UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of September, 2014

Commission File Number: 001-34476

BANCO SANTANDER (BRASIL) S.A.

(Exact name of registrant as specified in its charter)

Avenida Presidente Juscelino Kubitschek, 2041 and 2235

Bloco A – Vila Olimpia

São Paulo, SP 04543-011

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:Form 20-F ___X___ Form 40-F _______ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes _______ No ___X____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes _______ No ___X____

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes _______ No ___X____

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

Valuation Report of Santander Brazil and Santander S.A.

June 10, 2014

Contents

| | |

| | Sections | |

| 1 | Executive summary | 2 |

| 2 | Rothschild information and declarations | 9 |

| 3 | Valuation of Santander Brazil | 15 |

| 4 | Valuation of Santander S.A. | 31 |

| 5 | Exchange ratio between the Companies | 44 |

| |

| | Appendices | |

| A | Selected peers for Santander Brazil and Santander S.A. | 46 |

| B | Overview of the main players in the Brazilian banking industry | 51 |

| C | Selected analyst estimates for Santander Brazil and peers | 56 |

| D | Selected analyst estimates for Santander S.A. and peers | 59 |

| E | Disclaimer | 65 |

| 1 |  |

1. Executive summary

1.1 Introduction

In the context of the Material Fact released on April 29th, 2014(“Material Fact”),Banco Santander (Brasil) S.A. ("Santander Brazil" or "Company") informed the Market, and thus Rothschild, that BancoSantander S.A. (“BancoSantander” or “Santander S.A.”, and together with Santander Brazil, “Companies”) intends to launch a voluntary offer inBrazil and in theUnited States of America (“USA”)to acquire up to the totality of the shares of Santander Brazil which are not held by Santander S.A. with the objective to take the company out of BM&FBOVESPA S.A.–Bolsa de Valores, Mercadorias e Futuros’ ("BM&FBOVESPA“)Nível 2 corporate governance listing segment, in exchange for shares of Santander S.A. pursuant to paragraph 4th, Article 157 of Law nº 6.404/76, CVM Instruction nº 358/02 and nº 361, Title Xof the By-Laws of Santander Brazil and Sections X and XI of Nível 2 Listing Rules (the“Voluntary Exchange TenderOffer” or “OPA”).

According to the Material Fact, the offer is voluntary and minority holders of Santander Brazil may choose whether or not to participate in the transaction, which is not subject to a minimum acceptance level. Santander S.A. shares would be traded on the São Paulo stock exchange through Brazilian Depositary Receipts (BDRs). Shareholders who accept the offer would receive, through BDRs or through American Depositary Receipts (ADRs), 0.70 newly-issued shares of Santander S.A. for every unit or ADR of Santander Brazil. Afterthe OPA, the intention of Santander S.A.’s is to keep theshares of Santander Brazil listed on BM&FBOVESPA. However, they would migrate from the Nível 2 corporategovernance listing segment to the traditional segment of BM&FBovespa.

In this context, N M Rothschild & Sons (Brasil) Ltda. (“Rothschild”) was hired by Santander Brazil to prepare the Valuation Report for purposes of the OPA, as per the Material Fact.

In this Valuation Report, Santander Brazil’s and Santander S.A.’s share price were both assessed according to the same criteria, as follows:n

nVolume weighted average trading price –In the 12-month period immediately before the date of the Material Fact, and

–Between the date of the Material Fact and June 10th, 2014

nShareholders’equity book value per share as of March 31st, 2014 (adjusted for intangible items)

nEconomic value based on the comparable trading multiples valuation methodology

Except as otherwise stated, all financial information used was prepared according to International Financial ReportingStandards (“IFRS”).

| 3 |  |

| 1. Executive summary |

| 1.2 Valuation methodology |

In accordance with CVM Instruction nº361, Rothschild has performed a multi-approach valuation of SantanderBrazil’sunits and of Santander S.A.’sshares based on the three required criteria: volume weighted average price, book value and economic value

| 4 |  |

| 1. Executive summary |

| 1.3 Valuation methodology (continuation) |

|

| Considerations on the applicability of the discounted cash flow methodology (DCF) in this specific case |

|

nThe valuation approach based on DCF or on dividend discount methodologies takes into consideration thecompanies’operational and financial characteristics and its growth perspectives, but may be subject to significant uncertainties and inaccuracies due to the number of variables involved and the difficulty to predict them with an acceptable level of precision. nThis methodology relies on a large number of operational and macroeconomic assumptions, especially considering that this valuation involves a multinational financial group with a large number of activities in various segments and in multiple countries which are difficult to predict over the long-term. nBecause the valuation involves, in this particular case, a multinational financial institution, this approach would entail such a level of complexity that it could actually result in a higher inaccuracy, given thevolatility of assumptions such as interest rates, spreads, default rates, among others, in multiple countries. In addition, the approach would require forecasts related to regulatory items in multiple jurisdictions,such as the regulation on minimum level of capital, which would increase the inaccuracy of the analysis. nDealing with such complexity and inherent imprecision was considered unnecessary and not recommended in this situation, especially given the existence of highly comparable companies with strong level of liquidity, as explained on pages 5, 27 and 41 of this Report nFor these reasons, we did not perform a valuation based on DCF nor on dividend discount methodologies |

|

|

|

|

|

|

|

|

|

|

|

Notes

1 Market capitalization was calculated based on 30-days volume-weighted unit price (for Santander Brazil) and share price (for Santander S.A.) as of the day of publication of the Material Fact

2 Sample of analysts’ projections include all projections of the Reuters brokers’ consensus for adjusted net income, provided by Thomson for Brazilian companies and by Factset for European companies

3 Tangible book corresponds to “Shareholders’ equity”-“Intangible assets” for Santander Brazil as per 2014 January –March Financial Report in IFRS and to Shareholders’ equity” + “Equity adjustments by valuation” – “Goodwill” as perSantander S.A. 2014 January–March Financial Report– “Other intangible assets” as per Santander S.A 2013 Auditor’s Report andAnnual Consolidated accounts

| 5 |  |

1. Executive summary

1.4 Valuation summary for Santander Brazil

| Economic value of Santander Brazil’s unit betweenR$10.63 and R$11.69 |

| Summary valuation of Santander Brazil´s unit (R$ per unit1) | | Valuation approach |

| | The valuation of Santander Brazil´s units is based on the following methodologies: nVolume weighted average price per unit –VWAP 12M before the Material Fact disclosed by Santander S.A. on April, 29th2014 –VWAP from the Material Fact date to June 10th, 2014 nBook value: –Tangible book value2(“TBV) perunit nEconomic value based on comparable trading multiples: –Valuation based on trading multiples ofselected Brazilian banks with a retail focus,namely: Itaú, Bradesco and Banco do Brasil –Source: Reuters consensus net income estimates published by Thomson as of June 10th, 2014 The methodology adopted to the definition of Santander Brazil´s units economic value was the economic based on comparable trading7.5multiples |

Source:Thomson, Reuters,Bloomberg and Santander Brazil filings and comparable companies’ filings.Notes:1) total number of units outstanding equivalent to 3,827m net of 25m treasury units. 2) Tangible book defined as“Shareholders’ equity” – “Intangible assets” (as per Santander Brazil 2014 January –March Financial Report in IFRS). 3) P/E 14E, 15E, and 16E based on consensus net income estimates published by Thomson based on Reuters consensus as of June 10th, 2014 and unit price based on Bloomberg, calculated as the weighted average unit price on the 30 days prior to the announcement date

| 6 |  |

1. Executive summary

1.5 Valuation summary for Santander S.A.

| Economic value of Santander S.A.’s share between €6.07 and€6.67 |

| Summary valuation of Santander S.A.’s share (€per share¹) | | Valuation approach |

| | The valuation of Santander S.A. shares is basedon the following methodologies:

nVolume weighted average share price:

–VWAP 12M before the Material Factdisclosed by Santander S.A. on April, 29th2014

–VWAP from the Material Fact date to June,10th2014

nBook value:

–Tangible book value2(“TBV”) per share

nEconomic value based on comparable tradingmultiples :

–Valuation based on trading multiples ofselected European banks with a retail focus,

namely: HSBC, Lloyds Banking Group, BNPParibas, BBVA, Nordea, Intesa San Paolo,Unicredit, Société Générale and CréditAgricole –Source: Reuters consensus net incomeestimates published by Factset as of June,10th2014

methodology adopted to determineSantander S.A. shares economic value was theeconomicovalue based on comparable tradingmultiples The methodology adopted to determine Santander S.A. shares economic value was the economic value based on comparable trading multiples |

Source:Factest as of June, 10th2014 and Santander S.A.filings and comparable companies’ filings.Notes:1) Total outstanding shares of 11,561m (as per Santander S.A. 2014 January–March Financial Report) net of 39m treasury shares (as per Comisión Nacional del Mercado de Valores as of June,10th 2014). 2) Tangible book defined as “Shareholders’ equity” + “Equity adjustments by valuation” – “Goodwill” (as per Santander 2014 January–March Financial Report)– “Other intangible assets” (as per Santander 2013 Auditor’s Report and Annual Consolidated accounts).3) P/E 14E, 15E and 16E based on consensus net income estimates published by Facset based on Reuters consensus as of June 10th, 2014 and share price based also on Facset, calculated as the weighted average share price on the 30 days prior to the announcement date

| 7 |  |

1. Executive summary

1.6 Exchange ratio between the Companies

| Summary of exchange ratio (Santander Brazil unit / Santander S.A. share) | | Valuation approach |

| | The values presented hereby for the exchangeratio are based on the following assumptions:

nEUR/BRL exchange rate as of June 10th, 2014: 3.02

nFor comparable trading multiples valuation ranges: – Minimum of the range correspond to the exchange ratio between the maximum value of the range for Santander S.A. share and the minimum of the range for Santander Brazil’s unit – Maximum of the range correspond to the exchange ratio between the minimum value of the range for Santander S.A. share and the maximum of the range for Santander Brazil’s unit The methodology adopted to determine the exchange ratio was the economic value based on comparable trading multiples |

| 8 |  |

2. Rothschild information and declarations

2. Rothschild information and declarations

2.1 Information regarding Rothschild

Rothschild is a global financial advisory firm focused on mergers and acquisitions, strategic advice, shareholding reorganizations and financial restructurings, with over 50 offices worldwide.

Relevant Experience

Rothschild has significant experience advising large companies in Brazil, in Spain and globally.

