Exhibit 99.2 NASDAQ GS:NWBI Merger With MutualFirst Financial, Inc. October 30, 2019

Presented By Ronald J. Seiffert – Chairman, President & CEO William W. Harvey, Jr. –Senior EVP & CFO David W. Heeter –Director, President & CEO Christopher D. Cook –CFO

Disclosures Forward‐Looking Statement This presentation contains forward‐looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward‐looking statements include, but are not limited to, statements about (1) the benefits of the merger between Northwest Bancshares, Inc. (“Northwest”) and MutualFirst Financial, Inc. (“MutualFirst”), including anticipated future results, cost savings and accretion to reported earnings that may be realized from the merger; (2) Northwest’s and MutualFirst’s plans, objectives, expectations and intentions and other statements contained in this presentation that are not historical facts; and (3) other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” or words of similar meaning. Forward‐looking statements involve risks and uncertainties that may cause actual results to differ materially from those in such statements. The following factors, among others, could cause actual results to differ materially from the anticipated results expressed in the forward‐ looking statements: the businesses of Northwest and MutualFirst may not be combined successfully, or such combination may take longer than expected; the cost savings from the merger may not be fully realized or may take longer than expected; operating costs, customer loss and business disruption following the merger may be greater than expected; governmental approvals of the merger may not be obtained, or adverse regulatory conditions may be imposed in connection with governmental approvals of the merger or otherwise; the stockholders of MutualFirst may revise their approval of the merger; credit and interest rate risks associated with Northwest’s and MutualFirst’s respective businesses; and difficulties associated with achieving expected future financial results. Additional factors that could cause actual results to differ materially from those expressed in the forward‐looking statements are discussed in Northwest’s and MutualFirst’s reports (such as the Annual Report on Form 10‐K, Quarterly Reports on Form 10‐Q and Current Reports on Form 8‐K) filed with the SEC and available at the SEC’s Internet website (www.sec.gov). All subsequent written and oral forward‐looking statements concerning the proposed transaction or other matters attributable to Northwest or MutualFirst or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Except as required by law, Northwest and MutualFirst do not undertake any obligation to update any forward‐ looking statement to reflect circumstances or events that occur after the date the forward‐looking statement is made. 3

Disclosures (Continued) Additional Information About the Proposed Merger and Where to Find It Investors and stockholders are urged to carefully review and consider each of Northwest’s and MutualFirst’s public filings with the SEC, including, but not limited to, their Annual Reports on Form 10‐K, their proxy statements, their Current Reports on Form 8‐Kandtheir Quarterly Reports on Form 10‐Q. The documents filed by Northwest and MutualFirst with the Securities and Exchange Commission (the “SEC”) may be obtained at the SEC’s Internet site (www.sec.gov). You will also be able to obtain these documents, free of charge, from Northwest at www.northwest.com under the tab “SEC Filings” under “Investor Relations” or by requesting them in writing to Northwest Bancshares, Inc., P.O. Box 128, Warren, Pennsylvania 16365, Attention: Ronald J. Seiffert, President and CEO, or from MutualFirst at www.bankwithmutual.com under the tab “SEC Filings” under “Investor Relations” or by requesting them in writing to MutualFirst Financial, Inc., 110 E. Charles Street, Muncie, Indiana 47305, Attention: Chris D. Cook. In connection with the proposed merger, Northwest will file with the SEC a registration statement on Form S‐4 that will include a proxy statement of MutualFirst and a prospectus of Northwest, as well as other relevant documents concerning the proposed merger. Investors and stockholders are urged to read the registration statement and the proxy statement/prospectus regarding the proposed merger when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. Copies of the registration statement and proxy statement/prospectus and the filings that will be incorporated by reference therein, as well as other filings containing information about Northwest and MutualFirst, when they become available, may be obtained at the SEC’s Internet site (www.sec.gov). Free copies of these documents may be obtained as described in the preceding paragraph. MutualFirst and Northwest and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of MutualFirst in connection with the proposed merger, information about the directors and executive officers of Northwest is set forth in the proxy statement for the Northwest 2019 annual meeting of stockholders, as filed with the SEC on Schedule 14A on March 7, 2019. Information about the directors and executive officers of MutualFirst is set forth in the proxy statement for the MutualFirst 2019 annual meeting of stockholders, as filed with the SEC on Schedule 14A on March 22, 2019. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction and a description of their direct and indirect interests, by security holdings or otherwise, may be obtained by reading the proxy statement/prospectus and other relevant documents regarding the proposed merger to be filed with the SEC when they become available. Free copies of these documents may be obtained as described above. 4

