- BSBR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Banco Santander (BSBR) 6-KBSBR20210225_6K2

Filed: 25 Feb 21, 5:12pm

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes _______ No ___X____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes _______ No ___X____

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes _______ No ___X____

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

BANCO SANTANDER (BRASIL) S.A.

Publicly-Held Company with Authorized Capital

CNPJ/ME No. 90.400.888/0001-42

NIRE 35.300.332.067

MATERIAL FACT

BANCO SANTANDER (BRASIL) S.A. (“Santander Brasil”), in compliance with article 157 of Law No. 6,404/76 and Brazilian Securities Commission (“CVM”) Rulings Nos. 358/02 and 565/15, further to the Material Facts disclosed on November 16, 2020 and February 2, 2021, informs its shareholders and the market in general that Santander Brasil’s Board of Directors, in a meeting held on this date, approved the proposal to segregate Santander Brasil’s equity interest in its wholly-owned subsidiary Getnet Adquirência e Serviços para Meios de Pagamentos S.A. (“Getnet” and, jointly with Santander Brasil, the “Companies”), by means of a spin-off from Santander Brasil (“Spin-off”), to be resolved upon by the shareholders of Santander Brasil in an Extraordinary Shareholders’ Meeting.

In addition, on this date, the Fiscal Board of Santander Brasil opined in favor of the Spin-off proposal.

The main terms and conditions of the Spin-off proposal are laid out below:

1. Companies involved in the Spin-off

Santander Brasil is a publicly-held company, with its principal place of business in the City of São Paulo, State of São Paulo, at Avenida Presidente Juscelino Kubitschek, No. 2041 and 2235 – Bloco A, Vila Olímpia, Zip Code No. 04.543-011, registered with the National Registry of Legal Entity of the Ministry of the Economy (Cadastro Nacional de Pessoa Jurídica – “CNPJ/ME”) under No. 90.400.888/0001-42 and with its by-laws registered with the Board of Trade of the State of São Paulo (Junta Comercial do Estado de São Paulo – “JUCESP”) under NIRE No. 35.300.394.925. Santander Brasil is a multi-service banking institution duly authorized to operate by the Brazilian Central Bank (“BACEN”).

Getnet is a privately-held joint-stock corporation, with its principal place of business in the City of São Paulo, State of São Paulo, at Av. Pres. Juscelino Kubitschek, 2041 - cj 121, Bloco A Cond. WTORRE JK - Vila Nova Conceição – Zip Code No. 04543-011,

registered with the CNPJ/ME under No. 10.440.482/0001-54 and with its by-laws registered with the JUCESP under NIRE No. 43.300.051.773. Getnet is a payment institution, with a license to operate as an acquirer and issuer of electronic currency, duly authorized to operate by BACEN. Santander Brasil currently holds all of the shares issued by Getnet, representing the total amount of its share capital.

2. Summary and Purpose of the Spin-off

2.1. Summary of the Transaction. The terms and conditions of the Spin-off to be proposed to Santander Brasil’s shareholders in the Extraordinary Shareholders’ Meeting are set forth in the Protocol and Justification of the Partial Spin-off from Banco Santander (Brasil) S.A., executed on this date between Getnet and Santander Brasil (“Protocol and Justification”).

2.1.1. The main steps of the Spin-off include the segregation from Santander Brasil of the total amount of shares issued by Getnet and held by Santander Brasil (“Spun-off Portion”), representing 100% of Getnet’s share capital (“Getnet Shares”), which will result in the allotment of the Getnet Shares to Santander Brasil’s shareholders, in the same proportion of their equity interest held in Santander Brasil (excluding treasury shares), as detailed below.

2.1.2. Therefore, Santander Brasil’s shareholders will receive, as applicable, common shares and/or preferred shares issued by Getnet and/or certificates of deposit of shares, with each certificate representing one common share and one preferred share issued by Getnet (“Getnet Units”), at the rate of 0.25 common share, preferred share or Getnet Unit, as the case may be, for each one (1) common share, preferred share or certificate of deposit of shares (“Unit”) issued by Santander Brasil (for more information please see item 4 of this Material Fact). Holders of American Depositary Shares representing units of Santander Brasil shares (“Santander Brasil ADSs”) will receive American Depositary Shares, each representing one Getnet Unit (“Getnet ADSs”) at a rate of 0.25 Getnet ADSs for each Santander Brasil ADS held.