Among the recent transactions performed in the financial industry in Brazil, we highlight:

Among the recent transactions performed in the financial industry in Spain, we highlight:

Internal approval process

Rothschild’s internal valuation committee reviewed the analysis performed by the project team. The committeeis formed by professionals with experience in M&A and financial advisory. This committee has met with the project team and discussed the main assumptions and aspects related to the valuation methodologies presented in the Valuation Report and approved its release.

| 10 |  |

2. Rothschild information and declarations

2.2 Information regarding Rothschild

Experience in transactions that involved valuation of Brazilian listed companies in the last 3 years

| 11 |  |

2. Rothschild information and declarations

2.3 Rothschild team responsible for the report

| | | | |

| | Background | | Experience |

| |

| |

| Paolo Pellegrini | n | Paolo is a Managing Director of Rothschild in Brazil and a Global Partner. He has over 20 yearsof experience in banking, capital markets and corporate finance, in the Brazilian andinternational markets. Paolo joined Rothschild in 2010. Before that he was a managing directorat Itaú-BBA. Paolo has a degree in business administration from Universidade Federal do RioGrande do Sul | n | His recent transaction experience includes advice toCosan, Grupo Rede, Almeida Júnior, Biosev, Grupo SBF,Lupatech among others |

| | |

| | |

| | |

| | | | |

| |

| Gustavo Saito | n | Gustavo is a Director of Rothschild in Brazil. He has 15 years of experience in mergers andacquisitions and equity capital markets. He joined Rothschild in 2003 having worked before atCredit Suisse. Gustavo has business degree from Fundação Getúlio Vargas. | n | His recent transaction experience includes advice to Itaú,Banco do Brasil, Casino, Camargo Correa, MagazineLuíza, BM&F Bovespa, DASA, GP Investments, Fibria,Vivo, Copersucar and Tereos Internacional among others |

| | | |

| | | |

| | | |

| |

| Victor Leclercq | n | Victor Leclercq is a Vice-President of Rothschild in Brazil. He joined Rothschild in Paris in 2007and moved to the São Paulo office in 2012. Prior to joining Rothschild, Victor has spent 6months with Morgan Stanley in Paris. Victor graduated from Ecole Normale Supérieure (rued'Ulm) and from HEC Paris | n | His recent transaction experience includes advice toCasino, GDF SUEZ, Biosev, EDF, Albioma among others |

| | | |

| | | |

| | | | |

| |

| Klaus Schmidt | n | Klaus is an analyst of Rothschild in Brazil. He has 2 years of experience in the financialmarkets, focusing on M&A and holds a double-degree in business administration andeconomics from Insper - Instituto de Ensino e Pesquisa. Klaus attended a semester atUniversity of St. Gallen, in Switzerland | n | His recent transaction experience includes advice toCosan, B2W and Mills Engenharia e Serviços |

| | | |

| | | |

| | | |

| 12 |  |

2. Rothschild information and declarations

2.4 Rothschild S.A. team responsible for the report

| | | | |

| | Background | | Experience |

| |

| |

| Jacobo Gómez | n | Jacobo is a Managing Director of Rothschild in Spain. He has over 14 years of experience inbanking in the Spanish and international markets. Jacobo joined Rothschild in 2009. Before thathe worked for 8 years at Lehman Brothers in the financial institutions group in London andMadrid. Jacobo has a degree in business administration and a second degree in actuarialsciences from Universidad Pontificia de Comillas (ICADE) | n | His recent transaction experience includes advice toSantander, Bankia, Banco Sabadell, GNB Sudameris,CaixaBank and BBVA among others |

| | | |

| | | |

| |

| Juan Venegas | n | Juan is a Vice-President of Rothschild in Spain. He joined Rothschild in Madrid in 2010. Prior tojoining Rothschild, Juan worked in the FIG Corporate Finance Division of KPMG. Juan has adegree in Industrial Engineering from Universidad Pontificia de Comillas (ICAI) | n | His recent transaction experience includes advice toSantander, Bankia, Banco Sabadell, CaixaBank, BBVAamong others |

| | | |

| | | |

| 13 |  |

2. Rothschild information and declarations

2.5Declarations

| |

| 1 | As of the date of this Valuation Report, neither Rothschild nor its controlling entity Rothschild Latin America NV, nor any member of the team involved in preparing the Valuation Report own shares issued by Santander Brazil or Santander S.A., or derivatives referenced on it, be it on its own proprietary account or under discretionary administration. |

| |

| 2 | Rothschild states that it does not have any commercial or credit information of any kind that can impact the Valuation Report. |

| |

| 3 | Rothschild does not have any conflict of interest that can reduce the independency required to the accomplishment of its functions. |

| |

| 4 | For providing this Valuation Report, Rothschild will receive the net fixed amount of US$800,000.00 (eight hundred thousand United States dollars) and no variable compensation. |

| |

| 5 | In the last 12-month period until the present date, Rothschild has received no remuneration neither from Santander Brazil nor from Santander S.A. (not considering the compensation to be received due to the issuance of this Valuation Report), and its affiliate in Spain, Rothschild S.A., received for purposes of compensation for financial advisory services rendered to Santander S.A., the amount of US$4,500,000.00, and received no remuneration from Santander Brazil (not considering the compensation to be received due to the issuance of this Valuation Report). |

| |

| 6 | As mentioned in note 14 on page 68, in Appendix F of this Report (“Disclaimer"), Rothschild is entitled to certain indemnifications, to be paid by Santander Brazil, due to certain liabilities that might arise from our work. |

| |

| 14 |  |

3. Valuation of Santander Brazil

3. Valuation of Santander Brazil

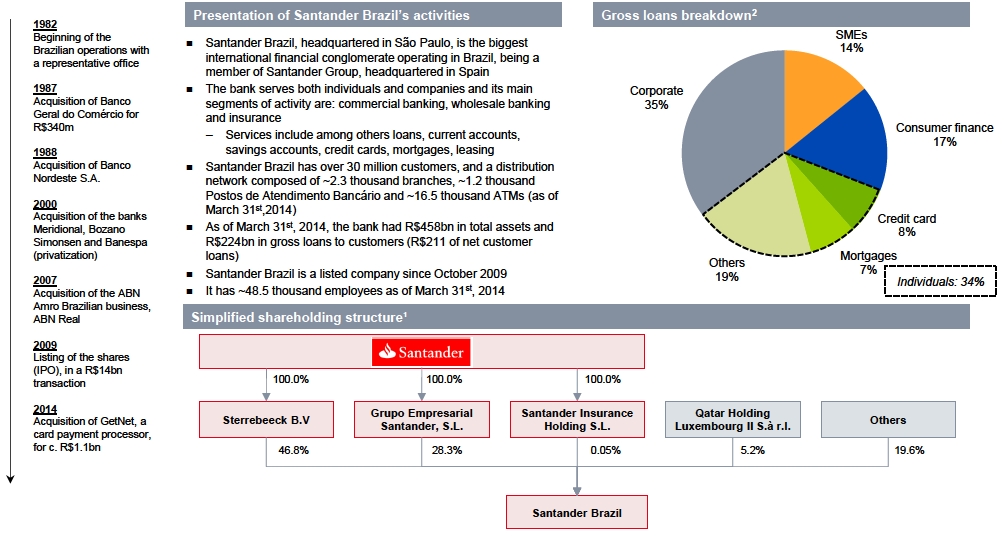

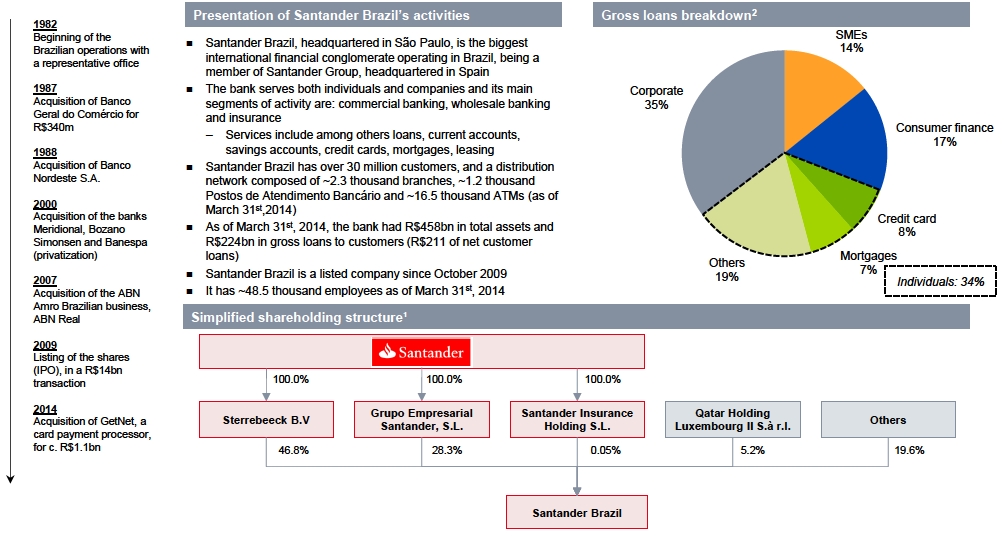

3.1 Company overview

Main highlights

SourceCompany, CVM

Notes

1 Based on the total number of shares, excluding shares held in treasury, as of June 9th, 2014 (CVM’s website accessed on June 9th, 2014)

