- BSBR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Banco Santander (BSBR) 6-KCurrent report (foreign)

Filed: 27 Mar 23, 8:20pm

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes _______ No ___X____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes _______ No ___X____

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes _______ No ___X____

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

|

SUMMARY

| 1. Message from the Board of Directors | 4 |

| 2. Call Notice of Meeting | 5 |

| 3. Participation of shareholders in the OGM | 7 |

| 4. Matters to be resolved at the OGM | 12 |

| EXHIBIT I: TEMPLATE OF POWER OF ATTORNEY | 15 |

| EXHIBIT II: COMMENTS OF THE MANAGEMENT TO THE FINANCIAL CONDITION OF THE COMPANY | 17 |

| EXHIBIT III: BOARD PROPOSAL FOR ALLOCATION OF NET PROFIT FOR THE FISCAL YEAR | 74 |

| EXIBIT IV: PROPOSAL FOR ELECTION OF THE COMPANY'S BOARD OF DIRECTORS | 83 |

| Exhibit V: ITEM 8 of the Reference Form | 91 |

|

1. Message from the Board of Directors

Dear Shareholder,

It is with great pleasure that I invite you, a shareholder of Banco Santander (Brasil) S.A. (“Santander Brasil” or “Company”), to participate in our Ordinary General Meeting (“OGM”), to be held on April 28, 2023, at 3:00 P.M.

Besides this Management Proposal (“Proposal”) a Manual for Participation in the OGM (“Manual”) was prepared to assist you in understanding the matters presented, providing a conscious and reasoned decision-making process, anticipating possible clarifications and voting guidelines.

Pursuant to the Call Notice made available, we shall take resolutions on the following matters:

(i) To TAKE the management accounts, to examine, discuss and vote on the Company’s Financial Statements related to the fiscal year ended on December 31, 2022, accompanied by the Management Report, the balance sheet, other parts of the financial statements, external auditors’ opinion and the Audit Committee Report;

(ii) To DECIDE on the allocation of net income for the year 2022 and the distribution of dividends;

(iii) To FIX the number of members that will compose the Board of Directors in the mandate from 2023 to 2025;

(iv) To ELECT the members of the Company's Board of Directors for a term of office from 2023 to 2025; and

(v) To FIX the annual global compensation of the Company´s management and members of Audit Committee.

As established by the Brazilian Securities and Exchange Commission (CVM), in order to facilitate its analysis and evaluation of the matters to be resolved on our OGM, this Proposal includes exhibits containing the information made available in addition to the Call Notice.

We are at your disposal to clarify any questions through the emails acionistas@santander.com.br oriented at non-financial individual and corporate investors and ri@santander.com.br for institutional investors.

We hope that this Proposal and the Manual fulfills its purpose in assisting your decision making. Your participation is essential for the Company.

Sincerely,

Deborah Stern Vieitas

Vice Chairwoman of the Board of Directors

|

2. Call Notice of Meeting

[to be published in the newspaper “Valor Econômico” in editions of March 28, 29 and 30, 2023]

BANCO SANTANDER (BRASIL) S.A.

Publicly-Held Company of Authorized Capital

CNPJ/MF 90.400.888/0001-42 - NIRE 35.300.332.067

NOTICE OF MEETING – ORDINARY GENERAL MEETING - Shareholders are hereby invited to attend the Ordinary General Meeting (“OGM”) to be held on April 28, 2023, at 3:00 PM, at the principal place of business of Banco Santander (Brasil) S.A. (“Santander Brasil” or “Company”), located at Avenida Presidente Juscelino Kubitschek No. 2235 and 2014 – 2nd mezzanine, Vila Olímpia, São Paulo/SP, to resolve upon the following Agenda:

(i) To TAKE the management accounts, to examine, discuss and vote on the Company’s Financial Statements related to the fiscal year ended on December 31, 2022, accompanied by the Management Report, the balance sheet, other parts of the financial statements, external auditors’ opinion and the Audit Committee Report;

(ii) To DECIDE on the allocation of net income for the year 2022 and the distribution of dividends;

(iii) To FIX the number of members that will compose the Board of Directors in the mandate from 2023 to 2025;

(iv) To ELECT the members of the Company's Board of Directors for a term of office from 2023 to 2025; and

(v) To FIX the annual global compensation of the Company´s management and members of Audit Committee.

Observation for participation and Vote during the Meeting

Participation in the Meeting: Shareholders, their legal representatives or attorneys-in-fact may participate in the Meeting in any of the following ways:

In person - The shareholders or their legal representatives shall appear at the OGM with the appropriate identity documents. In the event of representation of a shareholder by an attorney-in-fact, shareholders shall leave at the Company's principal place of business, at least seventy-two (72) hours before the OGM is held, a power of attorney granted according to the applicable law;

Remote Voting Ballot: the Company implemented the remote voting system pursuant to CVM Resolution 81/22, enabling our Shareholders to send remote voting ballots directly to the Company, to the bookkeeper or through their respective custodian agents, in accordance with the procedures described in the General Meeting Participation Manual.

|

Our recommendation to the shareholders is to make use of remote voting instruments, either by the electronic means available or by sending written votes to the Company, or granting standardized powers of attorney with voting guidance, according to the instructions provided in the Management Proposal for the OGM to be held in April 28, 2023.

General Instructions

1. As provided in CVM Resolution No. 70/22, the minimum percentage of participation in the voting capital required for the application of the multiple voting process for the election of the members of the Board of Directors is 5%;

2. As provided in § 2 of article 161 of Law No. 6,404/76 and art. 4 of CVM Resolution No. 70/22, the installation of the Fiscal Council by the General Meeting shall occur at the request of shareholders representing at least 2% (two percent) of the shares with voting rights, or 1% (one per cent) of non-voting shares; and

3. The documents related to the matters to be examined and resolved at the OGM are available to shareholders (i) at the Company's principal place of business, at Avenida Presidente Juscelino Kubitschek, nº 2041 Wtorre JK, 9th floor - Corporate Legal Department, where they can be consulted, on working days, from 10:00 a.m. until 4:00 p.m., and on its website (www.ri.santander.com.br – at Corporate Governance >> Minutes of the Meeting); (ii) on the website of the Brazilian Securities and Exchange Commission (www.cvm.gov.br) and (iii) on the website of B3 S.A. - Brasil, Bolsa, Balcão (http://www.b3.com.br).

São Paulo, March 27, 2023 – Deborah Stern Vieitas – Vice Chairwoman of the Board of Directors.

___________________________________________________

|

3. Participation of shareholders in the OGM

Santander Brasil shareholders may participate in the OGM in person, by a duly appointed proxy, as specified in item 3.2 below, or by Remote Voting.

Shareholders will be required to provide the following documents to participate in the OGM:

| Individual: | · identity document with photo[1] (original or copy) · proof of ownership of the shares issued by the Company, issued by the depository and/or custodian financial institution (original or copy) |

| Legal entity: | · corporate documents that prove the legal representation of the shareholder (original or copy)[2] · legal representative's identity document with photo (original or copy) |

| Investment fund | · identity document of the legal representative of the Investment Fund’s manager (or of the manager, as the case may be) with photo (original or copy) · simple copy of the last consolidated bylaws of the fund and of the Articles of Association or Organization of its manager, in addition to the corporate documentation granting powers of representation (minutes of election of the officers and/or power of attorney) |

3.1. In-person Participation

Santander Brasil shareholders may participate in the OGM by attending the place where it will be held and declaring their vote, according to the types of shares they own (common and/or preferred), and the matters to be voted on. In accordance with the provisions of Article 126 of Law No. 6,404/76, shareholders shall attend the Shareholders' Meeting presenting, in addition to the identity document, proof of ownership of the shares issued by the Company, issued by the depository and/or custodian financial institution. The Company recommends that said proof be issued within two (2) business days before the date scheduled for the Meeting.

[1] The following documents may be presented: (i) General Registration Identity Card (RG); (ii) Foreigner Registration Identity Card (RNE); (iii) Valid passport; (iv) Class Organization Card valid as a civil identity for legal purposes (e.g.: OAB, CRM, CRC, CREA); or (v) National Driver's License (CNH) with photo.

[2] Articles of Incorporation/Organization e Minutes/Instruments of election of legal representatives registered with the competent body.

|

Corporate shareholders, such as companies and investment funds, shall be represented in accordance with their Articles of Association, Articles of Organization or Bylaws, delivering documents proving the regularity of the representation, accompanied by the Minutes of the election of the Managers, if applicable, at the place and term indicated in the item below. Prior to the OGM, the shareholders shall sign the Attendance Book. Shareholders without voting rights may attend the OGM and discuss all matters submitted for resolution.

3.2. Participation by Proxy

The shareholder may be represented at the OGM by an attorney-in-fact, duly appointed under a public or private instrument, and pursuant to article 126, § 1 of the Corporations Act, the attorneys-in-fact shall have been appointed less than one (1) year ago, and they shall be (i) shareholders of the Company, (ii) managers of the Company, (iii) lawyers, or (iv) financial institutions, with the investment fund’s manager being responsible for representing the quotaholders.

The originals or copies of the documents mentioned above may be delivered at the Company's principal place of business by the time the OGM is held.