2.1.3. The fractions of common shares or preferred shares issued by Getnet or of Getnet Units will be segregated and sold in as many auctions as necessary, to be held at B3 S.A. – Brasil, Bolsa, Balcão (“B3”), with the sales proceeds being made available to the respective owners of the fractions, as per the notice to shareholders to be released in the future. Similarly, the depositary with respect to the Santander Brasil ADSs, the U.S. book-entry settlement system and participants in that system will sell

fractional entitlements to Getnet ADSs and distribute the net proceeds to the holders of Santander Brasil ADSs entitled to them.

2.1.4. As a result of the Spin-off, Getnet will apply for the registration as a publicly-held company (Category A) with the CVM (“Publicly-held Company Registration”), as well as for the listing of Getnet Shares and Getnet Units for trading in the traditional segment of B3. Furthermore, Getnet will apply for (a) the registration of the Getnet Units and the Getnet Shares with the U.S. Securities and Exchange Commission, under the U.S. Securities Exchange Act, and (b) the listing of the Getnet ADSs for trading on the Nasdaq Stock Market (“NASDAQ”).

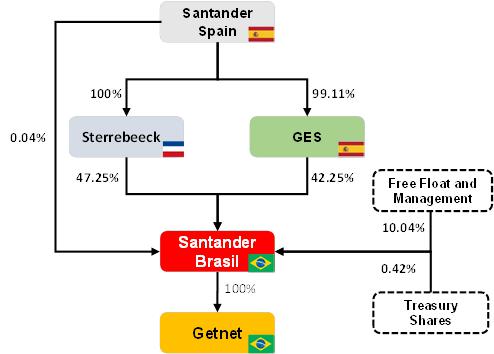

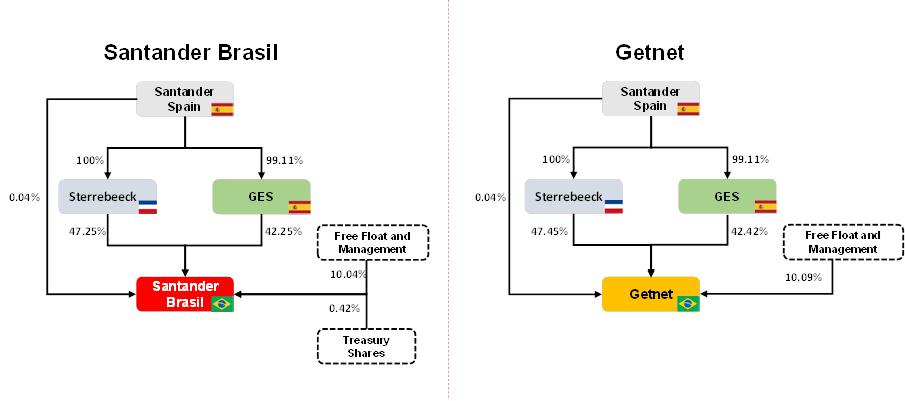

2.1.5. The charts below present the simplified organizational structure of Santander Brasil and Getnet before and after the implementation of the Spin-off. For illustrative purposes, the charts were prepared assuming that current equity stakes held by each party will remain the same until the conclusion of the Spin-off.

Pre Spin-off corporate structure

Post Spin-off corporate structure

(*) Shares issued by Santander Brasil and held in treasury will be excluded from the distribution of Getnet shares in connection with the Spin-off. Getnet will not have any treasury shares after the Spin-off.

2.1.6. After the approval of the Spin-off by the Extraordinary Shareholders’ Meeting, Santander Brasil’s shares and Units will be traded with the right to receive the Getnet Shares and Getnet Units until the record date, which, once determined, will be disclosed to the market by means of a Notice to Shareholders. The record date will be determined by Santander Brasil together with B3 after (a) the completion by Getnet of (i) the Publicly-held Company Registration; (ii) the listing of Getnet Shares and Getnet Units for trading on the B3; (iii) the registration of the Getnet Units and the Getnet Shares with the U.S. Securities and Exchange Commission, under the U.S. Securities Exchange Act; and (iv) the listing of the Getnet ADSs for trading on NASDAQ; and (b) the approval of the Spin-off by BACEN, as per item 6 below. Following the approval of the Spin-off by the Extraordinary Shareholders’ Meeting, Santander Brasil’s ADSs will also trade with the right to receive Getnet ADSs until the open of trading on the business day prior to the record date for Santander Brasil ADSs, which will be disclosed to the market in due course.

2.1.7. The legal and accounting segregation of Santander Brasil and Getnet, as a consequence of the Spin-off, will become effective upon its approval by both companies’ shareholders at the relevant Extraordinary Shareholders’ Meetings.

