UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K/A

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2019

Commission File Number: 001-34476

BANCO SANTANDER (BRASIL) S.A.

(Exact name of registrant as specified in its charter)

Avenida Presidente Juscelino Kubitschek, 2041 and 2235

Bloco A – Vila Olimpia

São Paulo, SP 04543-011

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:Form 20-F ___X___ Form 40-F _______ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes _______ No ___X____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes _______ No ___X____

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes _______ No ___X____

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

SUMMARY

| |

| 1. Message from the Chairman of the Board of Directors | 3 |

| |

| 2. Call Notice | 5 |

| 3. Participation of the Shareholders in the OEGM | 7 |

| 3.1. Attendance | 7 |

| 3.2. Representation by attorney-in-fact | 7 |

| 3.3. Remote Voting Participation | 8 |

| 3.4. ADRs Holders | 10 |

| |

| 4. Matters to be resolved in the OEGM | 10 |

| At the Ordinary Shareholders Meeting: | 10 |

4.1. To TAKE the management accounts, examining, discussing and voting theCompany’s Financial Statements related to the fiscal year ended on December 31,2018, together with the Management Report, the balance sheet, other parts of thefinancial statements,external auditors’ opinion and the Audit Committee Report | 10 |

|

|

|

| 4.2. To DECIDE on the destination of the net profit of the fiscal year of 2018 and the distribution of dividends | 11 |

| 4.3. To FIX the number of members that will compose the Board of Directors in the mandate from 2019 to 2021 | 12 |

| 4.4. To ELECT the members of the Company's Board of Directors for a term of office from 2019 to 2021 | 12 |

| 4.5. To FIX the annual overall compensation of the Company´s management and members of Audit Committee | 13 |

| |

| At the Extraordinary Shareholders Meeting: | 14 |

4.6. To AMEND the wording of articles 21 and 24 of the Company's Bylaws, in order to modify the rules for the installation of meetings of the Executive Board, granting of mandates and representation of the Company | 14 |

| 4.7. To APPROVE the consolidation of the Company’s Bylaws | 14 |

| |

| EXHIBIT I–COMMENTS OF THE MANAGEMENT TO THE FINANCIAL CONDITION OF THE COMPANY | 15 |

| |

| EXHIBIT II | 94 |

| BOARD PROPOSAL FOR ALLOCATION OF NET PROFIT FOR THE FISCAL YEAR | |

| |

| EXHIBIT III | 101 |

| PROPOSAL FOR ELECTION OF THE COMPANY'S BOARD OF DIRECTORS | 101 |

| |

| EXHIBIT IV | 112 |

| |

| EXHIBIT V | 152 |

| Proposal for amendment of the Company’s ByLaws with the information | 152 |

2

|

1.Message from the Chairman of the Board of Directors

Dear Shareholders,

I am very pleased to invite you, shareholder of Santander Brasil, to participate of theOrdinary and Extraordinary General Meeting (“OEGM”) of Santander Brasil, called for April 26, 2019 at 3 p.m.,at the Company's headquarters located atAvenida Presidente Juscelino Kubitschek, 2235 – 1st mezzanine –Vila Olímpia - São Paulo, State of São Paulo, Brazil.

This Manual for Participation in the Ordinary and Extraordinary General Meeting (“Manual”), was preparedto assist you on the comprehension of the presented matters, to take decisions, anticipating possible clarifications and voting orientations.

Pursuant to the Call Notice turned available, we shall take resolutions on the following matters:

At the Ordinary Shareholders Meeting:

(i)To TAKE the management accounts, examining, discussing and voting the Company’s Financial Statements related to the fiscal year ended on December 31, 2018, together with the Management Report, the balance sheet, other parts of the financial statements, external auditors’ opinion and the Audit Committee Report;

(ii)To DECIDE on the destination of the net profit of the fiscal year of 2018 and the distribution of dividends;

(iii)To FIX the number of members that will compose the Board of Directors in the mandate from 2019 to 2021;

(iv)To ELECT the members of the Company's Board of Directors for a term of office from2019 to 2021; and

(v)To FIX the annual overall compensation of the Company´s management and members of Audit Committee.

At the Extraordinary Shareholders Meeting:

(i) To AMEND the wording of articles 21 and 24 of the Company's Bylaws, in order to modify the rules for the installation of meetings of the Executive Board, granting of mandates and representation of the Company; and

(ii) Due to the deliberate in item (i), APPROVE the consolidation of the Company's Bylaws.

In order to facilitate your analysis and appreciation of the matters to be resolved in the OEGM, we attached as exhibits to this Manual all documents related to the matter of the Call Notice into the form of exhibits to this Manual, in attention to the CVM requirements.

3

|

We are at your disposal to clarify any doubts through our emailsacionistas@santander.com.br for individual investors and non-financial entities andri@santander.com.br for institutional investors.

We hope that this Manual will fulfill its purpose of assisting you with clarification on the matters to be resolved. Your participation in this important event is essential for the Company.

Very truly yours,

Álvaro Antônio Cardoso de Souza

Chairman of the Board of Directors

4

2. Call Notice

[to be published in theDiário Oficial do Estado de São Paulo (Official Gazette of the State of São Paulo)andValor Econômico, in editions of March 27th, 28th and 29th, 2019]

BANCO SANTANDER (BRASIL) S.A.

Public-Held Company with Authorized Capital

Corporate Taxpayer ID (CNPJ/MF) 90.400.888/0001-42

Company Registration (NIRE) 35.300.332.067

CALL NOTICE–ORDINARY AND EXTRAORDINARY GENERAL MEETING -The shareholders are hereby called to attend the Ordinary and Extraordinary General Meeting (“OEGM”) to be held on April 26, 2019, at 3 p.m., at the Company head offices, located in the City of São Paulo, State of São Paulo, at Avenida Presidente Juscelino Kubitschek No. 2235, 1º mezzanine, Vila Olímpia, to resolve on the following Agenda:

At the Ordinary Shareholders Meeting:

(i)To TAKE the management accounts, examining, discussing and voting the Company’s Financial Statements related to the fiscal year ended on December 31, 2018, together with the Management Report, the balance sheet, other parts of the financial statements, external auditors’ opinion and the Audit Committee Report;

(ii)To DECIDE on the destination of the net profit of the fiscal year of 2018 and the distribution of dividends;

(iii)To FIX the number of members that will compose the Board of Directors in the mandate from 2019 to 2021;

(iv)To ELECT the members of the Company's Board of Directors for a term of office from2019 to 2021; and

(v)To FIX the annual overall compensation of the Company´s management and members of Audit Committee.

At the Extraordinary Shareholders Meeting:

(i) To AMEND the wording of articles 21 and 24 of the Company's Bylaws, in order to modify the rules for the installation of meetings of the Executive Board, granting of mandates and representation of the Company; and

(ii) Due to the deliberate in item (i), APPROVE the consolidation of the Company's Bylaws.

5

General Instructions:

1. As provided for in CVM Instruction No. 165/91, as amended by CVM Instruction No. 282/98, the minimum percentage of stake in the voting capital required to request the multiple voting process for the election of members of the Board of Directors is equal to five percent (5%);

2. Pursuant to paragraph 2 of article 161 of Law 6404/76 and CVM Instruction No.324/00, the installation of the Fiscal Council by the General Meeting shall occur at the request of shareholders representing at least 2% (two percent ) of the voting shares, or 1% (one percent) of the non-voting shares;

3. The shareholders or their legal representatives should attend the OEGM bringing the relevant identity documents. In the event of representation of a shareholder by means of a proxy, the shareholders shall deliver at the Company’s head office, no less than seventy-two (72) hours before the Ordinary and Extraordinary General Meeting, a power of attorney granted according to the law; and

4. The documents related to the matters to be analyzed at the OEGM are available to shareholders (i) at the Company’s head office, at Avenida Presidente Juscelino Kubitschek, No. 2041 and 2235 - Bloco A, Vila Olímpia, São Paulo/SP, 9th floor - Corporate Law Department, where they can be consulted, on business days, from 10:00 am to 4:00 pm, and also at its website (www.ri.santander.com.br – in Corporate Governance > Minutes and Management Meetings); (ii) at the Brazilian Securities and Exchange Commission (Comissão de Valores Mobiliários), at Rua Sete de Setembro No. 111, 5th Floor, Consultation Center, Rio de Janeiro/RJ or at Rua Cincinato Braga No. 340, 2nd to 4th floors, Ed. Delta Plaza, São Paulo/SP and on its website (www.cvm.gov.br) and (iii) at the B3 S.A. – Brasil, Bolsa, Balcão, at Rua XV de Novembro No. 275, São Paulo/SP and on its website (www.b3.com.br); and

5.Remote Voting Form: the Company implemented the remote voting system in accordance with CVM Instruction 481/09, as amended by CVM Instructions 561 and 570/15, enabling Shareholders to send remote voting form directly to the Company, to the bookkeeping or their respective custodian, according to the procedures described in the Manual for Participation in Shareholder´s meeting.

