Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | |

| (Mark One) | | |

ý |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009 |

OR |

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

|

Commission File Number 001-34579

Cobalt International Energy, Inc.

(Exact name of registrant as specified in its charter)

| | |

Delaware

(State or other jurisdiction of

incorporation or organization) | | 27-0821169

(I.R.S. Employer

Identification No.) |

Two Post Oak Central

1980 Post Oak Boulevard, Suite 1200

Houston, TX 77056

(Address of principal executive offices, including zip code)

(713) 579-9100

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Securities Act:

| | |

| Title of Each Class | | Name of Each Exchange on Which Registered |

|---|

| Common stock, $0.01 par value | | The New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Securities Act:None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No ý

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer ý

(Do not check if a

smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Act). Yes o No ý

As of June 30, 2009, the last business day of the registrant's most recently completed second fiscal quarter, the registrant's common stock was not listed on any domestic exchange or over-the-counter market. The registrant's common stock began trading on the New York Stock Exchange on December 16, 2009. As of December 31, 2009, the aggregate market value of the registrant's common stock held by non-affiliates was approximately $1,392 million based on the closing price of the registrant's common stock on the New York Stock Exchange on December 31, 2009.

As of March 29, 2010, the registrant had 356,594,544 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's proxy statement relating to the 2010 Annual Meeting of Shareholders, to be filed within 120 days of the end of the fiscal year covered by this report, are incorporated by reference into Part III of this Annual Report on Form 10-K.

Table of Contents

Cobalt International Energy, Inc.

| | | | | | |

Item

No. | |

| | Page

No. | |

|---|

PART I

|

|

1 | | Business | | | 2 | |

1A | | Risk Factors | | | 40 | |

1B | | Unresolved Staff Comments | | | 53 | |

2 | | Properties | | | 53 | |

3 | | Legal Proceedings | | | 53 | |

4 | | (Removed and Reserved) | | | 53 | |

PART II

|

|

5 | | Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | | 54 | |

6 | | Selected Financial Data | | | 55 | |

7 | | Management's Discussion and Analysis of Financial Condition and Results of Operations | | | 57 | |

7A | | Quantitative and Qualitative Disclosures About Market Risk | | | 70 | |

8 | | Financial Statements and Supplementary Data | | | 71 | |

9 | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | | 71 | |

9A | | Controls and Procedures | | | 71 | |

9B | | Other Information | | | 71 | |

PART III

|

|

10 | | Directors, Executive Officers and Corporate Governance | | | 71 | |

11 | | Executive Compensation | | | 71 | |

12 | | Security Ownership of Certain Beneficial Owners and Management Related Stockholder Matters | | | 72 | |

13 | | Certain Relationships and Related Transactions, and Director Independence | | | 72 | |

14 | | Principal Accountant Fees and Services | | | 72 | |

| | Glossary of Selected Oil and Gas Terms | | |

73 | |

PART IV

|

|

15 | | Exhibits and Financial Statement Schedules | | | 78 | |

| | Signatures | | | 81 | |

Table of Contents

PART I

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains estimates and forward-looking statements, principally in "Business," "Risk Factors," and "Management's Discussion and Analysis of Financial Condition and Results of Operations." Our estimates and forward-looking statements are mainly based on our current expectations and estimates of future events and trends, which affect or may affect our businesses and operations. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to several risks and uncertainties and are made in light of information currently available to us. Many important factors, in addition to the factors described in this Annual Report on Form 10-K, may adversely affect our results as indicated in forward-looking statements. You should read this Annual Report on Form 10-K and the documents that we have filed as exhibits hereto completely and with the understanding that our actual future results may be materially different from what we expect.

Our estimates and forward-looking statements may be influenced by the following factors, among others:

- •

- uncertainties inherent in making estimates of our oil and natural gas data;

- •

- the volatility of oil prices;

- •

- discovery and development of oil reserves;

- •

- projected and targeted capital expenditures and other costs, commitments and revenues;

- •

- current and future government regulation of the oil and gas industry;

- •

- changes in environmental laws or the implementation of those laws;

- •

- termination of or intervention in concessions, rights or authorizations granted by the United States, Angolan and Gabonese governments to us;

- •

- competition;

- •

- our ability to find, acquire or gain access to other prospects and to successfully develop our current prospects;

- •

- the successful implementation of our and our partners' prospect development and drilling plans;

- •

- the availability and cost of drilling rigs, production equipment, supplies, personnel and oilfield services;

- •

- the availability and cost of developing appropriate infrastructure around and transportation to our prospects;

- •

- military operations, terrorist acts, wars or embargoes;

- •

- the ability to obtain financing;

- •

- our dependence on our key management personnel and our ability to attract and retain qualified personnel;

- •

- our vulnerability to severe weather events, especially tropical storms and hurricanes in the U.S. Gulf of Mexico;

- •

- the cost and availability of adequate insurance coverage; and

- •

- other risk factors discussed in the "Risk Factors" section of this Annual Report on Form 10-K.

The words "believe," "may," "will," "aim," "estimate," "continue," "anticipate," "intend," "expect," "plan" and similar words are intended to identify estimates and forward-looking statements. Estimates and forward-looking statements speak only as of the date they were made, and, except to the extent required by law, we undertake no obligation to update or to review any estimate and/or forward-looking statement because of new information, future events or other factors. Estimates and forward-looking statements involve risks and uncertainties and are not guarantees of future performance. As a result of the risks and uncertainties described above, the estimates and forward-looking statements discussed in this Annual Report on Form 10-K might not occur and our future

Table of Contents

results and our performance may differ materially from those expressed in these forward-looking statements due to, including, but not limited to, the factors mentioned above. Because of these uncertainties, you should not place undue reliance on these forward-looking statements.

Item 1. Business

Overview

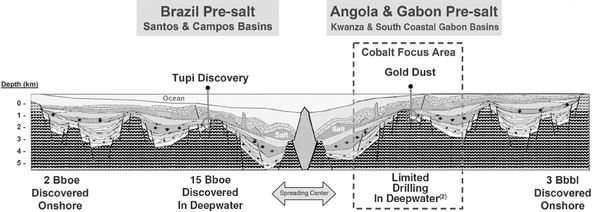

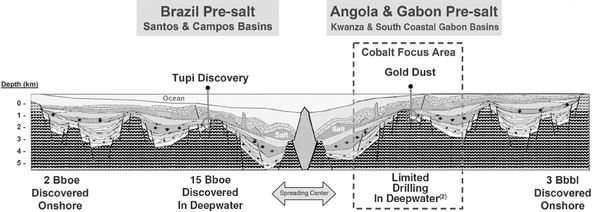

We are an independent, oil-focused exploration and production company with a world-class below salt prospect inventory in the deepwater of the U.S. Gulf of Mexico and offshore Angola and Gabon in West Africa. We were formed in late 2005 by experienced industry executives and private equity investors who believed that a team of veteran explorationists, equipped with industry-leading data, newly available seismic technologies, industry contacts and adequate funding, could acquire a deepwater prospect inventory that would rival the supermajor oil companies. After considering numerous global oil-producing regions in which to focus our exploration and development efforts, we selected the deepwater U.S. Gulf of Mexico and offshore Angola and Gabon due to the largely unrealized hydrocarbon potential offered by below salt horizons within these regions. We believe that we have been successful in assembling such an inventory and that our asset portfolio would be very difficult to replicate. In December 2009, we completed our initial public offering, which together with a concurrent private offering and the exercise by the underwriters of their overallotment option yielded gross proceeds of $1 billion, and we became a listed company on the New York Stock Exchange. We believe that we are well-positioned, through our prospect maturation efforts, active drilling program, long-term strategic alliances with key industry participants and with the proceeds from our initial public offering, to unlock the potential of and de-risk our prospects on an accelerated basis.

Primarily through our highly targeted leasing strategy, which was the result of an in-depth, multi-year study of potential regional hydrocarbon accumulations within the deepwater U.S. Gulf of Mexico and select regions offshore West Africa, we have established a current portfolio of 134 identified, well-defined prospects, comprised of 48 prospects located in the deepwater U.S. Gulf of Mexico and 86 prospects located in Blocks 9 and 21 offshore Angola and the Diaba Block offshore Gabon. All of our prospects are oil-focused.

