February 16, 2023 KBW CONFERENCE PRESENTERS Louis J. Torchio President & Chief Executive Officer William W. Harvey Jr. SEVP, Chief Operating Officer & Chief Financial Officer

2 Cautionary Note Regarding Forward-Looking Statements The information contained in this presentation may contain forward-looking statements. When used or incorporated by reference in disclosure documents, the words “believe,” “anticipate,” “estimate,” “expect,” “project,” “target,” “goal” and similar expressions are intended to identify forward-looking statements within the meaning of section 27A of the Securities Act of 1933 and section 21E of the Securities Exchange Act of 1934. These forward-looking statements include but are not limited to: statements of our goals, intentions and expectations; statements regarding our business plans, prospects, growth and operating strategies; statements regarding the quality of our loan and investment portfolios; and estimates of our risks and future costs and benefits. These forward-looking statements are based on current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward- looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Such forward-looking statements are subject to certain risks, uncertainties and assumptions, including but not limited to the following: general economic conditions, either nationally or in our market areas, that are different than expected; inflation and changes in the interest rate environment that reduce our margins or reduce the fair value of financial instruments; major catastrophes such as earthquakes, floods or other natural or human disasters and infectious disease outbreaks, including the current coronavirus (COVID-19) pandemic, the related disruption to local, regional and global economic activity and financial markets, and the impact that any of the foregoing may have on us and our customers and other constituencies; adverse changes in the securities and credit markets; cyber-security concerns, including an interruption or breach in the security of our website or other information systems; technological changes that may be more difficult or expensive than expected; the ability of third-party providers to perform their obligations to us; competition among depository and other financial institutions; our ability to enter new markets successfully and capitalize on growth opportunities; managing our internal growth and our ability to successfully integrate acquired entities, businesses or branch offices; changes in consumer spending, borrowing and savings habits; our ability to access cost-effective funding; our ability to continue to increase and manage our commercial and personal loans; changes in the level and direction of loan delinquencies and charge-offs and changes in estimates of the adequacy of the allowance for credit losses; timing of revenue and expenditures; possible impairments of securities held by us, including those issued by government entities and government sponsored enterprises; our ability to receive regulatory approvals for proposed transactions or new lines of business; changes in legislative and regulatory matters; changes in the financial performance and/or condition of our borrowers; the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Securities and Exchange Commission, the Public Company Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard setters; our ability to retain key employees; other risks and uncertainties, including those occurring in the United States and world financial systems; and the risk that our analysis of these risks and forces could be incorrect and/or that the strategies developed to address them could be unsuccessful. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated, expected or projected. These and other risk factors are more fully described in this presentation and in the Northwest Bancshares, Inc. (the “Company”) Annual Report on Form 10-K for the year ended December 31, 2021 under the section entitled "Item 1A - Risk Factors," and from time to time in other filings made by the Company with the SEC. These forward-looking statements speak only at the date of the presentation. The Company expressly disclaims any obligation to publicly release any updates or revisions to reflect any change in the Company’s expectations with regard to any change in events, conditions or circumstances on which any such statement is based. Non-GAAP Financial Measures This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Management uses these “non-GAAP” measures in its analysis of the Company’s performance. Management believes these non-GAAP financial measures allow for better comparability of period-to-period operating performance. Additionally, the Company believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. DISCLAIMER

3 OVERVIEW OF NORTHWEST BANCSHARES, INC.

4 SUMMARY • Leading regional bank, based in Warren, PA, and founded in 1896. • Holding Company, Northwest Bancshares, Inc. (NWBI), headquartered in fast growing Columbus, OH. • Strong footprint in Pennsylvania, Western New York, Ohio, and Indiana. • Diversified fee income mix including mortgage banking, trust, and investment advisory with fee income ~20% of total revenues. In addition, SBA loan sales will add meaningful revenue opportunities. • Successful acquisition track record ~30 acquisitions since IPO (1994). • Steady, controlled growth to $14.1bn in assets from $8.0bn in assets in 2009, the year of the second-step conversion. • Stable core deposit franchise with many opportunities to deploy funds into active commercial markets across four states including Buffalo, Pittsburgh, Cleveland, Columbus, and Indianapolis. OVERVIEW OF NORTHWEST BANCSHARES, INC. 4 NASDAQ: “NWBI”

5 KEY STATS – DECEMBER 31, 2022 • Assets: $14.1bn • Loans: $10.9bn • Total Deposits: $11.5bn • Loans/Deposits: 95.25% • TCE/TA: 8.03% • CET1 Ratio: 13.04% • Total Delinquency: 0.79% • NPAs/Assets: 0.58% • ROAA: 0.94% • ROAE: 8.80% • Efficiency Ratio: 62.10% • Reserves/Loans: 1.08% • NCOs/Average Loans: 0.02% • Reserves/NPLs: 143.98% OVERVIEW OF NORTHWEST BANCSHARES, INC. 4 NASDAQ: “NWBI”

6 A NETWORK OF OFFICES ACROSS 4 STATES OVERVIEW OF NORTHWEST BANCSHARES, INC. Summary 4 Sum ary NASDAQ: “NWBI”

7 RECENT ACCOLADES OVERVIEW OF NORTHWEST BANCSHARES, INC. Summary 4 Sum ary NASDAQ: “NWBI”

8 FRANCHISE HIGHLIGHTS MANAGEMENT CULTURE & TRACK RECORD • Experienced and dedicated management team. • Excellent M&A execution track record. • Consistent EPS growth with diversified revenue base. HIGH-QUALITY LOAN PORTFOLIO • Expertise in Mortgage & Home Equity augmented by controlled growth in Dealer Services, C&I and CRE. • Strong credit metrics. STRONG CUSTOMER BASE AND WELL- POSITIONED MARKET SHARE • Increasingly commercial customer focused. • Fee income businesses provide diverse revenue streams and cross-sell opportunities. • Demonstrated ability to grow via M&A and organically in Ohio, Pennsylvania, New York and Indiana. EXCEPTIONAL FINANCIAL PERFORMANCE • Attractive return profile with low historic volatility. • Well capitalized and liquid balance sheet. • Appropriately reserved given strong credit and underwriting standards and loan mix. EXECUTING STRATEGIC OBJECTIVES • Intense focus on retaining, hiring, and developing human capital. • Reduce costs with more efficient technology. • Drive organic growth through multiple production channels. • Tailor services to client needs via digital banking. • Evaluate and execute accretive M&A opportunities.

9 STRATEGIC FOCUS

10 COMMERCIAL • Commercial relationships continue to be a growing segment of our business as commercial loans and deposits have grown steadily. • NWBI’s Midwest/Mid-Atlantic geographies are well positioned with business growth opportunities. • Business segments include middle market and large corporate lending as well as medium sized and small businesses. • Key metro growth markets target Buffalo, Pittsburgh, Cleveland, Columbus, Indianapolis, and Philadelphia with growth also being experienced in southern Michigan, West Virginia, Northern Virginia and Maryland. • Competencies include C&I, CRE, Healthcare and SBA banking verticals. • We’ve recently added an Equipment Finance Group that will focus on business aviation, OTR trucking, inland/offshore marine financing and general equipment loans in the middle market to large corporate finance space. This new capability broadens our commercial loan offering and has many strategic benefits including, industry and geographic expansion and additional fee income and relationship opportunities. STRATEGIC FOCUS

11 COMMERCIAL (Continued) • With the continued increase in private equity and home office liquidity, we have launched a Sponsored Finance vertical to partner with these entities for their financing needs. • We continue to build on our Corporate Finance capabilities, where we not only invest in syndicated credit within our footprint but have the in-house expertise to agent niche deals. • Our business deposit mix continues to grow as we focus on earning “primary bank status” by offering a holistic, essential-partner value proposition. • Treasury Pro, our new business online banking platform, is designed specifically to support commercial and small business customers with treasury management needs. Treasury Pro offers everything a business may need to manage their cash flow – ACH and wire payments, customized reporting, entitlements and more, all supported by robust security, alerts, and approvals. This new solution significantly enhances customer experience and better positions Northwest as a commercial partner across our markets, providing all digital business banking capabilities within a single digital platform. STRATEGIC FOCUS

12 BUSINESS BANKING/SMALL BUSINESS LENDING • Hired industry expert to lead the business banking and small business lending efforts. • Implementing state-of-the-art loan origination system. • We’ve recently established an SBA Lending vertical, including the addition of experienced SBA credit and sales management. This new focus broadens our Business Banking loan offering and provides strategic benefits including expanded relationship opportunities and the generation of additional fee income on secondary market sales. • Augmented by equipment finance agreement purchases of approximately $200 million during 2022. • Treasury Pro, our new business online banking platform, is designed specifically to support small business customers with treasury management needs, offering everything a business may need to manage their cash flow within a single, secure digital platform. STRATEGIC FOCUS

13 RETAIL/DIGITAL • We’ve been digitally transforming our bank, launching new technology (features and functionality) to improve both customer experience and our ability to grow, including: • New online and mobile banking experience with improved capabilities (Zelle, Alerts, Credit Score, CardValet, consumer wires, business bill pay enhancement). • New deposit and loan account opening experience. • New website – northwest.com, improved shopping and buying experience. • New marketing optimization and personalization engine – allows us to harness the power of our customer data, artificial intelligence and machine learning to hyper- target existing customers with specific consumer offers to improve wallet share and cross-sell of our offerings. • State-of-the-art digital platform is driving new business and cross-sell opportunities (digital account acquisition) in an easier, secure, and more cost-effective way. • We are expanding our footprint (markets) and testing ways to grow new customer relationships through a fully digital shopping and buying experience. Our objective is to grow new deposits and households where we currently don’t have a retail (branch) presence. This program could be expanded into other states contiguous with our current four-state footprint. STRATEGIC FOCUS

14 RETAIL/BRANCH OPTIMIZATION • Because customers are choosing more convenient ways to interact with our bank, branch traffic and transaction volumes have decreased, while usage of our digital channels, like online and mobile banking, have dramatically increased. • Because of this ongoing shift in customer behavior and preferences, we continue to evaluate the efficiency of our retail network and have consolidated over 100 branches in the past six years. In many cases, the consolidated branches were in close proximity to another Northwest location. STRATEGIC FOCUS

15 MORTGAGE • Focused on driving fee income through our mortgage banking platform. • Over $1.0 billion of annual 1-4 family mortgage loan originations. • Provides flexibility to manage our balance sheet based on economic conditions and desire to hold outstandings. • Long record of low delinquencies and net charge-offs. • We significantly expanded our residential mortgage capability through the development of a new, state-of-the-art residential mortgage loan origination platform and the development of a broader array of mortgage products. • Market expansion of our mortgage and home equity products. STRATEGIC FOCUS

16 DEALER SERVICES • Driven by Indirect Auto and Power Sports, this business line has grown steadily in a nine-state market area with an emphasis on higher credit quality. • Long record of low delinquencies and net charge-offs. • Average FICO score over 770. • We significantly expanded the distribution of our power sports lending capability to dealerships from Pennsylvania into our other nine-state auto dealer loan markets. In addition, we developed a new, streamlined loan funding process, which significantly reduced the funding times. STRATEGIC FOCUS

17 TRUST & INVESTMENT SERVICES • Business Solutions: Business trust revenue has remained strong over the past year as we continue to diversify our mix of both revenue and assets under management. • Personal Solutions: We continue to grow personal trust revenue through our focus on relationships, service and customized investment management solutions. Successful partnership with LPL Financial as a broker-dealer will allow us to grow investment management revenue. • Total AUM of approximately $6.3 billion. STRATEGIC FOCUS

18 ENVIRONMENTAL, SOCIAL & GOVERNANCE (ESG) AND DIVERSITY & INCLUSION (DEI) • It is our mission to promote a workplace where all our employees can contribute, innovate, and thrive. • Newly created leadership roles for both ESG and DEI to drive our efforts across our bank and footprint. • Inclusion Council created in 2020 to promote diversity, equity and inclusion in our workplace. • Creation of Employee Resource Groups (ERG) to further support employee engagement and raise cultural awareness. STRATEGIC FOCUS

19 DEFINING A DISTINCTIVE M&A CULTURE

20 M&A in current and contiguous markets remains a focus: • Knowledge of our customers and their markets is a strategic advantage. Focused credit & deposit due diligence and re-underwriting: • Dedicated and experienced team focused on due diligence and maintaining NWBI’s strong credit standard. To supplement this, 3rd party deposit diligence drives branch and pricing efficiencies. Supplement whole bank M&A with acquisitions of fee income businesses: • Scale benefits particularly relevant in our fee income businesses. Talent retention, culture and human capital: • Despite NWBI’s strong management team, the ability to add to management “bench strength” is a key consideration in M&A. Alignment of a common culture: • A distinctive, high-performance culture embraced and advocated by the leadership team is a key driver of successful integration. OUR M&A PHILOSOPHY

