such report, depending on the timing for resolution of the comments raised by the Staff, we will timely file a confidential treatment request to cover the period between this information becoming public and the actual publication of the Company’s 2012 annual audited financial statements.

12

“ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT RISK

Market Risk

Generally

We are exposed to market risk mainly as a result of the following activities:

| · | Trading in financial instruments, which involves interest rate, foreign exchange rate, equity price and volatility risks. |

| · | Engaging in retail banking activities, which involves interest rate risk because a change in interest rates affects interest income, interest expense and customer behavior. |

| · | Investing in assets (including subsidiaries) whose returns or accounts are denominated in currencies other than the real, which involves foreign exchange rate risk. |

| · | Investing in subsidiaries and other companies, which subjects us to equity price risk. |

| · | All trading and non-trading activities, which involve liquidity risk. |

Primary Market Risks and How They Arise

The primary market risks to which we are exposed are interest rate risk, foreign exchange rate risk, equity price risk, volatility risk and liquidity risk. We are exposed to interest rate risk whenever there is a mismatch between interest rate sensitive assets and liabilities, subject to any hedging we have engaged in using interest rate swaps or other off-balance sheet derivative instruments. Interest rate risk arises in connection with both our trading and non-trading activities.

We are exposed to foreign exchange rate risk as a result of mismatches between assets and liabilities, and off-balance sheet items denominated in different currencies, either as a result of trading or in the normal course of business. We maintain non-trading open currency positions arising from our investments in overseas subsidiaries (such as our Cayman Islands branch), affiliates and their currency funding. Our principal non-trading currency exposure is the U.S. Dollar, which, as mandated by our policies, is hedged to the real within established limits.

We are exposed to equity price risk in connection with both our trading and non-trading investments in equity securities.

We are also exposed to liquidity risk. Market depth is the main liquidity driver in our trading portfolio, even though our policy is to trade the most liquid assets. Our liquidity risk also arises in non-trading activity due to the maturity gap between assets and liabilities mostly in the retail banking business.

We use derivatives for both trading and non-trading activities. Trading derivatives are used to eliminate, reduce or modify risk in trading portfolios (interest rate, foreign exchange and equity price risk), and to provide financial services to customers. Our principal counterparties (in addition to customers) for this activity are financial institutions and the BM&FBOVESPA. Our principal derivative instruments include interest rate swaps, interest rate futures, foreign exchange forwards, foreign exchange futures, foreign exchange options, cross currency swaps, equity index futures and equity options and interest rate options.

We also use derivatives in non-trading activity in order to manage the interest rate risk and foreign exchange risk arising from asset and liability management activity. We use interest rate and foreign exchange non-optional derivatives in non-trading activity.

We have no credit derivatives in Brazil, as there is no market for credit derivatives in Brazil.

13

Procedures for Measuring and Managing Market Risk

Our board of directors is responsible for establishing our policies, procedures and limits with respect to market risk, including which businesses to enter into and maintain. The risk committee monitors our overall performance in light of the risks assumed. Together with the local and global assets and liabilities committees, each market risk unit measures and monitors our market and liquidity risk and provides figures to the assets and liabilities committees to use in managing such risks.

Market risk is regulated and controlled through certain policies, set forth in our market and liquidity risk management policies manual (as described below), and through structures setting forth specific limits to our exposure to market risk which is based on global limits established for the entire Santander Group. In addition, authorized products are listed and reviewed periodically.

These policies, procedures and limits on market risk are applicable to all units, businesses or portfolios susceptible to market risk.

Market and Liquidity Risk Management Policies Manual

The market and liquidity risk management policies manual, or the “Manual”, is a compilation of policies that describe the control framework used by the Santander Group to identify, measure and manage market risk exposures inherent in our activities in the financial markets. The Manual is employed for market risk management purposes at all levels in the Santander Group and within its subsidiaries (including us), providing a general and global action framework and establishing risk rules for all levels.

The Manual’s main objective is to set forth the risk level which our board of directors deems acceptable and to describe and report all risk policies and controls that our board of directors has established. All risk managers within the Santander Group must ensure that each business activity is performed in accordance with the policies established in the Manual. The Manual is followed in market risk decision-making in all business units and activities.