Our prospect inventory as of December 31, 2009 is summarized in the table below:

| | | | | | | | | | |

| | Identified

Prospects(1) | | Identified Prospects

on which an Initial

Exploratory Well is

Expected to be Spud

by End of 2012(1) | |

|---|

U.S. Gulf of Mexico | | | | | | | |

| | Miocene | | | | | | | |

| | | Tahiti Basin | | | 3 | | | 3 | |

| | | Adjacent Miocene | | | 18 | | | 4 | |

| | Inboard Lower Tertiary(2) | | | 21 | | | 6 | |

| | Dual Miocene and inboard Lower Tertiary | | | 6 | | | 2 | |

| | | | | | |

| | | | U.S. Gulf of Mexico subtotal | | | 48 | | | 15 | |

West Africa | | | | | | | |

| | Angola(3) | | | 42 | | | 5 | |

| | Gabon | | | 44 | | | 2 | |

| | | | | | |

| | | | West Africa subtotal | | | 86 | | | 7 | |

| | | | | | |

Total Portfolio | | | 134 | | | 22 | |

| | | | | | |

- (1)

- See "Risk Factors—We have no proved reserves and areas that we decide to drill may not yield oil in commercial quantities or quality, or at all," "Risk Factors—Our identified drilling locations are scheduled out over several years, making them susceptible to uncertainties that could materially alter the occurrence or timing of their drilling," and "—How We Identify and Analyze Prospects."

2

Table of Contents

- (2)

- What we refer to as the inboard Lower Tertiary is an emerging trend located to the northwest of existing outboard Lower Tertiary fields such as St. Malo, Jack and Cascade. Based on the drilling results of Shenandoah #1, we believe that discoveries in the inboard Lower Tertiary will exhibit meaningfully better reservoir characteristics than had previously been encountered by the industry in the outboard Lower Tertiary.

- (3)

- On February 24, 2010, we executed Risk Services Agreements for Blocks 9 and 21 offshore Angola which converted the contractual rights we acquired in such blocks in 2007 into licenses to explore for, develop and produce oil from these blocks. We also have retained contractual rights with respect to one additional block offshore Angola. This table excludes the additional block.

Strategic Relationships

On April 6, 2009, we announced a long-term alliance with TOTAL E&P USA, INC. ("TOTAL") in which, through a series of transactions, we combined our respective U.S. Gulf of Mexico exploratory lease inventory (which excludes the Heidelberg portion of our Ligurian/Heidelberg prospect, our Shenandoah prospect, and all developed or producing properties held by TOTAL in the U.S. Gulf of Mexico) through the exchange of a 40% interest in our leases for a 60% interest in TOTAL's leases, resulting in a current combined alliance portfolio covering 215 blocks. We will act as operator on behalf of the alliance through the exploration and appraisal phases of development. As part of the alliance, TOTAL committed, among other things, to (i) provide a 5th generation deepwater rig to drill a mandatory five-well program on existing Cobalt-operated blocks, (ii) pay up to $300 million to carry a substantial share of Cobalt's costs with respect to this five-well program (above the amounts TOTAL has agreed to pay as owner of a 40% interest), (iii) pay an initial amount of approximately $280 million primarily as reimbursement of our share of historical costs in our contributed properties and consideration under purchase and sale agreements, (iv) pay 40% of the general and administrative costs relating to our operations in the U.S. Gulf of Mexico during the 10-year alliance term, and (v) award us up to $180 million based on the success of the alliance's initial five-well program, in all cases subject to certain conditions and limitations. Additionally, as part of the alliance, we formed a U.S. Gulf of Mexico-wide area of mutual interest with TOTAL, whereby each party has the right to participate in any oil and natural gas lease interest acquired by the other party within this area.

On April 22, 2009, we announced a partnership in the U.S. Gulf of Mexico with the national oil company of Angola, Sociedade Nacional de Combustíveis de Angola—Empresa Pública ("Sonangol"), pursuant to an agreement we had entered into with Sonangol immediately following the 2008 MMS Central Gulf of Mexico Lease Sale, whereby they acquired a 25% non-operated interest of our pre-TOTAL alliance interests in 11 of our U.S. Gulf of Mexico leases. The price Sonangol paid us for this interest was calculated using the price we paid for these leases plus $10 million to cover our historical seismic and exploration costs. Additionally, as part of the partnership, we formed an area of mutual interest with Sonangol covering a subset of the U.S. Gulf of Mexico, whereby each party has the right to participate in any oil and natural gas lease interest acquired by the other party within this area until mid-May 2010. This transaction is notable as it represents Sonangol's initial entry into the North American exploration and production sector.

Drilling Results

As of March 29, 2010, we have drilled as operator two exploratory wells (Ligurian #1 and Criollo #1) and participated as non-operator in three exploratory wells (Heidelberg #1, Shenandoah #1 and Firefox #1) and one appraisal well (Heidelberg #2), of which Firefox #1 and Heidelberg #2 are currently being drilled.

3

Table of Contents

Heidelberg #1, Ligurian #1 and Heidelberg #2. On February 2, 2009, we announced that the Heidelberg #1 well had encountered more than 200 feet of net pay thickness in the Miocene horizons. Located in approximately 5,200 feet of water in Green Canyon 859 within the Tahiti Basin Miocene trend, this well was drilled to approximately 30,000 feet. Anadarko Petroleum Corporation ("Anadarko") operates the block and we hold a 9.375% working interest. We purchased our interest in Green Canyon 859 and 903 (the "Heidelberg blocks") from an existing owner in May 2008 after we successfully acquired 100% of the working interest in the adjacent blocks of Green Canyon 813, 814 and 858 (the "Ligurian blocks") in the 2008 MMS Central Gulf of Mexico Lease Sale.

On July 16, 2009, we spud Ligurian #1 on Green Canyon 858 to target the upper- and middle-Miocene horizons. On October 28, 2009, we and our partners decided to temporarily cease drilling operations on Ligurian #1 having encountered operational difficulties when drilling below salt through an unforeseen geologic formation before reaching total depth or testing the targeted horizons. We did encounter oil in the wellbore above the targeted horizons, but believe further drilling operations will be required to adequately test the prospect. Since ceasing drilling operations, we have been evaluating the significant amount of new information that we have gathered from Ligurian #1, including results from the reprocessing of seismic data. We expect to resume exploratory activity on the Ligurian blocks during the third quarter of 2010.

On February 17, 2010, the Heidelberg #2 appraisal well was spud by Anadarko in approximately 5,300 feet of water in Green Canyon 903. This well is currently drilling towards a targeted depth of approximately 31,500 feet.

Shenandoah #1. On February 4, 2009, we announced that the Shenandoah #1 well had been drilled into Lower Tertiary horizons. Anadarko, as operator, has stated that this well encountered approximately 300 feet of net pay thickness. This well, located in approximately 5,750 feet of water in Walker Ridge 52, was drilled to approximately 30,000 feet. Anadarko operates the block and we hold a 20% working interest. We strategically purchased our interest in Shenandoah #1 to test our hypothesis that targeting the previously undrilled inboard Lower Tertiary, which we regard as an emerging trend located to the northwest of existing outboard Lower Tertiary fields such as St. Malo, Jack and Cascade, would lead to discoveries that exhibit meaningfully better reservoir characteristics than had previously been encountered by the industry in the outboard Lower Tertiary. We believe the successful results of the Shenandoah #1 well support our hypothesis.

Criollo #1. On January 29, 2010, we announced that we had reached a planned total depth of approximately 31,000 feet in the Criollo exploration sidetrack well located in approximately 4,200 feet of water in Green Canyon 685 within the Tahiti Basin Miocene trend. The original well encountered 55 feet of net pay thickness in Miocene horizons and the sidetrack encountered 73 feet of net pay thickness in correlative reservoirs. Both the original well and the sidetrack encountered structural complexities associated with salt, which prevented the testing of the entire prospective interval. We have suspended operations on the well and we are conducting a detailed review of the well data and reprocessing the existing 3-D pre-stack depth seismic data so that we and our partner can determine the next appropriate steps. We refer to the sidetrack well and the original well as the Criollo #1 exploratory well. We hold a 60% working interest in this prospect.

Firefox #1. On February 10, 2010, the Firefox #1 exploratory well was spud by BHP Billiton Petroleum (GOM) Inc. ("BHP") in approximately 4,400 feet of water in Green Canyon 817 within the Tahiti Basin Miocene trend and approximately six miles northeast of the Heidelberg discovery. This well is currently drilling towards a targeted measured depth of approximately 34,000 feet. We hold a 30% working interest in this prospect.

4

Table of Contents

Drilling Rigs

We have entered into a two-year drilling contract with a subsidiary of ENSCO International Incorporated ("ENSCO"), which may be extended to up to four years at our option, for the use of the ENSCO 8503 deepwater 5th generation semi-submersible drilling rig in our exploration and development efforts in the U.S. Gulf of Mexico. We expect to take delivery of the ENSCO 8503 drilling rig, which is currently under construction, in the fourth quarter of 2010. We expect to be able to drill at least two wells with the ENSCO 8503 during the initial two year term of this agreement and at least two additional wells should we extend the contract. The lease for the ENSCO 8503 drilling rig has an aggregate rate for the first two years of the contract of approximately $372 million, representing a base operating rate of $510,000 per day, subject to adjustment.