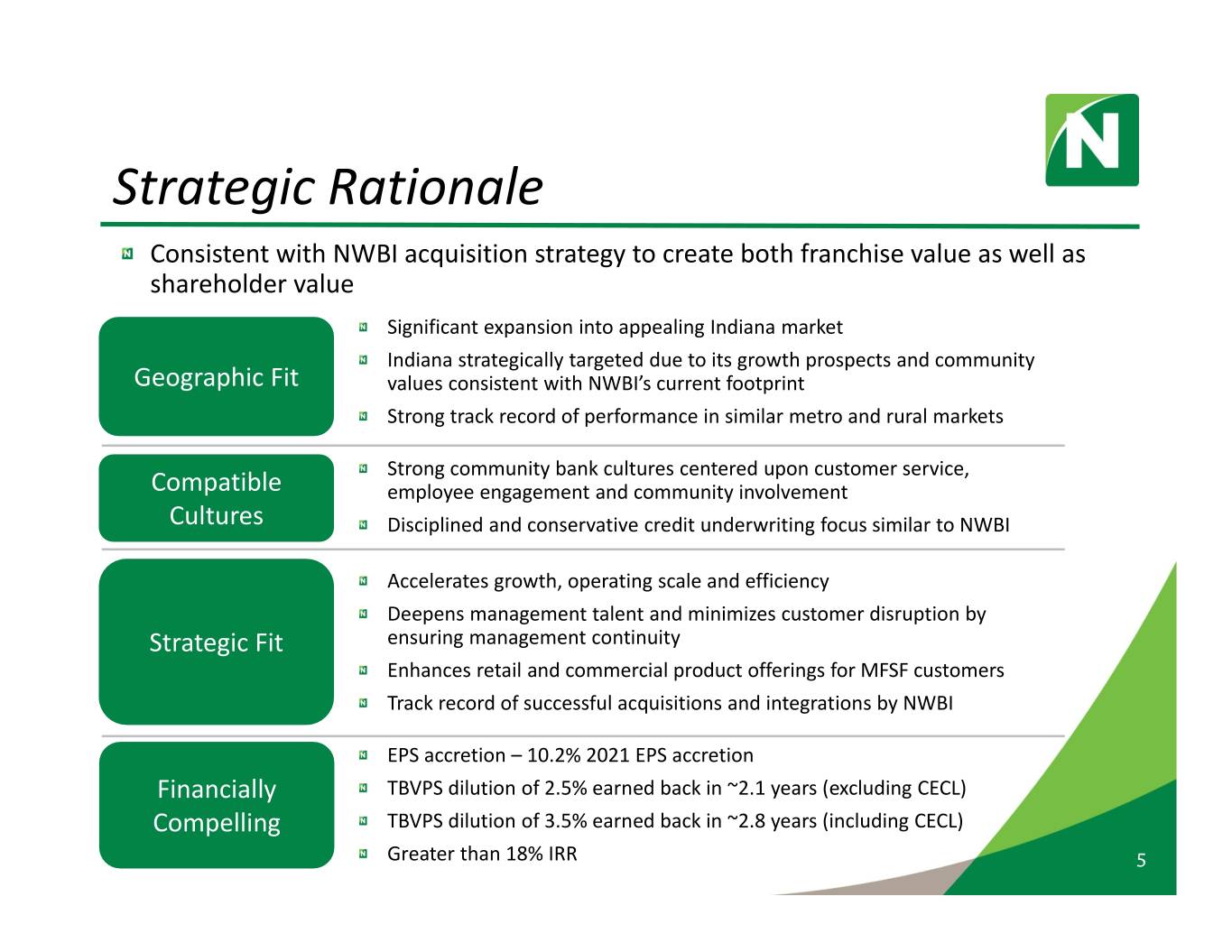

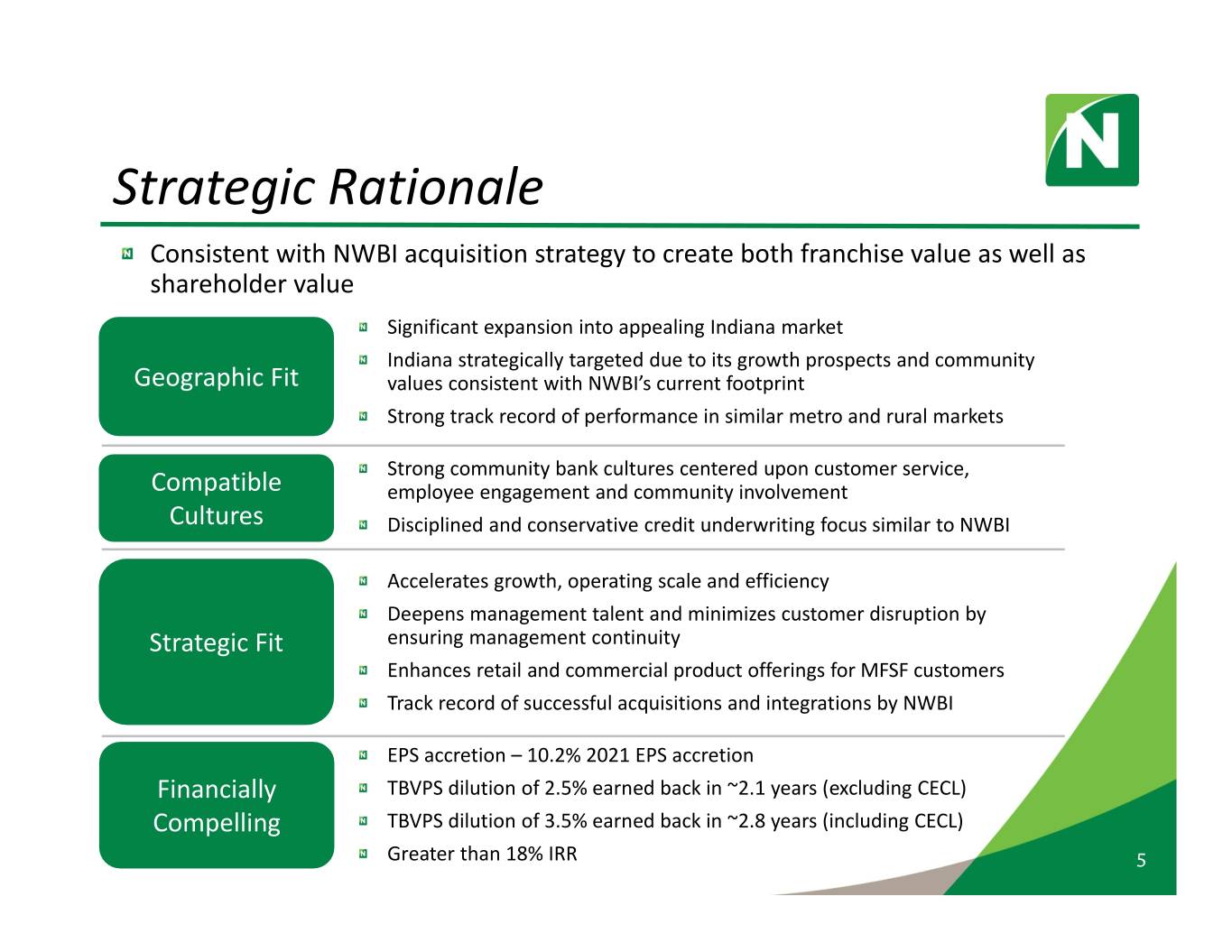

Strategic Rationale Consistent with NWBI acquisition strategy to create both franchise value as well as shareholder value Significant expansion into appealing Indiana market Indiana strategically targeted due to its growth prospects and community Geographic Fit values consistent with NWBI’s current footprint Strong track record of performance in similar metro and rural markets Strong community bank cultures centered upon customer service, Compatible employee engagement and community involvement Cultures Disciplined and conservative credit underwriting focus similar to NWBI Accelerates growth, operating scale and efficiency Deepens management talent and minimizes customer disruption by Strategic Fit ensuring management continuity Enhances retail and commercial product offerings for MFSF customers Track record of successful acquisitions and integrations by NWBI EPS accretion – 10.2% 2021 EPS accretion Financially TBVPS dilution of 2.5% earned back in ~2.1 years (excluding CECL) Compelling TBVPS dilution of 3.5% earned back in ~2.8 years (including CECL) Greater than 18% IRR 5