Market Risk Management Procedures

All functions developed by risk management are documented and regulated by different procedures, including measurement, control and reporting responsibilities. Internal and external auditors audit the compliance with this internal regulation to ensure that our market risk policies are followed.

Market Risk Limit Structure

The market risk limit structure represents the Bank’ risk appetite and is aligned with our global market risk management policies, which encompass all of our business units and serve to:

| · | Identify and define the main types of risk incurred in a manner consistent with our business strategy. |

| · | Quantify and report to our business segments with respect to appropriate risk levels and risk profile in line with senior management’s assessment of risks to help avoid any of our business segments taking undesired risks. |

| · | Provide flexibility to our business segments to timely and efficiently establish risk positions responsive to market changes and our business strategies, and always within acceptable Santander Group risk levels. |

| · | Allow the individuals and teams originating new business to take prudent risks that will help attain budgeted results. |

| · | Establish investment alternatives by limiting equity consumption. |

14

| · | Define the range of products and underlying assets within each unit of treasury can operate, taking into consideration our risk modeling and valuation systems and our liquidity tools. This will help to constrain all market risk within the business management and defined risk strategy. |

Global market risk management policies define our risk limit structure while the risk committee reviews and approves such policies. Business managers administer their activities within these limits. The risk limit structure covers both our trading and non-trading portfolios and includes limits on fixed income instruments, equity securities, foreign exchange and other derivative instruments.

Limits considered to be global limits refer to the business unit level. To date, system restrictions prevent intra-day limits. Our business units must comply with approved limits. Potential excesses require a range of actions carried out by the global market risk function unit including (1) providing risk-reducing suggestions and controls, which are the result of breaking “alarm” limits and (2) taking executive actions that require risk takers to close out positions to reduce risk levels.

Statistical Tools for Measuring and Managing Market Risk

Trading Activity

The trading portfolio comprises our proprietary positions in financial instruments held for resale and/or bought to take advantage of current and/or expected differences between purchase and sale prices. This portfolio also includes positions in financial instruments deriving from market-making and sales. As a result of trading fixed income securities, equity securities and foreign exchange, we are exposed to interest rate, equity price and foreign exchange rate risks. We are also exposed to volatility when derivatives are used.

We actively manage market risk arising from proprietary trading and market-making activities through the use of cash and derivative financial instruments traded in over-the-counter, or “OTC”, and organized markets. We typically hedge interest rate risk derived from market-making by buying or selling very liquid cash securities such as government bonds, or futures contracts listed at BM&FBOVESPA.

We manage foreign exchange rate risk through spot transactions executed in the global foreign exchange inter-bank market, as well as through forward foreign exchange, cross-currency swaps, FX futures at the BM&FBOVESPA and foreign exchange options. We hedge equity price risk by buying or selling the underlying individual stocks in the organized equity markets in which they are traded or futures contracts on individual stocks listed in organized markets like the BM&FBOVESPA. We hedge volatility risk arising from market-making in options and option-related products by either buying and selling option contracts listed in organized markets like the BM&FBOVESPA, or entering risk reversal transactions in the inter-bank OTC market. We use value at risk or “VaR”, to measure our market risk associated with all of our trading activity.

VaR model. Locally, we use a variety of mathematical and statistical models, including VaR models, historical simulations and stress testing to measure, monitor, report and manage market risk. Such numbers, produced locally, also serve as input for global activities such as evaluations of return on risk adjusted capital, or “RORAC”, and to allocate economic capital to various activities in order to evaluate the RORAC of such activities.

As calculated by us, VaR is an estimate of the expected maximum loss in the market value of a given portfolio over a one-day time horizon at a 99% confidence interval. It is the maximum one-day loss that we estimate we would suffer on a given portfolio 99% of the time, subject to certain assumptions and limitations discussed below. Conversely, it is the figure that we would expect to exceed only 1.0% of the time, or approximately three days per year. VaR provides a single estimate of market risk that is comparable from one market risk to the other.

Our standard methodology is based on historical simulation (521 days). In order to capture recent market volatility in the model, our VaR figure is the maximum between the 1% percentile and the 1%

15

weighted percentile of the simulated profit and loss distribution. This loss distribution is calculated by applying an exponential decline factor, which accords less weight to the observations farthest away in time.