However, in order to facilitate shareholders' access to the OGM, we recommend that the delivery of such documents be made at least seventy-two (72) hours before the OGM is held.

In the case of submittal of documents via email, we request that the shareholder contact the Company, so that the originals or copies can be delivered by the day the OGM is held.

In case the Shareholder is unable to attend the OGM or cannot yet be represented by an attorney-in-fact of his/her/their choice, the Company will make available an attorney-in-fact to vote for the shareholder, in accordance with his/her/their voting instructions, according to the power of attorney template in Exhibit I to this Proposal.

Furthermore, it should be noted that in addition to the power of attorney, the shareholder shall forward the documents required by the Company to participate in the OGM, as provided for in item 3 above.

The documents shall be delivered at the Company’s principal place of business, at Avenida Presidente Juscelino Kubitschek, No. 2041 and 2235 – Bloco A - Vila Olímpia - São Paulo – SP, 9th floor – Corporate - Legal Department, email: rafael.faria@santander.com.br.

3.3. Remote Voting Participation

Pursuant to articles 21-A et seq. of CVM Ruling No. 481/2009, the Company's shareholders may also vote at shareholders’ meetings by means of remote voting, to be formalized through the “remote voting ballot” (“Ballot”), the template of which is available in the Corporate Governance area of the Company’s Investor Relations website (www.ri.santander.com.br), or on the website of the Brazilian Securities and Exchange Commission – CVM (http://sistemas.cvm.gov.br/?CiaDoc).

|

The shareholder that chooses to exercise his/her/their voting rights remotely shall do so by one of the options described below:

(I) Submittal of the Ballot to Custody agents

The Shareholder that chooses to cast remote voting through his/her/its respective custodian agent (“Custodian") shall convey his/her/their voting instructions in accordance to the rules determined by the Custodian, which shall forward said voting ballots to the Central Depository of B3 S.A. - Brasil, Bolsa, Balcão. Shareholders shall contact his/her/their respective Custodians to check the procedures established by them for issuance of ballot voting instructions, as well as the documents and information required to do so.

The Shareholder shall convey the instructions for completion of the Ballot to his/her/their Custody agents by 04/20/2023 (including), unless defined otherwise by them.

(II) Submittal of the Ballot by the Shareholder to the Bookkeeper

The Shareholder who chooses to cast the remote vote through the Company's Bookkeeper shall observe the following instructions, so that the Ballot can be deemed valid and the votes are counted:

(i) all fields shall be duly completed;

(ii) all pages shall be initialed;

(iii) the last page shall be signed by the Shareholder or his/her/their legal representative(s), as applicable, and in accordance with the applicable legislation.

The following documents shall be forwarded to the Bookkeeper:

(i) original copy of the Ballot, duly completed, initialed and signed; and

(ii) copy of the following documents:

The documents shall be sent to the Bookkeeper within 7 days before the date of the OGM, in other words, by 04/20/2023 (including) (i) at the following address: Banco Santander (Brasil) S.A. – Shareholders – Bookkeeping of Shares – Rua Amador Bueno, 474 – 2nd floor – Setor vermelho - Santo Amaro – São Paulo/SP – CEP 04752- 005; or (ii) via email, to the electronic address custodiaacionistavotodistancia@santander.com.br.

|

After receiving the documents, the Bookkeeper, within three (3) days, will inform the Shareholder regarding the receipt of the documents and their acceptance. If the submitted documentation is not considered suitable, the Ballot shall be considered invalid, and the Shareholder may regularize it by 04/20/2023.

Ballots received by the Bookkeeper after 04/20/2023 shall be disregarded.

(III) Submittal of the Ballot directly to the Company

The Shareholder who chooses to cast the remote vote through the Company shall observe the following instructions, so that the Ballot can be deemed valid and the votes are counted:

(i) all fields shall be duly completed;

(ii) all pages shall be initialed;

(iii) the last page shall be signed by the Shareholder or his/her/its legal representative(s), as applicable, and in accordance with the applicable legislation.

The following documents shall be forwarded to the Company:

(i) original copy of the Ballot, duly completed, initialed and signed; and

(ii) copy of the following documents:

The documents shall be sent to the Company within 7 days before the date of the OGM, in other words, by 04/20/2023 (including) (i) at the following address: Banco Santander (Brasil) S.A. - Investor Relations - Avenida Presidente Juscelino Kubitscheck, 2235 - 26th floor - Vila Olímpia - São Paulo/SP - CEP 04543-011; or (ii) via email, to the electronic address ri@santander.com.br.

After receiving the documents, the Company, within three (3) days, will inform the Shareholder regarding the receipt of the documents and their acceptance. If the submitted documentation is not considered suitable, the Ballot shall be considered invalid, and the Shareholder may regularize it by 04/20/2023.

Ballots received by the Company after 04/20/2023 shall be disregarded.

|

General Information:

Ø in accordance with Article 44 of CVM Resolution nº 81/22, the Central Depository of B3 S.A. - Brasil, Bolsa, Balcão, upon receiving the voting instructions from the shareholders through their respective custody agents shall disregard any diverging instructions in relation to the same resolution that has been issued by the same CPF or CNPJ registration number; and

Ø upon termination of the deadline for remote voting, in other words, by 04/20/2023 (including), the shareholder will not be able to change the voting instructions already sent, except if attending the Shareholders' Meeting or represented by power of attorney, upon express request for disregard of the voting instructions sent through the Ballot, before the respective matter(s) is subject to voting.

3.4. ADS holders

Holders of American Depositary Shares (ADSs) shall be given the right to vote on the matters listed on the Agenda, subject to the same criteria applied in relation to national investors, according to the type of shares (common or preferred) on which their ADSs are backed. ADS holders will be duly instructed by The Bank of New York Mellon, depository institution for ADSs backed by Santander Brasil shares.

|

4. Matters to be resolved at the OGM

Below you shall find clarifications made by the Company’s management regarding each of the items to be resolved in the OGM. According to the Call Notice made available to the shareholders, our OGM shall take resolutions regarding the following matters of the Agenda:

4.1 To TAKE the management accounts, to examine, discuss and vote on the Company’s Financial Statements related to the fiscal year ended on December 31, 2022, accompanied by the Management Report, the balance sheet, other parts of the financial statements, external auditors’ opinion and the Audit Committee Report.

The documents presented by the management are:

i. Management Report showing the operating statistics and the analysis and discussion of the Administrative Officers of the principal accounts of the Statement of Income for the Fiscal Year;

ii. Comments of the administrative officers on the financial condition of the Company (Exhibit II - Item 2 of the Reference Form);

iii. Copy of the Financial Statements and Explanatory Notes;

iv. Opinion of the Independent Auditors;

v. Summary of the report of the Audit Committee; and

vi. Standardized financial statements form – DFP.

The management documents identified above, except for item ii above, were made available to the CVM, via the IPE system, at the time of disclosure of the individual and consolidated financial statements of the Company prepared in accordance with Accounting Practices Adopted in Brazil applicable to institutions authorized to operate by the Brazilian Central Bank, on February 2nd, 2023, and for the consolidated financial statements of the Company in accordance with the IFRS as issued by the IASB made available on February 28th, 2023. These documents can be found on the electronic address of CVM (www.cvm.gov.br), or of the Company (www.ri.santander.com.brand www.santander.com.br/acionistas), according to information shown in Exhibit II to this Management Proposal.

The Company's management proposes that the shareholders examine in detail the management accounts and the Company's Financial Statements so that they can deliberate about their approval.

|

4.2. To DECIDE on the allocation of net income for the year ended on December 31, 2022 and the distribution of dividends

(a) Net Profit Allocation

The Executive Board presents a proposal for the fiscal year 2022 net profit allocation in compliance with the provisions of Article 10, first paragraph, item II and the respective Annex A to CVM Resolution 81/22. Said proposal is contained in the Exhibit III to this Management Proposal. We recommend the careful reading of said exhibit.

The net profit of the Company in the fiscal year 2022 was R$ 12,358,521,447.76.

Management proposes the following allocation for net income for the year 2022:

1. The amount of R$ 617,926,072.39, to the Company’s legal reserve account;

2. The amount of R$6,800,000,000.00, as dividends and Interest on Equity to shareholders, which have been the object of decision in the meetings of the Board of Directors held on February 01, 2022; April 14, 2022; August 05, 2022; and Ocotober 13, 2022, of which R$5,280,000,000.00 as and Interest on Equity allocated within the mandatory minimum dividends and R$ 1,520,000,000.00 as interim dividends; and

3. The balance of the remaining net profit after the distributions above, to the value of R$ 4,940,595,375.37, for the Dividend Equalization Reserve account, pursuant to Article 36, item III-a of the Company's Bylaws.

The board understands that the proposal for allocation of net profits above was formulated in accordance with the legal and statutory obligations applicable to the Company, and is in line with the goals and strategies of the Company, which is why the board recommends its approval without restrictions.