2 As of March31st, 2014–Breakdown in BR GAAP

| 16 |  |

3. Valuation of Santander Brazil

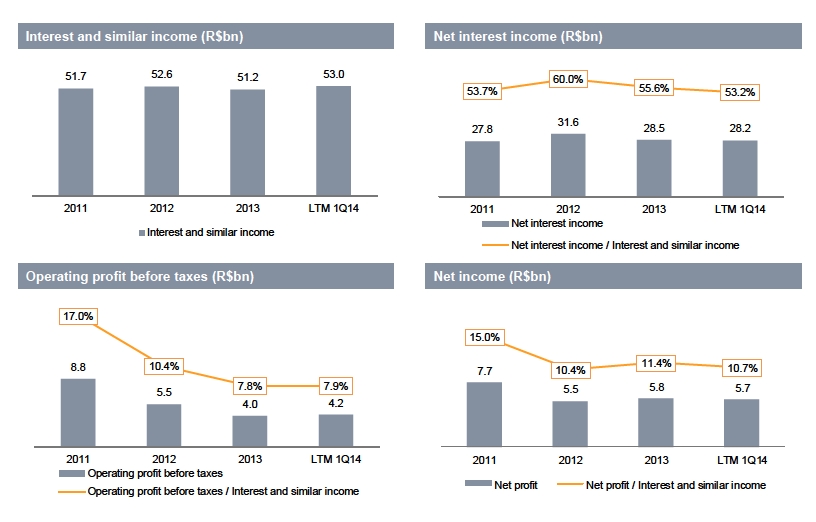

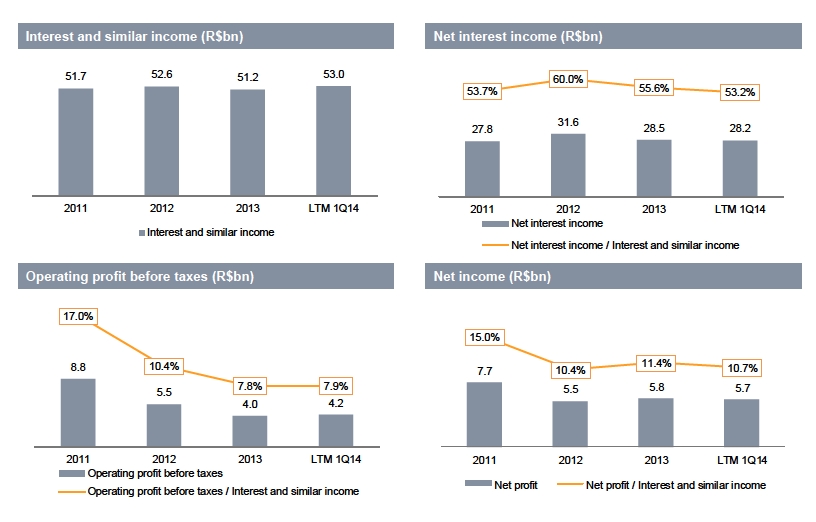

3.2 Company overview

Financial and operating performance

| 17 |  |

3. Valuation of Santander Brazil

3.3 Historical financial analysis of Santander Brazil

Balance sheet–Fiscal years ended on December 31stand 1Q14

| 18 |  |

3. Valuation of Santander Brazil

3.4 Historical financial analysis of Santander Brazil

Profit & loss

| 19 |  |

3. Valuation of Santander Brazil

3.5 Brazilian banking sector overview (1/2)

| |

Despite

macroeconomic

headwinds (high level

of inflation, low realGDP growth outlook

for 2014-2015…) and

falling consumerconfidence, the credit

market remainsstrong with publicbanks supporting

loan growth |  |

|

|

|

|

|

|

|

|

|

|

|

| |

| Note |

| 1 | Fundação Getúlio Vargas IBRE |

| 20 |  |

3. Valuation of Santander Brazil

3.6 Brazilian banking sector overview (2/2)

Overview of the main publicly traded players

SourceCompanies (as of 4Q13–according to IFRS, except for BTG Pactual and Banco da Amazônia only publishing in BR GAAP)

| 21 |  |

3. Valuation of Santander Brazil

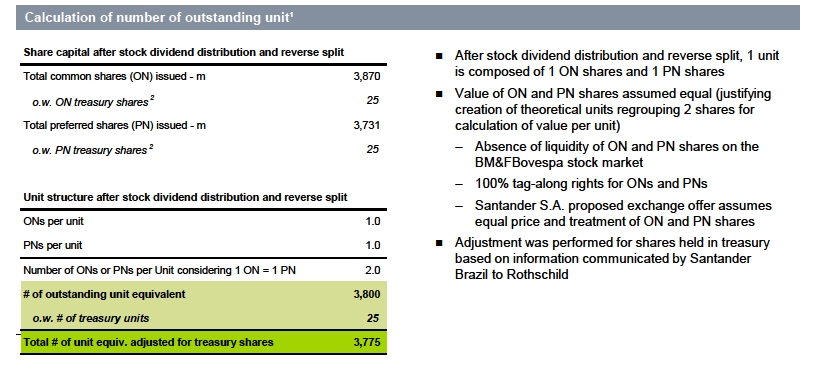

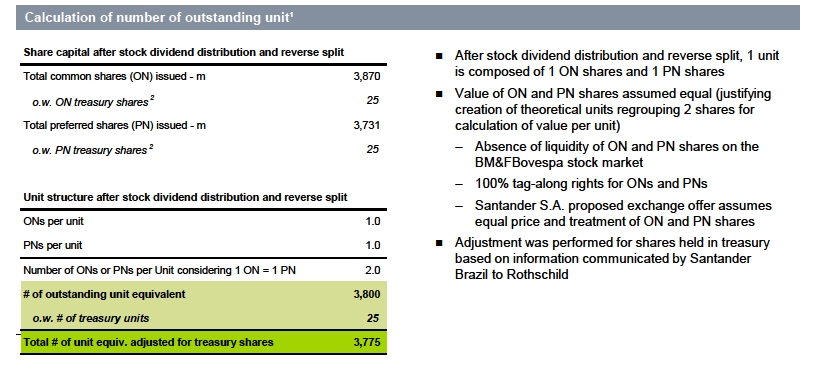

3.7 Overview of share capital of Santander Brazil (1/2)

Details on stock dividend and reverse split

Proposed stock dividend and reverse split approved by Santander Brazil’s shareholders on March 18th, 2014 and by the Brazilian Central Bank on April 22nd, 20141

Stock dividend distribution of 0.047619048 preferred share (“PN shares” or “PNs”) for each existingcommon share (“ON shares” or “ONs”) or existing preferred share1

nIssuance of 19,002,100,957 new PN shares1

–Number of ON shares to remain at 212,841,731,7541

–Number of PN shares to increase from 186,202,385,151 to 205,204,486,1081nEquivalent to a distribution of 5 PN shares for each existing unitnEach unit, formerly composed of 55 ON shares and 50 PN shares, will be composed of 55 ON shares and 55 PN shares following the stock dividend distribution, without any impact on the value of each unit

Reverse split of 1 ON share and 1 PN share for 55 ON shares and 55 PN shares1

nIn the rest of the report, “New Share” defined as Santander Brazil share following reverse splitnNumber of shares to decrease from 418,046,217,862 to 7,600,840,3251

–Number of ON shares to decrease from 212,841,731,754 to 3,869,849,6681

–Number of PN shares to decrease from 205,204,486,108 to 3,730,990,6571

nEach unit to be composed of 1 ON share and 1 PN share, instead of 55 ON shares and 55 ON shares1, without anyimpact on the value of each unit

nTotal shares held in treasury post stock dividend distribution and reverse split: 25,345,519 ON shares and 25,345,519 PN shares2

| |

| Notes |

| 1 | Material Fact published on April, 23th2014 |

| 2 | Company information communicated to Rothschild as of June, 10th2014 |

| 22 |  |

3. Valuation of Santander Brazil

3.8 Overview of share capital of Santander Brazil (2/2)

SourceCompany, CVM

Notes

1 Based on the total number of shares, excluding shares held in treasury, as of June 9th, 2014

2 Company information communicated to Rothschild as of June, 10th2014

| 23 |  |

3. Valuation of Santander Brazil

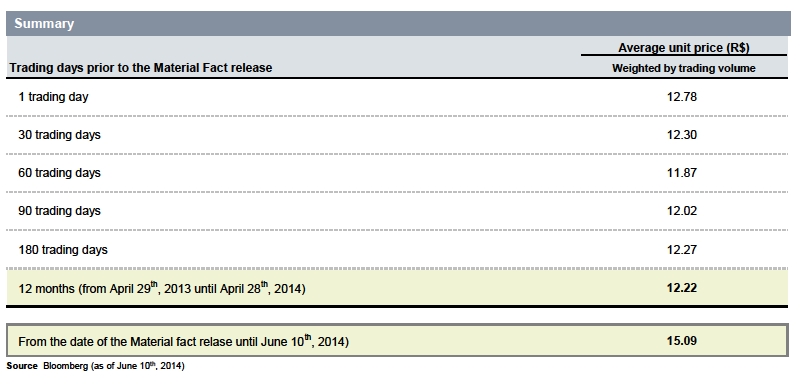

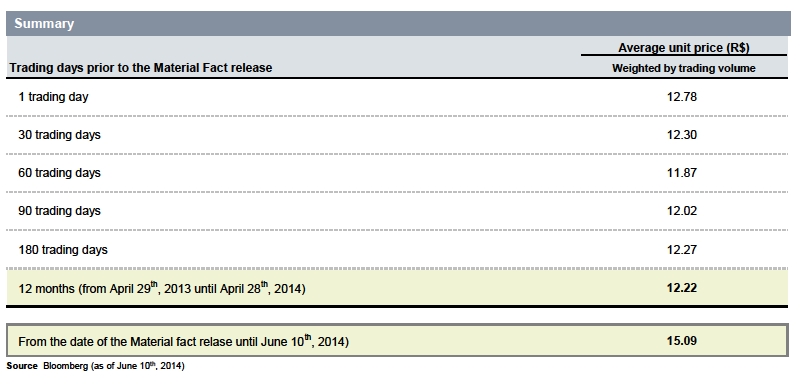

3.9 Valuation by volume weighted average price (1/2)

VWAP points to R$12.22 in the last twelve months prior to announcement date and R$15.09 from the announcement date to June 10th, 2014

| 24 |  |

3. Valuation of Santander Brazil

3.10 Valuation by volume weighted average price (2/2)

Average price calculated for the periods of 1, 30, 60, 90, 180 trading days and 1 year before the date of the Material Fact and for the period since the date of the Material Fact until June 10th, 2014

| 25 |  |

3. Valuation of Santander Brazil

3.11 Shareholder´s equity book value per unit

As of March, 31st2014, Santander Brazil’s book value per unit was of R$20.30 andtangible book value per unit was of R$12.62

| 26 |  |

3. Valuation of Santander Brazil

3.12 Comparable trading multiples methodology

|

| Details on methodology applied |

Notes 1 Tangible book corresponds to“Shareholders’ equity”-“Intangible assets” (asper Santander Brazil 2014 January–March Financial Report in IFRS) 2 Book value correspondsto “Shareholders’ equity”(as per Santander Brazil 2014 January–March Financial Report in IFRS)–See adjustment performed for Bradesco and Banco do Brasil in Section 3.13 3 As provided in Article 238 of Law 6,404/76, "the legal entity that controls a joint capital company (referring to“companhia de economia mista”, inPortuguese) has the duties and responsibilities of the controlling shareholder (Articles 116 and 117), but may guide the company's activities in order to meet the public interest that justified its creation" | | nPursuant to CVM Instruction 361, Rothschild has selected the comparable trading multiples valuation approach in order to estimate the economic value of Santander Brazil nComparable Trading Multiples is a relative valuation method which estimates the value of a company using ratios of market valuation to financial metrics of similar publicly traded companies; traditional trading multiples include P/E, and P/TBV –P/E multiples are based on volume weighted average share price over the last 30 days prior to the publication of the Material Fact published by Bloomberg as of June 10th, 2014, and consensus estimates of net income for Santander Brazil and selected comparable companies published by Thomson as of June 10th, 2014 –P/TBV multiples are based on volume weighted average share price over the last 30 days prior to the publication of the Material Fact published by Bloomberg as of June 10th, 2014, and tangible book values1as of March 31st2014 –Given disparity in level of goodwill and intangibles among peers, P/BV1was not considered nTrading multiplesof Santander Brazil’s comparablecompanies were calculated based on the net income forecasts for the years 2014, 2015 and 2016, and applied over the net income forecasts for Santander Brazil over the same years, given that forecasts from market analysts are generally limited to three years nThe calculation of trading multiples was based on the 30-day volume-weighted average share price until April 28th, 2014 –A historical period of 30 days was chosen, in order to reduce short-term volatility in the share price. The adoption of longer historical periods would not necessarily reflect the current fundamentals of the companies nSelected comparable companies are Brazilian banks with similar scale and retail focus (see Appendix B for more details on selection of peers): –Itaú –Bradesco –Banco do Brasil3 nThe institutions selected have similar business models than that of Santander Brazil –Despite the small number of companies comparable to Santander Brazil, the sample is of high quality, as it comprises direct competitors, with comparable scale, high liquidity and they all are included in the Bovespa Index –We believe that adding Latin American institutions to the sample of companies comparable to Santander Brazil would notimprove the quality of the analysis, mainly due to the lack of Latin American banks based in other geographies, with scale and operations in Brazil comparable to Santander Brazil. Conversely, Santander Brazil has an essentially Brazilian operation, with no direct operations in other geographies of Latin America. –A description of these institutions is provided in Appendix A |