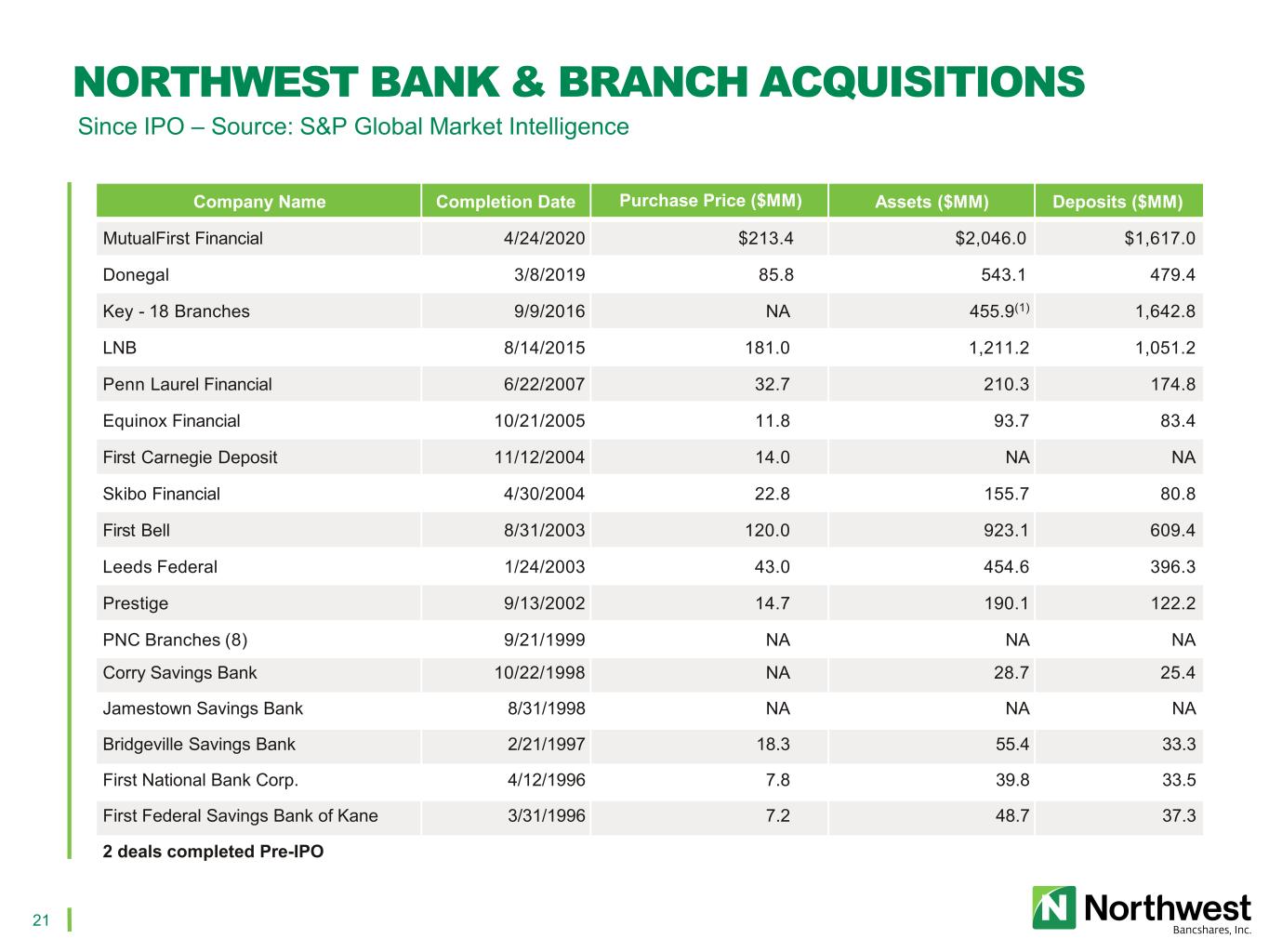

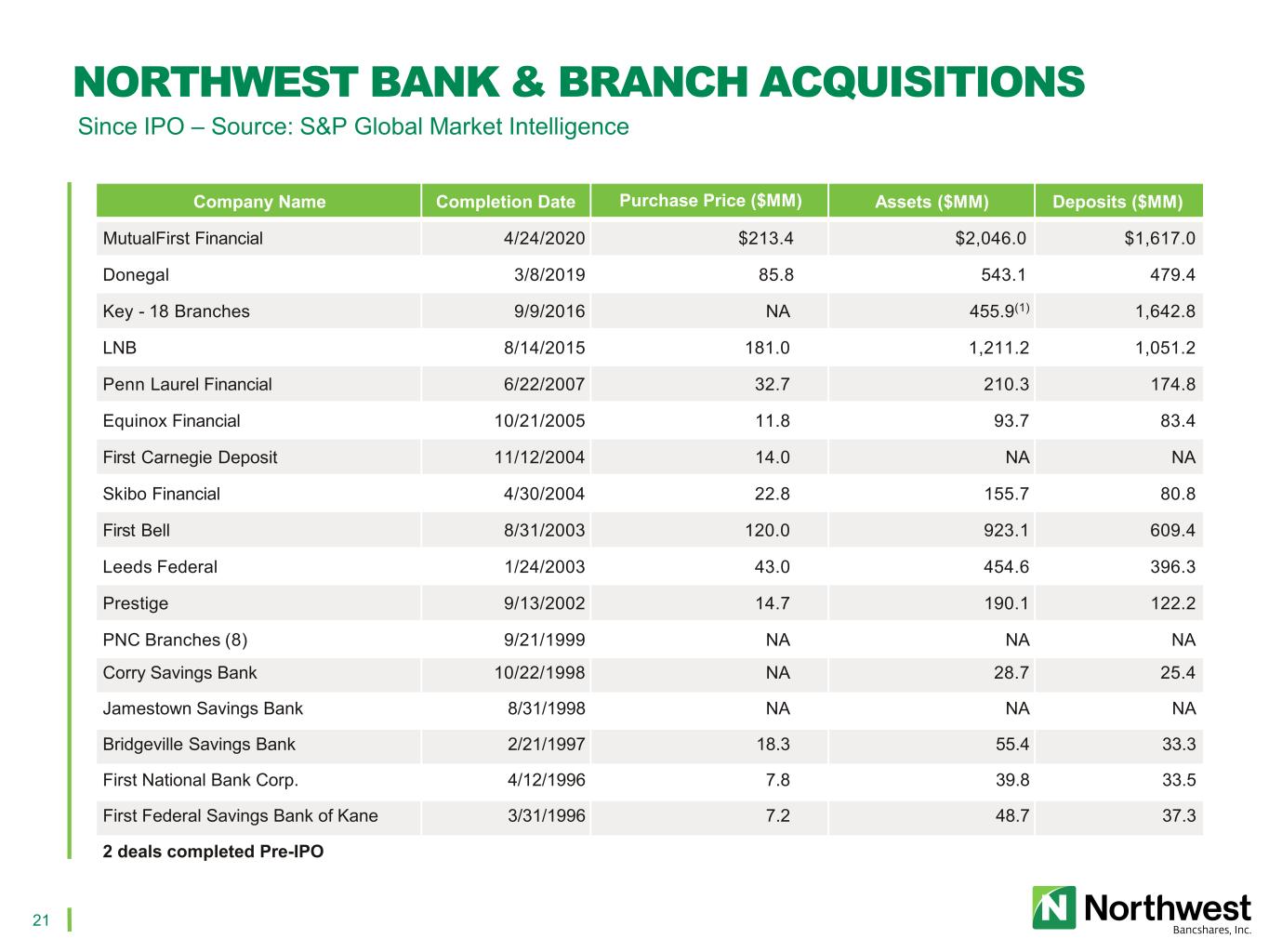

21 NORTHWEST BANK & BRANCH ACQUISITIONS (1) Assets shown as loans acquired in transaction. Company Name Completion Date Assets ($MM) Deposits ($MM) MutualFirst Financial 4/24/2020 $213.4 $2,046.0 $1,617.0 Donegal 3/8/2019 85.8 543.1 479.4 Key - 18 Branches 9/9/2016 NA 455.9(1) 1,642.8 LNB 8/14/2015 181.0 1,211.2 1,051.2 Penn Laurel Financial 6/22/2007 32.7 210.3 174.8 Equinox Financial 10/21/2005 11.8 93.7 83.4 First Carnegie Deposit 11/12/2004 14.0 NA NA Skibo Financial 4/30/2004 22.8 155.7 80.8 First Bell 8/31/2003 120.0 923.1 609.4 Leeds Federal 1/24/2003 43.0 454.6 396.3 Prestige 9/13/2002 14.7 190.1 122.2 PNC Branches (8) 9/21/1999 NA NA NA Corry Savings Bank 10/22/1998 NA 28.7 25.4 Jame ow S vings Ba k 8/31/1998 NA NA NA Bridgeville Savings Bank 2/21/1997 18.3 55.4 33.3 First National Bank Corp. 4/12/1996 7.8 39.8 33.5 First Federal Savings Bank of Kane 3/31/1996 7.2 48.7 37.3 2 deals completed Pre-IPO Since IPO – Source: S&P Global Market Intelligence Purchase Price ($MM)

22 FINANCIAL OVERVIEW

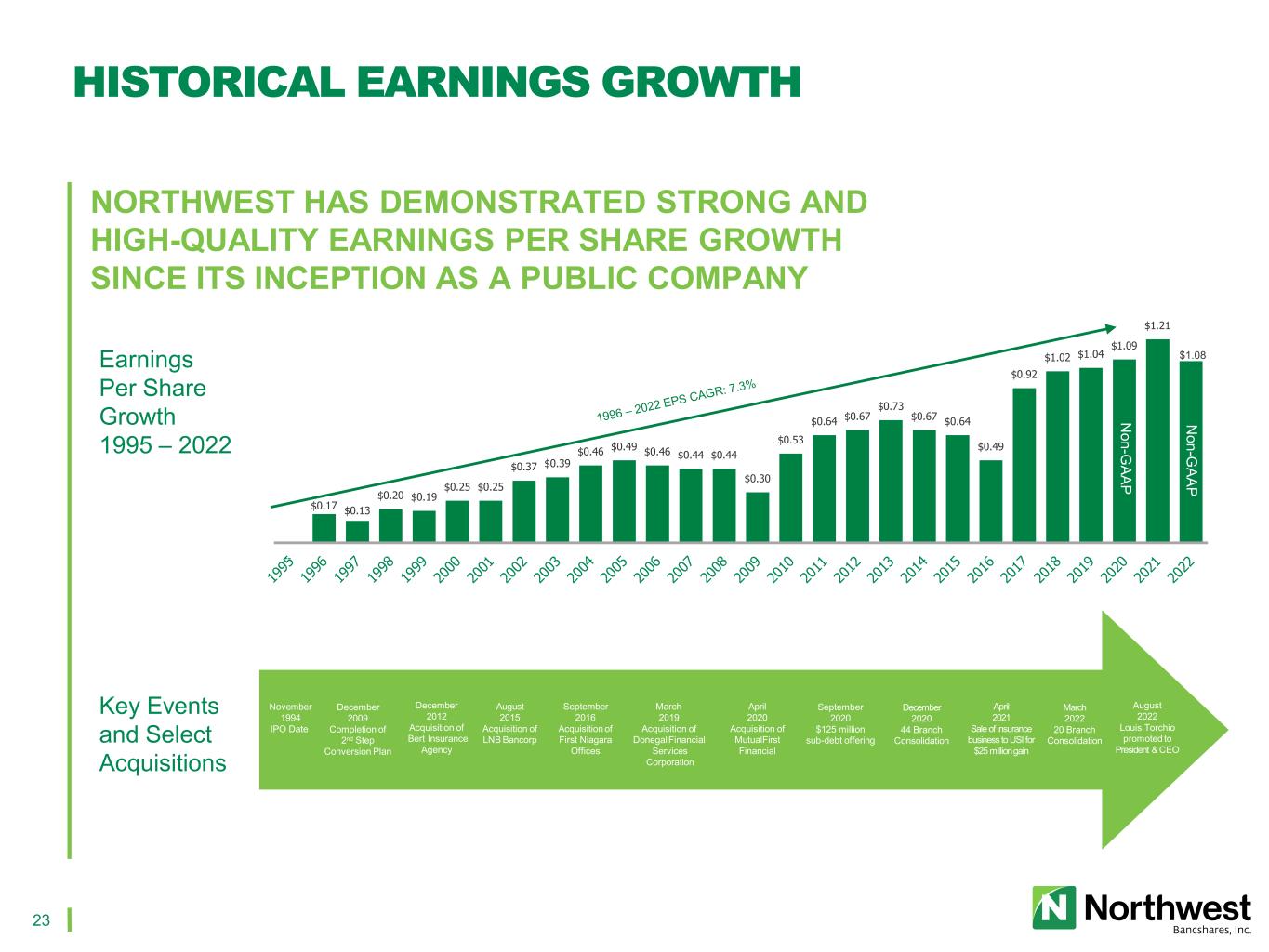

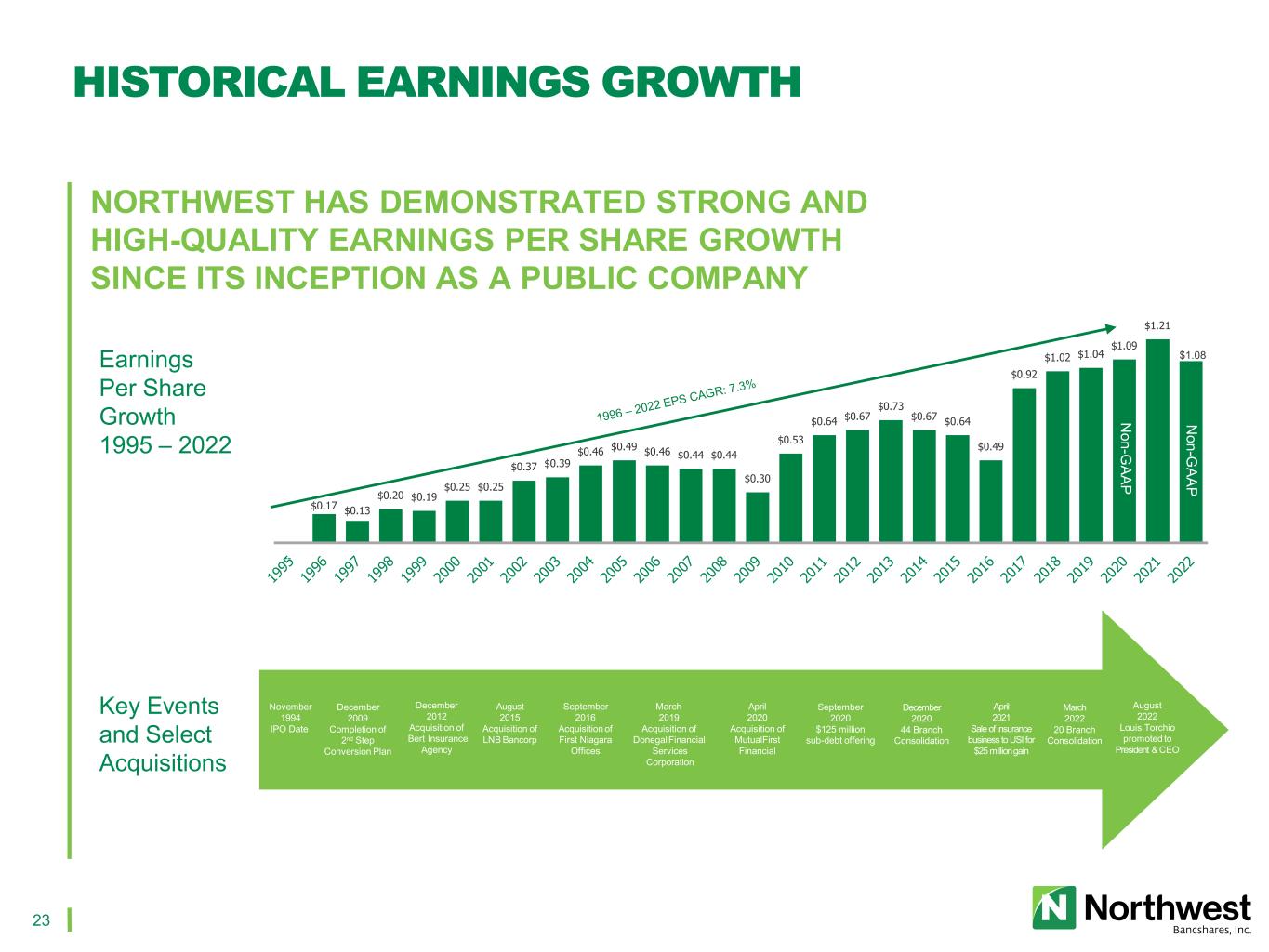

23 August 2015 Acquisition of LNB Bancorp September 2016 Acquisition of First Niagara Offices March 2019 Acquisition of DonegalFinancial Services Corporation December 2009 Completion of 2nd Step Conversion Plan December 2012 Acquisition of Bert Insurance Agency November 1994 IPO Date April 2020 Acquisition of MutualFirst Financial September 2020 $125 million sub-debt offering December 2020 44 Branch Consolidation April 2021 Sale of insurance business to USI for $25 million gain 15 March 2022 20 Branch Consolidation August 2022 Louis Torchio promoted to President & CEO $0.17 $0.13 $0.20 $0.19 $0.25 $0.25 $0.37 $0.39 $0.46 $0.49 $0.46 $0.44 $0.44 $0.30 $0.53 $0.64 $0.67 $0.73 $0.67 $0.64 $0.49 $0.92 $1.02 $1.04 $1.09 $1.21 $1.08 N on-G AAP -- N on-G AAP Earnings Per Share Growth 1995 – 2022 Key Events and Select Acquisitions NORTHWEST HAS DEMONSTRATED STRONG AND HIGH-QUALITY EARNINGS PER SHARE GROWTH SINCE ITS INCEPTION AS A PUBLIC COMPANY HISTORICAL EARNINGS GROWTH

24 $1.6 $2.1 $3.1 $3.9 $5.2 $6.5 $6.7 $8.0 $8.0 $7.9 $9.0 $9.4 $10.5 $13.8 $14.5 $14.1 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 '95 '98 '01 '04 '07 '10 '13 '16 '19 '22 $0.2 $0.2 $0.2 $0.3 $0.4 $0.6 $0.6 $1.3 $1.2 $1.2 $1.2 $1.2 $1.4 $1.5 $1.6 $1.5 $0.0 $0.2 $0.4 $0.6 $0.8 $1.0 $1.2 $1.4 $1.6 $1.8 '95 '98 '01 '04 '07 '10 '13 '16 '19 '22 Second Step Conversion $1.2$1.5 $2.3 $2.9 $3.3 $4.7 $4.8 $5.3 $5.6 $5.8 $7.2 $7.8 $8.8 $10.5 $10.0 $10.9 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 '95 '98 '01 '04 '07 '10 '13 '16 '19 '22 $1.3 $1.6 $2.5 $3.3 $4.3 $5.2 $5.5 $5.6 $5.8 $5.7 $6.6 $7.8 $8.6 $11.6 $12.3 $11.5 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 '95 '98 '01 '04 '07 '10 '13 '16 '19 '22 Total Assets ($ in billions) Stockholder’s Equity ($ in billions) Total Gross Loans ($ in billions) Total Deposits ($ in billions) NORTHWEST HAS A DEMONSTRATED TRACK RECORD OF STRONG AND STABLE BALANCE SHEET GROWTH SINCE IPO TRACK RECORD OF STEADY BALANCE SHEET GROWTH