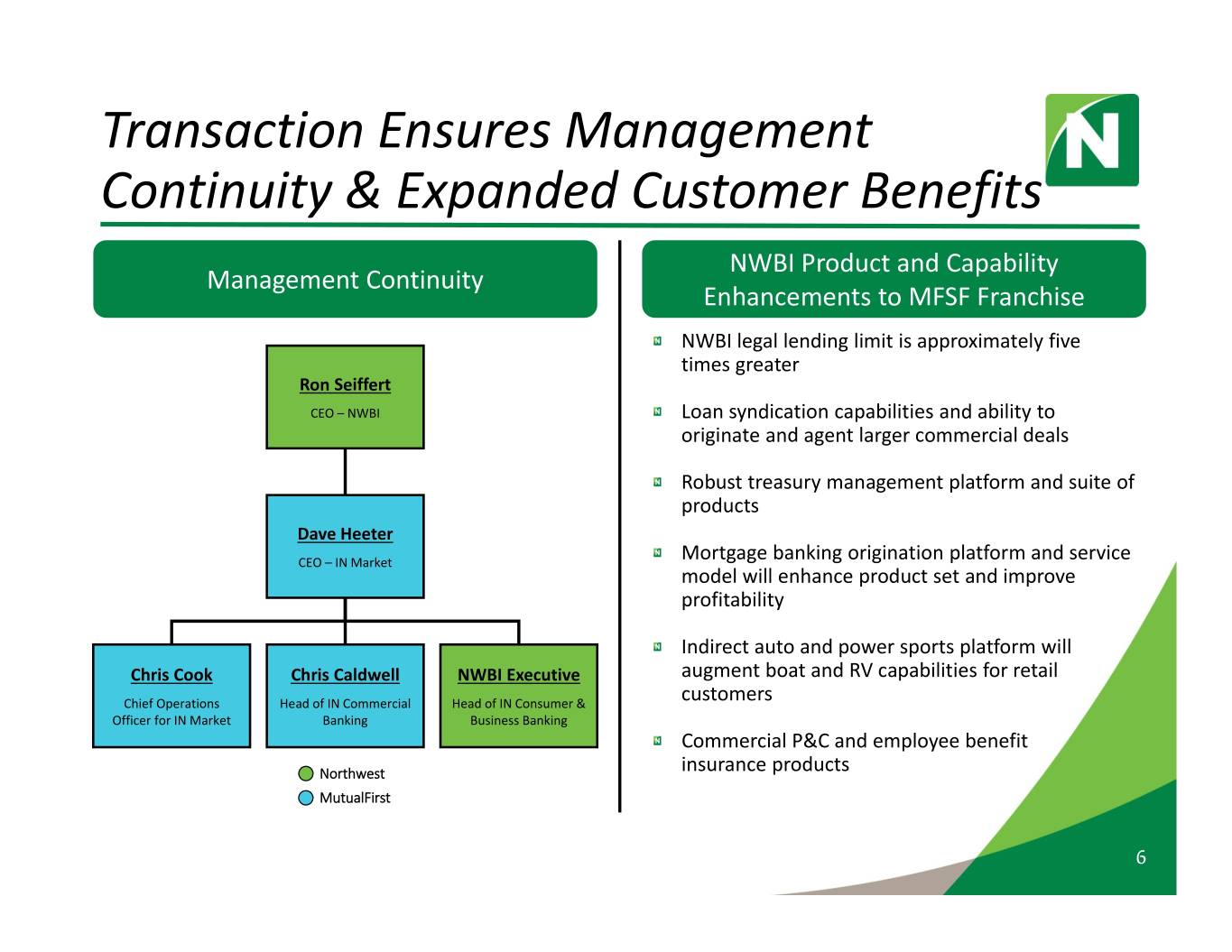

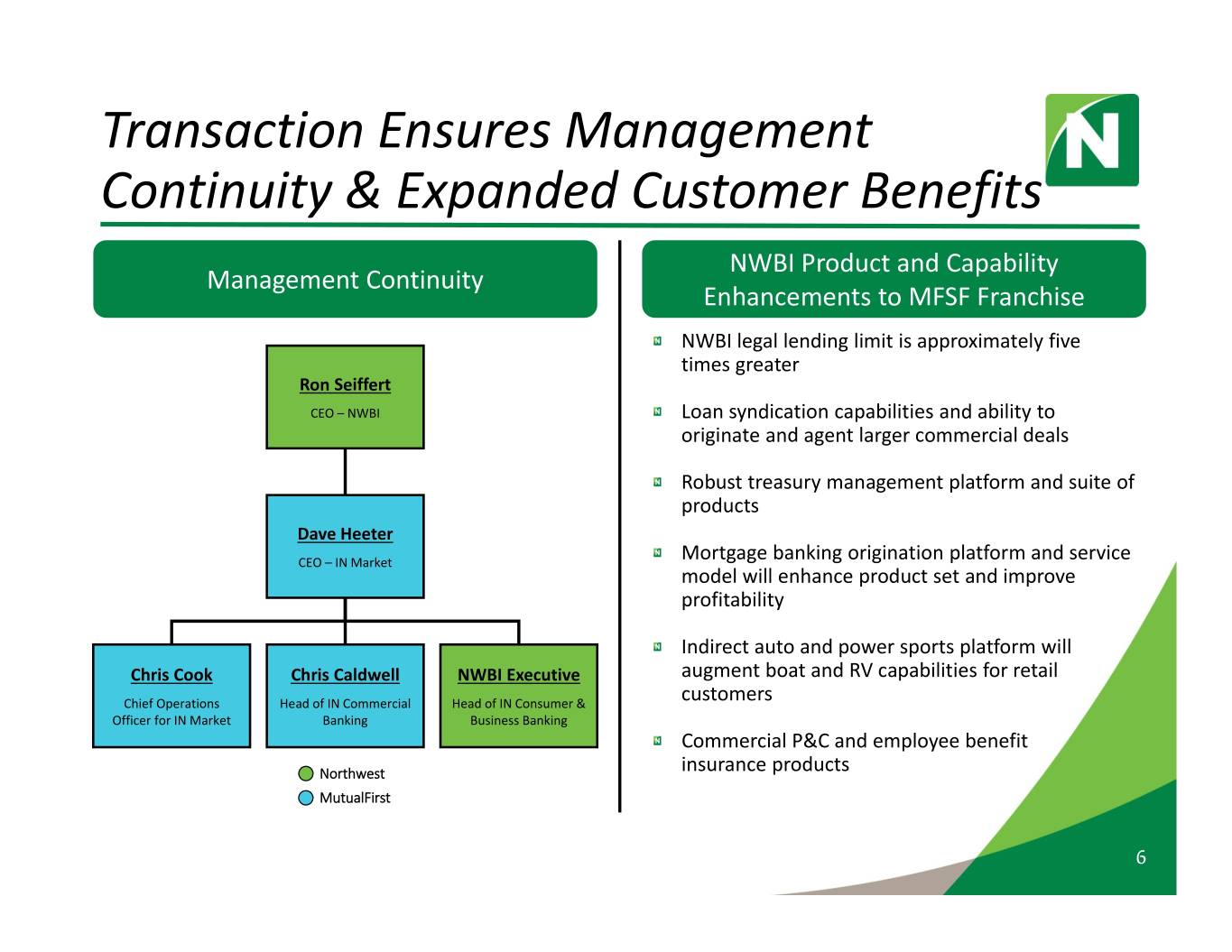

Transaction Ensures Management Continuity & Expanded Customer Benefits NWBI Product and Capability Management Continuity Enhancements to MFSF Franchise NWBI legal lending limit is approximately five times greater Ron Seiffert CEO –NWBI Loan syndication capabilities and ability to originate and agent larger commercial deals Robust treasury management platform and suite of products Dave Heeter CEO –IN Market Mortgage banking origination platform and service model will enhance product set and improve profitability Indirect auto and power sports platform will Chris Cook Chris Caldwell NWBI Executive augment boat and RV capabilities for retail Chief Operations Head of IN Commercial Head of IN Consumer & customers Officer for IN Market Banking Business Banking Commercial P&C and employee benefit Northwest insurance products MutualFirst 6

NWBI –A Growing Footprint with a Strong Track Record of Acquisitions 30+ acquisitions during last 16 years in Midwest and Mid‐Atlantic ($ millions) Northwest MutualFirst Combined Assets 10,580 2,074 12,654 Loans 8,852 1,517 10,369 Deposits 8,682 1,573 10,255 Branches 182 39 221 Buffalo Northwest Branches Erie MutualFirst ‐ 2019 South Bend Cleveland Warsaw Fort Wayne Donegal ‐ 2018 Pittsburgh Muncie KeyCorp Branches ‐ 2016 Lancaster Indianapolis LNB Bancorp ‐ 2014 Bloomington Source: S&P Global Market Intelligence; Company SEC and regulatory filings. Financial Data as of 9/30/2019. 7 Does not reflect purchase accounting or merger adjustments.