| 27 |  |

3. Valuation of Santander Brazil

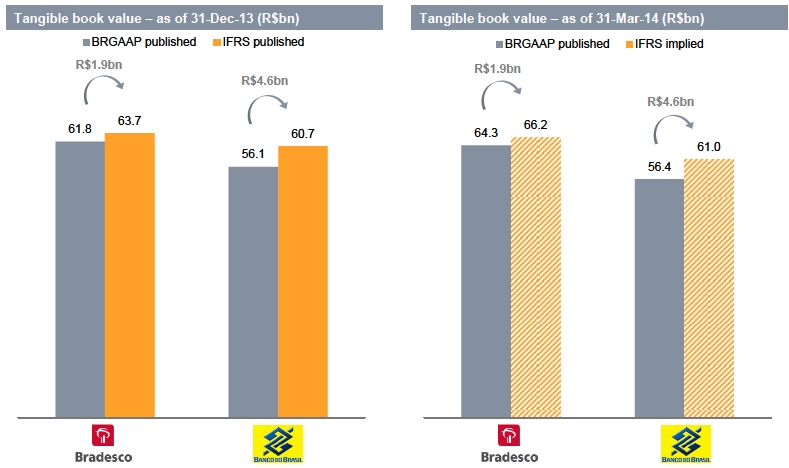

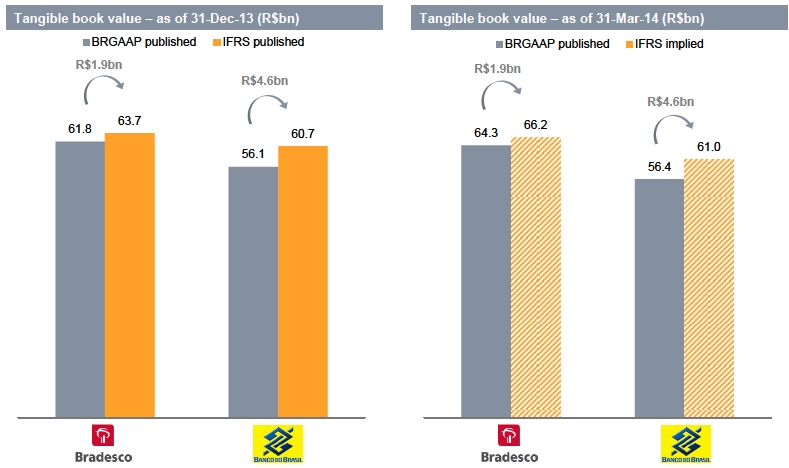

3.13 Adjustments performed for P/TBV of peers

As Bradesco and Banco do Brasil only report in IFRS as of year end and last set of published figures for March 31st,2014, are only available in BR GAAP established by BACEN, Tangible Book value in IFRS as of March 31st,2014, was estimated based on Tangible Book value in BR GAAP adjusting for the difference between BR GAAP and IFRS as of December 31st, 2013

SourceCompanies’ financial reports in BR GAAP and IFRS

| 28 |  |

3. Valuation of Santander Brazil

3.14 Trading multiples

| 29 |  |

3. Valuation of Santander Brazil

3.15 Valuation based on comparable trading multiples

Trading multiples methodology, based on P/E, leads to a range of value per unit between R$10.63 and R$11.69

Comparable methodology based onP/TBV was notconsidered as appropriate to value Santander Brazil: - High level of capitalization of Santander Brazil compared to its peers (11.5% Tangible Book Value/ Total assets vs. on average 6.7% for its three peers), as of December 31st, 2013 - Low level of operating margins of Santander Brazil (11.2% Net Income/ Income from interest and similar income vs. on average 13.7% for its three peers), in 2013 |  |

SourceCompanies, Bloomberg market data, Thomson based on Reuters consensus, Research reports

Notes

1 Thomson (as of June 10th, 2014)– Brokers’ estimates based on Reuters consensus (median)

| 30 |  |

4. Valuation of Santander S.A.

4. Valuation of Santander S.A.

4.1 Brief overview of Santander S.A.

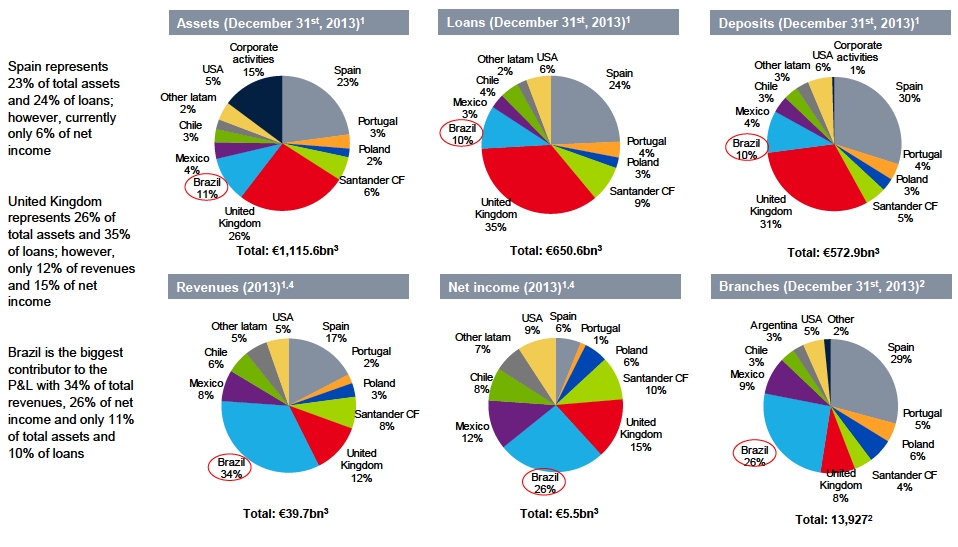

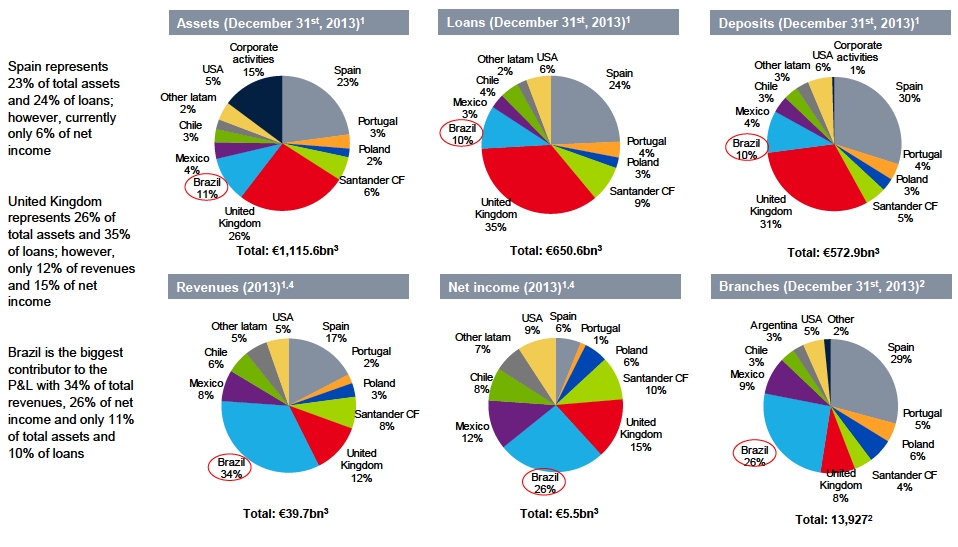

Overview of activities and geographical footprint

| Overview | | Global presence (2013) |

nSantander S.A. is a global banking group with significant presence in Iberia, Latin America, UK, USA, Germany and Poland nAs of end December 2013, the Group had c.182,958 employees, over 100m customers and aworldwide presence with c.13,927 branches n€81.3bn market cap as of April, 28th2014 (P/E 14E of 13.9x, P/E 15E of 11.9x and P/TBV as of March, 31stof 1.88x), total assets of€1.2trn, net customer loans of€678bn and net income of€1.6bn in 1Q14 nBanco Santander has not taken part so far in the Spanish domestic consolidation process; however, it has been active abroad with recent transactions including the filing for IPO of its USA consumer subsidiary, acquisition of an 8% of Bank of Shanghai, sale of Colombia operations to Corpbanca, sale of 50% of its asset management division, sale of 33% of its USA consumer finance division and bancassurance agreement with Zurich for Latin America core markets nLong-term ratings of BBB+ (S&P), Baa1 (Moody’s) and A- (Fitch) | |  |

| | | | |

| Continental Europe | UK | Latin America | | USA |

| |

n#3 banking group in Spain by total assets | nTop-5 bank in the UK afterthe acquisition of AbbeyNational (in 2004), Allianceand Leicester (Jul-08) andBradford and Bingley

branches and deposits(Sep-08) | nLeading positions in Brazil, Mexico, Chile and Argentina with 6,046 branches and almost 91,000 employees | n | In Jan-09, Santander S.A. acquired the remaining stake (75.7%) that it did not hold yet in Sovereign for c.€1.4bn |

n Spain: customer loans of€157bn and deposits of€183bn, 2,915 branches with 18,704 employees. | nFocus on SMEs and individuals, savings and lending products, cards and consumer credit | n | Strong presence in North East region with 706 branches, 9,741employees and more than 1.7 million customers |

nSantander S.A. Consumer Finance: leading consumer lender in 13 European countries with customer loans of€56bn, deposits of €31bn, 610 branches and 9,872 employees | nBrazil: net customer loans of R$211bn and 48.5 thousand employees | n | Total assets of€79bn, customer loans of €59bn and deposits of€40bn as of Mar-14 |

nPortugal: former Banco Totta,€24bn customer loans and€24bn deposits, 5,635 employees and 640 branches. In 2014 has been named Best Bank in Portugal | nFocused on retail banking: market shares of 12.5% in mortgages and 5.7% in SMEs | nMexico: customer loans of€22bn and deposits of €26bn, 14,804 employees and 1,258 branches (Mar-14) | n | The bank sold 33% of its consumer finance US operations in Oct-11 to Warburg, KKR and Centerbridge Partners |

nPoland: in Jan-13 Bank Zachodni WBK (acquired in Sep-10) and Kredyt Bank merged consolidating Santander S.A. as #3 bank in Poland by total assets (€28.7bn) with 12,363 employees and c.830 branches | n1,157 branches, 25,368 employees and 25.5m customers | nChile: customer loans of€28bn and deposits of€20bn, 12,290 employees and 493 branches (Mar-14) | n | Completed IPO of its US consumer subsidiary in Jan-14 |

| nTotal assets of€338bn and net customer loans of €234bn | nArgentina: customer loans€5.1bn and deposits of €5.9m, 6,874 employees and 370 branches | | |