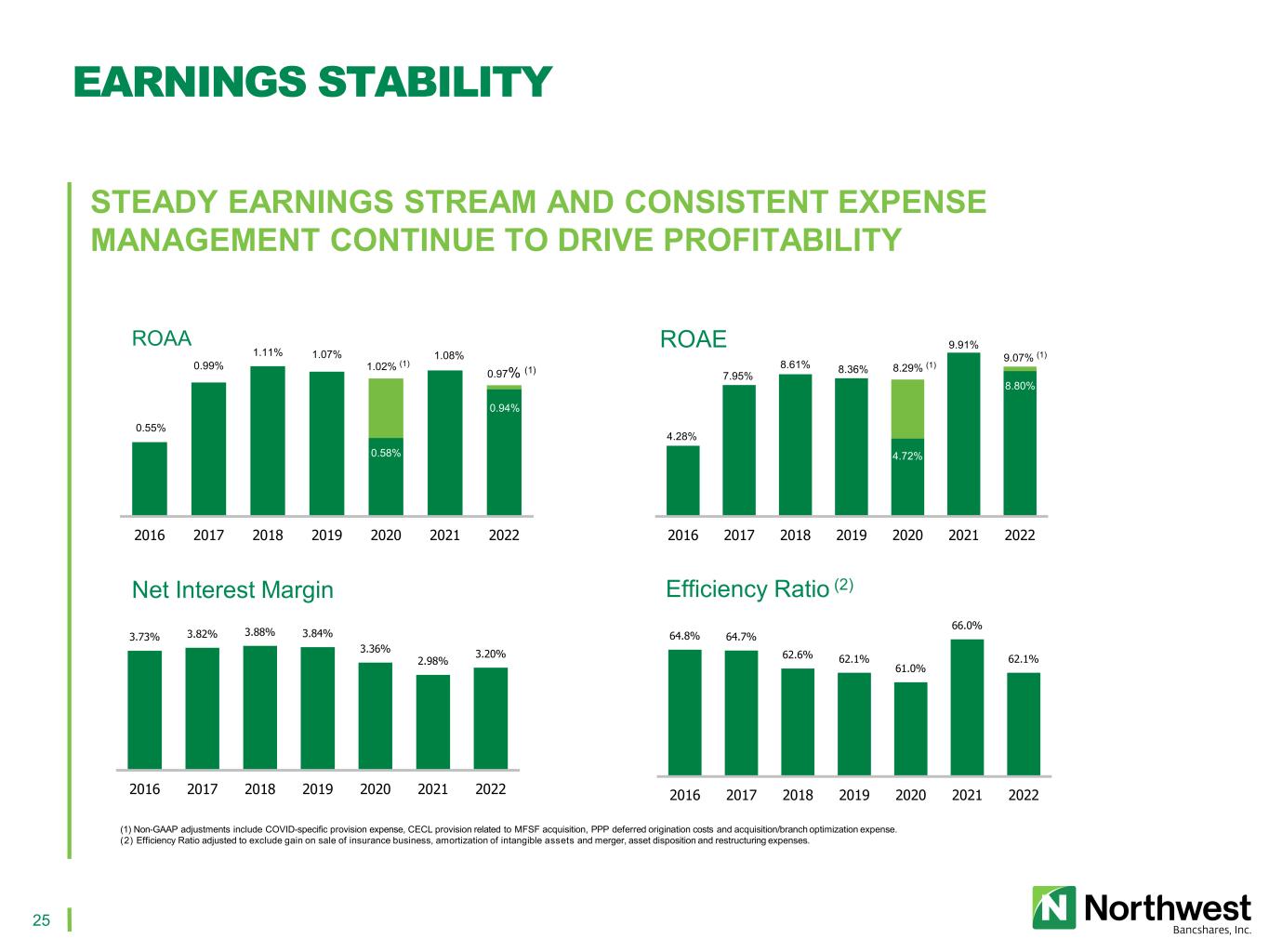

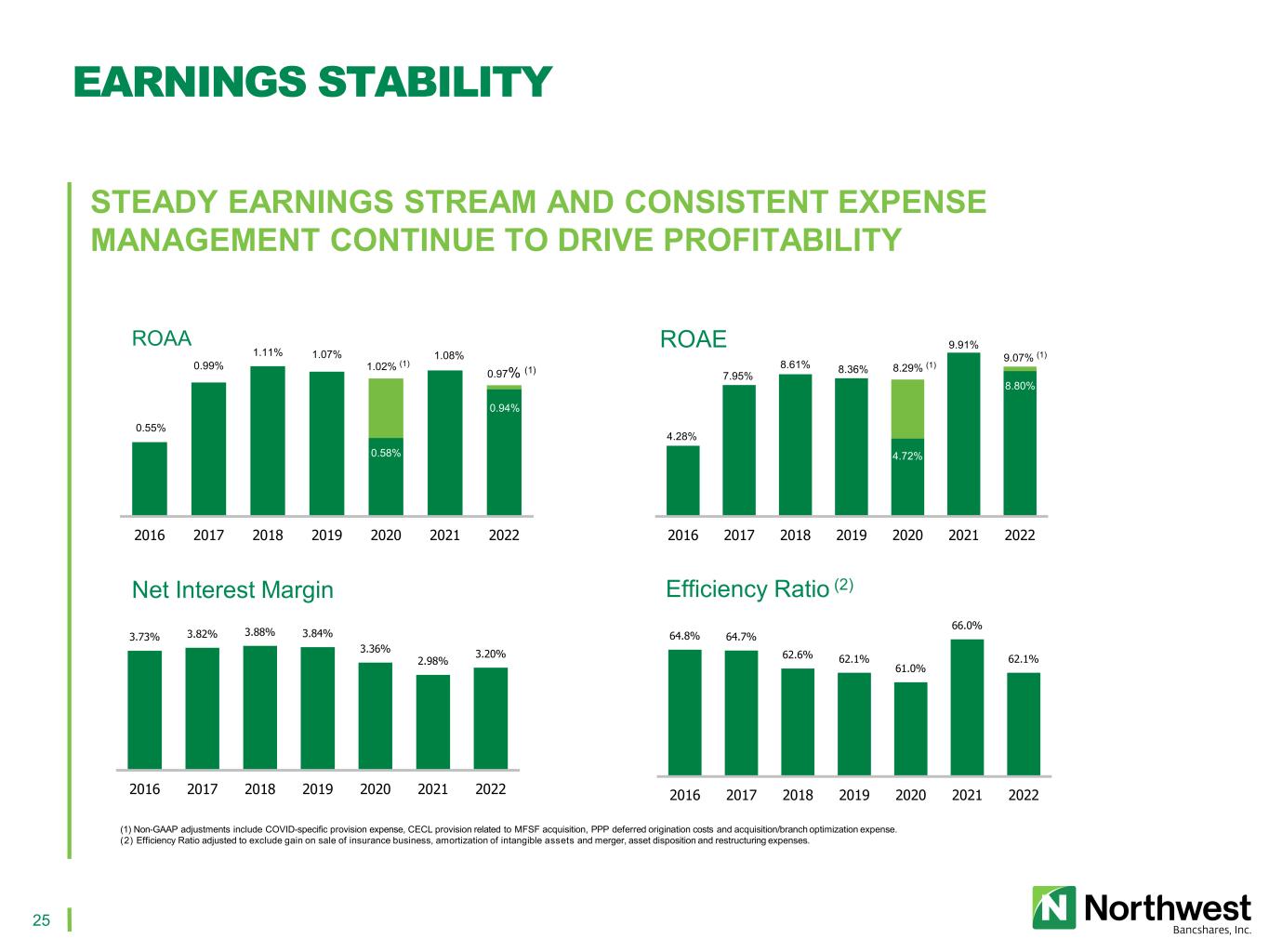

25 4.28% 7.95% 8.61% 8.36% 4.72% 9.91% 8.80% 2016 2017 2018 2019 2020 2021 2022 17 (1) Non-GAAP adjustments include COVID-specific provision expense, CECL provision related to MFSF acquisition, PPP deferred origination costs and acquisition/branch optimization expense. (2) Efficiency Ratio adjusted to exclude gain on sale of insurance business, amortization of intangible assets and merger, asset disposition and restructuring expenses. 0.55% 0.99% 1.11% 1.07% 0.58% 1.08% 2016 2017 2018 2019 2020 2021 2022 1.02% (1) 0.94% 0.97% (1) 3.73% 3.82% 3.88% 3.84% 3.36% 2.98% 3.20% 2016 2017 2018 2019 2020 2021 2022 64.8% 64.7% 62.6% 62.1% 61.0% 66.0% 62.1% 2016 2017 2018 2019 2020 2021 2022 ROAA ROAE Net Interest Margin Efficiency Ratio (2) STEADY EARNINGS STREAM AND CONSISTENT EXPENSE MANAGEMENT CONTINUE TO DRIVE PROFITABILITY EARNINGS STABILITY 9.07% (1) 8.29% (1)

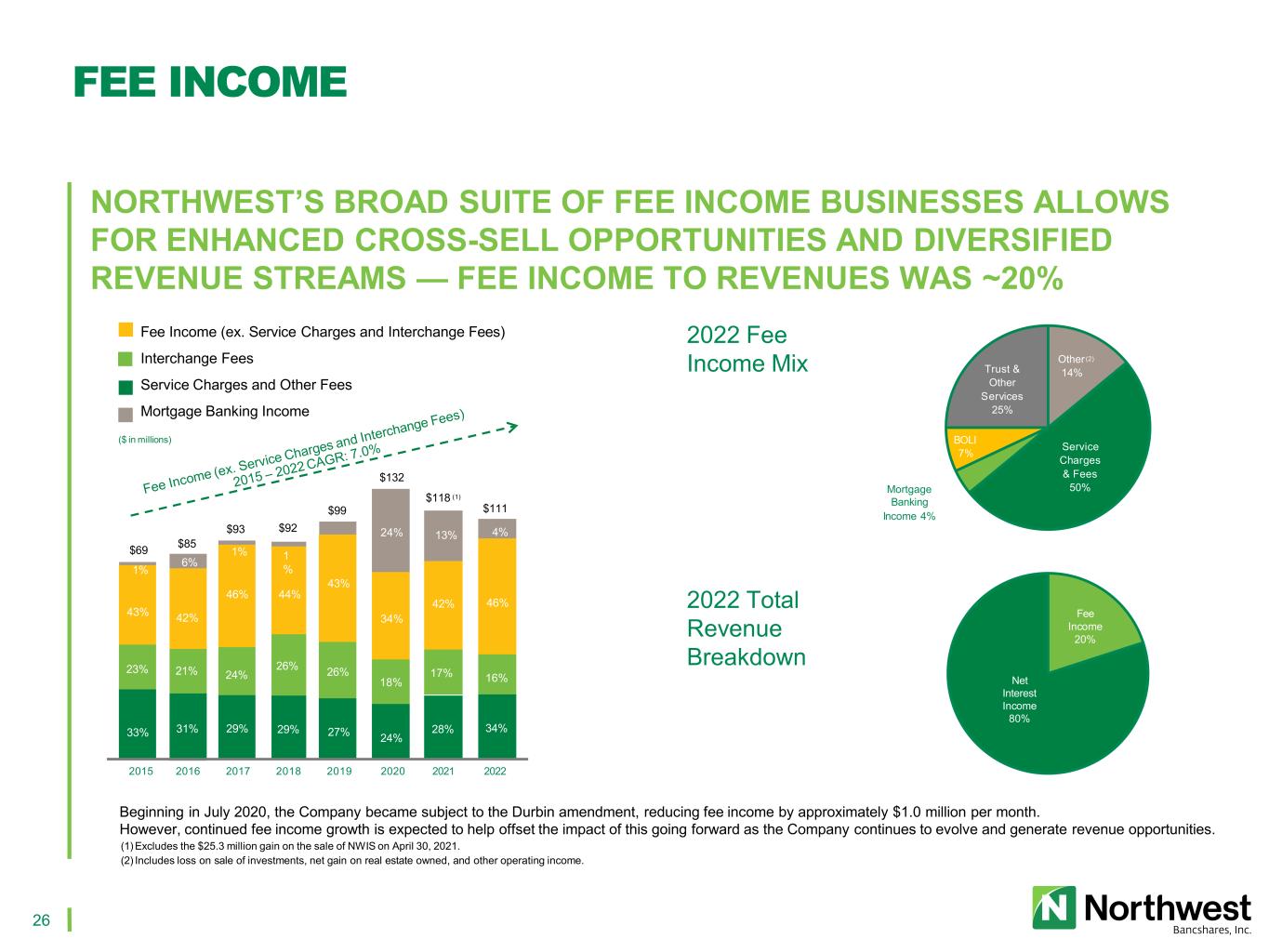

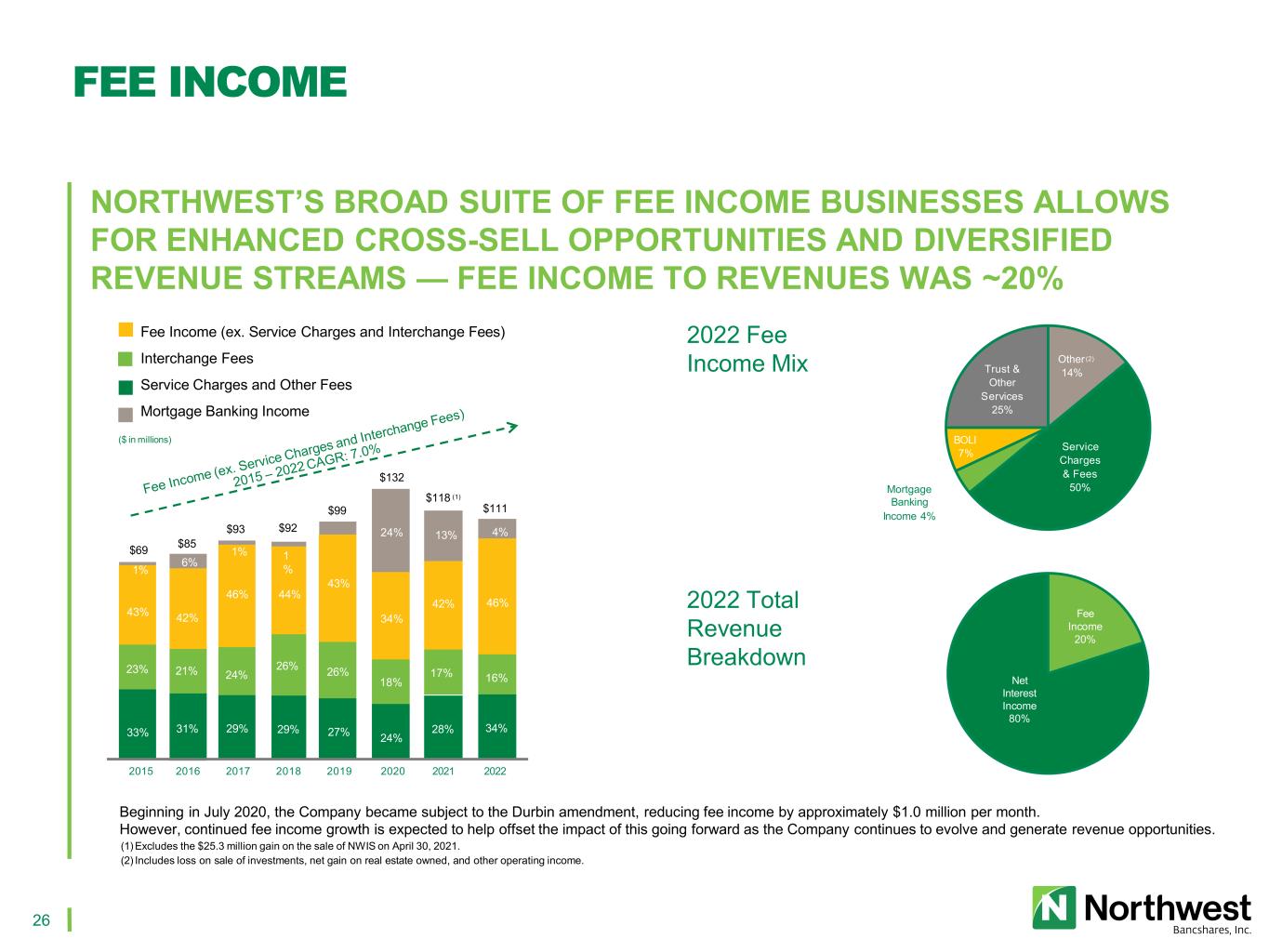

26 Other 14% (2) Service Charges & Fees 50%Mortgage Banking Income 4% Trust & Other Services 25% BOLI 7% Fee Income 20% Net Interest Income 80% Beginning in July 2020, the Company became subject to the Durbin amendment, reducing fee income by approximately $1.0 million per month. However, continued fee income growth is expected to help offset the impact of this going forward as the Company continues to evolve and generate revenue opportunities. (1) Excludes the $25.3 million gain on the sale of NWIS on April 30, 2021. (2) Includes loss on sale of investments, net gain on real estate owned, and other operating income. 4% Fee Income (ex. Service Charges and Interchange Fees) Interchange Fees Service Charges and Other Fees Mortgage Banking Income 28%33% 31% 29% 24% 23% 21% 24% 26% 26% 18% 42% 46% 44% 43% $69 $85 $93 $92 $99 $132 43% 1% 1% 1 % 4 % 6% 27%29% $118 42% 24% (1) 34% 17% 13% 46% 16% $111 4% 34% 2015 2016 2017 2018 2019 2020 2021 2022 ($ in millions) 2022 Fee Income Mix 2022 Total Revenue Breakdown NORTHWEST’S BROAD SUITE OF FEE INCOME BUSINESSES ALLOWS FOR ENHANCED CROSS-SELL OPPORTUNITIES AND DIVERSIFIED REVENUE STREAMS — FEE INCOME TO REVENUES WAS ~20% FEE INCOME