We use VaR estimates to alert senior management whenever the statistically estimated losses in our portfolios exceed prudent levels. Limits on VaR are used to control exposure on a portfolio-by-portfolio basis.

Assumptions and limitations. Our VaR methodology should be interpreted in light of the limitations that (1) a one-day time horizon may not fully capture the market risk of positions that cannot be liquidated or hedged within one day and (2) at present, we compute VaR at the close of business and trading positions may change substantially during the course of the trading day.

Scenario analysis and calibration measures. Because of these limitations in VaR methodology, in addition to historical simulation, we use stress testing to analyze the impact of extreme market movements and adopt policies and procedures in an effort to protect our capital and results of operations against such contingencies. In order to calibrate our VaR model, we use back testing, which is a comparative analysis between VaR estimates and the daily clean profit and loss (theoretical result generated assuming the mark-to-market daily variation of the portfolio considering only the movement of the market variables). The purpose of these tests is to verify and measure the precision of the models used to calculate VaR.

Non-trading Activities

Interest rate risk. We analyze the sensitivity of net interest margin and market value of equity to changes in interest rates. This sensitivity arises from gaps in maturity dates and interest rates in the different asset and liability accounts. Certain re-pricing hypotheses are used for products without explicit contractual maturities based on the economic environment (financial and commercial).

On the basis of the positioning of balance sheet interest rates, as well as the market situation and outlook, we take financial measures to adjust the positioning to levels in line with Santander Group policies. These measures range from taking positions in markets to defining the interest rate features of commercial products. The measures used to control interest rate risk are the interest rate gap analysis, the sensitivity of net interest margin and market value of equity to changes in interest rates, VaR and analysis of scenarios.

Interest rate gap of assets and liabilities. Interest rate gap analysis focuses on lags or mismatches between changes in the value of asset, liability and off-balance sheet items. Gap analysis provides a basic representation of the balance sheet structure and allows for the detection of interest rate risk by concentration of maturities. It is also a useful tool for estimating the impact of eventual interest rate movements on net interest margin or equity.

All on- and off-balance sheet items must be broken down by their flows and analyzed in terms of re-pricing and maturity. In the case of those items that do not have a contractual maturity, an internal model of analysis is used and estimates are made of their duration and sensitivity.

Net interest margin sensitivity. The sensitivity of net interest margin measures the change in the short- and medium-term in the accruals expected over a 12-month period, in response to a shift in the yield curve. The yield curve is calculated by simulating the net interest margin, both for a scenario of a shift in the yield curve as well as for the current scenario. The sensitivity is the difference between the two margins calculated.

Market value of equity sensitivity (MVE). Net worth sensitivity measures the interest risk implicit in net worth (equity) over the entire life of the operation on the basis of the effect that a change in interest rates has on the current values of financial assets and liabilities. This is an additional measure to the sensitivity of the net interest margin.

16

Value at risk. The VaR for balance sheet activity and investment portfolios is calculated with the same standard as for trading and historical simulation, with a confidence level of 99% and a time frame of one day.

Analysis of scenarios of stress test. We apply three scenarios for the performance of interest rates: six standard deviations up and six standard deviations down of risk factors and one abrupt scenario in which risk factors are increased by 50% up and down from current levels. These scenarios are applied to the balance sheet, obtaining the impact on net worth as well as the projections of net interest revenue for the year.

Quantitative Analysis

Trading Activity

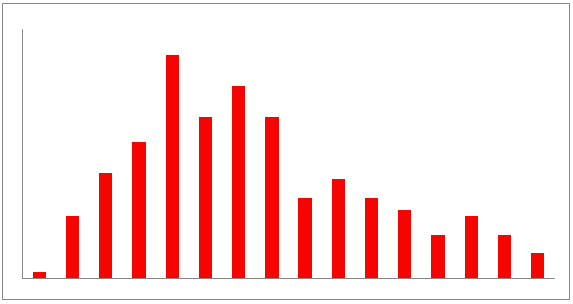

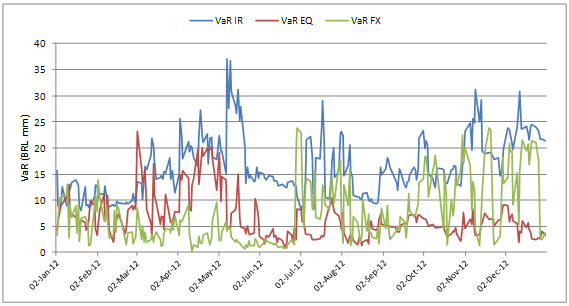

Quantitative analysis of daily VaR in 2012. Our risk performance with regard to trading activity in financial markets during 2012, measured by daily VaR, is shown in the following graph.