| | nIt is also present in Puerto Rico, Uruguay and Peru | | |

| | nClosed sale of Banco de Venezuela to the Venezuelan Government for€750m in Jul-09 and Colombian subsidiary to CorpBanca for€910m in Dec-11 | | |

| | | | | |

| | | | |

SourceCompany publicly available information, Bloomberg as of June, 10th2014, market capitalization based on 30-day volume-weighted average share price until April. 28th2014

| 32 |  |

4. Valuation of Santander S.A.

4.2 Brief overview of3%Santander S.A.

SourceSantander S.A. 2013 Annual Report and Santander S.A. 2013 January–December Financial Report.Notes:1) As reported in Santander S.A. 2013 January–December Financial Report. 2) As reported in Santander S.A. 2013 Annual Report. 3) Santander S.A. consolidated figure as reported in Santander S.A. 2013 AnnualReport. 4) Geographical breakdown does not include “Corporate activities”

| 33 |  |

4. Valuation of Santander S.A.

4.3 Historical financial analysis of Santander S.A.

Balance sheet

| | | | | | | | | | |

| Balance sheet - Assets | | Balance sheet - Liabilities |

| |

| €m | 2011 | 2012 | 2013 | 1Q14 | | €m | 2011 | 2012 | 2013 | 1Q14 |

| |

| Cash and deposits in CB | 96,524 | 118,488 | 77,103 | 82,402 | | Trading portfolio | 146,948 | 143,242 | 94,673 | 105,947 |

| Trading portfolio | 172,638 | 177,917 | 115,289 | 128,631 | | Other financial liabilities at fair value | 44,909 | 45,418 | 42,311 | 51,500 |

| Other financial assets at fair value | 19,563 | 28,356 | 31,381 | 38,992 | | Deposits from central banks | 34,996 | 50,938 | 9,788 | 11,125 |

| Available for sale securities | 86,613 | 92,266 | 83,799 | 90,889 | | Interbank funding | 81,373 | 80,732 | 76,534 | 86,988 |

| Interbank loans | 42,389 | 53,785 | 56,017 | 46,357 | | Customer deposits | 588,977 | 589,104 | 572,853 | 573,255 |

| Customer loans | 730,296 | 696,014 | 650,581 | 677,639 | | Debt securities | 189,110 | 201,064 | 171,390 | 179,446 |

| Hedge derivatives | 9,898 | 7,936 | 8,301 | n.a. | | Subordinated debt | 22,992 | 18,238 | 16,139 | 17,738 |

| Non current assets held for sale | 5,338 | 5,700 | 4,892 | n.a. | | Hedge derivatives | 6,444 | 6,444 | 5,283 | n.a. |

| Participations | 4,155 | 4,454 | 5,536 | 3,502 | | Provisions | 15,572 | 16,148 | 14,475 | 14,900 |

| Pension liabilities | 2,146 | 405 | 342 | n.a. | | Tax liabilities | 8,174 | 7,765 | 6,079 | n.a. |

| Fixed assets | 13,846 | 13,860 | 13,654 | n.a. | | Other liabilities | 29,172 | 29,232 | 26,211 | 45,298 |

| Intangible assets | 28,083 | 28,062 | 26,241 | n.a. | | Total liabilities | 1,168,667 | 1,188,325 | 1,035,736 | 1,086,197 |

| Tax assets | 22,901 | 27,053 | 26,819 | n.a. | | Valuation adjustments | (4,482) | (9,474) | (14,152) | (13,253) |

| Other assets | 17,136 | 15,304 | 15,683 | 100,305 | | Equity | 80,896 | 81,334 | 84,740 | 85,631 |

| | | | | | | Minorities | 6,445 | 9,415 | 9,314 | 10,142 |

| | | | | | | Shareholders' equity | 82,859 | 81,275 | 79,902 | 82,520 |

| Total assets | 1,251,526 | 1,269,600 | 1,115,638 | 1,168,718 | | Total liabilities and equity | 1,251,526 | 1,269,600 | 1,115,638 | 1,168,718 |

SourceSantander S.A. 2011, 2012 and 2013 Auditor’s Report and Annual Consolidated accounts and Santander S.A. 2014 January –March Financial Report

| 34 |  |

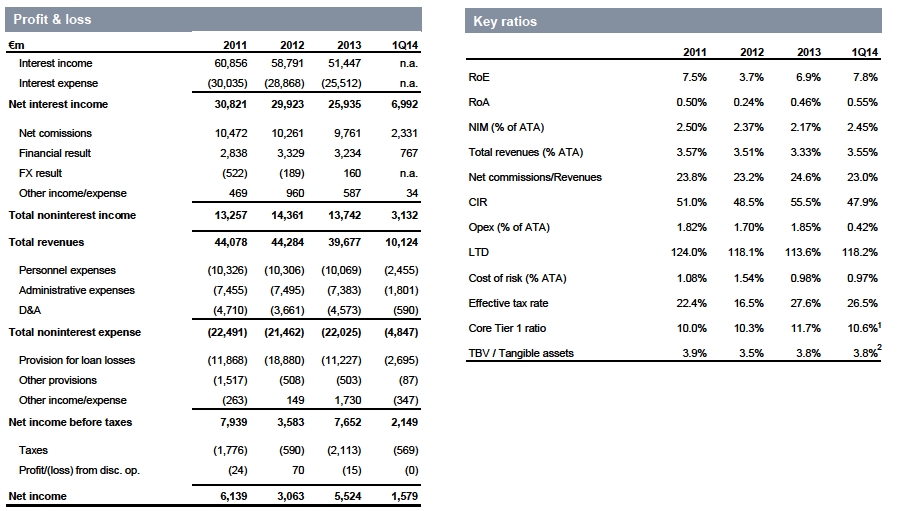

4. Valuation of Santander S.A.

4.4 Historical financial analysis of Santander S.A.

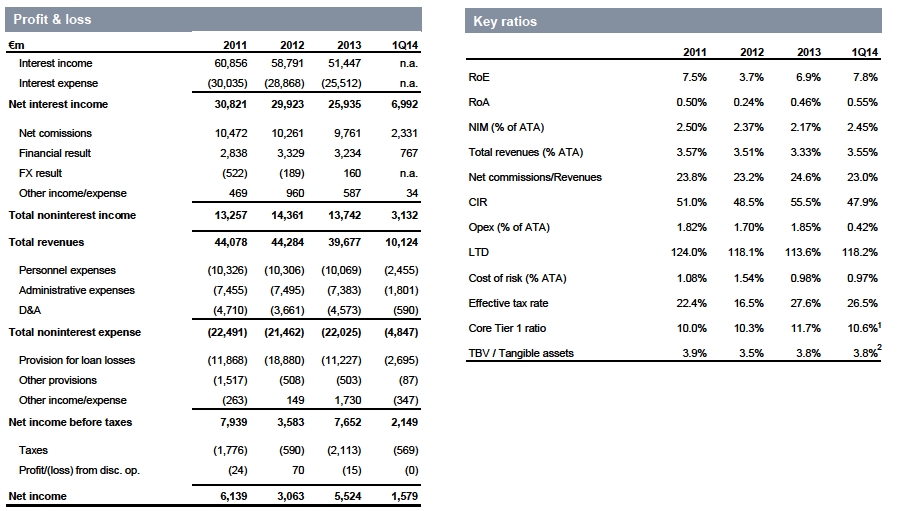

Profit & loss and key ratios

SourceSantander S.A. 2011, 2012 and 2013 Auditor’s Report and Annual Consolidated accounts and Santander S.A. 2014 January –March Financial Report.Notes:1) 1Q14 Core Tier 1 ratio not comparable with previous years as it refers to new regulation which entered in force in January 2014 (CRD IV). 2) Tangible book defined for1Q14 as “Shareholders’ equity” + “Equity adjustments by valuation” – “Goodwill” (asper Santander S.A. 2014 January–March Financial Report)– “Other intangible assets” (as per Santander S.A. 2013 Auditor’s Report and Annual Consolidated accounts) and Tangible assets defined for 1Q14 as

“Total assets” – “Goodwill” (as per Santander S.A. 2014 January –March Financial Report)– “Other intangible assets” (as per Santander S.A. 2013 Auditor’s Report and Annual Consolidated accounts)

| 35 |  |

4. Valuation of Santander S.A.

4.5 Santander S.A. key milestones

SourceCompany webpage

| 36 |  |

4. Valuation of Santander S.A.

4.6 Spanish banking system overview

Spanishbanks leaving behind the crisis; P&L full recovery expected for 2016

Significant consolidation has taken place in the last 4 years Significant improvement of the macro prospects as the Spanish economy gradually corrects all the imbalances that originated the crisis back in 2008 Consolidation and cost optimization key to increased profitability for the Spanish banks Santander S.A. is #3 bank in Spain with€281bn total assets anda 9.3% market share

| |  |

| Current key themes in the Spanish banking landscape |

| |

| nThe Spanish economy is recovering faster than expected driven by improving confidence, household consumption, funding costs, current account |

| and a stabilizing labor and housing market. This is already positively affecting banks fundamentals: |

| |

| – | Gradual improvement inasset quality(improving NPL entries and stability in coverage ratios) combined with initial steps towards a more |

| | meaningful reduction of RE assets |

| |

| – | Significant improvement infundingcosts driven by fall in retail term deposits costs and improved access to wholesale markets given |

| | investors’ change in risk perception |

| |

| – | Basel III capital positionsignificantly improved after Government guarantee on certain DTAs (private domestic Spanish banks already |

| | complying with Basel III fully loaded market requirements) |

| |

| – | Increased profitability ratiosdriven by falling retail deposits costs, new business higher spreads and the important restructuring process |

| | undertaken by Spanish banks |

SourceCompanies financial statements, AEB, CECA, UNACC, Bank of Spain and Factset

| 37 |  |

4. Valuation of Santander S.A.

4.7 Valuation by volume weighted average price (1/2)

VWAP points to€6.05 in the last twelve months prior to the announcement date and€7.39 from the announcement date to June, 10th2014