(b) Distribution of Dividends

As better detailed in the Exhibit III to this Management Proposal, the Company management has approved the distribution to its shareholders the global amount of R$6,800,000,000.00, as dividends and Interest on Equity to the shareholders, which have been the object of decision in the meetings of the Board of Directors held on February 01, 2022; April 14, 2022; August 05, 2022; and Ocotober 13, 2022, of which R$5,280,000,000.00 as and Interest on Equity allocated within the mandatory minimum dividends and R$ 1,520,000,000.00 as interim dividends and were paid to shareholders based on their respective shares in the share capital of the Company.

|

4.3. To FIX the number of members that will compose the Board of Directors in the mandate from 2023 to 2025

The Company’s management proposes that the Board of Directors comprises of 10 members for a term of office to be effective between the OGM of 2023 and the Ordinary General Meeting of 2025.

4.4. To ELECT the members of the Company's Board of Directors for a term of office from 2023 to 2025

After complying with the applicable governance approvals, the Company proposes to the OGM the election for a new term of two (2) years, of the following candidates recommended by the controlling shareholders to compose the Board of Directors of the Company:

| Name | Position |

| Deborah Stern Vieitas | Chairwoman and Independent Director |

| Jose Antonio Alvarez Alvarez | Vice-Chairman |

| Angel Santodomingo Martell | Director |

| Deborah Patricia Wright | Independent Director |

| Ede Ilson Viani | Director |

| José de Paiva Ferreira | Independent Director |

| José Garcia Cantera | Director |

| Marília Artimonte Rocca | Independent Director |

| Mario Roberto Opice Leão | Director |

| Pedro Augusto de Melo | Independent Director |

The information related to the election of the members of the Board of Directors of the Company, pursuant to article 11 of CVM Resolution 81/22, can be found in the Exhibit IV to this Management Proposal.

4.5. To FIX the annual global compensation of the Company´s management and members of Audit Committee

The management presents a proposal for remuneration of the Company’s management, complying with the provisions of Article 13, items I and II of CVM Resolution 81/22 and item 8 of the Reference Form of the Company, on the terms of Exhibit IV to this Manegment Proposal

For the period from January to December, 2023, the amount proposed by the management as the annual global compensation for the Company’s management (Board of Directors and Executive Board) is of up to R$ 500,000,000.00 (five hundred million Brazilian Reais), covering fixed remuneration, variable remuneration and the stock base remuneration.

The amount proposed by the Board of Directors as annual global compensation of the members of the Audit Committee for the twelve (12) months period counting from January 1st, 2023 is of up to R$ 4,000,000.00 (four million Brazilian Reais).

|

EXHIBIT I:

TEMPLATE OF POWER OF ATTORNEY

[SHAREHOLDER], [QUALIFICATION] (“Grantor”), appoints as his/her/its attorneys-in-fact Messrs. CAROLINA SILVIA ALVES NOGUEIRA TRINDADE, Brazilian, married, registered with OAB/RJ under no. 182.414 and under the CPF/ME under no. 124.143.167.13; and RAFAEL TRIDICO FARIA, Brazilian, married, registered with OAB/SP 358.447 and under the CPF/ME under no. 409.544.508-41, both of them lawyers, with commercial address in the Capital City of the State of São Paulo, at Avenida Presidente Juscelino Kubitschek Nos. 2041 and 2235 - Bloco A - Vila Olímpia (“Grantees”) to represent, collectively or individually, regardless of the order of appointment, the Grantor, as shareholder of Banco Santander (Brasil) S.A. ("Company"), at the Company's Ordinary General Meeting to be held, on first call, on April 28, 2023, at 3:00 PM, at the Company's principal place of business, at Avenida Presidente Juscelino Kubitschek No. 2235 and 2041 - 2nd mezzanine, Vila Olímpia, São Paulo/SP, and if necessary on second call, on a date to be informed in due course, to whom powers are granted to attend the meeting and vote, on behalf of the Grantor, in accordance with the voting guidelines set forth below for each of the items on the Agenda:

(i) To TAKE the management accounts, to examine, discuss and vote on the Company’s Financial Statements related to the fiscal year ended on December 31, 2022, accompanied by the Management Report, the balance sheet, other parts of the financial statements, external auditors’ opinion and the Audit Committee Report.

( ) For ( ) Against ( ) Abstention

(ii) To DECIDE on the allocation of net income for the year 2022 and the distribution of dividends.

( ) For ( ) Against ( ) Abstention

(iii) To FIX the number of members that will compose the Board of Directors in the mandate from 2023 to 2025.

( ) For ( ) Against ( ) Abstention

(iv) To ELECT the members of the Company's Board of Directors for a term of office from 2023 to 2025

( ) For ( ) Against ( ) Abstention

(v) To FIX the annual global compensation of the Company´s management and members of Audit Committee;

( ) For ( ) Against ( ) Abstention

The Grantees are hereby authorized to abstain from any resolution or act for which they have not received, at their discretion, sufficiently specific voting guidelines. The Grantor shall hold the Grantees above harmless and free from any and all claims, disputes, demands, losses, or damages, of any nature, arising from the fulfillment of this instrument, except in cases of acts performed in an abusive and excessive manner, pursuant to the legislation in effect.

|

This power of attorney shall only be valid for the Company's Ordinary General Meeting mentioned above.

[Local], [month] [day], 2023.

_____________________________________________

[Signature of Grantor]

|

EXHIBIT II

COMMENTS OF THE MANAGEMENT TO THE FINANCIAL CONDITION OF THE COMPANY

(Pursuant to Item III of the article 10 of CVM Resolution 81/22)

2.1. Officers should comment on:

a. general financial and equity conditions

At the end of the fourth quarter of 2022, Banco Santander observed the median of the projections of economic agents regarding the performance of the Brazilian economy indicate growth of the Brazilian GDP of 3.0% in 2022 compared to the expansion of 5.0% in the previous year. The projection for 2022 is higher than that observed at the end of the third quarter and, in the Bank's assessment, was influenced by the recent publication that the effective result observed in that period was in line with the median of market expectations, despite the bullish revision in the previous results of the historical series, indicating greater robustness of the Brazilian economy in 2022. It seems to us that robustness is directly linked to the maintenance of the fiscal and tax incentives previously approved and that were implemented throughout the second half of the year. The economic activity data released fell short of our estimate of GDP growth in the previous quarter – we estimated a rise of 4.2% – but we believe that the frustration was directly linked to the revision mentioned in the historical series and not to the change in recent growth dynamics. Along with the stimuli mentioned earlier, this picture has led us to alter our expectation about what the expansion will be in 2022. Instead of the previous 2.6% estimate, we currently project growth of 3.0% in 2022.

In the last quarter of 2022, the Bank witnessed the year-on-year variation of the IPCA decline to 5.8% from the level of 7.2% observed at the end of the third quarter. Despite the retreat, the level reached was still above the 3.5% target set for 2022. The Bank understands that this inflationary environment and the balance of risks were the motivators for the Central Bank of Brazil to have justified the maintenance of the basic rate at 13.75% p.a. between the end of the third quarter of 2022 and the previous quarter. Santander believes that this approach to the Selic rate increases the chance that inflation will converge to the targets set within the time horizon relevant to monetary policy, especially after the signaling of the elected government that it will increase the amount of public spending from next year, which could make the disinflation process slower. In this sense, the Bank projects that the Selic rate will reach 12.00% p.a. by the end of 2023 and 9.0% p.a. at the end of 2024.

Regarding the behavior of the exchange rate, Banco Santander saw the price of the Brazilian currency against the U.S. dollar fluctuate between R$5.02/US$ and R$5.53/US$ in the fourth quarter and end the period quoted at R$5.22/US$. That is, below the price of R $ 5.41 / US $ verified at the end of the third quarter. The volatility demonstrated by the real's trajectory is in line with our prediction that the exchange rate will have limited room to register significant appreciation in the coming years. In fact, we project that the exchange rate will reach $5.40/$ by the end of 2023 and $5.50/$$ by the end of 2025.

|

The aforementioned performances took place in the midst of an international environment that the Bank judged unfavorable and that had as highlights the following themes: 1) maintenance of inflationary pressures around the globe; 2) signaling of more extensive adjustment in U.S. monetary policy; 3) intensification in the pace of normalization of monetary policy in the Eurozone and; 4) new outbreaks of COVID-19 contamination in China, raising fears of an intense slowdown in that country's economy that would trigger a global recession of great magnitude. In the domestic environment, Santander understands that the main themes were the following: 1) closing of the presidential election without damage to the Brazilian institutional framework; 2) approval of a constitutional amendment authorizing the elected government to increase the amount of public expenditures not subject to the public spending ceiling rule from 2023 and ; 3) deterioration in the expectations of economic agents regarding the beginning of the process of reducing the SELIC rate in 2023 (previously, they pointed to the possibility of cuts at the beginning of the year and, currently, they indicate a chance for the second half of 2023).

| (i) | 2022 |

For the year ended December 31, 2022, we reported consolidated net income of R$14.4 billion, a decrease of 7.8% compared to 2021. Total assets for the year ended December 31, 2022 reached R$985,451 million, an increase of 5.8% over 2021. Shareholders' equity reached R$110,183 million and adjusted ROAE (excluding the effect of goodwill) was 14.2% in 2022.

Our Basel capital adequacy ratio, in accordance with Central Bank regulations, was 13.9% as of December 31, 2022.