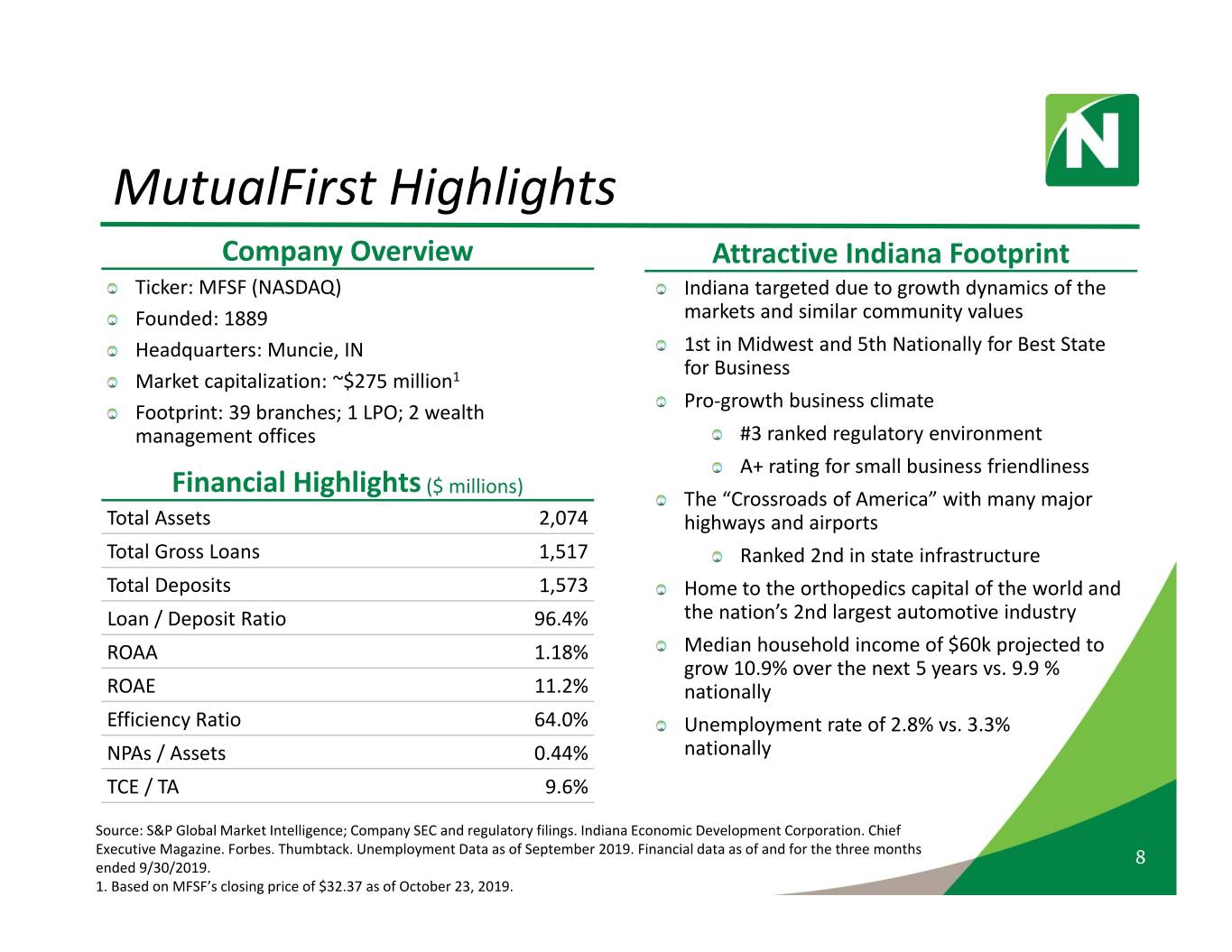

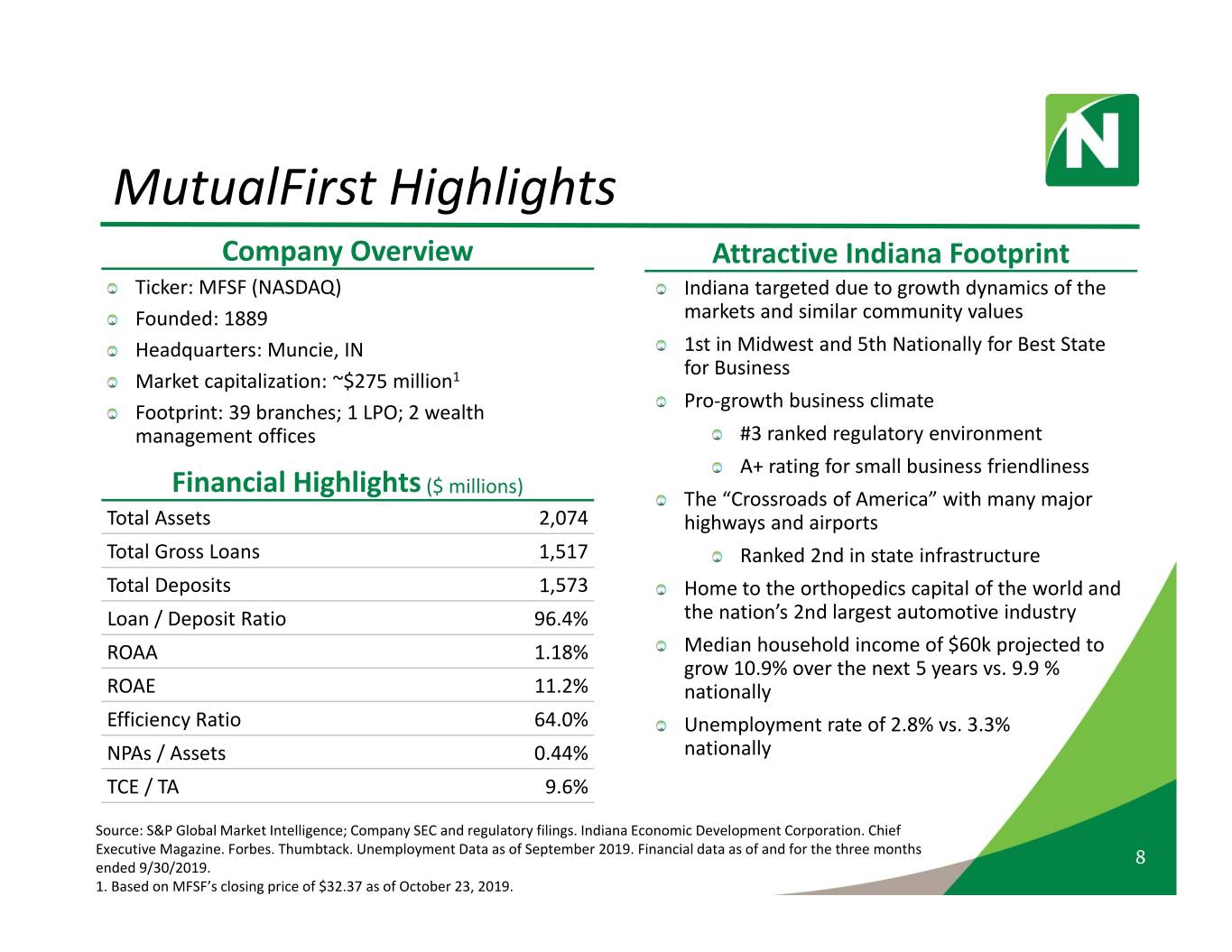

MutualFirst Highlights Company Overview Attractive Indiana Footprint Ticker: MFSF (NASDAQ) Indiana targeted due to growth dynamics of the Founded: 1889 markets and similar community values Headquarters: Muncie, IN 1st in Midwest and 5th Nationally for Best State for Business Market capitalization: ~$275 million1 Pro‐growth business climate Footprint: 39 branches; 1 LPO; 2 wealth management offices #3 ranked regulatory environment A+ rating for small business friendliness Financial Highlights ($ millions) The “Crossroads of America” with many major Total Assets 2,074 highways and airports Total Gross Loans 1,517 Ranked 2nd in state infrastructure Total Deposits 1,573 Home to the orthopedics capital of the world and Loan / Deposit Ratio 96.4% the nation’s 2nd largest automotive industry ROAA 1.18% Median household income of $60k projected to grow 10.9% over the next 5 years vs. 9.9 % ROAE 11.2% nationally Efficiency Ratio 64.0% Unemployment rate of 2.8% vs. 3.3% NPAs / Assets 0.44% nationally TCE / TA 9.6% Source: S&P Global Market Intelligence; Company SEC and regulatory filings. Indiana Economic Development Corporation. Chief Executive Magazine. Forbes. Thumbtack. Unemployment Data as of September 2019. Financial data as of and for the three months 8 ended 9/30/2019. 1. Based on MFSF’s closing price of $32.37 as of October 23, 2019.