On March 8, 2010, we entered into a Rig Assignment Agreement with Anadarko providing for the assignment to Cobalt of the Ocean Monarch drilling rig. We plan to use the Ocean Monarch to drill our North Platte #1 exploratory well. We expect Anadarko to make the Ocean Monarch available to us on or about May 1, 2010, depending upon when the current assignee of the Ocean Monarch concludes its designated drilling operations. We committed to use the Ocean Monarch for a minimum of 75 days at a day rate of approximately $440,000, and have the option to use the Ocean Monarch to drill a second well.

We continually evaluate opportunities to contract for the use of additional rigs to increase our capacity to drill additional wells.

Recent Events

On June 11, 2009, the Council of Ministers of Angola published Decree Law No. 15/09 and Decree Law No. 14/09 which granted the mining rights for the prospecting, exploration, development and production of hydrocarbons on Blocks 9 and 21 offshore Angola, respectively, to Sonangol, as the national concessionaire, and appointed Cobalt as the operator of Blocks 9 and 21. Pursuant to these Decrees Laws, in October 2009, we completed negotiations with Sonangol and initialed the finalized Risk Services Agreements for Blocks 9 and 21 offshore Angola. On December 16, 2009, the Council of Ministers of Angola approved the terms of the finalized Risk Services Agreements. On February 24, 2010, we executed Risk Services Agreements for Blocks 9 and 21 offshore Angola with Sonangol, as well as Sonangol Pesquisa e Produção, S.A., Nazaki Oil and Gáz, S.A. and Alper Oil, Limitada. The Risk Services Agreements govern our 40% interest in and operatorship of Blocks 9 and 21 offshore Angola and form the basis of our exploration, development and production operations on these blocks. Their execution is a key milestone that allows for the commencement of our offshore Angola drilling program, currently planned to begin within the next twelve months.

How We Identify and Analyze Prospects

Our prospect identification and analysis approach is based on a thorough, basin-wide understanding of the geologic trends within our focus areas. From our inception, we have been focused on acquiring and reprocessing the highest quality seismic data available, including the application of advanced imaging technology, such as wide-azimuth seismic. This approach differs considerably from often-followed industry practice of acquiring more narrowly focused, prospect-specific data on a block-by-block basis. In the Gulf of Mexico, we have licenses covering approximately 17.8 million acres (72,000 square kilometers) of processed 3-D depth-migrated seismic data and approximately 17.7 million acres (71,800 square kilometers) of wide-azimuth 3-D depth data. In addition, we have performed proprietary reprocessing on approximately 2.9 million acres (11,800 square kilometers) of 3-D seismic data to enhance image quality and velocity model confidence. Our proprietary seismic reprocessing was performed by third-party geophysical providers using leading-edge technologies, including reverse time migration algorithms for pre-stack depth migration and 3-D surface related

5

Table of Contents

multiple elimination (SRME) for multiple attenuation. We also have licensed approximately 78,000 line miles (125,000 kilometers) of 2-D pre-stack depth-migrated seismic data in the U.S. Gulf of Mexico. In West Africa, we have acquired approximately 125,000 line miles (200,000 line kilometers) of 2-D seismic data and approximately 3,200 square miles (8,300 square kilometers) of 3-D seismic data. Our approach to data acquisition entails analyzing regional data, including industry well results, to understand a given trend's specific geology and defining those areas that offer the highest potential for large hydrocarbon deposits. After these areas are identified, we seek to acquire and reprocess the highest resolution subsurface data available in the potential prospect's direct vicinity. This includes advanced imaging information, such as wide-azimuth studies, to further our understanding of a particular reservoir's characteristics, including both trapping mechanics and fluid migration patterns. Reprocessing is accomplished through a series of model building steps that incorporate the geometry of the salt and below salt geology to optimize the final image. In addition, we gather publicly available information, such as logs, press releases and industry intelligence, which we use to evaluate industry results and activities in order to understand the relationships between industry drilled prospects and our portfolio of undrilled prospects.

As part of our prospect identification and analysis approach, we estimate three primary characteristics:

- •

- mean prospect area—being the mean aerial extent of a hydrocarbon-bearing rock section of a prospect (expressed in acres);

- •

- mean "net pay" thickness—being the mean vertical extent of the effective hydrocarbon-bearing rock (expressed in feet); and

- •

- hydrocarbon yield—being the hydrocarbons that can ultimately be recovered from a volume of rock (expressed in barrels of oil-equivalent per acre-foot).

We use industry recognized probabilistic methods to estimate the ranges of potential outcomes for each characteristic. The ranges are checked for reasonableness by comparison to probabilistic distributions of analogous discoveries and fields (including dry holes), which we refer to as analogs. For instance, in evaluating our three primary characteristics in the Tahiti Basin Miocene trend, we extensively studied successful discoveries, including the Tahiti field, a subsalt Miocene field. Analogs also provide critical information regarding the age, thickness, quality of reservoir rock and components of hydrocarbon yield. As analog discoveries are appraised and become producing fields, they also provide performance data, including production and decline rates. By analyzing analogs in a basin, we refine and improve the accuracy of the estimates we calculate for prospects. We also work with DeGolyer and MacNaughton, an independent petroleum consulting firm, in assessing our prospects.

The accuracy of our estimates is subject to a number of risks and uncertainties as described under the heading "Risk Factors—We face substantial uncertainty in estimating the characteristics of our prospects, so you should not place undue reliance on any of our estimates."

The following describes how we determine the estimates of our three primary characteristics.

6

Table of Contents

Prospect Area

The aerial extent of a hydrocarbon-bearing section of a prospect is referred to as "prospect area." To determine our prospect area, we use our seismic data and all available geologic data to map the aerial extent of the closures or trapping geometries that can hold hydrocarbons. Because it is not possible to directly detect the presence of hydrocarbons, we use statistical methods to define the amount of the closure that can be filled with hydrocarbons. We use a lognormal distribution to define the probabilities of the size of the prospect area. The prospect area may extend across multiple lease blocks or license areas, including on lease blocks and license areas in which we do not own an interest.

Net Pay Thickness

The vertical extent of the effective hydrocarbon-bearing rock is referred to as "net pay" thickness. We estimate the amount of net pay thickness for a prospect by using wireline log information from wells in applicable analog fields. Our estimates for the net pay thickness of a prospect are validated with our studies of historical field thicknesses. As with our area estimations, we use a lognormal distribution to establish the probabilities of the net pay thickness of a prospect.

The expected net pay thickness of the exploration well may differ from the mean net pay thickness of the prospect due to several factors, including the relative location of the exploration well on the structure, potential thickness variations that may occur across the prospect and the extent to which potential reservoir horizons are penetrated.

7

Table of Contents

Hydrocarbon yield is a measure of the quantity of oil and natural gas ultimately recoverable from a given volume of reservoir rock. Estimating hydrocarbon yield involves an analysis of a combination of several factors including reservoir characteristics, hydrocarbon and fluid properties and recovery efficiency. Reservoir characteristics include porosity (the ratio of the volume of voids or pore space to the total volume, in other words, the storage capacity of a reservoir rock), permeability (the measure of the ease with which fluids will flow through the pore spaces of a reservoir rock) and hydrocarbon saturation (the percentage of oil and natural gas relative to water in the pore spaces of the reservoir rock). We estimate probabilistically the ranges for these reservoir characteristics by performing a petrophysical analysis of analogous wells and reservoirs in order to determine the range of these reservoir characteristics.

Hydrocarbon and fluid properties, including the gas-oil ratio and recoverable oil per acre-foot, are estimated using published or commercially available information from offset fields to determine likely ranges expected in the prospect trend.

Recovery efficiency is estimated from modeling multiple development scenarios that consider (i) the expected initial reservoir pressure, (ii) the number of wells used for production, (iii) the type of reservoir drive mechanism, (iv) the type of secondary recovery methods (if used), and (v) the expected reservoir abandonment pressure.

How We Acquire Prospects

Once a prospect is identified and analyzed, we may seek to acquire leasehold title to the lease blocks (in the U.S. Gulf of Mexico) or license area (offshore Angola and Gabon) that include the prospect. The leasehold acquisition typically occurs from one of two sources: from governments through lease sales, licensing rounds or direct negotiations, or from other oil and gas companies through direct purchases, trades or farm-in arrangements. The leasehold acquisition provides us with title to specific blocks or license areas that we believe includes the entire prospect or a portion thereof. For each block or license area, our ownership percentage is referred to as our working interest. For those prospects which extend beyond our leasehold acreage, we include only the portion of prospect acreage for which we hold leasehold title. We refer to this as the net mean area of the prospect. Depending on the terms of our lease or license agreement, we may be required to pay royalties on our oil and gas production.