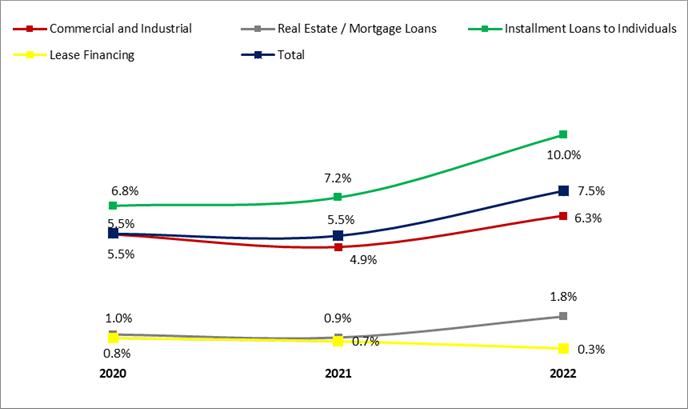

As of December 31, 2022, our portfolio of loans and advances to gross customers grew by 6.3% to R$524,655 million, compared to R$493,355 million as of December 31, 2021.

The following table presents a managerial breakdown of our portfolio of loans and advances to customers (gross) by customer category on the dates indicated.

For the year ended December 31 | Variations between December 31, 2022 vs. December 31, 2021 | ||||

2022 | 2021 | 2020 | R$ million | % | |

| (in millions of R$, except percentages) | |||||

| Individual | 243.399 | 203.678 | 174.042 | 39.721 | 17,0% |

| Consumer finance | 58.824 | 55.441 | 51.637 | 3.383 | 7,4% |

| Small and Medium Enterprises | 62.916 | 59.602 | 54.525 | 3.314 | 9,3% |

| Large Companies (1) | 159.516 | 174.634 | 137.618 | (15.118) | 26,9% |

| Total | 524.655 | 493.355 | 417.822 | 31.300 | 18,1% |

| (1) | Companies with annual gross revenues in excess of R$200 million, including our global corporate clients. |

Our total funding as of December 31, 2022 was R$732,691 million, an increase of 6.4% compared to R$688,645 million at December 31, 2021.

| (ii) | 2021 |

For the year ended December 31, 2021, we reported consolidated net income of R$15.6 billion, an increase of 15.7% compared to 2020. Total assets for the year ended December 31, 2021 reached R$931,208 million, a decrease of 0.3% compared to 2020. Shareholders' equity reached R$105,974 million and adjusted ROAE (excluding the effect of goodwill) was 20.2% in 2021.

Our Basel capital adequacy ratio, in accordance with Central Bank regulations, was 14.9% as of December 31, 2021.

|

As of December 31, 2021, our portfolio of loans and advances to gross customers grew by 18.1% to R$493,355 million, compared to R$417,822 million as of December 31, 2020.

The following table presents a managerial breakdown of our portfolio of loans and advances to customers (gross) by customer category on the dates indicated.

For the year ended December 31 | Variations between December 31, 2021 vs. December 31, 2020 | ||||

2021 | 2020 | 2019 | R$ million | % | |

| (in millions of R$, except percentages) | |||||

| Individual | 203.678 | 174.042 | 156.177 | 29.636 | 17,0% |

| Consumer finance | 55.441 | 51.637 | 48.421 | 3.804 | 7,4% |

| Small and Medium Enterprises | 59.602 | 54.525 | 53.119 | 5.077 | 9,3% |

| Large Companies (1) | 174.634 | 137.618 | 89.539 | 37.016 | 26,9% |

| Total | 493.355 | 417.822 | 347.257 | 75.533 | 18,1% |

| (1) | Companies with annual gross revenues in excess of R$200 million, including our global corporate clients. |

Our total funding as of December 31, 2021 was R$688,645 million, an increase of 6.4% compared to R$647,465 million at December 31, 2020.

| (ii) | 2020 |

For the year ended December 31, 2020, we reported consolidated net income of R$13.4 billion, a decrease of 19.1% compared to 2019. Total assets for the year ended December 31, 2020 reached R$936,201 million, an increase of 22.8% over 2019. Shareholders' equity reached R$106,090 million and adjusted ROAE (excluding the effect of goodwill) was 18.4% in 2020.

Our Basel capital adequacy ratio, in accordance with Central Bank regulations, was 15.3% as of December 31, 2020.

As of December 31, 2020, our portfolio of loans and advances to gross customers grew by 20.3% to R$417,822 million, compared to R$347,257 million as of December 31, 2019.

The following table presents a managerial breakdown of our portfolio of loans and advances to customers (gross) by customer category on the dates indicated.

For the year ended December 31 | Variations between December 31, 2020 vs. December 31, 2019 | ||||

2020 | 2019 | 2018 | R$ million | % | |

| (in millions of R$, except percentages) | |||||

| Individual | 174.042 | 156.177 | 133.603 | 17.865 | 11,4% |

| Consumer finance | 51.637 | 48.421 | 40.964 | 3.216 | 6,6% |

| Small and Medium Enterprises | 54.525 | 53.119 | 49.624 | 1.406 | 2,6% |

| Large Companies (1) | 137.618 | 89.539 | 97.112 | 48.079 | 53,7% |

| Total | 417.822 | 347.257 | 321.303 | 70.565 | 20,3% |

| (1) | Companies with annual gross revenues in excess of R$200 million, including our global corporate clients. |

Our total funding as of December 31, 2020 was R$647,465 million, an increase of 24.5% compared to R$519,664 million at December 31, 2019.

|

b. capital structure:

| Liability Structure | ||||||

| LIABILITIES In millions of Reais | Dec/22 | % of total liabilities | Dec/21 | % of total liabilities | Dec/20 | % of total liabilities |

| Own Capital – Shareholders Equity (1) |

110.680 | 11% | 105.974 | 11% | 106.089 | 11% |

| Third Party Capital – Short Term (2) |

602.245 | 61% | 427.965 | 46% | 591.257 | 64% |

| Third Party Capital – Long Term (2) |

272.526 | 28% | 366.988 | 43% | 236.232 | 25% |

| Total Liabilities | 985.451 | 100% | 931.208 | 100% | 933.578 | 100% |

(1) Includes Non-Controlling Participation

(2) Current liabilities

(3) Total liabilities, except Shareholders' Equity and Current Liabilities

Debt ratio, according to the formula: third-party capital / total assets x 100, is 89.

In addition, the following table shows the direct shareholding (common and preferred shares) as of December 31, 2022:

Major Shareholders | Common stock | Percentage of Outstanding Common Shares | Preferred Shares | Percentage of Outstanding Preferred Shares | Total Shares (thousands) | Percentage of Total Capital Stock |

| Sterrebeeck BV (1) | 1.809.583.330 | 47,387 | 1.733.643.596 | 47,112 | 3.543.226.926 | 47,252 |

| Grupo Empresarial Santander SL (1) | 1.627.891.019 | 42,630 | 1.539.863.493 | 41,846 | 3.167.754.512 | 42,245 |

| Santander Bank, S.A. | 2.696.163 | 0,071 | - | - | 2.696.163 | 0,036 |

| Directors / Executives (2) | 3.860.825 | 0,101 | 3.860.824 | 0,105 | 7.721.649 | 0,103 |

| Treasury Shares | 31.138.524 | 0,825 | 31.138.524 | 0,846 | 62.277.048 | 0,831 |

| Other minority shareholders | 343.525.170 | 8,996 | 371.329.583 | 10,091 | 714.854.753 | 9,533 |

| Total | 3.818.695.031 | 100,000 | 3.679.836.020 | 100,000 | 7.498.531.051 | 100,000 |

| (1) | It includes members of the Company's senior management. |

| (2) | An affiliate of Grupo Santander |

| (i) | Equity and Non-Controlling Shareholder Participation |

As of December 31, 2022, the Company's capital stock was R$55,000,000,000.00, fully paid up and divided into 7,498,531,051 shares, all nominative, book-entry and without par value.

In accordance with our current bylaws, our capital stock may be increased to the limit of the authorized capital, regardless of statutory changes, by resolution of our Board of Directors and through the issuance of up to 9,090,909,090 new shares, being established that the total number of preferred shares may not exceed 50.0% of the total number of shares. in circulation. Any capital increase exceeding this limit requires shareholder approval.

|

| (ii) | Equity and Third Parties |

Revenue from equity instruments for the year ended December 31, 2022 totaled R$38 million, a decrease of R$52 million from R$90 million for the year ended December 31, 2021, mainly due to higher dividend gains from an investment fund, Santander Fundo de Investimento Amazonas Multimercado Crédito Privado de Investimento no Exterior, in 2021 compared to 2022.

Profit from equity instruments for the year ended December 31, 2021 totaled R$90 million, an increase of R$56 million over the R$19 million year ended December 31, 2020, mainly due to higher dividend gains received from an investment fund, Santander Investment Fund Amazonas Multimarket Private Investment Credit Abroad as a result of gains in equity positions in the direction of hedges. of derivatives, R$84.8 million.

| (iii) | Benchmark Equity – Basel Index |

Our capital management is based on conservative principles with continuous monitoring of items that affect our level of solvency. We are obliged to comply with Brazilian capital adequacy regulations in accordance with the rules of the Central Bank of Brazil. In October 2013, the new capital implementation regulations and regulatory capital requirements of the Basel Committee on Banking Supervision (Basel III) came into force in Brazil. The minimum regulatory capital requirement is currently 11%. The Tier I requirement is 6.0%, divided into basic capital of at least 4.5%, consisting primarily of share capital and profit reserves, including shares, units of ownership, reserves and income earned, and additional capital consisting primarily of certain reserves, earned income, and securities and hybrid instruments as capital authorized by the Central Bank of Brazil.