* Date format used is day/month/year.

VaR during 2012 fluctuated in a range between R$ 9 million and R$ 38 million. The VaR variance shown in the chart above was mainly due to changes of positions taken by trading book during 2012.

As observed in the histogram below, the VaR maintained a range between R$13 million and R$29 million on 80% of days in 2012.

17

Histogram of Risk – VaR (in millions of R$)

Risk by factor. The minimum, maximum, average and year-end 2012 risk values in VaR terms were as follows:

Minimum | Average | Maximum | Last | |||||||||||||

| (in Millions of R$) | ||||||||||||||||

| Total Trading | ||||||||||||||||

Total VaR | 9.06 | 20.76 | 38.37 | 21.63 | ||||||||||||

Diversification Effect | (0.12 | ) | (9.69 | ) | (45.61 | ) | (6.74 | ) | ||||||||

IR VaR | 8.04 | 16.38 | 37.08 | 21.39 | ||||||||||||

Equity VaR | 0.96 | 6.63 | 23.10 | 3.28 | ||||||||||||

FX VaR | 0.18 | 7.44 | 23.80 | 3.71 | ||||||||||||

The average VaR for 2012 was R$20.8 million, a little bit lower than 2011 average due to the low market volatility in 2012.

The average risk of the three main risk factors, interest rates, equity price and exchange rates, were R$16.4 million, R$6.6 million and R$7.4 million, respectively, with a negative average diversification effect of R$9.7 million. The chart below shows the evolution of the risk groups VaR interest rates (IR), VaR exchange rates (FX) and VaR equity prices.

18

* Date format used is day/month/year.

Risk Statistics in 2012

Risk management of structured derivatives. Our structured derivatives activity (OTC) is mainly focused on structuring investment and hedging products for customers. These transactions include options on FX equities, currencies, fixed-income instruments and mostly market making books.

Scenario analysis. Different stress test scenarios were analyzed during 2011. A scenario of correlation break, generated results that are presented below.

Worst Case Scenario

The table below shows, on December 30, 2011, the maximum daily losses for each risk factor (fixed-income, equities and currencies), in a scenario which uses historical volatilities and simulates variations of the risk factors of +/-3 and +/-6 standard deviations on a daily basis. From this group of scenarios, we generate a table of stress test results, which identifies the largest loss per risk factor. The sum of the largest losses of each risk factor is the result of the Worst Case Scenario, which considers the break of correlation between risk factors.

Worst Case Stress Test

Fixed Income | Equity | FX | Total | |||||||||||||

| (in Million of R$) | ||||||||||||||||

Total Trading | (58.51 | ) | (10.67 | ) | (9.57 | ) | (78.75 | ) | ||||||||

The stress test shows that the economic loss suffered by the group in the marked-to-market result would be, if this scenario materialized in the market, R$78.8 million.

Non-trading Activity

Asset and liability management. We actively manage the market risks inherent in the banking book, mostly retail banking. Management addresses the structural risks of interest rates, liquidity and exchange rates.

19

The purpose of financial management is to make net interest revenue from our commercial activities more stable and recurrent, maintaining adequate levels of liquidity and solvency.

The financial management area analyzes structural interest rate risk derived from mismatches in maturity and revision dates for assets and liabilities in each of the currencies in which we operate. For each currency, the risk measured is the interest gap, the sensitivity of net interest revenue and the sensitivity of the economic value.

The global financial management area manages structural risk on a centralized basis. This allows the use of homogenous methodologies, adapted to each local market where we operate. In the euro-dollar area, the financial management area directly manages the risks of our parent and coordinates management of the rest of the units that operate in convertible currencies. There is a local team in Santander Brasil that manages balance sheet risks under the same frameworks, in coordination with the global financial management area. The asset and liability committees of each country and, when necessary, the markets committee of our parent are responsible for risk management decisions.