2.2. Purpose. The purpose of the Spin-off is to enable Getnet to explore the full potential of its businesses as part of the strategy of the Santander Group to concentrate the technology and payments businesses of the group within PagoNxt, a new technology-focused global payment platform.

2.2.1. After the Spin-off, Getnet will be, as Santander Brasil is currently, controlled by Banco Santander, S.A. (Spain). As indicated, Banco Santander, S.A. (Spain) will cause most of its equity interest in Getnet to form part of its new platform PagoNxt.

3. Main Benefits, Costs and Risks of the Spin-off

3.1. Main Benefits. After the conclusion of the Spin-off, Santander Brasil’s shareholders shall receive equity interests in Getnet, of the same nature and proportion as the equity interests owned by them in Santander Brasil. Accordingly, the shareholders of Santander Brasil will continue to hold the same equity interest they currently hold in Santander Brasil, while also becoming shareholders of Getnet.

3.1.1. Upon the implementation of the Spin-off, Getnet will strategically operate within a global structure, bringing more efficiency, diversification of revenue sources, speed of execution and integration with the other payment businesses of the Santander Group. Furthermore, the intention is to generate economic value for Santander Brasil's shareholders, since companies in Getnet's operating segment present a higher relative market value than the banking segment.

3.1.2. Additionally, the Spin-off will provide Getnet with direct access to capital markets and other sources of funding, hence allowing it to prioritize investments according to its profile and scope of activities, thus creating more value for its shareholders.

3.2. Costs. The Board of Directors estimates that the Spin-off costs to be incurred by Santander Brasil will be, approximately, BRL 22,000,000.00 (twenty-two million Brazilian reais), including expenses relating to publications, independent auditors, appraisers, legal advisors and other professionals hired to advise on the transaction.

3.3. Risks. There are certain inherent risks related to the variation of the price of the shares issued by Santander Brasil and of Getnet Shares and Getnet Units, once the latter begin trading. Such risks are inherent in capital markets trades and will be incurred by all shareholders of Santander Brasil, which will thereupon be also shareholders of Getnet. Furthermore, the expected benefits of the Spin-off may not materialize.

3.3.1. The Spin-off requires approval from BACEN, as set forth in Ruling CMN No. 4,122/12.

3.3.2. Please see the Management Proposal to be made available when the shareholders are called to the Extraordinary Shareholders’ Meeting, for further information on the risk factors applicable to Getnet.

4. Exchange ratio of the shares and criteria for the determination of the substitution ratio

4.1. The Spun-off Portion will include all Getnet Shares. Therefore, the Spun-off Portion’s merger into Getnet, at book value, as described in the relevant appraisal report, will not have any impact on Getnet's share capital nor will it dilute any shareholder’s equity interest held in Getnet. As a consequence of the Spun-off Portion’s merger into Getnet, the Getnet Shares will be allotted to the shareholders of Santander Brasil, as described above.

4.2. The Getnet Shares will be delivered directly to Santander Brasil's shareholders, on the record date to be disclosed in due course, pro rata to their equity interests in Santander Brasil, at the ratio of 0.25 common shares, preferred shares or Getnet Units, as the case may be, issued by Getnet for each one (1) common share, preferred share or Unit issued by Santander Brasil, respectively. In addition, each holder of a Santander Brasil ADS on the ADS record date will receive Getnet ADSs at a rate of 0.25 Getnet ADS for each one (1) Santander Brasil ADS.

4.3. The delivery ratio of the Getnet Shares, Getnet Units and Getnet ADSs in relation to the shares, Units and ADSs of Santander Brasil was determined considering (a) the total number of issued and outstanding shares of Santander Brasil, equal to 3,802,873,911 common shares and 3,664,014,900 preferred shares (excluding treasury shares); and (b) the total number of issued and outstanding shares of Getnet, equal to 950,718,477 common shares and 916,003,725 preferred shares (excluding treasury shares).

4.4. Should any corporate event of Santander Brasil or Getnet occur after the present date, which results in a change in the total number of issued and outstanding shares of Santander Brasil or Getnet, excluding treasury shares, the delivery ratio of the Getnet Shares, Getnet Units and Getnet ADSs in relation to the shares, Units and ADSs of

Santander Brasil, as indicated above, shall be adjusted proportionally, so that Santander Brasil's shareholders hold the total amount of shares issued by Getnet after the Spin-off.