According to the new rules on regulatory capital in Brazil, the value of the goodwill for the calculation of the capital base was deducted in accordance with the "phase-in" for implementation of Basel III in Brazil, which was completed on January 1, 2019. The following table presents the percentage of goodwill deduction required for each year up to 2022:

Basel III Phase in | |||||

2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| 80% | 100% | 100% | 100% | 100% | 100% |

Source: Central Bank of Brazil; Resolution No. 4,192 of the Central Bank of Brazil of March 2013.

For the base year 2022, the Reference Equity requirement was 10.625%, including 8.00% Minimum Reference Equity, plus 1.625% Additional Capital Conservation and 1.00% Systemic Additional. The Level I Reference Equity reaches 8.625% and the Minimum Principal Capital 7.125%.

In the month of October 2021 the Additional Capital Conservation increased to 2.00%. Thus, in December the requirement of PR is 11.00%. It is considered 8.00% of Minimum Reference Equity added to 2.00% of Additional Capital Conservation and 1.00% of Systemic Addition, with the requirement of PR Level I of 9.00% and Minimum Principal Capital of 7.50%. From April 2022 the PR requirement will reach 11.50%, considering 8.00% of Minimum Reference Equity added to 2.50% of Additional Capital Conservation and 1.00% of Systemic Addition, with requirement of PR Level I and Minimum Main Capital of 9.50% of 8.00%, respectively.

|

On December 31, | ||||||

2022(1) | 2021(1) | 2020(1) | ||||

| (In millions of R$, except percentages) | ||||||

| Level I Reference Assets | 75.943,7 | 76.969,9 | 77.571,5 | |||

| Main Capital | 69.229,0 | 69.919,9 | 71.006,3 | |||

| Complementary Capital | 6.714,7 | 7.050,1 | 6.565,2 | |||

| Level II Reference Assets | 13.109,8 | 12.591,3 | 6.554,4 | |||

| Reference Heritage (Level I and II) | 89.053,5 | 89.561,3 | 84.125,9 | |||

| Required Reference Assets | 638.635,9 | 600.741,3 | 551.569,1 | |||

| Credit Risk Portion (2) | 559.230,6 | 527.119,3 | 478.303,5 | |||

| Market Risk Portion (3) | 19.332,1 | 15.122,2 | 15.846,2 | |||

| Operational Risk Portion | 60.073,2 | 58.499,8 | 57.419,4 | |||

| Basel Index Level I | 11,89% | 12,81% | 14,06% | |||

| Basel Capital Main Index | 10,84% | 11,64% | 12,87% | |||

| Basel Index | 13,94% | 14,91% | 15,25% | |||

| (1) | Values calculated based on the consolidated information of the Prudential Consolidated. |

| (2) | To calculate the allocation of capital for credit risk, modifications and inclusions of BACEN circular 3,714 of August 20, 2014, BACEN circular 3,770 of October 29, 2015, which amends circular 3,644 of March 4, 2013, were considered. |

| (3) | Includes the portions for market risk exposures subject to changes in foreign currency coupon rates (PJUR2), price indices (PJUR3) and interest rate (PJUR1/PJUR4), commodity prices (PCOM), the price of shares classified in the trading book (PACS) and portions for exposure of gold, foreign currency and operations subject to exchange variation (PCAM). |

c. ability to pay in relation to financial commitments entered into

Our Executive Board understands that we present sufficiently adequate financial and patrimonial conditions for the payments of our commitments.

The management of our payment capacity is done dynamically through the implementation of limits and control models, approved and monitored by the Assets and Liabilities Committee (ALCO), which acts in accordance with the guidelines and procedures established by the Santander Group and the Central Bank. The control and management of the ability to pay are carried out through the analysis of cash flow positions, structural liquidity and simulations of potential losses of resources under stress scenarios. A funding plan is also elaborated that takes into account the best structuring of the sources of funding to achieve the necessary diversification in terms of maturities, instruments and markets in addition to the establishment of contingency plans. These controls, together with the maintenance of a minimum liquidity margin, guarantee sufficient resources to honor customer deposits and other obligations, grant loans and financing to clients, meet their own working capital needs for investment and address any risks related to liquidity crises.

We actively manage the risks intrinsic to commercial banking activity, such as the structural risks of interest rates, liquidity and exchange rates. Our goal of financial management is to make net interest income from business activities more stable and recurring while maintaining adequate levels of liquidity and solvency. Financial management also analyzes the structural interest rate risk derived from divergences between the maturity dates and revision of assets and liabilities in each of the currencies we operate.

The following tables show the intervals between pricing dates of financial assets and liabilities with different maturity dates, at December 31, 2022, 2021 and 2020, respectively (liquidity position):

|

| 2022 | In millions of Reais | ||||||

| In sight | Up to 3 months | 3 to 12 months | 1 to 3 years | 3 to 5 years | After 5 years | Total | |

| Assets: | |||||||

| Availability | 21.589 | 415 | - | - | - | - | 22.003 |

| Debt instruments (2) | 16.743 | 6.128 | 24.067 | 51.980 | 33.417 | 70.577 | 202.913 |

| Equity instruments | 2.474 | 43 | 116 | 2 | - | 3 | 2.639 |

| Loans and other amounts with credit institutions | 54 | 542 | 10.740 | 8.724 | 641 | 13 | 20.713 |

| Loans and advances to customers | 11.271 | 123.503 | 117.101 | 152.555 | 38.944 | 47.255 | 490.630 |

| Derivatives | 6 | 4.365 | 2.828 | 4.661 | 3.034 | 7.081 | 21.976 |

| Reserves at the Central Bank of Brazil | 96.850 | 30.787 | - | - | - | - | 127.637 |

| Total | 148.987 | 165.784 | 154.853 | 217.923 | 76.035 | 124.930 | 888.511 |

| Liabilities: | |||||||

| Financial liabilities at amortized cost: | |||||||

| Deposits of credit institutions (1) | 356 | 95.792 | 237 | 14.469 | 2.902 | 2.323 | 116.079 |

| Customer Deposits (1) | 77.835 | 185.159 | 98.821 | 85.233 | 42.787 | 119 | 489.953 |

| Securities obligations (1) | 2.206 | 12.356 | 32.545 | 44.723 | 10.150 | 5.140 | 107.121 |

| Equity Eligible Debt Instruments | - | 6.787 | 876 | 1.359 | 1.527 | 8.990 | 19.538 |

| Other financial liabilities | 186 | 35.254 | 3.660 | 23.346 | 88 | 59 | 62.593 |

| Short positions | - | 144 | 3.084 | 4.575 | 5.396 | 8.848 | 22.047 |

| Derivatives | - | 5.077 | 3.131 | 5.367 | 2.976 | 2.149 | 18.699 |

| Total | 80.583 | 340.569 | 142.354 | 179.073 | 65.825 | 27.628 | 836.031 |

| 2021 | In millions of Reais | ||||||

| In sight | Up to 3 months | 3 to 12 months | 1 to 3 years | 3 to 5 years | After 5 years | Total | |

| Assets: | |||||||

| Availability | 15.431 | 1.227 | - | - | - | - | 16.657 |

| Debt instruments (2) | 1.612 | 119.780 | 20.353 | 5.835 | 38.904 | 38.728 | 225.212 |

| Equity instruments | - | - | - | - | - | 2.528 | 2.528 |

| Loans and other amounts with credit institutions | 11.177 | 2.717 | 1.749 | 10.828 | 15 | - | 26.485 |

| Loans and advances to customers | 70.399 | 82.203 | 84.986 | 152.609 | 31.902 | 42.744 | 464.844 |

| Derivatives | - | 8.668 | 2.836 | 1.646 | 5.990 | 2.001 | 21.140 |

| Reserves at the Central Bank of Brazil | 69.179 | 15.737 | - | - | - | - | 84.916 |

| Total | 167.798 | 230.332 | 109.923 | 170.916 | 76.811 | 86.000 | 841.783 |

| Liabilities: | |||||||

| Financial liabilities at amortized cost: | |||||||

| Deposits of credit institutions (1) | 10.052 | 60.636 | 39.748 | 6.681 | 1.657 | 2.230 | 121.006 |

| Customer Deposits (1) | 86.052 | 79.688 | 56.178 | 163.642 | 83.327 | 75 | 468.961 |

| Securities obligations (1) | - | 28.052 | 5.039 | 35.844 | 9.342 | 760 | 79.037 |

| Equity Eligible Debt Instruments | - | 5.553 | - | 14.089 | - | - | 19.641 |

| Other financial liabilities | 3.935 | 771 | 9.962 | 11.673 | 35.108 | - | 61.449 |

| Short positions | - | 12.781 | - | - | - | - | 12.781 |

| Derivatives | 642 | 7.240 | 2.504 | 9.117 | 3.773 | 1.343 | 24.619 |

| Total | 100.681 | 194.720 | 113.431 | 241.046 | 133.206 | 4.409 | 787.493 |

|

| 2020 | In millions of Reais | ||||||

| In sight | Up to 3 months | 3 to 12 months | 1 to 3 years | 3 to 5 years | After 5 years | Total | |