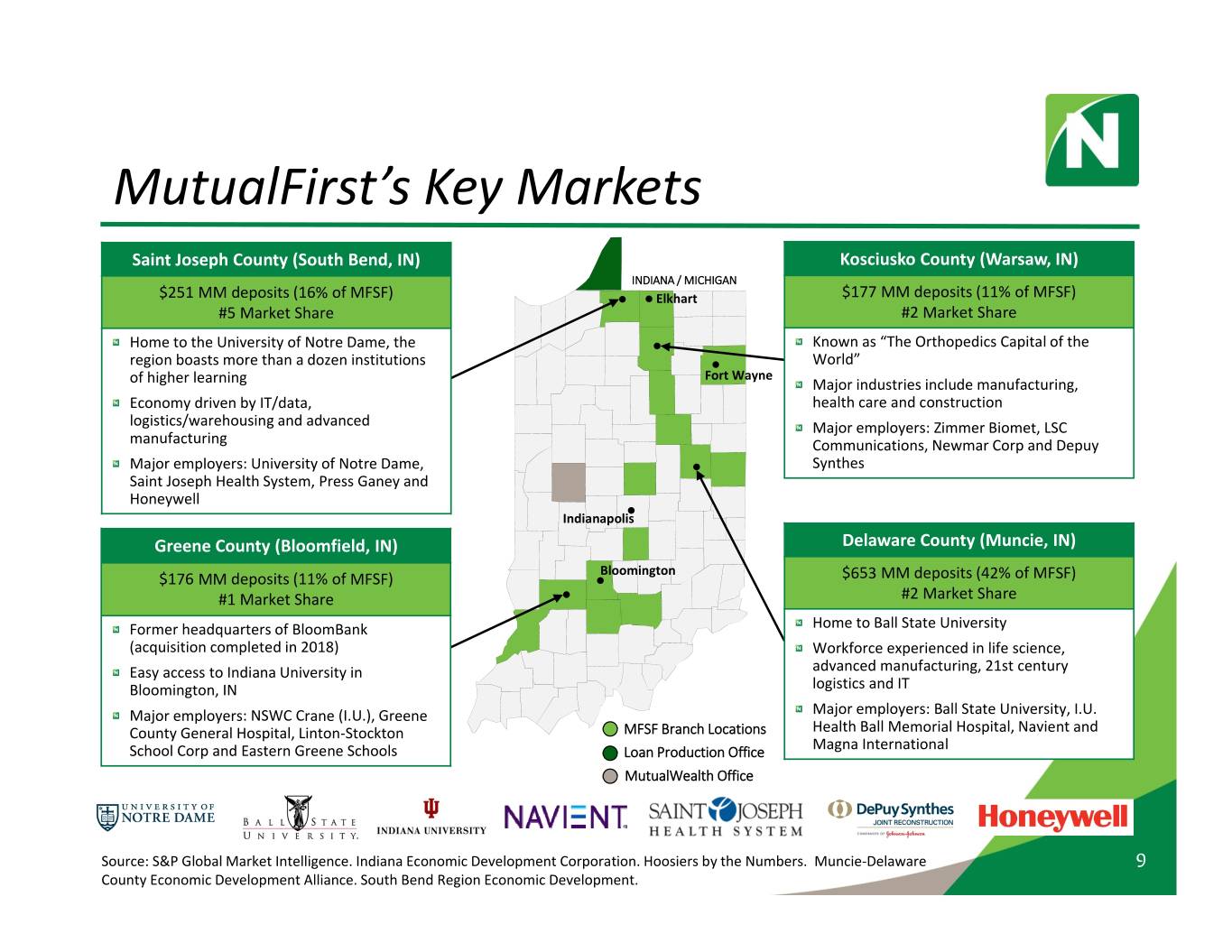

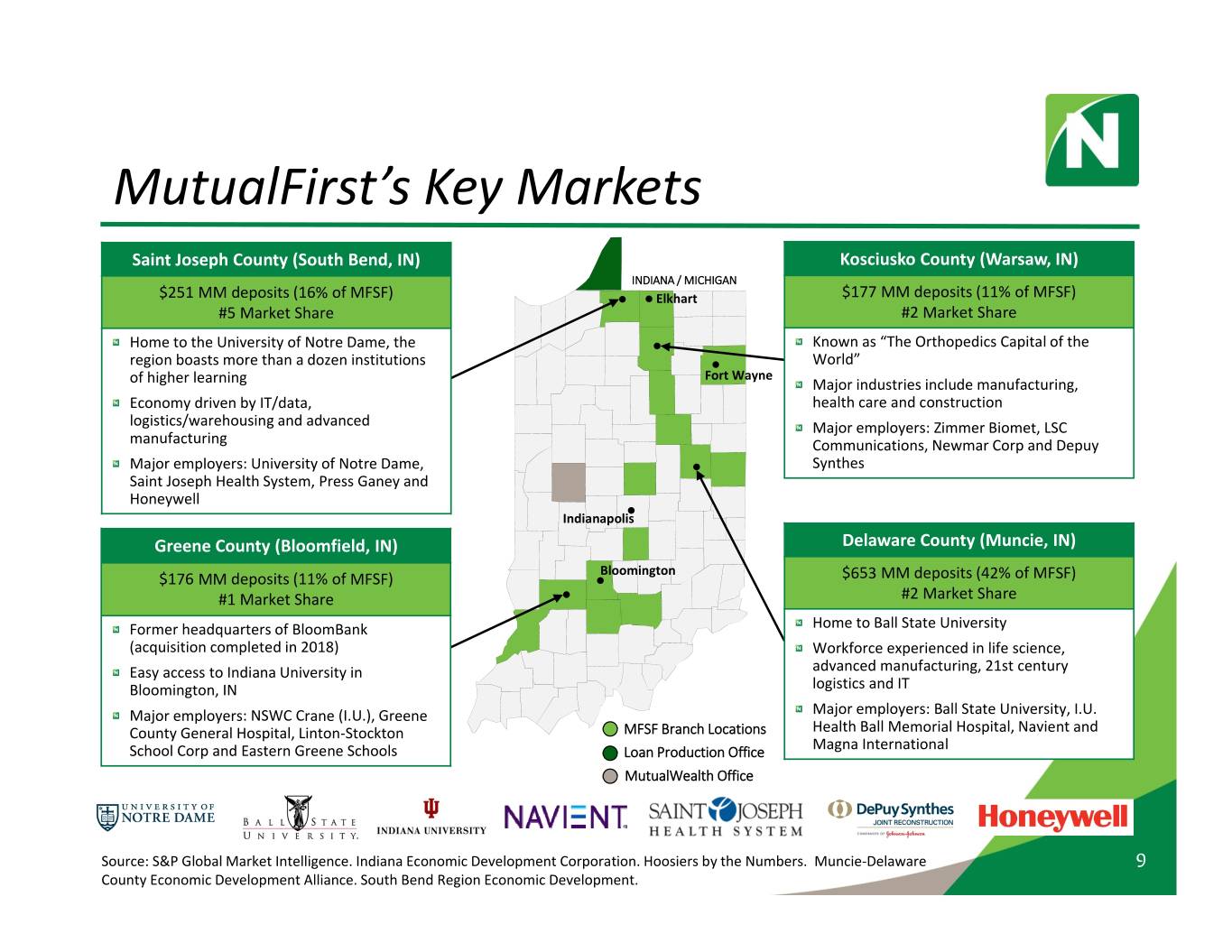

MutualFirst’s Key Markets Saint Joseph County (South Bend, IN) Kosciusko County (Warsaw, IN) INDIANA / MICHIGAN $251 MM deposits (16% of MFSF) Elkhart $177 MM deposits (11% of MFSF) #5 Market Share #2 Market Share Home to the University of Notre Dame, the Known as “The Orthopedics Capital of the region boasts more than a dozen institutions World” Fort Wayne of higher learning Major industries include manufacturing, Economy driven by IT/data, health care and construction logistics/warehousing and advanced Major employers: Zimmer Biomet, LSC manufacturing Communications, Newmar Corp and Depuy Major employers: University of Notre Dame, Synthes Saint Joseph Health System, Press Ganey and Honeywell Indianapolis Greene County (Bloomfield, IN) Delaware County (Muncie, IN) Bloomington $176 MM deposits (11% of MFSF) $653 MM deposits (42% of MFSF) #1 Market Share #2 Market Share Former headquarters of BloomBank Home to Ball State University (acquisition completed in 2018) Workforce experienced in life science, Easy access to Indiana University in advanced manufacturing, 21st century Bloomington, IN logistics and IT Major employers: NSWC Crane (I.U.), Greene Major employers: Ball State University, I.U. County General Hospital, Linton‐Stockton MFSF Branch Locations Health Ball Memorial Hospital, Navient and School Corp and Eastern Greene Schools Loan Production Office Magna International MutualWealth Office Source: S&P Global Market Intelligence. Indiana Economic Development Corporation. Hoosiers by the Numbers. Muncie‐Delaware 9 County Economic Development Alliance. South Bend Region Economic Development.

Transaction Expected to Boost Deposit Gathering Capabilities Expanded product set for consumers and small businesses, including competitive electronic banking products and sophisticated cash management services, will help drive continued deposit growth in MutualFirst’s markets Northwest MutualFirst Combined Time Time 18.8% 20.9% Time 32.2% Checking Checking Checking 41.3% 43.1% 41.6% Savings Savings 18.8% 17.7% Savings Money 11.2% Money Money Market Market Market 21.1% 13.5% 19.9% Total Cost of Deposits: 0.63% Total Cost of Deposits: 1.00% Total Cost of Deposits: 0.69% Source: S&P Global Market Intelligence; Company data. Financial Data as of and for the three months ended 9/30/2019. 10 Does not reflect purchase accounting or merger adjustments.