Deepwater U.S. Gulf of Mexico

Our oil-focused exploration efforts primarily target subsalt Miocene and Lower Tertiary horizons in the deepwater U.S. Gulf of Mexico. The deepwater subsalt petroleum provinces are the least explored of the accessible regions of the U.S. Gulf of Mexico. Advances in technology over the past 10 years have led to significant discoveries and increased the hydrocarbon assessment in the deepwater U.S. Gulf of Mexico. These horizons are characterized by well-defined hydrocarbon systems, comprised primarily of high-quality source rock and crude oil, and contain several of the most significant hydrocarbon discoveries in the deepwater U.S. Gulf of Mexico, including Tahiti (Green Canyon 640), Knotty Head (Green Canyon 512) and Kaskida (Keathley Canyon 292).

The Miocene play is generally characterized by reservoirs exhibiting high permeability and containing high-quality oil and natural gas. One of the most prolific regions within the Miocene play is the Tahiti Basin, which includes discoveries such as Tahiti, Caesar, Tonga, Friesian, Knotty Head, Pony and Heidelberg.

8

Table of Contents

The following table presents the most recent data published by the MMS regarding selected industry discoveries in the Miocene trend(1):

| | | | | | | | | | | | | | | | | | | |

Field (Block) | | Reservoir

Depth (feet) | | Sand | | Total

Area

(acres)(2) | | Net Pay

Thickness

(feet) | | Gas-Oil

Ratio

(scf/bbl)(3) | | Recoverable

Oil per

Acre-foot

(bbl/acre-foot)(4) | |

|---|

Tahiti (Green Canyon 640) | | | 24,200 | | M15A | | | 3,500 | | | 150 | | | 467 | | | 404 | |

| | | 25,800 | | M18A | | | 1,500 | | | 35 | | | 680 | | | 344 | |

| | | 26,000 | | M21A | | | 3,600 | | | 70 | | | 505 | | | 378 | |

| | | 26,200 | | M21B | | | 3,300 | | | 100 | | | 510 | | | 323 | |

| | | | | | | | | | | | | | | | |

| | Tahiti Total | | | 335 | | | 508 | (5) | | 370 | (5) |

Knotty Head (Green Canyon 512) | | |

27,800 | | 27850 | | |

209 | | |

15 | | |

390 | | |

335 | |

| | | 28,000 | | MM50 | | | 882 | | | 92 | | | 395 | | | 303 | |

| | | 28,800 | | 30_31 | | | 315 | | | 36 | | | 395 | | | 300 | |

| | | 29,200 | | MM65up | | | 643 | | | 62 | | | 375 | | | 340 | |

| | | 29,800 | | MM65low | | | 1,106 | | | 27 | | | 380 | | | 251 | |

| | | 30,400 | | MM70up | | | 700 | | | 9 | | | 380 | | | 181 | |

| | | 30,600 | | MM70mid | | | 924 | | | 57 | | | 380 | | | 260 | |

| | | 30,800 | | MM70low | | | 892 | | | 47 | | | 380 | | | 260 | |

| | | 31,500 | | MM90 | | | 3,763 | | | 29 | | | 379 | | | 253 | |

| | | 31,700 | | 31900 | | | 1,942 | | | 12 | | | 410 | | | 223 | |

| | | | | | | | | | | | | | | | |

| | Knotty Head Total | | | 386 | | | 385 | (5) | | 285 | (5) |

Atlantis (Green Canyon 743) | | |

16,610 | | Upper_M7 | | |

945 | | |

55 | | |

647 | | |

669 | |

| | | 17,096 | | Mid_M7 | | | 3,128 | | | 130 | | | 647 | | | 670 | |

| | | 17,419 | | Lower_M7 | | | 2,550 | | | 99 | | | 647 | | | 651 | |

| | | 17,522 | | M8 | | | 1,077 | | | 39 | | | 647 | | | 529 | |

| | | 17,698 | | M9 | | | 1,456 | | | 97 | | | 647 | | | 458 | |

| | | | | | | | | | | | | | | | |

| | Atlantis Total | | | 420 | | | 647 | (5) | | 604 | (5) |

Mad Dog (Green Canyon 826) | | |

18,400 | | M60_SERIES | | |

922 | | |

157 | | |

830 | | |

246 | |

| | | 20,707 | | M20_SERIES | | | 3,296 | | | 170 | | | 267 | | | 290 | |

| | | | | | | | | | | | | | | | |

| | Mad Dog Total | | | 327 | | | 537 | (5) | | 269 | (5) |

Shenzi (Green Canyon 654) | | |

24,200 | | M8 | | |

970 | | |

122 | | |

500 | | |

334 | |

| | | 24,500 | | M7_STRAY | | | 1,058 | | | 29 | | | 500 | | | 384 | |

| | | 25,500 | | M9 | | | 6,090 | | | 205 | | | 495 | | | 361 | |

| | | | | | | | | | | | | | | | |

| | Shenzi Total | | | 356 | | | 497 | (5) | | 354 | (5) |

Puma (Green Canyon 823) | | |

16,750 | | MMM1 | | |

53 | | |

79 | | |

800 | | |

426 | |

| | | 17,260 | | MMM3 | | | 258 | | | 120 | | | 800 | | | 426 | |

| | | 17,965 | | MMM7 | | | 145 | | | 50 | | | 800 | | | 426 | |

| | | | | | | | | | | | | | | | |

| | Puma Total | | | 249 | | | 800 | (5) | | 426 | (5) |

K2 (Green Canyon 562) | | |

24,150 | | M14 | | |

3,645 | | |

20 | | |

890 | | |

279 | |

| | | 24,250 | | M20_Upper | | | 300 | | | 30 | | | 550 | | | 359 | |

| | | 26,262 | | M20_Lower | | | 4,549 | | | 53 | | | 670 | | | 185 | |

| | | 26,504 | | M20_Middle | | | 4,710 | | | 37 | | | 654 | | | 178 | |

| | | | | | | | | | | | | | | | |

| | K2 total | | | 140 | | | 671 | (5) | | 234 | (5) |

- (1)

- See the MMS' website:http://www.gomr.mms.gov/homepg/pubinfo/freeasci/Atlas/freeatlas.html. The information of this website is not incorporated into this Annual Report. Although the data published on the MMS website contains information on hundreds of fields in the U.S. Gulf of Mexico, we have included in this table only the deepwater subsalt Miocene fields that are most analogous to our Tahiti Basin Miocene trend and Adjacent Miocene trend prospects, based on the close proximity of these fields to our prospects and the similar reservoir depths, petrophysical properties and net pay thickness

9

Table of Contents

expected for our prospects. Based on these same metrics, of the seven fields presented in the table, we believe the two most analogous fields to our Tahiti Basin Miocene trend and Adjacent Miocene trend prospects are Tahiti and Knotty Head. The MMS keeps log and well data confidential for two years after receipt from companies drilling in the U.S. Gulf of Mexico. As a result, the most recent 2010 data available from the MMS does not include wells drilled after 2006, including Caesar, Tonga, Fresian, Pony and Heidelberg. We do not own interests in any of the fields listed in this table.

- (2)

- Represents the "gross area" of each field, which includes acreage of the field on all associated blocks. The "gross area" is different than the "net area", which would include only the acreage on which a particular owner holds leasehold title.

- (3)

- Represents the ratio of the volume of gas that comes out of solution from the volume of oil at standard conditions (expressed in standard cubic feet per barrel of oil).

- (4)

- Represents the amount of oil that can ultimately be recovered from a volume of rock (expressed in barrels of oil per acre-foot).

- (5)

- Represents the net pay thickness-weighted average of "gas-oil ratio" and "recoverable oil per acre-foot," as applicable.

The Lower Tertiary horizon is an older formation than the Miocene, and, as such, is generally deeper, with higher pressures and greater geologic complexity, than the Miocene play. These reservoirs are generally located in water depths of 5,000 feet to 8,000 feet, and have shown net pay thickness zones of up to 800 feet. In 2006, the discovery at Kaskida (Keathley Canyon 292) encountered 800 feet of net pay thickness. A more recent discovery in the Lower Tertiary, Shenandoah, has encountered approximately 300 feet of net pay thickness. Although to date there has been no commercial production from the Lower Tertiary horizon, the industry has been successful in terms of locating and drilling large hydrocarbon-bearing structures in this horizon. The reservoir quality of the Lower Tertiary has proven to be highly variable. Some regions, including those areas in which many of the historical Lower Tertiary discoveries have been made, exhibit lower permeability and generally lower natural gas content compared to the Miocene horizon. Another sub-region in the Lower Tertiary that has exhibited reservoir characteristics very similar to that of existing Miocene discoveries is the inboard Lower Tertiary trend, which includes the Shenandoah discovery. To date, however, the inboard Lower Tertiary trend remains largely undrilled.