São Paulo, March 26, 2019 –Álvaro Antonio Cardoso de Souza - Chairman of the Board of Directors.

___________________________________________________

6

3. Participation of the Shareholders in theOEGM

The shareholders of Santander Brasil may attend the OEGMpersonally, through aduly appointed and established attorney-in-factor throughRemote Voting.

The following documents will be required from the shareholders to attend the Ordinary and Extraordinary General Meeting:

Individual | • ID document with photo1(original or certifiedcopy) •proofofownershipofsharesissuedbytheCompany,issued by the custody agent and / or custodian financial institution (original or certifiedcopy) |

Legal entity | • corporatedocumentsthatevidencethelegalrepresentation of the shareholder (original or certifiedcopy)2 • IDdocumentofthelegalrepresentativewithphoto(original or certifiedcopy) |

3.1. Attendance

The shareholders of Santander Brasil may attend the General Meetings by attending the place of their performance and declaring their vote, according to the kind of shares they hold (common and/or preferred) and the matters to be voted on. Pursuant to the provisions of Article 126 of Law 6.404/76, shareholders mustattend the General Meetings, in addition to the identity document, proof of ownership of shares issued by the Company, issued by the depositary financial institution and/or custody agent. The Company recommends that such proof be issued within two (2) business days prior to the date scheduled for theMeeting.

Corporate shareholders, such as Commercial Companies and Investment Funds, must be represented in accordance with their Bylaws, Articles of Incorporation or Regulation, providing documents proving the regularity of the representation, accompanied by a Minutes of the election of the entity’s management members, as the case may be, in place and term indicated in the item below. Before the General Meetings are installed, the shareholders will sign the Attendance Book. Non-voting shareholders may attend General Meetings and discuss all matters submitted for deliberation.

3.2. Representation byattorney-in-fact

The shareholder may be represented at the OEGM by a proxy, duly constituted by a publicorprivateinstrument,andpursuanttoarticle126,paragraph1oftheBrazilian CorporationLaw,theattorneys-in-factmusthavebeenconstitutedlessthanone(1), and should be (i) the Company's shareholders, (ii) the Company's management members, (iii) lawyers, or (iv) financial institutions, with the administrator of to represent the fund’squotaholders.

Theoriginalsorcertifiedcopiesofthedocumentsreferredtoabovemaybedelivered at the Company's headquarters until the time of theOEGM.

1Thefollowingdocumentsmaybepresented:(i)GeneralRegistrationIDCard(RG);(ii)ForeignerIdentity Card (RNE); (iii) Valid passport; (iv) Professional Class ID Card valid as a civil identity for legal purpose (e.g.: OAB, CRM, CRC, CREA); or (v) National Driver’s License (CNH) withphoto.

2By-Laws/Articles of Association and Minutes/Instruments of election of the legal representatives registered with the pertinent body

However, in order to turn available the access of shareholders at the OEGM, we recommendthatthedeliveryofthesedocumentsbemadeatleastseventy-two(72) hours prior to theOEGM.

Inthecaseofsendingthedocumentsbye-mail,theoriginalsorcertifiedcopiesmust be delivered to the Company's headquarters on the day of theOEGM.The documents must be delivered to the Company's registered office at Avenida Presidente Juscelino Kubitschek, 2041 and 2235 - Vila Olímpia - São Paulo, State of SãoPaulo,Brazil,9thfloor-CorporateLegalDepartment,at+55113553-5438and + 55 11 3553-5641, e-mail: juridsocietario@santander.com.br.

7

|

|

3.3. Remote Voting Participation

Pursuant to articles 21-A and following of CVM Instruction 481/2009, the Company's shareholders may also exercise their vote at general meetings by means of remote voting, to be formalized in an electronic document called Remote Voting Form, whose model is available in the Corporate Governance area ofthe Investor Relations website of Santander Brasil (www.ri.santander.com.br) or on the website of the Brazilian Securities and Exchange Commission (CVM) (http://sistemas.cvm.gov.br/?CiaDoc).

A shareholder that elects to exercise his right to vote at a Remote must do so by one of the options described below:

(I) Delivery of Remote Voting Formdirectly to the Custody Agent

The shareholder that chooses to exercise the remote voting through its custody agent (“Custody Agent”) shall transmit the voting instructions observing the rules determined by the Custody Agent, which shall send such voting manifestations to the Depositary Central of B3 S.A. – Brasil, Bolsa, Balcão. The Shareholders must contact their respective Custody Agents to verify the procedures established by them for issuance of the voting instructions through the Form, as well as the documents and information required.

The Shareholder shall transmit the instruction for fulfillment of the Form to the Custody Agent untilApril 18th, 2019(including), except if a different term is determined by the Custody Agents.

(II) Delivery of Remote Voting Form directly to the bookkeeper

The shareholder that chooses to exercise the remote voting through the Company’s bookkeeper must observe the following instructions in order for the Remote Voting Form to be considered valid and the votes counted:

(i) all the blank spaces must be duly fulfilled;

(ii) all the pages must be initialed;

(iii) the last page must be signed by the shareholder or its legal representative(s), as the case may be and pursuant to the applicable legislation in force; and

(iv) the Form must be certified by a notary.

The following documents have to be sent to the Company’s bookkeeper:

(i) original Form, duly fulfilled, initialed and signed; and

(ii) certified copies of the documents that follows:

Ø Individual (shareholder or legal representative): Identification document with picture (Identity Card - RG and CPF/MF; Driver License – CNH or Professional Card issued with public faith and containing the CPF number). For documents issued abroad it is necessary the respective sworn translation duly certified by the competent consulate (“consularization”).

Ø Legal Entities/Corporations: (i) Articles of Association or Bylaws duly updated, with the document that prove the representation powers (minutes of election); (ii) Identity Card with picture of the representatives (RG and CPF; CNH or Professional Card issued with public faith and containing the CPF number). For documentsissued abroad it is necessary the respective sworn translation duly certified by the competent consulate (“consularization”).

8

|

|

The documents must be sent to the Company’s bookkeeper within seven (7) days before the OEGM, in fact,April 18th, 2019(including), through(i)mail to Banco Santander (Brasil) S.A. –Acionistas –Escrituração de Ações – Rua Amador Bueno, 474 – 2nd floor – Red Sector – Santo Amaro – São Paulo/SP, Brazil – 04752-005; or(ii) via e-mail: custodiaacionistavotoadistancia@santander.com.br.

After the receipt of such documents, the bookkeeper, within three (3) days, shall inform the shareholder about the receipt of such documents and its acceptance. If the sent documents are not considered proper, the Form shall be deemed invalid, being the shareholder able to regularize it untilApril 18th, 2019.

The Forms received by the bookkeeper afterApril 18th, 2019 shall not be considered for voting purposes.

(III) Delivery of the Remote Voting Form directly to the Company

The shareholder that chooses to exercise the remote voting directly through the Company observe the following instructions in order for the Remote Voting Form to be considered valid and the votes counted:

(i) all the blank spaces must be duly fulfilled;

(ii) all the pages must be initialed;

(iii) the last page must be signed by the Shareholder or its legal representative(s), as the case may be and pursuant to the applicable legislation in force; and

(iv) the Form must be certified by a notary.

The following documents have to be sent to the Company:

(i) original Form, duly fulfilled, initialed and signed; and

(ii) certified copies of the documents that follows:

· Individual (shareholder or legal representative): Identification document with picture (Identity Card - RG and CPF/MF; Driver License – CNH or Professional Card issued with public faith and containing the CPF number). For documents issued abroad it is necessary the respective sworn translation duly certified by the competent consulate (“consularization”).

· Legal Entities/Corporations: (i) Articles of Association or Bylaws duly updated, with the document that prove the representation powers (minutes of election); (ii) Identity Card with picture of the representatives (RG and CPF; CNH or Professional Card issued with public faith and containing the CPF number). For documents issued abroad it is necessary the respective sworn translation duly certified by the competent consulate (“consularization”).

The documents must be sent to the Company within seven (7) days before the Ordinary General Meeting, in fact, untilApril 18th, 2019(including) (i) mail to Banco Santander (Brasil) S.A. – Investors Relations – Avenida Presidente Juscelino Kubitschek, 2235 – 26th floor – Vila Olímpia – São Paulo/SP, Brazil –04543-011; or(ii) via e-mail: ri@santander.com.br.