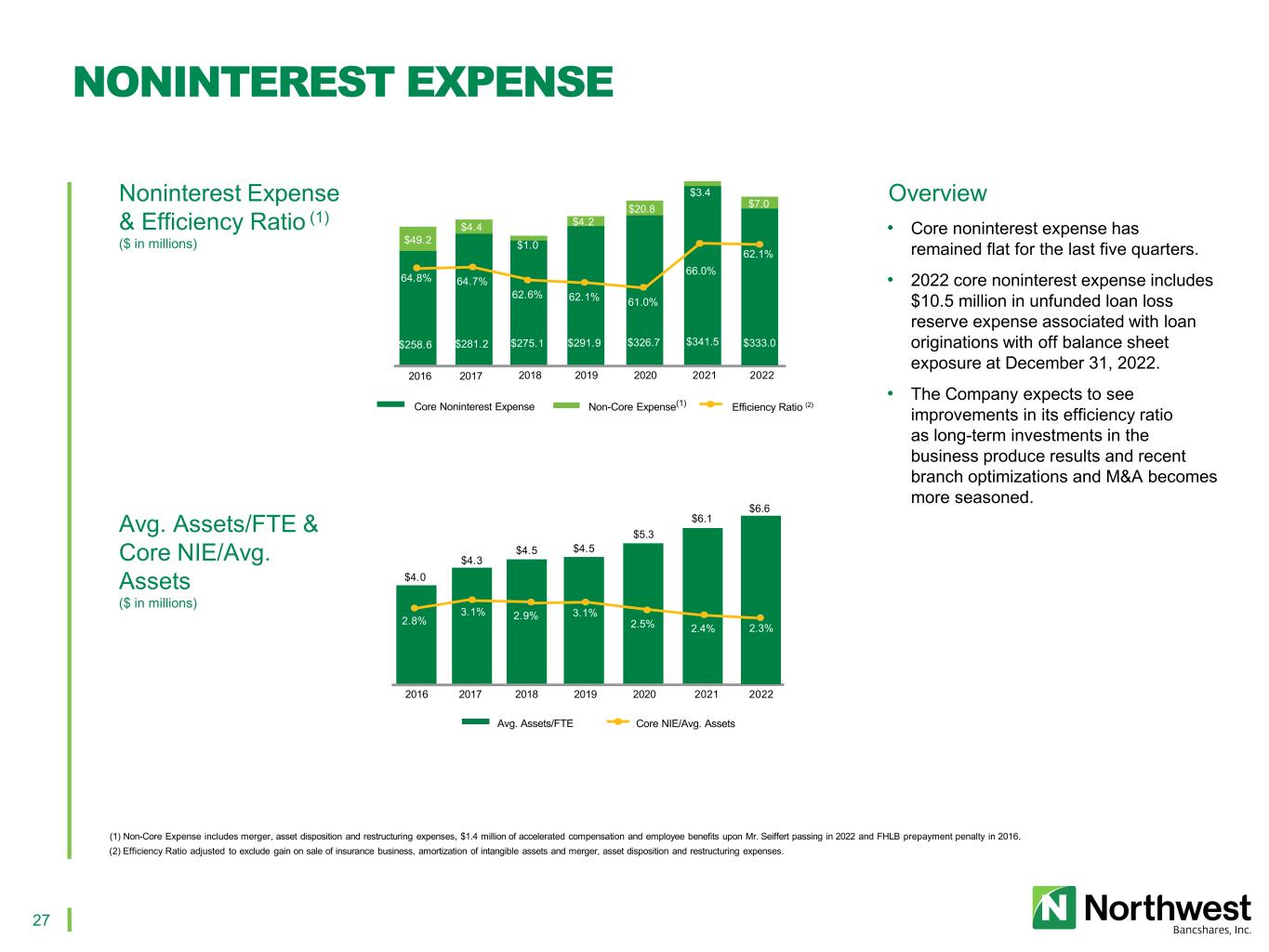

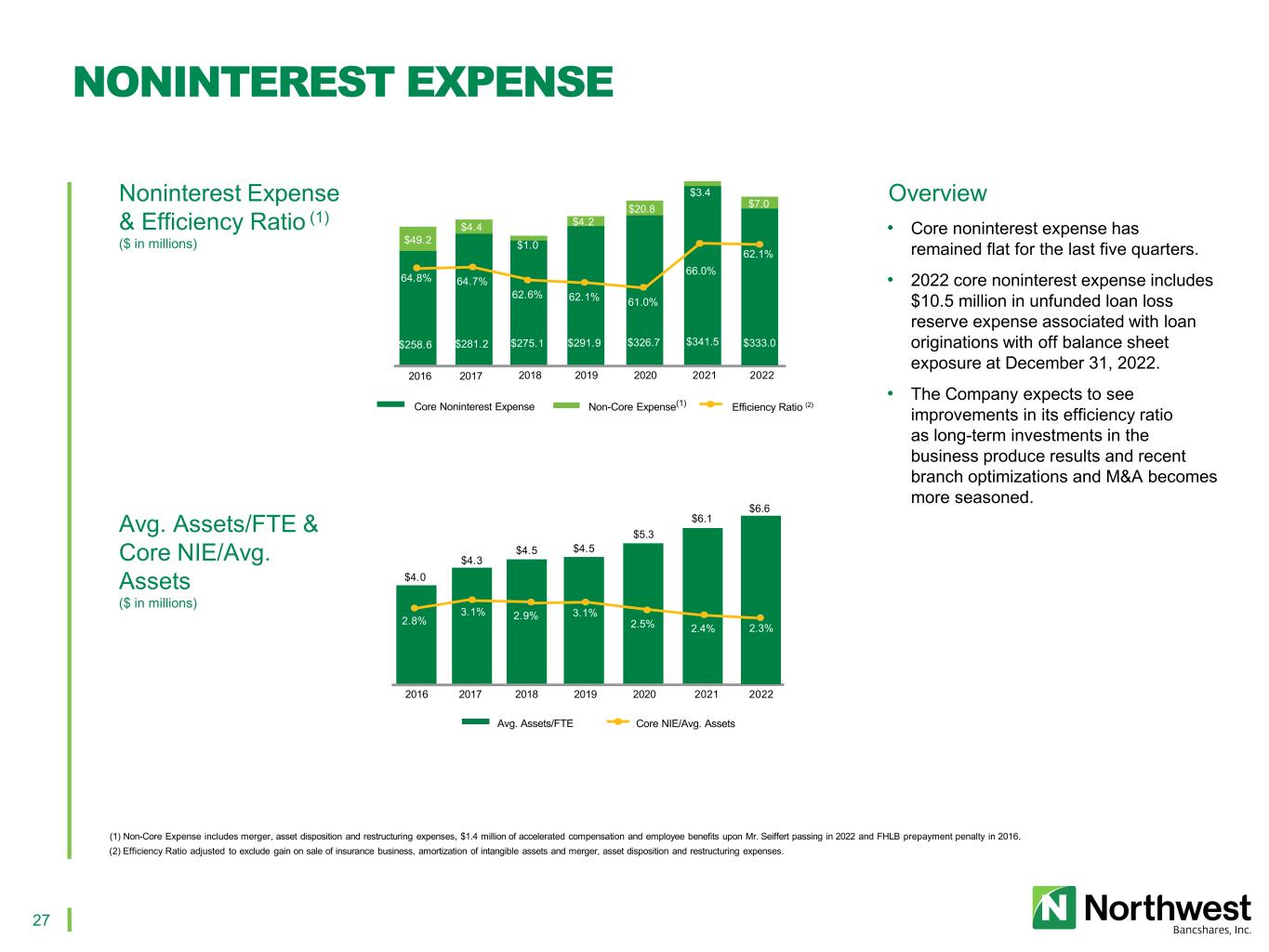

27 2018 2019 2020 2021 2022 $258.6 $281.2 $275.1 $291.9 $49.2 $4.4 $1.0 $4.2 $20.8 64.8% 64.7% 62.6% 62.1% 61.0% 2016 2017 $326.7 $3.4 66.0% $341.5 Non-Core Expense(1) Efficiency Ratio (2)Core Noninterest Expense $333.0 62.1% $7.0 2016 2017 2018 2019 2020 2021 2022 $4.0 $4.3 $4.5 $4.5 $5.3 2.8% 3.1% 2.9% 3.1% 2.5% $6.1 2.4% Core NIE/Avg. AssetsAvg. Assets/FTE $6.6 2.3% Noninterest Expense & Efficiency Ratio (1) ($ in millions) Avg. Assets/FTE & Core NIE/Avg. Assets ($ in millions) • Core noninterest expense has remained flat for the last five quarters. • 2022 core noninterest expense includes $10.5 million in unfunded loan loss reserve expense associated with loan originations with off balance sheet exposure at December 31, 2022. • The Company expects to see improvements in its efficiency ratio as long-term investments in the business produce results and recent branch optimizations and M&A becomes more seasoned. Overview NONINTEREST EXPENSE (1) Non-Core Expense includes merger, asset disposition and restructuring expenses, $1.4 million of accelerated compensation and employee benefits upon Mr. Seiffert passing in 2022 and FHLB prepayment penalty in 2016. (2) Efficiency Ratio adjusted to exclude gain on sale of insurance business, amortization of intangible assets and merger, asset disposition and restructuring expenses.