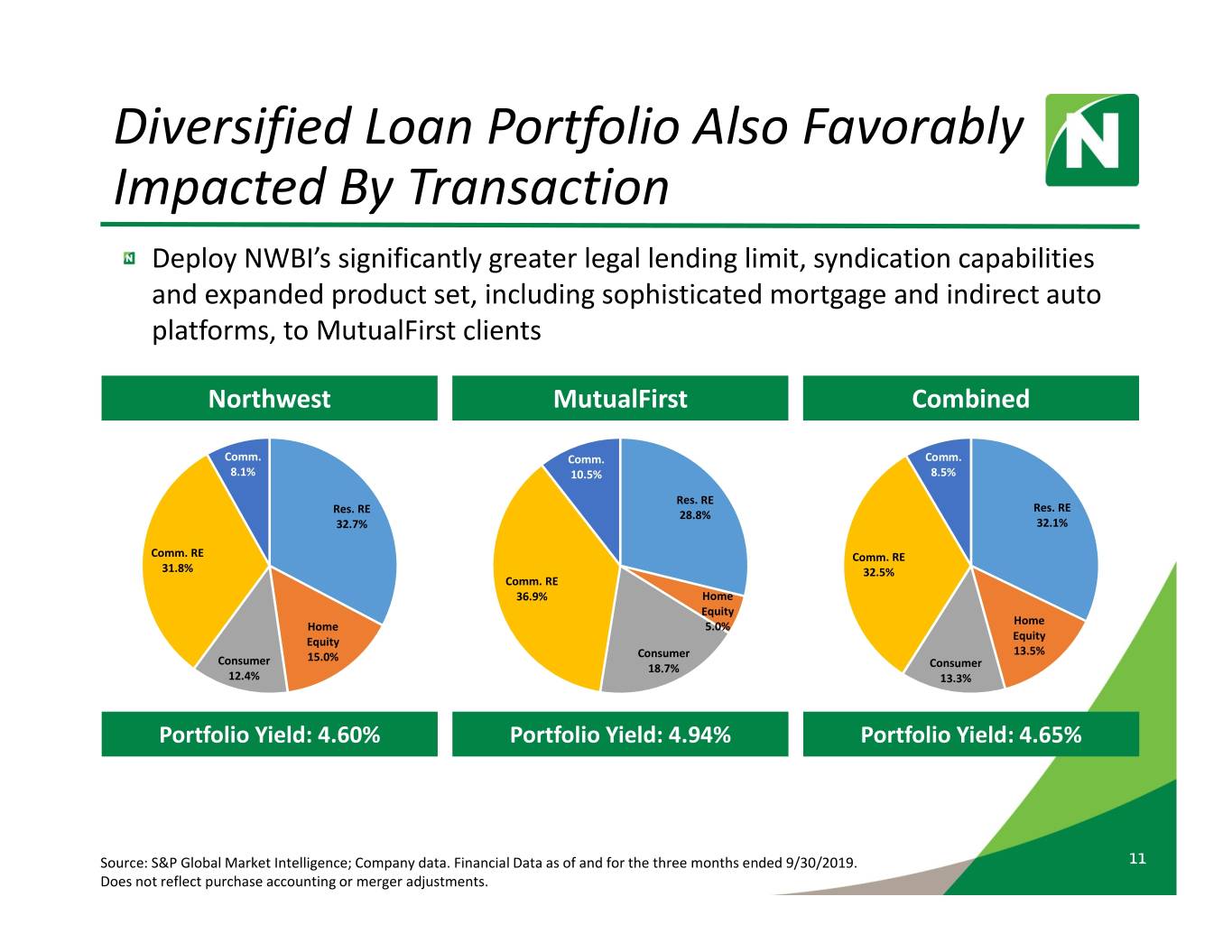

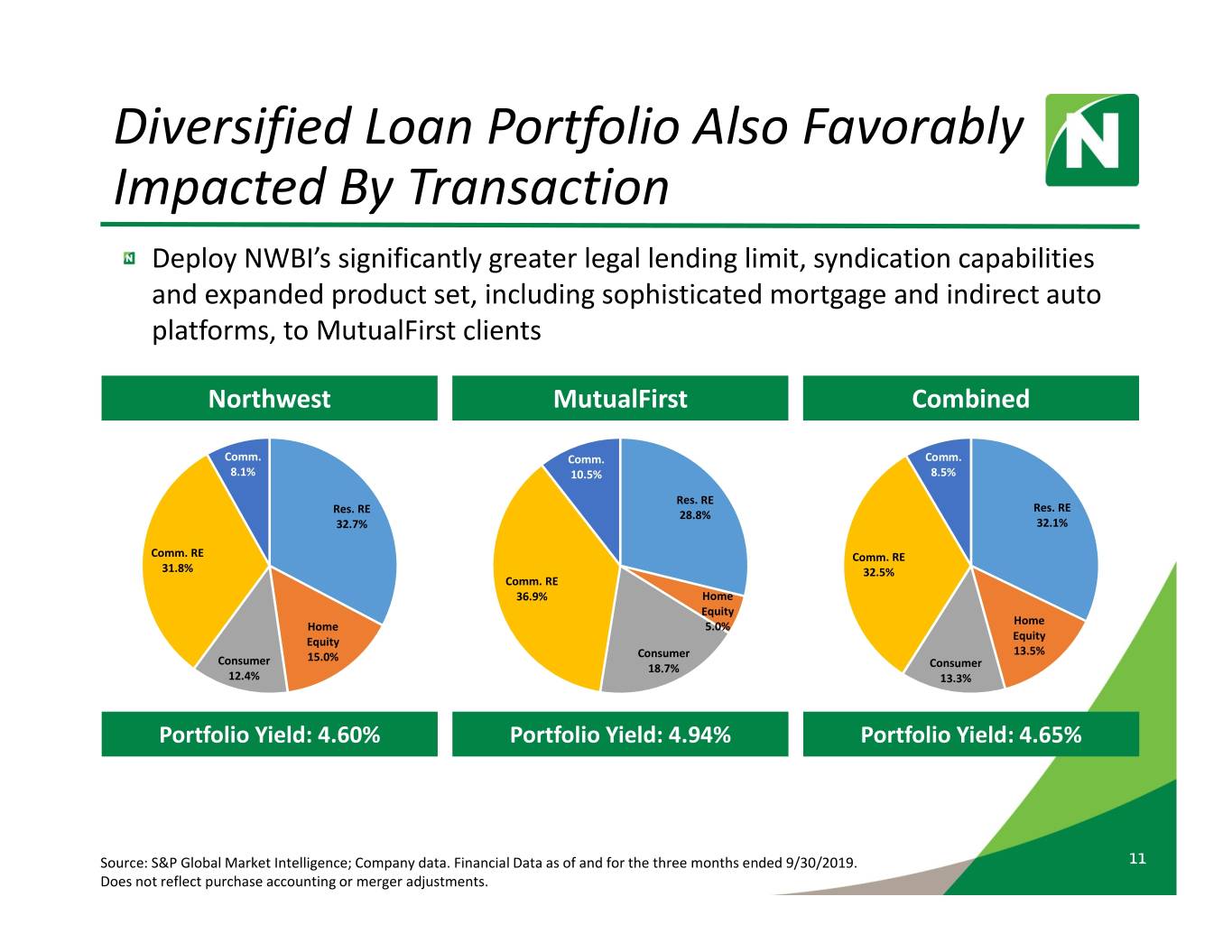

Diversified Loan Portfolio Also Favorably Impacted By Transaction Deploy NWBI’s significantly greater legal lending limit, syndication capabilities and expanded product set, including sophisticated mortgage and indirect auto platforms, to MutualFirst clients Northwest MutualFirst Combined Comm. Comm. Comm. 8.1% 10.5% 8.5% Res. RE Res. RE Res. RE 28.8% 32.7% 32.1% Comm. RE Comm. RE 31.8% 32.5% Comm. RE 36.9% Home Equity Home 5.0% Home Equity Equity Consumer 13.5% Consumer 15.0% 18.7% Consumer 12.4% 13.3% Portfolio Yield: 4.60% Portfolio Yield: 4.94% Portfolio Yield: 4.65% Source: S&P Global Market Intelligence; Company data. Financial Data as of and for the three months ended 9/30/2019. 11 Does not reflect purchase accounting or merger adjustments.

Comprehensive Due Diligence Process Conducted Engaged third party resources to assist with credit and deposit due diligence efforts Credit diligence coverage: Reviewed 55% of total commercial loan exposure Reviewed 89% of criticized commercial loan exposure Reviewed 91% of classified commercial loan exposure Reviewed 71% of non‐owner occupied commercial real estate loan exposure Reviewed 76% of construction and land development loan exposure Deposit diligence coverage Detailed deposit file review by both internal and third party resources on concentration levels, customer tenure, pricing opportunities and market potential Additional areas of comprehensive diligence focus: Retail banking Risk management / governance Commercial lending IT / bank operations / facilities Finance / accounting Human resources Mortgage / consumer lending Wealth Management 12