After the receipt of such documents, the Company, within three (3) days, shall inform the shareholder about the receipt of such documents and its acceptance. If the sent documentsare not considered proper, the Form shall be deemed invalid, being the shareholder able to regularize it untilApril 18th, 2019.

9

|

|

The Forms received by the Company afterApril 18th, 2019 shall not be considered for voting purposes.

General Information:

Ø in accordance with Article 21-S of CVM Instruction 481, the Central Depositary of B3 S.A. – Brasil, Bolsa, Balcão, upon receiving shareholder voting instructions through its respective custody agent, shall not consider any instructions that differ from the same resolution that have been issued by the same CPF or CNPJ registration number; and

Ø after the deadline for remote voting, that is, untilApril 18th, 2019 (including), the shareholder may not change the voting instructions already sent, unless presented at the Ordinary General Meeting or represented by proxy, upon explicit request to not consider the instructions in the Remote Voting Form submitted before the respective Forms were placed.

3.4. ADRs Holders

Holders of American Depositary Receipts (ADRs) will be entitled to vote on matters listed on the Agenda, according to the same criteria applied to national investors, according to the type of shares (common or preferred) in which their ADRs are backed. The holders of ADRs will be duly instructed by The Bank of New York Mellon, the depositary financial institution of the ADRs backed by the shares of Santander Brasil.

4. Matters to be resolved in the OEGM

Below you shall find clarifications made by the Company’s management regarding each of the items to be resolved in the OEGM. According to the Call Notice made available to the shareholders, our OEGM shall take resolutions regarding the following matters of the Agenda:

At the Ordinary Shareholders Meeting:

4.1. To TAKE the management accounts, examining, discussing and voting the Company’s Financial Statements related to the fiscal year ended on December 31, 2018, together with the Management Report, the balance sheet, other parts of the financial statements, external auditors’ opinion and the Audit Committee Report

The documents presented by the management are:

- Management Report showing the operating statistics and the analysis and discussion of the Administrative Officers of the principal accounts of the Statement of Income for the Fiscal Year;

- Comments of the administrative officers on the financial condition of the Company (Exhibit I – Item 10 of the Reference Form);

- Copy of the Financial Statements and Explanatory Notes;

- Opinion of the Independent Auditors;

- Summary of the report of the Audit Committee; and

- Standardized financial statements form – DFP.

10

|

|

The management documents identified above, except for item ii above, were made available to the CVM, via the IPE system, at the time of disclosure of the individual and consolidated financial statements of the Company prepared in accordance with Accounting Practices Adopted in Brazil applicable to institutions authorized to operate by the Brazilian Central Bank, on January 30th, 2019, and for the consolidated financial statements of the Company in accordance with the IFRS as issued by the IASB turned available on February 28th, 2019. These documents can be found on the electronic address of the CVM (www.cvm.gov.br), or of the Company (www.ri.santander.com.brand www.santander.com.br/acionistas),according to information shown inExhibit I of this Manual.

The Company's management proposes that the shareholders examine in detail the management accounts and the Company's Financial Statements so that they can deliberate about their approval.

4.2. To DECIDE on the destination of the net profit of the fiscal year of 2018 and the distribution of dividends

(a) Net Profit Allocation

The Executive Board presents a proposal for the fiscal year 2018 net profit allocation in compliance with the provisions of Article 9, first paragraph, item II and the respective Annex 9-1-II to CVM Instruction 481. Said proposal is contained inAnnex II to this Manual. We recommend the careful reading of said Annex.

Net profit corresponds to the result recorded in the fiscal year, after deductions of accumulated losses, provision for income tax and statutory profits of employees and administrators, if applicable.

The net profit of the Company in the fiscal year 2018 was R$ 12,166,394.

The allocation of the net profit consists in determining the net profit installments: (i) which will be appropriated to legal and statutory profit reserves, (ii) which will be distributed as dividends, or (iii) retained.

The board shall submit to the Ordinary General Meeting a proposal for allocation to be given to the net profit of the fiscal year, which shall observe the provisions in the Corporations Law and in Article 36 of the Company's Bylaws:

- 5%, at least, to the legal reserve, until reaching 20% of the share capital. In the fiscal year in which the legal reserve balance, added to capital reserve amounts, exceeds 30% of the share capital, the allocation of part of the fiscal year's net profit to the legal reserve will not be mandatory;

- 25% of the annual net income adjusted pursuant to Article 202 of Corporations Law for the payment of mandatory minimum dividends to shareholders; and

- The remaining balance, if there is any, may(a) be allocated to the Reserve for Dividend Equalization, which will be limited to 50% of the share capital and its purpose will be to ensure resources for the payment of dividends, including as interest on own capital, or interim, in order to maintain the flow of remuneration to shareholders, and, upon reaching that limit, the ordinary general meeting shall be responsible for deciding on the balance, either proceeding its distribution to shareholders or to the increase of share capital, or(b) be retained in order to meet capital investment requirements set forth in the Company's general budget submitted by the board to approval by the general meeting and revised annually by said meeting when having a duration of more than one fiscal year.

11

|

|

The Reserve balance for Dividend Equalization, added to the balances of other profit reserves, upon implementing unrealized profit reserves and contingency reserves, may not exceed the value of the share capital. Once this maximum limit is reached, the general meeting may decide on the application of the excess in the payment or increase of the share capital, or in the distribution of dividends.

The profits not allocated in the terms above must be distributed as dividends, according to paragraph 6 of Article 202 of Corporations Law.

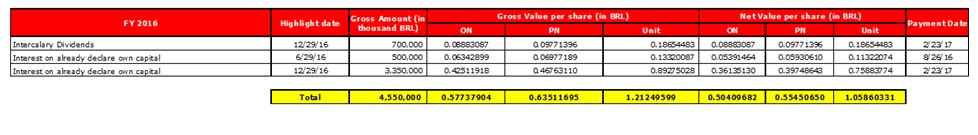

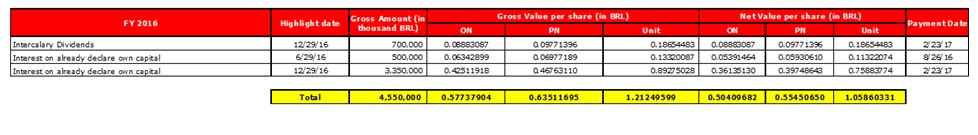

On the basis of the above, the board proposes the following allocation for the fiscal year 2016 net profit:

1. The value of R$ 608,320 to the Legal Reserve account;

2. The value of R$ 6,600,000, as dividends and interest on own capital to shareholders, which have been the object of decision in the meetings of the Board of Directors held on March 27, June 26, September 28 and december 28, 2018, of which R$ 2,520,000as interest on net equity charged to the value of the mandatory minimum dividends andR$ 4,080,000 in the form of interim dividends; and

3. The balance of the remaining net profit after the distributions above, to the value of R$ 4,958,075 , for the Dividend Equalization Reserve account, pursuant to Article 36, item III-a of the Company's Bylaws.

The board understands that the proposal for allocation of net profits above was formulated in accordance with the legal and statutory obligations applicable to the Company, and is in line with the goals and strategies of the Company, which is why the board recommends its approval without restrictions.

(b) Distribution of Dividends

As better detailed inAnnex II of this Manual, the board has approved the distribution to shareholders in the overall amount of R$ 6,600,000 as dividends and interest on own capital to shareholders, which have been the object of decision in the meetings of the Board of Directors held on March 27, June 26, September 28 and december 28, 2018, of which R$ 4,080,000as interest on net equity charged to the value of the mandatory minimum dividends andR$2,520,000 as intercalary dividends. These values correspond to 57.10% of the adjusted net profit of the Company, and were paid to shareholders based on their respective shares in the share capital of the Company.

4.3. To FIX the number of members that will compose the Board of Directors in the mandate from 2019 to 2021

The Company’s management proposes that the Board of Directors comprise 10 members for a term of office to be effective between the OEGM of 2019 and the Ordinary Shareholders’ Meeting of 2021.

4.4. To ELECT the members of the Company's Board of Directors for a term of office from 2019 to 2021

After complying with the applicable governance approvals, the Company proposes to the OEGM the election for a new term of two (2) years, of the following candidatesrecommended by the controlling shareholders to compose the Board of Directors of the Company:

12

|

|

Name | Post |

Álvaro Antônio Cardoso de Souza | Chairman and Independent Director |

Sergio Agapito Lires Rial | Vice-Chairman |

Celso Clemente Giacometti | Independent Director |

Conrado Engel | Director |

Deborah Patricia Wright | Independent Director |

Deborah Stern Vieitas | Independent Director |

José Antonio Alvarez Alvarez | Director |

José de Paiva Ferreira | Director |

José Maria Nus Badía | Director |

Marília Artimonte Rocca | Independent Director |

The information related to the election of the members of the Board of Directors of the Company, pursuant to article 10 of CVM Instruction 481, can be found on Exhibit III of this Manual.