Quantitative Analysis of Interest Rate Risk in 2012

Convertible Currencies

At the end of 2012, the sensitivity of net interest margin at one year, to a parallel rise of 100 basis points in the local yield curve was R$272 million.

In addition, at the end of 2012, the sensitivity of net worth to parallel rises of 100 basis points in the yield curves was R$1,532 million in the local currency yield curve.

Structural Gap

The following table shows the managerial gaps between the re-pricing dates of our assets and liabilities in December 31, 2012 (in millions of R$).

Structural Gap | Total | 01-Month | 1-3 Months | 3-6 Months | 6-12 Months | 1-3 Years | 3-5 Years | >5 Years | Not Sensitive | |||||||||||||||||||||||||||

Money Market | 173,228 | 71,230 | 6,502 | 8,595 | 13,671 | 32,259 | 19,239 | 20,724 | 1,007 | |||||||||||||||||||||||||||

Loans | 187,369 | 31,776 | 22,615 | 33,875 | 31,738 | 45,509 | 9,363 | 6,437 | 5,911 | |||||||||||||||||||||||||||

Permanent | 24,619 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 24,619 | |||||||||||||||||||||||||||

Other | 90,984 | 41,788 | 0 | 0 | 0 | 0 | 0 | 0 | 49,196 | |||||||||||||||||||||||||||

Total Assets | 476,200 | 144,794 | 29,117 | 42,469 | 45,409 | 77,767 | 28,603 | 27,162 | 80,734 | |||||||||||||||||||||||||||

Money Market | (182,984 | ) | (139,573 | ) | (1,192 | ) | (3,164 | ) | (4,428 | ) | (10,883 | ) | (10,773 | ) | (12,970 | ) | – | |||||||||||||||||||

Deposits | (124,726 | ) | (71,212 | ) | (991 | ) | (518 | ) | (17,439 | ) | (33,244 | ) | (813 | ) | (275 | ) | (234 | ) | ||||||||||||||||||

Equity and Other | (168,489 | ) | (45,085 | ) | (7,276 | ) | (3,962 | ) | (1,433 | ) | (5 | ) | – | – | (110,728 | ) | ||||||||||||||||||||

Total Liabilities | (476,200 | ) | (255,870 | ) | (9,459 | ) | (7,644 | ) | (23,300 | ) | (44,133 | ) | (11,587 | ) | (13,245 | ) | (110,962 | ) | ||||||||||||||||||

Balance Gap | – | (111,076 | ) | 19,658 | 34,825 | 22,109 | 33,635 | 17,016 | 13,917 | (30,228 | ) | |||||||||||||||||||||||||

Off-Balance Gap | – | 16,437 | (4,419 | ) | 2,455 | 1,574 | (6,920 | ) | (6,905 | ) | (2,223 | ) | – | |||||||||||||||||||||||

| Total Structural Gap | – | (94,639 | ) | 15,240 | 37,280 | 23,683 | 26,715 | 10,111 | 11,694 | (30,228 | ) | |||||||||||||||||||||||||

Accumulated Gap | – | (94,639 | ) | (79,399 | ) | (42,119 | ) | (18,436 | ) | 8,279 | 18,390 | 30,084 | (145 | ) | ||||||||||||||||||||||

20

The interest rate risk of our balance sheet management portfolios, measured by the sensitivity of the net margin to a parallel movement of 100 basis points, increased R$ 9 million along 2012, obtaining the maximum level of R$ 272 million in December. The sensitivity of the market value increased R$41 million during 2012, obtaining the maximum level of R$ 1,593 million in July .The main occurrences during the year of 2012 that influenced this growth of sensitivity, were the growth of the loans portfolio (increasing MVE in R$ 84 million), the duration increase of pre-fixed Brazilian sovereign bonds (increasing MVE in R$ 94 million) and sale of 181.420 contracts of DI futures - Cash Flow Hedge (creasing MVE in R$ 144 million).

The following chart shows our net interest margin, or “NIM”, and equity, or “MVE”, sensitivity during each month in 2012.