Source:Factset as of June, 10th2014

| 38 |  |

4. Valuation of Santander S.A.

4.8 Valuation by volume weighted average price (2/2)

Average price calculated for the periods of 1, 30, 60, 90, 180 trading days and 1 year before the date of the Material Fact and for the period since the date of the Material Fact until June, 10th2014

| 39 |  |

4. Valuation of Santander S.A.

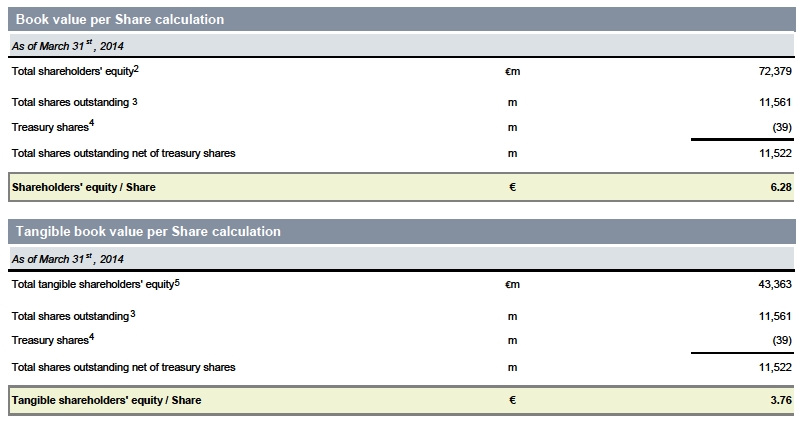

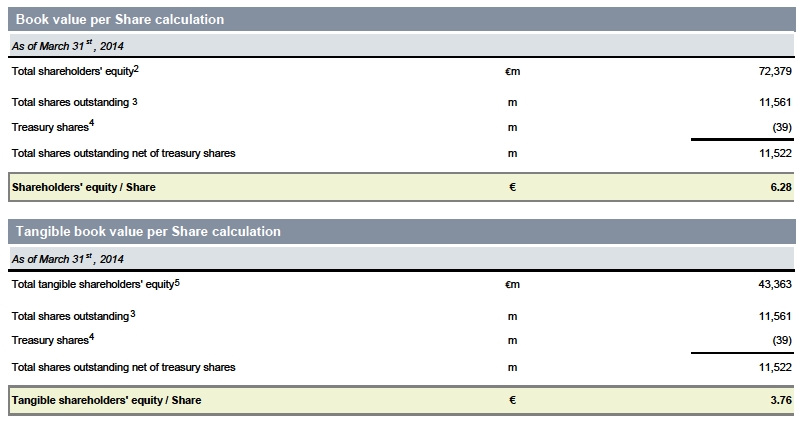

4.9 Shareholder’s equity book value per unit

Book value and tangible book value per share as of March, 31st2014 points to €6.28 and €3.76, respectively

Source:Company information and CNMV

Notes

1 IFRS accounting principles

2 Book value defined as“Shareholders’ equity” + “Equity adjustments by valuation” (as per SantanderS.A. 2014 January–March Financial Report)

3 11,561m outstanding shares (as per Santander S.A. 2014 January–March Financial Report)

4 39m treasury shares as per Comisión Nacional del Mercado de Valores as of June, 10th2014

5 Tangible book corresponds to“Shareholders’ equity” + “Equity adjustments by valuation” – “Goodwill” (as perSantander S.A. 2014 January–March Financial Report)–“Other intangible assets” (asper Santander S.A. 2013Auditor’s Report and AnnualConsolidated accounts)

| 40 |  |

4. Valuation of Santander S.A.

4.10 Comparable trading multiples methodology

| Details on methodology applied |

Notes 1 Tangible book corresponds to “Shareholders’ equity” + “Equity adjustments by valuation” – “Goodwill” (as per Santander S.A. 2014 January–March Financial Report)– “Other intangible assets” (asper Santander S.A. 2013 Auditor’s Report and Annual Consolidated accounts) 2 Book value defined as “Shareholders’ equity” + “Equity adjustments by valuation” (as perSantander S.A. 2014 January–March Financial Report) | nPursuant to CVM Instruction 361, Rothschild has selected the comparable trading multiples valuation approach in order to estimate the economic value of Santander S.A.nComparable Trading Multiples is a relative valuation method which estimates the value of a company using metrics of similarpublicly traded companies; traditional trading multiples include P/E and P/TBV –P/E multiples are based on volume weighted average share price over the last 30 days prior to the publication of the Material Fact published by Factset as of June, 10th2014 and consensus estimates of net income for Santander S.A. and selected comparable companies published by Factset as of June, 10th2014 –P/TBV multiples are based on volume weighted average share price over the last 30 days prior to the publication of the Material Fact published by Factset as of June, 10th2014 and tangible book values1as of March 31st2014 –Given disparity in level of goodwill and intangibles among peers, P/BV2was not considered nTrading multiplesof Santander S.A.’s comparablecompanies were calculated based on net income projections by analysts for the years 2014, 2015 and 2016, and applied to the net income projections by analysts for Santander S.A. over the same years, given that estimates reported by market analysts are generally limited to three years nThe calculation of the trading multiples was based on the 30-day volume-weighted average share price until April 28th, 2014 –A historical period of 30 days was chosen, in order to reduce short-term volatility in the share price. The adoption of longer historical periods would not necessarily reflect the current fundamentals of the companies nSelected comparable companies are European banks with a retail focus (a description of the selected institutions is provided on Appendix A): –HSBC –BNP Paribas –Lloyds Banking Group –BBVA –Nordea –Intesa Sao Paolo –UniCredit –Société Générale –Crédit Agricole nThe institutions selected have similar business models than that of Santander S.A. –We have excluded from the sample European banks with significant investment banking operations (i.e. Deutsche Bank, Barclays, Credit Suisse and UBS), not geographically diversified or without large retail operations in Europe (i.e. Standard Chartered) and those banks which recently went through government led processes of reorganization and recapitalizationas part of a restructuring process (i.e. Royal Bank of Scotland, ING and Commerzbank) |

| 41 |  |

4. Valuation of Santander S.A.

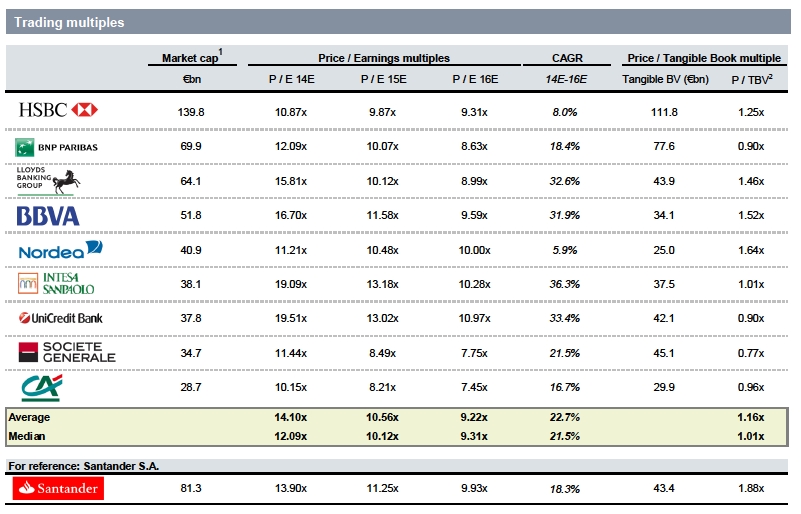

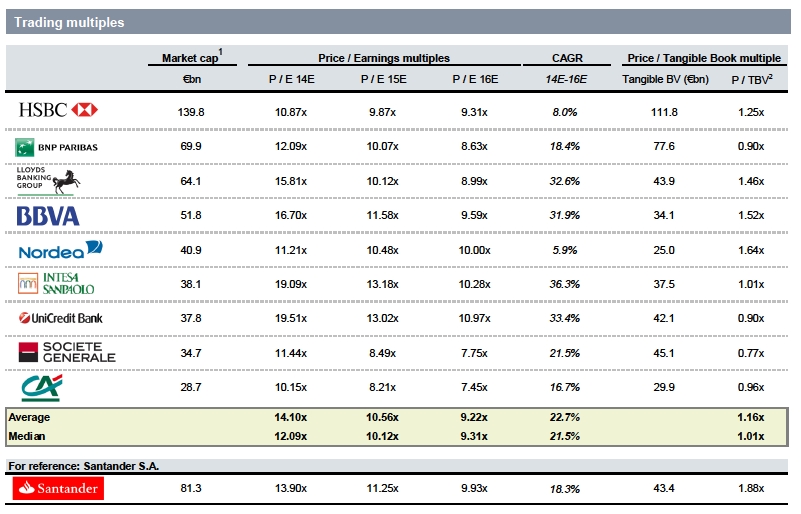

4.11 Trading multiples

SourceCompany information and Factset

Notes

1 Based on the 30-day volume-weighted average share price until April 28th, 2014 (adjusted by cash dividends, historical pricing and historical volume)

2 Intangible assets of HSBC, Lloyds Banking Group, Société Générale and Intesa Sanpaolo as of December 31st2013

| 42 |  |

4. Valuation of Santander S.A.

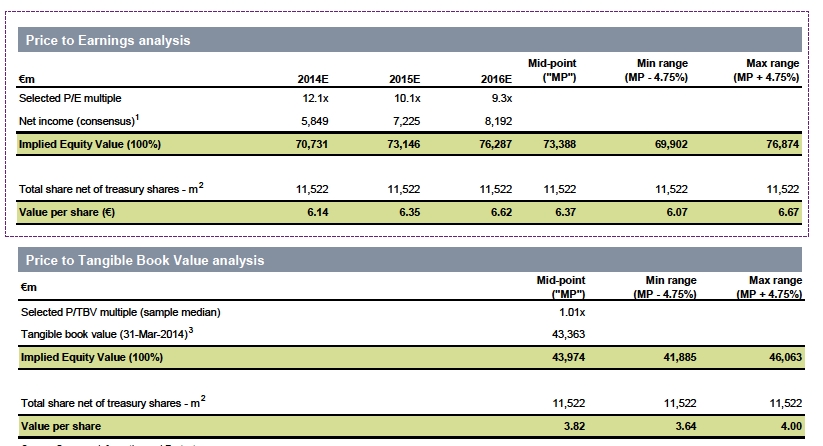

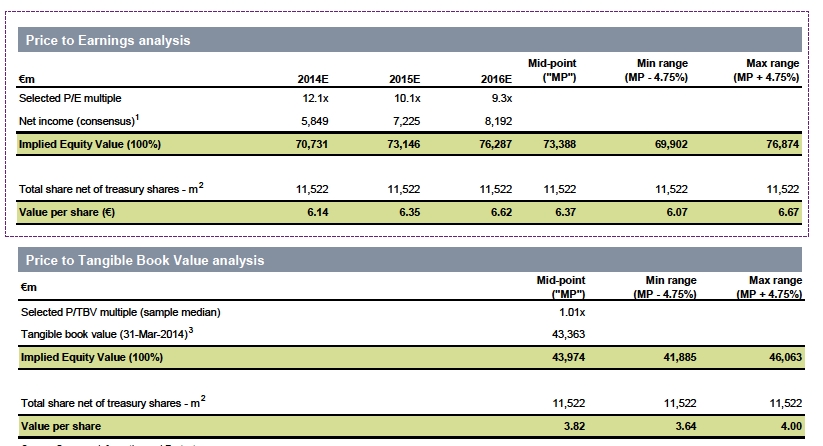

4.12 Valuation based on comparable trading multiples

Trading multiples methodology, based on P/E, points to a range between€6.07 and€m€6.67 per share

SourceCompany information and Factset

Notes

1 Consensus estimates of earnings for Santander S.A. published by Factset as of June, 10th2014

2 11,561m shares (as per Santander S.A. 2014 January–March Financial Report) and 39m treasury shares as per Comisión Nacional del Mercado de Valores as of June, 10th2014