4.5. To FIX the annual overall compensation of the Company´s management and members of Audit Committee

The management presents a proposal for remuneration of the Company’s management, complying with the provisions of Article 12, items I and II of CVM Instruction 481 and item 13 of the Reference Form of the Company, on the terms ofExhibit III to this Manual.

In 2018, the Ordinary General Meeting, held on April 27, approved a total annual remuneration for the managers of the Company, in an amount of up to R$ 300,000,000.00 (three hundred million Brazilian Reais) for the 2018 financial year, and for the Audit Committee in an amount of R$ 3,000,000.00 (three million Brazilian Reais) for the same period. Effectively, for the period from January to December, 2018 it was paid to the Company’s management members the amount of R$ 284.940.368,86 (two hundred eigth-for million, nine hundred and forty thousand, three hundred and sixty-eight Brazilian Reais and eighty-six cents), being acknowledged that such amount does not include social security duties.

For the period from January to December, 2019, the amount proposed by management as the overall remuneration of the Company’s management members (Board of Directors and Executive Board) is up to R$ 400,000,000.00 (four hundred million Brazilian Reais), covering fixed remuneration, variable remuneration and the portion that is based on shares.

The management members global compensation amount proposed is superior of the cap amount approved for the period from January to December, 2018, without considering the social security duties, which the estimative for the period from January to December 2019 is to reach the amount of R$ 26,970,000.00 (twenty-six million, nine hundred and seventy thousand Brazilian Reais).

The amount proposed by the Board of Directors as overall remuneration of the members of the Audit Committee for the twelve (12) months period counting from January 1st, 2019 is of R$ 4,000,000.00 (four million Brazilian Reais).

13

|

At the Extraordinary Shareholders Meeting:

4.6. To AMEND the wording of articles 21 and 24 of the Company's Bylaws, in order to modify the rules for the installation of meetings of the Executive Board, granting of mandates and representation of the Company

The Company’s management proposes to approve the changes indicated below, with the purpose of adapting the Bylaws rules to the composition of the Company's Board of Executive Officers, which currently has only one Officer who holds the position of "Executive Officer".

Therefore, the following changes to the Company's Bylaws should be made:

a. Amendment of itens I and II and deletion of item III of article 21, as well as amendment of its third paragraph, in order to soften (i) the rules for commencement of Mettings of the Executive Board e (ii) deliberation of the opening, transfer or closing of branches, offices or representative offices of the Company.

b. Amendment of item I and deletion of item II of article 24, with the consequent renumbering of the other items. Also, the wording of the first and second paragraphs of the same article will be modified.

4.7. To APPROVE the consolidation of the Company’s Bylaws

The proposal above aims to consolidate the Company’s Bylaws due to the amendment proposed on item 4.6 above.

For purposes of complying with article 11 of CVM Normative Instruction 481, the consolidated ByLaws is attached asExhibit V, with the highlighted proposed changes.

The amendment to the Bylaws of the Company are subject to authorization of the Brazilian Central Bank, according to the applicable laws.

14

|

EXHIBIT I – COMMENTS OF THE MANAGEMENT TO THE FINANCIAL CONDITION OF THE COMPANY

(Pursuant to item III of article 9 of CVM Instruction 481)

10. Officers comments

10.1 Officers should comment on:

a. general financial and equity conditions

The Brazilian financial assets registered a smaller volatility in the last three months of 2018 as compared with their performance in the quarter before. However, exchange and interest rates as well as equity market prices oscillated within a still relatively wide range. The Bank considers that these oscillations had to do with the continuation of turbulences on the international front and the maintenance of an elevated level of uncertainty regarding economic policy guidelines that the newly elected Brazilian government is going to carry out. Nonetheless, Banco Santander reminds that Brazilian financial assets ended December 2018 at far better levels than those observed in September 2018.

As far as the international environment is concerned, Santander believes that some factors played a substantial role and thwarted a retreat in the risk aversion regarding emerging economies – except for Brazil, which registered an improvement on the back of the end of electoral process. The Bank notes that, notwithstanding the fact that the US and China have reached a verbal agreement about their trade relationship, the materialization of a formal document continues to be uncertain. Consequently, the fear that such an imbroglio may foster a slowdown in the world economic growth continued to be alive. On top of that, despite US economic data have continued to register favorable economic readings of late, first signs that the rhythm of expansion would have peaked have appeared and raised concerns that a significant slowdown may be on its way – especially due to lagged effects of prior interest rate hikes. Incidentally, Banco Santander highlights that market players have already started assigning higher chances of a slower interest rate hike process in the US throughout 2019. On the one hand, if such a backdrop would mean a slower narrowing of the interest rate differential to other economies – which, would mean less pressure over their currencies – on the other hand, it would reinforce the perception that a stronger slowdown in the US economy may be closer than previously thought. The impact of such a circumstance for the world is much more critical than the first one, in Santander’s opinion. Additionally, the Bank saw this factor as the seemingly reason for part of the weakening that the USD registered against other currencies.

For Banco Santander, both factors have kept global financial conditions far from their best moments and they have continued to weigh on the performance of emerging economies. The Bank believes that such a setback has hit less intensely the Brazilian financial assets because the country’s balance of payments continues to bear a sound position (high level of international reserves and sizeable net inflows of foreign direct investments, in tandem with a low level of external indebtedness). Santander Bank considers that such a mix explains part of the strengthening that the BRL has shown of late. The Bank emphasizes that attributes a positive bias regarding the perception of risk towards the Brazilian economy, as it consider that there is a mounting chance of fiscal improvements to materialize. However, the Bank reckons that the international environment should remain as a source of concern on the back of new key events that may potentially add nervousness to market participants – e.g., Brexit’s denouement and presidential elections in Argentina. Due to that, the Santander Bank believes the jittery international front should prevail slightly over the domestic milieu, thus leading to a mild increase in the risk aversion. As a result, the Bank foresees the FX rate to end 2019 at R$4.00 per US$.

15

|

Regarding the Brazilian economy, Banco Santander perception that the deterioration in the balance of risks on the international front and uncertainties referring to the domestic environment would hit both consumers and entrepreneurs’ confidence proved right, as activity indicators ran at a slow beat in the last three months of 2018. As a result, the Bank revised downwards its forecast for the GDP growth in 2018 once again (to 1.3% from 1.5% previously).

Notwithstanding this mild expansion observed in the last quarter of 2018, the Bank’s expectation for the Brazilian GDP growth in 2019 points towards an outcome in the 3.0% vicinity – a marginal review as compared with the previous 3.2% growth projection – on the back of solid macroeconomic fundamentals and spikes shown by consumer and entrepreneurs’ confidence indicators in the last months. Banco Santander reinforces that inflation remains under control (it ended 2018 below the targeted level and it is likely to do it so in 2019), balance of payments is favorable and there are incipient signs of a credit recovery. On the back of these factors, Santander Bank believes that the base interest rate should continue to run at low levels – for the Brazilian standards – for more than a while, especially as inflation expectations remains anchored and the level of idle capacity still runs high. Indeed, the Bank expects the base interest rate to become higher than now only by 2020, which means the Selic target rate should remain unchanged at 6.50% pa throughout 2019.

Banco Santander forecasts for growth, inflation and low interest rates are based on the continuity of the reform agenda in the Brazilian economy, especially in the fiscal field. Banco Santander reiterates the assessment that the willingness and commitment of the newly elected government to seek stabilization of the public debt as well as to maintain a sustainable economic policy will be fundamental for the country to achieve long-term economic and social development.

(i) 2018

In the year ended December 31, 2018, the Company reported a consolidated net income of R$12.8 billion, a 28.9% increase compared to 2017. Total assets in the year ended December 31, 2018, reached R$723,865 million, an increase of 10.8% compared to 2017. Shareholders’ equity reached R$91,882 million and the adjusted ROE (excluding effect of goodwill) was of 21.0% in 2018.

The Basel adequacy rate of the Company, according to the Central Bank rules, was 15.1% as of December 31, 2018.

As of December 31, 2018, the gross clients loans and advances portfolio of the Company grew 10.6% and reached R$321,933 million, compared to R$287,829 million as of December 31, 2017.