Interest Rate Risk Profile at December 31, 2012

The currency gap tables below show the managerial distribution of risk by maturity and currency in Brazil as of December 31, 2012 (in millions of R$).

Gaps in Local Currency | Total | 01-Month | 1-3 Months | 3-6 Months | 6-12 Months | 1-3 Years | 3-5 Years | >5 Years | Not Sensitive | |||||||||||||||||||||||||||

Money Market | 139,873 | 59,564 | 6,375 | 8,428 | 12,469 | 27,332 | 14,960 | 10,043 | 703 | |||||||||||||||||||||||||||

Loans | 163,888 | 28,997 | 19,877 | 25,915 | 27,441 | 41,039 | 8,608 | 6,172 | 5,693 | |||||||||||||||||||||||||||

Permanent | 24,450 | – | – | – | – | – | – | – | 24,450 | |||||||||||||||||||||||||||

Others | 49,359 | 238 | – | – | – | – | – | – | 49,121 | |||||||||||||||||||||||||||

Total Assets | 377,570 | 88,799 | 26,252 | 34,343 | 39,910 | 68,371 | 23,568 | 16,215 | 79,966 | |||||||||||||||||||||||||||

Money Market | (147,046 | ) | (134,276 | ) | (806 | ) | (1,986 | ) | (2,484 | ) | (3,324 | ) | (2,282 | ) | (1,887 | ) | – | |||||||||||||||||||

Deposits | (122,668 | ) | (70,214 | ) | (125 | ) | (369 | ) | (17,439 | ) | (33,244 | ) | (786 | ) | (257 | ) | (234 | ) | ||||||||||||||||||

| Equity and Other | (112,810 | ) | (4,401 | ) | – | – | – | – | – | – | (108,409 | ) | ||||||||||||||||||||||||

| Total Liabilities | (382,523 | ) | (208,892 | ) | (931 | ) | (2,355 | ) | (19,923 | ) | (36,568 | ) | (3,068 | ) | (2,144 | ) | (108,643 | ) | ||||||||||||||||||

| Off-Balance Gap | 4,932 | 20,744 | (3,176 | ) | 2,844 | 1,739 | (8,863 | ) | (6,171 | ) | (2,184 | ) | – | |||||||||||||||||||||||

Gap | (22 | ) | (99,348 | ) | 22,145 | 34,832 | 21,725 | 22,940 | 14,329 | 11,887 | (28,677 | ) | ||||||||||||||||||||||||

Gaps in Foreign Currency | Total | 01-Month | 1-3 Months | 3-6 Months | 6-12 Months | 1-3 Years | 3-5 Years | >5 Years | Not Sensitive | |||||||||||||||||||||||||||

Money Market | 33,355 | 11,667 | 127 | 166 | 1,202 | 4,927 | 4,280 | 10,682 | 305 | |||||||||||||||||||||||||||

Loans | 23,481 | 2,779 | 2,738 | 7,959 | 4,297 | 4,470 | 755 | 265 | 218 | |||||||||||||||||||||||||||

Permanent | 169 | – | – | – | – | – | – | – | 169 | |||||||||||||||||||||||||||

Others | 41,625 | 41,550 | – | – | – | – | – | – | 75 | |||||||||||||||||||||||||||

Total Assets | 98,630 | 55,995 | 2,865 | 8,126 | 5,499 | 9,397 | 5,034 | 10,946 | 767 | |||||||||||||||||||||||||||

Money Market | (35,938 | ) | (5,297 | ) | (385 | ) | (1,178 | ) | (1,944 | ) | (7,560 | ) | (8,491 | ) | (11,083 | ) | – | |||||||||||||||||||

Deposits | (2,058 | ) | (998 | ) | (866 | ) | (149 | ) | – | – | (27 | ) | (18 | ) | – | |||||||||||||||||||||

Equity and Other | (55,679 | ) | (40,684 | ) | (7,276 | ) | (3,962 | ) | (1,433 | ) | (5 | ) | – | – | (2,319 | ) | ||||||||||||||||||||

Total Liabilities | (93,676 | ) | (46,979 | ) | (8,528 | ) | (5,289 | ) | (3,377 | ) | (7,565 | ) | (8,518 | ) | (11,101 | ) | (2,319 | ) | ||||||||||||||||||