| Assets: | |||||||

| Availability | 7.374 | 12.775 | - | - | - | - | 20.149 |

| Debt instruments (2) | 433 | 13.196 | 33.904 | 64.226 | 70.18 | 48.162 | 230.103 |

| Equity instruments | - | - | - | - | - | 2.329 | 2.329 |

| Loans and other amounts with credit institutions | - | 2.778 | 35.728 | 15.155 | 363 | 48 | 54.073 |

| Loans and advances to customers | 29.386 | 80.282 | 93.750 | 98.550 | 47.161 | 44.640 | 393.768 |

| Derivatives | - | 14.558 | 1.994 | 4.104 | 1.870 | 3.721 | 26.248 |

| Reserves at the Central Bank of Brazil | 58.777 | 57.355 | - | - | - | - | 116.132 |

| Total | 95.969 | 180.943 | 165.377 | 182.035 | 119.576 | 98.901 | 842.801 |

| Liabilities: | |||||||

| Financial liabilities at amortized cost: | |||||||

| Deposits of credit institutions (1) | - | 83.923 | 43.315 | 3.764 | - | 655 | 131.657 |

| Customer Deposits (1) | 85.433 | 139.191 | 121.805 | 62.769 | 36.578 | 38 | 445.814 |

| Securities obligations (1) | - | 8.815 | 18.736 | 28.158 | 747 | 418 | 56.876 |

| Equity Eligible Debt Instruments | - | 220 | - | 12.899 | - | - | 13.120 |

| Other financial liabilities | 23 | 21.859 | 20.730 | 17.203 | 5 | 2 | 59.823 |

| Short positions | - | 45.808 | - | - | - | - | 45.808 |

| Derivatives | - | 2.047 | 1.974 |

5.388 | 7.744 | 12.204 | 29.357 |

| Total | 85.457 | 301.863 | 206.560 | 130.181 | 45.075 | 13.317 | 782.454 |

| (1) | They include obligations that may have anticipated chargeability, being: demand and term deposits, committed operations with customers, LCI and LCA. |

The following table shows financial assets and liabilities by domestic and foreign currency as of December 31, 2022, 2021 and 2020 (currency position):

|

On December 31, | ||||||

2022 | 2021 | 2020 | ||||

National Currency | Foreign currency | National Currency | Foreign currency | National Currency | Foreign currency | |

| (in millions of R$) | ||||||

| Assets | ||||||

| Cash and reserves at the Central Bank | 11.346 | 10.657 | 5.806 | 10.851 | 4.532 | 15.617 |

| Debt instruments | 185.814 | 17.098 | 208.132 | 17.080 | 226.787 | 3.315 |

| Equity instruments | 19.784 | 929 | 22.689 | 3.797 | 50.553 | 3.520 |

| Loans and other amounts with credit institutions, gross | 416.127 | 74.503 | 398.335 | 66.509 | 372.946 | 3.520 |

| Loans and advances to customers, gross | 2.582 | 57 | 2.483 | 45 | 2.329 | 20.822 |

| Total | 635.653 | 103.244 | 637.445 | 98.282 | 657.147 | 43.274 |

| Liabilities | ||||||

| Financial liabilities at amortized cost | ||||||

| Deposits of the Central Bank and credit institutions | 59.366 | 56.713 | 62.332 | 58.674 | 86.564 | 45.093 |

| Customer deposits | 457.188 | 32.765 | 468.961 | — | 445.814 | — |

| Securities obligations | 92.638 | 14.483 | 66.028 | 13.009 | 45.477 | 9.399 |

| Capital Eligible Debt Instruments | 19.538 | — | — | 19.641 | — | 13.120 |

| Other financial liabilities | 71.371 | 143 | 68.496 | 413 | 66.708 | 153 |

| Total | 700.101 | 104.104 | 665.817 | 84.877 | 646.563 | 67.765 |

|

d. sources of financing for working capital and for investments in used non-current assets

The following table presents the composition of the fundraisers on the dates indicated:

On December 31, | |||

2022 | 2021 | 2020 | |

| (in millions of R$) | |||

| Customer deposits | 489.953 | 468.961 | 445.814 |

| Current accounts | 26.607 | 41.742 | 35.550 |

| Savings accounts | 60.171 | 65.249 | 62.210 |

| Time deposits | 339.943 | 280.955 | 269.929 |

| Repurchase agreements | 63.232 | 81.014 | 78.124 |

| Transactions backed by Private Securities (1) | 17.309 | 20.103 | 14.944 |

| Operations guaranteed by Public Securities | 45.923 | 60.911 | 63.180 |

| Deposits of the Central Bank of Brazil and credit institutions | 116.079 | 121.006 | 131.657 |

| Demand deposits | 3.521 | 126 | 296 |

| Time deposits (2) | 87.824 | 75.755 | 76.489 |

| Repurchase agreements | 24.734 | 45.125 | 54.872 |

| Transactions backed by Private Securities (1) | 70 | 13.478 | 13.844 |

| Operations guaranteed by Public Securities | 24.664 | 31.647 | 41.028 |

| Total deposits | 606.033 | 589.967 | 577.470 |

| Negotiable debt securities | 107.121 | 79.037 | 56.876 |

| Agribusiness Letters of Credit | 24.045 | 16.989 | 14.747 |

| Financial Letters | 33.713 | 25.074 | 12.750 |

| Real Estate Credit Notes | 34.854 | 24.021 | 19.979 |

| Securities and other securities | 14.508 | 12.952 | 9.399 |

| Debt Instruments Eligible to Compose Tier 1 and Tier 2 Capital | 19.538 | 19.641 | 13.120 |

| Total Funding | 732.691 | 688.645 | 647.466 |

| __________________ |

| (1) | It mainly refers to committed operations backed by debentures. |

| (2) | It includes operations with credit institutions linked to export and import financing lines, transfers from BNDES and FINAME and abroad in other lines of credit abroad. |

| (i) | Deposits |

| · | Customer Deposits: Our customer deposit balance was R$489.9 billion as of December 31, 2022, R$468.9 billion as of December 31, 2021 and R$445.8 billion as of December 31, 2020, representing 66.9%, 68.1% and 68.9% of our total financing, respectively. |

| · | Current Accounts: Our current account balance was R$ 26.6 billion at December 31, 2022, R$ 41.7 billion at December 31, 2021 and R$ 35.6 billion at December 31, 2020, representing 4.4%, 7.1% and 6.2% of total deposits, respectively. |

| · | Savings Accounts: Our savings account balance was R$ 60.2 billion at December 31, 2022, R$ 65.2 billion at December 31, 2021 and R$ 62.2 billion at December 31, 2020, representing 9.9%, 11.1% and 10.8% of total deposits, respectively. |

| · | Customer Time Deposits: Our balance of customer term deposits was R$339.9 billion as of December 31, 2022, R$281.0 billion as of December 31, 2021 and R$269.9 billion as of December 31, 2020, representing 56.1%, 47.6% and 46.7% of total deposits, respectively. |

| · | Repurchase Agreements: We maintain a portfolio of Brazilian public and private sector debt instruments used to obtain overnight funds from other financial institutions or investment funds through the sale of such securities and simultaneously agreeing to repurchase them. Due to the short-term nature (overnight) of this source of financing, such transactions are volatile and generally composed of Brazilian public securities and repurchase agreements linked to debentures. Securities sold in committed operations decreased to R$63.2 billion at December 31, 2022, from R$81.0 billion at December 31, 2021 and R$78.1 billion at December 31, 2020, representing 10.4%, 13.7% and 13.5% of total deposits, respectively. |

|

| (ii) | Central Bank Deposits and Credit Institutions |

Our balance of deposits from the Central Bank of Brazil and credit institutions was R$ 116.1 billion at December 31, 2022, R$ 121.0 billion at December 31, 2021 and R$ 131.7 billion at December 31, 2020, representing 19.2%, 20.5% and 22.8% of total deposits, respectively.

Our deposit balance mainly includes national loans and Transfers Obligations:

| · | Loan obligations. We have relationships with banks around the world, providing lines of credit linked to foreign currencies (either to the dollar or to a basket of foreign currencies). We apply the proceeds of these transactions primarily to loan operations linked to the U.S. dollar and, in particular, to trade finance operations. |

| · | National Transfers. Loans from public institutions, mainly BNDES and FINAME, for which we act as a financial agent. Financing these sources in Brazil represents a method of providing long-term loans with attractive average interest rates for certain sectors of the economy. The loans of these funds are allocated by the BNDES, through banks, to specific sectors focused on economic development. This type of loan is known as a "pass-through." Because the funds passed on are usually paired and/or financed by loans from a federal government agency, we do not assume risk of term or interest rate incompatibility, nor do we charge interest at a fixed margin on the cost of the funds. However, we retain the borrower's commercial credit risk and therefore have discretion in the decision of the loan and in the application of the credit criteria. This type of financing is not affected by the requirement of compulsory deposit. The transfer is usually guaranteed, although it is not required by the terms of the transfer. |

| (iii) | Other Means of Funding |

| (iii.1) | Debt Securities |

Our balance of negotiable debt securities was R$107.1 billion as of December 31, 2022, R$79.0 billion as of December 31, 2021, and R$56.9 billion as of December 31, 2020, representing 14.6%, 11.5% and 8.8% of our total financing, respectively.