The chart below presents the management details on the loans and advances portfolio (gross) of the Company per client category on the indicated dates.

| For the year ended December, 31 | Variations between December 31, 2018 vs. December 31, 2017 |

| | | | | |

| (in millions of R$ , except for percentages) |

Individuals | 133,603 | 107,610 | 91,195 | 25,993 | 24.2% |

Consumers financing | 40,964 | 33,170 | 26,608 | 7,794 | 23.5% |

Small and Medium Companies (1) | 49,624 | 46,879 | 42,440 | 2,746 | 5.9% |

Large Companies (2) | 97,112 | 100,171 | 108,195 | (3,059) | (3,1)% |

Total | 321,303 | 287,829 | 268,438 | 33,474 | 11,6% |

(1) Companies with annual gross revenue of up to R$ 200 million.

(2) Companies with annual gross revenue higher than R$ 200 million, including global corporate clients of the Company.

16

|

|

O total de captações da Companhia em 31 de dezembro de 2018 foi de R$497.512 milhões, um aumento de 14,5% comparado com R$434.620 milhões em 31 de dezembro de 2017.

(ii) 2017

In the year ended December 31, 2017, the Company reported a consolidated net income of R$9.1 billion, a 22.4% increase compared to 2016. Total assets in the year ended December 31, 2017, reached R$645,703 million, an increase of 1.8% compared to 2016. Shareholders’ equity reached R$87,425 million and the adjusted ROE (excluding effect of goodwill) was of 15.4% in 2017.

The Basel adequacy rate of the Company, according to the Central Bank rules, was 15.8% as of December 31, 2017.

��

As of December 31, 2017, the gross clients loans and advances portfolio of the Company grew 7.2% and reached R$287,829 million, compared to R$268,438 million as of December 31, 2016.

The chart below presents the management details on the loans and advances portfolio (gross) of the Company per client category on the indicated dates.

| For the year ended December, 31 | Variations between December 31, 2017 vs. December 31, 2016 |

| | | | | |

| (in millions of R$ , except for percentages) |

Individuals | 107,610 | 91,195 | 84,578 | 16,415 | 18.0% |

Consumers financing | 33,170 | 26,608 | 25,850 | 6,562 | 24.7% |

Small and Medium Companies (1) | 46,879 | 42,440 | 43,524 | 4,439 | 10.5% |

Large Companies (2) | 100,171 | 108,195 | 113,315 | (8,024) | (7.4)% |

Total | 287,829 | 268,438 | 267,266 | 19,391 | 7.2% |

(1) Companies with annual gross revenue of up to R$ 200 million.

(2) Companies with annual gross revenue higher than R$ 200 million, including global corporate clients of the Company.

Total funding of the Company as of December 31, 2017 was of R$434,620 million, a 0.02% reduce compared to R$434,700 million on December 31, 2016.

(iii) 2016

In the year ended on December 31, 2016, the Company reported a consolidated net income of R$ 7.5 billion, a 24.1% drop compared to 2015. Total assets in the year ended December 31, 2016, reached R$ 634,393 million, up 4.8% from 2015. Shareholders’ equity reached R$ 85.435 million and the adjusted ROE (excluding effect of spread) was of 13.3% in 2016.

The Basel adequacy rate of the Company, according to the Central Bank rules, was 16.3% as of December 31, 2016.

As of December 31, 2016, the gross clients loans and advances portfolio of the Company grew 0.4% and reached R$ 268,438 million, compared to R$ 267,266 million as of December 31, 2015.

17

|

|

The chart below presents the management details on the loans and advances portfolio (gross) of the Company per client category on the indicated dates.

| For the year ended December, 31 | Variations between December 31, 2016 vs. December 31, 2015 |

| | | | | |

| (in millions of R$ , except for percentages) |

Individuals | 91,195 | 84,578 | 77,809 | 7.8% | 6,617 |

Consumers financing | 26,608 | 25,850 | 27,686 | 2.9% | 758 |

Small and Medium Companies (1) | 42,440 | 43,524 | 42,191 | (2.5)% | (1,084) |

Large Companies (2) | 108,195 | 113,315 | 101,425 | (4.5)% | (5,120) |

Total | 268,438 | 267,266 | 249,111 | 0.4% | 1,171 |

(1) Companies with annual gross revenue of up to R$ 200 million.

(2) Companies with annual gross revenue higher than R$ 200 million, including global corporate clients of the Company.

Total funding of the Company as of December 31, 2016 was of R$434,700 million, a 2.2% increase compared to R$ 425,209 million on December 31, 2015.

b. capital structure:

(1) Includes non-controlling interest.

(2) Current Liabilities.

(3) Total liabilities, except shareholders' equity and current liabilities.

Indebtedness index, according to the formula: third capital / total assets x 100, is 87

Further, the chart below shows the direct equity interest (common and preferred shares) as of December 31, 2018:

| Common shares (thousands) | | Preferred shares (thousands) | | | |

| |

Sterrebeeck BV(2) | 1,809,583 | 47.4% | 1,733,644 | 47.1% | 3,543,227 | 47.2% |

Grupo Empresarial Santander SL | 1,107,673 | 29.0% | 1,019,645 | 27.7% | 2,127,318 | 28.4% |

Banco Santander, S.A. | 521,964 | 13.7% | 519,268 | 14.1% | 1,041,232 | 13.9% |

Treasury stock | 13,316 | 0.35% | 13,316 | 0.36% | 26,632 | 0.36% |

Banco Madesant | 950 | 0.02% | 950 | 0.03% | 1,900 | 0.03% |

Employees(1) | 6,916 | 0.18% | 6,917 | 0.19% | 13,833 | 0.18% |

Other minority shareholders | | | | | | |

Total | | | | | | |

(1) Includes members of senior management of the Company.

(2) An affiliate of Santander Group

18

|

|

(i) Equity Capital and Interest of Non-Controlling Shareholders

As of December 31, 2018, the Company’s capital was of R$ 57,000 million, fully paid, and divided into 7,498,531,051 shares, all of them registered, book-entry and with no par value.

Pursuant to the Company’s current Bylaws, the Company’s capital may be increased up to the limit of the authorized capital, irrespective of amendments to the Bylaws, upon a resolution of the Board of Directors of the Company and issuance of up to 9,090,909,090 new shares, whereas the total number of preferred shares shall not exceed 50.0% of the total number of outstanding shares. Any capital increase in excess of such limit requires the approval of the shareholders.

(ii) Equity and Third-Parties’ Capital

The revenue from equity capital in the year ended December 31, 2018 totalized R$ 33 million, and recorded an R$ 50 million decreased compared to the R$ 83 million revenue in the year ended December 31, 2017. This decrease is mainly due to a decrease in dividends from investments recorded on financial assets available for sale.

(iii) Reference Assets – Basel Ratio

The Company’s capital management is based on traditional principles and ongoing monitoring of items that affect the Company’s solvency level. The Company must abide by the Brazilian regulations of capital adjustment according to the rules of the Central Bank. In October 2013, the new regulations of capital implementation and the reference assets requirements of the Basel Committee on Banking Supervision (Basel III) came into force in Brazil. The minimum reference assets requirements are currently 11%. The requirement Level I is 6.0%, divided into basic capital of at least 4.5%, mainly comprised of capital stock and reserves of profits, including shares, ownership units, reserves and income earned, and additional capital mainly comprised of certain reserves, and bonds and hybrid instruments as capital authorized by the Central Bank.

According to the new reference assets rules in Brazil, the premium amount in the calculation of the capital base was deducted from the capital base according to the “phase-in” for implementation of Basel III in Brazil, which will be completed until the beginning of 2019. The table below shows the percentage of premium deduction required for each year until 2019:

Source: Central Bank; Resolution CMN No. 4,192 March, 2013.

Moreover, if the Basel III requirements were fully implemented on this date, the Company would keep a suitable reference assets index according to the Basel III rules those of Central Bank.

The Basel adequacy rate of the Company, according to the Central Bank rules, was 15.06% as of December 31, 2018.

| |

| | | |

| (In millions of R$ , except percentages) |

Level I Reference Assets | 61,476.7 | 56,386.0 | 56,264,0 |

Principal Capital | 56,581.5 | 52,196.9 | 52,136.8 |

Supplementary Capital | 4,895.2 | 4,189.1 | 4,127.2 |

Level II Reference Assets | 4,887.2 | 4,250.5 | 4,280.8 |

Reference Assets (Level I and II) | 66,363.9 | 60,636.4 | 60,544.9 |

Required Reference Assets | 440,562.9 | 35,439.8 | 36,669.6 |

Credit Risk Portion(2) | 358,955.6 | 30,034.4 | 31,309.9 |

Market Risk Portion(3) | 39,231.8 | 2,391.8 | 2,388.6 |

Operational Risk Portion | 42,375.6 | 3,013.6 | 2,971.0 |

Level I Basel Ratio | 13.95% | 14.72% | 15.15% |

Basel Ratio Principal Capital | 12.84% | 13.62% | 14.04% |

Basel Ratio | 15.06% | 15.83% | 16.30% |

(1) Amounts calculated based on consolidated information by Prudential Consolidated.