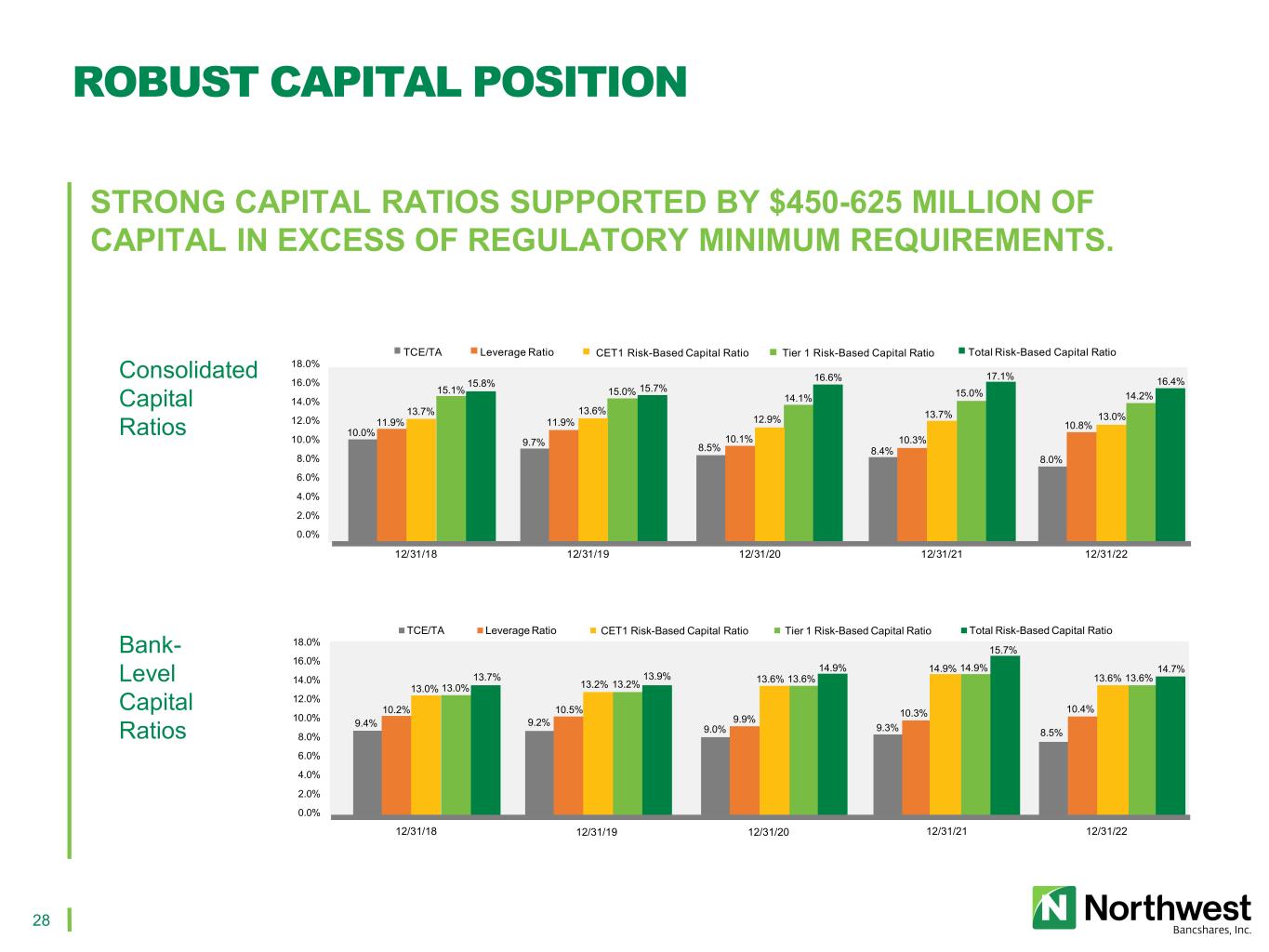

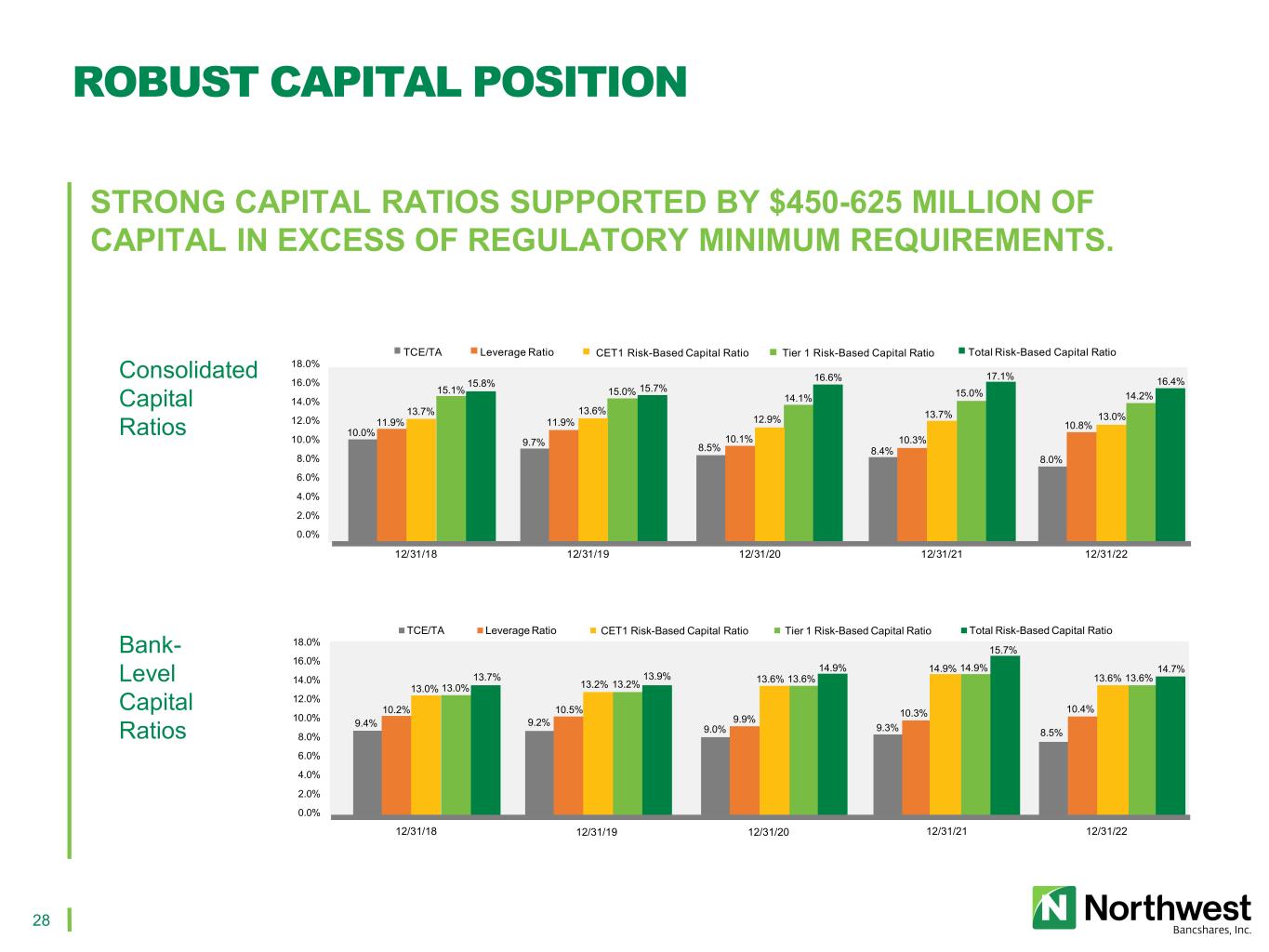

28 18.0% 16.0% 14.0% 12.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0.0% 12/31/18 12/31/19 12/31/20 12/31/21 12/31/22 TCE/TA Leverage Ratio CET1 Risk-Based Capital Ratio Tier 1 Risk-Based Capital Ratio Total Risk-Based Capital Ratio 8.0% 10.8% 16.4% 13.0% 14.2% 10.0% 11.9% 15.8% 13.7% 15.1% 9.7% 11.9% 15.7% 13.6% 15.0% 8.5% 10.1% 16.6% 12.9% 14.1% 8.4% 10.3% 17.1% 13.7% 15.0% 18.0% 16.0% 14.0% 12.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0.0% 12/31/18 12/31/19 12/31/20 12/31/21 12/31/22 TCE/TA Leverage Ratio Total Risk-Based Capital RatioCET1 Risk-Based Capital Ratio Tier 1 Risk-Based Capital Ratio 8.5% 10.4% 14.7% 13.6% 13.6% 9.4% 10.2% 13.7% 13.0% 13.0% 9.2% 10.5% 13.9% 13.2% 13.2% 9.0% 9.9% 14.9% 13.6% 13.6% 9.3% 10.3% 15.7% 14.9% 14.9% Consolidated Capital Ratios Bank- Level Capital Ratios STRONG CAPITAL RATIOS SUPPORTED BY $450-625 MILLION OF CAPITAL IN EXCESS OF REGULATORY MINIMUM REQUIREMENTS. ROBUST CAPITAL POSITION

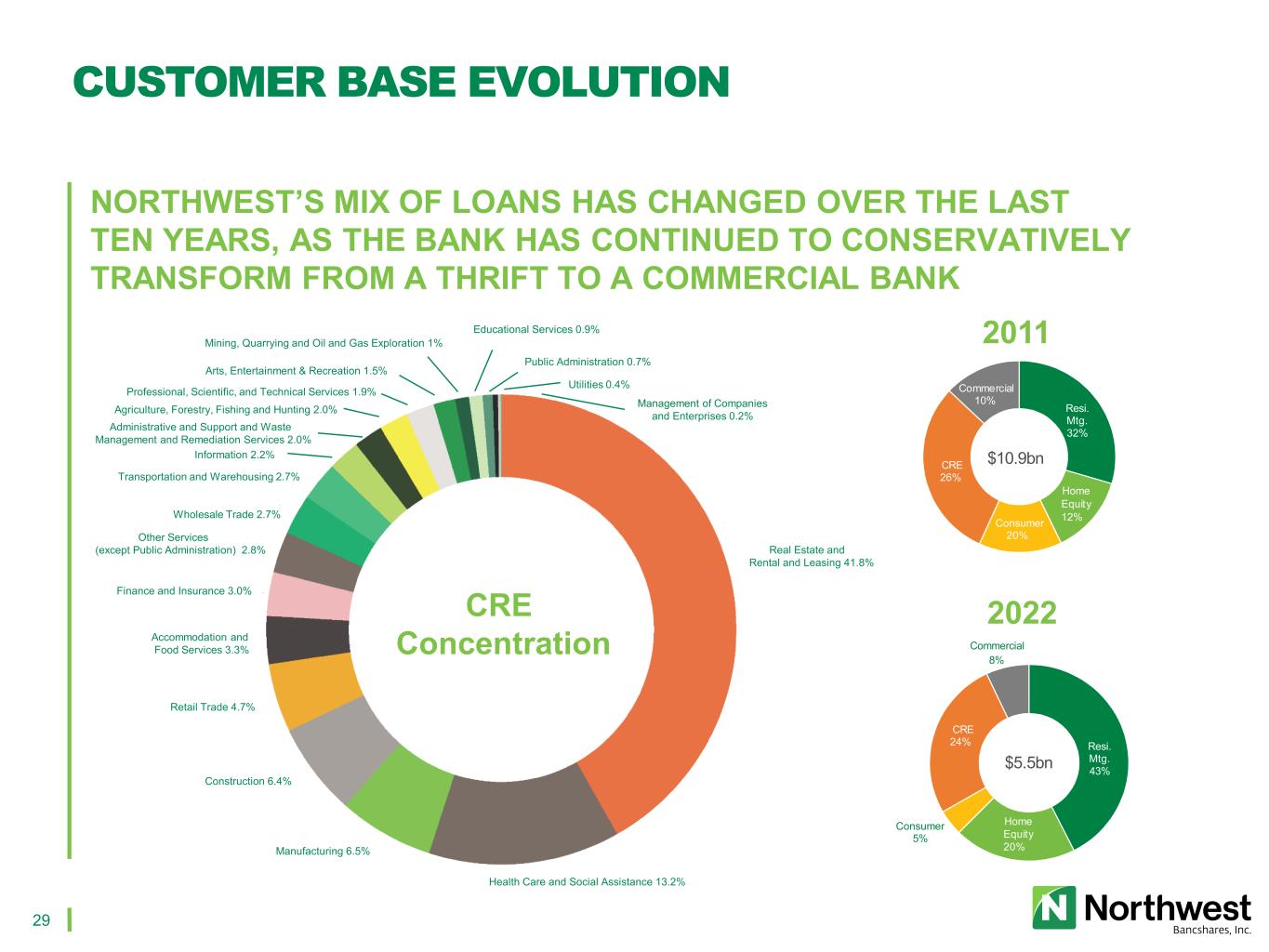

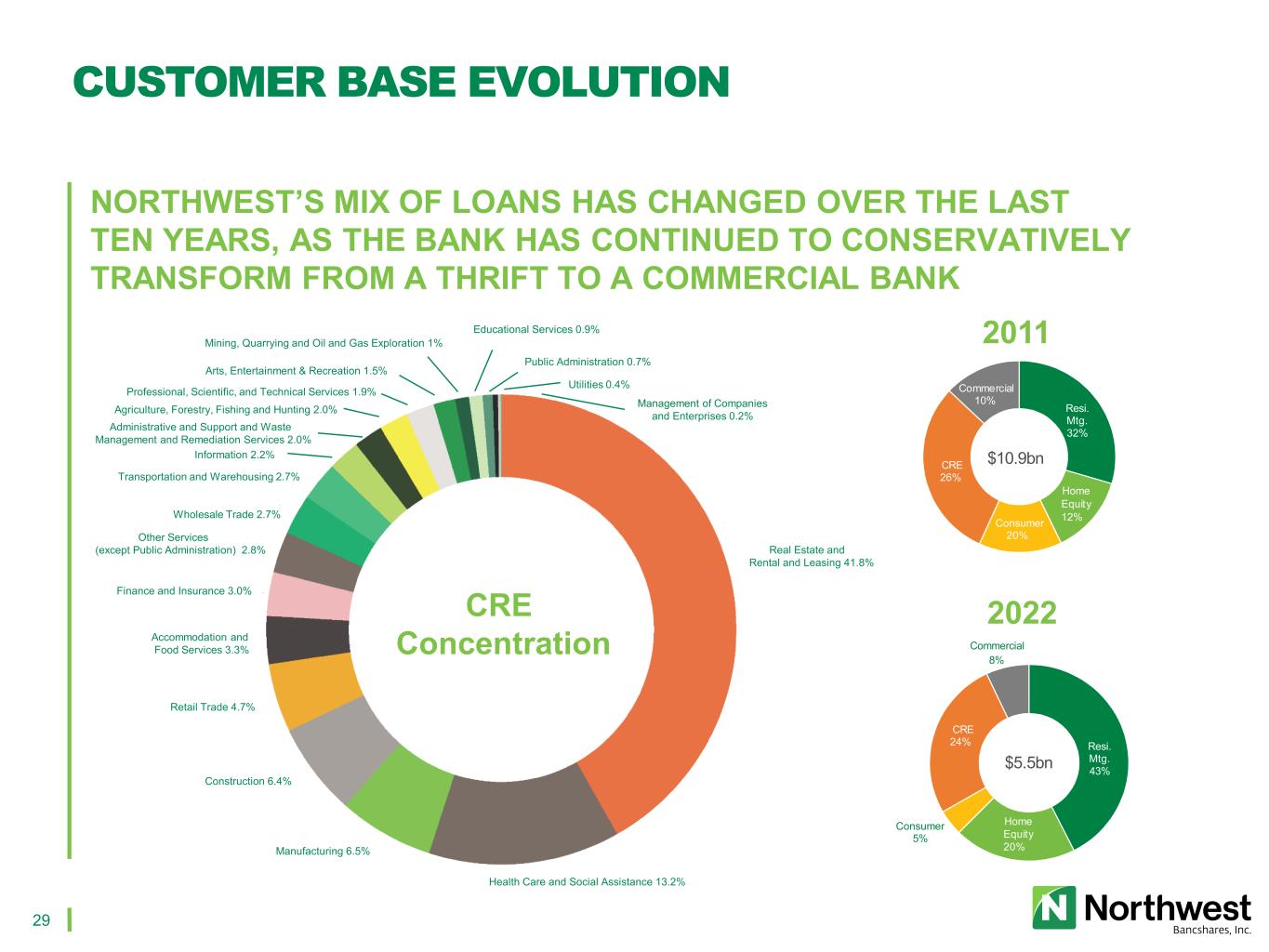

29 Resi. Mtg. 32% Home Equity 12%Consumer 20% CRE 26% Commercial 10% $10.9bn NORTHWEST’S MIX OF LOANS HAS CHANGED OVER THE LAST TEN YEARS, AS THE BANK HAS CONTINUED TO CONSERVATIVELY TRANSFORM FROM A THRIFT TO A COMMERCIAL BANK CUSTOMER BASE EVOLUTION Educational Services 0.9% 2011 2022 Utilities 0.4% Professional, Scientific, and Technical Services 1.9% Agriculture, Forestry, Fishing and Hunting 2.0% Information 2.2% Finance and Insurance 3.0% Accommodation and Food Services 3.3% Construction 6.4% Health Care and Social Assistance 13.2% Mining, Quarrying and Oil and Gas Exploration 1% Public Administration 0.7% Retail Trade 4.7% Manufacturing 6.5% Wholesale Trade 2.7% Other Services (except Public Administration) 2.8% Arts, Entertainment & Recreation 1.5% Transportation and Warehousing 2.7% Administrative and Support and Waste Management and Remediation Services 2.0% Resi. Mtg. 43% Home Equity 20% CRE 24% $5.5bn Consumer 5% Commercial 8% Management of Companies and Enterprises 0.2% Real Estate and Rental and Leasing 41.8% CRE Concentration