10

Table of Contents

The following table presents the most recent data published by the MMS regarding selected industry discoveries in the outboard Lower Tertiary trend(1):

| | | | | | | | | | | | | | | | | | | |

Field(2) | | Reservoir

Depth (ft) | | Sand | | Total

Area

(acres)(2) | | Net Pay

Thickness

(feet) | | Gas-Oil

Ratio

(scf/bbl)(3) | | Recoverable

Oil per

Acre-foot

(bbl/acre-foot)(4) | |

|---|

St Malo (Walker Ridge 678) | | | 27,154 | | Wilcox1 | | | 6,438 | | | 185 | | | 160 | | | 128 | |

| | | 27,741 | | Wilcox2 | | | 6,170 | | | 121 | | | 160 | | | 124 | |

| | | | | | | | | | | | | | | | |

| | St Malo Total | | | 306 | | | 160 | (5) | | 126 | (5) |

Cascade (Walker Ridge 206) | | |

25,358 | | Sand1 | | |

973 | | |

107 | | |

160 | | |

173 | |

| | | 25,669 | | Sand2 | | | 490 | | | 36 | | | 160 | | | 192 | |

| | | 26,209 | | Sand3 | | | 630 | | | 56 | | | 160 | | | 104 | |

| | | | | | | | | | | | | | | | |

| | Cascade Total | | | 199 | | | 160 | (5) | | 157 | (5) |

Jack (Walker Ridge 759) | | |

27,000 | | Wilcox1 | | |

7,502 | | |

140 | | |

160 | | |

141 | |

| | | 27,669 | | Wilcox2 | | | 4,859 | | | 84 | | | 160 | | | 155 | |

| | | | | | | | | | | | | | | | |

| | Jack Total | | | 224 | | | 160 | (5) | | 146 | (5) |

Stones (Walker Ridge 508) | | |

26,826 | | Wilcox1 | | |

4,970 | | |

210 | | |

136 | | |

114 | |

Chinook (Walker Ridge 469) | | |

25,600 | | Sand1 | | |

1,270 | | |

201 | | |

160 | | |

245 | |

- (1)

- See the MMS' website:http://www.gomr.mms.gov/homepg/pubinfo/freeasci/Atlas/freeatlas.html. The information of this website is not incorporated into this Annual Report. Although the data published on the MMS website contains information on hundreds of fields in the U.S. Gulf of Mexico, we have included in this table only the deepwater subsalt outboard Lower Tertiary fields. What we refer to in this prospectus as the inboard Lower Tertiary is an emerging trend located to the northwest of existing outboard Lower Tertiary fields such as St. Malo, Jack and Cascade. We believe that discoveries in the inboard Lower Tertiary will exhibit meaningfully better reservoir characteristics than had previously been encountered by the industry in the outboard Lower Tertiary. We believe the results of the Shenandoah #1 well support this hypothesis. The MMS keeps log and well data confidential for two years after receipt from companies drilling in the U.S. Gulf of Mexico. As a result, the most recent 2010 data available from the MMS does not include wells drilled after 2006, including Kaskida and Shenandoah. We do not own interests in any of the fields listed in this table.

- (2)

- Represents the "gross area" of each field, which includes acreage of the field on all associated blocks. The "gross area" is different than the "net area", which would include only the acreage on which a particular owner holds leasehold title.

- (3)

- Represents the ratio of the volume of gas that comes out of solution from the volume of oil at standard conditions (expressed in standard cubic feet per barrel of oil).

- (4)

- Represents the amount of oil that can ultimately be recovered from a volume of rock (expressed in barrels of oil per acre-foot).

- (5)

- Represents the net pay thickness-weighted average of "gas-oil ratio" and "recoverable oil per acre-foot," as applicable.

As of December 31, 2009, we owned working interests in 225 blocks within the deepwater U.S. Gulf of Mexico covering approximately 1.3 million gross acres (0.6 million net acres). Our blocks are located primarily in the Green Canyon, Garden Banks, Walker Ridge and Keathley Canyon protraction areas. As of December 31, 2009, we have identified 48 prospects on our blocks: 3 Tahiti Basin Miocene trend prospects, 18 Adjacent Miocene trend prospects, 21 inboard Lower Tertiary trend prospects and 6 dual Miocene and Lower Tertiary trend prospects.

11

Table of Contents

Tahiti Basin. Our Tahiti Basin Miocene trend prospects are located in one of the most successful hydrocarbon bearing basins within the deepwater U.S. Gulf of Mexico. Discoveries in this region include Tahiti, Caesar (Green Canyon 683), Tonga (Green Canyon 726), Friesian (Green Canyon 599), Knotty Head, Pony (Green Canyon 468) and Heidelberg #1.

Adjacent Miocene. We believe our prospects within the Adjacent Miocene trend offer substantial, commercially viable resource potential due to similarities in the geologic profile to that of the Tahiti Basin Miocene trend. However, any analogies drawn by us from other wells, prospects or producing fields may not prove to be accurate indicators of the success of developing reserves from our prospects. Our prospect inventory in this trend benefits from significant seismic delineation via proprietary 3-D reprocessing that indicates large, well-defined subsalt closures.

Inboard Lower Tertiary. We were an early mover in the inboard Lower Tertiary trend, targeting specific lease blocks as early as 2006. Our technical team's hypothesis regarding the region's potentially higher-quality reservoir properties was supported by the successful result of the Shenandoah #1 well in which we participated. This discovery had reservoir characteristics more similar to Miocene reservoirs. Inboard Lower Tertiary trend prospects are characterized by large, well-defined subsalt closures of a similar size to historic outboard Lower Tertiary discoveries, but are differentiated by what we believe to be potentially superior reservoir quality.

We are the operator of approximately 75% of our U.S. Gulf of Mexico blocks. Most of our U.S. Gulf of Mexico blocks have a 10-year primary term, expiring between 2016 and 2019. Assuming we are able to commence exploration and production activities or successfully exploit our properties during the primary lease term, our leases would extend beyond the primary term, generally for the life of production. In the U.S. Gulf of Mexico, the royalties on our lease blocks range from 12.5% to 18.75% with an average of 15%.

Deepwater U.S. Gulf of Mexico exploration plays rely on hydrocarbons generated from several rich oil-prone source rocks. Rivers draining the North American continent provided vast quantities of sand, silt and mud to the Gulf of Mexico through major deltas similar to the present-day Mississippi and Rio Grande deltas. Sandstone reservoirs in two main geological formations, the Miocene and Lower Tertiary horizons, were ultimately transported and deposited by gravity flows in slope minibasins and on the paleo-basin floor. Hydrocarbon seals are provided by salts and the muds integral to the depositional system.

One of the most important aspects of the deepwater U.S. Gulf of Mexico is the presence of multiple layers of salt. Deposited early in the basin's history, the salt is key to both the region's complexity and its longevity as an exploration province. The upward movement of salt, through the surrounding rock, formed most of the structures in the present-day deepwater U.S. Gulf of Mexico. The interaction of sediment load and salt movement partitioned the hydrocarbons into numerous moderate-size accumulations rather than just a few super-giant fields.

Much of the deepwater province is covered by a salt canopy, which has historically prevented the oil and gas industry from effectively exploring the region's potential. This region has recently garnered interest from the industry with recent advances in seismic technology, which has provided clearer imaging beneath the salt canopy. Regional geologic reconstructions postulated the presence of mature source rock, reservoir, and trapping configurations in the subsalt region, but only since the advent of 3-D depth-migrated seismic data have geoscientists been able to develop exploration prospects to test the potential beneath the extensive salt canopy.