(2) For the calculation of capital allocation for Credit Risk, the modifications and inclusions of Bacen Official Letter 3714 of August 20, 2014, Bacen Official Letter 3770 of October 29, 2015, which amends Official Letter 3644 of March 4, 2013 were considered.

(3) It includes portions for exposure to market risk subject to variations on coupon rates in foreign currency, or "PJUR2", price indexes or "PJUR3" and interest rate or "PJUR1 / PJUR4", of the price of goods “commodities” or "PCOM”, of the price of shares classified as negotiation portfolios, or "PACS”, and portions for exposure to gold, foreign currency and transactions subject to currency variation, or “PCAM.”

19

|

c. ability to pay the financial obligations assumed

The Management Board understands that the Company shows financial and equity conditions sufficiently adequate for the payment of their assumed obligations.

The administration of Company's creditworthiness is made dynamically through the implementation of limits and control models, approved and supervised by the Assets and Liabilities Committee (ALCO), which operates according to guidelines and procedures established by Grupo Santander and the Central Bank. The control and management of the creditworthiness are made through the analysis of cash flow positions, structural liquidity and simulations of potential losses of resources under stress scenarios. Also, a plan is prepared containing funding requirements that consider the best structure for the funding sources, in order to achieve the necessary diversification in terms of maturities, instruments and markets, as well as the establishment of contingency plans. These controls, together with the maintenance of a minimum liquidity margin, guarantee sufficient resources to honor client deposits and other obligations, to give loans and financing to clients, fulfill the specific needs of working capital for investment and to cope with occasional risks related to liquidity crisis.

The Company actively administers the risks intrinsic to the activity of commercial bank, such as structural risks of interest rates, liquidity and foreign exchange rates. The objective of the financial management is to turn the net income with interest from commercial activities more stable and recurring, maintaining adequate levels of liquidity and solvency. Financial management also analyses the risk of structural interest rate derived from the divergences between the maturities and review of assets and liabilities in each currency operated by the Company.

The following table shows the intervals between the pricing dates of financial assets and liabilities with different maturity dates, on December 31, 2018, 2017 and 2016, respectively (liquidity position):

20

|

(1) Include obligations that may have early enforceability, such as: demand deposits and time deposits, repurchase transactions with clients, LCI and LCA.

21

|

The following table shows the financial assets and liabilities by national currency and foreign currency, on December 31, 2018, 2017 and 2016 (currency position):

| |

| | | |

| | | | | | |

| (in millions of R$ ) |

Assets | | | | | | |

Cash and balances with the Brazilian Central Bank | 16,651 | 15,065 | 100.740 | 126 | 110.430 | 175 |

Debt instruments | 166,743 | 8,690 | 137.240 | 11.666 | 134.038 | 9.788 |

Equity securities | 1,106 | — | 1.624 | 15.364 | 2.426 | — |

Loans and other amounts with credit institutions, gross | 79,167 | 17,902 | 17.005 | 15.364 | 25.421 | 2.542 |

Loans and advances to customers, gross | | | | | | |

Total | | | | | | |

| | | | | | |

Liabilities | | | | | | |

Financial liabilities at amortized cost | 74,160 | 24,863 | 56.563 | 22.812 | 51.340 | 27.294 |

Deposits from Brazilian Central Bank and Credit Institutions | 304,198 | — | 276.042 | — | 247.445 | — |

Customer deposits | 70,109 | 4,517 | 68.335 | 1.912 | 92.132 | 7.711 |

Securities obligations | 9,886 | — | 519 | — | 466 | — |

Subordinated liabilities | — | 9,780 | 8.435 | — | 8.312 | — |

Other financial liabilities | | | | | | |

Total | | | | | | |

Information related to the analysis of sensitivity of operation portfolios and banking generated by the Company’s corporate systems and the structure of risk management is available in items 10.2.b and c.

d. sources of financing for working capital and for investments in non-current assets used

The following table presents details of the capital-raisings made on the indicated dates

| |

| | | |

| |

Customer Deposits | 304,198 | 276,042 | 247,445 |

Checking account | 18,854 | 17,560 | 15,868 |

Savings Account | 46,068 | 40,572 | 36,051 |

Time deposits | 190,983 | 146,818 | 94,479 |

Repurchase agreements | 48,293 | 71,092 | 101,047 |

Transactions backed by Private Bonds(1) | 6,978 | 33,903 | 59,460 |

Transactions backed by Public Bonds(1) | | | |

Deposits from Central Bank and deposits from credit institutions | 99,023 | 79,374 | 78,634 |

Demand deposits(1) | 710 | 306 | 314 |

Time deposits(2) | 47,227 | 52,739 | 49,549 |

Repurchase agreements | 51,086 | 26,329 | 28,771 |

Transactions backed by Private Bonds(1) | 6,978 | - | 446 |

Transactions backed by Public Bonds(1) | | | |

Total deposits | | | |

Debt securities | | | |

Agribusiness Credit Bills | 11,925 | 8,854 | 6,981 |

Financial Bills | 30,721 | 31,686 | 61,157 |

Real Estate Credit Notes | 27,160 | 27,714 | 23,983 |

Eurobonds and other securities | | | |

Debt instruments Eligible to Establish Capital | | | |

Subordinated Debt | | | |

Total Funding | | | |

__________________

(1) They basically refer to repurchase transactions backed by own debentures.

(2) Includes transactions with credit institutions resulting from debt facilities to export and import, on lending in the country (BNDES and Finame) and from abroad, and other foreign debt facilities.

22

|

(i) Deposits

· Customer Deposits. The Company’s balance of customer deposits was R$304.2 billion on December 31, 2018, R$276.0 billion on December 31, 2017, and R$247.4 billion on December 31, 2016, representing 61.1%, 63.5% and 56.9% of the Company’s total funding, respectively.

· Checking Account: The Company’s balance of deposits into checking accounts was R$18.9 billion on December 31, 2018, R$17.6 billion on December 31, 2017 and R$15.9 billion on December 31, 2016, representing 4.7%, 4.9% and 4.9% of total deposits, respectively.

· Savings Account: The Company’s balance of deposits into savings accounts was R$46.1 billion on December 31, 2018, R$40.6 billion on December 31, 2017 and R$36.1 billion on December 31, 2016, representing 11.4%, 11.4% and 11.1% of total deposits, respectively.

· Customer Time Deposits: The Company’s balance of time deposits from customers was R$191.0 billion on December 31, 2018, R$146.8 billion on December 31, 2017 and R$94.5 billion on December 31, 2016, representing 47.4%, 41.3% and 29.0% of total deposits, respectively.

· Customer Deposits—Repurchase Agreements: The Company maintains a portfolio of debt instruments from the Brazilian public and private sectors, which is used to obtain overnight funds from other financial institutions or investment funds by selling such securities simultaneously agreeing to repurchase them. Due to the short-term (overnight) nature of this funding source, such transactions are volatile, and are composed, generally, of Brazilian public securities and of debentures repurchase agreements. Securities sold under repurchase agreements decreased to R$48.3 billion on December 31, 2018 and as of December 31, 2017, decreased R$71.1 billion, a move contrary to that of the previous year, in which there was growth to R $ 101.0 billion as of December 31, 2016, compared to the previous year, representing 12.0%, 20.0% and 31.0% of total deposits, respectively.

(ii) Deposits from Brazilian Central Bank and Credit Institutions

The balance of deposits from the Central Bank and credit institutions was of R$99,0 billion as of December 31, 2018, R$79.4 billion as of December 31, 2017 and R$78.6 billion on December 31, 2016, representing 24.6%, 22.3% and 24.1% of total deposits, respectively.

It also includes Obligations for Loans and Domestic Transfers:

· Obligations for loans. The Company has relations with banks all over the world, providing credit facilities pegged to foreign currencies (both in North-Americandollars as a basket of currencies). The Company applies the proceeds from these transactions mainly to U.S. dollar-linked lending operations and in particular to trade finance operations.

23

|

|

· Domestic Transfers.The Company operates in the transfer from public institutions, mainly BNDES and FINAME, for which the Company acts as a financial agent. Funding from these sources in Brazil represents a method of providing long-term loans with attractive average interest rates to certain sectors of the economy. Loans from these funds are allocated by BNDES through banks to specific sectors targeted for economic development. This type of loan is known as “repassing” or “transfer.” Within the scope of this agreement, the Company loans funds from BNDES or FINAME, the subsidiary for funding of BNDES equipment, and transfers them to specific sectors of the economy. These loans are generally granted at rates below the average market rates and have an average maturity of up to five years. Because the transferred funds are generally matched and/or funded by loans from a federal government agency, we take no interest rate or maturity mismatch risk nor charge interest at a fixed margin over its cost of funds. However, the Company retains the commercial credit risk of borrower and, therefore, we have a discretionary power in the credit decision making and application of credit criteria. This type of funding is not affected by compulsory deposit requirements. The transfer is generally secured or guaranteed, although this is not required by the terms of the transfer.