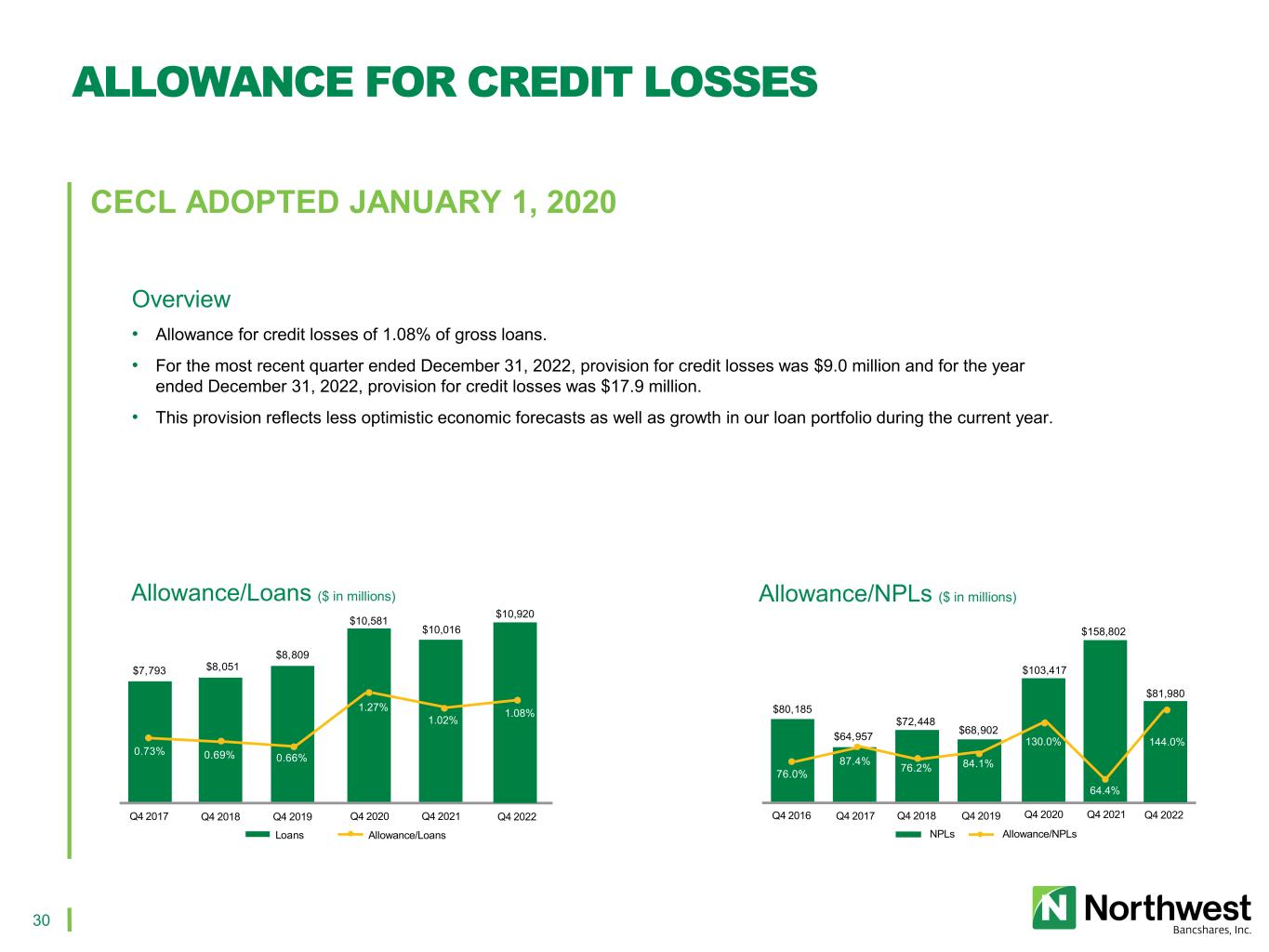

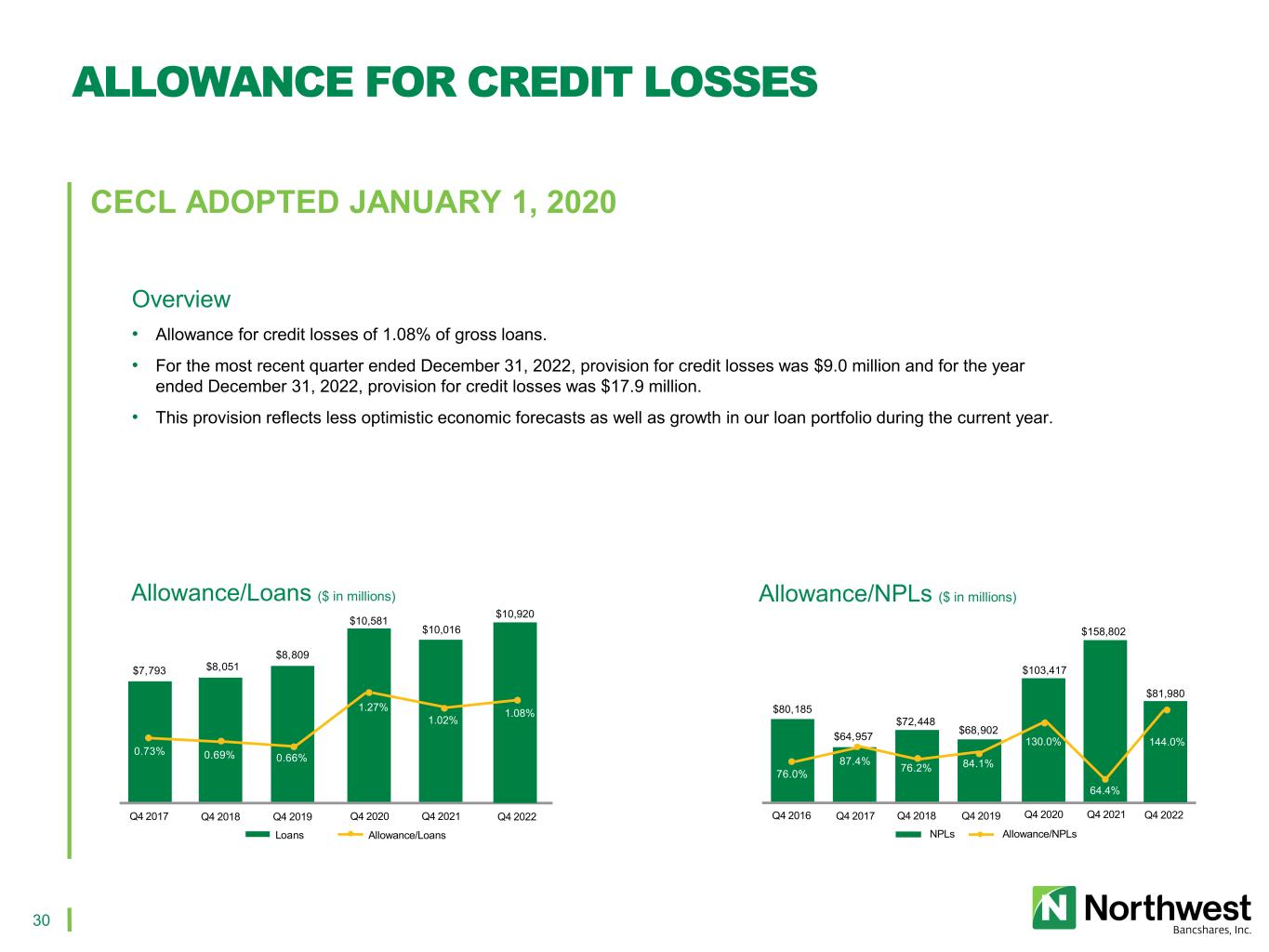

30 $7,793 $8,051 $8,809 $10,581 0.73% 0.69% 0.66% 1.27% Q4 2017 Q4 2018 Q4 2019 Allowance/Loans Q4 2020 Loans $10,016 1.02% Q4 2021 $10,920 1.08% Q4 2022 NPLs Allowance/NPLs $80,185 $64,957 $72,448 $68,902 $158,802 76.0% 87.4% 76.2% 84.1% 130.0% Q4 2016 64.4% $103,417 Q4 2017 Q4 2018 Q4 2019 Q4 2020 Q4 2021 $81,980 144.0% Q4 2022 Overview Allowance/Loans ($ in millions) Allowance/NPLs ($ in millions) CECL ADOPTED JANUARY 1, 2020 ALLOWANCE FOR CREDIT LOSSES • Allowance for credit losses of 1.08% of gross loans. • For the most recent quarter ended December 31, 2022, provision for credit losses was $9.0 million and for the year ended December 31, 2022, provision for credit losses was $17.9 million. • This provision reflects less optimistic economic forecasts as well as growth in our loan portfolio during the current year.

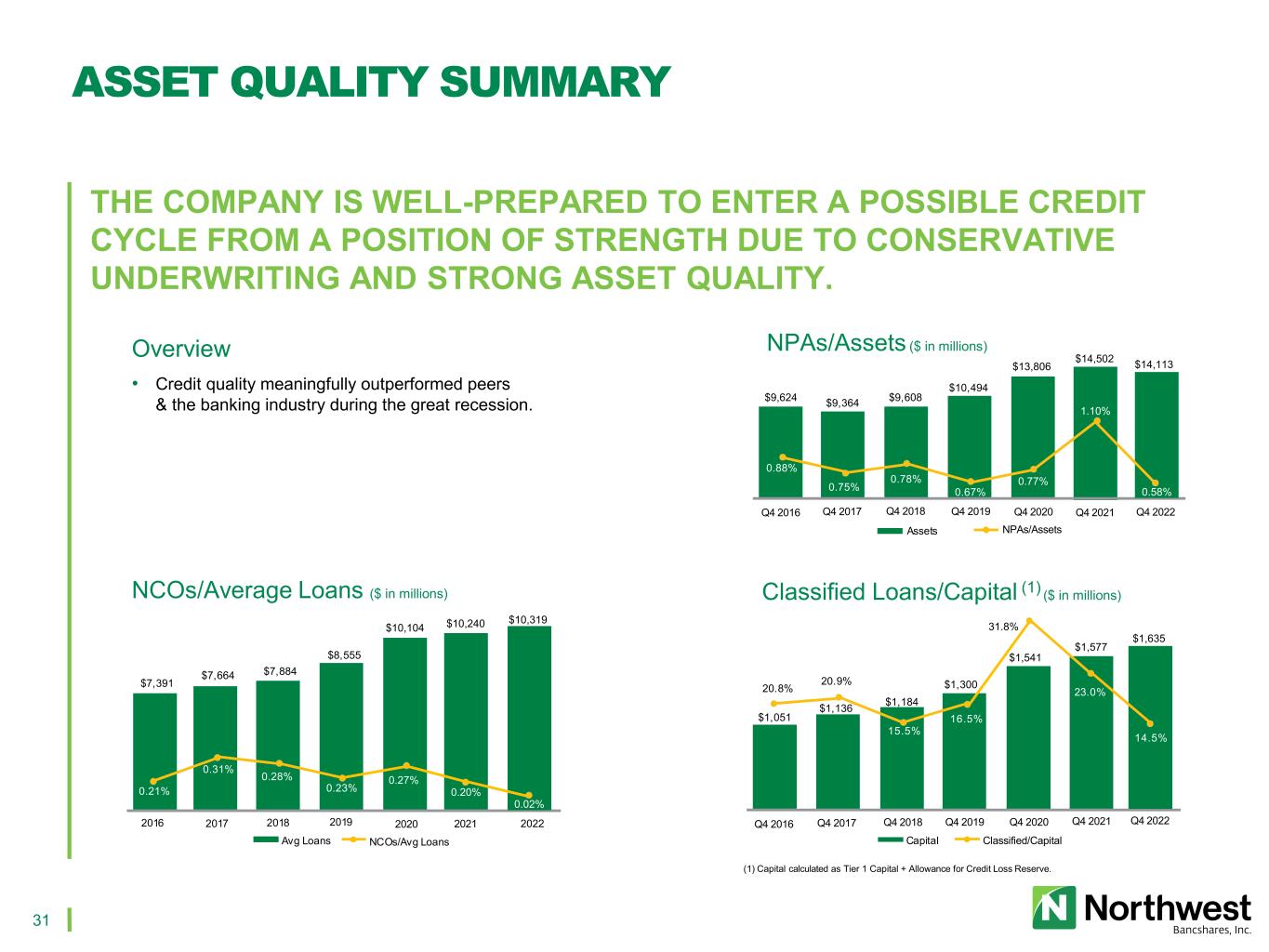

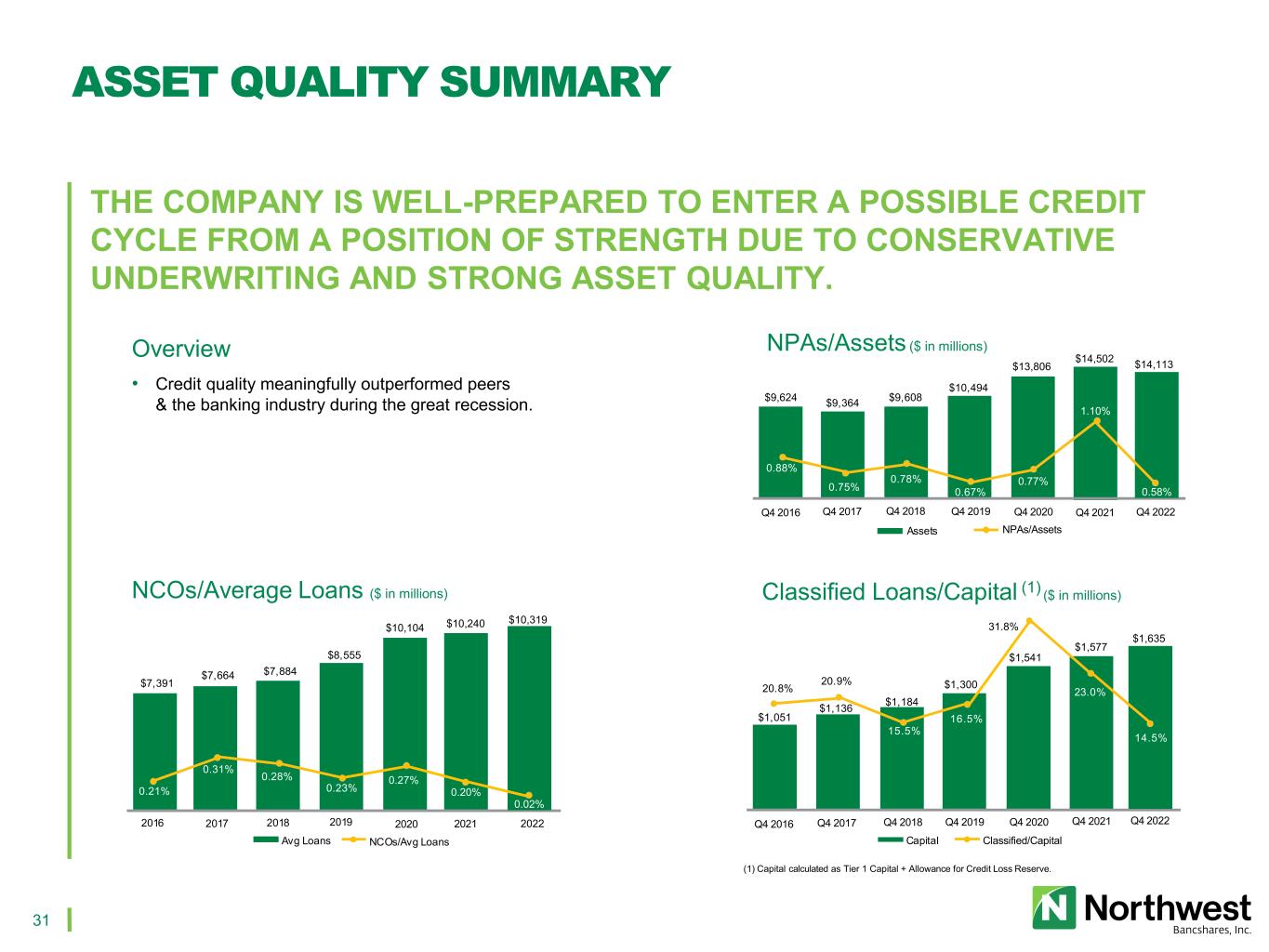

31 THE COMPANY IS WELL-PREPARED TO ENTER A POSSIBLE CREDIT CYCLE FROM A POSITION OF STRENGTH DUE TO CONSERVATIVE UNDERWRITING AND STRONG ASSET QUALITY. $1,051 $1,136 $1,184 $1,300 $1,541 20.8% 20.9% 31.8% Q4 2016 Q4 2017 Q4 2018 Q4 2019 Q4 2020 Capital Classified/Capital 24 $1,577 15.5% 16.5% 23.0% Q4 2021 $1,635 14.5% Q4 2022 (1) Capital calculated as Tier 1 Capital + Allowance for Credit Loss Reserve. Q4 2016 Q4 2017 Q4 2018 NPAs/Assets Q4 2020 Assets 0.88% 0.75% 0.78% 0.67% 1.10% 0.77% $9,624 $9,364 $9,608 $10,494 $13,806 $14,502 Q4 2019 Q4 2021 0.58% $14,113 Q4 2022 $7,391 $7,664 $7,884 $8,555 $10,104 0.21% 0.31% 0.28% 0.23% 0.27% 2016 2017 2018 NCOs/Avg Loans 2021 Avg Loans $10,240 0.20% 2019 2020 $10,319 0.02% 2022 • Credit quality meaningfully outperformed peers & the banking industry during the great recession. Overview NPAs/Assets ($ in millions) NCOs/Average Loans ($ in millions) ASSET QUALITY SUMMARY Classified Loans/Capital (1) ($ in millions)