Off-Balance Gap | (4,932 | ) | (4,307 | ) | (1,242 | ) | (388 | ) | (164 | ) | 1,943 | (734 | ) | (39 | ) | – | ||||||||||||||||||||

Gap | 22 | 4,709 | (6,905 | ) | 2,448 | 1,958 | 3,775 | (4,218 | ) | (194 | ) | (1,552 | ) | |||||||||||||||||||||||

21

Market Risk: VaR Consolidated Analysis

Our total daily VaR as of December 31st, 2012 and December 30th, 2011, broken down by trading and structural (non-trading) portfolios, is set forth below. The VaR data for trading and non-trading portfolios of Santander Brasil were summed and does not reflect the diversification effect.

At December 31st | ||||||||||||||||||||

2012 | 2011 | |||||||||||||||||||

Low | Average | High | Period End | Period End | ||||||||||||||||

| (in millions of R$) | ||||||||||||||||||||

Trading | 9.06 | 20.8 | 38.4 | 21.6 | 19.4 | |||||||||||||||

Non-trading | 211.9 | 282.0 | 338.2 | 295.5 | 251.8 | |||||||||||||||

Diversification effect | – | – | – | – | – | |||||||||||||||

Total | 220.9 | 302.7 | 376.6 | 317.1 | 271.2 | |||||||||||||||

Note: VaR figures for trading and non-trading portfolios were added, thus disregarding the diversification effect.

Our daily VaR estimates of interest rate risk, foreign exchange rate risk and equity price risk were as set forth below.

Interest Rate Risk

At December 31st | ||||||||||||||||||||

2012 | 2011 | |||||||||||||||||||

Low | Average | High | Period End | Period End | ||||||||||||||||

| (in millions of R$) | ||||||||||||||||||||

| Interest rate risk | ||||||||||||||||||||

Trading | 8.0 | 16.4 | 37.1 | 21.4 | 18.6 | |||||||||||||||

Non-trading | 211.9 | 282.0 | 338.2 | 295.5 | 251.8 | |||||||||||||||

Diversification effect | – | – | – | – | – | |||||||||||||||

Total | 219.9 | 298.3 | 375.3 | 316.9 | 270.4 | |||||||||||||||

Note: VaR figures for trading and non-trading portfolios were added, thus disregarding the diversification effect.

Foreign Exchange Rate Risk

At December 31st | ||||||||||||||||||||

2012 | 2011 | |||||||||||||||||||

Low | Average | High | Period End | Period End | ||||||||||||||||

| (in millions of R$) | ||||||||||||||||||||

| Exchange rate risk | ||||||||||||||||||||

Trading | 0.2 | 7.4 | 23.8 | 3.7 | 1.7 | |||||||||||||||

Non-trading | N.A. | N.A. | N.A. | N.A. | N.A. | |||||||||||||||

Diversification effect | – | – | – | – | – | |||||||||||||||

Total | 0.2 | 7.4 | 23.8 | 3.7 | 1.7 | |||||||||||||||

Note: VaR figures for trading and non-trading portfolios were added, thus disregarding the diversification effect.

22

Equity Price Risk

At December 31st | ||||||||||||||||||||

2012 | 2011 | |||||||||||||||||||

Low | Average | High | Period End | Period End | ||||||||||||||||

| (in millions of R$) | ||||||||||||||||||||

| Equity price risk | ||||||||||||||||||||

Trading | 1.0 | 6.6 | 23.1 | 3.3 | 4.8 | |||||||||||||||

Non-trading | N.A. | N.A. | N.A. | N.A. | N.A. | |||||||||||||||

Diversification effect | – | – | – | – | – | |||||||||||||||

Total | 1.0 | 6.6 | 23.1 | 3.3 | 4.8 | |||||||||||||||

Note: VaR figures for trading and non-trading portfolios were added, thus disregarding the diversification effect.

Our daily VaR estimates by activity were as set forth below.