The Agribusiness Letter of Credit, which are freely negotiable credit notes and represent an unconditional promise of payment in cash, are issued exclusively by financial institutions and related to credit rights originated from transactions carried out between rural producers and their cooperatives and agents of the agribusiness production chain and foreign exchange acceptances, reached R$ 24.0 billion on December 31, 2022, R$ 17.0 billion at December 31, 2021 and R$ 14.7 billion at December 31, 2020.

|

Financial Letters are an alternative financing available to banks that can be characterized as senior or eligible to compose the reference equity, under the terms of CMN Resolution No. 5,007, of March 24, 2022, its minimum term must be 24 months and must be issued for a minimum amount of R $ 300,000 for subordinated transactions and R $ 50,000 for senior transactions. Our treasury bills balance totaled $33.7 billion as of December 31, 2022, an increase of 34.5% from December 31, 2021.

Real Estate Letters of Credit increased by 45.1%, from R$ 24.0 billion on December 31, 2021 to R$ 34.9 billion on December 31, 2022.

We issue securities, including under our Global Medium-Term Billing Program. Our balance of securities and other securities was $14.5 billion as of December 31, 2022 and $13.0 billion as of December 31, 2021. This change was mainly due to the fact that in 2022 we issued a higher aggregate value of securities than those that matured that year.

| (iv) | Eligible Instruments to compose Level I and Level II |

On November 5, 2018, our board of directors approved the issuance, through our agency in the Cayman Islands, of debt instruments to form part of our benchmark Tier 1 and Tier 2 equity in the total amount of $2.5 billion, pursuant to an offer made to non-U.S. persons pursuant to Regulation S of the U.S. Securities Act of 1993, as amended, or the "Offer of Notes". Our Note Offering was structured as follows: (i) $1.25 billion indexed at 7.25% per annum without maturity (perpetual) and interest paid semi-annually; and (ii) US$ 1.25 billion indexed at 6.125% per year due in November 2028 and interest paid semi-annually. These issues were made through our Cayman Islands branch and, as a result, do not generate liability for income tax at source. In addition, our board of directors also approved the redemption of debt instruments issued to be part of our Tier 1 and Level 2 regulatory capital as set forth in the board's resolution of January 14, 2014. The proceeds of the Note Offering were used to finance this redemption. On December 18, 2018, the Central Bank of Brazil authorized the operations contemplated in the Offer of Notes and the redemption, which were concluded on January 29, 2019.

In November and December 2021, Santander Brasil issued Financial Bills with subordination clause, to be used to compose our Level 2 reference equity, in the total amount of R$ 5.5 billion. The Financial Letters have a term of ten years and redemption and repurchase options in accordance with the applicable regulations. Financial Bills had an estimated 92 basis point impact on our Tier 2 benchmark equity.

As of December 31, 2022, the balance of Level 1 and Level 2 debt instruments was R$19.5 billion compared to R$19.6 billion as of December 31, 2021. This reduction of 0.5% was due to the non-replacement of certain debt instruments that reached maturity. The value remained virtually stable when compared to 2021, as no notes were issued or matured in 2022.

| (v) | Subordinated Debt |

As of December 31, 2022, we had no subordinated debts.

|

e. Sources of financing for working capital and for investments in non-current assets that you intend to use to cover liquidity deficiencies

Due to our stable and diversified sources of fundraising, which include a large deposit base of their clients as detailed in paragraph 2.1.d above, we have historically had no liquidity issues.

As part of our liquidity risk management, we have a formal plan with measures to be taken in scenarios of systemic liquidity crisis and/or arising from any risk to our corporate image. This liquidity contingency plan contains parameters of attention, as well as preventive measures and actions to be triggered in times of liquidity deficiency, if the reserves fall below certain parameters.

As sources of financing for working capital and for investments in non-current assets used to cover liquidity shortfalls, the following resources may be used: (i) deposit raising; (ii) securities issuances; (iii) transactions committed to public/private securities; (iv) transfer pricing review; (v) establishment of more restrictive credit policies; and (vi) release of guarantee margin at B3 S.A. – Brasil Bolsa, Balcão.

f. levels of indebtedness and the characteristics of such debts, further describing:

| (i) | relevant loan and financing agreements |

There are no loan agreements or other debt instruments that our management deems to be relevant to us, with the exception of the securities representing debt of our issuance described in Section 12 of the Reference Form.

| (ii) | other long-term relationships with financial institutions |

Our main sources of funds are local deposits in the form of cash and term accounts, in line with other Brazilian banks, as well as borrowings in the open market, namely, bonds of own issue and bonds of the Federal Government with commitment to repurchase ("committed operations").

We also have deposits in credit institutions related to export and import financing lines raised from banks abroad and intended for application in foreign exchange commercial operations related to export and import financing. We are also part of long-term obligations via transfers, all in accordance with the operational policies of the BNDES system.

| (ii.1) | Eurobonds and Securitization Notes - MT100 |

External issues of securities denominated in foreign currency include securities and other securities (Eurobonds and Structured Notes). The following table shows the detailed composition of Eurobonds:

| Emission | Maturity | Interest Rate (a.a.) | 2022 | 2021 | 2020 |

| 2018 | 2025 | 4,4% | - | 306.253 | 4.213.777 |

| 2019 | 2027 | Up to 6.4% + CDI | 32.204 | 1.189.699 | 1.279.506 |

| 2020 | 2027 | Up to 6.4% + CDI | 90.069 | 3.363.551 | 3.905.993 |

| 2021 | 2031 | Up to 9% + CDI | 6.306.335 | 8.092.563 | - |

| 2022 | 2035 | Up to 9% + CDI | 8.079.519 | - | - |

| Total | 14.508.127 | 12.952.066 | 9.399.276 |

|

| (ii.2) | Subordinated debts |

We use subordinated debt instruments in its funding structure, represented by securities issued in accordance with the rules of the Central Bank, which are used as Reference Equity - Level 2, to calculate the operational limits, including Subordinated CDBs, certificates of deposit issued by us in the local market, in various issues, at interest rates updated by the CDI or the IPCA.

| (iii) | degree of subordination between debts |

In case of our judicial or extrajudicial liquidation there is a preference order regarding the payment of the various creditors of the mass provided for by law, which must be respected under the Brazilian legislation in force at the time. Specifically, with regard to the financial debts that make up our indebtedness, the following payment order must be observed: debts guaranteed by collateral, unsecured debts and subordinated debts. It is worth mentioning that, in relation to debts with real guarantee, creditors prefer to others up to the limit of the asset given as collateral and, as far as it remains, will have their credits included in the payment order of the creditors. Among the creditors there is no degree of subordination, just as there is no degree of subordination between the various subordinated creditors.

(iv) any restrictions imposed on the Company, in particular, in relation to debt limits and contracting of new debts, the distribution of dividends, the disposal of assets, the issuance of new securities and the sale of corporate control, as well as whether the Company has been complying with these restrictions

Regarding securities issued abroad, whose descriptions of operations and programs are described in Item 12.7 of the Reference Form ("Securitization Program" and "Medium Term Notes – MTN"), the main restrictions imposed on the issuer, existing in financing agreements, are also described in the same item.

g. limits on contracted financing and percentages already used

The information requested in this item is not applicable to financial institutions. We are subject, however, to the parameters determined by the monetary authorities, in line with the Basel principles.

h. material changes in items in the income and cash flow statements

| (i) | Assets and Liabilities (in millions of reais): |

| Assets | 2022 | 2021 | Var. 2022x2021 | 2020 | Var. 2021x2020 |

| Availability and Reserves at the Central Bank of Brazil | 22.003 | 16.657 | 32,1% | 20.149 | -17,3% |

| Financial Assets Measured at Fair Value in Earnings | 58.547 | 18.859 | 210,4% | 60.900 | -69,0% |

| Financial Assets Measured at Fair Value in Earnings Held for Trading | 84.834 | 70.571 | 20,2% | 95.843 | -26,4% |

| Financial Assets Not Intended for Trading Mandatorily Measured at Fair Value in Earnings | 2.134 | 870 | 145,3% | 500 | 74,0% |

| Financial Assets Measured at Fair Value in Other Comprehensive Results | 55.426 | 101.242 | -45,3% | 109.740 | -7,7% |

| Financial Assets Measured at Amortized Cost | 663.824 | 633.241 | 4,8% | 554.925 | 14,1% |

| Derivatives Used as Hedge | 1.741 | 342 | 409,1% | 743 | -54,0% |

| Non-Current Assets Held for Sales | 699 | 816 | -14,3% | 1.093 | -25,3% |

| Participations in Affiliates and Joint Ventures | 1.728 | 1.232 | 40,3% | 1.095 | 12,5% |

| Tax Credits | 46.446 | 41.757 | 11,2% | 41.064 | 1,7% |

| Other Assets | 8.275 | 6.049 | 36,8% | 7.222 | -16,2% |

| Tangible Asset | 8.191 | 8.783 | -6,7% | 9.537 | -7,9% |

| Intangible Asset | 31.603 | 30.787 | 2,7% | 30.766 | 0,1% |

| Total Assets | 985.451 | 931.208 | 5,8% | 933.578 | -0,3% |

|

The following are the main changes in balance sheet accounts for the financial years 2022, 2021 and 2020.