12

Table of Contents

Our prospects in the U.S. Gulf of Mexico as of December 31, 2009 are summarized in the following table. In interpreting this information, specific reference should be made to the subsections of this Annual Report on Form 10-K titled "Risk Factors—We face substantial uncertainties in estimating the characteristics of our prospects, so you should not place undue reliance on any of our estimates" and "Business—How We Identify and Analyze Prospects."

| | | | | | | | |

Prospect | | Cobalt Working

Interest(1) | | Block

Operator(s) | | Projected

Spud Year |

|---|

Miocene | | | | | | |

| | Tahiti Basin | | | | | | |

| | | Ligurian/Heidelberg | | (2) | | Cobalt/Anadarko | | (2) |

| | | Criollo | | 60% | | Cobalt | | Criollo #1 drilled(3) |

| | | Firefox | | 30% | | BHP | | Firefox #1 spud(4) |

| | Adjacent Miocene | | | | | | |

| | | Rum Ramsey | | 24% | | BHP | | late 2010 or early 2011 |

| | | Lyell | | 15% | | Anadarko | | 2011 |

| | | Rocky Mountain | | 45% | | Cobalt | | 2012 |

| | | Saddelbred | | 60% | | Cobalt | | 2012 |

| | | Sulu | | 45% | | Cobalt | | post 2012 |

| | | 13 additional prospects (average) | | 40% | | (various) | | post 2012 |

Inboard Lower Tertiary | | | | | | |

| | | Shenandoah | | 20% | | Anadarko | | Shenandoah #1 drilled(5) |

| | | North Platte | | 60% | | Cobalt | | 2010 |

| | | Aegean | | 60% | | Cobalt | | late 2010 or early 2011 |

| | | Catalan | | (6) | | Eni/Cobalt | | late 2010 |

| | | Latvian | | 60% | | Cobalt | | 2012 |

| | | Williams Fork | | (7) | | Cobalt/Nexen | | 2012 |

| | | Caspian | | (8) | | Cobalt | | post 2012 |

| | | El Ciervo | | (9) | | Eni/Samson | | post 2012 |

| | | South Platte | | 60% | | Cobalt | | post 2012 |

| | | Baffin Bay | | 60% | | Cobalt | | post 2012 |

| | | 11 additional prospects (average) | | 41% | | (various) | | post 2012 |

Dual Miocene and Inboard Lower Tertiary | | | | | | |

| | | Ardennes | | 42% | | Cobalt | | 2011 |

| | | Racer | | 24% | | BHP | | 2011 |

| | | Percheron | | 60% | | Cobalt | | post 2012 |

| | | 3 additional prospects (average) | | 40% | | (various) | | post 2012 |

- (1)

- Our working interests do not reflect our net economic interests, which take into account royalties. See "Business—Deepwater U.S. Gulf of Mexico."

- (2)

- Our Ligurian/Heidelberg prospect is comprised of two areas: Heidelberg (Green Canyon 859 and 903) and Ligurian (Green Canyon 813, 814 and 858). On February 2, 2009, we announced that the Heidelberg #1 well had been drilled, encountering more than 200 feet of net pay thickness in the Miocene horizons. On July 16, 2009, we spud the Ligurian #1 well to also target the upper- and

13

Table of Contents

middle-Miocene horizons. On October 28, 2009, we and our partners decided to temporarily cease drilling operations on Ligurian #1 having encountered operational difficulties when drilling below salt through an unforeseen geologic formation before reaching total depth or testing the targeted horizons. We did encounter oil in the wellbore above the targeted horizons, but believe further drilling operations will be required to adequately test the prospect. Since ceasing drilling operations, we have been evaluating the significant amount of new information that we have gathered from Ligurian #1, including results from the reprocessing of seismic data. We expect to resume exploratory activity on the Ligurian blocks during the third quarter of 2010. On February 17, 2010, the Heidelberg #2 appraisal well was spud by Anadarko in approximately 5,300 feet of water in Green Canyon 903. This well is currently drilling towards a targeted depth of approximately 31,500 feet.

Further details regarding these prospects are as follows:

| | | | | | | |

Area | | Cobalt Working

Interest | | Operator | | Projected Spud Year |

|---|

| Heidelberg | | | 9.375 | % | Anadarko | | Heidelberg #1 drilled; Heidelberg #2 spud |

| Ligurian | | | 45 | % | Cobalt | | Ligurian #1 drilled and suspended; exploratory activity expected to resume on Ligurian during the third quarter of 2010 |

- (3)

- On January 29, 2010, we announced that we had reached a planned total depth of approximately 31,000 feet in the Criollo exploration sidetrack well located in approximately 4,200 feet of water in Green Canyon 685 within the Tahiti Basin Miocene trend. The original well encountered 55 feet of net pay thickness in Miocene horizons and the sidetrack encountered 73 feet of net pay thickness in correlative reservoirs. Both the original well and the sidetrack encountered structural complexities associated with salt, which prevented the testing of the entire prospective interval. We have suspended operations on the well and we are conducting a detailed review of the well data and reprocessing the existing 3D pre-stack depth seismic data so that we and our partner can determine the next appropriate steps. While the Criollo prospect remains prospective, the potential size of the prospect has likely been reduced and the commerciality of the prospect has yet to be determined. We refer to the sidetrack well and the original well as the Criollo #1 exploratory well.

- (4)

- On February 10, 2010, the Firefox #1 exploratory well was spud by BHP in approximately 4,400 feet of water in Green Canyon 817 within the Tahiti Basin Miocene trend and approximately six miles northeast of the Heidelberg discovery. This well is currently drilling towards a targeted measured depth of approximately 34,000 feet.

- (5)

- On February 4, 2009, we announced that the Shenandoah #1 well had been drilled into Lower Tertiary horizons. Anadarko, as operator, has stated that this well encountered approximately 300 feet of net pay thickness.

- (6)

- Our Catalan prospect is comprised of four blocks as follows:

| | | | | |

Block | | Cobalt Working

Interest | | Operator |

|---|

Keathley Canyon 129 | | | 40 | % | Cobalt |

Walker Ridge 133 and 90 | | | 33.33 | % | Eni |

Walker Ridge 89 | | | 16.67 | % | Eni |

14

Table of Contents

- (7)

- Our Williams Fork prospect is comprised of five blocks as follows:

| | | | | |

Block | | Cobalt Working

Interest | | Operator |

|---|

Garden Banks 821 | | | 60 | % | Cobalt |

Garden Banks 823, 865, 866 and 867 | | | 30 | % | Nexen |

- (8)

- Our Caspian prospect is comprised of six blocks as follows:

| | | | | |

Block | | Cobalt Working

Interest | | Operator |

|---|

Garden Banks 495, 496 and 539 | | | 60 | % | Cobalt |

Garden Banks 497, 540 and 541 | | | 50 | % | Cobalt |

- (9)

- Our El Ciervo prospect is comprised of five blocks as follows:

| | | | | |

Block | | Cobalt Working

Interest | | Operator |

|---|

Walker Ridge 354, 399 and 443 | | | 20 | % | Eni |

Walker Ridge 355 and 487 | | | 50 | % | Samson |

The subsalt Miocene trend is an established play in the deepwater U.S. Gulf of Mexico. Major discoveries in this trend include Thunder Horse, Atlantis, Tahiti, Mad Dog, Knotty Head and Heidelberg. This trend is characterized by high quality reservoirs and fluid properties, resulting in high production well rates and recovery factors. We believe the primary geologic risk in this trend is the seal capacity required to trap hydrocarbons. To address this risk, we have conducted extensive regional studies, including proprietary seismic processing, proprietary pore pressure modeling, as well as other geological and geophysical predictive techniques, to better define the seal capacity for each prospect in the trend. Based on these studies, we have identified two trends located primarily in the Green Canyon protraction area, which we refer to as the Tahiti Basin Miocene trend and the Adjacent Miocene trend. A detailed description of each trend and certain of our associated prospects within each trend is included below.

The Tahiti Basin Miocene trend is in one of the most successful hydrocarbon bearing basins within the deepwater U.S. Gulf of Mexico. Major discoveries in this area include Tahiti, Friesian, Caesar, Tonga, Knotty Head, Pony and the discovery at Heidelberg #1. Because many fields have been discovered in this area, a network of facility and pipeline infrastructure may be available for commercializing potential discoveries.

Ligurian/Heidelberg

Ligurian/Heidelberg is a 3-way prospect targeting Miocene horizons. We believe Green Canyon blocks 813, 814 and 858 (which we refer to as the "Ligurian blocks") and Green Canyon blocks 859 and 903 (which we refer to as the "Heidelberg blocks") cover a common structure accumulation, and we therefore refer to them as a joint prospect. We are the named operator and own a 45% working interest in the Ligurian blocks, and we have a 9.375% working interest in the Anadarko-operated Heidelberg blocks. We purchased our interest in the Heidelberg blocks from an existing owner in May 2008 after we successfully acquired 100% of the working interest in the adjacent Ligurian blocks in the 2008 MMS Central Gulf of Mexico Lease Sale. This prospect was mapped using proprietarily processed, pre-stack, depth-migrated, wide-azimuth 3-D seismic data. On February 2, 2009, we

15

Table of Contents

announced that the Heidelberg #1 well had been drilled, encountering more than 200 feet of net pay thickness in the Miocene horizon. On July 16, 2009, we spud the Ligurian #1 well to also target the upper- and middle-Miocene horizons. On October 28, 2009, we and our partners decided to temporarily cease drilling operations on Ligurian #1 having encountered operational difficulties when drilling below salt through an unforeseen geologic formation before reaching total depth or testing the targeted horizons. We did encounter oil in the wellbore above the targeted horizons, but believe further drilling operations will be required to adequately test the prospect. Since ceasing drilling operations, we have been evaluating the significant amount of new information that we have gathered from Ligurian #1, including from our reprocessing of seismic data based on this new information, and we expect to resume exploratory activity on the Ligurian blocks during the third quarter of 2010. On February 17, 2010, the Heidelberg #2 appraisal well was spud by Anadarko in approximately 5,300 feet of water in Green Canyon 903. This well is currently drilling towards a targeted depth of approximately 31,500 feet. The untested Miocene horizons of this prospect have an estimated mean net area of 5,300 acres and an estimated mean net pay thickness of 200 feet.