3Tangible book corresponds to “Total equity” – “Minority Interests” – “Equity adjustments by valuation” – “Goodwill” (as per Santander S.A. 2014 January–March Financial Report)–“Other intangible assets” (as per Santander S.A. 2013 Auditor’s Report and Annual Consolidated accounts)

| 43 |  |

5. Exchange ratio between the Companies

5. Exchange ratio between the Companies

5.1 Exchange ratio between the Companies

| 45 |  |

Appendix A. Selected peers for Santander Brazil and Santander S.A.

| | |

| | | Appendix A. Selected peers for Santander Brazil and |

| | | Santander S.A. |

| A.1 Selected peers for Santander Brazil |

| 47 |  |

| |

| | Appendix A. Selected peers for Santander Brazil and |

| | Santander S.A. |

| A.2 Selected peers for Santander S.A. |

SourceCompany information and Bloomberg as of June 10th, 2014, market capitalization based on 30-day volume-weighted average share price until April, 28th2014

| 48 |  |

| |

| | Appendix A. Selected peers for Santander Brazil and |

| | Santander S.A. |

| A.3 Selected peers for Santander S.A. |

SourceCompany information and Bloomberg as of June 10th, 2014, market capitalization based on 30-day volume-weighted average share price until April, 28th2014

| 49 |  |

| |

| | Appendix A. Selected peers for Santander Brazil and |

| | Santander S.A. |

| A.4 Selected peers for Santander S.A. |

SourceCompany information and Bloomberg as of June 10th, 2014, market capitalization based on 30-day volume-weighted average share price until April, 28th2014

| 50 |  |

Appendix B. Overview of the main players in the Brazilian banking industry

Appendix B. Overview of the main players in the

Brazilian banking industry

B.1 Large and diversified commercial banks

Publicly traded banksin Brazil

SourceCompanies, Bloomberg (as of 4Q13–according to IFRS)

Notes

1 Based on size and business mix

2 Based on the 30-day average share price until April 28th, 2014

3 IFRS, as of 4Q13

| 52 |  |

Appendix B. Overview of the main players in the

Brazilian banking industry

B.2 Large but less diversified banks

Publicly traded banks in Brazil

SourceCompanies, Bloomberg (as of 4Q13–according to BR GAAP, in absence of publication in IFRS)

Notes

1 Based on size and business mix

2 Based on the 30-day average share price until April 28th, 2014

3 IFRS, as of 4Q13

| 53 |  |

| |

| | Appendix B. Overview of the main players in the |

| | Brazilian banking industry |

| B.3 Mid-sized commercial banks |

Publicly traded banks in Brazil |

Notes

1 Based on size and business mix

2 Based on the 30-day average share price until April 28th, 2014

3 IFRS, as of 4Q13

| 54 |  |

| |

| | Appendix B. Overview of the main players in the |

| | Brazilian banking industry |

| B.4 Small commercial banks | |

Publicly traded banks in Brazil |

SourceCompanies, Bloomberg (as of 4Q13–according to IFRS)

Notes

1 Based on size and business mix

2 Based on the 30-day average share price until April 28th, 2014

3 IFRS, as of 4Q13

| 55 |  |

Appendix C. Selected analyst estimates for Santander Brazil and peers

Appendix C. Selected analyst estimates for Santander

Brazil and peers

C.1 Selected analyst estimates for Santander Brazil and peers

SourceConsensus estimates of earnings published by Thomson as of June 10th, 2014

| 57 |  |

Appendix C. Selected analyst estimates for Santander

Brazil and peers

C.2 Selected analyst estimates for Santander Brazil and peers

SourceConsensus estimates of earnings published by Thomson as of June 10th, 2014

| 58 |  |

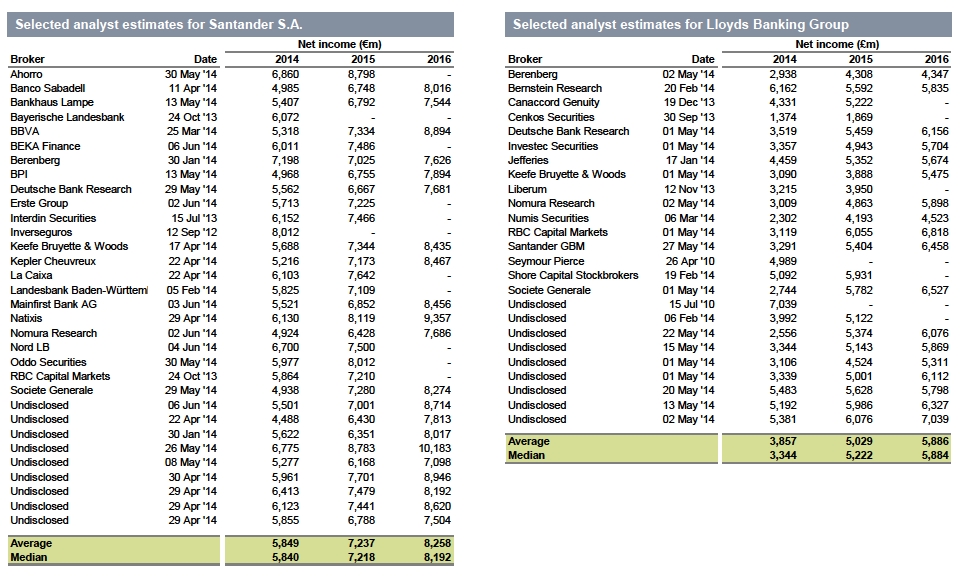

Appendix D. Selected analyst estimates for Santander S.A. and peers

Appendix D. Selected analyst estimates for Santander

S.A. and peers

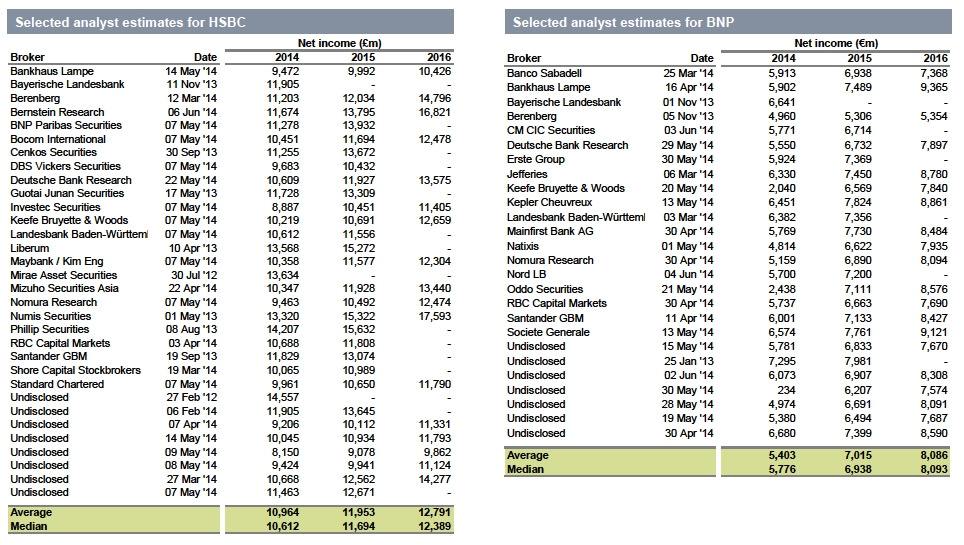

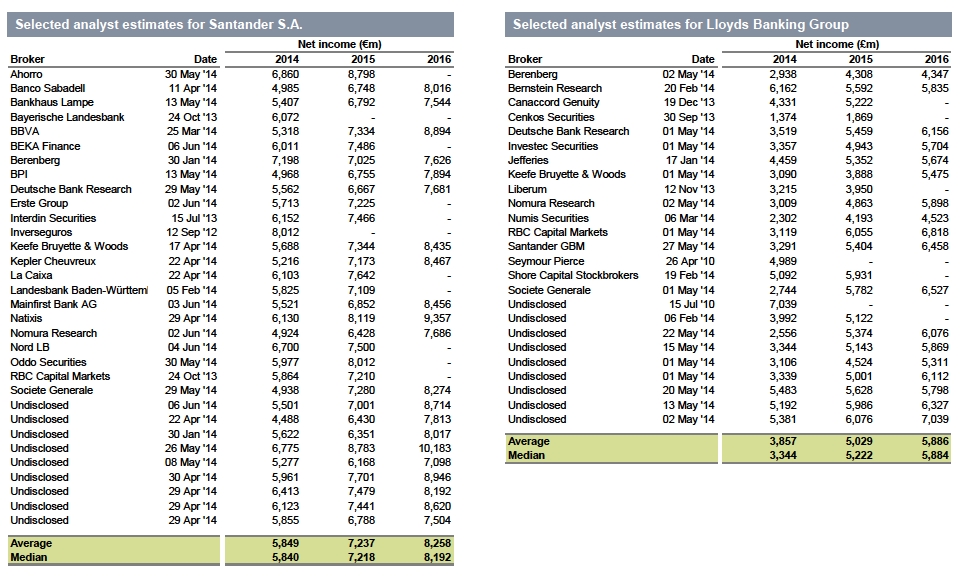

D.1 Selected analyst estimates for Santander S.A. and peers

Source:Consensus estimates of earnings published by Factset as of June, 10th2014

| 60 |  |

Appendix D. Selected analyst estimates for Santander

S.A. and peers

D.2 Selected analyst estimates for Santander S.A. and peers

Source:Consensus estimates of earnings published by Factset as of June, 10th2014

| 61 |  |

Appendix D. Selected analyst estimates for Santander

S.A. and peers

D.3 Selected analyst estimates for Santander S.A. and peers

Source:Consensus estimates of earnings published by Factset as of June, 10th2014

| 62 |  |

Appendix D. Selected analyst estimates for Santander

S.A. and peers

D.4 Selected analyst estimates for Santander S.A. and peers

Source:Consensus estimates of earnings published by Factset as of June, 10th2014

| 63 |  |

Appendix D. Selected analyst estimates for Santander

S.A. and peers

D.5 Selected analyst estimates for Santander S.A. and peers

Source:Consensus estimates of earnings published by Factset as of June, 10th2014

| |

| | Appendix E. Disclaimer |

| Disclaimer | |

1. N M Rothschild & Sons (Brazil) Ltda. ("Rothschild") was engaged by Banco Santander (Brasil) S.A. ("Santander Brazil" or "Company") to prepare a valuation report ("Valuation Report") on the units of Santander Brazil and on the shares of Banco Santander S.A.(“SantanderS.A.”,and together with Santander Brazil,“Companies”)in the context of the Material Fact published on April 29, 2014, whereby Santander Brazil informed the Market, and thus Rothschild, that Banco Santander S.A.(“BancoSantander”or“SantanderS.A.”,and together with Santander Brazil,“Companies”)intendsto launch a voluntary offer in Brazil and in the United States of America(“USA”)to acquire up to the totality of the shares of Santander Brazil whichare not held by Santander S.A. with the objective to take the company out of BM&FBOVESPA S.A.–Bolsa de Valores, Mercadorias e Futuros’ ("BM&FBOVESPA“)Nível 2 corporate governance listing segment, in exchange for shares of Santander S.A.(“Transaction”or“PublicOffering Project of Santander S.A.”),in accordance with Securities and Exchange Commission (CVM) Ruling No. 361 as of March 5, 2002, as amended by CVM Rulings No. 436, of July 5, 2006, No. 480, of December 7, 2009, No. 487, of November 25, 2010 and No. 492, of February 23, 2011(“CVMRuling No. 361”),and with the Regulation of the BM&FBOVESPA Nível 2. After the OPA, the intention of Santander S.A.’sis to keep the shares of Santander Brazil listed on BM&FBOVESPA. However, they would migrate from the Nível 2 corporate governance listing segment to the traditional segment of BM&FBovespa.