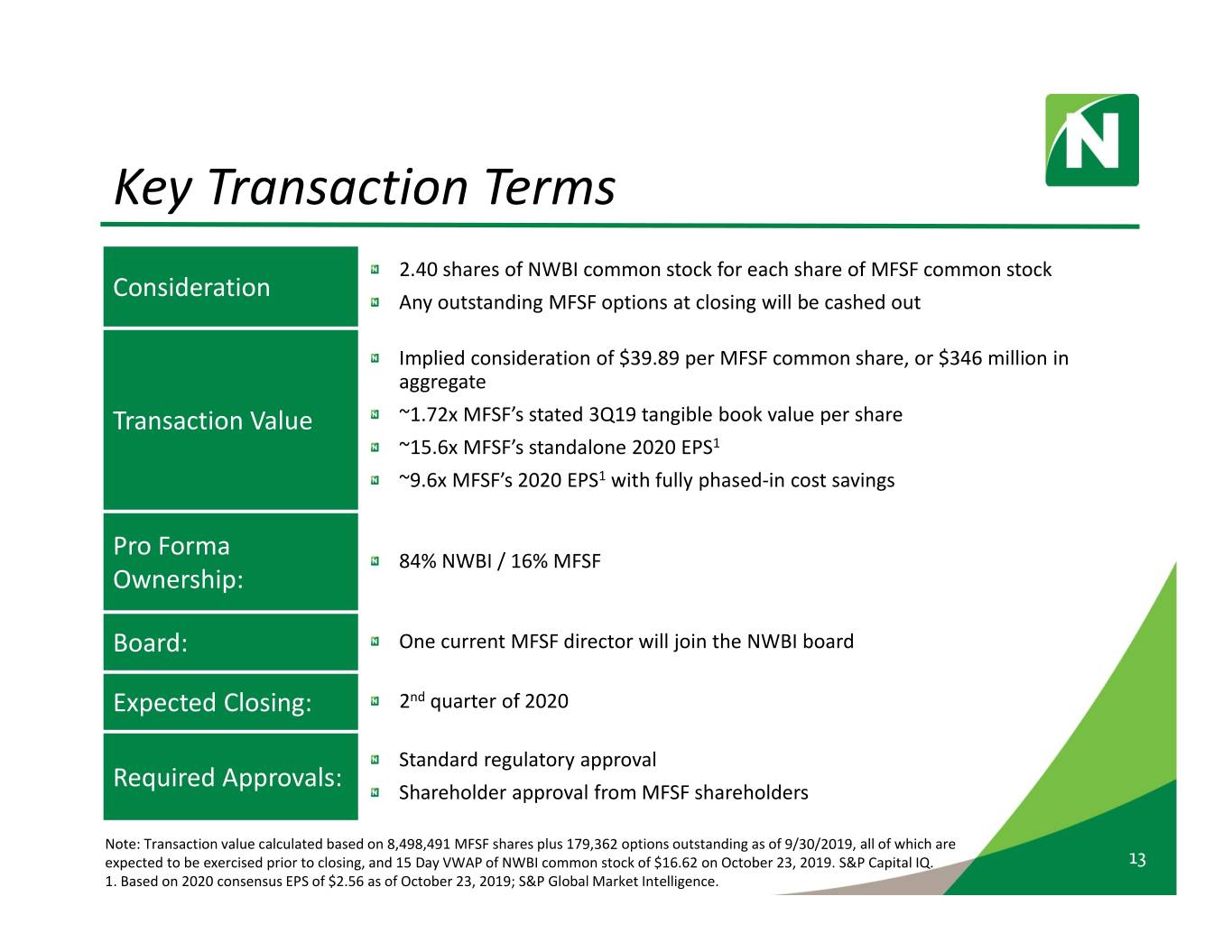

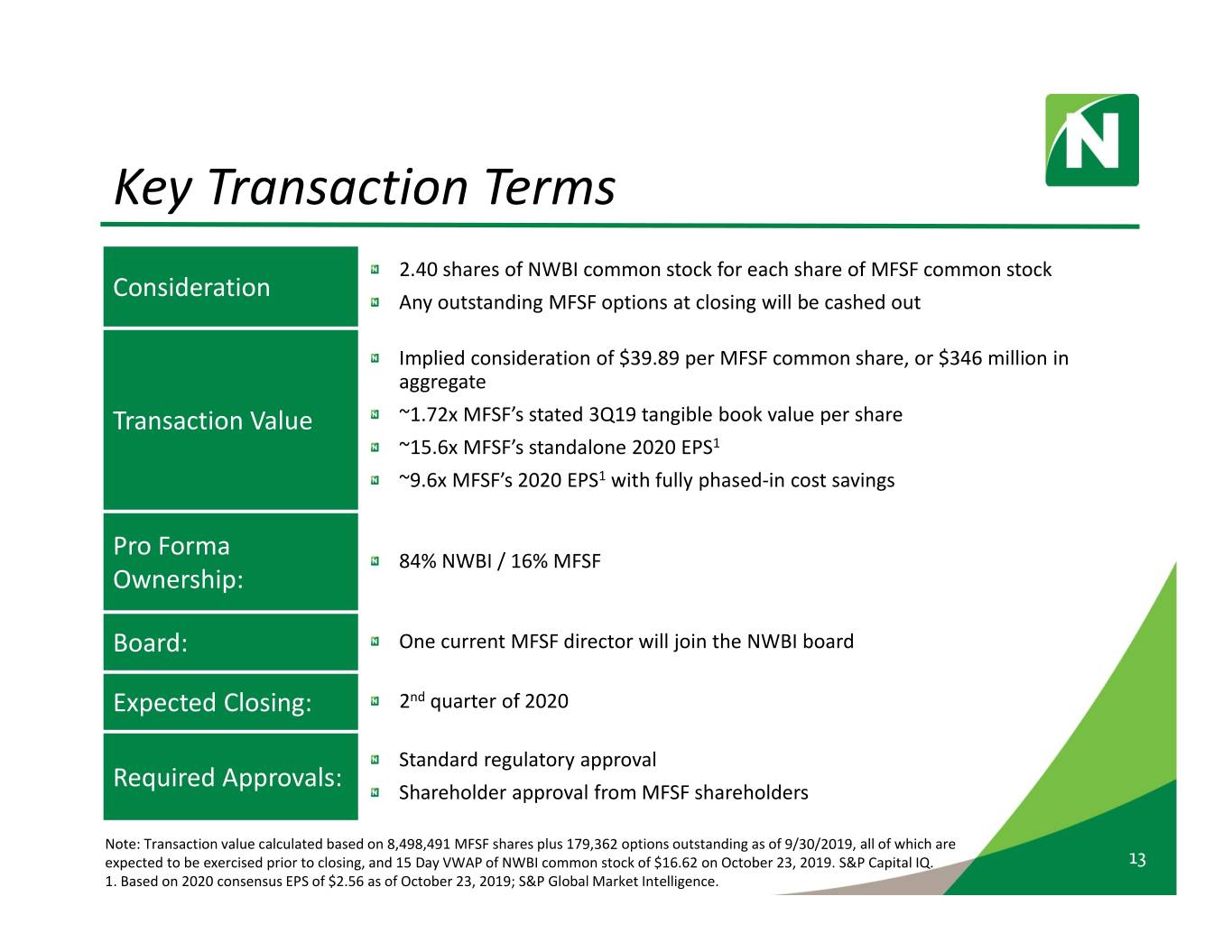

Key Transaction Terms 2.40 shares of NWBI common stock for each share of MFSF common stock Consideration Any outstanding MFSF options at closing will be cashed out Implied consideration of $39.89 per MFSF common share, or $346 million in aggregate Transaction Value ~1.72x MFSF’s stated 3Q19 tangible book value per share ~15.6x MFSF’s standalone 2020 EPS1 ~9.6x MFSF’s 2020 EPS1 with fully phased‐in cost savings Pro Forma 84% NWBI / 16% MFSF Ownership: Board: One current MFSF director will join the NWBI board Expected Closing: 2nd quarter of 2020 Standard regulatory approval Required Approvals: Shareholder approval from MFSF shareholders Note: Transaction value calculated based on 8,498,491 MFSF shares plus 179,362 options outstanding as of 9/30/2019, all of which are expected to be exercised prior to closing, and 15 Day VWAP of NWBI common stock of $16.62 on October 23, 2019. S&P Capital IQ. 13 1. Based on 2020 consensus EPS of $2.56 as of October 23, 2019; S&P Global Market Intelligence.

Key Merger Assumptions and Results Expense Savings Total restructuring charges: ~$30 million (pre‐tax) Approximately 30% of MFSF’s annualized 3Q19 operating expenses, or $17.2 million + Transaction (pre‐tax) Expense Revenue synergies: identified but not modeled Total gross credit mark: $26.9 million (1.77% of gross loans) $3.6 million on purchased credit deteriorated (PCD) loans $23.2 million on non‐PCD loans Purchase Additional $16 million estimated allowance related to CECL Accounting ~$11.4 million interest rate mark on loan portfolio, accreted over 5 years ~$4.1 million net fair value mark downs on time deposits and borrowings, amortized over 5 years Real estate and other mark ups: $6.3 million Core deposit intangible: $16.8 million, amortized over 10 years Other Estimated Durbin impact on MFSF’s earnings: $2.5 million pre‐tax on an annual basis Adjustments 2020: 6.1% accretive (excluding one‐time costs) 2021: 10.2% accretive Returns ~2.5% tangible book value per share dilution with ~2.1 year earnback excluding CECL1 ~3.5% tangible book value per share dilution with ~2.8 year earnback including CECL1 14 1. Crossover method. Includes all restructuring and other deal‐related costs.