(iii) Other Methods of Funding

(iii.1) Debt Instruments

The Company’s balance of debt instruments was R$74.6 billion on December 31, 2018, R$70.2 billion on December 31, 2017 and R$99.8 billion on December 31, 2016, representing 15.0%, 16.7% and 23.0% of the Company’s total funding, respectively.

The Agribusiness Credit Bills are credit instruments freely traded and represent a commitment of future payment, exclusively issued by financial institutions regarding credit rights originated from transactions between rural manufacturers and their cooperatives and other agricultural manufacturing chain agents and exchange acceptances. The Agribusiness Credit Bills reached R$11.9 billion on December 31, 2018, R$8.9 billion on December 31, 2017 and R$6.9 billion on December 31, 2016.

The financial bills are alternative funding instruments for banks that can be characterized as senior or eligible to form the Reference Assets for purposes of regulation of capital adequacy. Pursuant to CMN Resolution 4,123 of August 23, 2012, its minimum term must be twenty-four (24) months and it must be issued for a minimum amount of R$300 thousand for subordinated transactions and R$150 thousand for senior transactions that add up to R$30,7 billion on December 31, 2018, a decrease of 3% compared to December 2017.

Real Estate Credit Notes, or “LCI,” increased 2.0%, from R$27.7 billion on December 31, 2017 to R$27.2 billion in December 2018.

The Company issues securities, under the Global Medium Term Notes Program of U.S.$10,000,000,000,00. The Company’s balance of securities issued abroad was R$4.8 billion on December 31, 2018 and R$2 billion on December 31, 2017. This change took place mainly as a result of the non-replacement of certain debt instruments that reached their maturity.

(iv) Instruments Eligible to compose Level I and Level II

24

|

|

The Company issued debt form the Level I and Level II of the Reference Assets as part of the plan of optimization of its capital. On December 31, 2018, the balance of both instruments (Level I and Level II) was R$9.8 billion, compared to the balance of R$8.4 billion on December 31, 2017. This variation was caused by the liquidation of the previous instruments eligible to compose capital and the issuance of new ones. For additional information, see note 20 of our financial demonstration.

(v) Subordinated Debt

On December 31, 2018, the Company’s subordinated debt included R$9.9 billion in deposit certificates issued by the Company at the local market in several issuances with interest rate indexed to CDI or IPCA.

e. Sources of financing for working capital and for investments in non-current assets that it intends to use to cover liquidity deficiencies

Due to the Company’s stable and diversified sources of fund raising, which include a large deposit base of its clients as detailed in item 10.1.d above, the Company historically has not had liquidity problems.

As part of management of the liquidity risk, the Company has a formal plan with measures to be adopted in scenarios of crisis of systemic liquidity and/or arising out of possible risk to the image of the Company. This liquidity contingency plan contains attention parameters, in addition to measures and preventive actions to be taken at moments of liquidity deficiency, if the reserves are below certain parameters.

As sources of financing for working capital and for investments in non-current assets that it uses to cover liquidity deficiencies, the following resources may be used: (i) deposit funding; (ii) issuance of bonds; (iii) repurchase transactions with public/private bonds; (iv) review of transfer prices; (v) establishment of more restrictive credit policies; and (vi) release of guarantee margin at B3.

f. levels of indebtedness and the characteristics of such debts, describing also:

(i) Relevant loan and financing agreements

There are no loan agreements or other debt instruments that management deems to be relevant to the Company, except for the securities representing debt issued by the Company described in Section 18 of the Reference Form.

(ii) Other long-term relationships with financial institutions

The Company’s primary resource sources are local deposits in the modalities demand, savings and long-term, aligned with other Brazilian banks, as well as fundraising in the open market – own securities and Federal Government securities with buy back commitment ("repurchase agreements").

The Company also has deposits with credit institutions referring to debt facilities to export and import with banks abroad, and to be applied in commercial foreign exchange operations, related to financing of export and import. The Company is also a party to long-term obligations through on lendings,all in accordance with the operational policies of BNDES System.

25

|

|

(ii.1) Eurobonds and Securitization Notes - MT100

External issuance of bonds designated in foreign currency includes bonds and other securities (Eurobonds and Structured Notes).The following table shows the detailed composition of Eurobonds.

(ii.2) Subordinated debts

The Company uses subordinated debt instruments in its fundraising structure, represented by securities issued according to the rules of Central Bank, which are used as Reference Assets – Level II, in order to form the operational limits, including Subordinated CDBs, deposit certificates issued by the Company in the local market, in several issuances, at interest rates updated by CDI or IPCA. The following table shows the detailed composition of subordinated debts:

(1) Subordinated time deposits issued by Banco Santander S.A. with yield paid at the end of the term together with the principal.

(2) Indexed by 100% and 112% of the CDI.

(3) Indexed by the IPCA (extended consumer price index) plus interest of 8.3% p.a. to 8.4% p.a.

(4) On December 18, 2018, the Bank issued an approval for the repurchase of the Notes issued on January 29, 2014, which resulted in the reclassification of these instruments from the Series of Eligible Debt Instruments to Subordinated Debt Capital.

(iii) Level of subordination between the debts

In case of judicial or extra-judicial liquidation of the Company, there is an order of distribution for payment of the creditors of the bankruptcy estate as provided for in law, which must be respected in accordance with Brazilian legislation in force at the time. Specifically, in regard to the financial debts that form the Company’s indebtedness, the following order of payment must be followed asset-backed debts, unsecured debts and subordinated debts. It is worth mentioning that, as to asset-backed debts, the creditors prefer them to the others up to the limit of the collateral and, to the extent of exceeding,their credits will be included in the payment order of the unsecured creditors. Among unsecured creditors there is no level of subordination, as well as there is no level of subordination among the many subordinated creditors.

26

(iv) any restrictions imposed on the Company, particularly in relation to limits of indebtedness and contracting of new debts, to distribution of dividends, to sale of assets, to issuance of new securities and to the sale of equity control, and whether the Company has been respecting such restrictions

As to the bonds issued abroad, whose descriptions of transactions and programs are presented inItem 18.10 of the Reference Form (“Securitization Program” and “Medium Term Notes – MTN”), the main restrictions imposed on the issuer, existing in facility agreements, are also described in the same item, more specifically in sessions 18.10.I.h.(v) and 18.10.II.h.(v).

g. limits of loans taken out and percentages already used

The information requested in this item does not apply to financial institutions. However, the Company is subject to he parameters determined by monetary authorities, in accordance with the Basel principles.

h. significant alterations in each item of the financial statements

(i) Assets and Liabilities (in million Reais):

27

|

Please find below the main variations in accounts of the balance sheet for the years 2018, 2017 and 2016.

The Company’s total assets reached, on December 31, 2018, R$723,865 million, an increase of 12.1% compared to 2017, whose total assets reached R$645,703 million, 1.8% greater than the year ended on December 31, 2016, in the amount of R$634,393 million.

The portfolio of loans and advance to gross clients, with no accommodation papers and suretyships, added up to R$337,872 million on December 31, 2018, an increase of 16.5% compared to R$290,037 million on December 31, 2017, and an increase of 8.1% if compared to the balance of R$268,286 million on December 31, 2016. The Individual segment presented an evolution of 22.6% compared to 2017, followed by a 19.5% increase in the segment of consumer finance. On the other hand, the segment of large companies presented a decrease of 3.6%, maintaining the movement observed in 2017 and 2016, but the growth of the individuals portfolio supported the growth of the portfolio of loans and advances to gross customers for 2018.

On December 31, 2018, total deposits totaled R$403,221, representing 55.7% of total liabilities and shareholders' equity. On December 31, 2018, total deposits totaled R$355,417 million, representing 55.0% of total liabilities and shareholders' equity. At December 31, 2016, total deposits totaled R$326,079 million, representing 51.4% of total liabilities and shareholders' equity. Time deposits represented 59.1%, 56.1% and 44.2% of total deposits at December 31, 2018, 2017 and 2016, respectively.

The balance of deposits as of December 31, 2018 increased by 13.4% in relation to the previous year, mainly due to the 19.4% growth in time deposit operations and the 2% increase in repo operations. The balance of deposits as of December 31, 2017 increased by 9.0% in relation to the previous year, mainly due to a 38.6% increase in time deposit operations and a 25% decrease in repo operations. The balance of deposits as of December 31, 2016 increased by 4.3% in relation to the previous year, basically due to a 12.9% growth in repo operations.