Criollo

Criollo is a 3-way prospect targeting Miocene horizons located in Green Canyon blocks 685 and 729, where we are the named operator and own a 60% working interest. This prospect was acquired in the 2007 MMS Central Gulf of Mexico Lease Sale. This prospect is syncline separated from the Tahiti and the Friesian discoveries. Criollo was mapped using proprietarily processed, pre-stack, depth-migrated, wide-azimuth 3-D seismic data. On January 29, 2010, we announced that we had reached a total depth of approximately 31,000 feet in the Criollo exploration well located in approximately 4,200 feet of water in Green Canyon 685 within the Tahiti Basin Miocene trend. The original well encountered 55 feet of net pay thickness in Miocene horizons and the sidetrack encountered 73 feet of net pay thickness in correlative reservoirs. Both the original well and the sidetrack encountered structural complexities associated with salt, which prevented the testing of the entire prospective interval. We have suspended operations on the well and we are conducting a detailed review of the well data and reprocessing the existing 3D pre-stack depth seismic data so that we and our partner can determine the next appropriate steps. We refer to the sidetrack well and the original well as the Criollo #1 exploratory well. After taking into account the results of the Criollo #1 exploratory well, this prospect has an estimated mean net area of 900 acres and an estimated mean net pay thickness of 230 feet.

Firefox

Firefox is a 3-way prospect targeting Miocene horizons located in Green Canyon blocks 773, 817 and 818, where BHP is the named operator and we own a 30% working interest. This prospect was acquired in the 2007 MMS Central Gulf of Mexico Lease Sale. This prospect is syncline separated from the Heidelberg discovery. Firefox was mapped using proprietarily processed, pre-stack, depth-migrated, wide-azimuth 3-D seismic data. This prospect has an estimated mean net area of 4,000 acres and an estimated mean net pay thickness of 230 feet. On February 10, 2010, the Firefox #1 exploratory well was spud by BHP in approximately 4,400 feet of water in Green Canyon 817 within the Tahiti Basin Miocene trend and approximately six miles northeast of the Heidelberg discovery. This well is currently drilling towards a targeted measured depth of approximately 34,000 feet.

The Adjacent Miocene trend is located adjacent to the Tahiti Basin Miocene trend. We believe our prospects within the Adjacent Miocene trend offer substantial, commercially viable resource potential due to similarities in the geologic profile to that of the Tahiti Basin Miocene trend. Our prospect inventory in this trend benefits from significant seismic delineation via proprietary 3-D reprocessing

16

Table of Contents

that indicates large, well-defined subsalt closures. In much of the trend there is limited facility and pipeline infrastructure. As such, we anticipate that free-standing, independent facilities may be required to develop discoveries in this area.

Rum Ramsey

Rum Ramsey is a 3-way prospect targeting Miocene horizons located in Green Canyon blocks 632, 633 and 676, where BHP is the named operator and we own a 24% working interest. This prospect was acquired in the 2008 MMS Central Gulf of Mexico Lease Sale and through a 2008 trade. Rum Ramsey was mapped using our proprietarily processed, pre-stack, depth-migrated, narrow-azimuth 3-D seismic data and non-proprietary, pre-stack, depth-migrated, wide-azimuth 3-D seismic data. This prospect has an estimated mean net area of 4,500 acres and an estimated mean net pay thickness of 150 feet. We expect the initial exploration well on this prospect to be drilled in late 2010 or early 2011.

Lyell

Lyell is a 4-way prospect targeting Miocene horizons located in Green Canyon blocks 550 and 551, where Anadarko is the named operator and we own a 15% working interest. This prospect was acquired through a 2006 farm-in agreement and 2009 direct purchase. Lyell was mapped using non-proprietary, pre-stack, depth-migrated, wide-azimuth 3-D seismic data. This prospect has an estimated mean net area of 3,500 acres and an estimated mean net pay thickness of 230 feet. We expect the initial exploration well on this prospect to be drilled in 2011.

Rocky Mountain

Rocky Mountain is a 3-way prospect targeting Miocene horizons located in Mississippi Canyon blocks 649, 693 and 737, where we are the named operator and own a 45% working interest. This prospect was acquired in the 2008 MMS Central Gulf of Mexico Lease Sale and is syncline separated from the Blind Faith field. Rocky Mountain was mapped using our proprietarily processed, pre-stack, depth-migrated, narrow-azimuth 3-D seismic data. This prospect has an estimated mean net area of 2,400 acres and an estimated mean net pay thickness of 210 feet. We expect the initial exploration well on this prospect to be drilled in 2012.

Saddelbred

Saddelbred is a 3-way prospect targeting Miocene horizons located in Green Canyon blocks 457 and 458, where we are the named operator and own a 60% working interest. This prospect was acquired in the 2007 MMS Central Gulf of Mexico Lease Sale. Saddelbred was mapped using our proprietarily processed, wave-equation, pre-stack, depth-migrated, narrow-azimuth 3-D seismic data. This prospect has an estimated mean net area of 3,200 acres and an estimated mean net pay thickness of 140 feet. We expect the initial exploration well on this prospect to be drilled in 2012.

Sulu

Sulu is a 3-way prospect targeting Miocene horizons located in Green Canyon blocks 258, 259 and 302, where we are the named operator and own a 45% working interest. This prospect was acquired in the 2007 and 2008 MMS Central Gulf of Mexico Lease Sales and offsets the Anadarko-operated Samurai discovery. Sulu was mapped using non-proprietarily processed pre-stack, depth-migrated, narrow-azimuth 3-D seismic data. This prospect has an estimated mean net area of 4,000 acres and an estimated mean net pay thickness of 150 feet. We expect the initial exploration well on this prospect to be drilled post 2012.

17

Table of Contents

Additional Adjacent Miocene Prospects

We have 13 additional prospects targeting Miocene horizons, in which we have a combined average working interest of 43%. All of these prospects are operated by either Cobalt or various other companies. Each of these additional prospects was acquired in various MMS Gulf of Mexico Lease Sales or through direct purchases or trades. We mapped these prospects using a variety of 3-D seismic data. These prospects have a combined average estimated mean net area of 990 acres and a combined average estimated mean net pay thickness of 190 feet. We expect the initial exploration well on each of these additional prospects to be drilled post 2012.

The inboard Lower Tertiary is an emerging trend located to the northwest of existing outboard Lower Tertiary fields such as St. Malo, Jack and Cascade. We were an early mover in the inboard Lower Tertiary trend, targeting specific lease blocks as early as 2006. Our technical team's hypothesis regarding the region's potentially higher-quality reservoir properties was supported by the result of the Shenandoah #1 well in which we participated. This discovery had reservoir characteristics more similar to Miocene reservoirs. We believe our inboard Lower Tertiary blocks are characterized by large, well-defined structures of a similar size to historic outboard Lower Tertiary discoveries, but are differentiated by what we believe to be potentially superior reservoir quality. Because the inboard Lower Tertiary is an emerging trend, there is limited facility and pipeline infrastructure in the area. As such, we anticipate that free-standing, independent facilities may be required to develop discoveries in this area.

Shenandoah

Shenandoah is a 3-way prospect targeting Lower Tertiary horizons located in Walker Ridge blocks 51 and 52, where Anadarko is the named operator and we own a 20% working interest. This prospect was acquired through a 2008 purchase. Shenandoah was mapped using non-proprietarily processed pre-stack, depth-migrated, wide-azimuth 3-D seismic data. Proprietary reprocessing of wide-azimuth seismic data is in progress. On February 4, 2009, we announced that the Shenandoah #1 well had been drilled into Lower Tertiary horizons. Anadarko, as operator, has stated that this well encountered approximately 300 feet of net pay thickness. We expect an appraisal well on this prospect will be drilled in late 2011. The untested Lower Tertiary horizons of this prospect have an estimated mean net area of 4,600 acres and an estimated mean net pay thickness of 400 feet.