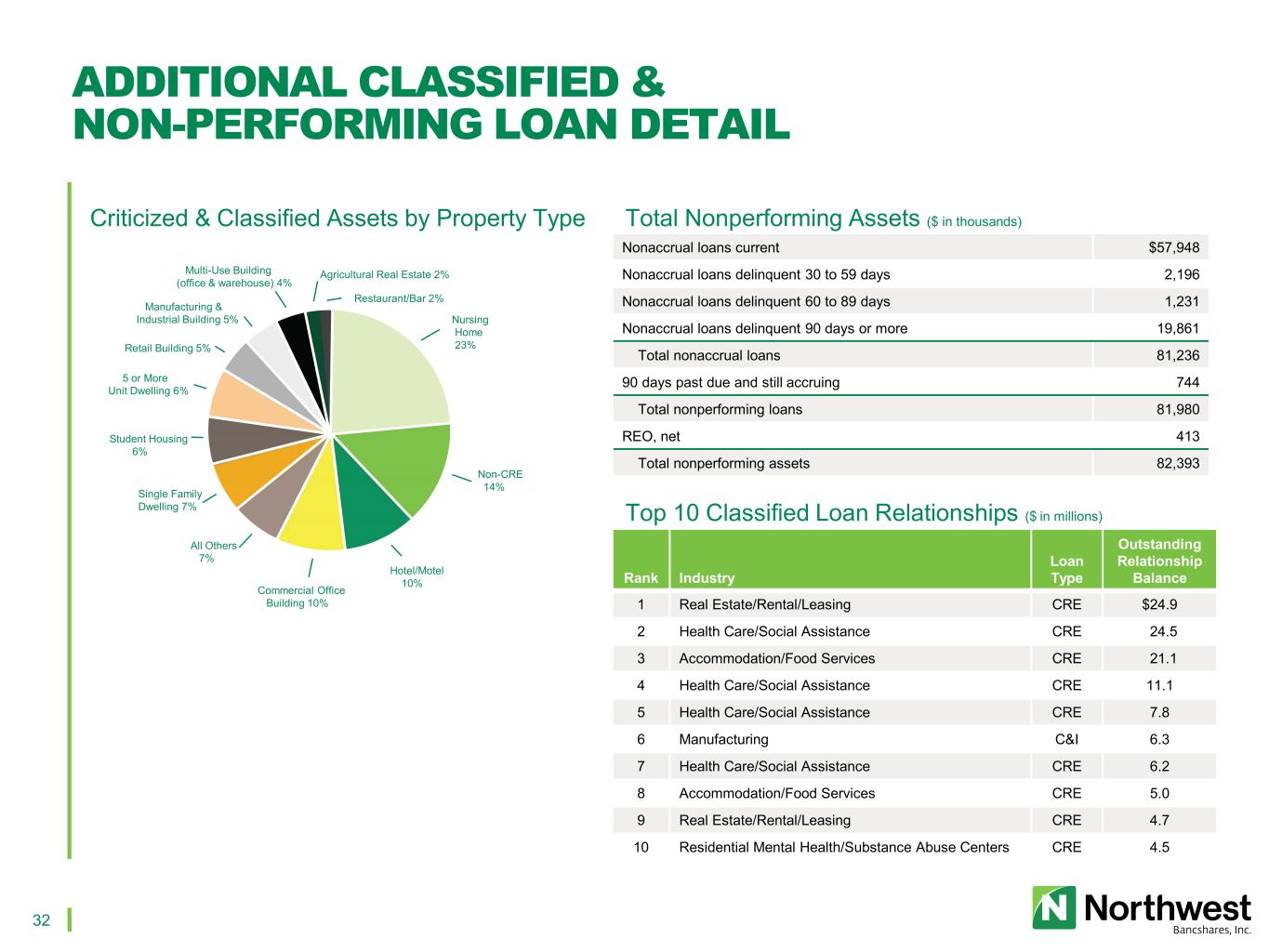

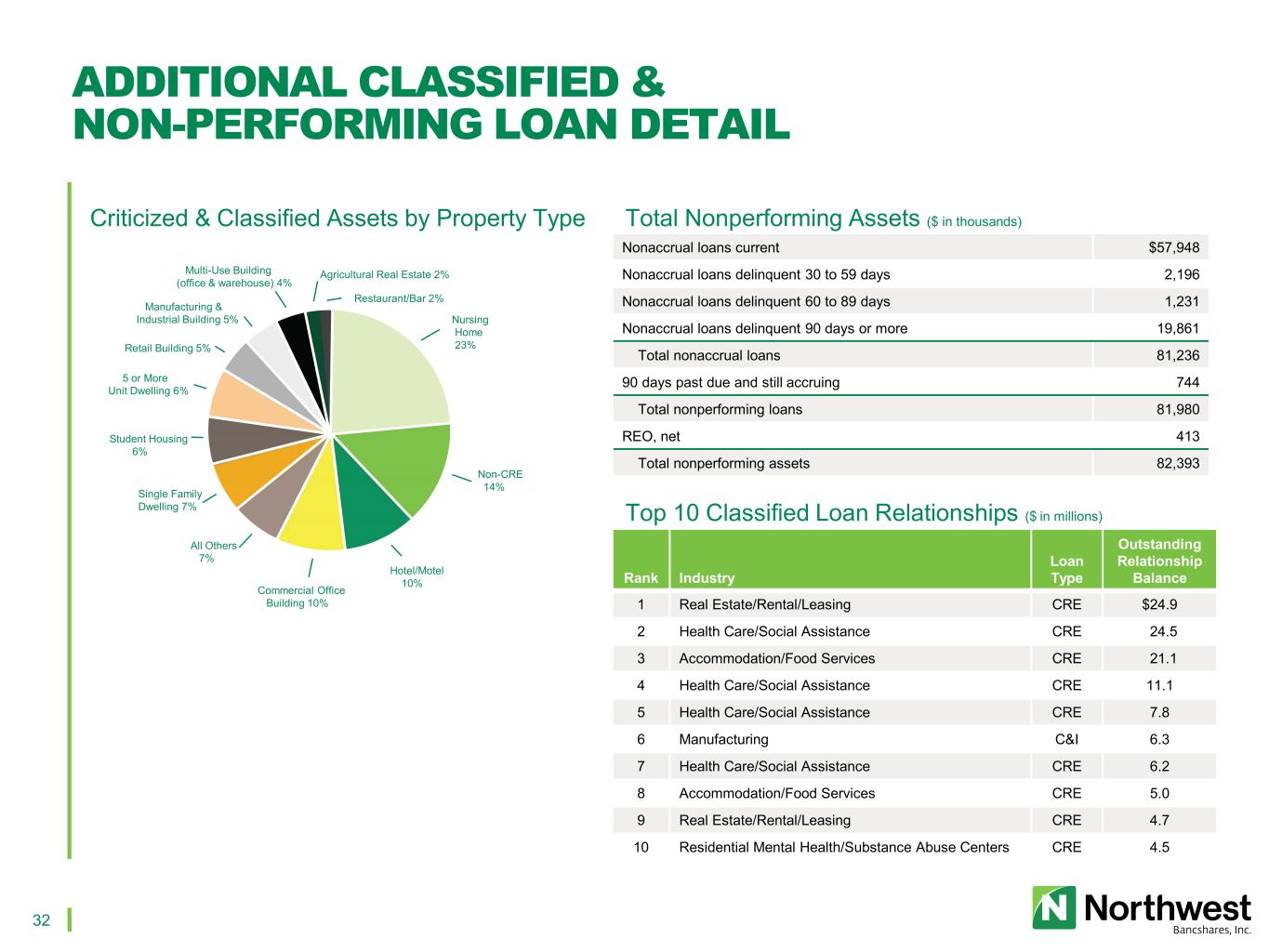

32 25 Nonaccrual loans current $57,948 Nonaccrual loans delinquent 30 to 59 days 2,196 Nonaccrual loans delinquent 60 to 89 days 1,231 Nonaccrual loans delinquent 90 days or more 19,861 Total nonaccrual loans 81,236 90 days past due and still accruing 744 Total nonperforming loans 81,980 REO, net 413 Total nonperforming assets 82,393 Rank Industry Loan Type Outstanding Relationship Balance 1 Real Estate/Rental/Leasing CRE $24.9 2 Health Care/Social Assistance CRE 24.5 3 Accommodation/Food Services CRE 21.1 4 Health Care/Social Assistance CRE 11.1 5 Health Care/Social Assistance CRE 7.8 6 Manufacturing C&I 6.3 7 Health Care/Social Assistance CRE 6.2 8 Accommodation/Food Services CRE 5.0 9 Real Estate/Rental/Leasing CRE 4.7 10 Residential Mental Health/Substance Abuse Centers CRE 4.5 Total Nonperforming Assets ($ in thousands) Top 10 Classified Loan Relationships ($ in millions) ADDITIONAL CLASSIFIED & NON-PERFORMING LOAN DETAIL Restaurant/Bar 2% Multi-Use Building (office & warehouse) 4% Manufacturing & Industrial Building 5% Retail Building 5% Student Housing 6% Single Family Dwelling 7% All Others 7% 5 or More Unit Dwelling 6% Commercial Office Building 10% Hotel/Motel 10% Non-CRE 14% Nursing Home 23% Agricultural Real Estate 2% Criticized & Classified Assets by Property Type

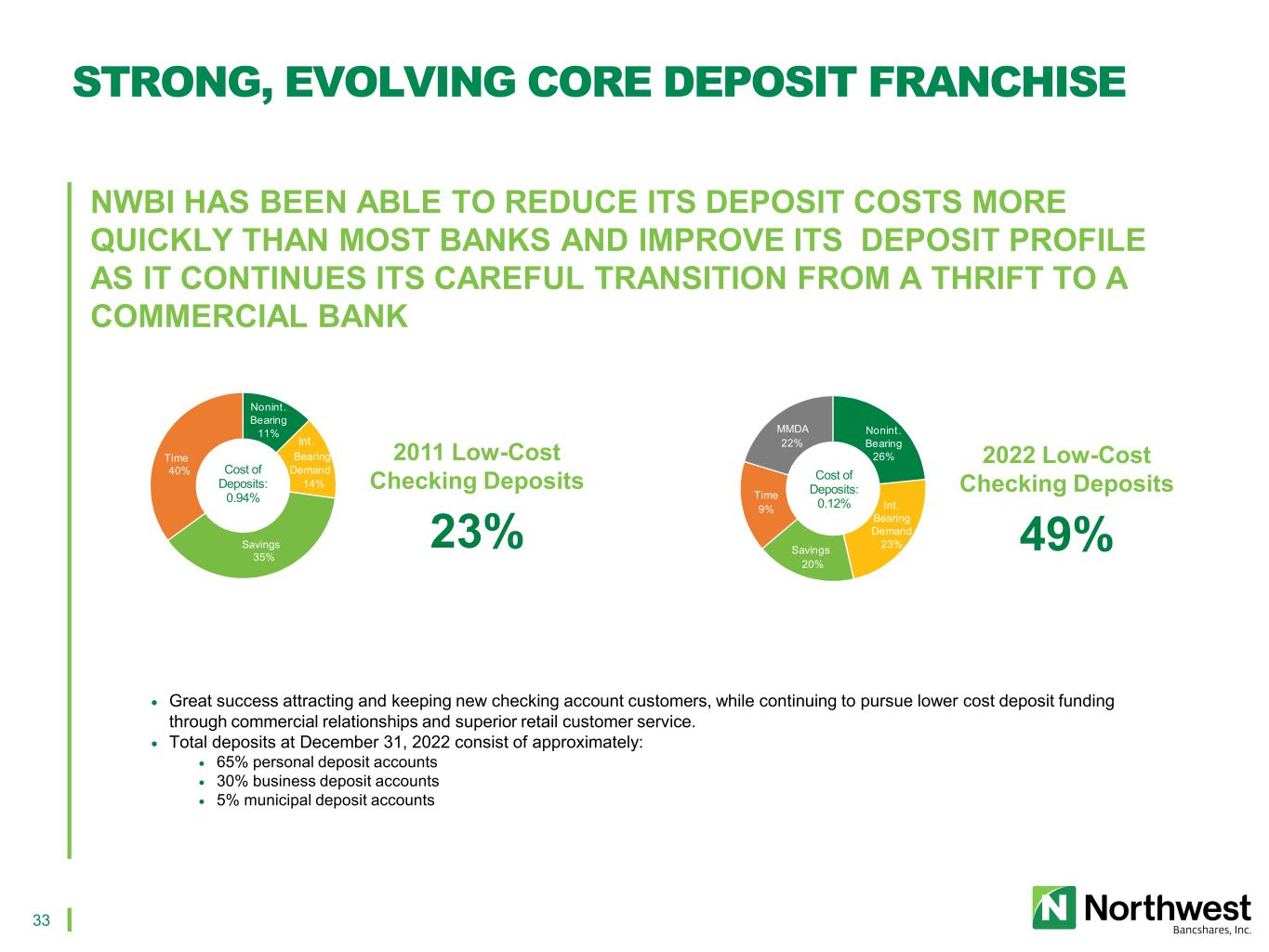

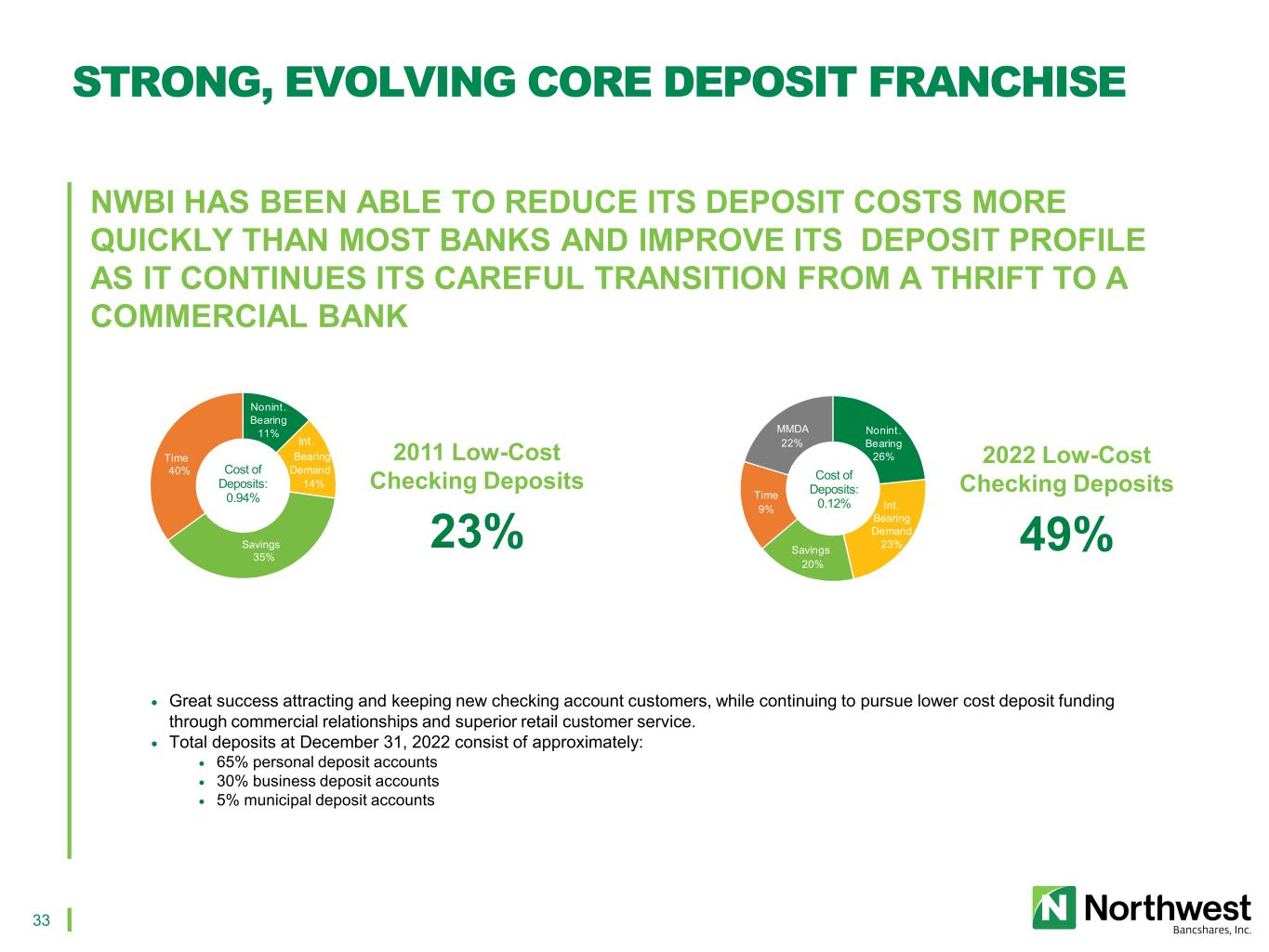

33 Nonint . Bearing 26% Int. Bearing Demand 23%Savings 20% Time 9% MMDA 22% Cost of Deposits: 0.12% Nonint . Bearing 11% Int. Bearing Demand 14% Savings 35% Time 40% Cost of Deposits: 0.94% 2011 Low-Cost Checking Deposits 23% NWBI HAS BEEN ABLE TO REDUCE ITS DEPOSIT COSTS MORE QUICKLY THAN MOST BANKS AND IMPROVE ITS DEPOSIT PROFILE AS IT CONTINUES ITS CAREFUL TRANSITION FROM A THRIFT TO A COMMERCIAL BANK STRONG, EVOLVING CORE DEPOSIT FRANCHISE • Great success attracting and keeping new checking account customers, while continuing to pursue lower cost deposit funding through commercial relationships and superior retail customer service. • Total deposits at December 31, 2022 consist of approximately: • 65% personal deposit accounts • 30% business deposit accounts • 5% municipal deposit accounts 2022 Low-Cost Checking Deposits 49%