5. Main assets and liabilities that shall constitute the Spun-Off Portion of Santander Brasil to be conveyed to the shareholders

5.1. The Spun-off Portion to be transferred to Getnet, equal to 3.1422% of Santander Brasil’s net equity and of which the net book value, as appraised by PricewaterhouseCoopers Auditores Independentes, is two billion, four hundred and seventy million, five hundred and sixty-six thousand, six hundred and forty-three Brazilian Reais and three cents (R$ 2,470,566,643.03) as of December 31, 2020, comprises (i) the equity interest held by Santander Brasil in Getnet, corresponding to one billion, eight hundred and sixty-six million, seven hundred and twenty-two thousand, two hundred and two (1,866,722,202) shares, being nine hundred and fifty million, seven hundred and eighteen thousand, four hundred and seventy-seven (950,718,477) common shares and nine hundred and sixteen million, three thousand, seven hundred and twenty-five (916,003,725) preferred shares issued by Getnet, in the amount of two billion, seventy-two million, thirty-three thousand, three hundred and ninety-seven Brazilian Reais and seven cents (R$ 2,072,033,397.07), (ii) the balance of the goodwill (ágio) paid by Santander Brasil upon the acquisition of such Getnet Shares in the amount of nine hundred and fifty-seven million, two hundred and sixty-one thousand, two hundred and twenty-eight Brazilian Reais (R$ 957,261,228.00), and (iii) the provision to maintain the integrity of Getnet’s net equity in an amount equivalent to the balance of such goodwill (ágio) minus the tax credit related to the premium amortization benefit resulting from the Spin-off, in the amount of five hundred and fifty-eight million, seven hundred and twenty seven thousand, nine hundred and eighty-two Brazilian Reais and four cents (R$ 558,727,982.04).

5.2. The net amount to be transferred to Getnet corresponding to the goodwill (ágio) minus the provision to maintain the integrity of Getnet’s net equity will be recorded to Getnet’s accounting records as capital reserve. The tax benefit resulting from the goodwill amortization to be earned by Getnet, pursuant to Brazilian tax legislation, will benefit all of its shareholders.

6. Regulatory approvals and other conditions for the delivery of the Getnet Shares

6.1. The delivery of the Getnet Shares to the shareholders of Santander Brasil shall occur upon the satisfaction of the following conditions, as per the record date to be informed in due course to the shareholders and the market in general:

(i) approval by Santander Brasil’s shareholders in the relevant Extraordinary Shareholders’ Meeting of the Spin-off;

(ii) ratification of the Spin-off by the BACEN;

(iii) conclusion of the Publicly-held Company Registration before the CVM and the registration of the Getnet Units and Getnet Shares under the U.S. Securities Exchange Act; and

(iv) obtaining the listing approvals from the B3 and NASDAQ.

7. Applicability of the share exchange ratio calculated pursuant to article 264 of Law No. 6,404, of 1976

7.1. Santander Brasil understands that article 264 of Law No. 6,404, of 1976 does not apply to the Spin-off, considering that Getnet is 100% owned by Santander Brasil.

8. Applicability of the right to withdraw and amount of recovery

8.1. Pursuant to the applicable legislation, the Spin-off does not trigger withdrawal rights for Santander Brasil’s shareholders, considering that such transaction does not result in (i) any alteration of Santander Brasil’s corporate purpose; (ii) any reduction of Santander Brasil’s mandatory dividend; or (iii) any equity interest in a group of entities, as set forth in articles 136 and 137 of Law No. 6,404 of 1976. Furthermore, (a) the Getnet Units and the Getnet Shares and (b) the Getnet ADSs will be listed for trading, respectively, in the traditional segment of the B3 and on NASDAQ.

9. Other material information

9.1. Summons to the Extraordinary Shareholders’ Meeting. Santander Brasil’s Board of Directors shall, in due course, summon its shareholders to resolve on the Spin-off at an Extraordinary Shareholders’ Meeting, to be held on March 31, 2021 (the “Meeting”).

9.2. Spin-off Documents. The Protocol and Justification, the Appraisal Report of the Spun-off Portion of Santander Brasil and other information required pursuant to CVM Ruling No. 481/09 shall be disclosed in due course when Santander Brasil’s shareholders are called to the Meeting.

****

For further clarification, please contact Santander Brasil's Investor Relations Office.

São Paulo, February 25, 2021.

Angel Santodomingo Martell

Investors Relations Officer

Banco Santander (Brasil) S.A.

Banco Santander (Brasil) S.A. | ||

| By: | /S/ Amancio Acurcio Gouveia | |

Amancio Acurcio Gouveia Officer Without Specific Designation | ||

| By: | /S/ Angel Santodomingo Martell | |

Angel Santodomingo Martell Vice - President Executive Officer | ||