North Platte

North Platte is a 4-way prospect targeting Lower Tertiary horizons located in Garden Banks blocks 915, 958, 959, 1002 and 1003, where we are the named operator and own a 60% working interest. This prospect was acquired in the 2006 MMS Western Gulf of Mexico Lease Sale and the 2007 and 2008 MMS Central Gulf of Mexico Lease Sales. North Platte was mapped using our proprietarily processed, pre-stack, depth-migrated, wide-azimuth 3-D seismic data. This prospect has an estimated mean net area of 7,500 acres and an estimated mean net pay thickness of 360 feet. We expect the initial exploration well on this prospect to be drilled in 2010.

Aegean

Aegean is a 3-way prospect targeting Lower Tertiary horizons located in Keathley Canyon blocks 163 and 207, where we are the named operator and own a 60% working interest. This prospect was acquired in the 2008 MMS Central Gulf of Mexico Lease Sale. Aegean was mapped using non-proprietarily processed, pre-stack, depth-migrated, wide-azimuth 3-D seismic data. Proprietary reprocessing of the wide-azimuth seismic data is in progress. This prospect has an estimated mean net

18

Table of Contents

area of 3,400 acres and an estimated mean net pay thickness of 370 feet. We expect the initial exploration well on this prospect to be drilled in late 2010 or early 2011.

Catalan

Catalan is a 3-way prospect targeting Lower Tertiary horizons located in Keathley Canyon block 129 and Walker Ridge blocks 89, 90 and 133, where we are the named operator on the Keathley Canyon block with Eni being the named operator on the three Walker Ridge blocks. We have a 40%, 16.67%, 33.33% and 33.33% working interest in Keathley Canyon block 129 and Walker Ridge blocks 89, 90 and 133, respectively. This prospect was primarily acquired in the 2008 and 2009 MMS Central Gulf of Mexico Lease Sales and in a 2009 trade. Catalan was mapped using our proprietarily processed, pre-stack, depth-migrated, wide-azimuth 3-D seismic data. This prospect has an estimated mean net area of 5,400 acres and an estimated mean net pay thickness of 360 feet. We expect the initial exploration well on this prospect to be drilled in late 2010.

Latvian

Latvian is a 3-way prospect targeting Lower Tertiary horizons located in Garden Banks blocks 874, 917, 918 and 919, where we are the named operator and own a 60% working interest. This prospect was acquired in the 2006 MMS Western Gulf of Mexico Lease Sale and the 2007 and 2008 MMS Central Gulf of Mexico Lease Sales. Latvian was mapped using our proprietarily processed, pre-stack, depth-migrated, wide-azimuth 3-D seismic data. This prospect has an estimated mean net area of 5,200 acres and an estimated mean net pay thickness of 300 feet. We expect the initial exploration well on this prospect to be drilled in 2012.

Williams Fork

Williams Fork is a 3-way prospect targeting Lower Tertiary horizons located in Garden Banks blocks 821, 823, 865, 866 and 867, where Nexen is the named operator except for Garden Banks 821 for which we are the operator. We have a 60% working interest in Garden Banks block 821 and a 30% working interest in the remaining blocks. This prospect was acquired in the 2006 MMS Western Gulf of Mexico Lease Sale and the 2007 and 2008 MMS Central Gulf of Mexico Lease Sales. Williams Fork was mapped using non-proprietarily processed, pre-stack, depth-migrated wide-azimuth 3-D seismic data. This prospect has an estimated mean net area of 5,200 acres and an estimated mean net pay thickness of 300 feet. We expect the initial exploration well on this prospect to be drilled in 2012.

Caspian

Caspian is a 4-way prospect targeting Lower Tertiary horizons located in Garden Banks blocks 495, 496, 497, 539, 540 and 541, where we are the named operator and own a 50% working interest in Garden Banks blocks 497, 540 and 541 and a 60% working interest in the remaining blocks. This prospect was acquired in the 2008 MMS Western Gulf of Mexico Lease Sale, the 2009 MMS Central Gulf of Mexico Lease Sale and a 2009 trade. Caspian was mapped using our non-proprietarily processed, pre-stack, depth-migrated, narrow-azimuth 3-D seismic data. This prospect has an estimated mean net area of 8,200 acres and an estimated mean net pay thickness of 300 feet. We expect the initial exploration well on this prospect to be drilled post 2012.

El Ciervo

El Ciervo is a 3-way prospect targeting Lower Tertiary horizons located in Walker Ridge blocks 354, 355, 399, 443 and 487, where Eni and Samson are the named operators. We have a 20%, 50%, 20%, 20% and 50% working interest in Walker Ridge blocks 354, 355, 399, 443 and 487, respectively. This prospect was acquired in the 2008 and 2009 MMS Central Gulf of Mexico Lease Sales. El Ciervo

19

Table of Contents

was mapped using our non-proprietarily processed, pre-stack, depth-migrated, narrow-azimuth 3-D seismic data. This prospect has an estimated mean net area of 6,600 acres and an estimated mean net pay thickness of 300 feet. We expect the initial exploration well on this prospect to be drilled post 2012.

South Platte

South Platte is a 3-way prospect targeting Lower Tertiary horizons located in Garden Banks blocks 1003 and 1004 and Keathley Canyon blocks 35 and 36, where we are the named operator and own a 60% working interest. This prospect was acquired in the 2006 MMS Western Gulf of Mexico Lease Sale, the 2008 MMS Central Gulf of Mexico Lease Sale and through a 2009 trade. South Platte was mapped using our proprietarily processed, pre-stack, depth-migrated, wide-azimuth 3-D seismic data. This prospect has an estimated mean net area of 4,000 acres and an estimated mean net pay thickness of 300 feet. We expect the initial exploration well on this prospect to be drilled post 2012.

Baffin Bay

Baffin Bay is a 3-way prospect targeting Lower Tertiary horizons located in Garden Banks blocks 956 and 957, where we are the named operator and own a 60% working interest. This prospect was acquired in the 2008 MMS Central Gulf of Mexico Lease Sale. Baffin Bay was mapped using our proprietarily processed, pre-stack, depth-migrated, wide-azimuth 3-D seismic data. This prospect has an estimated mean net area of 2,300 acres and an estimated mean net pay thickness of 300 feet. We expect the initial exploration well on this prospect to be drilled post 2012.

Additional Inboard Lower Tertiary Prospects

We have 11 additional prospects targeting inboard Lower Tertiary horizons, in which we have a combined average working interest of 45%. All of these prospects are operated by either Cobalt or various other companies. Each of these additional prospects was acquired in various MMS Gulf of Mexico Lease Sales or through trades. We mapped these prospects using a variety of 3-D seismic data. These prospects have a combined average estimated mean net area of 1,700 acres and a combined average estimated mean net pay thickness of 300 feet. We expect the initial exploration well on each of these additional prospects to be drilled post 2012.

The following prospects target both Miocene and Lower Tertiary horizons.

Ardennes

Ardennes is a 4-way prospect targeting Miocene and Lower Tertiary horizons located in Green Canyon blocks 895, 896 and 939, where we are the named operator and own a 42% working interest. This prospect was acquired through a 2007 direct purchase, a trade in 2008, and in the 2007 and 2008 MMS Central Gulf of Mexico Lease Sales. Ardennes was mapped using our processed, pre-stack, depth-migrated, narrow-azimuth 3-D seismic data and non-proprietary, pre-stack, depth-migrated, wide-azimuth 3-D seismic data. Proprietary reprocessing of the wide-azimuth seismic data is in progress. The Miocene horizons of this prospect have an estimated mean net area of 7,500 acres and an estimated mean net pay thickness of 190 feet. In addition to the Miocene horizons, the Lower Tertiary horizons of this prospect have an estimated mean net area of 6,000 acres and an estimated mean net pay thickness of 300 feet. We expect the initial exploration well on this prospect to be drilled in 2011.

20

Table of Contents

Racer

Racer is a 3-way prospect targeting Miocene and Lower Tertiary horizons located in Green Canyon blocks 762 and 806, where BHP is the named operator and we own a 24% working interest. This prospect was acquired in the 2007 MMS Central Gulf of Mexico Lease Sale and through a trade in 2008. Racer was mapped using our proprietarily processed, pre-stack, depth-migrated, narrow-azimuth 3-D seismic data and non-proprietary wide-azimuth 3-D depth data. The Miocene horizons of this prospect have an estimated mean net area of 4,800 acres and an estimated mean net pay thickness of 150 feet. In addition to the Miocene horizons, the Lower Tertiary horizons of this prospect have an estimated mean net area of 5,200 acres and an estimated mean net pay thickness of 300 feet. We expect the initial exploration well on this prospect to be drilled in 2011.

Percheron