2. This Valuation Report has been prepared exclusively for use in connection with the Public Offering Project of Santander S.A. pursuant to Law No. 6.404/76(“Corporations Law”)and CVM Instruction 361 and complies with the requirements and provisions thereunder, particularly those set out in Exhibit III, and may not be used for any other purpose, including, without limitation, for the purposes of articles 8 (introductory paragraph), 45, 227 paragraph 2, 228 paragraph 2, 229 paragraph 5, 252 paragraph 1 and 264 of the Corporations Law, and CVM Instruction No. 319 of December 3, 1999, as amended. This Valuation Report may not be used for any purpose other than in the context described above without the prior written authorization of Rothschild. This Valuation Report, including its analyses and conclusions, (i) does not constitute a recommendation to any board member or shareholder of Santander Brazil or Santander S.A., or any of their controlling, controlled, or related companies ("Affiliates") on how to vote or act on any matter relating to the Transaction; (ii) should not be interpreted as a recommendation concerning the exchange parity and (iii) cannot be used to justify the voting rights of any person on any matter.

3. To come to the conclusions presented in this Valuation Report, we took into account public information, such as financial studies, analyses, research, and financial, economic and market criteria, that we considered relevant (collectively, the "Information").

4. Within the scope of our review we do not assume any responsibility or liability for independent investigation of any of the Information and we relied on the completeness and accuracy of the Information in all material respects. Furthermore, we were not asked to perform, and we did not perform, (i) independent verification of the Information or of the documentation that supports the Information; (ii) a technical audit of theCompanies’operations; (iii) independent verification or valuation of any of SantanderBrazil’sand/or Santander S.A.’sassets or liabilities (including any property, assets or unrecorded contingency, liability or financing); (iv) assessment of theCompanies’solvency under bankruptcy, insolvency, or similar legislation; or (v) any physical inspection of theCompanies’properties, facilities or assets. We are not an accounting firm and we do not provide accounting or auditing services in connection with this Valuation Report or with the Transaction. We are not a law firm and we do not provide legal, regulatory or tax services regarding this Valuation Report or the Transaction. The preparation of this Valuation Report by Rothschild does not include any service or opinion related to such services.

| 66 |  |

| |

| | Appendix E. Disclaimer |

| Disclaimer | |

5. Rothschild, its officers, employees, consultants, agents, and representatives do not provide, and will not provide, any representation, direct or implied, or any warranty concerning the accuracy or completeness of the Information (including financial and operating projections from equity research analysts, and assumptions and estimates on which such projections were based) used in the preparation of this Valuation Report.

6. No accounting, financial, legal, tax, or any other kind of due diligence process was performed with respect to Santander Brazil or Santander S.A. or any third party.

7. No representation or warranty, direct or implied, is made by Rothschild regarding the truthfulness, accuracy, or sufficiency of the information contained herein, or the Information which this Valuation Report was based on. Nothing contained in this Valuation Report may be interpreted or construed as a representation by Rothschild as to the past or the future.

8. The operating and financial projections included or used in this Valuation Report were based on public information published by equity research analysts and available in public databases, and we assume that such projections reflect the best estimates currently available regarding the future financial performance of the Companies, which was valued on a stand-alone basis, and, therefore do not include operating, tax, or other benefits or losses, including but not limited to any goodwill, or any synergies, incremental value, or costs, if any, that the Companies may have after the conclusion of the Public Offering Project of Santander S.A., if launched, or of any other transaction. This Valuation Report also does not take into account any operational and financial gains or losses that may occur after the Transaction as a result of commercial changes in existing business transactions between Santander S.A. and Santander Brazil.

9. We assumed that the operational and financial projections published by equity research analysts and available in public databases (i) were prepared in a reasonable manner on bases that reflect the best estimates currently available regarding theCompanies’future financial performance and regarding future demand and market growth; and (ii) from the delivery date of the Information until the present date, neither the Companies nor their management are aware of any information that could materially impact the business, financial condition, assets, liabilities, business prospects, business transactions or the number of shares issued by the Companies, and neither of them are aware of any other significant event that could make the market information incorrect or inaccurate in any material aspect, or have a material effect on this Valuation Report.

10. This Valuation Report is not and should not be used as (i) an opinion on the fairness of the Transaction; (ii) a recommendation concerning any aspect of the Transaction; (iii) a valuation report issued for any purpose other than those set forth in CVM Instruction 361, and should the Transaction be registered with the U.S. Securities and Exchange Commission ("SEC") or disclosed in the United States of America by reason ofrules issued by SEC, and the purposes set forth under applicable law and regulations of the United States of America; or (iv) an opinion on thefairness of the Transaction, or a determination of fair price under the Public Offering Project of Santander S.A.. This Valuation Report has not been compiled or prepared in order to comply with any legal or regulatory provision in Brazil or abroad, except for those applicable to the Transaction.

| 67 |  |

| |

| | Appendix E. Disclaimer |

| Disclaimer | |

11. The preparation of a financial analysis is a complex process which involves subjective judgments and various determinations as to the most appropriate and relevant analysis methods, and the application of such methods to the specific circumstances. Accordingly, this Valuation Report is not subject to a partial analysis. In order to come to the conclusions presented in this Valuation Report, we did not give specific weight to given factors considered in this Valuation Report, but instead applied qualitative reasoning to the analyses and factors, considered within the specificcircumstances of the Companies. We came to a final conclusion based on the results of the entire analysis, considered as a whole, and we did notcome to conclusions based on, or related to, any individual factors or methods in our analysis. Accordingly, our analysis must be considered as a whole and the selection of parts of our analysis, or specific factors, without considering the whole of our analysis and conclusions, may result in an incomplete and incorrect understanding of the processes used in our analysis and conclusions. The estimates contained in the analysis under the Valuation Report, and the valuation resulting from any specific analysis are not necessarily indicative of the real values, results or future values, which may be significantly more or less favorable than those suggested by this analysis. We do not express any opinion with respect to the prices at which the units or shares related to the Transaction could be traded on the securities market at anytime.

12. This Valuation Report is intended only to indicate a range of values for the units and shares in connection with the Transaction, as of the base date used under each method, pursuant to CVM Instruction 361, and does not assess any other aspect or implication of the Transaction or of any agreement, contract or understanding made in relation to the Transaction. This Valuation Report does not deal with the merits of the Transaction in comparison to other business strategies that may be available to the Companies or its shareholders, and does not deal with any business decision they take to make or accept the Transaction. The shareholders of the Companies should seek the advice of their financial advisors to obtain opinions on the making and acceptance of the Transaction. The results presented in this Valuation Report refer exclusively to the Transaction and do not apply to any other matter or transaction, now or in the future, related to the Companies, the economic groups to which it belongs, or to the sector in which it operates.

13. This Valuation Report is based on public information available to us up to the present date, and the points expressed are subject to change in function of a number of factors, such as market, economic, and other conditions, as well as theCompanies’business and perspectives. Rothschild has assumed that all authorizations and approvals required for consummation of the transaction described in this Valuation Report will be obtained and that no change, material limitation, restriction, or condition will be imposed for the obtaining of such authorizations or approvals. Rothschild does not assume any responsibility or liability to update, rectify or cancel this Valuation Report, in whole or in part, after the present date, or to indicate any events or matters related to third parties that Rothschild may become aware of and that change the contents of this Valuation Reportafter the present date, subject to the provisions of article 8 paragraph II of CVM Instruction 361.

14. Santander S.A. agreed to reimburse us for all our expenses and Santander Brazil agreed to indemnify us, and certain individuals related to us, in connection with certain liabilities and expenses that may arise because of our engagement, unless when arising from negligence or wilful misconduct. We will receive a fee for the preparation of this Valuation Report (to be paid by Santander S.A.), regardless the closing of the Public Offering Project of Santander S.A. and our conclusions under this Valuation Report. The fee that we will receive is detailed in the item“Informationabout theAppraiser”on page 14 of this Valuation Report and will be paid by Santander S.A., in accordance with local regulation.

| 68 |  |

| |

| | Appendix E. Disclaimer |

| Disclaimer | |

15. We have rendered from time to time in the past financial advisory and other services to Santander S.A. and to the Company or its Affiliates, for which we were paid, and we may in future render such services to Santander S.A. and to the Company or its Affiliates, for which we would expect to be paid.

16. This Valuation Report is the intellectual property of Rothschild and may not be published, reproduced, copied, summarized, quoted, disclosed or distributed, in whole or in part, or used by third parties, without the prior written authorization of Rothschild, except as required by Law nº 6,404/76 and by the rules issued by the CVM and, should the Public Offering Project of Santander S.A. be registered with the Securities and Exchange Commission or disclosed in the United States of America, by the applicable law and regulations of the United States of America. If the disclosure of this Valuation Report becomes necessary under applicable law, it may only be disclosed if its contents are reproduced in their entirety, and any description or reference to Rothschild must be made in a manner reasonably acceptable to Rothschild.

17. Rothschild declares that the Companies and their managements, in the course of our work, did not direct, limit, hinder or perform any acts that could have compromised the access, use or knowledge of information, assets, documents, or work methodologies relevant to the quality of the conclusions presented here, and did not restrictRothschild’scapacity to determine the conclusions presented in this Valuation Report. When preparing the Report, Rothschild held conference calls and a meeting with members of theCompany’smanagement, to discuss details on certain information regarding Santander Brazil. On June 12, 2014, Rothschild presented to the independent members of the Board of Santander Brazil, tothe Chairman of the Board of Santander Brazil and to executive officers of Santander Brazil, the Report, which was published on June 13, 2014.18. The financial calculations included in this Valuation Report may not always result in a precise number due to rounding.

19. This Valuation Report was written exclusively in Portuguese and, in the event it is translated to another language, the Portuguese version shall prevail for all purposes and effects.

20. The base date for this Valuation Report is June 10th, 2014.

| 69 |  |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: September 18, 2014

Banco Santander (Brasil) S.A. |

| | |

| By: | /S/ Amancio Acurcio Gouveia

| |

| | Amancio Acurcio Gouveia

Officer Without Specific Designation

| |

| | |

|

| | |

| By: | /S/ Angel Santodomingo Martell

| |

| | Angel Santodomingo Martell

Vice - President Executive Officer

| |