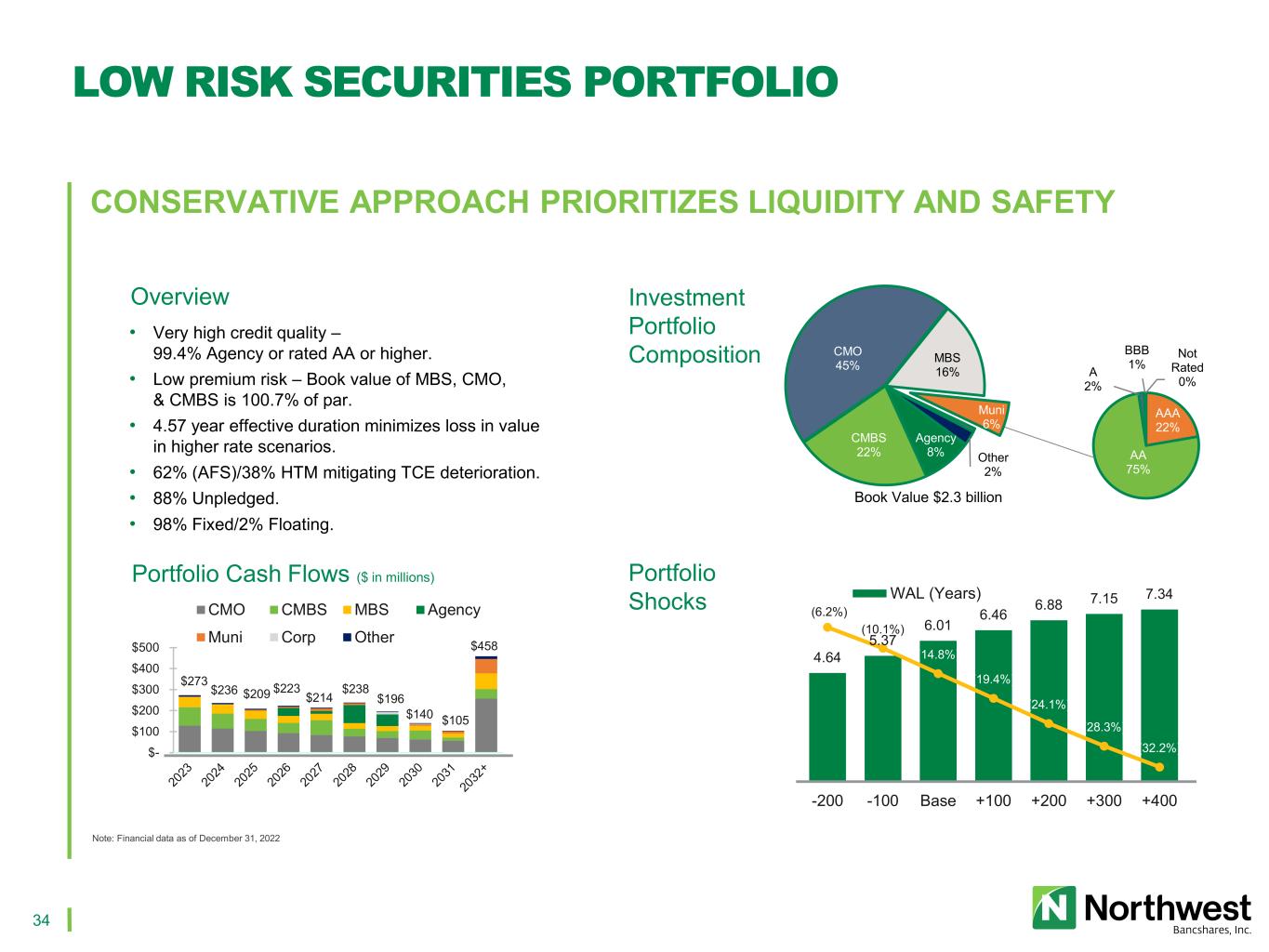

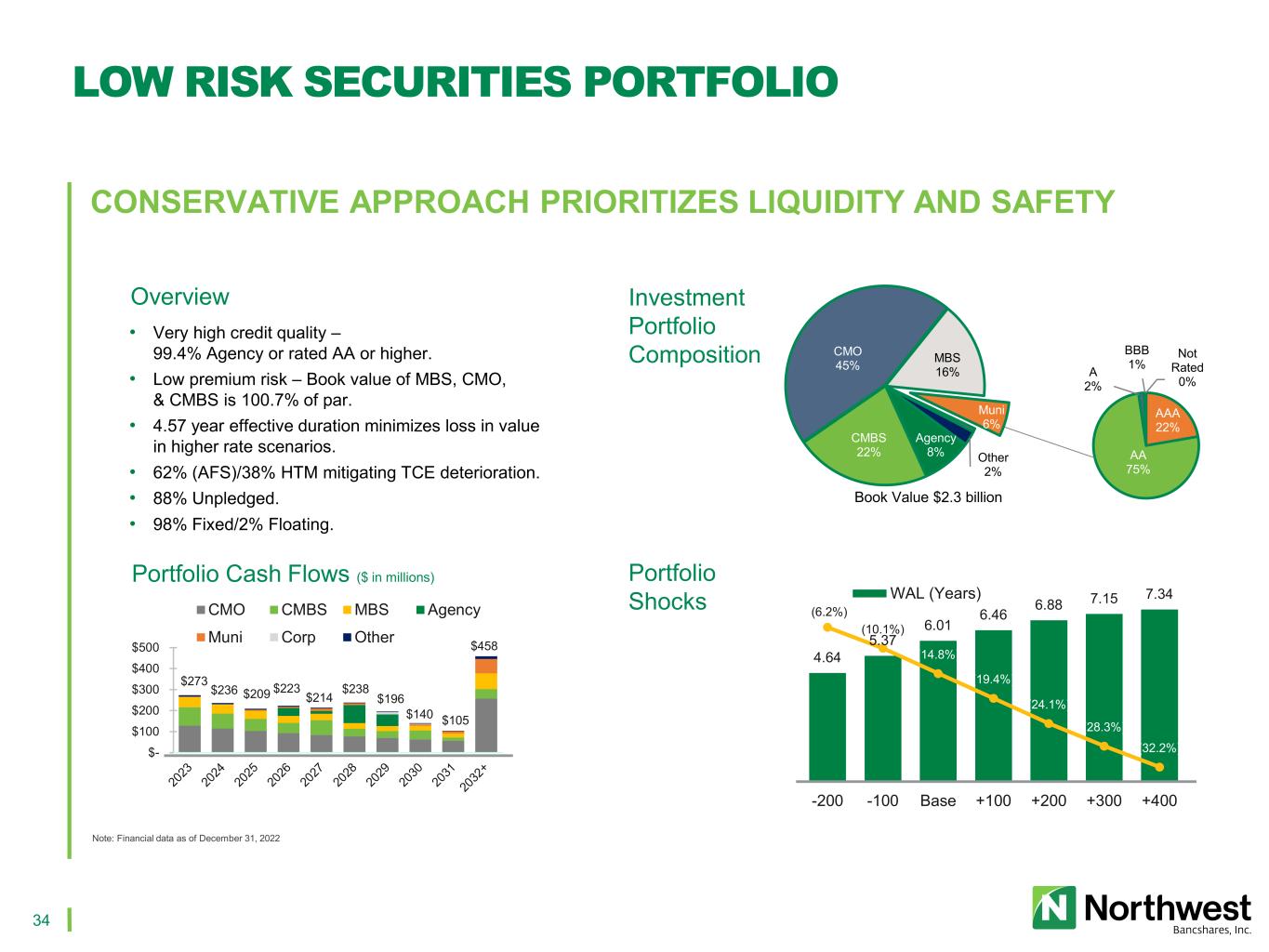

34 CONSERVATIVE APPROACH PRIORITIZES LIQUIDITY AND SAFETY LOW RISK SECURITIES PORTFOLIO Note: Financial data as of December 31, 2022 $273 $236 $209 $223 $214 $238 $196 $140 $105 $458 $- $100 $200 $300 $400 $500 CMO CMBS MBS Agency Muni Corp Other AAA 22% AA 75% A 2% BBB 1% Not Rated 0% Book Value $2.3 billion Agency 8% CMBS 22% CMO 45% MBS 16% Muni 6% Other 2% 4.64 5.37 6.01 6.46 6.88 7.15 7.34 (6.2%) (10.1%) (14.8%) (19.4%) (24.1%) (28.3%) (32.2%) 0 1 2 3 4 5 6 7 8 -200 -100 Base +100 +200 +300 +400 WAL (Years) • Very high credit quality – 99.4% Agency or rated AA or higher. • Low premium risk – Book value of MBS, CMO, & CMBS is 100.7% of par. • 4.57 year effective duration minimizes loss in value in higher rate scenarios. • 62% (AFS)/38% HTM mitigating TCE deterioration. • 88% Unpledged. • 98% Fixed/2% Floating. Investment Portfolio Composition Overview Portfolio Cash Flows ($ in millions) Portfolio Shocks

35 APPENDIX

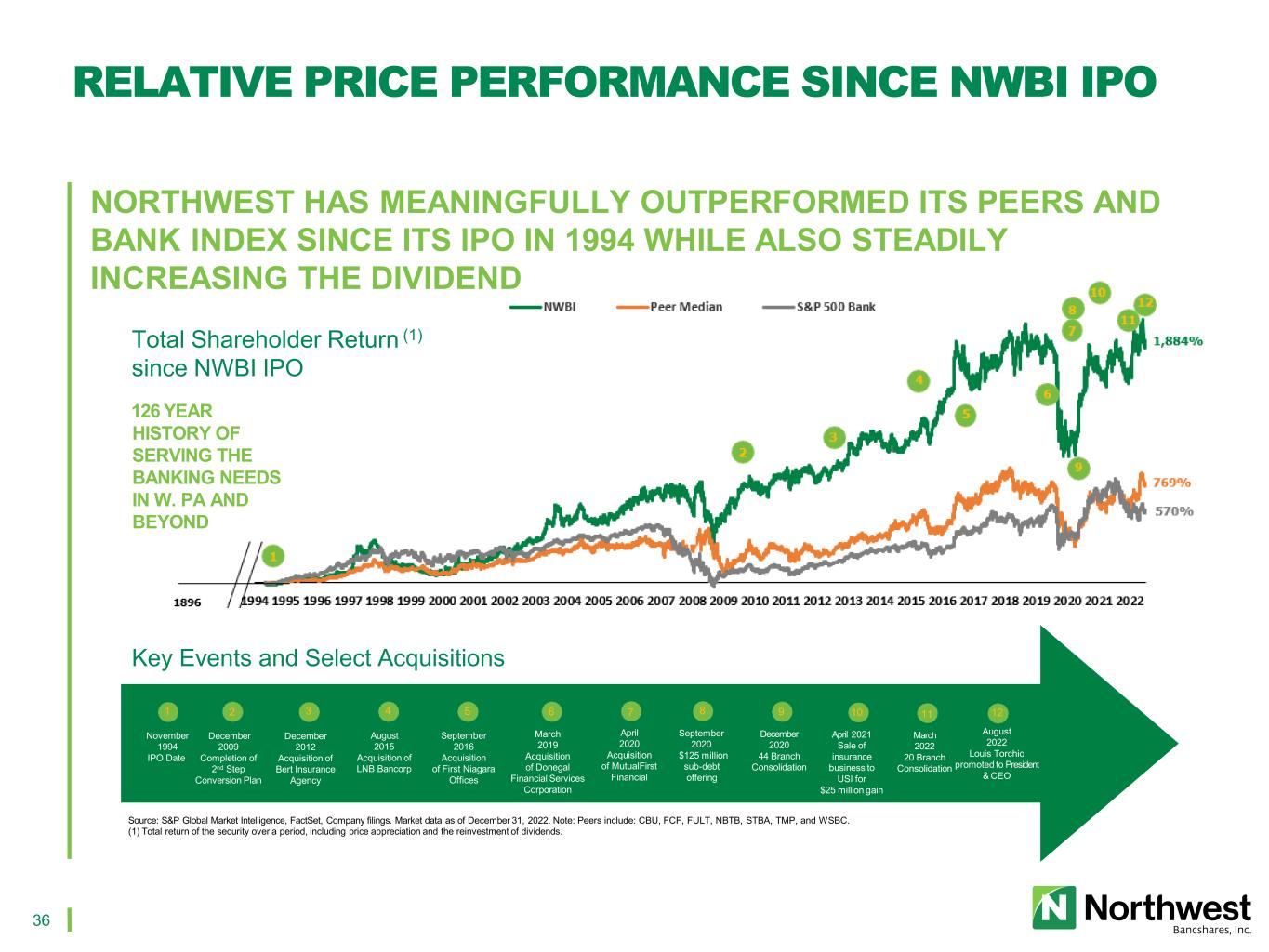

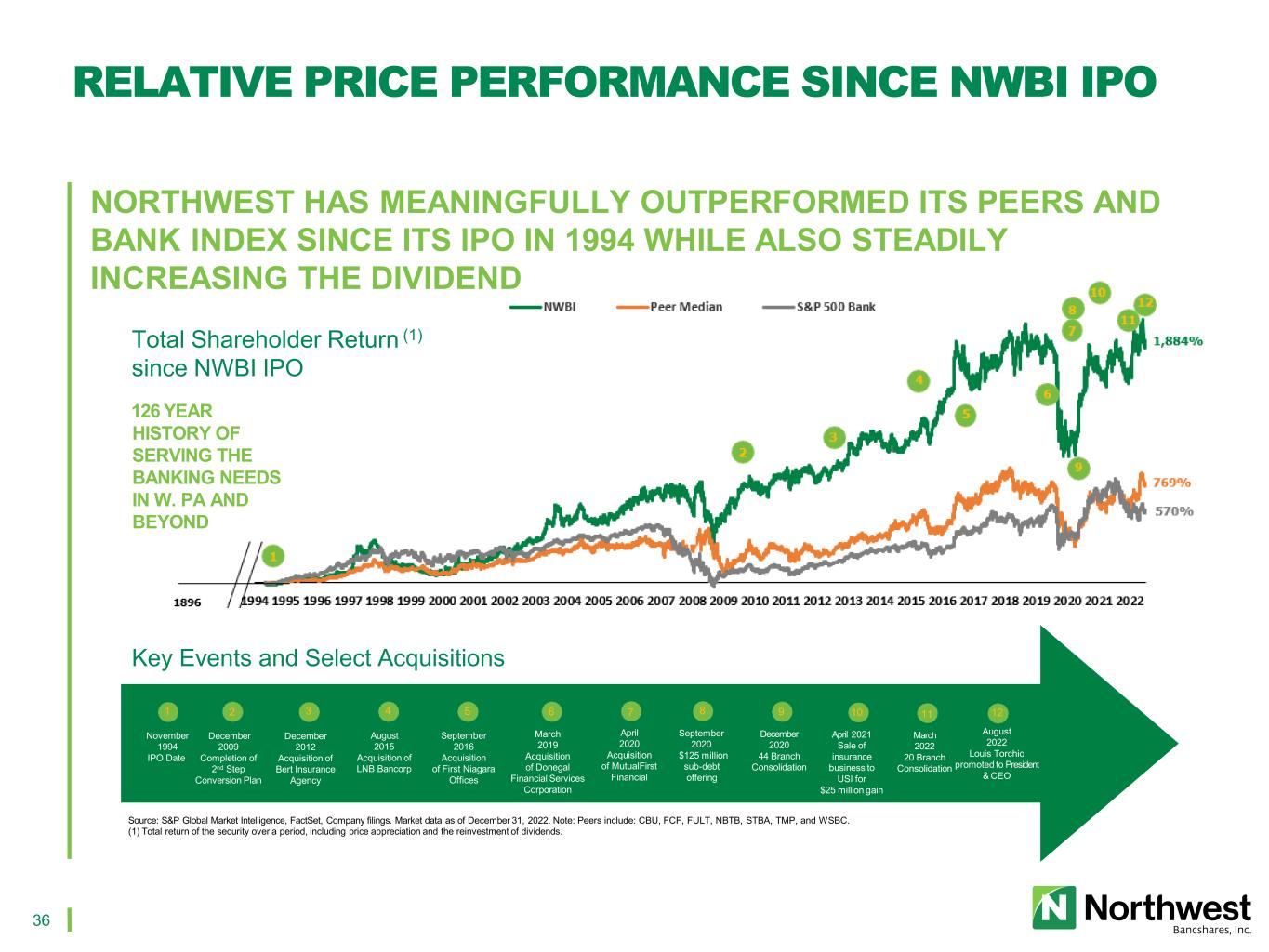

36 Source: S&P Global Market Intelligence, FactSet, Company filings. Market data as of December 31, 2022. Note: Peers include: CBU, FCF, FULT, NBTB, STBA, TMP, and WSBC. (1) Total return of the security over a period, including price appreciation and the reinvestment of dividends. August 2015 Acquisition of LNB Bancorp September 2016 Acquisition of First Niagara Offices March 2019 Acquisition of Donegal Financial Services Corporation December 2009 Completion of 2nd Step Conversion Plan September 2020 $125 million sub-debt offering December 2012 Acquisition of Bert Insurance Agency June 2018 Ronald Seiffert promoted to CEO November 1994 IPO Date December 2020 44 Branch Consolidation April 2021 Sale of insurance business to USI for $25 million gain March 022 20 Branch Consolidation November 1994 IPO Date 1 2 3 4 5 6 7 8 9 10 11 12 August 2015 Acquisition of LNB Bancorp September 2016 Acquisition of First Niagara Offices March 2019 Acquisition of Donegal Financial Services Corporation December 2009 Completion of 2nd Step Conversion Plan September 2020 $125 million sub-debt offering December 2012 Acquisition of Bert Insurance Agency April 2020 Acquisition of MutualFirst Financial December 2020 44 Branch Consolidation April 2021 Sale of insurance business to USI for $25 million gain March 2022 20 Branch Consolidation August 20 2 Louis Tor io prom ted to President & CEO Total Shareholder Return (1) since NWBI IPO Key Events and Select Acquisitions 126 YEAR HISTORY OF SERVING THE BANKING NEEDS IN W. PA AND BEYOND NORTHWEST HAS MEANINGFULLY OUTPERFORMED ITS PEERS AND BANK INDEX SINCE ITS IPO IN 1994 WHILE ALSO STEADILY INCREASING THE DIVIDEND RELATIVE PRICE PERFORMANCE SINCE NWBI IPO