| Liabilities and Equity | 2022 | 2021 | Var. 2022x2021 | 2020 | Var. 2021x2020 |

| Financial Liabilities for Trading | 40.747 | 36.953 | 10,3% | 75.020 | -50,7% |

| Financial Liabilities Measured at Fair Value in Earnings | 8.922 | 7.460 | 19,6% | 7.038 | 6,0% |

| Financial Liabilities at Amortized Cost | 795.284 | 750.094 | 6,0% | 707.289 | 6,1% |

| Derivatives Used as Hedge | - | 447 | -100,0% | 145 | 208,3% |

| Provisions | 9.115 | 11.604 | -21,4% | 13.815 | -16,0% |

| Tax Liabilities | 7.811 | 8.175 | -4,5% | 10.130 | -19,3% |

| Other Obligations | 12.892 | 10.501 | 22,8% | 14.051 | -25,3% |

| Total Liabilities | 874.771 | 825.234 | 6,0% | 827.489 | -0,3% |

| Equity | 114.669 | 109.046 | 5,2% | 106.205 | 2,7% |

| Other Comprehensive Results | -4.486 | -3406 | 31,7% | -428 | 695,8% |

| Shareholders' Equity Attributable to the Controller | 110.183 | 105.640 | 4,3% | 105.777 | -0,1% |

| Total Equity | 110.680 | 105.974 | 4,4% | 106.090 | -0,1% |

| Total Liabilities and Shareholders' Equity | 985.450 | 931.208 | 5,8% | 933.578 | -0,3% |

Our total assets reached, as of December 31, 2022, R$985,451 million, a growth of 5.83% compared to 2021, whose total assets reached R$931,208 million, 0.25% lower than the year ended December 31, 2020, in the amount of R$933,578 million.

The portfolio of loans and advances to gross customers, without guarantees and guarantees, totaled R$524,655 at December 31, 2022, a growth of 6.3% compared to R$493,355 million at December 31, 2021, a growth of 6.3% compared to R$417,822 million at December 31, 2020. The Large Companies presented a reduction of 8.7% compared to 2021, being an increase of 19.5% in the Individual segment.

Consolidated shareholders' equity totaled R$110,183 million at December 31, 2022, R$105,640 million at December 31, 2021 and R$105,777 million at December 31, 2020, an increase of 4.4% at December 31, 2022 compared to 2021 and a decrease of 0.1% at December 31, 2021 compared to 2020. The change in shareholders' equity in the year is mainly due to the growth in revenues, Net Income for the period in the amount of R$14,339 million and reduced by the payment of Dividends and Interest on Own Capital in the amount of R$8,100 million.

|

2.2. The directors must comment:

a. results of operations of the Company:

Results of Operations for the Years Ended December 31, 2022, 2021 and 2020

The following table provides an overview of the key core aspects of our results of operations for the years ended December 31, 2022, 2021 and 2020:

Total Revenue totaled R$66,475 million in 2022, an increase of 4.0%, or R$2,548 million compared to the year ended December 31, 2021, driven by an increase in earnings in financial assets and liabilities (net) and exchange rate differences (net), offset by a decrease in net interest income due to the impact of interest rate increases on the cost of financing.

Consolidated Net Income totaled R$14,339 million in the year ended December 31, 2022, a decrease of 7.8% compared to the year ended December 31, 2021, primarily due to: (i) a 4.0% increase in total revenue as described above, (ii) the increase in losses due to a reduction in the recoverable amount of financial assets of 45.1% in 2022 driven by the individual loan portfolio and a specific case of large client in our wholesale segment that entered into judicial reorganization process (judicial reorganization), (iii) a 5.3% increase in administrative expenses in 2022 due to the increase in inflation in the period (with inflation reaching 5.8% in 2022), and (iv) reduction in tax rates from 37.1% to 26.7%. For more information, please see note "c.1) Legal and Administrative Proceedings – Related to Tax and Social Security" in our audited consolidated financial statements included elsewhere in this annual report. | The Customer Loan Portfolio totaled R$524 billion as of December 31, 2022, an increase of 6.3% compared to December 31, 2021, mainly due to increases in the portfolio of loans to individuals, especially payroll mortgages, credit cards and personal credit.

Credit Quality remains at reasonable levels and supports our growth. The ratio of depreciated assets to credit risk was 6.9% in the year ended December 31, 2022, an increase of 1.9 p.p. compared to the previous year. The coverage ratio was 89.8% in the year ended December 31, 2022, a decrease of 20.6 p.p. from 110.4% in the year ended December 31, 2021. Our Basel Capital Adequacy Ratio was 13.9% for the year ended December 31, 2022, a decrease of 1.0 p.p. compared to the year ended December 31, 2021.

The deposits of the Central Bank of Brazil and the deposits of credit institutions plus customer deposits increased by 2.7%, reaching R$ 606 billion in 2022. |

Results of Operations

The following table presents our consolidated operating results for the years ended December 31, 2022, 2021 and 2020:

|

For the financial year ended December 31, | |||||

2022 | 2021 | 2020 | Amendment % 2022/2021 | Amendment % 2021/2020 | |

| (in millions of R$, except percentages) | |||||

| Net interest income | 47.503 | 51.318 | 44.443 | (7,4) | 15,5 |

| Profits from equity instruments | 38 | 90 | 34 | (57,7) | 166,8 |

| Corporate profits accounted for by the equity method | 199 | 144 | 112 | 38,1 | 28,6 |

| Net fee and commission income (expense) | 14.876 | 15.274 | 16.228 | (2,6) | (5,9) |

| Gains (losses) on financial assets and liabilities (net) and exchange differences (net) | 4.699 | (1.781) | (11.703) | (363,9) | (84,8) |

| Other operating income (expenses) (net) | (841) | (1.120) | (873) | (24,9) | 28,3 |

| Total profit | 66.475 | 63.926 | 48.242 | 4,0 | 32,5 |

| Administrative expenditure | (18.240) | (17.316) | (17.115) | 5,3 | 1,2 |

| Depreciation and amortization | (2.586) | (2.434) | (2.579) | 6,2 | (5,6) |

| Provisions (net) | (1.215) | (2.179) | (1.657) | (44,2) | 31,6 |

| Impairment losses on financial assets (net) | (24.829) | (17.113) | (17.450) | 45,1 | (1,9) |

| Impairment losses on other (net) assets | (161) | (166) | (85) | (2,6) | 95,3 |

| Other non-financial gains (losses) | 131 | 33 | 308 | 304,4 | (89,5) |

| Operating profit before tax | 19.575 | 24.750 | 9.664 | (20,9) | 156,1 |

| Income tax | (5.235) | (9.191) | 3.787 | (43,0) | (342,7) |

| Consolidated net income for the year | 14.339 | 15.559 | 13.451 | (7,8) | 15,7 |

Consolidated profit for the year

Our consolidated net income for the year ended December 31, 2022 was R$14,339 million, a decrease of R$1,220 million, or 7.8%, compared to our consolidated net income of R$15,559 million for the year ended December 31, 2021, primarily due to an increase in losses due to a reduction in the recoverable amount of financial assets of R$7,716 million, or 45.1%, to R$ 24,829 million in the year ended December 31, 2022, from R$ 17,113 million in the fiscal year December 31, 2021, due to the deterioration of the loan portfolio that was impacted by a specific case of a large client in our wholesale segment that filed for judicial reorganization, and a reduction in net interest income from R$3,815 million, or 7.4%, to R$47,503 million in the year ended December 31, 2022 from R$51,318 million in December 31, 2021, primarily due to an increase in interest rates in force in Brazil as a result of the Central Bank of Brazil's increases in the SELIC rate to suppress inflation and a decrease in revenue and d fees received from customers as a result of more selective credit policies and services and an increase in the cost of our obligations as a result of higher interest rates.

Our consolidated net income for the year ended December 31, 2021 was R$15,559 million, an increase of R$2,109 million, or 15.7%, compared to our consolidated net income of R$13,451 million for the year ended December 31, 2020, as a result of an increase in net interest income of R$6,876 million, or 15.5%, to R$51,318 million in the year ended December 31, 2021, from R$44,443 million in the year ended December 31, 2020 to be driven by our loan portfolio.

Net interest income

Net interest income for the year ended December 31, 2022 was R$47,503 million, a decrease of 7.4% or R$3,815 million from R$51,318 million for the year ended December 31, 2021. This reduction was primarily due to the increase in interest rates, which increased pressure on our margins, partially offset by an increase in gains/losses on financial assets and liabilities (net) and exchange rate differences (net).

The average total of assets earned in 2022 was R$ 903.4 billion, an increase of 7.13% or R$ 60.1 billion compared to R$ 843.3 billion in 2021. The main drivers of this increase were an increase of R$ 42.4 billion, or 9.2%, in the average of loans and advances to customers and a reduction of R$ 11.2 billion in the average of debt instruments.

|

Net income (net interest income divided by average profitable assets) in 2022 was 5.3% and 6.1% in 2021. Net income (net interest income divided by average profitable assets) was 6.1% in 2021 compared to 6.0% in 2020.