At December 31st | ||||||||||||||||||||

2012 | 2011 | |||||||||||||||||||

Low | Average | High | Period End | Period End | ||||||||||||||||

| (in millions of R$) | ||||||||||||||||||||

| Trading | ||||||||||||||||||||

Interest rate risk | 8.0 | 16.4 | 37.1 | 21.4 | 18.6 | |||||||||||||||

Exchange rate risk | 0.2 | 7.4 | 23.8 | 3.7 | 1.7 | |||||||||||||||

Equity | 1.0 | 6.6 | 23.1 | 3.3 | 4.8 | |||||||||||||||

| Total Trading | 9.1 | 20.8 | 38.4 | 21.6 | 19.4 | |||||||||||||||

| Non-Trading | ||||||||||||||||||||

Interest rate | 211.9 | 282,0 | 338.2 | 295.5 | 251.8 | |||||||||||||||

Exchange rate | N.A. | N.A. | N.A. | N.A. | N.A. | |||||||||||||||

Equity | N.A. | N.A. | N.A. | N.A. | N.A. | |||||||||||||||

Total Non-Trading | 211.9 | 282.0 | 338.2 | 295.5 | 251.8 | |||||||||||||||

Total (Trading + Non-Trading) | 220.9 | 302.7 | 376.6 | 317.1 | 271.2 | |||||||||||||||

| Interest rate | 219.9 | 298.3 | 375.3 | 316.9 | 270.4 | |||||||||||||||

| Exchange rate | 0.2 | 7.4 | 23.8 | 3.7 | 1.7 | |||||||||||||||

| Equity | 1.0 | 6.6 | 23.1 | 3.3 | 4.8 | |||||||||||||||

Note: VaR figures for trading and non-trading portfolios were added, thus disregarding the diversification effect.

23

Consolidated Balance Sheets, page F-5

20. We note your disclosure of Cash and balances with the Brazilian Central Bank within your Consolidated Balance Sheets. Based on your disclosure within the Consolidated Cash Flow Statements and Notes 4 and 5.a, you indicate that this amount excludes a portion of your cash and cash equivalents and includes amounts in the form of money market investments that are not cash equivalents and amounts that are regarded as restricted use. Given that paragraph 54(i) of IAS 1 requires presentation of cash and cash equivalents as a separate line item within the statement of financial position, please tell us how you determined your presentation was transparent and appropriate based on that guidance. Additionally, please revise your disclosure in future filings to include a reconciliation of cash and cash equivalents reported in the Balance Sheets to the amount of cash and cash equivalents reported in the Cash Flow Statements. Finally, consider presenting your unrestricted cash and cash equivalents as a separate line item within your Cash Flow Statements and Balance Sheets. Refer to paragraphs 45 and 48 of IAS 7.

Response:

We respectfully inform the Staff that we reviewed our disclosure and we present the main components of cash and cash equivalents at the bottom of the statement of cash flows, which also refers to notes 4 and 5, explaining the items considered as cash and cash equivalents, as shown below. In addition, in note 4 we present a footnote explaining we have deposits with the Brazilian Central Bank, which cannot be used freely by Banco Santander, in accordance with paragraph 48 of IAS 7, so these amounts are not considered as cash and cash equivalents.

In order to address paragraph 45 of IAS 7, as currently we do not present cash and cash equivalents as a separate line item in the balance sheet, we present the components of cash and cash equivalents and the reconciliation to line items reported in the balance sheet in the statement of cash flows, as shown below:

Note | 2011 | 2010 | 2009 | |||||||||||||

| Cash and cash equivalents components | (thousands of Brazilian reais - R$) | |||||||||||||||

Cash | 4 | 3,542,707 | 3,158,003 | 3,630,669 | ||||||||||||

Loans and other | 5. | a | 5,474,700 | 6,188,896 | 15,099,734 | |||||||||||

Total of cash and cash equivalents | 9,017,899 | 9,346,899 | 18,730,403 | |||||||||||||

The details on the breakdown of cash and cash equivalents of Banco Santander presented in notes 4 and 5 are shown below:

| Note 4 | 2011 | 2010 | 2009 | |||||||||

| (thousands of reais) | ||||||||||||

| Cash and cash equivalents | 3,542,707 | 3,158,003 | 18,730,403 | |||||||||

| Of which | – | – | – | |||||||||

Cash | 3,542,707 | 3,158,003 | 3,630,669 | |||||||||