The consolidated shareholders’ equity added up to R$91,003 million on December 31, 2018, R$87,088 million on December 31, 2017 and reached R$84,813 million by the end of 2016, with an increase of 5.0% on December 31, 2018 compared to 2017 and an increase of 3.1% of December 31, 2017 compared to 2016. Evolution in the shareholders’ equity during the net income for the year was mainly due to revenue growth in the Net Income for the period of R$12,800 million and reduced by the highlight of Dividends and Interest on Equity in the amount of R$6,600 million.

28

|

|

10.2. Directors should comment:

The. results of the Company's operations:

Results of Operations for the years ended December 31, 2018, 2017 and 2016

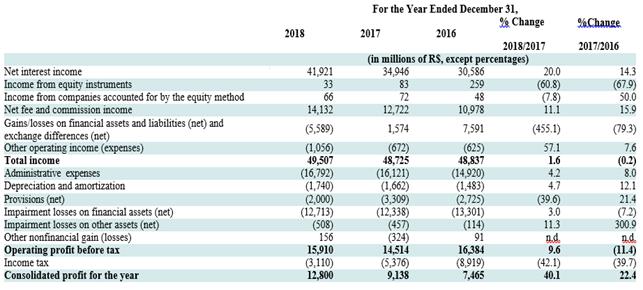

The following table provides an overview of the main key aspects of our results of operations for the years ended December 31, 2018, 2017 and 2016:

Executive Summary |

Results |

Total Income Our total income amounted to R$49,507 million for the year ended December 31, 2018, an increase of 1.6% as compared to R$48,725 million for the year ended December 31, 2017. This performance was primarily due to an R$6,975 million increase in net interest income resulting from a 11.6% of an increase in our loan portfolio, with a stronger contribution from commercial banking segment and higher fee and commission income due to 11.6% increase in our total active customer base and a 24.8% increase in the number of loyal customers. These factors were partially offset by a decrease in gains losses on financial assets and liabilities (net) and exchange differences (net), mainly as a consequence of our hedging on investments abroad in 2018. Excluding the effects of the hedge for investment abroad, our total income would have amounted to R$55,374 million in the year ended December 31, 2018 an increase of 11.8% compared to the year ended December 31, 2017. Our total income amounted to R$48,725 million for the year ended December 31, 2017, a decrease of 0.2% as compared to R$48,837 million for the year ended December 31, 2016. This decrease was primarily due to lower gains/losses on financial assets and liabilities (net) and exchange differences (net) of R$1,576 million in the year ended December 31, 2017 as compared to R$7,591 million in the year ended December 31, 2016, mainly as a consequence of our results of hedging on investments abroad in 2017. This decrease was offset by an increase in our net interest income of R$4,360 million, or 14.3% mainly due to an increase in our credit portfolio and margins charged on the loans we extend, and an increase in net fees and commissions of R$1,744 million, or 15.9% due to an increase in the number loyal customers and an increase in the volume of transactions processed. Excluding the effects of the hedge for investment held abroad, our total income would have amounted to R$49,535 million in the year ended December 31, 2017, an increase of 17.6% compared to the year ended December 31, 2016. | Impairment losses on Financial Assets (Net) Our impairment losses on financial assets (net) reached R$12,713 million for the year ended December 31, 2018, an increase of R$375 million, or 3.0% compared to our impairment losses on financial assets (net) in the year ended December 31, 2017. This increase was principally due to Installment Loans to Individuals, because of the IFRS 9 adoption in 2018 and the recurrent growth of the credit portfolio in this segment. Our impairment losses on financial assets (net) reached R$12,338 million for the year ended December 31, 2017, a decrease of R$963 million, or 7.2% compared to our impairment losses on financial assets (net) in the year ended December 31, 2016. This decrease was primarily due to certain risk management measures which we have undertaken in recent years. |

Consolidated Profit for the Year Our consolidated profit for the year ended December 31, 2018 was 12,800 million, an increase of R$3,662 million, or 40.1%, primarily as a result of an increase of R$6,975 million in net interest income and an increase of R$ 1,410 million in net fees and commissions as well as lower expenses of R$1,310 million in provisions (net) partially offset by losses of R$7,165 million in gains/losses on financial assets and liabilities (net) and exchange differences (net). Our consolidated profit for the year ended December 31, 2017 was R$9,138 million, an increase of R$1,673 million, or 22.4%, as a result of an increase in the volume of transactions primarily due to our expanded digital offering and an increase in the number of loyal customers. | Efficiency Our efficiency ratio was 33.9% in December 2018, a 0.8 p.p. increase from 33.1% in December 2017. Our efficiency ratio was 33.1% in December 2017, a 2.5 p.p. decrease from 30.6% in December 2016. Disregarding the effect of the hedge for investment abroad on our revenues, our adjusted efficiency ratio reached 30.3%, 32.5% and 34.9% in December 31, 2018, 2017 and 2016, respectively. This improvement is due to our operation model and increased revenues. |

Loan Portfolio Our total loan portfolio to customers reached R$ 321.3 billion on December 31, 2018, an increase of 11.6% in 12 months, mainly due to an increase in loans to individuals and consumer finance portfolio. Loans to individuals grew 24.2% in 2018, driven by credit cards, payroll loans and mortgages, while our consumer finance loan portfolio grew 23.5%, mainly due to the fact that vehicle financing increased at a faster pace than the market growth rate. In 2017, our total loan portfolio totaled R$287.8 billion, an increase of 7.2% as compared to the year ended December 31, 2016, driven by loans to individuals (principally credit cards, payroll loans and agricultural loans) and consumer finance portfolio. Our consumer finance loan portfolio grew 24.7% in 2017, mainly due to an increase in vehicle financing greater than the market growth rate. | Credit Quality Our impaired assets to credit risk ratio was 7.0% for the year ended December 31, 2018, a 0.3 p.p. increase as compared to 6.7% in the year ended December 31, 2017. We believe this decrease was due to the effectiveness of our model and the strength of our risk management. Our coverage ratio (provisions for impairment losses as a percentage of impaired assets) was 102.4% in the year ended December 31, 2018, a 7.0 p.p. increase as compared to 95.4% December 31, 2017. Our Basel Capital adequacy ratio, calculated in accordance with the regulations and guidance of the Brazilian Central Bank, was 15.1% for the year ended December 31, 2018, a decrease from 15.8%, as of December 31, 2017. For the year ended December 31, 2016 this ratio was 15.8%. Our capital indicators remain at comfortable levels and support our growth. |

Deposits Deposits from Brazilian Central Bank and deposits from credit institutions plus customer deposits increased by 13.5% to R$403.2 billion on December 31, 2018. For the year ended December 31, 2017, deposits from Brazilian Central Bank and deposits from credit institutions plus customer deposits amounted to R$355.4 billion, a 9.0% increase compared to R$326.1 billion in the year ended December 31, 2016. |

29

|

Results of Operations

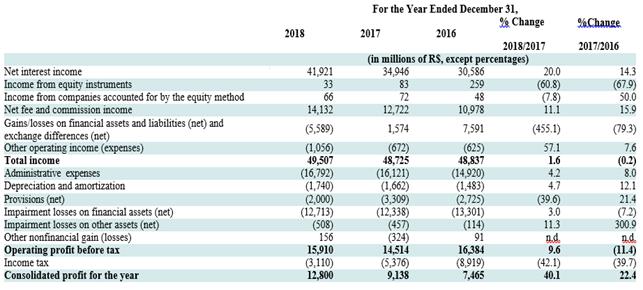

The following table presents our consolidated results of operations for the years ended December 31, 2018, 2017 and 2016:

30

Consolidated Profit for the Year

Our consolidated profit for the year ended December 31, 2018 was R$12,800 million, an increase of R$3,662 million, or 40.1%, as compared to our consolidated profit of R$9,138 million for the year ended December 31, 2017 as a result of:

(i) anincreaseofR$6,975millioninnetinterestincomemostlydrivenbygrowthinourloanportfoliodrivenbyourcommercialbankingsegment;

(ii) an increase of R$1,410 million in net fees and commissions, primarily as a result of an increase of R$571 million in revenues from credit and debit cards,anincreaseofR$370millioninrevenuesfromcurrentaccountservicesandanincreaseofR$354millioninrevenuesfrominsuranceandprize- linkedsavingsproducts.Theseincreasewereinturnduetoan11.6%increaseinourtotalactivecustomerbaseandan24.8%increaseinthenumberof loyalcustomers;

(iii) adecreaseofR$7,163millioningains/lossesonfinancialassetsandliabilities(net)andexchangedifferences(net),bothofwhichincludetheeffectsof thehedgeforinvestmentheldabroad.